Notice of the Ordinary meeting of

Notice of the Ordinary meeting of

Audit, Risk and Finance

Committee

Te Kōmiti Kaute /

Tūraru / Pūtea

Agenda | Rārangi take

|

Date: Wednesday

20 November 2024

Time: 9.00a.m.

Location: Council

Chamber

Floor 2A, Civic House

110 Trafalgar Street, Nelson

|

Chairperson Ms

Catherine Taylor

Members His

Worship the Mayor Nick Smith

Cr

Rohan O'Neill-Stevens

Cr

Mel Courtney

Cr

Rachel Sanson

Mr

Lindsay McKenzie

Quorum 3 Nigel

Philpott

Chief Executive

governance.advisers@ncc.govt.nz

www.nelson.govt.nz

Nelson City Council Disclaimer

Please note that the contents of these

Council and Committee agendas have yet to be considered by Council and officer

recommendations may be altered or changed by the Council in the process of

making the formal Council decision. For enquiries call (03) 5460436.

Excerpt from Nelson City Council Delegations Register

Audit, Risk and Finance

Committee

This is a Committee of Council

Areas of

Responsibility

·

Any matters raised by Audit New Zealand or the Office of the

Auditor-General

·

Audit processes and management of financial risk

·

Chairperson’s input into financial aspects of draft

Statements of Expectation and draft Statements of Intent for Nelson City

Council Controlled Organisations, Council Controlled Trading Organisations and

Council Organisations

·

Council’s Annual Report

·

Council’s financial performance

·

Council’s Treasury policies

·

Health and Safety

·

Internal audit

·

Monitoring organisational risks, including debtors and legal

proceedings

·

Procurement Policy

Powers to

Decide

·

Appointment of a deputy Chair

Powers to Recommend

to Council

·

Adoption of Council’s Annual Report

·

To write off outstanding accounts receivable or remit fees and

charges of amounts over the Chief Executive’s delegated authority.

·

All other matters within the areas of responsibility or any other

matters referred to it by the Council

For the Terms of Reference

for the Audit, Risk and Finance Committee please refer to document NDOCS-1974015928-887.

Audit, Risk and Finance Committee

20 November 2024

Page

No.

Karakia

and Mihi Timatanga

1. Apologies

2. Confirmation of Order of

Business

3. Interests

4. Public Forum

5. Confirmation

of Minutes

6. Audit

New Zealand report on the Long Term Plan 2024-2034 10 - 22

7. Quarterly

Risk Report - 30 Sept 2024 23 - 46

8. Quarterly

Internal Audit Report - 30 Sept 2024 47 - 49

9. Quarterly

Finance Report to 30 September 2024 50 - 71

10. Public

Transport Services Contract - Working Group Review 72 - 88

11. Exclusion of the Public

Karakia

Whakamutanga

Procedural Items

1. Apologies

Nil

2. Confirmation of

Order of Business

3. Interests

3.1 Updates

to the Interests Register

3.2 Identify

any conflicts of interest in the agenda

4. Public Forum

5. Confirmation of

Minutes

5.1 18 September 2024 5 - 9

Document number M20754

Recommendation

|

That the Audit, Risk and Finance Committee

1. Confirms the minutes of the meeting of the

Audit, Risk and Finance Committee, held on 18 September 2024, as a true and

correct record.

|

Present: Ms

C Taylor (Chairperson), His Worship the Mayor N Smith, Councillors M Courtney,

R Sanson and Mr L McKenzie

In

Attendance: Acting Chief Executive (A Louverdis), Group

Manager Environmental Management (M Bishop), Group Manager Corporate Services

(N Harrison), Group Manager Strategy and Communications (N McDonald), Team

Leader Governance (R Byrne) and Governance Adviser (A

Andrews)

Apologies : Deputy

Mayor R O'Neill-Stevens

Karakia

and Mihi Timatanga

1. Apologies

|

Resolved ARF/2024/046

|

|

|

That the Audit, Risk and Finance Committee

1. Receives and accepts the apologies

from Deputy Mayor O’Neill Stevens for attendance and Mr McKenzie for lateness.

|

|

Courtney/Sanson Carried

|

2. Confirmation of

Order of Business

There was no change to the order

of business.

3. Interests

There were no updates to the

Interests Register, and no interests with items on the agenda were declared.

4. Confirmation of

Minutes

4.1 14

August 2024

Document number M20712, agenda

pages 7 - 13 refer.

|

Resolved ARF/2024/047

|

|

|

That the Audit, Risk and

Finance Committee

1. Confirms

the minutes of the meeting of the Audit, Risk and Finance Committee, held on

14 August 2024, as a true and correct record.

|

|

Sanson/His Worship the Mayor Carried

|

5. Draft Annual Report

2023/24

Document number R28614, agenda

pages 14 - 194 refer.

Group Manager Strategy &

Communications, Nicky McDonald, Group Manager Corporate Services, Nikki

Harrison, Manager Strategy, Jessica Ettridge and Manager Finance, Prabath

Jayawardana took the report as read. They answered questions on performance

measures, feedback from Audit NZ, development contributions, dividend timing,

external funding accrual, Waka Kotahi funding and key issues.

|

Resolved ARF/2024/048

|

|

|

That

the Audit, Risk and Finance Committee

1. Receives the report

Draft Annual Report 2023/24 (R28614)

and its Attachments; and

2. Notes that the

draft Annual Report will be audited before being presented to Council for

adoption on 31 October 2024, the statutory deadline.

|

|

Sanson/Courtney Carried

|

6. Carry Forwards -

2023/24 for Approval

Document number R28796, agenda

pages 195 - 207 refer.

Group Manager Infrastructure,

Alec Louverdis and Team Leader Accountants, Alistair Roper took the report as

read. They answered questions on scale of the funds being carried forward in

comparison to the previous financial year, comparison between storm recovery

work and carried forward budgets, overestimating budgets and carrying forward

underspent budgets, Better Off funding, Water Done Well funding and progress of

the project and Three Waters staffing.

|

Resolved ARF/2024/049

|

|

|

That

the Audit, Risk and Finance Committee

1. Receives the report

Carry Forwards - 2023/24 for Approval (R28796) and its

Attachments.

|

|

His Worship the

Mayor/Courtney Carried

|

|

Recommendation to Council

ARF/2024/050

|

|

|

That the Council

1. Approves the net

capital carry forward of $12 million –$12.3 million net to 2024/25 and

$250,000 back from 2025/26; and

2. Notes that the net

capital carry forward is in addition to the net capital carry forward of

$24.2 million approved during the Long Term Plan 2024/34 process, taking the

total carry forward to $36.3 million of which $34.1 million is for the

2024/25 year and $1.4 million is for the 2025/26 year; and $500,000 is for

the 2026/27 year and $300,000 is for the 2029/30 year; and

3. Notes the savings

and reallocations in 2023/24 capital expenditure of $3.4 million including

staff time which is in addition to the $0.7 million savings and reallocations

already recognised in the May 2024 Long Term Plan 2024/34 deliberations; and

4. Notes that the

total 2024/25 capital budget (including staff costs and Aug 2022 severe

weather event related budgets and excluding consolidations, vested assets and

scope adjustment) will be adjusted by these resolutions from a total of

$107.1 million to a total of $119.3 million; and

5. Approves net

capital grants carried forward of $628,000 to align with the timing of

capital expenditure budgets; and

6. Approves capital

grant budget of $4.1 million of Crown funding for slip effected property

purchases to be carried back to 2023/24 to align with the accrual of that

income that has been made for our Annual Report 2023/24; and

7. Approves the carry

forward of $612,000 unspent operating expenditure budget to 2024/25,

accompanied by $567,000 of operating grant funding budget.

|

|

His Worship the

Mayor/Courtney Carried

|

7. Exclusion of the

Public

|

Resolved ARF/2024/051

|

|

|

That the Audit, Risk and Finance Committee

1. Excludes the public from the following parts of the proceedings of

this meeting.

2. The general subject of each matter to be considered while the

public is excluded, the reason for passing this resolution in relation to

each matter and the specific grounds under section 48(1) of the Local

Government Official Information and Meetings Act 1987 for the passing of this

resolution are as follows:

|

|

His Worship the Mayor/Sanson Carried

|

|

Item

|

General subject of each matter to be

considered

|

Reason for passing this resolution in

relation to each matter

|

Particular interests protected (where

applicable)

|

|

1

|

Audit, Risk and Finance Committee Meeting - Confidential Minutes

- 14 August 2024

|

Section

48(1)(a)

The

public conduct of this matter would be likely to result in disclosure of

information for which good reason exists under section 7.

|

The withholding of the information is necessary:

· Section

7(2)(a)

To protect the

privacy of natural persons, including that of a deceased person

· Section

7(2)(d)

To avoid

prejudice to measures protecting the health and safety of members of the

public

· Section

7(2)(c)(ii)

To protect

information which is subject to an obligation of confidence or which any

person has been or could be compelled to provide under the authority of any

enactment, where the making available of the information would be likely

otherwise to damage the public interest

· Section

7(2)(g)

To maintain

legal professional privilege

|

The meeting went into confidential session at 10.06a.m.

and resumed in public session at 10.07a.m.

The only business transacted in

confidential session was to confirm the minutes. In accordance with the Local

Government Official Information and Meetings Act, no reason for withholding

this information from the public exists, therefore this business has been

recorded in the open minutes.

|

Resolved ARF/2024/052

|

|

|

That the Audit, Risk and Finance Committee

1. Confirms

the minutes of part of the meeting of the Audit, Risk and Finance Committee,

held with the public excluded on 14 August 2024, as a true and correct

record.

|

|

His Worship the

Mayor/Courtney Carried

|

Karakia

Whakamutanga

There being no further business

the meeting ended at 10.07a.m.

Confirmed as a correct record

of proceedings by resolution on (date)

Resolution

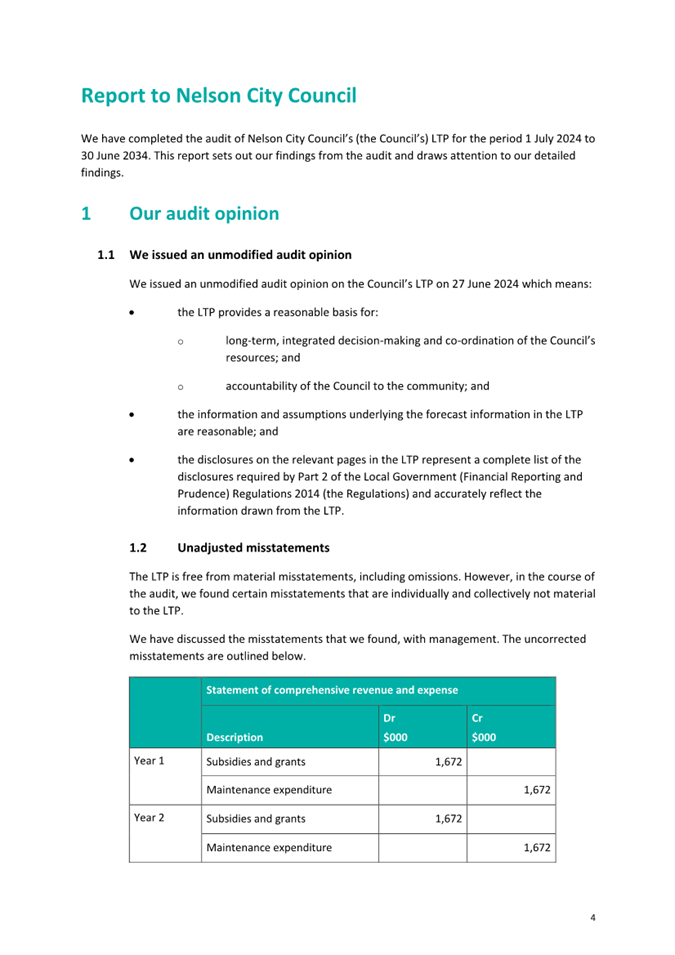

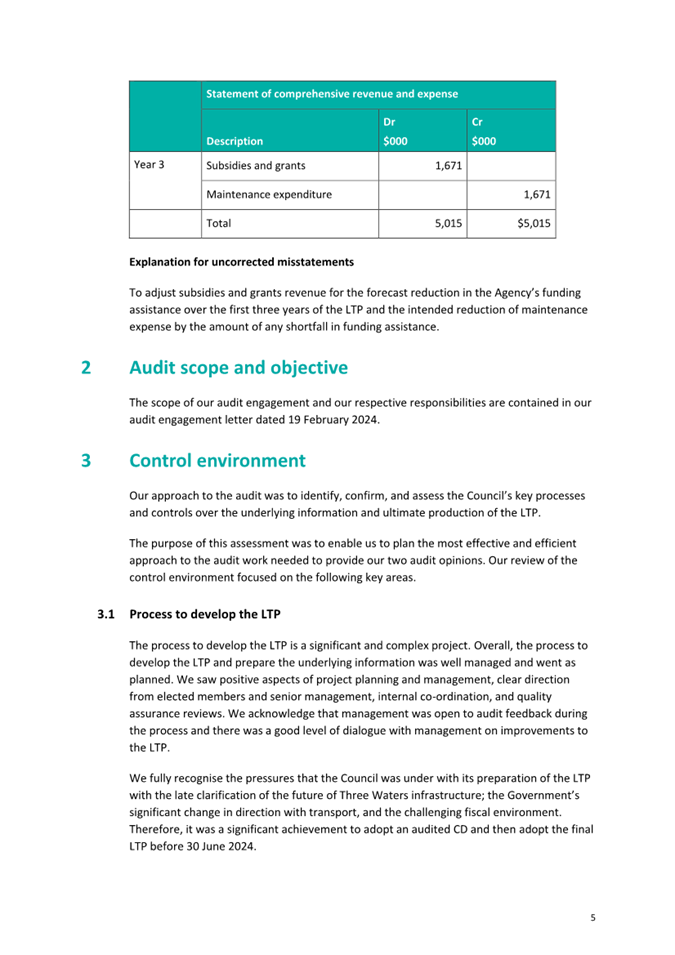

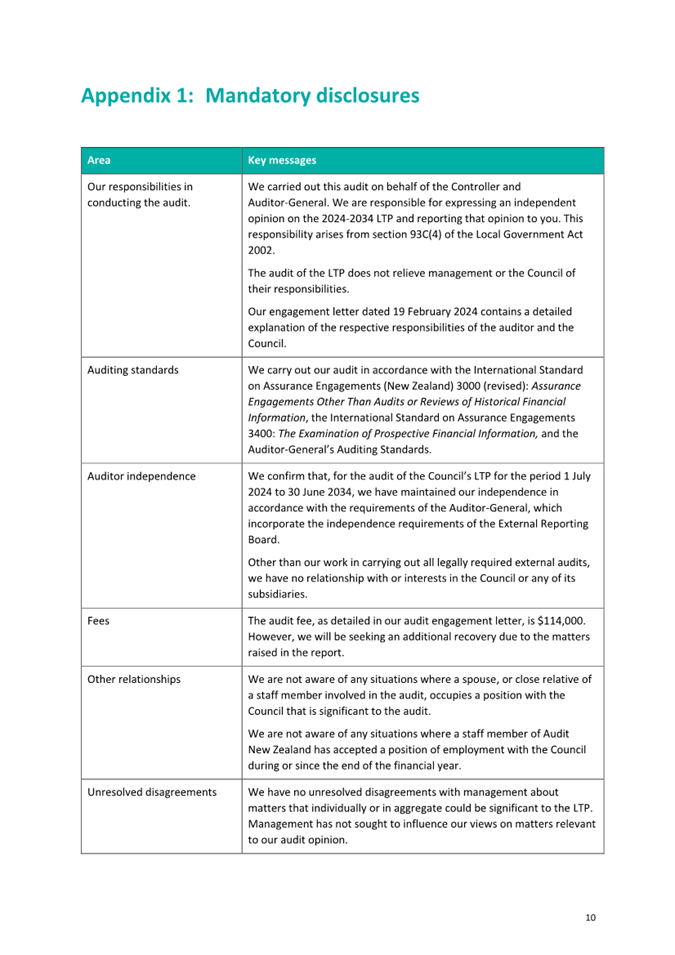

Item 6: Audit New

Zealand report on the Long Term Plan 2024-2034

|

|

Audit, Risk and Finance Committee

20 November 2024

|

Report

Title: Audit

New Zealand report on the Long Term Plan 2024-2034

Report

Author: Louis Dalzell - Senior

Policy Adviser

Report

Authoriser: Nikki Harrison - Group Manager Corporate

Services

Report

Number: R28605

1. Purpose of Report

1.1 To provide the

Committee with Audit New Zealand’s report on the audit of the Long Term

Plan 2024-2034.

2. Recommendation

|

That the

Audit, Risk and Finance Committee

1. Receives the report Audit New Zealand report on

the Long Term Plan 2024-2034 (R28605)

and its attachment; and

2. Notes

the areas of audit emphasis and Council’s response .

|

3. Background

3.1 Audit New Zealand

conducted an audit of the Long Term Plan 2024-2034, issuing an unmodified

opinion before Council adopted the Plan on 27 June 2024. A report outlining the

audit findings (Attachment 1) is now presented to the Committee for

information. This report supplements the audit report on the Long Term Plan

2024-2034 Consultation Document presented on 5 June 2024.

3.2 During the audit a few

items were given deeper consideration because of the impact they could have on

delivery of the Long Term Plan (pages 7-8 of Attachment 1):

3.2.1 NZ Transport Agency Waka Kotahi

funding assumption (Audit accepted Council’s approach on the basis of

materiality).

3.2.2 Delivery of capital programme

assumption (Audit concluded that the capital programme remains achievable).

3.2.3 Impact of the growth assumption (Audit

reviewed for compliance with the National Policy Statement on Urban

Development).

3.3 There was also further

discussion about one Level of Service performance measure:

3.3.1 Audit recommended Council’s

Transport Activity Management Plan performance measure on the numbers of people

who walk or bike to work and school should be measured more frequently than the

five-yearly census. Council’s management comment explained why this was

not practical or affordable, and outlined the other data collected that allows

Council insight into how the measure is tracking on a more regular basis.

3.4 The report concluded

that Council had a good process and sound controls in place for developing the

Plan, and that the underlying information was reasonable. It also noted that it

was a significant achievement to adopt the Plan within statutory deadlines in

the challenging and changing environment faced by Council and the local

government sector.

Attachments

Attachment 1: Report

to the Council on the audit of Nelson City Council’s long-term plan for

the period 1 July 2024 to 30 June 2034 ⇩

Item 6: Audit New Zealand report on the Long Term Plan

2024-2034: Attachment 1

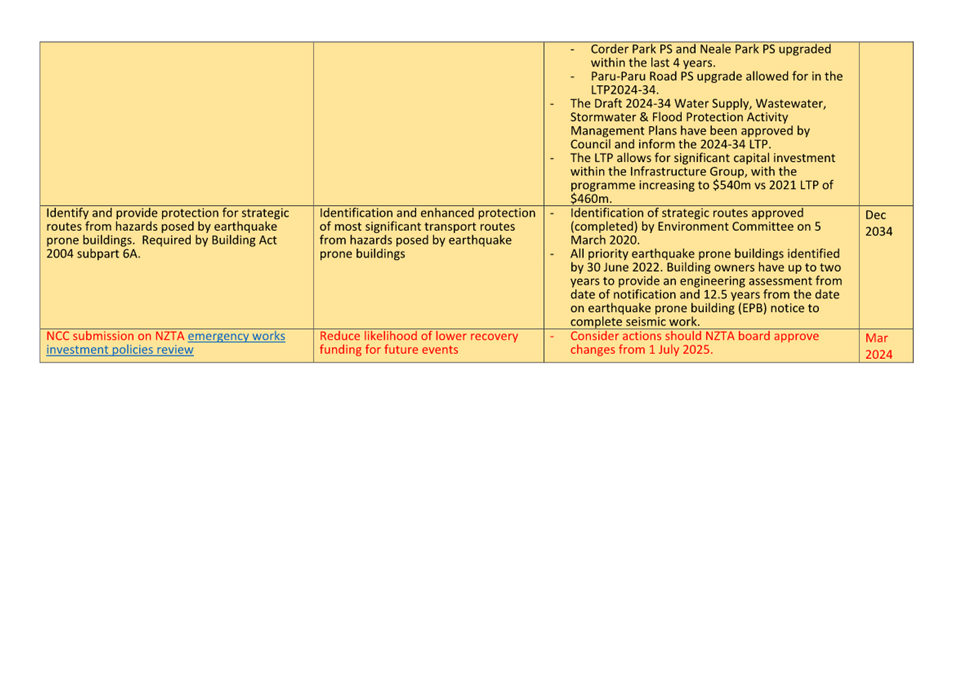

Item 7: Quarterly Risk

Report - 30 Sept 2024

|

|

Audit, Risk and Finance Committee

20 November 2024

|

Report Title: Quarterly

Risk Report - 30 Sept 2024

Report

Author: Chris Logan - Audit

and Risk Analyst

Report

Authoriser: Nikki Harrison - Group Manager Corporate

Services

Report

Number: R28839

1. Purpose of Report

1.1 To provide information

to the Audit, Risk and Finance Committee on the organisational and group risks

through to the end of the first quarter of 2024/25.

2. Recommendation

|

That the

Audit, Risk and Finance Committee

1. Receives the report Quarterly Risk Report - 30

Sept 2024 (R28839) and its

attachment.

|

3. Background

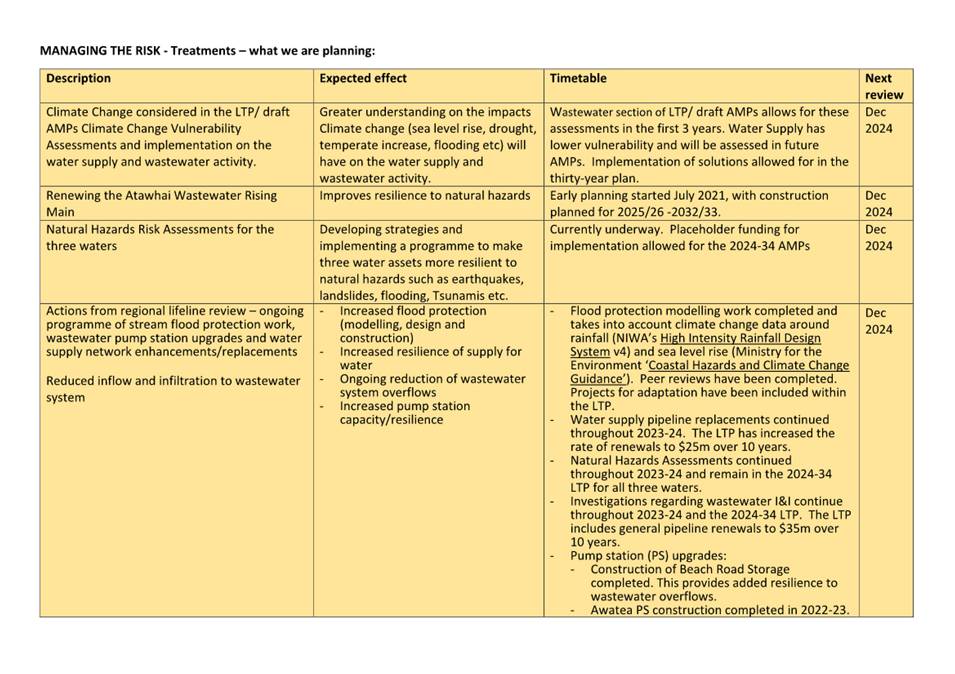

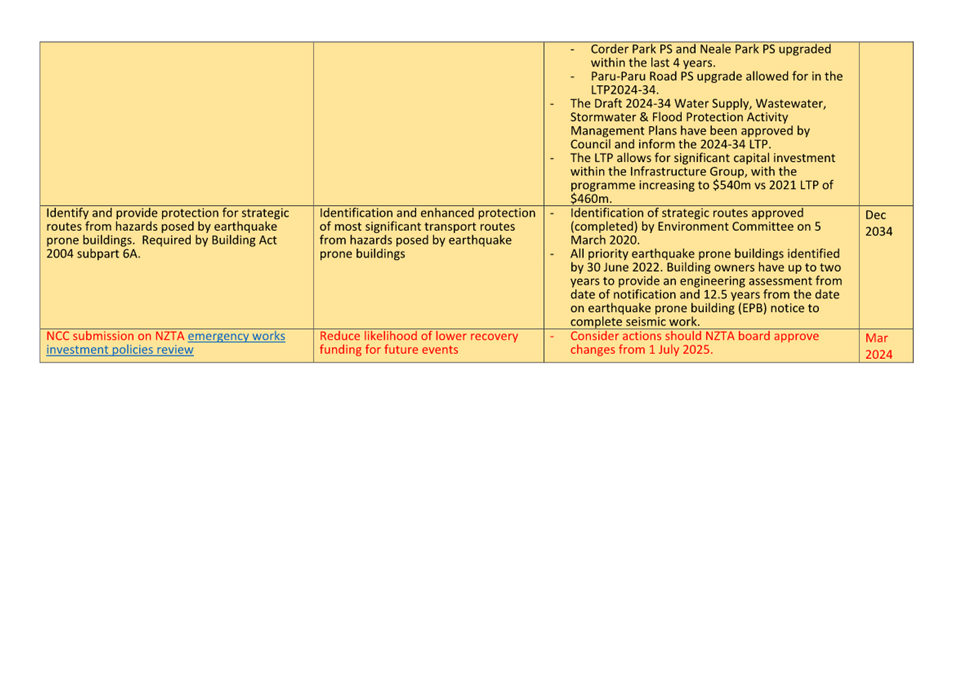

3.1 This report describes

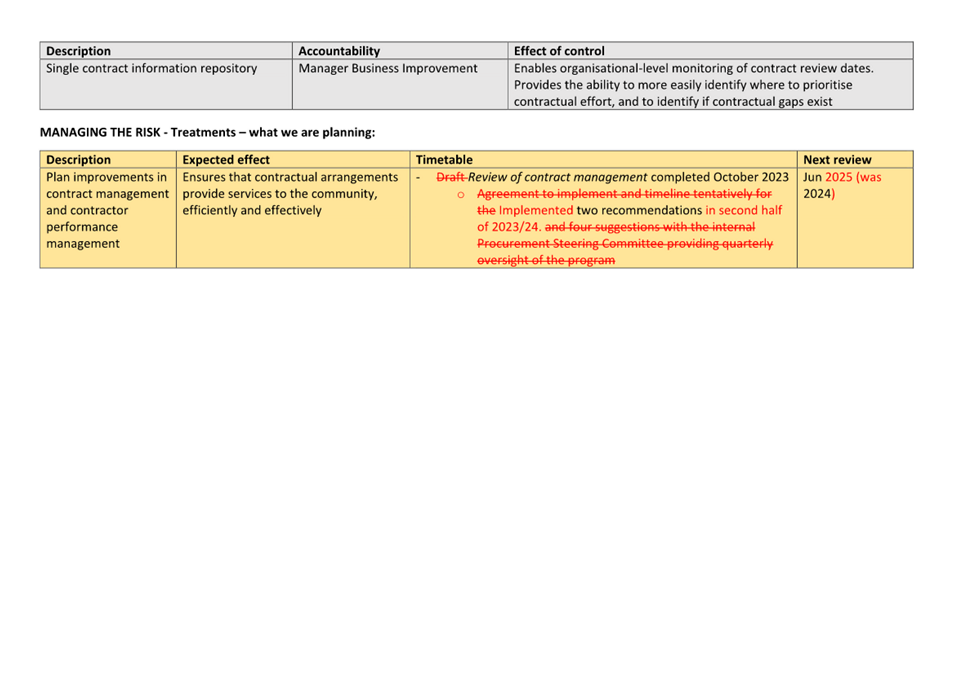

key risk areas, divided by risk theme organisational risks) and reporting Group

4. Key Risk Areas by

Theme (Organisational Risks)

4.1 Risks relating to

Council and joint operations are monitored via Council’s risk register.

