Notice of the Ordinary meeting of

Nelson City Council

Te Kaunihera o Whakatū

|

Date: Thursday

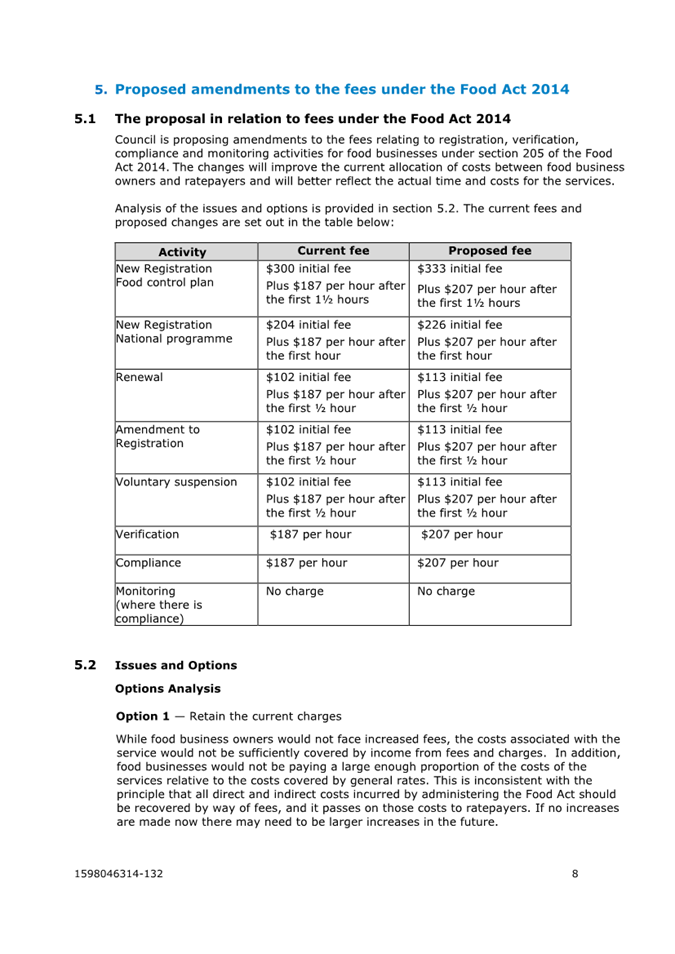

1 February 2024

Time: 9.00a.m.

Location: Council

Chamber

Floor 2A, Civic House

110 Trafalgar Street, Nelson

|

Agenda

Rārangi take

Chairperson His

Worship the Mayor Nick Smith

Deputy

Mayor Cr

Rohan O'Neill-Stevens

Members Cr

Matty Anderson

Cr

Matthew Benge

Cr

Trudie Brand

Cr

Mel Courtney

Cr

James Hodgson

Cr

Kahu Paki Paki

Cr

Pete Rainey

Cr

Campbell Rollo

Cr

Rachel Sanson

Cr

Tim Skinner

Cr

Aaron Stallard

Quorum 7 Nigel

Philpott

Chief Executive

Nelson City Council Disclaimer

Please note that the contents of these

Council and Committee agendas have yet to be considered by Council and officer

recommendations may be altered or changed by the Council in the process of

making the formal Council decision. For enquiries call (03) 5460436.

1

February 2024

Page

No.

Karakia and Mihi Timatanga

1. Apologies

Nil

2. Confirmation

of Order of Business

3. Interests

3.1 Updates

to the Interests Register

3.2 Identify

any conflicts of interest in the agenda

4. Public Forum

5. Confirmation

of Minutes

5.1 14

December 2023 11 - 39

Document number M20414

Recommendation

|

That the Council

1. Confirms the minutes of the meeting

of the Council, held on 14 December 2023, as a true and correct record.

|

6. Confirmation of Minutes

- 7 December 2023 40 - 48

Document number R28296

Recommendation

|

That

the Council

1. Confirms the minutes of the meeting

of the Council, held on 7 December 2023, as a true and correct record.

|

7. The Suter Art

Gallery Te Aratoi o Whakatū Trust Strategic Presentation

Julie Catchpole, Director, Ruth

Roebuck, Manager Commerce and Enterprise and Steve Green, Chair of the Suter

Art Gallery Te Aratoi o Whakatū Trust will give a strategic presentation.

8. Brook Waimarama

Sanctuary Trust Annual Report 49

- 98

Document number R28171

Recommendation

|

That

the Council

1. Receives

the report Brook Waimarama Sanctuary Trust Annual Report (R28171) and its attachment

(2134162460-1151).

|

9 Nelson Events

Strategy implementation update 99 - 109

Document number R28240

This item was deferred from the Council meeting on

14 December 2023.

Recommendation

|

That

the Council

1. Receives the report Nelson Events

Strategy implementation update (R28240) and its attachment

(839498445-17987); and

2. Approves increasing the delegation

levels for the Nelson Events Fund as outlined below:

a. The

Events Development Committee may approve funding up to $45,000

b. The

Chief Executive may approve funding between $45,001 and $99,999

c. Council

may approve funding of $100,000 or above.

|

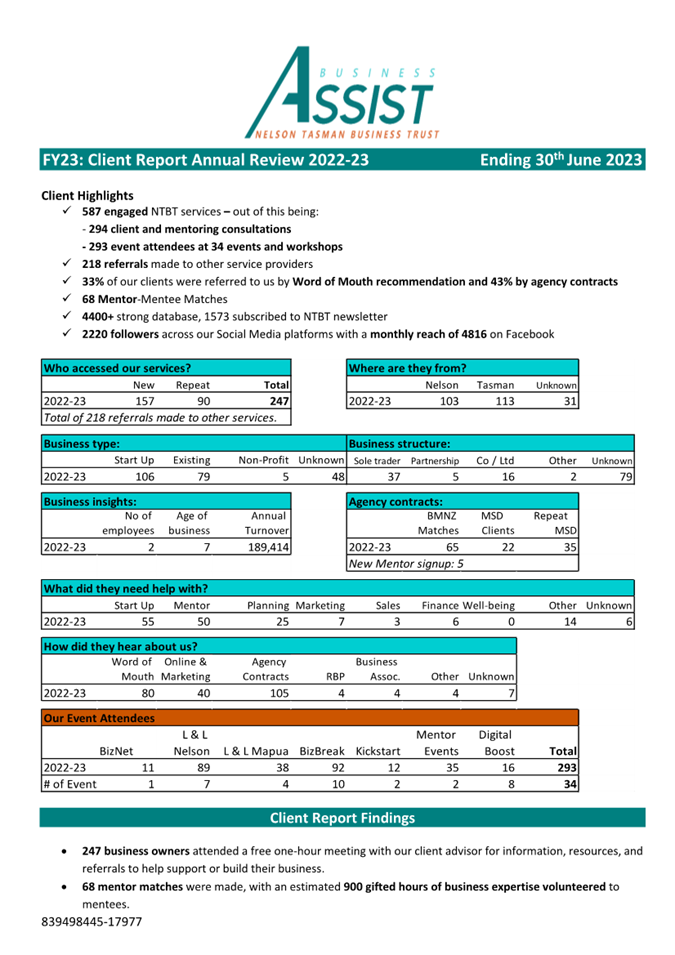

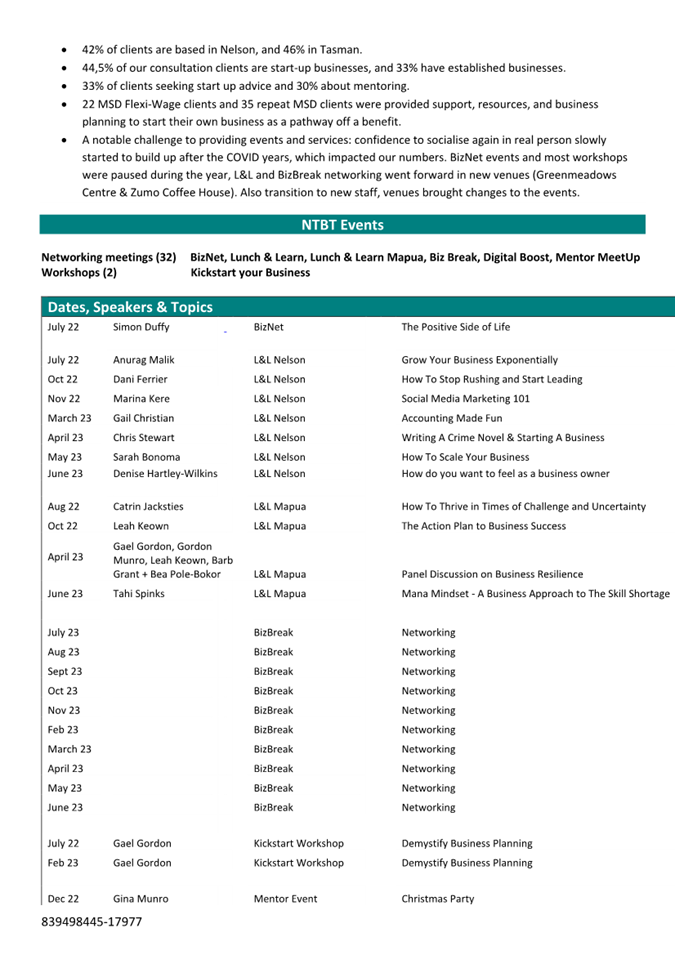

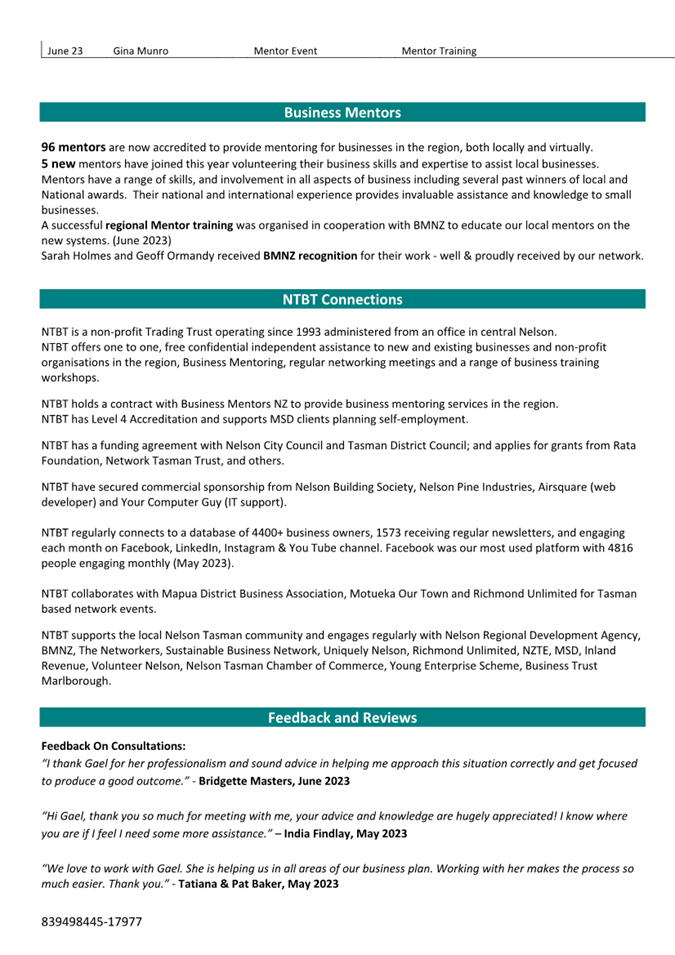

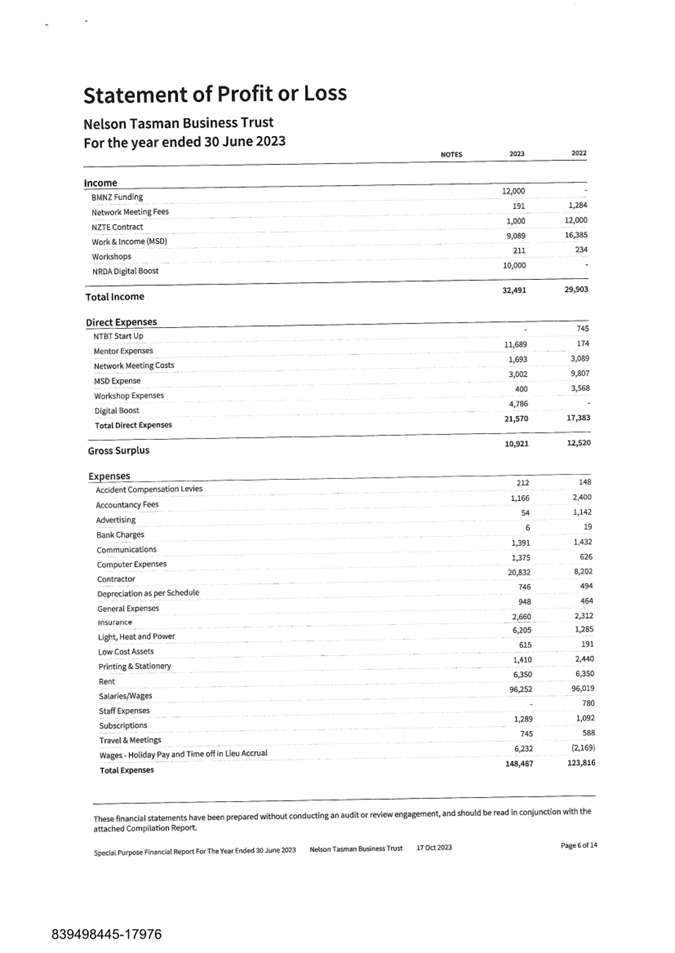

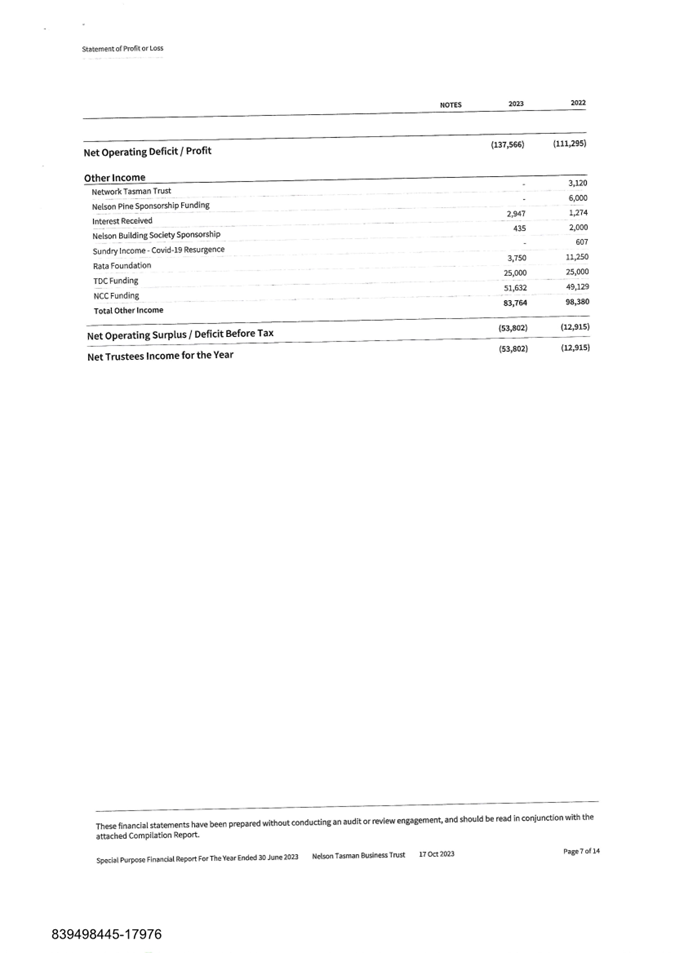

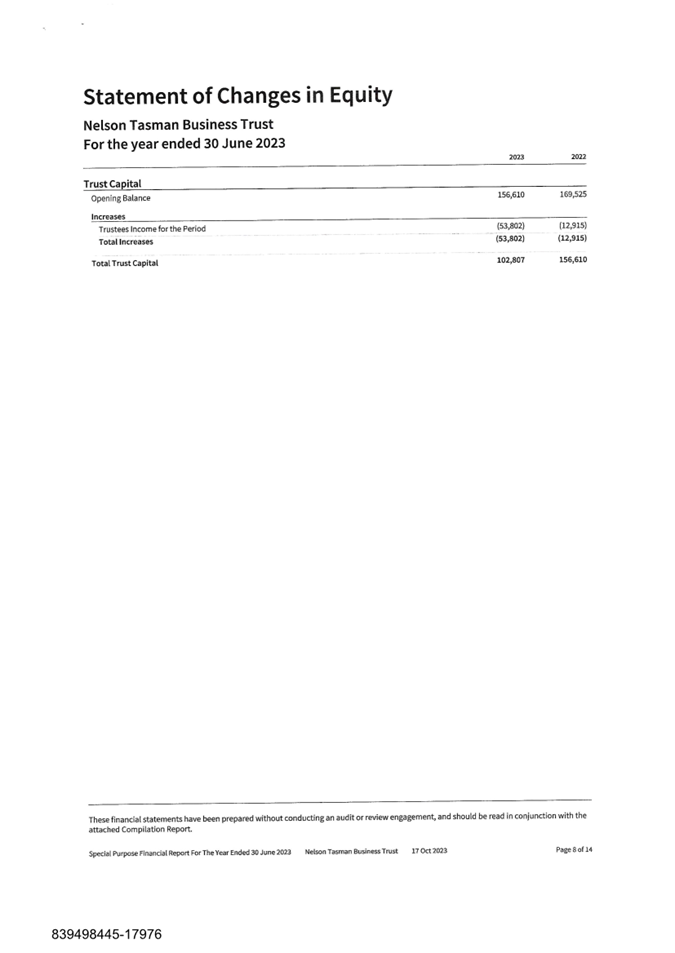

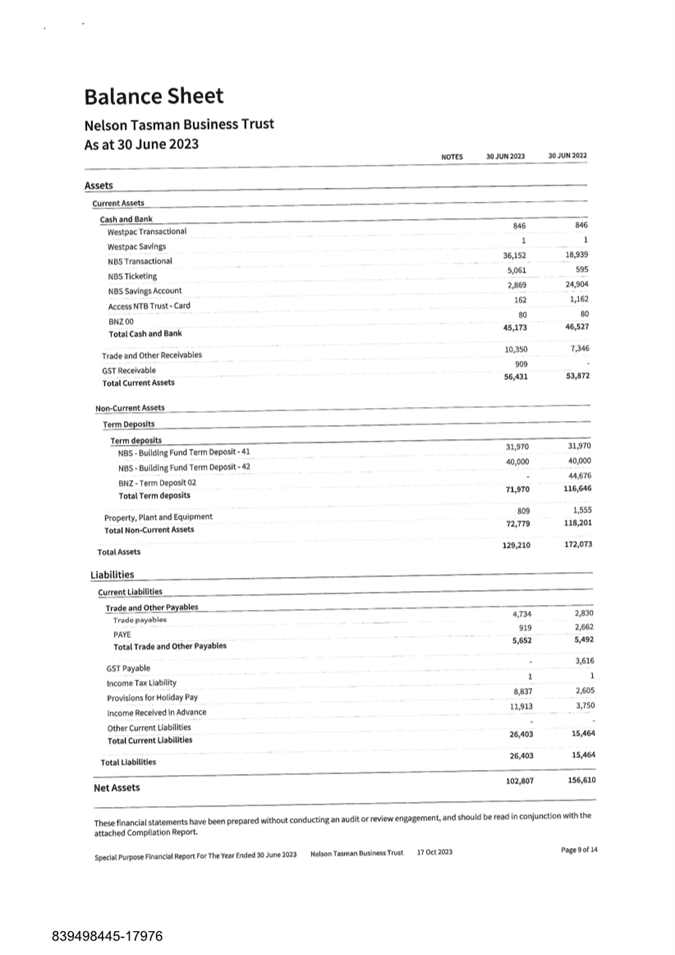

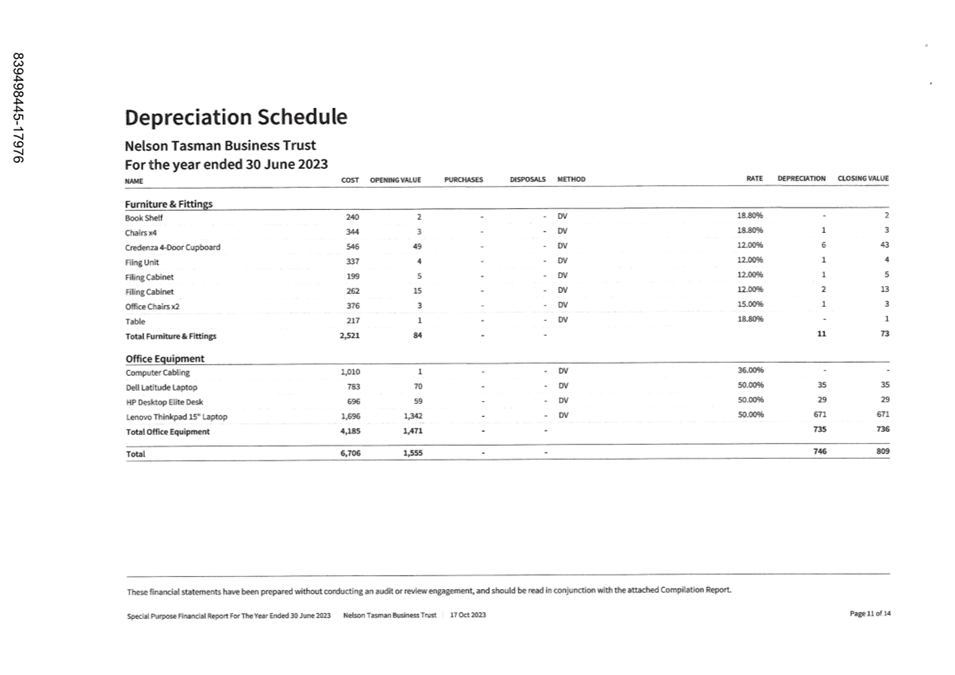

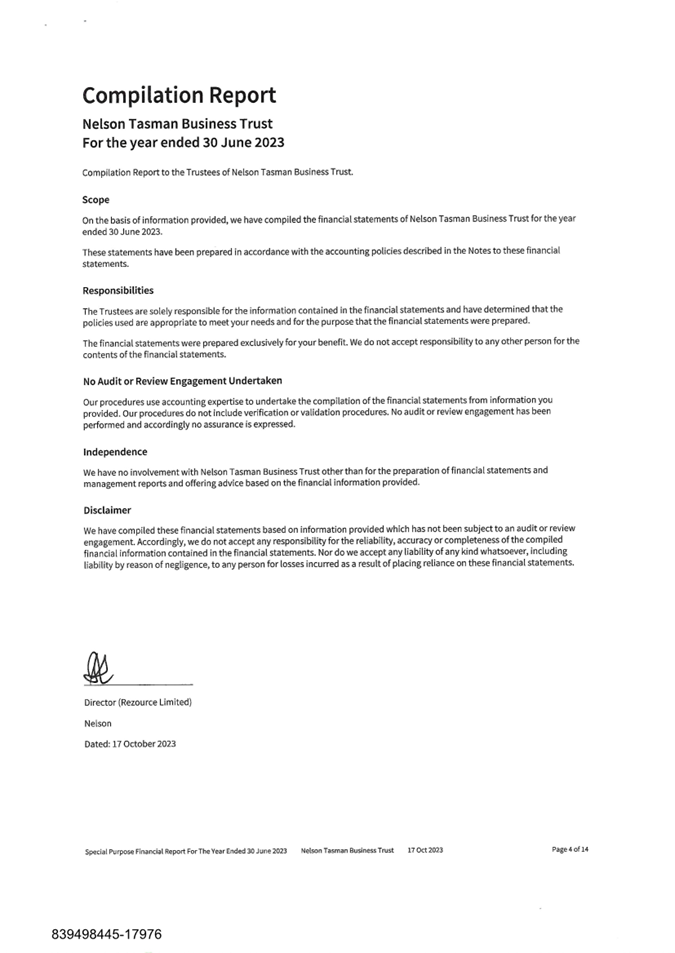

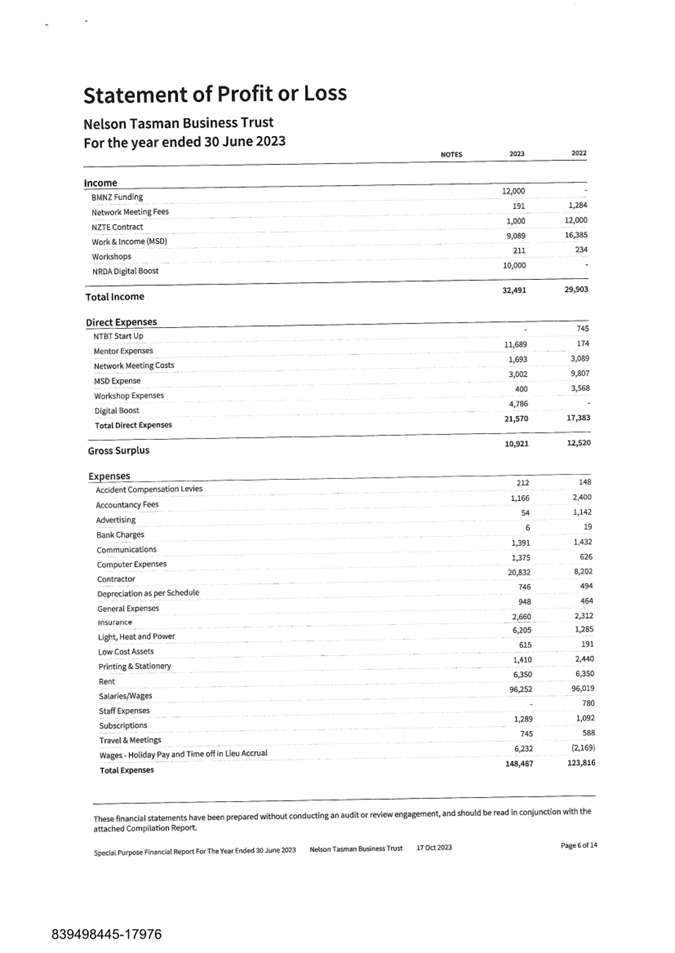

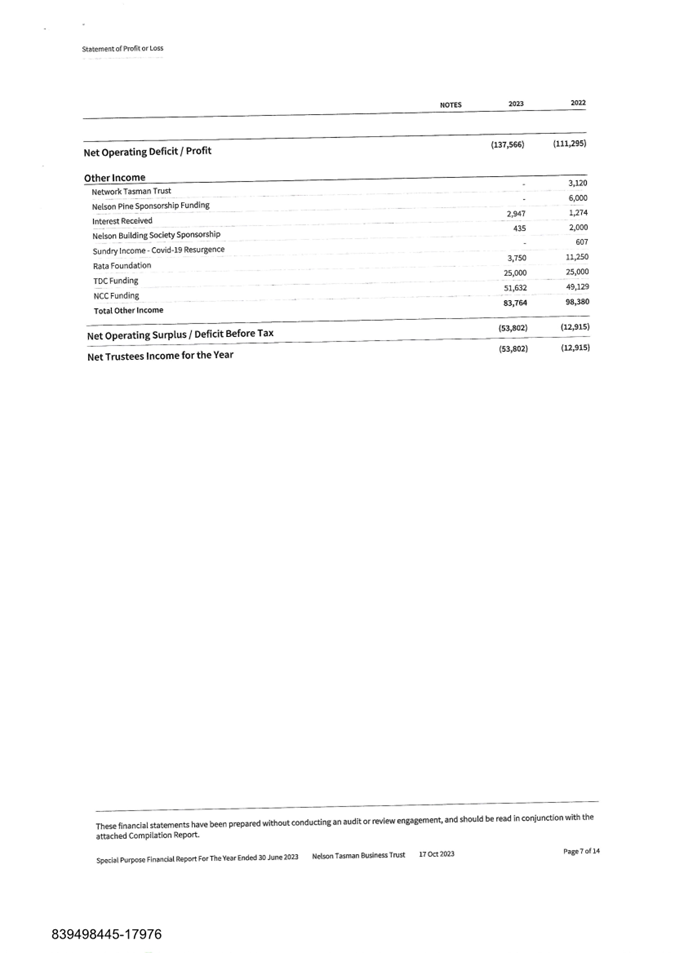

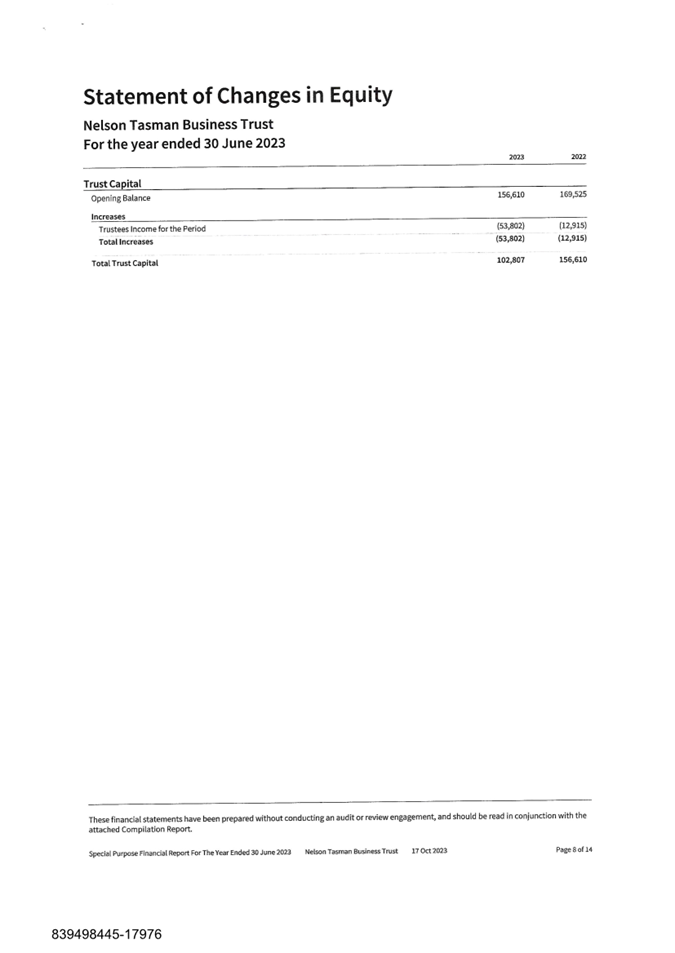

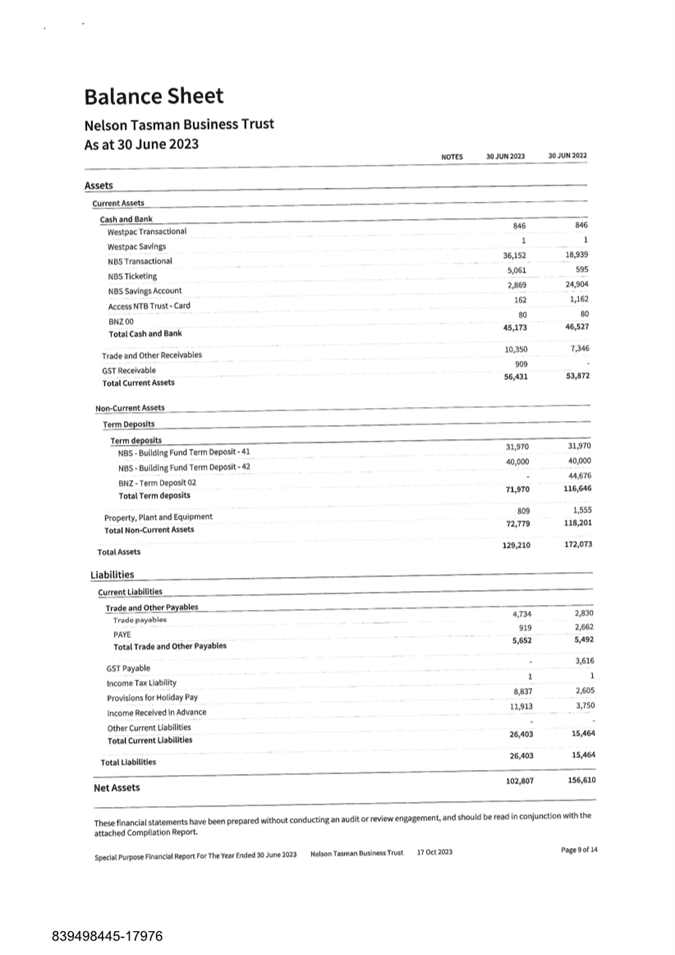

10. Nelson Tasman Business Trust

Annual Report 2022/23 110 - 128

Document number R28241

This item was deferred from the Council meeting on

14 December 2023.

Recommendation

|

That

the Council

1. Receives

the report Nelson Tasman Business Trust Annual Report 2022/23 (R28241) and its attachments

(839498445-17977 and 839498445-17976).

|

11. Mayor's Report 129 - 132

Document number R28311

Recommendation

|

That

the Council

1. Receives

the report Mayor's Report (R28311).

|

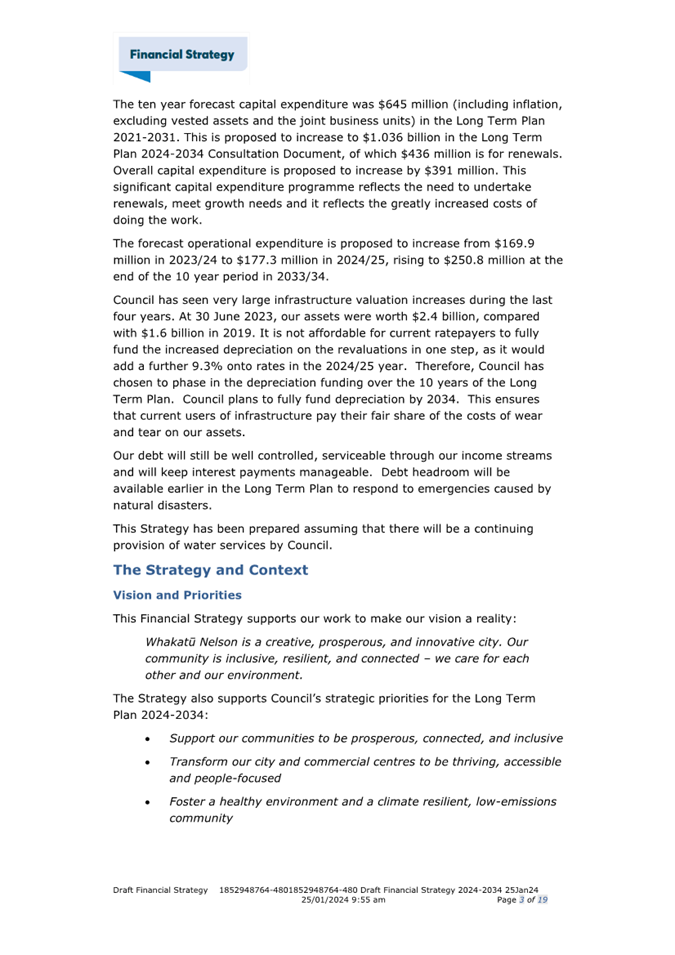

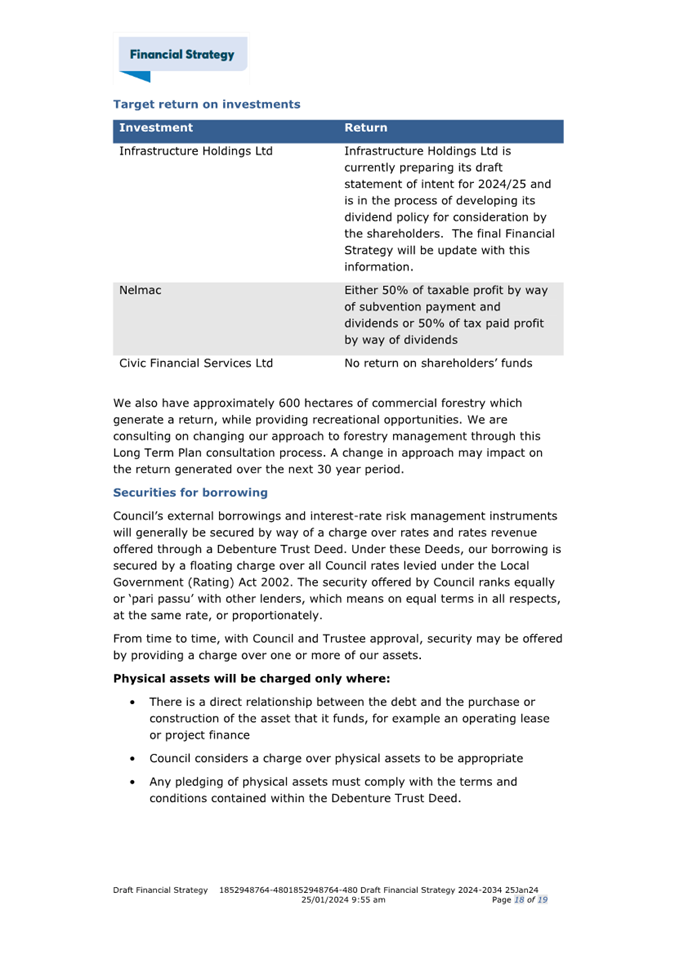

12. Approval of Draft Financial

Strategy as supporting information for Long Term Plan 2024-2034 consultation 133 - 157

