Notice of the Ordinary meeting of

Audit, Risk and Finance Subcommittee

Te Kōmiti Āpiti, Kaute / Tūraru /

Pūtea

|

Date: Tuesday

22 February 2022

Time: 9.00a.m.

Location: via

Zoom

|

Agenda

Rārangi take

Chairperson Mr

John Peters

Members Her

Worship the Mayor Rachel Reese

Cr

Judene Edgar

Cr

Matt Lawrey

Cr

Rachel Sanson

Mr

John Murray

Quorum 3 Pat

Dougherty

Chief Executive

Nelson City Council Disclaimer

Please note that the contents of these

Council and Committee agendas have yet to be considered by Council and officer

recommendations may be altered or changed by the Council in the process of

making the formal Council decision. For enquiries call (03) 5460436.

Audit, Risk and Finance

Subcommittee

This is a subcommittee of Council

Areas of

Responsibility

·

Any matters raised by Audit New Zealand or the Office of the

Auditor-General

·

Audit processes and management of financial risk

·

Chairperson’s input into financial aspects of draft

Statements of Expectation and draft Statements of Intent for Nelson City

Council Controlled Organisations, Council Controlled Trading Organisations and

Council Organisations

·

Council’s Annual Report

·

Council’s financial performance

·

Council’s Treasury policies

·

Health and Safety

·

Internal audit

·

Monitoring organisational risks, including debtors and legal

proceedings

·

Procurement Policy

Powers to

Decide

·

Appointment of a deputy Chair

Powers to

Recommend to Council

·

Adoption of Council’s Annual Report

·

To write off outstanding accounts receivable or remit fees and

charges of amounts over the Chief Executive’s delegated authority.

·

All other matters within the areas of responsibility or any other

matters referred to it by the Council

For the Terms of Reference for the

Audit, Risk and Finance Subcommittee please refer to document A1437349.

Audit, Risk and Finance Subcommittee

22

February 2022

Page

No.

Karakia

and Mihi Timatanga

1. Apologies

Nil

2. Confirmation

of Order of Business

3. Interests

3.1 Updates

to the Interests Register

3.2 Identify

any conflicts of interest in the agenda

4. Public

Forum

5. Confirmation

of Minutes

5.1 25

November 2021 8 - 14

Document number M19121

Recommendation

|

That the Audit, Risk and Finance Subcommittee

1. Confirms the minutes of the meeting

of the Audit, Risk and Finance Subcommittee, held on 25 November 2021, as a

true and correct record.

|

6. Chairperson's Report 15 - 16

Document number R26631

Recommendation

|

That

the Audit, Risk and Finance Subcommittee

1. Receives

the report Chairperson's Report (R26631).

|

7. Service Delivery

Reviews (s17A reviews) work programme 17 - 25

Document number R26275

Recommendation

|

That

the Audit, Risk and Finance Subcommittee

1. Receives

the report Service Delivery Reviews (s17A reviews) work programme (R26275) and its attachment (A2762199).

|

Recommendation to Council

|

That the Council

1. Approves the increase in the value

threshold that triggers a service delivery review under section 17A of the

Local Government Act 2002 from $100,000 to $250,000 per annum for contracts

and activity areas; and

2. Approves applying the two

exemptions under the Local Government Act 2002 sections 17A(3)(A) and

17A(3)(b) for the Nelson Regional Sewerage Business Unit and Utilities

– Stormwater/Flood Protection/Wastewater (including Wastewater

Treatment Plant(s)/Water Supply.

|

8. Quarterly Finance

Report - 31 December 2021 26 - 50

Document number R26519

Recommendation

|

That

the Audit, Risk and Finance Subcommittee

1. Receives

the report Quarterly Finance Report - 31 December 2021 (R26519) and its attachments (A2829541,

A2821555, and A2750424).

|

9. Quarterly Health,

Safety and Wellbeing Report - 31 December 2021 51 - 67

Document number R26521

Recommendation

|

That

the Audit, Risk and Finance Subcommittee

1. Receives

the report Quarterly Health, Safety and Wellbeing Report - 31 December 2021

(R26521) and its attachment

(A2818999).

|

10. Quarterly Internal Audit Report

- 31 December 2021 68 - 71

Document number R26485

Recommendation

|

That

the Audit, Risk and Finance Subcommittee

1. Receives

the report Quarterly Internal Audit Report - 31 December 2021 (R26485) and its attachment (A2813648).

|

11. Quarterly Risk Report - 31

December 2021 72 - 100

Document number R26486

Recommendation

|

That

the Audit, Risk and Finance Subcommittee

1. Receives

the report Quarterly Risk Report - 31 December 2021 (R26486) and its attachment (A2587873).

|

Confidential Business

12. Exclusion

of the Public

Recommendation

That the Audit,

Risk and Finance Subcommittee

1.

Excludes the

public from the following parts of the proceedings of this meeting.

2.

The general subject of each matter to be

considered while the public is excluded, the reason for passing this resolution

in relation to each matter and the specific grounds under section 48(1) of the

Local Government Official Information and Meetings Act 1987 for the passing of

this resolution are as follows:

|

Item

|

General subject of each matter to be

considered

|

Reason for passing this resolution in

relation to each matter

|

Particular interests protected (where

applicable)

|

|

1

|

Audit, Risk and Finance Subcommittee Meeting - Confidential

Minutes - 25 November 2021

|

Section

48(1)(a)

The

public conduct of this matter would be likely to result in disclosure of

information for which good reason exists under section 7.

|

The withholding of the information is necessary:

· Section

7(2)(a)

To protect the

privacy of natural persons, including that of a deceased person

· Section

7(2)(g)

To maintain

legal professional privilege

· Section

7(2)(c)(ii)

To protect

information which is subject to an obligation of confidence or which any

person has been or could be compelled to provide under the authority of any

enactment, where the making available of the information would be likely

otherwise to damage the public interest

· Section

7(2)(j)

To prevent the

disclosure or use of official information for improper gain or improper

advantage

|

|

2

|

Quarterly

Update On Debts - 31 December 2021

|

Section

48(1)(a)

The public conduct of this

matter would be likely to result in disclosure of information for which good

reason exists under section 7

|

The withholding of the information is necessary:

· Section 7(2)(a)

To protect the privacy of

natural persons, including that of a deceased person

· Section 7(2)(g)

To maintain legal

professional privilege

|

|

3

|

Quarterly Report on Legal Proceedings

|

Section 48(1)(a)

The public

conduct of this matter would be likely to result in disclosure of information

for which good reason exists under section 7

|

The withholding of the information is necessary:

· Section

7(2)(c)(ii)

To protect

information which is subject to an obligation of confidence or which any

person has been or could be compelled to provide under the authority of any

enactment, where the making available of the information would be likely

otherwise to damage the public interest

· Section

7(2)(g)

To maintain

legal professional privilege

|

Karakia

Whakamutanga

Audit, Risk and Finance

Subcommittee Minutes - 25 November 2021

Present: Mr

J Murray (Chairperson), Her Worship the Mayor R Reese, Councillors J

Edgar, M Lawrey and R Sanson (via Zoom)

In

Attendance: Councillor G Noonan, Group Manager Infrastructure

(A Louverdis), Group Manager Corporate Services (N Harrison), Group Manager

Strategy and Communications (N McDonald), Team Leader Governance (R Byrne),

Governance Adviser (J Brandt) and Governance Support Officer (A Bryce-Neumann)

Apology: Mr

J Peters

1. Apologies

|

Resolved ARF/2021/044

|

|

|

That the Audit, Risk and

Finance Subcommittee

1. Receives

and accepts an apology from Mr J Peters.

|

|

Murray/Edgar Carried

|

2. Confirmation of

Order of Business

There was no change to the order

of business. However items 8 and 9 from the open agenda had confidential

elements discussed in the confidential part of the meeting.

3. Interests

There were no updates to the

Interests Register, and no interests with items on the agenda were declared.

4. Public Forum

There was no public forum.

5. Confirmation of

Minutes

5.1 14

September 2021

Document number M18926, agenda

pages 7 - 13 refer.

|

Resolved ARF/2021/045

|

|

|

That the Audit, Risk and

Finance Subcommittee

1. Confirms

the minutes of the meeting of the Audit, Risk and Finance Subcommittee, held

on 14 September 2021, as a true and correct record.

|

|

Lawrey/Sanson Carried

|

6. Health,

Safety and Wellbeing Report, July - September 2021

Document number R26171, agenda

pages 14 - 28 refer.

Health Safety and Wellness

Adviser, Malcolm Hughes, presented the report.

Mr Hughes noted that since the

writing of the report, the Government had announced the introduction of a

COVID-19 traffic light system, which would commence on 3 December 2021.

It was noted that there was a

lack of clarity in regards to responsibilities relating to Elected Members

under the Health and Safety at Work Act, including interactions with the public

and wellbeing. An additional clause was added to the resolution to request a

report.

The meeting was adjourned from

9.56a.m. until 10.02a.m.

|

Resolved ARF/2021/046

|

|

|

That

the Audit, Risk and Finance Subcommittee

1. Receives the report Health, Safety and Wellbeing Report, July - September

2021 (R26171) and its

attachment (A2782852) and

2. Requests a report to come to

the Audit Risk and Finance Subcommittee outlining the responsibilities of

Nelson City Council applicable to Elected Members under the Health and Safety

at Work Act 2015.

|

|

Edgar/Her Worship the Mayor Carried

|

7. Quarterly Finance

Report for the three months ending 30 September 2021

Document number R26191, agenda

pages 29 - 50 refer.

Group Manager Corporate Services,

Nikki Harrison, supported by Manager Finance, Prabath Jayawardana, and Policy

Coordinator, Laura Bruce, presented the report.

|

Resolved ARF/2021/047

|

|

|

That

the Audit, Risk and Finance Subcommittee

1. Receives the report

Quarterly Finance Report for the three months ending 30 September 2021

(R26191) and its attachments

(A2776828, A2766313, A2777804 and A2771754).

|

|

Her Worship the Mayor/Lawrey Carried

|

8. Quarterly Internal

Audit Report - 30 September 2021

Document number R26312, agenda

pages 51 - 56 refer.

Audit and Risk Analyst, Chris

Logan, presented the report. A correction to agenda page 55 was noted for Key

Findings, item 2, in that the sentence should read: Although difficult to

quantify, the magnitude of avoided costs savings from the more open

relationship and early involvement of contractors is in the order of 5% of the

counter-factual contract cost.

Mr Logan noted that there was

capacity for two internal audit topics for the next quarter. The Subcommittee

suggested the following topics for internal audits to be undertaken:

· Review of the

Environmental Inspections Ltd contract

· Review of

workplace health and safety, particularly from a wellbeing perspective (stress

audit).

|

Resolved ARF/2021/048

|

|

|

That

the Audit, Risk and Finance Subcommittee

1. Receives the report

Quarterly Internal Audit Report - 30 September 2021 (R26312) and its attachment (A2763671).

|

|

Lawrey/Sanson Carried

|

9. Quarterly Risk

Report - 30 September 2021

Document number R26313, agenda

pages 57 - 85 refer.

Audit and Risk Analyst, Chris

Logan, presented the report.

Group Manager Corporate Services,

Nikki Harrison, made a clarification regarding the reference to remedial

actions concerning non-compliance of Council owned campgrounds alluded to in

report section 7.2; noting that no decisions had been made regarding Council

owned campgrounds and that an options paper was scheduled to go to the

Strategic Development and Property Subcommittee on 3 December 2021.

|

Resolved ARF/2021/049

|

|

|

That

the Audit, Risk and Finance Subcommittee

1. Receives the report Quarterly Risk Report – 30 September

2021 (R26313) and its

attachment (A2587873).

|

|

Sanson/Her Worship the Mayor Carried

|

10. Exclusion

of the Public

|

Resolved ARF/2021/050

|

|

|

That the Audit, Risk and

Finance Subcommittee

1. Excludes the public from the

following parts of the proceedings of this meeting.

2. The general subject of each matter

to be considered while the public is excluded, the reason for passing this

resolution in relation to each matter and the specific grounds under section

48(1) of the Local Government Official Information and Meetings Act 1987 for

the passing of this resolution are as follows:

|

|

Her Worship the Mayor/Sanson Carried

|

|

Item

|

General subject of each matter to be

considered

|

Reason for passing this resolution in

relation to each matter

|

Particular interests protected (where

applicable)

|

|

|

Quarterly Internal Audit Report –

30 September 2021

Discussion

|

Section

48(1)(a)

The public conduct of this matter would

be likely to result in disclosure of information for which good reason exists

under section 7

|

The withholding of the information is

necessary:

· Section

7(2)(j)

To prevent the disclosure or use of

official information for improper gain or improper advantage

|

|

|

Quarterly Risk Report – 30 September 2021

Discussion

|

Section 48(1)(a)

The public conduct of this matter would be likely to

result in disclosure of information for which good reason exists under

section 7

|

The withholding of the information is necessary:

· Section

7(2)(g)

To maintain legal professional privilege

|

|

1

|

Audit, Risk and Finance Subcommittee

Meeting - Confidential Minutes - 14 September 2021

|

Section 48(1)(a)

The public conduct of this matter would

be likely to result in disclosure of information for which good reason exists

under section 7.

|

The withholding of the information is

necessary:

· Section 7(2)(j)

To

prevent the disclosure or use of official information for improper gain or

improper advantage

|

|

2

|

Quarterly Update On Debts - 30 September 2021

|

Section 48(1)(a)

The public conduct of this

matter would be likely to result in disclosure of information for which good reason

exists under section 7

|

The withholding of the information is necessary:

· Section 7(2)(a)

To protect the privacy of

natural persons, including that of a deceased person

· Section

7(2)(g)

To maintain legal

professional privilege

|

|

3

|

Quarterly Report on Legal Proceedings

|

Section

48(1)(a)

The public

conduct of this matter would be likely to result in disclosure of information

for which good reason exists under section 7

|

The withholding of the information is

necessary:

· Section

7(2)(c)(ii)

To protect

information which is subject to an obligation of confidence or which any

person has been or could be compelled to provide under the authority of any

enactment, where the making available of the information would be likely otherwise

to damage the public interest

· Section 7(2)(g)

To maintain

legal professional privilege

|

|

4

|

Cyber Security Matters

|

Section 48(1)(a)

The public conduct of this

matter would be likely to result in disclosure of information for which good

reason exists under section 7

|

The withholding of the information is necessary:

· Section 7(2)(j)

To prevent the disclosure

or use of official information for improper gain or improper advantage

|

The meeting went into confidential session at 11.12a.m.

and resumed in public session at 12.20p.m.

11. Restatements

It was resolved while the public was

excluded:

|

1

|

CONFIDENTIAL: Quarterly

Update On Debts - 30 September 2021

|

|

|

That

the Audit, Risk and Finance Subcommittee

2. Agrees

that the Report (R26196) and its attachment (A2216183) remain confidential at

this time.

|

|

2

|

CONFIDENTIAL: Quarterly

Report on Legal Proceedings

|

|

|

That

the Audit, Risk and Finance Subcommittee

2. Agrees

that the report Quarterly Report on Legal Proceedings (R26359) and its

attachment (A2782657) remain confidential.

|

There being no further business the

meeting ended at 12.20p.m.

Confirmed as a correct record of proceedings by

resolution on (date)

Item 6: Chairperson's

Report

|

|

Audit, Risk and Finance Subcommittee

22 February 2022

|

REPORT R26631

Chairperson's

Report

1. Purpose

of Report

1.1 To

update the Subcommittee on current matters.

2. Recommendation

|

That the Audit, Risk and Finance Subcommittee

1. Receives

the report Chairperson's Report (R26631).

|

3. Background

3.1 Welcome

to the first meeting of the Audit Risk and Finance Subcommittee for

2022. The fact that we are meeting by Zoom is indicative of the

continuing challenges caused – and the flexibility required – by

the prevailing pandemic circumstances.

3.2 We

had previously had to cancel the Risk Management workshop for all Councillors,

which will probably now be best left over to the new triennium.

3.3 As

advised in my report for the 25th November 2021 meeting, we also had to pursue

the issue of the internal audit programme outside of the meeting format and,

following discussion with the Audit and Risk Analyst, the suggested internal

audit priorities will be confirmed at this meeting.

3.4 I

was also hopeful that this meeting would be able to evaluate the outcomes of

the work that has been ongoing on the re-forecasting of the budget in light of

the various disruptions caused by Covid-19. However, timing of this is

such that the findings will be going straight to Council on the 17th February,

so the Subcommittee will receive a verbal update on this from the Group Manager,

Corporate Services.

3.5 And

finally – if it’s not too late, I would like to take the

opportunity to thank all members of the Subcommittee and all supporting

officers for their valued contribution in 2021, and wish you all the very best

for 2022.

Author: John

Peters, Chairperson - Audit Risk and Finance Subcommittee

Attachments

Nil

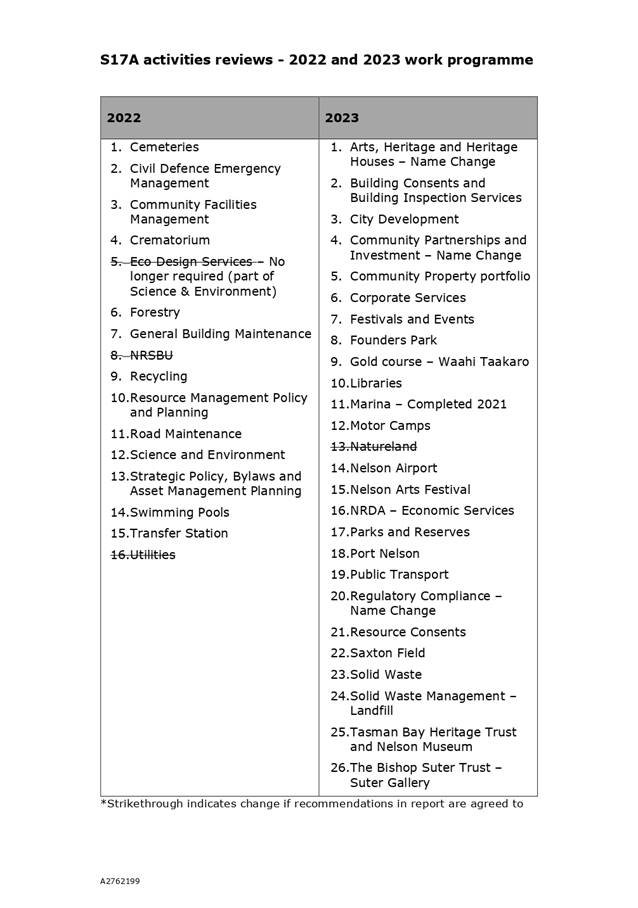

Item 7: Service

Delivery Reviews (s17A reviews) work programme

|

|

Audit, Risk and Finance Subcommittee

22 February 2022

|

REPORT R26275

Service

Delivery Reviews (s17A reviews) work programme

1. Purpose

of Report

1.1 To

outline the 2022 service delivery review work programme.

1.2 To

align the value threshold for service delivery reviews with Council’s

Procurement Policy.

1.3 To

make three waters services exempt from service delivery reviews due to Central

Government’s reform programme.

2. Recommendation

|

That the Audit, Risk and Finance Subcommittee

1. Receives

the report Service Delivery Reviews (s17A reviews) work programme (R26275) and its attachment (A2762199).

|

Recommendation to Council

|

That the

Council

1. Approves the increase in the value

threshold that triggers a service delivery review under section 17A of the

Local Government Act 2002 from $100,000 to $250,000 per annum for contracts

and activity areas; and

2. Approves applying the two

exemptions under the Local Government Act 2002 sections 17A(3)(A) and

17A(3)(b) for the Nelson Regional Sewerage Business Unit and Utilities

– Stormwater/Flood Protection/Wastewater (including Wastewater

Treatment Plant(s)/Water Supply.

|

3. Update

3.1 A

service delivery review determines whether the existing means of delivering a

service remains the most efficient, effective and appropriate method. This

includes consideration of the current method of governance, funding, and

delivery of the service alongside the alternative options that are available.

This is to encourage good quality local infrastructure, local public

services, and performance of regulatory functions.

3.2 It

is important to note that a s17A review of services covers how the services are

delivered. It is not about the quality of the services, which are reviewed as

part of activity management plan development.

3.3 There

are two types of reviews:

3.3.1 Review

of service areas, such as a business activity, within Council (activity

reviews)

3.3.2 Review

of services which are delivered via contract, such as a maintenance contract

(contract reviews).

3.4 Under

section

17A of the Local Government Act 2002 Council is required to undertake

activity reviews ‘not later than six years following the last

review’ and contract reviews ‘within two years before the expiry of

the contract’.

3.5 In

November 2015, Council agreed to the approach staff would take to meet the new

legislative requirements. This included an agreed schedule of activity review

areas, use of a review template, and a review timeline.

3.6 The

first round of service reviews focused on 42 service delivery areas across the

full range of Council’s activities. Reviews in these areas were completed

in 2017 and overseen by Council’s Audit and Risk Committee.

3.7 Service

delivery reviews were discussed at the 25 May 2021 Audit, Risk and Finance

subcommittee meeting. The subcommittee noted that there are other factors,

other than the size of the activity budget, which could enable an exemption

– such as the staff resource required to conduct a review. It was also

noted that exemptions could be applied following a ‘desktop review’

and that there may not be a need for a full review.

3.8 The

subcommittee agreed to defer the matter pending discussion with relevant chairs

of committees. Officers have met and discussed work programmes with the chairs

who have s17A reviews within their committee’s delegations.

3.9 The

subcommittee requested officers to report back on options for how the service

review exemptions could best be applied with reference to community wellbeing

and the significance of the services.

4. Discussion

There are exemptions available to Council

4.1 Section

17A(3) provides two exemptions to the review requirements:

17A(3)(a) A local authority

is not required to undertake the review in respect of a function to the extent

that delivery arrangements are bound by legislation, contract or binding

agreement so that they cannot be changed within the next two years;

17A(3)(b) A local authority

is not required to undertake the review if it is satisfied that the potential

benefits do not justify the cost of the review.

Financial considerations for

exemptions

4.2 Section

17A(3)(b) is for circumstances where the service is small or where cost savings

resulting from a review may be minor. In 2015, Council, using the Procurement

Policy as a guide, set a threshold that activities with a value below $100,000

be exempt from review.

Other considerations for

exemptions

4.3 Under

the legislation costs and benefits other than financial matters (such as

staffing resources) can also be considered.

4.4 Council’s

review template provides for other considerations for exemption including;

time, policy and regulatory changes, cost and capacity implications and the

views of service users. This is part of the required ‘desktop

review’, at which point officers can recommend a full review to the

relevant committee if one is required.

4.5 Although

there is a financial threshold operating, reviews below this level can be

brought to the relevant committee if it is considered that other factors

warrant it.

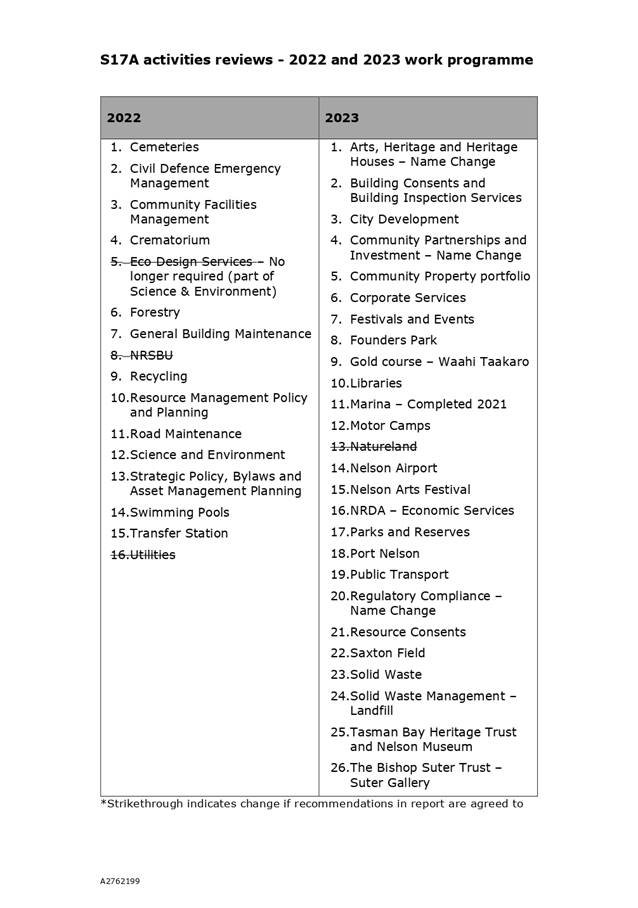

2022 and 2023 work

programme for activity reviews

4.6 Council

has a schedule of activity reviews for services which exceed the financial

threshold. Most of these reviews are scheduled for 2022 and 2023. Full details

can be found in Attachment 1 (A2762199). Since the triggers for contract reviews

are different (paragraph 4.2), these are undertaken when needed and are not

included in the schedule.

4.7 Council

will be able to monitor progress on the completion of the reviews through an

annual update report to the Audit, Risk and Finance subcommittee.

4.8 In

situations where a change to the way a service is delivered is proposed, that

decision will need to consider Council’s Significance and Engagement

Policy and any public engagement required.

Recommendation to align the financial value threshold

with Council’s Procurement Policy

4.9 Under

the current process, the threshold is $100,000 for contracts and activity

areas. This threshold was adopted using Council’s Procurement Policy as a

guide, specifically aligning with the requirement to publicly advertise tenders

which was set at $100,000 in 2015.

4.10 Under

the current Procurement Policy 2021-2026, the open competitive threshold is

$250,000. It is recommended that the s17A threshold for both contracts and

activity areas be increased to align with this.

4.11 This

change in threshold would not materially impact the number of service area

delivery reviews which are required to be undertaken. Based on 2021/22 figures,

only one review would no longer be required – for Natureland. Staying at

a $100,000 threshold would not increase the number of activity reviews

required, as all Council’s activities between $100,000 and $250,000 would

be captured in current programme.

4.12 This

change would have a more significant impact on contract reviews. There would be

a reduction in contract reviews of approximately 9 over the 2022-2023 period.

However, it is important to note that these contracts are still reviewed as

part of Council’s due diligence obligations (such as Council’s

tendering process), and regular reviews of contract performance are undertaken

as part of normal business.

Three Waters Reform programme and impacts on s17A

reviews

4.13 Central

Government is currently undertaking its Three Waters Reform programme. This

includes reviewing the governance, management and service delivery of three

water services, the same aspects which are part of a service delivery review.

4.14 Officers

propose that an exemption should be applied to Council’s three waters

related service delivery areas:

4.14.1 Nelson

Regional Sewerage Business Unit (NRSBU)

4.14.2 Utilities

- Stormwater/Flood Protection/Wastewater (including

Wastewater Treatment Plant(s)/Water Supply) (due in 2023)

4.15 The

Government has outlined its reform programme, which will see these activity

areas transfer to the new Water Service Entities by July 2024. Therefore, the

resource demand and costs to Council involved in undertaking a review of these

services outweigh any potential benefits, as Council will not be able to

materially change aspects of its three waters services prior to the reform.

