Item 5: Adoption of the

Annual Plan 2023/24 Consultation Document and Supporting Information

|

|

Council

23 March 2023

|

REPORT R27501

Adoption of the Annual

Plan 2023/24 Consultation Document and Supporting Information

1. Purpose of Report

1.1 To

adopt the Annual Plan 2023/24 Consultation Document and its supporting

information.

1.2 To

approve the public consultation process for the Annual Plan 2023/24.

2. Summary

2.1 Council

is required to prepare and adopt an Annual Plan by 30 June each year. If there

are significant or material changes proposed to the work programme set out in

the Long Term Plan for the year, then Council must consult via a consultation

document which outlines these changes. The consultation document is an

exceptions document and focuses on the key proposed variances for that year

from what was proposed in the Long Term Plan 2021–31.

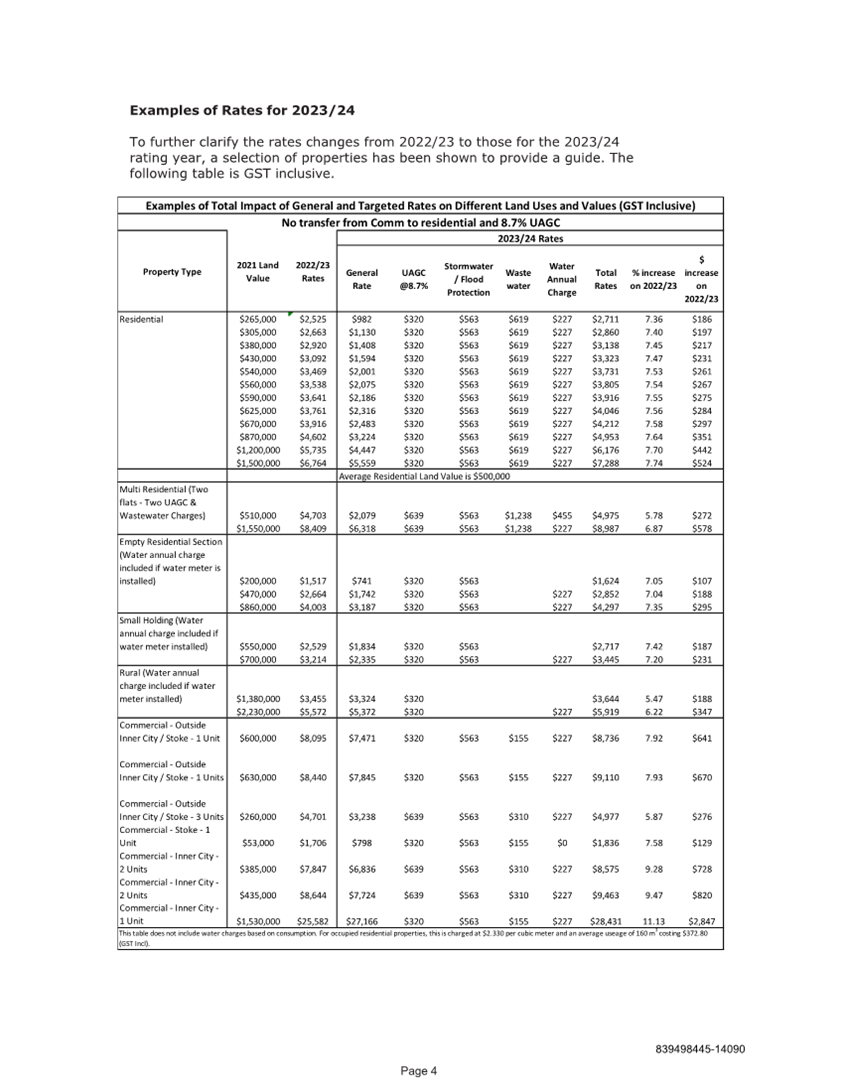

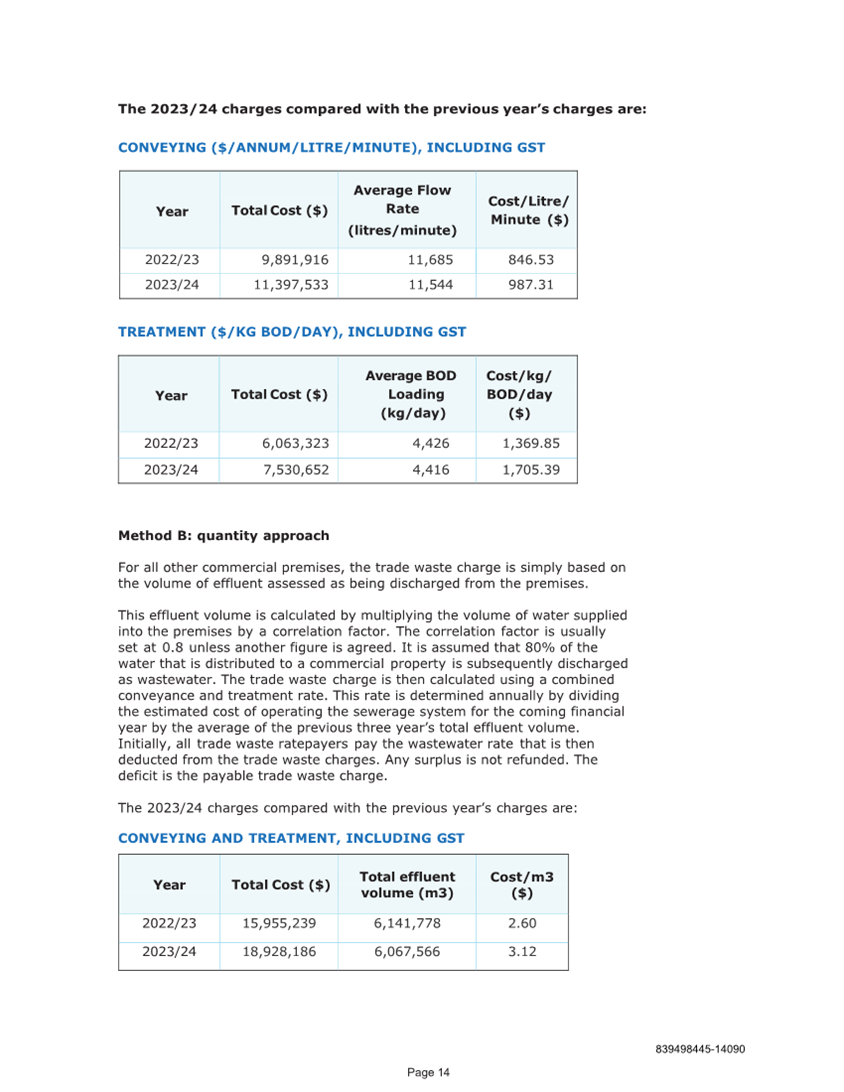

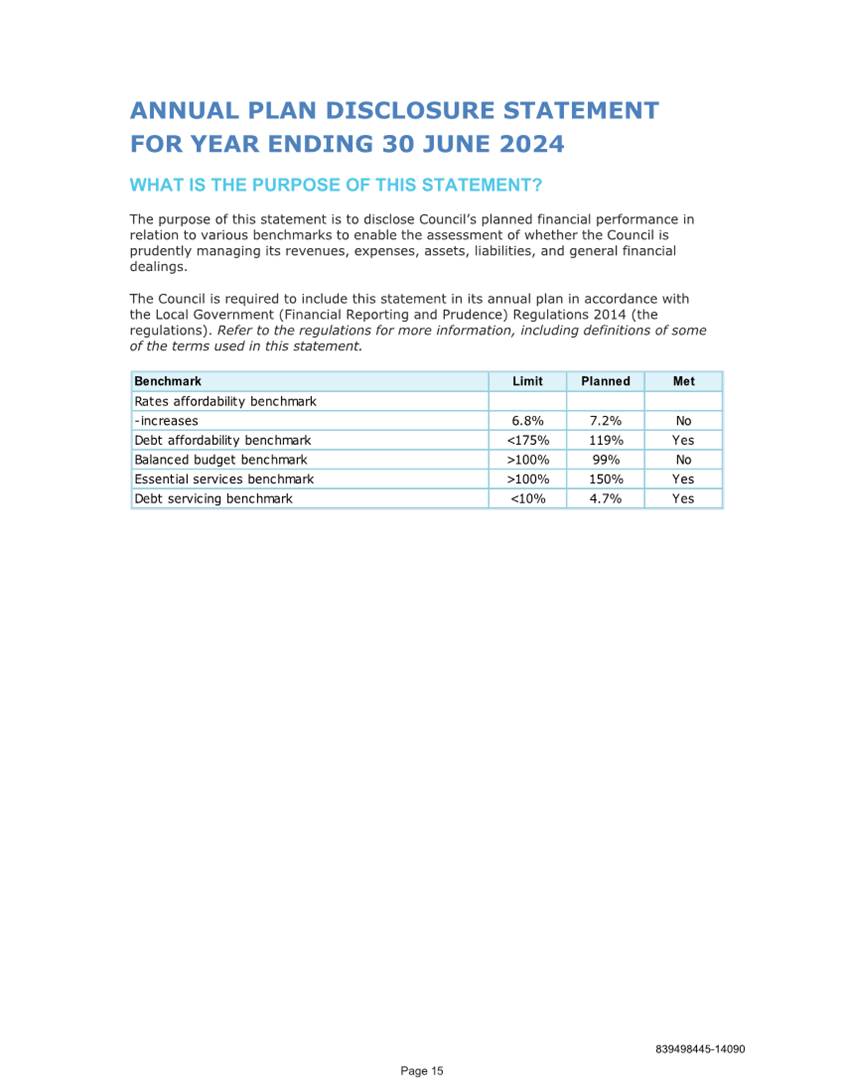

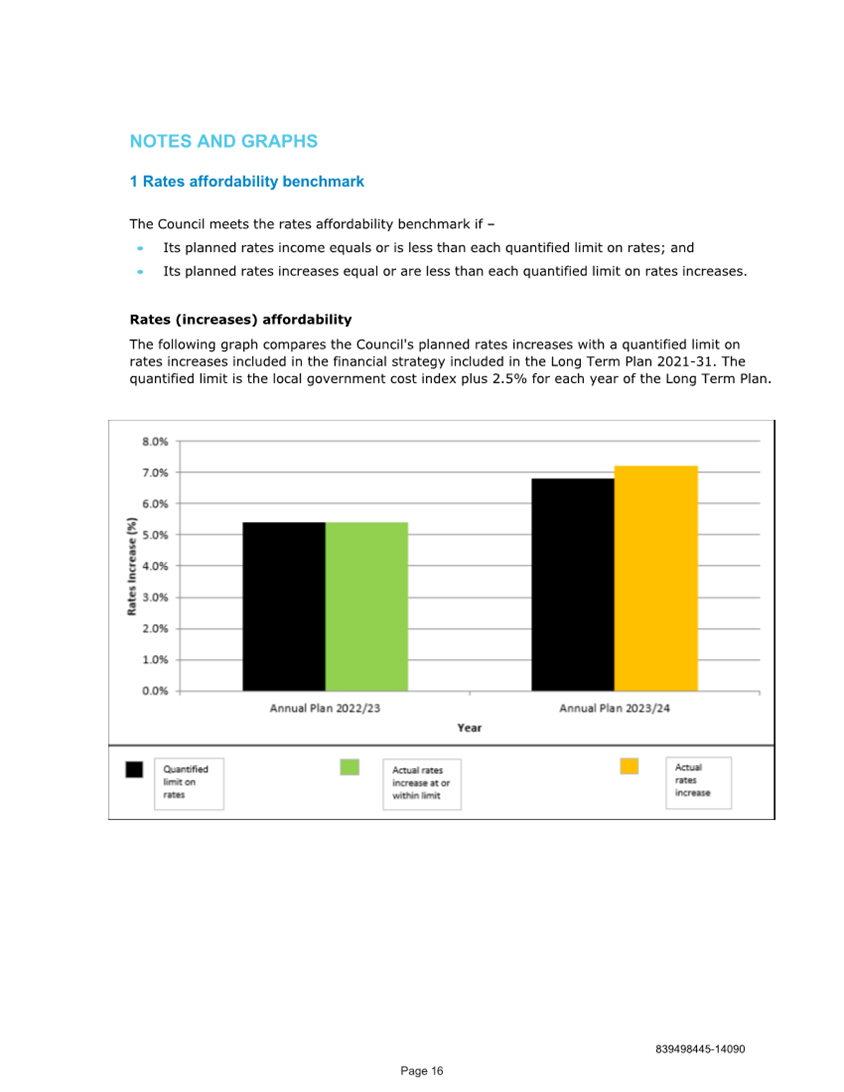

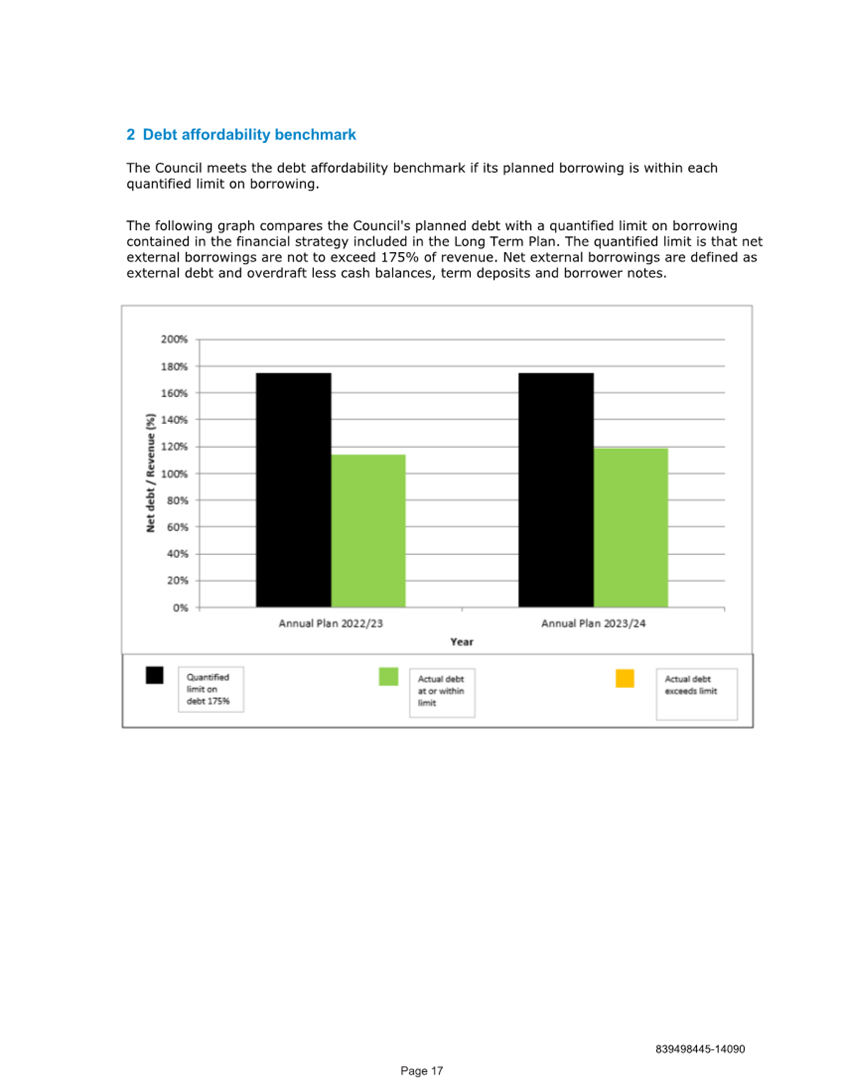

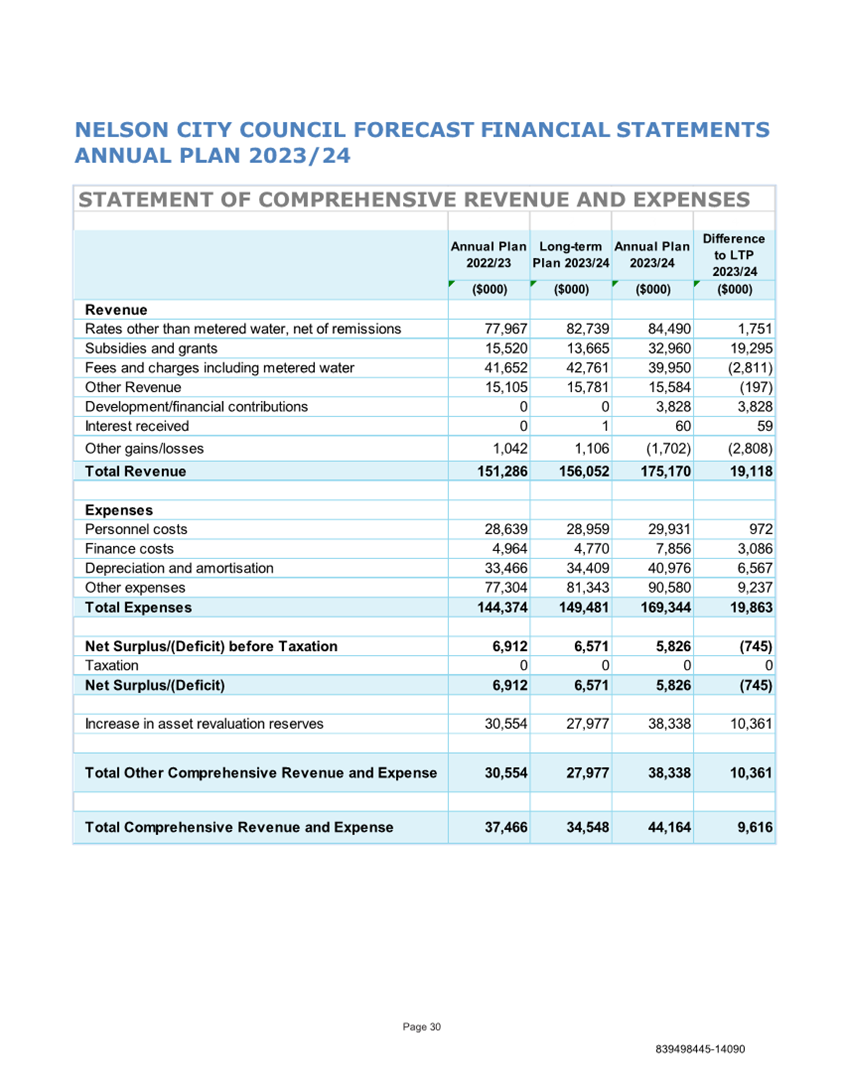

2.2 The

average rates increase proposed in the Annual Plan 2023/24 Consultation

Document is 7.2%, and the proposed debt at the end of June 2024 is projected to

be $199.6 million. Year three of the Long Term Plan projected an average rates

increase of 5% and net debt of $191.93 million. It is important to note that in

2020/21 when the Long Term Plan was developed the forecast inflation for this

current year was 2.5%, but is now in excess of 7% and this is the principal

reason for the variation. Recovery from the August 2022 severe weather event, inflationary

pressures, increasing operating costs and rising interest costs have all

contributed to the proposed rates and debt increases.

