Notice of the Ordinary meeting of

Audit, Risk and Finance Committee

Te Kōmiti Kaute / Tūraru / Pūtea

|

Date: Thursday

1 June 2023

Time: 9.00a.m.

Location: Council

Chamber

Floor 2A, Civic House

110 Trafalgar Street, Nelson

|

Agenda

Rārangi take

Chairperson Ms

Catherine Taylor

Members His

Worship the Mayor Nick Smith

Deputy Mayor Rohan

O'Neill-Stevens

Cr

Mel Courtney

Cr

Rachel Sanson

Ms

Shanell Kelly

Quorum 3 Nigel

Philpott

Chief Executive

Nelson City Council Disclaimer

Please note that the contents of these

Council and Committee agendas have yet to be considered by Council and officer

recommendations may be altered or changed by the Council in the process of

making the formal Council decision. For enquiries call (03) 5460436.

Audit, Risk and Finance

Committee

This is a Committee of Council

Areas of

Responsibility

·

Any matters raised by Audit New Zealand or the Office of the

Auditor-General

·

Audit processes and management of financial risk

·

Chairperson’s input into financial aspects of draft Statements

of Expectation and draft Statements of Intent for Nelson City Council

Controlled Organisations, Council Controlled Trading Organisations and Council

Organisations

·

Council’s Annual Report

·

Council’s financial performance

·

Council’s Treasury policies

·

Health and Safety

·

Internal audit

·

Monitoring organisational risks, including debtors and legal

proceedings

·

Procurement Policy

Powers to

Decide

·

Appointment of a deputy Chair

Powers to

Recommend to Council

·

Adoption of Council’s Annual Report

·

To write off outstanding accounts receivable or remit fees and

charges of amounts over the Chief Executive’s delegated authority.

·

All other matters within the areas of responsibility or any other

matters referred to it by the Council

For the Terms of Reference for the Audit, Risk and Finance Committee

please refer to document NDOCS-1974015928-887.

Item 7: Privacy Act

2020 - Reporting

Audit,

Risk and Finance Committee

1

June 2023

Page

No.

Karakia

and Mihi Timatanga

1. Apologies

Nil

2. Confirmation

of Order of Business

3. Interests

3.1 Updates

to the Interests Register

3.2 Identify

any conflicts of interest in the agenda

4. Public Forum

5. Confirmation

of Minutes

5.1 24

February 2023 7 - 13

Document number M20013

Recommendation

|

That the Audit, Risk and Finance Committee

1. Confirms the minutes of the

meeting of the Audit, Risk and Finance Committee, held on 24 February 2023,

as a true and correct record.

|

6. John Mackey Audit

New Zealand

John Mackey from Audit NZ will brief

the committee on the 2021/22 Audit which was presented to 24 February 2023

meeting.

7. Privacy Act 2020 - Reporting 13 - 25

Document number R27656

Recommendation

|

That

the Audit, Risk and Finance Committee

1. Receives

the report Privacy Act 2020 - Reporting (R27656) and its attachment (1738230957-18024); and

2. Notes that Council’s Privacy Policy and Breach

Management Plan applies also to elected and appointed members and training on

compliance with the Privacy Act has and will be provided as part of induction

for elected and appointed members.

|

8. Review of Council's

Section 17A service delivery reviews process 26 - 33

Document number R27716

Recommendation

|

That

the Audit, Risk and Finance Committee

1. Receives

the report Review of Council's Section 17A service delivery reviews process

(R27716); and

2. Notes the findings from the

review of Council’s process for Section 17A service delivery reviews

contained within this report.

|

Recommendation to Council

|

That the Council

1. Approves the below changes to

Council’s Section 17A review process:

a. Increase

the value threshold that triggers a service delivery review under Section 17A

of the Local Government Act 2002 from $100,000 to $1 million per annum; and

b. Delegate

the Chief Executive responsibility to sign off reviews unless they meet a

threshold of either:

i. proposing

considerable change to the service’s delivery and/or

ii. is

assessed as being of medium or high significance against Council’s

Significance and Engagement Policy; and

c. An

annual report be presented to Council on progress and outcomes of

Council’s Section 17A reviews.

|

9. Quarterly Internal

Audit Report - 31 March 2023 34 - 38

Document number R27624

Recommendation

|

That

the Audit, Risk and Finance Committee

1. Receives

the report Quarterly Internal Audit Report - 31 March 2023 (R27624) and its attachment

(1194974384-3369).

|

10. Internal Audit Plan 2023-2024 39 - 48

Document number R27626

Recommendation

|

That

the Audit, Risk and Finance Committee

1. Receives

the report Internal Audit Plan 2023-2024 (R27626) and its attachments (1194974384-3370 and

1194974384-3368).

|

Recommendation to Council

|

That the Council

1. Approves the Draft Annual

Internal Audit Plan for the year to 30 June 2024 (1194974384-3368).

|

11. Quarterly Finance Report to 31

March 2023 49 - 76

Document number R27695

Recommendation

|

That

the Audit, Risk and Finance Committee

1. Receives

the report Quarterly Finance Report to 31 March 2023 (R27695) and its attachments (1857728953-779,

839498445-14467 and 839498445-14468).

|

12. Quarterly Risk Report - 31

March 2023 77

- 103

Document number R27625

Recommendation

|

That

the Audit, Risk and Finance Committee

1. Receives

the report Quarterly Risk Report - 31 March 2023 (R27625) and its attachment (1759736513-9).

|

13. Health,

Safety and Wellbeing Report to 31 March 2023 104 - 117

Document number R27582

Recommendation

|

That

the Audit, Risk and Finance Committee

1. Receives

the report Health, Safety and Wellbeing Report to 31 March 2023 (R27582) and its attachment (855153265-3812).

|

Confidential

Business

14. Exclusion of the Public

Recommendation

That the Audit,

Risk and Finance Committee

1. Excludes the public from the following

parts of the proceedings of this meeting.

2. The general subject of each matter to be considered while the public

is excluded, the reason for passing this resolution in relation to each matter

and the specific grounds under section 48(1) of the Local Government Official

Information and Meetings Act 1987 for the passing of this resolution are as

follows:

|

Item

|

General subject of each matter to be

considered

|

Reason for passing this resolution in

relation to each matter

|

Particular interests protected (where

applicable)

|

|

1

|

Audit, Risk and Finance Committee Meeting - Confidential Minutes

- 24 February 2023

|

Section

48(1)(a)

The

public conduct of this matter would be likely to result in disclosure of

information for which good reason exists under section 7.

|

The withholding of the information is necessary:

· Section

7(2)(g)

To maintain

legal professional privilege

· Section

7(2)(a)

To protect the

privacy of natural persons, including that of a deceased person

|

|

2

|

Health,

Safety and Wellbeing to 31 March 2023

|

Section

48(1)(a)

The public conduct of this

matter would be likely to result in disclosure of information for which good

reason exists under section 7

|

The withholding of the information is necessary:

· Section 7(2)(a)

To protect the privacy of

natural persons, including that of a deceased person

|

|

3

|

Organisational Risk - Deep Dives

|

Section 48(1)(a)

The public

conduct of this matter would be likely to result in disclosure of information

for which good reason exists under section 7

|

The withholding of the information is necessary:

· Section

7(2)(j)

To prevent the

disclosure or use of official information for improper gain or improper

advantage

|

|

4

|

Quarterly

Report on Legal Proceedings

|

Section

48(1)(a)

The public conduct of this

matter would be likely to result in disclosure of information for which good

reason exists under section 7

|

The withholding of the information is necessary:

· Section 7(2)(g)

To maintain legal

professional privilege

|

|

5

|

Quarterly Update on Debts - 31 March 2023

|

Section 48(1)(a)

The public

conduct of this matter would be likely to result in disclosure of information

for which good reason exists under section 7

|

The withholding of the information is necessary:

· Section

7(2)(a)

To protect the

privacy of natural persons, including that of a deceased person

|

Karakia

Whakamutanga

Present: Ms

C Taylor (Chairperson), His Worship the Mayor N Smith, Deputy Mayor R

O'Neill-Stevens, Councillor M Courtney, R Sanson and Ms S Kelly

In

Attendance: Interim Chief Executive (L McKenzie), Group

Manager Infrastructure (A Louverdis), Group Manager Environmental Management (D

Bush-King), Group Manager Corporate Services (N Harrison) and Governance

Adviser (T Kruger) and Assistant Governance Adviser (A Bryce-Neumann)

Apologies : Nil

Karakia

and Mihi Timatanga

1. Apologies

There were no apologies.

2. Confirmation of

Order of Business

There was no change to the order

of business.

3. Interests

No interests with items on the

agenda were declared.

Ms C Taylor (Chairperson)

declared a non-pecuniary interest as a Member and the Chair of the Regulatory

Committee of Waka Kotahi and as Chair of the Nelson Airport Noise Environment

Advisory Committee.

4. Public Forum

There was no public forum.

5. Confirmation of

Minutes

There

were no minutes to confirm.

6. Quarterly Finance

Report to 31 December 2022

Document number R27419, agenda

pages 6 - 34 refer.

Group Manager

Corporate Services, Nikki Harrison, took the report as read and tabled an

updated page for the Operating Budget (1857728953-678) and answered questions

on the Infrastructure revaluation impacts, flood events, staff expenditure

increases due to inflation and recoveries breakdown.

|

Resolved ARF/2023/001

|

|

|

That

the Audit, Risk and Finance Committee

1. Receives the report

Quarterly Finance Report to 31 December 2022 (R27419) and its attachments (1857728953-647, 839498445-13756 and

839498445-13835).

|

|

O'Neill-Stevens/Courtney Carried

|

|

Attachments

1 1857728953-678 - Updated Operating Budget

|

7. Quarterly Internal

Audit Report - 31 December 2022

Document number R27420, agenda

pages 35 - 39 refer.

Audit and Risk Analyst, Chris

Logan, took the report as read.

Group Manager Corporate Services,

Nikki Harrison advised that if there were any high risk matters they would be

reported to the Committee.

|

Resolved ARF/2023/002

|

|

|

That

the Audit, Risk and Finance Committee

1. Receives the report

Quarterly Internal Audit Report - 31 December 2022 (R27420) and its attachment

(1194974384-3349).

|

|

Taylor/Kelly Carried

|

8. Quarterly Risk

Report - 31 December 2022

Document number R27421, agenda

pages 40 - 43 refer.

Audit and Risk Analyst, Chris

Logan, took the report.

Group Manager, Corporate Services,

Nikki Harrison advised going forward how the threshold of the top ten risks

would be reported, reviewed and presented to the Committee.

|

Resolved ARF/2023/003

|

|

|

That

the Audit, Risk and Finance Committee

1. Receives the report

Quarterly Risk Report - 31 December 2022 (R27421).

|

|

Courtney/O'Neill-Stevens Carried

|

9. Health, Safety and

Wellbeing Report to 31 December 2022

Document number R27426, agenda

pages 44 - 61 refer.

Health Safety and Wellness

Adviser, Malcolm Hughes, took the report as read and answered questions about

the presence of homeless people in the parks and associated risks to

security.

|

Resolved ARF/2023/004

|

|

|

That

the Audit, Risk and Finance Committee

1. Receives the report

Health, Safety and Wellbeing Report to 31 December 2022 (R27426) and its attachment

(855153265-3563).

|

|

O'Neill-Stevens/Courtney Carried

|

The meeting was

adjourned from 10.56a.m. until 11.07a.m.

10. Letter from Audit NZ on Annual

Report for year ending 30 June 2022

Document number R27491, agenda

pages 62 - 102 refer.

Group Manager Corporate Services,

Nikki Harrison took the report as read and answered questions on the process

for preparation of an external audit and the potential for additional fees

charged by Audit NZ, if information was not readily available.

In response to questions Nikki

Harrison advised that the updated Procurement Policy would be circulated to

members and uploaded to Council’s website next week.

|

Resolved ARF/2023/005

|

|

|

That

the Audit, Risk and Finance Committee

1. Receives the report

Letter from Audit NZ on Annual Report for year ending 30 June 2022 (R27491) and its attachment (2126778665-296)

2. Notes Audit

NZ’s comments (2126778665-296) and how officers intend to address the issues raised.

|

|

Kelly/Taylor Carried

|

11. Exclusion

of the Public

|

Resolved ARF/2023/006

|

|

|

That the Audit, Risk and

Finance Committee

1. Excludes the public

from the following parts of the proceedings of this meeting.

2. The general subject of each

matter to be considered while the public is excluded, the reason for passing

this resolution in relation to each matter and the specific grounds under

section 48(1) of the Local Government Official Information and Meetings Act

1987 for the passing of this resolution are as follows:

|

|

Courtney/O'Neill-Stevens Carried

|

|

Item

|

General subject of each matter to be

considered

|

Reason for passing this resolution in

relation to each matter

|

Particular interests protected (where

applicable)

|

|

1

|

Quarterly

Report on Legal Proceedings

|

Section

48(1)(a)

The public conduct of this

matter would be likely to result in disclosure of information for which good

reason exists under section 7

|

The withholding of the information is necessary:

· Section 7(2)(g)

To maintain legal

professional privilege

|

|

2

|

Quarterly Update on Debts - 31 December 2022

|

Section 48(1)(a)

The public

conduct of this matter would be likely to result in disclosure of information

for which good reason exists under section 7

|

The withholding of the information is necessary:

· Section

7(2)(a)

To protect the

privacy of natural persons, including that of a deceased person

· Section

7(2)(g)

To maintain

legal professional privilege

|

The meeting went into confidential session at 11.15a.m.

and resumed in public session at 11.42a.m.

Karakia

Whakamutanga

12. Restatements

It was resolved while the public was

excluded:

|

1

|

CONFIDENTIAL: Quarterly

Report on Legal Proceedings

|

|

|

2. Agrees that the

report Quarterly Report on Legal Proceedings (R27284) and its attachment

(142319133-363) remain confidential.

|

|

2

|

CONFIDENTIAL: Quarterly

Update on Debts - 31 December 2022

|

|

|

2. Agrees

that the Report and its attachment (1857728953-643) remain confidential at

this time.

|

There being no further business the meeting ended at 11.43a.m.

Confirmed as a correct record of proceedings by

resolution on (date)

|

|

Audit, Risk and Finance Committee

1 June 2023

|

REPORT R27656

Privacy Act 2020 -

Reporting

1. Purpose of Report

1.1 To provide a 6

monthly update on actions underway to monitor and manage privacy related

matters following the coming into force of the Privacy Act 2020.

2. Recommendation

|

That the Audit, Risk and Finance Committee

1. Receives

the report Privacy Act 2020 - Reporting (R27656) and its attachment (1738230957-18024); and

2. Notes that Council’s Privacy Policy and Breach

Management Plan applies also to elected and appointed members and training on

compliance with the Privacy Act has and will be provided as part of induction

for elected and appointed members.

|

3. Systems and

controls

Privacy

policy and breach management plan

3.1 Council’s

Privacy Policy and breach management plan (see Attachment 1, 1738230957-18024)

has been finalised and provides guidance in how privacy matters will be

addressed. This Policy applies to all employees, members (elected and

appointed), and to any appointed “officers” of the Council who are

directly employed by a contractor to the Council. It outlines what a privacy

breach is, how it can be caused and the steps Council will take when a

suspected/confirmed breach has occurred.

3.2 A breach/ near

miss register has also been developed. The register has been carefully structured

to provide information for the Privacy Officer on any system or training gaps

without becoming a breach of personal information in itself.

3.3 From the Policy,

the work programme to ensure staff, contractors, members, and those holding

statutory officer roles on behalf on Council understand and meet their privacy

obligations has been updated.

IT and cyber security

3.4 Ongoing security

improvements and training are undertaken to prevent breaches through cyber

security risk.

3.5 The use of

memory sticks is currently targeted (through discouragement and monitoring) to

reduce risk of data loss.

Privacy statements

3.6 A number of

privacy statements have been updated or drafted for regular activities of

Council to provide increased transparency to the public around Council’s

collection, use and storage of personal information.

3.7 These include

statements for use in Local Government Act consultation/ engagement, Resource

Management Act (RMA) consultation, local/regional and national emergencies,

competitions and surveys run by or on behalf of Council, and events

(particularly where images may be captured).

4. Compliance

Investigations

4.1 One compliance

matter was raised and investigated since the previous reporting period to

September 2022.

4.1.1 A

party affected by the August 2022 rain event raised a complaint in relation to

how their information was used during the recovery. On investigation the

complaint was not upheld.

4.1.2 Nonetheless,

privacy statements advising the community about the collection, use and storage

of personal information in instances of local/ regional and national

emergencies have been drafted and are currently under review. The intention is

that this information be proactively placed on Council’s website as well

as included in communications should an emergency event occur.

Follow up actions from

previously reported compliance matters

4.1.3 An

updated privacy statement for RMA (Form 5) consultations has now been finalised

for use.

4.1.4 A

debrief was undertaken with staff involved in a matter related to two email

communications sent in the second half of the 2021 year, and adjustments made

to specific third-party interactions.

5. Training and

advice

5.1 Privacy

requirements for elected members were included in the induction programme for

the incoming Council. Appointed members will also be provided with information

on appointment.

5.2 A site has been

established on Council’s intranet to provide quick access for staff to

privacy essentials including policy, training and other key information.

Similar information will be provided to members via LGHub, Council’s

document sharing portal for member meeting and reference documents.

5.3 An induction

presentation on privacy fundamentals has been prepared for Council workers,

including actions they need to take if a breach is suspected.

5.4 A suite of

Frequently Asked Questions has been initiated, which will be added to over time

as queries, compliance matters or guidance from the Privacy Commissioner raise

topics to cover.

5.5 Initial advice

on the use of AI (ChatGPT) for Council activities has been provided, with

further guidance to support decision-making to be prepared following

anticipated guidance from the Privacy Commissioner in May.

5.6 Advice has been

provided on a number of specific situations to ensure privacy matters are

understood and compliance is maintained.

6. Conclusion

6.1 Both proactive

and responsive actions continue within the privacy space.

6.2 Ways to

appropriately resource the privacy work programme remains an ongoing

discussion.

Author: Devorah

Nicuarta-Smith, Manager Governance and Support Services

Authoriser: Nicky

McDonald, Group Manager Strategy and

Communications

Attachments

Attachment 1: 1738230957-18024

Privacy (personal information) policy and breach management plan ⇩

Item 7: Privacy Act 2020 - Reporting: Attachment 1

Item 8: Review of

Council's Section 17A service delivery reviews process

|

|

Audit, Risk and Finance Committee

1 June 2023

|

REPORT R27716

Review of Council's

Section 17A service delivery reviews process

1. Purpose of Report

1.1 To report back

to the Committee on a review undertaken of the process for Section 17A service

delivery reviews.

1.2 To recommend

changes to Council’s Section 17A service delivery reviews process be

approved by Council.

2. Summary

2.1 At its 22

September 2022 meeting, Council asked staff to undertake a review of

Council’s Section 17A service delivery reviews process. Staff reviewed

the current process, comparing it against a sample of other councils’

processes and Taituarā best practice guidance.

Informed by the findings of the

review, staff recommend making changes to Council’s current process,

including increasing the value threshold for triggering a review, and

clarifying what triggers different levels of sign-off for a completed review.

3. Recommendation

|

That the Audit, Risk and Finance Committee

1. Receives

the report Review of Council's Section 17A service delivery reviews process (R27716); and

2. Notes the findings from

the review of Council’s process for Section 17A service delivery

reviews contained within this report.

|

Recommendation to Council

|

That the

Council

1. Approves the below

changes to Council’s Section 17A review process:

a. Increase the value threshold

that triggers a service delivery review under Section 17A of the Local

Government Act 2002 from $100,000 to $1 million per annum; and

b. Delegate the Chief Executive

responsibility to sign off reviews unless they meet a threshold of either:

i. proposing considerable

change to the service’s delivery and/or

ii. is assessed as being of

medium or high significance against Council’s Significance and

Engagement Policy; and

c. An annual report be presented

to Council on progress and outcomes of Council’s Section 17A reviews.

|

4. Background

4.1 Service delivery

reviews are a requirement of Section 17A of the Local Government Act 2002 and

they determine whether the existing means of delivering a service remains the

most efficient, effective and appropriate method. This includes consideration

of the method of governance, funding, and delivery of the service and the

alternative options that are available. The reviews do not cover the quality of

services themselves.

4.2 There are two

types of reviews:

4.2.1 Reviews of service areas within

Council, such as a business activity (activity reviews). These reviews may

encompass the review of one or more service contracts.

4.2.2 Reviews of services delivered

via contract, such as a maintenance contract (contract reviews).

4.3 Under the Act,

Council is required to undertake Section 17A service delivery reviews when it

is considering a significant change to a level of service, and no less often

than every six years. Contract reviews are undertaken within two years before

the expiry of a contract.

Exemptions

4.4 Section 17A(3)

provides two exemptions to these review requirements:

4.4.1 A local authority is not

required to undertake a review where delivery arrangements are bound by legislation,

contract or binding agreement and cannot be changed within the next two years.

4.4.2 A local authority is not

required to undertake the review if it is satisfied that the potential benefits

do not justify the cost of the review e.g., the service is small or where cost

savings resulting from a review may be minor. In 2015, Council, using the

Procurement Policy as a guide, set a threshold that activities with a value of

up to $100,000 be exempt from review.

5. Discussion

5.1 Council at its

22 September 2022 meeting resolved:

Resolved CL/2022/239

2. Requests officers undertake a

review of the process for S17A service delivery reviews to reflect Taituara

best practice advice and reports the review to the Audit, Risk and Finance

Committee (or equivalent); and

Council’s

process

5.2 Council’s

current process for Section 17A reviews is outlined below.

5.2.1 Staff consider if a Section 17A

service delivery review is required, taking account of the exemptions in

paragraph 4.4.

5.2.2 If the service is determined to

be in scope of a review, staff undertake an initial assessment of the service.

This assessment includes the current arrangements of the service; what the

service is, why it is provided, how it is delivered and funded and what the

operating costs are. If the initial assessment determines that a more in-depth

review is required, staff analyse different delivery methods of the service and

identify the most cost-effective option and what the recommendations of the

review are.

5.2.3 Section 17A reviews had been

approved by the Senior Leadership Team but following a resolution of Council at

the 22 September 2022 meeting, all now come to Council for approval.

Review of

the current process

5.3 Staff have

reviewed the current Section 17A review process as outlined below:

5.3.1 Comparing Council’s

process against Taituarā best practice guidance.

5.3.2 Comparing the process with other

councils of a similar size.

5.4 The key findings

and recommendations from the review are outlined below.

5.4.1 Council’s value threshold

of $100,000 to trigger a review is low. Taituarā guidance recommends that

councils set a limit on contract value where any potential savings are deemed

to be outweighed by the cost of doing a review. In 2014, following the

introduction of Section 17A reviews, it provided a suggested example for a

medium-sized council of a $250,000 threshold. Nine years later Council’s

$100,000 threshold is very much out of step, and this has been exacerbated by

the high inflation environment. Staff recommend increasing the value threshold

to $1million.

5.4.2 To provide an indication of the

amount of service delivery reviews under different threshold options, staff did

an analysis of the number of activity reviews required under the existing

threshold of $100,000, compared with a $500,000 and $1 million threshold. Staff

have calculated the estimated value of these activities by operating

expenditure and overheads.

5.4.3 Please note, this is only an

estimate, as the review areas would require an updated assessment of financial

costs following the adoption of the Long Term Plan. In summary based on this

analysis, there are:

5.4.3.1 38

activity reviews required at the $100,000 threshold

5.4.3.2 27

activity reviews required at the $500,000 threshold

5.4.3.3 23

activity reviews required at the $1 million threshold.

5.4.4 The process for approval of

reviews could be more efficient. The Local Government Act 2002 does not

prescribe a sign-off process for Section 17A reviews. Currently, all Section

17A reviews are required to be approved by Council. To focus governance

consideration on the most significant reviews it is recommended that the Chief

Executive be delegated responsibility to sign off routine reviews. If reviews

are either proposing considerable change to the service’s delivery and/or

are of medium or high significance against Council’s Significance and

Engagement Policy then they would come to Council for consideration.

5.4.5 If the current delegation stays

in place, approximately 25 extra reports, applying the $1million value

threshold, would come to Council over the six-year review period. The number

would be closer to 50 if the $100,000 threshold remained. Other councils are

similarly conscious of making best use of governance time in their Section 17A

review process. Marlborough District Council, for example, undertakes a

preliminary analysis every six years of its high-level delivery and relative

cost effectiveness, and provides a single report to Council where decisions are

made on any areas that require a more in-depth review. Tasman District Council

doesn’t have a policy on Section 17A reviews.

5.4.6 An annual report to Council

on progress and outcomes of Council’s Section 17A reviews would be useful

to ensure elected members have oversight. Staff also propose a folder be made

available in LGHub where Section 17A reviews are saved once approved by the

Chief Executive. This means elected members can access completed reviews at any

time.

3. Options

|

|

|

Advantages

|

· Ensures

elected members and staff efforts are focused on areas of high priority and

significance and where greater efficiencies could be gained.

· Council

maintains oversight of the progress and outcomes of all Section 17A reviews.

|

|

Risks and Disadvantages

|

· None

obvious.

|

|

|

|

Advantages

|

· None

obvious.

|

|

Risks and Disadvantages

|

· Requires

more staff and elected member time undertaking reviews, reducing resources

for other priority work.

|

|

Option 3: Request amendments to the proposed changes to

Council’s Section 17A reviews process

|

|

Advantages

|

· Amendments

can be incorporated before the draft procedure goes to Council for approval.

|

|

Risks and Disadvantages

|

· Implementation

of the procedure could be delayed and staff time would continue to be

required to undertake reviews over the current $100,000 threshold.

|

4. Next

Steps

5.5 If the

recommendations are approved by the Committee and subsequently by Council,

staff will implement the changes, including setting up a folder in LGHub where

all reviews will be saved.

Author: Ailish

Neyland, Policy Adviser

Authoriser: Nicky

McDonald, Group Manager Strategy and Communications

Attachments

Nil

|

Important considerations for decision making

|

|

Fit with Purpose of Local Government

The recommendation supports Council’s

requirements under Section 17A of the Local Government Act 2002. Undertaking

Council activities in the most effective manner possible contributes to the

four aspects of community wellbeing.

|

|

Consistency with Community Outcomes

and Council Policy

The recommendations support the following Community

Outcomes:

• Our

infrastructure is efficient, cost effective and meets current and future

needs

• Our

communities have access to a range of social, educational and recreational

facilities and activities.

|

|

Risk

Recommending the proposed changes to Council reduces

the risk that resources are allocated to reviews which realise minor or no

benefits.

|

|

Financial impact

The recommendations would have no direct financial

impact to Council.

|

|

Degree of significance and level of

engagement

This matter is of low significance as it does not

impact levels of service and has no financial impact and therefore no

community engagement has been undertaken.

|

|

Climate Impact

The decision in this report will have no impact on

the ability of Council to proactively respond to the impacts of climate

change now or in the future.

|

|

Inclusion of Māori in the

decision making process

No engagement with Māori has been

undertaken in preparing this report.

|

|

Delegations

The Audit, Risk and Finance Committee has the

following delegations to consider in relation to the requirements of the

Local Government Act 2002:

Areas of Responsibility:

• Council’s

financial performance

• Internal

Audit

• Procurement

Policy

Powers to Recommend to Council:

• All

other matters within the areas of responsibility or any other matters

referred to it by the Council.

|

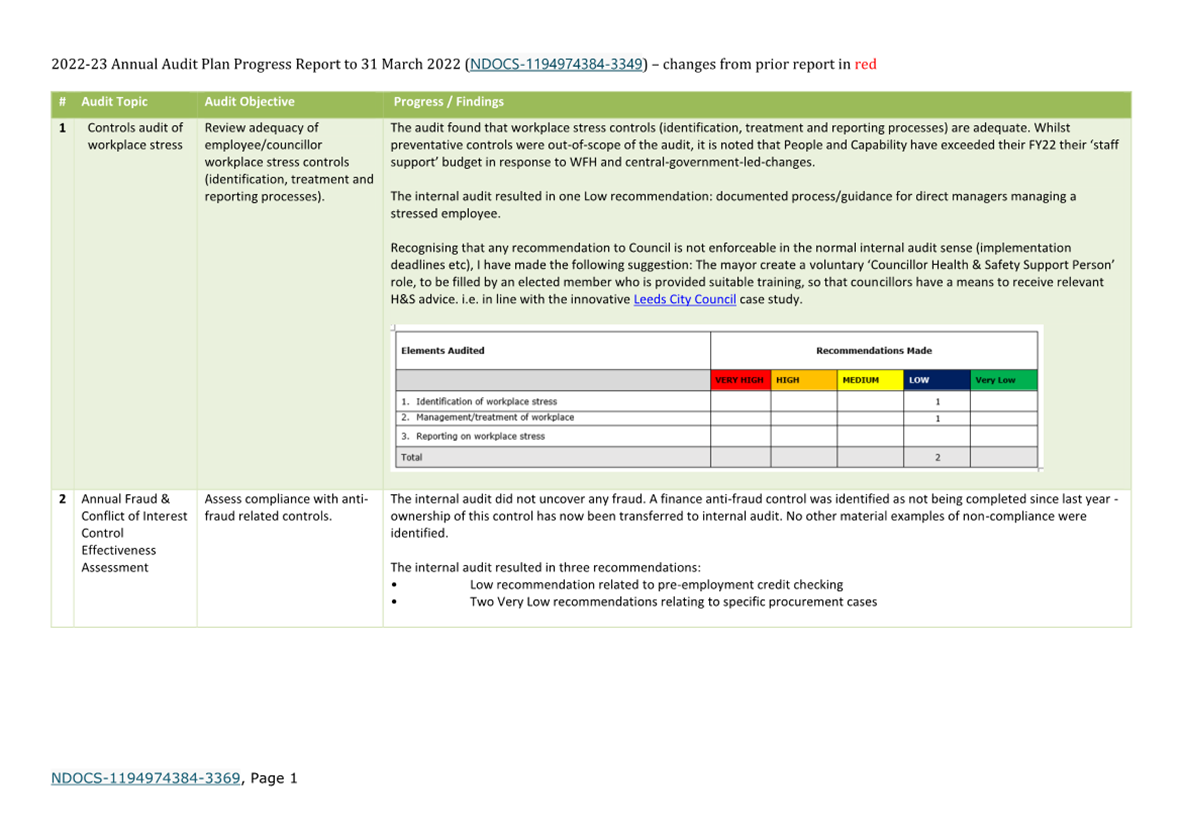

Item 9: Quarterly

Internal Audit Report - 31 March 2023

|

|

Audit, Risk and Finance Committee

1 June 2023

|

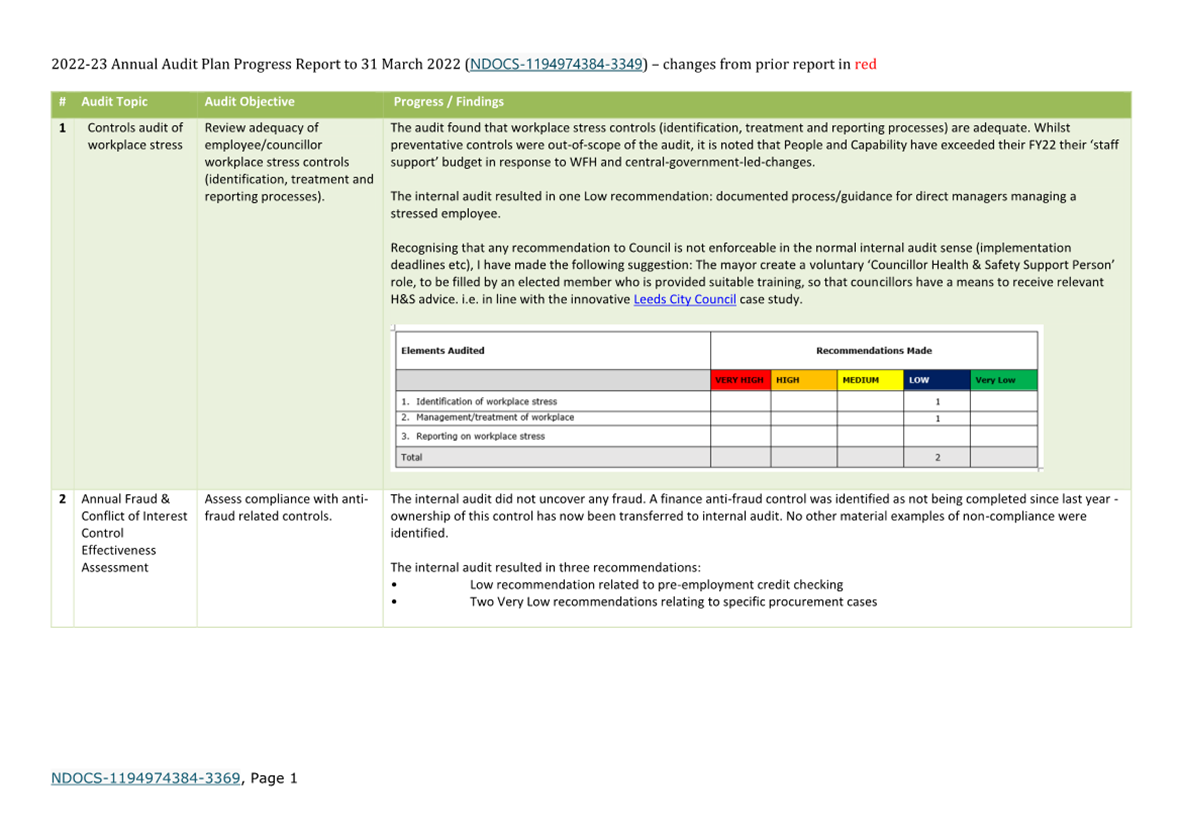

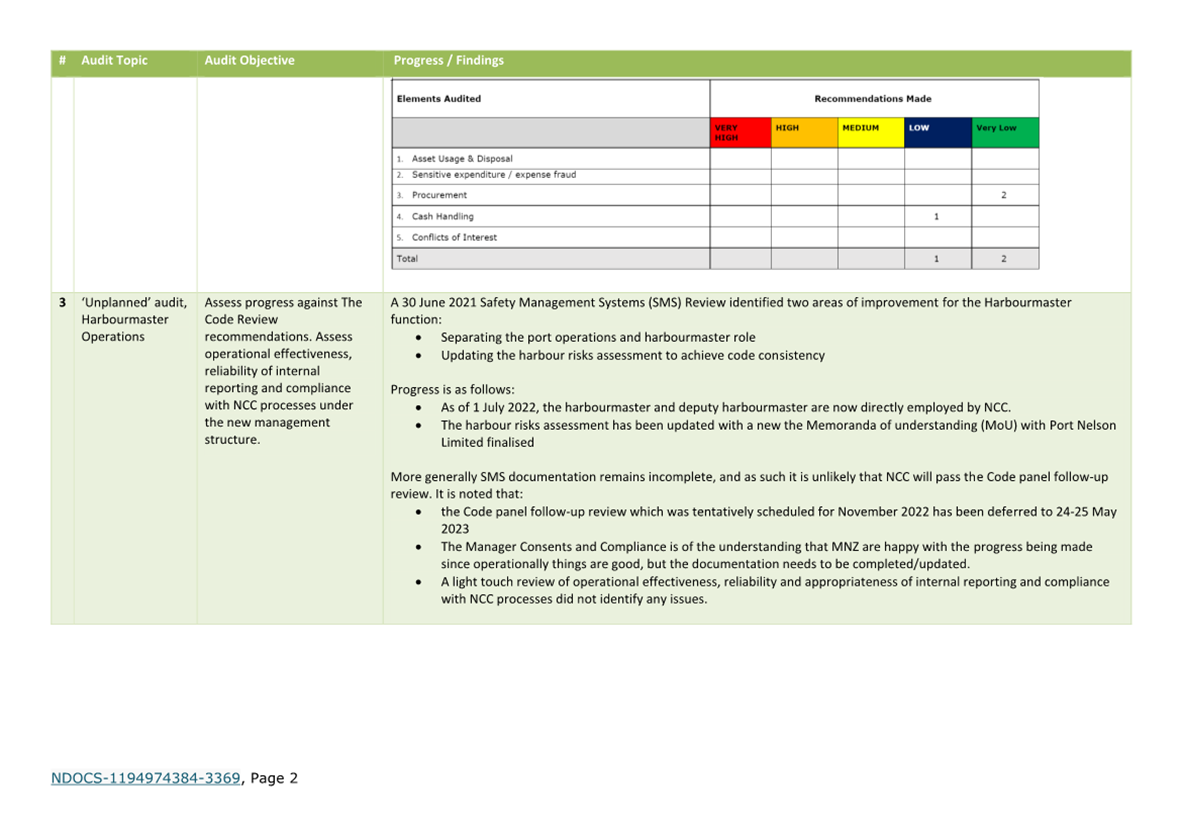

REPORT R27624

Quarterly Internal Audit

Report - 31 March 2023

1. Purpose of Report

1.1 To update the

Audit, Risk and Finance Committee on the internal audit activity for the quarter

year to 31 March 2023.

2. Recommendation

|

That the Audit, Risk and Finance Committee

1. Receives

the report Quarterly Internal Audit Report - 31 March 2023 (R27624) and its attachment

(1194974384-3369).

|

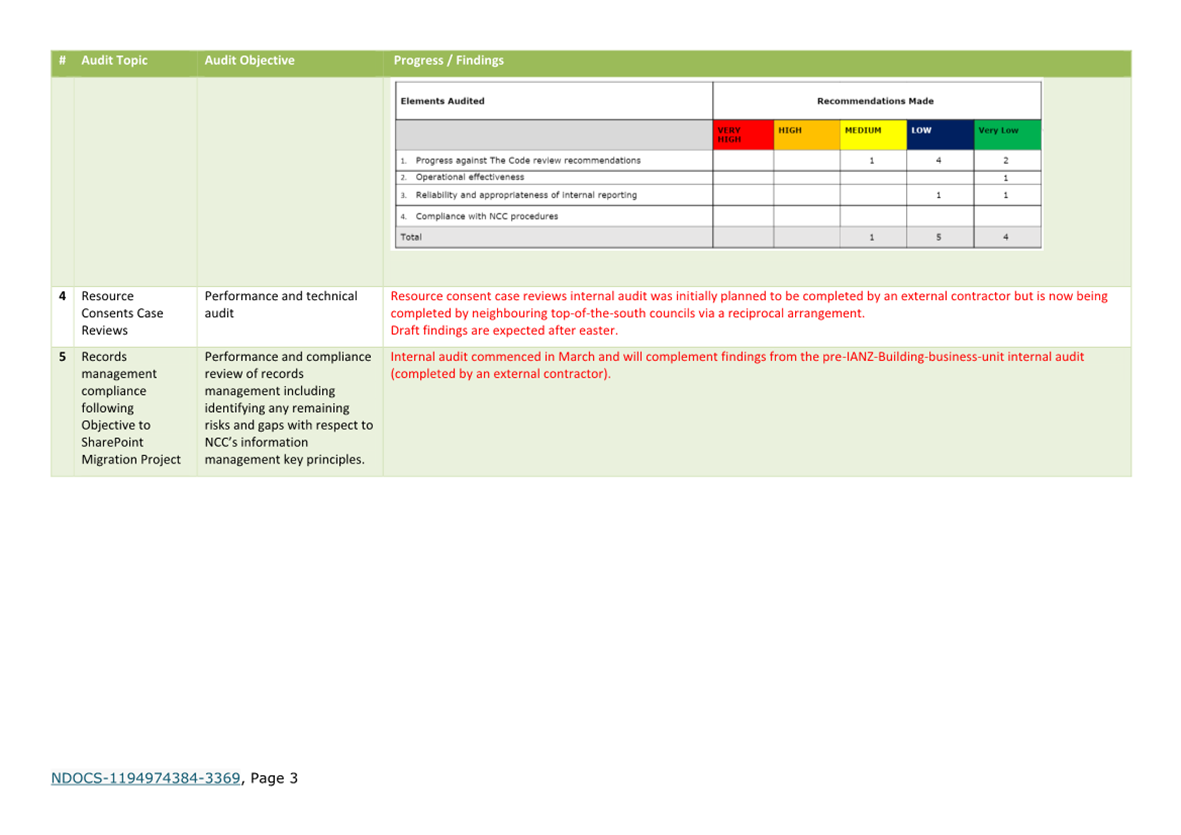

3. Background

3.1 Under

Council’s Internal Audit Charter approved by Council on 15 November 2018

the Audit, Risk and Finance Subcommittee (now a Committee) requires a periodic

update on the progress of internal audit activities. The 2022-23 Internal Audit

Plan (the Plan) was approved by the Audit, Risk and Finance Subcommittee on 24

May 2022. The Plan provides for four planned audits, with an allowance for a

further one ‘unplanned’ audit.

4. Overview of

Progress on the 2022/23 Internal Audit Plan

4.1 A detailed

summary is provided in Attachment 1 (1194974384-3369).

4.2 No internal

audits were completed over the quarter to 31 March 2023 with prioritisation

given to insurance claim preparation for the August weather event.

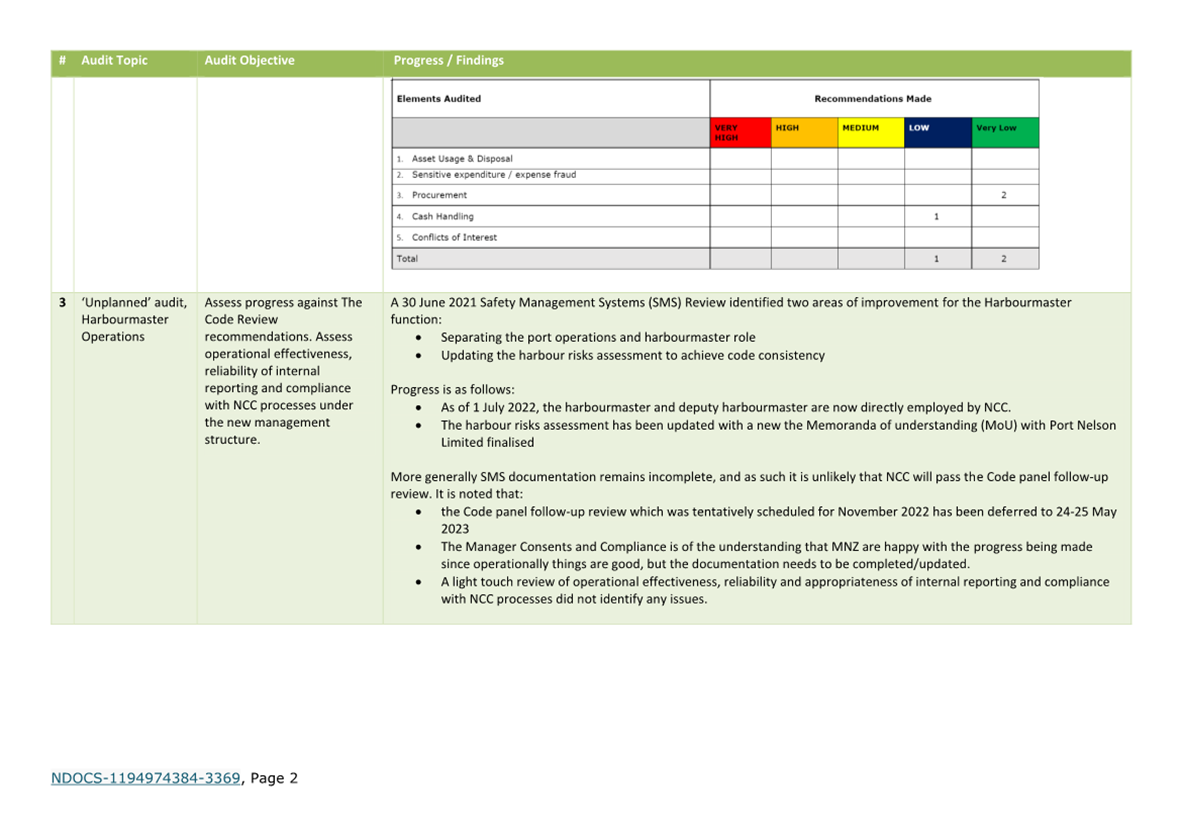

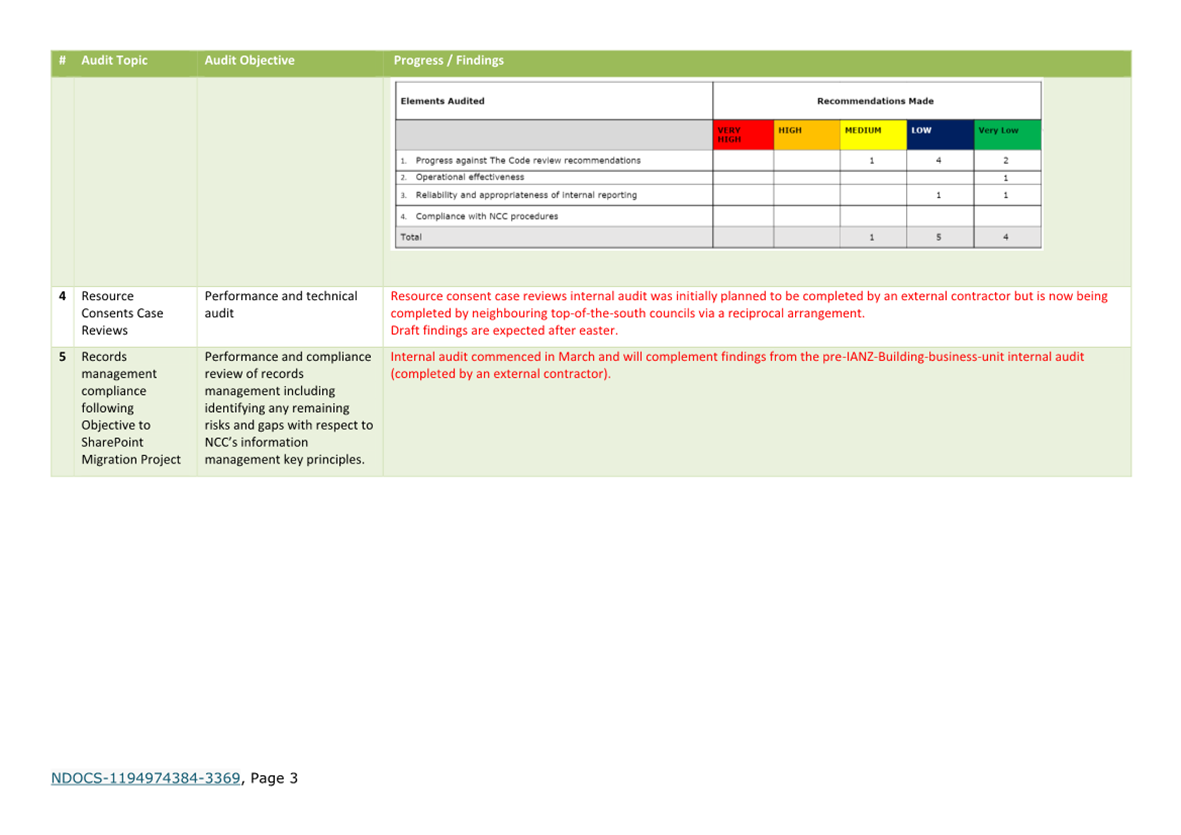

4.3 There are two

remaining incomplete audits:

4.3.1 Resource

consent case reviews internal audit was initially planned to be completed by an

external contractor but is now being completed by neighbouring top-of-the-south

councils via a reciprocal arrangement. Draft findings are expected after

Easter.

4.3.2 Records

management compliance following Objective to SharePoint Migration Project

internal audit commenced in March and will complement findings from the

pre-IANZ-Building-business-unit internal audit (completed by an external

contractor).

5. Significant

external audits that are not reported separately to the Audit, Risk and Finance

Committee

5.1 The

International Accreditation New Zealand’s (IANZ’s) Building Consent

Authority (BCA) two-yearly audit is due to commence in June 2023.

5.2 Reporting the progress

on implementation of the Greenmeadows external review recommendation, has been

incorporated into the 2023-2024 Annual Audit Plan for the first half of the

year.

Author: Chris

Logan, Audit and Risk Analyst

Authoriser: Nikki

Harrison, Group Manager Corporate Services

Attachments

Attachment 1: 1194974384-3369

Annual Audit Plan Progress - 31 Mar 2023 ⇩

Item 9: Quarterly Internal Audit Report - 31 March

2023: Attachment 1

Item 10: Internal Audit

Plan 2023-2024

|

|

Audit, Risk and Finance Committee

1 June 2023

|

REPORT R27626

Internal Audit Plan

2023-2024

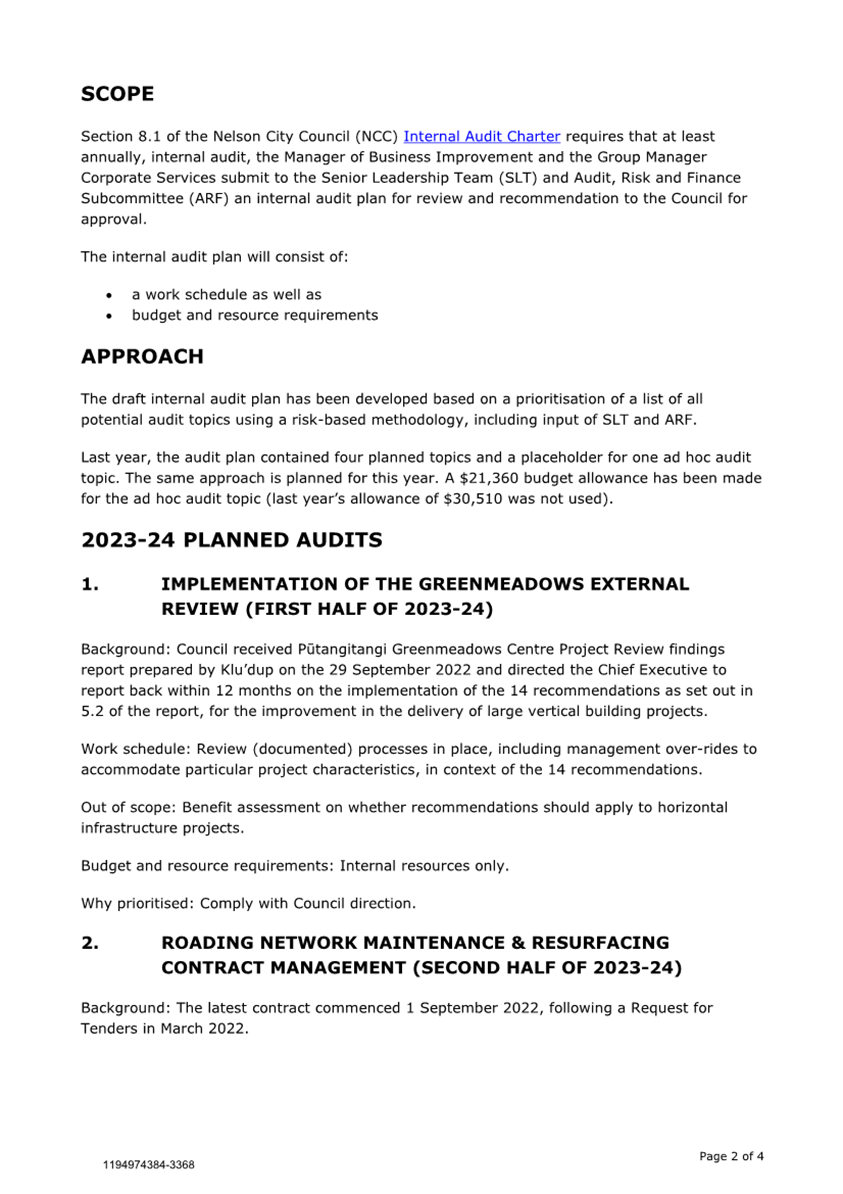

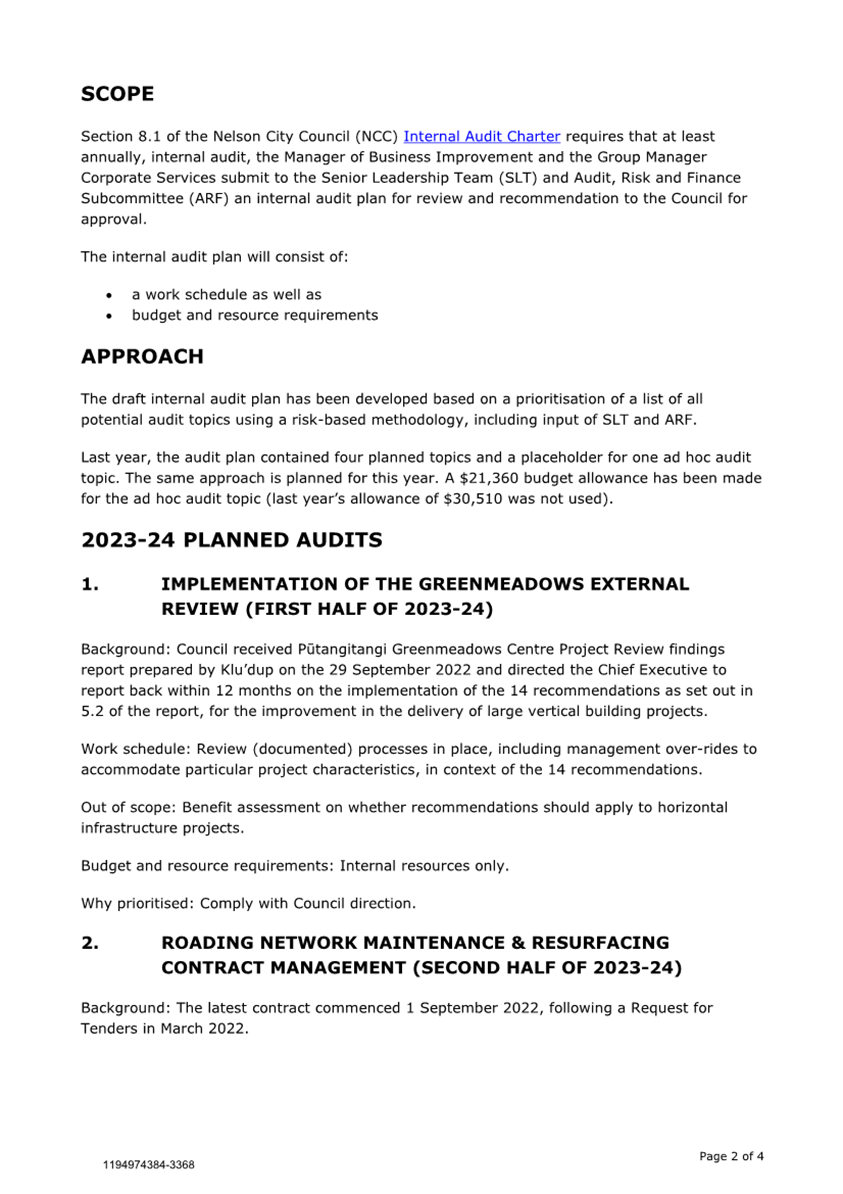

1. Purpose of Report

1.1 To approve the

Draft Annual Internal Audit Plan to 30 June 2024.

