Notice of the Ordinary meeting of

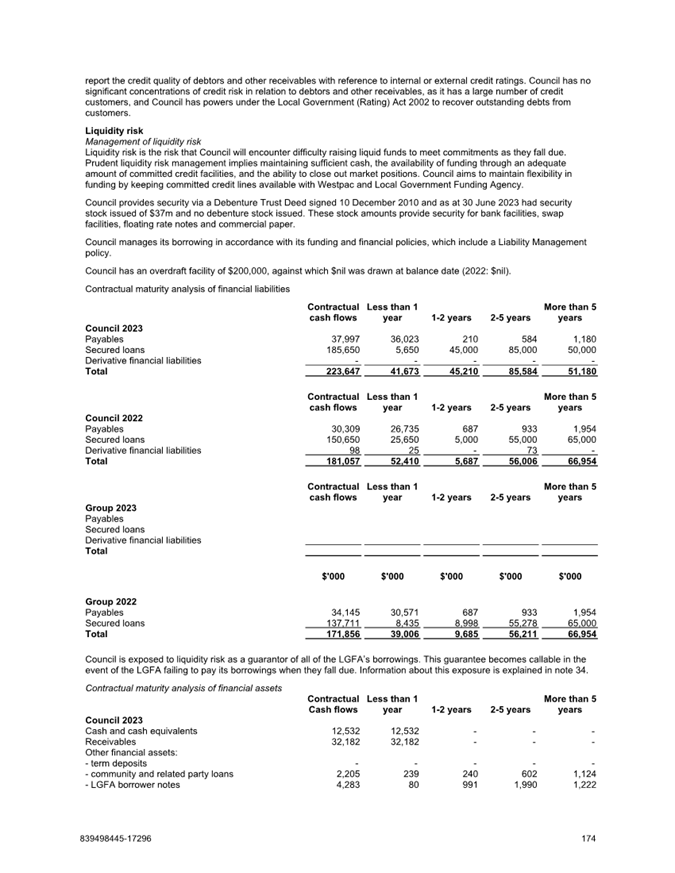

Audit, Risk and Finance Committee

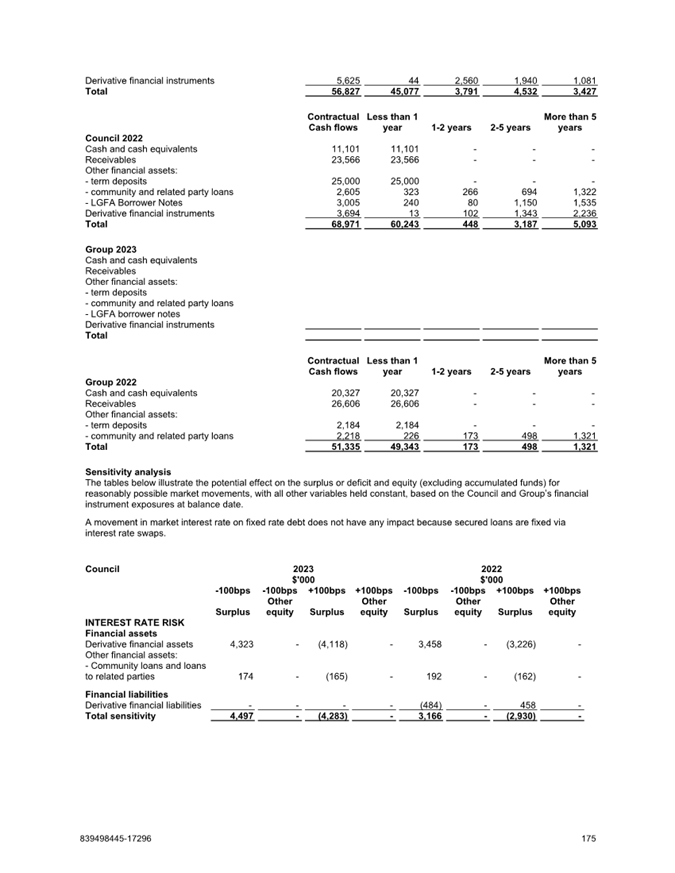

Te Kōmiti Kaute / Tūraru / Pūtea

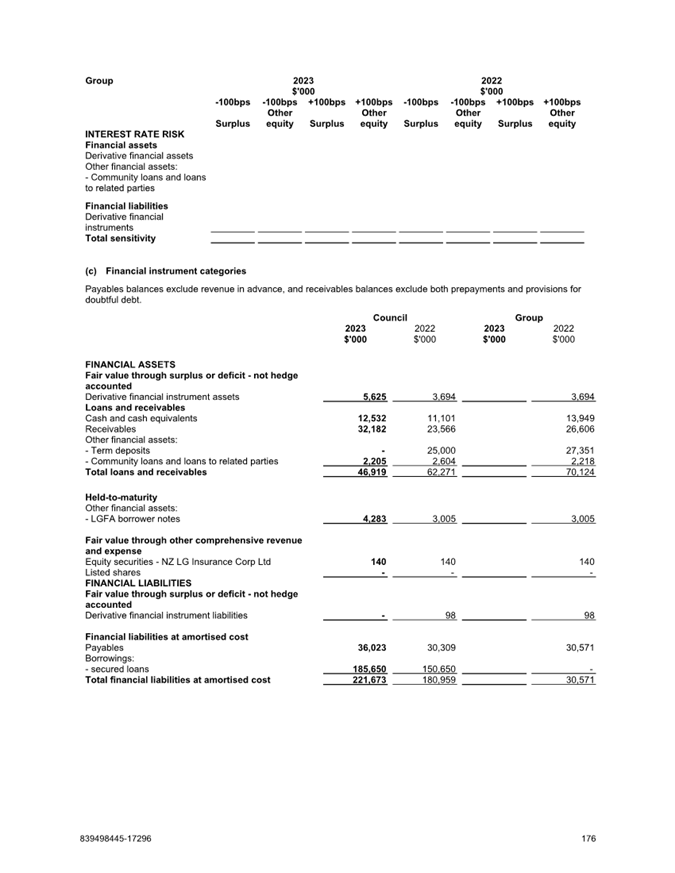

|

Date: Friday

15 September 2023

Time: 9.00a.m.

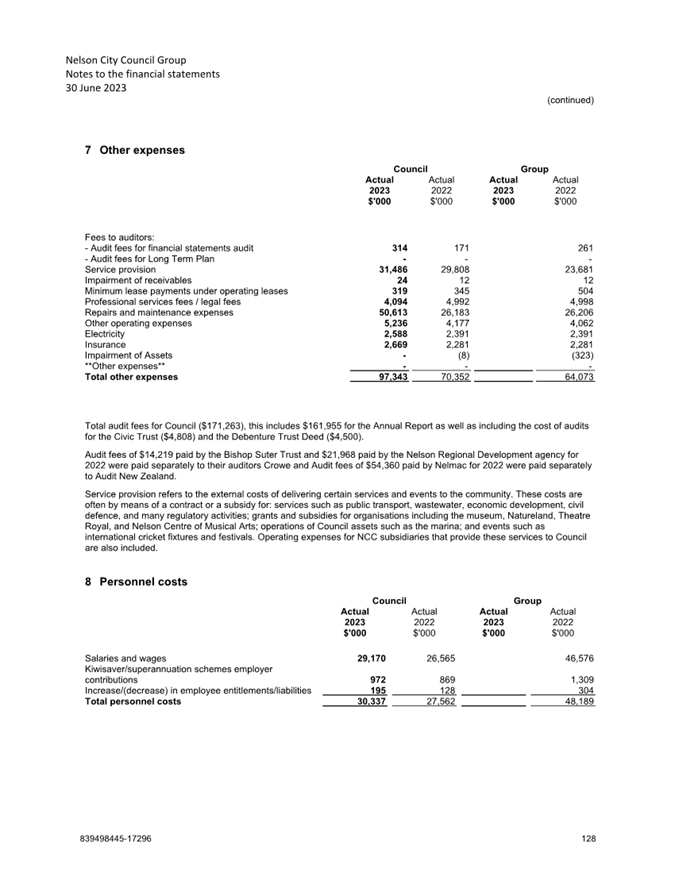

Location: Council

Chamber

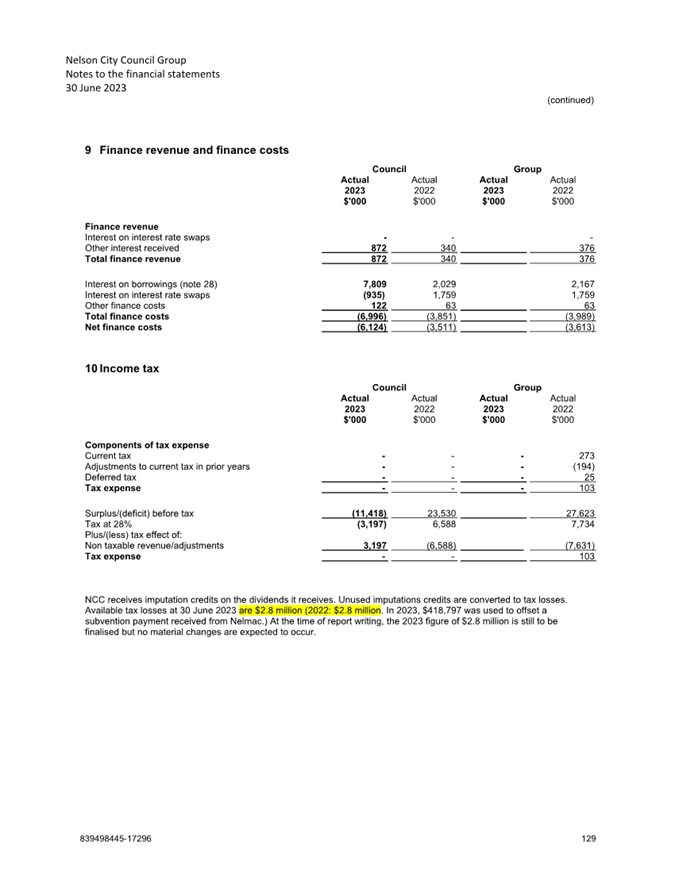

Floor 2A, Civic House

110 Trafalgar Street, Nelson

|

Agenda

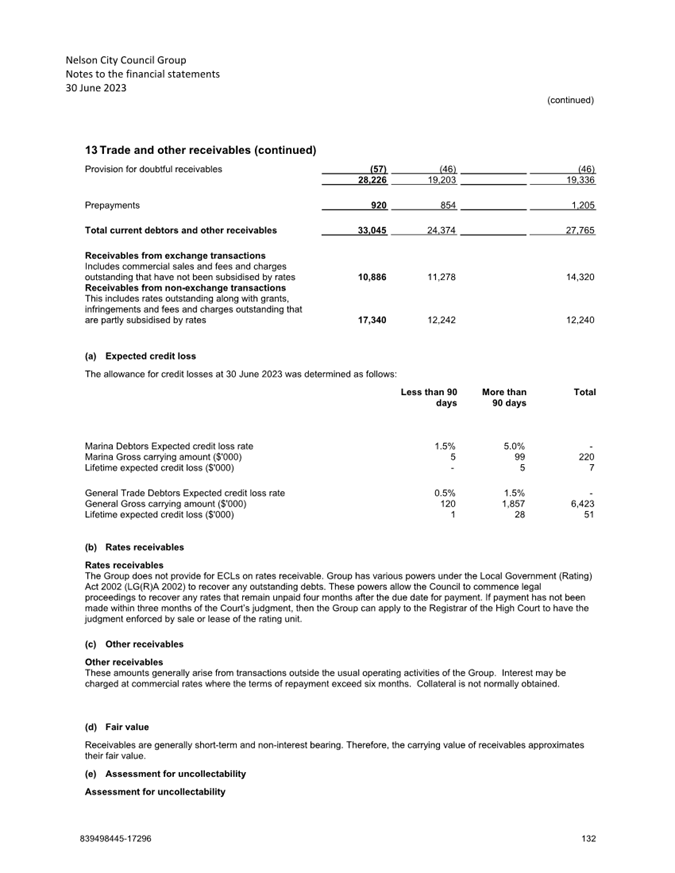

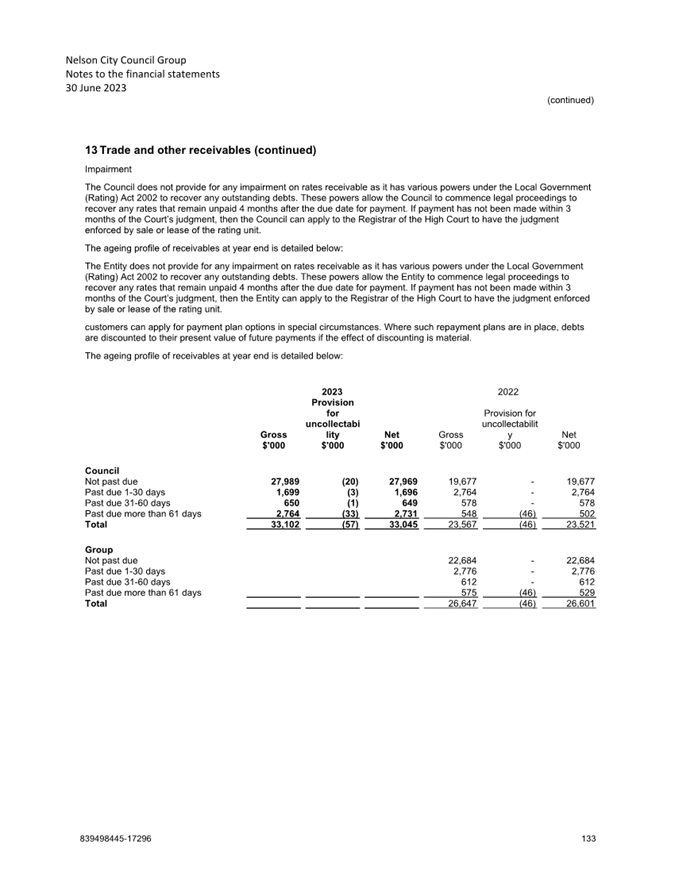

Rārangi take

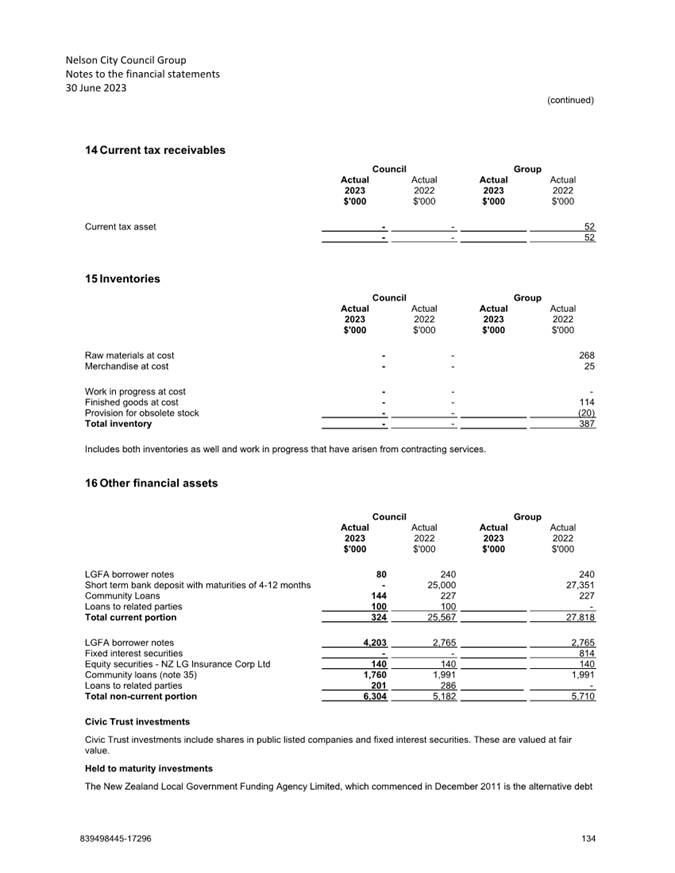

Chairperson Ms

Catherine Taylor

Members His

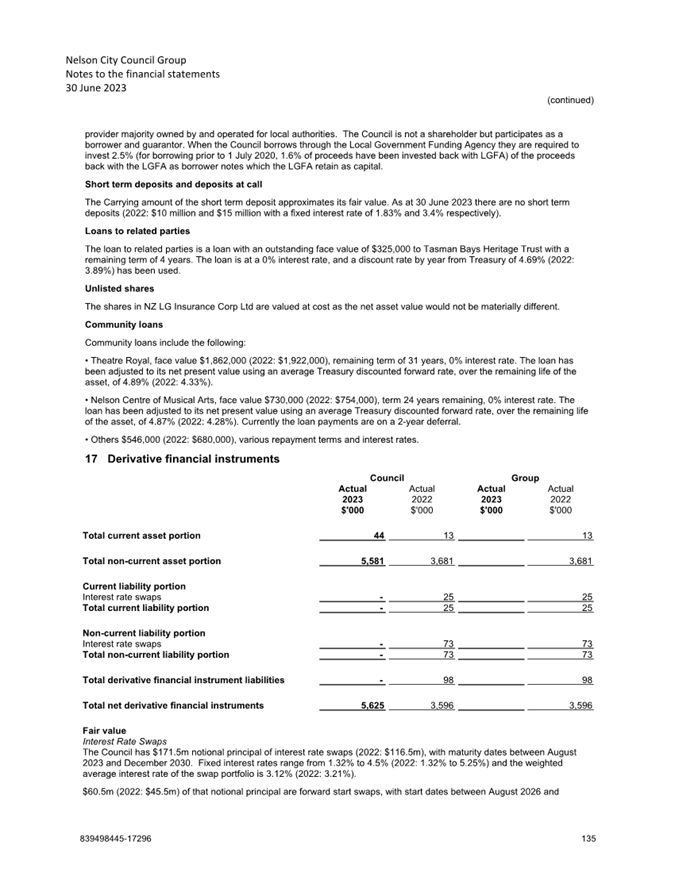

Worship the Mayor Nick Smith

Deputy

Mayor Rohan O'Neill-Stevens

Cr

Mel Courtney

Cr

Rachel Sanson

Member

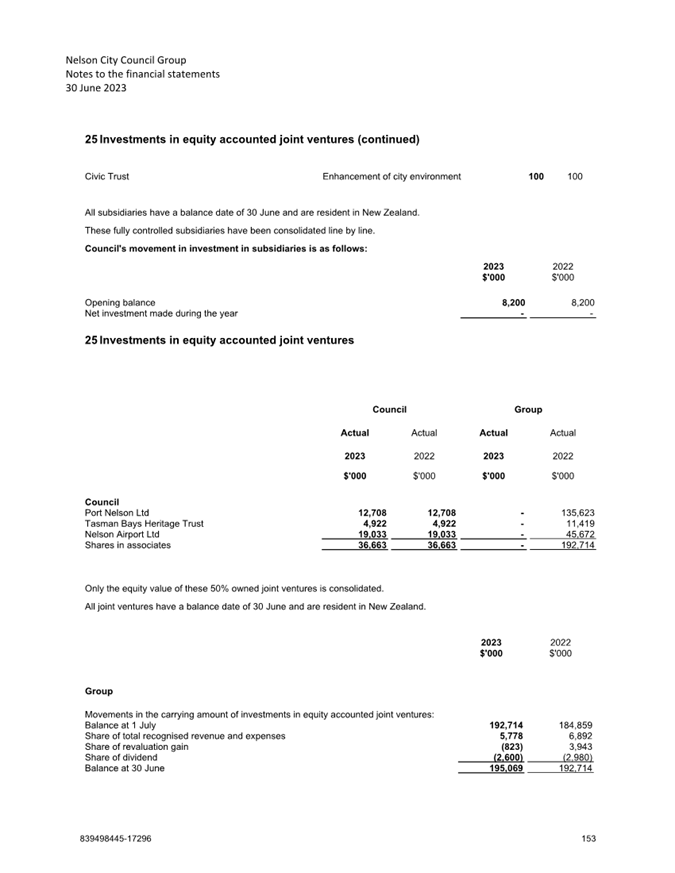

Lindsay McKenzie

Quorum 3 Nigel

Philpott

Chief Executive

Nelson City Council Disclaimer

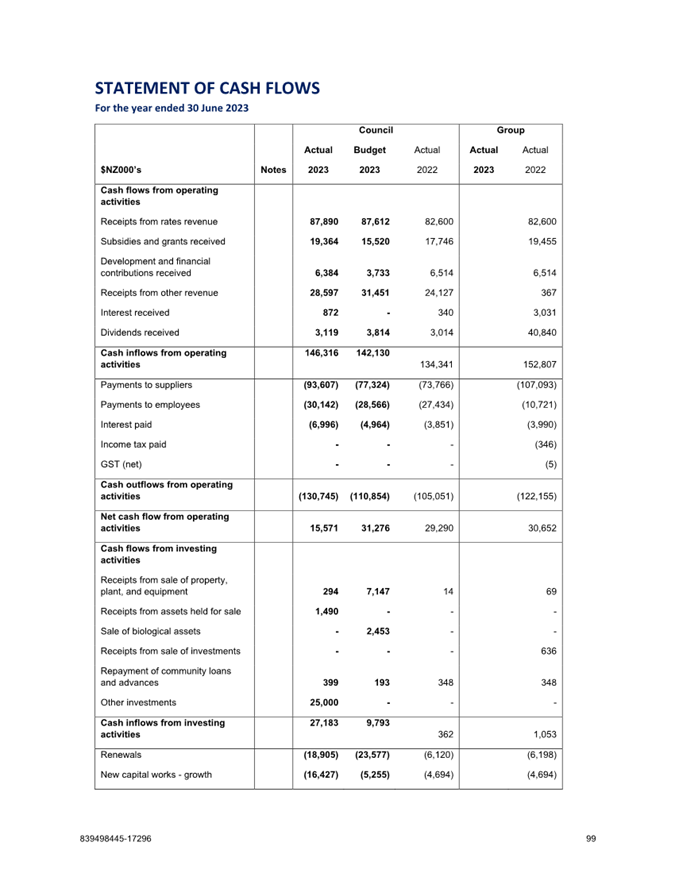

Please note that the contents of these

Council and Committee agendas have yet to be considered by Council and officer recommendations

may be altered or changed by the Council in the process of making the formal

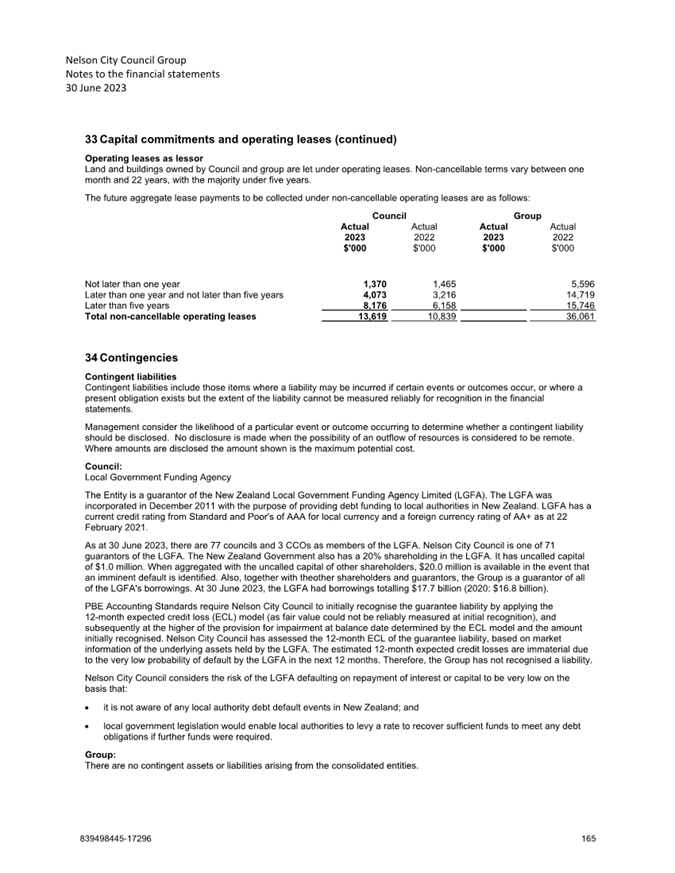

Council decision. For enquiries call (03) 5460436.

Audit, Risk and Finance

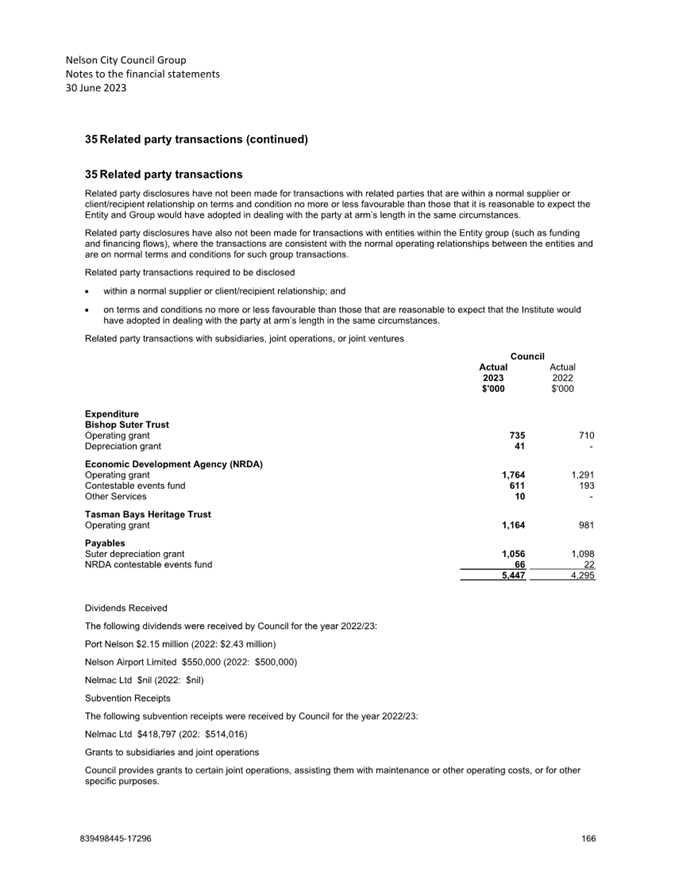

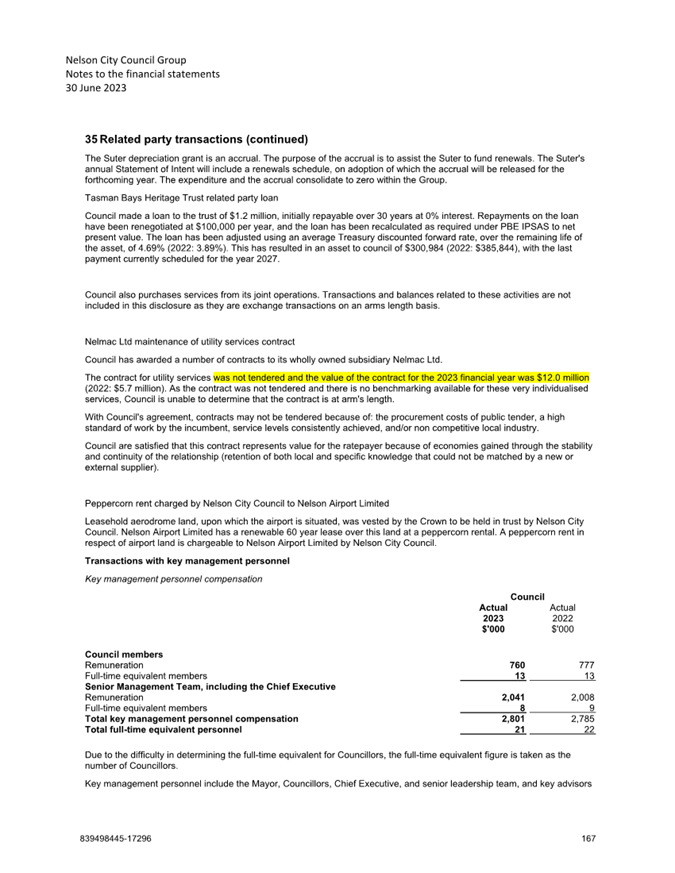

Committee

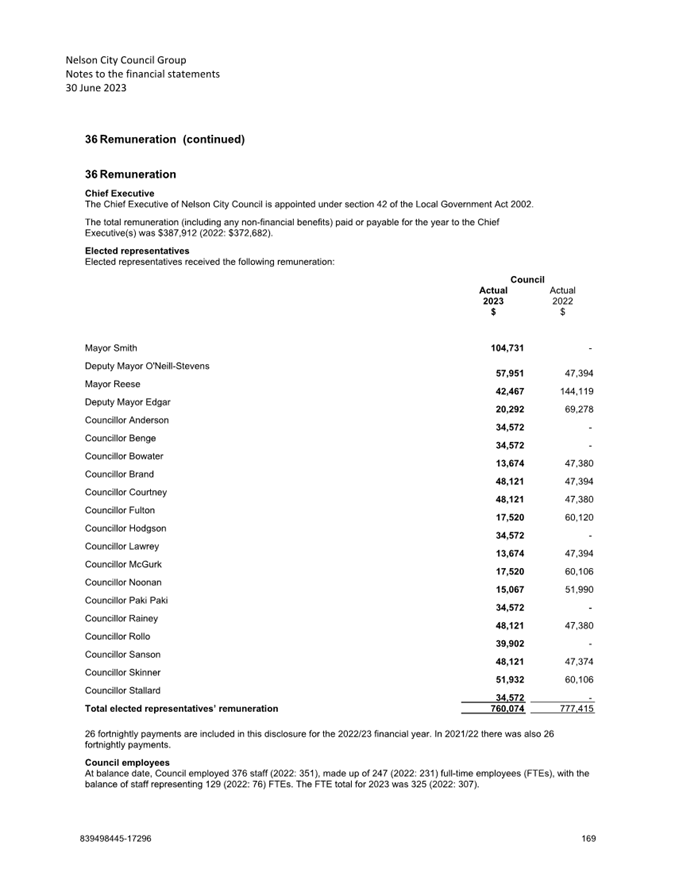

This is a Committee of Council

Areas of

Responsibility

·

Any matters raised by Audit New Zealand or the Office of the

Auditor-General

·

Audit processes and management of financial risk

·

Chairperson’s input into financial aspects of draft

Statements of Expectation and draft Statements of Intent for Nelson City

Council Controlled Organisations, Council Controlled Trading Organisations and

Council Organisations

·

Council’s Annual Report

·

Council’s financial performance

·

Council’s Treasury policies

·

Health and Safety

·

Internal audit

·

Monitoring organisational risks, including debtors and legal

proceedings

·

Procurement Policy

Powers to

Decide

·

Appointment of a deputy Chair

Powers to

Recommend to Council

·

Adoption of Council’s Annual Report

·

To write off outstanding accounts receivable or remit fees and

charges of amounts over the Chief Executive’s delegated authority.

·

All other matters within the areas of responsibility or any other

matters referred to it by the Council

For the Terms of Reference for the Audit, Risk and Finance Committee

please refer to document NDOCS-1974015928-887.

Audit, Risk and Finance Committee

15

September 2023

Page

No.

Karakia

and Mihi Timatanga

1. Apologies

An

apology has been received from Councillor R Sanson

2. Confirmation

of Order of Business

3. Interests

3.1 Updates

to the Interests Register

3.2 Identify

any conflicts of interest in the agenda

4. Public Forum

5. Confirmation

of Minutes

5.1 1 June

2023 9 - 17

Document number M20175

Recommendation

|

That the Audit, Risk and Finance Committee

1. Confirms the minutes of the meeting

of the Audit, Risk and Finance Committee, held on 1 June 2023, as a true and

correct record.

|

6. Audit New

Zealand: Audit Letters 18 - 68

Document number R27895

Recommendation

|

That

the Audit, Risk and Finance Committee

1. Receives

the report Audit New Zealand: Audit Letters (R27895) and its attachments

(2126778665-306, 2126778665-305 and 2126778665-312); and

2. Notes that following feedback from

the Audit, Risk and Finance Committee, His Worship the Mayor Hon Dr Smith

will sign the Audit Engagement Letter to Audit NZ; and

3. Notes the Committee can provide

feedback on the Audit Proposal Letter to Audit New Zealand if required,

noting His Worship the Mayor Hon Dr Smith will sign the letter once the Committee’s

feedback has been incorporated.

|

7. Quarterly Finance

Report to 30 June 2023 69 - 90

Document number R27698

Recommendation

|

That

the Audit, Risk and Finance Committee

1. Receives

the report Quarterly Finance Report to 30 June 2023 (R27698) and its attachments

(1857728953-1036, 839498445-17283, and 839498445-17269).

|

8. Quarterly Internal

Audit Report - 30 June 2023 91 - 96

Document number R27678

Recommendation

|

That

the Audit, Risk and Finance Committee

1. Receives

the report Quarterly Internal Audit Report - 30 June 2023 (R27678) and its attachment

(1194974384-3470).

|

9. Quarterly Risk

Report - 30 June 2023 97 - 124

Document number R27679

Recommendation

|

That

the Audit, Risk and Finance Committee

1. Receives

the report Quarterly Risk Report - 30 June 2023 (R27679) and its attachment (1759736513).

|

10. Annual Tax Update 125 - 139

Document number R27574

Recommendation

|

That

the Audit, Risk and Finance Committee

1. Receives

the report Annual Tax Update (R27574)

and its attachment (2130083480-450).

|

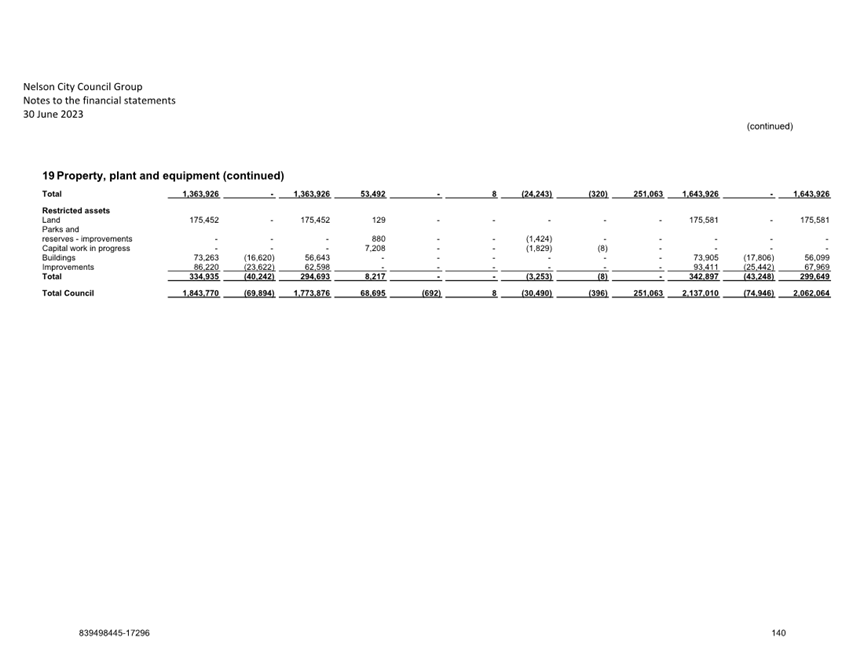

11. Carry Forwards 2022/23 140 - 149

Document number R27806

Recommendation

|

That

the Audit, Risk and Finance Committee

1. Receives

the report Carry Forwards 2022/23 (R27806)

and its attachments (332184083-4933 and 332184083-4932).

|

Recommendation to Council

|

That the Council

1. Approves the carry forward of $8.2

million–$8.1 million to 2023/24 and $143,000 to 2024/25; and

2. Notes that this is in addition to

the carry forward of $21.9 million approved during the Annual Plan 2023/24

process, taking the total carry forward to $30.1 million of which $27 million

is for the 2023/24 year and $3.1 million is for the 2024/25 year; and

3. Notes the total savings and

reallocations in 2022/23 capital expenditure of $2.6 million; and

4. Notes that the total 2023/24

capital budget (including staff costs and work on attending to the slips

originating on Council land and excluding consolidations, vested assets,

scope adjustment and other August 2022 flood recovery budgets) will be

adjusted by these resolutions from a total of $85.7 million to a total of

$93.7 million; and

5. Approves the carry forward of

$447,000 unspent operating budget to 2023/24.

|

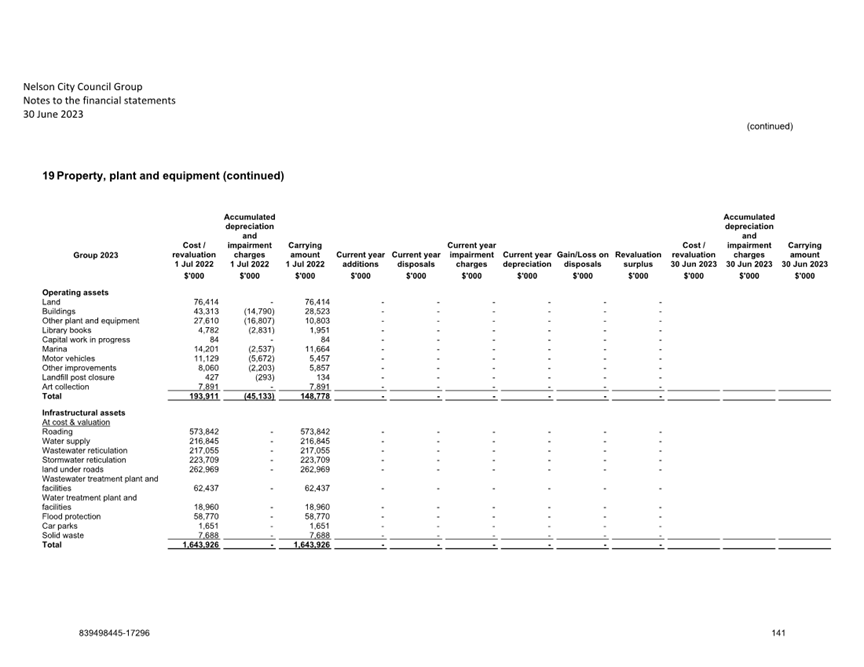

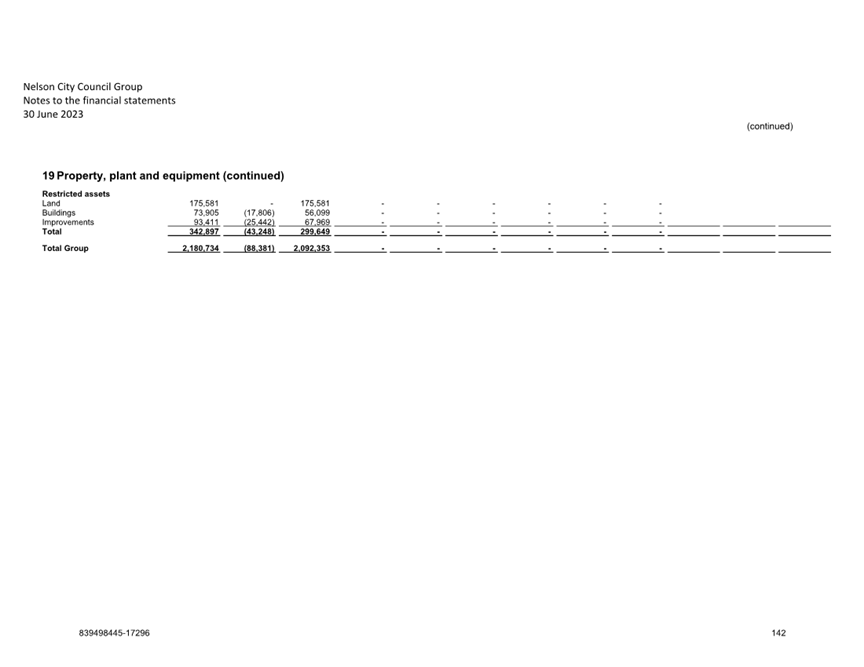

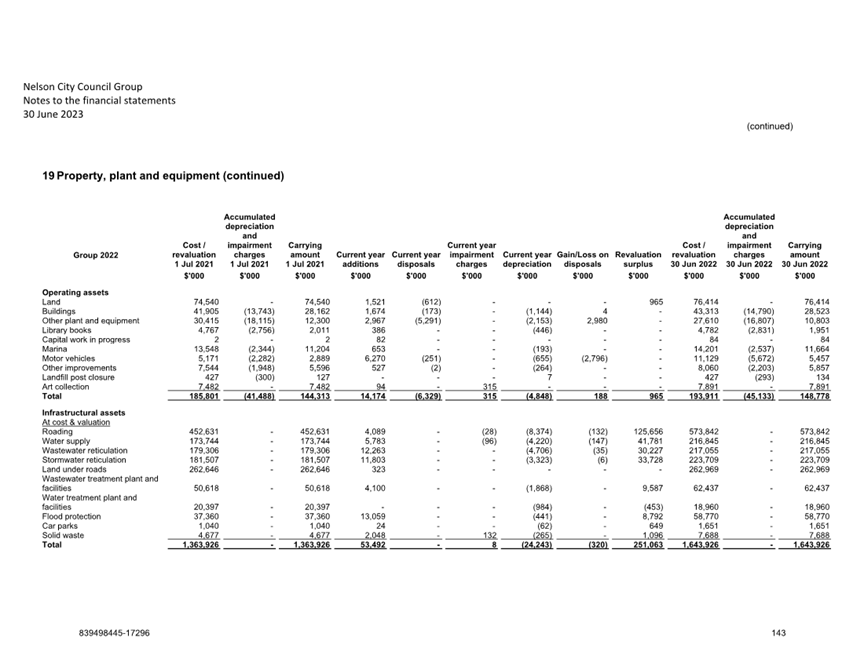

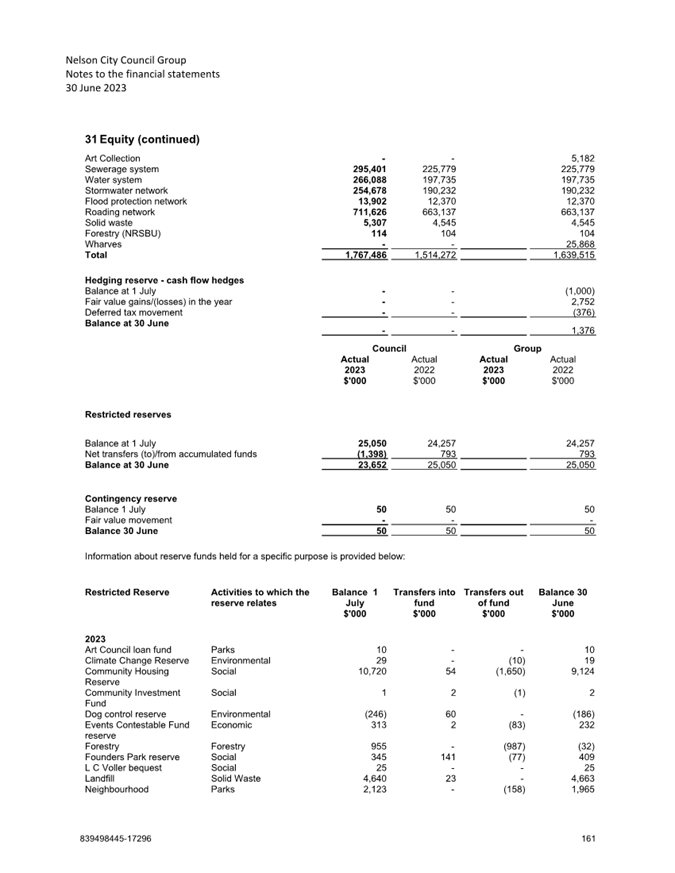

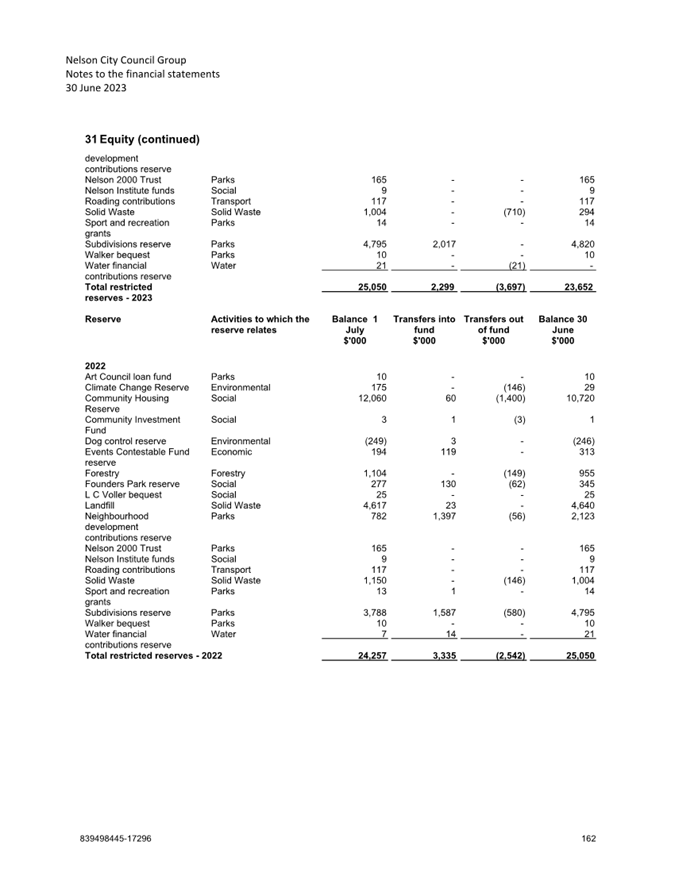

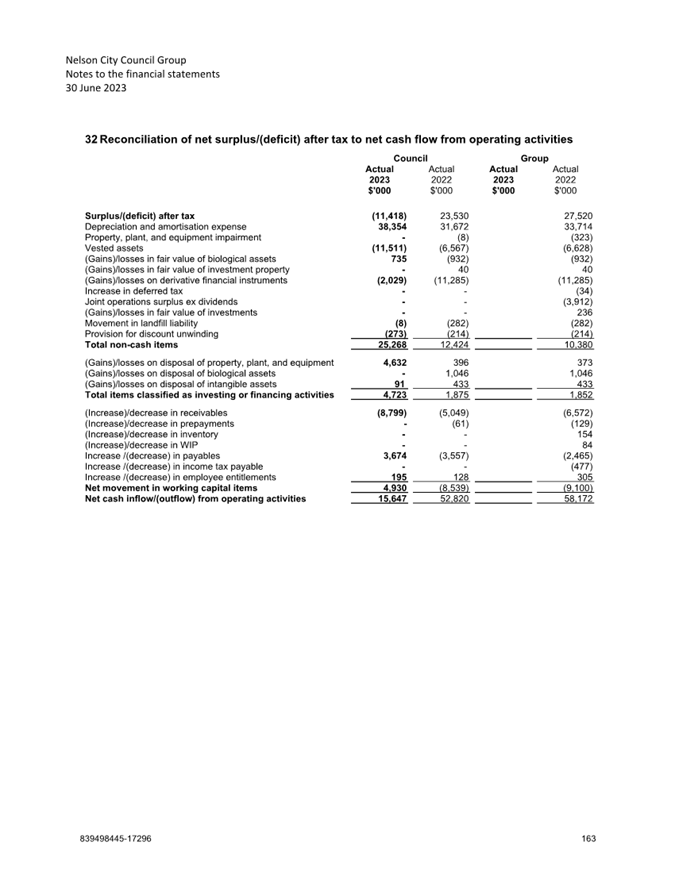

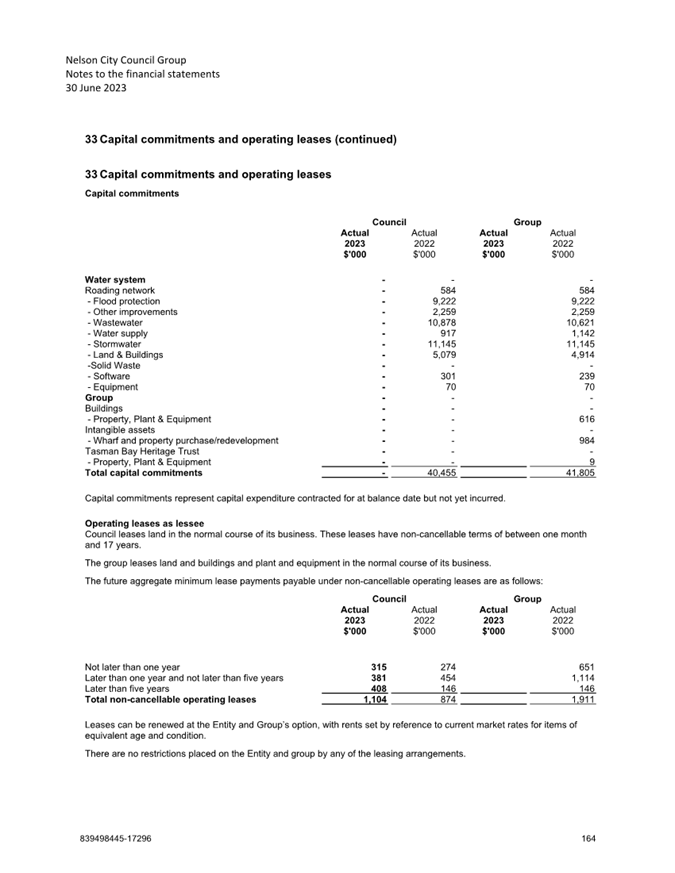

12. Draft Annual Report 2022/23 150 - 342

Document number R27872

Recommendation

|

That

the Audit, Risk and Finance Committee

1. Receives

the report Draft Annual Report 2022/23 (R27872) and its attachment (839498445-17289); and

2. Notes the draft Annual Report

2022/23 has been prepared and will be audited before being presented to

Council for adoption following audit, prior to the 31 October 2023 statutory

deadline.

|

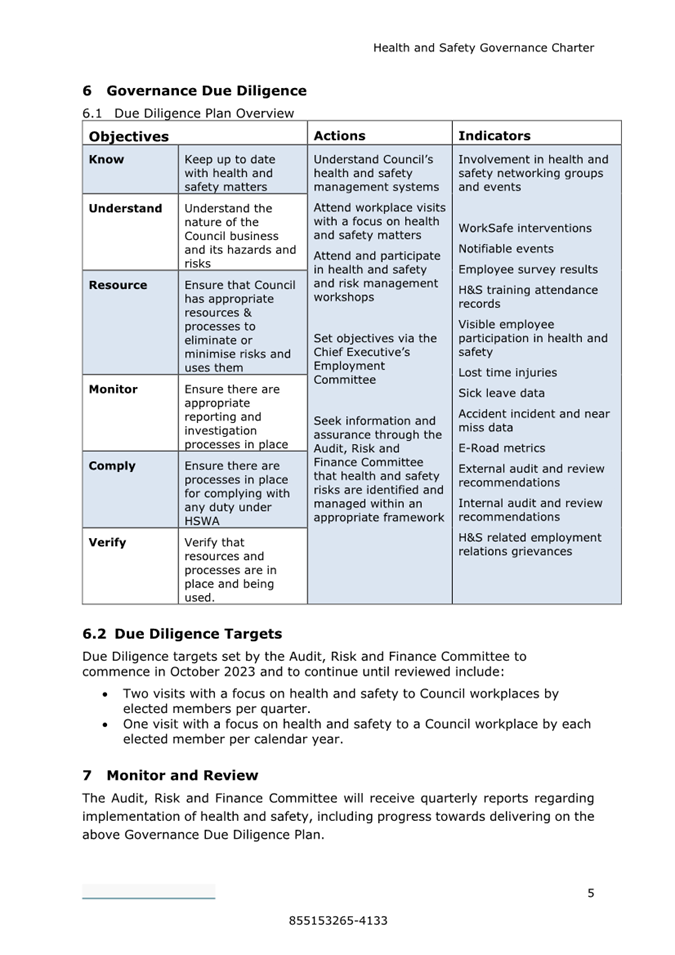

13. Review of Health and Safety

Governance Charter 343 - 354

Document number R27905

Recommendation

|

That

the Audit, Risk and Finance Committee

1. Receives

the report Review of Health and Safety Governance Charter (R27905) and its attachment (855153265-4133).

|

Recommendation to Council

|

That the Council

1. Approves the revised Health and

Safety Governance Charter (855153265-4133).

|

14. Organisational

Risk - Deep Dive 355 - 355

Document number R27837

Recommendation

|

That

the Audit, Risk and Finance Committee

1. Receives

the report Organisational Risk - Deep Dive (R27837).

|

Confidential Business

15. Exclusion of the Public

Recommendation

That the Audit,

Risk and Finance Committee

1.

Excludes the

public from the following parts of the proceedings of this meeting.

2.

