|

That

the Council

1. Receives

the report Supplementary information - Holding Company decision (R26950) and its attachments (A2904599 IHL

constitution changes incl 7 June JSC, A2904600 IHL SHA changes incl 7 June

JSC and A2904604 Summary of constitution - changes incl 7 Jun JSC).

Recommendation from the Joint Shareholders Committee

The Council notes that:

Purpose

A. The

purpose of these resolutions is to seek the Council’s approval of the

documents and transactions necessary to approve the:

a) Restructuring

Proposals (including the Initial Share Issue); and

b) Financing

Proposals (including the New Share Issue).

B. The

Restructuring Proposals, Initial Share Issue, Financing Proposals and New

Share Issue are explained below.

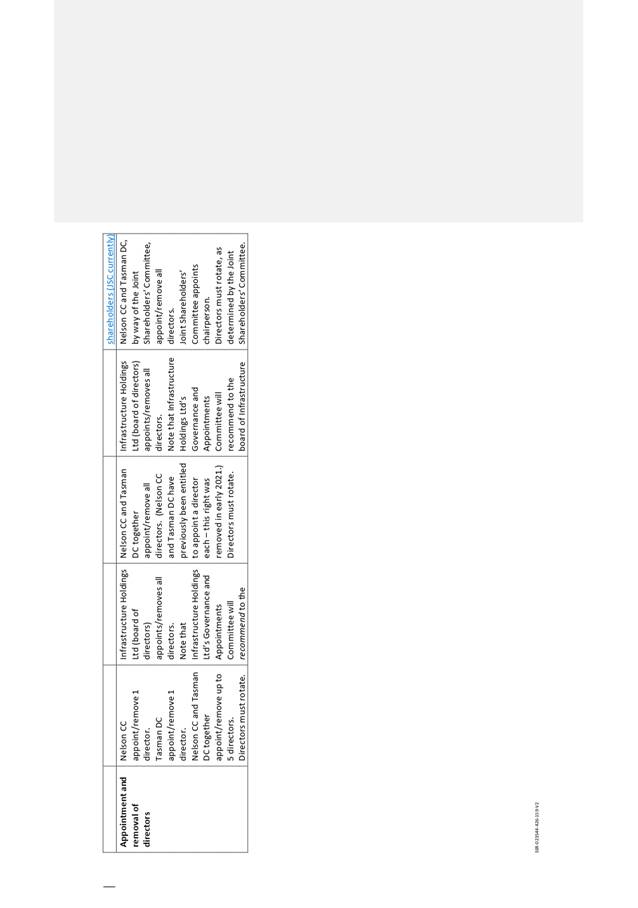

A new holding company

for Port Nelson Limited and Nelson Airport Limited

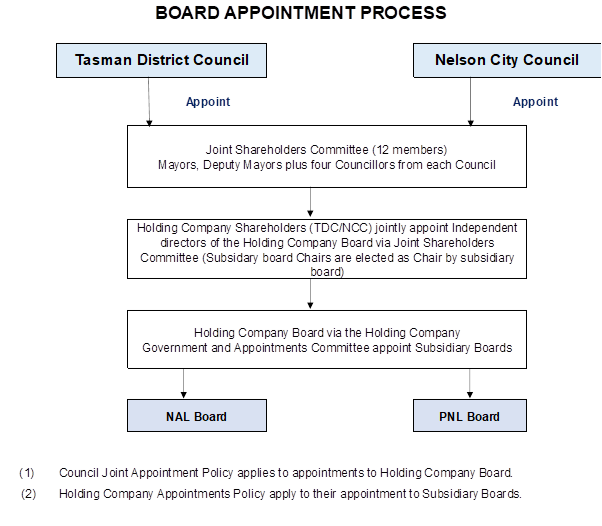

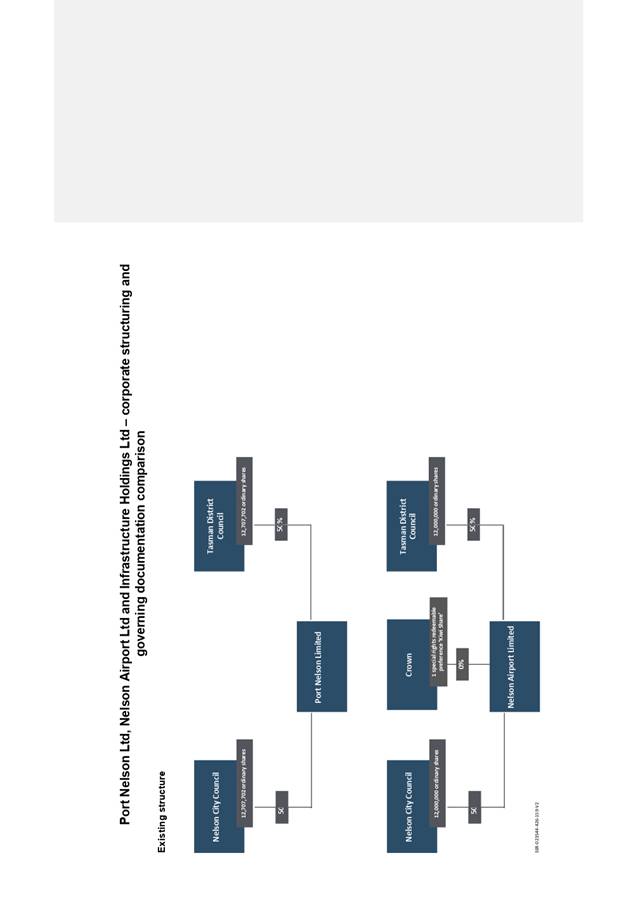

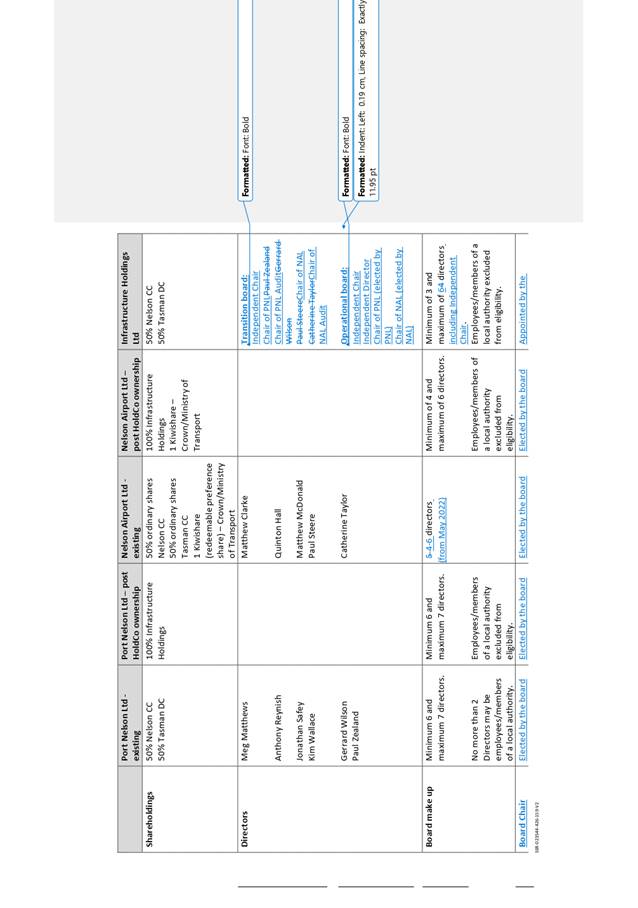

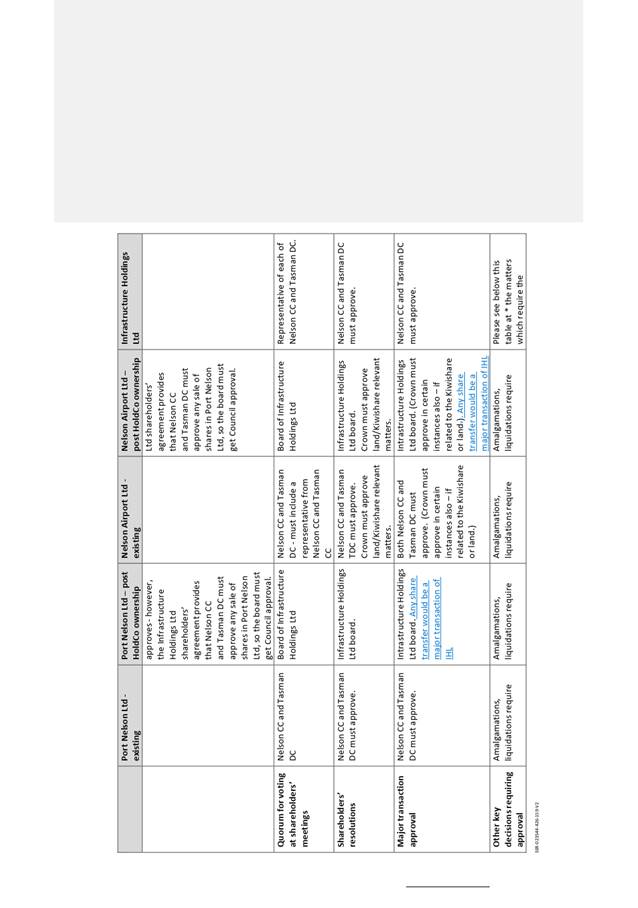

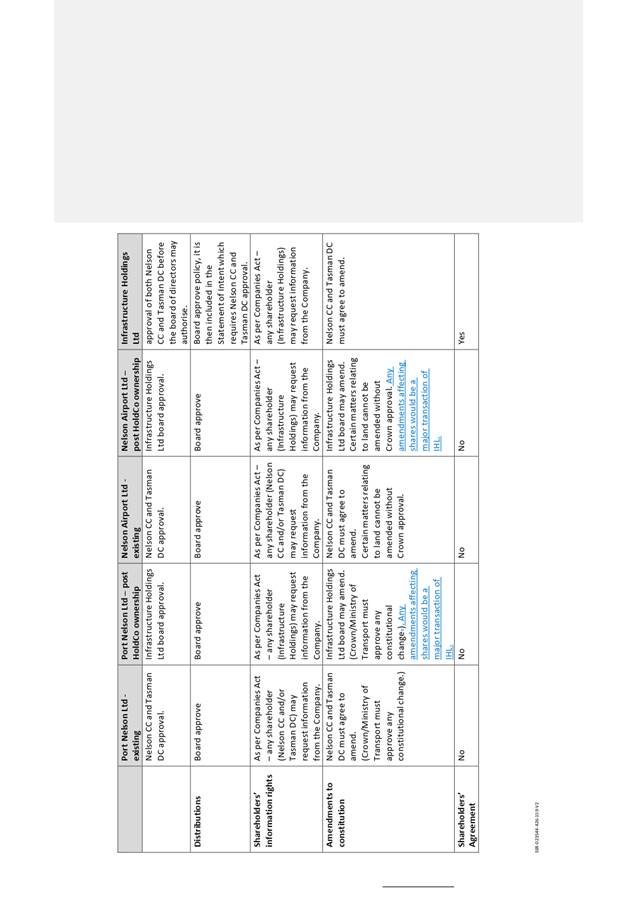

