Notice of the Ordinary meeting of

Nelson City Council

Te Kaunihera o Whakatū

|

Date: Tuesday

14 June 2022

Time: 9.00a.m.

Location: via

Zoom

|

Agenda

Rārangi take

Chairperson Her

Worship the Mayor Rachel Reese

Deputy

Mayor Cr

Judene Edgar

Members Cr

Yvonne Bowater

Cr

Trudie Brand

Cr

Mel Courtney

Cr

Kate Fulton

Cr

Matt Lawrey

Cr

Rohan O'Neill-Stevens

Cr

Brian McGurk

Cr

Gaile Noonan

Cr

Pete Rainey

Cr

Rachel Sanson

Cr

Tim Skinner

Quorum 7 Pat

Dougherty

Chief Executive

Nelson City Council Disclaimer

Please note that the contents of these

Council and Committee agendas have yet to be considered by Council and officer

recommendations may be altered or changed by the Council in the process of

making the formal Council decision. For enquiries call (03) 5460436.

Following are the values agreed during the 2019 – 2022

term:

A. Whakautetanga: respect

B. Kōrero Pono: integrity

C. Māiatanga: courage

D. Whakamanatanga: effectiveness

E. Whakamōwaitanga: humility

F. Kaitiakitanga: stewardship

G. Manaakitanga: generosity of spirit

14

June 2022

Page

No.

Karakia and Mihi Timatanga

1. Apologies

Nil

2. Confirmation

of Order of Business

3. Interests

3.1 Updates

to the Interests Register

3.2 Identify

any conflicts of interest in the agenda

4. Public

Forum

5. Recommendations from

Committees

5.1 Audit, Risk and Finance

Subcommittee - 24 May 2022

5.1.1 Draft

Annual Internal Audit Plan to 30 June 2023

|

Recommendation to Council

|

|

|

That the Council

1. Approves

the Draft Annual Internal Audit Plan for the year to 30 June 2023 (A2867251).

|

5.2 Strategic Development and

Property Subcommittee - 9 June 2022

5.2.1 Nelson

Marina Masterplan

|

Recommendation to Council

|

|

|

That the Council

1. Approves releasing the Draft Nelson

Marina Masterplan (A2893150) for consultation and community feedback; and

2. Approves the public feedback

document (A2893152).

|

6. Mayor's Report 13

- 14

Document number R26948

That the Council

1. Receives the report Mayor's Report (R26948) and its attachment (A2898827).

7. Adoption of the

Annual Plan 2022/23 and setting of the rates 15 - 41

Document number R26771

Recommendation

|

That

the Council

1. Receives the report Adoption of the

Annual Plan 2022/23 and setting of the rates (R26771) and its

attachments (A2891743, A2891469, and A2900167); and

2. Agrees that the content of the

Annual Plan 2022/23 does not include significant or material differences to

year two of the Long Term Plan 2021-31; and

3. Approves the budget carry forwards

as set out in Attachment 1 (A2891743); and

4. Reconfirms, as approved through the

Long Term Plan 2021-31, that setting an unbalanced budget in the Annual Plan

2022/23 is prudent in terms of section 100 of the Local Government Act 2002,

given the ongoing effects of the COVID-19 pandemic on the local economy and

ratepayers, and having had regard to the matters in section 100(2) of the

Local Government Act 2002;

5. Adopts the Annual Plan 2022/23

(A2900167) pursuant to Section 95 of the Local Government Act 2002; and

6. Delegates the Mayor, Deputy Mayor

and Chief Executive to make any necessary minor editorial amendments prior to

the release of the Annual Plan 2022/23 to the public; and

7. Sets the following rates under the

Local Government (Rating) Act 2002, on rating units in the district for the

financial year commencing on 1 July 2022 and ending on 30 June 2023.

The revenue approved below

will be raised by the rates and charges

that follow.

Revenue approved:

General

Rate $43,641,098

Uniform Annual General

Charge

$11,113,932

Stormwater

and Flood Protection Charge $8,561,516

Waste

Water Charge $10,776,338

Water

Annual Charge

$4,133,539

Water Volumetric Charge $9,644,924

Rates and

Charges (excluding GST) $87,871,347

Goods and

Services Tax(at the current rate) $13,180,702

Total

Rates and Charges $101,052,049

The rates and charges below are GST inclusive.

(1) General Rate

A general rate set under section 13 of the Local Government

(Rating) Act 2002, assessed on a differential land value basis as described

below:

·

a rate of 0.34323 cents in the dollar of land value on every rating

unit in the “residential – single unit” category.

·

a rate of 0.34323 cents in the dollar of land value on every rating

unit in the “residential empty section” category.

·

a rate of 0.37755 cents in the dollar of land value on every rating

unit in the “single residential unit forming part of a parent

valuation, the remainder of which is non-rateable” category. This

represents a plus 10% differential on land value.

·

a rate of 0.37755 cents in the dollar of land value on every rating

unit in the “multi residential” category. This represents a plus

10% differential on land value.

·

a rate of 1.15049 cents in the dollar of land value on every rating

unit in the “commercial – excluding inner city and Stoke

commercial” subject to 100% commercial and industrial (occupied and

empty) category. This represents a plus 235.195% differential on land value.

·

a rate of 0.94869 cents in the dollar of land value on every rating

unit in the “commercial – excluding inner city and Stoke

commercial” subject to 25% residential and 75% commercial”

category. This represents a plus 176.4% differential on land value.

·

a rate of 0.74687 cents in the dollar of land value on every rating

unit in the “commercial – excluding inner city and Stoke

commercial” subject to 50% residential and 50% commercial”

category. This represents a plus 117.6% differential on land value.

·

a rate of 0.54505 cents in the dollar of land value on every rating

unit in the “commercial – excluding inner city and Stoke

commercial” subject to 75% residential and 25% commercial”

category. This represents a plus 58.8% differential on land value.

·

a rate of 1.59411 cents in the dollar of land value on every rating

unit in the “commercial inner city” subject to 100% commercial

and industrial (occupied and empty) category. This represents a plus 364.445%

differential on land value.

·

a rate of 1.28128 cents in the dollar of land value on every rating

unit in the “commercial inner city subject to 25% residential and 75%

commercial” category. This represents a plus 273.3% differential on

land value.

·

a rate of 0.96860 cents in the dollar of land value on every rating

unit in the “commercial inner city subject to 50% residential and 50%

commercial” category. This represents a plus 182.2% differential on

land value.

·

a rate of 0.65591 cents in the dollar of land value on every rating

unit in the “commercial inner city subject to 75% residential and 25%

commercial” category. This represents a plus 91.1% differential on land

value.

·

a rate of 1.38583 cents in the dollar of land value on every rating

unit in the “Stoke commercial subject to 100% commercial and industrial

(occupied and empty)” category. This represents a plus 303.76%

differential on land value.

·

a rate of 1.12511 cents in the dollar of land value on every rating

unit in the “Stoke commercial subject to 25% residential and 75%

commercial” category. This represents a plus 227.8% differential on

land value.

·

a rate of 0.86460 cents in the dollar of land value on every rating

unit in the “Stoke commercial subject to 50% residential and 50%

commercial” category. This represents a plus 151.9% differential on

land value.

·

a rate of 0.60374 cents in the dollar of land value on every rating

unit in the “Stoke commercial subject to 75% residential and 25%

commercial” category. This represents a plus 75.9% differential on land

value.

·

a rate of 0.22310 cents in the dollar of land value on every rating

unit in the “rural” category. This represents a minus 35%

differential on land value.

·

a rate of 0.30891 cents in the dollar of land value on every rating

unit in the “small holding” category. This represents a minus 10%

differential on land value.

(2) Uniform Annual General Charge

A uniform annual general charge under section 15 of the Local

Government (Rating) Act 2002 of $376.05 per separately used or inhabited part

of a rating unit.

(3) Stormwater and Flood Protection Charge

A targeted rate under section 16 of the Local Government (Rating)

Act 2002 of $454.43 per rating unit, this rate is payable by all ratepayers

excluding rural rating units, rating units east of the Gentle Annie saddle, Saxton’s

Island and Council’s stormwater network.

(4) Waste Water Charge

A targeted rate for waste water disposal under section 16 of the

Local Government (Rating) Act 2002 of:

· $564.72 per separately used or inhabited part of a residential,

multi residential, rural and small holding rating units that is connected

either directly or through a private drain to a public waste water drain.

· For commercial rating units, a waste water charge of $141.18 per

separately used or inhabited part of a rating unit that is connected either

directly or through a private drain to a public waste water drain.

Note: a trade waste charge will also be levied.

(5) Water Annual Charge

A targeted rate for water supply under Section 16 of the Local

Government (Rating) Act 2002, of:

Water charge (per connection) $220.69

(6) Water Volumetric Rate

A targeted rate for water provided under Section 19 of the Local

Government (Rating) Act 2002, of:

Price of water:

Usage up to 10,000 cu.m/year $2.295

per m³

Usage from 10,001 – 100,000

cu.m/year $1.962

per m³

Usage over 100,000 cu.m/year $1.548

per m³

Summer irrigation usage over

10,000 cu.m/year $2.129

per m³

(7) Low Valued Properties

Remission Value

In accordance Section 85 of the Local Government (Rating) Act 2002

and Council’s Rates Remission Policy, Council sets the land value for

the Low Valued Properties Rates Remission at $10,000.

Other Rating Information:

Due Dates for Payment of Rates

The above rates (excluding water volumetric rates) shall be

payable in four instalments on the following dates:

|

Instalment

Number

|

Instalment Date

|

Last Date for Payment

|

Penalty Applied

|

|

Instalment 1

|

25 July 2022

|

22 August 2022

|

26 August 2022

|

|

Instalment 2

|

25 October 2022

|

21 November 2022

|

25 November 2022

|

|

Instalment 3

|

25 January 2023

|

20 February 2023

|

24 February 2023

|

|

Instalment 4

|

26 April 2023

|

22 May 2023

|

26 May 2023

|

Rates instalments not paid on or by the Last Date for payment

above will incur penalties as detailed in the section “Penalty on

Rates”.

Due Dates for Payment of Water Volumetric Rates

Water volumetric rates shall be payable on the following dates:

|

Billing Month

|

Last Date for Payment

|

|

July 2022

|

22 August

2022

|

|

August

2022

|

20 September

2022

|

|

September

2022

|

20 October

2022

|

|

October

2022

|

21

November 2022

|

|

November

2022

|

20

December 2022

|

|

December

2022

|

20 January

2023

|

|

January

2023

|

20

February 2023

|

|

February

2023

|

20 March

2023

|

|

March 2023

|

20 April

2023

|

|

April 2023

|

22 May

2023

|

|

May 2023

|

20 June

2023

|

|

June 2023

|

20 July

2023

|

Penalty on Rates

Pursuant to Sections 57 and 58 of the Local Government (Rating)

Act 2002, the council authorises the following penalties on unpaid rates

(excluding volumetric water rate accounts) and delegates authority to the

Group Manager Corporate Services to apply them:

· a charge of 5% of the amount of each rate instalment remaining

unpaid after the due date stated above, to be added on the penalty date as

shown in the above table and also shown on each rate instalment notice.

· a charge of 5% will be added on 8 July 2022 to any balance from a

previous rating year (including penalties previously charged) remaining

outstanding on 1 July 2022.

· a further additional charge of 5% will be added on 11 January 2023

to any balance from a previous rating year (including penalties previously

charged) to which a penalty has been added according to the bullet point

above, remaining outstanding on 9 January 2023.

Penalty Remission

In accordance Section 85 of the Local Government (Rating) Act 2002

and Council’s Rates Remission Policy, the Council will approve the

remission of a penalty where the criteria of the policy has been met.

Payment of Rates

Rates shall be payable at the Council offices, Civic House, 110

Trafalgar Street, Nelson between the hours of 8.30am to 5.00pm Monday, Tuesday,

Thursday and Friday and 9.00am to 5.00pm Wednesday.

Where any payment is made by a ratepayer that is less than the

amount now payable, the Council will apply the payment firstly to any rates

outstanding from previous rating years and then to current year rates due.

|

8. Central Library

Development Project Progress Report to End of March 2022 Quarter 42

- 49

Document number R26822

Recommendation

|

That the Council

1. Receives

the report Central Library Development project

Progress Report to End of March 2022 Quarter (R26822).

|

9. Placeholder: Central

Library Development - Communications Strategy

This report will be distributed

in a supplementary agenda.

10. Quarterly update on significant

central government reform programmes 50 - 59

Document number R26888

Recommendation

|

That

the Council

1. Receives

the report Quarterly update on significant central government reform

programmes (R26888)

