Notice of the Ordinary meeting of

Audit, Risk and Finance Committee

Te Kōmiti Kaute / Tūraru / Pūtea

|

Date: Wednesday

14 February 2024

Time: 9.00a.m.

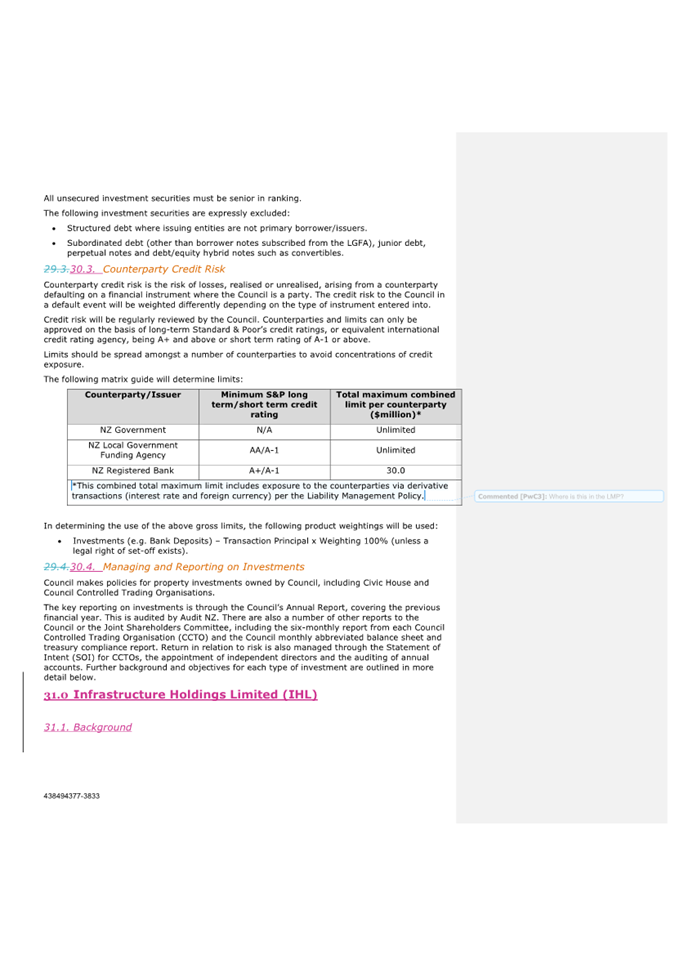

Location: Council

Chamber

Floor 2A, Civic House

110 Trafalgar Street, Nelson

|

Agenda

Rārangi take

Chairperson Ms

Catherine Taylor

Members His

Worship the Mayor Nick Smith

Cr

Rohan O'Neill-Stevens

Cr

Mel Courtney

Cr

Rachel Sanson

Mr

Lindsay McKenzie

Quorum 3 Nigel

Philpott

Chief Executive

Nelson City Council Disclaimer

Please note that the contents of these

Council and Committee agendas have yet to be considered by Council and officer

recommendations may be altered or changed by the Council in the process of

making the formal Council decision. For enquiries call (03) 5460436.

Audit, Risk and Finance

Committee

This is a Committee of Council

Areas of

Responsibility

·

Any matters raised by Audit New Zealand or the Office of the

Auditor-General

·

Audit processes and management of financial risk

·

Chairperson’s input into financial aspects of draft

Statements of Expectation and draft Statements of Intent for Nelson City

Council Controlled Organisations, Council Controlled Trading Organisations and

Council Organisations

·

Council’s Annual Report

·

Council’s financial performance

·

Council’s Treasury policies

·

Health and Safety

·

Internal audit

·

Monitoring organisational risks, including debtors and legal

proceedings

·

Procurement Policy

Powers to

Decide

·

Appointment of a deputy Chair

Powers to

Recommend to Council

·

Adoption of Council’s Annual Report

·

To write off outstanding accounts receivable or remit fees and

charges of amounts over the Chief Executive’s delegated authority.

·

All other matters within the areas of responsibility or any other

matters referred to it by the Council

For the Terms of Reference for the Audit, Risk and Finance Committee

please refer to document NDOCS-1974015928-887.

Audit, Risk and Finance Committee

14

February 2024

Page

No.

Karakia

and Mihi Timatanga

1. Apologies

An apology has been received from

Councillor R O'Neill-Stevens

2. Confirmation

of Order of Business

3. Interests

3.1 Updates

to the Interests Register

3.2 Identify

any conflicts of interest in the agenda

4. Public

Forum

5. Confirmation

of Minutes

5.1 24

November 2023 7 - 13

Document number M20377

Recommendation

|

That the Audit, Risk and Finance Committee

1. Confirms the minutes of the

meeting of the Audit, Risk and Finance Committee, held on 24 November 2023,

as a true and correct record.

|

6. Letter From Audit NZ

on Annual Report for year ending 30 June 2023 14 - 53

Document number R27973

Recommendation

|

That

the Audit, Risk and Finance Committee

1. Receives

the report Letter From Audit NZ on Annual Report for year ending 30 June 2023

(R27973) and its attachment

(2126778665-323); and

2. Notes

Audit NZ’s comments and how officers intend to address the issues

raised.

|

7. Draft Treasury

Management Policy including Liability Management and Investment Policies 54 - 98

Document number R28288

Recommendation

|

That

the Audit, Risk and Finance Committee

1. Receives

the report Draft Treasury Management Policy including Liability Management

and Investment Policies (R28288)

and its attachments (438494377-3859 and 438494377-3833).

|

Recommendation to Council

|

That the Council

1. Adopts the Treasury Management

Policy (438494377-3833).

|

8. Quarterly Finance

Report to 31 December 2023 99

- 121

Document number R28218

Recommendation

|

That

the Audit, Risk and Finance Committee

1. Receives

the report Quarterly Finance Report to 31 December 2023 (R28218) and its attachments

(1857728953-1257, 839498445-18200 and 839498445-18199).

|

9. Quarterly Risk

Report - 31 Dec 2023 122 - 147

Document number R28271

Recommendation

|

That

the Audit, Risk and Finance Committee

1. Receives

the report Quarterly Risk Report - 31 Dec 2023 (R28271) and its attachment (1759736513).

|

10. Quarterly Internal Audit Report

- 31 Dec 2023 148

- 151

Document number R28272

Recommendation

|

That

the Audit, Risk and Finance Committee

1. Receives

the report Quarterly Internal Audit Report - 31 Dec 2023 (R28272) and its

attachment (1194974384)

|

Confidential Business

11. Exclusion

of the Public

Recommendation

That

the Audit, Risk and Finance Committee

1.

Excludes the

public from the following parts of the proceedings of this meeting.

2.

The general subject of each matter to be

considered while the public is excluded, the reason for passing this resolution

in relation to each matter and the specific grounds under section 48(1) of the

Local Government Official Information and Meetings Act 1987 for the passing of

this resolution are as follows:

|

Item

|

General subject of each matter to be

considered

|

Reason for passing this resolution in

relation to each matter

|

Particular interests protected (where

applicable)

|

|

1

|

Audit, Risk and Finance Committee Meeting - Confidential Minutes

- 24 November 2023

|

Section

48(1)(a)

The

public conduct of this matter would be likely to result in disclosure of

information for which good reason exists under section 7.

|

The withholding of the information is necessary:

· Section

7(2)(a)

To protect the

privacy of natural persons, including that of a deceased person

· Section

7(2)(g)

To maintain

legal professional privilege

|

|

2

|

Health,

Safety and Wellbeing Report to 31 December 2023

|

Section

48(1)(a)

The public conduct of this

matter would be likely to result in disclosure of information for which good

reason exists under section 7

|

The withholding of the information is necessary:

· Section 7(2)(a)

To protect the privacy of

natural persons, including that of a deceased person

· Section 7(2)(d)

To avoid prejudice to

measures protecting the health and safety of members of the public

|

|

3

|

Quarterly Report on Legal Proceedings

|

Section 48(1)(a)

The public

conduct of this matter would be likely to result in disclosure of information

for which good reason exists under section 7

|

The withholding of the information is necessary:

· Section

7(2)(g)

To maintain

legal professional privilege

|

|

4

|

Quarterly

Update on Debts - 31 December 2023

|

Section

48(1)(a)

The public conduct of this

matter would be likely to result in disclosure of information for which good

reason exists under section 7

|

The withholding of the information is necessary:

· Section 7(2)(a)

To protect the privacy of

natural persons, including that of a deceased person

|

Karakia

Whakamutanga

Audit, Risk and Finance Committee

Minutes - 24 November 2023

Present: Ms

C Taylor (Chairperson), His Worship the Mayor N Smith, Councillor R

O'Neill-Stevens, M Courtney and R Sanson

In

Attendance: Chief Executive (N Philpott), Deputy Chief

Executive/Group Manager Infrastructure (A Louverdis), Group Manager Corporate

Services (N Harrison), Group Manager Strategy and Communications (N McDonald)

Senior Governance Adviser (H Wagener) and Assistant Governance Adviser (A

Bryce)

Apology: An

apology has been received from Mr L McKenzie

Karakia

and Mihi Timatanga

1. Apologies

|

Resolved ARF/2023/049

|

|

|

That the Audit, Risk and

Finance Committee

1. Receives

and accepts an apology from Mr L McKenzie.

|

|

Courtney/Sanson Carried

|

2. Confirmation of

Order of Business

There were no changes to the

order of business.

3. Interests

There were no updates to the Interests

Register, and no interests with items on the agenda were declared.

4. Public Forum

There was no public forum.

5. Confirmation of

Minutes

5.1 15

September 2023

Document number M20285, agenda

pages 7 - 16 refer.

|

Resolved ARF/2023/050

|

|

|

That the Audit, Risk and

Finance Committee

1. Confirms

the minutes of the meeting of the Audit, Risk and Finance Committee, held on

15 September 2023, as a true and correct record.

|

|

His Worship the

Mayor/Courtney Carried

|

6. Audit NZ - Audit

Engagement Letter for the Long Term Plan 2024-2034

Document number R28035, agenda

pages 17 - 18 refer.

The Appointed Auditor from Audit New Zealand, John

Mackay took the report as read, tabled an attachment (1852948764-472) and answered questions on

exclusion of the Water Services Reform Programme from the Long Term Plan

2024-2034 and agreement of the audit fees.

The meeting agreed to amendment of the

officer’s recommendation to provide for audit fees to be agreed as a

requirement for the signing of the letter from Audit New Zealand.

|

Resolved ARF/2023/051

|

|

|

That

the Audit, Risk and Finance Committee

1. Receives

the report Audit NZ - Audit Engagement Letter for the Long Term Plan

2024-2034 (R28035) and its attachment (to be tabled); and

2. Notes the Audit,

Risk and Finance Committee can provide feedback on the Audit Engagement

Letter to Audit NZ if required and that the Mayor will sign the letter once

the Committee’s feedback (if any) has been incorporated and audit fees

have been agreed.

|

|

Sanson/Courtney Carried

|

|

|

Attachments

1 1852948764-472 - Audit NZ Engagement Letter

|

7. Quarterly Internal

Audit Report - 30 Sept 2023

Document number R28053, agenda

pages 19 - 20 refer.

Group Manager Corporate Services, Nikki Harrison,

and Audit and Risk Analyst, Chris Logan took the report as read and answered

questions on the New Zealand’s Building Consent Authority two-yearly

audit and the review of Council’s updated Water Safety Plan.

|

Resolved ARF/2023/052

|

|

|

That

the Audit, Risk and Finance Committee

1. Receives the report

Quarterly Internal Audit Report - 30 Sept 2023 (R28053).

|

|

Sanson/His Worship the Mayor Carried

|

8. Quarterly Risk

Report - 30 Sept 2023

Document number R28049, agenda

pages 21 - 46 refer.

Group Manager Corporate Services, Nikki Harrison,

and Audit and Risk Analyst, Chris Logan took the report as read and answered

questions on loss of service performance from ineffective contracts and

contract management and optimisation of insurance.

|

Resolved ARF/2023/053

|

|

|

That

the Audit, Risk and Finance Committee

1. Receives the report

Quarterly Risk Report - 30 Sept 2023 (R28049)

and its attachment (1759736513).

|

|

Courtney/Sanson Carried

|

9. Privacy Act 2020 -

Reporting

Document number R28111, agenda

pages 47 - 48 refer.

Manager Governance and Support Services, Devorah

Nicuarta-Smith took the report as read and advised that the compliance

register was not attached to the report. She answered questions on

measures to ensure protection of privacy of submitters during the Long Term

Plan 2024-34 consultation.

|

Resolved ARF/2023/054

|

|

|

That

the Audit, Risk and Finance Committee

1. Receives the report

Privacy Act 2020 - Reporting (R28111).

|

|

Sanson/His Worship the Mayor Carried

|

10. Quarterly Finance Report to 30 September

2023

Document number R28129, agenda

pages 49 - 71 refer.

Group Manager Infrastructure, Alec Louverdis, Group

Manager Corporate Services, Nikki Harrison and Manager - Finance, Prabath

Jayawardana took the report as read and answered questions on the reduction in

Transport Choices Revenue, timing of capital expenditure, measures for

collection of outstanding rates and current employee leave liabilities.

|

Resolved ARF/2023/055

|

|

|

That

the Audit, Risk and Finance Committee

1. Receives the report Quarterly Finance Report to 30 September 2023

(R28129) and its attachments

(1857728953-1257, 839498445-17924 and 839498445-17948).

|

|

O'Neill-Stevens/Courtney Carried

|

11. Exclusion

of the Public

|

Resolved ARF/2023/056

|

|

|

That the Audit, Risk and

Finance Committee

1. Excludes the public from the

following parts of the proceedings of this meeting.

2. The general subject of each matter

to be considered while the public is excluded, the reason for passing this

resolution in relation to each matter and the specific grounds under section

48(1) of the Local Government Official Information and Meetings Act 1987 for

the passing of this resolution are as follows:

|

|

Courtney/O'Neill-Stevens Carried

|

|

Item

|

General subject of each matter to be considered

|

Reason for passing this resolution in

relation to each matter

|

Particular interests protected (where

applicable)

|

|

1

|

Audit, Risk and Finance Committee Meeting - Confidential Minutes

- 15 September 2023

|

Section

48(1)(a)

The

public conduct of this matter would be likely to result in disclosure of

information for which good reason exists under section 7.

|

The withholding of the information is necessary:

· Section

7(2)(a)

To protect the

privacy of natural persons, including that of a deceased person

· Section

7(2)(c)(ii)

To protect

information which is subject to an obligation of confidence or which any

person has been or could be compelled to provide under the authority of any

enactment, where the making available of the information would be likely

otherwise to damage the public interest

· Section

7(2)(g)

To maintain

legal professional privilege

|

|

2

|

Health,

Safety and Wellbeing Report to 30 September 2023

|

Section

48(1)(a)

The public conduct of this

matter would be likely to result in disclosure of information for which good

reason exists under section 7

|

The withholding of the information is necessary:

· Section 7(2)(a)

To protect the privacy of

natural persons, including that of a deceased person

|

|

3

|

Quarterly Report on Legal Proceedings

|

Section 48(1)(a)

The public

conduct of this matter would be likely to result in disclosure of information

for which good reason exists under section 7

|

The withholding of the information is necessary:

· Section

7(2)(g)

To maintain

legal professional privilege

|

|

4

|

Quarterly

Update on Debts - 30 September 2023

|

Section

48(1)(a)

The public conduct of this

matter would be likely to result in disclosure of information for which good

reason exists under section 7

|

The withholding of the information is necessary:

· Section 7(2)(a)

To protect the privacy of

natural persons, including that of a deceased person

|

|

5

|

Organisational Risk - Deep Dives

|

Section 48(1)(a)

The public

conduct of this matter would be likely to result in disclosure of information

for which good reason exists under section 7

|

The withholding of the information is necessary:

· Section

7(2)(j)

To prevent the

disclosure or use of official information for improper gain or improper

advantage

|

The meeting went into confidential session at 10.10a.m.

and resumed in public session at 12.04p.m.

Karakia

Whakamutanga

12. Restatements

It was resolved while the public was

excluded:

|

1

|

Health, Safety and Wellbeing

Report to 30 September 2023

|

|

|

2. Agrees that Report

(R28094) and Attachment (855153265-4266) remain confidential at this time.

|

|

2

|

Quarterly Report on Legal

Proceedings

|

|

|

2. Agrees that Report

Quarterly Report on Legal Proceedings (R27940) and Attachment (142319133-487) remain confidential at

this time.

|

|

3

|

Quarterly Update on Debts -

30 September 2023

|

|

|

2. Agrees that the Report

and its attachment (1857728953-1250) remain confidential at this time.

|

|

4

|

Organisational Risk - Deep

Dives

|

|

|

1. Receives

the report Organisational Risk - Deep Dives (R28145) and its Attachments

(731786637 and 416503567); and

2. Agrees that

Report (R28145), and the decision only be made publicly available; and

3. Agrees that

Attachments (731786637 and 416503567) remain confidential at this time.

|

There being no further business the meeting ended at 12.05p.m.

Confirmed as a correct record of proceedings by

resolution on (date)

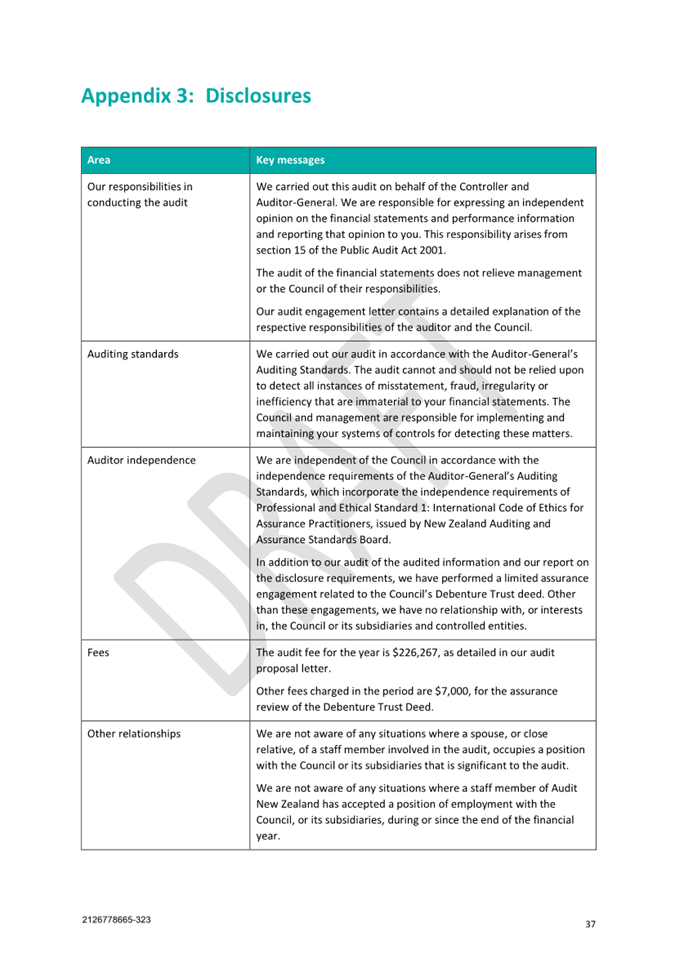

Item 6: Letter From

Audit NZ on Annual Report for year ending 30 June 2023

|

|

Audit, Risk and Finance Committee

14 February 2024

|

Report

Title: Letter

From Audit NZ on Annual Report for year ending 30 June 2023

Report

Author: Prabath

Jayawardana - Manager Finance

Report

Authoriser: Nikki Harrison - Group Manager Corporate

Services

Report

Number: R27973

1. Purpose of Report

1.1 To provide the letter

to the Council on the audit for the year ending 30 June 2023 from Audit NZ.

2. Recommendation

|

That

the Audit, Risk and Finance Committee

1. Receives

the report Letter From Audit NZ on Annual Report for year ending 30 June 2023

(R27973) and its

attachment (2126778665-323); and

2. Notes Audit NZ’s comments and how officers

intend to address the issues raised.

|

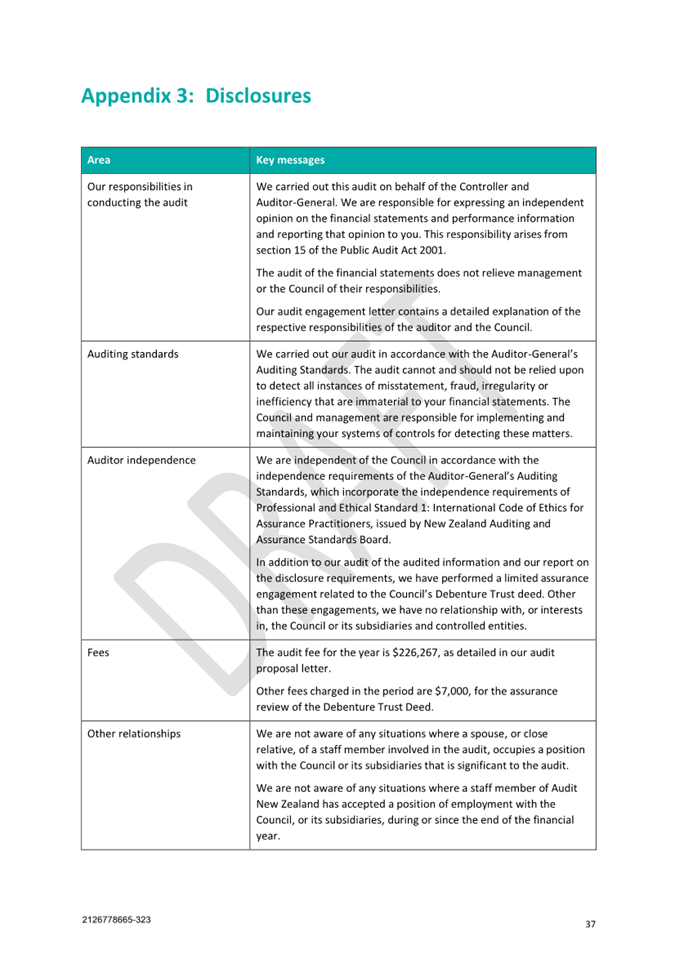

3. Background

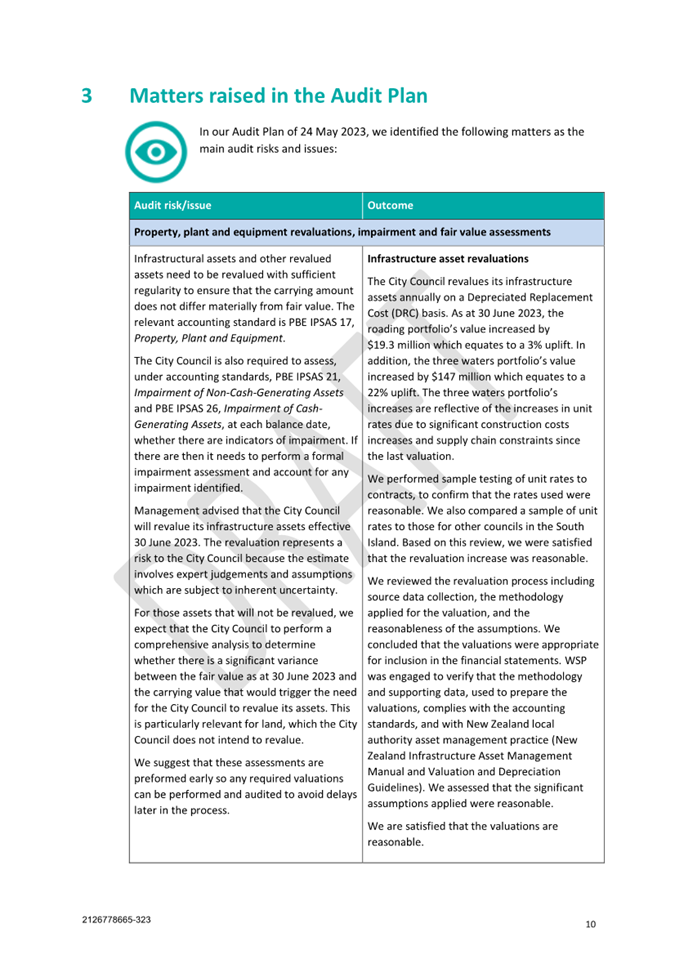

3.1 Audit

New Zealand (Audit NZ) issued an unmodified audit opinion on 31 October 2023

for the financial year ending 30 June 2023. This means that it was satisfied

that the financial statements fairly reflected Council's activities for the

year and its financial position at the end of the financial year.

3.2 Audit

NZ included an Emphasis of Matter paragraph to draw attention to the disclosure,

in the financial statements, of the inherent uncertainties in the

Government’s proposed Three Waters Reform programme and it’s offer

to fund up to $6 million to support the purchase of up to 14 “red

stickered” properties where the landslide risk is too high for those

property owners to return to their homes.

3.3 After

the audit is completed, Audit NZ issues a management letter to Council

outlining the findings of the audit.