2. Summary

2.1 The Internal

Audit Charter, approved by Council on 15 November 2018, requires that at least

annually, the internal auditor submits to the Audit, Risk and Finance Committee

(ARF) an internal audit plan for review and recommendation to the Council for

approval.

3. Recommendation

|

That the Audit, Risk and Finance Committee

1. Receives

the report Internal Audit Plan 2023-2024 (R27626) and its attachments (1194974384-3370 and 1194974384-3368).

|

Recommendation to Council

|

That the

Council

1. Approves the Draft

Annual Internal Audit Plan for the year to 30 June 2024 (1194974384-3368).

|

4. Background

4.1 The internal

audit plan consists of a work schedule as well as budget and resource

requirements for the next financial year. These items are described in Attachment

2 (1194974384-3368).

4.2 The internal

audit plan has been developed based on a prioritisation of a list of all

potential audit topics using a risk-based methodology.

4.3 Feedback on the

draft topics was sought from the Chair of the Audit, Risk and Finance Committee

prior to this meeting.

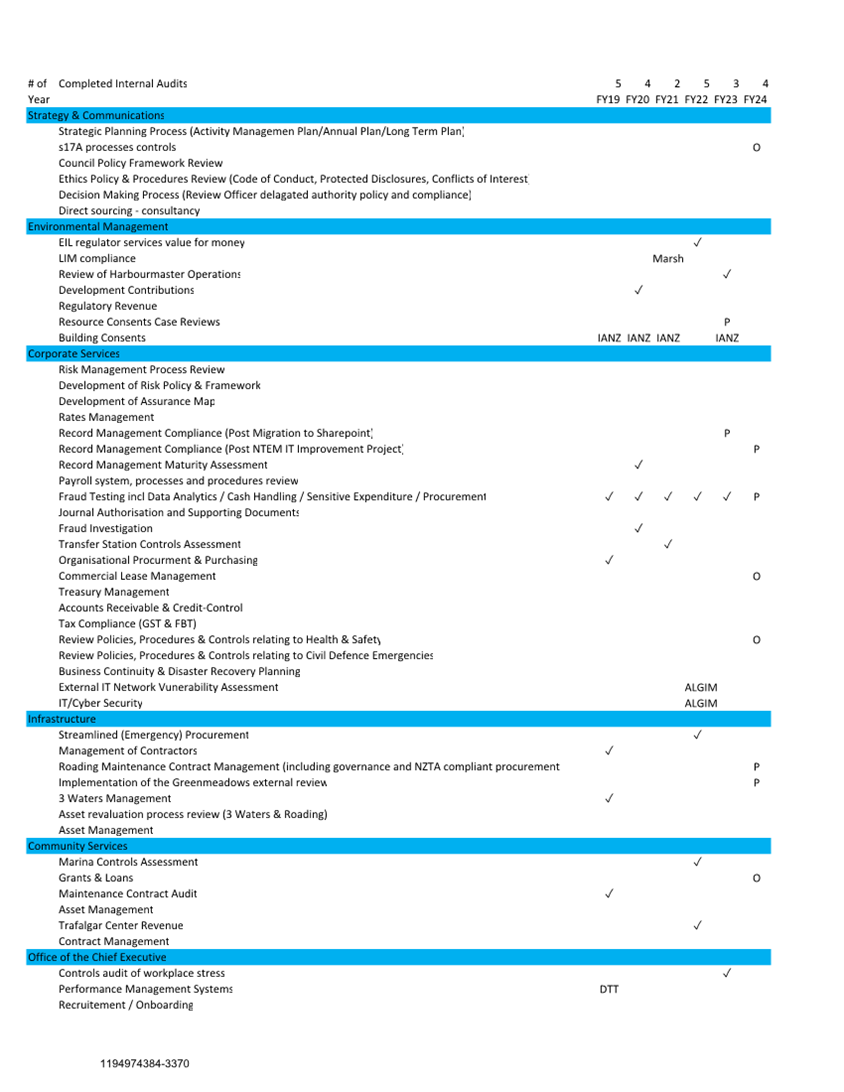

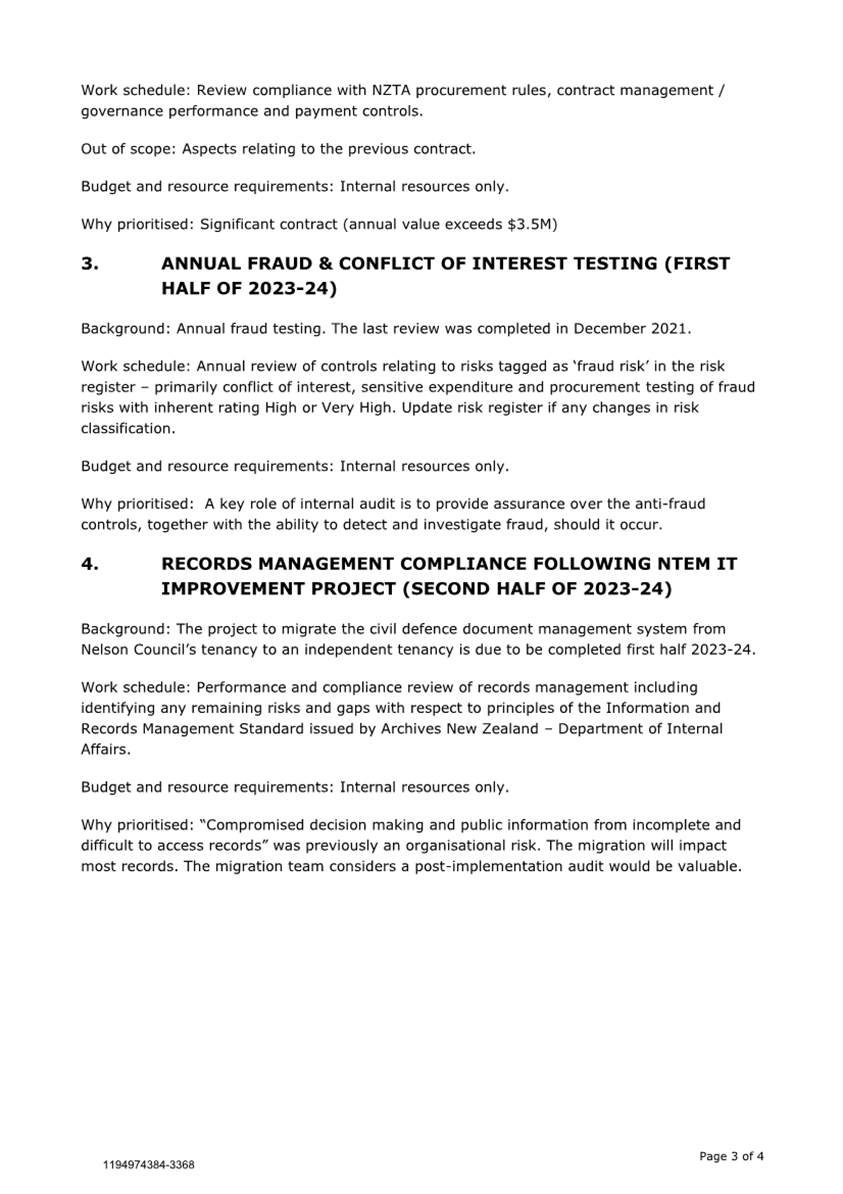

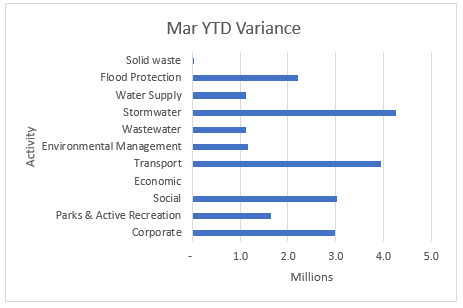

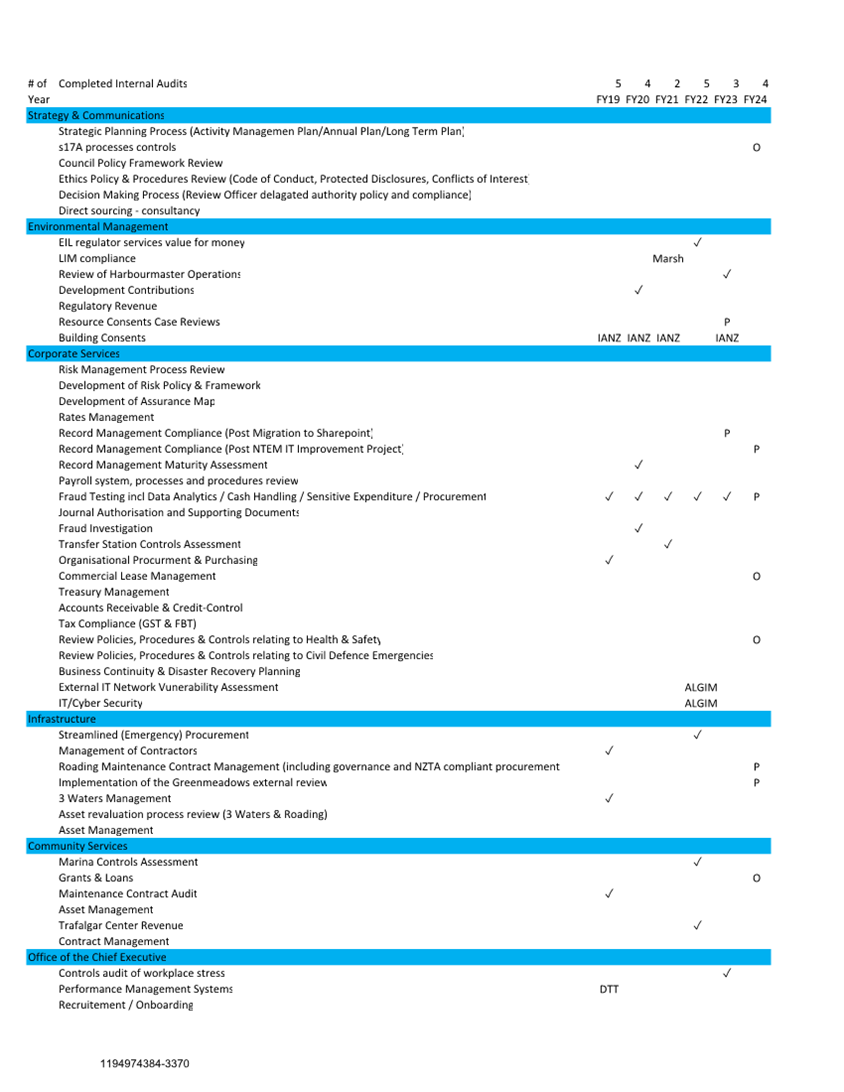

5. Discussion

5.1 A summary of

previous year internal audits in are described in the Attachment 1

(1194974384-3370).

5.2 Like last year,

the draft annual audit plan contains four planned topics and a placeholder for one

ad hoc audit topics. A budget of $21,360 has been allowed for should the ad hoc

audit topics require external specialists. In previous years the budget has

been $25,000. This years’ budget has been reduced due to the tight

financial situation for council.

5.3 The planned

topics are:

5.3.1 implementation of the

Greenmeadows external review (first half of 2023-24);

5.3.2 roading network maintenance

& resurfacing contract management (second half of 2023-24);

5.3.3 annual fraud & conflict of

interest testing (first half of 2023-24);

5.3.4 records management compliance

following Nelson Tasman Emergency Management IT improvement project (second

half of 2023-24);

6. Options

|

|

|

Advantages

|

· Flexibility

to audit emerging risk.

|

|

Risks and Disadvantages

|

· A loss

occurs that may have been avoided had an audit taken place for one of the

potential ad-hoc audit topics.

|

|

|

|

Advantages

|

· Flexibility

to audit emerging risk.

|

|

Risks and Disadvantages

|

· Increased

delivery risk as placeholder ad hoc audit topics not fully scoped.

|

|

|

|

Advantages

|

· Increased

flexibility to audit emerging risks.

|

|

Risks and Disadvantages

|

· Increased

delivery risk as suitable ad hoc audit topic may not be found

|

Author: Chris

Logan, Audit and Risk Analyst

Authoriser: Nikki

Harrison, Group Manager Corporate Services

Attachments

Attachment 1: 1194974384-3370

- Internal Audits Summary At 30 June 2023 ⇩

Attachment 2: 1194974384-3368

- Draft 2023-24 Internal Audit Plan - 31 March 2023 ⇩

|

Important considerations for decision making

|

|

Fit with Purpose of Local Government

This report provides a plan to assess whether

certain areas of Council's risk management, governance and internal control

processes are operating effectively.

Execution of the plan provides assurance that

Council is effectively promoting the social, economic, environmental, and

cultural well-being of communities in the present and for the future.

|

|

Consistency with Community Outcomes

and Council Policy

This report aligns with the Internal Audit Charter,

approved by Council on 15 November 2018.

|

|

Risk

If internal audits are not approved: the cost of

external audits may increase, the frequency and severity of internal control

failures may increase and it may become more difficult to retain

Council’s current credit rating.

|

|

Financial impact

This decision will fit within existing budgets.

|

|

Degree of significance and level of

engagement

This matter is of low significance because it does

not directly impact financial decisions, or the levels of services provided.

Therefore, no consultation is required.

|

|

Climate Impact

There has been no specific climate change impact

considered in the preparation of this report.

|

|

Inclusion of Māori in the

decision making process

No engagement with Māori has been undertaken in

preparing this report.

|

|

Delegations

The Audit, Risk and Finance Committee Committee

has the following delegations to consider

Areas of Responsibility:

Internal audit Delegations:

Powers to Recommend (if applicable):

All other matters within the areas of responsibility

or any other matters referred to it by the Council

|

Item 10: Internal Audit Plan 2023-2024: Attachment 1

Item 10: Internal Audit Plan 2023-2024: Attachment 2

Item 11: Quarterly

Finance Report to 31 March 2023

|

|

Audit, Risk and Finance Committee

1 June 2023

|

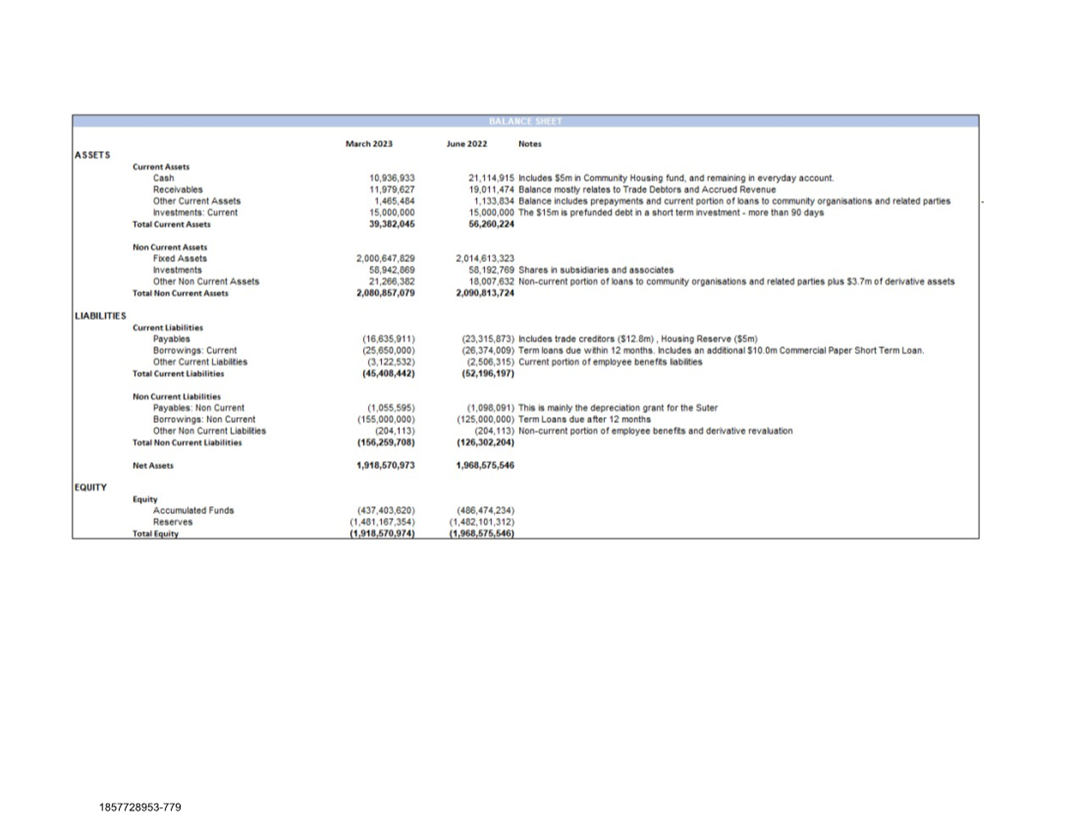

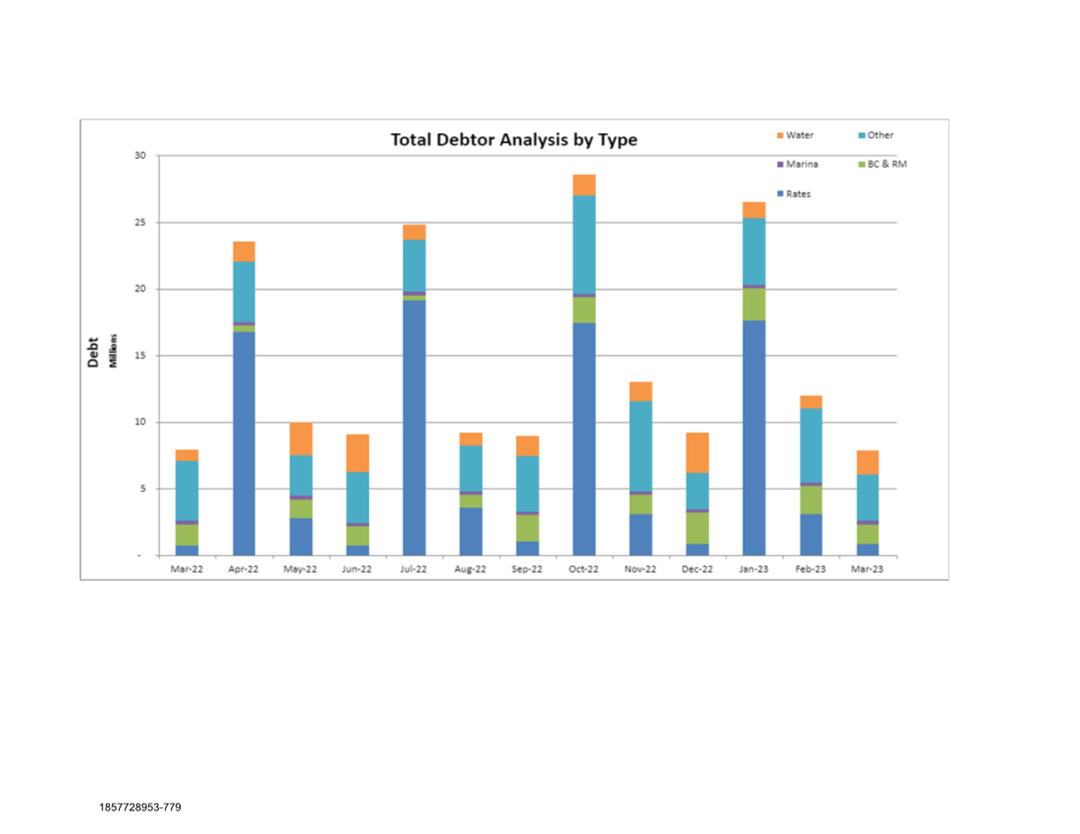

REPORT R27695

Quarterly Finance Report

to 31 March 2023

1. Purpose of Report

1.1 To

inform the Committee of the financial results for Council for the nine months

ended 31 March 2023 of the 2022/23 financial year, and to highlight any

material variations.

2. Recommendation

|

That the Audit, Risk and Finance Committee

1. Receives

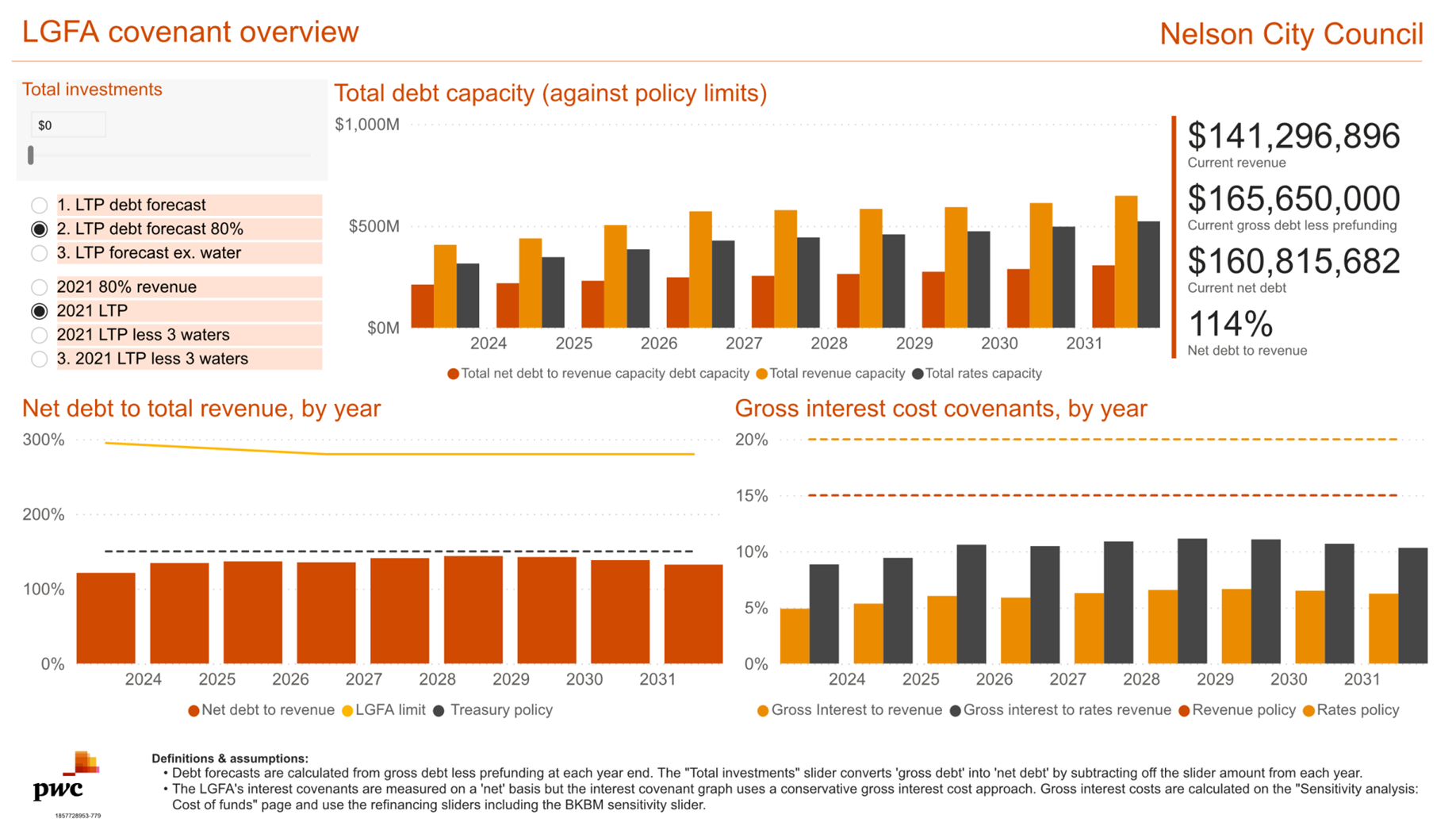

the report Quarterly Finance Report to 31 March 2023 (R27695) and its attachments (1857728953-779,

839498445-14467 and 839498445-14468).

|

3. Background

3.1 The

whole of Council financial reporting provided to this Committee focuses on the

nine-month performance (1 July 2022 to 31 March 2023) compared with the

year-to-date (YTD) approved capital and operating budgets. The quarterly report

includes Nelson City Council performance only and does not include its

subsidiaries, associates and joint ventures.

3.2 Unless

otherwise indicated, all information is against approved operating budgets,

which is Annual Plan 2022/23, plus any carry forwards, plus or minus any other

additions or changes as approved by the Council.

3.3 Commentary

is provided below for significant variances of +/- $500,000.

4. Financial

Performance

4.1 For the nine

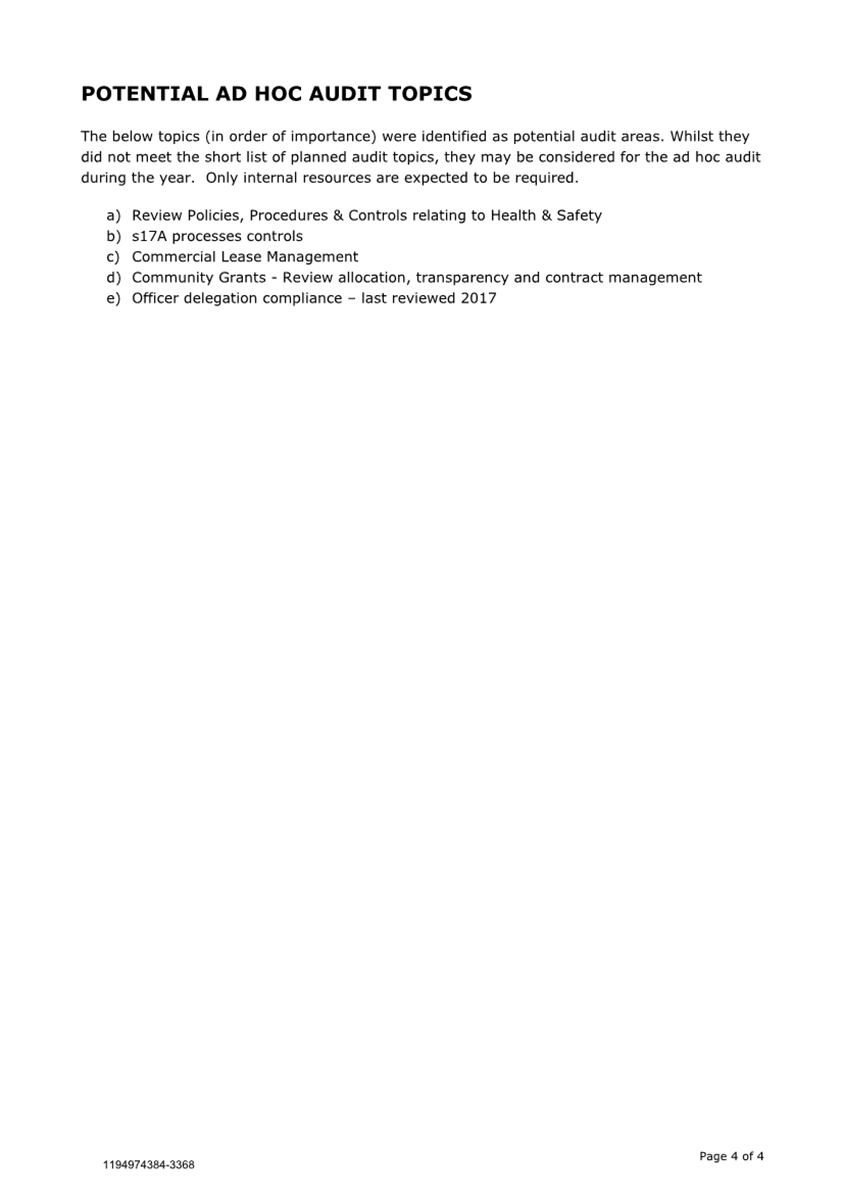

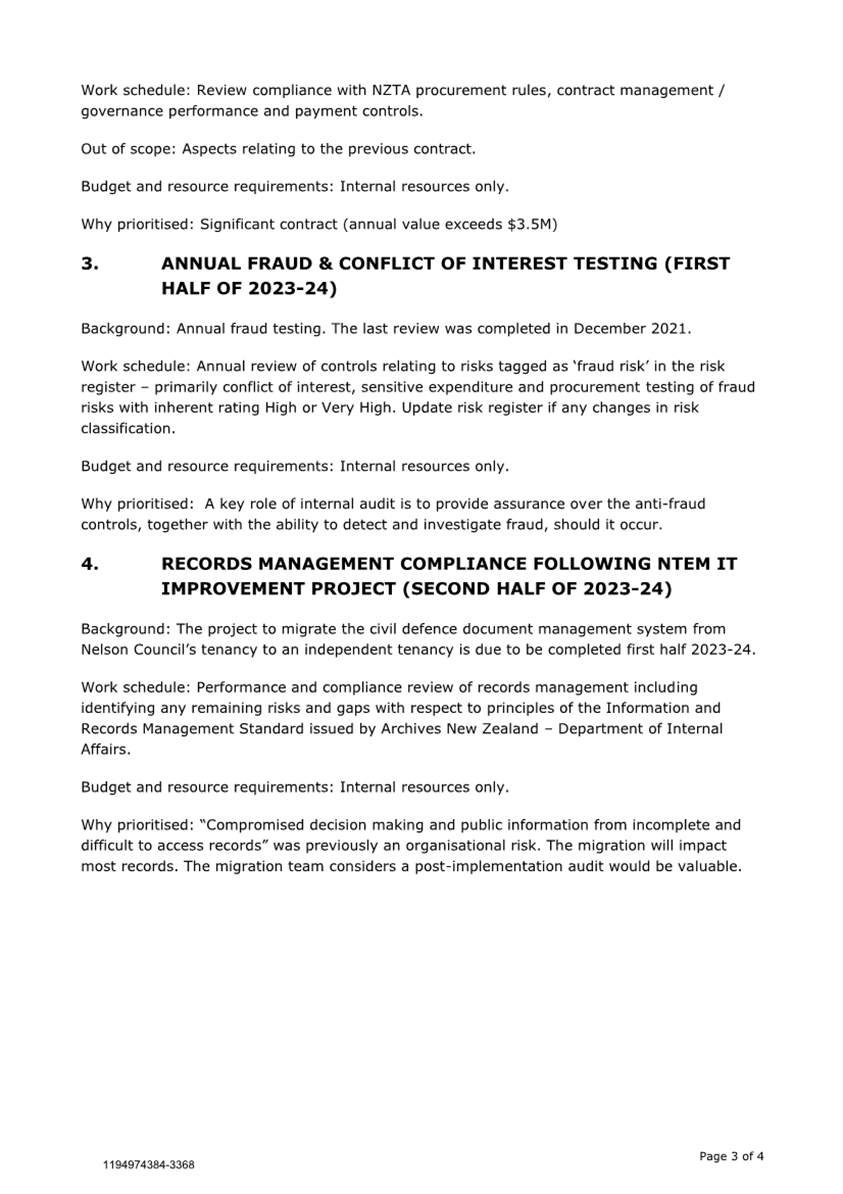

months ending 31 March 2023, the Council’s draft deficit is $4,524,000

unfavourable to the operating budget.

4.2 Profit and

Loss

4.3 Full Year

Budget

4.4 The

operating budget is a deficit of $7,011,000, which is less than the annual plan budget by $13,298,000.

The significant variances are as follows:

4.4.1 Revenue

has been budgeted to increase by $3.6m, which is due to $2.3m Waka Kotahi

weather event recoveries, as well as $0.9m for Neighbourhood Parks development

contributions.

4.4.2 Expenses

have been budgeted to increase by $16.9m. This is due to $12.4m of weather

event expenditure, $1.2m Housing Reserve grant expenditure, as well as $2.7m of

Cawthron/Port grant expenditure carried forward from the previous year

(subsequently removed from the forecast).

4.5 The forecast

budget is a deficit of $11,318,000, which is less than

the operating budget by $4,306,000. The significant variances are as

follows:

4.5.1 Revenue

has been forecasted to be $9.4m higher. This is mainly due to an increase of

$7.7m in weather-event recoveries, $0.9m for Neighbourhood Parks development

contributions and an increase of $0.6m for interest on short term

investments. This is partially offset by a $0.9m reduction in forestry

income.

4.5.2 Expenses

have been forecasted to be $13.7m higher. This is mainly due to an increase of

$5.9m in weather-event expenditure, $2.0m personnel costs, $1.6m finance costs

(offset by $0.6m interest revenue) and $5.2m depreciation expense. These higher

than operating budget variances are partially offset by an under variance of

$0.9m in other expenses due to following reasons;

· $2.7m Cawthron/Port

grant has been reforecast to Nil.

· Net of $1.5m Housing Reserve

grant has been moved to 2023/24.

· $1.2m increase in

harvesting cost (offset by higher forestry income as per 4.9).

· $1.0m increase in

regional sewerage costs due to significant increases in fixed charges and

increased costs associated with wet weather in July/August 2022.

· $0.7m increase in

Nelson Resource Management Plan costs.

4.6 Revenue

4.7 Rates income is greater than budget by $105,000. This is a

result of wastewater rates being over budget. This is due to more connections

being added than budgeted for (the budget workings were completed in May and

the rate strike was in July).

4.8 Subsidies

and grants income is less than budget by $892,000. Significant variances are as follows:

4.8.1 Waka

Kotahi Subsidies are greater than budget by

$859,000. $0.7m relates to the Waka Kotahi public transport

subsidies, due to additional public transport expenses.

4.8.2 Green

Waste income from Waste Minimisation Fund is less than

budget by $513,000. Green

waste is under budget in income due to expenses also being under budget. The

main contributor to lower expenses, is the kerbside kitchen waste service,

which has yet to commence.

4.8.3 Government

Grants (Capital in nature) are less than budget

by $1,532,000. Waka Kotahi capital grant spend is $2.1m less than budget

due to delays in the capital programme which was caused by the August 2022

weather event taking priority. This is partially offset by an increase in the

Ministry of Business grant of $0.7m for Saxton Creek Stage 4 upgrade.

4.9 Fees

and Charges income is less than budget by $712,000.

This is mainly due to Forestry income being less than budget by $816,000 as

a result of the changes to the planned timing of harvesting: Roding Forestry

income is $1.8m under budget against a nil budget which is partially offset by

over budget forestry income of $1m from Maitai and Marsden.

4.10 Other

revenue is greater than budget by $2,882,000.

Significant variances are as follows:

4.10.1 Development

Contributions are $2,223,000 greater than budget.

This is mainly due to the unbudgeted commercial developments happening in the

region - the major developments being Coastal view ($1.0m), 3D view ($0.2m) and

Bayview ($0.2m).

4.11 Interest

received is greater than budget by $522,000.

This is due to more funds being invested than planned because of pre-funding of

debt to take advantage of the favourable borrowing conditions at the time.

4.12 Expenses

4.13 Personnel

costs are greater than budget by $1,530,000. This

is mainly due to the following reasons:

4.13.1 The average salary

increase of 5% was higher than the budgeted salary increase of 3%. In dollar

figures, the increase in personnel costs to March 2023 is $516,000 (which

includes the increase in the annual leave balance).

4.13.2 Contractor/Temp

and Training Staff costs are $579,000 greater than budget. This is due to

labour shortages and the higher turnover of council staff. While most of the

business units contributed to this higher than planned variance, the biggest

contributors were Consents and Compliance ($615,000 over budget), Capital

Projects ($256,000 over budget), Transport and Solid Waste ($233,000 over

budget) and People and Capability ($142,000 over budget).

4.13.3 Other staff

costs are $435,000 greater than budget. Significant variances include:

· Additional

recruitment costs of $99,000 due to staff turnover and labour shortages.

· Additional

callout allowances (total allowances of $88,000 paid YTD and $65,000 higher

than prior year). These allowances mainly relate to harbourmaster, emergency

management, utilities engineering, and campground managers.

· Additional

kiwi saver costs of $34,000.

· Additional

health & safety / wellbeing costs of $20,000.

· Other

items, such as additional overtime for unbudgeted public holidays, additional

staff costs for covering staff on sick leave (sick/covid leave is up on prior

year).

4.14 Finance

Costs are greater than budget by $1,602,000. This

increase in interest costs is due to a) additional pre-funding of debt (which

is offset by the variance in interest income of $522,000), b) interest rate

increases than planned and c) higher weather event borrowings.

4.15 Depreciation

and amortisation costs are greater than budget by

$3,897,000. Depreciation has been based on the prior year asset

valuations. In the 2021/22 financials, the asset valuations saw significant

increases. This resulted in a much higher depreciation expense. This is

especially evident in Roads (unsubsidised), Wastewater, Stormwater, and Water

Supply.

4.16 Weather Event costs are greater than budget by $3,038,000.

4.16.1 The spend to

date on the August 2022 weather event is $15.4m (against an approved budget to

date of $12.4m). Offsetting these expenses is $2.6m of recoveries in

“Subsidies and Grants”.

4.16.2 Recoveries

received to date are $2.6m. This includes Waka Kotahi income of $2.3m, as well

as $0.15m from NZ lotteries, and $0.14m from insurance. Staff are progressing

insurance claims, NEMA and Waka Kotahi subsidies with relevant agencies and

forecasting to receive $9.8m by year end which is reflected in the full year

forecast above.

4.16.3 The Buildings

& Structure Loss Adjuster has accepted claims for numerous sites but claims

preparation/adjustment yet to be completed. To date we have only received

insurance payments of $0.14m for locations relating to the August 2022 Rain

Event (300 Wakefield Quay & Civic House).

4.16.4 Weather event reporting

goes to council quarterly, with the last meeting on 4 May 2023. The full year forecast

weather event costs for 2022/23 is currently $18.2 million (gross of recoveries).

4.16.5 There is a

further of $1.9m of capital expenditure outside of the net profit and loss (vs.

a budget of $0.5m).

4.17 Other Expenses are less than budget by $3,638,000.

Significant variances are as follows:

4.17.1 Cawthron/Port

Grant expenditure is less than budget by $1,350,000.

This is mainly due to the Cawthron institute and Port Nelsons’

decision not to go ahead with the proposed Science and Technology Precinct. The

forecast has been adjusted by the grant amount which is $2.7m.

4.17.2 City

Development expenditure is less than budget by $997,000.

This variance is solely due to the unbudgeted housing reserve grant

payments which are scheduled to be paid in the 2023/24 financial year.

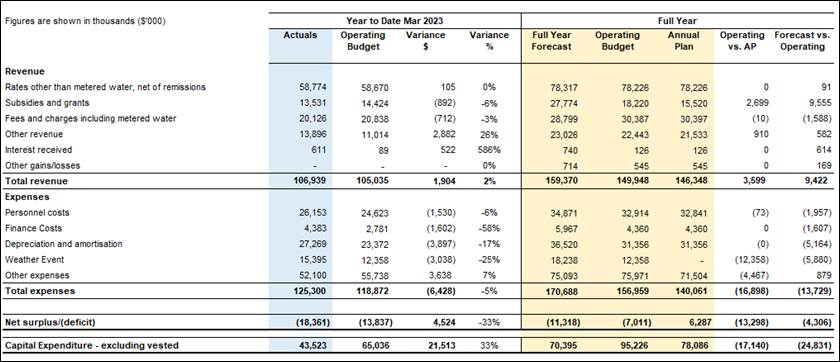

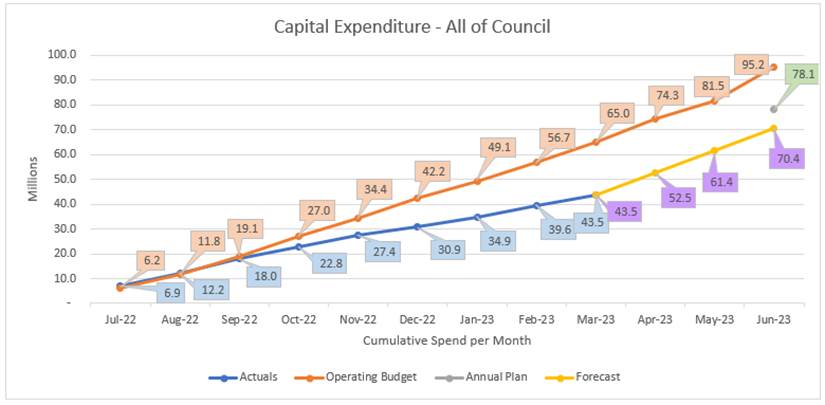

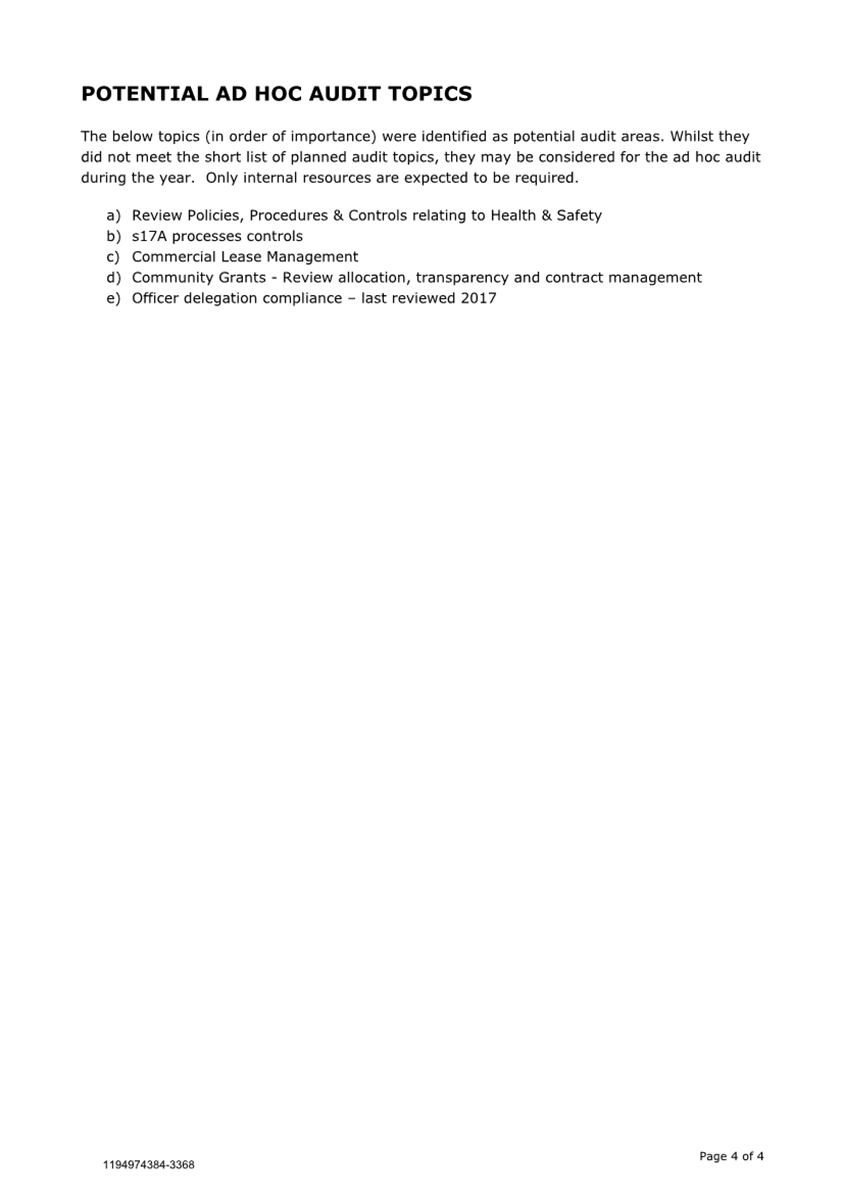

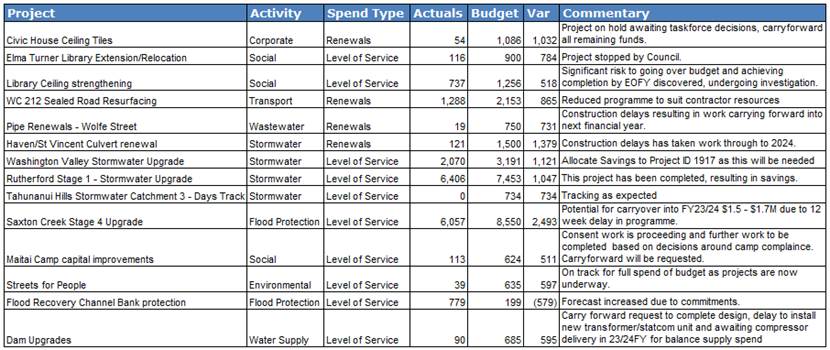

5. Capital

Expenditure

5.1 Capital

Expenditure (including staff time, excluding vested assets)

5.2 As

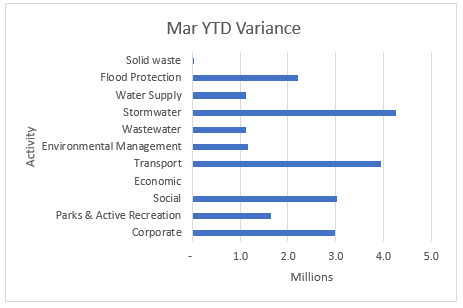

at 31 March 2023, Capital Expenditure was $43.5m, which is $21.5m under the

year-to-date operating budget of $65.0m. This underspend is across all

activities, with the main contributors being Transport ($4.0m), Stormwater

($4.3m), Corporate ($3.0m), Social ($3.0m), and Flood Protection ($2.2m).

5.3 Out

of the $21.5m variance above, $8.5m relates to Renewals, $10.3m relates to

Level of Service, $1.2m relates to Capital Growth, and $0.1m relates to Capital

Staff Costs.

5.4 Within

capital expenditure, there is a spend of $1.9m on the August 2022 weather event

(against a budget of $0.5m) for transport ($0.5m), wastewater ($0.3m), and

flood protection ($0.9m).

5.5 The

largest year to date capital variances contributing to the $21.5m variance are

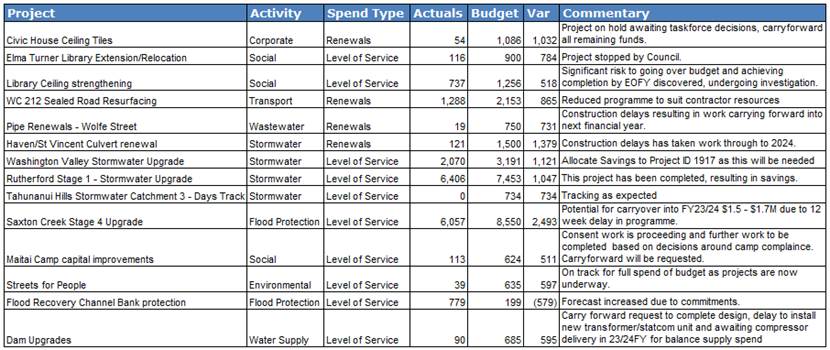

in the table below (variances +/- $500,000, rounded to $’000):

5.6 Staff

have reforecast the current year capital spend to 30 June 2023. The indicative

capital carry forwards requested is $21.9m, which is to be spread across years

3-4 of the Long Term Plan 2021/31 (i.e. 2023/24 and 2024/25). Changes are yet

to be approved.