Approximately 30% of risk entries by count have been identified as having a

common theme or cause which create risk concentrations that pose a threat at an

organisational level. These organisational risks are described below.

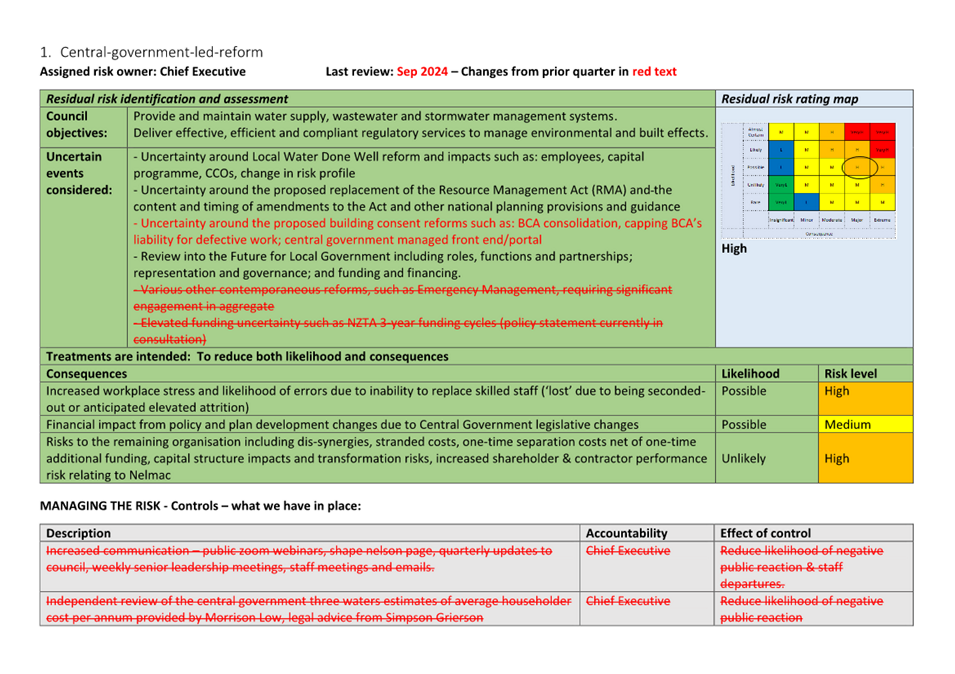

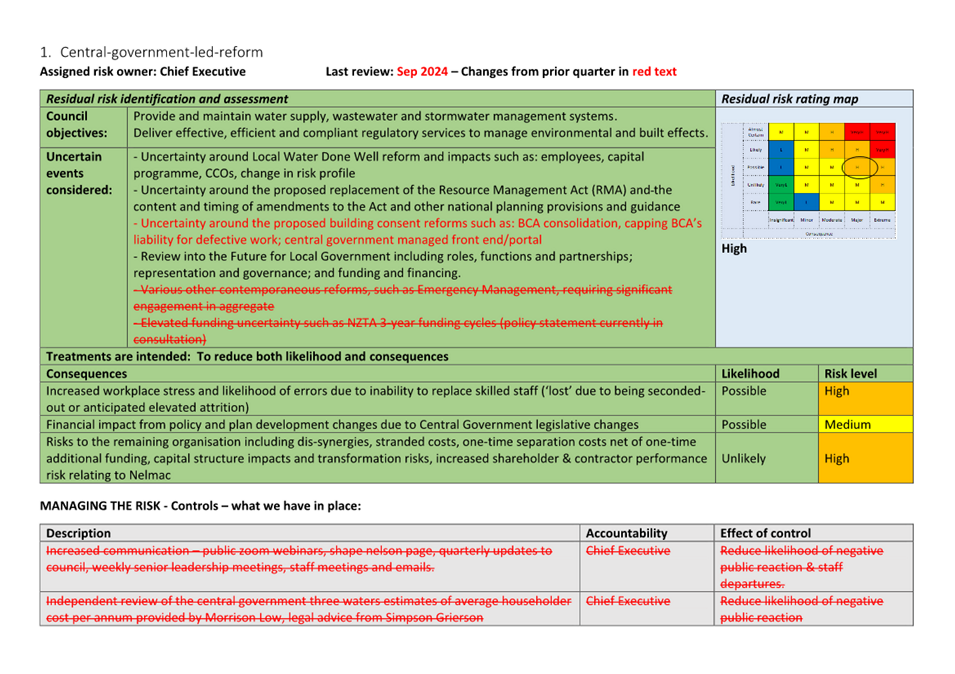

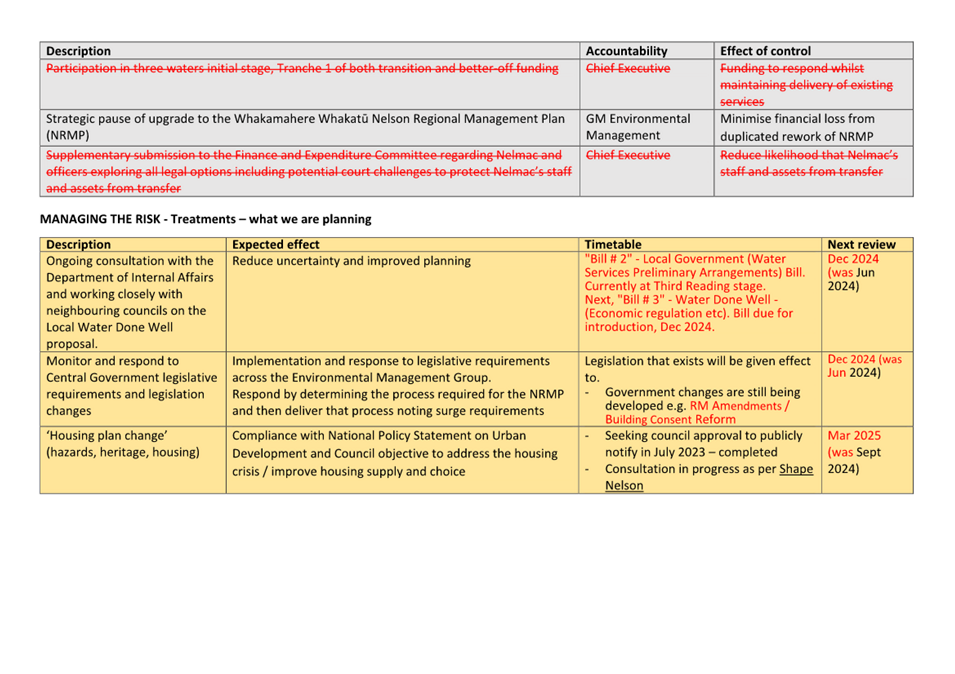

4.2 R1 -

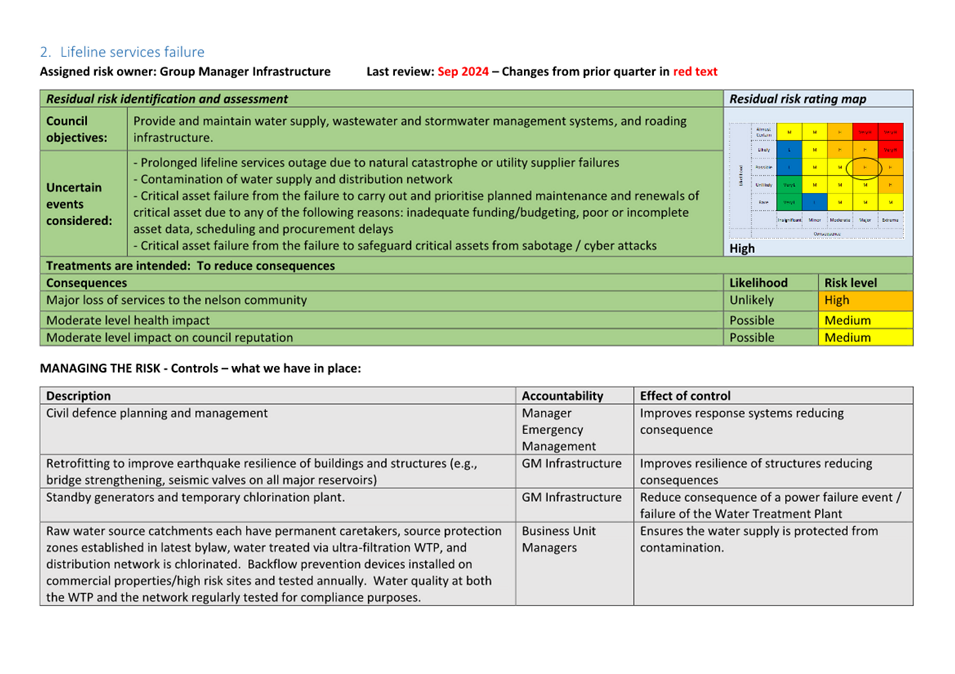

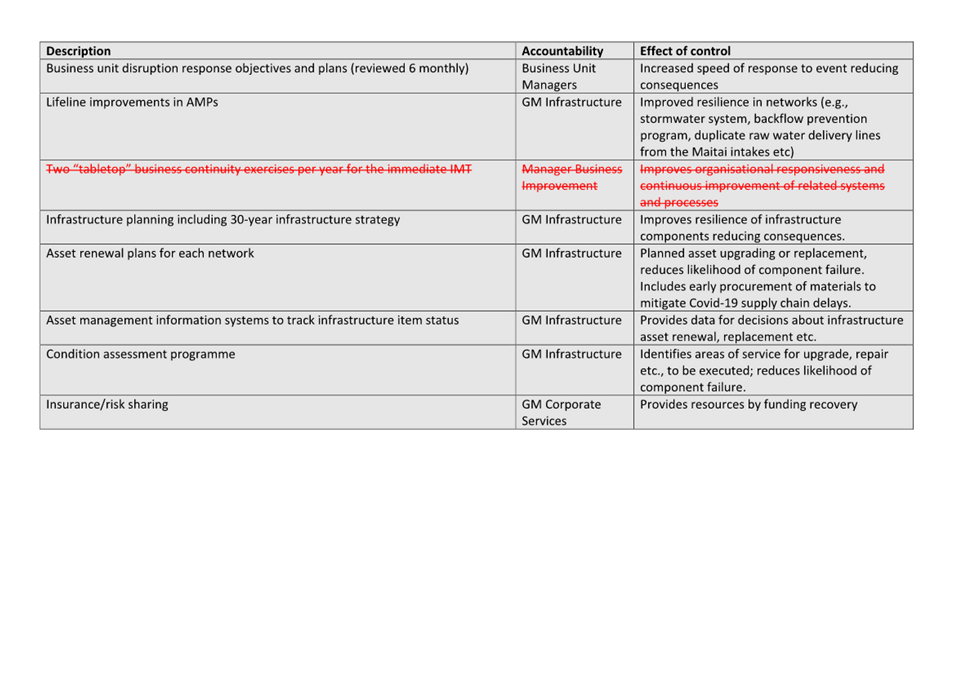

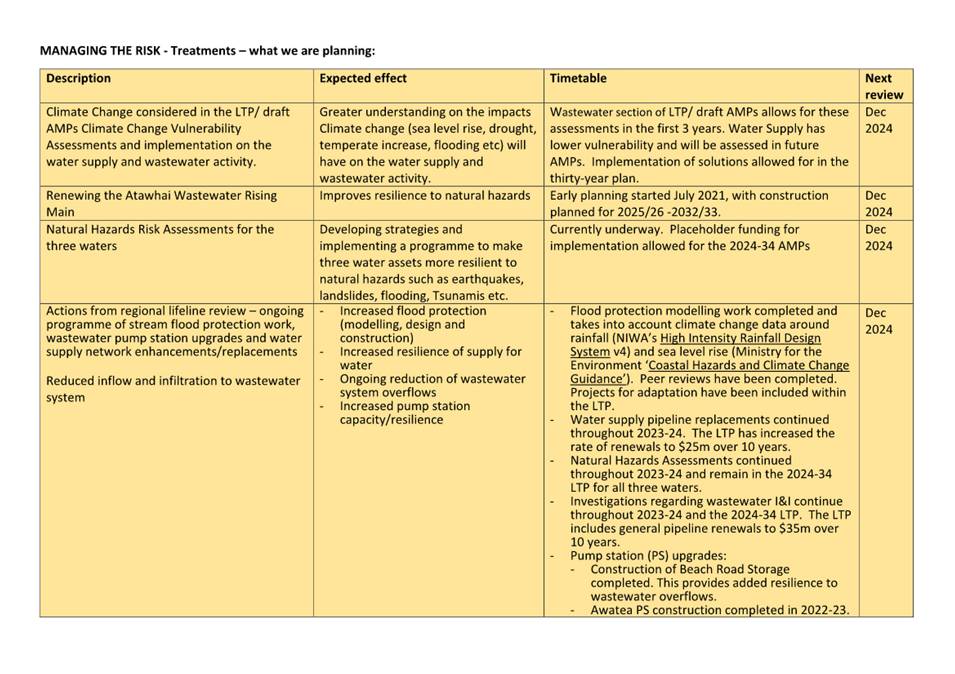

Central-government-led-reforms (Owner: Chief Executive). Risks relating to

deferral of and uncertainty around reforms remain. The risk rating remains at

High.

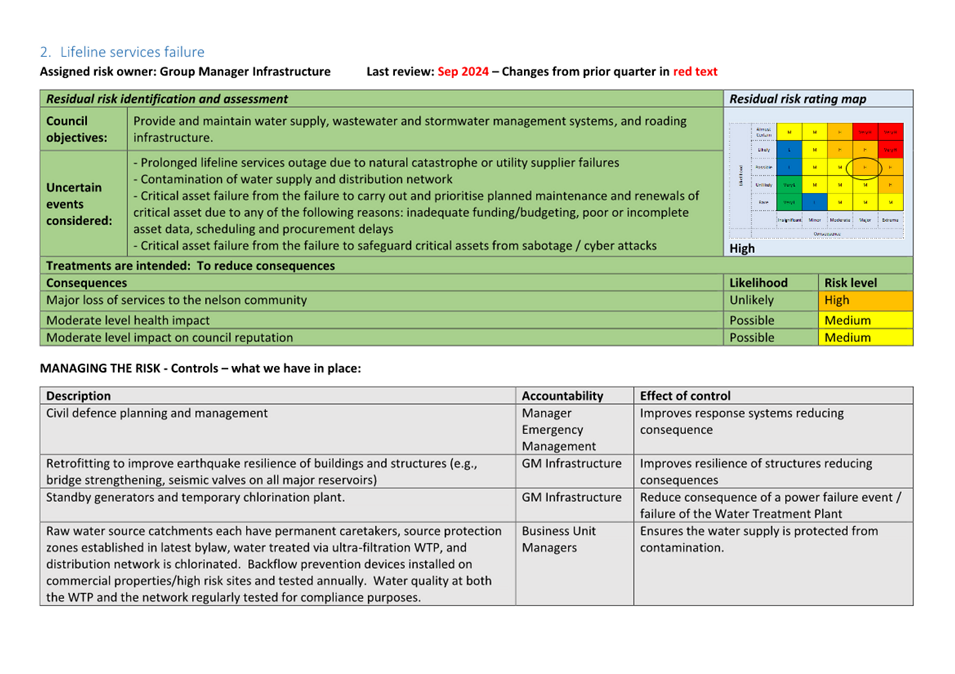

4.3 R2 - Lifeline services

failure (Owner: Group Manager Infrastructure). Flood-recovery work is ongoing.

The risk rating remains at High.

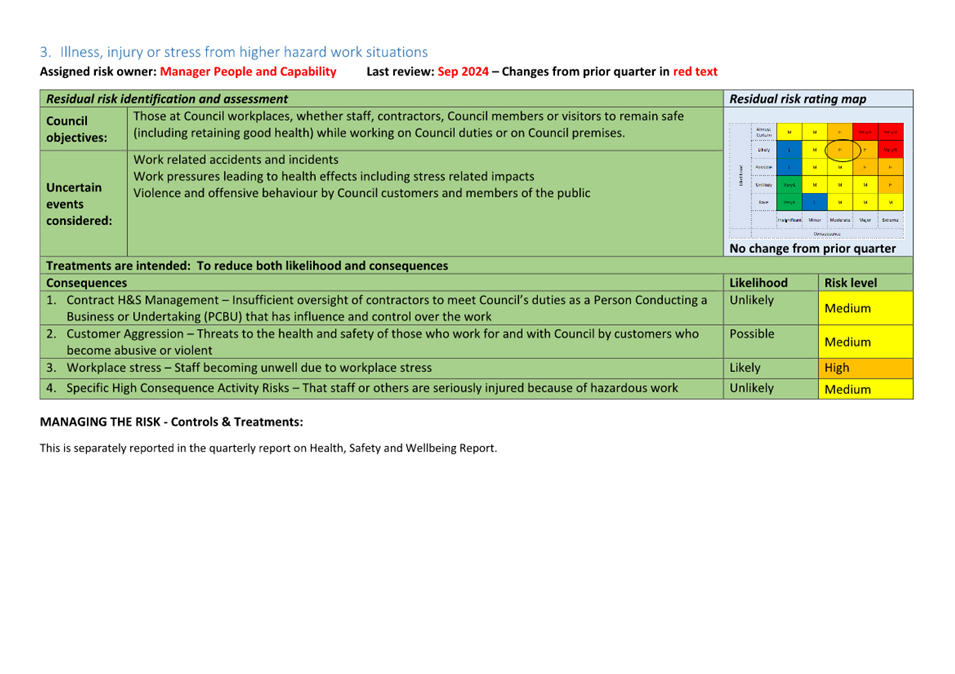

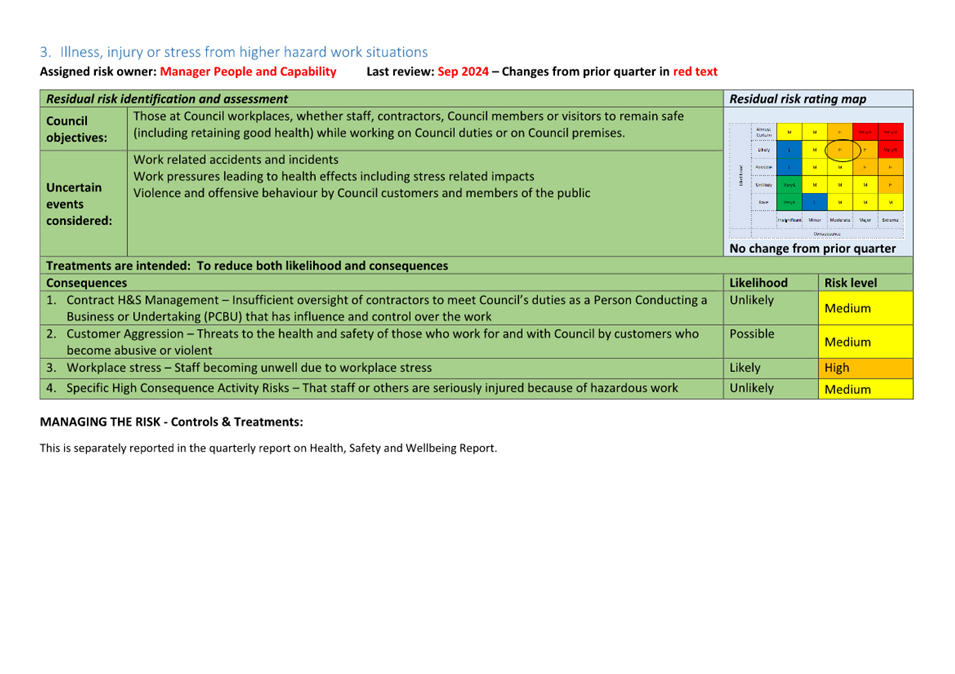

4.4 R3 - Illness, injury

or stress from higher hazard work situations (Owner: Group Manager Corporate

Services). Addressing workplace stress remains an organisational focus area.

The risk rating remains at High.

4.5 R4 - Loss of service

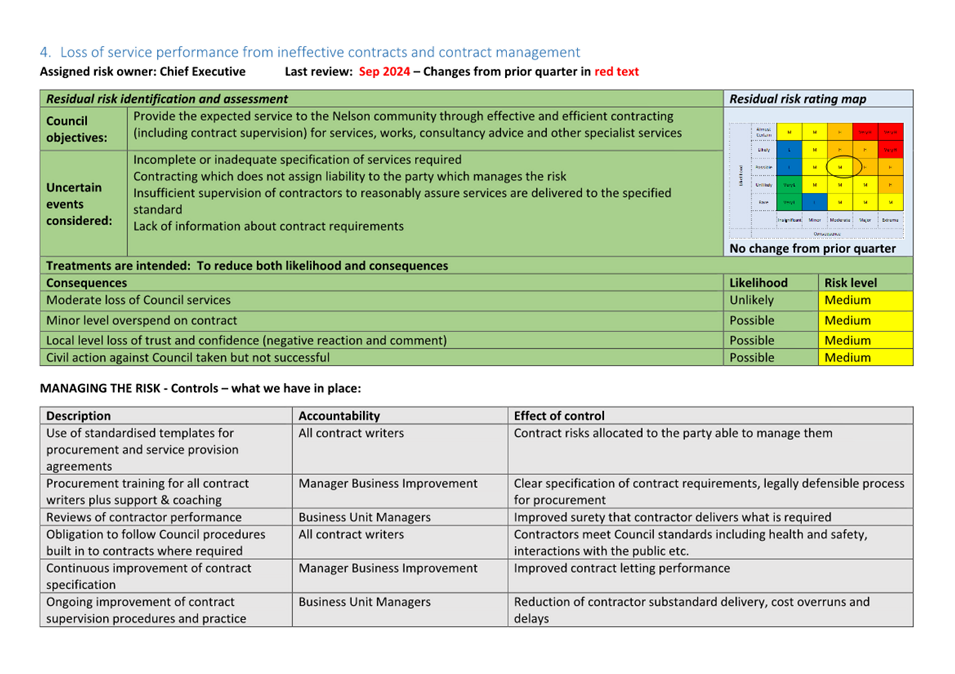

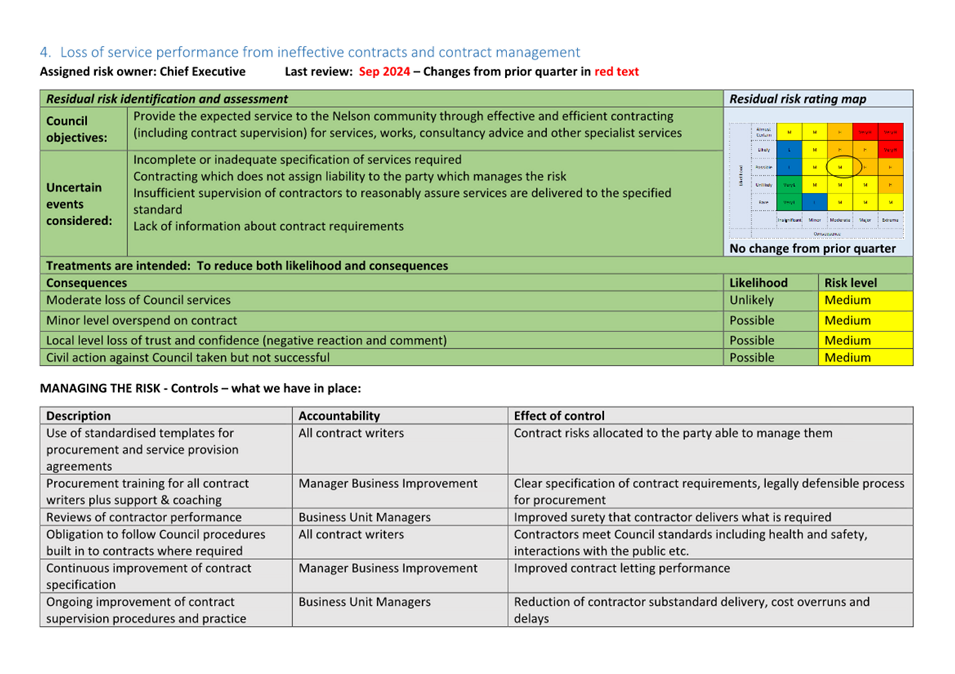

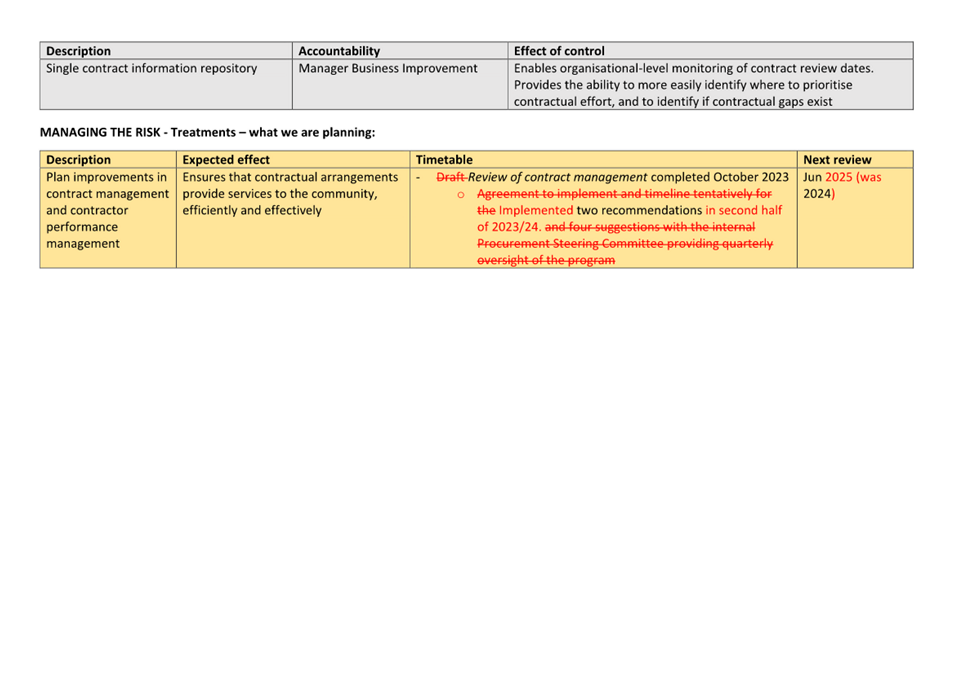

performance from ineffective contracts and contract management (Owner: Chief

Executive). The contract management improvement program continues to be

monitored quarterly by the internal Procurement Steering Committee. The risk

rating remains at Medium.