4.16 If

the Government’s Three Waters Reform does not proceed, Council can then

undertake a s17A review of the NRSBU and Utilities activities.

5. Options

5.1 Two

matters are considered - threshold for s17A reviews and Three Waters exemptions

as outlined below.

|

Threshold recommendation

|

|

Option

1: Increase threshold to $250,000 (for activities and contracts) -

Recommended

|

|

Advantages

|

· Aligns

the threshold to Council’s Procurement Policy

· Reduces

the number of reviews required compared to a threshold of $100,000

· Frees

staff time to focus on areas of higher priority

|

|

Risks and Disadvantages

|

· None

obvious

|

|

Option

2: Do not increase threshold to $250,000 (for activities and contracts)

|

|

Advantages

|

· More

contracts and services are reviewed

|

|

Risks and Disadvantages

|

· Lack

of consistency with Council’s Procurement Policy

· Requires

more staff time reducing resources available for higher priority work

· No/little

gain expected from the lower value reviews

|

|

Three waters service delivery

reviews

|

|

Option

1: Exempt three waters services from service delivery reviews - Recommended

|

|

Advantages

|

· Avoids

duplication with the current Three Waters Reform programme

· Frees

staff resources to focus on other work priorities

|

|

Risks and Disadvantages

|

· None

obvious

|

|

Option

2: Do not exempt three waters services from service delivery reviews

|

|

Advantages

|

· None

|

|

Risks and Disadvantages

|

· Council

is unlikely to be able to implement any potential changes prior to Central

Government-led reform

|

6. Conclusion

6.1 A

$250,000 per annum threshold is recommended as this aligns with Council’s

Procurement Policy and balances the need to review activities and contracts

against the risk of directing resource to work that is not expected to provide

value to the ratepayer.

6.2 Other

exemptions may be determined as part of the ‘desktop reviews’ of

service delivery areas which conclude that full reviews may not be required.

6.3 Exempting

the three water service areas from review for the 2022 and 2023 years is

recommended due to the Government’s Three Waters Reform programme.

7. Next

Steps

7.1 Business

Units will undertake relevant s17A service delivery reviews, reporting to the

appropriate committees.

7.2 A

report outlining progress, and the 2023 work programme, will be prepared for

the subcommittee in late 2022.

Author: Gareth

Power Gordon, Economic and Policy Adviser

Attachments

Attachment 1: A2762199 - 2022 and

2023 s17A activity review schedule ⇩

|

Important considerations for decision making

|

|

1. Fit

with Purpose of Local Government

The recommendations support Council’s

requirements under section 17A of the Local Government Act 2002. Undertaking

Council activities in the most effective manner possible contributes to all

four community wellbeings.

|

|

2. Consistency

with Community Outcomes and Council Policy

The recommendations support the following Community

Outcomes:

· Our

infrastructure is efficient, cost effective and meets current and future

needs

· Our

urban and rural environments are people-friendly, well planned and

sustainably managed

· Our

communities have access to a range of social, educational and recreational

facilities and activities.

|

|

3. Risk

Setting the threshold at $250,000 reduces the risk

that resources are allocated to reviews which are not expected to provide

benefits.

|

|

4. Financial

impact

Staff resources and a budget of $25,000 in non-LTP

years are allocated to complete the reviews.

|

|

5. Degree

of significance and level of engagement

This matter is of low significance as it does not

impact levels of service and has a low financial impact and therefore no

community engagement has been undertaken.

|

|

6. Climate

Impact

No impact on the climate results from this

recommendation.

|

|

7. Inclusion

of Māori in the decision making process

No engagement with Māori has been undertaken in

preparing this report.

|

|

8. Delegations

The Audit, Risk and Finance subcommittee has the

following delegations to consider in relation to the requirements of the

Local Government Act 2002

Areas of Responsibility:

· Council’s

financial performance

· Internal

Audit

· Procurement

Policy

Powers to Recommend to Council:

· All

other matters within the areas of responsibility or any other matters

referred to it by the Council

|

Item

7: Service Delivery Reviews (s17A reviews) work programme: Attachment 1

Item 8: Quarterly

Finance Report - 31 December 2021

|

|

Audit, Risk and Finance Subcommittee

22 February 2022

|

REPORT R26519

Quarterly

Finance Report - 31 December 2021

1. Purpose

of Report

1.1 To inform the

Subcommittee of the financial results for Council for the first half of

2021/22, and to highlight any material variations.

2. Recommendation

|

That the Audit, Risk and Finance Subcommittee

1. Receives

the report Quarterly Finance Report - 31 December 2021 (R26519) and its attachments (A2829541,

A2821555, and A2750424).

|

3. Background

3.1 Quarterly reports

on performance are being provided to each Committee on the performance and

delivery of projects and areas within their responsibility.

3.2 The whole of Council financial reporting provided to this

subcommittee focuses on the six-month performance (1 July 2021 to 31 December

2021) compared with the year-to-date (YTD) approved capital and operating

budgets.

3.3 Unless otherwise

indicated, all information is against approved operating budgets, which is year

one of the Long Term Plan 2021-31 (2021/22), plus any carry forwards, plus or

minus any other additions or changes as approved by the Council.

3.4 Commentary is provided below for

significant variances of +/- $50,000.

4. Financial

Performance

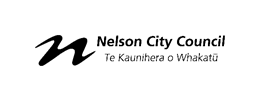

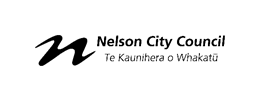

4.1 For the six months

ending 31 December 2021, the Council’s draft deficit is $731,000

favourable to budget.

4.2 Profit

and Loss

4.3 Income

4.4 Rates income is greater than budget by $72,000. Wastewater Rates are over budget by $54,000 due

to additional wastewater connections being added after wastewater charges had

been set, resulting in more units than budgeted paying charges for the year.

4.5 Other income is less than budget by $1.3m with significant variances as follows:

4.5.1 Investment Management income is greater than budget by $442,000. An

unbudgeted special dividend was received from Port Nelson of $280,000 which has

been used to repay debt in accordance with Council policy. This dividend was

paid in September 2021 for the 2020/2021 financial year in addition to the $2

million dividend already recognised in that financial year. Interest on Short

Term Investment is over budget by $102,000 due to more funds being invested

than planned as a result of pre-funding some debt to get the advantage of low

interest prevailed at the time.

An adjustment

for reduced income from rent relief provided by Council to tenants due to

COVID-19 was made with the full budget held in this cost centre. However, the

actual rent relief is being utilised within the cost centre that the rent

relief relates to which is creating a lower than planned YTD variance of

$165,000 in Investment Management. Actual rent relief provided totals $119,000

and been granted across various cost centres but mainly in Esplanade &

Foreshore Reserves, Greenmeadows Centre and Rental properties. Rent

relief is tracking under budget, with YTD rent relief budget being

$217,000.

4.5.2 Forestry income is less

than budget by $1.2m. Maitai Forest

income is behind budget by $1.6 million with no income year-to-date as the bulk

of the income now expected to be received in 2022/23. Brook/York Valley Forest

income is $348,000 over budget with income forecast to be $582,000 over budget

by the end of the year.

4.5.3 Landscape Reserves income is greater than budget by $92,000.

An unbudgeted grant of $20,000 has been received from MBIE for the

Maitai Mountain Bike Hub. Unbudgeted recovery income of $42,000 has been

received from other impacted parties from the winter heavy rain event that

caused multiple slips.

4.5.4 Nelson Library income is

greater than budget by $88,000. Unbudgeted

DIA income of $86,000 has been received which is used to fund seconded staff

and library electronic resources.

4.5.5 Parking Regulation income is greater than budget by $111,000.

Infringement Fees are over budget by $94,000 with the new system

capturing more incidents of non-compliance.

4.5.6 Parking and CBD Enhancement income is less than budget by $104,000. Rental Income is

under budget by $97,000 due to rental relief for outdoor dining as well as

credits being provided to tenants who are on income-based rental agreements for

the last financial year due to impacts from Covid restrictions.

4.5.7 Building Services income is

greater than budget by $309,000. Building Consent income and Quality

Assurance levies are ahead of budget by $223,000 and $64,000 respectively with

stronger market demand than anticipated.

4.5.8 Resource Consents income is

less than budget by $102,000. Consent

Fees are $95,000 behind budget although the consent numbers are similar

compared to last year. This is due to a lag in invoicing.

4.5.9 Waste Minimisation income is less than budget by $93,000. Local Disposal Levies

recoverable from Landfill is $89,000 behind budget due to expenditure items it

funds being behind budget. The details of the expenditure items are in the

below programmed expenditure section.

4.5.10 Transfer Station income is

greater than budget by $190,000. Local

Disposal Levies recoverable from Landfill is $159,000 ahead of budget due to

expenditure items it funds being ahead of budget. The details of the

expenditure items are in the below base expenditure section.

4.5.11 Wastewater income is less than

budget by $379,000. Commercial Trade

Waste income is under budget by $250,000 due to the impacts of covid lockdown.

Three Waters Stimulus Grant is $198,000 behind budget with no income yet

recognised as no eligible expenditure incurred that could be claimed.

4.5.12 Stormwater income is less than

budget by $99,000. Three Waters

Stimulus Grant is behind budget by $97,000 with no income yet recognised as no

eligible expenditure incurred that could be claimed.

4.5.13 Water Supply income is less than

budget by $488,000. Residential Water

Meter income is behind budget by $449,000 due to lower demand than planned.

4.6 Expenses

4.7 Staff Operating

expenditure is greater than budget by $232,000.

4.7.1 Increased activity in Building Consents has

necessitated the use of contractors and additional staff causing Staff

Operating Expenditure to be over budget, with this largely being offset by

increased income. Additional external funding has also been secured (such as in

the libraries) to fund extra roles.

4.8 Base

Expenditure is less than budget by $1.8m.

4.8.1 Forestry expenditure is

less than budget by $519,000. Maitai

Harvest costs are $1.1m behind budget with the bulk of the harvesting pushed

back until the 2022/23 Financial Year. Brook/York Valley are $474,000 over

budget which is partially offset by increased income.

4.8.2 Esplanade & Foreshore Reserves expenditure is greater than budget by $53,000. Property Maintenance Contract is over budget by

$37,000 and is forecast to increase to $50,000 due to contract variations

caused by new subdivisions providing additional esplanade reserves to be

maintained.

4.8.3 Monitoring The Environment expenditure is less than budget by $166,000. Several

expenditure items are behind budget as majority of the programme will be

completed over Autumn.

4.8.4 Developing the Resource Management Plan

expenditure is less than budget by $396,000. Significant changes have been approved by Council

in November 2021 to change the programme of works. This has delayed major work

that was to occur this year which has resulted in underspends across

expenditure items with Nelson Plan expenditure being under budget by $446,000

and forecasting to be $1.2m under budget by the end of the year.

4.8.5 Resource Consents expenditure is greater than budget by $137,000. External

Consultants are over budget by $140,000 and forecast to be $265,000 over budget

by the end of the year. This is driven by staff vacancies requiring consultants

to perform work to deal with the increased volume of consent being sought.

4.8.6 Stormwater expenditure is

greater than budget by $129,000. Stormwater

Reticulation Maintenance is over budget by $53,000 due to the larger volume of

rainfall requiring increased checks. Insurance is ahead of budget by $72,000

due to higher than anticipated asset revaluations which was not known at the

time of budgeting.

4.8.7 Transfer Station expenditure is greater than budget by $103,000. The Hopper Operation Contract is over budget by

$30,000 due to the new contract now including some additional services

previously paid out of different budget lines and forecast to finish $40,000

over budget. A budgeting error is causing a $71,000 variance and has been fixed

for the Annual Plan 2022/23.

4.8.8 Civic House expenditure is

less than budget by $95,000. Cleaning

expenditure is under budget by $21,000 with savings from Covid restrictions.

Electricity is behind budget by $30,000 with the December invoice had not been

received when the reporting process commenced.

4.8.9 Nelson Library expenditure is less than budget by $94,000. Insurance for Nelson library is behind budget by

$19,000 due to an allocation issue offset by an over budget variance of $16,000

for the Stoke Library. Electricity is behind budget by $25,000 with the

December invoice not received when the reporting process commenced. There are

also several other small variances which are expected to be spent.

4.8.10 Economic Development expenditure is

less than budget by $81,000. The Grant to the Economic Development

Agency is behind budget by $60,000 due to timing and is on track to be fully

spent.

4.8.11 Subsidised Roading expenditure is

less than budget by $72,000. This

is mainly due to some work being delayed by Covid restrictions.

4.8.12 Sports Parks expenditure is less

than budget by $69,000. Water

expenditure is behind the budget by $25,000 but expected to be on track over

the summer months, while the Base Contract is behind budget by $19,000 due to

timing and forecast to be spent by the end of the year.

4.8.13 Marina expenditure is less than

budget by $66,000. Various

repairs & maintenance expenditure items are behind budget by $55,000 in an

effort to find savings for Hardstand maintenance project. These savings will be

spent on that project in the second half of the year.

4.8.14 Water Supply expenditure is less

than budget by $65,000. Electricity

is $55,000 behind budget with the December invoice not received when the

reporting process commenced.

4.8.15 Recycling expenditure is less

than budget by $64,000. The Kerbside Collection Contract expenditure

is behind budget by $54,000 with this variance expected to reduce over the back

half of the year.

4.8.16 Communities of Greatest Need expenditure is less than budget by $56,000. Youth

Programmes expenditure is $45,000 behind budget with applications currently

being assessed and likely to be finalised in February.

4.9 Unprogrammed

Expenditure is greater than budget by $709,000.

4.9.1 Forestry expenditure is

less than budget by $100,000. Tantragee

Hazardous Tree Removal is under budget by $100,000 and forecast to finish under

budget by $200,000.

4.9.2 Landscapes Reserves expenditure is greater than budget by $163,000. Heavy Rain events are $159,000 over a nil budget due

to slips from rain events at Grampians, Botanical Hill and Sir Stanley

Whitehead which is forecast to reach $360,000 by the end of the financial year.

Savings across the activity of $150,000 have been found to fund this, with the

Emergency Response Fund funding the remainder.

4.9.3 Subsidised Roading expenditure is greater than budget by $191,000. Winter Storm

Damage is over budget by $145,000 due to an unexpected weather event but is not

forecast to increase much further. These costs are subsidised by Waka Kotahi.

Covid Response is over budget by $42,000 which is a one-off cost claimed by a

contractor as part of a wider contract due to Covid related costs. This is

expected to be subsidised by Waka Kotahi.

4.9.4 Unsubsidised Roading expenditure is greater than budget by $126,000. Unbudgeted

expenditure of $87,000 was incurred when works were required on Main Road Stoke

during Stage 4 of the Saxton Creek Upgrade.

4.9.5 Wastewater expenditure is

greater than budget by $61,000. Wastewater

Reticulation Reactive Maintenance is over budget by $61,000 with higher costs

than anticipated. This variance is forecast to increase to $72,000 by the end

of the year.

4.9.6 Public Transport expenditure is greater than budget by $50,000. Covid Response expenditure is over budget by $44,000

with additional bus cleaning costs incurred which are subsidised by Waka

Kotahi.

4.10 Programmed Expenditure is less than budget by $1.5m.

4.10.1 Conservation Reserves expenditure is

less than budget by $60,000. Programmed Maintenance and Weed Control

are behind the budget by $39,000 and $24,000 respectively with work expected to

be increasing in autumn and both forecast to be fully spent.

4.10.2 Sports Parks expenditure is greater

than budget by $57,000. Programmed

Property Maintenance is ahead of budget by $65,000 due to acceleration of some

work programmes but forecast to be underspent at the end of the year by $47,000

due to contractor staffing issues.

4.10.3 Marina expenditure is less than

budget by $103,000. Professional

Advice is behind budget by $72,000 due to uncertain timing for the governance

review which has now commenced. Maintenance Dredging Consent is behind budget

by $30,000 with the work to take place in the second half of the year.

4.10.4 Saxton Field expenditure is less

than budget by $232,000. The

Grant to TDC for Champion Drive is under budget by $235,000 which is a saving

as the project did not cost as much as anticipated.

4.10.5 Founders Park expenditure is

less than budget by $52,000. Programmed

Maintenance and Development Fund Expenditure are behind budget by $23,000 and

$13,000 respectively with projects planned later in the year.

4.10.6 Economic Development expenditure is

less than budget by $168,000. The

Events Contestable Fund is behind budget by $87,000 while International

Sporting Events are under budget by $48,000 and likely to finish $120,000 under

by the end of the financial year due to the ongoing impacts of Covid.

4.10.7 Waste Minimisation expenditure is

less than budget by $84,000. Community

Engagement Contract is under budget by $40,000 and likely to be underspent as a

result of low community uptake due to covid disruptions. Street Litter Bin

Technology is behind budget by $23,000 with a start date in February 2022.

4.10.8 Unsubsidised Roading expenditure is

less than budget by $232,000. Akersten Street rock repairs are

behind budget by $220,000 with design work with the contractor nearing

completion and work set to commence in quarter three.

4.10.9 Environmental Advocacy/Advice expenditure is less than budget by $146,000. Nelson Nature

expenditure items are behind budget by $96,000 with some work completed and

awaiting invoices, as well as contracts being in the process of finalizing to

complete the remainder of the work. Insulation Grant Programme is under budget

by $36,000 due to a prior year applicant refunding an unspent portion of their

grant.

4.10.10Wastewater expenditure is less

than budget by $124,000. Trade Waste Improvement Programme and

Natural Hazards Risk Assessment are behind budget by $42,000 and $30,000

respectively due to timing but on track to be fully spent.

4.10.11Stormwater expenditure is less

than budget by $94,000. Stormwater

Detention, Tahuna Stormwater and Fresh Water Quality Assessments are behind

budget by $37,000, $26,000 and $24,000 respectively. All budgets are

anticipated to be fully utilised by the end of the year although there may be a

small saving in the Fresh Water Quality Assessments.

4.10.12 Community Tools and Enablers expenditure is less than budget by $89,000. Grants to the

Arts Council and Refinery Art Gallery are $41,000 behind budget with their

invoices received late. Community Partnership Funds grants are $20,000 behind

budget with applications having opened recently.

4.11 Finance

expenditure is greater than budget by $230,000.

4.12 Depreciation

expenditure is greater

than budget by $160,000.

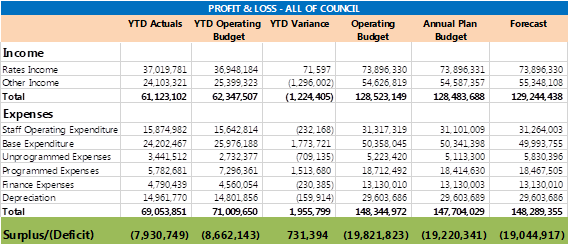

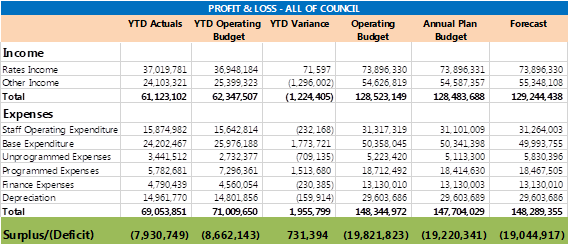

5. Capital

Expenditure

5.1 Capital Expenditure (including

staff time, excluding vested assets)

As at 31

December 2021, Capital Expenditure is $11.1 million behind the Operating Budget

of $31.2 million of which $5.9 million relates to Infrastructure, $711,000

relates to Environment, $1.4 million relates to Corporate Services, $362,000

relates to Strategic Development & Property, and $2.7 million relates to

Community and Recreation. Out of the $11.1 million variance above, $6.1m

relates to Level of Service, $3.9 million relates to Renewals and $1.0 million

relates to Growth projects.

6. Whakamahere

Whakatū Nelson Plan

6.1 Previous Audit, Risk and Finance

subcommittee reports have contained information relating to the Whakamahere

Whakatū Nelson Plan project. The project was a full review of

Council’s resource management plans. On 23 November 2021 Council resolved

to pause the Nelson Plan project until the Resource Management Act replacement

legislation has been passed (Natural, Built and Environment Act; and Strategic

Planning Act). Reporting to the Audit, Risk and Finance Subcommittee on the

project will also pause until the project is re-started.

6.2 While the wider project is paused, staff anticipate that much of the

work undertaken to date on the Nelson Plan will be able to be re-cast into

replacement plans once new legislation is in place. Some project work will

continue in relation to a housing plan change, coastal hazard planning,

freshwater planning, and air quality. Expenditure on the Nelson Plan project

will be significantly less than forecast in the Long Term Plan for the next

three years. The Annual Plan 2022/23 will include a revised budget for the

Environmental Planning project work.

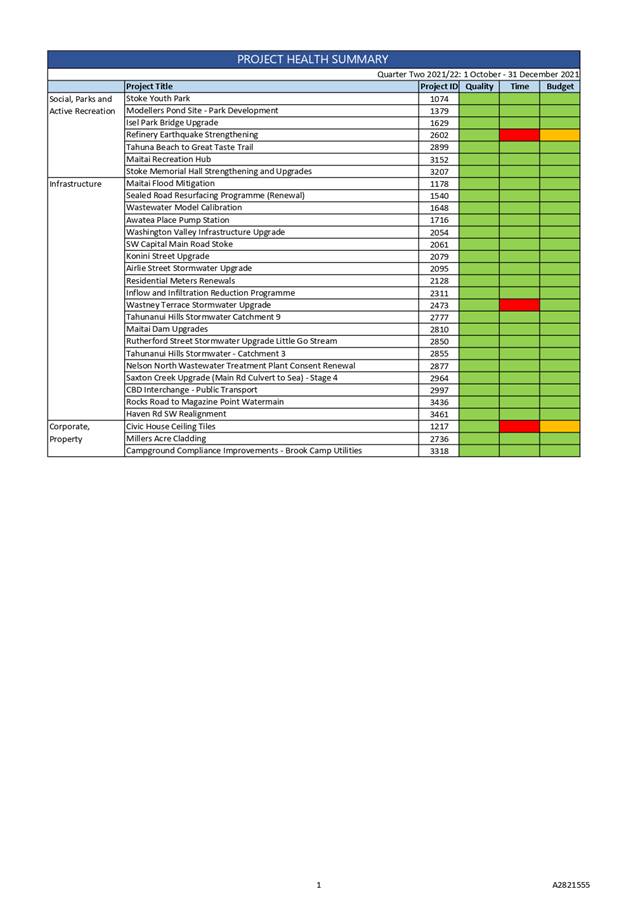

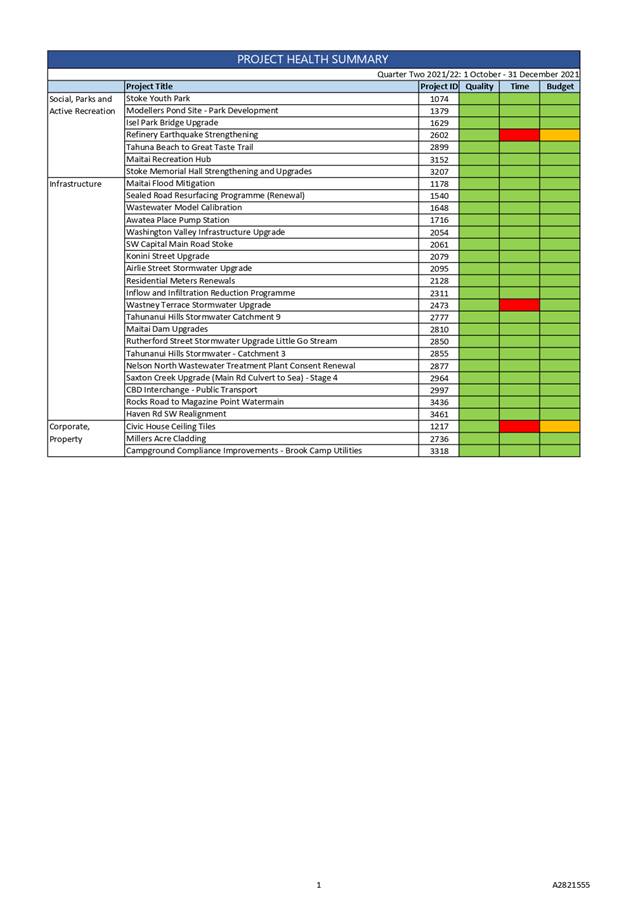

7. Project

Health

7.1 A table

summarising the health of projects across Council for which project sheets have

been generated is included as Attachment 2. It gives a red, amber, or green

rating for quality, time, and budget factors.

7.2 The full project

sheets are included as attachments to the Infrastructure, Community and

Recreation, and Environment and Climate Committees’ quarter one reports.