The general subject of each matter to be

considered while the public is excluded, the reason for passing this resolution

in relation to each matter and the specific grounds under section 48(1) of the

Local Government Official Information and Meetings Act 1987 for the passing of

this resolution are as follows:

|

Item

|

General subject of each matter to be

considered

|

Reason for passing this resolution in

relation to each matter

|

Particular interests protected (where

applicable)

|

|

1

|

Audit, Risk and Finance Committee Meeting - Confidential Minutes

- 1 June 2023

|

Section

48(1)(a)

The

public conduct of this matter would be likely to result in disclosure of

information for which good reason exists under section 7.

|

The withholding of the information is necessary:

· Section

7(2)(a)

To protect the

privacy of natural persons, including that of a deceased person

· Section

7(2)(j)

To prevent the

disclosure or use of official information for improper gain or improper

advantage

· Section

7(2)(g)

To maintain

legal professional privilege

|

|

2

|

Health,

Safety and Wellbeing Report to 30 June 2023

|

Section

48(1)(a)

The public conduct of this

matter would be likely to result in disclosure of information for which good

reason exists under section 7

|

The withholding of the information is necessary:

· Section 7(2)(a)

To protect the privacy of

natural persons, including that of a deceased person

|

|

3

|

Quarterly Report on Legal Proceedings

|

Section 48(1)(a)

The public

conduct of this matter would be likely to result in disclosure of information

for which good reason exists under section 7

|

The withholding of the information is necessary:

· Section

7(2)(c)(ii)

To protect

information which is subject to an obligation of confidence or which any

person has been or could be compelled to provide under the authority of any

enactment, where the making available of the information would be likely

otherwise to damage the public interest

· Section

7(2)(g)

To maintain

legal professional privilege

|

|

4

|

Quarterly

Update on Debts - 30 June 2023

|

Section

48(1)(a)

The public conduct of this

matter would be likely to result in disclosure of information for which good

reason exists under section 7

|

The withholding of the information is necessary:

· Section 7(2)(a)

To protect the privacy of

natural persons, including that of a deceased person

|

|

5

|

Bad Debts Write-Off - Year ending 30 June 2023

|

Section 48(1)(a)

The public

conduct of this matter would be likely to result in disclosure of information

for which good reason exists under section 7

|

The withholding of the information is necessary:

· Section

7(2)(a)

To protect the

privacy of natural persons, including that of a deceased person

|

Karakia

Whakamutanga

Audit,

Risk and Finance Committee Minutes - 1 June 2023

Present: Ms

C Taylor (Chairperson), His Worship the Mayor Hon Dr. N

Smith, Councillor R O'Neill-Stevens, M Courtney and R Sanson

In

Attendance: Chief Executive (N Philpott), Group Manager

Infrastructure (A Louverdis), Group Manager Environmental Management (M Bishop),

Group Manager Community Services (A White), Group Manager Corporate Services (N

Harrison), Group Manager Strategy and Communications (N McDonald), Team

Governance Team Leader (R Byrne) and Senior Governance Adviser (H Wagener)

Apologies : Ms

Shanell Kelly

Karakia

and Mihi Timatanga

1. Apologies

|

Apologies

|

|

Resolved ARF/2023/010

|

|

|

That the Audit, Risk and Finance Committee

1.

Receives and accepts the apologies from Ms. Shanell Kelly.

|

|

O'Neill-Stevens/Sanson Carried

|

2. Confirmation of

Order of Business

There was no change to the order

of business.

3. Interests

There were no updates to the

Interests Register, and no interests with items on the agenda were declared.

4. Public Forum

There was no public forum.

5. Confirmation of

Minutes

5.1 24

February 2023

Document number M20013, agenda

pages 7 - 13 refer.

|

Resolved ARF/2023/011

|

|

|

That the Audit, Risk and

Finance Committee

1. Confirms

the minutes of the meeting of the Audit, Risk and Finance Committee, held on

24 February 2023, as a true and correct record.

|

|

O'Neill-Stevens/Courtney Carried

|

6. John Mackey Audit

New Zealand

Document number R27736

|

John Mackey from Audit New Zealand briefed the Committee

on the 2021/22 Audit which had been presented to 24 February 2023 meeting.

He confirmed that the Council had met the statutory deadlines and no issues

of concerns had been raised. He discussed the uncertainty regarding the

revaluation of infrastructure assets, potential disclosure the proposed Water

Services Reform Programme, the amendment of the drinking water standards by Taumata

Arowa and the challenges faced to measure and audit greenhouse gas emissions.

|

7. Privacy Act 2020 -

Reporting

Document number R27656, agenda

pages 13 - 25 refer.

Group Manager Strategy and Communications, Nicky

McDonald, and Manager Governance and Support Services, Devorah

Nícuarta-Smith took the report as read and answered questions on

completion and updating of the register, investigation of a recent privacy

breach incident and proposed training in June 2023 of all staff on compliance.

|

Resolved ARF/2023/012

|

|

|

That

the Audit, Risk and Finance Committee

1. Receives the report

Privacy Act 2020 - Reporting (R27656)

and its attachment (1738230957-18024);

and

2. Notes that

Council’s Privacy Policy and Breach Management Plan applies also to

elected and appointed members and training on compliance with the Privacy Act

has and will be provided as part of induction for elected and appointed

members.

|

|

Courtney/Sanson Carried

|

8. Review of Council's

Section 17A service delivery reviews process

Document number R27716, agenda

pages 26 - 33 refer.

Group Manager Strategy and

Communications, Nicky McDonald, and Policy Advisor, Ailish Neyland took the

report as read and answered questions on the implications of the proposed increase

of the value threshold that would trigger a service delivery review under

Section 17A of the Local Government Act 2002.

An amendment to the officers’ recommendation

to Council was proposed by inserting a new clause to request the Chief

Executive to provide a report to the Council at the start of the Triennium

listing all Section 17A Reviews to be undertaken over the three years, at which

time Council would indicate any reviews that should be reported back to Council.

|

Resolved ARF/2023/013

|

|

|

That

the Audit, Risk and Finance Committee

1. Receives the report

Review of Council's Section 17A service delivery reviews process (R27716); and

2. Notes the

findings from the review of Council’s process for Section 17A service

delivery reviews contained within this report.

|

|

Sanson/O'Neill-Stevens Carried

|

9. Quarterly Internal

Audit Report - 31 March 2023

Document number R27624, agenda

pages 34 - 38 refer.

Group Manager Environment and Climate, Mandy Bishop

and Audit and Risk Analyst, Chris Logan, took the report as read and answered

questions on the reasons for neighbouring councils assisting with the review

instead of an independent contractor, progress on an external review of the

safety at ports and harbours and cash handling at Council and its facilities.

|

Resolved ARF/2023/015

|

|

|

That

the Audit, Risk and Finance Committee

1. Receives the report

Quarterly Internal Audit Report - 31 March 2023 (R27624) and its attachment

(1194974384-3369).

|

|

His Worship the Mayor/Sanson Carried

|

The meeting adjourned from 10.09a.m. until 10.19a.m.

10. Internal Audit Plan 2023-2024

Document number R27626, agenda

pages 39 - 48 refer.

Group Manager Environment and Climate, Mandy Bishop

and Audit and Risk Analyst, Chris Logan, took the report as read. Following

discussion about the best way to monitor regulatory risks in relation to compliance

with fire safety standards, an amendment was made to the officers’

recommendation to investigate and report back on progress on an option to

include an internal audit on the Building Act requirements for building Warrant

of Fitness for next year as part of the Draft Annual Internal Audit Plan.

|

Resolved ARF/2023/016

|

|

|

That

the Audit, Risk and Finance Committee

1. Receives

the report Internal Audit Plan 2023-2024 (R27626) and its attachments

(1194974384-3370 and 1194974384-3368); and

2. Requests that an

internal audit for 2023/24 for the Building Act

requirements for building Warrant of Fitness be added to the Draft Annual

Internal Audit Plan, subject to other reviews that may be underway, and to

report back on progress to the Audit, Risk and Finance Committee by 15

September 2023.

|

|

Courtney/His Worship the

Mayor Carried

|

|

Recommendation to Council

ARF/2023/017

|

|

|

That the Council

1. Approves

the Draft Annual Internal Audit Plan for the year to 30 June 2024

(1194974384-3368).

|

|

Courtney/His Worship the

Mayor Carried

|

11. Quarterly Finance Report to 31

March 2023

Document number R27695, agenda

pages 49 - 76 refer.

Manager Finance, Prabath Jayawardana, took the

report as read and answered questions on the infrastructure revaluation impacts

and the effect of the unbudgeted weather event. Mr. Jayawardana advised

on the reasons for the inclusion in the report of both the annual plan budget

and the operating budget. Group Manager Infrastructure, Alec Louverdis

answered questions on green waste income, dry weather overflow measurements of

wastewater and public transport patronage improvements.

|

Resolved ARF/2023/018

|

|

|

That

the Audit, Risk and Finance Committee

1. Receives the report

Quarterly Finance Report to 31 March 2023 (R27695) and its attachments (1857728953-779, 839498445-14467 and 839498445-14468).

|

|

Sanson/O'Neill-Stevens Carried

|

12. Quarterly Risk Report - 31

March 2023

Document number R27625, agenda

pages 77 - 103 refer.

Audit and Risk Analyst, Chris Logan, took the report

as read and answered questions.

|

Resolved ARF/2023/019

|

|

|

That

the Audit, Risk and Finance Committee

1. Receives the report

Quarterly Risk Report - 31 March 2023 (R27625) and its attachment (1759736513-9).

|

|

Sanson/Courtney Carried

|

13. Health, Safety and Wellbeing

Report to 31 March 2023

Document number R27582, agenda

pages 104 - 117 refer.

Health Safety and Wellness Adviser, Malcolm Hughes,

took the report as read and answered questions about the lower contract

management risk oversight and monitoring, the review of the Health and Safety

Governance Charter and the staff survey.

|

Resolved ARF/2023/020

|

|

|

That

the Audit, Risk and Finance Committee

1. Receives the report

Health, Safety and Wellbeing Report to 31 March 2023 (R27582) and its attachment

(855153265-3812).

|

|

Courtney/Sanson Carried

|

14. Exclusion

of the Public

|

Resolved ARF/2023/021

|

|

|

That the Audit, Risk and

Finance Committee

1. Excludes the public from the

following parts of the proceedings of this meeting.

2. The general subject of each matter

to be considered while the public is excluded, the reason for passing this

resolution in relation to each matter and the specific grounds under section

48(1) of the Local Government Official Information and Meetings Act 1987 for

the passing of this resolution are as follows:

|

|

His Worship the Mayor/Sanson Carried

|

|

Item

|

General subject of each matter to be

considered

|

Reason for passing this resolution in

relation to each matter

|

Particular interests protected (where

applicable)

|

|

1

|

Audit, Risk and Finance Committee Meeting - Confidential Minutes

- 24 February 2023

|

Section

48(1)(a)

The

public conduct of this matter would be likely to result in disclosure of

information for which good reason exists under section 7.

|

The withholding of the information is necessary:

· Section

7(2)(g)

To maintain

legal professional privilege

· Section

7(2)(a)

To protect the

privacy of natural persons, including that of a deceased person

|

|

2

|

Health,

Safety and Wellbeing to 31 March 2023

|

Section

48(1)(a)

The public conduct of this

matter would be likely to result in disclosure of information for which good

reason exists under section 7

|

The withholding of the information is necessary:

· Section 7(2)(a)

To protect the privacy of

natural persons, including that of a deceased person

|

|

3

|

Organisational Risk - Deep Dives

|

Section 48(1)(a)

The public

conduct of this matter would be likely to result in disclosure of information

for which good reason exists under section 7

|

The withholding of the information is necessary:

· Section

7(2)(j)

To prevent the

disclosure or use of official information for improper gain or improper

advantage

|

|

4

|

Quarterly

Report on Legal Proceedings

|

Section

48(1)(a)

The public conduct of this

matter would be likely to result in disclosure of information for which good

reason exists under section 7

|

The withholding of the information is necessary:

· Section 7(2)(g)

To maintain legal

professional privilege

|

|

5

|

Quarterly Update on Debts - 31 March 2023

|

Section 48(1)(a)

The public

conduct of this matter would be likely to result in disclosure of information

for which good reason exists under section 7

|

The withholding of the information is necessary:

· Section

7(2)(a)

To protect the

privacy of natural persons, including that of a deceased person

|

The meeting went into confidential session at 11.32 and

resumed in public session at 12.05 p.m.

Karakia

Whakamutanga

15. Restatements

It was resolved while the public was

excluded:

|

1

|

CONFIDENTIAL: Health, Safety

and Wellbeing to 31 March 2023

|

|

|

2. Agrees that Report (R27668)

remains confidential at this time.

|

|

3

|

CONFIDENTIAL: Quarterly

Report on Legal Proceedings

|

|

|

2. Agrees that the report

Quarterly Report on Legal Proceedings (R27619) and its attachment

(142319133-424) remain confidential at this time.

|

|

4

|

CONFIDENTIAL: Quarterly

Update on Debts - 31 March 2023

|

|

|

2. Agrees that the Report and its

attachment (1857728953-773) remain confidential at this time.

|

There being no further business the meeting ended at 12.06

p.m.

Confirmed as a correct record of proceedings by

resolution on (date)

Item 6: Audit New

Zealand: Audit Letters

|

|

Audit, Risk and Finance Committee

15 September 2023

|

Report

Title: Audit

New Zealand: Audit Letters

Report

Author: Nikki Harrison -

Group Manager Corporate Services

Report

Number: R27895

1. Purpose

of Report

1.1 To provide the

Committee with the Audit Plan from Audit New Zealand (Audit NZ) for the year

ending 30 June 2023.

1.2 To provide the

Committee with the Audit Engagement Letter for the years ending 30 June 2023,

2024 and 2025 and ask for any feedback before the letter is signed by the

Mayor.

1.3 To provide the

Committee with the Audit Proposal Letter for the 2023, 2024 and 2025 financial

years and ask for any feedback before the letter is signed by the Mayor.

2. Recommendation

|

That the Audit, Risk and Finance Committee

1. Receives

the report Audit New Zealand: Audit Letters (R27895) and its attachments (2126778665-306,

2126778665-305 and 2126778665-312); and

2. Notes that following feedback

from the Audit, Risk and Finance Committee, His Worship the Mayor Hon Dr

Smith will sign the Audit Engagement Letter to Audit NZ; and

3. Notes the Committee can

provide feedback on the Audit Proposal Letter to Audit New Zealand if

required, noting His Worship the Mayor Hon Dr Smith will sign the letter once

the Committee’s feedback has been incorporated.

|

3. Background

Audit Plan

3.1 The Audit Plan

(Attachment 1 – 2126778665-306) sets out the

audit arrangements and covers:

· Audit risks and

issues, both specific focus areas for Council and areas of interest for all

local authorities

· Group audit

· Audit process

· Reporting

protocols

· Audit logistics

· Expectations.

Materiality

3.2 Materiality refers to

information that, if omitted, misstated, or obscured, could influence

readers’ overall understanding of the financial statements.

3.3 For financial

statement materiality, Audit NZ has calculated Group and Parent materiality

thresholds into overall, specific and ‘clearly trivial’. All

uncorrected misstatements other than those that are clearly trivial will be

reported by Audit NZ.

3.4 For service

performance information materiality, Audit NZ has identified materiality

measures and presented them in a table. This will be reassessed during the

audit.

Timing

3.5 The final audit is

planned to commence on 11 September 2023, which is one week later than in

previous years. There has been a change to the statutory deadline from 31

December back to 31 October 2023 for the 2022/23 Audit Opinions to be issued

since last year.

3.6 The interim audit

letter was received on 29 August 2023 and there are no matters to be brought to

the Committee’s attention.

Audit Engagement Letter

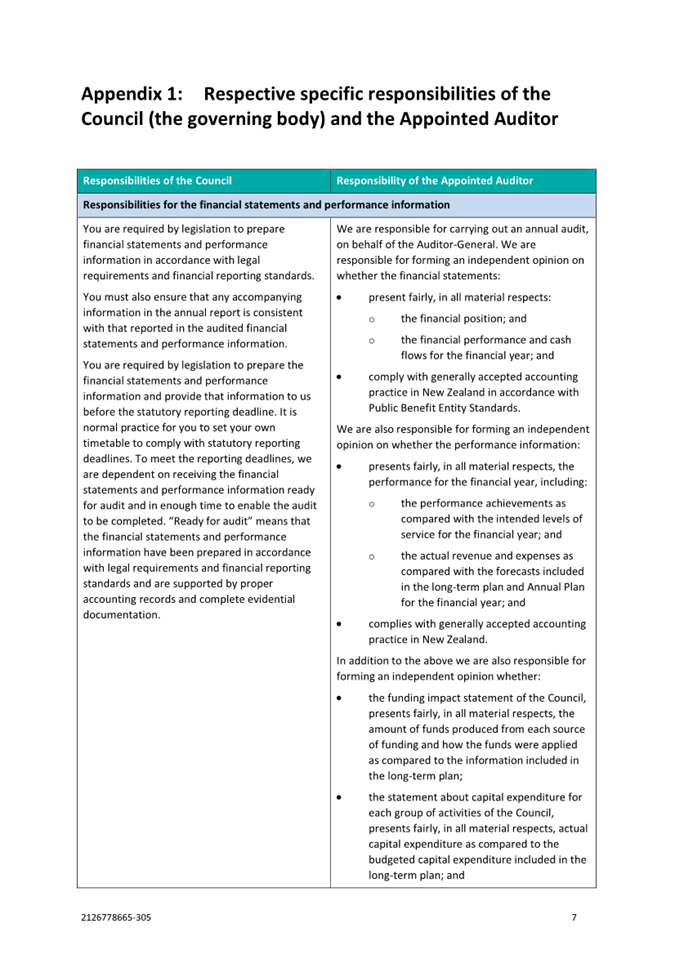

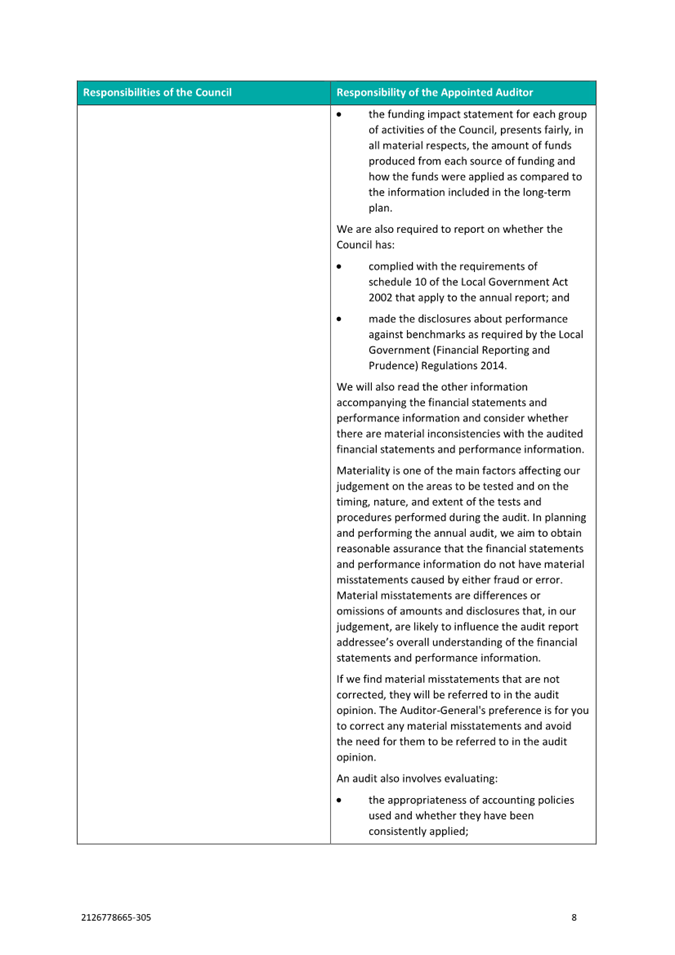

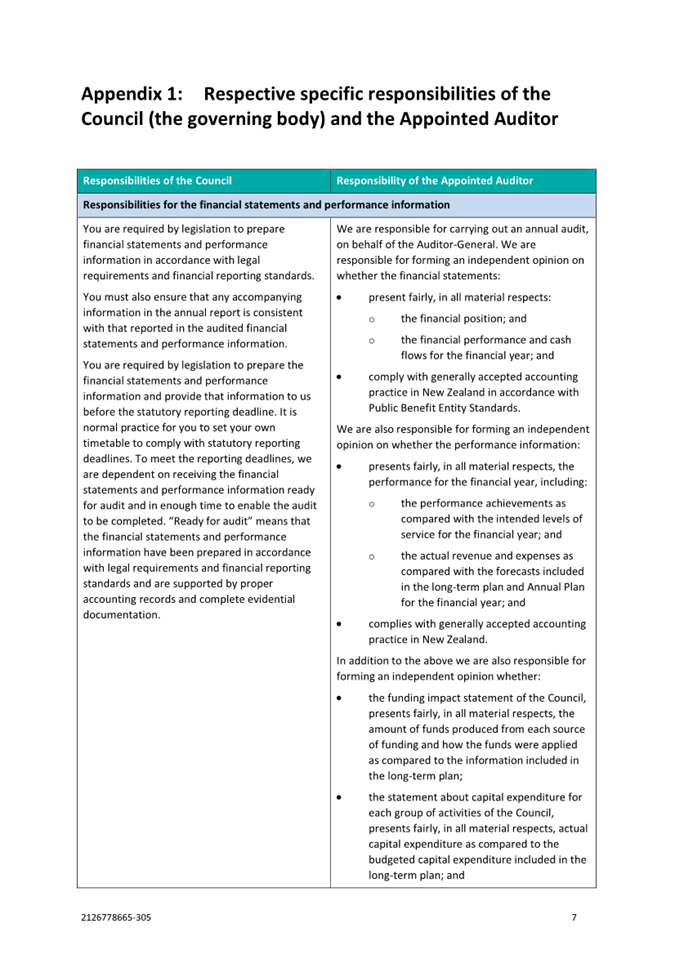

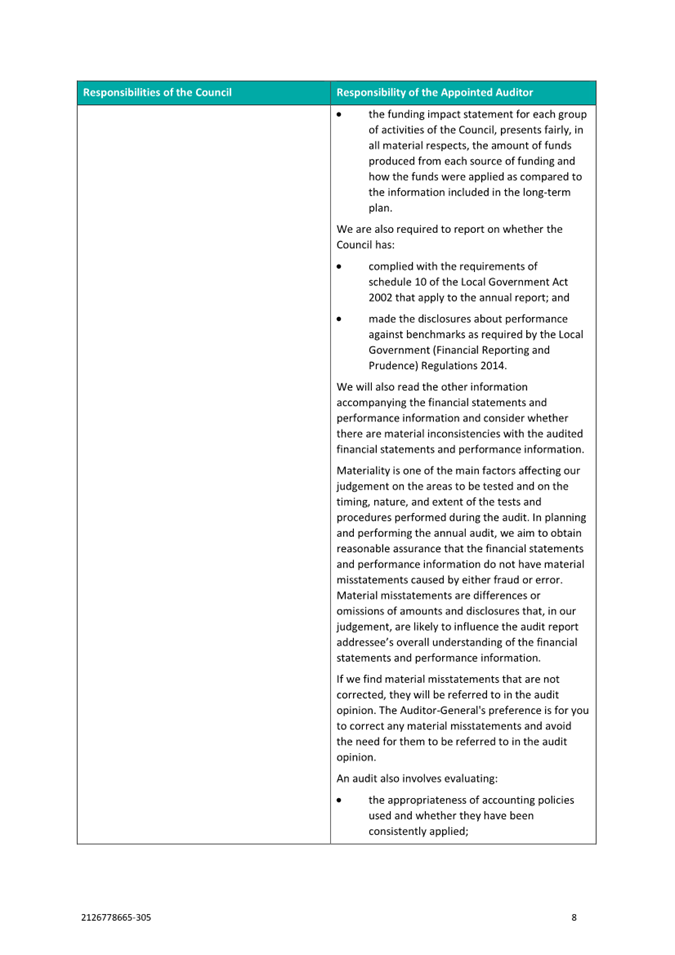

3.7 The Audit Engagement

Letter (Attachment 2 – 2126778665-305) covers the years 30 June 2023,

2024 and 2025 and sets out the terms of the audit engagement and the respective

responsibilities of the Council and Audit New Zealand.

3.8 This letter is

required to be signed by the Mayor to confirm that the details of the audit

match Council’s understanding of the arrangements.

Audit Proposal Letter

3.9 The Audit Proposal Letter

sets out the proposed audit fees and audit hours covering the years 30 June

2023, 2024 and 2025 agreed with the Office of the Auditor-General (Attachment 3

– 2126778665-312).

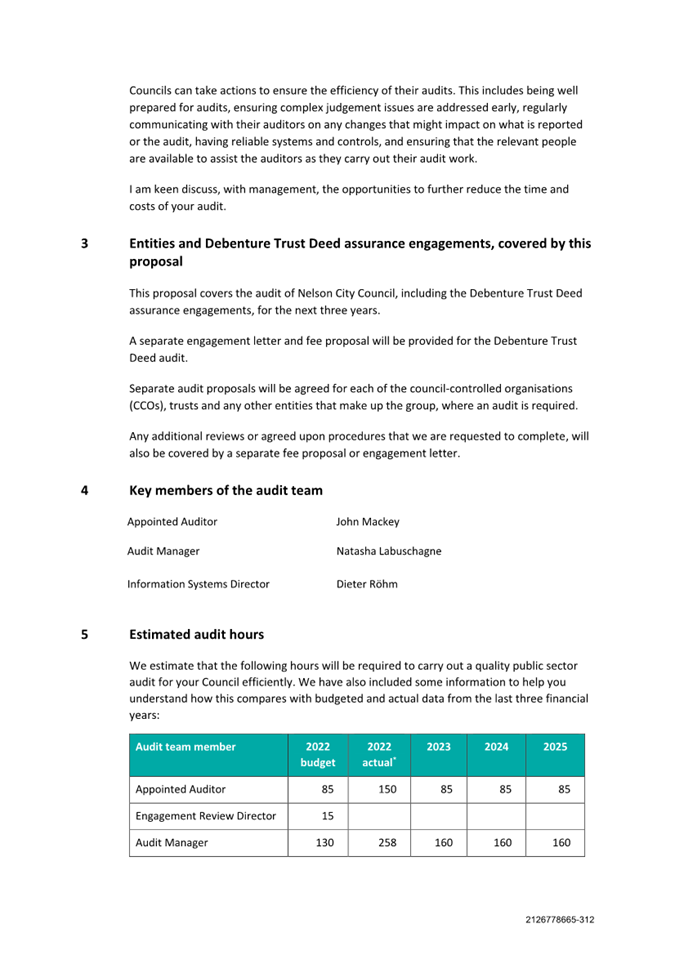

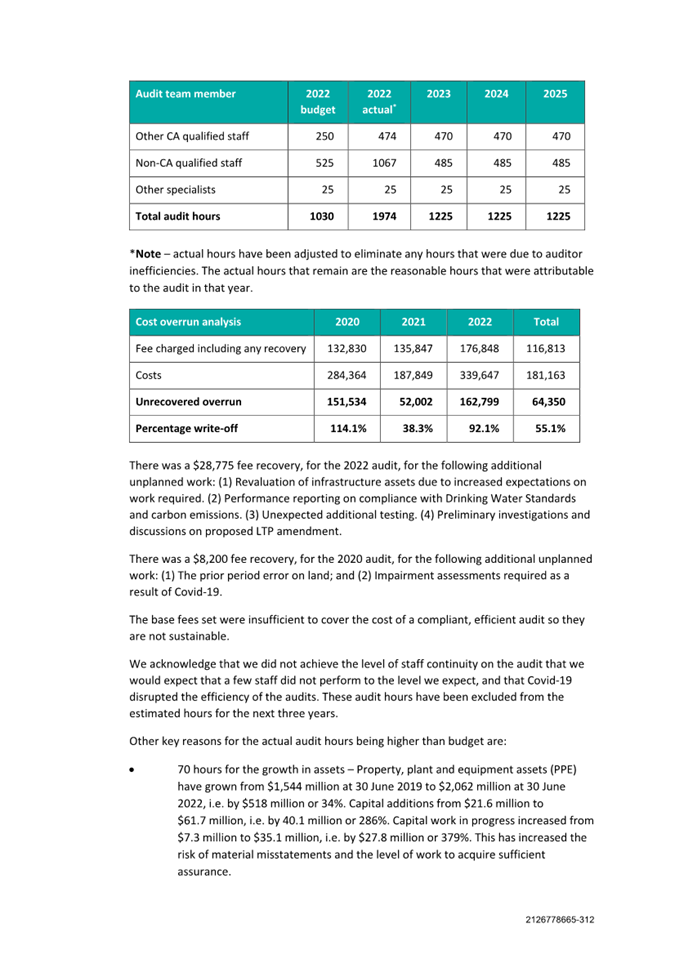

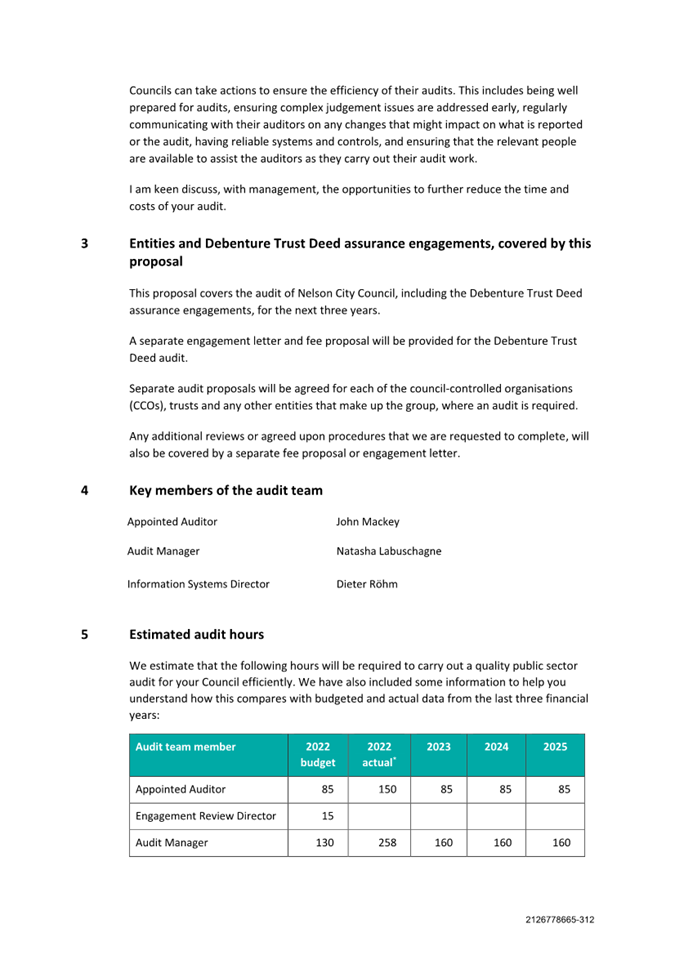

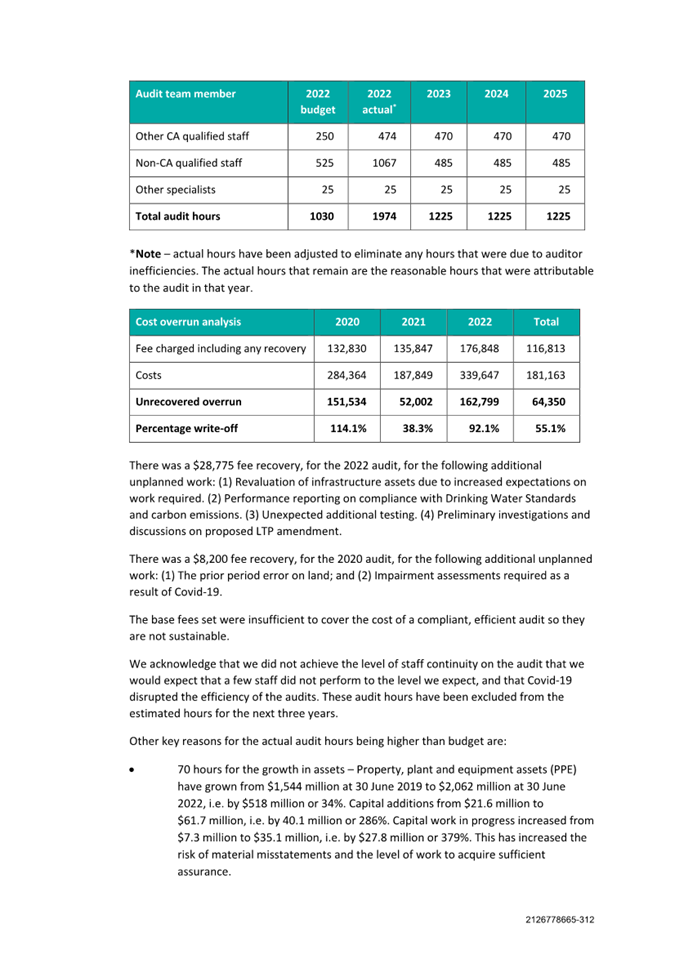

3.10 Section 6 of this letter outlines

that the proposed increase in audit fees be phased into full recovery by 2025

from $177,000 per annum to $284,000 – a 60% increase.

3.11 Officers have reviewed audit fees

from 2010 when the annual fee was $111,000 for approximately 700 hours of audit

work. For the next three years, the annual audit is budgeted at 2,000

hours. In the period since 2010 officers understand that the audit requirements

of non-financial performance measures have become more rigorous and accounting

and auditing standards more complex.

3.12 John Mackey, the appointed auditor,

will be available on Zoom at this Committee meeting to answer any questions

that may arise.

Attachments

Attachment 1: 2126778665-306

- NCC Audit Plan 2022-23 ⇩

Attachment 2: 2126778665-305

- NCC Audit Engagement Letter 2023-2025 ⇩

Attachment 3: 2126778665-312

- NCC Audit Proposal Letter 2023-25 ⇩

Item 6: Audit New Zealand: Audit Letters:

Attachment 1

Item 6:

Audit New Zealand: Audit Letters: Attachment 2

Item 6:

Audit New Zealand: Audit Letters: Attachment 3

Item 7: Quarterly

Finance Report to 30 June 2023

|

|

Audit, Risk and Finance Committee

15 September 2023

|

REPORT R27698

Quarterly Finance Report

to 30 June 2023

1. Purpose

of Report

1.1 To

inform the Committee of the financial results for Council for the twelve months

ended 30 June 2023, and to highlight any material variations.

2. Recommendation

|

That the Audit, Risk and Finance Committee

1. Receives

the report Quarterly Finance Report to 30 June 2023 (R27698) and its attachments (1857728953-1036,

839498445-17283, and 839498445-17269).

|

3. Background

3.1 The

whole of Council financial reporting provided to this Committee focuses on the

twelve-month performance (1 July 2022 to 30 June 2023) compared with the

approved Annual Plan capital and operating budgets. This annual report includes

the Nelson City Council consolidation, which incorporates Nelson Regional

Sewerage Business Unit, Civil Defence, and Nelson Tasman Regional Landfill

Business Unit. The Group accounts have not yet been prepared.

3.2 Unless

otherwise indicated, all information is against approved Annual Plan 2022/23

budget. Commentary is provided below for significant variances of +/- $500,000.

4. Financial

Performance

4.1 For

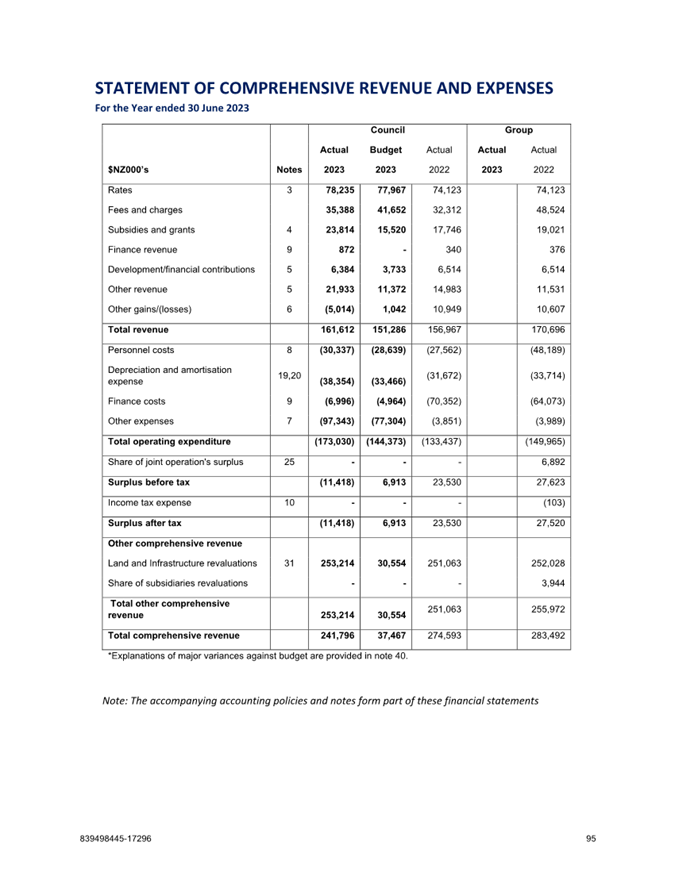

the twelve months ending 30 June 2023, the Council’s draft deficit of

$11.4m against a budgeted surplus of $6.9m ($18.3m unfavourable to budget).

4.2 Net

weather-related expenses amounted to $15.6m (including abandoned assets), which

is the majority of the $18.3m variance to budget.

4.3 Profit

and Loss

|

|

Council

|

|

|

Actual

|

Budget

|

Variance

|

|

$NZ000s

|

2023

|

2023

|

2023

|

|

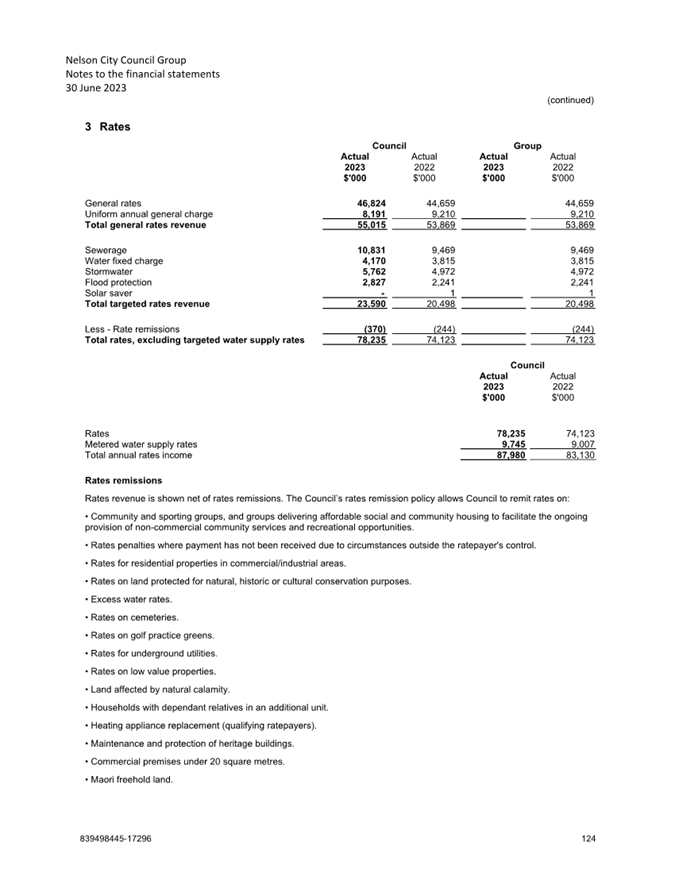

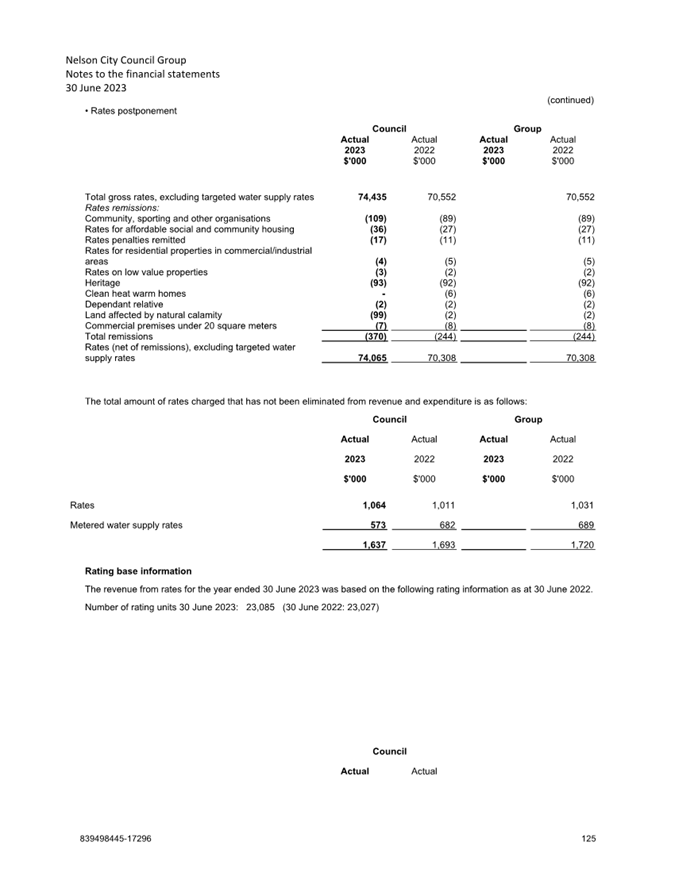

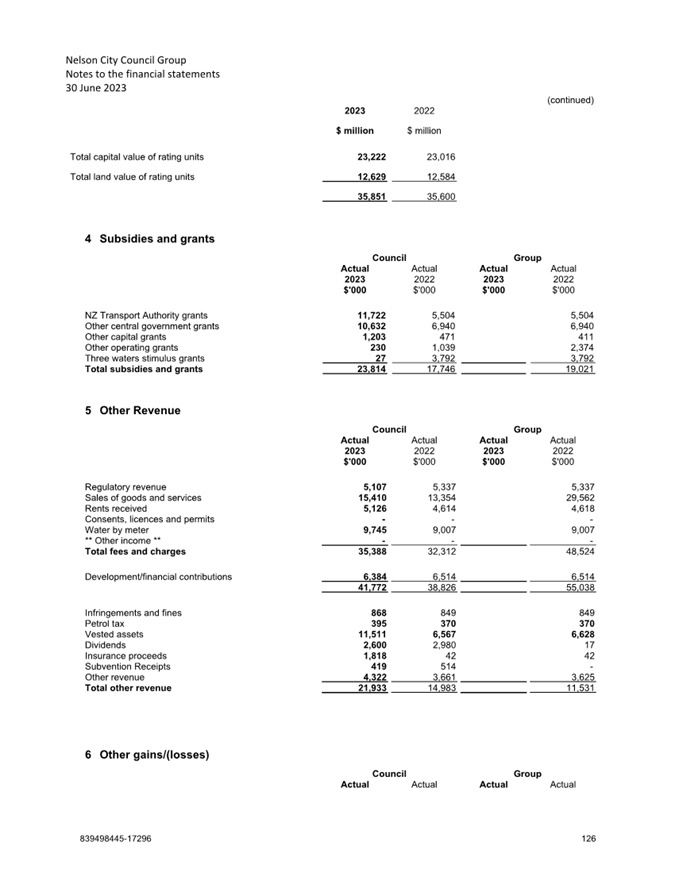

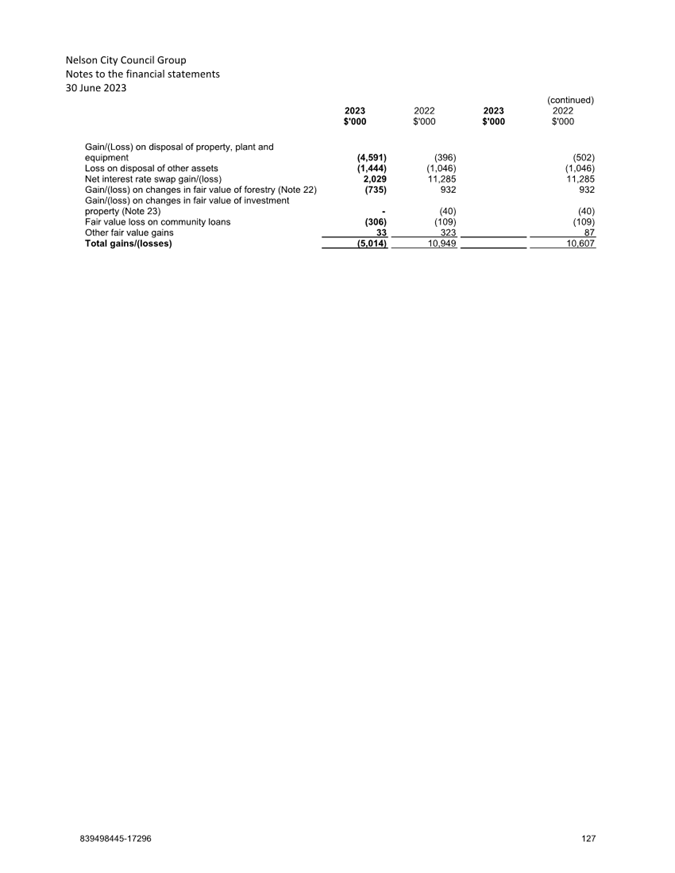

Rates

|

78,235

|

77,967

|

268

|

|

Fees and charges

|

35,388

|

41,652

|

(6,264)

|

|

Subsidies and grants

|

23,814

|

15,520

|

8,294

|

|

Finance revenue

|

872

|

-

|

872

|

|

Development/financial

contributions

|

6,384

|

3,733

|

2,651

|

|

Other revenue

|

21,933

|

11,372

|

10,561

|

|

Other gains/(losses)

|

(5,014)

|

1,042

|

(6,056)

|

|

Total revenue

|

161,612

|

151,286

|

10,326

|

|

Personnel costs

|

(30,337)

|

(28,639)

|

(1,698)

|

|

Depreciation and amortisation

expense

|

(38,354)

|

(33,466)

|

(4,888)

|

|

Finance costs

|

(6,996)

|

(4,964)

|

(2,032)

|

|

Weather-related expenses

|

(21,207)

|

-

|

(21,207)

|

|

Other expenses

|

(76,136)

|

(77,304)

|

1,168

|

|

Total operating expenditure

|

(173,030)

|

(144,373)

|

(28,657)

|

|

Share of joint operation's

surplus

|

-

|

-

|

-

|

|

Surplus before tax

|

(11,418)

|

6,913

|

(18,331)

|

|

Income tax expense

|

-

|

-

|

-

|

|

Surplus after tax

|

(11,418)

|

6,913

|

(18,331)

|

|

Other comprehensive revenue

|

|

|

|

|

Land and Infrastructure

revaluations

|

253,214

|

30,554

|

222,660

|

|

Share of subsidiaries

revaluations

|

-

|

-

|

-

|

|

Total other comprehensive

revenue

|

253,214

|

30,554

|

222,660

|

|

Total comprehensive revenue

|

241,796

|

37,467

|

204,329

|

4.4 Revenue

4.5 Rates

income is greater than budget by $268,000. This

is a result of wastewater rates being over budget due to more connections being

added (the budget was completed in May and the rate strike was in July).

4.6 Fees

and Charges income is less than budget by $6,264,000.

This is due to the following variances:

4.6.1 TDC

recovery income is nil against a budget of $2.8m due to actual income being recognised

under other revenue (section 4.9.4). This is due to the classification

differences for external reporting purposes.

4.6.2 Forestry

income is less than budget by $1m as a result of the changes to the planned

timing of harvesting. Roding Forestry income is nil against a $2.4m budget;

Marsden Forest income is $0.9m against a nil budget; and Maitai Forest is $1.0m

against a budget of $0.5m.

4.6.3 There is a

year-end accounting adjustment of $2.0m for forestry. This is because only the

movement in forestry fair value is considered as income for external reporting

purposes. This accounting adjustment offsets other expenses.

4.7 Subsidies

and grants income is greater than budget by

$8,294,000. Significant variances are as follows:

4.7.1 Waka

Kotahi Subsidies are greater than budget by $5.7m. $3.9m

relates to weather-related recoveries (unbudgeted), $1.2m for public transport

subsidies, due to additional public transport expenses, and $0.5m for other

transport cost recoveries.

4.7.2 Government

Grants (capital in nature) are less than budget

by $2.3m. Waka Kotahi capital grant spend is $2.3m less than budget due

to delays in the capital programme which was caused by the August 2022 weather

event taking priority.

4.7.3 NEMA

Grants are greater than budget by $4.5m. This

income is the current claim to NEMA for weather related costs up to 31 March

2023. A further claim for the period 1 April 2023 to 30 June 2023 is currently

being done, and it is expected to be submitted in September. It is noted

that we have not yet had confirmation of the $4.5m from NEMA.

4.7.4 Green

Waste income from Waste Minimisation Fund is less than

budget by $0.8m. Green

waste is under budget in income due to expenses also being under budget. The

main contributor to lower expenses is the kerbside kitchen waste service, which

has started later than planned.

4.7.5 Other

grants received is greater than budget by $0.6m. This

includes $0.3m of DIA Affordable Waters Grants, and $0.3m of MBIE/Lottery

grants for flood recovery. Both were unbudgeted.

4.8 Finance

Revenue is greater than budget by $872,000.

This is due to more funds being invested than planned because of pre-funding of

debt to take advantage of the favourable borrowing conditions at the time.

4.9 Development/Financial

Contributions are $2,651,000 greater than budget.

This is due to more development activity than budgeted. The major commercial

developments in the region include 62 Ngāti Rārua, Summerset,

Bayview, KFW, Solitaire, 3D View, Marsden, Housing New Zealand and HBO.

4.10 Other

revenue is greater than budget by $10,561,000.

Significant variances are as follows:

4.10.1 Vested Assets is greater than budget by $6.3m.

4.10.2 Dividend Income is less than budget by $0.8m due to less dividends

from Port Nelson than budgeted for.

4.10.3 Insurance

Recoveries is greater than budget by $1.8m. This

is an accrual for weather-related expenditure from the August 2022

floods.

4.10.4 TDC Recoveries is $2.8m greater than budget. This income was

reclassed from fees and charges where the annual plan budget sits, for

reporting purposes.

4.11 Other

gains/(losses) is less than budget by $6,056,000.

Significant variances are as follows:

4.11.1 $4.8m relates to

abandoned assets, which are infrastructure assets that have been replaced in

the fixed asset register. In 2022/23 this is high due to the August 2022

weather event.

4.11.2 $2.2m relates to the

forestry activity, comprising of a $0.7m loss on fair value of forestry, as

well as a $1.4m net loss in the forestry activity.

4.11.3 Offsetting the above

is a $1.0m gain to budget on the fair value of swaps ($2.0m total interest rate

swap revaluation gain for the year).

4.12 Expenses

4.13 Personnel

costs are greater than budget by $1,698,000. This

is mainly due to the following reasons:

4.13.1 Average salary

increase (5%) from July 2022 is higher than the budgeted increase of 3% as a

result of higher wage inflation than anticipated when the budget was set. In

dollar figures, the salary increase was $0.9m greater than budget.

4.13.2 There have been $0.9m

less of capitalised wages to budget. This variance is due to the recovery

programme being operating expenditure rather than capital expenditure.

4.13.3 While we were

expecting $0.8m in savings due to the high number of vacancies throughout the

year, this was not the case due to; $0.5m of Contractor/Temp and Training Staff

costs, and $0.3m of other staff costs.

4.13.4 While most of the

business units contributed to this higher than planned variance, the biggest

contributors were Consents and Compliance ($0.2m over budget), and People and

Capability ($0.3m over budget).

4.14 Depreciation

and amortisation costs are greater than budget by $4,888,000.

Depreciation has been based on the prior year asset valuations. In the

2021/22 financials, the asset valuations saw significant increases. This

resulted in a much higher depreciation expense. This is especially evident in

Roads (unsubsidised), Wastewater, Stormwater, and Water Supply.

4.15 Finance

costs are greater than budget by $2,032,000. This

increase in interest costs is due to a) additional pre-funding of debt (which

is offset by the $0.9m over variance in finance revenue), and b) $1.1m increase

in interest costs due to both higher interest rates and higher borrowings

relates to August 2022 weather event.

4.16 Weather

Event costs are greater than budget by $21,207,000.

4.16.1 The spend to date on

the August 2022 weather event is $21.2m. Offsetting these expenses are

recoveries in “Subsidies and Grants”.

4.16.2 Recoveries to date are

$10.4m. This includes Waka Kotahi income of $3.9m, $0.15m from NZ Lotteries,

$0.11m from MBIE, $1.8m from insurance, and $4.5m from NEMA. Staff are

progressing insurance claims, NEMA and Waka Kotahi subsidies with relevant

agencies and the $10.4m includes $6.3m of accruals. A further claim for NEMA

for the period 1 April 2023 to 30 June 2023 has not yet been submitted or

accrued for.

4.16.3 Buildings &

Structure Loss Adjuster has accepted claims for numerous sites but claims

preparation/adjustment has yet to be completed. To date we have only received

insurance payments of $0.14m for locations relating to the August 2022 flood

event (300 Wakefield Quay & Civic House).

4.16.4 Weather event

reporting goes to council quarterly, with the last meeting on 10 August 2023.

4.17 Other

expenses are less than budget by $1,168,000.

Significant variances are as follows:

4.17.1 Transport-related

expenditure is greater than budget by $1.0.m. This

includes $0.5m of subsidised bus service (offset in revenue).

4.17.2 Kerbside kitchen

waste service is less than budget by $0.7m due

to the delayed deployment of this service.

4.17.3 Greenwaste and

recycling levies is greater than budget by $0.5m.

4.17.4 Forestry expenses

is less than budget by $2.5m. This is

due to an accounting adjustment to reverse the forestry expenses and move these

to other gains/losses.

4.17.5 All other variances in

other expenses are below $0.5m.