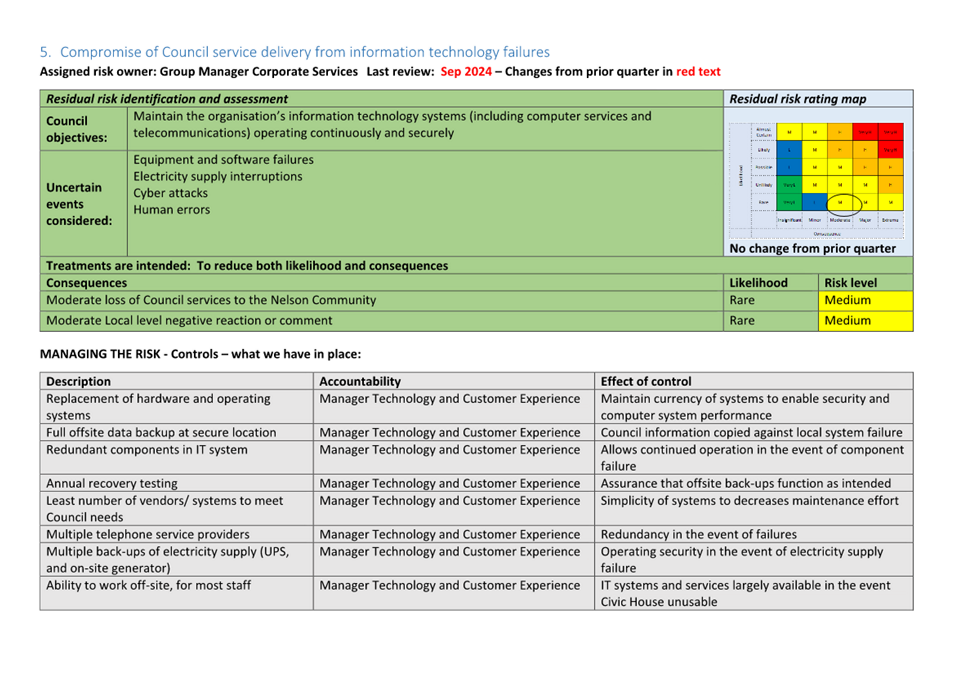

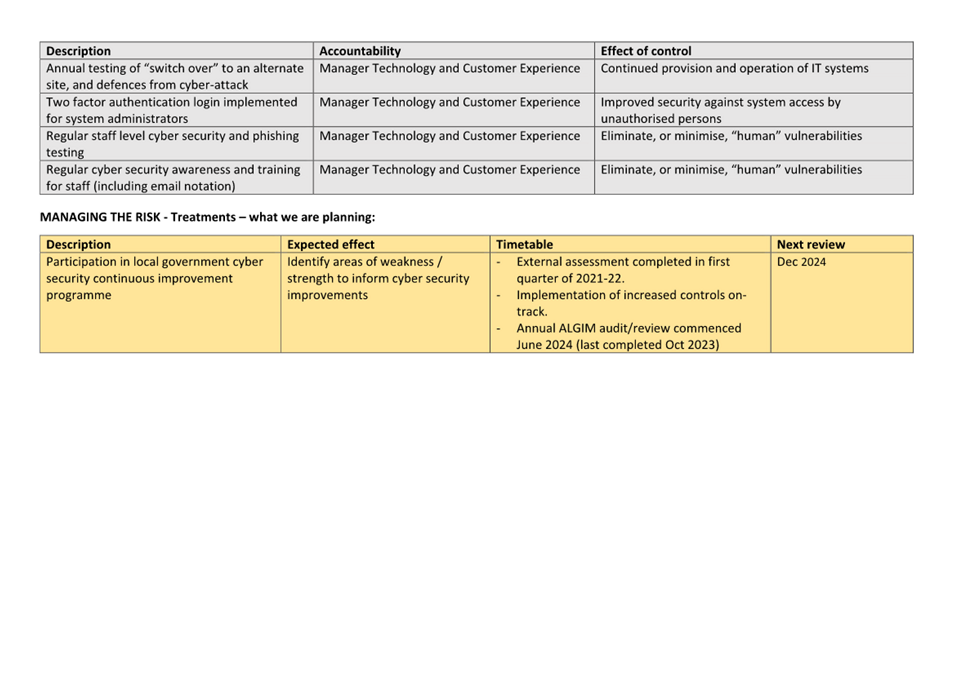

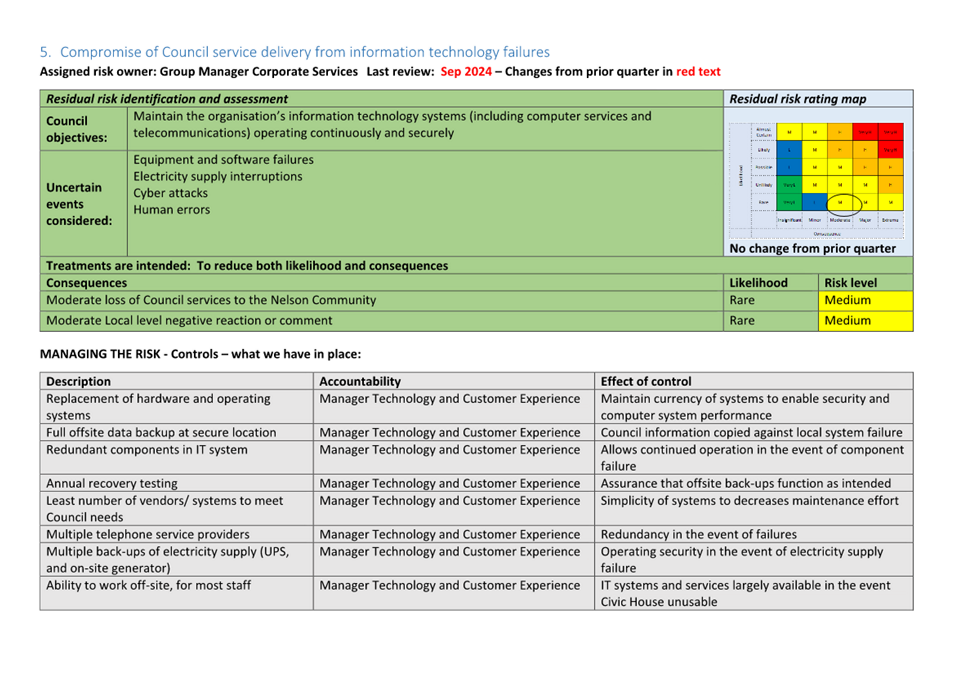

4.6 R5 - Compromise of

Council service delivery from information technology failures (Owner: Group

Manager Corporate Services). No new emerging risks to report at this time. The

risk rating remains at Medium.

4.7 R6 - Council work

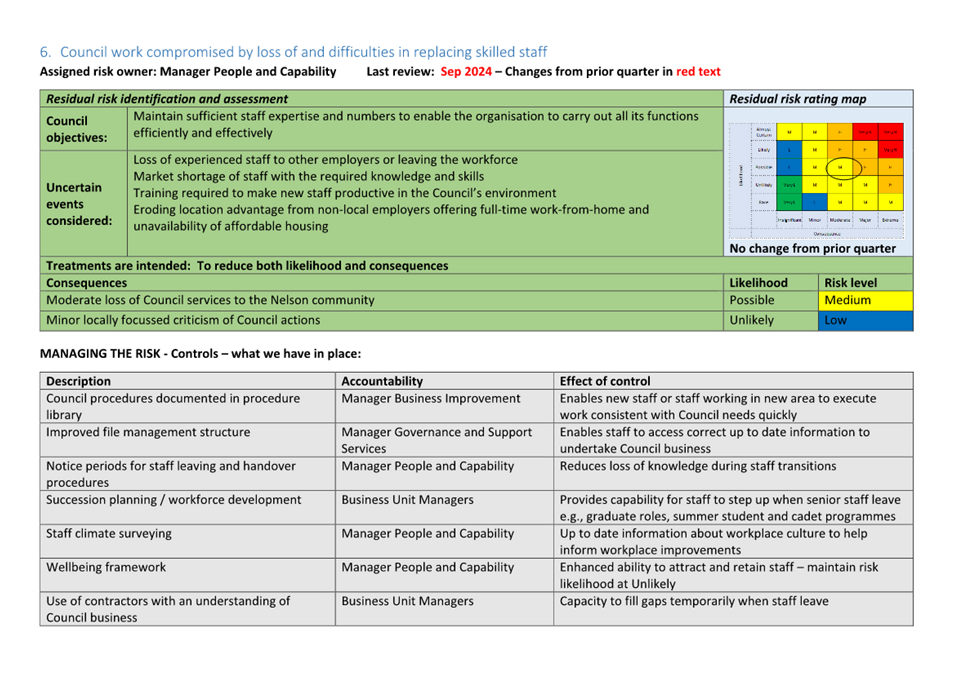

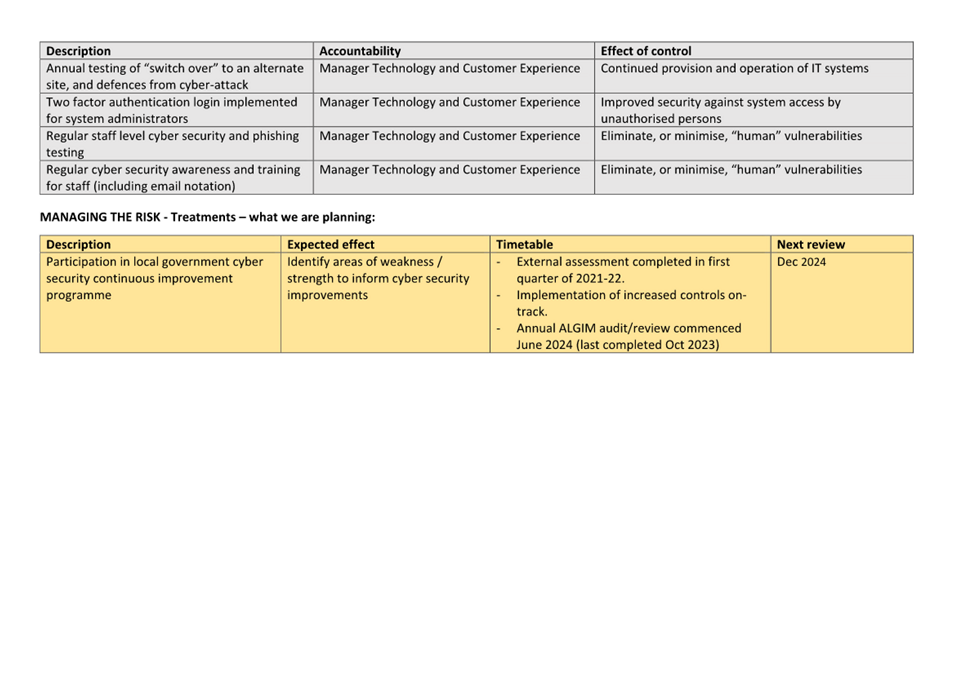

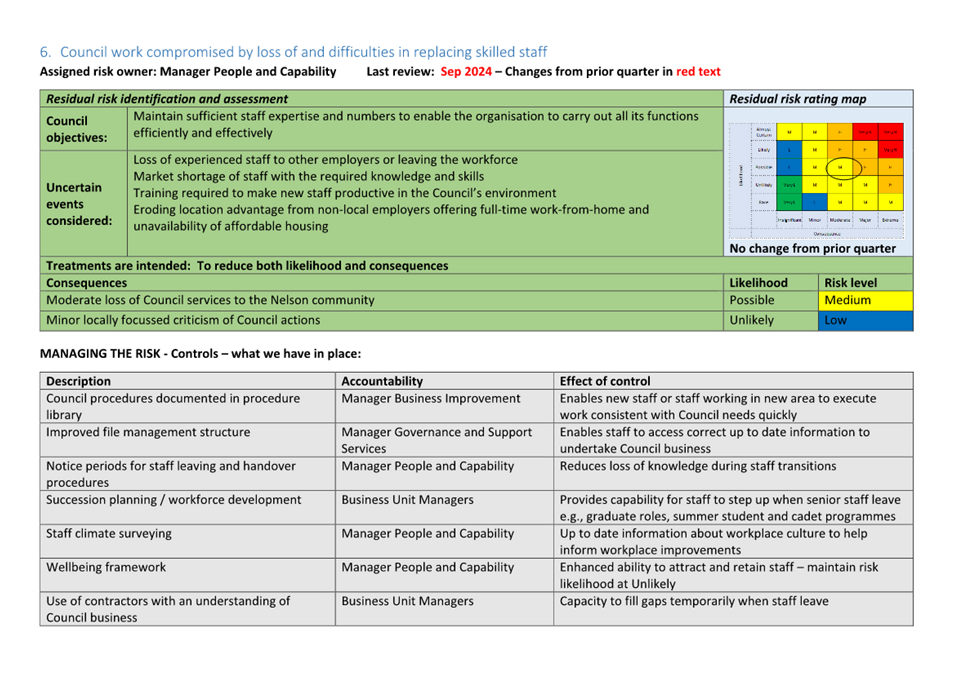

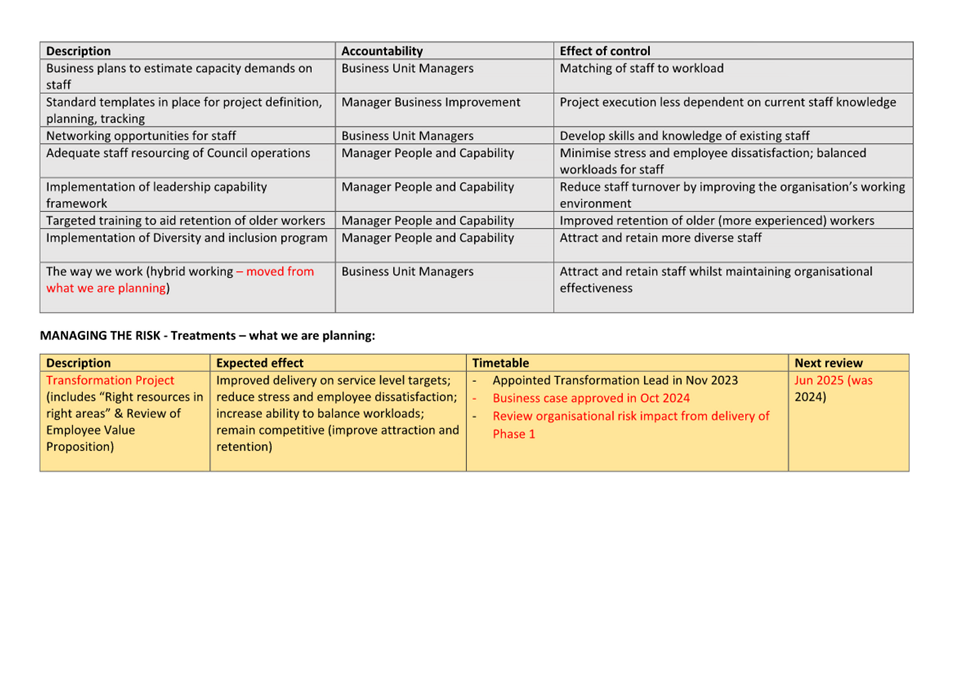

compromised by loss of and difficulties in replacing skilled staff (Owner:

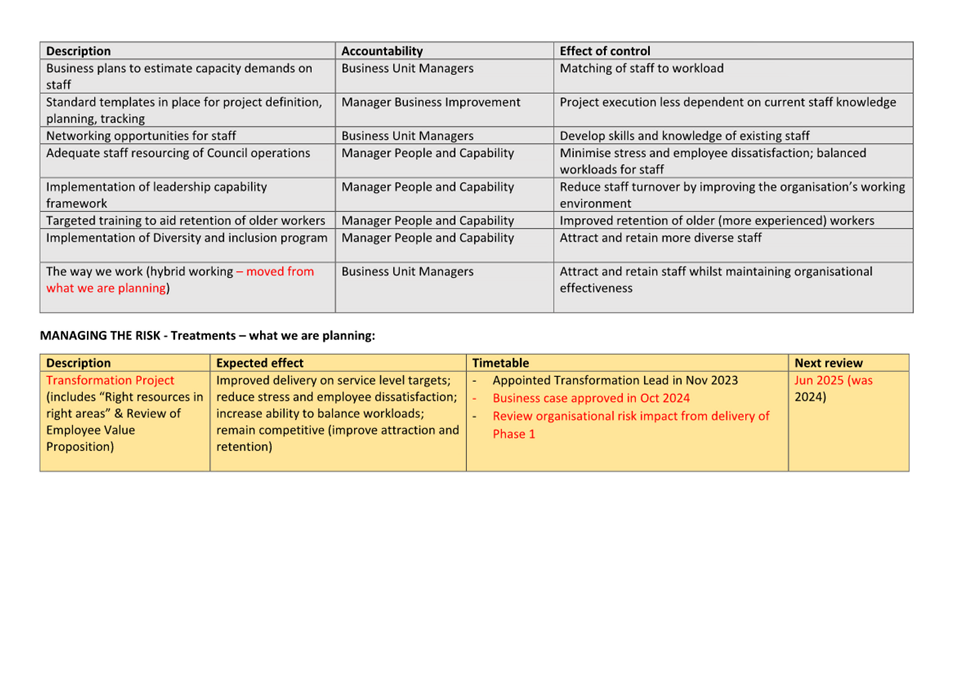

Manager People and Capability). Turnover is continuing to reduce throughout

2024 and no longstanding critical vacancies. Training, inducting and

establishing relationships within the organisation is now a key focus to ensure

that new talent is retained and can thrive. The organisational risk rating

remains at Medium as having the right resourcing in place is critical to our

service delivery.

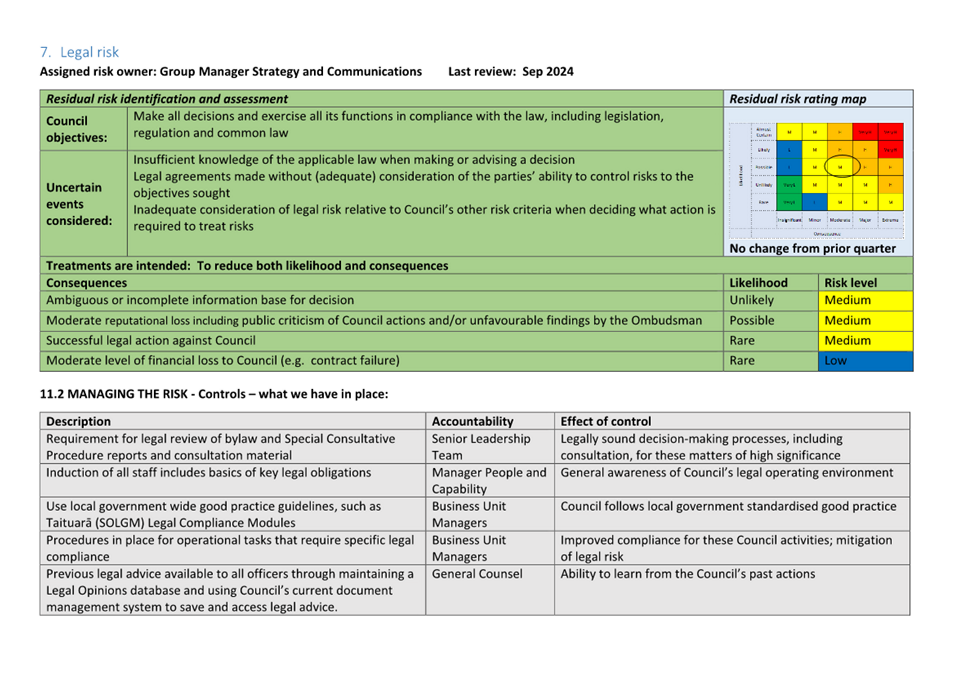

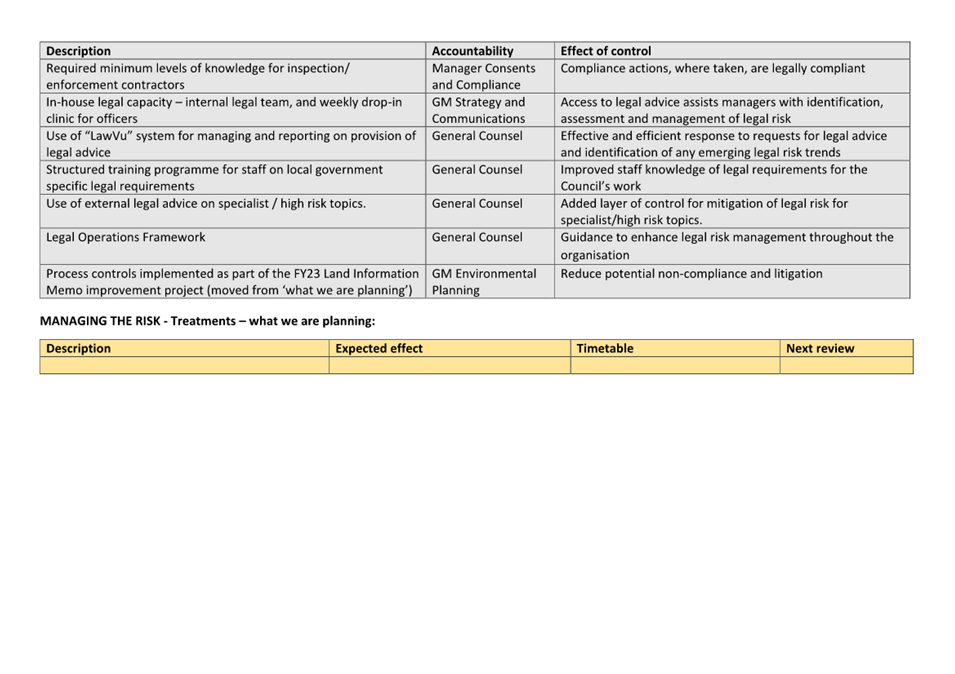

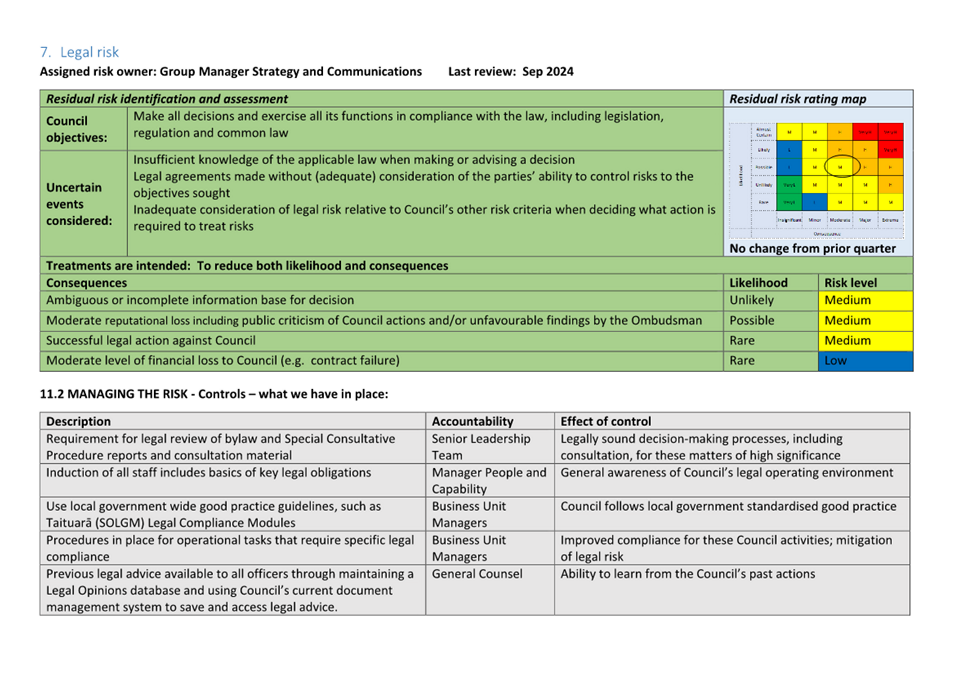

4.8 R7 - Legal Risk

(Owner: Group Manager Strategy and Communications). Other new legal proceedings

or emerging areas of increased litigation risk are separately reported in the

quarterly report on legal proceedings. The organisational risk rating

remains at Medium.

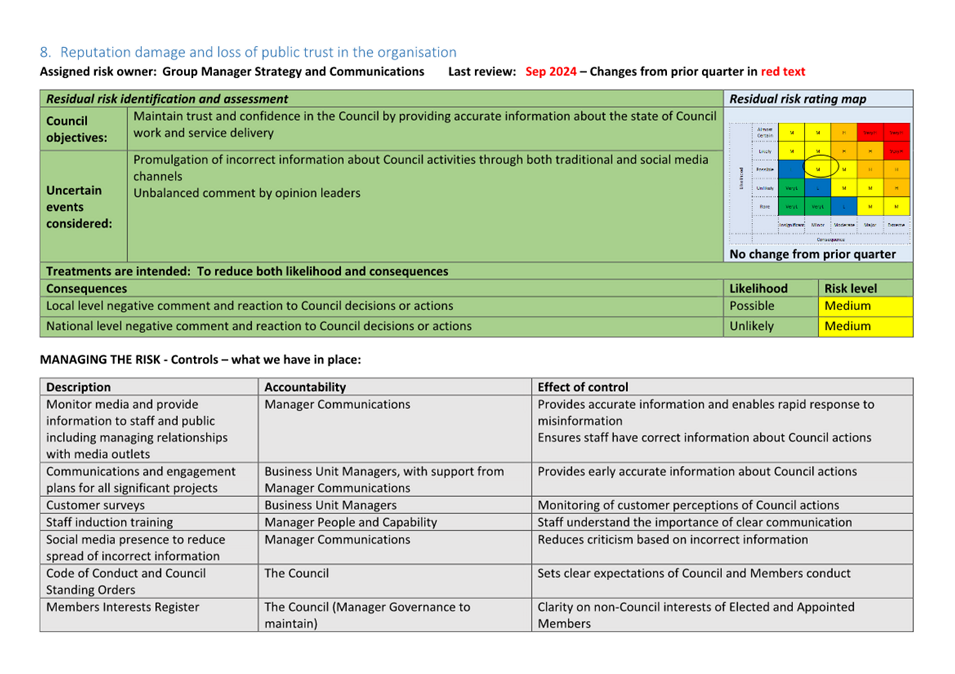

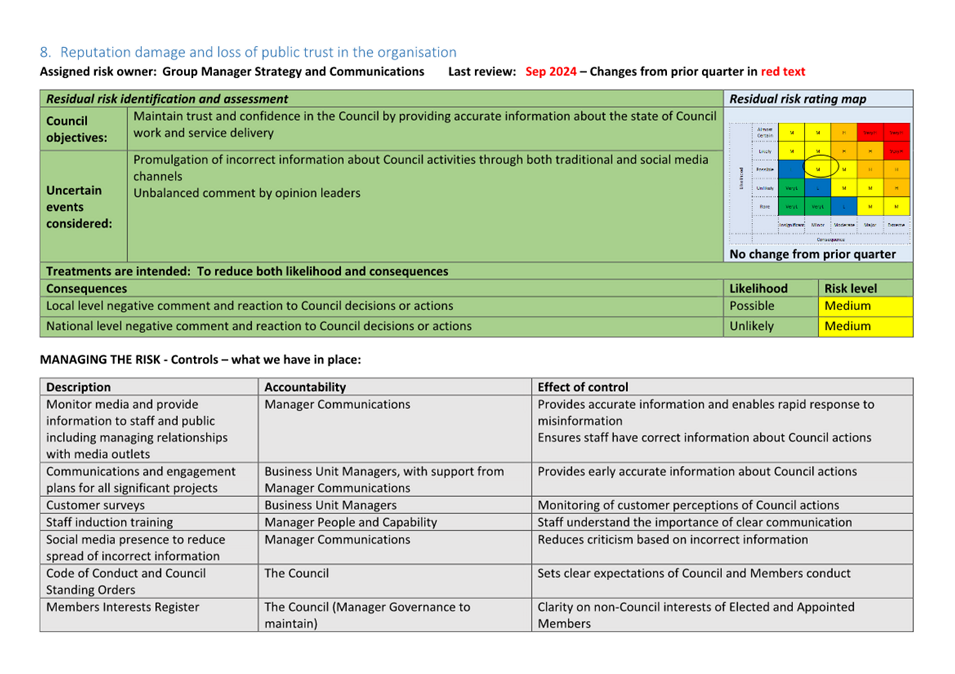

4.9 R8 - Reputation damage

and loss of public trust in the organisation (Group Manager Strategy and

Communications). No new emerging risks to report at this time. The risk rating

remains at Medium

5. Key Risk Areas by

Reporting Group

5.1 Council’s risk

register does not contain specific asset, activity, legal matter, or project

risks. Instead, these are rolled up into more general asset, activity, legal or

project risks. Any significant specific risks which are new or emerging are summarised

below by reporting group.

