Notice of the Ordinary meeting of

Audit, Risk and Finance Committee

Te Kōmiti Kaute / Tūraru / Pūtea

|

Date: Wednesday

14 August 2024

Time: 9.00a.m.

Location: Council

Chamber

Floor 2A, Civic House

110 Trafalgar Street, Nelson

|

Agenda

Rārangi take

Chairperson Ms

Catherine Taylor

Members His

Worship the Mayor Nick Smith

Cr

Rohan O'Neill-Stevens

Cr

Mel Courtney

Cr

Rachel Sanson

Mr

Lindsay McKenzie

Quorum 3 Nigel

Philpott

Chief Executive

Nelson City Council Disclaimer

Please note that the contents of these

Council and Committee agendas have yet to be considered by Council and officer

recommendations may be altered or changed by the Council in the process of

making the formal Council decision. For enquiries call (03) 5460436.

Audit, Risk and Finance

Committee

This is a Committee of Council

Areas of

Responsibility

·

Any matters raised by Audit New Zealand or the Office of the

Auditor-General

·

Audit processes and management of financial risk

·

Chairperson’s input into financial aspects of draft

Statements of Expectation and draft Statements of Intent for Nelson City

Council Controlled Organisations, Council Controlled Trading Organisations and

Council Organisations

·

Council’s Annual Report

·

Council’s financial performance

·

Council’s Treasury policies

·

Health and Safety

·

Internal audit

·

Monitoring organisational risks, including debtors and legal

proceedings

·

Procurement Policy

Powers to

Decide

·

Appointment of a deputy Chair

Powers to

Recommend to Council

·

Adoption of Council’s Annual Report

·

To write off outstanding accounts receivable or remit fees and

charges of amounts over the Chief Executive’s delegated authority.

·

All other matters within the areas of responsibility or any other

matters referred to it by the Council

For the Terms of Reference for the Audit, Risk and Finance Committee

please refer to document NDOCS-1974015928-887.

Audit, Risk and Finance Committee

14

August 2024

Page

No.

Karakia

and Mihi Timatanga

1. Apologies

Nil

2. Confirmation

of Order of Business

3. Interests

3.1 Updates

to the Interests Register

3.2 Identify

any conflicts of interest in the agenda

4. Public

Forum

5. Confirmation

of Minutes

5.1 5 June

2024 7 - 15

Document number M20599

Recommendation

|

That the Audit, Risk and Finance Committee

1. Confirms the minutes of the meeting

of the Audit, Risk and Finance Committee, held on 5 June 2024, as a true and

correct record.

|

6. Quarterly Internal

Audit Report - 30 June 2024 16 - 19

Document number R28694

Recommendation

|

That

the Audit, Risk and Finance Committee

1. Receives

the report Quarterly Internal Audit Report - 30 June 2024 (R28694) and its Attachment

(1194974384-3691).

|

7. Quarterly Risk

Report - 30 June 2024 20 - 44

Document number R28695

Recommendation

|

That

the Audit, Risk and Finance Committee

1. Receives

the report Quarterly Risk Report - 30 June 2024 (R28695) and Attachment (1759736513-18).

|

8. Quarterly Finance

Report to 30 June 2024 45 - 66

Document number R28611

Recommendation

|

That

the Audit, Risk and Finance Committee

1. Receives

the report Quarterly Finance Report to 30 June 2024 (R28611) and its Attachments

(1857728953-1938, 1530519604-14363 and 839498445-18731).

|

9. Annual Tax Update 67 - 78

Document number R28612

Recommendation

|

That

the Audit, Risk and Finance Committee

1. Receives

the report Annual Tax Update (R28612)

and its Attachment (2130083480-731).

|

10. Bad Debts write off - Year

ending 30 June 2024 79

- 80

Document number R28716

Recommendation

|

That

the Audit, Risk and Finance Committee

1. Receives

the report Bad Debts write off - Year ending 30 June 2024 (R28716).

|

Confidential Business

11. Exclusion

of the Public

Recommendation

That the Audit,

Risk and Finance Committee

1.

Excludes the

public from the following parts of the proceedings of this meeting.

2.

The general subject of each matter to be

considered while the public is excluded, the reason for passing this resolution

in relation to each matter and the specific grounds under section 48(1) of the

Local Government Official Information and Meetings Act 1987 for the passing of

this resolution are as follows:

|

Item

|

General subject of each matter to be

considered

|

Reason for passing this resolution in

relation to each matter

|

Particular interests protected (where

applicable)

|

|

1

|

Audit, Risk and Finance Committee Meeting - Confidential Minutes

- 5 June 2024

|

Section

48(1)(a)

The

public conduct of this matter would be likely to result in disclosure of

information for which good reason exists under section 7.

|

The withholding of the information is necessary:

· Section

7(2)(a)

To protect the

privacy of natural persons, including that of a deceased person

· Section

7(2)(d)

To avoid

prejudice to measures protecting the health and safety of members of the

public

· Section

7(2)(g)

To maintain

legal professional privilege

· Section

7(2)(b)(ii)

To protect

information where the making available of the information would be likely

unreasonably to prejudice the commercial position of the person who supplied

or who is the subject of the information

|

|

2

|

Quarterly

Health, Safety and Wellbeing Report to 30 June 2024

|

Section

48(1)(a)

The public conduct of this

matter would be likely to result in disclosure of information for which good

reason exists under section 7

|

The withholding of the information is necessary:

· Section 7(2)(a)

To protect the privacy of

natural persons, including that of a deceased person

· Section 7(2)(d)

To avoid prejudice to

measures protecting the health and safety of members of the public

|

|

3

|

Quarterly Report on Legal Proceedings

|

Section 48(1)(a)

The public

conduct of this matter would be likely to result in disclosure of information

for which good reason exists under section 7

|

The withholding of the information is necessary:

· Section

7(2)(c)(ii)

To protect

information which is subject to an obligation of confidence or which any

person has been or could be compelled to provide under the authority of any

enactment, where the making available of the information would be likely

otherwise to damage the public interest

· Section

7(2)(g)

To maintain

legal professional privilege

|

|

4

|

Quarterly

Update on Debts - 30 June 2024

|

Section

48(1)(a)

The public conduct of this

matter would be likely to result in disclosure of information for which good

reason exists under section 7

|

The withholding of the information is necessary:

· Section 7(2)(a)

To protect the privacy of

natural persons, including that of a deceased person

|

Karakia

Whakamutanga

Present: Ms

C Taylor (Chairperson), His Worship the Mayor N Smith, Councillors, M Courtney,

R O'Neill-Stevens, R Sanson and Mr L McKenzie

In

Attendance: Chief Executive (N Philpott), Group Manager

Environmental Management (M Bishop), Group Manager Corporate Services (N

Harrison), Group Manager Strategy and Communications (N McDonald), Acting Group

Manager Infrastructure (D Light), Team Leader Governance (R Byrne) and

Governance Adviser (A Bryce)

Apologies : Nil

Karakia

and Mihi Timatanga

1. Apologies

2. Confirmation of

Order of Business

Agenda Item 7 - Annual

Procurement update would be considered last on the open agenda to accommodate

staff availability.

3. Interests

There were no updates to the

Interests Register, and no interests with items on the agenda were declared.

4. Public Forum

There was no public forum.

5. Confirmation of

Minutes

5.1 14

February 2024

Document number M20444, agenda

pages 8 - 13 refer.

|

Resolved ARF/2024/015

|

|

|

That the Audit, Risk and

Finance Committee

1. Confirms

the minutes of the meeting of the Audit, Risk and Finance Committee, held on

14 February 2024, as a true and correct record.

|

|

Sanson/McKenzie Carried

|

6. Privacy

Update

Document number R28506, agenda

pages 14 - 16 refer.

Group Manager Strategy and

Communications, Nicky McDonald and Manager Governance and Support Services,

Devorah Nicuarta-Smith, took the report as read and provided an update to the

committee in relation to the compliance investigation themes. They answered

questions on the artificial intelligence policy and trials, CCTV cameras,

LGOIMA and Privacy Act requests.

|

Resolved ARF/2024/016

|

|

|

That

the Audit, Risk and Finance Committee

1. Receives the report

Privacy Update (R28506).

|

|

Courtney/His Worship the

Mayor Carried

|

7. Internal Audit Plan

2024-2025 (Agenda Item 8)

Document number R28460, agenda

pages 20 - 29 refer.

Audit and Risk Analyst, Chris

Logan, took the report as read and answered questions on the four proposed

audit topics: infrastructure physical works procurement, transformation

business case for change assistance, insourcing services and annual fraud &

conflict of interest testing, in the 2024/25 financial year.

Chief Executive, Nigel Philpott,

discussed the Transformation business case program model and monitoring, noting

this project was about creating organisational efficiencies rather than cost

savings.

|

Resolved ARF/2024/017

|

|

|

That

the Audit, Risk and Finance Committee

1. Receives the report

Internal Audit Plan 2024-2025 (R28460)

and its attachments (1194974384-3678 and 1194974384-3679).

|

|

O'Neill-Stevens/Sanson Carried

|

|

Recommendation to Council ARF/2024/018

|

|

|

That the Council

1. Approves

the Internal Audit Plan 2024-2025.

|

|

O'Neill-Stevens/Sanson Carried

|

8. Quarterly Internal

Audit Report - 31 Mar 2024 (Agenda Item 9)

Document number R28462, agenda

pages 30 - 33 refer.

Group Manager Corporate Services,

Nikki Harrison and Audit and Risk Analyst, Chris Logan, took the report as read

and answered questions on the risks, learnings and timing of the implementation

of the vertical construction external review.

|

Resolved ARF/2024/019

|

|

|

That

the Audit, Risk and Finance Committee

1. Receives the report

Quarterly Internal Audit Report - 31 Mar 2024 (R28462) and its attachment (1194974384-3677).

|

|

Courtney/McKenzie Carried

|

9. Quarterly Risk

Report - 31 Mar 2024 (Agenda Item 10)

Document number R28481, agenda

pages 34 - 57 refer.

Audit and Risk Analyst, Chris

Logan, took the report as read and answered questions on the change in organisational

risk lifeline services from medium to high, rerated risks procedures and Nelson

City Council’s risk tolerance reporting.

Chief Executive, Nigel Philpott

and Acting Group Manager Infrastructure, David Light, answered questions on the

contaminated soil issue and risk notifications.

|

Resolved ARF/2024/020

|

|

|

That

the Audit, Risk and Finance Committee

1. Receives the report

Quarterly Risk Report - 31 Mar 2024 (R28481)

and its attachment (1759736513-17).

|

|

His Worship the Mayor/O'Neill-Stevens Carried

|

10. Quarterly Finance Report to 31

March 2024 (Agenda Item 11)

Document number R28489, agenda

pages 58 - 80 refer.

Group Manager Corporate Services,

Nikki Harrison and Manager Finance, Prabath Jayawardana, took the report as

read and answered questions on government funding for kerbside kitchen waste

expenses, capital expenditure, monitoring and reporting and the eBus project

reporting.

Attendance: His Worship the Mayor

Hon Dr Smith left the meeting at 10.25a.m.

|

Resolved ARF/2024/021

|

|

|

That

the Audit, Risk and Finance Committee

1. Receives the report

Quarterly Finance Report to 31 March 2024 (R28489) and its attachments (839498445-18465 and

839498445-18471).

|

|

Courtney/McKenzie Carried

|

The

meeting adjourned from 10.30a.m. until 10.48a.m.

11. Audit Report on the Long Term

Plan 2024-2034 Consultation Document (Agenda Item 12)

Document number R28569, agenda

pages 81 - 99 refer.

Group Manager Strategy and

Communications, Nicky McDonald, took the report as read and answered questions

on active modes of transport measures, others councils undertaking surveys to

measure and monitor active transport statistics, levels of service and

measurements of accurate data collected via alternative measures and the draft

financial strategy.

Director Audit New Zealand, John

Mackey, spoke to the report and the Audit process.

Attendance: His Worship the Mayor

returned to the meeting at 10.58a.m.

|

Resolved ARF/2024/022

|

|

|

That

the Audit, Risk and Finance Committee

1. Receives the report

Audit Report on the Long Term Plan 2024-2034 Consultation Document (R28569) and its attachment

(1852948764-1132); and

2. Notes

Council’s response to four recommendations from Audit New Zealand on

the quality of asset data, active transport level of service, deliverability

of the capital programme and asset management maturity, highlighted in

sections 2.2, 2.3, 2.6 and 2.10 of the Audit Report (1852948764-1132).

|

|

O'Neill-Stevens/Sanson Carried

|

12. Audit New Zealand - Audit Plan

2023-24 (Agenda Item 13)

Document number R28571, agenda

pages 100 - 125 refer.

Group Manager Corporate Services,

Nikki Harrison, Director Audit New Zealand, Julian Tan and Manager Finance,

Prabath Jayawardana, took the report as read and answered questions on the

proposed focus areas for the audit.

|

Resolved ARF/2024/023

|

|

|

That

the Audit, Risk and Finance Committee

1. Receives the report

Audit New Zealand - Audit Plan 2023-24 (R28571) and its attachment

(2126778665-333).

|

|

Sanson/Courtney Carried

|

13. Annual

Procurement update (Agenda Item 7)

Document number R28282, agenda

pages 17 - 19 refer.

Procurement and Contracts Advisor,

Peter Denton, took the report as read and answered questions on reporting on

broader outcomes and timing for reviewing the procurement policy.

|

Resolved ARF/2024/024

|

|

|

That

the Audit, Risk and Finance Committee

1. Receives the report

Annual Procurement update (R28282).

|

|

Sanson/McKenzie Carried

|

14. Exclusion

of the Public

|

Resolved ARF/2024/025

|

|

|

That the Audit, Risk and

Finance Committee

1. Excludes the public from the

following parts of the proceedings of this meeting.

2. The general subject of each matter

to be considered while the public is excluded, the reason for passing this

resolution in relation to each matter and the specific grounds under section

48(1) of the Local Government Official Information and Meetings Act 1987 for

the passing of this resolution are as follows:

|

|

Courtney/McKenzie Carried

|

|

Item

|

General subject of each matter to be

considered

|

Reason for passing this resolution in

relation to each matter

|

Particular interests protected (where

applicable)

|

|

1

|

Audit, Risk and Finance Committee Meeting - Confidential Minutes

- 14 February 2024

|

Section

48(1)(a)

The

public conduct of this matter would be likely to result in disclosure of

information for which good reason exists under section 7.

|

The withholding of the information is necessary:

· Section

7(2)(a)

To protect the

privacy of natural persons, including that of a deceased person

· Section

7(2)(d)

To avoid

prejudice to measures protecting the health and safety of members of the

public

· Section

7(2)(g)

To maintain

legal professional privilege

|

|

2

|

Quarterly

Health, Safety and Wellbeing Report to 31 March 2024

|

Section

48(1)(a)

The public conduct of this

matter would be likely to result in disclosure of information for which good

reason exists under section 7

|

The withholding of the information is necessary:

· Section 7(2)(a)

To protect the privacy of

natural persons, including that of a deceased person

· Section 7(2)(d)

To avoid prejudice to

measures protecting the health and safety of members of the public

|

|

3

|

Quarterly Report on Legal Proceedings

|

Section 48(1)(a)

The public

conduct of this matter would be likely to result in disclosure of information

for which good reason exists under section 7

|

The withholding of the information is necessary:

· Section

7(2)(g)

To maintain

legal professional privilege

|

|

4

|

Insurance

Optimisation

|

Section

48(1)(a)

The public conduct of this

matter would be likely to result in disclosure of information for which good

reason exists under section 7

|

The withholding of the information is necessary:

· Section 7(2)(b)(ii)

To protect information

where the making available of the information would be likely unreasonably to

prejudice the commercial position of the person who supplied or who is the

subject of the information

|

|

5

|

Quarterly Update on Debts - 31 March 2024

|

Section 48(1)(a)

The public

conduct of this matter would be likely to result in disclosure of information

for which good reason exists under section 7

|

The withholding of the information is necessary:

· Section

7(2)(a)

To protect the

privacy of natural persons, including that of a deceased person

|

|

6

|

Project

Management Oversight - eBus Project

|

Section

48(1)(a)

The public conduct of this

matter would be likely to result in disclosure of information for which good

reason exists under section 7

|

The withholding of the information is necessary:

· Section 7(2)(a)

To protect the privacy of

natural persons, including that of a deceased person

|

The meeting went into confidential session at 11.34a.m.

and resumed in public session at 12.50p.m.

Karakia

Whakamutanga

15. Restatements

It was resolved while the public was

excluded:

|

1

|

CONFIDENTIAL: Project

Management Oversight - eBus Project (Agenda Item 6)

|

|

|

2. Agrees

that the decision remains confidential.

|

|

2

|

CONFIDENTIAL: Quarterly

Health, Safety and Wellbeing Report to 31 March 2024 (Agenda Item 2)

|

|

|

2. Agrees that the

Quarterly Health, Safety and Wellbeing Report

to 31 March 2024 Report (R28548) and attachment

(855153265-4717) remain confidential at this time.

|

|

3

|

CONFIDENTIAL: Quarterly

Report on Legal Proceedings (Agenda Item 3)

|

|

|

2. Agrees

that the report Quarterly Report on Legal Proceedings (R28407)

and Attachment (142319133-546) remain confidential.

|

|

4

|

CONFIDENTIAL: Insurance

Optimisation (Agenda Item 4)

|

|

|

1. Receives the report

Insurance Optimisation (R28442)

and its attachment (1731786637-3743); and

2. Notes that

the recommendations are being taken due to increased premiums over the number

of years; and

3. Notes that

these recommendations will result in increased financial risk to the Council;

and

4. Agrees

that Report (R28442) and the decision only be made publicly

available; and

5. Agrees

that Attachment (1731786637-3743) remain confidential

at this time.

|

|

6

|

CONFIDENTIAL: Quarterly

Update on Debts - 31 March 2024 (Agenda Item 5)

|

|

|

2. Agrees

that the report Quarterly Update on Debts - 31 March 2024 (R28488) and its

attachment (1857728953-1637) remain confidential at this time.

|

There being no further business the meeting ended at 12.50p.m.

