Notice of the Ordinary meeting of

Audit, Risk and Finance Committee

Te Kōmiti Kaute / Tūraru / Pūtea

|

Date: Friday

24 February 2023

Time: 9.00a.m.

Location: Council

Chamber

Civic House

110 Trafalgar Street, Nelson

|

Agenda

Rārangi take

Chairperson Catherine

Taylor

Members His

Worship the Mayor Nick Smith

Deputy

Mayor Rohan O'Neill-Stevens

Cr

Mel Courtney

Cr

Rachel Sanson

Shanell

Kelly

Quorum 3 Lindsay

McKenzie

Interim Chief Executive

Nelson City Council Disclaimer

Please note that the contents of these

Council and Committee agendas have yet to be considered by Council and officer

recommendations may be altered or changed by the Council in the process of

making the formal Council decision. For enquiries call (03) 5460436.

Audit, Risk and Finance

Committee

This is a Committee of Council

Areas of Responsibility

·

Any matters raised by Audit New Zealand or the Office of the

Auditor-General

·

Audit processes and management of financial risk

·

Chairperson’s input into financial aspects of draft

Statements of Expectation and draft Statements of Intent for Nelson City

Council Controlled Organisations, Council Controlled Trading Organisations and

Council Organisations

·

Council’s Annual Report

·

Council’s financial performance

·

Council’s Treasury policies

·

Health and Safety

·

Internal audit

·

Monitoring organisational risks, including debtors and legal

proceedings

·

Procurement Policy

Powers to

Decide

·

Appointment of a deputy Chair

Powers to

Recommend to Council

·

Adoption of Council’s Annual Report

·

To write off outstanding accounts receivable or remit fees and

charges of amounts over the Chief Executive’s delegated authority.

·

All other matters within the areas of responsibility or any other

matters referred to it by the Council

For the Terms of Reference for the Audit, Risk and Finance Committee

please refer to document NDOCS-1974015928-887.

Audit, Risk and Finance

Subcommittee Minutes - 13 September 2022

Audit, Risk and

Finance Committee

24

February 2023

Page

No.

Karakia

and Mihi Timatanga

1. Apologies

Nil

2. Confirmation

of Order of Business

3. Interests

3.1 Updates

to the Interests Register

3.2 Identify

any conflicts of interest in the agenda

4. Public

Forum

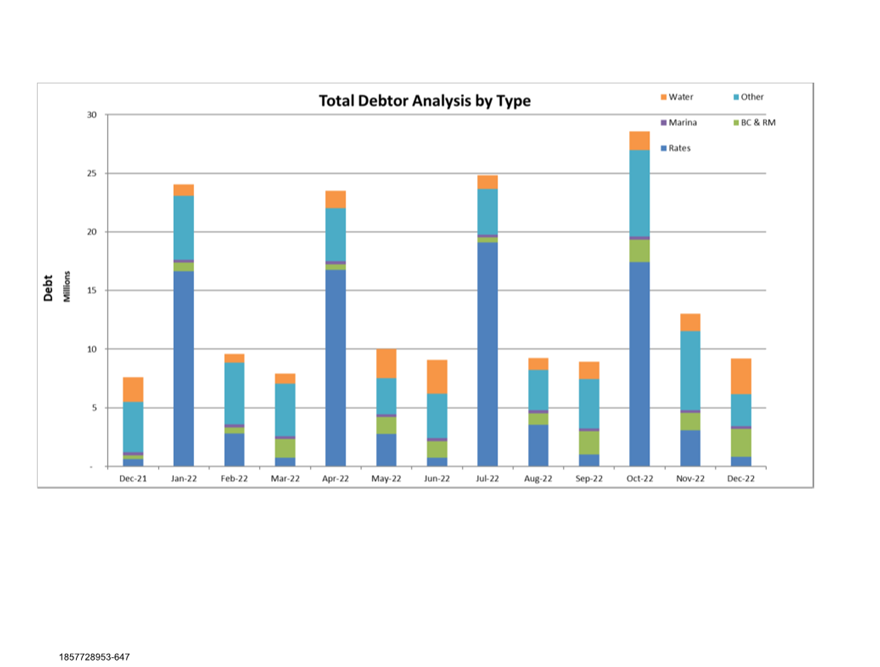

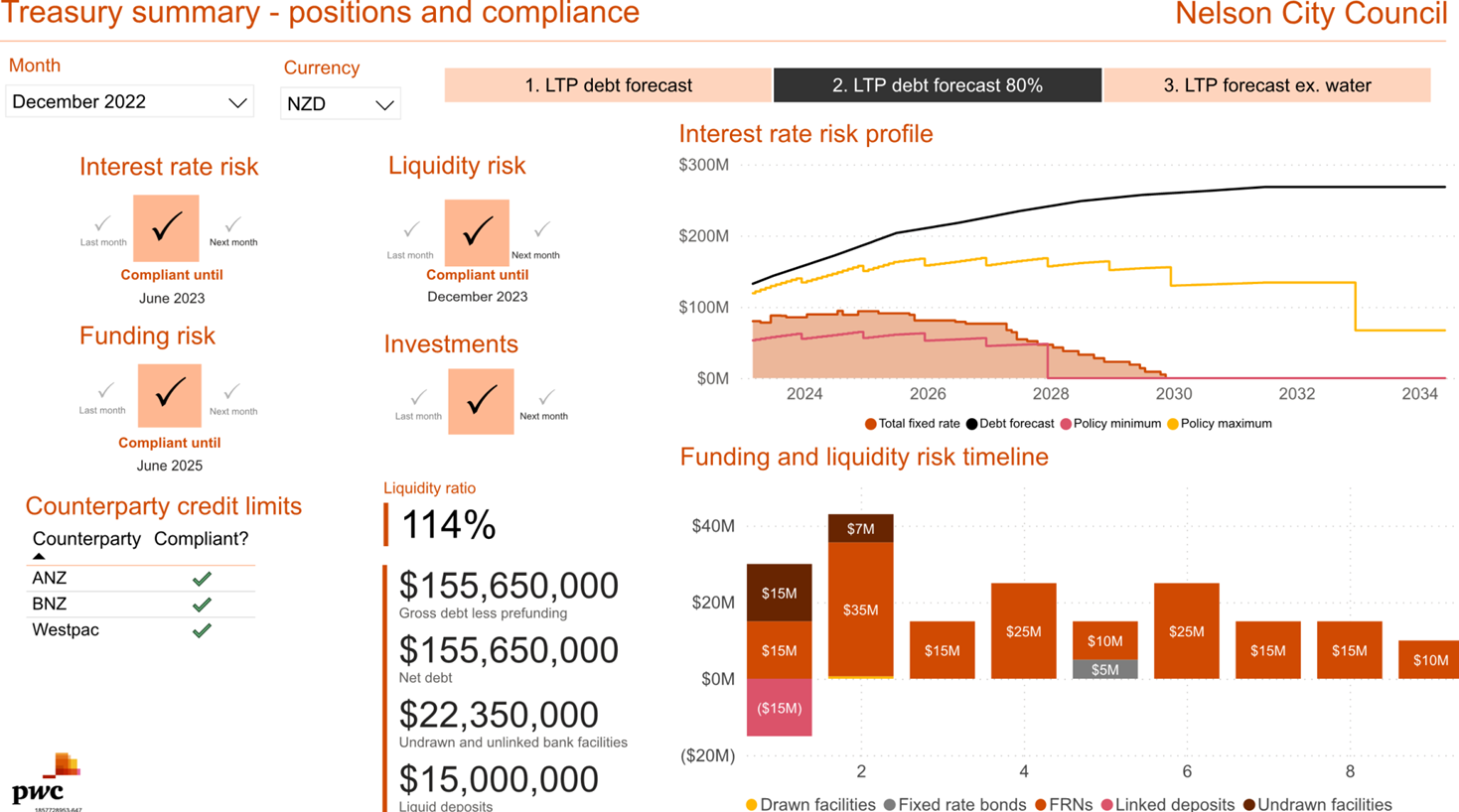

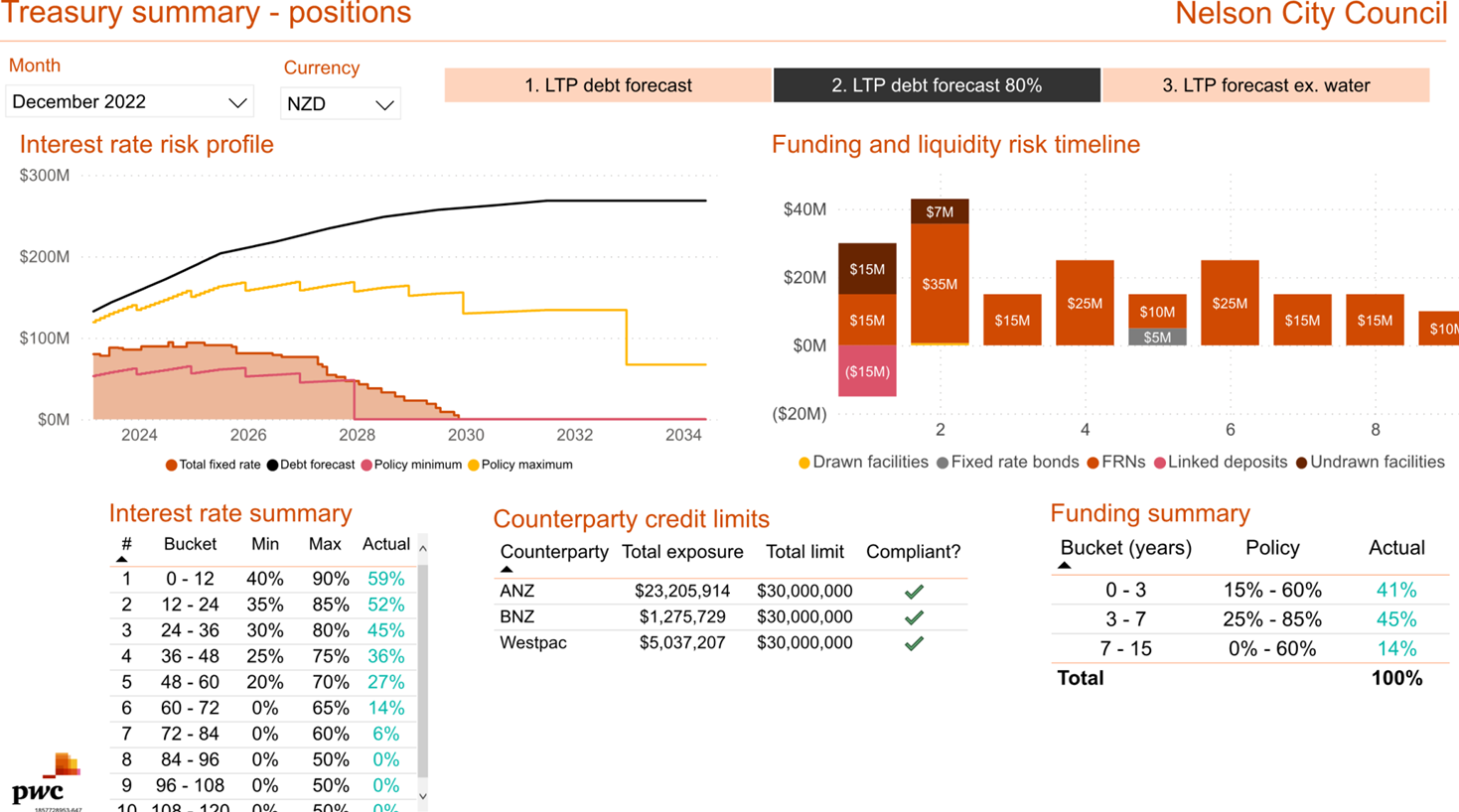

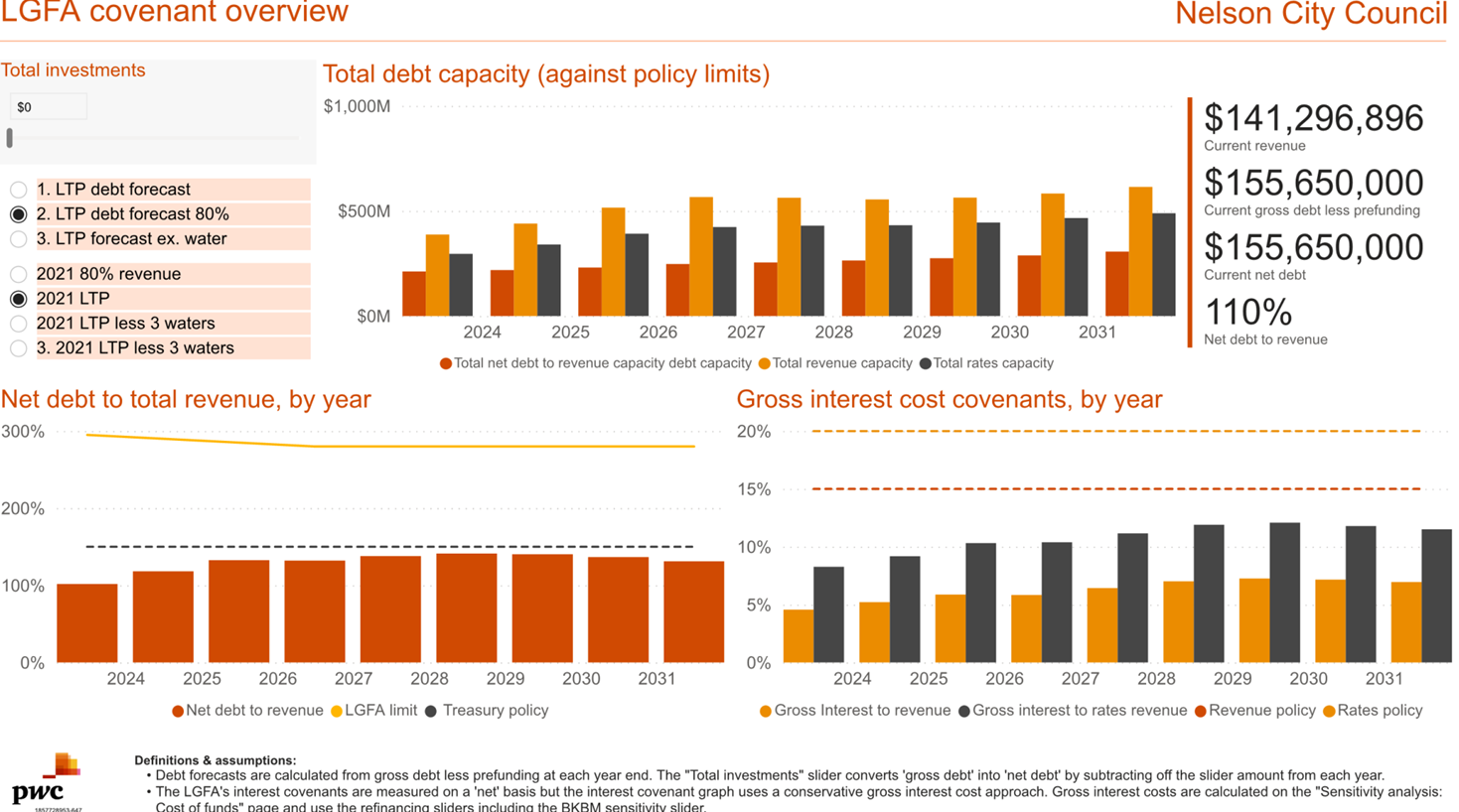

5. Quarterly Finance

Report to 31 December 2022 7 - 35

Document number R27419

Recommendation

|

That

the Audit, Risk and Finance Committee

1. Receives

the report Quarterly Finance Report to 31 December 2022 (R27419) and its attachments

(1857728953-647, 839498445-13756 and 839498445-13835).

|

6. Quarterly Internal

Audit Report - 31 December 2022 36 - 40

Document number R27420

Recommendation

|

That

the Audit, Risk and Finance Committee

1. Receives

the report Quarterly Internal Audit Report - 31 December 2022 (R27420) and its attachment

(1194974384-3349).

|

7. Quarterly Risk

Report - 31 December 2022 41 - 44

Document number R27421

Recommendation

|

That

the Audit, Risk and Finance Committee

1. Receives

the report Quarterly Risk Report - 31 December 2022 (R27421).

|

8. Health, Safety and

Wellbeing Report to 31 December 2022 45 - 62

Document number R27426

Recommendation

|

That

the Audit, Risk and Finance Committee

1. Receives

the report Health, Safety and Wellbeing Report to 31 December 2022 (R27426) and its attachment

(855153265-3563).

|

9. Letter from Audit NZ

on Annual Report for year ending 30 June 2022 63 - 103

Document number R27491

Recommendation

|

That

the Audit, Risk and Finance Committee

1. Receives

the report Letter from Audit NZ on Annual Report for year ending 30 June 2022

(R27491) and its attachment

(2126778665-296); and

2. Notes Audit NZ’s comments and how officers intend to

address the issues raised (2126778665-296).

|

Confidential Business

10. Exclusion

of the Public

Recommendation

That the Audit,

Risk and Finance Committee

1.

Excludes the

public from the following parts of the proceedings of this meeting.

2.

The general subject of each matter to be

considered while the public is excluded, the reason for passing this resolution

in relation to each matter and the specific grounds under section 48(1) of the

Local Government Official Information and Meetings Act 1987 for the passing of

this resolution are as follows:

|

Item

|

General subject of each matter to be

considered

|

Reason for passing this resolution in

relation to each matter

|

Particular interests protected (where

applicable)

|

|

1

|

Quarterly

Report on Legal Proceedings

|

Section

48(1)(a)

The public conduct of this

matter would be likely to result in disclosure of information for which good

reason exists under section 7

|

The withholding of the information is necessary:

· Section 7(2)(g)

To maintain legal

professional privilege

|

|

2

|

Quarterly Update on Debts - 31 December 2022

|

Section 48(1)(a)

The public

conduct of this matter would be likely to result in disclosure of information

for which good reason exists under section 7

|

The withholding of the information is necessary:

· Section

7(2)(a)

To protect the

privacy of natural persons, including that of a deceased person

· Section

7(2)(g)

To maintain

legal professional privilege

|

Karakia

Whakamutanga

Item 6: Quarterly

Finance Report to 31 December 2022

|

|

Audit, Risk and Finance Committee

24 February 2023

|

REPORT R27419

Quarterly

Finance Report to 31 December 2022

1. Purpose of Report

1.1 To

inform the Committee of the financial results for Council for the first six

months of 2022/23, and to highlight any material variations.

2. Recommendation

|

That the Audit, Risk and Finance Committee

1. Receives

the report Quarterly Finance Report to 31 December 2022 (R27419) and its attachments (1857728953-647,

839498445-13756 and 839498445-13835).

|

3. Background

3.1 The whole of Council financial reporting provided to this Committee

focuses on the six-month performance (1 July 2022 to 31 December 2022) compared

with the year-to-date (YTD) approved capital and operating budgets. The

quarterly report includes Nelson City Council performance only and does not

include its subsidiaries, associates, and joint ventures.

3.2 Unless

otherwise indicated, all information is against approved operating budgets,

which is Annual Plan 2022/23, plus any carry forwards, plus or minus any other

additions or changes as approved by the Council.

3.3 Commentary

is provided below for significant variances of +/- $100,000.

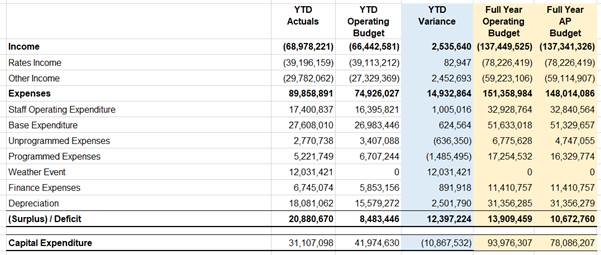

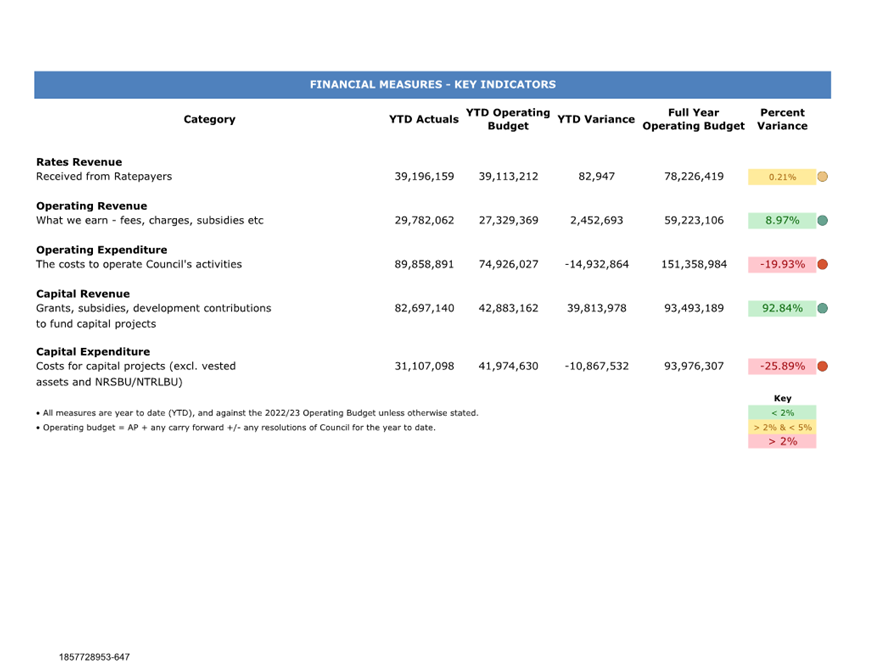

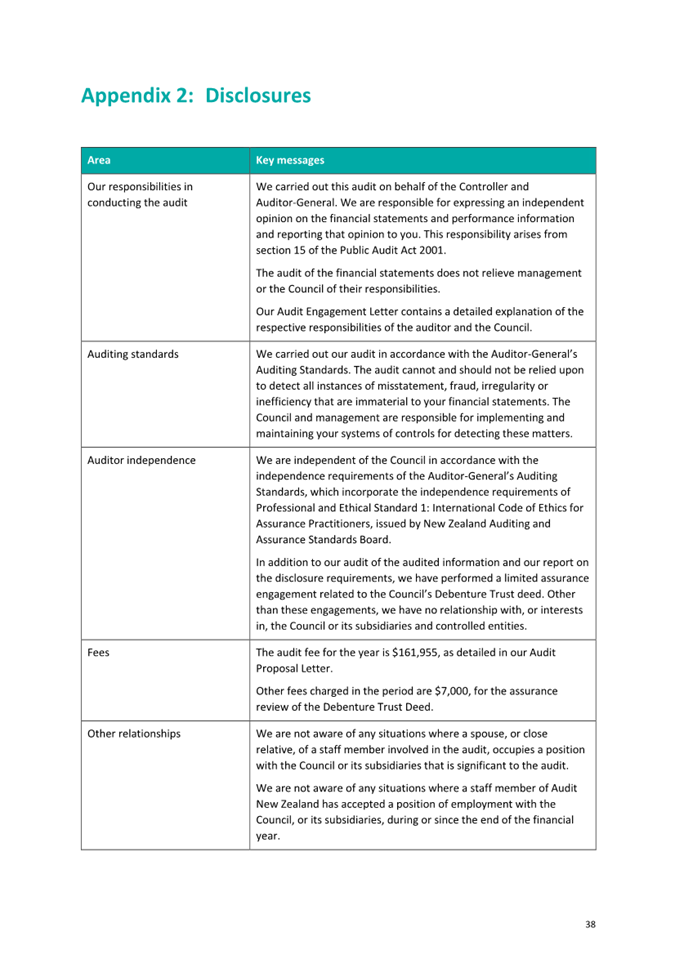

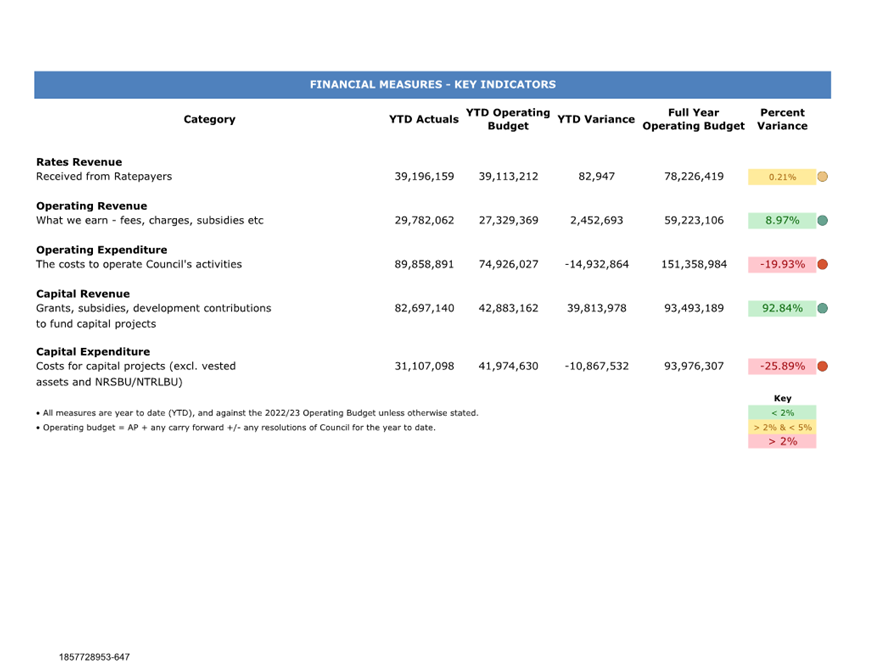

4. Financial Performance

4.1 For

the six months ending 31 December 2022, the Council’s draft deficit is

$12,397,000 unfavourable to budget, primarily driven by unbudgeted expenditure

(net of recoveries) on the August 2022 weather event of $10.1m.

4.2 Profit and Loss

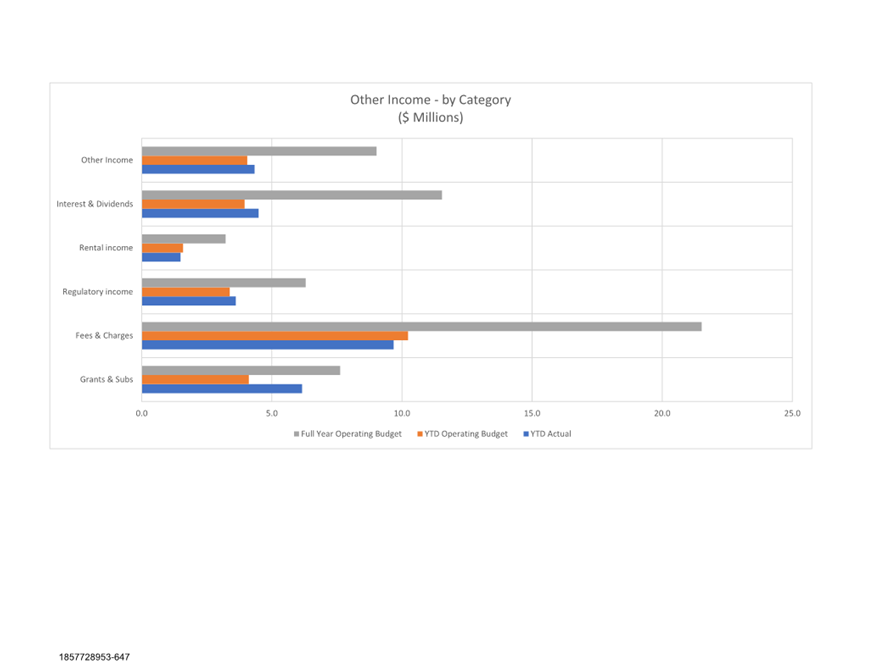

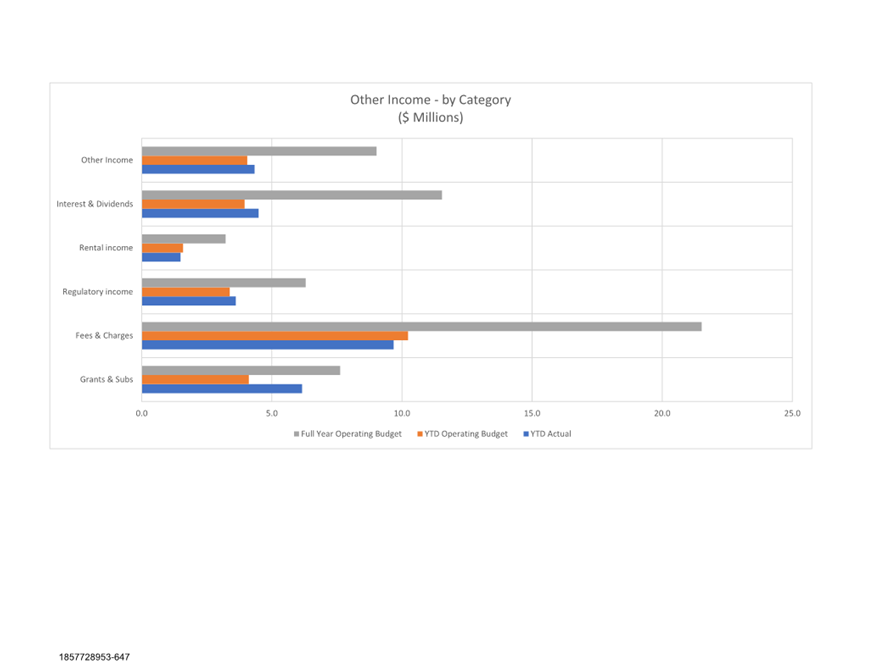

4.3 Income

4.4 Rates

income is greater than budget by $83,000. This

is a result of wastewater rates being over budget. This is due to more

connections being added than budgeted (the budget workings were completed in

May and the rate strike in July).

4.5 Other

income is greater than budget by $2.5m with significant variances as follows:

4.5.1 Waka Kotahi Maintenance Income is greater than budget by $1.9m. This is the

result of $1.9m in unbudgeted funding for the flood recovery (i.e., 51% of

$3,736,000 spent on subsidised roading expenditure for the floods).