3. Recommendation

|

That the Council

1. Receives the report Adoption

of the Annual Plan 2023/24 Consultation Document and Supporting Information(R27501)

and its attachments (839498445-13646 and 839498445-14090); and

2. Adopts

the Supporting Information for the Annual Plan 2023/24 Consultation Document

(839498445-13958) that is relied on for the Annual Plan 2023/24 Consultation

Document, as required by section 95A(4) of the Local Government Act 2002; and

3. Agrees

that the Annual Plan 2023/24 Consultation Document (839498445-13646) provides

the basis for effective public consultation and clearly identifies and

explains the significant or material differences between the proposed Annual

Plan 2023/24 and year three of the Long Term Plan 2021–31; and

4. Notes under section 80

of the Local Government Act 2022, that the proposed work programme, rates

increases and debt projections in the Annual Plan 2023/24 Consultation

Document and supporting information:

a. Are

significantly inconsistent with the Long Term Plan 2021–31 and the Financial Strategy; and

b. That

the reasons for this inconsistency are principally the costs of recovery from

the August 2022 severe weather event, inflationary pressures, rising interest

costs, bringing forward funding for projects to take advantage of available

Government financial support, and decisions to respond to the changing needs

of the Nelson community; and

c. That

Council does not intend to amend the Long Term Plan 2021–31 or the Financial Strategy to accommodate

the proposed decisions; and

5. Agrees

to maintain the commercial differential to collect 22.6% of total rates

(excluding water annual charge and water volumetric rate) for 2023/24

consistent with the level collected in 2022/23; and

6. Notes

that, having had regard to the matters in section 100(2) of the Local

Government Act 2002 and as approved in the Long Term Plan 2021-31, the

setting of an unbalanced budget in the Annual Plan 2023/24 remains prudent

given the ongoing effects of the COVID-19 pandemic on the local economy and

ratepayers and further notes that, more recently, Council budgets have been

impacted by the unforeseen additional costs associated with the August 2022

severe weather event and the sharp rise in inflation and interest costs; and

7. Adopts

the Annual Plan 2023/24 Consultation Document (839498445-13646) for public

consultation, as required

by section 95A of the Local Government Act 2002; and

8. Agrees that His Worship

Mayor and Chief Executive be delegated authority to approve any minor

amendments required to the Annual Plan 2023/24 Consultation Document and the

supporting information prior to them being published and made available for

public consultation; and

9. Approves the

consultation approach (set out in paragraphs 5.12 to 5.14 of this report (R27501)

and agrees that the approach:

a. includes

sufficient steps to ensure the Annual Plan 2023/24 Consultation Document and

supporting information will be reasonably accessible to the public and will

be publicised in a manner appropriate to its purpose and significance; and

b. will

result in the Annual Plan 2023/24 Consultation Document and supporting

information being as widely publicised as is reasonably practicable as a

basis for consultation; and

c. meets

the requirements of section 82 of the Local Government Act 2002; and

10. Notes that the statement of proposal for

changes to Council’s schedule of fees and charges for 2023/24 will be

consulted on alongside consultation on the Annual Plan 2023/24 Consultation

Document.

|

4. Background

4.1 Section

95 of the Local Government Act 2002 (LGA2002) states that a local authority

must prepare and adopt an annual plan for each financial year and that it must

consult in a manner that gives effect to the requirements of section 82 before

adopting an annual plan. However, consultation is not required if the proposed

annual plan does not include significant or material differences from the

content of the long term plan for the financial year to which the proposed

annual plan relates.

4.2 Council’s

Significance and Engagement Policy sets out the relationship between the degree

of significance that a matter has, and the level and type of community

engagement that is likely to take place. Under this policy, Council determines

the appropriate level of engagement on a case by case basis and in proportion

to the level of significance of the matter being considered.

4.3 Staff

undertook an assessment of the significance of the proposed changes for the

Annual Plan 2023/24 from year three of the Long Term Plan 2021–31 against Council’s Significance and

Engagement Policy. The assessment indicated that the proposed key changes for

the Annual Plan 2023/24 were of high significance. At its meeting on 9 February

2023, Council agreed that the proposed key changes were of high significance

and that it needed to consult through an annual plan consultation process.

4.4 Elected

member feedback from three days of annual planning workshops and three Annual

Plan 2023/24 Taskforce meetings has informed the development of the

Consultation Document and supporting information.

5. Discussion

5.1 Section

95A of the LGA2002 sets out the purpose and content requirements for a

consultation document. The proposed process, the draft Consultation Document

and the supporting information outlined below, meet the requirements of this

section.

Consultation Document

5.2 The

Consultation Document (Attachment 1) outlines the proposed key changes to the

work programme, and the other main changes from the Long Term Plan 2021–2031 by activity area.

5.3 The

proposed key changes for the Annual Plan 2023/24 are:

· The

approach to rates – an average rates rise of 7.2%

· Recovery

from the August 2022 severe weather event

· Reduction

in spending on a new library

· Infrastructure

Acceleration Fund – infrastructure upgrade to unlock city centre living

· Maitahi

Bayview Development subdivision (Maitai Valley) utilities and transport

connections.

5.4 Detail

on these proposed changes is outlined in the Consultation Document and

supporting information, attached to this report.

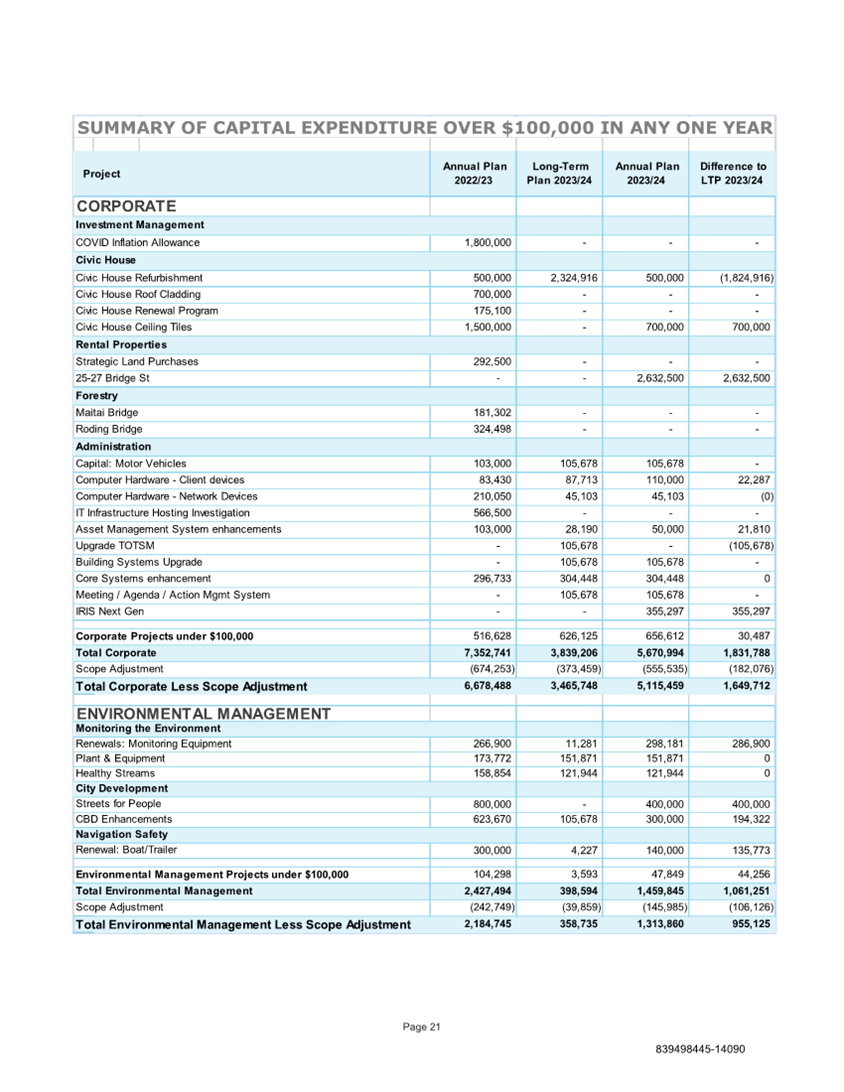

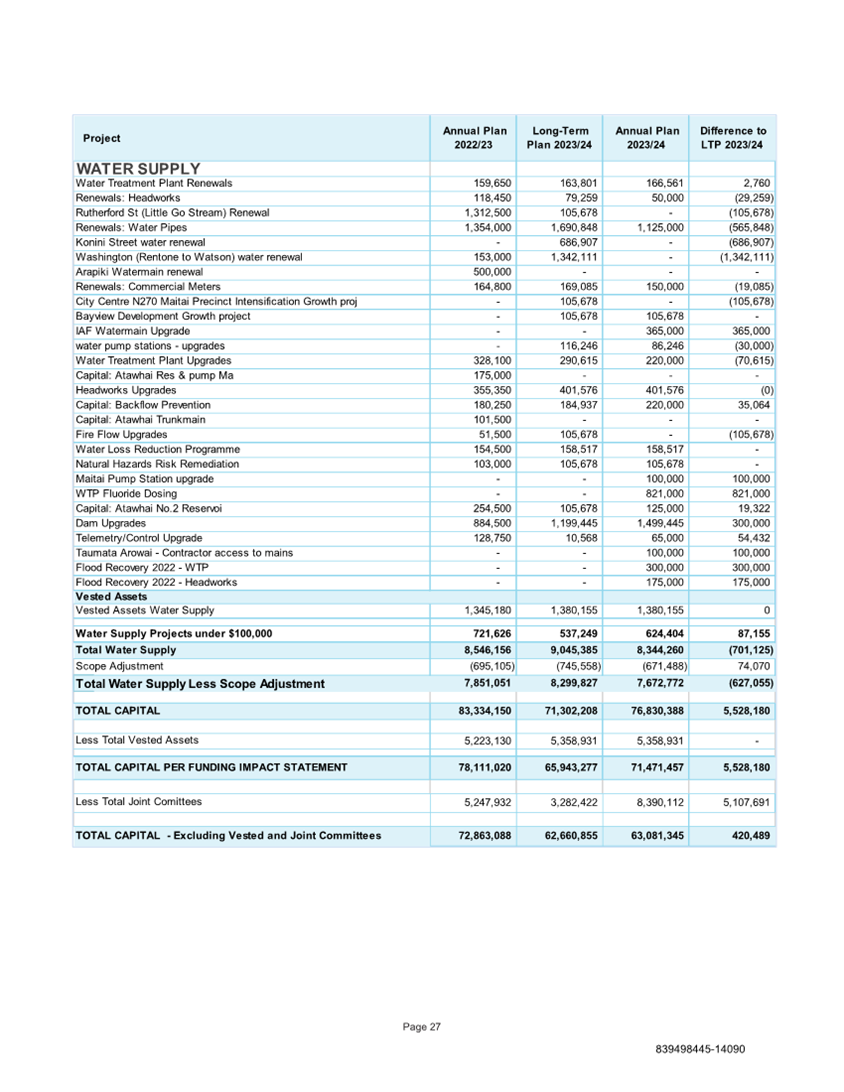

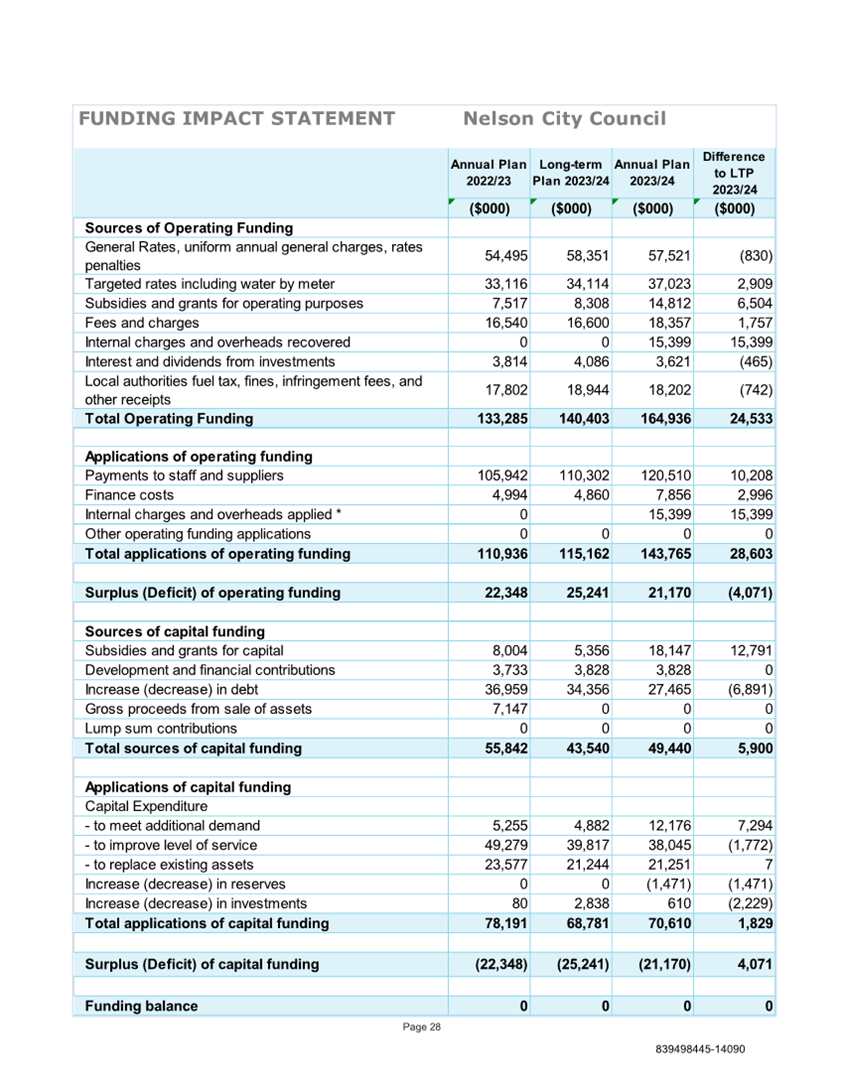

5.5 The

overall effect of the proposed work programme is to decrease slightly the

capital works programme from the programme outlined in year three of the Long

Term Plan, from $59.5 million to $59.2 million (excluding vested assets, staff

costs, Nelson Regional Sewerage Business Unit and Nelson Tasman Regional

Landfill Business Unit). Operational expenditure has increased. The overall

effect of the proposed changes is an increase in rates revenue of 7.2% and debt

at the end of June 2024 of $199.6 million. These figures are different to year

three of the Long Term Plan, which projected a rates revenue increase of 5% and

debt of $191.93 million, albeit in 2020 no one foresaw inflation exceeding 7%

in this year.