5.2 Office of the Chief

Executive: No new emerging risks to report at this time.

5.3 Infrastructure

Group: Construction downturn in subdivision work has resulting in

more tenders on some Council works that has realised competitive pricing in

some cases.

5.4 Community Services

Group:

5.4.1 Risks associated with two of three

Council-owned campgrounds (one operated and one leased) remain elevated whilst

non-compliance remediation actions are being implemented. The risks previously

monitored by elected members through the Strategic Development and Property

Subcommittee have been monitored through the usual organisational processes

since that subcommittee ceased at the end of the last triennium.

5.4.2 Risks associated with wood processing

waste deposited at Tāhunanui Beach in the 1960s have been investigated, a

remediation option has been approved by Council, funding has been secured from

Ministry for Environment, and work to remove the contaminated material is well

underway.

5.5 Environmental

Management Group: Some planning positions remain vacant. Workload stress

continues for both planning teams due to complexity of work and uncertainty

about national legislation reform.

5.6 Strategy and

Communications Group: No new emerging risks to report at this time.

5.7 Corporate Services

Group: No new emerging risks to report at this time.

6. Insurance renewal

update

6.1 Below-ground-essential-infrastructure

insurance was renewed from 1 November 2024 for $1.36M (prior year $1.66M). The

bulk of this ‘savings’ is expected to be used to increase the

(sub)limit to 20% of insured values (last year 9%), which equates to a maximum

pay-out of $160M. To put this into context:

6.1.1 NCC left the LAPP scheme in 2017, as

cover of approximately 7% of insured values was deemed inadequate.

6.1.2 When NCC joined the current (South

Island Collective) scheme in 2017, cover was 23% of insured values.

6.1.3 Since 2017, asset values have

increased by a factor of 2.7 yet the (sub)limit has only increased by a factor

of 1.1.

6.1.4 Aon & Tonkin +Taylor 2015 scenario

analysis indicated a 1 in 500 year earthquake return damage ratio of between

14% and 26%.

6.1.5 The Christchurch earthquake series,

saw percent of network damaged ranging from 3% (drinking water reticulation),

to 30% (waste water reticulation including pipelining).

Attachments

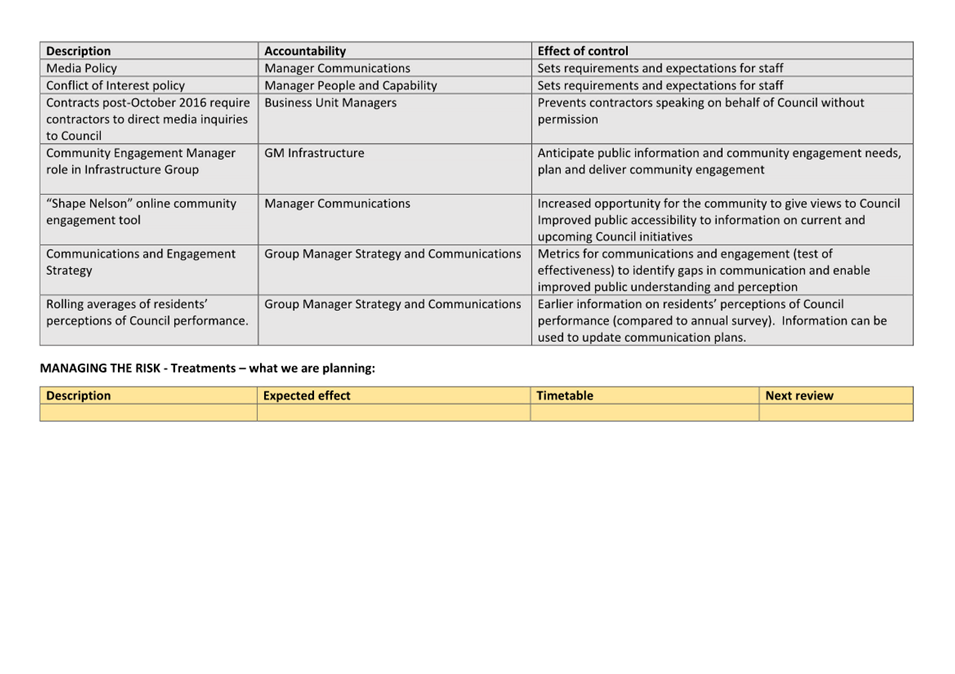

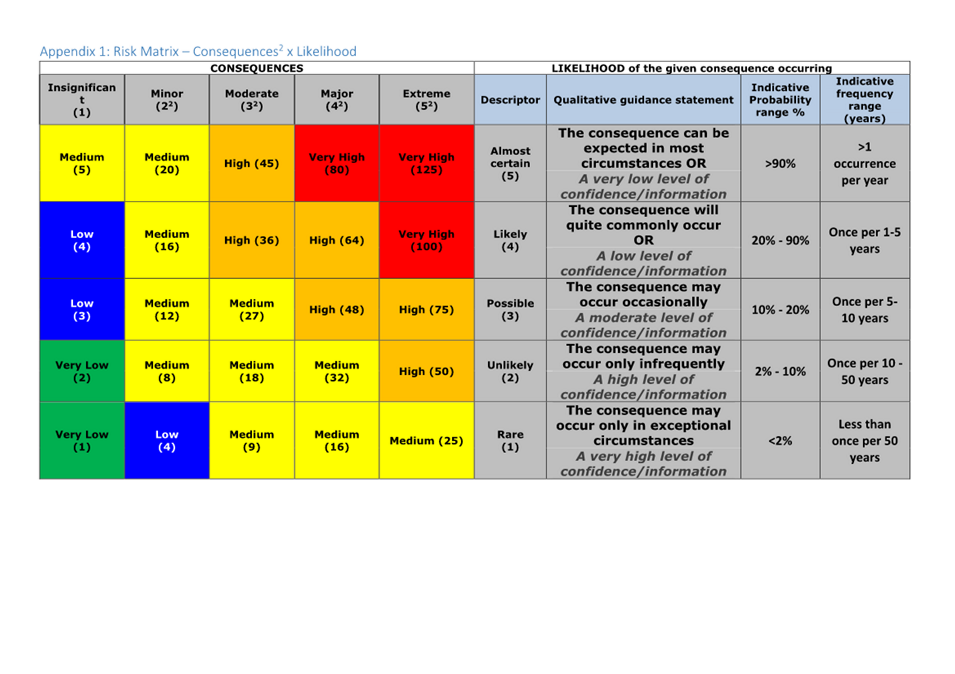

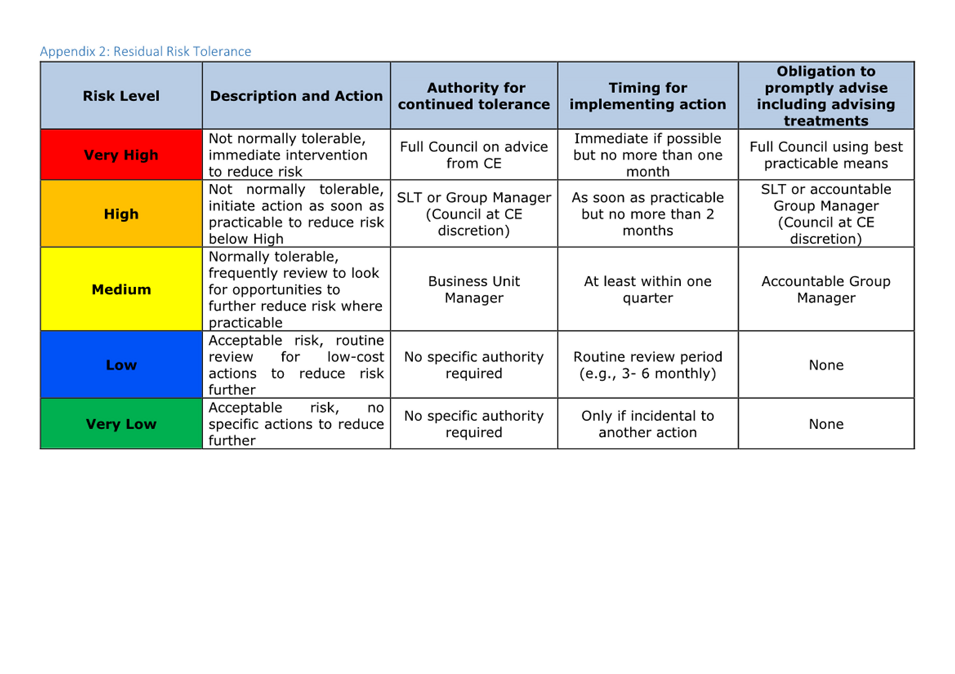

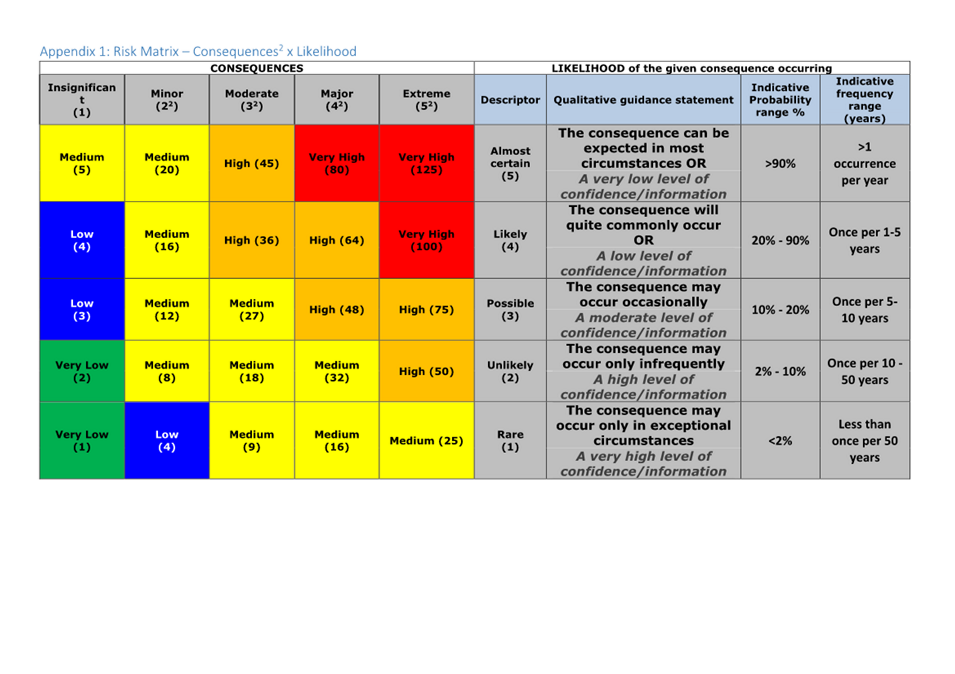

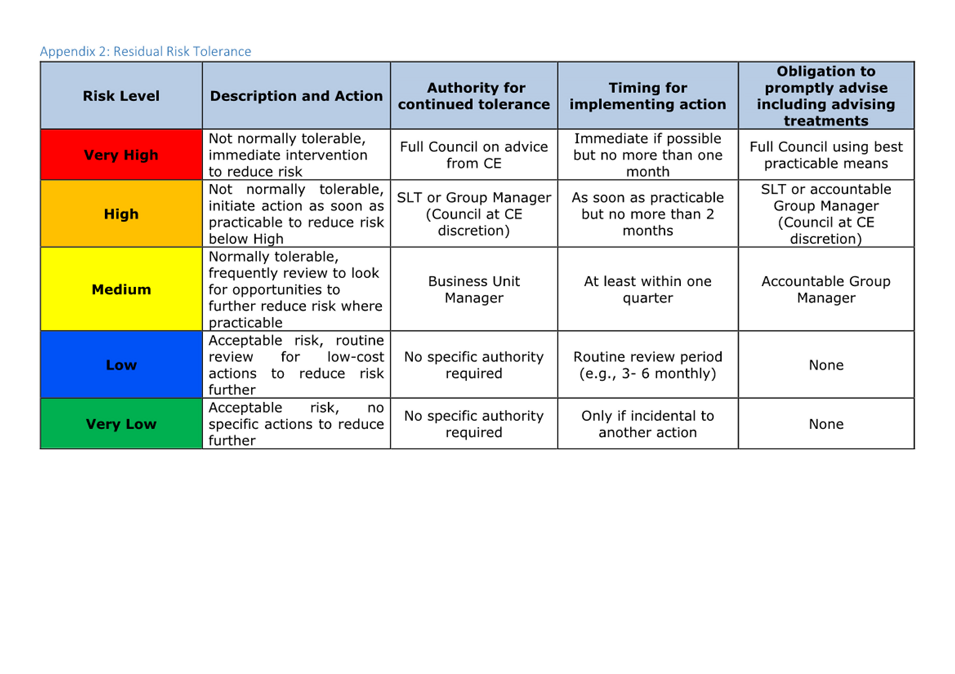

Attachment 1: 1Q25 key

organisational risks for ARF ⇩

Item 7: Quarterly Risk Report - 30 Sept 2024:

Attachment 1

Item 8: Quarterly

Internal Audit Report - 30 Sept 2024

|

|

Audit, Risk and Finance Committee

20 November 2024

|

Report

Title: Quarterly

Internal Audit Report - 30 Sept 2024

Report

Author: Chris Logan - Audit

and Risk Analyst

Report

Authoriser: Nikki Harrison - Group Manager Corporate

Services

Report

Number: R28840

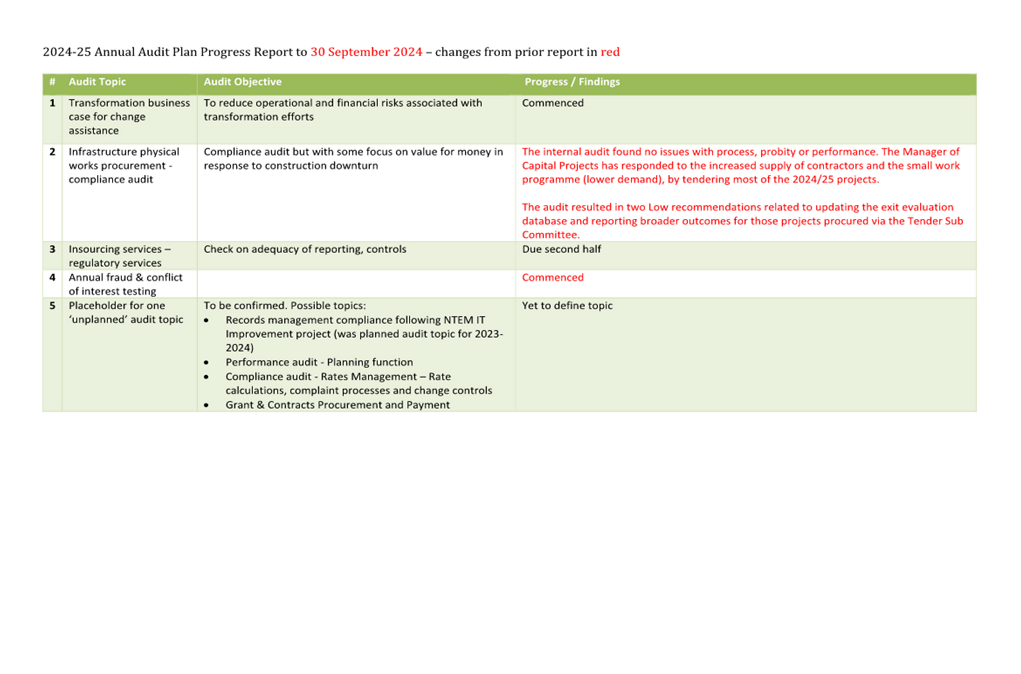

1. Purpose of Report

1.1 To update the Audit,

Risk and Finance Committee on the internal audit activity through to the end of

the first quarter of 2024/25.

2. Recommendation

|

That the

Audit, Risk and Finance Committee

1. Receives the report Quarterly Internal Audit

Report - 30 Sept 2024 (R28840)

and its attachment.

|

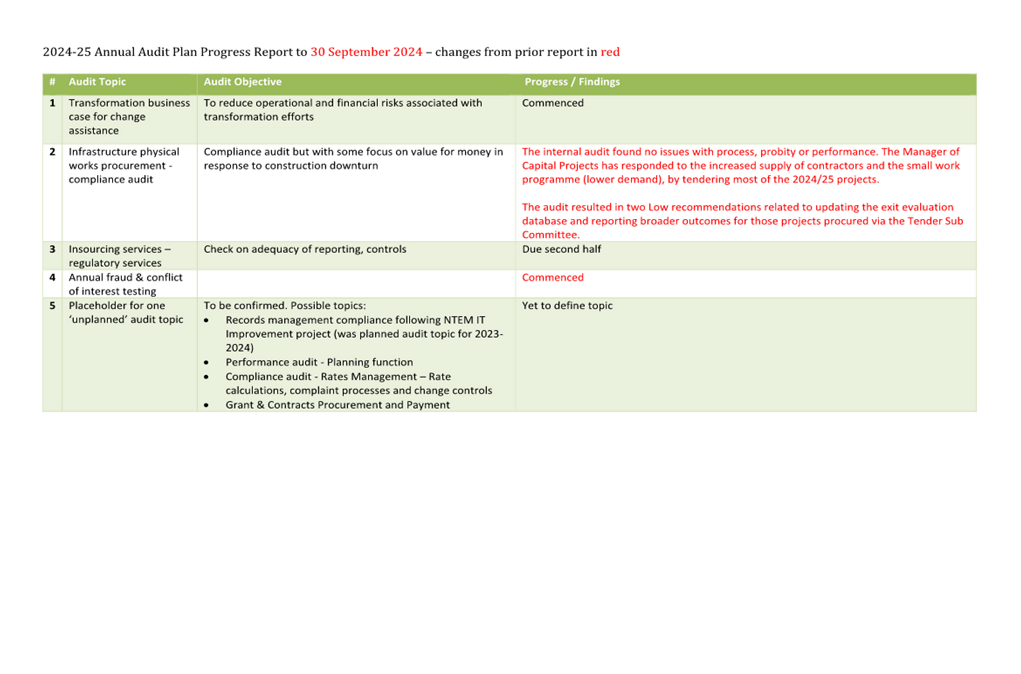

3. Background

3.1 Under Council’s

Internal Audit Charter, the Audit, Risk and Finance Committee requires a

periodic update on the progress of internal audit activities. The 2024-25

Internal Audit Plan (the Plan) was approved by the Council on 6 June 2024.

4. Overview of

Progress on the 2024/25 Internal Audit Plan

4.1 An audit of Infrastructure

physical works procurement was completed during the quarter, resulting in two

Low recommendations.

4.2 Of the remaining

audits:

4.2.1 Two

are in progress

4.2.2 One

is yet to commence, and

4.2.3 One

is yet to be defined

5. Significant

external audits that are not reported separately to the Audit, Risk and Finance

Committee

5.1 The Building team

passed their International Accreditation New Zealand (IANZ) June 2024 audit.

The next routine audit will be in two years’ time.

5.2 Council had a security

audit through SAM for Compliance and ALGIM in August. The auditor assessed

our cybersecurity risk mitigation effectiveness. The results show an

improvement in a number of areas when compared against the framework

conformance levels observed in October 2023. A comparison of the Nelson City

Council assessment results against the ALGIM Cybersecurity Programme national

benchmark for August 2024 shows that the Council continues to have conformance

levels generally above the current benchmark. The only area where Nelson City

Council is behind the national benchmark is with the area of anomaly detection

and the primary means of improvement in this area is to implement a Security

Information and Event Management system, and officers continue to investigate

finding an affordable option for this.

Attachments

Attachment 1: Annual Audit Plan

Progress - 30 Sep 2024 ⇩

Item 8: Quarterly Internal Audit Report - 30 Sept

2024: Attachment 1

Item 9: Quarterly

Finance Report to 30 September 2024

|

|

Audit, Risk and Finance Committee

20 November 2024

|

Report

Title: Quarterly

Finance Report to 30 September 2024

Report

Author: Prabath

Jayawardana - Manager Finance

Report

Authoriser: Nikki Harrison - Group Manager Corporate

Services

Report

Number: R28871

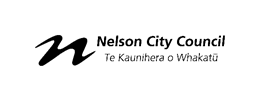

1. Purpose of Report

1.1 To inform the

Committee of the financial results for Council for the three months ended 30

September 2024, and to highlight any material variations.

2. Recommendation

|

That the

Audit, Risk and Finance Committee

1. Receives

the report Quarterly Finance Report to 30 September 2024 (R28871).

|

3. Background

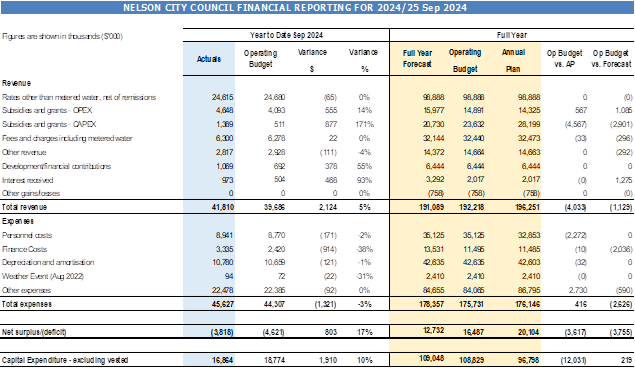

3.1 The

whole of Council financial reporting provided to this Committee focuses on the

three-month performance (1 July 2024 to 30 September 2024) compared with the year-to-date (YTD) approved capital and operating

expenditure budgets. The quarterly report includes Nelson City

Council performance only and does not include its subsidiaries, associates and

joint ventures.

3.2 Unless

otherwise indicated, all information is against approved operating budgets, which is Annual Plan 2024/25, plus any carry forwards, plus or minus

any other additions or changes as approved by the Council.

3.3 Commentary

is provided below for significant variances of +/- $500,000.

4. Financial

Performance

4.1 For

the three months ending 30 September 2024, the Council’s draft

deficit is $3.8m against a budgeted deficit of $4.6m ($0.8m favourable to

budget), mainly due to reasons explained from 4.3 below.

4.2 Profit

and Loss

Full Year Forecast vs. Operating Budget Net

surplus/(deficit)

4.3 The

Full Year Forecast is less than the Operating

Budget by $3.8 million. There are

increases and decreases in different areas but the significant changes are:

4.3.1 Subsidies and Grants - Opex: Tahunanui Sawdust Risk

Mitigation Grant. The forecast has been increased by $0.7m to reflect the

agreed Government Funding from the newly opened Contaminated Sites and

Vulnerable Landfills Fund. The grant amounts to 75% of the total expected

cleanup cost of $4.59m.

4.3.2 Subsidies and Grants – Capex: Forecast has

been decreased by $4.5m in Subsidised Roading to reflect the reduced funding

from NZTA Waka Kotahi however the operating budget has not been adjusted as

this requires Council approval. This is partially offset by unbudgeted $1.6m of

Maitai Flood Management Grants (RIF) with $0.7m in Stormwater and $0.9m in

Flood Protection.

4.3.3 Finance Revenue: includes an increase to forecast

of $1.3m due to additional pre-funding of future debt maturities (which

partially offsets the higher than forecast Finance Costs below).

4.3.4 The forecast for Finance Costs has increased by

($2.0m) due in part to prefunding of debt (see Finance Revenue), and in part to

higher than budgeted debt levels. Opening debt levels had some permanent

differences and some timing differences due to a delay in some funding for

weather event related costs.

4.3.5 Other Expenses includes an overall increase to

forecast of ($0.6m) however there are many increases and decreases spread over

many different areas with no one variance over $0.15m.

Operating

Budget vs. Annual Plan Budget Net surplus/(deficit)

4.4 The

Full Year Operating Budget is less than the

Annual Plan Budget by $3.6 million. There are increases and

decreases in different areas but the significant changes are:

4.4.1 Subsidies and Grants – Opex: Includes an

increase in operating budget of $0.6m for Operating Grants carried forward from

2023/24 to align with timing of costs of which $0.5m was 3 Waters Better off funding

(timing difference).

4.4.2 Subsidies and Grants – Capex (Corporate): Includes

a ($4.1m) reduction in operating budget, as the Crown capital funding for slip properties

was carried back to 2023/24 during the Annual Report audit (timing).

4.4.3 Subsidies and Grants – Capex

(Transport): Includes a total reduction in operating budget of $1.3m in

public transport for the Millers Acre bus interchange. NZTA Waka Kotahi funding

for the next three years, through the National Land Transport Programme, was

confirmed after the LTP was signed off. Budgets have been reduced to match the

reduced income from NZTA Waka Kotahi as the Council decided to proceed the

project without NZTA Waka Kotahi funding at 10 October 2024 Council meeting

(R28780).

4.4.4 Personnel Costs and other expenses include a budget

re-allocation of $2.1m from other expenses to Personnel costs with Regulatory

Services functions coming in house (reclassification).

