Notice of the Ordinary meeting of

Nelson City Council

Te Kaunihera o Whakatū

|

Date: Thursday

14 December 2023

Time: 9.00a.m.

Location: Council

Chamber

Floor 2A, Civic House

110 Trafalgar Street, Nelson

|

Agenda

Rārangi take

Chairperson His

Worship the Mayor Nick Smith

Deputy

Mayor Cr

Rohan O'Neill-Stevens

Members Cr

Matty Anderson

Cr

Matthew Benge

Cr

Trudie Brand

Cr

Mel Courtney

Cr

James Hodgson

Cr

Kahu Paki Paki

Cr

Pete Rainey

Cr

Campbell Rollo

Cr

Rachel Sanson

Cr

Tim Skinner

Cr

Aaron Stallard

Quorum 7 Nigel

Philpott

Chief Executive

Nelson City Council Disclaimer

Please note that the contents of these

Council and Committee agendas have yet to be considered by Council and officer

recommendations may be altered or changed by the Council in the process of

making the formal Council decision. For enquiries call (03) 5460436.

14

December 2023

Page

No.

Karakia and Mihi Timatanga

Please

note:

The

number of reports and matters to be considered in this Agenda are extensive and

will take longer than the time available on 14 December. Therefore, the meeting

will adjourn at the end of the day and reconvene at 9.00am on Friday 15

December to complete any outstanding items.

1. Apologies

Nil

2. Confirmation

of Order of Business

3. Interests

3.1 Updates

to the Interests Register

3.2 Identify

any conflicts of interest in the agenda

4. Public Forum

4.1 Relationship City of

Portsmouth, New Hampshire

Councillor Rich Blalock from the

City of Portsmouth, New Hampshire USA, will speak about establishing a Sister

City relationship.

5. Confirmation

of Minutes

5.1 9

November 2023 15 - 29

Document number M20350

Recommendation

|

That the Council

1. Confirms the minutes of the meeting

of the Council, held on 9 November 2023, as a true and correct record.

|

6. Recommendations from

Committees

6.1 Nelson Regional Sewerage Business

Unit - 28 November 2023

Refer

to Nelson

Regional Sewerage Business Unit - 28 November 2023 for documentation

6.1.1 Nelson

Regional Sewerage Business Unit - Business Plan 2024-25

|

Recommendation to Council

|

|

|

That

the Nelson City Council and Tasman District Councils

1. Receive the Nelson Regional

Sewerage Business Unit Business Plan 2024-25 (1080325921-756), and

2. Approves the Nelson Regional

Sewerage Business Unit Business Plan 2024-25 (1080325921-756).

|

6.1.2 Nelson

Regional Sewerage Business Unit - Activity Management Plan 2024-34

|

Recommendation to Council

|

|

|

That

the Nelson City Council and Tasman District Councils

1. Receive the Nelson Regional

Sewerage Business Unit Activity Management Plan 2024-34 (1080325921-753); and

2. Approves the Nelson Regional

Sewerage Business Unit Activity Management Plan 2024-34 (1080325921-753)

as the version to inform the development of the Long Term Plan 2024-34.

3. Notes that the Nelson Regional

Sewerage Business Unit Activity Management Plan 2024-34 (1080325921-753) will

be updated, and the final Activity Management Plan approved by Council after

the adoption of the Long Term Plan 2024-2034.

|

6.2 Nelson Tasman Regional Landfill

Business Unit - 1 December 2023

Refer to Nelson

Tasman Regional Landfill Business Unit - 1 December 2023 for documentation

6.2.1 Nelson

Tasman Regional Landfill Business Unit - Activity Management Plan 2024-34

|

Recommendation to Council

|

|

|

That the

Nelson City Council and Tasman District Councils

1. Receive the Nelson Tasman Regional

Landfill Business Unit Activity Management Plan 2024-34 (1399367370-8789);

and

2. Approve the Nelson Tasman Regional

Landfill Business Unit Activity Management Plan 2023-34 (1399367370-8789) as

the version to inform the development of the Long Term Plan 2024-34.

3. Notes that the Nelson Tasman

Regional Landfill Business Unit Activity Management Plan 2023-24

(1399367370-8789) will be updated, and the final Activity Management Plan

approved by Council after the adoption of the Long Term Plan 2024-2034.

|

6.2.2 Nelson

Tasman Regional Landfill Business Unit - Business Plan 2024-25

|

Recommendation to Council

|

|

|

That

Nelson City Council and Tasman District Councils

1. Receive the Nelson Tasman Regional

Landfill Business Unit Business Plan 2024-25 (1399367370-8784); and

2. Approve

the Nelson Tasman Regional Landfill Business Unit Business Plan

2024-25 (1399367370-8784).

|

6.3 Regional Pest Management Joint

Committee - 8 December 2023

Refer to Regional

Pest Management Committee - 08Dec2023 for documentation

6.3.1 Regional

Pest Management Plan 2019 – 2029 Partial Review Consultation report RRPMC23-12-1

|

Recommendation to Council

|

|

|

That the

Nelson City Council and Tasman District Councils

1. Approves public notification of the draft

Regional Pest Management Plan 2019 – 2029 Partial Review Consultation

document for the partial review of the Tasman–Nelson Regional Pest

Management Plan 2019-2029, commencing 23 February 2024, for a period of one

month, closing on 23 March 2024.

|

7. Mayor's Report 30 - 53

Document number R28118

Recommendation

|

That the Council

1.

Receives the report Mayor’s Report (R28118); and

2.

Approves for consultation in the Long Term Plan 2024-34

Consultation Document that the expected net cost to Council of $59.8 million

for recovery from the August 2022 storm be funded by a separate rate set on a

uniform basis of $330 per rateable unit including GST for the ten year period

2024-25 to 2034-35; and

3.

Approves for consultation in the Long Term Plan 2024-34

Consultation Document:

a.

Separating the stormwater and flood protection activities into a

uniform charge for the former and a rate based on land value for the latter;

b.

Extending the flood protection rate across the region to include the

Nelson North communities;

c.

Changing the uniform charge for flood protection to a rate based on

land value;

d.

Retaining the charge for stormwater as a uniform charge and extending

the exclusion to include properties in the rural zone; and

4.

Requests that officers prepare the Long Term Plan 2024-34

Consultation Document on the basis that the Three Waters Reform does not

proceed and continue, as with previous Long Term Plans, to include provision

for the ongoing management and investment in Council’s drinking water,

wastewater and stormwater assets; and

5.

Approves including in the Long Term Plan 2024-34 Consultation

Document the phasing in of a new Rates Cap Policy of CPI + growth from the

current policy of Local Government Cost Index (LGCI) + 2.5% plus growth with

LGCI + 2.5% plus growth in Year 1, LGCI + 2% plus growth in Year 2, LGCI +

1.5% plus growth in Year 3, LGCI + 1% plus growth in Year 4 and CPI + growth

for Years 5-10; and

6.

Approves for consultation in the Long Term Plan 2024-34

Consultation Document an increase of the Debt Cap Policy from the Long Term

Plan 2021-31 of net external debt not exceeding 175% of Council revenue to a

new debt cap of not exceeding 200% of Council revenue; and

7.

* Approves for consultation in the Long Term Plan 2024-34

Consultation Document the proposed write-off of the Nelson Centre of Musical

Arts’ debt to Council of $730,000 at $73,000 per year over the 10 years

of the Long Term Plan; and

8.

Approves for consultation in the Long Term Plan 2024-34

Consultation Document capital funding of $200,000 in Year 1 (2024-25) and

$3.05 million in Year 2 (2025-26) to enable stage one and two of the

Tāhunanui Beach upgrade to be progressed, noting the Nelson Surf Life

Saving Club facility development requires a 50% contribution from the club of

$1.6 million ;and

9.

* Approves for consultation in the Long Term Plan 2024-34

Consultation Document that $1.6 million be allocated in Year 4 (2027-28) of

the Plan for the development of a central city community arts hub; and

10.

* Approves including in the Long Term Plan 2024-34 Consultation

Document capital funding of $1.3250 million in Year 2 (2025-26) and

$1.325 million in Year 3 (2026-27) for an all-weather sports turf, noting

that sports clubs would be required to contribute 50% of the cost

($1.325m). and

11.

Approves for consultation in the Long Term Plan 2024-34

Consultation Document that net capital funding $4 million per year in Years

4, 5 and 6 (2027-28, 2028-29 and 2029-30) be included for a new road link

between Hill Street North and Suffolk Road, subject to NZ Transport

Agency-Waka Kotahi subsidies, significant development contributions from

adjoining developments and possible contributions from Tasman District

Council; and

12.

* Approves for consultation in the Long Term Plan 2024-34

Consultation Document capital funding for Council’s share of the

east-west cycle link with $0.5 million in Year 2, $4 million in Year 3 and

$0.9 million in Year 4, subject to receiving the 51% NZ Transport Agency-Waka

Kotahi Funding Assistance Rate subsidy; and

13.

Approves for consultation in the Long Term Plan 2024-34

Consultation Document removal of the kerbside kitchen waste collection

service funding, provided for in the previous LTP 2021-31, resulting in

savings of $75,000 in Year 1, $76,650 in Year 2, $104,550 in Year 3, $1.471

million in Year 4, $1.476 million in Year 5, $1.507 million in Year 6, $1.537

million in Year 7, $1.515 million in Year 8, $1.539 million in year 9 and

$1.573 million in Year 10, totalling $10.875 million in savings; and

14.

* Approves for consultation in the draft Long Term Plan 2024-34

budget sufficient funding, estimated at $100,000 per annum, to maintain the

city hanging flower baskets; and

15.

Approves for consultation in the Long Term Plan 2024-34

Consultation Document an events budget capped at $1.780 million (the current

2023-24 budget) for each year, resulting in savings over the current draft

LTP of $60,000 in Year 1 (2024-25), $225,000 in Year 2 (2025-26), $180,000 in

Year 3 (2026-27) and totalling $3 million over the 10-year LTP and for

Council officers to review the proposed events programme and budgets

including exploring greater sponsorship and partnering so as to achieve the

optimum economic, community and cultural benefits within this capped

budget.and

16.

Agrees that the Chief Executive and His Worship the Mayor

continue to work on refining the Long Term Plan budget so as to temper the

rates increases, as long as any refinements are consistent with Council

discussions or decisions, prior to the finalising of the LTP Consultation

Document by Council in March.

|

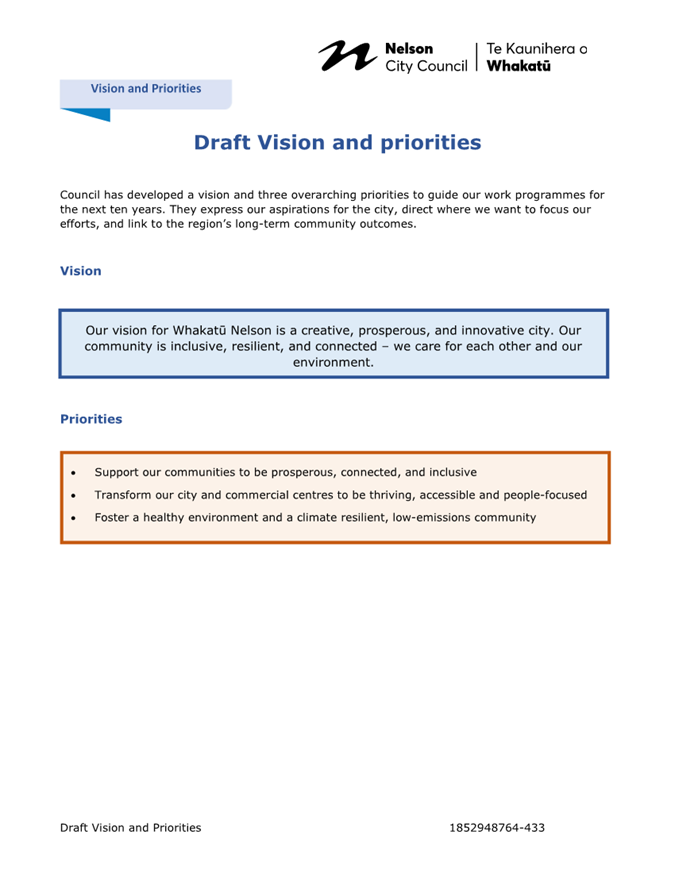

8. Long Term Plan

2024-2034 Supporting Information and change to Rates Remission Policy 54 - 89

Document number R28167

Recommendation

|

That

the Council

1. Receives the report Long Term Plan

2024-2034 Supporting Information and change to Rates Remission Policy

(R28167) and its attachments (1852948764-433, 1852948764-460,

1852948764-398, 1852948764-399, 1852948764-265);

and

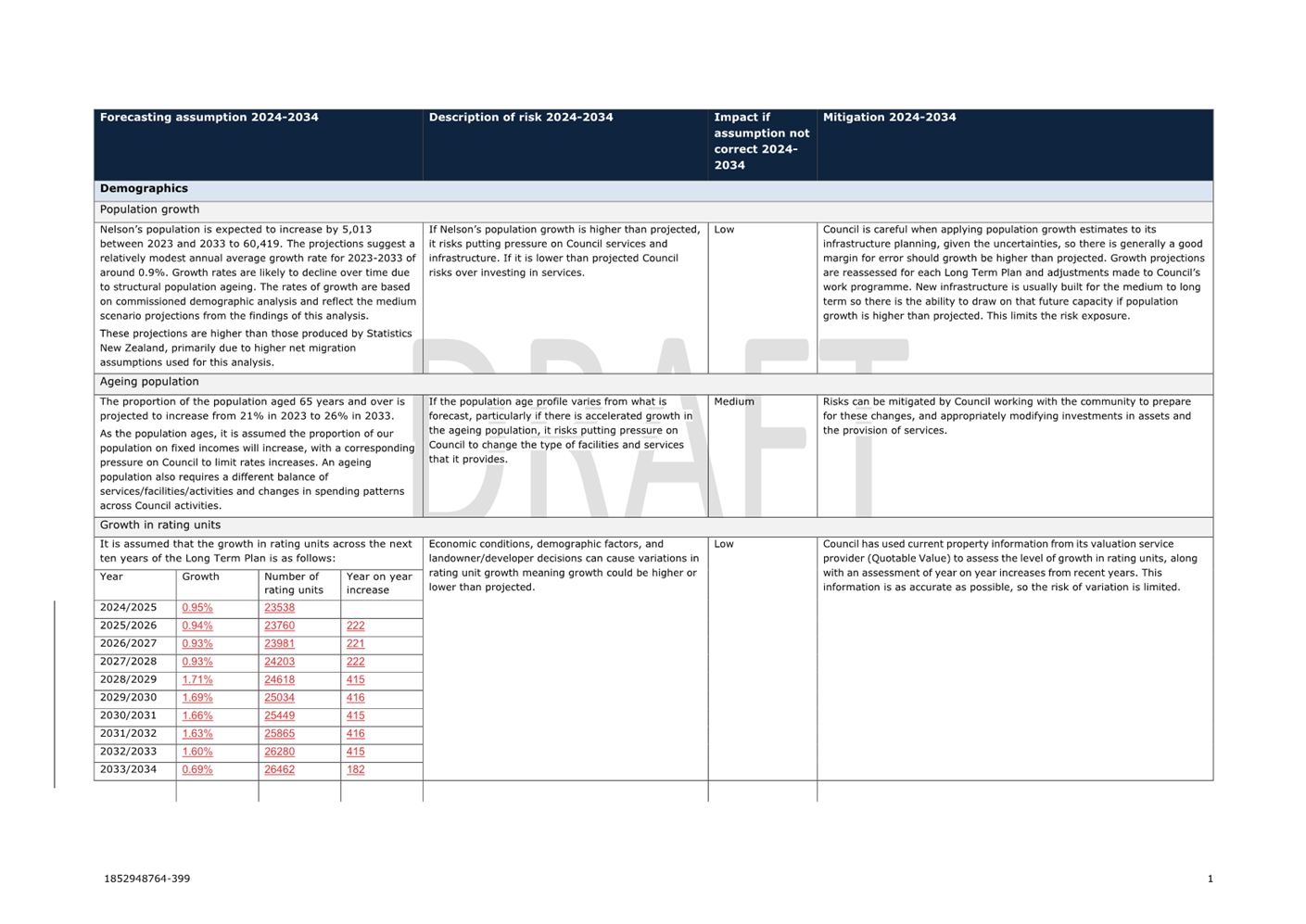

2. Adopts the following documents as

supporting information for Nelson’s Long Term Plan 2024-2034 Consultation

Document as required by section 93G of the Local Government Act 2002:

2.1 Draft

Vision and Priorities (1852948764-433)

2.2 Draft

Community Outcomes (1852948764-460)

2.3 Draft Statement on Fostering Māori Participation in

Council Decision Making (1852948764-398)

2.4 Draft Forecasting Assumptions (1852948764-399); and

3. Agrees that

His Worship Mayor Hon Dr Smith and the Chief Executive be delegated authority

to approve any minor amendments required to the supporting information

included in Report R28167, prior to it being made available for public

consultation, including any amendments necessary to address any legislative

requirements prior to the consultation occurring; and

4. Adopts the revised Draft Rates

Remission

Policy

(1852948764-265),

updated to remove the Heritage Buildings remission, for public consultation

in accordance with sections 102, 109, 82 and 82A of the Local Government Act

2002; and

5. Notes that Council has previously

agreed to the consultation on the Draft Rates Remission Policy occurring at

the same time as the Long Term Plan 2024-2034 consultation process, and that

His Worship Mayor Hon Dr Smith and the Chief Executive may approve any minor

amendments to the Policy prior to it being made publicly available.