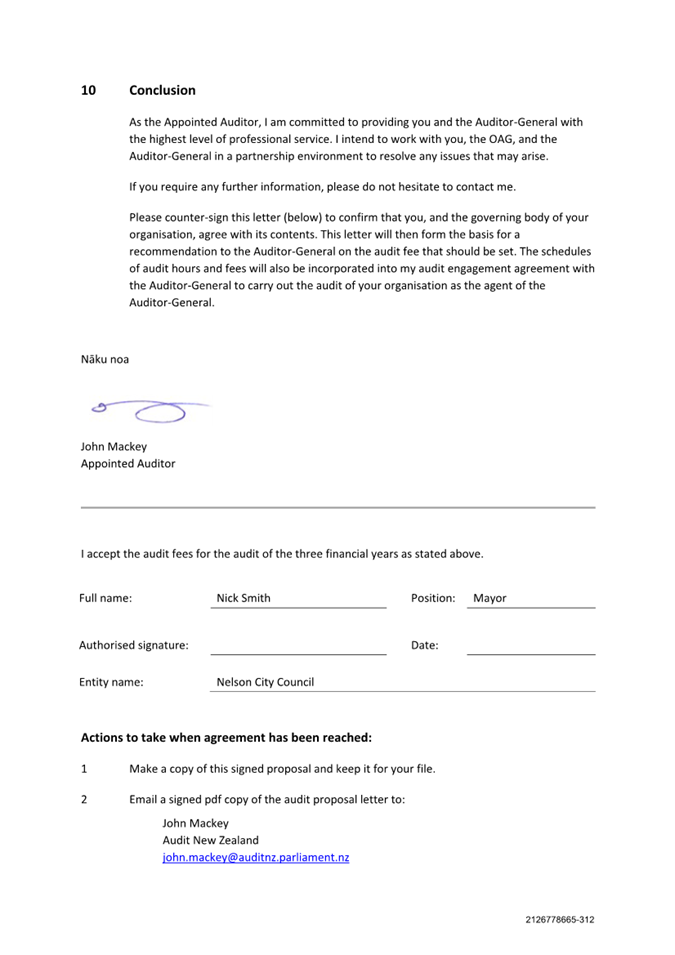

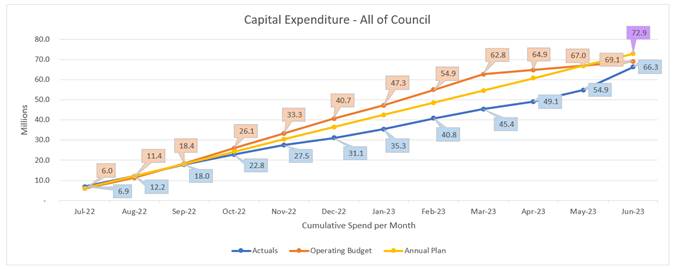

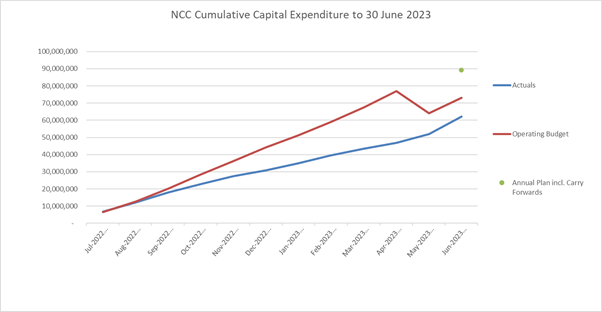

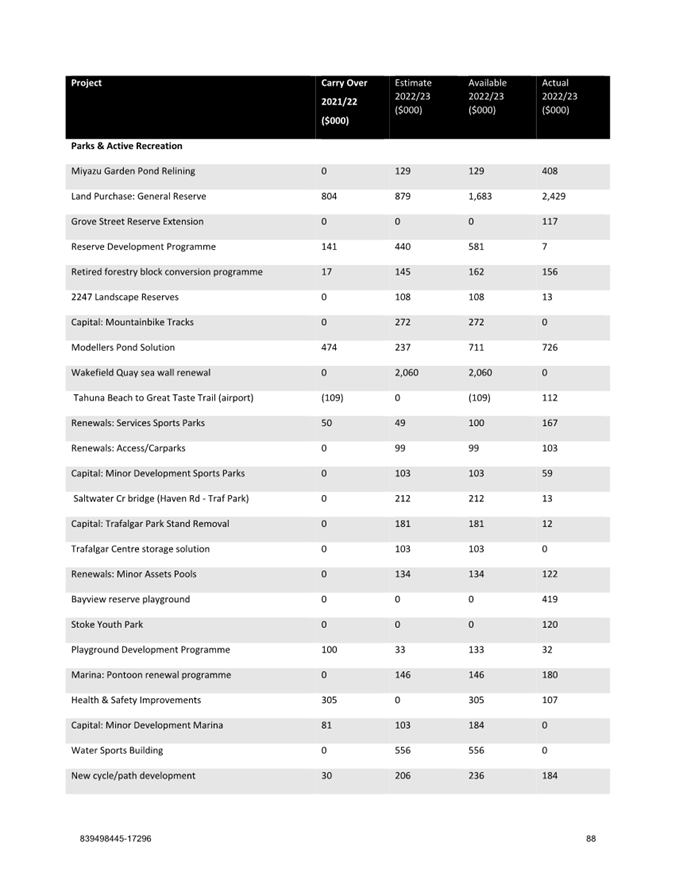

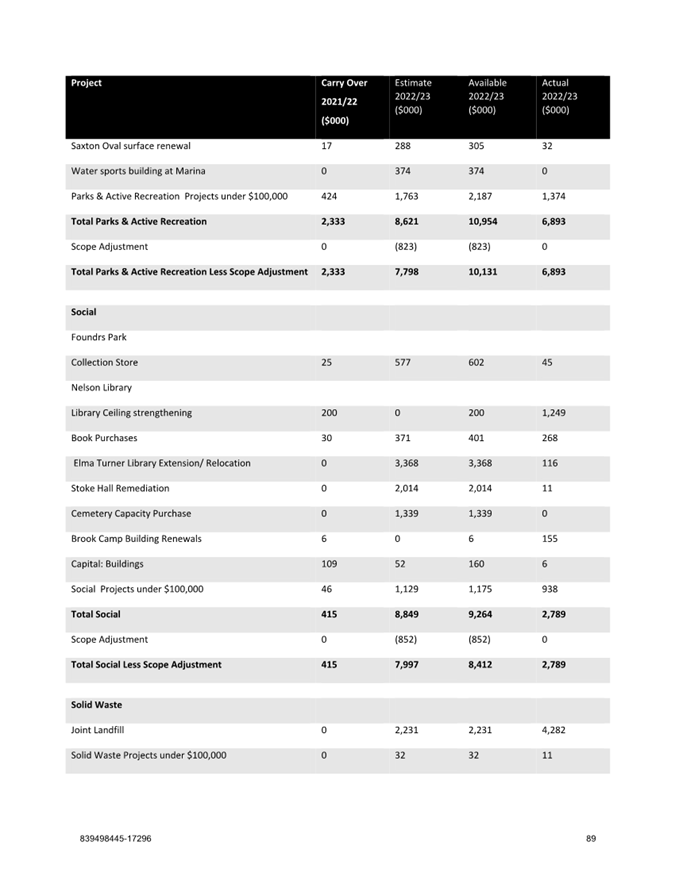

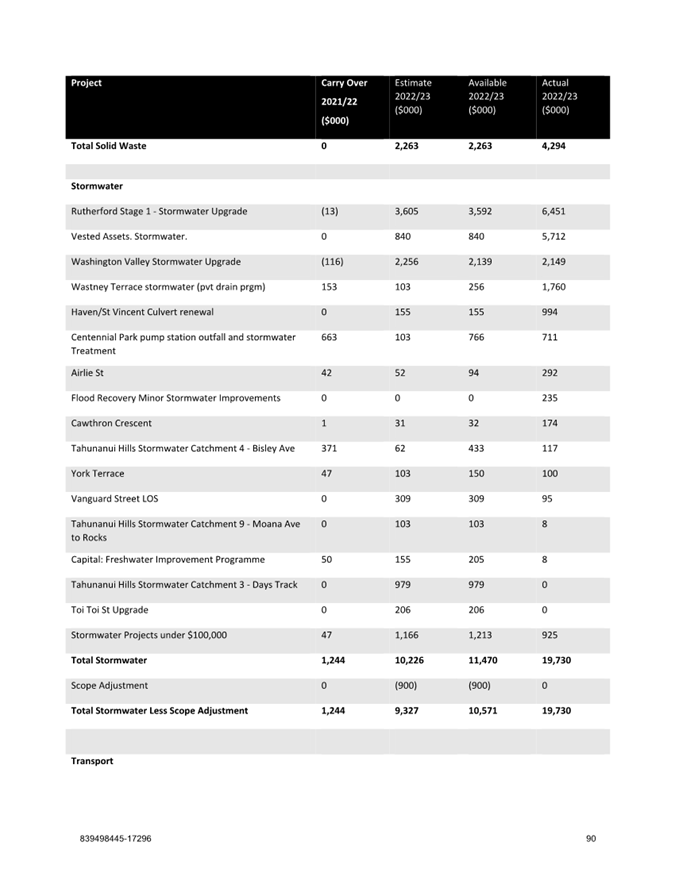

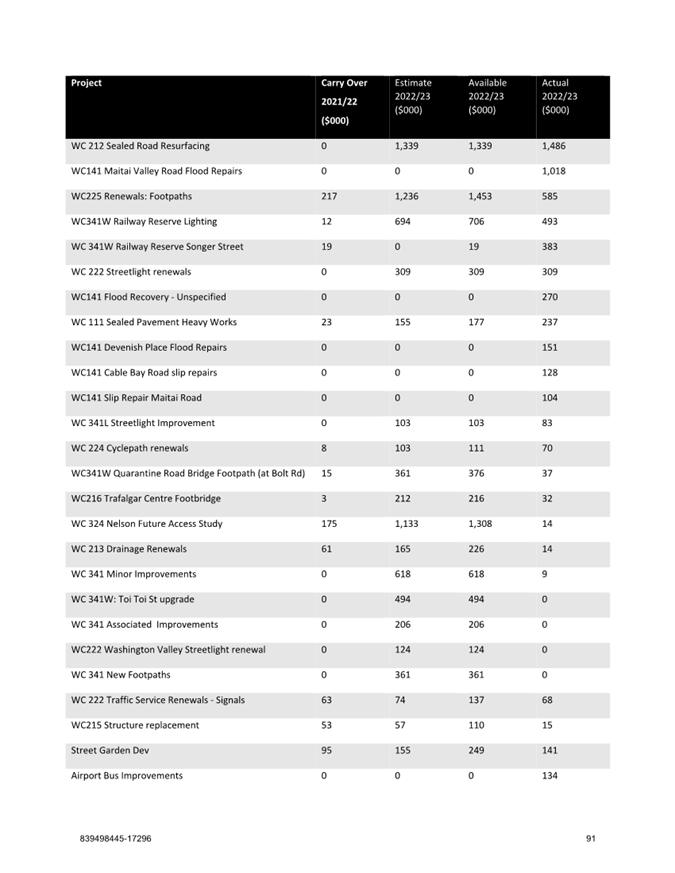

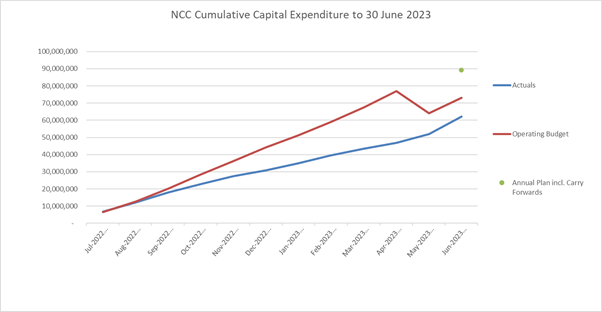

5. Capital

Expenditure

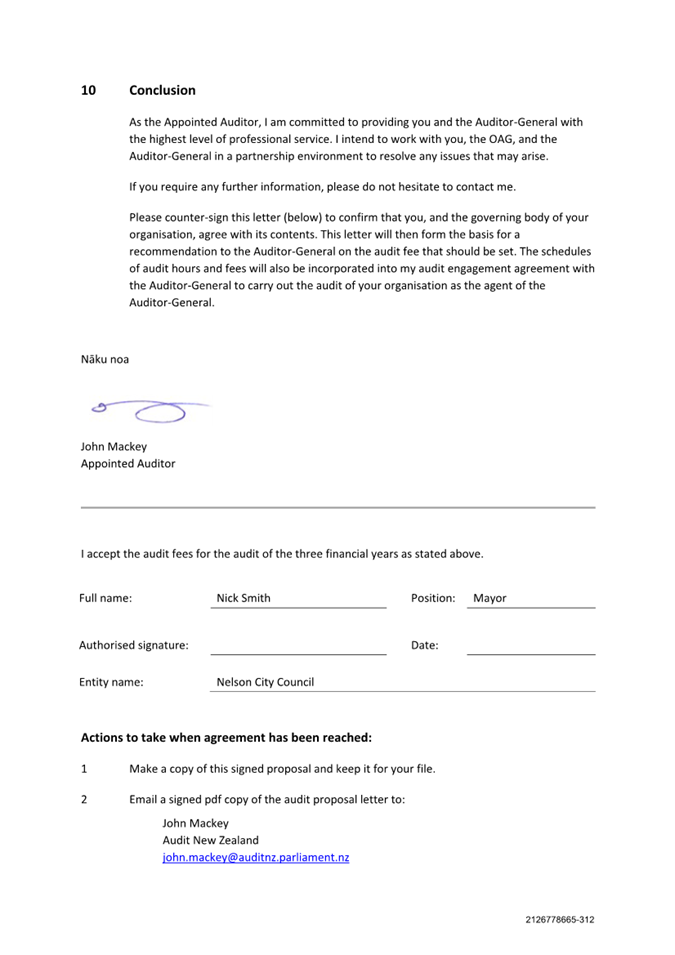

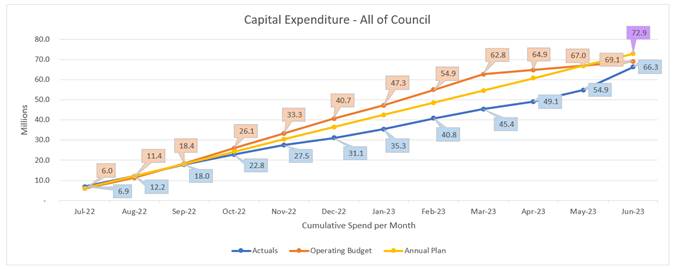

5.1 Capital Expenditure

(including staff time, excluding vested assets and joint operations)

5.2 As

at 30 June 2023, capital expenditure was $66.3m which is $6.6m under the full

year Annual Plan budget of $72.9m. The main contributors to the underspend were

Corporate ($3.6m), Social ($3.6m), and Transport ($1.3m).

5.3 Out

of the $6.6m variance above, $5.4m relates to Renewals, $0.4m relates to

Capital Growth, $0.9m relates to Capital Staff Costs, which is offset by $0.1m

Level of Service.

5.4 The

reason for the $0.1m overspend in Level of Service is a spend of $4.2m on the

August 2022 weather event. This was made up of transport ($1.9m), wastewater

($0.9m), stormwater ($0.3m), water supply ($0.1m) and flood protection ($0.9m).

6. Cash Flow

Management

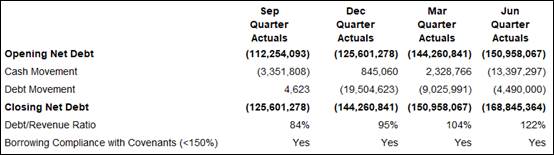

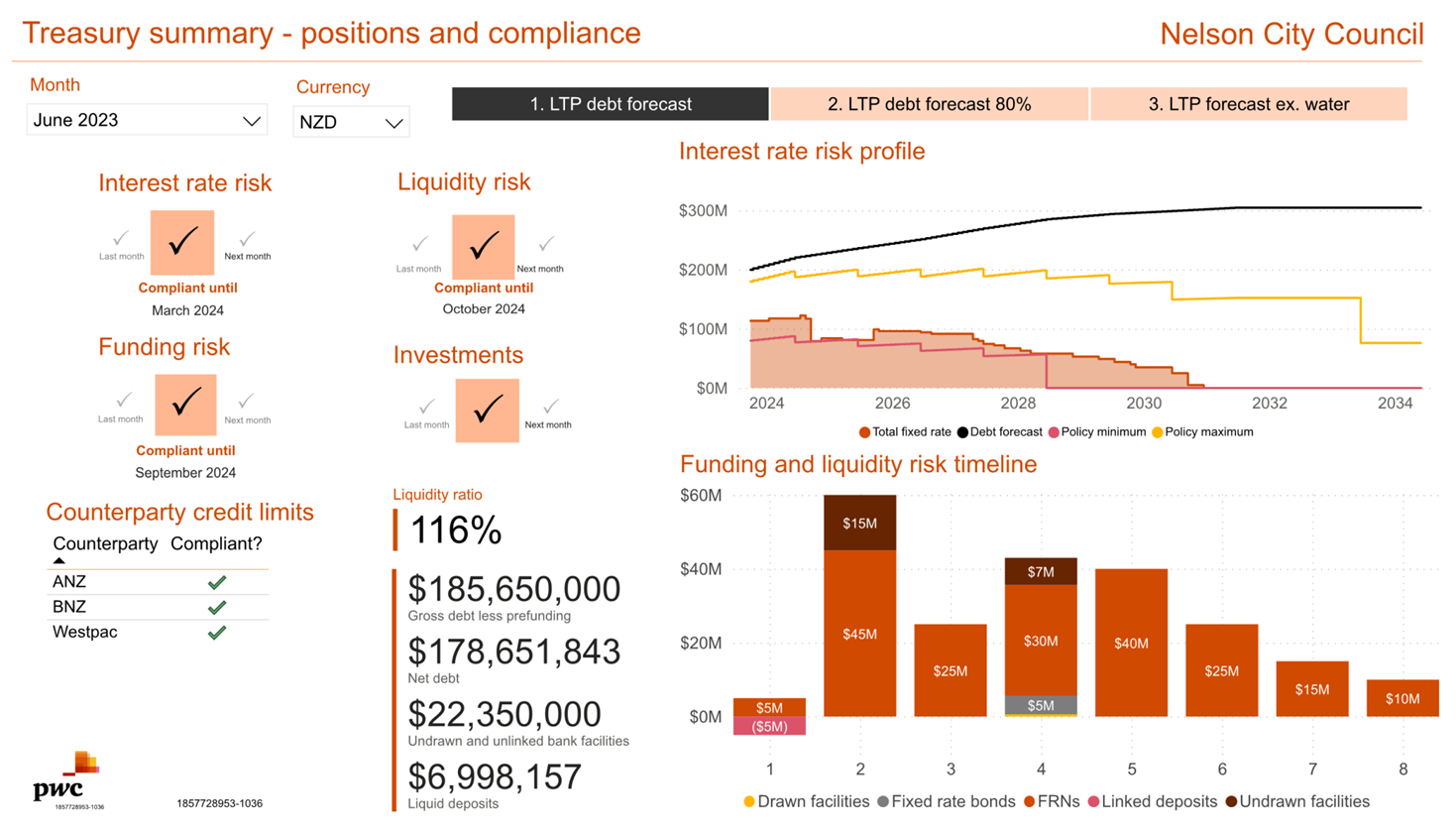

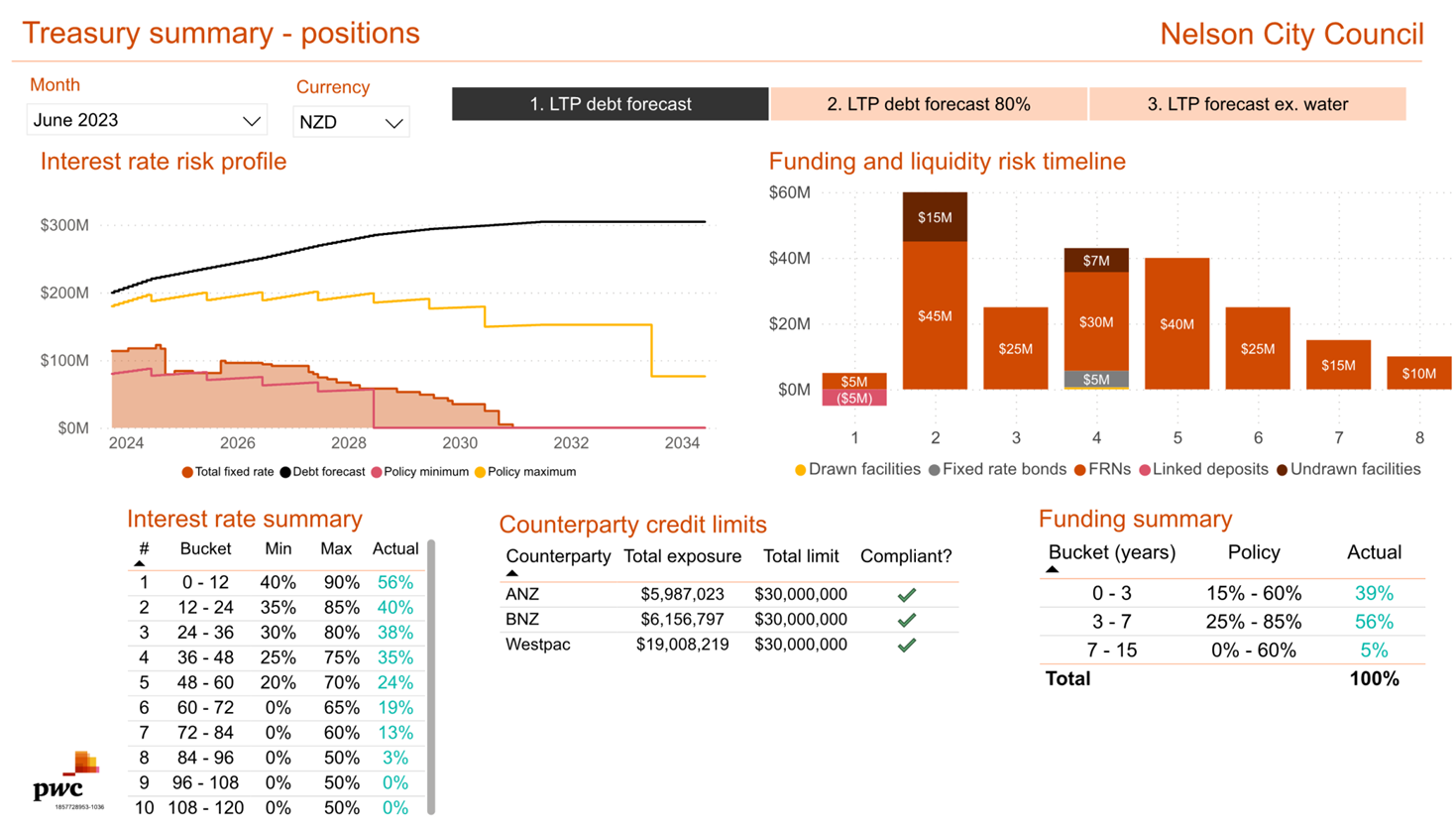

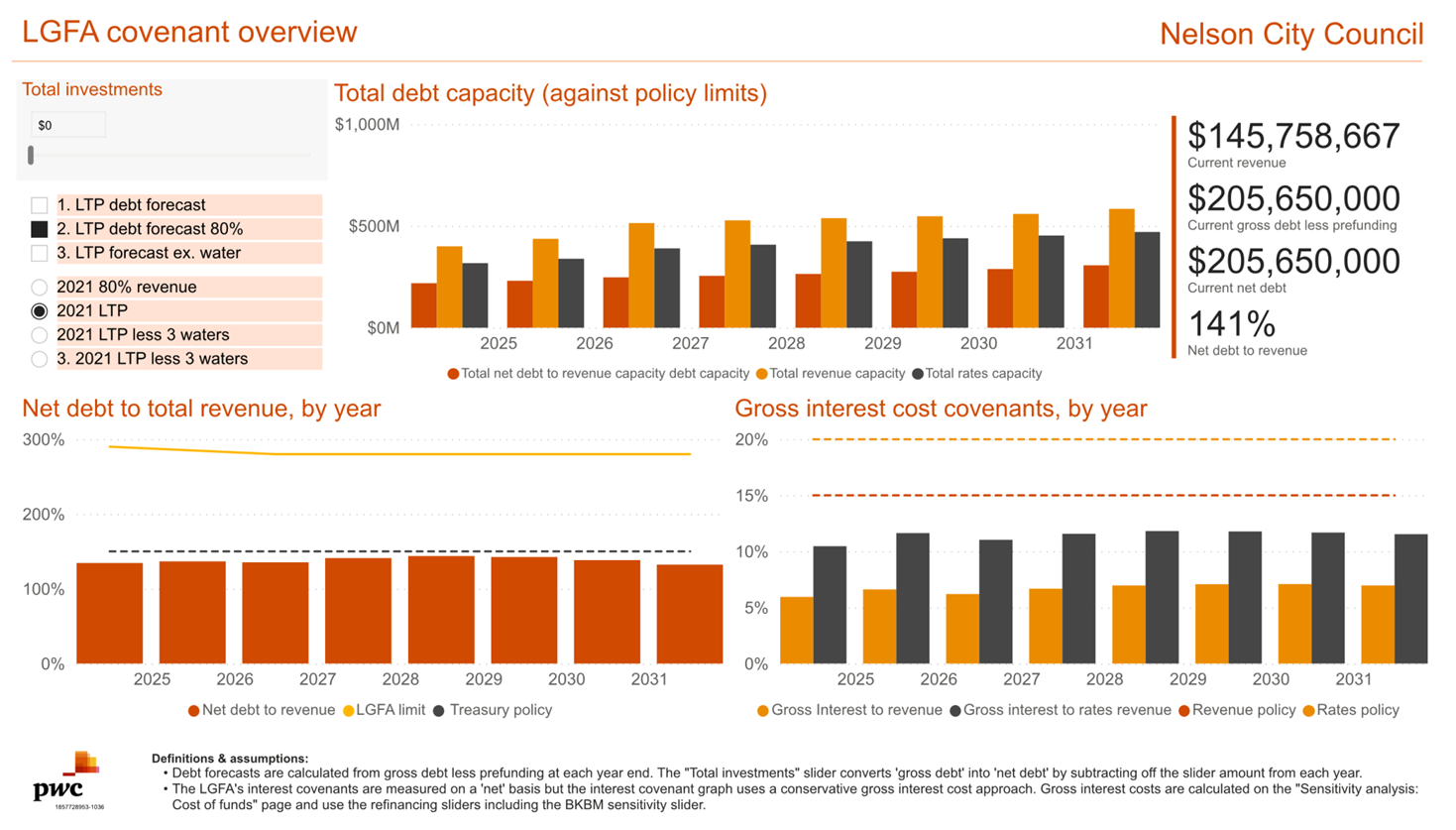

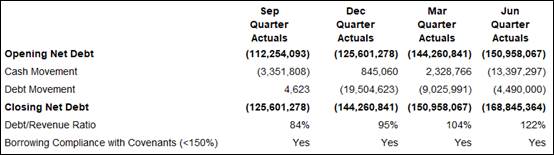

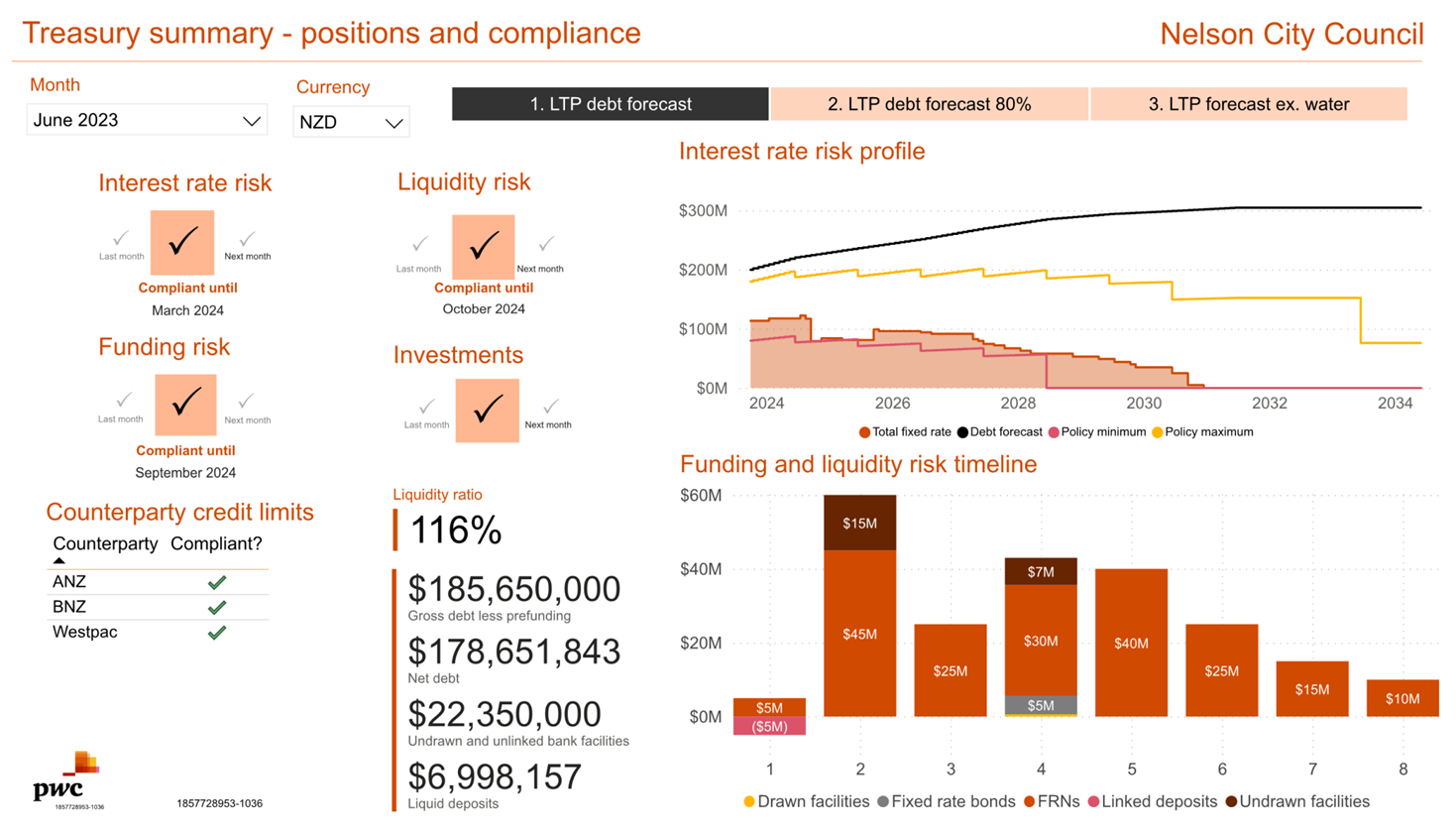

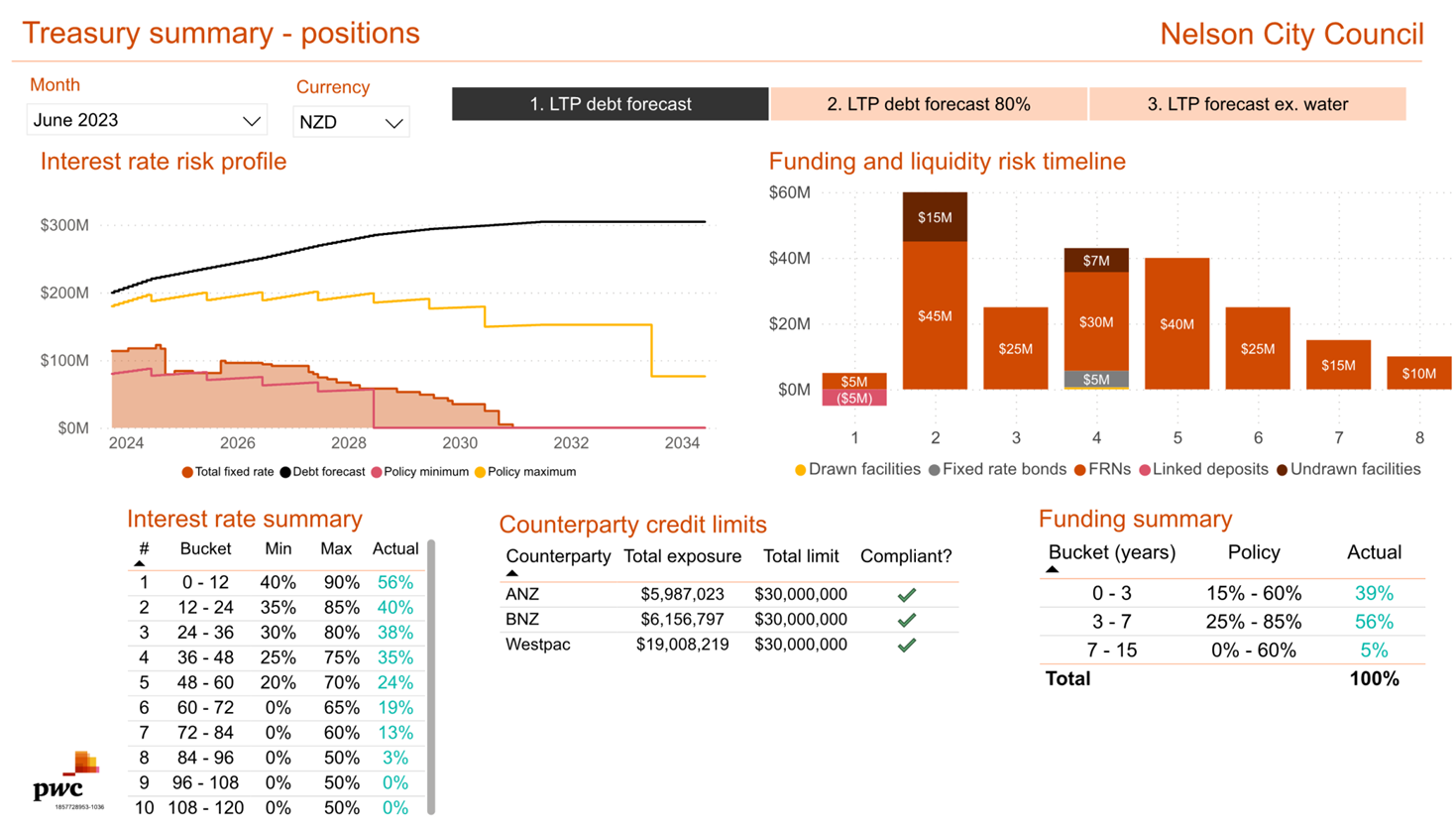

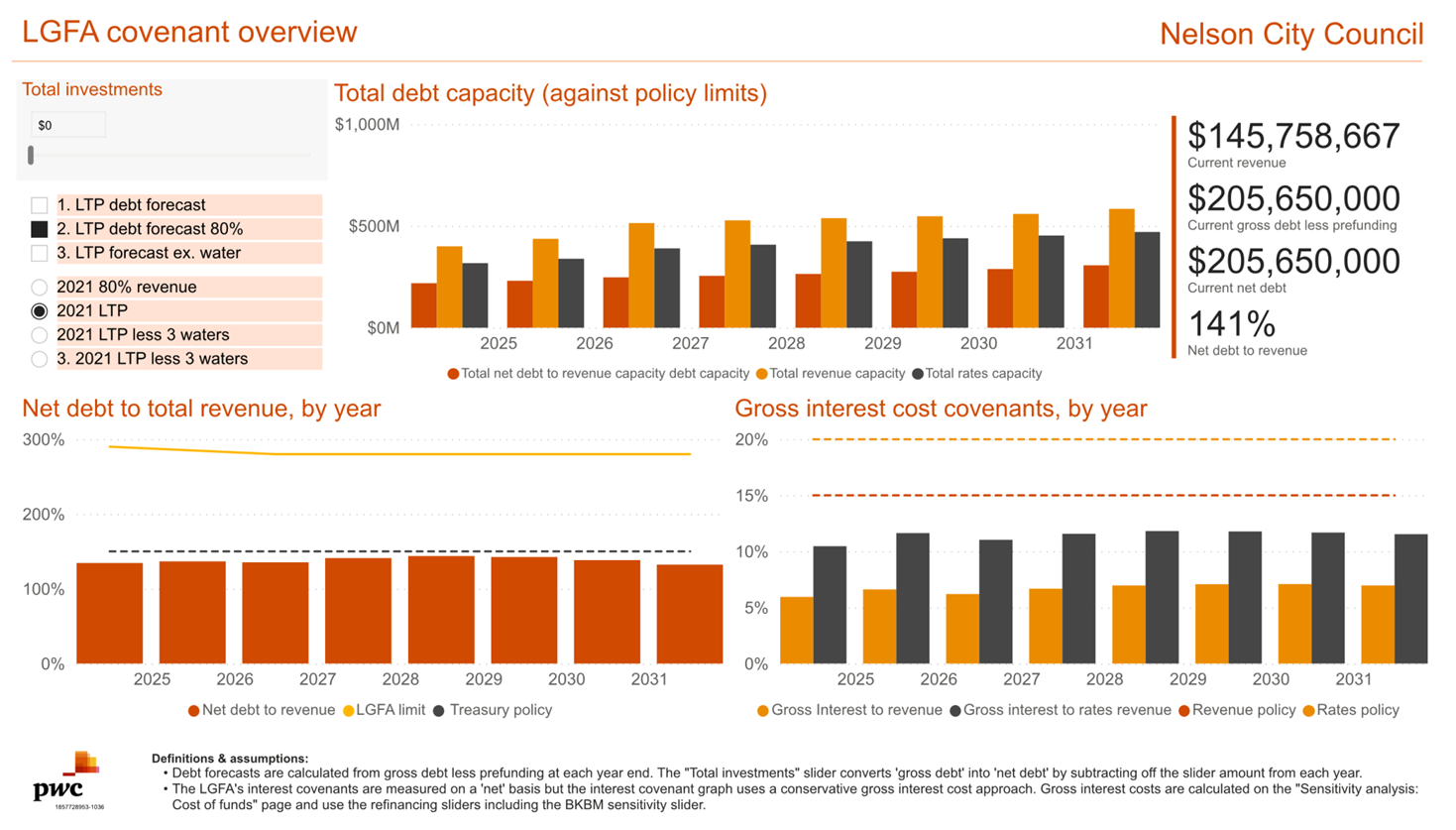

6.1 Net Debt

6.2 As

at 30 June 2023, there was a net debt of $168.8m compared with budgeted net

debt of $161.0m ($111.6m at 30 June 2022). Net debt has increased by $57.2m

since 30 June 2022.

6.3 For

the twelve months ended 30 June 2023, LGFA borrowings have increased by $45.0m

and term deposits have decreased by $25.0m. This increase in debt has been to

fund the August 2022 weather event ($21.5m net expenditure), capital

expenditure during the year ($30.7m net of funded depreciation), as well as to

fund working capital ($4.3m net payables at 30 June 2022).

6.4 Attachment

1 (1857728953-1036) shows compliance with the Treasury policy.

7. Rates Aging

7.1 Over

the last twelve months officers have seen outstanding rates balances increasing

slightly which highlights the cost of living and interest rate increases

impacting on the community. Officers are working hard to get ratepayers on to

payment plans.

7.2 Total

rates outstanding as at 30 June 2023 were $689,021. Below are the rates

outstanding at the end of each rating quarter.

Total

Rates Outstanding

8. Housing Capped Fund:

$2.5m drawdown

8.1 Council

divested its 142 community housing units to Kāinga Ora in 2021. As part of

the transfer of ownership, a Capped Fund was established from a portion of the

proceeds to cover Kāinga Ora’s costs for some specified types of work

on the units. In June this year Kāinga Ora claimed an amount of $2,497,872

from the Capped Fund to cover costs in relation to retrofitting and renewals at

the Nayland units. As the works met the requirements of the Fund, the requested

amount was drawn down leaving $2,783,000 in the Fund as at 31 July 2023.

9. Project

Health

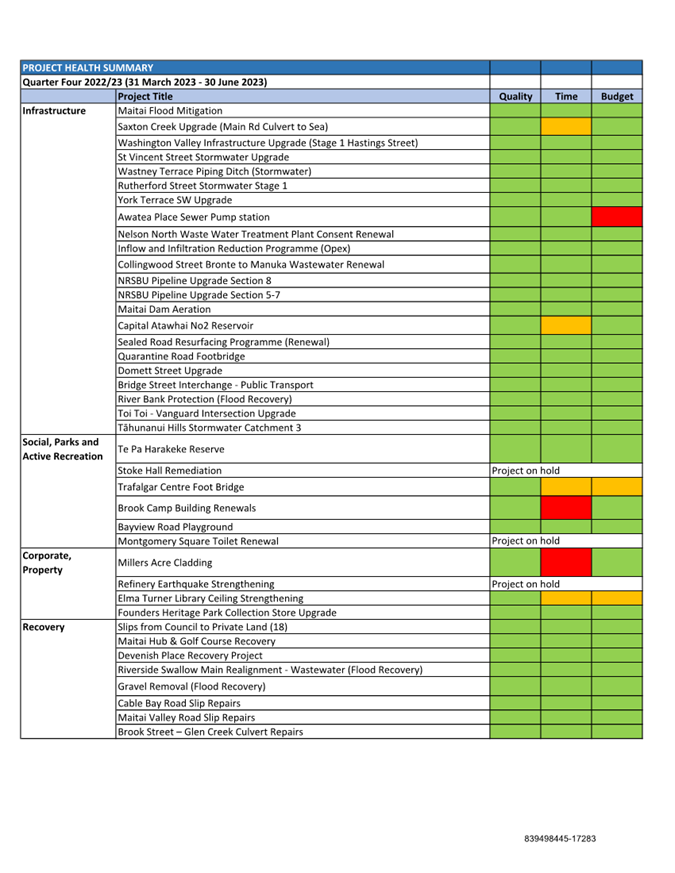

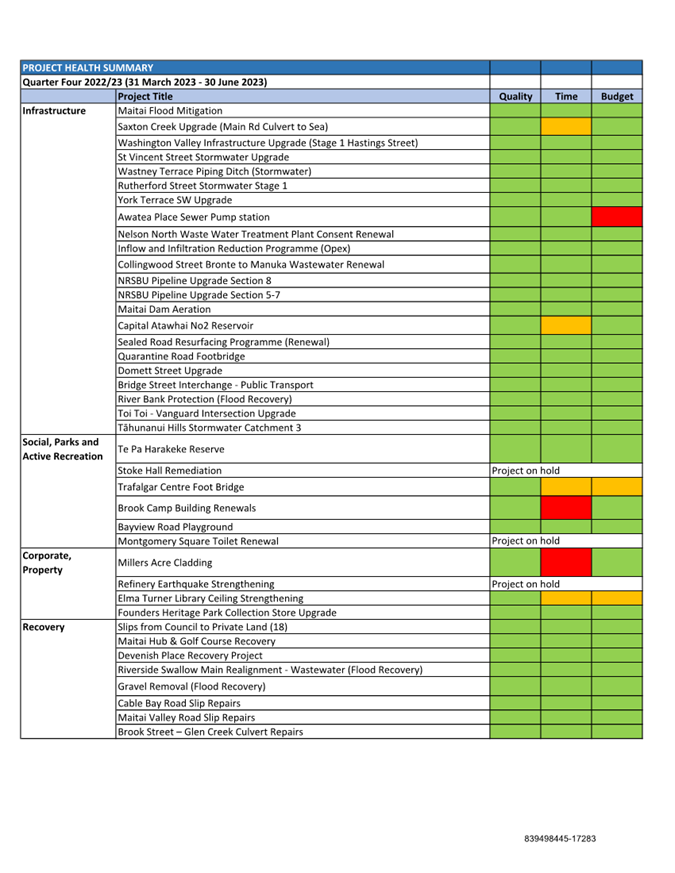

9.1 Attachment

2 (839498445-17283) summarises the health of projects across Council. The

table gives a red, amber or green rating for quality, time and budget factors.

9.2 The

majority of the orange and red are as a result of delays due to weather events

in August 2022 and May 2023, the impact of COVID-19 and supply chain delays in

material and equipment from overseas.

9.3 Projects

on hold indicate projects that require further workshops or discussion.