Confirmed as a correct record of proceedings by

resolution on (date)

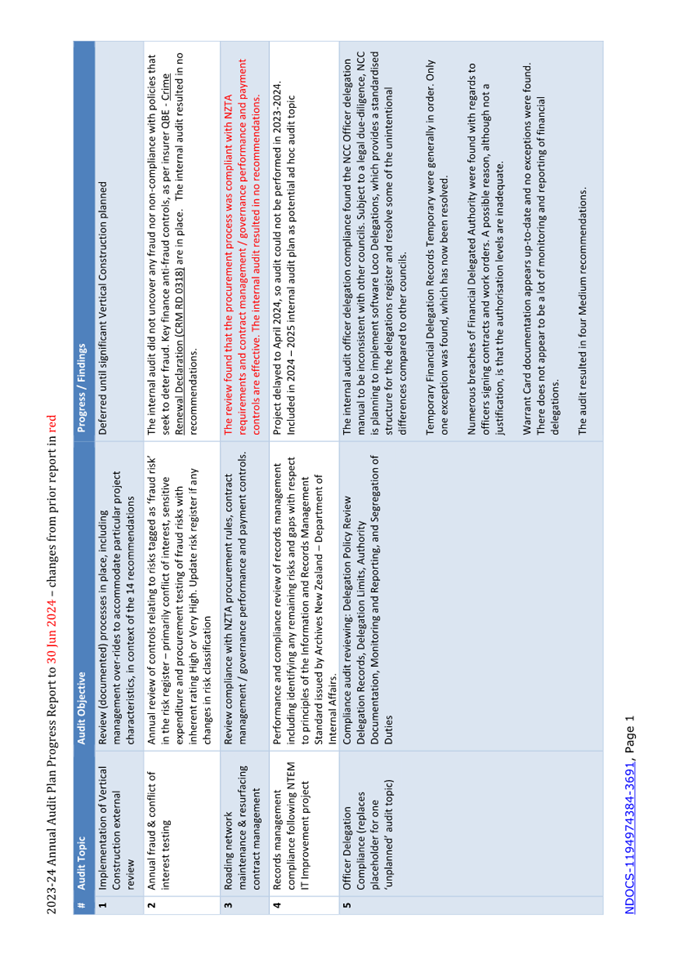

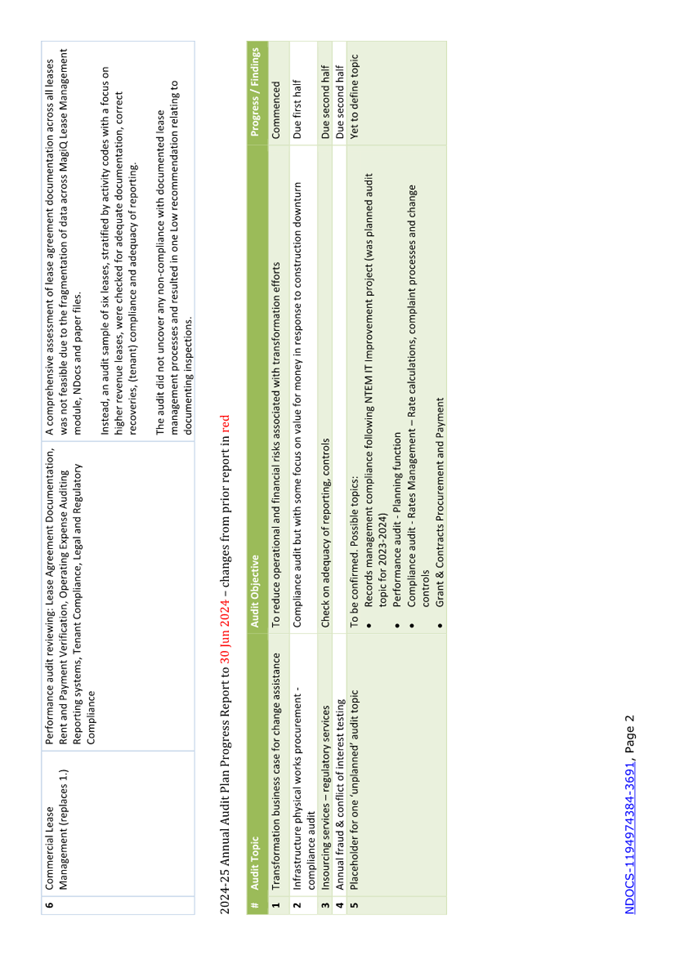

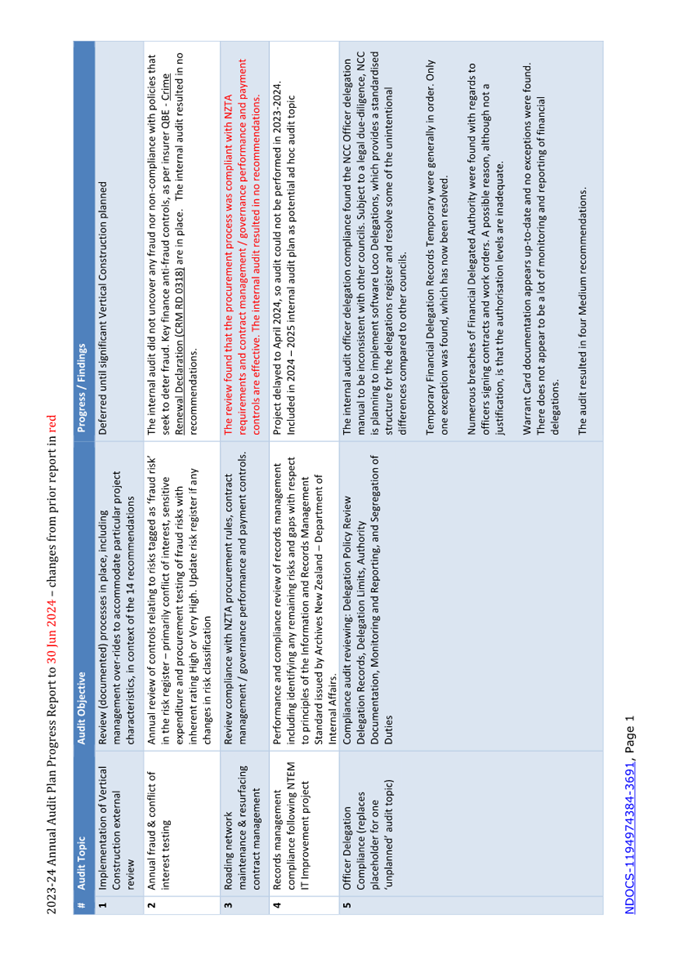

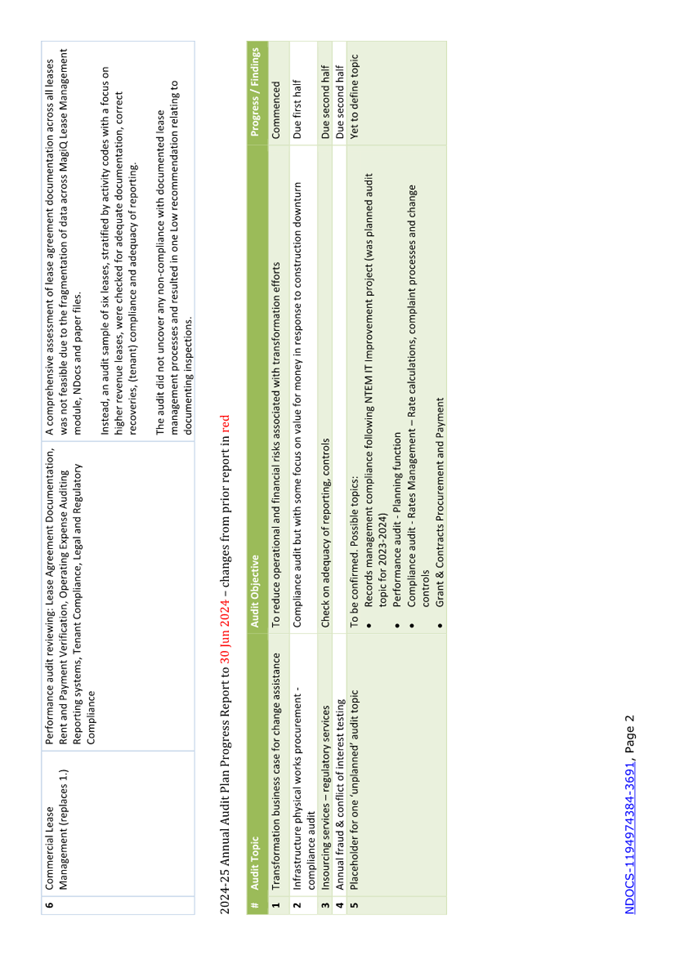

Item 6: Quarterly

Internal Audit Report - 30 June 2024

|

|

Audit, Risk and Finance Committee

14 August 2024

|

Report

Title: Quarterly

Internal Audit Report - 30 June 2024

Report

Author: Chris Logan - Audit

and Risk Analyst

Report

Authoriser: Nikki Harrison - Group Manager Corporate

Services

Report

Number: R28694

1. Purpose of Report

1.1 To update the Audit,

Risk and Finance Committee on the internal audit activity through to the end of

the fourth quarter of 2023/24.

2. Recommendation

|

That

the Audit, Risk and Finance Committee

1. Receives

the report Quarterly Internal Audit Report - 30 June 2024 (R28694) and its Attachment

(1194974384-3691).

|

3. Background

3.1 Under Council’s

Internal Audit Charter, the Audit, Risk and Finance Committee requires a

periodic update on the progress of internal audit activities. The 2023-24

Internal Audit Plan (the Plan) was approved by the Council on 8 June 2023.

4. Overview of

Progress on the 2023/24 Internal Audit Plan

4.1 One audit was

completed during the quarter - Roading network maintenance & resurfacing

contract management. The review found that the procurement process was

compliant with NZTA Waka Kotahi requirements and contract management /

governance performance and payment controls are effective. The internal audit

resulted in no recommendations.

4.2 Only four of the five

audits were completed this year.

4.3 Further information on

the status and outcome of the audits is provided in the attachment.

5. Significant

external audits that are not reported separately to the Audit, Risk and Finance

Committee

5.1 The International

Accreditation New Zealand’s (IANZ’s) Building Consent Authority

(BCA) audit commenced in June 2024 and provided the eight non-compliances are

cleared by Sep 2024 the next routine audit will be in two years time.

6. Status of

Outstanding Significant Risk Exposures and Control Issues Identified from

Internal Audits

6.1 Information is not

readily accessible nor retrievable (IANZ GNC) – the majority of NDocs

Improvements Business Case benefits have been realised and the advanced search

functionality is expected to be rolled out by the end of the first quarter of

2024/25.

6.2 Staff are finding it

difficult to find NCC internal policies – Closed - Internal register is

now live and has been communicated to all employees.

Attachments

Attachment 1: 1194974384-3691

Annual Audit Plan Progress - 30 June 2024 ⇩

Item 6: Quarterly Internal Audit Report - 30 June

2024: Attachment 1

Item 7: Quarterly Risk

Report - 30 June 2024

|

|

Audit, Risk and Finance Committee

14 August 2024

|

Report

Title: Quarterly

Risk Report - 30 June 2024

Report

Author: Chris Logan - Audit

and Risk Analyst

Report

Authoriser: Nikki Harrison - Group Manager Corporate

Services

Report

Number: R28695

1. Purpose of Report

1.1 To provide information

to the Audit, Risk and Finance Committee on the organisational and group risks

through to the end of the fourth quarter of 2023/24.

1.2 To update to the

Audit, Risk and Finance Committee on insurance renewals.

2. Recommendation

|

That

the Audit, Risk and Finance Committee

1. Receives

the report Quarterly Risk Report - 30 June 2024 (R28695) and Attachment (1759736513-18).

|

3. Background

3.1 This report describes

key risk areas, divided by risk theme organisational risks) and reporting

Group.

4. Key Risk Areas by

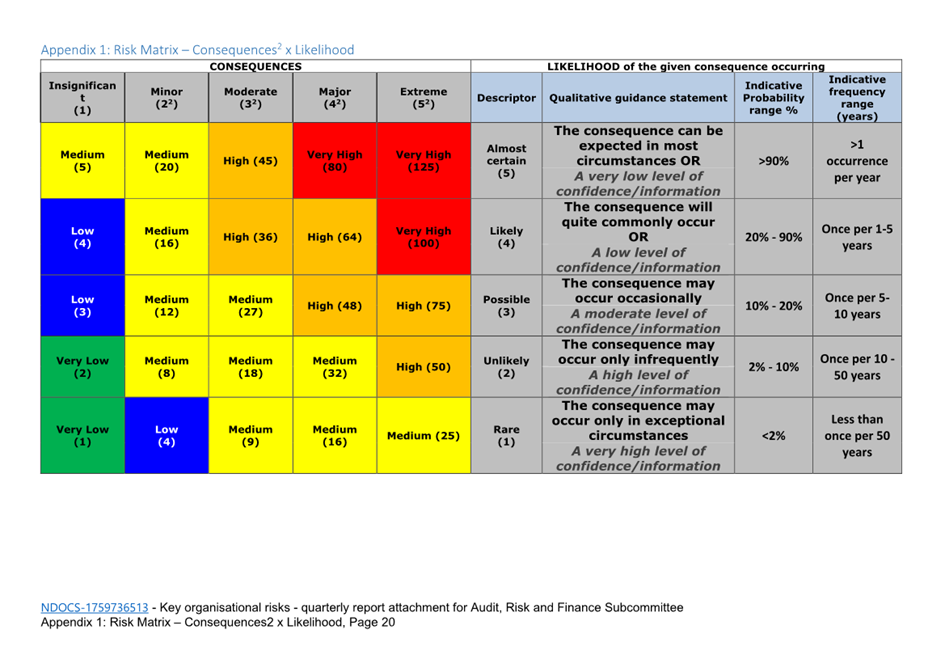

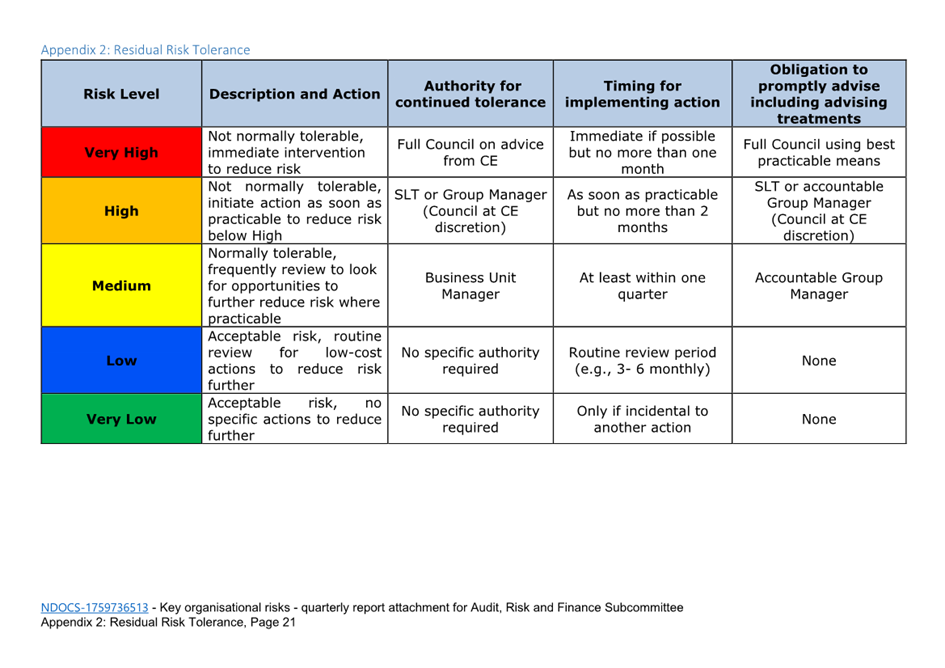

Theme (Organisational Risks)

4.1 Risks relating to

Council and joint operations are monitored via Council’s risk register.

Approximately 30% of risk entries by count have been identified as having a

common theme or cause which create risk concentrations that pose a threat at an

organisational level. These organisational risks are described below.

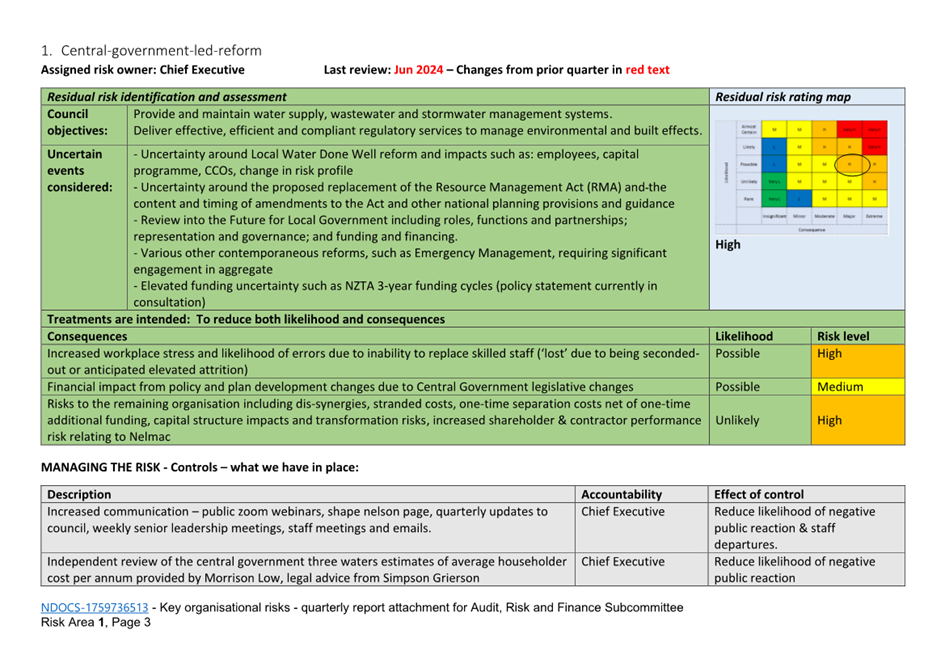

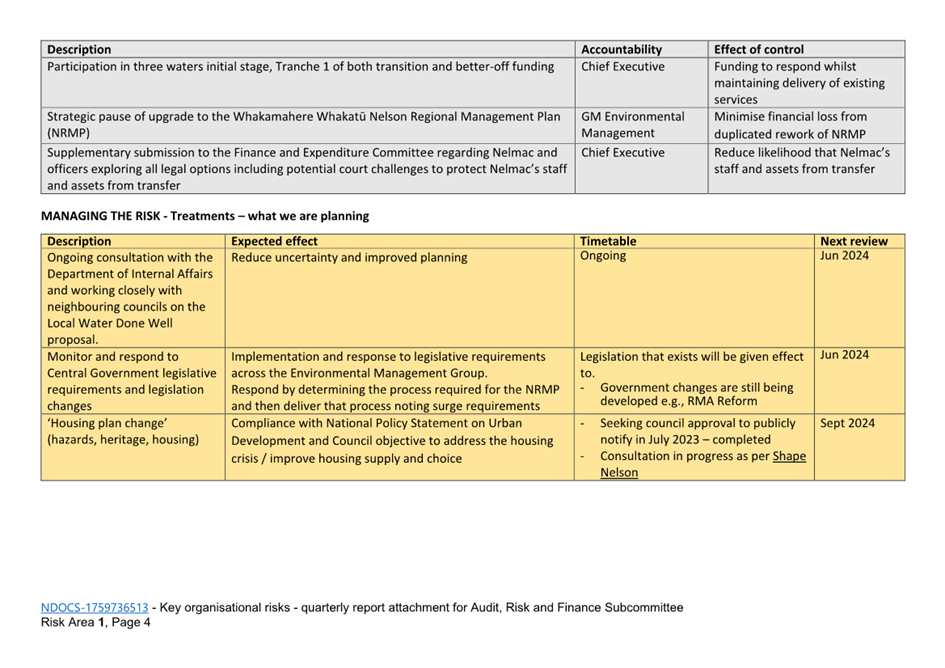

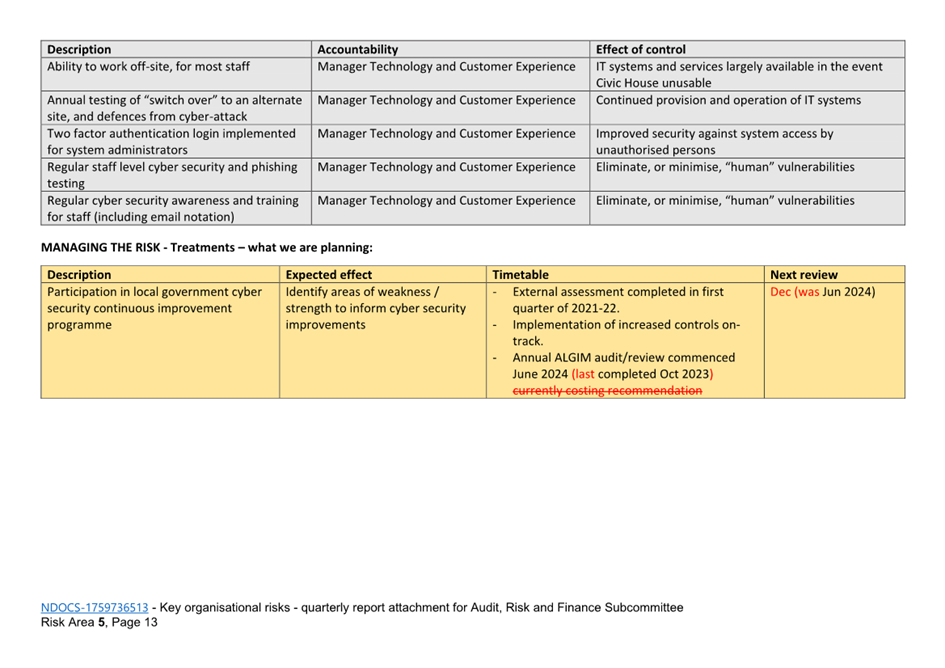

4.2 R1 -

Central-government-led-reforms (Owner: Chief Executive). Risks relating to

deferral of and uncertainty around reforms remain. The risk rating remains at

High.

4.3 R2 - Lifeline

services failure (Owner: Group Manager Infrastructure). Flood-recovery work

is ongoing. The risk rating remains at High.

4.4 R3 - Illness,

injury or stress from higher hazard work situations (Owner: Group Manager

Corporate Services). Addressing workplace stress remains an organisational

focus area. The risk rating remains at High.

4.5 R4 - Loss of

service performance from ineffective contracts and contract management

(Owner: Chief Executive). The contract management improvement program continues

to be monitored quarterly by the internal Procurement Steering Committee. The

risk rating remains at Medium.

4.6 R5 - Compromise of

Council service delivery from information technology failures (Owner: Group

Manager Corporate Services). No new emerging risks to report at this time. The

risk rating remains at Medium.