Document number R28265

Recommendation

|

That

the Council

1. Receives the report Approval of

Draft Financial Strategy as supporting information for Long Term Plan

2024-2034 consultation (R28265) and its attachment (1852948764-480); and

2. Approves the Draft Financial

Strategy (1852948764-480) as supporting information for the Long Term Plan

2024-2034 consultation process in accordance with sections 93G and 101A of

the Local Government Act 2002; and

3. Agrees that His Worship Mayor Hon

Dr Smith and the Chief Executive be delegated authority to approve any minor

amendments required to the Financial Strategy prior to it being made

available as supporting information during the Long Term Plan consultation

process, including any amendments necessary to address audit requirements or

any legislative changes prior to the consultation occurring.

|

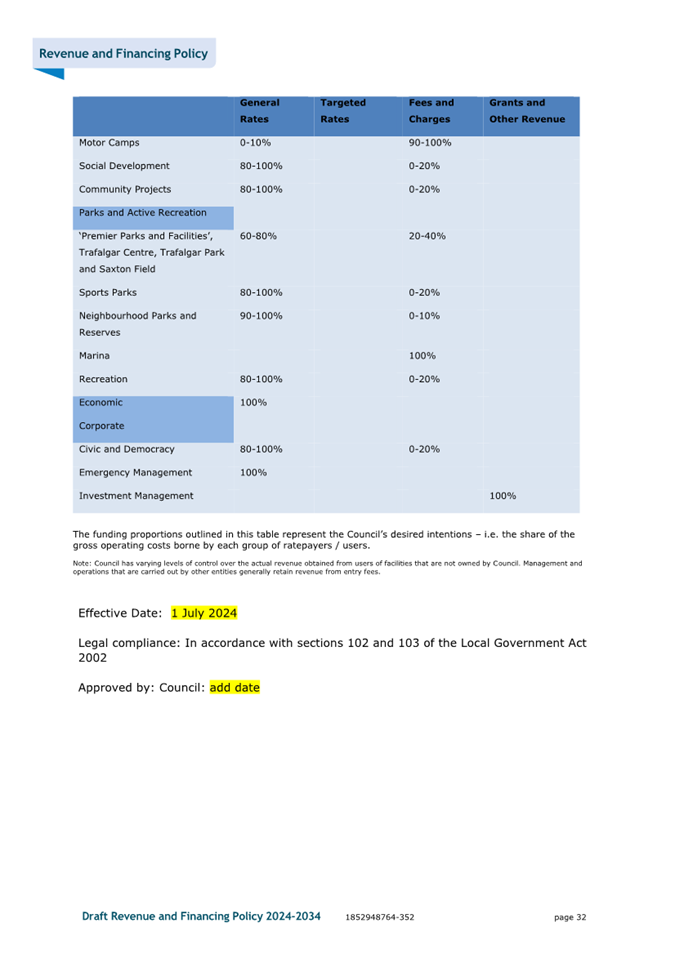

13. Draft Revenue and Financing

Policy for Consultation 158 - 196

Document number R28112

Recommendation

|

That

the Council

1. Receives the report Draft Revenue

and Financing Policy for Consultation (R28112) and its attachment

(1852948764-352); and

2. Approves the Draft Revenue and

Financing Policy (1852948764-352) for public

consultation in accordance with sections 102, 103, 82 and 82A of the Local

Government Act 2002; and

3. Agrees that the consultation on the

Draft Revenue and Financing Policy will occur at the same time as the Long

Term Plan 2024-2034 consultation process; and

4. Agrees that His Worship Mayor Hon

Dr Smith and the Chief Executive be delegated authority to approve any minor

amendments required to the Draft Revenue and Financing Policy prior to it

being made available for public consultation, including any amendments

necessary to address audit requirements or any legislative changes prior to

the consultation occurring.