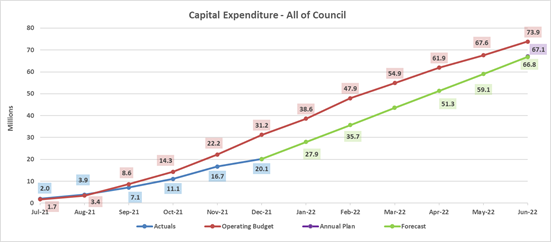

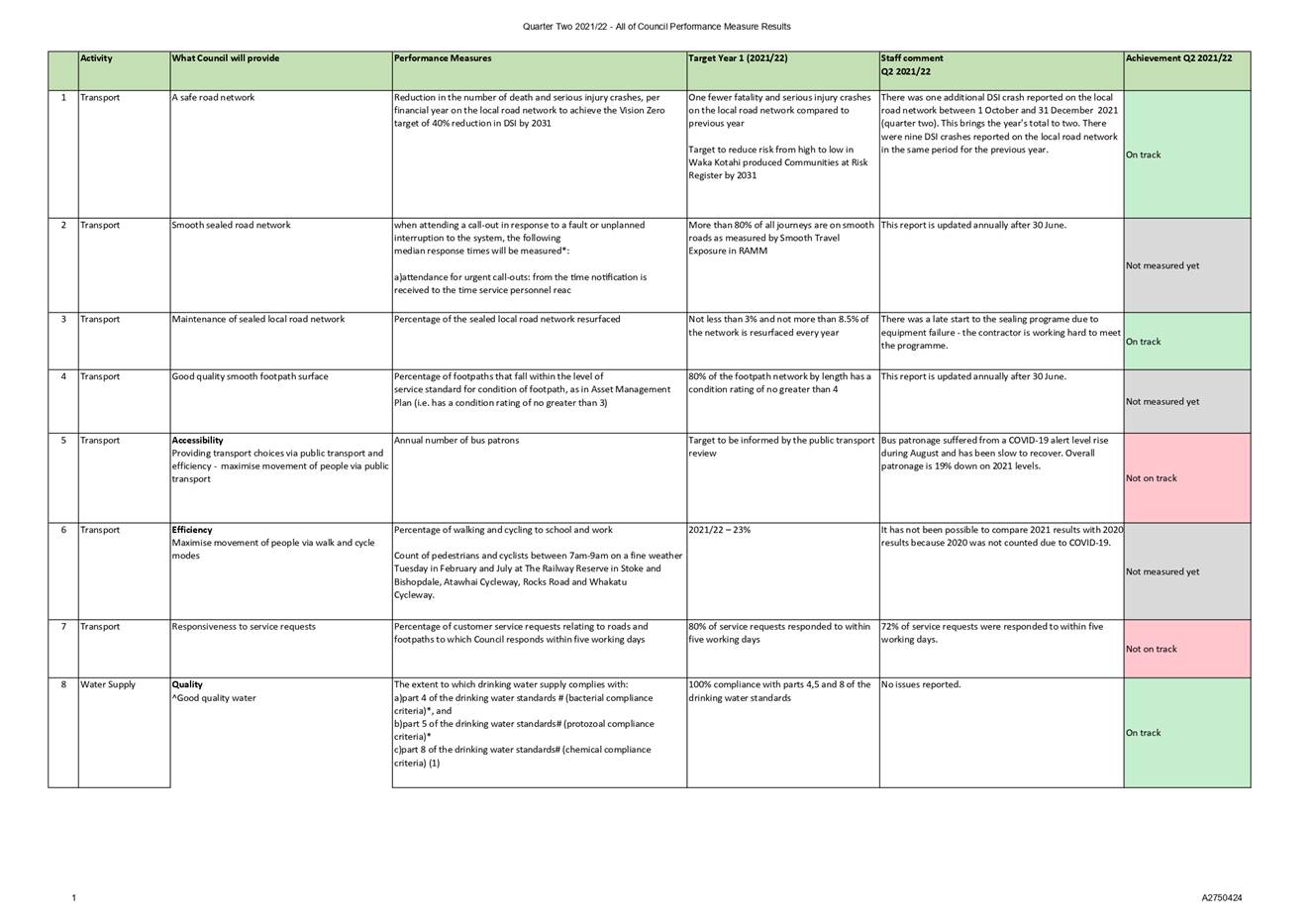

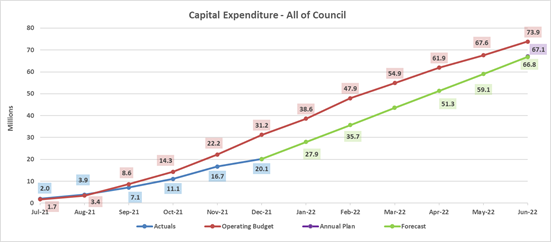

8. Performance

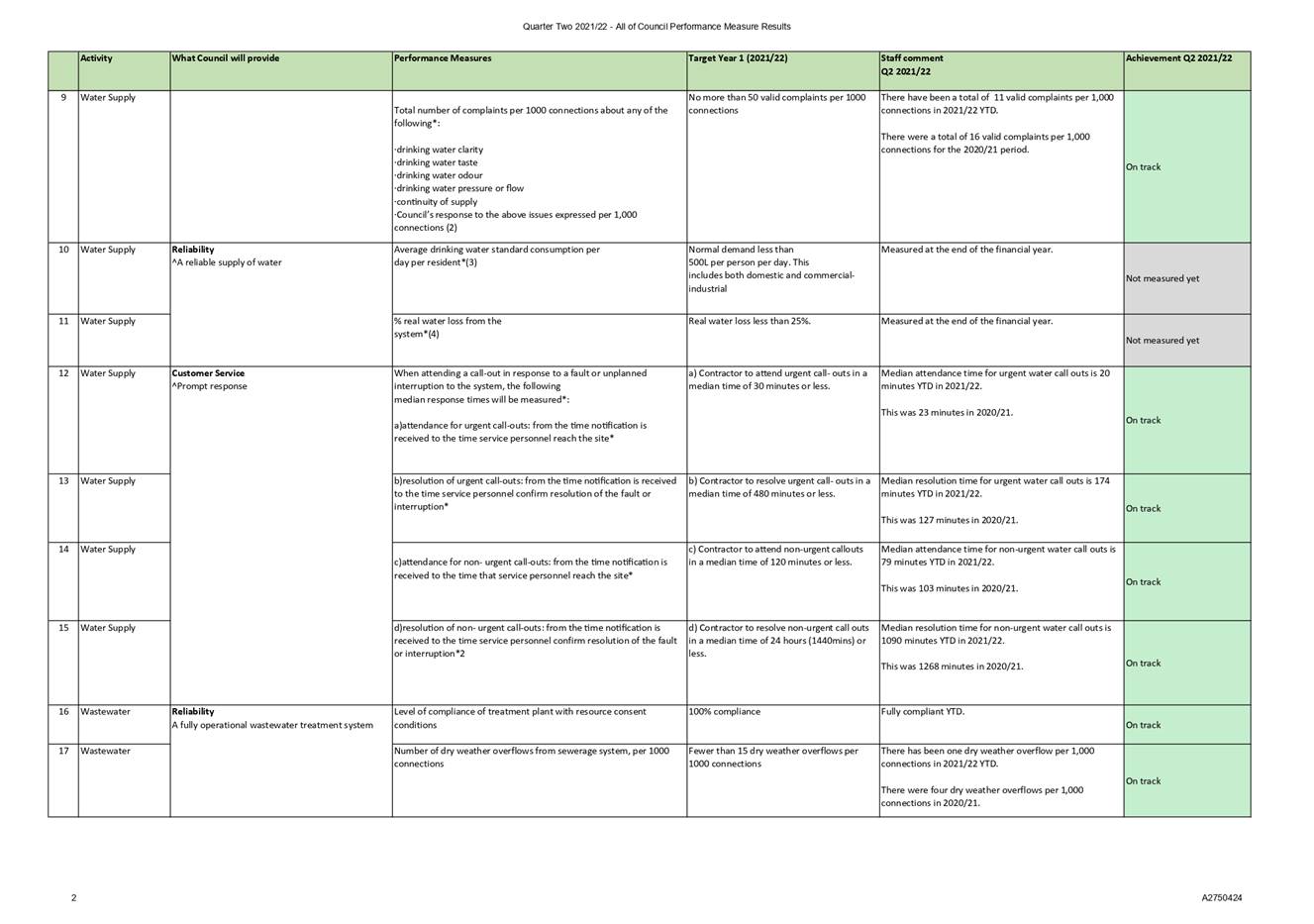

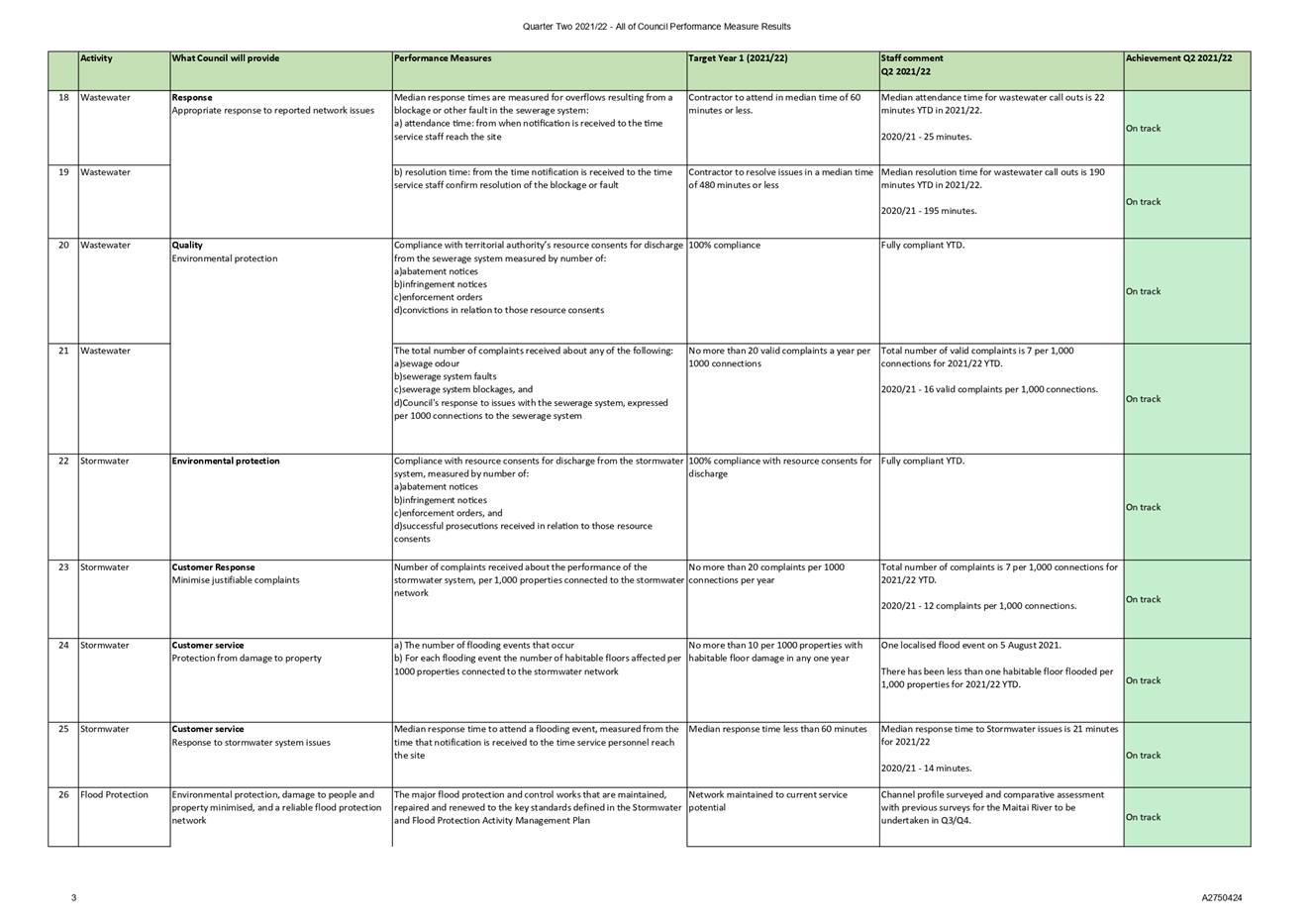

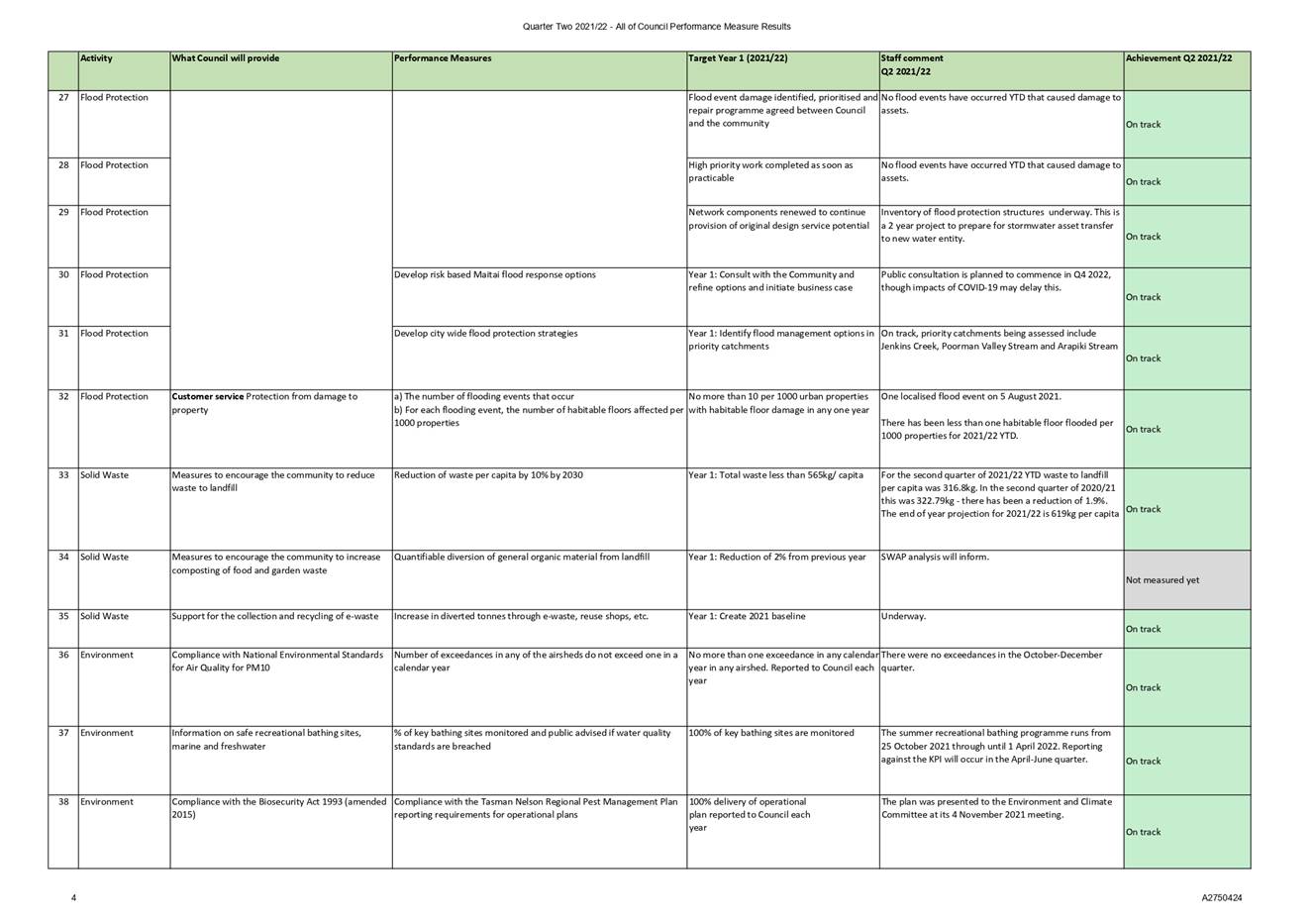

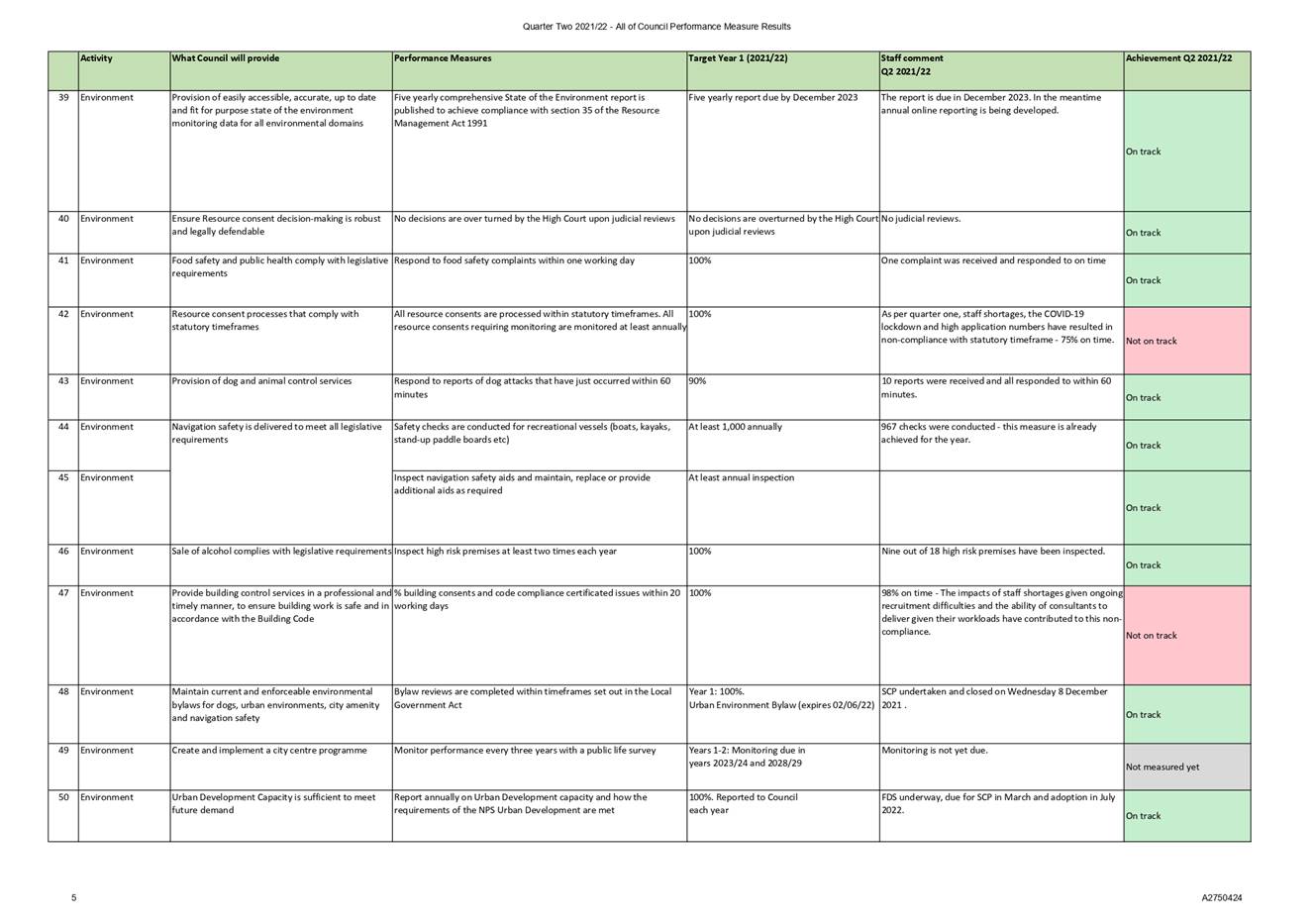

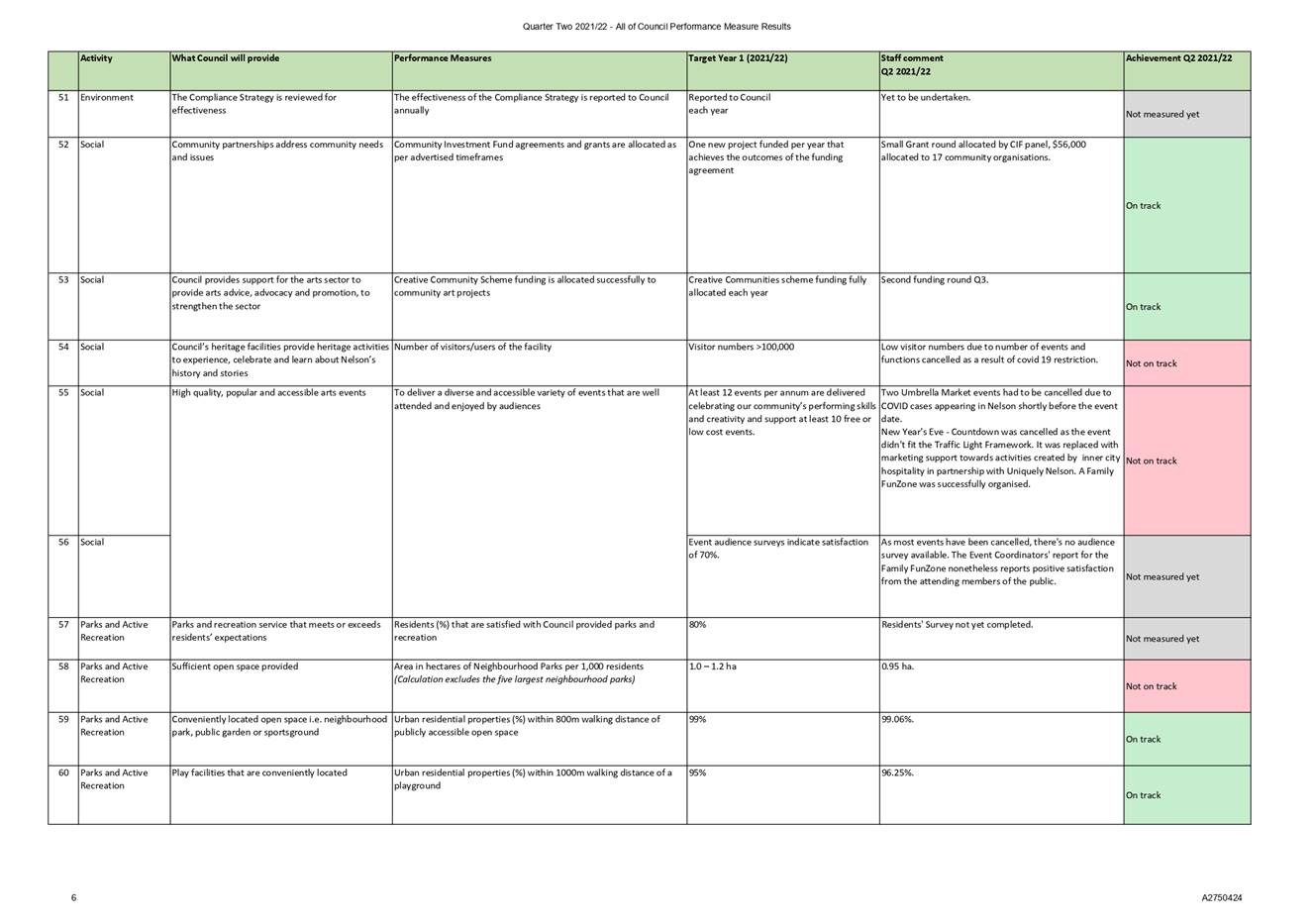

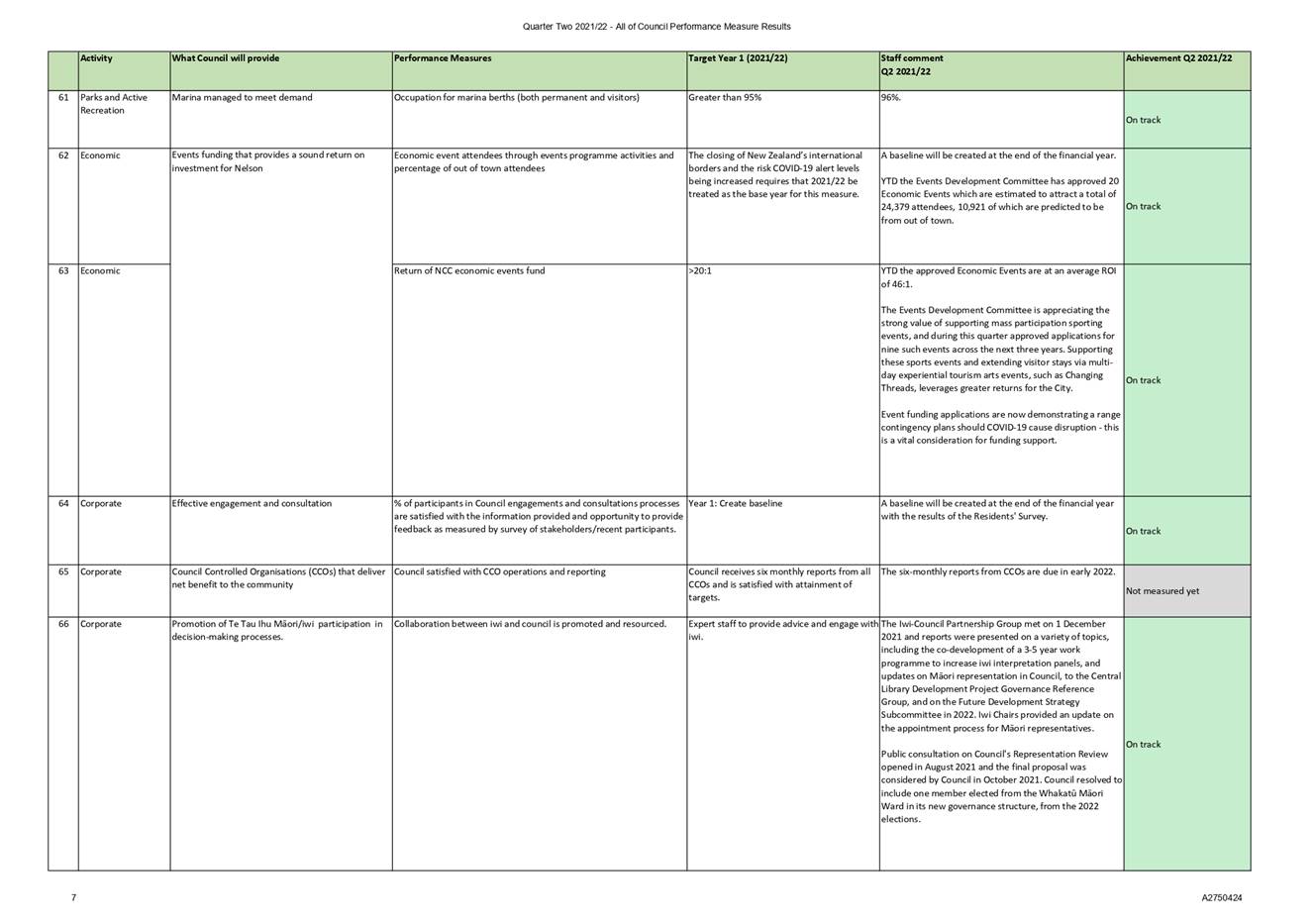

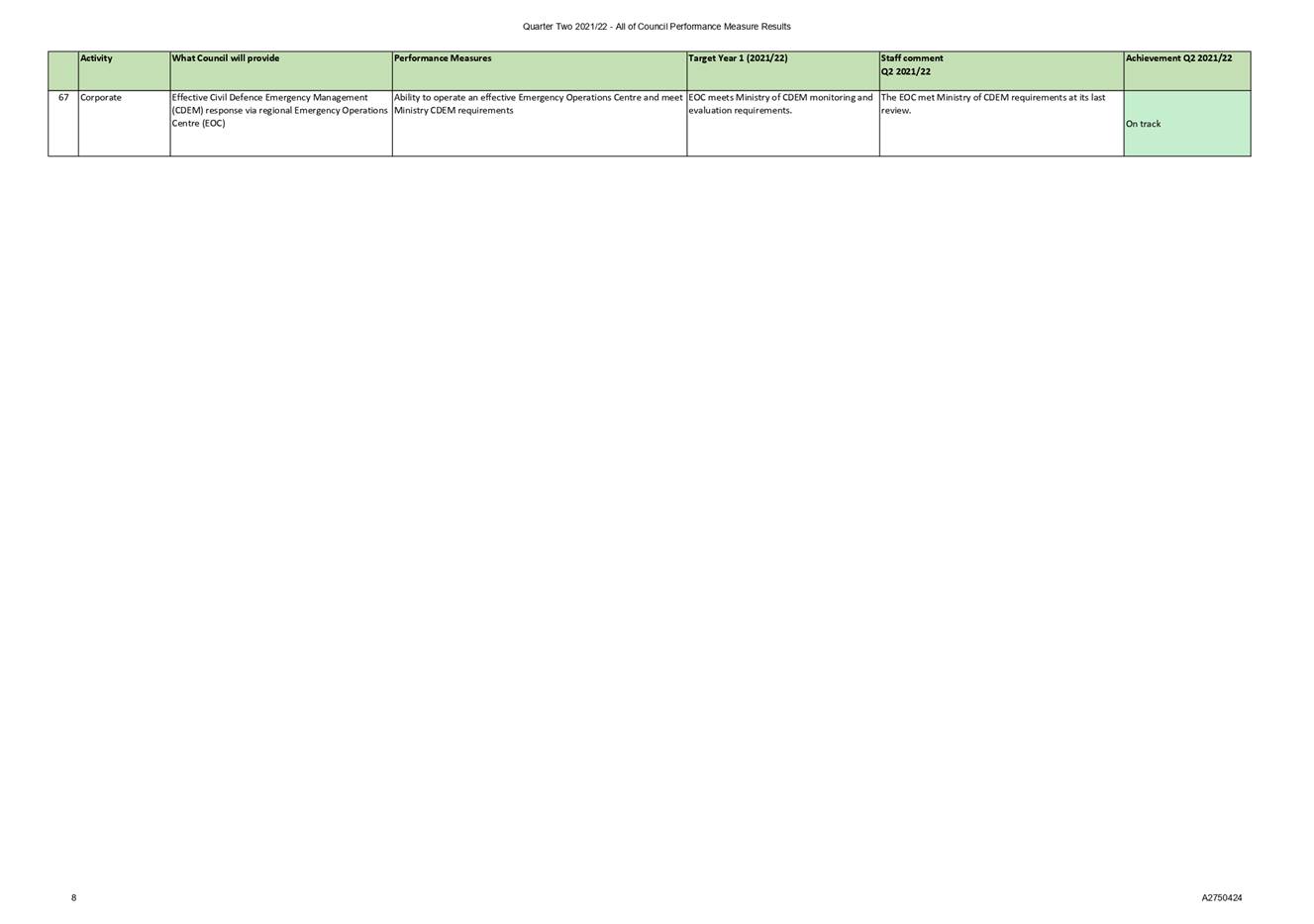

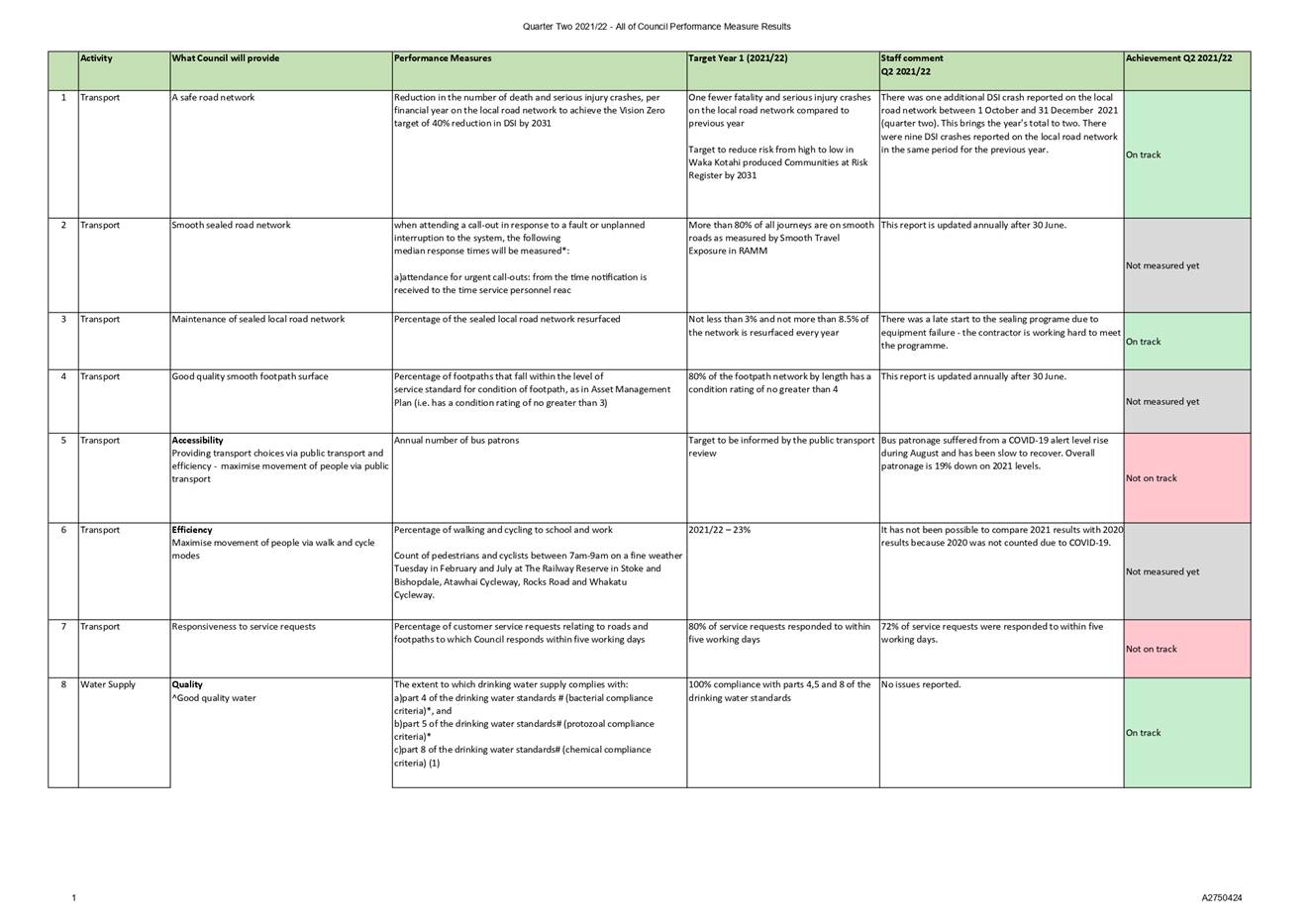

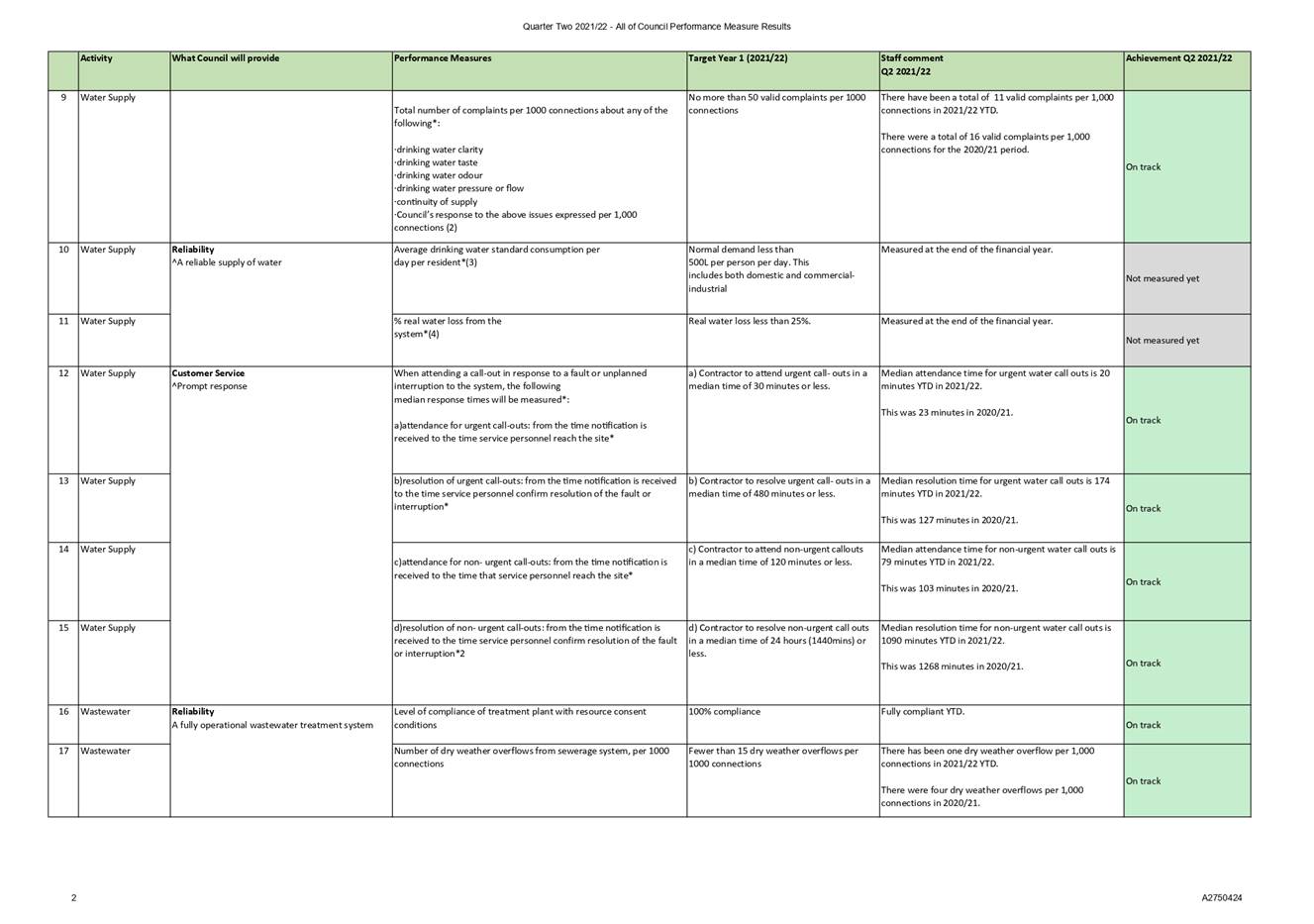

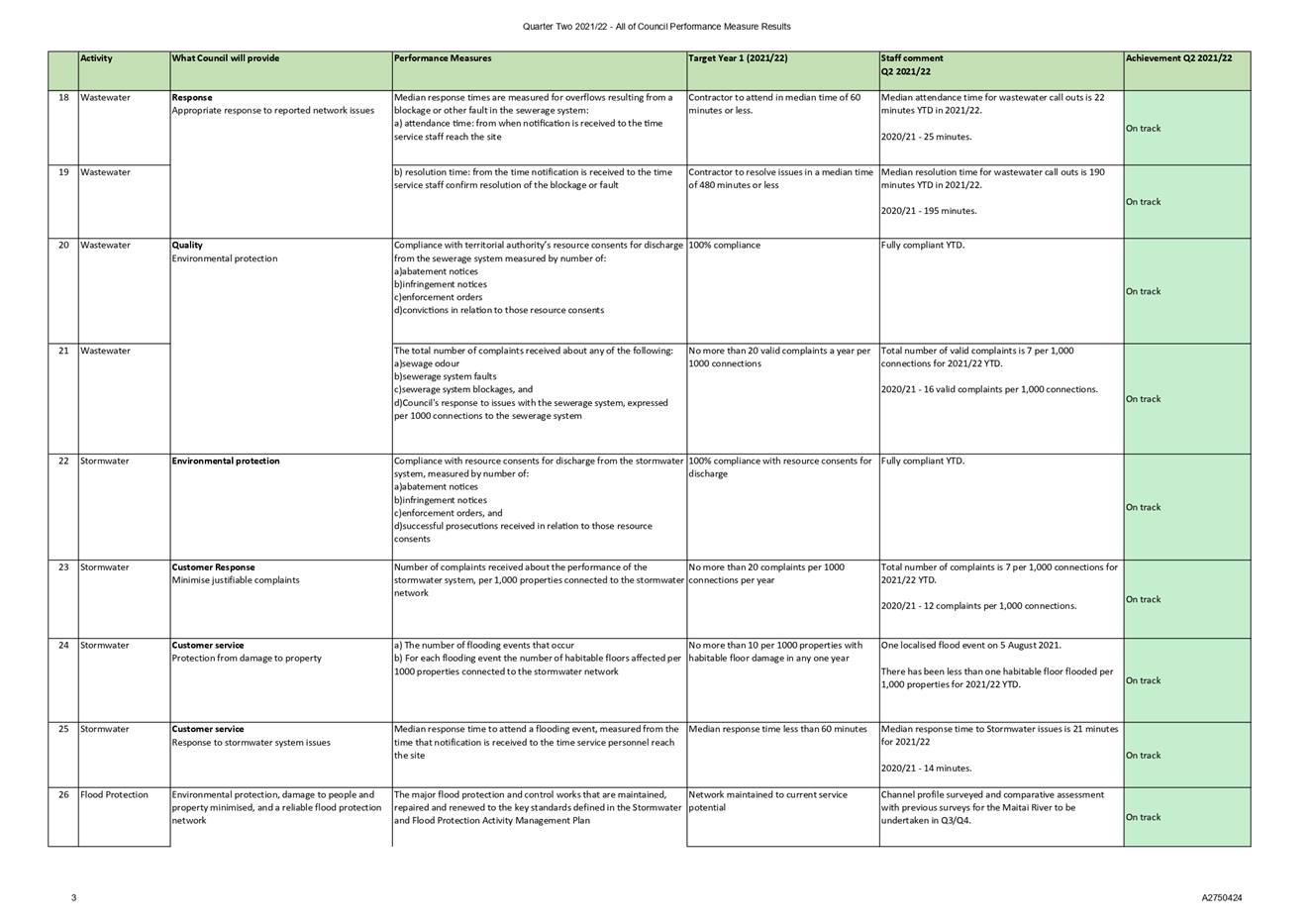

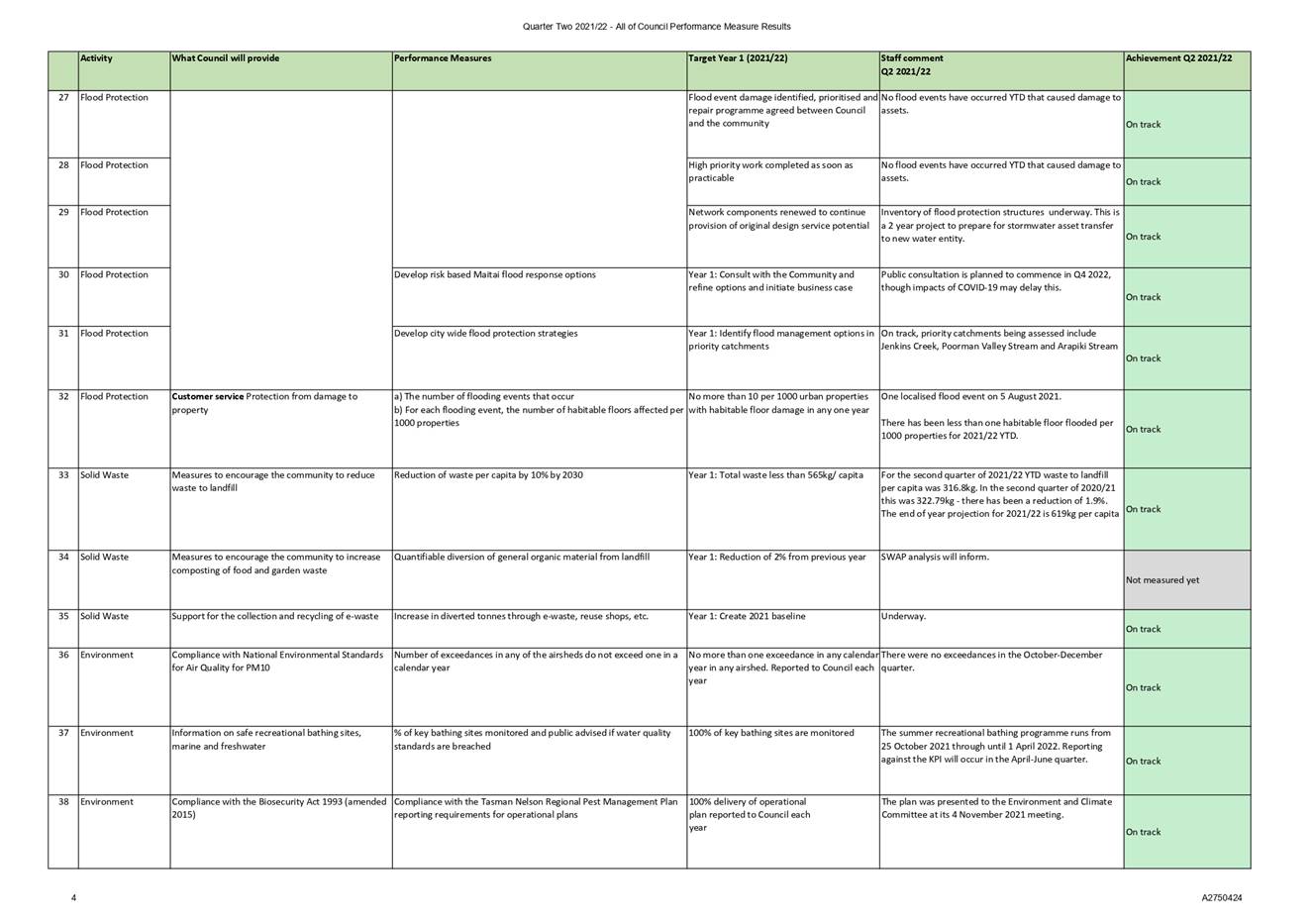

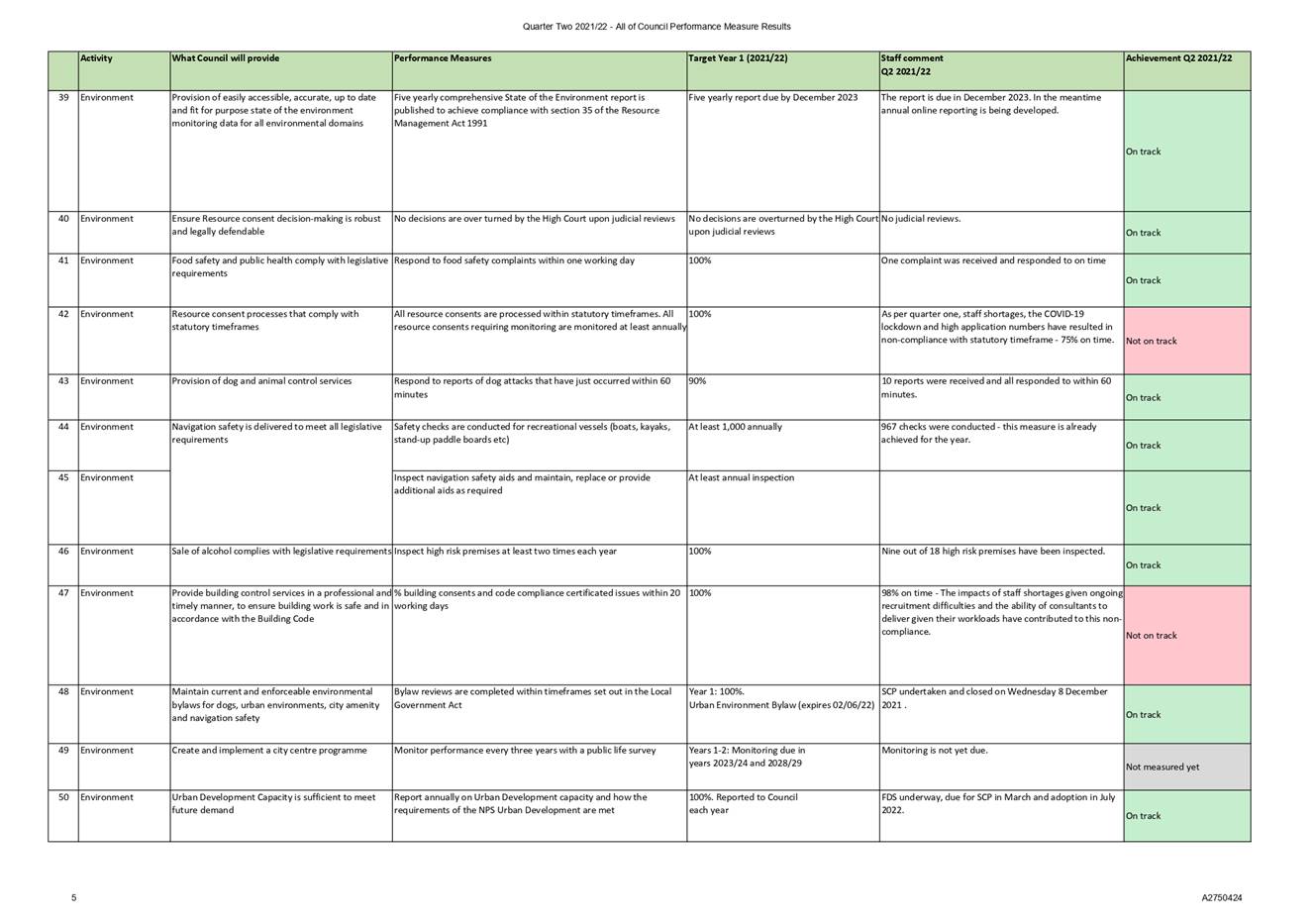

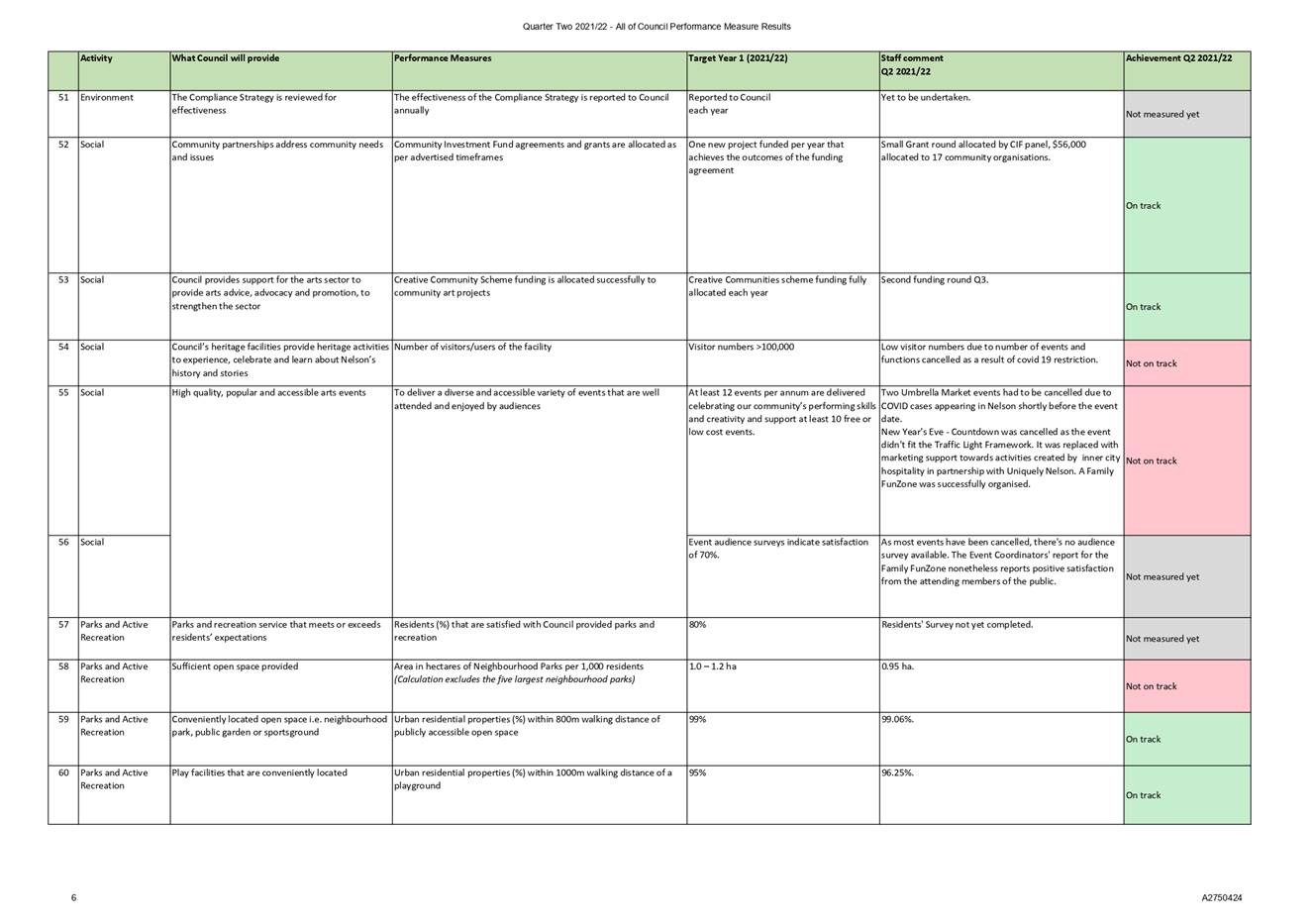