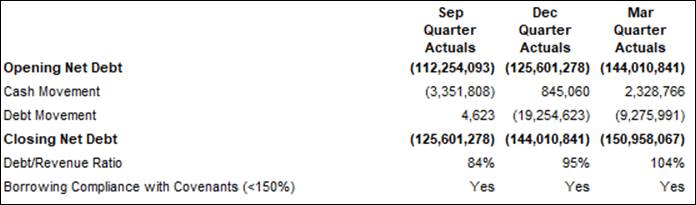

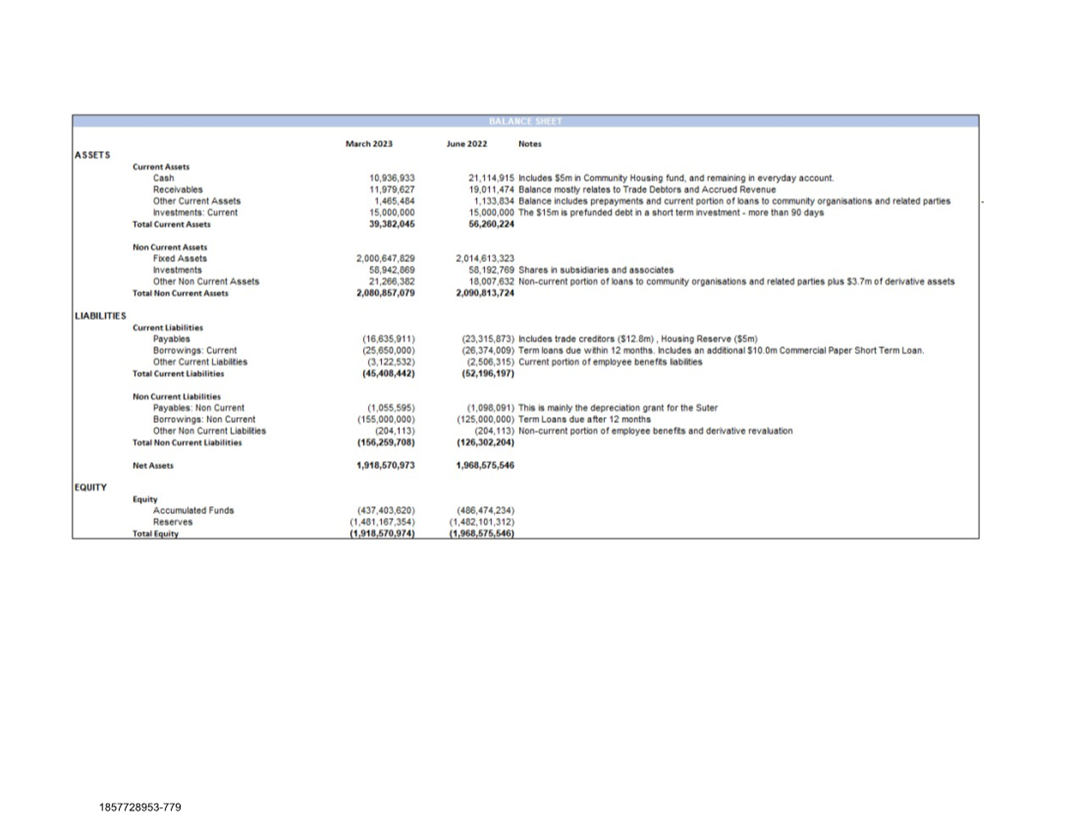

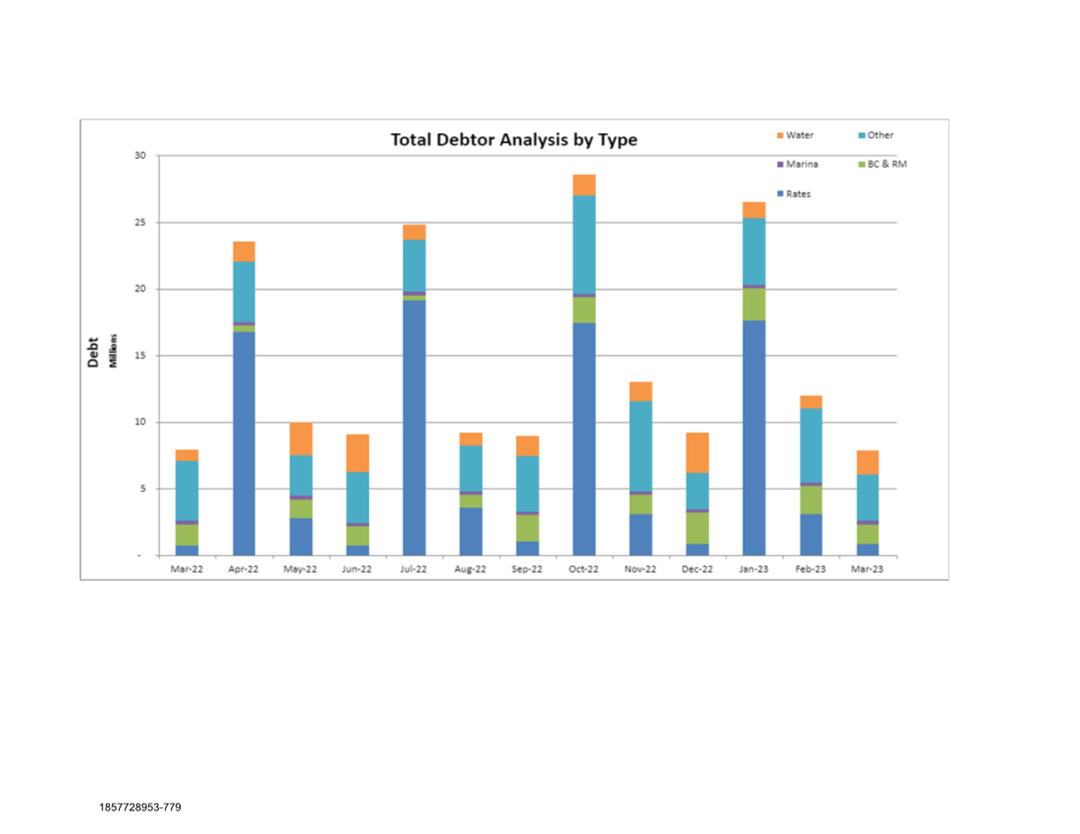

6. Cash Flow

Management

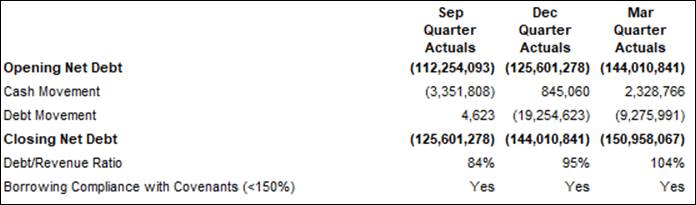

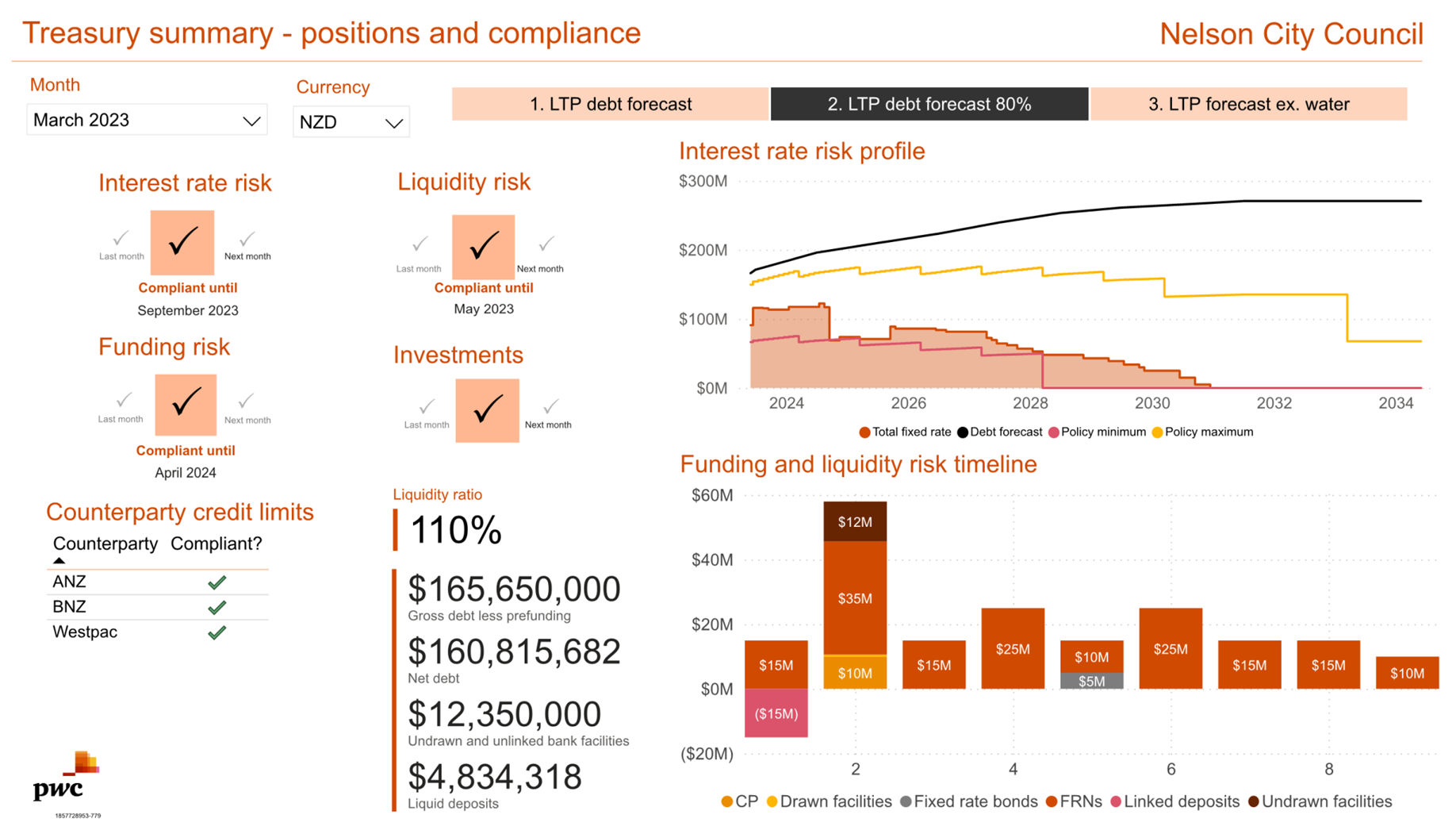

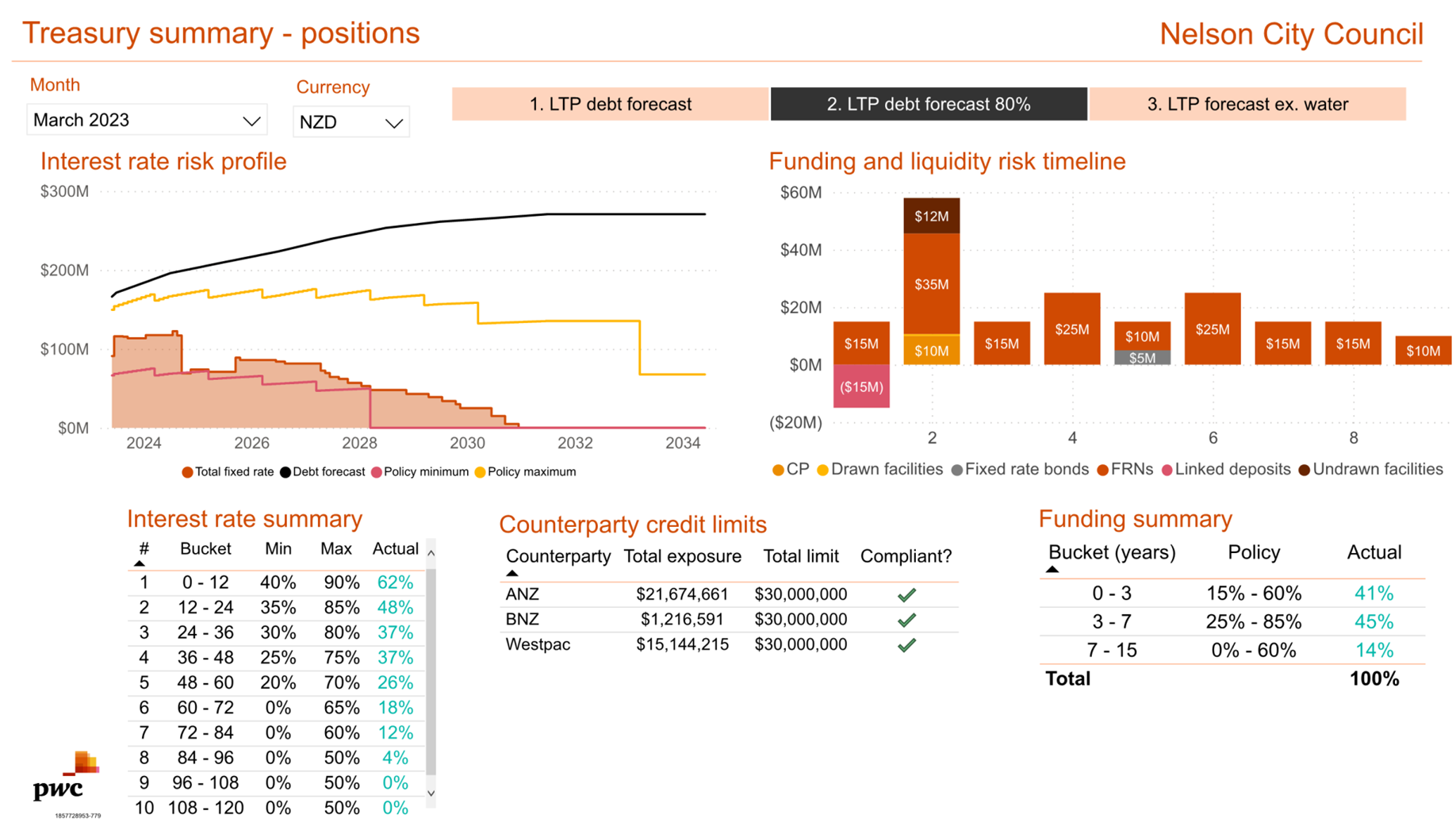

6.1 Net Debt

6.2 As

at 31 March 2023, there was a net debt of $150.9m ($144.0m at 31 December 2022,

and $112.3m at 30 June 2022). Net debt has increased by $6.9m since 31 December

2022, and $38.7m since 30 June 2022.

6.3 For

the nine months ended 31 March 2023, LGFA borrowings have increased by $30.0m

and term deposits have decreased by $10.0m. This increase in debt has been to

fund the unbudgeted August 2022 weather event ($14.9m net expenditure), capital

expenditure during the year ($21.4m net of funded depreciation), as well as to

fund working capital ($4.3m net payables at 30 June 2022).

6.4 Budgeted

net debt at 30 June 2023 was $161.0m, this has now been forecasted to be

$165.2m.

7. Council

Fundraising

7.1 Council’s

fundraising adviser position was established in 2020 to identify funding

opportunities for Council and submit applications. It is aimed to provide

updates to the Audit, Risk and Finance Committee on an annual basis to

highlight challenges and opportunities for Council fundraising.

7.2 Fundraising

trends nationally have been impacted by COVID-19, severe weather events

(flooding, cyclone damage), inflation and fear of recession. The 2022 Not For

Profit sector report noted it had been a challenging year for organisations

securing sustainable funding due to factors including, variable investment

returns, rarity of contract terms beyond one year and pressures on the

discretionary income of donors. Events and community fundraising have had a

particularly difficult time. Many organisations, including Councils are

eligible to apply for grant funding but do not always do so, limited by their

capacity to deliver projects if their applications are successful - due to

staffing shortages, inflationary pressures or funding requirements which

exclude management/overhead costs.

7.3 During

the Jan to Dec 2022 period, the Fundraising Adviser has worked with a range of

business units in submitting the following successful funding proposals:

• $56,000 (Lottery Facilities Fund) towards Stoke Youth

Park’s Parkour gymnastic feature

• $150,000 (Ministry of Business, Innovation and

Employment) to fund the Welcoming Communities Programme.

• $60,000 (Lottery Environment & Heritage) to fund

Conservation Plans for Broadgreen, Isel and Melrose Historic Houses.

• $193,000 (Tourism Infrastructure Fund) towards Maitai

River path Sunday Hole renewal.

• $6,000 (Ministry for Culture & Heritage) for Founders

Waitangi Day Kai Fest.

Since January 2023 proposals currently in progress include:

• Waste Minimisation Fund: approximately $75,000 to

develop a Business Case for kerbside waste collection in partnership with TDC.

• Tourism Infrastructure Fund: $1.1m towards the proposed

Marina Promenade construction.

• Lottery Environment & Heritage Fund: Support for

textiles promotion and website development.

The Adviser has also provided support services for the Better Off

Funding application and mentoring to entities who are users of Council assets

(about potential funding opportunities eg Skate Nelson Bays successful bid for

$10,000 to Pub Charity NZ).

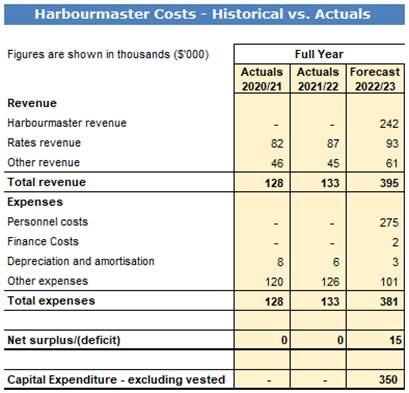

8. Follow up on

Previous Meeting Questions

8.1 Harbour

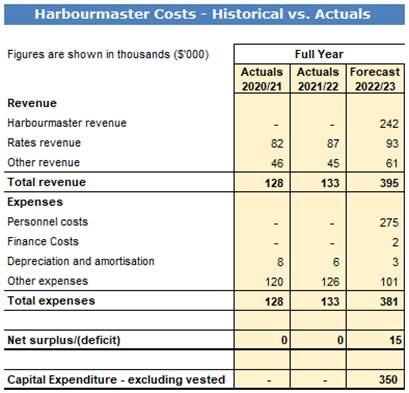

Master Costs

8.2 The

2022/23 forecasted harbourmaster surplus is $15,000. The surplus is $15,000

more than compared to 2021/22 and 2020/21. While personnel costs are greater in

2022/23, this has been offset by the increase in harbourmaster revenue.

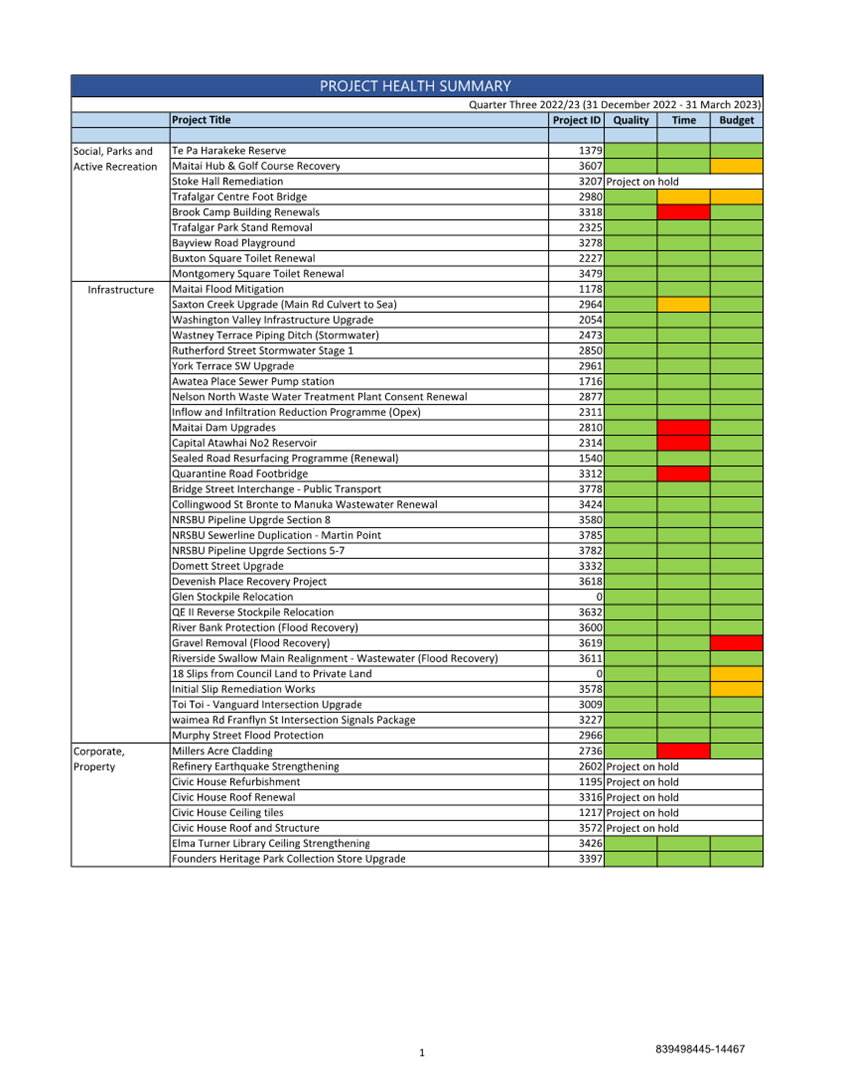

9. Project

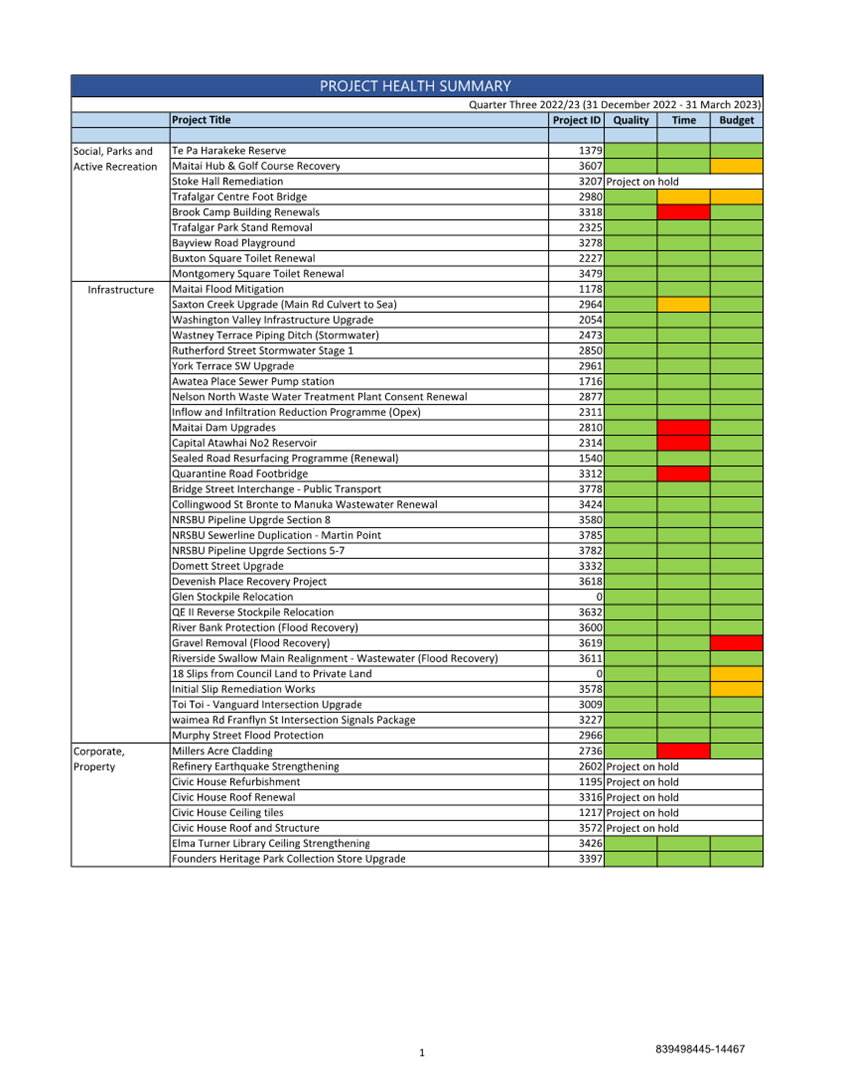

Health

9.1 A

table summarising the health of projects across has been generated is included

as attachment 2 (839498445-14467). It gives a red, amber or green rating for

quality, time and budget factors.

9.2 The

majority of the orange and red are as a result of delays – this was

perpetuated with the wet winter and the weather event.

9.3 Projects

on hold indicate projects that require further workshops or discussion.