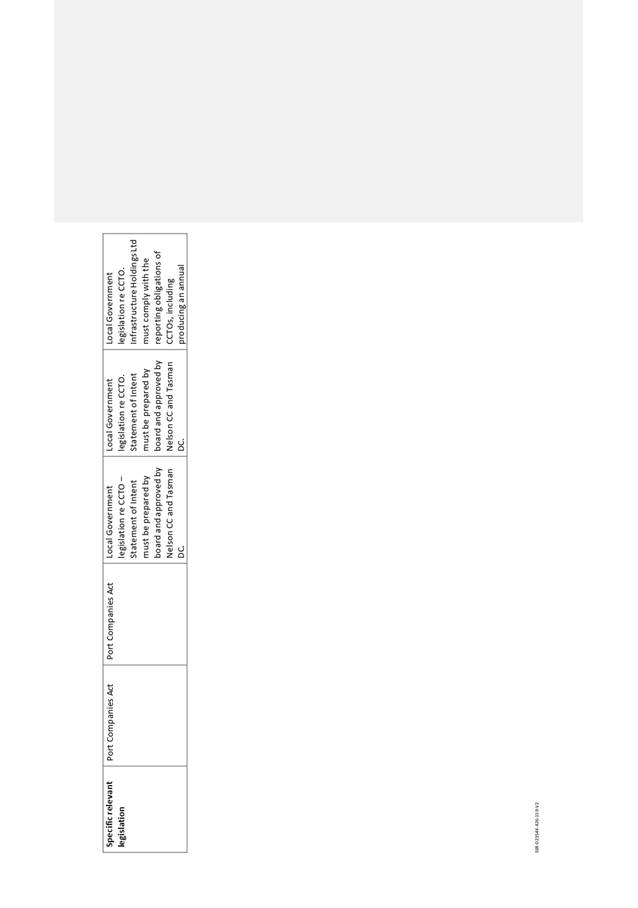

C. Nelson

City Council and Tasman District Council (together, the Shareholders) have

together been investigating the incorporation of a holding company which they

will own in equal shares. The holding company will hold and administer

investments in entities in which the Shareholders have a substantial interest

for the benefit of the Nelson and Tasman regions, being Port Nelson Limited

(PNL) and Nelson Airport Limited (NAL).

D. Nelson

City Council and Tasman District Council through their Long Term Plan process