|

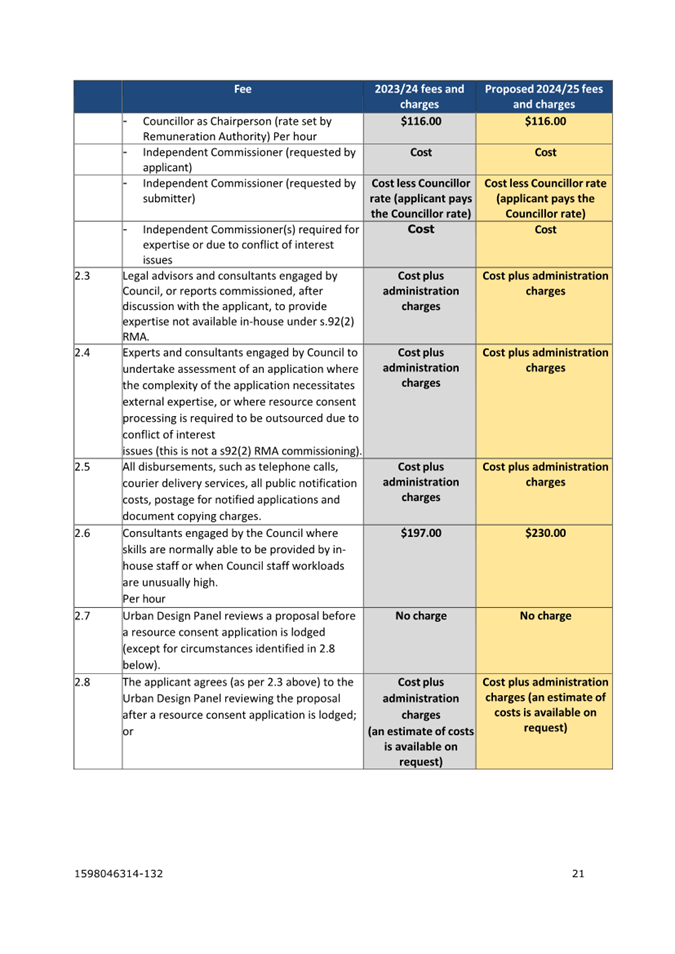

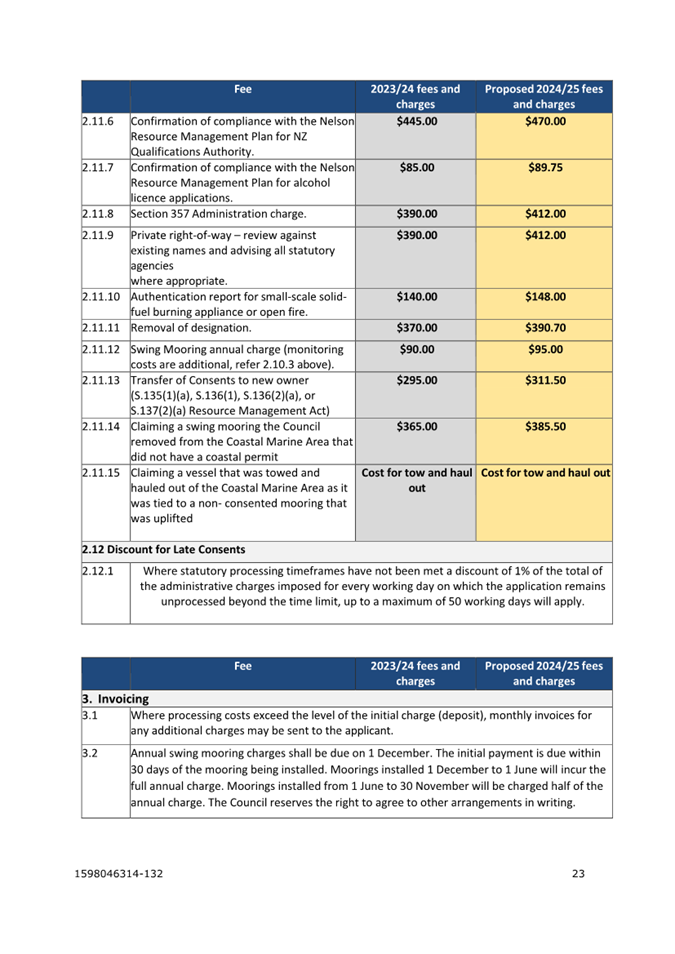

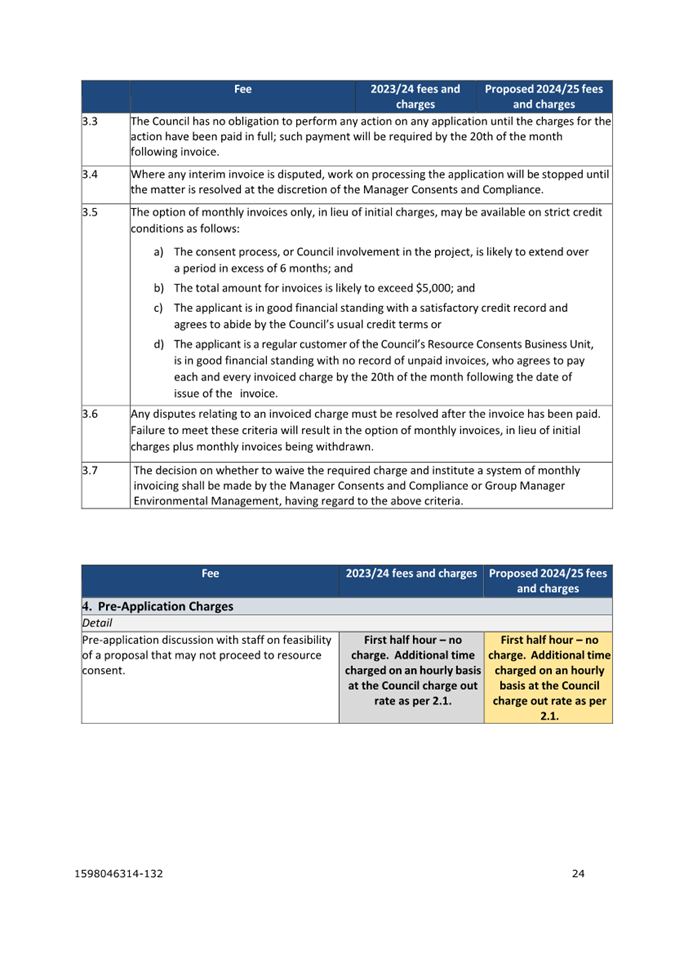

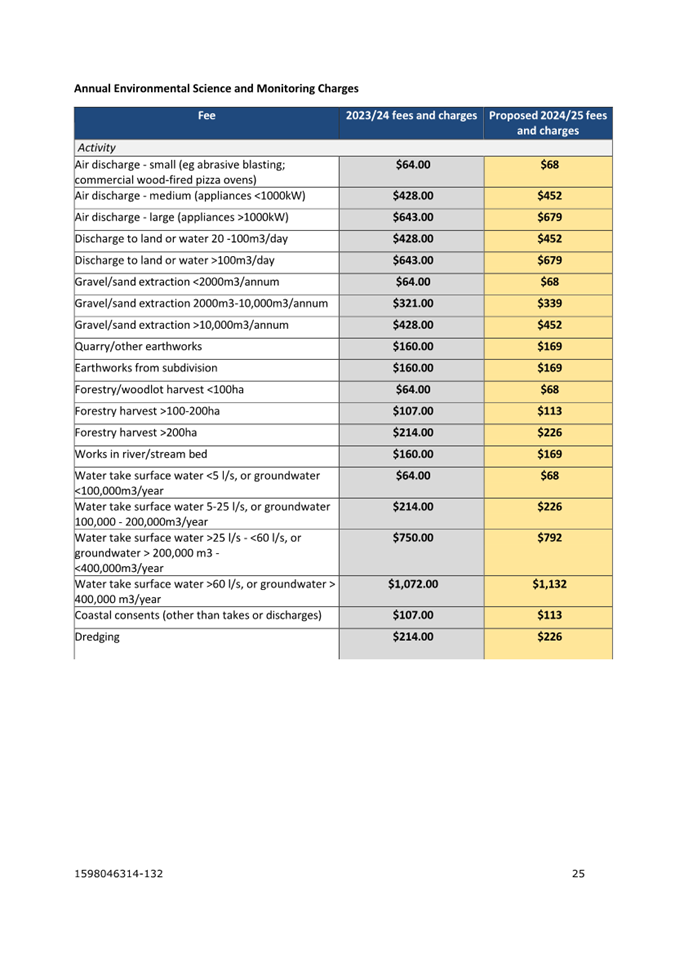

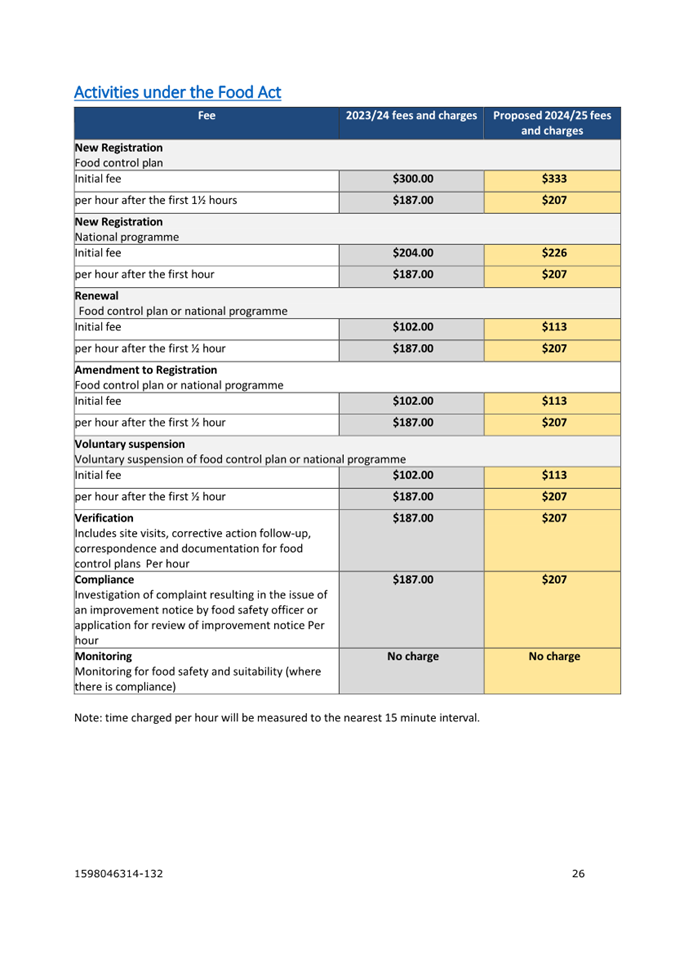

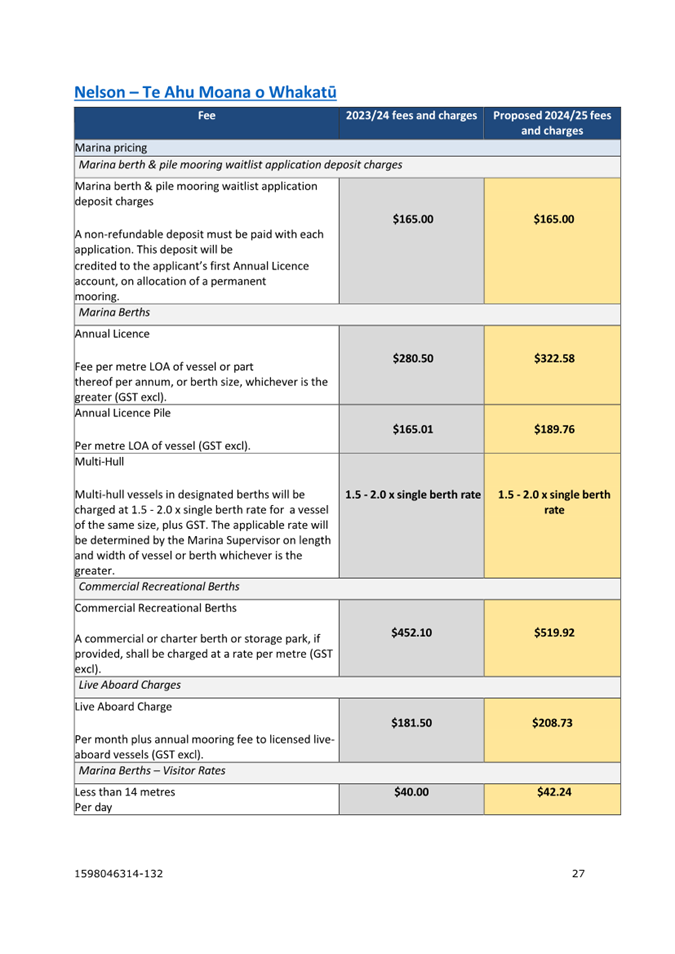

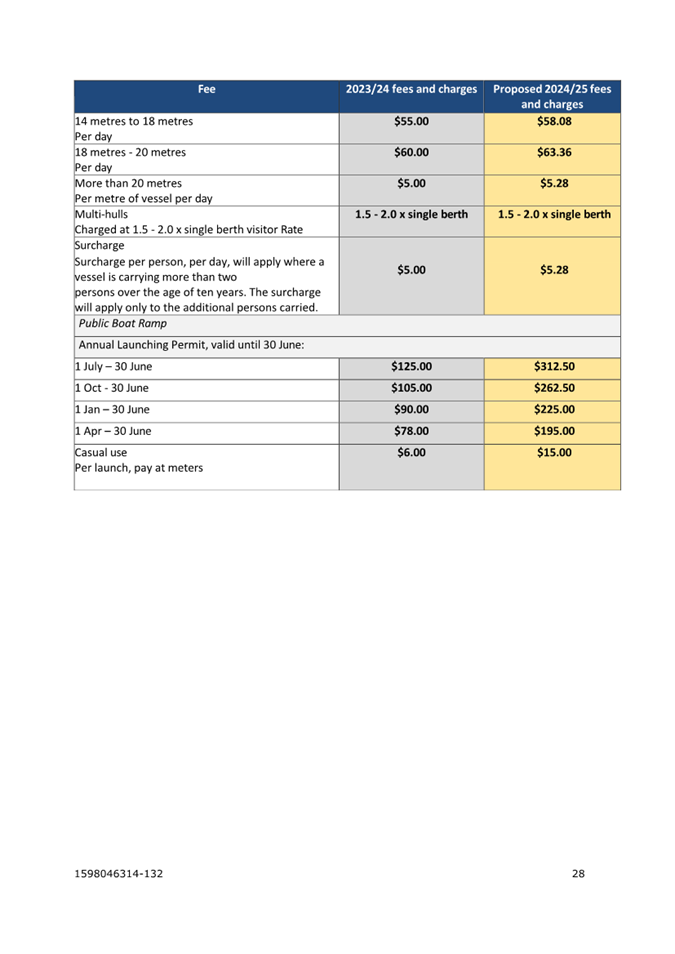

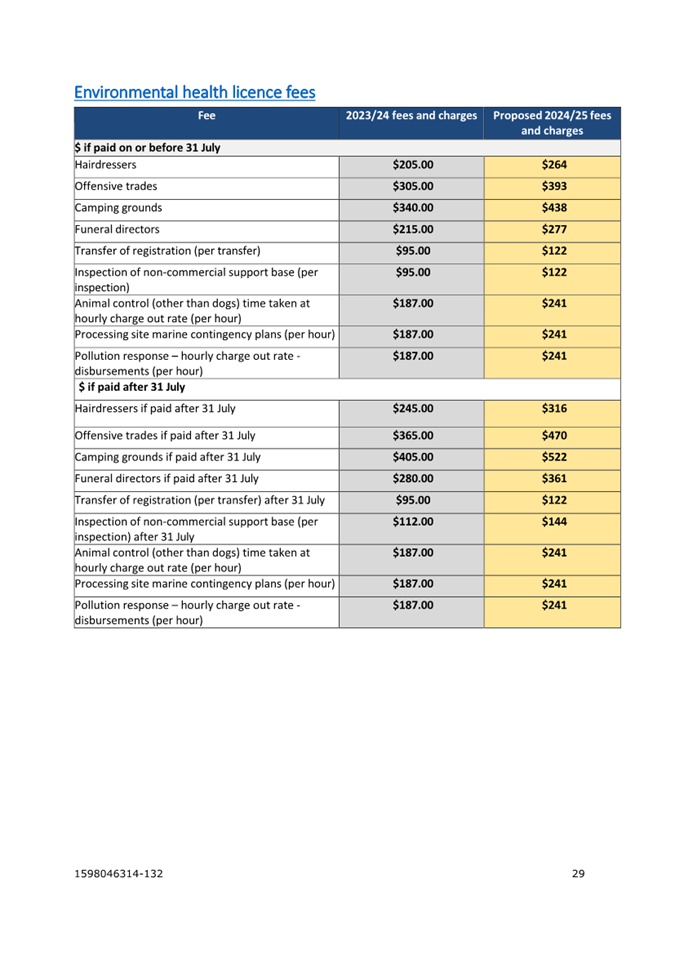

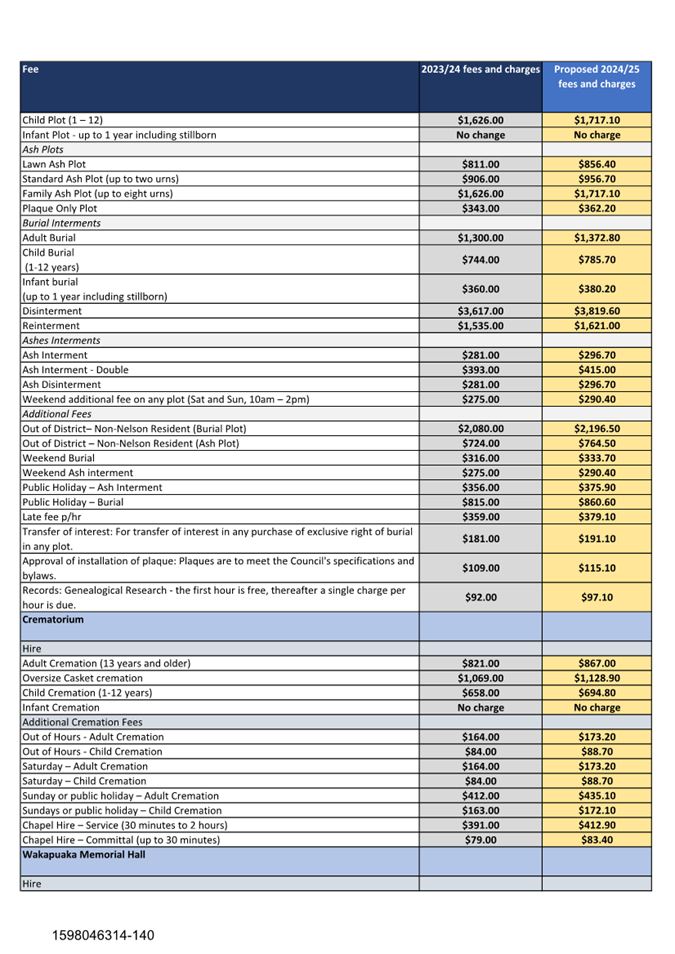

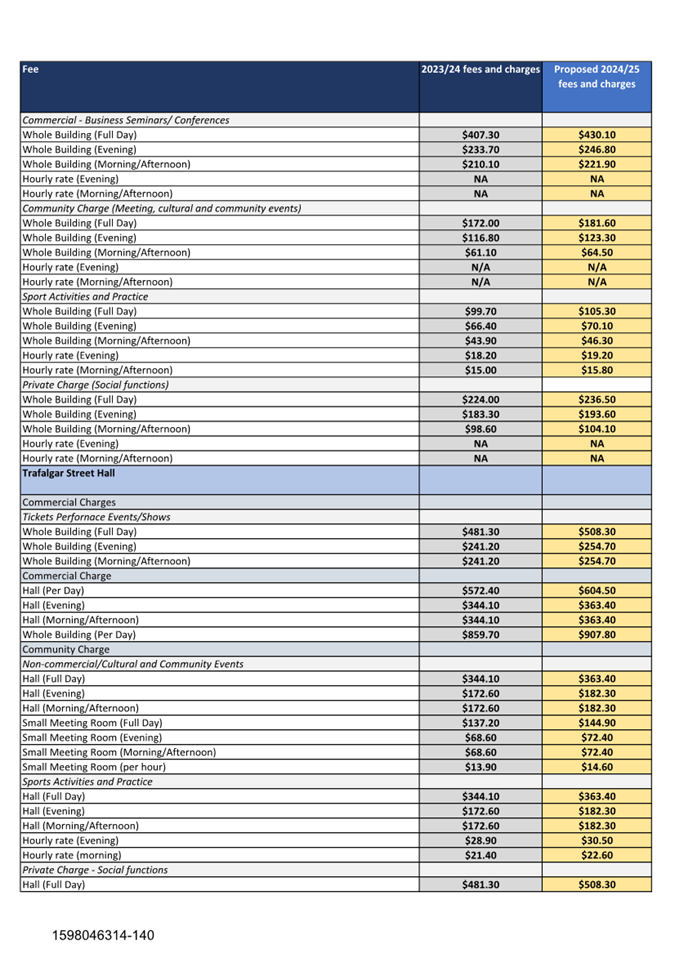

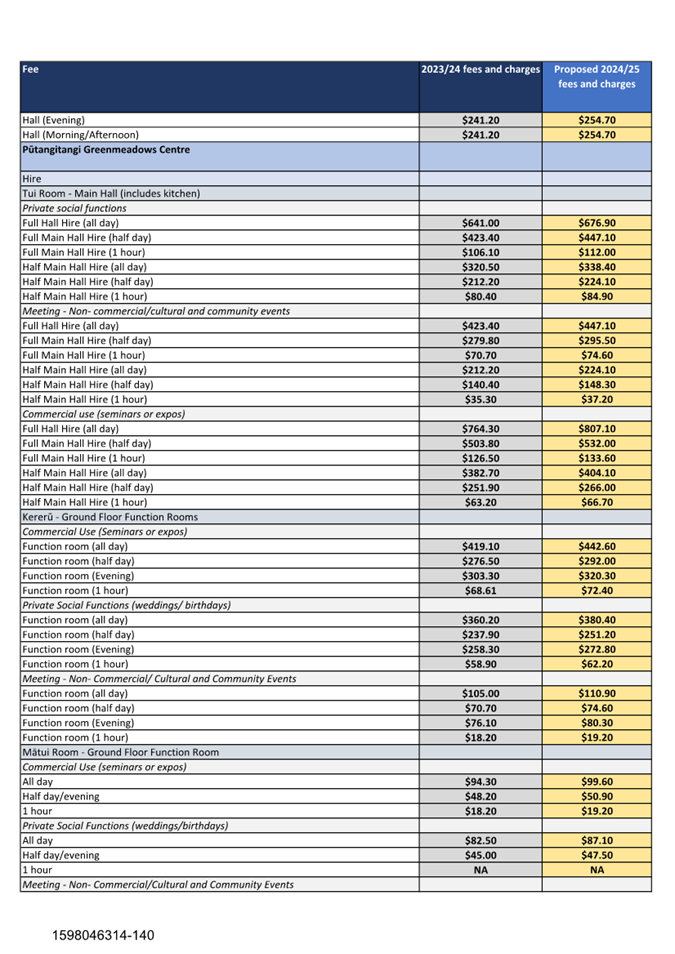

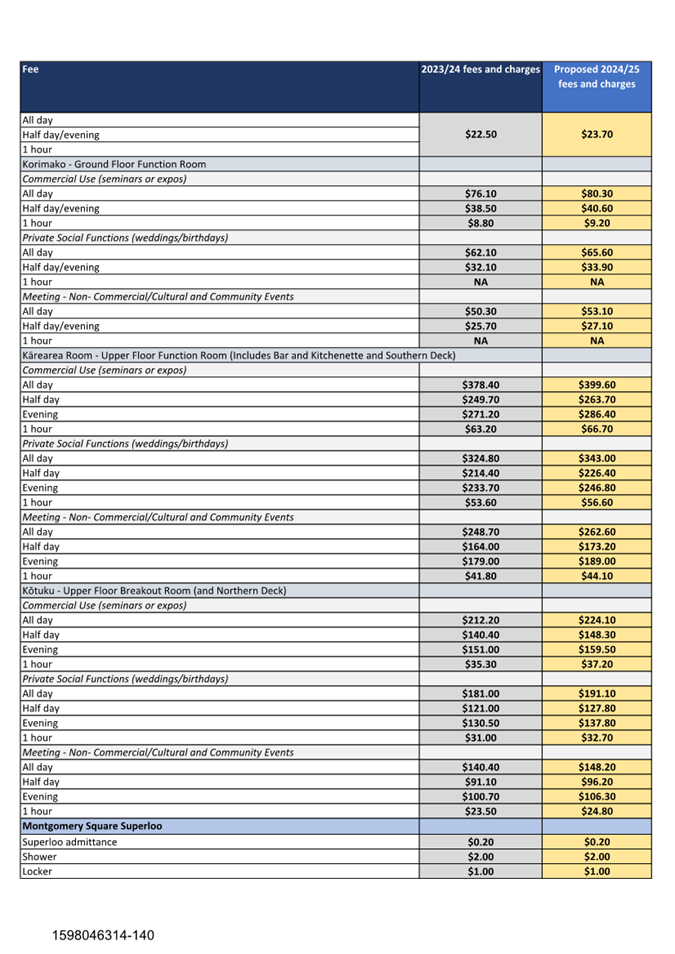

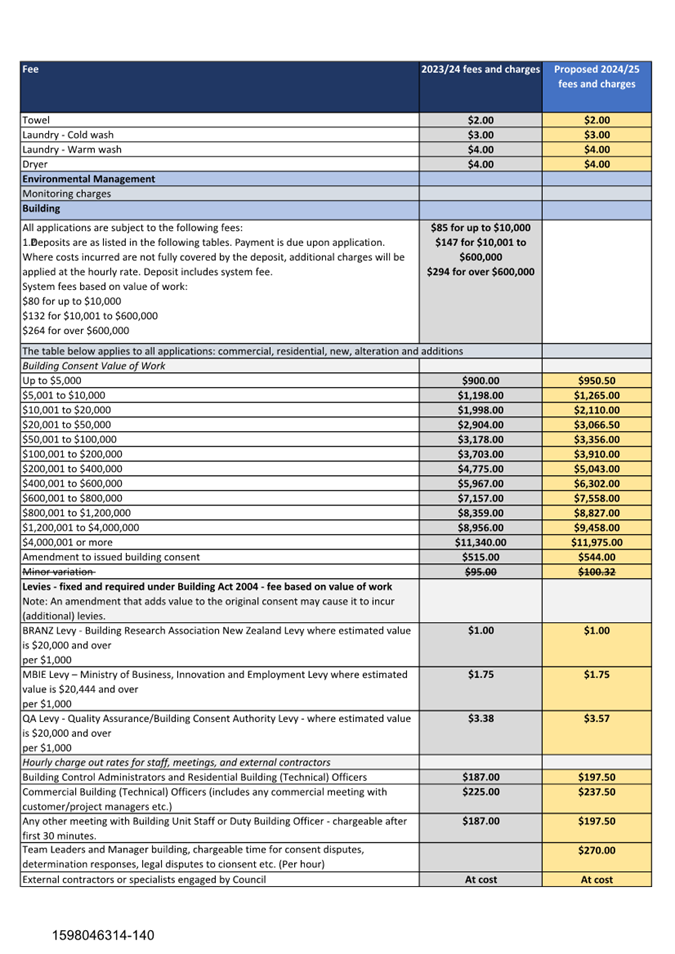

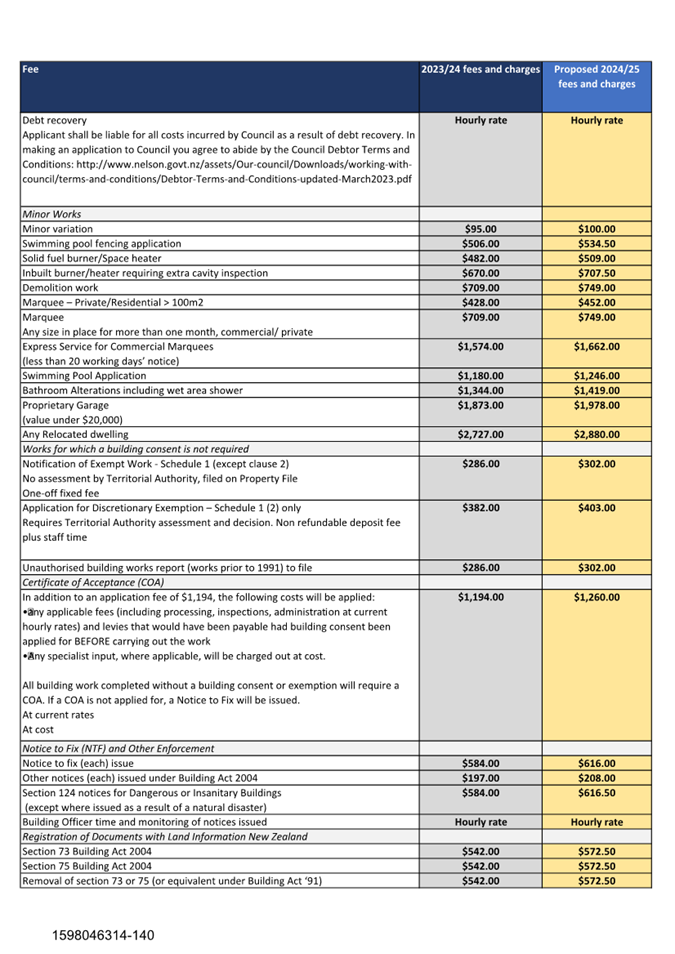

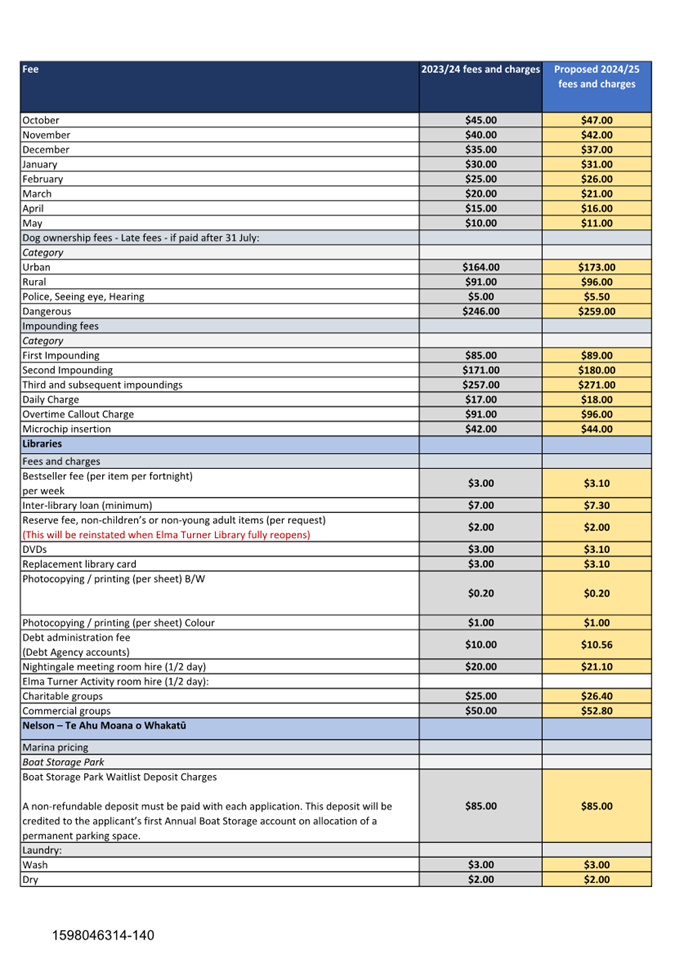

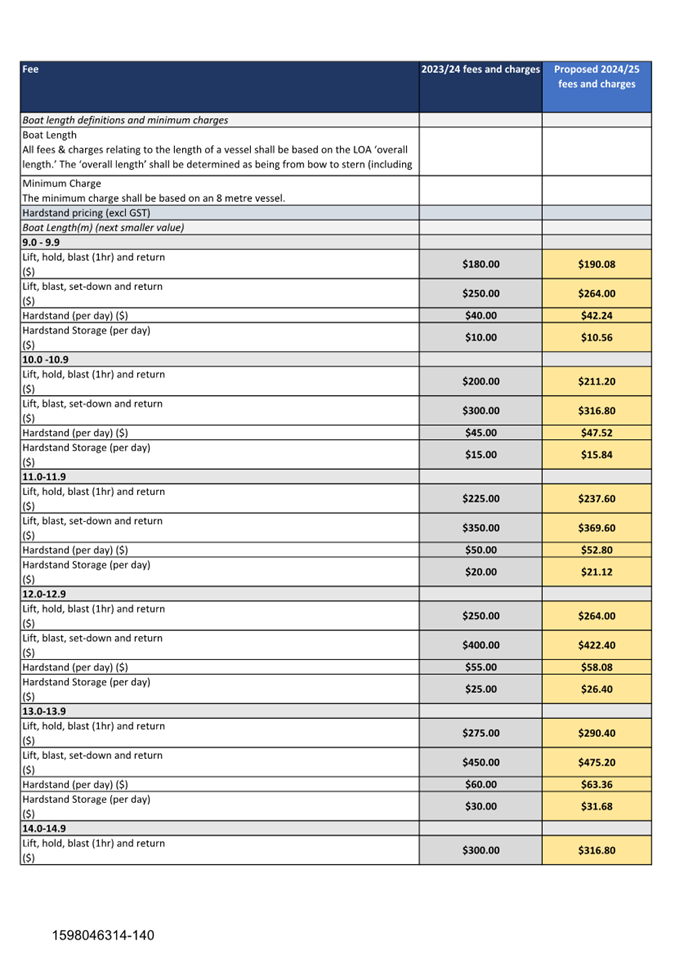

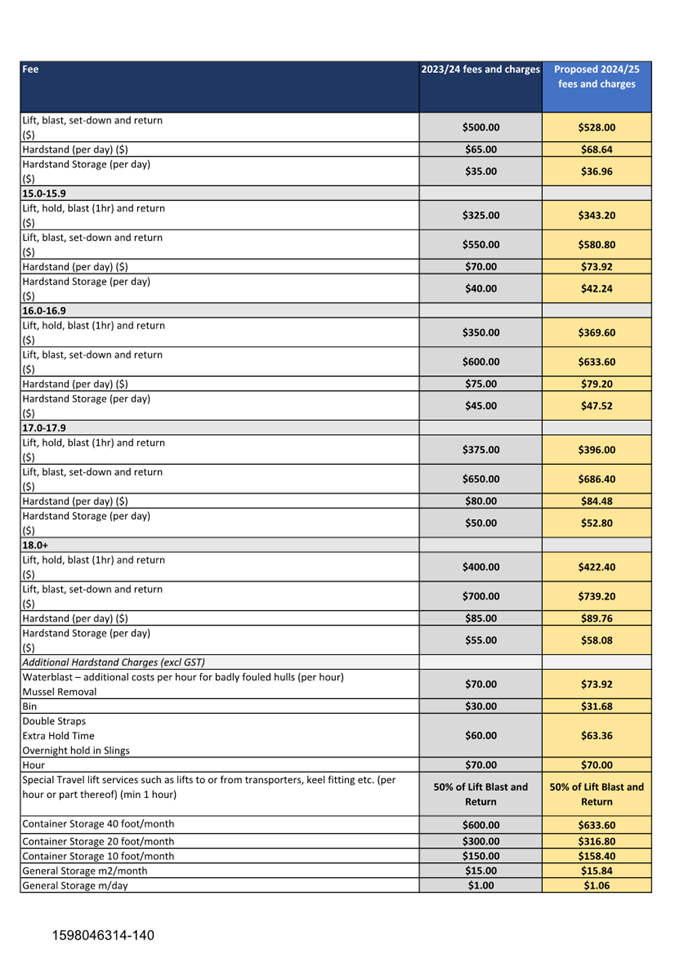

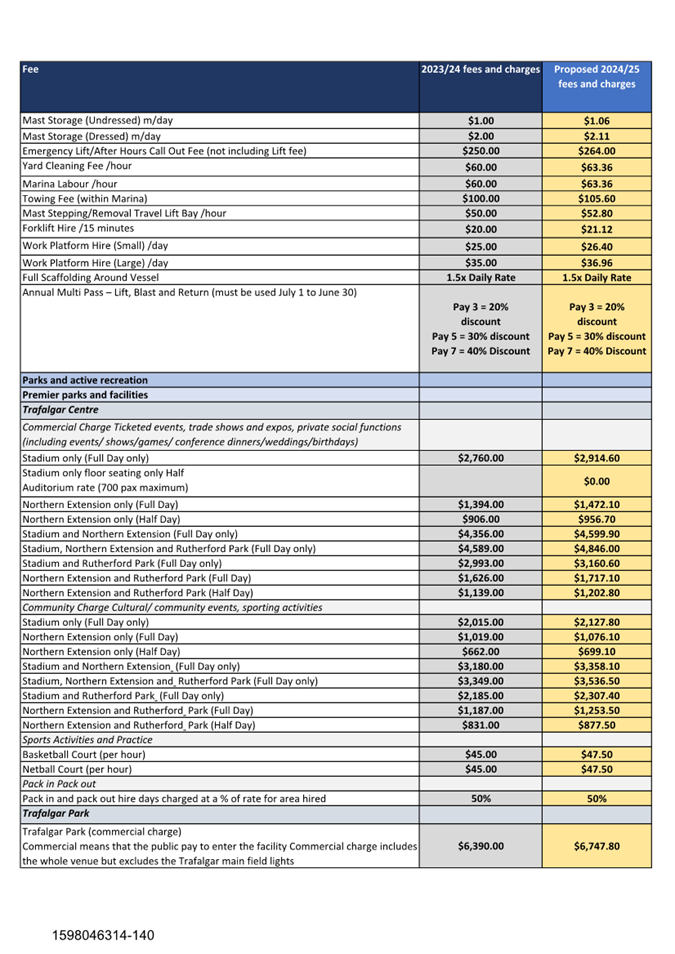

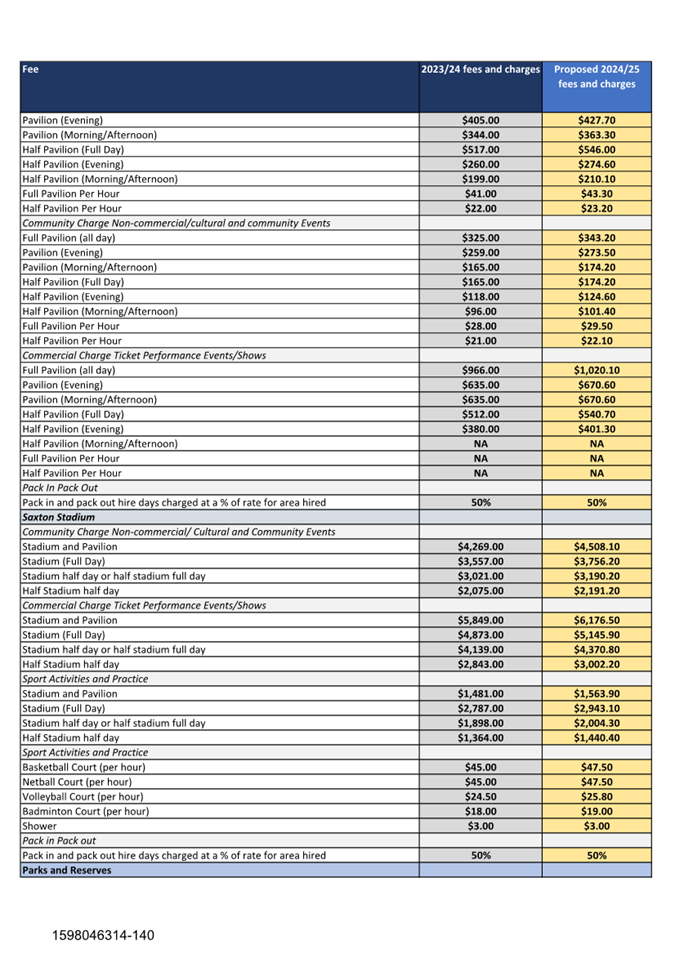

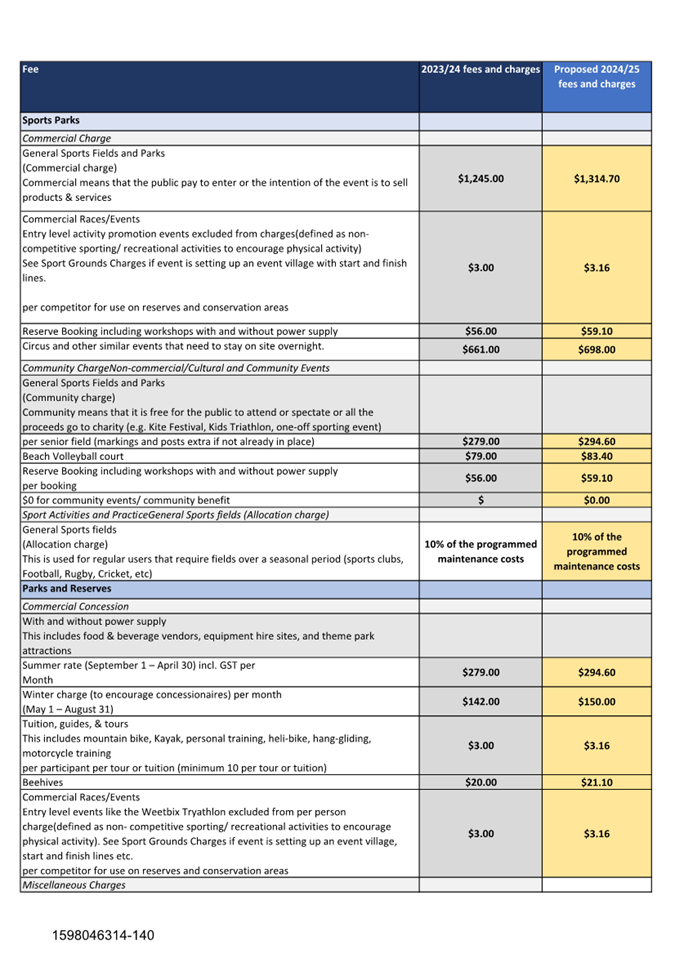

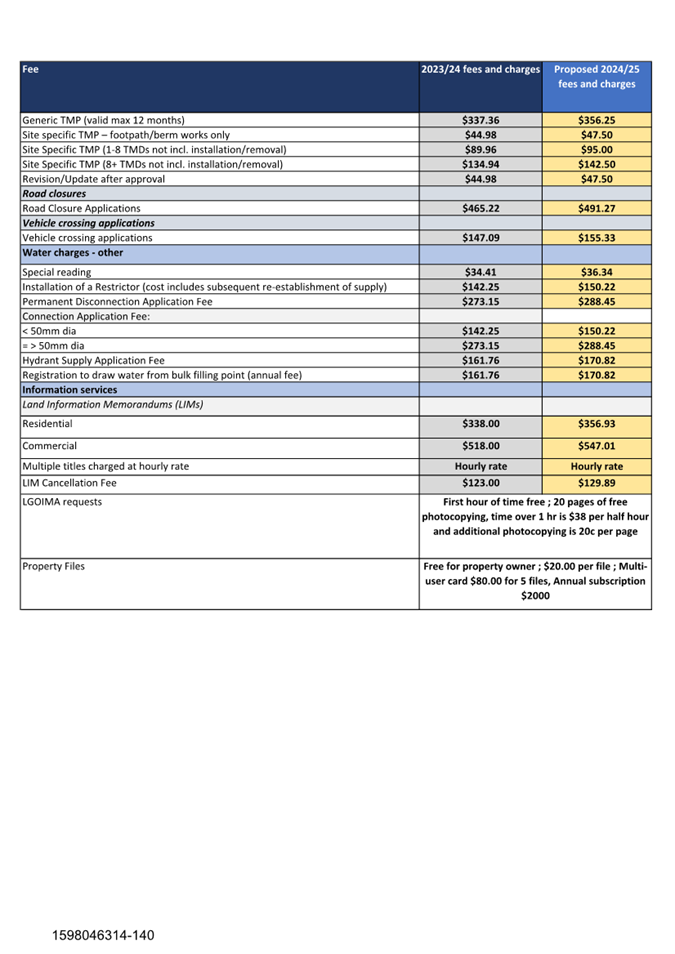

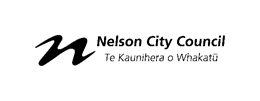

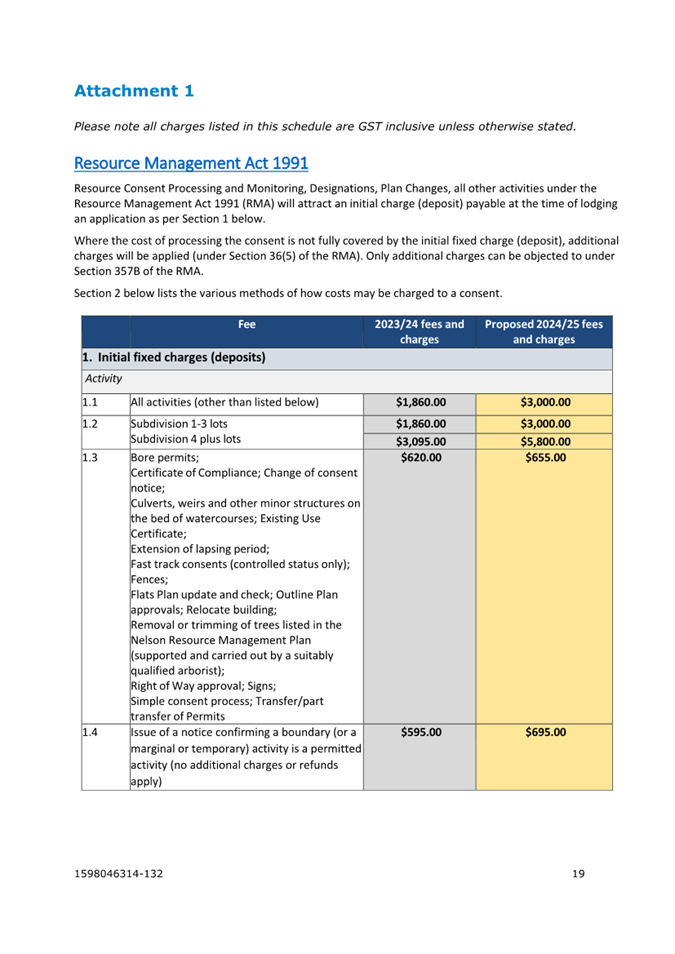

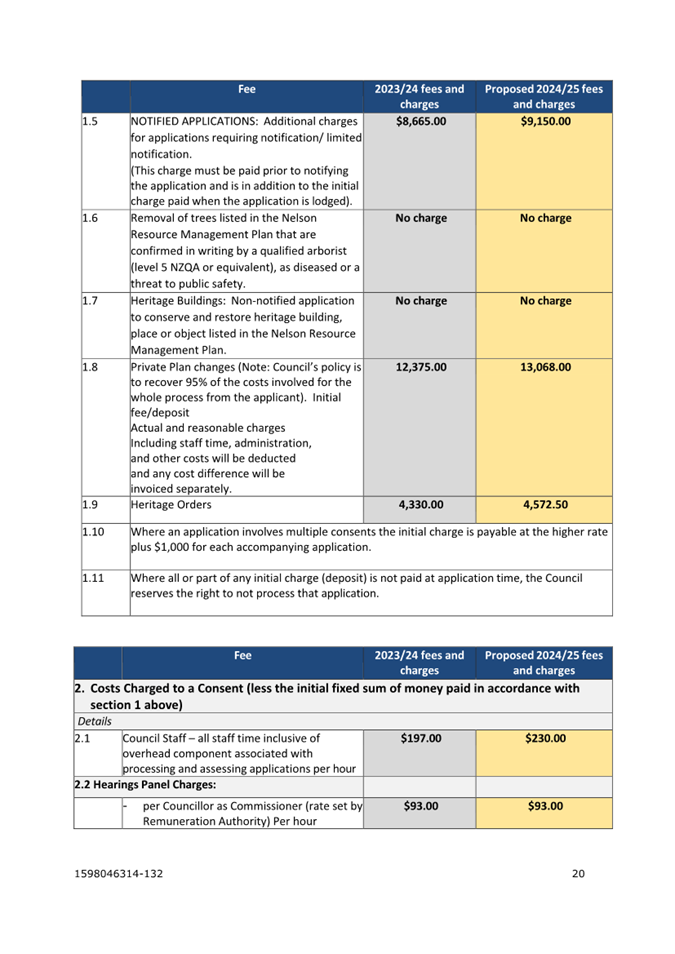

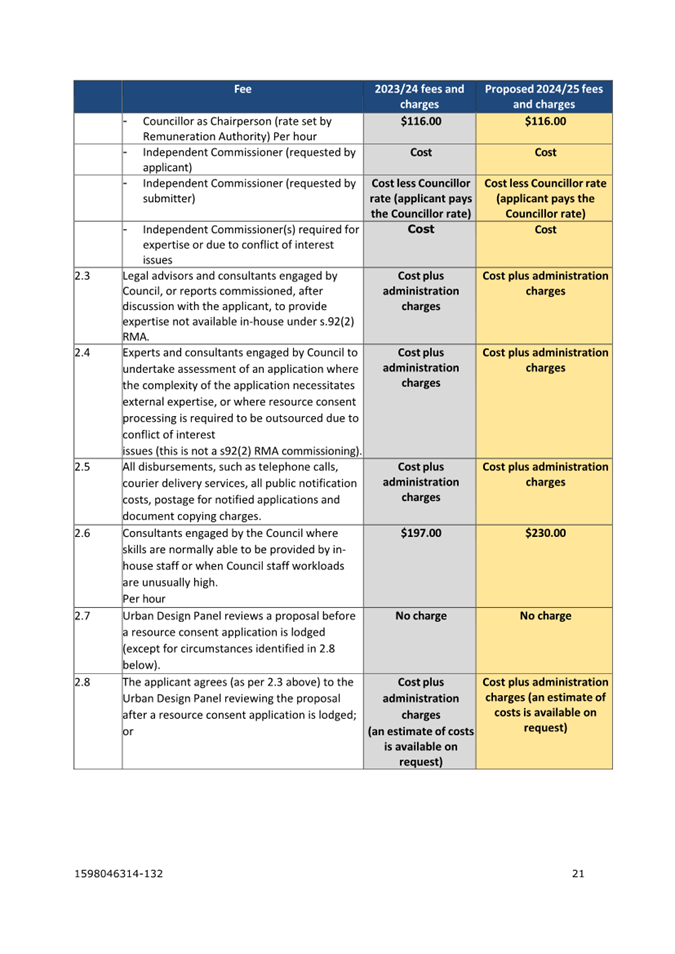

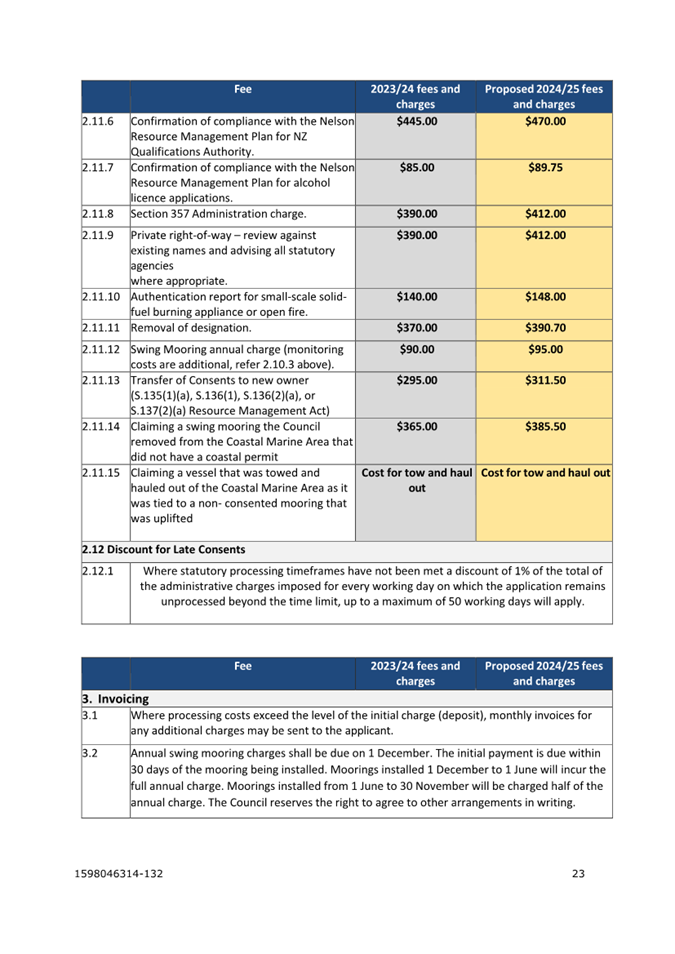

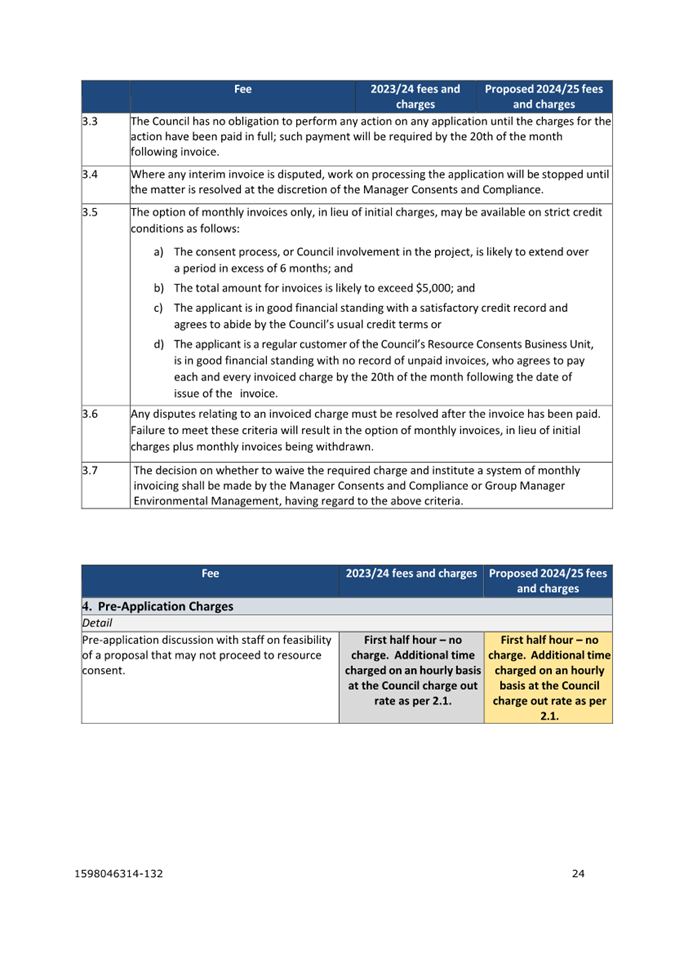

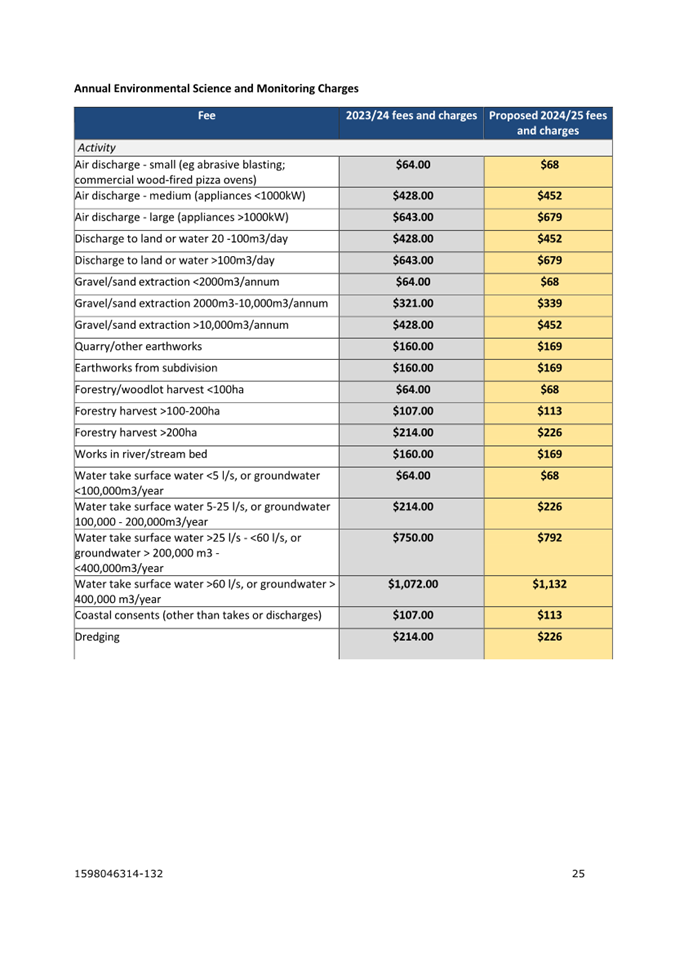

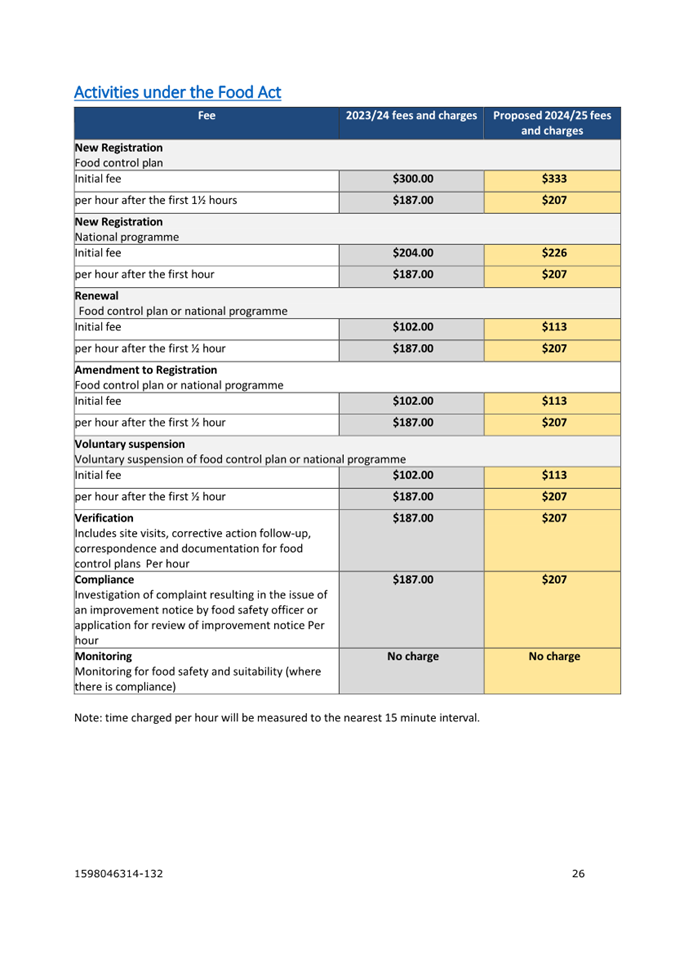

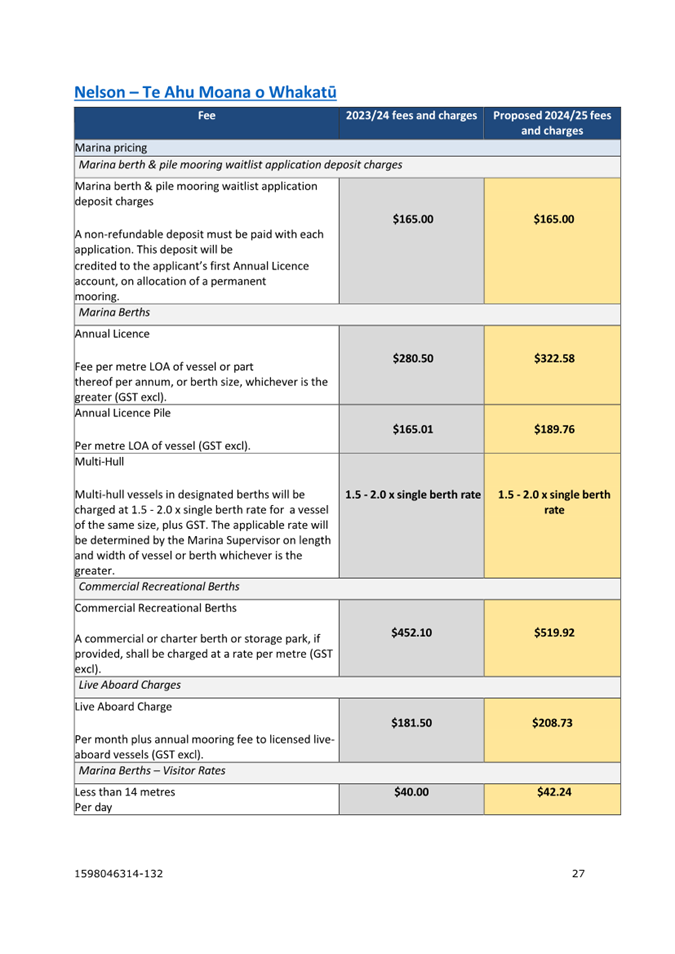

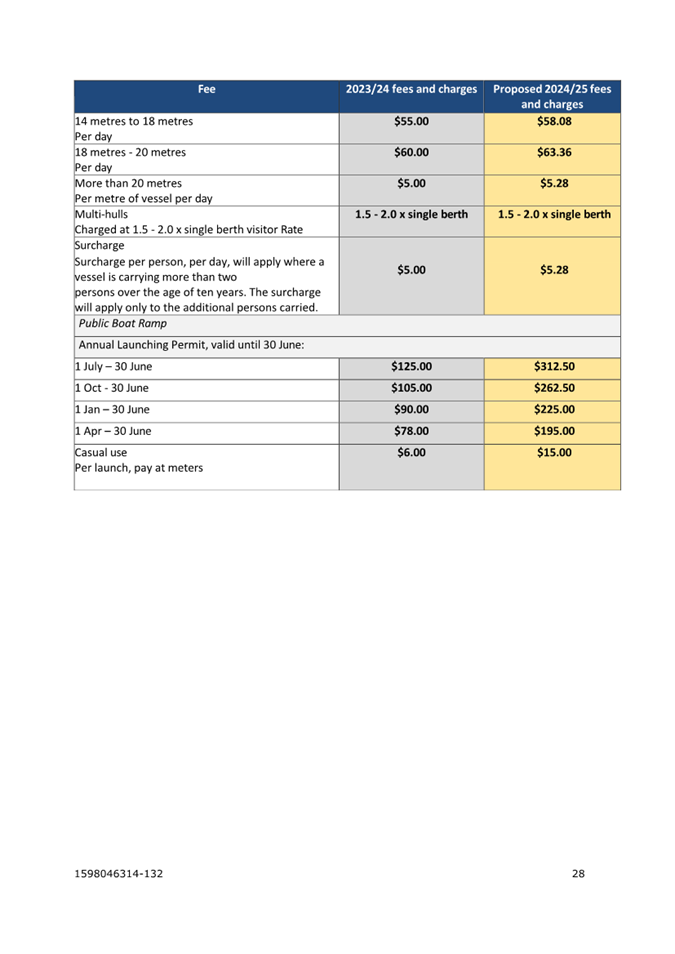

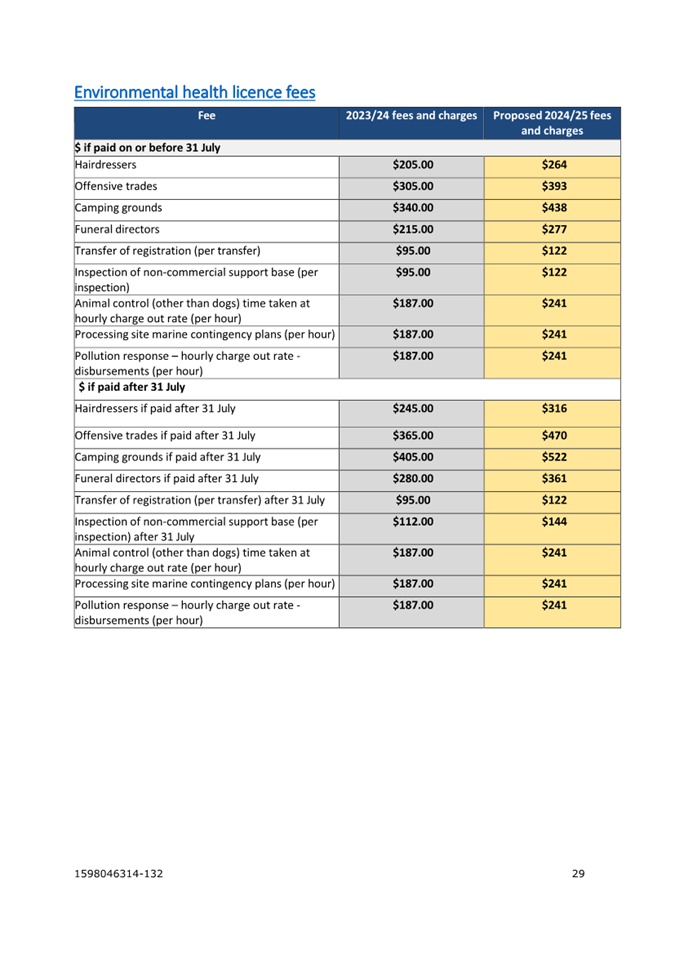

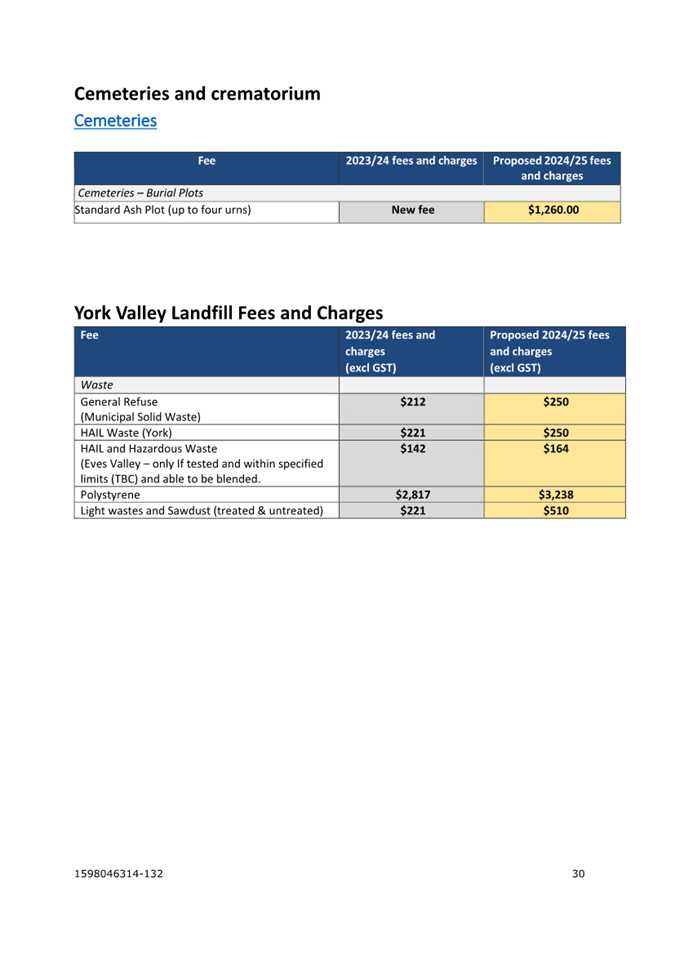

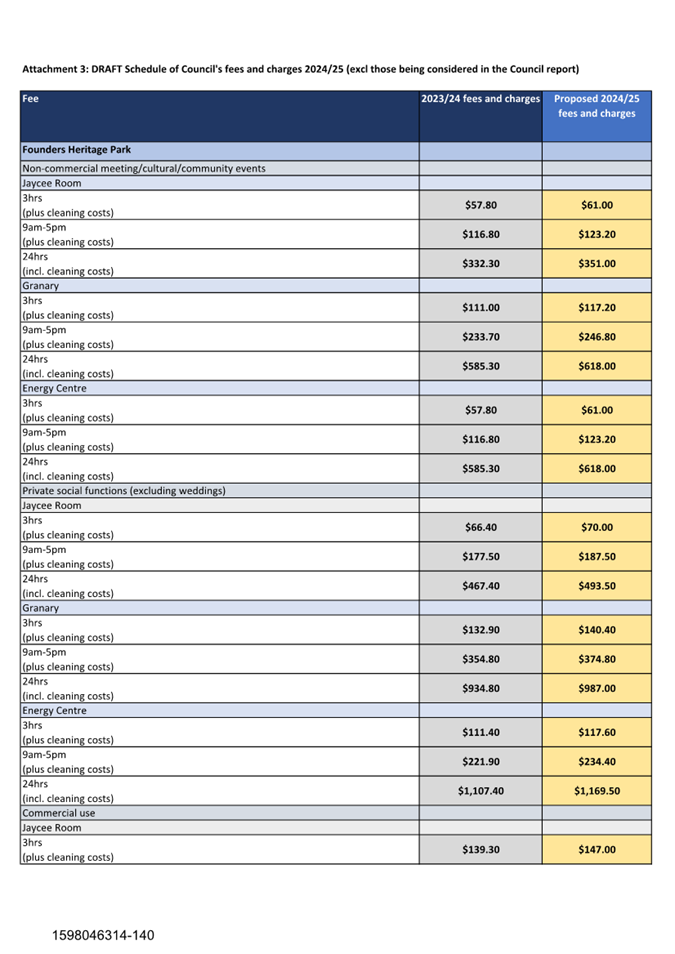

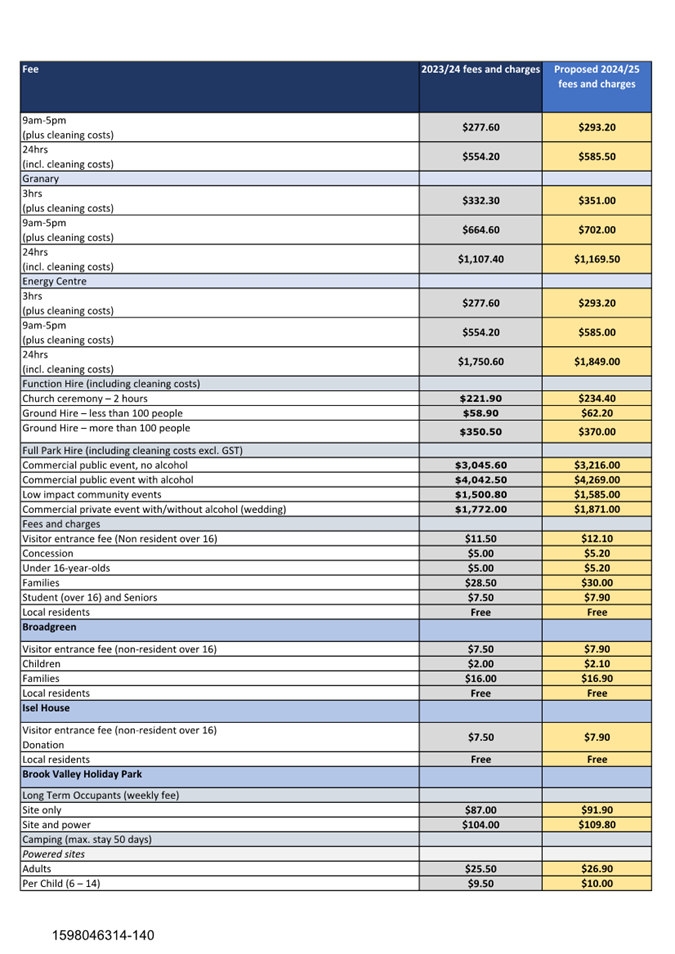

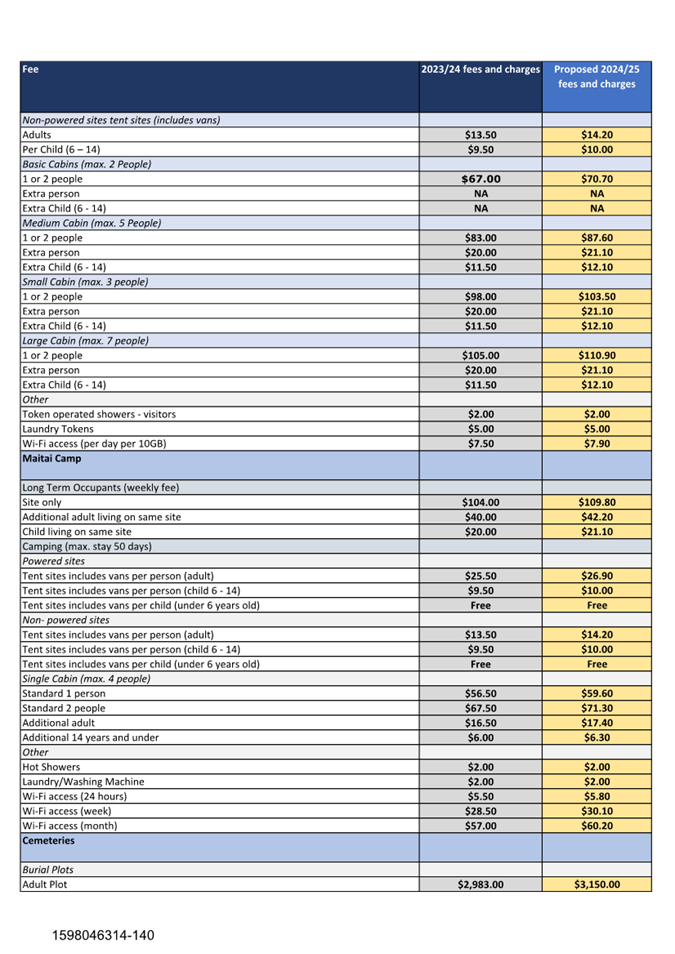

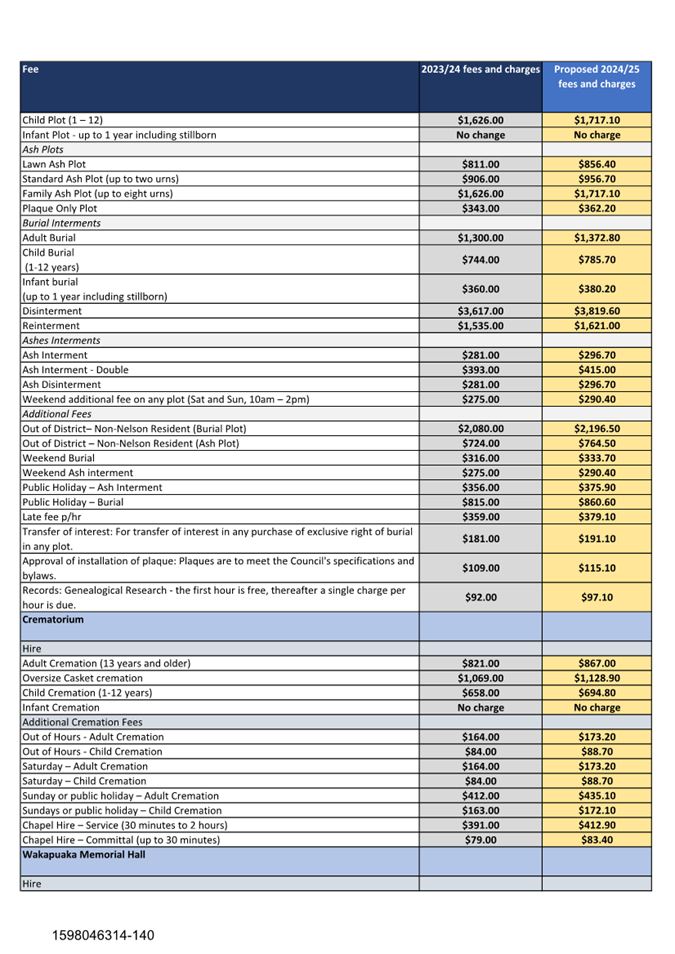

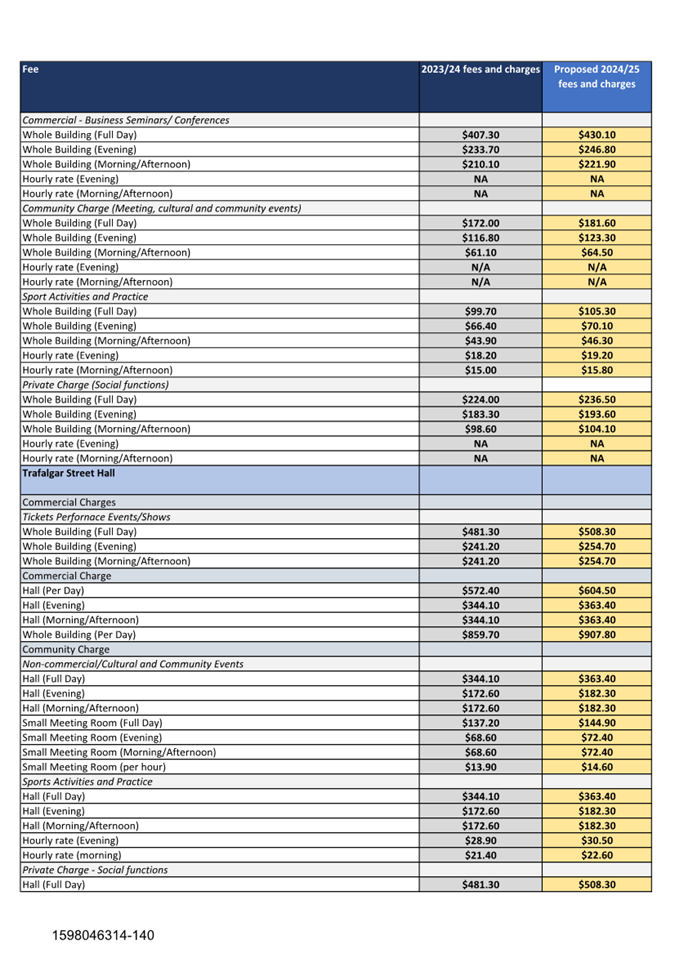

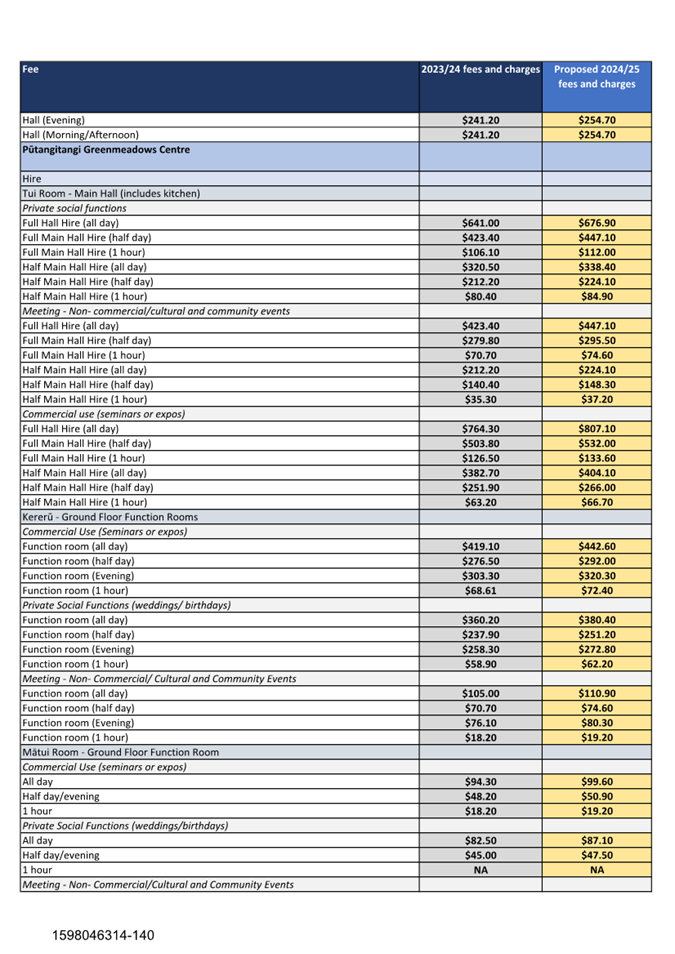

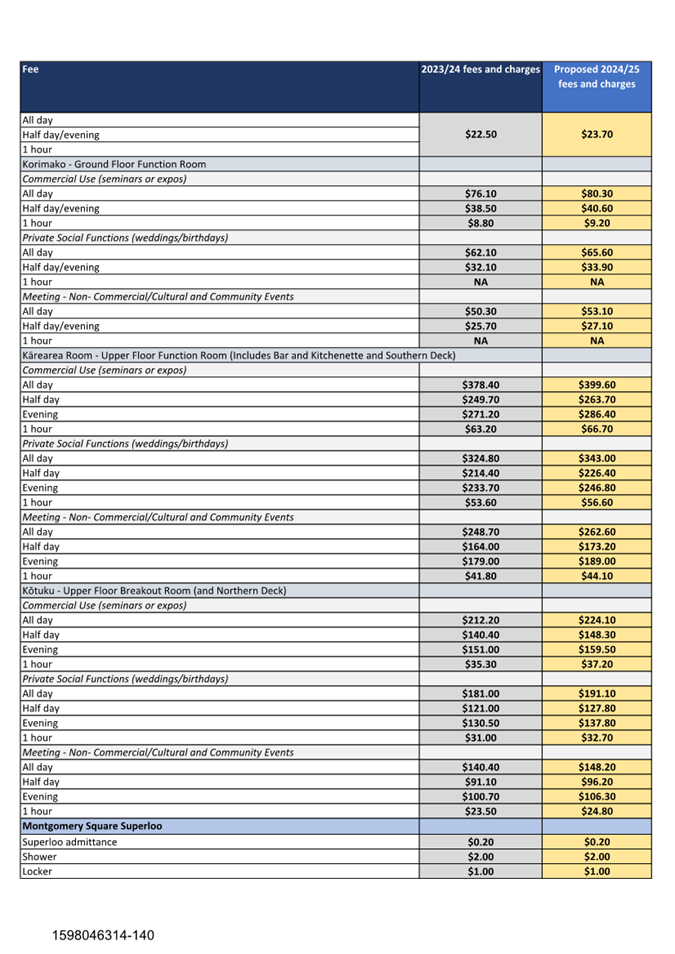

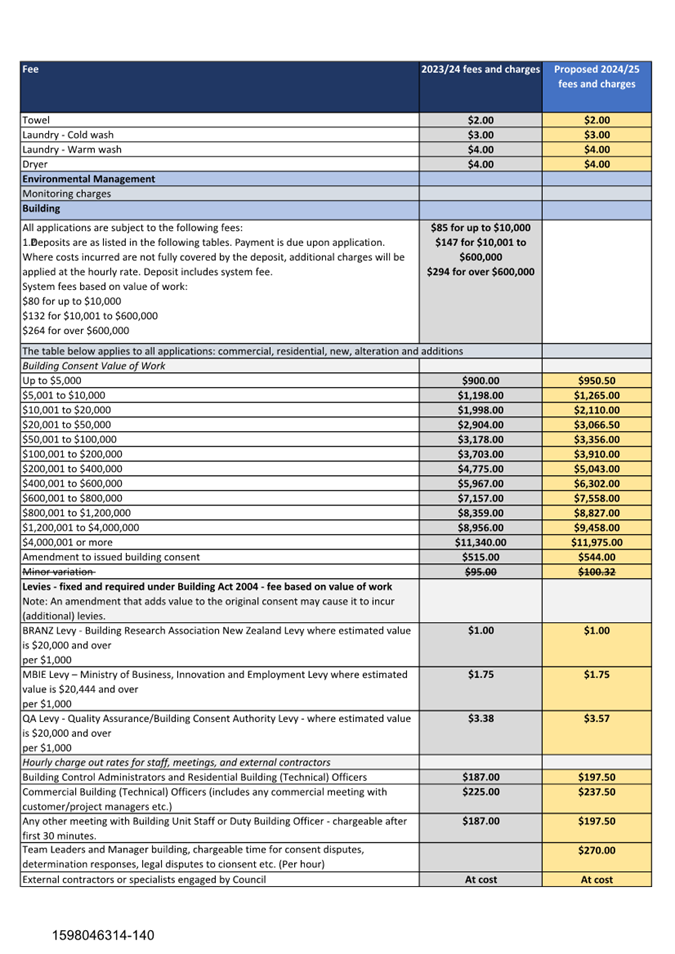

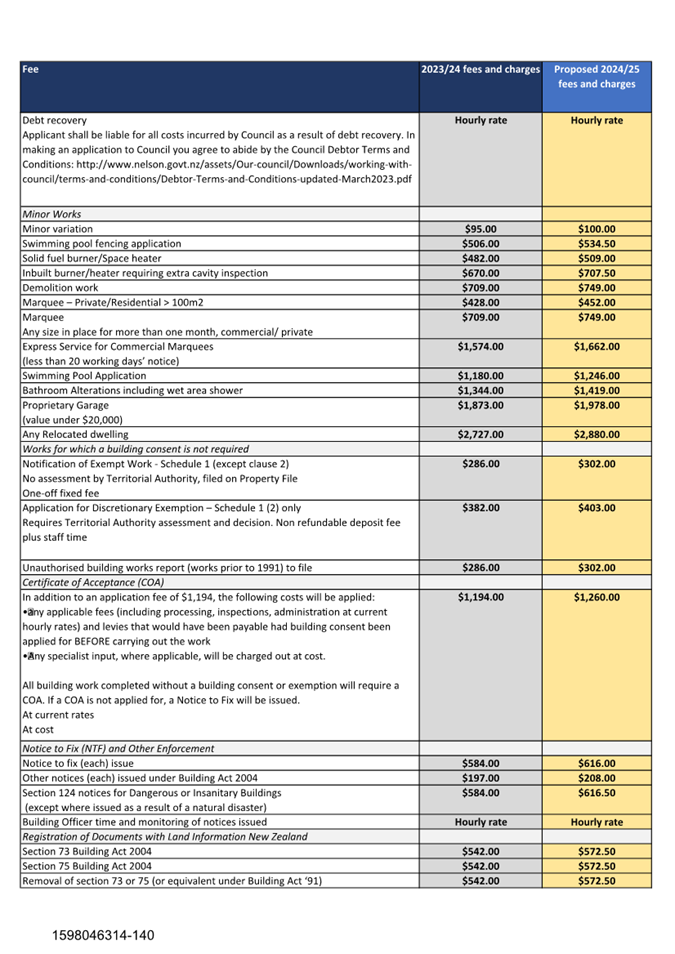

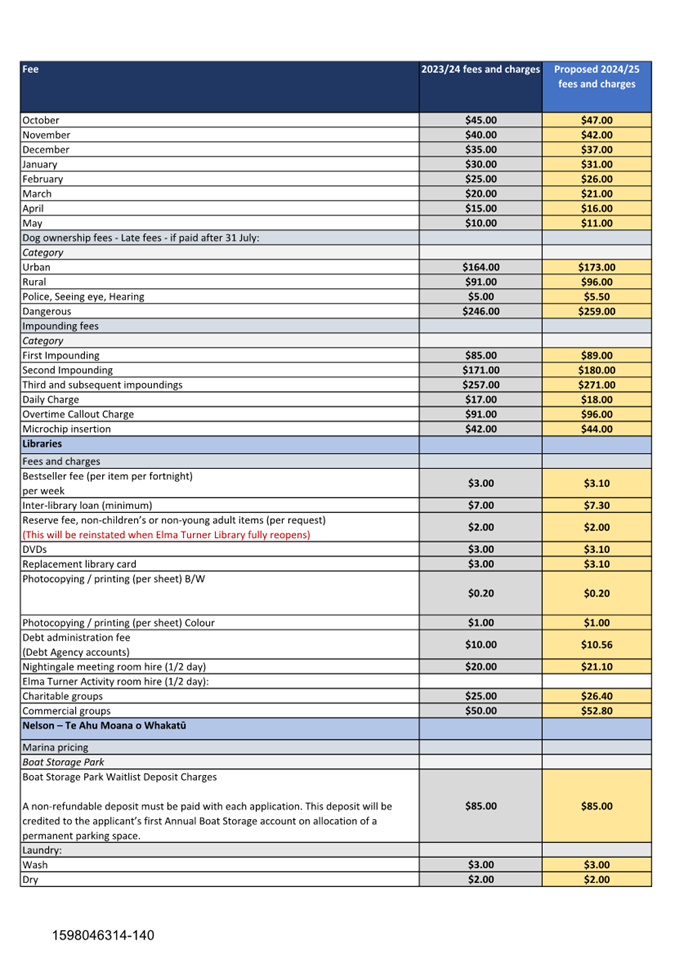

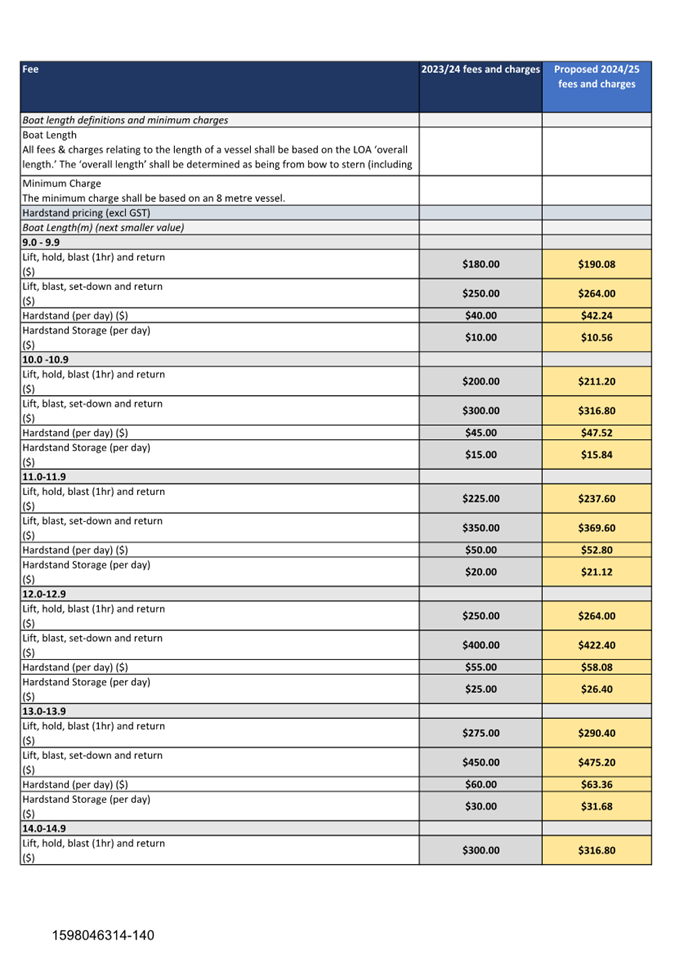

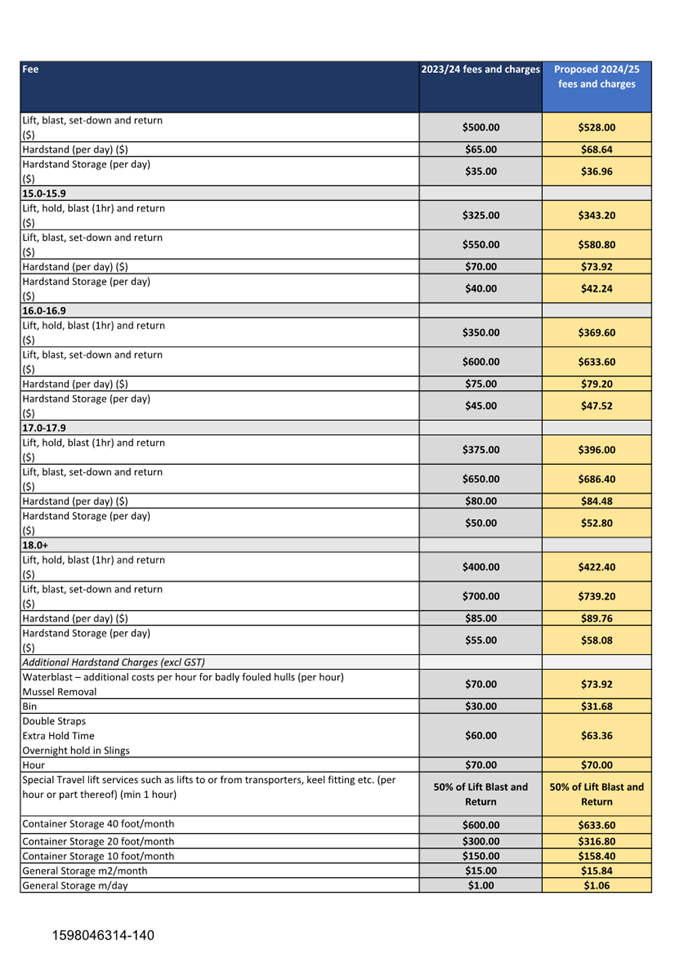

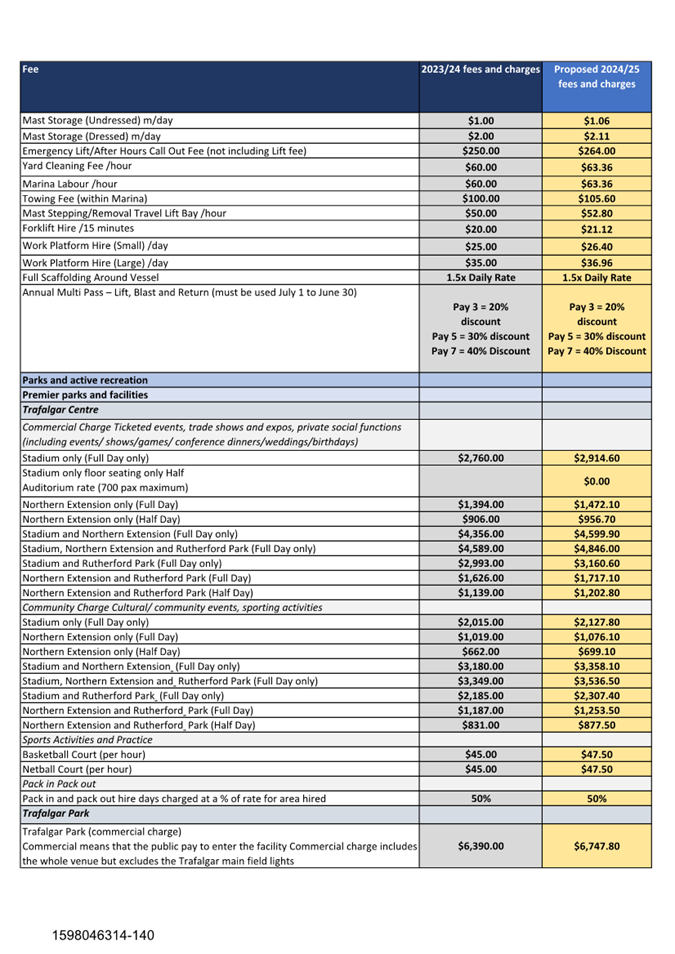

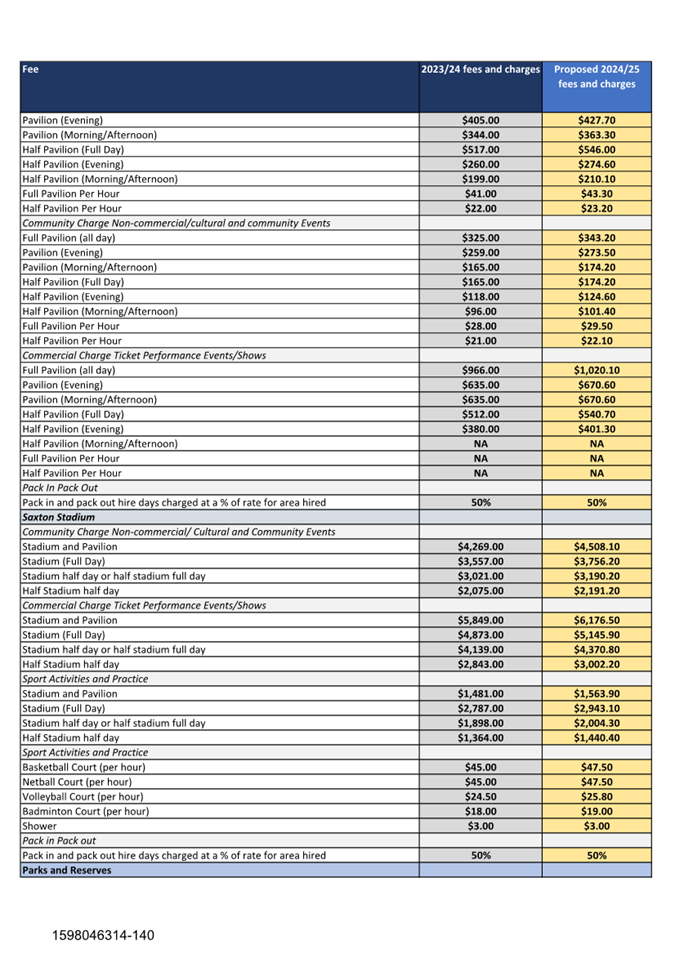

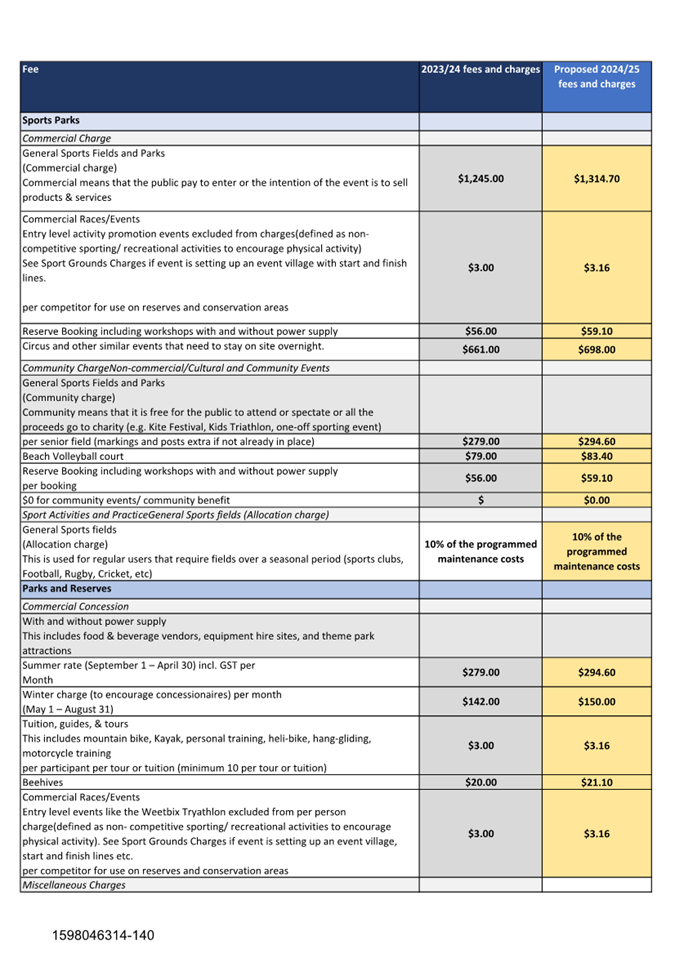

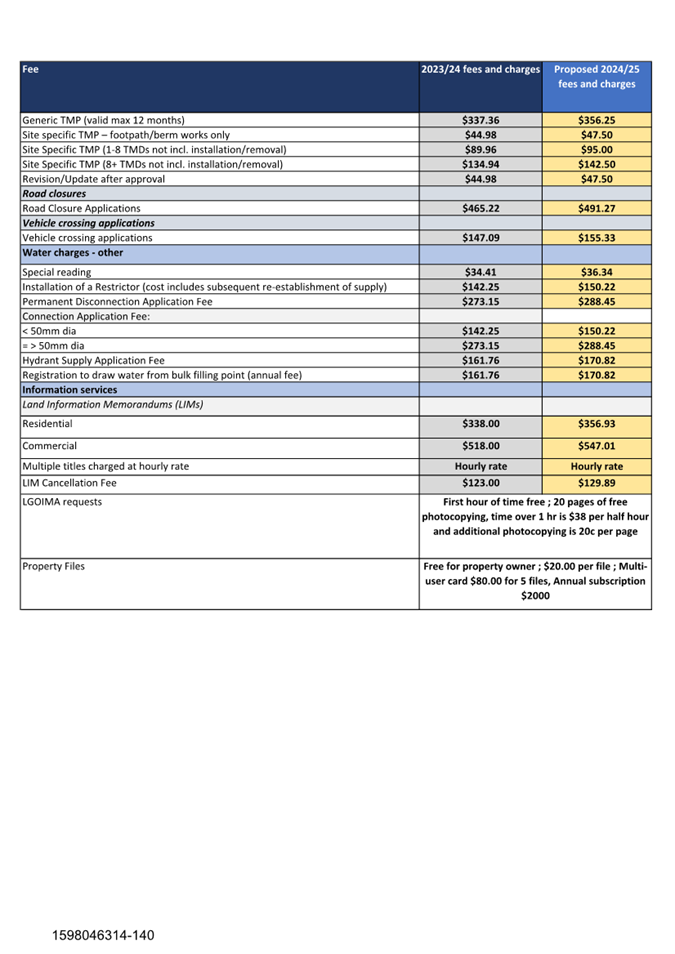

14. Proposed changes to Council's

fees and charges for 2024/25 197 - 279

Document number R28216

Recommendation

|

That

the Council

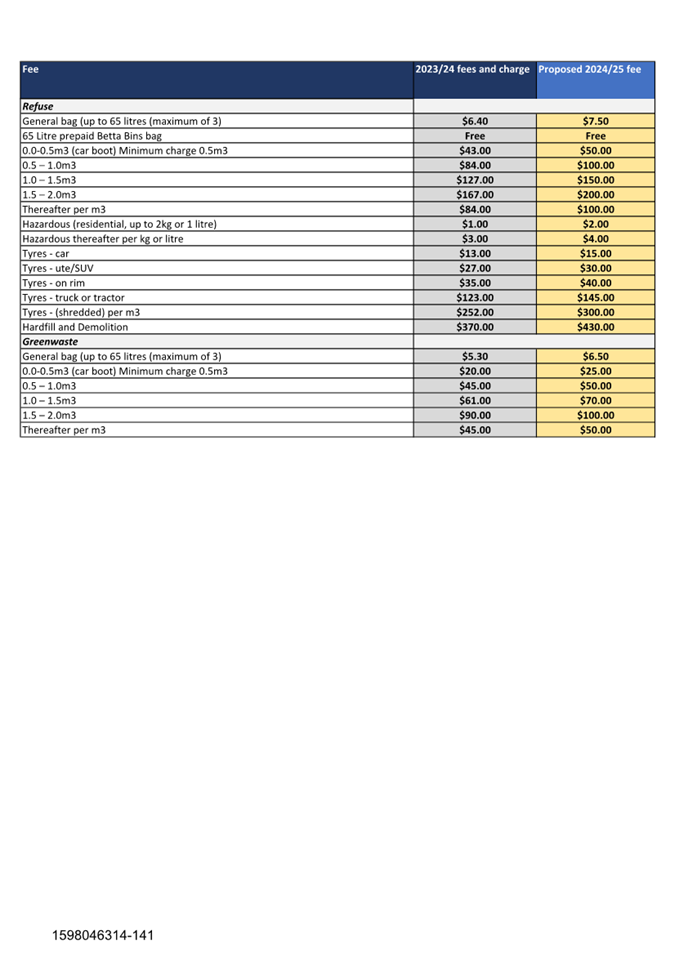

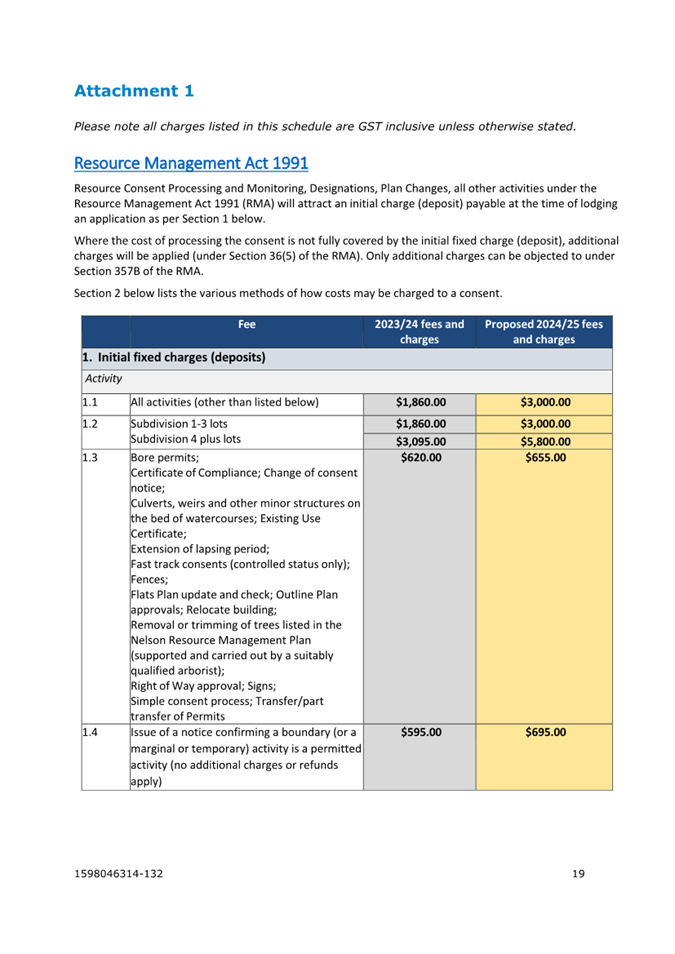

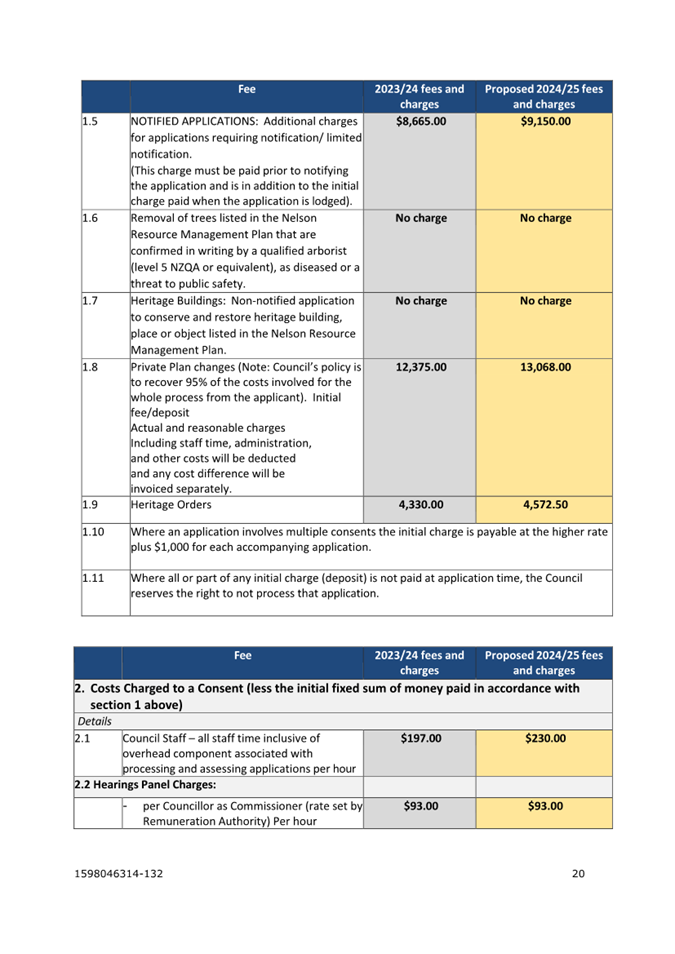

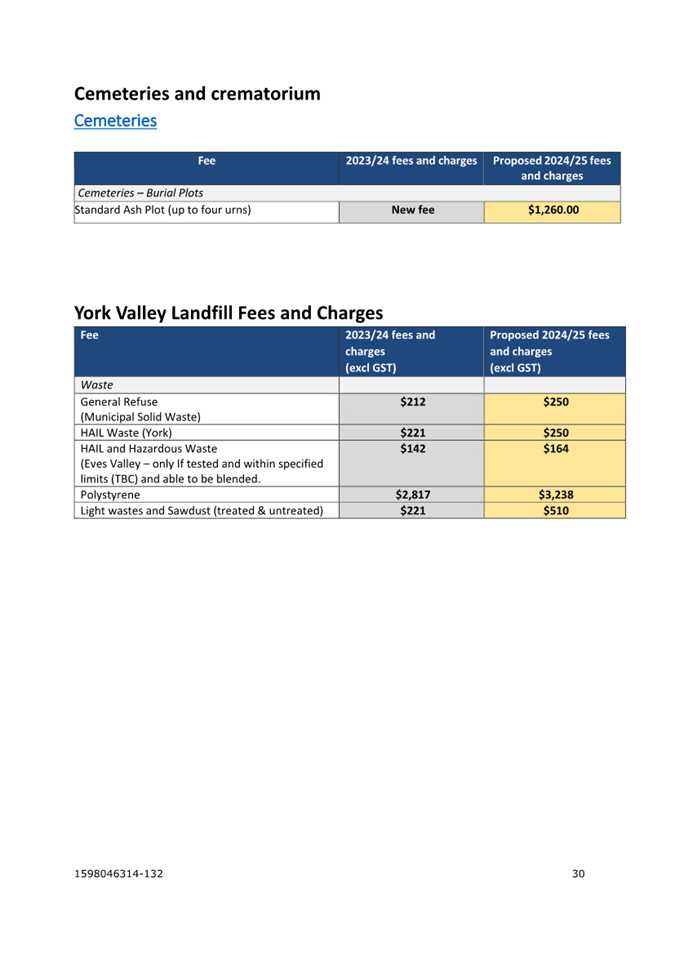

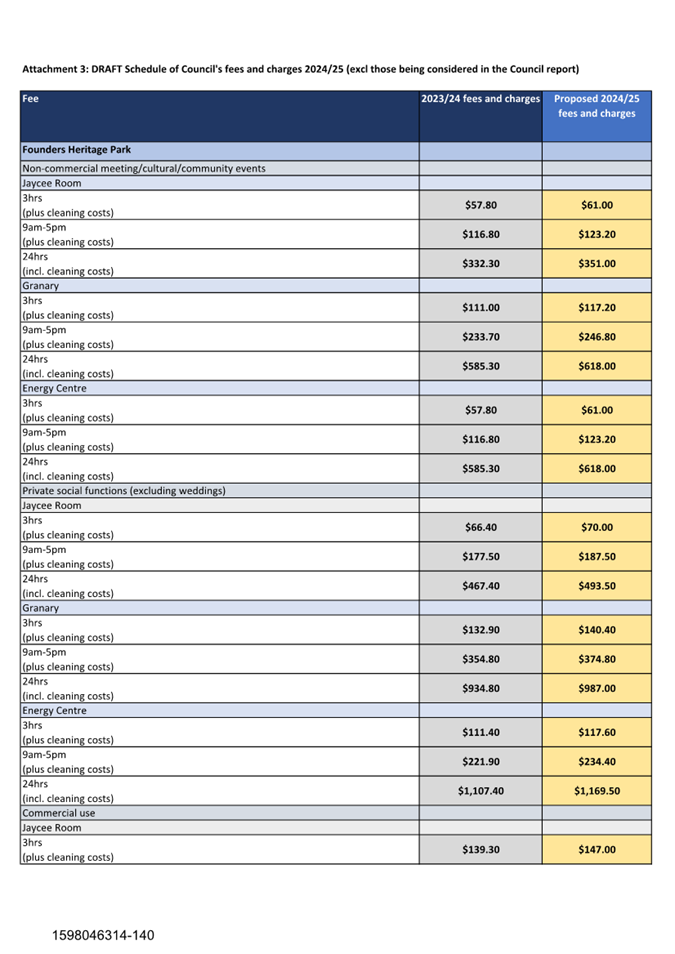

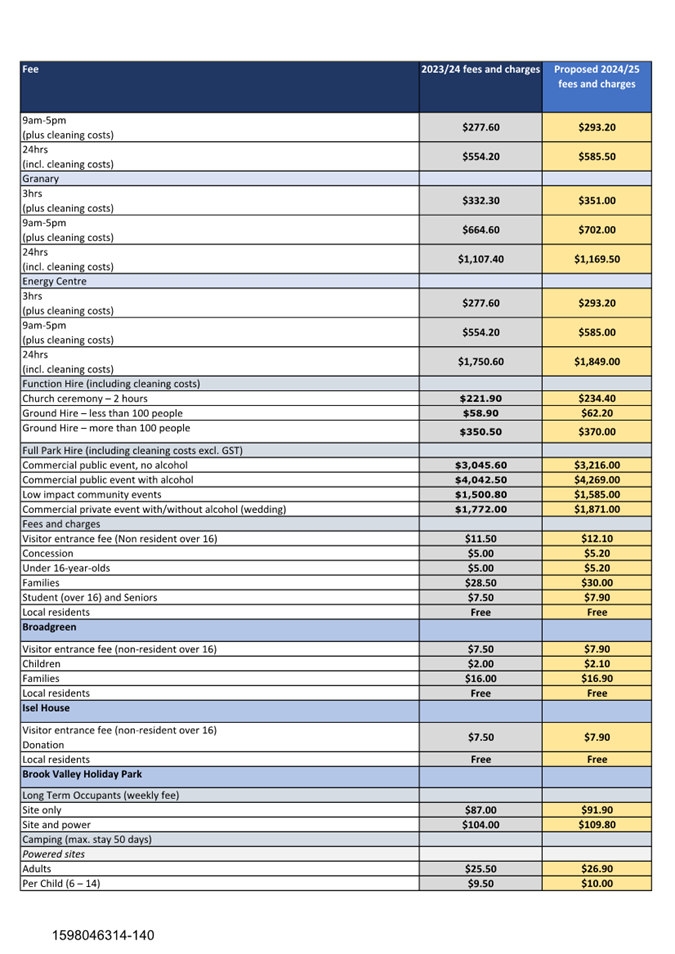

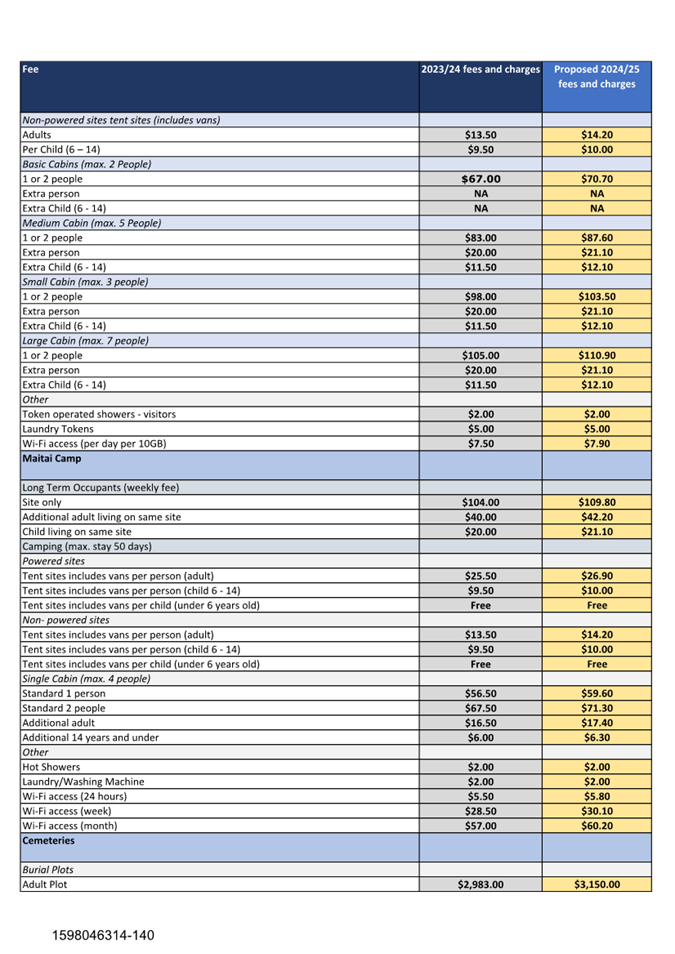

1. Receives the report Proposed

changes to Council's fees and charges for 2024/25 (R28216) and its

attachments (1598046314-141), (1598046314-132) and (1598046314-140); and

2. Adopts the proposed Schedule of

Fees and Charges in Attachment 1 (1598046314-141) noting that those fees do

not require consultation; and

3. Approves, subject to the Long Term

plan consultation process on the Regional Landfill fees, an increase of 17.7%

(rounded for cash handling) to Solid Waste charges at the Nelson Waste

Recovery Centre (as set out in Attachment 1(1598046314-141)) effective 1 July

2024; and

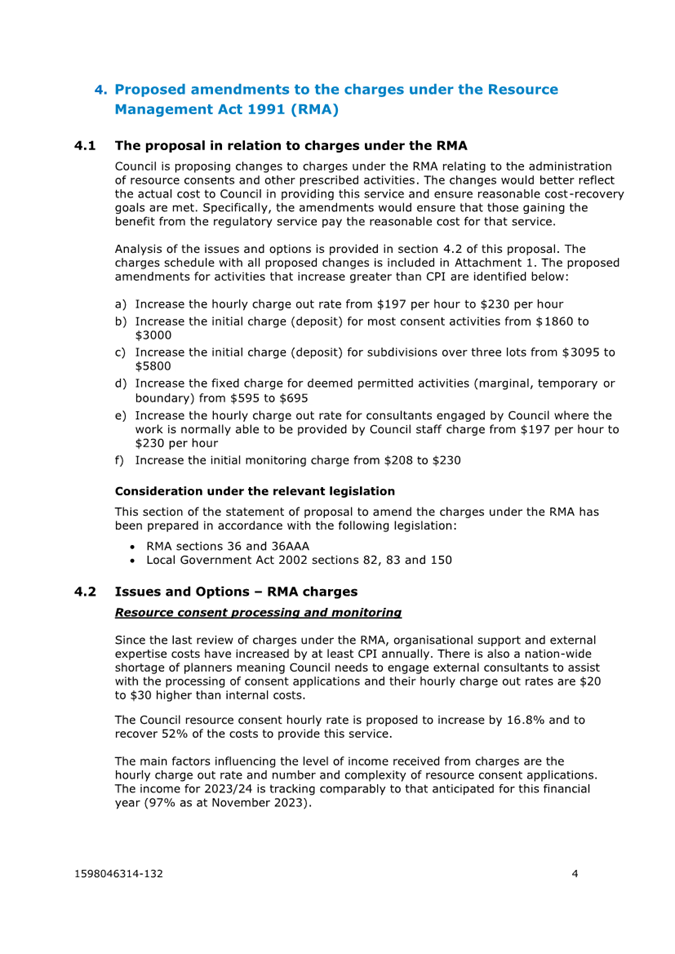

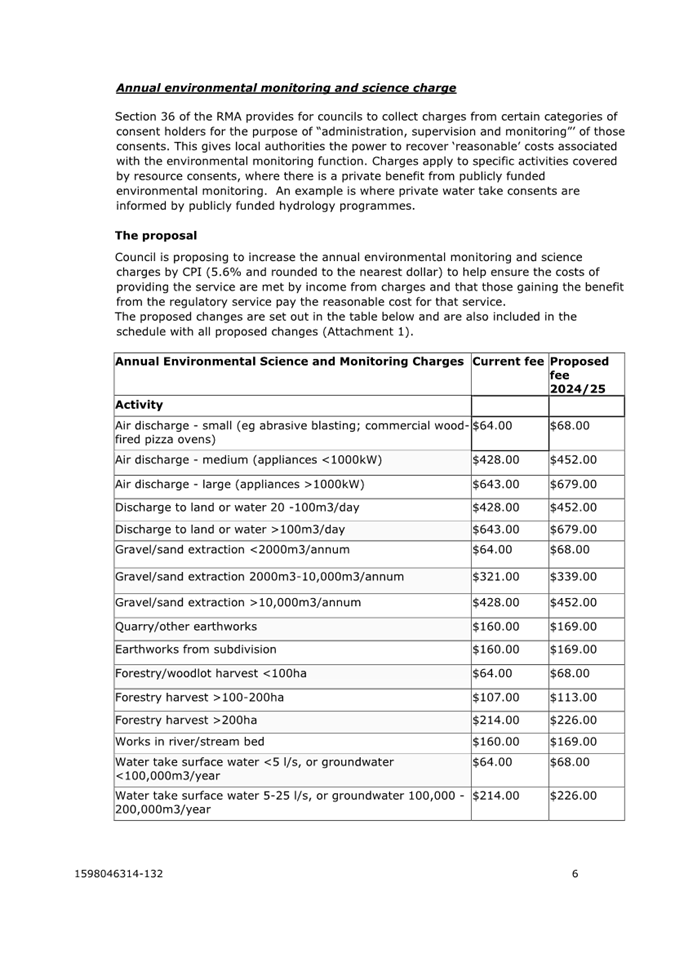

4. Adopts the Statement of Proposal

for the proposed Schedule of Fees and Charges in Attachment 2

(1598046314-132) for those fees and charges that must be consulted on using

the Special Consultative Procedure under section 83 of the Local Government

Act 2002; and

5. Notes that all proposed fee changes

in this report that are not approved by Council, will be consulted on using

the same process (even where the Special Consultative Procedure is not

required); and

6. Agrees a summary of information in

the Statement of Proposal is not necessary to enable public understanding of

the proposal; and

7. Approves the consultation approach

(set out in section 5.10 of this report) and agrees:

a) the approach includes sufficient steps to ensure the

Statement of Proposal will be reasonably accessible to the public and will be

publicised in a manner appropriate to its purpose and significance; and

b) the approach will result in the Statement of Proposal being

as widely publicised as is reasonably practicable as a basis for

consultation.

|

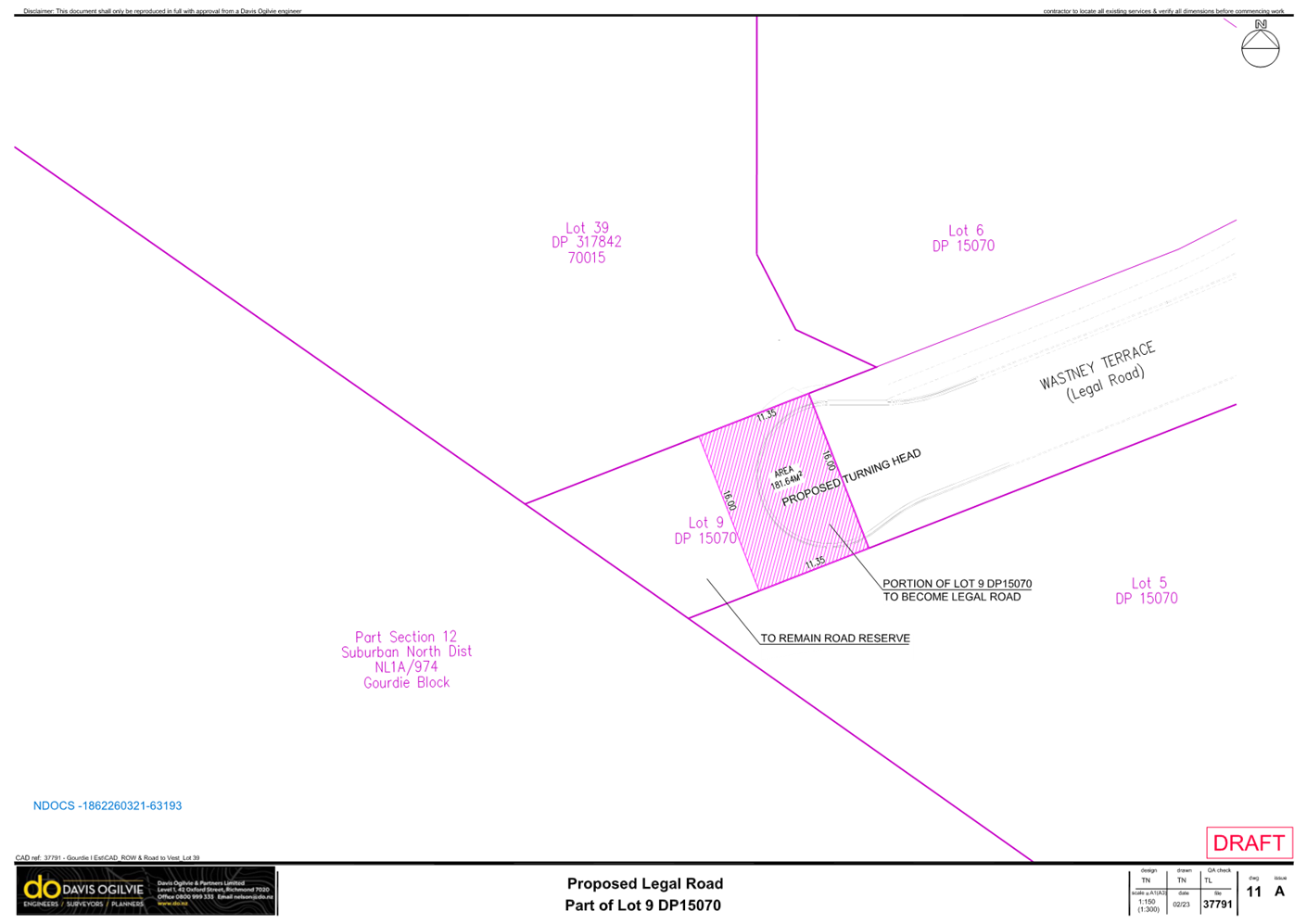

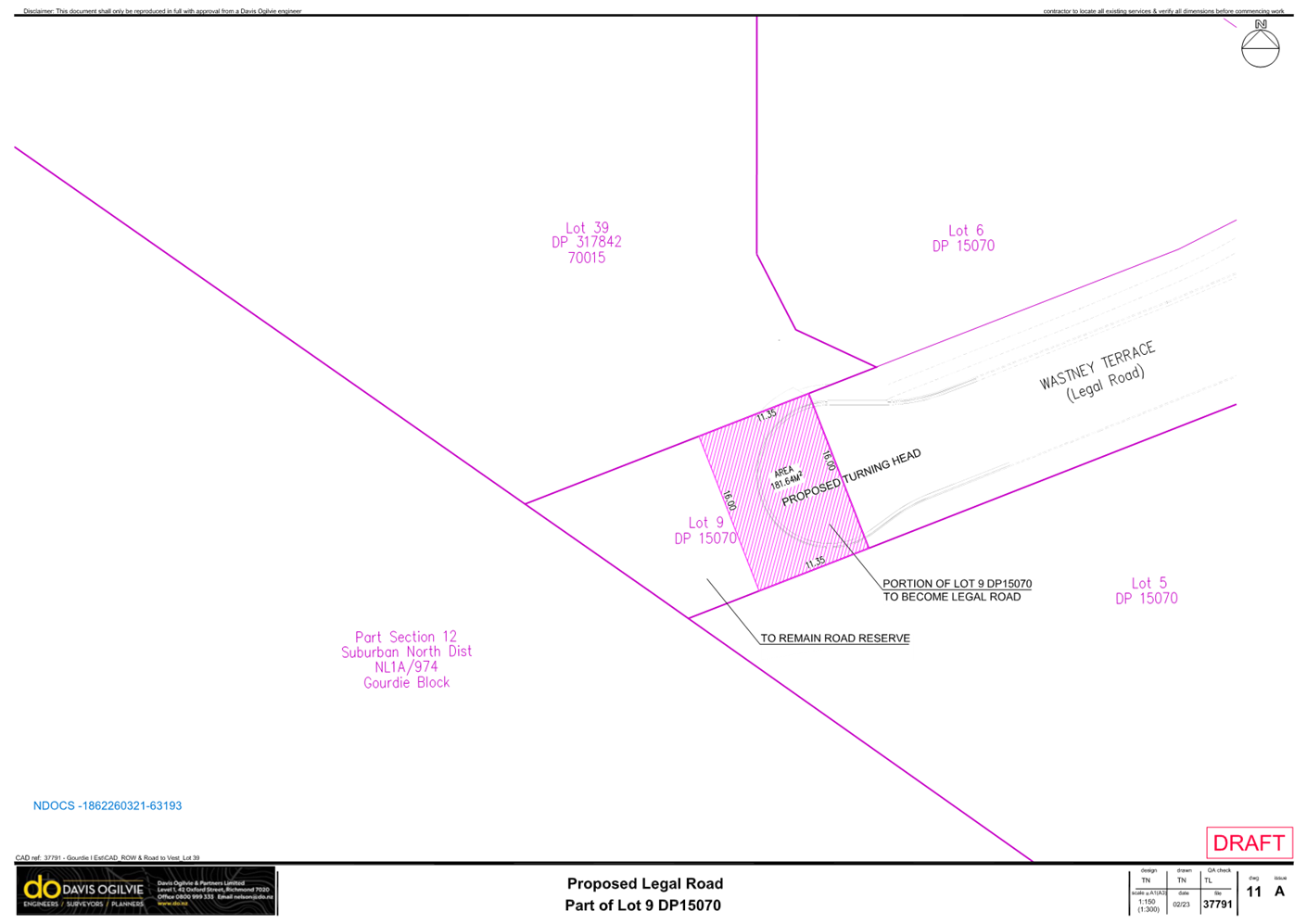

15. Dedication

of Council land to Legal Road - Wastney Terrace 280

- 286

Document number R28242

Recommendation

|

That

the Council

1. Receives the report Dedication of

Council land to Legal Road - Wastney Terrace (R28242) and its attachments

(1862260321-63192 , 1862260321-63193); and

2. Agrees to dedicate the portion of

Road Reserve shown in Attachment 2 (1862260321-63193) of Report R28242 (Lot 9

DP15070 Wastney Terrace, Nelson) as legal road pursuant to Section 111 of the

Reserves Act 1977.

|

Confidential Business

16. Exclusion of the Public

Recommendation

That the Council

1.

Excludes the