4.5.2 Investment Management income is greater than budget by $0.6m.

Interest from Nelson Regional Sewerage Business Unit is

greater than budget by $178,000 due to, a) an increase in the loan amount, and

b) an increase in interest rates.

Interest on Short Term Investment

is over budget by $437,000 due to more funds being invested than planned

because of pre-funding of debt to take advantage of favourable borrowing

conditions at the time.

4.5.3 Public Transport income is greater than budget by $0.4m. $200,000 of

this income is due additional subsidy for the half price bus fares. The

remaining is due to increased subsidy income from Waka Kotahi for additional

expenditure.

4.5.4 Developing Resource Management Plan

income is greater than budget by $0.3m. All

this income was generated from the Maitahi Bayview plan change recovery

charges. This income is unbudgeted costs which are included in expenses below.

Recoveries for these costs are $312,000.

4.5.5 Building Services income is greater than budget by $0.3m. Quality

Assurance levies and revenue are over budget by $198,000, and $113,000

respectively with stronger market demand than anticipated for the first half of

the year.

4.5.6 Water Supply income is greater than budget by $0.1m. Water by

meter Commercial is $146,000 over budget. This is due to higher than

anticipated water usage.

4.5.7 Three Waters Grant income is greater than budget

by $0.1m. Year to date there has been $133,500 collected for

transitional support and there is a further $0.5m available for the financial

year. This was unbudgeted.

4.5.8 Navigational Safety Income is greater than budget

by $0.1m. This income of $141,000 is from payments for the Harbour

Master services from Port Nelson Limited.

4.5.9 MBIE Income is greater than budget

by $0.1m. There has been an unbudgeted spend on responsible camping

initiatives which has been funded by MBIE.

4.5.10 Transfer Station income is greater than budget

by $0.1m. Landfill local disposal levies is over budget

by $105,000 due to expenses also being over budget. The details of the

expenditure items are mentioned in the expenses section below.

4.5.11 Wastewater income is less than budget by $0.2m. Commercial Trade Waste income is under budget by

$200,000 due to delays in data collection for NZ King Salmon.

4.5.12 BeeCard Trip income less

than budget by $0.2m. This is due to the half price fares (which was

topped by through Waka Kotahi income above), as well as 1 week free bus fare in

August during the flood event.

4.5.13 Forestry income is less

than budget by $0.2m. This is due to

changes to the planned timing of harvesting that affected the harvest revenue

as follows: Maitai Forest income is $591,000 over budget. Marsden Forest is $454,000

over a nil budget, Roding Forest income is $1,215,000 under budget.

4.5.14 Monitoring the Environment income is less than budget by $0.2m. The income budgeted

to be received from the MPI Hill Country Erosion fund is yet to be invoiced.

This will be invoiced upon completion of deliverables and reporting. The amount

to be invoiced will be $320,000 by the end of financial year.

4.5.15 Resource Consents income is less than budget by $0.1m. Consent Fees are

$134,000 under budget as application numbers are tracking lower than budgeted

for.

4.5.16 Waste Minimisation income is less than budget by $0.1m. The contribution

from Waste Minimisation Fund is less than budget by $342,000. This will be

claimed once the costs have been incurred for the diversion of construction and

demolition waste.

4.5.17 Maitai Camp income is

less than budget by $0.1m. Revenue from camp fees and rentals are down

due to lower than budgeted occupancy.

4.5.18 Marina income is less

than budget by $0.1m. Fees from the travel lift are lower than

budgeted by $103,000 due to lower usage than anticipated.

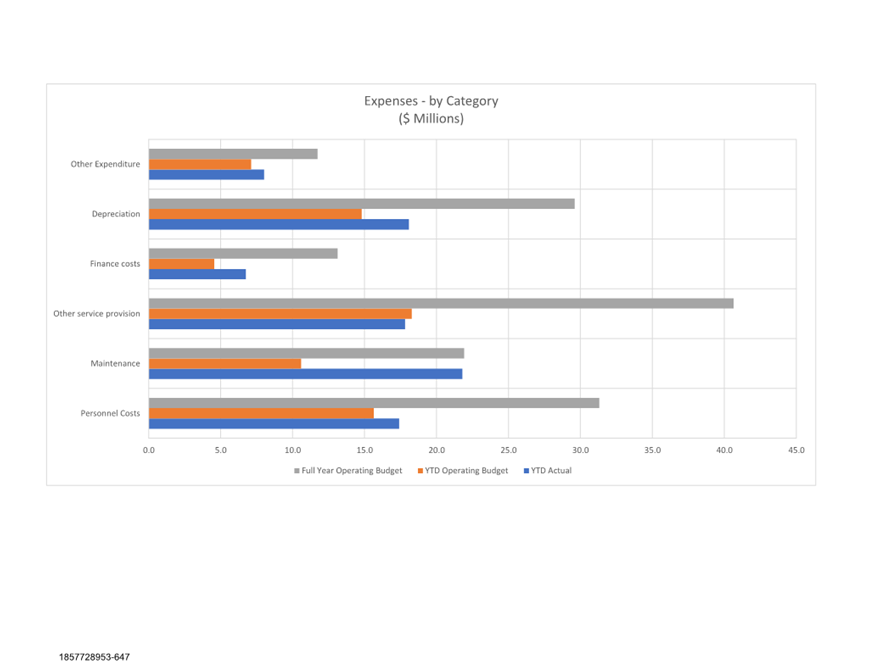

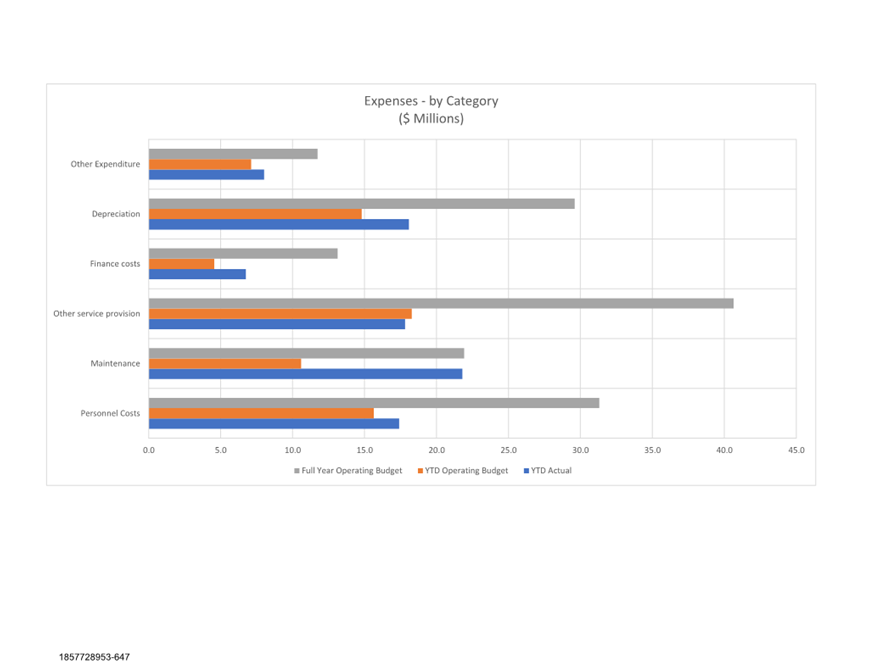

4.6 Expenses

4.6.1 Staff

Operating expenditure is greater than budget by $1.0m.

This is mainly due to following reasons;

· Actual

average salary increase (5%) is higher than the budgeted increase of 3% as a

result of higher wage inflation than anticipated when the budget was set. In

dollar figures, the increase in YTD salaries is approximately $773,000 against

a budget of $411,000 which resulted in a higher than budget variance of

$362,000.

· On

top of the higher paid wages, the labour shortages in the market have meant a

higher turnover of council staff, leading to higher than budgeted

Contractor/temporary staff costs ($408,000 YTD) and training costs ($55,000

YTD).

· The

remaining $0.2m is due to other staff costs, such as overtime paid ($11,000),

higher recruitment costs ($33,000 over budget), additional leave and call out

allowances for those staff who worked during the August 2022 floods, and

additional leave for those staff who worked on the additional unbudgeted public

holiday. There have also been a few unbudgeted new roles, for instance

Navigators ($22k).

While most of the business units contributed to this higher

than planned variance, Consents and Compliance ($369,000 over budget), Capital

Projects ($169,000 over budget), Transport & Solid Waste ($122,000 over

budget), People and Capability ($98,000 over budget) and Building ($93,000 over

budget) were the biggest contributors.

4.7 Base

Expenditure is greater

than budget by $0.6m with significant variances as follows:

4.7.1 Forestry

expenditure is greater than budget by $0.4m. Maitai

($711,000) and Marsden Valley ($409,000) harvest costs are over budget due to

work being brought forward while Roding harvest costs are $738,000 under

budget.

4.7.2 Resource Consents expenditure is greater than budget by $0.1m. This is to deal

with the increased volume and complexity of consents being sought.

4.7.3 Developing the Resource Management

Plan expenditure is greater than budget by $0.3m. This

is due to the unbudgeted consultant cost of $324,000 incurred on Maitahi

Bayview plan change which was fully recovered in income.

4.7.4 Subsidised Bus Service is greater than budget by $0.2m. This is due to

fuel price rises and an increase in bus driver wages. This is subsidised via

income.

4.7.5 Regional

Sewerage expenditure is greater than budget by $0.6m. This

is due to increases in fixed charges and charges for loads greater than

budgeted for, plus increased costs associated with the flows from the August

weather event.

4.7.6 Landfill expenditure is greater than budget by $0.1m. This is due to

variation in disposal levies required from Waste Minimisation, Transfer Station

and recycling. The differences are funded from reserves.

4.8 Unprogrammed

Expenditure is less than budget by $0.6m with

significant variances as follows:

4.8.1 City Development expenditure is less than budget by $0.5m. This

variance is solely due to the unbudgeted housing reserve grant payments which

are scheduled to be paid in the 2023/24 financial year.

4.9 Programmed

Expenditure is less than budget by $1.5m with

significant variances as follows:

4.9.1 Monitoring the Environment is less than budget by $0.3m. Healthy streams

and Hill Country Erosion expenses are behind by $123,000 and $154,000

respectively, although the full spend is expected by the end of the 2022/23

financial year.

4.9.2 Environmental Advocacy is less than budget by $0.2m. The full spend

for the Nelson Nature and Maitai projects are expected by the end of the

financial year.

4.9.3 Stormwater expenditure is less than budget by $0.1m. A variety of

expenditure items are under budget across the activity.

4.10 Weather

Event expenditure is an unbudgeted

spend of $12.0m. The spend to date for the August 2022 weather

event is $12,031,000. Offsetting these expenses is income from Waka Kotahi

of $1.9m for subsidised roading (51% of actual roading costs expensed).

The weather event report goes to council quarterly and the

next report is going to the meeting on 9 March 2023. The forecast

weather event costs for 2022/23 is currently $19.2 million (gross of

recoveries).

4.11 Finance

expenditure is greater

than budget by $0.9m. $437,000 is due an increase in interest from

additional pre-funding of debt (which is offset against interest income). The

remaining is mainly due to the interest rate increases and higher weather event

borrowings.

4.12 Depreciation

expenditure is greater

than budget by $2.5m. Depreciation has been based on the prior year

asset valuations. In the 2021/22 financials, the asset valuations saw

significant increases. This resulted in a much higher depreciation

expense. This is especially evident in Roads (unsubsidised), Wastewater,

Stormwater, Water Supply, with year to date increases in depreciation of

$1,267,000, $475,000, $321,000 and $551,000 respectively.

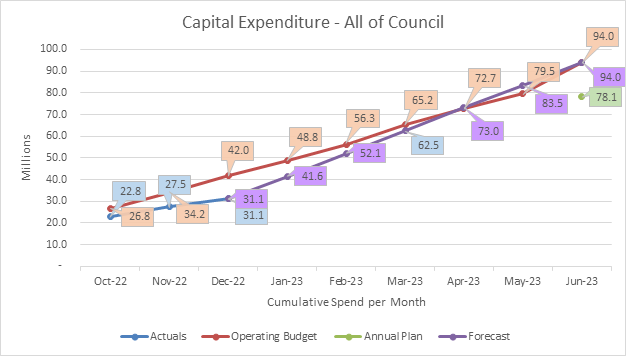

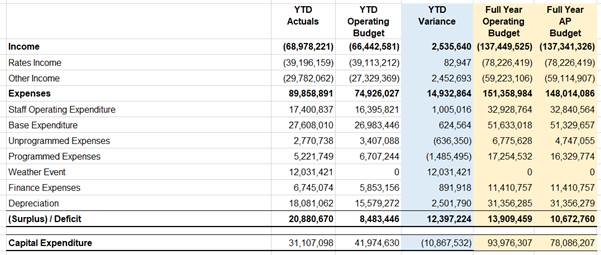

5. Capital

Expenditure

5.1 Capital

Expenditure (including staff time, excluding vested assets)

5.2 As

at 31 December 2022, Capital Expenditure was $31.1 million, which is $10.9

million under the operating budget of $42.0 million. This underspend is across

all activities, with the main contributors being Stormwater ($3.2 million),

Transport ($1.9 million), Corporate ($1.4 million), Social ($1.3 million), and

Flood Protection ($1.1 million).

5.3 Out of the $10.9

million variance above, $4.7 million relates to Renewals, $6.4 million relates

to Level of Service, and $0.1 million relates to Capital Staff Costs. Offsetting

this, Capital Growth is $0.3 million over budget.

5.4 The largest year to

date capital variances contributing to the $10.9 million variance are as

follows:

Renewals (less than budget by $4.7 million):

· Civic House is

$1.0m behind budget.

· A

programme to resurface 2% of the network is $1.0m behind budget. This is due to

a short lead in period for the new contractor and the challenging resourcing

market. Plans are in place to meet budget because a sustained low resurfacing

rate will result in deterioration of the pavement assets.

· Haven St/Vincent

Culvert renewal is $0.9m behind budget and has requested to carry-forward to

2023/24.

Level of Service (less than budget by $6.4 million):

· Saxton Creek

Upgrade is $1.6m behind budget.

· Elma Turner

Library is $1.2m behind budget.

· Rutherford Stage 1

– Stormwater upgrade is $1.1m behind budget.

· Washington Valley

Stormwater Upgrade is $1.0m behind budget.

· Tahunanui Hills

Stormwater catchment 3 and 4 is $0.7m behind budget in total.

Capital Growth (greater than budget by $0.3 million):

· Land purchases is

$0.7m over budget, with purchases at Saxton, Bayview and Toi Toi.

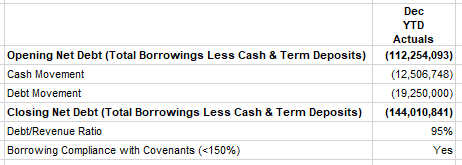

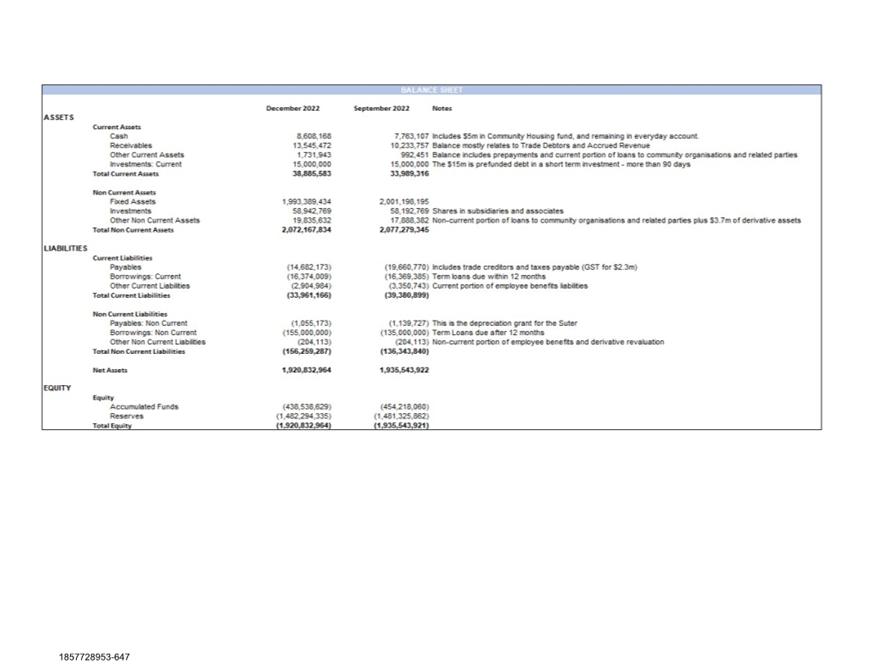

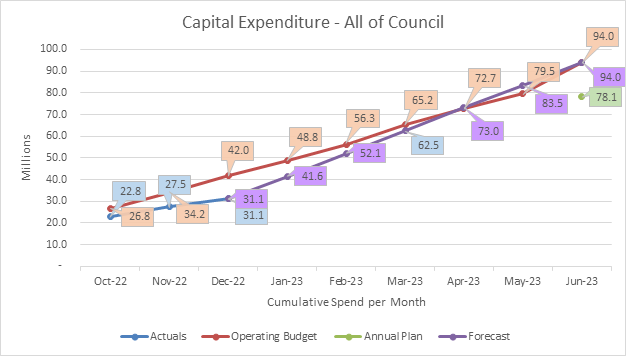

6. Cash Flow

Management

6.1 Net Debt

6.2 As

at 31 December 2022, there was net debt of $144.0 million (30 June 2022:

$112.3m). Net debt has increased by $31.8m for the 6 months ended 31 December

2022, with LGFA borrowings increasing by $20.0m, and term deposits decreasing

by $10.0m. This increase in net debt has been used to fund the August 2022

weather event ($10.1m net expenditure), capital expenditure during the year

($15.5m, net of funded depreciation), as well as to fund working capital ($4.3m

net payables at 30 June 2022).

6.3 Budgeted net debt at

30 June 2023 was $161m, this is now forecast to be $174m.

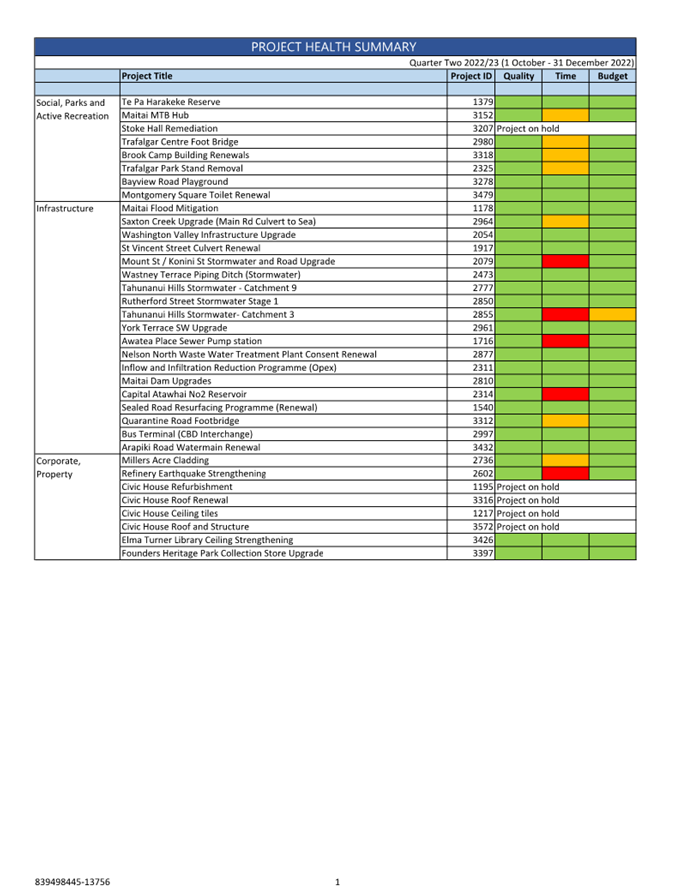

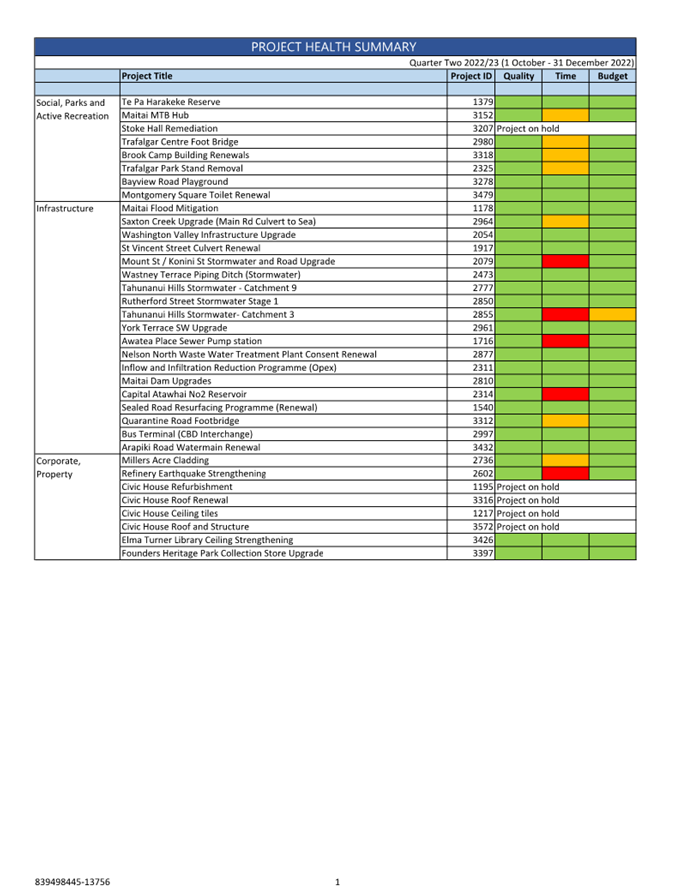

7. Project Health

7.1 A table summarising

the health of projects across Council for which project sheets have been

generated is included as attachment 2. It gives a red, amber or green rating

for quality, time and budget factors.

7.2 The majority of amber

and red are as a result of delays – this was perpetuated with the wet

winter and the weather event.

7.3 Projects on hold

indicate projects that require further workshops or discussion.