|

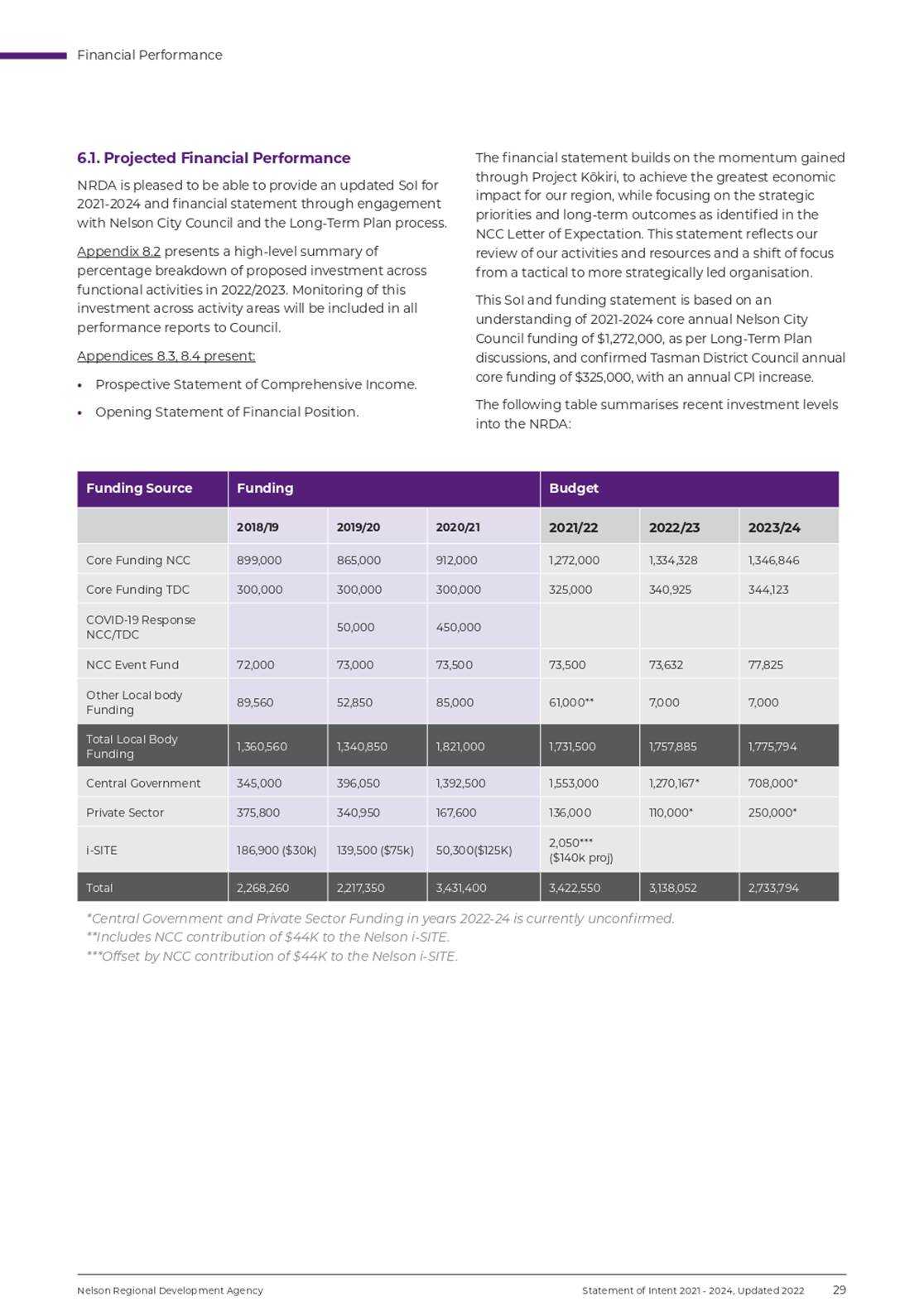

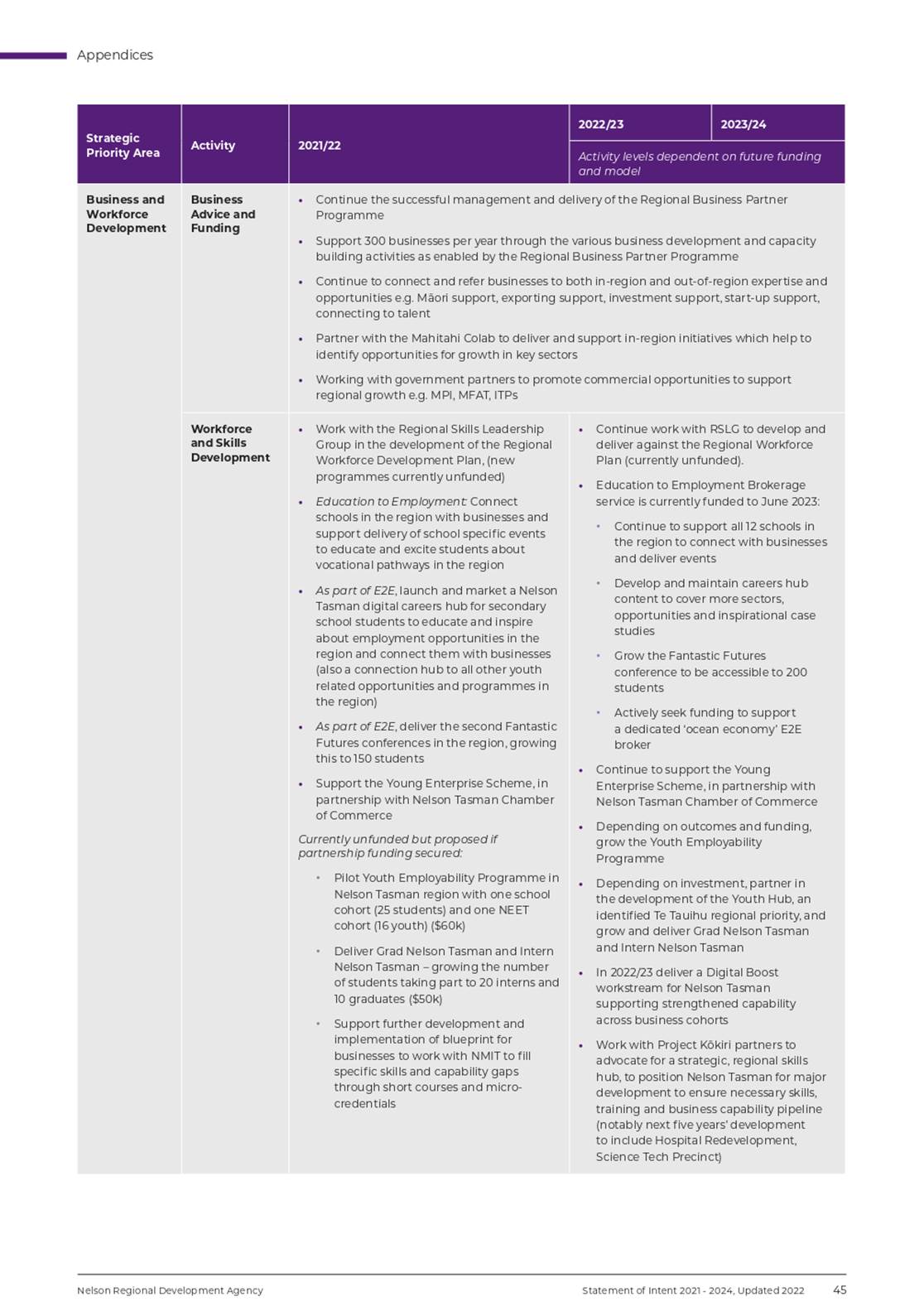

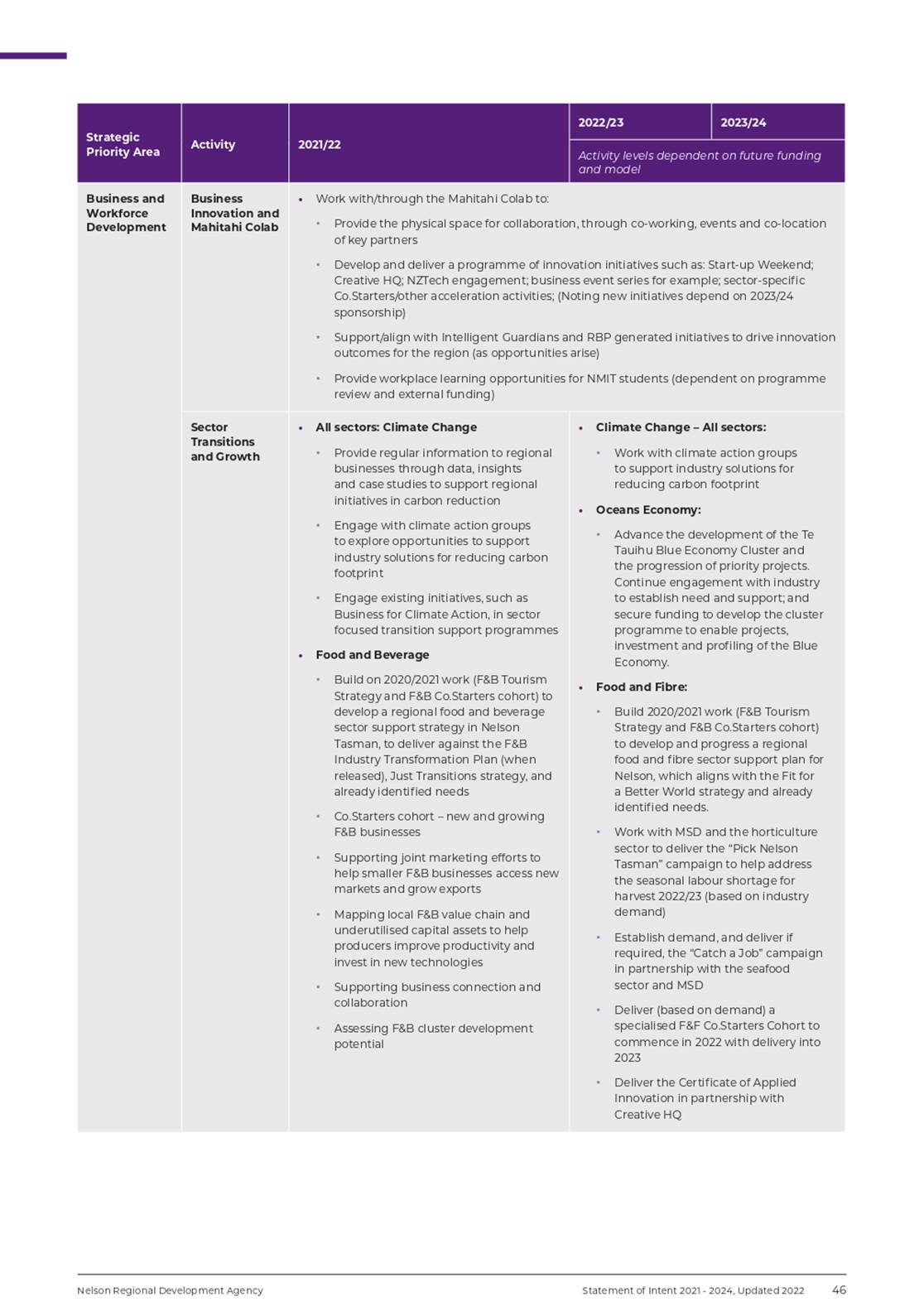

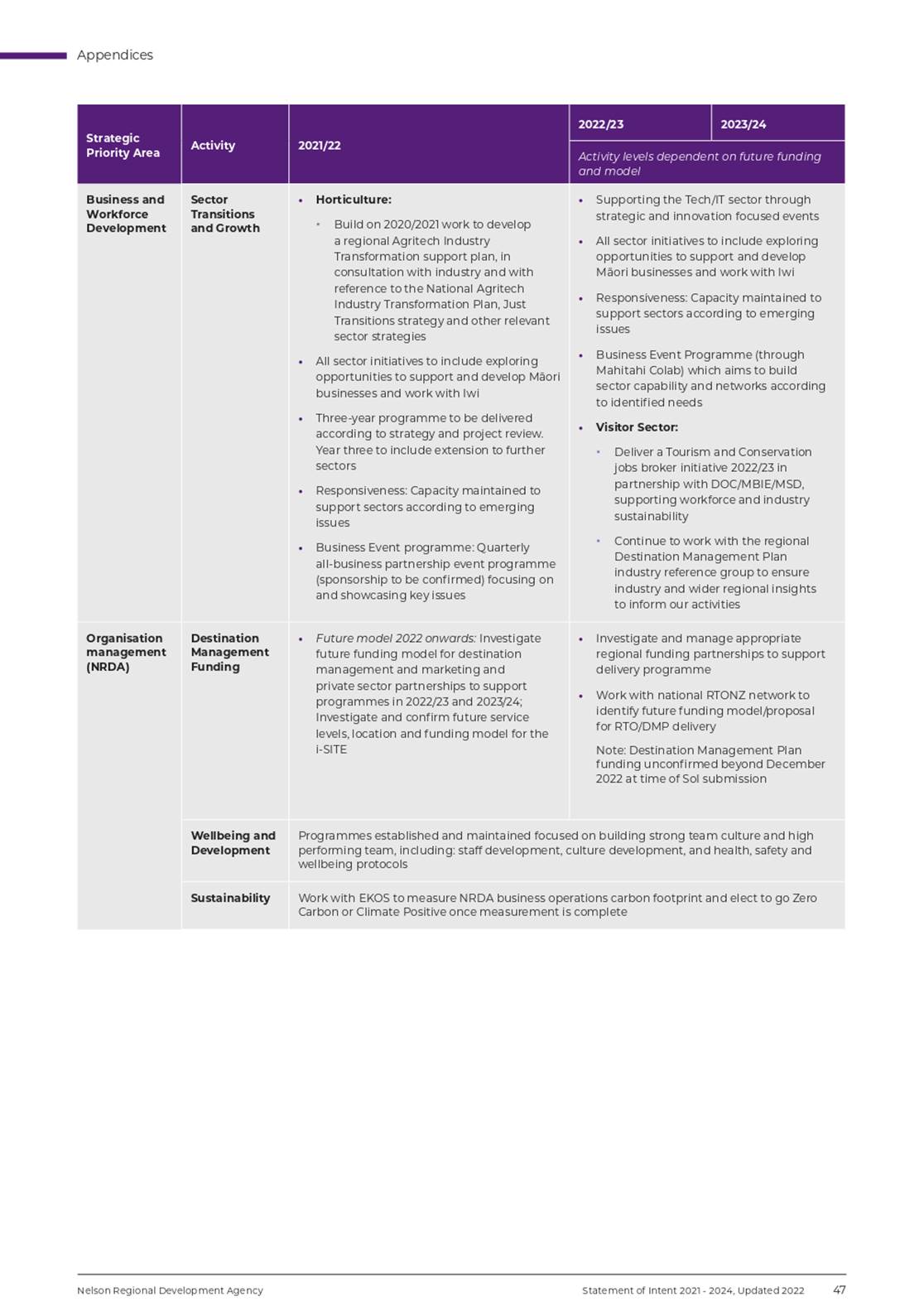

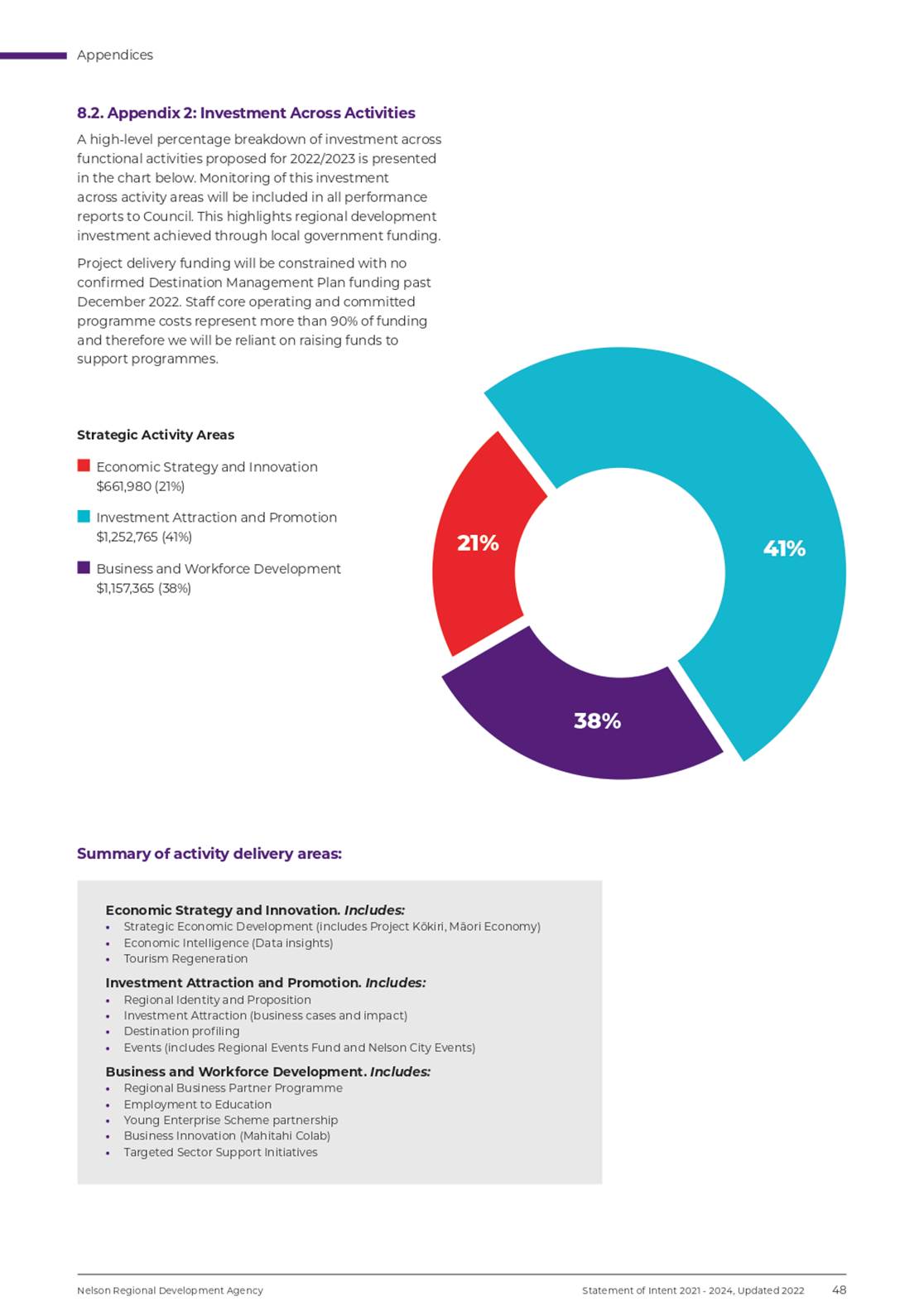

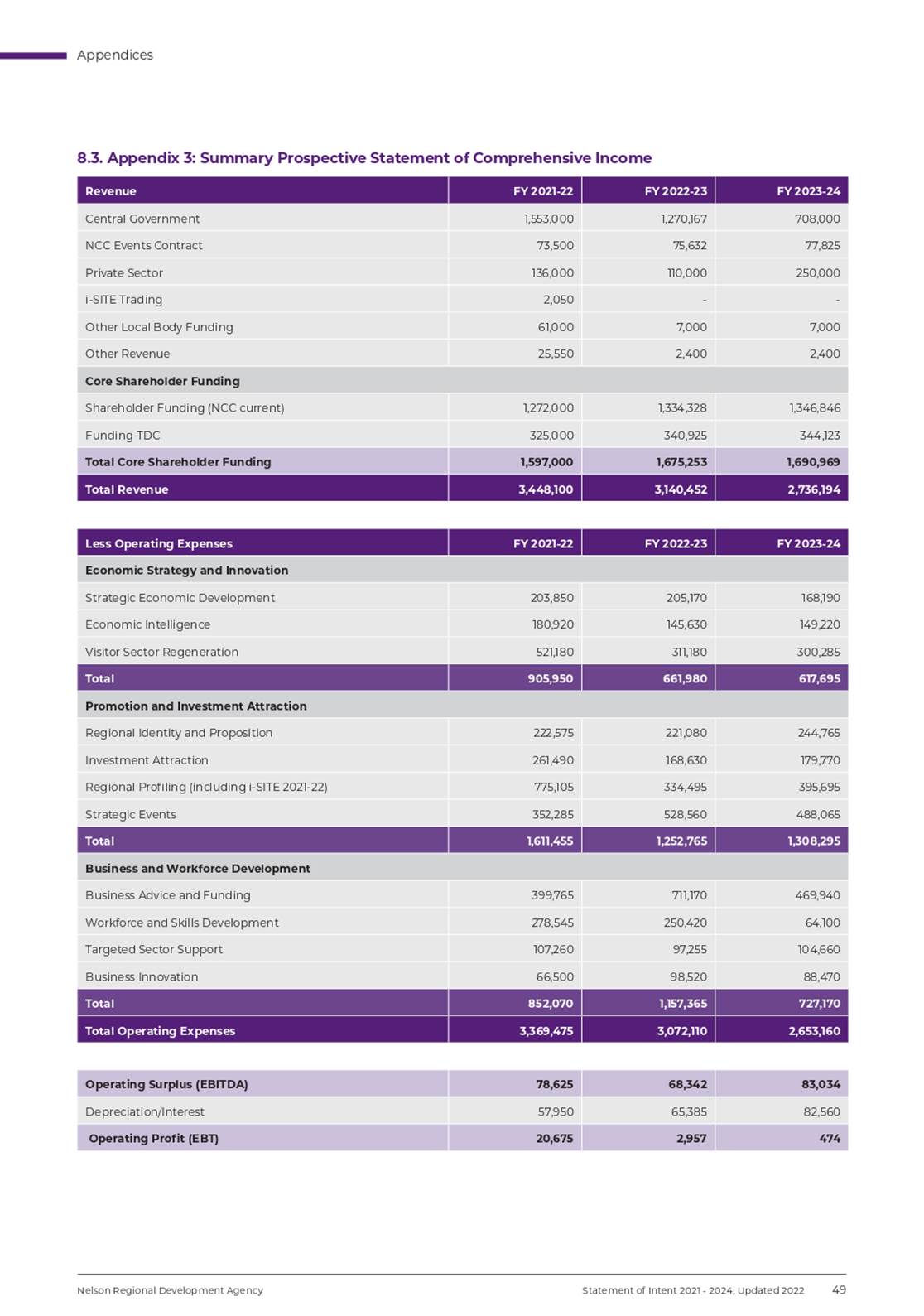

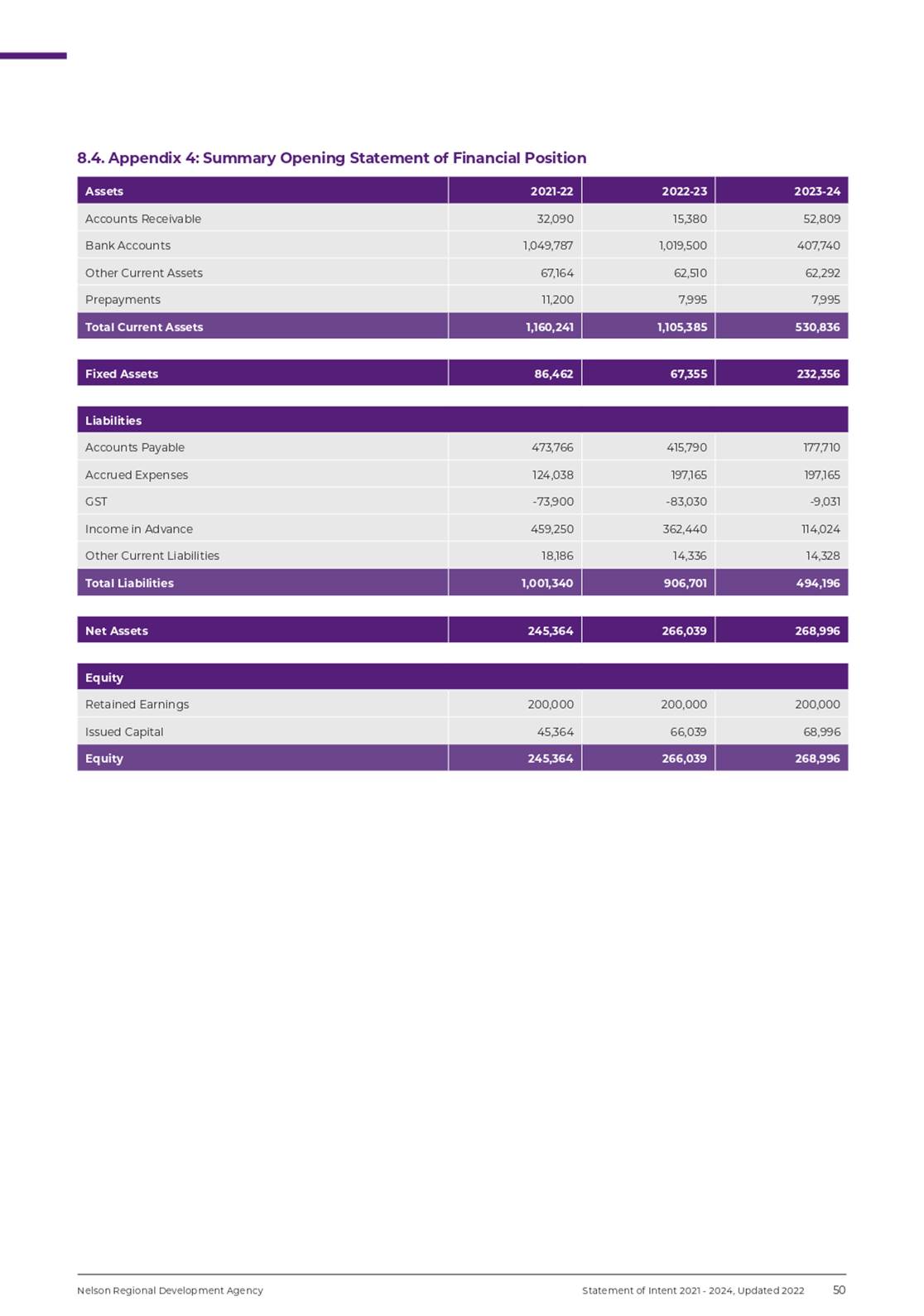

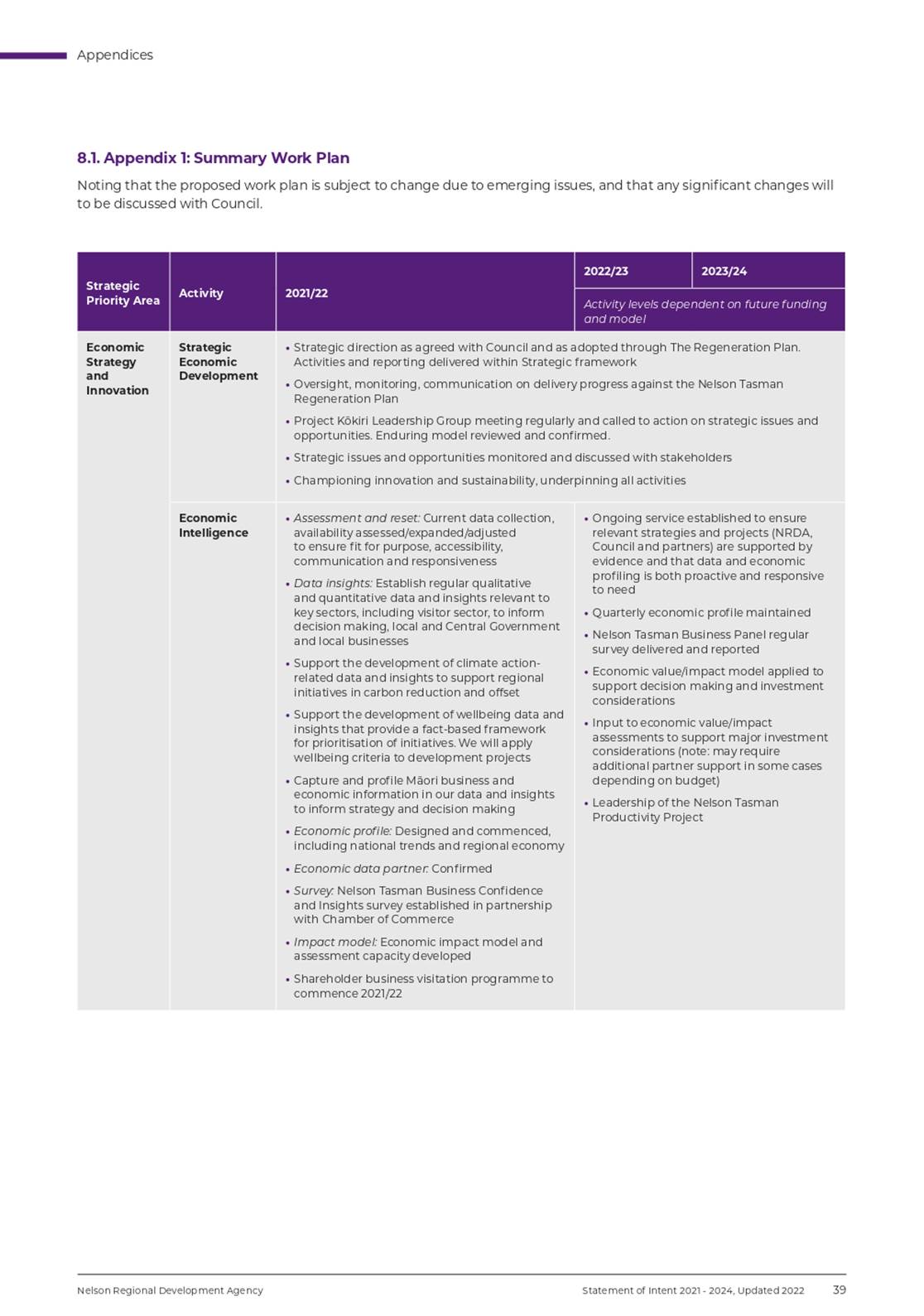

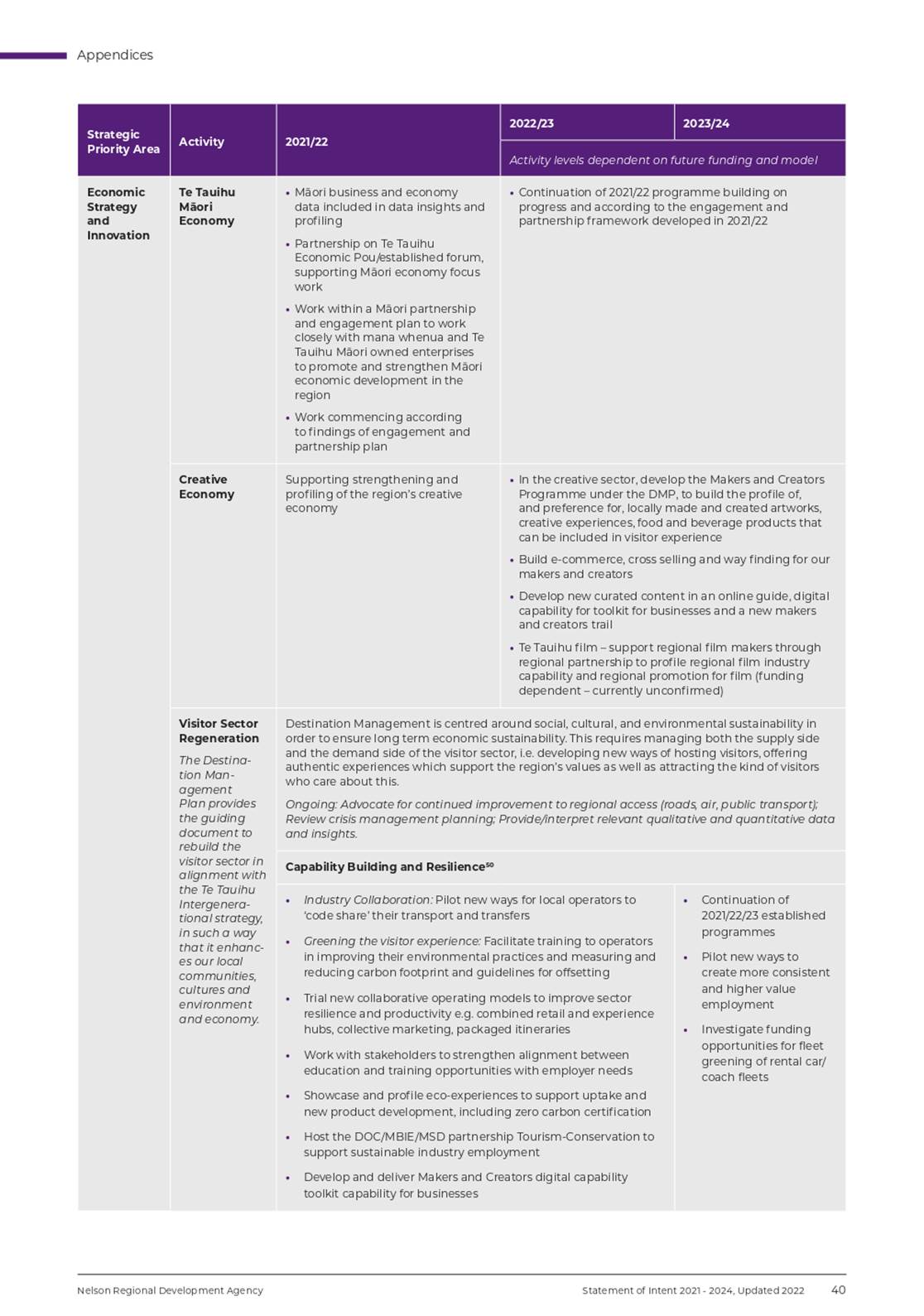

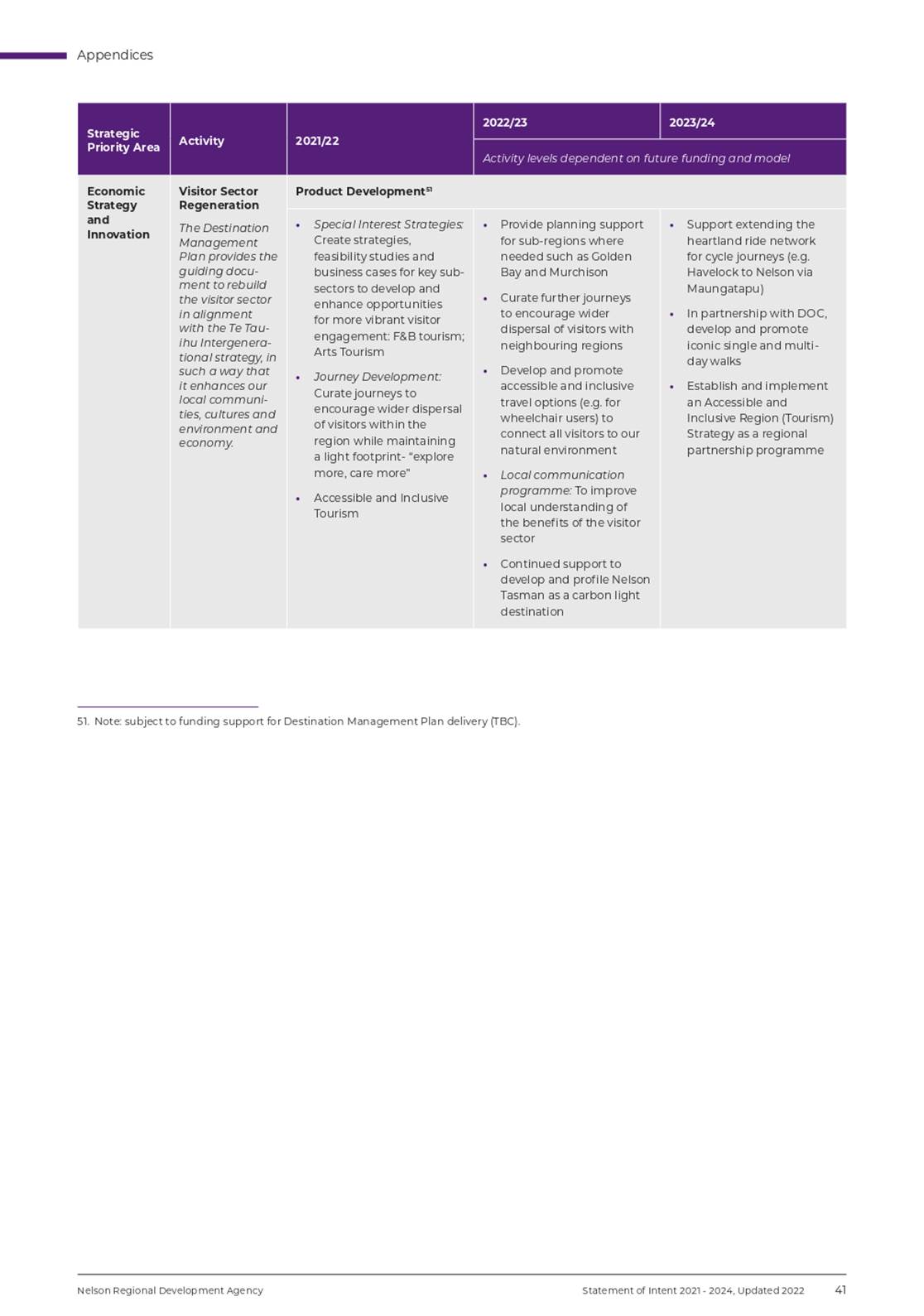

11. Nelson Regional Development

Agency Statement of Intent 2022/2023 60 - 119

Document number R26709

Recommendation

|

That the Council

1. Receives the report Nelson Regional

Development Agency Statement of Intent 2022/2023 (R26709) and its attachment

(A2901525); and

2. Agrees that the Nelson

Regional Development Agency Statement of Intent 2022/23 meets Council’s

expectations and is approved as the final Statement of Intent for 2022/23.

|

Confidential Business

12. Exclusion

of the Public

Recommendation

That the Council

1. Excludes the public from the following

parts of the proceedings of this meeting.

2. The general subject of each matter to be considered while the public

is excluded, the reason for passing this resolution in relation to each matter

and the specific grounds under section 48(1) of the Local Government Official

Information and Meetings Act 1987 for the passing of this resolution are as

follows:

|

Item

|

General subject of each matter to be

considered

|

Reason for passing this resolution in

relation to each matter

|

Particular interests protected (where

applicable)

|

|

|

Recommendations from Committees

|

|

|

|

1

|

Strategic Development and Property Subcommittee - 9

June 2022

Relocatable

Home Park Maitai Valley Motor Camp Approval

|

Section

48(1)(a)

The public conduct of this

matter would be likely to result in disclosure of information for which good

reason exists under section 7

|

The withholding of the information is necessary:

· Section 7(2)(a)

To protect the privacy of

natural persons, including that of a deceased person

· Section 7(2)(g)

To maintain legal

professional privilege

|

|

2

|

Nelmac Limited Director Reappointment

|

Section 48(1)(a)

The public

conduct of this matter would be likely to result in disclosure of information

for which good reason exists under section 7

|

The withholding of the information is necessary:

· Section

7(2)(a)

To protect the

privacy of natural persons, including that of a deceased person

|

Karakia Whakamutanga

Item 6: Mayor's Report

|

|

Council

14 June 2022

|

REPORT R26948

Mayor's

Report

1. Purpose

of Report

1.1 To

update Council on current matters.

2. Recommendation

|

That

the Council

1. Receives

the report Mayor's Report (R26948)

and its attachment (A2898827).

|

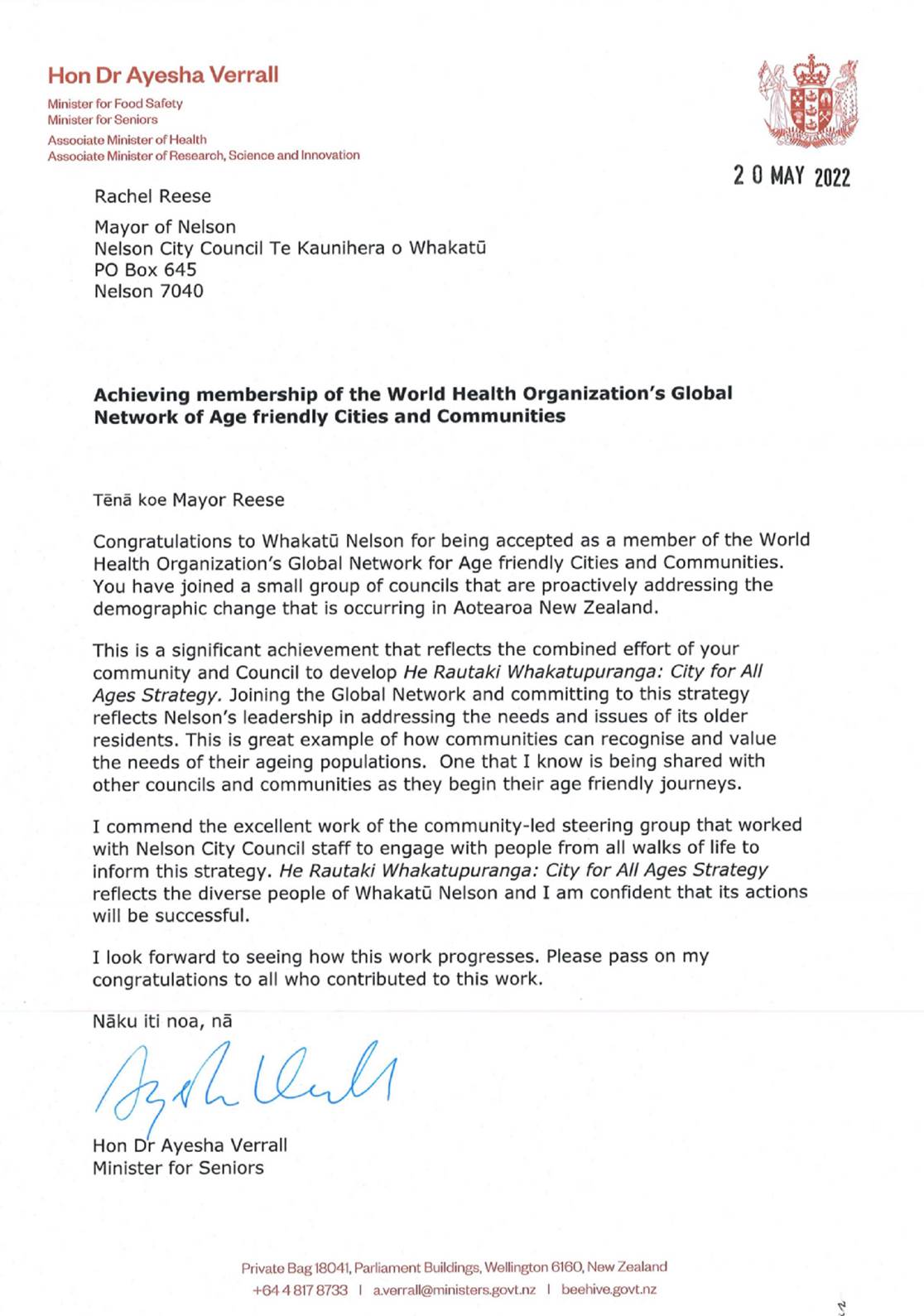

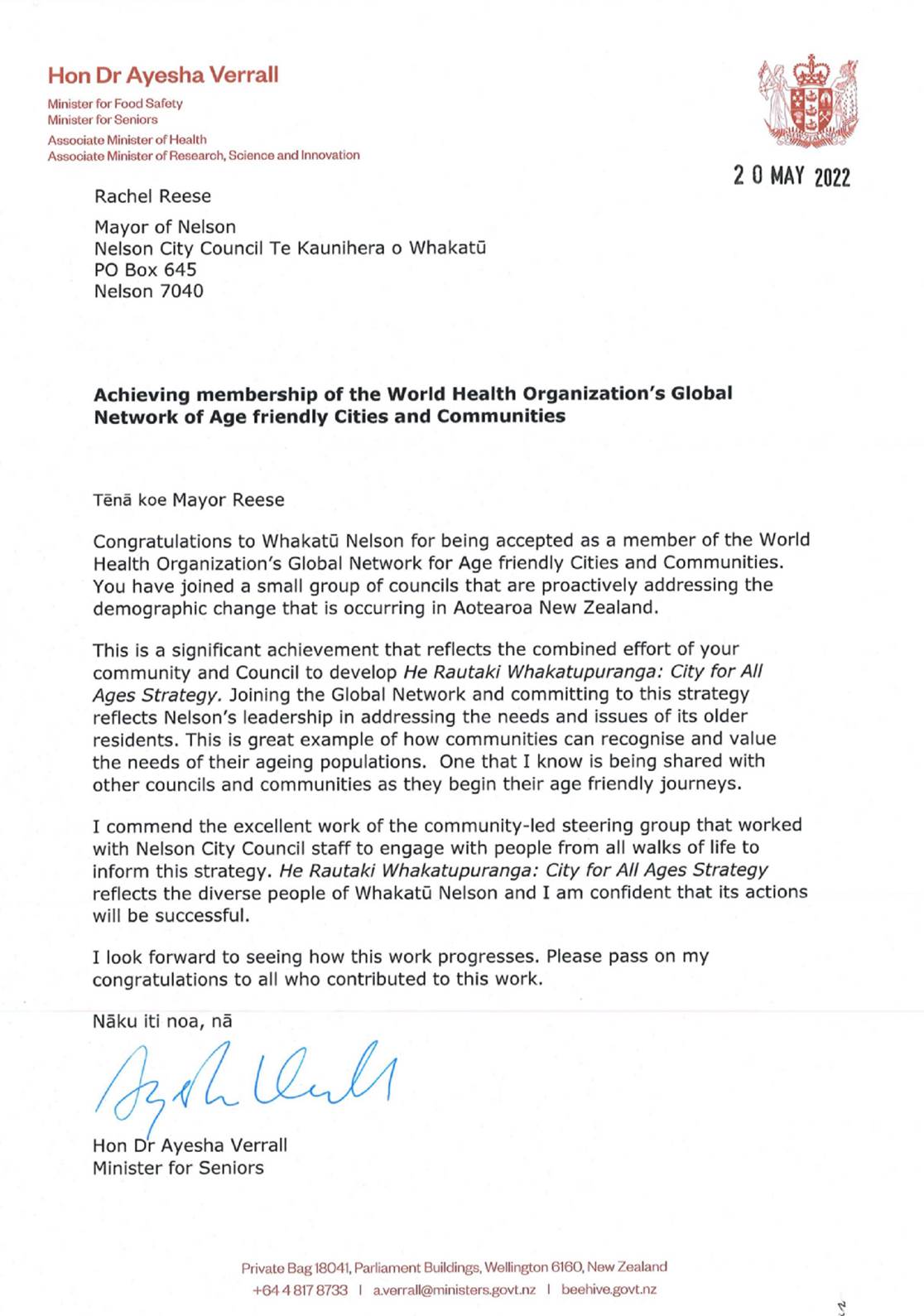

3. World

Health Organisation’s Global Network of Age friendly Cities and

Communities.

3.1 Whakatu

Nelson has officially been accepted into the World Health Organisation’s

Global Network of Age-friendly Cities and Communities (GNAFCC). A letter of

congratulations from Hon Dr Ayesha Verrall, Minister for Seniors is attached

(A2898827).

3.2 The

WHO Global Age-friendly Cities Guide identifies core characteristics of an

age-friendly city in eight areas of urban life: outdoor spaces and buildings;

transportation; housing; social participation; respect and social inclusion;

civic participation and employment; communication and information; and

community support and health services.

3.3 The

combined effort of Council and the community to develop He Rautaki

Whakatupuranga: City for All Ages Strategy contributed to this significant

achievement.

Author: Rachel

Reese, Mayor of Nelson

Attachments

Attachment 1: A2898827 Hon Dr

Ayesha Verrall re WHO's Global Network of Age friendly cities ⇩

Item 7: Adoption of the

Annual Plan 2022/23 and setting of the rates

|

|

Council

14 June 2022

|

REPORT R26771

Adoption

of the Annual Plan 2022/23 and setting of the rates

1. Purpose

of Report

1.1 To

approve carry forwards, adopt the Annual Plan 2022/23, and set the rates for

2022/23.

2. Summary

2.1 Council

is required to adopt the final Annual Plan 2022/23 by 30 June 2022, in

accordance with s95(3) of the Local Government Act 2002.

3. Recommendation

|

That the Council

1. Receives the report Adoption of the

Annual Plan 2022/23 and setting of the rates (R26771) and its

attachments (A2891743, A2891469, and A2900167); and

2. Agrees that the content of the

Annual Plan 2022/23 does not include significant or material differences to

year two of the Long Term Plan 2021-31; and

3. Approves the budget carry forwards

as set out in Attachment 1 (A2891743); and

4. Reconfirms, as approved through the

Long Term Plan 2021-31, that setting an unbalanced budget in the Annual Plan

2022/23 is prudent in terms of section 100 of the Local Government Act 2002,

given the ongoing effects of the COVID-19 pandemic on the local economy and

ratepayers, and having had regard to the matters in section 100(2) of the

Local Government Act 2002;

5. Adopts the Annual Plan 2022/23