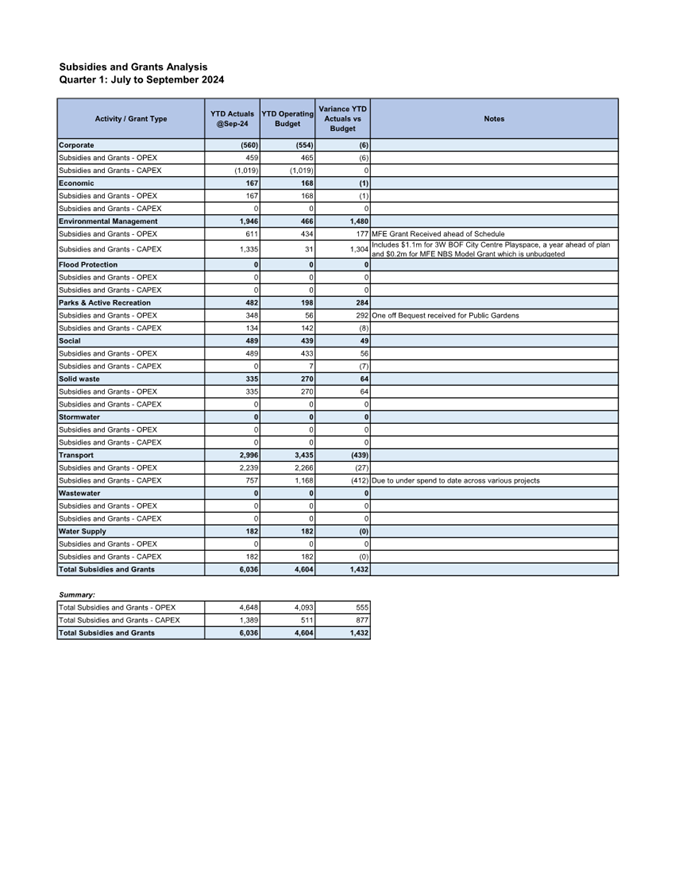

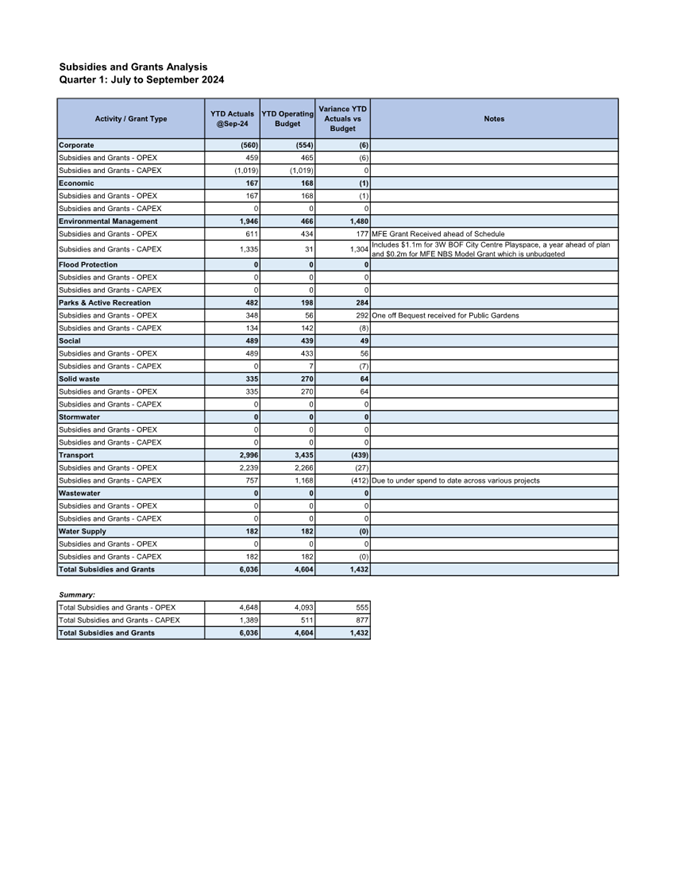

4.5 Revenue

4.6 Rates

income is in-line with budget.

4.7 Subsidies

and Grants - OPEX income is greater than budget by

$555,000. Attachment 1 includes a

detailed analysis of this variance.

4.8 Subsidies

and Grants - CAPEX income is greater than budget by

$877,000. Attachment 1 includes a

detailed analysis of this variance.

4.9 Fees

and Charges income is in-line with budget.

4.10 Other

Revenue is less than budget by $111,000.

4.11 Development

Contributions is greater than budget by $378,000.

4.12 Finance

Revenue is greater than budget by $468,000.

This is due to additional pre-funding of future debt maturities (see partial

offset in Finance costs below).

4.13 Other

gains/(losses) is in-line with budget.

4.14 Expenses

4.15 Personnel

costs are greater than budget by $171,000.

There have been savings in personnel costs of $556,000 across different

activities however the YTD vacancy provision in the budget was high at 9% ($727,000).

4.16 Finance

costs are greater than budget by $914,000. This

increase in interest costs is due to additional pre-funding of debt (which has

a partial offset of $468,000 from Finance Revenue). The remaining is due to

higher than budgeted debt levels as addressed in 4.3.4 above, partially offset

by lower interest rates than budgeted for.

4.17 Depreciation

and amortisation costs are greater than budget by

$121,000. Depreciation has been based on the 2023/24 asset

valuations, which saw large increases. This resulted in a higher

depreciation expense than planned.

4.18 Weather

Event costs are in-line with budget.

4.19 Other

expenses are in-line with budget. There are variances within, however none are

greater/less than budget by $0.5m.

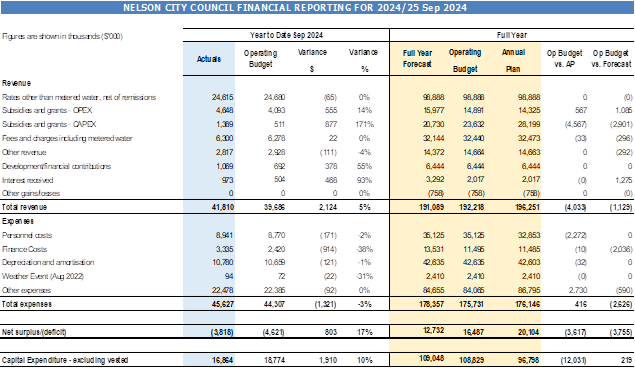

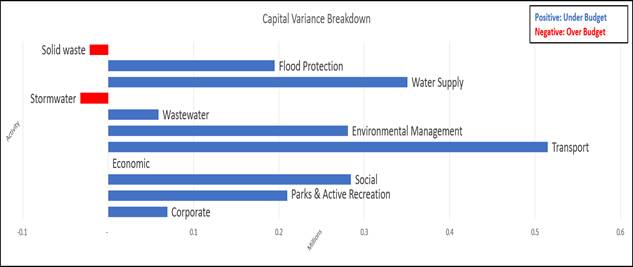

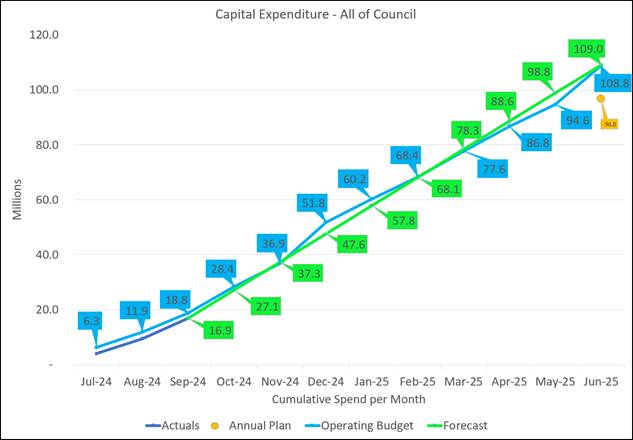

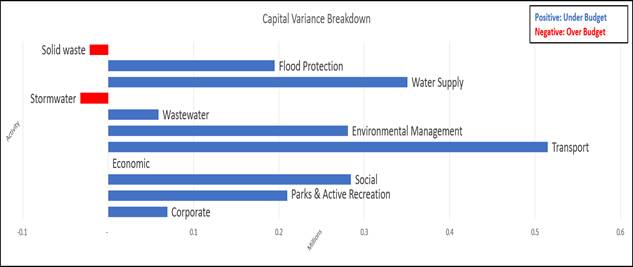

5. Capital

Expenditure

5.1 Capital Expenditure

(including staff time, excluding vested assets and joint operations)

5.2 As

at 30 September 2024, capital expenditure was $16.9m which is $1.9m under the

YTD Operating Budget of $18.8m. Transport was the main contributor being less

than budget by ($0.5m) which generates less CAPEX Subsidies and Grants as

discussed above.

5.3 The

operating budget includes the carry forwards from 2023/24 which were approved

at the October 2024 Council Meeting.

5.4 A high-level breakdown

by activity:

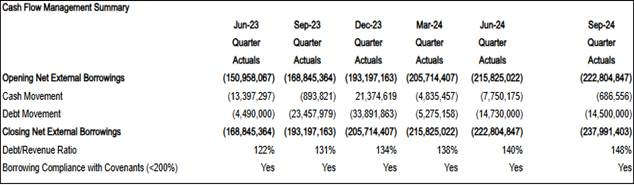

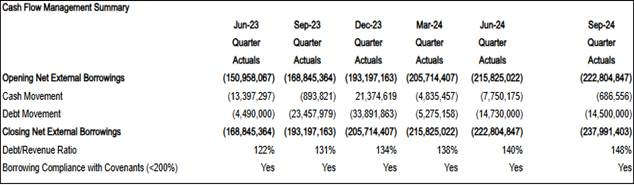

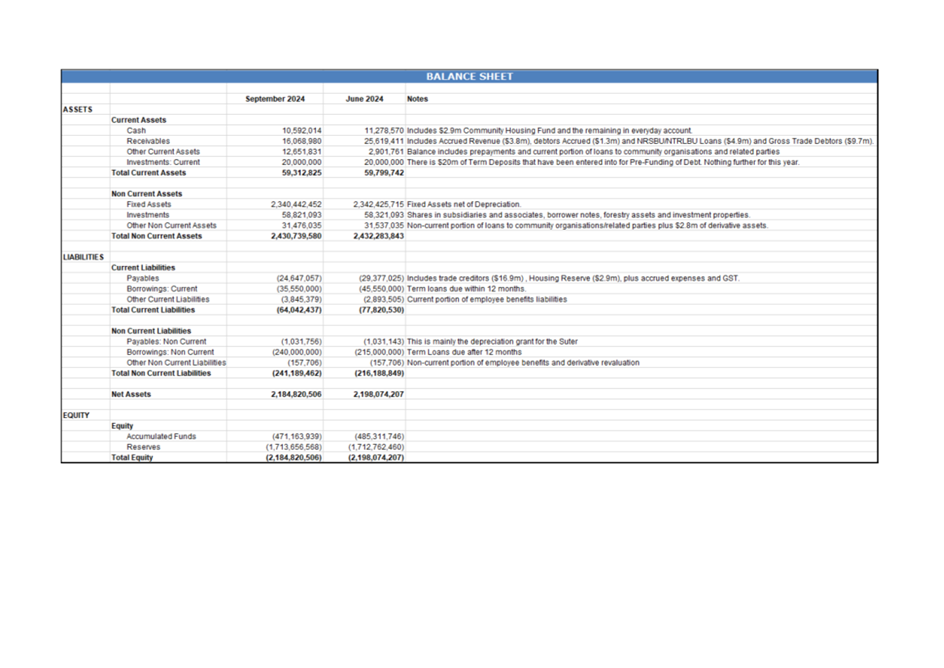

6. Cash Flow

Management

6.1 Net External

Borrowings

6.2 As

at 30 September 2024, there were net external borrowings of $238.0m. This has

increased from 30 June 2024 by $15.2m. The full-year Annual Plan budget is

$252.3m.

6.3 This

$15.2m increase in net external borrowings from 30 June 2024 is due to: a) to

fund the August 2022 weather event ($0.09m expenditure), b) to fund capital

expenditure during the year ($6.2m net of funded depreciation) c) the balance

is due to timing of cash inflows and outflows being different than planned.

6.4 Attachment

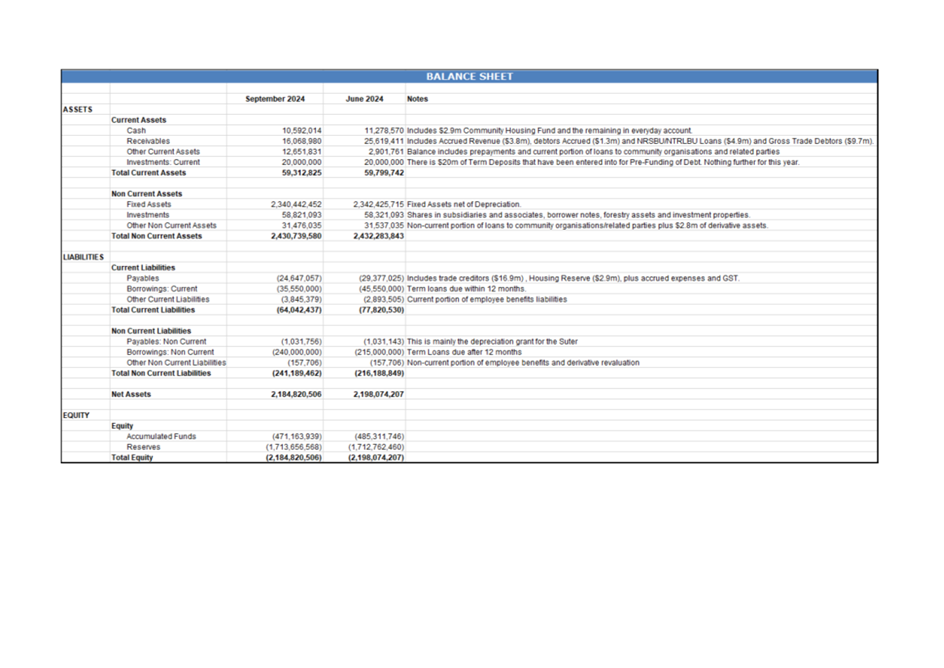

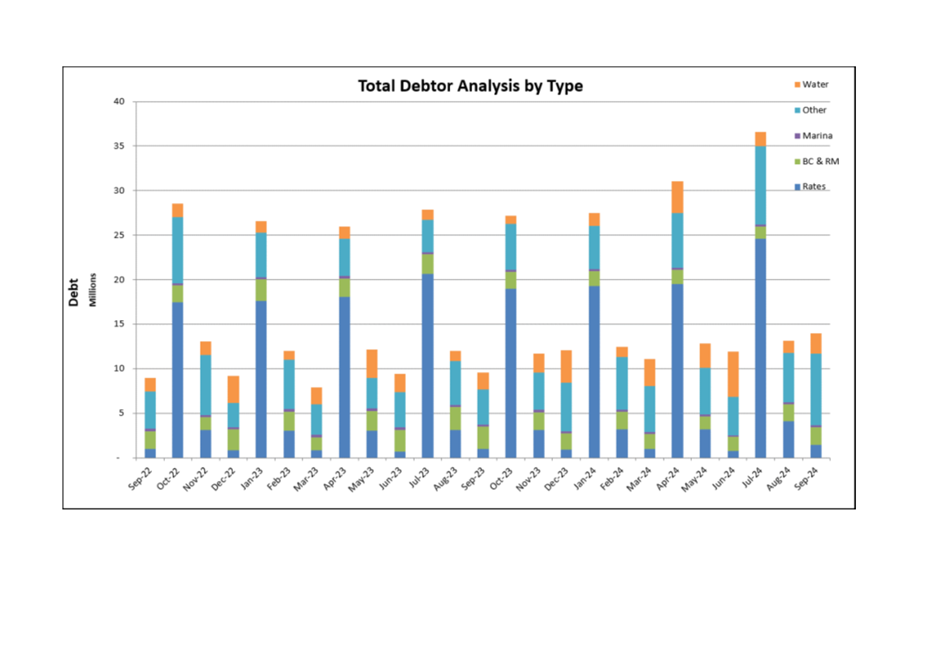

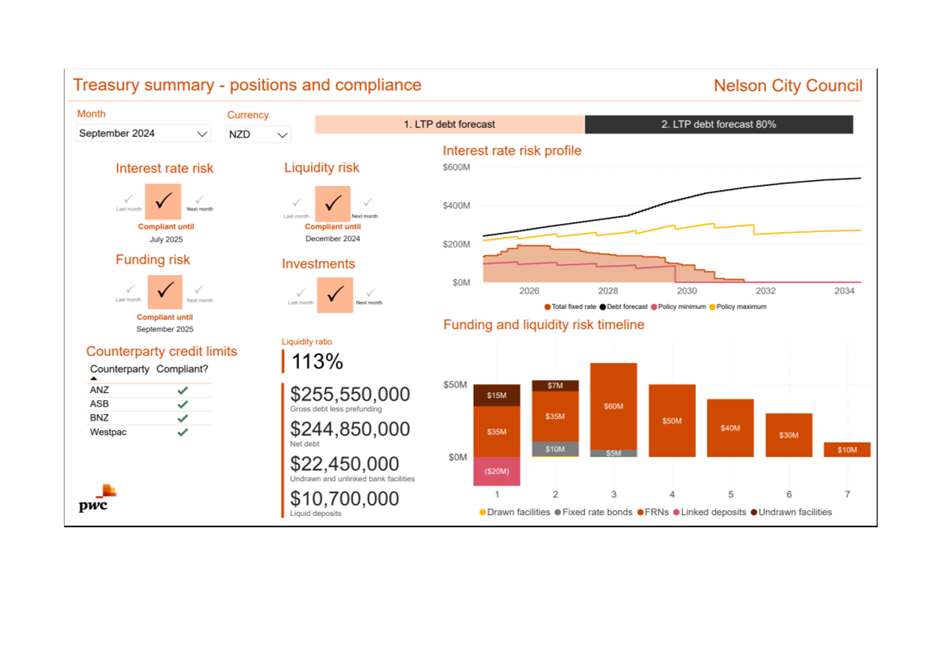

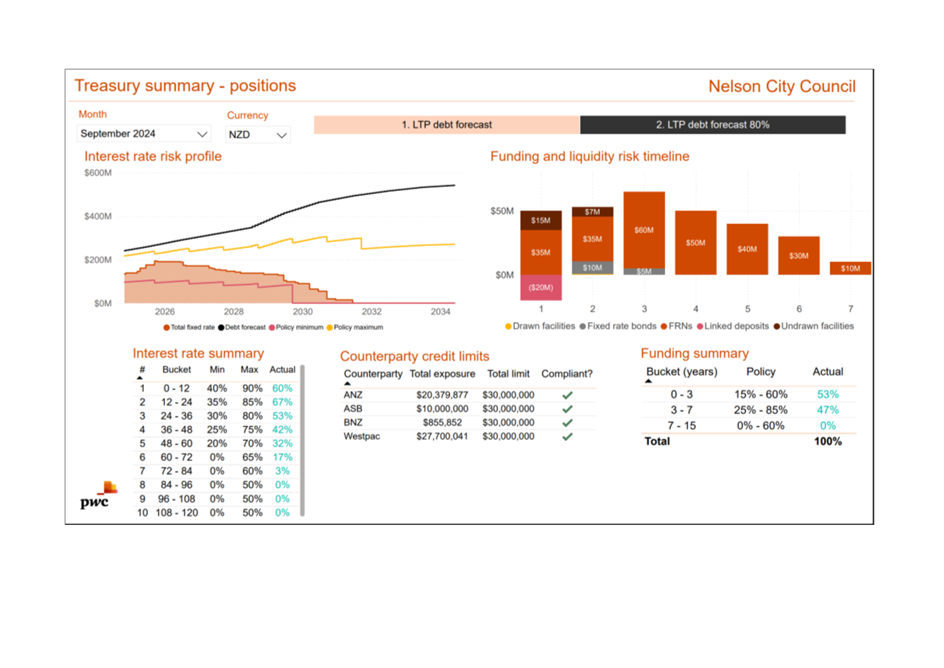

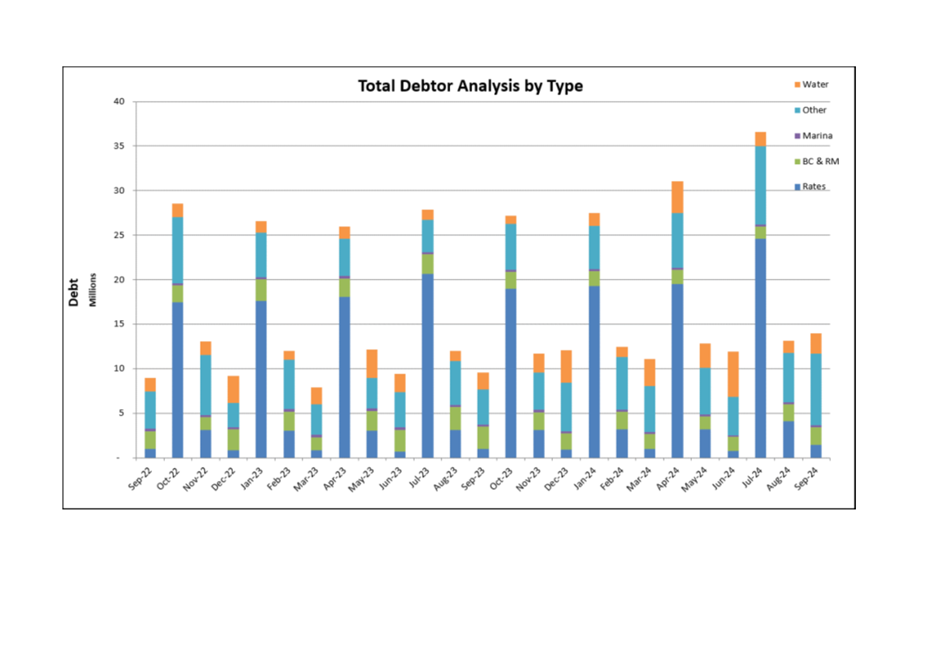

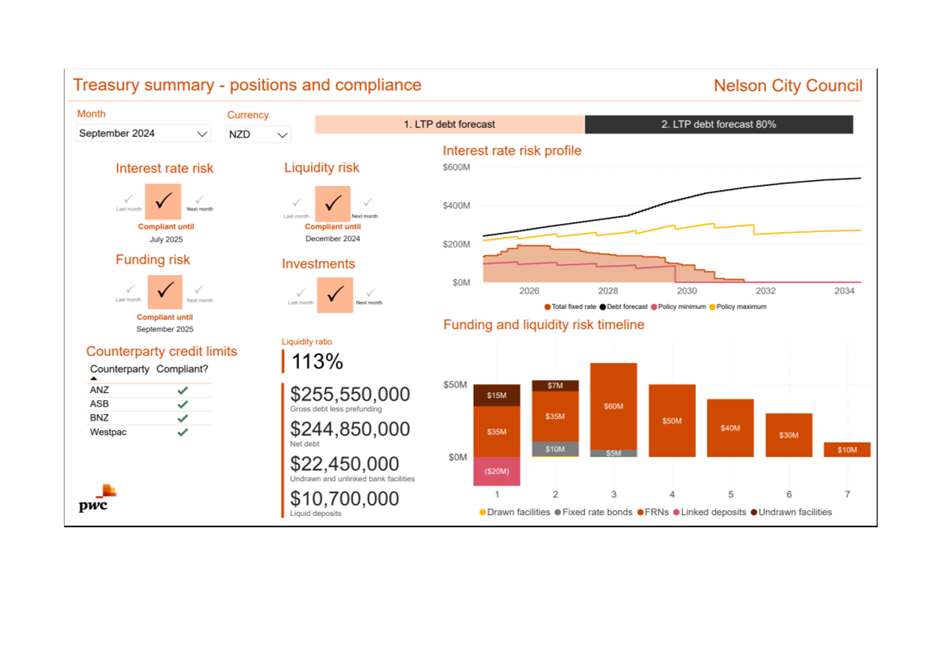

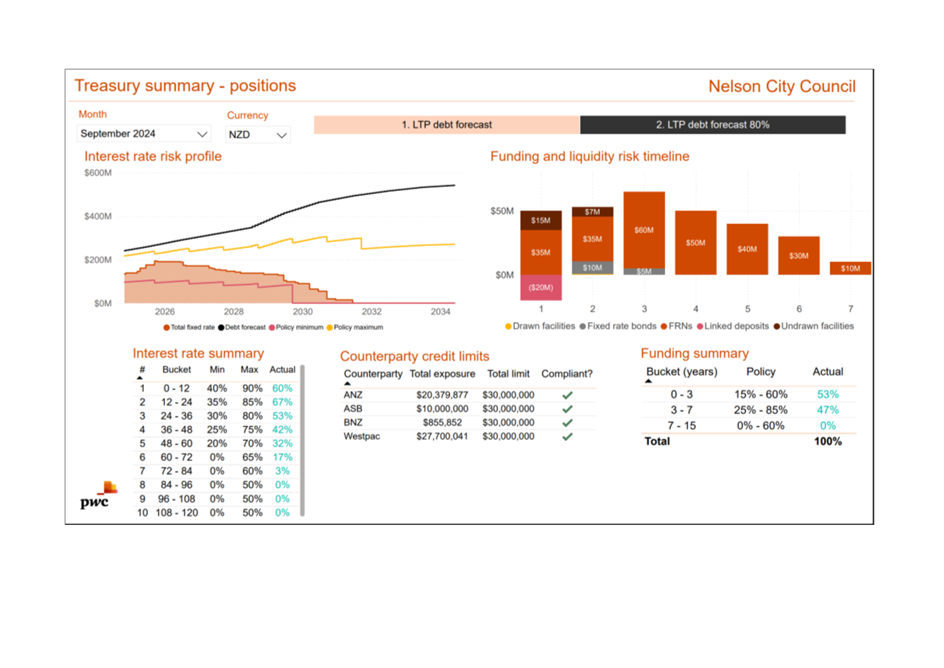

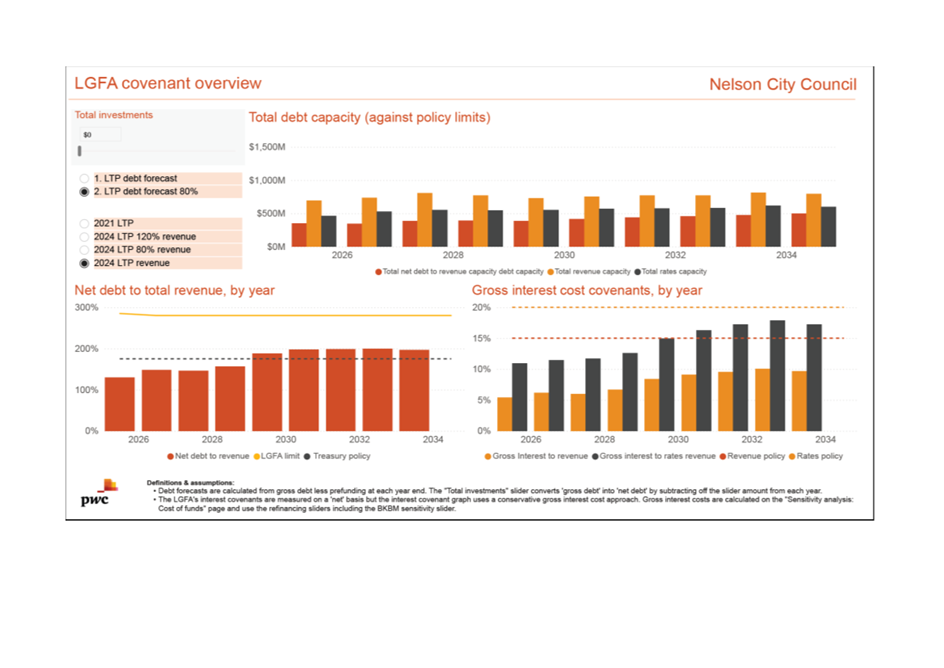

2 includes the statement of financial position (Balance sheet), Debtors graph

and compliance with the Treasury policy as at 30 September 2024.