3.4 In the letter to

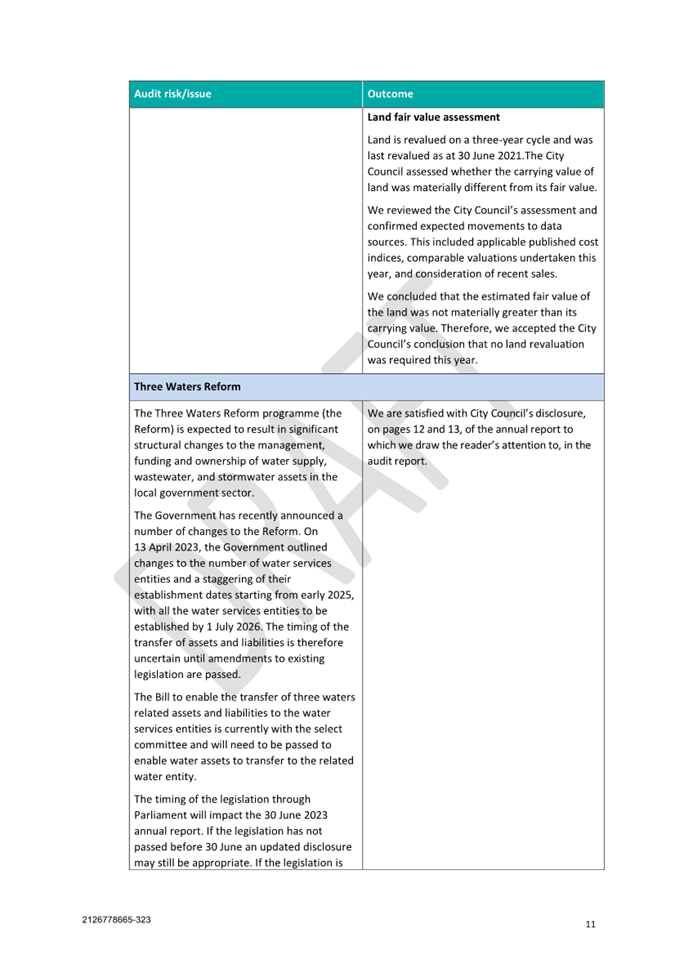

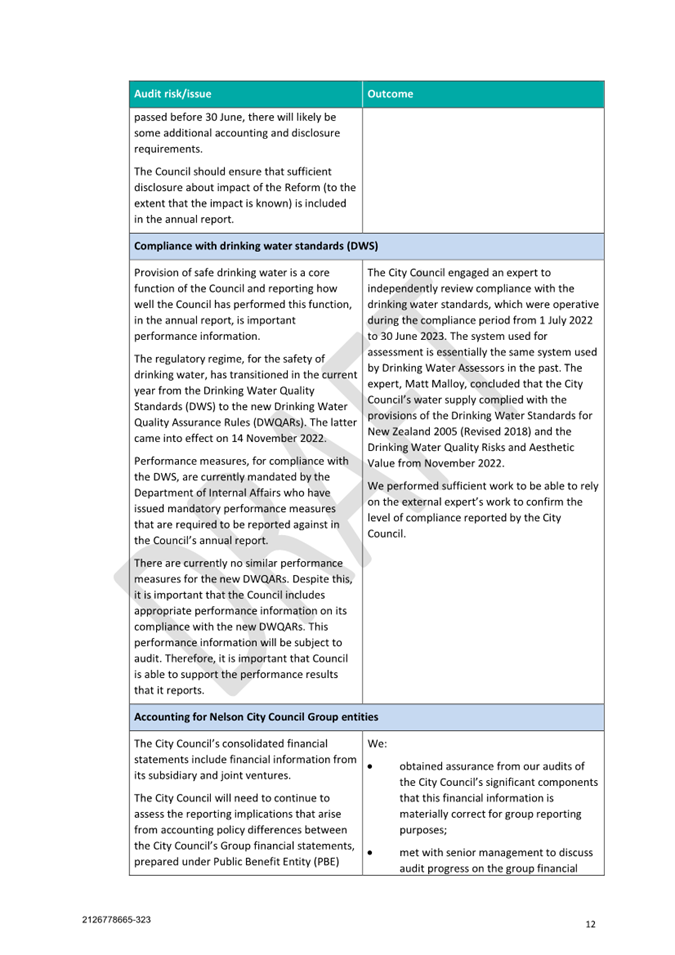

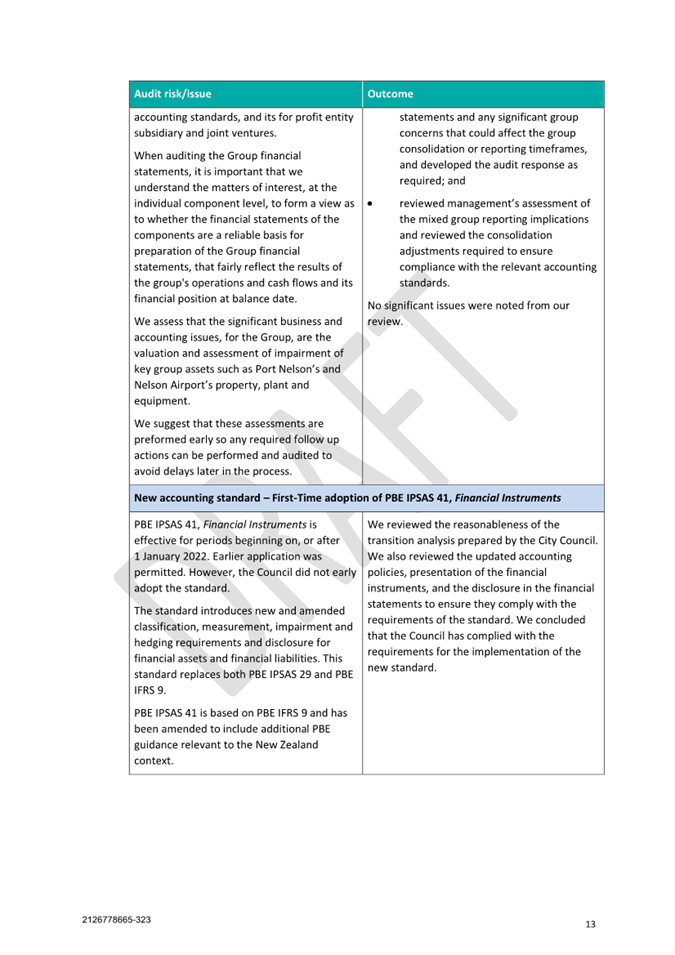

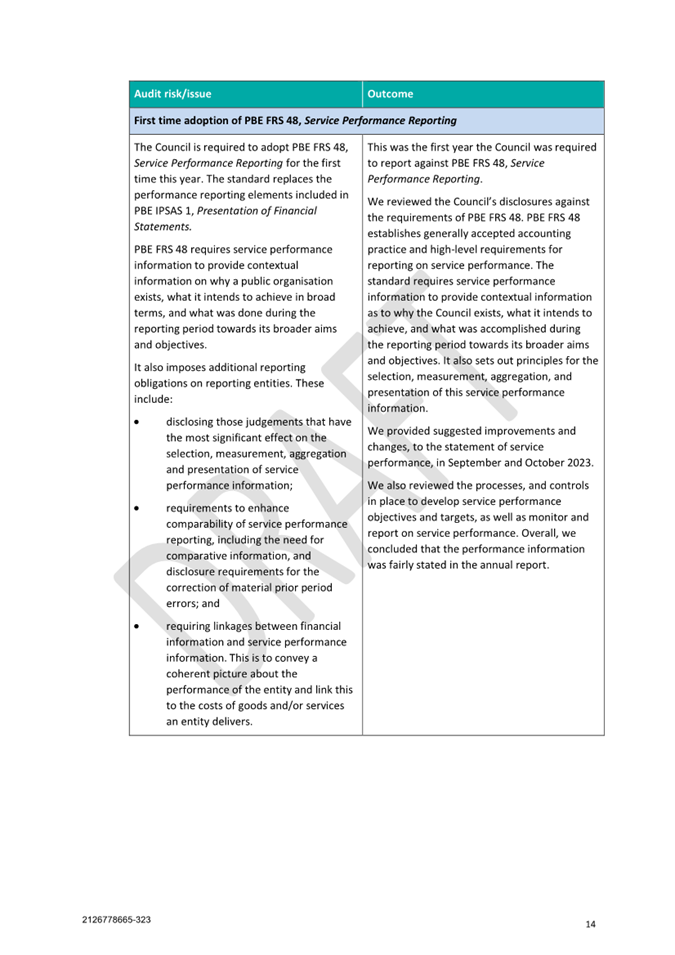

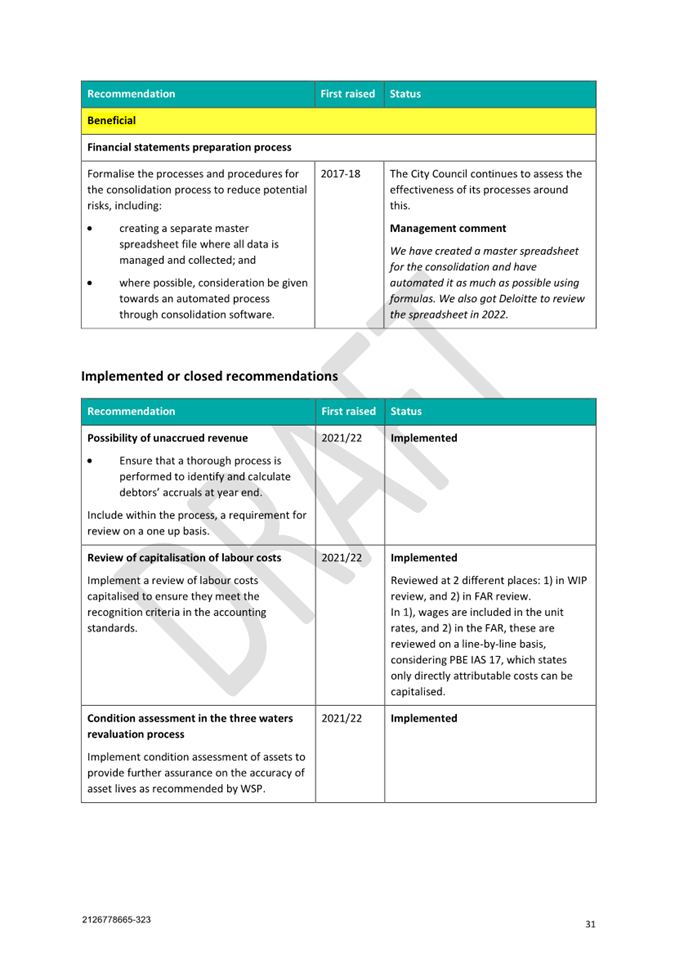

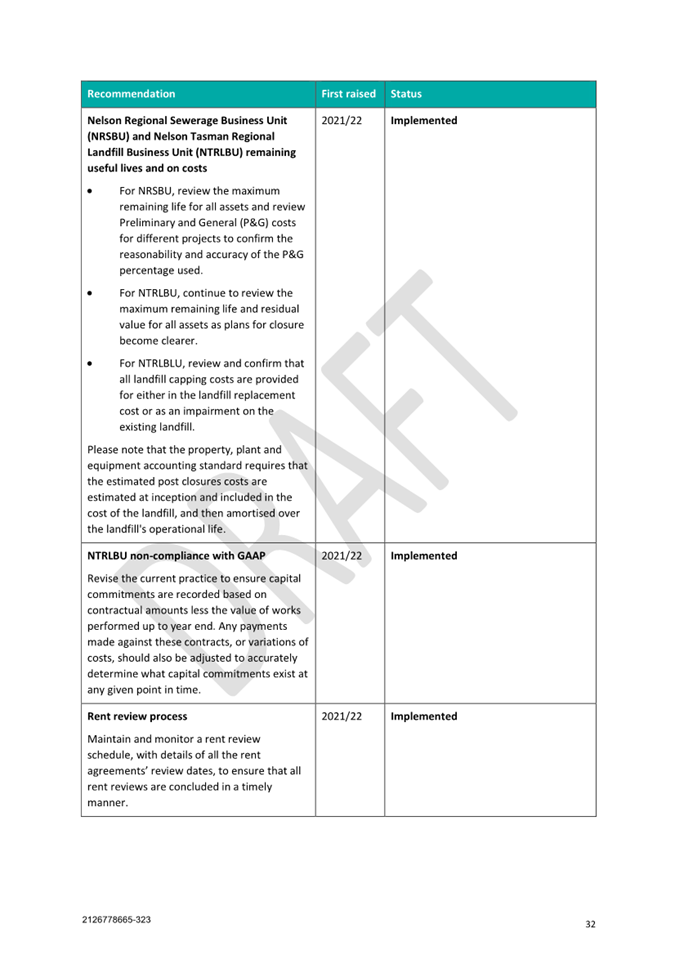

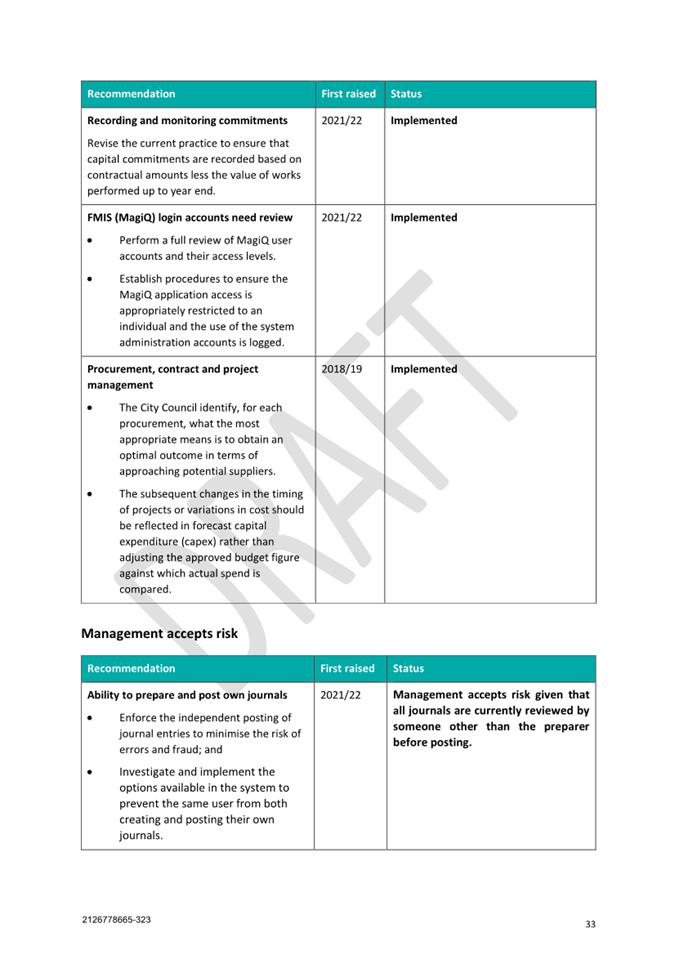

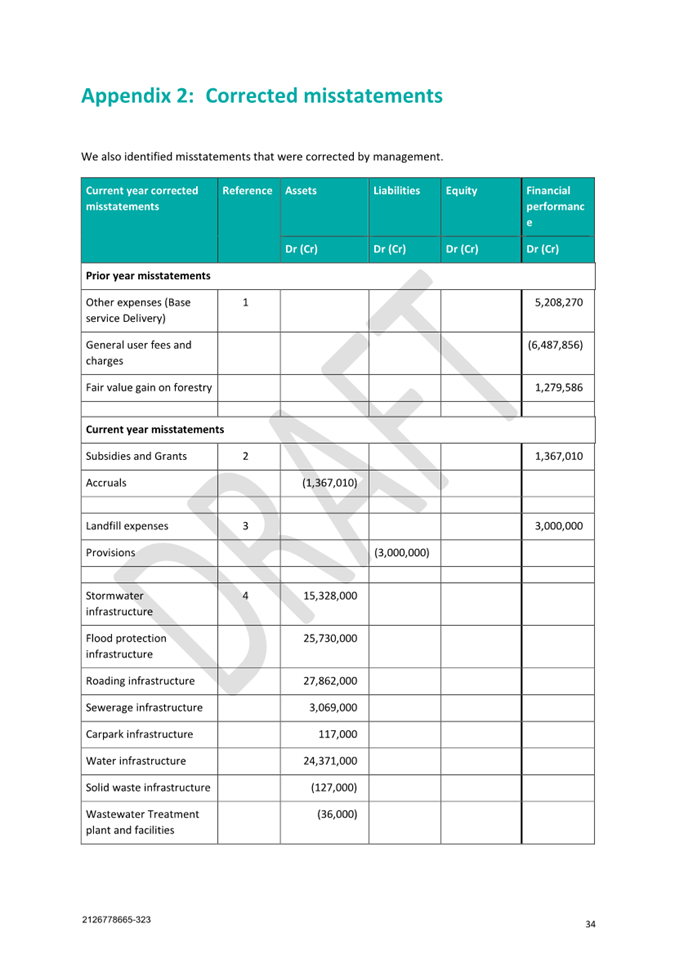

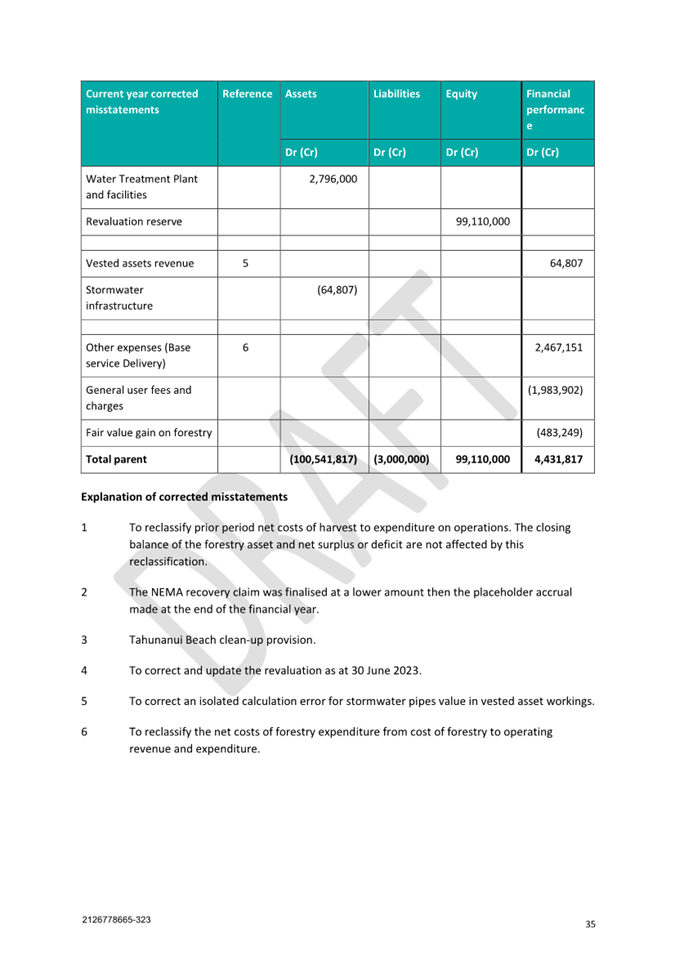

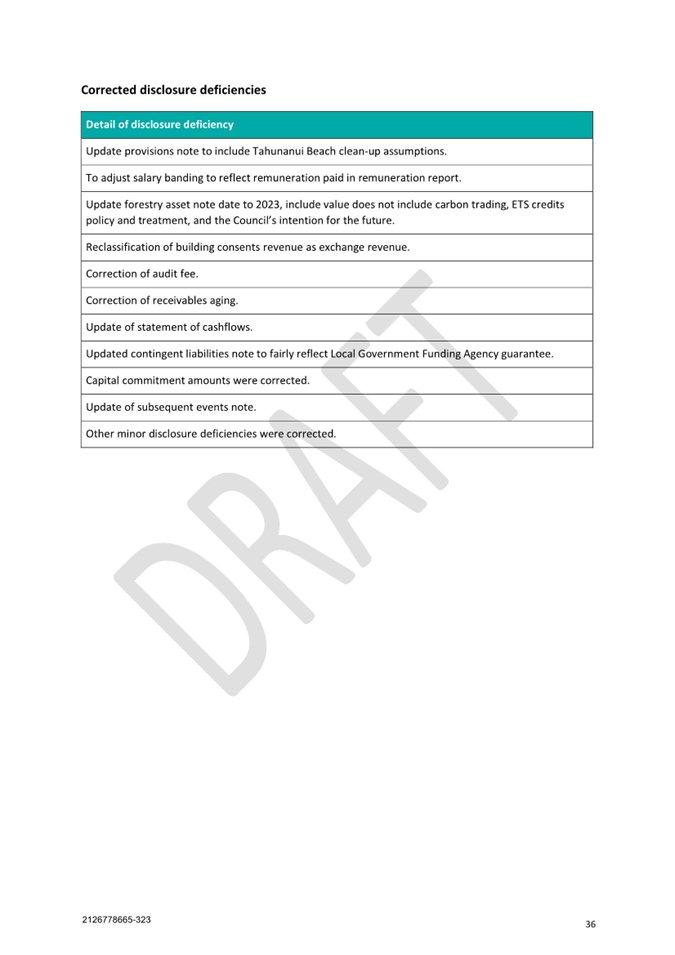

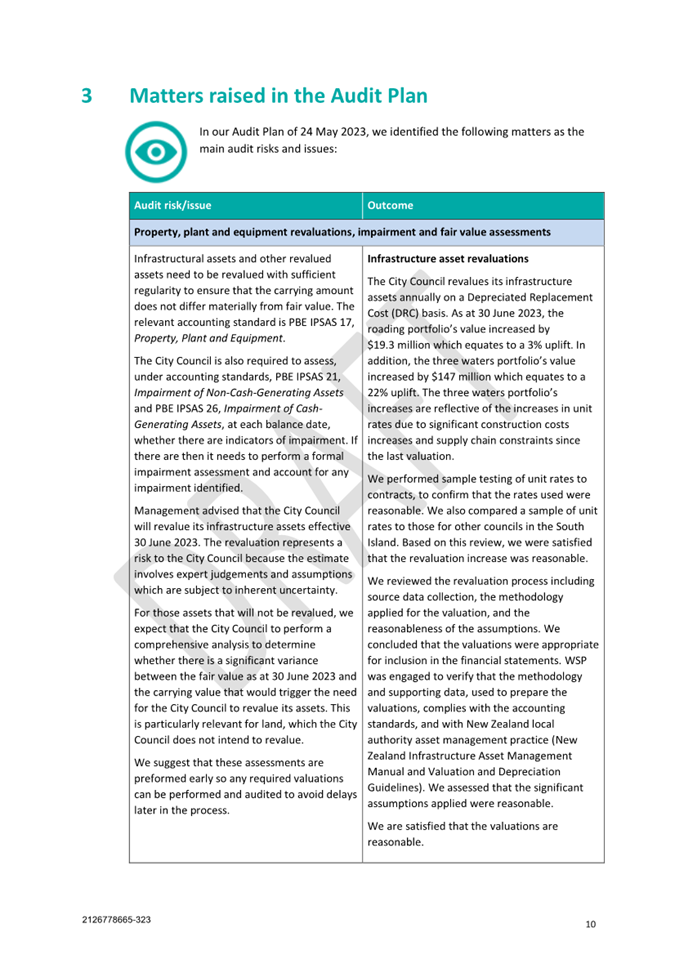

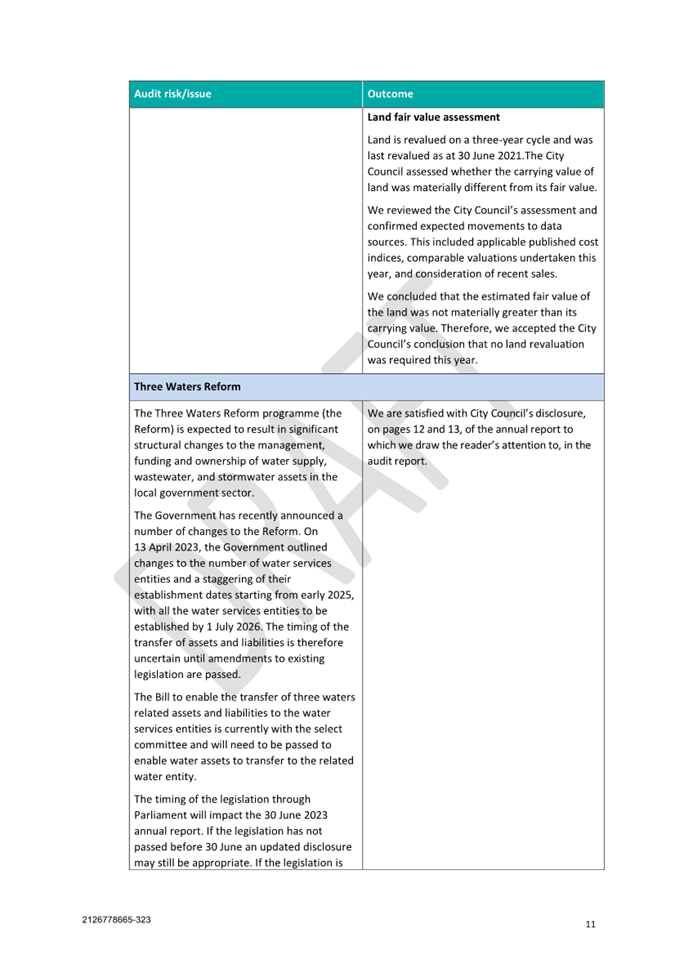

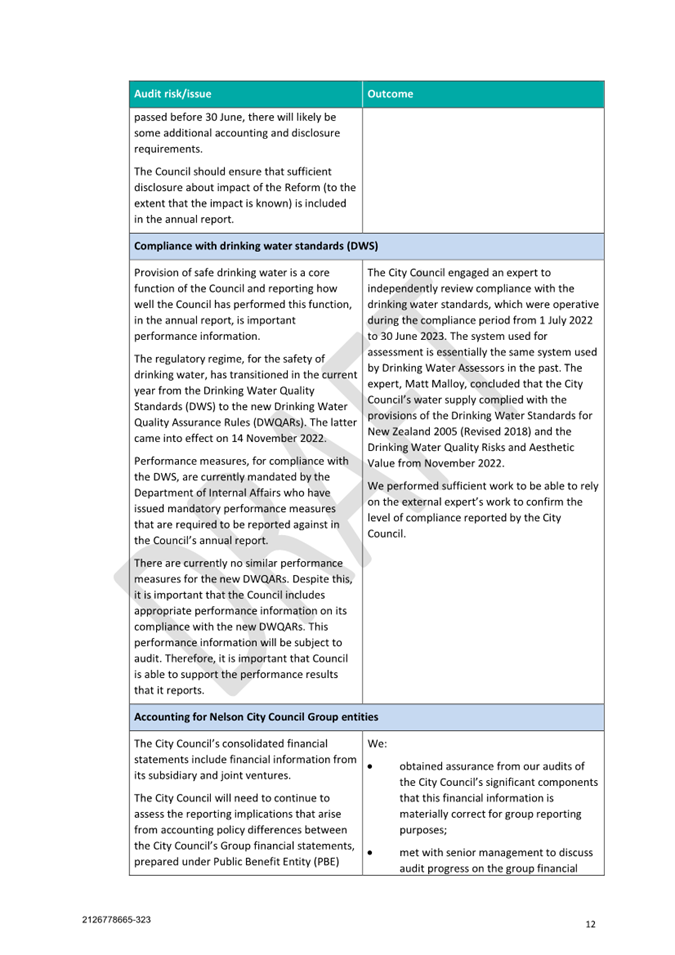

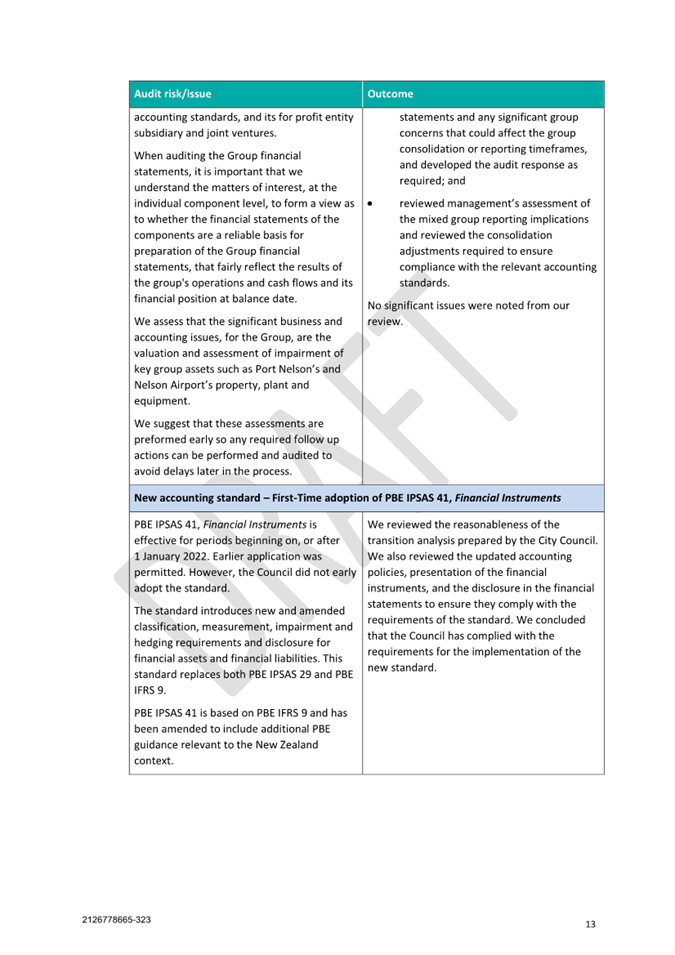

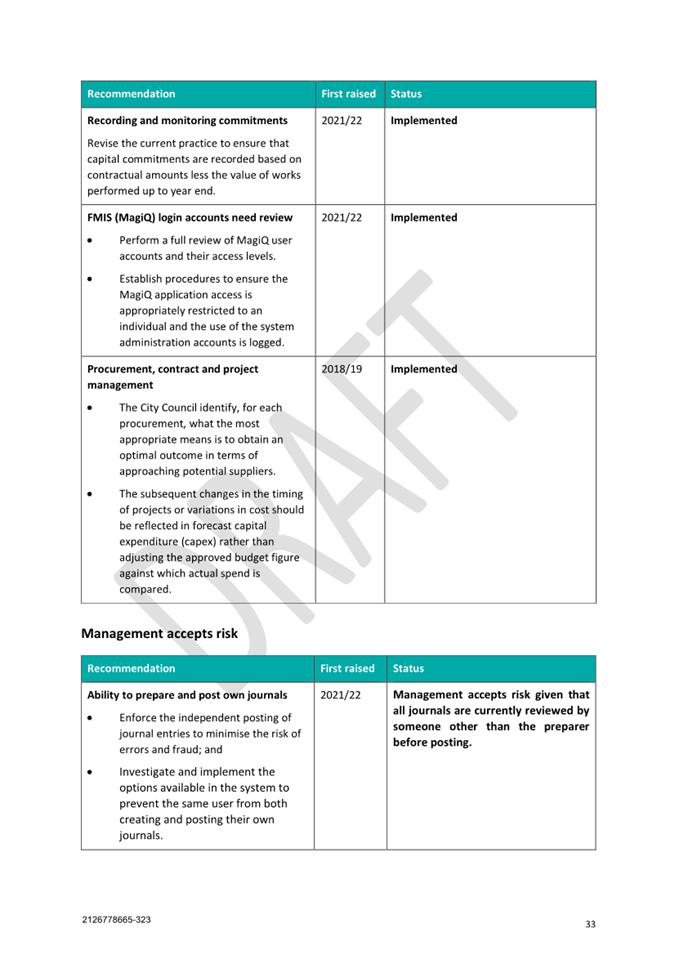

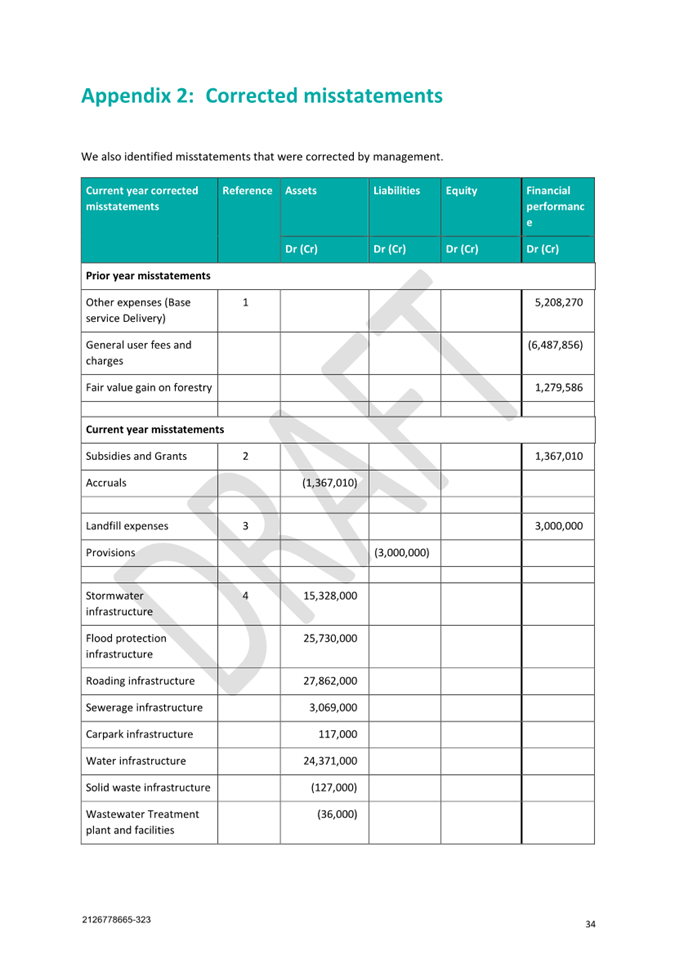

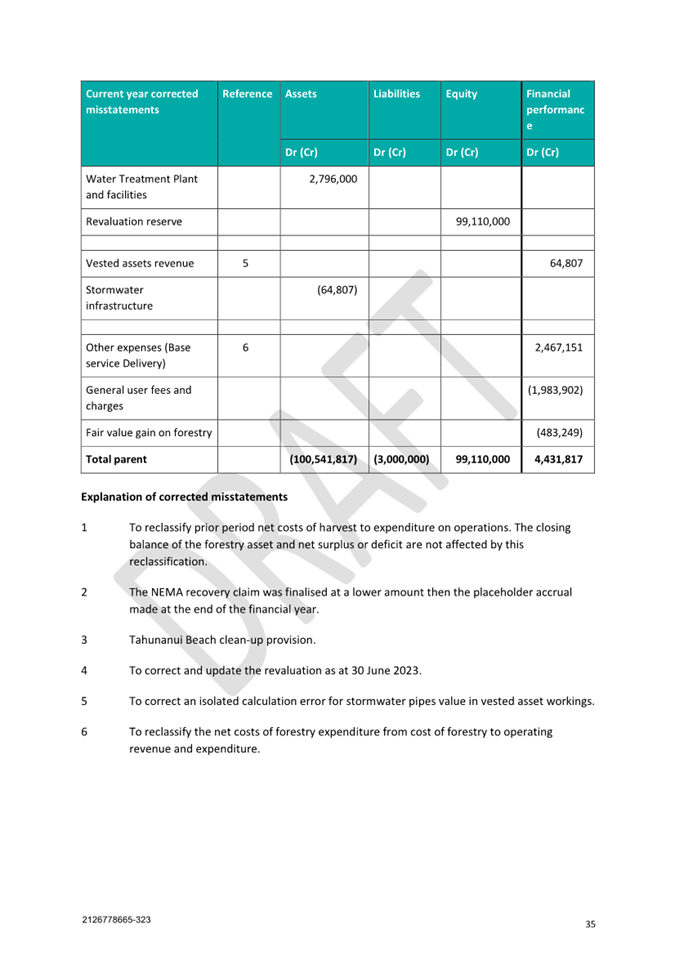

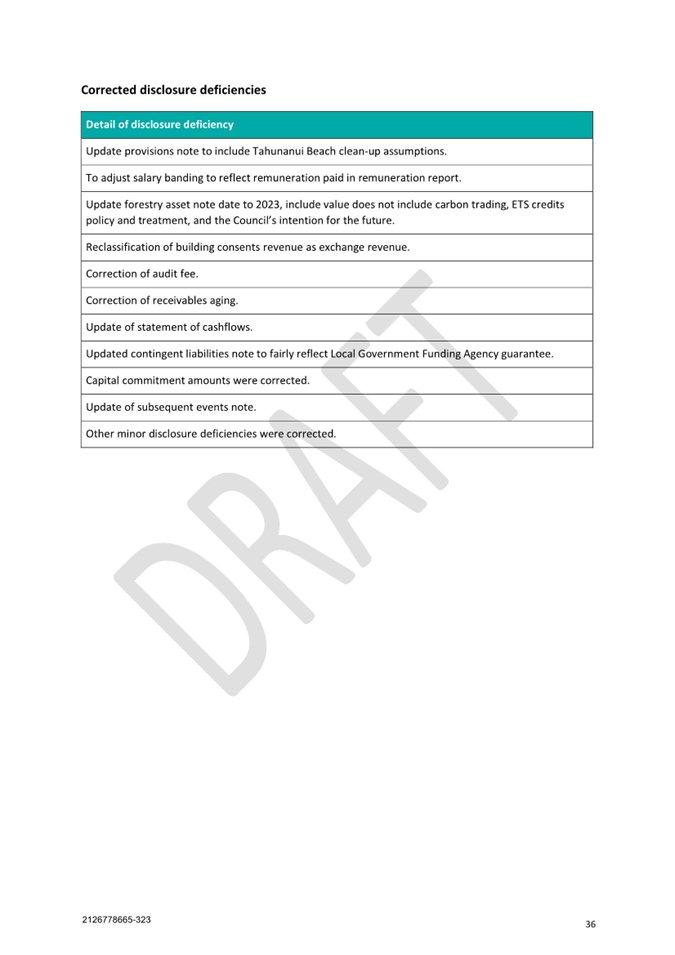

Council, received on 14 November 2023 (Section 3, Attachment 1), Audit NZ

comment on a number of matters considered in the Audit Plan to be the main

audit risks and issues:

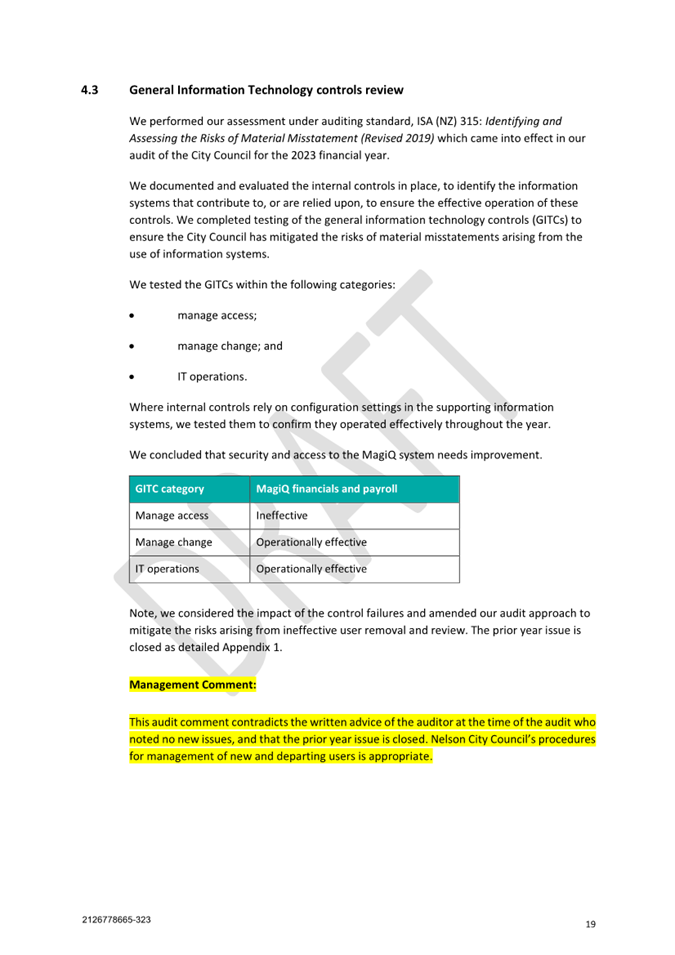

· Property, plant

and equipment revaluations, impairment and fair value assessments

· Three Water Reform

· Compliance with

drinking water standards

· Accounting for

Nelson City Council group entities

· New Accounting Standard

– First-Time adoption of PBE IPSAS 41, Financial Instruments

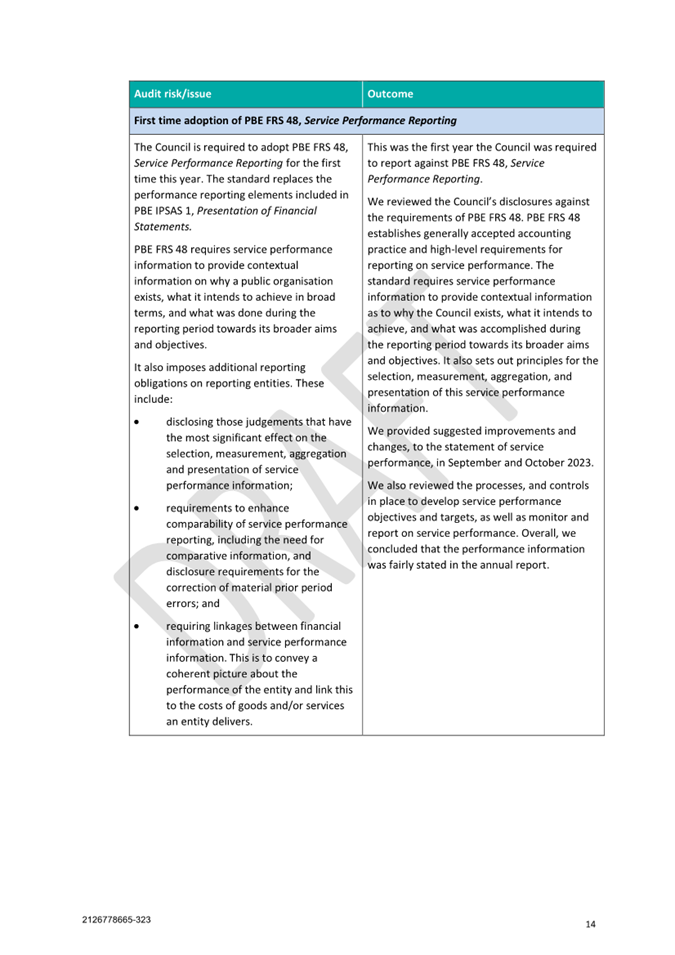

· First time

adoption of PBE FRS 48, Service Performance Reporting

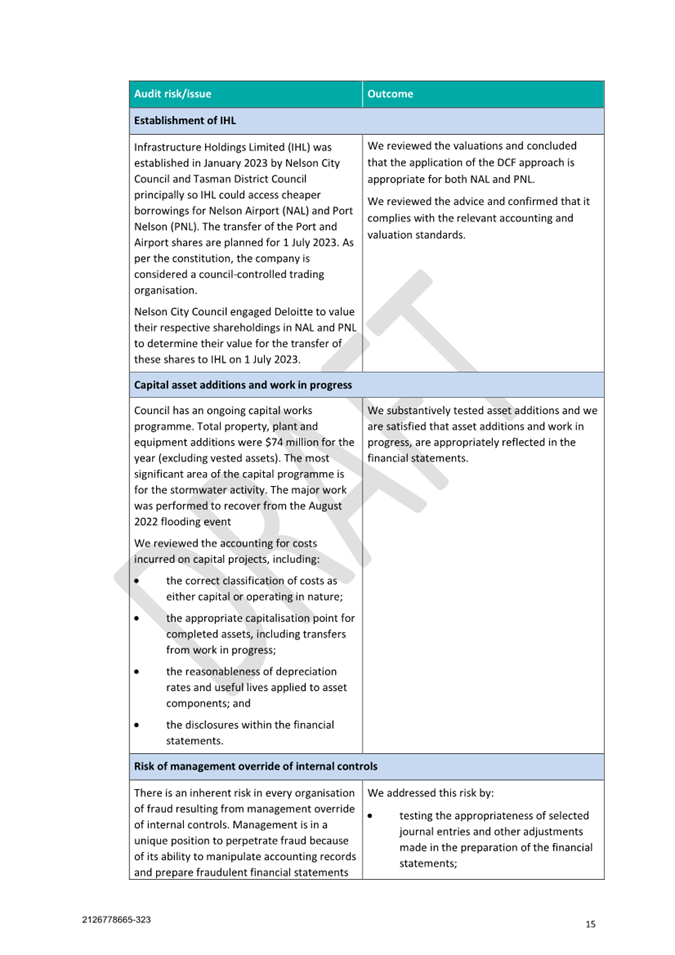

· Establishment of

IHL

· Capital asset

additions and work in progress

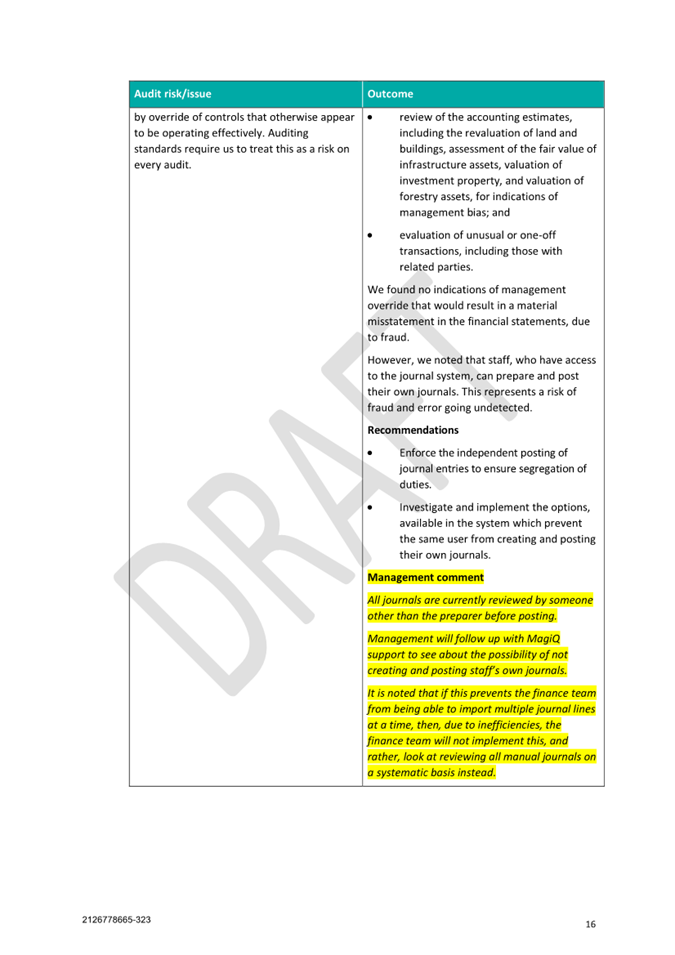

· Risk of management

override of internal controls

3.5 Matters identified

during the audit include:

· Revaluation of

infrastructure assets

· Drinking water

quality performance measures (protozoa and bacteria)

4. Conclusion

4.1 That

the Committee notes the matters raised in the management letter for the year

ending 30 June 2023 and the manner in which officers propose to address them.

Attachments

Attachment 1: 2126778665-323

- Letter from Audit NZ on Annual Report for year ending 30 June 2023 ⇩

Item 6: Letter From Audit NZ on Annual Report for year

ending 30 June 2023: Attachment 1

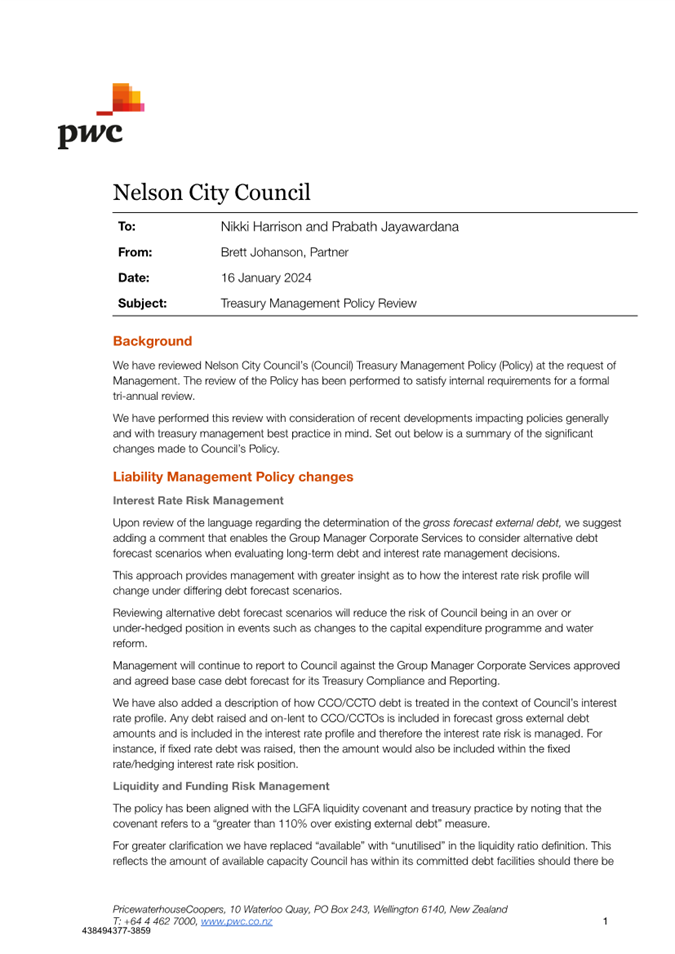

Item 7: Draft Treasury

Management Policy including Liability Management and Investment Policies

|

|

Audit, Risk and Finance Committee

14 February 2024

|

Report

Title: Draft

Treasury Management Policy including Liability Management and Investment

Policies

Report

Author: Nikki Harrison -

Group Manager Corporate Services

Report

Number: R28288

1. Purpose

of Report

1.1 To adopt the new

Treasury Management Policy including the amended Liability Management and

Investment Policies.