(A2900167) pursuant to Section 95 of the Local Government Act 2002; and

6. Delegates the Mayor, Deputy Mayor

and Chief Executive to make any necessary minor editorial amendments prior to

the release of the Annual Plan 2022/23 to the public; and

7. Sets the following rates under the

Local Government (Rating) Act 2002, on rating units in the district for the

financial year commencing on 1 July 2022 and ending on 30 June 2023.

The revenue approved below

will be raised by the rates and charges

that follow.

Revenue approved:

General

Rate $43,641,098

Uniform Annual General

Charge

$11,113,932

Stormwater

and Flood Protection Charge $8,561,516

Waste

Water Charge $10,776,338

Water

Annual Charge $4,133,539

Water Volumetric Charge $9,644,924

Rates and

Charges (excluding GST) $87,871,347

Goods and

Services Tax

(at the current rate) $13,180,702

Total

Rates and Charges $101,052,049

The rates and charges below are GST inclusive.

(1) General Rate

A general rate set under section 13 of the Local Government

(Rating) Act 2002, assessed on a differential land value basis as described

below:

· a rate of 0.34323 cents in the dollar of land value on every

rating unit in the “residential – single unit” category.

· a rate of 0.34323 cents in the dollar of land value on every

rating unit in the “residential empty section” category.

· a rate of 0.37755 cents in the dollar of land value on every

rating unit in the “single residential unit forming part of a parent

valuation, the remainder of which is non-rateable” category. This

represents a plus 10% differential on land value.

· a rate of 0.37755 cents in the dollar of land value on every

rating unit in the “multi residential” category. This represents

a plus 10% differential on land value.

· a rate of 1.15049 cents in the dollar of land value on every

rating unit in the “commercial – excluding inner city and Stoke

commercial” subject to 100% commercial and industrial (occupied and

empty) category. This represents a plus 235.195% differential on land value.

· a rate of 0.94869 cents in the dollar of land value on every

rating unit in the “commercial – excluding inner city and Stoke

commercial” subject to 25% residential and 75% commercial”

category. This represents a plus 176.4% differential on land value.

· a rate of 0.74687 cents in the dollar of land value on every

rating unit in the “commercial – excluding inner city and Stoke

commercial” subject to 50% residential and 50% commercial”

category. This represents a plus 117.6% differential on land value.

· a rate of 0.54505 cents in the dollar of land value on every

rating unit in the “commercial – excluding inner city and Stoke

commercial” subject to 75% residential and 25% commercial”

category. This represents a plus 58.8% differential on land value.

· a rate of 1.59411 cents in the dollar of land value on every

rating unit in the “commercial inner city” subject to 100%

commercial and industrial (occupied and empty) category. This represents a

plus 364.445% differential on land value.

· a rate of 1.28128 cents in the dollar of land value on every

rating unit in the “commercial inner city subject to 25% residential

and 75% commercial” category. This represents a plus 273.3%

differential on land value.

· a rate of 0.96860 cents in the dollar of land value on every

rating unit in the “commercial inner city subject to 50% residential

and 50% commercial” category. This represents a plus 182.2%

differential on land value.

· a rate of 0.65591 cents in the dollar of land value on every

rating unit in the “commercial inner city subject to 75% residential

and 25% commercial” category. This represents a plus 91.1% differential

on land value.

· a rate of 1.38583 cents in the dollar of land value on every

rating unit in the “Stoke commercial subject to 100% commercial and

industrial (occupied and empty)” category. This represents a plus

303.76% differential on land value.

· a rate of 1.12511 cents in the dollar of land value on every

rating unit in the “Stoke commercial subject to 25% residential and 75%

commercial” category. This represents a plus 227.8% differential on

land value.

· a rate of 0.86460 cents in the dollar of land value on every

rating unit in the “Stoke commercial subject to 50% residential and 50%

commercial” category. This represents a plus 151.9% differential on

land value.

· a rate of 0.60374 cents in the dollar of land value on every

rating unit in the “Stoke commercial subject to 75% residential and 25%

commercial” category. This represents a plus 75.9% differential on land

value.

· a rate of 0.22310 cents in the dollar of land value on every

rating unit in the “rural” category. This represents a minus 35%

differential on land value.

· a rate of 0.30891 cents in the dollar of land value on every

rating unit in the “small holding” category. This represents a

minus 10% differential on land value.

(2) Uniform Annual General Charge

A uniform annual general charge under section 15 of the Local

Government (Rating) Act 2002 of $376.05 per separately used or inhabited part

of a rating unit.