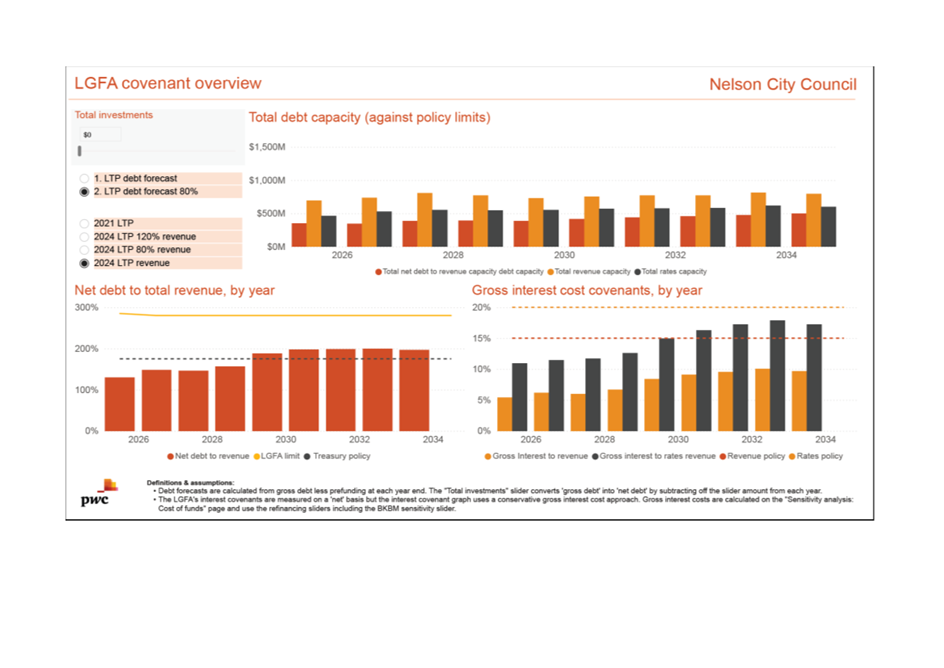

6.5 The

net debt figure in the treasury compliance report (Attachment 2) is different

from above 6.2 mainly due to LGFA borrowing notes not being included in the PWC

tool.

7. Rates

7.1 City wide Revaluation

Release to Ratepayers

7.1.1 Council is required to revalue property values for

rating purposes every three years and the revaluation is due this year as at 1

September 2024.

7.1.2 Under the Rating Valuation legislation, the Valuer

General’s Office is responsible for scheduling and approving

revaluations. Council’s Valuation Service Provider (Quotable Value) are

currently working on the new 2024 property values, and these are due to be

submitted to Office of the Valuer General for auditing in March 2025.

7.1.3 Before the release of the new property values to

our ratepayers, Quotable Value will provide Council an overview of the changes

in values from our previous revaluation that was dated 1 September 2021 to the

current 2024 property values.

7.2 Rates Aging

7.3 Total rates

outstanding as at 30 September 2024 were $1.5m which includes $1.2m for Instalment

one for the current rating year. Below are the rates outstanding at the end of

each rating quarter.

Total

Rates Outstanding

YTD Rates

at 31 October 2024

7.4 Rates outstanding as

of 1 July 2024 were $797,000 and this amount has been reduced to $264,000 as of

31 October 2024.

7.5 As

at 31 October, rates outstanding for Instalment one (2024/25) are $534,000 and

this represents 1.88% of the total rates that were levied ($28,556,000) in July

2024.

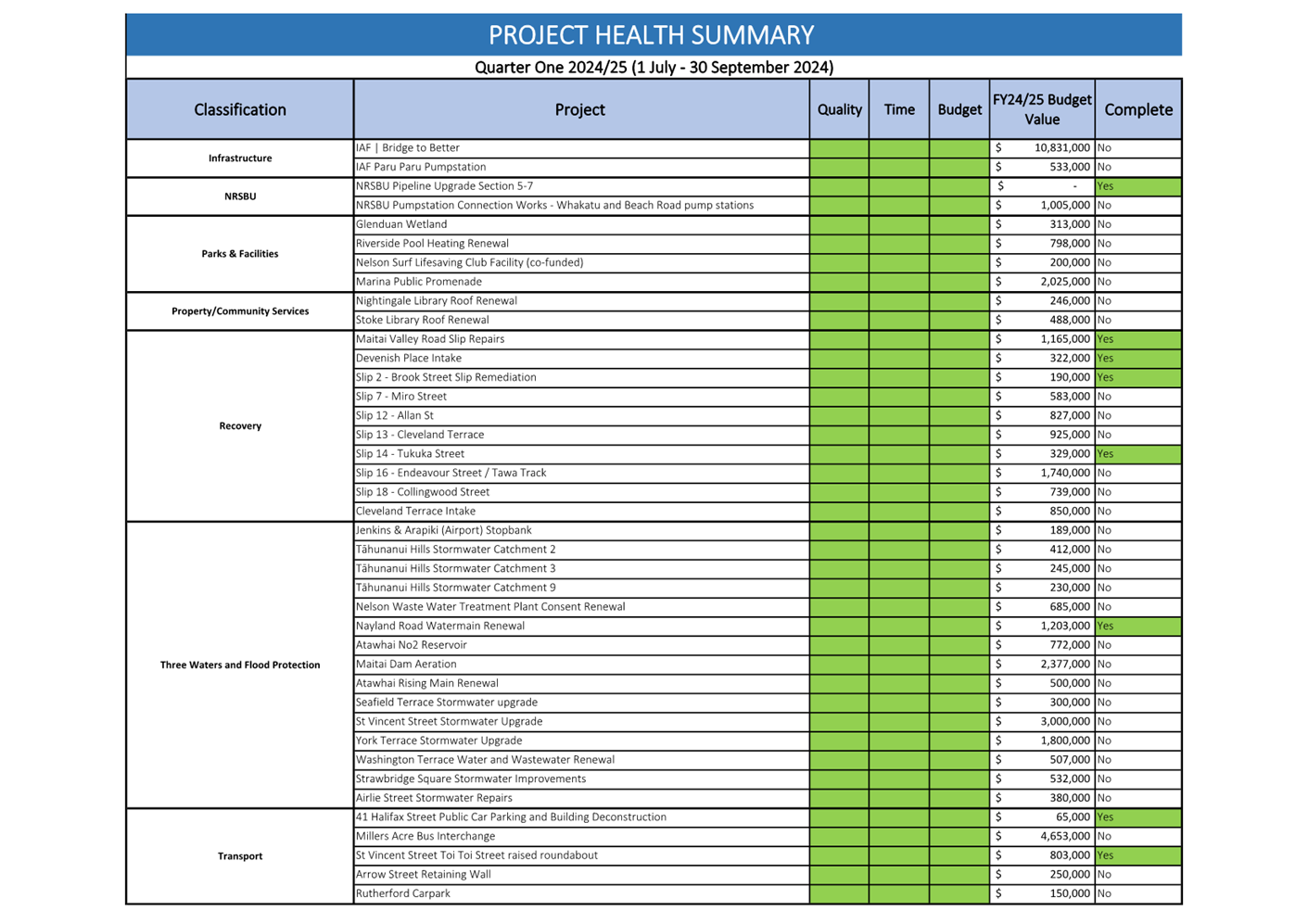

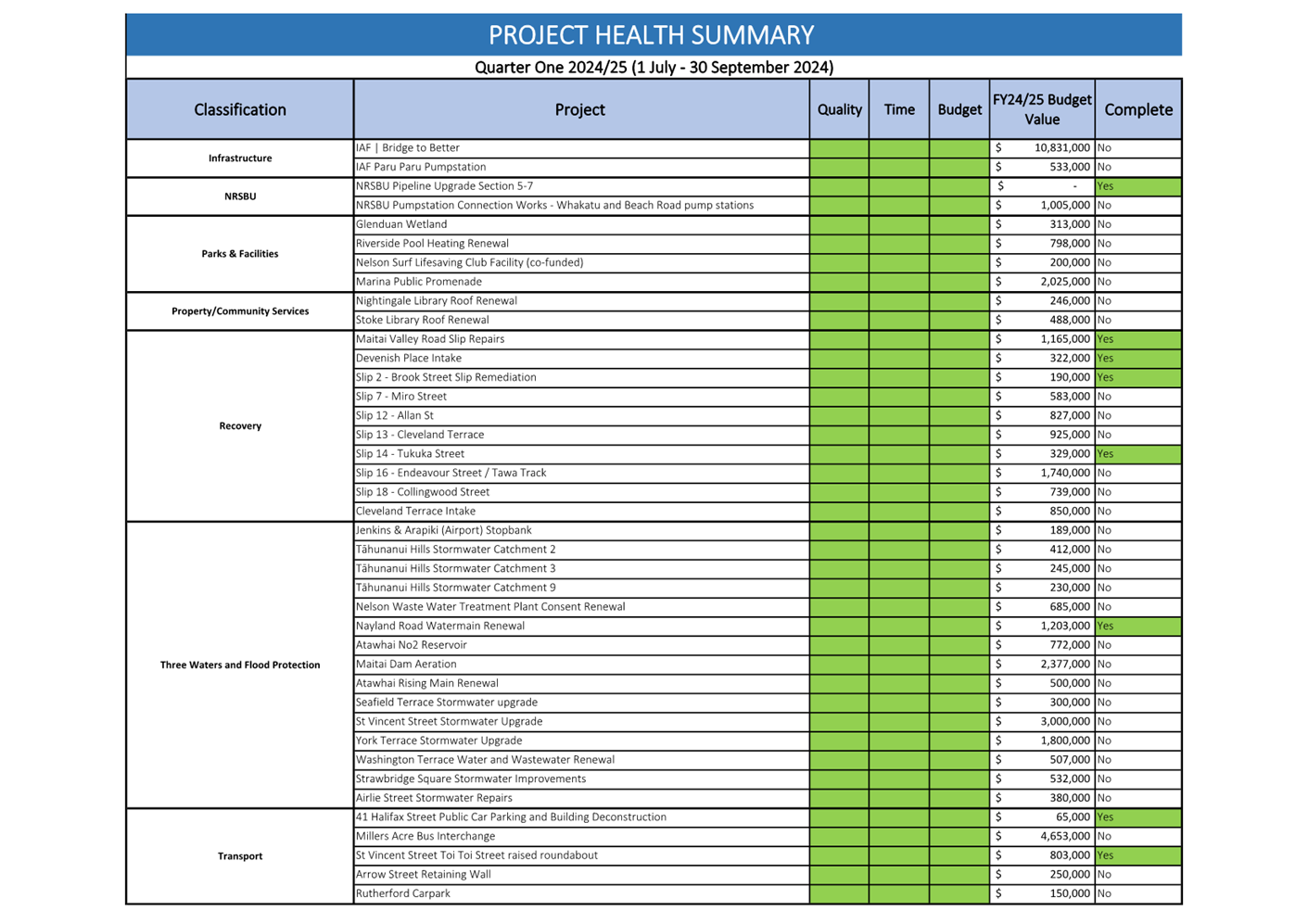

8. Project Health

8.1 Attachment 3

summarises the health of projects across Council. The table gives a red, amber

or green rating for quality, time and budget factors.

8.2 A number of large

projects have progressed well this quarter with many going to tender and strong

interest from contractors due to a quiet market.

8.3 Paru Paru Road Pump

Station Early Contractor Involvement (ECI), St Vincent Street Culvert

Replacement ECI and the Bridge to Better ECI have been tendered but not yet awarded.

8.4 Atawhai Rising Main

Design Professional Services has also been tendered and negotiations are

underway with a preferred tenderer.

8.5 Bridge to Better

projects, Halifax St – Collingwood St Watermain Upgrade and Bridge Street

East Watermain Upgrade have also been tendered but not yet awarded.