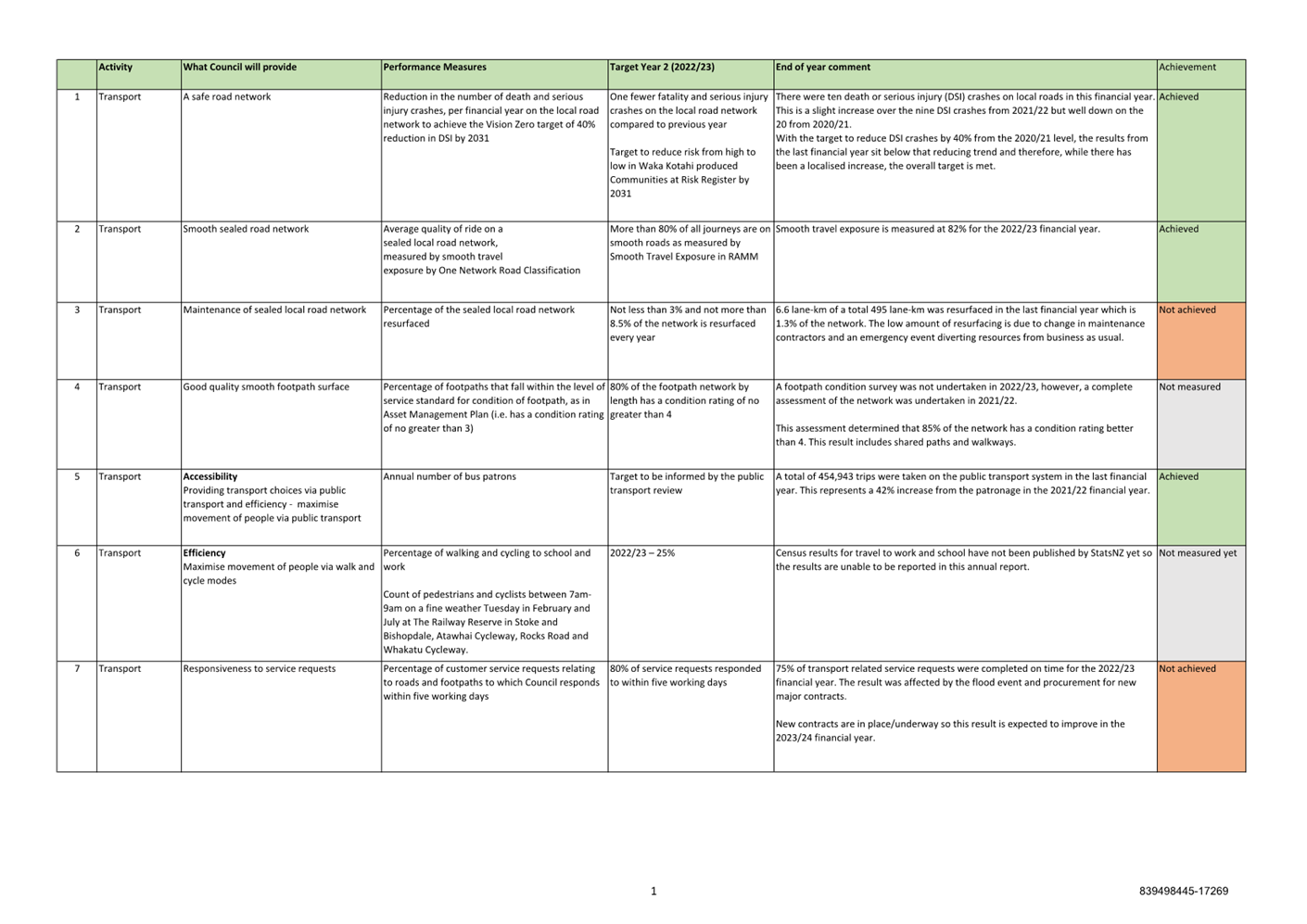

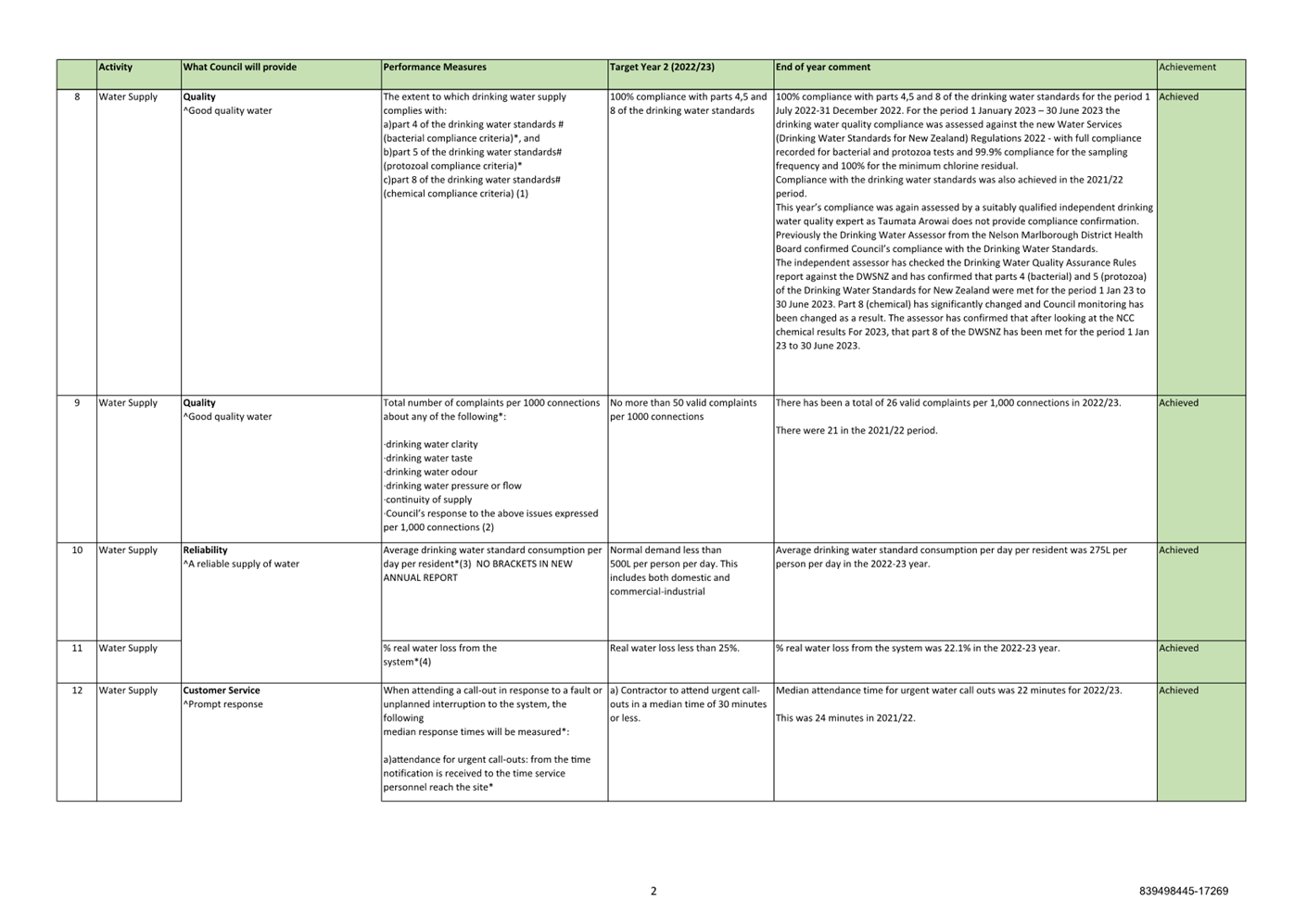

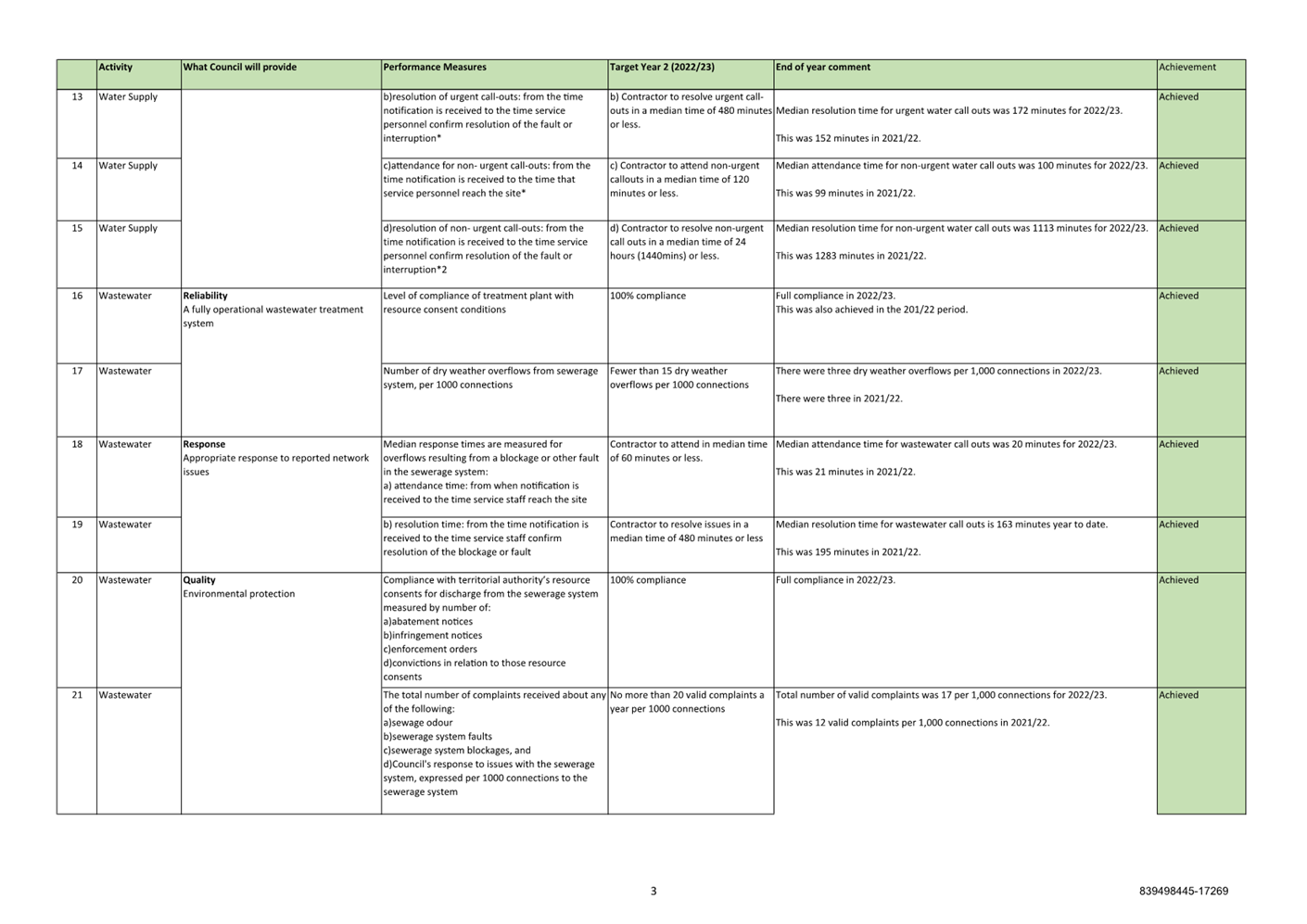

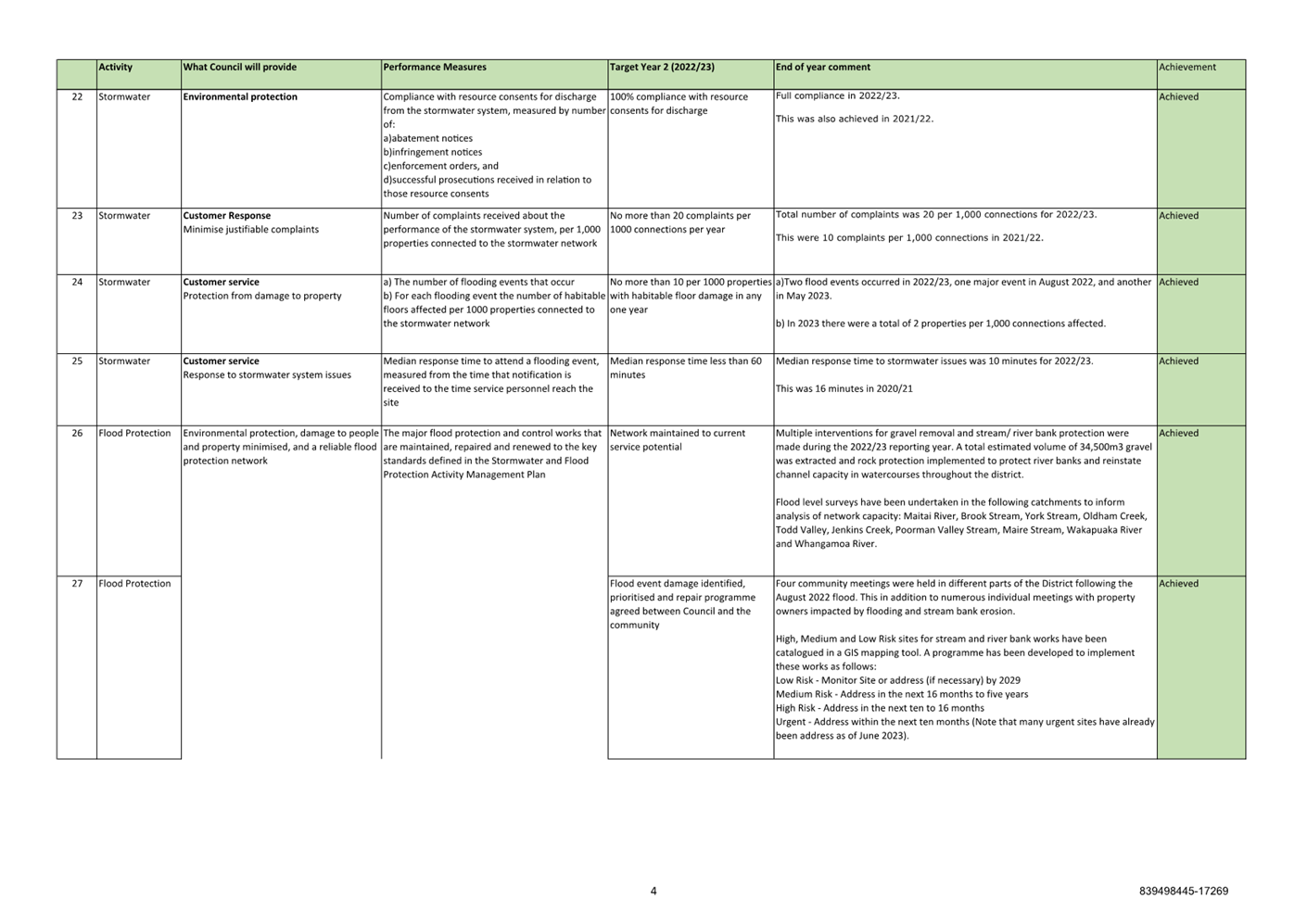

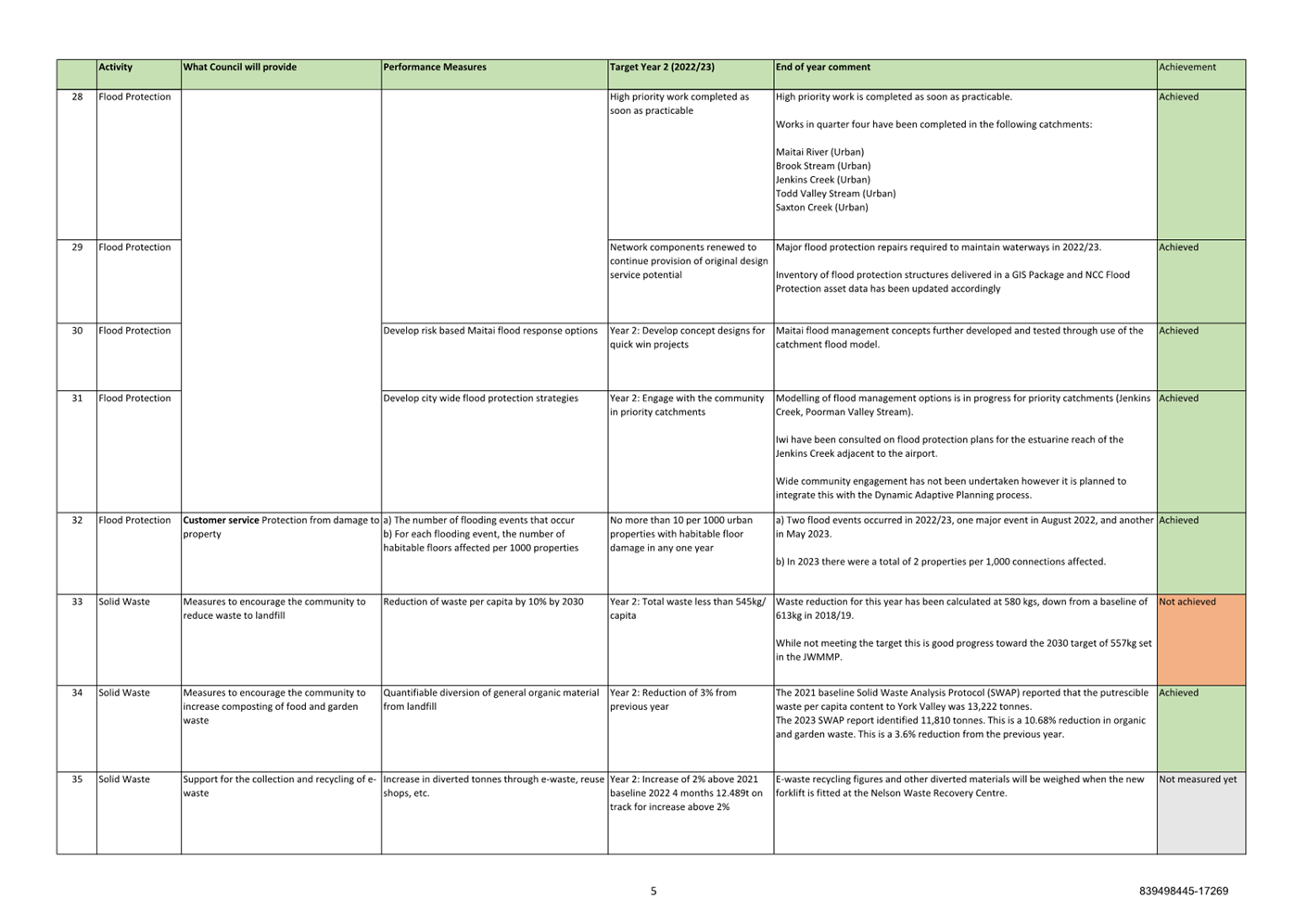

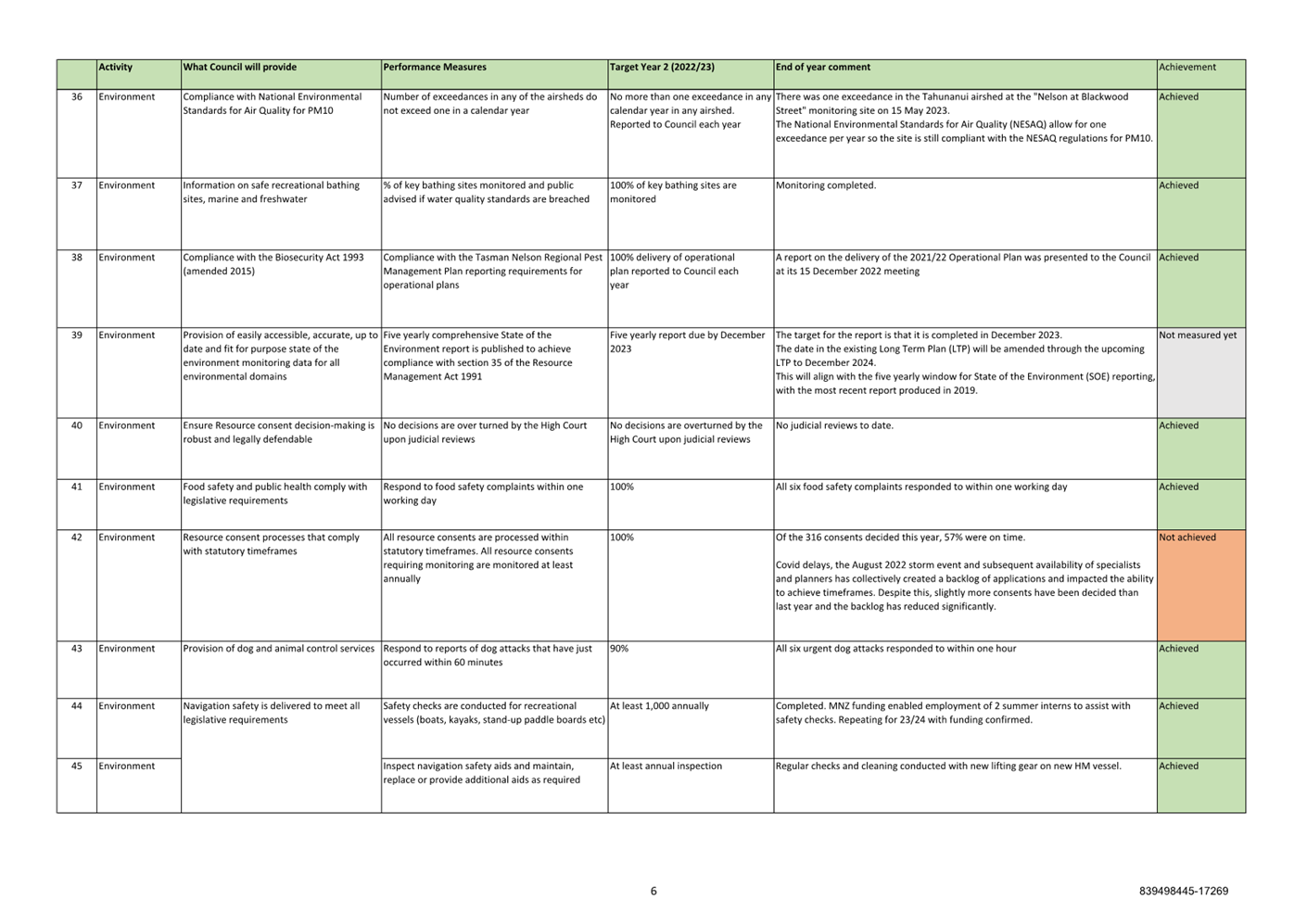

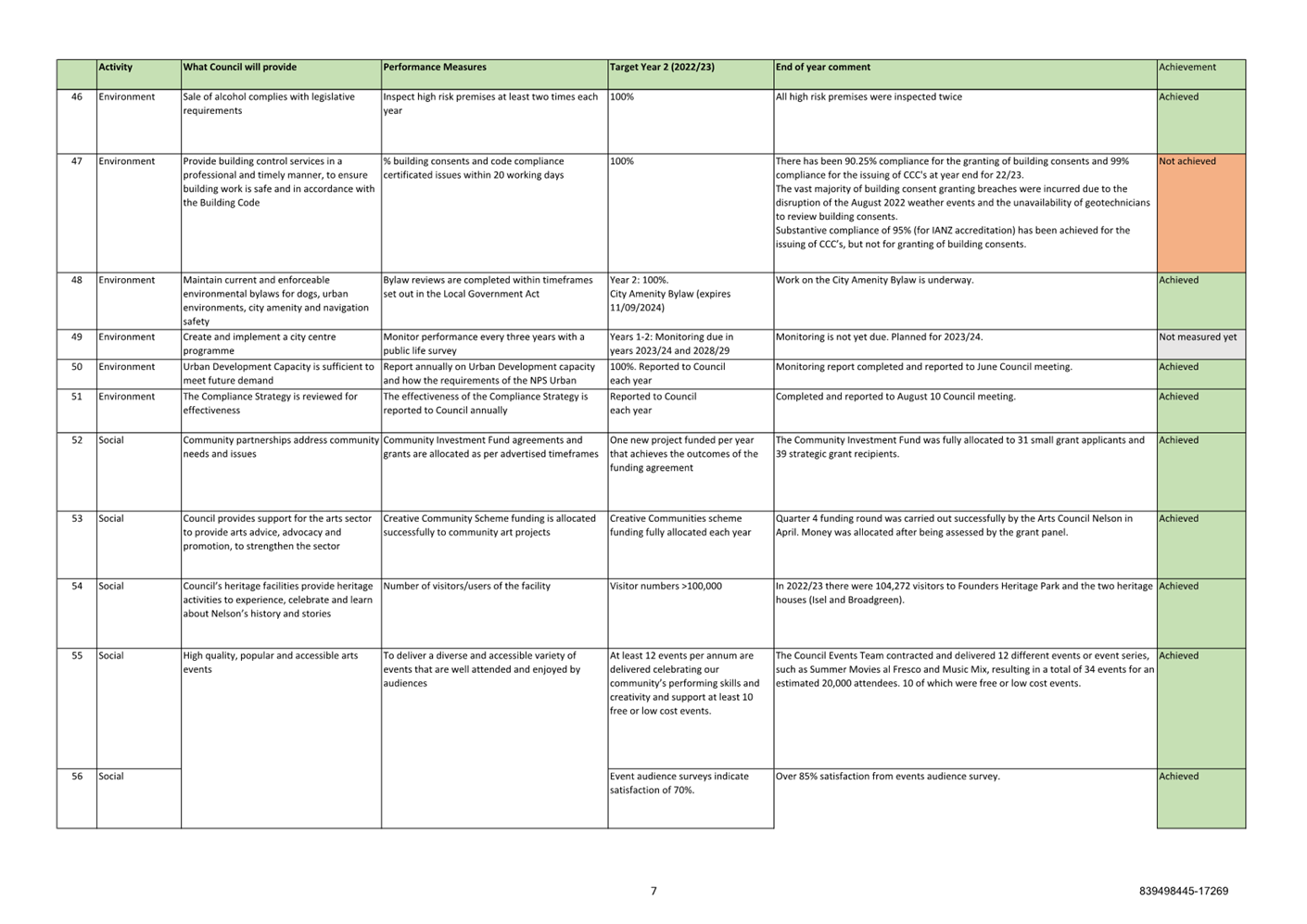

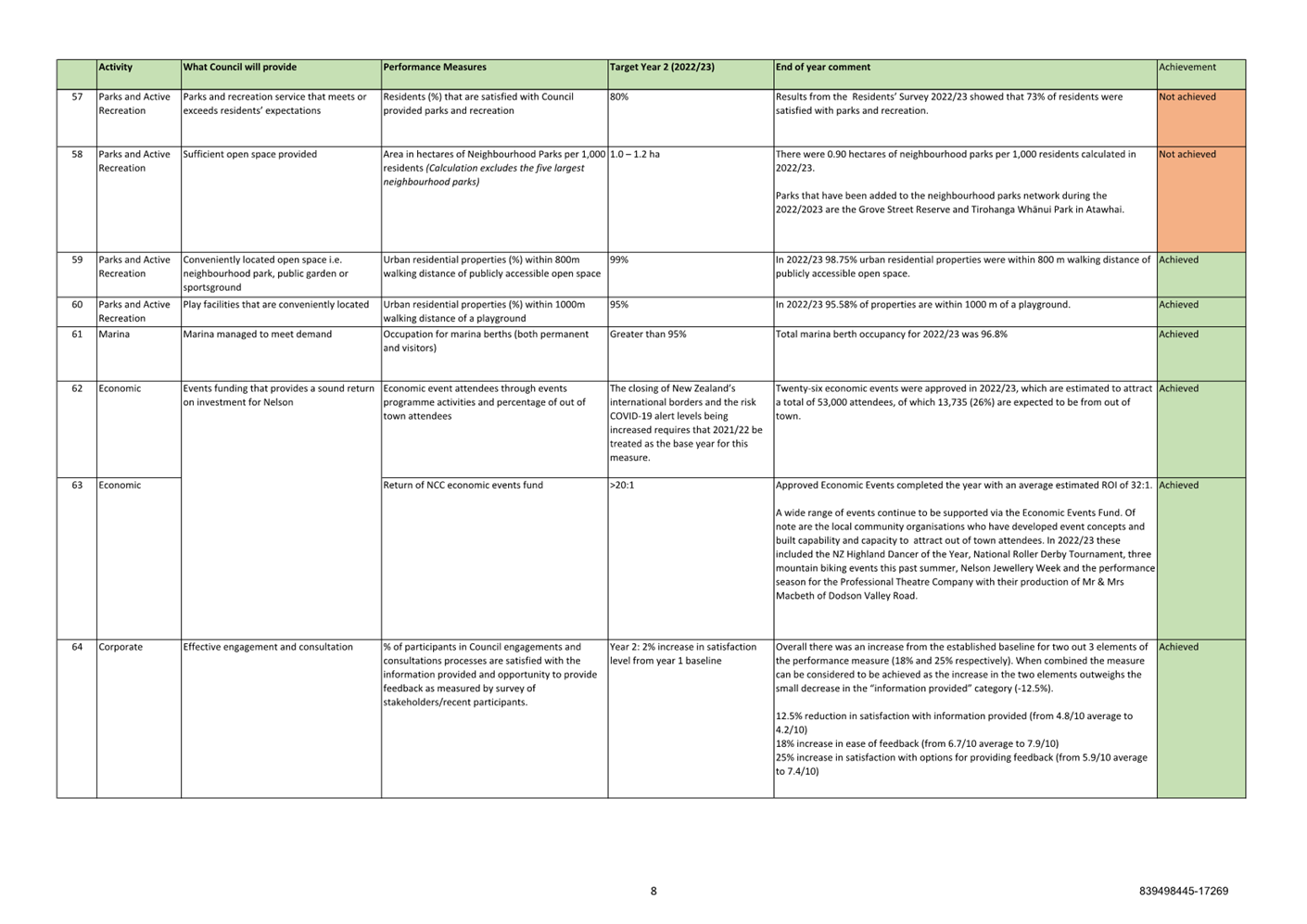

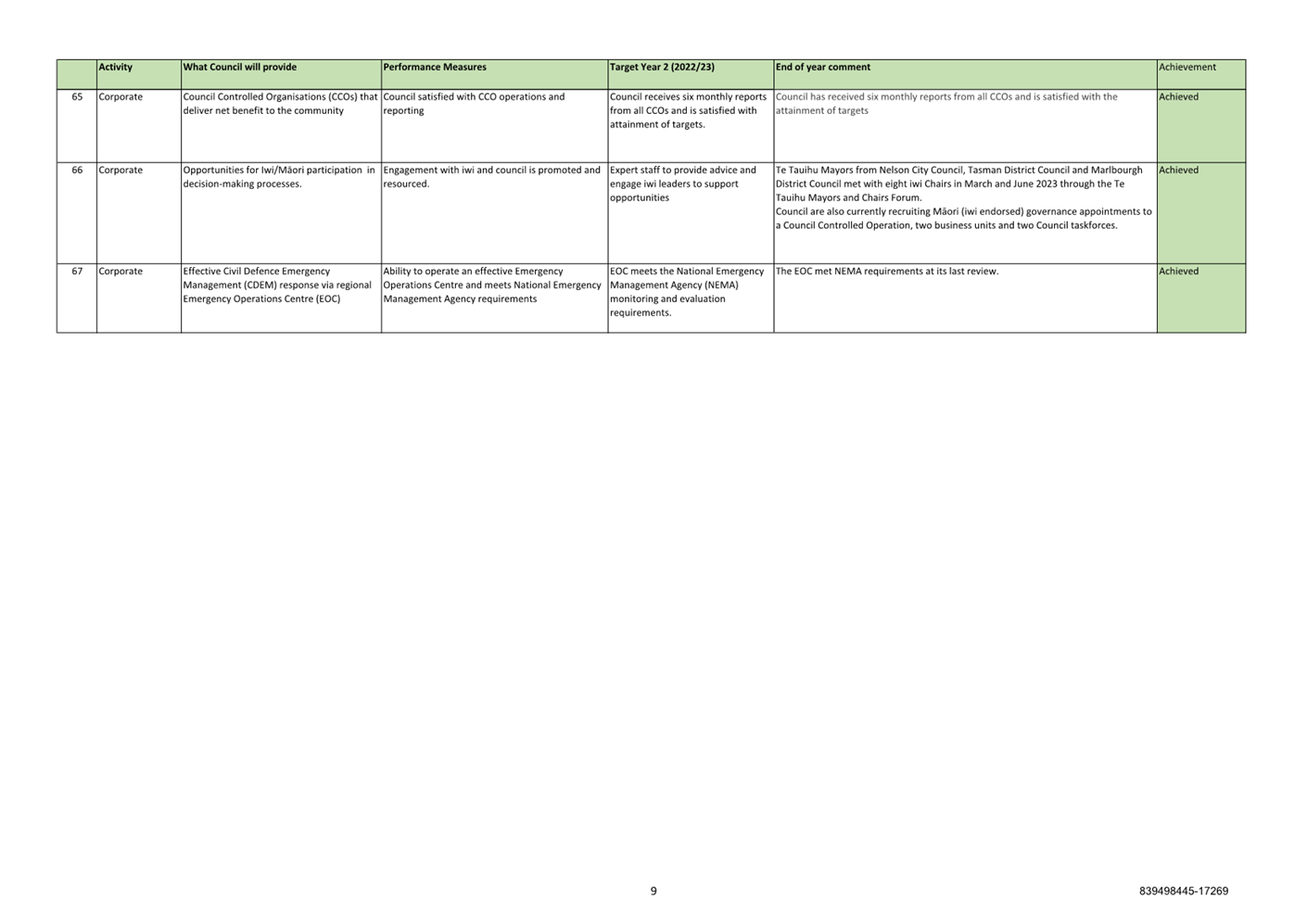

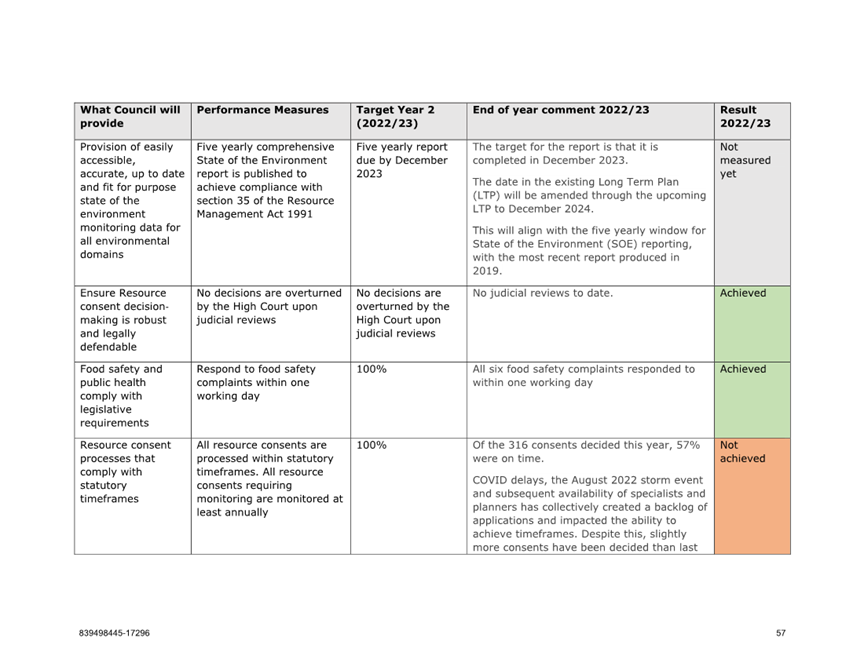

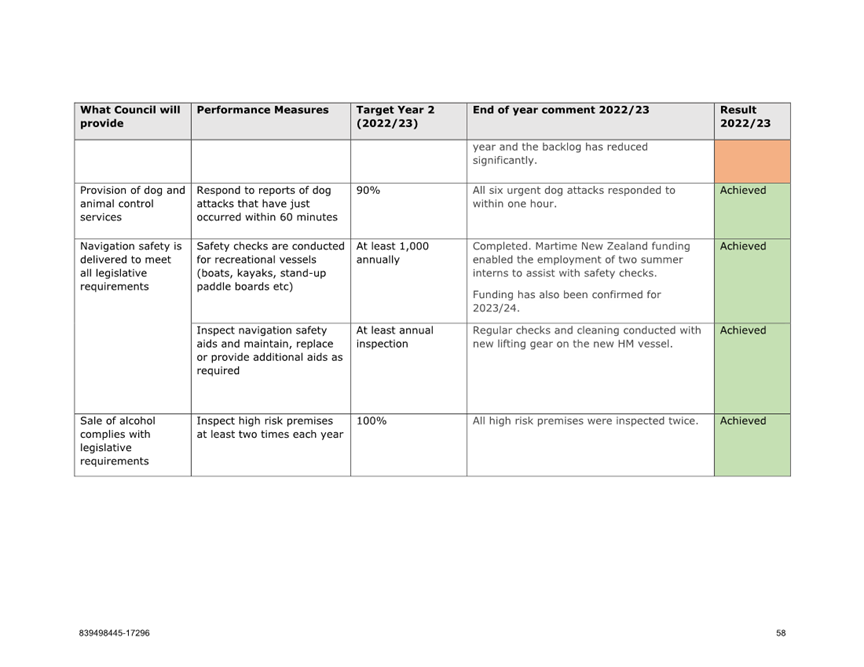

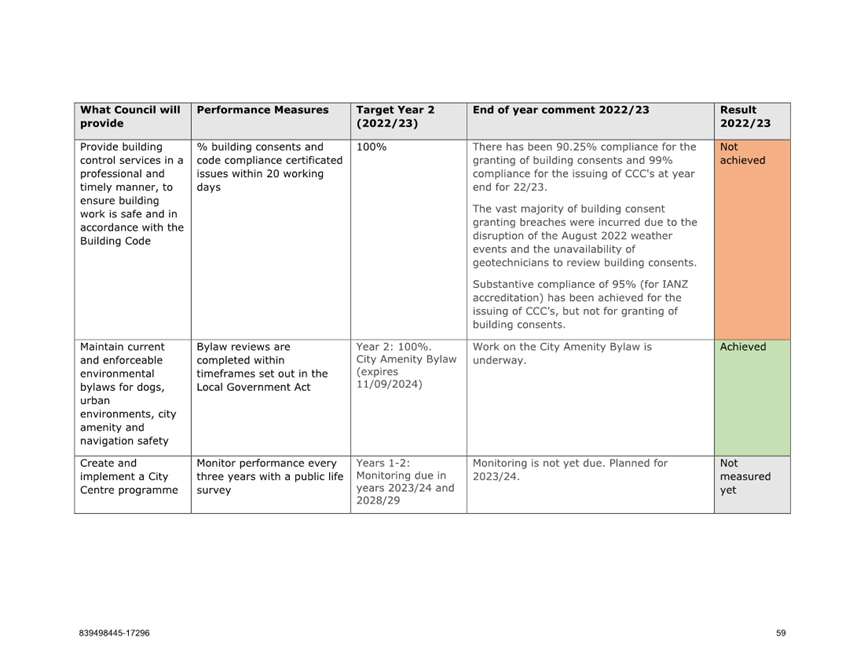

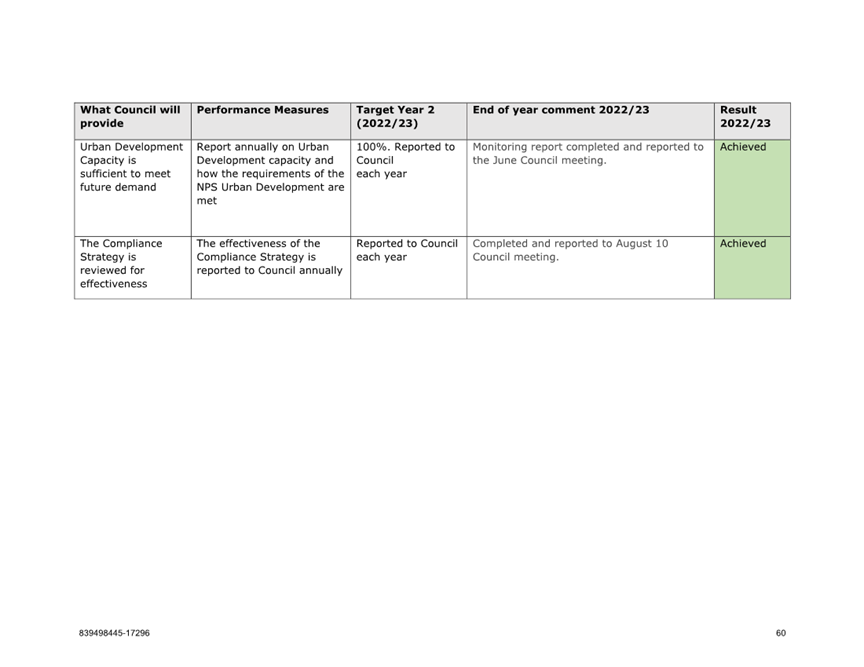

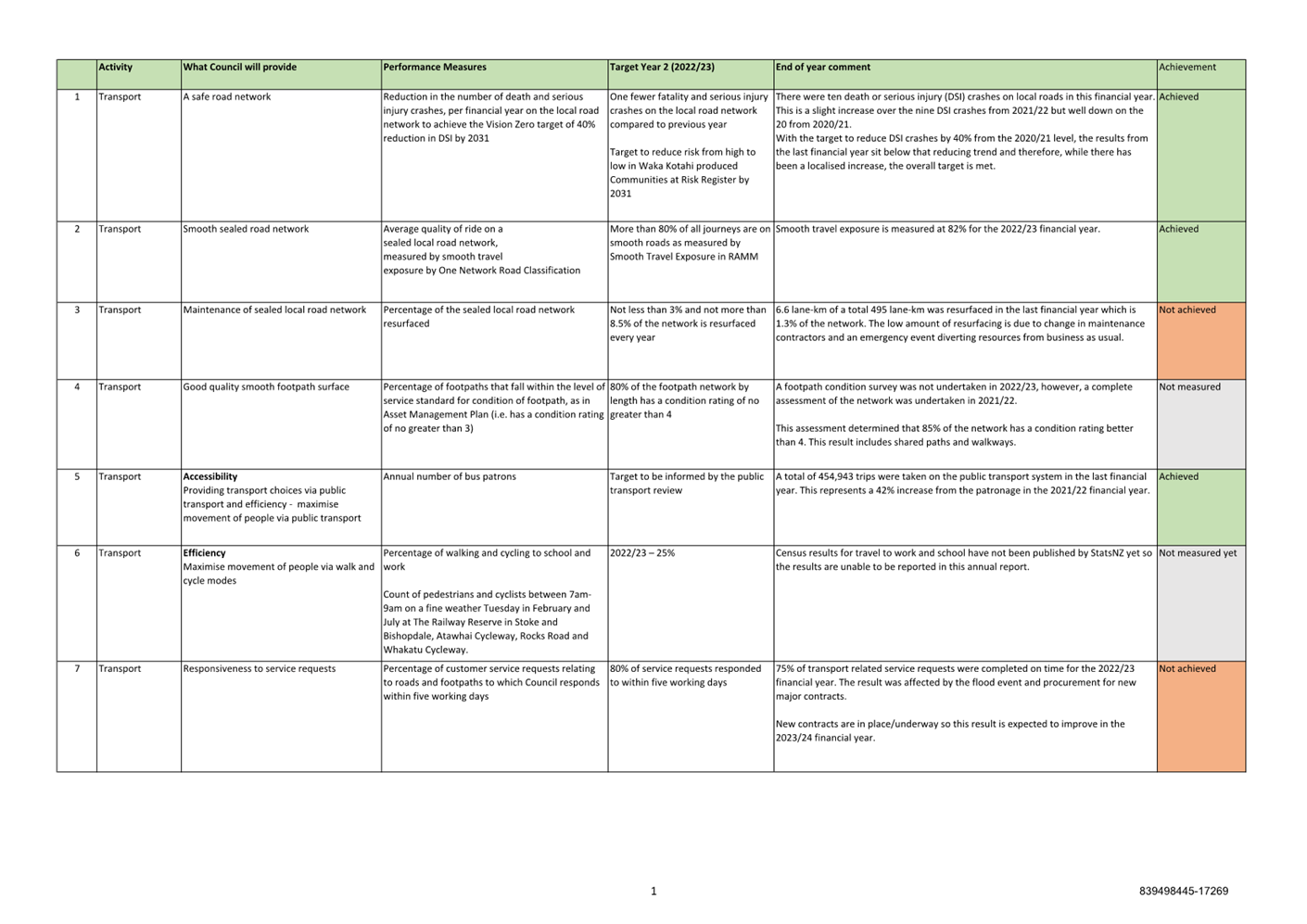

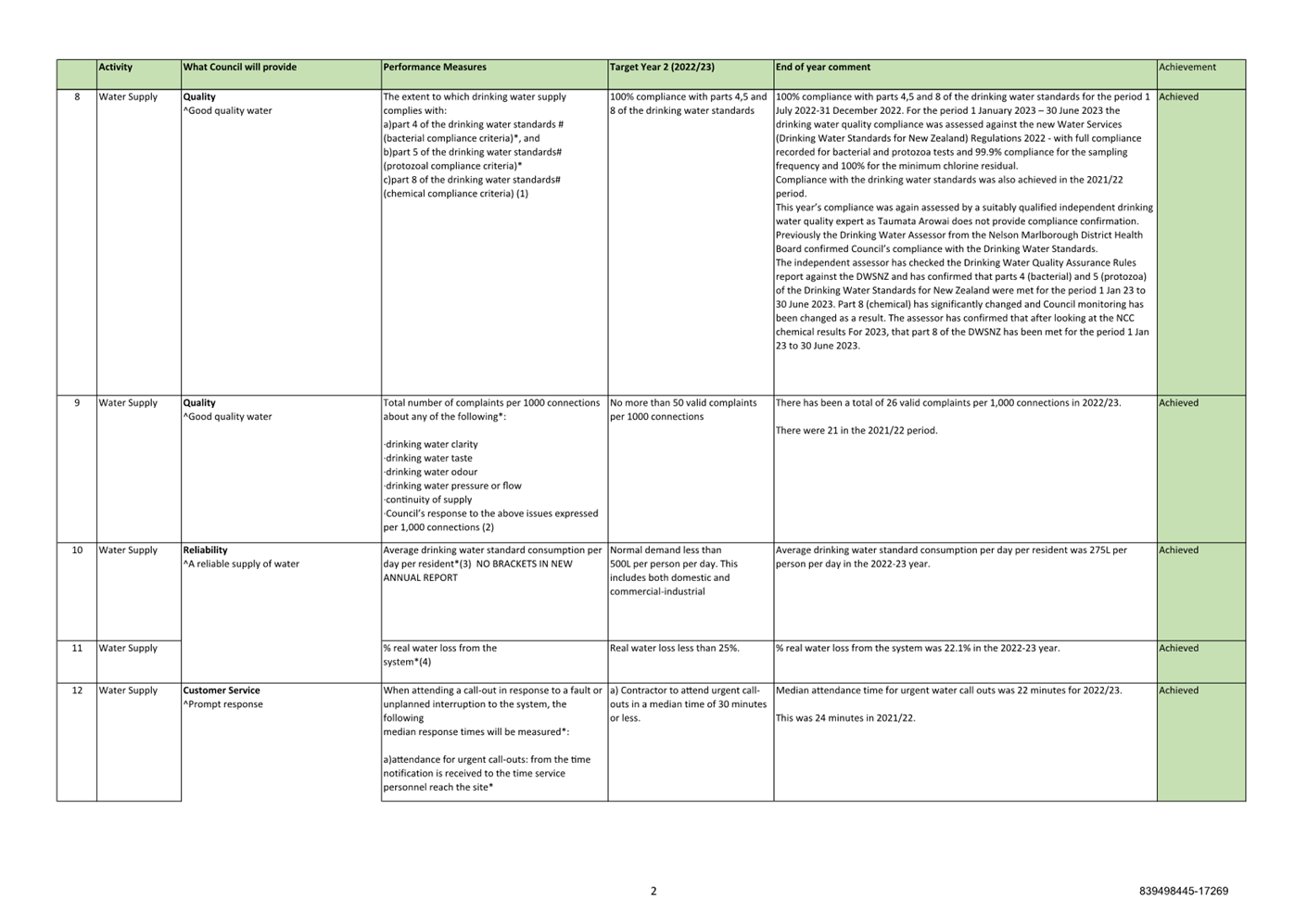

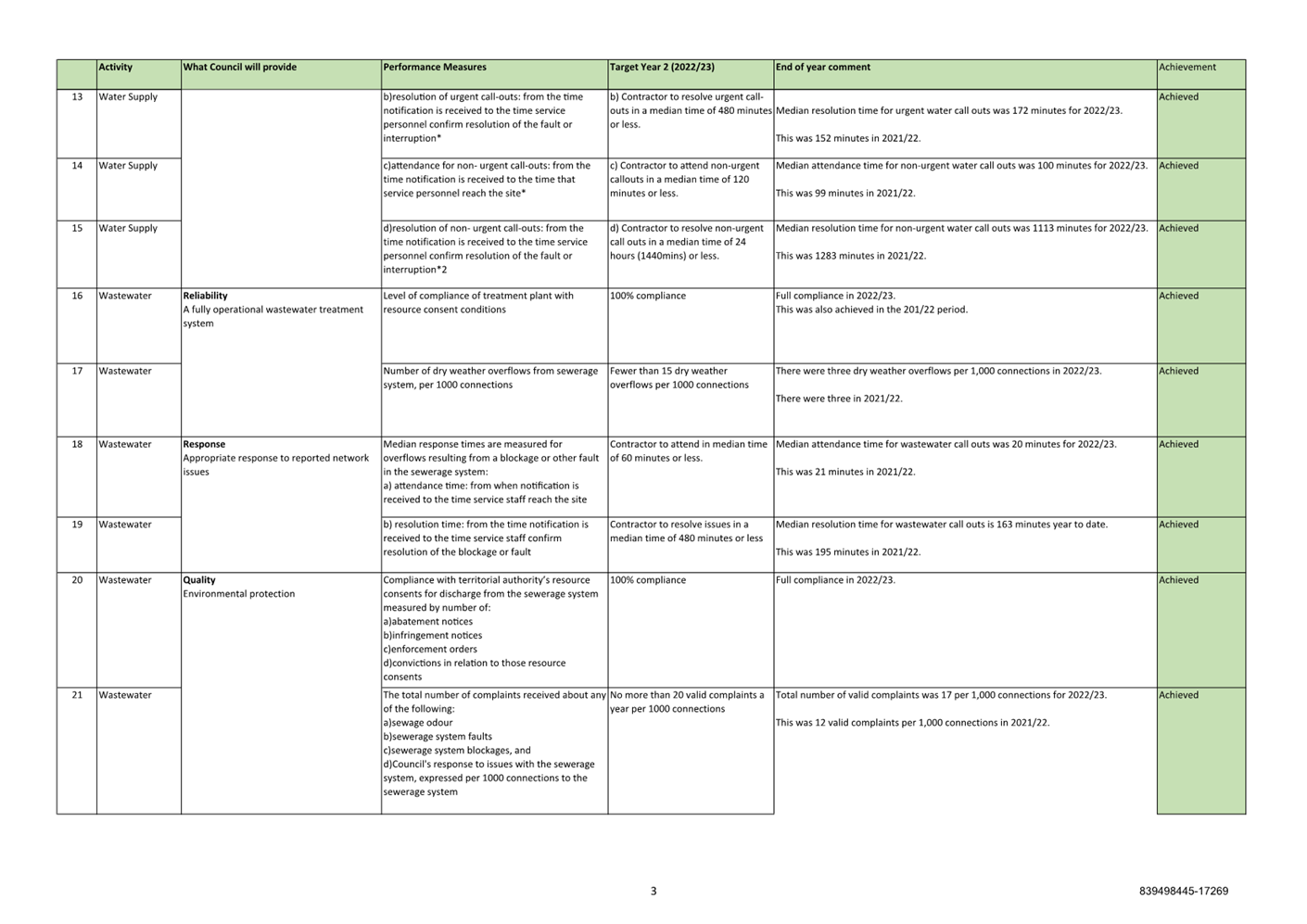

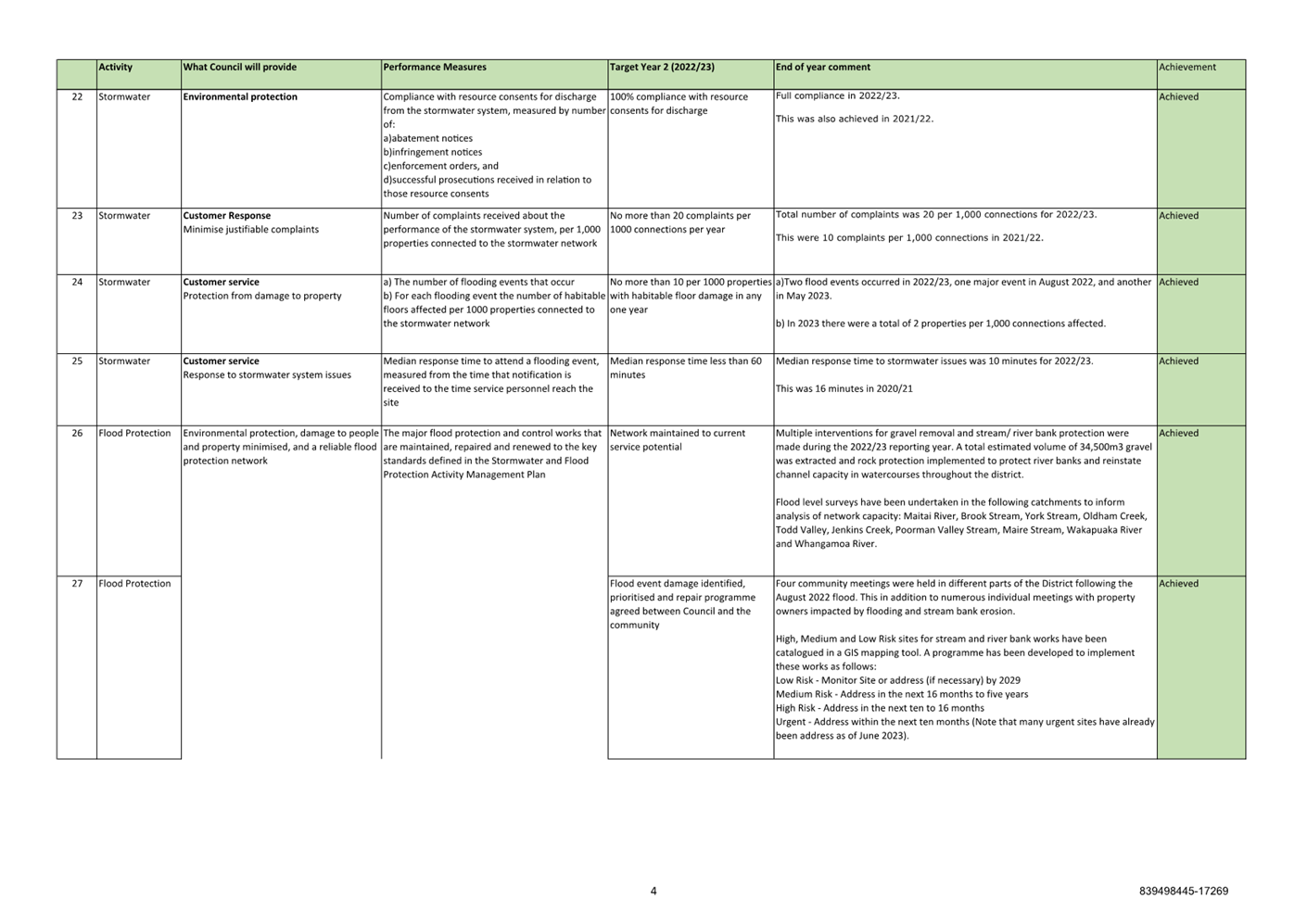

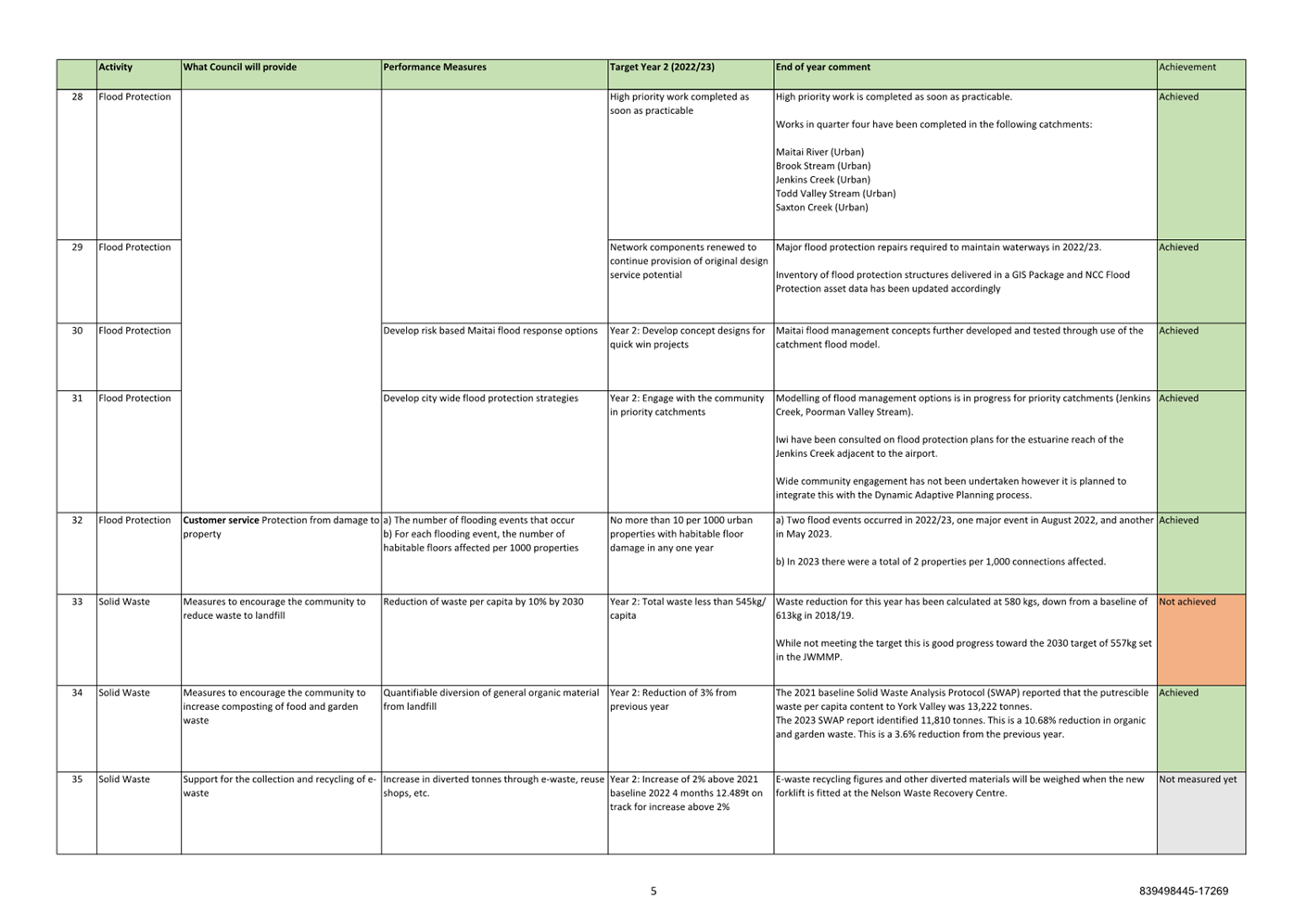

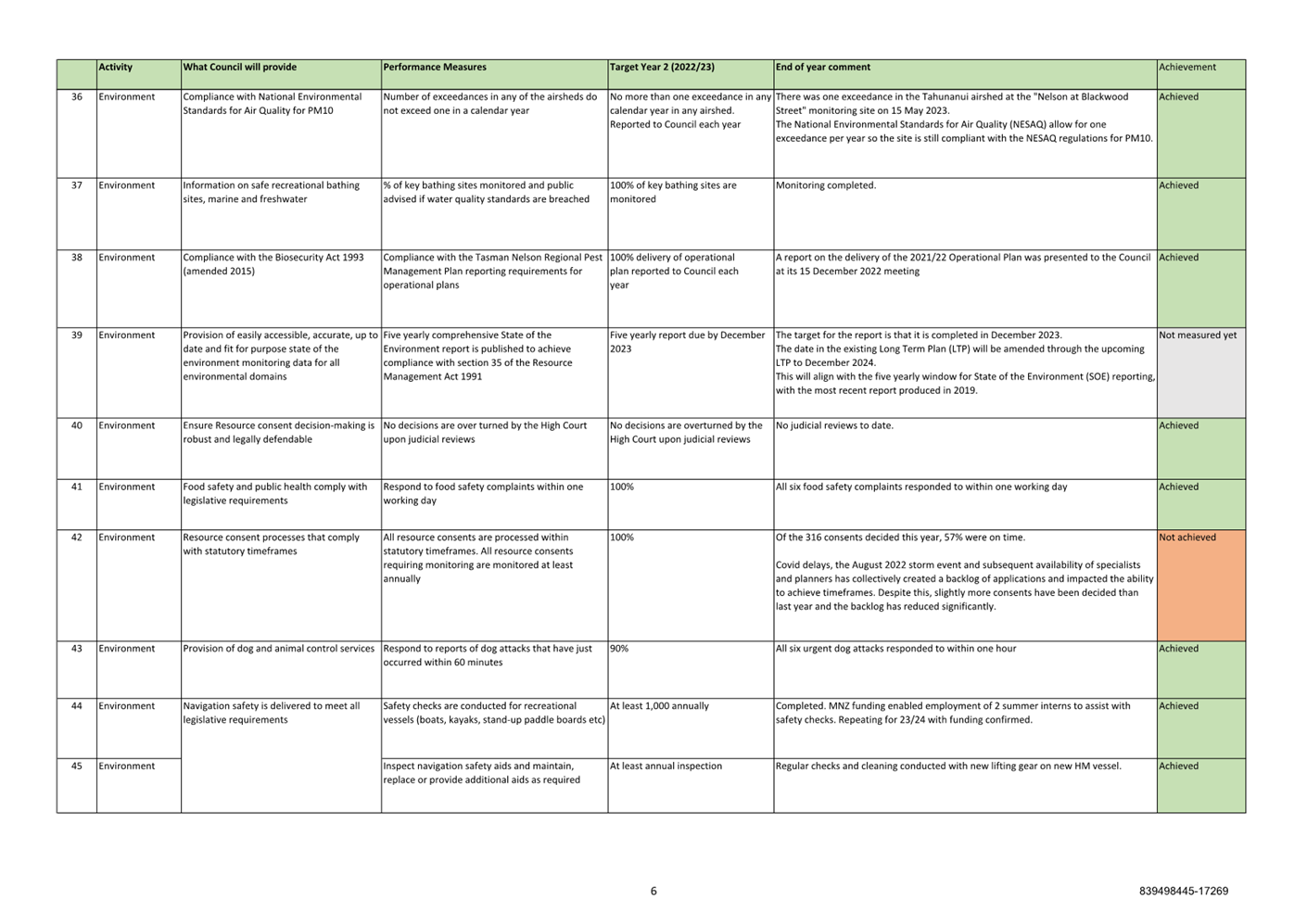

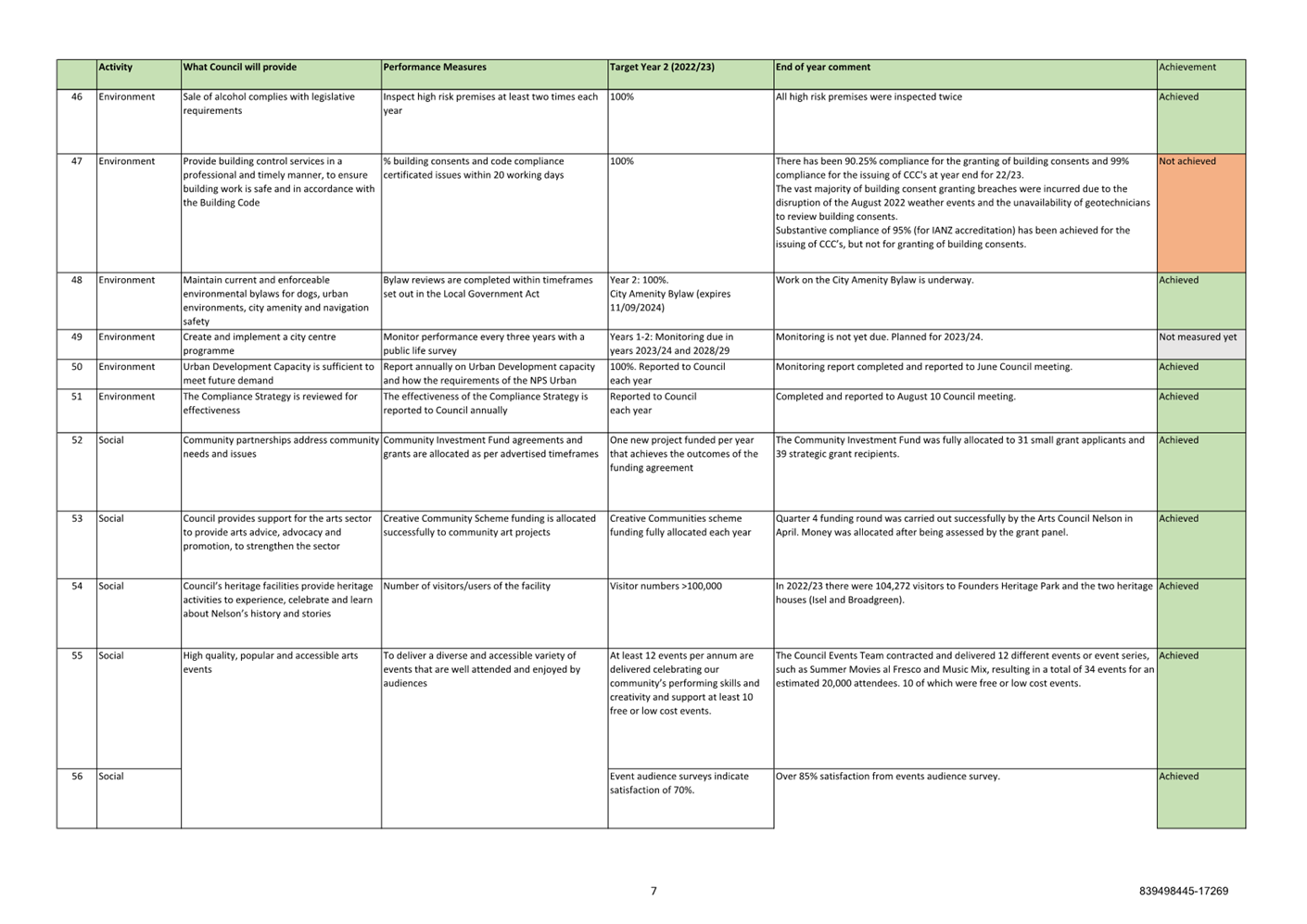

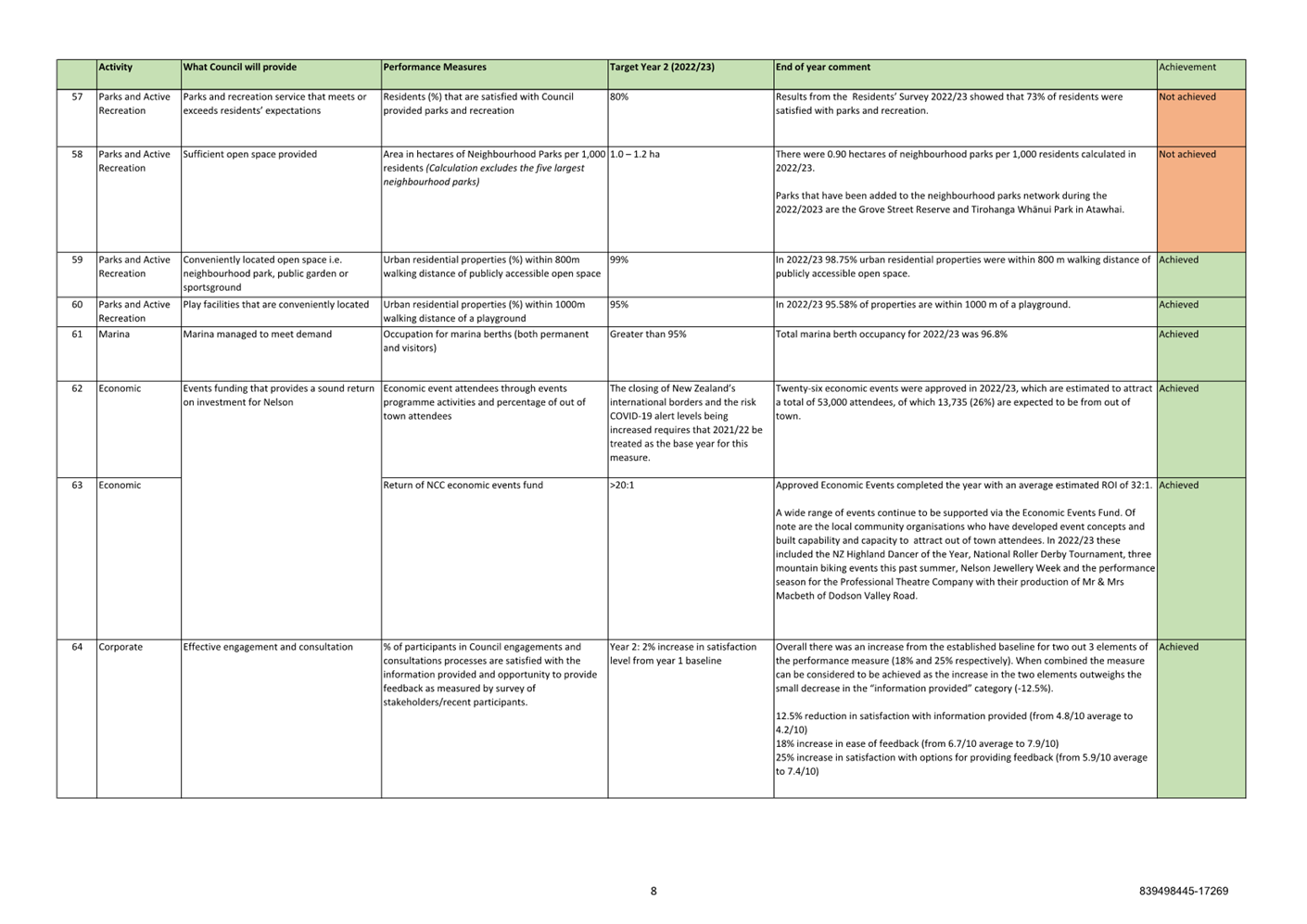

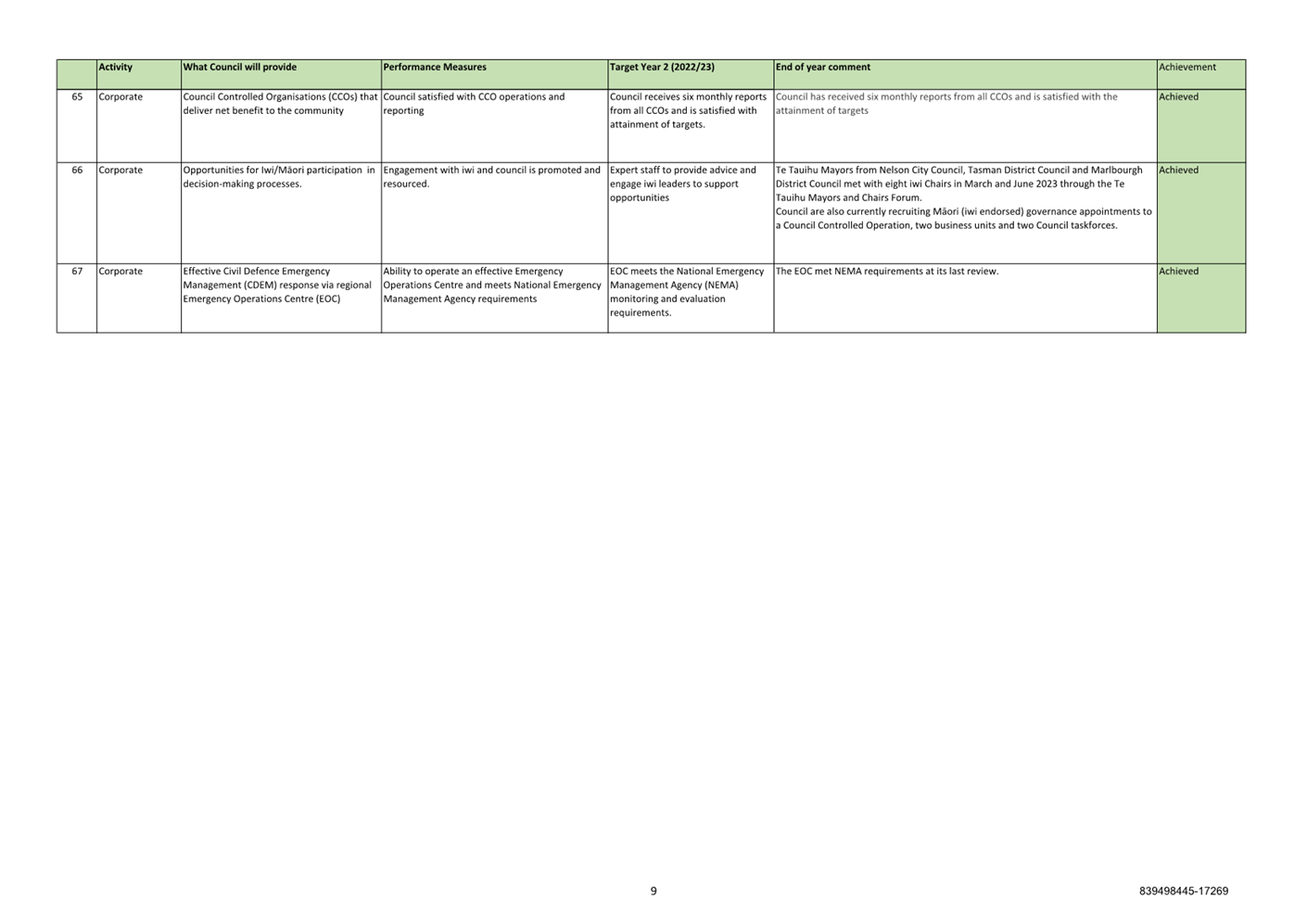

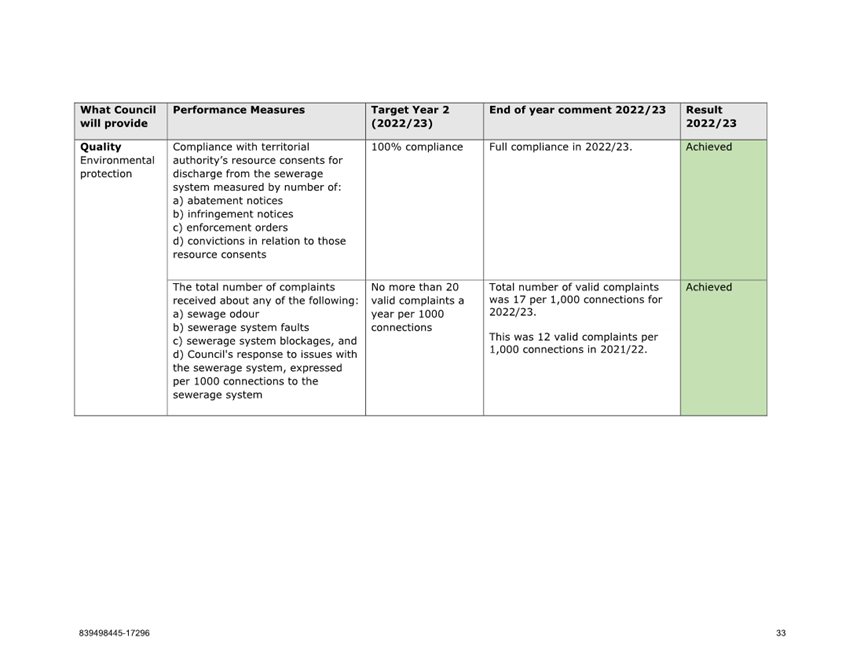

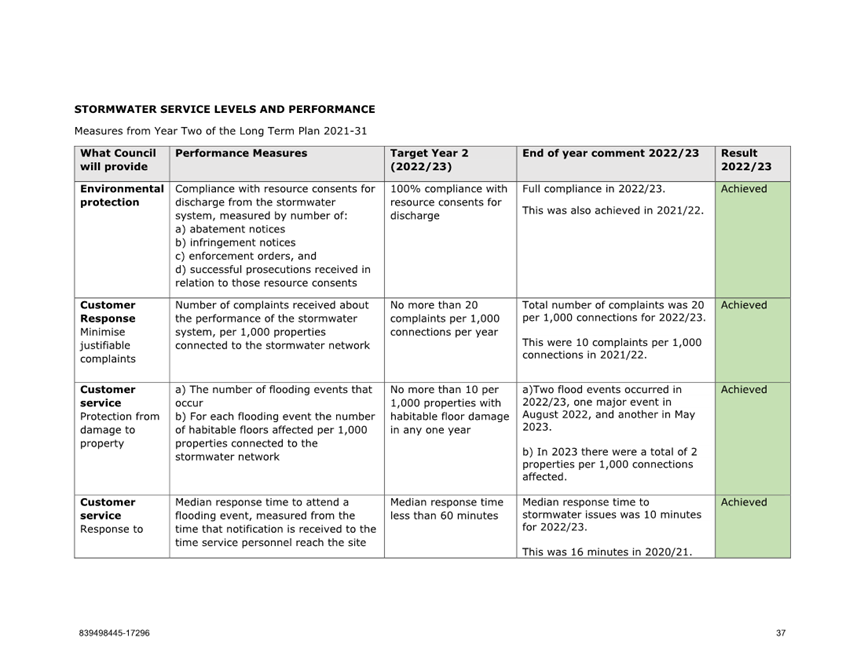

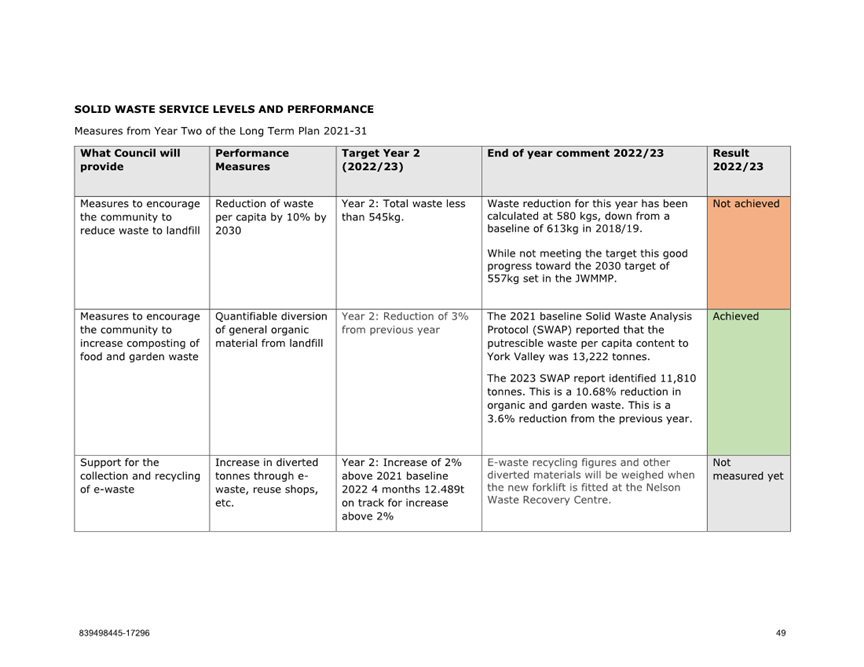

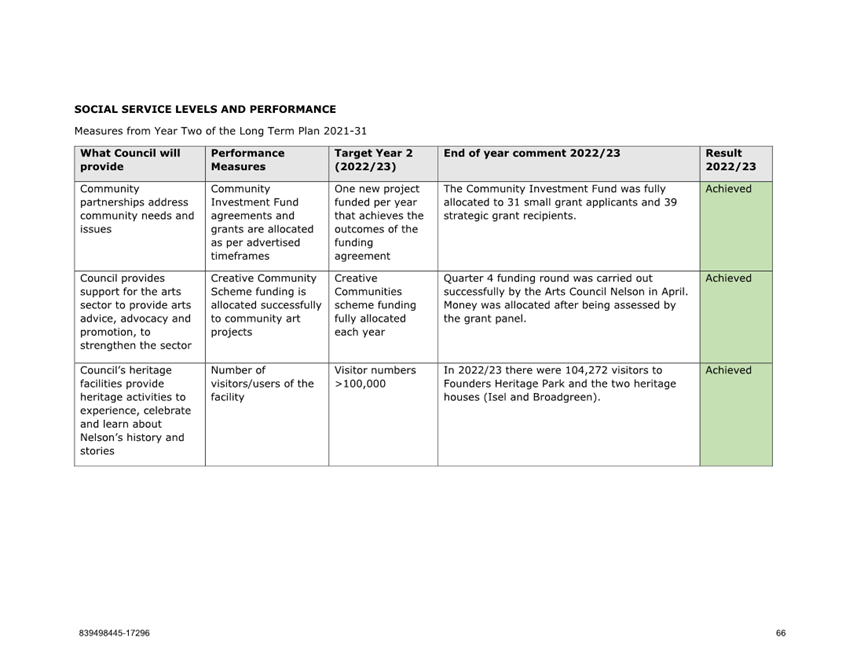

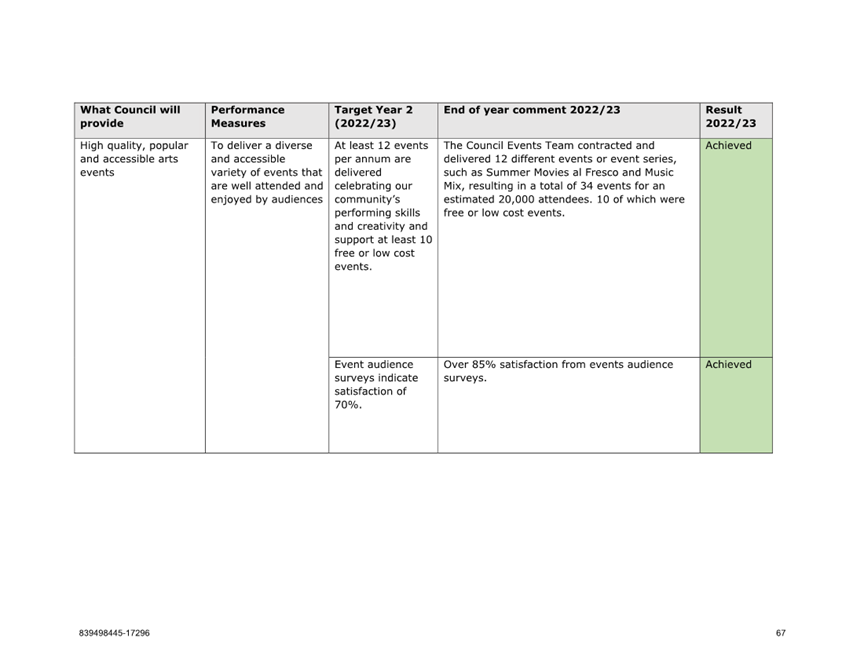

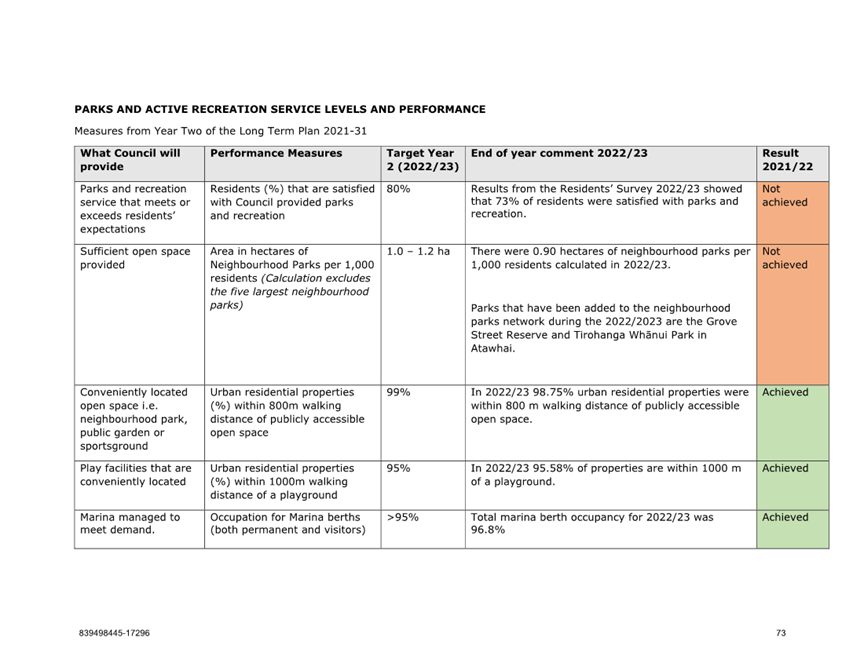

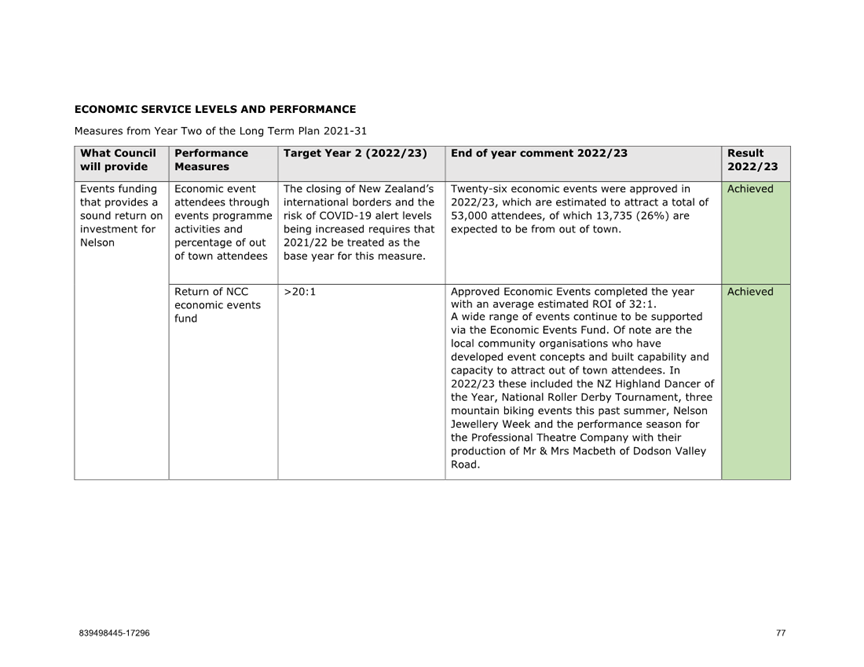

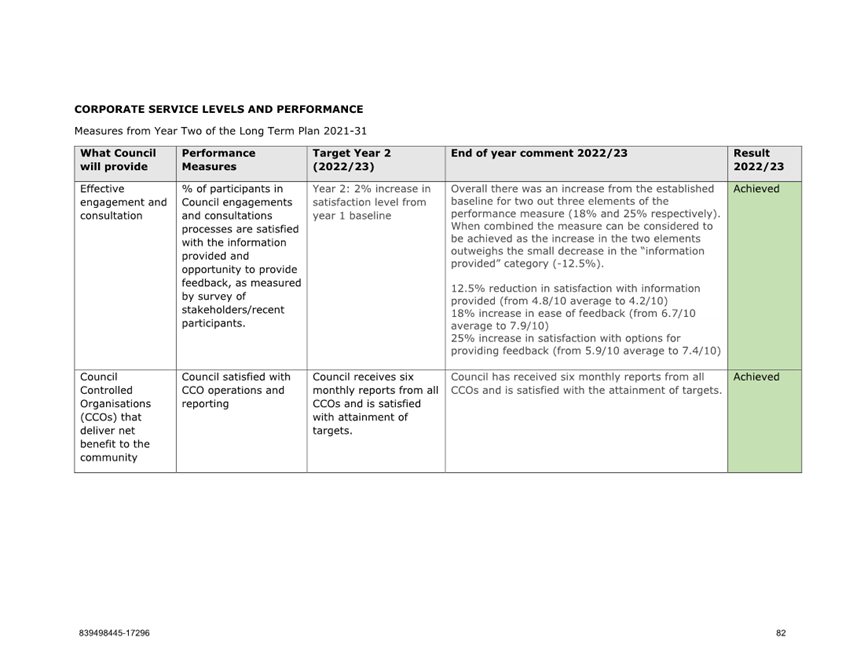

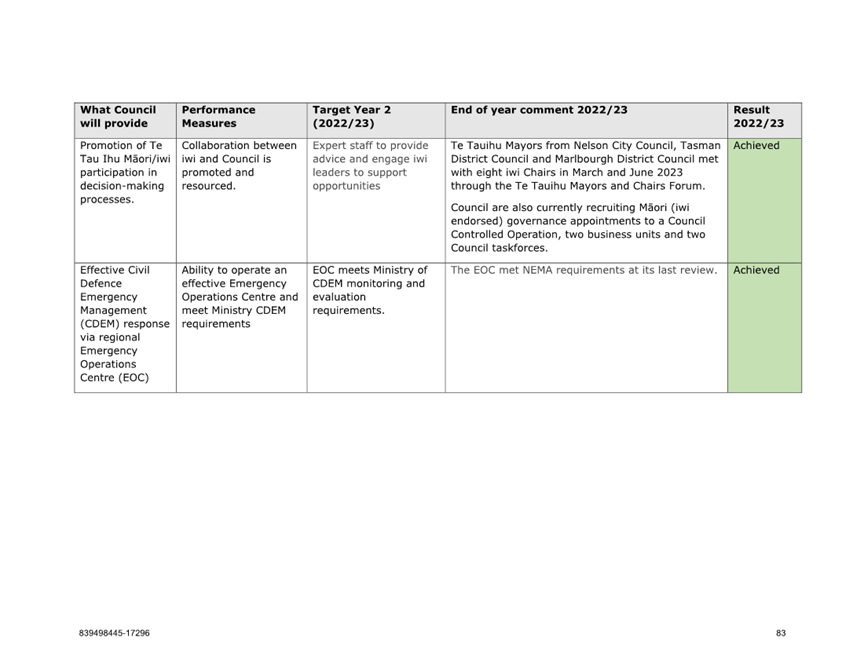

10. Performance

Measures

10.1 Council

reports on 67 non-financial performance measures across its activity areas, as

set out in the Long Term Plan 2021-31. These are evaluated as ‘achieved,

not achieved, or not measured’ at the end of the year.

10.2 At the

time of writing this report, 55 are achieved, seven are not achieved, and five

are not measured yet. The percentages are measured as 82.08%, 10.44% and 7.46%

respectively. If any results are challenged during the audit, these numbers may

change slightly.

10.3 Attachment

3 (839498445-17269) details Council’s performance measure results so far

across all its activities.

Author: Prabath

Jayawardana, Manager Finance

Authoriser: Nikki

Harrison, Group Manager Corporate Services

Attachments

Attachment 1: 1857728953-1036 -

Finance Attachment Q4 Reporting March 2023 ⇩

Attachment 2: 839498445-17283

- Project Health Summary - 6Sept2023 ⇩

Attachment 3: 839498445-17269

- Final Quarterly Reporting - 2022-23 - Performance Measures September 2023 ⇩

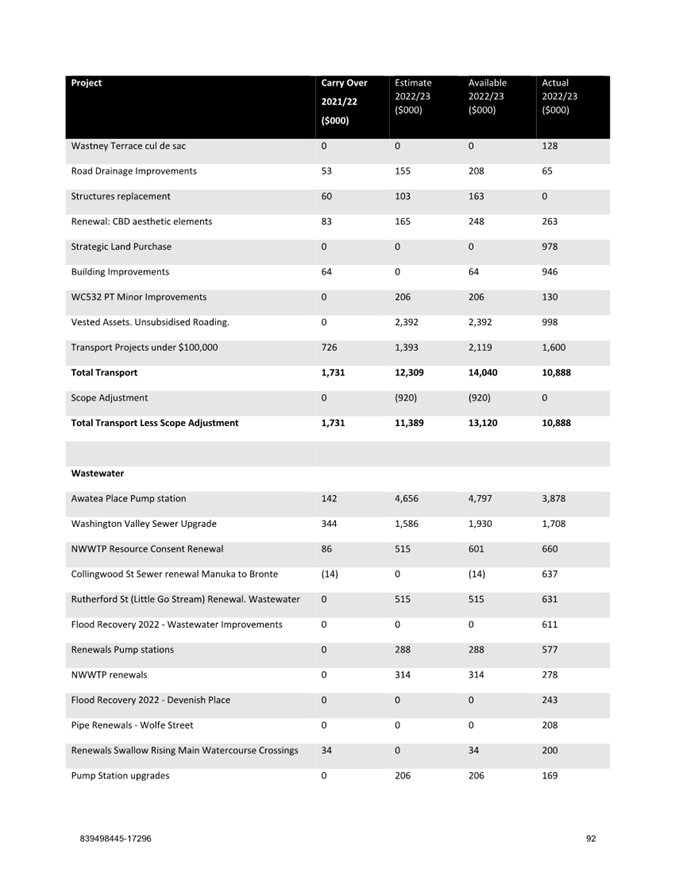

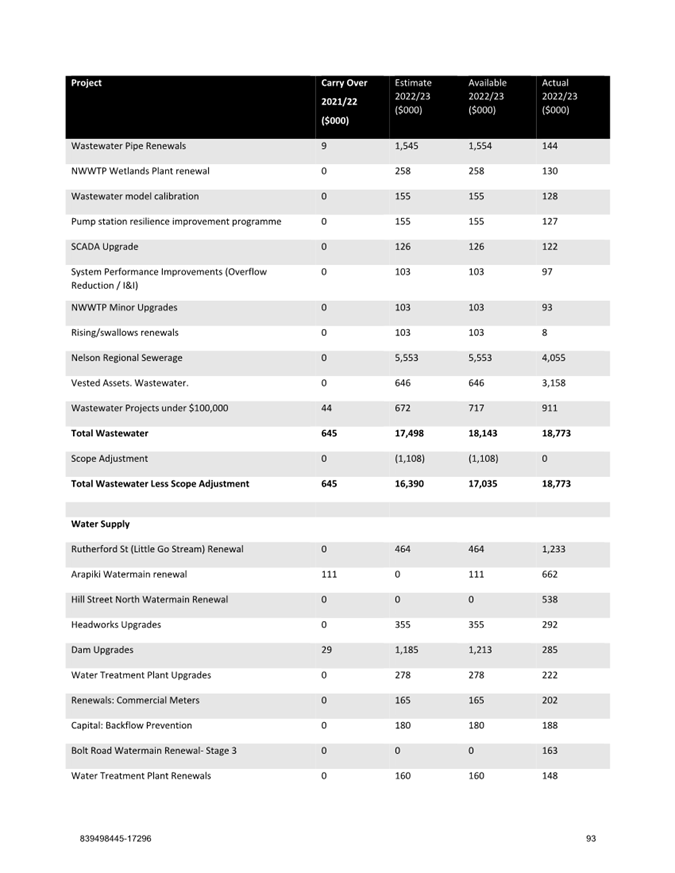

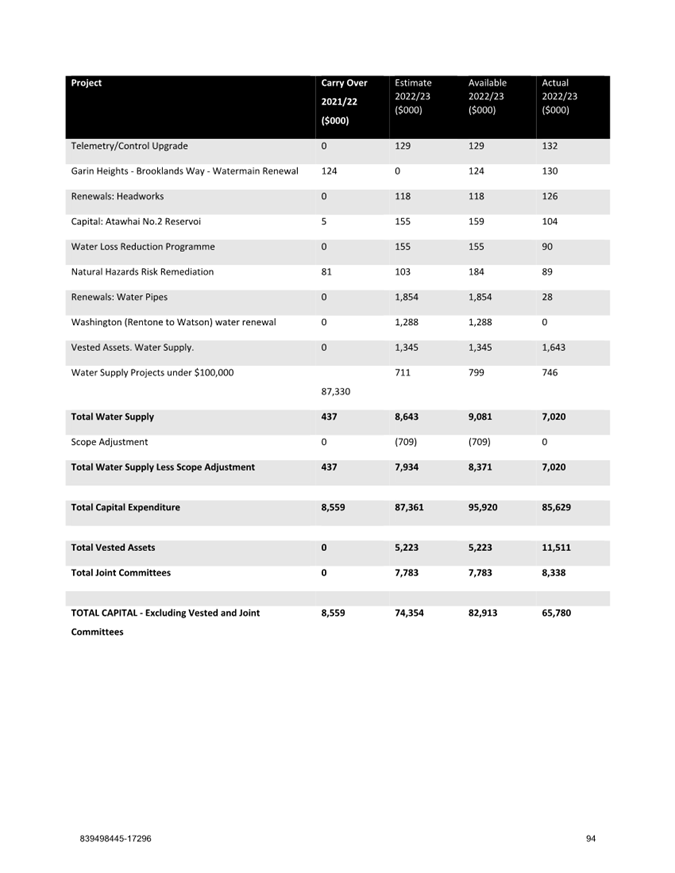

Item 7: Quarterly Finance Report to 30 June 2023:

Attachment 1

Item 7:

Quarterly Finance Report to 30 June 2023: Attachment 2

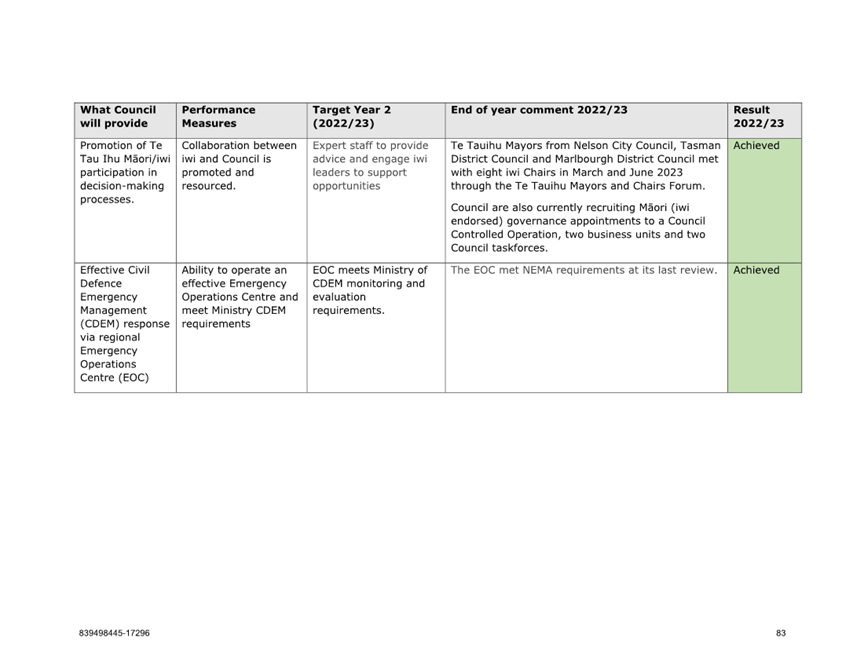

Item 7: Quarterly Finance Report to 30 June 2023:

Attachment 3

Item 8: Quarterly

Internal Audit Report - 30 June 2023

|

|

Audit, Risk and Finance Committee

15 September 2023

|

REPORT R27678

Quarterly Internal Audit

Report - 30 June 2023

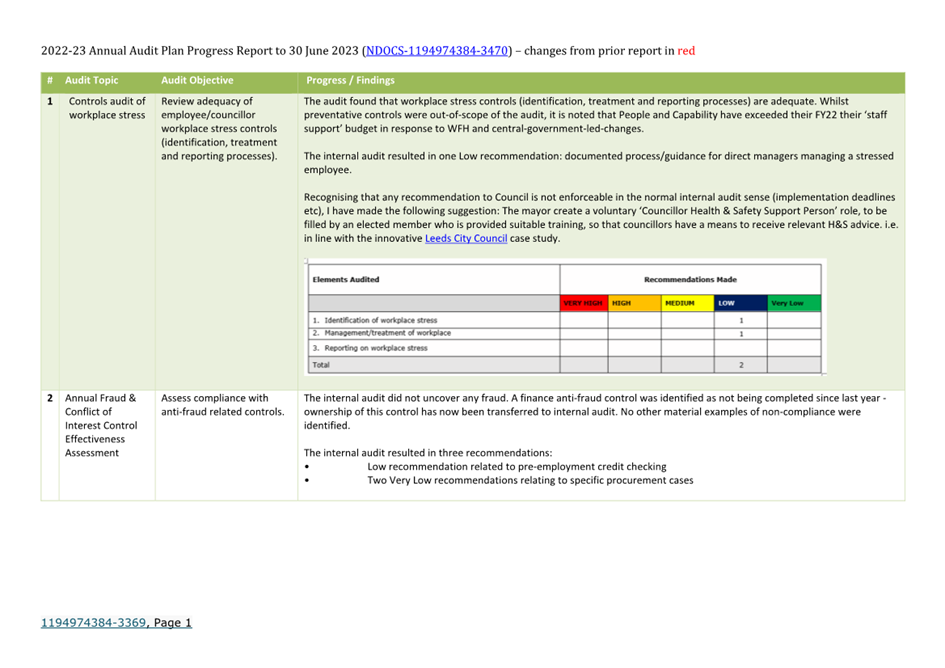

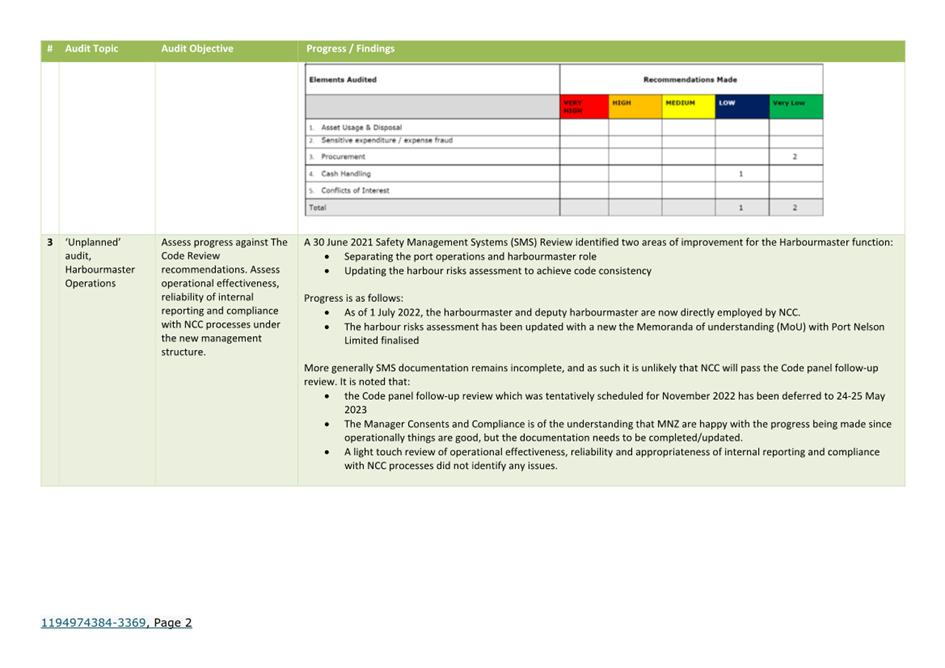

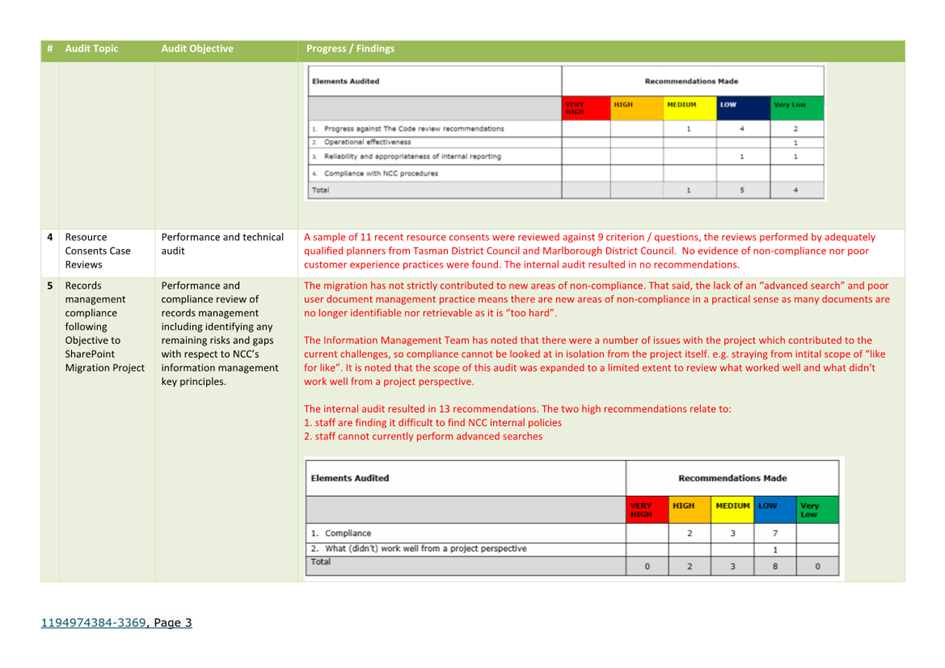

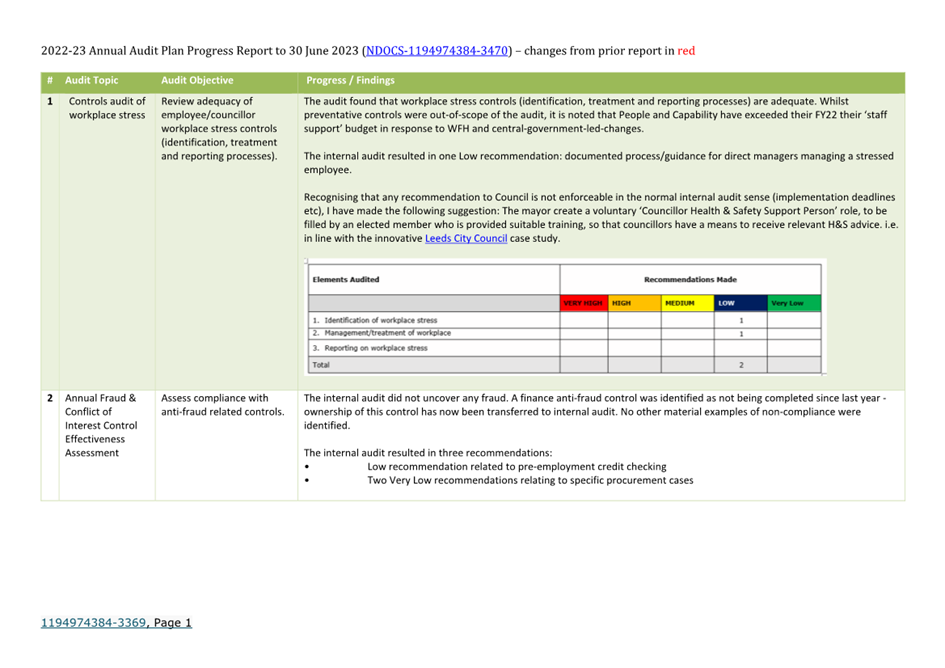

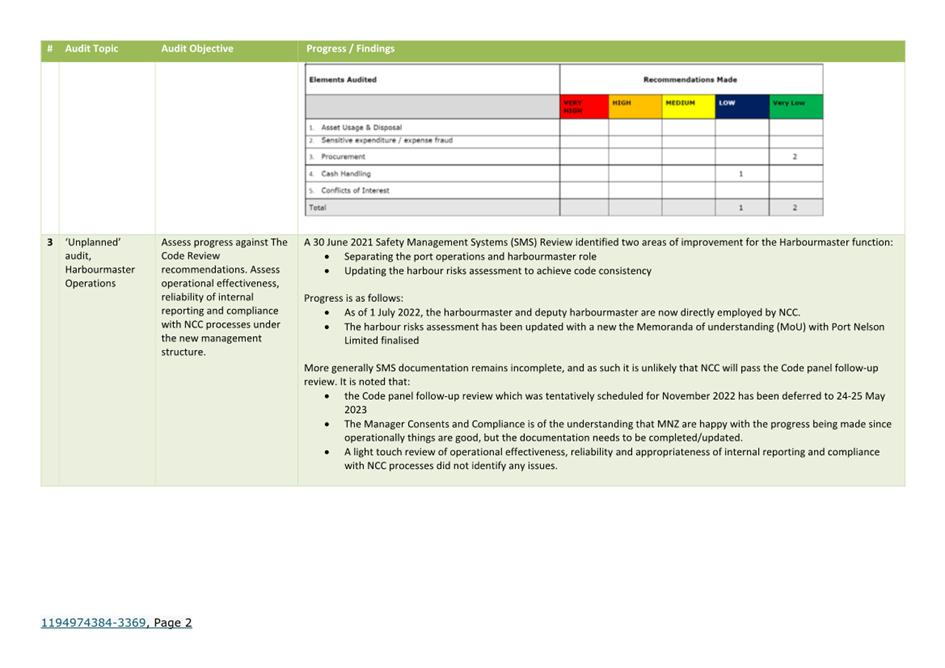

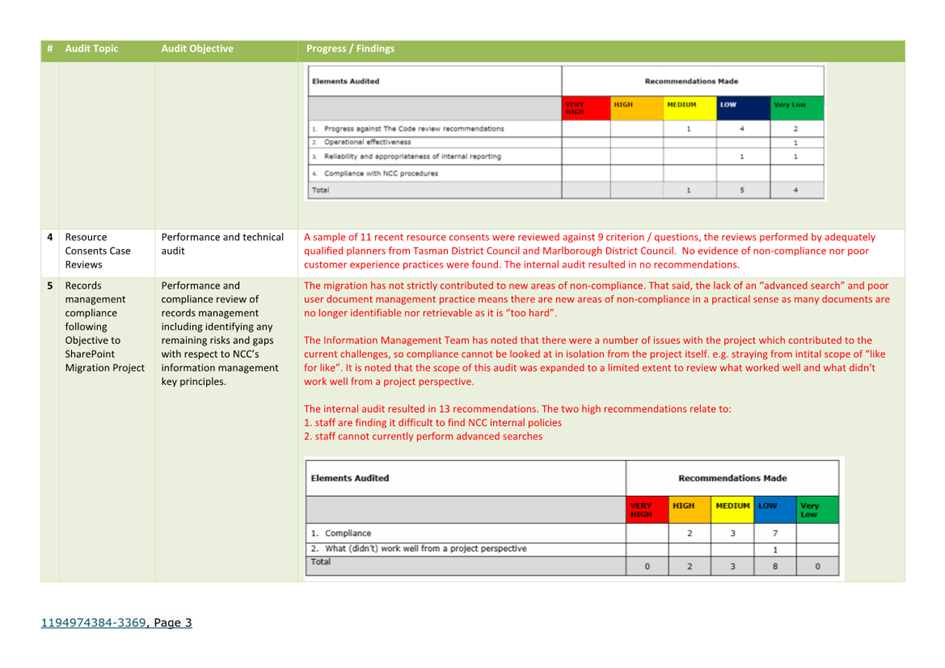

1. Purpose of Report