|

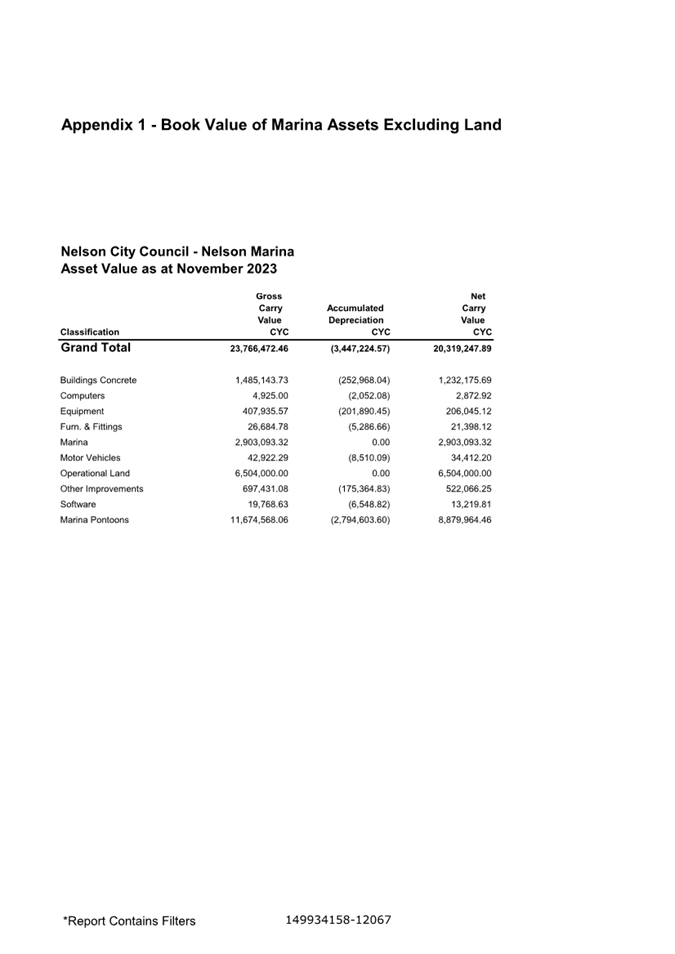

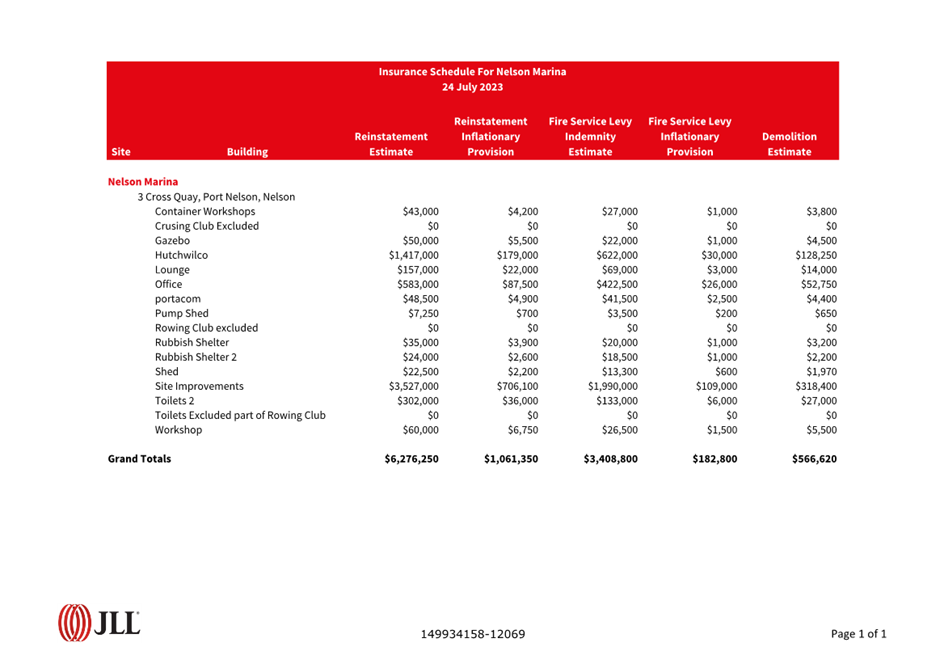

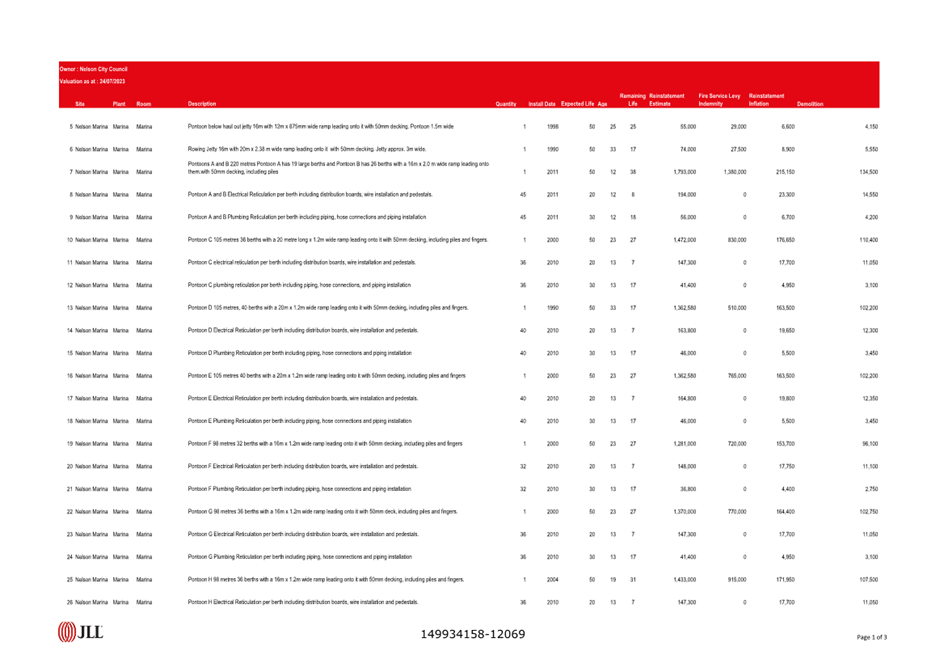

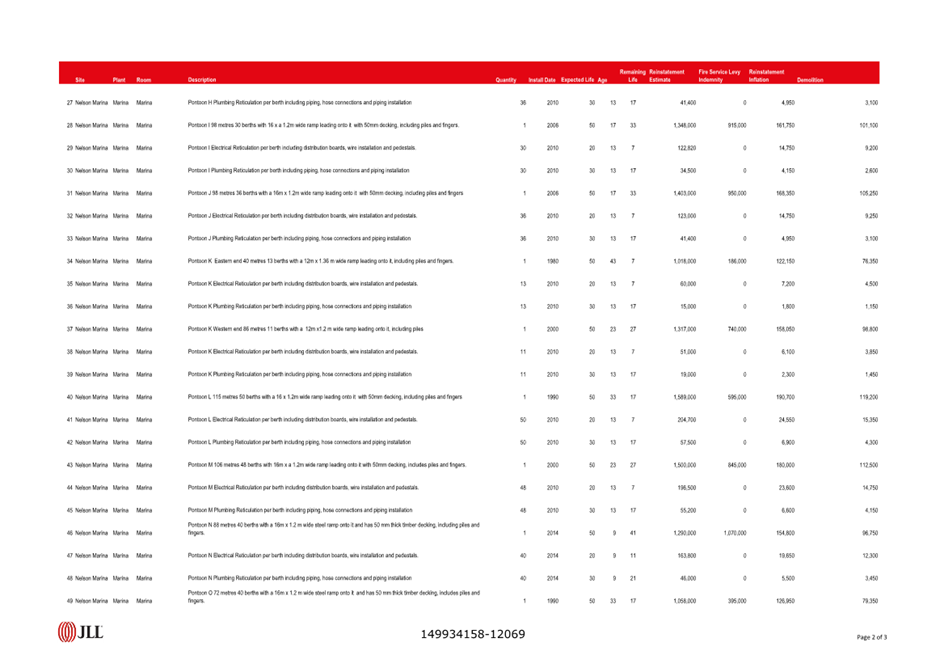

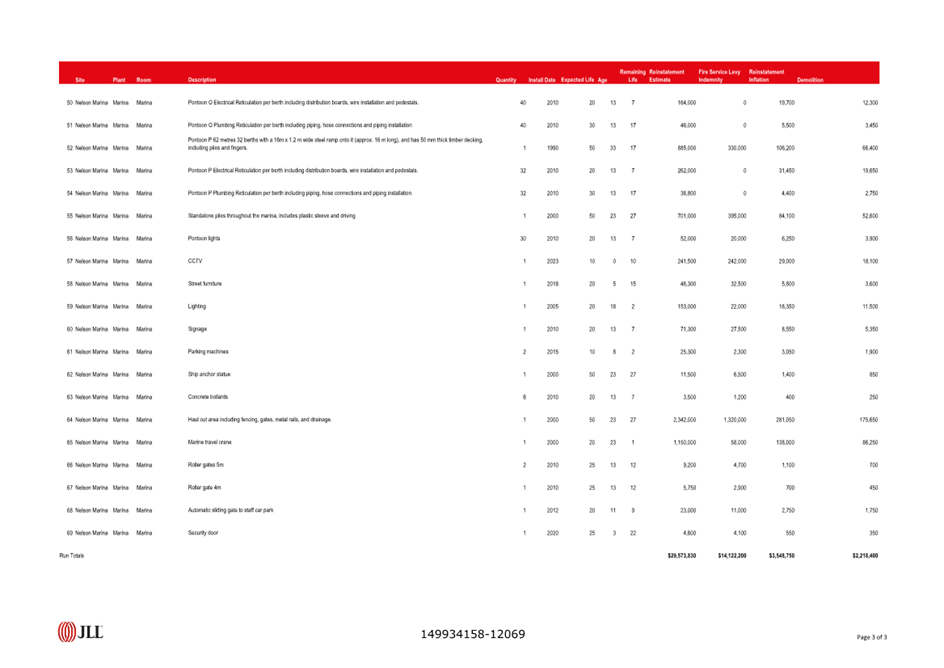

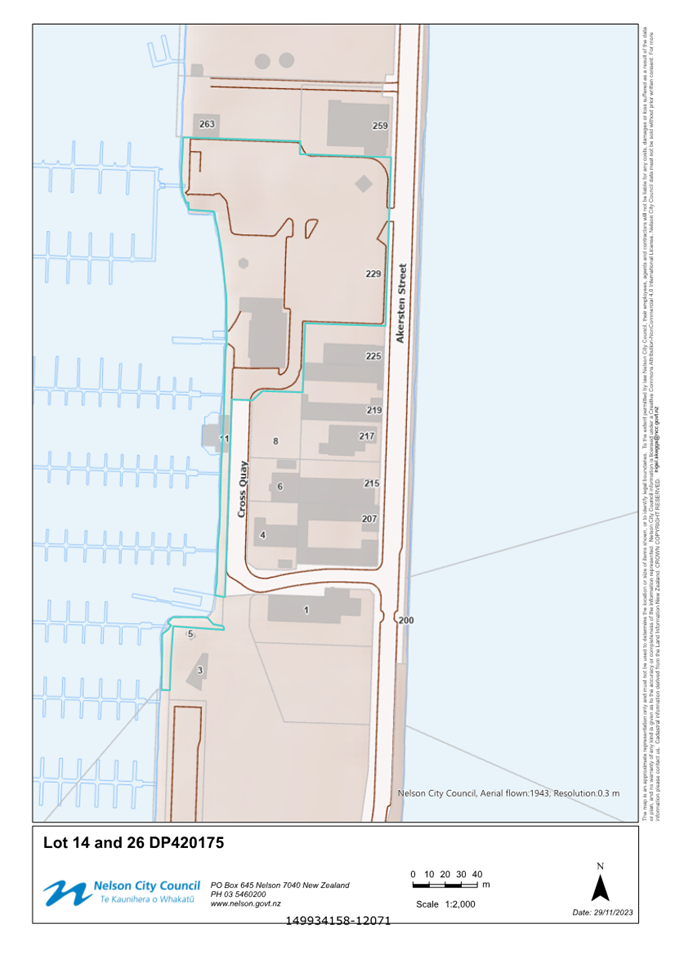

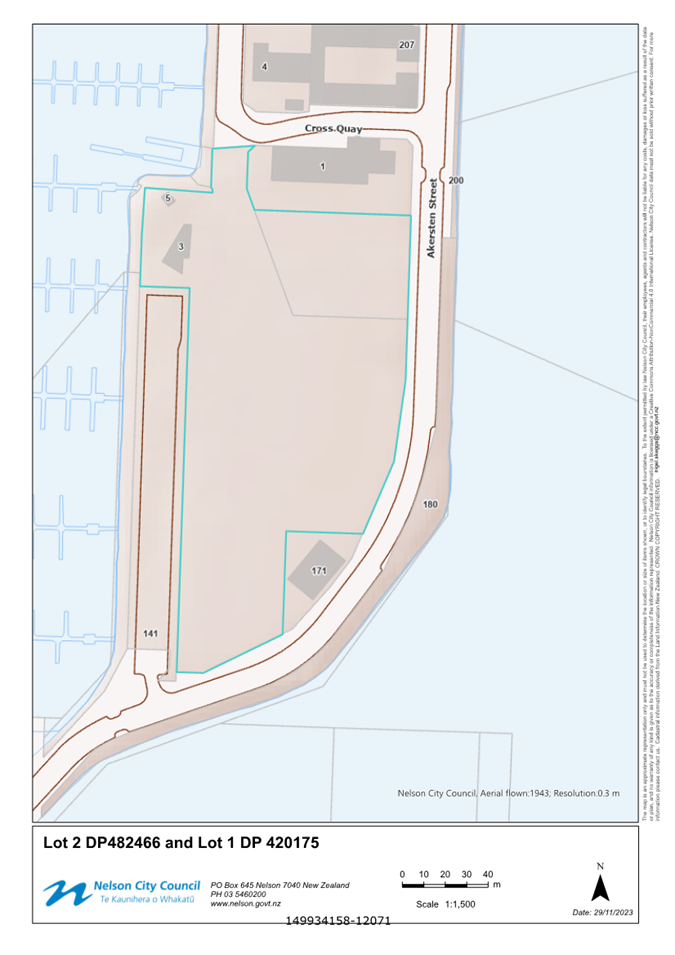

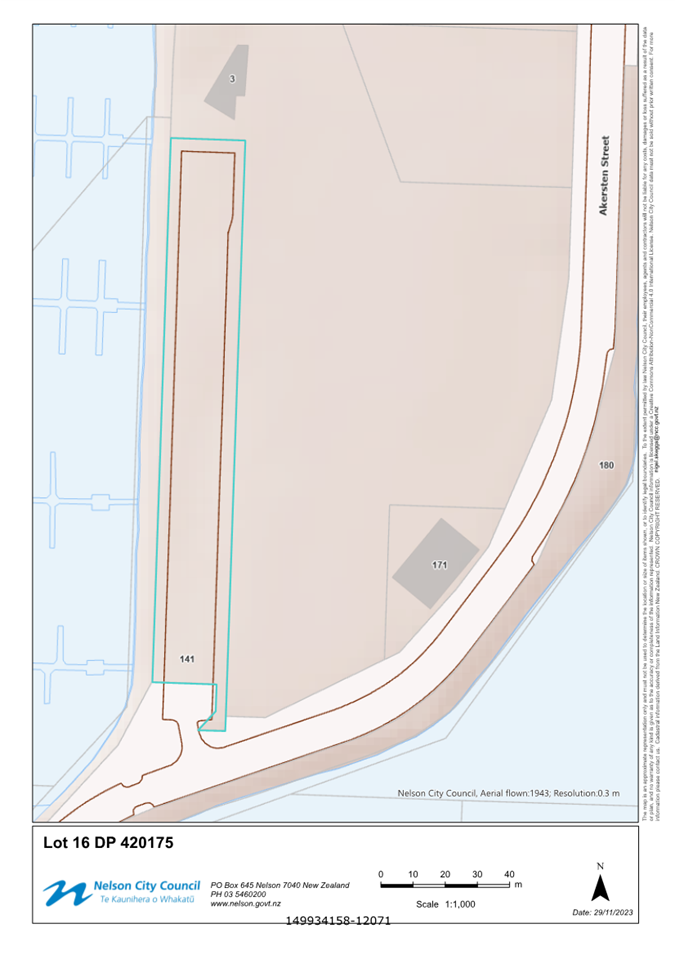

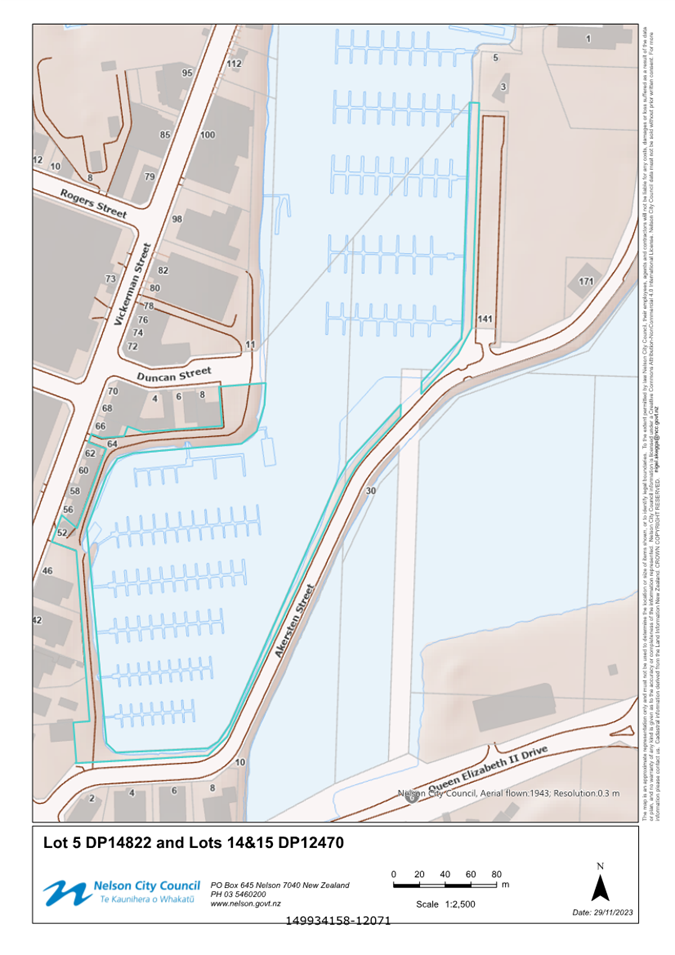

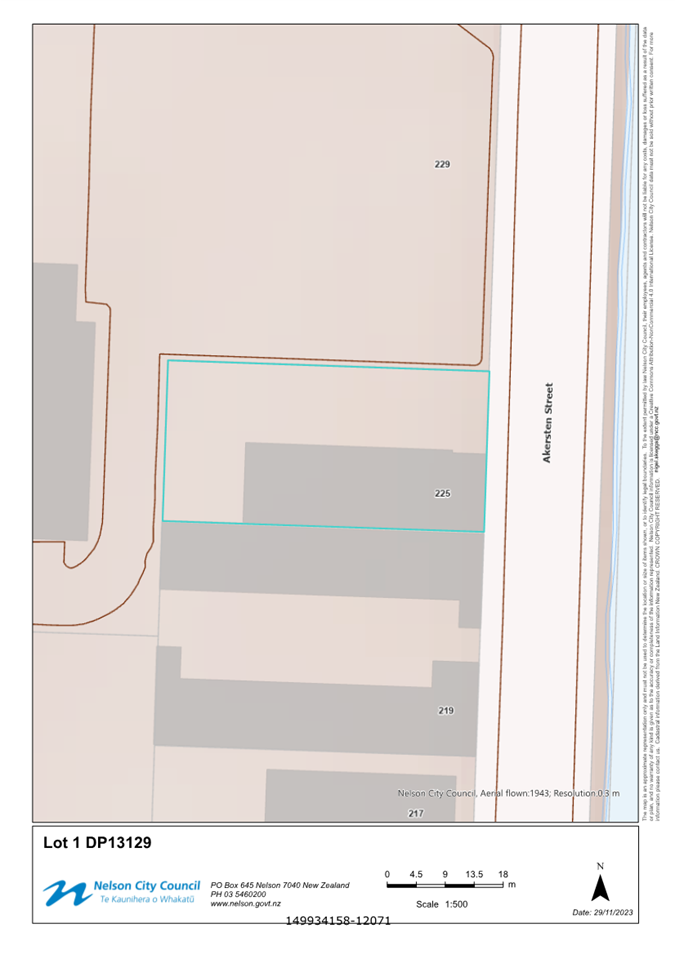

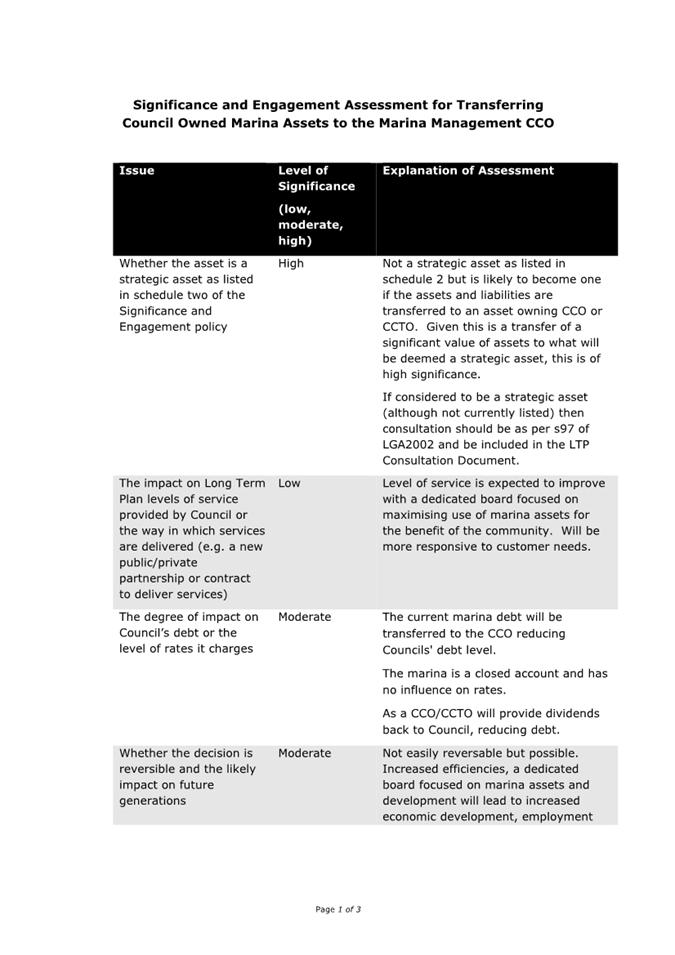

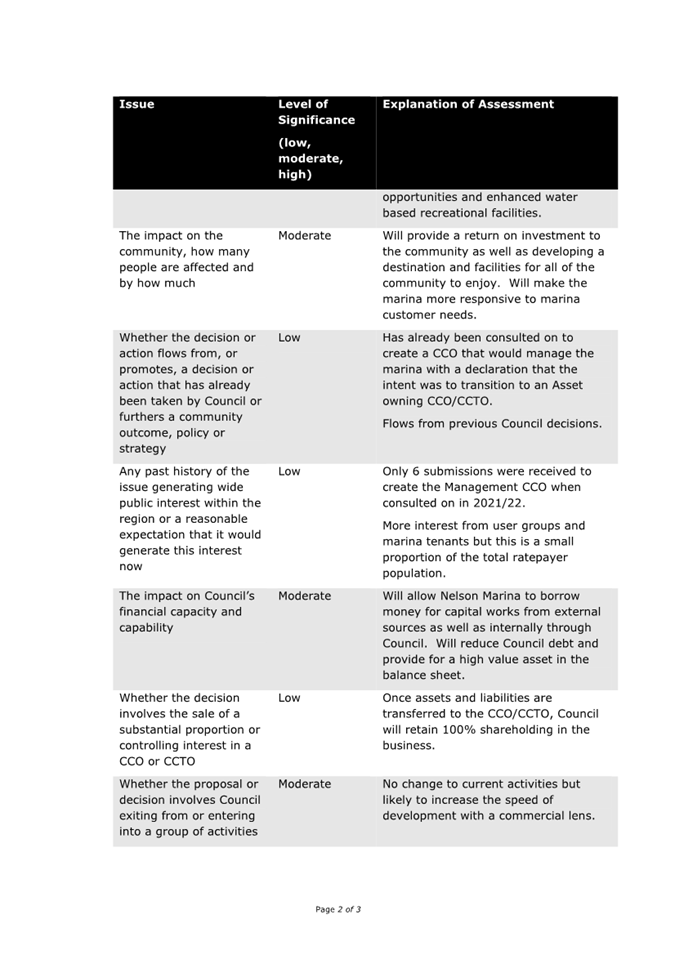

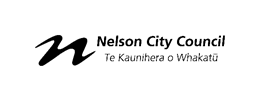

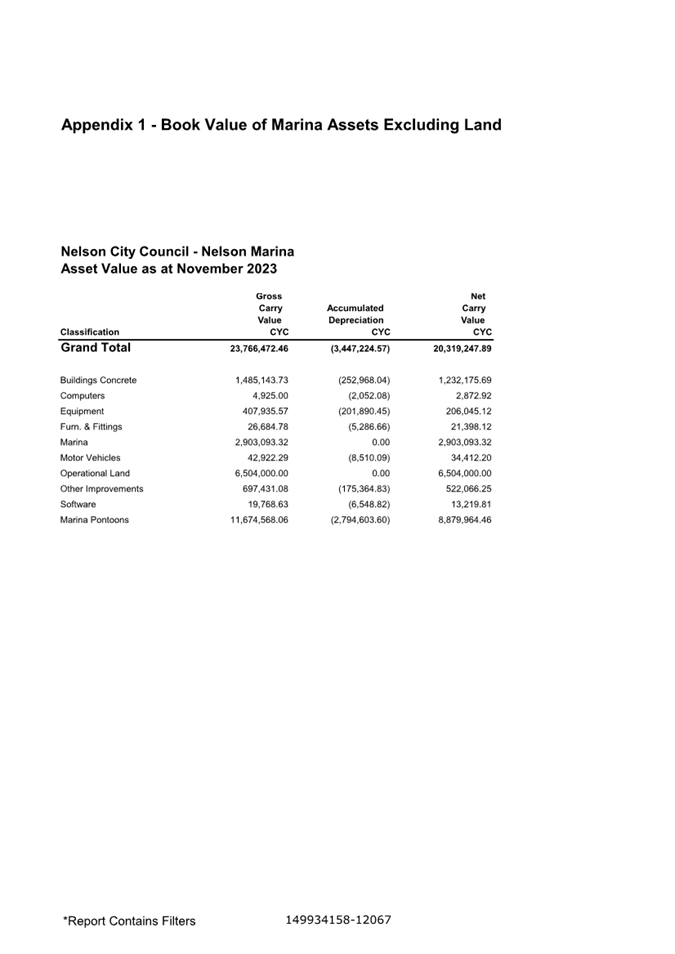

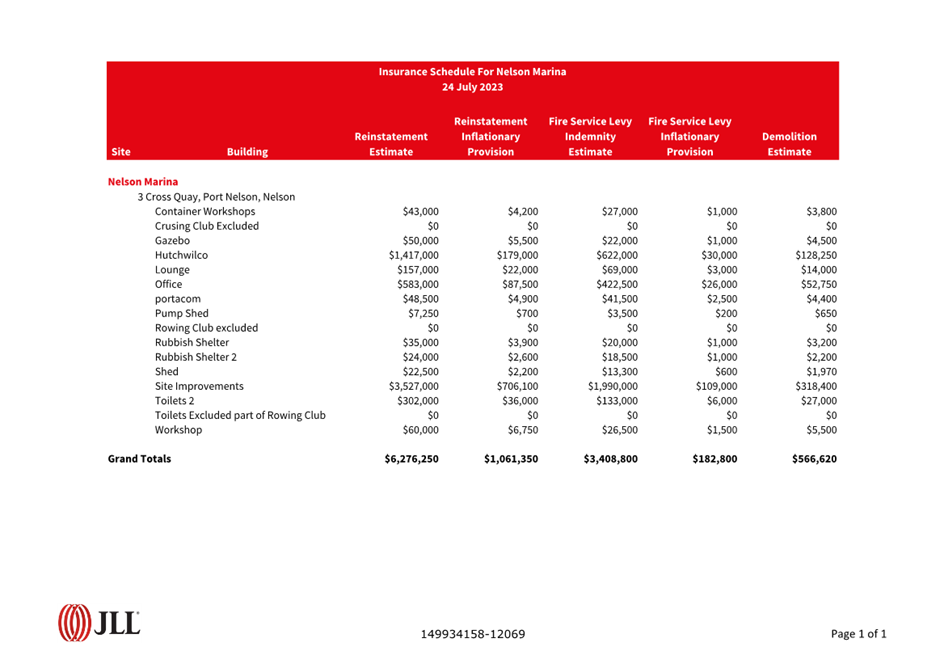

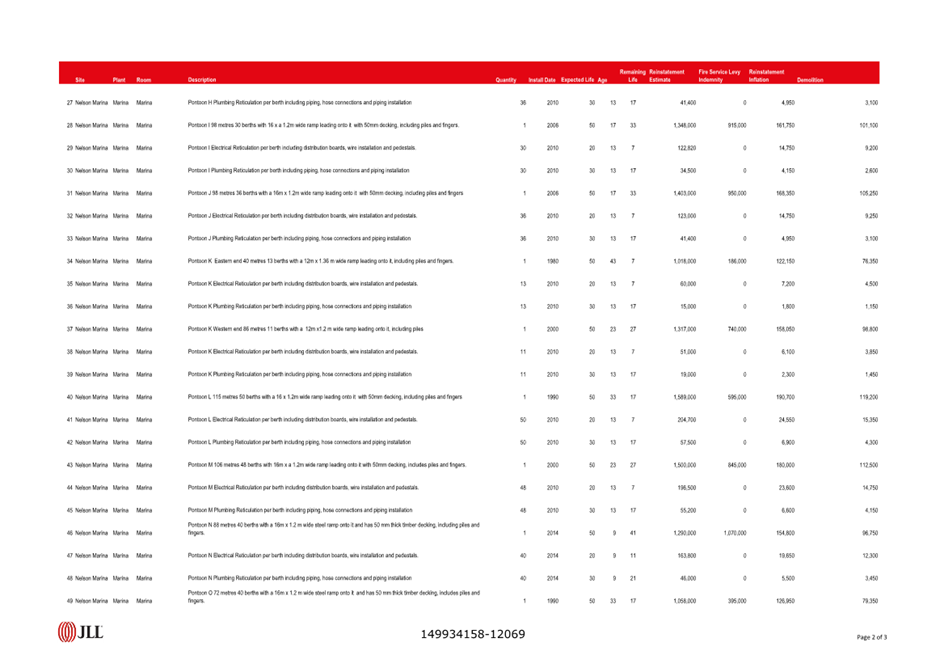

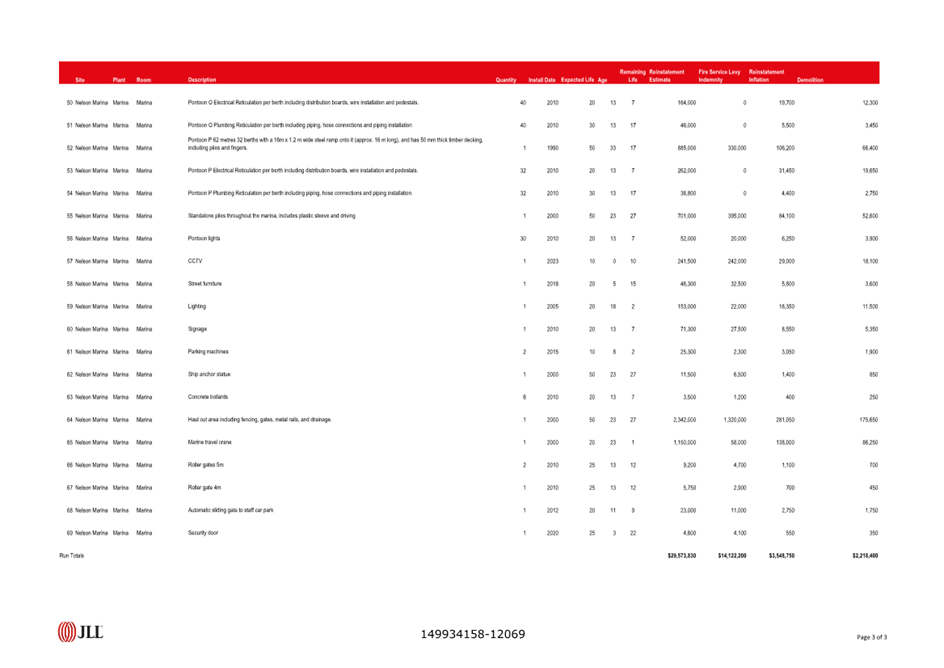

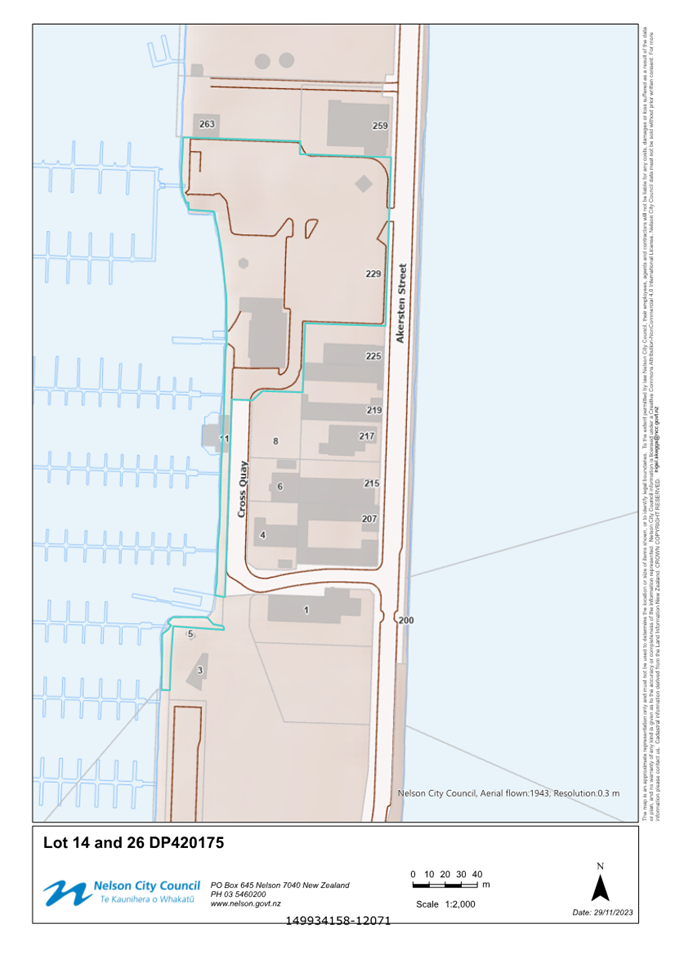

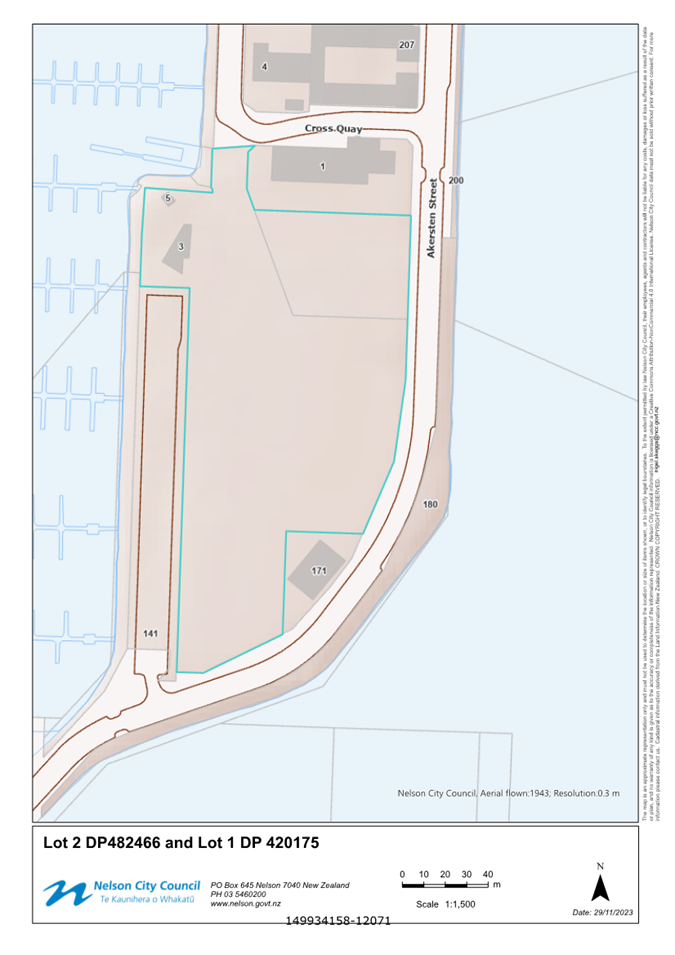

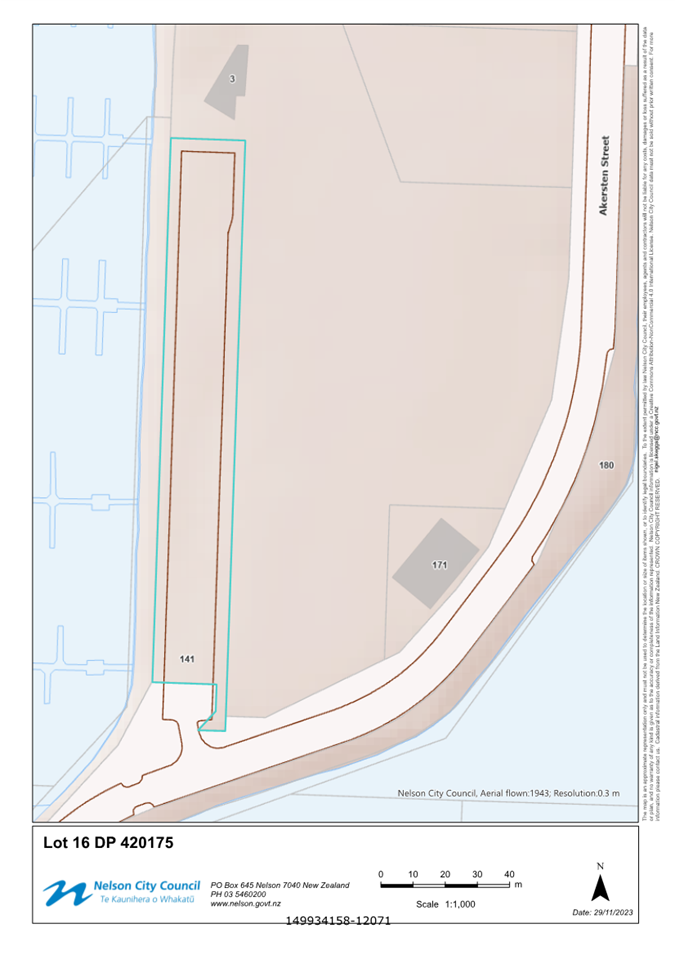

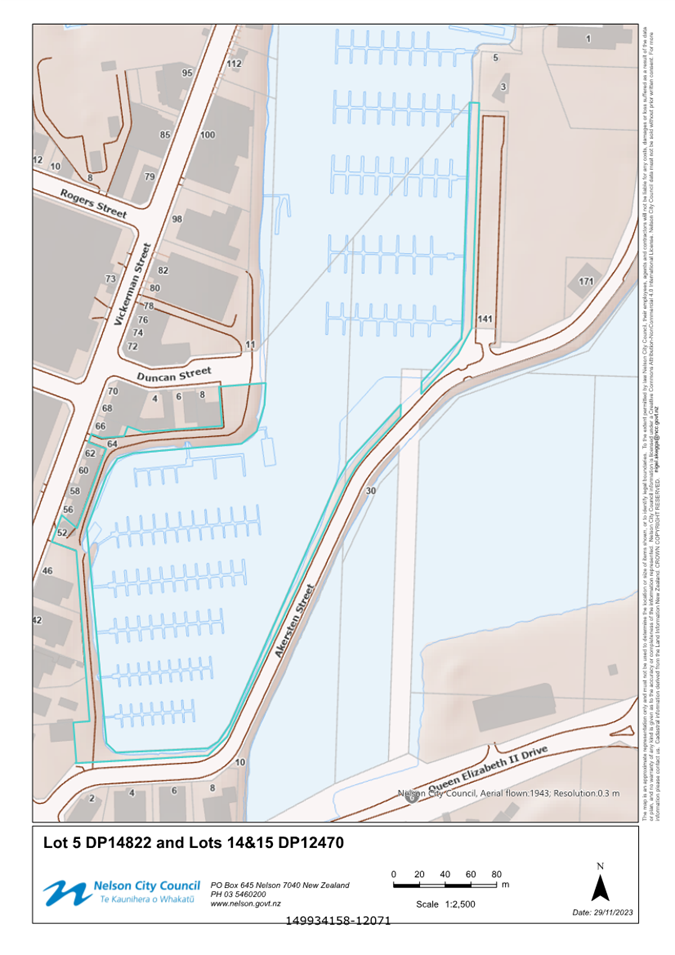

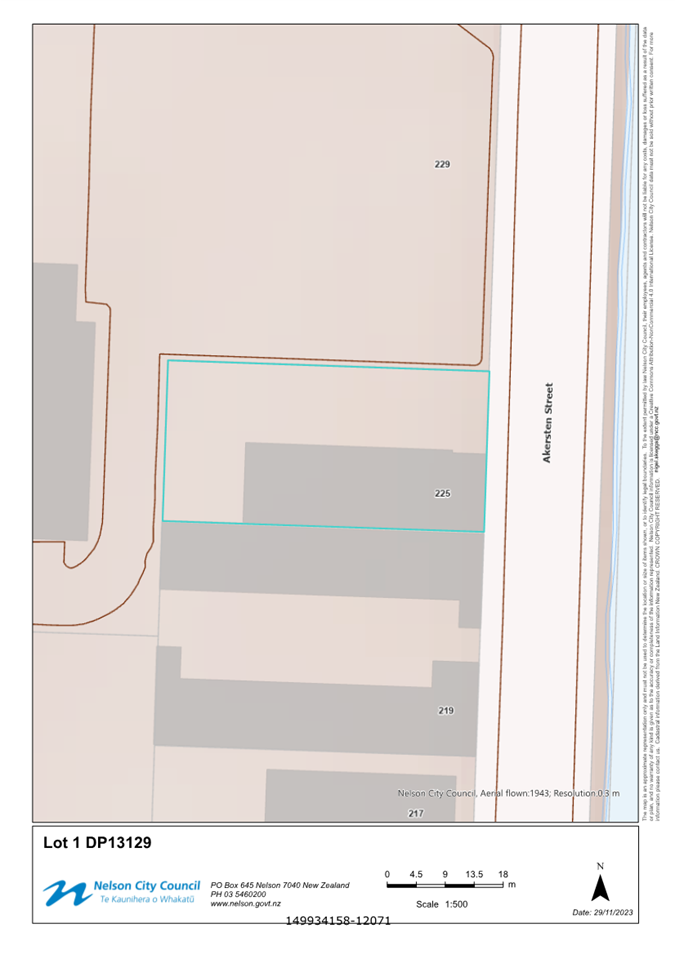

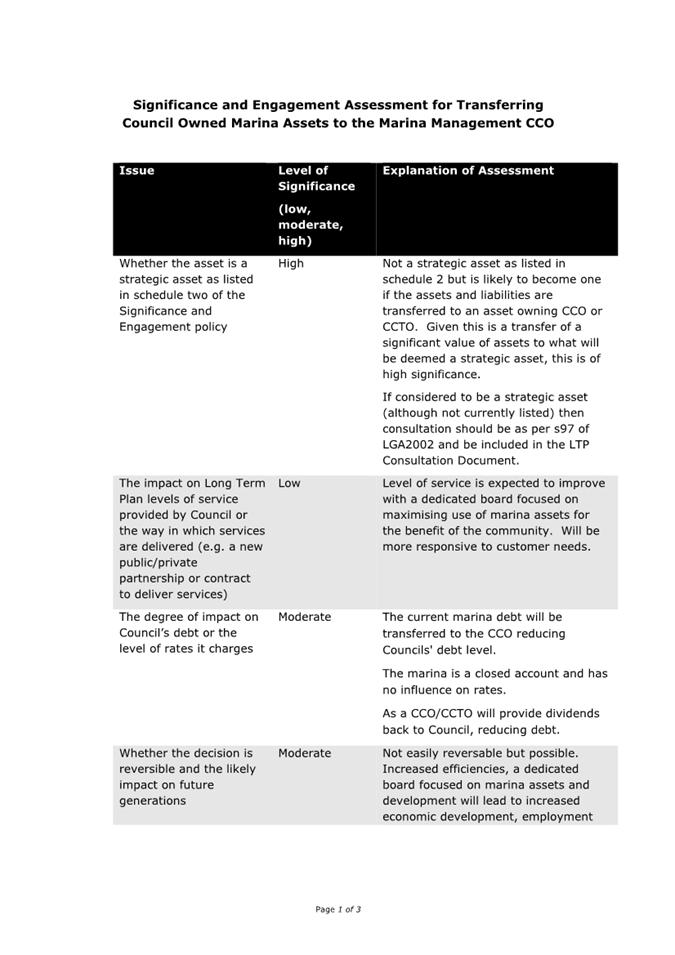

9. Change in Marina Governance

from Management CCO to Asset Owning CCO - Transfer of Marina Assets and

Liabilities to CCO 90 - 119

Document number R28179

Recommendation

|

That

the Council

1. Receives the report Change in

Marina Governance from Management CCO to Asset Owning CCO - Transfer of

Marina Assets and Liabilities to CCO (R28179) and its attachments

(149934158-12067, 149934158-12069, 149934158-12071, and 149934158- 12096);

and

2. Approves the establishment of an

Asset Owning Council Controlled Organisation as the preferred governance

model for Nelson Marina; and

3. Agrees, subject to consultation, to

provide for the transfer of the Marina assets and liabilities to the Marina

CCO in the Long Term Plan; and

4. Agrees to consult with the

community through the Long Term Plan 2024-34 Consultation document on the

change from a Management Council Controlled Organisation to an Asset Owning

Council Controlled Organisation for Nelson Marina, and the transfer of the

Council’s Marina assets to that CCO.