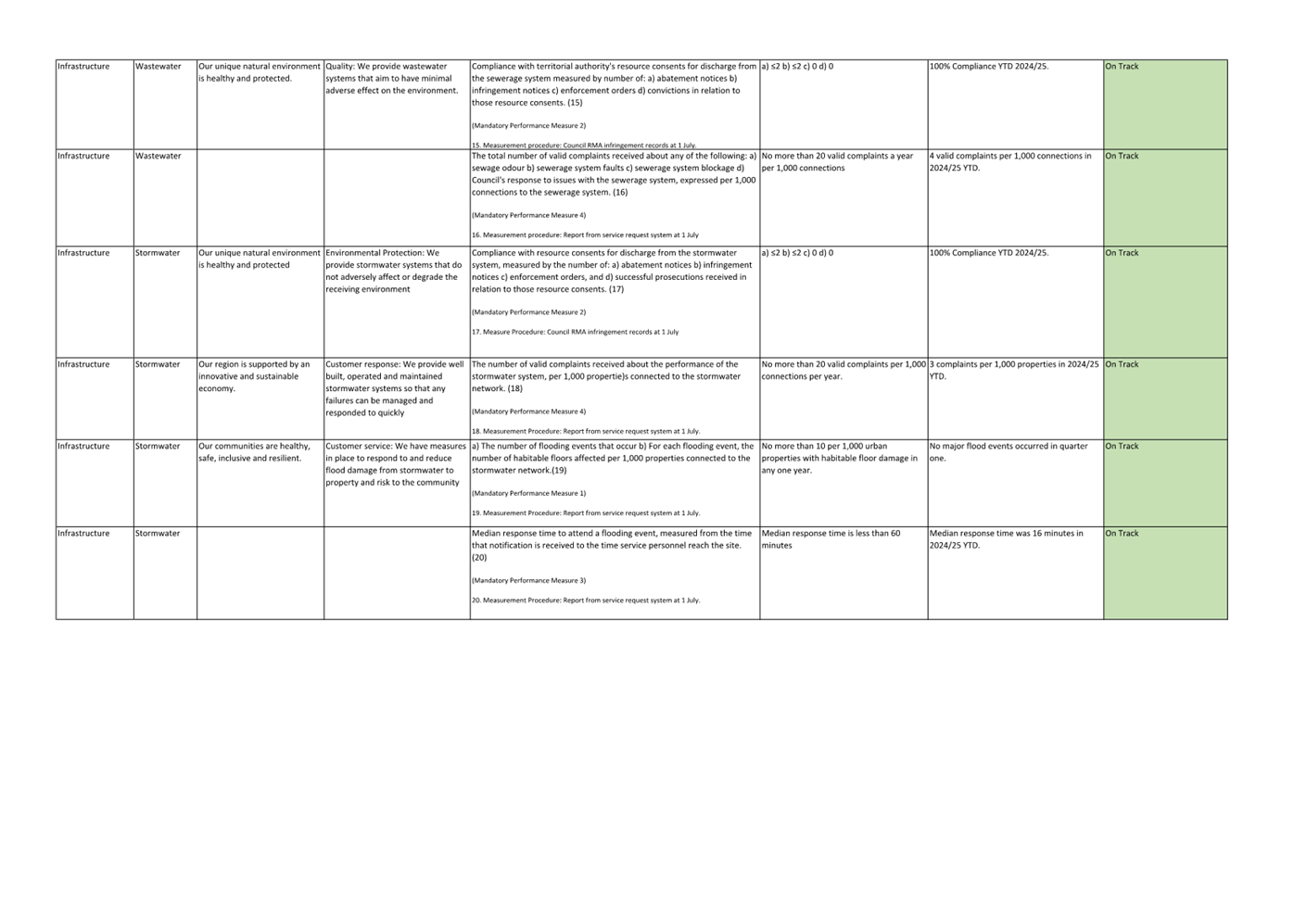

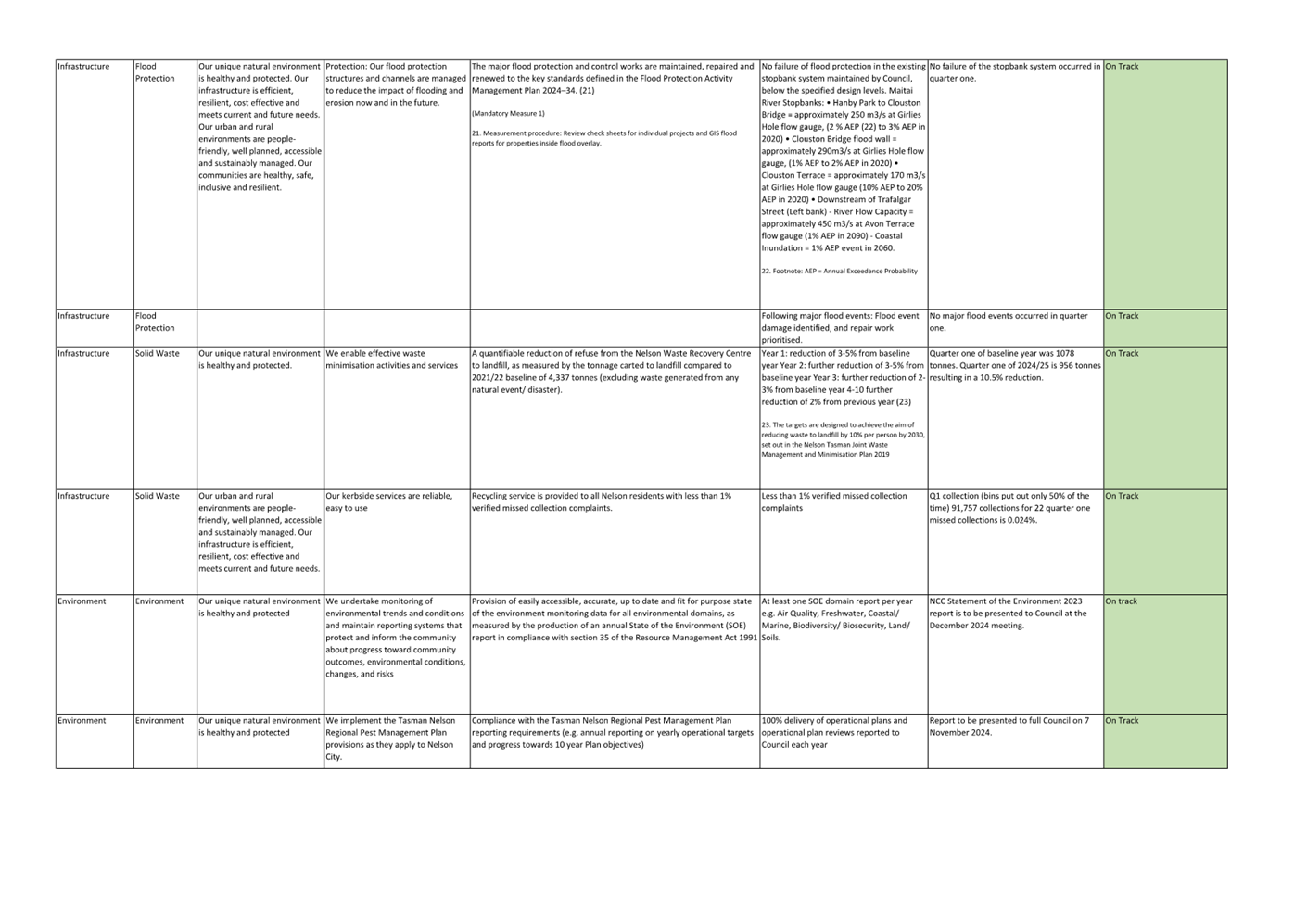

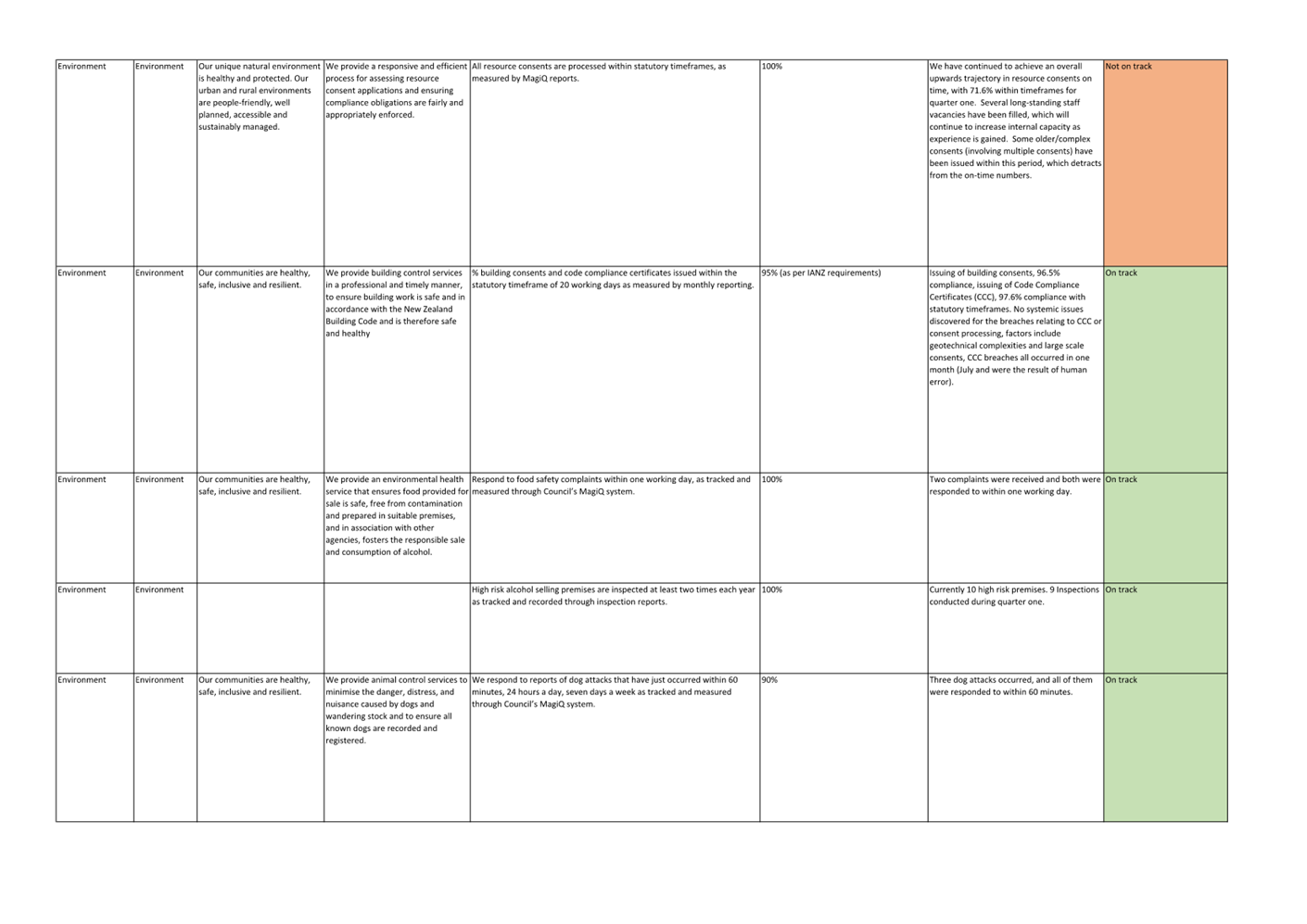

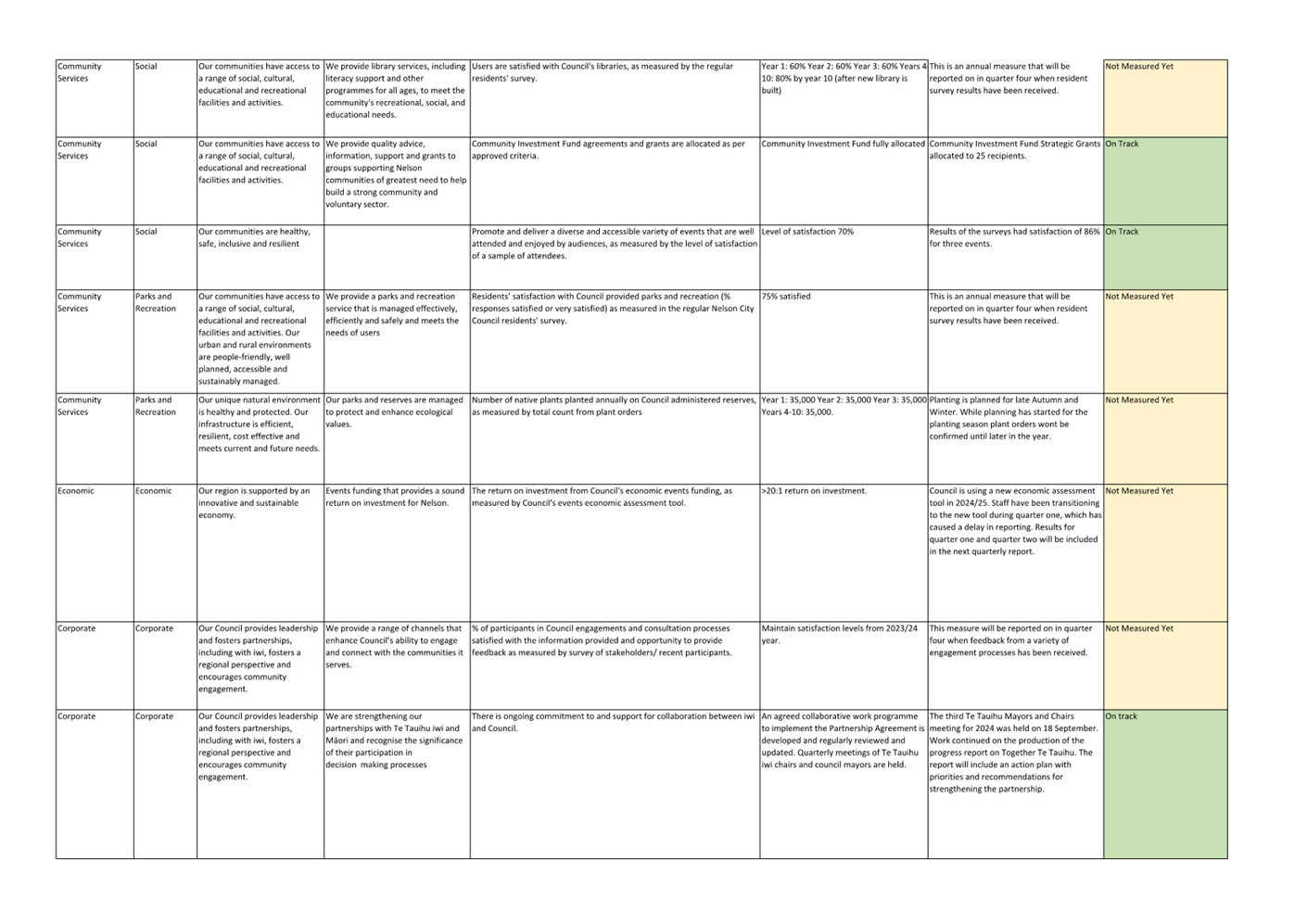

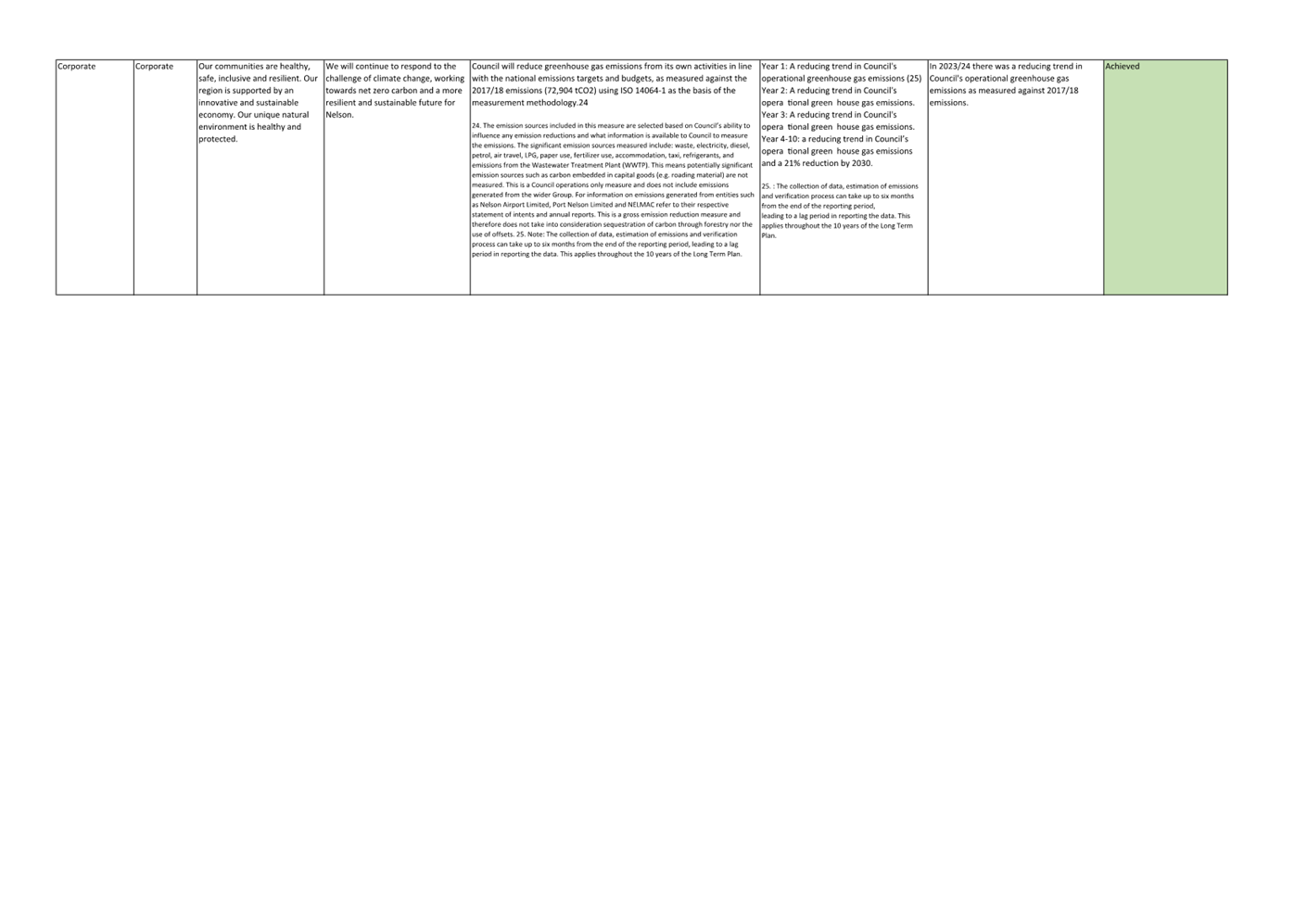

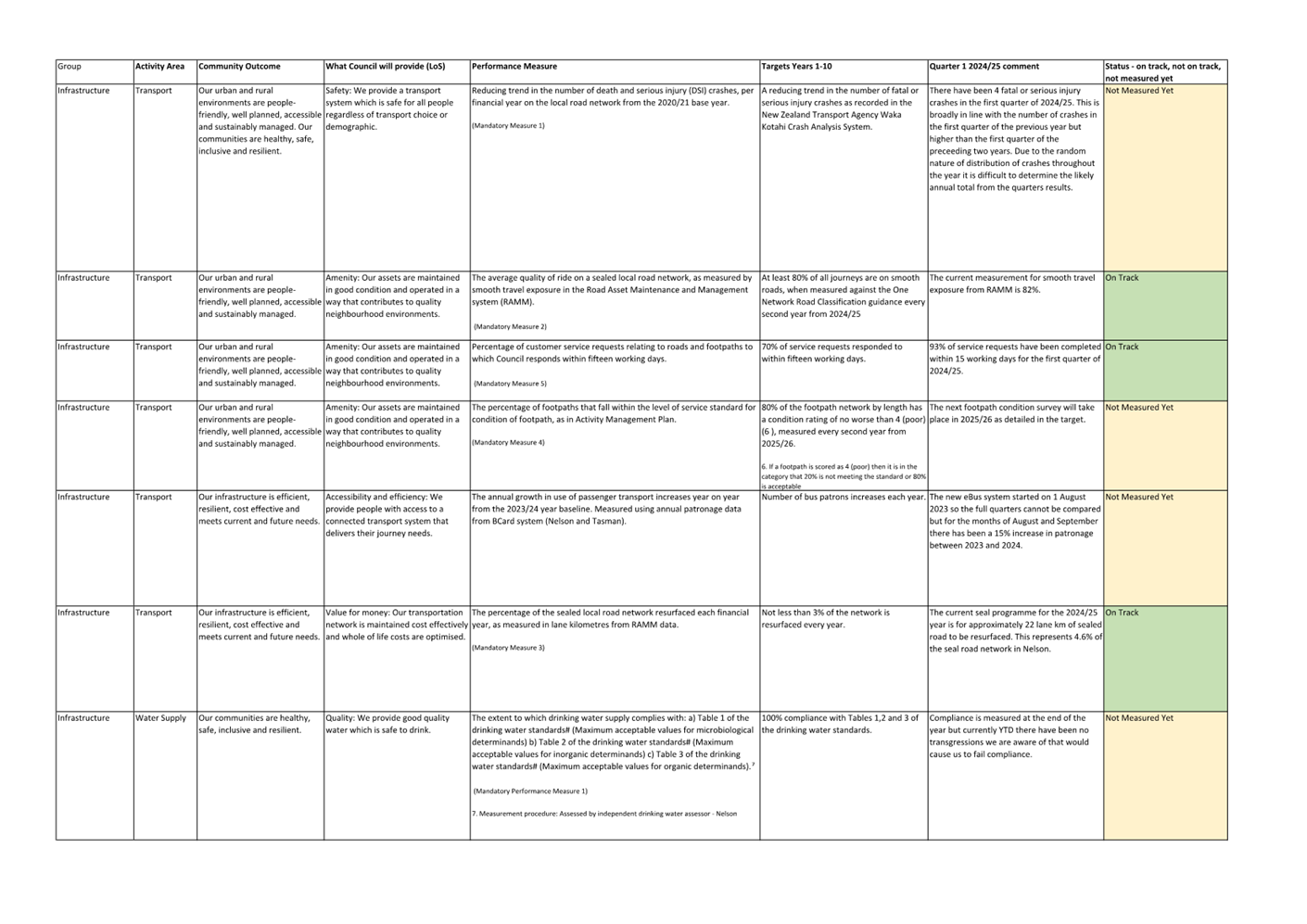

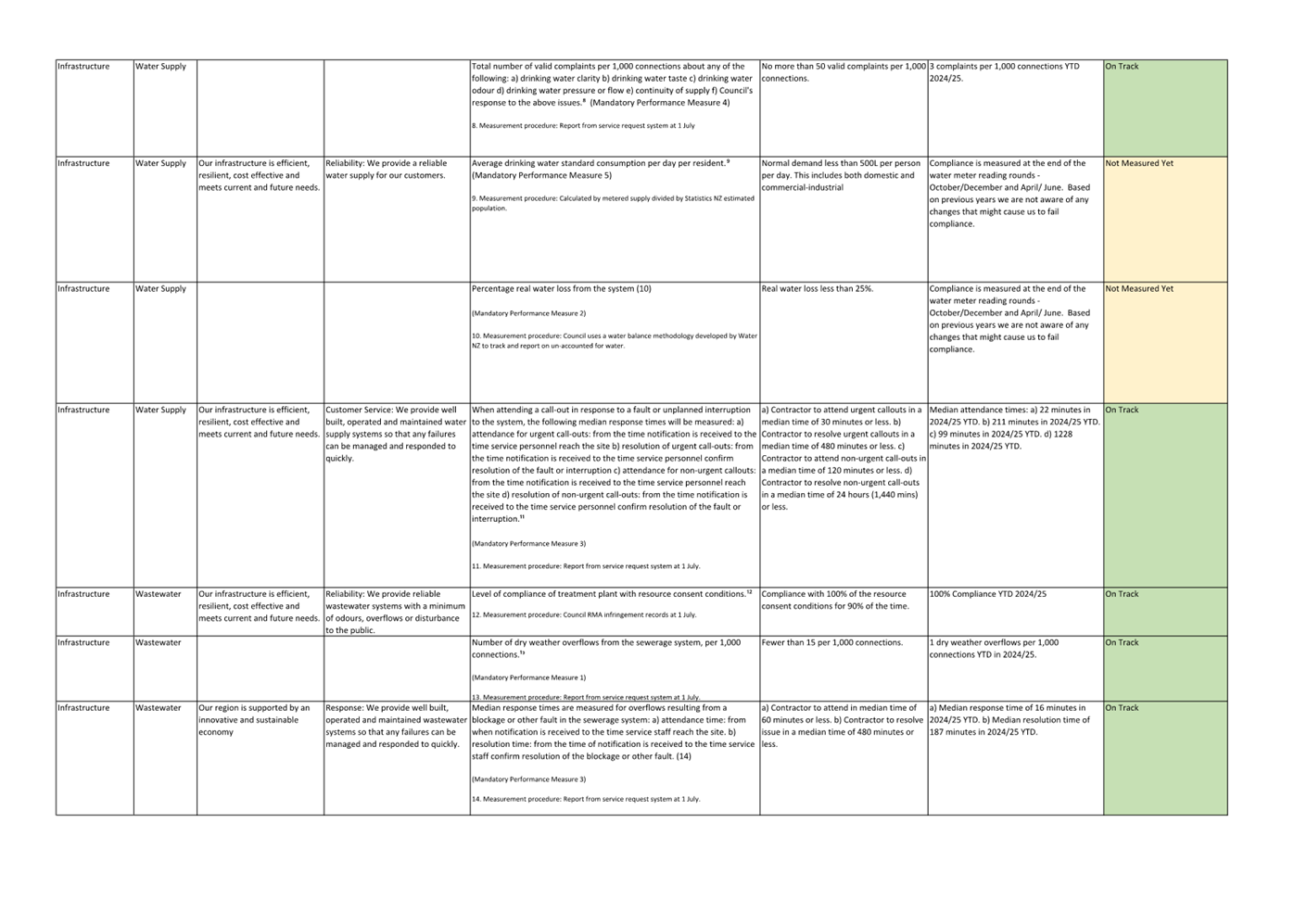

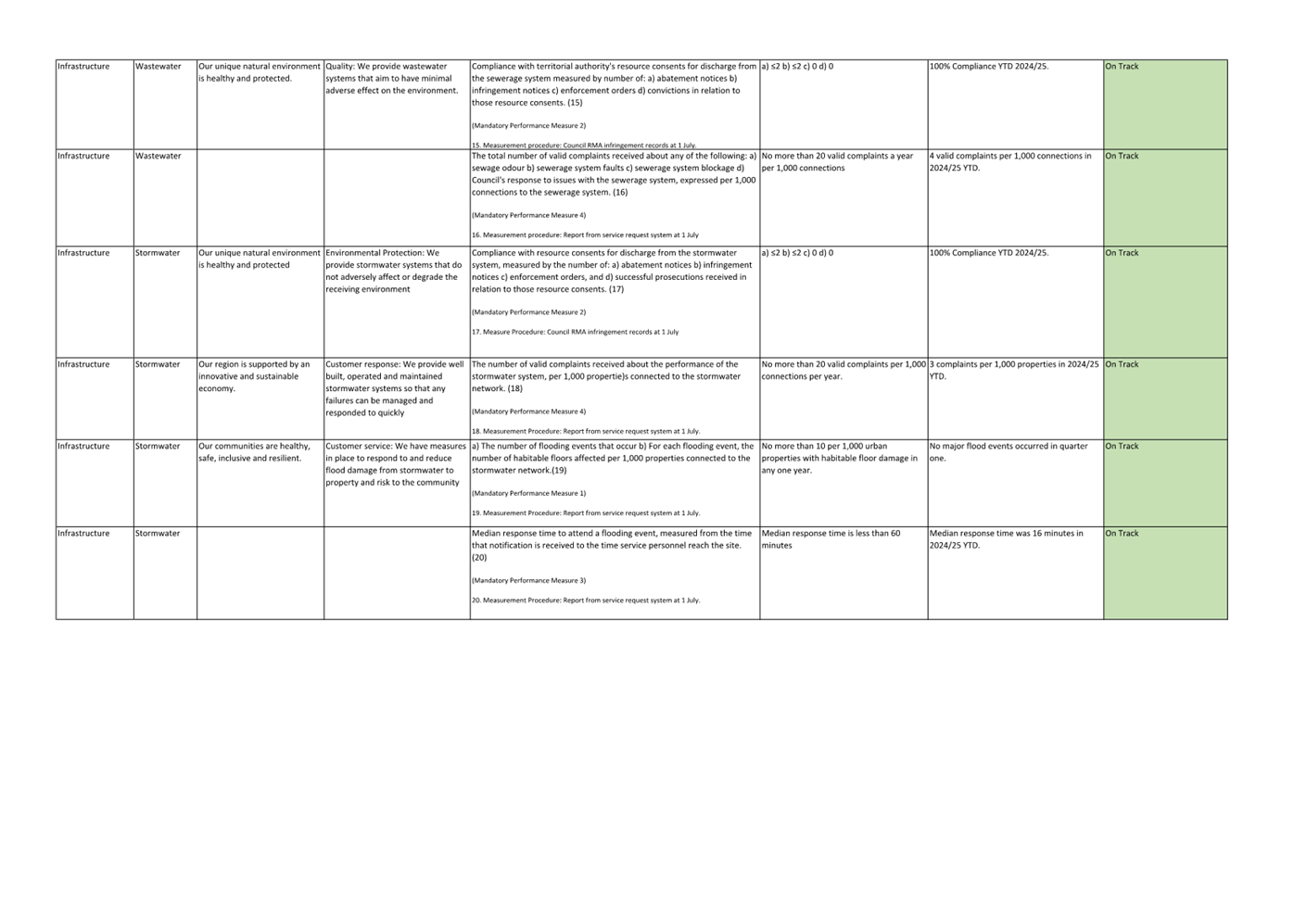

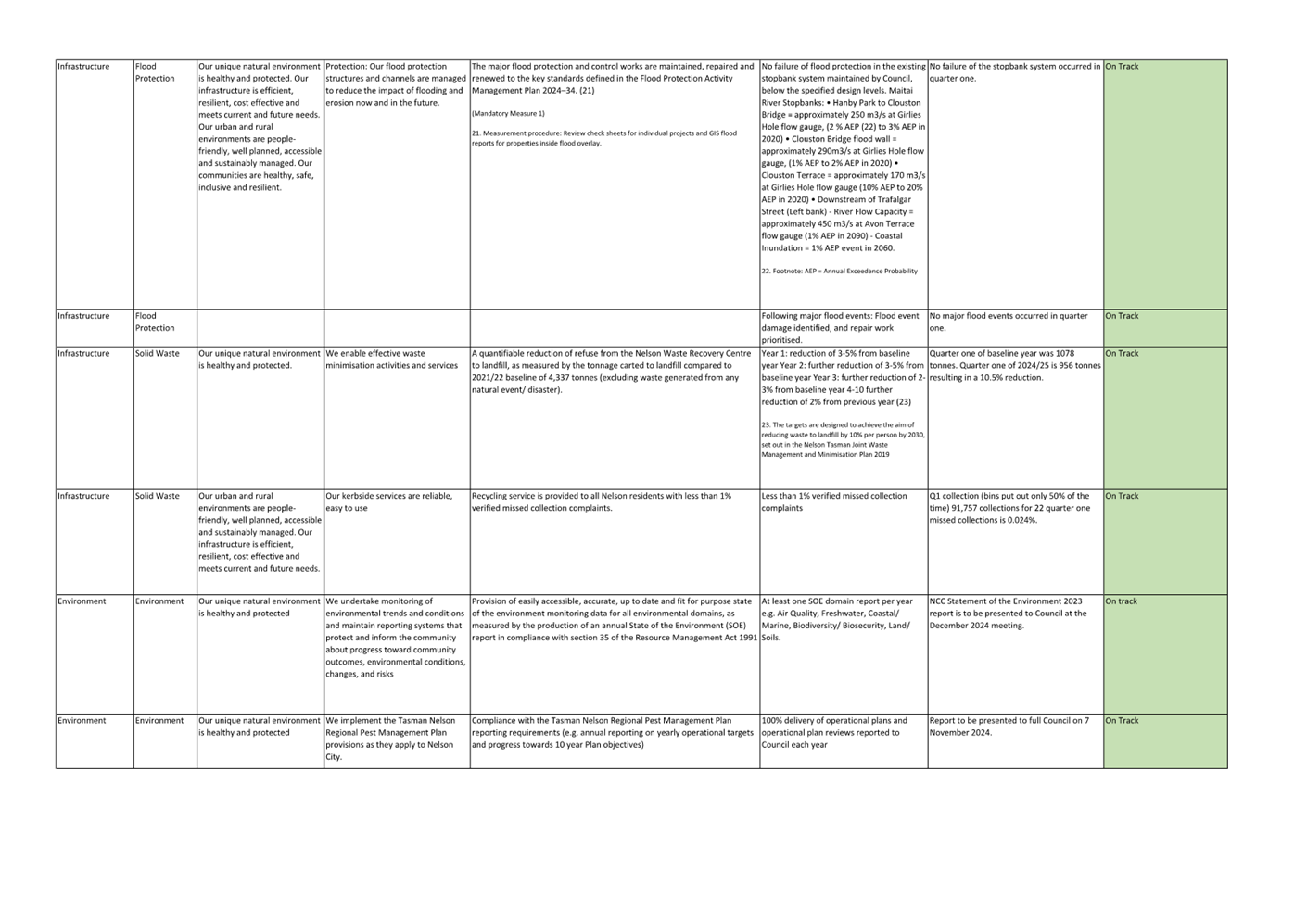

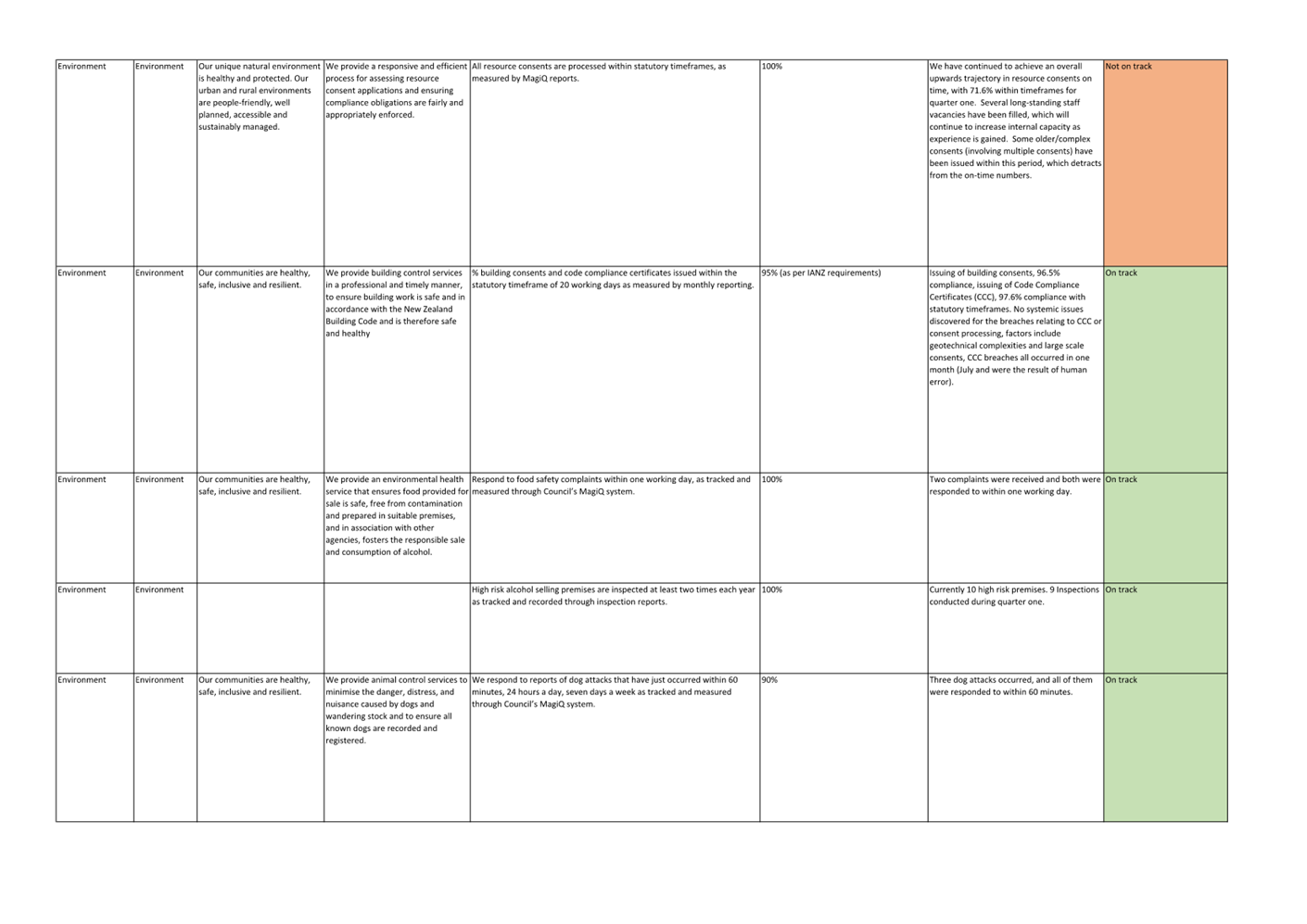

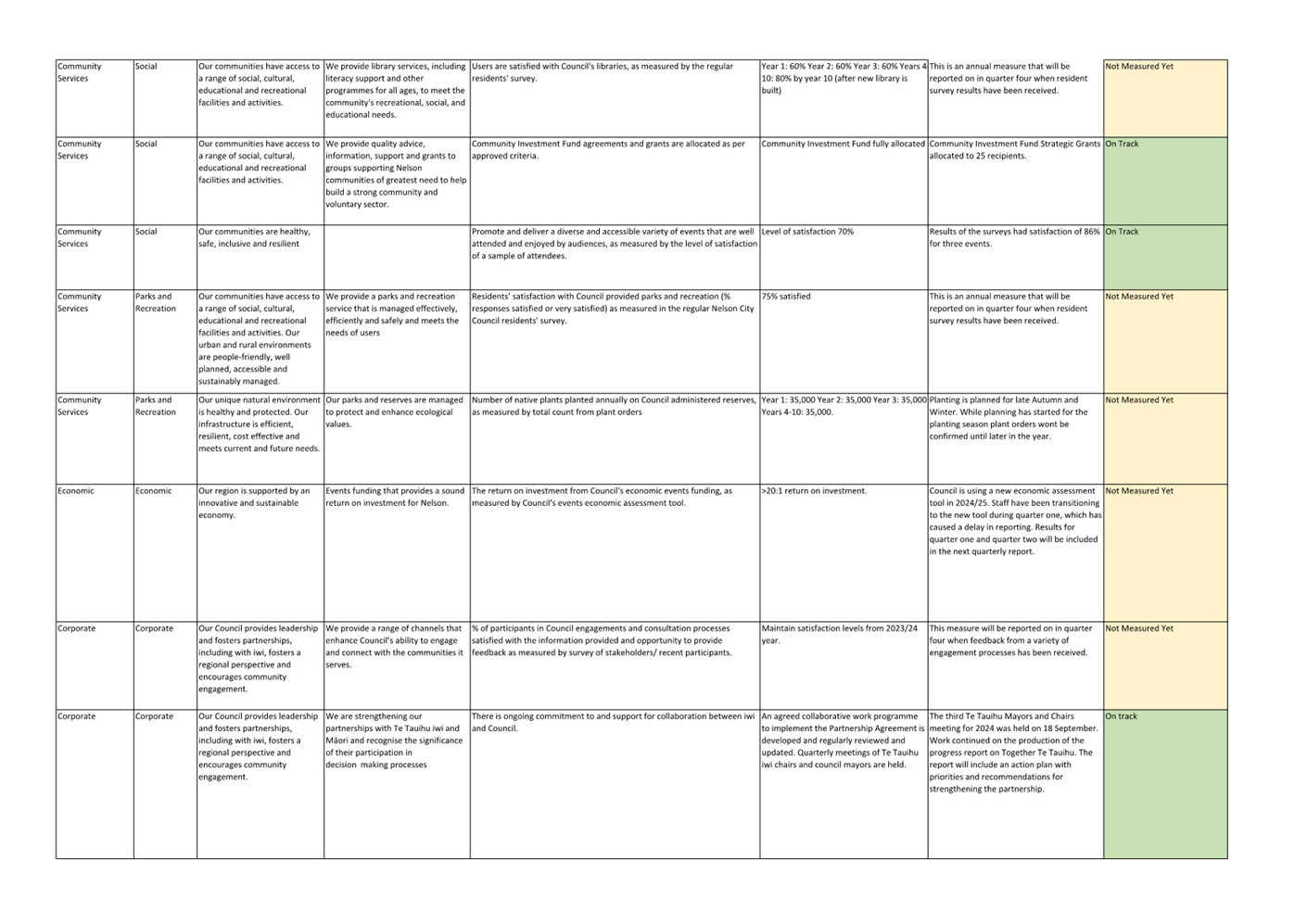

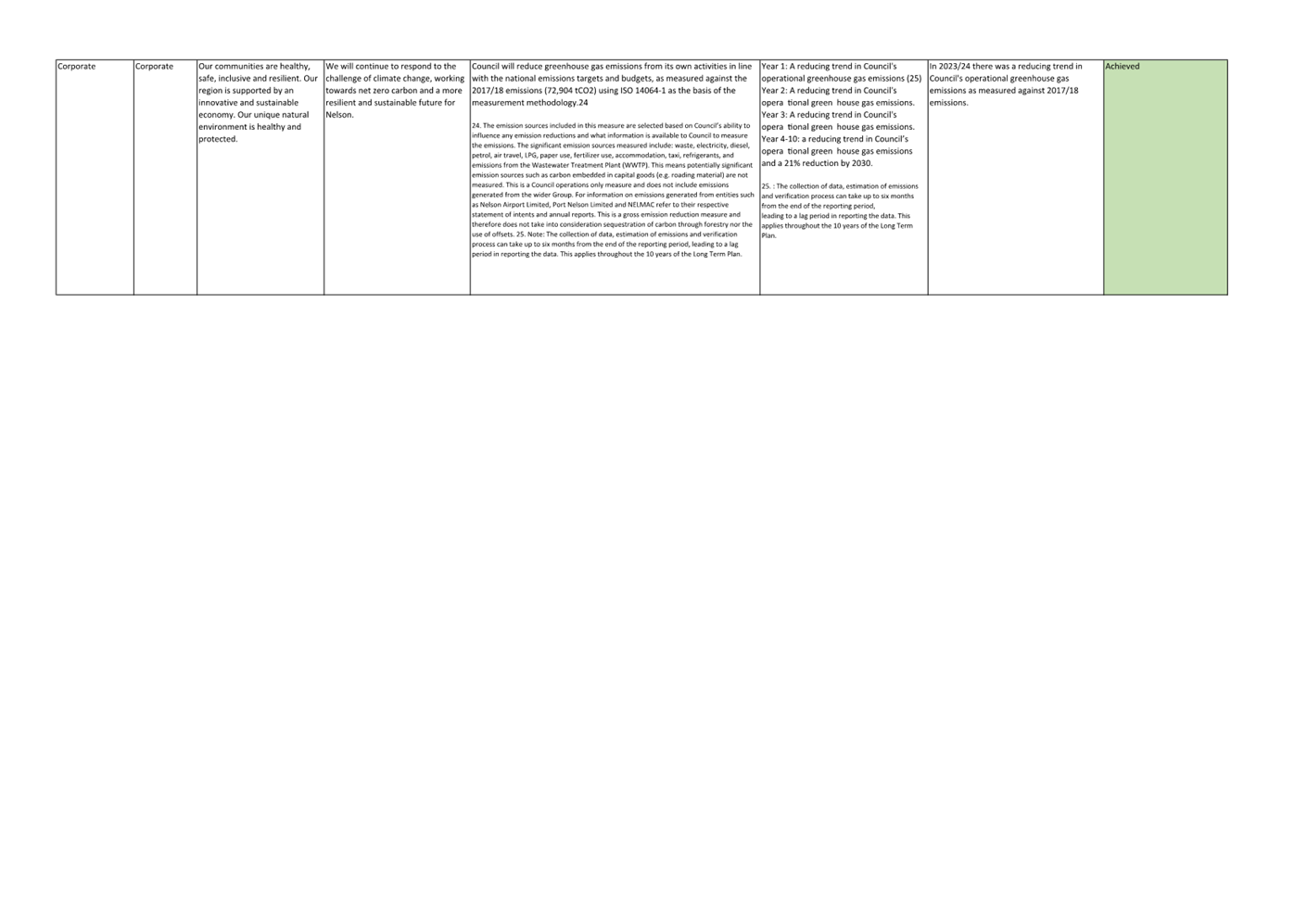

9. Performance

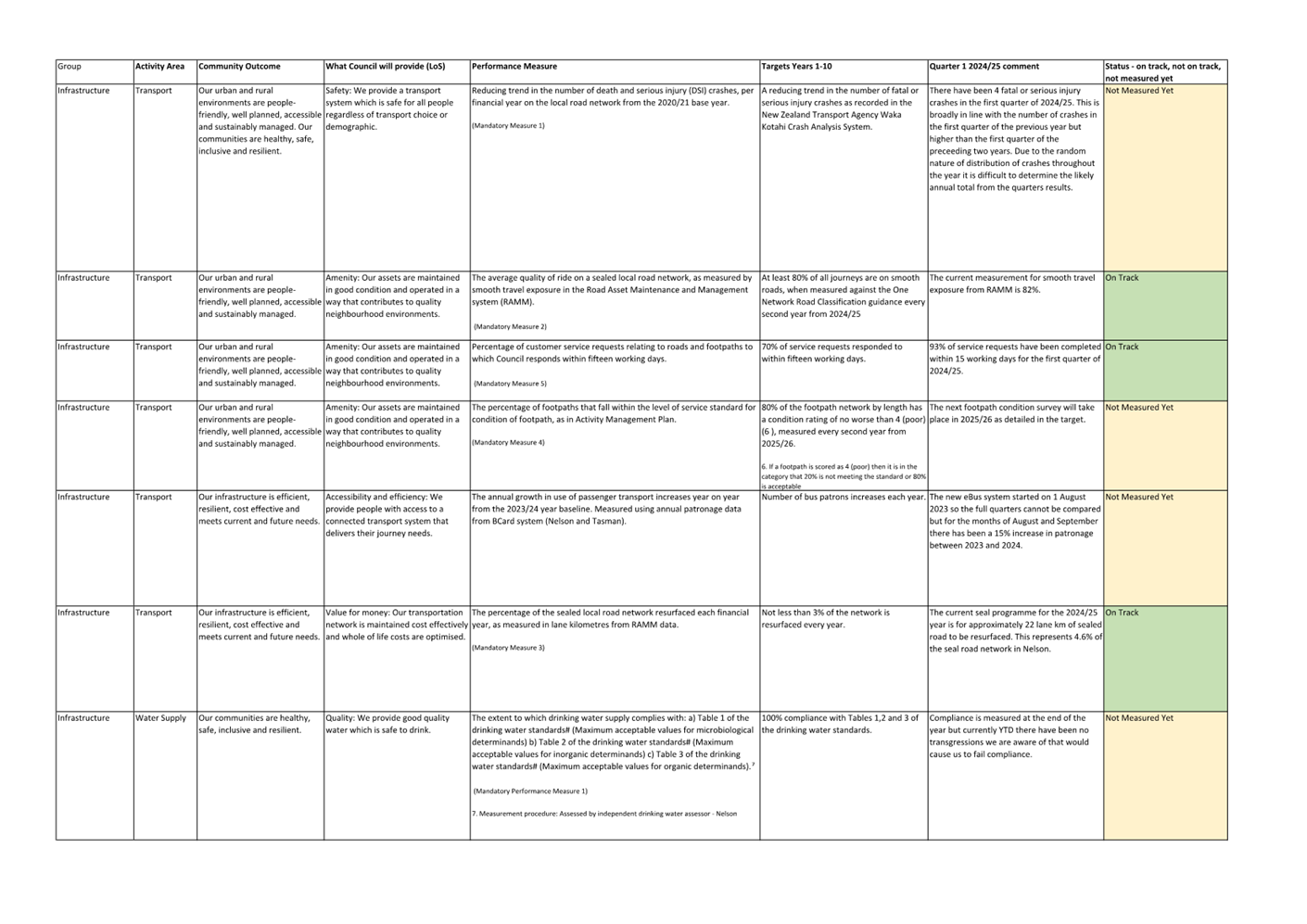

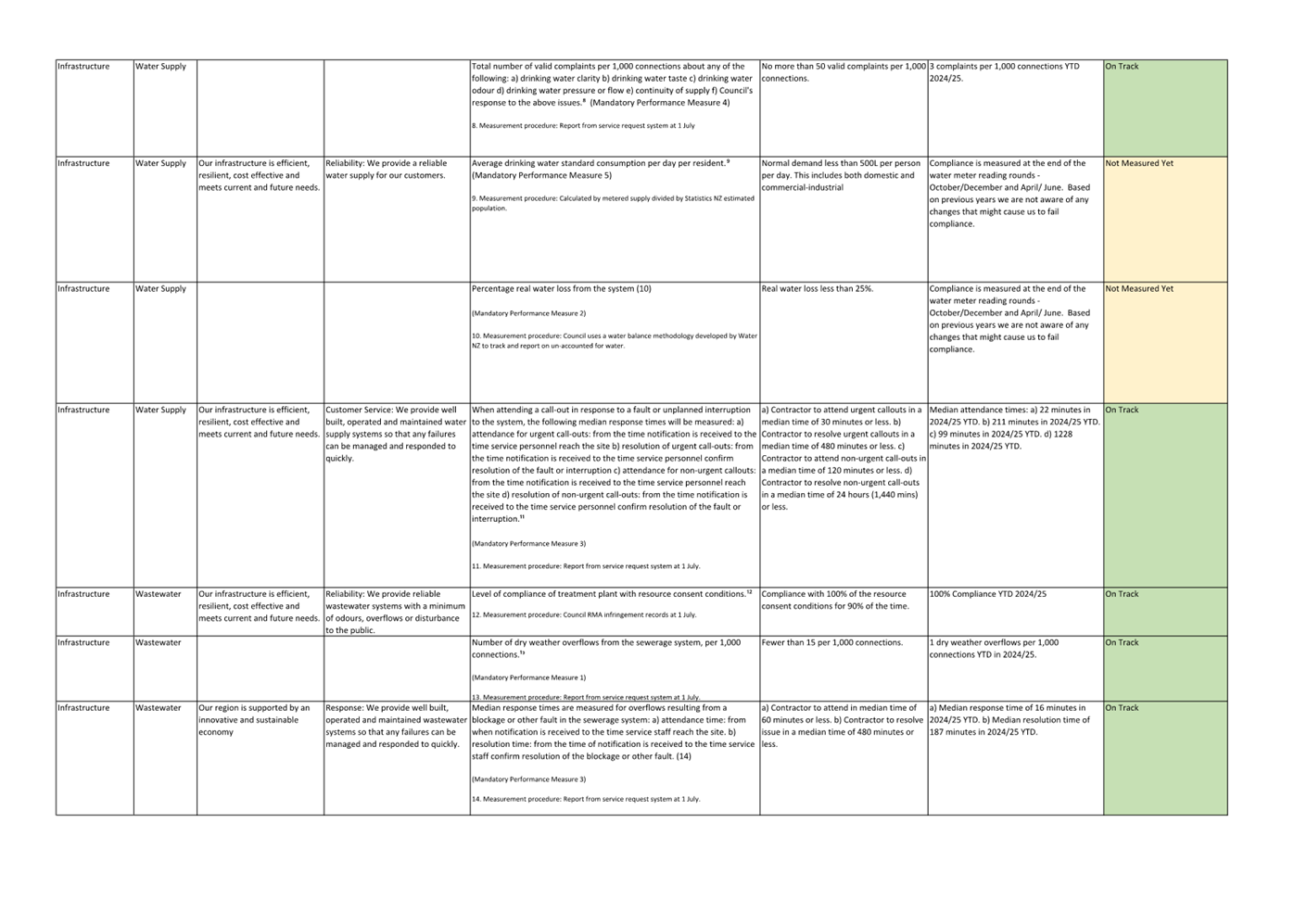

Measures

9.1 Council reports on 40

non-financial performance measures across its activity areas, as set out in the

Long Term Plan 2024-34. These are generally evaluated as ‘on track, not

measured yet and not on track’ during the first three quarters of the

year, however, in this instance, one performance measure has already been

achieved.

9.2 For quarter one

2024/25, 26 are on track, 12 are not measured yet, 1 is not on track and 1 is

achieved. The percentages are measured as 65%, 30%, 2.5% and 2.5% respectively.

9.3 Attachment 4 details

Council’s performance measures so far across all its activities.

Attachments

Attachment 1: 1857728953-2238

Appendix for Council Reports for Sep-24 Subsidies and Grants ⇩

Attachment 2: 1857728953-2242

Appendix for Council Reports for Sep-24 Financial Info ⇩

Attachment 3: 1530519604-15548

- Project Health Summary ⇩

Attachment 4: 839498445-20010

- Performance Measure Table Q1 2024 - 2025 ⇩

Item 9: Quarterly Finance Report to 30 September 2024:

Attachment 1

Item 9: Quarterly Finance Report to 30 September 2024:

Attachment 2

Item 9:

Quarterly Finance Report to 30 September 2024: Attachment 3

Item 9: Quarterly Finance Report to 30 September 2024:

Attachment 4

Item 10: Public

Transport Services Contract - Working Group Review

|

|

Audit, Risk and Finance Committee

20 November 2024

|

Report Title: Public

Transport Services Contract - Working Group Review

Report

Author: Nicky McDonald -

Group Manager Strategy and Communications

Report

Authoriser: Nicky McDonald - Group Manager Strategy and

Communications

Report

Number: R28881

1. Purpose

of Report

1.1 To consider the report

of the Working Group looking into the public transport services project.

2. Summary

2.1 The June 2024 meeting

of the Audit, Risk and Finance Committee, concerned by the $2million project

overspend, initiated a review of the governance, management and oversight of

the public transport services contract. The Terms of Reference for the Working

Group are in Attachment 1. The report that has been prepared by the Working

Group tasked with looking into the matter is in Attachment 2.

3. Recommendation

|

That the

Audit, Risk and Finance Committee

1. Receives the report Public Transport Services

Contract - Working Group Review and its attachments; and

2. Directs the Chief Executive to consider all the Public

Transport Services Contract Working Group recommendations, but in particular

the operational recommendations (as set out in 5.6.1 to 5.6.5 of report

R28881), as part of the suite of changes to Council project management that

will developed through the Shaping Our Future transformation project; and

3. Refers

the report of the Public Transport Services Contract Working Group to

Council.

|

Recommendation to Council

|

That the

Council

1. Consider

the recommendations from the Public Transport Services Contract Working Group

relating to governance oversight of significant projects (as set out in 5.6.6

to 5.6.13 of report R28881) and have regard for them when undertaking joint

activities with other councils/agencies and in any future review of

governance arrangements; and

2. Direct

the Chief Executive to provide Tasman District Council with recommendations

from the Public Transport Services Contract Working Group relating to

governance oversight of significant projects (as set out in 5.6.6 to 5.6.13

of report R28881) for its consideration;

3. Direct

the Chief Executive to provide the Chair of the Joint Nelson Tasman Regional

Transport Committee with a copy of the report of the Public Transport

Services Contract Working Group for the information of the Committee.

|

4. Background

4.1 At its 5 June 2024

meeting, the Audit, Risk and Finance Committee resolved as follows:

ARF/2024/026

1. Requests a review of the governance management

and oversight of the eBus project with Terms of Reference to be determined by

the Audit, Risk and Finance Chair Catherine Taylor, member Lindsay McKenzie and

Councillor O'Neill-Stevens, with the intention of the review reporting back by

December 2024.

4.2 A Working Group of the

above Audit, Risk and Finance Committee members has prepared a report reviewing

the public transport project. During development of the report the Group met

with relevant Nelson City and Tasman District Council staff and with Councillor

Stuart Bryant, Chair of the Joint Nelson Tasman Regional Transport Committee

(RTC), and Christeen MacKenzie, a member of Tasman District Council’s

Audit and Risk Committee. As part of these meetings the Working Group had a

full and frank discussion with staff responsible for the project and heard how

lessons had already been taken from their reflection on the project and would

be applied in future.

4.3 The Working

Group’s report of its findings is in Attachment 2.

5. Discussion

5.1 The context for

establishment of a Working Group was the concern expressed at the RTC in April

2024 about a $2million overspend on the public transport project and the project management that led to this being a funding fait accompli

presented to the RTC. The Working Group considered the retendering and

awarding of the contract for public transport, a contract that encompassed

services in both council areas but that was negotiated and overseen by staff

from Nelson City Council. It focussed on lessons that could be learned

from the process that are relevant to the Audit, Risk and Finance

Committee’s mandate to monitor organisational risks.

Key Findings

5.2 The Working Group

findings are detailed in full in Attachment 2 and summarised below along with

all the resulting recommendations.

5.3 An early conclusion of

the Working Group was that the lack of a business case contributed to problems

in the project as did weaknesses in the project planning and risk

identification. These issues were driven in large part by timing constraints

which were not adjusted, despite the impact of the August 2022 severe weather

event, and put the project team under extreme pressure.

5.4 Another finding of the

review was that the unclear governance oversight meant there was not a

straightforward reporting line for the project. The RTC did not have the

mandate to provide the level of oversight needed for the project (eg no

financial delegations), and did not meet frequently enough to realistically

undertake that role.

5.5 Council elections

during the development of the project saw changes in governance arrangements

that added complexity to oversight of the project.

Recommendations

5.6 Following are the full

set of recommendations from the Working Group developed as part of its

investigation into the causes of problems in the public transport project.

5.6.1 Develop and use a purposeful business

case template for significant project proposals and use a common template for

joint council projects.

5.6.2 Develop and use a formal project

planning template for significant complex project proposals and use a common

template for joint council projects.

5.6.3 Develop and use a structured risk

assessment and management approach for significant project proposals.

5.6.4 Involve an independent expert voice so

that any pressures and biases that have the potential to influence officers can