(3) Stormwater and Flood Protection Charge

A targeted rate under section 16 of the Local Government (Rating)

Act 2002 of $454.43 per rating unit, this rate is payable by all ratepayers

excluding rural rating units, rating units east of the Gentle Annie saddle,

Saxton’s Island and Council’s stormwater network.

(4) Waste Water Charge

A targeted rate for waste water disposal under section 16 of the

Local Government (Rating) Act 2002 of:

· $564.72 per separately used or inhabited part of a residential,

multi residential, rural and small holding rating units that is connected

either directly or through a private drain to a public waste water drain.

· For commercial rating units, a waste water charge of $141.18 per

separately used or inhabited part of a rating unit that is connected either

directly or through a private drain to a public waste water drain.

Note: a trade waste charge will also be levied.

(5) Water Annual Charge

A targeted rate for water supply under Section 16 of the Local

Government (Rating) Act 2002, of:

Water charge (per connection) $220.69

(6) Water Volumetric Rate

A targeted rate for water provided under Section 19 of the Local

Government (Rating) Act 2002, of:

Price of water:

Usage up to 10,000 cu.m/year $2.295

per m³

Usage from 10,001 – 100,000

cu.m/year $1.962

per m³

Usage over 100,000 cu.m/year $1.548

per m³

Summer irrigation usage over

10,000 cu.m/year $2.129 per m³

(7) Low Valued Properties

Remission Value

In accordance Section 85 of the Local Government (Rating) Act 2002

and Council’s Rates Remission Policy, Council sets the land value for

the Low Valued Properties Rates Remission at $10,000.

Other Rating Information:

Due Dates for Payment of Rates

The above rates (excluding water volumetric rates) shall be

payable in four instalments on the following dates:

|

Instalment

Number

|

Instalment Date

|

Last Date for Payment

|

Penalty Applied

|

|

Instalment 1

|

25 July 2022

|

22 August 2022

|

26 August 2022

|

|

Instalment 2

|

25 October 2022

|

21 November 2022

|

25 November 2022

|

|

Instalment 3

|

25 January 2023

|

20 February 2023

|

24 February 2023

|

|

Instalment 4

|

26 April 2023

|

22 May 2023

|

26 May 2023

|

Rates instalments not paid on or by the Last Date for payment

above will incur penalties as detailed in the section “Penalty on

Rates”.

Due Dates for Payment of Water Volumetric

Rates

Water volumetric rates shall be payable on the following dates:

|

Billing Month

|

Last Date for Payment

|

|

July 2022

|

22 August

2022

|

|

August

2022

|

20

September 2022

|

|

September

2022

|

20 October

2022

|

|

October

2022

|

21

November 2022

|

|

November

2022

|

20

December 2022

|

|

December

2022

|

20 January

2023

|

|

January

2023

|

20

February 2023

|

|

February

2023

|

20 March

2023

|

|

March 2023

|

20 April

2023

|

|

April 2023

|

22 May

2023

|

|

May 2023

|

20 June

2023

|

|

June 2023

|

20 July

2023

|

Penalty on Rates

Pursuant to Sections 57 and 58 of the Local Government (Rating)

Act 2002, the council authorises the following penalties on unpaid rates

(excluding volumetric water rate accounts) and delegates authority to the

Group Manager Corporate Services to apply them:

· a charge of 5% of the amount of each rate instalment remaining

unpaid after the due date stated above, to be added on the penalty date as

shown in the above table and also shown on each rate instalment notice.

· a charge of 5% will be added on 8 July 2022 to any balance from a

previous rating year (including penalties previously charged) remaining

outstanding on 1 July 2022.

· a further additional charge of 5% will be added on 11 January 2023

to any balance from a previous rating year (including penalties previously

charged) to which a penalty has been added according to the bullet point

above, remaining outstanding on 9 January 2023.

Penalty Remission

In accordance Section 85 of the Local Government (Rating) Act 2002

and Council’s Rates Remission Policy, the Council will approve the

remission of a penalty where the criteria of the policy has been met.

Payment of Rates

Rates shall be payable at the Council offices, Civic House, 110

Trafalgar Street, Nelson between the hours of 8.30am to 5.00pm Monday,

Tuesday, Thursday and Friday and 9.00am to 5.00pm Wednesday.

Where any payment is made by a ratepayer that is less than the

amount now payable, the Council will apply the payment firstly to any rates

outstanding from previous rating years and then to current year rates due.

|

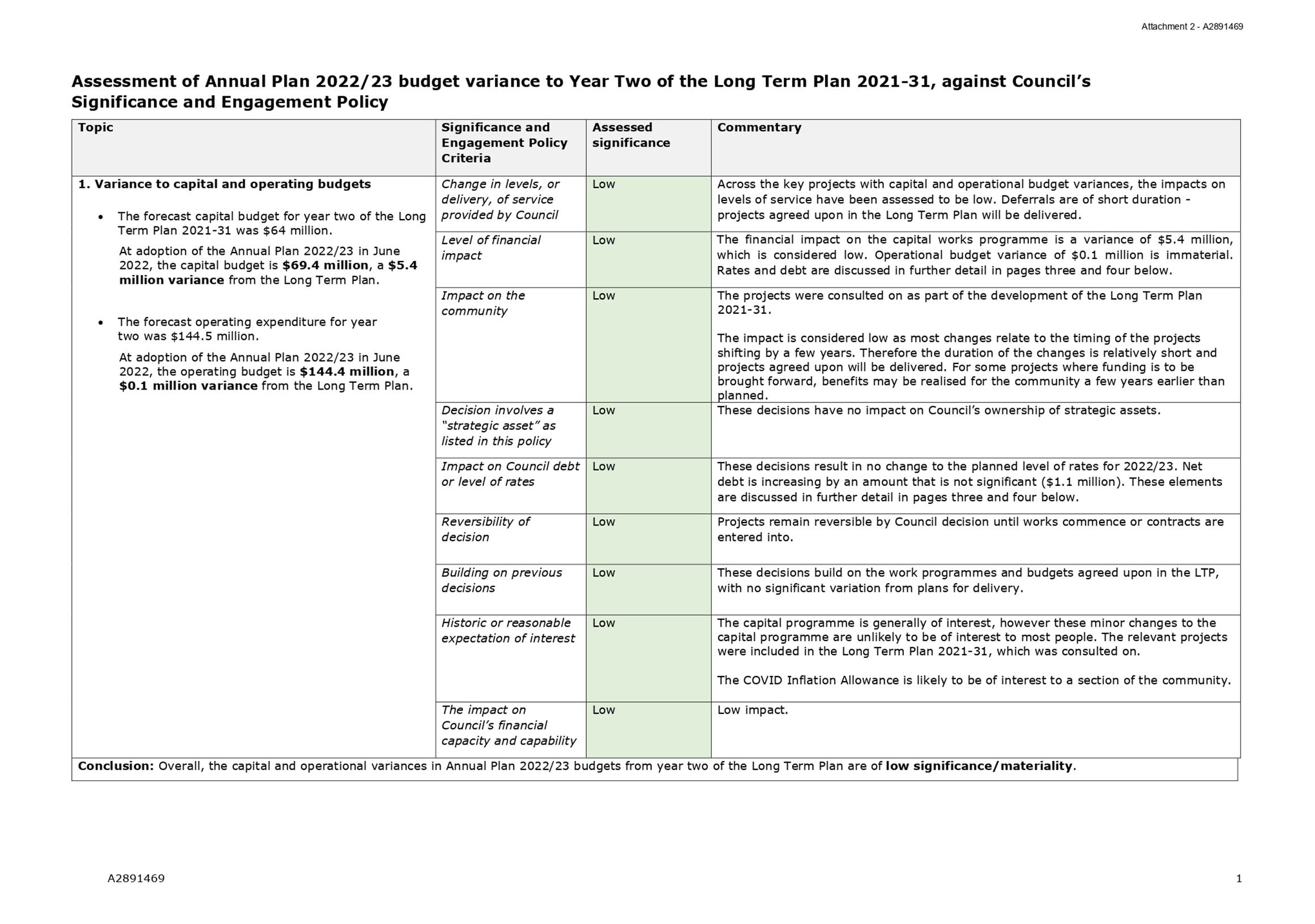

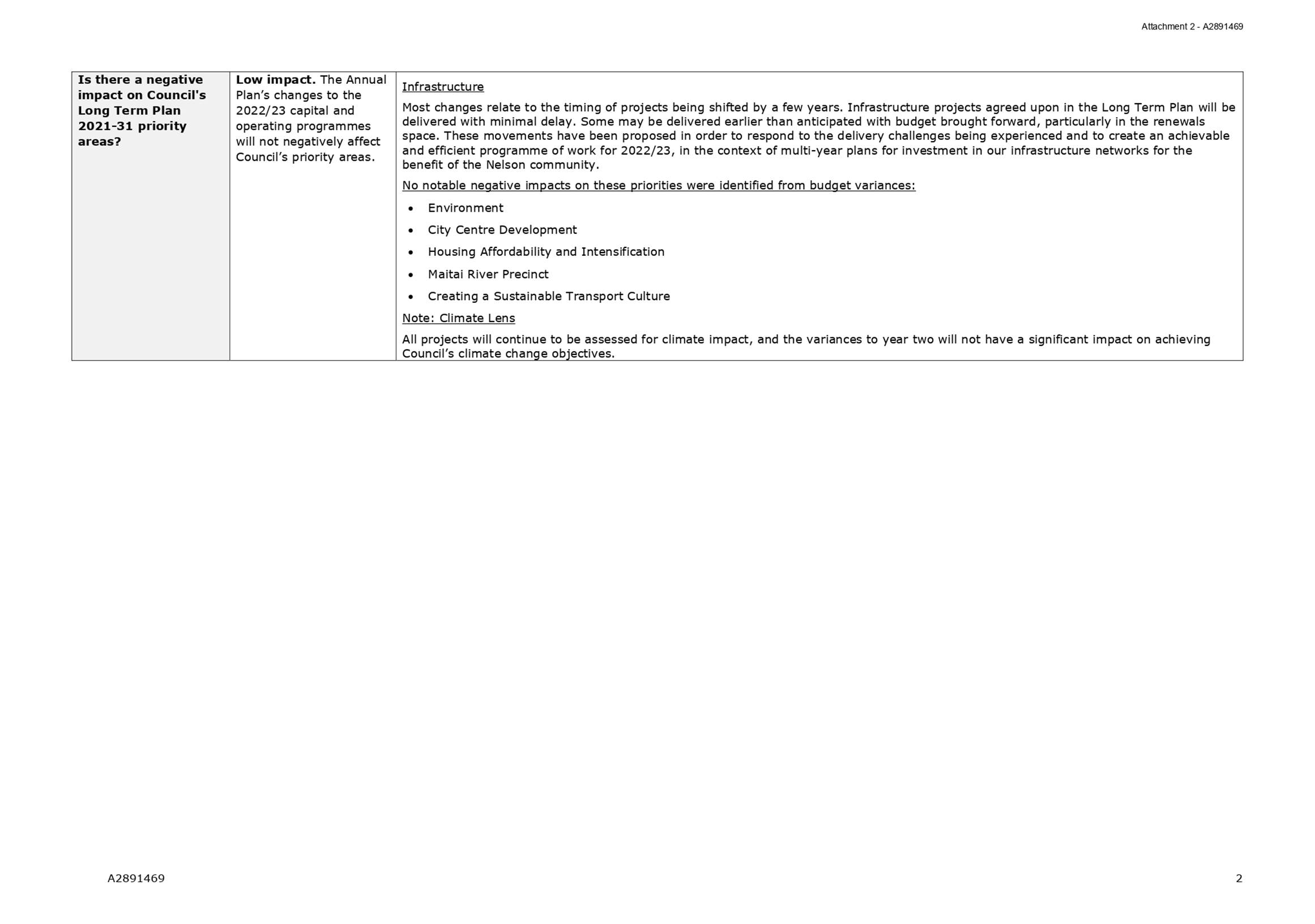

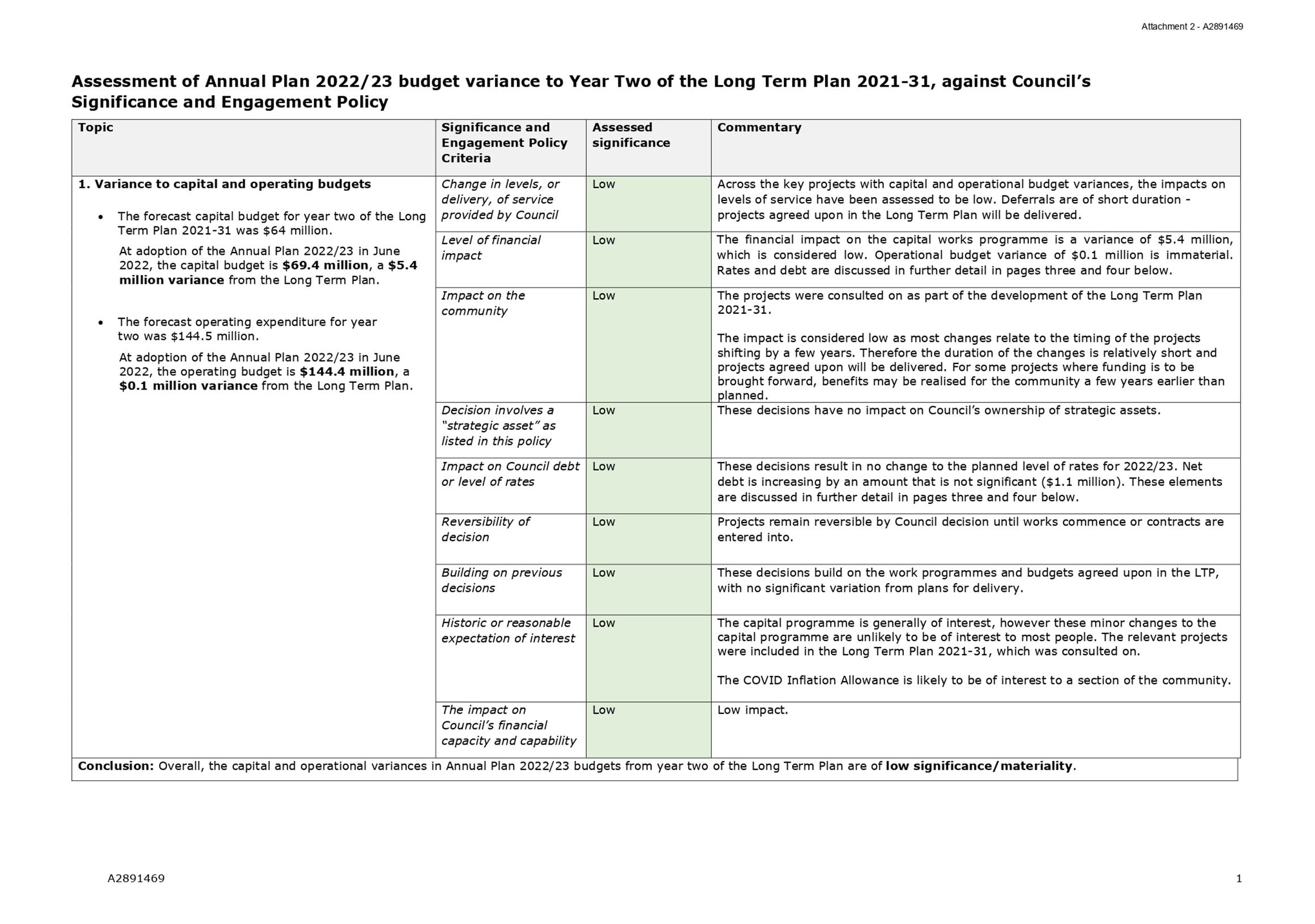

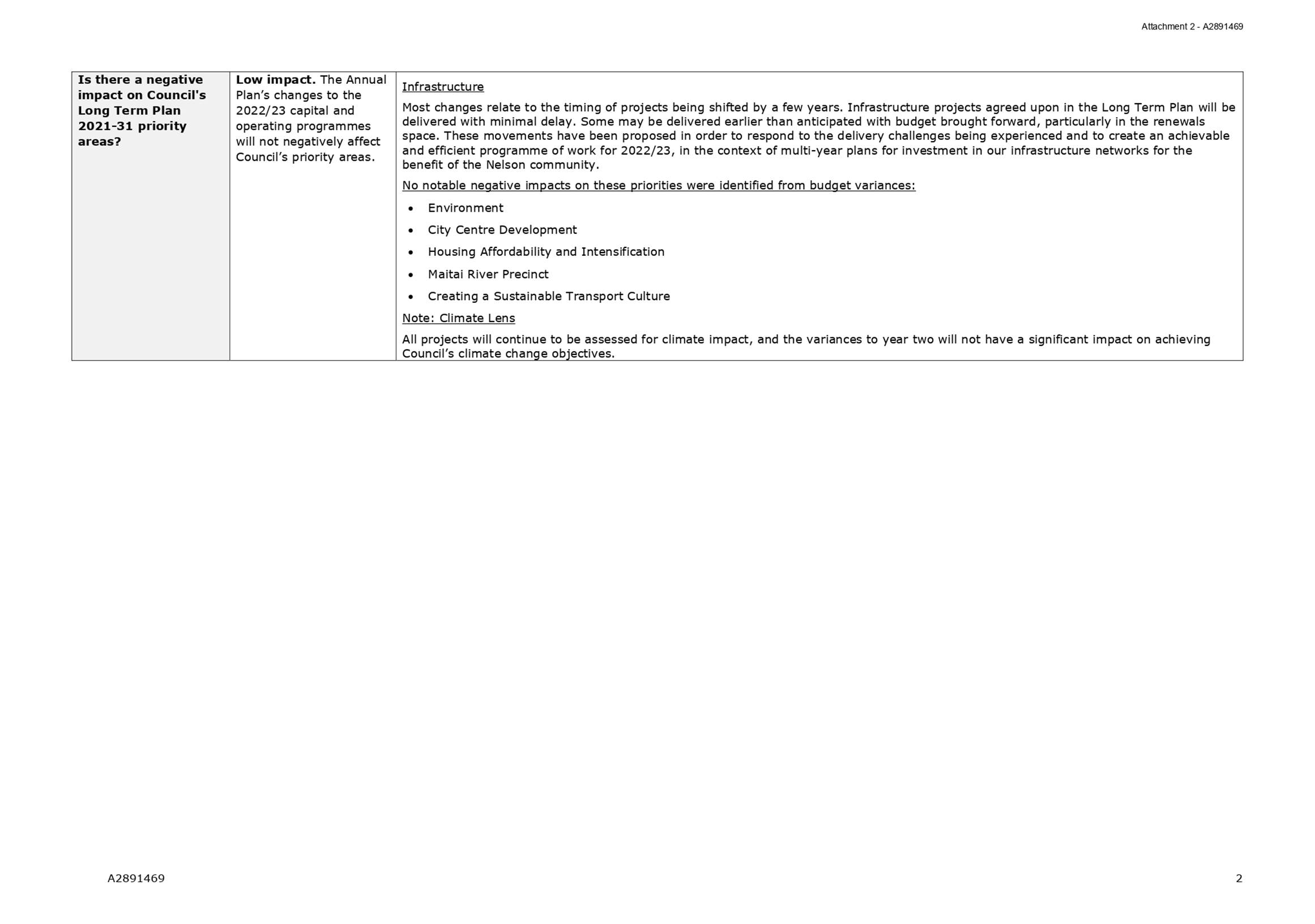

4. Background

4.1 Council

workshops on the Annual Plan were held in December 2021, and February and March

2022. At its meeting of 10 March 2022 Council agreed that the content of the

Annual Plan 2022/23 did not include significant or material differences to year

two of the Long Term Plan, and therefore public consultation on the document

was not required.

4.2 The

decision not to consult on this Annual Plan and the reasons for this were

shared with the community via a media

release and in the

23

March issue of Our Nelson.

4.3 A

Council workshop was held on 17 May 2022 to discuss variances to budgets since

they were presented at the Council meeting on 10 March. Attachment 2 contains

an assessment of the significance of variances from the Long Term Plan, in

accordance with Council’s Significance and Engagement Policy. Having

regard to those assessments, staff do not consider these variances to be

significant or material, so there is no requirement for public consultation.

4.4 Attachment

1 contains the proposed carry forwards presented today for approval by Council.

5.