|

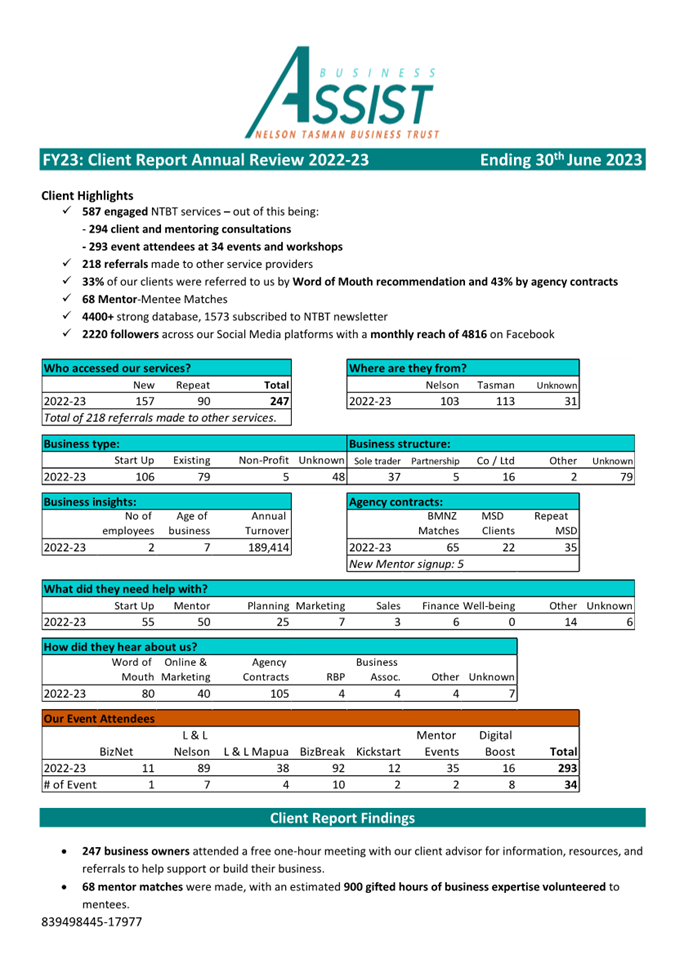

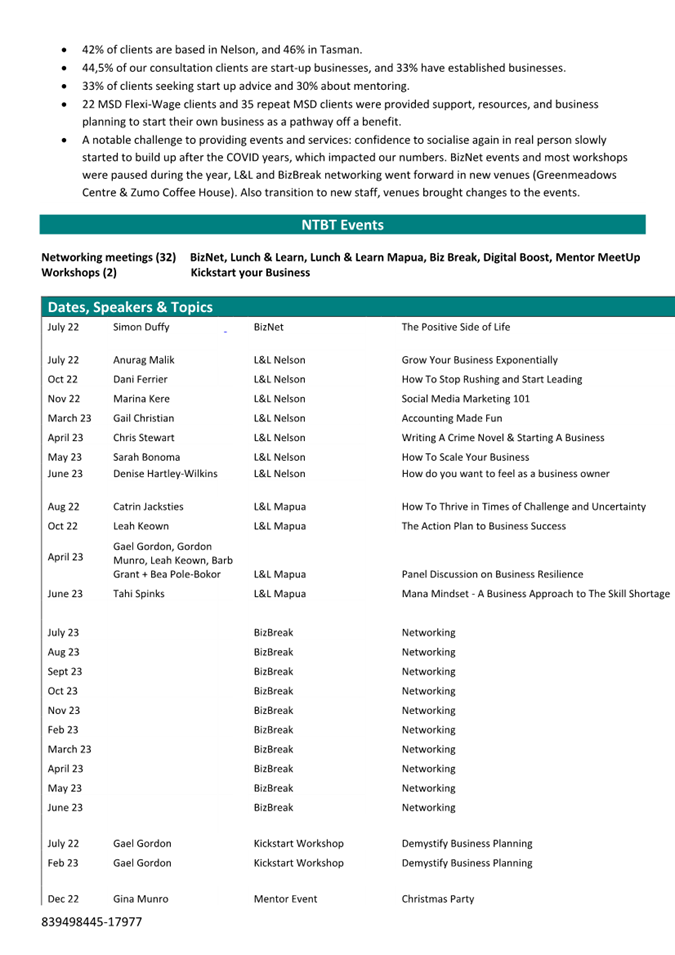

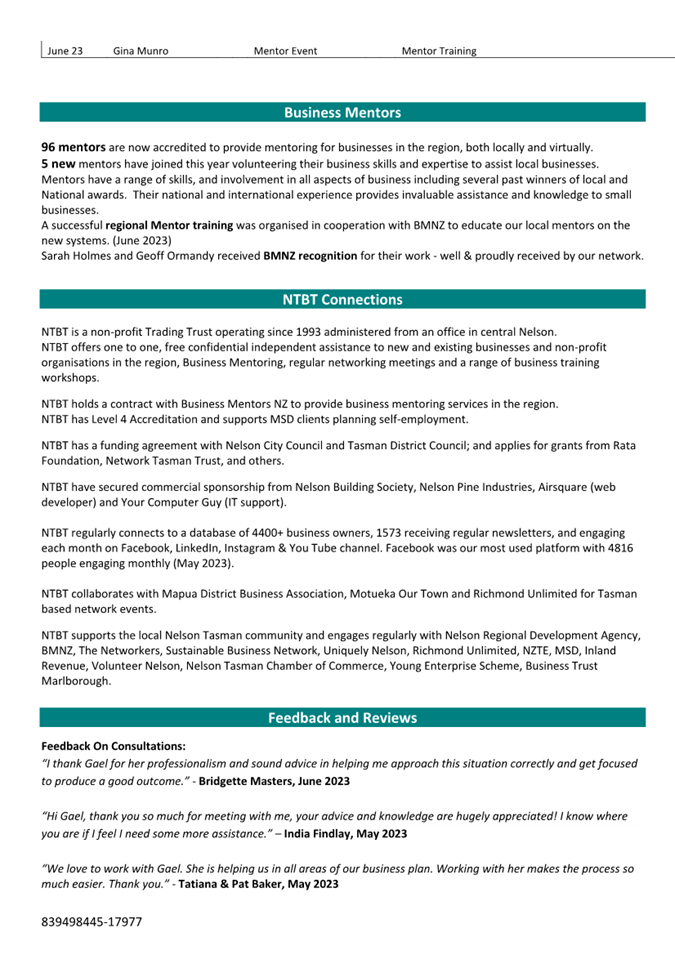

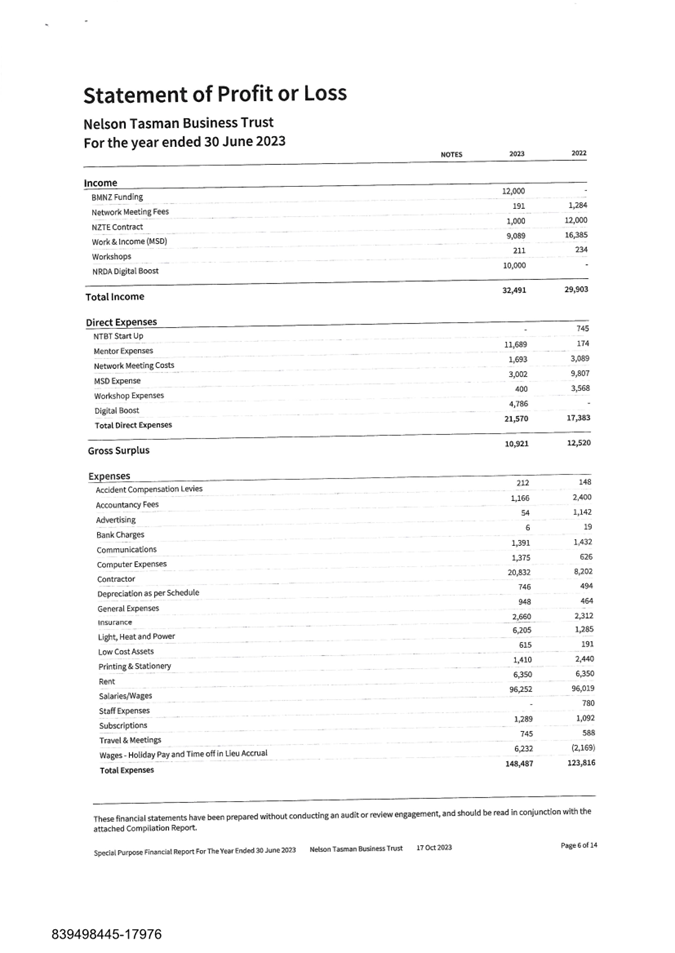

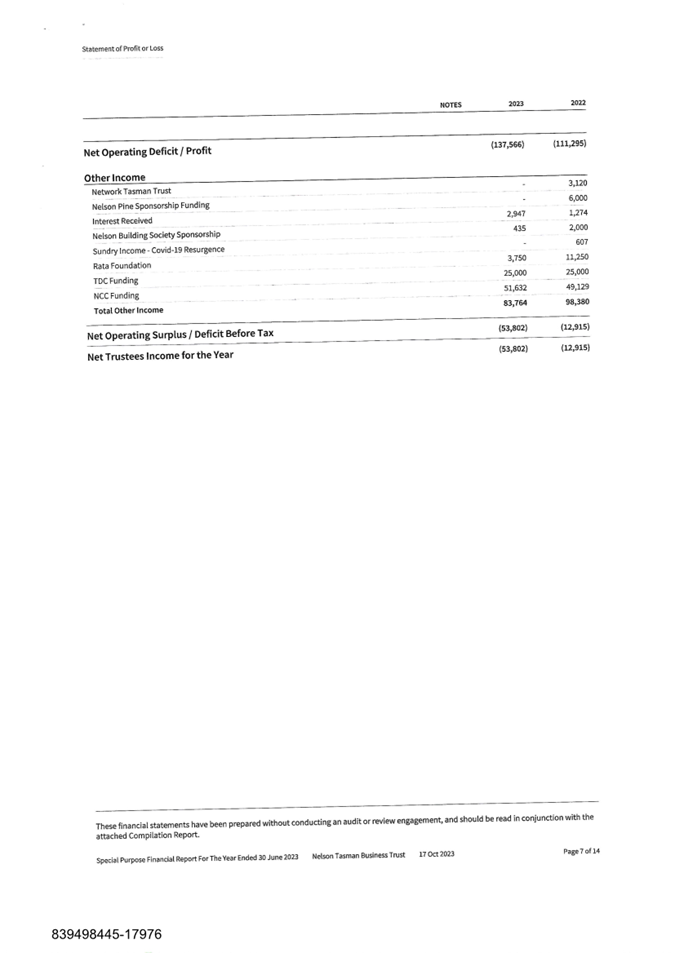

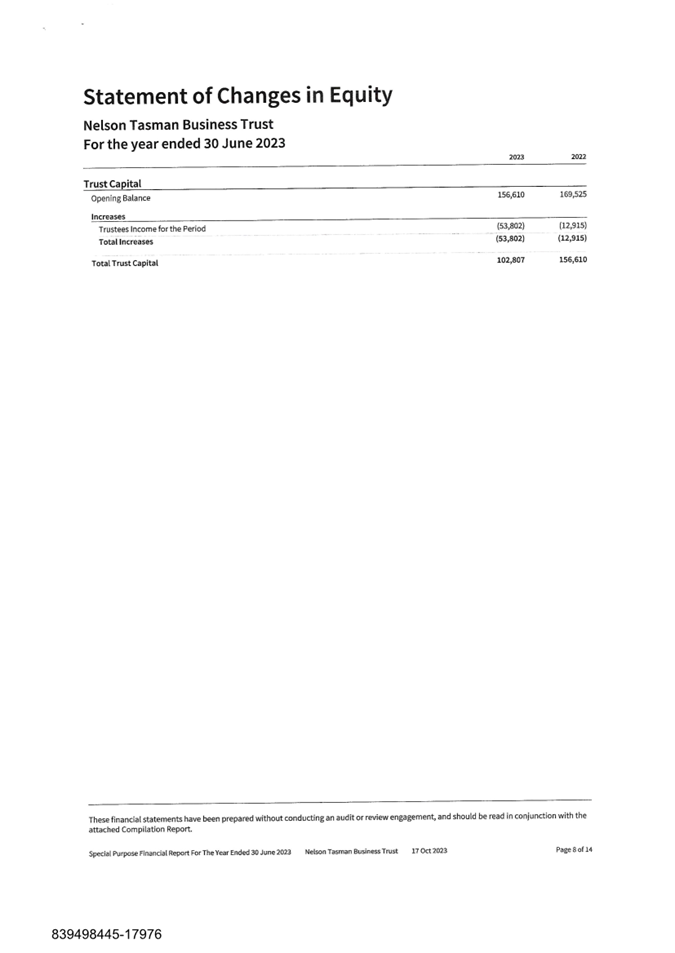

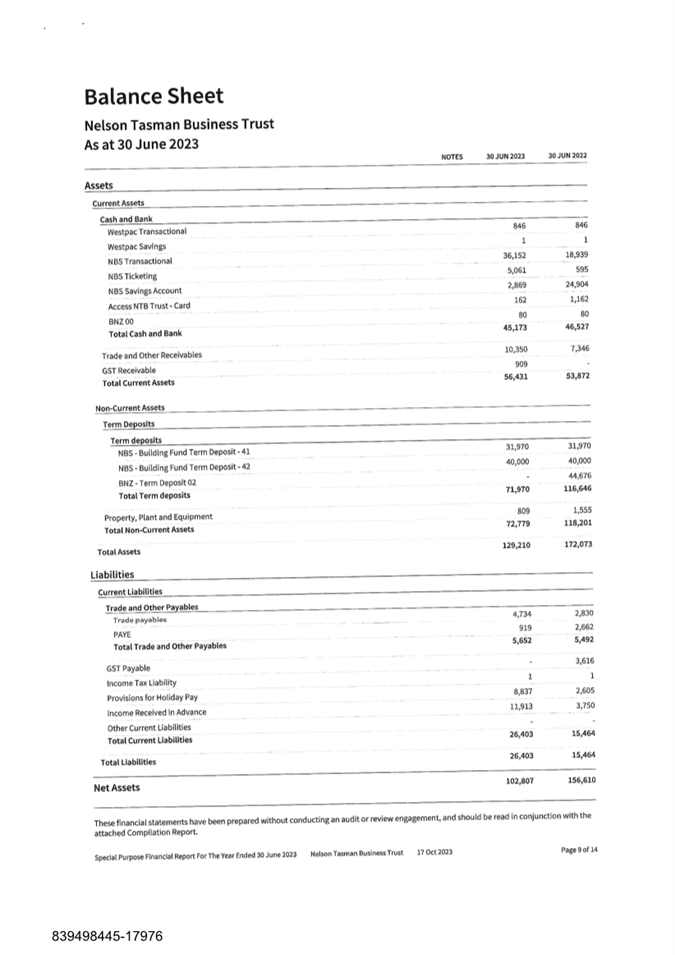

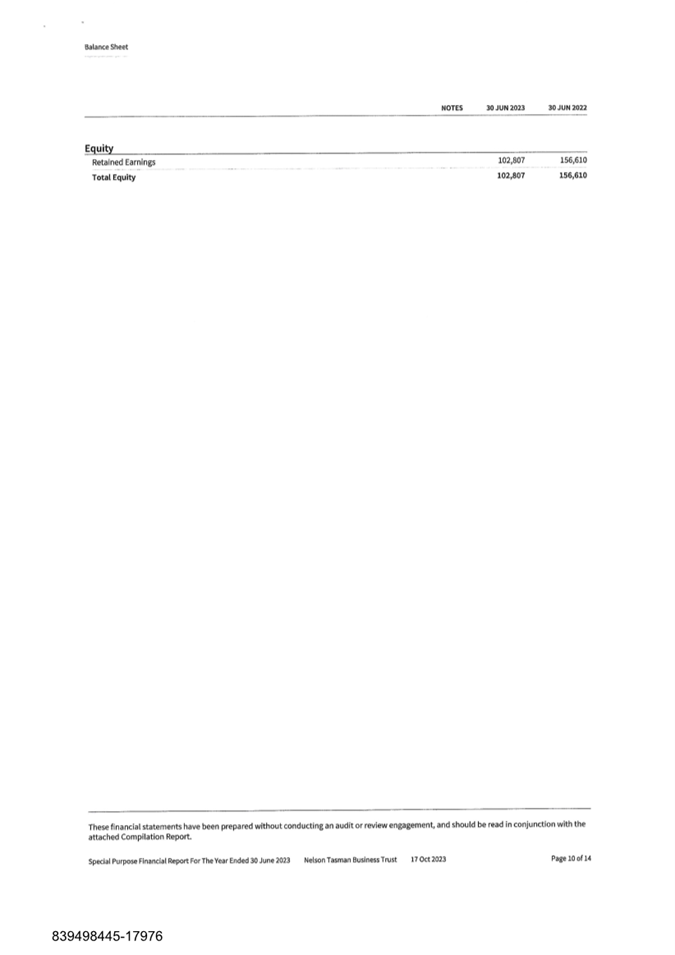

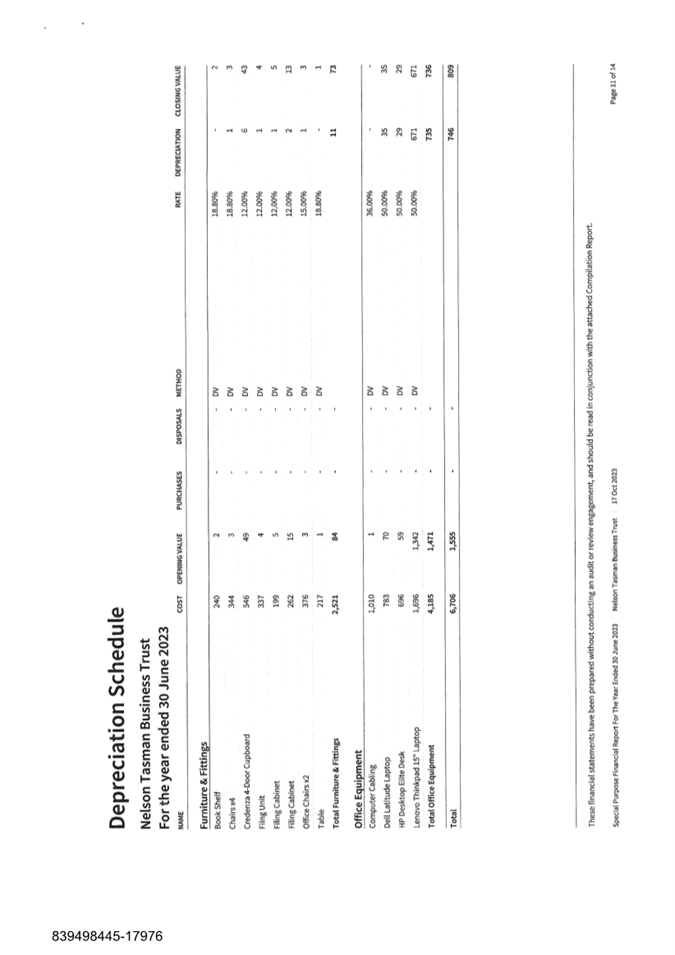

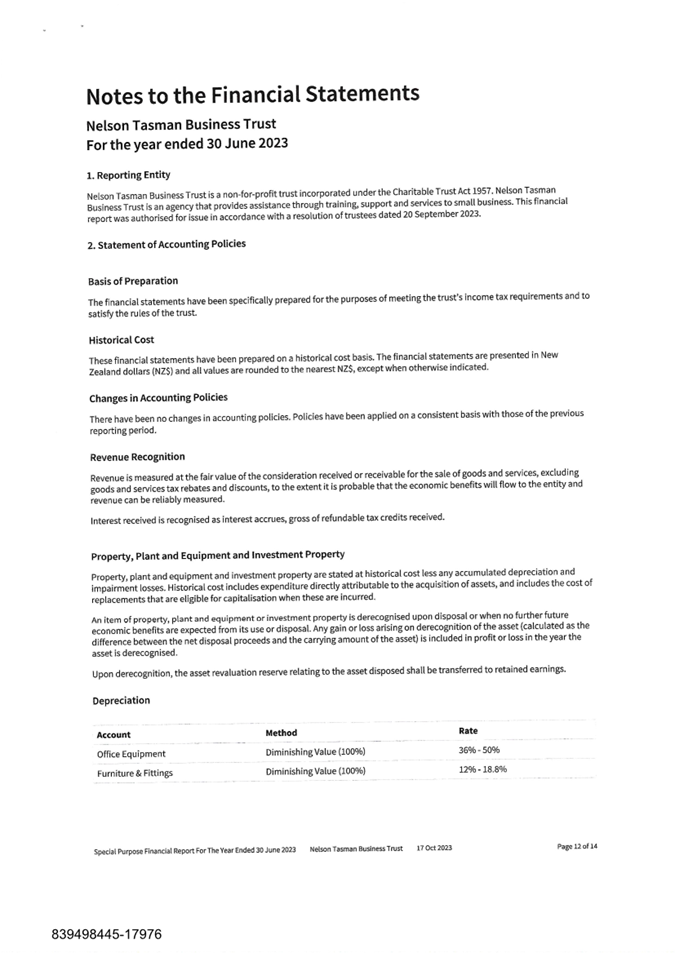

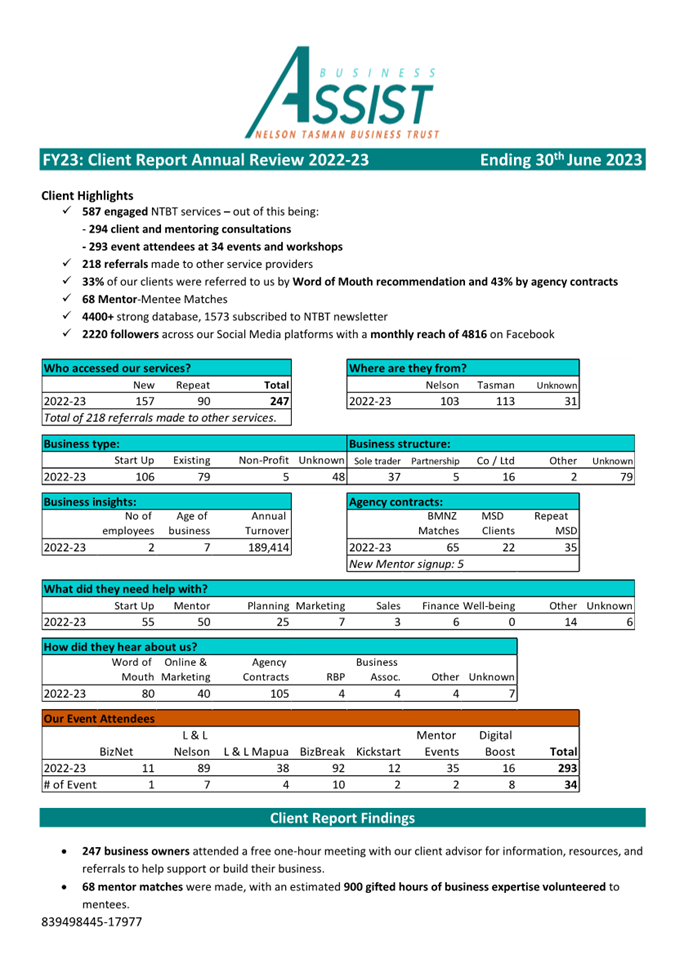

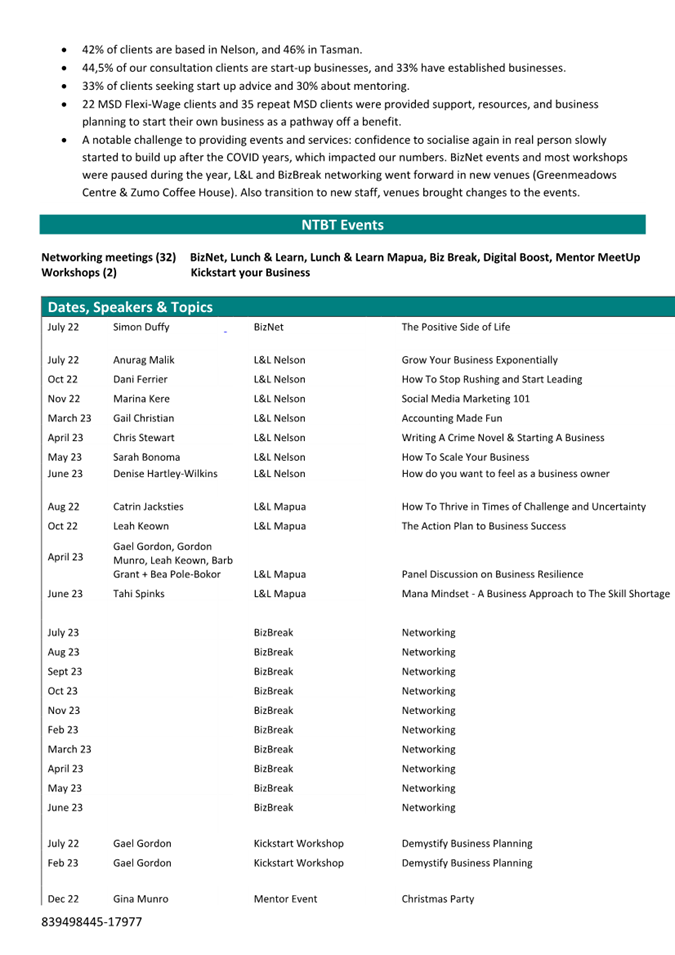