public from the following parts of the proceedings of this meeting.

2.

The general subject of each matter to be

considered while the public is excluded, the reason for passing this resolution

in relation to each matter and the specific grounds under section 48(1) of the

Local Government Official Information and Meetings Act 1987 for the passing of

this resolution are as follows:

|

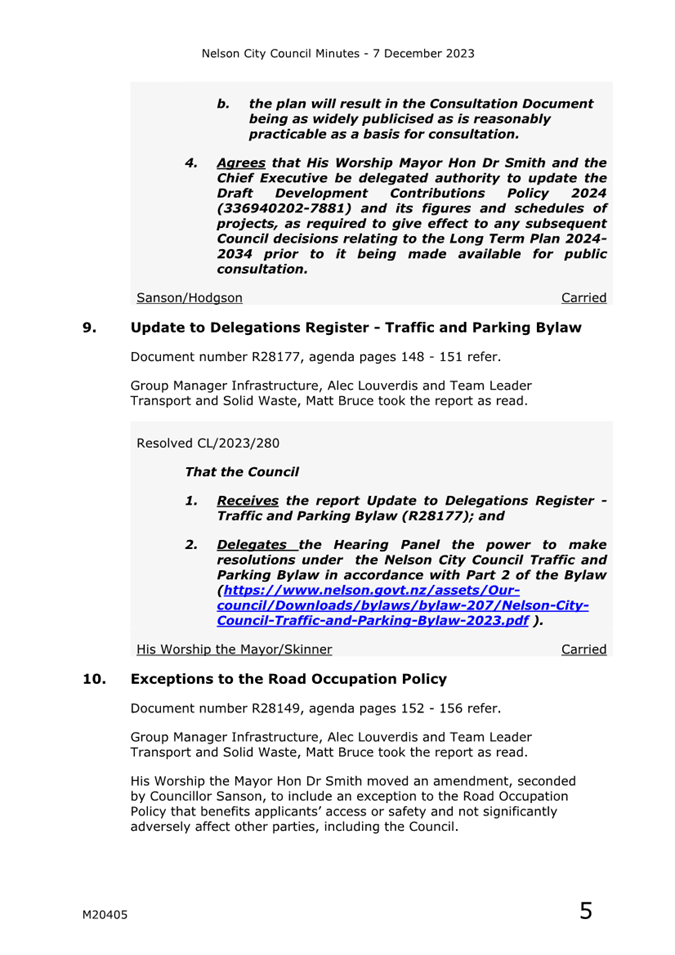

Item

|

General subject of each matter to be

considered

|

Reason for passing this resolution in

relation to each matter

|

Particular interests protected (where

applicable)

|

|

1

|

Council Meeting - Confidential Minutes - 14 December 2023

|

Section

48(1)(a)

The

public conduct of this matter would be likely to result in disclosure of

information for which good reason exists under section 7.

|

The withholding of the information is necessary:

· Section

7(2)(g)

To maintain

legal professional privilege

· Section

7(2)(h)

To enable the

local authority to carry out, without prejudice or disadvantage, commercial

activities

· Section

7(2)(i)

To enable the

local authority to carry on, without prejudice or disadvantage, negotiations

(including commercial and industrial negotiations)

· Section

48(1)(d)

That the

exclusion of the public from the whole or the relevant part of the

proceedings of the meeting is necessary to enable the local authority to

deliberate in private on its decision or recommendation in any proceedings to

which this paragraph applies.

Section 48(2)

Paragraph (d) of subsection (1) applies to -

(a) Any proceedings before a local authority where -

(i) A right of appeal lies to any Court or tribunal against the final

decision of the local authority in those proceedings; or

(ii) The local authority is required, by any enactment, to make a

recommendation in respect of the matter that is the subject of those

proceedings; and

c) Any proceedings of a local authority in relation to any application or

objection under the Marine Farming Act 1971.

· Section

7(2)(j)

To prevent the

disclosure or use of official information for improper gain or improper

advantage

· Section

7(2)(a)

To protect the

privacy of natural persons, including that of a deceased person

|

|

2

|

Confirmation

of Minutes - 7 December 2023

|

Section

48(1)(a)

The public conduct of this

matter would be likely to result in disclosure of information for which good

reason exists under section 7

|

The withholding of the information is necessary:

· Section 7(2)(g)

To maintain legal

professional privilege

· Section 7(2)(i)

To enable the local

authority to carry on, without prejudice or disadvantage, negotiations

(including commercial and industrial negotiations)

|

|

3

|

Visitor Information Services - proposed current and future

approach

|

Section 48(1)(a)

The public

conduct of this matter would be likely to result in disclosure of information

for which good reason exists under section 7

|

The withholding of the information is necessary:

· Section

7(2)(a)

To protect the

privacy of natural persons, including that of a deceased person

· Section

7(2)(i)

To enable the

local authority to carry on, without prejudice or disadvantage, negotiations

(including commercial and industrial negotiations)

|

|

4

|

Statement

of Expectations 2024-2027 - Nelson Regional Development Agency

|

Section

48(1)(a)

The public conduct of this

matter would be likely to result in disclosure of information for which good

reason exists under section 7

|

The withholding of the information is necessary:

· Section 7(2)(i)

To enable the local

authority to carry on, without prejudice or disadvantage, negotiations

(including commercial and industrial negotiations)

|

|

5

|

Statement of Expectations 2024/25 - The Suter Art Gallery Te

Aratoi o Whakatū Trust

|

Section 48(1)(a)

The public

conduct of this matter would be likely to result in disclosure of information

for which good reason exists under section 7

|

The withholding of the information is necessary:

· Section

7(2)(i)

To enable the

local authority to carry on, without prejudice or disadvantage, negotiations

(including commercial and industrial negotiations)

· Section

7(2)(j)

To prevent the

disclosure or use of official information for improper gain or improper

advantage

|

|

6

|

Statement

of Expectations 2024/25 - Nelmac Limited

|

Section

48(1)(a)

The public conduct of this

matter would be likely to result in disclosure of information for which good

reason exists under section 7

|

The withholding of the information is necessary:

· Section 7(2)(i)

To enable the local

authority to carry on, without prejudice or disadvantage, negotiations

(including commercial and industrial negotiations)

|

|

7

|

Statement of Expectations 2024/25 - Nelson Marina

|

Section 48(1)(a)

The public