2. Recommendation

|

That

the Audit, Risk and Finance Committee

1. Receives

the report Draft Treasury Management Policy including Liability Management

and Investment Policies (R28288)

and its attachments (438494377-3859 and 438494377-3833).

|

Recommendation to Council

|

That the

Council

1. Adopts the Treasury

Management Policy (438494377-3833).

|

3. Background

3.1 Under the Local

Government Act 2002 (LGA) section 102(2)(b) and (c) Council must adopt a

Liability Management Policy and an Investment Policy. The current

Treasury Management Policy including Liability Management and Investment

Policies was adopted in June 2021 and is due for review in June 2024 to align

with the Long Term Plan 2024-34.

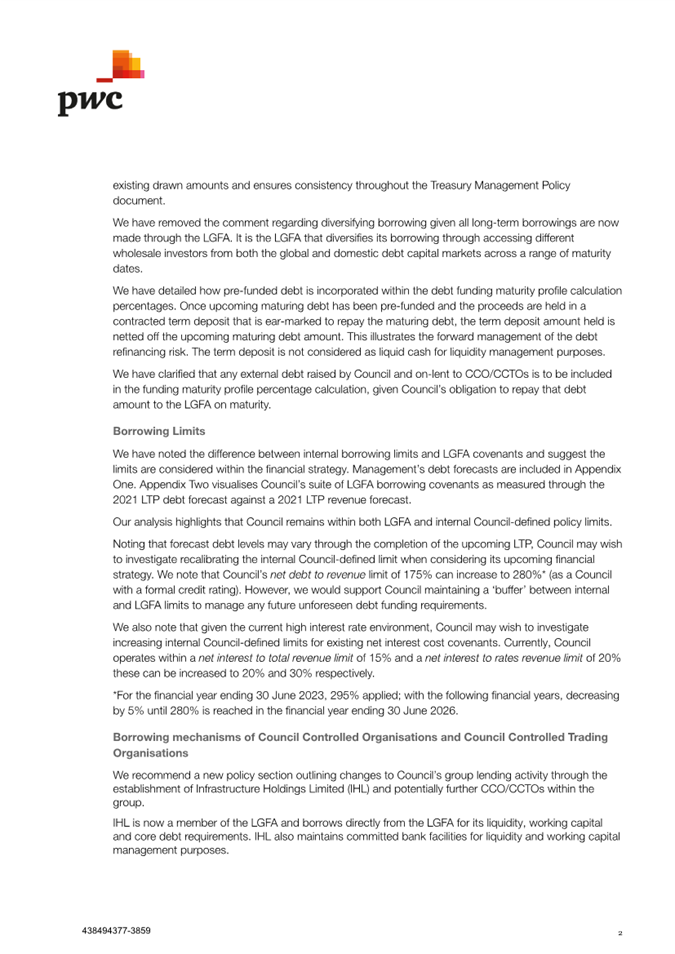

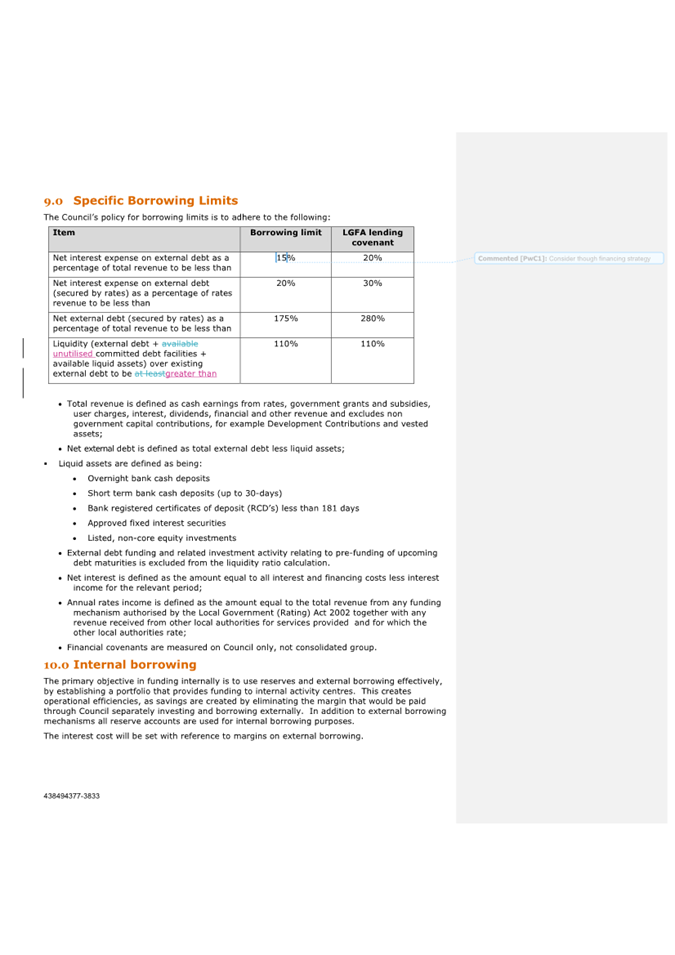

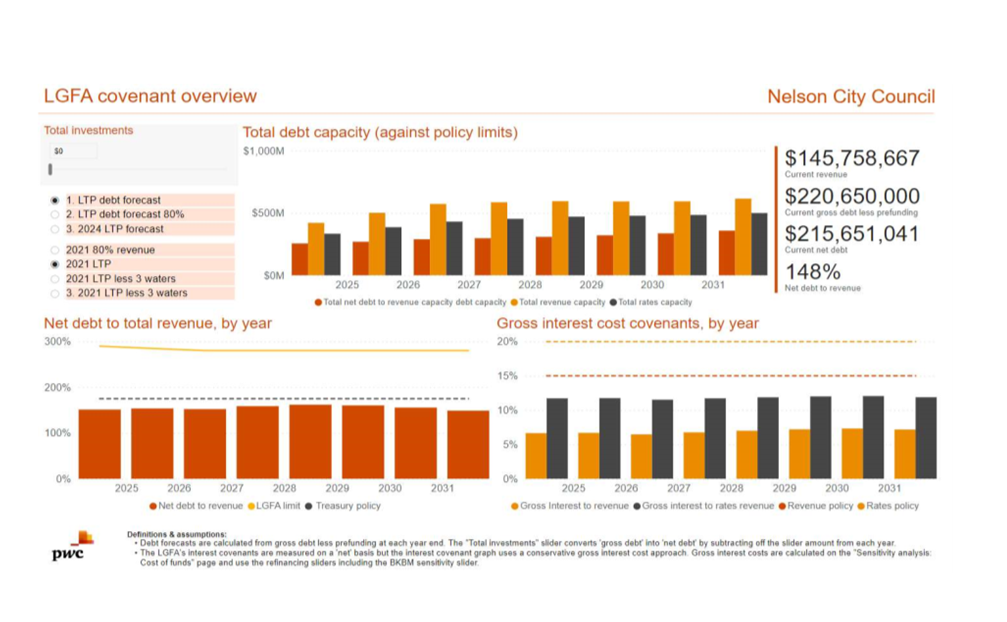

3.2 In order to manage

Council’s proposed work programme in the LTP 2024-34, the debt to revenue

ratio is proposed to be changed from 175% to 200%. This change to the Financial

Strategy needs to be also changed in the Treasury Management Policy.

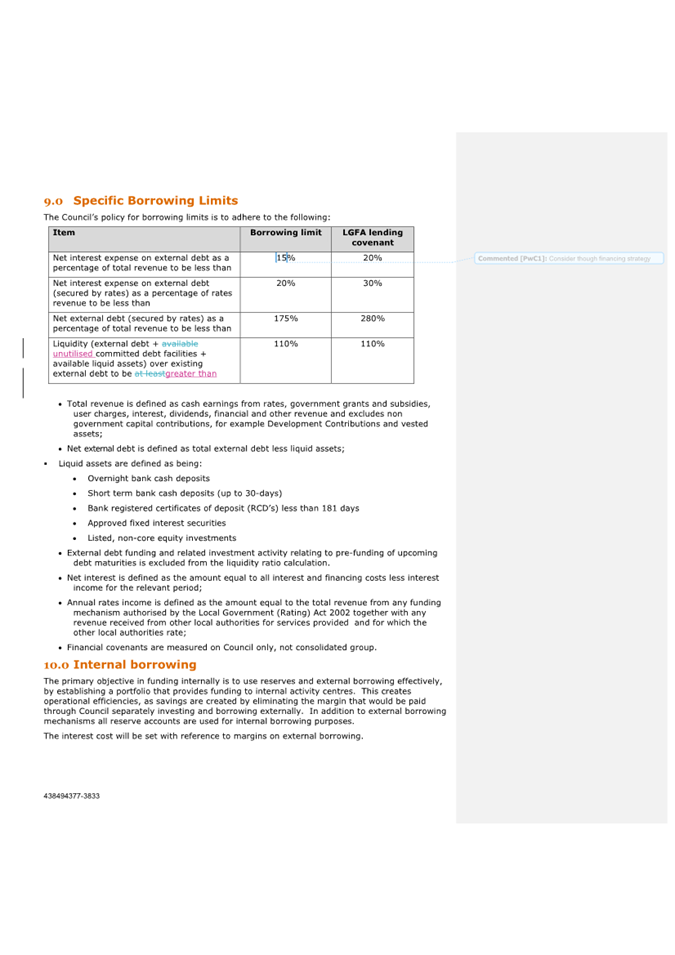

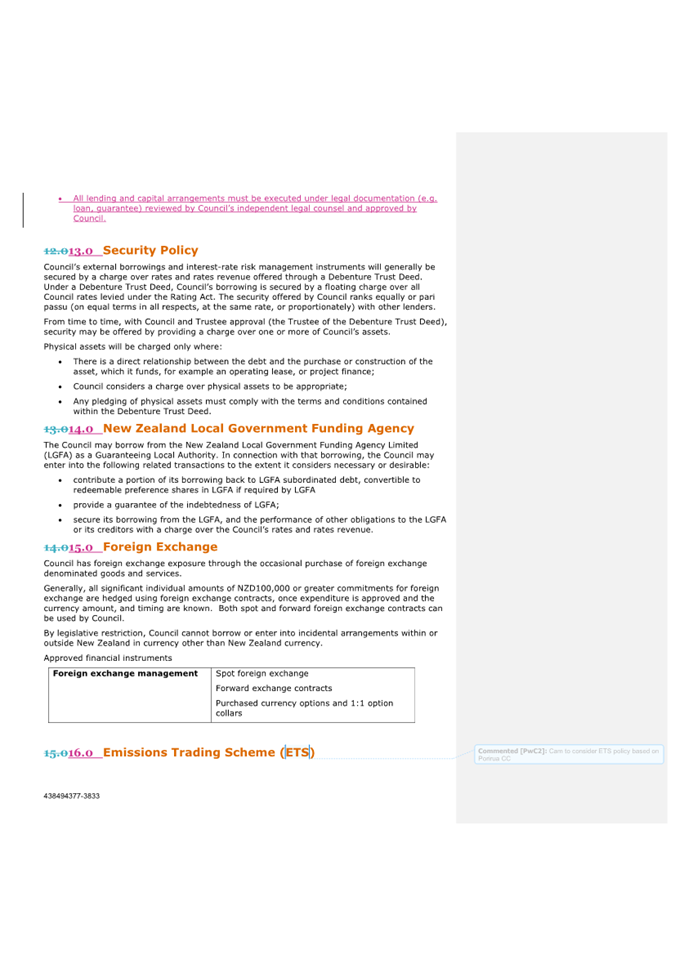

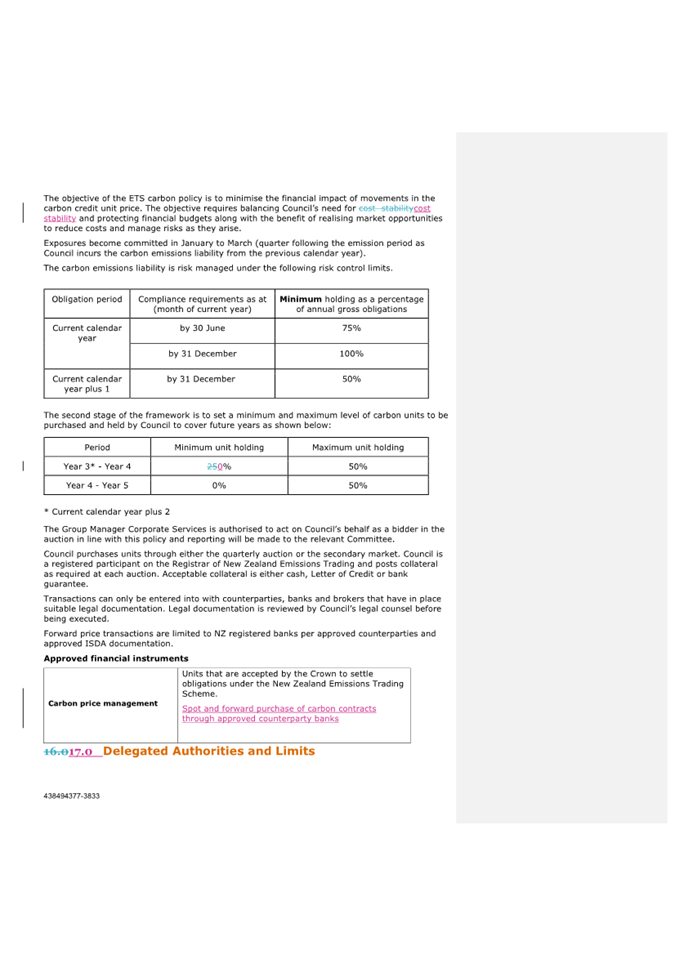

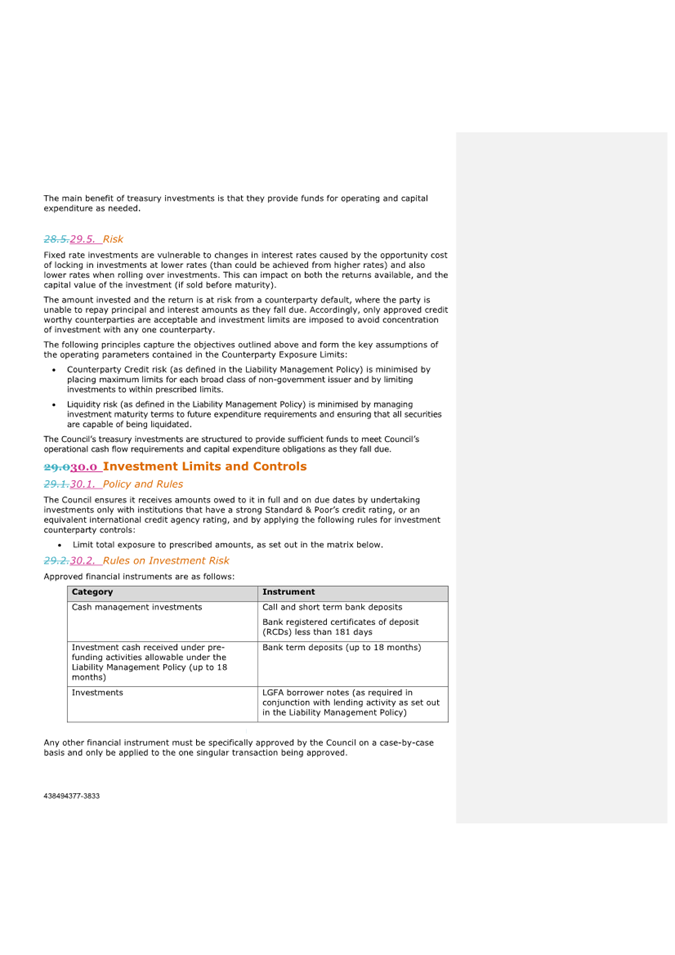

4. Discussion

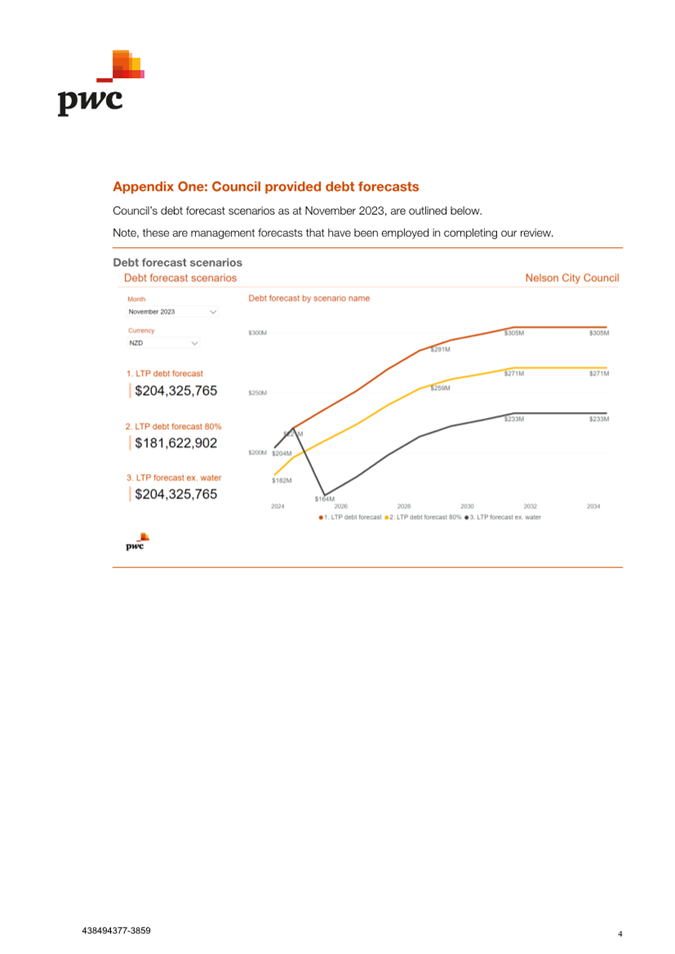

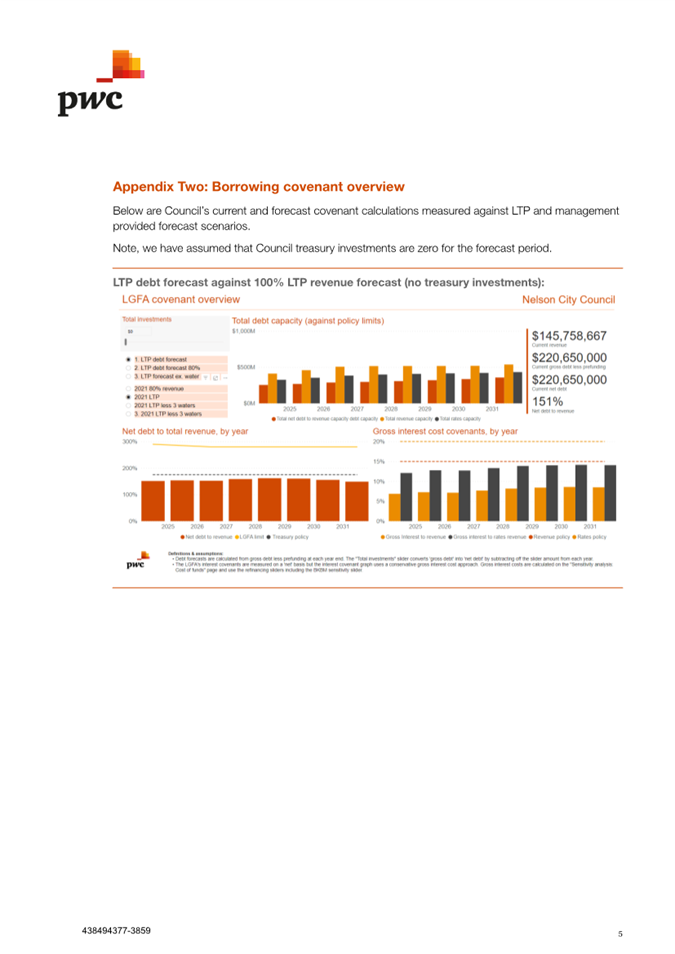

4.1 The Council’s

treasury advisors, Price Waterhouse Cooper (PWC), have reviewed and updated the

Council’s draft Treasury Management Policy to continue to align with

sound treasury management sector practice. Their cover memo is included as

Attachment 1 and key recommendations are included below.

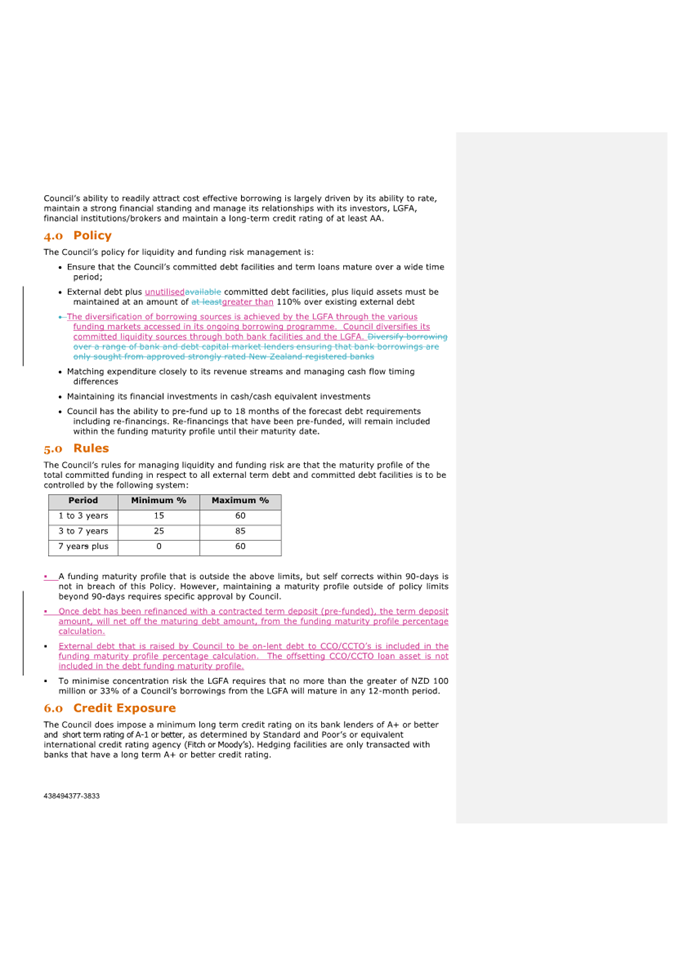

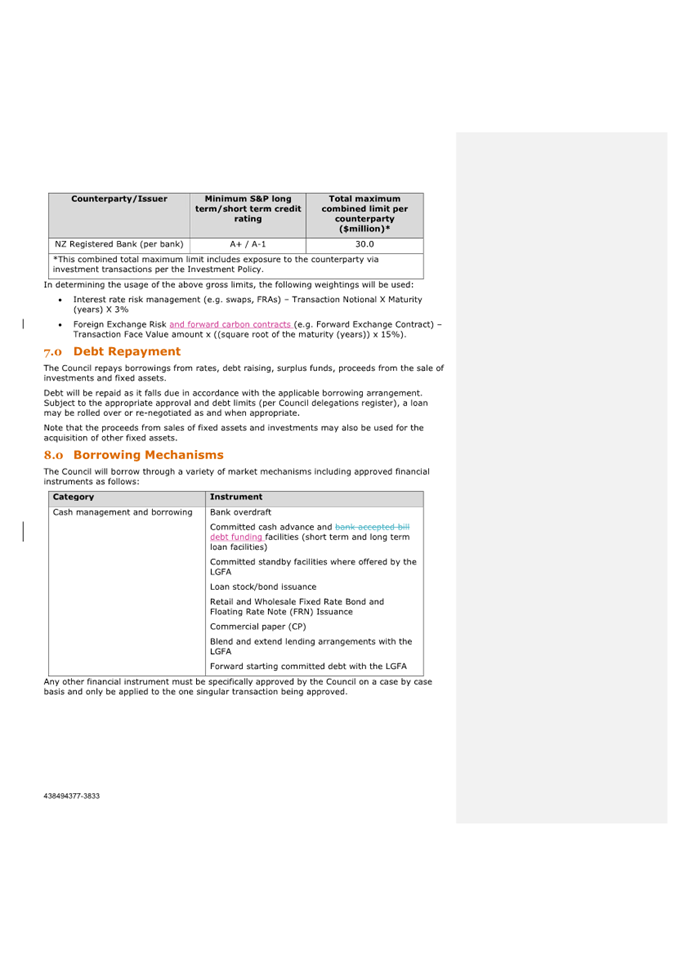

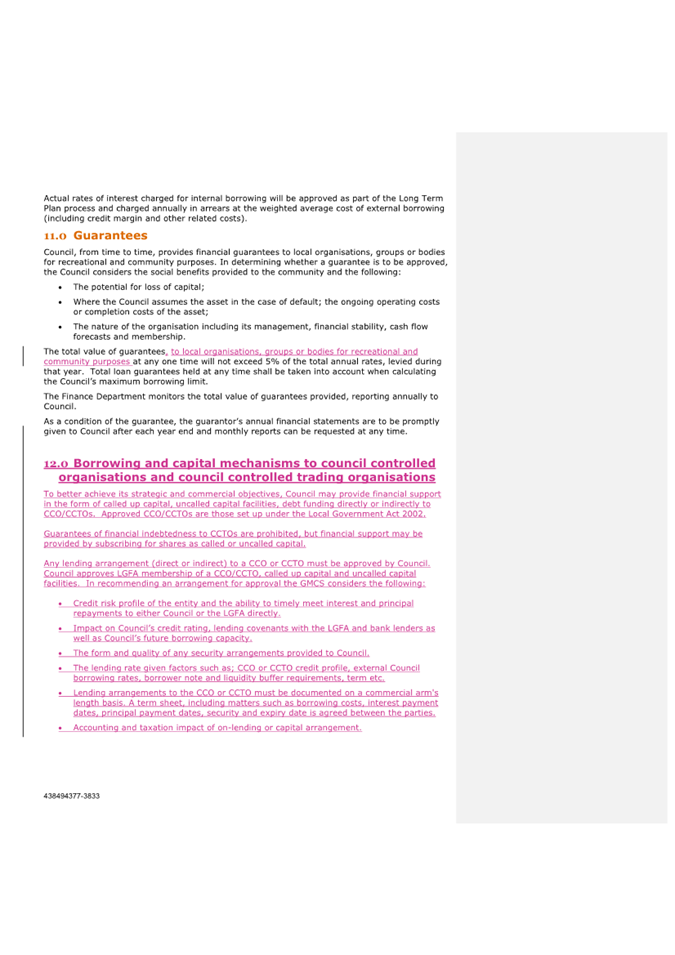

Liability Management Policy

4.2 The following

recommendations were made based on the review and updates from the Financial

Strategy:

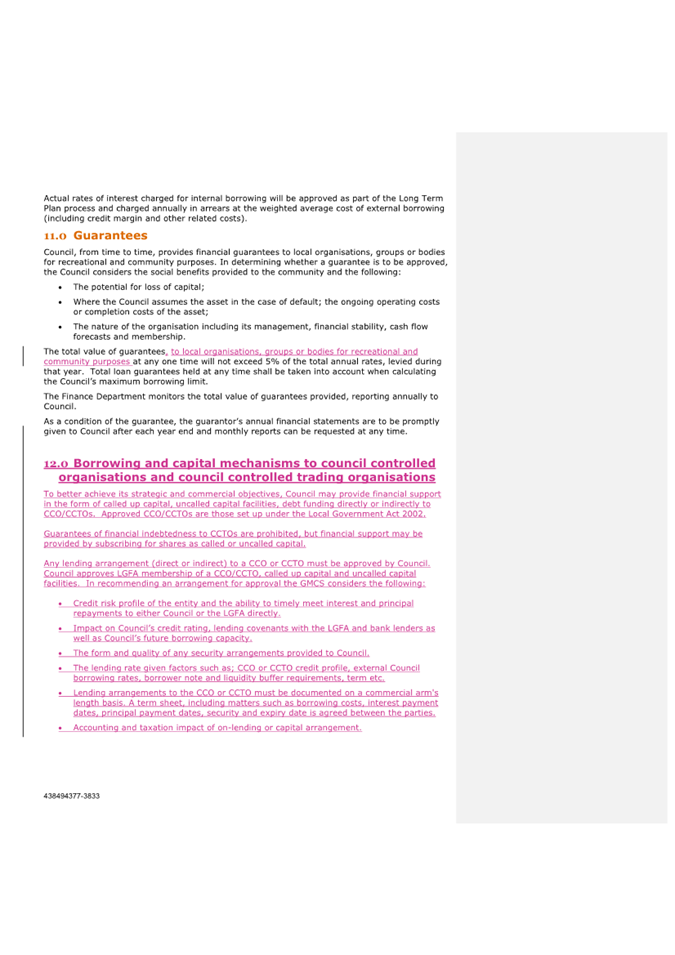

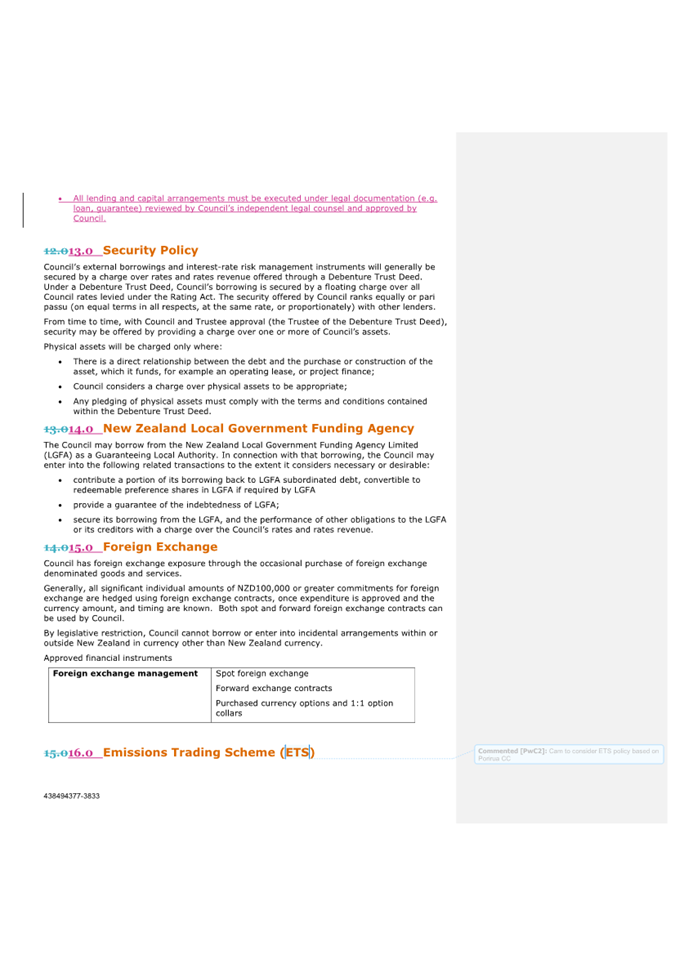

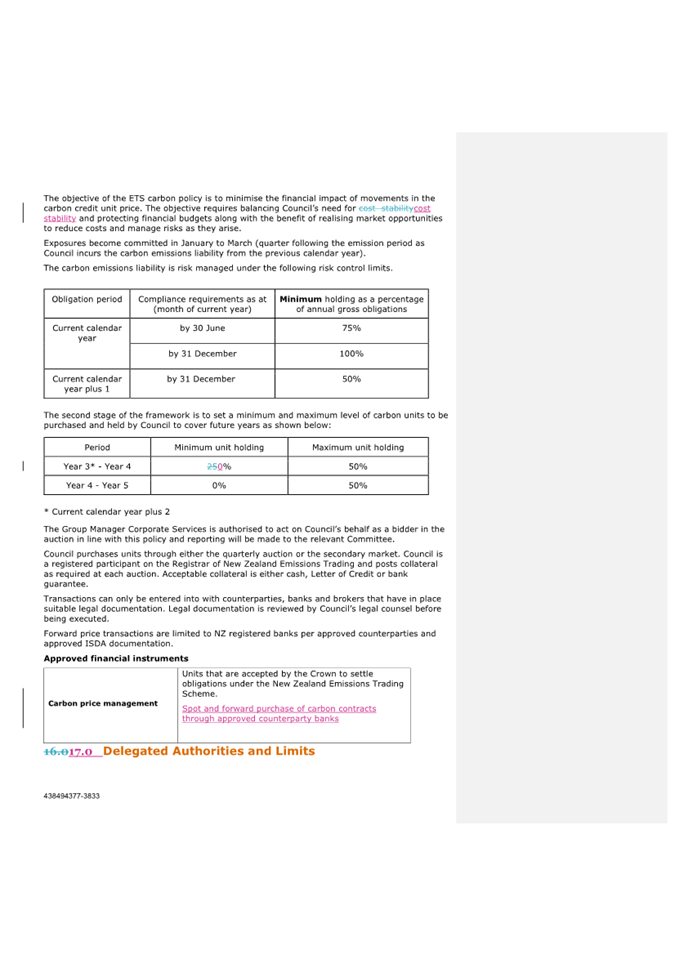

4.2.1 Section 12 has been added outlining

changes to Council’s group lending activity through the establishment of

Infrastructure Holdings Limited (IHL) and potentially further Council

Controlled Organisation/Council Controlled Trading Organisations within the

Council group. Inclusion of this policy section will allow the Council,

by separate decision, to consider providing lending support to, for example the

proposed Marina CCO, and the section includes a framework to apply when

considering these decisions.

4.2.2 In order to reflect changes made to

the Financial Strategy as part of the draft 2024-34 LTP, the net external debt

as a percentage of total revenue has been changed to 200% (previously 175%) in

Section 9.

Investment Policy

4.3 The changes to the

Investment Policy are:

4.3.1 The policy has been updated to

recognise the establishment of Infrastructure Holdings Limited and included

comments on its role and purpose as a centralised treasury function. The Port

Nelson Limited and Nelson Airport Limited investments have been consolidated

under the Infrastructure Holdings Limited investment.

4.3.2 The forestry section has been updated

to reflect the proposal in the Long Term Plan 2024-34 to transition away from

commercial forestry over time.

4.4 Finance staff have

conducted a review of the changes in depth and are satisfied with the

recommendations.

5. Options

|

|

|

Advantages

|

· Changes

are recommended by Council’s treasury advisor and are considered

current best practice

· Can

continue to proactively manage treasury risk

· Updated

for the holding company borrowing directly from the LGFA

· Allows

for CCO/CCTO borrowing via the Council

|

|

Risks and Disadvantages

|

· None

|

|

|

|

Advantages

|

· No

change from existing policy

|

|

Risks and Disadvantages

|

· Policy

will not conform to current best practice

· Will

not allow for CCO/CCTO borrowing via the Council

|

6. Next Steps

6.1 On approval at Council

the adopted Treasury Management Policy will come into effect and will be

updated on the Council website.

6.2 Active daily

monitoring of compliance against the policies is the responsibility of the Group

Manager Corporate Services and the Finance Manager.