Supporting information

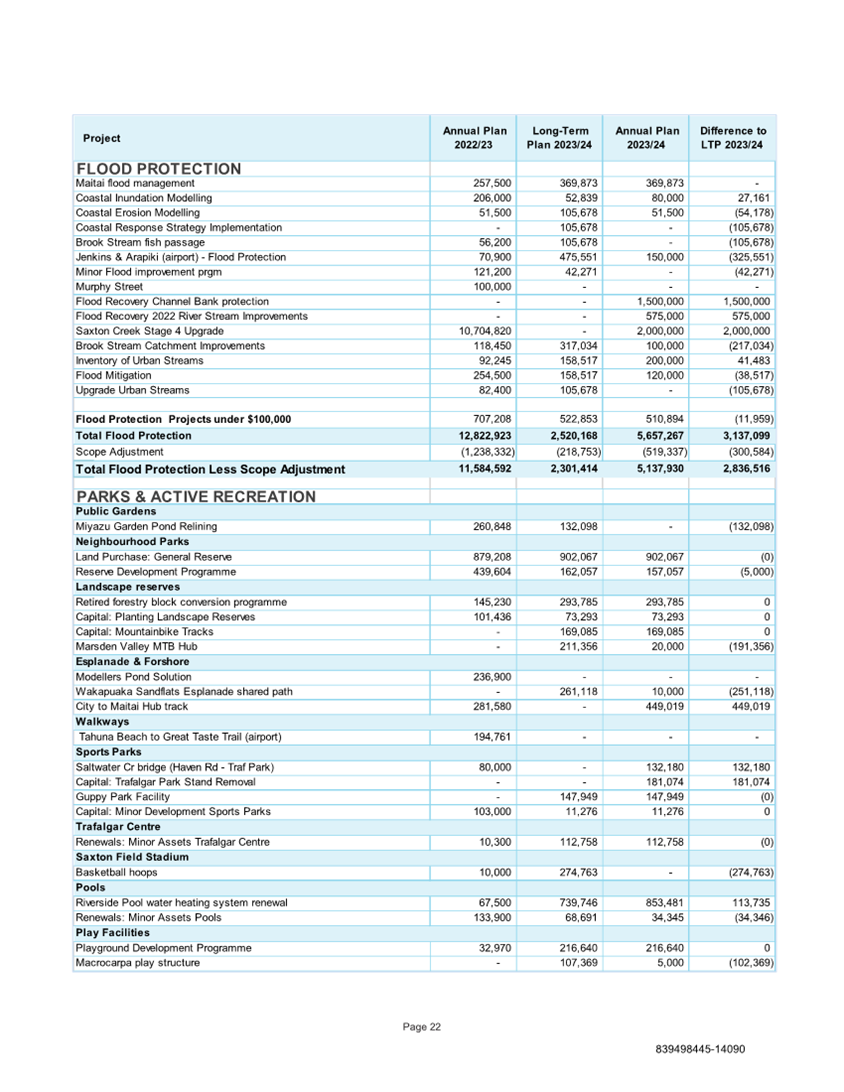

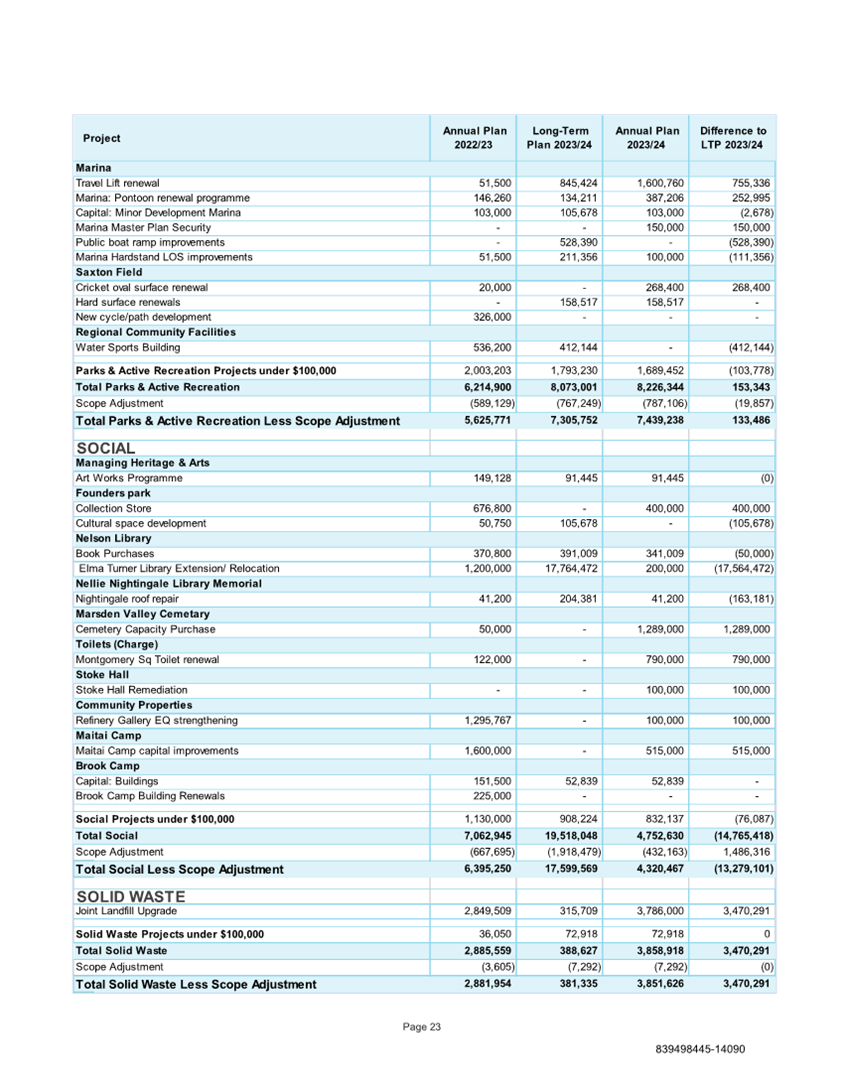

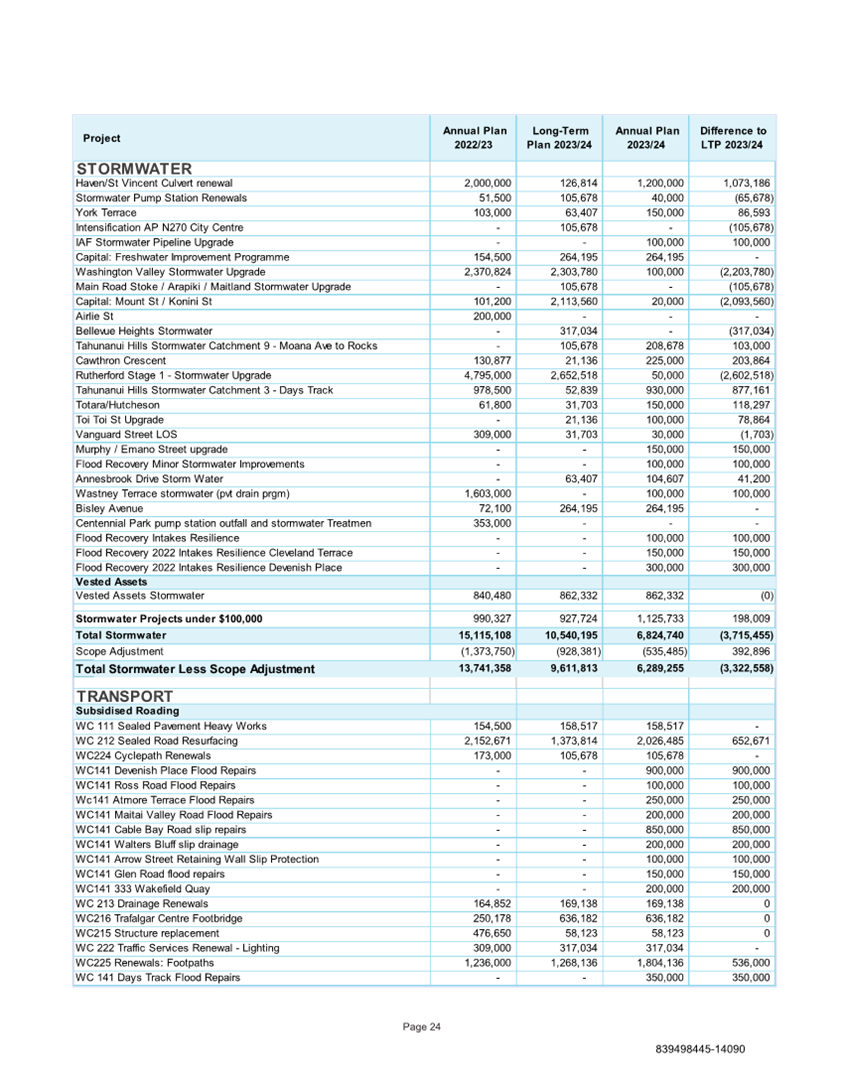

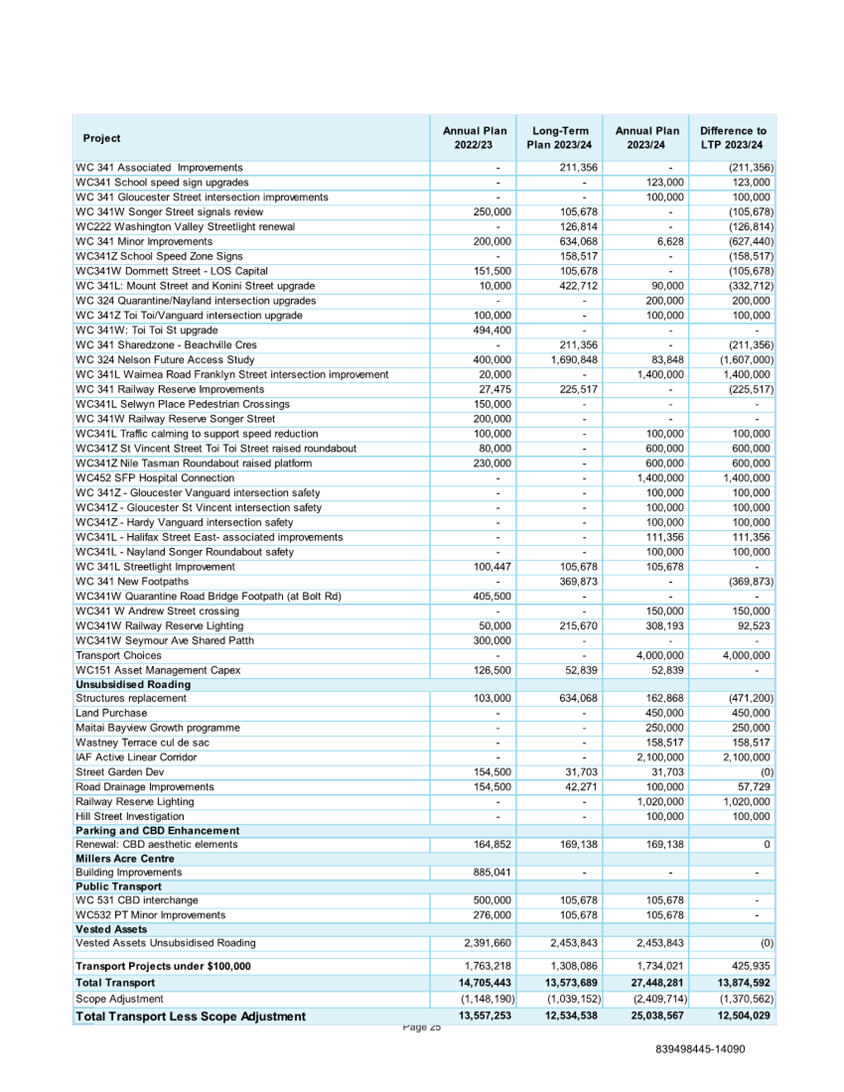

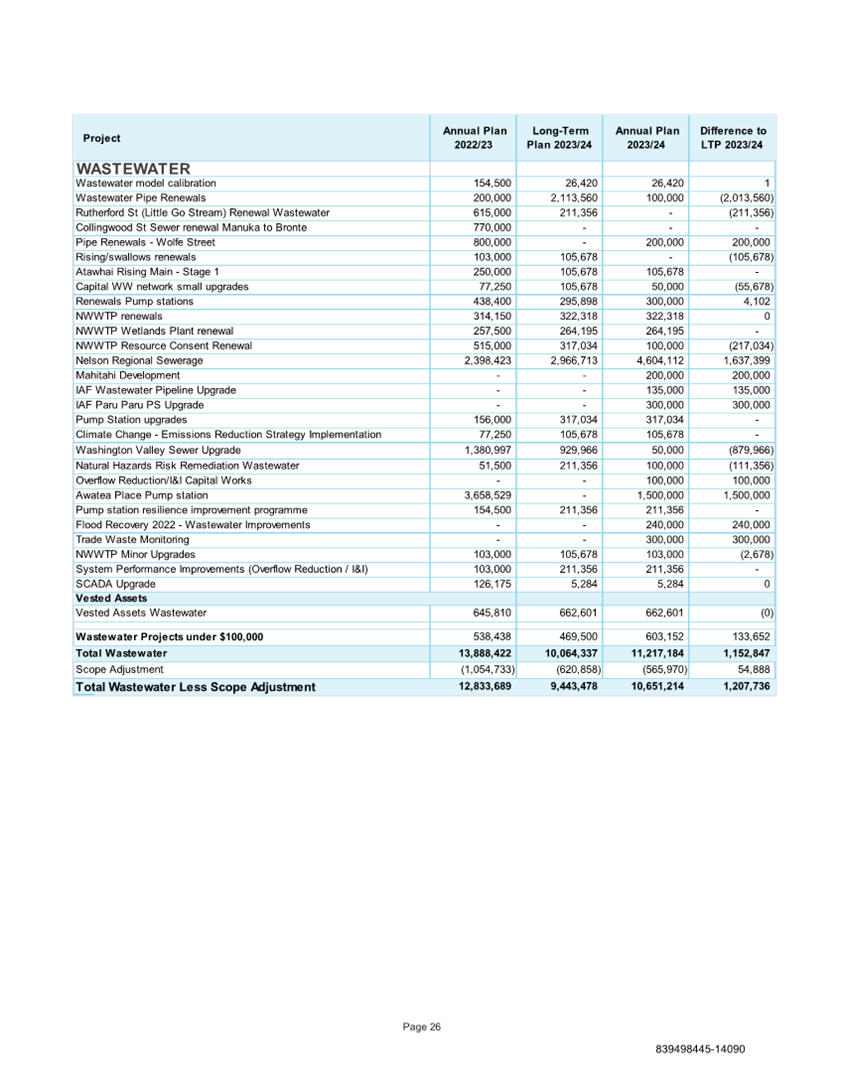

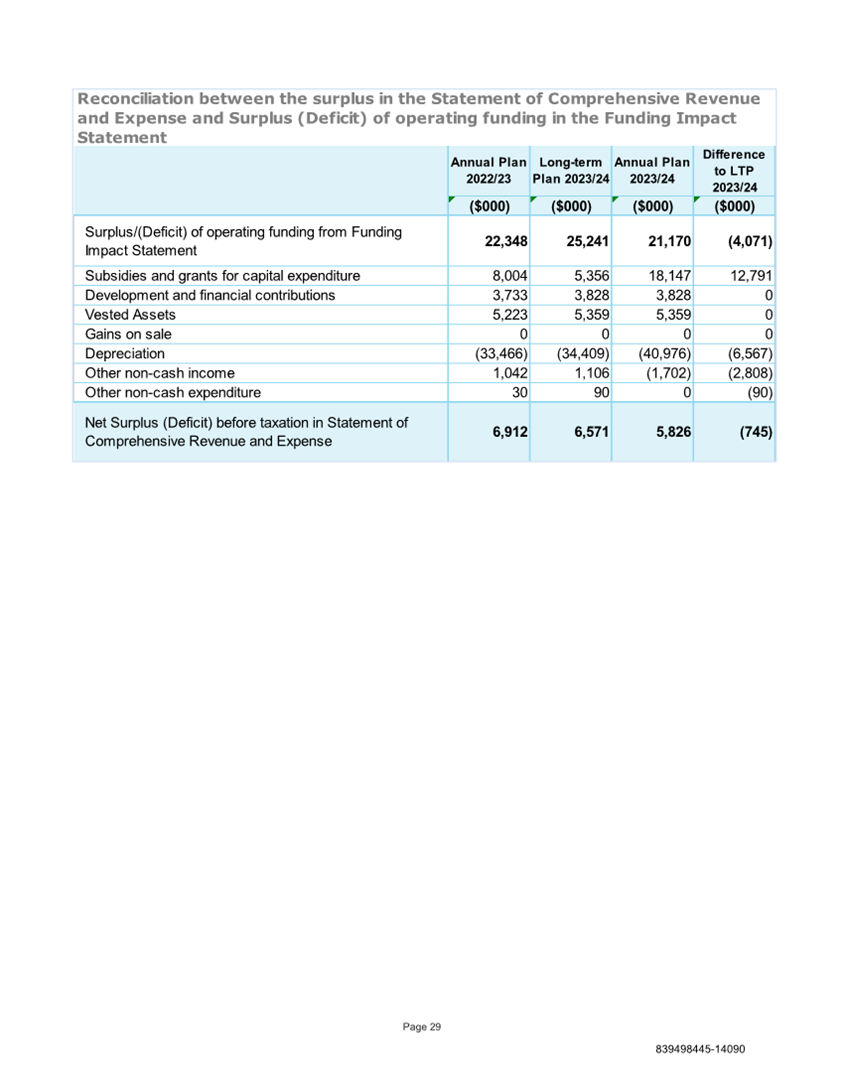

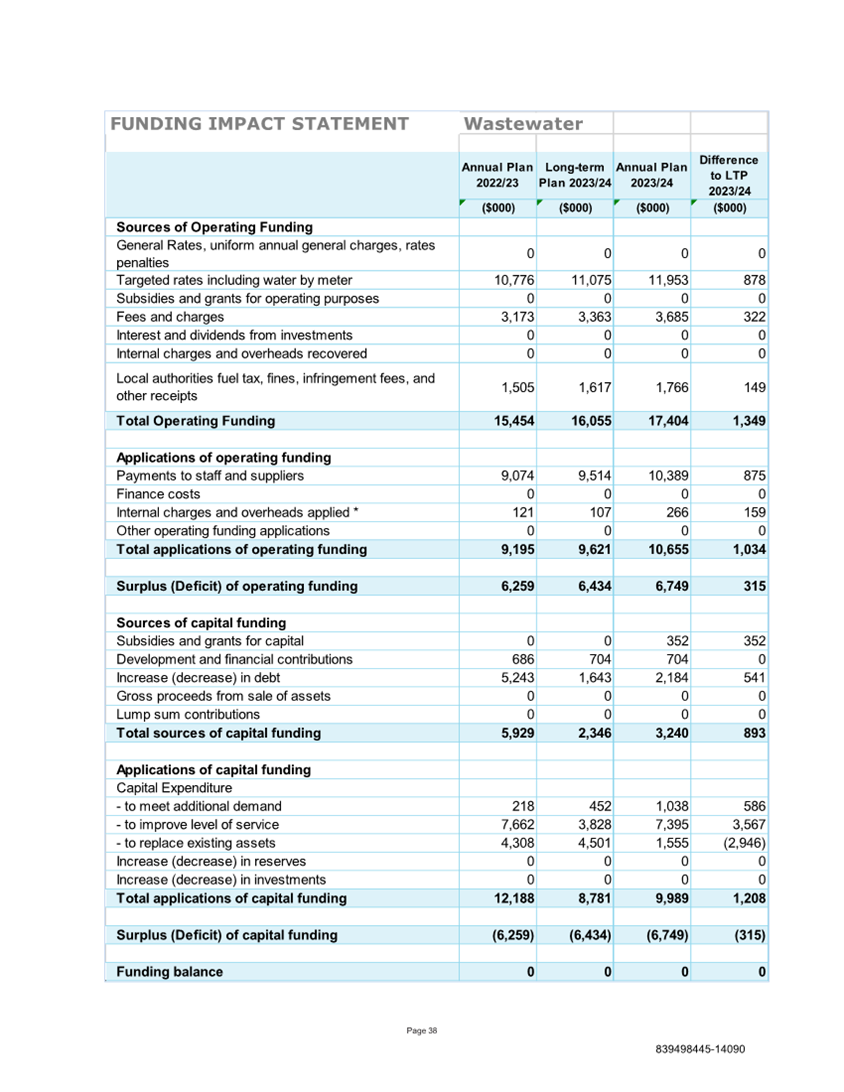

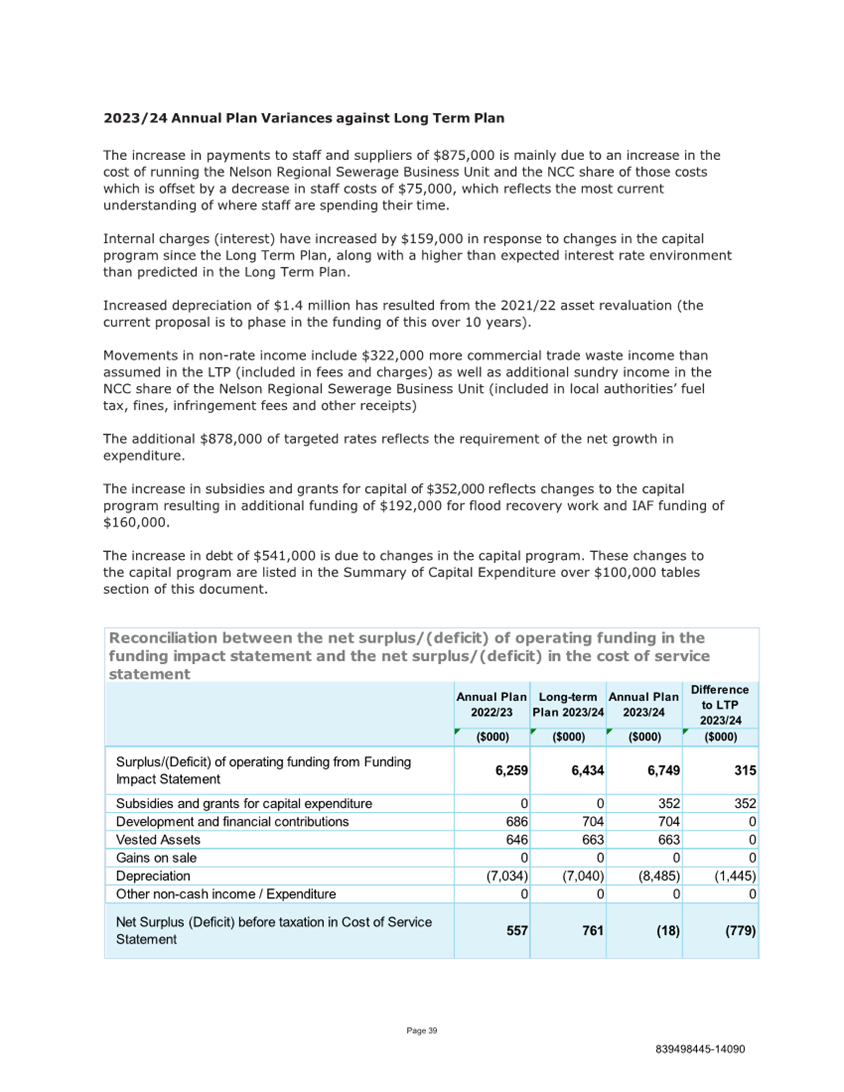