conduct of this matter would be likely to result in disclosure of information

for which good reason exists under section 7

|

The withholding of the information is necessary:

· Section 7(2)(i)

To enable the

local authority to carry on, without prejudice or disadvantage, negotiations

(including commercial and industrial negotiations)

|

|

8

|

Nelson

Regional Sewerage Business Unit Iwi Representative Appointment

|

Section

48(1)(a)

The public conduct of this

matter would be likely to result in disclosure of information for which good

reason exists under section 7

|

The withholding of the information is necessary:

· Section 7(2)(a)

To protect the privacy of

natural persons, including that of a deceased person

|

Karakia Whakamutanga

Nelson City Council Minutes - 14

December 2023

Present: His

Worship the Mayor N Smith (Chairperson), Councillors M Anderson, M Benge, T

Brand, M Courtney, J Hodgson, R O'Neill-Stevens (Deputy Mayor), K Paki Paki, P

Rainey, C Rollo, R Sanson, T Skinner and A Stallard

In

Attendance: Chief Executive (N Philpott), Deputy Chief

Executive/Group Manager Infrastructure (A Louverdis), Group Manager

Environmental Management (M Bishop), Group Manager Community Services (A

White), Group Manager Corporate Services (N Harrison), Group Manager Strategy

and Communications (N McDonald) Team Leader Governance (R Byrne) and Senior

Governance Adviser (H Wagener)

Apologies : Nil

Karakia

and Mihi Timatanga

1. Apologies

No apologies were received.

2. Confirmation of

Order of Business

There was no change to the order

of business.

3. Interests

There were no updates to the

Interests Register.

His Worship the Mayor Hon Dr

Smith declared an interest in Item 7 Mayor’s Report Clause 17 - Feasibility

study/exploring of options for a Pan Pacific Community Hub and took no part in discussion or voting on the matter.

Councillor Hodgson declared a

non-pecuniary interest in Item 4 of the Confidential Agenda - The Brook Valley

Holiday Park - Revision of Lease Process and took no part in

discussion or voting on the matter.

Councillor Rainey subsequently

declared an Interest in Item 7 Mayor’s Report Clause 15 -

Events Programme and took no part in discussion or voting

on the matter.

4. Public Forum

4.1. Councillor Rich Blalock -

Establishing Sister City Relationship City of Portsmouth, New Hampshire, United

States of America

Document number R28226

|

Councillor Rich Blalock from the City of Portsmouth, New

Hampshire USA, accompanied by Michael Walker, spoke about establishing a

Sister City/Friendship City relationship.

|

5. Confirmation of

Minutes

5.1 9

November 2023

Document number M20350, agenda

pages 15 - 29 refer.

|

Resolved CL/2023/287

|

|

|

That the Council

1. Confirms

the minutes of the meeting of the Council, held on 9 November 2023, as a true

and correct record.

|

|

Courtney/Sanson Carried

|

6. Recommendations from

Committees

6.1 Nelson Regional Sewerage

Business Unit - 28 November 2023

6.1.1 Nelson

Regional Sewerage Business Unit - Business Plan 2024-25

|

Recommendation to Council

CL/2023/288

|

|

|

That the Nelson City Council and Tasman District Councils

1. Receive

the Nelson Regional Sewerage Business Unit Business Plan 2024-25

(1080325921-756), and

2. Approves

the Nelson Regional Sewerage Business Unit Business Plan 2024-25

(1080325921-756).

|

|

Paki Paki/Skinner Carried

|

6.1.2 Nelson

Regional Sewerage Business Unit - Activity Management Plan 2024-34

|

Recommendation to Council

CL/2023/289

|

|

|

That the Nelson City Council and Tasman District Councils

1. Receive

the Nelson Regional Sewerage Business Unit Activity Management Plan 2024-34

(1080325921-753); and

2. Approves

the Nelson Regional Sewerage Business Unit Activity Management Plan

2024-34 (1080325921-753) as the version to inform the development of the

Long Term Plan 2024-34.

3. Notes

that the Nelson Regional Sewerage Business Unit Activity Management Plan

2024-34 (1080325921-753) will be updated, and the final Activity Management

Plan approved by Council after the adoption of the Long Term Plan 2024-2034.

|

|

Paki Paki/Skinner Carried

|

6.2 Nelson Tasman Regional Landfill

Business Unit - 1 December 2023

6.2.1 Nelson

Tasman Regional Landfill Business Unit - Activity Management Plan 2024-34

General Manager Regional Services,

Nathan Clarke answered questions about opportunities for diversion of waste,

the lifespan and capacity of the landfill.

|

Recommendation to Council

CL/2023/290

|

|

|

That the Nelson City Council and Tasman District Councils

1. Receive

the Nelson Tasman Regional Landfill Business Unit Activity Management Plan

2024-34 (1399367370-8789); and

2. Approve

the Nelson Tasman Regional Landfill Business Unit Activity Management Plan

2023-34 (1399367370-8789) as the version to inform the development of the

Long Term Plan 2024-34.