and Joint Shareholders Committee (JSC), have each received and reviewed

advice from Deloitte about operational synergies of holding investments,

being PNL and NAL, in a holding company, and tax structure options.

E. The

name agreed for the holding company is Infrastructure Holdings Limited (IHL).

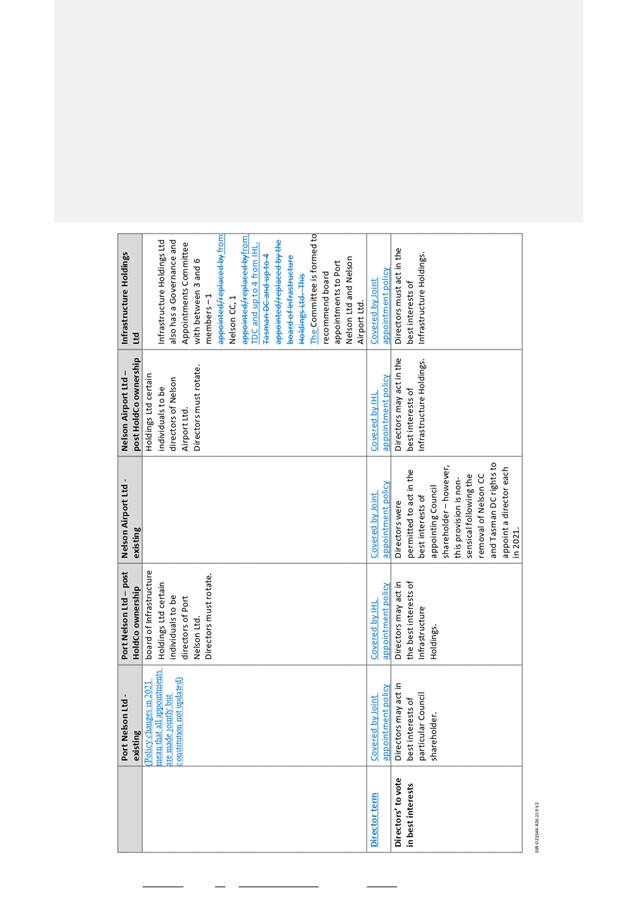

F. The

initial directors approved for IHL are Catherine Taylor, Paul Steere, Gerrard

Wilson and Paul Zealand and an independent chairperson is being recruited.