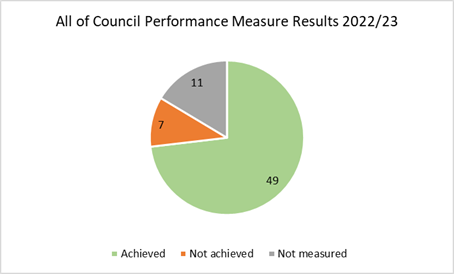

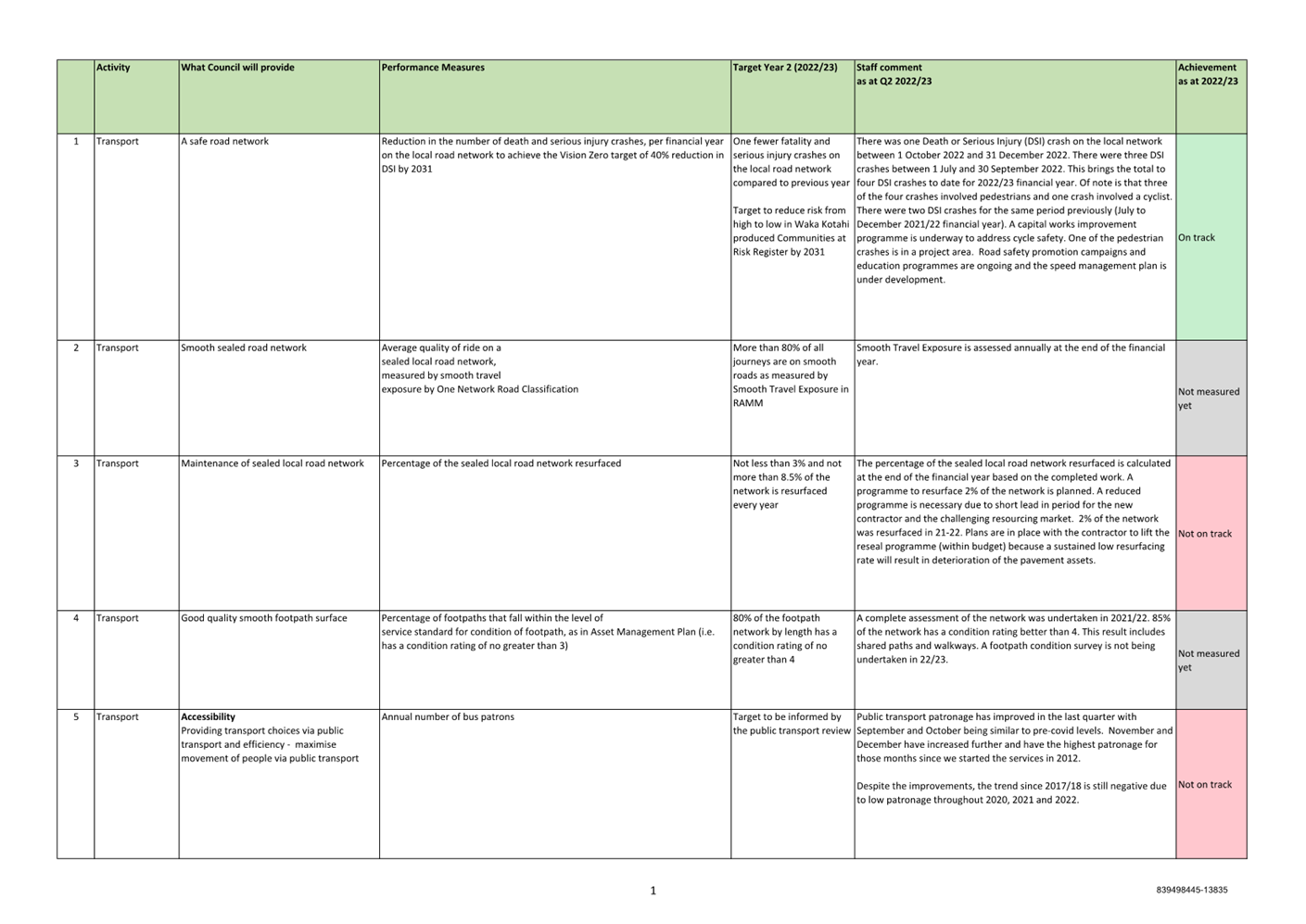

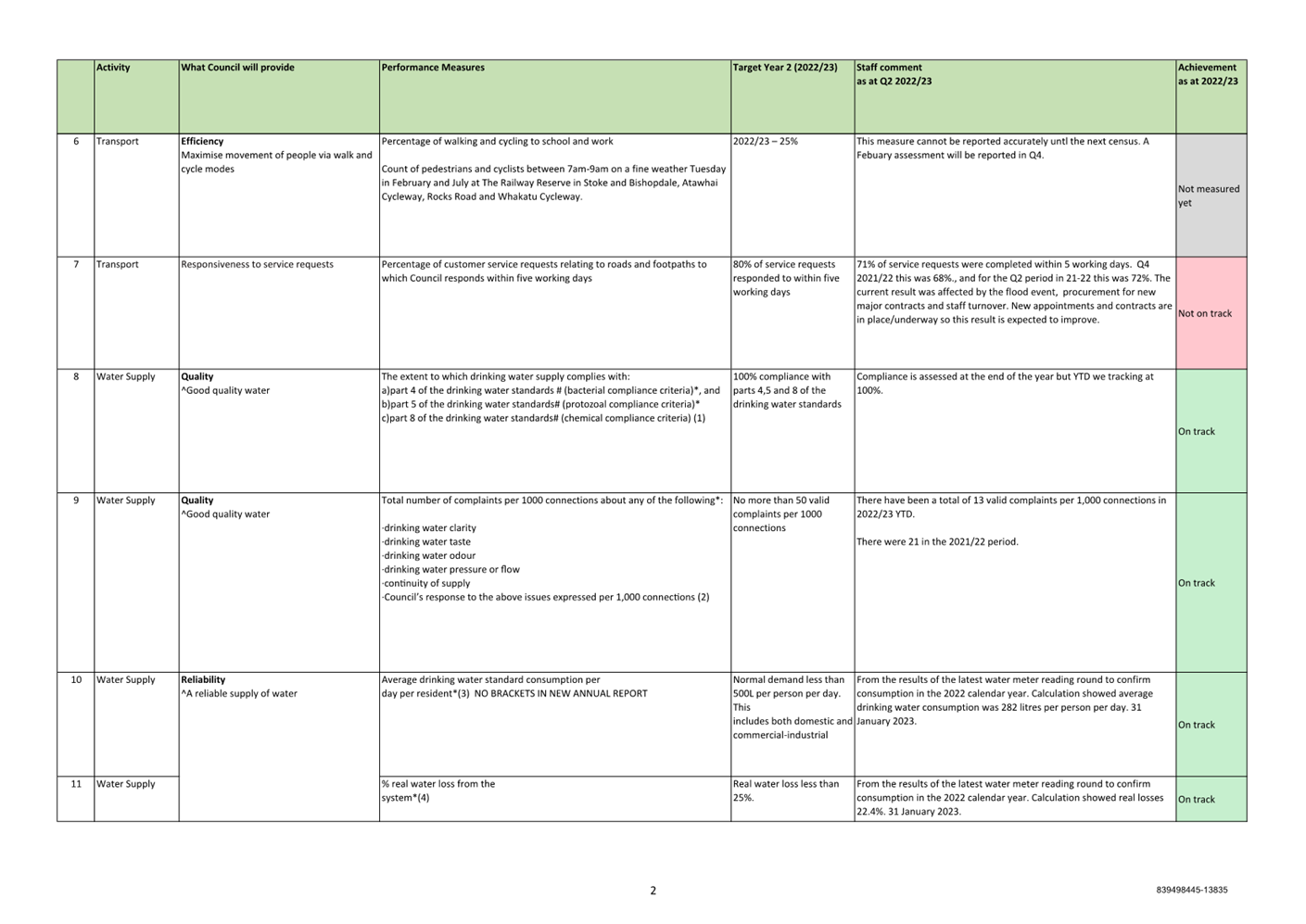

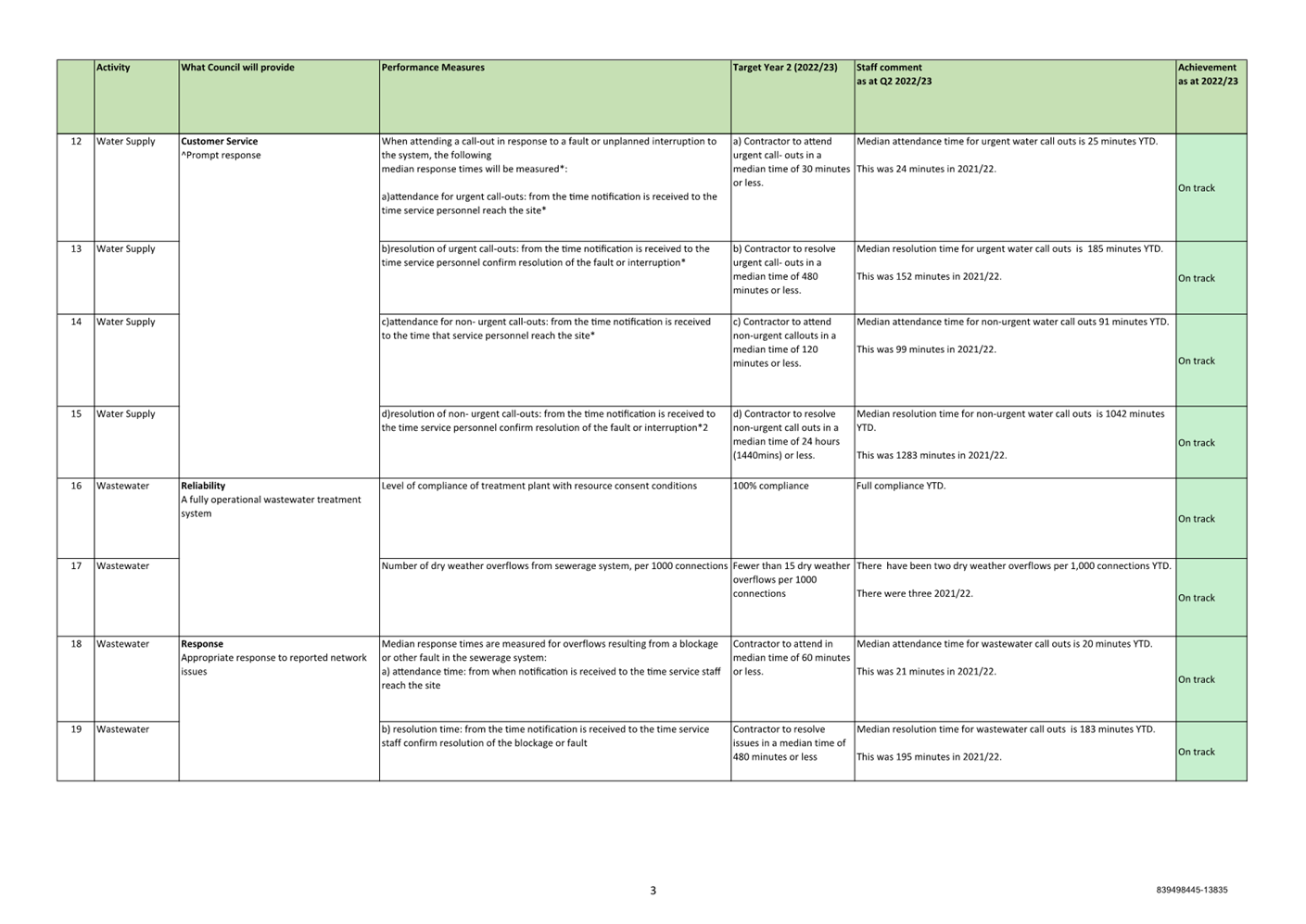

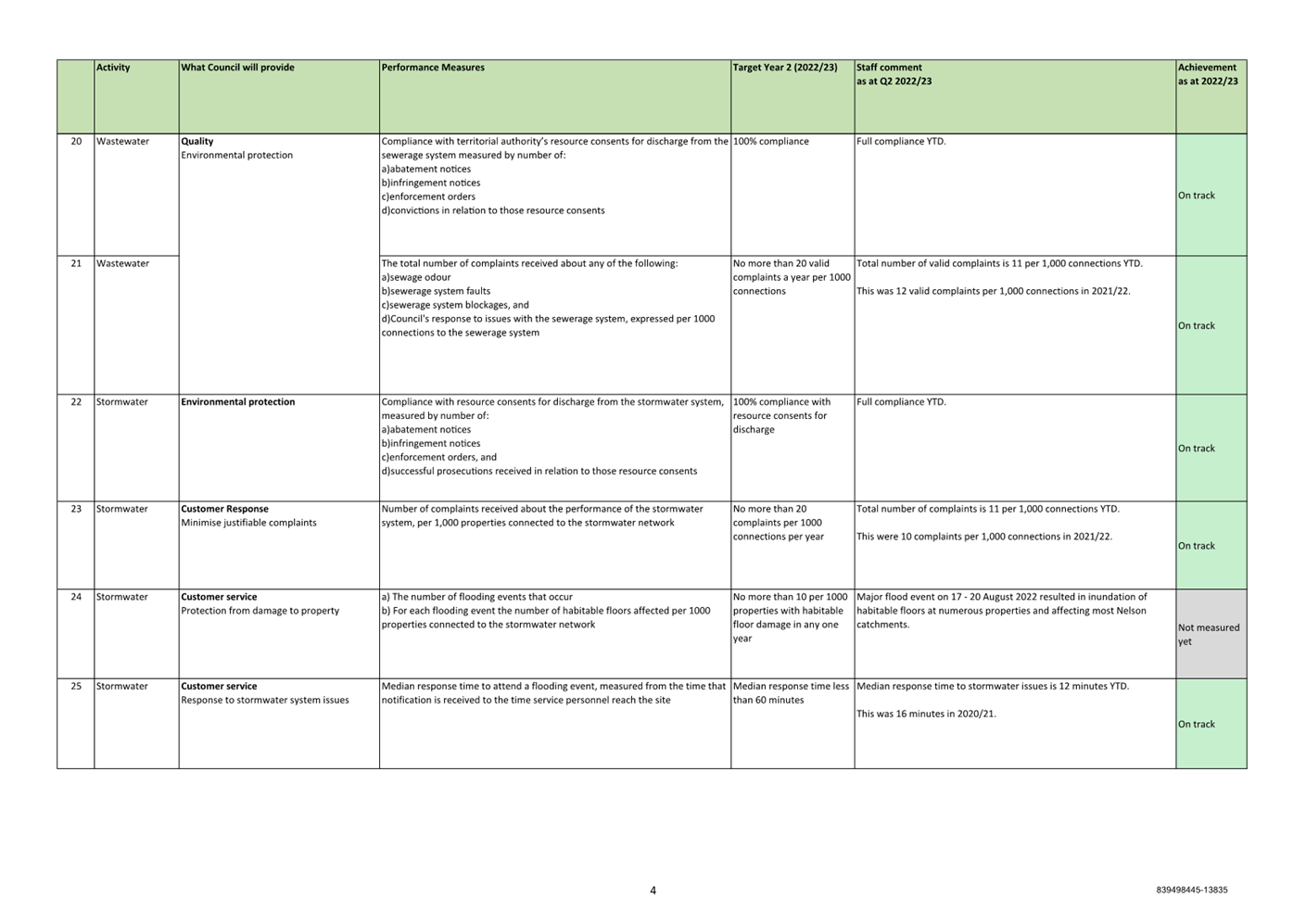

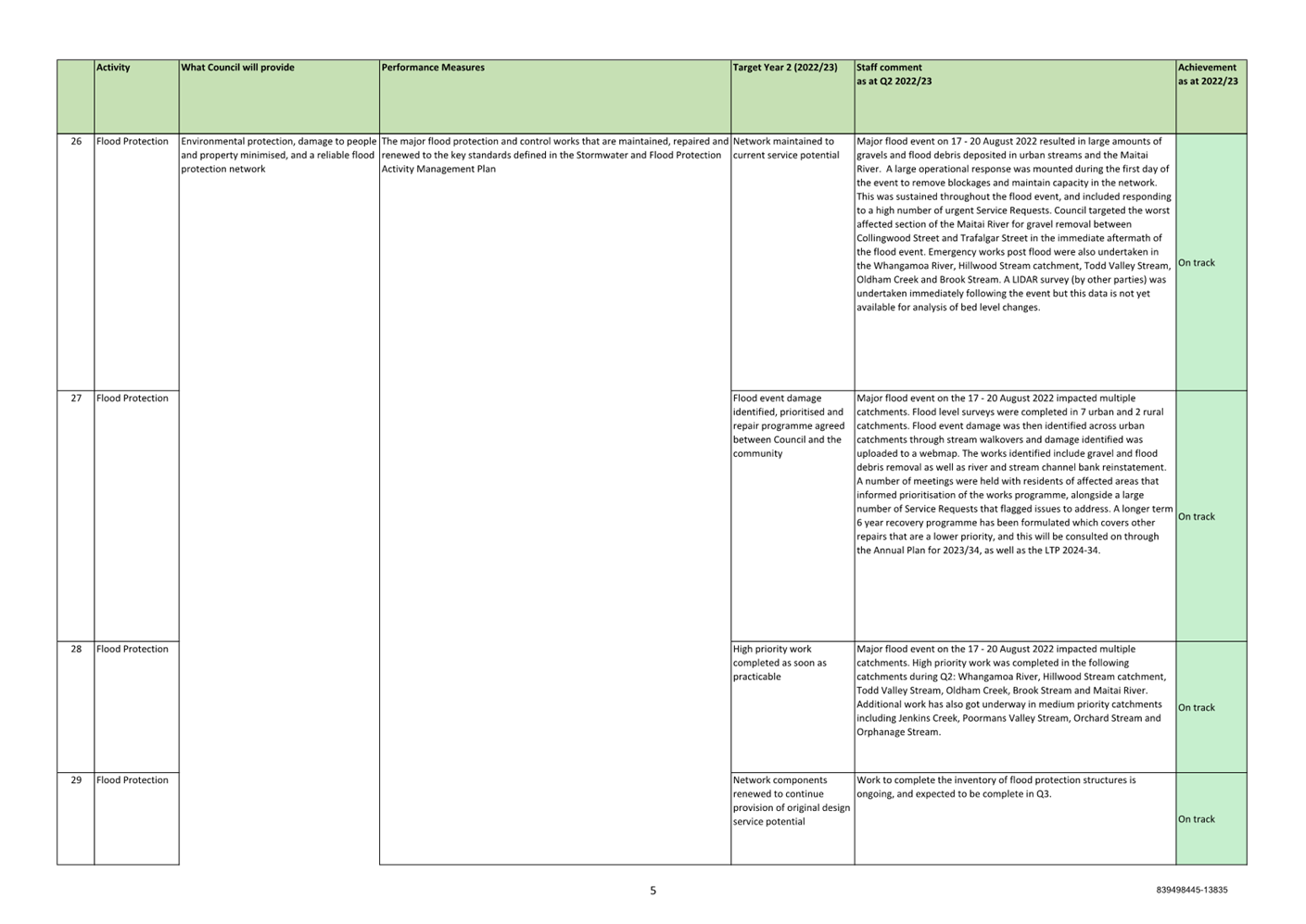

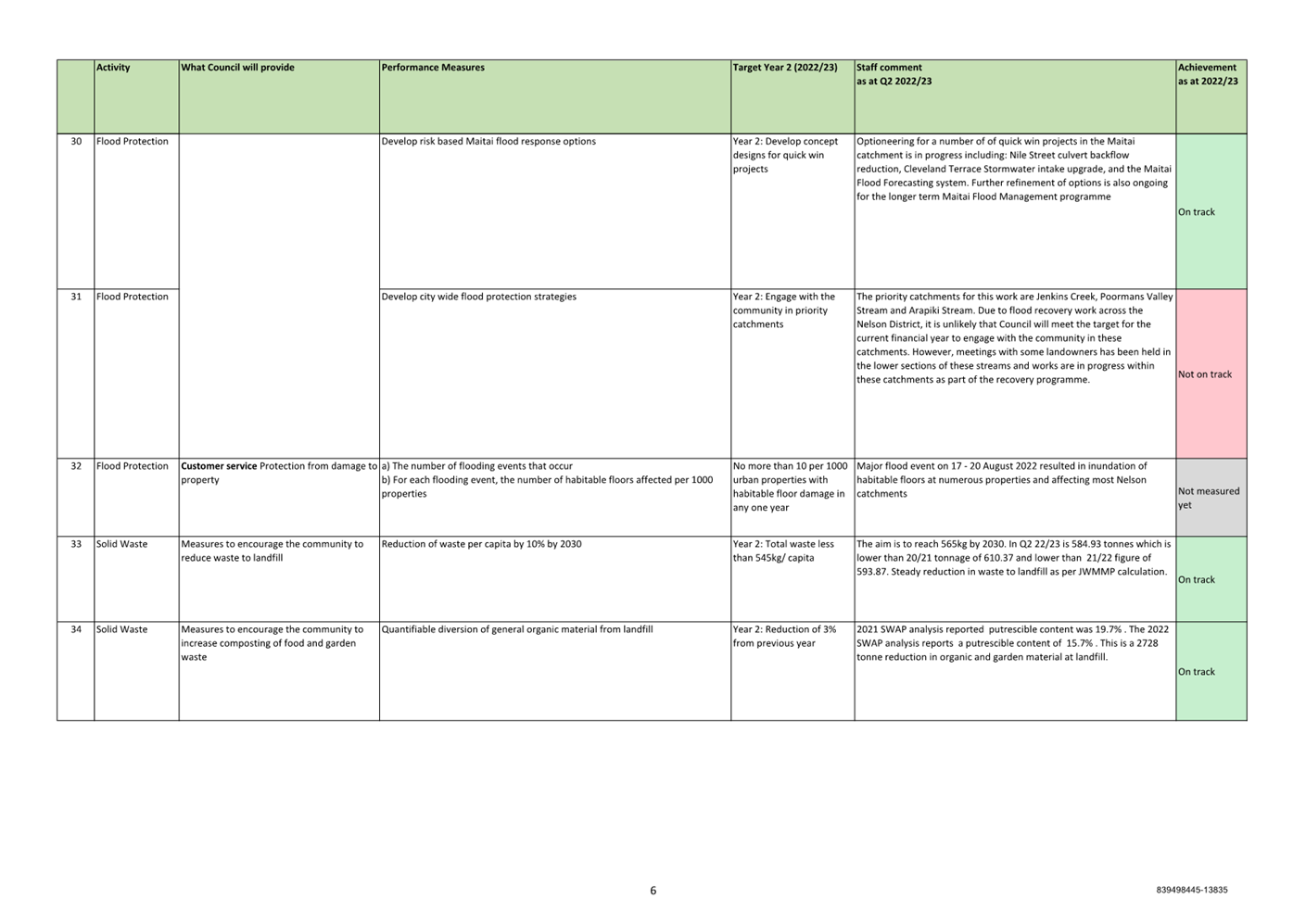

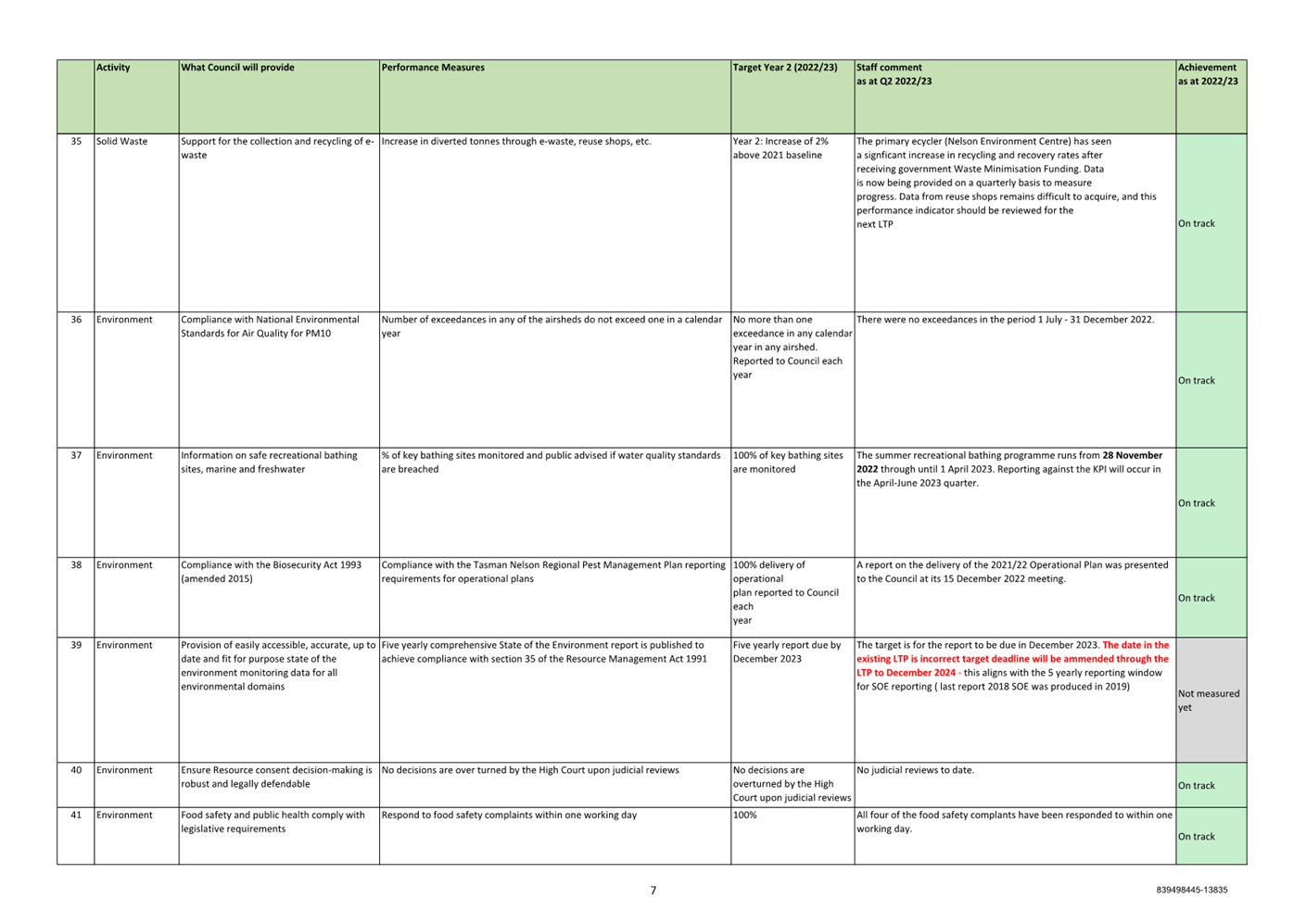

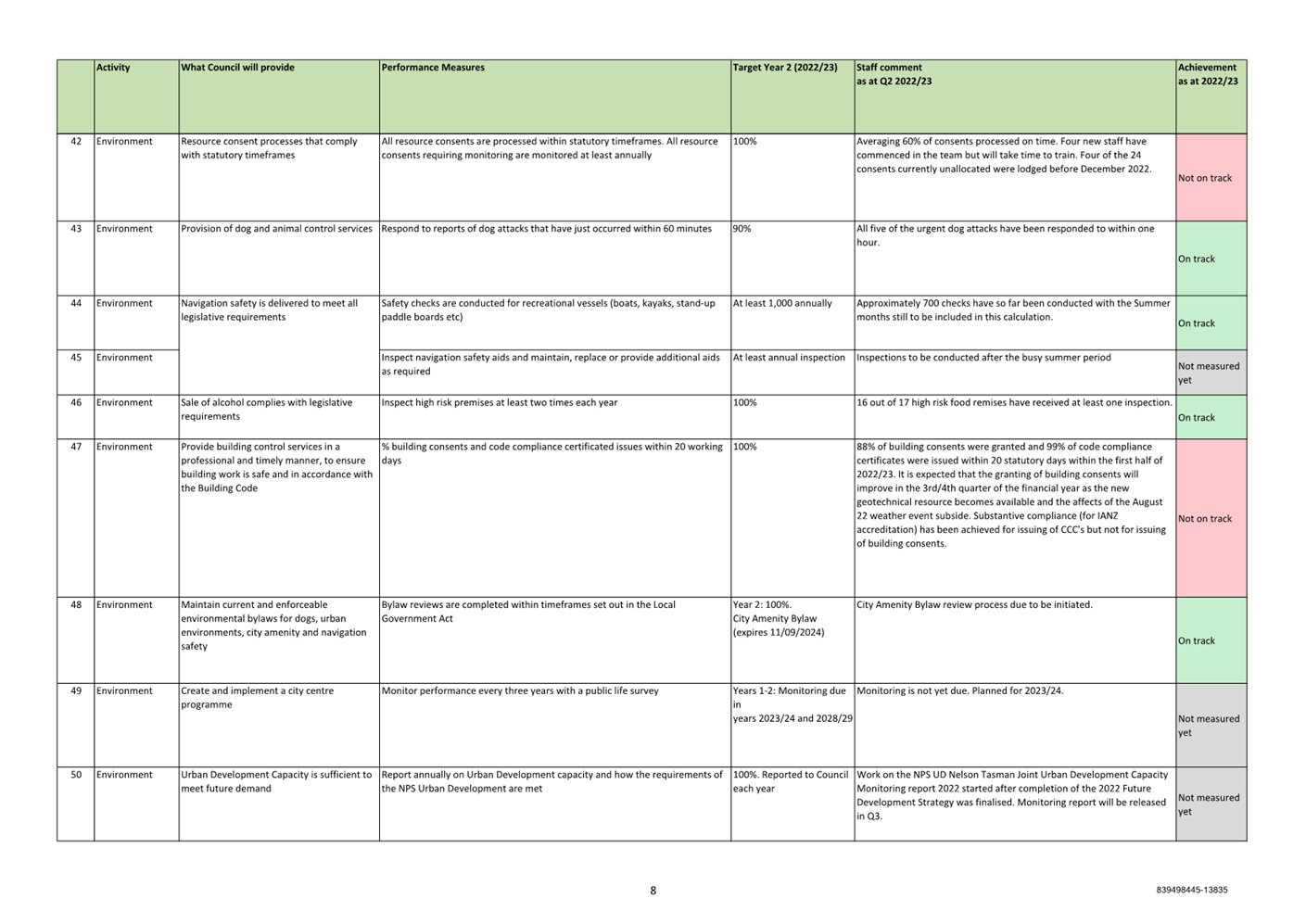

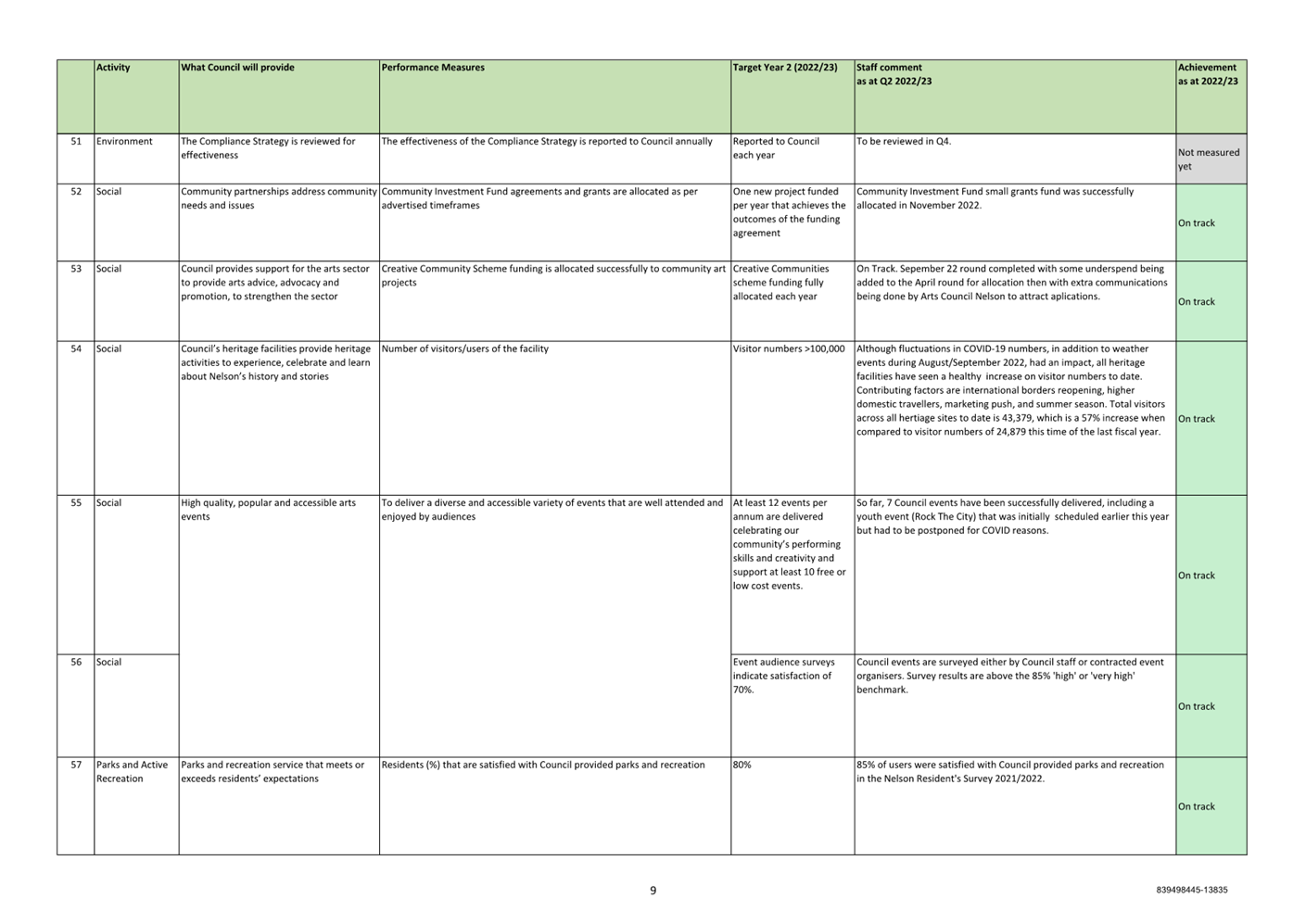

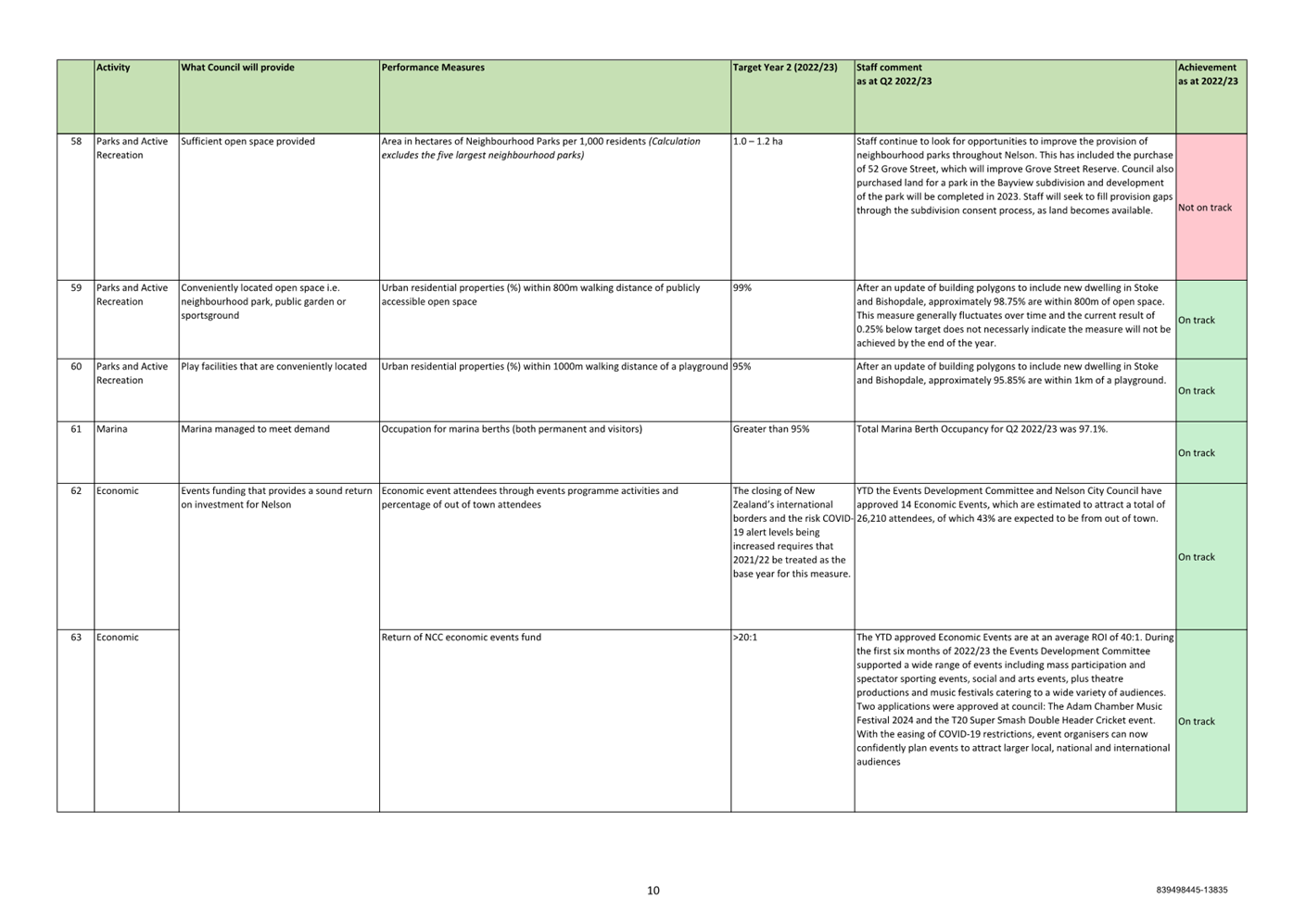

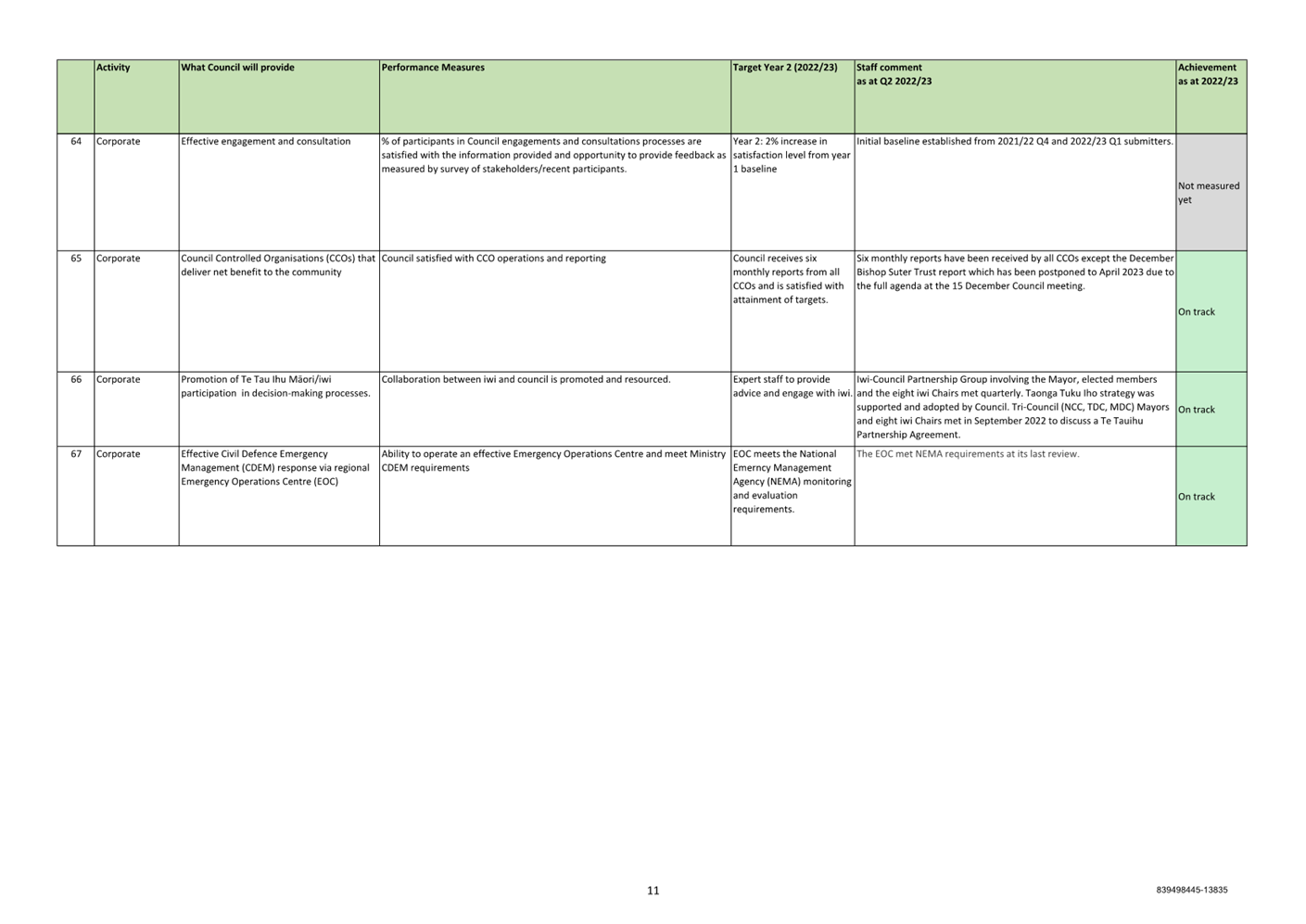

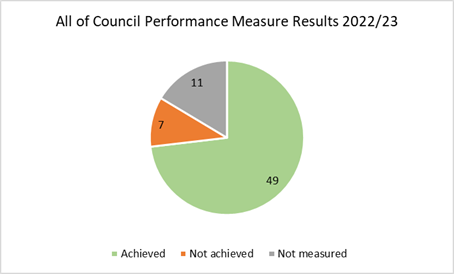

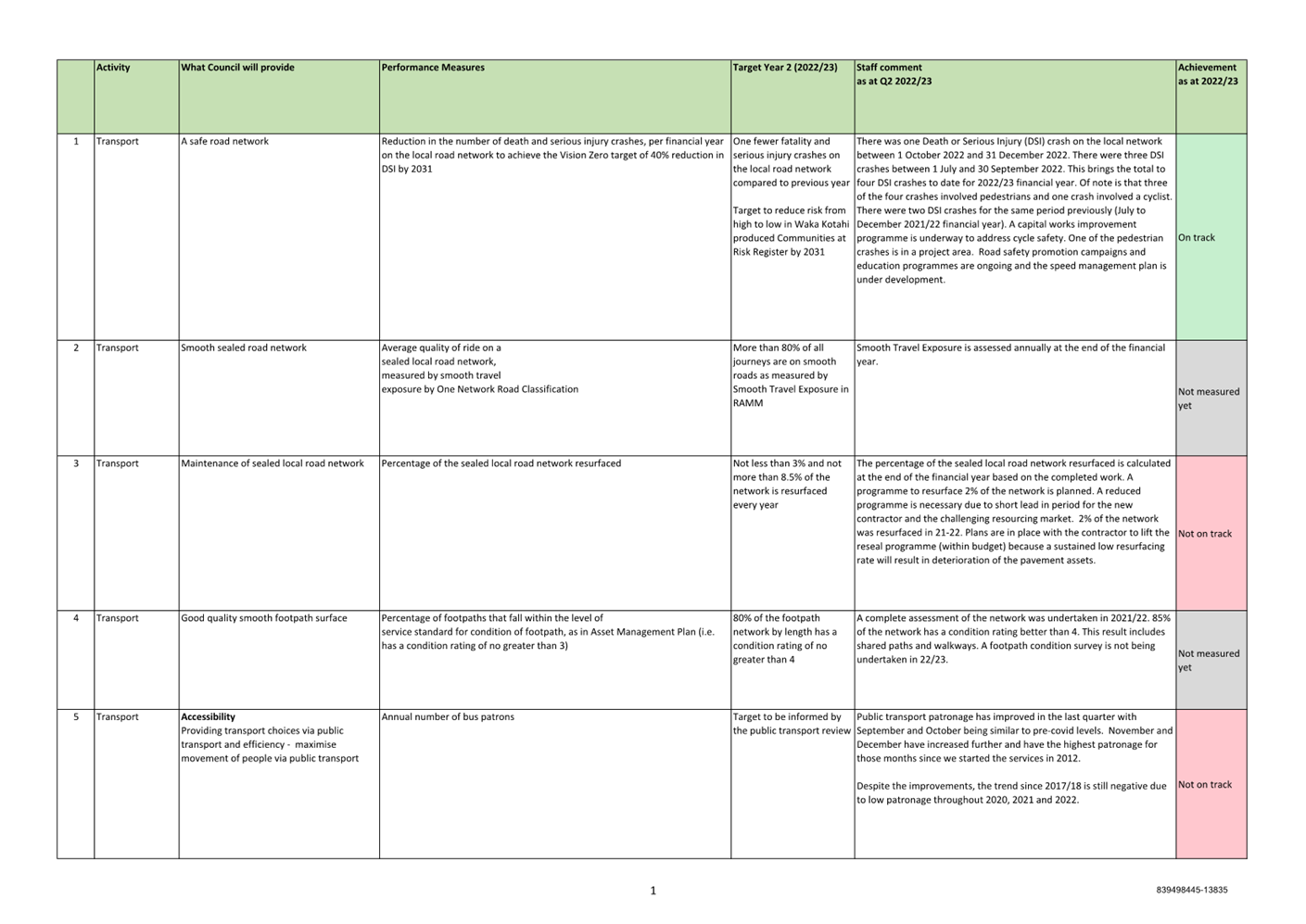

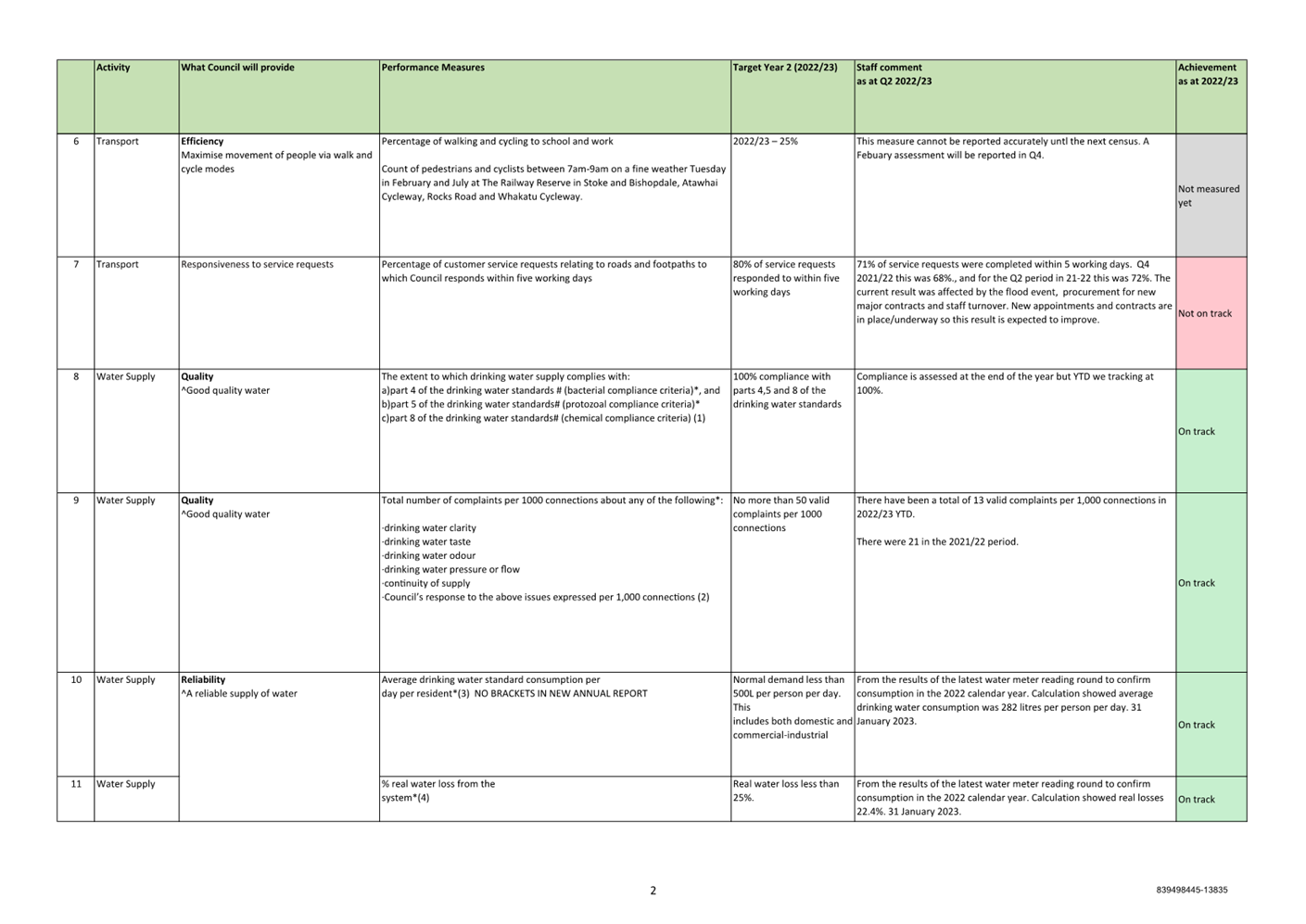

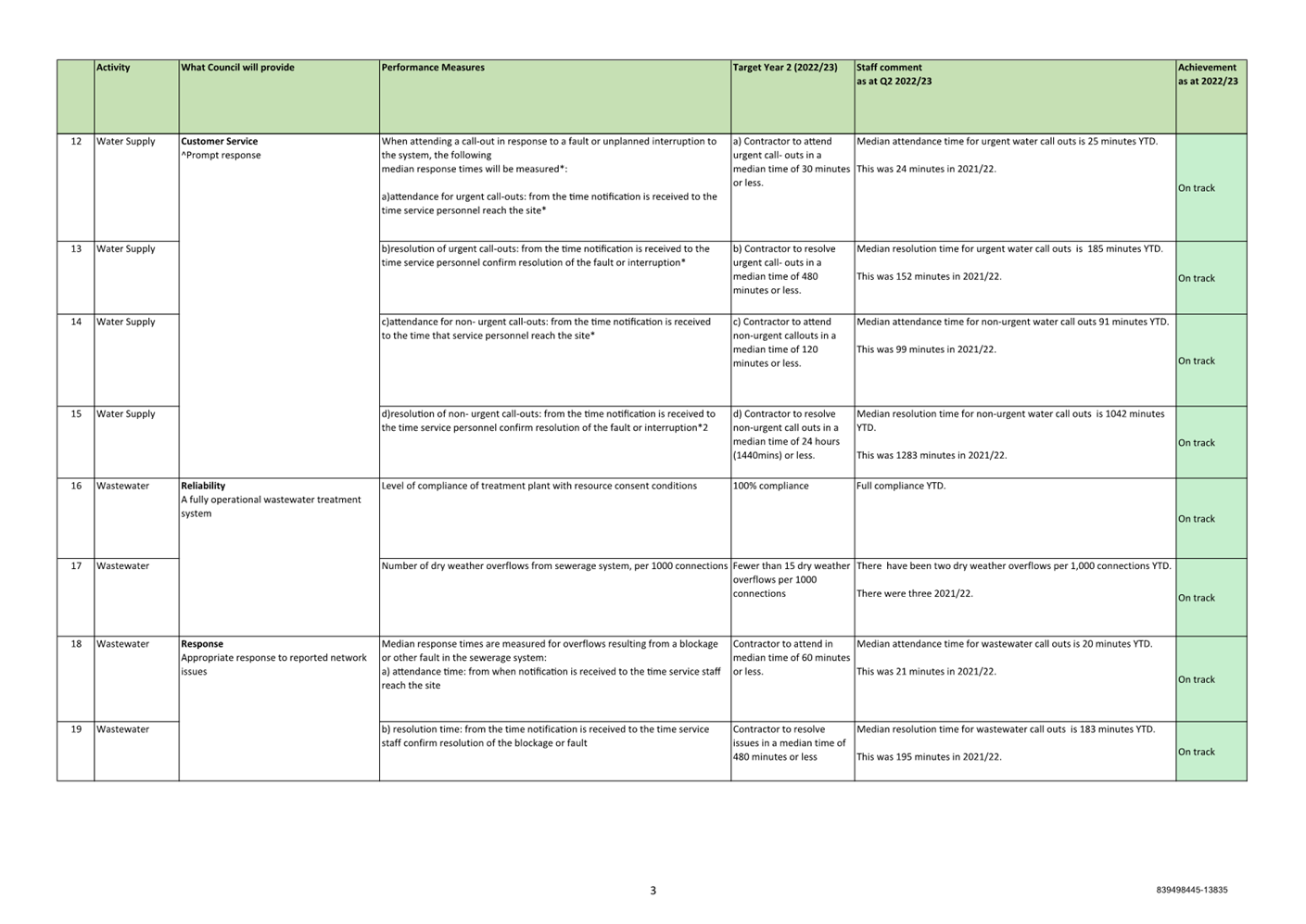

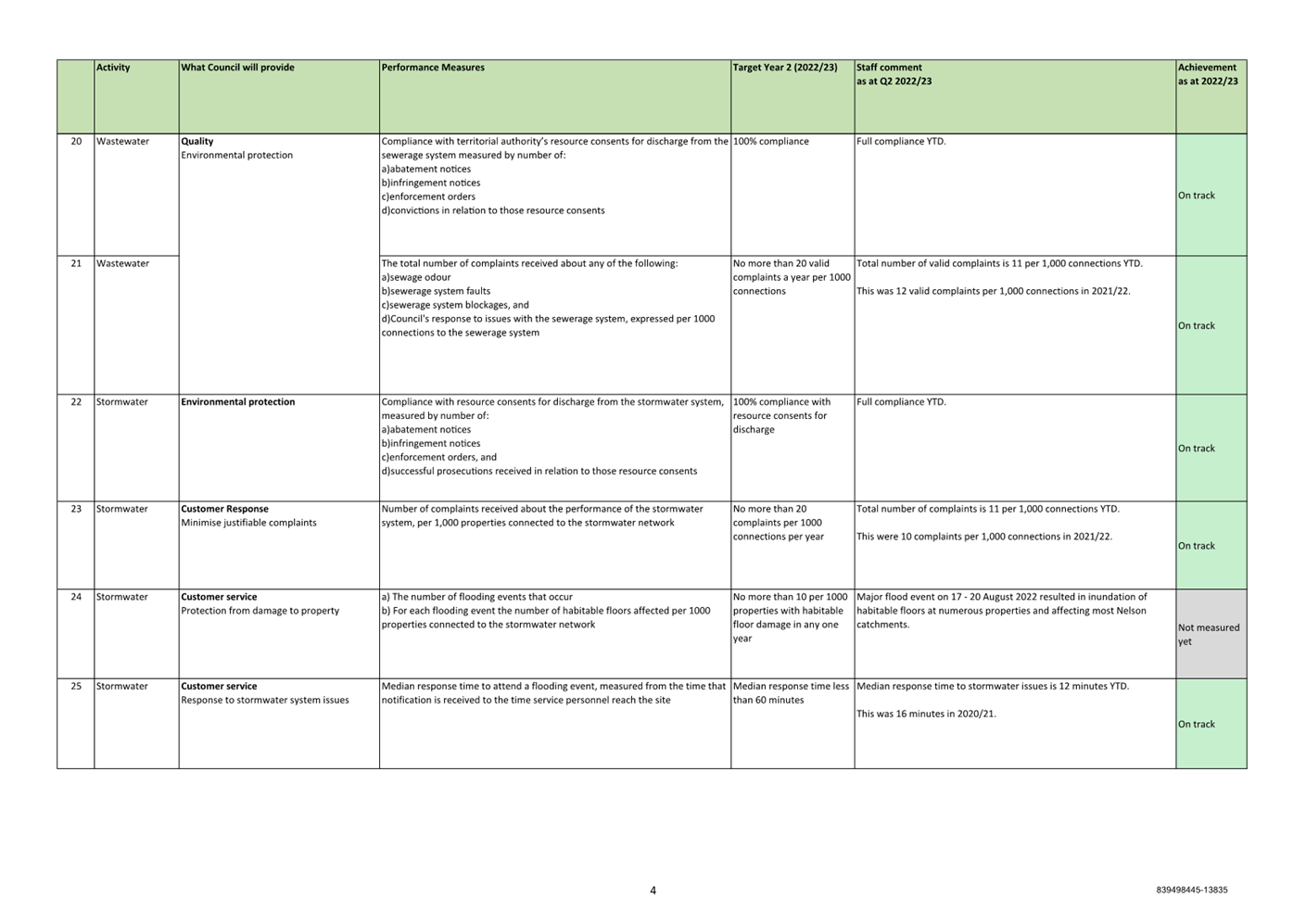

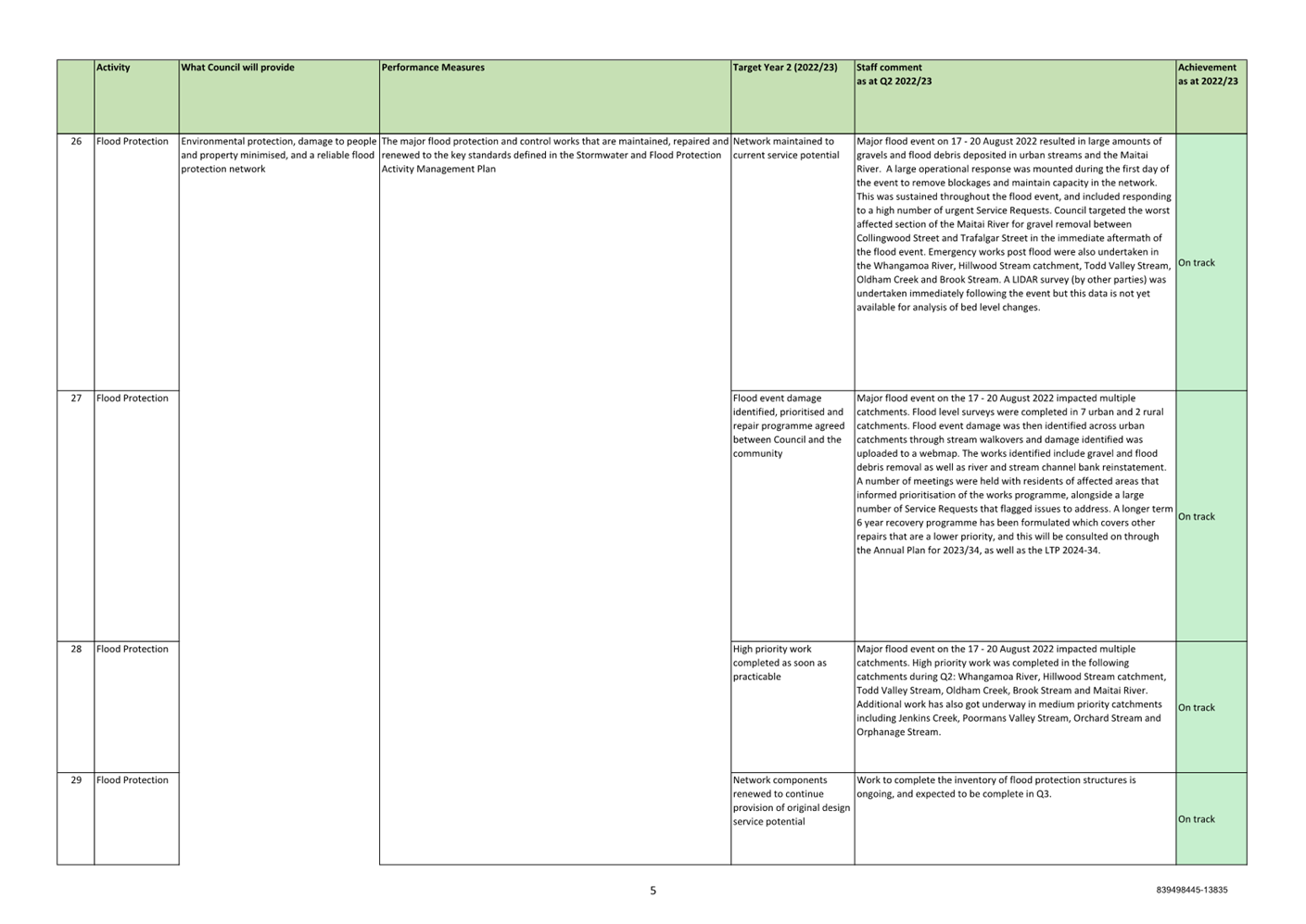

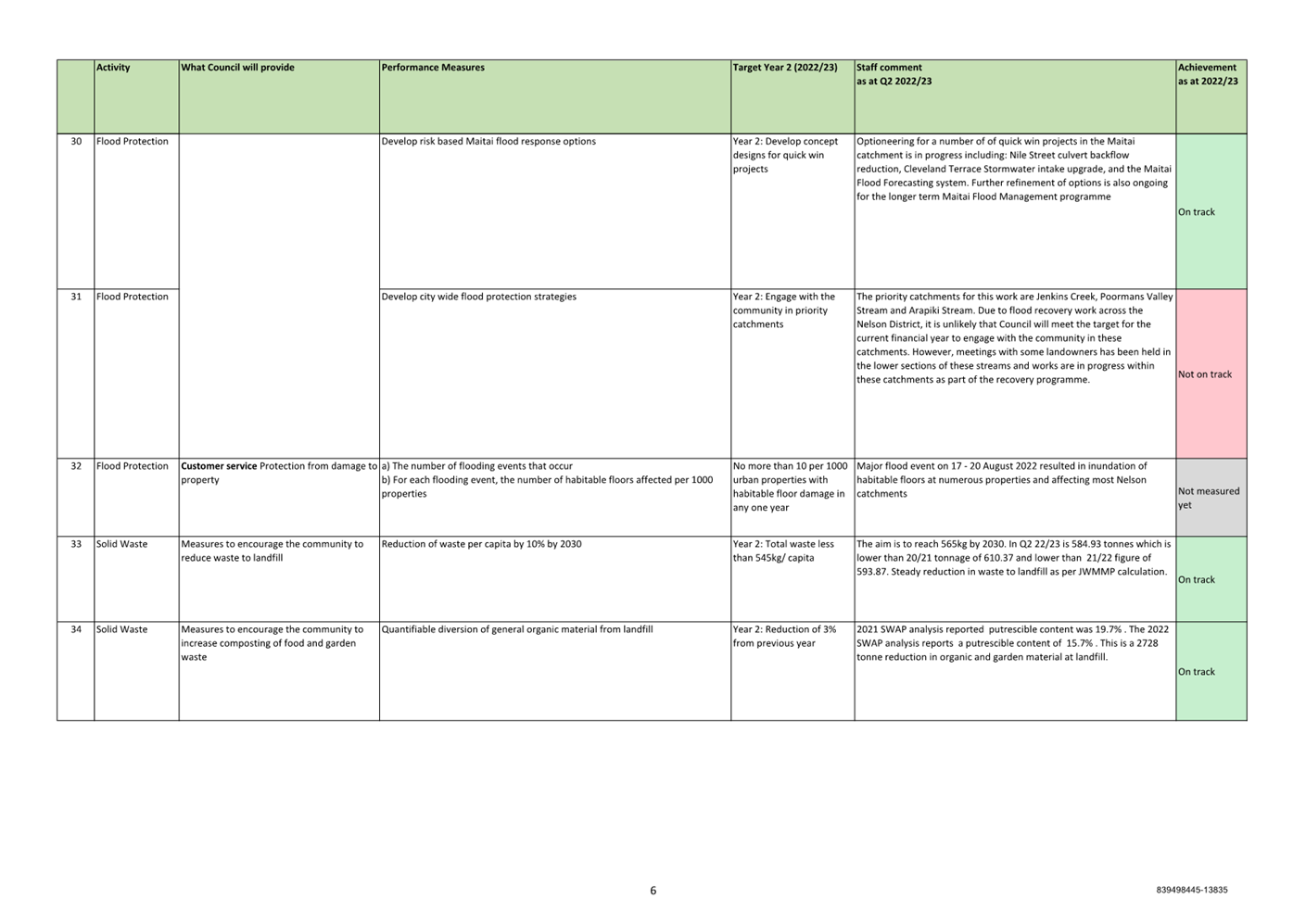

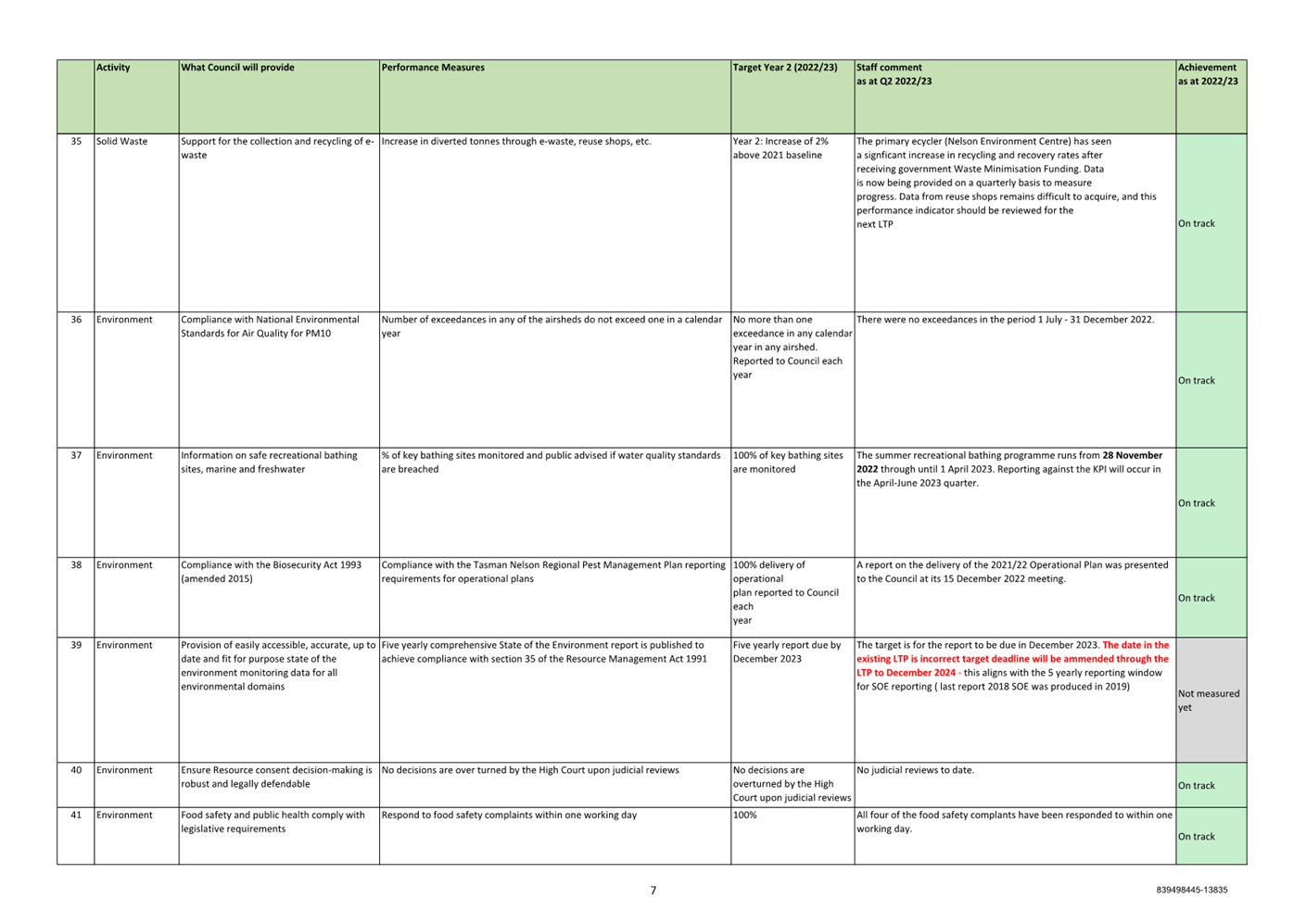

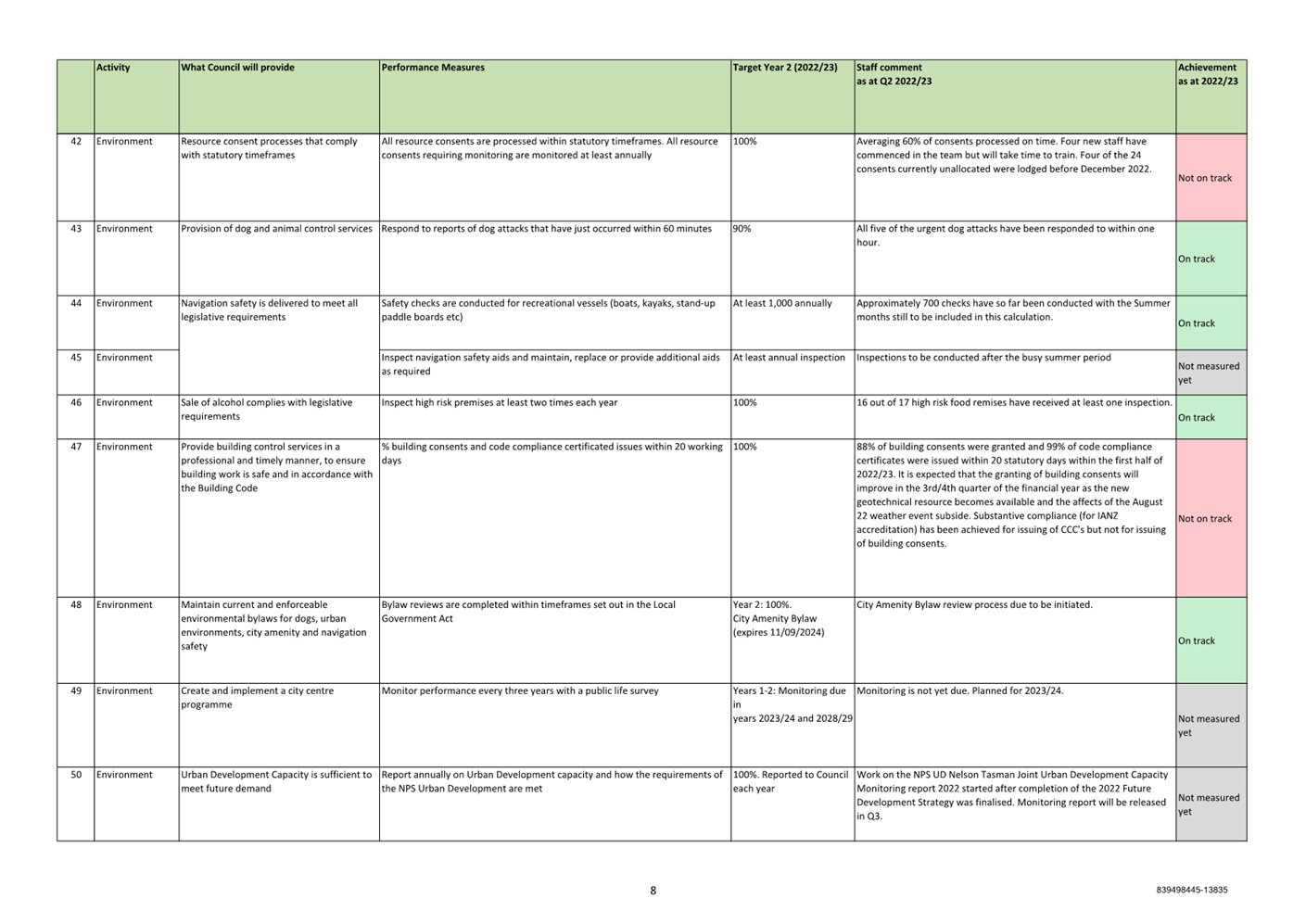

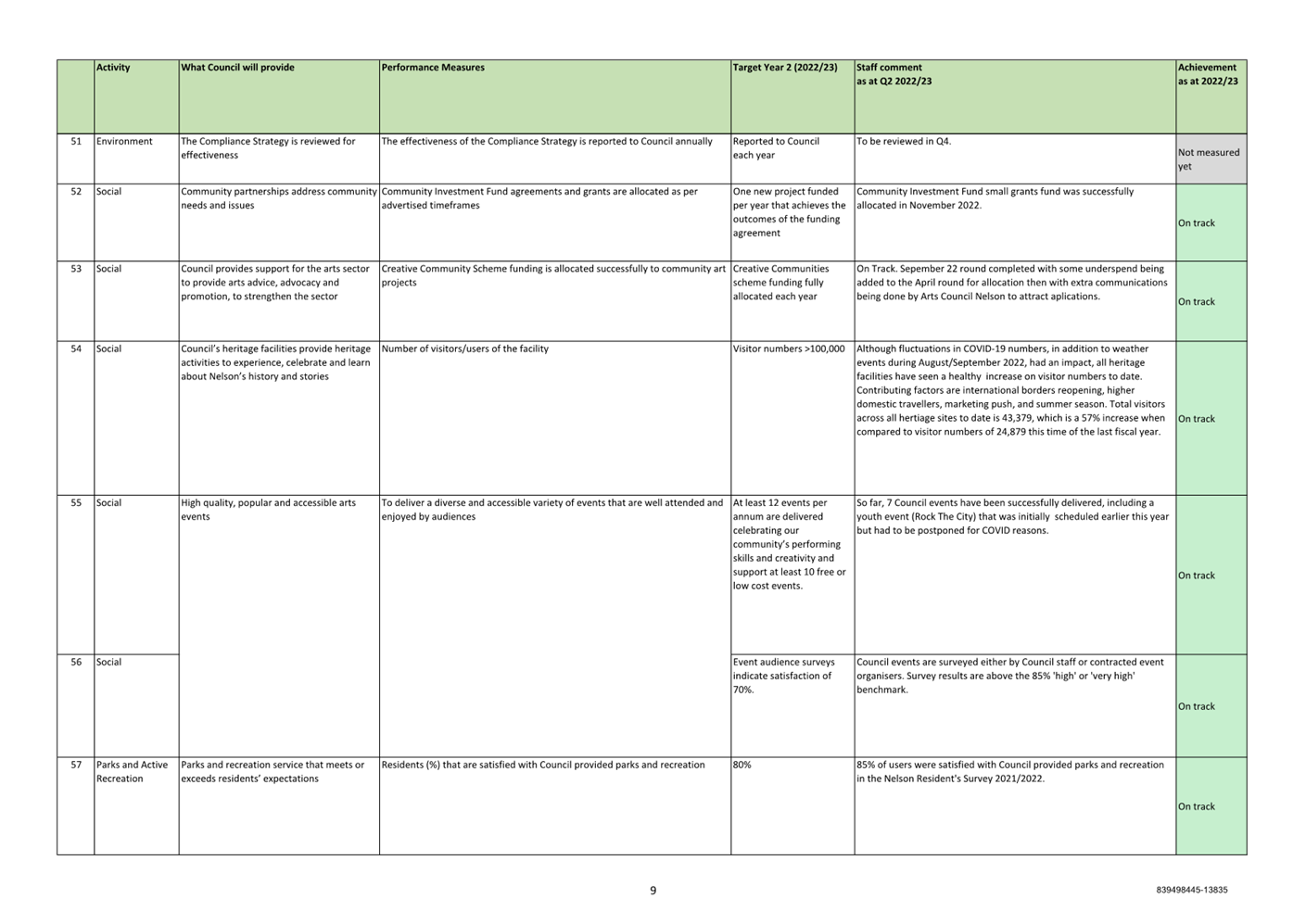

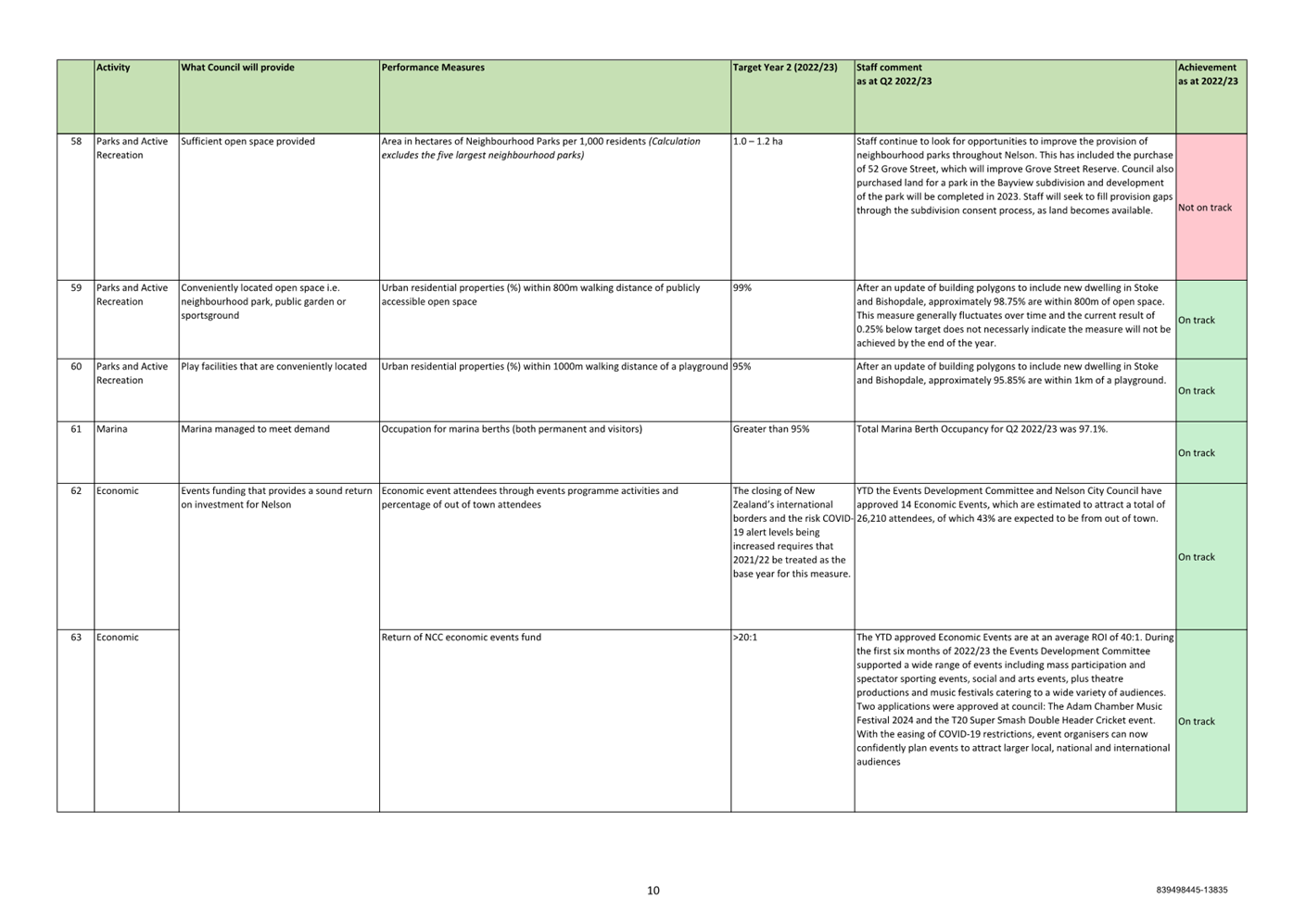

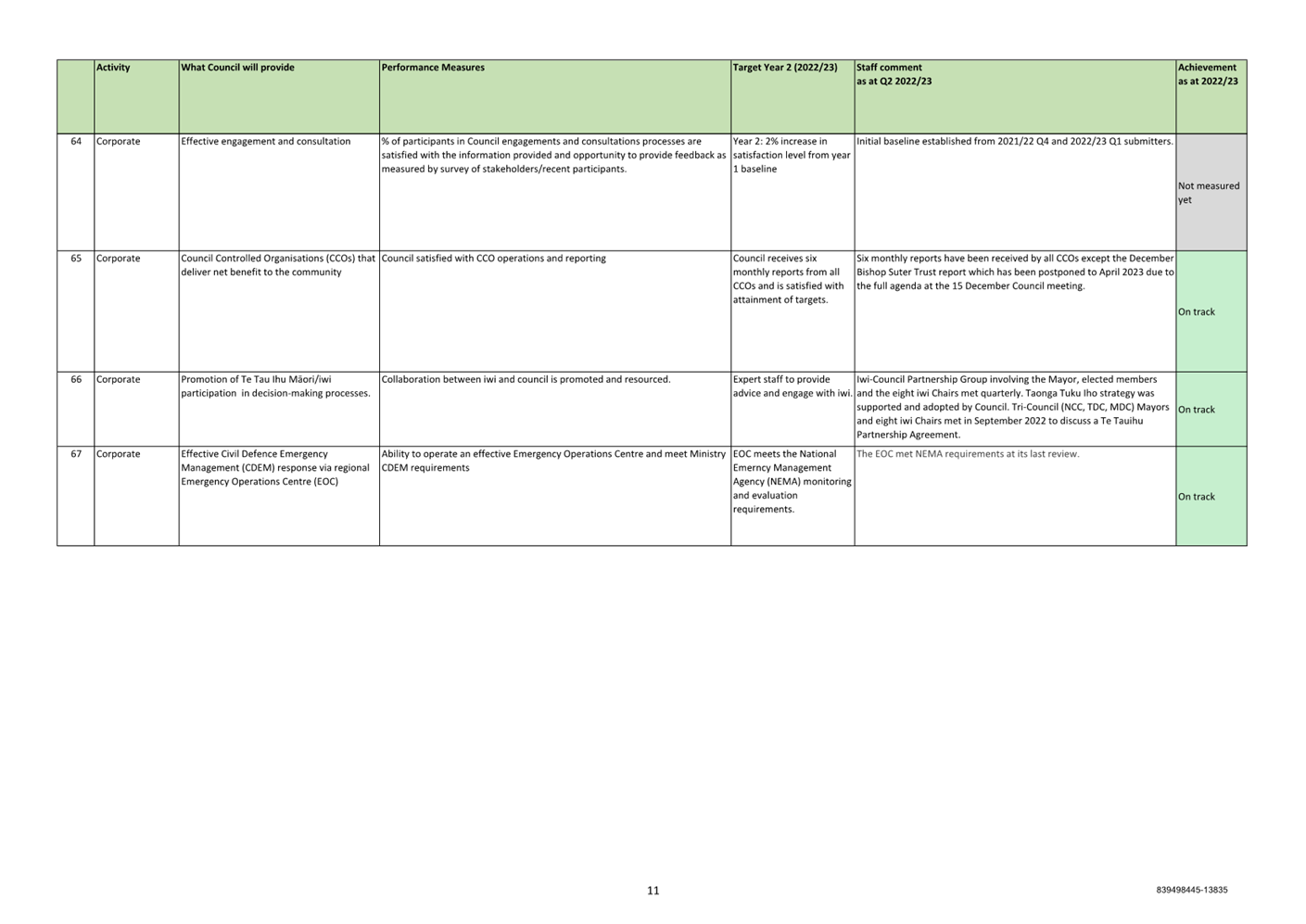

8. Performance

Measures

8.1 Council reports on 67