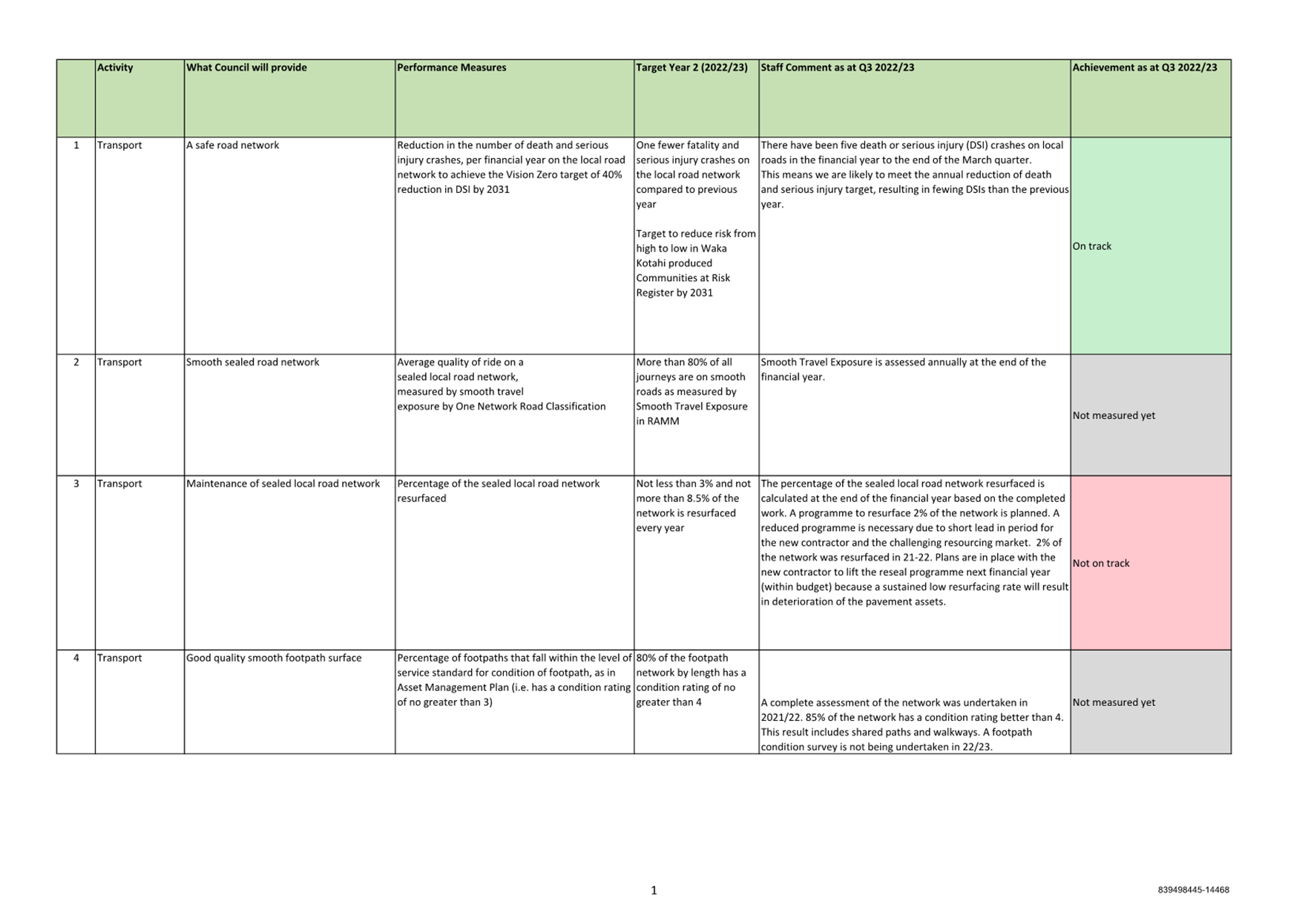

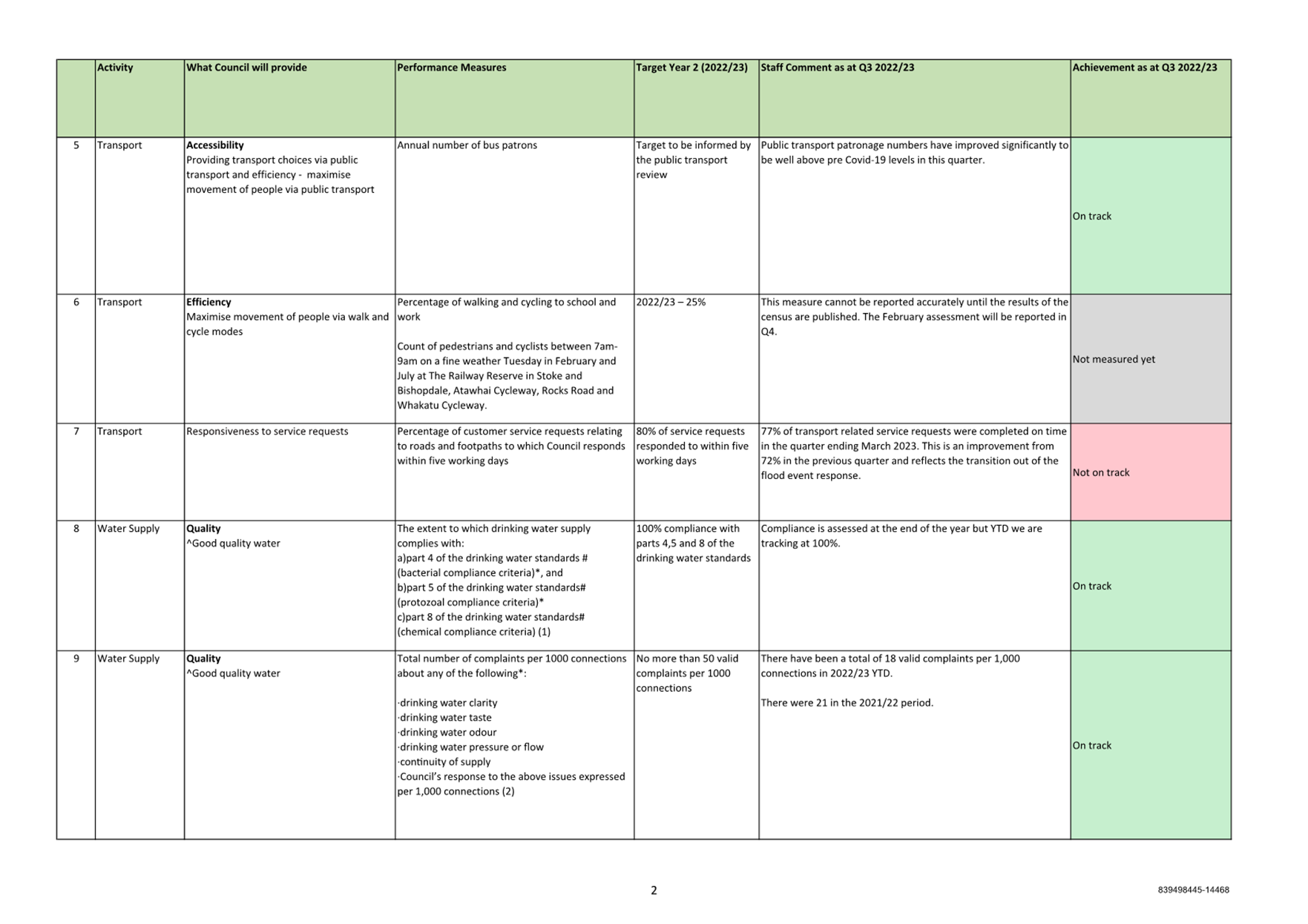

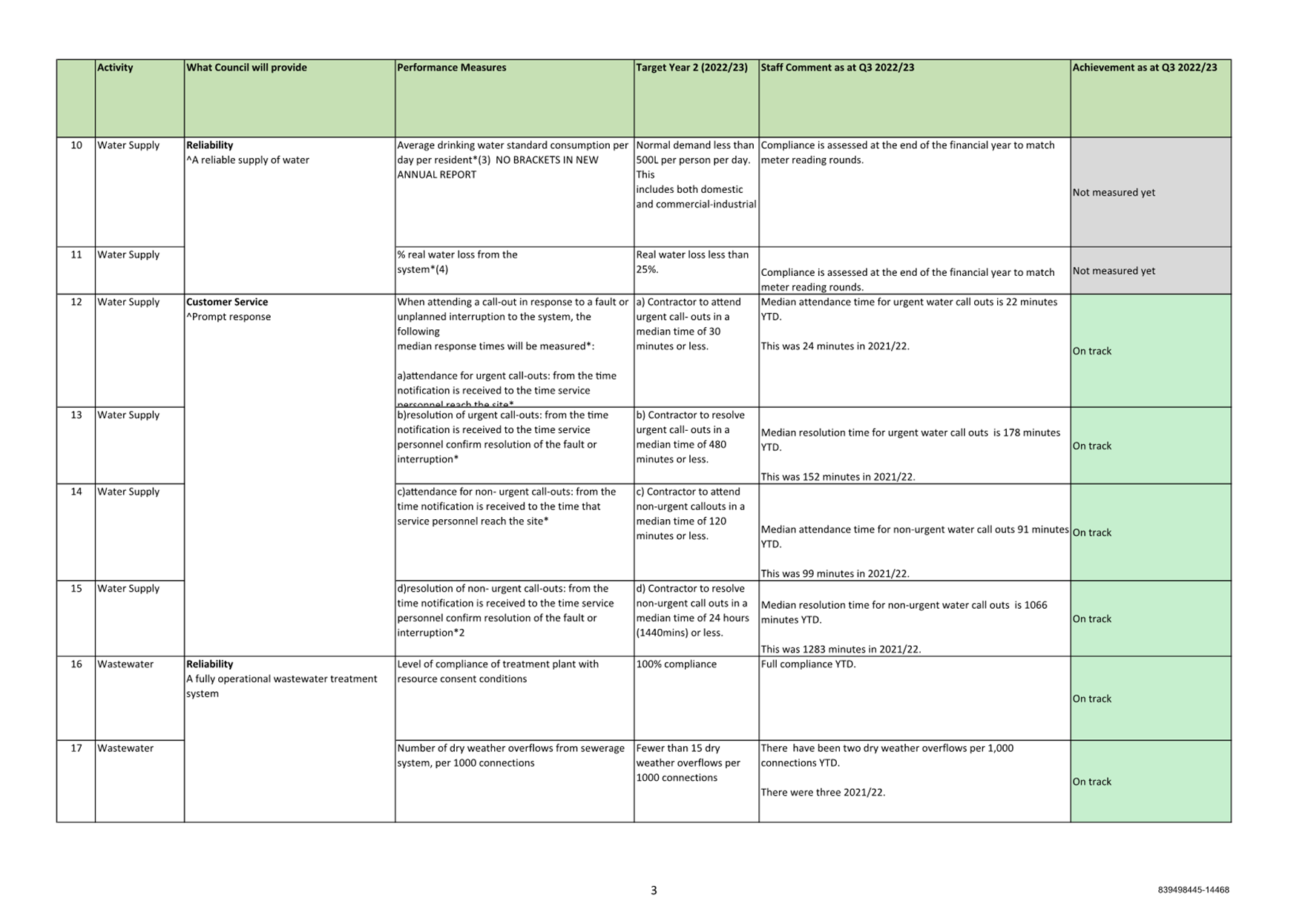

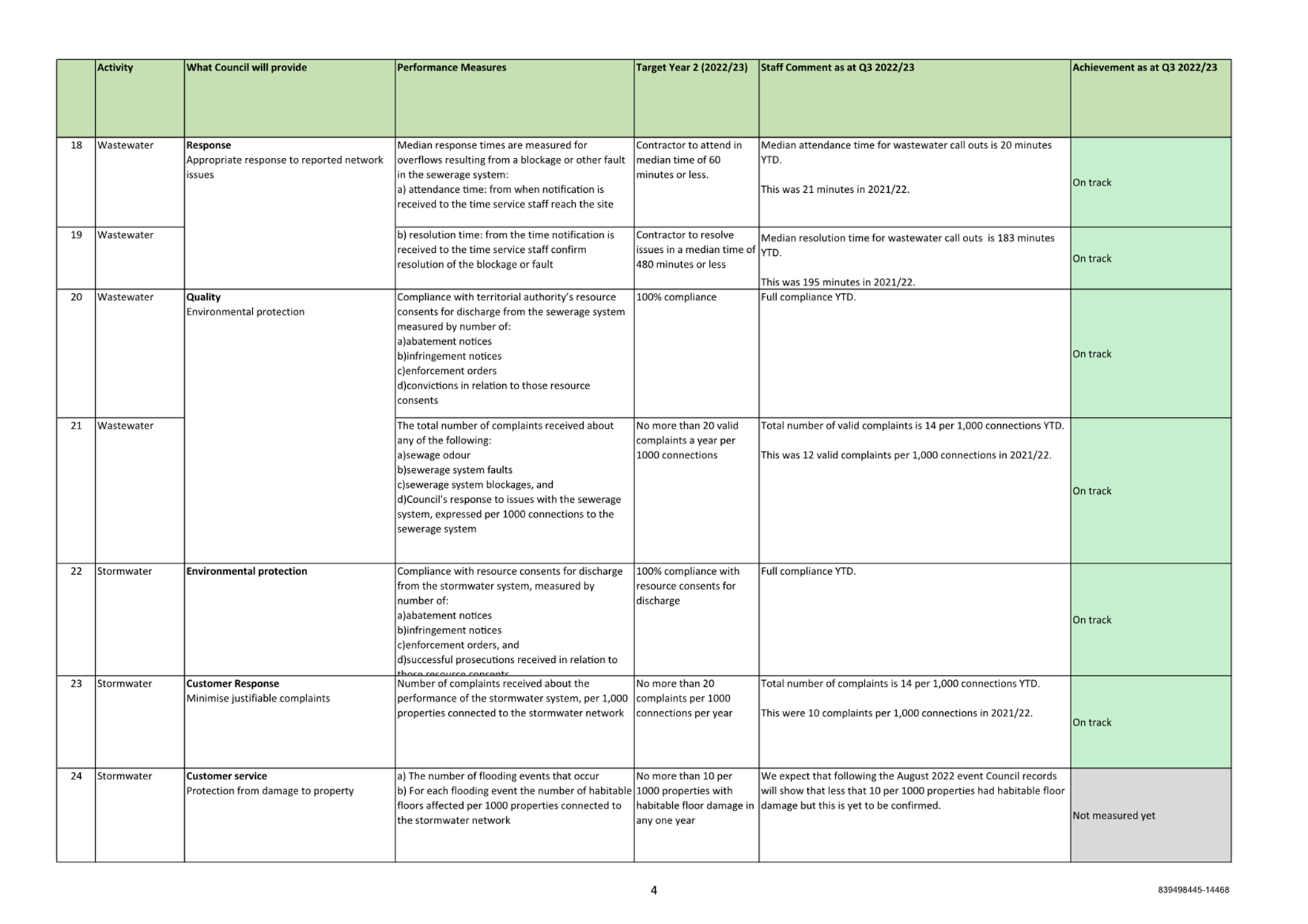

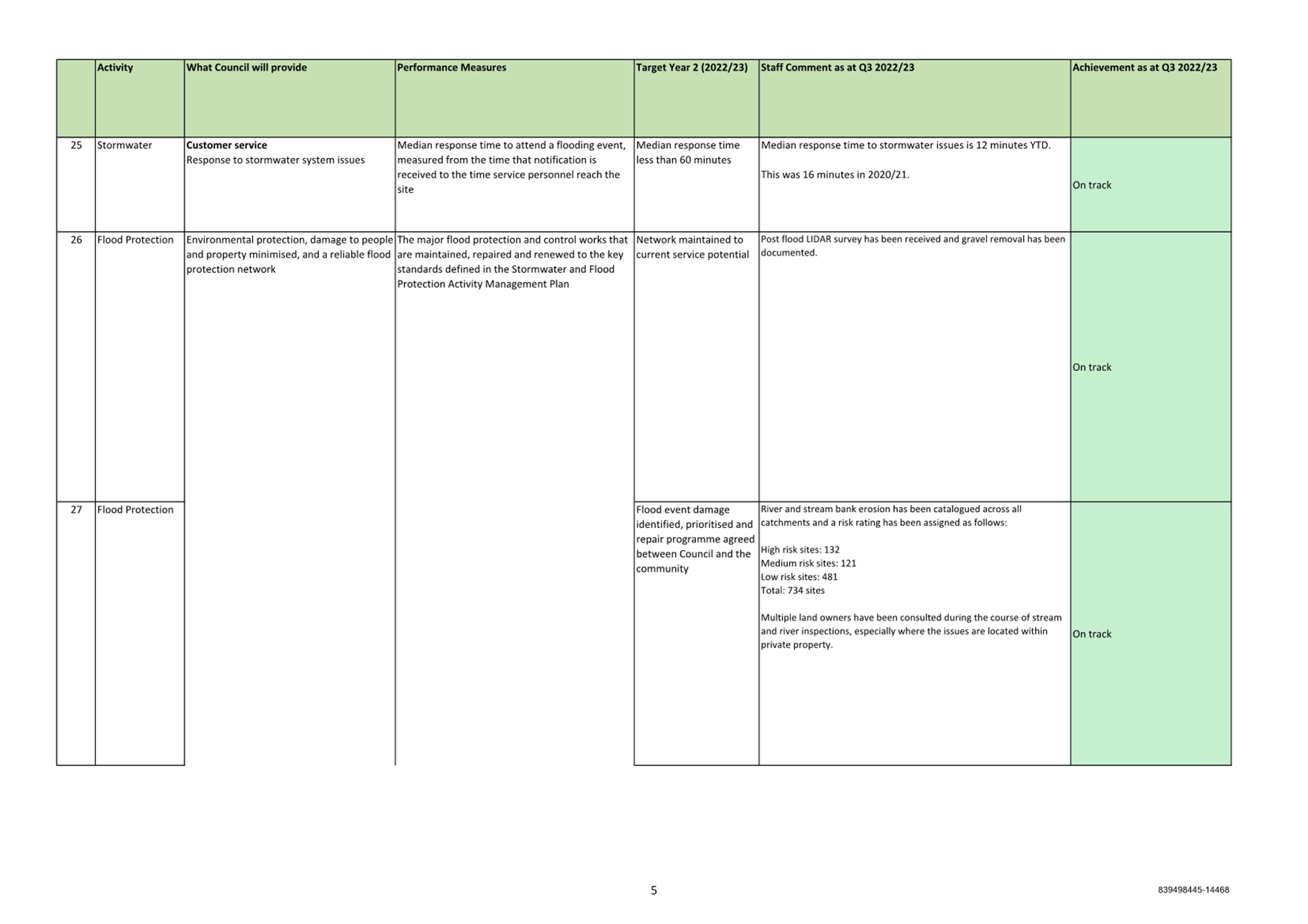

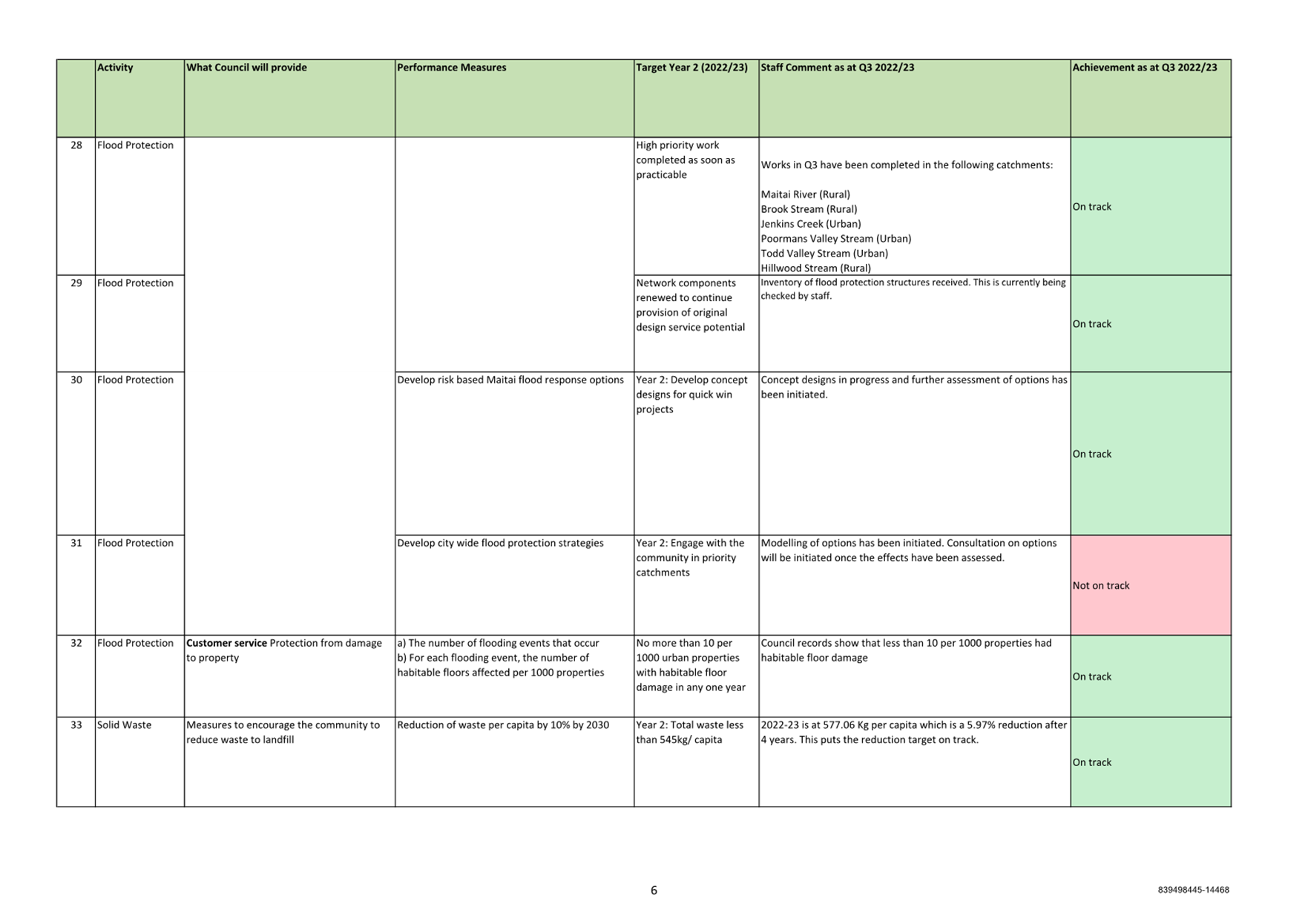

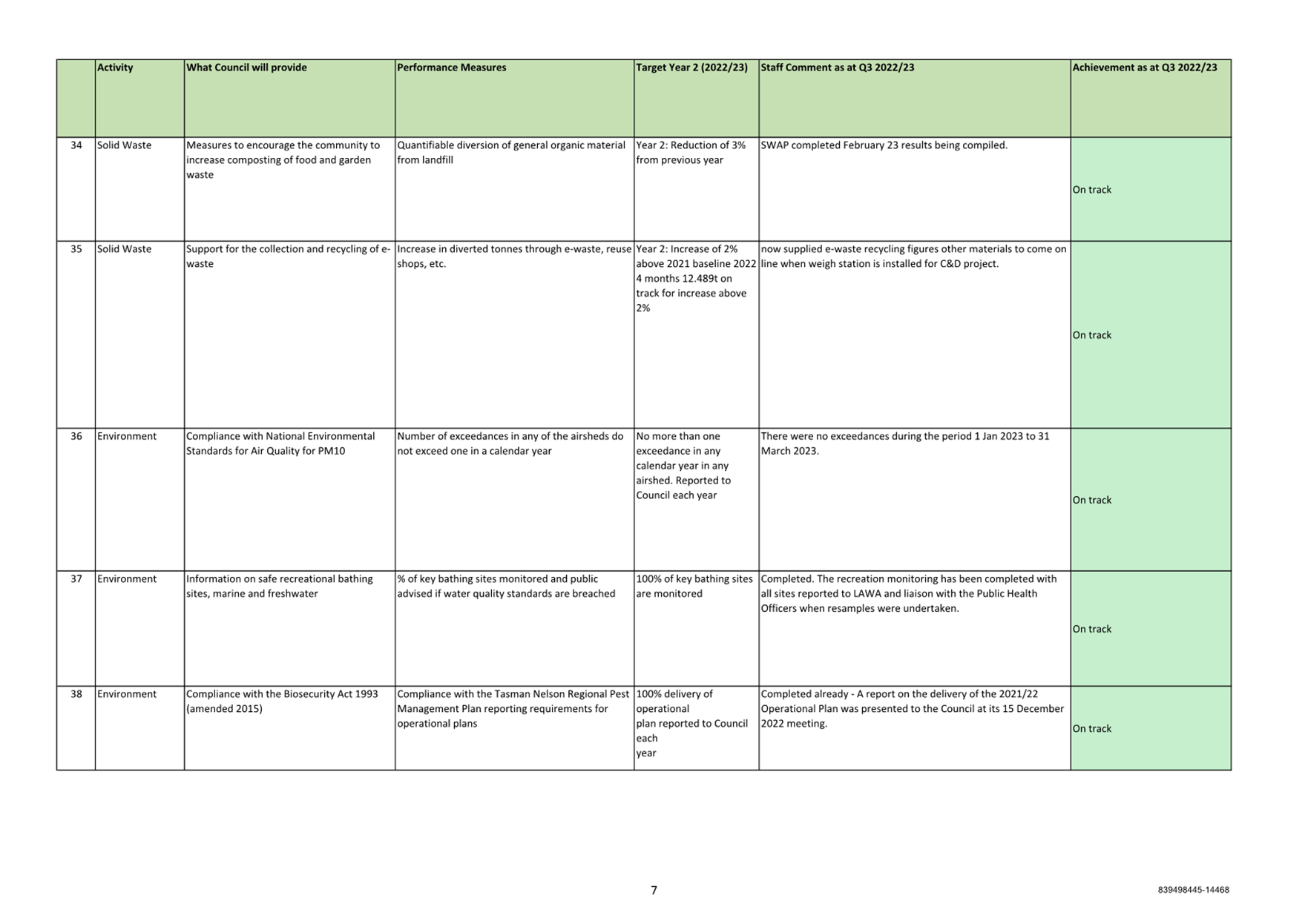

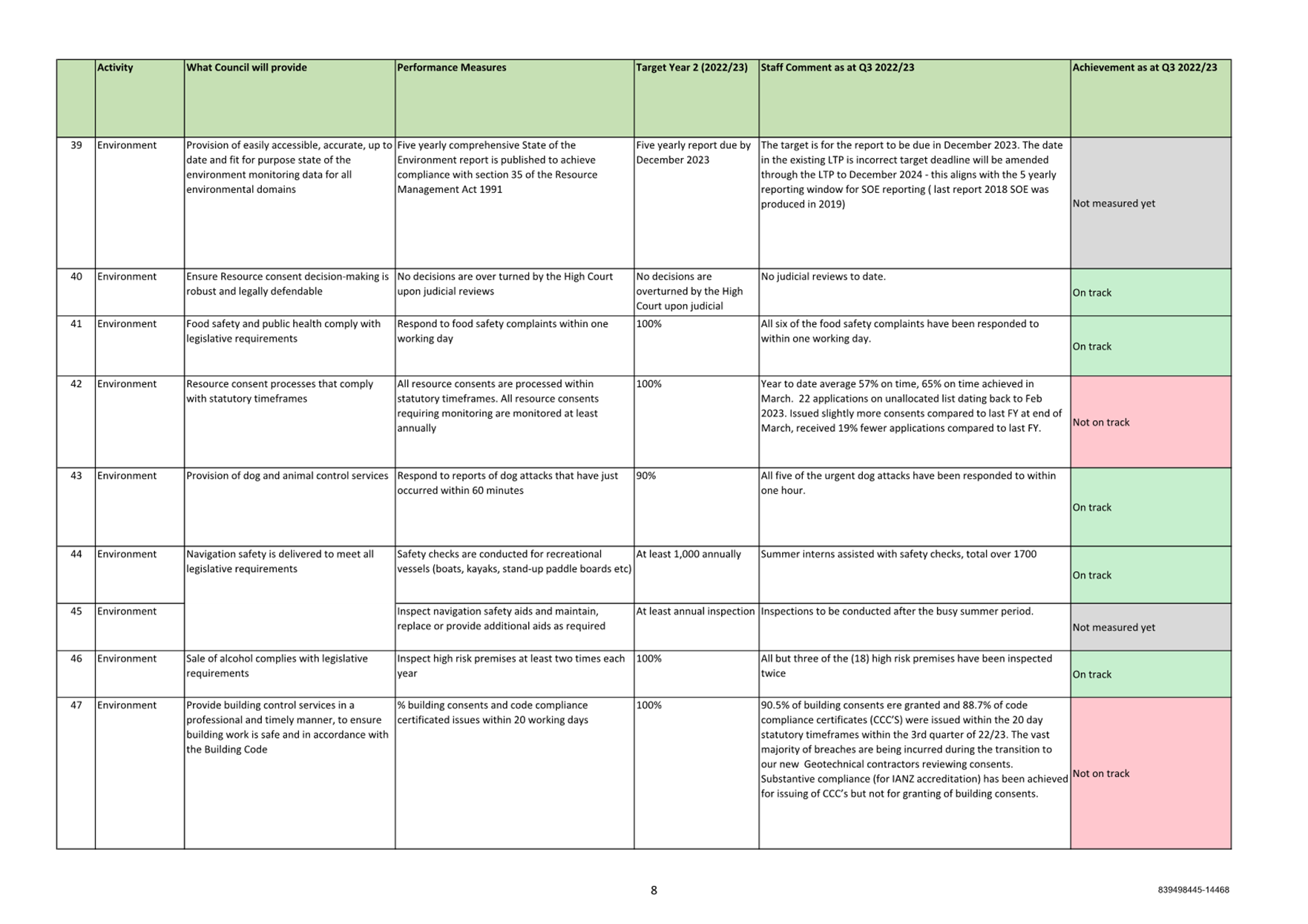

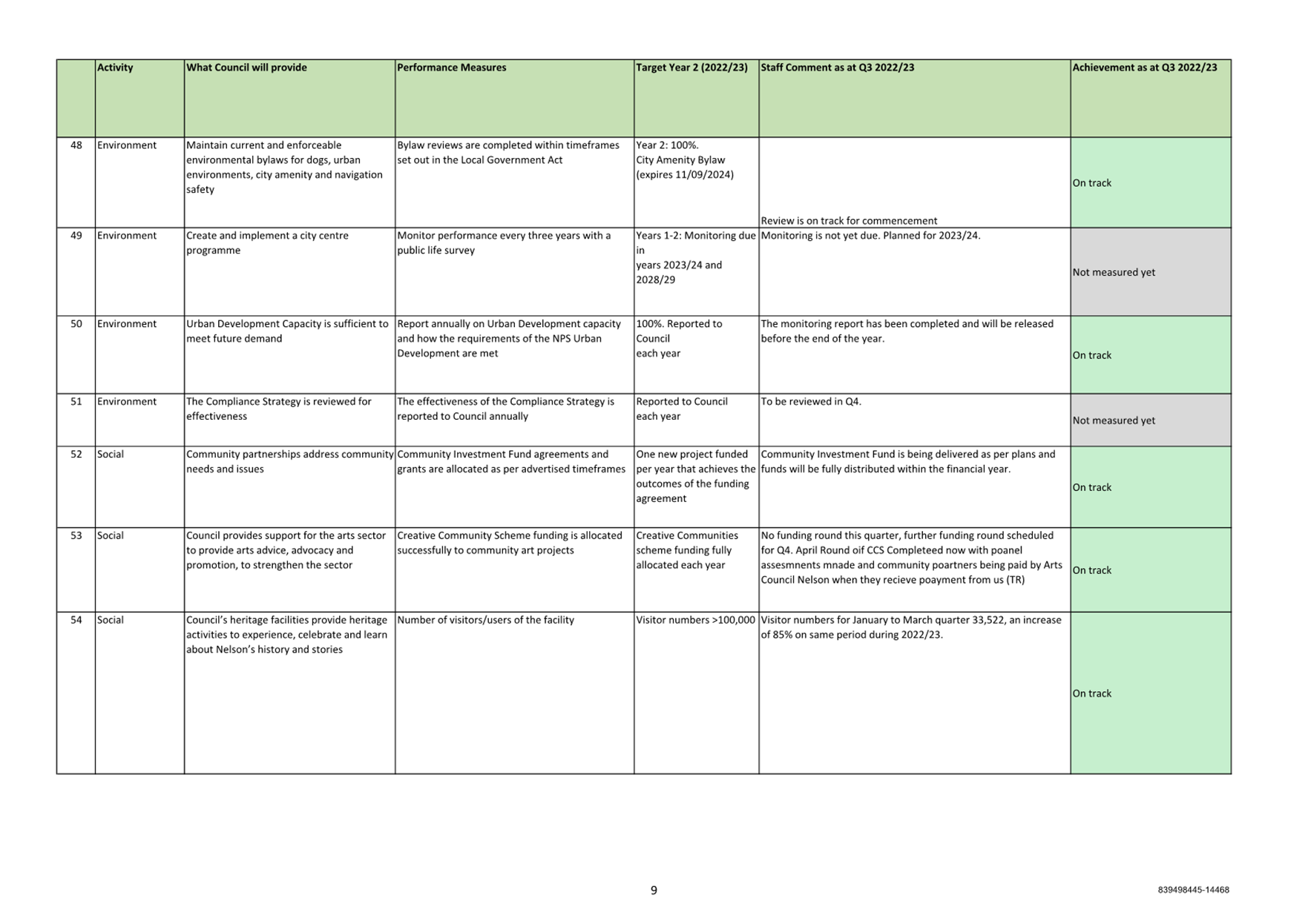

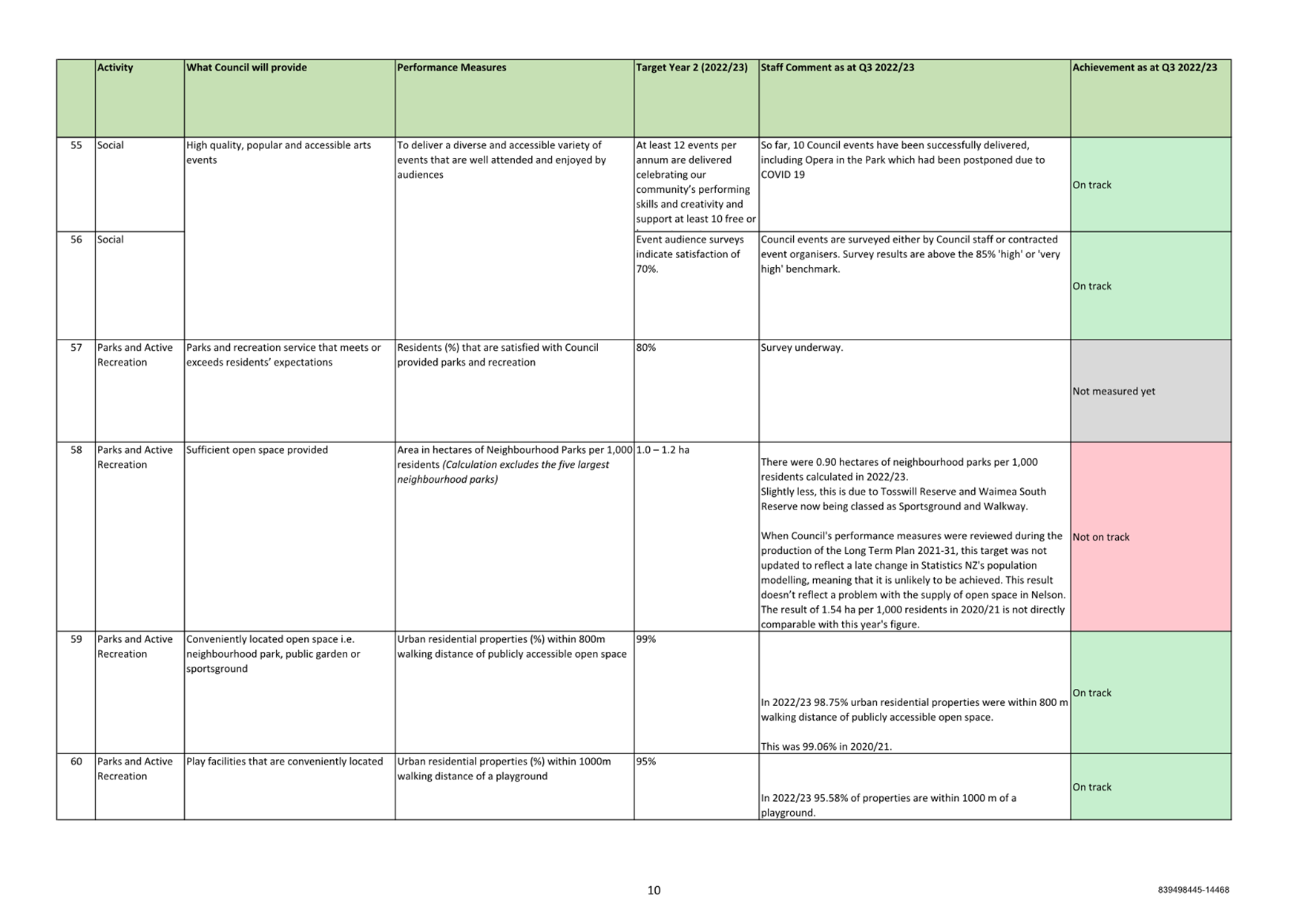

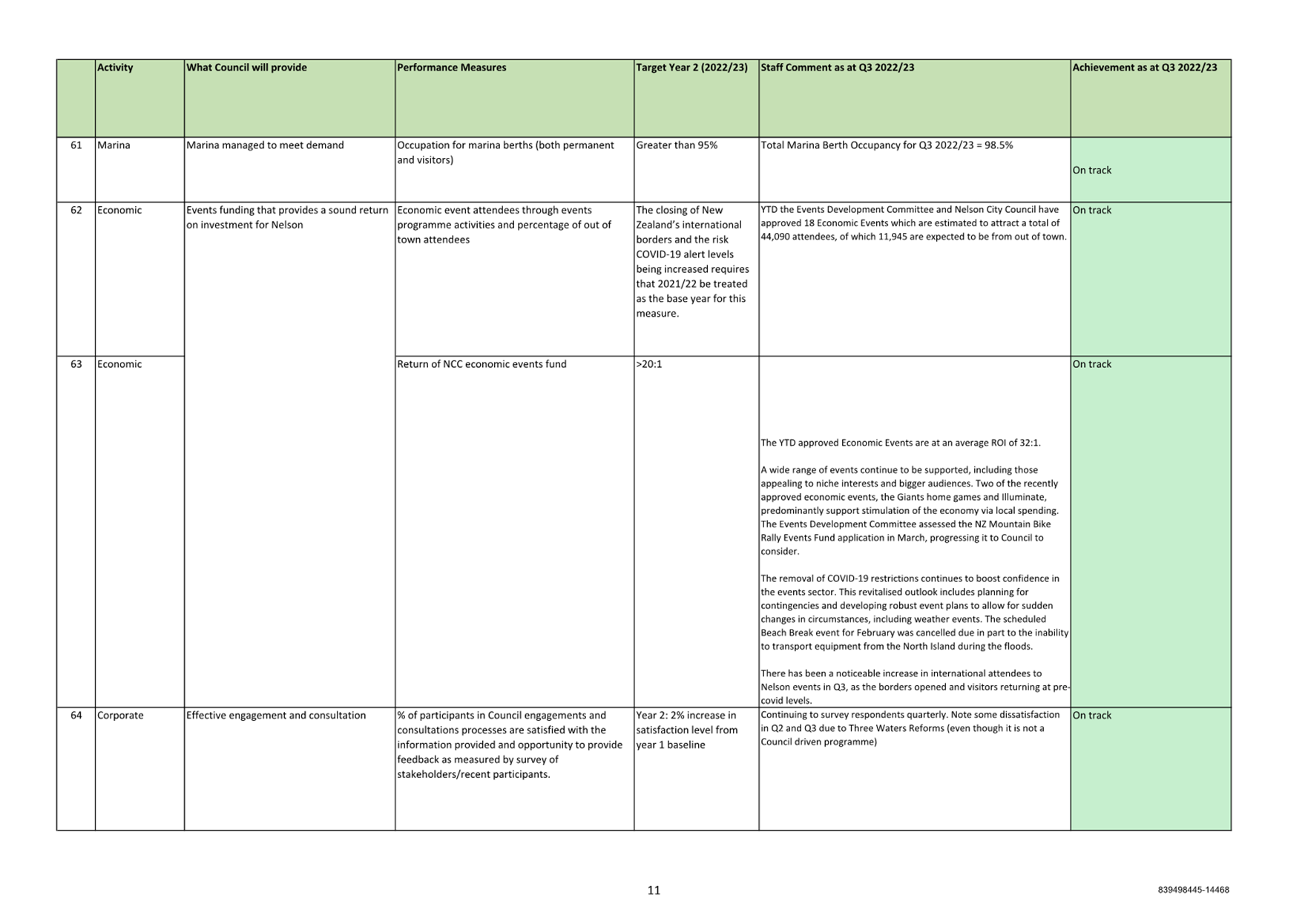

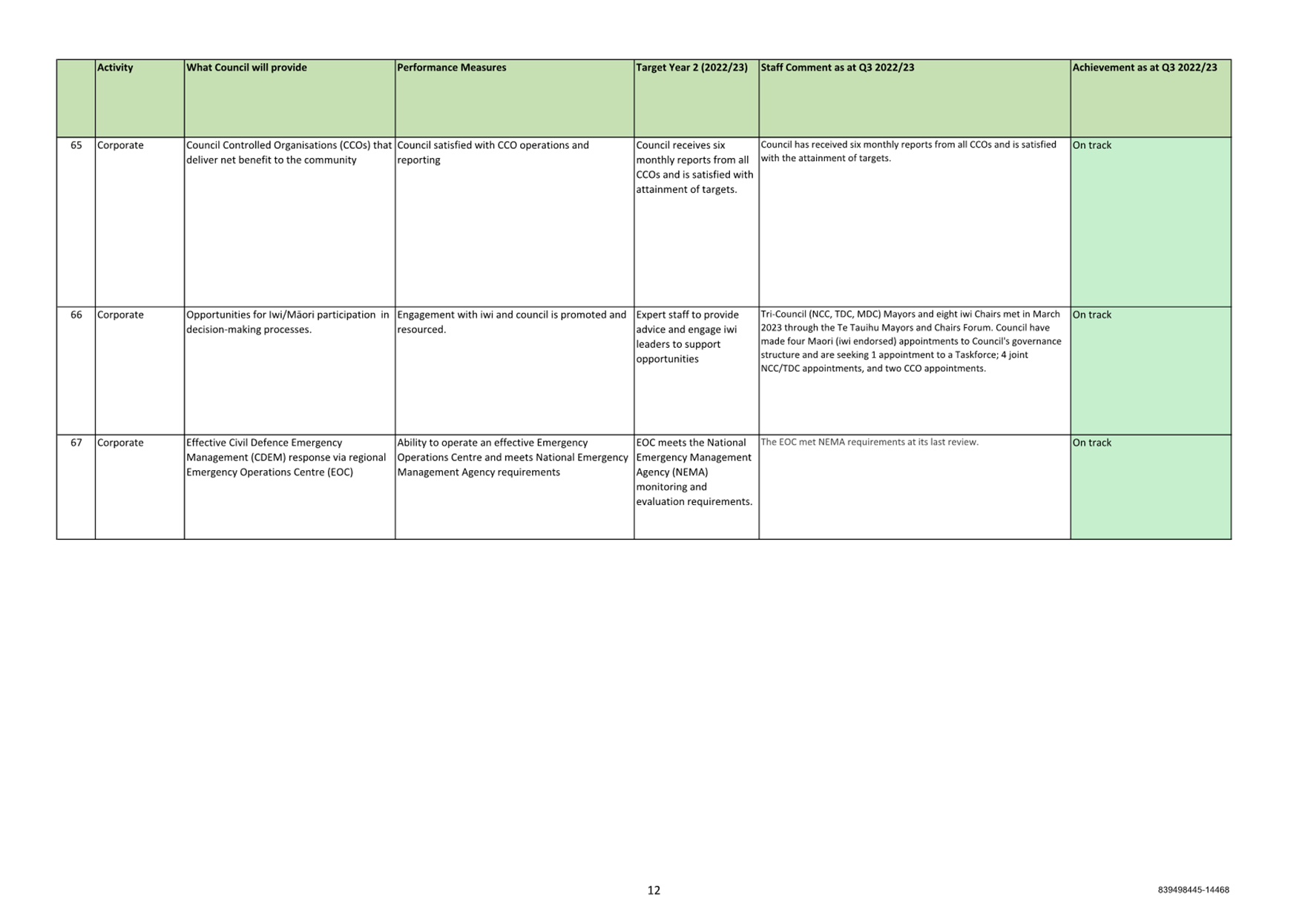

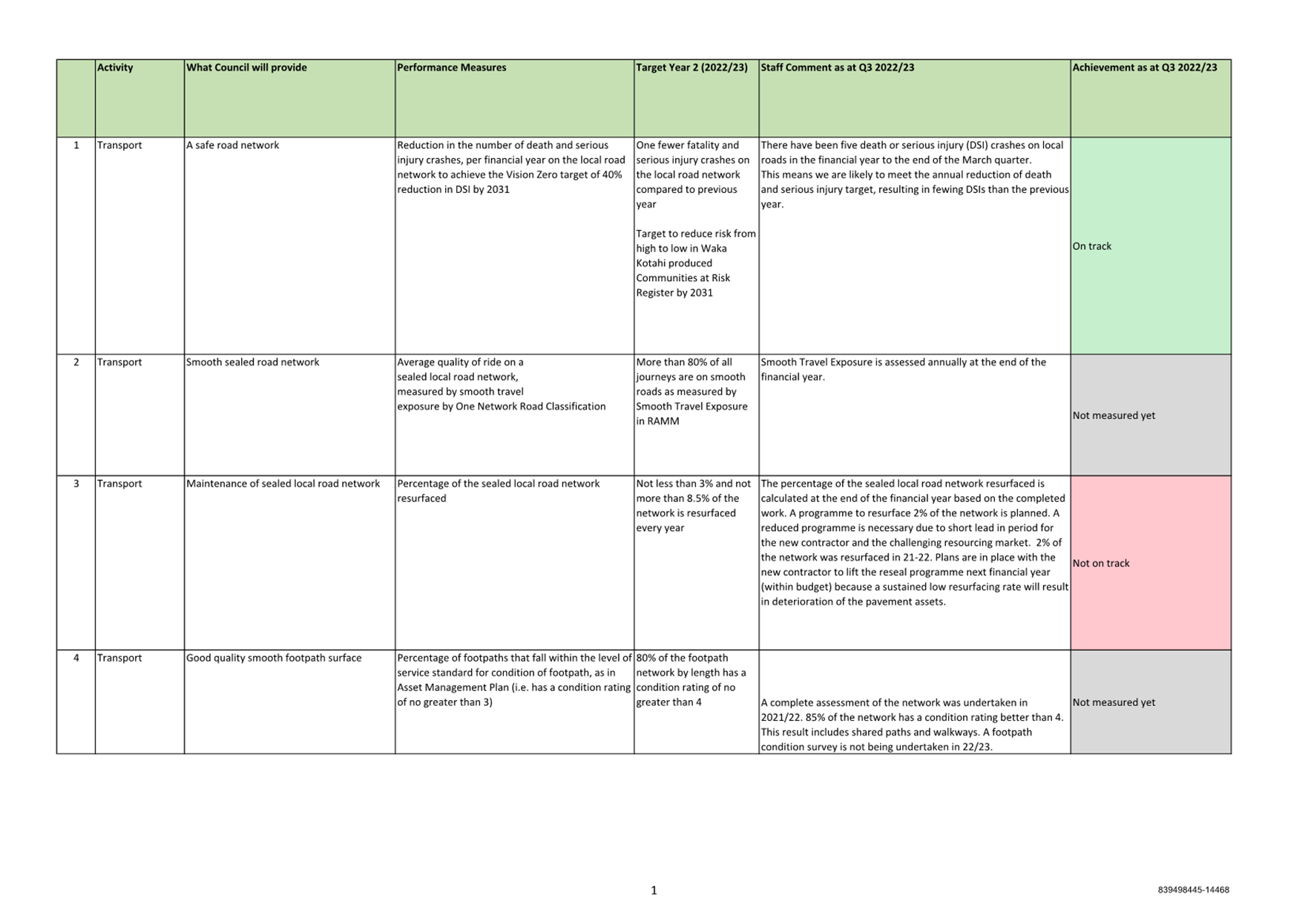

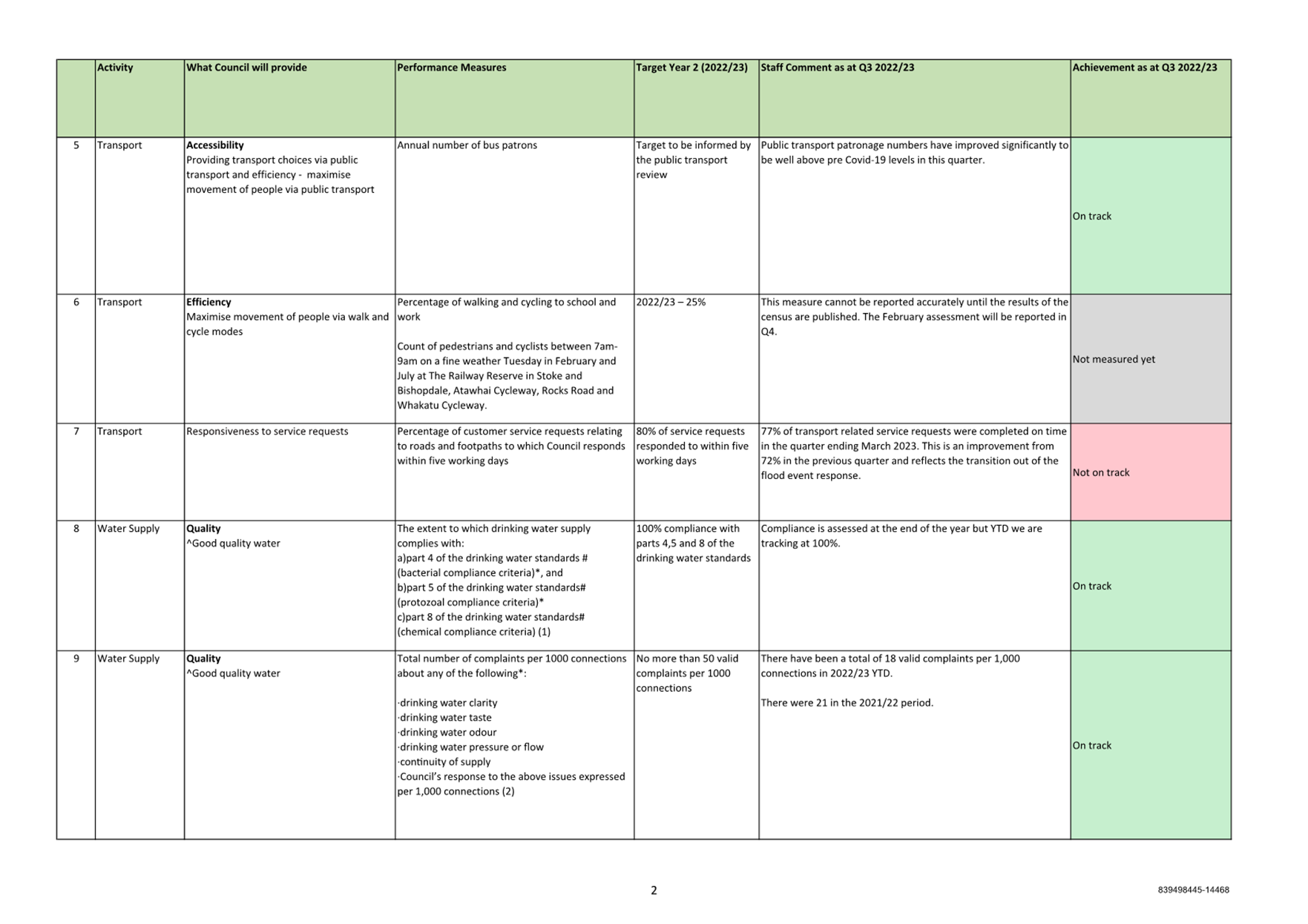

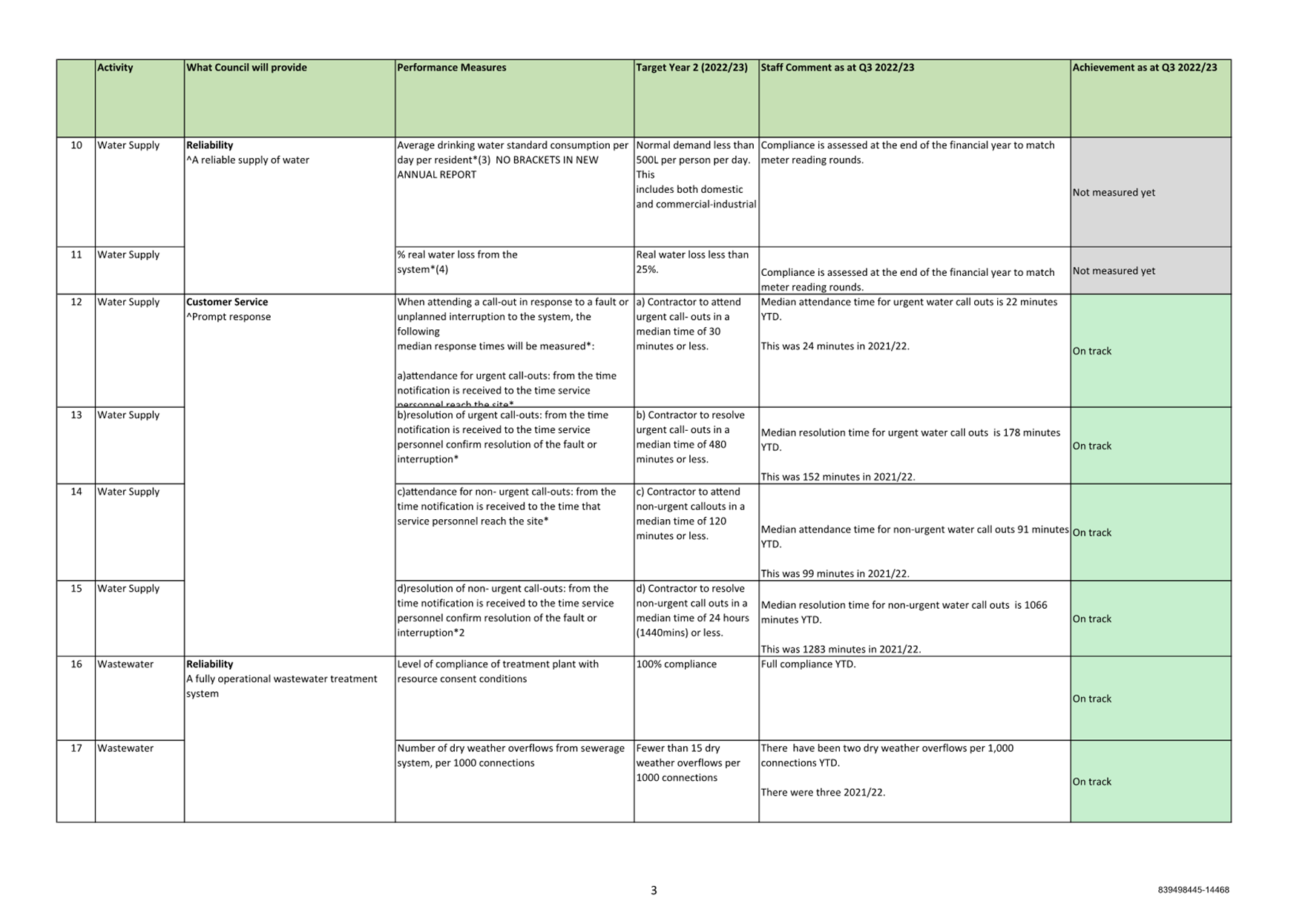

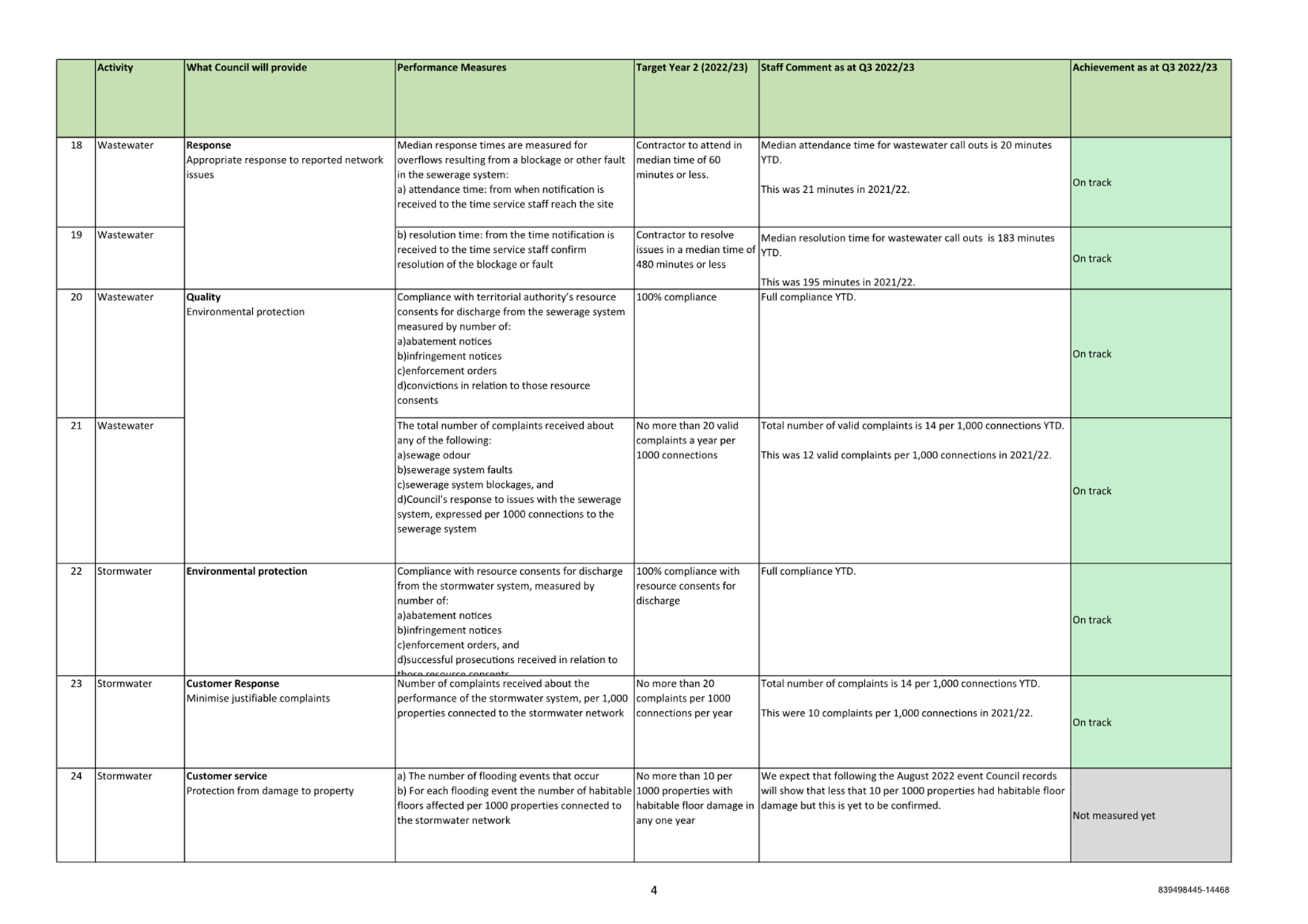

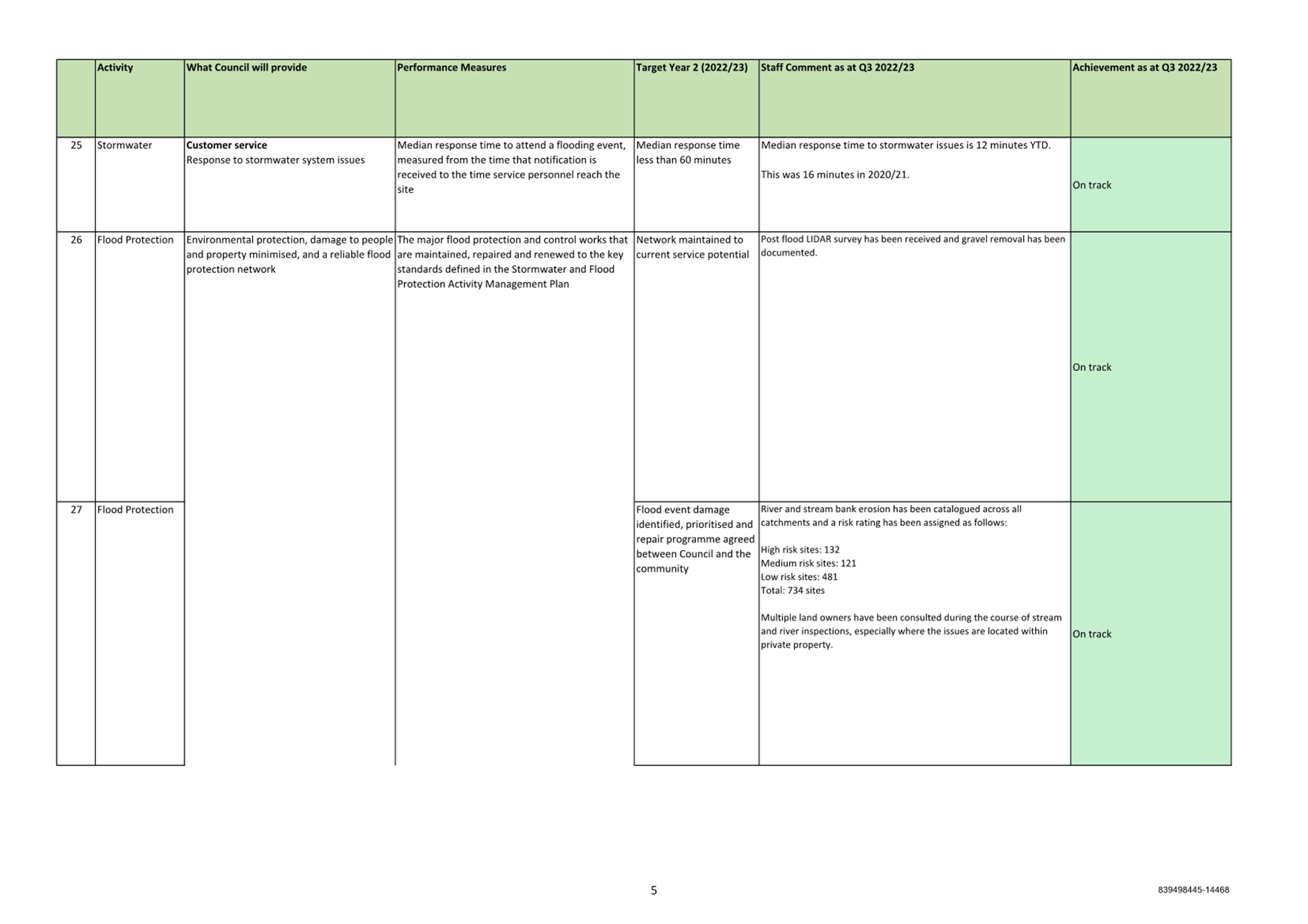

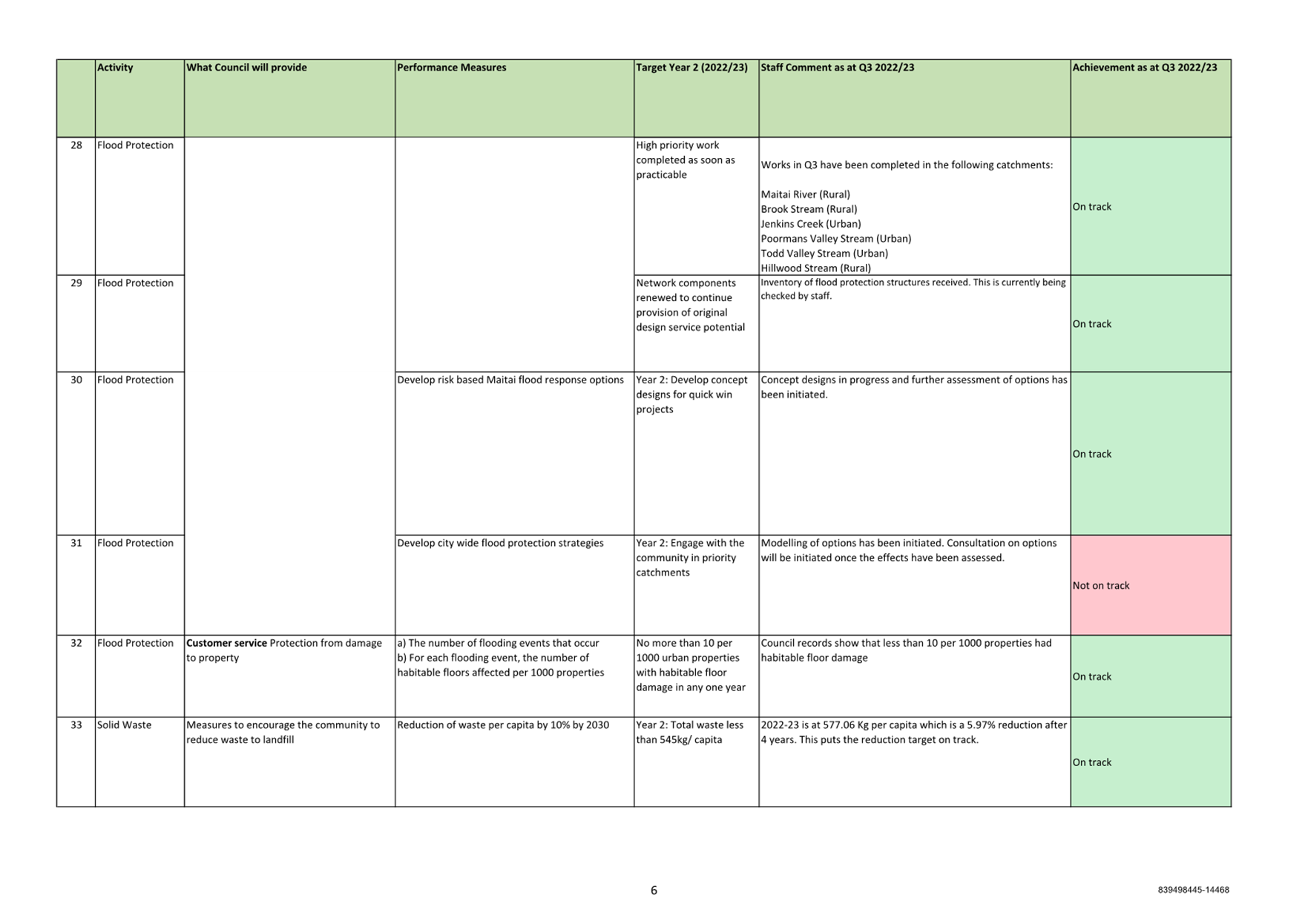

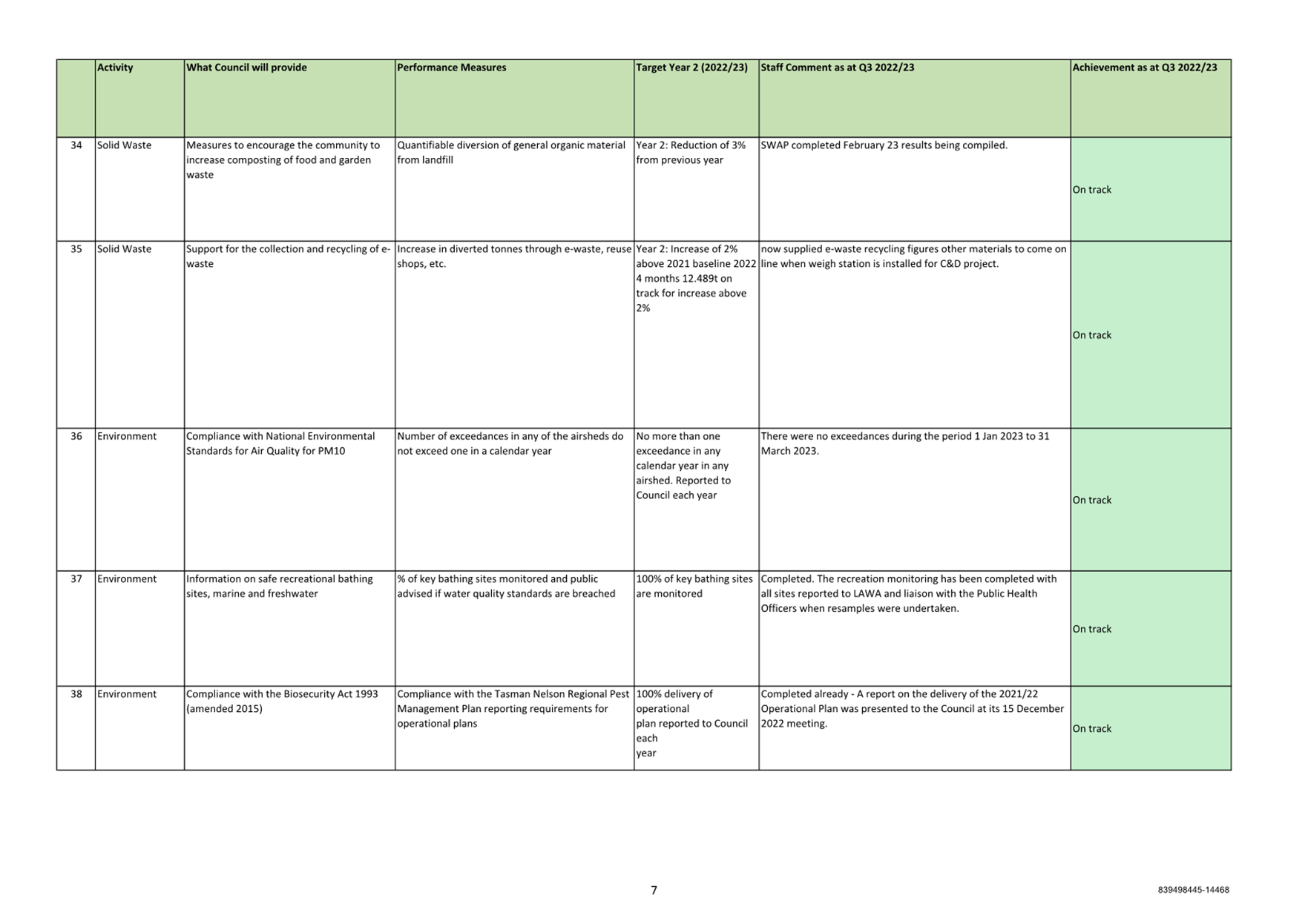

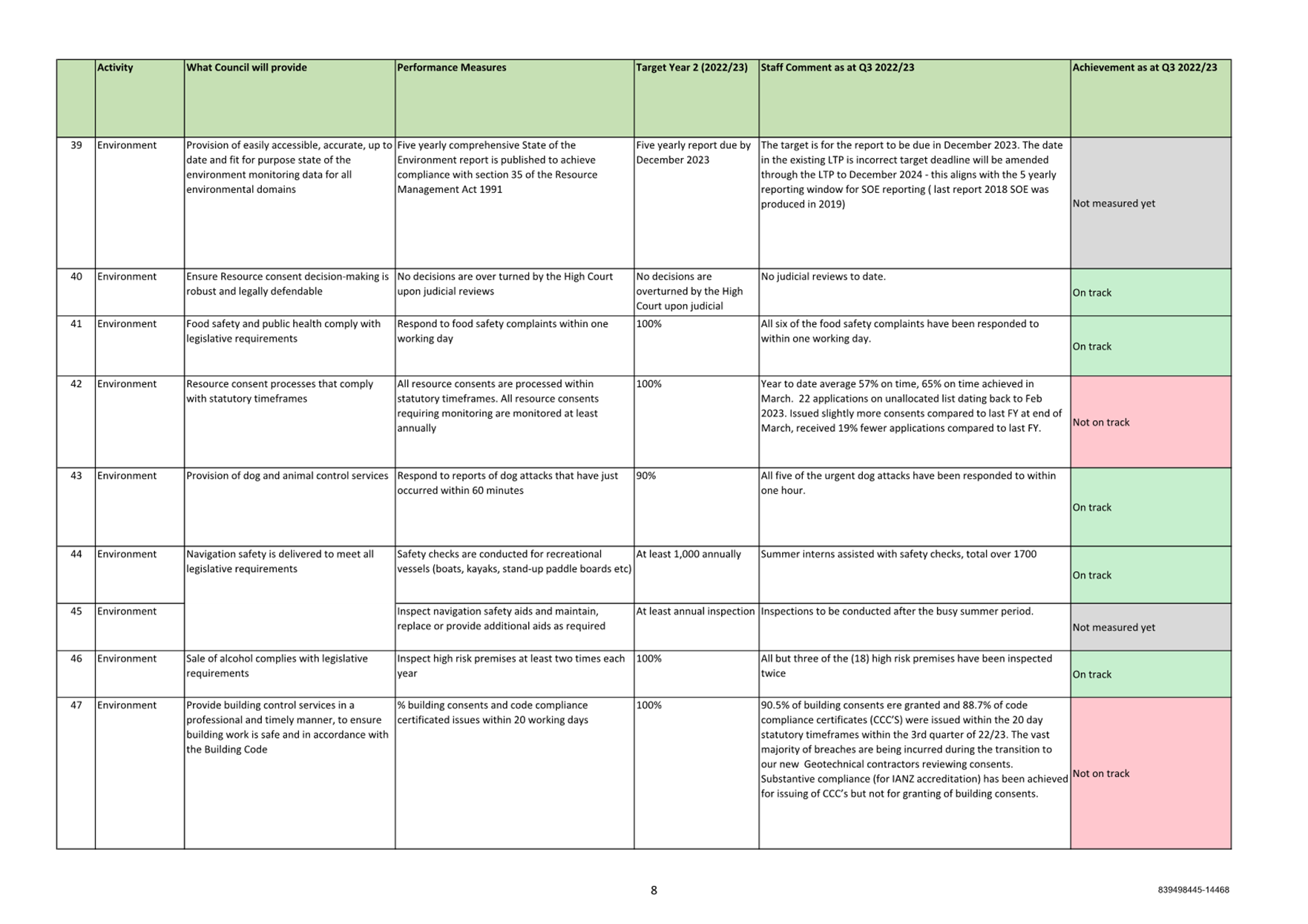

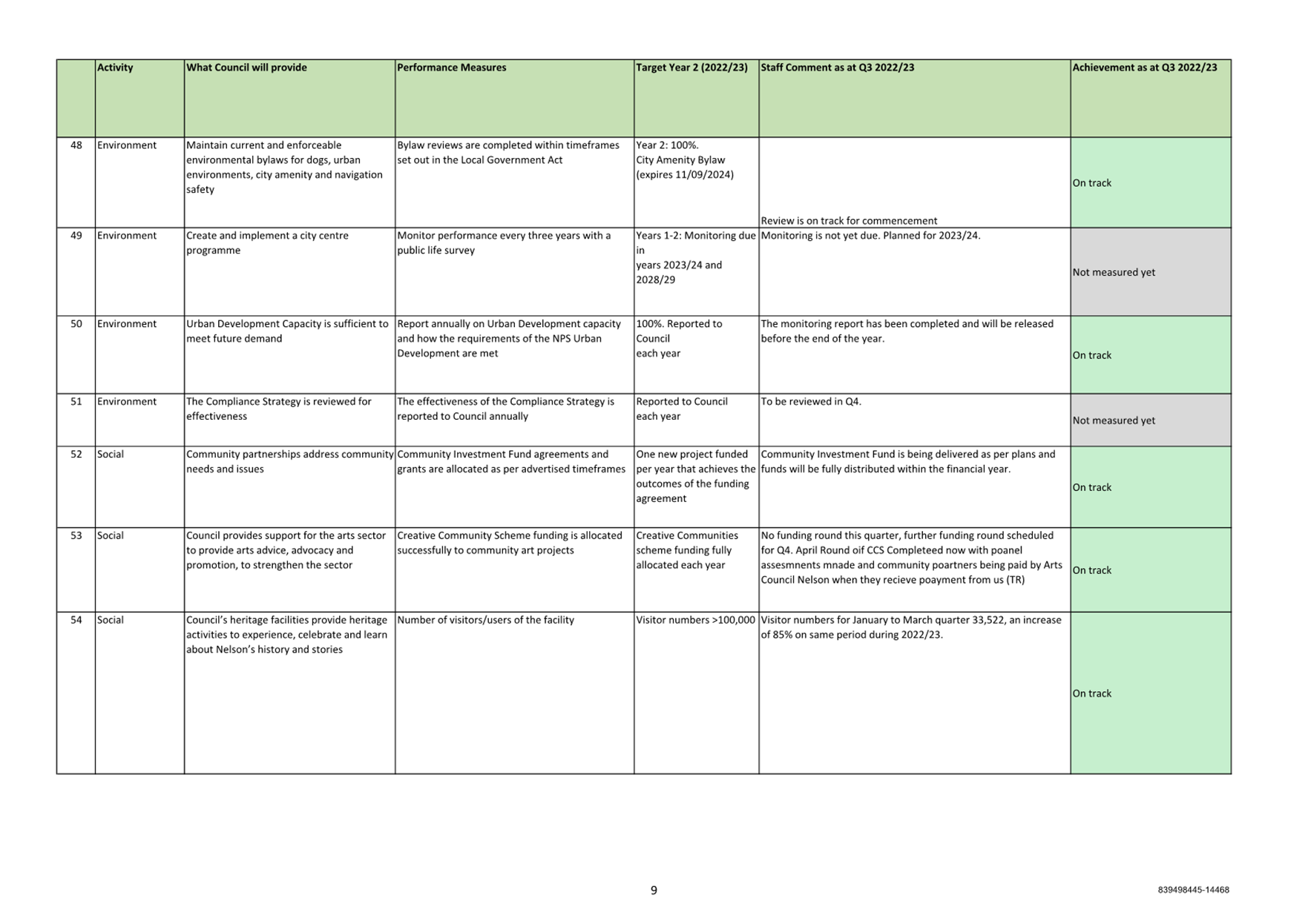

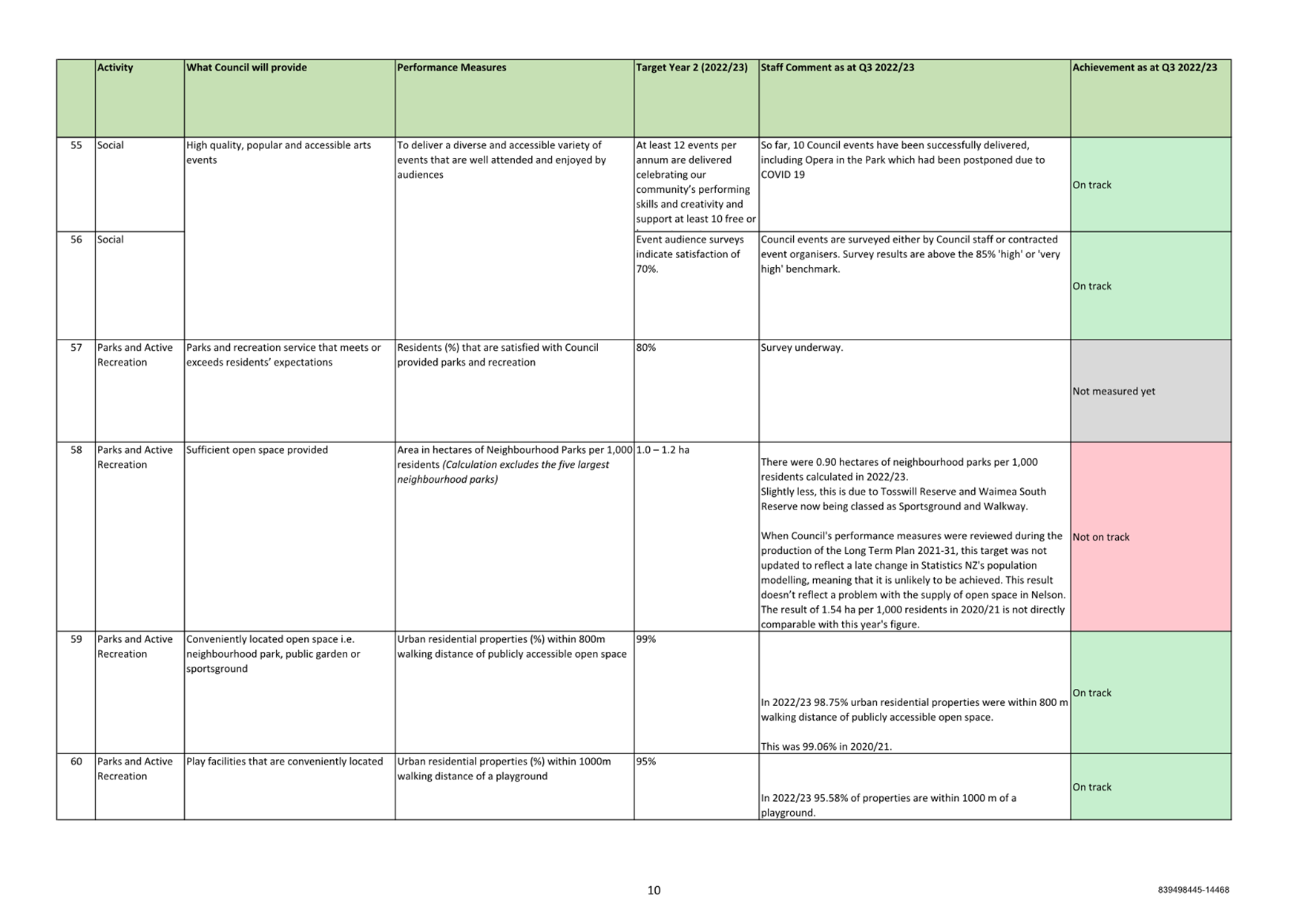

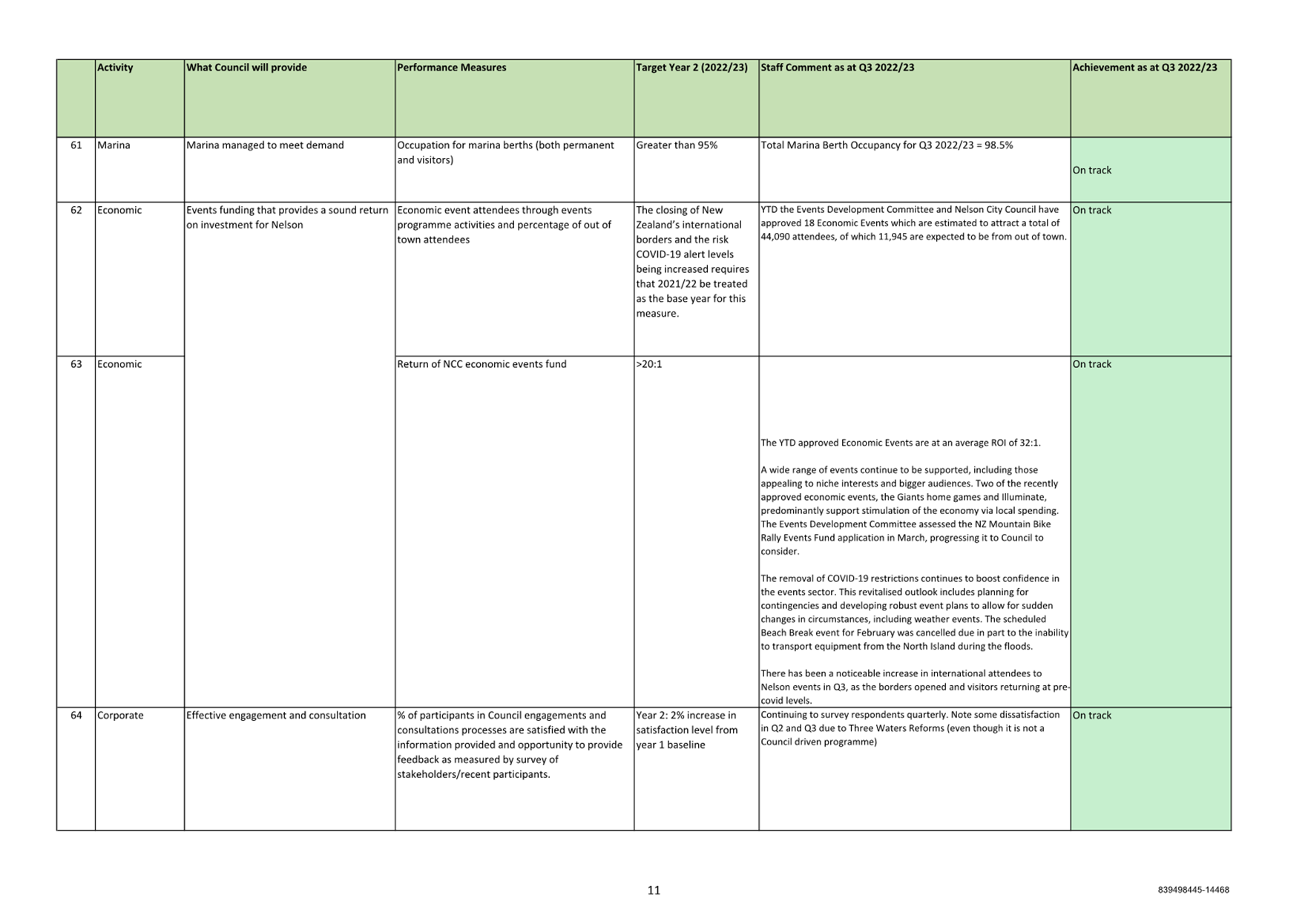

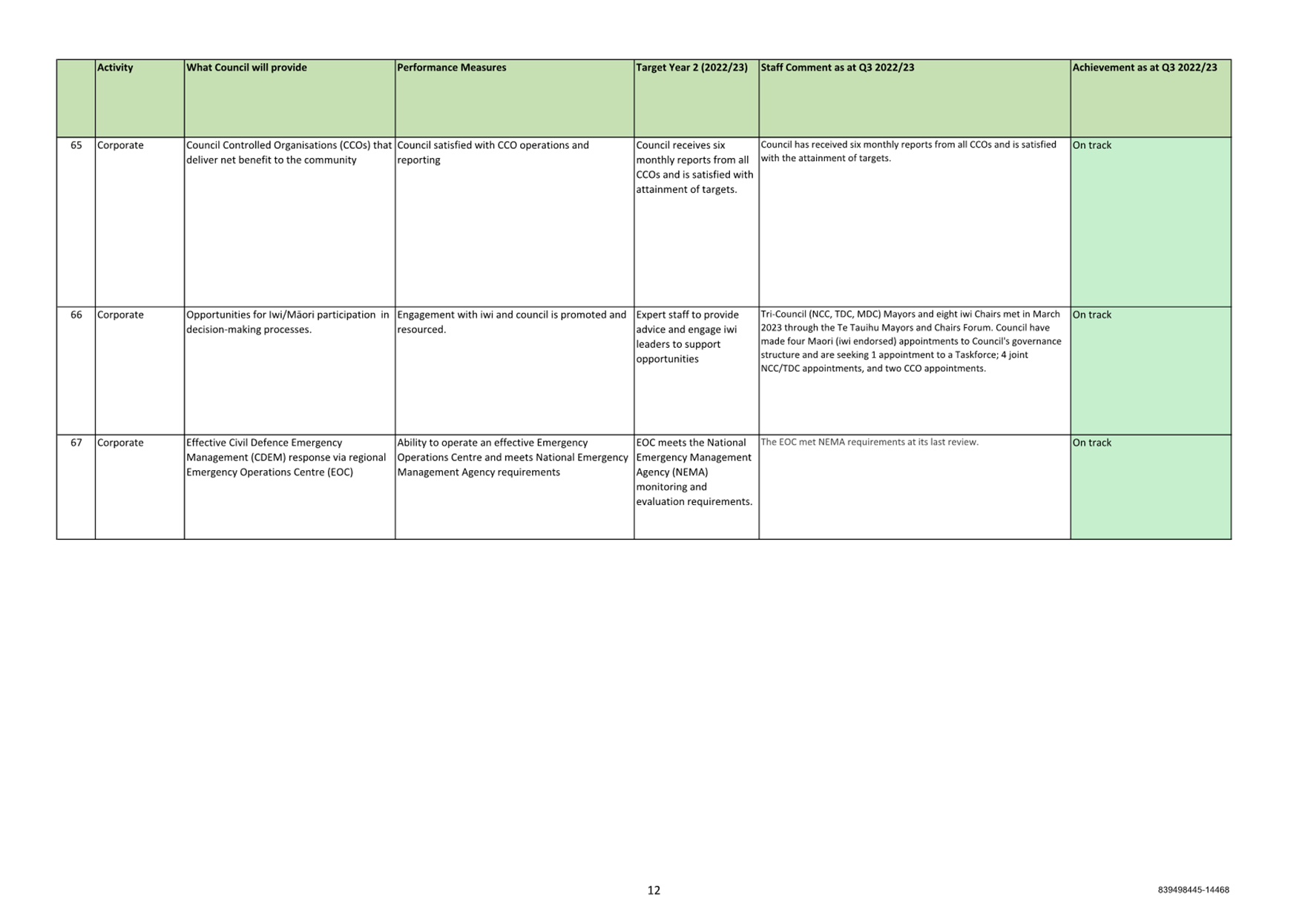

10. Performance

Measures

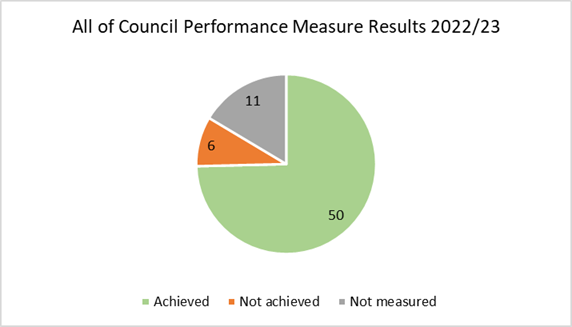

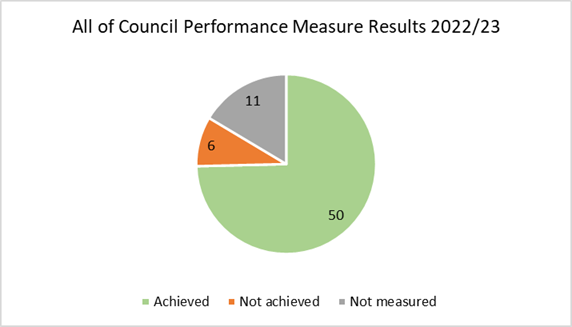

10.1 Council

reports on 67 non-financial performance measures across its activity areas, as

set out in the Long Term Plan 2021-31. These are evaluated as ‘on

track/not on track/not measured yet’ for the first three quarters of the

year.