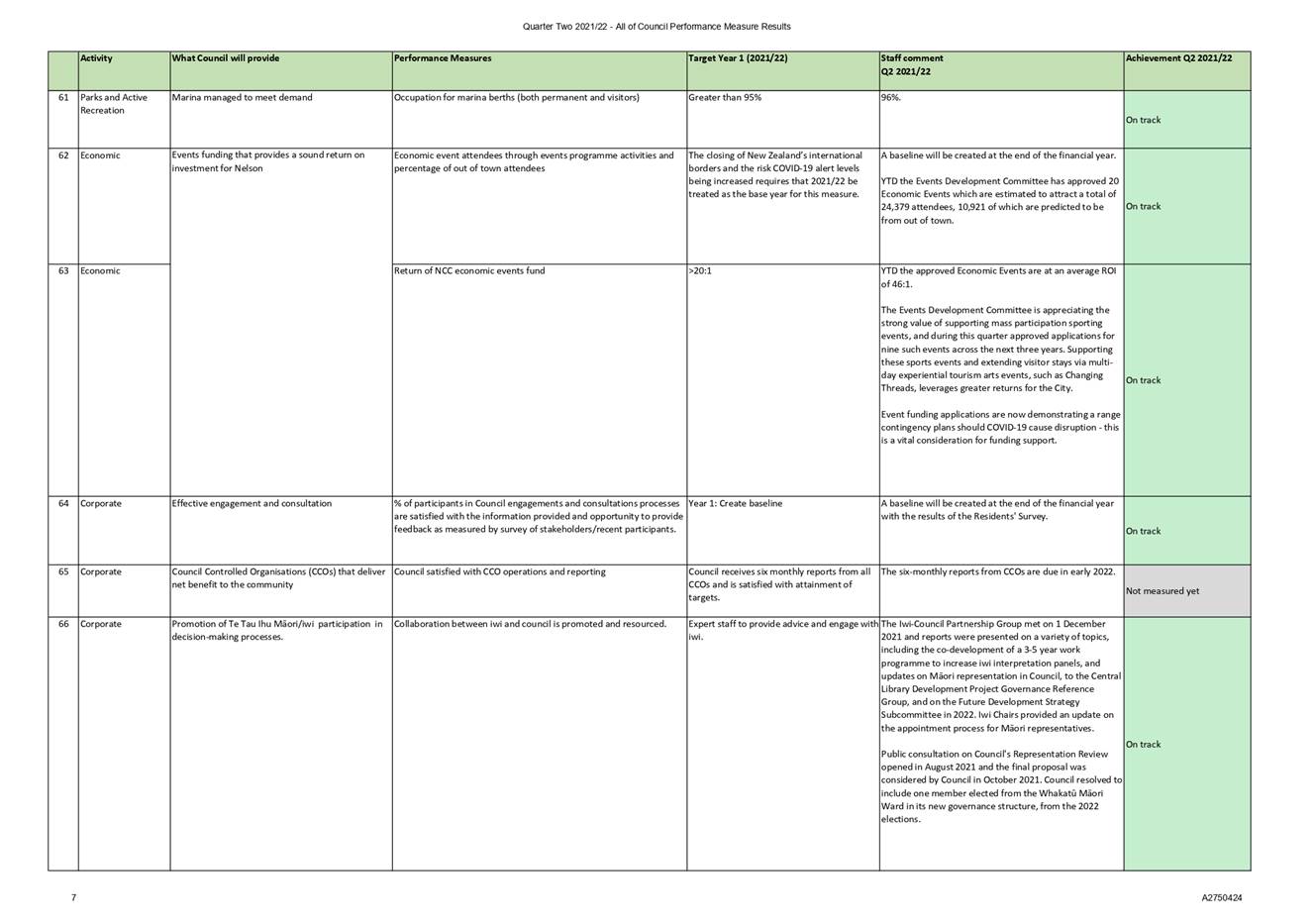

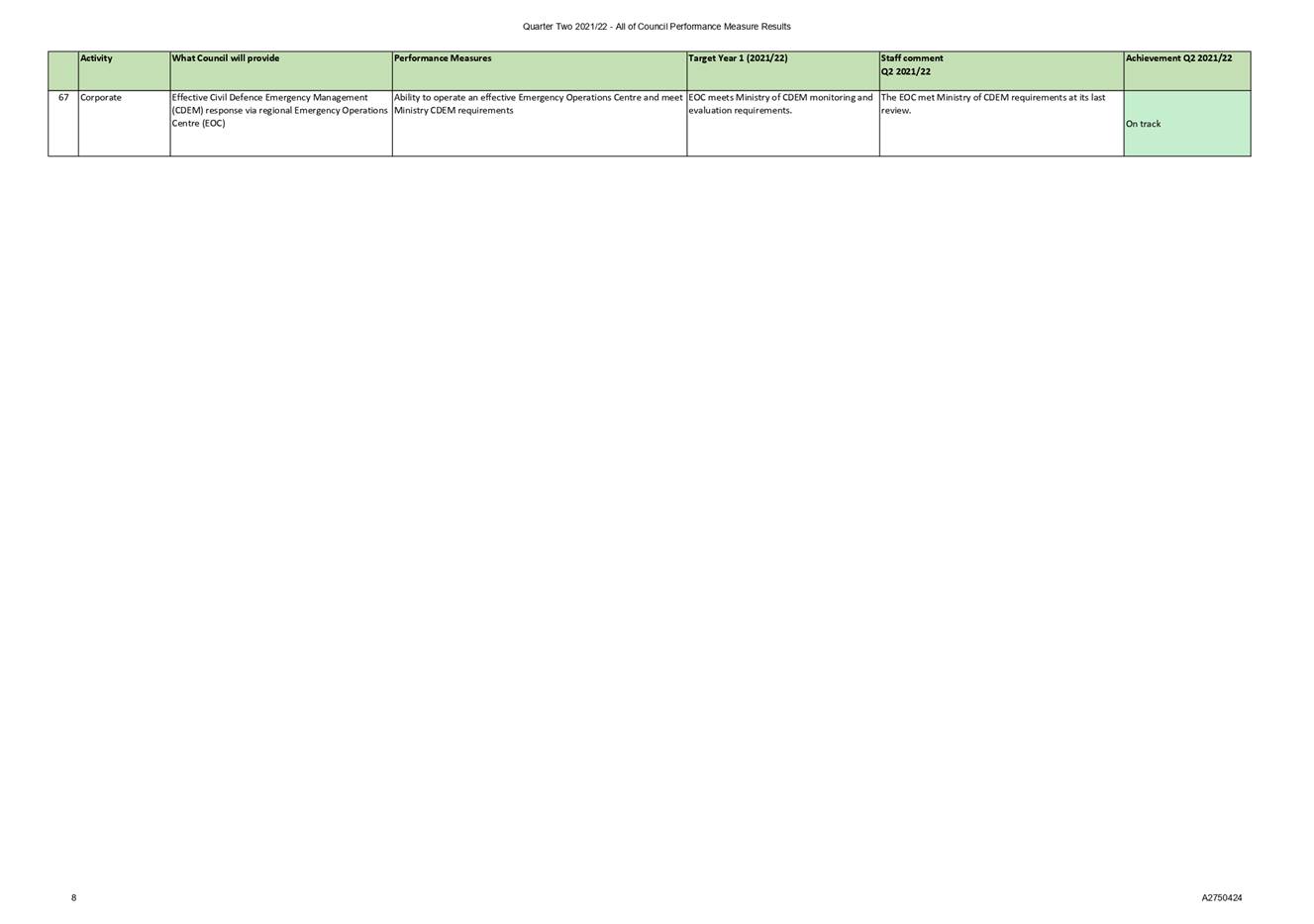

Measures

8.1 Council reports on

67 non-financial performance measures across its activity areas, as set out in

the Long Term Plan 2021-31. These are evaluated as ‘on track/not on

track/not measured yet’ for the first three quarters of the year.

8.2 Of the 67 measures, 49 are on

track to achieve, seven are not on track, and 11 have not been able to be

measured yet as at quarter two.

8.3 Attachment 3 details

Council’s performance measure results so far across all its activities.

They will also be discussed in the Infrastructure, Environment and Climate, and

Community and Recreation Committees’ respective quarterly reports.