Discussion

Variance to budgets

5.1 The

table below provides a high-level overview of proposed variance from the Long

Term Plan as presented to Council on 10 March, and the final figures.

|

|

Year Two

LTP

|

Proposed

AP 2022/23

10 Mar 2022

|

Proposed Variance to LTP

10 Mar 2022

|

Final

AP 2022/23

|

Final Variance to LTP

|

|

Rates

increase

|

5.4%

|

5.4%

|

Nil

|

5.4%

|

Nil

|

|

Rates

cap

|

5.4%

|

5.4%

|

Nil

|

5.4%

|

Nil

|

|

Uniform

Annual General Charge (UAGC)

|

13%

|

11%

|

(2%)

|

11%

|

(2%)

|

|

Net debt

at 30 June 2023

|

$159.9 m

|

$161.7 m

|

$1.8 m

|

$161.0m

|

$1.1 m

|

|

Debt/revenue

ratio

|

113%

|

112%

|

(1%)

|

114%

|

1%

|

|

Capital

spend (Excluding capital staff costs, vested

assets, regional consolidations)

|

$64 m

|

$66.7 m

|

$2.7 m

|

$69.4m

|

$5.4m

|

|

Operating

Expenditure

(As per

Annual Plan statement of comprehensive revenue and expense)

|

$144.5 m

|

$142.1 m

|

$2.4 m

|

$144.4 m

|

$0.1 m

|

|

Other

Income (Excluding regional consolidations, water

by meter & internal interest)

|

$41.8 m

|

$41.4 m

|

($0.4 m)

|

$42 m

|

$0.2 m

|

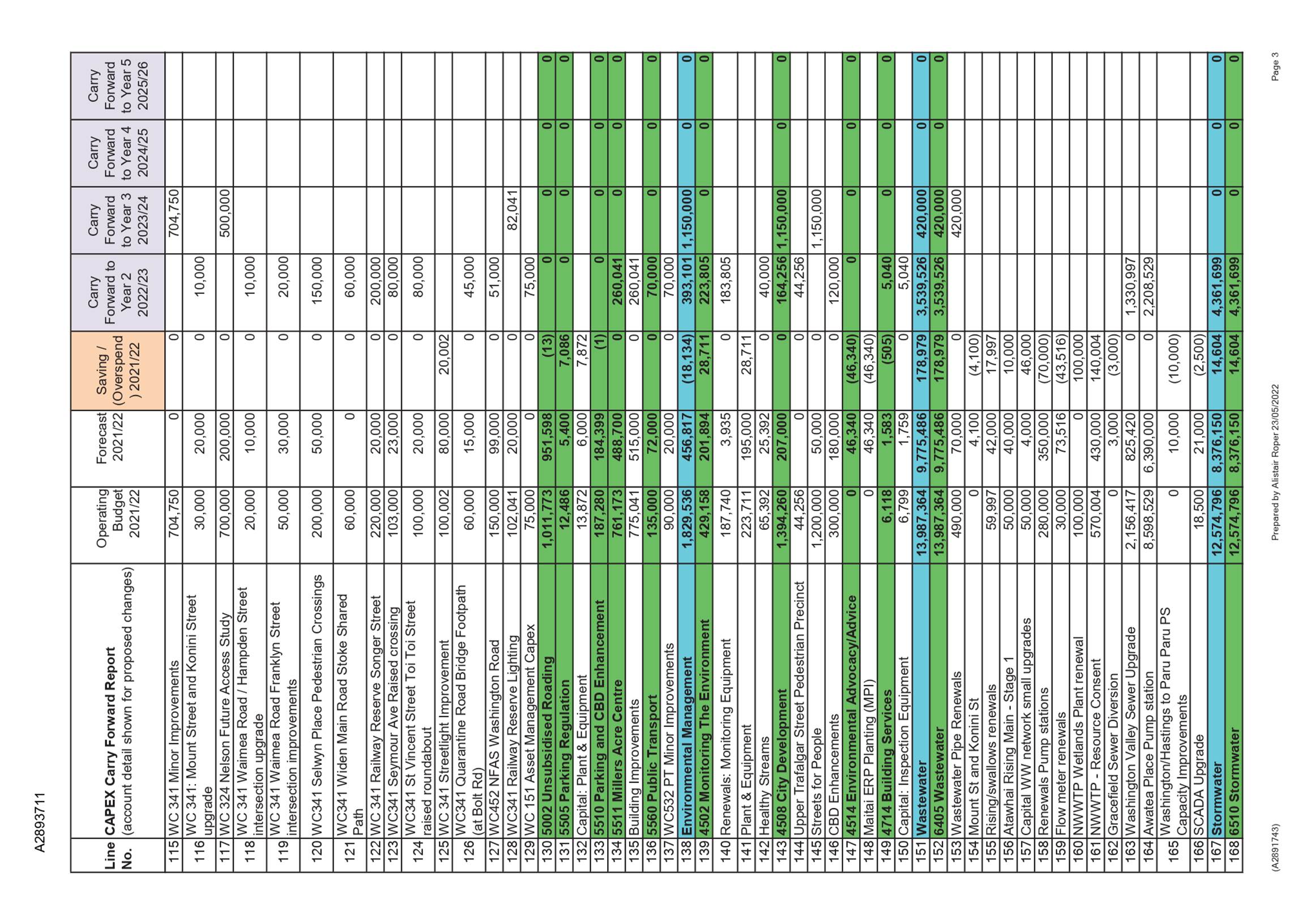

5.2 Capital

changes since 10 March which are over $500,000 are discussed below:

Civic

House projects

5.3 The 2022/23 budget for

refurbishment of Civic House has been reduced by $2.5 million, to $500,000. $2

million has been carried over into 2023/24, as more time is needed to develop a

new approach. The pandemic has changed how Council operates and further change

is coming from the Three Waters reform and changes to the Resource Management

Act. New ways of working have required a rethink of the original business case.

5.4 Budgets

carried over from 2021/22 for the renewal of Civic House’s roof have been

reduced by $218,000 to $700,000 for the year. Options are being developed to

strengthen the roof to above 34% NBS.

5.5 $900,000

has been added to the ceiling tiles remediation budget (including carry

forwards) bringing the total for 2022/23 to $1.5 million. This will allow

funding for working through remediation, based on priorities identified in a

detailed seismic assessment that is being prepared.

Library Precinct development

5.3 The proposed budget of

$3.4 million for this project in 2022/23 has been reduced to $1.2 million, due

to rephasing of the project. $2.2 million has been carried over to 2025/26.

Maitai

Camp improvements

5.4 Planned

capital improvements at the Maitai Campground in 2022/23 are largely

achievable, though there is some pressure on delivery. $515,000 has been

carried over into 2023/24 to continue the project, resulting in a $1.6 million

budget for 2022/23. The focus for the year will be on compliance work.

Sealed

road resurfacing

5.5 $813,000 has been

carried over from 2021/22 into 2022/23 for road resurfacing, as the contractor

had limitations on the amount of work that it could achieve in 2021/22. The

$2.3 million total budget in 2022/23 will be spent under a new road maintenance

contract.

Millers Acre Centre building

improvements

5.6 Miller’s

Acre budgets for 2022/23 have increased by $610,000, to $885,000. Additional

funds were approved by Council on 10 May 2022, to enable the recladding project

to progress. $260,000 was carried over from 2021/22.

Wastewater projects

5.7 To

assist with reducing the overall capital expenditure programme for 2022/23, the

renewal of wastewater pipelines within Wolfe Street will now be phased over two

financial years. This has resulted in $800,000 being carried over into 2023/24,

leaving $800,000 in 2022/23.

5.8 The

Awatea Place pump station project experienced delays in the latter half of

2021/22, so the construction works have been phased into 2022/23. $2.2 million

has been carried over into 2022/23 for this, giving a total of $3.7 million.

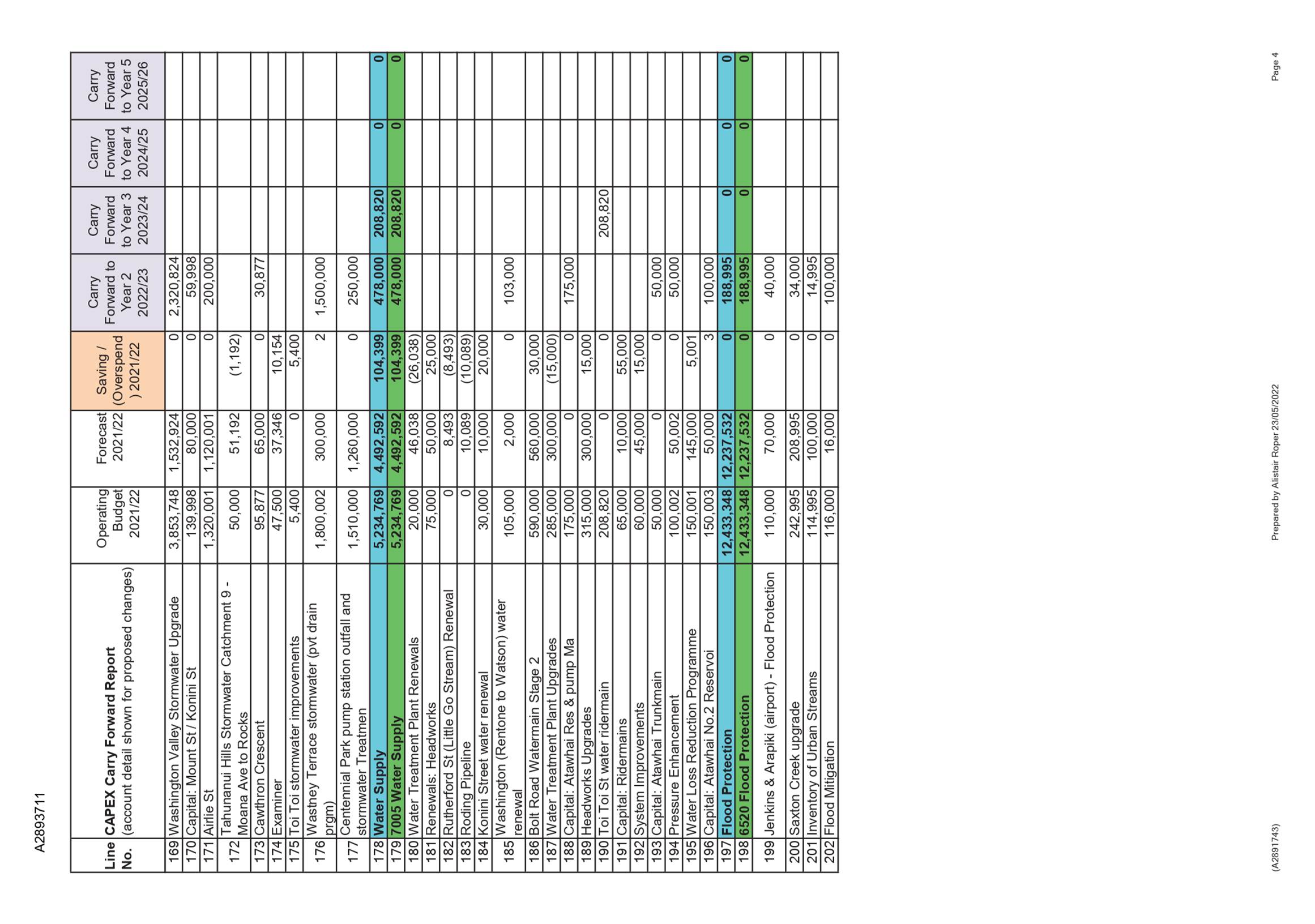

Stormwater projects

5.9 The

Washington Valley Infrastructure Upgrade – Stage 1 (Hastings Street) will

not be completed in 2021/22, due to late start on site and COVID-19

restrictions/staff shortages. Construction and budgets are phased over two

financial years (2021/22 and 2022/23). Progress on site has been slower than

expected, for reasons including the discovery of contaminated coal tar

material, the cost implications of which are still being worked on. As a

result, funds are being carried over into 2022/23, with the project due for

completion that year. $911,000 has been carried over in the stormwater portion

of the project, bringing its total budget for 2022/23 to $2.4 million.

5.10 Budgets for the Rutherford Street stormwater upgrades have increased

by $640,000 to $4.8 million for 2022/23, as part of an approved funding

increase to the Rutherford Street Upgrades group of projects. This has resulted

from changes to the design and scheduling of work, including a longer

construction duration to minimise disruption to the public and the continuing

rise in material costs.

5.11 Due

to late awarding of tender, work on the Wastney Terrace stormwater construction

programme has moved into 2022/23, resulting in $553,000 being carried over from

2021/22 ($1.6 million total for the year).

Water Supply projects

5.12 Budgets for Rutherford Street water renewals have increased by

$535,000 to $1.3 million for 2022/23, as part of a funding increase to the

Rutherford Street Upgrade group of projects described above.

5.13 To

assist with reducing the overall capital expenditure programme for 2022/23, the

renewal of water pipelines within Wolfe Street will now proceed in 2023/24.

This has resulted in $500,000 being carried over into 2023/24, leaving $1.4

million budget for 2022/23.