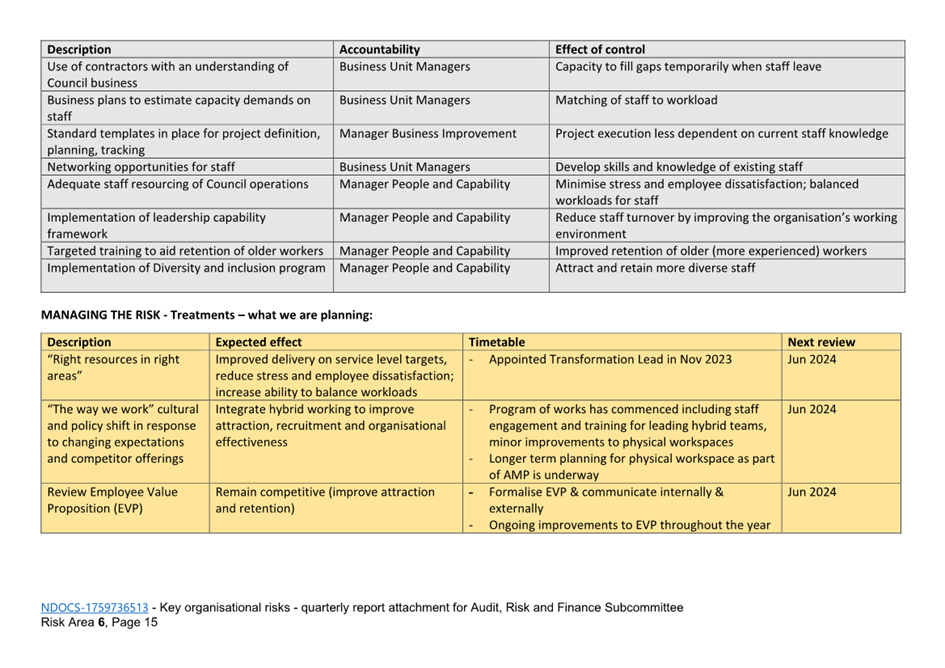

4.7 R6 - Council work

compromised by loss of and difficulties in replacing skilled staff (Owner:

Manager People and Capability). Turnover is starting to ease and most critical

roles which had been vacant for long periods are now filled. Training,

inducting and establishing relationships within the organisation is now a key

focus to ensure that new talent is retained and can thrive. The organisational

risk rating remains at Medium until we see this trend continue through the back

half of 2024.

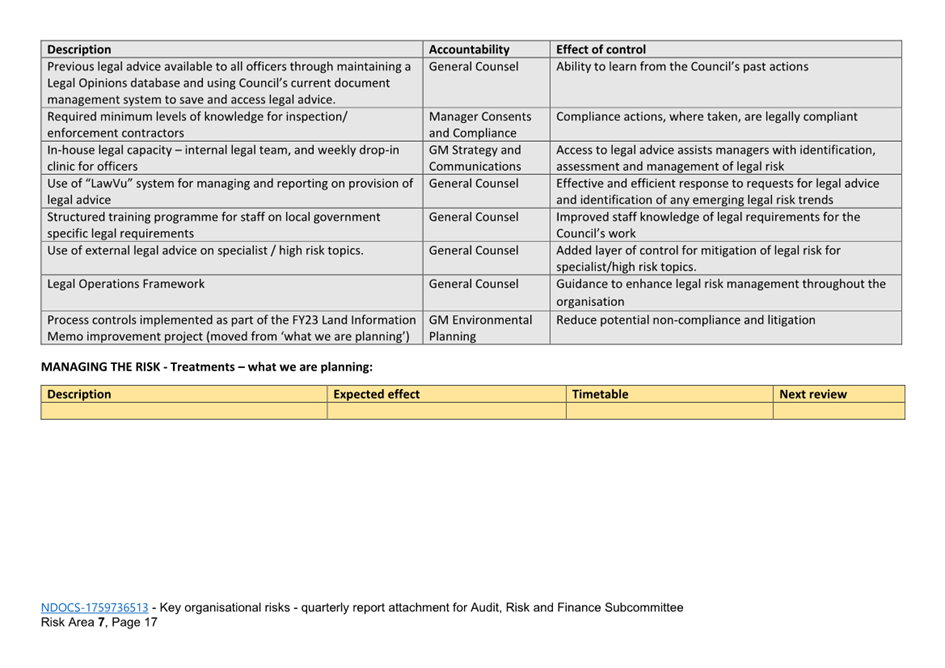

4.8 R7 - Legal Risk

(Owner: Group Manager Strategy and Communications). No emerging organisational

risks to report at this time noting that any new legal proceedings or emerging

areas of increased litigation risk are separately reported in the quarterly

report on legal proceedings. The organisational risk rating remains at

Medium.

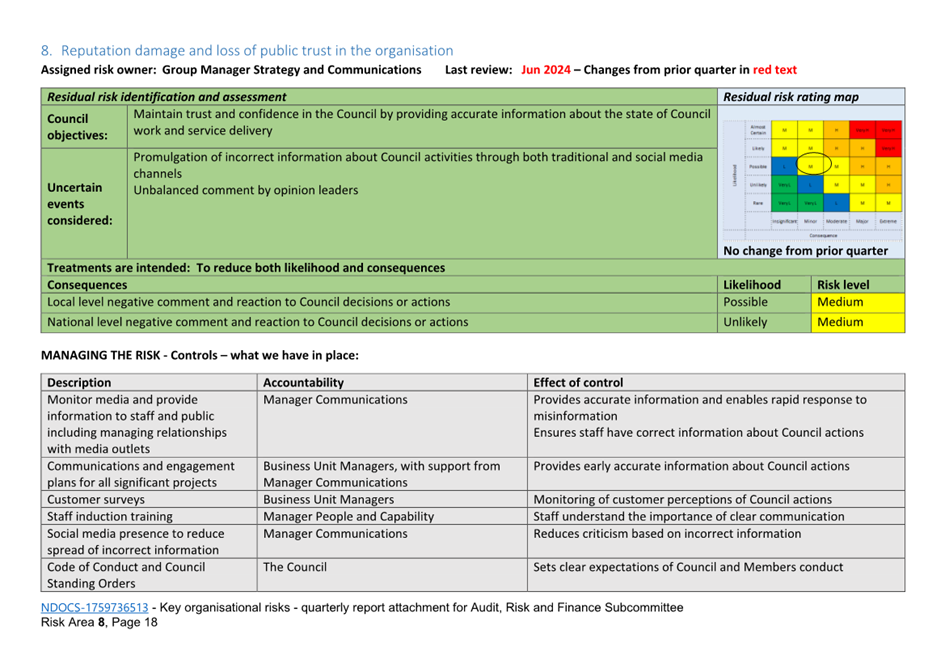

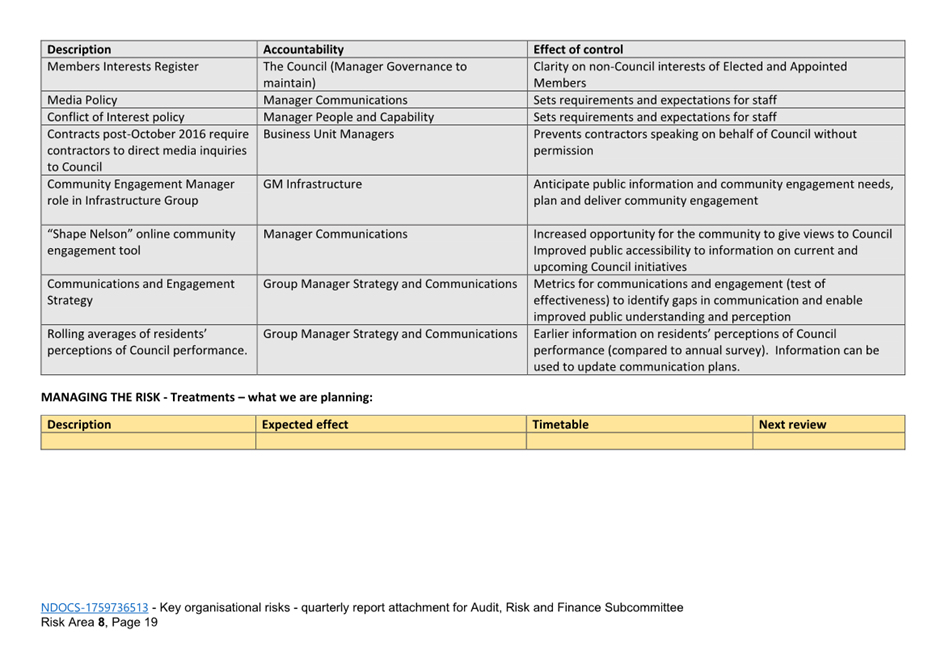

4.9 R8 - Reputation

damage and loss of public trust in the organisation (Group Manager Strategy

and Communications). No new emerging risks to report at this time. The risk

rating remains at Medium

5. Key Risk Areas by

Reporting Group

5.1 Council’s risk

register does not contain specific asset, activity, legal matter, or project

risks. Instead, these are rolled up into more general asset, activity, legal or

project risks. Any significant specific risks which are new or emerging are

summarised below by reporting group.

5.2 Office of the Chief

Executive: No new emerging risks to report at this time.

5.3 Infrastructure

Group: Construction downturn in subdivision

work has resulting in more tenders on some Council works that has realised

competitive pricing in some cases.

5.4 Community Services

Group:

5.4.1 Risks associated with two of three

Council-owned campgrounds (two operated and one leased) remain elevated whilst

non-compliance remediation actions are being implemented. The risks previously

monitored by elected members through the Strategic Development and Property

Subcommittee have been monitored through the usual organisational processes

since that subcommittee ceased at the end of the last triennium. Since the last

report to this Committee, non-compliance with one campground has been resolved.

5.4.2 Risks associated with wood processing

waste deposited at Tāhunanui Beach in the 1960s have been investigated,

and a remediation option has been approved by Council, with funding from MfE

currently being sought.

5.5 Environmental

Management Group: Some senior planning positions remain vacant. Workload

stress continues for both planning teams due to complexity of work and

uncertainty about national legislation reform.

5.6 Strategy

and Communications Group: No new emerging risks to report at this

time.

5.7 Corporate Services

Group:

5.7.1 No

new emerging risks to report at this time.

5.7.2 There was one High risk notification

made to the Chair of ARF during the quarter relating to Council potentially not

having any Professional Indemnity Insurance from 1 July 2024. It is noted that

primary layer insurance is now in place.

6. Insurance renewal

update

6.1 Excluding

below-ground-essential-infrastructure insurance, which is due to renew 1

November 2024, Nelson City Council renewed all major insurance policies for

financial year 2024-25. Highlights of the 1 July 2024 renewal include:

6.1.1 Material Damage & Business

Interruption premium $1.4M (previously $1.8M). Reduction in premium in line

with decision to reduce cover as agreed by Council 6 June 2024.

6.1.2 Other lines, premiums were previously

$0.4M and were renewed for $0.5M (annualised). However, the Professional

Indemnity (PI), Public Liability (PL), and Harbour Master liability & Wreck

Removal (HMWR) coverage limits have been significantly reduced:

· PI

coverage limit is now $15M in the aggregate but subject to an additional

multi-council $30M limit. Options for excess layer coverage are yet to be

determined. Previously coverage was AU$300M each claim.

· PL

is coverage limit is now $15M each claim with a $30M natural disaster aggregate

limit. Previously coverage was AU$300M each claim.

· Harbour

Master liability coverage limit is now $25M in aggregate (previously $50M) and

Wreck Removal coverage limit is now $10M in aggregate (previously $50M).

Officers declined to take up excess cover which would have increased cover to

$50M/$25M respectively given the additional cost and maximum foreseeable loss

scenario.

6.2 Officers are currently

reviewing the below-ground-essential-infrastructure insurance, the review

includes:

6.2.1 increasing the limit from $180M to

$300M - limit is currently 9% of insured asset value whilst 1 in 500 probably

maximum loss scenario is in the range of 14% to 26%+ of insured asset value;

6.2.2 increasing the excess from $1.8M to

$5M - to reduce premium impact of the limit increase, which is estimated to

cost an additional $0.7M to $0.9M; and

6.2.3 investigating parametric insurance

options, where the claim payments are determined by weather/earthquake station

measurements, potentially expanding ‘coverage’ to roading.

Attachments

Attachment 1: 1759736513-18 4Q24

key organisational risks for ARF ⇩

Item 7: Quarterly Risk Report - 30 June 2024:

Attachment 1

Item 8: Quarterly

Finance Report to 30 June 2024

|

|

Audit, Risk and Finance Committee

14 August 2024

|

Report

Title: Quarterly

Finance Report to 30 June 2024

Report

Author: Prabath

Jayawardana - Manager Finance

Report

Authoriser: Nikki Harrison - Group Manager Corporate

Services

Report

Number: R28611

1. Purpose of Report

1.1 To inform the

Committee of the financial results for Council for the twelve months ended 30

June 2024, and to highlight any material variations.

2. Recommendation

|

That

the Audit, Risk and Finance Committee

1. Receives

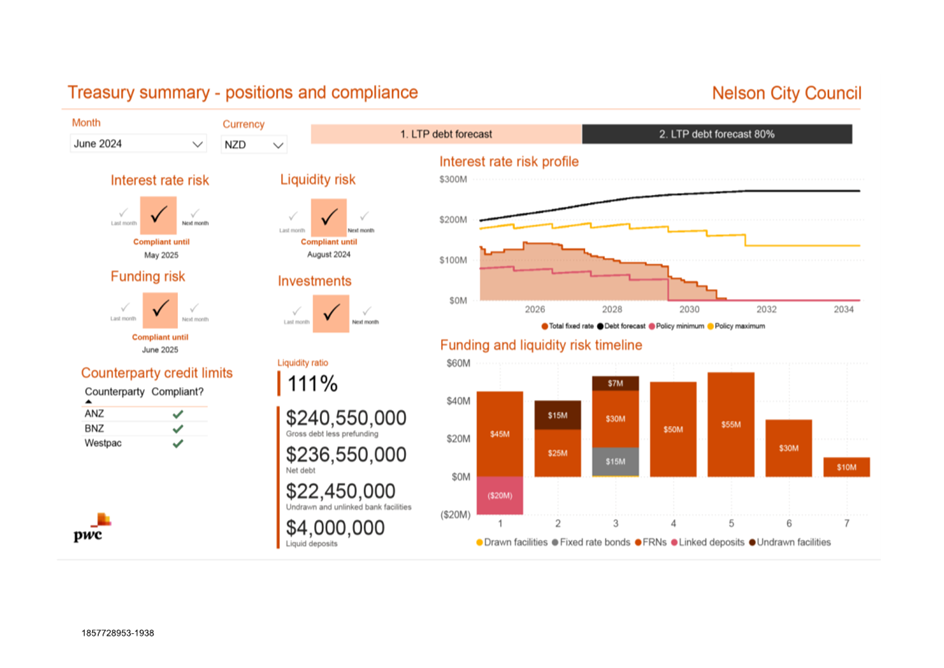

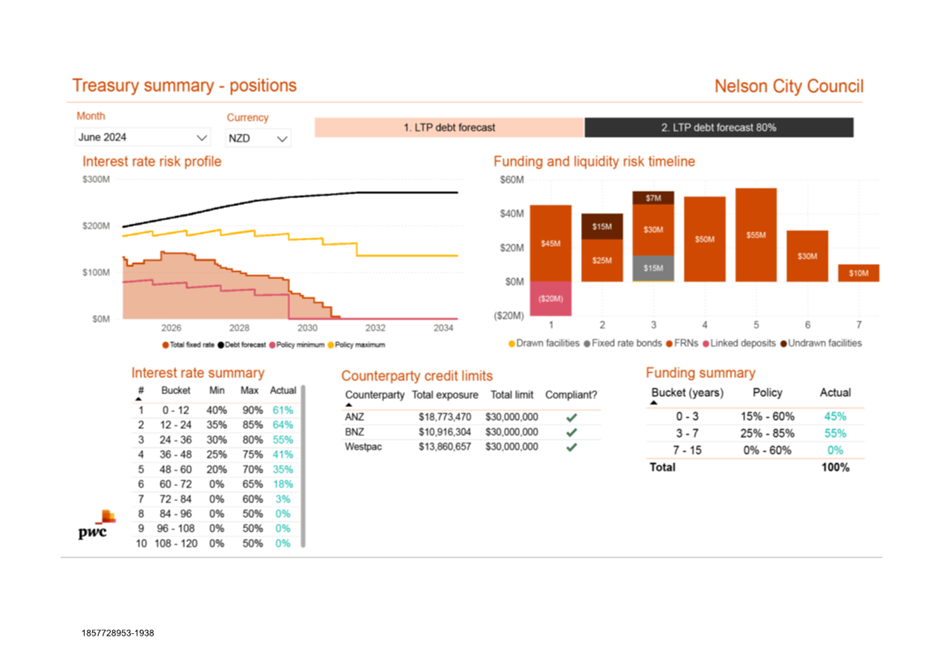

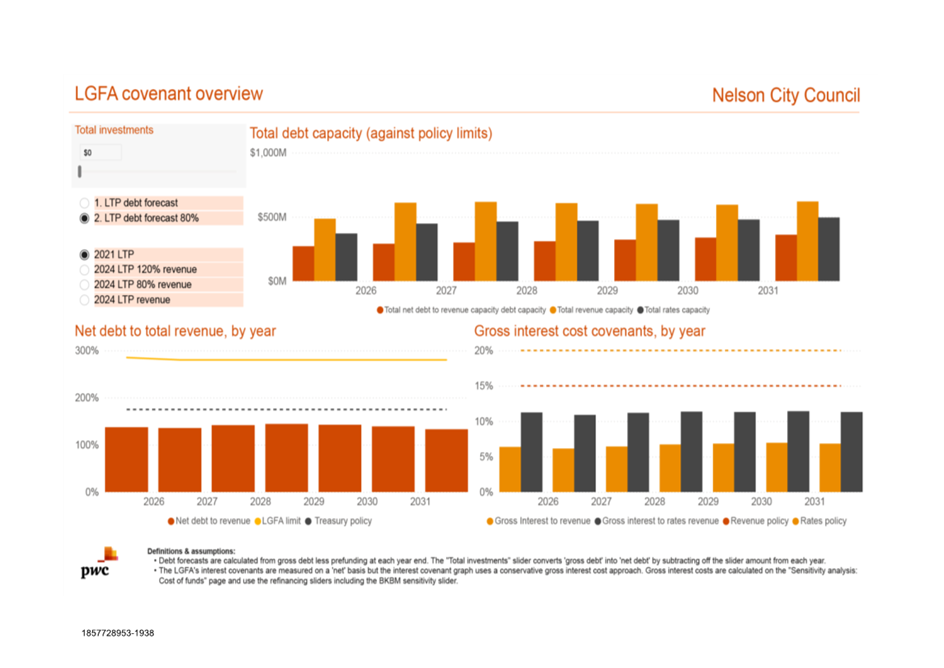

the report Quarterly Finance Report to 30 June 2024 (R28611) and its Attachments (1857728953-1938,

1530519604-14363 and 839498445-18731).

|

3. Background

3.1 The

whole of Council financial reporting provided to this Committee focuses on the

twelve-month performance (1 July 2023 to 30 June 2024) compared with the year-to-date (YTD) approved capital and operating

expenditure budgets. The quarterly report includes Nelson City

Council performance only and does not include its subsidiaries, associates, and

joint ventures.

3.2 Unless

otherwise indicated, all information is against approved operating budgets, which is Annual Plan 2023/24, plus any carry forwards, plus or minus

any other additions or changes as approved by the Council.

3.3 Commentary

is provided below for significant variances of +/- $500,000.