Attachments

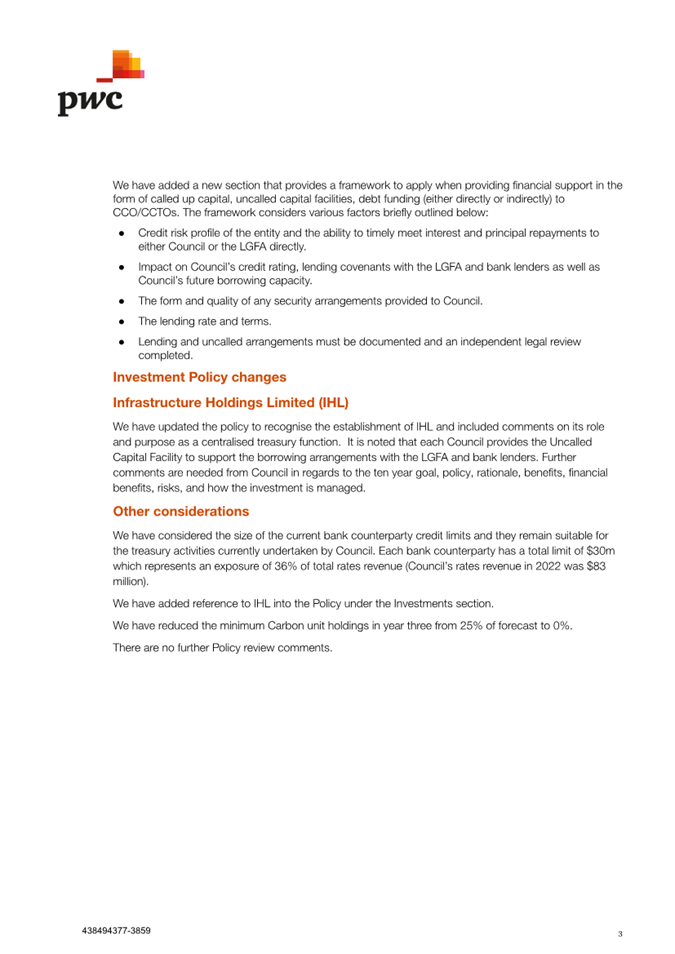

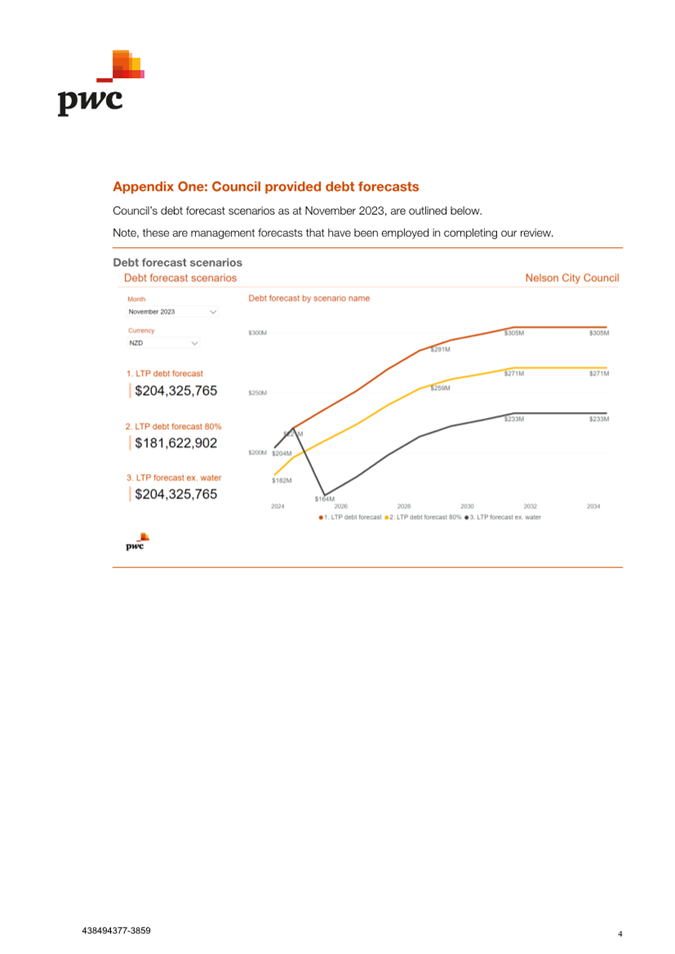

Attachment 1: 438494377-3859 -

Nelson City Council Policy Review Memo January 2024 ⇩

Attachment 2: 438494377-3833

Treasury Management Policy - Apr2021 (PwC edits) ⇩

|

Important considerations for decision making

|

|

Fit with Purpose of Local Government

Risk management through having an Investment

Policy and Liability Management Policy ensures Council is effectively

promoting the social, economic, environmental, and cultural well-being of

communities in the present and for the future.

|

|

Consistency with Community Outcomes

and Council Policy

The Liability Management and Investment Policies

are required by section 102 of the Local Government Act. Nothing in the

proposed Treasury Management Policy (including the Investment Policy and Liability

Management Policy) is inconsistent with any other previous Council decision

or Council Policy. Updating the policy supports the community outcome

“Our Council provides leadership and fosters partnerships, a regional

perspective and community engagement”.

|

|

Risk

There is limited risk from the proposed changes.

|

|

Financial impact

There is no direct financial impact from adopting

the Treasury Management Policy.

|

|

Degree of significance and level of

engagement

This matter is of low significance because it

includes minor amendments to existing policies, therefore no consultation has

taken place.

|

|

Climate Impact

None.

|

|

Inclusion of Māori in the

decision making process

No engagement with Māori has been undertaken

in preparing this report.

|

|

Legal

context

· Council has

power to make this decision under the Local Government Act section 102 (5).

The Council does not need to consult on the Treasury Management Policy.

|

|

Delegations

The Audit Risk and Finance committee has the following

delegations to consider Investment and Liability Management Policies:

Areas of Responsibility:

· Council’s

Treasury policies

Powers to Decide:

· none

Powers to Recommend:

· Any

matters within the areas of responsibility

|

Item 7: Draft Treasury Management Policy including

Liability Management and Investment Policies: Attachment 1

Item 7: Draft Treasury

Management Policy including Liability Management and Investment Policies:

Attachment 2

Item 8: Quarterly

Finance Report to 31 December 2023

|

|

Audit, Risk and Finance Committee

14 February 2024

|

Report

Title: Quarterly

Finance Report to 31 December 2023

Report

Author: Prabath

Jayawardana - Manager Finance

Report

Authoriser: Nikki Harrison - Group Manager Corporate

Services

Report

Number: R28218

1. Purpose of Report

1.1 To

inform the Committee of the financial results for Council for six months ended 31

December 2023, and to highlight any material variations.

2. Recommendation

|

That

the Audit, Risk and Finance Committee

1. Receives

the report Quarterly Finance Report to 31 December 2023 (R28218) and its attachments (1857728953-1257,

839498445-18200 and 839498445-18199).

|

3. Background

3.1 The

whole of Council financial reporting provided to this Committee focuses on the

six-month performance (1 July 2023 to 31 December 2023) compared with the the year-to-date (YTD) approved capital and operating

expenditure budgets. The quarterly report includes Nelson City

Council performance only and does not include its subsidiaries, associates, and

joint ventures.

3.2 Unless

otherwise indicated, all information is against approved Operating budgets, which is Annual Plan 2023/24, plus any carry forwards, plus or minus

any other additions or changes as approved by the Council.

3.3 Commentary

is provided below for significant variances of +/- $500,000.

4. Financial

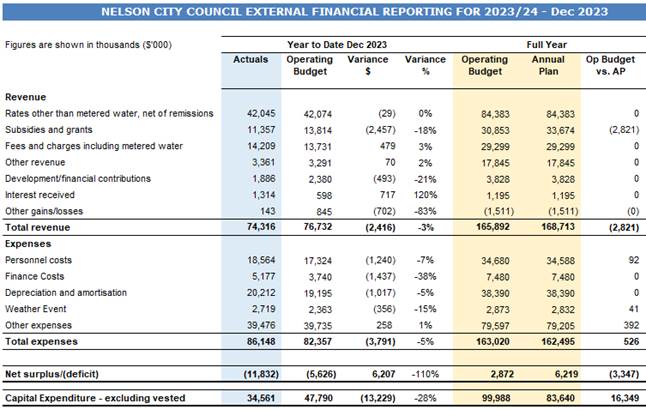

Performance

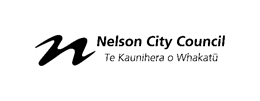

4.1 For

the six months ending 31 December 2023, the Council’s draft deficit is $11.8m

against a budgeted deficit of $5.6m ($6.2m unfavourable to budget), mainly due

to reasons explained below.

4.2 Profit

and Loss

Operating

Budget vs. Annual Plan Budget

4.3 The

Full Year Operating Budget is less than the Annual Plan

Budget by $3,300,000. This is mainly due to a $3.6m reduction in Transport

Choices Grants, with an offsetting $1.0m reduction in Transport Choices

expenses (net $2.6m).

4.4 Revenue

4.5 Rates

income is in-line with budget.

4.6 Subsidies

and Grants is less than budget by $2,457,000. This

is mainly due to $1.5m reduction in Transport subsidies and grants (relating to

multiple projects including Active Linear Corridor, Transport Choices, Railway

Lighting and the weather event), a reduction of $0.6m in Waste Management

Funding (see below reduction in kerbside kitchen waste expenses), as well as a

reduction in 3 Waters Better Off Funding due to funding delays (see below

reduction in expenses). Offsetting this is $0.6m in Environmental Grants from

MFE and MPI received earlier than budgeted for.

4.7 Fees

and Charges income is greater than budget by

$479,000. This is mainly due to water by meter charges to

residential and commercial being higher than anticipated.

4.8 Other

revenue is in line with budget and there

are no significant variances greater than $0.5m.

4.9 Development

Contributions is less than budget by $493,000.

This is due to less development activity than budgeted for.

4.10 Finance

Revenue is greater than budget by $717,000.

This is due to more funds being invested than planned because of pre-funding of

debt. Currently there is $25m of investments for pre-funding of debt.

4.11 Other

gains/(losses) is less than budget by $702,000. This

relates to the forestry activity, with net income being less than budget due to

delays in harvesting at Marsden and Roding Forest.

4.12 Expenses

4.13 Personnel

costs are greater than budget by $1,240,000. This

is mainly due to the expected savings from the vacancy provision ($1.5m

provision) not being achieved. Instead, any cost savings from vacancies have

been spent on temp staff, higher duty allowances, and other staff-related

costs.

4.14 Depreciation

and amortisation costs are greater than budget by $1,017,000.

Depreciation has been based on the 2022/23 asset valuations, in which we

saw large increases. This resulted in a higher depreciation expense than

planned.

4.15 Finance

costs are greater than budget by $1,437,000. This

increase in interest costs is due to a) additional pre-funding of debt (which

is offset by the $0.7m over variance in finance revenue), and b) $0.7m increase

in interest costs due to both higher interest rates and borrowings than planned

for the 6-months ended 31 December 2023.

4.16 Weather

Event costs are greater than budget by $356,000

with there being no significant variances greater than $0.5m.

4.17 Other

expenses are less than budget by $258,000.

Significant variances are as follows:

4.17.1 Insurance is greater than budget by $1.0m. This is because

of increases in premiums due to a) increases in asset values, and b) higher

premium rates.

4.17.2 Public Transport

Costs are greater than budget by $30,000. While

the bus service contract is greater than budget by $1.1m, this is offset by minor

improvements budget of $1.1m not being spent to date.

4.17.3 Kerbside Kitchen

Waste expenses are less than budget by $713,000.

This government-funded initiative has been delayed.

4.17.4 Three Waters Better

Off Funding is less than budget by $592,000.

This is due to delays in funding (refer to subsidies and grants above).

4.17.5 Reticulation

Maintenance is greater than budget by $545,000.

This is due to reactive spending on wastewater, stormwater and water supply

reticulation.

4.17.6 Riskpool Claim is greater than budget by $230,000. This is due to

a historic exposure to calls dating pre-2010/11 when Nelson City Council was

part of a New Zealand Mutual Liability Riskpool Scheme for Insurance. This is

funded by the building insurance reserve.

4.17.7 All other variances in other expenses are below $0.5m.

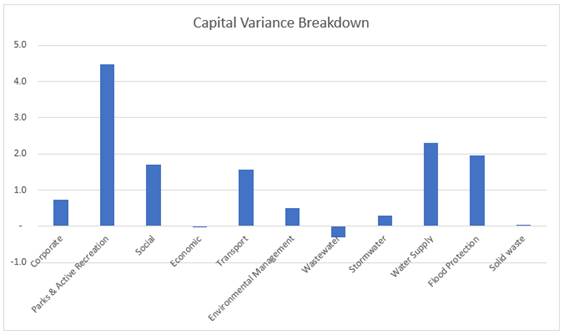

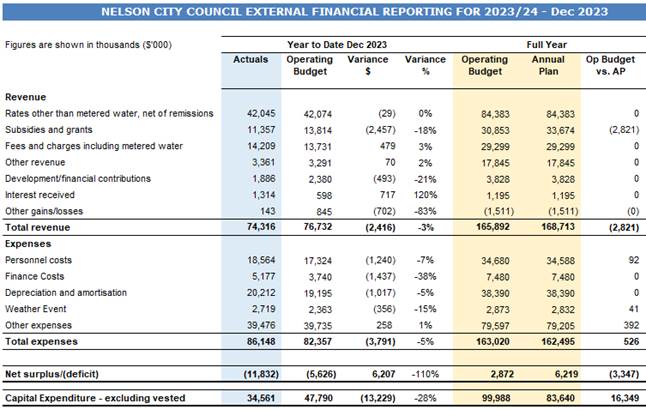

4.18 Profit

and Loss by Activity

4.19 The profit and loss has been

broken down by activity per the above table. Non-controllable income and

expenses have been taken out, so that results per activity are not skewed. Most

of the variance year to date is in the non-controllable income and expenses.

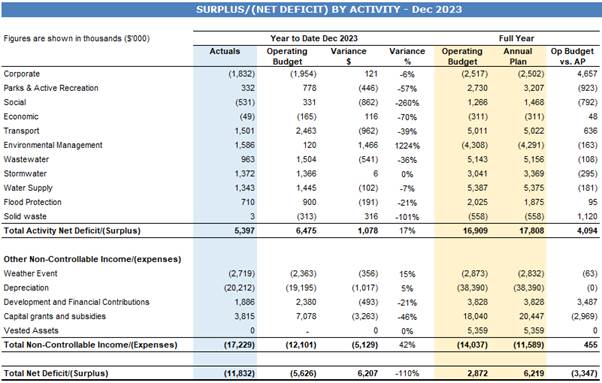

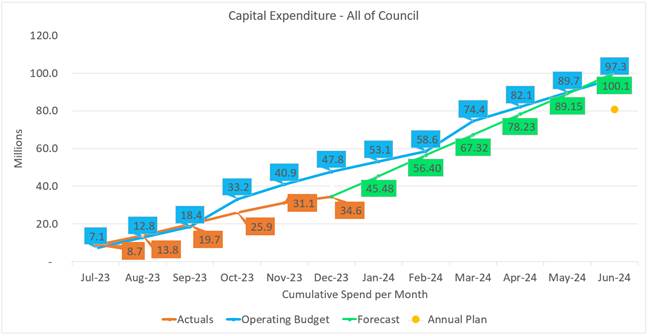

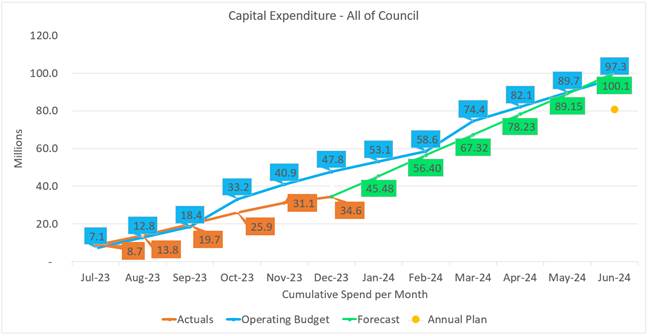

5. Capital

Expenditure

5.1 Capital Expenditure

(including staff time, excluding vested assets and joint operations)

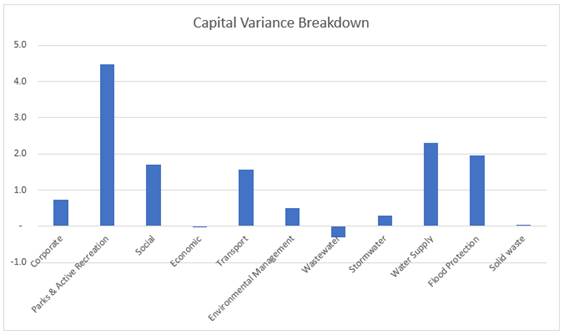

5.2 As

at 31 December 2023, capital expenditure was $34.6m which is $13.3m under the

YTD Operating Budget of $47.8m. The main contributors to the variance were

Transport ($1.6m), Parks & Recreation ($4.5m), Social ($1.7m), Water Supply

($2.3m), and Flood Protection ($2.0m).

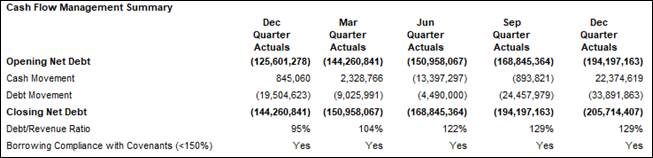

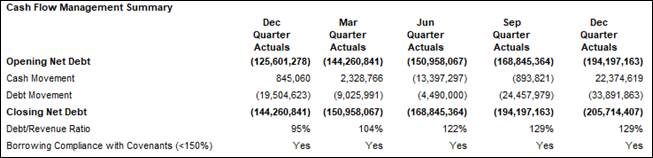

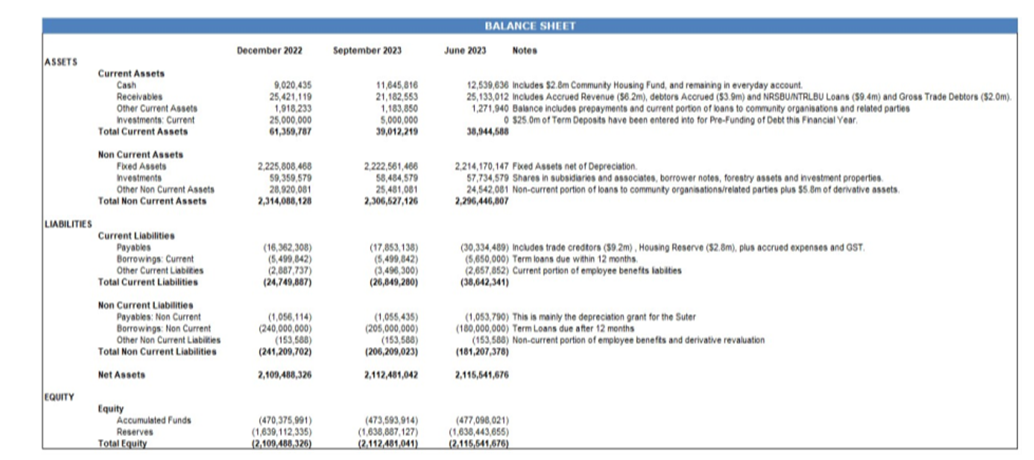

6. Cash Flow

Management

6.1 Net Debt

6.2 As

at 31 December 2023, there was a net debt of $205.7m. This has increased from

30 June 2023 by $36.9m. The full-year Annual Plan budget is $207.9m.

6.3 This

$36.9m increase in net debt from 30 June 2023 is due to: a) to fund the August

2022 weather event ($2.7m expenditure), b) to fund capital expenditure during

the year ($15.4m net of funded depreciation), c) to fund $1.5m advance to

Nelson Tasman Regional Landfill Business Unit (NTRLBU), d) to fund $9.4m

advance in working capital and term loan to Nelson Regional Sewerage Business

Unit, and e) drawdown of Housing NZ funds of $2.5m. The balance is due to

timing of cash inflows and outflows being different than planned.

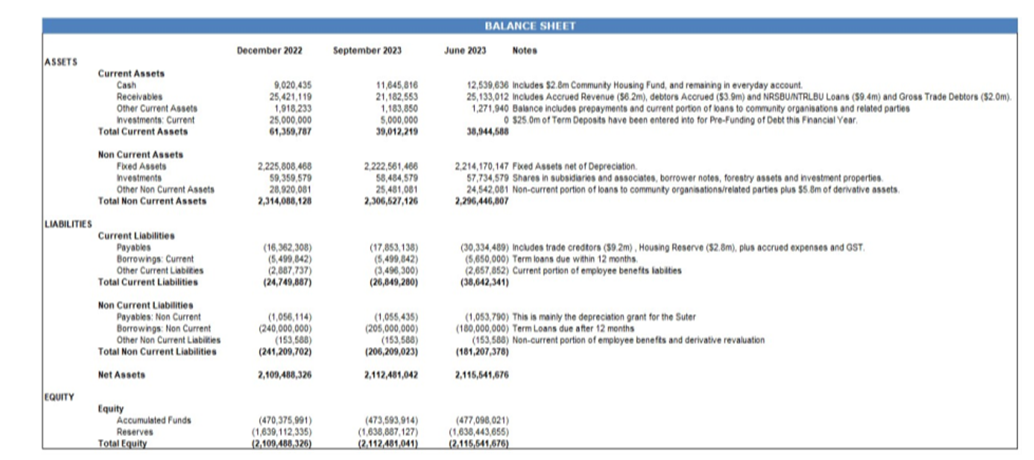

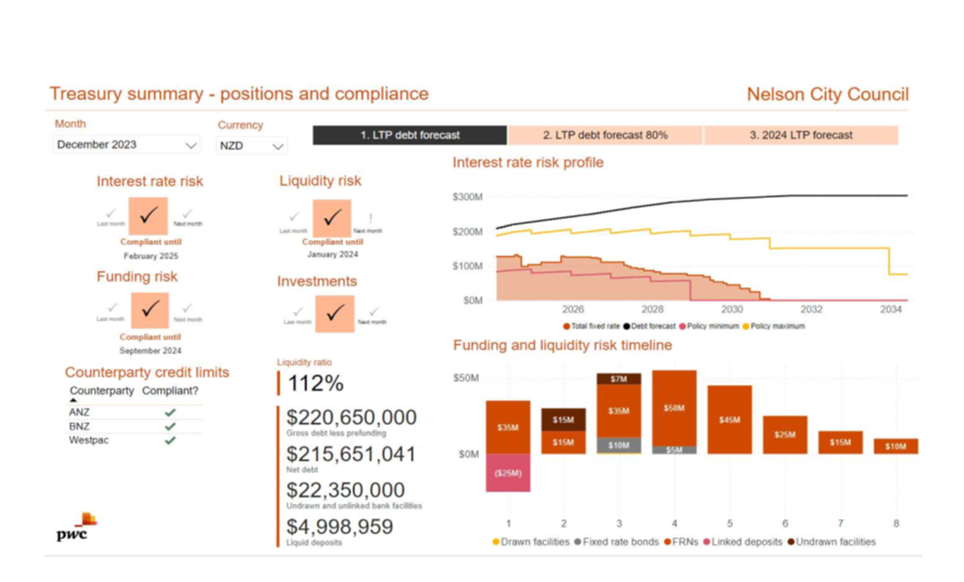

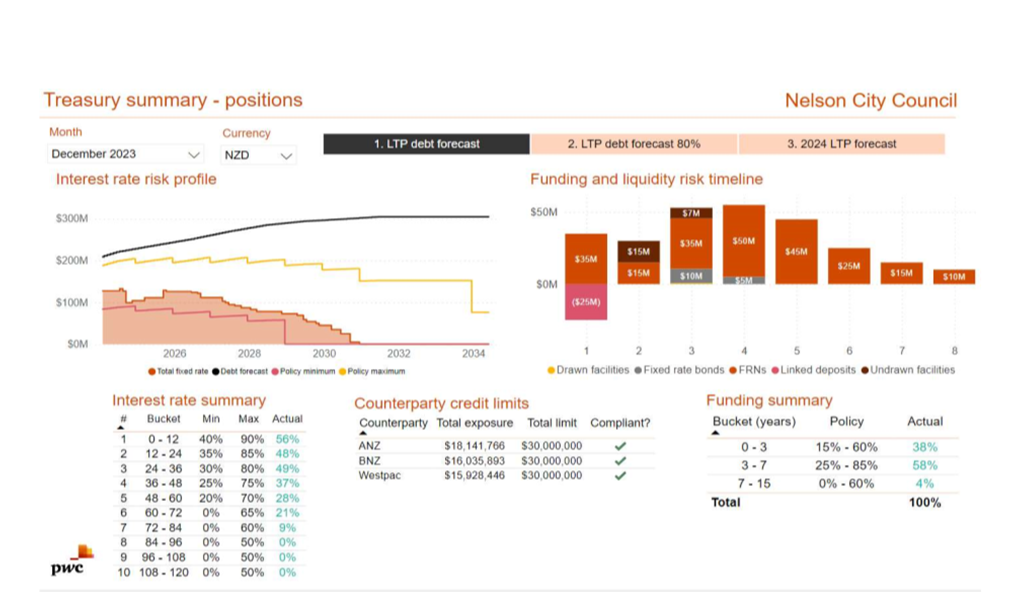

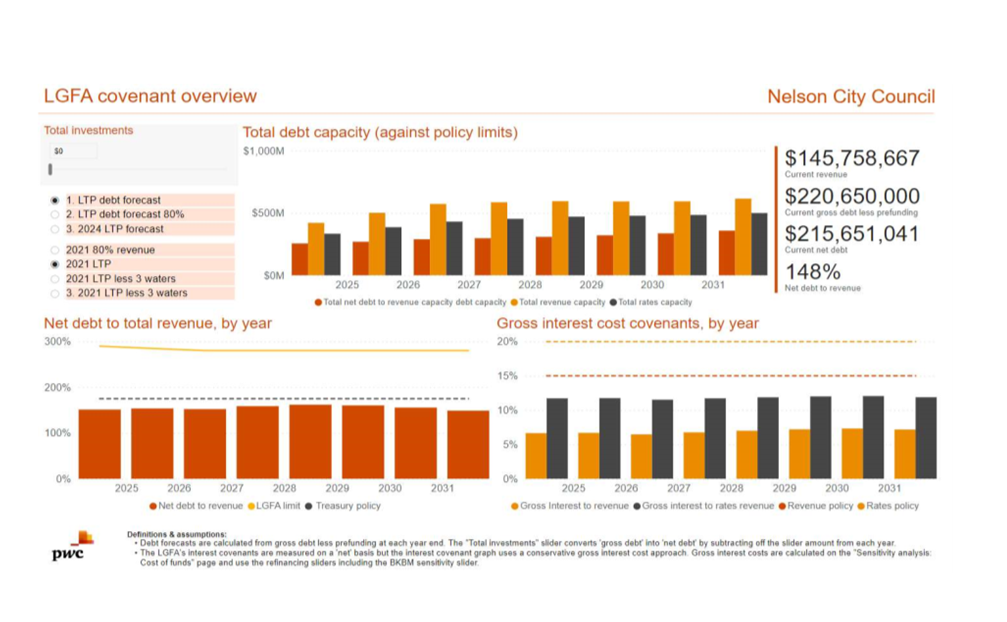

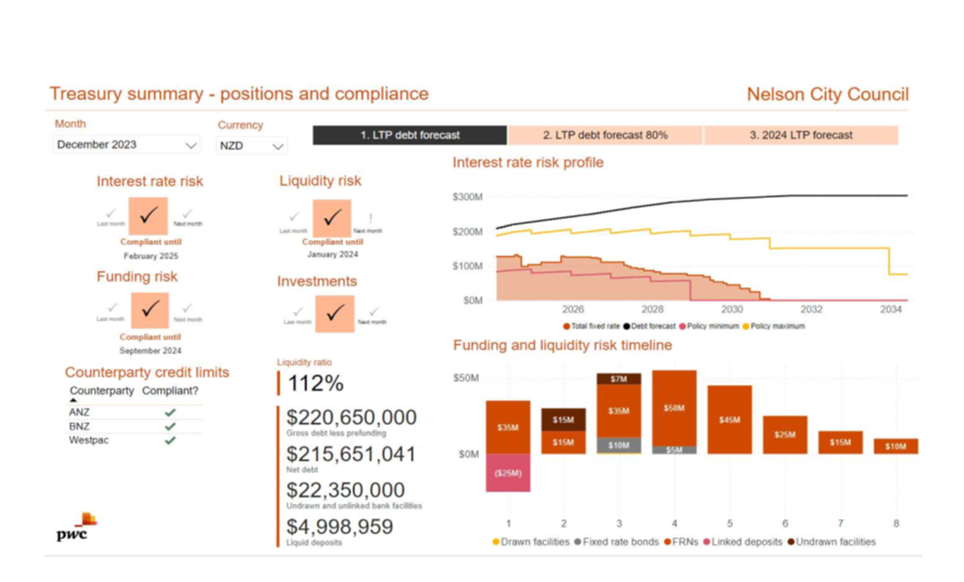

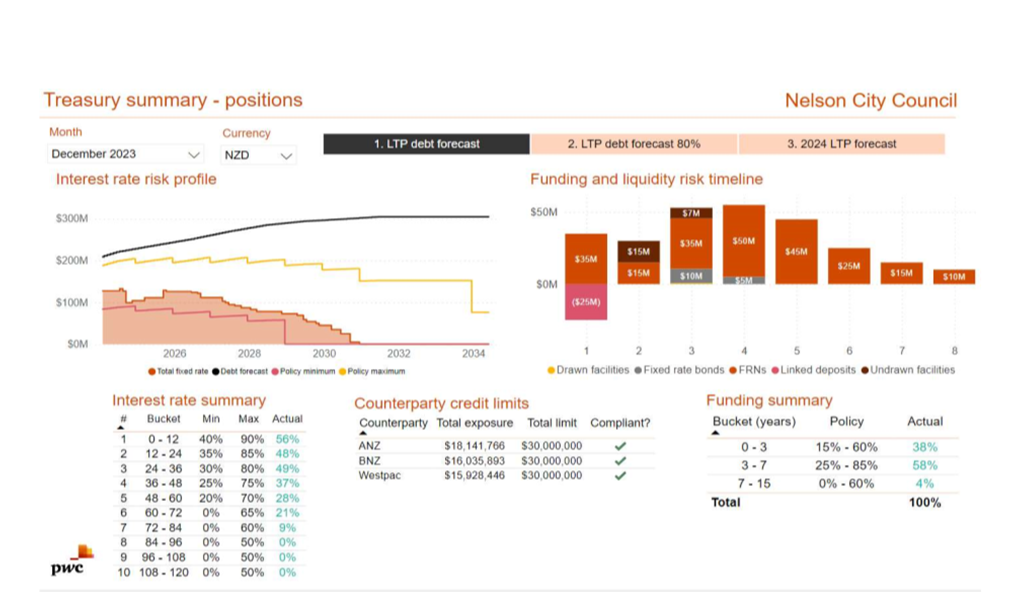

6.4 Attachment

1 (1857728953-1257) includes the statement of financial position (Balance

sheet), Debtors graph and compliance with the Treasury policy as at 31 December

2023.

6.5 The

net debt figure in the treasury compliance report (Attachment 1) is different

from above 6.2 mainly due to LGFA borrowing notes not being included in the PWC

tool.

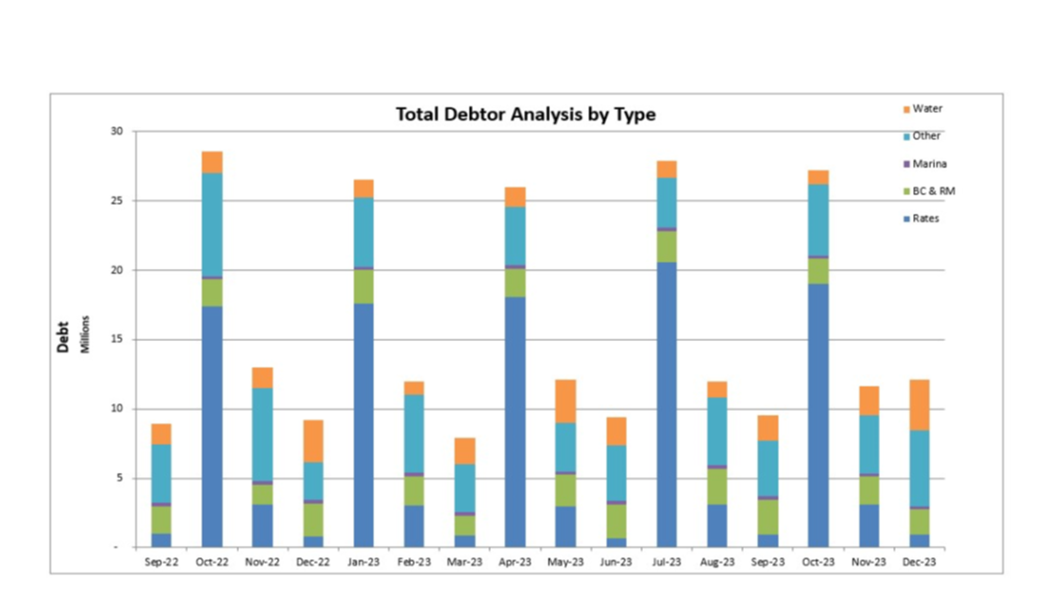

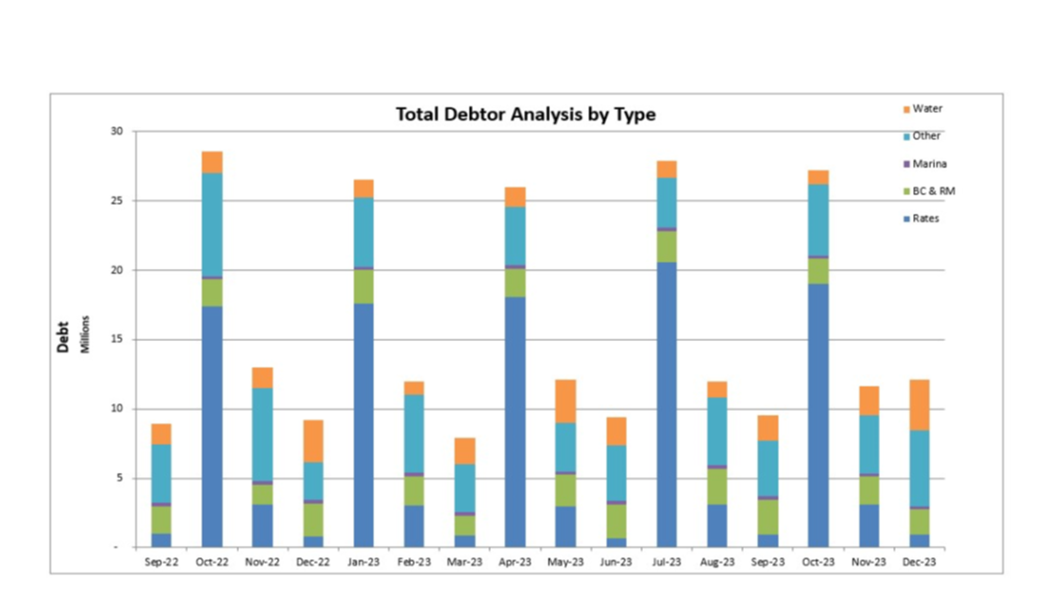

7. Rates Aging

7.1 Over

the last twelve months officers have seen outstanding rates balances increasing

slightly which highlights the cost of living and interest rate increases

impacting on the community. Officers are working hard to get ratepayers on to

payment plans.

7.2 Total

rates outstanding as at 31 December 2023 were $924,991. Below are the rates

outstanding at the end of each rating quarter.