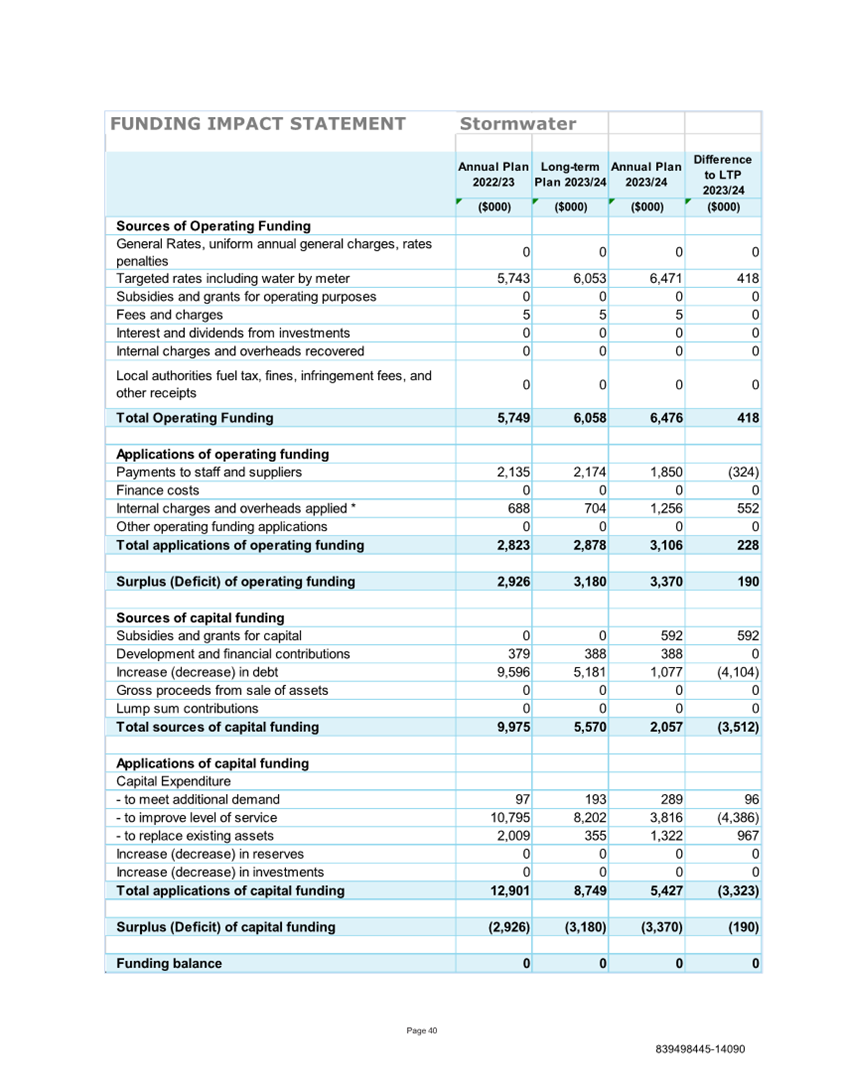

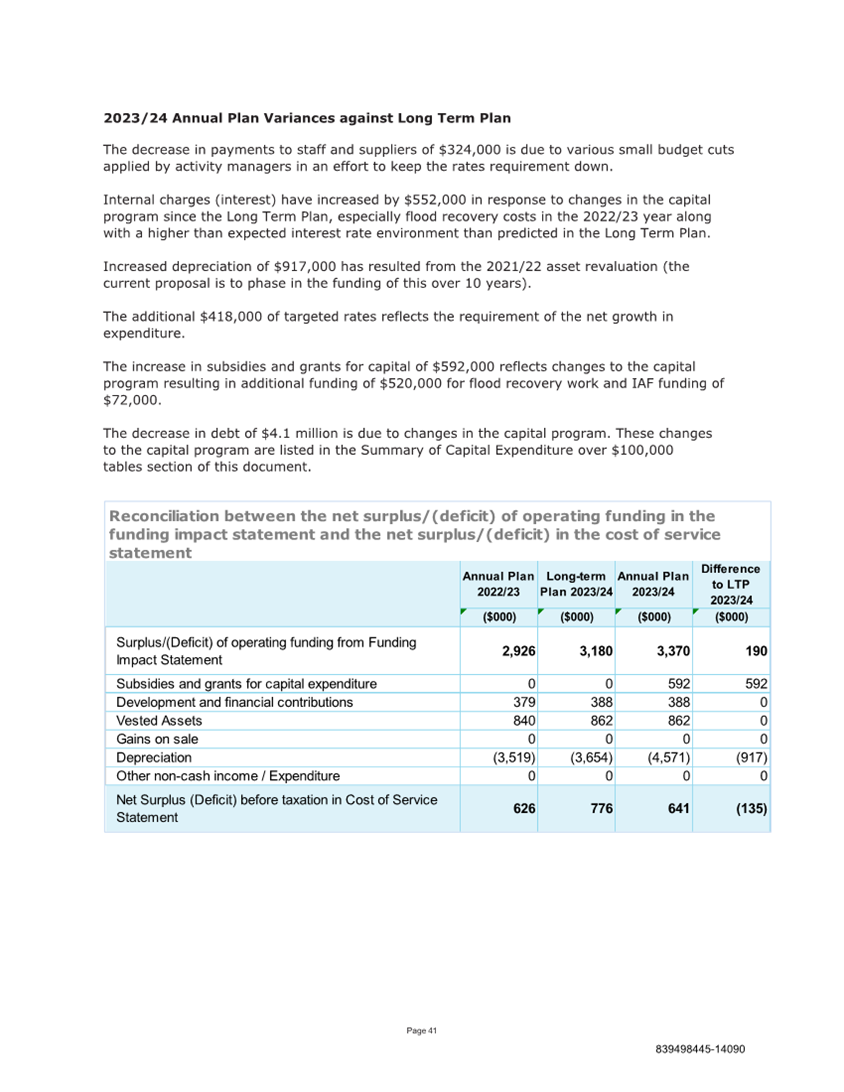

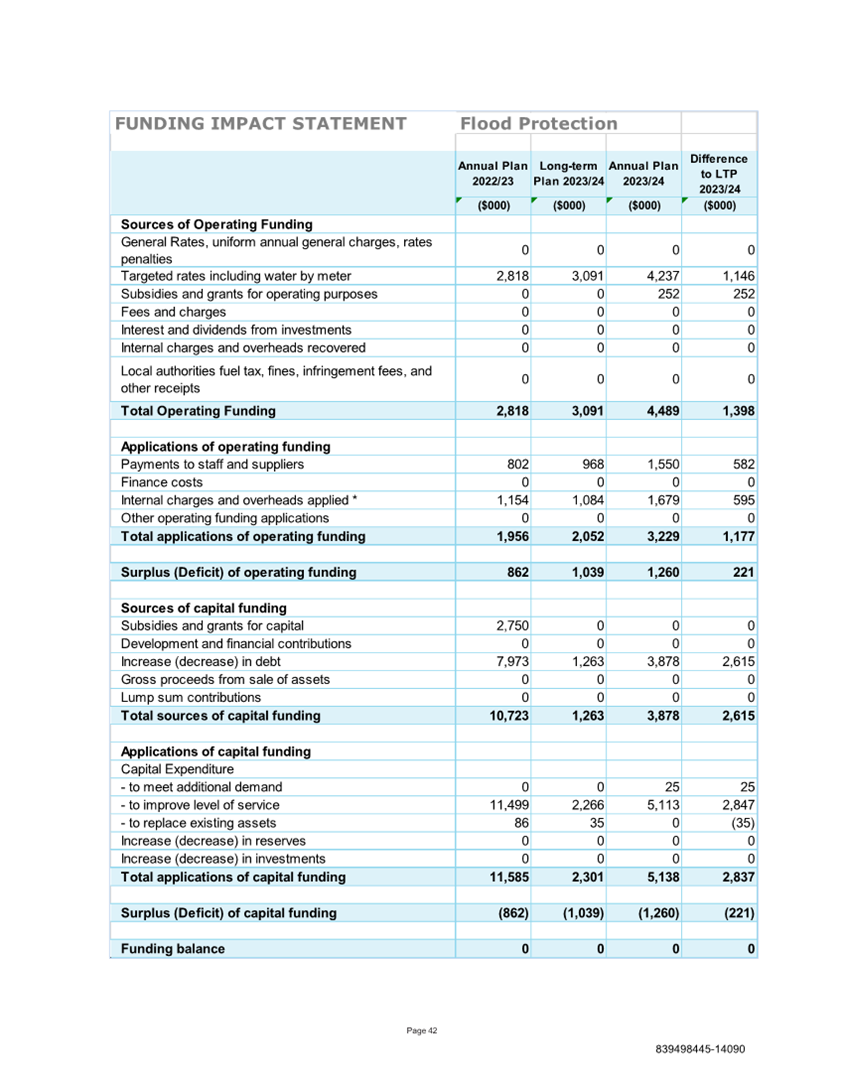

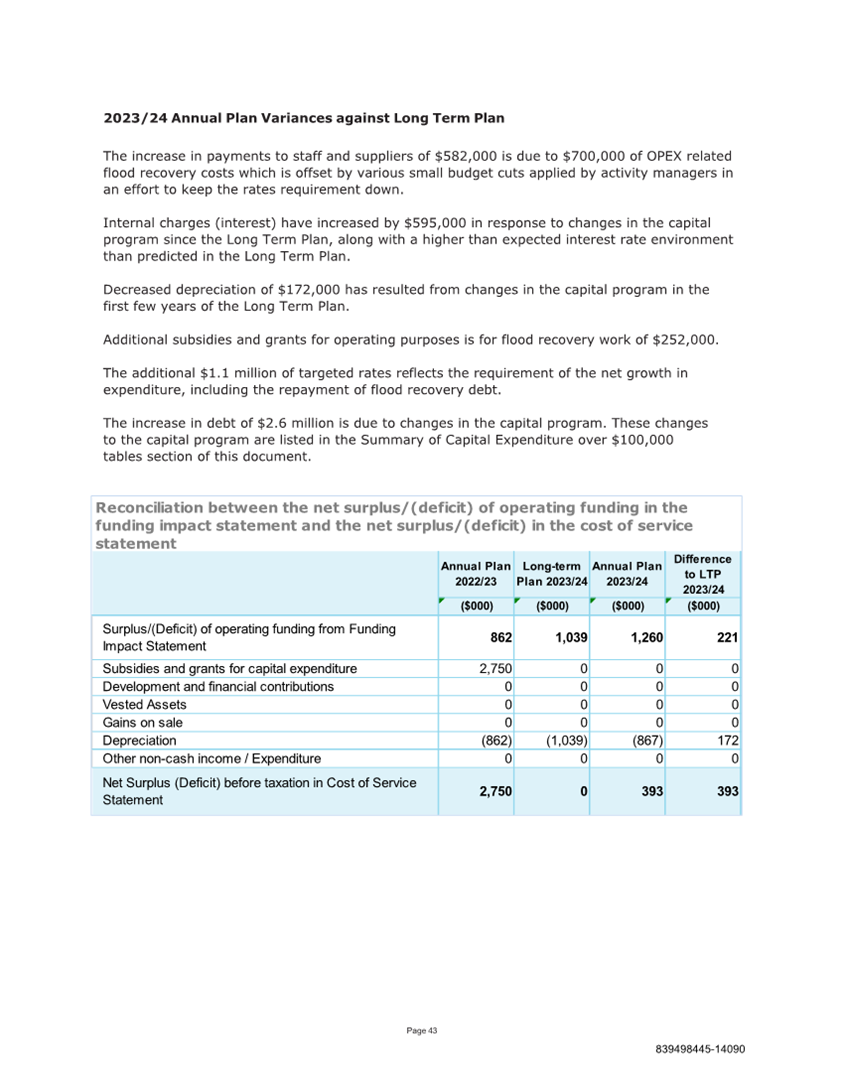

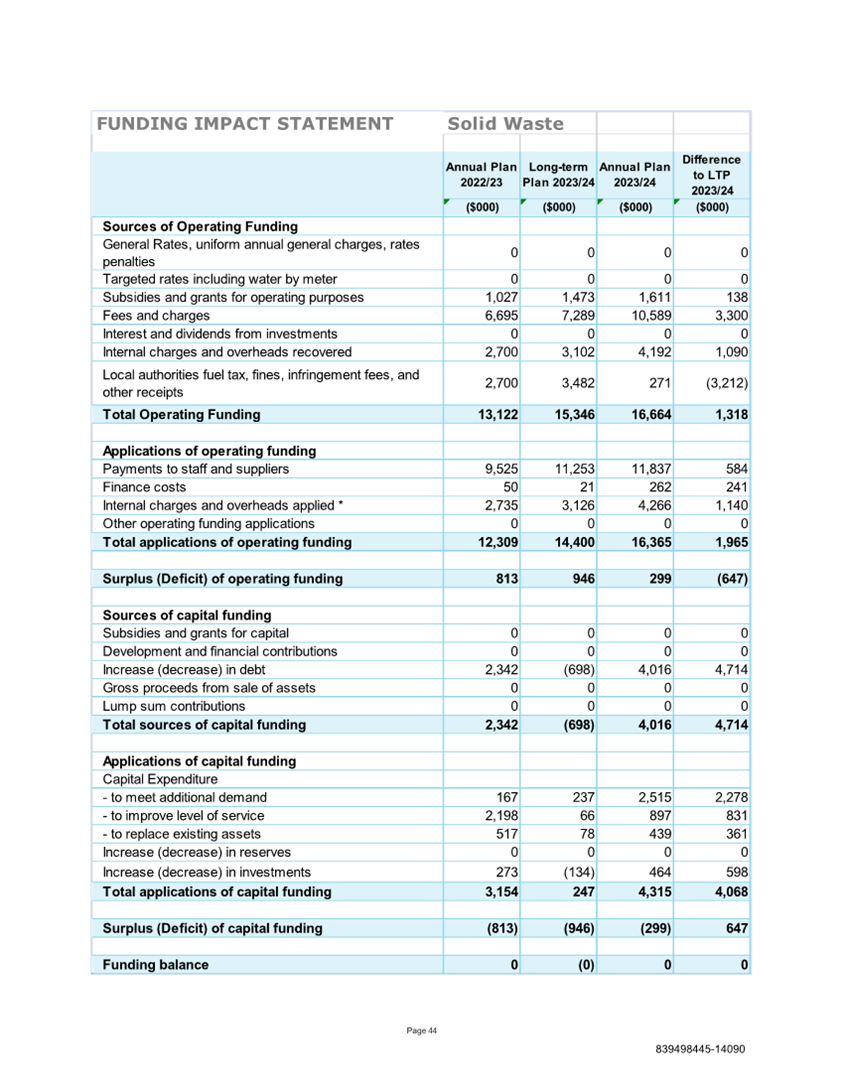

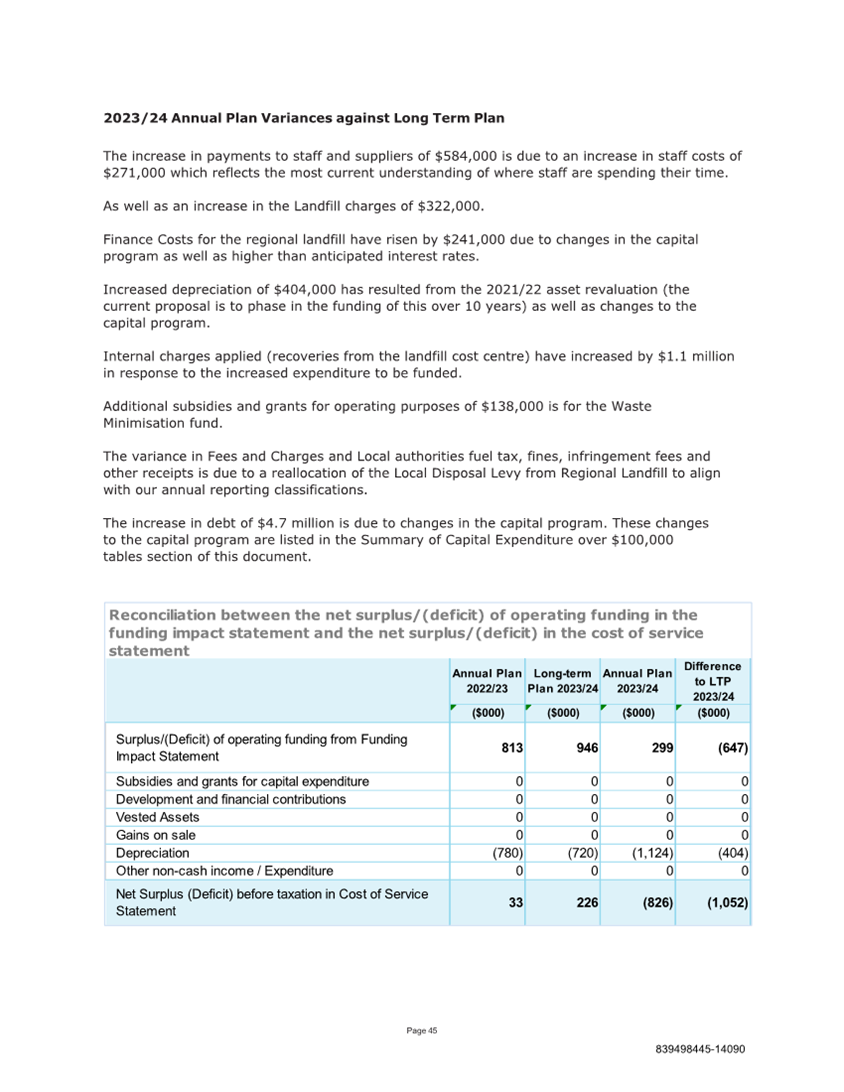

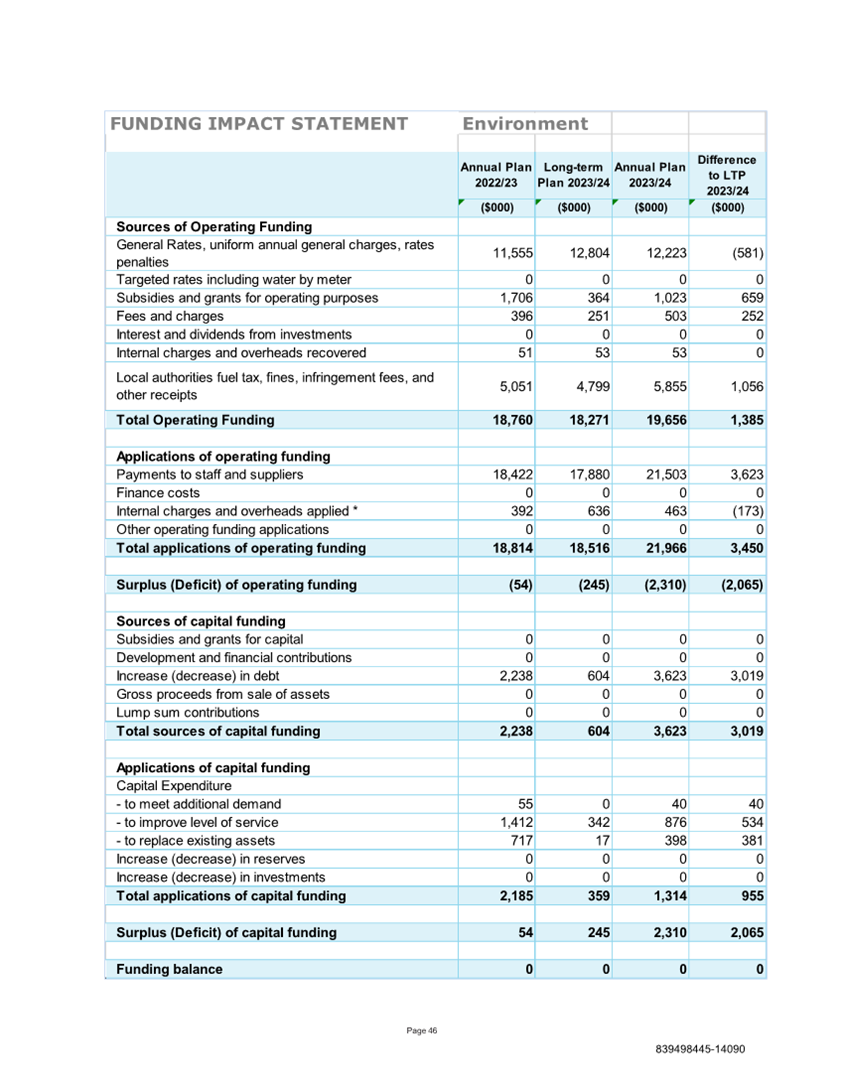

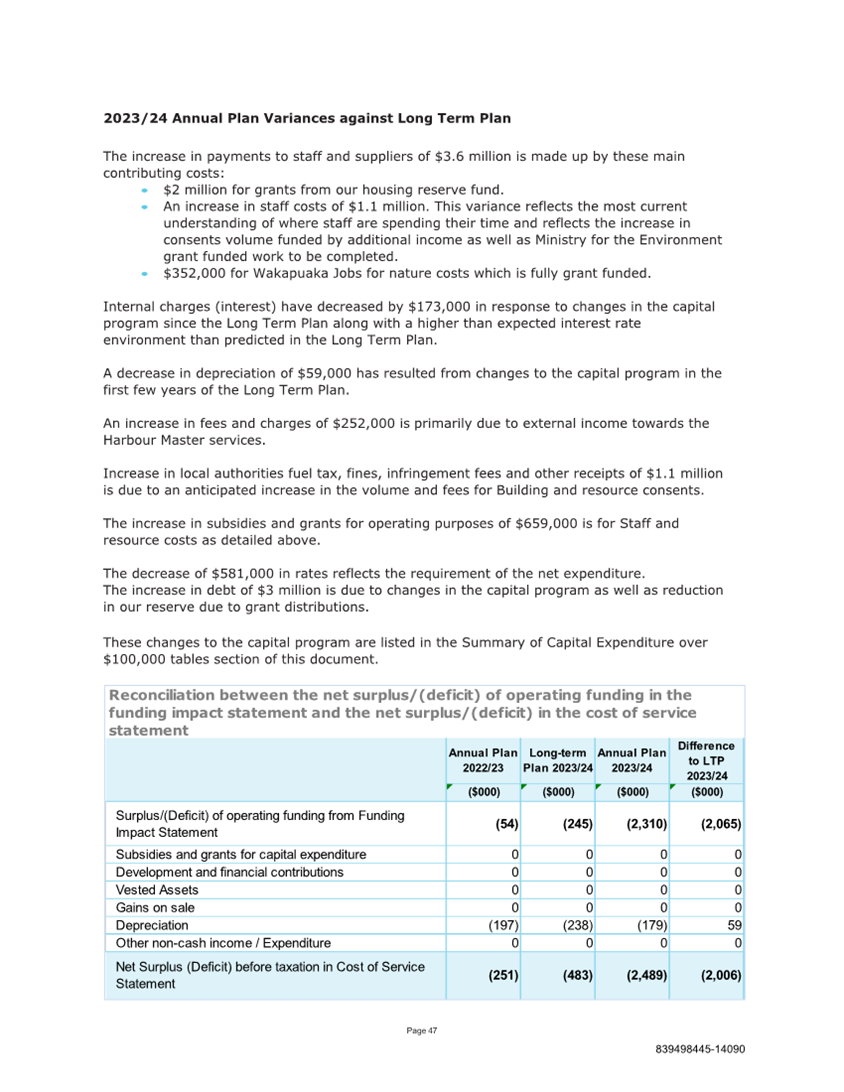

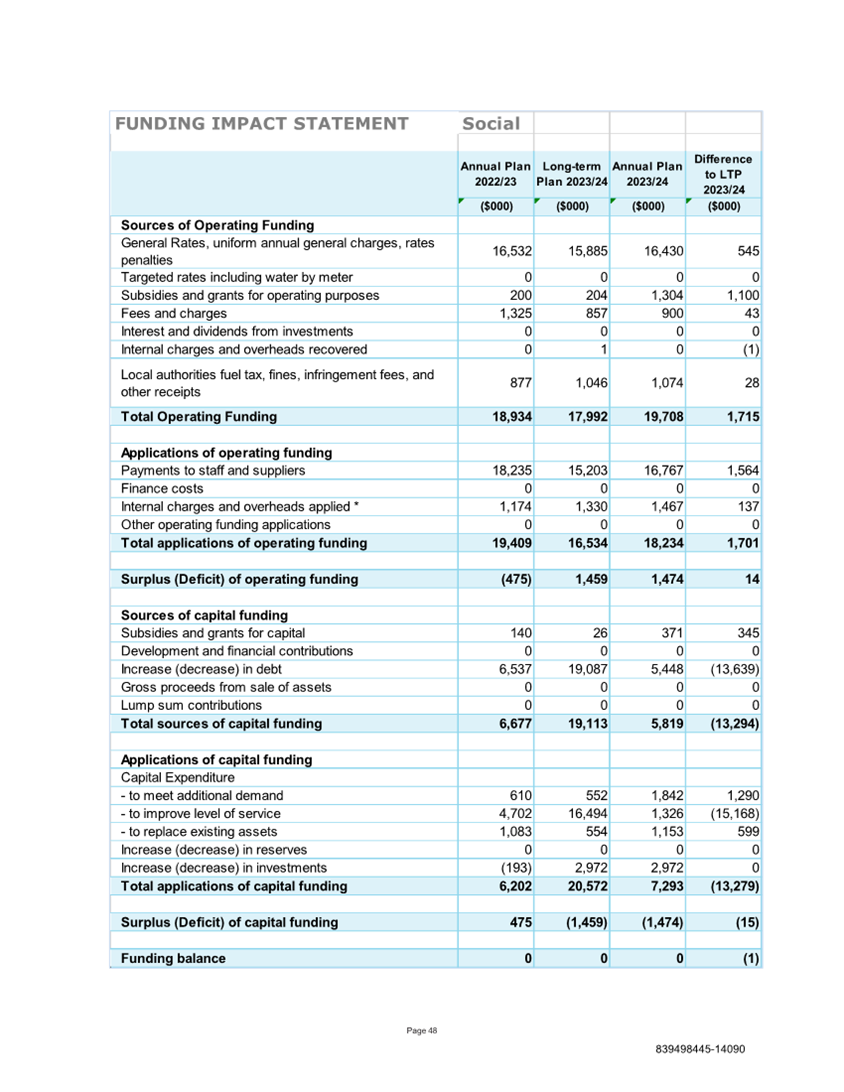