3.4 Note that this is a draft result, as year-end is still in progress.

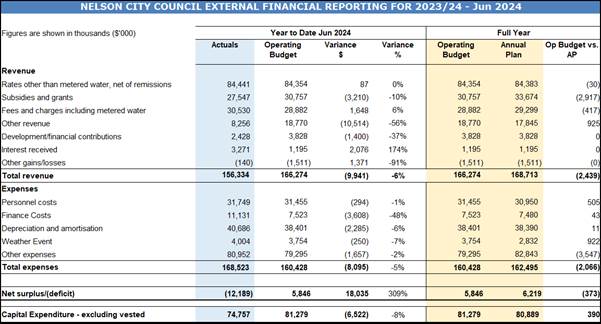

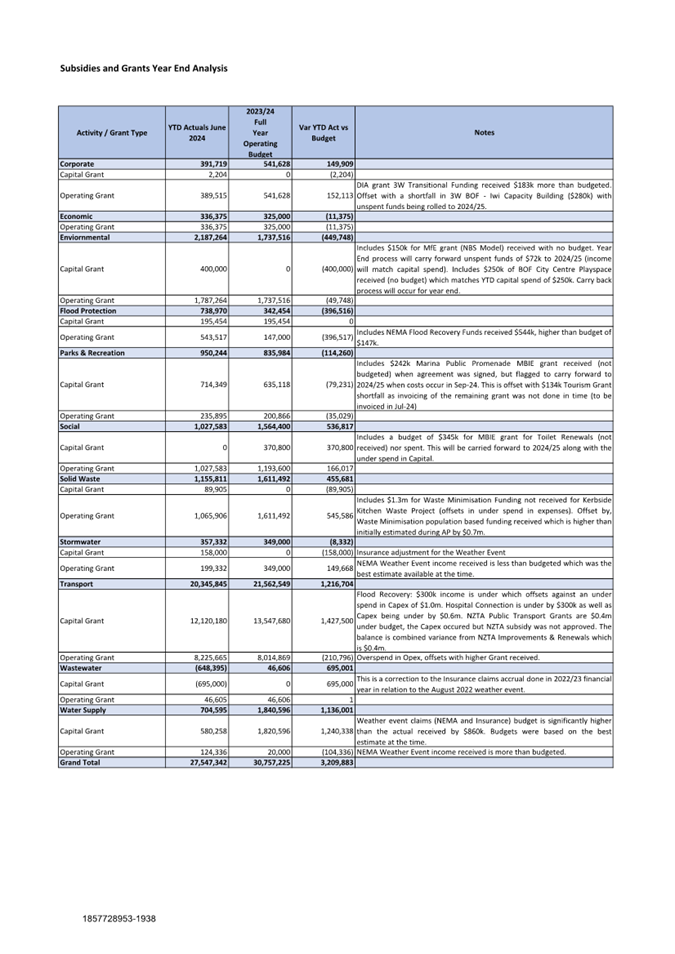

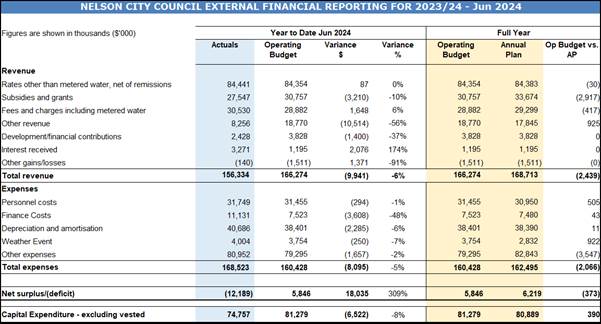

4. Financial

Performance

4.1 For

the twelve months ending 30 June 2024, the Council’s draft deficit is

$12.2m against a budgeted surplus of $5.8m ($18.0m unfavourable to budget),

mainly due to reasons explained below.

4.2 Profit

and Loss

4.3 Revenue

4.4 Rates

income is in-line with budget.

4.5 Subsidies

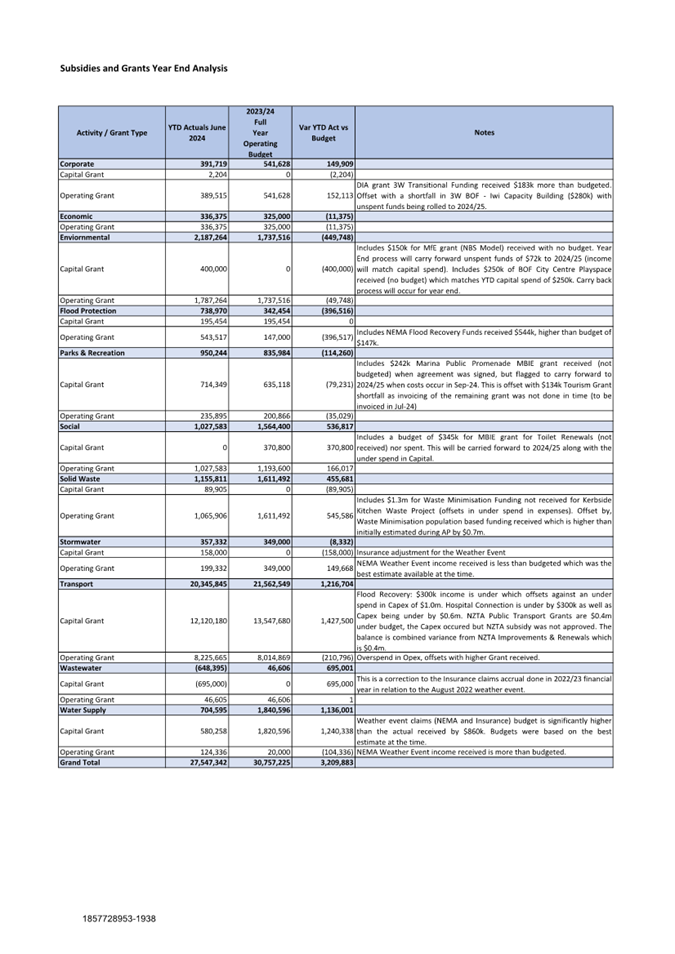

and Grants is less than budget by $3,210,000. Attachment

1 (1857728953-1938) includes a detailed analysis of

this variance.

4.6 Fees

and Charges income is greater than budget by

$1,648,000. This is mainly due to water by meter charges to

residential and commercial users by $0.6m due to higher water usage than

anticipated. Consent fees and Job sales are also higher than budget by $0.6m

which offsets the higher than budget other expense variance below.

4.7 Other

revenue is less than budget by $10,514,000. The NRSBU Profit Share Washup is yet to be done

(budget is $1.7m) and the Infrastructure Holdings Limited (IHL) dividend has

not been accrued due to the new IHL dividend policy, resulting in a shortfall

of $3.1m compared to budget. The Port Nelson and Nelson Airport dividends

previously declared prior to year end and paid the next financial year: now

declared and paid in the same financial year. This is a timing issue as the

result will be two years of dividend income in 2024/25. Vested asset income

is yet to be calculated (budget is $5.4m).

4.8 Development

Contributions is less than budget by $1,400,000.

This is due to less development activity than budgeted for.

4.9 Finance

Revenue is greater than budget by $2,076,000.

This is due to more funds being invested than planned because of pre-funding of

debt. Currently there is $20m of investments for pre-funding of debt (see

offset in Finance costs below).

4.10 Other

gains/(losses) is less than budget by $1,371,000.

This relates to the forestry activity, with net income being less than

budget due to delays in harvesting at Marsden and Roding Forest.

4.11 Expenses

4.12 Personnel

costs are greater than budget by $294,000.

There have been savings in personnel costs of $2.8m across different

activities however the YTD vacancy provision was $3.1m.

4.13 Finance

costs are greater than budget by $3,608,000. This

increase in interest costs is due to additional pre-funding of debt (which is

offset by the $2.1m extra in finance revenue), and higher interest rates and

borrowings than planned during the year.

4.14 Depreciation

and amortisation costs are greater than budget by

$2,285,000. Depreciation has been based on the 2022/23 asset

valuations, which saw large increases. This resulted in a higher

depreciation expense than planned.

4.15 Weather

Event costs are greater than budget by $250,000

with there being no significant variances greater than $0.5m.

4.16 Other

expenses are greater than budget by $1,657,000.

Significant variances are as follows:

4.16.1 Insurance is greater than budget by $1,226,000. This is

because of increases in premiums due to a) increases in asset values, and b)

higher premium rates.

4.16.2 Kerbside Kitchen

Waste expenses are less than budget by $1,408,000.

This government-funded initiative has been delayed.

4.16.3 Resource Consent

Job Purchases is greater than budget by $617,000

from the greater use of consultants due to staff vacancies (partial offset by

lower personnel costs and higher Fees & Charges).

4.16.4 Riskpool Claim is greater than budget by $230,000. This is due to

a historic exposure to calls dating pre-2010/11 when Nelson City Council was

part of a New Zealand Mutual Liability Riskpool Scheme for Insurance. This has

been funded from the building insurance reserve.

4.16.5 All other variances in other expenses are below $0.5m.

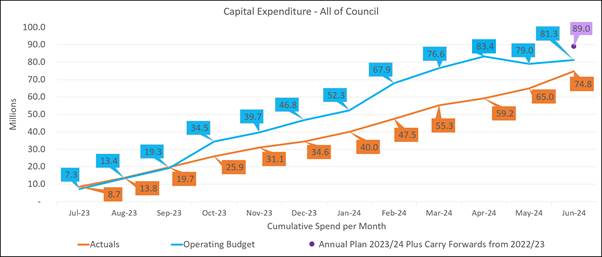

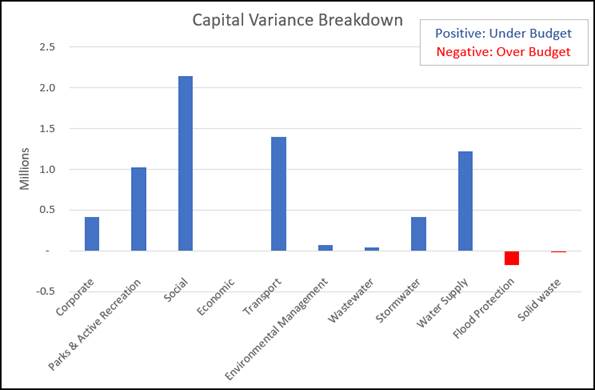

5. Capital

Expenditure

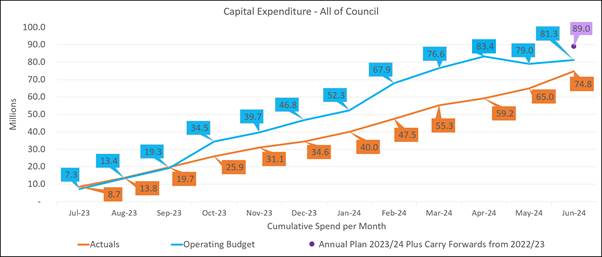

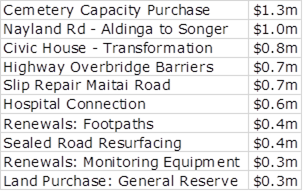

5.1 Capital Expenditure

(including staff time, excluding vested assets and joint operations)

5.2 As

at 30 June 2024, capital expenditure was $74.8m which is $6.5m under the Full

Year Operating Budget of $81.3m. The operating budget is lower by $20.1m than

the previous quarter due to carry forwards being approved during the

deliberations meeting in May 2024. The main contributors to the remaining

variance were Social ($2.1m), Transport ($1.4m), Water Supply ($1.2m), Parks

& Active Recreation ($1.0m).

5.3 The

actual capital programme delivery was 84% against the Annual Plan 2023/24 (including

carry forwards from 2022/23). The actuals include the Brook Street Property

Purchases ($7.2m) which were not budgeted at the time. The capital program delivery

is 76% once those property purchases were removed from the actuals.

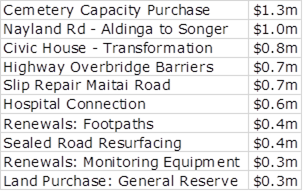

5.4 The

final carry forwards report will be brought to the 18 September 2024 Committee

meeting for approval and recommendation to Council when the Draft Annual Report

is presented. The top 10 lower than operating budget variances are as below;

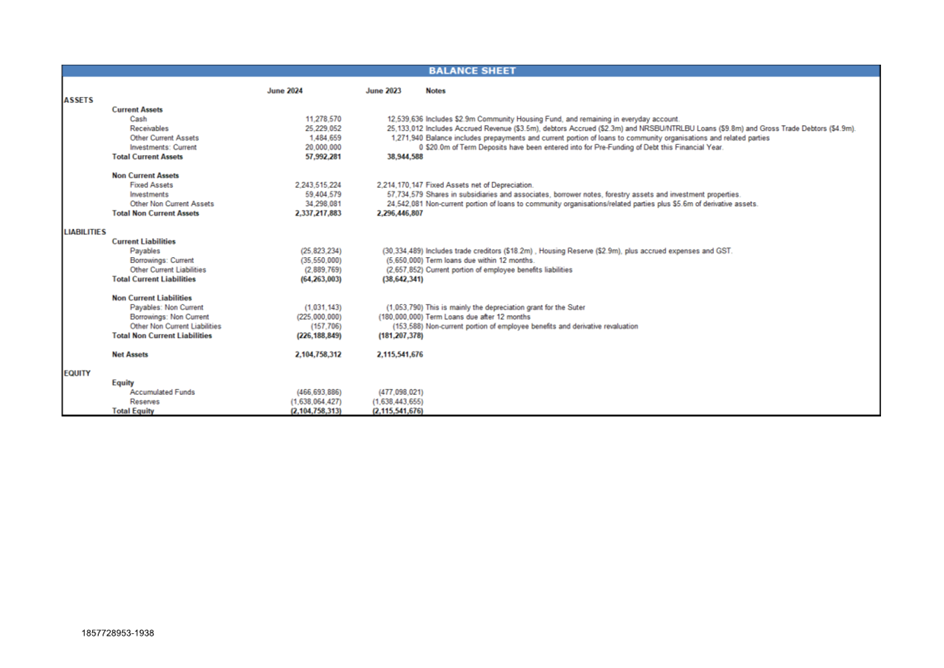

6. Cash Flow

Management

6.1 Net Debt

6.2 As

at 30 June 2024, there was a net debt of $223.5m. This has increased from 30

June 2023 by $54.6m. The full-year Annual Plan budget is $207.9m.

6.3 This

$54.6m increase in net debt from 30 June 2023 is due to: a) to fund the August

2022 weather event ($4.0m expenditure), b) to fund capital expenditure during

the year ($36.4m net of funded depreciation), c) to fund $4.0m advance to

Nelson Tasman Regional Landfill Business Unit (NTRLBU), d) to fund $8.8m

advance in working capital and term loan to Nelson Regional Sewerage Business

Unit, and e) drawdown of Housing NZ funds of $2.5m. The balance is due to

timing of cash inflows and outflows being different than planned.

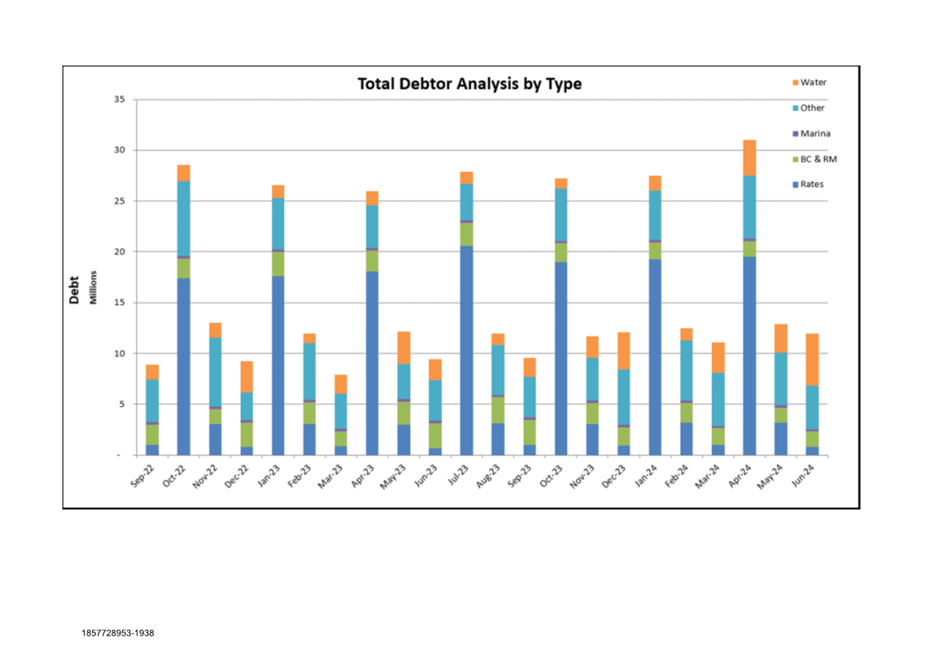

6.4 Attachment

1 (1857728953-1938) includes the statement of financial

position (Balance sheet), Debtors graph and compliance with the Treasury policy

as at 30 June 2024.

6.5 The

net debt figure in the treasury compliance report (Attachment 1) is different

from above 6.2 mainly due to LGFA borrowing notes not being included in the PWC

tool.

7. Rates Aging

7.1 Over

the last twelve months officers have seen outstanding rates balances increasing

slightly which highlights the cost of living and interest rate increases

impacting on the community. Officers are working hard to get ratepayers on to

payment plans.

7.2 Total

rates outstanding as at 30 June 2024 were $797,328. Below are the rates

outstanding at the end of each rating quarter.

Total Rates Outstanding

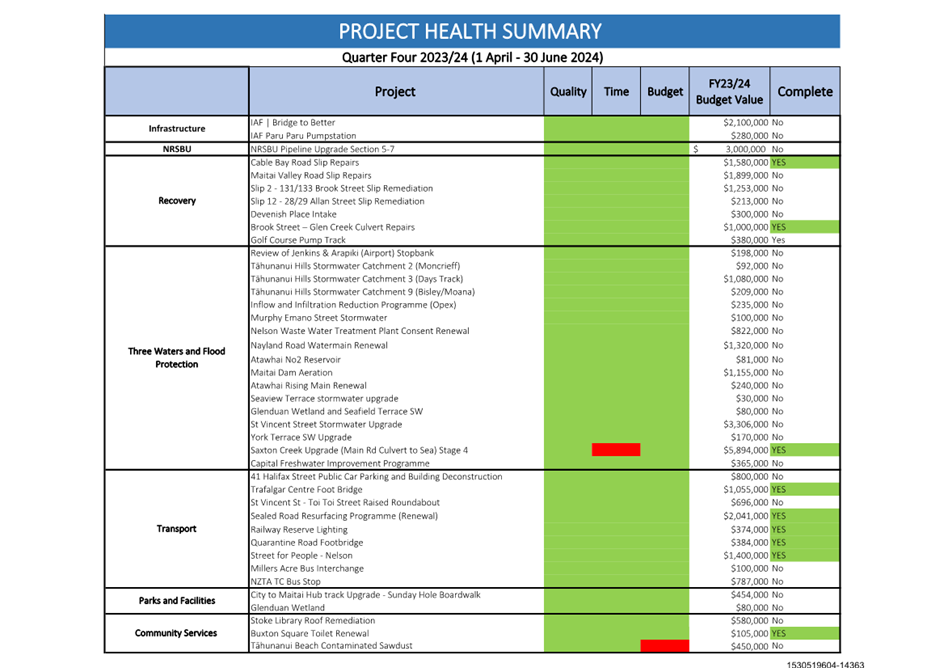

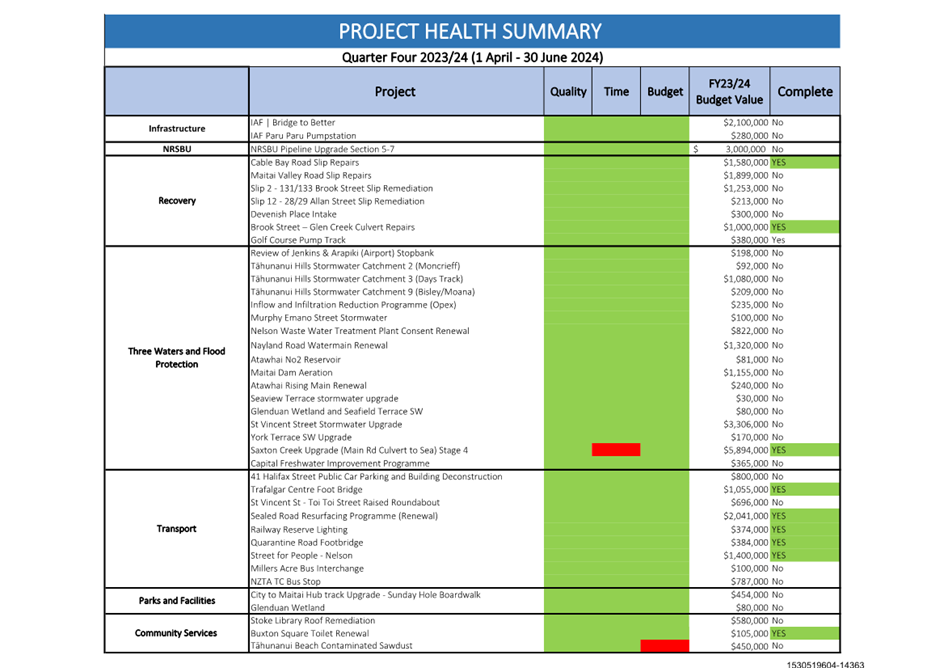

8. Project Health

8.1 Attachment 2

(1530519604-14363) summarises the health of projects across Council. The table

gives a red, amber or green rating for quality, time and budget factors.

8.2 Projects have

progressed well this quarter, impacts on supply chains and delays due to covid

have largely resolved and a quiet construction market has led to competitive

pricing.

8.3 The red on Saxtons

Creek Upgrade Stage 4 is due to the weather events in August 2022 and May 2023

and red on Tāhuananui Beach Contaminated Sawdust is due to the funding not

yet being approved.