be managed.

5.6.5 Appoint a dedicated suitably

experienced project manager to lead significant complex projects especially

those that involve deliverables for the two councils jointly.

5.6.6 Assign governance oversight for

significant projects to a relevant committee, subcommittee, taskforce or

working party with an express obligation to do so in its terms of reference,

with appropriate powers to act along with training for its members and support

from an independent party to perform that oversight role.

5.6.7 Establish a formal reporting (to

governance) regime for significant projects that ensures timely, accurate and

transparent information is provided on, for example -

· finances - budget, costs to date;

· stage of completion/milestones;

· estimated outturn cost;

· health, safety and environment;

· critical risks and their

mitigation;

· scope changes;

· resourcing;

· contractor performance;

· contractual matters

5.6.8 Ensure that significant complex

projects that are at critical stages are supported to be progressed during the

pre and post-election periods and interregnum by, for example a project

governance group being appointed to progress the work.

5.6.9 Ensure that committees, subcommittees,

taskforces, and other reporting bodies that have responsibilities assigned to

them are given the authority and support to effectively

carry out those responsibilities subject to appropriate reporting up obligations.

5.6.10 Establish and agree a set of obligations on the

lead council/administrator and reciprocal obligations on the other party in

relation to joint projects and their delivery.

5.6.11 Review the level and any conditions on the

exercising of officers’ delegations where the exercise of those

delegations creates obligations (contractual, financial) on another council or

entity.

5.6.12 Require prompt reporting by officers to

governance, with a recommendation to reset,

when an approved budget is likely to be exceeded.

5.6.13 Evaluate and mitigate the risks associated with

funding agreements and contract terms that are misaligned.

6. Options

6.1 The

Committee could make changes to the recommendations or decline to take action

on the recommendations. However, the preferred option is to refer the report

and recommendations to both councils for consideration and to direct the Chief

Executive to consider implementation of the recommendations, via

Council’s transformation project. As the recommendations have wider

applicability than just one project they will be helpful to consider as

standard approaches for more complex projects in future. They have the

potential to help mitigate future risk to Council in the delivery of

significant and complex projects.

7. Conclusion

7.1 The Audit, Risk and

Finance request for a review of the governance management and oversight of the

public transport project has been fulfilled.

Attachments

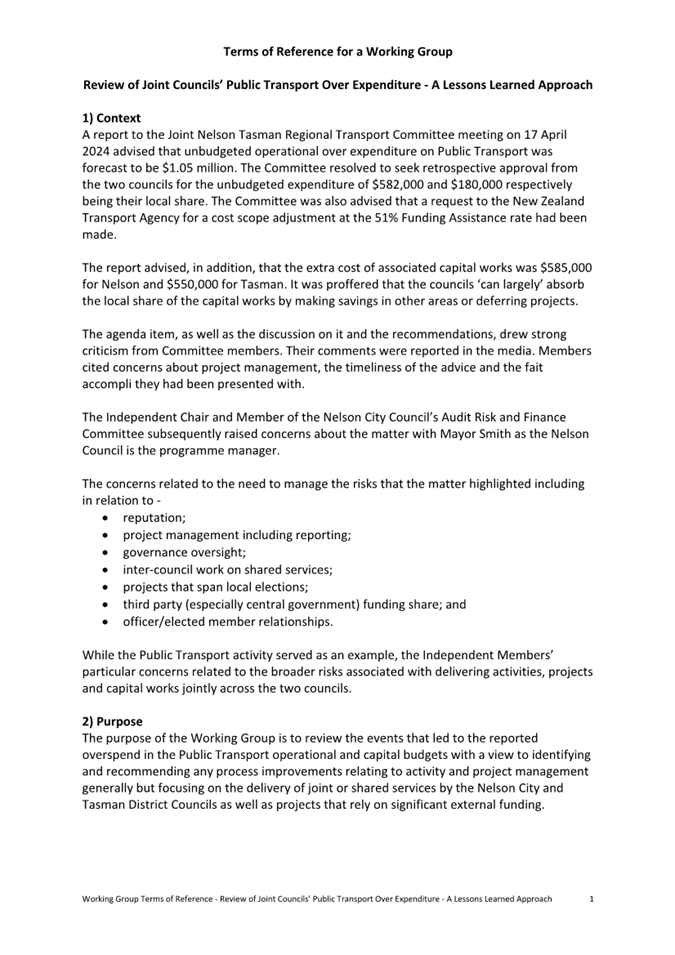

Attachment 1: Public Transport

Working Group Terms of Reference ⇩

Attachment 2: Public

Transport Working Group Report ⇩

|

Important

considerations for decision making

|

|

Fit with Purpose of Local Government

Review of Council project management processes with

a view to reducing risk contributes to community economic wellbeing.

|

|

Consistency with Community Outcomes

and Council Policy

The decision in this report supports the following

community outcomes:

Our infrastructure is efficient, resilient, cost

effective and meets current and future needs

Our Council provides leadership and fosters

partnerships, including with iwi, fosters a regional perspective, and

encourages community engagement

|

|

Risk

The recommendations from the Working Group have the

potential to reduce risk on future Council projects if included as part of

standard practice.

|

|

Financial impact

There is no financial impact of the decision in this

report. However, if Council implements the recommendations there will need to

be allowance made within future project budgets to accommodate the extra

requirements.

|

|

Degree of significance and level of

engagement

This matter is of low significance because it deals

with a review of a project that has now been implemented and there is no

requirement for engagement.

|

|

Climate Impact

Improved project management

offers an opportunity to better factor climate change risks and impacts into

Council’s work programme. There is also an opportunity for climate

change considerations to be included within any new templates implemented.

|

|

Inclusion of Māori in the

decision making process

No engagement with Māori has been undertaken in

preparing this report.

|

|

Delegations

The Audit, Risk and Finance

Committee has the delegation for matters related to monitoring risk.

|

Item 10: Public Transport Services Contract - Working

Group Review: Attachment 1

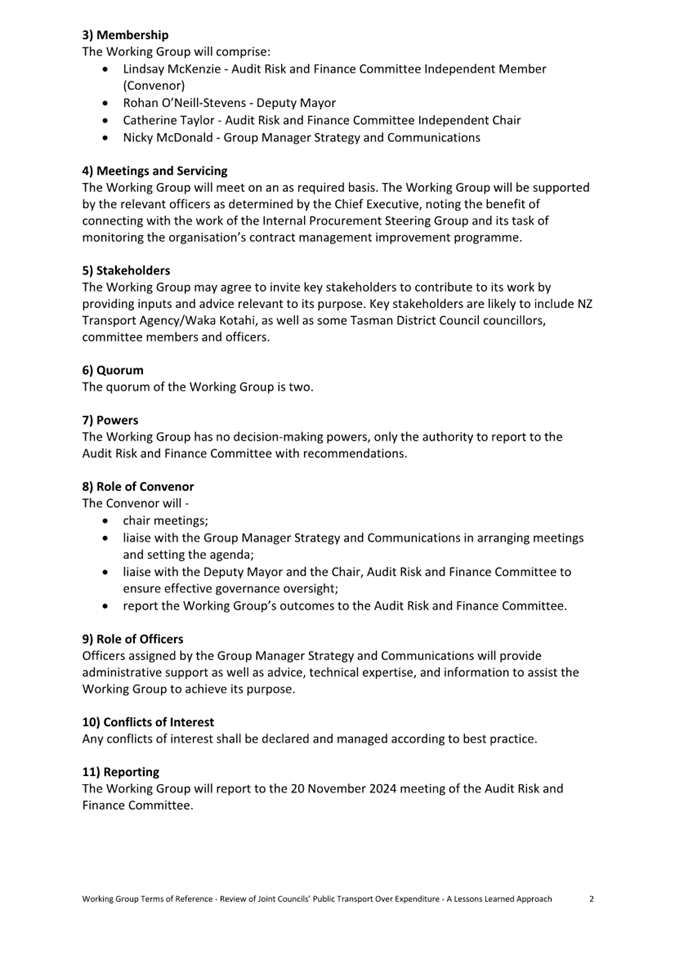

Item 10:

Public Transport Services Contract - Working Group Review: Attachment 2

Item 11: Exclusion of the Public

11. Exclusion of the Public

Recommendation

|

That the Audit, Risk and

Finance Committee

1.

Confirms, in accordance with sections 48(5)

and 48(6) of the Local Government Official Information and Meetings Act 1987,

that Executive Director at PricewaterhouseCoopers (PWC), Brett Johanson

remain after the public has been excluded, for Item 3 of the Confidential

agenda (PriceWaterhouseCoopers Treasury Presentation), as he has knowledge

relating to xxxx that will assist the meeting.

|

Recommendation

That the Audit,

Risk and Finance Committee

1.

Excludes the public from the following parts of

the proceedings of this meeting.

2.

The general subject of each matter to be

considered while the public is excluded, the reason for passing this resolution

in relation to each matter and the specific grounds under section 48(1) of the

Local Government Official Information and Meetings Act 1987 for the passing of

this resolution are as follows:

|

Item

|

General subject of each matter to be

considered

|

Reason for passing this resolution in

relation to each matter

|

Particular interests protected (where

applicable)

|

|

1

|

Quarterly

Health, Safety and Wellbeing Report to 30 September 2024

|

Section

48(1)(a)

The public conduct of this

matter would be likely to result in disclosure of information for which good

reason exists under section 7

|

The withholding of the information is necessary:

· Section 7(2)(a)

To protect the privacy of

natural persons, including that of a deceased person

· Section 7(2)(d)

To avoid prejudice to

measures protecting the health and safety of members of the public

|

|

2

|

Quarterly

Debt Report - 30 September 2024

|

Section

48(1)(a)

The public conduct of this

matter would be likely to result in disclosure of information for which good

reason exists under section 7

|

The withholding of the information is necessary:

· Section 7(2)(a)

To protect the privacy of

natural persons, including that of a deceased person

|

|

3

|

PriceWaterhouseCoopers

Treasury Presentation

|

Section

48(1)(a)

The public conduct of this

matter would be likely to result in disclosure of information for which good

reason exists under section 7

|

The withholding of the information is necessary:

· Section 7(2)(h)

To enable the local

authority to carry out, without prejudice or disadvantage, commercial

activities

|

|

4

|

Quarterly

Report on Legal Proceedings

|

Section

48(1)(a)

The public conduct of this

matter would be likely to result in disclosure of information for which good

reason exists under section 7

|

The withholding of the information is necessary:

· Section 7(2)(g)

To maintain legal

professional privilege

|

Notice of the Ordinary meeting of

Notice of the Ordinary meeting of