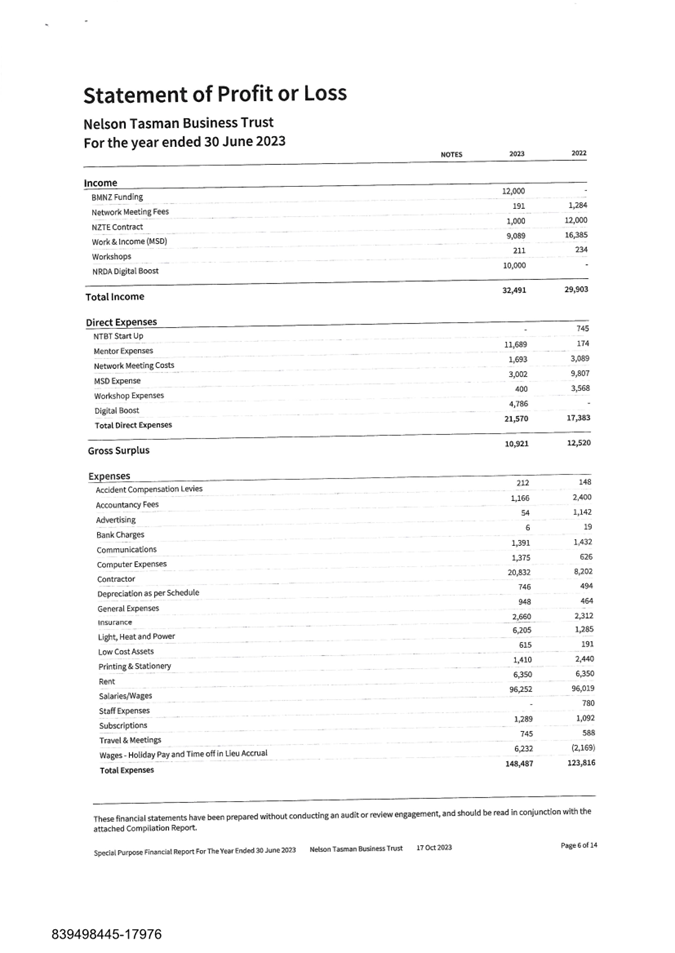

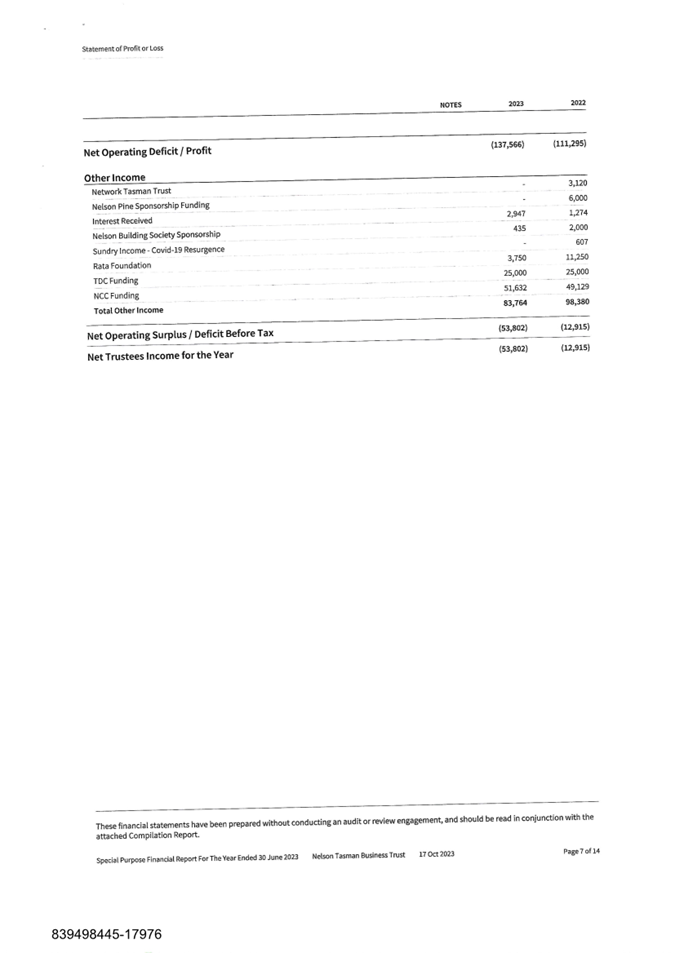

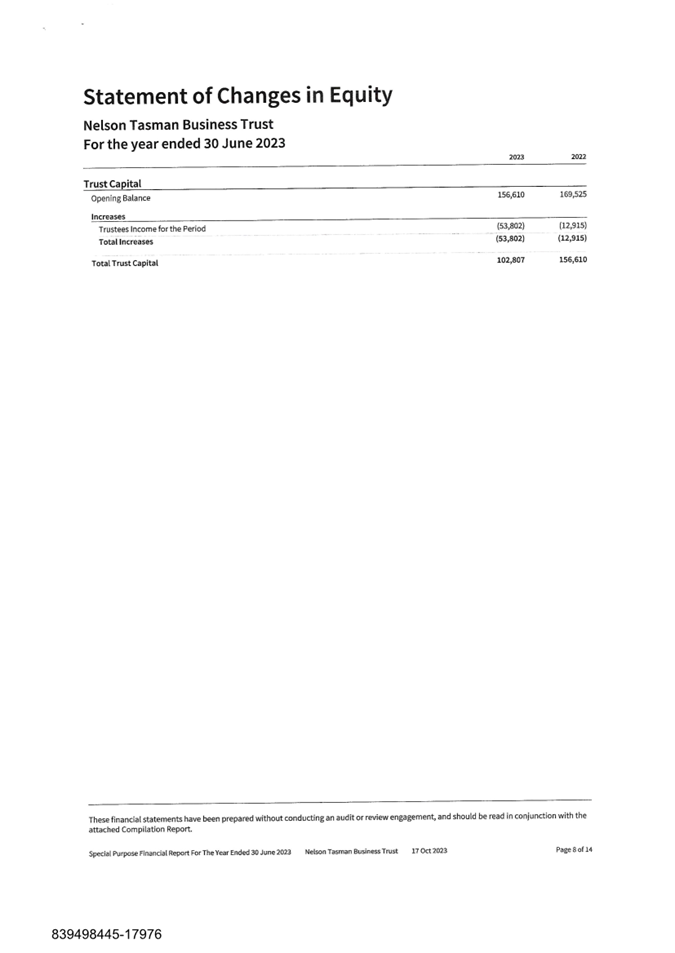

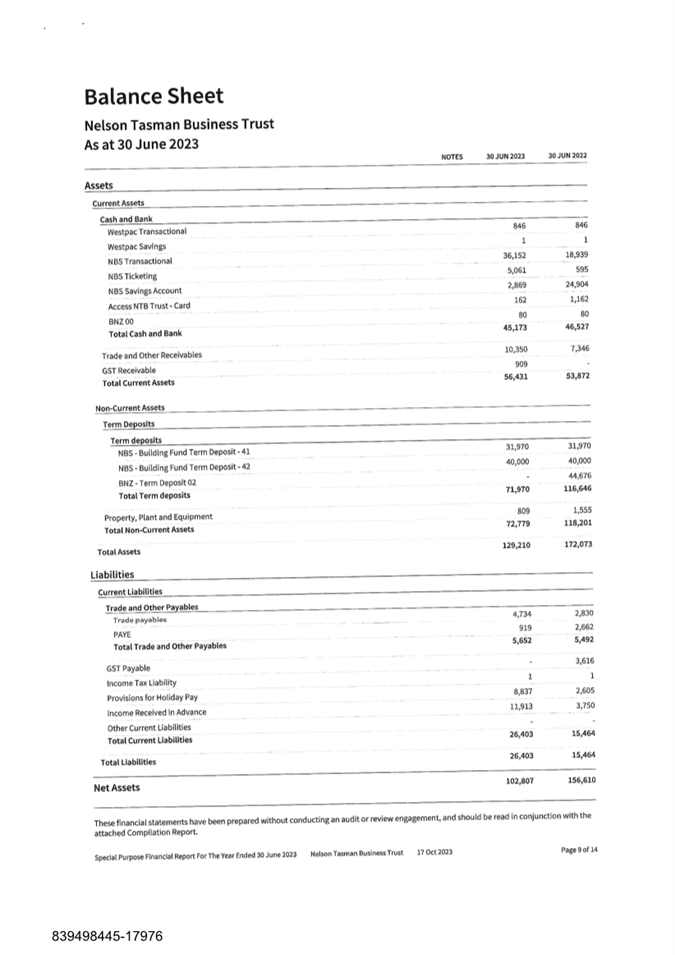

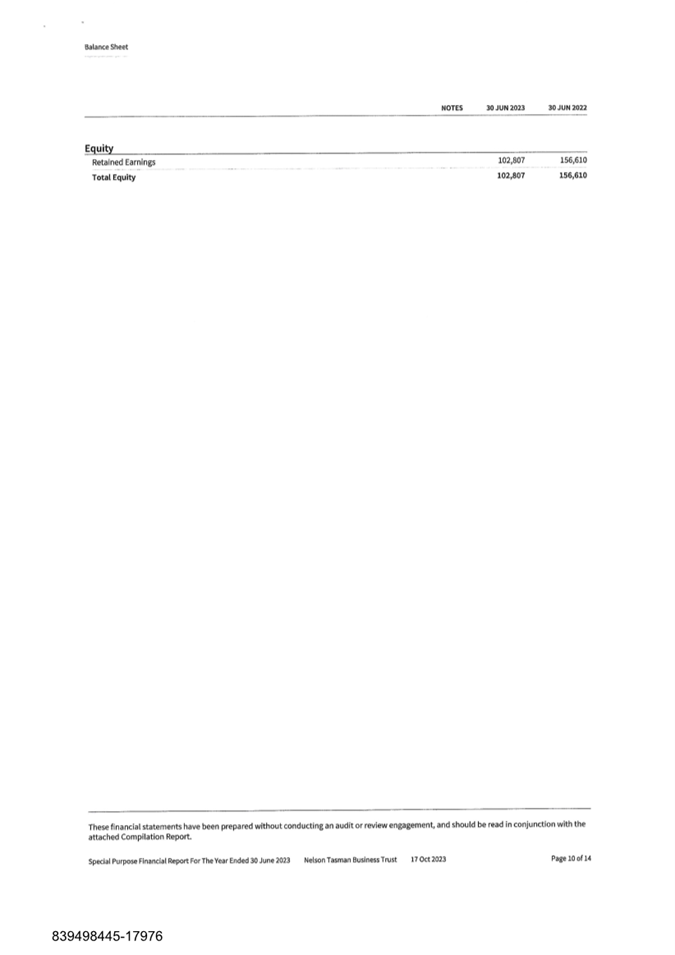

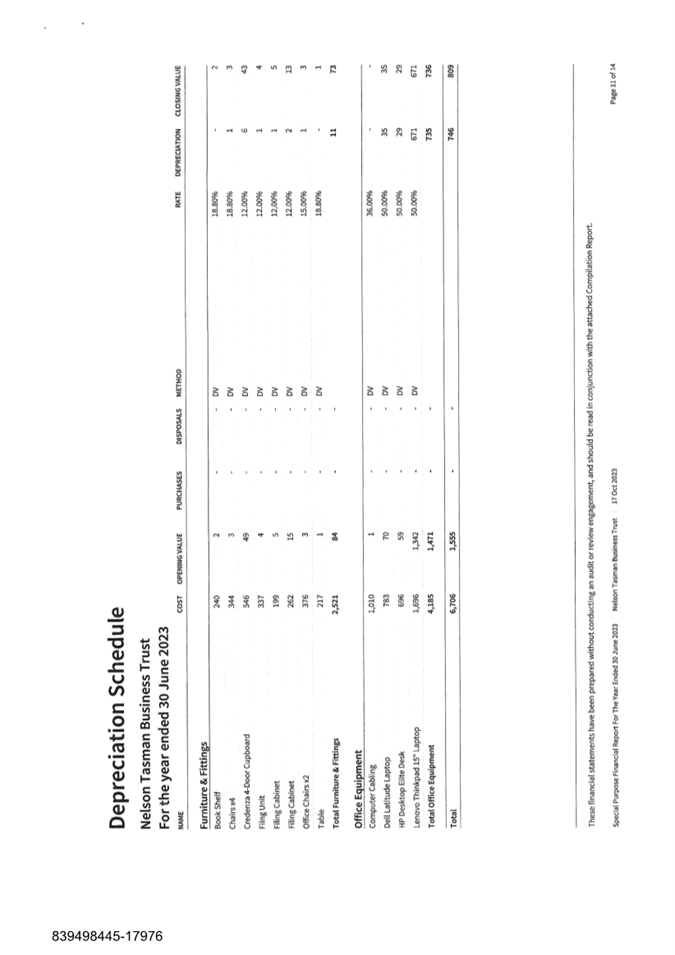

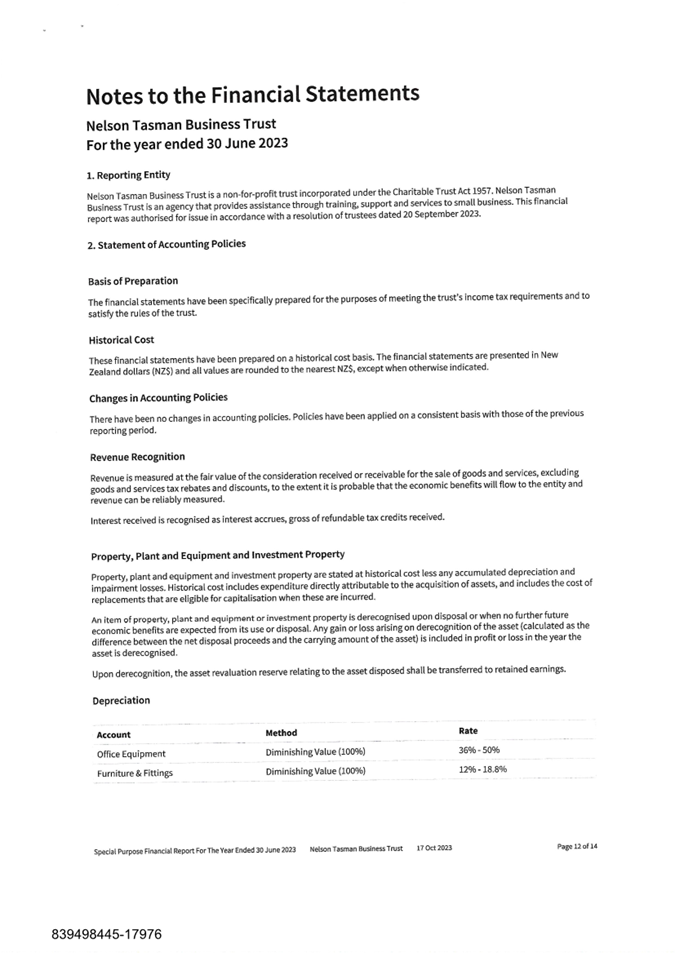

10. Nelson Tasman Business Trust

Annual Report 2022/23 120 - 138

Document number R27944

Recommendation

|

That

the Council

1. Receives

the report Nelson Tasman Business Trust Annual Report 2022/23 (R27944) and its attachments