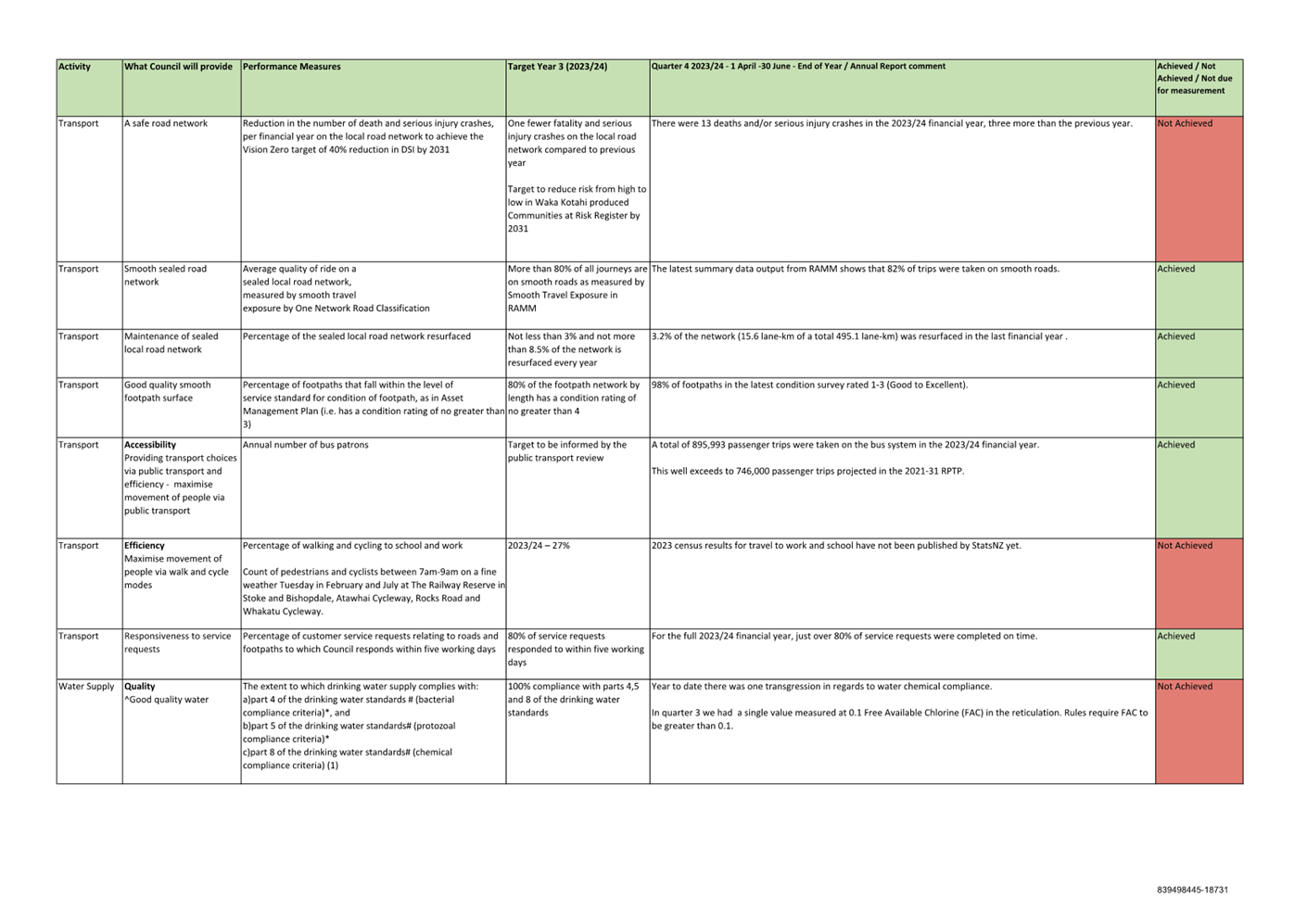

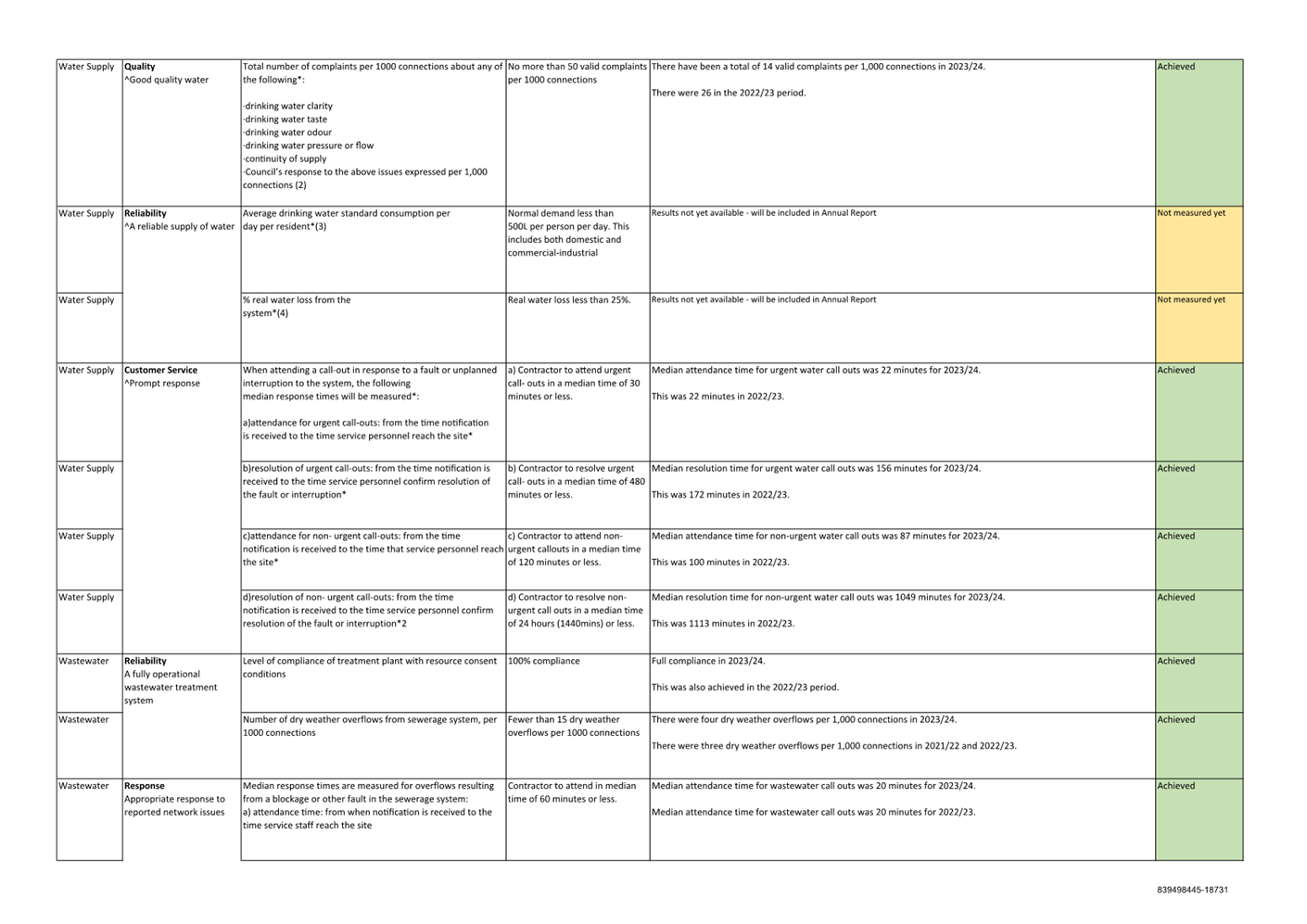

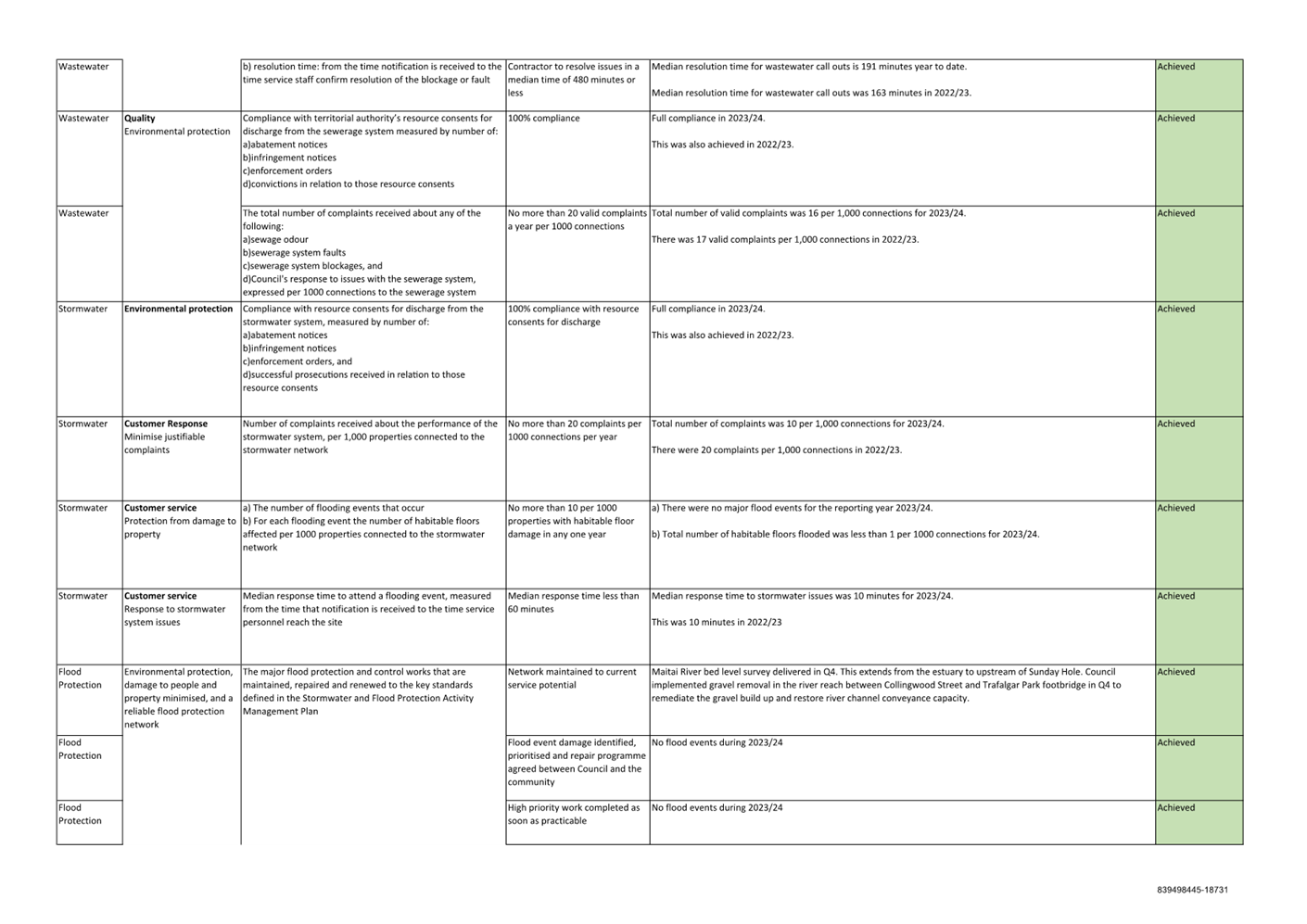

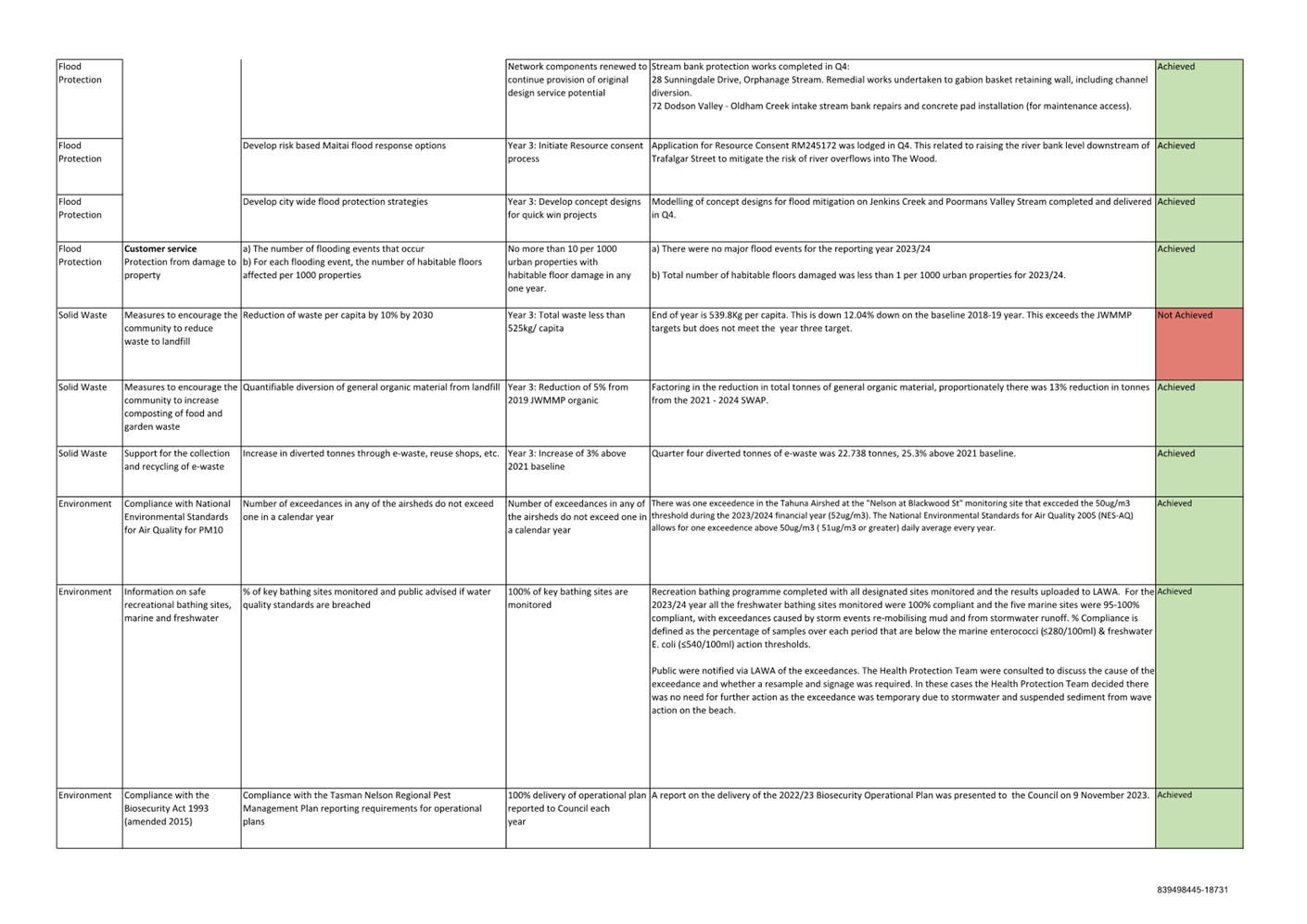

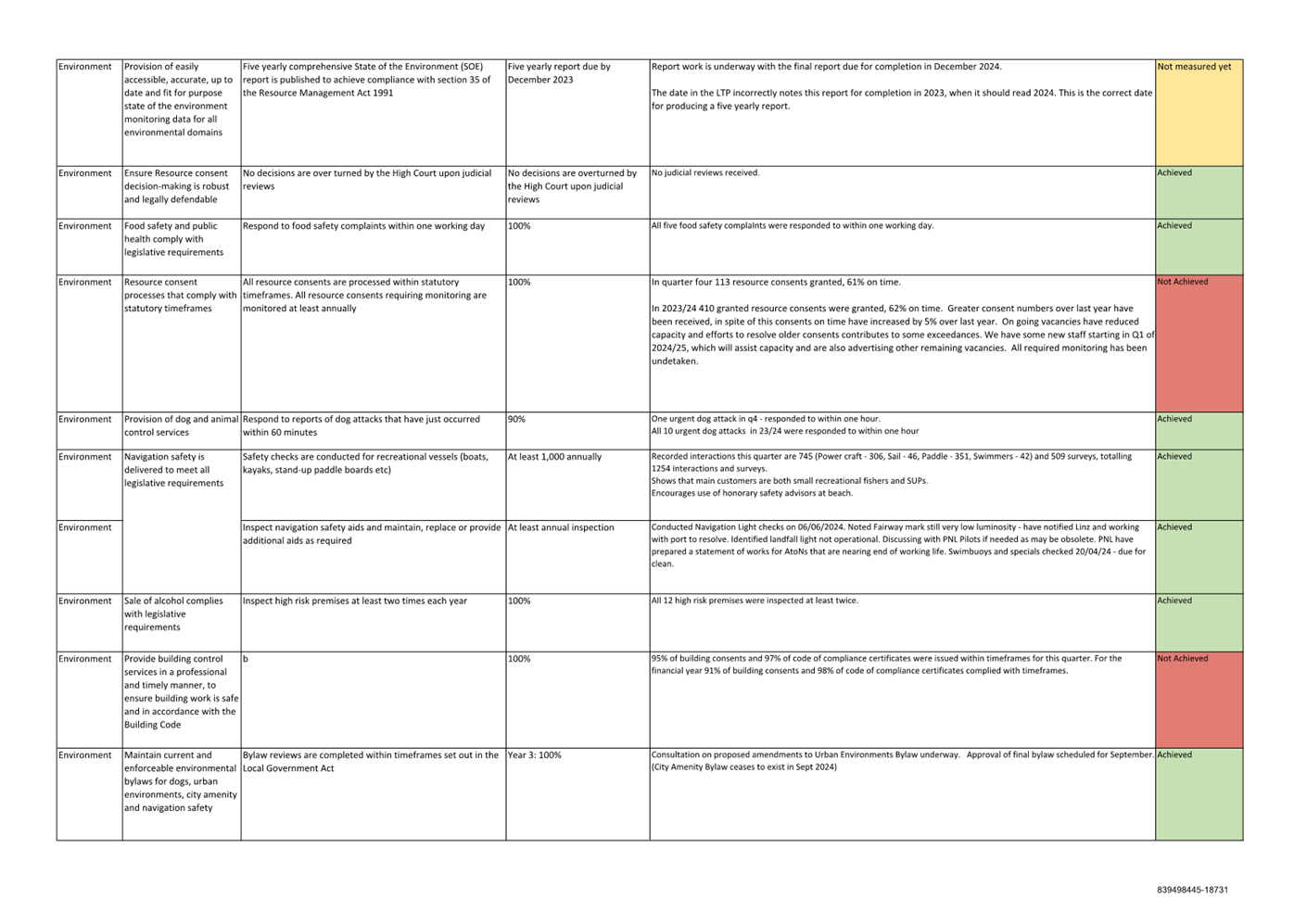

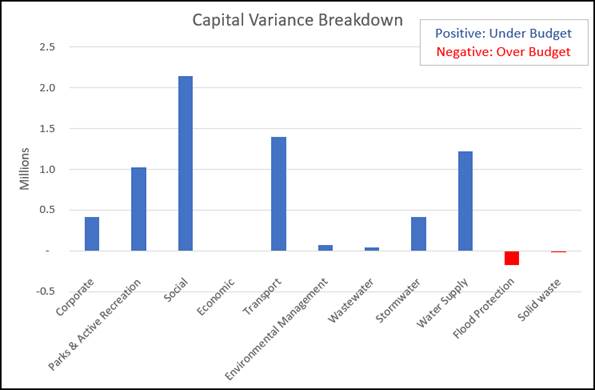

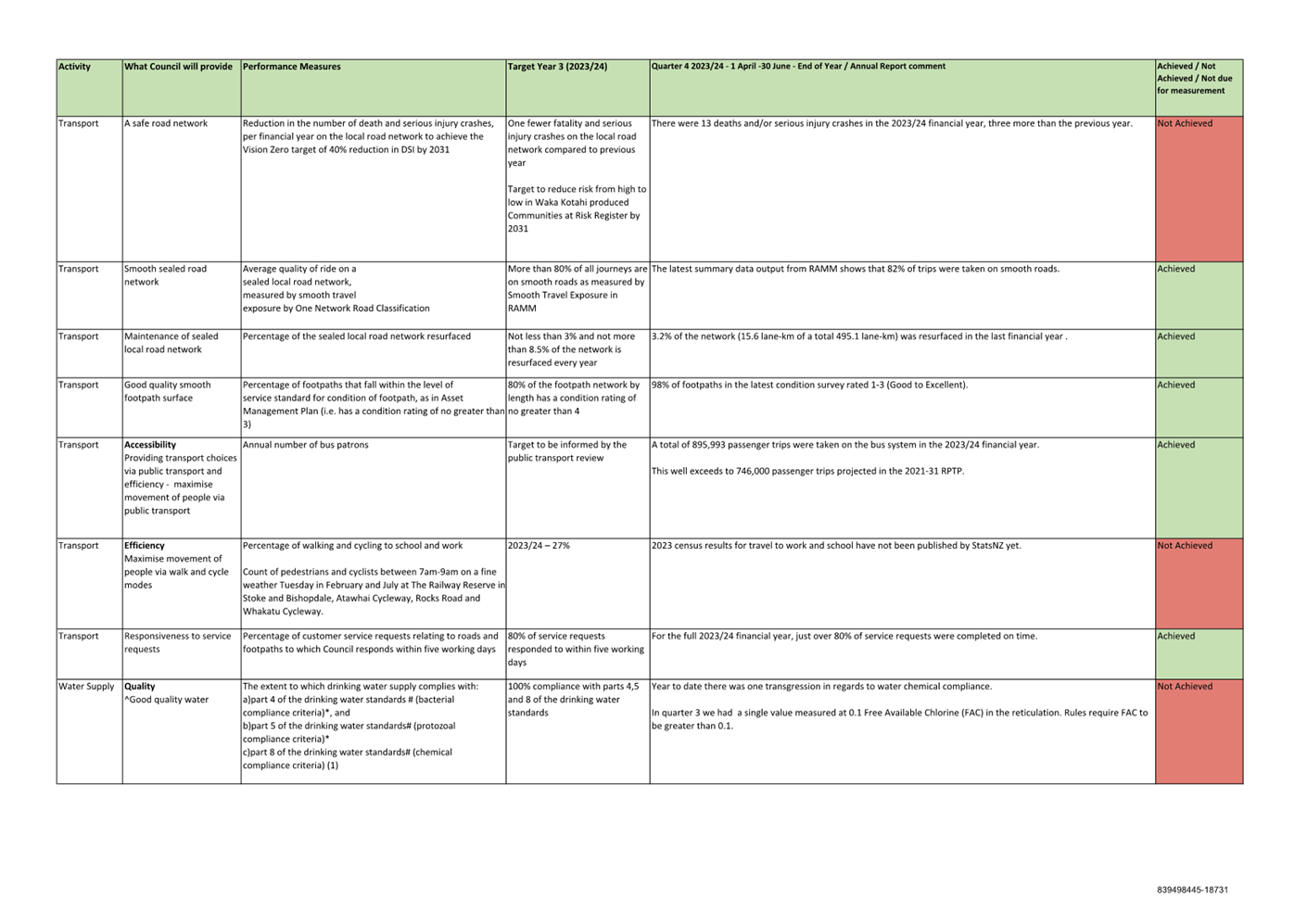

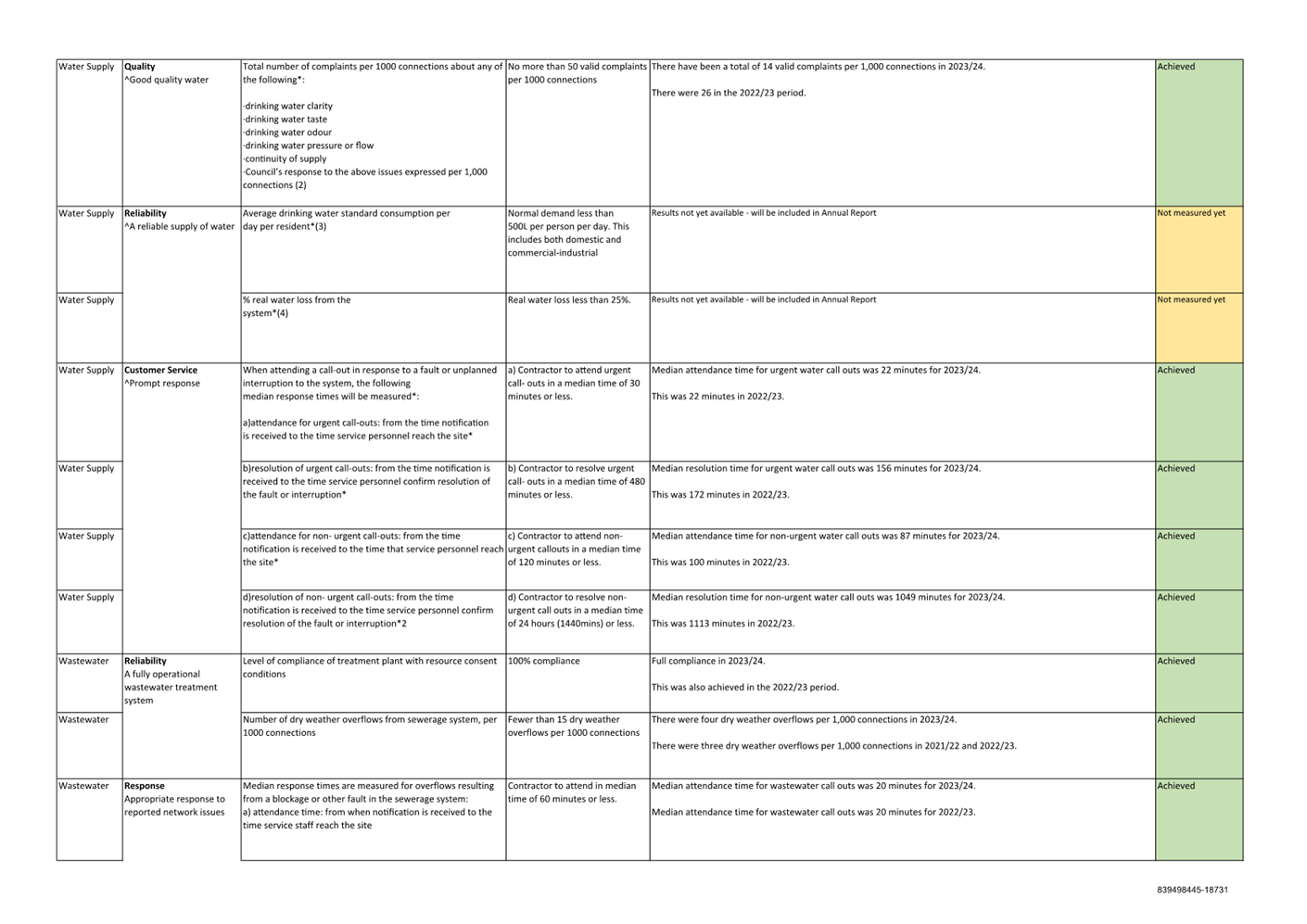

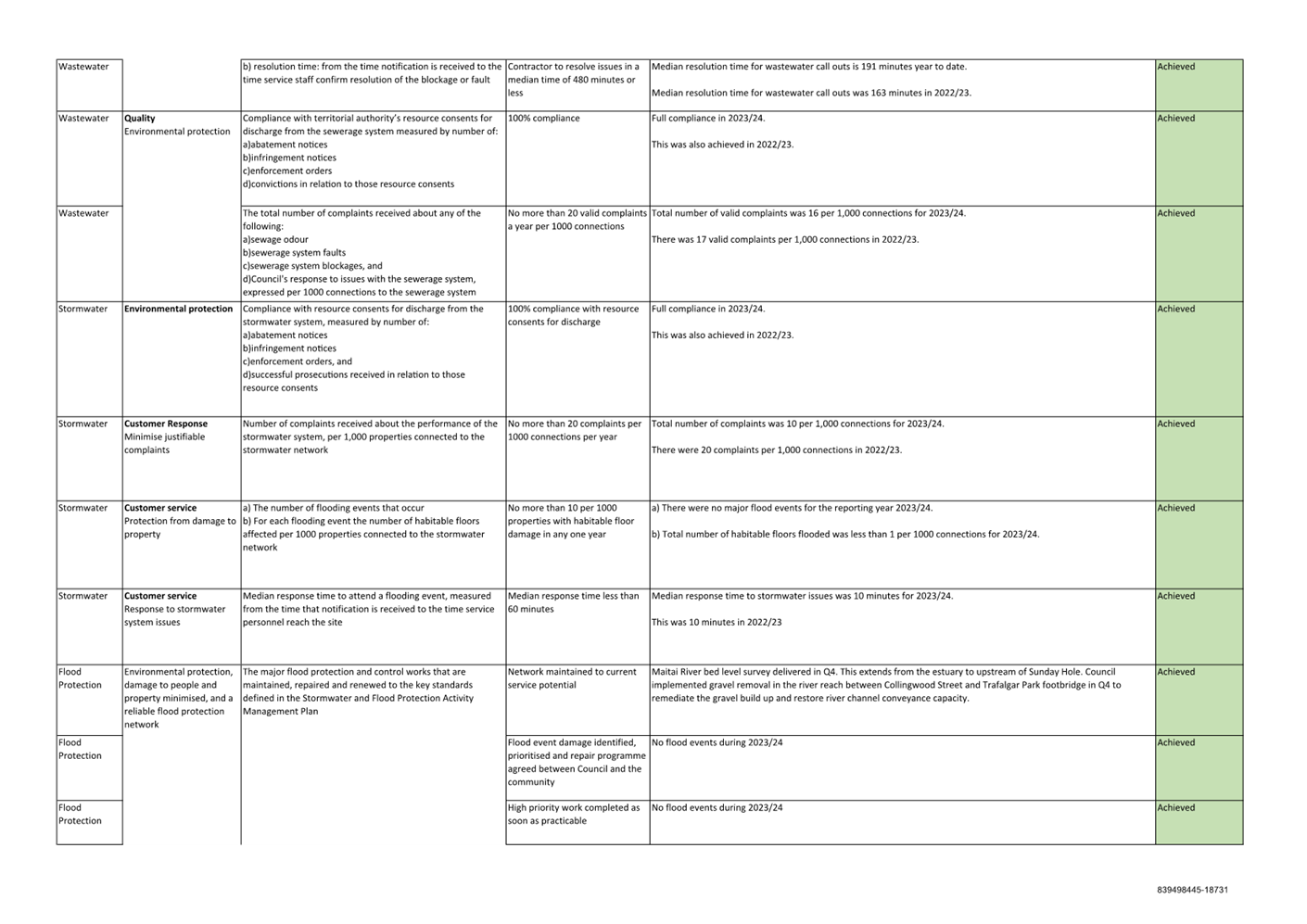

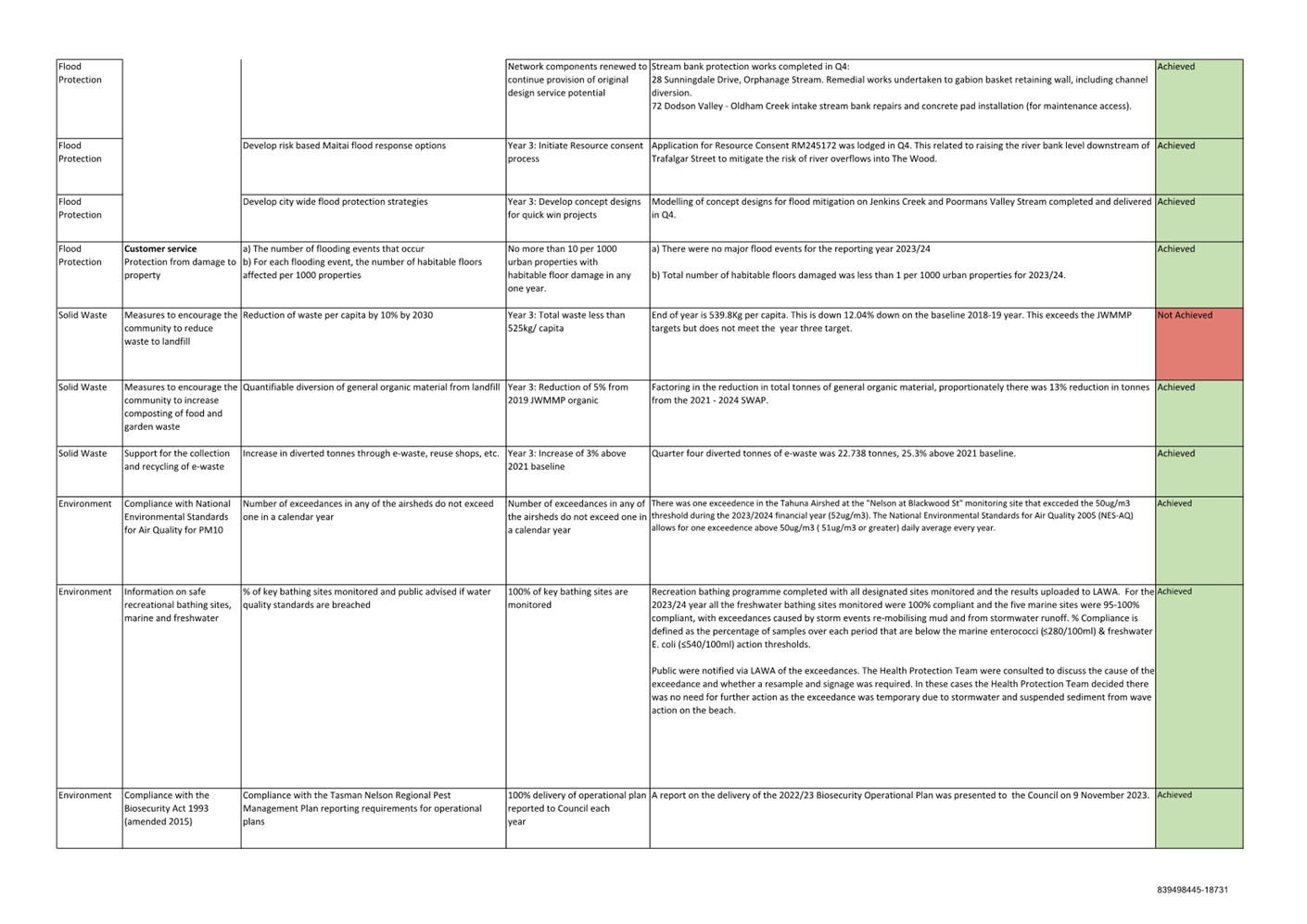

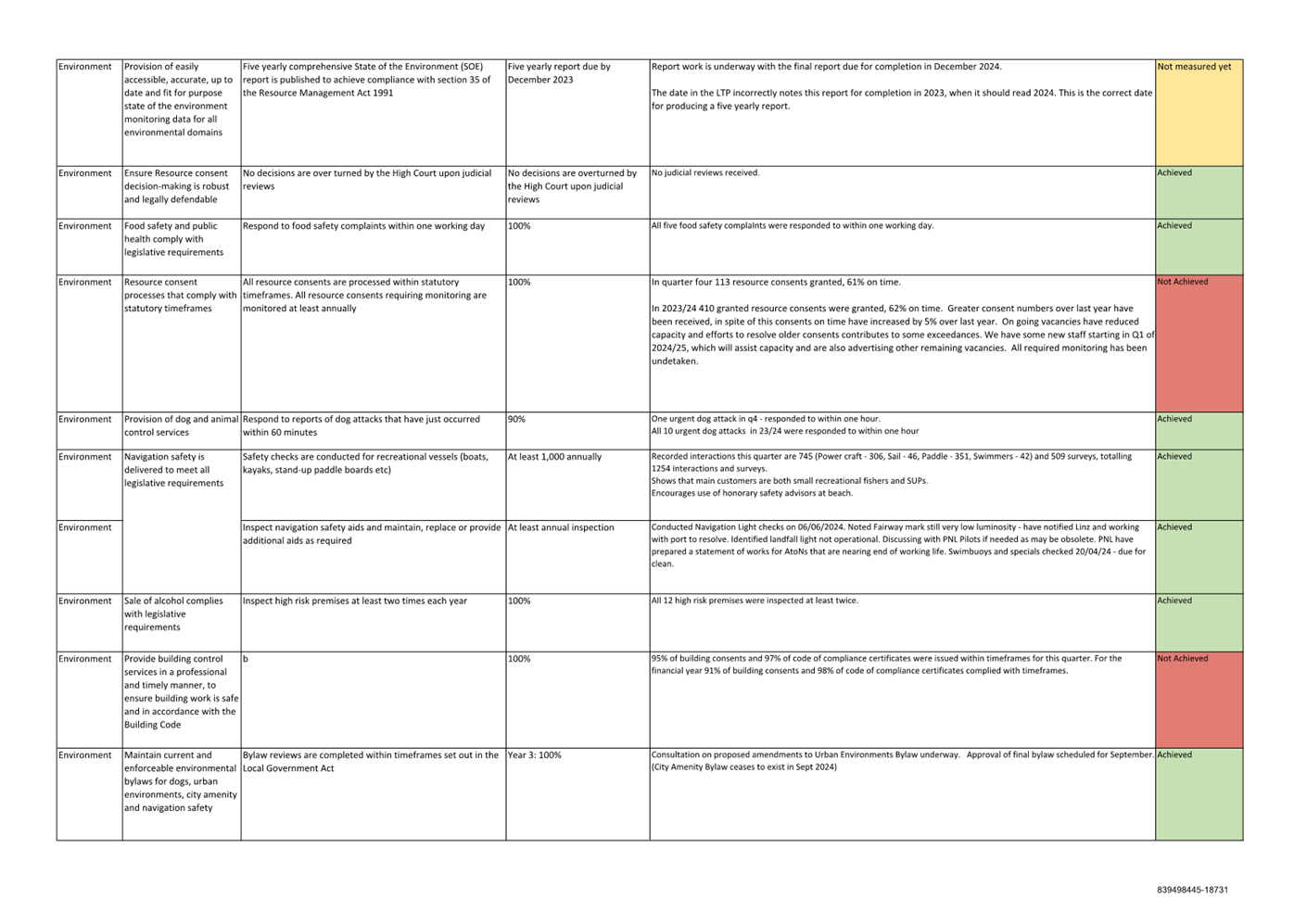