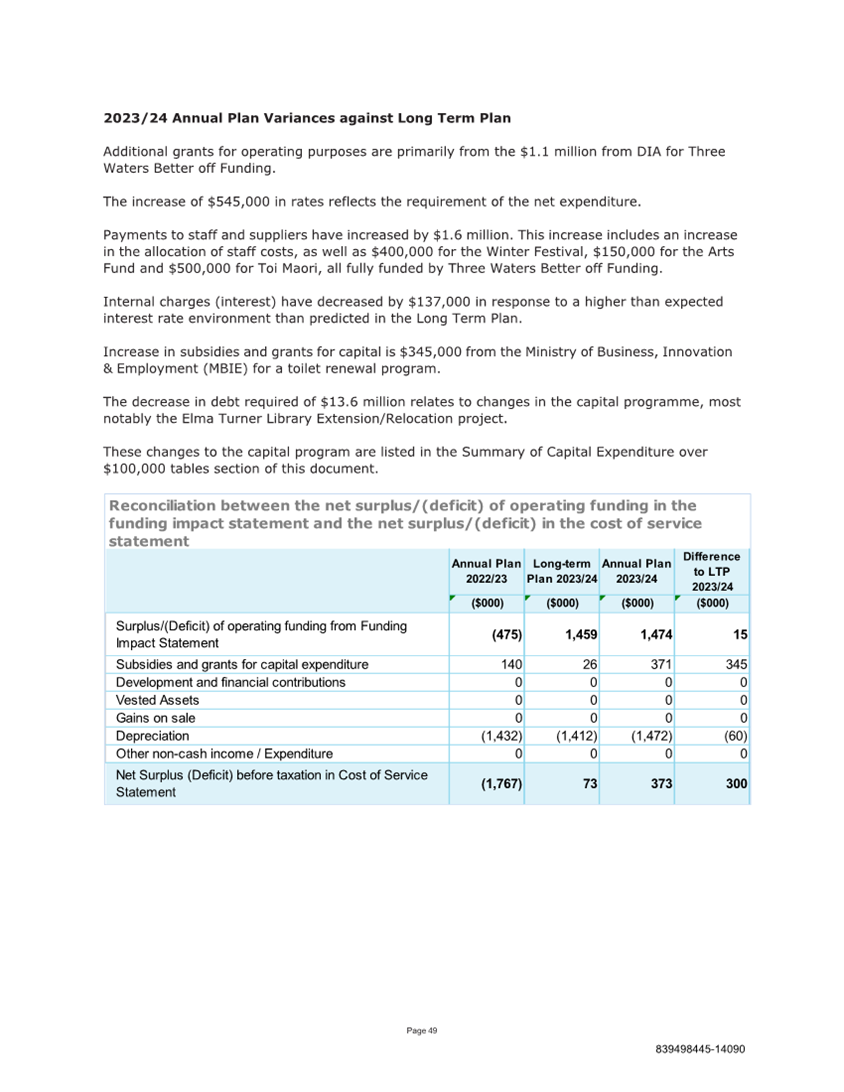

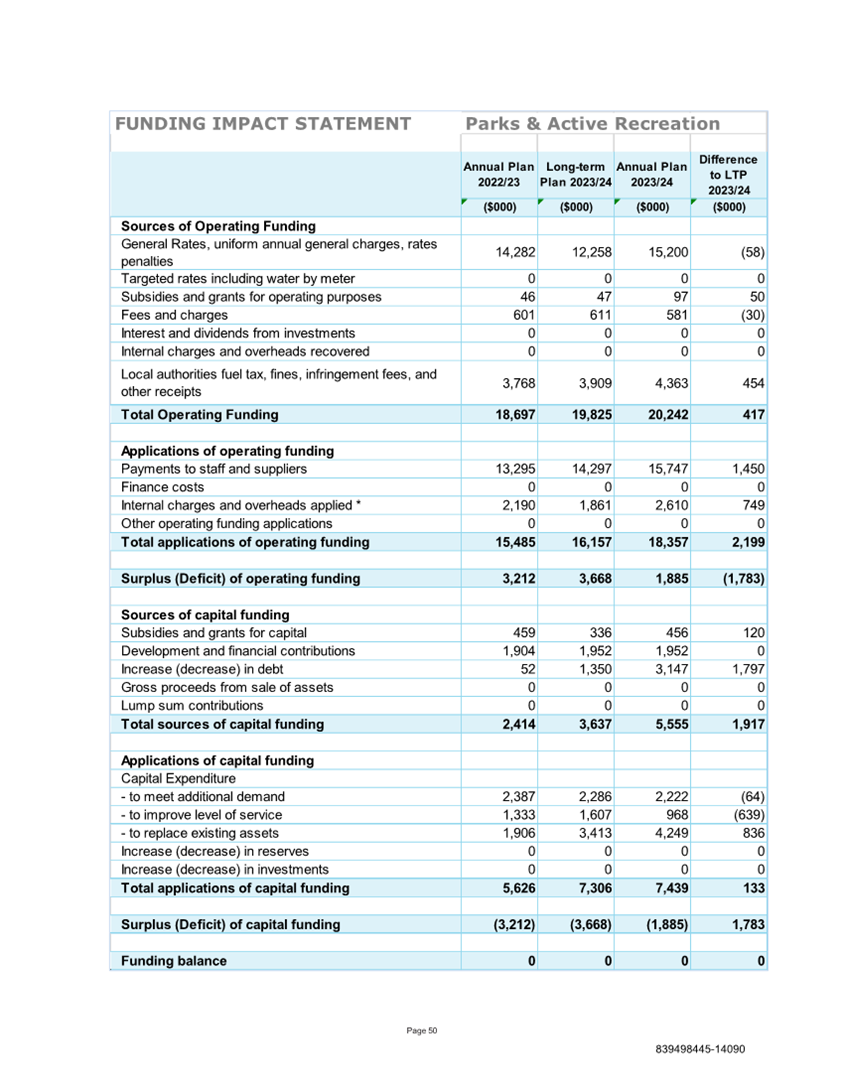

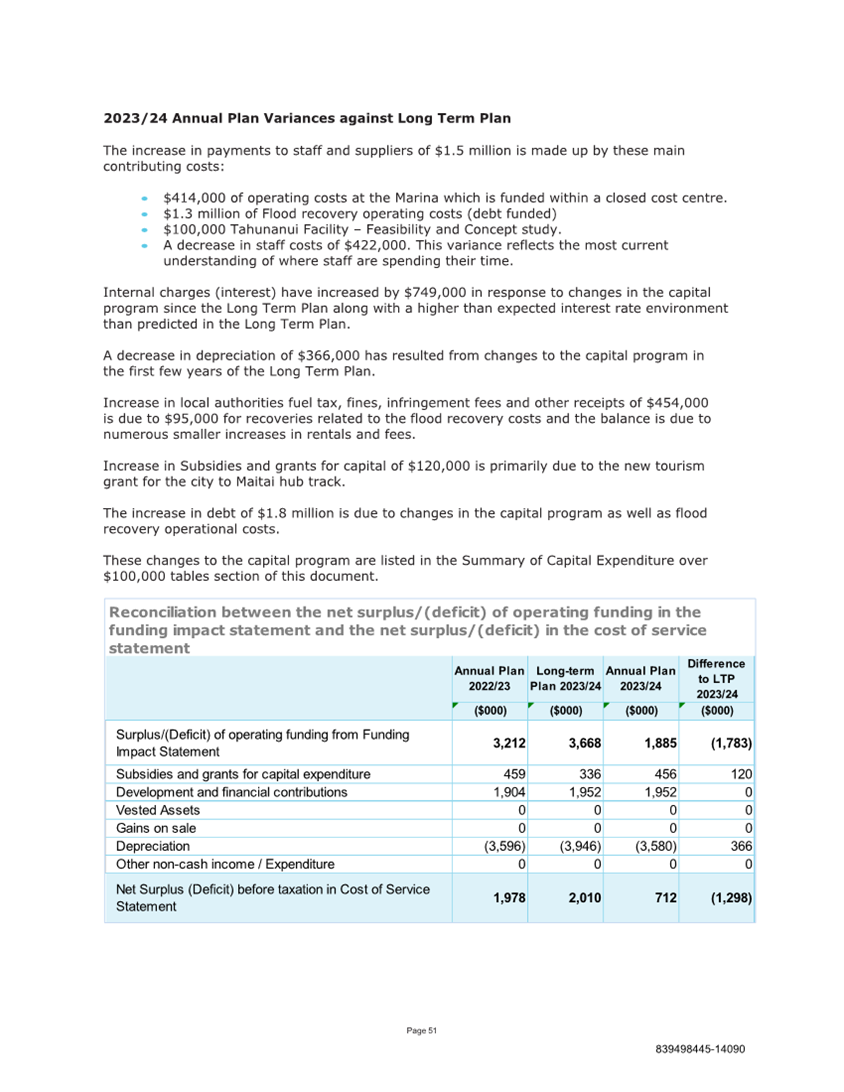

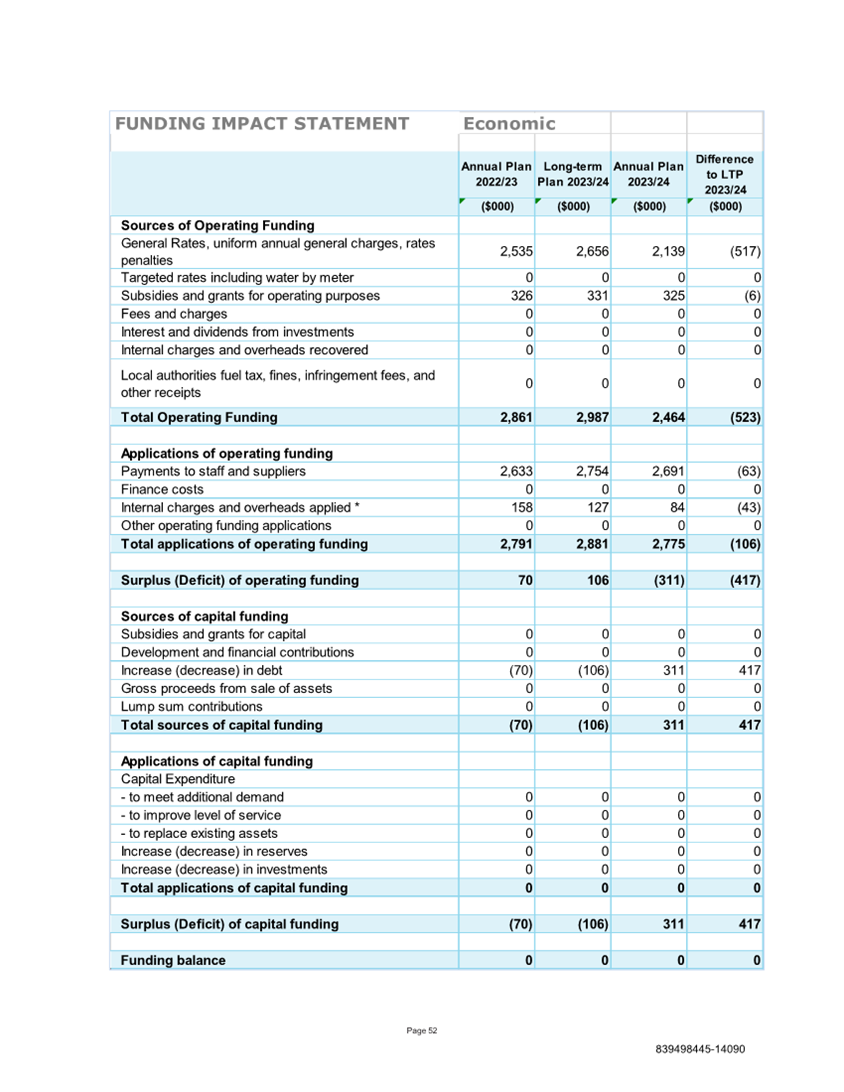

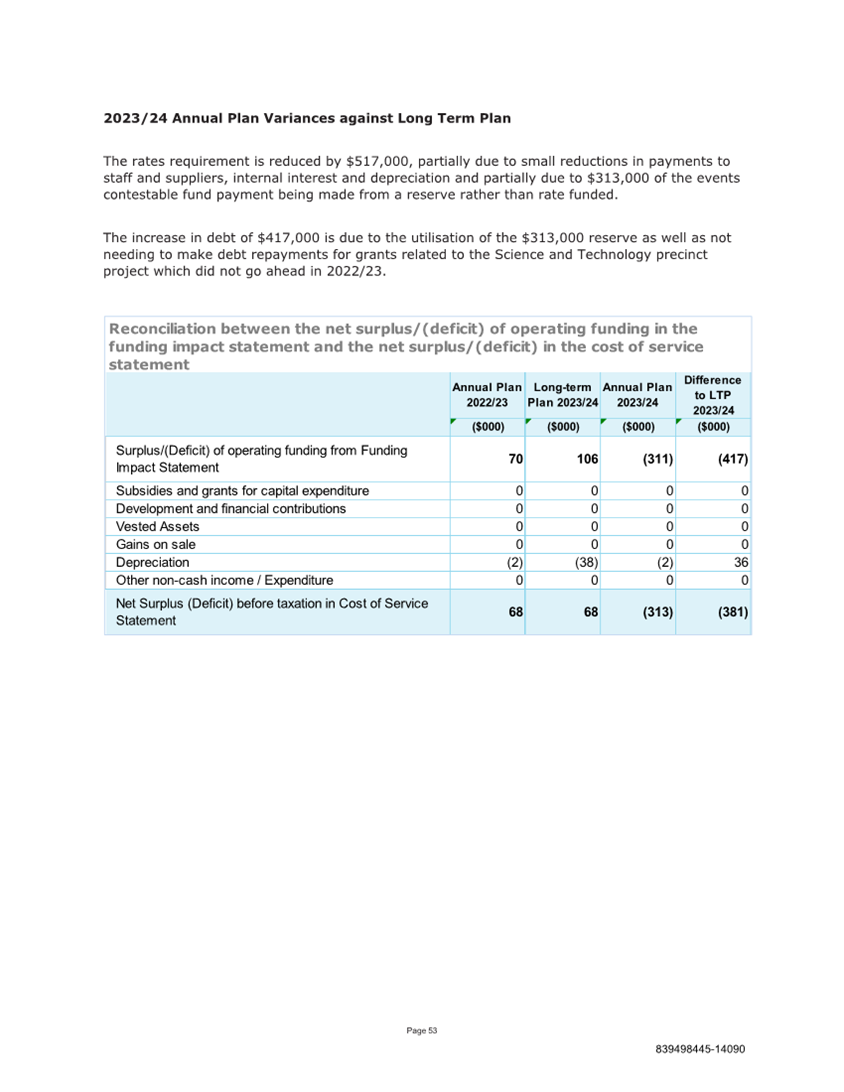

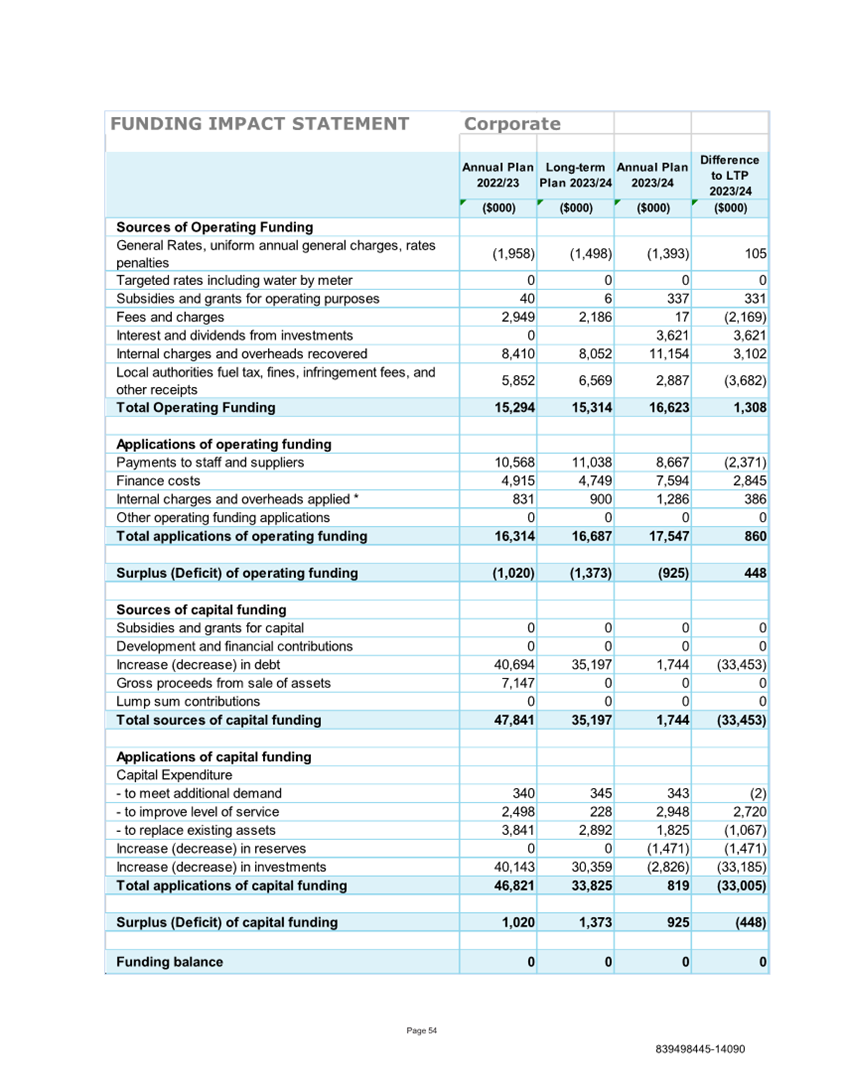

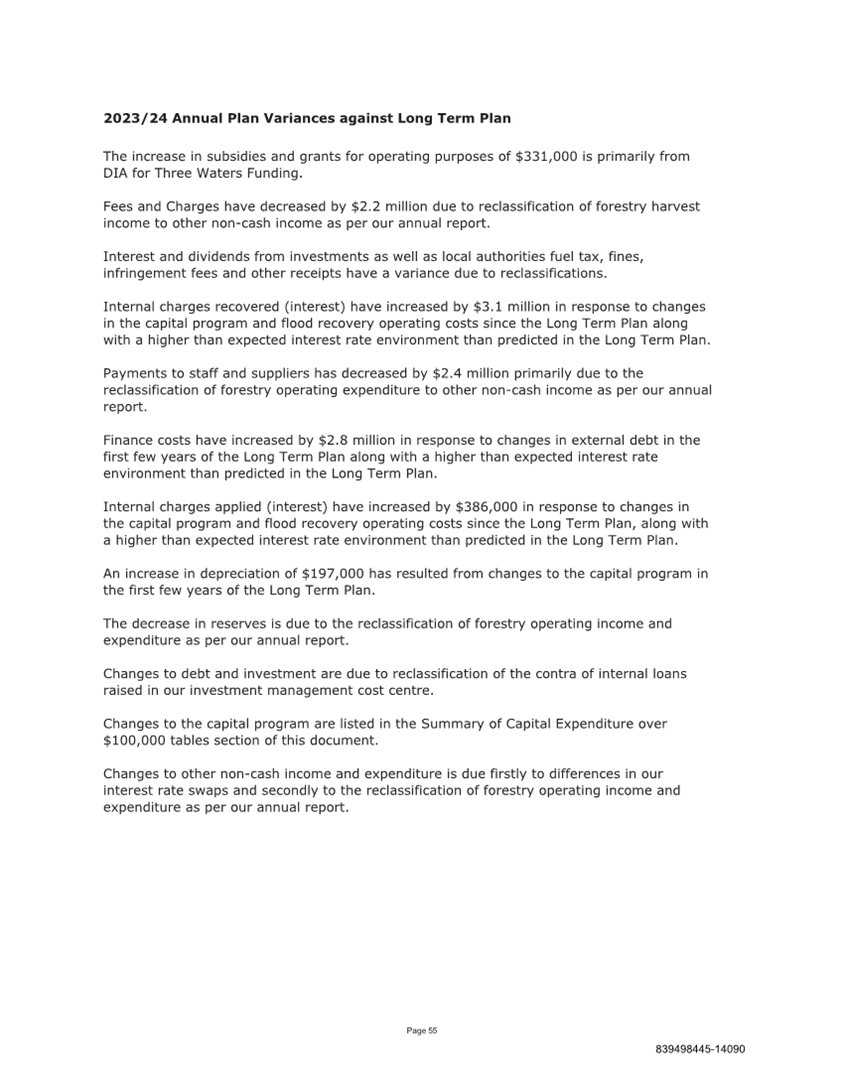

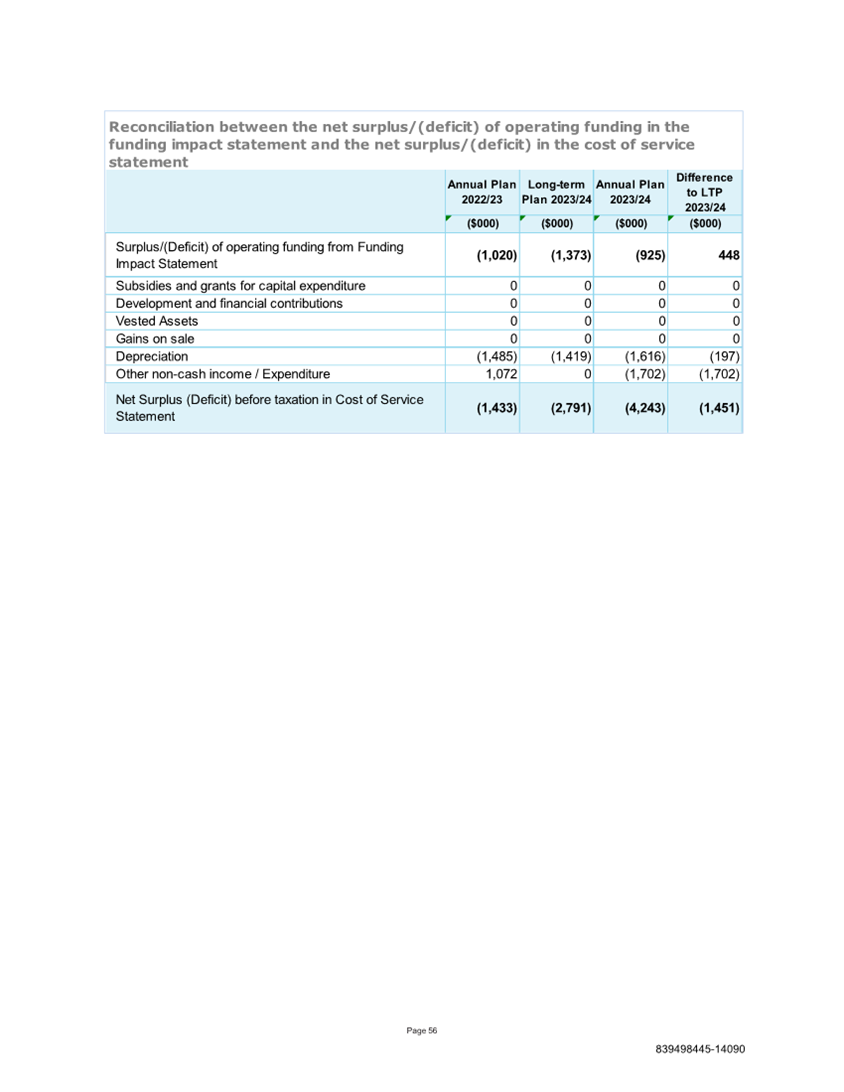