Author: Prabath

Jayawardana, Manager Finance

Attachments

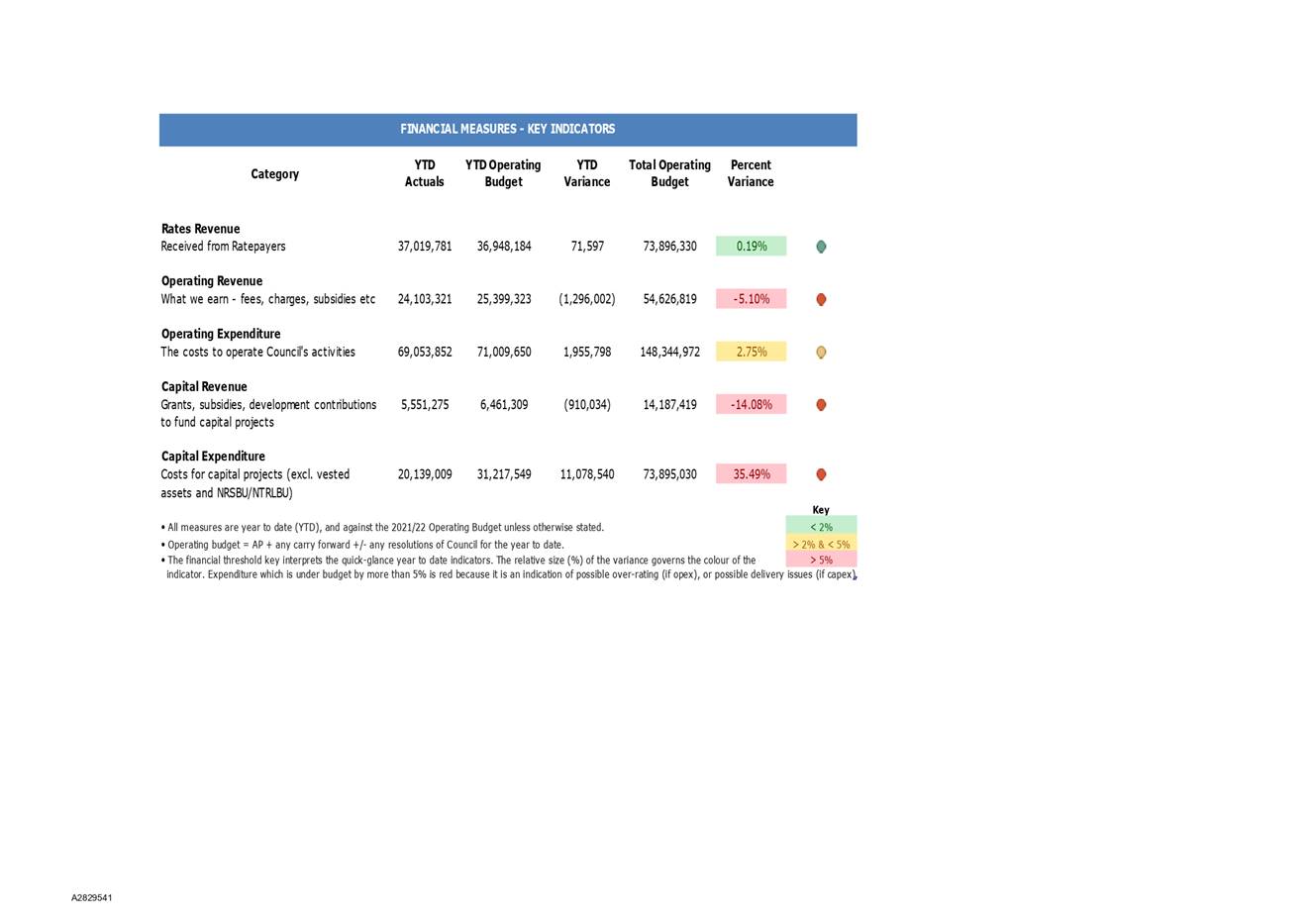

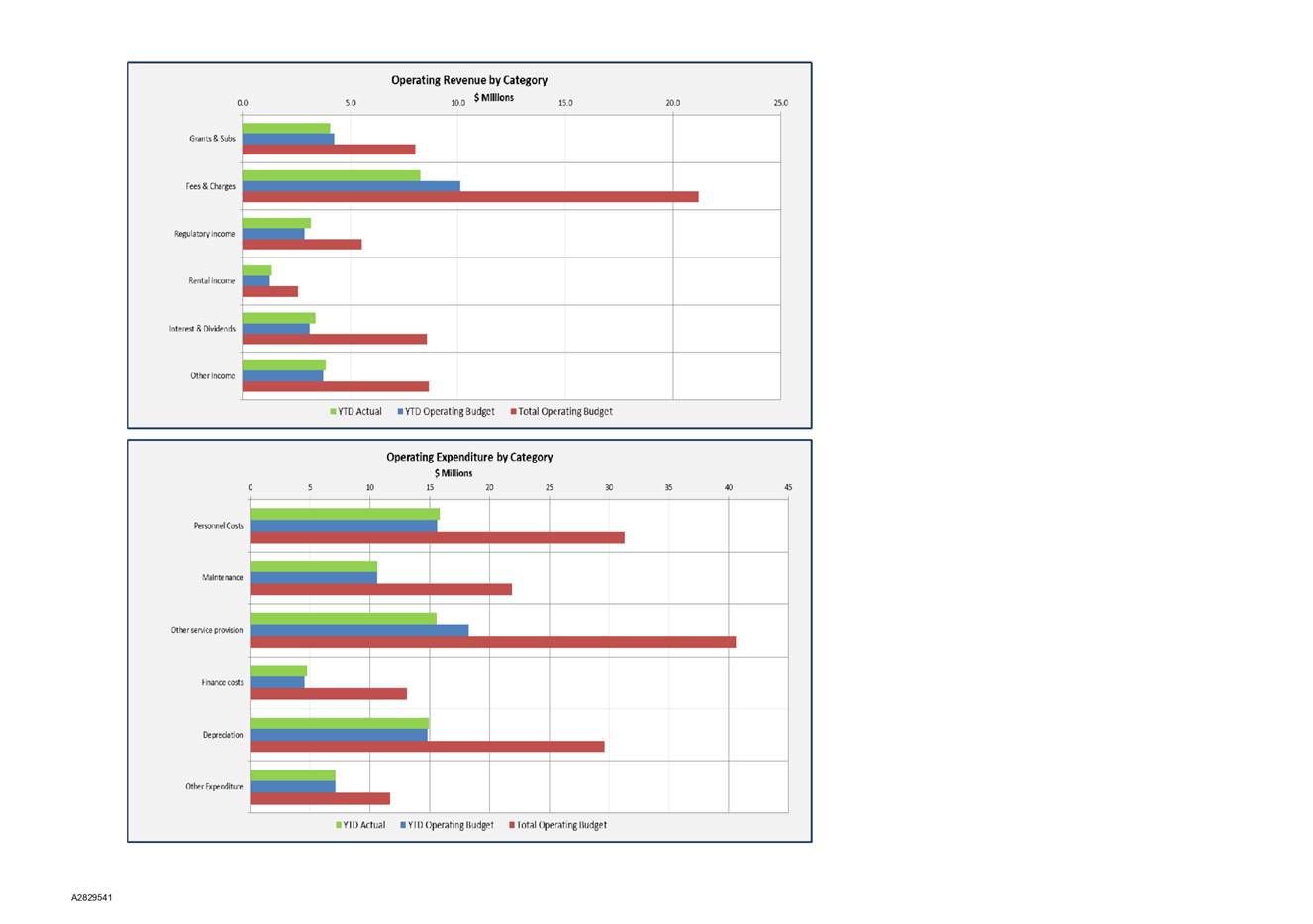

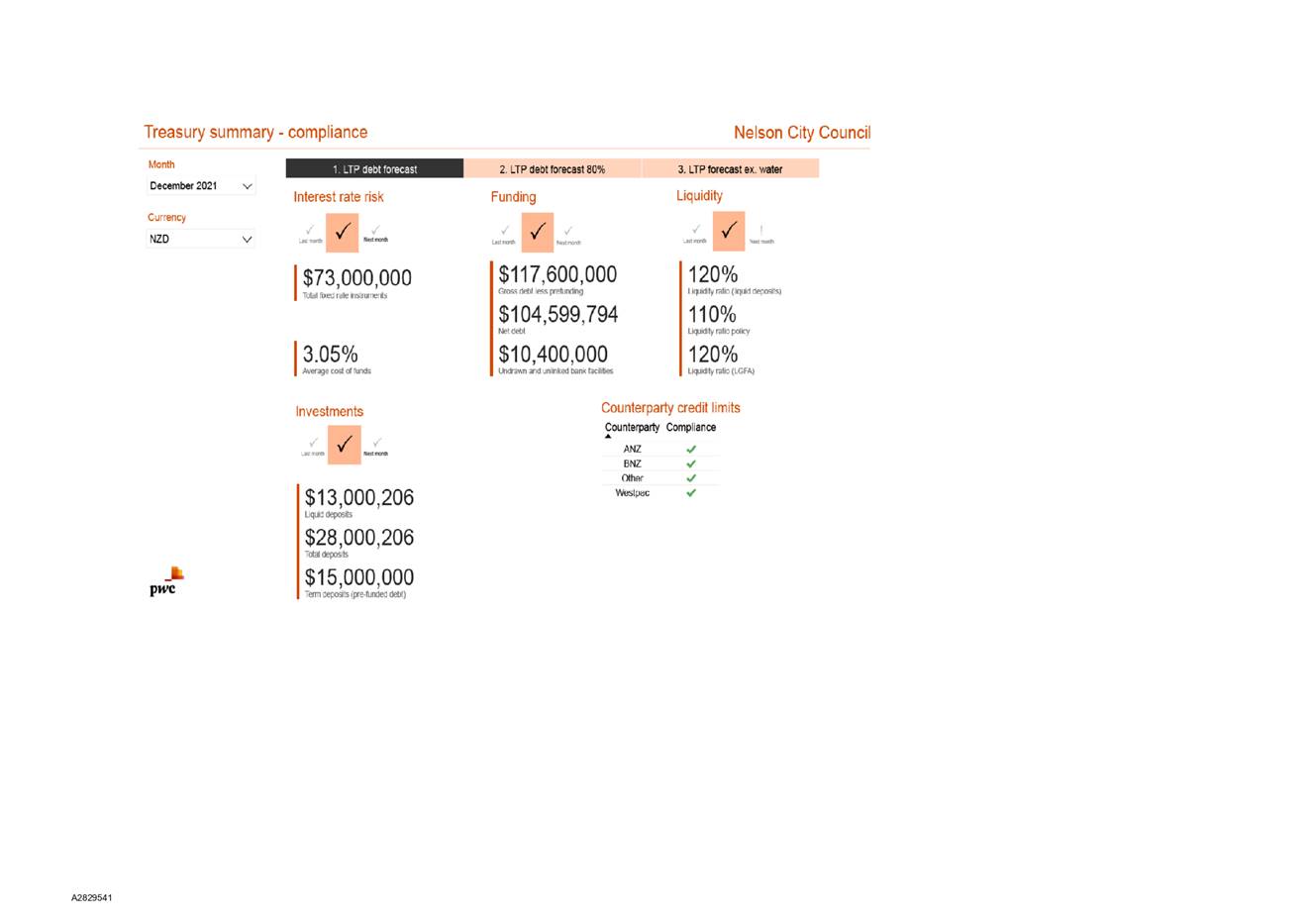

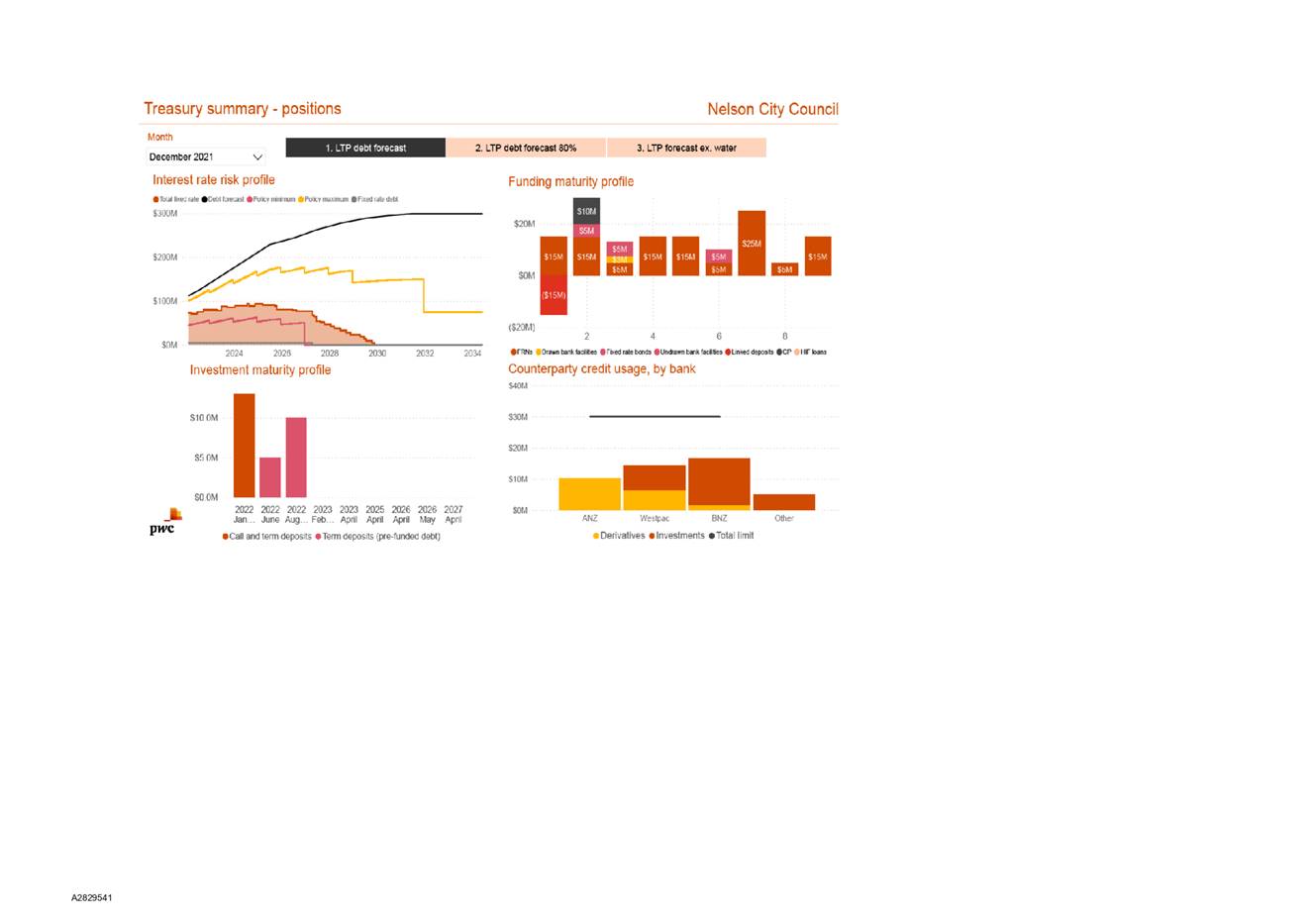

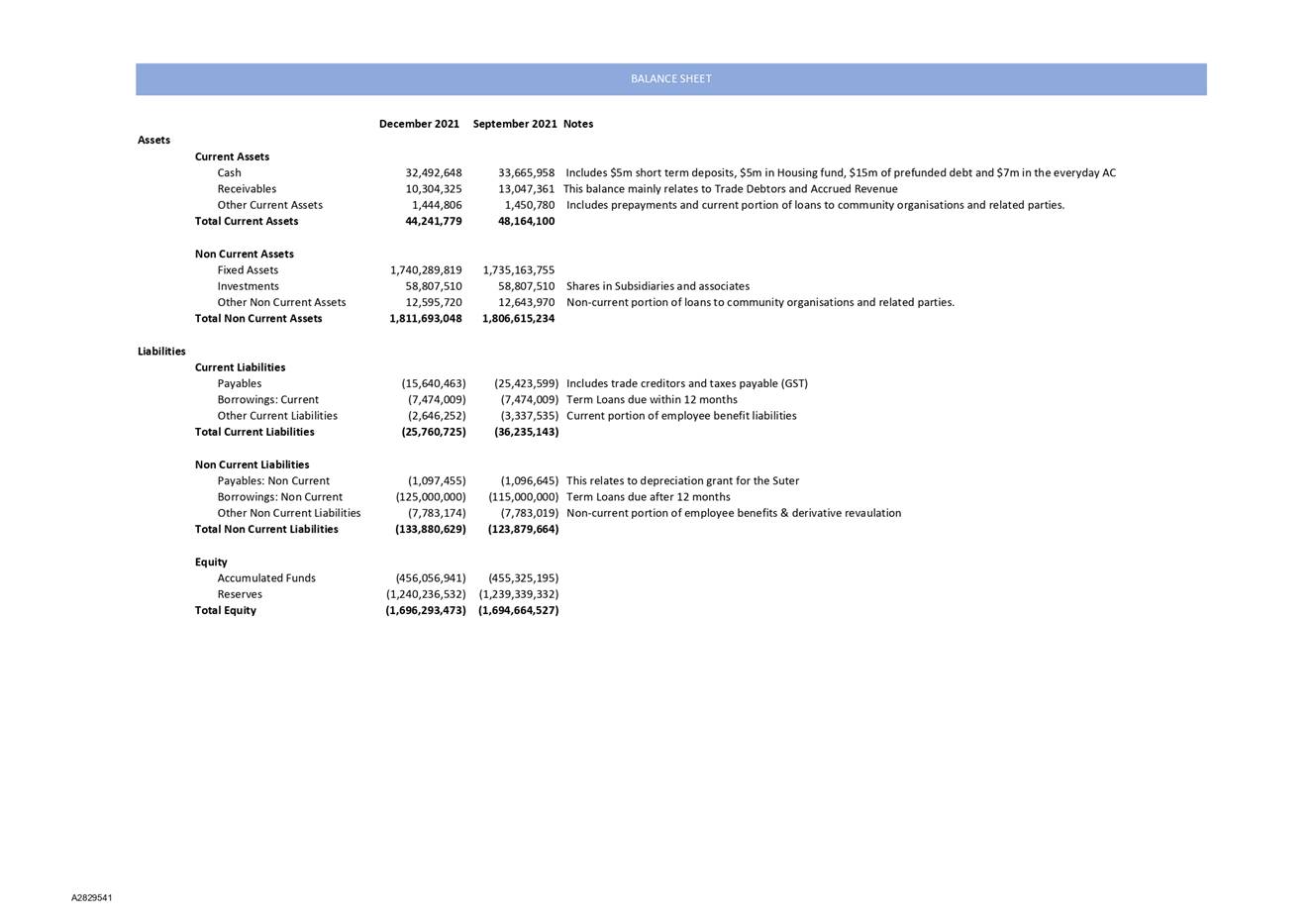

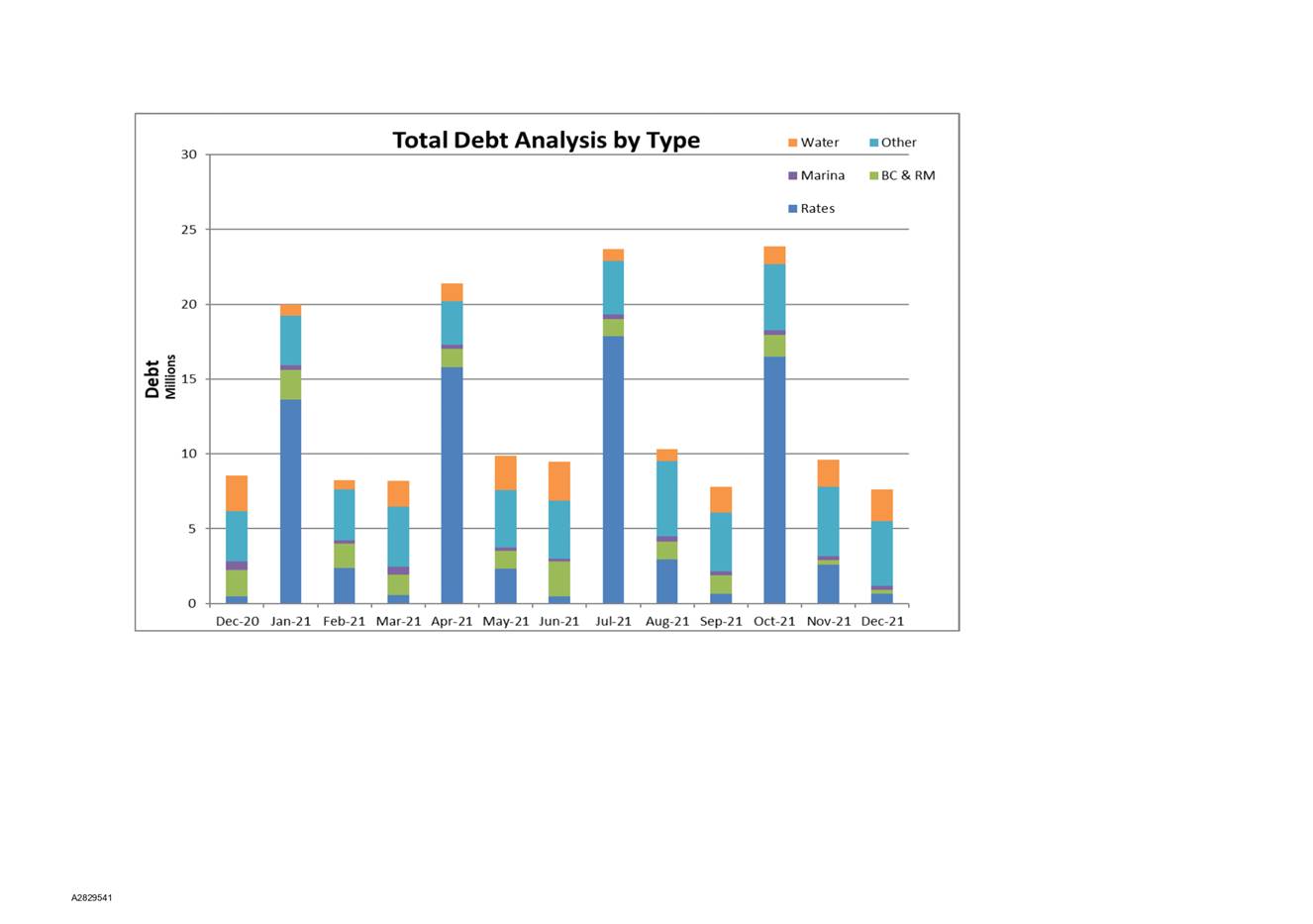

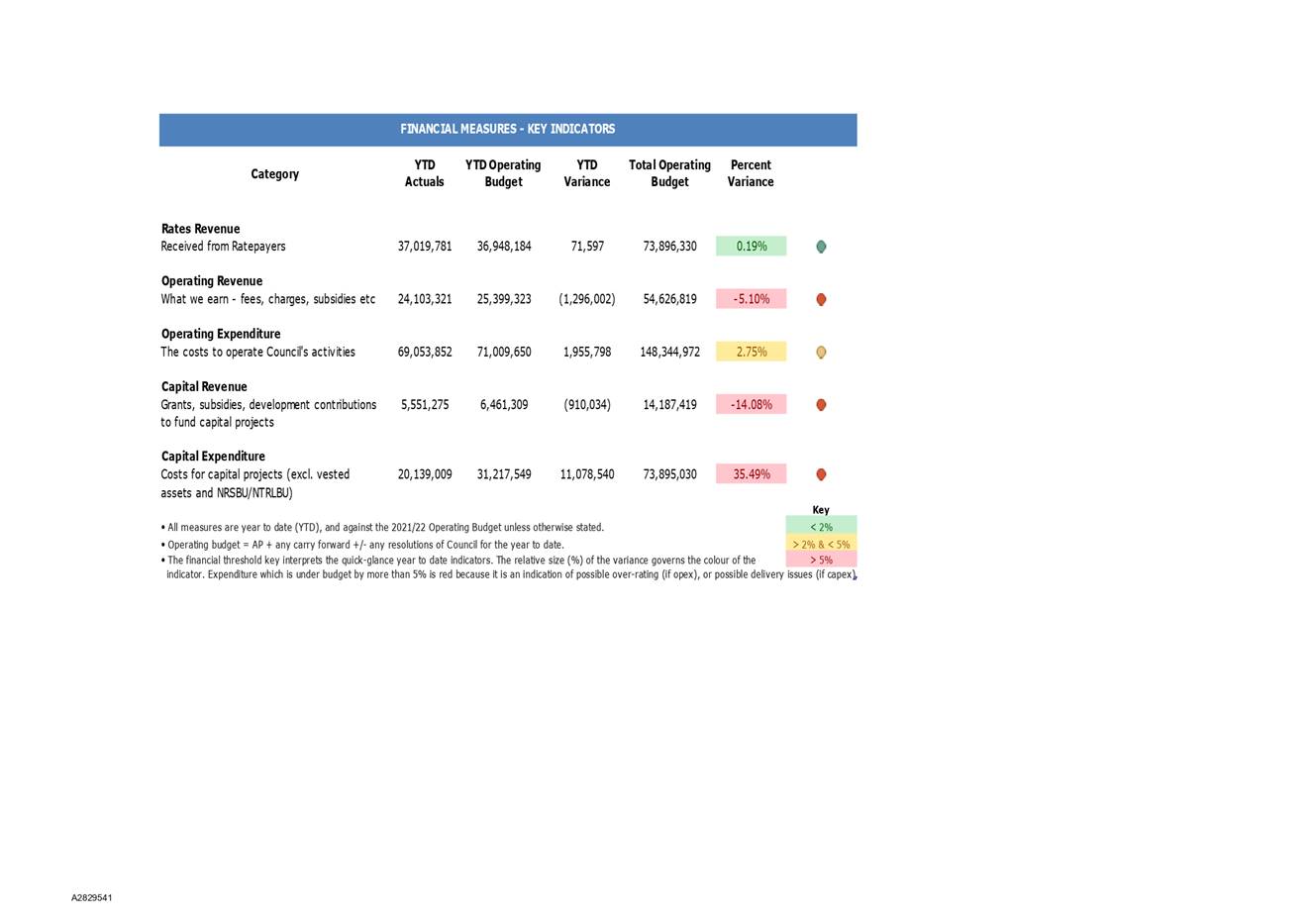

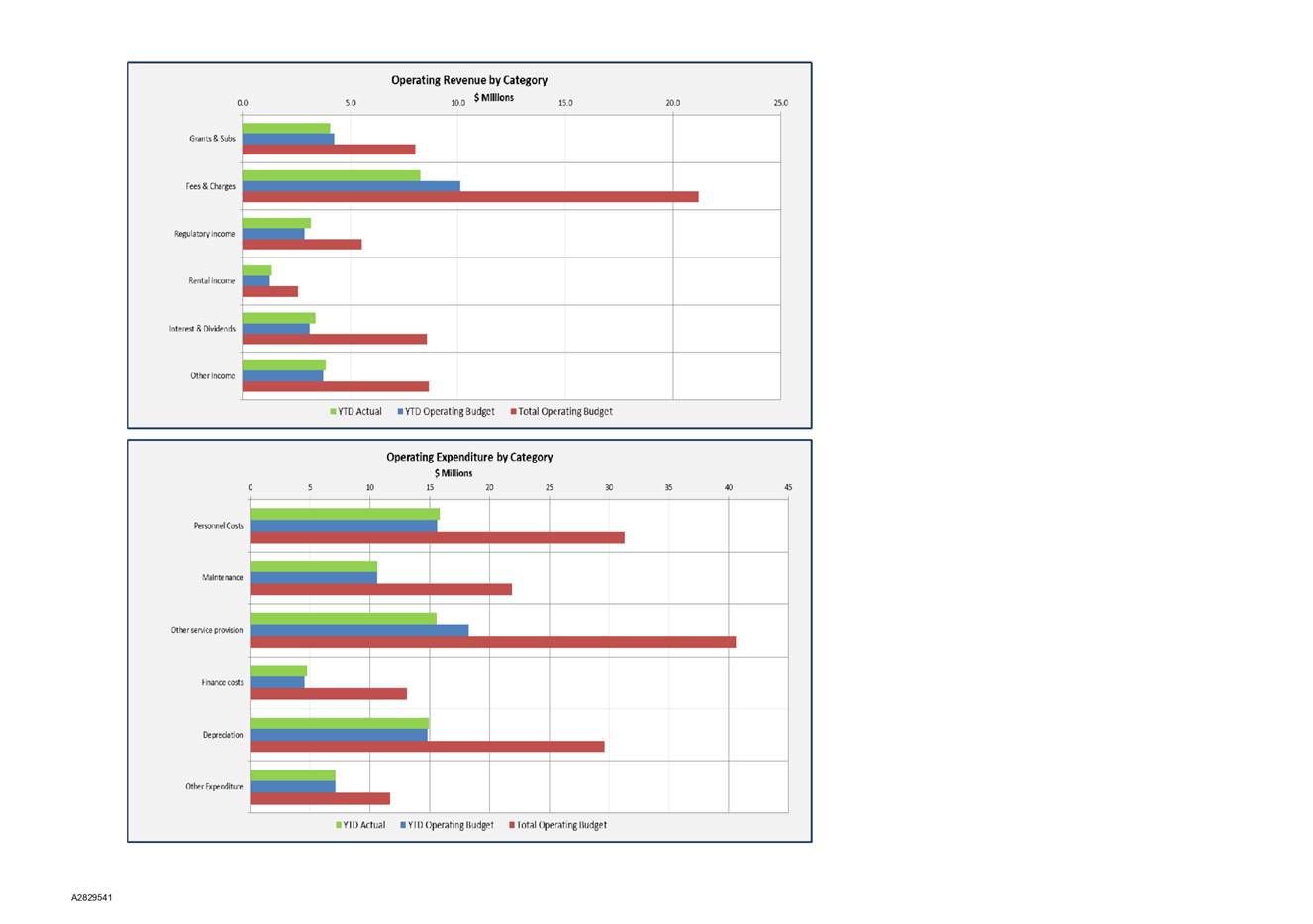

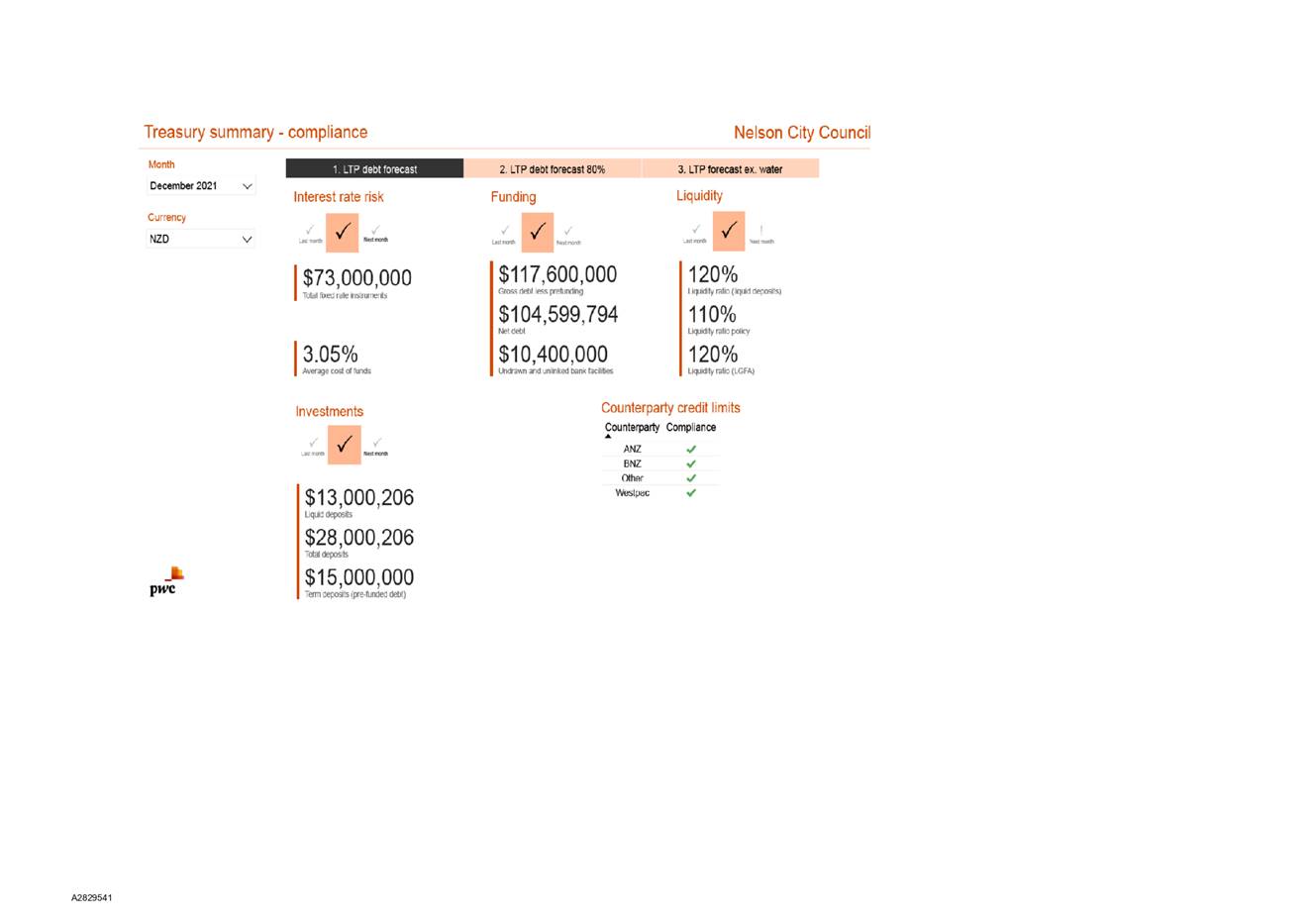

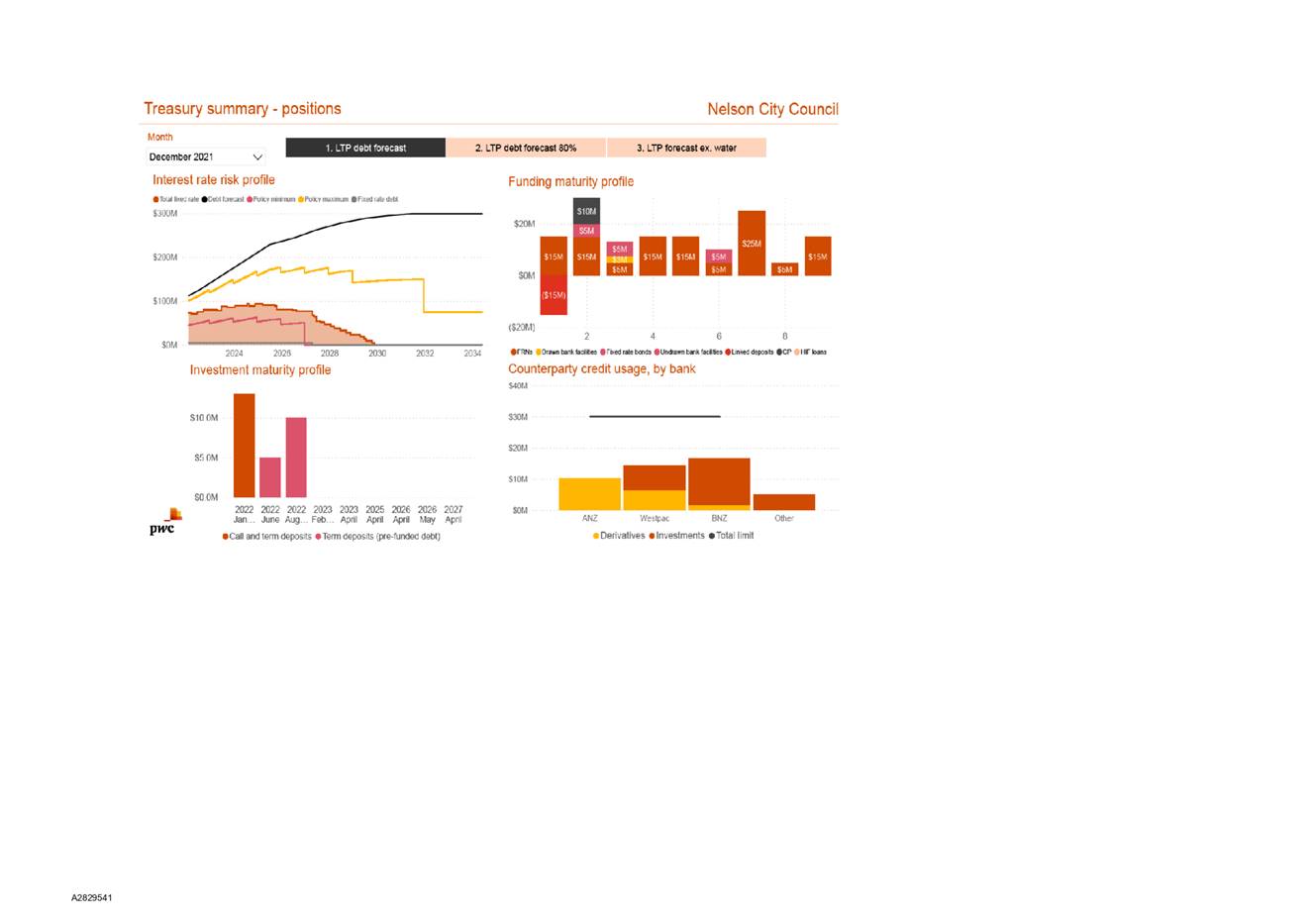

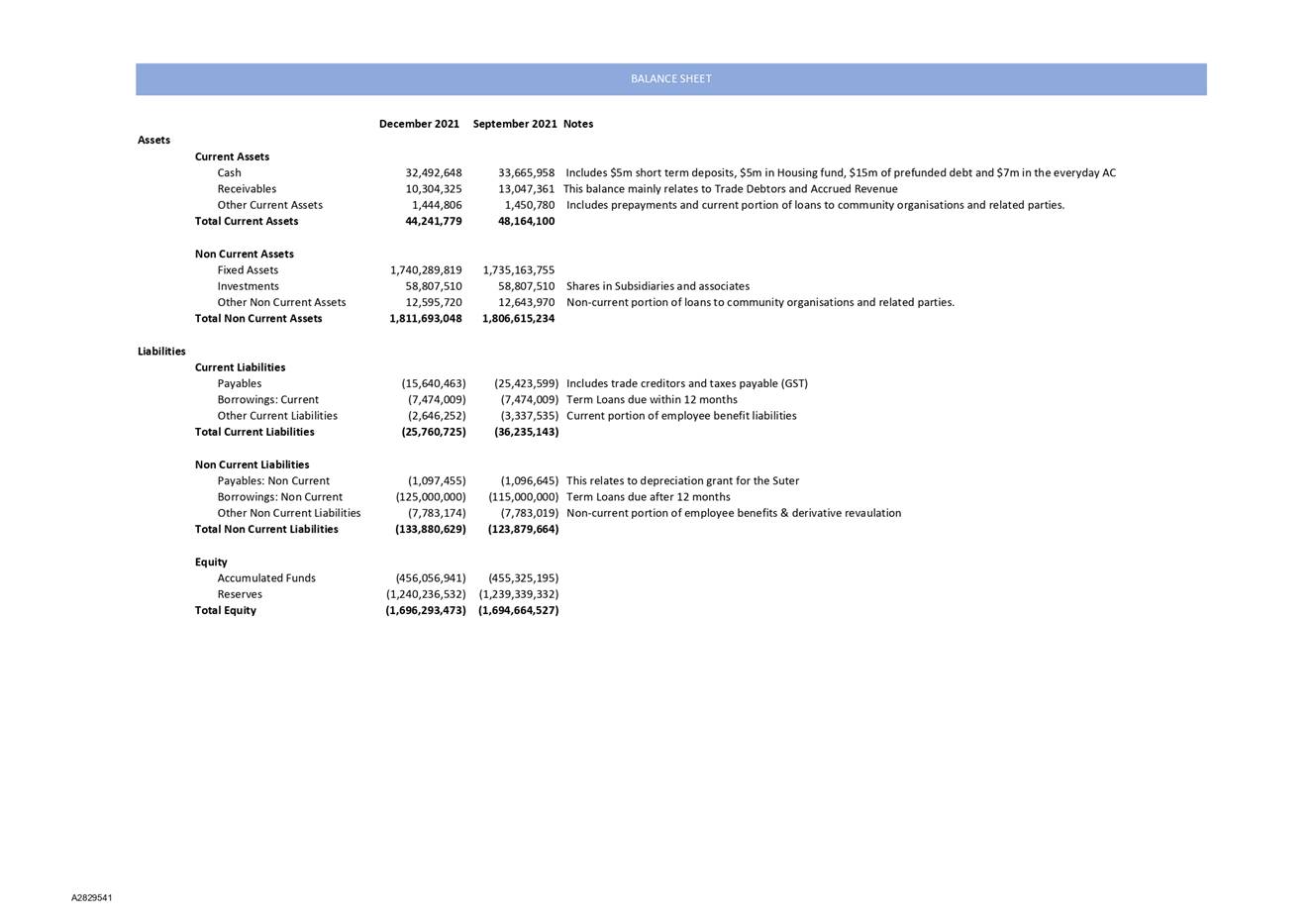

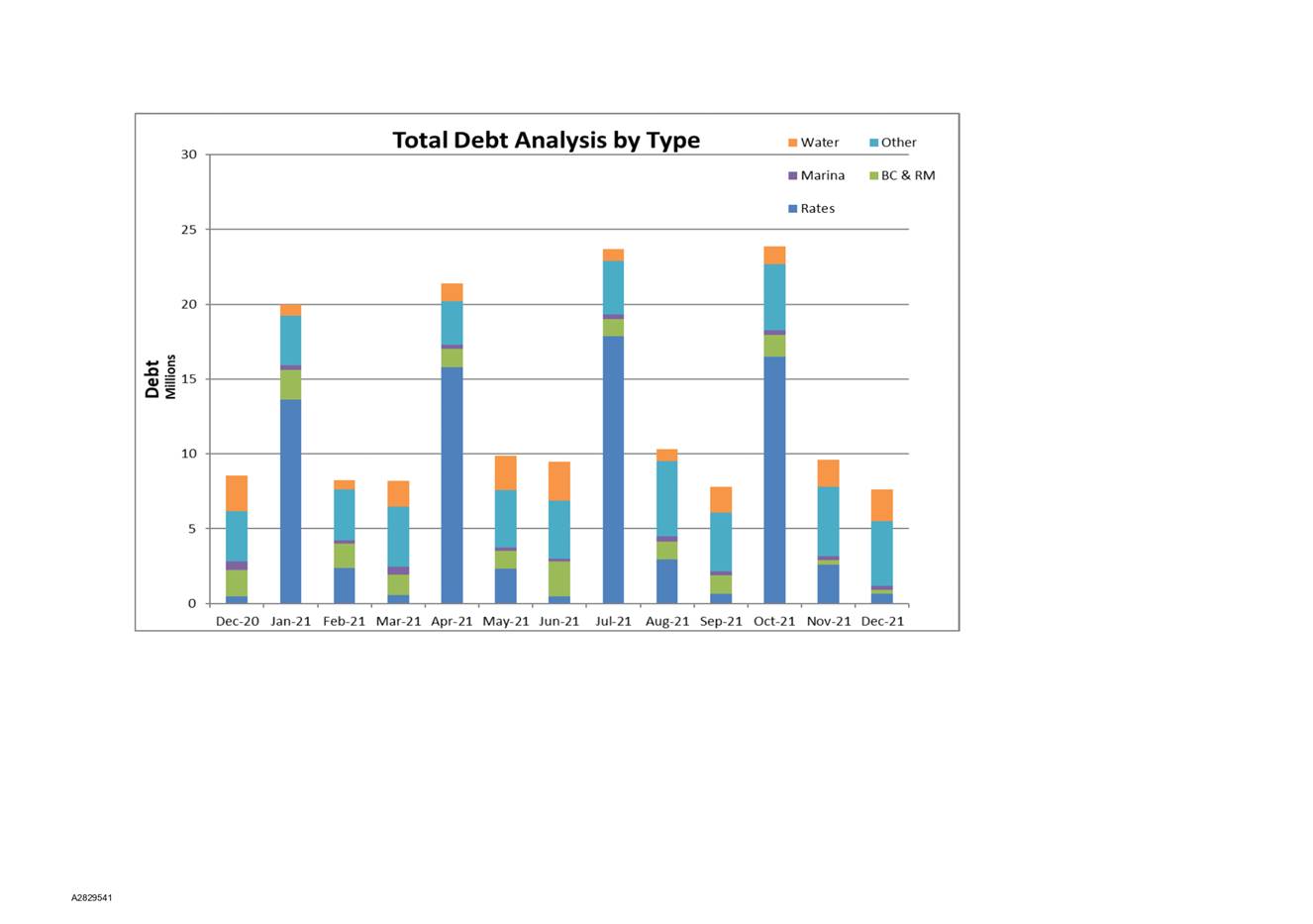

Attachment 1: A2829541 - Finance

Dashboard and Graphs - Quarter Two 2021/22 ⇩

Attachment 2: A2821555

- All of Council Project Health Summary - Quarter Two 2021/22 ⇩

Attachment 3: A2750424

- All activities' performance measure results - Quarter Two 2021/22 ⇩

Item

8: Quarterly Finance Report - 31 December 2021: Attachment 1