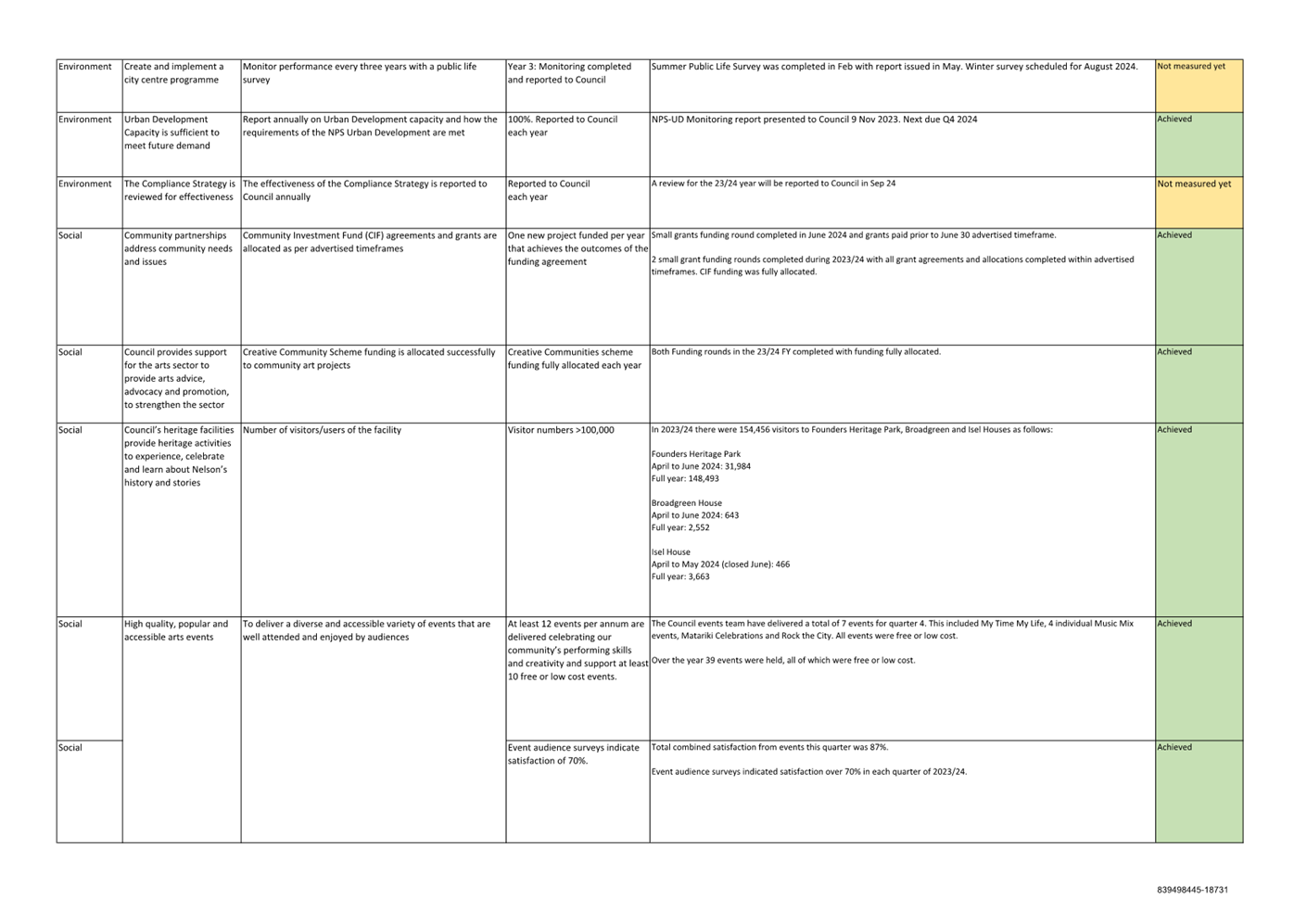

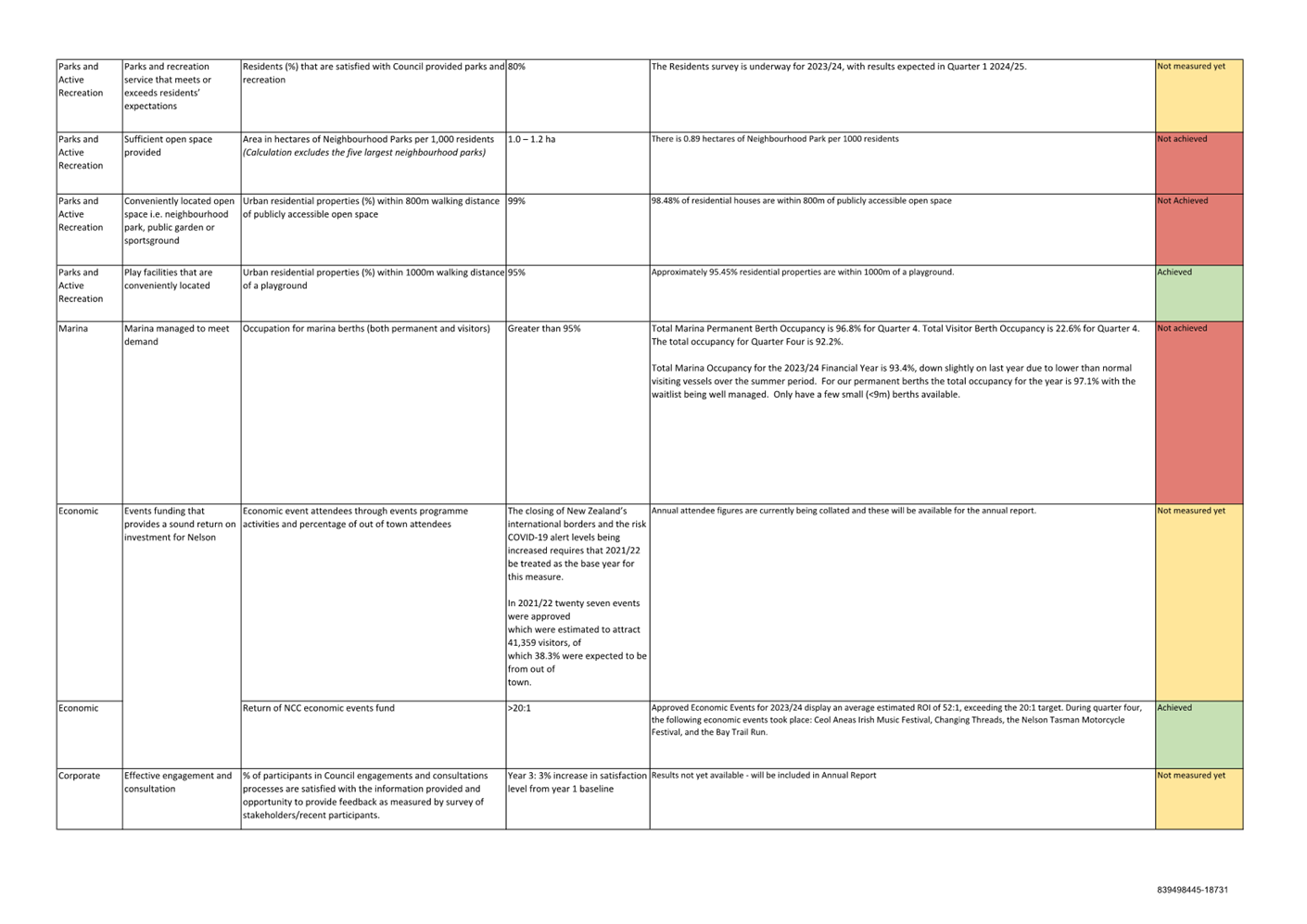

9. Performance

Measures

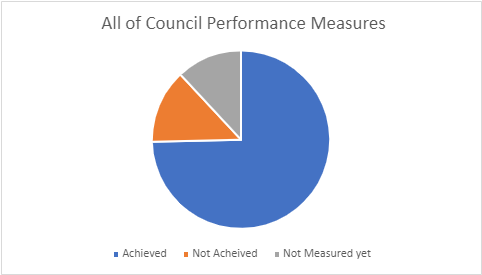

9.1 Council reports on 67

non-financial performance measures across its activity areas, as set out in the

Long Term Plan 2021-31. These are evaluated as ‘achieved, not achieved,

or not measured’ at the end of the year.

9.2 At the time of writing