Restructuring Proposals

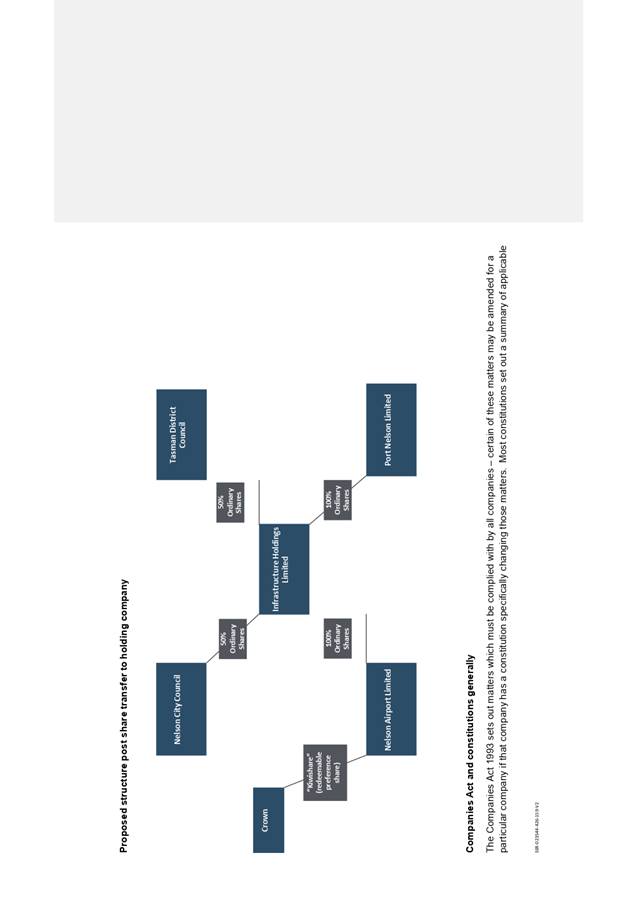

G. As

part of the proposal to incorporate IHL, it is proposed that each of the

Shareholders transfer all their shares in PNL and NAL to IHL (Share Sale) for

$8,446,000 in total (Purchase Price). The Purchase Price will be owed to the

Shareholders in equal portions (being $4,223,000 each). The Crown holds, and

will continue to hold, one special “Kiwi Share” in NAL.

H. The

Purchase Price allocation is:

a) $2,400,000

for the shares in NAL; and

b) $6,046,000

for the shares in PNL.