10.2 Of

the 67 measures, 50 are on track, 6 are not on track, and 11 are not measured

yet. (24 February 2023 results were 49,7, and 11 respectively).

10.3 Attachment

3 (839498445-14468) details Council’s performance measure results so far

across all its activities.

Author: Prabath

Jayawardana, Manager Finance

Authoriser: Nikki

Harrison, Group Manager Corporate Services

Attachments

Attachment 1: 1857728953-779

Finance Attachment Q3 Reporting Mar-23 ⇩

Attachment 2: 839498445-14467

Mar2023 - Project Health Summary 16May2023 ⇩

Attachment 3: 839498445-14468

Quarterly Reporting - 2022-23 - Performance Measures 16May2023 ⇩

Item 11: Quarterly Finance Report to 31 March 2023:

Attachment 1

Item 11:

Quarterly Finance Report to 31 March 2023: Attachment 2

Item 11: Quarterly Finance Report to 31 March 2023: Attachment 3

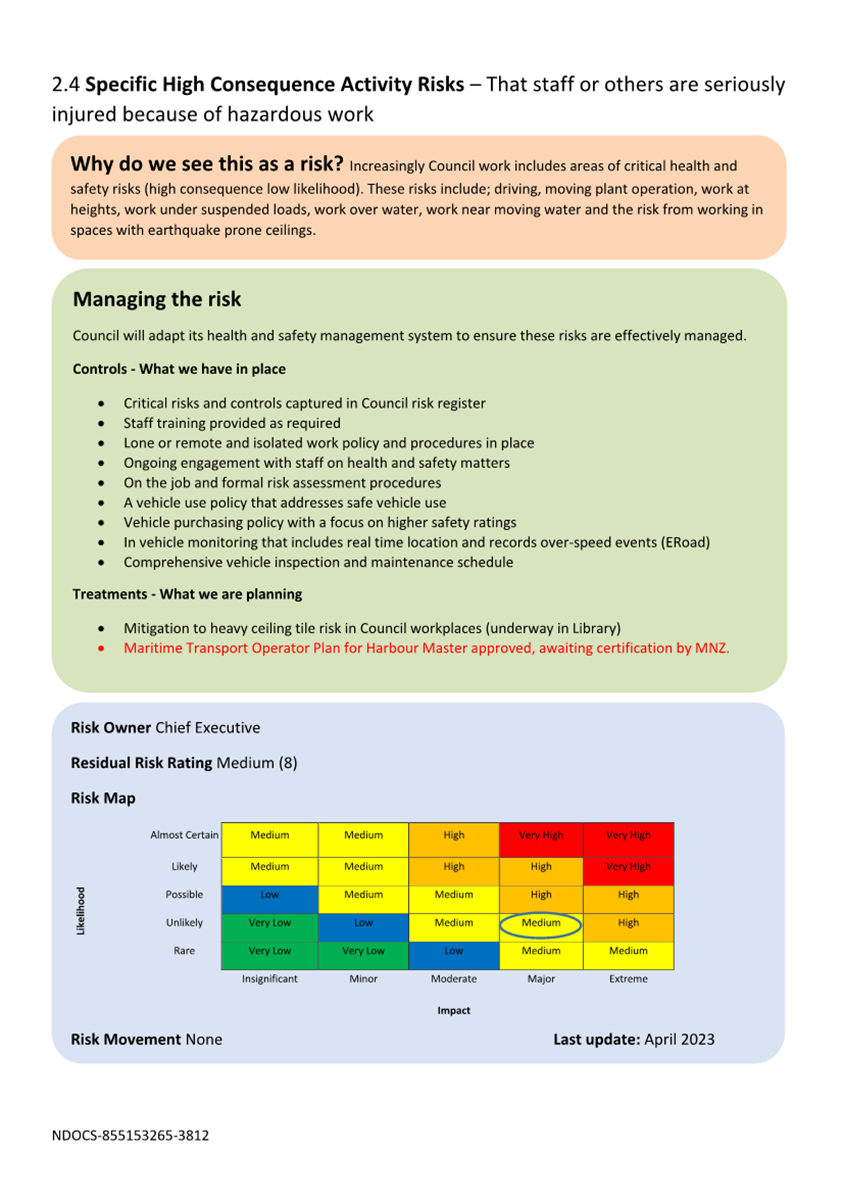

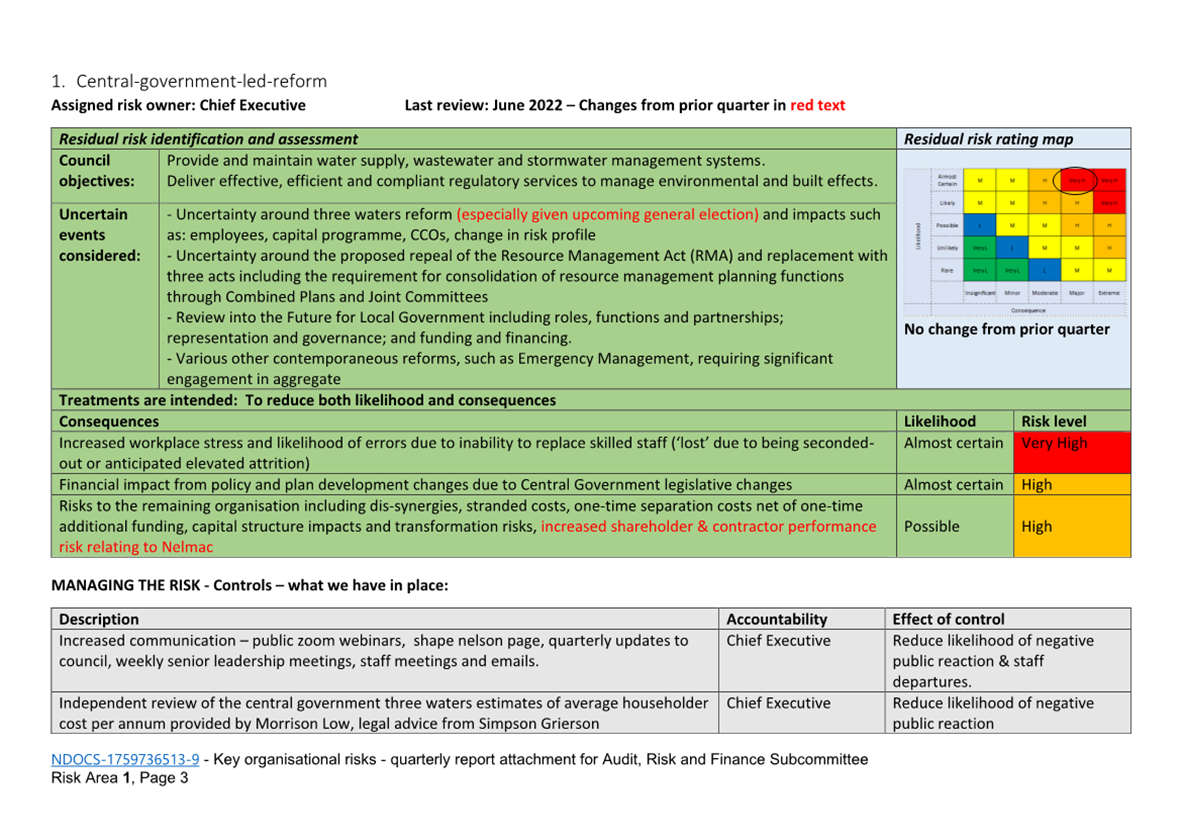

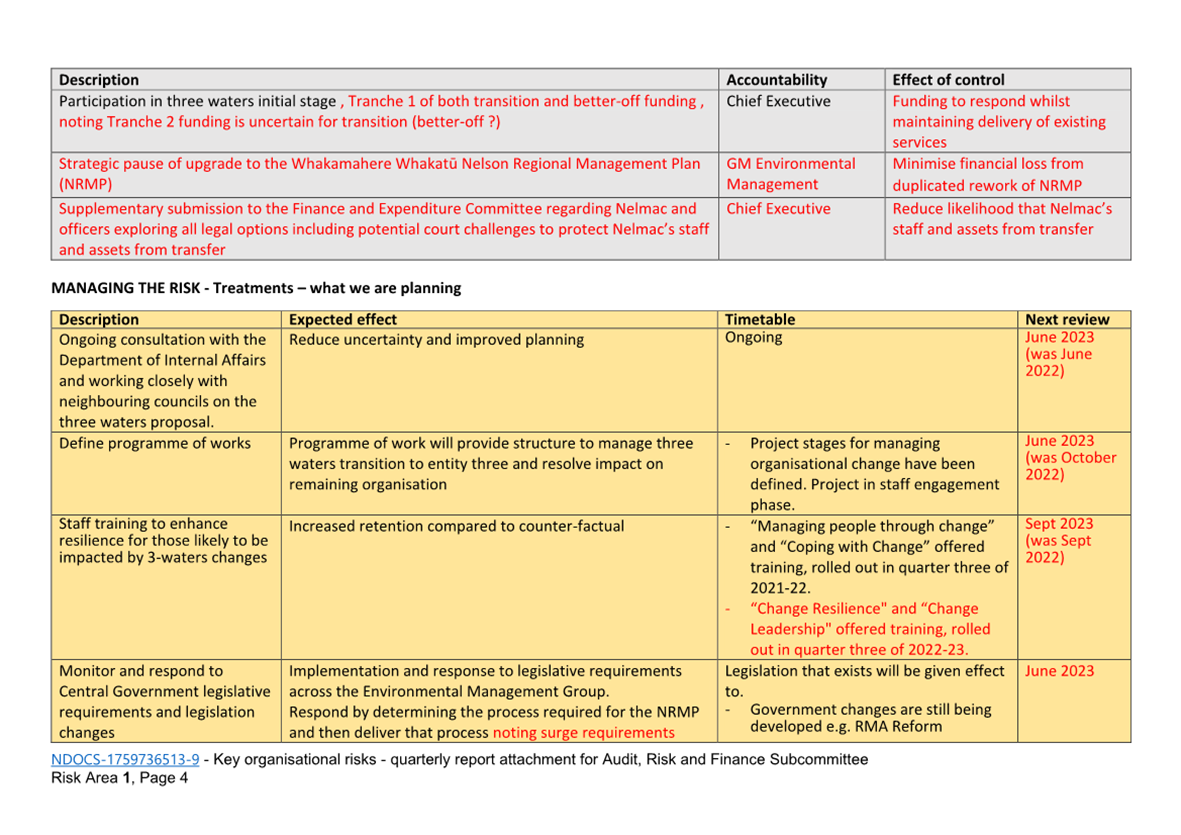

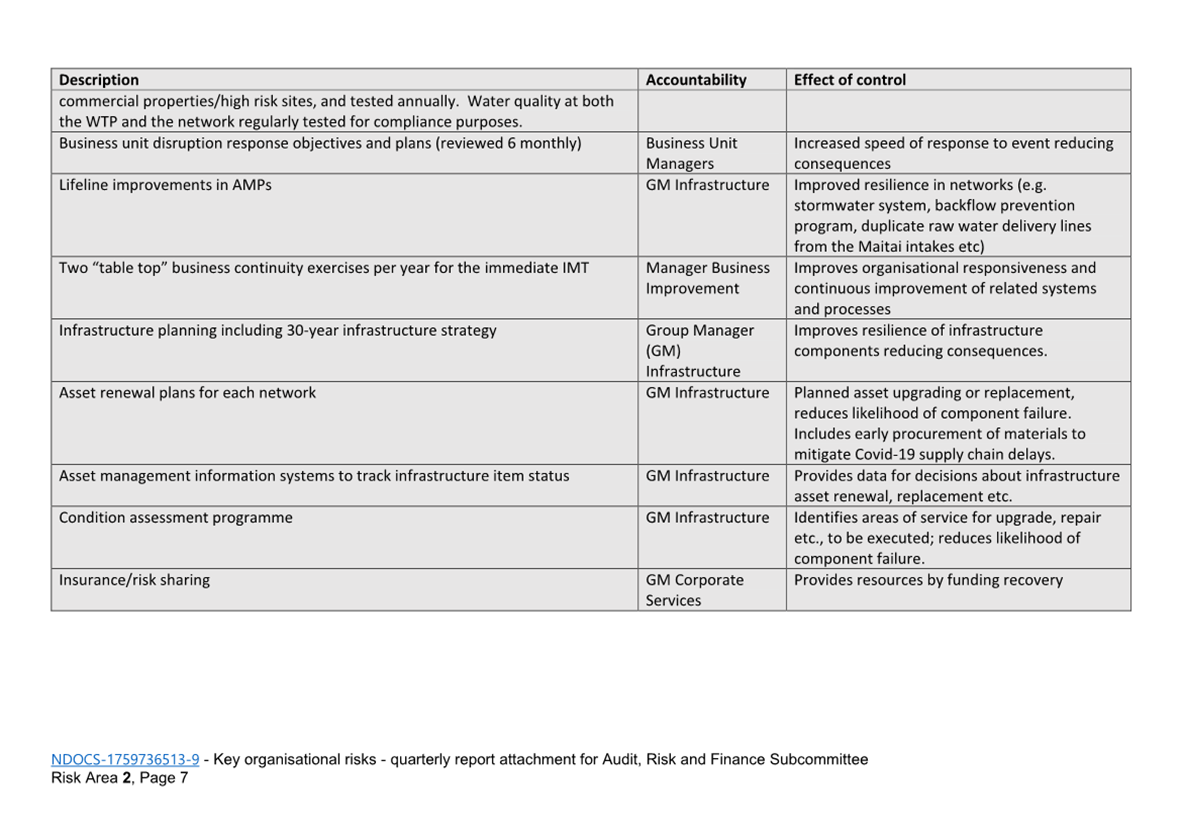

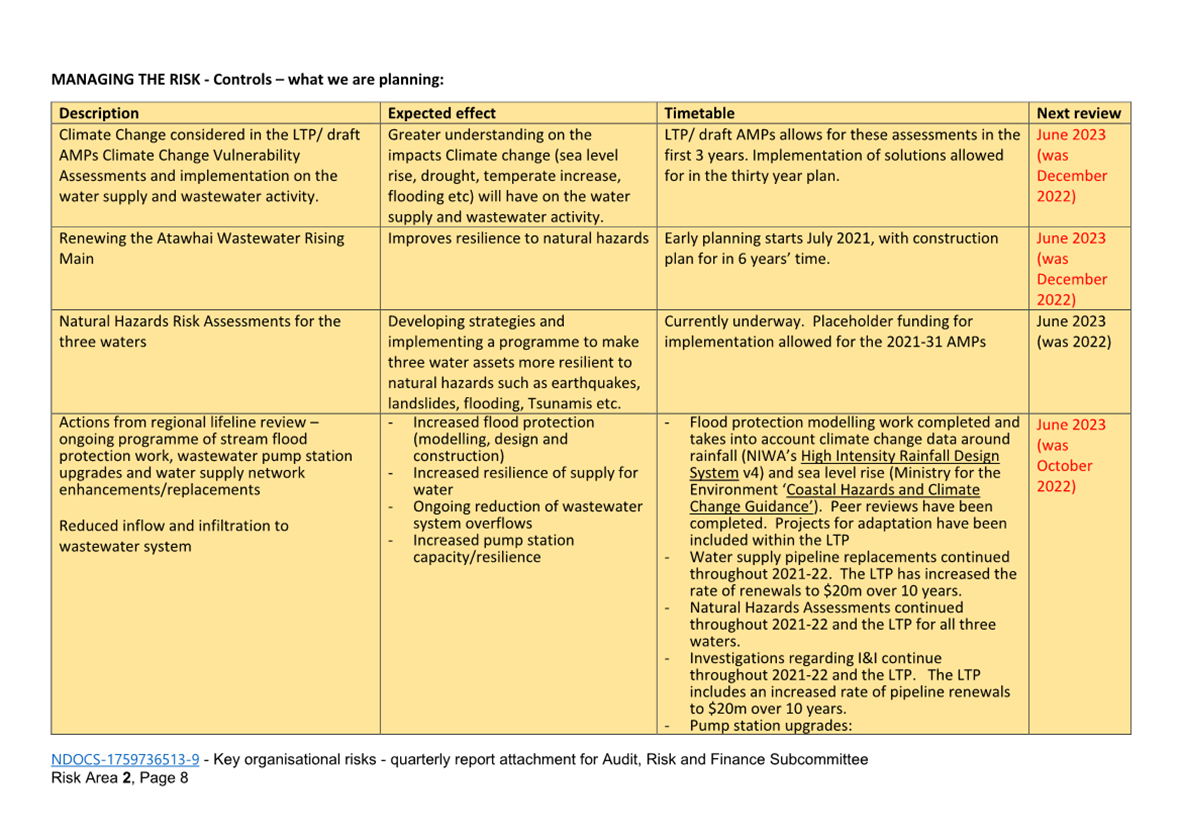

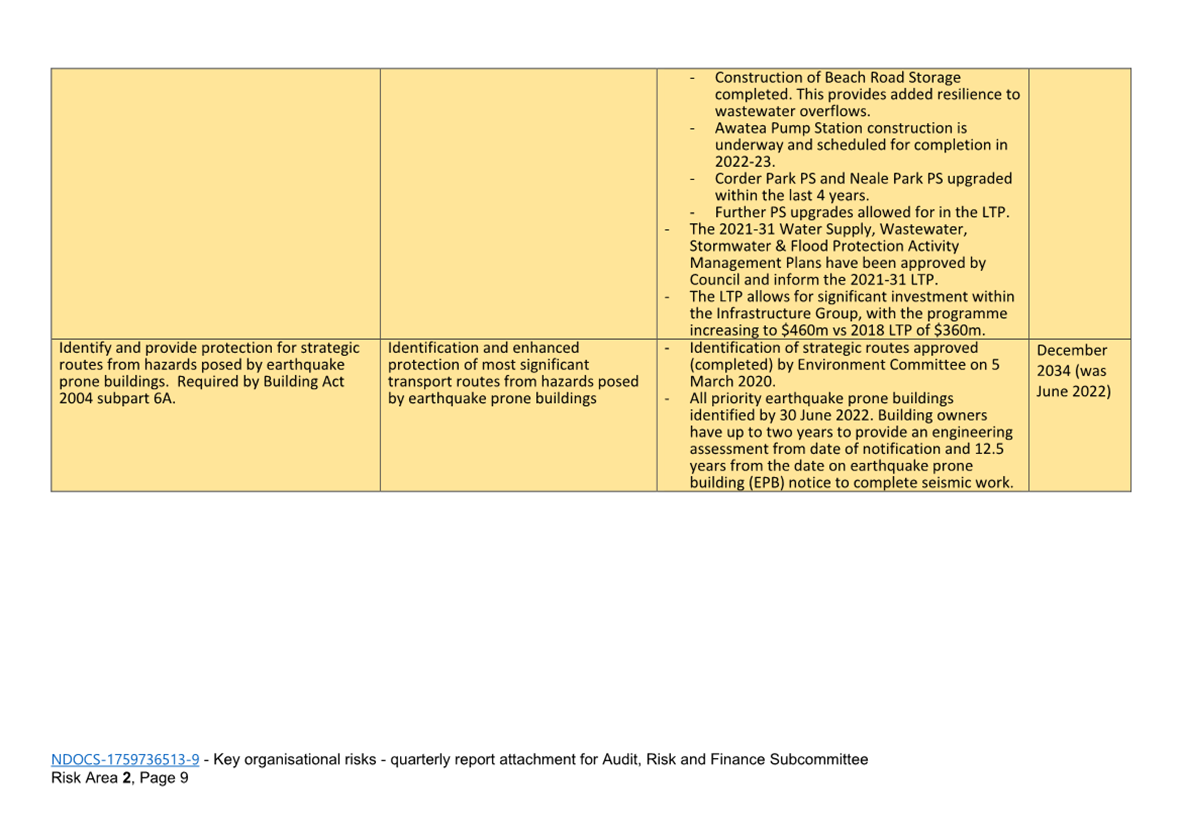

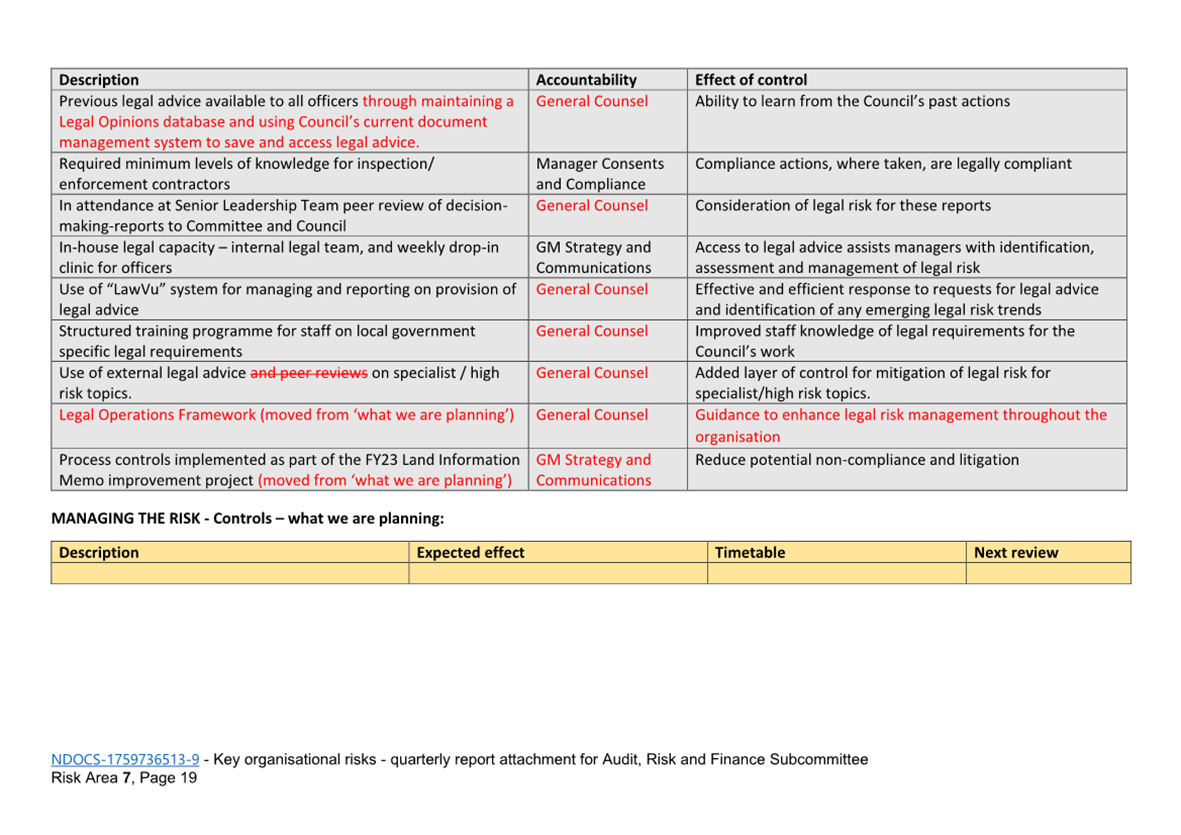

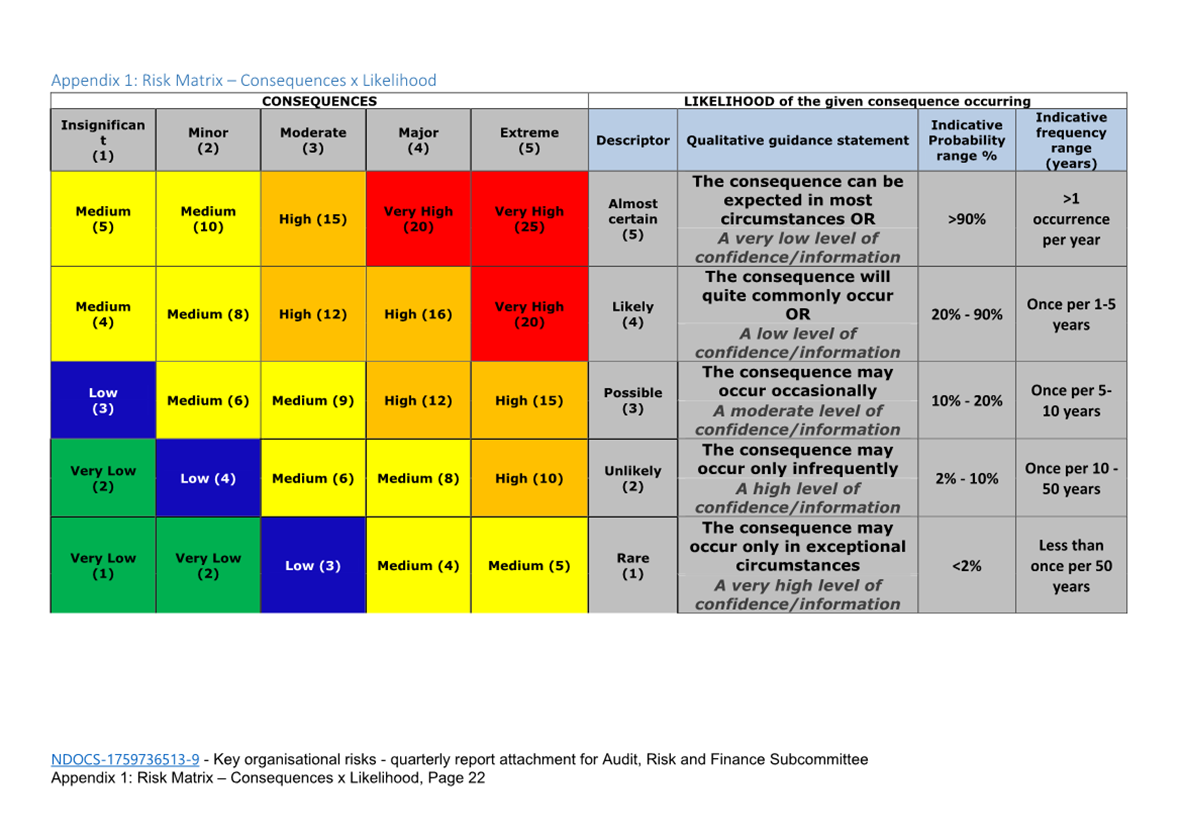

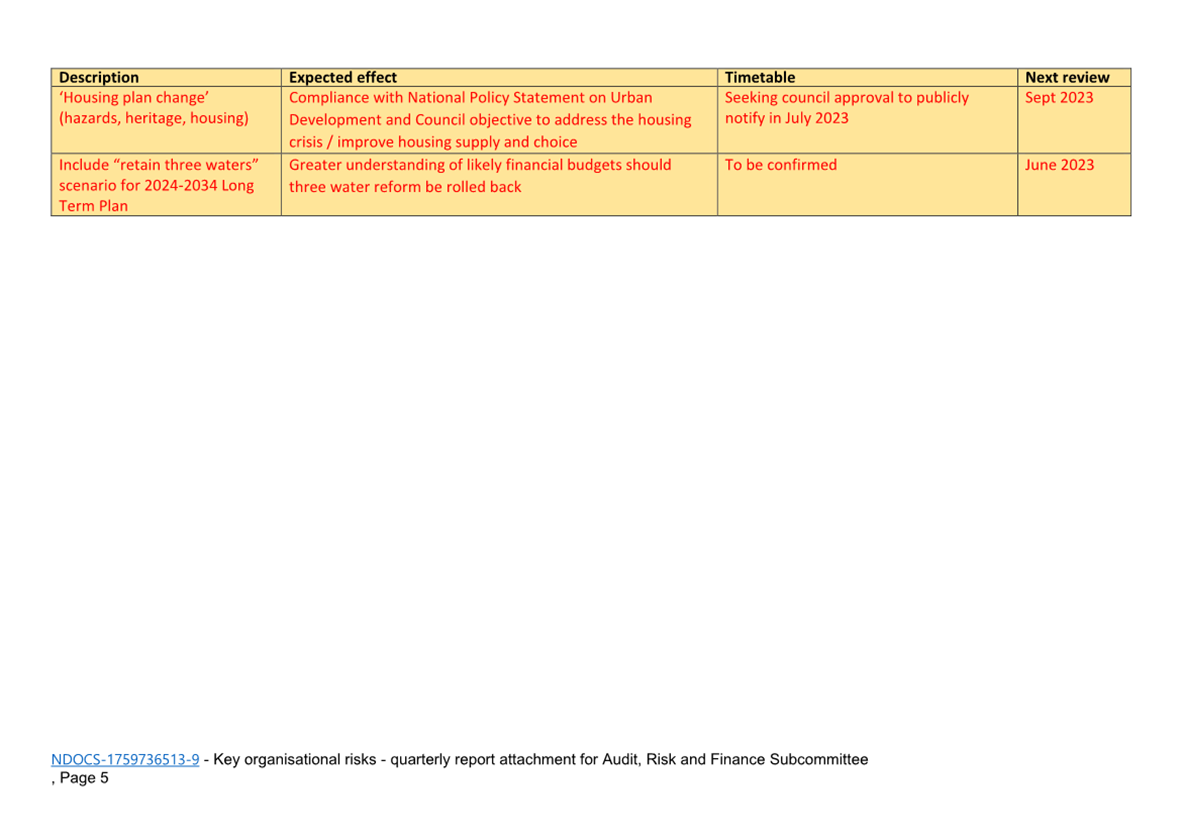

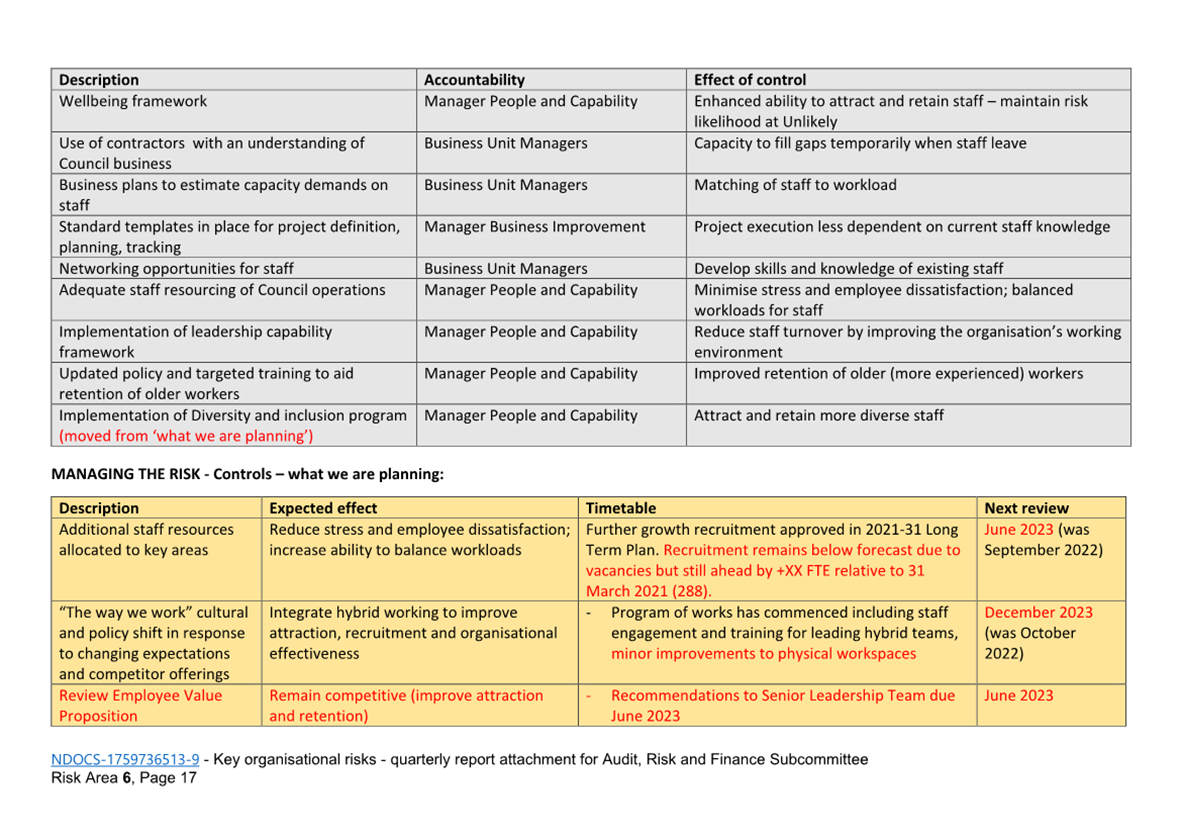

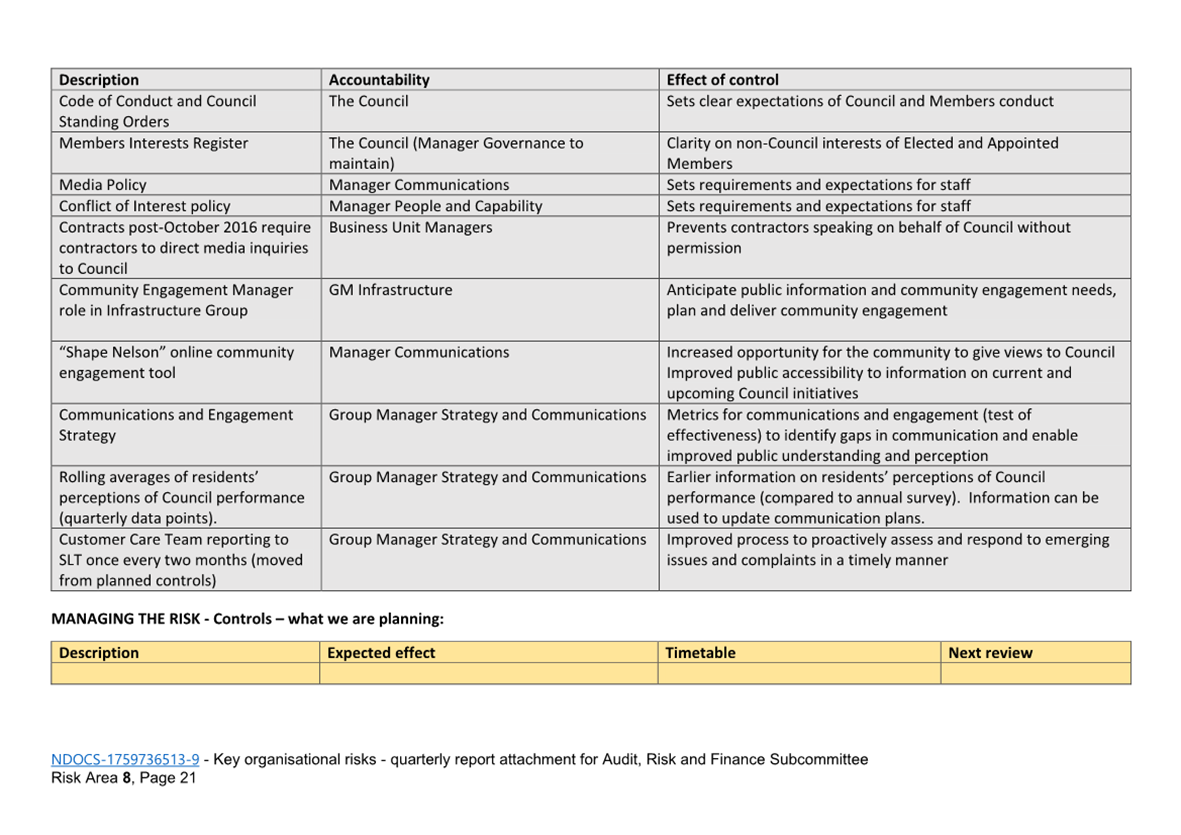

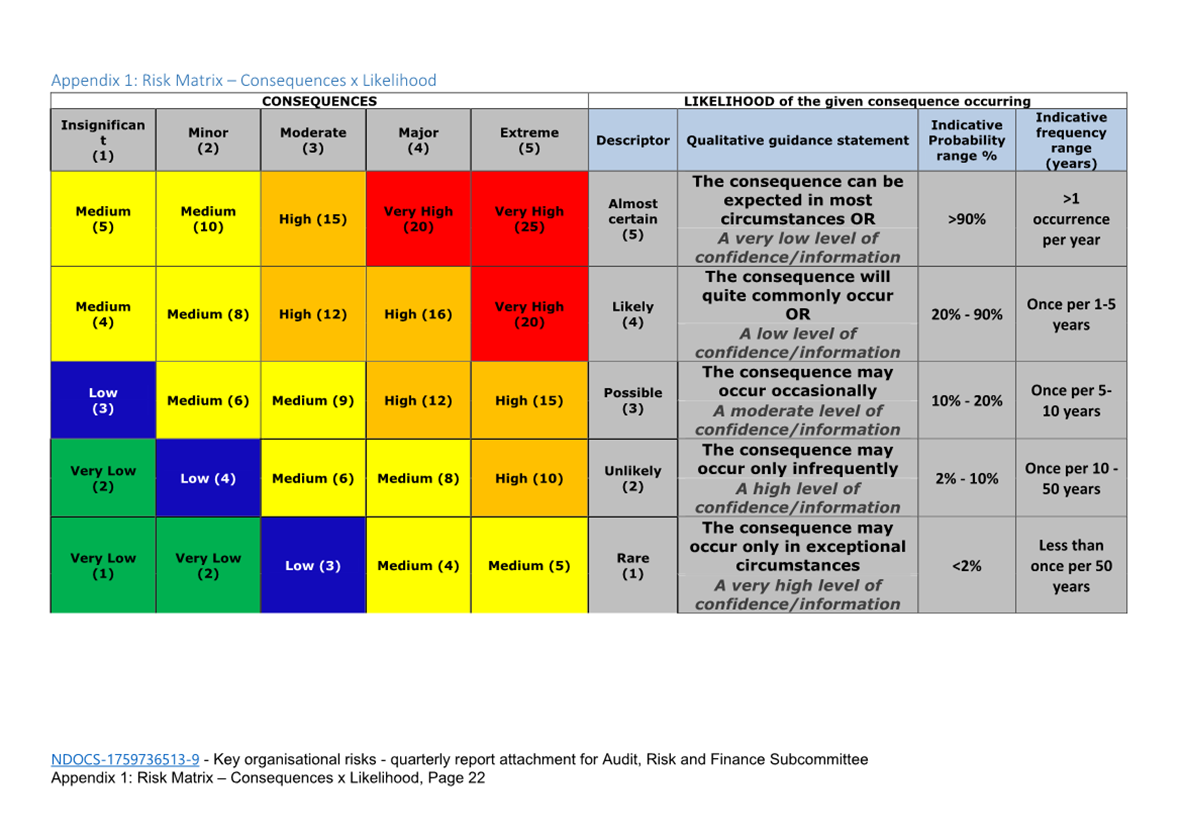

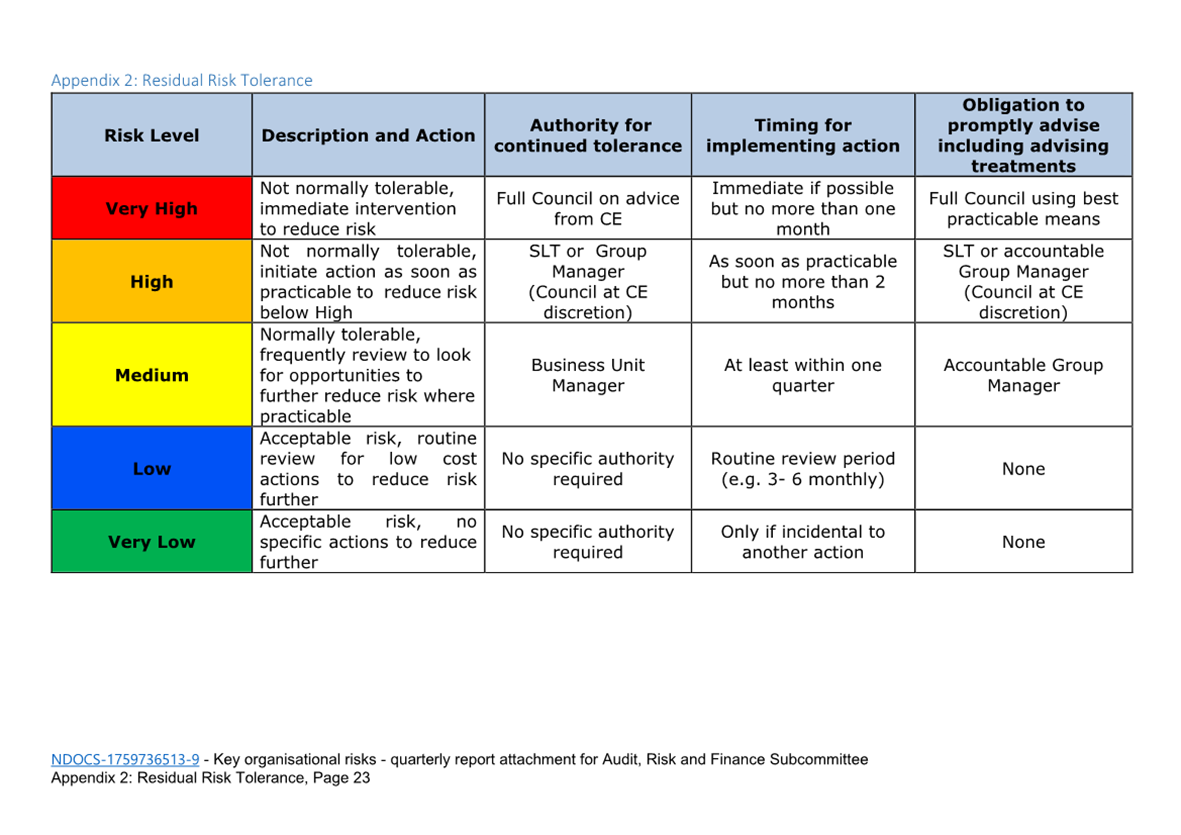

Item 12: Quarterly Risk

Report - 31 March 2023

|

|

Audit, Risk and Finance Committee

1 June 2023

|

REPORT R27625

Quarterly Risk Report - 31

March 2023

1. Purpose of Report

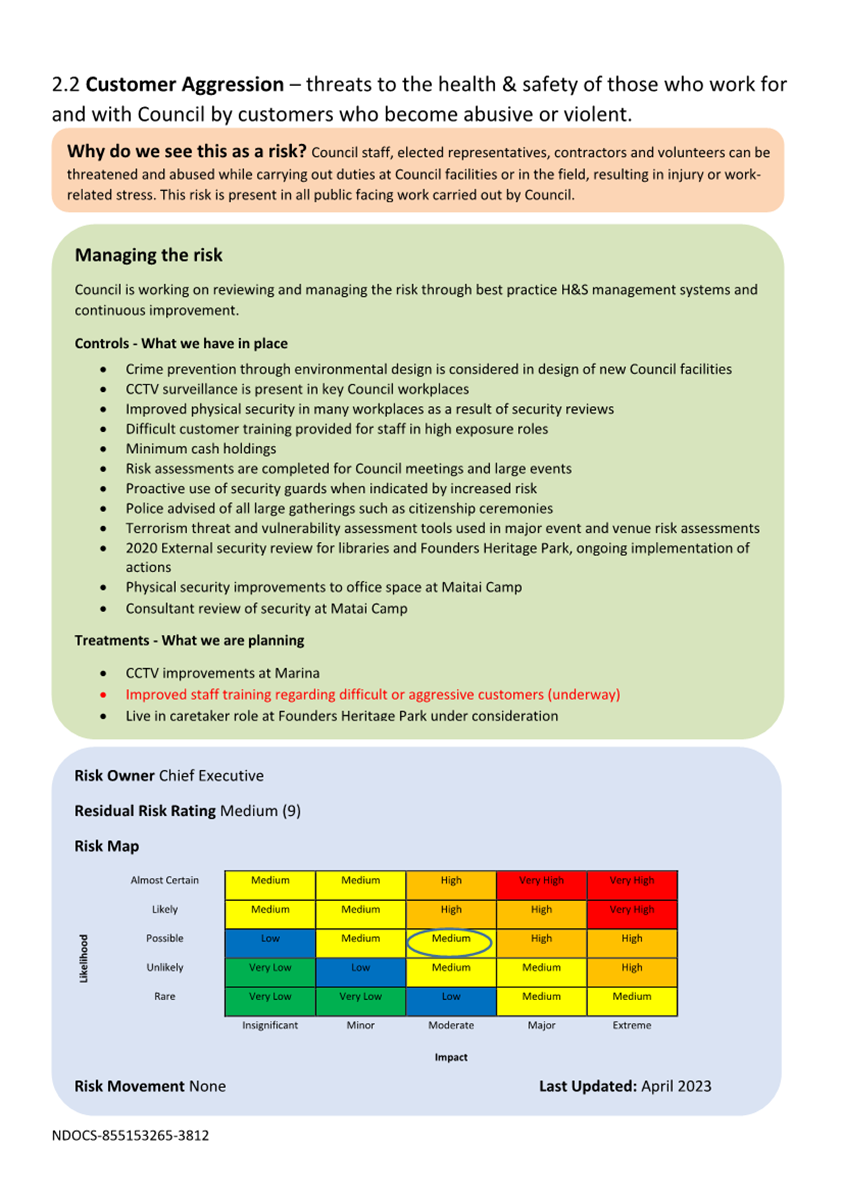

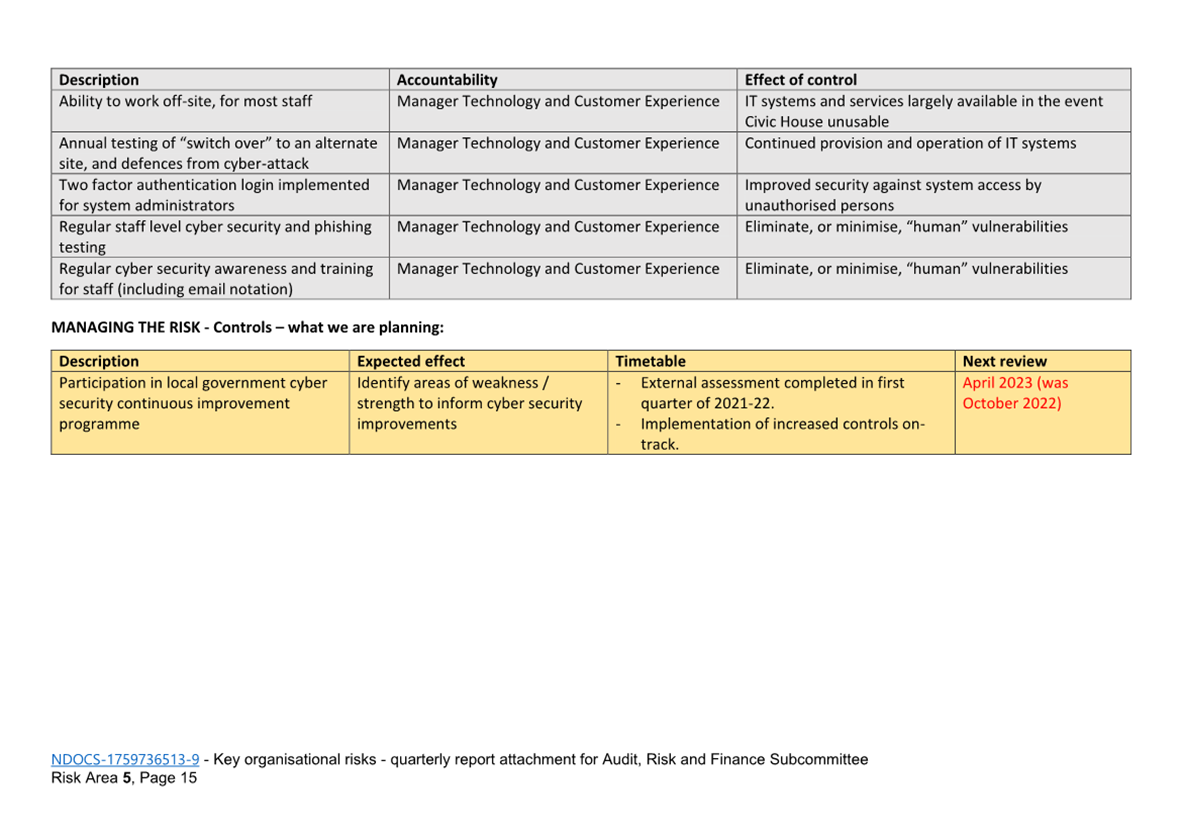

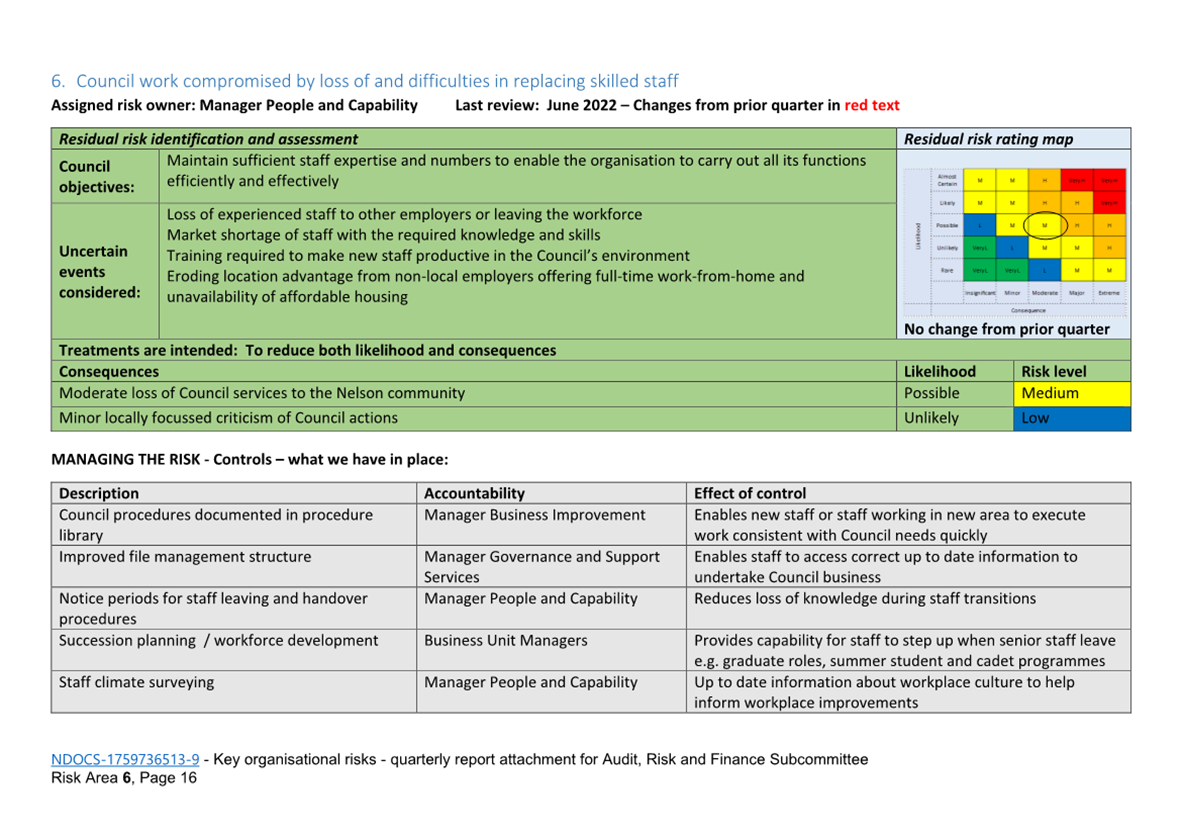

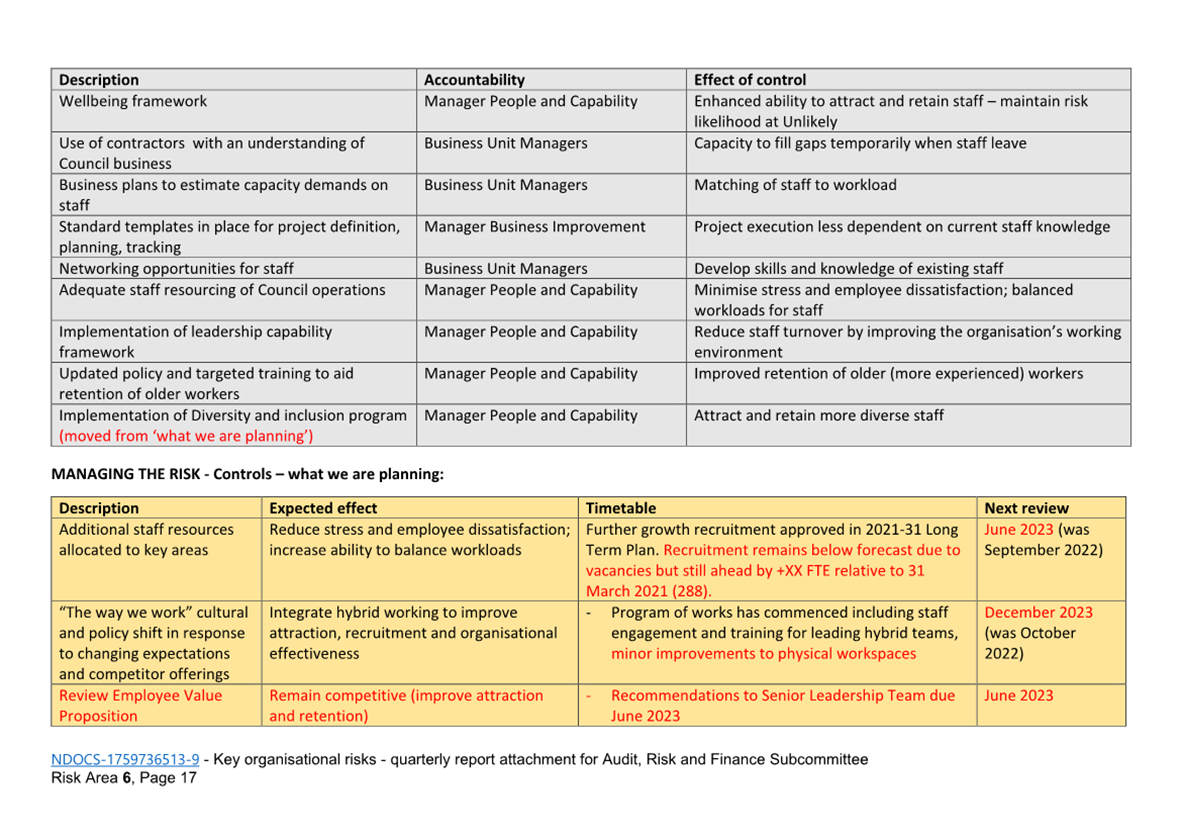

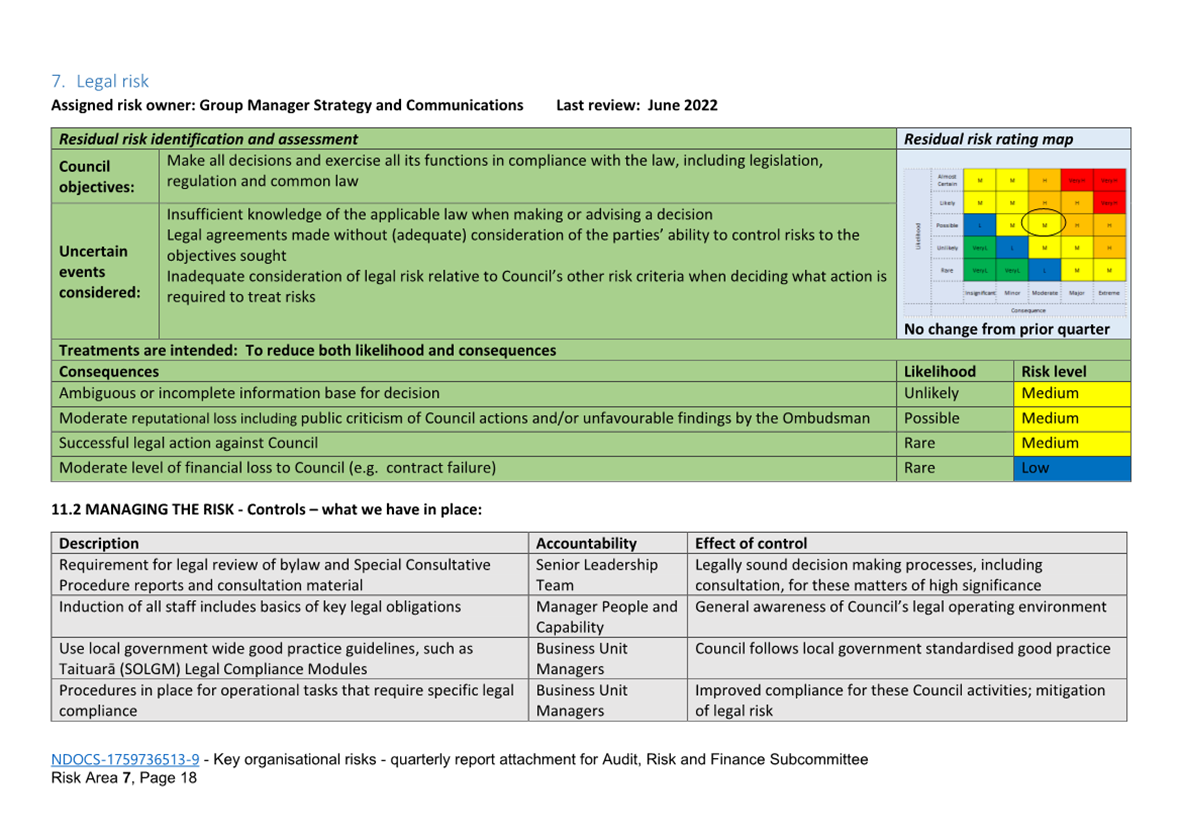

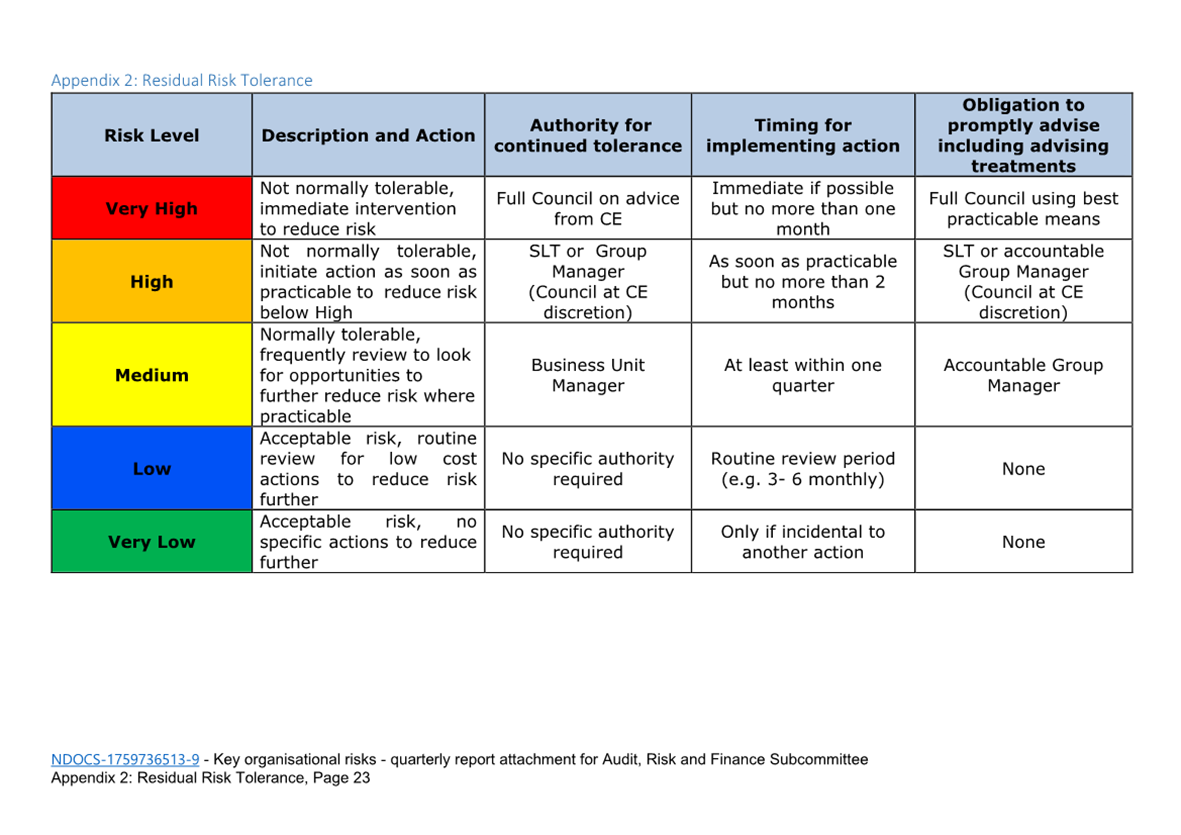

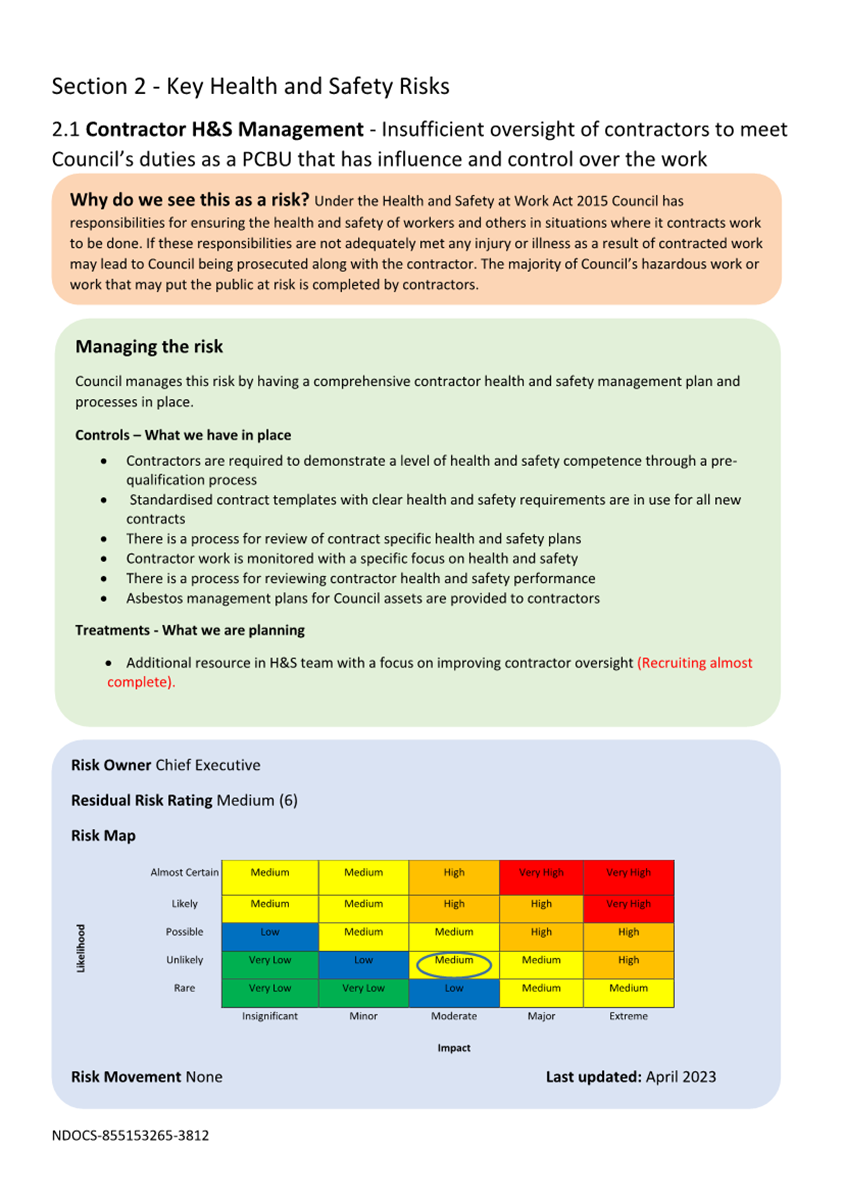

1.1 To provide

information to the Audit, Risk and Finance Committee on the organisational

risks through to end of the third quarter of 2022/23.

2. Recommendation

|

That the Audit, Risk and Finance Committee

1. Receives

the report Quarterly Risk Report - 31 March 2023 (R27625) and its attachment (1759736513-9).

|

3. Background

3.1 This report

includes an update on progress against the risk management work plan and

describes key risk areas, divided by risk theme (organisational risks) and

reporting Group.

4. Progress on Risk

Management Work Plan

4.1 The 2022/23 risk

management work plan, which was set prior to the appointment of the new Chairperson

in February 2023 and prior to the Local Government Elections in September 2022,

includes:

4.1.1 risk

training for four business units – three completed

4.1.2 two

team leader or manager anti-fraud trainings – one completed

4.1.3 new

councillor risk management induction – not yet completed

4.1.4 review risk tolerance with new

chair of Audit, Risk and Finance – not yet completed

4.1.5 updating the legal compliance

consequence description – not yet completed

5. Putting

Organisational Risks in Context

5.1 Risks relating

to Council and joint operations are monitored via Council’s risk register.

5.1.1 Risks relating to subsidiaries

and joint ventures are limited to ownership risks. Risks relating to

contracted-out activities are limited to residual/non-contracted-out risks.

Specific asset, activity, legal matter, or project risks are rolled up into

more general asset, activity, legal or project risks however any significant