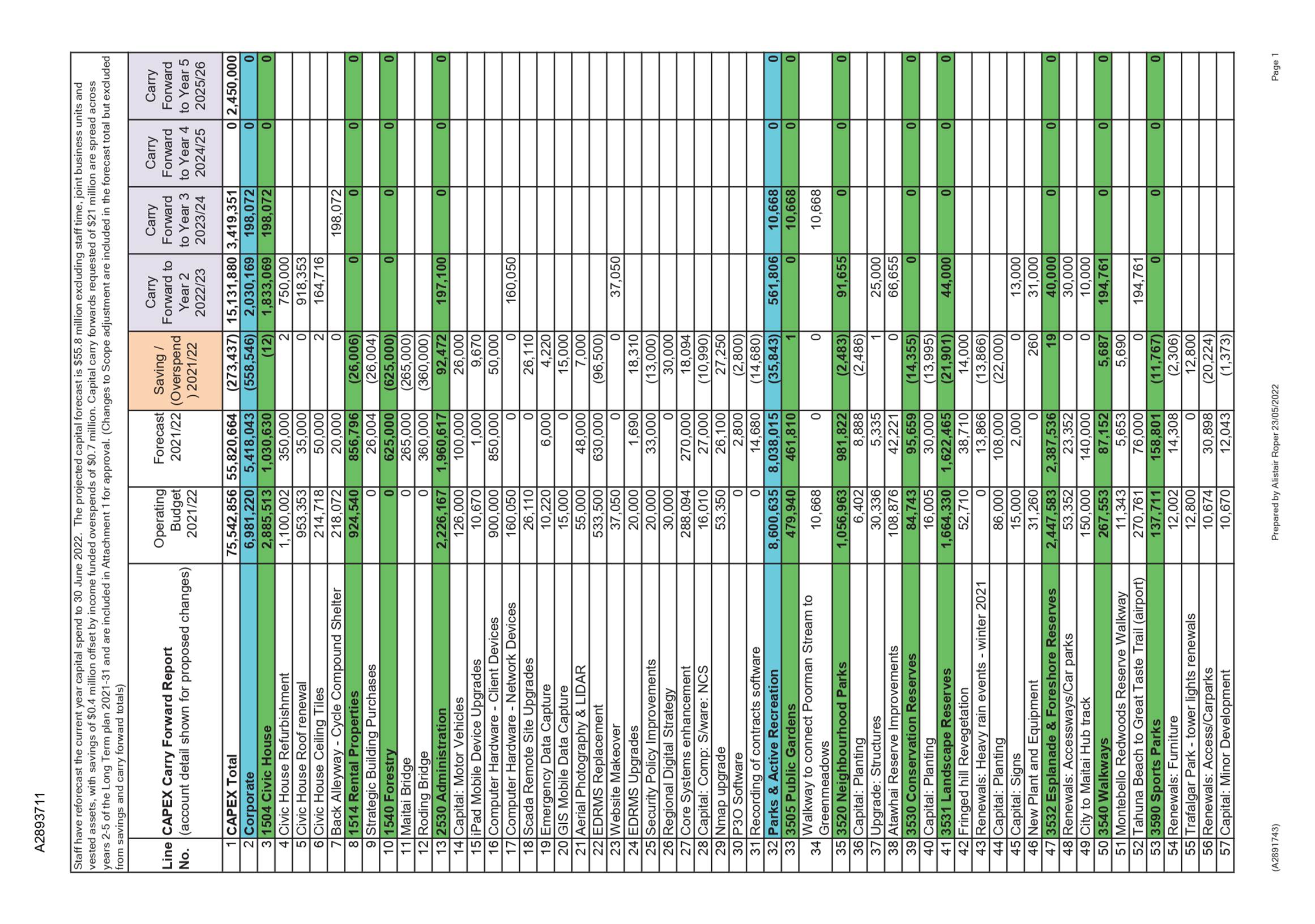

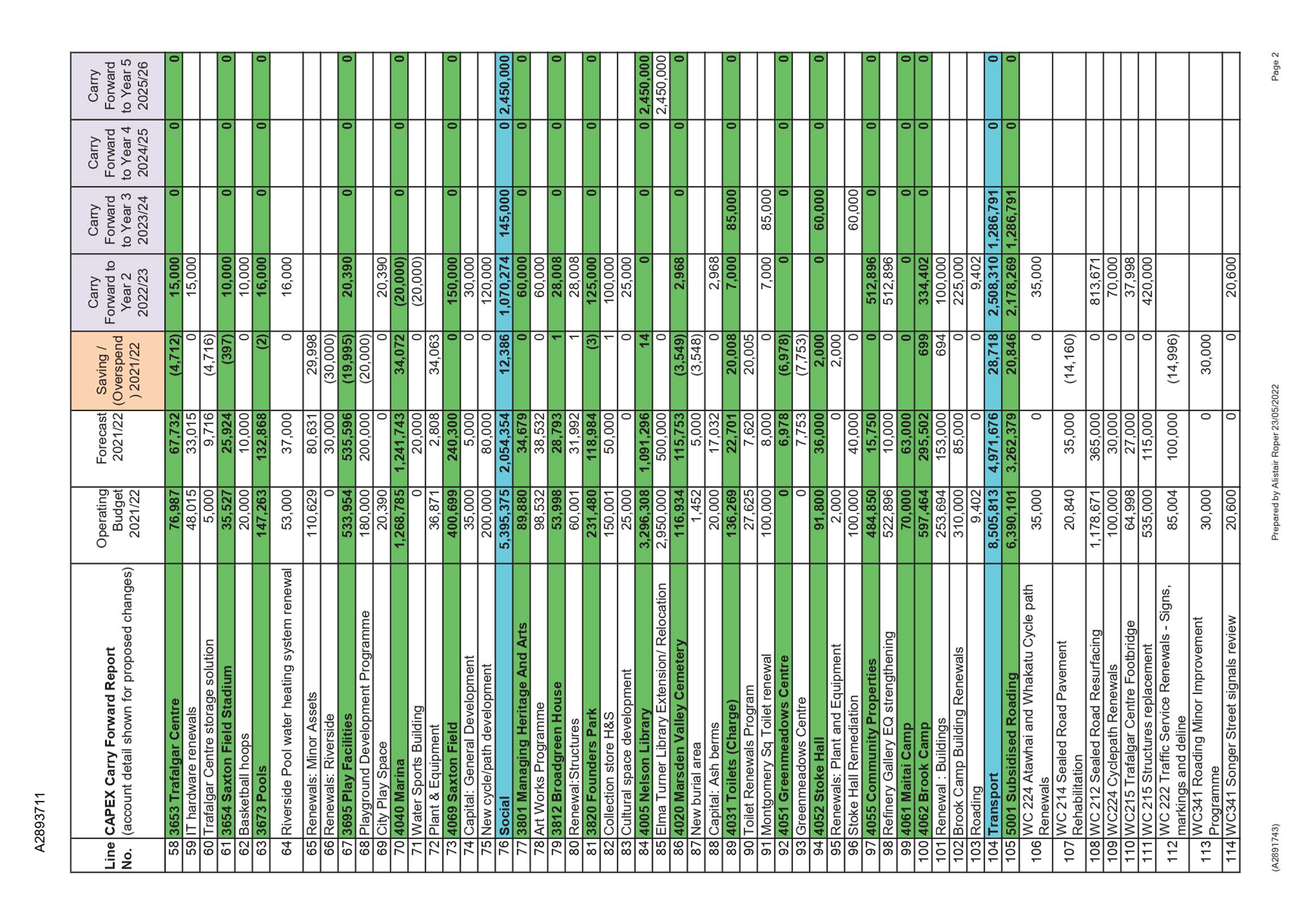

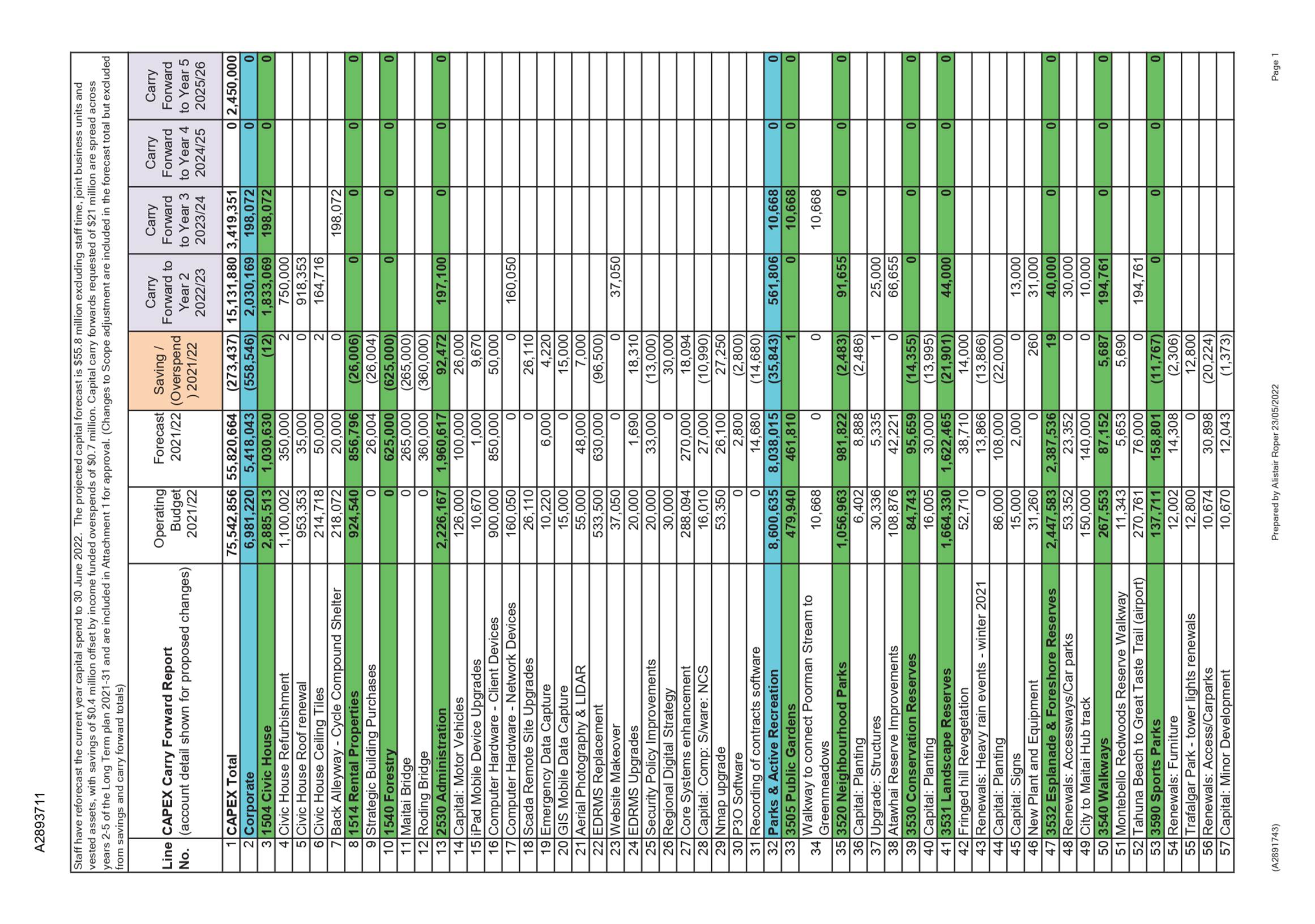

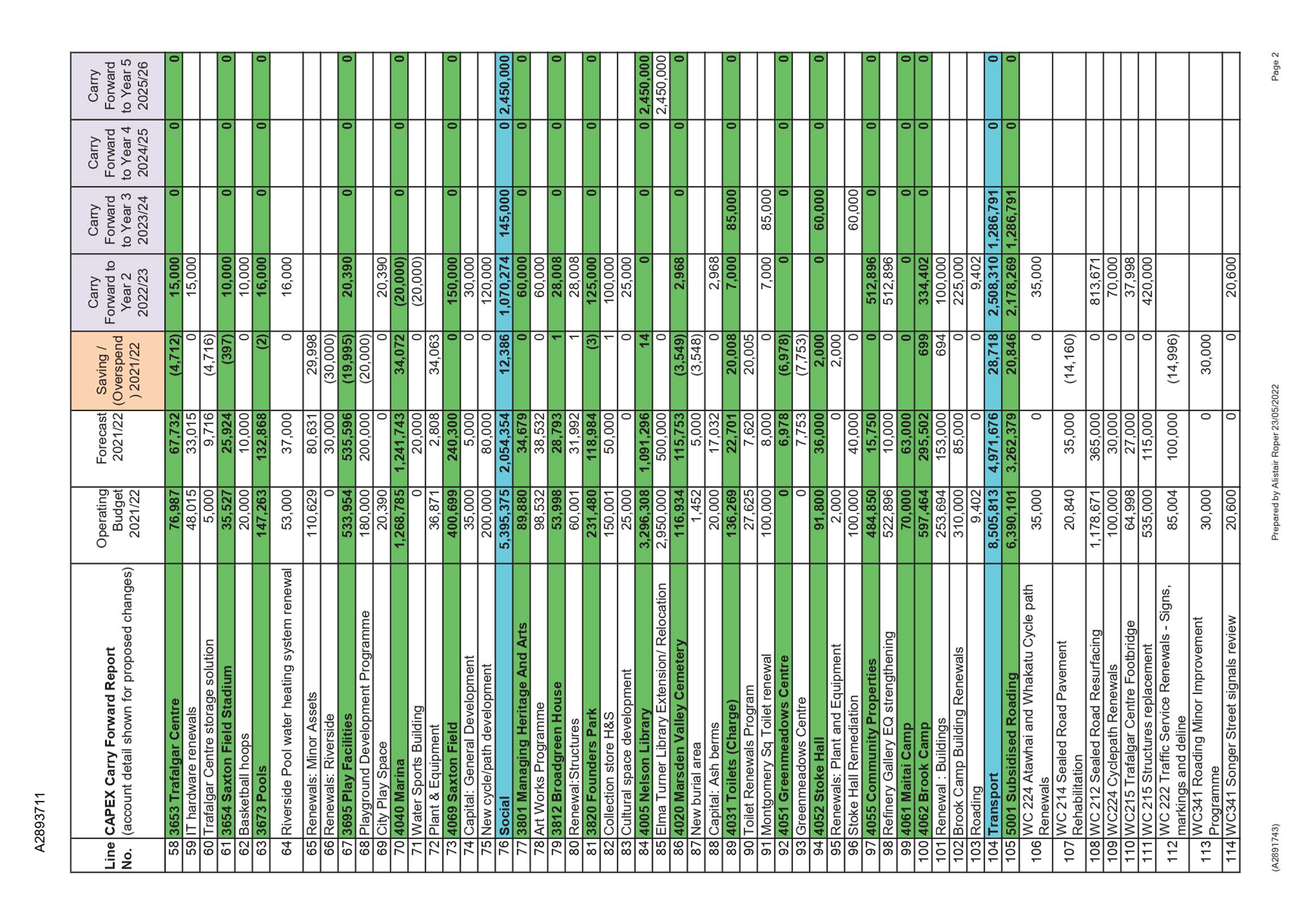

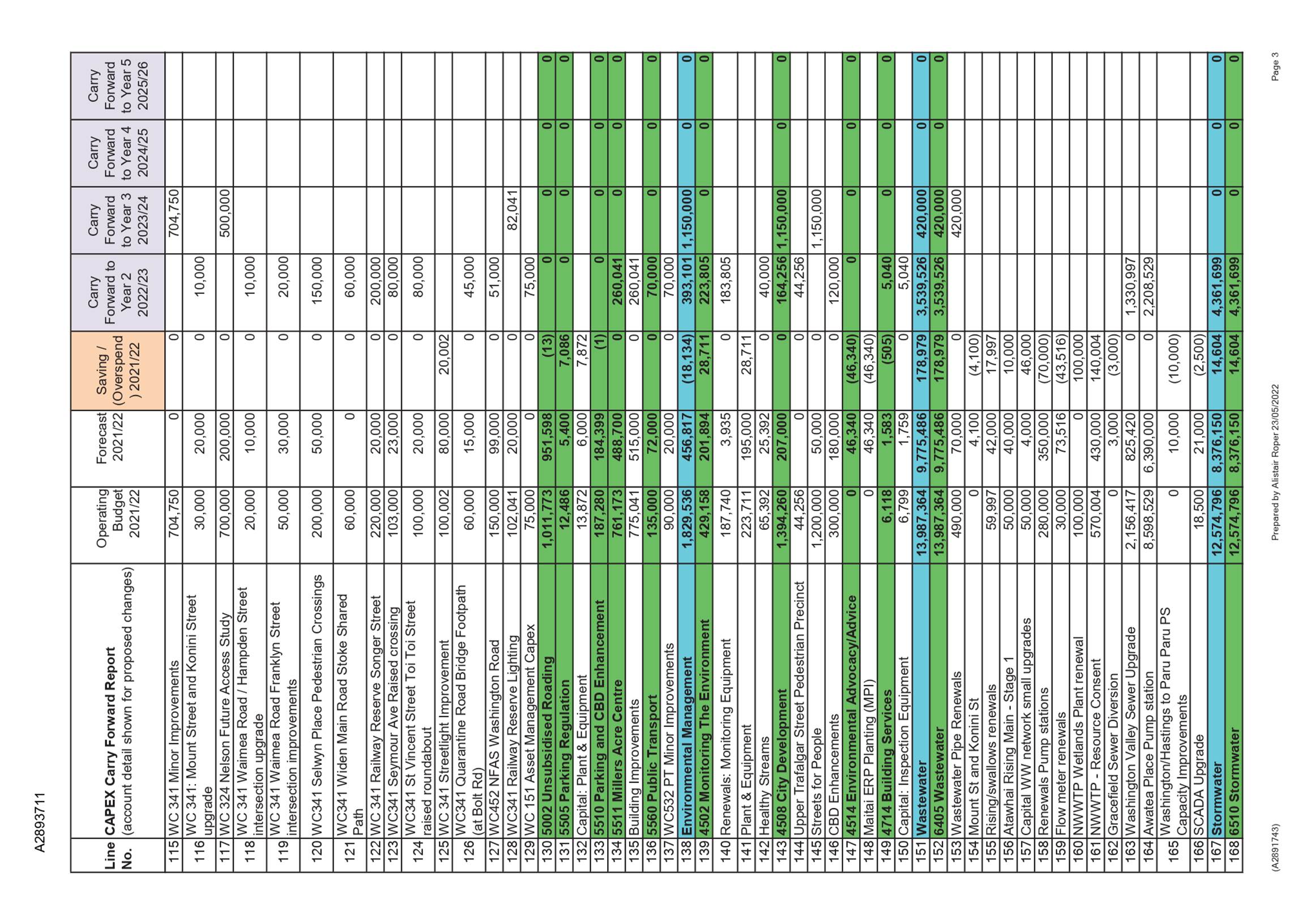

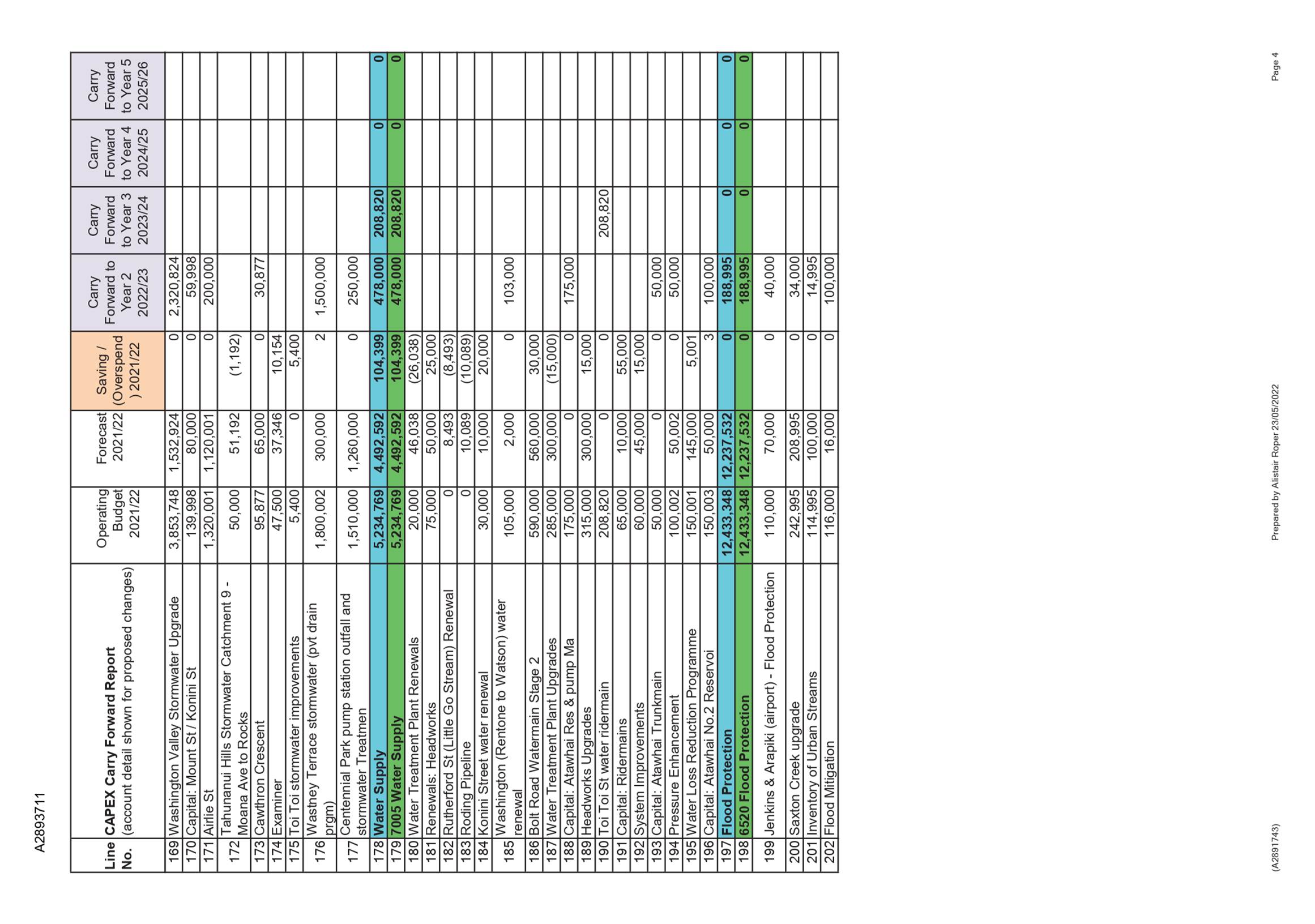

Carry

Forwards

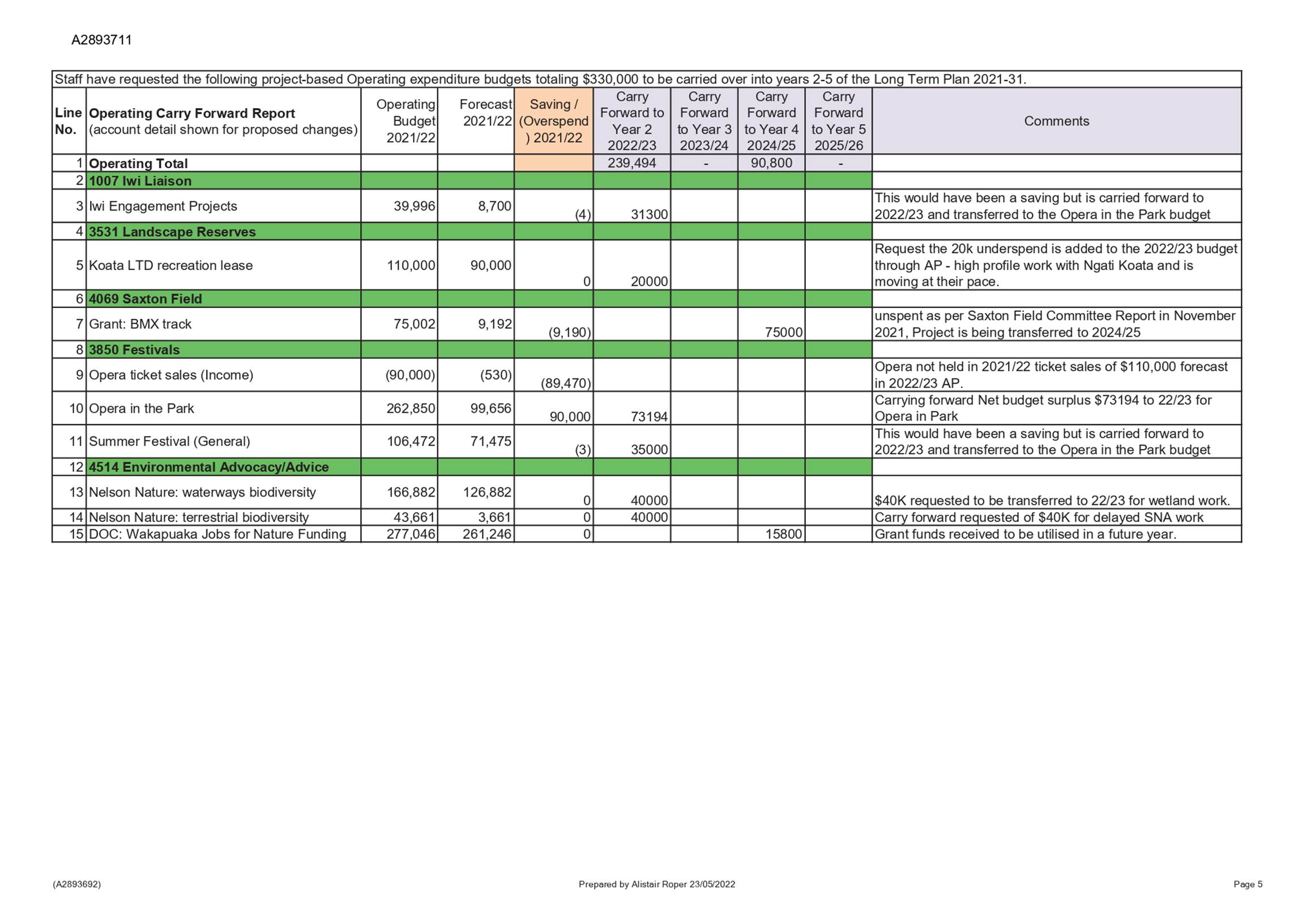

5.14 Staff

have reforecast the current year capital spend to 30 June 2022. The

projected capital forecast is $55.8 million, excluding staff time, joint

business units and vested assets, with savings of $0.4 million offset by income

funded overspends of $0.7 million. Capital carry forwards requested of $21

million are spread across years 2-5 of the Long Term Plan 2021-31 and are

included in Attachment 1 for approval. $15 million of this is budget carried

over from 2021/22 into 2022/23, and is included in the $71.6 million capital

programme for 2022/23. (Changes to scope adjustment are included in the

forecast total, but excluded from savings and carry forward totals).

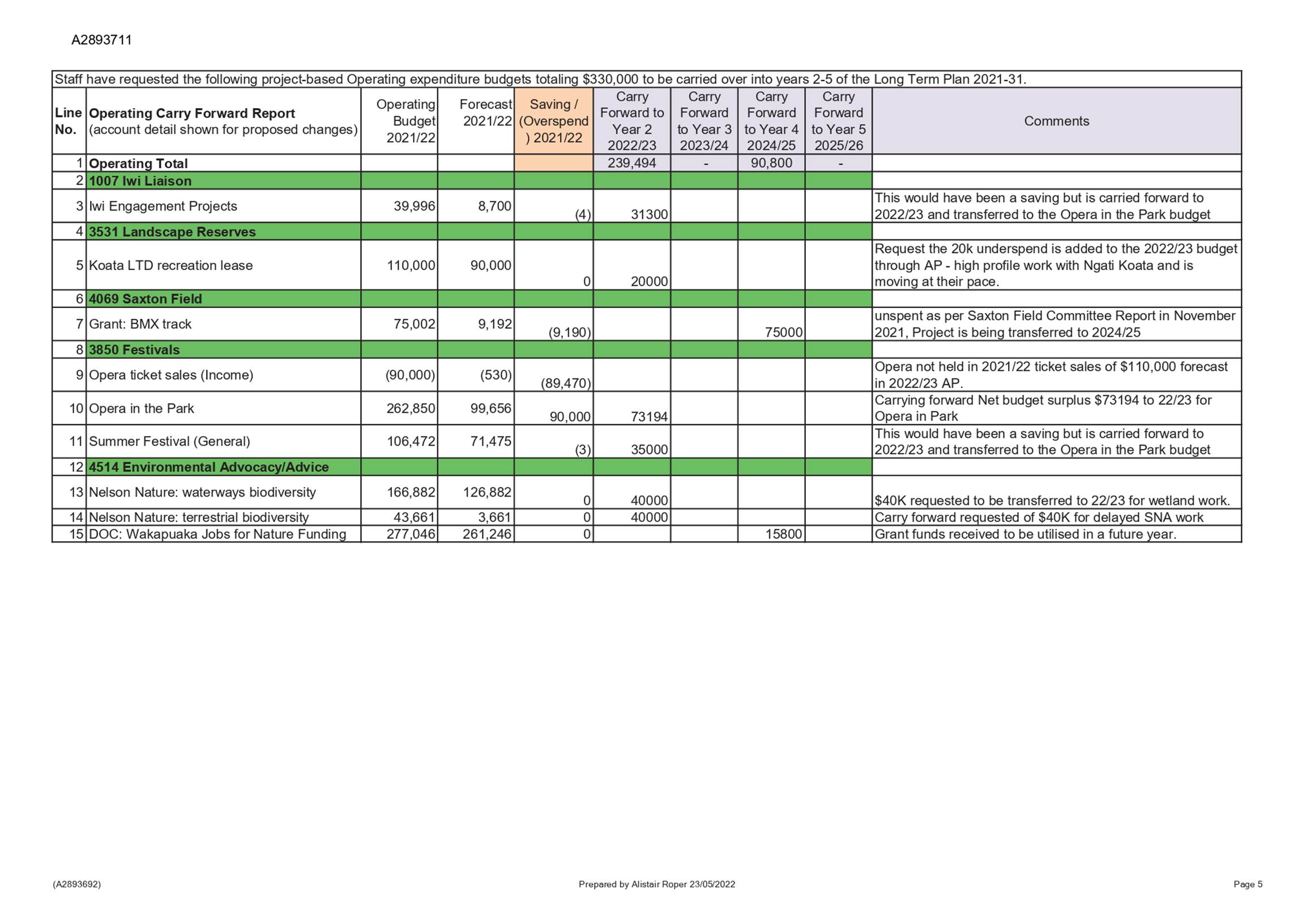

5.15 Staff

have also requested project-based operating expenditure budgets totalling

$330,000 to be carried over into years 2-5 of the Long Term Plan 2021-31

(Attachment 1).

COVID Inflation Allowance

5.16 COVID-19

has resulted in increased costs that have posed many challenges to the delivery

of Council’s capital works programme throughout 2021/22. A COVID

Inflation Allowance was approved by Council on 17 February 2022 and management

thereof delegated to the Tenders Subcommittee, with reporting to the Audit, Risk

and Finance (ARF) Subcommittee. This was to supplement potential project cost

‘overs’ arising from the ever increasing materials and equipment

costs, to complement the already successful streamlined procurement process, to

award tenders more quickly, and to stay ahead of a very fast-moving, uncertain

and volatile market. Based on the information available at that time, $1.8

million was included for 2022/23. The effectiveness of the new Inflation

Allowance measures will be reported to Council via the ARF Subcommittee on a

quarterly basis.

5.17 Since

March 2022, further disruptions to the global and national economy have been

seen, caused chiefly by New Zealand’s Omicron variant outbreak and the

Russia/Ukraine conflict. Predictions by Business and Economic Research Limited

earlier in the year that material markets would stabilise and then ease over

the next 12 months have not been realised. On the contrary, costs for materials

have increased even further. Labour shortages in construction remains an

extremely volatile issue, with this not likely to ease any time in the short to

medium term. This is likely to result in pressure on the budget allocation of

$1.8 million. Any requests for further funding will be brought to full Council.