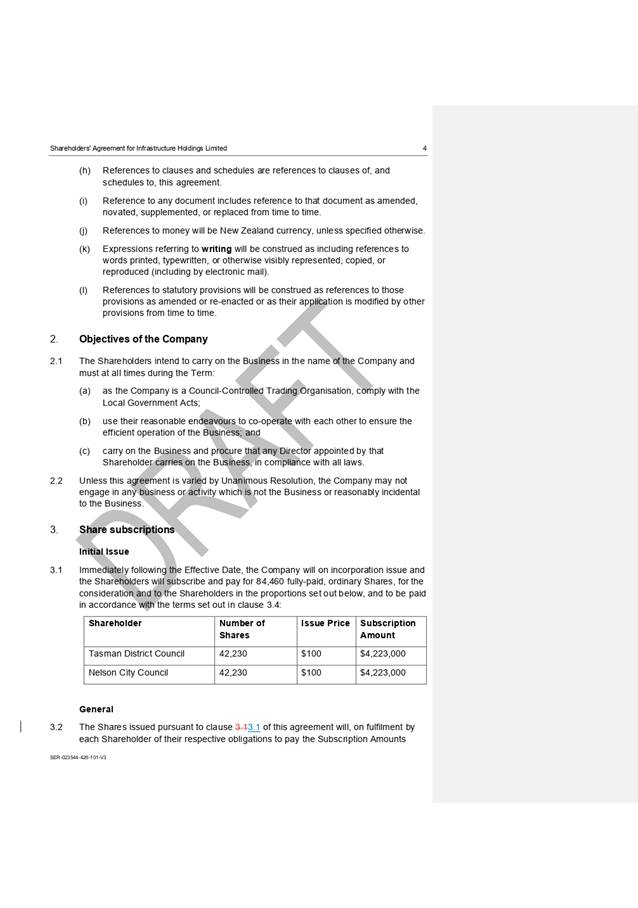

I. Nelson

City Council and Tasman District Council will each subscribe for 42,230

ordinary shares in IHL (being 84,460 ordinary shares in total) (Initial

Shares), at an issue price of $100.00 per share (Initial Share Issue). The

total subscription amount for the Initial Shares is therefore $8,446,000 (Initial

Subscription Amount), which is equal to the Purchase Price.

J. Accordingly,

the Purchase Price will be satisfied on a cashless basis by set-off against

the Initial Subscription Amount.

K. The

sale of shares in PNL and NAL and the subscription for the Initial Shares

will be referred to in these resolutions as the “Restructuring

Proposals”.

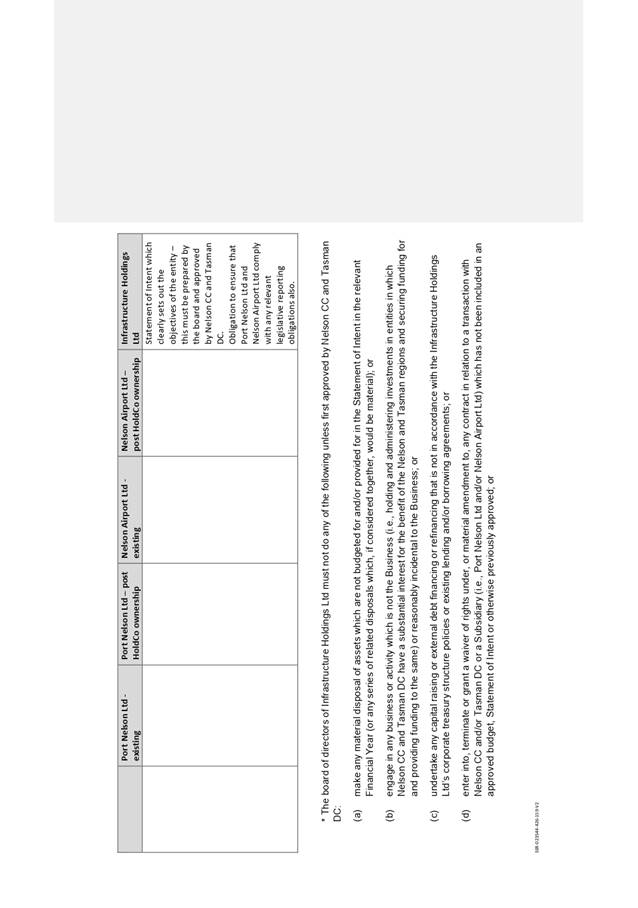

Financing

Proposals

L. The

New Zealand Local Government Funding Agency Limited (LGFA) is a limited

liability company owned by central government and local authorities. It was

established to borrow funds and then on-lend those funds to local authorities

and (now) council-controlled trading organisations (CCTOs) at lower margins

than those local authorities and council-controlled organisations would

otherwise pay.

M. Currently,

PNL and NAL service their debt requirements through ordinary bank borrowing

from Westpac New Zealand Limited (Westpac). However, it is projected that

PNL’s and NAL’s debt requirements and financing costs may

increase over the next 10+ years to meet infrastructure-upgrade demands.

N. Given

the projected increase in PNL’s and NAL’s debt requirements and

financing costs, IHL’s primary purpose is to operate as a treasury

vehicle for PNL and NAL. To achieve this purpose, it is further

proposed that (Financing Proposals) IHL will:

a) join

the LGFA borrowing programme (LGFA Accession) as a CCTO, following which, IHL

will be able to borrow funds directly from LGFA by issuing securities to

LGFA;

b) enter

into borrowing and risk hedging facilities with Westpac, which is PNL’s

and NAL’s current bank; and

c) on-lend

amounts borrowed from the LGFA borrowing programme and Westpac to PNL and NAL

under intra-group funding arrangements.