1.1 To update the Audit,

Risk and Finance Committee on the internal audit activity through to the end of

the fourth quarter of 30 June 2023.

2. Recommendation

|

That the Audit, Risk and Finance Committee

1. Receives

the report Quarterly Internal Audit Report - 30 June 2023 (R27678) and its attachment

(1194974384-3470).

|

3. Background

3.1 Under Council’s

Internal Audit Charter approved by Council on 15 November 2018, the Audit, Risk

and Finance Subcommittee (now a Committee) requires a periodic update on the progress

of internal audit activities. The 2022-23 Internal Audit Plan (the Plan) was

approved by the Audit, Risk and Finance Subcommittee on 24 May 2022. The Plan

provides for four planned audits, with an allowance for a further one

‘unplanned’ audit.

4. Overview of

Progress on the 2022/23 Internal Audit Plan

4.1 A detailed summary is

provided in Attachment 1 (1194974384-3470).

4.2 The two remaining

audits for the year ending 30 June 2023 were completed:

4.2.1 The resource consent case reviews

internal audit resulted in no recommendations.

4.2.2 The internal audit of the migration of

the document management system resulted in 13 recommendations, of which two

high recommendations relate to:

a) staff

are finding it difficult to find NCC internal policies.

b) staff

cannot currently perform advanced searches.

4.3 The Audit Risk and

Finance Committee has previously asked for status updates on any outstanding

very high internal audit recommendations. A verbal update on the status of the high

recommendations will be provided at the meeting.

5. Overview of

Progress on the 2023/24 Internal Audit Plan

5.1 A possible audit of

the Building Warrant of Fitness processes was tabled at the 1 June 2023 Audit

Risk and Finance Committee. This potential audit has been deprioritised given that

NCC’s response to MBIE went beyond MBIE’s request for information

for three or more storied premises and noting that officers already had work

under way with FENZ.

6. Significant

external audits that are not reported separately to the Audit, Risk and Finance

Committee

6.1 The

International Accreditation New Zealand’s (IANZ’s) Building Consent

Authority (BCA) two-yearly audit resulted in an initial assessment, summarised

as follows:

6.2 A verbal update on the

status of the BCA audit will be provided at the meeting.

Author: Chris

Logan, Audit and Risk Analyst

Authoriser: Nikki

Harrison, Group Manager Corporate Services

Attachments

Attachment 1: 1194974384-3470 -

Annual Audit Plan Progress - 30 Jun 2023 ⇩

Item 8: Quarterly Internal Audit Report - 30 June

2023: Attachment 1

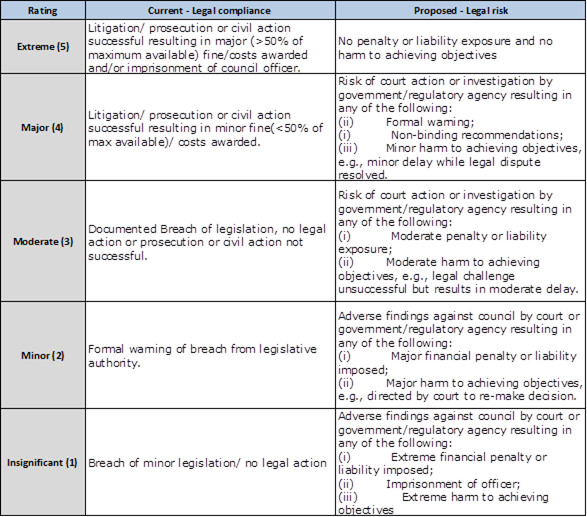

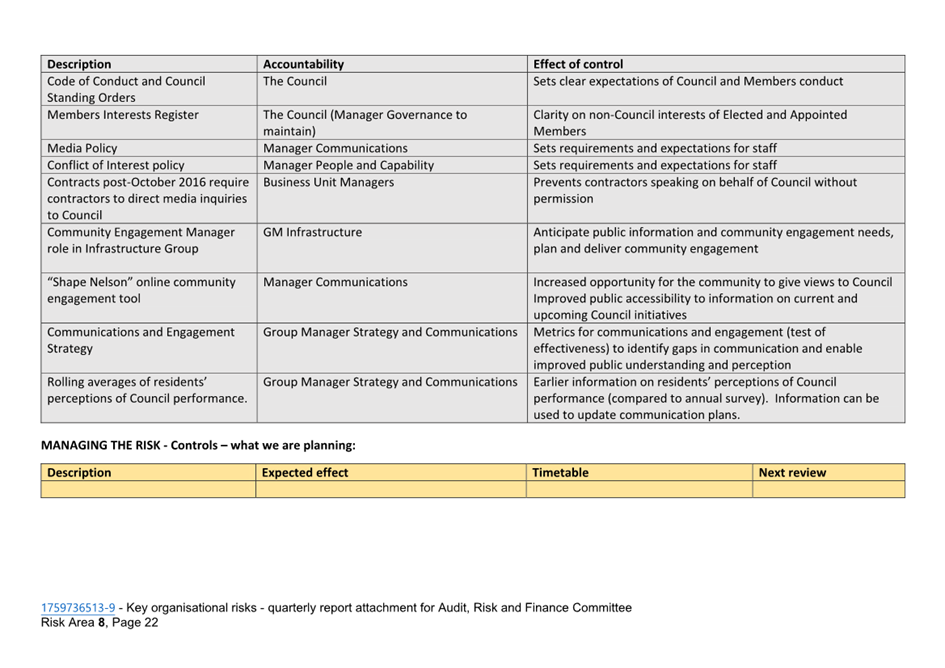

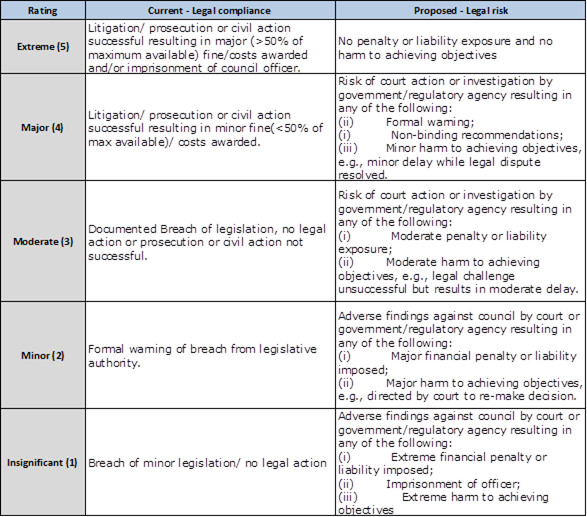

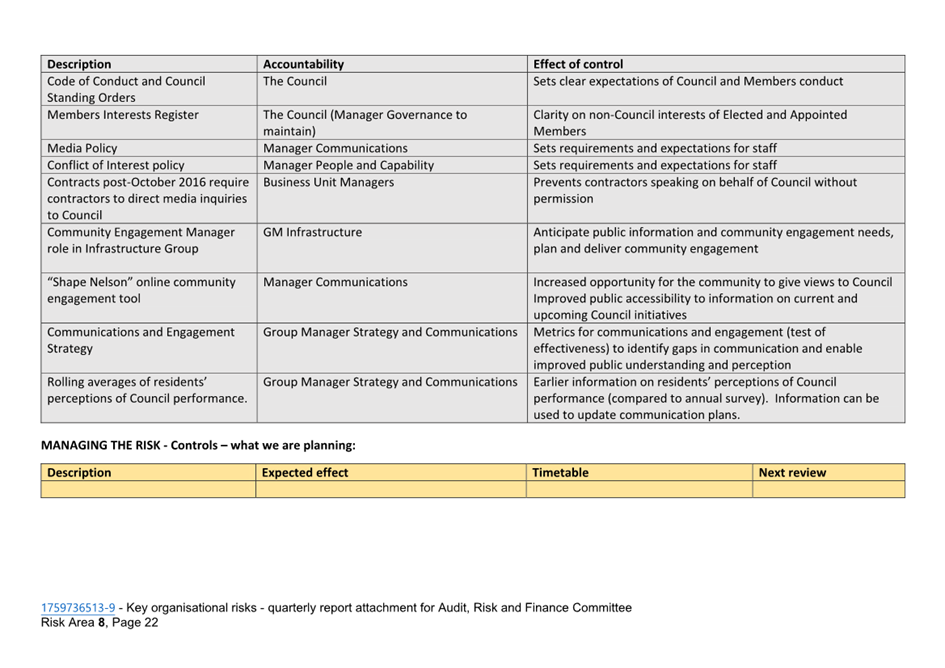

Item 9: Quarterly Risk

Report - 30 June 2023

|

|

Audit, Risk and Finance Committee

15 September 2023

|

REPORT R27679

Quarterly Risk Report - 30

June 2023

1. Purpose of Report

1.1 To provide information

to the Audit, Risk and Finance Committee on the organisational risks through to

the end of the fourth quarter of 2022/23.