Total

Rates Outstanding

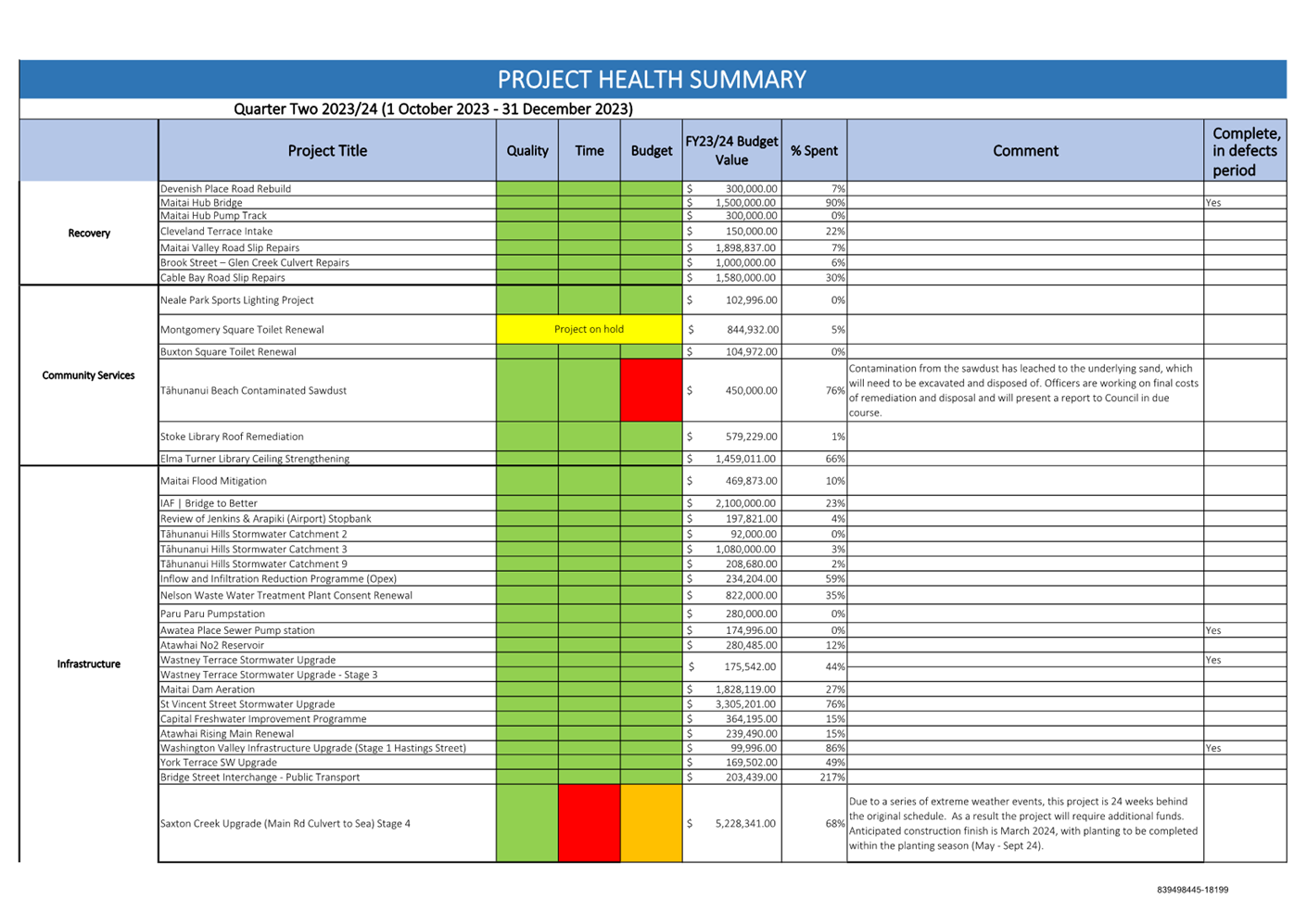

8. Project

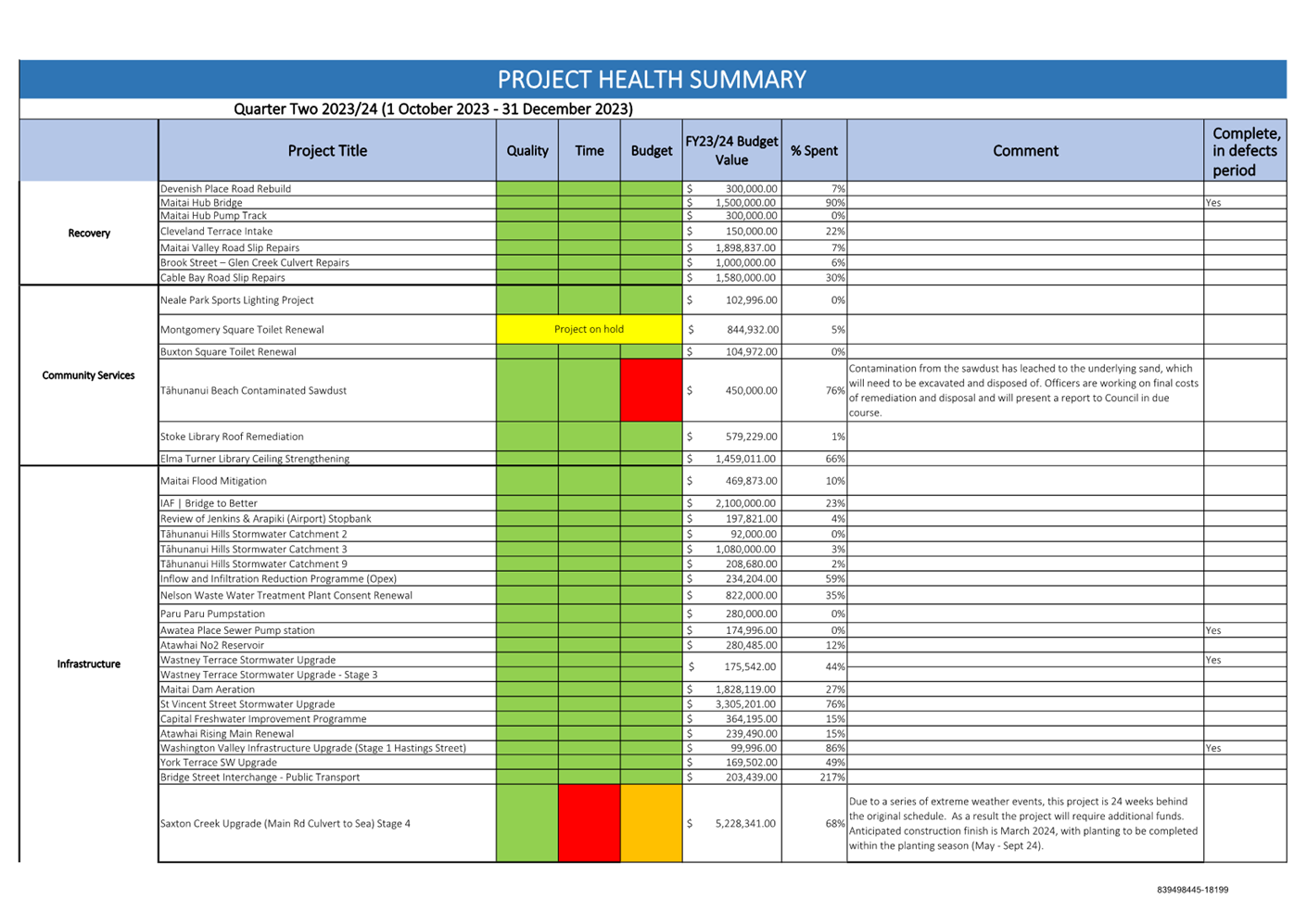

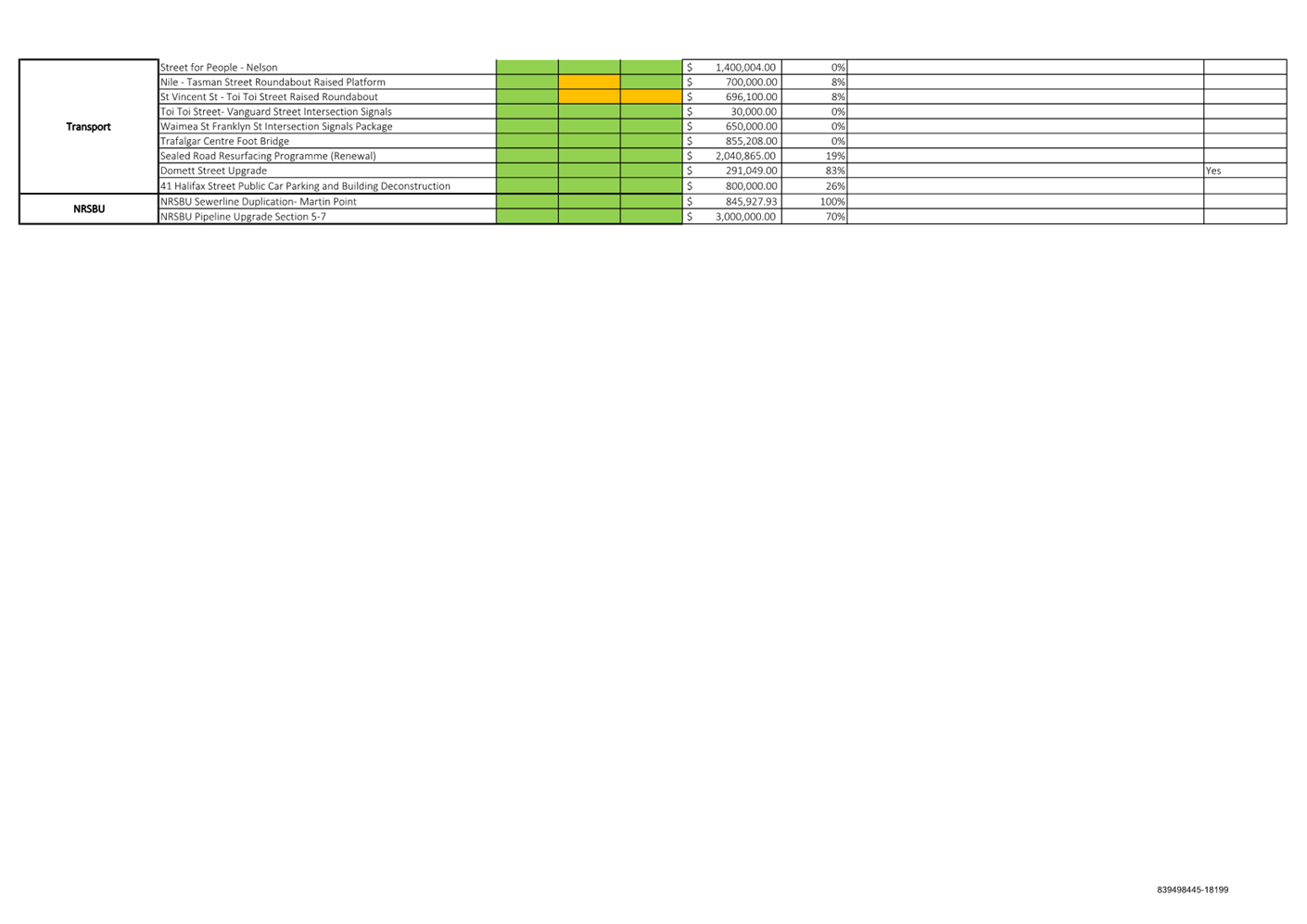

Health

8.1 A table summarising

the health of projects across Council has been generated and is included as

attachment 2 (839498445-18200). It gives a red, amber or green rating for

quality, time and budget factors.

8.2 The majority of the

orange and red are as a result of delays due to weather events in August 2022

and May 2023, the impact of COVID 19 and supply chain delays in material and

equipment from overseas.

8.3 Projects on hold

indicate projects that require further workshops or discussion.