O. Joining

the LGFA borrowing programme will enable IHL to access cheaper core debt on

behalf of PNL and NAL. As a “port company” under the Port

Companies Act 1988, PNL is not permitted to join LGFA and NAL does not have

the scale to make joining LGFA economical. It is considered that, once

implemented, the Financing Proposals will deliver considerable financial

benefits, including savings in financing costs for PNL and NAL and,

consequently, increased dividend return to Nelson City Council and Tasman District

Council (as the ultimate owners of PNL and NAL). Nelson City Council and

Tasman District Council through their Long Term Plan process and the JSC have

each received and reviewed advice from Deloitte about LGFA funding benefits.

P. PNL

and NAL will continue to require the flexibility offered by Westpac’s

transactional banking products. IHL will also enter into borrowing and risk

hedging facilities with Westpac for working capital requirements and

risk-management (such as interest-rate hedging).

The LGFA Accession and Westpac facilities

Q. LGFA

and Westpac will require certain credit support as conditions to the LGFA

Accession and the availability of the Westpac facilities. Such credit support

will include:

a) a

subscription from the Shareholders for an agreed amount of uncalled and

unpaid equity capital in IHL (further details are described below);

b) IHL,

PNL and NAL will each cross-guarantee each other’s obligations to LGFA,

Westpac as lender under borrowing facilities and Westpac as counter-party to

risk-management facilities (together, the Finance Parties); and

c) IHL,

PNL and NAL will each grant general security over all of their personal

property in favour of the Finance Parties. In the case of IHL, this

will include security over its right to call for uncalled and unpaid equity

capital.

R. As

mentioned above, it will be a condition to the LGFA Accession and the

availability of the Westpac facilities that the Shareholders subscribe for,

and IHL issues to the Shareholders (New Share Issue), a further 1,165,000

ordinary shares each (totalling 2,330,000 ordinary shares) in IHL (New Shares)

for an issue price of $100.00 per share. The total amount payable for the New

Shares will therefore be $233,000,000 (Issue Amount). The Issue Amount will

remain uncalled and unpaid until such time as the directors of IHL make a

call on the New Shares for the Issue Amount.

Shareholder

approvals

S. The

Restructuring Proposals and the Financing Proposals will require the approval

of the Shareholders as:

a) the

proposals are, or may be, “major transactions” (as defined in

section 129 of the Companies Act 1993 (Act));

b) the

Initial Share Issue and the New Share Issue require the agreement of

IHL’s entitled persons (as that term is defined in the Act) for the

purposes of section 107(2) of the Act. The only entitled persons of IHL will

be the Shareholders; and

c) Nelson

City Council and Tasman District Council (as the shareholders of IHL) must

consent, for the purposes of section 50 of the Act and for all other

purposes, to becoming the holder of the Initial Shares and the New Shares.

T. Accordingly,

IHL’s board of directors will, at the relevant times, separately

request that Tasman District Council and Nelson City Council (as shareholders

and entitled persons of IHL) confirm and approve IHL’s entry into,

execution and performance, of the:

a) Restructuring

Proposals (including the Initial Share Issue); and

b) Financing

Proposals (including the New Share Issue),

by separate unanimous resolutions and entitled

persons’ agreements. The unanimous resolutions and entitled

persons’ agreements for the Restructuring Proposals and the Financing

Proposals are together referred to as the “Unanimous Shareholder

Resolutions and Entitled Persons’ Agreements”.