3. Notes

that the Nelson Tasman Regional Landfill Business Unit Activity Management

Plan 2023-24 (1399367370-8789) will be updated, and the final Activity

Management Plan approved by Council after the adoption of the Long Term Plan

2024-2034.

|

|

Courtney/Stallard Carried

|

6.2.2 Nelson

Tasman Regional Landfill Business Unit - Business Plan 2024-25

|

Recommendation to Council

CL/2023/291

|

|

|

That Nelson City Council and Tasman District Councils

1. Receive

the Nelson Tasman Regional Landfill Business Unit Business Plan 2024-25 (1399367370-8784); and

2. Approve the Nelson Tasman

Regional Landfill Business Unit Business Plan 2024-25 (1399367370-8784).

|

|

Courtney/Stallard Carried

|

6.3 Regional Pest Management Joint

Committee - 8 December 2023

6.3.1 Regional Pest

Management Plan 2019 – 2029 Partial Review Consultation report

RRPMC23-12-1

|

Resolved CL/2023/292

|

|

|

That the Council

1. Approves

public notification of the draft Regional Pest Management Plan 2019 –

2029 Partial Review Consultation document for the partial review of the

Tasman–Nelson Regional Pest Management Plan 2019-2029, commencing 23

February 2024, for a period of one month, closing on 23 March 2024 .

|

|

Benge/Sanson Carried

|

7. Mayor's Report

Document number R28221

His Worship the Mayor Hon

Dr Smith took the report as read and noted that as the report included his

requests for inclusion in the Draft Long Term Plan and requests from other

Elected Members, each clause would be debated and voted on separately. A

request was received to vote each clause by division.

|

Clause 1 – Receiving Report

|

|

Resolved CL/2023/293

|

|

|

That the Council

1. Receives

the report Mayor's Report (R28221); and

|

|

His Worship the Mayor/O'Neill-Stevens Carried

|

|

Clause

2 – Separate rate for August 2022 storm recovery

His

Worship the Mayor Hon Dr Smith, Chief Executive, Nigel Philpott and Group

Manager Corporate Services, Nikki Harrison, answered questions on uniform and

proportional rating options, equity and transparency.

|

|

Resolved CL/2023/294

|

|

1. Approves for

consultation in the Long Term Plan 2024-34 Consultation Document that the

expected net cost to Council of $59.8 million for recovery from the August

2022 storm be funded by a separate rate set on a uniform basis of $330 per

rateable unit including GST for the ten year period 2024-25 to 2034-35; and

|

The motion was put and a

division was called:

|

|

For

His

Worship the Mayor Smith (Chairperson)

Cr

Anderson

Cr

Benge

Cr

Brand

Cr

Courtney

Cr

Hodgson

Cr

O'Neill-Stevens

Cr Paki

Paki

Cr

Rainey

Cr

Rollo

Cr

Sanson

Cr

Skinner

Cr

Stallard

|

Against

Nil

|

|

|

The

motion was carried 13 - 0.

|

|

|

His Worship the Mayor/Brand Carried

|

|

Clause

3 – Stormwater/river catchment spilt and extension

His

Worship the Mayor Hon Dr Smith answered a question on inclusion of stormwater

activity rates based on land value.

|

|

Resolved CL/2023/295

|

|

2. Approves

for consultation in the Long Term Plan 2024-34 Consultation Document:

a. Separating

the stormwater and flood protection activities into a uniform charge for the

former and a rate based on land value for the latter;

b. Extending

the flood protection rate across the region to include the Nelson North

communities;

c. Changing

the uniform charge for flood protection to a rate based on land value;

d. Retaining the

charge for stormwater as a uniform charge and extending the exclusion to

include properties in the rural zone; and

|

The motion was put and a

division was called:

|

|

For

His

Worship the Mayor Smith (Chairperson)

Cr

Anderson

Cr

Benge

Cr

Brand

Cr

Courtney

Cr

Hodgson

Cr

O'Neill-Stevens

Cr Paki

Paki

Cr

Rainey

Cr

Rollo

Cr

Sanson

Cr

Skinner

Cr

Stallard

|

Against

Nil

|

|

|

The

motion was carried 13 - 0.

|

|

|

His Worship the Mayor/Stallard Carried

|

|

The

meeting was adjourned from 10.24a.m. until 10.35a.m.

|

|

Clause

4 - Three Waters reform

His

Worship the Mayor Hon Dr Smith tabled

supporting information (1982984479-6935).

|

|

Resolved CL/2023/296

|

|

3. Requests

that officers prepare the Long Term Plan 2024-34 Consultation Document on the

basis that the Three Waters Reform does not proceed and continue, as with

previous Long Term Plans, to include provision for the ongoing management and

investment in Council’s drinking water, wastewater and stormwater

assets; and

|

The motion was put and a

division was called:

|

|

For

His

Worship the Mayor Smith (Chairperson)

Cr

Anderson

Cr

Benge

Cr

Brand

Cr

Courtney

Cr

Hodgson

Cr O'Neill-Stevens

Cr Paki

Paki

Cr

Rainey

Cr

Rollo

Cr

Sanson

Cr

Skinner

Cr

Stallard

|

Against

Nil

|

|

|

The

motion was carried 13 - 0.

|

|

|

His Worship the Mayor/O'Neill-Stevens Carried

|

|

Clause

5 – Rates cap policy

His Worship the Mayor Hon Dr Smith, Chief Executive,

Nigel Philpott and Group Manager Corporate Services, Nikki Harrison, answered

questions on the advantages and disadvantages of Council using the Consumer

Price Index and the Local Government Cost Index for setting a cap on rate

increases in the Long Term Plan.

|

|

5. Approves

including in the Long Term Plan 2024-34 Consultation Document the phasing in

of a new Rates Cap Policy of CPI + growth from the current policy of Local

Government Cost Index (LGCI) + 2.5% plus growth with LGCI + 2.5% plus growth

in Year 1, LGCI + 2% plus growth in Year 2, LGCI + 1.5% plus growth in Year

3, LGCI + 1% plus growth in Year 4 and CPI + growth for Years 5-10; and

|

The motion was put and a

division was called:

|

|

For

His

Worship the Mayor Smith (Chairperson)

Cr

Anderson

Cr

Benge

Cr

Brand

Cr

Courtney

Cr Paki

Paki

Cr

Rollo

|

Against

Cr

Hodgson

Cr

O'Neill-Stevens

Cr

Rainey

Cr

Sanson

Cr

Skinner

Cr

Stallard

|

|

|

The

motion was carried 7 - 6. See note below, the motion was reput.

|

|

|

His Worship the Mayor/Courtney Carried

|

|

Subsequently, later in the meeting the resolution under

clause 5 on the Mayor’s Report was reconsidered, as members had

expressed concern that they had not fully understood the clause. Standing

Orders were temporarily suspended in order for members to revote.

|

|

Clause

6 – Debt Cap Policy

His Worship the Mayor Hon Dr Smith, Chief Executive,

Nigel Philpott and Group Manager Corporate Services, Nikki Harrison answered

questions on the short- and long-term implications of exceeding the debt cap

set by Council.

|

|

Resolved CL/2023/297

|

|

4. Approves for consultation in the Long Term Plan 2024-34

Consultation Document an increase of the Debt Cap Policy from the Long Term

Plan 2021-31 of net external debt not exceeding 175% of Council revenue to a

new debt cap of not exceeding 200% of Council revenue; and

|

The motion was put and a

division was called:

|

|

For

His

Worship the Mayor Smith (Chairperson)

Cr

Anderson

Cr

Benge

Cr

Brand

Cr

Courtney

Cr

Hodgson

Cr

O'Neill-Stevens

Cr Paki

Paki

Cr

Rainey

Cr

Rollo

Cr

Sanson

Cr

Skinner

Cr

Stallard

|

Against

Nil

|

|

|

The

motion was carried 13 - 0.

|

|

|

His Worship the Mayor/Rainey Carried

|

|

The

meeting was adjourned from 11.42a.m. until 11.52a.m.

|

|

Clause

7 - Nelson Centre of Musical Arts’ debt write-off

His

Worship the Mayor Hon Dr Smith and Group Manager Corporate Services, Nikki

Harrison, answered questions on the effect on rates of the proposed write-off

of Nelson Centre of Musical Arts’ debt to Council, commensurate

reduction of their annual grant and setting of a precedent of debt

forgiveness for other community groups. The motion was amended with the mover

and seconder’s agreement to clarify that the debt repayment portion of

the annual grant to the Nelson Centre of Musical Arts be removed.

|

|

The meeting was adjourned from

12.00p.m until 12.06p.m.

|

|

Resolved

|

|

5. Approves for consultation in the

Long Term Plan 2024-34 Consultation Document the proposed write-off of the

Nelson Centre of Musical Arts’ debt to Council of $730,000 at $73,000

per year over the 10 years of the Long Term Plan and that the debt repayment

portion of the annual grant of $33,000 per year to the Nelson Centre of

Musical Arts be removed; and

|

The motion was put and a

division was called:

|

|

For

Cr

Anderson

Cr

O'Neill-Stevens

Cr Paki

Paki

Cr

Rainey

Cr

Sanson

Cr

Stallard

|

Against

His

Worship the Mayor Smith (Chairperson)

Cr

Benge

Cr Brand

Cr

Courtney

Cr

Hodgson

Cr

Rollo

Cr

Skinner

|

|

|

The

motion was lost 6 - 7.

|

|

|

Rainey/Sanson Lost

|

|

Clause

8 - Tāhunanui Beach facilities

His Worship the Mayor Hon Dr Smith, Group Manager

Community Services, Andrew White and Group Manager Infrastructure, Alec

Louverdis answered questions about the membership and capacity of Nelson Surf

Life Saving Club to raise the requisite funds, and the development,

ownership, maintenance, use and management of the facility. The motion was

amended with the mover and seconder’s agreement to reflect updated

financial information.

|

|

The meeting was adjourned from 1.04 p.m. until 2.17 p.m.

|

|

Resolved CL/2023/298

|

|

8. Approves

for consultation in the Long Term Plan 2024-34 Consultation Document capital

funding of $200,000 in Year 1 (2024-25), $1.52 million in Year 2 (2025-26)

and $1.53 million in Year 3 (2026 - 27) to enable stage one and two of the

Tāhunanui Beach upgrade to be progressed, noting the Nelson Surf Life

Saving Club facility development requires a 50% contribution from the club of

$1.6 million; and

|

The motion was put and a

division was called:

|

|

For

His

Worship the Mayor Smith (Chairperson)

Cr

Anderson

Cr

Benge

Cr

Courtney

Cr

O'Neill-Stevens

Cr

Rollo

Cr

Skinner

|

Against

Cr

Brand

Cr

Hodgson

Cr Paki

Paki

Cr

Rainey

Cr

Sanson

Cr

Stallard

|

|

|

The

motion was carried 7-6.

|

|

|

His Worship the Mayor/Rollo Carried

|

|

Clause

9 - Arts hub capital funding

His

Worship the Mayor Hon Dr Smith answered a question on the future of the

existing temporary arts hub.

|

|

Resolved CL/2023/299

|

|

9. Approves

for consultation in the Long Term Plan 2024-34 Consultation Document that

$1.6 million be allocated in Year 4 (2027-28) of the Plan for the development

of a central city community arts hub; and

|

The motion was put and a

division was called:

|

|

For

His

Worship the Mayor Smith (Chairperson)

Cr

Anderson

Cr

Benge

Cr

Brand

Cr

Courtney

Cr

O'Neill-Stevens

Cr Paki

Paki

Cr

Rainey

Cr

Rollo

Cr

Sanson

Cr

Skinner

Cr

Stallard

|

Against

Cr

Hodgson

|

|

|

The motion

was carried 12 - 1.

|

|

|

O'Neill-Stevens/Anderson Carried

|

|

The meeting was adjourned from 2.58p.m. until

3.15p.m.

|

|

Extension of Meeting Time

|

|

Resolved CL/2023/300

|

|

That the Council

1. Extends the meeting time beyond six hours, pursuant to Standing

Order 4.2.

|

|

Paki Paki/Rainey Carried

|

|

Clause 5 – Using

Consumer Price Index (revote)

His Worship the Mayor Hon Dr Smith advised that some

members had expressed concern that they had not fully understood Clause 5 of

the Mayor’s Report and he proposed temporarily suspending Standing

Orders in order to reconsider the decision.

|

|

Resolved CL/2023/301

|

|

That

the Council

1. Temporarily

suspends Nelson City Council Standing Order 24 to reconsider resolution of

clause 5 of the Mayor’s Report

|

The motion was put and a

division was called:

|

|

For

His

Worship the Mayor Smith (Chairperson)

Cr Anderson

Cr

Brand

Cr

Hodgson

Cr

O'Neill-Stevens

Cr Paki

Paki

Cr

Rainey

Cr

Rollo

Cr

Sanson

Cr

Skinner

Cr

Stallard

|

Against

Cr

Benge

Cr

Courtney

|

|

|

The

motion was carried 11 - 2.

|

|

|

His Worship the Mayor/O'Neill-Stevens Carried

|

|

5. Approves

including in the Long Term Plan 2024-34 Consultation Document the phasing in

of a new Rates Cap Policy of CPI + growth from the current policy of Local

Government Cost Index (LGCI) + 2.5% plus growth with LGCI + 2.5% plus growth

in Year 1, LGCI + 2% plus growth in Year 2, LGCI + 1.5% plus growth in Year

3, LGCI + 1% plus growth in Year 4 and CPI + growth for Years 5-10; and

|

The motion was put and a

division was called:

|

|

For

His

Worship the Mayor Smith (Chairperson)

Cr

Benge

Cr

Courtney

|

Against

Cr

Anderson

Cr

Brand

Cr

Hodgson

Cr

O'Neill-Stevens

Cr Paki

Paki

Cr

Rainey

Cr

Rollo

Cr

Sanson

Cr

Skinner

Cr

Stallard

|

|

|

The

motion was lost 3 - 10.

|

|

|

His Worship the Mayor/Courtney

|

|

Clause

10 - All-Weather Sports Turf

His Worship the Mayor Hon Dr

Smith and Group Manager Community Services, Andrew White answered questions

on lighting, ownership and maintenance of the grounds, alternative sites,

lifespan and sustainability of the grounds, use by multiple users, fencing, and

developments at other sites.

|

|

Resolved CL/2023/302

|

|

10. Approves

including in the Long Term Plan 2024-34 Consultation Document capital funding

of $1.3250 million in Year 2 (2025-26) and $1.325 million in Year 3 (2026-27)

for an all-weather sports turf, noting that sports clubs would be required to

contribute 50% of the cost ($1.325m); and

|

The motion was put and a

division was called:

|

|

For

Cr

Smith (Chairperson)

Cr

Anderson

Cr

Benge

Cr

Courtney

Cr

Hodgson

Cr

O'Neill-Stevens

Cr Paki

Paki

Cr

Rollo

Cr

Skinner

|

Against

Cr

Brand

Cr

Rainey

Cr

Sanson

Cr

Stallard

|

|

|

The

motion was carried 9 - 4.

|

|

|

Skinner/Rollo Carried

|

|

The meeting was adjourned from 4.18p.m.

until 4.30p.m.

|

|

Clause

11 - Hill Street-Suffolk Road link

His Worship the Mayor Hon Dr

Smith, Group Manager Infrastructure, Alec Louverdis and Group Manager

Corporate Services, Nikki Harrison, answered questions on transport

infrastructure investment, potential contributions from developers and Waka

Kotahi, inclusion of the project in the Long Term Plan and Regional Transport

Plan and the timing and development of a business case.

|

|

11. Approves for consultation in the Long

Term Plan 2024-34 Consultation Document that net capital funding $4 million

per year in Years 4, 5 and 6 (2027-28, 2028-29 and 2029-30) be included for a

new road link between Hill Street North and Suffolk Road, subject to NZ

Transport Agency-Waka Kotahi subsidies, significant development contributions

from adjoining developments and possible contributions from Tasman District

Council; and

|

The motion was put and a

division was called:

|

|

For

His

Worship the Mayor Smith (Chairperson)

Cr

Benge

Cr

Courtney

Cr

Skinner

|

Against

Cr

Anderson

Cr

Brand

Cr

Hodgson

Cr

O'Neill-Stevens

Cr Paki

Paki

Cr Rainey

Cr

Rollo

Cr

Sanson

Cr

Stallard

|

|

|

The

motion was lost 4 - 9.

|

|

|

His Worship the Mayor/Benge

|

|

Clause

12 - East-west cycleway

His Worship the Mayor Hon Dr

Smith and Group Manager Infrastructure, Alec Louverdis answered questions on

timing of the project, development of a business case and availability of

funding from Waka Kotahi.

|

|

Resolved CL/2023/303 Lost

|

|

12. Approves

for consultation in the Long Term Plan 2024-34 Consultation Document capital

funding for Council’s share of the east-west cycle link with $0.5

million in Year 2, $4 million in Year 3 and $0.9 million in Year 4, subject

to receiving the 51% NZ Transport Agency-Waka Kotahi Funding Assistance Rate

subsidy; and

|

The motion was put and a

division was called:

|

|

For

His

Worship the Mayor Smith (Chairperson)

Cr

Anderson

Cr

Brand

Cr

Courtney

Cr

Hodgson

Cr

O'Neill-Stevens

Cr Paki

Paki

Cr

Rainey

Cr

Rollo

Cr

Sanson

Cr

Skinner

Cr

Stallard

|

Against

Cr

Benge

|

|

|

The

motion was carried 12 - 1.

|

|

|

Stallard/Sanson Carried

|

|

Attachments

1 1982984479-6935 -

Council 14Dec2023 tabled letter from Minister - Water Services

|

The item was adjourned in

order to move in to Confidential Session to consider Item 5 of the Confidential

Agenda.

8 Exclusion of

the Public

|

Resolved CL/2023/304

|

|

|

That the Council

1. Excludes

the public from the following parts of the proceedings of this meeting.

2. The

general subject of each matter to be considered while the public is excluded,

the reason for passing this resolution in relation to each matter and the

specific grounds under section 48(1) of the Local Government Official

Information and Meetings Act 1987 for the passing of this resolution are as

follows:

|

5

|

Plan Change 31 - Hearing Panel recommendations

|

Section

48(1)(a)

The public conduct of

this matter would be likely to result in disclosure of information for

which good reason exists under section 7

|

The withholding of the information is

necessary:

· Section 48(1)(d)

That the

exclusion of the public from the whole or the relevant part of the

proceedings of the meeting is necessary to enable the local authority to

deliberate in private on its decision or recommendation in any proceedings

to which this paragraph applies.

Section 48(2)

Paragraph (d) of subsection (1) applies to -

(a) Any proceedings before a local authority where -

(i) A right of appeal lies to any Court or tribunal against the final

decision of the local authority in those proceedings; or

(ii) The local authority is required, by any enactment, to make a

recommendation in respect of the matter that is the subject of those

proceedings; and

c) Any proceedings of a local authority in relation to any application or

objection under the Marine Farming Act 1971.

|

|

|

His Worship the Mayor/Paki Paki Carried

|

The meeting went into confidential session at 6.00p.m.

and resumed in public session at 6.15p.m. at which time the meeting adjourned,

to be reconvened at 9.00a.m. on Friday 15 December 2023.

Present: His

Worship the Mayor N Smith (Chairperson), Councillors M Anderson, M Benge, T

Brand, M Courtney, J Hodgson, R O'Neill-Stevens (Deputy Mayor), K Paki Paki, P

Rainey, C Rollo, R Sanson, T Skinner and A Stallard

In

Attendance: Chief Executive (N Philpott), Deputy Chief

Executive/Group Manager Infrastructure (A Louverdis), Group Manager

Environmental Management (M Bishop), Group Manager Community Services (A

White), Group Manager Corporate Services (N Harrison), Group Manager Strategy

and Communications (N McDonald) Team Leader Governance (R Byrne) and Senior

Governance Adviser (H Wagener)

Apologies : Nil

Karakia

and Mihi Timatanga

9 Mayor's Report

– Reconvened (Agenda Item 7)

|

Clause 13 - Removal from

previous LTP of kerbside kitchen waste collection service

His Worship the Mayor Hon Dr

Smith and Group Manager Infrastructure, Alec Louverdis answered questions on

the long term costs to ratepayers of and community participation in the

kerbside kitchen waste collection service, the development of a business

case, use of Waste Management and Minimisation Plan levy funding, waste

collection services in Nelson City and Tasman District, community

participation in similar services in other territorial authorities and prior

consultation with iwi in terms of Together Te Tauihu – A Partnership

Agreement for a Stronger Te Tauihu.

His Worship the Mayor Hon Dr

Smith, seconded by Councillor Hodgson moved the item, during debate a

closure motion was moved.

|

|

Resolved CL/2023/305

|

|

|

That the Council

1. Puts

the motion under debate, pursuant to Standing Order 25.2(b).

|

|

O'Neill-Stevens/Sanson Carried

|

|

13. Approves for consultation in the Long Term Plan

2024-34 Consultation Document removal of the kerbside kitchen waste

collection service funding, provided for in the previous LTP 2021-31,

resulting in savings of $75,000 in Year 1, $76,650 in Year 2, $104,550 in

Year 3, $1.471 million in Year 4, $1.476 million in Year 5, $1.507 million in

Year 6, $1.537 million in Year 7, $1.515 million in Year 8, $1.539 million in

year 9 and $1.573 million in Year 10, totalling $10.875 million in savings;

and

|

The motion was put and a

division was called:

|

|

For

His

Worship the Mayor Smith (Chairperson)

Cr

Benge

Cr Brand

Cr

Hodgson

Cr

Rollo

Cr

Skinner

|

Against

Cr

Anderson

Cr

Courtney

Cr

O'Neill-Stevens

Cr Paki

Paki

Cr

Rainey

Cr

Sanson

Cr

Stallard

|

|

|

The

motion was lost 6 - 7.

|

|

|

His Worship the Mayor/Hodgson Lost

|

|

The meeting was adjourned from 10.45a.m. until 10.53a.m.

at which time Councillor Skinner was not in attendance.

|

|

Clause

14 - Hanging Flower Baskets

Attendance: Councillor Skinner

joined the meeting at 11.03a.m.

|

|

Resolved CL/2023/306

|

|

14. Approves for

consultation in the draft Long Term Plan 2024-34 budget sufficient funding,

estimated at $100,000 per annum, to maintain the city hanging flower baskets;

and

|

The motion was put and a

division was called:

|

|

For

His

Worship the Mayor Hon Dr Smith (Chairperson)

Cr

Anderson

Cr

Benge

Cr Brand

Cr

Courtney

Cr

O'Neill-Stevens

Cr Paki

Paki

Cr

Rollo

|

Against

Cr

Hodgson

Cr

Rainey

Cr

Sanson

Cr

Skinner

Cr

Stallard

|

|

|

The

motion was carried 8 - 5.

|

|

|

Courtney/Rollo Carried

|

|

Clause

15 - Events funding cap

Councillor Rainey subsequently declared an interest in

Item 5 Mayor’s Report, Clause 15. He took no part in discussion or

voting on the matter.

|

|

15. Approves

for consultation in the Long Term Plan 2024-34 Consultation Document an

events budget capped at $1.780 million (the current 2023-24 budget) for each

year, resulting in savings over the current draft LTP of $60,000 in Year 1

(2024-25), $225,000 in Year 2 (2025-26), $180,000 in Year 3 (2026-27) and

totalling $3 million over the 10-year LTP and for Council officers to review

the proposed events programme and budgets including exploring greater

sponsorship and partnering so as to achieve the optimum economic, community

and cultural benefits within this capped budget; and

|

The motion was put and a

division was called:

|

|

For

His

Worship the Mayor Hon Dr Smith (Chairperson)

Cr

Benge

Cr

Brand

Cr

Hodgson

Cr

Skinner

|

Against

Cr

Anderson

Cr

Courtney

Cr

O'Neill-Stevens

Cr Paki

Paki

Cr

Rollo

Cr

Sanson

Cr

Stallard

|

Abstained/Interest

Cr

Rainey

|

|

The

motion was lost 5 - 7. Lost

|

|

|

His Worship the Mayor/Skinner

|

|

Additional

Clause 17 - Pasifika Community Priority Projects

Councillor

Anderson, seconded by Councillor Paki Paki proposed an additional

clause to provide in the Long Term Plan 2024-34 Consultation Document a

budget allocation in Year 1 of up to $20,000 for a feasibility

study/exploring of options for a Pan Pacific Community Hub. His Worship

the Mayor Hon Dr Smith declared an interest and vacated the chair at 11.40

a.m. The Deputy Mayor O'Neill-Stevens assumed the chair.

|

|

The

meeting was adjourned from 11.44 a.m. until 11.58 a.m.

The

motion was amended with the mover and seconder’s agreement to allocate

the proposed funding to provide for staff resource to engage with the

Pasifika community.

|

|

Resolved CL/2023/307

|

|

17. Approves for

consultation in the Long Term Plan 2024-34 Consultation Document a budget

allocation in Year 1 of up to $20,000 to provide staff resource to engage

with the Pasifika Community on priority projects.

|

The motion was put and a

division was called:

|

|

For

Cr

Anderson

Cr

Benge

Cr

Brand

Cr

Courtney

Cr

Hodgson

Cr

O'Neill-Stevens

Cr Paki

Paki

Cr

Rainey

Cr

Rollo

Cr

Sanson

Cr

Stallard

|

Against

Cr

Skinner

|

Abstained/Interest

His

Worship the Mayor Hon Dr Smith (Chairperson)

|

|

The

motion was carried 11 - 1.

|

|

|

Anderson/Paki Paki Carried

|

|

Clause

16 – Refinement of Long Term Plan Budget

His Worship the Mayor Hon Dr

Smith answered questions on inclusion of elected members in the process to

make changes.

|

|

Resolved CL/2023/308

|

|

16. Agrees

that the Chief Executive and His Worship the Mayor continue to work on

refining the Long Term Plan budget so as to temper the rates increases, as

long as any refinements are consistent with Council discussions or decisions,

prior to the finalising of the LTP Consultation Document by Council in March

|

The motion was put and a

division was called:

|

|

For

His

Worship the Mayor Hon Dr Smith (Chairperson)

Cr

Anderson

Cr

Benge

Cr

Brand

Cr

Courtney

Cr

Hodgson

Cr

O'Neill-Stevens

Cr Paki

Paki

Cr

Rollo

Cr

Skinner

|

Against

Cr

Rainey

Cr

Sanson

Cr

Stallard

|

|

|

The

motion was carried 10 - 3.

|

|

|

His Worship the Mayor/Skinner Carried

|

Attendance: Councillor Skinner

left the meeting 12.10 p.m.

Attendance: Councillor O'Neill-Stevens

left the meeting 12.15 p.m.

10. Long Term Plan 2024-2034

Supporting Information and change to Rates Remission Policy (Item 8 of the

Agenda)

Document number R28167, agenda

pages 56 - 91 refer.

Group Manager Strategy and

Communications, Nicky McDonald, and Acting Manager Strategy, Susan Coleman took

the report as read.

Councillor Stallard moved, seconded by Councillor

Paki Paki, the officer’s recommendation to include amending Draft

Community Outcomes (1852948764-460) (p64 of the Agenda) to replace

“growing population” with “our population”.

|

Resolved CL/2023/309

|

|

|

That

the Council

1. Receives

the report Long Term Plan 2024-2034 Supporting Information and change to

Rates Remission Policy (R28167) and its attachments (1852948764-433, 1852948764-460,

1852948764-398, 1852948764-399, 1852948764-265);

and

2. Adopts

the following documents as supporting information for Nelson’s Long

Term Plan 2024-2034 Consultation Document as required by section 93G of the

Local Government Act 2002:

2.1 Draft Vision and Priorities (1852948764-433)

2.2 Draft Community Outcomes (1852948764-460) amended to

replace “growing population” with “our population”.

2.3 Draft Statement on Fostering Māori Participation in Council Decision

Making (1852948764-398)

2.4 Draft Forecasting Assumptions

(1852948764-399); and

3. Agrees

that His Worship Mayor Hon Dr Smith and the Chief Executive be delegated

authority to approve any minor amendments required to the supporting

information included in Report R28167, prior to it being made available for

public consultation, including any amendments necessary to address any

legislative requirements prior to the consultation occurring; and

4. Adopts

the revised Draft Rates Remission

Policy

(1852948764-265),

updated to remove the Heritage Buildings remission, for public consultation

in accordance with sections 102, 109, 82 and 82A of the Local Government Act

2002; and

5. Notes

that Council has previously agreed to the consultation on the Draft Rates

Remission Policy occurring at the same time as the Long Term Plan 2024-2034

consultation process, and that His Worship Mayor Hon Dr Smith and the Chief

Executive may approve any minor amendments to the Policy prior to it being

made publicly available.

|

|

His Worship the Mayor/Hodgson Carried

|

The meeting was adjourned from

12.51 p.m. until 1.17 p.m. at which time Councillor Rainey left

the meeting.

11. Change in Marina Governance

from Management CCO to Asset Owning CCO - Transfer of Marina Assets and

Liabilities to CCO (Item 9 of the Agenda)

Document number R28179, agenda

pages 92 - 121 refer.

Group Manager Community Services, Andrew White and

Marina Manager, Nigel Skeggs took the report as read and answered questions on

the location of the proposed cycleway, the management of sea sport facility

development and the establishment of a Council Controlled trading Organisation.

|

Resolved CL/2023/310

|

|

|

That

the Council

1. Receives

the report Change in Marina Governance from Management Council Controlled Organisation

to Asset Owning Council Controlled Organisation - Transfer of Marina Assets

and Liabilities to Council Controlled Organisation (R28179) and its

attachments (149934158-12067, 149934158-12069, 149934158-12071, and

149934158- 12096); and

2. Approves

the establishment of an Asset Owning Council Controlled Organisation as the

preferred governance model for Nelson Marina; and

3. Agrees,

subject to consultation, to provide for the transfer of the Marina assets and

liabilities to the Marina Council Controlled Organisation in the Long Term

Plan; and

4. Agrees to

consult with the community through the Long Term Plan 2024-34 Consultation

document on the change from a Management Council Controlled Organisation to

an Asset Owning Council Controlled Organisation for Nelson Marina, and the

transfer of the Council’s Marina assets and liabilities to Asset Owning

Council Controlled Organisation for Nelson Marina.

|

|

Brand/Skinner Carried

|

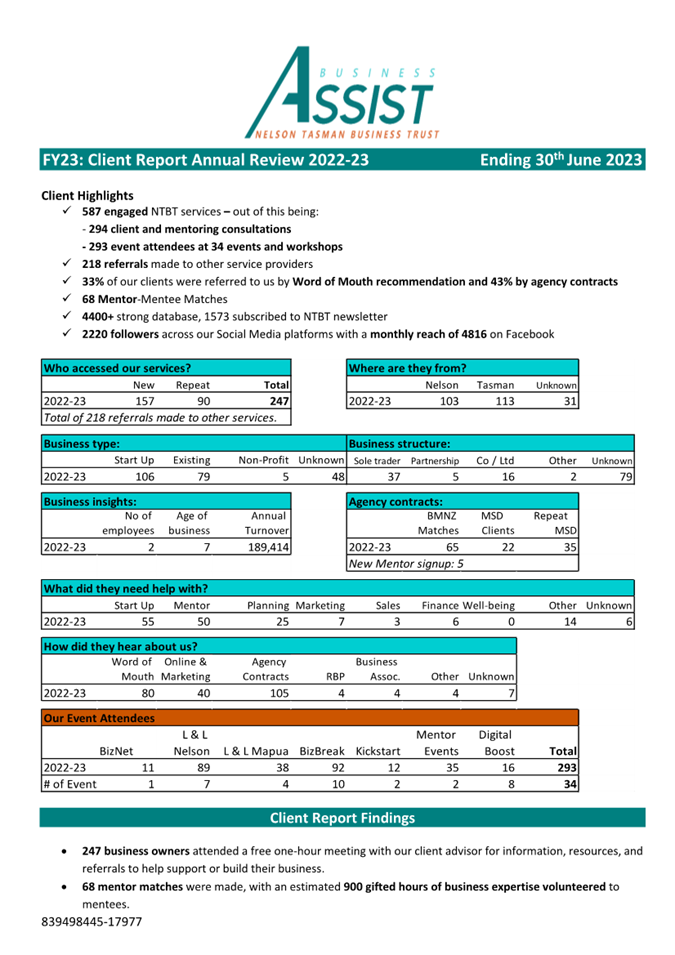

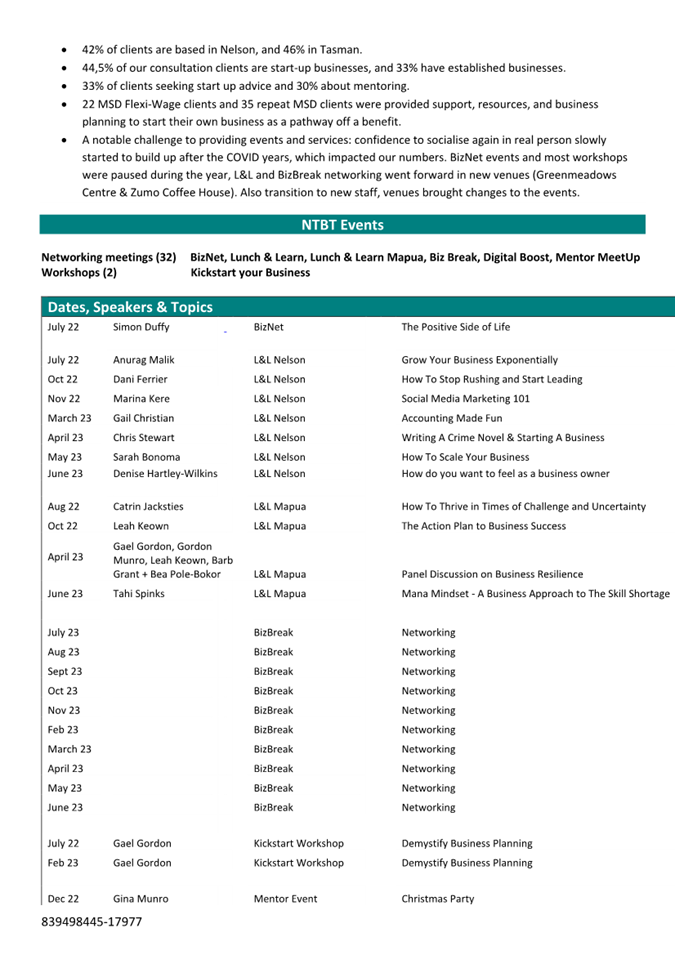

12. Nelson Tasman Business Trust

Annual Report 2022/23 (Item 10 of the Agenda)

Document number R27944, agenda

pages 122 - 140 refer.

|

Defer item to another

meeting

|

|

Resolved CL/2023/311

|

|

|

That the Council

1. Defers

the item Nelson Tasman Business Trust Annual Report 2022/23 (Item 10 of the

Agenda) to be considered at the Council meeting to be held on 1 February 2024

at 9.00 a.m. in the Council Chambers.

|

|

His Worship the Mayor/Paki

Paki Carried

|

13. Nelson Events Strategy

implementation update (Item 11 of the Agenda)

Document number R27953, agenda

pages 141 - 151 refer.

|

Defer item to another

meeting

|

|

Resolved CL/2023/312

|

|

|

That the Council

1. Defers

the item Nelson Events Strategy implementation update (Item 11 of the Agenda)

to be considered at the Council meeting to be held on 1 February 2024 at 9.00

a.m. in the Council Chambers.

|

|

His Worship the Mayor/Paki

Paki Carried

|

14. Exclusion of the Public

Sam Cottier from The Property Group was in

attendance for Item 7 August 2022 Extreme Weather Event Recovery - Land

Purchase of the Confidential agenda to answer questions and, accordingly, the

following resolution is required to be passed:

|

Resolved CL/2023/313

|

|

|

That

the Council

1. Confirms, in accordance

with sections 48(5) and 48(6) of the Local Government Official Information

and Meetings Act 1987, that Sam Cottier from The Property Group remain after

the public has been excluded, for Item 7 of the Confidential agenda August

2022 Extreme Weather Event Recovery - Land Purchase), as they have knowledge

that will assist the meeting.

|

|

His Worship the

Mayor/Courtney Carried

|

|

Resolved CL/2023/314

|

|

|

That the Council

1. Excludes the public from the

following parts of the proceedings of this meeting.

2. The general subject of each matter

to be considered while the public is excluded, the reason for passing this

resolution in relation to each matter and the specific grounds under section

48(1) of the Local Government Official Information and Meetings Act 1987 for

the passing of this resolution are as follows:

|

|

His Worship the

Mayor/Courtney Carried

|

|

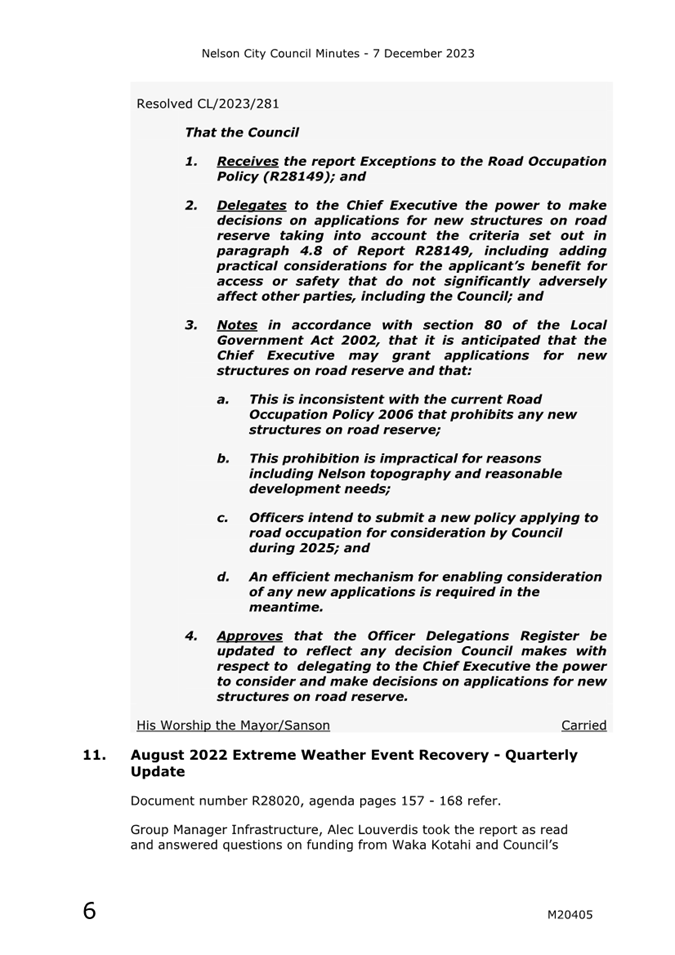

Item

|

General subject of each matter to be

considered

|

Reason for passing this resolution in

relation to each matter

|

Particular interests protected (where

applicable)

|

|

1

|

Council Meeting - Confidential Minutes - 9 November 2023

|

Section

48(1)(a)

The

public conduct of this matter would be likely to result in disclosure of

information for which good reason exists under section 7.

|

The withholding of the information is necessary:

· Section

7(2)(i)

To enable the

local authority to carry on, without prejudice or disadvantage, negotiations

(including commercial and industrial negotiations)

· Section

7(2)(a)

To protect the

privacy of natural persons, including that of a deceased person

· Section

7(2)(h)

To enable the

local authority to carry out, without prejudice or disadvantage, commercial

activities

|

|

2

|

Kāinga Ora Social and Affordable Housing Development

Achilles and Rutherford Streets

|

Section 48(1)(a)

The public

conduct of this matter would be likely to result in disclosure of information

for which good reason exists under section 7

|

The withholding of the information is necessary:

· Section

7(2)(g)

To maintain

legal professional privilege

· Section

7(2)(h)

To enable the

local authority to carry out, without prejudice or disadvantage, commercial

activities

· Section

7(2)(i)

To enable the

local authority to carry on, without prejudice or disadvantage, negotiations

(including commercial and industrial negotiations)

|

|

3

|

Proposed

Inner City Land Purchase and Sale

|

Section

48(1)(a)

The public conduct of this

matter would be likely to result in disclosure of information for which good

reason exists under section 7

|

The withholding of the information is necessary:

· Section 7(2)(g)

To maintain legal

professional privilege

· Section 7(2)(i)

To enable the local

authority to carry on, without prejudice or disadvantage, negotiations

(including commercial and industrial negotiations)

|

|

4

|

The Brook Valley Holiday Park - Revision of Lease Process

|

Section 48(1)(a)

The public

conduct of this matter would be likely to result in disclosure of information

for which good reason exists under section 7

|

The withholding of the information is necessary:

· Section

7(2)(h)

To enable the

local authority to carry out, without prejudice or disadvantage, commercial

activities

|

|

6

|

Visitor Information Services - proposed current and future

approach

|

Section 48(1)(a)

The public

conduct of this matter would be likely to result in disclosure of information

for which good reason exists under section 7

|

The withholding of the information is necessary:

· Section

7(2)(a)

To protect the

privacy of natural persons, including that of a deceased person

· Section

7(2)(i)

To enable the

local authority to carry on, without prejudice or disadvantage, negotiations

(including commercial and industrial negotiations)

|

|

7

|

August

2022 Extreme Weather Event Recovery - Land purchase

|

Section

48(1)(a)

The public conduct of this

matter would be likely to result in disclosure of information for which good

reason exists under section 7

|

The withholding of the information is necessary:

· Section 7(2)(g)

To maintain legal

professional privilege

· Section 7(2)(i)

To enable the local

authority to carry on, without prejudice or disadvantage, negotiations

(including commercial and industrial negotiations)

|

|

8

|

Statement of Expectations 2024-2027 - Nelson Regional

Development Agency

|

Section 48(1)(a)

The public

conduct of this matter would be likely to result in disclosure of information

for which good reason exists under section 7

|

The withholding of the information is necessary:

· Section

7(2)(i)

To enable the

local authority to carry on, without prejudice or disadvantage, negotiations

(including commercial and industrial negotiations)

|

|

9

|

Statement

of Expectations 2024/25 - The Suter Art Gallery Te Aratoi o Whakatū

Trust

|

Section

48(1)(a)

The public conduct of this

matter would be likely to result in disclosure of information for which good

reason exists under section 7

|

The withholding of the information is necessary:

· Section 7(2)(i)

To enable the local

authority to carry on, without prejudice or disadvantage, negotiations

(including commercial and industrial negotiations)

· Section 7(2)(j)

To prevent the disclosure

or use of official information for improper gain or improper advantage

|

|

10

|

Statement of Expectations 2024/25 - Nelmac Limited

|

Section 48(1)(a)

The public

conduct of this matter would be likely to result in disclosure of information

for which good reason exists under section 7

|

The withholding of the information is necessary:

· Section

7(2)(i)

To enable the

local authority to carry on, without prejudice or disadvantage, negotiations

(including commercial and industrial negotiations)

|

The meeting went into confidential session at 1.33

p.m. and resumed in public session at 4.15 p.m.