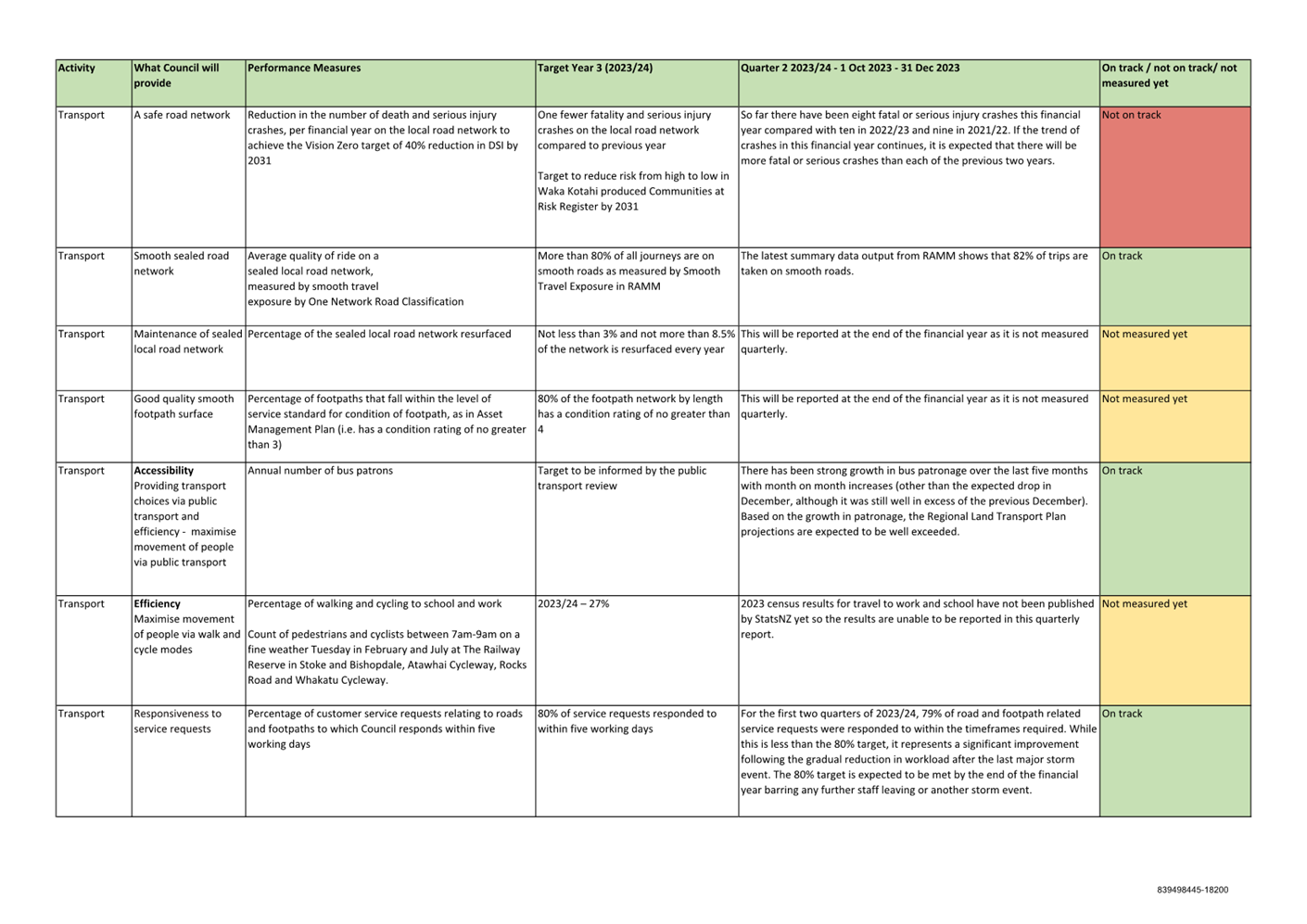

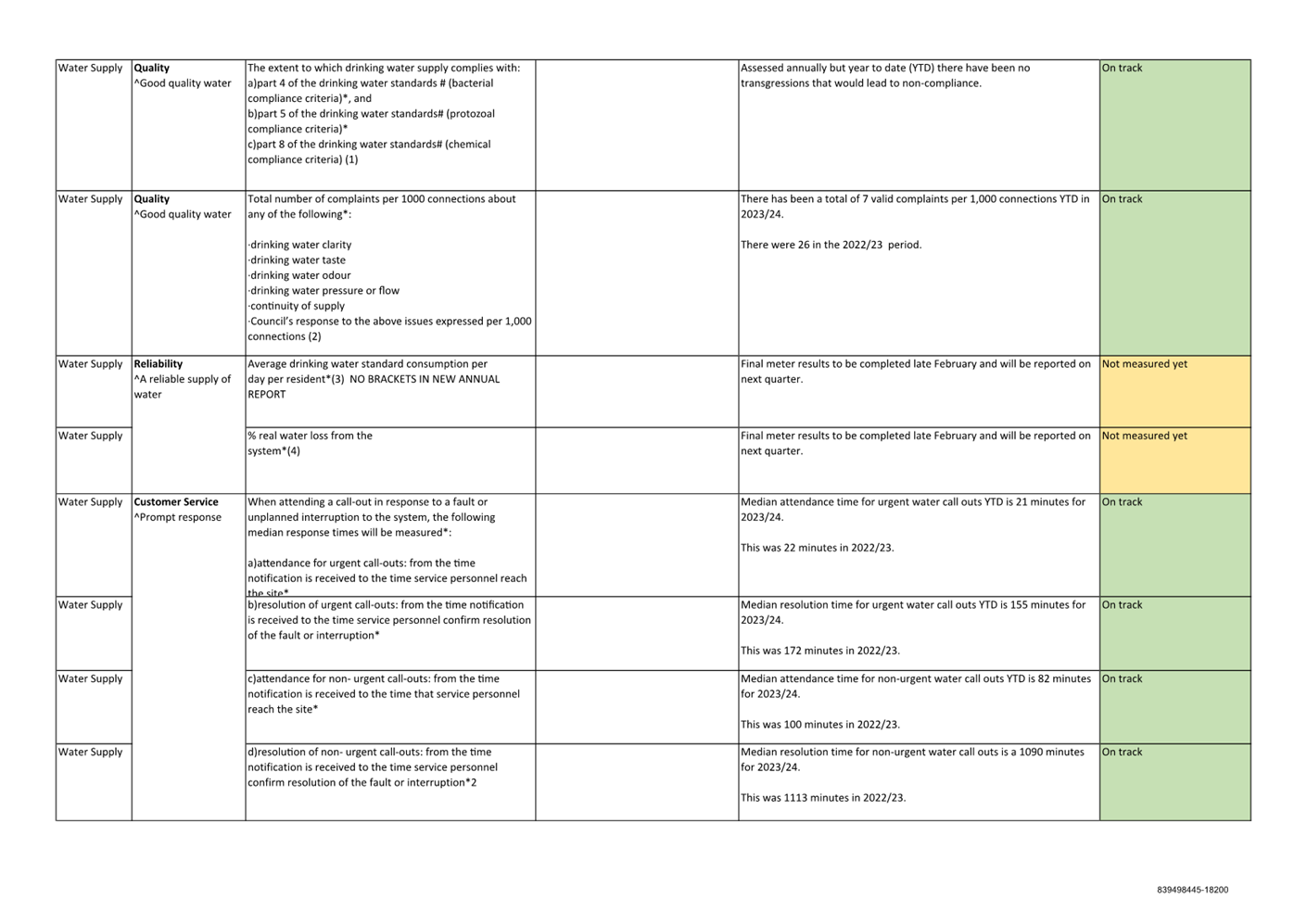

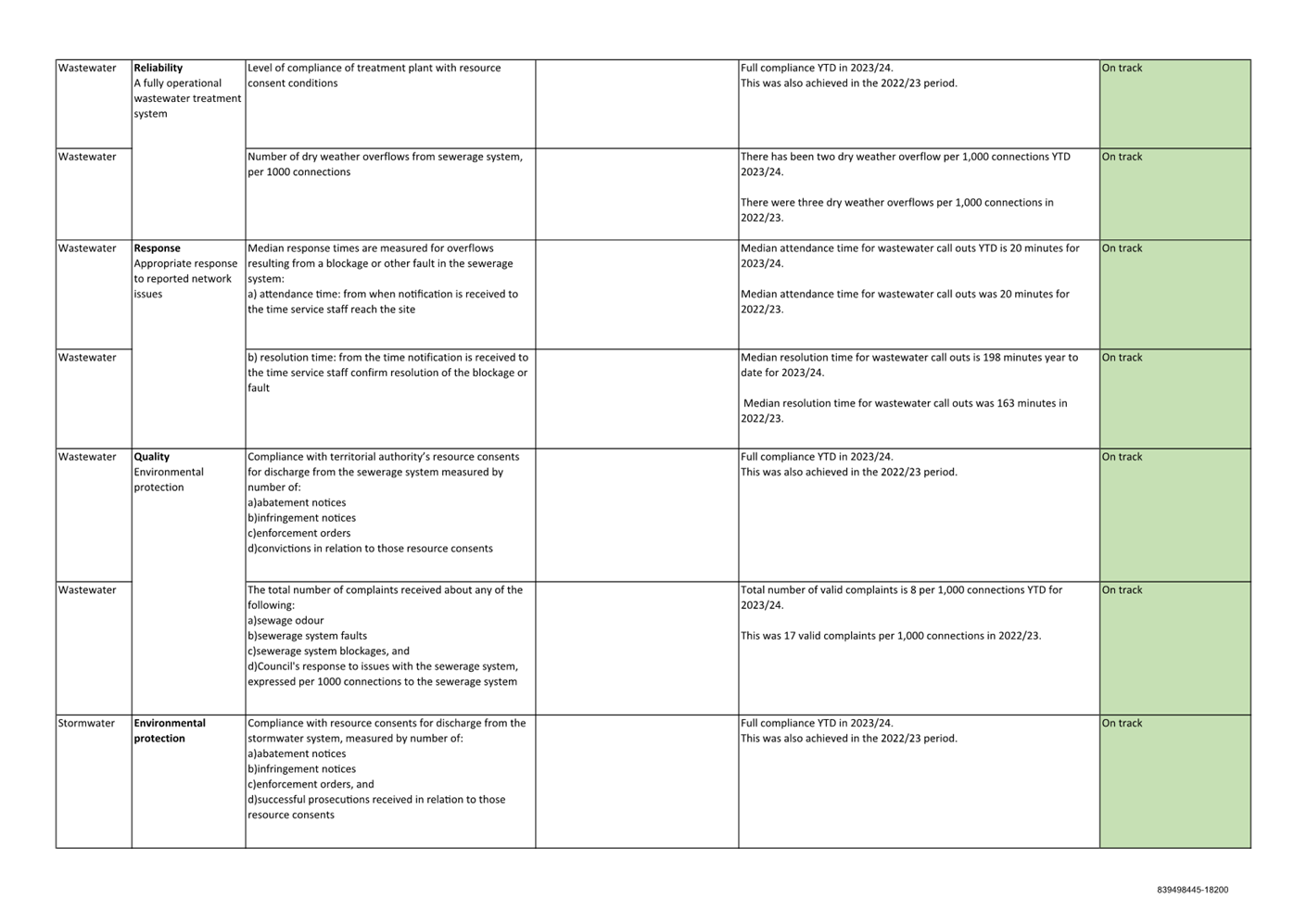

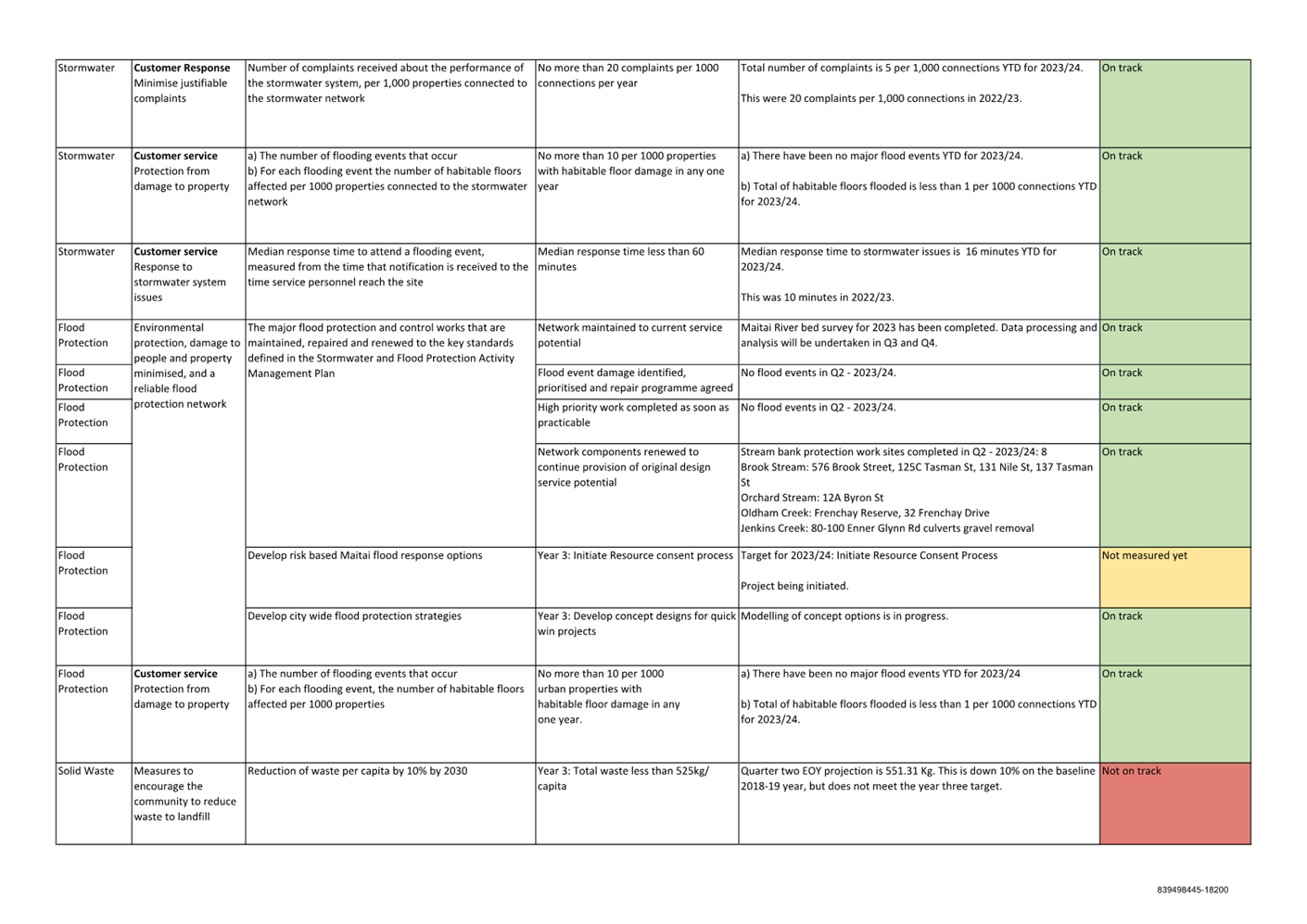

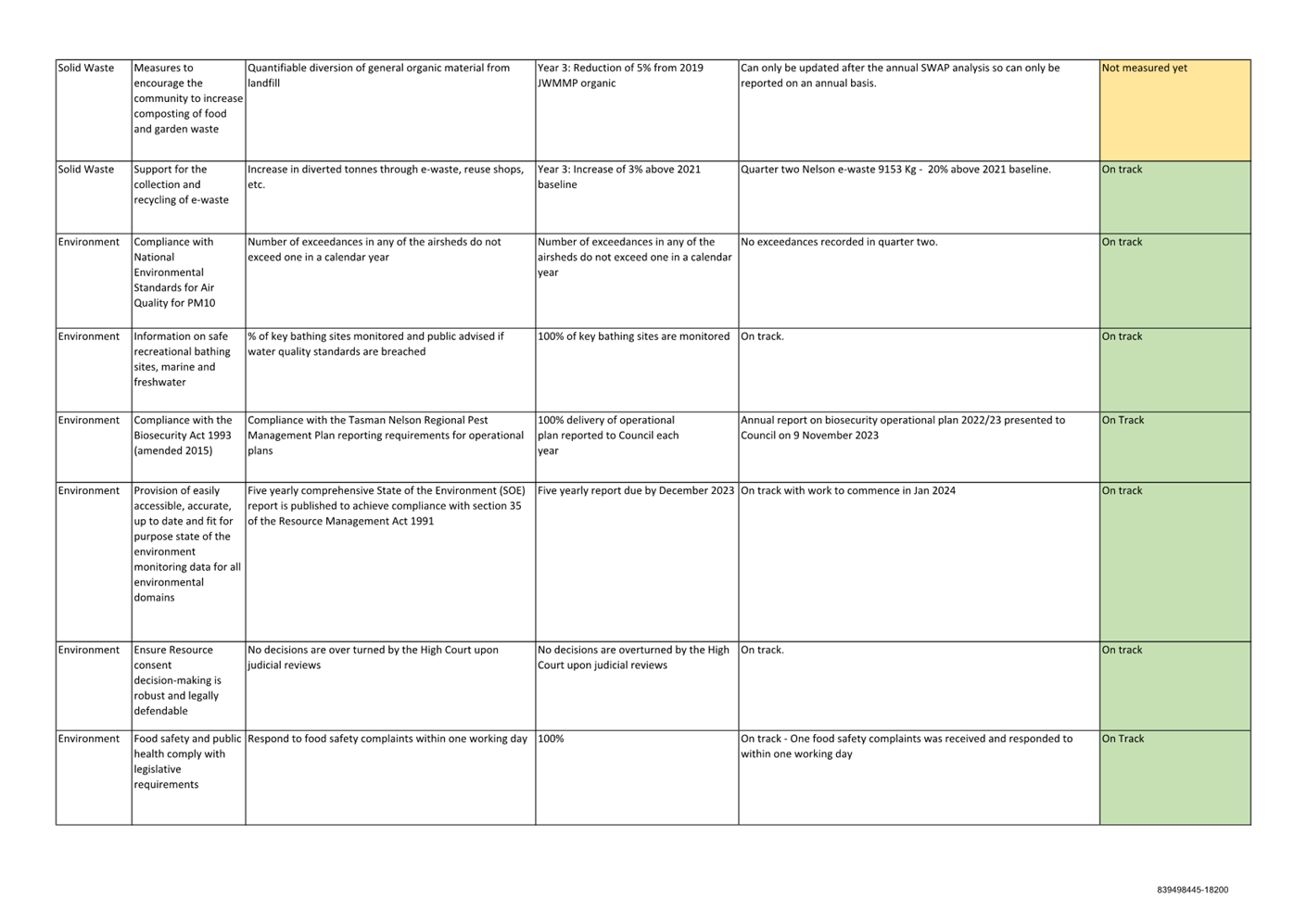

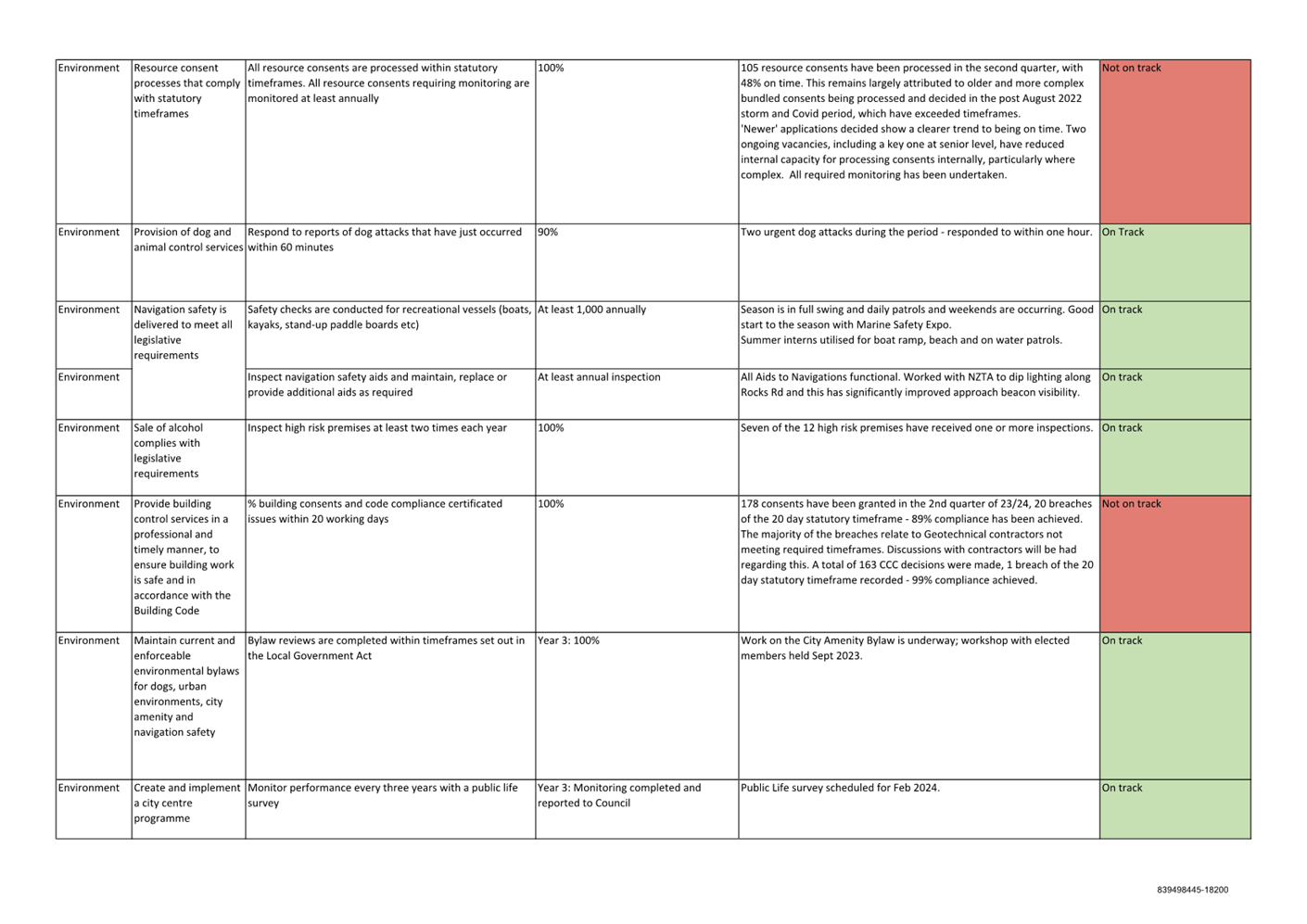

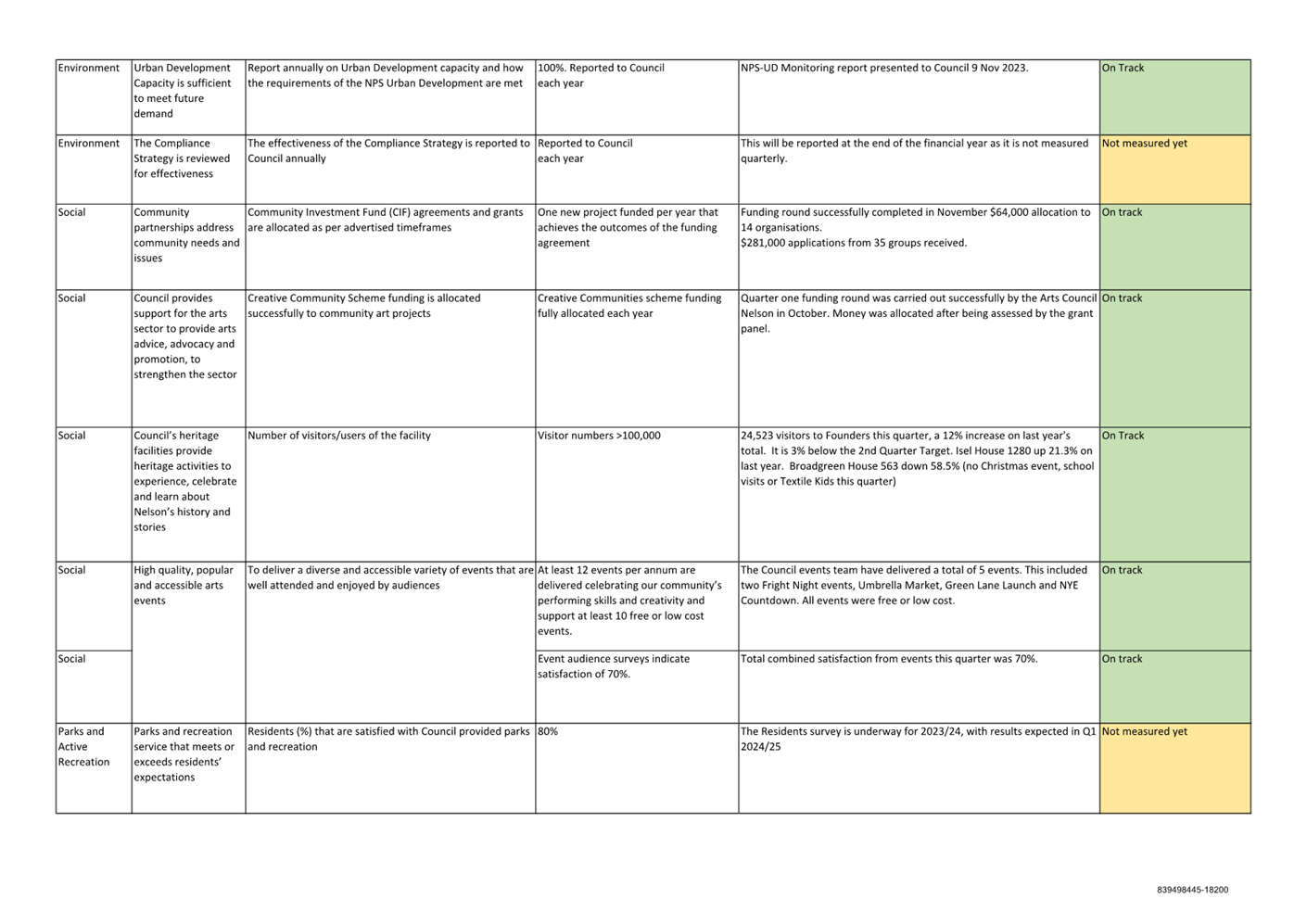

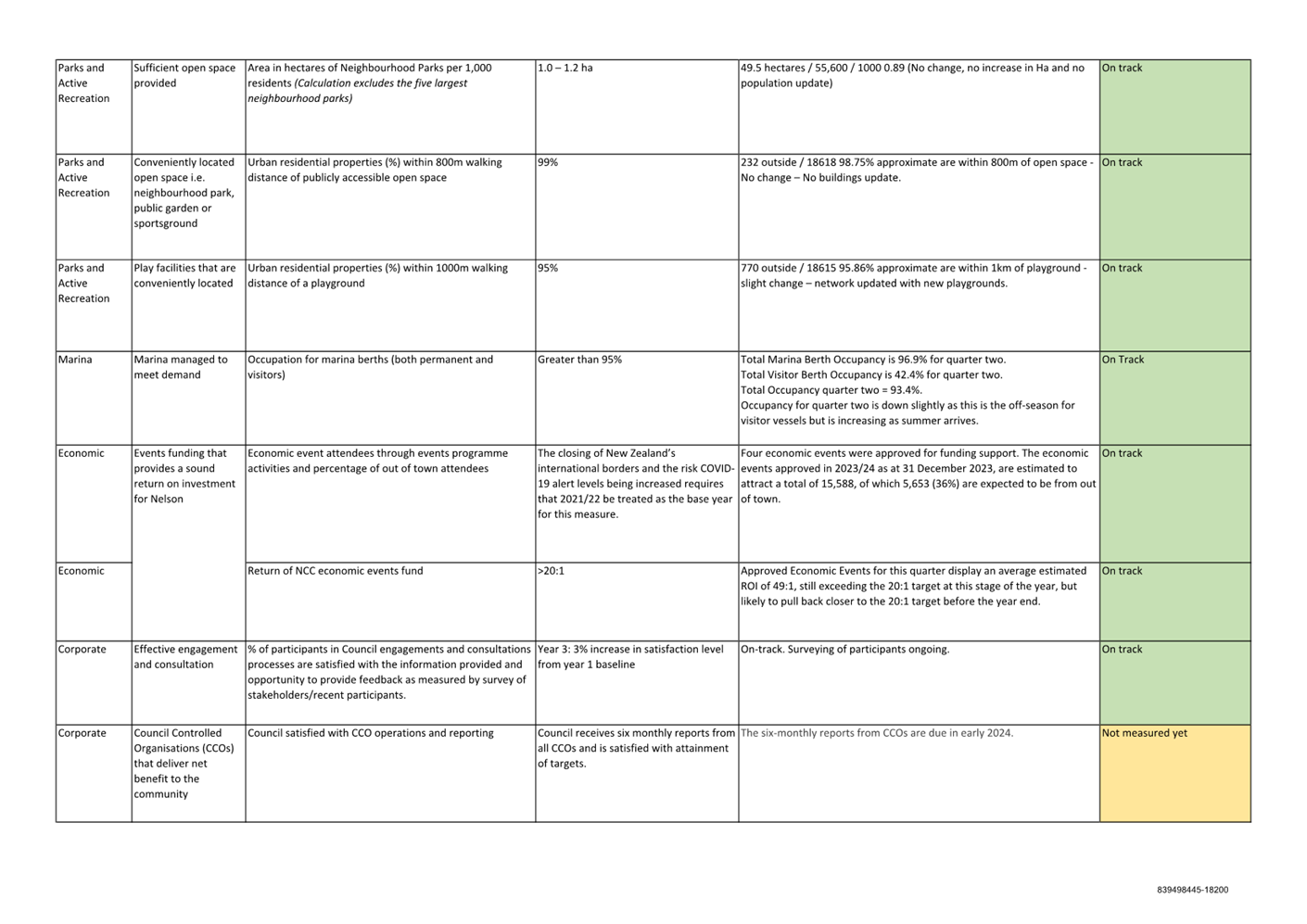

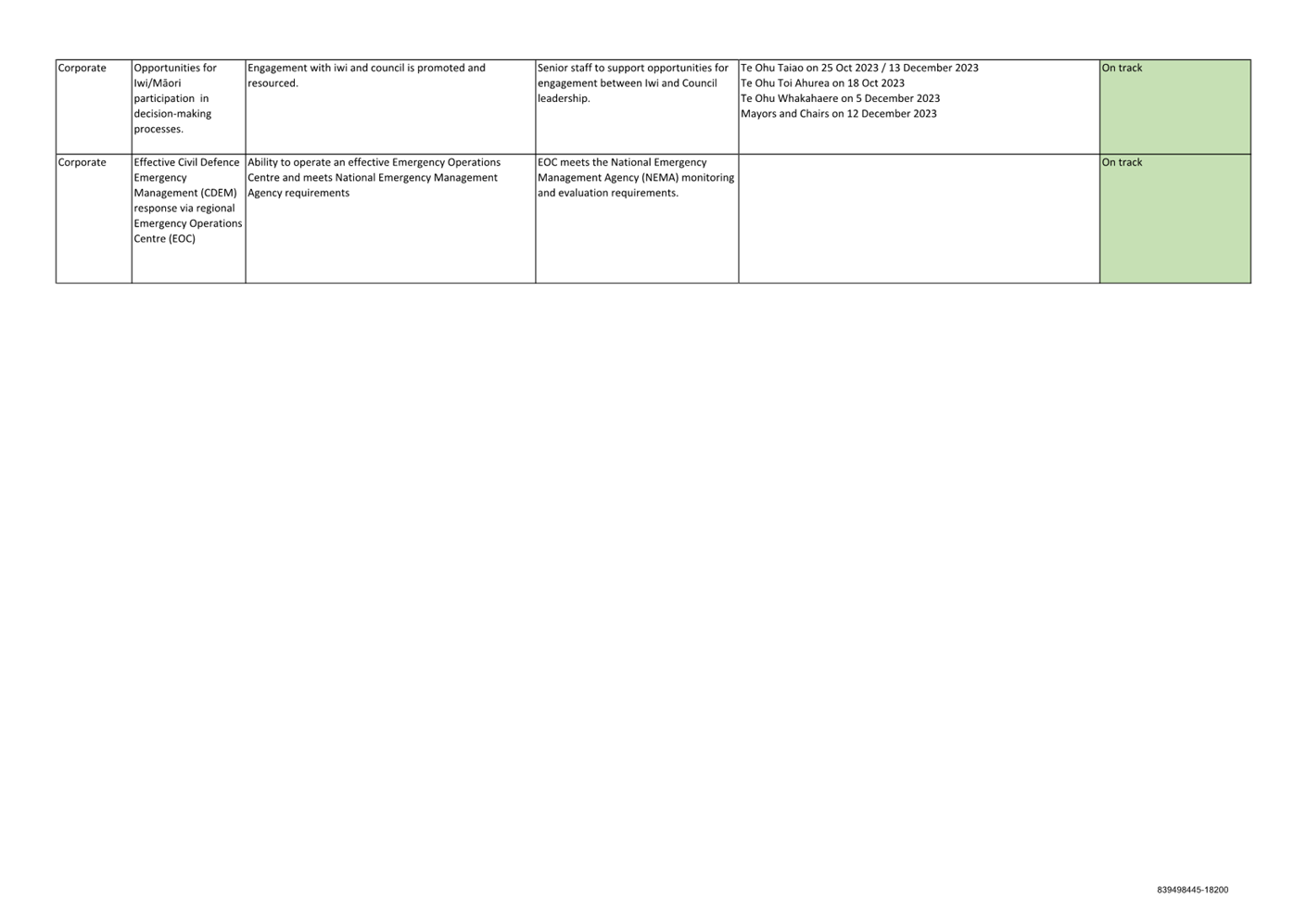

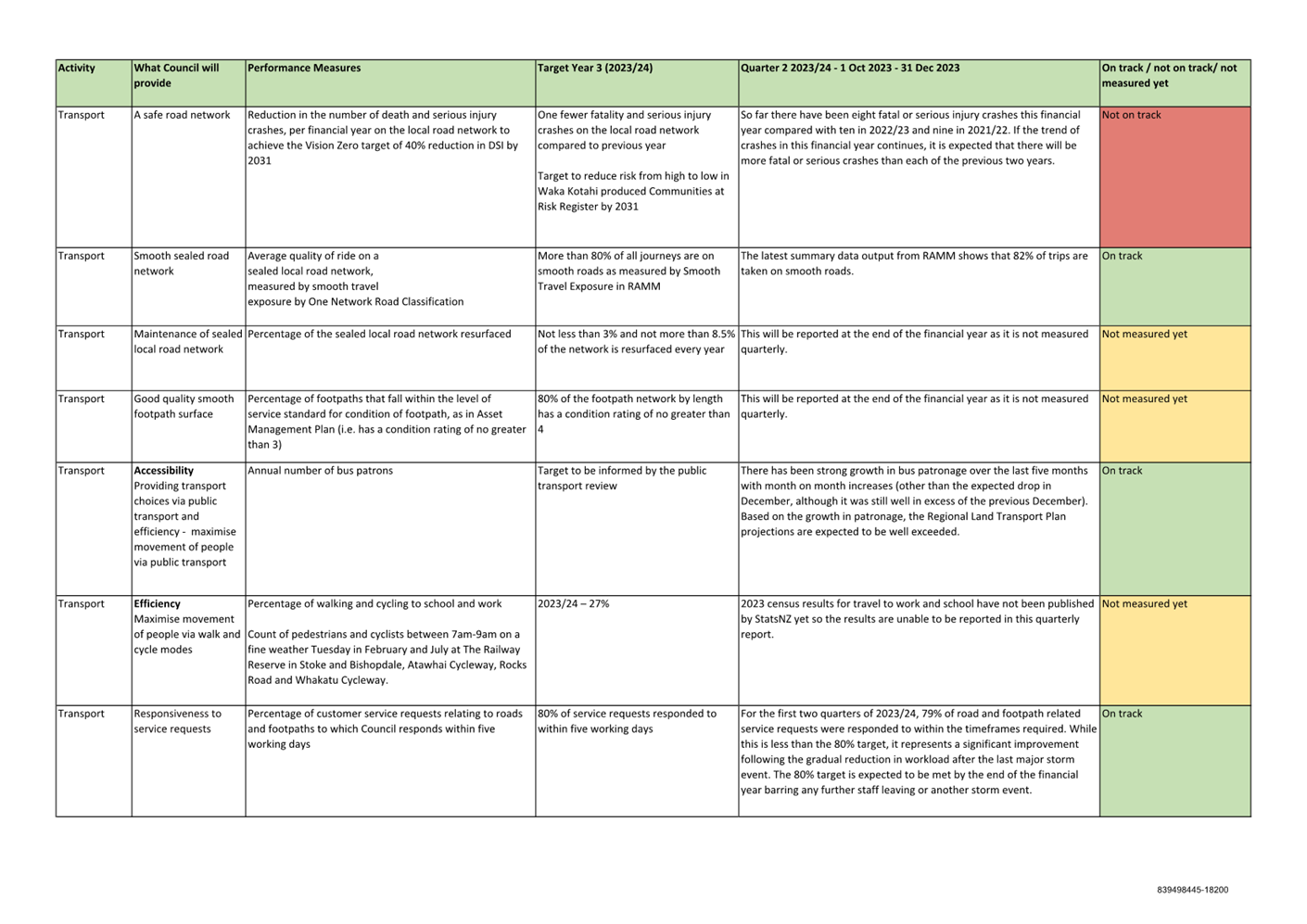

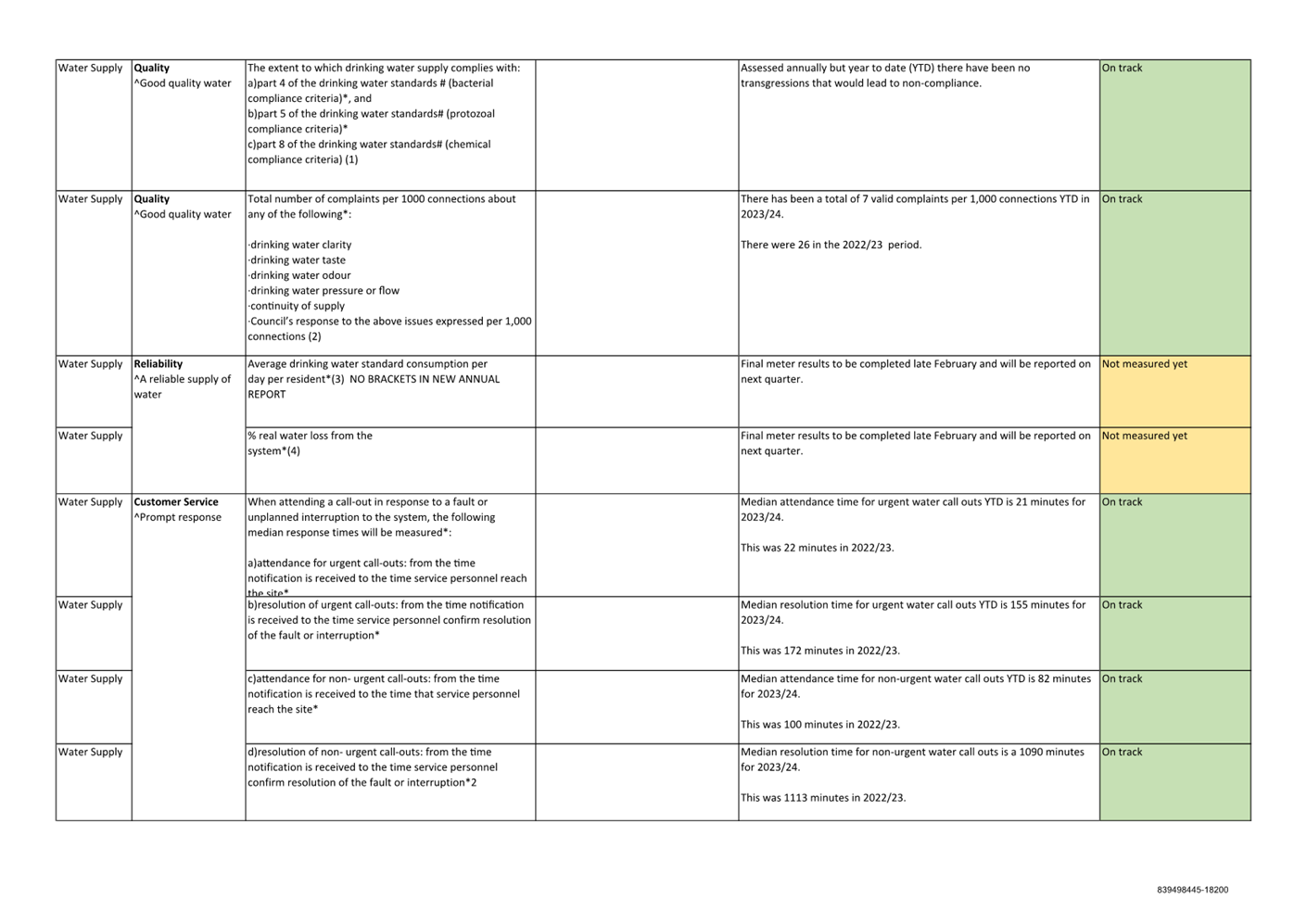

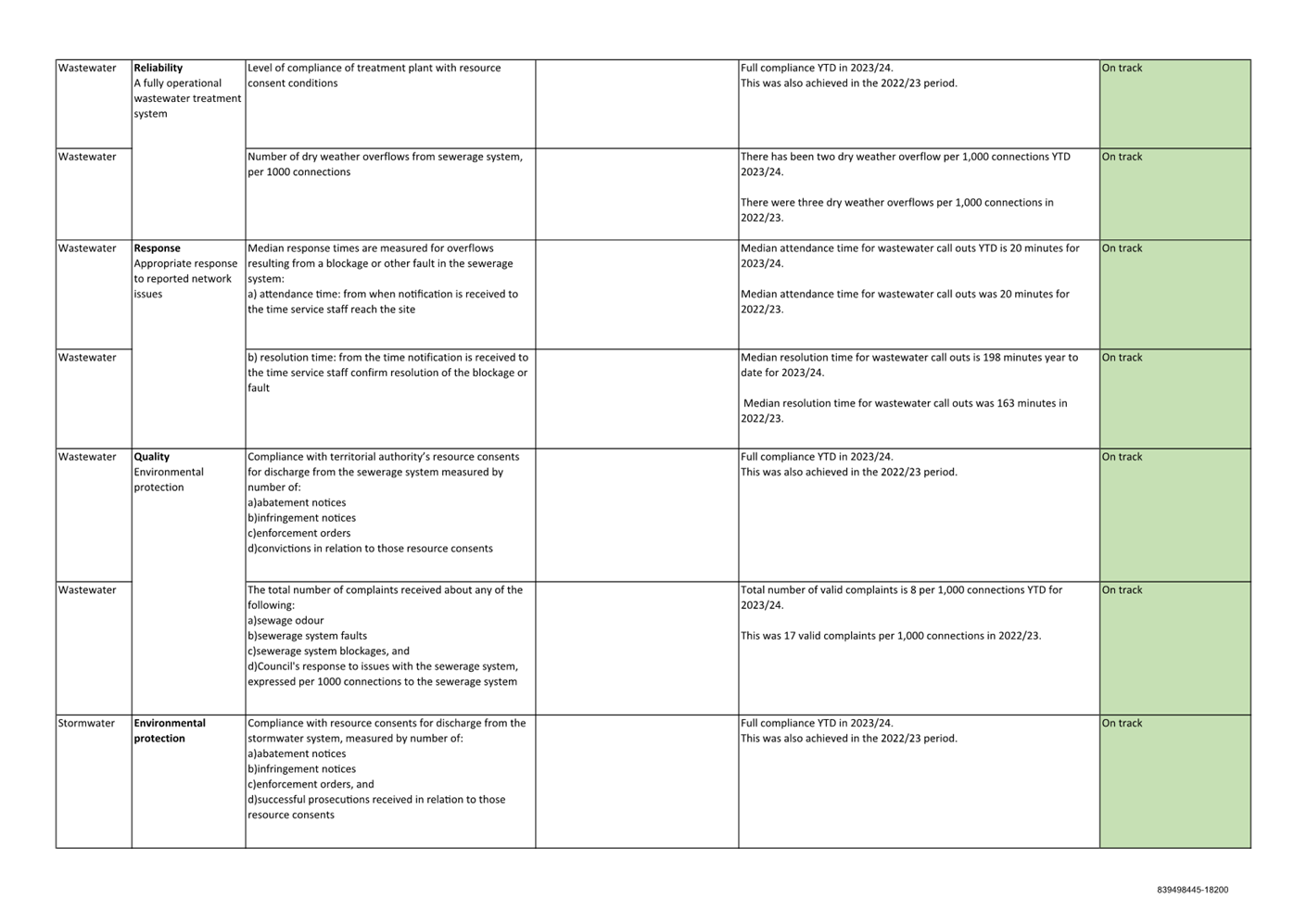

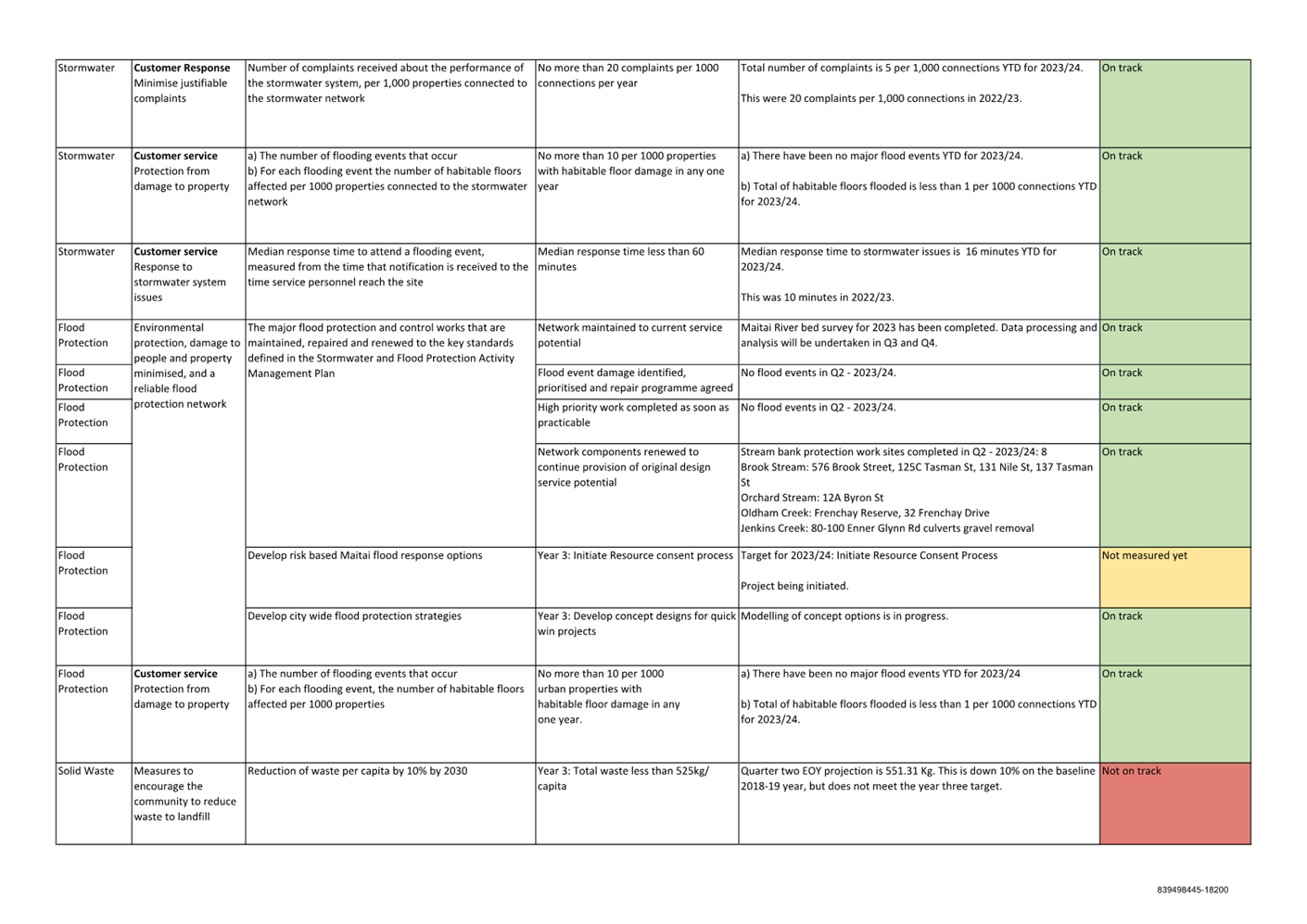

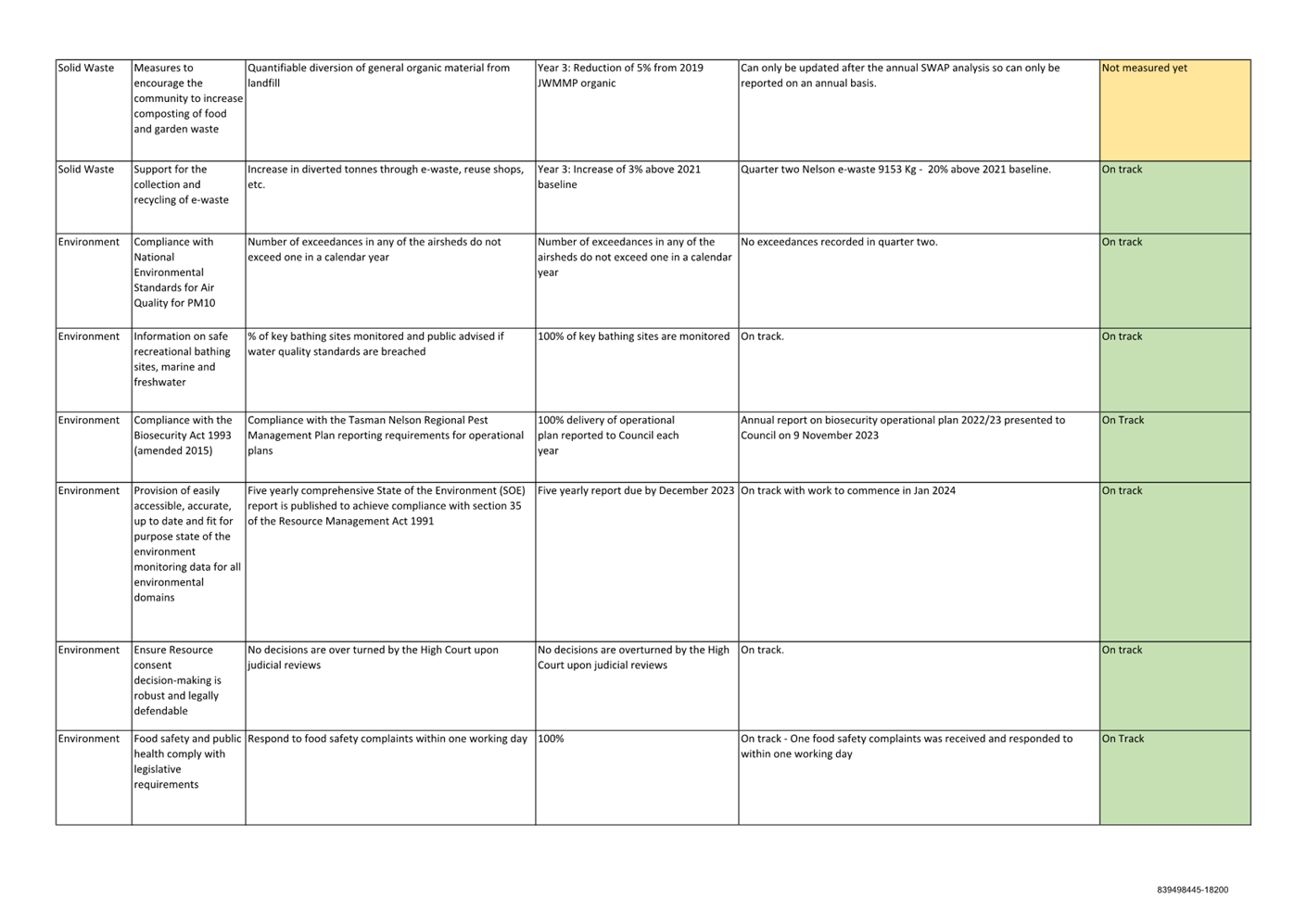

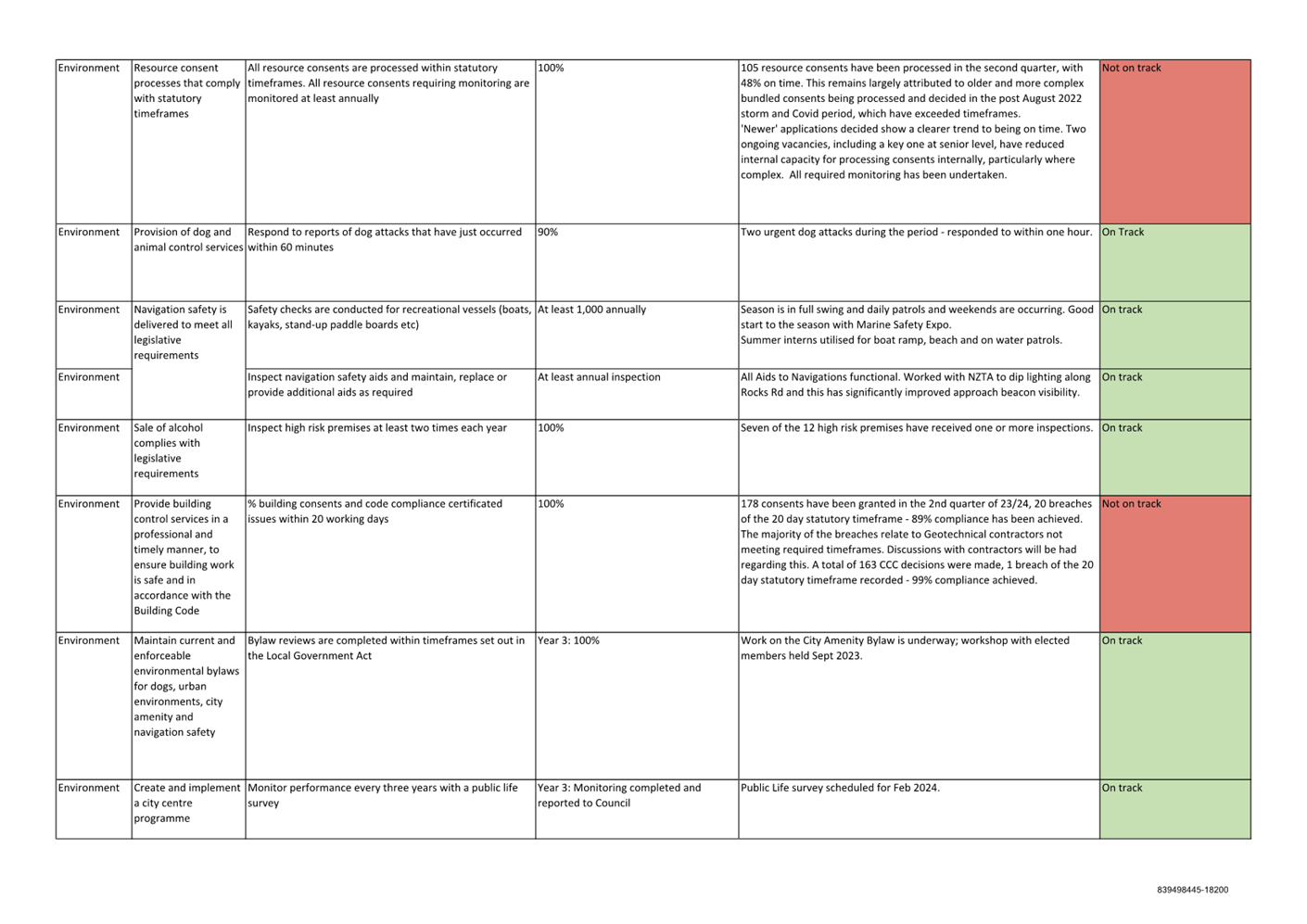

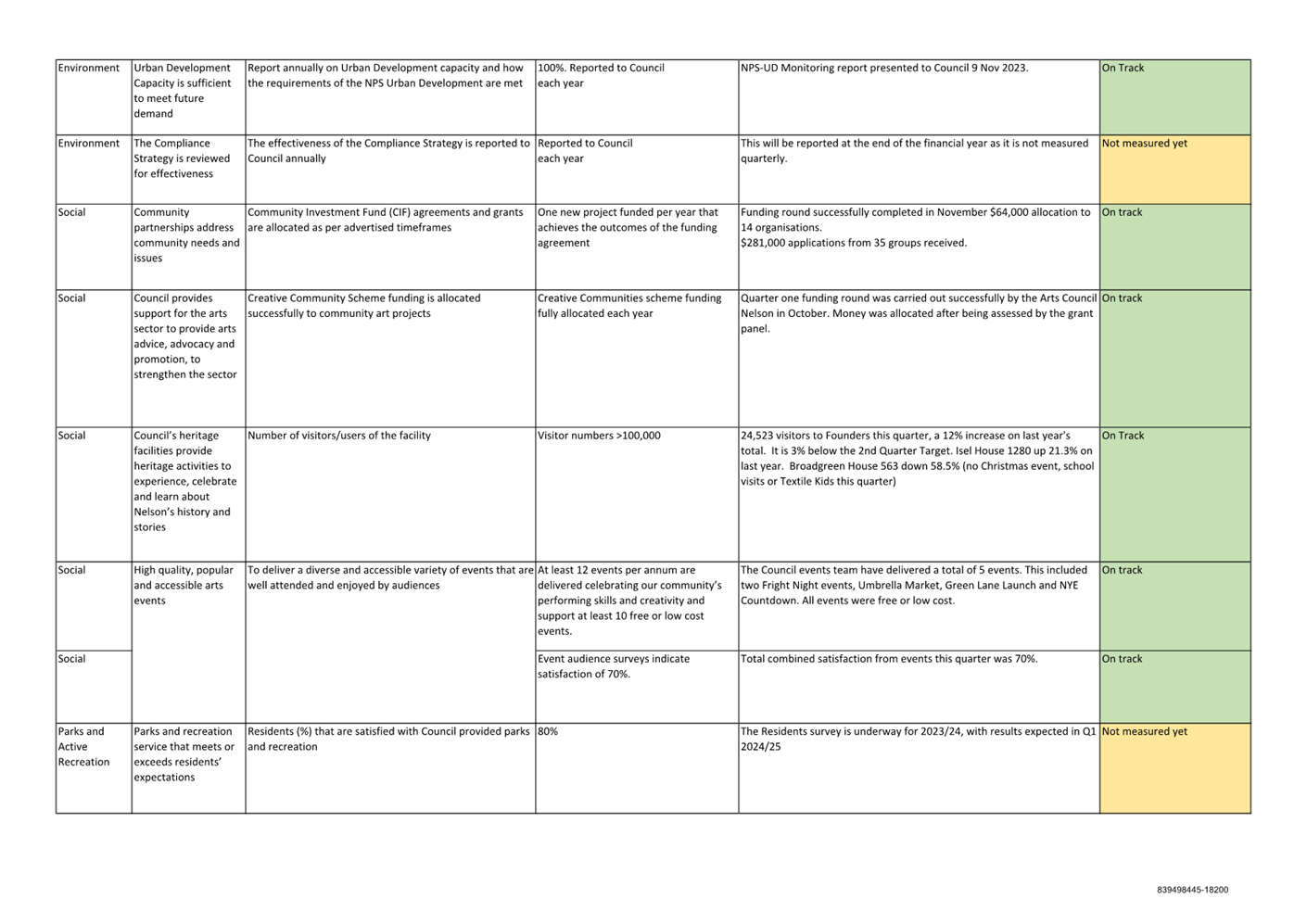

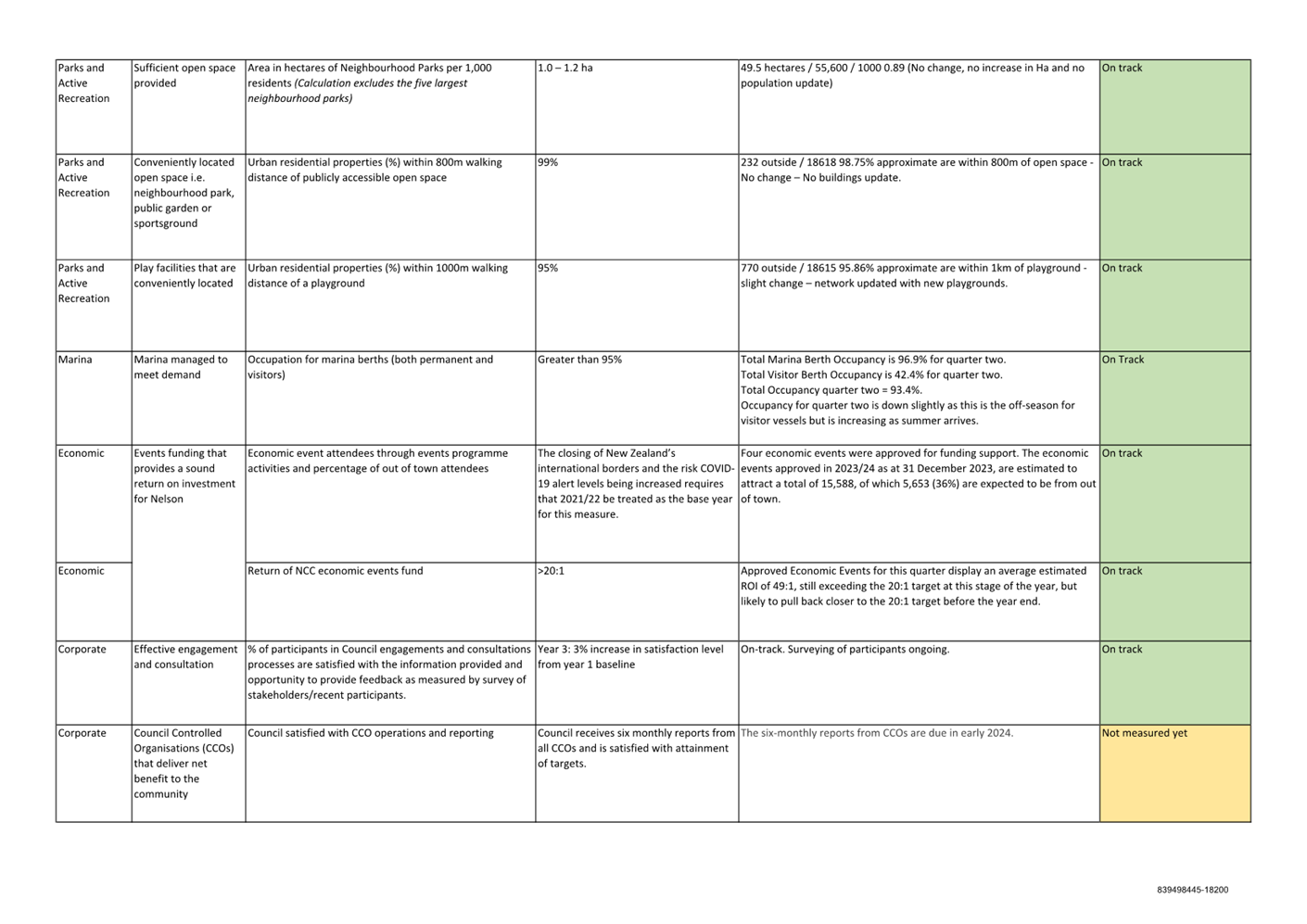

9. Performance

Measures

9.1 Council reports on 67

non-financial performance measures across its activity areas, as set out in the

Long Term Plan 2021-31. These are evaluated as ‘on track/not on track/not

measured yet’.

9.2 Of the 67 measures, 53

are currently on track, 10 are not measured yet, 4 are not measured yet.