Next steps

U. In

order to incorporate IHL and give effect to the Restructuring Proposals, the

Shareholders will need to:

a) register IHL as

a limited liability company on the New Zealand Companies Office and each

complete the Companies Office requirements in relation to the incorporation

of IHL (such as shareholder consent forms) (Companies Office Forms);

b) appoint

directors to the board of IHL (including an independent chairperson);

c) cause IHL to

adopt the constitution in the form attached (the Constitution);

d) enter into a

shareholders’ agreement (which will include the subscription provisions

for the Initial Shares) with IHL, in the form attached (the Shareholders’ Agreement);

e) enter into a sale and purchase agreement with IHL relating to the

transfer of shares in PNL and NAL in the form attached (the Sale and Purchase

Agreement);

f) execute and

deliver the share transfer forms (in the form attached) in relation to the

Sale and Purchase Agreement (the Share Transfer Forms); and

g) any other

documents necessary or desirable in connection with the Restructuring

Proposals.

The Companies Office Forms,

Shareholders’ Agreement, Sale and Purchase Agreement, Share Transfer

Forms and any other documents captured by paragraph U.g) above, are together

referred to as the “Restructuring Documents”, and the

transactions contemplated by the Restructuring Documents are referred to as

the “Restructuring Transactions”.

V. In

order to give effect to the Financing Proposals, each of the Shareholders

will need to enter into:

a) a subscription

agreement (in the form attached) with IHL, under which the Shareholders will

subscribe for the New Shares (Subscription Agreement);

b) (as part of the

LGFA Accession) accession deeds to the multi-issuer deed and notes

subscription agreement (which Tasman District Council and Nelson City Council

are each already a party to) (Accession Deeds); and

c) any

other documents necessary or desirable in connection with the

Financing Proposals.

The Subscription Agreement, the Accession

Deeds and any other documents captured by paragraph 0 are together referred

to as the “Financing Documents” and the transactions contemplated

by the Financing Documents are referred to as the “Financing

Transactions”.

Documents

W. The

Council tables the most recent drafts of the Restructuring Documents, the

Subscription Agreement and the Unanimous Shareholder Resolutions and

Entitled Persons’ Agreements.

X. The

Council has not tabled copies of the Accession Deeds because they are not yet

available for the Council to review and approve. However, the Accession

Deeds will be based on the standard form for accession deeds scheduled to the

LGFA Multi-Issuer Deed and Notes Subscription Agreement respectively.

That the Council resolves:

1. the

Council consents, for the purposes of section 50 of the Act and for all other

purposes, to being the joint owner in equal shares of the Initial Shares and

the New Shares;

2. the

form of the Constitution be approved, and the Shareholders will cause IHL to

adopt the Constitution;

3. the

Restructuring Documents and the Restructuring Transactions (including,

specifically, the Initial Share Issue) are approved, and any pre-emptive

rights available to the Shareholders in relation to the Share Sale are to be

waived in the Sale and Purchase Agreement;

4. the

Financing Documents and the Financing Transactions (including, specifically,

the New Share Issue) are approved;

5. the

forms of the Unanimous Shareholder Resolutions and Entitled Persons’

Agreements are approved;

6. the

Council enters into and, following execution, delivers and performs its

obligations under, each of the Restructuring Documents and the Financing Documents

and that these documents may be executed by:

a) (in

the case of agreements) the Chief Executive; and

b) (in

the case of deeds) two elected members,

on behalf of the Council, subject to any minor

amendments cleared by both Tasman District Council’s and Nelson City

Council’s legal advisors;

7. when

requested to do so by the board of IHL, the Chief Executive is authorised to

sign the Unanimous Shareholder Resolutions and Entitled Persons’

Agreements on behalf of the Council, subject to any minor amendments cleared

by both TDC’s and NCC’s legal advisors;

8. the

Chief Executive is authorised on behalf of the Council to, subject to

clearance by both Tasman District Council’s and Nelson City

Council’s legal advisors:

a) approve

any further minor amendments to the Restructuring Documents, the Financing

Documents and the Unanimous Shareholder Resolutions and Entitled

Persons’ Agreements prior to their execution; ands

b) enter

into, execute, and deliver such other agreements, instruments, notices,

communications, and other documents; and

c) do

such other things, in connection with the

Restructuring Documents and the Restructuring Transactions, the Financing

Documents and the Financing Transactions, and the Unanimous Shareholder

Resolutions and Entitled Persons’ Agreements, as the Chief Executive

may consider necessary.

|