2. Recommendation

|

That the Audit, Risk and Finance Committee

1. Receives

the report Quarterly Risk Report - 30 June 2023 (R27679) and its attachment (1759736513).

|

3. Background

3.1 This report includes

an update on progress against the risk management work plan and describes key

risk areas, divided by risk theme (organisational risks) and reporting Group.

4. Progress on Risk

Management Work Plan

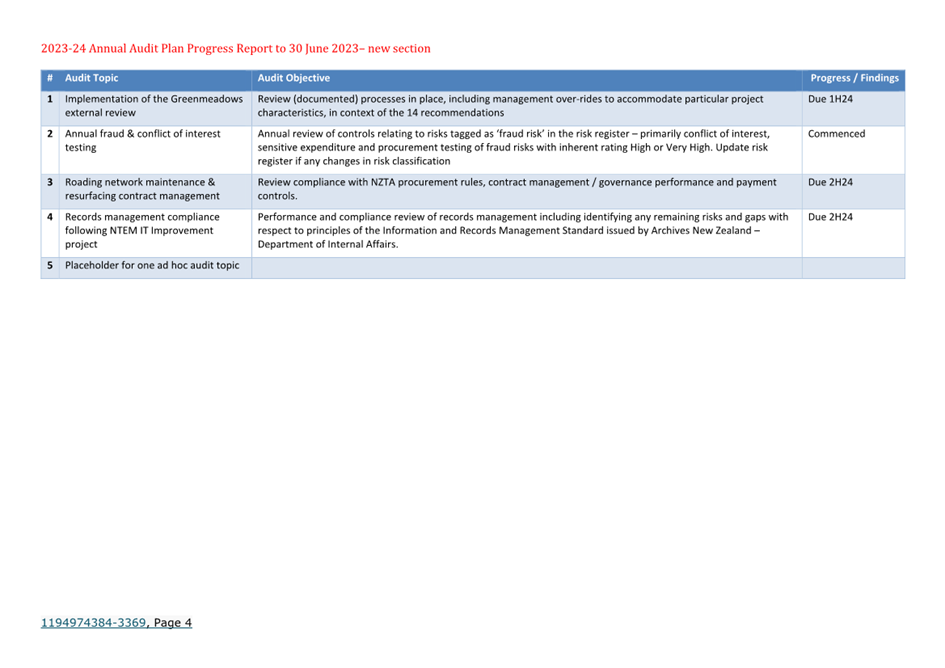

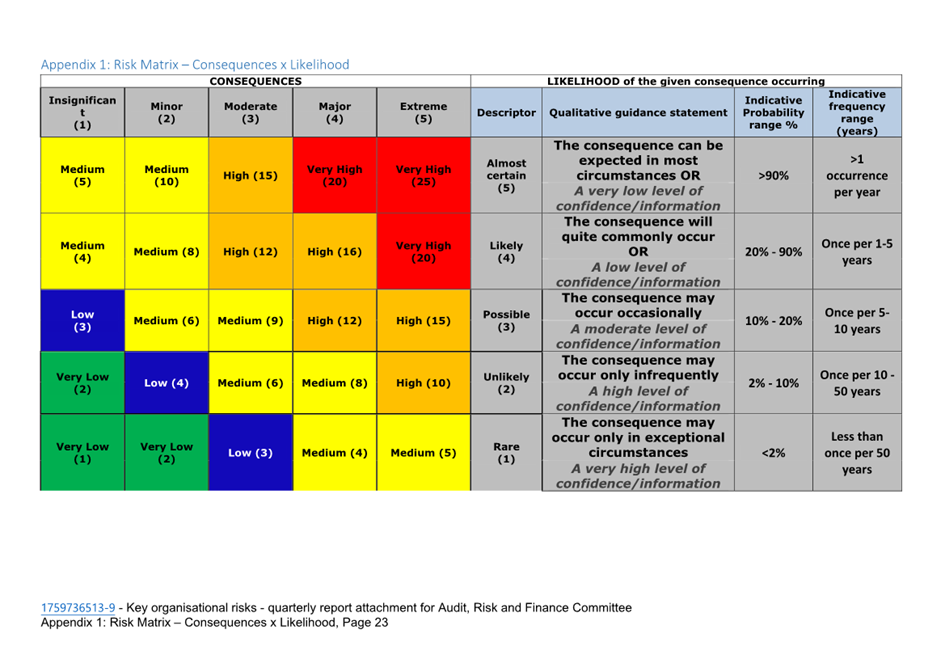

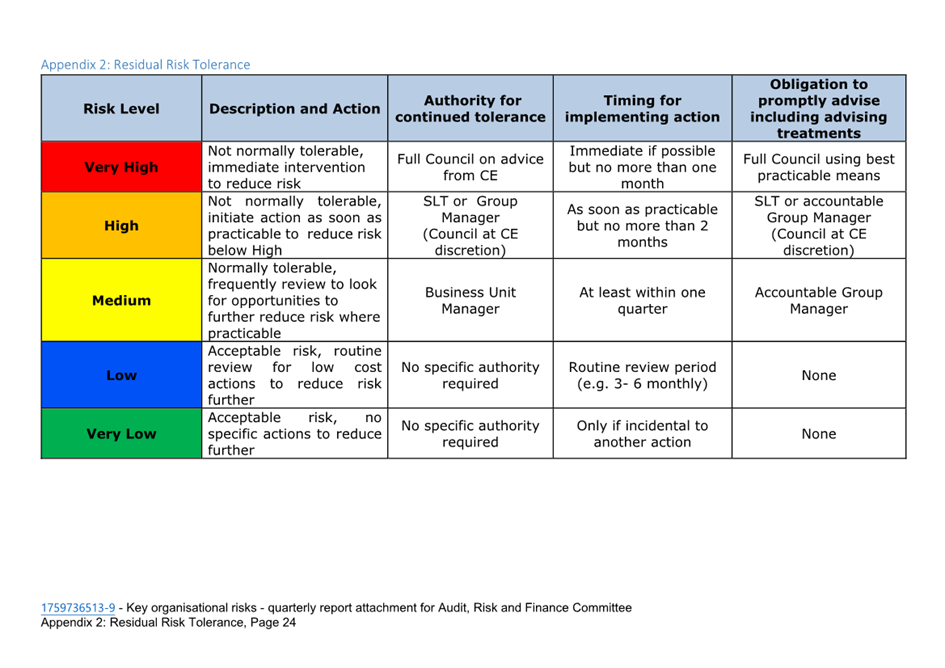

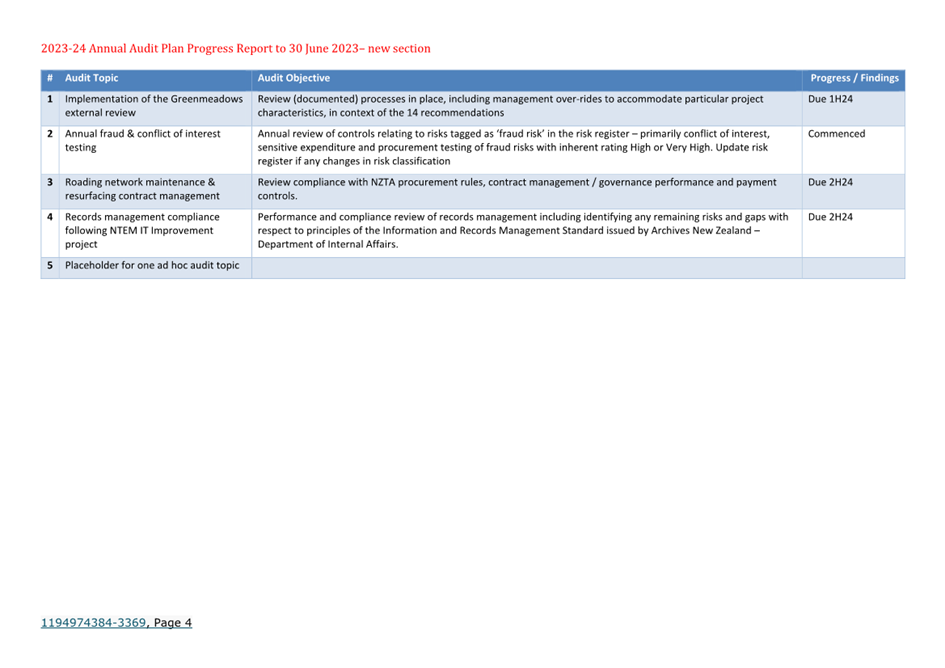

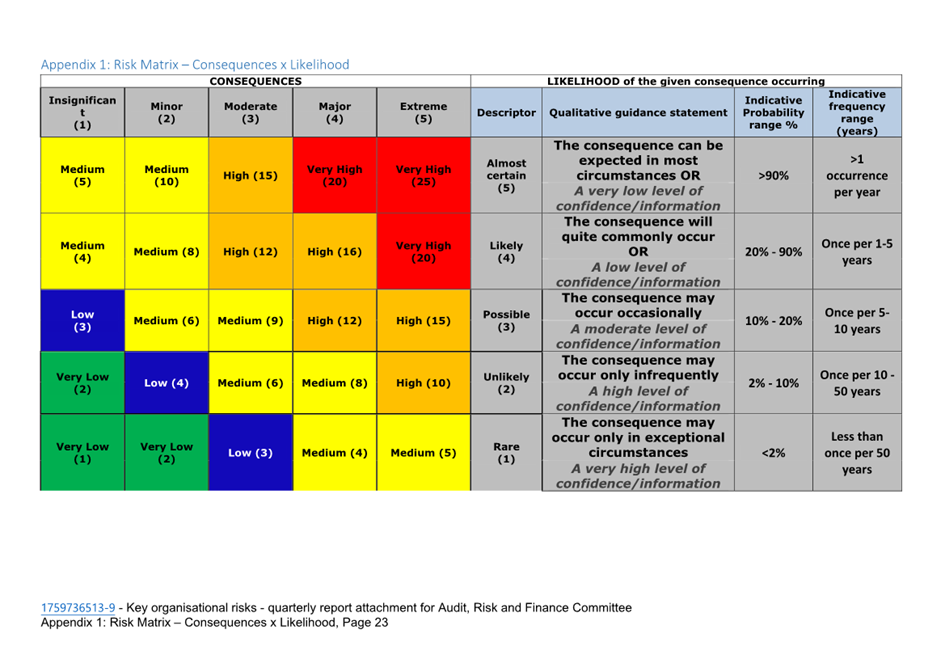

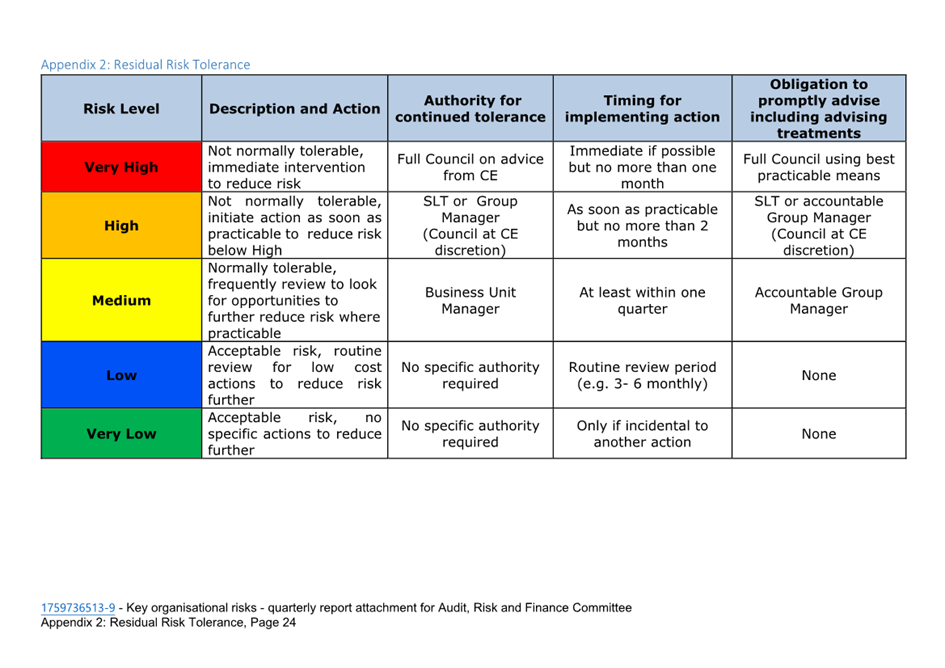

4.1 The 2022/23 risk

management work plan, which was set prior to the appointment of the new Chairperson

in February 2023 and prior to the Local Government Elections in September 2022,

includes:

4.1.1 risk

training for four business units – three completed.

4.1.2 two

team leader or manager anti-fraud trainings – one completed.

4.1.3 new

councillor risk management induction – not yet completed.

4.1.4 review risk tolerance with new Chair

of Audit, Risk and Finance – not yet completed.

4.1.5 updating the legal compliance

consequence description –completed.

4.2 The legal compliance

consequence description is being updated to improve clarity for officers and

better reflect the local government context. The descriptions, as per below,

have been set as to not change the Council risk tolerance.

4.3 The description for

the financial risk consequence domain, which was set in 2017, is also being

updated to allow for ‘fiscal drag’.

4.3.1 Dollar thresholds are being increased

by 50% e.g. Extreme currently means Overspend, loss (i.e. spend without

result) or income loss of > $5m OR >100% of business unit budget, but

will change to Overspend, loss (i.e. spend without result) or income loss of

> $7.5m OR >100% of business unit budget.

4.3.2 The 50% growth reflects the growth in

Council’s ability to bear financial risk, as measured by debt headroom

and total equity.

4.4 The 2023/24 risk

management work plan has yet to be set but officers welcome any views, e.g.

whether there is a desire for a broader update of Council’s risk tolerance/appetite.

5. Key Risk Areas by

Theme (Organisational Risks)

5.1 Risks relating to Council

and joint operations are monitored via Council’s risk register. Approximately

30% of risk entries by count have been identified as having a common theme or

cause which create risk concentrations that pose a threat at an organisational

level. These organisational risks are described below.

5.2 R1 -

Central-government-led-reforms (Owner: Chief Executive). Whilst noting that

project management is in place to manage organisational changes within the

Affordable Waters transition programme both at the elected member and staff

level, the risk rating remains at Very High.

5.3 R2 - Lifeline

services failure (Owner: Group Manager Infrastructure). Flood-recovery work

is ongoing, with consultancy capacity constraints, especially geotechnical

engineers. No other new emerging risks to report at this time. The risk rating

remains at Medium.

5.4 R3 - Illness,

injury or stress from higher hazard work situations (Owner: Group Manager

Corporate Services). Workplace stress continues to emerge. The risk rating

remains at High.

5.5 R4 - Loss of

service performance from ineffective contracts and contract management

(Owner: Chief Executive). Work on planned treatments paused due to staff

vacancies. The risk rating remains at Medium.

5.6 R5

- Compromise of Council service delivery from information technology failures

(Owner: Group Manager Corporate Services). No new emerging risks to report at

this time. The risk rating remains at Low.

5.7 R6 - Council work

compromised by loss of and difficulties in replacing skilled staff (Owner:

Manager People and Capability). Increase in turnover this quarter with some

‘hard-to-fill’ roles remaining open despite repeated recruitment

efforts, engaging recruitment consultants and re-evaluating the job

description. The situation is not expected to change soon with turnover at the

Business Unit Manager level. The organisational risk rating remains at Medium.

5.8 R7 - Legal Risk (Owner:

Group Manager Strategy and Communications). No emerging organisational risks to

report at this time noting that any new legal proceedings or emerging areas of

increased litigation risk are separately reported in the quarterly report on

legal proceedings. The organisational risk rating remains at Medium.

5.9 R8 - Reputation

damage and loss of public trust in the organisation (Group Manager Strategy

and Communications). No new emerging risks to report at this time. The risk

rating remains at Medium.

6. Key Risk Areas by

Reporting Group

6.1 Council’s risk

register does not contain specific asset, activity, legal matter, or project

risks. Instead, these are rolled up into more general asset, activity, legal or

project risks. Any significant specific risks which are new or emerging are

summarised below by reporting group.

6.2 Office of the Chief

Executive: No new emerging risks to report at this time.

6.3 Infrastructure

Group: Risk is High due to recovery constraints. Supply chain and

contractor constraint risks rated down to Medium (previously Very High). No new

emerging risks to report at this time.

6.4 Community Services

Group:

6.4.1 Risks associated with Council-owned

campgrounds (two operated and one leased) remain elevated whilst non-compliance

remediation actions are being implemented. The risks previously monitored by

elected members through the Strategic Development and Property Subcommittee

have been monitored through the usual organisational processes since that subcommittee

ceased at the end of the last triennium.

6.4.2 Risks associated with wood processing

waste deposited at Tāhunanui Beach in the 1960s/1970s are under

investigation, with mitigation options to be brought to Council for

consideration later in the year.

6.5 Environmental

Management Group: Risk is High due to vacancies in two of the five Business

Unit Manager roles. Risk relates to delivery, workload stress and ability to

recruit.

6.6 Strategy

and Communications Group: Retention and recruitment continue to

be a challenge, magnifying certain risks such as workplace stress.

6.7 Corporate Services

Group: Infrastructure insurance renewal risks emerging (cost and

expansiveness of coverage) due to inflation pressures and recent losses (August

rain event, January North Island flooding and Hurricane Ian).

Author: Chris

Logan, Audit and Risk Analyst

Authoriser: Nikki

Harrison, Group Manager Corporate Services

Attachments

Attachment 1: 1759736513-9 4Q23

key organisational risks for Audit, Risk and Finance Committee ⇩

Item 9: Quarterly Risk Report - 30 June 2023:

Attachment 1

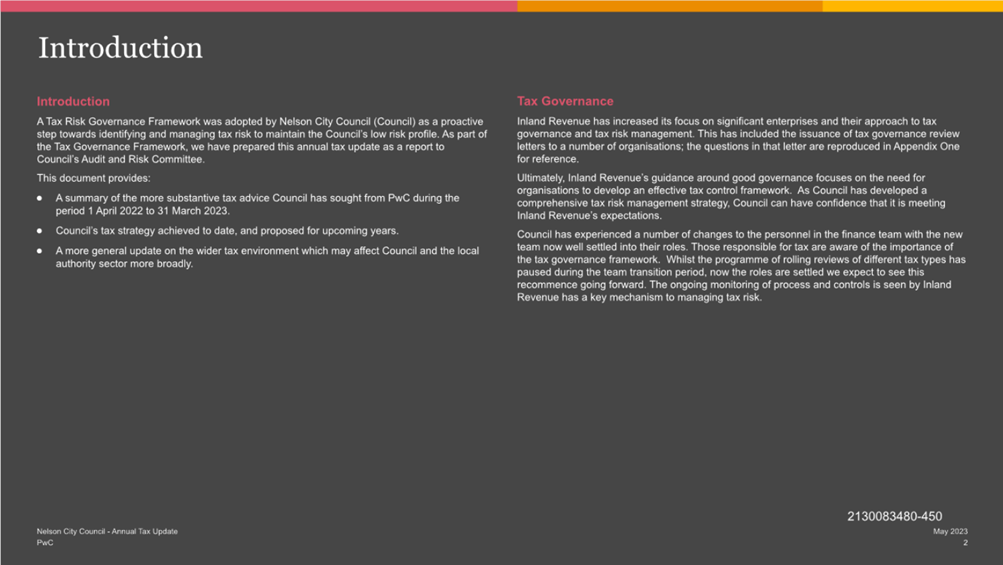

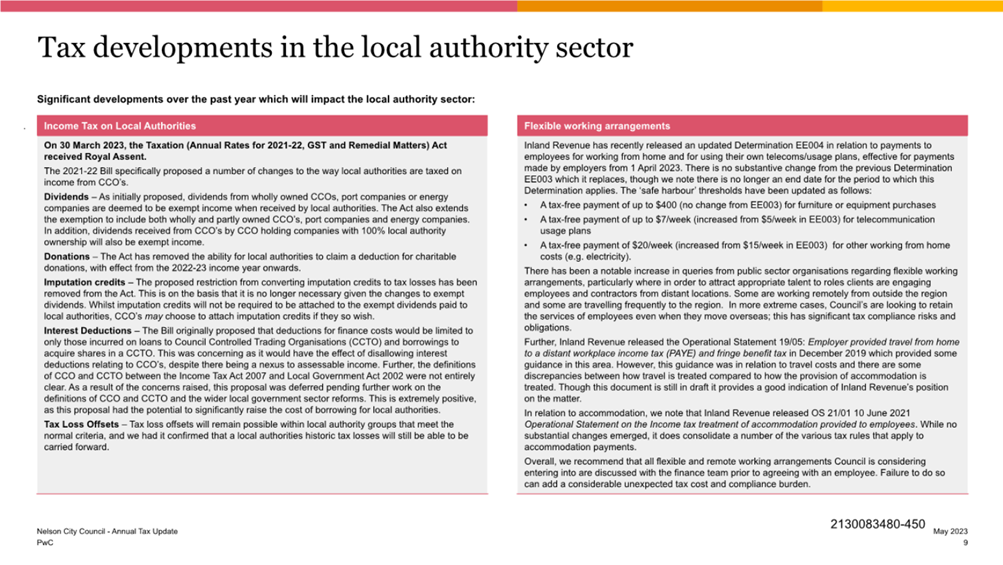

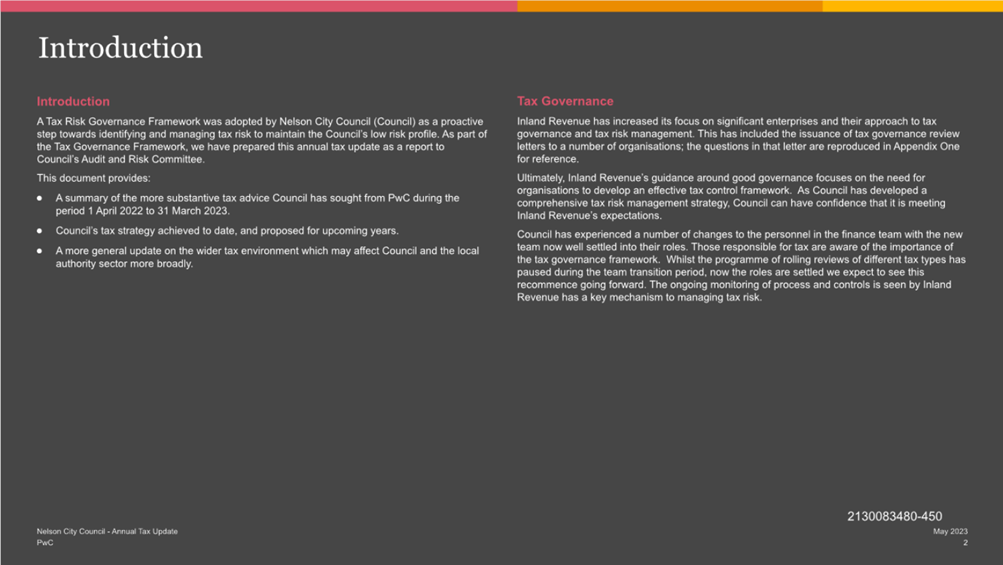

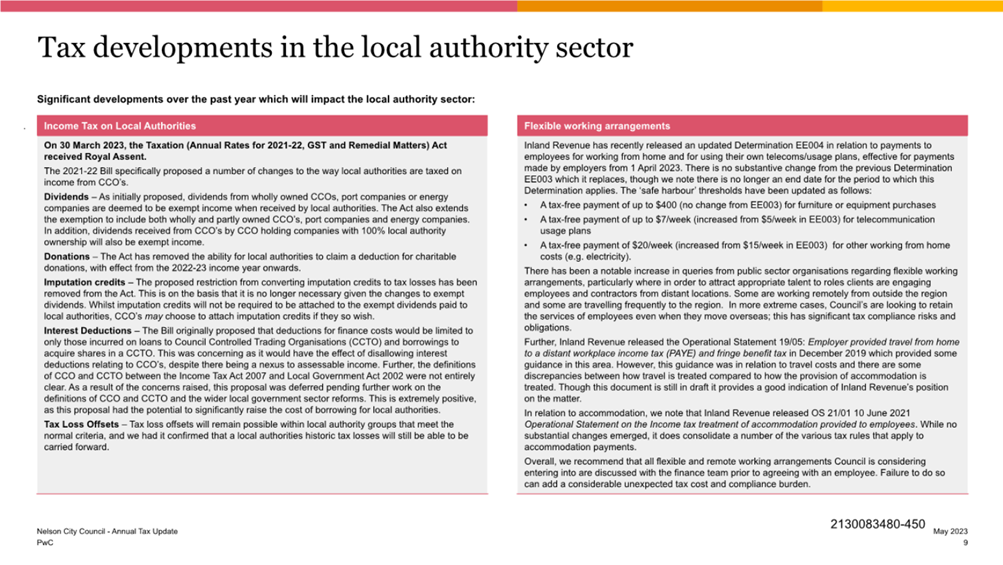

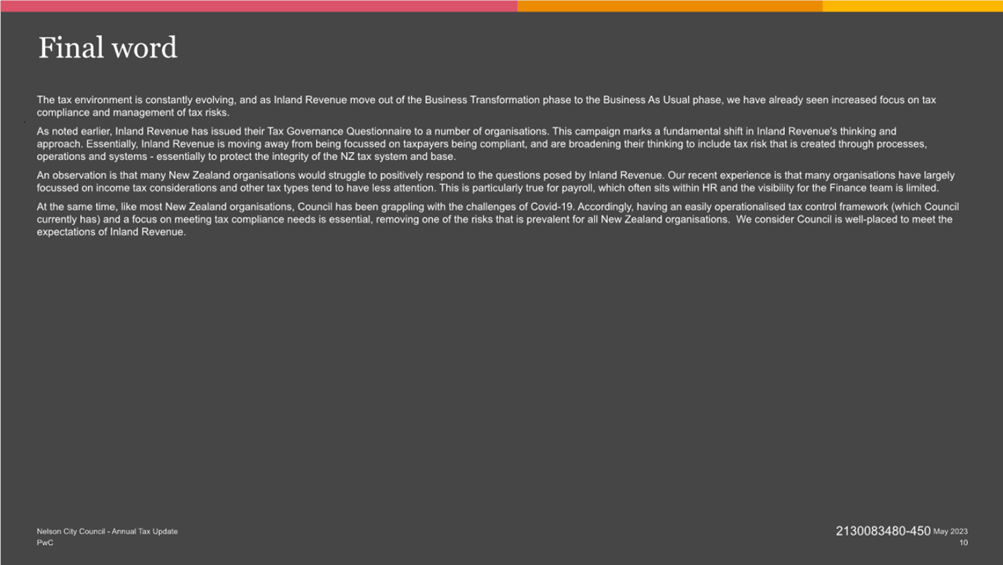

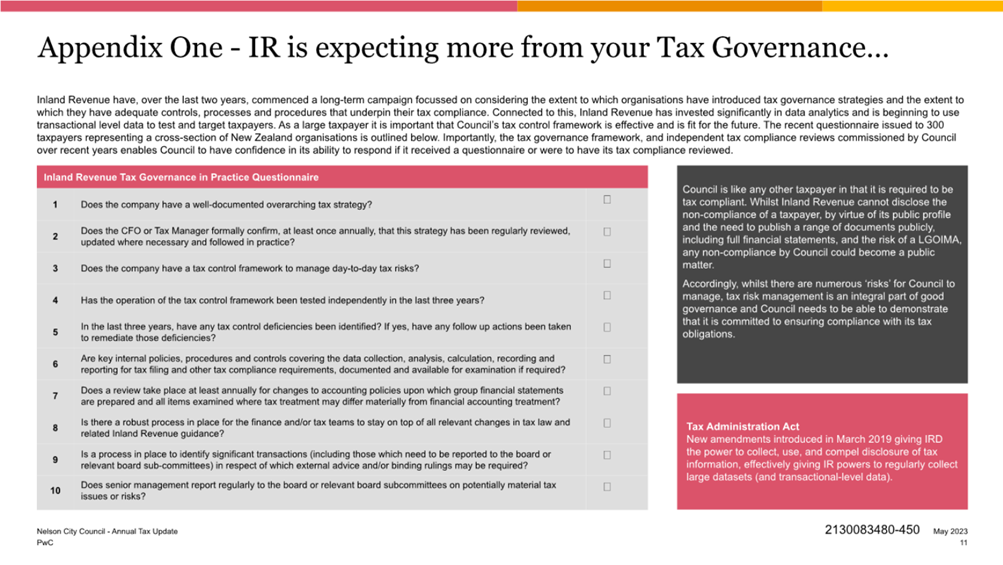

Item 10: Annual Tax

Update

|

|

Audit, Risk and Finance Committee

15 September 2023

|

REPORT R27574

Annual Tax Update

1. Purpose

of Report

1.1 To

advise the Committee of Council’s tax activities over the prior year and

provide some context for the current tax environment.

2. Recommendation

|

That the Audit, Risk and Finance Committee

1. Receives

the report Annual Tax Update (R27574)

and its attachment (2130083480-450).

|

3. Background

3.1 The

Tax Risk Governance Framework was adopted

by Council in May 2017 as a proactive step towards identifying and managing tax

risk to maintain its low risk profile. This Annual Tax Update (Attachment 1

– 2130083480-450) has been

prepared as part of that framework.

3.2 The

Annual Tax Update provides:

· A summary

of the tax advice that Council has sought during the period 1 April 2022 to 31

March 2023.

· Commentary

on tax matters currently being addressed as at 31 May 2023.

· A more

general high-level update on the wider tax environment as it might affect

Council.

· An

overview of the Tax Risk Management Strategy.

3.3 The

Annual Tax Update report from Council’s tax advisors (PWC), the Pay as

You Earn (PAYE) compliance evaluation and Fringe Benefit Tax (FBT) compliance

evaluation are included with this report as Attachment 1.

Tax advice

received and matters addressed

3.4 For

the most part, the tax compliance of Council has been ‘business as

usual’ for much of the year with the various tax returns (GST, PAYE, FBT,

etc.) being filed on time and without any concerns being raised.

3.5 That

said, it is appropriate to comment on the following areas where assistance has

been provided to Council:

· Advice

sought in relation to GST queries from ratepayers.

· Advice

sought on Mayoral fund application for donee status with Inland Revenue,

including assistance with submission of the application to Inland Revenue.

3.6 Finally, it is noted that Council has

continued to obtain support as follows:

· Continued

to subscribe to and actively use PWC’s online Indirect Tax Policies and

Guides.

· Maintained

its subscription to PWC’s “GST on Property Guide”.

· Sought

assistance on a number of ad hoc queries to strengthen Council’s business

decisions.

· Received

assistance with completion and filing of Council’s income tax return.

Tax

strategy

3.7 Page

4 of the Annual Tax Update sets out work planned for the 2022/23 financial year

up to 2024/25 and page 5 outlines the work done during the period ending 31

March 2023.

Other

relevant matters

3.8 Pages

6 to 9 summarise tax developments during the period. Some of the matters

that are of particular interest or relevance to Nelson City Council are:

· An

increase in queries from Local Government clients regarding flexible working

arrangements particularly where, in order to attract appropriate talent to

roles, Councils are engaging employees and contractors from distant locations.

· Dividends

from wholly or partially owned CCOs, port companies or energy companies are

deemed to be exempt income when received by local authorities.

Council’s

tax figures

3.9 Generally,

Council is exempt from income tax with the main exception being some income

from CCTOs, such as subvention payments. However, Council has significant tax

obligations in relation to GST and PAYE in particular. The quantum is

highlighted in this section.

3.10 In the 12 months ending 31 March 2023, Council has accounted

for:

|

Tax

|

12 month

period ending

|

Amount

|

|

GST output tax

|

31 March 2023

|

$20.5million

|

|

GST input tax

|

31 March 2023

|

$22.3million

|

|

PAYE and ACC

|

31 March 2023

|

$7.3million

|

|

FBT

|

31 March 2023

|

$57,000

|

3.11 Council

also acts as agent for the Nelson Regional Sewerage Business Unit, Nelson

Tasman Regional Landfill Business Unit and Nelson Tasman Civil Defence and

Emergency Management. The numbers above exclude those entities.

4. Conclusion

4.1 Council

formally adopted the Tax Governance Framework on 18 May 2017 and the Tax Risk

Management Strategy on 14 December 2017. These form a solid foundation for

managing tax risk.

4.2 The

Tax Risk Management Strategy is a simple tool to ensure that tax risk is being

identified and managed appropriately while providing the Committee with a quick

visual tool to see the steps Council has taken to manage tax risk and the

forward looking strategy.

4.3 The

adoption of the Framework and the Strategy ensures that complacency does not

arise amongst the finance team, senior leadership team or those with oversight

for audit and risk.

Author: Prabath

Jayawardana, Manager Finance

Authoriser: Nikki

Harrison, Group Manager Corporate Services

Attachments

Attachment 1: 2130083480-450 -

Annual Tax Update 2023 ⇩

Item 10: Annual Tax Update: Attachment 1

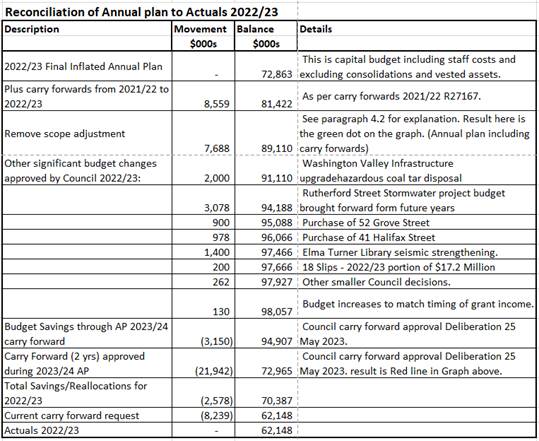

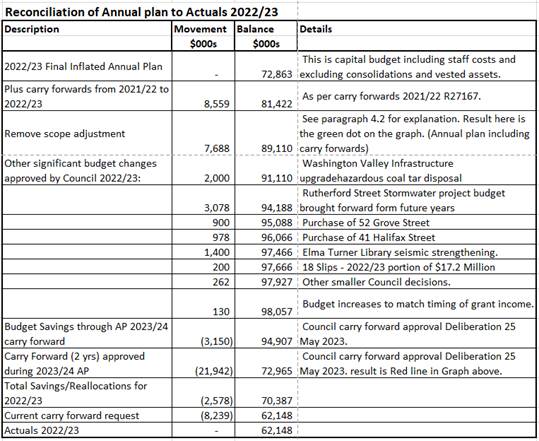

Item 11: Carry Forwards

2022/23

|

|

Audit, Risk and Finance Committee

15 September 2023

|

REPORT R27806

Carry Forwards 2022/23

1. Purpose of Report

1.1 To approve the carry

forward from 2022/23 to the new financial year (2023/24).

2. Summary

2.1 Invoice processing is

complete for the 2022/23 financial year and officers have reviewed project

expenditure to identify savings and any required carry-over.

3. Recommendation

|

That the Audit, Risk and Finance Committee

1. Receives

the report Carry Forwards 2022/23 (R27806)

and its attachments (332184083-4933 and 332184083-4932).

|

Recommendation to Council

|

That the

Council

1. Approves the carry forward of

$8.2 million–$8.1 million to 2023/24 and $143,000 to 2024/25; and

2. Notes that this is in

addition to the carry forward of $21.9 million approved during the Annual

Plan 2023/24 process, taking the total carry forward to $30.1 million of

which $27 million is for the 2023/24 year and $3.1 million is for the 2024/25

year; and

3. Notes the total savings and

reallocations in 2022/23 capital expenditure of $2.6 million; and

4. Notes that the total 2023/24

capital budget (including staff costs and work on attending to the slips

originating on Council land and excluding consolidations, vested assets,

scope adjustment and other August 2022 flood recovery budgets) will be

adjusted by these resolutions from a total of $85.7 million to a total of

$93.7 million; and

5. Approves the carry forward of

$447,000 unspent operating budget to 2023/24.

|

4. Background

4.1 The capital programme

for 2022/23, as agreed in the Annual Plan 2022-23 totalled $72.9 million,

including staff costs and scope adjustment and excluding Nelson Regional

Sewerage Business Unit (NRSBU), Nelson Tasman Regional Landfill and vested

assets. Excluding scope adjustment from this figure, the capital budget for

2022/23 totalled $80.6 million. These figures also include the budgets and

actuals to date attending to remediating the slips that have originated on

Council-owned land, but exclude all other budgets and actuals related to the

August 2022 extreme weather event recovery. All figures quoted in this report

are calculated on this basis.

4.2 Scope adjustment was

applied in the Long Term Plan 2021-31 (as noted on page 222 of the LTP 2021-31)

to the overall capital programme which adjusted the overall budget down by

approximately 10% per year. This adjustment acknowledges that Council is

unlikely to use the full capital budget in any given year and so helps to avoid

over funding of activities. To show an accurate reconciliation of budget to

actuals, approximately 10% is removed as scope adjustment from the figures in

this report as mentioned in paragraph 4.1.

4.3 The addition of

2021/22 carry forwards, and other resolutions of Council over the 2022/23 year

adjusted the total capital budget to $98.1 million.

4.4 The 2022/23 capital

budgets were forecast quarterly throughout 2022/23 with a view to what could

realistically be achieved in the remainder of the financial year. The capital

budget was reforecast to $73 million in May 2023. The 2022/23 budget movements

incorporated in year zero of the 2023/24 Annual Plan were approved during

deliberations on the Annual Plan on 25 May 2023. In particular, $21.9 million

was carried forward from 2022/23 to 2023/24 and future years during the Annual

Plan process.

Total capital expenditure for

the 2022/23 year was $62.1 million, $27 million less than the Annual Plan 2022/23

including carry forwards of $89.1 million.

4.5 Reasons for capital

carry forwards include project delivery delays due to:

- Alterations

to the phasing of multi-year projects resulting from wet weather (August 2022

and May 2023) and negotiations with external parties.

- Delay

in lead time in procuring materials and equipment as a result of COVID-19.

- A

large percentage of the infrastructure carry forward relates to projects that

were well under way on site before the end of the financial year and hence

committed but were delayed by wet weather and negotiations.

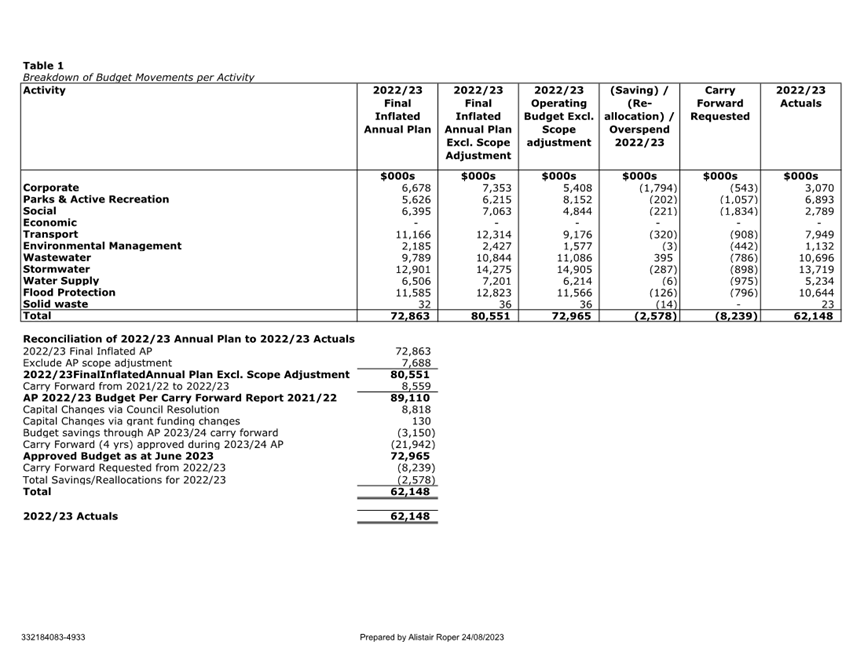

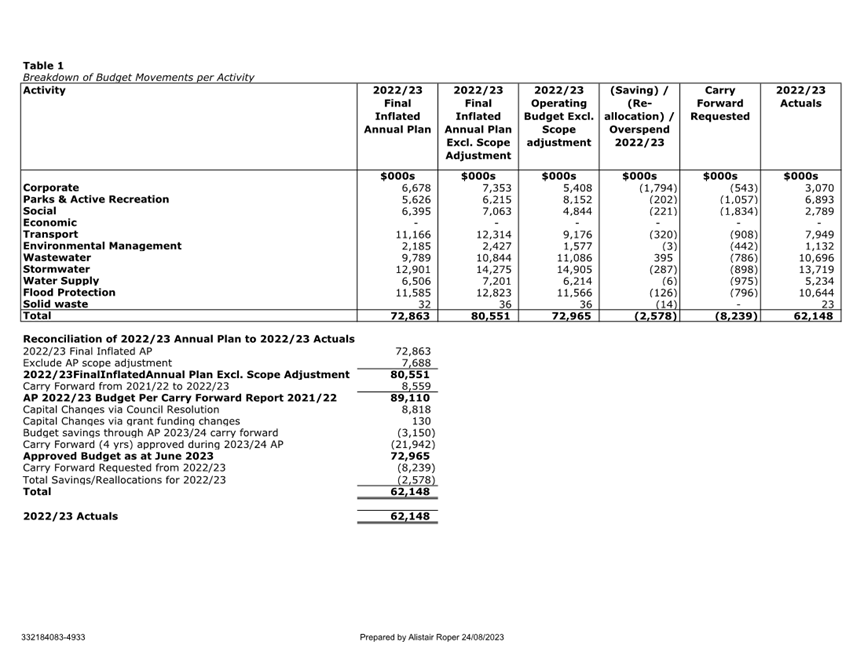

5. Discussion

Capital savings and

reallocations

5.1 Officers identified

savings and reallocations of $2.6 million in capital expenditure in 2022/23. In

total, this saving will have a positive impact on interest, depreciation and

debt levels due to less borrowings and the capital expenditure not occurring.

Capital carry forwards

5.2 Officers have

requested that a net $8.2 million be carried forward. $9 million to be added to

2023/24 and $143,000 to be added to 2024/25 capital budgets while $924,000 is

being carried back from 2023/24 to cover some projects tracking ahead of

schedule and some small overspends.

5.3 A breakdown of budget

movements in total 2022/23 capital budgets is provided in Table 1 (Attachment 1

– 332184083-4933).

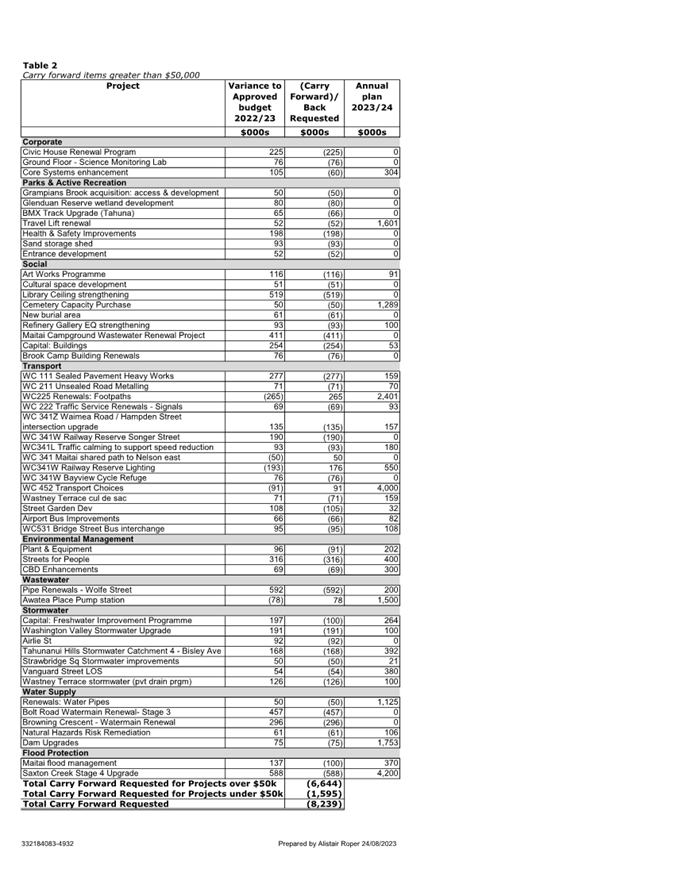

5.4 Table 2 (Attachment 2

– 332184083-4932) itemises capital projects with carry forwards requested

greater than $50,000. These are new carry forwards which have been requested in

addition to those approved during the Annual Plan 2023/24 process.

Operating carry forwards

5.5 In addition to the

capital carry forward requests, there are operating expense budgets, totalling

$447,000, that have been requested by officers to carry forward to 2023/24 as

detailed below:

- Nelson

Nature: waterways and terrestrial biodiversity budgets of $158,000 (delayed

national policy);

- LIM

improvement project $10,000;

- Archiving

project $44,000;

- Weed

control programme $47,000;

- Total

mobility Ridewise implementation $11,000;

- Stormwater

strategies for Tāhuna, central Nelson and renewals $150,000;

- Building

Act compliance dams $5,000;

- SW

Condition Assessments $5,000;

- Storm

and flood protection asset management support $18,000.

6. Options

6.1 Council officers

support Option 1, approve the recommendations. Not approving the

recommendations would be problematic as the future scope of some of these

projects has been agreed through Committee and Council resolutions including

Annual and Long Term Plans prior to this meeting. Work has continued on these

projects based on those decisions.

|

|

|

Advantages

|

· Work has continued on

2022/23 capital projects and costs have been incurred

· The carry forward

spending is within previously approved budgets

· The majority of carry

forward requests are for projects that are in progress and carry forward of

budget is required to realise expected Council outcomes

|

|

Risks and Disadvantages

|

· None

|

|

|

|

Advantages

|

· If Council

wished, it could remove some items from the list of budgets to be carried

forward

· Savings in

future debt, depreciation, interest and maintenance costs would occur

|

|

Risks and Disadvantages

|

· The projects

concerned would then not have sufficient budget to be completed

· Council does not

have complete information through this report to fully inform such a decision

|

7. Conclusion

7.1 An analysis of capital

expenditure against forecast for 2022/23 indicates:

- There

are savings and reallocations from the capital budget of $2.6 million compared

to the approved budget for 2022/23.

- Capital

budget of $8.2 million not spent should be carried forward to the 2023/24 year.

- Operating

expenses totalling $447,000 have been requested by staff to carry forward to

2023/24.

8. Next Steps

8.1 Once approved, budgets

will be updated to reflect the approved resolutions.

Author: Alistair

Roper, Management Accountant

Authoriser: Nikki

Harrison, Group Manager Corporate Services

Attachments

Attachment 1: 332184083-4933

Table 1 - Carry forwards 2022-23 ⇩

Attachment 2: 332184083-4932

Table 2 - Carry forwards 2022-23 ⇩

|

Important considerations for decision making

|

|

Fit with Purpose of Local Government

Approval of the recommendation will allow

progress/completion of approved projects. This will promote social, economic

and environmental wellbeing in the present and future through employment,

stimulus of the local economy and delivery of public infrastructure and

community services.

|

|

Consistency with Community Outcomes

and Council Policy

This decision supports all the community outcomes

but most particularly that our infrastructure is efficient, cost effective

and meets current and future needs.

|

|

Risk

Failure to approve the recommendation will introduce

risk (financial, contractor and community relationships) which does not

currently exist.

|

|

Financial impact

There is little financial impact from approving the

recommendation as budgets are already approved and funded.

|

|

Degree of significance and level of

engagement

This matter is of low significance as budgets are

already approved and the recommendation confirms business as usual. Therefore

no engagement is required.

|

|

Climate Impact

Adaptation

This decision will have no impact on the ability of

the Council or District to proactively respond to the impacts of climate

change now or in the future.

The decision is not sensitive to higher emission

scenarios or more rapid climate changes.

Mitigation

This decision is likely to result in no impact in

greenhouse gas emissions.

|

|

Inclusion of Māori in the

decision making process

No engagement with Māori has been undertaken in

preparing this report.

|

|

Delegations

The Audit Risk and Finance Committee has the following

delegations to consider the 2022/23 carry forwards.