non-financial performance measures across its activity areas, as set out in the

Long Term Plan 2021-31. These are evaluated as ‘on track/not on track/not

measured yet’ for the first three quarters of the year.

8.2 Of the 67 measures, 49

are on track to achieve, 7 are not on track, and 11 have not been able to be

measured yet as at quarter two. (31 March 2022 results were 50, 9 and 8

respectively).

8.3 Attachment 3 details

Council’s performance measure results so far across all its activities.

Author: Prabath

Jayawardana, Manager Finance

Attachments

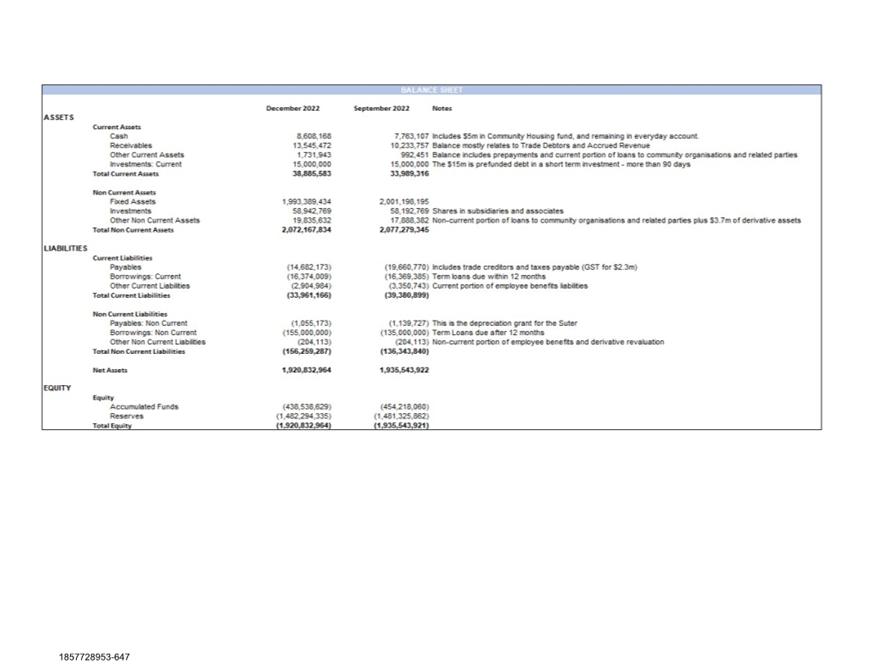

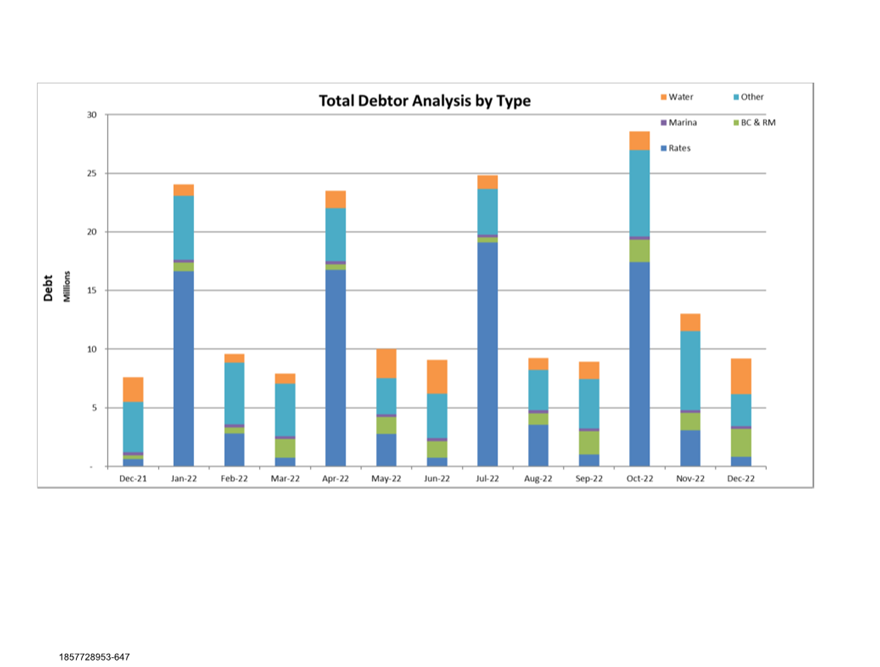

Attachment 1: 1857728953-647

- Finance Dashboard and Graphs - Quarter two 2022/23 ⇩

Attachment 2: 839498445-13756

- Project Health Summary 1 Oct - 31 December 2022 ⇩

Attachment 3: 839498445-13835

- Quarterly Reporting - 22-23 - Performance Measures ⇩

Item 6: Quarterly Finance Report to 31 December 2022: Attachment 1

Item 6: Quarterly

Finance Report to 31 December 2022: Attachment 2

Item 6: Quarterly Finance Report to 31 December 2022:

Attachment 3

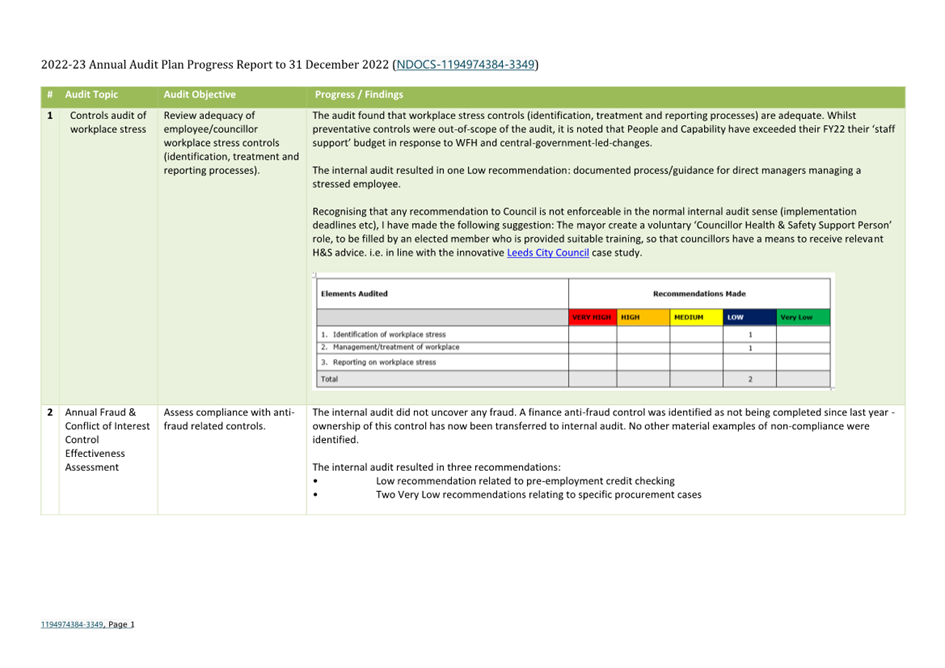

Item 7: Quarterly

Internal Audit Report - 31 December 2022

|

|

Audit, Risk and Finance Committee

24 February 2023

|

REPORT R27420

Quarterly

Internal Audit Report - 31 December 2022

1. Purpose of Report

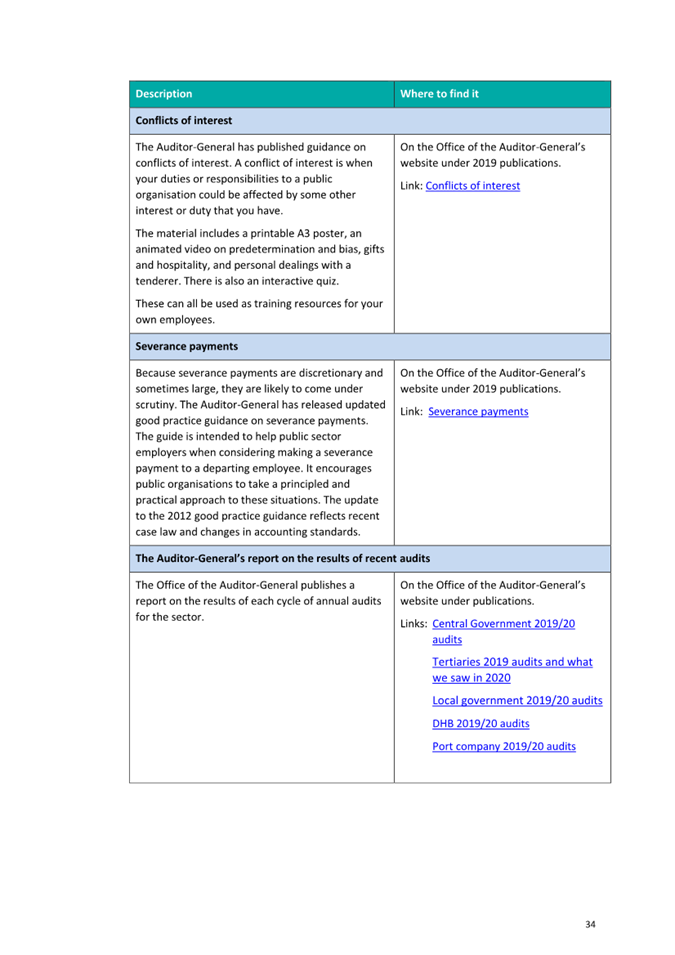

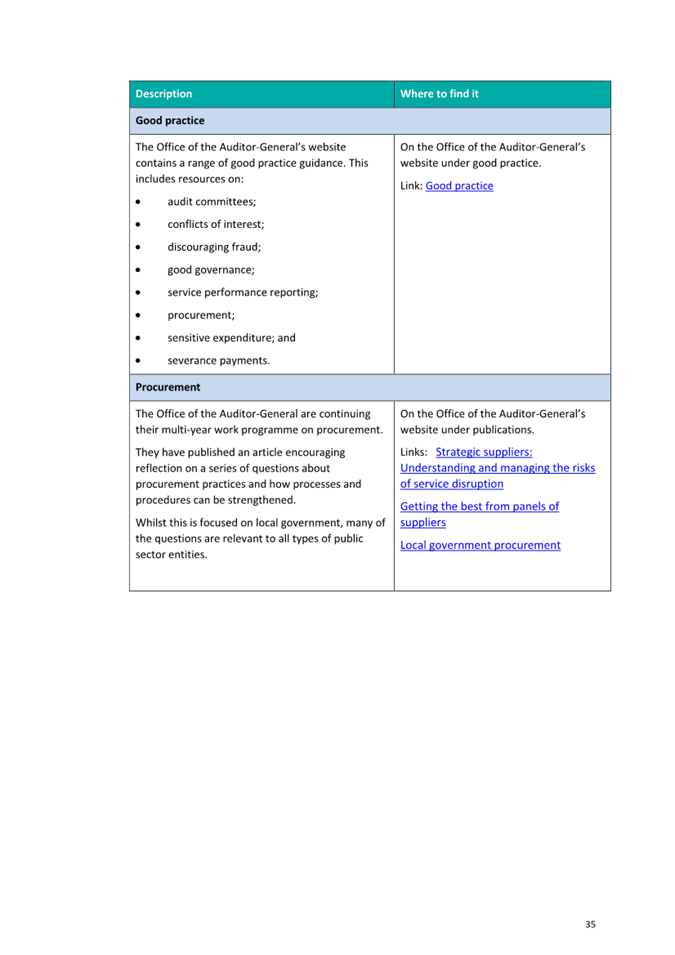

1.1 To update the Audit,

Risk and Finance Committee on the internal audit activity for the half year to

31 December 2022.

2. Recommendation

|

That the Audit, Risk and Finance Committee

1. Receives

the report Quarterly Internal Audit Report - 31 December 2022 (R27420) and its attachment (1194974384-3349).

|

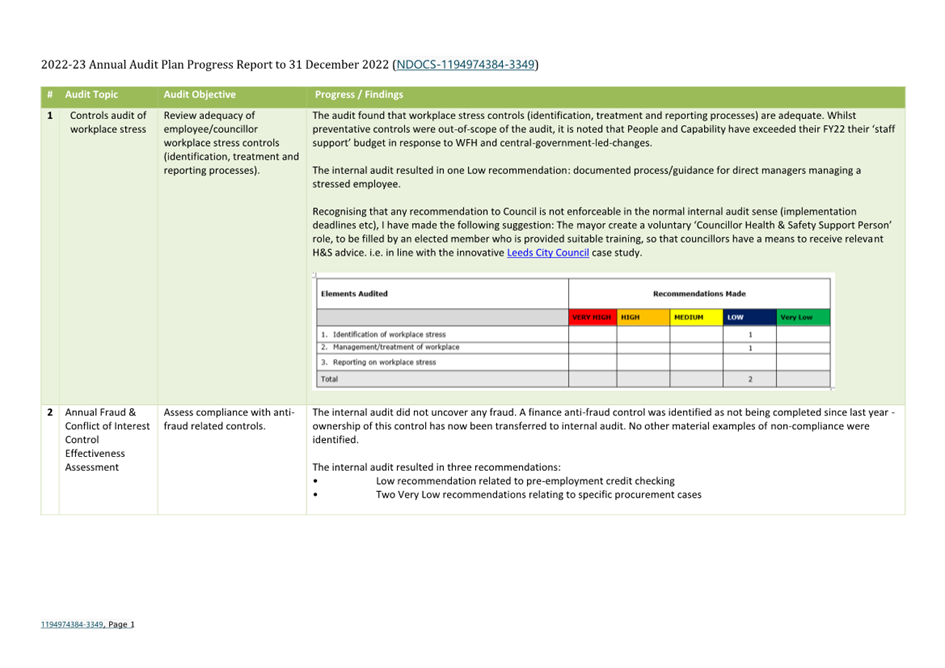

3. Background

3.1 Under Council’s

Internal Audit Charter approved by Council on 15 November 2018 the Audit, Risk

and Finance Subcommittee (now a Committee) requires a periodic update on the

progress of internal audit activities. The 2022-23 Internal Audit Plan (the

Plan) was approved by the Audit, Risk and Finance Subcommittee on 24 May 2022.