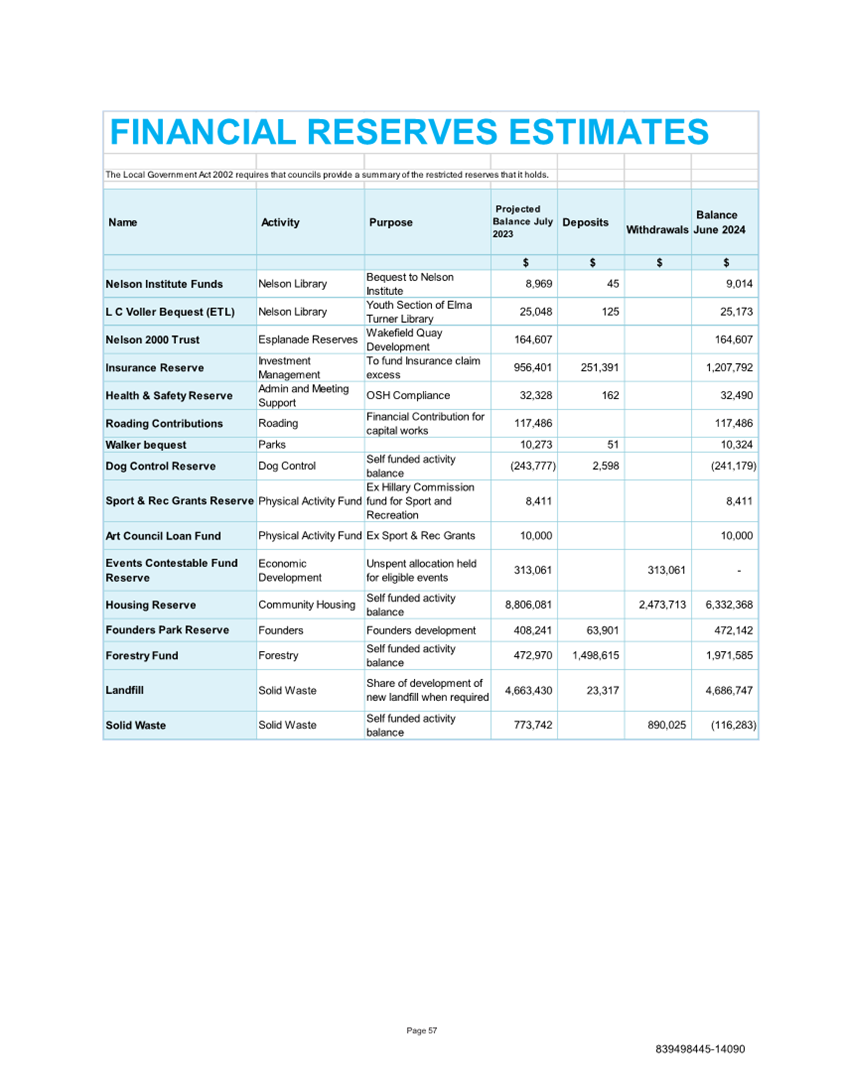

5.6 Under section

95A(4) LGA2002, Council must adopt the supporting information that is relied on

for the content of the consultation document, before it adopts the consultation

document itself. This information must also be made available to the

public as part of the consultation process and includes detailed financial