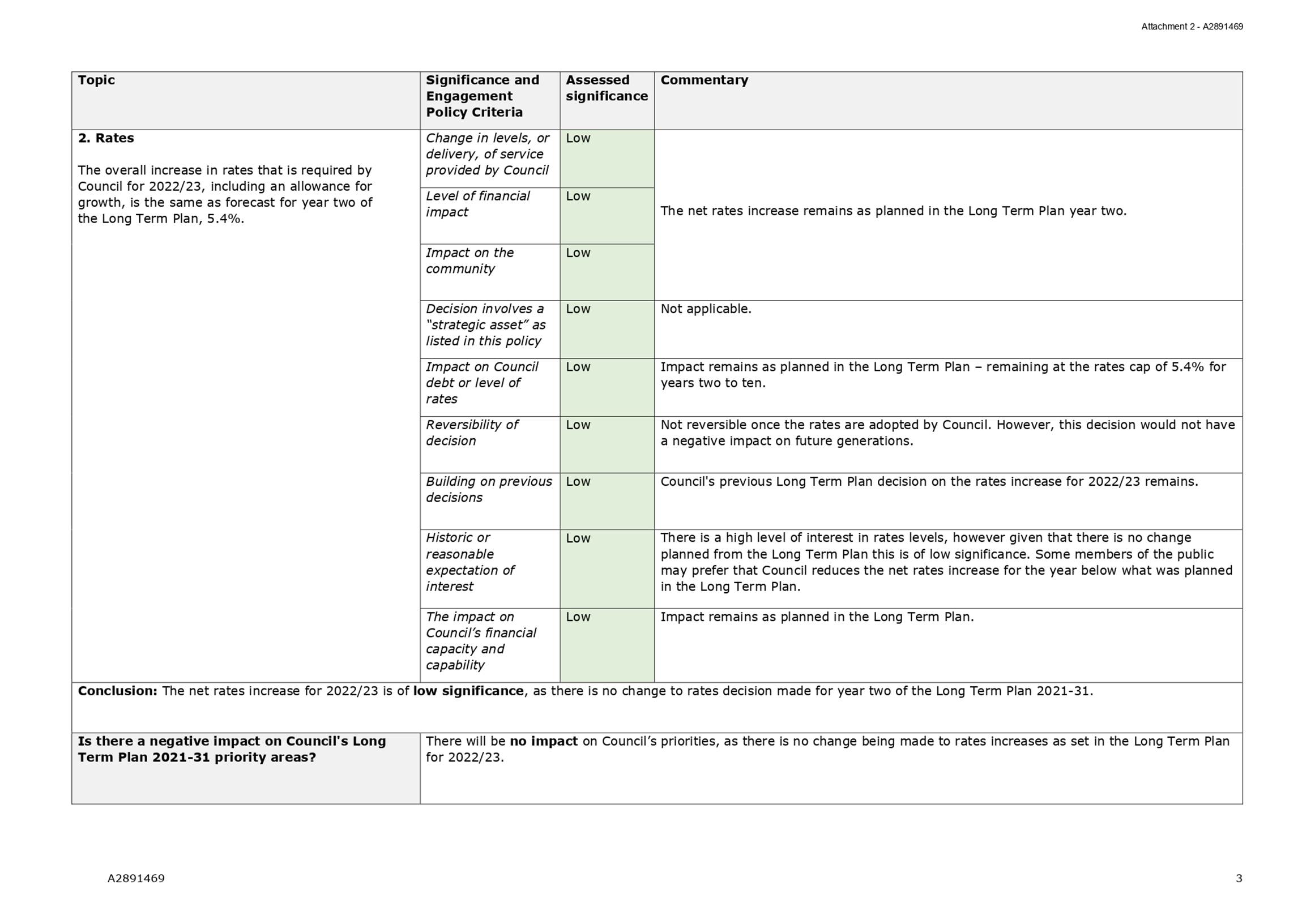

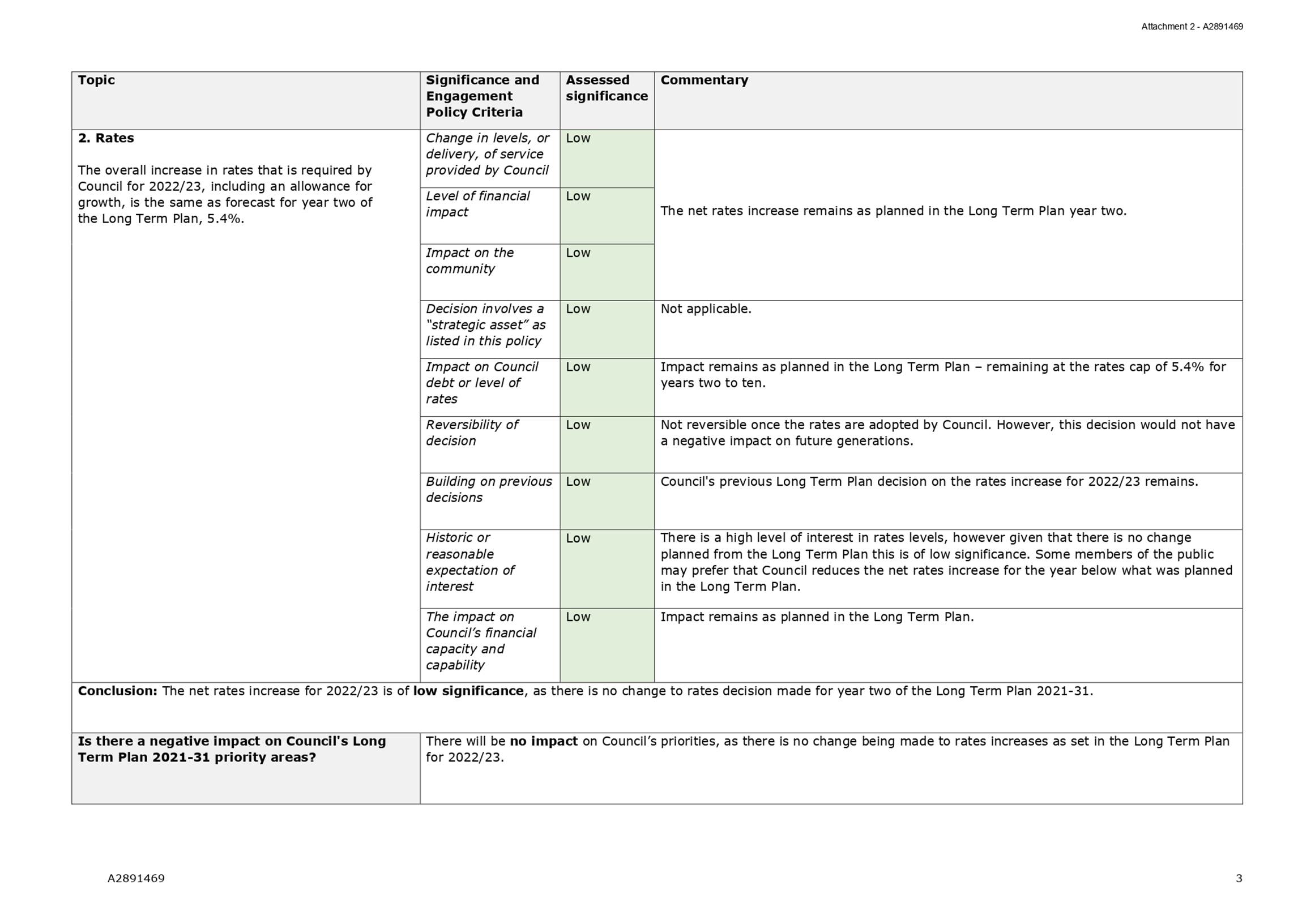

Setting of the rates

5.18 Following

adoption of the Annual Plan, Council needs to pass a resolution to set the

rates for the 2022/23 financial year.

5.19 The

Annual Plan 2022/23 does not include any change to the rates increase set for

year two of the Long Term Plan – this will remain at 5.4%. This level of

rates is below the March 2022 annualised Consumer Price Index (CPI) inflation

rate of 6.9%.

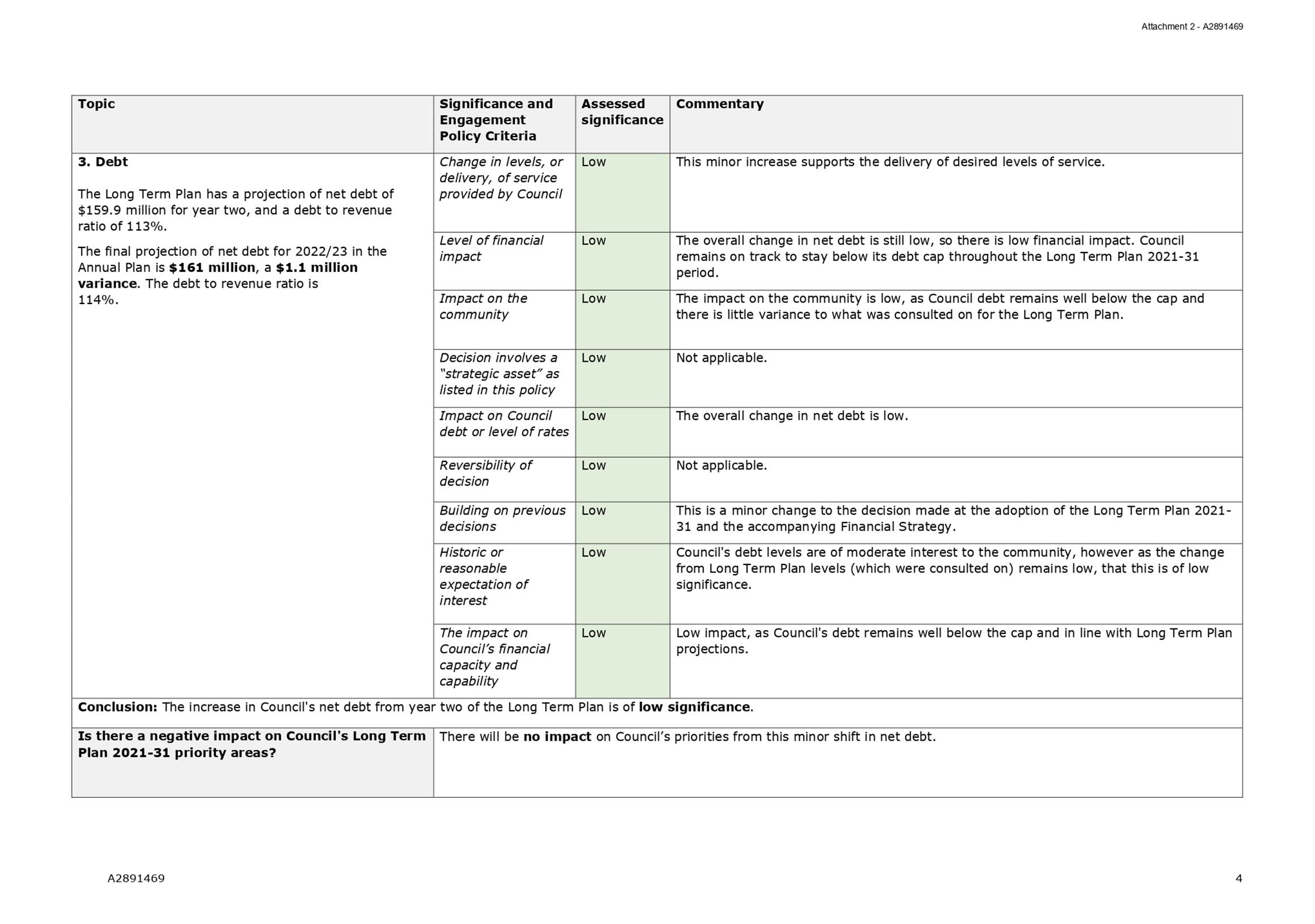

5.20 Net

debt is forecast to increase from what was forecast in the Long Term Plan -

from $159.9 million to $161 million.

5.21 The

Long Term Plan increased the debt/revenue cap to 175% (from 150%) to fund

infrastructure investment. The Long Term Plan debt/revenue figure for year two

was 113%, and the final Annual Plan 2022/23 figure is 114%.

Unbalanced budget

5.22 Section 100 of the Local Government Act 2002

requires that local authorities must ensure that each year’s projected

operating revenues are set at a level sufficient to meet that year’s

projected operating expenses. However, the Act also provides that a local

authority may set revenues at a different level if it resolves that it is

financially prudent to do so, having regard to:

(a) the estimated expenses of

achieving and maintaining the predicted levels of service provision set out in

the long-term plan, including the estimated expenses associated with

maintaining the service capacity and integrity of assets throughout their

useful life; and

(b) the projected revenue available to fund

the estimated expenses associated with maintaining the service capacity and

integrity of assets throughout their useful life; and

(c) the equitable allocation of

responsibility for funding the provision and maintenance of assets and

facilities throughout their useful life; and

(d) the funding and financial policies

adopted under LGA (2002) section 102.

5.23 The balanced budget benchmark is normally at

least 100%, i.e. that revenue for the year (excluding development

contributions, financial contributions, vested assets, gains on derivative

financial instruments, and revaluations of property, plant, or equipment)

exceeds operating expenses (excluding losses on derivative financial

instruments and revaluations of property, plant, or equipment).

5.24 In relation to 2022/23 Council confirmed an

unbalanced budget was prudent at the adoption of the Long Term Plan 2021-31 on

24 June 2021:

Confirms

that setting an unbalanced budget in 2021/22, 2022/23 and 2023/24 of the Long

Term Plan 2021 – 2031 is prudent in terms of section 100 of the

Local Government Act 2002, given the ongoing effects of the COVID-19 pandemic

on the local economy and ratepayers, and having had regard to the matters in

section 100(2) of the Local Government Act 2002;

5.25 Council does not meet the balanced budget

benchmark for 2022/23, with a planned level of 98%. This is consistent with

year two of the Long Term Plan 2021-31 Financial Strategy, where it was

acknowledged that COVID-19 has had a significant impact on Council’s finances.

It was resolved to have an unbalanced budget (projected operation expenditure

exceeding projected operating income) for years one, two and three of the Long

Term Plan, to maintain services and integrity of assets. This shortfall will be

funded using Council’s balance sheet (debt).

Revaluation impacts

5.26 Revaluations

are challenging a number of councils around the country. As detailed in the 10

March report to Council, the three-yearly revaluation of the City in September

2021 saw a 73% average increase in Nelson’s land valuations, which are

used as a basis of setting rates. The impact of this is a change in the

distribution of rates collected. 2022/23 rates increases for lower value

properties are above average, and higher value properties are receiving lower

rate increases. This does not change the total amount of rates collected by

Council.

5.27 Attempts

by Council to smooth the impact of the 2021 revaluation on lower value

properties (through, for example, further reducing the UAGC) would not be

sufficient to counter the significant increases in house prices that Nelson has

experienced. Attempts to manipulate financial levers to address the housing

crisis are likely to create flow on effects in other areas. Council’s

Rating Policy will be considered as part of the next Long Term Plan, 2024-34.

5.28 Issues

with funding and income for local government, and a possible review of the

rating system, require more fundamental consideration across the sector.

Council has raised the issue with the Future For Local Government Panel.

Communications with the

public

5.29 Households

with rates increases in the top 10% will receive a letter in July outlining the

factors that have led to the increase, and detailing the types of assistance

offered by Council.

5.30 After

adoption, a media release will inform the public of key information about the

Annual Plan and the rates for 2022/23. A summary will be published in Our

Nelson, and the final designed Annual Plan document will be made available.

6. Options

6.1 Council

can, as recommended, approve the carry forwards as set out in Attachment 1,

adopt the Annual Plan 2022/23, and set the rates for the 2022/23 financial

year. Alternatively, Council could ask that further amendments be made to

budgets and/or the Annual Plan 2022/23, and that updated documents and

resolutions be brought back to a future Council meeting.

6.2 Approving

the carry forwards in Attachment 1, adopting the Annual Plan and setting the

rates is the preferred option. The alternative would make it difficult for

Council to adopt the Annual Plan and set rates for 2022/23 by 30 June 2022. The

resolution provides for minor amendments to be approved by the Mayor, Deputy

Mayor, and Chief Executive.

7. Conclusion

7.1 It

is recommended that Council approve the carry forwards as set out in Attachment

1, adopt the Annual Plan 2022/23, and set the rates for the 2022/23 financial

year.

Author: Nicky

McDonald, Group Manager Strategy and Communications and Nikki Harrison Group

Manager Corporate Services

Attachments

Attachment 1: A2893711 - Capital

and operating carry forwards - Annual Plan 2022/23 ⇩

Attachment 2: A2891469

- Annual Plan 2022/23 variance to the Long Term Plan - Significance and

Engagement Policy Assessment ⇩

Attachment 3: A2900167

- Annual Plan 2022/23 (Circulated separately) ⇨

|

Important considerations for decision making

|

|

1. Fit with Purpose of Local Government

Adopting the Annual Plan 2022/23 supports the

wellbeing of Nelson residents and businesses, as it sets out how Council will

fund and deliver infrastructure, community services, regulatory functions and

support services during 2022/23.

|

|

2. Consistency with Community Outcomes and Council

Policy

The Annual Plan supports all of Council’s

Community Outcomes.

|

|

3. Risk

The Local Government Act 2002 Amendment Act 2014 (Section

33) specified that consultation

is not required if the proposed annual plan does not include significant or

material differences from the content of the long-term plan for the financial

year to which the proposed annual plan relates.

These amendments were designed to streamline

consultation to make it more useful, practical and effective, and to

introduce more flexibility and discretion for councils. The purpose of the

annual plan was amended to reflect the legislative changes. It is a document

which identifies variance from the long term plan and provides a statutory

link between the long term plan and the annual setting of rates.

Council has not previously taken the route of not

consulting on an annual plan. There is a possibility that the significance or

materiality assessment made in relation to these changes may be challenged.

However, based on the overall changes to the

rates revenue, net debt level, and capital works programme, staff consider it

unlikely that any legal challenge would be successful.

|

|

4. Financial impact

The financial impact of adopting the Annual Plan

2022/23 is summarised in the table at 5.1.

|

|

5. Degree of significance and level of engagement

Adoption of the Annual Plan on the terms proposed is

of low significance having regard to Council’s Significance and

Engagement Policy, and as further detailed in the enclosed table at

Attachment Two. The changes to year two of the Long Term Plan are not significant

and consultation under the Local Government Act is not required. Changes made

have not altered rates requirements, and projected debt levels have not

changed significantly.

|

|

6. Climate Impact

This decision will have no

impact on the ability of Council to proactively respond to the impacts of

climate change now or in the future.

|

|

7. Inclusion of Māori in the decision making

process

No engagement with Māori has been undertaken in

preparing this report.

|

|

8. Delegations

The adoption of the Annual Plan and setting of rates

are decisions for Council.

|

Item

7: Adoption of the Annual Plan 2022/23 and setting of the rates: Attachment 1

Item 7: Adoption of the Annual Plan

2022/23 and setting of the rates: Attachment 2

Item 8: Central Library

Development Project Progress Report to End of March 2022 Quarter

|

|

Council

14 June 2022

|

REPORT R26822

Central

Library Development Project Progress Report to End of March 2022 Quarter

1. Purpose

of Report

1.1 To

update Council on the progress of the major project – the Central Library

Development Project.

2. Recommendation

|

That the Council

1. Receives the report Central Library

Development Project Progress Report to End of March 2022 Quarter (R26822).

|

3. Background

3.1 The

Central Library Development project is a major project for the Nelson Region.

The new, modern library is intended to create an enticing place for the Nelson

community. While retaining valued library services at its core, the transformed

library will offer the community much more. For example, it may be an incubator

for learning, creativity and innovation, alongside being a safe and welcoming

place for all.

3.2 The

Central Library Development project gives effect to the key actions identified

in Te Ara ō Whakatū – the pathways of Nelson by creating an

enticing destination facility in the Central City during the daytime and

evening. In particular, the project delivers on:

3.2.1 Great

Places – creating an exciting social space offering appeal across a wide age

range.

3.2.2 Precinct

Power – creating a gateway to the riverside precinct and a stimulus for

further redevelopment of the precinct by Wakatū Inc.

3.2.3 People

at Play – enhancing the current library offering as a safe and inviting

place for children in the Central City.

3.3 At

its 18 May 2021 meeting, Council:

(2) Reconfirms

that, having considered submissions on the Long Term Plan 2021-31 and having

considered the business case, Council’s preferred option is to build a

new library building on the corner of Halifax Street and Trafalgar Street,

within the Riverside Precinct, subject to agreement with Wakatū

Incorporation on a land exchange involving that site and the current library

site, and completion of a flood mitigation plan for the proposed building

footprint including consideration of effects on adjoining sites.

3.4 Further,

Council:

(3) Confirms

that, prior to negotiations taking place:

· Council

will approve the land exchange negotiation team and its brief; and

(4) Confirms

that on completion of negotiations:

· Council will

approve the community engagement process (including a communication strategy),

project management and governance approach, procurement process, financial

management, and reporting and approvals processes for the proposed new library

building and landscaping; and

(5) Notes

that under best practice a Quality Assurance Framework is used for the life of

the project

(6) Confirms

that prior to design

· Council will

approve the level of any shared community spaces (including provision for

community organisations) in the library building project scope; and

(7) Notes

the guiding principle of developing an accessible community space, that

officers also consider housing opportunities in the planning process and to report

to Council on considerations; and

(8) Confirms

that, should negotiations with Wakatū Incorporation on a land exchange be

unsuccessful, officers will seek confirmation from Council to proceed with

Option Four – to construct a new high specification library on the

current site.

3.5 Subsequently,

at its 23 September 2021 meeting, Council made the following resolutions:

2. Amends

clause 4 of resolution CL/2021/090 made during the 18-20 May 2021 Council

meeting, to:

Confirms that, on

completion of negotiations:

· Council will

approve the community engagement process (including a communication strategy

and engagement plan), project management and governance approach, procurement

process, financial management, and reporting and approvals processes for the

proposed new library building and landscaping, noting that this work will

run in parallel with land exchange negotiations; and

3.6 Since

the 18 May 2021 Council meeting, notable progress has been made with the

Central Library Development Project. Key achievements include:

3.7 At

its 23 September 2021 meeting, Council made the following resolution addressing

clause (3) of its May resolution:

Approves the Nelson

Central Library Development Land Exchange Negotiation Team, consisting of the

Group Manager Community Services (Team Lead), Group Manager Infrastructure,

John Murray and Sam Cottier (Lead Negotiator); and

3.8 The

land exchange negotiations have been steadily progressing with Wakatū

Incorporation (Wakatū) since the establishment of the negotiation team

(see section 4.1).

3.9 The

Flood Mitigation Plan was presented to Council on 23 September 2021, where it

was agreed that the flood modelling undertaken demonstrated that the proposed

Nelson Central Library had a negligible effect on the adjacent properties, if

design and landscape features are included into the design brief. Those

requirements will be included in the final brief.