The Plan provides for four planned audits, with an allowance for a further one ‘unplanned’

audit.

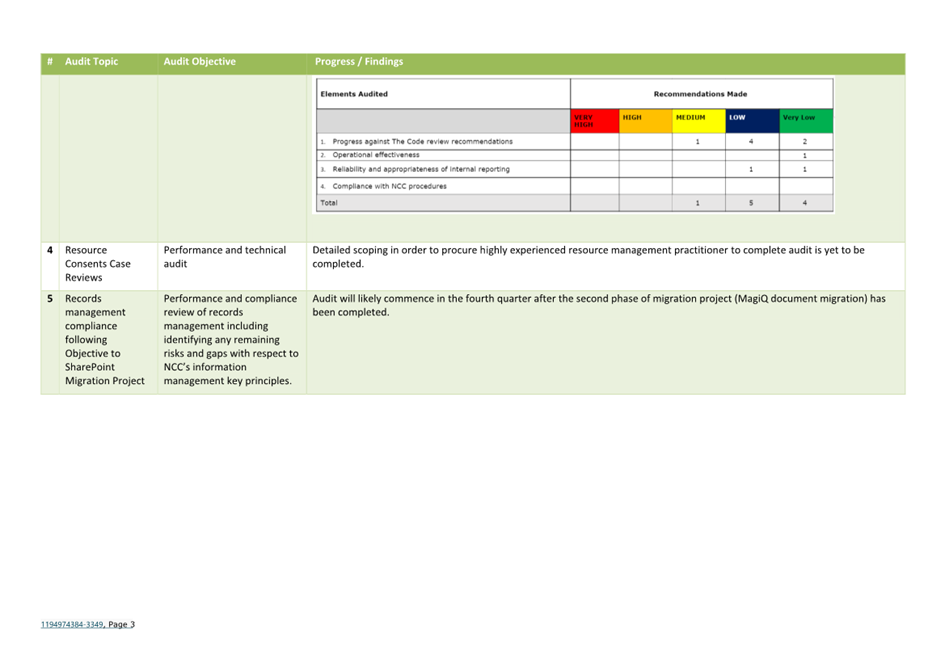

4. Overview of

Progress on the 2022/23 Internal Audit Plan

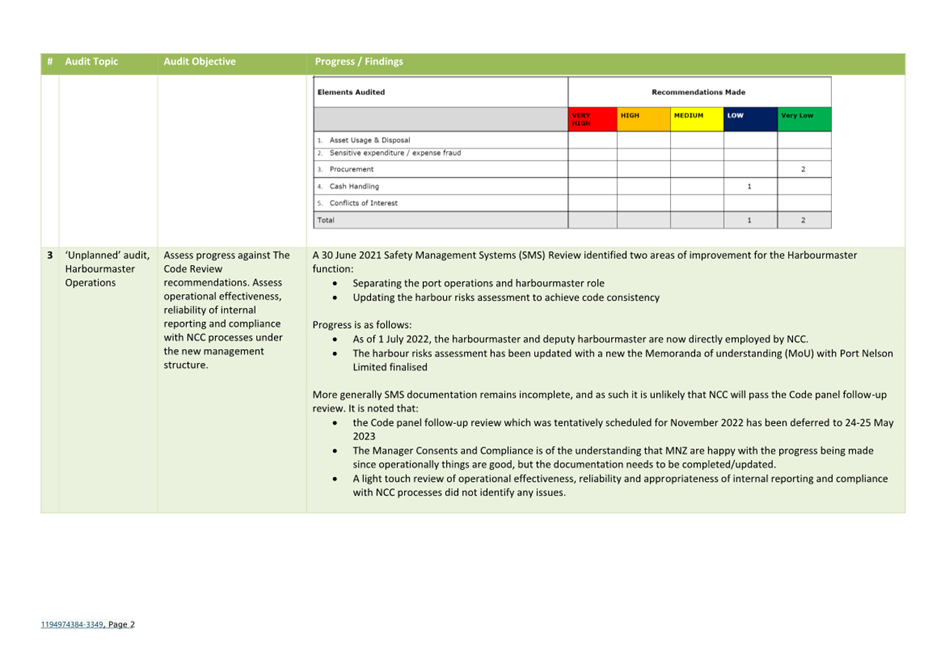

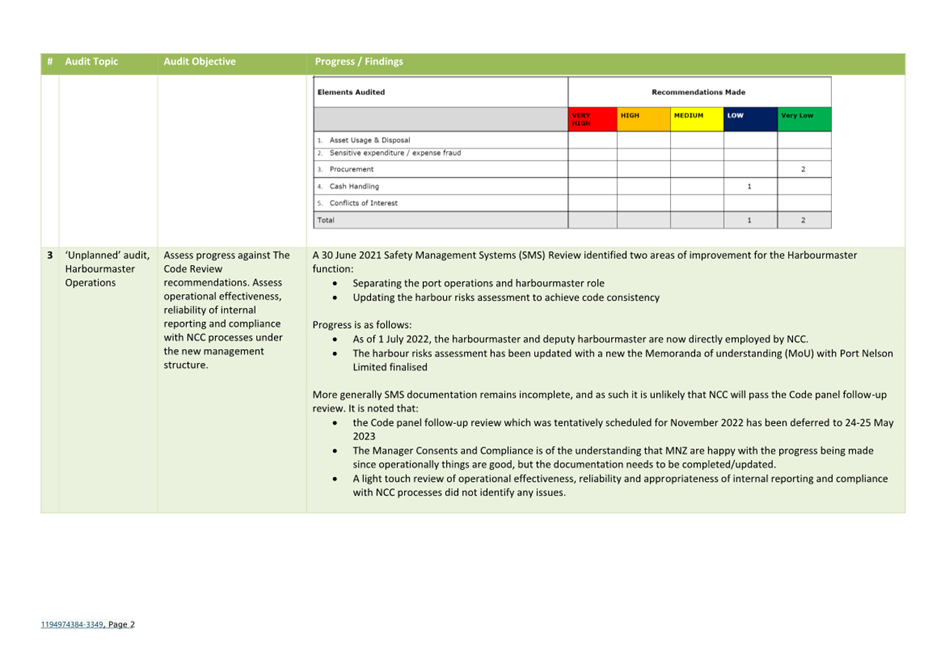

4.1 One ‘unplanned’

audit and two planned and have been completed as at 31 December 2022:

4.1.1

Controls audit of workplace stress

4.1.2 Annual

fraud & conflict of interest control effectiveness assessment

4.1.3 ‘Unplanned’

audit, harbourmaster operations

4.2 Further details of Plan

progress are provided in Attachment 1 - Annual Audit Plan Progress to 31 December

2022.

5. Significant

external audits that are not reported separately to the Audit, Risk and Finance

Committee

5.1 The International

Accreditation New Zealand’s (IANZ’s) Building Consent Authority (BCA)

two-yearly audit is due to commence in June 2023. In preparation, the Building

business unit has commissioned an internal audit (completed by an external

contractor) which, amongst other things, will look at compliance with

Regulation 18 – Requiring technical qualifications and Regulation 15

– Keeping organisational records.

5.2 Progress on

recommendations relating to the external review of council processes for

managing large construction projects, focusing on the Greenmeadows

Pūtangitangi building will be provided next quarter.

Author: Chris

Logan, Audit and Risk Analyst

Attachments

Attachment 1: 1194974384-3349

Annual Audit Plan Progress - 31 Dec 2022 ⇩

Item 7: Quarterly Internal Audit Report - 31 December

2022: Attachment 1

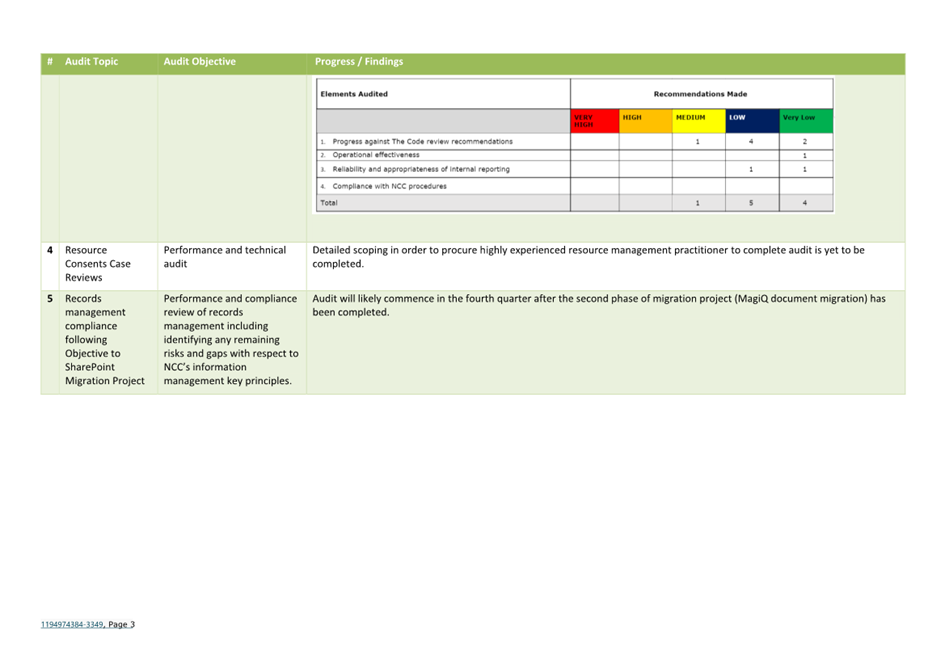

Item 8: Quarterly Risk

Report - 31 December 2022

|

|

Audit, Risk and Finance Committee

24 February 2023

|

REPORT R27421

Quarterly

Risk Report - 31 December 2022

1. Purpose of Report

1.1 To provide information

to the Audit, Risk and Finance Committee on the organisational risks through to

end of the first half of 2022-23.

2. Recommendation

|

That the Audit, Risk and Finance Committee

1. Receives

the report Quarterly Risk Report - 31 December 2022 (R27421).

|

3. Background

3.1 This report includes

information on risk management practice, a summary of Council risks and a

deeper dive into key risk areas, divided by risk theme (organisational risks)

and reporting Group.

4. Risk Management

Practice

4.1 The 2022-23 risk

management work plan includes:

4.1.1 risk training for four business units

4.1.2 two team leader or manager anti-fraud

trainings

4.1.3 new councillor risk management induction

4.1.4 review risk tolerance with new chair

of Audit, Risk and Finance

4.1.5 updating the legal compliance

consequence description

5. Putting

Organisational Risks in Context

5.1 This section

summarises risks relating to Council and joint operations. Risks relating to

subsidiaries and joint ventures are limited to ownership risks. Risks relating

to contracted-out activities are limited to residual/non-contracted-out risks.

Specific asset, activity, legal matter, or project risks are rolled up into

more general asset, activity, legal or project risks however any significant

items are summarised in the last section.

5.2 There were 478 risk

entries in the centralised register at 19 December 2022 compared to 437 at 30

June 2022, with 11 risks deleted and 52 risks added.

5.3 Thirty-two of the risk

entries have status overdue (treatments have not been signed off) compared to

13 at 30 June 2022. A level of 10-20 overdue risk entries would be considered

reasonable given the treatment renewal process is new and the sign-off delays

associated with newly identified risks. An effort is being made to bring overdues

down early next calendar year to a more acceptable level.

5.4 Risk entries are

categorised in two ways:

5.4.1 risks with no apparent common theme or

cause and hence unlikely to pose a threat at an organisational level (348 risk

entries), and

5.4.2 risks with identified common themes or

causes which create risk concentrations that pose a threat at an organisational

level (130 risk entries)

5.5 The latter is the

focus of this report and further detail is provided the next section.

6. Key Risk Areas By

Theme (Organisational Risks)

6.1 A summary of key risk

themes is provided below:

6.2 R1

- Central-government-led-reforms (Owner: Chief Executive). Whilst noting that

project management is in place to manage organisational changes within the

three-waters transition program both at the elected member and staff level, the

risk rating remains at Very High.

6.3 R2

- Lifeline services failure (Owner: Group Manager Infrastructure).

Flood-recovery work is ongoing, with contractor/resource capacity constraints and

detailed scoping for many permanent infrastructure repairs yet to be completed.

No other new emerging risks to report at this time. The risk rating remains at

Medium.

6.4 R3 - Illness, injury

or stress from higher hazard work situations (Owner: Group Manager Corporate

Services). A review of underlying risk register entries for this organisational

risk was completed, with the assistance of the Heath Safety & Wellness

Adviser, during the first half of the financial year resulting in a decreased

risk score for some risks. However, the risk rating remains at High.

6.5 R4 - Loss of service

performance from ineffective contracts and contract management (Owner: Chief

Executive). Work on planned treatments paused due to staff vacancies. The

risk rating remains at Medium.

6.6 R5

- Compromise of Council service delivery from information technology failures

(Owner: Group Manager Corporate Services). No new emerging risks to report at

this time. The risk rating remains at Low.

6.7 R6 - Council work

compromised by loss of and difficulties in replacing skilled staff (Owner:

Manager People and Capability). At end of December there were 53 vacancies (cf.

47 vacancies in May), some of which have been open for some time despite

repeated recruitment efforts, engaging recruitment consultants and

re-evaluating the job description. The organisational risk rating remains at

Medium.

6.8 R7 – Legal Risk

(Owner: Group Manager Strategy and Communications). Increased legal risks as

part of the flood recovery e.g. Council slips on private land – rated

Medium. No other emerging organisational risks to report at this time noting

that any new legal proceedings or emerging areas of increased litigation risk

are separately reported in the quarterly report on legal proceedings. The

organisational risk rating remains at Medium.

6.9 R8

- Reputation damage and loss of public trust in the organisation (Group Manager

Strategy and Communications). No new emerging risks

to report at this time. The risk rating remains at Medium.

6.10 R9 - Disruption to Council

service delivery due to significant increase in COVID-19 cases (Owner: Chief

Executive). Insignificant impact on Council services to date. The

organisational risk rating remains at Medium.

7. Key Risk Areas By

Reporting Group

7.1 Office of the Chief

Executive: No new emerging risks to report at this time.

7.2 Infrastructure

Group: COVID-19 related risks are being realised including on-site

project delays from self-isolation requirements and previously noted related

supply chain risks for materials. The Utilities and Roading business units,

NTRLBU and NRSBU labour and contractor capacity remains constrained resulting

in elevated operational risk. For the Utilities team, the situation is expected

to deteriorate especially with the work expected on the three-waters reform.

7.3 Community

Services Group: Risks associated with Council owned campgrounds (two operated

and one leased) remain elevated whilst non-compliance remediation actions are

being implemented. Specifically, the risk around displacing vulnerable people

is being closely managed at present through significant support being provided

to residents. The risks previously monitored by elected members through the

Strategic Development and Property Subcommittee have been monitored through the

usual organisational processes since that subcommittee ceased operating.

7.4 Environmental

Management Group: No new emerging risks to report at this time.

7.5 Strategy

and Communications Group: Retention and recruitment continues to be a

challenge, magnifying certain risks such as workplace stress.

7.6 Corporate

Services Group: No new emerging risks to

report at this time.

Author: Chris

Logan, Audit and Risk Analyst

Attachments

Nil

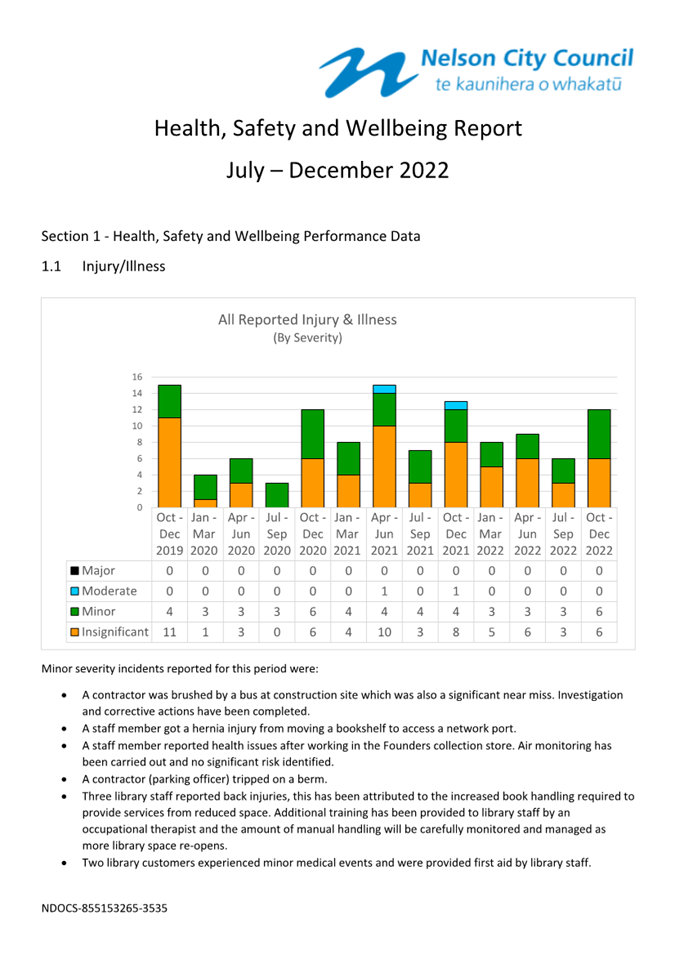

Item 9: Health, Safety

and Wellbeing Report to 31 December 2022

|

|

Audit, Risk and Finance Committee

24 February 2023

|

REPORT R27426

Health,

Safety and Wellbeing Report to 31 December 2022

1. Purpose of Report

1.1 To provide the

Committee with a report on health, safety and wellbeing data collected over the

period July to December 2022.

1.2 To

update the Committee on key health and safety risks, including controls and

treatments.

2. Summary

2.1 A

number of incidents at the Matai Camp have resulted in a review of Camp

security and staff safety.

2.2 Council’s

key health and safety risk COVID-19 impacts has decreased since the previous

report.

2.3 Two

risks have been removed from the key health and safety risks.

3. Recommendation

|

That the Audit, Risk and Finance Committee

1. Receives

the report Health, Safety and Wellbeing Report to 31 December 2022 (R27426) and its attachment

(855153265-3563).

|

4. Background

4.1 Elected members, as

‘Officers’ under the Health and Safety at Work Act 2015 (HSWA), are

required to undertake due diligence on health and safety matters.

Council’s Health and Safety Governance Charter states that Council will

receive quarterly reports regarding the implementation of health and

safety. Council has delegated the responsibility for health and safety to

the Audit, Risk and Finance Committee.

4.2 Health, safety and

wellbeing performance data reports provide an overview based on key lead and lag

indicators. Where a concerning trend is identified more detail is provided to

better understand issues and implement appropriate controls.

4.3 Providing an update on

key health and safety risks expands on the very high-level overview provided in

the organisational risk report.

4.4 There was no Audit,

Risk and Finance Committee meeting to report to following quarter one 22/23,

therefore this report includes incidents from a six-month period.

5. Discussion

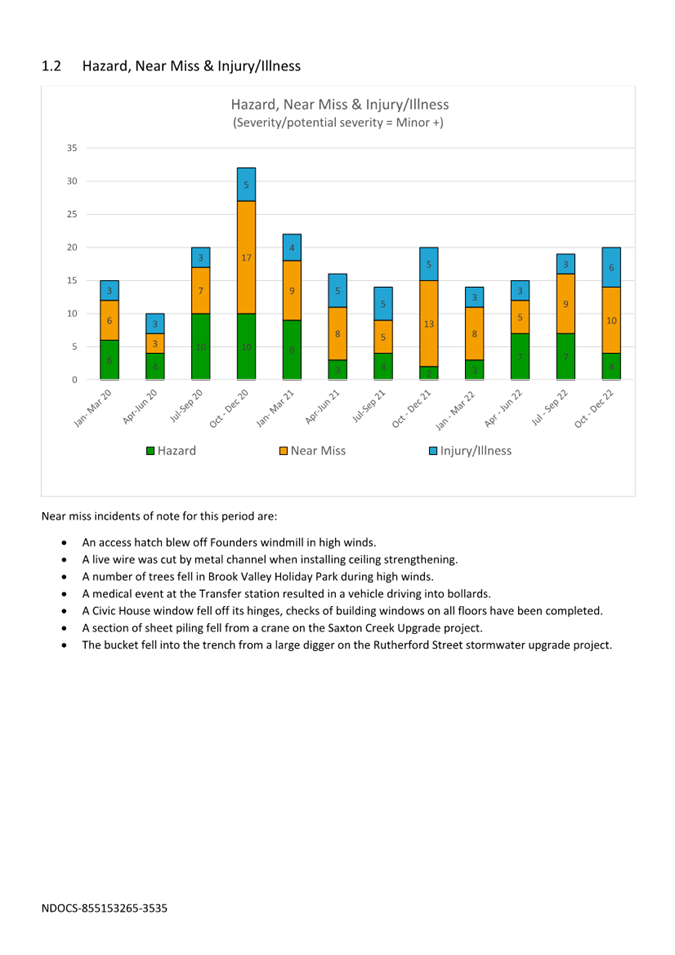

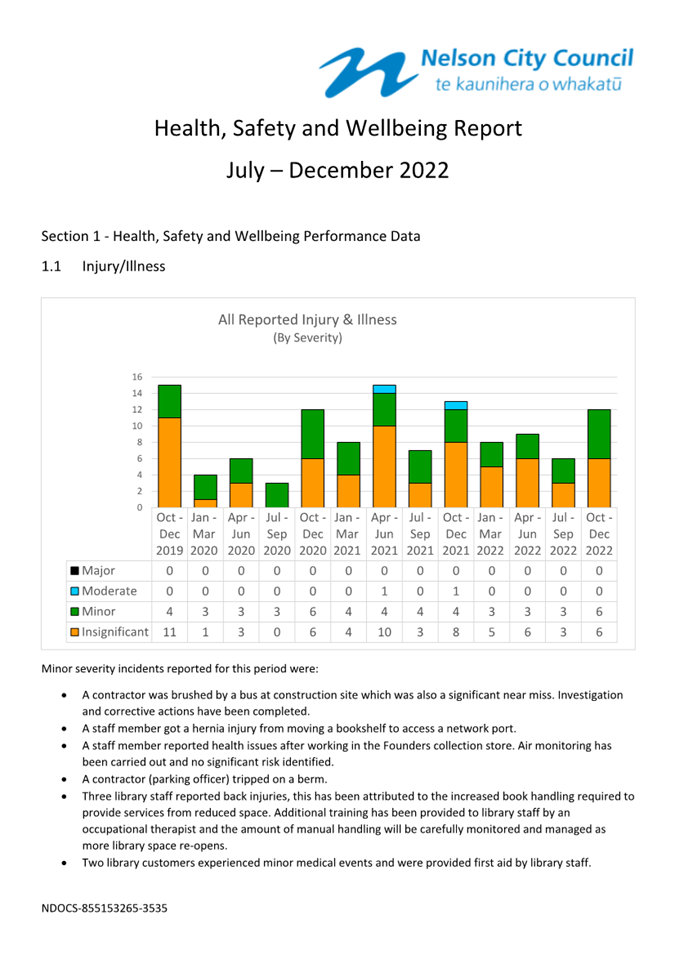

5.1 Incidents of note:

5.1.1 All

injury or illness incidents of minor severity or greater for the reporting

period are noted in the attachment; any significant incidents or incident

trends of note are outlined below.

5.1.2 Three

lower back injuries were reported by library staff. Increased book handling is

required to provide services while operating out of a smaller space. Additional

injury prevention training has been provided to library staff by an

occupational therapist and book handling processes will be carefully monitored

and managed as more library space re-opens.

5.1.3 A

contractor was brushed by a passing bus while visiting the Rutherford Street

stormwater project, the contractor was talking to workers inside the site

through the site fencing and had not signed into the site at the time of the incident.

The contractor has provided a full investigation report and implemented

corrective actions.

5.1.4 Two

near miss incidents involving separate contractors related to heavy objects

falling from height. In both cases the key control of not having workers under

suspended loads was effective at preventing harm. Further controls have been

implemented by these contractors to reduce the likelihood of objects falling

from height.

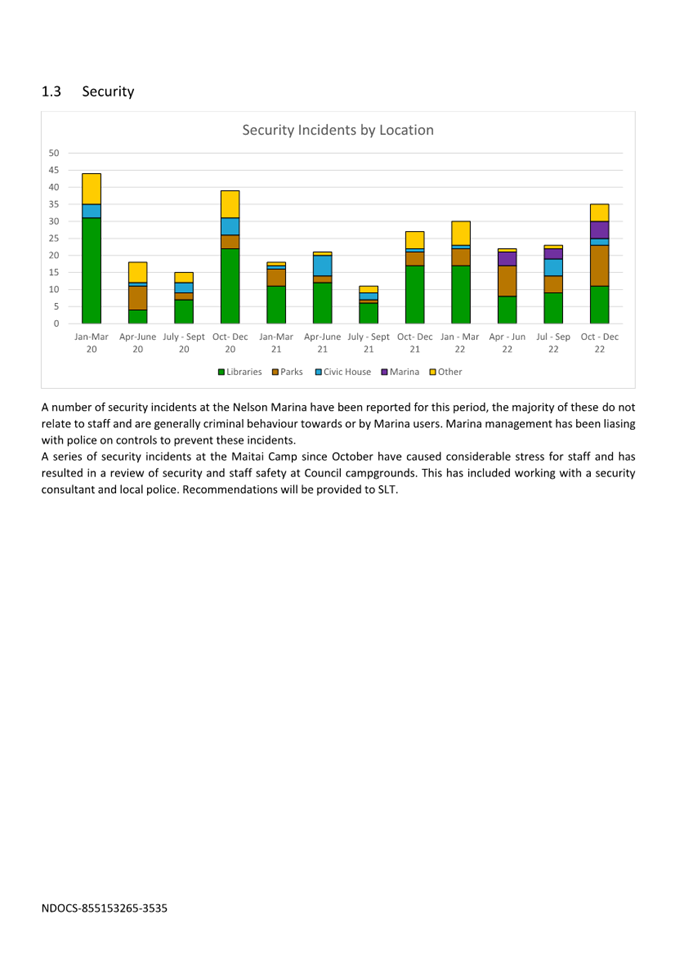

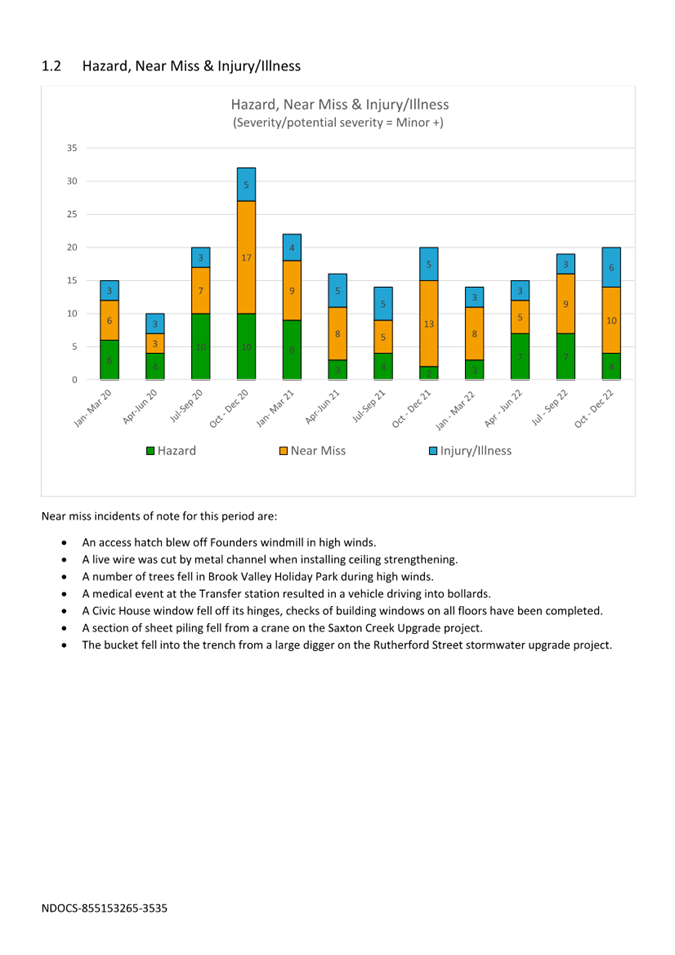

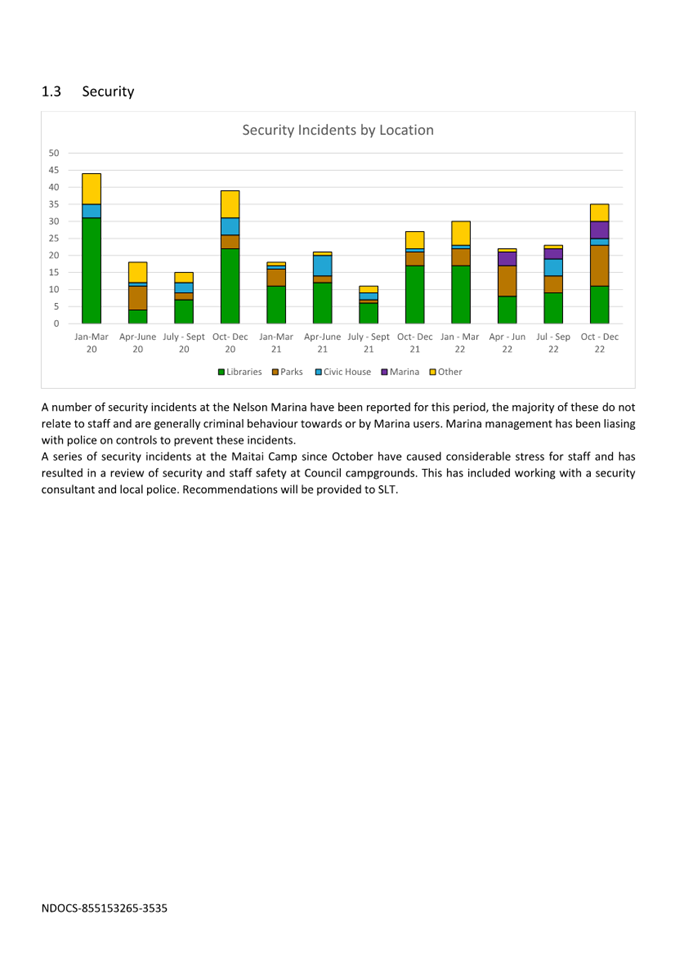

5.1.5 All

the security incidents reported in the park’s category were at Council

run campgrounds with the majority for this reporting period being at the Maitai

Valley Campground. Camp staff have completed aggressive customer training and a

security consultant has provided recommendations for improvements to physical

security. These recommendations are being considered and actions prioritised by

Council officers. Additional security guard services were engaged at

campgrounds over the busy new year period and during The Bay Dreams Event.