(839498445-17977 and 839498445-17976).

|

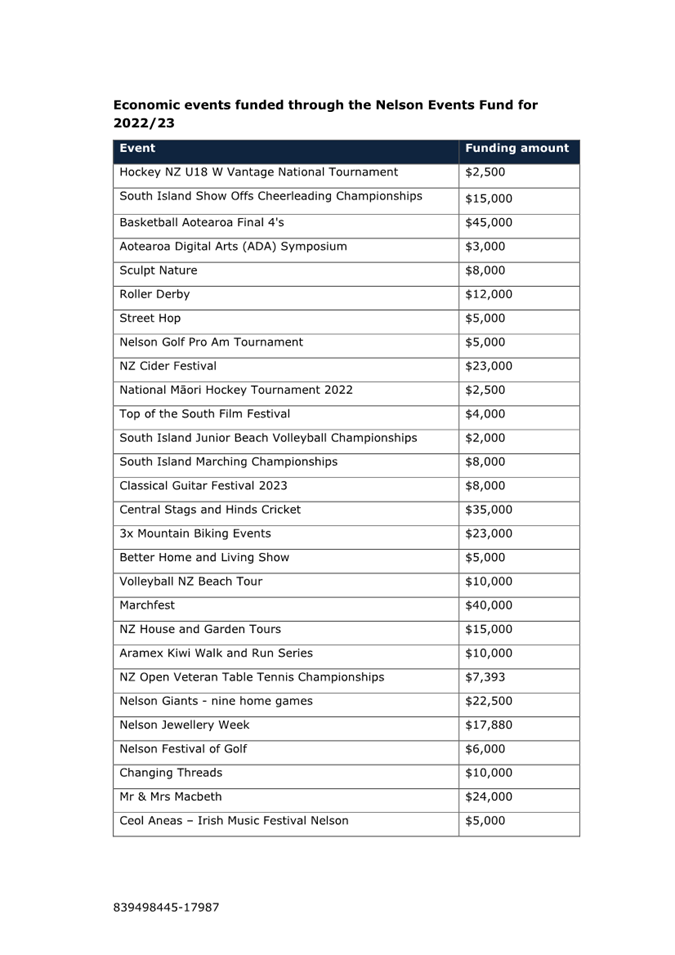

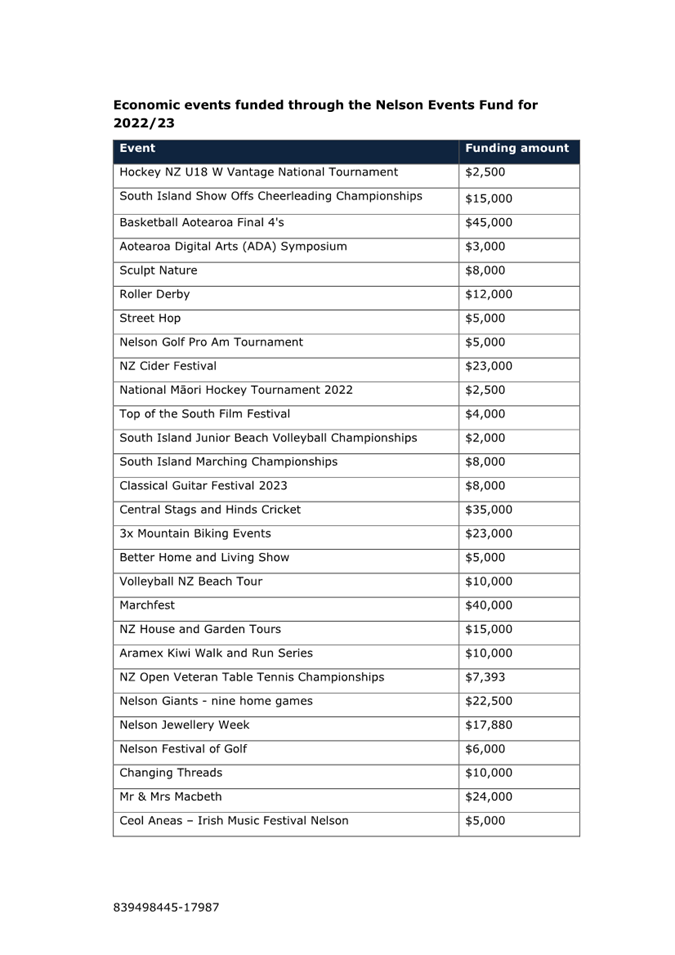

11. Nelson

Events Strategy implementation update 139

- 149

Document number R27953

Recommendation

|

That

the Council

1. Receives the report Nelson Events

Strategy implementation update (R27953) and its attachment

(839498445-17987); and

2. Approves increasing the delegation

levels for the Nelson Events Fund as outlined below:

a. The

Events Development Committee may approve funding up to $45,000

b. The

Chief Executive may approve funding between $45,001 and $99,999

c. Council

may approve funding of $100,000 or above.

|

Confidential Business

12. Exclusion of the Public

Recommendation

|

That

the Council

1.

Confirms, in

accordance with sections 48(5) and 48(6) of the Local Government Official

Information and Meetings Act 1987, that name and name remain after the public

has been excluded, for Item# of the Confidential agenda (item title), as he/she/they

has/have knowledge relating to (description) that will assist the meeting.

|

Recommendation

That the Council

1.

Excludes the

public from the following parts of the proceedings of this meeting.

2.

The general subject of each matter to be

considered while the public is excluded, the reason for passing this resolution

in relation to each matter and the specific grounds under section 48(1) of the

Local Government Official Information and Meetings Act 1987 for the passing of

this resolution are as follows:

|

Item

|

General subject of each matter to be

considered

|

Reason for passing this resolution in

relation to each matter

|

Particular interests protected (where

applicable)

|

|

1

|

Council Meeting - Confidential Minutes - 9 November 2023

|

Section

48(1)(a)

The

public conduct of this matter would be likely to result in disclosure of

information for which good reason exists under section 7.

|

The withholding of the information is necessary:

· Section

7(2)(i)

To enable the

local authority to carry on, without prejudice or disadvantage, negotiations

(including commercial and industrial negotiations)

· Section

7(2)(a)

To protect the privacy

of natural persons, including that of a deceased person

· Section

7(2)(h)

To enable the

local authority to carry out, without prejudice or disadvantage, commercial

activities

|

|

2

|

Kāinga Ora Social and Affordable Housing Development Achilles

and Rutherford Streets

|

Section 48(1)(a)

The public

conduct of this matter would be likely to result in disclosure of information

for which good reason exists under section 7

|

The withholding of the information is necessary:

· Section

7(2)(g)

To maintain

legal professional privilege

· Section

7(2)(h)

To enable the

local authority to carry out, without prejudice or disadvantage, commercial

activities

· Section

7(2)(i)

To enable the

local authority to carry on, without prejudice or disadvantage, negotiations

(including commercial and industrial negotiations)

|

|

3

|

Proposed

Inner City Land Purchase and Sale

|

Section

48(1)(a)

The public conduct of this

matter would be likely to result in disclosure of information for which good

reason exists under section 7

|

The withholding of the information is necessary:

· Section 7(2)(g)

To maintain legal

professional privilege

· Section 7(2)(i)

To enable the local

authority to carry on, without prejudice or disadvantage, negotiations

(including commercial and industrial negotiations)

|

|

4

|

The Brook Valley Holiday Park - Revision of Lease Process

|

Section 48(1)(a)

The public

conduct of this matter would be likely to result in disclosure of information

for which good reason exists under section 7

|

The withholding of the information is necessary:

· Section

7(2)(h)

To enable the

local authority to carry out, without prejudice or disadvantage, commercial

activities

|

|

5

|

Plan

Change 31 - Hearing Panel recommendations

|

Section

48(1)(a)

The public conduct of this

matter would be likely to result in disclosure of information for which good

reason exists under section 7

|

The withholding of the information is necessary:

· Section 48(1)(d)

That the exclusion of the

public from the whole or the relevant part of the proceedings of the meeting

is necessary to enable the local authority to deliberate in private on its

decision or recommendation in any proceedings to which this paragraph applies.

Section 48(2)

Paragraph (d) of subsection (1) applies to -

(a) Any proceedings before a local authority where -

(i) A right of appeal lies to any Court or tribunal against the final

decision of the local authority in those proceedings; or

(ii) The local authority is required, by any enactment, to make a

recommendation in respect of the matter that is the subject of those

proceedings; and

c) Any proceedings of a local authority in relation to any application or

objection under the Marine Farming Act 1971.

|

|

6

|

Visitor Information Services - proposed current and future

approach

|

Section 48(1)(a)

The public

conduct of this matter would be likely to result in disclosure of information

for which good reason exists under section 7

|

The withholding of the information is necessary:

· Section

7(2)(a)

To protect the

privacy of natural persons, including that of a deceased person

· Section

7(2)(i)

To enable the

local authority to carry on, without prejudice or disadvantage, negotiations

(including commercial and industrial negotiations)

|

|

7

|

August

2022 Extreme Weather Event Recovery - Land purchase

|

Section

48(1)(a)

The public conduct of this

matter would be likely to result in disclosure of information for which good

reason exists under section 7

|

The withholding of the information is necessary:

· Section 7(2)(g)

To maintain legal

professional privilege

· Section 7(2)(i)

To enable the local

authority to carry on, without prejudice or disadvantage, negotiations

(including commercial and industrial negotiations)

|

|

8

|

Statement of Expectations 2024-2027 - Nelson Regional

Development Agency

|

Section 48(1)(a)

The public

conduct of this matter would be likely to result in disclosure of information

for which good reason exists under section 7

|

The withholding of the information is necessary:

· Section

7(2)(i)

To enable the

local authority to carry on, without prejudice or disadvantage, negotiations

(including commercial and industrial negotiations)

|

|

9

|

Statement

of Expectations 2024/25 - The Suter Art Gallery Te Aratoi o Whakatū

Trust

|

Section

48(1)(a)

The public conduct of this

matter would be likely to result in disclosure of information for which good

reason exists under section 7

|

The withholding of the information is necessary:

· Section 7(2)(i)

To enable the local

authority to carry on, without prejudice or disadvantage, negotiations

(including commercial and industrial negotiations)

· Section 7(2)(j)

To prevent the disclosure

or use of official information for improper gain or improper advantage

|

|

10

|

Statement of Expectations 2024/25 - Nelmac Limited

|

Section 48(1)(a)

The public

conduct of this matter would be likely to result in disclosure of information

for which good reason exists under section 7

|

The withholding of the information is necessary:

· Section

7(2)(i)

To enable the

local authority to carry on, without prejudice or disadvantage, negotiations

(including commercial and industrial negotiations)

|

Karakia Whakamutanga

Nelson City Council Minutes - 9 November

2023

Present: His

Worship the Mayor N Smith (Chairperson), Councillors M Anderson, M Benge, T

Brand, M Courtney, J Hodgson, Councillor R O'Neill-Stevens (Deputy Mayor), K

Paki Paki, P Rainey, C Rollo, R Sanson, T Skinner and A Stallard

In

Attendance: Chief Executive (N Philpott), Deputy Chief

Executive/Group Manager Infrastructure (A Louverdis), Group Manager

Environmental Management (M Bishop), Group Manager Community Services (A

White), Group Manager Corporate Services (N Harrison), Group Manager Strategy

and Communications (N McDonald) and Senior Governance Adviser (H Wagener) and

Assistant Governance Adviser (A Bryce)

Apologies : Councillor

Rollo for lateness

Karakia

and Mihi Timatanga

1. Apologies

|

Apologies

|

|

Resolved CL/2023/248

|

|

|

That the Council

1. Receives

and accepts the apologies from Councillor Rollo for lateness.

|

|

His Worship the Mayor/Sanson Carried

|

2. Confirmation of

Order of Business

There was no change to the order

of business.

3. Interests

There were no updates to the

Interests Register.

Councillor Sanson declared a

non-pecuniary interest in Item 8. Nelson Regional Development Agency Annual

Report 2022-23 of the Agenda and Councillor Hodgson declared a non-pecuniary interest

in Item 5. Brook Valley Holiday Park - Approval of Lessee of the Confidential

Agenda and took no part in discussion or voting on the matter.

4. Public Forum

4.1. The Regional Community

Development Agency Establishment Group

Document number R28121

|

Penny Molner and Leigh Manson, representatives of the

Regional Community Development Agency Establishment Group and Shane Graham,

Chief Executive of Te Rūnanga o Ngāti Rārua, gave a PowerPoint

presentation (1982984479-6774) and answered questions about the relationship

between the Regional Community Development Agency Establishment Group and The

Community & Whanau Nelson Network and access to resources.

|

|

Attachments

1 1982984479-6774 - Regional Community Development Agency

Establishment Group Presentation

|

4.2. Matthew Kidson - What If

Nelson Whakatu

Document number R28137

|

Matthew Kidson, representative of What If Nelson Whakatu,

gave a PowerPoint presentation (1982984479-6779) and answered questions about

the necessity of industrial building space and enabling collaboration at a

science and technology precinct, the importance of establishing and

maintaining high tech manufacturing capacity to enable growth and lessons

learnt from the discontinuance of an earlier attempt at Port Nelson.

|

|

Attachments

1 1982984479-6779 - What If Nelson Whakatu Presentation

|

5. Confirmation of

Minutes

5.1 19

October 2023

Document number M20318, agenda

pages 12 - 31 refer.

|

Resolved CL/2023/249

|

|

|

That the Council

1. Confirms

the minutes of the meeting of the Council, held on 19 October 2023, as a true

and correct record.

|

|

His Worship the

Mayor/Anderson Carried

|

5.2 26

October 2023

Document number M20333, agenda

pages 32 - 37 refer.

|

Resolved CL/2023/250

|

|

|

That the Council

1. Confirms

the minutes of the meeting of the Council, held on 26 October 2023, as a true

and correct record.

|

|

O'Neill-Stevens/Skinner Carried

|

6 Recommendations

from Committees

|

6.1 Nelson Tasman Regional

Landfill Business Unit Meeting – 18 August 2023

|

|

6.1.1 Nelson

Tasman Regional Landfill Business Unit Annual Report 2022/2023

|

|

Resolved CL/2023/251

|

|

That the Council

1. Receives

the Nelson Tasman Regional Landfill Business Unit Annual Report 2022/23

(1995708647-51) and its attachments (749984575-1082).

|

|

Courtney/Stallard Carried

|

|

6.2 Nelson Regional Sewerage

Business Unit Meeting – 1 September 2023

|

|

6.2.1 Nelson Regional Sewerage Business Unit Annual

Report 2022/23 Summary

|

|

Resolved CL/2023/252

|

|

That the Nelson City

Council and Tasman District Council

1. Receives the Nelson Regional

Sewerage Business Unit Annual Report 2022/23 (1080325921-570) and Financial

Statements (1080325921-577).

|

|

Skinner/Sanson Carried

|

|

6.3 Saxton

Field Committee – 7 November 2023

|

|

6.3.1 Saxton

Field Activity Management Plan 2024-34

|

|

Resolved CL/2023/253

|

|

That

the Council

1. Approves

the draft Saxton Field Activity Management Plan 2024-34 (NDOCS-196698121-297) as the version to inform the development of the Long

Term Plan 2024-2034 for Nelson City Council and Tasman District Council.

|

|

Courtney/Stallard Carried

|

7. Mayor's Report

Document number R28071

|

His Worship the Mayor Hon Dr Smith provided a verbal

update of his visit to the United States of America and Central America.

|

The meeting was adjourned from 10.06a.m.

until 10.14a.m.

8. Nelson Centre of

Musical Arts Strategic Presentation

Document number R27936

|

Chair Jan Trayes, Director, James Donaldson, Funding and

Development Manager, Jessica St. Germain, Education Manager Myles Payne of

the Nelson Centre of Musical Arts, gave a PowerPoint presentation (1982984479-6778)

and answered questions on the launching of the Nelson Centre of Musical Arts

Foundation.

|

|

Attachments

1 1982984479-6778 - Nelson Centre of Musical Arts

Presentation

|

9. Nelson

Regional Development Agency Annual Report 2022-23

Document number R27941, agenda

pages 116 - 172 refer.

Attendance: Councillor Rollo joined the

meeting at 10.47 a.m.

Chair, Sarah-Jane Weir, Chief Executive, Fiona

Wilson Craig, and Visitor Destination Manager Boodee of the Nelson Regional

Development Agency gave a PowerPoint presentation (1982984479-6769) and

answered questions on the work done to rebuild funding of area promotion from

the tourism operators and benefiting the retail and hospitality sectors through

summer events.

|

Resolved CL/2023/254

|

|

|

That the Council

1. Receives

the report Nelson Regional Development Agency Annual Report 2022-23 (R27941)

and its attachment (839498445-16866); and

2. Notes the

receipt of the Nelson Regional Development Agency’s Annual Report

2022-23 (839498445-16866) as required under the Local Government Act 2002.

|

|

His Worship the

Mayor/Courtney Carried

|

|

|

Attachments

1 1982984479-6769 - Nelson Regional Development Agency

Presentation

|

10. Right Tree Right Place

Taskforce Recommendations

Document number R28013, agenda

pages 173 - 394 refer.

Group Manager Infrastructure, Alec

Louverdis, Strategic Advisor Infrastructure, Mark Macfarlane, Right Tree Right

Place Taskforce members, Stuart Orme, Andrew Fenemor and John Hutton took the

report as read and answered questions on inclusion of manu whenua in the

taskforce, prioritisation of pest management measures and comparison with

reserves managed by Department of Conservation, establishment of an independent

community-based land management authority, appointment of a staff member

responsible for forest management and prioritisation of implementation of

recommendations.

Right Tree Right Place Taskforce member, Stuart Orme tabled

supporting information (1982984479-6759).

The motion was put, and a division was called.

|

Resolved CL/2023/255

|

|

|

That the Council

1. Receives

the report Right Tree Right Place Taskforce Recommendations (R28013) and its

attachments (1833911234-251 and

1833911234-252); and

2. Adopts

the Right Tree Right Place Taskforce Recommendations as set out in full in

the Right Tree Right Place Taskforce Report (Attachment 1 1833911234-251) and

summarised in Summary of Right Tree Right Place

Taskforce Recommendations (Attachment 2 1833911234-252) for consultation

through the Long Term Plan 2024-34; and

3. Notes

that whilst a Forestry Activity Management Plan will not be produced for Council

approval to guide the 2024-34 Long Term Plan, budgets will be included in the

2024-34 Long Term Plan (with a focus on the first three years) to give effect

to the broader outcomes of the Right Tree Right Place Taskforce

recommendations; and

4. Notes

that the Right Tree Right Place Taskforce recommendations represent a

significant change in direction for Council with respect to its commercial

forestry that will require time for officers to work through and that

in the interim officers and Council’s contracted commercial forestry

manager will continue to

monitor the commercial estate and undertake essential forestry operations as

required.

|

The motion was put, and a

division was called:

|

|

For

Cr

Smith (Chairperson)

Cr

Anderson

Cr

Benge

Cr

Brand

Cr Courtney

Cr

Hodgson

Cr

O'Neill-Stevens

Cr Paki

Paki

Cr

Rainey

Cr

Rollo

Cr

Sanson

Cr

Stallard

|

Against

Nil

|

Absent

Cr

Skinner

|

|

The

motion was carried 12 - 0.

|

|

|

Sanson/Benge Carried

|

|

|

Attachments

1 1982984479-6759 - Right Tree Right Place Taskforce Recommendations

- Updates to the Value of the NCC Forest Estate Paper

|

The meeting was adjourned from

12.05p.m.until 12.17p.m.