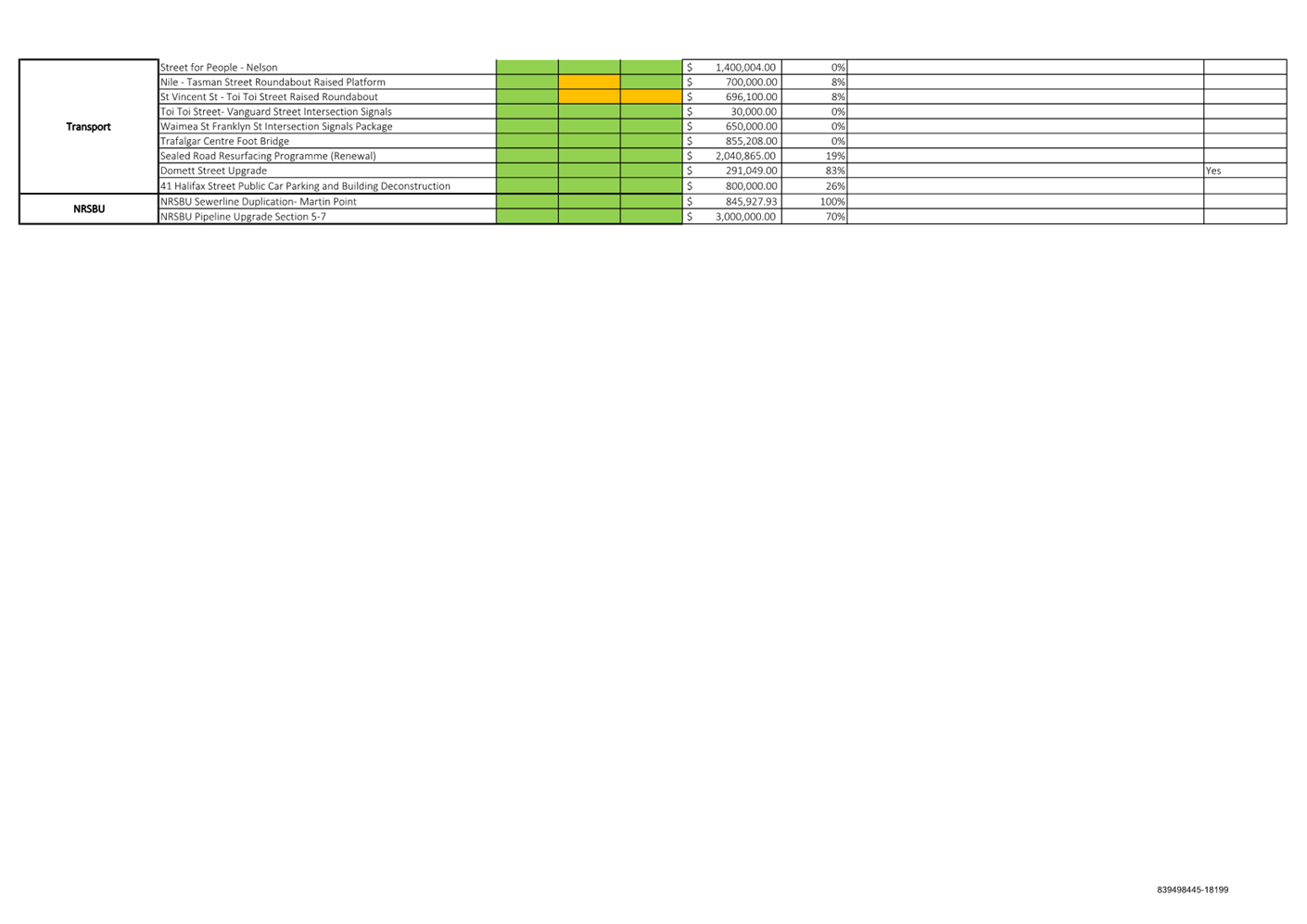

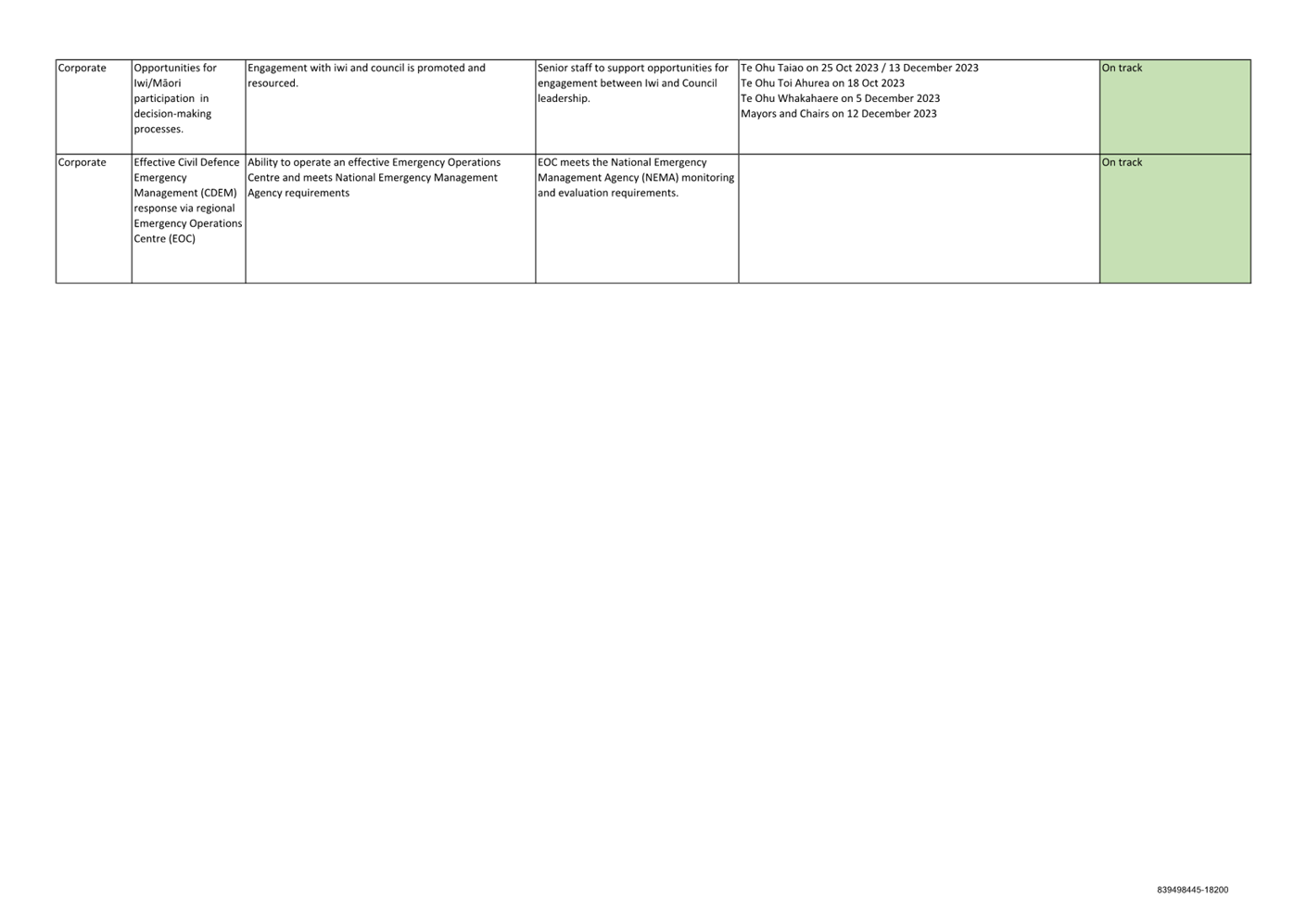

A spreadsheet with commentary on these measures is included as attachment 3 (839498445-18199).

Attachments

Attachment 1: 1857728953-1257 -

Dec-23 Appendix for Finance Report for Council ⇩

Attachment 2: 839498445-18200

- Performance Measures Quarter Two 2023 2024 ⇩

Attachment 3: 839498445-18199

- Project Health Summary - Quarter Two 2023 2024 ⇩

Item 8: Quarterly Finance Report to 31 December 2023:

Attachment 1

Item 8: Quarterly

Finance Report to 31 December 2023: Attachment 2

Item 8:

Quarterly Finance Report to 31 December 2023: Attachment 3

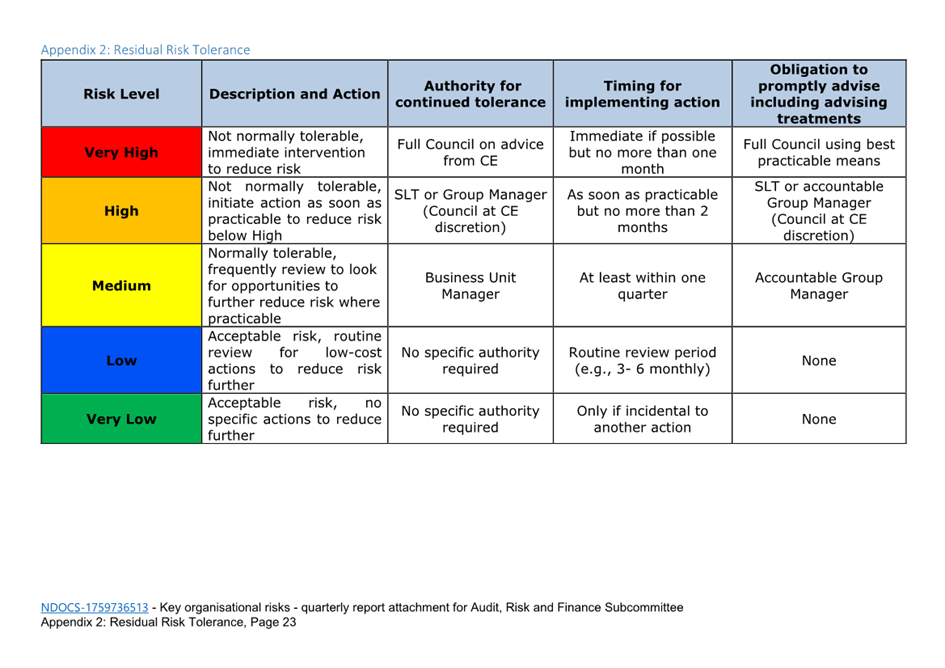

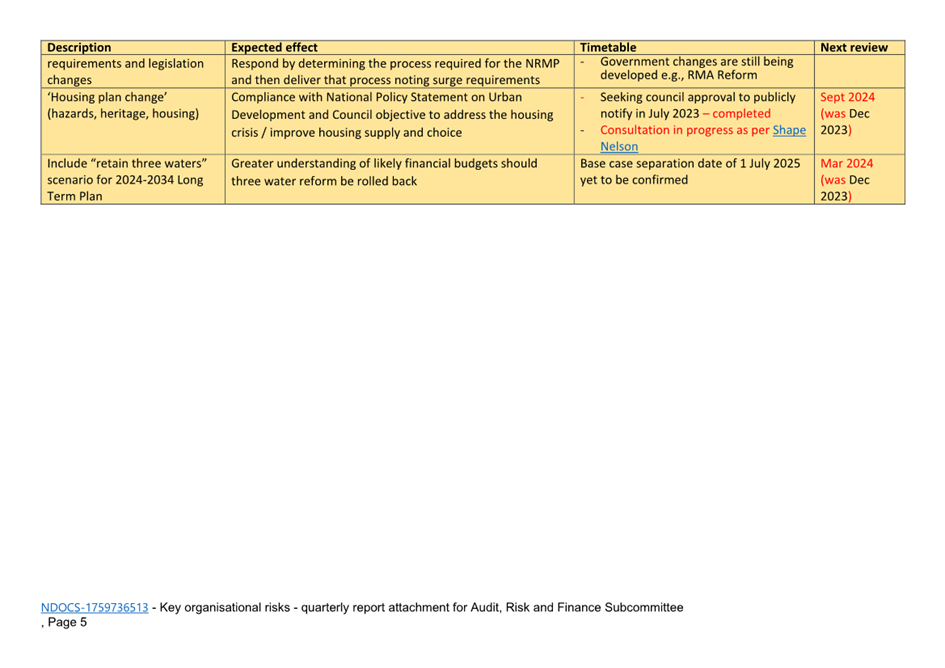

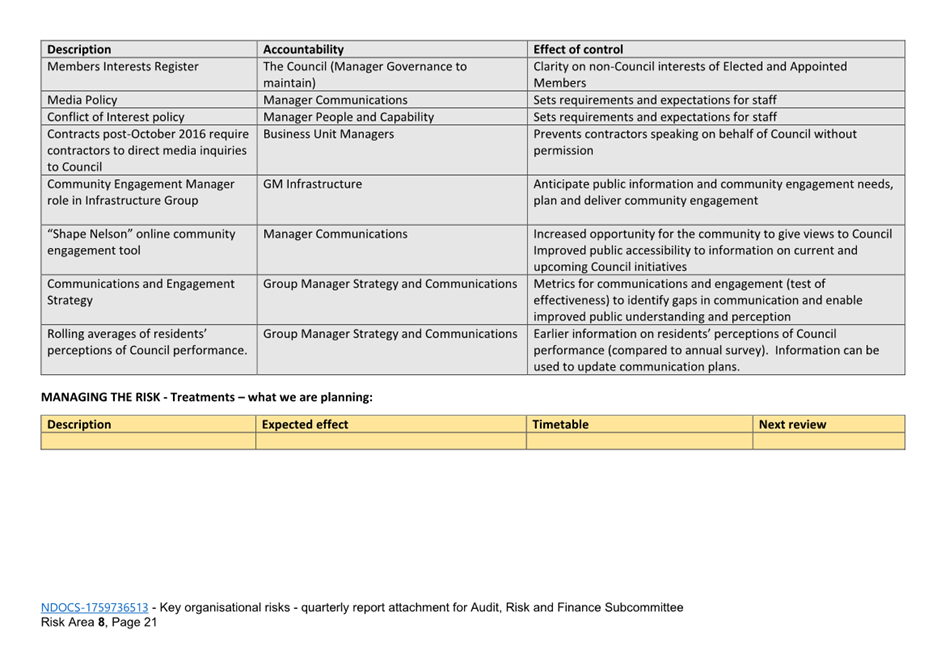

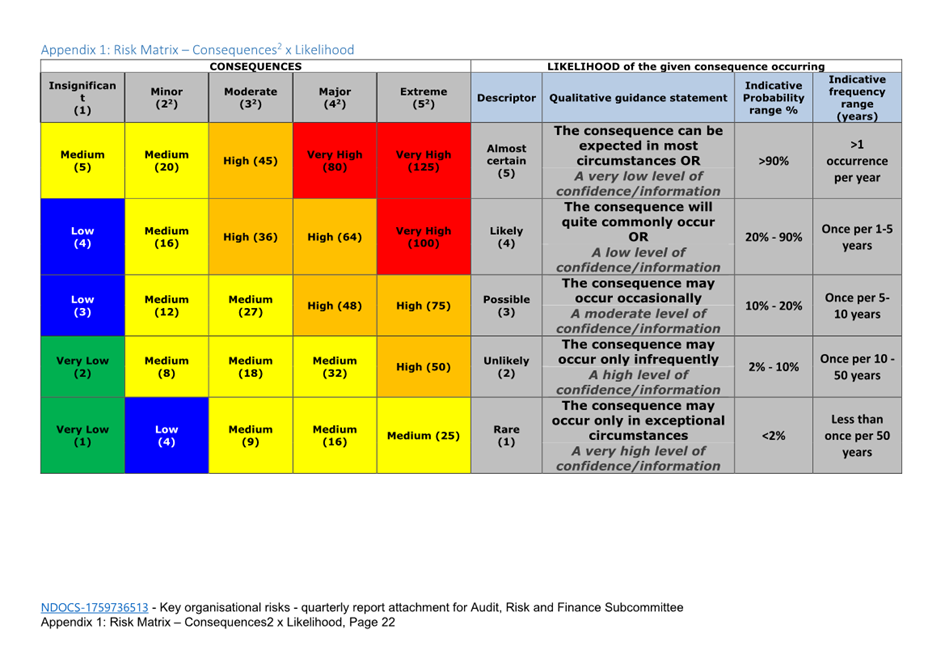

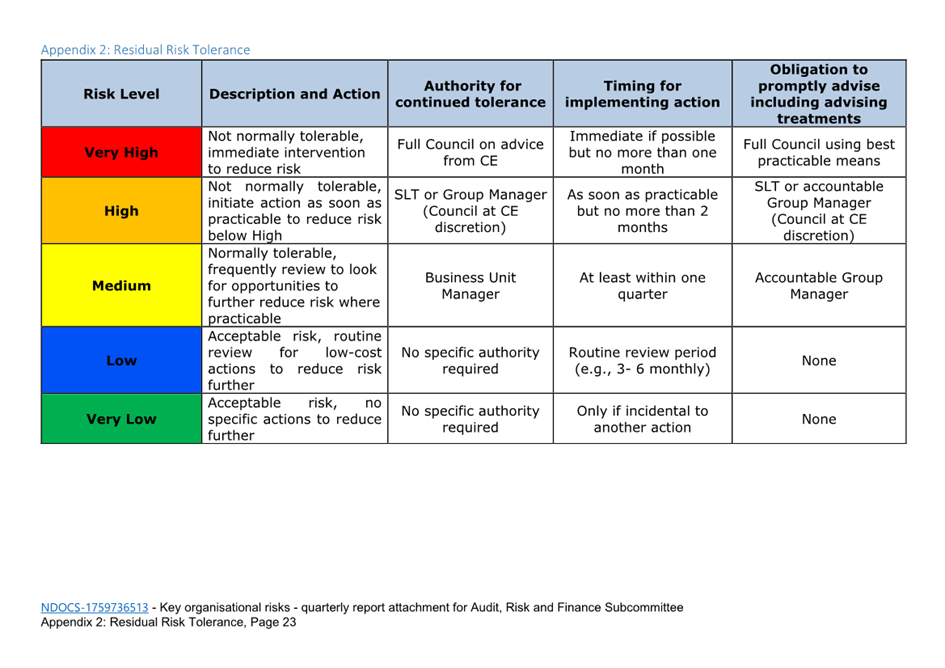

Item 9: Quarterly Risk

Report - 31 Dec 2023

|

|

Audit, Risk and Finance Committee

14 February 2024

|

Report

Title: Quarterly

Risk Report - 31 Dec 2023

Report

Author: Chris Logan - Audit

and Risk Analyst

Report

Authoriser: Nikki Harrison - Group Manager Corporate

Services

Report

Number: R28271

1. Purpose of Report

1.1 To provide information

to the Audit, Risk and Finance Committee on the organisational risks through to

the end of the second quarter of 2023/24.

2. Recommendation

|

That

the Audit, Risk and Finance Committee

1. Receives

the report Quarterly Risk Report - 31 Dec 2023 (R28271) and its attachment (1759736513).

|

3. Background

3.1 This report describes

key risk areas, divided by risk theme organisational risks) and reporting

Group.

4. Key Risk Areas by

Theme (Organisational Risks)

4.1 Risks relating to

Council and joint operations are monitored via Council’s risk register.

Approximately 30% of risk entries by count have been identified as having a

common theme or cause which create risk concentrations that pose a threat at an

organisational level. These organisational risks are described below.

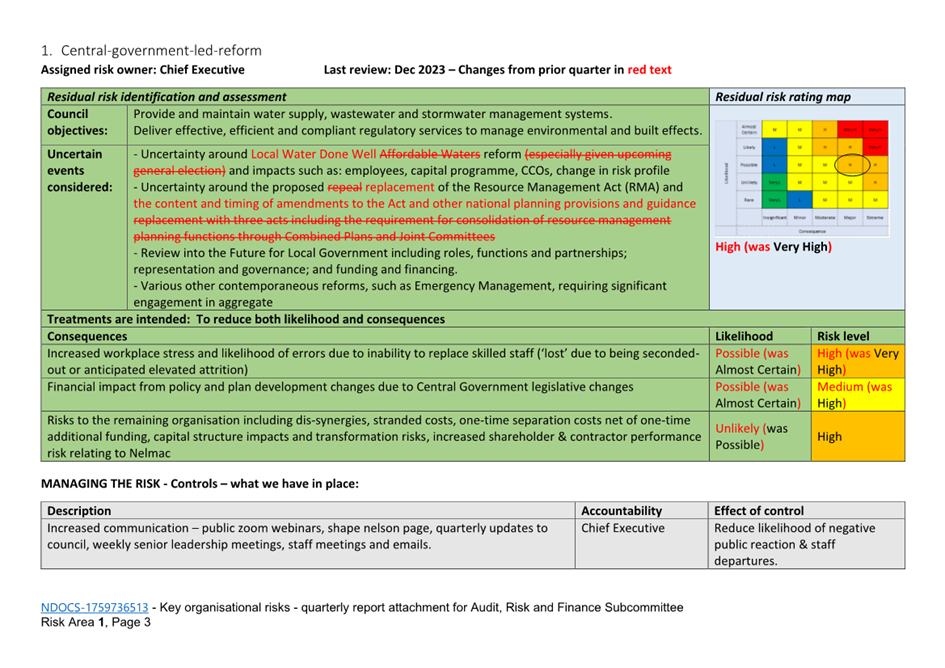

4.2 Organisational risk

“Central-government-led-reform” has been rerated to High from Very

High. There were no changes in risk rating for the other organisational risks.

4.3 R1 -

Central-government-led-reforms (Owner: Chief Executive). Deferral of and

uncertainty around reforms has resulted in rerating this risk to High from Very

High.

4.4 R2 - Lifeline

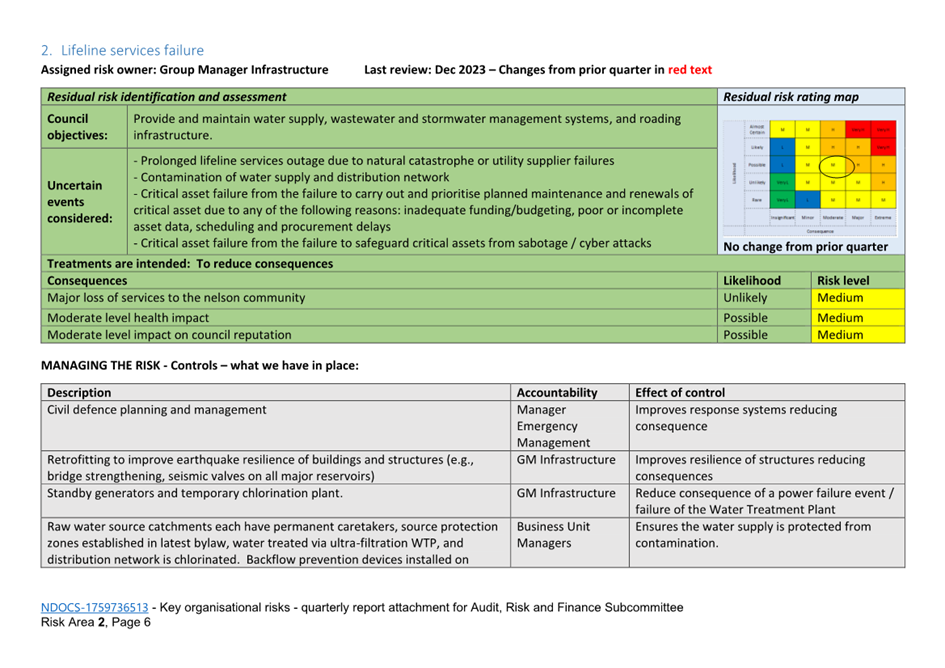

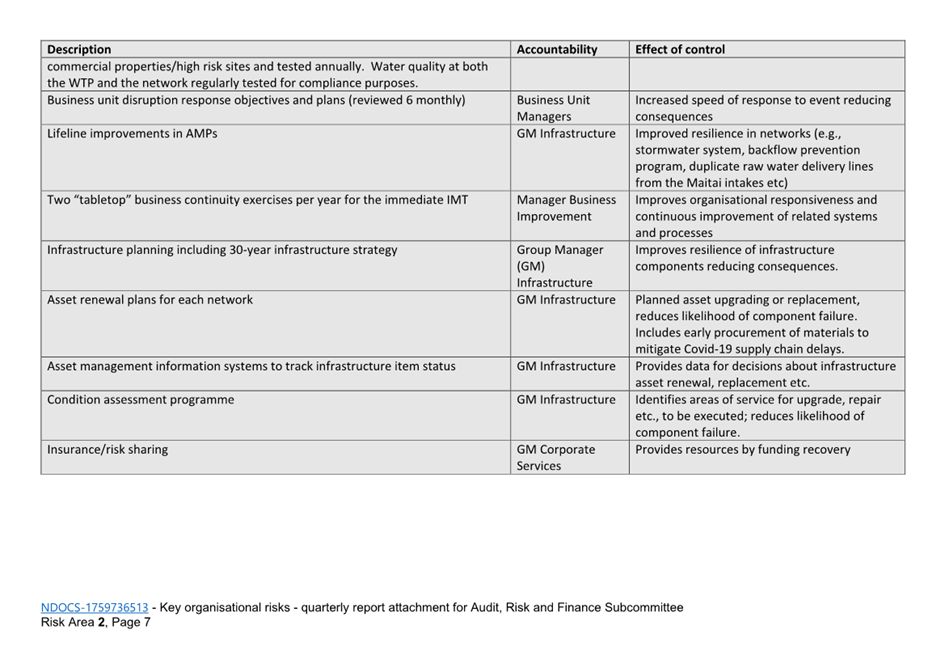

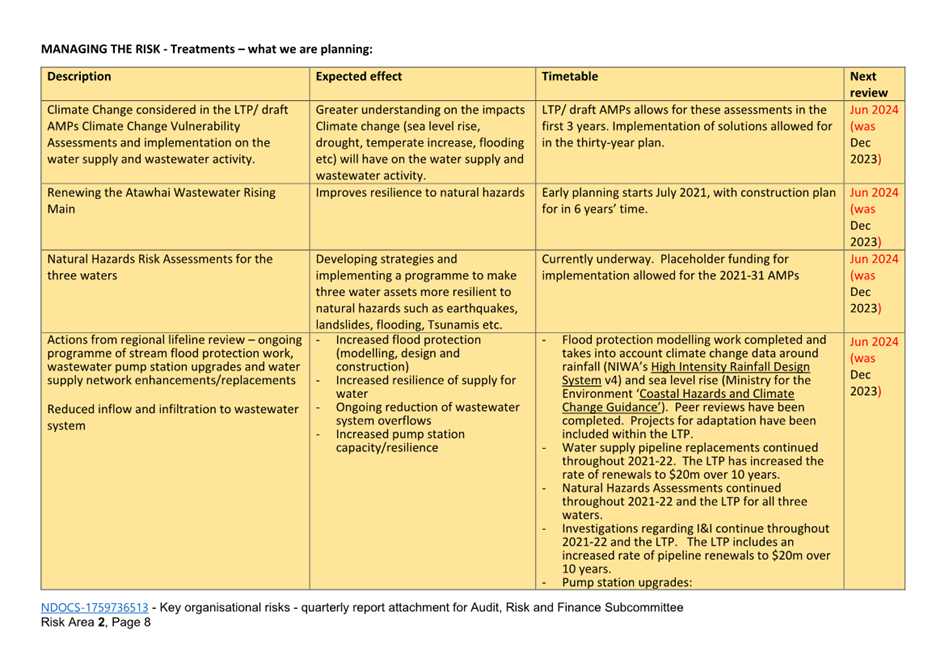

services failure (Owner: Group Manager Infrastructure). Flood-recovery work

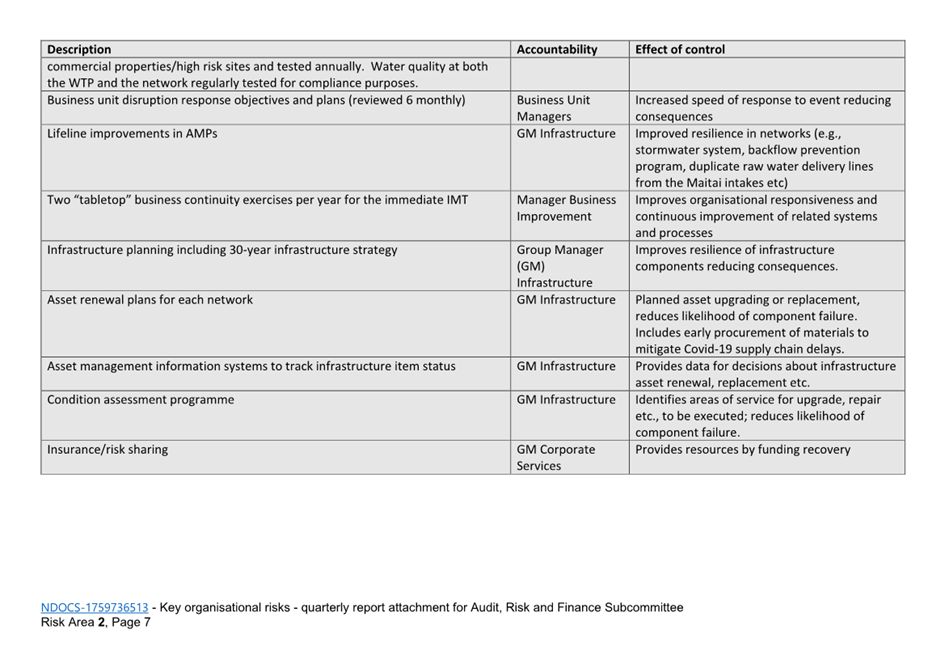

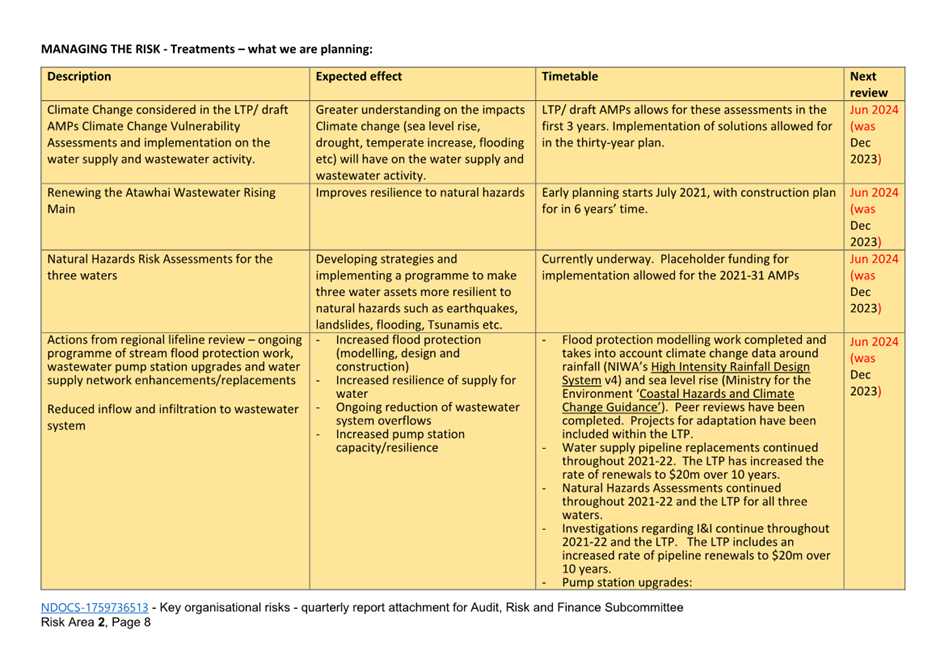

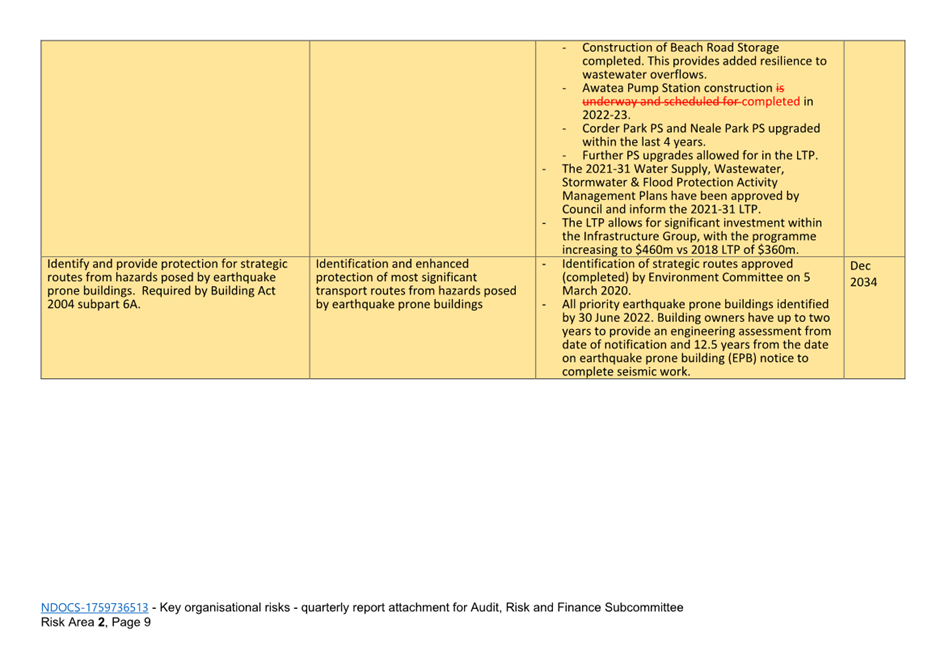

is ongoing. No other new emerging risks to report at this time.

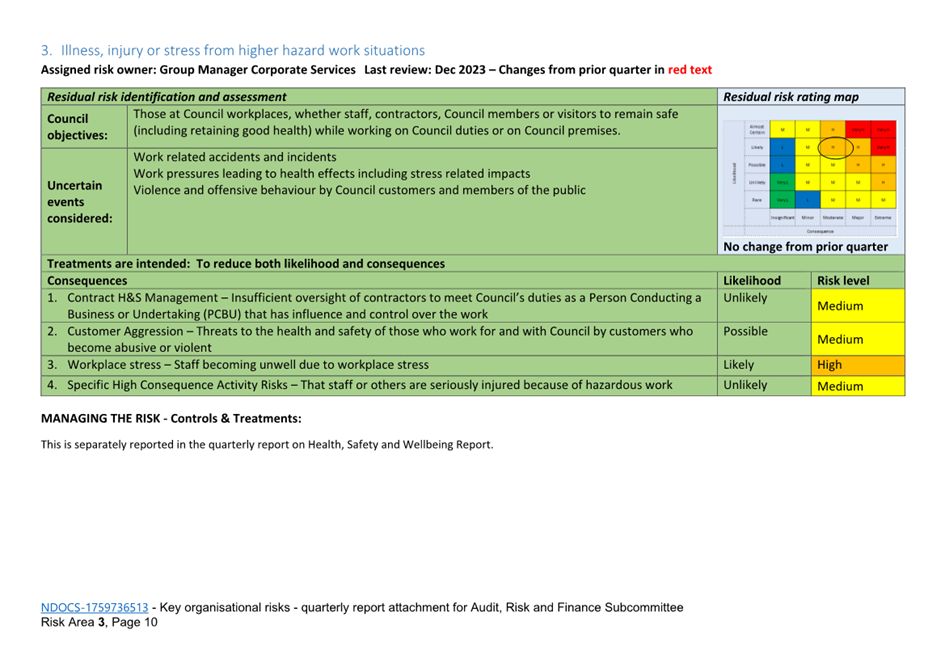

4.5 R3 - Illness,

injury or stress from higher hazard work situations (Owner: Group Manager

Corporate Services). Addressing workplace stress remains an organisational

focus area. The risk rating remains at High.

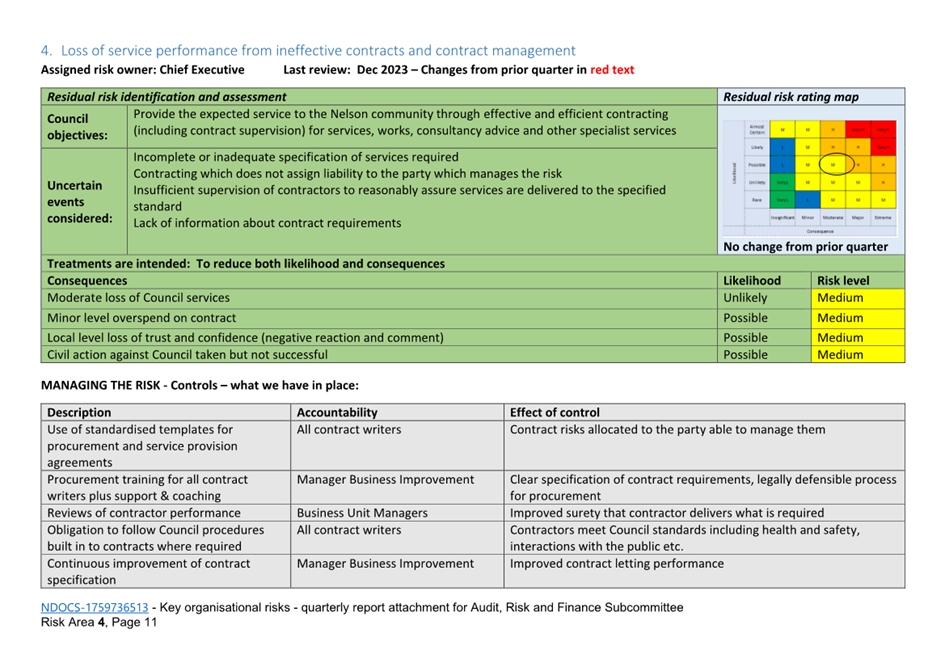

4.6 R4 - Loss of

service performance from ineffective contracts and contract management

(Owner: Chief Executive). Contract management improvement program tentatively

agreed with quarterly monitoring of program provided by the internal

Procurement Steering Committee. The risk rating remains at Medium.