Agrees that the flood

modelling presented in the Nelson Central Library Redevelopment - Flood

Mitigation Plan (A2733041) demonstrates that the proposed Nelson Central

Library Development (corner of Trafalgar/Halifax Streets) has negligible effect

on adjacent properties if design and landscape features are incorporated into

the design brief; and

3.10 The

flood modelling will continue to be revisited if new and pertinent evidence

arises or there are changes in the legislative context that may impact the development.

3.11 The

organisation chart was established (clause (4) of the May resolutions) with

membership of the Steering Group, Governance Reference Group, Project Control

Group and Project Management team confirmed.

3.12 A

Project Manager from Council’s Project Management Office was appointed as

the internal project manager for the Central Library Development project.

3.13 A

rigorous two-stage procurement process, commencing in October 2021, was

undertaken to select a suitable Project Director. An appointment was made in

December 2021.

3.14 A

high-level project plan was developed in January 2022 with an updated detailed

project plan and comprehensive risk register completed in March 2022.

3.15 Two

engagement specialists were contracted to deliver the first phase of the

community engagement process – Crestani Communication and Bowland

Consulting. An Iwi Liaison was appointed to guide the iwi engagement process.

3.16 The

community engagement strategy was approved at Council’s 23 March 2022

meeting. This identified four engagement phases throughout the Central Library

Development project. These are:

3.16.1 Phase

1: Engagement on the process and the idea

· Vison,

benefits, opportunity for input

· Blue skies

– explore a future library experience

3.16.2 Phase

2: Engagement on concept design

Have we got it right?

3.16.3 Phase

3: Community update on preliminary design

Share the latest design and explain

the choices that needed to be made

3.16.4 Phase

4: Engagement with user groups on developed design

The specifics of what we are

proposing – will the layout/functionality work?

3.16.5 Construction

phase: keep dialogue going to maintain goodwill.

3.16.6 Completed

living library: keep dialogue going between locals and their library.

4. Discussion

4.1 Site

negotiations

4.1.1 The

land exchange negotiation with Wakatū Inc is progressing well, with the

negotiation team anticipating that a Pre-development Agreement will be ready

for Council consideration by the end of June 2022.

4.1.2 Geotech

testing of the site, a critical part of due diligence, was completed by the end

of May. The report on the test results is expected mid to late June 2022.

4.2 Housing

opportunities

4.2.1 A

workshop with elected members on the housing opportunities was held on 23

March. The opportunity for housing either within the library site or as

part of the wider precinct development can continue to be explored through

until the concept design phase for the project.

4.3 Sustainability

objectives

4.3.1 Beca

has been engaged to develop climate change mitigation and environmental

sustainability objectives for the new building and surrounding landscaping. The

draft report was received in late May, with the finalised report expected in

early June. This will be reported through to the Governance Reference

Group in June and to the wider council as part of proposed regular

communication updates.

4.4 Communication

4.4.1 It

is proposed to provide short fortnightly updates to elected members on the

progress of the Central Library Development project as part of the regular

internal communication updates. This will be in addition to quarterly

major project reporting to Council.

4.4.2 Locally

based Publik Agency has been engaged to lead the communication strand of work

for the project. A draft communication strategy is currently being developed,

which will be reported to Council for adoption at

either its June or July meeting in accordance with the LTP resolution (see

section 3.1 above).

4.4.3 It

is anticipated that the first phase of communication will focus on context

setting and building community excitement and engagement with the project.

Pre-engagement discussions with key stakeholders will continue concurrently

through this communication phase.

4.5 Community

engagement process

4.5.1 Dates

for the commencement of the wider community engagement process are still to be

confirmed. However, the process is likely to commence sometime after the

conclusion of the DAPP engagement process.

4.5.2 Once

dates are finalised, the first phase of engagement for the Central Library

Development project, will inform the development of the brief for the concept

design.

4.5.3 A

range of engagement tools and methodologies will be used to raise awareness of

the process and to make it easy for all Nelsonians to participate either in

person, in print, online or via an 0800 number.

4.5.4 These

include but are not limited to:

- Shape

Nelson – the key information source and where residents can sign up for

regular email updates on the project

- Public

drop ins and pop ups at locations like the Farmers Market and Victory Centre

- Social

media surveys

- Interactive

booths at the Central Library and elsewhere.

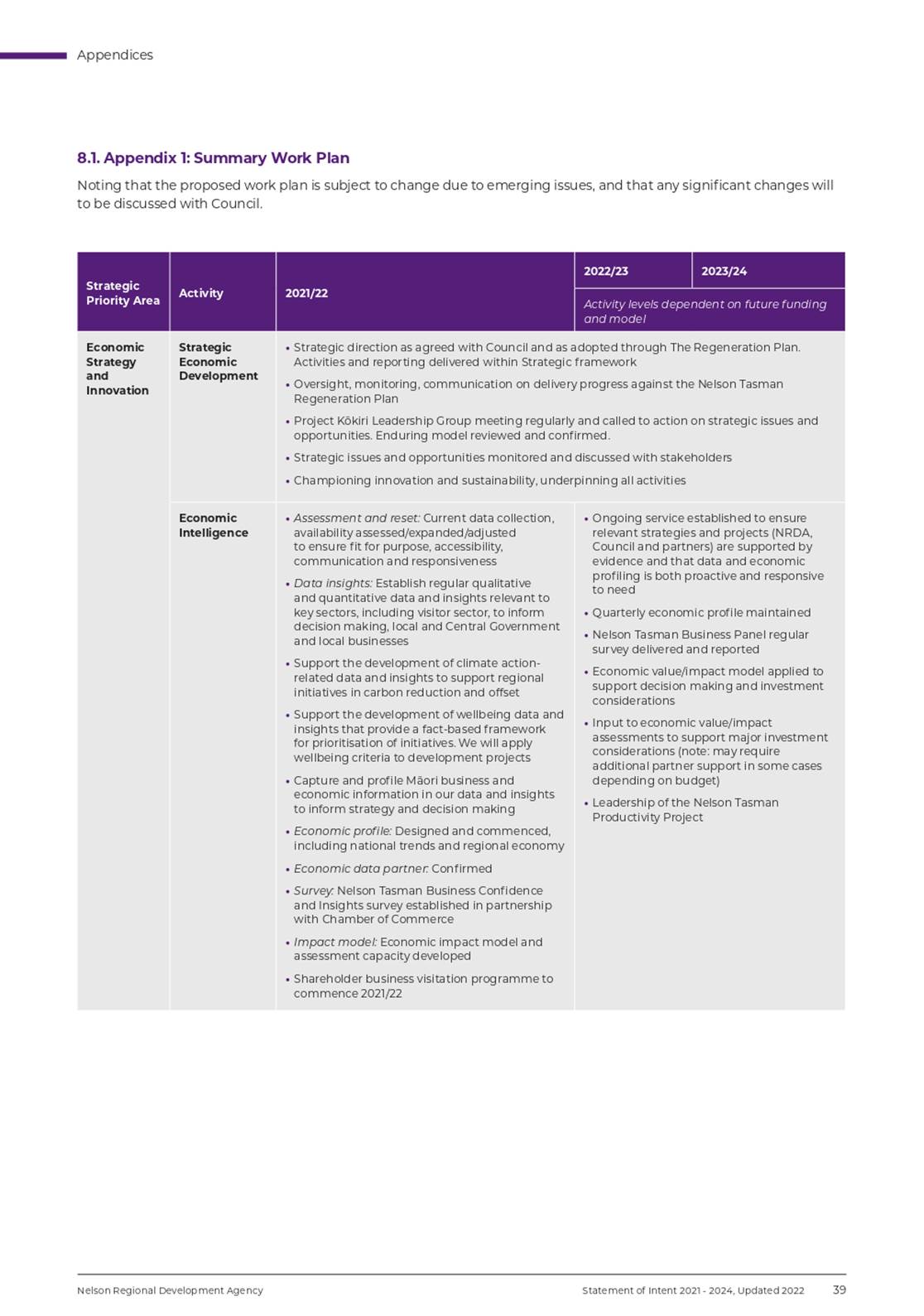

1.

Figure 1 Concept sketch of

interactive booths for Central Library

2.

Figure 2 Detail of example

imagery for each booth

4.6 Iwi Engagement

4.6.1 The

Iwi Engagement Plan, being led by the Iwi Liaison officer, is continuing to

progress. It is advantageous that this process is proceeding ahead of the

wider community engagement process. An initial hui for the Central

Library Development project is likely to be held in July.

5. Finance

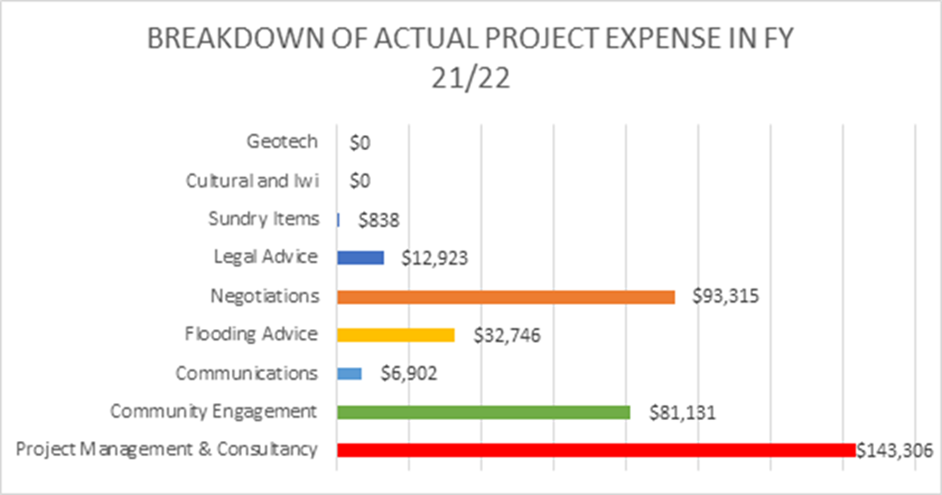

5.1 Budget

expenditure is well within the estimates for the 2021/22 financial year. The

following expenditure is to 31 May 2022.

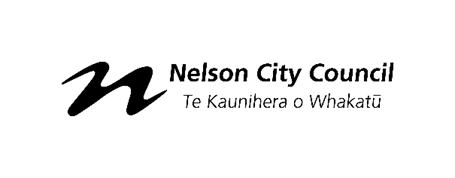

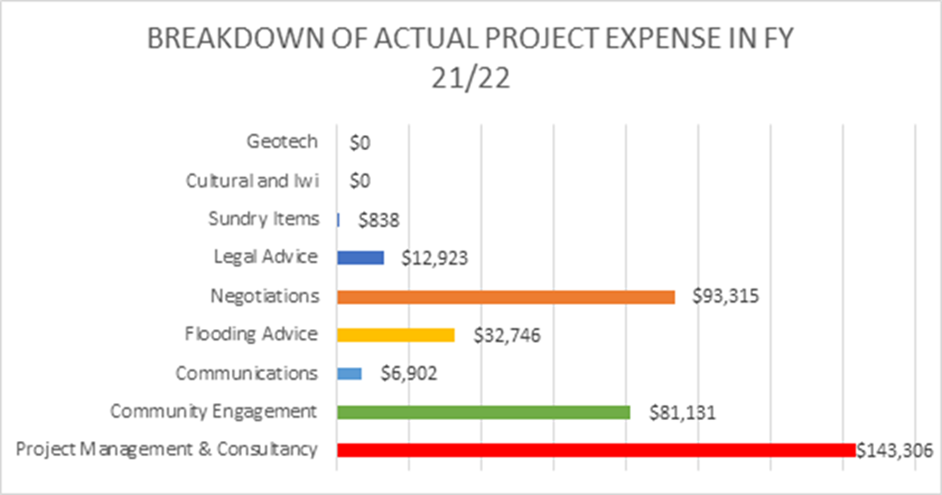

5.2 Breakdown

of actual project expense in 2021/22 financial year

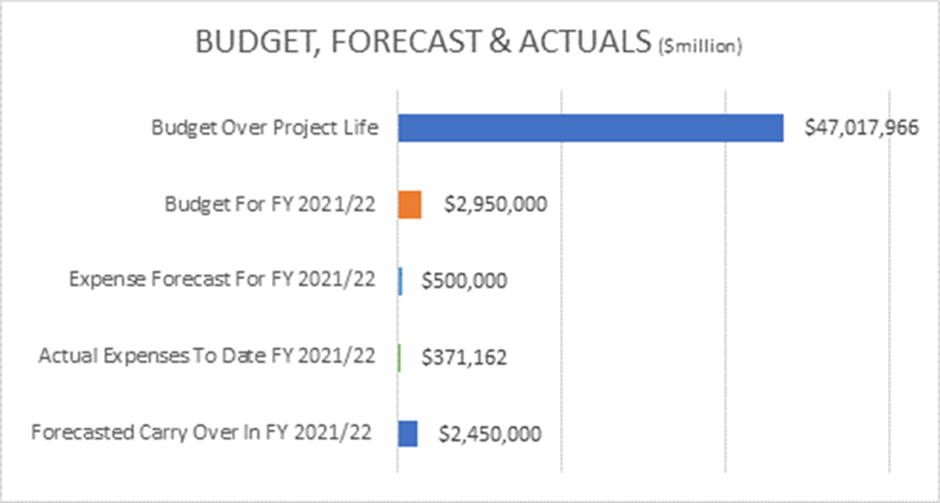

5.3 Budget,

forecast and actuals

6. Risks

6.1 A

detailed risk register has been prepared for the project, which is regularly

updated as any new risks are identified, or risks are closed off.

6.2 Project

risks continue to be actively monitored by the Project Control Group,

Governance Reference Group and Steering Group.

7. Conclusion

7.1 The

land exchange negotiation with Wakatū Inc is progressing well, with

results from the Geotech testing due in June.

7.2 The

negotiation team advises that it anticipates a Pre-Development Agreement will

be ready for Council consideration by the end of June 2022.

7.3 The

development of the Communication Strategy is progressing well, with a draft to

be reported to Council for adoption at either its June or July meeting.

8. Next Steps

8.1 The

draft communications strategy will be presented to Council at either its June

or July meeting for consideration and adoption.

8.2 A

Central Library Development project hui with iwi will be scheduled potentially

in July.

8.3 The

dates for wider community engagement will be finalised.

Author: Alice

Heather, Central Library Development Project Director

Attachments

Nil

Item 10: Quarterly

update on significant central government reform programmes

|

|

Council

14 June 2022

|

REPORT R26888

Quarterly

update on significant central government reform programmes

1. Purpose

of Report

1.1 To

provide Council a quarterly update on significant reform programmes impacting

local government.

2. Recommendation

|

That

the Council

1. Receives

the report Quarterly update on significant central government reform

programmes (R26888)

|

3. Context

3.1 There

are a large number of significant central government work programmes underway

related to local government. They include:

3.1.1 Future

for Local Government Review

3.1.2 Three

Waters Reform programme

3.1.3 Resource

Management Act reforms

3.1.4 Climate

change policies

3.1.5 Civil

defence changes

3.2 Collectively,

these programmes will considerably change the operating environment for local

government.

3.3 The

Future for Local Government Review is looking at local government arrangements

as a whole – what the sector does, how it does it and how it pays for it.

The outcomes of the review will flow into the implementation of all the other

changes.

3.4 Concerns

have been raised regarding aspects of the reform programmes and their impact on

local government. These include:

3.4.1 capacity

for councils to respond to and prepare for these significant reforms, including

resourcing

3.4.2 uncertainty

around timeframes

3.4.3 having

the right skills and qualified staff to implement the changes.

4. Future

for Local Government

Background

4.1 In

April 2021 the Future for Local Government Review was established by the

Minister of Local Government. The purpose of the review is to “identify

how our system of local democracy needs to evolve over the next 30 years, to

improve the wellbeing of New Zealand communities and the environment, and

actively embody the treaty partnership”.[3]

4.2 The

scope of the review includes the following aspects of local government:

4.2.1 Roles,

functions and partnerships

4.2.2 Representation

and governance

4.2.3 Funding

and financing.

4.3 A

Review Panel was appointed to undertake the review, which is being conducted in

three stages:

4.3.1 Stage

one – Early soundings to identify the initial scope and early engagement

with local government.

4.3.2 Stage

two – Engagement with individual councils and broader public engagement

about the future of local governance alongside research and policy development.

This will conclude with a report to the Minister with draft findings and

recommendations.

4.3.3 Stage

three – formal consultation about the draft recommendations. Submissions

will be considered before the Review Panel delivers its final report in April

2023.

Key updates

4.4 In

mid-2021, Council had a workshop to identify key themes and ideas on the review

and the notes from this workshop were shared with the Review Panel.

4.5 On

8 October 2021, the Review Panel released its Interim

Report, which outlined the priority issues, looked at the current state of

play for local government and the context for change. In the report, the Panel

outlined five priority questions they will consider when designing the most

effective system of local governance.

4.6 Council

had a workshop on 1 March 2022 to discuss the Interim Report and then met with the

Review Panel on 29 March 2022 to discuss the five priority questions and

provide feedback.

Next steps

4.7 After

engagement with individual councils, the Review panel began work on the draft

report, which will outline its findings and recommendations. While councils

were engaged with directly, the general public now have an opportunity to

express their views through an open survey until the end of June.

4.8 There

are no actions for Council until the Review Panel delivers its draft report,

due by 30 September 2022. Following this will be a formal

consultation/engagement process.

5. Three

Waters Reform

Background

5.1 On

27 October 2021, the Government announced the next steps for the Three Waters

Reform programme, including confirming the establishment of four water services

entities to manage New Zealand’s drinking water, wastewater and

stormwater networks, and mandating an “all in approach”. Nelson

City Council has been placed in Water Service Entity C.

5.2 A

water services regulator has been established, Taumata Arowai, which will

enforce existing standards to ensure that drinking water suppliers provide safe

drinking water to consumers, with significant penalties proposed, including

fines and criminal proceedings, if suppliers do not comply.

5.3 On

10 November 2021, the Government announced the establishment of a Working Group

made up of representatives from local government and iwi/Māori to consider

how representation, governance and accountability for the new water service

entities can be strengthened.

5.4 Council

received reports providing updates on the reform programme at the 23

September 2021 and 8

December 2021 Council meetings.

Key updates

Recommendations

from the Three Waters Working Group

5.5 In

April 2022, the Government announced it would accept the vast majority of the

Working Group’s recommendations, which means to:

5.5.1 provide

for a public shareholding structure that makes community ownership clear, with

shares allocated to councils reflective of the size of their communities (one

share per 50,000 people)

5.5.2 further

strengthen and clarify the role of the Regional Representative Group; with

joint oversight from local councils and mana whenua to ensure community voice

and provide tighter accountability from each water services entity board

5.5.3 maintain

that board members are to be appointed based on skills and competency

5.5.4 strengthen

connections to smaller communities including through local sub-committees

feeding into the Regional Representative Group, to ensure all

communities’ voices are considered as part of investment prioritisation

5.5.5 recognise

and embrace Te Mana o te Wai – the health and wellbeing of our

waterways and waterbodies – as a korowai, or principle, that applies

across the water services framework.

Better

off funding package

5.6 The

Government is providing a better off funding package to local authorities in

recognition of the significance to the local government sector (and the

communities they serve) of the transfer of responsibility for water service

delivery. The $2 billion package has been pre-allocated to councils based on a

nationally consistent formula and is available in two tranches. The first $500

million is available from 1 July 2022 and the remaining $1.5 billion will be

available from 1 July 2024.

5.7 Nelson

City Council has access to $5.18million in the first tranche. Council needs to

develop a funding proposal which demonstrates engagement with iwi/Māori,

outlines how the projects meet the funding criteria, and undertake a wellbeing

assessment setting out the expected benefits. Council’s process for the

first tranche includes holding a workshop in late May for elected members to

provide input on the appropriate criteria and projects to put forward in an

application. Engagement with iwi will also be undertaken as the application is

developed. The final application will come to a Council meeting for approval

before being submitted to the Department of Internal Affairs.

5.8 Applications

for tranche one funding close on 30 September 2022.

Establishing Water Service

Entity C

5.9 Work

is underway to establish the water service entities. Council staff are

participating in multiple workstreams and steering groups. An internal project

team has been established to build working relationships with the National

Transition Unit and field its requests for information. Transition Reference

Groups have been established at a national level to provide advice to the

National Transition Unit. Council representatives have been confirmed on the

“People & Workforce” and “Asset Management, Operations

and Stormwater” reference groups.

5.10 Council

has also established a working group to respond to the large number of Three

Waters related requests for information under the Local Government Official

Information and Meetings Act 1987.

5.11 The

Local Transition Team for Water Service Entity C was set up in May 2022 and

comprises senior staff from each “Entity C” Council. The

Local Transition Team will form local working groups of subject matter experts

to support the operational set up of the water service entity. An interim

organisation, known as “Local Establishment Entity C”, is being set

up this year, with recruitment for a Chief Executive and senior management

roles taking place from July to December 2022. The Local Transition Team

and related local working groups will then be absorbed into Local Establishment

Entity C, which in turn will become Water Service Entity C on 1 July 2024.

Next steps

Water Services Entities Bill

5.12 The

next stage of the Government’s programme is to release the draft Water

Service Entities Bill for consultation, which is expected in

mid-2022. Council agreed at the 8 December 2021 meeting that community

engagement will be undertaken prior to Council submitting on the draft

legislation (8

December Council agenda, page 180).

5.13 Once

the Water Services Entities Bill has been released and timeframes are

understood, Council will make a submission to the Government, informed by

feedback from the community.

6. Resource

Management Act 1991 (RMA) Reforms

Background

6.1 In

February 2021, the Government announced it would repeal the RMA and enact new

legislation. The three proposed acts are:

6.1.1 Natural

and Built Environments Act, as the main replacement for the RMA, to protect and

restore the environment while better enabling development

6.1.2 Strategic

Planning Act, requiring the development of

long-term regional spatial strategies to help coordinate and integrate

decisions made under relevant legislation

6.1.3 Climate

Adaptation Act, to address complex issues associated with managed retreat.

6.2 The

Government released an exposure draft of the Natural and Built Environments Act

in June 2021 and invited submissions. Council provided its submission and

highlighted concerns around the lack of detail in the draft legislation,

governance arrangements, and a proposal for Nelson, Tasman and Marlborough

councils to produce a combined natural and built environment plan as well as a

combined spatial plan.

6.3 The