Areas of Responsibility:

· Council’s

financial performance

Powers to Recommend (if applicable):

· All

other matters within the areas of responsibility or any other matters

referred to it by Council

|

Item 11: Carry Forwards 2022/23: Attachment 1

Item 11: Carry Forwards 2022/23: Attachment 2

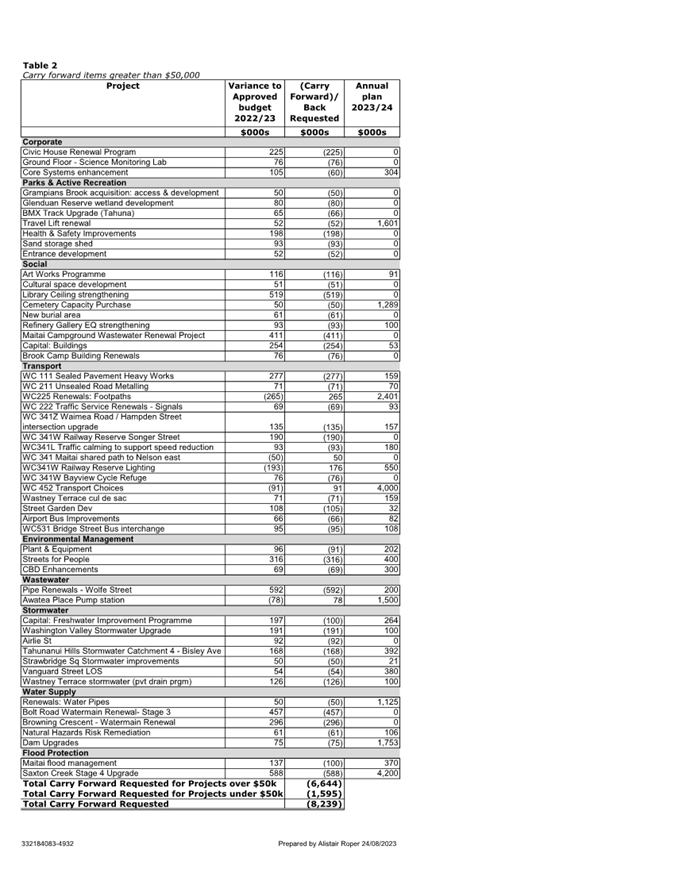

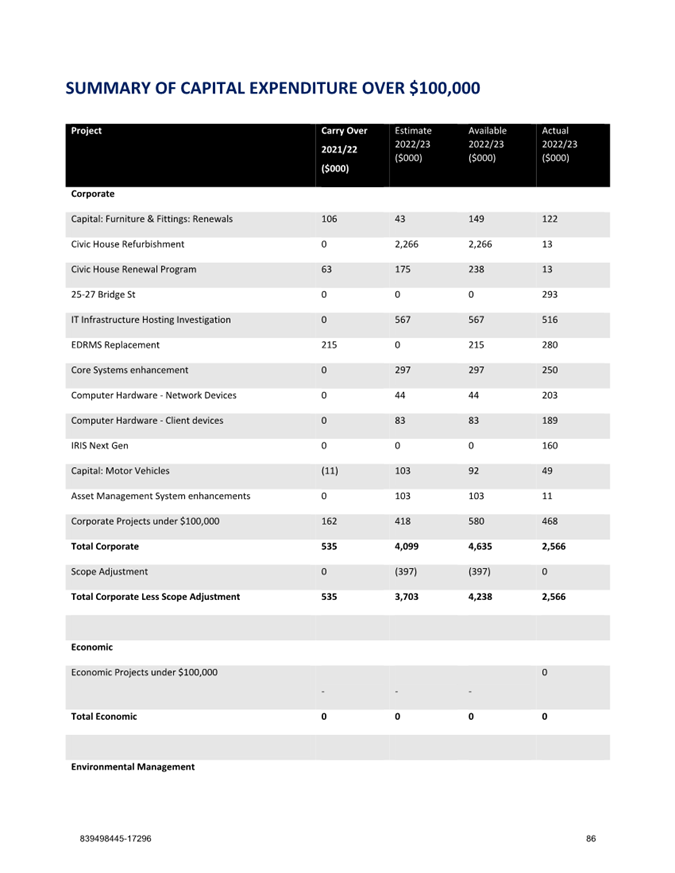

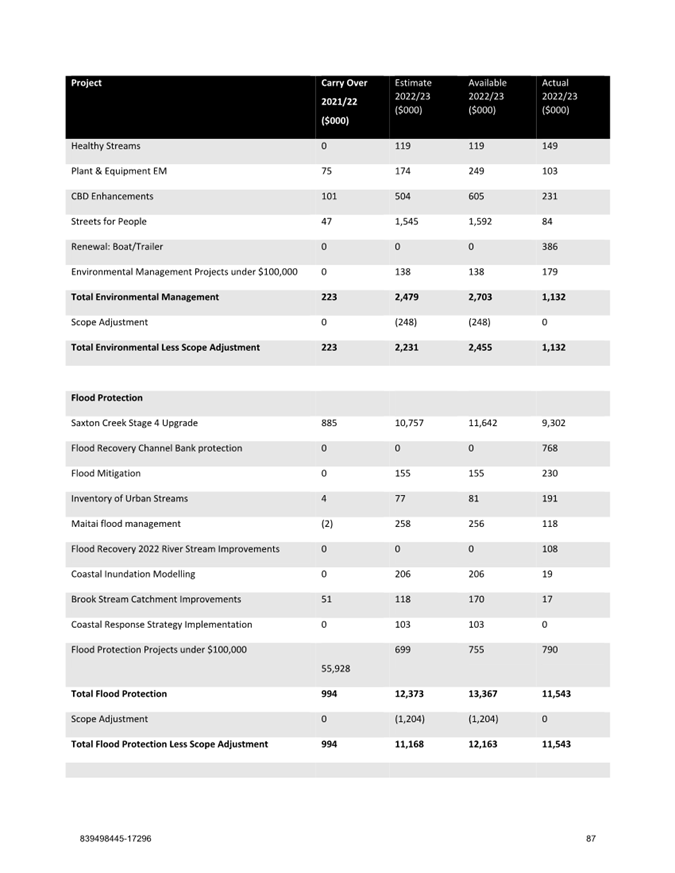

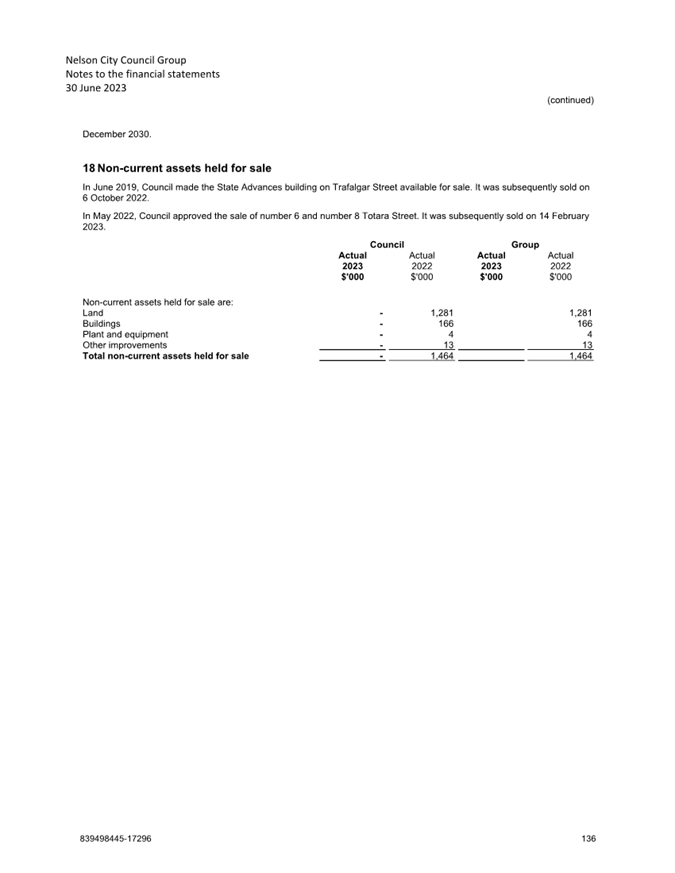

Item 12: Draft Annual

Report 2022/23

|

|

Audit, Risk and Finance Committee

15 September 2023

|

REPORT R27872

Draft Annual Report 2022/23

1. Purpose of Report

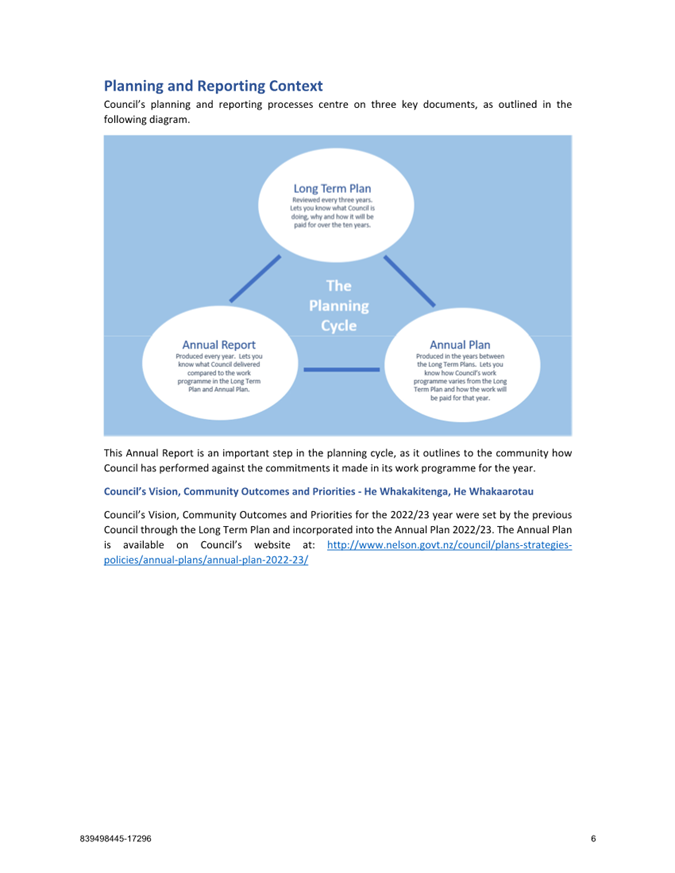

1.1 To provide a copy of

the draft Annual Report 2022/23 prior to auditing by Audit New Zealand.

2. Summary

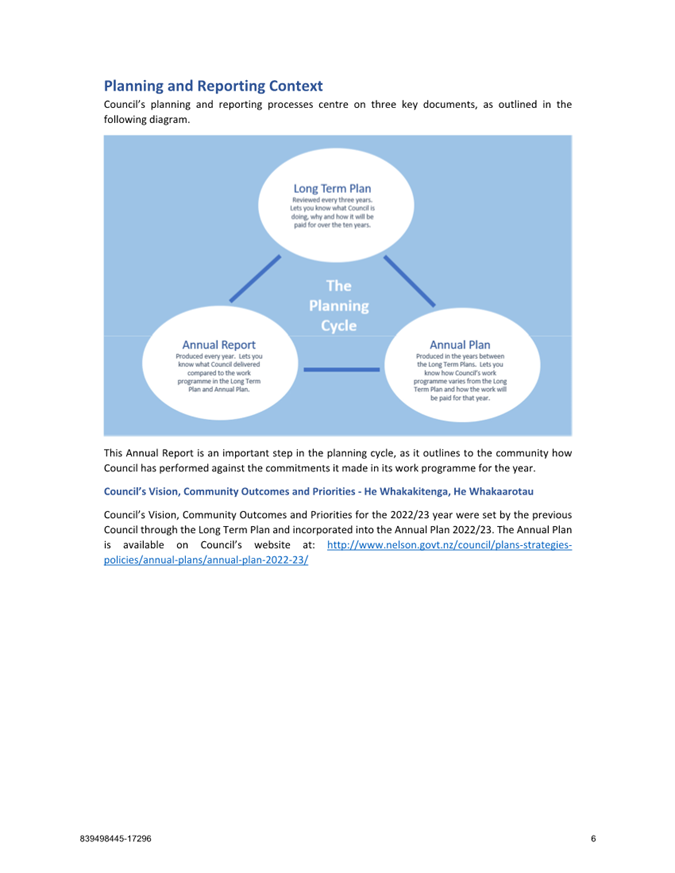

2.1 The

draft Annual Report for the 2022/23 financial year has been prepared and is

provided as Attachment 1. The audit of the Annual Report is scheduled to

commence mid-September, and there are likely to be some changes to the Annual Report

as a result of the audit process.

3. Recommendation

|

That the Audit, Risk and Finance Committee

1. Receives

the report Draft Annual Report 2022/23 (R27872) and its attachment (839498445-17289); and

2. Notes the draft Annual Report

2022/23 has been prepared and will be audited before being presented to

Council for adoption following audit, prior to the 31 October 2023 statutory

deadline.

|

4. Background

4.1 An

Annual Report must be completed to comply with section 98 of the Local

Government Act 2002.

4.2 The purpose of this

Annual Report is to compare Council’s actual performance in 2022/23

against the targets set out in year two of the Long Term Plan 2021-31. It also

provides accountability to the Nelson community for the decisions made

throughout the year.

5. Discussion

5.1 The

attached draft Annual Report 2022/23 is intended to provide the Committee with

information staff have to date. This is not the final Annual Report for the

year, as it is likely to require modification through the auditing process,

which is yet to occur.

5.2 The

Local Government Act requires councils to adopt the final Annual Report within

four months of the end of the financial year (31 October).

5.3 At

the time of writing this report, Council is currently waiting to receive

finalised draft financial statements and performance measures from some of its

CCOs and CCTOs. Therefore, the group financial statements and performance

measure tables have not been prepared yet.

Financial

Commentary

5.4 The

deficit before revaluation is $11.4 million against a budgeted surplus of $6.9

million. Net weather-related expenses amounted to $15.6m (including abandoned

assets), which is the majority of the $18.3m variance to budget.

5.5 The

reasons for this variance will be explained in the final Annual Report Note 40.

This is yet to be completed however the variances are mainly due to following

reasons:

5.6 Fees

and charges are $6.3 million lower than budget, this is mainly due to the

following:

· TDC

recovery income is nil against a budget of $2.8 million due to actual income

has been recognized under other revenue (section 5.10) as a result of the

classification differences for external reporting purposes.

· Harvesting

income being lower than budgeted by $3.0 million as a result of the changes to

the planned timing of harvesting and a year-end accounting adjustment (where

only the movement in forestry fair value is considered as income for external

reporting purposes).