Item 8: Quarterly Finance Report - 31

December 2021: Attachment 2

Item

8: Quarterly Finance Report - 31 December 2021: Attachment 3

Item 9: Quarterly

Health, Safety and Wellbeing Report - 31 December 2021

|

|

Audit, Risk and Finance Subcommittee

22 February 2022

|

REPORT R26521

Quarterly

Health, Safety and Wellbeing Report - 31 December 2021

1. Purpose

of Report

1.1 To

provide the Subcommittee with a report on health, safety and wellbeing data

collected over the period October to December 2021.

1.2 To

update the Subcommittee on key health and safety risks, including controls and

treatments.

2. Summary

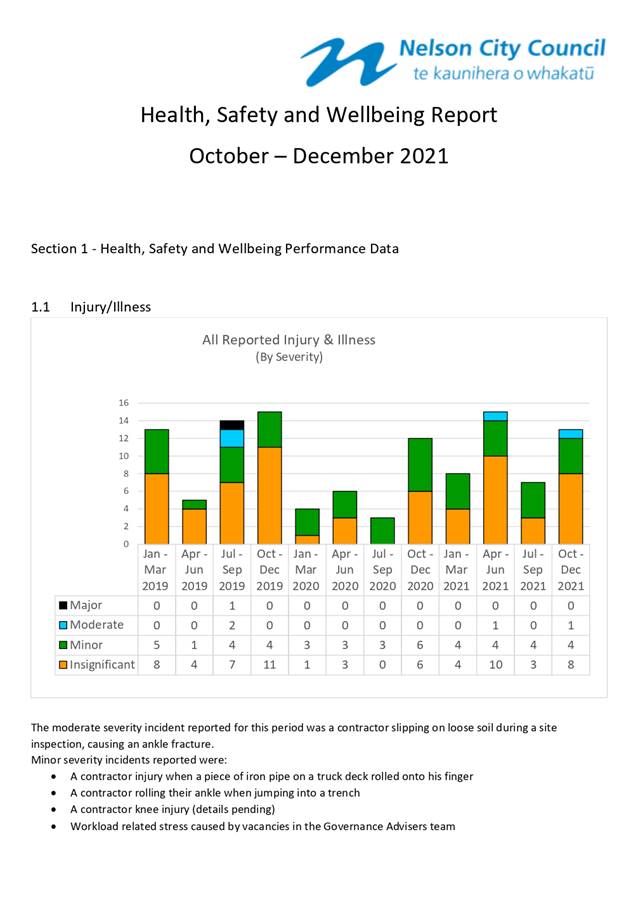

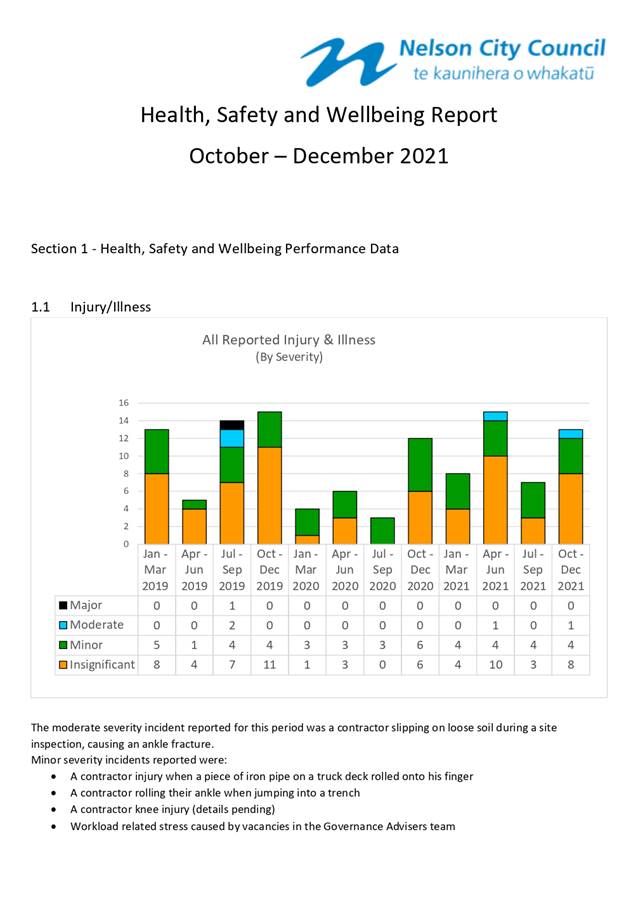

2.1 Significant

incidents reported for this period are an enforcement contractor slipping on

loose soil causing an ankle fracture and two cable strike incidents on a

Council project.