forecasts, changes to the capital expenditure programme, and the proposed

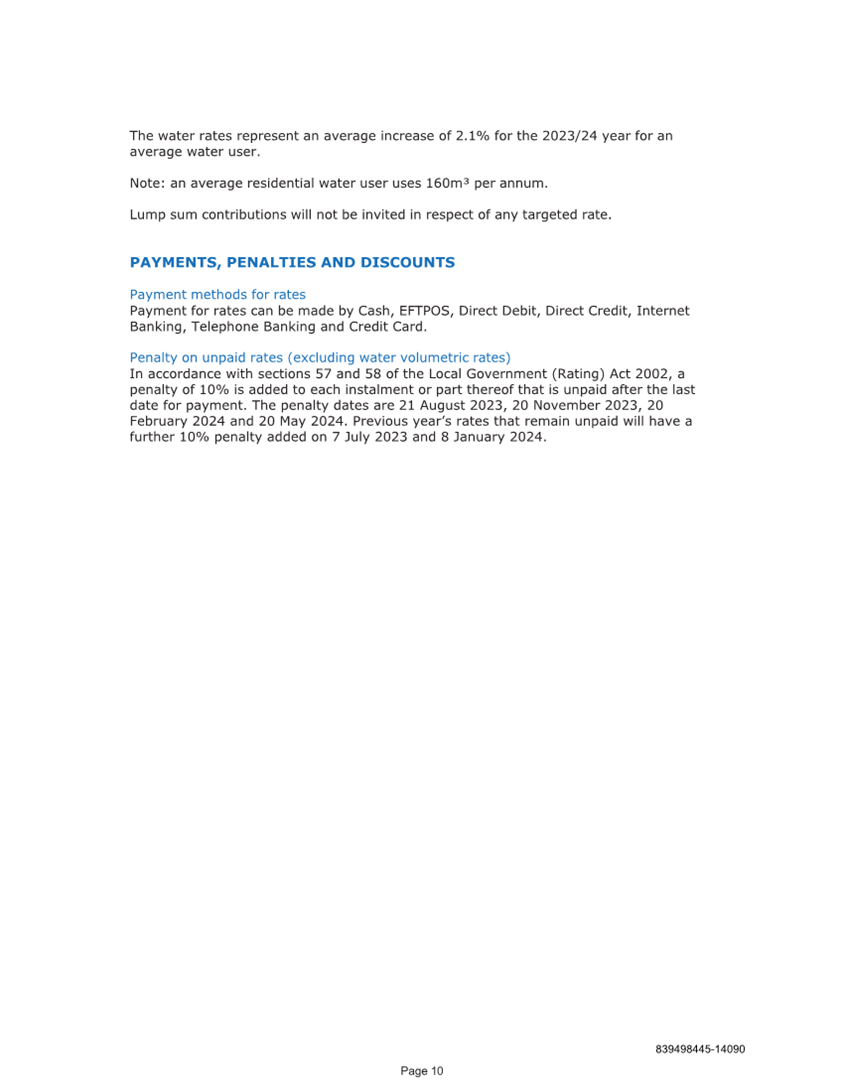

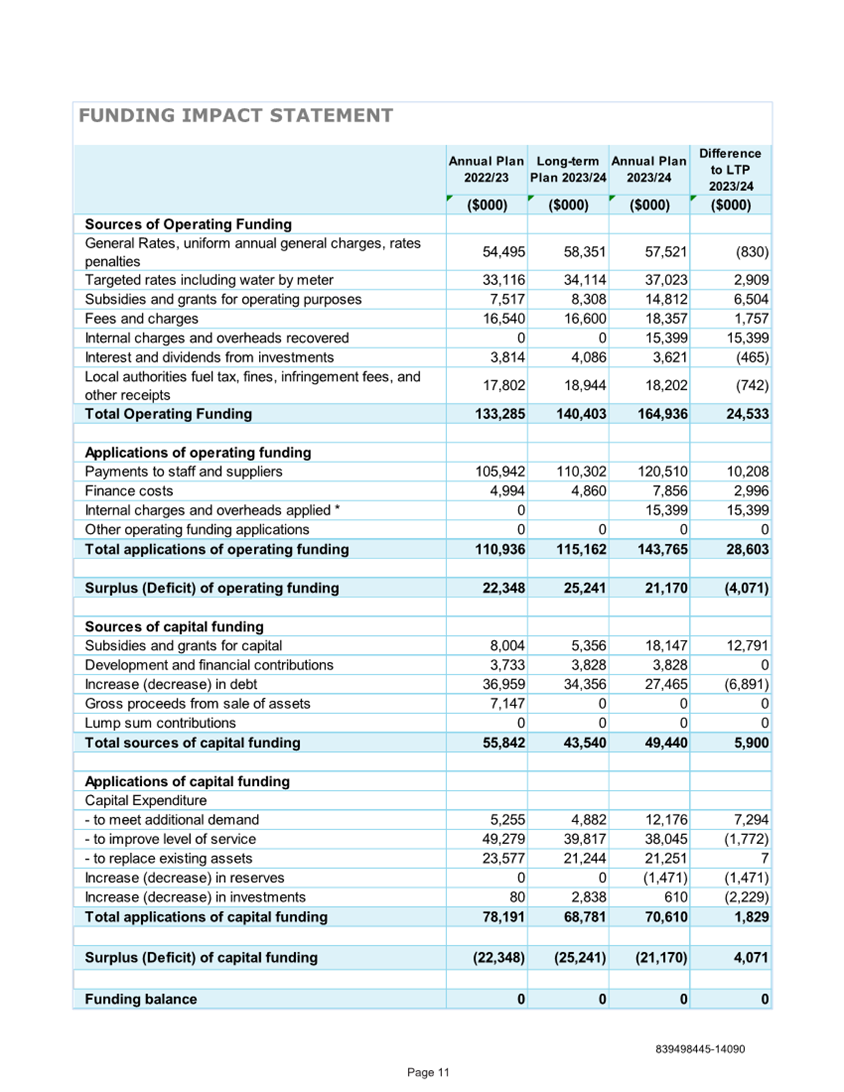

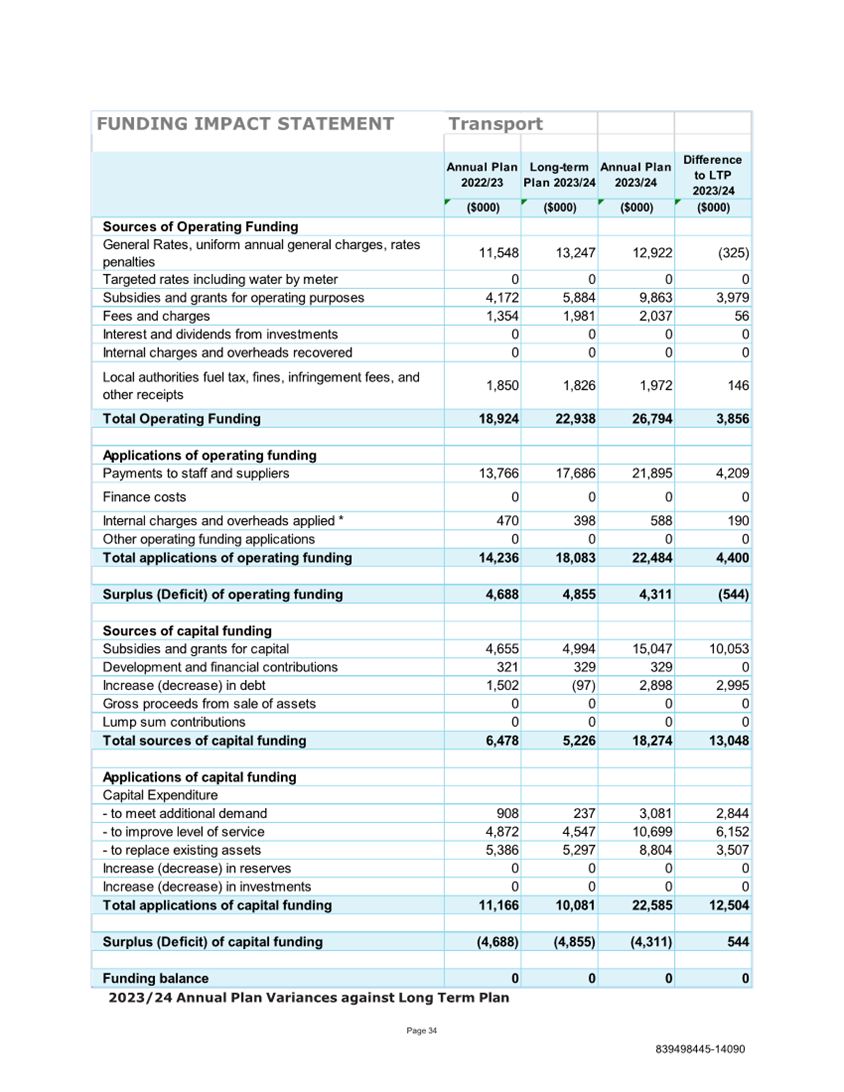

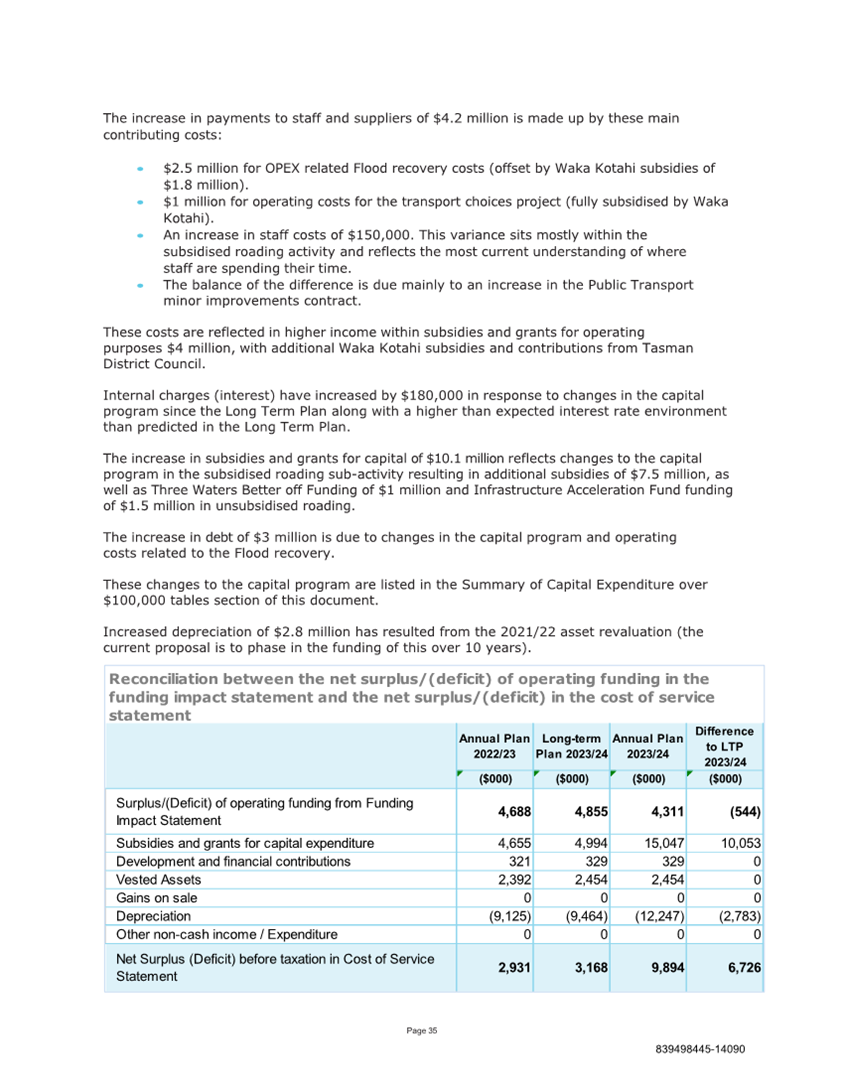

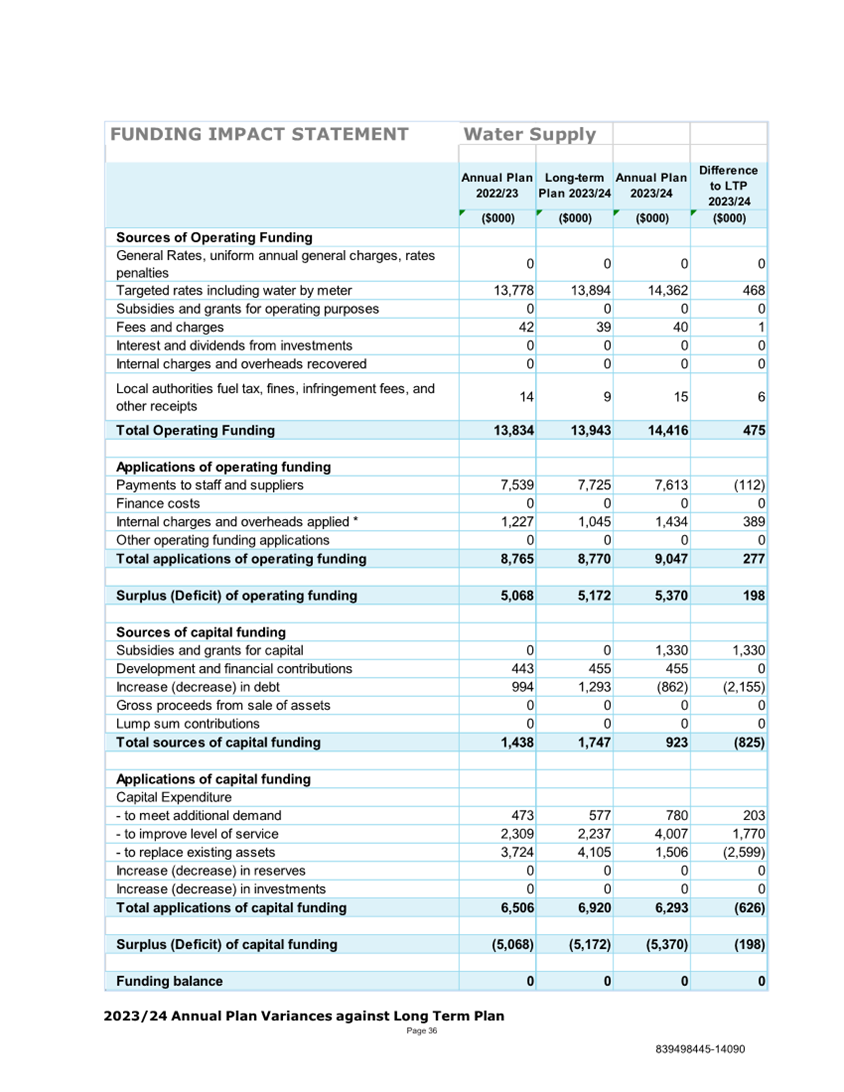

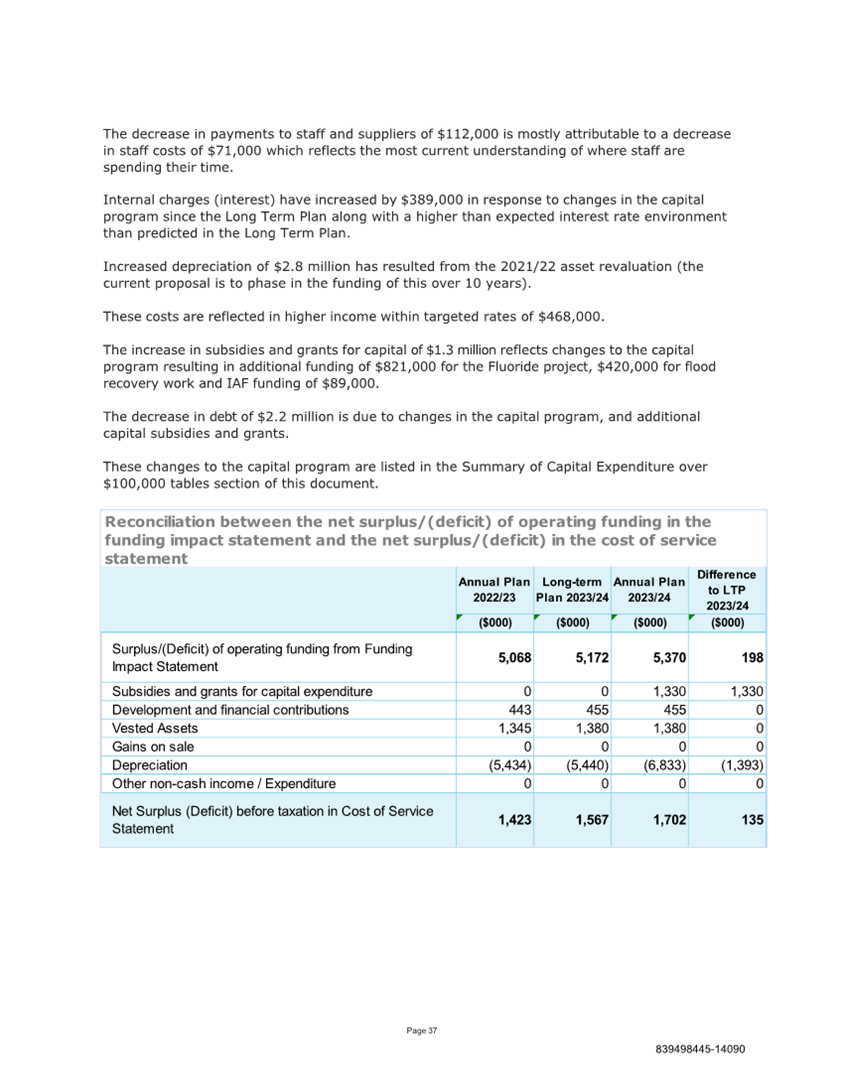

Funding Impact Statement (Attachment 2).