items are summarised in the last section.

5.2 Risk entries are

categorised in two ways:

5.2.1 Operational risks with no

apparent common theme or cause and hence unlikely to pose a threat at an organisational

level (approximately 70% of risk entries by count), and

5.2.2 Organisational risks with

identified common themes or causes which create risk concentrations that pose a

threat at an organisational level (approximately 30% of risk entries by count)

5.3 The latter is

the focus of this report and further detail is provided the next section.

6. Key Risk Areas by

Theme (Organisational Risks)

6.1 “Disruption

to Council service delivery due to significant increase in COVID-19 cases”

is no longer being reported as an organisational risk but will still be covered

by the Heath, Safety and Wellbeing Report.

6.2 A summary of key

risk themes is provided below. The attachment to this report describes each

risk theme in more detail, its existing controls and planned risk treatments.

For ease of comparison to the prior quarter, new text (with the exception of

‘Central-government-led-reforms’) in the attachment has been

coloured red.

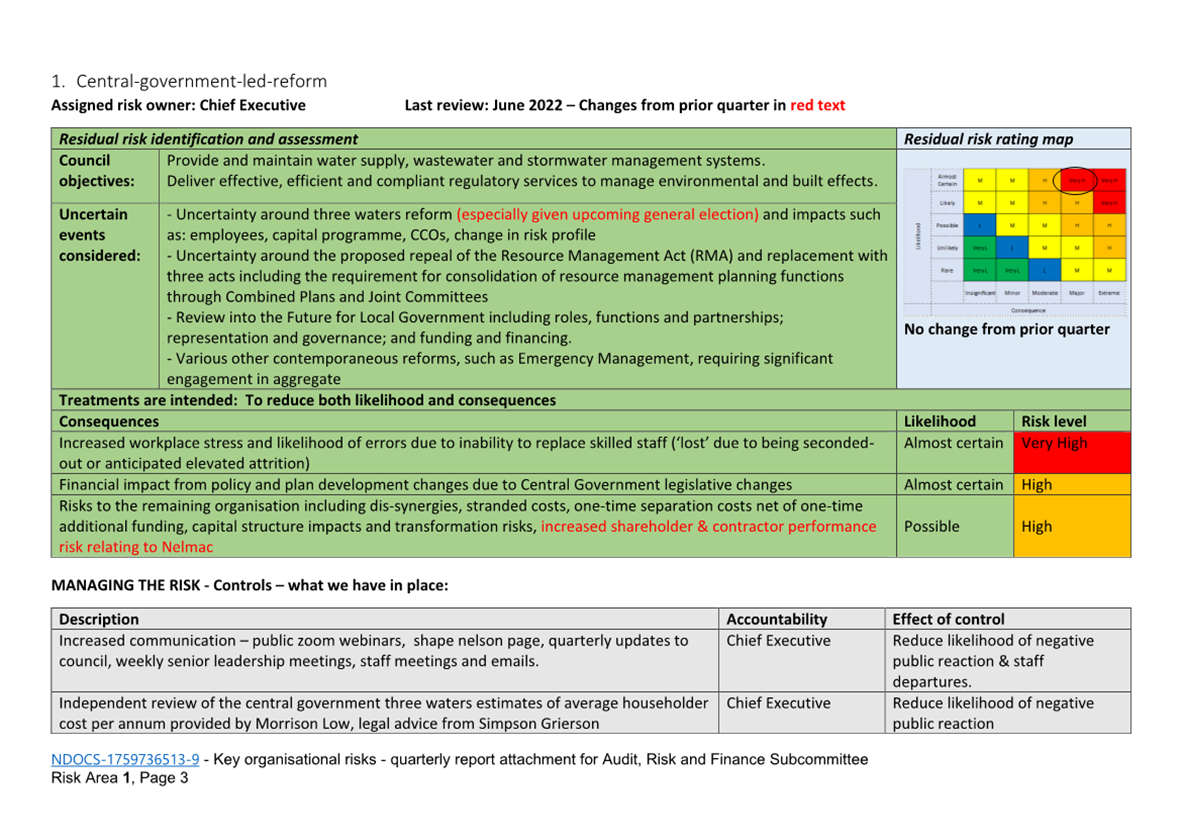

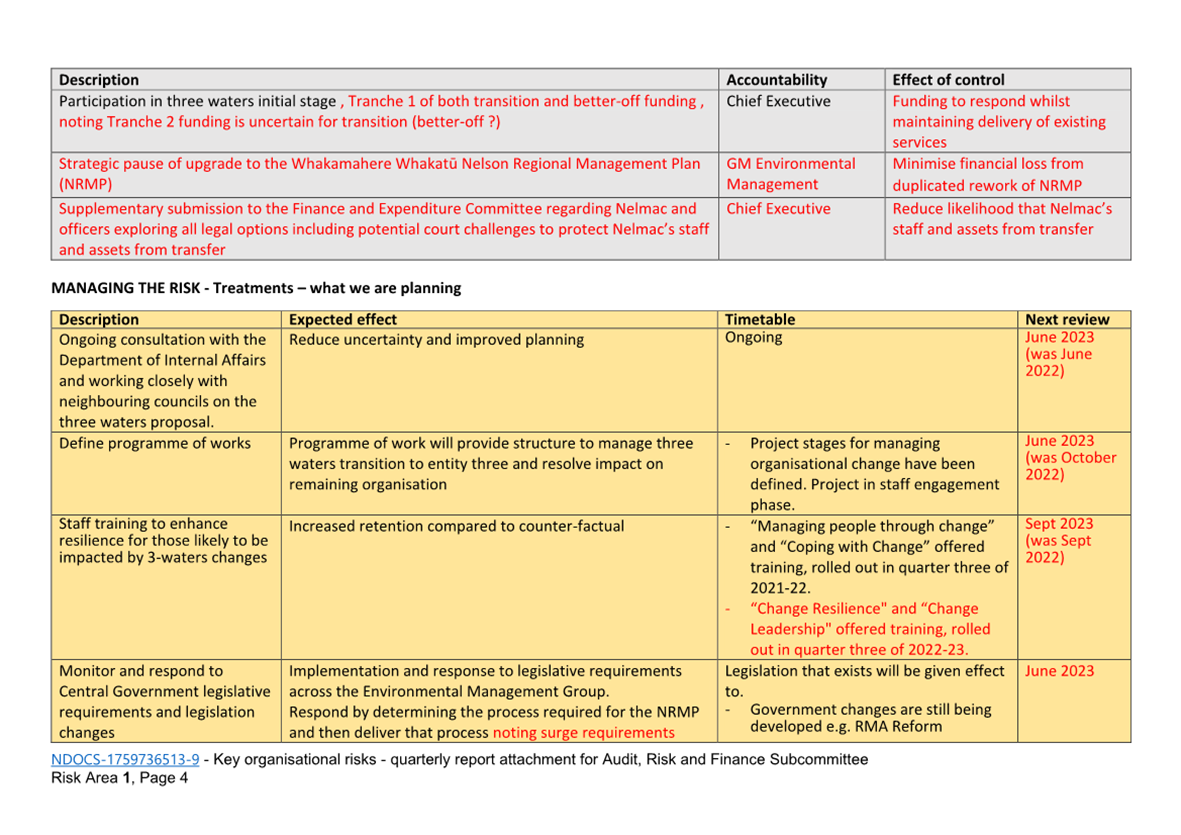

6.3 R1 -

Central-government-led-reforms (Owner: Chief Executive). Whilst noting that

project management is in place to manage organisational changes within the

three-waters transition program both at the elected member and staff level, the

risk rating remains at Very High.

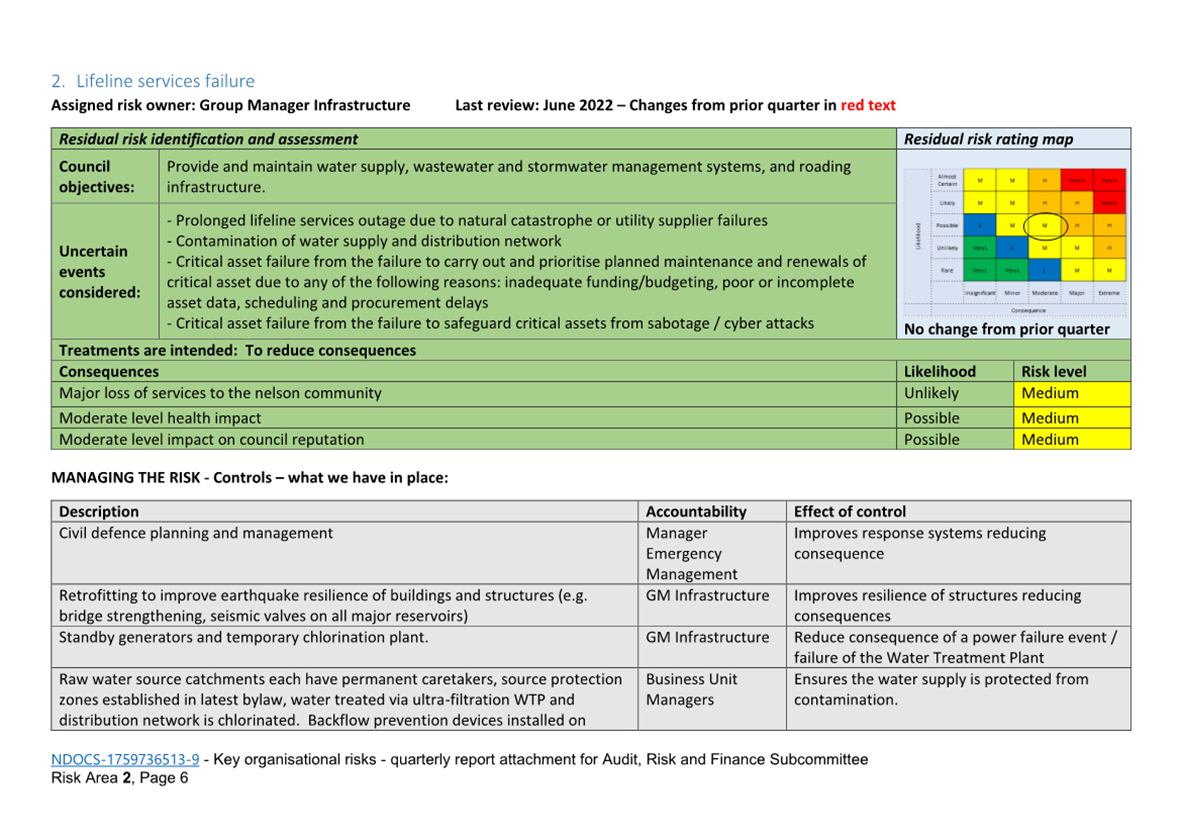

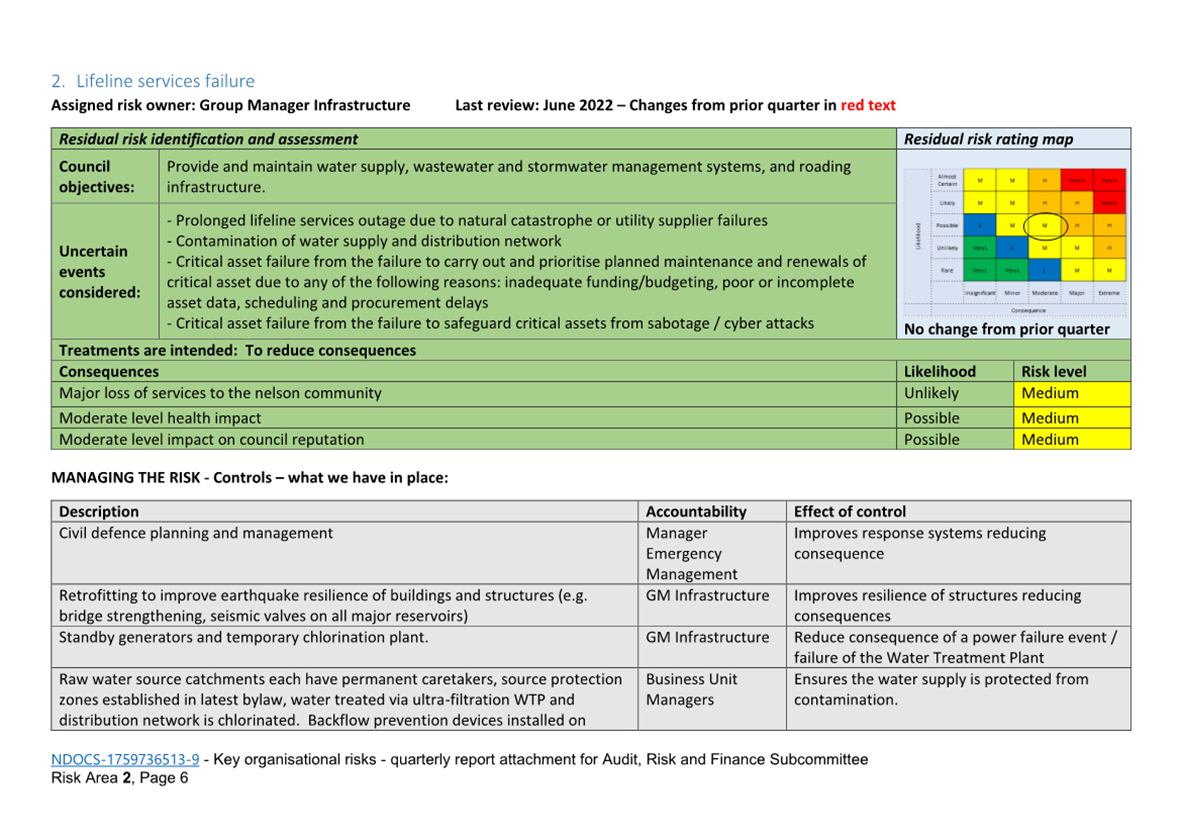

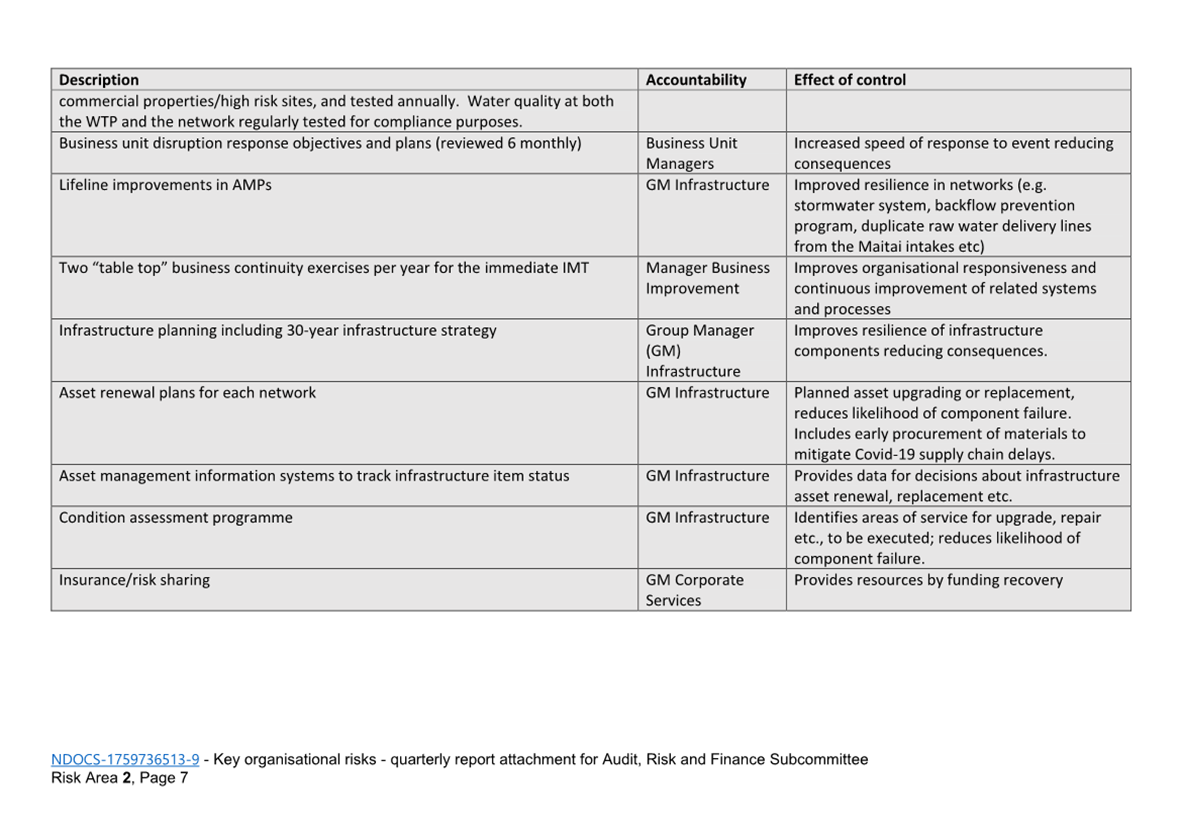

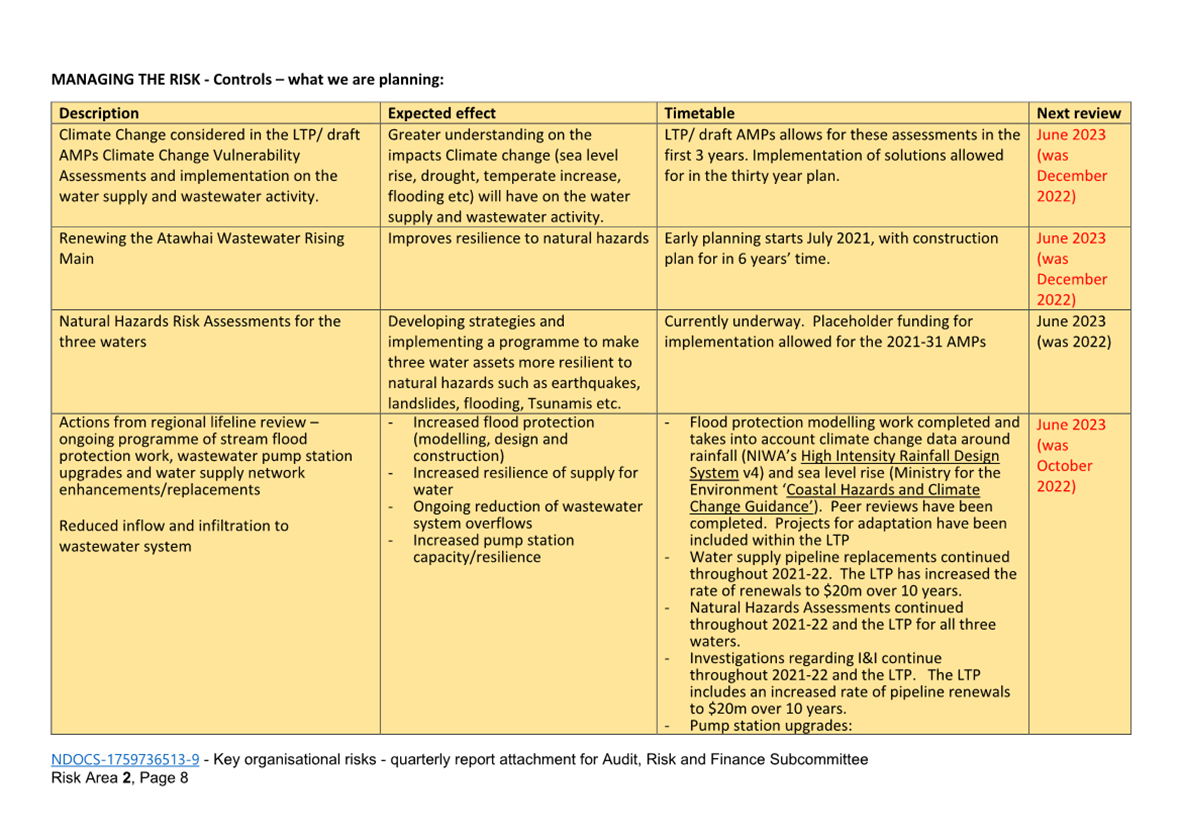

6.4 R2 - Lifeline

services failure (Owner: Group Manager Infrastructure). Flood-recovery work

is ongoing, with contractor/resource capacity constraints and detailed scoping

for many permanent infrastructure repairs yet to be completed. No other new

emerging risks to report at this time. The risk rating remains at Medium.

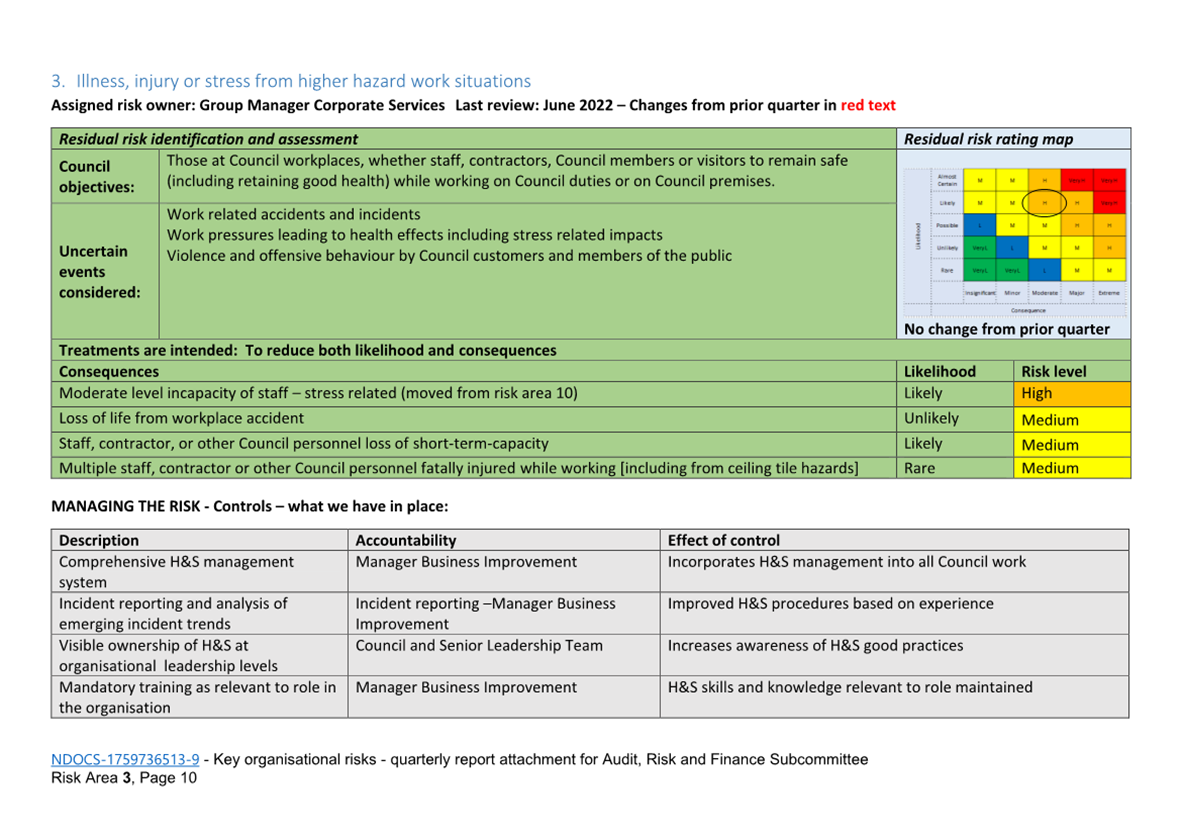

6.5 R3

- Illness, injury or stress from higher hazard work situations (Owner:

Group Manager Corporate Services). Workplace stress continues to emerge. The

risk rating remains at High. For clarity, misalignment between the Heath,

Safety and Wellbeing Report has now been corrected, and the risk is now being

reported consistently as High.

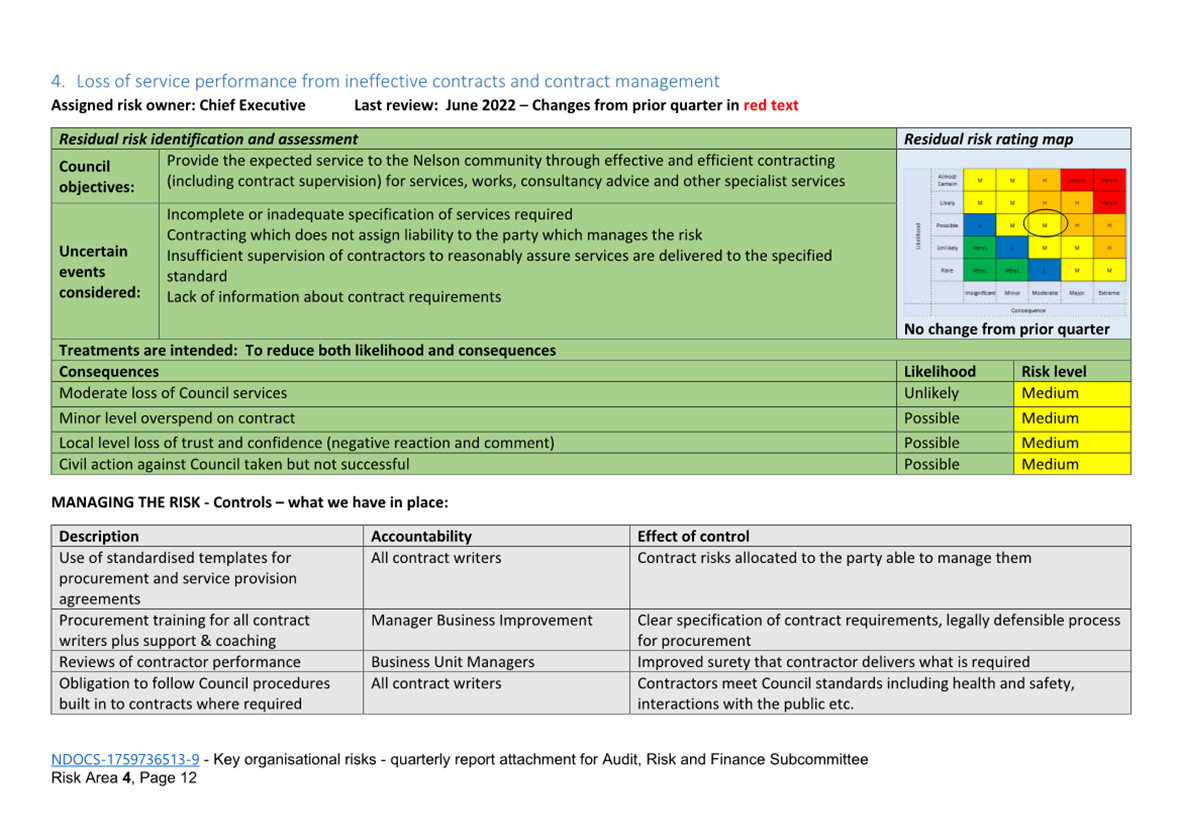

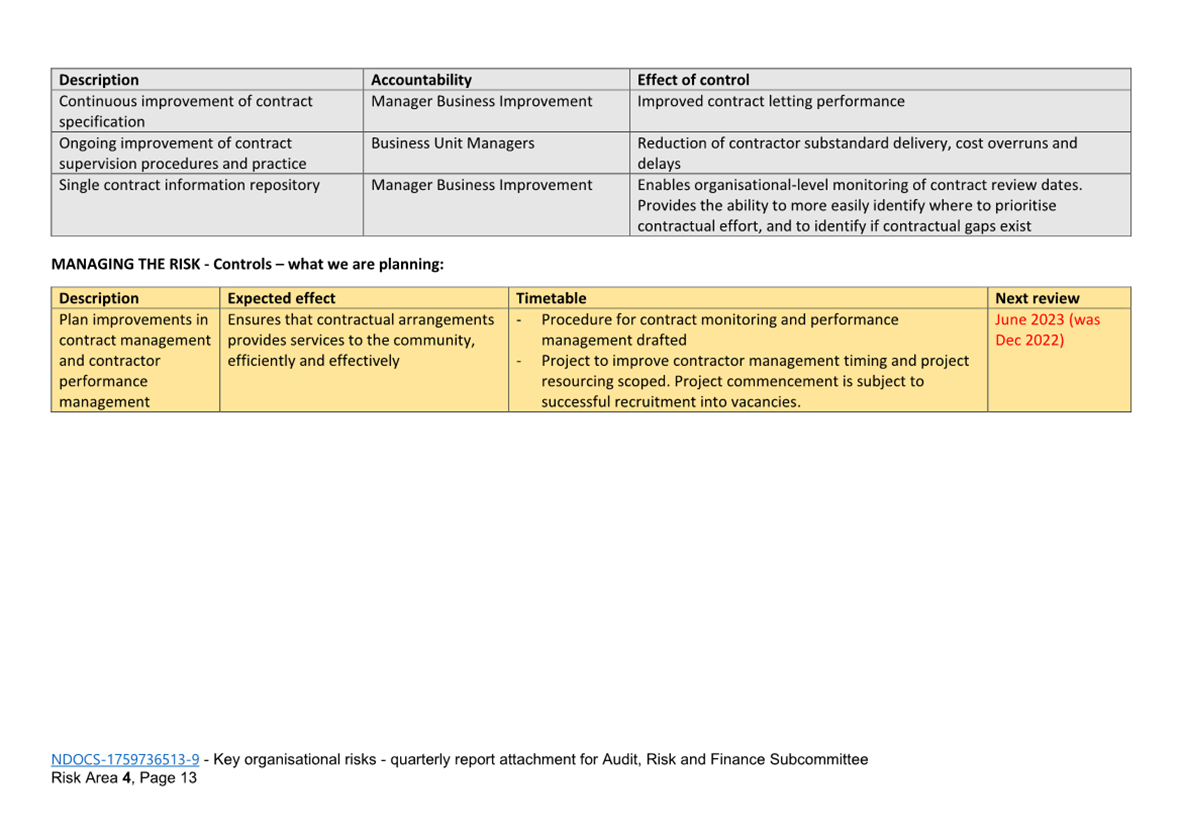

6.6 R4 - Loss of

service performance from ineffective contracts and contract management

(Owner: Chief Executive). Work on planned treatments paused due to staff

vacancies. The risk rating remains at Medium.

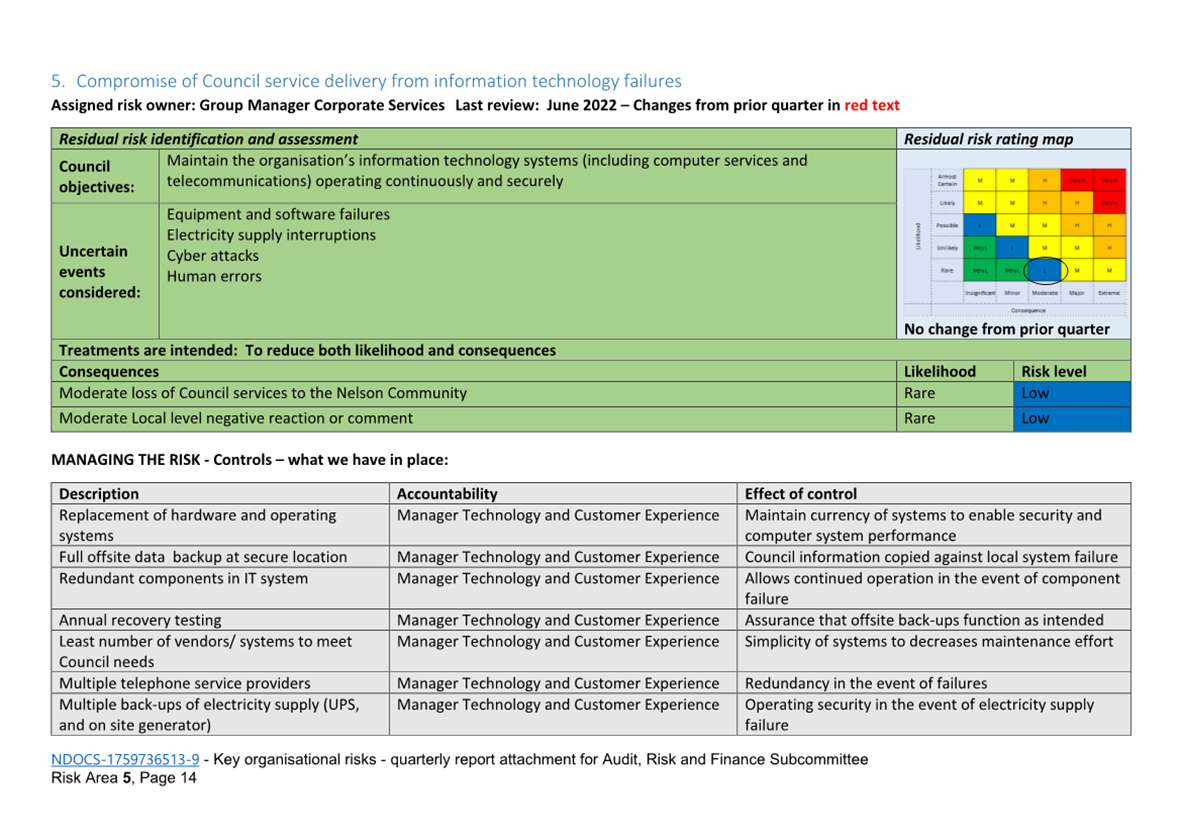

6.7 R5 -

Compromise of Council service delivery from information technology failures

(Owner: Group Manager Corporate Services). No new emerging risks to report at

this time. The risk rating remains at Low.

6.8 R6 - Council

work compromised by loss of and difficulties in replacing skilled staff

(Owner: Manager People and Capability). Vacancies have reduced over the quarter

due to reduced resignations however some ‘hard-to-fill’ roles

continue to remain open despite repeated recruitment efforts, engaging

recruitment consultants and re-evaluating the job description. The situation is

not expected to change soon with six Business Unit Manager roles recently

becoming vacant. The organisational risk rating remains at Medium.