5.1.6 The

Marina reported several incidents related to criminal behaviour on vessels and

other areas of the marina. Liaison with police is occurring and CCTV

improvements are planned.

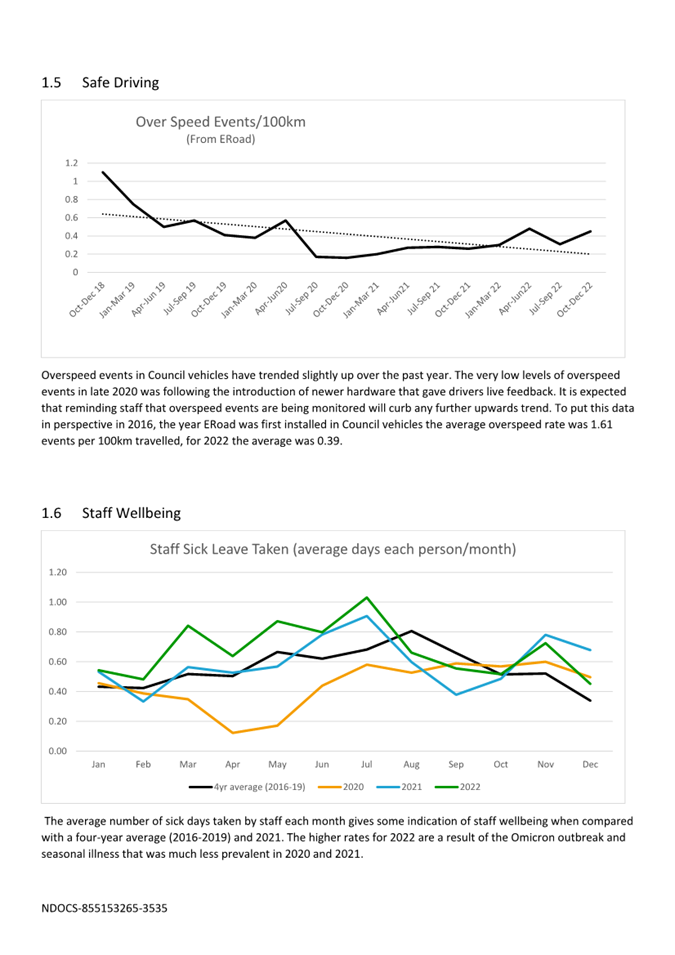

5.2 COVID-19

Response

5.2.1 The

second and third waves of Omicron in July and December impacted a number of

staff. Effective workplace controls have kept rates of workplace transmission

low even though very few mandatory controls remain.

5.2.2 Staff

reporting of COVID-19 positive test results allows for a timely response to information

about possible workplace exposure and ensures the effectiveness of controls can

be monitored.

5.2.3 Council’s

COVID monitoring group monitors data and COVID-19 news on an ongoing basis. The

monitoring group currently meets six weekly and reports to SLT if a significant

trend or risk is identified.

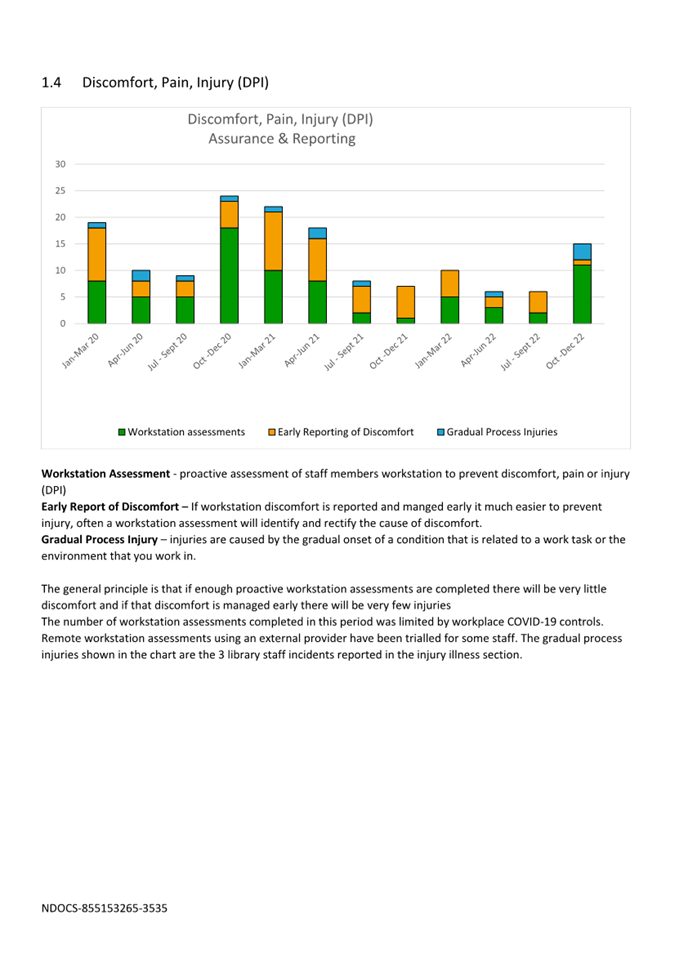

5.3 Lead

Indicators

5.3.1 Reported

contractor health and safety oversight activities such as safe work

observations and health and safety document reviews remain significantly lower

than 2021 levels. Discussions with staff indicate that this a reflection of not

reporting these activities in the health and safety database rather than not

completing them.

5.3.2 A

trial of remote workstation assessments and having more staff present in the

workplace has allowed for an increasing number of workstation assessments to be

completed.

5.4 Due

Diligence Activities

5.4.1 Three

safe work observations or safety tours were reported for this period and are

detailed in the attachment. Only one of these was attended by an elected

member.

5.4.2 During

July and August these site visits for elected members were not scheduled due to

COVID-19 risk. Following this the election and induction of the new Council

impacted the ability to schedule workplace visits with a specific focus on

health and safety.

5.4.3 A

review of the Health and Safety Governance Charter is scheduled for April 2023.

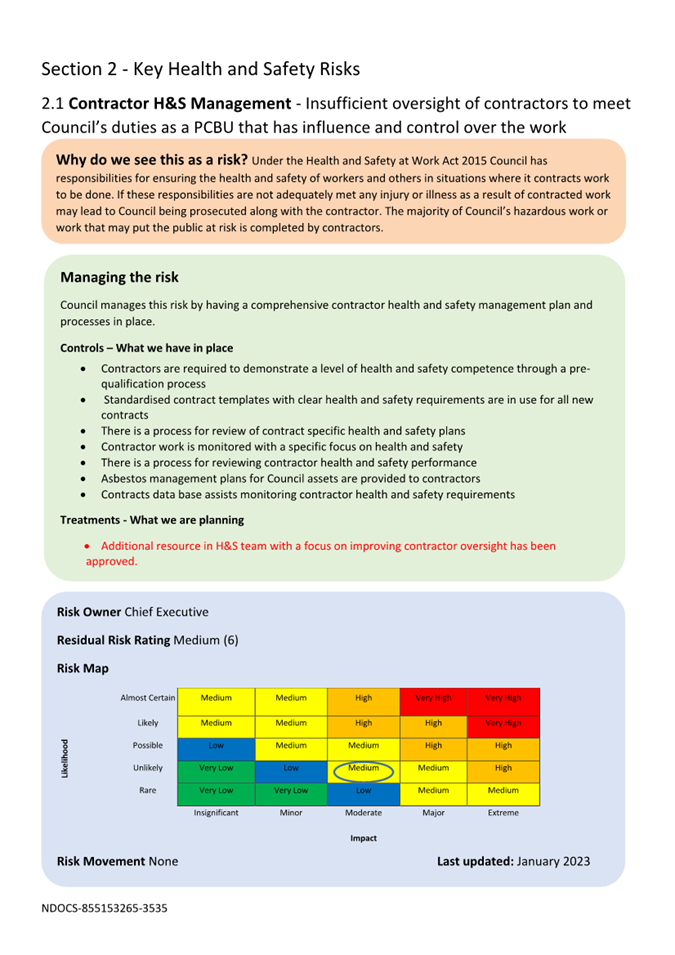

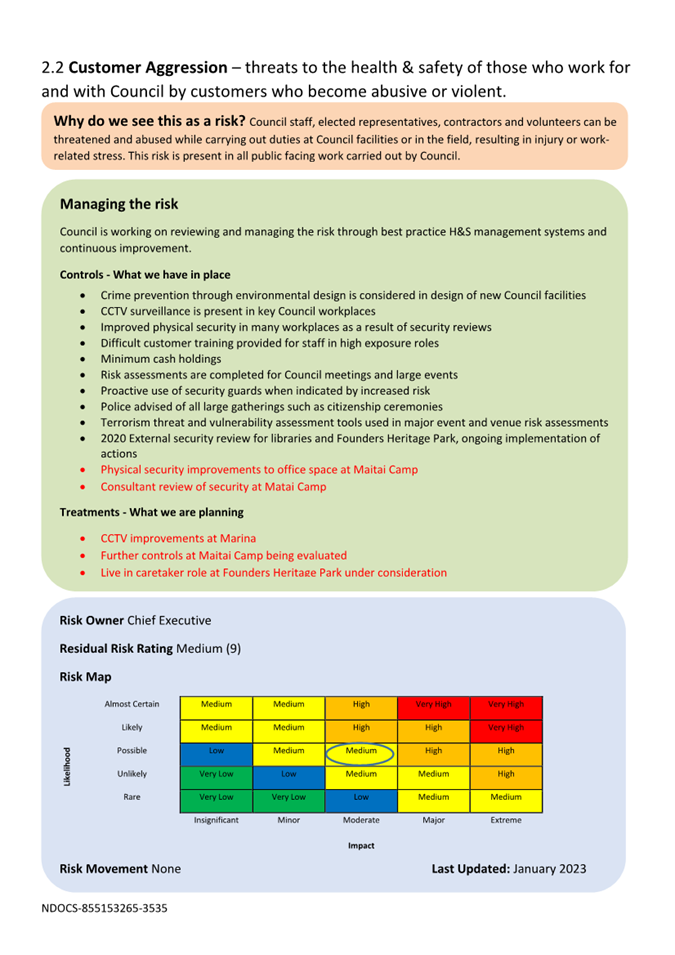

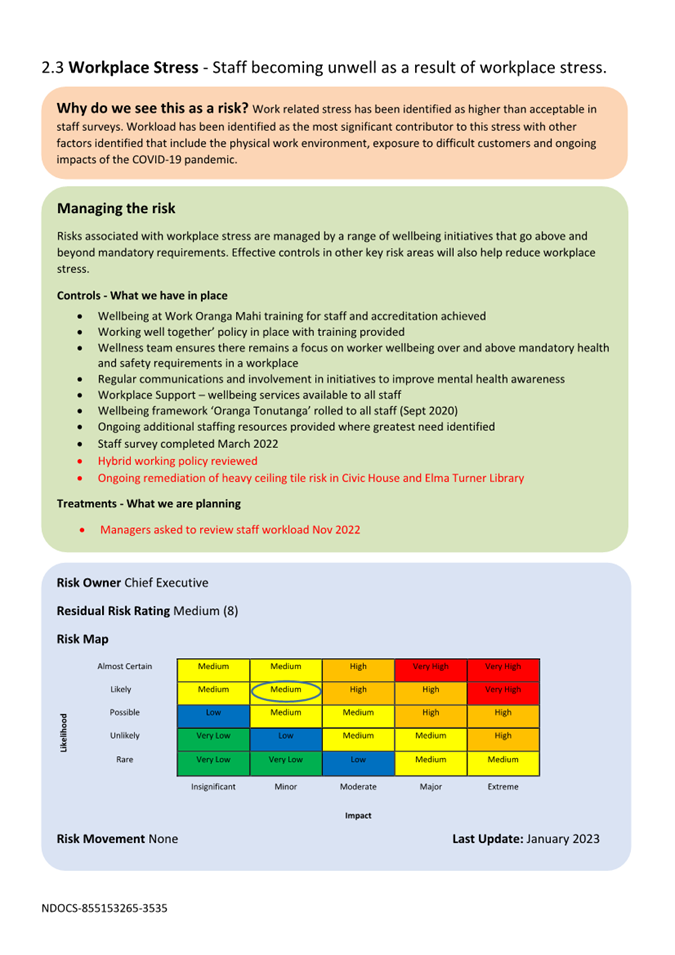

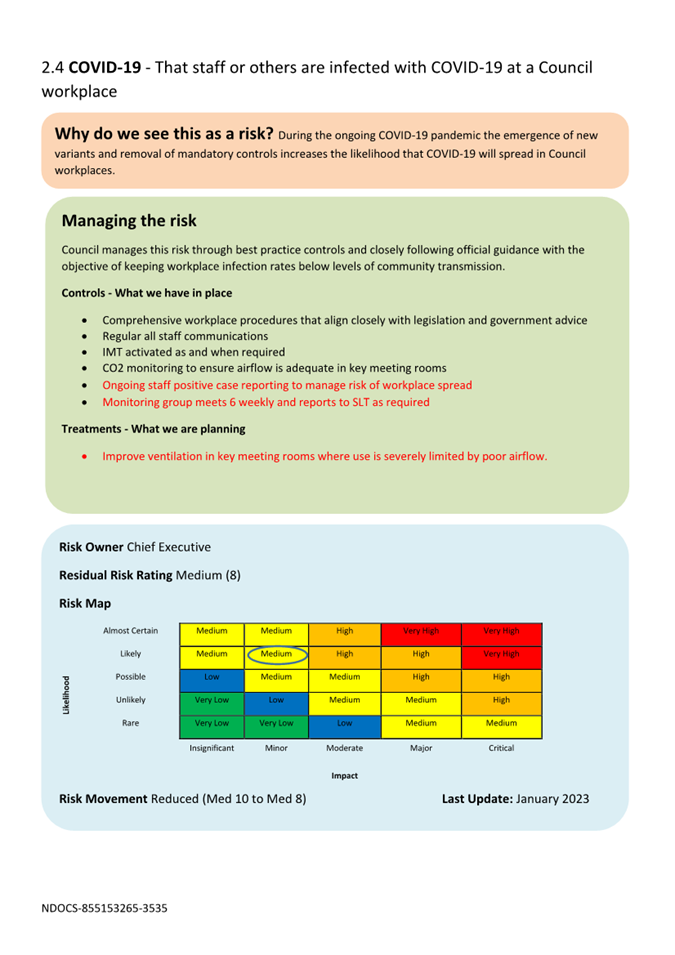

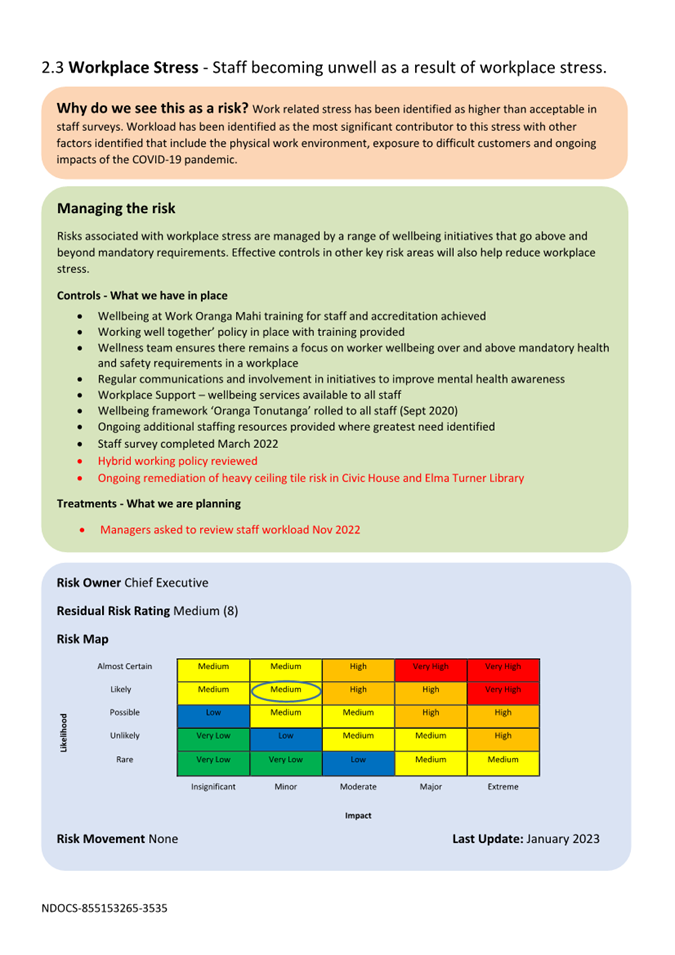

6. Key

Health, Safety and Wellbeing Risks

6.1 Key

health, safety and wellbeing risks have been reviewed. Changes to treatments

and controls since the previous report are shown in red text.

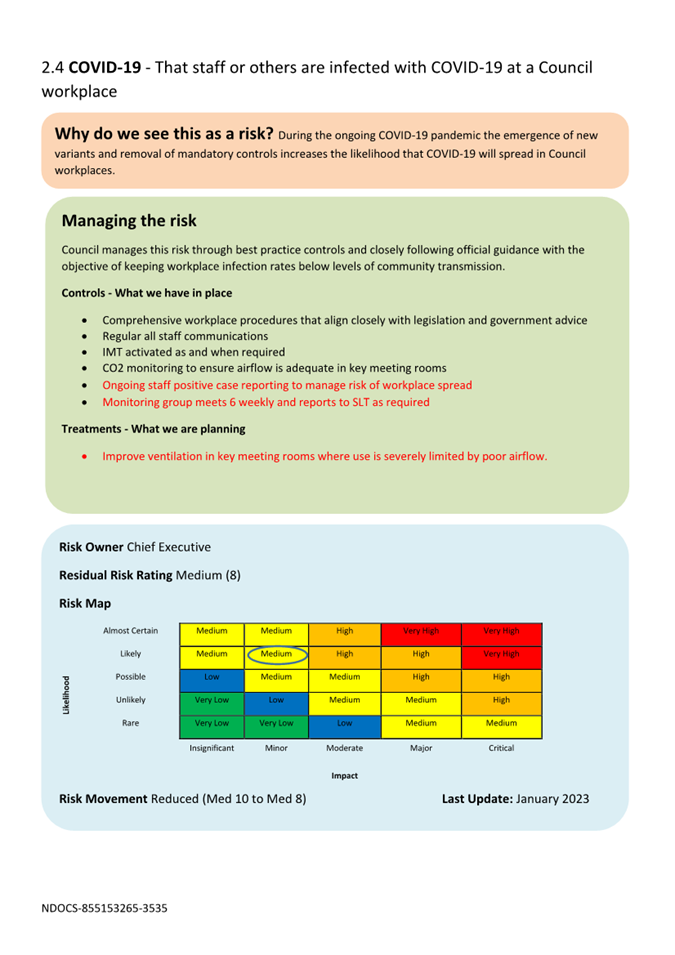

6.2 The

key risks contractor health and safety oversight, customer aggression and

workplace stress remain unchanged.

6.3 COVID-19

(That staff or others are infected with COVID-19 at a Council workplace) risk

has been assessed as decreasing from medium(10) to medium(8). This risk will be

removed from Councils key health and safety risks when the risk decreases further.

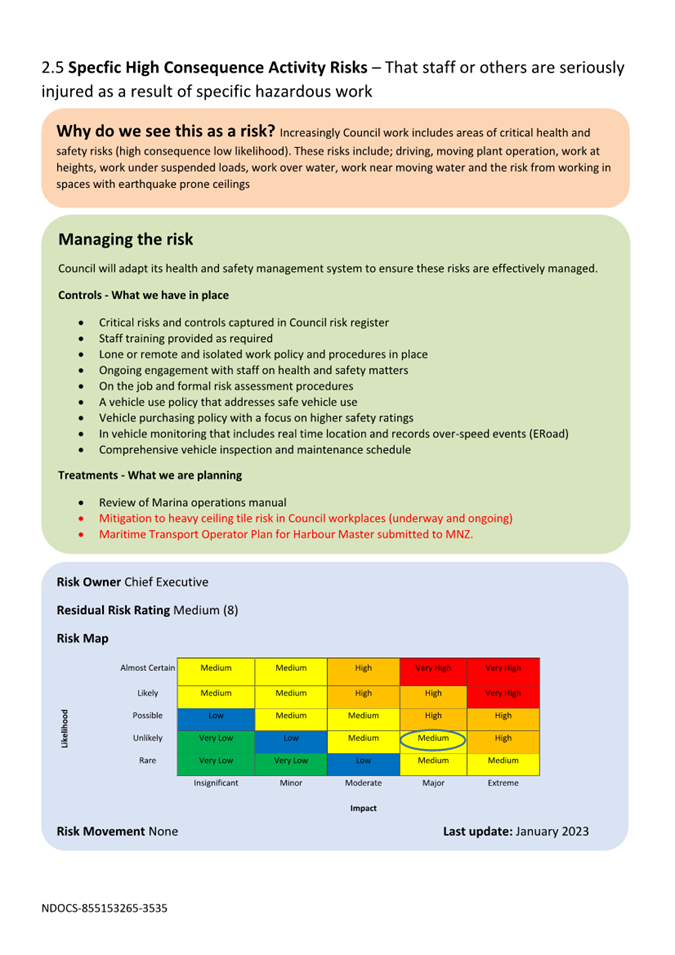

6.4 The

review of the key health and safety risks identified that the title ‘high

energy sources (that staff or others are seriously injured due to inadequate

control of high energy sources)’. was potentially confusing and this risk

has been renamed as ‘Specific high consequence activity risks (that staff

or others are seriously injured as a result of specific hazardous work)’.

This addresses a number of high consequence but very low likelihood risks

associated with Council work and includes driving and working in spaces with

earthquake prone ceilings.

6.5 The

risk ‘sedentary or strenuous work (staff becoming unwell or injured due

to the sedentary or strenuous nature of their work)’ has been removed

from Council’s key health and safety risks. Although the majority of

Council staff may be exposed to these risks, consequences are generally low and

processes for control of these risks are comprehensive and well understood.

6.6 The

risk ‘emergency preparedness (that emergency plans for Council work and

workplaces are not effective when required, resulting in increased harm from an

adverse event)’ has also been removed from Council’s key health and

safety risks. A review of this risk identified that although improvements can

be made in emergency plans and procedures a greater reduction in risk was

likely to be achieved by an increased focus on the underlying high consequence

risks such as remediation of earthquake prone ceilings and ensuring safe

vehicle use.

Author: Malcolm

Hughes, Health Safety and Wellness Adviser

Attachments

Attachment 1: 855153265-3563 -

Health, Safety and Wellbeing Report - July-December 2022. ⇩

Item 9: Health, Safety and Wellbeing Report to 31

December 2022: Attachment 1

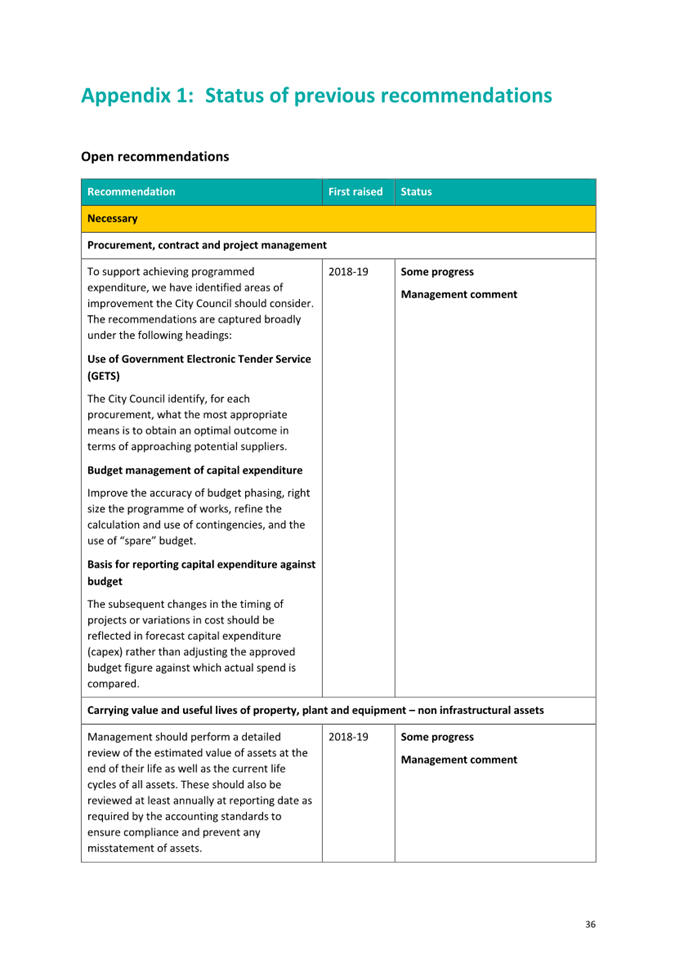

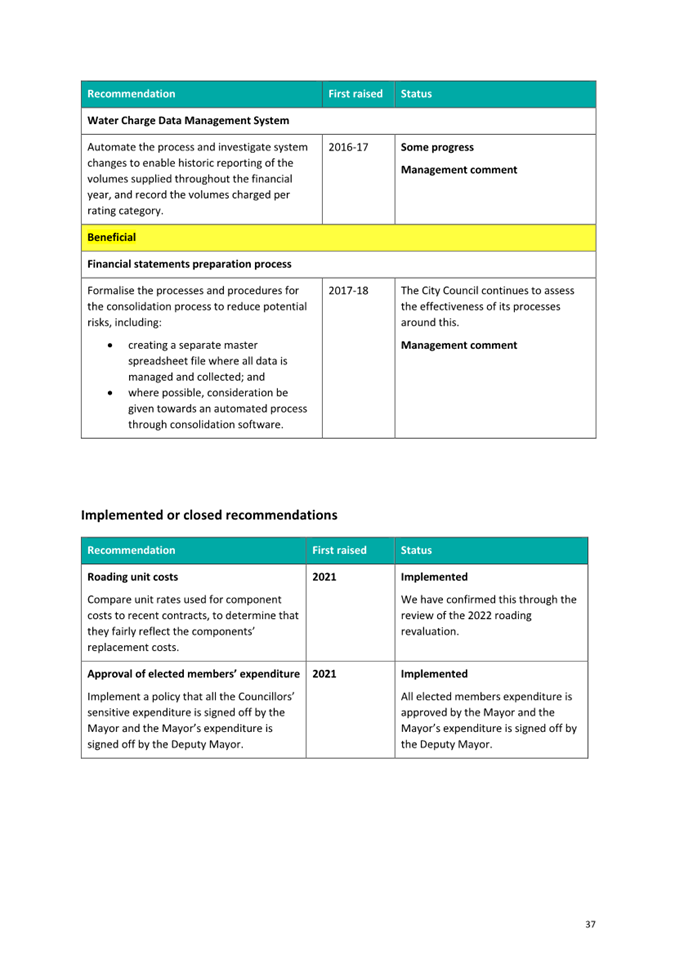

Item 10: Letter from

Audit NZ on Annual Report for year ending 30 June 2022

|

|

Audit, Risk and Finance Committee

24 February 2023

|

REPORT R27491

Letter from Audit NZ on

Annual Report for year ending 30 June 2022

1. Purpose of Report

1.1 To provide the letter

to the Council on the audit for the year ending 30 June 2022 from Audit NZ.

2. Recommendation

|

That the Audit, Risk and Finance Committee

1. Receives

the report Letter from Audit NZ on Annual Report for year ending 30 June 2022

(R27491) and its attachment

(2126778665-296); and

2. Notes Audit NZ’s comments and how officers intend to

address the issues raised (2126778665-296).

|

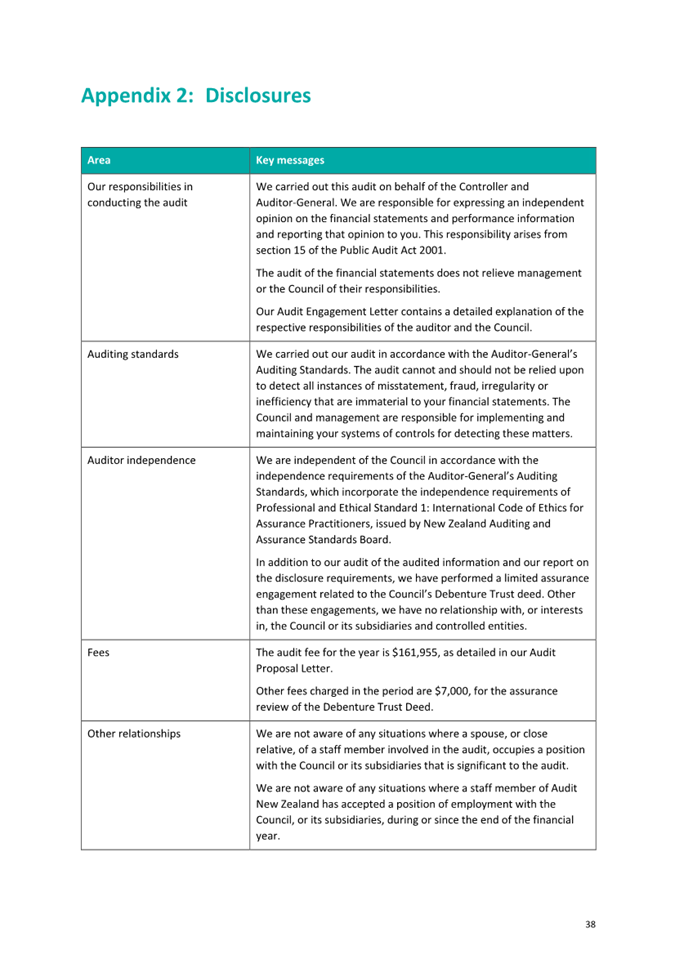

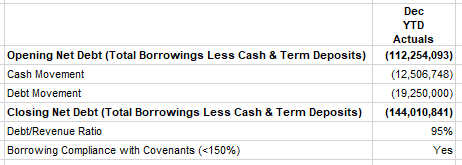

3. Background

3.1 Audit New Zealand

(Audit NZ) issued an unmodified audit opinion on 15 December 2022 for the

financial year ending 30 June 2022. This means that it was satisfied that the

financial statements fairly reflected Council's activities for the year and its

financial position at the end of the financial year.