Consequences of the rates approach

5.7 A

key focus for Council in considering its approach to rates setting for the

2023/24 year has been affordability. Aware of the cost of living pressures

households and businesses are facing, Council has tried to minimise the

increase in rates. While rates are not a major factor driving the increasing

costs the community is experiencing, Council did not wish to add to

inflationary pressures with a rates rise above the rate of inflation.

5.8 Some

of the impacts of this approach will be an increase in debt (from not fully

funding depreciation) and a reduction in service in a range of areas. It is

unlikely to be possible to restore all reduced services in year 1 of the Long

Term Plan 2024–34 because of the significant rates increase that would

generate, so a phased approach or some permanent changes are likely to be

necessary. Likewise, phasing in funding of depreciation will have a cumulative

impact over the first few years of the Long Term Plan. The overall impact is

likely to require a rethinking of Council’s Financial Strategy as the

Long Term Plan is developed.

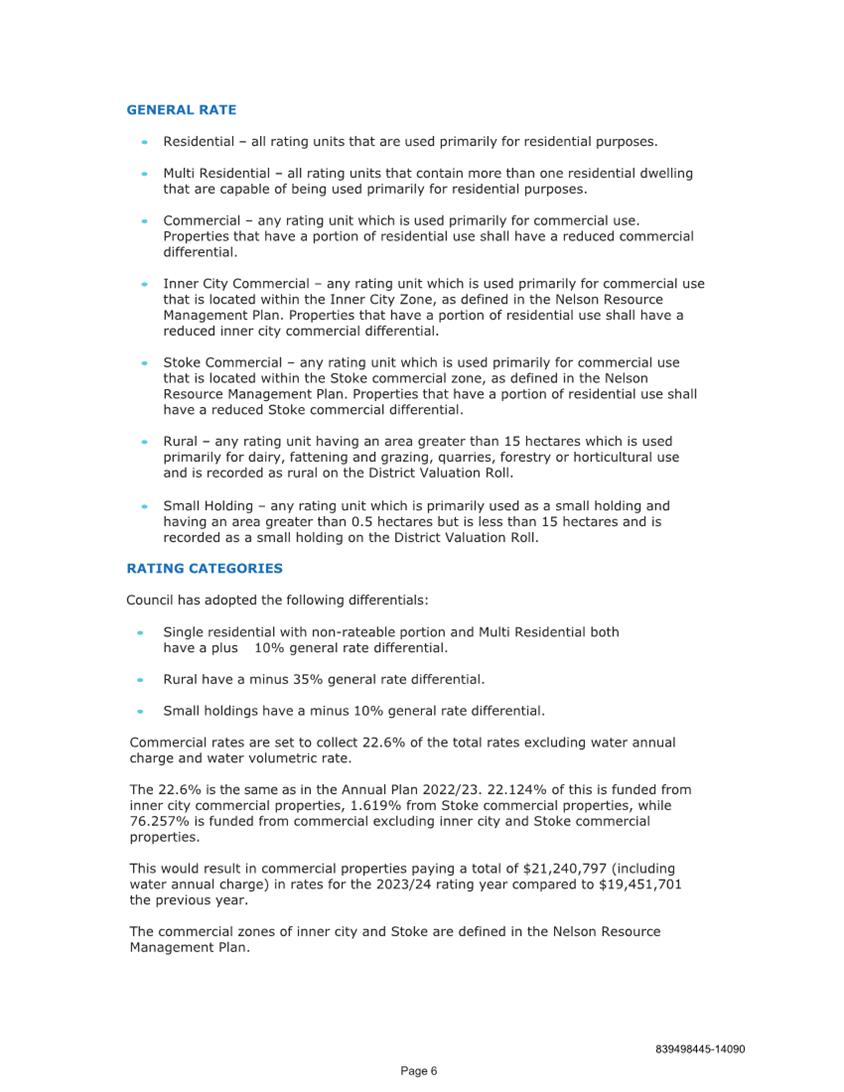

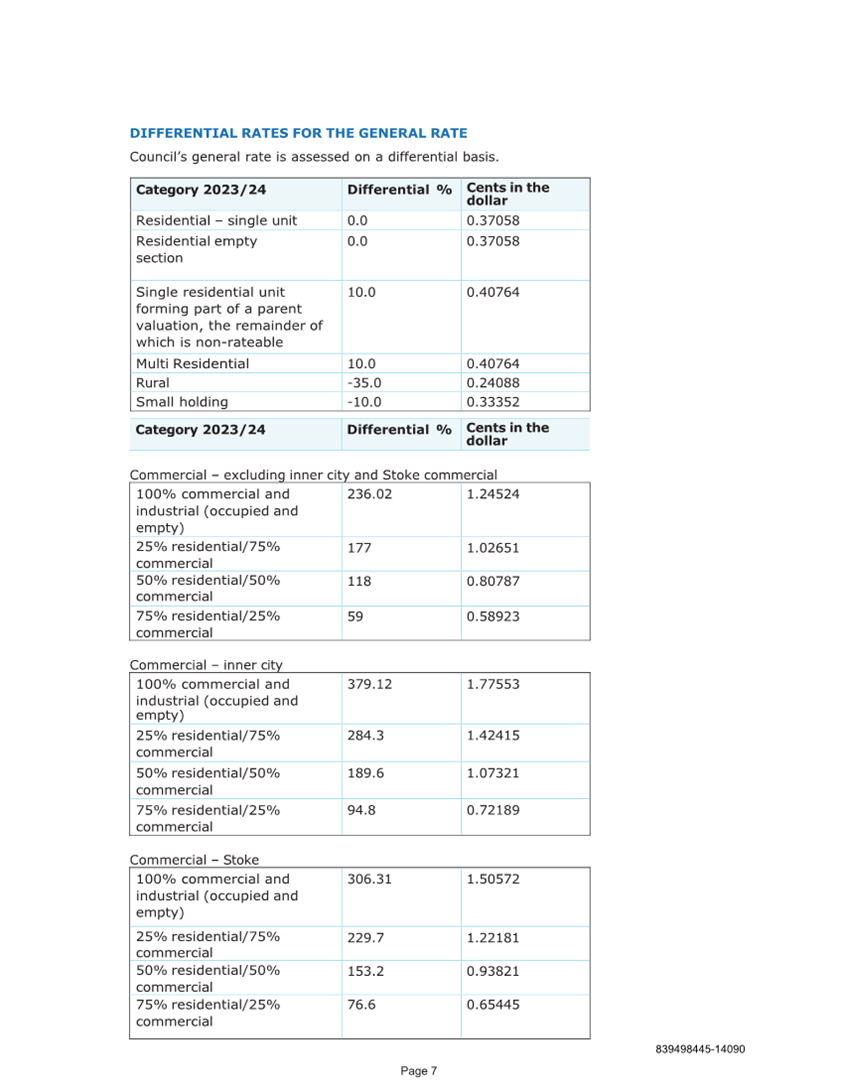

Commercial differential

5.9 The

commercial differential recognises the additional services that businesses

receive, such as extra rubbish collection, street sweeping and events to

attract visitors. The percentage collected has been decreased by 0.5% per annum

for the last five years to reduce the burden on the commercial sector. The Long

Term Plan outlined that Council would continue to reduce the proportion of

rates collected from commercial properties by 0.5% per year for the first three

years, reviewed annually during the annual plan process.

5.10 Council

has assessed the relative rating contributions to find a suitable balance

between commercial and residential properties in the context of the cost of

living increases and impact on residential ratepayers. Following this

review, the commercial differential for 2023/24 is proposed to be retained at

the same level as 2022/23. This would result in 22.6% of total rates

being collected from commercial rates.

5.11 Council

can consider an appropriate level for the commercial differential again in

future years through the Long Term Plan 2024–34.

Consultation process

5.12 The

proposed consultation process involves:

· Preparation

and adoption of a consultation document and supporting information.

· A

submission period of 29 March to 30 April for the public to make submissions.

· Hearings

to enable submitters to present their submissions to Council

· Deliberations

and decisions on the matters raised in submissions, followed by adopting the

final Annual Plan 2023/24.

5.13 Adoption

of the final Annual Plan and setting the rates is planned to occur on 22 June

2023.

5.14 The

following are the key methods proposed to raise public awareness of the

consultation process:

· Promote

the opportunity to submit on the Consultation Document in Our Nelson, which is

delivered to households in Nelson.

· Advertise

in local media.

· Make

available hard copies of the Consultation Document at Council’s Customer

Service Centre and libraries;

· Make

available the Consultation Document and supporting information on the Council

website.

· Provide

opportunities for the public to discuss the Consultation Document with elected

members, for example a stall at the Saturday Market.

· Make

available copies of the Consultation Document for elected members to take to

any community meetings that they attend during the consultation period

· Publicise

the Consultation Document and opportunity to submit on social media, by media

release and Antenno posts.

5.15 These methods may be

amended as the consultation process progresses. Staff also expect there will be

local media coverage on the key topics and changes outlined in the Consultation

Document.

5.16 The consultation process

above is proportionate to the significance of the matters raised and is in

accordance with sections 95A, 82 and 82A of the LGA2002.

Inconsistencies with the

Long Term Plan and Financial Strategy

5.17 If

Council makes a decision which is significantly inconsistent with, or could

have consequences that will be significantly inconsistent with, any Council

policy or plan, section 80 of the LGA2002 requires that when making the

decision Council clearly identifies:

a) The

inconsistency

b) The

reasons for the inconsistency

c) Any

intention of the local authority to amend the policy or plan to accommodate the

decision.

5.18 The proposals in the Annual Plan 2023/24 Consultation

Document are inconsistent with the work programme, rates increases and debt

levels in the Long Term Plan and the Financial Strategy. The

reasons for the Consultation Document proposals being inconsistent with those

documents are principally the costs of recovery from the August 2022 severe

weather event, inflationary pressures, rising interest costs, bringing forward

funding for projects to take advantage of available Government financial

support, and decisions to respond to the changing needs of the Nelson

community. In February 2023, Council decided not to undertake an amendment

to the Long Term Plan 2021–31 to accommodate these changes. A new Long

Term Plan and Financial Strategy will be prepared and consulted on during the

2023/24 financial year.

5.19 The

resolutions contained in this report meet the requirements of section 80 of the

LGA2002.

Unbalanced budget

5.20 Section 100 of the LGA2002

requires that local authorities must ensure that each year’s projected

operating revenues are set at a level sufficient to meet that year’s

projected operating expenses. However, the Act also provides that a local

authority may set revenues at a different level if it resolves that it is

financially prudent to do so, having regard to:

a) the

estimated expenses of achieving and maintaining the predicted levels of service

provision set out in the long-term plan, including the estimated expenses

associated with maintaining the service capacity and integrity of assets

throughout their useful life; and

b) the

projected revenue available to fund the estimated expenses associated with

maintaining the service capacity and integrity of assets throughout their

useful life; and

c) the

equitable allocation of responsibility for funding the provision and

maintenance of assets and facilities throughout their useful life; and

d) the

funding and financial policies adopted under LGA (2002) section 102.

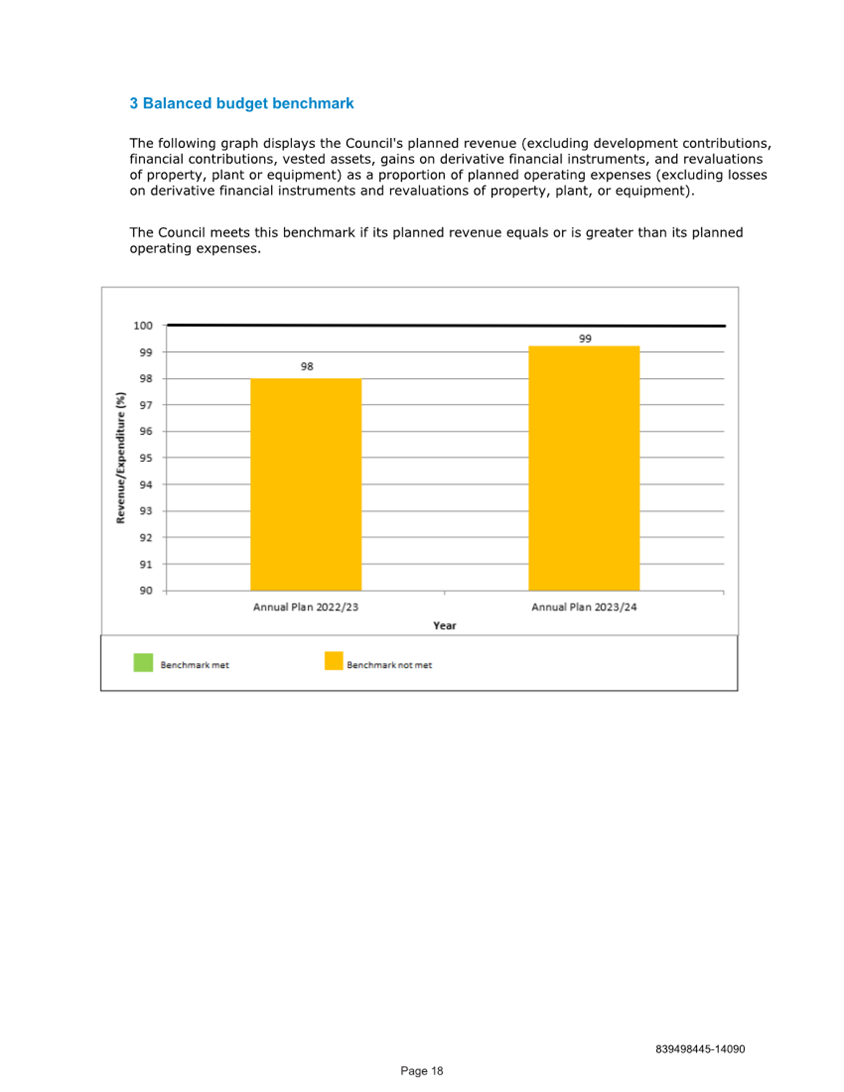

5.21 The balanced budget

benchmark is normally at least 100%, i.e., that revenue for the year (excluding

development contributions, financial contributions, vested assets, gains on

derivative financial instruments, and revaluations of property, plant, or

equipment) exceeds operating expenses (excluding losses on derivative financial

instruments and revaluations of property, plant, or equipment).

5.22 In relation to 2023/24

Council confirmed an unbalanced budget was prudent at the adoption of the Long

Term Plan 2021–31 on 24 June 2021:

Resolved CL/2021/115

3. Confirms that setting an unbalanced budget in

2021/22, 2022/23 and 2023/24 of the Long Term Plan 2021–2031 is prudent

in terms of section 100 of the Local Government Act 2002, given the ongoing

effects of the COVID-19 pandemic on the local economy and ratepayers, and

having had regard to the matters in section 100(2) of the Local Government Act

2002;

5.23 Since that time Council has

had to manage the additional impact upon budgets of the August 2022 severe

weather event and the sharp rise in inflation and interest costs. These

budgetary pressures have added to the reasons why Council considers it is

prudent to set an unbalanced budget.

5.24 Council does not meet the

balanced budget benchmark for 2023/24, with a planned level of 99%. This is

consistent with year three of the Long Term Plan 2021–31

Financial Strategy, where it was acknowledged that COVID-19 has had a

significant impact on Council’s finances. It was resolved to have an

unbalanced budget (projected operating expenditure exceeding projected

operating income) for years one, two and three of the Long Term Plan, to

maintain services and integrity of assets. This shortfall will be funded using

Council’s balance sheet (debt).

Schedule of fees and charges

5.25 On 9 February 2023 Council

resolved to consult on a statement of proposal for a proposed schedule of fees

and charges for 2023/24 (report R27414).

5.26 For

ease of public participation, it is proposed to carry out this consultation

alongside the consultation on the Annual Plan 2023/24 Consultation Document.

6. Options

|

|

|

Advantages

|

· Meets

the requirements of the LGA2002.

· Provides

the community with the opportunity to provide feedback to Council on what is

proposed.

· Allows

Council to consider feedback and make changes to work programmes and budgets

before the final Annual Plan is adopted by Council.

· The

statutory deadline of adopting the final Annual Plan prior to 30 June 2023

should be met.

|

|

Risks and Disadvantages

|

· Council

would not have an opportunity to make major changes to the documents, if it

considers they are needed prior to public consultation.

|

|

|

|

Advantages

|

· If

Council considers that the Consultation Document does not meet its needs or

the needs of the community, Council can request staff to make further changes

before releasing it for public consultation.

|

|

Risks and Disadvantages

|

· Financial

changes are likely to have an impact on the rates increase and level of debt.

· A

revised consultation document and supporting information would need to be

developed and adopted by Council, which would delay the consultation process.

· Increased

risk that the final Annual Plan is not adopted by 30 June 2023, as required

under the LGA2002. This would mean that Council

would not be able to strike its rates for the 2023/24 financial year by 30

June 2023.

|

7. Conclusion

7.1 The Consultation Document sets out the key changes Council

is proposing for the 2023/24 financial year and provides a good basis for

public consultation. Staff recommend that the Consultation Document and

supporting information be adopted and approved for public consultation.

8. Next Steps

8.1 Council will undertake the consultation process as outlined

in paragraphs 5.12 to 5.14. Staff will then prepare a final Annual Plan

2023/24 for Council’s adoption before 30 June 2023.

Authors: Nicky McDonald, Group

Manager Strategy and Communications Nikki

Harrison, Group Manager Corporate Services

Attachments

Attachment 1: 839498445-13646

Annual Plan 2023/24 Consultation Document (Circulated separately)

Attachment 2: 839498445-14090

Supporting information ⇩