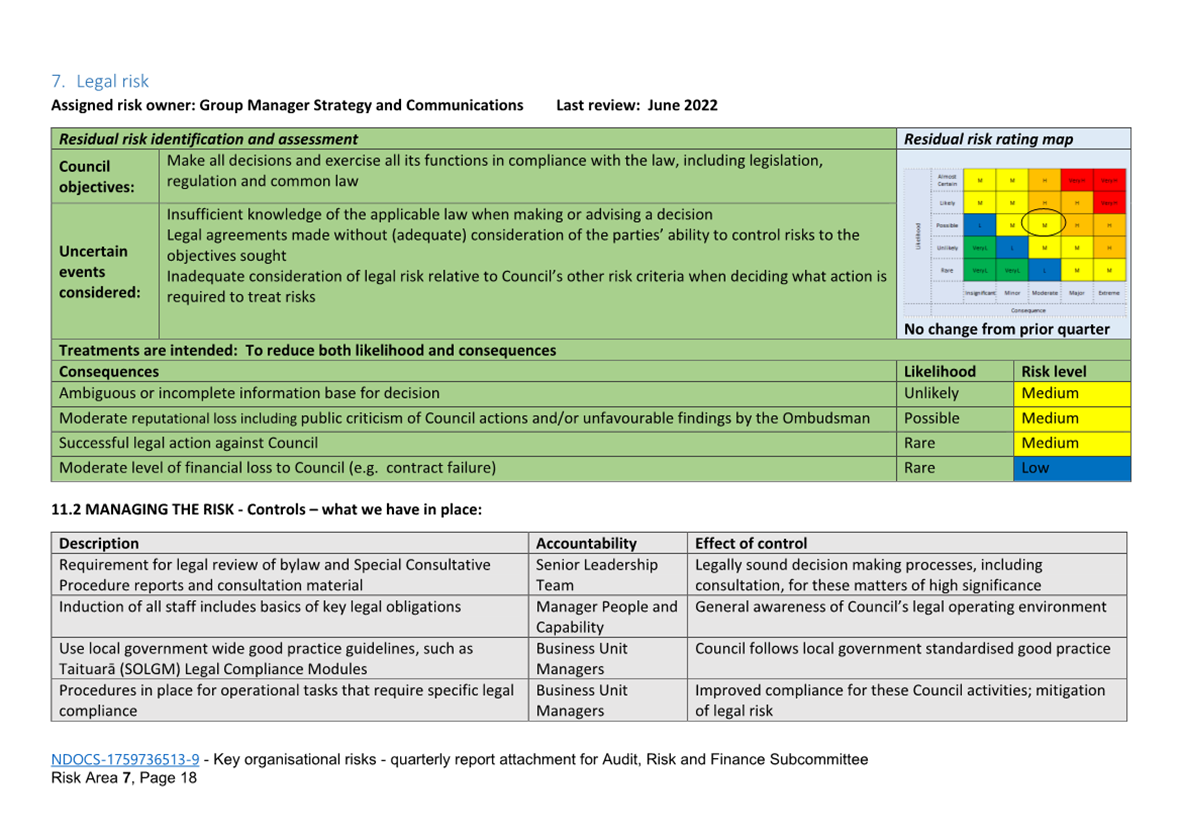

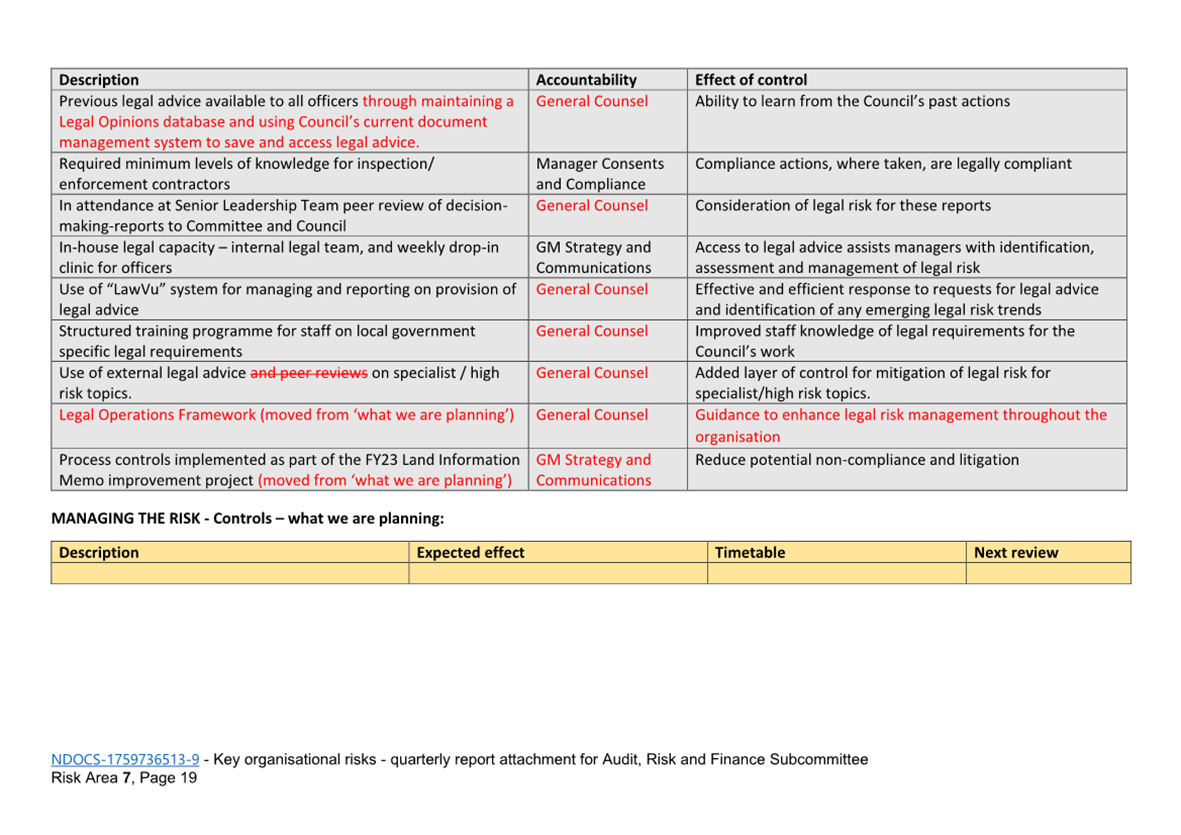

6.9 R7 –

Legal Risk (Owner: Group Manager Strategy and Communications). No emerging

organisational risks to report at this time noting that any new legal

proceedings or emerging areas of increased litigation risk are separately

reported in the quarterly report on legal proceedings. The organisational

risk rating remains at Medium.

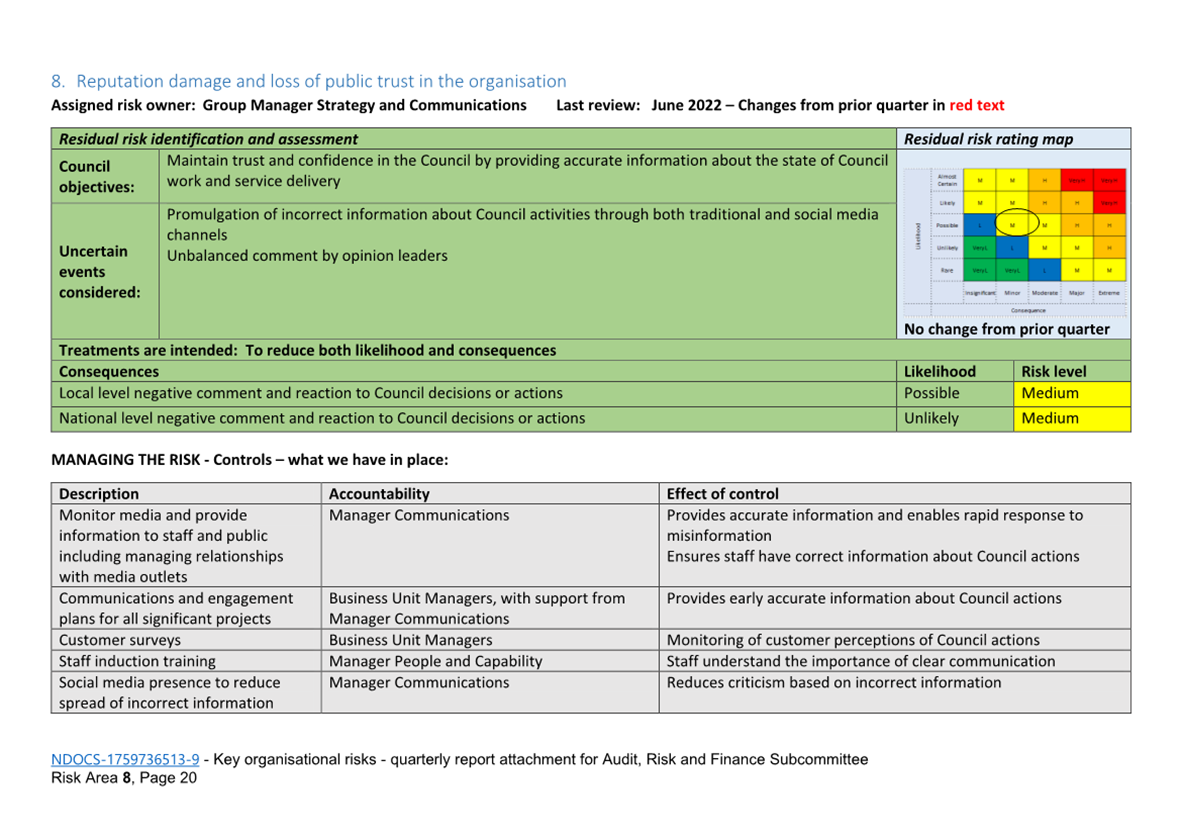

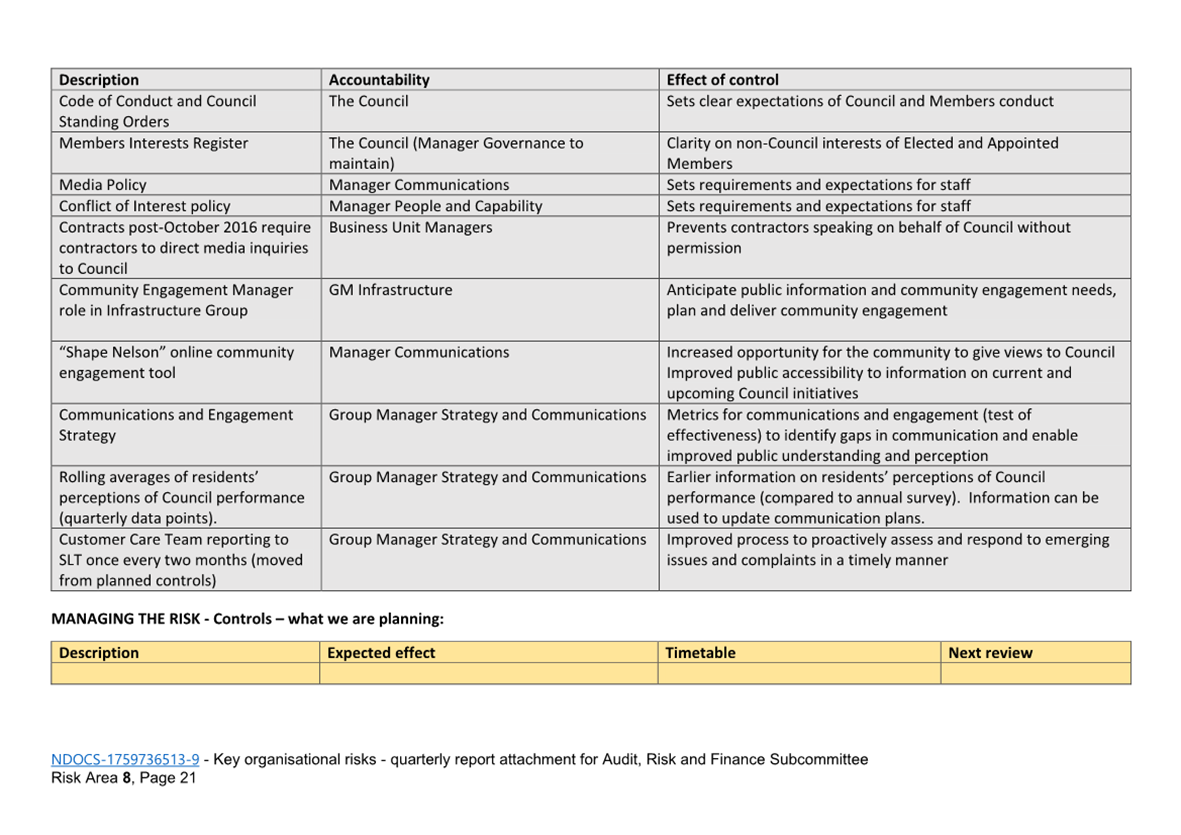

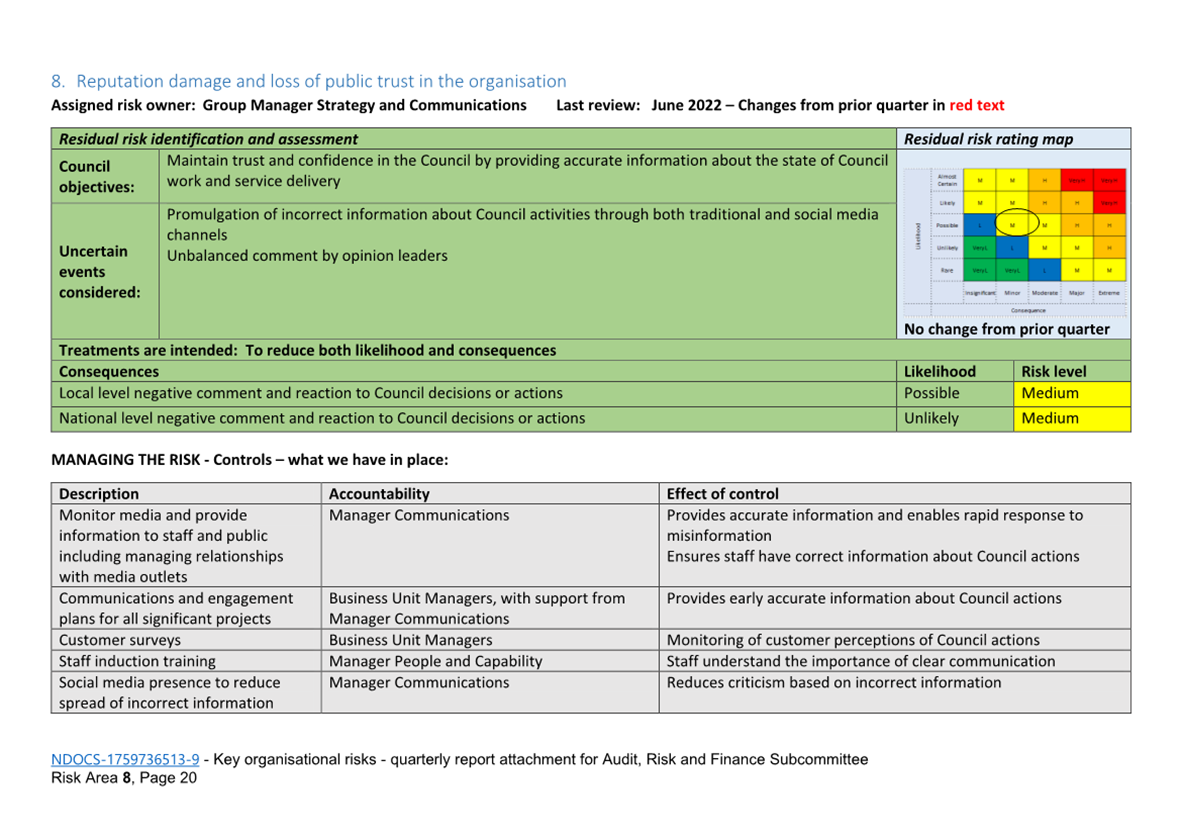

6.10 R8 - Reputation damage

and loss of public trust in the organisation (Group Manager Strategy and

Communications). No new emerging risks to report at this time. The risk rating

remains at Medium

7. Key

Risk Areas by Reporting Group

7.1 Office of the

Chief Executive: No new emerging risks to report at this time.

7.2 Infrastructure

Group: Risk is Very High due to aforementioned: supply chain risks for

materials, labour and contractor capacity remains constrained across all

business units resulting in elevated operational risk.

7.3 Community

Services Group: Risks associated with Council owned campgrounds (two operated

and one leased) remain elevated whilst non-compliance remediation actions are

being implemented. The risks previously monitored by elected members through

the Strategic Development and Property Subcommittee have been monitored through

the usual organisational processes since that subcommittee ceased operating.

7.4 Environmental

Management Group: Risk is High due to vacancies in four of the five Business

Unit Manager roles. Risk relates to delivery, workload stress and ability to

recruit.

7.5 Strategy and

Communications Group: No new emerging risks to report at this time.

7.6 Corporate

Services Group: Insurance renewal risks emerging (cost and expansiveness

of coverage) due to inflation pressures and recent losses (August rain event,

January north island flooding and Hurricane Ian).

Author: Chris

Logan, Audit and Risk Analyst

Authoriser: Nikki

Harrison, Group Manager Corporate Services

Attachments

Attachment 1: 1759736513-9

- 3Q23 key organisational risks for ARF ⇩

Item 12: Quarterly Risk Report - 31 March 2023:

Attachment 1

Item 13: Health, Safety

and Wellbeing Report to 31 March 2023

|

|

Audit, Risk and Finance Committee

1 June 2023

|

REPORT R27582

Health, Safety and

Wellbeing Report to 31 March 2023

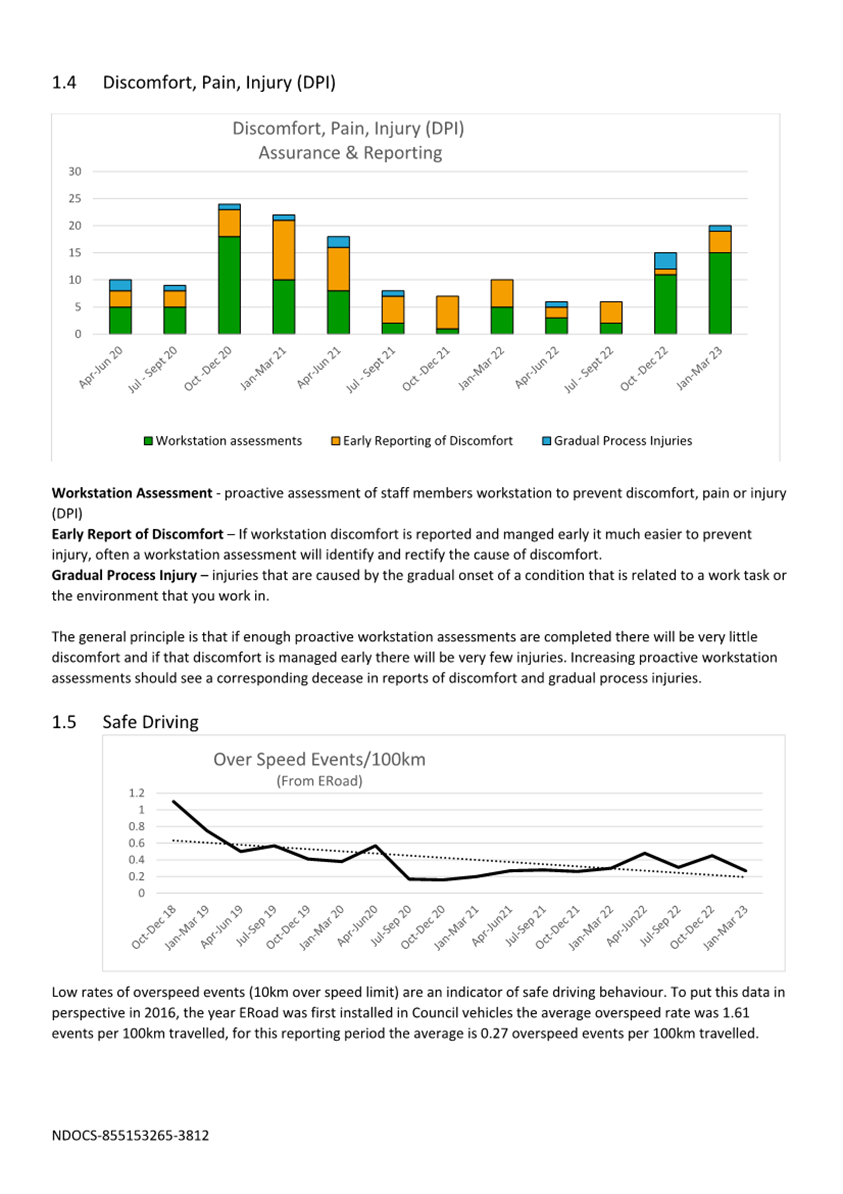

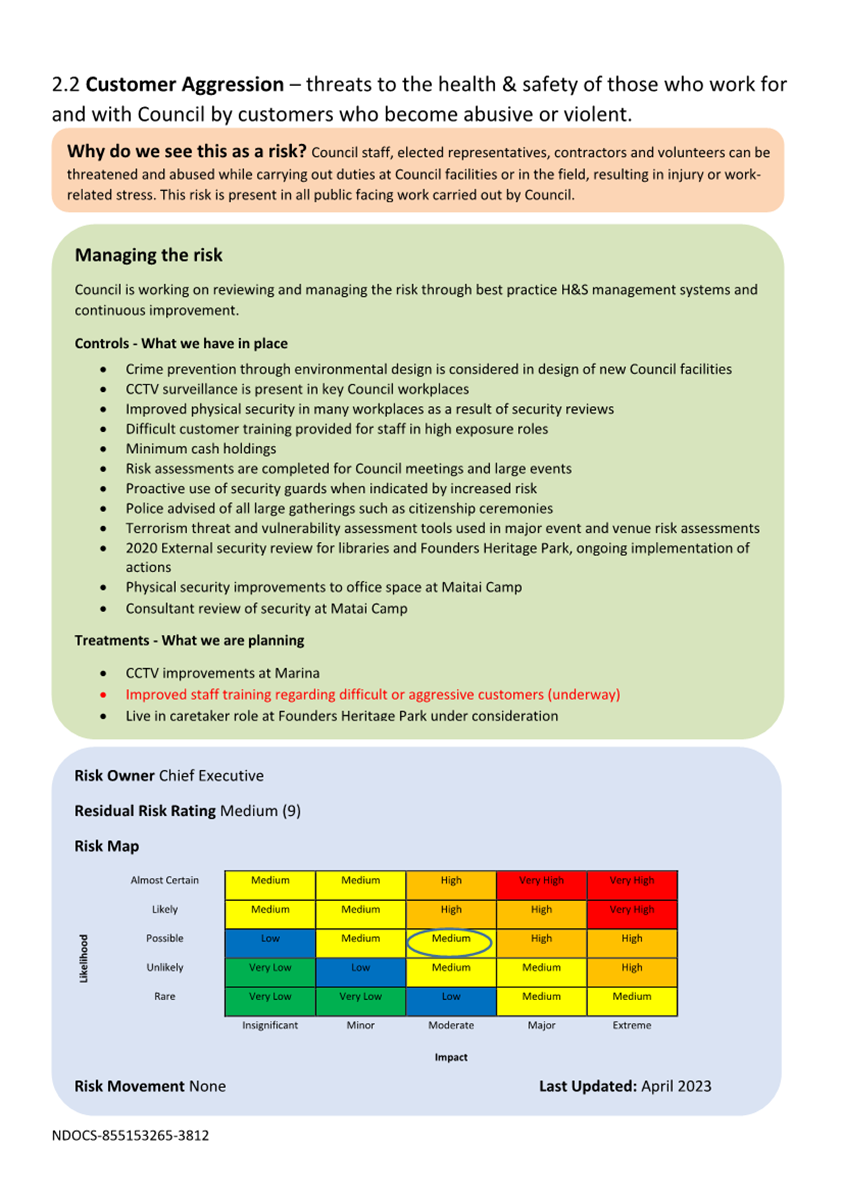

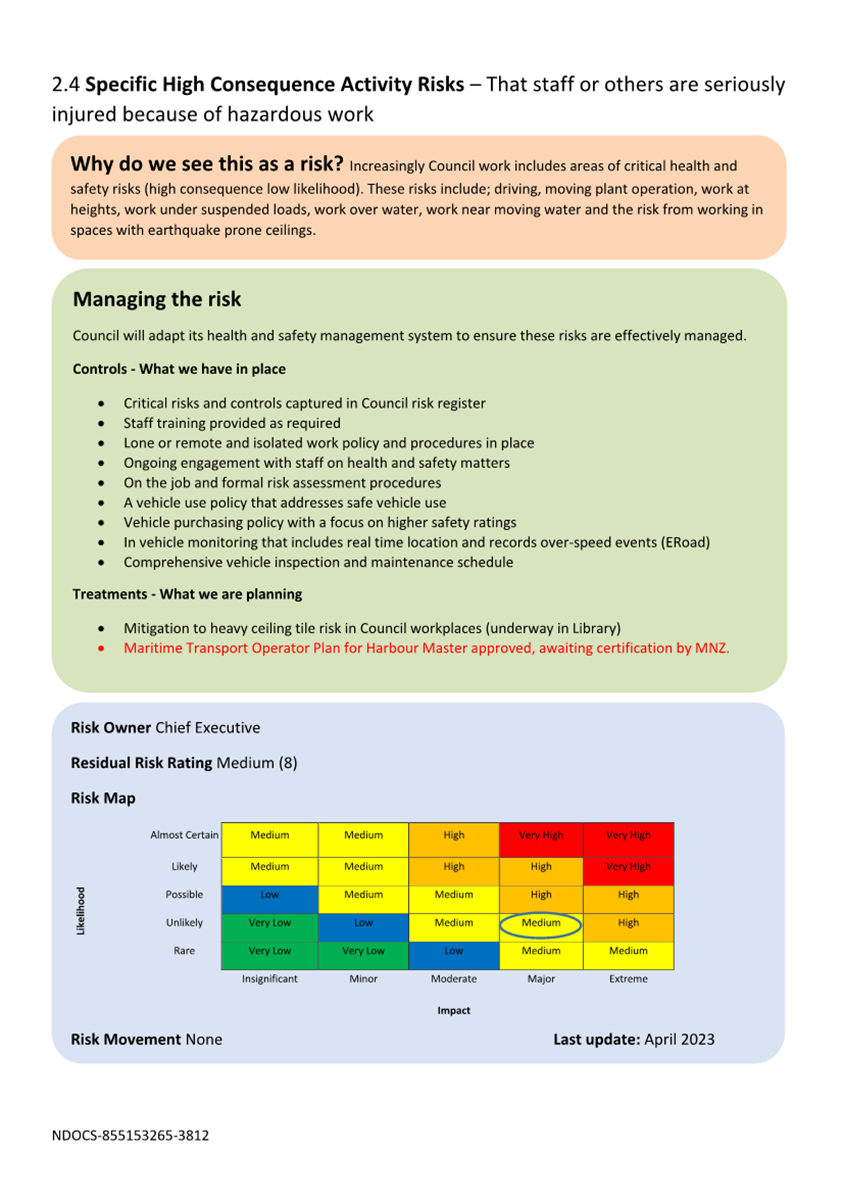

1. Purpose of Report

1.1 To

provide the Committee with a report on health, safety and wellbeing data

collected over the period January to March 2023.

1.2 To

update the Committee on key health and safety risks, including controls and

treatments.

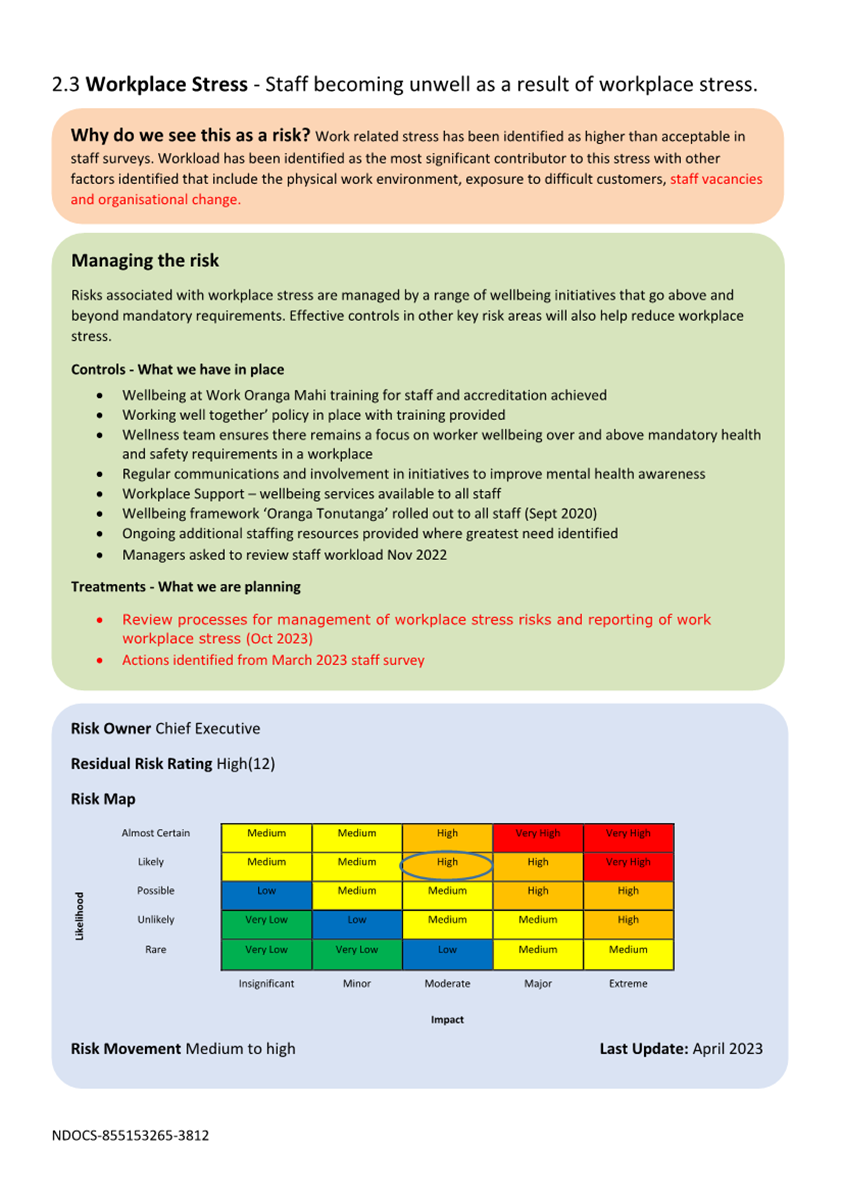

2. Summary

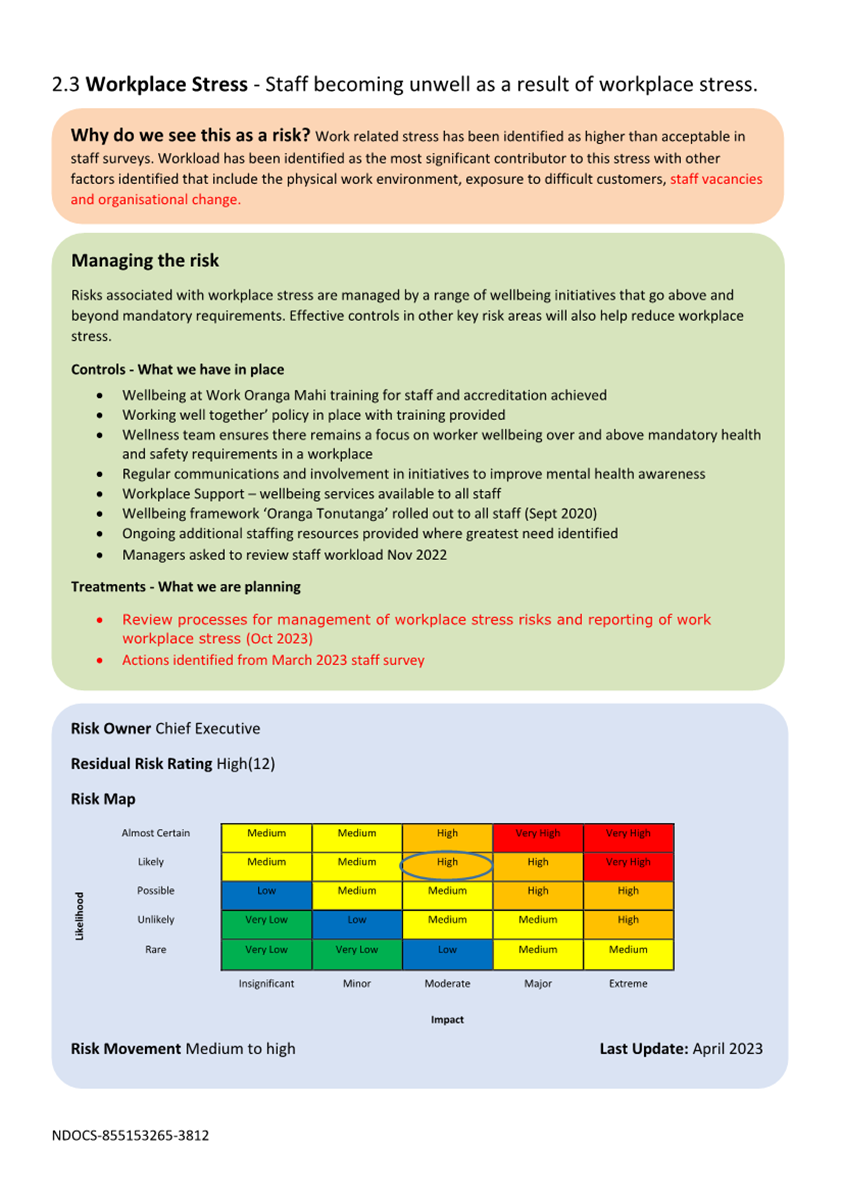

2.1 Three incidents

of workplace stress requiring one week or more off work have been reported for

this period.

2.2 To protect the

privacy of individuals involved incidents relating to workplace stress and

security incidents are outlined in a separate confidential report.

2.3 Council’s

key health and safety risk ‘workplace stress’ has been assessed as

moving from a medium to a high risk.

3. Recommendation

|

That the Audit, Risk and Finance Committee

1. Receives

the report Health, Safety and Wellbeing Report to 31 March 2023 (R27582) and its attachment (855153265-3812).

|

4. Background

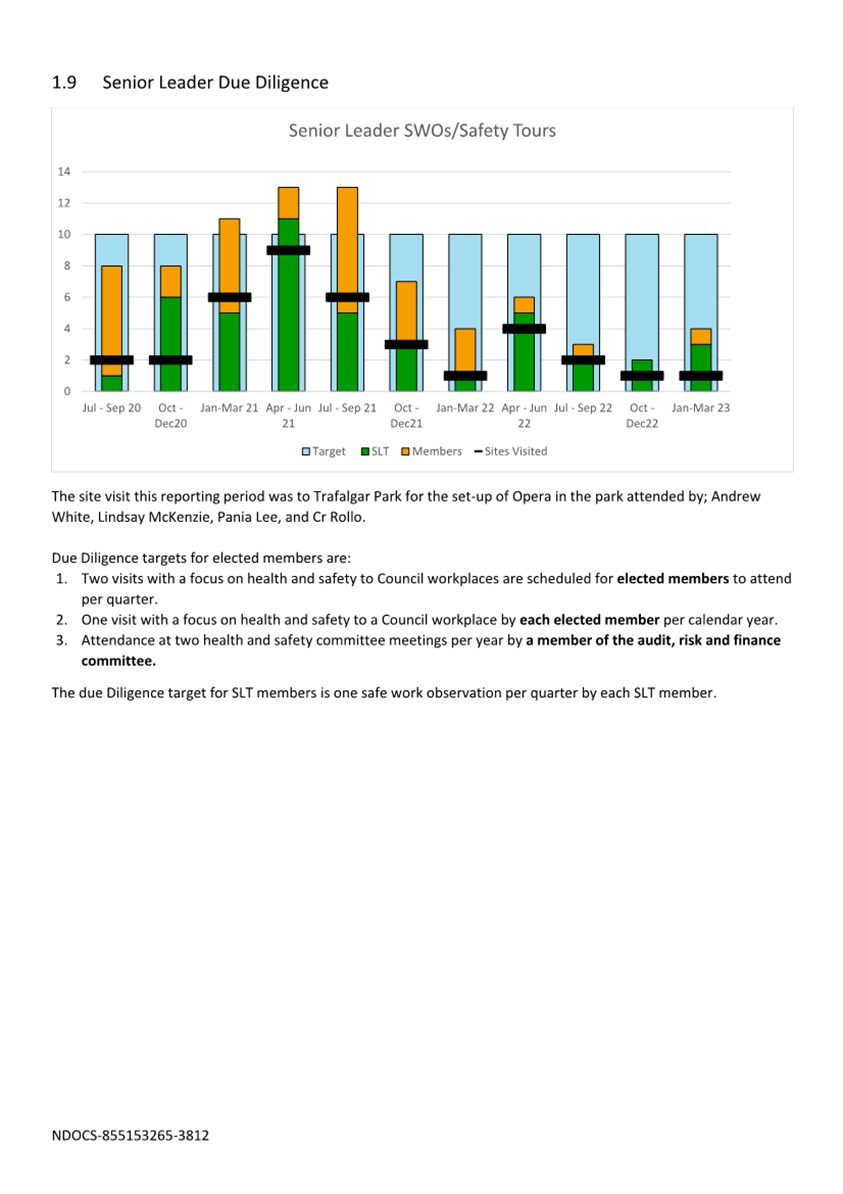

4.1 Elected members,

as ‘Officers’ under the Health and Safety at Work Act 2015 (HSWA),

are required to undertake due diligence on health and safety matters.

Council’s Health and Safety Governance Charter states that Council will

receive quarterly reports regarding the implementation of health and

safety. Council has delegated the responsibility for health and safety to

the Audit, Risk and Finance Committee.

4.2 Health, safety

and wellbeing performance data reports provide an overview based on key lead

and lag indicators. Where a concerning trend is identified more detail is

provided in this report to better understand issues, treatments and controls.

Providing an update on key

health and safety risks expands on the very high-level overview provided in the

organisational risk report.

5. Discussion

5.1 Incidents of

note:

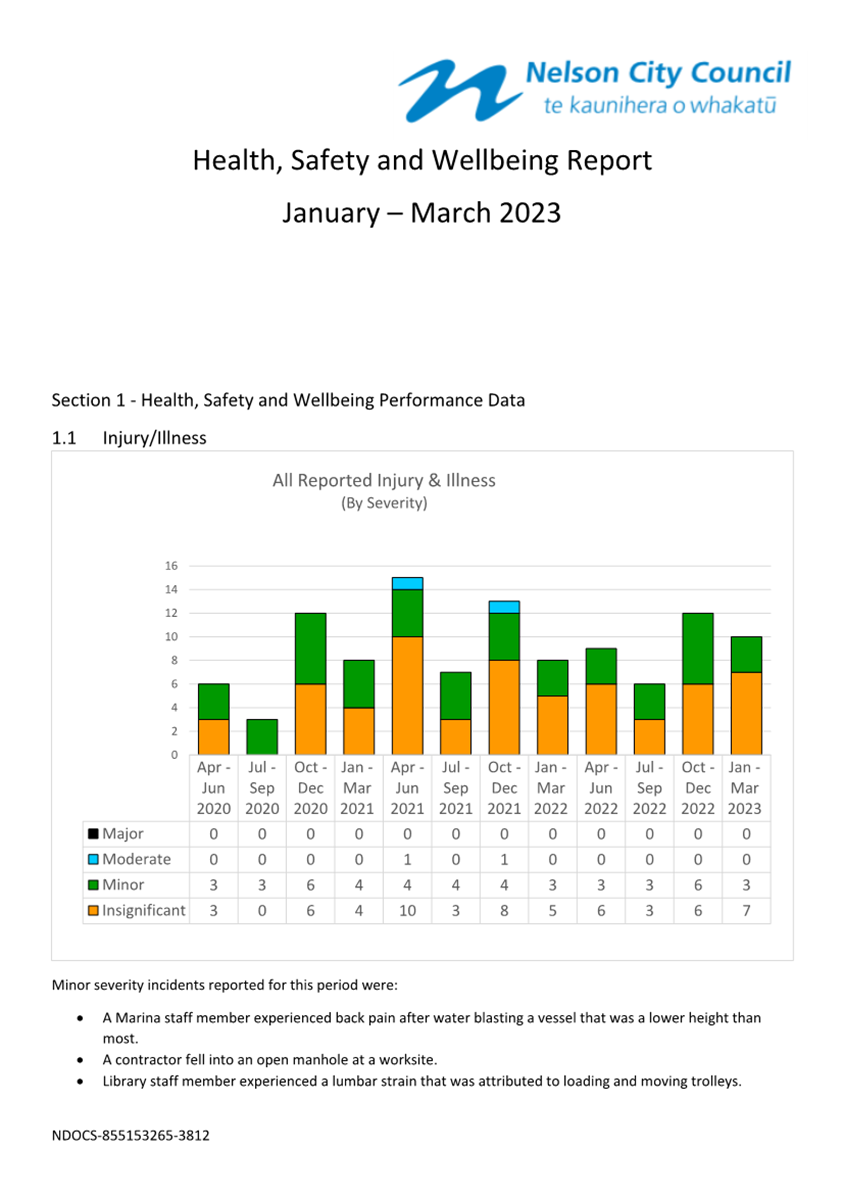

5.1.1 All

injury or illness incidents of minor severity or greater for the reporting

period are noted in the attachment and any significant incidents or incident

trends of note are outlined below.

5.2 A significant

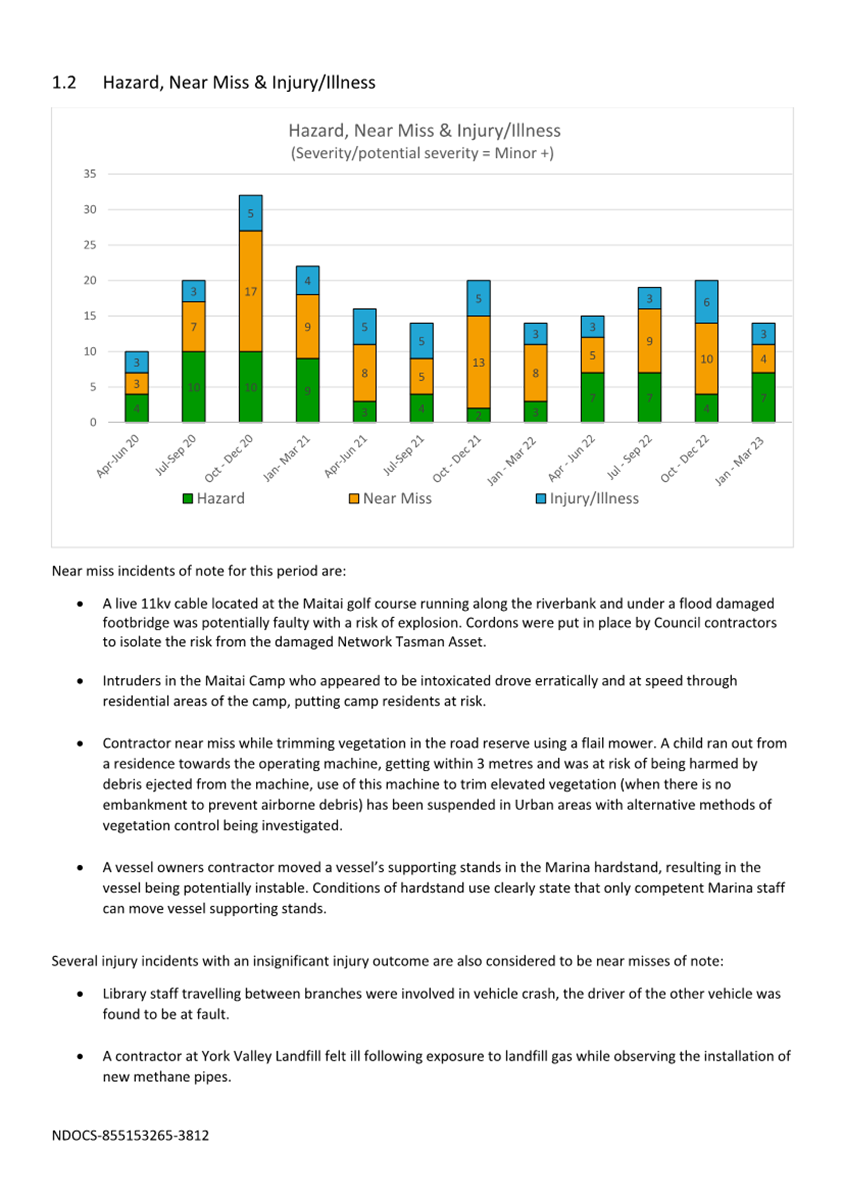

near miss occurred while a contractor was operating a flail mower to trim

roadside vegetation. A young child ran out from a residence getting within 3

metres of the operating machine while the cutting head was elevated off the

ground. There was a high risk of being injured by debris ejected from the

machine. Use of the flail mower to trim elevated vegetation (when there is no

embankment behind the cutting head to prevent airborne debris) has been

suspended in urban areas while alternative methods of vegetation control are

investigated.

5.3 Comprehensive

investigation reports outlining corrective actions have been received by

Council for the Contractor Incidents, contractor fell into an open manhole at a

worksite and a worker felt ill following exposure to landfill gas.

5.4 Security

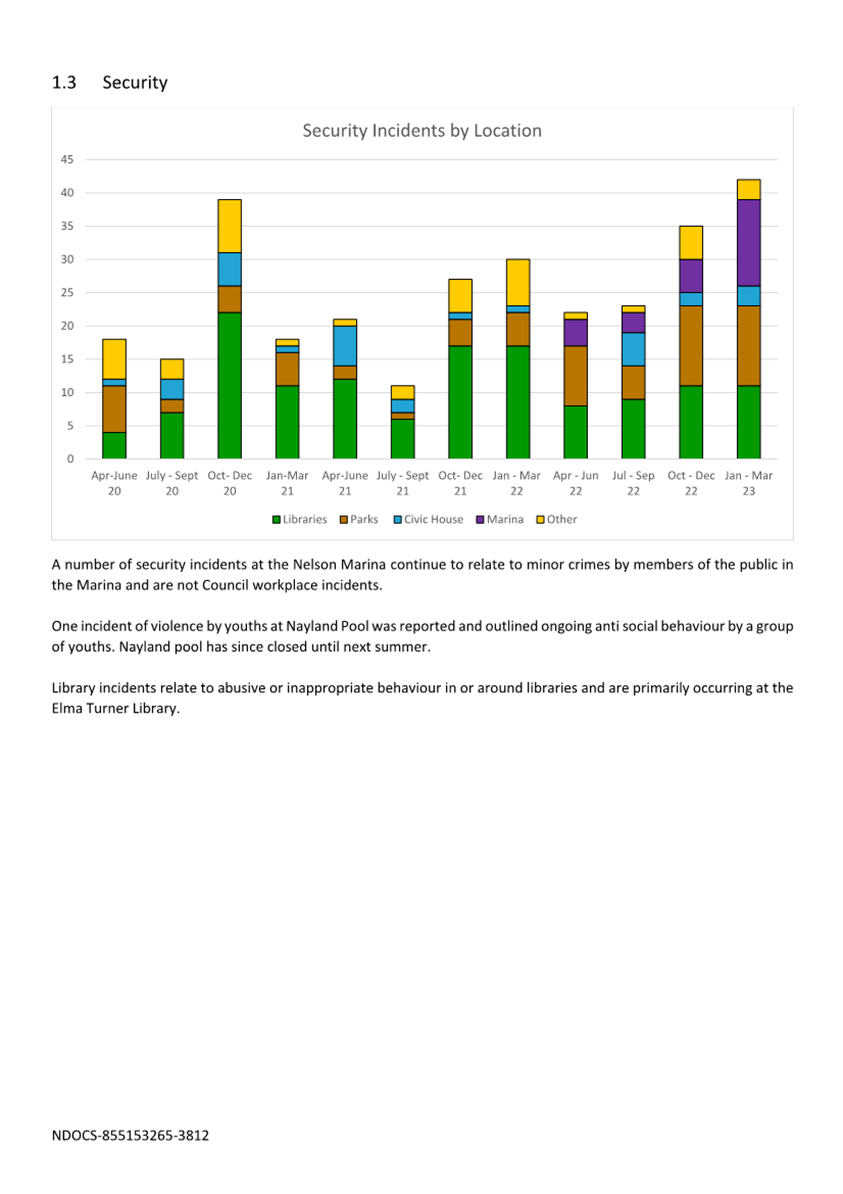

incidents continue to be reported in three key areas; libraries, marina and

campgrounds. Marina incidents primarily relate to minor crimes by members of

the public in the marina and are not Council workplace incidents. Library

incidents generally relate to behaviour of indviduals in and around the

libraries with the key concern being the cumulative effect on staff wellbeing

from dealing with repeated incidents.

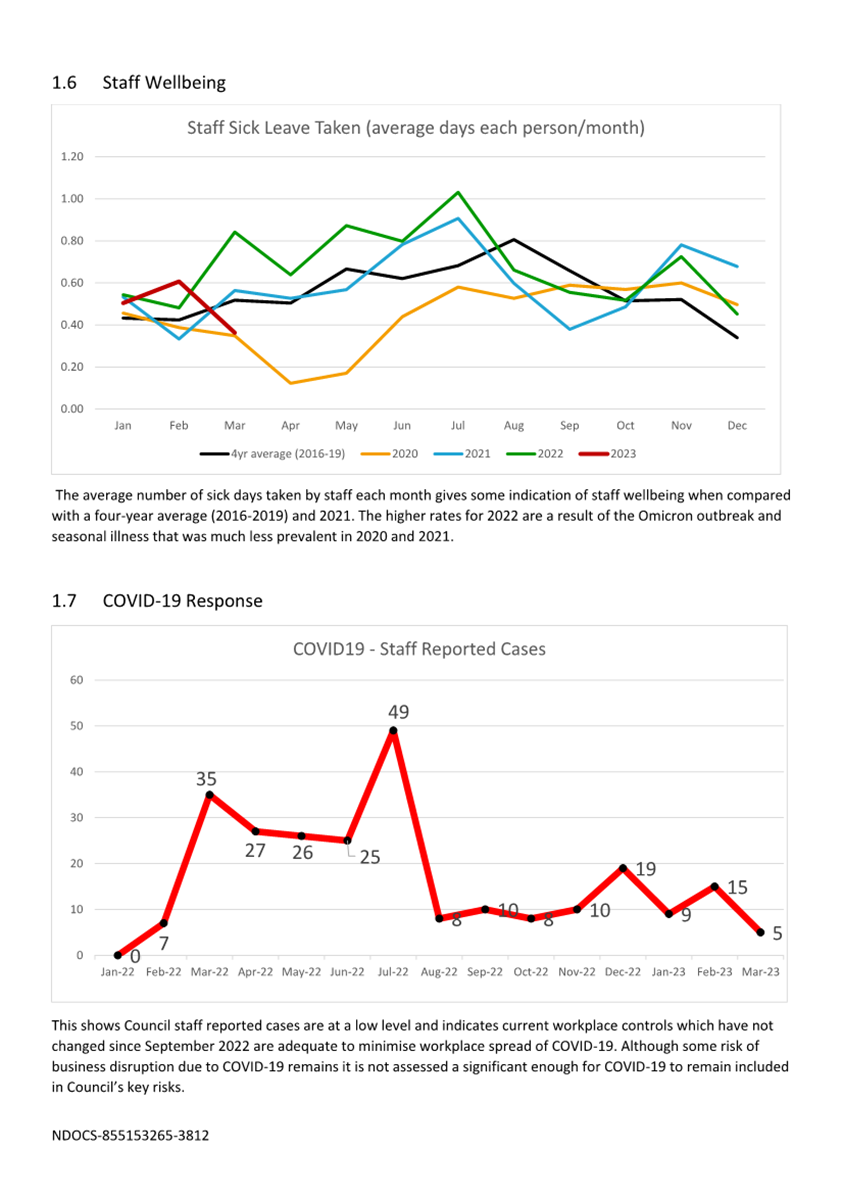

5.5 Council COVID-19

reported case data shows that workplace controls continue to be effective even

during waves of infection such as occurred in March, July and December 2022.

These controls have remained unchanged since September 2022 and are expected to

be adequate through further waves. Ensuring adequate ventilation in workplaces

will be problematic throughout winter and is of particular concern in some

meeting rooms.

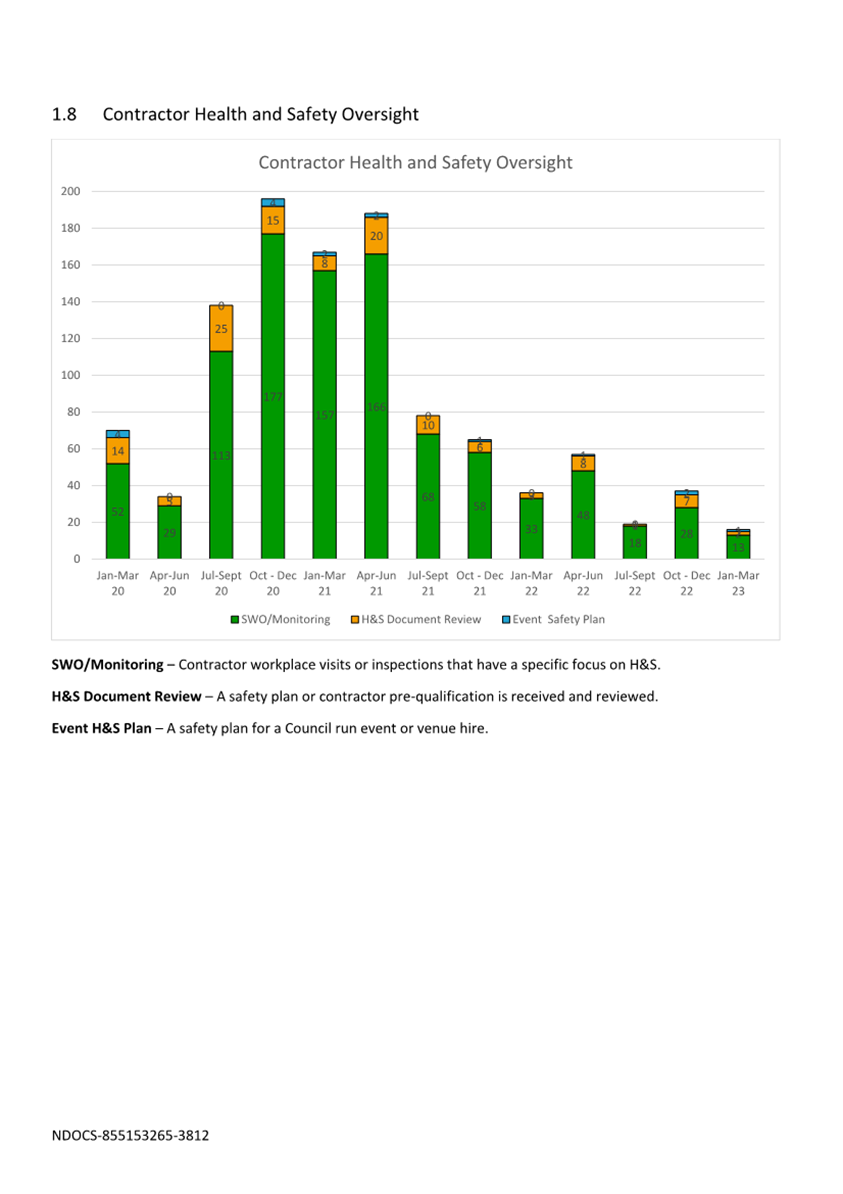

5.6 Reported

contractor health and safety oversight events remain at much lower levels than the

previous two years. Communication with business unit managers is underway to

try and improve the recording of this data. A new Health Safety and Wellbeing

Advisor role will allow for more support to be provided to contract supervisors

in recording contractor health and safety oversight activity.