the report 50 are achieved, nine are not achieved and eight are not measured

yet. The percentages are measured as 74.62%, 13.43% and 11.94% respectively. These

numbers are draft and subject to audit.

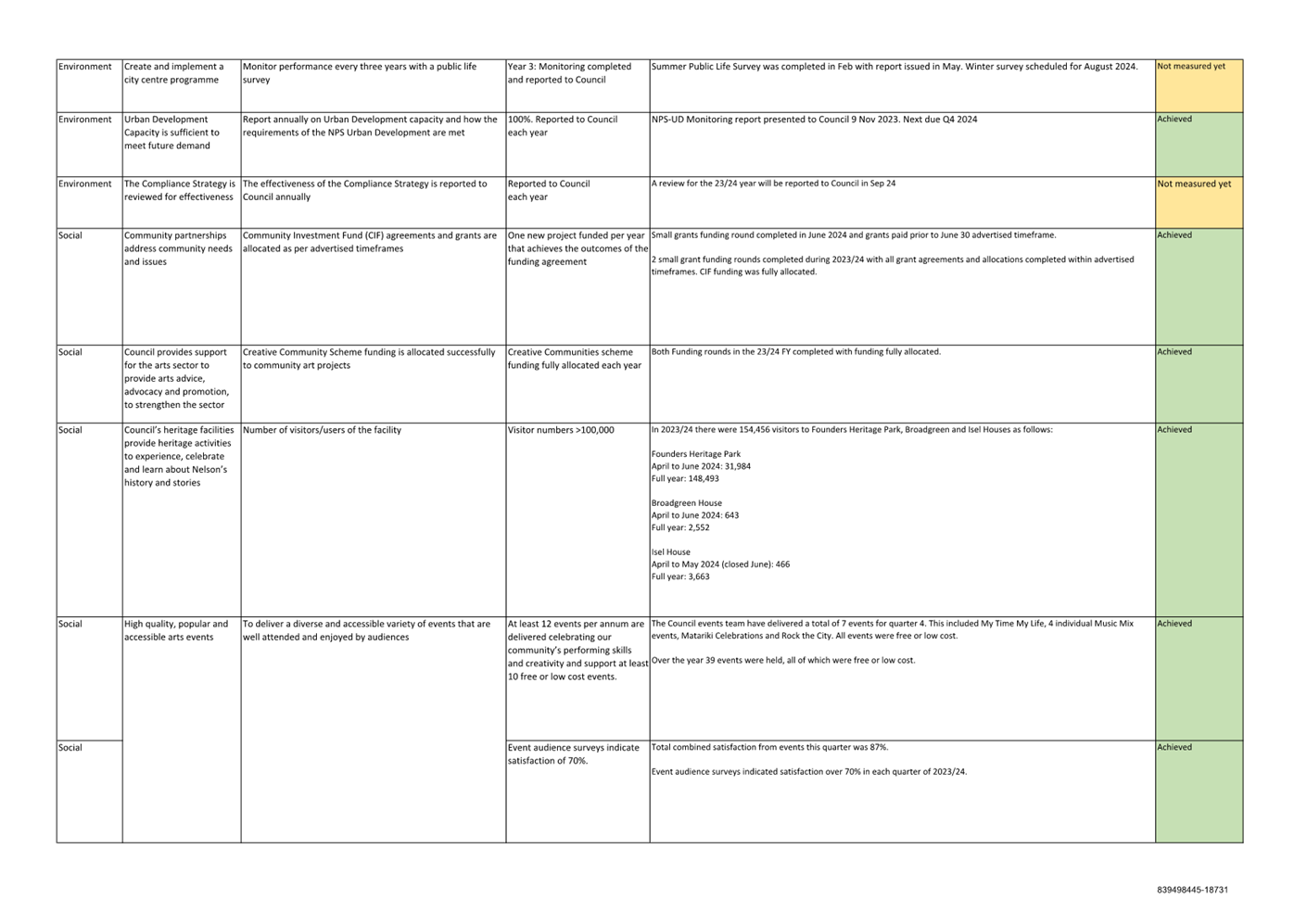

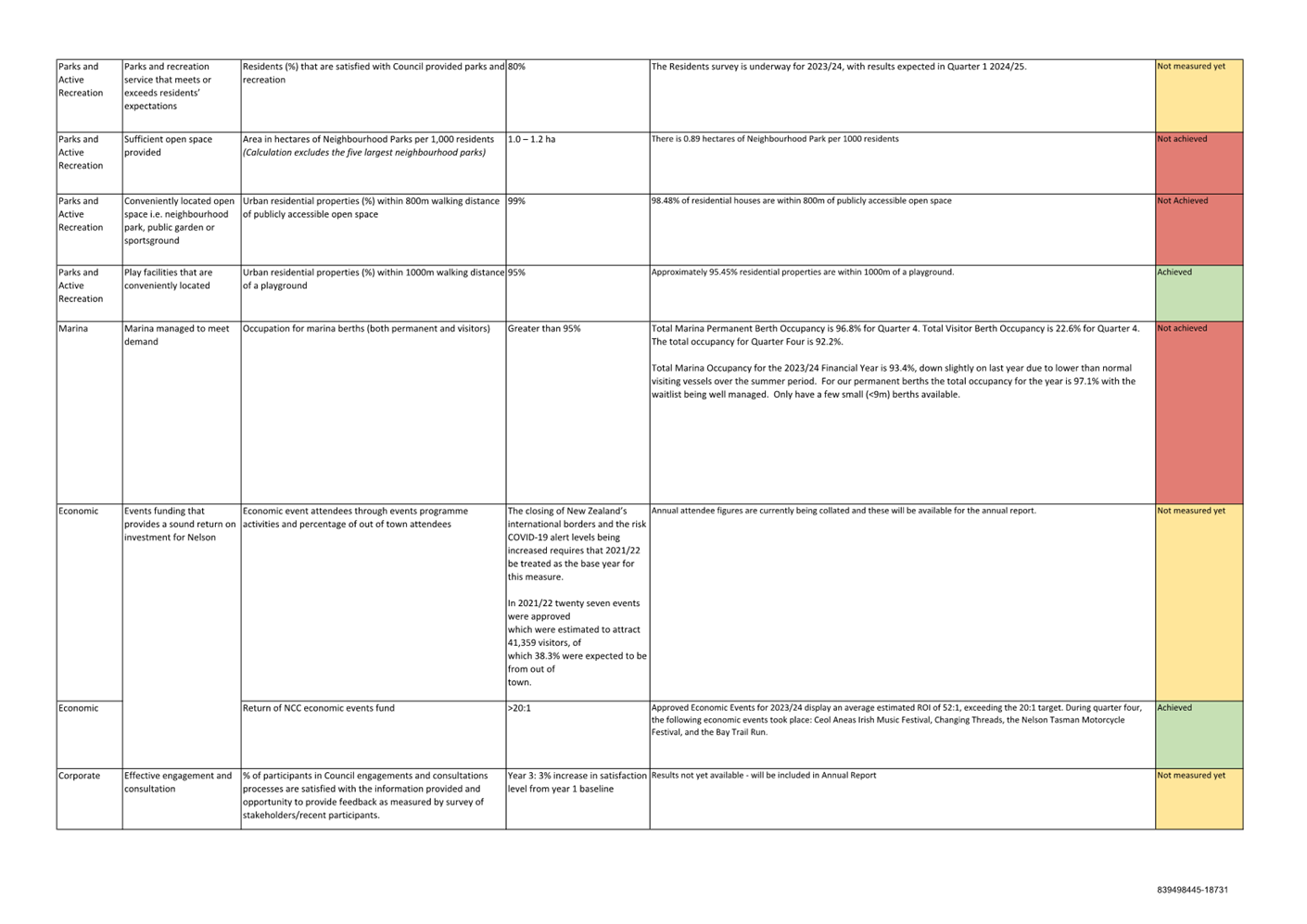

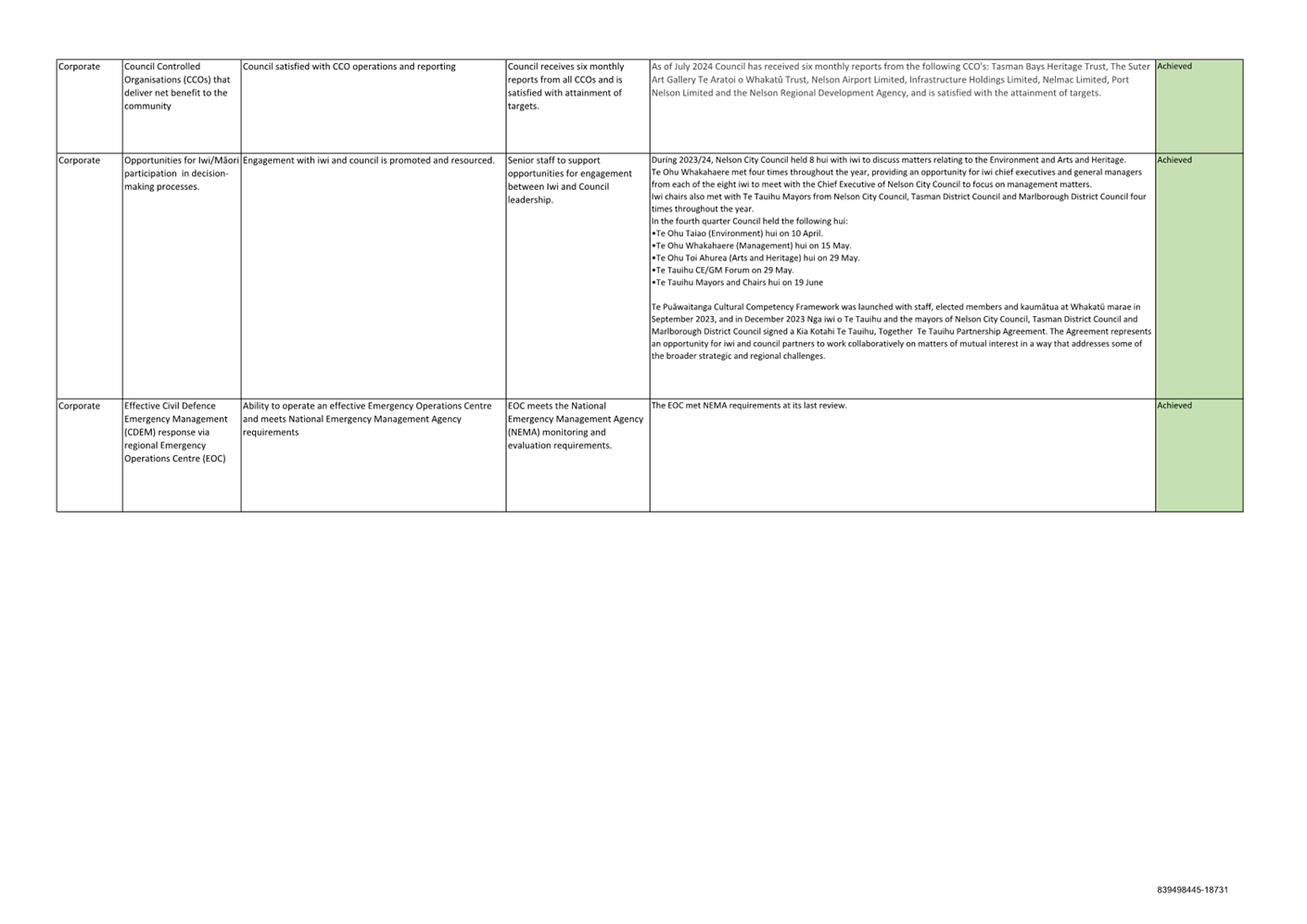

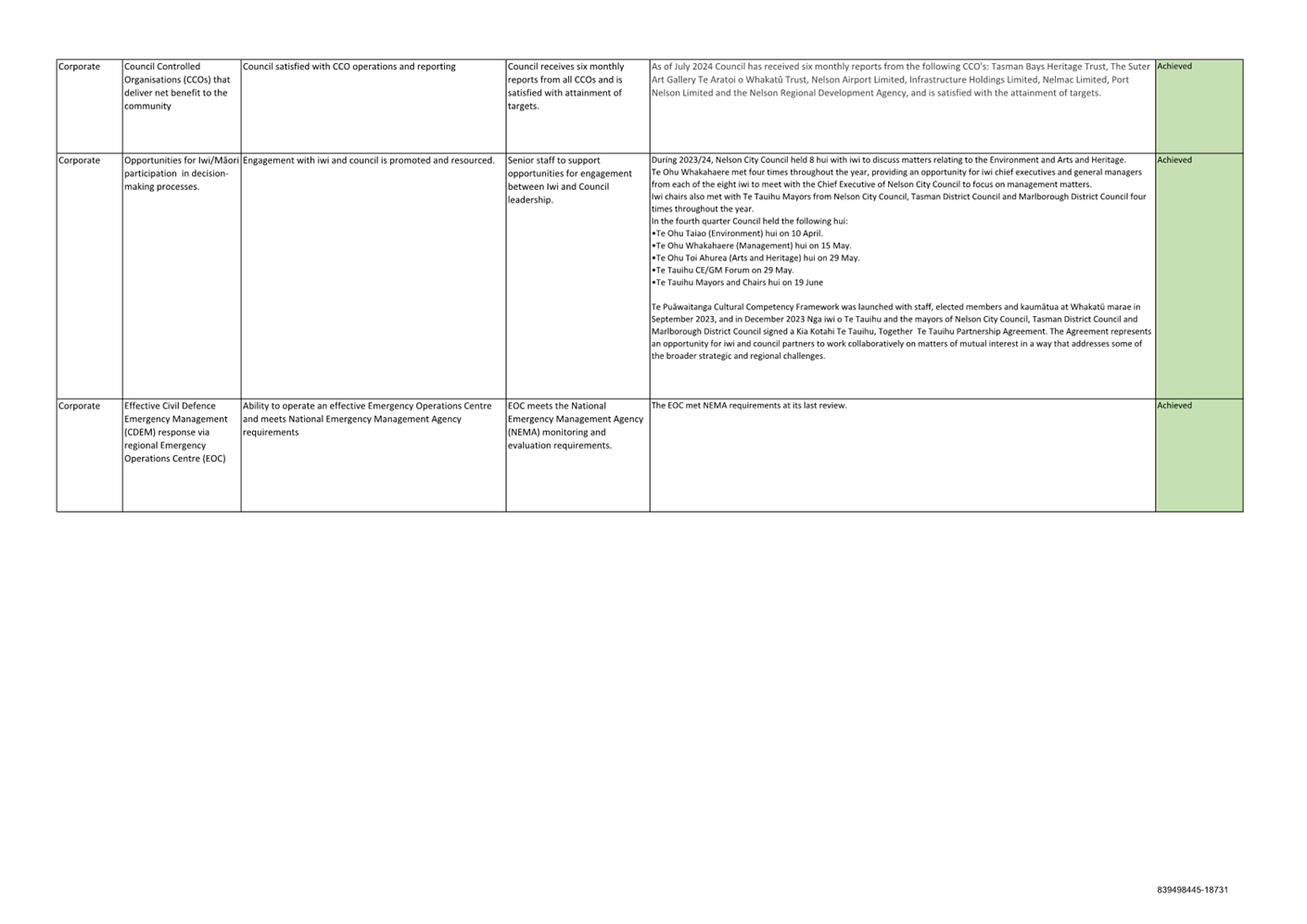

9.3 Attachment 3

(839498445-18731) details Council’s performance measures so far across

all its activities.