2.2 Council’s

key health and safety risks have been reviewed resulting in significant changes

to the categories reported on.

3. Recommendation

|

That the Audit, Risk and Finance Subcommittee

1. Receives

the report Quarterly Health, Safety and Wellbeing Report - 31 December 2021

(R26521) and its attachment

(A2818999).

|

4. Background

4.1 Elected

members, as ‘Officers’ under the Health and Safety at Work Act 2015

(HSWA), are required to undertake due diligence on health and safety matters.

Council’s Health and Safety Governance Charter states that Council will

receive quarterly reports regarding the implementation of health and

safety. Council has delegated the responsibility for health and safety to

the Audit, Risk and Finance Subcommittee.

4.2 Health,

safety and wellbeing performance data reports provide an overview based on key

lead and lag indicators. Where a concerning trend is identified more detail is

provided in order to better understand issues and implement appropriate

controls.

5. Discussion

5.1 Incidents

of note

5.1.1 An

enforcement contractor slipped on loose soil during a visit to a residence

causing an ankle fracture.

5.1.2

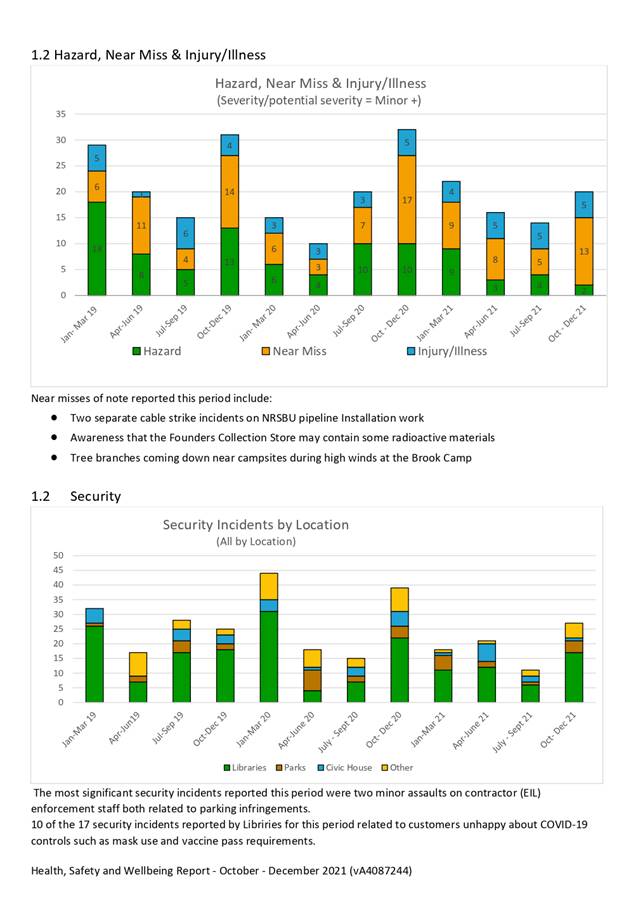

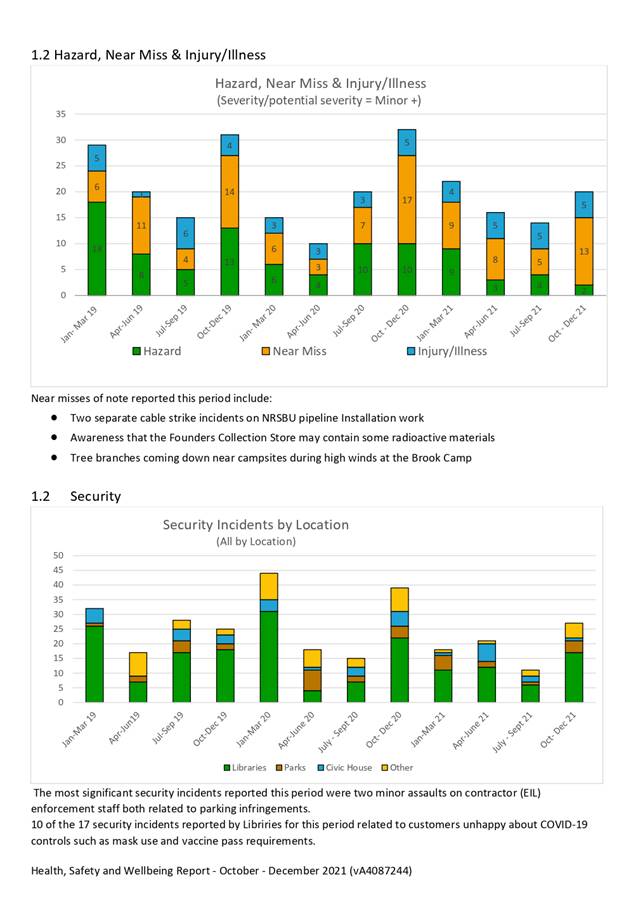

Two cable strike near miss incidents involving a high voltage cable occurred on

the same Council project. A process was followed by Council’s contractor

to identify services, however this incident has highlighted significant

limitations in the way services are located by utility providers. Lessons

learnt from the incident have been shared and procedures improved to prevent a

reoccurrence.

5.1.3 A

risk assessment has identified that some items in the Founders collection store

may contain radioactive materials. This is considered a low risk as long as

controls are in place when items are handled.

5.1.4 Tree

branches fell near a camp site during high winds at the Brook Valley Holiday

Park. Trees at the Brook Camp are periodically inspected by an arborist. The investigation

of this incident is considering options to improve this process and reduce the

risk further.

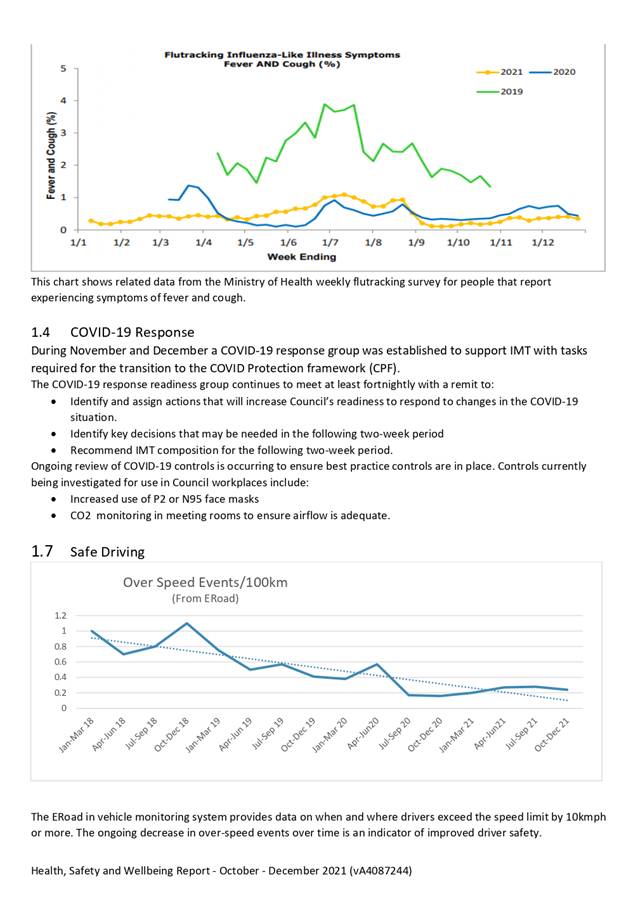

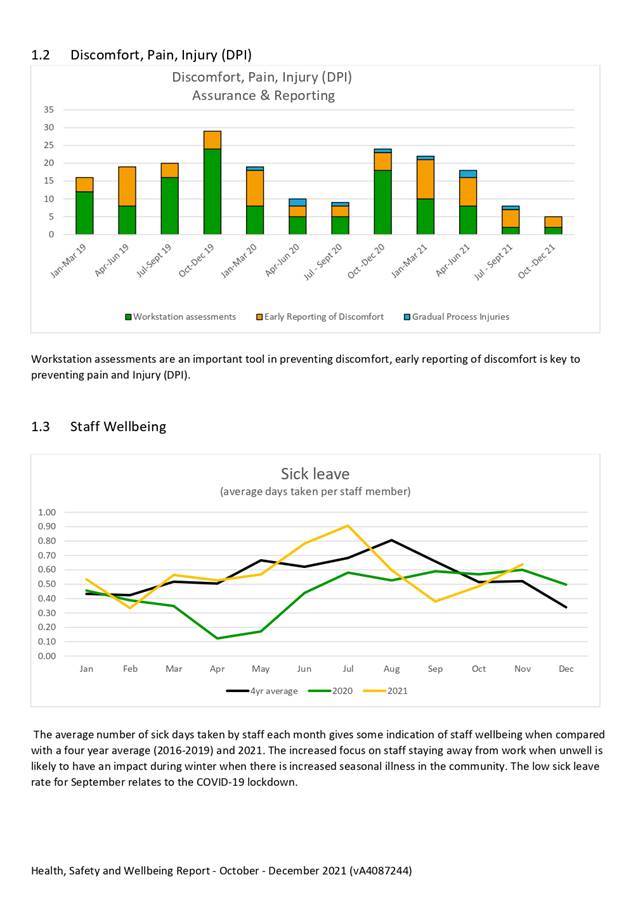

5.2 COVID-19

Response

5.2.1 Preparation

for the COVID-19 protection framework required considerable resource across the

organisation and impacted other work programs.

5.2.2 The

implementation of the requirement for vaccine passes (CVCs) in libraries has

resulted in an increase in difficult customer interactions but has also

received a lot of positive feedback from customers.

5.2.3 COVID-19

controls are reviewed on an ongoing basis as new information becomes available.

Additional controls being considered include increased use of N95 masks and CO2

monitoring in meeting rooms to indicate if airflow is adequate to reduce risk

from COVID-19.

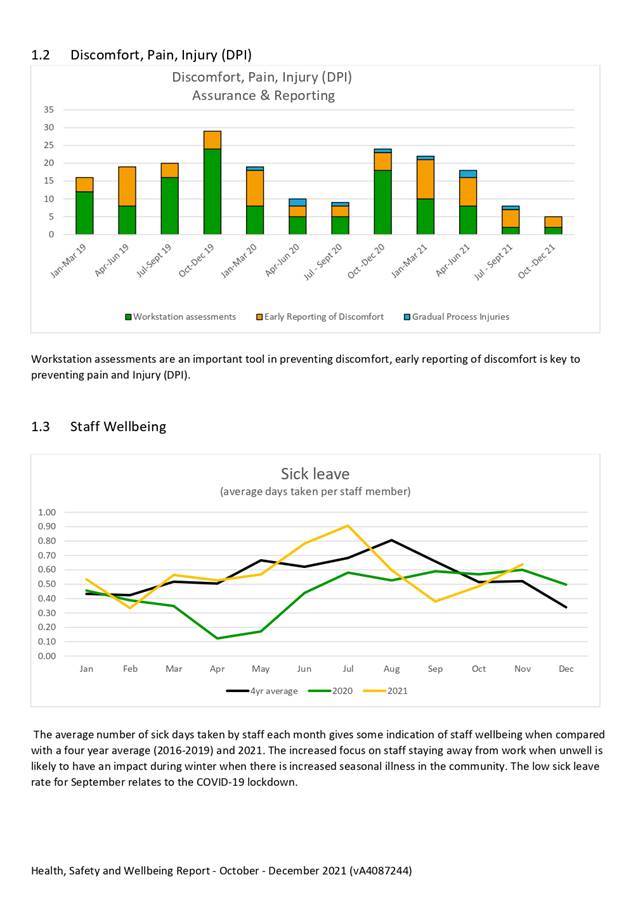

5.3 Lead

Indicators

5.3.1 Low

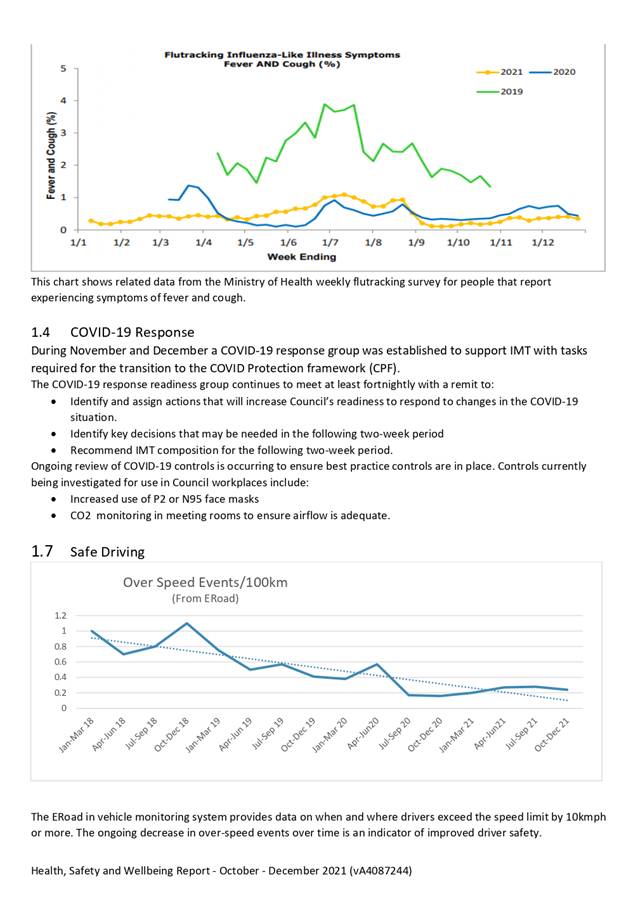

rates of overspeed events continue

5.3.2 Workgroup

toolbox talk completion continues to be an area where some workgroups need to

improve.

5.3.3 Although

not as high as the previous year contractor health and safety oversight activities

reported continue to exceed historical data.

5.4 Due

Diligence Activities

5.4.1 Three

separate Safe work observations or safety tours were completed. Three SLT

members and four elected members attended these site visits.

5.4.2 There

is now sufficient data to show these activities in a chart. Although targets

were not reached for this quarter they were exceeded for the calendar year.

6. Key

Health and Safety Risk Review

6.1 Key

health safety risks have been reviewed with particular attention to the inclusion

of emerging or new key risk areas and greater clarity through refined

categories.

6.2 Changes

or new work completed by Council staff that have been considered in this review

includes: marina work, increased roles involved in environmental monitoring,

the ongoing COVID-19 pandemic, increased remote working and upcoming changes in

local government such as the three waters reform.

6.3 Previous

reports included the following key risk categories:

· Health and safety

oversight of contractors

· Customer aggression

· Workplace stress and

sedentary work

· Lone, remote or isolated

work

· Driving

· Marina risks (temporary

category)

6.4 Two

categories remain unchanged in this report:

· Contractor

Health and Safety management, and

· Customer Aggression

6.5 Workplace

stress and sedentary work, previously a single category has been separated into

two new categories:

· Workplace

stress, and

· Sedentary or strenuous

work

6.6 Three

categories have been removed or integrated into other categories:

· Driving

· Marina risks

· Lone, remote or isolated

work.

Key aspects of the risks in

these categories have been included in two new categories, high energy sources

and emergency preparedness.

6.7 Two

new categories have been added:

· COVID-19

· Emergency Preparedness

6.8 Further

details of each risk including their controls and treatments are outlined in

the attachment and can be summarised as:

6.8.1 Contractor

Health and Safety management – medium (6), no change

6.8.2 Customer

Aggression – medium (9), no change

6.8.3 Workplace

stress – medium (8) new category to reflect upcoming period of

considerable change.

6.8.4 Sedentary

or strenuous work – medium (6) new category separated from workplace

stress that is anticipated to move to a low risk following minor improvements in

focus on controls. These risks are grouped together because the systems and

processes for controlling them are to a large extent the same and rely on

prevention or early detection as the most effective controls.

6.8.5 COVID-19

- medium (10) a new category to reflect the ongoing pandemic and the risk

presented by new variants of the disease such as omicron. It is anticipated

that this will be a temporary category.

6.8.6 High

energy sources – medium (8) new category to better capture a range of

high consequence low likelihood risks. And includes risks previously captured

in Driving, Marina and Remote and Isolated Work.

6.8.7 Emergency

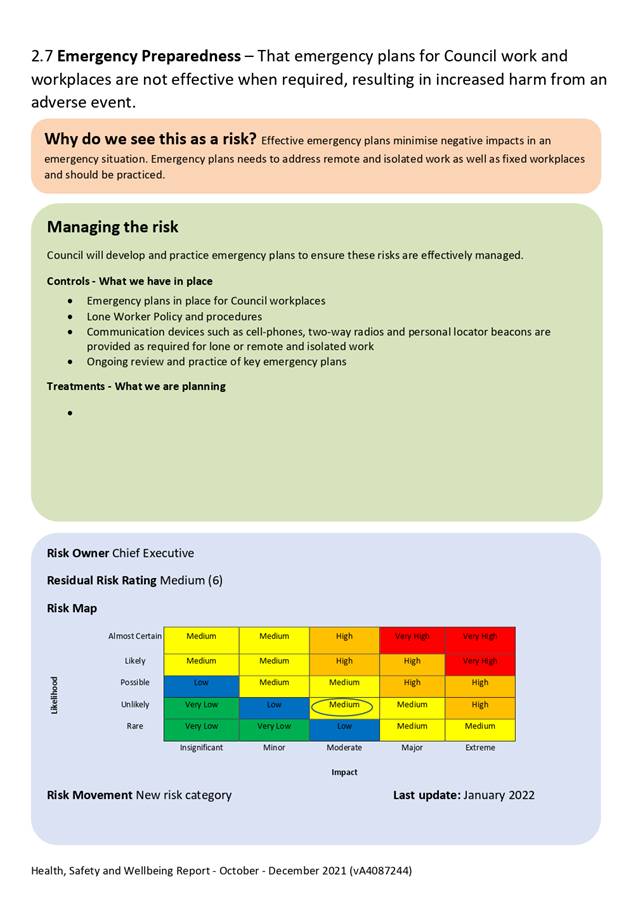

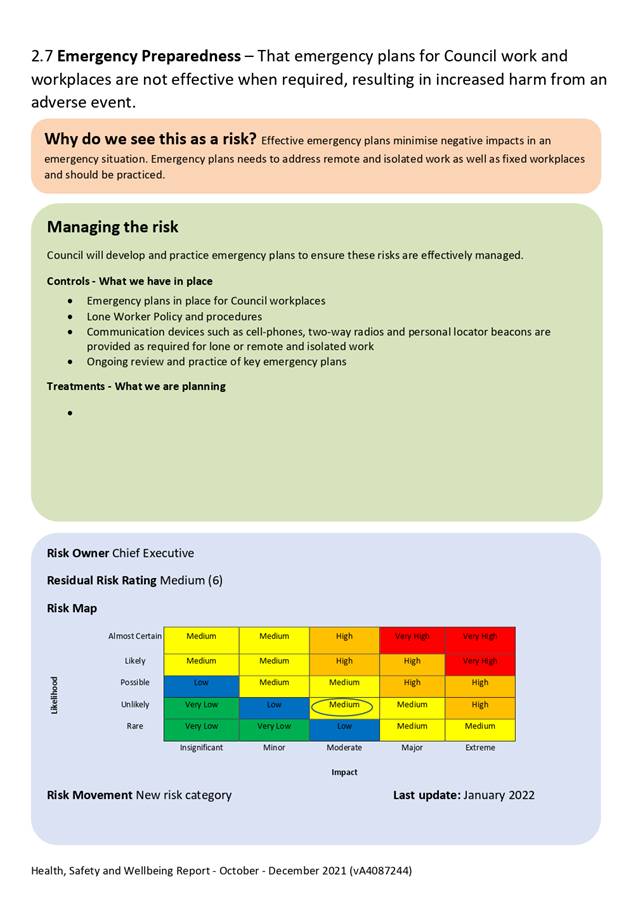

preparedness – medium (6) new category that includes aspects of the

previous lone or remote and isolated work risk.

Author: Malcolm

Hughes, Health Safety and Wellness Adviser

Attachments

Attachment 1: Health, Safety and

Wellbeing Report, October -December 2021 (A2818999) ⇩

Item

9: Quarterly Health, Safety and Wellbeing Report - 31 December 2021: Attachment

1

Item 10: Quarterly

Internal Audit Report - 31 December 2021

|

|

Audit, Risk and Finance Subcommittee

22 February 2022

|

REPORT R26485

Quarterly

Internal Audit Report - 31 December 2021

1. Purpose

of Report

1.1 To

update the Audit, Risk and Finance Subcommittee on the internal audit activity

for the quarter to 31 December 2021.

2. Recommendation

|

That the Audit, Risk and Finance Subcommittee

1. Receives

the report Quarterly Internal Audit Report - 31 December 2021 (R26485) and its attachment (A2813648).

|

3. Background

3.1 Under

Council’s Internal Audit Charter approved by Council on 15 November 2018

the Audit, Risk and Finance Subcommittee requires a periodic update on the

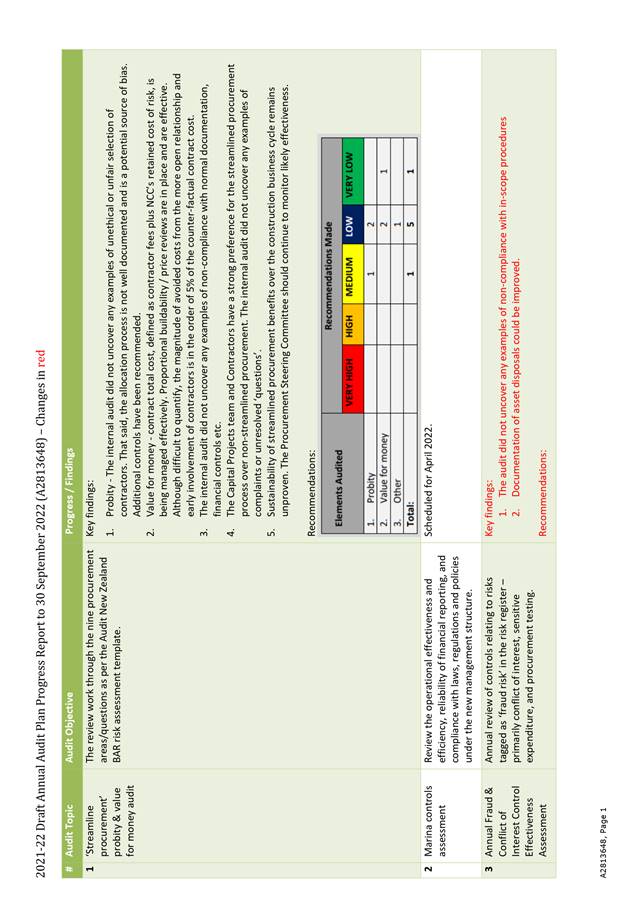

progress of internal audit activities. The 2021-22 Internal Audit Plan (the

Plan) was approved by the Audit, Risk and Finance Subcommittee on 25 May 2021.

The Plan provides for three planned audits, with an allowance for a further two

unplanned audits.

4. Overview

of Progress on the 2020-22 Internal Audit Plan

4.1 Two

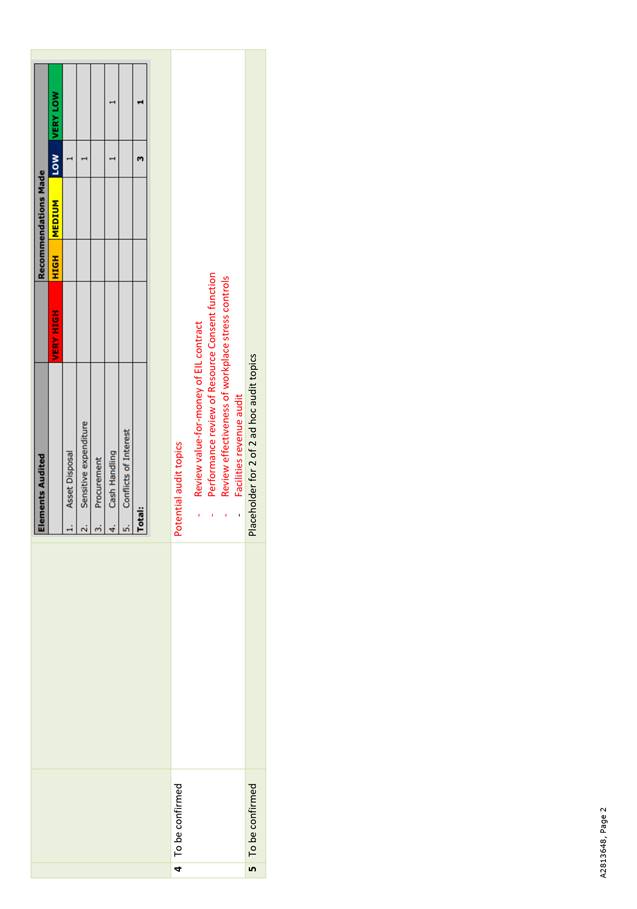

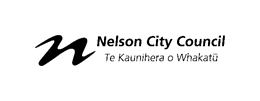

of the three planned audits have been completed as at 31 December 2021. Further

details of plan progress is provided in attachment Annual Audit Plan Progress

to 31 December 2021, and an overview provided below.

4.2 The

annual fraud internal audit was completed in November 2021. The audit assessed

compliance with fraud related controls relating to asset disposals, sensitive

expenditure, procurement, cash handling and conflicts of interest. The audit

did not uncover any examples of non-compliance with in-scope procedures however

documentation of asset disposals could be improved. The audit resulted in four

recommendations (three low and one very low). As at the end of quarter two

2021-22, two of the recommendations have been resolved and one partially

resolved.