11. Nelson Biodiversity Forum

membership

Document number R28067, agenda

pages 395 - 429 refer.

Acting Group Manager Environmental Management,

Michelle Joubert, Manager Science and Environment, Clive Appleton, and Team

Leader Science and Environment, Leigh Marshall took the report as read.

|

.Resolved CL/2023/256

|

|

|

That

the Council

1. Receives

the report Nelson Biodiversity Forum membership (R28067) and its attachments

(596364813-8039) and (596364813-9162); and

2. Approves

Council as a signatory member of the Nelson Biodiversity Forum.

|

|

O'Neill-Stevens/Sanson Carried

|

12. Biosecurity Annual Report

2022/23 & Operational Plan 2023/24

Document number R28066, agenda

pages 430 - 496 refer.

Acting Group Manager Environmental Management, Manager

Science and Environment, Clive Appleton, Environmental Programmes Adviser,

Richard Frizzell, took the report as read and answered a question about pest

weed management along Waimea Inlet.

|

Resolved CL/2023/257

|

|

|

That

the Council

1. Receives

the report Biosecurity Annual Report 2022/23 & Operational Plan 2023/24

(R28066) and its attachments (596364813-9167 and 596364813-9168); and

2. Approves

the Operational Plan 2023/24 (596364813-9168) for the Tasman Nelson Regional

Pest Management Plan.

|

|

Sanson/Stallard Carried

|

13. National Policy Statement -

Urban Development annual monitoring report 2022/2023

Document number R28038, agenda

pages 497 - 519 refer.

Acting Group Manager Environmental Management,

Michelle Joubert and Senior City Development Adviser, Martin Kozinsky took the

report as read and answered questions on housing security, discussions with

central government about migration setting and comparison with Tasman District

Council on applications for consents for sections in greenfield developments.

|

Resolved CL/2023/258

|

|

|

That

the Council

1. Receives the report

National Policy Statement - Urban Development annual monitoring report

2022/2023 (R28038) and its

attachment (336940202-7807); and

2. Approves

publishing the report National Policy Statement on Urban Development,

Nelson-Tasman Joint Monitoring Report, June 2023 (336940202-7807) on the

Council’s website.

|

|

Sanson/O'Neill-Stevens Carried

|

14. Residents' Survey 2022/23

Document number R27937, agenda

pages 520 - 567 refer.

Group Manager Strategy and Communications, Nicky

McDonald and Senior Policy Adviser, Louis Dalziell took the report as read and

answered questions on the number and constituency of questions in the survey in

comparison with earlier surveys, learnings, inclusion of persons under 18 years

old and the varying levels of satisfaction across issues and demographics.

|

Resolved CL/2023/259

|

|

|

That

the Council

1. Receives the report

Residents' Survey 2022/23 (R27937)

and its attachment (1224871364-335); and

2. Notes

that the results of the Residents’ Survey 2022/23 will be made

available to the public on the Council website.

|

|

His Worship the Mayor/Skinner Carried

|

15. Draft 2024-2054 Infrastructure

Strategy

Document number R27901, agenda

pages 568 - 574 refer.

Group Manager Infrastructure, Alec

Louverdis, Strategic Advisor Infrastructure, Mark Macfarlane, took the report

as read and answered questions on the inclusion of nature-based solutions,

Right Tree, Right Place Taskforce recommendations, flood management plans and

three waters infrastructure.

Attendance: Councillor Rainey left the meeting at 12.02p.m.

|

Resolved CL/2023/260

|

|

|

That

the Council

1. Receives

the report Draft 2024-2054 Infrastructure Strategy (R27901) and its

attachment (1530519604-11301); and

2. Approves

the amended Draft 2024-2054 Infrastructure Strategy (1530519604-11301) as the

version to inform the Long Term Plan 2024-2034 and all relevant Activity

Management Plans; and

3. Notes

that the amended Draft 2024-2054 Infrastructure Strategy (1530519604-11301)

will be updated, and the final version will be approved by Council after the

adoption of the Long Term Plan 2024-2034.

|

|

Sanson/Skinner Carried

|

16. Draft Community Partnerships

Activity Management Plan 2024 - 2034

Document number R27927, agenda

pages 575 - 580 refer.

Group Manager Community Services Andrew White and Manager

Community Partnerships, Mark Preston-Thomas took the report as read and

answered questions on the vulnerable housing support programme.

|

Resolved CL/2023/261

|

|

|

That

the Council

1. Receives

the report Draft Community Partnerships Activity Management Plan 2024 - 2034

(R27927) and its attachment (636019211-1680); and

2. Approves

the Draft Community Partnerships Activity Management Plan 2024-2034

(636019211-1680) as the version to inform the development of the Long Term

Plan 2024-2034; and

3. Notes

that the financial tables in the Draft Community Partnerships Activity

Management Plan 2024-2034 (636019211-1680) are subject to change as draft

budgets are developed; and

4. Notes

that the Draft Community Partnerships Activity Management Plan 2024-2034

(636019211-1682) will be updated, and the final Activity Management Plan

approved by Council after the adoption of the Long Term Plan 2024-2034.

|

|

Brand/Rollo Carried

|

17. Draft Parks and Facilities

Activity Management Plan 2024-2034

Document number R27900, agenda

pages 581 - 589 refer.

Group Manager Community Services

Andrew White, Manager Parks and Facilities, Hannah Curwood and Senior Parks and

Facilities Activity Planner, Carol Stewart took the report as read and answered

questions on inclusion of contaminated sawdust at Tāhunanui Beach in the

Activity Management Plan, reduction of pest plant control measures, funding for

adopt a spot programme, and the pop-up park in the Nelson Central Business

District.

An additional motion was requested by Councillor

Rollo, supported by Councillor Brand for a report, for consideration through

the Long Term Plan process, on the development of an accessibility strategy and

an accessibility audit of Council owned facilities.

The meeting was adjourned from 1.21p.m. until 1.30p.m.

With the agreement of members, the additional motion was

taken separately.

|

Additional Motion

|

|

Resolved CL/2023/262

|

|

|

That the Council

4. Requests

a report, for consideration through the Long Term Plan process, on the

development of an accessibility strategy and an accessibility audit of

Council owned facilities.

|

|

Rollo/Brand Carried

|

Attendance: Councillor Rainey

joined the meeting at 1.45p.m.

|

Resolved CL/2023/263

|

|

|

That

the Council

1. Receives

the report Draft Parks and Facilities Activity Management Plan 2024-2034

(R27900) and its attachment (196698121-52613); and

2. Approves

the Draft Parks and Facilities Activity Management Plan 2024-2034

(196698121-52613) as the version to inform the development of the Long Term

Plan 2024-2034; and

3. Notes

that the Draft Parks and Facilities Activity Management Plan 2024-2034

(196698121-52613) will be updated, and the final Activity Management Plan

approved by Council after the adoption of the Long Term Plan 2024-2034.

|

|

His Worship the Mayor/Rollo Carried

|

18. Draft Property Activity

Management Plan 2024-2034

Document number R28068, agenda

pages 590 - 596 refer.

Group Manager Corporate Services Nikki Harrison,

Manager Property Services, Rebecca van Orden and Property Asset Planner, Tess

Harvey took the report as read.

|

Resolved CL/2023/264

|

|

|

That

the Council

1. Receives

the report Draft Property Activity Management Plan 2024-2034 (R28068) and its

attachment (714127617-20137); and

2. Approves

the Draft Property Activity Management Plan 2024-2034 (714127617-20137) as

the version to inform the development of the Long Term Plan 2024-2034; and

3. Notes

that the Draft Property Activity Management Plan 2024-2034 (714127617-20137)will

be updated, and the final Property Activity Management Plan approved by

Council after the adoption of the Long Term Plan 2024-2034.

|

|

Skinner/Brand Carried

|

19. Exclusion of the Public

Sarah Holman, of Breeze

Consulting Ltd, was in attendance for Item 5 of the Confidential agenda to

answer questions and, accordingly, the following resolution is required to be

passed:

|

Resolved CL/2023/265

|

|

|

That

the Council

1. Confirms,

in accordance with sections 48(5) and 48(6) of the Local Government Official

Information and Meetings Act 1987, that Sarah Holman, a Consultant of Breeze

Consulting Ltd, remain after the public has been excluded, for Item 5 of the

Confidential agenda (Brook Valley Holiday Park - Approval of Lessee), as she

has knowledge relating to Holiday Park that will assist the meeting.

|

|

Skinner/Brand Carried

|

|

Resolved CL/2023/266

|

|

|

That the Council

1. Excludes the public from the

following parts of the proceedings of this meeting.

2. The general subject of each matter

to be considered while the public is excluded, the reason for passing this

resolution in relation to each matter and the specific grounds under section

48(1) of the Local Government Official Information and Meetings Act 1987 for

the passing of this resolution are as follows:

|

|

Skinner/Brand Carried

|

|

Item

|

General subject of each matter to be

considered

|

Reason for passing this resolution in relation

to each matter

|

Particular interests protected (where

applicable)

|

|

1

|

Council Meeting - Confidential Minutes - 19 October 2023

|

Section

48(1)(a)

The

public conduct of this matter would be likely to result in disclosure of

information for which good reason exists under section 7.

|

The withholding of the information is necessary:

· Section

7(2)(h)

To enable the

local authority to carry out, without prejudice or disadvantage, commercial

activities

· Section

7(2)(g)

To maintain

legal professional privilege

· Section

7(2)(i)

To enable the

local authority to carry on, without prejudice or disadvantage, negotiations

(including commercial and industrial negotiations)

|

|

2

|

City of

Nelson Civic Trust - Trustee Appointments

|

Section

48(1)(a)

The public conduct of this

matter would be likely to result in disclosure of information for which good

reason exists under section 7

|

The withholding of the information is necessary:

· Section 7(2)(a)

To protect the privacy of

natural persons, including that of a deceased person

|

|

3

|

Nelson Regional Development Agency - Board remuneration

|

Section 48(1)(a)

The public

conduct of this matter would be likely to result in disclosure of information

for which good reason exists under section 7

|

The withholding of the information is necessary:

· Section

7(2)(i)

To enable the

local authority to carry on, without prejudice or disadvantage, negotiations

(including commercial and industrial negotiations)

|

|

4

|

Appointment

of non-elected District Licensing Committee members

|

Section

48(1)(a)

The public conduct of this

matter would be likely to result in disclosure of information for which good

reason exists under section 7

|

The withholding of the information is necessary:

· Section 7(2)(a)

To protect the privacy of

natural persons, including that of a deceased person

|

|

5

|

Brook Valley Holiday Park - Approval of Lessee

Confidential until negotiations are finalised.

|

Section 48(1)(a)

The public

conduct of this matter would be likely to result in disclosure of information

for which good reason exists under section 7

|

The withholding of the information is necessary:

· Section

7(2)(i)

To enable the

local authority to carry on, without prejudice or disadvantage, negotiations

(including commercial and industrial negotiations)

|

|

6

|

Housing

Reserve

|

Section

48(1)(a)

The public conduct of this

matter would be likely to result in disclosure of information for which good

reason exists under section 7

|

The withholding of the information is necessary:

· Section 7(2)(h)

To enable the local

authority to carry out, without prejudice or disadvantage, commercial

activities

|

The meeting was adjourned 2.03p.m.

The meeting went into confidential session at 3.00p.m.

and resumed in public session at 4.51p.m.

Karakia

Whakamutanga

20. Restatements

It was resolved while the public was

excluded:

|

1

|

City of Nelson Civic Trust -

Trustee Appointments

|

|

|

4. Agrees that the decision only

be made publicly available once the trustees have been advised, and

that the decision will then be made available at

http://www.nelson.govt.nz/council/council-structure/council-organisations-2/city-of-nelson-civic-trust/civic-trust-trustees/.

|

|

2

|

Nelson Regional Development

Agency - Board remuneration

|

|

|

3. Agrees that report R27943 and

the decision be made publicly available after negotiations have concluded.

|

|

3

|

Appointment of non-elected

District Licensing Committee members

|

|

|

4. Agrees that the appointment be

made publicly available on nelson.govt.nz, after the reappointment has been

confirmed with the members; and

5. Agrees

that report (R27428) remain confidential at this time.

|

|

5

|

Brook Valley Holiday Park -

Approval of Lessee

|

|

|

1. Leaves the Brook Valley

Holiday Park - Approval of Lessee to lie on the table.

|

|

6

|

Housing Reserve

|

|

|

7. Agrees that Report (R28054),

Attachment (336940202-7778) and the decision be made publicly available

following completion of negotiations.

|

There being no further business

the meeting ended at 4.52p.m.

Confirmed as a correct record of proceedings by

resolution on (date)

Item 7: Mayor's Report

|

|

Council

14 December 2023

|

Report

Title: Mayor's

Report

Report

Author: Hon Dr Nick

Smith - Mayor

Report

Number: R28223

1.

Purpose of Report

State the outcome you want to

achieve with the report. To consider/decide/adopt etc. The wording must align

with your recommendation. Do not use this report if no decision is required,

use the Brief Report.

1.1

To consider items for inclusion in the Consultation Document for the

draft Long Term Plan 2024-34.

2.

Recommendation

* Denotes

proposals advocated by Councillors for debate and not necessarily supported by

the Mayor.

Recommendations to start with a verb e.g.

approves/notes/allocates. Stick to one idea per clause, each clause must stand

alone.

|

That

the Council

1.

Receives the report (R28118); and

2.

Approves for consultation in the Long Term Plan

2024-34 Consultation Document that the expected net cost to Council of $59.8

million for recovery from the August 2022 storm be funded by a separate rate

set on a uniform basis of $330 per rateable unit including GST for the ten

year period 2024-25 to 2034-35; and

3.

Approves for consultation in the Long Term Plan

2024-34 Consultation Document:

a.

Separating the stormwater and flood protection

activities into a uniform charge for the former and a rate based on land

value for the latter;

b.

Extending the flood protection rate across the region to

include the Nelson North communities;

c.

Changing the uniform charge for flood protection to a

rate based on land value;

d.

Retaining the charge for stormwater as a uniform charge

and extending the exclusion to include properties in the rural zone; and

4.

Requests that officers prepare the Long Term Plan

2024-34 Consultation Document on

the basis that the Three Waters Reform does not proceed and continue, as with

previous Long Term Plans, to include provision for the ongoing management and

investment in Council’s drinking water, wastewater and stormwater

assets; and

5.

Approves including in the Long Term Plan 2024-34

Consultation Document the phasing in of a new Rates Cap Policy of CPI +

growth from the current policy of Local Government Cost Index (LGCI) + 2.5%

plus growth with LGCI + 2.5% plus growth in Year 1, LGCI + 2% plus growth in

Year 2, LGCI + 1.5% plus growth in Year 3, LGCI + 1% plus growth in Year 4

and CPI + growth for Years 5-10; and

6.

Approves for consultation in the Long Term Plan

2024-34 Consultation Document an increase of the Debt Cap Policy from the

Long Term Plan 2021-31 of net external debt not exceeding 175% of Council

revenue to a new debt cap of not exceeding 200% of Council revenue; and

7.

* Approves for consultation in the Long Term Plan

2024-34 Consultation Document the proposed write-off of the Nelson Centre of

Musical Arts’ debt to Council of $730,000 at $73,000 per year over the

10 years of the Long Term Plan; and

8.

Approves for consultation in the Long Term Plan

2024-34 Consultation Document capital funding of $200,000 in Year 1 (2024-25)

and $3.05 million in Year 2 (2025-26) to enable stage one and two of the

Tāhunanui Beach upgrade to be progressed, noting the Nelson Surf Life

Saving Club facility development requires a 50% contribution from the club of

$1.6 million ;and

9.

* Approves for consultation in the Long Term Plan

2024-34 Consultation Document that $1.6 million be allocated in Year 4

(2027-28) of the Plan for the development of a central city community arts

hub; and

10.

* Approves including in the Long Term Plan

2024-34 Consultation Document capital funding of $1.3250 million in

Year 2 (2025-26) and $1.325 million in Year 3 (2026-27) for an all-weather

sports turf, noting that sports clubs would be required to contribute 50% of

the cost ($1.325m). and

11.

Approves for consultation in the Long Term Plan

2024-34 Consultation Document that net capital funding $4 million per year in

Years 4, 5 and 6 (2027-28, 2028-29 and 2029-30) be included for a new road

link between Hill Street North and Suffolk Road, subject to NZ Transport

Agency-Waka Kotahi subsidies, significant development contributions from

adjoining developments and possible contributions from Tasman District

Council; and

12.

* Approves for consultation in the Long Term Plan

2024-34 Consultation Document capital funding for Council’s share of

the east-west cycle link with $0.5 million in Year 2, $4 million in Year 3

and $0.9 million in Year 4, subject to receiving the 51% NZ Transport

Agency-Waka Kotahi Funding Assistance Rate subsidy; and

13.

Approves for consultation in the Long Term Plan

2024-34 Consultation Document removal of the kerbside kitchen waste

collection service funding, provided for in the previous LTP 2021-31, resulting

in savings of $75,000 in Year 1, $76,650 in Year 2, $104,550 in Year 3,

$1.471 million in Year 4, $1.476 million in Year 5, $1.507 million in Year 6,

$1.537 million in Year 7, $1.515 million in Year 8, $1.539 million in year 9

and $1.573 million in Year 10, totalling $10.875 million in savings; and

14.

* Approves for consultation in the draft Long

Term Plan 2024-34 budget sufficient funding, estimated at $100,000 per annum,

to maintain the city hanging flower baskets; and

15.

Approves for consultation in the Long Term Plan

2024-34 Consultation Document an events budget capped at $1.780

million (the current 2023-24 budget) for each year, resulting in savings over

the current draft LTP of $60,000 in Year 1 (2024-25), $225,000 in Year 2

(2025-26), $180,000 in Year 3 (2026-27) and totalling $3 million over the

10-year LTP and for Council officers to review the proposed events programme

and budgets including exploring greater sponsorship and partnering so as to

achieve the optimum economic, community and cultural benefits within this

capped budget.and

16.

Agrees that the Chief Executive and His Worship

the Mayor continue to work on refining the Long Term Plan budget so as to

temper the rates increases, as long as any refinements are consistent with

Council discussions or decisions, prior to the finalising of the LTP

Consultation Document by Council in March.

|

3.

Background

Background for context. Remind them of why the report has been

produced, previous Council decisions and dates where possible. Succinctly

provide sufficient information that someone new to the topic can understand how

we got to the current situation.

3.1 The development of a

Long Term Plan is a requirement of the Local Government Act 2002.

4. Discussion

Use informative headings to break up discussion of key issues,

headings can be standard or creative.

Include essential information necessary for good decision making.

Cover risks, who gains/who loses, compliance, legal context, trade-offs, whole

of life and hidden costs. Include immediate and long term financial

implications, desired outcomes and next steps.

In accordance with LGA s80, this section must note if the

recommendation is likely to be inconsistent with any other previous Council

decision or if there is any intention to amend a policy or plan to accommodate

the recommendation, and if so, why.

If the report is on a public agenda, do not to refer here to

specific legal advice that you have received. Do not cut and paste extracts

from legal advice. Stick to more general contextual information for the

decision maker on the relevant legal framework. Referring to specific legal

advice that you have received would potentially waive legal privilege.

4.1 The development of

Nelson City Council’s Long Term Plan 2024-34 is the most important and significant

work for Elected Members during the triennium. It involves making decisions on

Council priorities and rates amounting to approximately $1.4 billion of public

funds.

4.2 Council has been

receiving briefings on activity management plans over the past few months and

has had a series of workshops on key issues. It now needs to make some

decisions before Christmas on proposals to go into the Long Term Plan (LTP)

Consultation Document. This is to enable a draft to go to the Auditor-General

in February, for the Consultation Document to be adopted and published in

March, for hearings and deliberations to occur in May and for Council to make

final decisions in June. The Local Government Act defines my role as to lead

the development of the Long Term Plan.

4.3 This LTP has been

described by officers as the most challenging in decades with Council facing a

perfect storm of the highest inflation in decades, sharply rising interest

rates, tens of millions in damage from the extreme weather event in August 2022

and significant policy uncertainty. This is compounded by households and

businesses being under acute financial pressure and unable to absorb the cost

of significant rates increases. Council has struggled with these competing

pressures and looks forward to constructively engaging with our community as we

address these competing demands.