Attachments

Attachment 1: 1857728953-1938

Appendix for Council Reports for June-24 ⇩

Attachment 2: 839498445-18731

Q4 Performance Measures 2023-24 ⇩

Attachment 3: 1530519604-14363

Q4 Project Health Summary 2023-24 ⇩

Item 8: Quarterly Finance Report to 30 June 2024:

Attachment 1

Item 8:

Quarterly Finance Report to 30 June 2024: Attachment 2

Item 8:

Quarterly Finance Report to 30 June 2024: Attachment 3

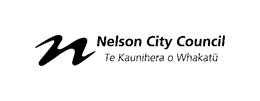

Item 9: Annual Tax

Update

|

|

Audit, Risk and Finance Committee

14 August 2024

|

Report

Title: Annual

Tax Update

Report

Author: Prabath

Jayawardana - Manager Finance

Report

Authoriser: Nikki Harrison - Group Manager Corporate

Services

Report

Number: R28612

1. Purpose of Report

1.1 To advise the

Committee of Council’s tax activities over the prior year and provide

some context for the current tax environment.

2. Recommendation

|

That

the Audit, Risk and Finance Committee

1. Receives

the report Annual Tax Update (R28612)

and its Attachment (2130083480-731).

|

3. Background

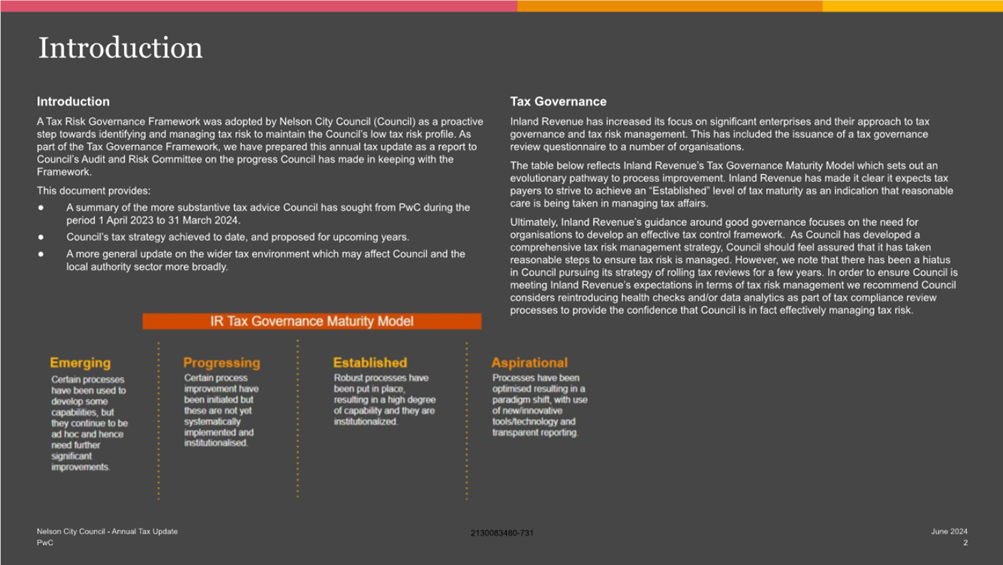

3.1 The Tax Risk

Governance Framework was adopted by Council in May 2017 as a proactive step

towards identifying and managing tax risk to maintain its low risk profile.

This Annual Tax Update (Attachment 1 – 2130083480-731) has been prepared

as part of that framework.

3.2 The Annual Tax Update

provides:

3.2.1 A summary of the tax advice that

Council has sought during the period 1 April 2023 to 31 March 2024.

3.3 Commentary on tax

matters currently being addressed as at 30 June 2024.

3.4 A more general

high-level update on the wider tax environment as it might affect Council.

3.5 An overview of the Tax

Risk Management Strategy.

3.6 The Annual Tax Update

report from Council’s tax advisors (PWC), the Pay as You Earn (PAYE)

compliance evaluation and Fringe Benefit Tax (FBT) compliance evaluation are

included with this report as Attachment 1.

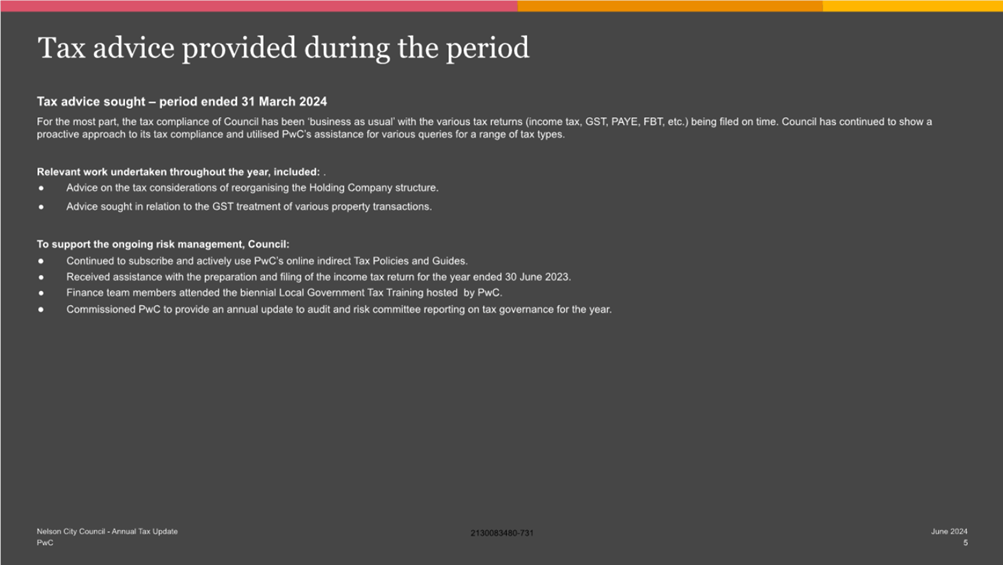

4. Tax advice received and matters addressed

4.1 For the most part, the

tax compliance of Council has been ‘business as usual’ for much of

the year with the various tax returns (GST, PAYE, FBT, etc.) being filed on

time and without any concerns being raised.

4.2 That said, it is

appropriate to comment on the following areas where assistance has been

provided to Council:

4.2.1 Advice sought on the tax

considerations of reorganising the Holding Company structure.

4.2.2 Advice sought in relation to the GST

treatment of various property transactions.

4.3 Finally, it is noted

that Council has continued to obtain support as follows:

4.3.1 Continued to subscribe to and actively

use PWC’s online Indirect Tax Policies and Guides.

4.3.2 Maintained its subscription to

PWC’s “GST on Property Guide”.

4.3.3 Sought assistance on a number of ad

hoc queries to strengthen Council’s business decisions.

4.3.4 Received assistance with completion

and filing of Council’s income tax return.

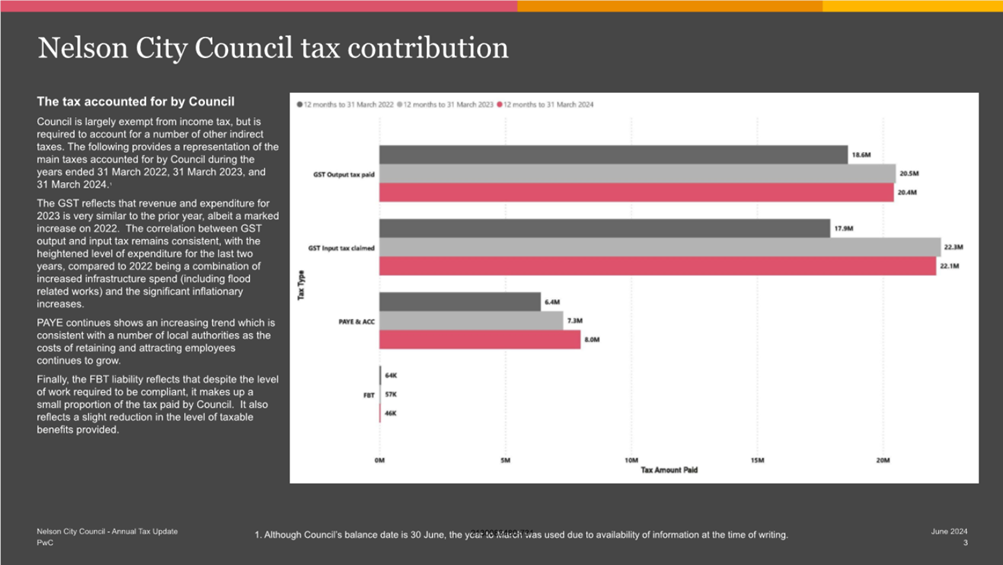

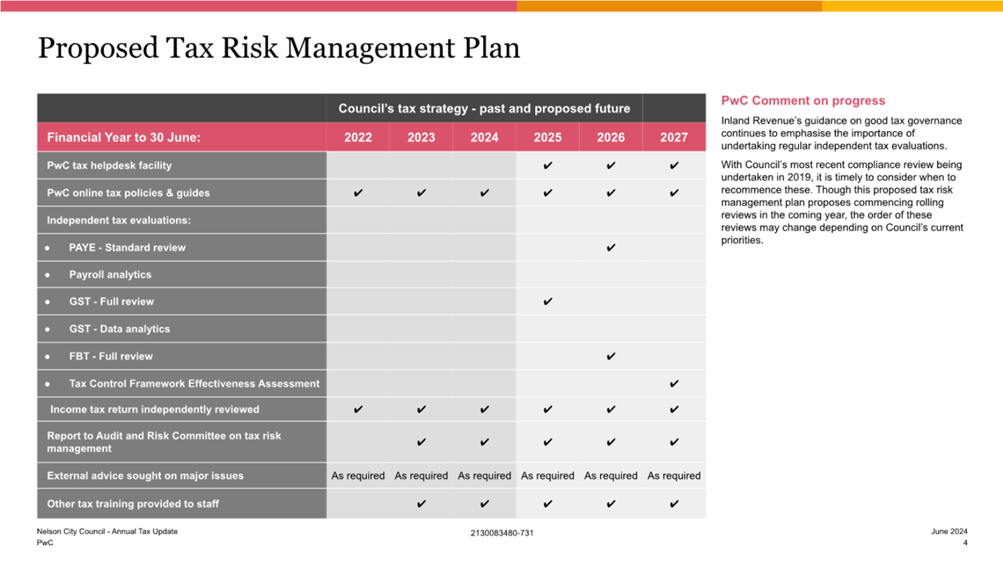

5. Tax strategy

5.1 Page 4 of the Annual

Tax Update sets out work planned for the 2024/25 financial year up to 2026/27

and page 5 outlines the work done during the period ending 31 March 2024.

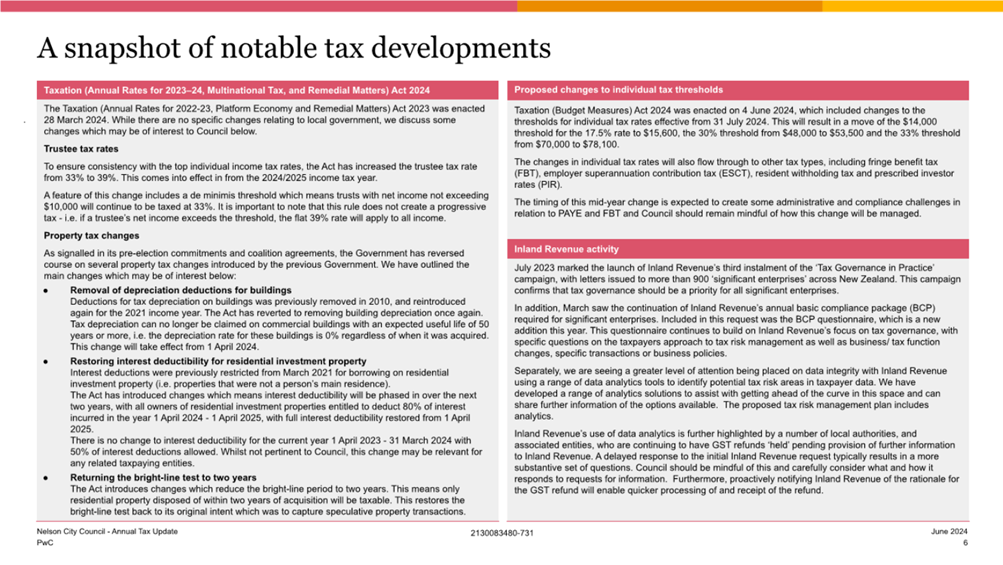

6. Other relevant

matters

6.1 Pages 6 to 7 summarise

tax developments during the period. Some of the matters that are of

particular interest or relevance to Nelson City Council are:

6.1.1 The changes to how water is delivered

in the future need to be carefully worked through, regardless of whether it is

under a new legislative framework, or within the existing framework.

6.1.2 The increase in the rate of interest

that applies for fringe benefit tax purposes to employment-related loans from

7.89% to 8.41% from 1 October 2023.

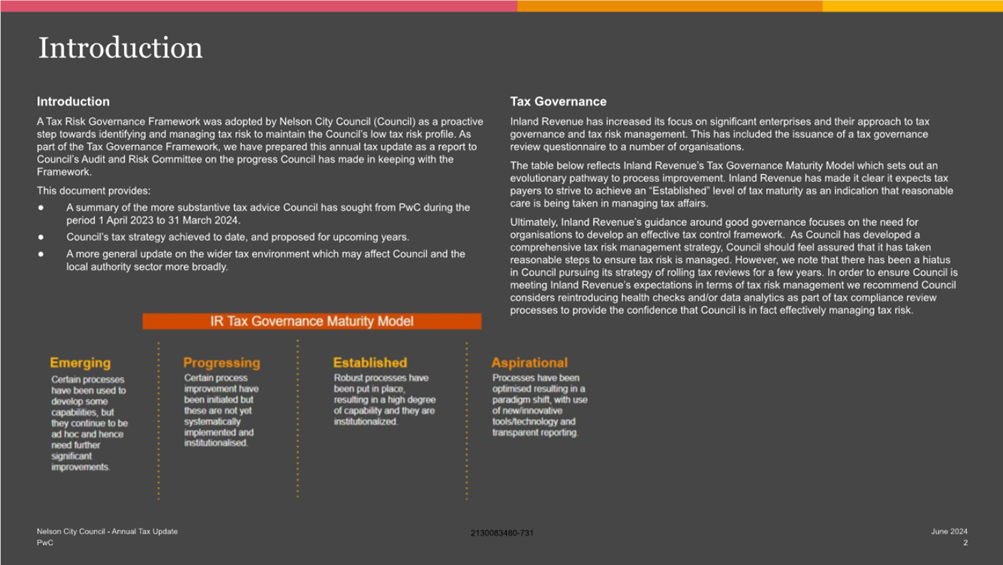

7. Council’s

tax figures

7.1 Generally,

Council is exempt from income tax with the main exception being some income

from CCTOs, such as subvention payments. However, Council has significant tax

obligations in relation to GST and PAYE in particular. The quantum is

highlighted in this section.

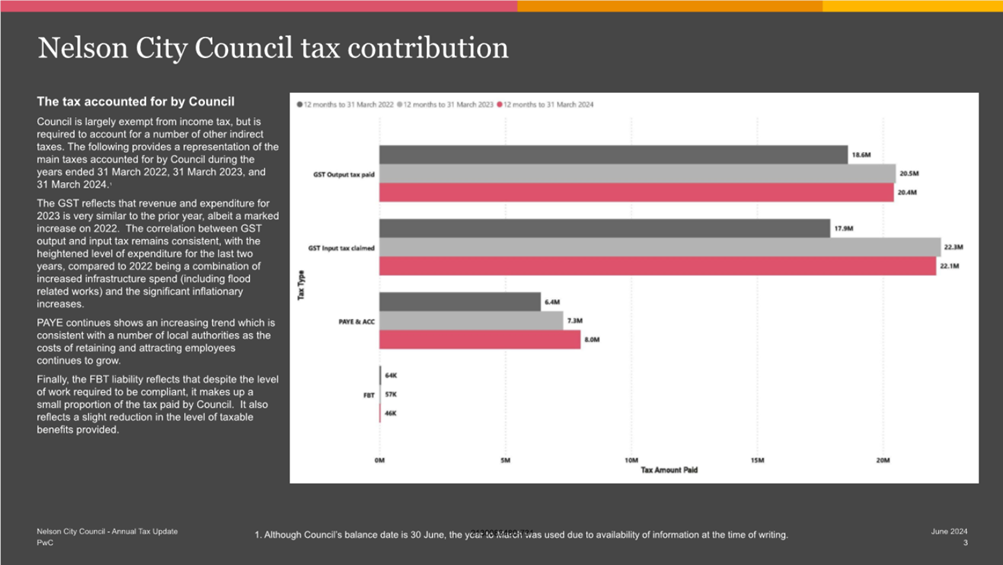

7.2 In

the 12 months ending 31 March 2024, Council has accounted for:

|

Tax

|

12 month

period ending

|

Amount

|

|

GST output tax

|

31 March 2024

|

$20.4million

|

|

GST input tax

|

31 March 2024

|

$22.1million

|

|

PAYE and ACC

|

31 March 2024

|

$8.0million

|

|

FBT

|

31 March 2024

|

$46,000

|

7.3 For

the 12 months ending 31 March 2023, Council tax figures are as below:

|

Tax

|

12 month

period ending

|

Amount

|

|

GST output tax

|

31 March 2023

|

$20.5million

|

|

GST input tax

|

31 March 2023

|

$22.3million

|

|

PAYE and ACC

|

31 March 2023

|

$7.3million

|

|

FBT

|

31 March 2023

|

$57,000

|

7.4 Council

also acts as agent for the Nelson Regional Sewerage Business Unit, Nelson

Tasman Regional Landfill Business Unit and Nelson Tasman Civil Defence and

Emergency Management. The numbers above exclude those entities.

8. Conclusion

8.1 Council

formally adopted the Tax Governance Framework on 18 May 2017 and the Tax Risk

Management Strategy on 14 December 2017. These form a solid foundation for

managing tax risk.

8.2 The

Tax Risk Management Strategy is a simple tool to ensure that tax risk is being

identified and managed appropriately while providing the Committee with a quick

visual tool to see the steps Council has taken to manage tax risk and the

forward looking strategy.

8.3 The

adoption of the Framework and the Strategy ensures that complacency does not

arise amongst the finance team, senior leadership team or those with oversight

for audit and risk.

Attachments

Attachment 1: 2130083480-731 PWC

Annual Tax Update - 1 April 2023 - 31 March 2024 ⇩

Item 9: Annual Tax Update: Attachment 1

Item 10: Bad Debts

write off - Year ending 30 June 2024

|

|

Audit, Risk and Finance Committee

14 August 2024

|

Report

Title: Bad

Debts write off - Year ending 30 June 2024

Report

Author: Prabath

Jayawardana - Manager Finance

Report

Authoriser: Nikki Harrison - Group Manager Corporate

Services

Report

Number: R28716

1. Purpose of Report

1.1 To inform the Audit,

Risk and Finance Committee of the level of bad debts written off for the year

ending 30 June 2024.

2. Recommendation

|

That

the Audit, Risk and Finance Committee

1. Receives

the report Bad Debts write off - Year ending 30 June 2024 (R28716).

|

3. Background

3.1 There were no debts

over $10,000 to be written off for the year ending 30 June 2024.

|

Over

$10,000 (Excluding GST)

|

|

|

|

|

|

|

Write-off 2024

|

|

Write-off 2023

|

|

|

$

|

No.

|

$

|

No.

|

|

Dog

Impounding

|

$0

|

|

$0

|

|

|

Marina

Fees

|

$0

|

|

$18,726

|

1

|

|

General

Debtors

|

$0

|

|

$0

|

|

|

Regulatory

|

$0

|

|

$0

|

|

|

Total

|

$0

|

|

$18,726

|

1

|

3.2 A

number of accounts under $10,000 per debtor have been written off by the Group

Manager Corporate Services under officer delegation. These totalled $14,398

excluding GST.

|

Under

$10,000 (Excluding GST)

|

|

|

|

|

|

|

Write-off 2024

|

|

Write-off 2023

|

|

|

$

|

No.

|

$

|

No.

|

|

Dog

Impounding

|

$628

|

3

|

$743

|

2

|

|

Marina

Fees

|

$2,116

|

6

|

$13,750

|

6

|

|

General

Debtors

|

$11,443

|

15

|

$4,025

|

3

|

|

Regulatory

|

$211

|

1

|

$420

|

2

|

|

Total

|

$14,398

|

25

|

$18,938

|

13

|

3.3 The

decision to write off debts is an administrative one and, although the debts

are written off from an accounting point of view, a record is still kept and if

an opportunity to recover the debt arises, action will be taken. Most of this

balance is with Credit Recoveries Limited, Council’s debt recovery

agency, who will continue recovery activities. Every possible effort has

been made to locate and obtain payment from these debtors.

3.4 A

comparison of debt written off between 2023/24 and 2022/23 is as follows:

|

Summary

|

|

|

|

|

Write-off 2024

|

Write-off 2023

|

|

$

|

$

|

|

Over

$10,000

|

$0

|

$18,726

|

|

Under

$10,000

|

$14,398

|

$18,938

|

|

Cost

for year

|

$14,398

|

$37,664

|

Attachments

Nil