4.7 R5 - Compromise of

Council service delivery from information technology failures (Owner: Group

Manager Corporate Services). No new emerging risks to report. The risk rating

remains at Low.

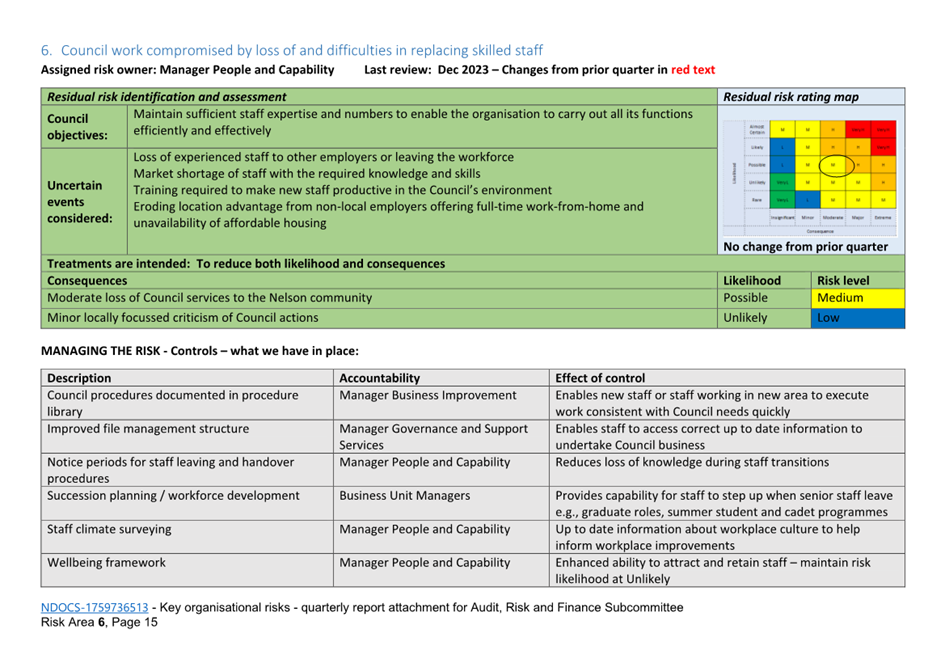

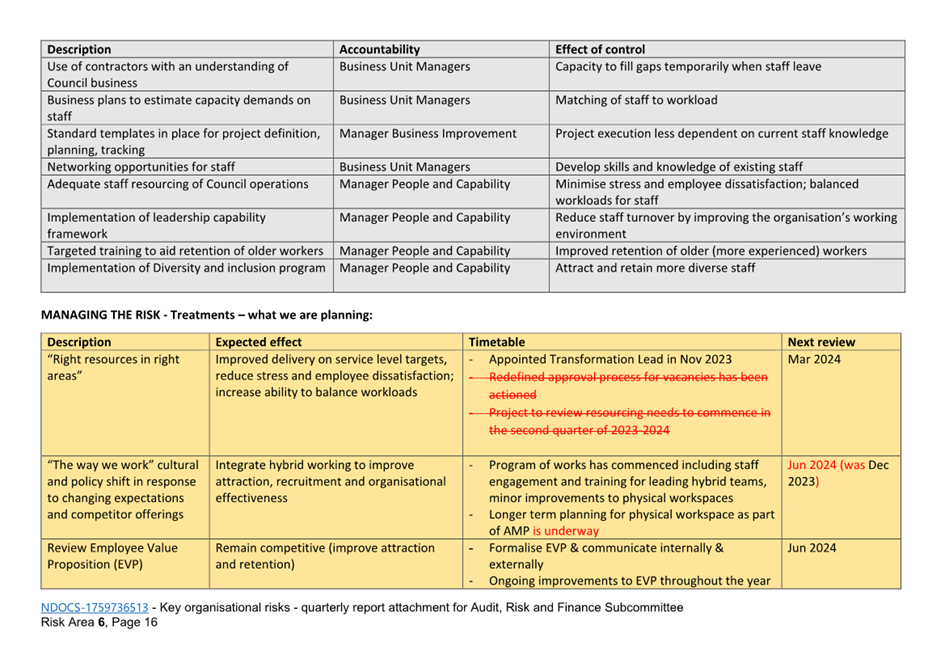

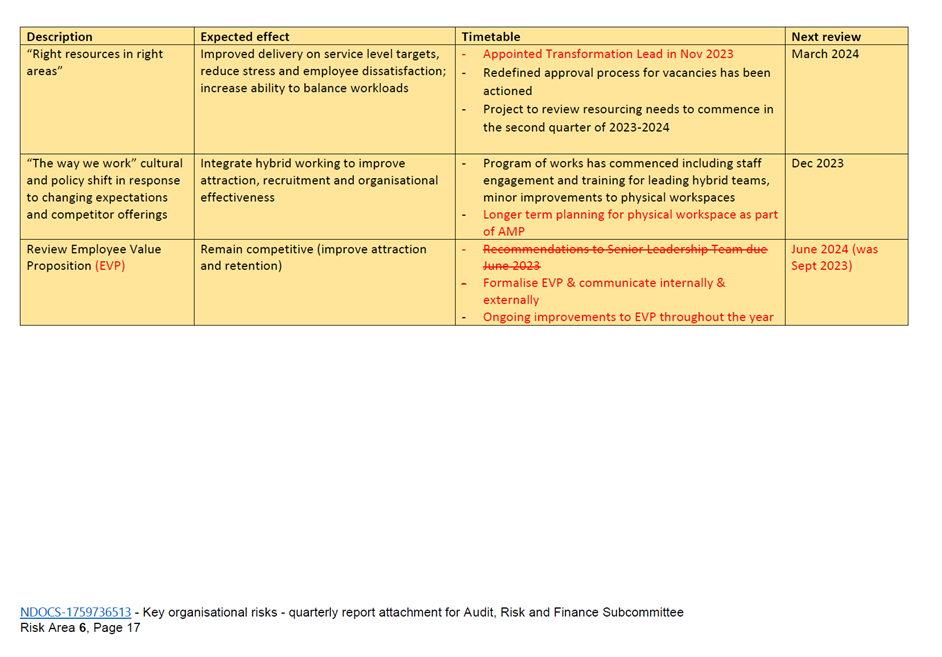

4.8 R6 - Council work

compromised by loss of and difficulties in replacing skilled staff (Owner:

Manager People and Capability). Turnover remains high with some

‘hard-to-fill’ roles remaining open despite repeated recruitment

efforts, engaging recruitment consultants and re-evaluating the job

description. The organisational risk rating remains at Medium.

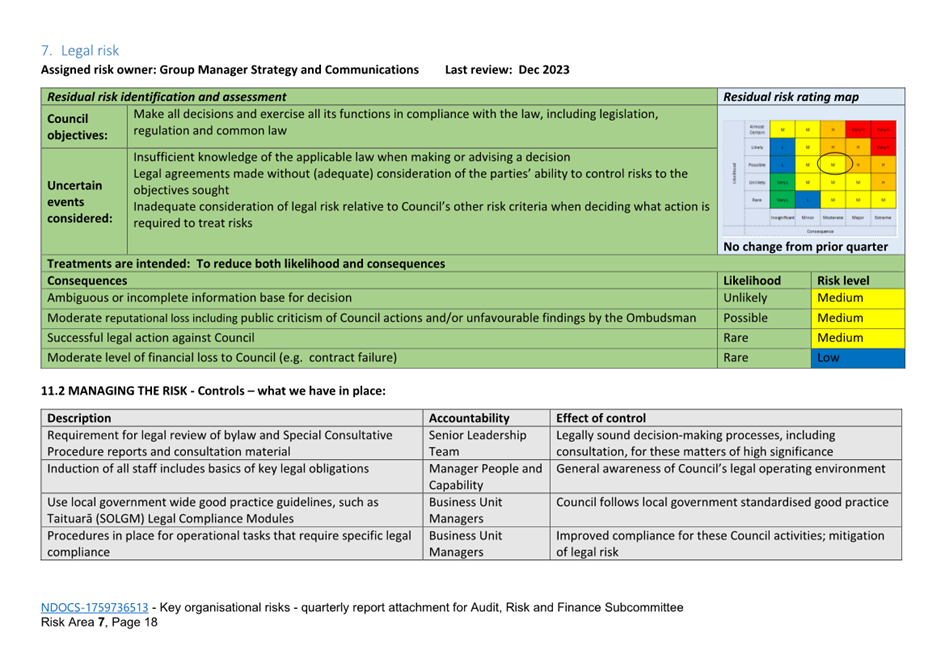

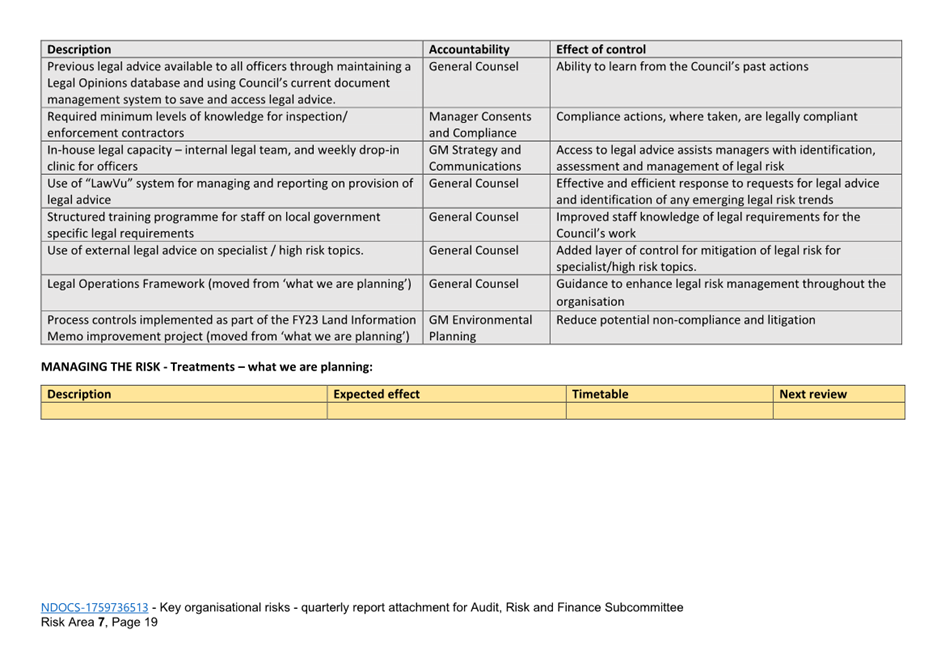

4.9 R7 - Legal Risk

(Owner: Group Manager Strategy and Communications). No emerging organisational

risks to report at this time noting that any new legal proceedings or emerging

areas of increased litigation risk are separately reported in the quarterly

report on legal proceedings. The organisational risk rating remains at

Medium.

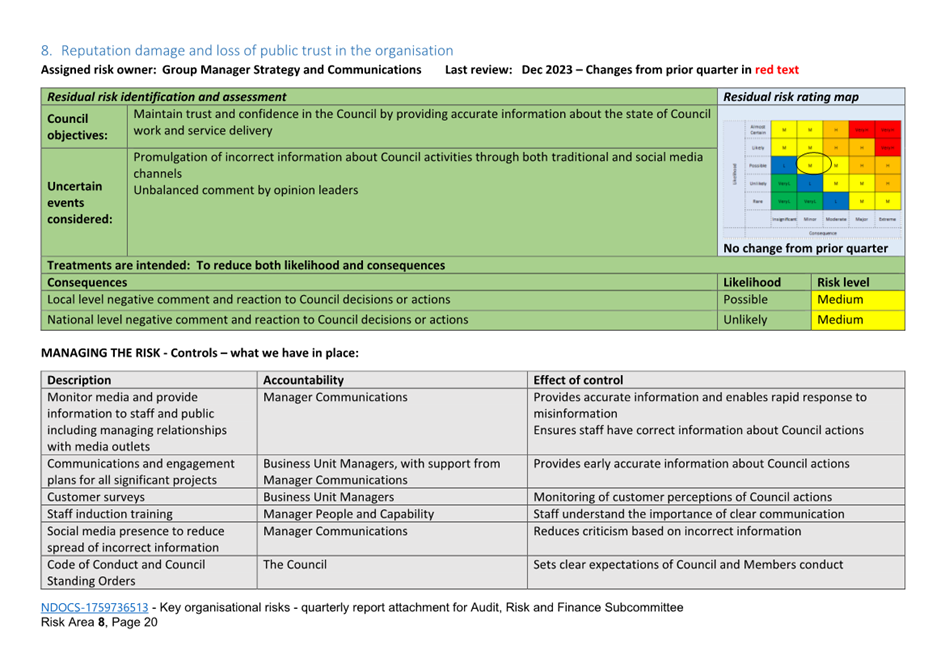

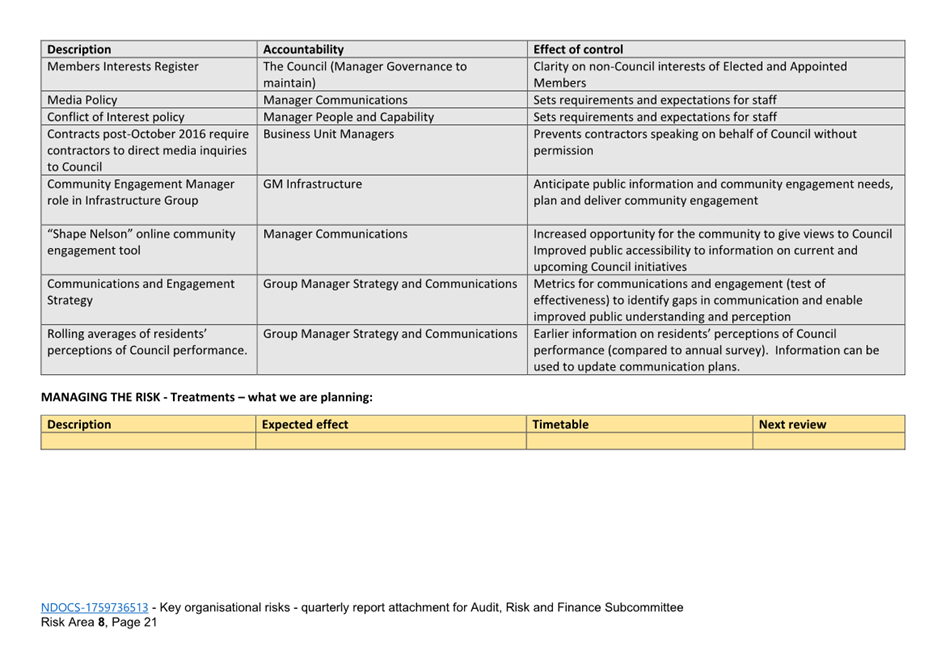

4.10 R8 - Reputation damage and

loss of public trust in the organisation (Group Manager Strategy and

Communications). No new emerging risks to report at this time. The risk rating

remains at Medium.

5. Key Risk Areas by

Reporting Group

5.1 Council’s risk

register does not contain specific asset, activity, legal matter, or project

risks. Instead, these are rolled up into more general asset, activity, legal or

project risks. Any significant specific risks which are new or emerging are

summarised below by reporting group.

5.2 Office of the Chief

Executive: No new emerging risks to report at this time.

5.3 Infrastructure

Group: Supply chain and contractor constraint risks rated down to

Low. Consultants are being used, where appropriate, to ensure work programmes

continue to be delivered to cover staff vacancies.

5.4 Community Services

Group:

5.4.1 Risks associated with Council-owned

campgrounds (two operated and one leased) remain elevated whilst non-compliance

remediation actions are being implemented. The risks previously monitored by

elected members through the Strategic Development and Property Subcommittee

have been monitored through the usual organisational processes since that

subcommittee ceased at the end of the last triennium.

5.4.2 Risks associated with wood processing

waste deposited at Tāhunanui Beach in the 1960s/1970s are under

investigation, with mitigation options to be brought to Council for

consideration later in the year.

5.5 Environmental

Management Group: Some senior vacancies have or soon will be filled,

mitigating risks relating to delivery and ability to recruit. Workload stress

may shift from causes due to vacancies to causes due to uncertainty about

national legislation reform.

5.6 Strategy

and Communications Group: No new emerging risks to report at this

time.

5.7 Corporate Services

Group: Project to optimise insurance is underway. The project may

result in increased financial risk.

Attachments

Attachment 1: 1759736513 - 2Q24

key organisational risks for ARF ⇩

Item 9: Quarterly Risk Report - 31 Dec 2023:

Attachment 1

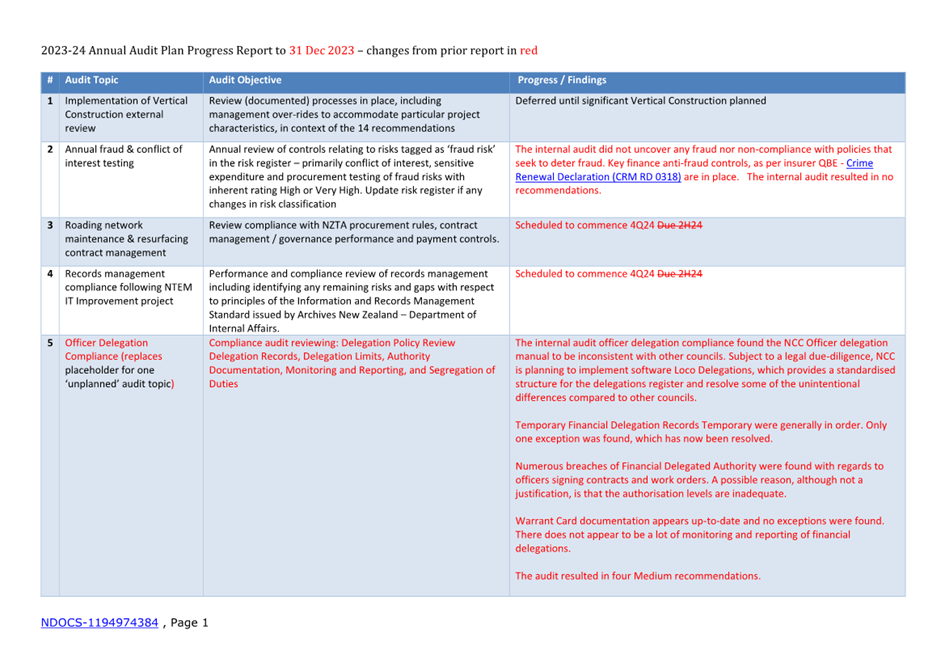

Item 10: Quarterly

Internal Audit Report - 31 Dec 2023

|

|

Audit, Risk and Finance Committee

14 February 2024

|

Report

Title: Quarterly

Internal Audit Report - 31 Dec 2023

Report

Author: Chris Logan - Audit

and Risk Analyst

Report

Authoriser: Nikki Harrison - Group Manager Corporate

Services

Report

Number: R28272

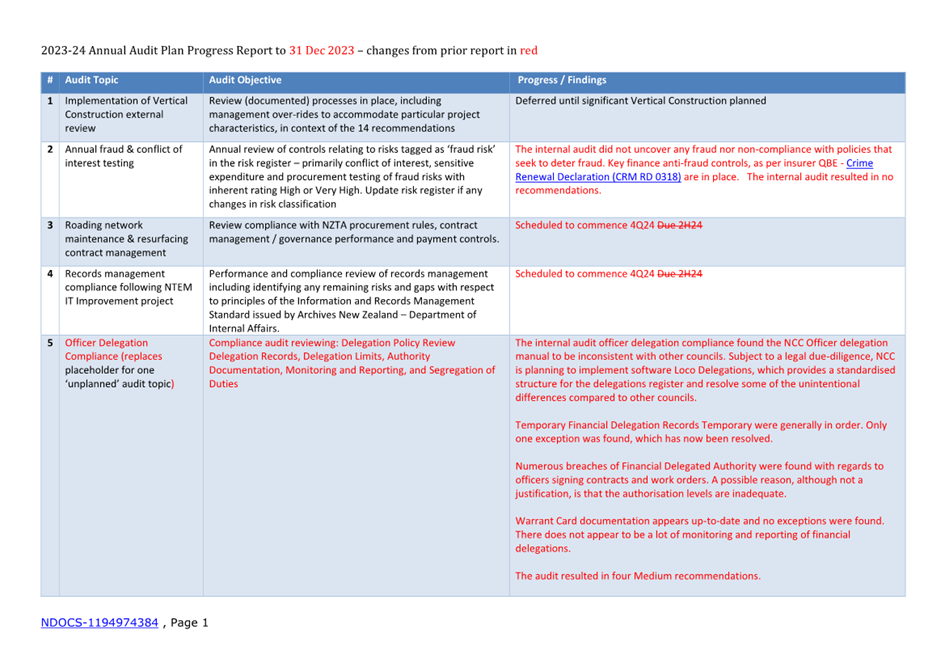

1. Purpose of Report

1.1 To update the Audit,

Risk and Finance Committee on the internal audit activity through to the end of

the second quarter of 2023/24.

2. Recommendation

|

That

the Audit, Risk and Finance Committee

1. Receives

the report Quarterly Internal Audit Report - 31 Dec 2023 (R28272) and its attachment

(1194974384).

|

3. Background

3.1 Under Council’s

Internal Audit Charter, the Audit, Risk and Finance Committee requires a

periodic update on the progress of internal audit activities. The 2023-24

Internal Audit Plan (the Plan) was approved by the Council on 8 June 2023.

4. Overview of

Progress on the 2023/24 Internal Audit Plan

4.1 Two audits were

completed during the quarter and one commenced:

4.1.1 The Annual Fraud, Conflict of

Interest & Sensitive Expenditure internal audit resulted in no

recommendations.

4.1.2 Officer Delegation Compliance

internal audit resulted in four medium recommendations.

4.1.3 An internal audit of Commercial

Lease Management was commenced.

4.2 Inclusion of both

4.1.2 and 4.1.3 into the audit plan was approved by the Chair of the Audit,

Risk and Finance committee and had previously been flagged as potential audits

in the audit plan. These audits replace the deferred audit of the Implementation

of Vertical Construction external review and fills the placeholder for an

‘unplanned’ audit.

4.3 Further information on

the status and outcome of the audits is provided in the attachment.

5. Significant

external audits that are not reported separately to the Audit, Risk and Finance

Committee

5.1 An external audit of Council’s

full year 2023 operational greenhouse gas emission footprint is due to commence

in the second quarter of 2023-2Q24. An update on the outcome will be provided

to this committee as part of end of year 2024 reporting.

6. Status of

Outstanding Significant Risk Exposures and Control Issues Identified from

Internal Audits

6.1 Staff cannot

currently perform advanced searches – Status unchanged - NDocs

Improvements Business Case approved. The majority of benefits are expected by

May 2024 (IANZ deadline) or the end of 2023-24 (advanced search).

6.2 Staff

are finding it difficult to find NCC internal policies – Status

unchanged - Work has commenced on implementing this recommendation.

Attachments

Attachment 1: 1194974384 - Annual

Audit Plan Progress - 31 Dec 2023 ⇩

Item 10: Quarterly Internal Audit Report - 31 Dec

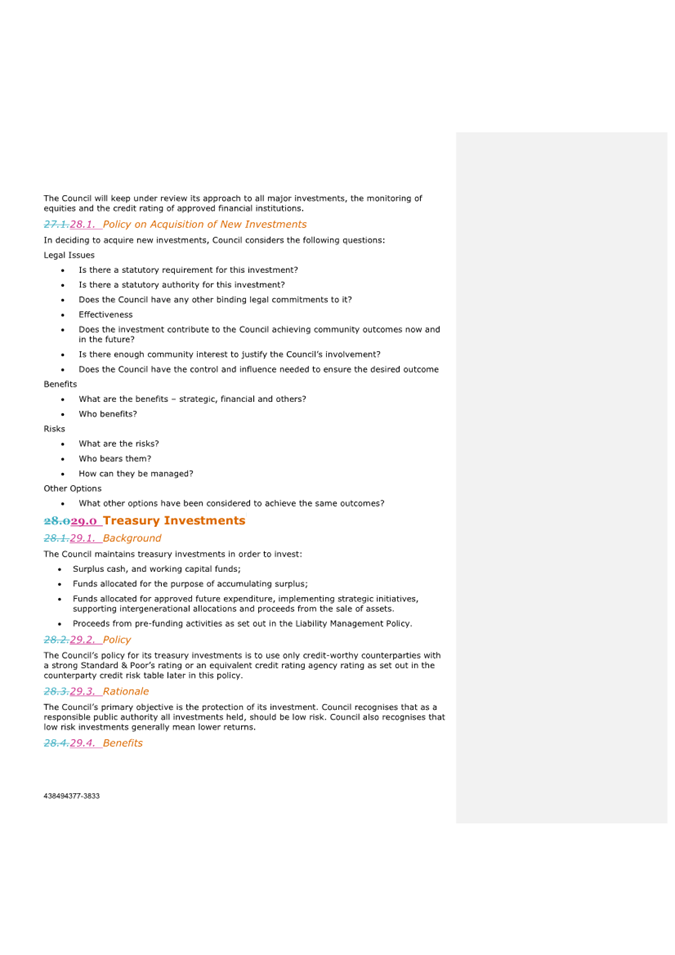

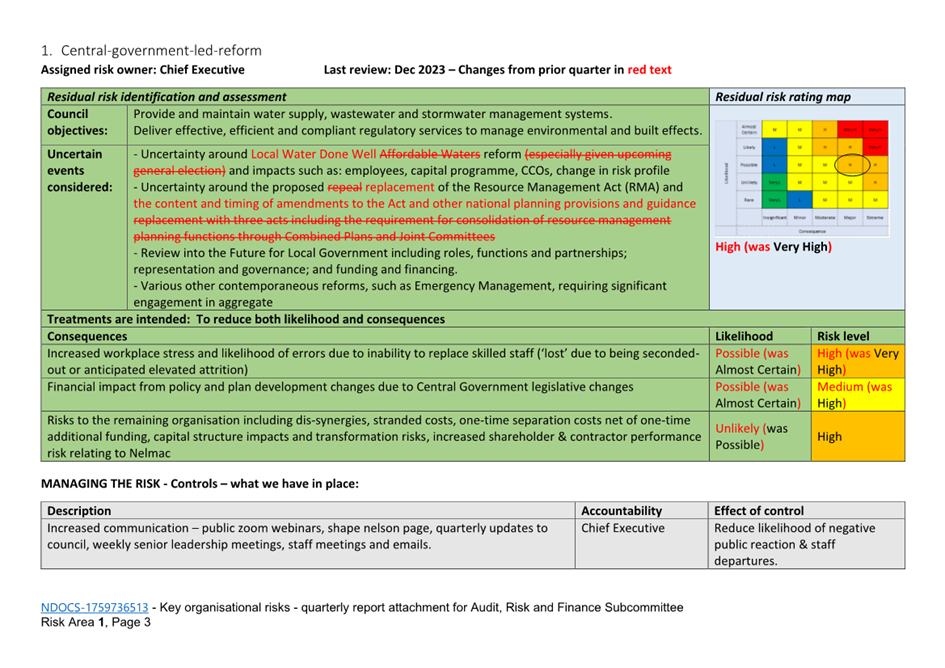

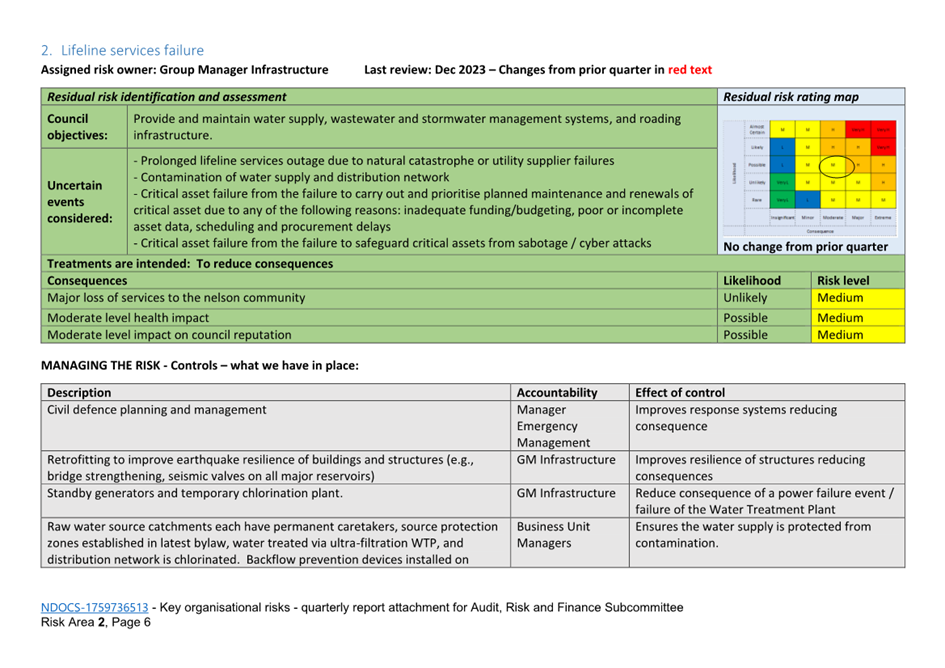

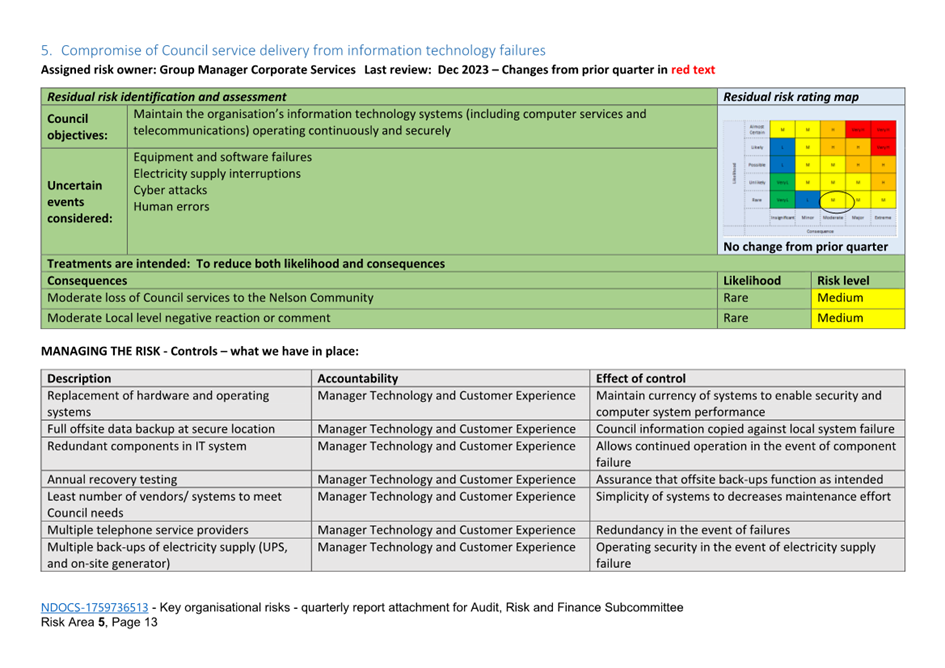

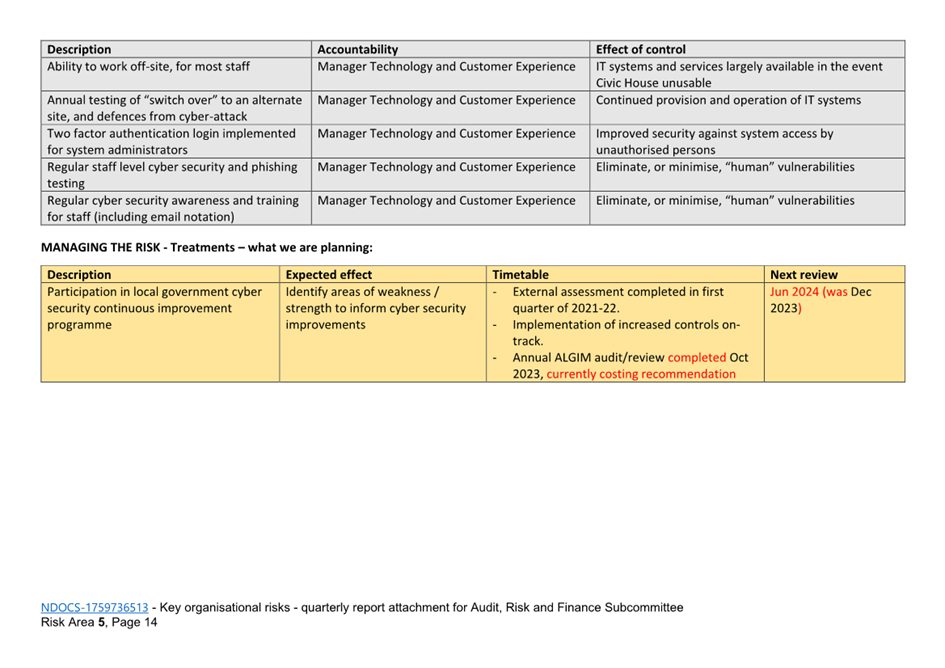

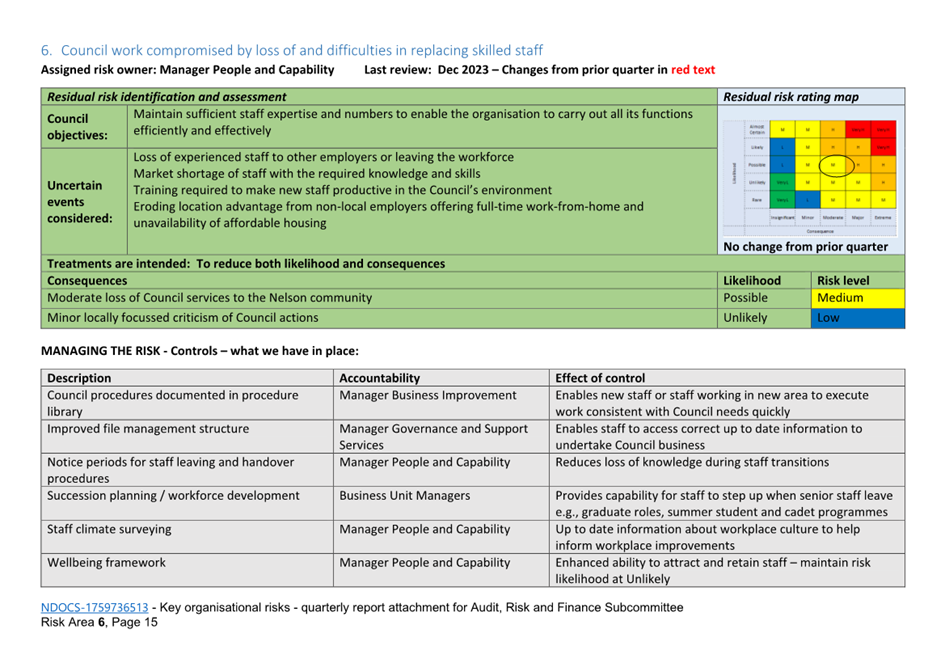

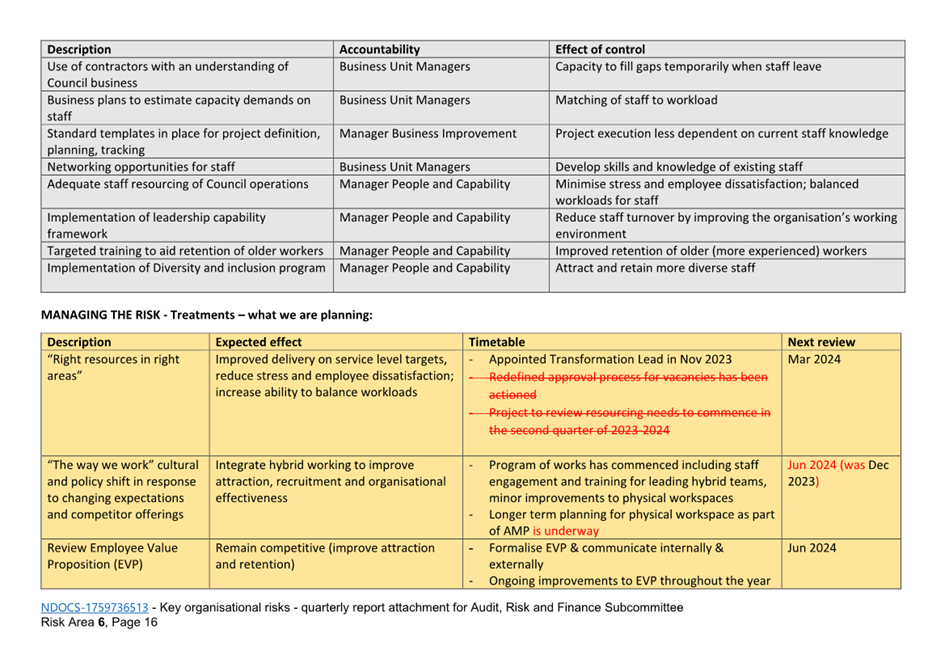

2023: Attachment 1