4.4 We are not the only

Council facing these problems with others proposing large rate increases. These

include proposed rate increases of 25.5% by Hamilton City Council, 16.5% by

Hutt City Council, 13.3% by Christchurch City Council and 13.75% by Auckland

Council – albeit these councils are also at the early stage of their

rate-setting process.

4.5 The following are

significant factors:

4.5.1 Storm recovery costs from the August

2022 event;

4.5.2 Depreciation and civil construction

costs;

4.5.3 Interest rates;

4.5.4 Insurance;

4.5.5 Operational costs.

4.6 Council finances are

also being adversely affected by reduced dividends from our trading entities

such as Nelmac, Port Nelson Ltd and Nelson Airport Ltd since the last Long Term

Plan due to the general economic downturn and difficult trading conditions.

There is some upside in the benefits from Infrastructure Holdings Ltd that will

offset the effect of lower dividends next year and throughout the Long Term

Plan.

4.7 Council staff, in

consultation with Elected Members, have been working hard over the past four

months to find potential savings to reduce costs and temper the increased costs

of rates for families and businesses. The latest proposals incorporate the

following rate increases but are subject to change relative to the decisions

being considered in this report – ie they do not include the extra

spending or savings proposals by myself, as Mayor, or from Councillors. Each of

the items are to be considered by Council on 14 December 2023 as part of this

report.

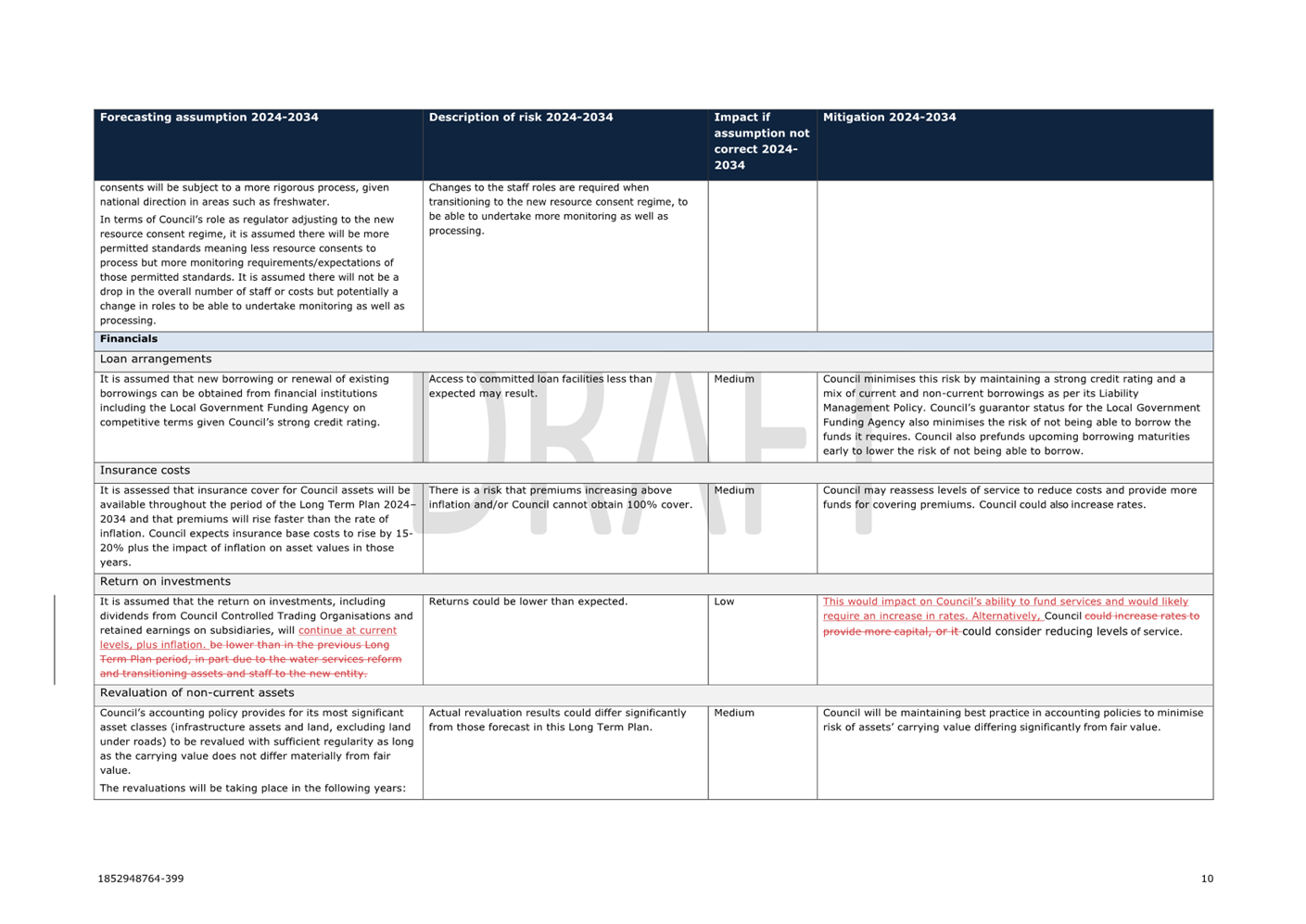

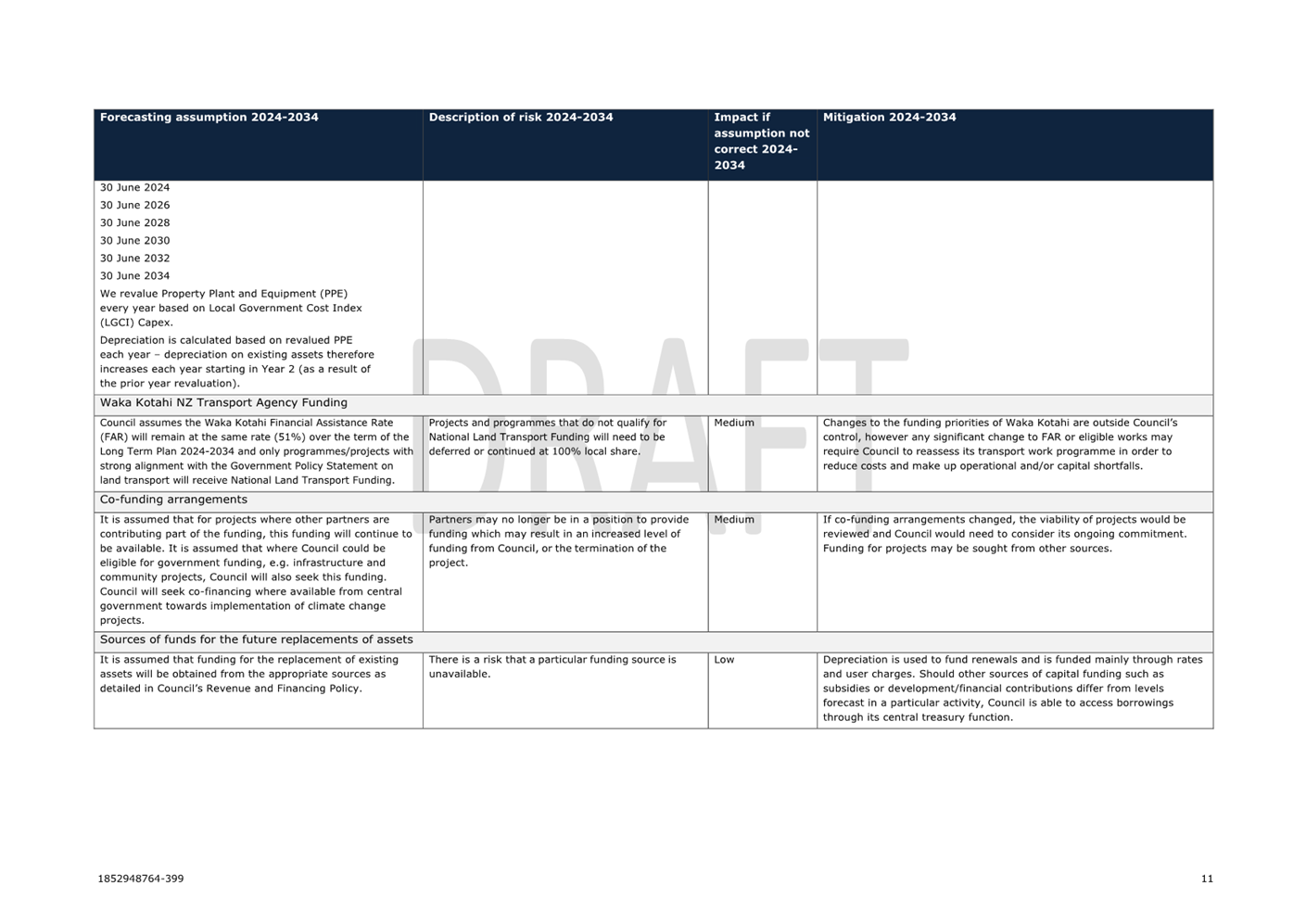

4.8 Current draft LTP

2024-34 proposals (excluding items R7-R15 for consideration) have the following

impacts on rates and debt[NM1] :

|

Year

|

1

|

2

|

3

|

4

|

5

|

6

|

7

|

8

|

9

|

10

|

|

Rate Increase

(%)

|

8.2

|

5.4

|

4.1

|

5.8

|

3.5

|

5.0

|

2.8

|

2.8

|

1.2

|

3.1

|

|

Storm recovery

levy per rateable unit ($)

|

330

|

330

|

330

|

330

|

330

|

330

|

330

|

330

|

330

|

330[NH2]

|

|

Debt (%)

|

137

|

135

|

135

|

146

|

179

|

184

|

189

|

193

|

196

|

198

|

R2 - August 2022

flood recovery levy

4.9 The first major

problem is how Council meets its costs from the August 2022 extreme weather

event. These include the cost of the emergency, repairs to the damaged

infrastructure and facilities, and taking the approach of building back better

to improve our resilience to future events. We had made a decision to complete

these works over six years and fund them over 10.

4.10 In 2022, we only had rough

estimates of the costs but we now have more reliable estimates. These costs can

be summarised as: $2.3 million for the emergency response, $11.1 million for

repairing water services, $19.3 million for repairing roads, $17.1 million for

river works, $9.3 million for parks and streams, $27.4 million for Council

landslides and $3 million for other landslides. This comes to a total of $89.5

million. This is offset by recovery from insurance of $2.3 million and

government of $27.4 million, leaving a net cost to Council of $59.8 million. If

the net cost is different to these estimates, including interest cost over the

ten year period, then any variation will run through the general emergency

fund.

4.11 The proposal I am recommending

through the Long Term Plan is that this net cost to Council of $59.8 million is

funded by a separate rate set on a uniform basis of $330 per rateable unit

including GST, from 2024-25 to 2034-35. I note that this separate rate would

have needed to be $500 per rateable unit for 2024-25 to 2034-35 if we had not

secured government support.

4.12 I acknowledge this proposed $330

flood recovery rate for the next 10 years is a significant and additional

burden for our community. The effect could be reduced by extending the period

beyond 10 years but this increases Council’s debt and interest costs. The

period of repayment is a balance between not wanting to impose an excessive

cost today with the increasing risk of not having it paid off before the next

natural disaster strikes.

4.13 I do not think it is prudent to

extend the repayment period out by more than 10 years, particularly with the

known increased risks of weather events from climate change.

Other Options

4.14 Council could choose not to

create a separate rate but to include the cost of the recovery within the

existing rates. The advantage of this would be a more straightforward rating system

and reduce administration – it would not, however, acknowledge and

highlight the significance of the event or the need to separately address the

impact of such major natural disasters. Council could choose a longer or

shorter repayment period as noted in para 4.12.

5. Recommendation

That the Council

Approves

for consultation in the Long Term Plan 2024-34 Consultation Document that the

expected net cost to Council of $59.8 million for recovery from the August 2022

storm be funded by a separate rate set on a uniform basis of $330 per rateable

unit including GST for the ten year period 2024-25 to 2034-35.

R3

- Stormwater/river catchment spilt and extension

5.1 Council currently

funds its stormwater and river works as a single uniform charge even though

they are separate activities. Work has been prepared as part of the Three

Waters Reform programme to separate this rate. There has been no rating of the

Nelson North area for the Wakapuaka and Whangamoa rivers.

5.2 There is a good case

for including a rate for the management of these Nelson North rivers,

particularly given the expense of the August 2022 floods where extensive work

was required. It would not be fair to extend the existing combined

stormwater-river catchment rate to these properties as they do not have

Council-provided stormwater services. It would also be fairer if the river

catchment work was funded as a land-value rate rather than a uniform charge as

larger property owners such as foresters would pay a fairer share.

5.3 The proposal is to

split the stormwater and river catchment rates across the city. It is proposed

to continue to rate for stormwater on the basis of a uniform charge but fund

the river catchment work on a land-value basis.

Other

Options

5.4 Council could choose

to continue with the status quo but that would limit the ability of Council to

respond to the residents experiencing flood impacts in the Nelson North area or

provide the assistance they are looking for from Council. Council could

consider charging the flood protection rate as a fixed charge or based on

capital value but land value is a fairer method to allocate the rates.

6. Recommendation

That the Council

Approves

for consultation in the draft Long Term Plan 2024-34 Consultation Document:

a. Separating

the stormwater and flood protection activities into a uniform charge for the

former and a rate based on land value for the latter;

b. Extending

the flood protection rate across the region to include the Nelson North

communities;

c. Changing

the uniform charge for flood protection to a rate based on land value;

d. Retaining

the charge for stormwater as a uniform charge and extending the exclusion to

include properties in the rural zone.

R4

– Three Waters reform

6.1 Council faces the

difficult issue of how to deal with the uncertainty of Three Waters Reform in

its Long Term Plan 2024-34. We have had clear signals from the Government in

its Coalition Agreements and 100 Day Plan that it will repeal the existing

legislation that would have transferred our significant water infrastructure

assets in 2026. This is essentially a timing issue as the repeal legislation is

expected to be passed during the period that we are required to develop and

consult on our Long Term Plan.

6.2 The exclusion of

Council’s three waters assets, investment and maintenance from our LTP

from year 3 would have a massive effect on all aspects of the plan relating to

rates, debt and significant policies. It would be confusing for the public,

disruptive to the process and a substantial demand on officers’ time. It

would also do a disservice to the purpose of any Three Waters changes aimed at

improving the planning and investment of quality infrastructure.

6.3 I believe we should

take a common-sense approach to this issue in the development of the LTP by

continuing to include three waters services.

6.4 There is some risk

that the Auditor-General may adversely comment on this in his audit in February

but I believe the Auditor-General will understand our dilemma. I would prefer

an adverse comment rather than producing a Consultation Document that makes no

sense to the public.

7.

Recommendation

That the Council

Requests

that officers prepare the Long Term Plan 2024-34 Consultation Document on the

basis that the Three Waters Reform does not proceed and continue, as with

previous Long Term Plans, to include provision for the ongoing management and

investment in Council’s drinking water, wastewater and stormwater assets

R5

- Rates cap policy

7.1

Nelson City Council rates have been increasing much faster than the rate

of inflation. In the decade 2010 to 2020, rate increases were 2.5 times greater

with average rates increasing 37.7% compared with inflation, measured by the

Consumers Price Index (CPI), of 15.2%.

7.2 Rate increases were

deliberately curtailed during Covid with a zero increase in 202 0-21

followed by 5.6% in 2021-22 and 5.4% in 2022-23. The rate increase for 2023-24

was 7.2%, in line with inflation.

7.3 The rating cap policy

in the current Long Term Plan 2021-31 is LGCI + 2.5% plus growth. LGCI is Local

Government Cost Index. For the previous LTP 2018-28, the rating policy was LGCI

+ 2% plus growth.

7.4 In my view we should

be aiming over the long term to constrain rate increases to no more than the

average rate of inflation plus growth. If the rate increase is set higher than

the CPI, we need to have exceptional circumstances and be able to justify a

larger increase.

7.5 I do not consider that

the Local Government Cost Index is the best tool for setting the rates cap. It

is poorly understood by the public, quite volatile and the data on which it is

based is not as robust as the Consumers Price Index. The changing activity

areas of local government and the differences in activities between Councils

also means it is not an accurate proxy for the costs Nelson City Council faces.

7.6 The CPI has the

advantage of being officially recognised as the rate of inflation, is well

understood by the public and is used to adjust pensions and benefits. This

question of whether we use the LGCI or CPI is also one of whether we take an

inward-looking view from a Council perspective or we focus on how rates have an

impact on our wider community.

7.7 I also do not support

the additional 2.5% on top of the LGCI. It is an arbitrary figure and signals

that Council will grow its overall role in the community. The 2.5% extra per

year compounds over the decade to an increase of 28%. The risk with such growth

in costs is that we increase the burden on households and businesses and the

share of local Gross Domestic Product (GDP) with an adverse effect on social

and economic wellbeing.

7.8 I propose that

Council’s future rating policy be to keep long-term overall rate

increases to the CPI but allow for growth, ie the objective is that the cost of

rates to households will increase by no more than the rate of inflation. The

allowance for growth means that if our community grows by 300 households per

year, or 1%, as it has typically, then this 1% should be added to the CPI in

setting the total rates collected across the city.

7.9 It should be noted

that having such a rating policy would not be so rigid as to prohibit increases

that differ from this policy. Our rates increase in 2022 was different to the

LTP policy. The difference had to be noted and explained. The significant storm

costs are an example of where a difference could be justified.

7.10 The purpose of having the rates

cap policy is to set out our long-term ambition for rates but will inevitably

have to adapt to circumstances and changing rates of inflation.

7.11 The adoption of a policy of

limiting rate increases to the CPI is the right response to the cost-of-living

crisis. It is about Council recognising that we need to work hard at

constraining costs in the foreseeable future to help our community and country

get inflation in check.

7.12 The proposed change in rating

policy from LGCI + 2.5% to CPI + growth represents a significant change in

direction. I am recommending the change be phased in over a number of years.

However, it is important to signal through the Long Term Plan Council’s

intention to phase in a tighter constraint on Council expenditure and rate

increases.

Other Options

7.13 Council could choose to continue

with its current rates cap of LGCI +2.5% + growth. The advantage of this option

is that it acknowledges that Council’s costs (particularly in relation to

infrastructure) may escalate above the CPI level given the different basket of

goods that drive Council costs, it would allow Council to fund growth driven

projects despite the lag before development contributions are collected and it

provides leeway for Council to choose to increase services to the community.

The credit rating agency Standard and Poor’s will also view any further

constraint on rates rises unfavourably. The disadvantage is that rates would

not be kept as low as with a CPI linked rates cap.

8.

Recommendation

That the Council

approves including in the

Long Term Plan 2024-34 Consultation Document the phasing in of a new Rates Cap

Policy of CPI + growth from the current policy of LGCI + 2.5% plus growth with

LGCI + 2.5% plus growth in Year 1, LGCI + 2% plus growth in Year 2, LGCI + 1.5%

plus growth in Year 3, LGCI + 1% plus growth in Year 4 and CPI + growth for

Years 5-10.

R6

- Debt cap policy

8.1

Council will need to increase its debt cap to meet the programme of

infrastructure works proposed and to fund the August 2022 flood recovery work.

This work is to be undertaken over six years but paid for over 10 years,

requiring interim borrowing.

8.2

The current debt cap (debt affordability benchmark) is that net external

debt is not to exceed 175% of revenue. Net external debt is defined as total

debt cash, term deposits and borrower notes. Revenue is defined as cash

earnings from rates, government grants and subsidies, user chargers, interest,

dividends, and excluding development contributions, financial contributions,

vested assets, gains on derivative financial instruments and revaluations of

property, plant or equipment.

8.3

The proposal to be included in the draft LTP for consultation is that

this debt cap be increased to 200%. I believe this increase is affordable,

noting that the Local Government Funding Agency (LGFA) sets a maximum of 280%.

8.4

Nelson’s net debt levels are moderate by comparison with other Councils

and the Nelson City Council balance sheet and equity remains strong through the

draft LTP. The risk in not increasing the debt cap is that we would have

insufficient borrowing capacity to progress necessary investments in

Nelson’s infrastructure without significantly higher rate increases. The

decision on the debt cap and rate increase is an intergenerational debate about

how much cost is met today and how much we ask future ratepayers to fund.

Other Options

8.5

Council could choose to continue with its current debt cap of 175% but

this would require a significant reduction in the capital program over the 10

year period (of at least $65 million). Council could choose to increase

the debt cap above 200% as the LGFA allow borrowing up to 280% but this may

have an impact on the Council’s external credit rating.