5.6.1 A

review of the Health and Safety Governance Charter is underway and will be

presented at the next Audit, Risk and Finance Committee meeting.

6. Key

Health, Safety and Wellbeing Risks

6.1 Key

health, safety and wellbeing risks have been reviewed. Changes to treatments

and controls since the previous report are shown in red text.

6.2 Workplace

stress (that staff become unwell as a result of workplace stress) risk has been

assessed as increasing from a medium risk to a high risk. The key indicators

leading to this assessment are, increased reported cases of staff requiring

leave for workplace stress and results from the staff survey completed in March

2023. More detail will be provided on staff survey results once they have been

reviewed by SLT and Business Unit managers.

6.3 COVID-19

(that staff or others are infected with COVID-19 at a Council workplace) has

been removed from Council’s key health and safety risks. Data relating to

previous waves of infection show that Council’s workplace controls are

effective, and that significant business disruption is unlikely.

6.4 All

other key health and safety risks are assessed as unchanged.

Author: Malcolm

Hughes, Senior Health Safety and Wellness Adviser

Authoriser: Nikki

Harrison, Group Manager Corporate Services

Attachments

Attachment 1: 855153265-3812

Health, Safety and Wellbeing Report - January - March 2023 ⇩

Item 13: Health, Safety and Wellbeing Report to 31

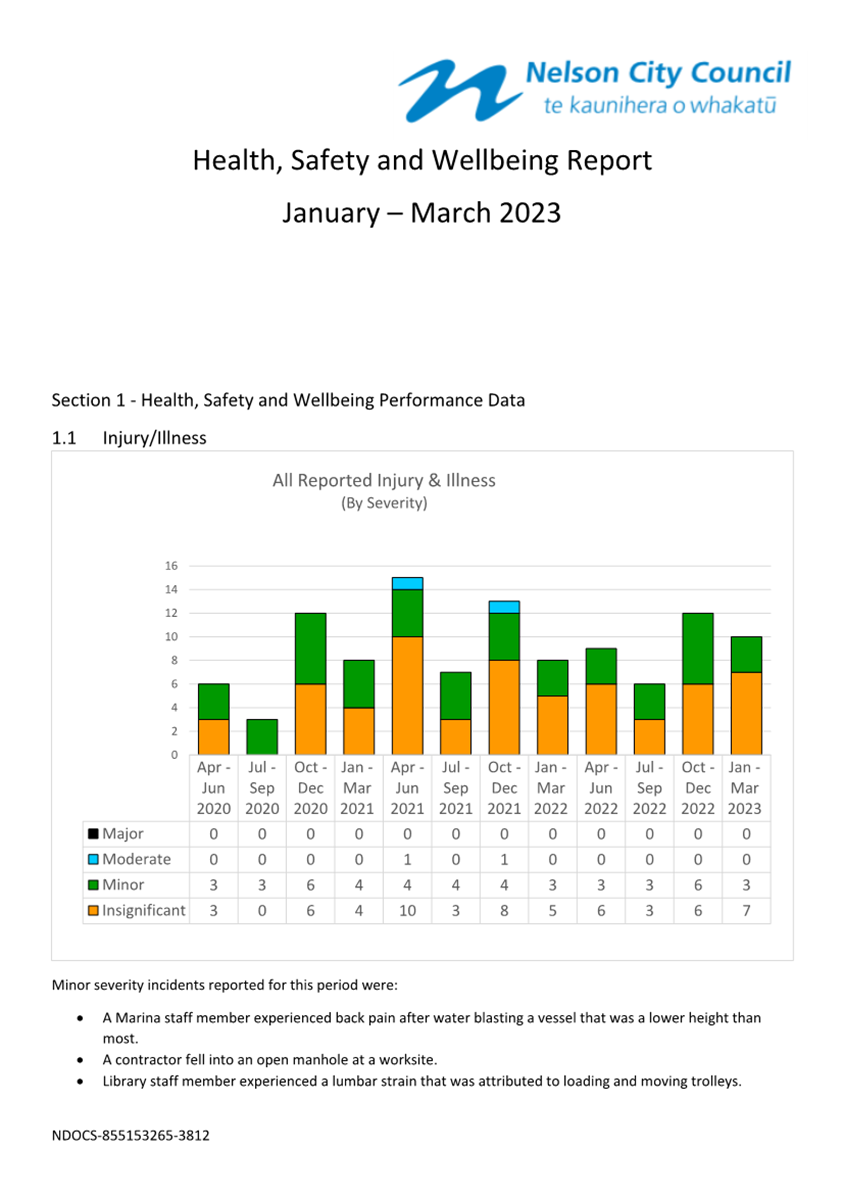

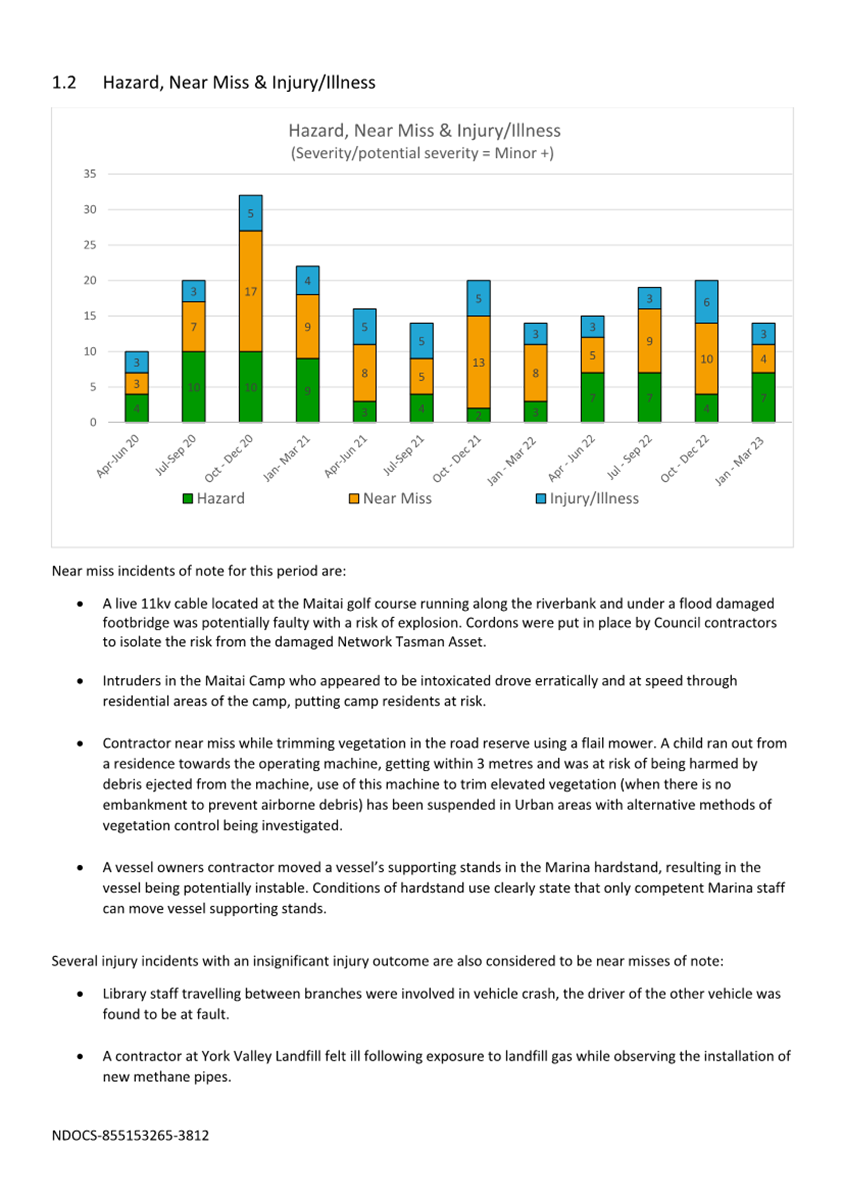

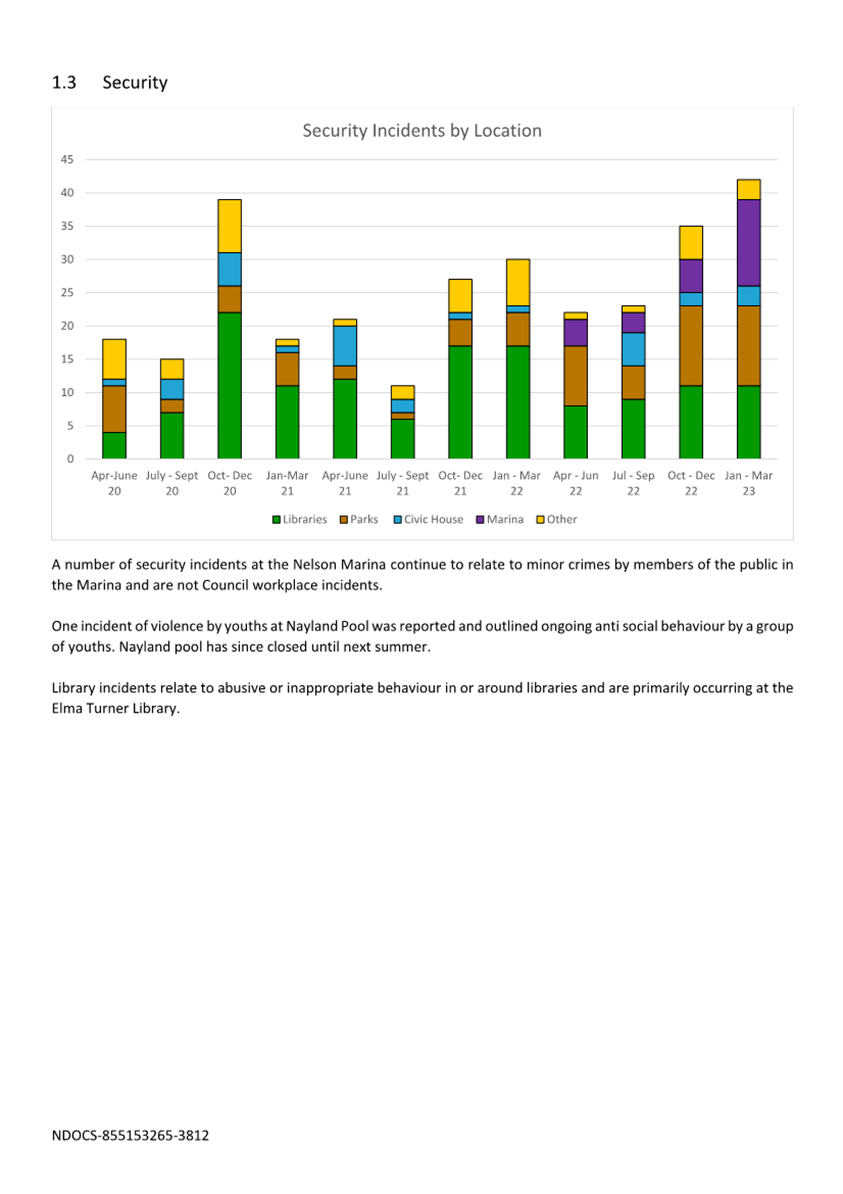

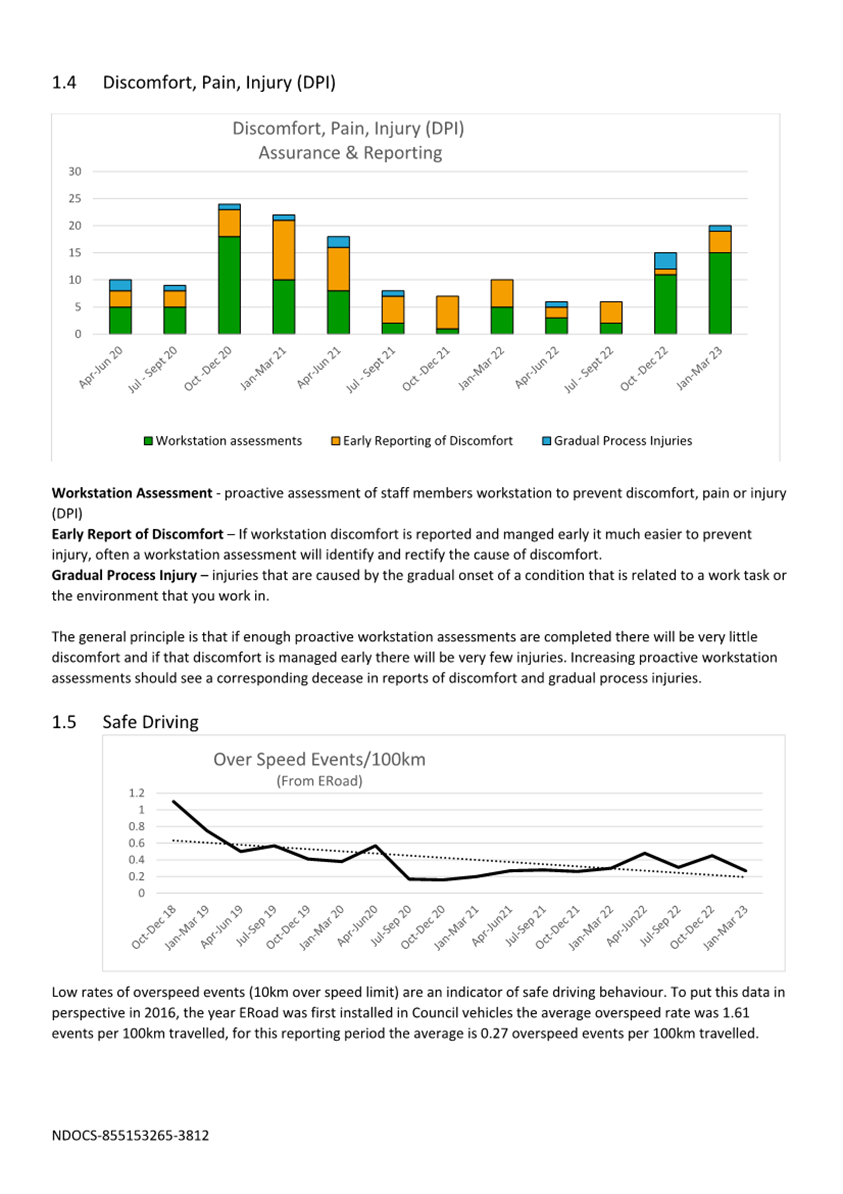

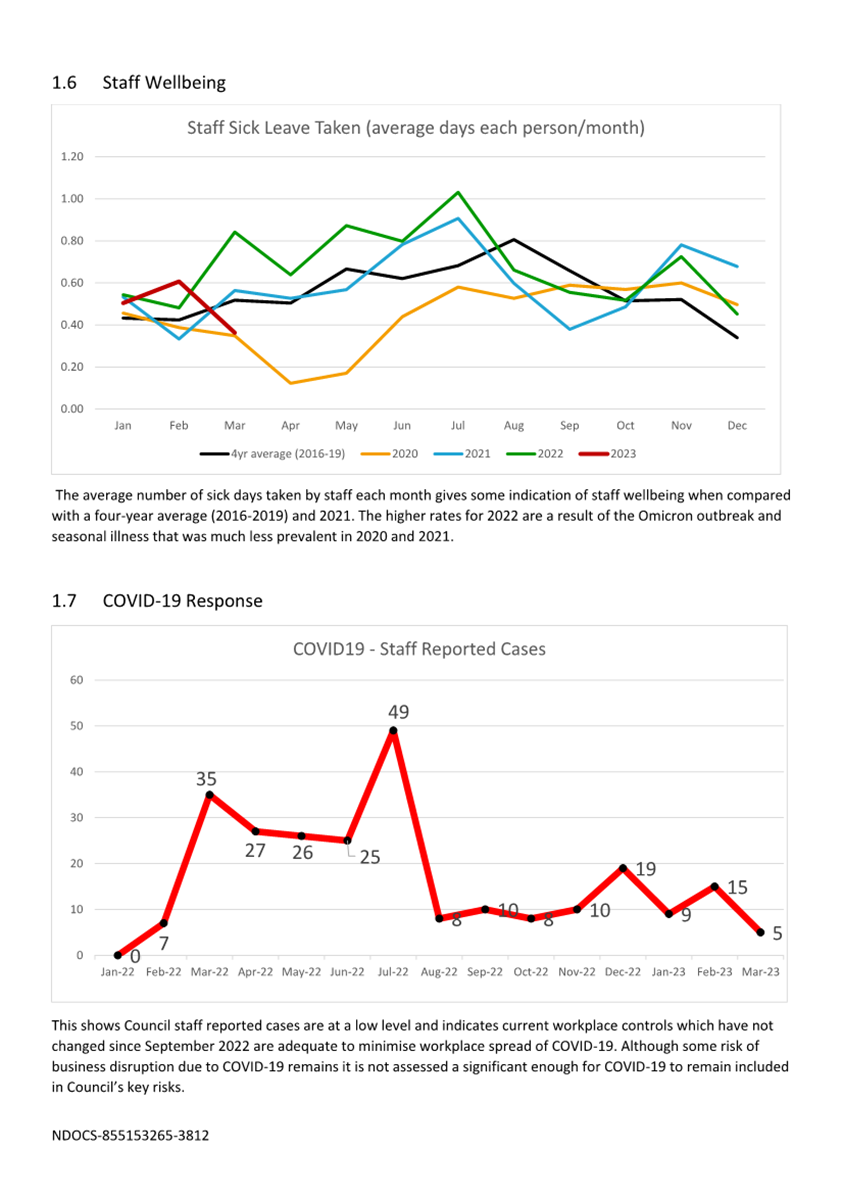

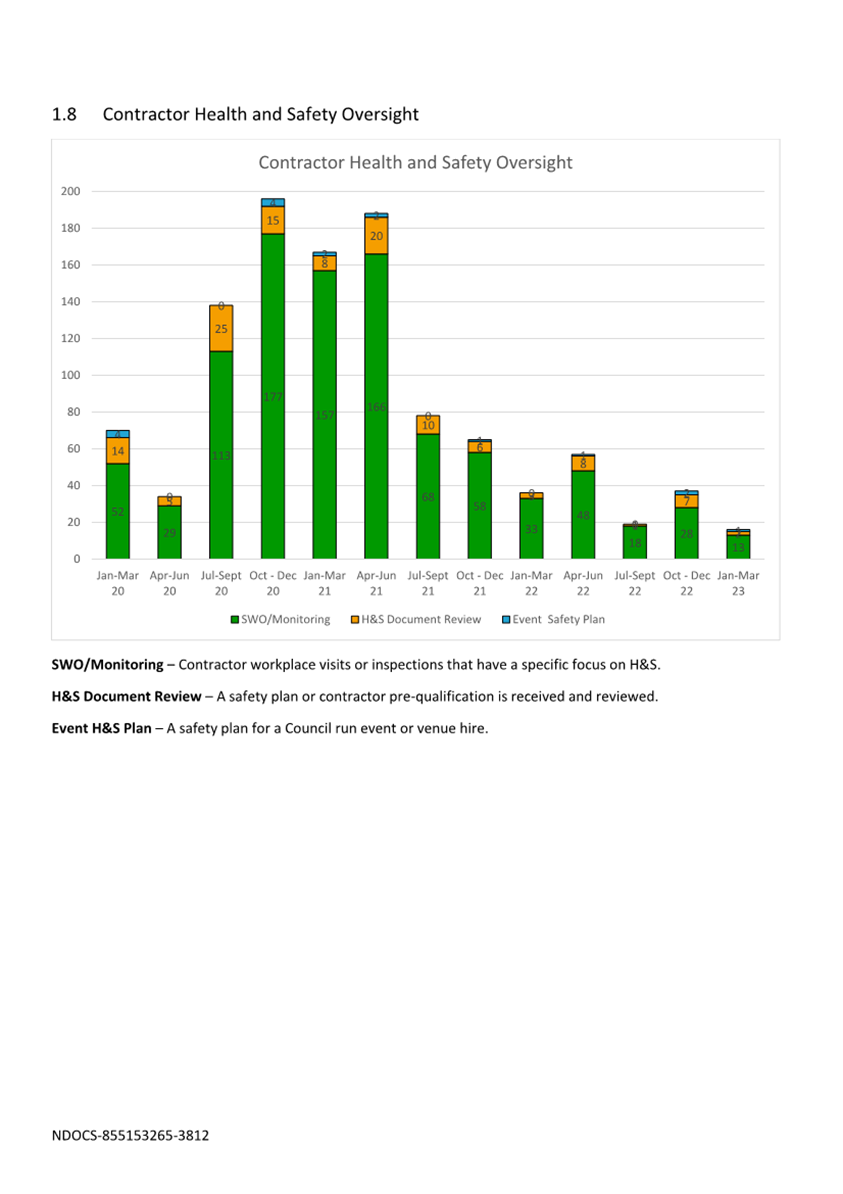

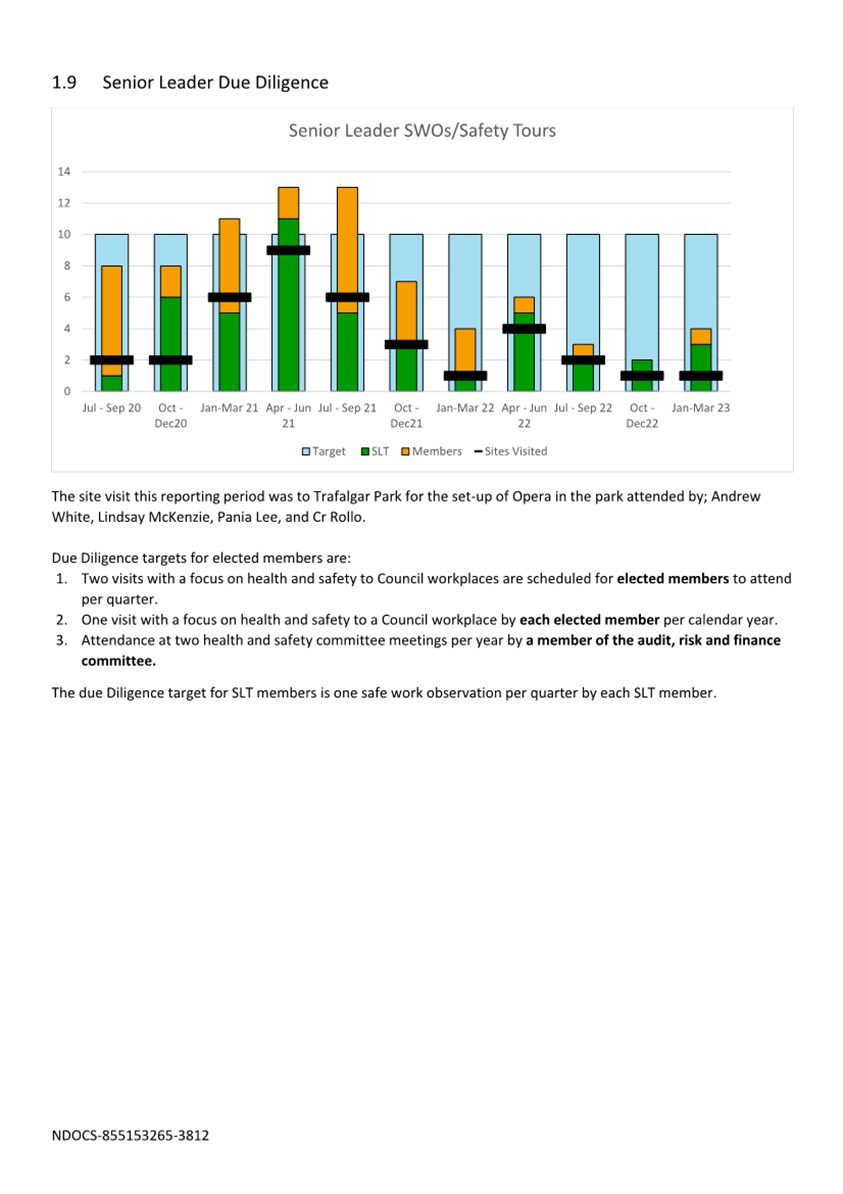

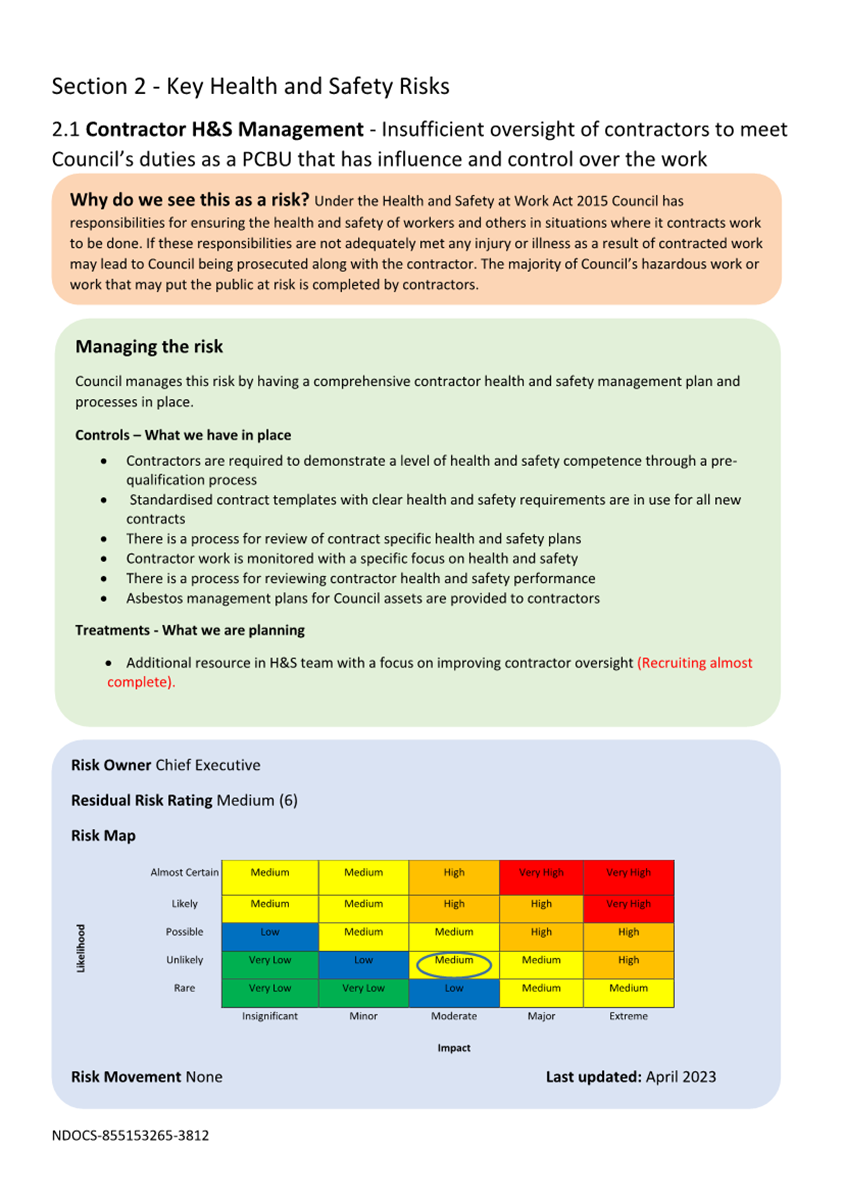

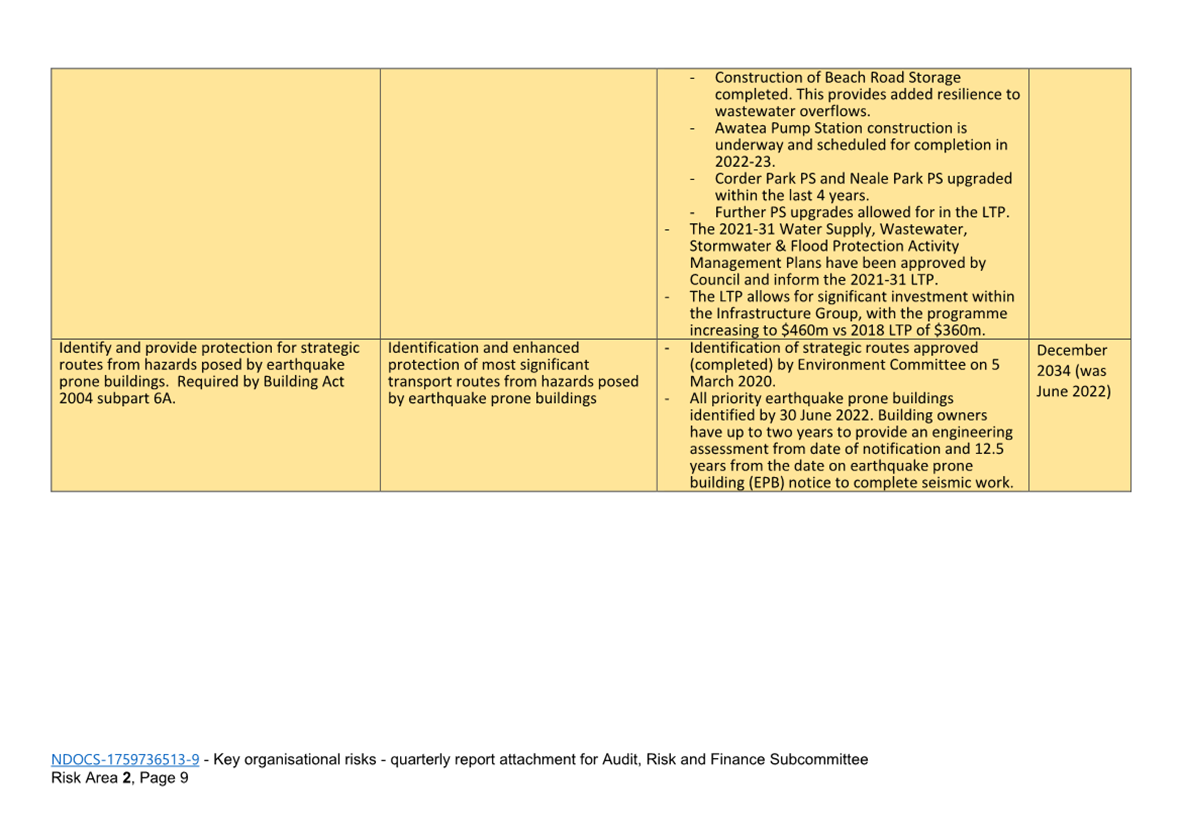

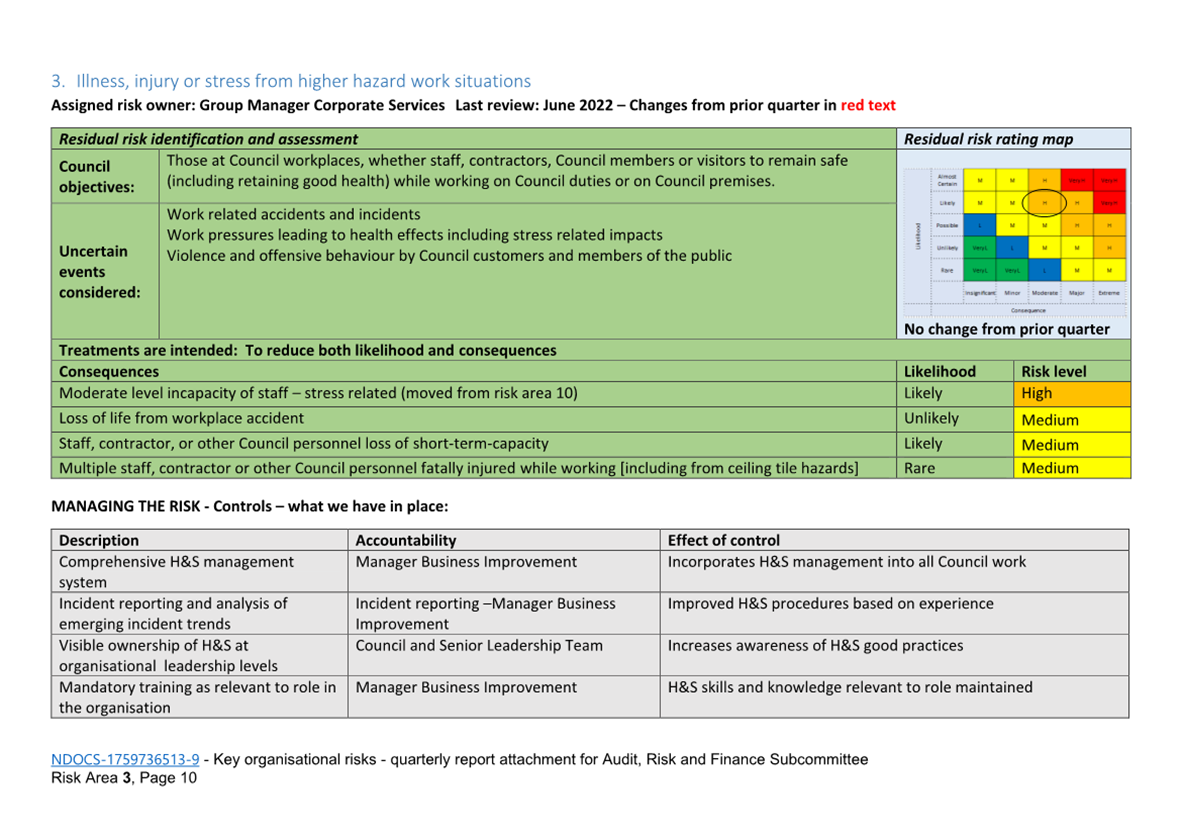

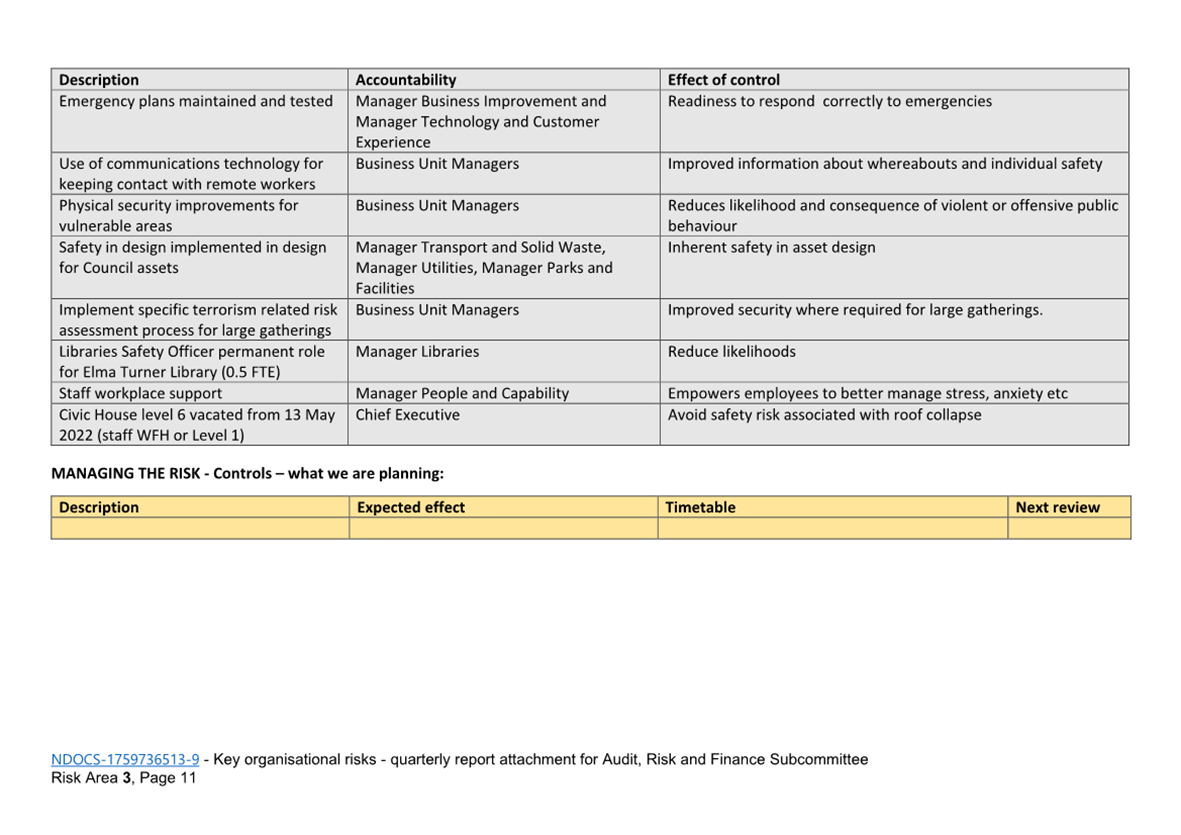

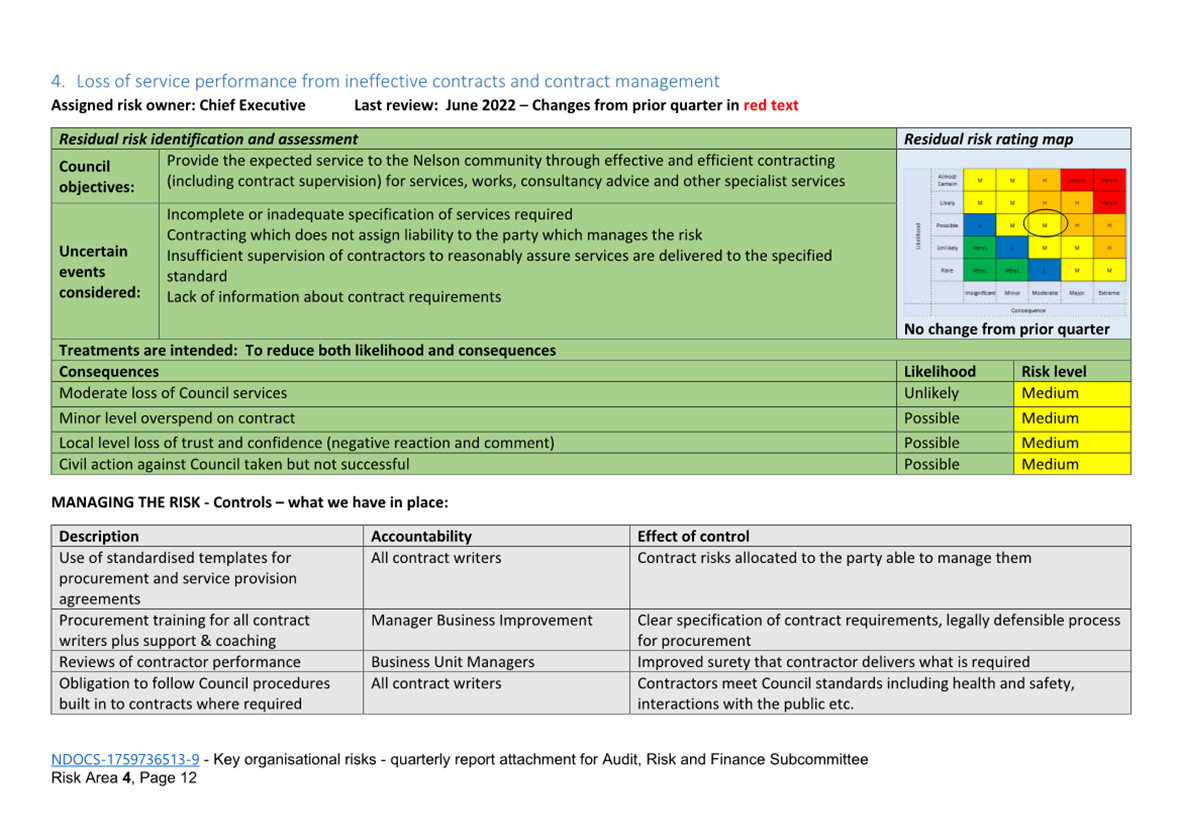

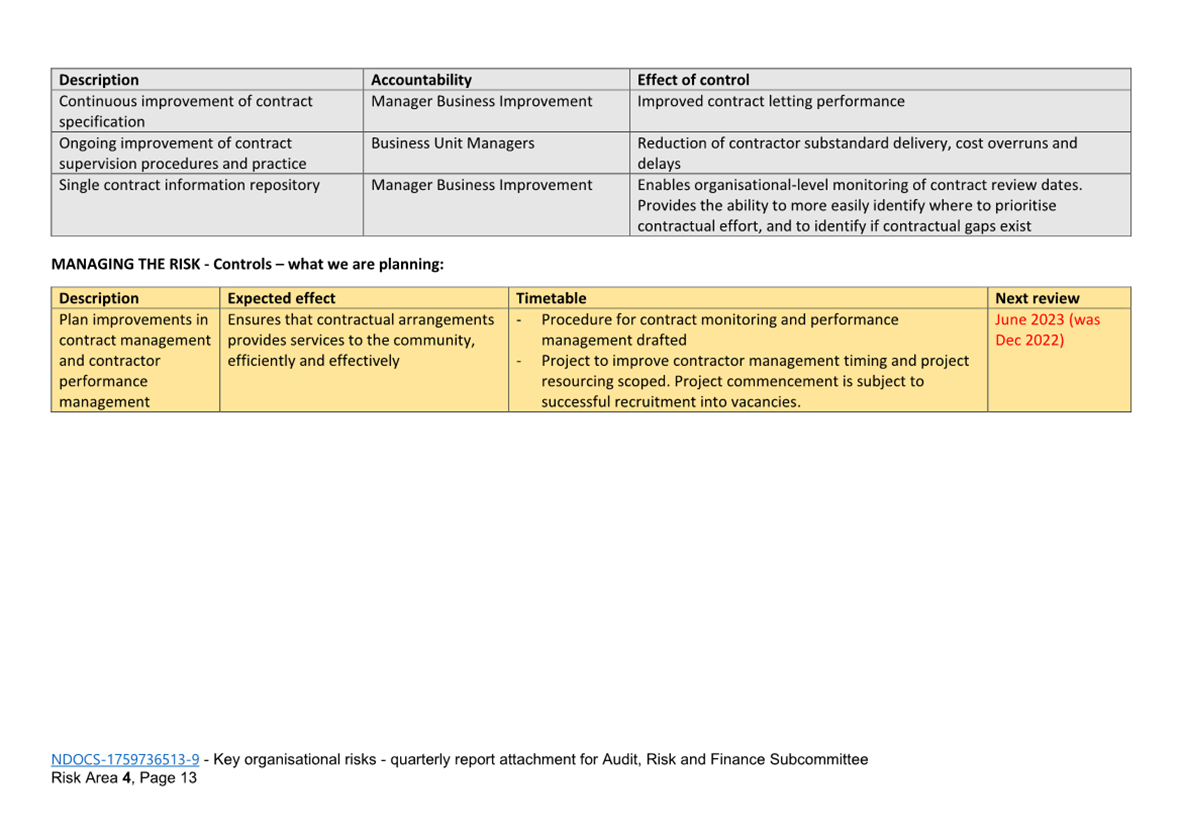

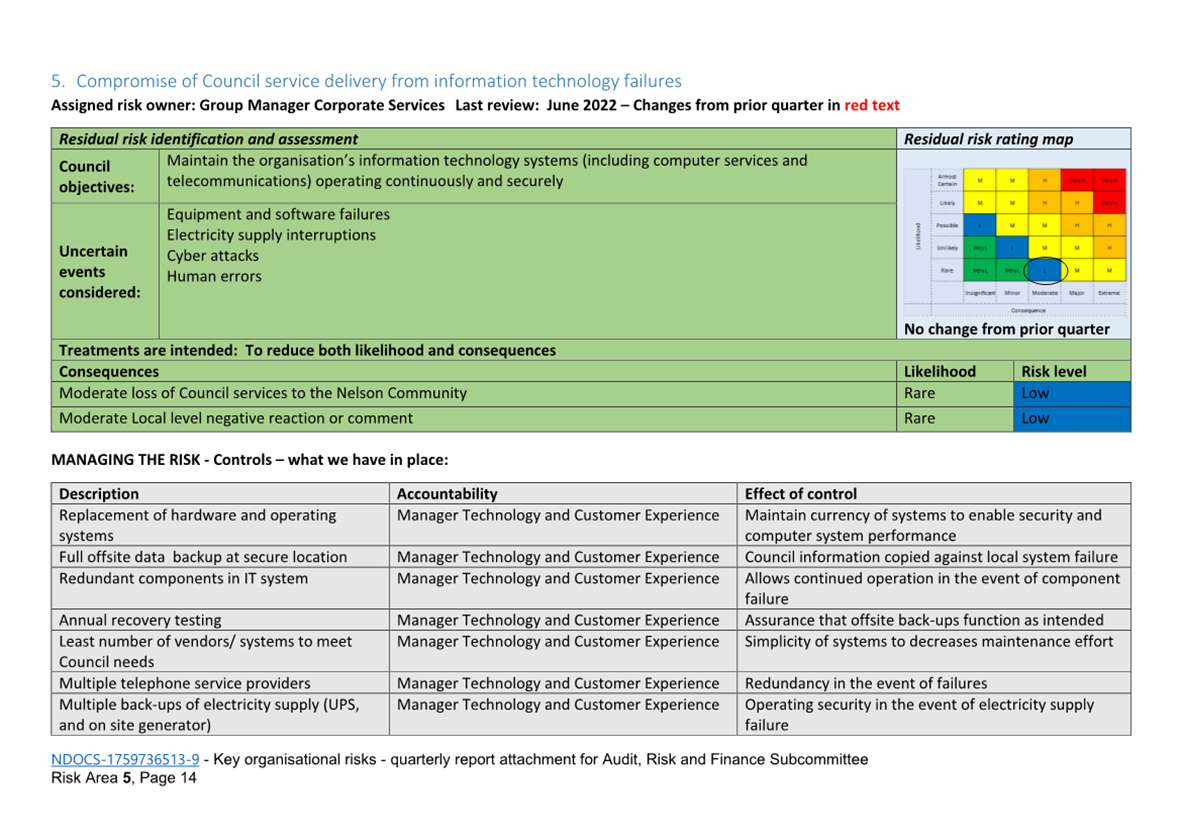

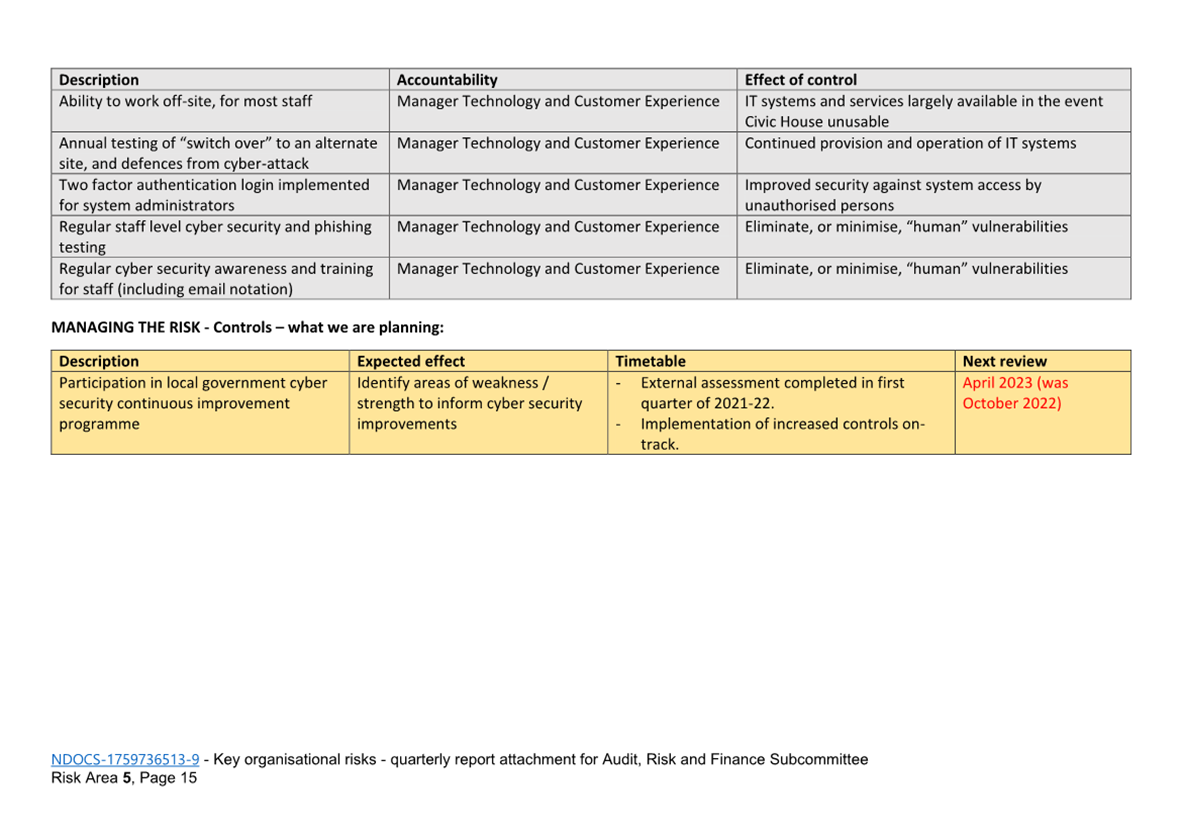

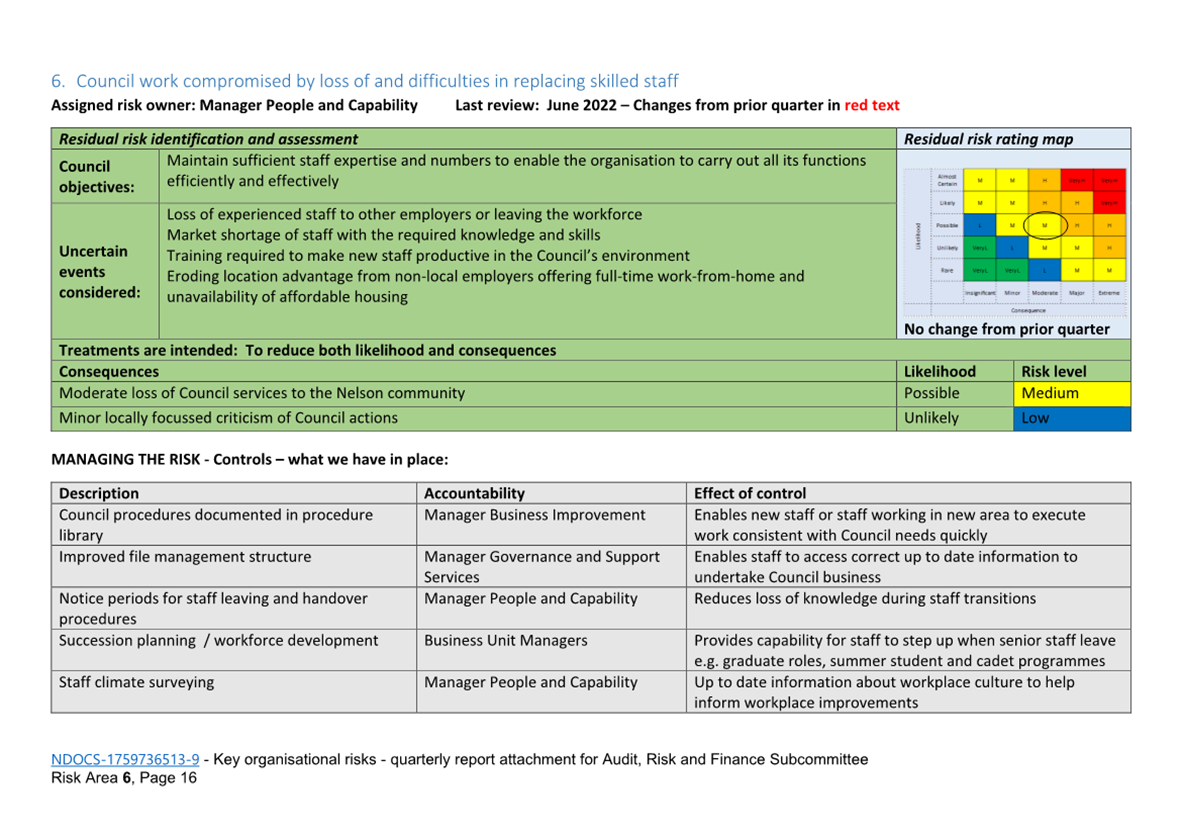

March 2023: Attachment 1