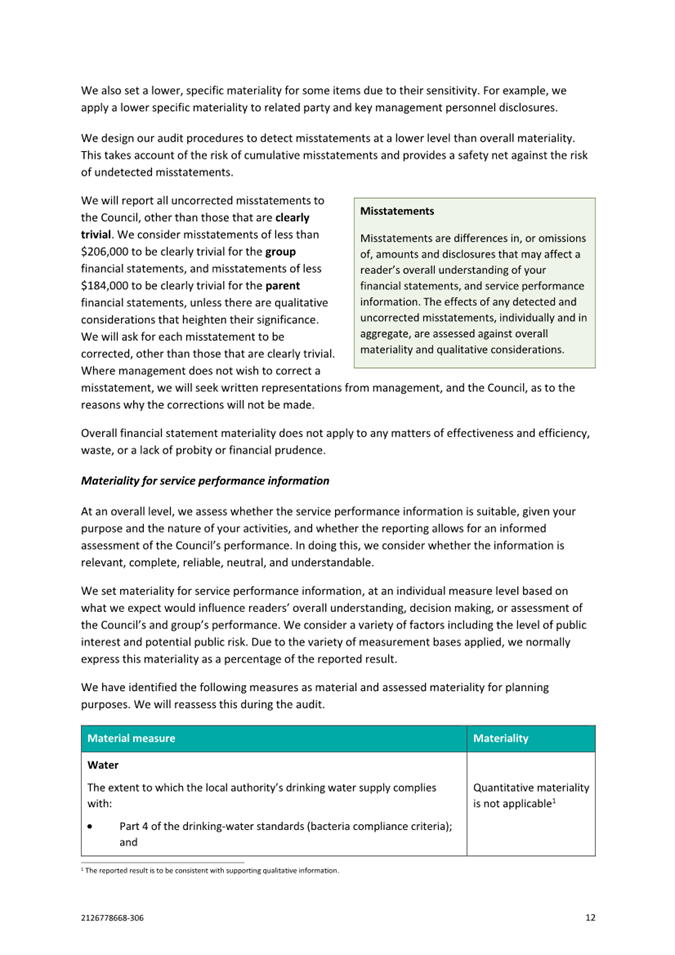

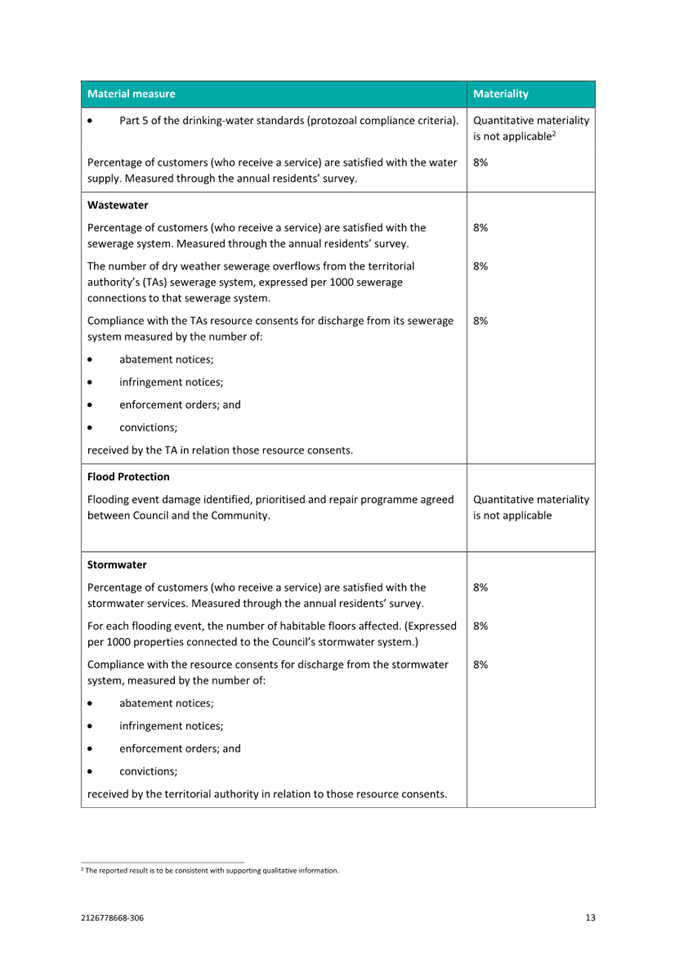

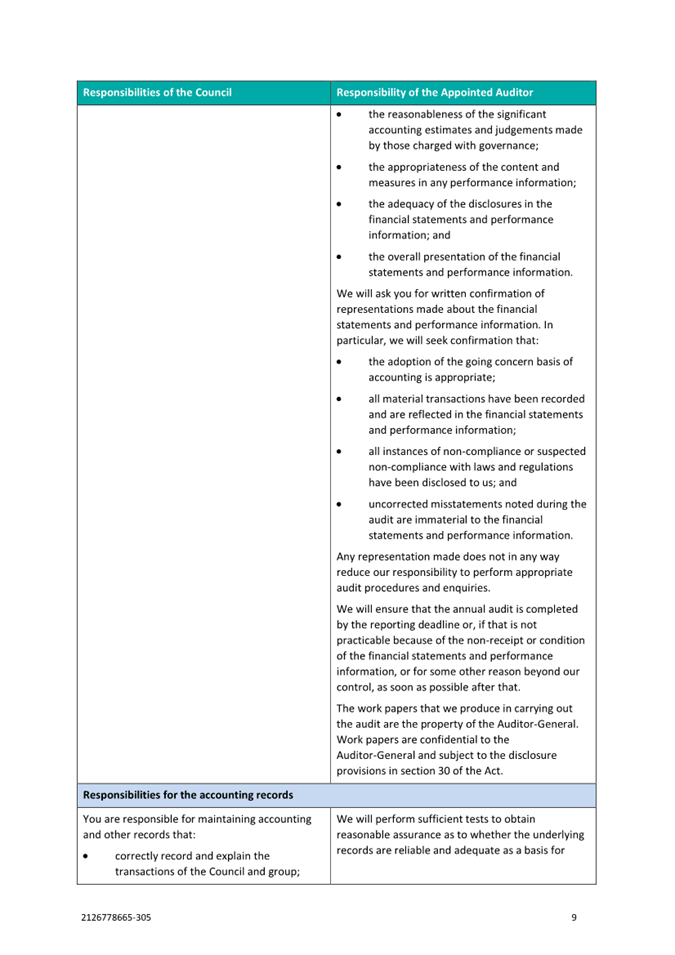

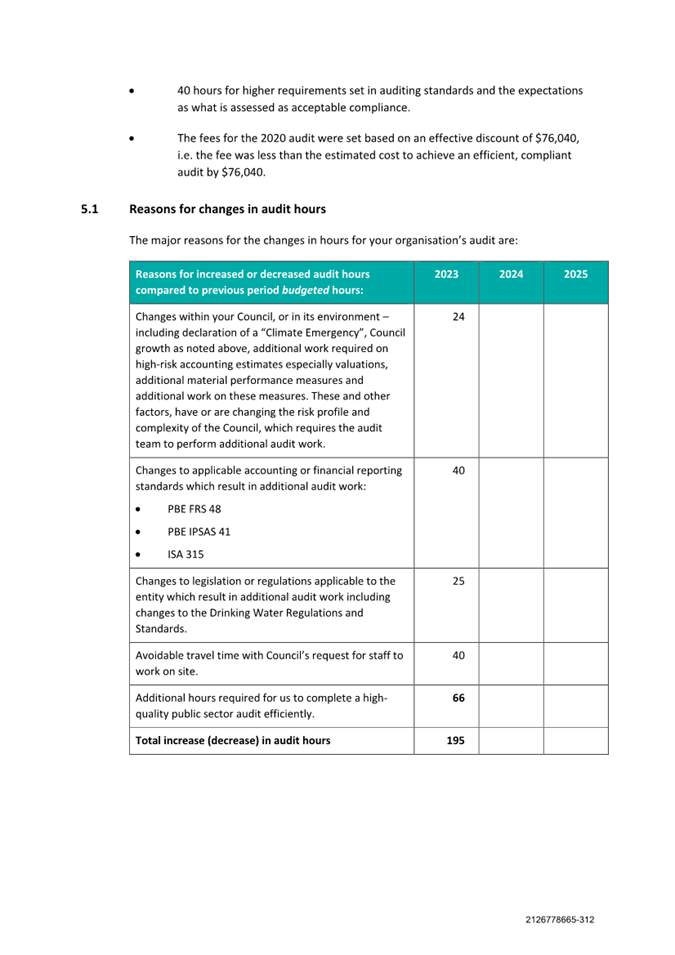

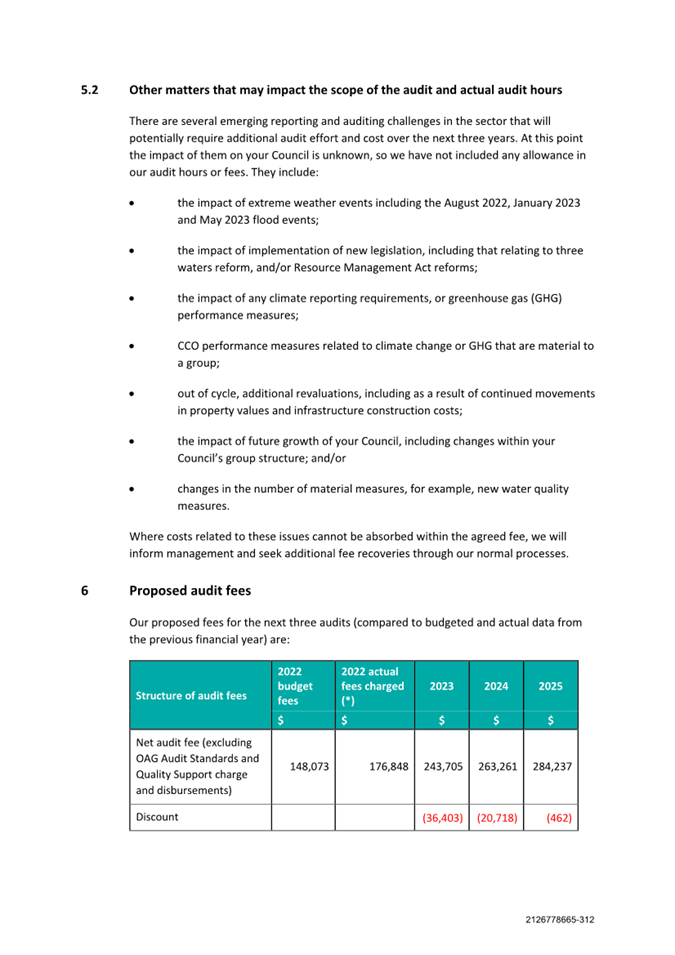

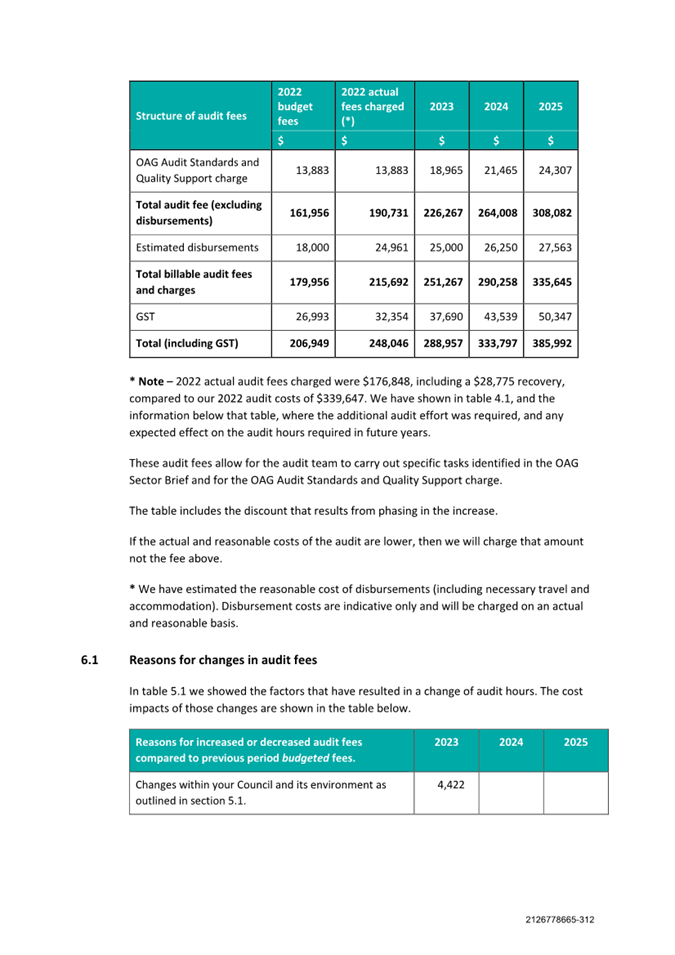

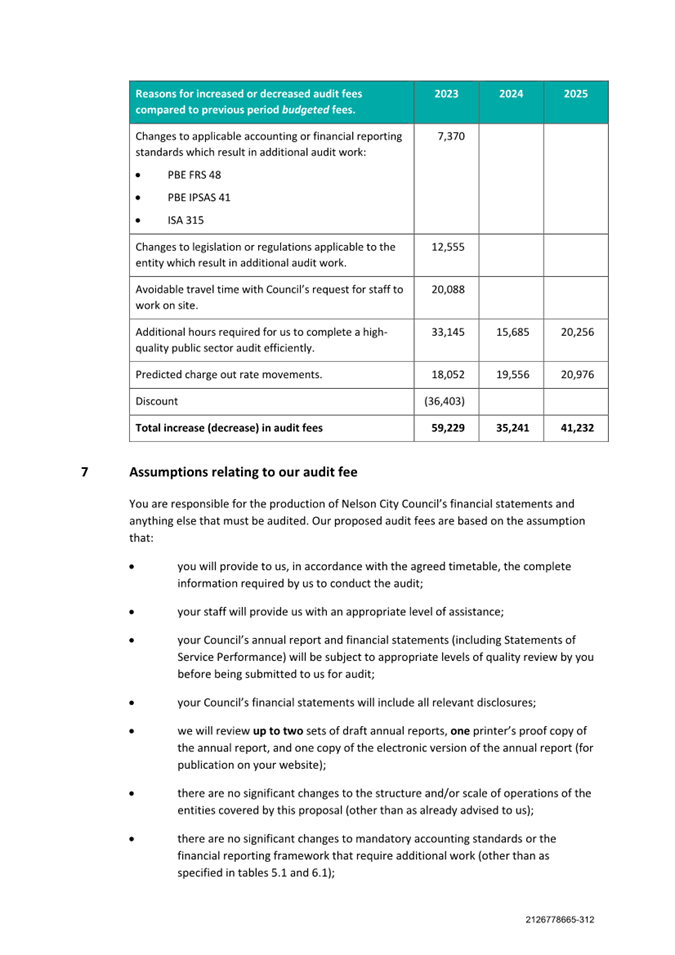

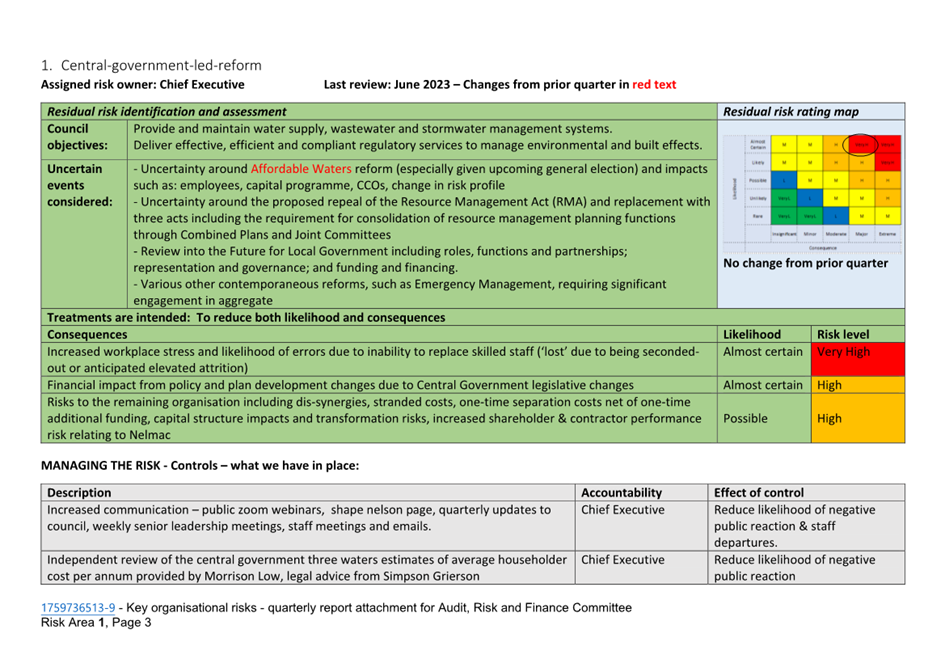

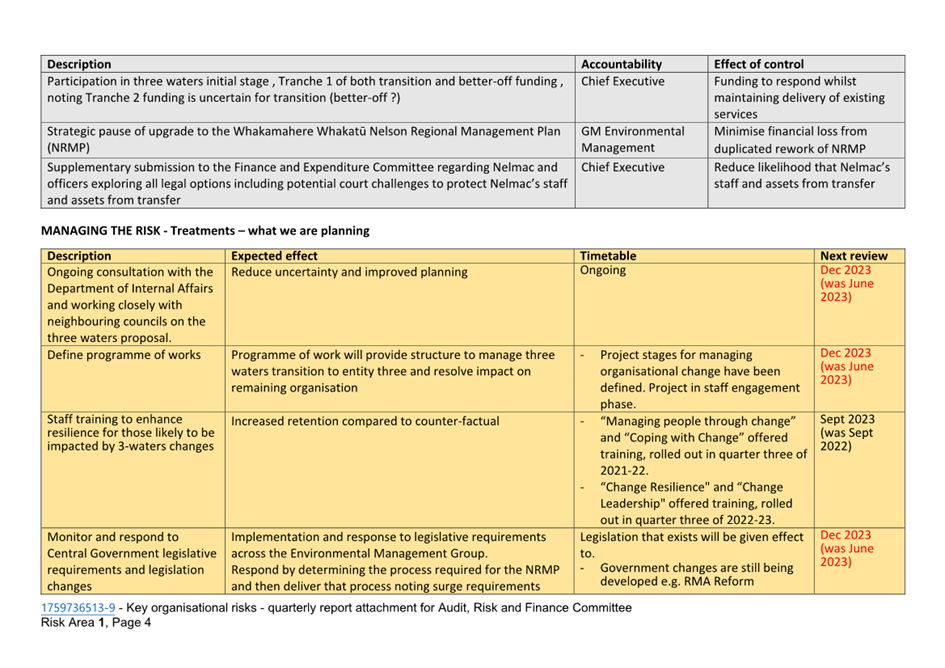

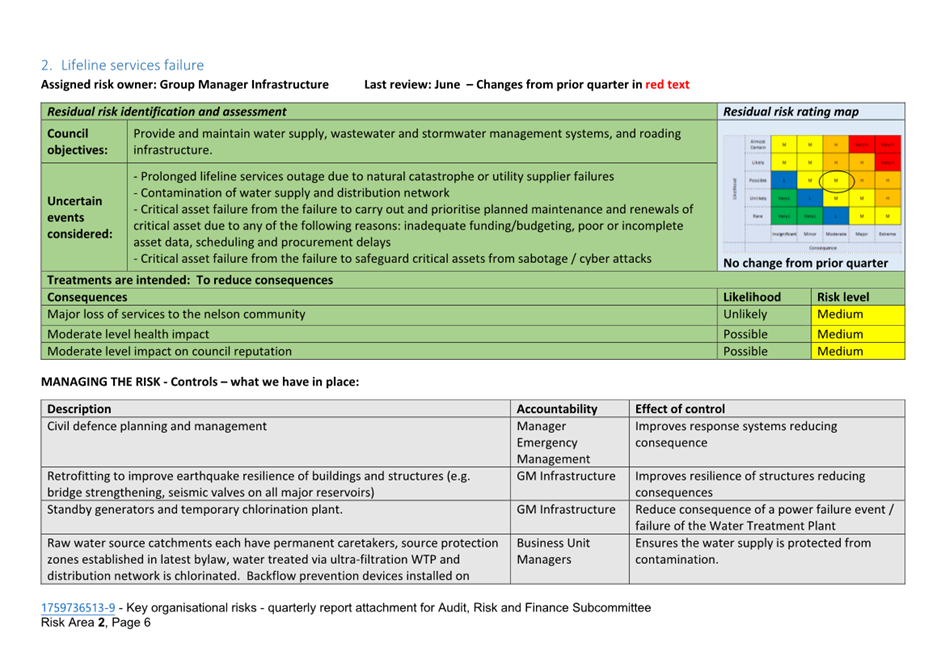

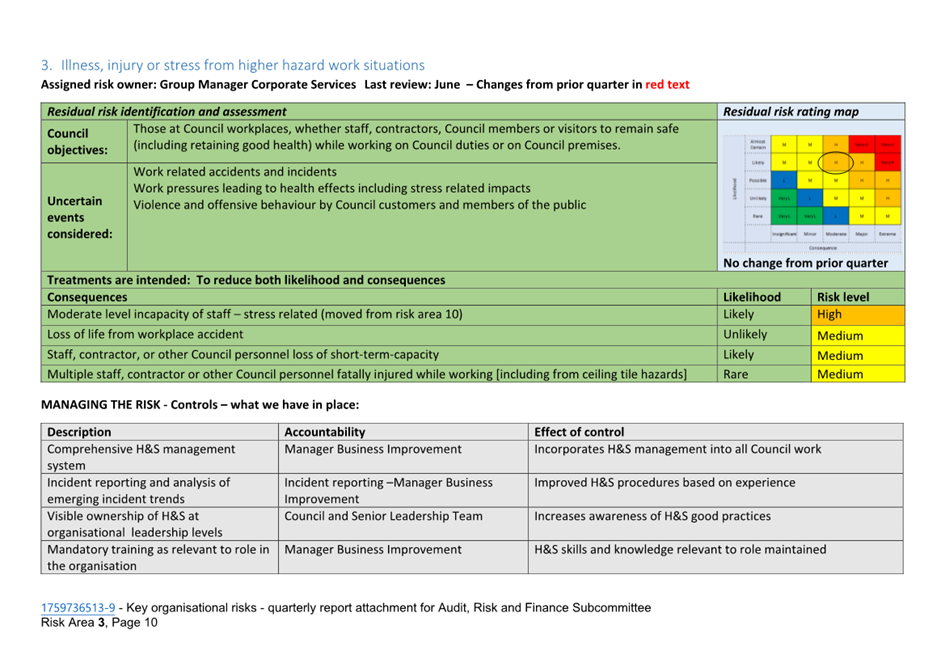

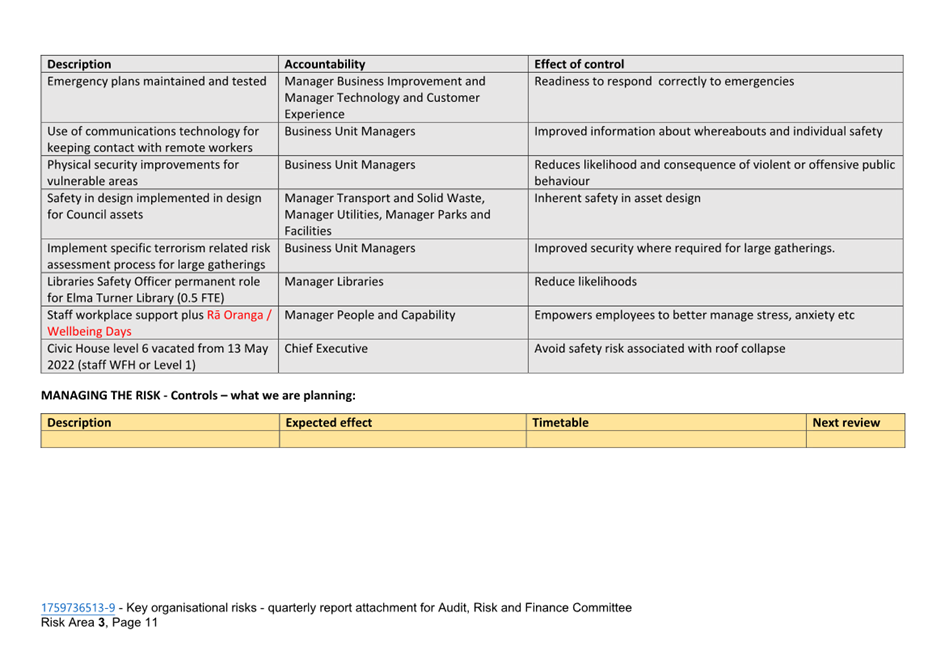

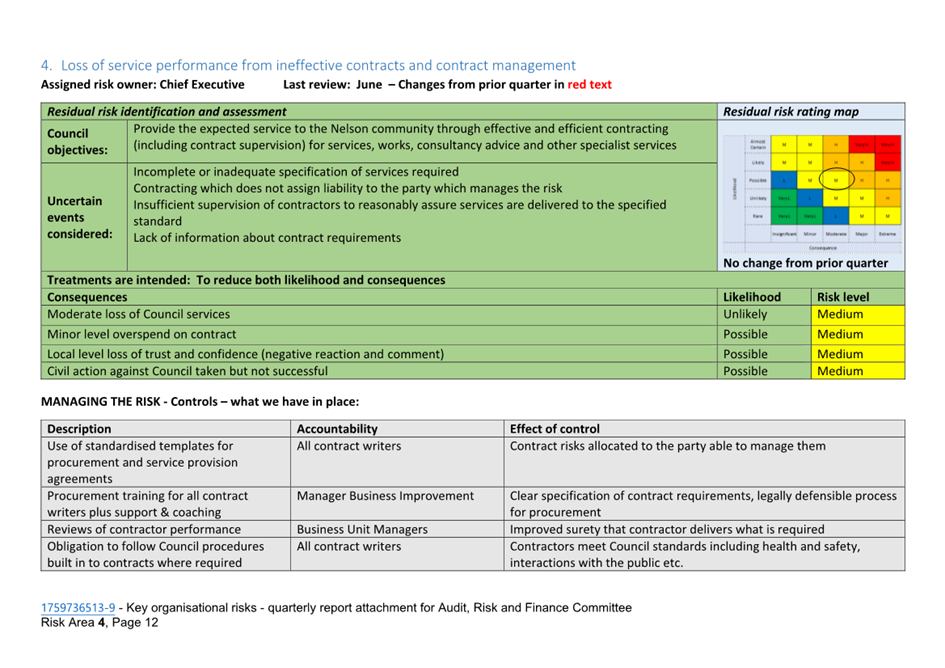

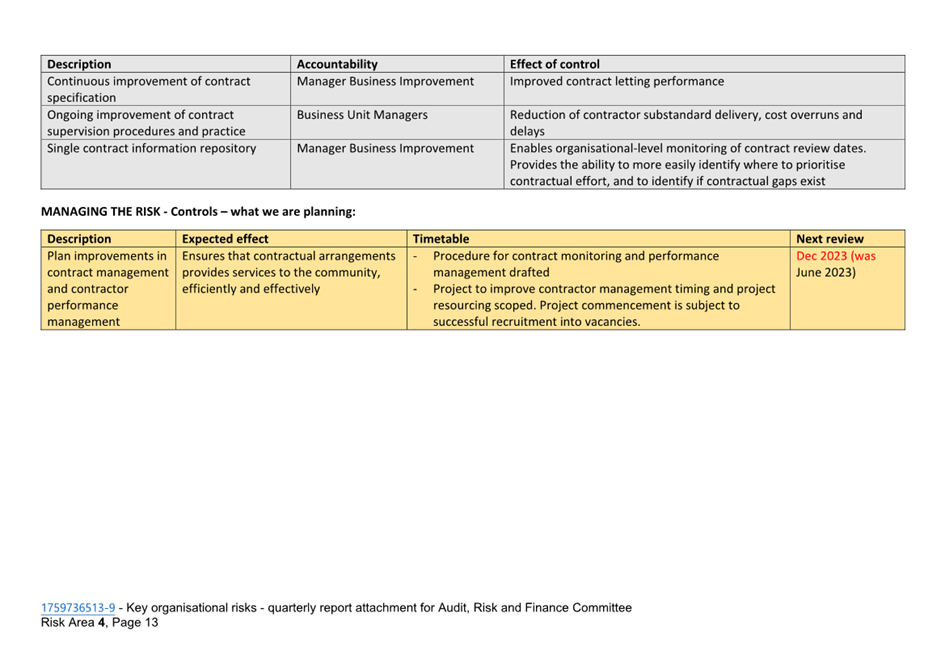

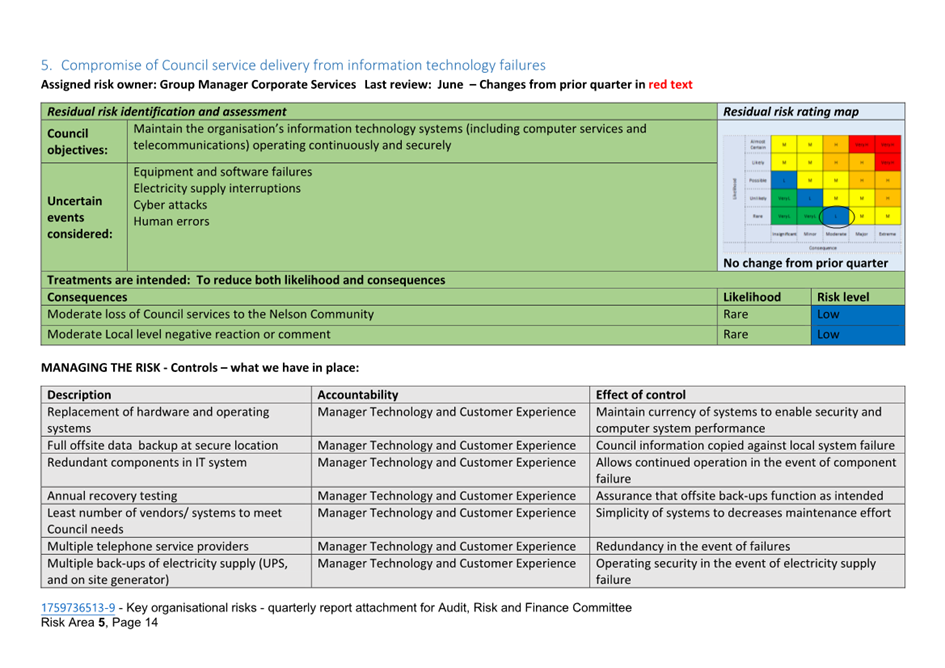

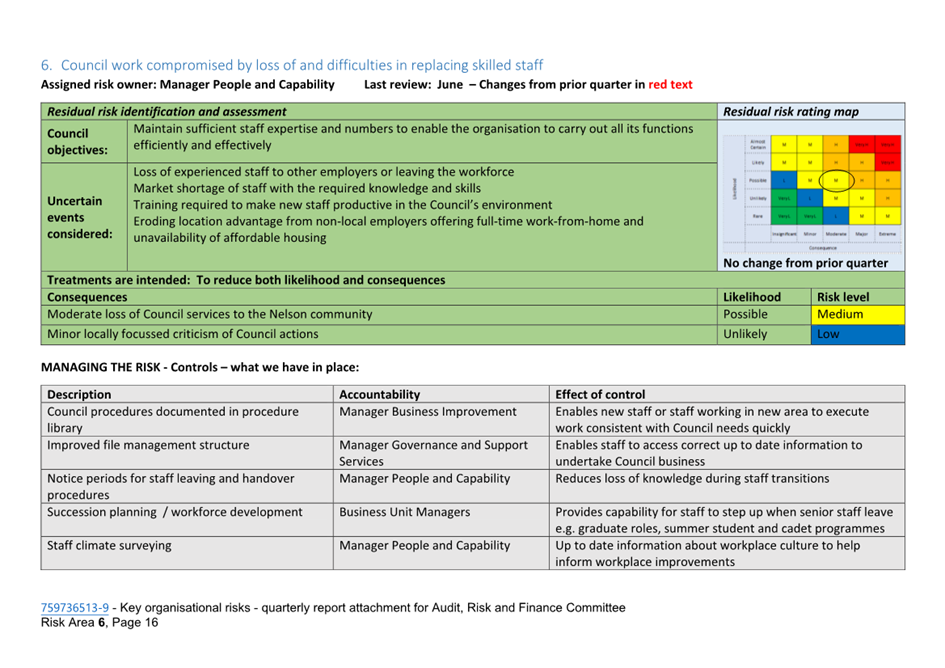

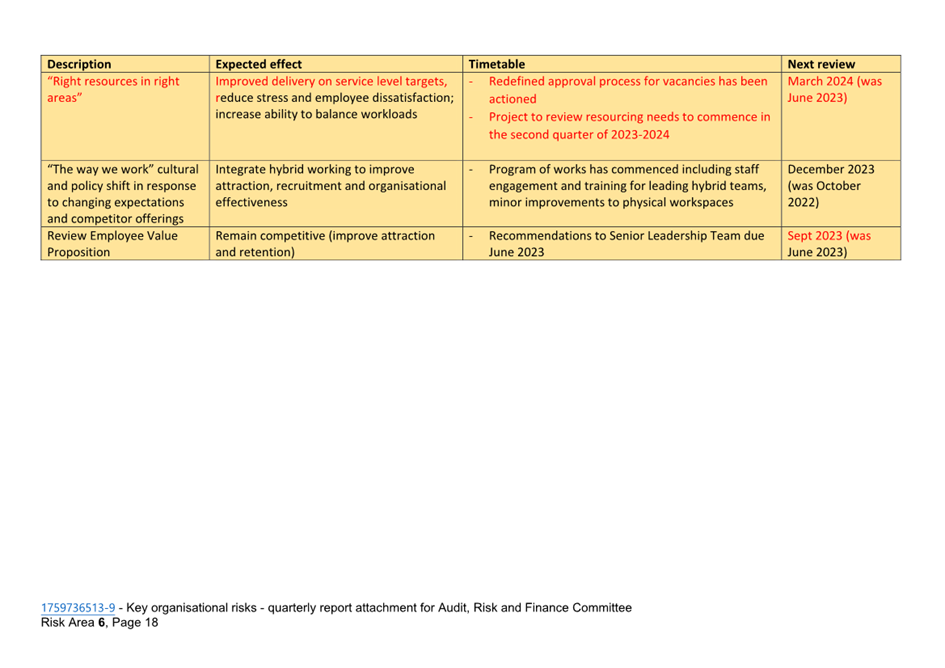

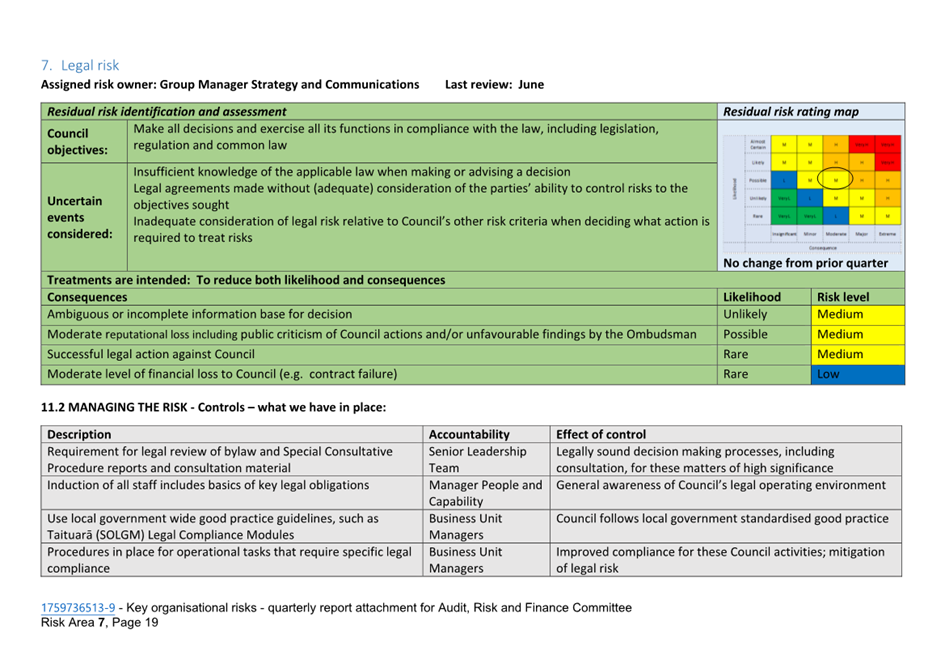

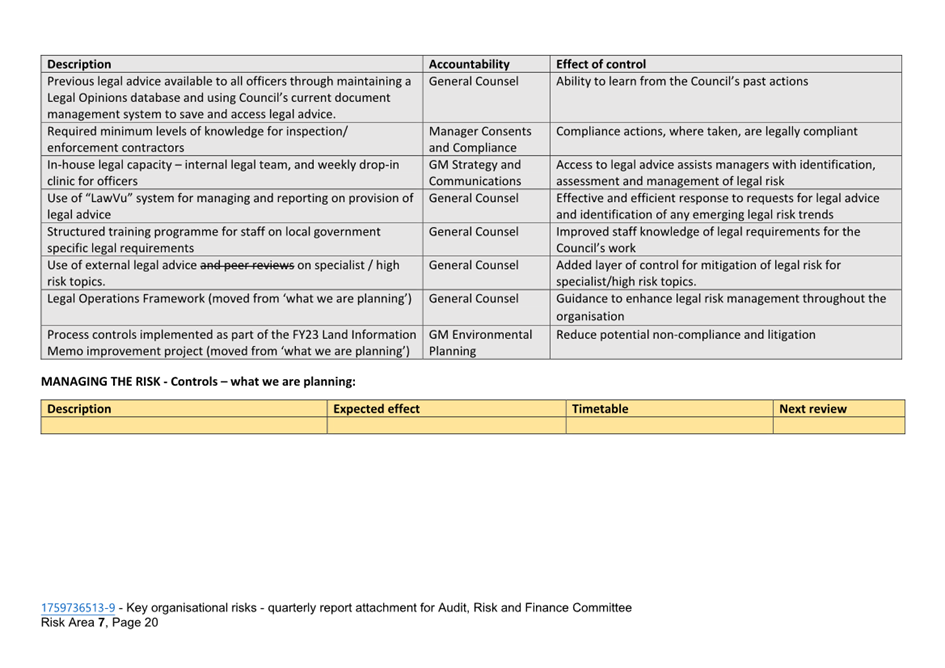

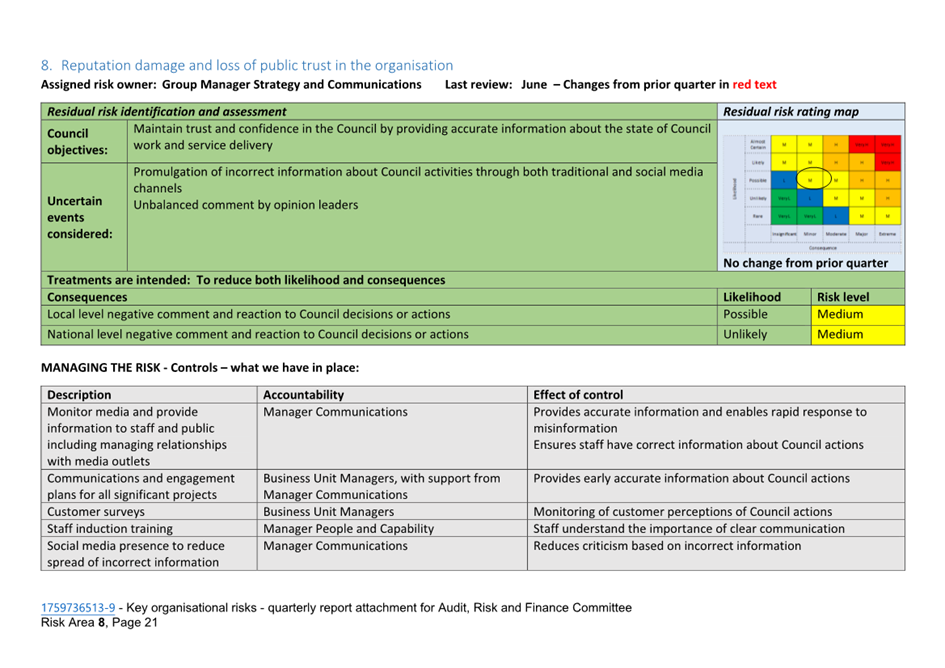

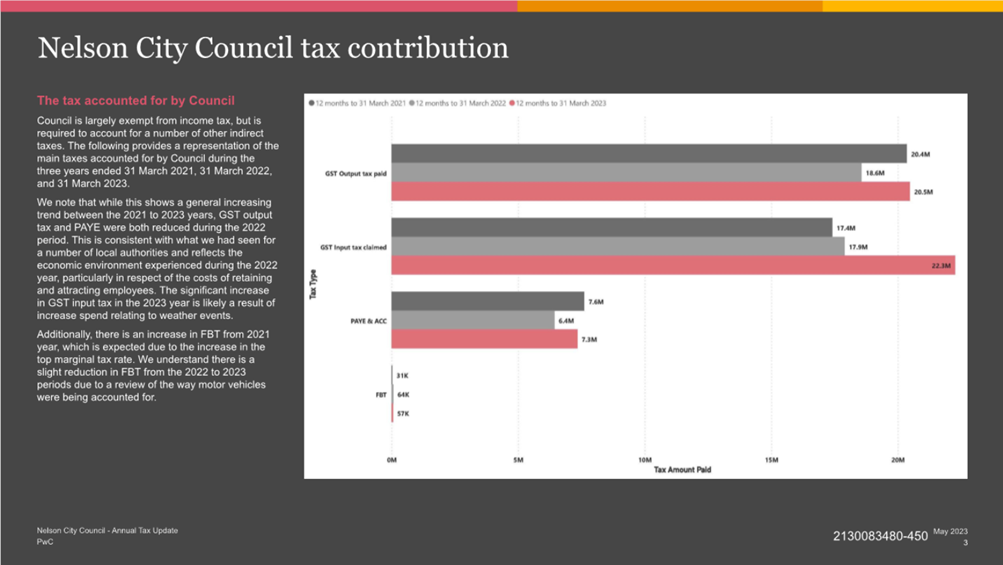

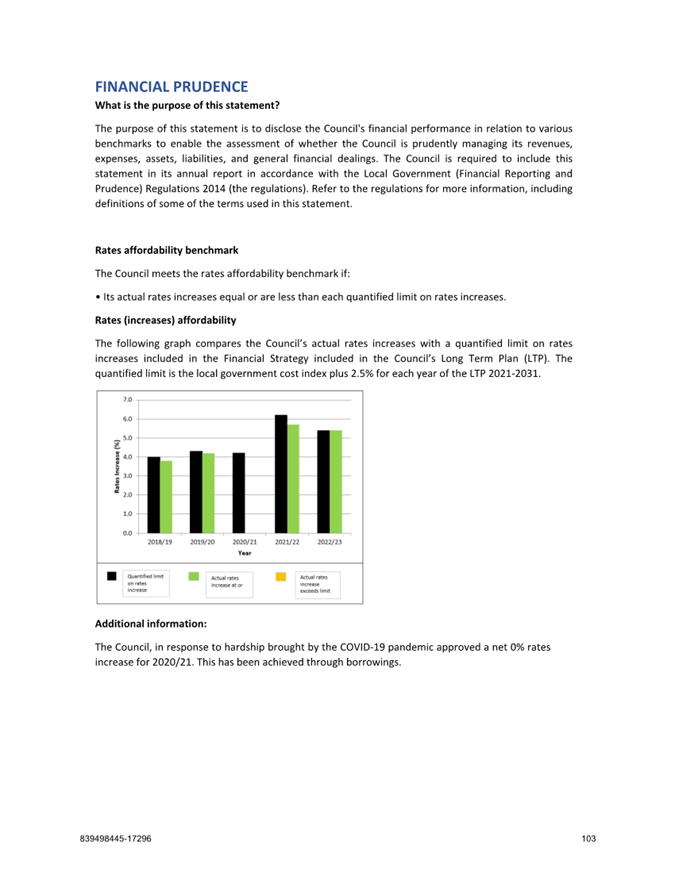

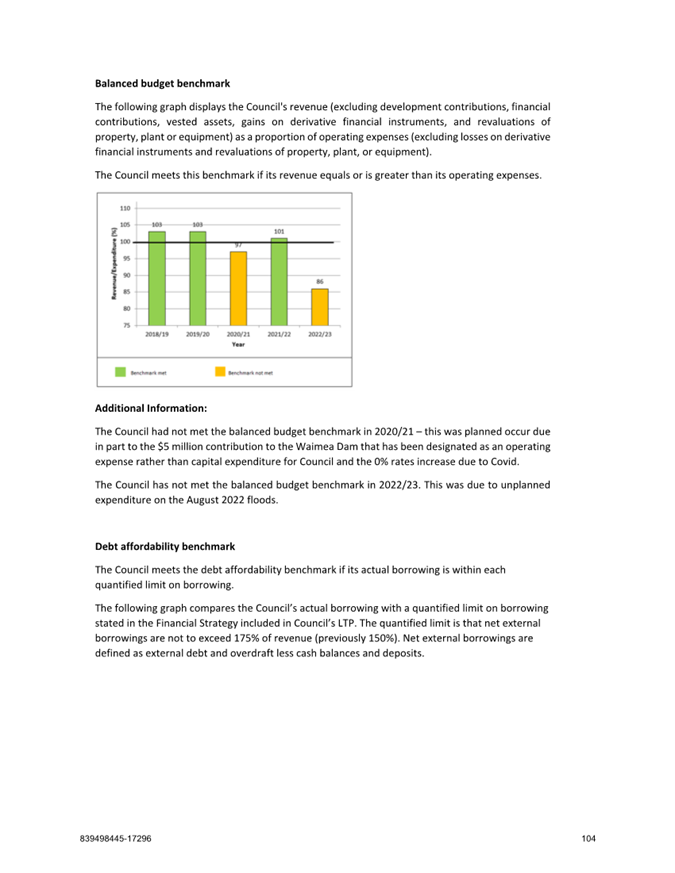

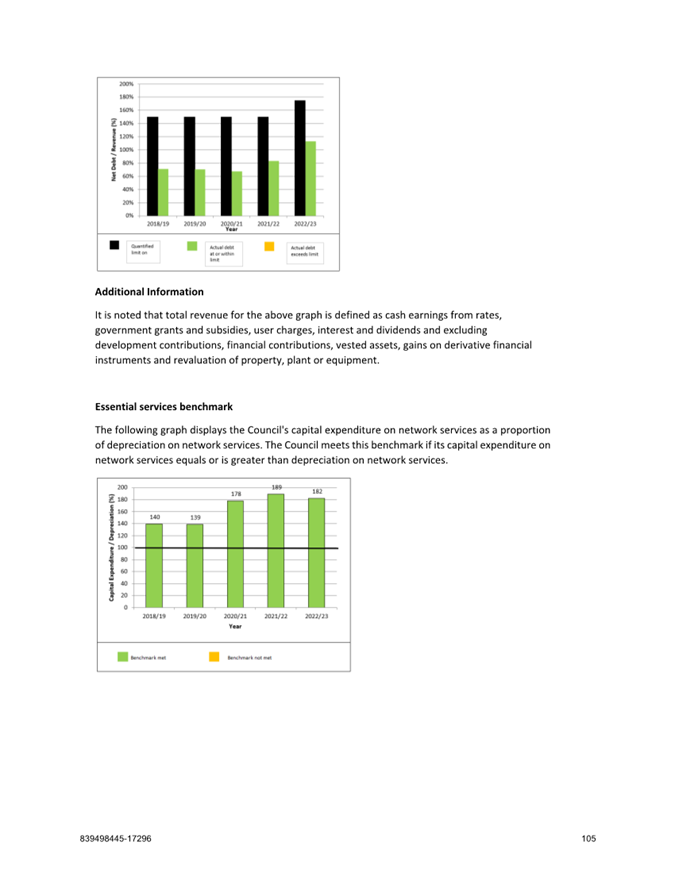

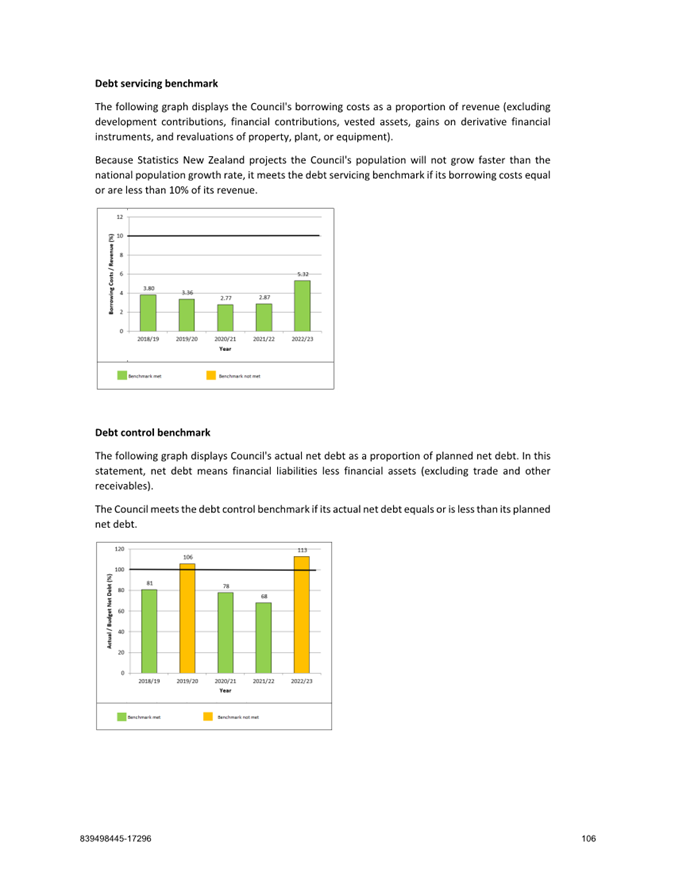

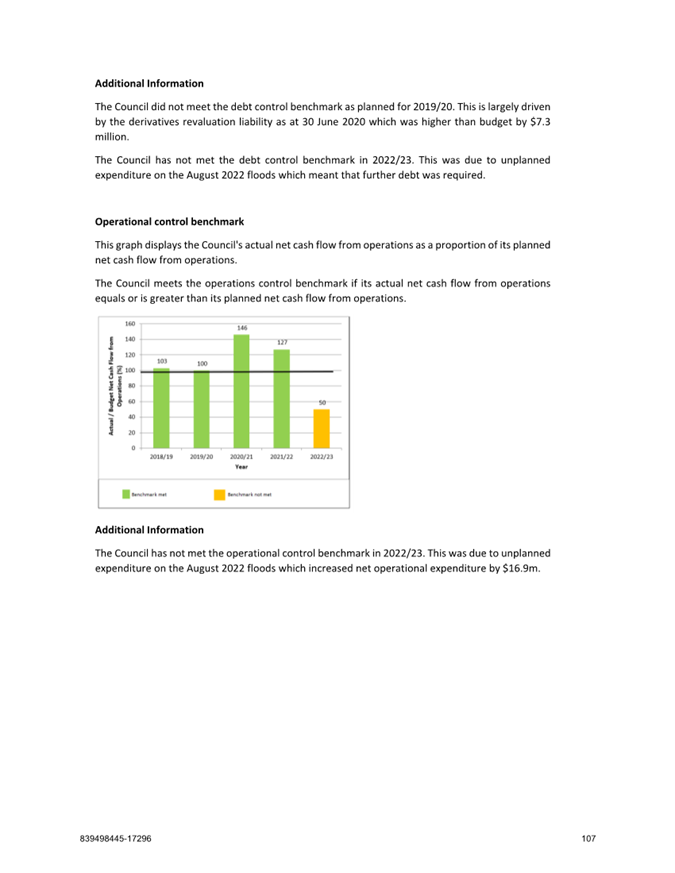

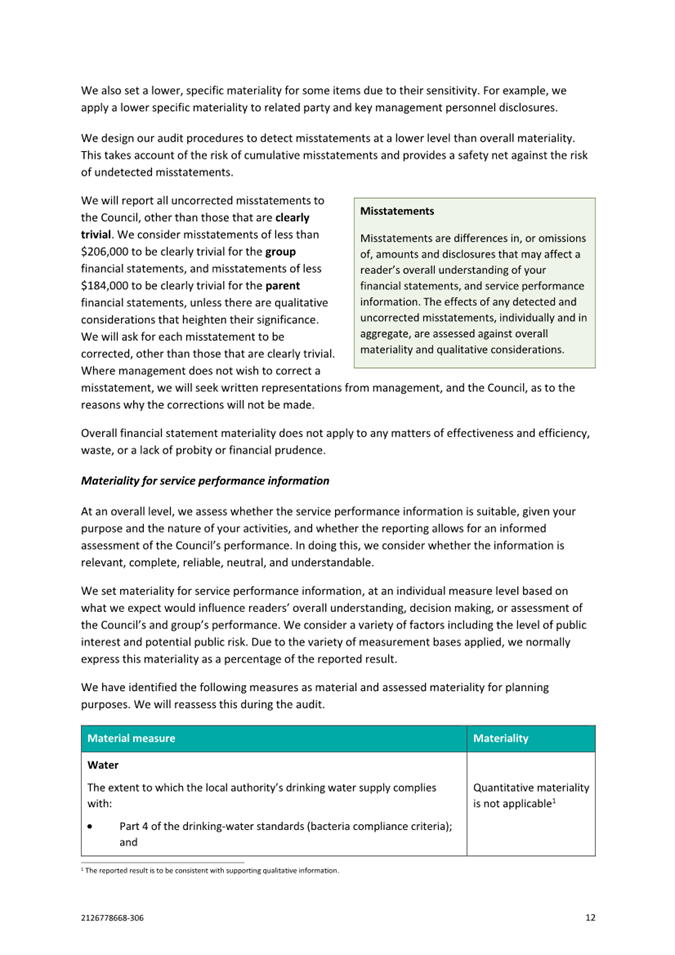

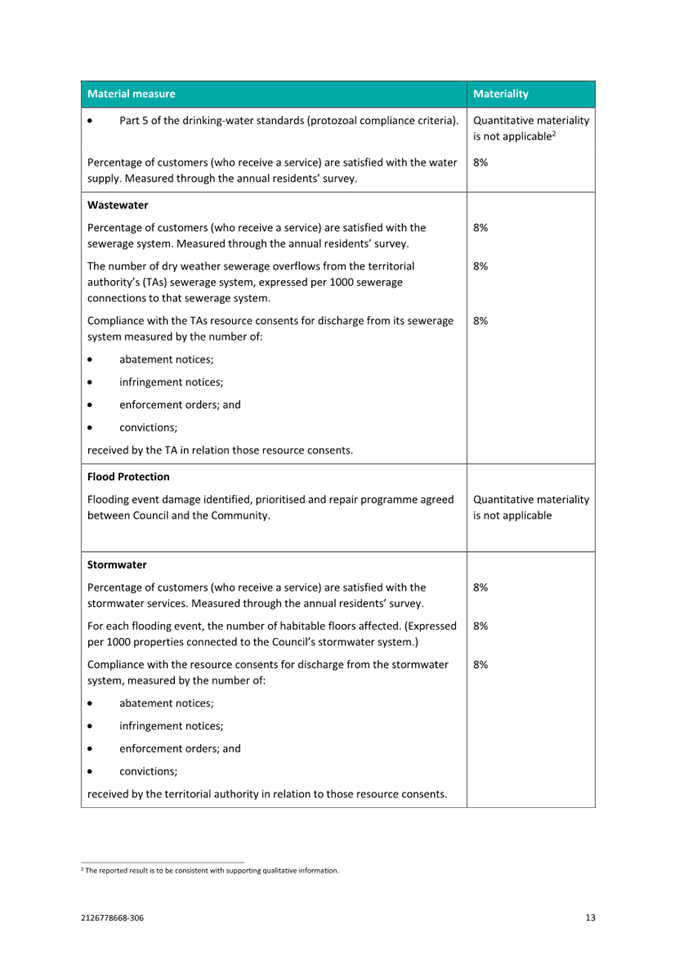

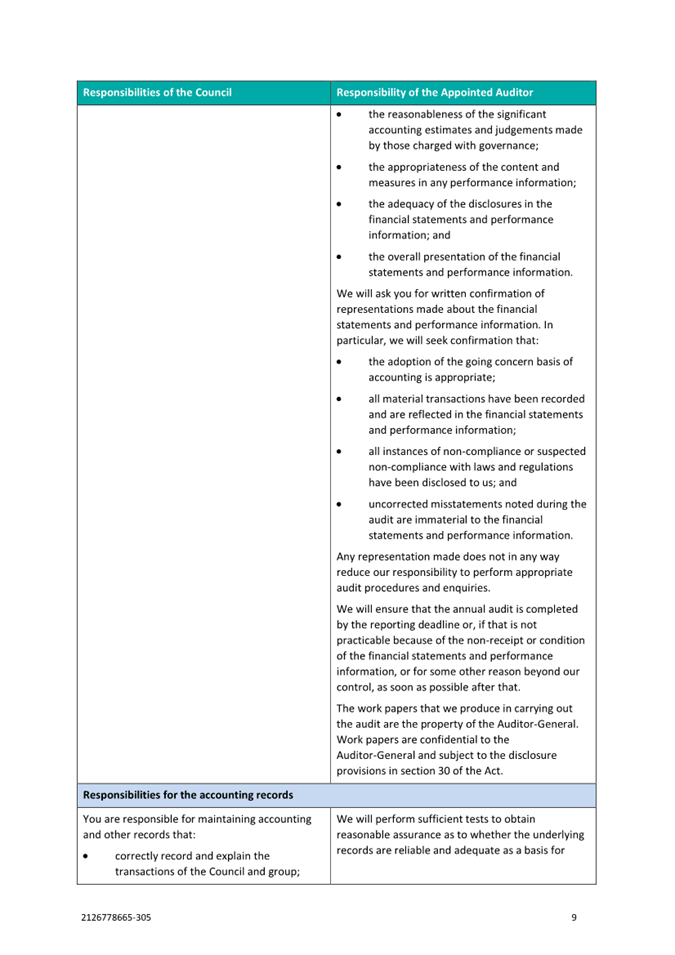

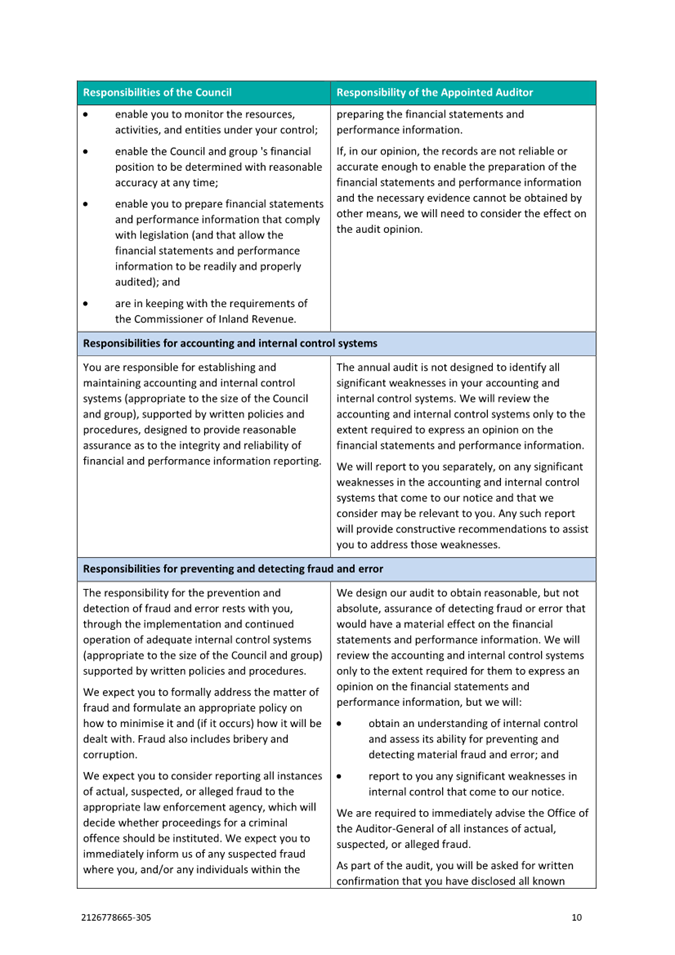

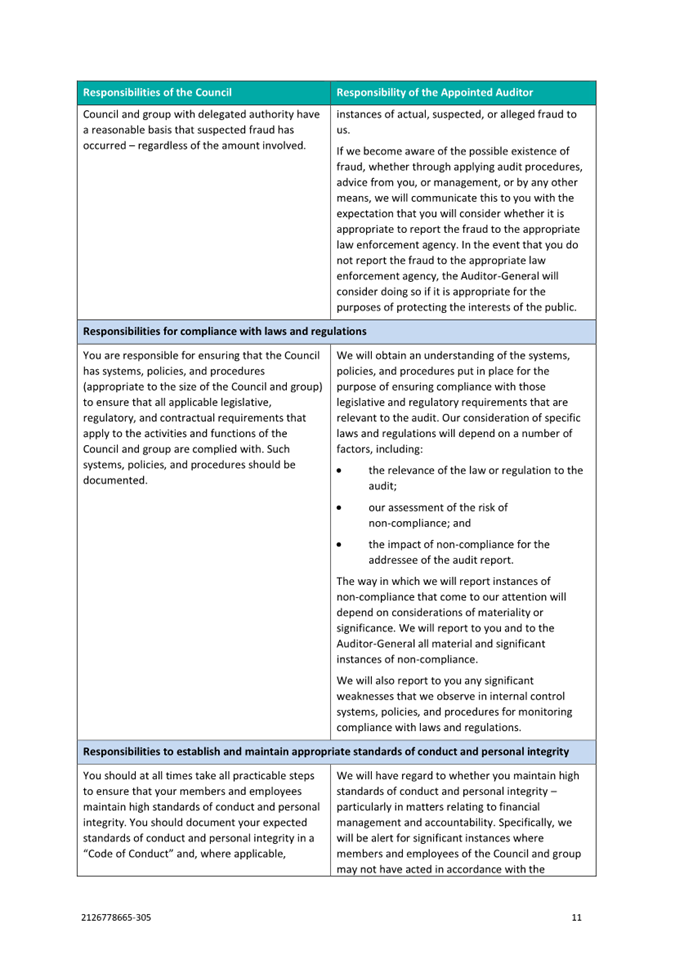

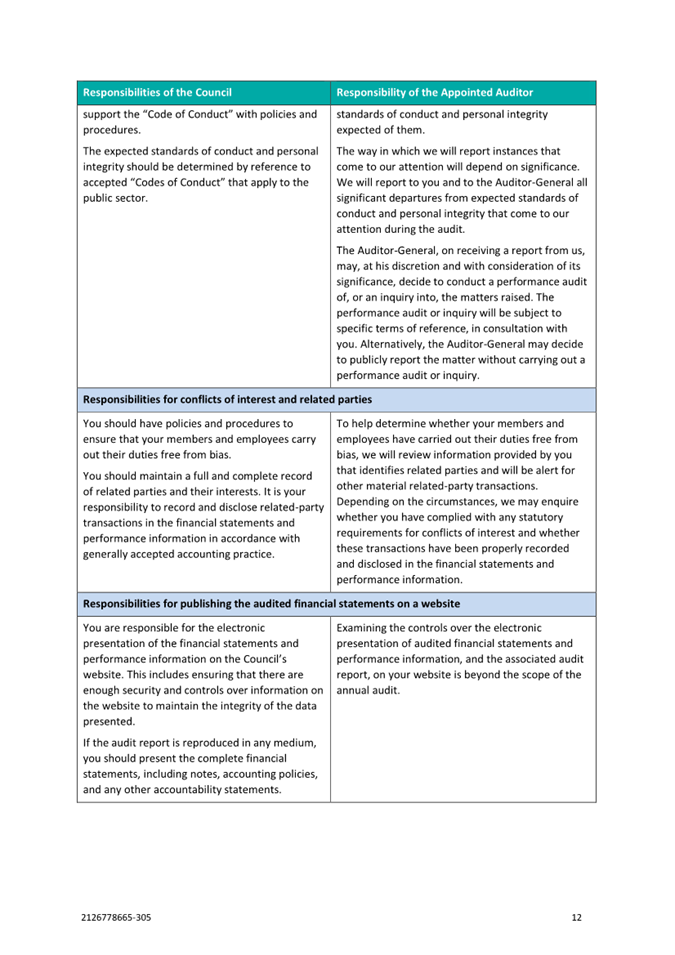

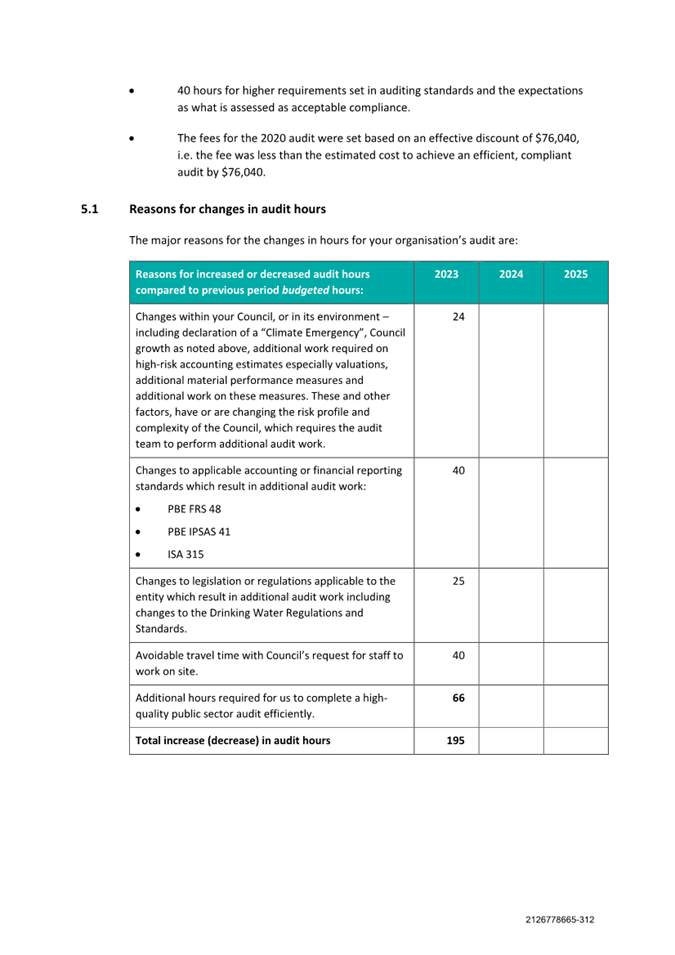

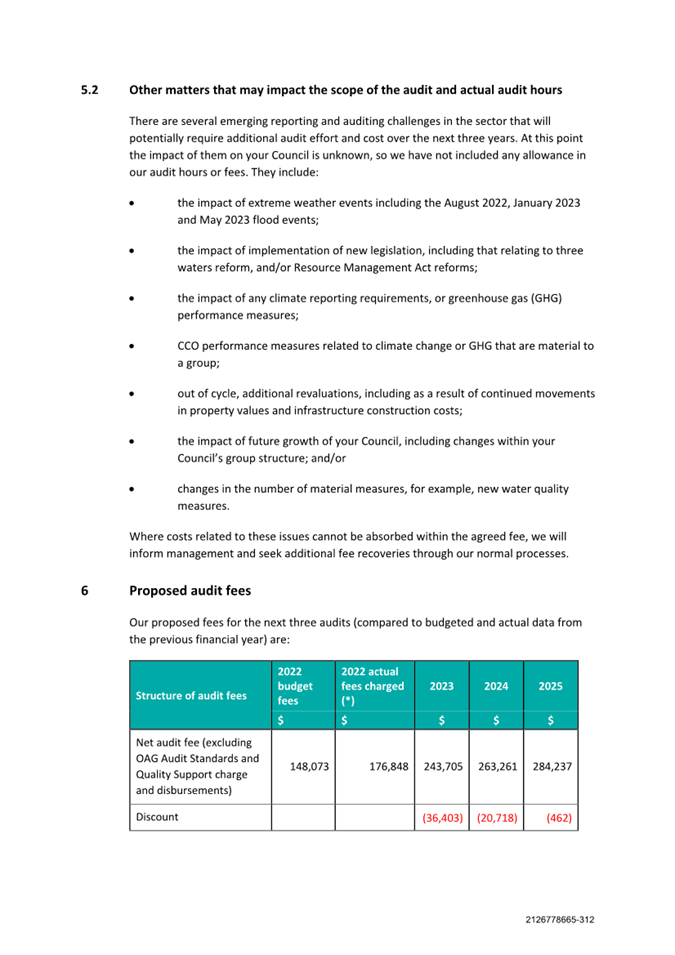

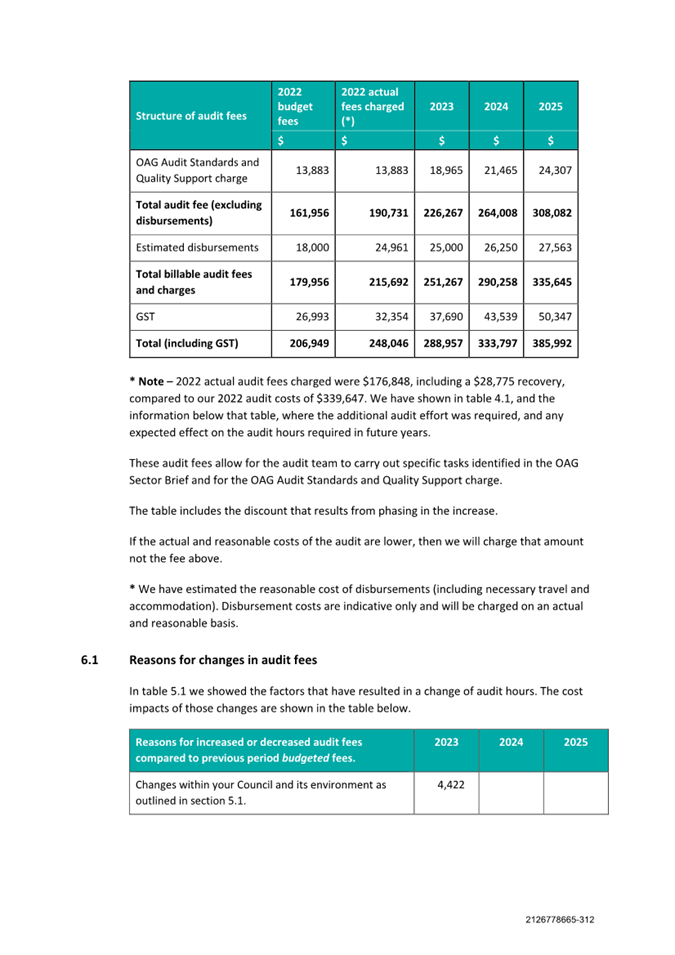

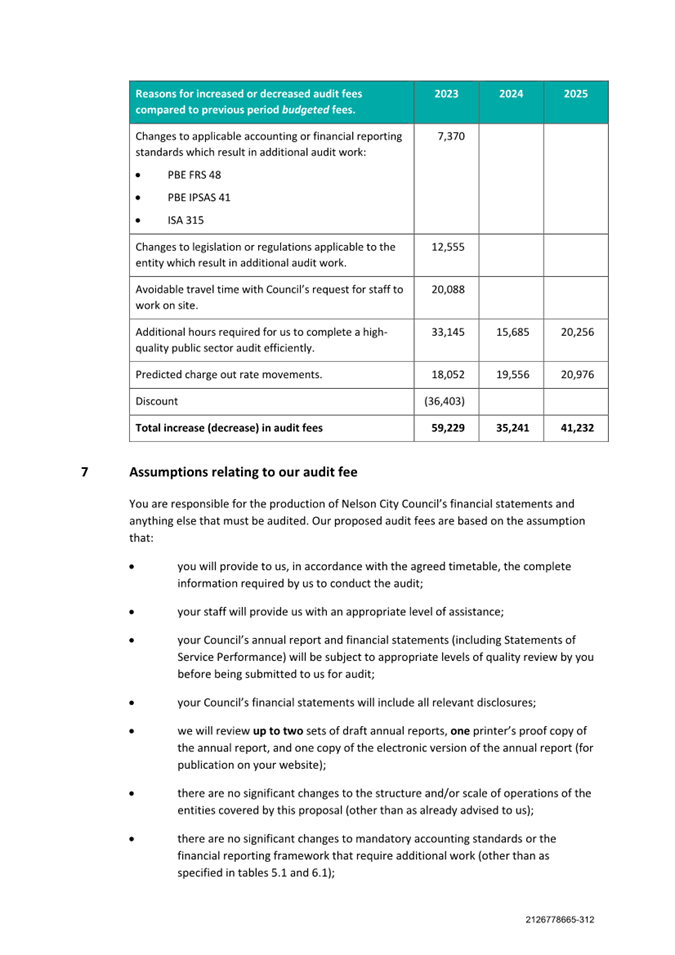

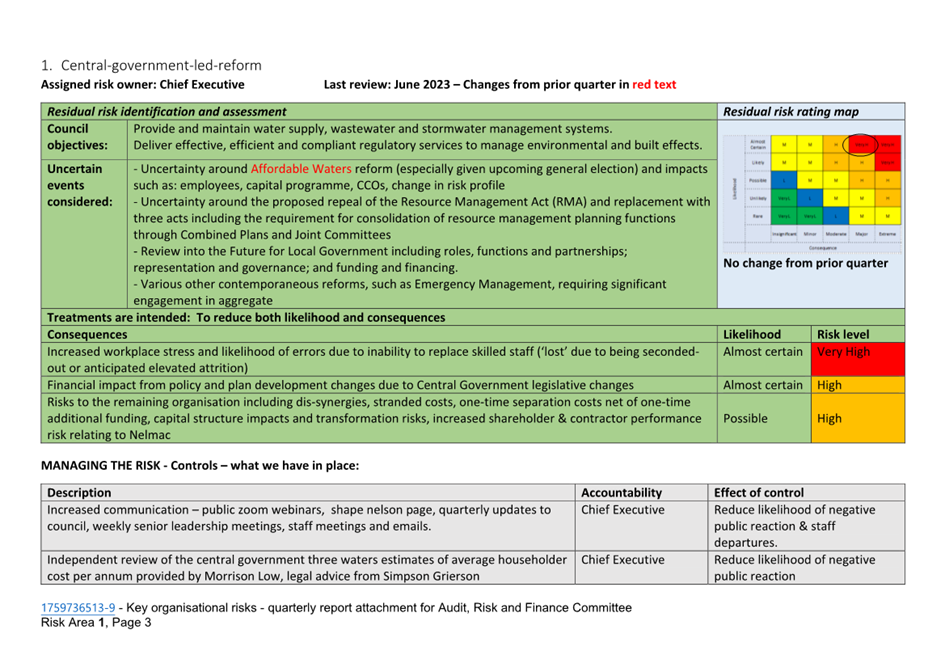

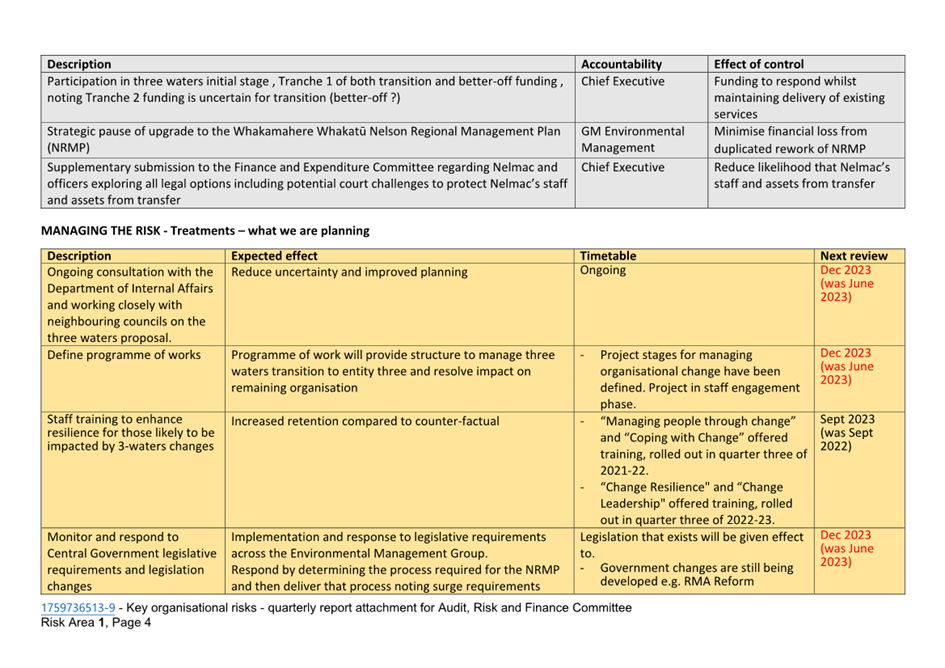

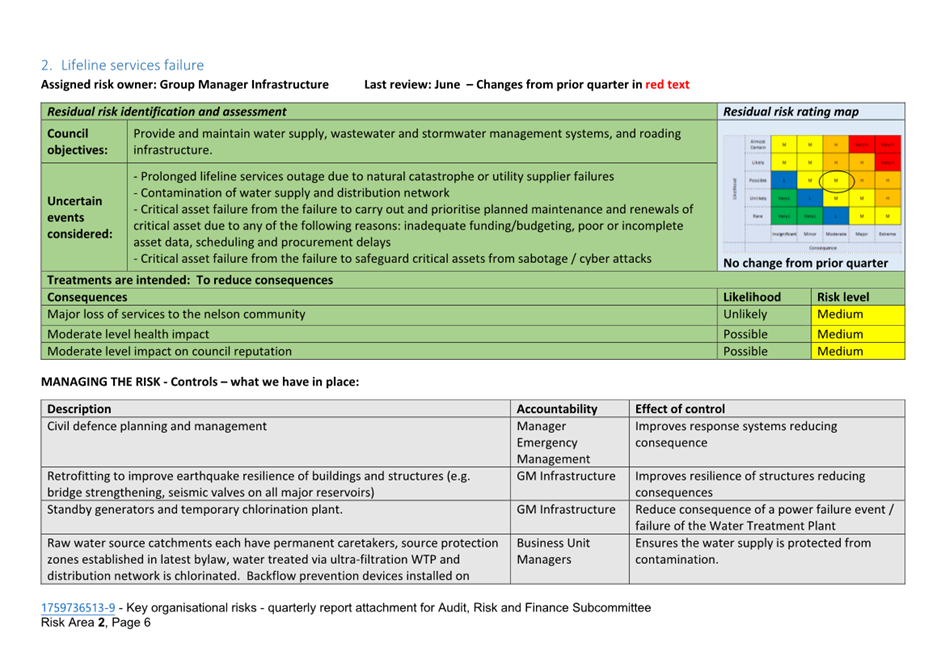

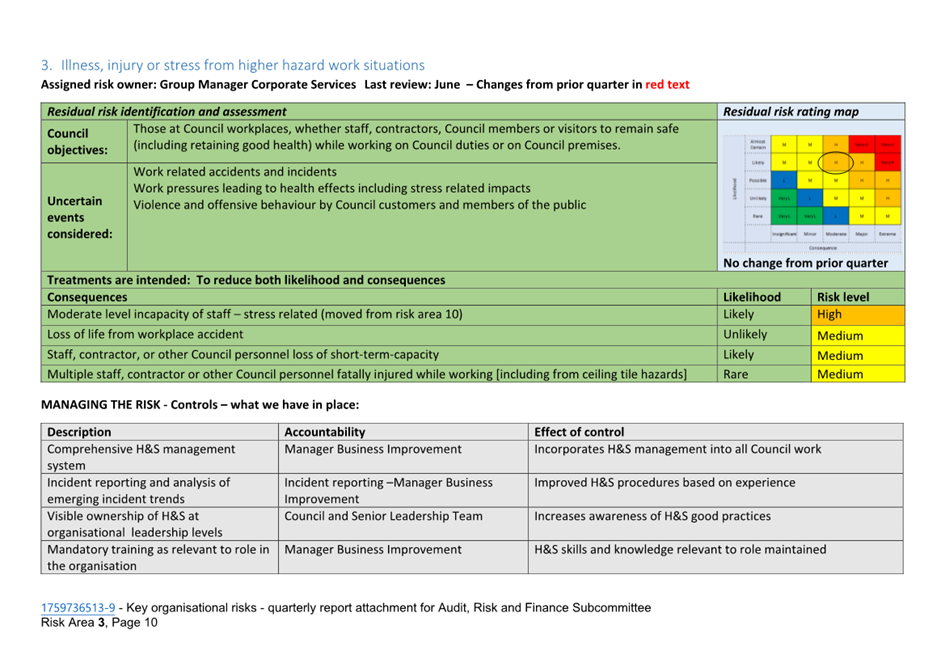

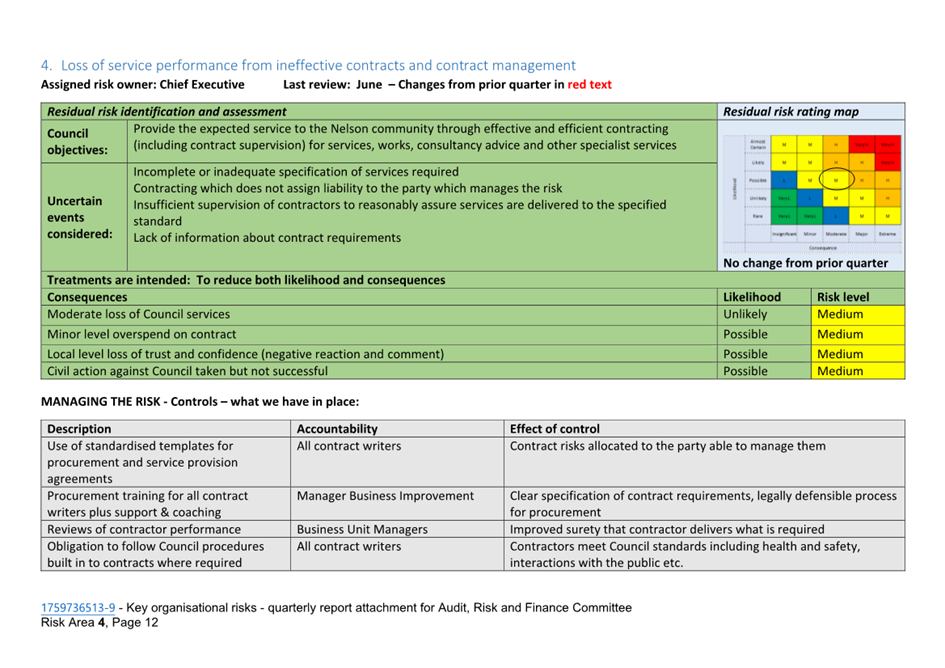

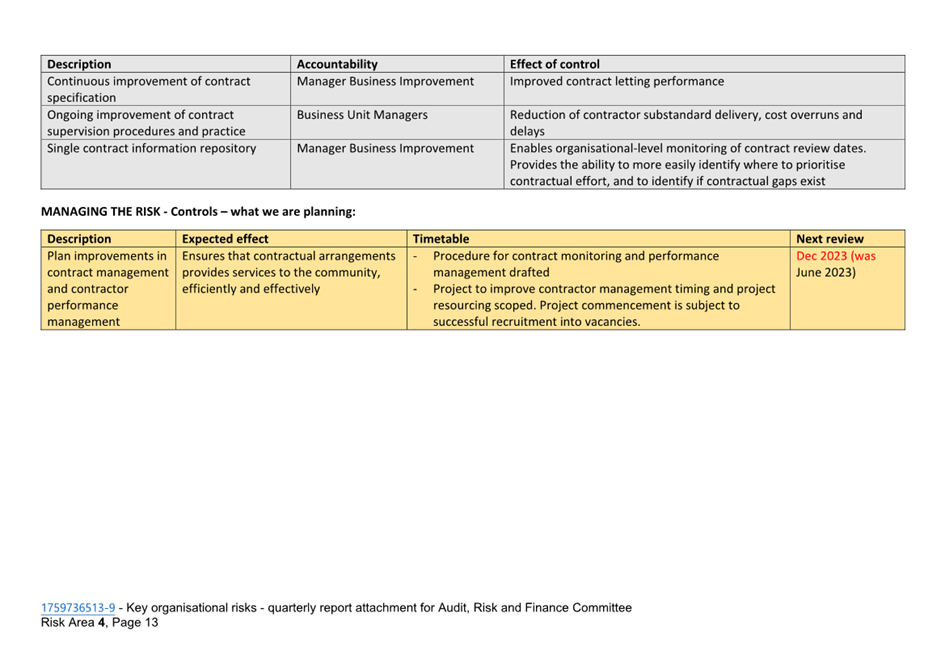

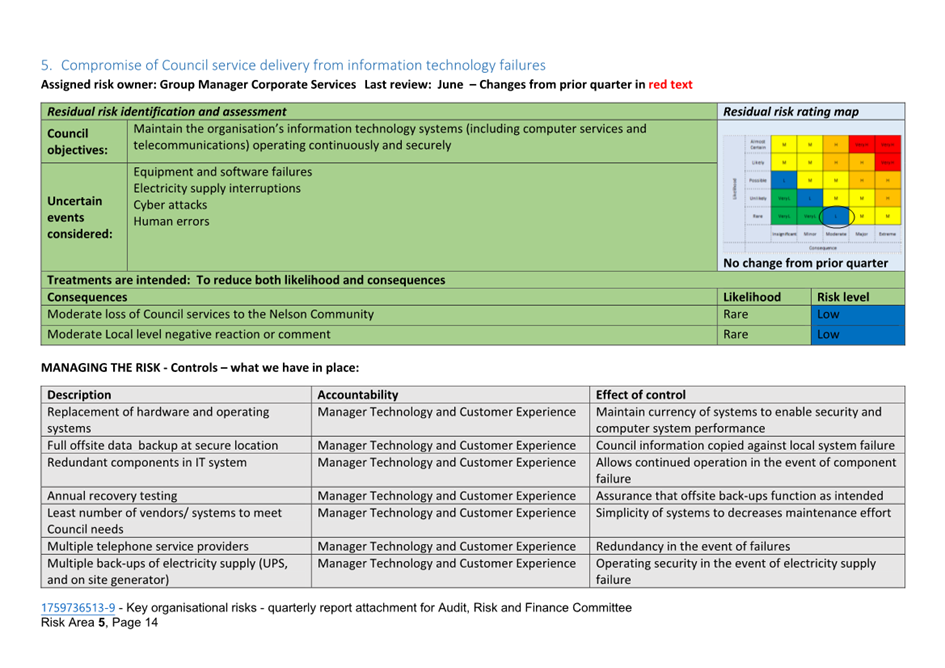

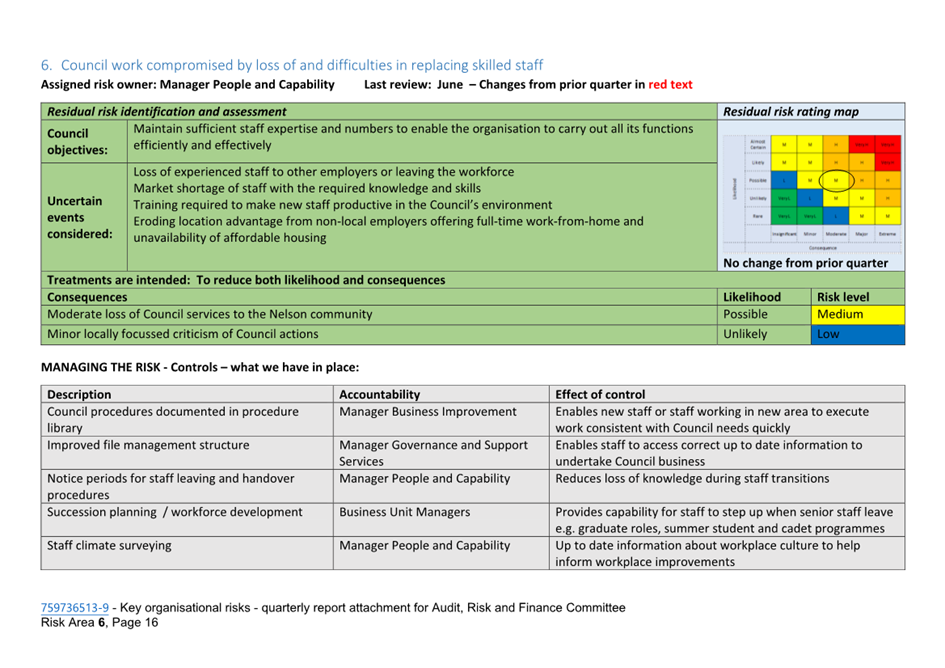

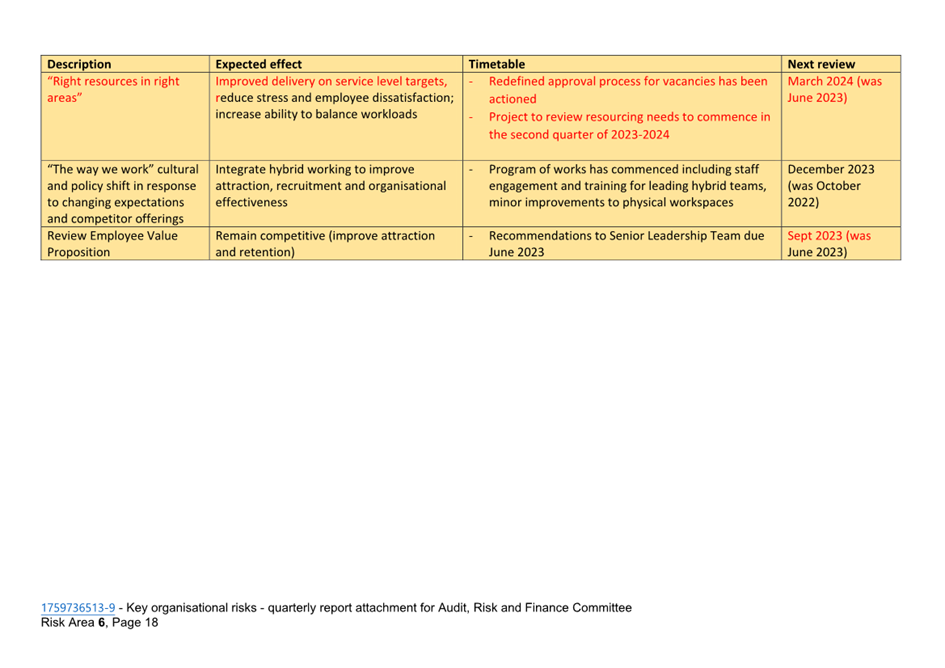

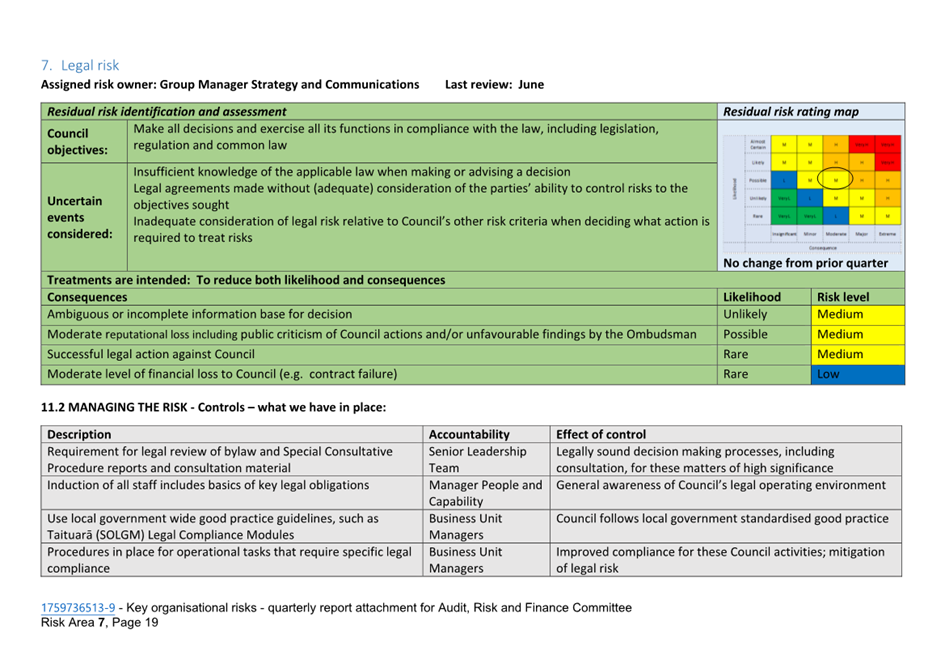

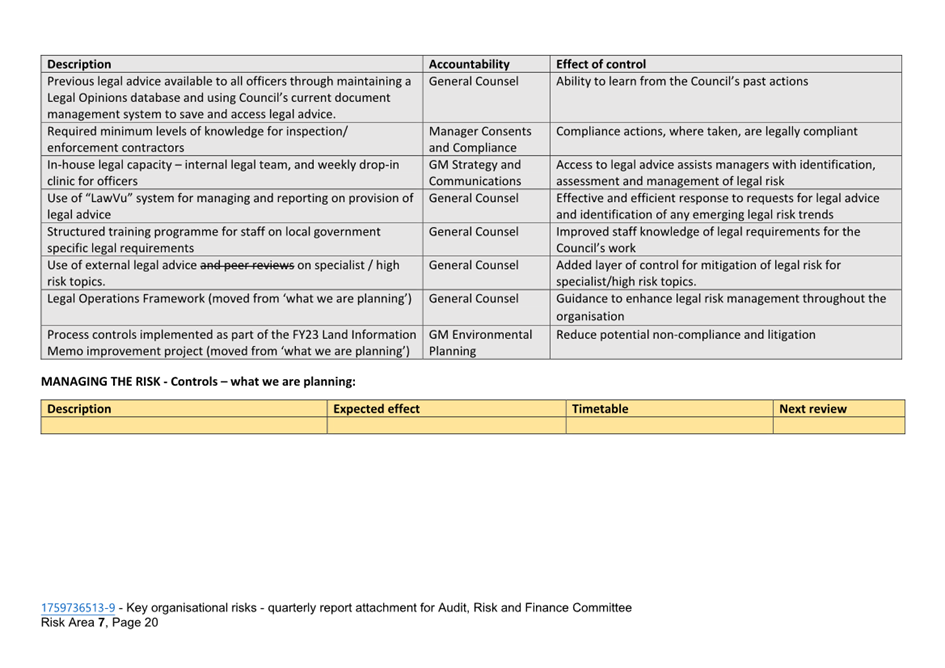

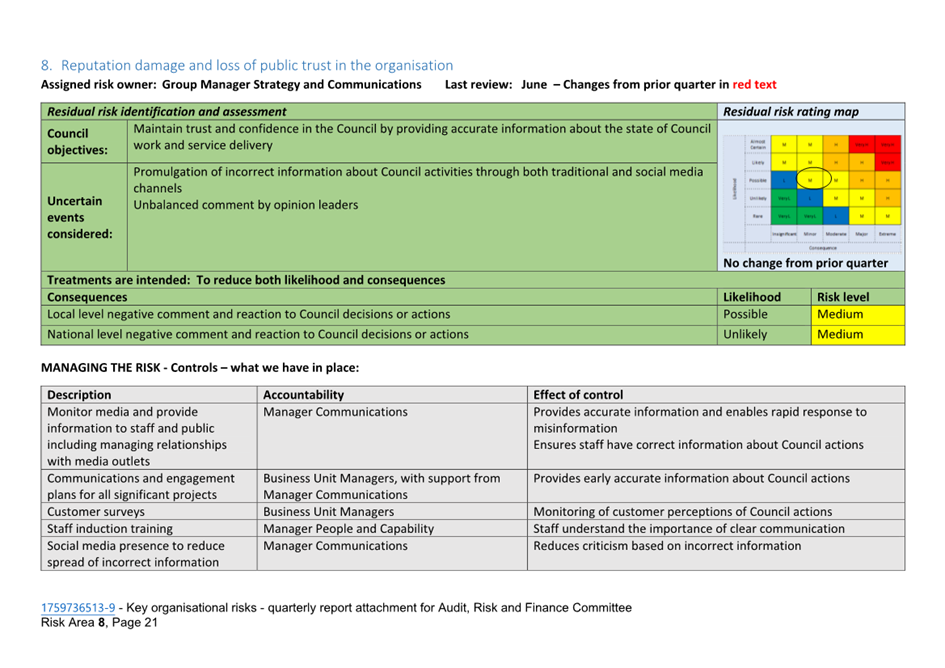

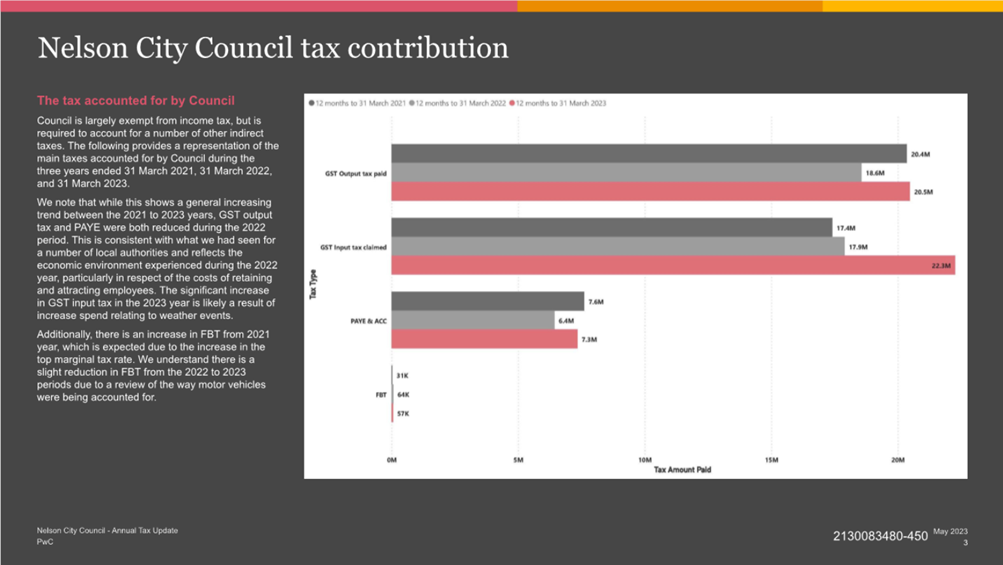

5.7 Subsidies