Karakia

Whakamutanga

15. Restatements

It was resolved while the public was

excluded:

|

2

|

Kāinga Ora Social and

Affordable Housing Development Achilles and Rutherford Streets

|

|

|

3. Agrees that Report

(R27980) and decision remain confidential at this time.

|

|

3

|

Proposed Inner City Land

Purchase and Sale

|

|

|

4. Agrees that the report R27976

remain confidential at this time

|

|

4

|

The Brook Valley Holiday Park

- Revision of Lease Process

|

|

|

3. Agrees that the decision only

be made publicly available following the signing of the Deed of Lease and the

Management Agreement of Brook Valley Holiday Park or once the 2024-34 Long

Term Plan has been adopted; and

4. Agrees that Report (R28150),

and its Attachments 196698121-52616, 196698121-52618, 196698121-52619,

196698121-52615, 196698121-54293 remain confidential at this time.

|

|

5

|

Plan Change 31 - Hearing

Panel recommendations

|

|

|

5. Agrees that that Report

(R28214), Attachment (539570224-18492) and the decision be made publicly

available following notice of the decision to all parties

|

|

6

|

Visitor Information Services

- proposed current and future approach

|

|

|

1. Defers the item 6 -Visitor

Information Services - proposed current and future approach to be considered

at the Council meeting to be held on 1 February 2024 at 9.00a.m. in the

Council Chambers.

|

|

7

|

August 2022 Extreme Weather

Event Recovery - Land purchase

|

|

|

6. Agrees

that the decision only be made publicly available following the sale and

purchase settlement date; and

7. Agrees that the Report

(R28182) and its attachments (1590798627-939 and 1590798627-940) remain

confidential.

|

|

8

|

Statement of Expectations

2024-2027 - Nelson Regional Development Agency

|

|

|

1. Defers the item 8 - Statement

of Expectations 2024-2027 - Nelson Regional Development Agency to be

considered at the Council meeting to be held on 1 February 2024 at 9.00a.m.

in the Council Chambers.

|

|

9

|

Statement of Expectations

2024/25 - The Suter Art Gallery Te Aratoi o Whakatū Trust

|

|

|

1. Defers the item 9. - Statement

of Expectations 2024/25 - The Suter Art Gallery Te Aratoi o Whakatū

Trust to be considered at the Council meeting to be held on 1 February 2024

at 9.00a.m. in the Council Chambers.

|

|

10

|

Statement of Expectations

2024/25 - Nelmac Limited

|

|

|

1. Defers the item 10 - Statement

of Expectations 2024/25 - Nelmac Limited to be considered at the Council

meeting to be held on 1 February 2024 at 9.00a.m. in the Council Chambers.

|

There being no further business

the meeting ended at 4.15p.m.

Confirmed as a correct record of proceedings by

resolution on (date)

Item 6: Confirmation of Minutes - 7 December 2023:

Attachment 1

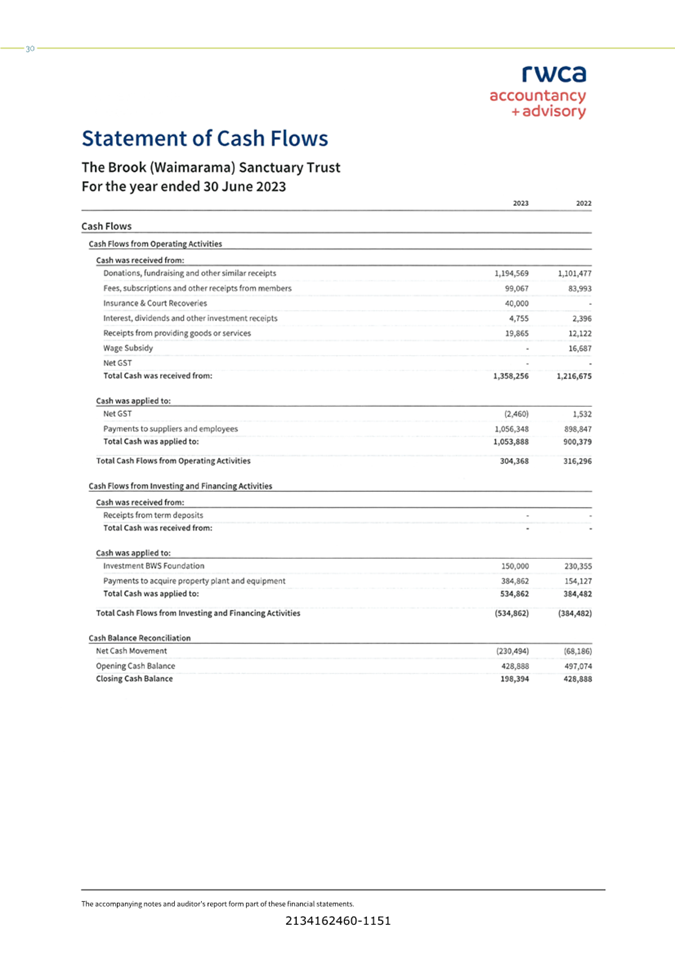

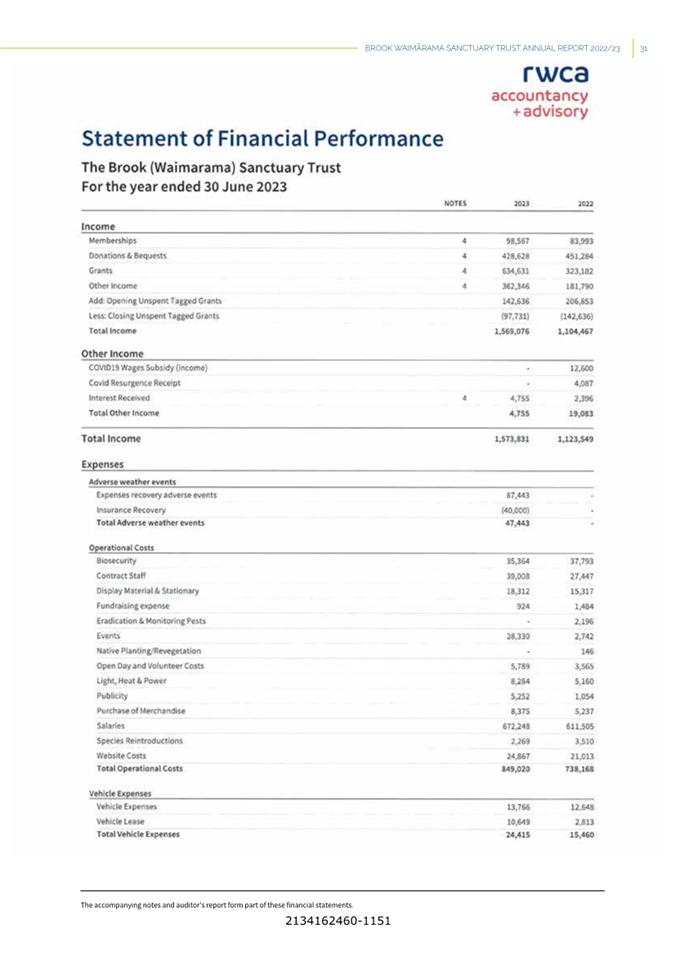

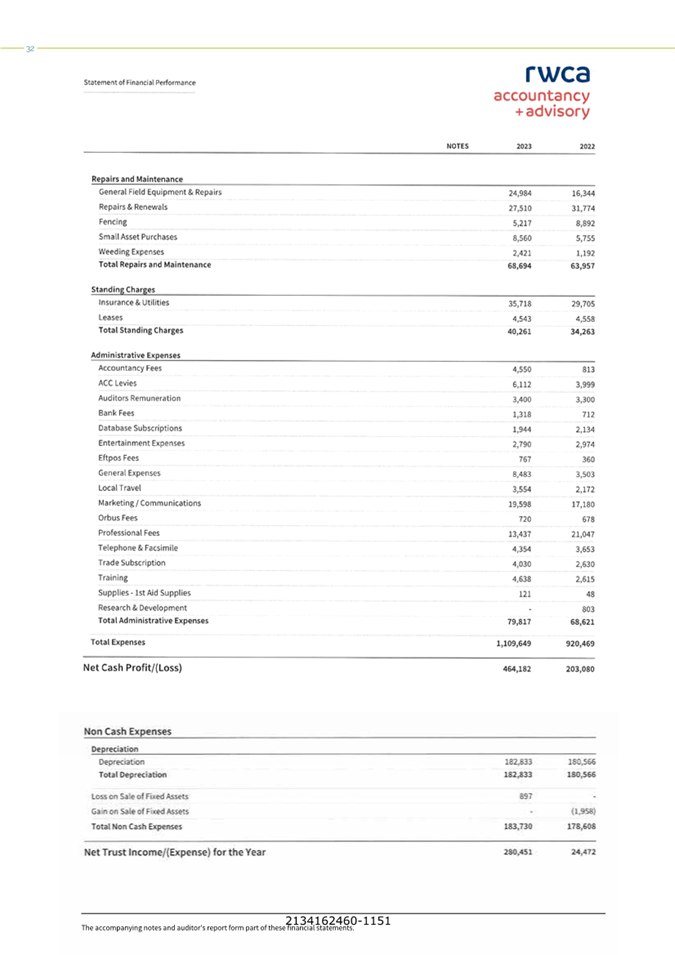

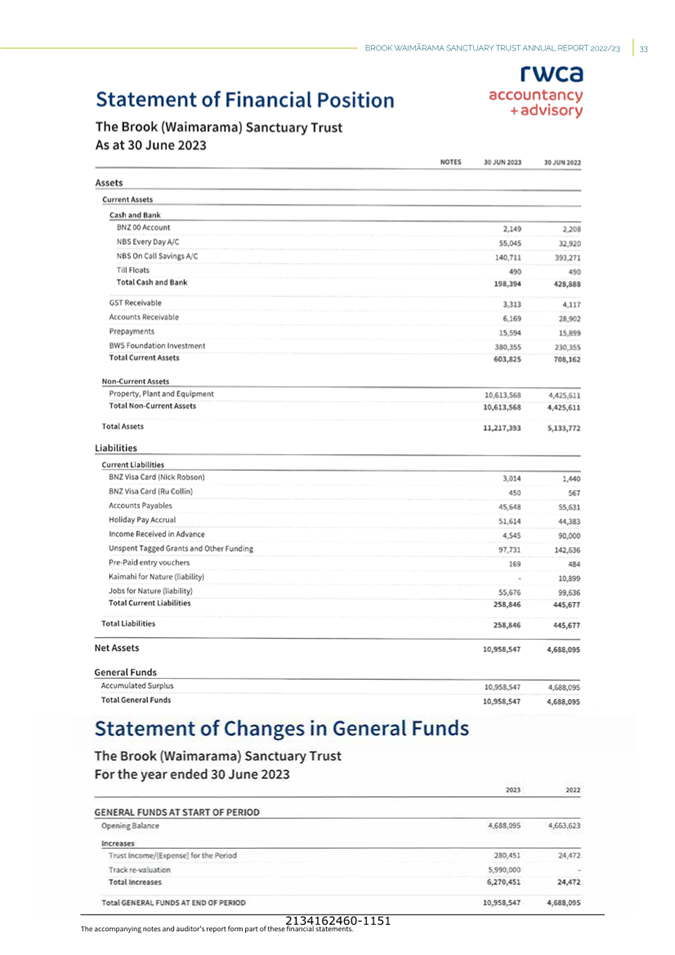

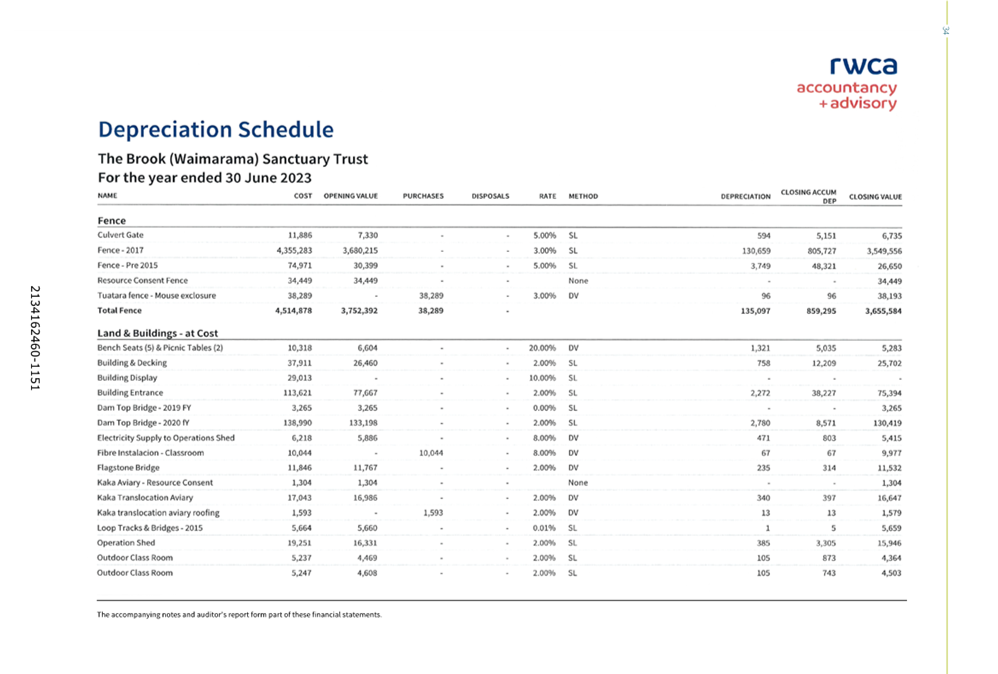

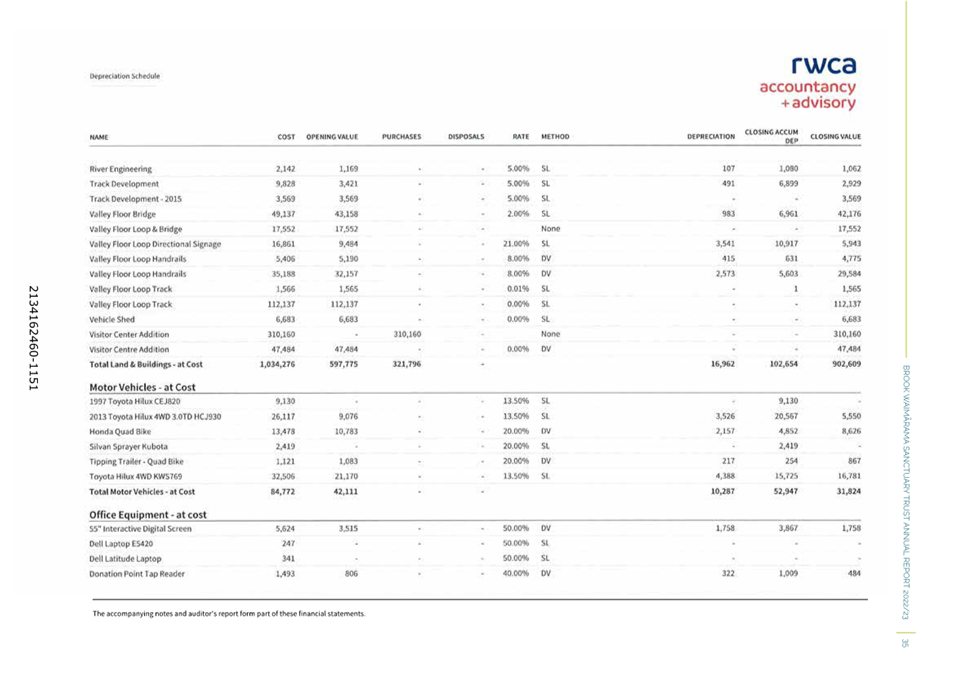

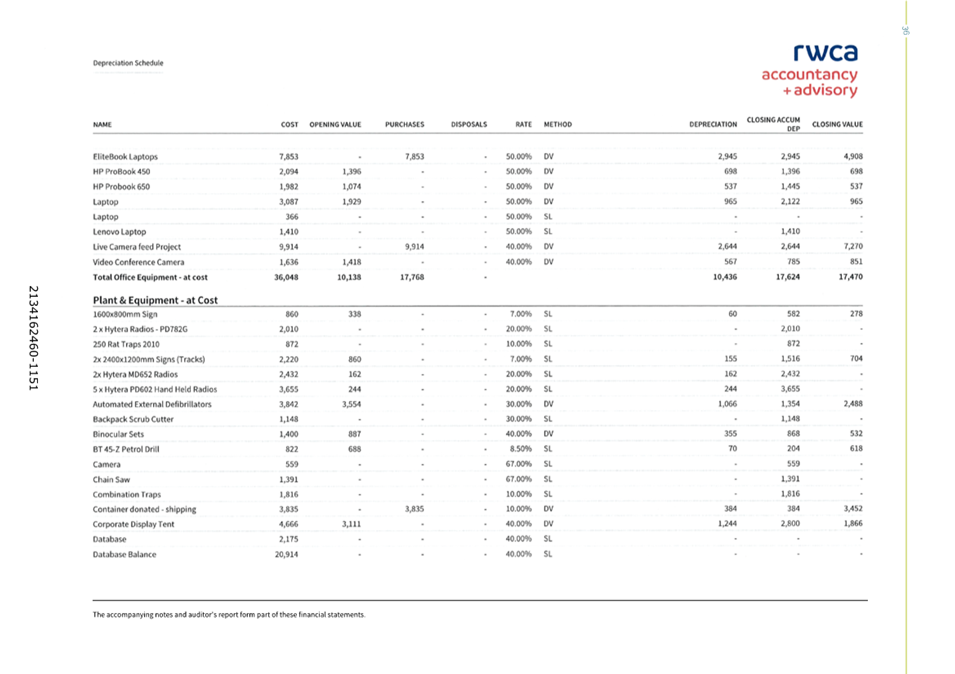

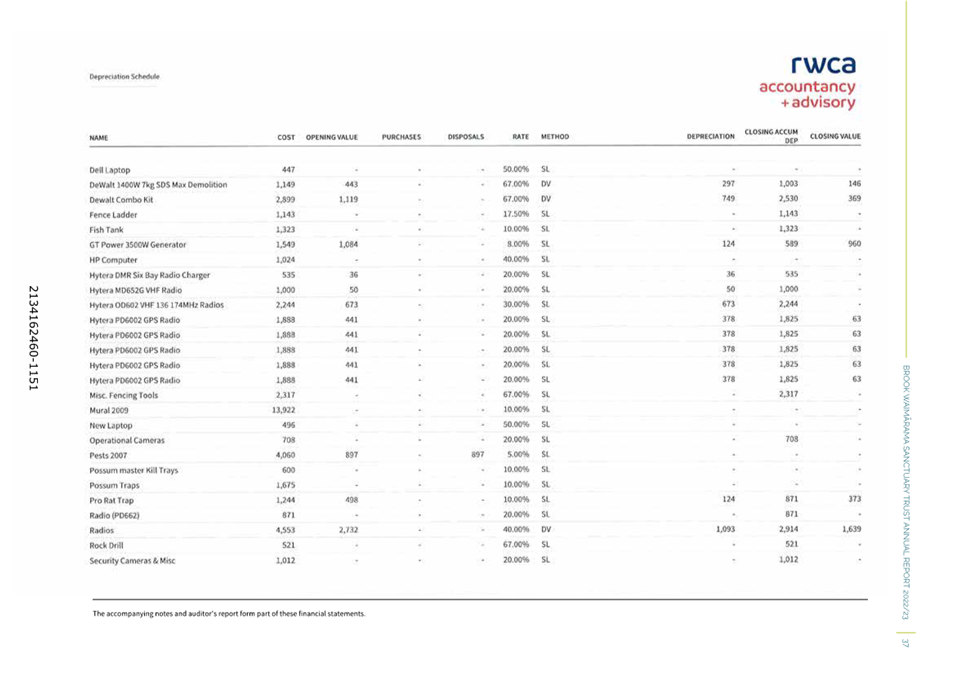

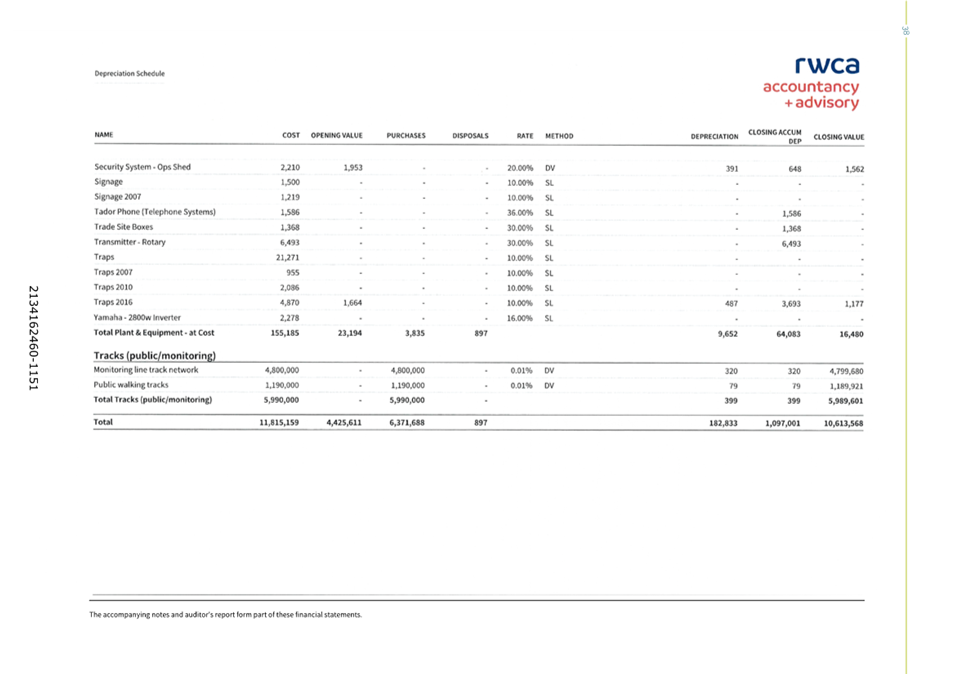

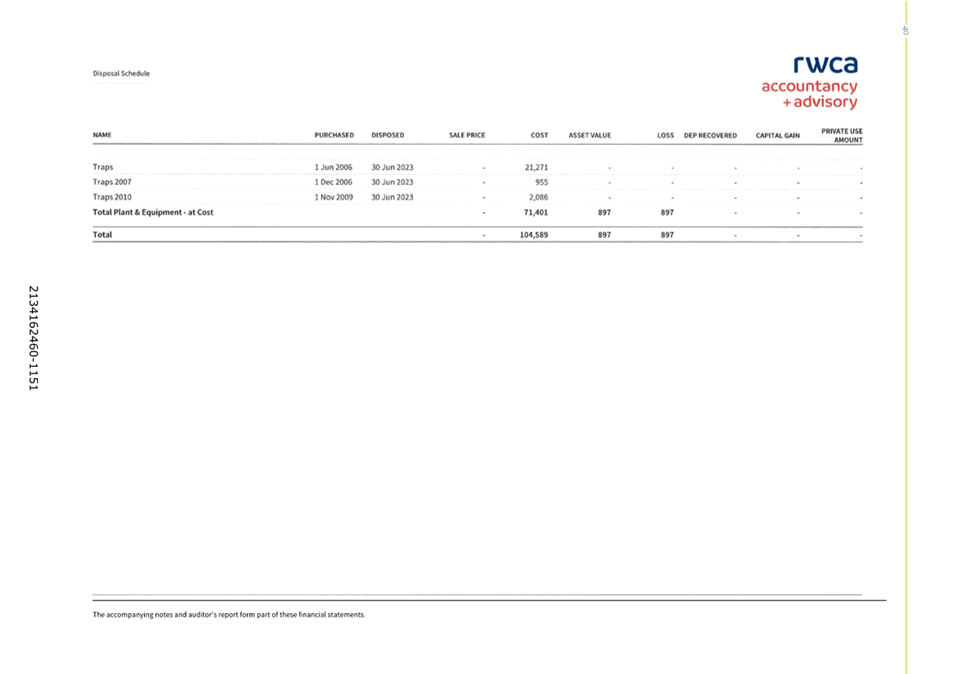

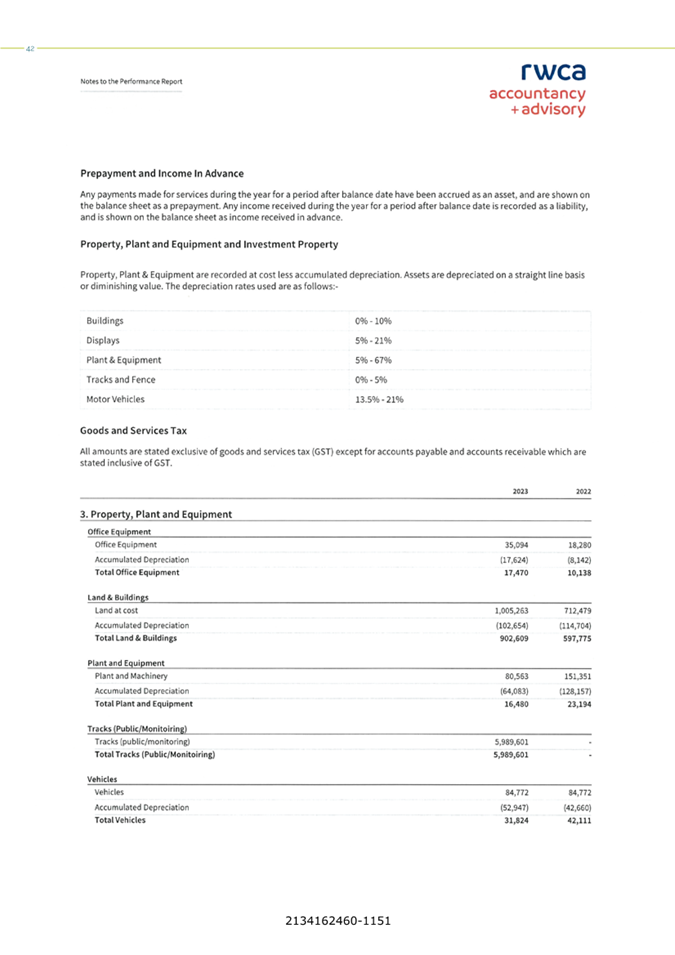

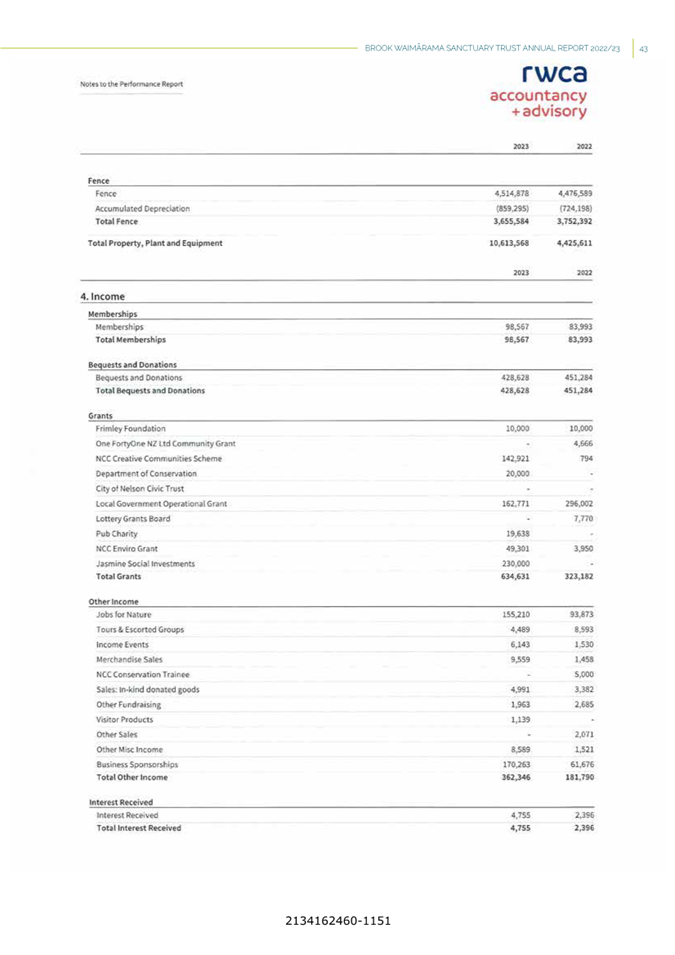

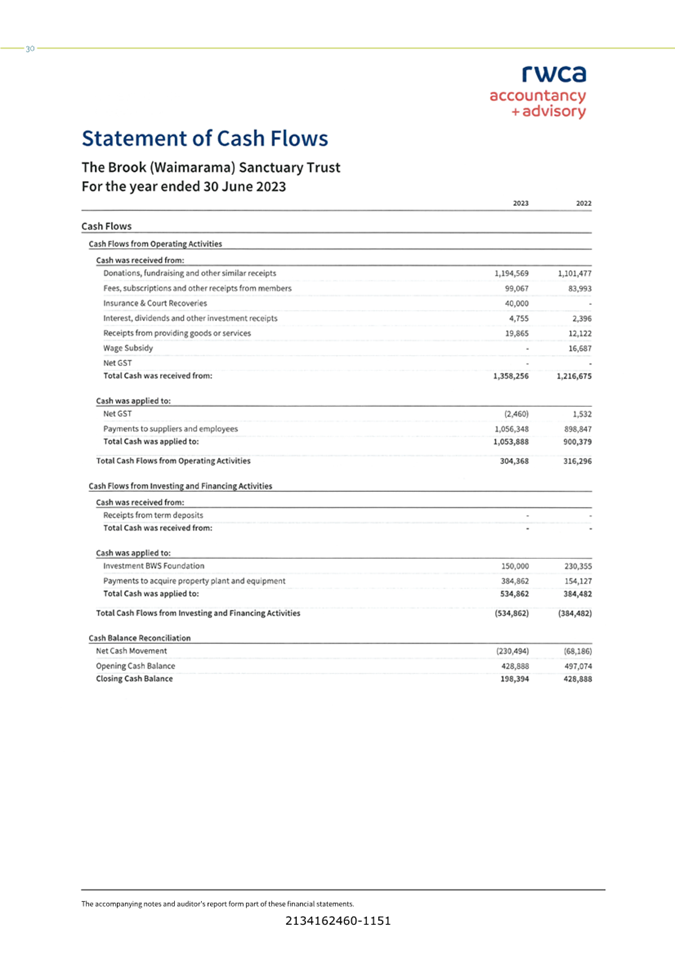

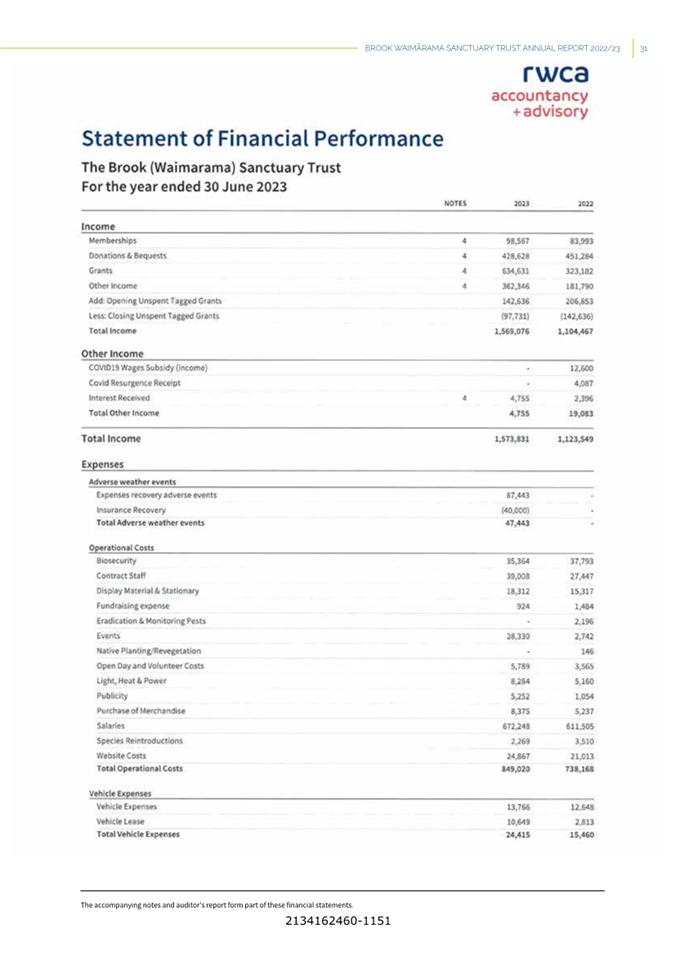

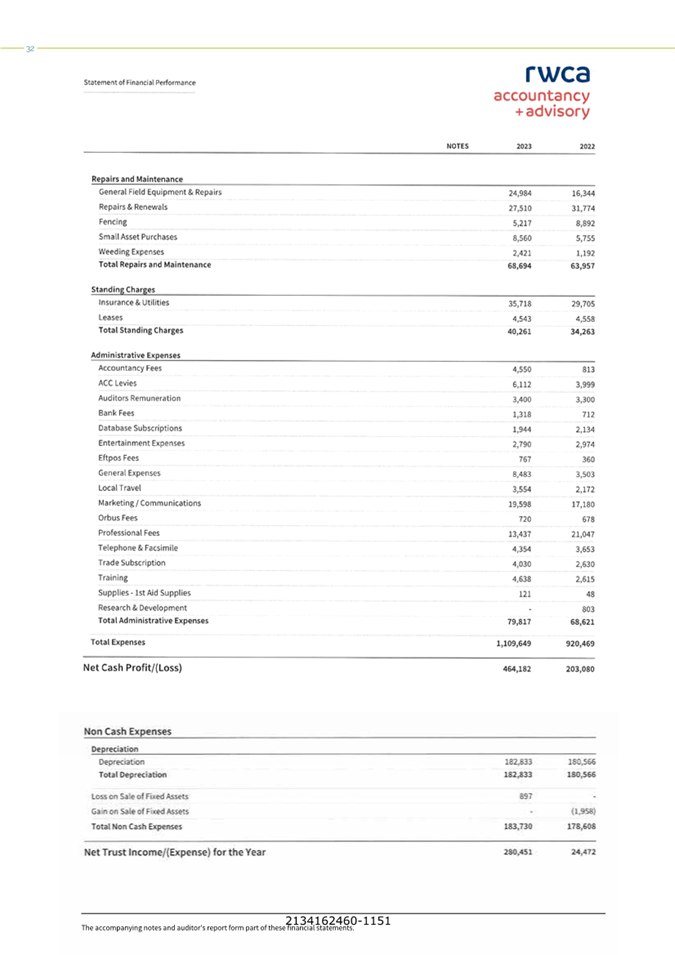

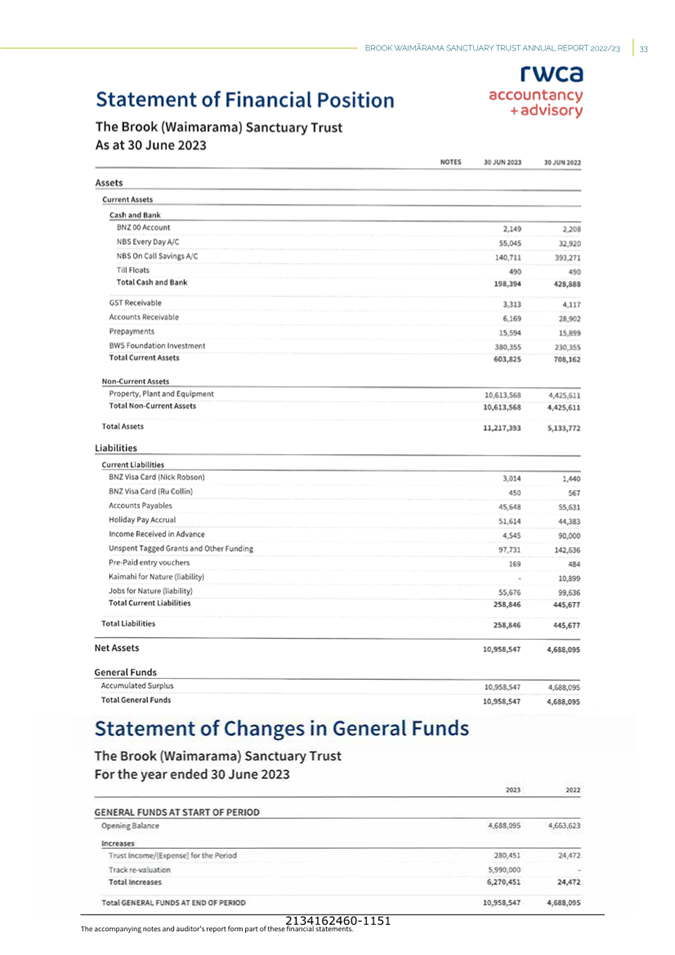

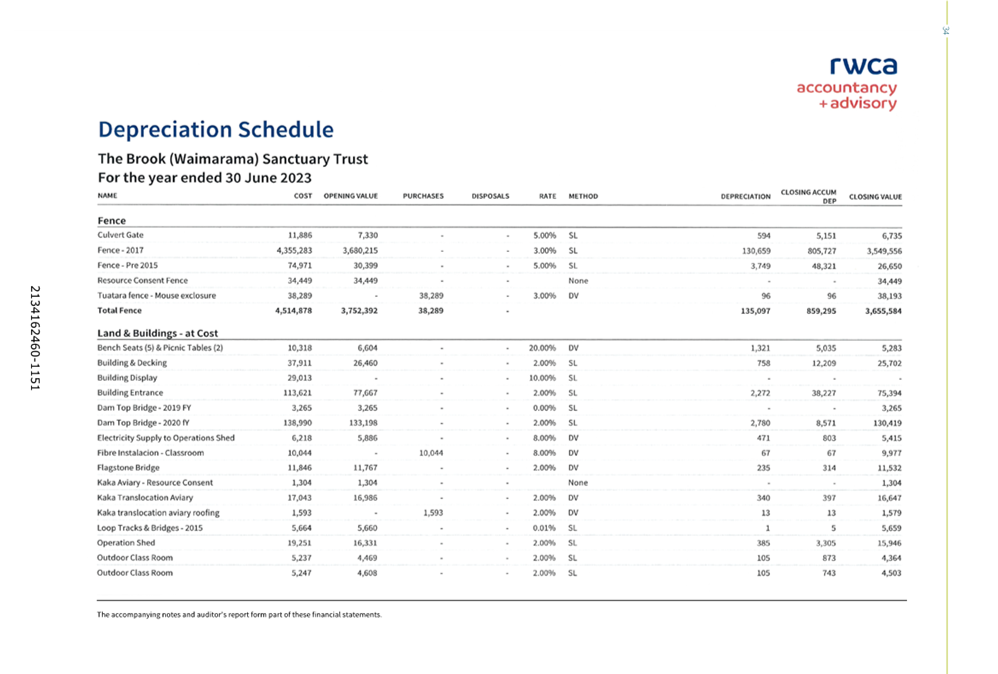

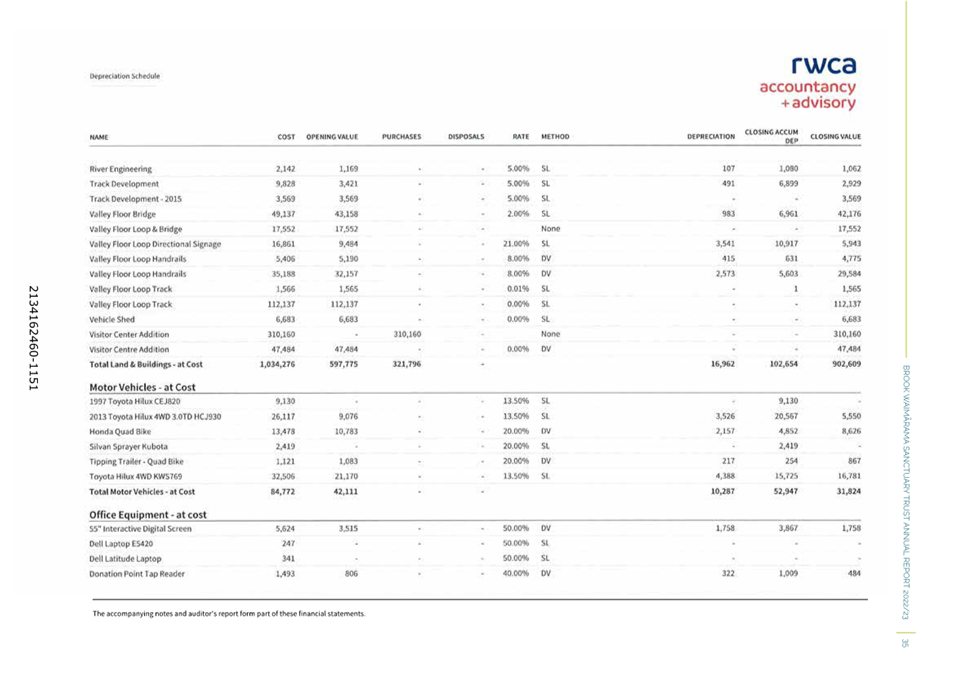

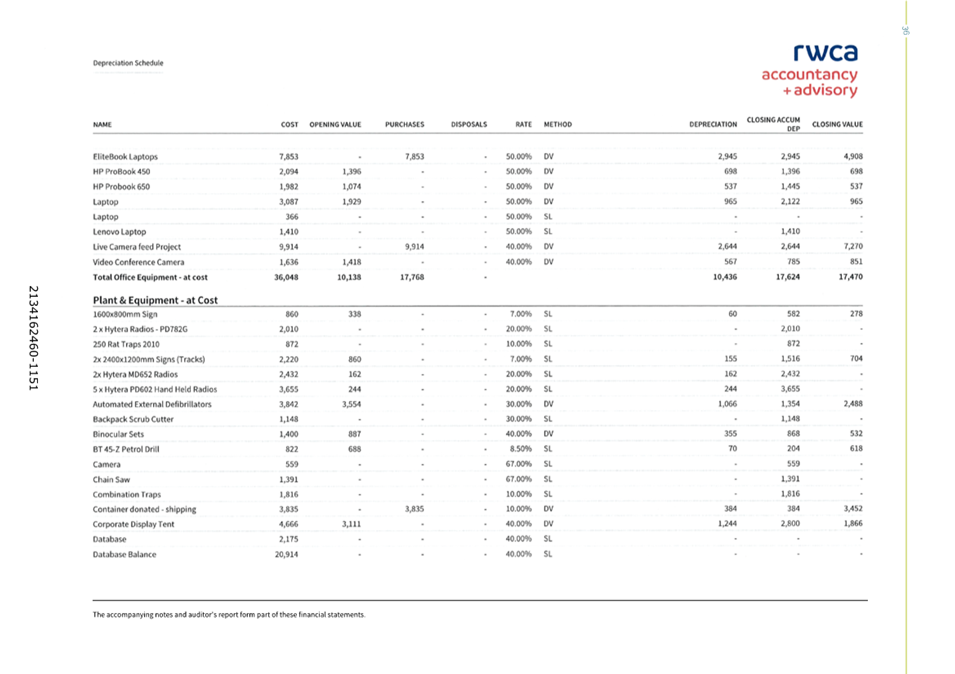

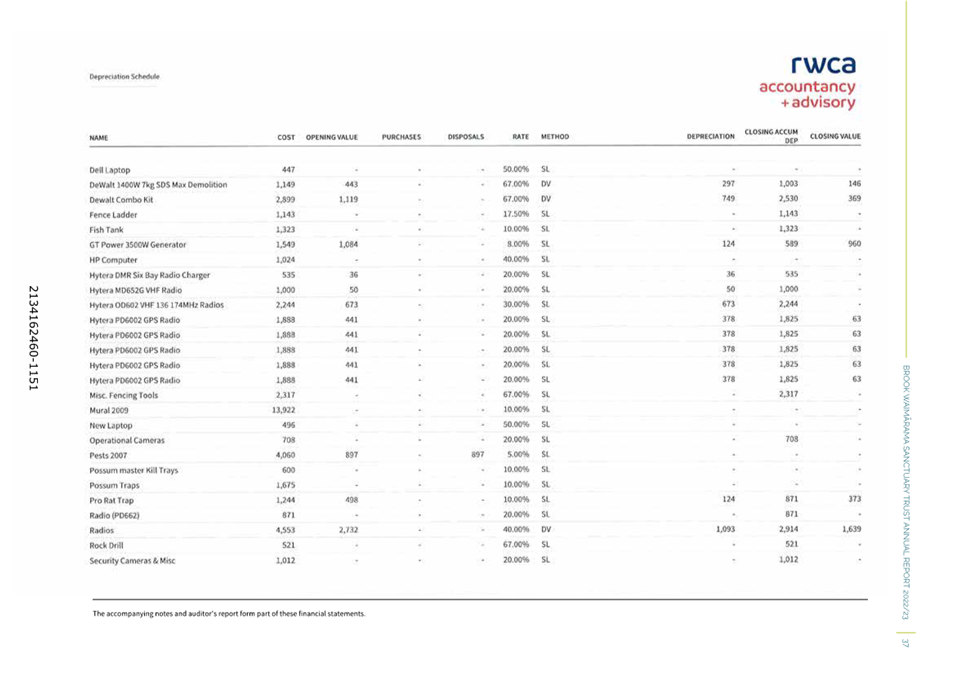

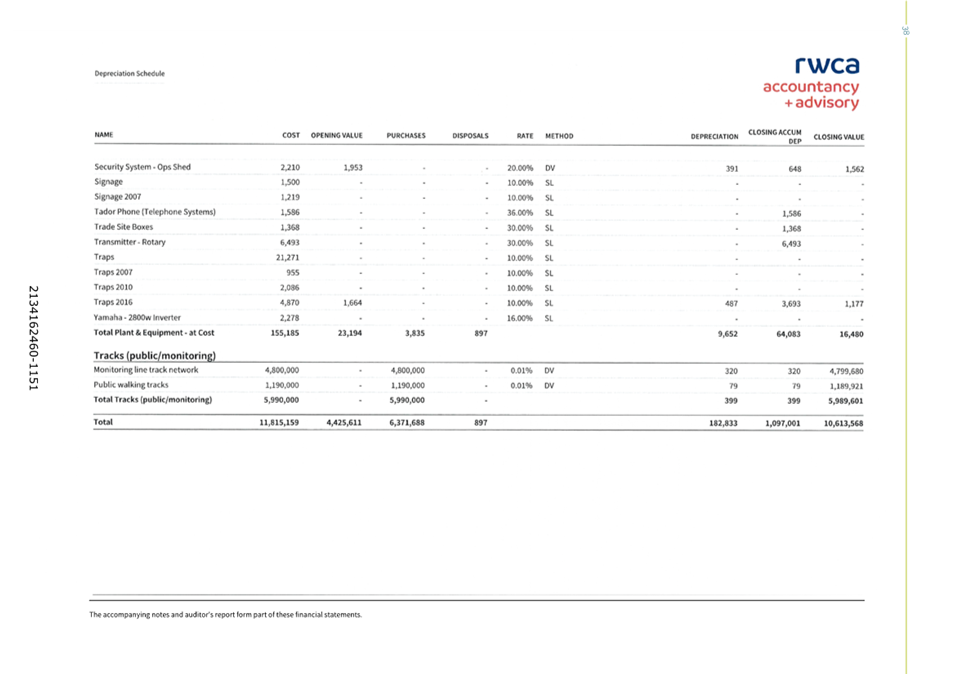

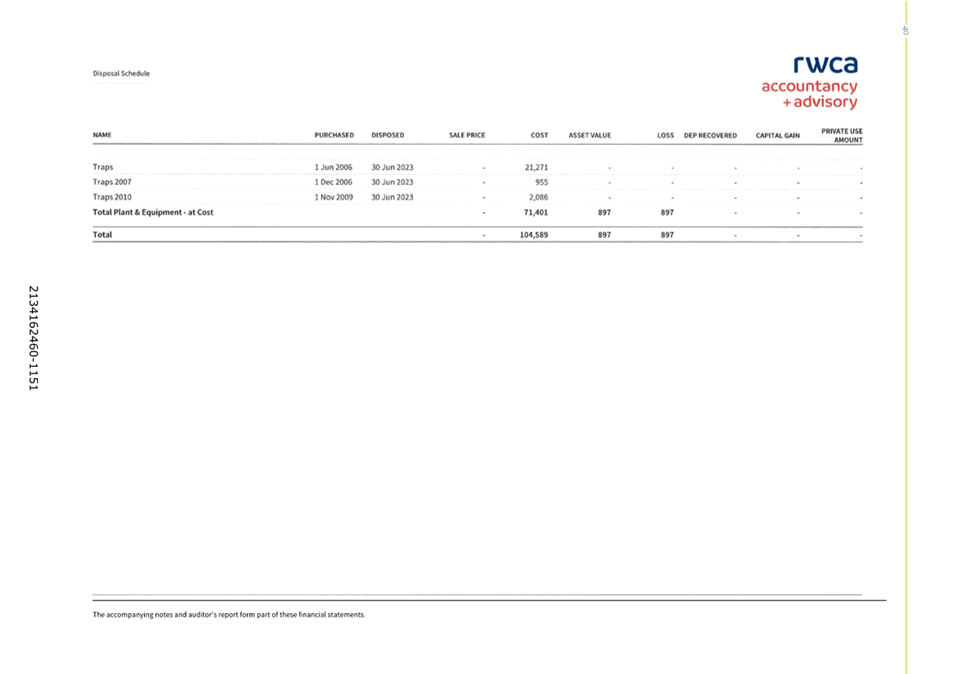

Item 8: Brook Waimarama

Sanctuary Trust Annual Report

|

|

Council

1 February 2024

|

Report

Title: Brook

Waimarama Sanctuary Trust Annual Report

Report

Author: Martin Croft - Acting

Group Manager Community Services

Report

Number: R28171

1. Purpose of Report

1.1 To present an update

from the Brook Waimarama Sanctuary Trust, including its Annual Report 2023.

1.2 Ru Collin (Chief

Executive) and Nick Tilly from the Brook Waimarama Sanctuary, will speak to the

report.

2. Recommendation

|

That

the Council

1. Receives

the report Brook Waimarama Sanctuary Trust Annual Report (R28171) and its attachment

(2134162460-1151).

|

3. Background

3.1 The Brook Waimarama

Sanctuary is a community initiative to create a pest-free wildlife sanctuary in

the upper Brook Valley. The project was launched in 2004, with construction of

a visitor centre being completed in 2007, a 14.4km predator proof fence being

completed in 2016 and a pest eradication operation undertaken in 2017. Nelson

City Council (Council) has supported the project with funding of $1,036,000

towards the fence construction and provides annual operational funding and

leases Council-owned land to the Brook Waimarama Sanctuary Trust (BWST).

3.2 There is a Memorandum

of Understanding between BWST and Council with the aim of achieving a working

partnership to maintain, enhance and promote the sanctuary.

3.3 Operational funding is

managed through an operational services contract, which includes fence

maintenance, track maintenance, and salaries for staff and contractors. In the

2023/24 financial year, the BWST will receive a grant of $168,468 for operation

services at the Sanctuary.

3.4 The BWST Annual Report

for 2022/23 is attached (2134162460-1151).

3.5 A highlight for this

year is the completion of the new visitor centre, with an enhanced feature hall

that people pass through when entering the Sanctuary. A record 16,457 people

visited the Sanctuary, despite the Sanctuary having to close to repair damage caused

by the severe weather event of August 2022.

3.6 A continued concern

for the Sanctuary, is the reliance on donations, grants, sponsorships, and

other fundraising activities to cover operational expenses.

Attachments

Attachment 1: 2134162460-1151 -

Brook Waimarama Sanctuary Trust Annual Report 2023 ⇩

Item 8: Brook Waimarama Sanctuary Trust Annual Report:

Attachment 1

Item 8: Brook Waimarama Sanctuary Trust Annual Report:

Attachment 1

Item 9: Nelson Events

Strategy implementation update

|

|

Council

1 February 2024

|

Report

Title: Nelson

Events Strategy implementation update

Report

Author: Ailish Neyland -

Policy Adviser

Report

Authoriser: Nicky McDonald - Group Manager Strategy and

Communications

Report

Number: R28240

This

item was deferred from the Council meeting on 14 December 2023

1. Purpose

of Report

1.1 To provide an update

on the implementation of the Nelson Events Strategy for the period of 1 July

2022 to 30 June 2023.

1.2 To approve increasing

the Chief Executive and Events Development Committee delegation levels for

approving funding through the Nelson Events Fund.

2. Summary

2.1 Council supported a

wide range of events in 2022/23, contributing to the social, economic and

cultural wellbeing of the community. It also delivered a range of events

directly to the community, however, the current economic environment is driving

up costs to deliver events. Staff are reviewing how Council could take a more

strategic approach to delivering and supporting events.

2.2 To reflect inflation

and increasing costs, staff propose an increase to the Events Fund delegation

levels for approving funding.

3. Recommendation

|

That

the Council

1. Receives the report Nelson

Events Strategy implementation update (R28240) and its attachment

(839498445-17987); and

2. Approves increasing the

delegation levels for the Nelson Events Fund as outlined below:

a. The Events Development

Committee may approve funding up to $45,000

b. The Chief Executive may approve

funding between $45,001 and $99,999

c. Council may approve funding of

$100,000 or above.

|

4. Background

4.1 The Nelson Events

Strategy was adopted in 2018 and provided a vision and objectives to guide

Council’s support for the city’s events. The Strategy’s

vision is “events that strengthen the region and its identity, stimulate

a prosperous, vibrant and engaged community and deliver value at the right

time”.

4.2 The report has been

prepared with input from the Nelson Regional Development Agency (NRDA).

Council supports a wide range

of events

4.3 Nelson’s events

portfolio is wide-ranging, including arts, heritage, culture, music and sport. Events

directly delivered by Council fill a gap in the local event offering with most

of them being provided as free entry events or heavily underwritten to maintain

a level of accessibility for all in the community.

4.4 Council delivers a

range of associated services to support events, such as resource, noise and

building consents, marketing and communication support, road closures and

traffic management plans. Council also provides guidance to event organisers to

help them navigate the different aspects of the planning process, such as

health and safety, risk management, waste management, climate change

mitigation, and ensuring organisers are aware of the regulatory requirements.

Venues

4.5 Council supports the

provision of venues across Nelson that can be used for events. The Nelson

City Council Venues website supports organisers to find a venue and provides

guidance to those planning an event.

4.6 Council staff, along

with the maintenance contractors CLM and Nelmac, have ensured that

Council’s event facilities (indoor and out) are presented to a high

standard for events and endeavour to ensure that resources can be allocated to

accommodate different opportunities, even at short notice.

In 2022, Council adopted He

Tātai Whetū, Whakatū Nelson’s Arts and Creativity Strategy,

which included an action to “Advance business cases to explore

opportunities for new venue development” for gaps identified in an

analysis of Nelson’s community arts facilities. Council allocated

$100,000 operating expenditure in 2023/24 to investigate opportunities for a

new arts hub to support the arts sector. A scoping document is being finalised,

which will have sufficient detail to serve as the base for development of a

business case on an arts hub.

Funding

4.7 The NRDA administers

funds distributed through Council’s Events Fund, which has two streams

– economic and community. The economic stream recognises that events are

an increasingly important contributor that can grow the visitor market and make

Nelson an attractive destination. The community stream recognises that events

are important for building a sense of belonging, identity and pride within

Nelson’s diverse community. The NRDA also administers Council’s

Venue Hire Fund. Events delivered by Council use a different pool of funding

managed in-house.

4.8 The Events Development

Committee, which includes Council and NRDA staff, reviews applications to the

Events Fund and Venue Hire Fund and makes decisions about the funding

allocation, unless the level of funding sought is above the Committee’s

delegated level, meaning it requires approval by either Council’s Chief

Executive or full Council.

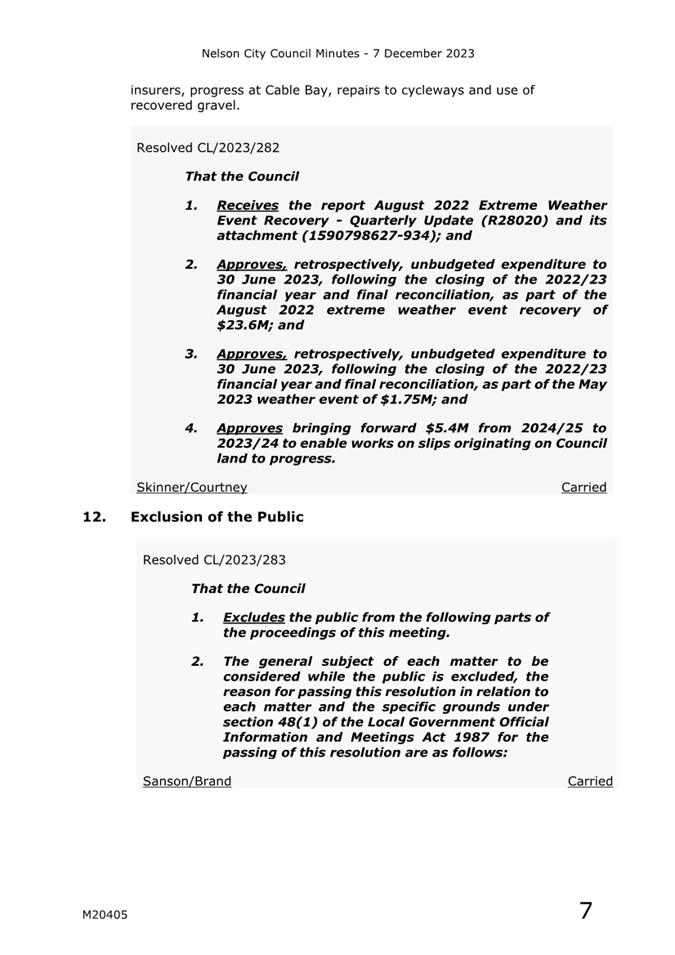

4.9 All

of Council’s event budgets for 2023/24 are outlined in the table below.

|

Item

|

2023/24

|

|

Nelson

Arts Festival

|

$604,000

|

|

Economic

Events Fund

|

$399,709

|

|

Kapa

Haka (Te Matatini)

|

$147,700

|

|

Council

Delivered Events

|

$112,331

|

|

Matariki

|

$20,000

Actual

cost $104,950

|

|

Te Ramaroa

|

$117,171

|

|

Community

Events Fund

|

$83,081

|

|

Tuku

|

$75,748

|

|

Council

Requested Events

|

$52,750

|

|

New

Years Eve

|

$37,147

|

|

Santa

Parade

|

$32,000

|

|

Youth

Events

|

$34,948

|

|

Venue

Hire Fund

|

$30,870

|

|

Waitangi

|

$5,417

Actual

$25,500

|

|

Summer

Events Programme

|

$9,000

|

|

Opera

in the Park

|

$0

|

|

4

Lanes (Winter Event)

|

$26,375

|

|

Total

|

$1,788,247

|

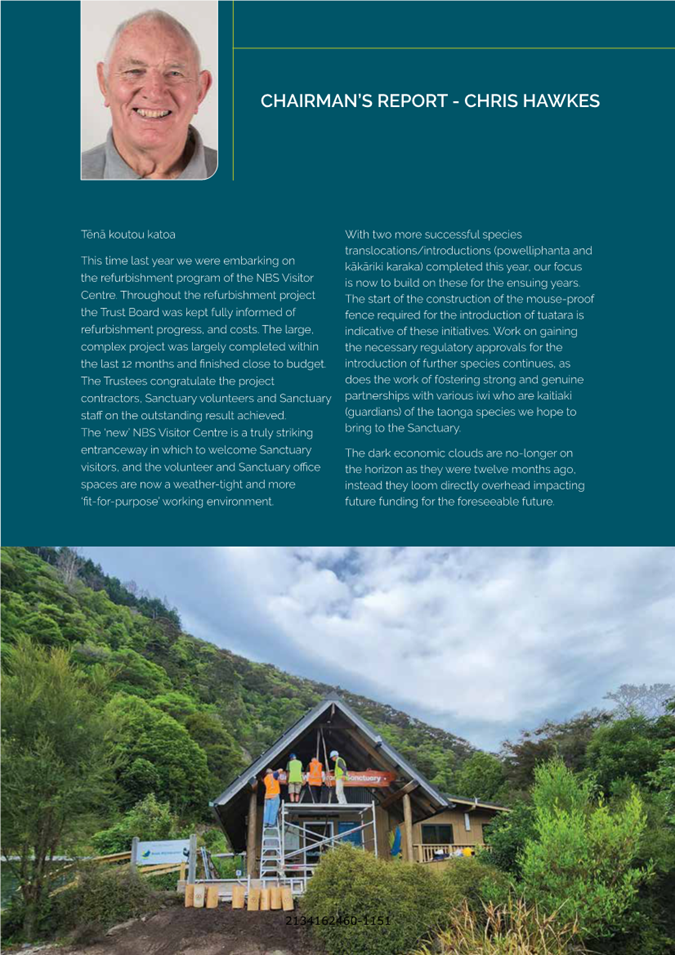

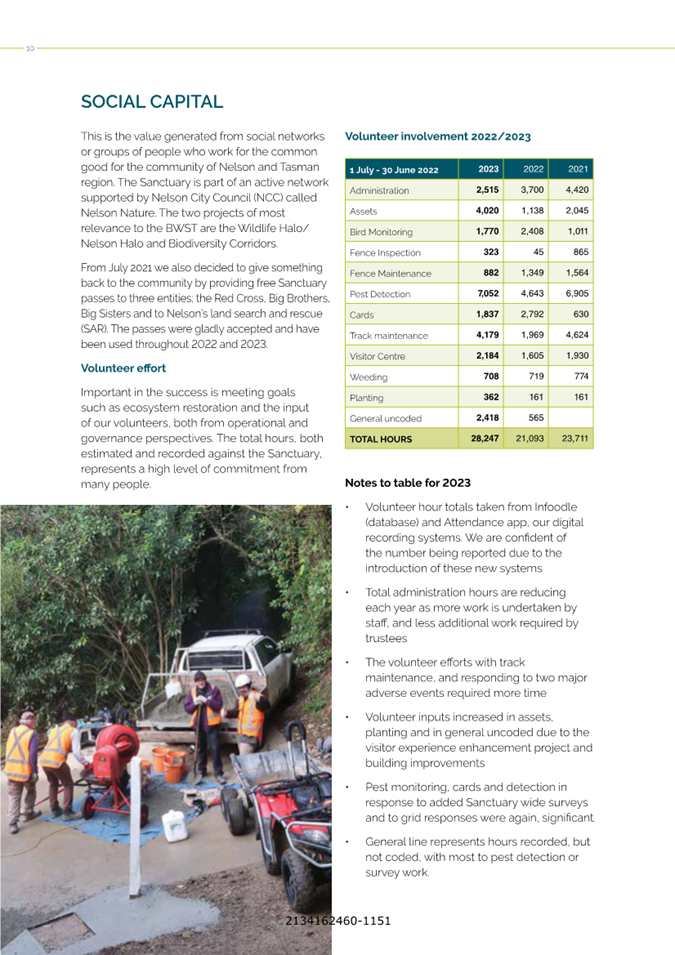

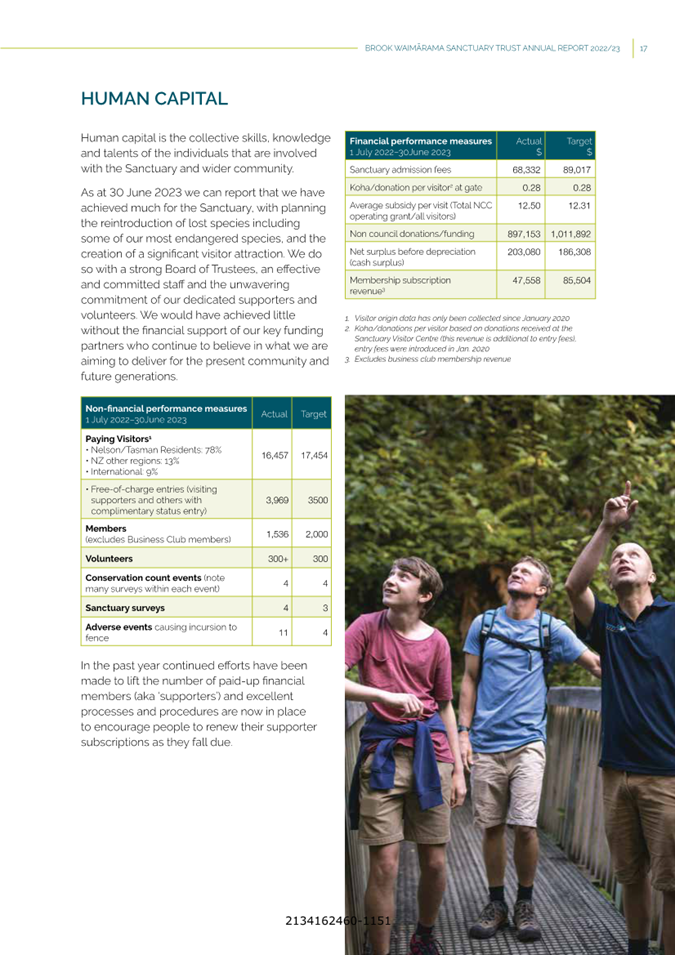

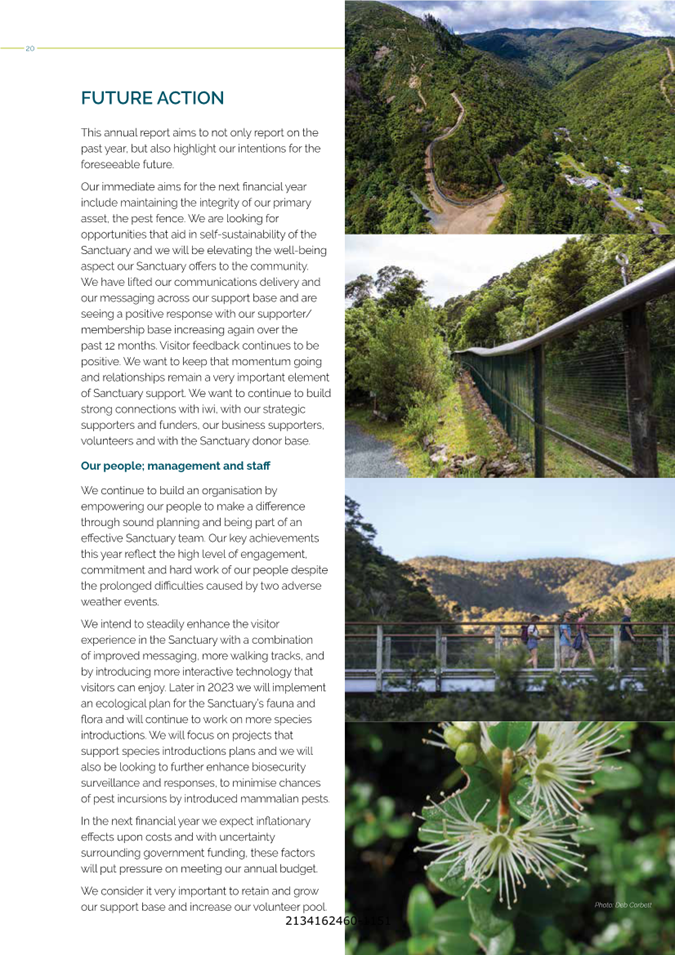

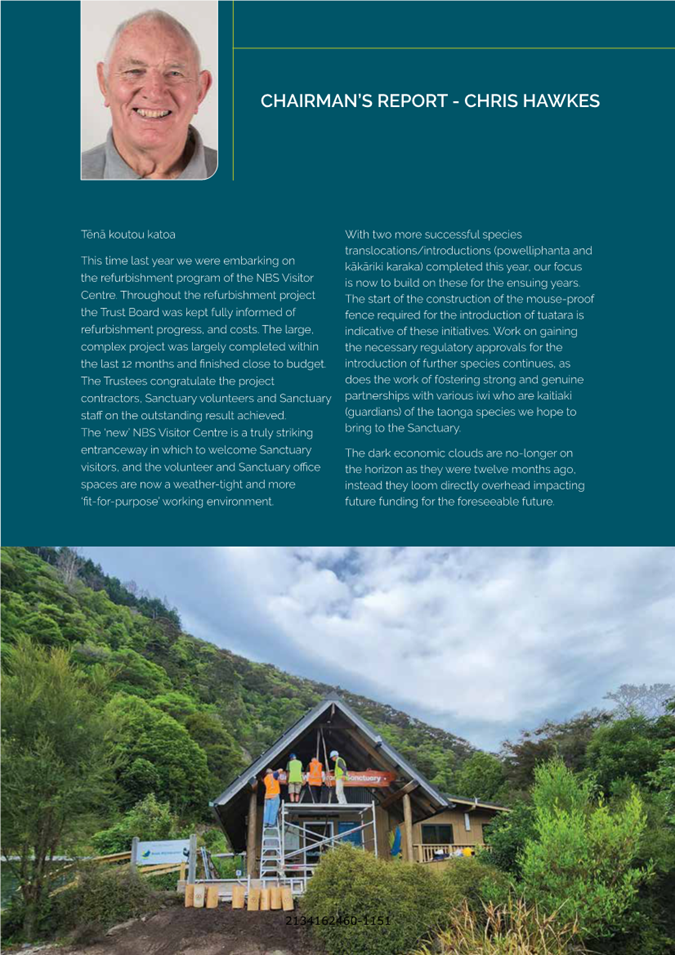

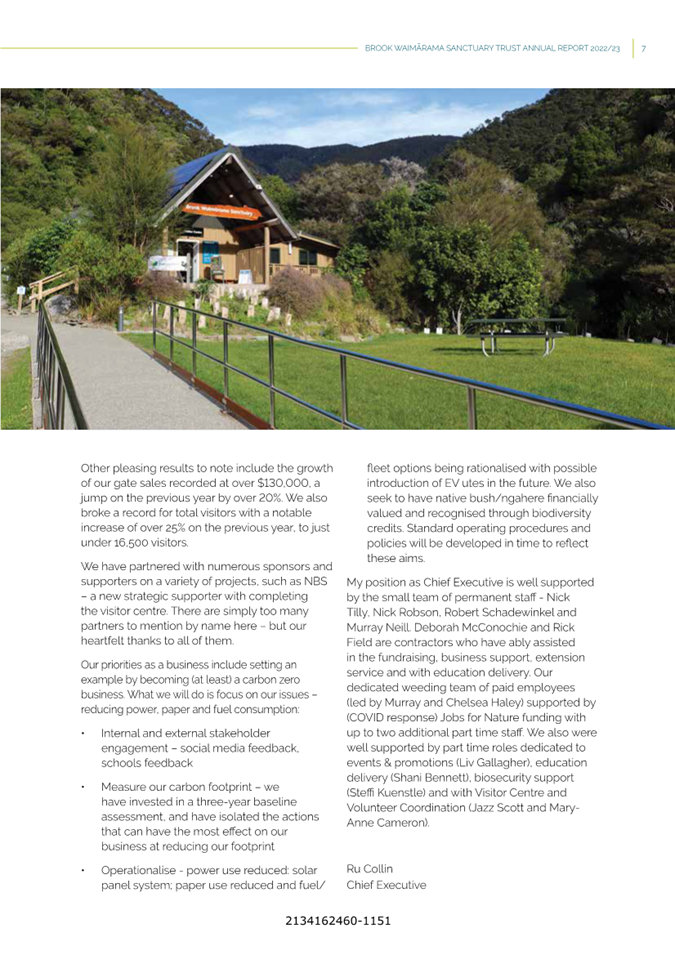

5. Discussion