3.2 Audit NZ included an

Emphasis of Matter paragraph to draw attention to the disclosure, in the

financial statements, of the inherent uncertainties in the Government’s

proposed Three Waters Reform programme.

3.3 After the audit is

completed, Audit NZ issues a management letter to Council outlining the

findings of the audit.

3.4 In the letter to

Council, received on 27 January 2023 (Section 3, Attachment 1), Audit NZ

comment on a number of matters considered in the Audit Plan to be the main

audit risks and issues:

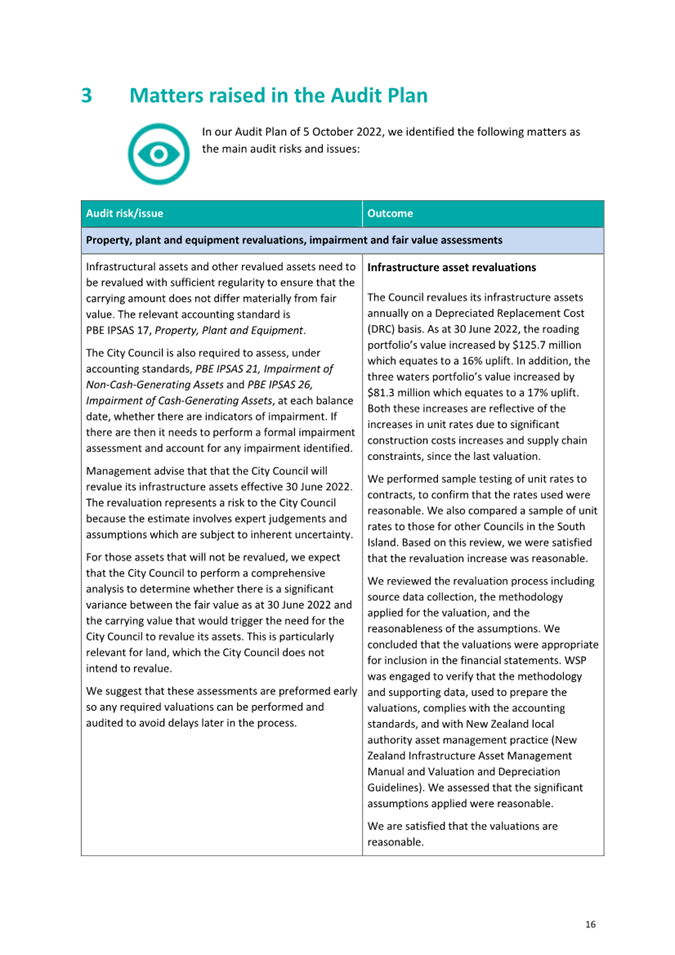

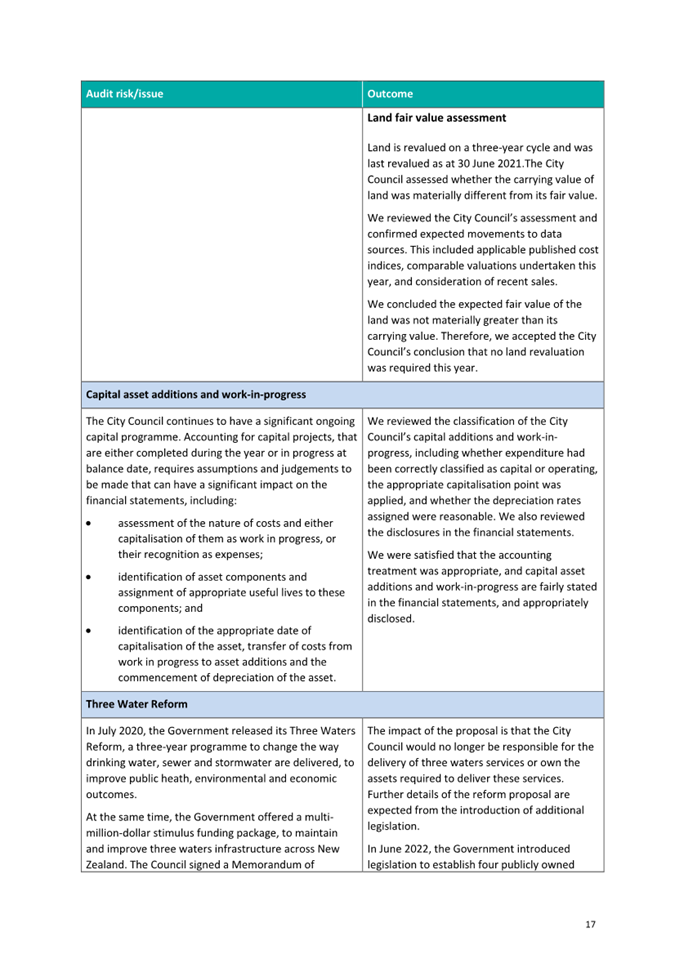

· Property, plant

and equipment revaluations, impairment and fair value assessments

· Capital asset

additions and work-in-progress

· Three Water Reform

· Compliance with

drinking water standards

· Accounting for

Nelson City Council group entities

· COVID-19 pandemic

· Rates

· Risk of management

override of internal controls

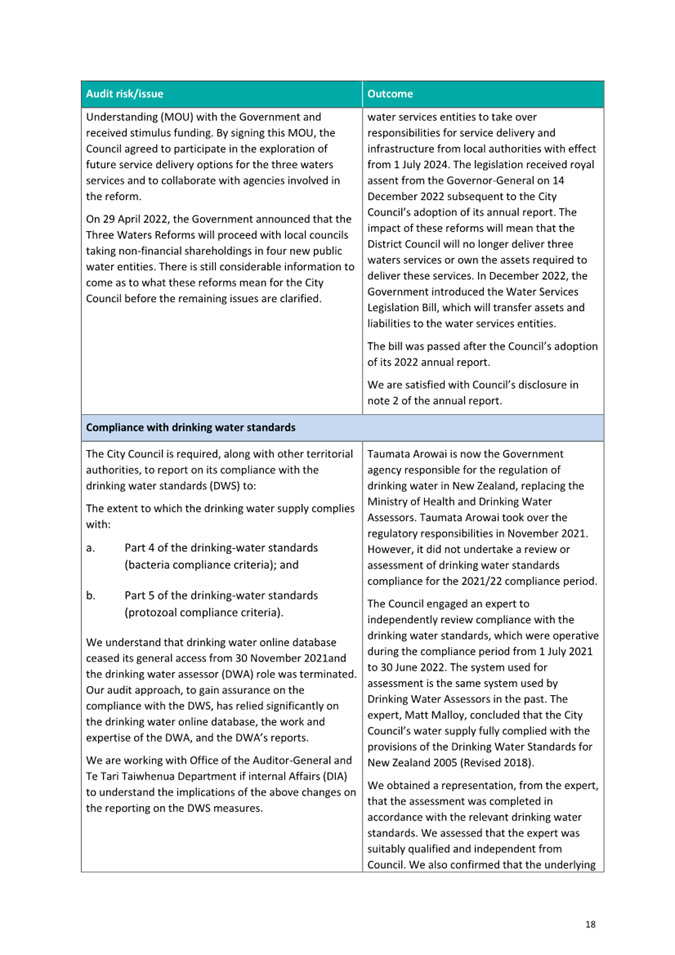

3.5 Matters identified

during the audit include:

· Revaluation of

infrastructure assets

· Drinking water

quality performance measures (protozoa and bacteria)

· Greenhouse gas

emissions reporting

4. Conclusion

4.1 That the Committee

notes the matters raised in the management letter for the year ending 30 June

2022 and the manner in which officers propose to address them.

Author: Prabath

Jayawardana, Manager Finance

Attachments

Attachment 1: 2126778665-296 -

Report to Governors - Final ⇩

Item 10: Letter from Audit NZ on Annual Report for

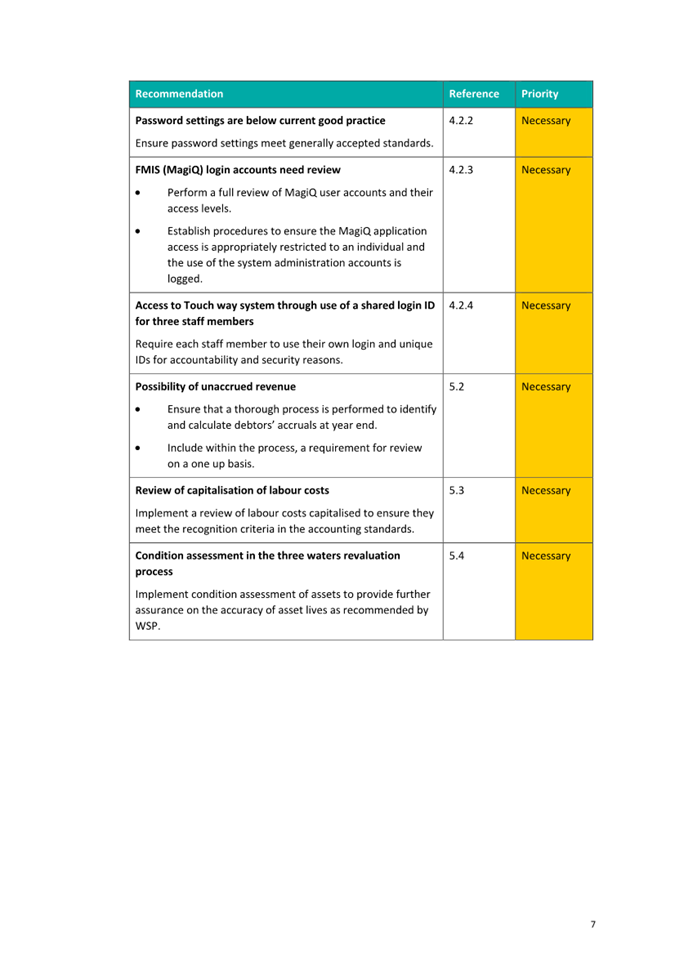

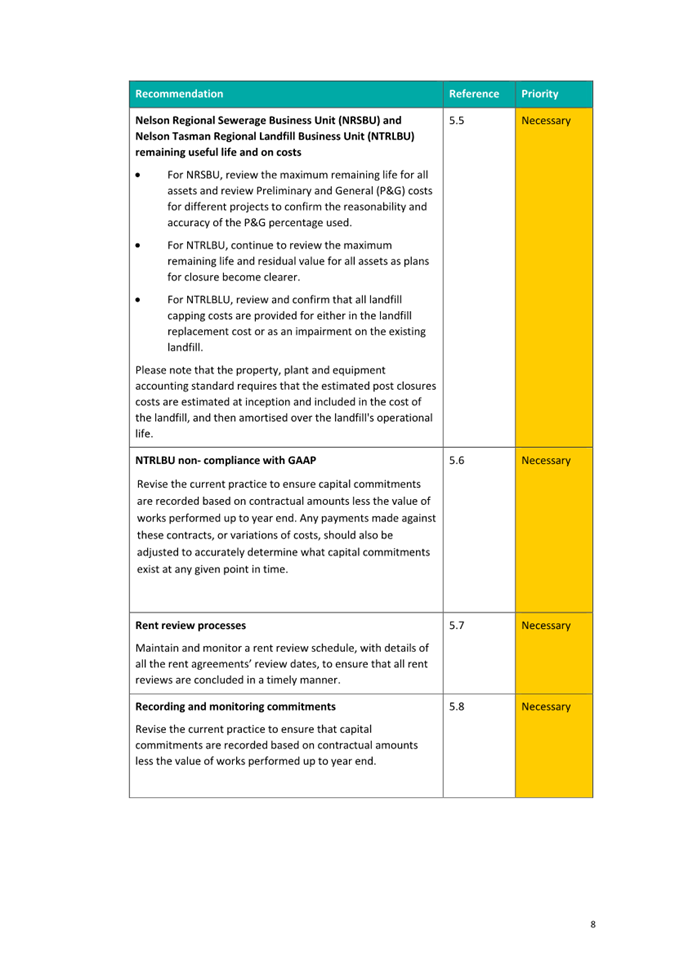

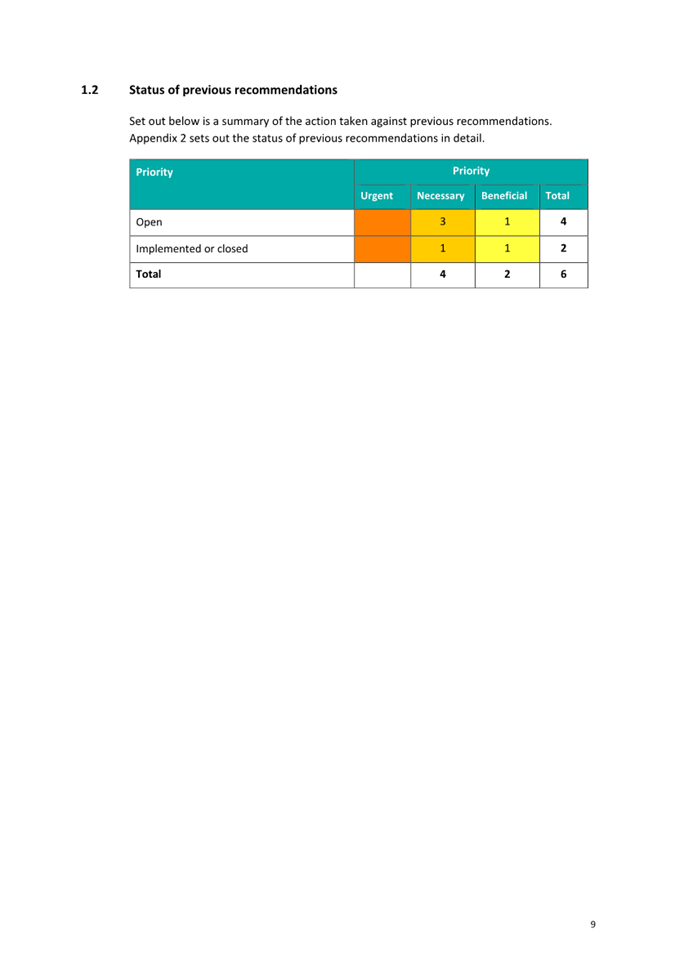

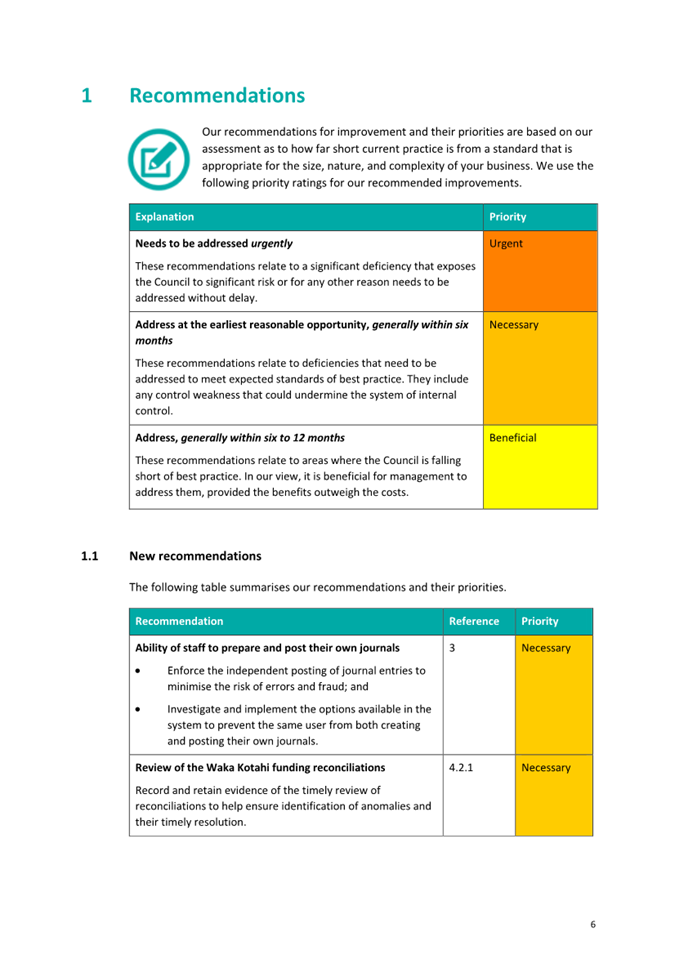

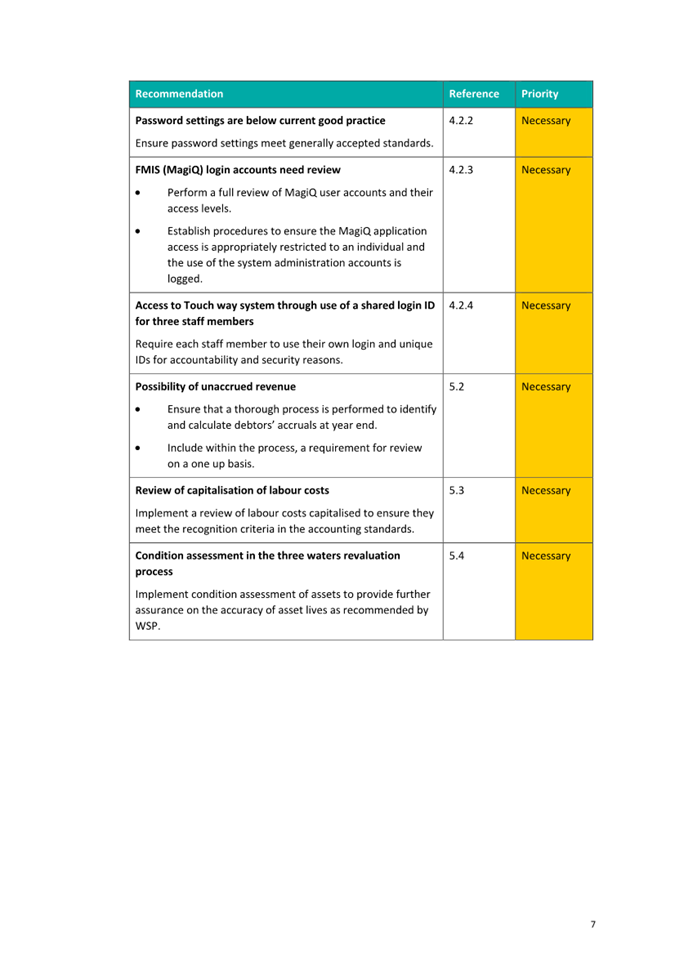

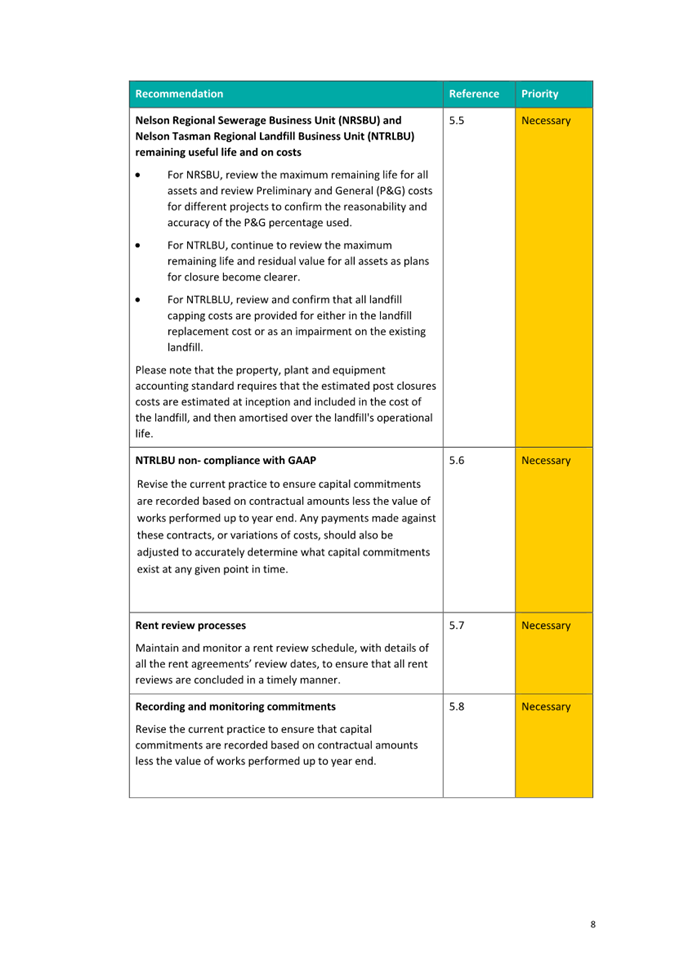

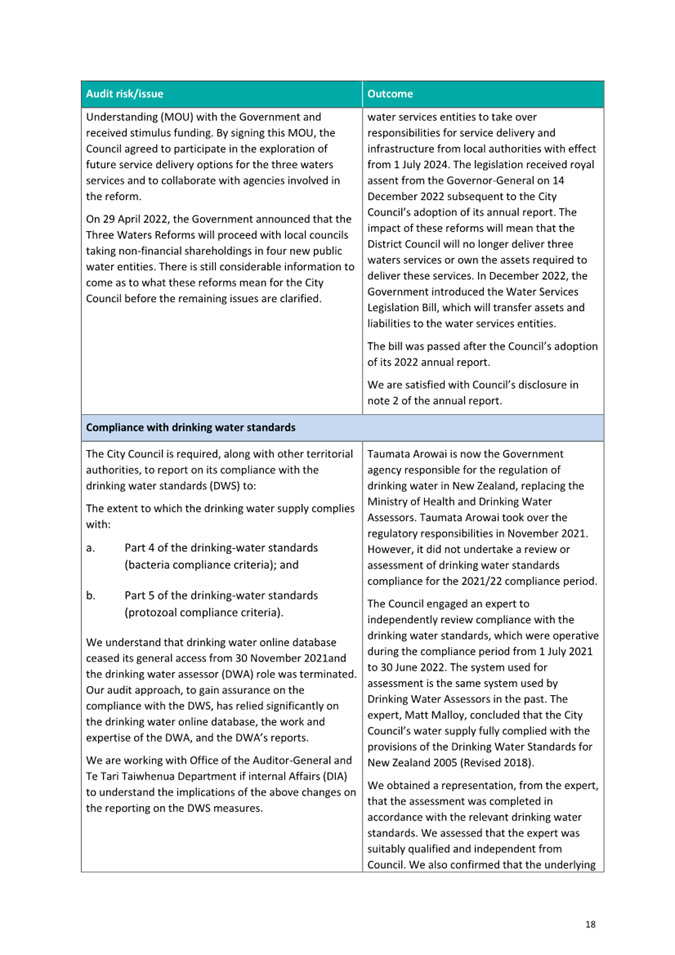

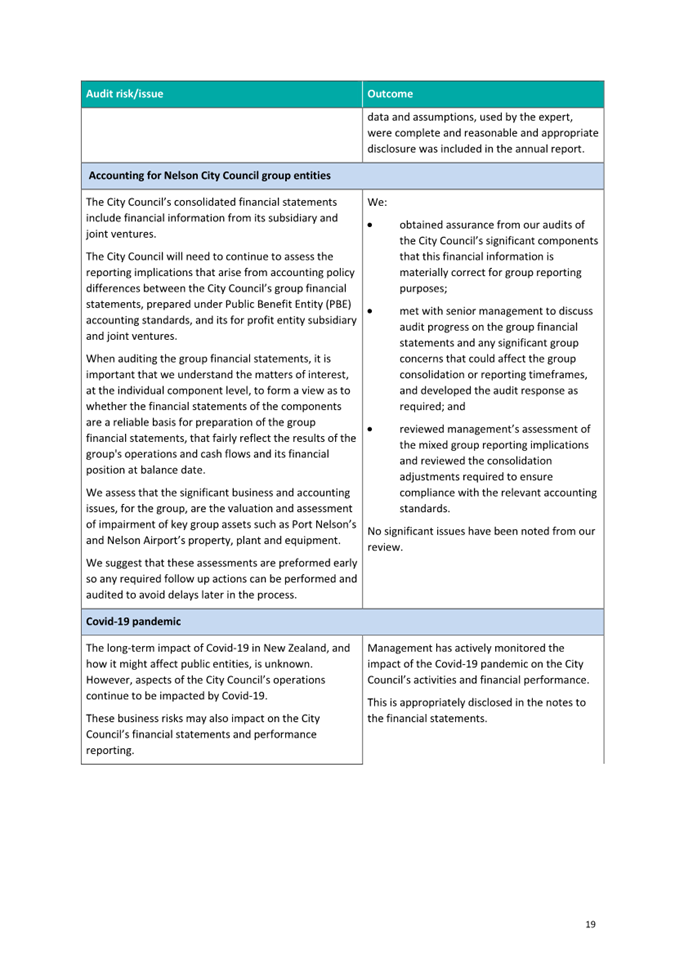

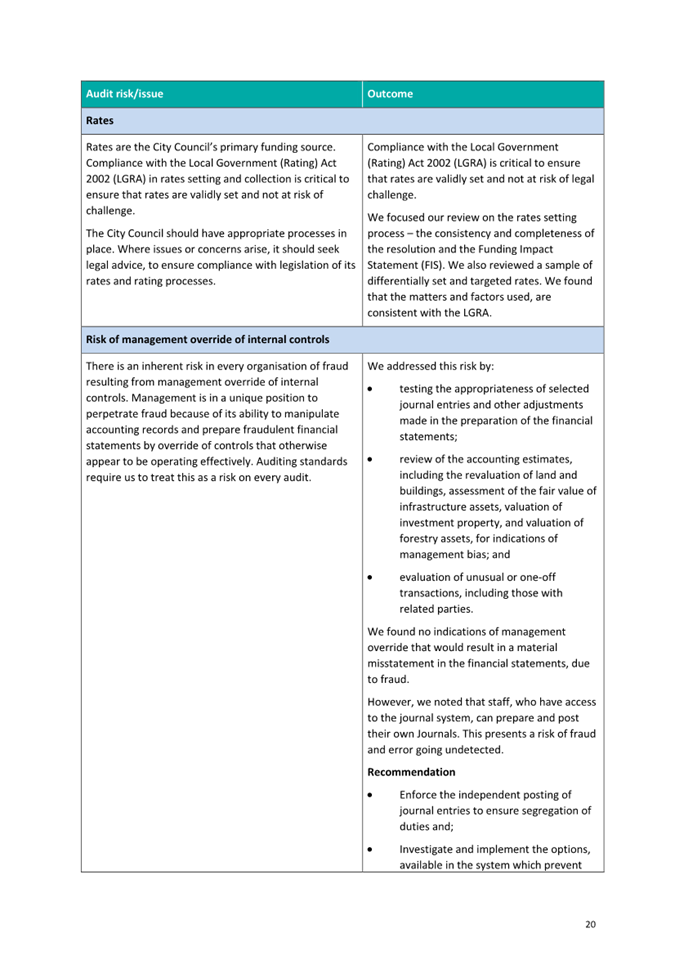

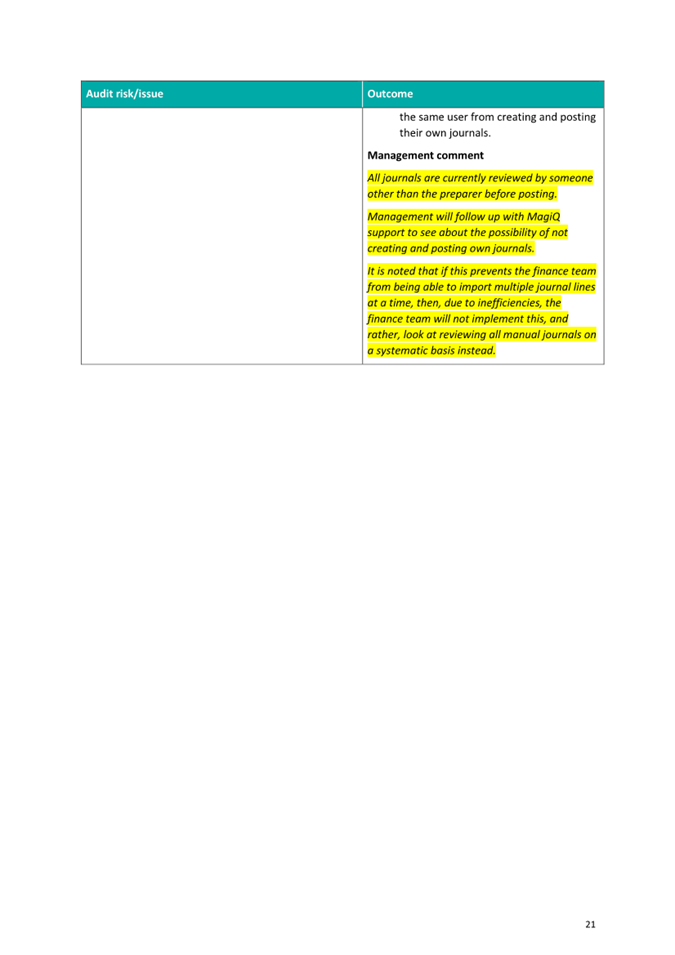

year ending 30 June 2022: Attachment 1