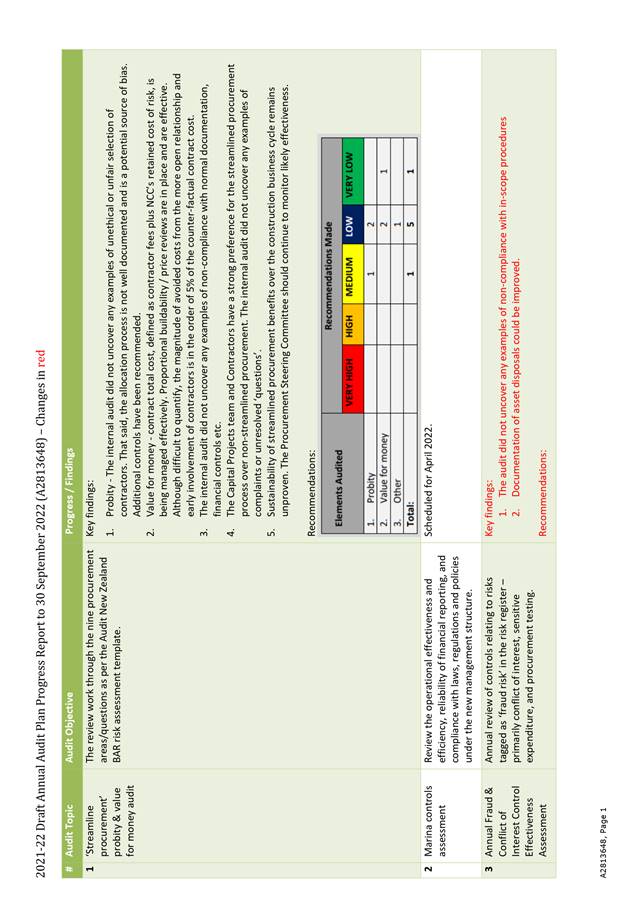

4.3 The

two unplanned internal audits placeholders have now been filled:

4.3.1 The

Trafalgar Centre revenue audit is currently in progress. This audit was

selected given the upcoming 2021/22 s17A review and review of the management

contract (which expires in 2022/23).

4.3.2 The

EIL regulator services value for money audit is yet to commence. This audit was

selected following the potential topics raised at the Audit, Risk and Finance

subcommittee last quarter and after management feedback on feasible scope and

timing of each audit. This audit was selected as it was deemed to be the most

feasible and the audit could assist in the related Section 17A review that is

due by 30 June 2022. Audit topics that were not selected this year will

be considered for inclusion in the 2022/23 audit plan.

5. New

and Outstanding Significant Risk Exposures and Control Issues Identified from

Internal Audits

5.1 There

are no new significant risk exposures identified from internal audits and there

were no outstanding items at end of quarter one 2021-22.

6. Significant

external audits that are not reported separately to the Audit, Risk and Finance

Subcommittee

6.1 As noted in the prior

quarter, the audit of the 2021 rating revaluation will be performed by the

Office of the Valuer General over December/January. Audit approval is expected

at the end of January.

6.2 Terms

of Reference and appointment of an external auditor for the review of

Council’s management process for all large projects (including a section

on the Greenmeadows Pūtangitangi building) was completed by the Working

Group in December 2021.

Author: Chris

Logan, Audit and Risk Analyst

Attachments

Attachment 1: A2813648 Annual

Audit Plan Progress to 31 Dec 2021 ⇩

Item

10: Quarterly Internal Audit Report - 31 December 2021: Attachment 1

Item 11: Quarterly Risk

Report - 31 December 2021

|

|

Audit, Risk and Finance Subcommittee

22 February 2022

|

REPORT R26486

Quarterly

Risk Report - 31 December 2021

1. Purpose

of Report

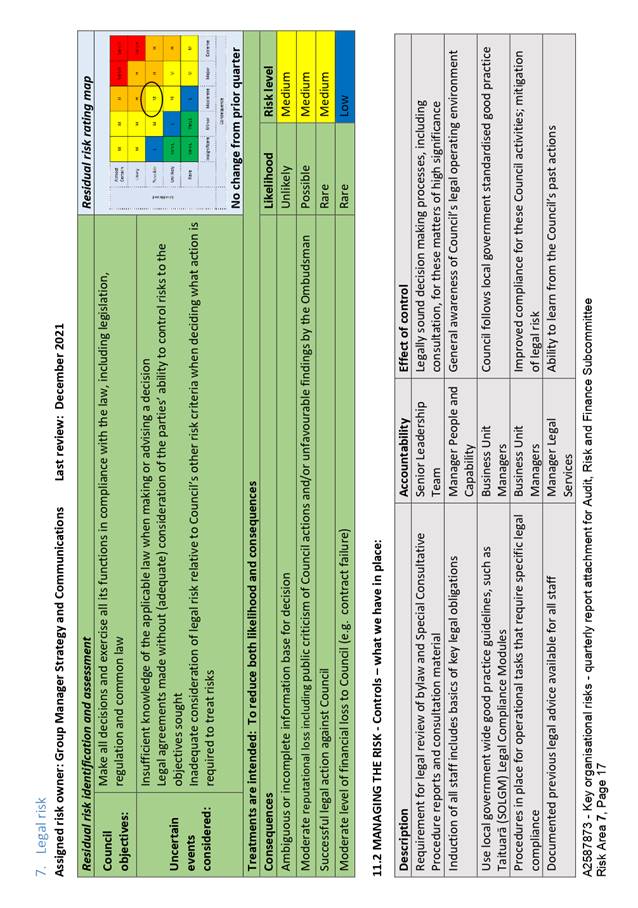

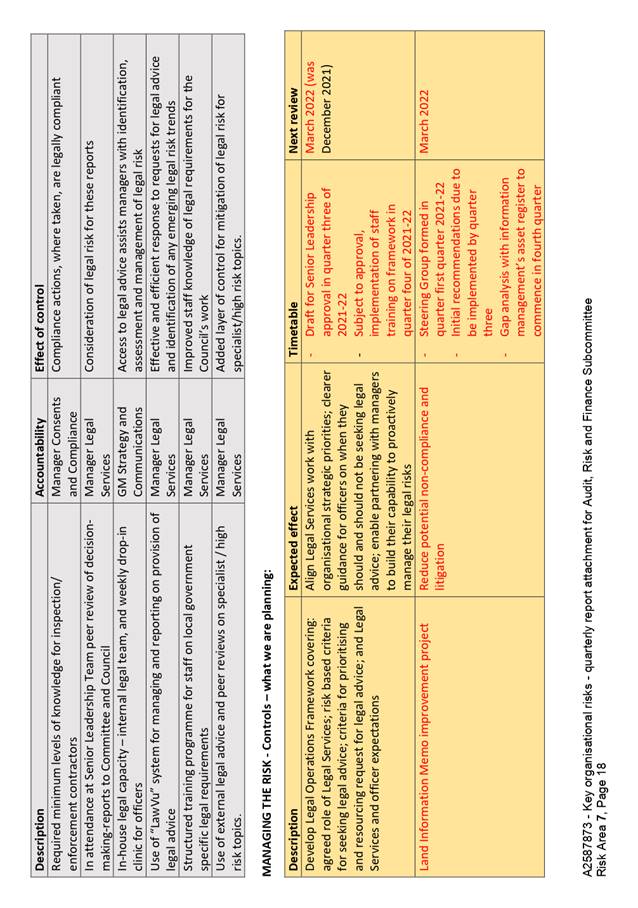

1.1 To

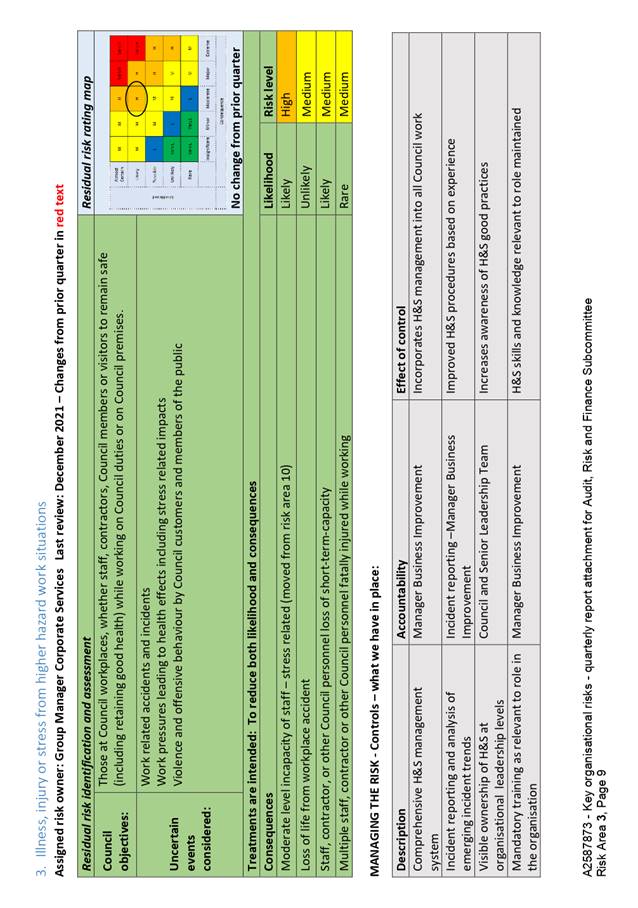

provide information to the Audit, Risk and Finance Subcommittee on the

organisational risks through to end of quarter two 2021-22.

2. Recommendation

|

That the Audit, Risk and Finance Subcommittee

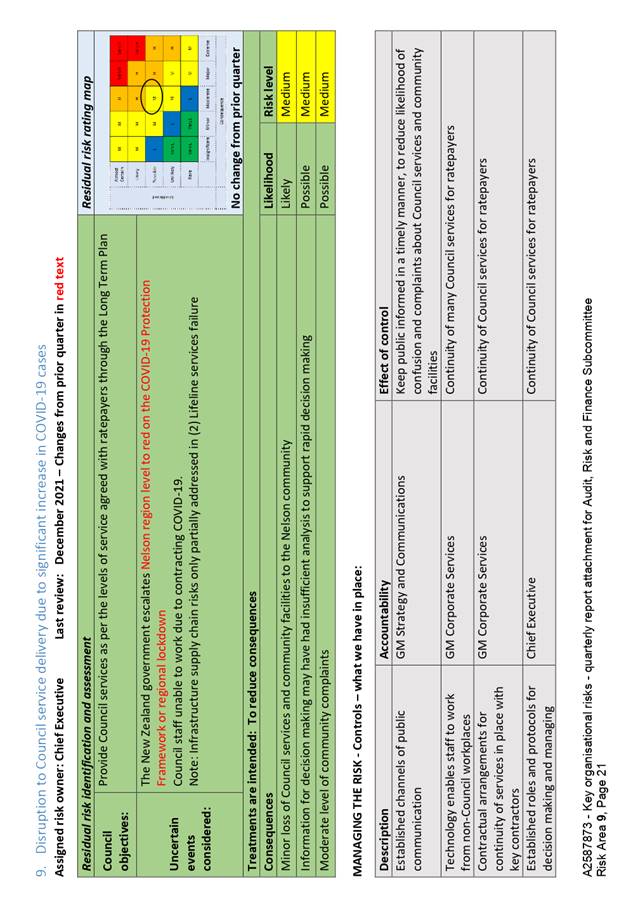

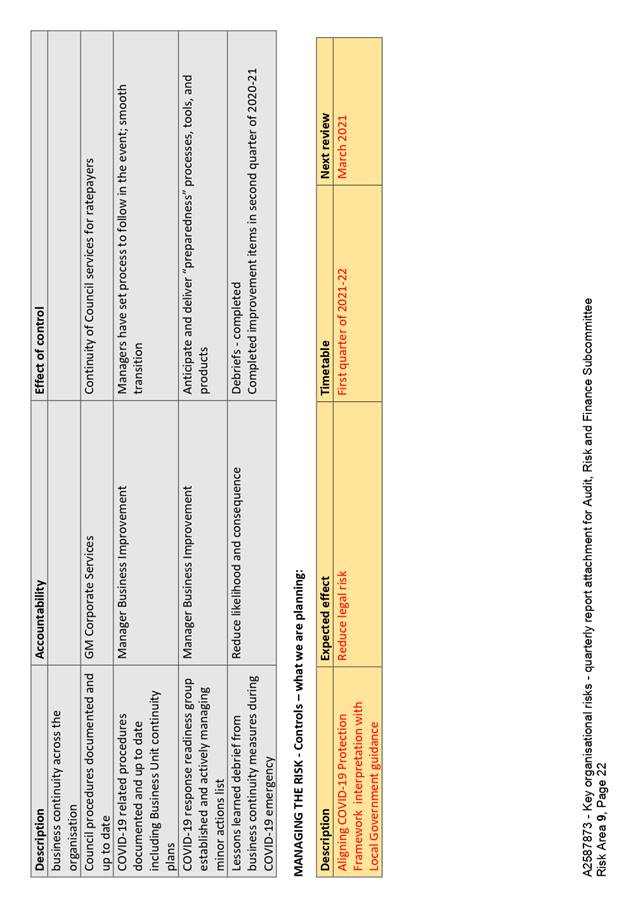

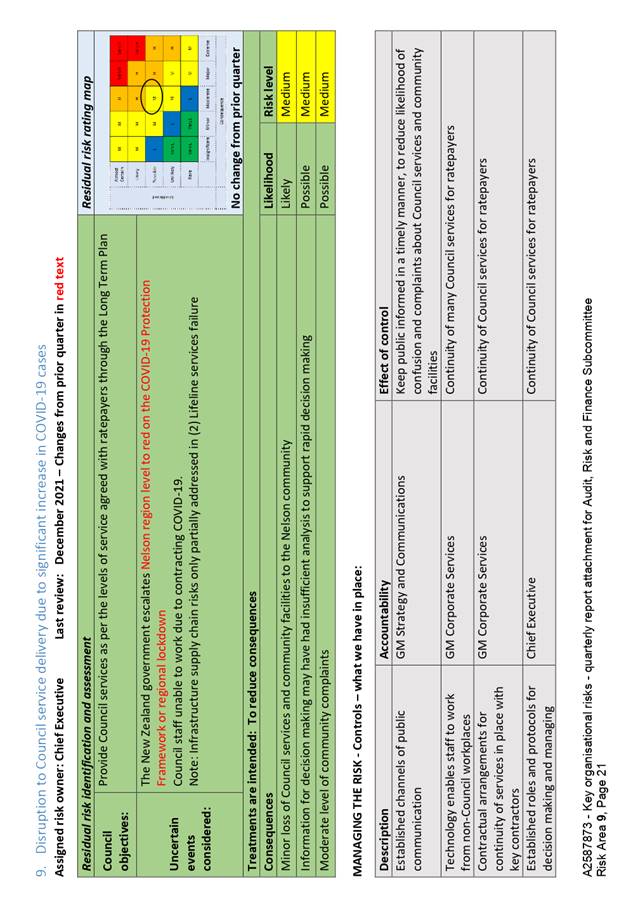

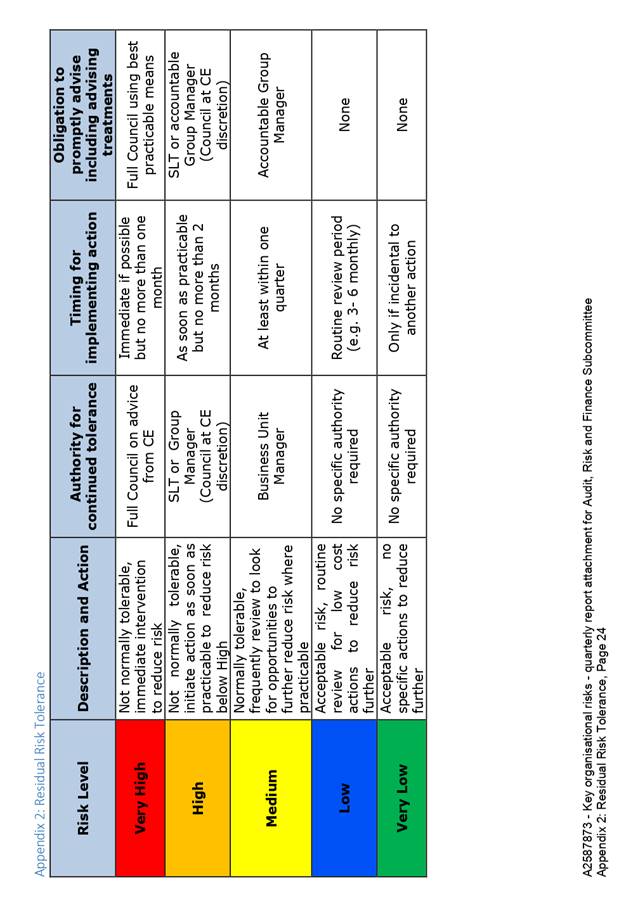

1. Receives

the report Quarterly Risk Report - 31 December 2021 (R26486) and its attachment (A2587873).

|

3. Background

3.1 This

report includes information on risk management practice, a summary of council

risks and a deeper dive into key risk areas, sliced by risk theme

(organisational risks) and reporting group.

3.2 Due to the summer holiday

period, the reporting close date for this report is 21 December 2021. The

early close was considered reasonable in light of the fact that normally the

delay between the end of the reporting period and the date of the subcommittee

is just under two months.

4. Risk

Management Practice

4.1 The

2021-22 risk management work plan is on track:

4.1.1 risk

training for two business units was completed over quarter

one of 2021-22;

4.1.2 partly

automated risk reporting is now available to Group Managers to further embed

management oversight of risk;

4.1.3 no

progress has been made on reporting enterprise level risk metrics in this

report to inform and test against an organisation wide risk appetite however

this is only due in the second half of the financial year;

4.1.4 The

risk management maturity self-assessment was completed and reported in quarter

one of 2021-22; and

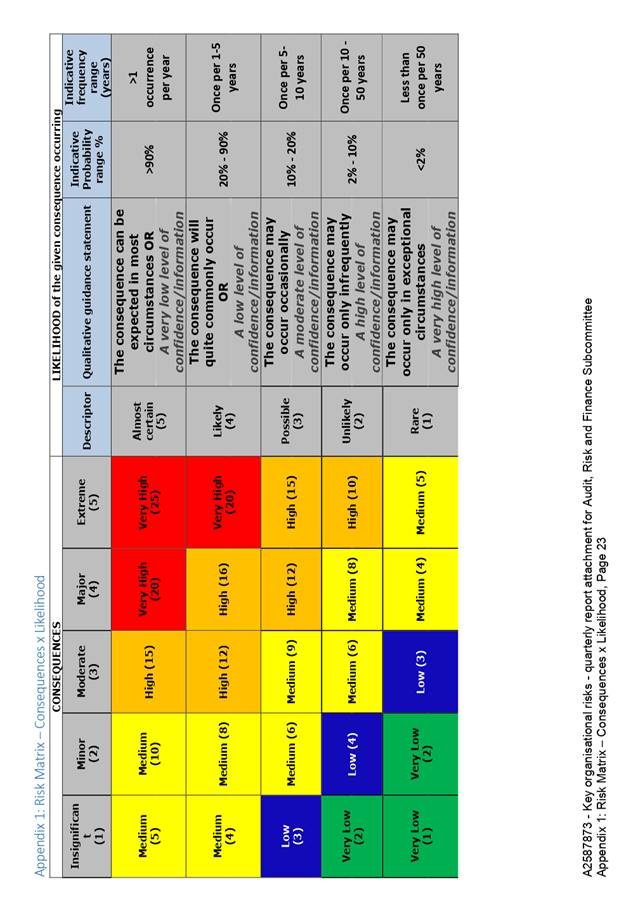

4.2 Following

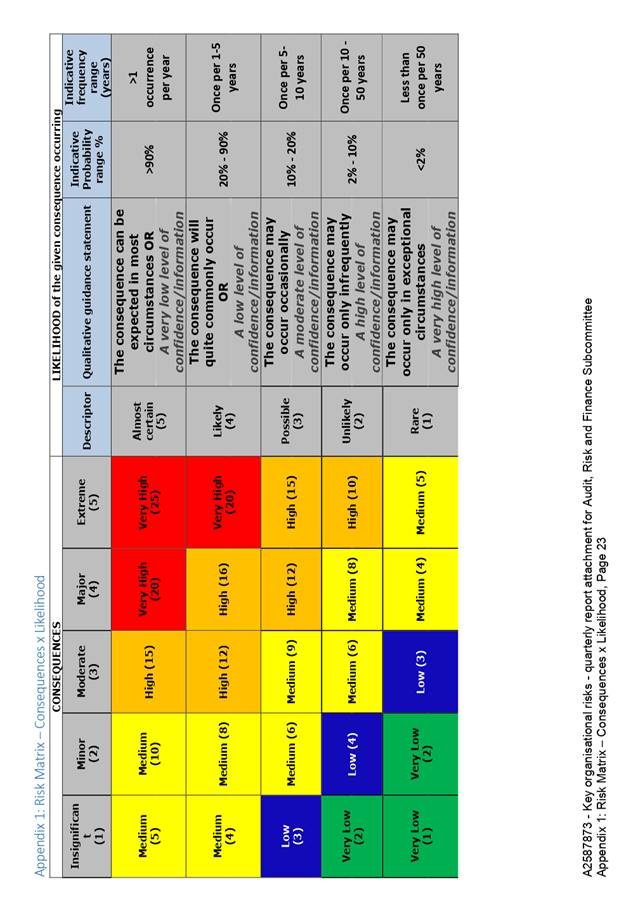

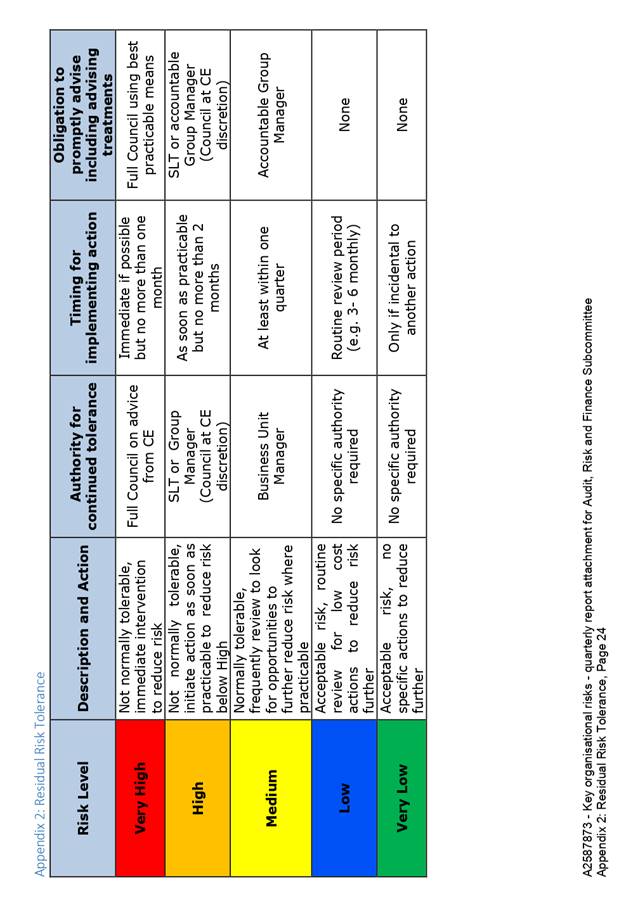

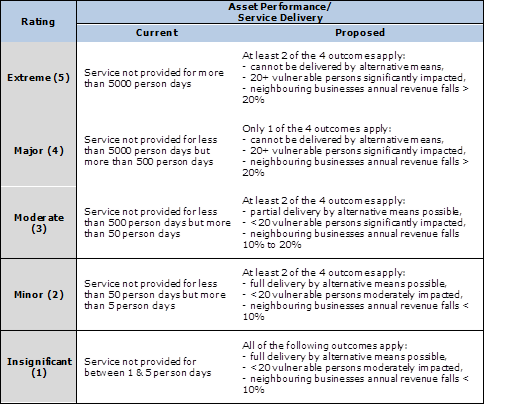

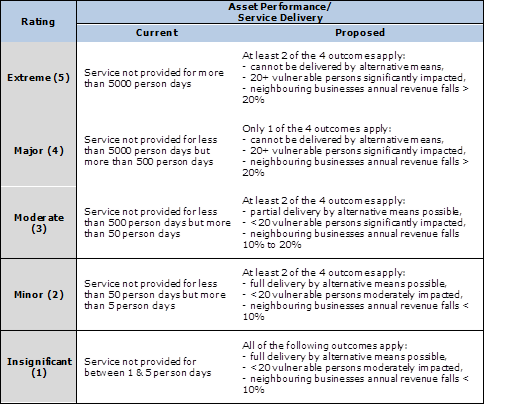

feedback, it is proposed to change the descriptions for the consequence domain

Asset Performance/Service Delivery as per below.

4.3 The

proposed descriptions were adapted as to not change Council’s risk

tolerance whilst providing a more intuitive and workable description in line

with local

government best practice.

4.4 A

similar update of the descriptions for the consequence domain Legal Compliance

will be completed as part of the development of the Legal Operations Framework

in the third quarter of 2021-22.

5. Putting

Organisational Risks in Context

5.1 This

section summarises risks relating to Council and joint operations. Risks

relating to subsidiaries and joint ventures are limited to ownership risks.

Risks relating to contracted-out activities is limited to

residual/non-contracted-out risks. Specific asset, activity, legal matter or

project risks, are rolled up into more general asset, activity, legal or

project risks however any significant items are summarised in the last section.

5.2 There

were 427 risk entries in the centralised register at 31 Dec 2021 compared to

422 in the prior quarter, with ten risks deleted and fifteen risks added.

Changes came from:

5.2.1 an

annual review by the Manager Community Partnerships resulted in one risk

deleted, one risk added, and eleven treatments added to existing risks

5.2.2 refreshing

the Accounting Services risks to reflect incoming and outgoing staff (three

risks added)

5.2.3 splitting

out a lifeline services risk into four separate risks based on asset type to

better reflect risk ownerships and risk treatment differences (three risks

added)

5.2.4 various

updates from eleven other business units.

5.3 Six

of the risk entries have status overdue as treatments have not been signed off

compared to 15 in the prior quarter. Ten to twenty overdue risk entries is

considered reasonable given the treatment renewal process is new and the

sign-off delays associated with newly identified risks.

5.4 The

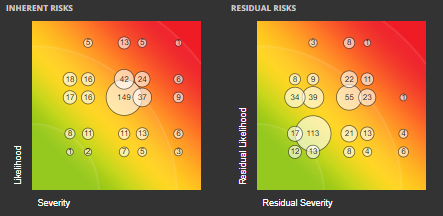

following chart is the heatmap for all the risk entries, noting that inherent

risks are notionally before controls (including risk transfers), whilst

residual risks are notionally after controls.

5.5 Risk

entries are categorised in two ways:

5.5.1 risks

with no apparent common theme or cause and hence are unlikely to pose a threat

at an organisational level (316 risk entries), and

5.5.2 risks

with identified common themes or causes which create risk concentrations that

pose a threat at an organisational level (119 risk entries)

5.6 The

latter is the focus of this report of which further detail is provided the next

section.

6. Key

Risk Areas By Theme (Organisational Risks)

6.1 There

have been no organisational risk movements to report during quarter two of

2021-22.

6.2 A

summary of key risk themes is provided below. The attachment to this report

describes each risk theme in more detail, its existing controls and planned

risk treatments. For ease of comparison to the prior quarter, new text in the

attachment has been coloured red.

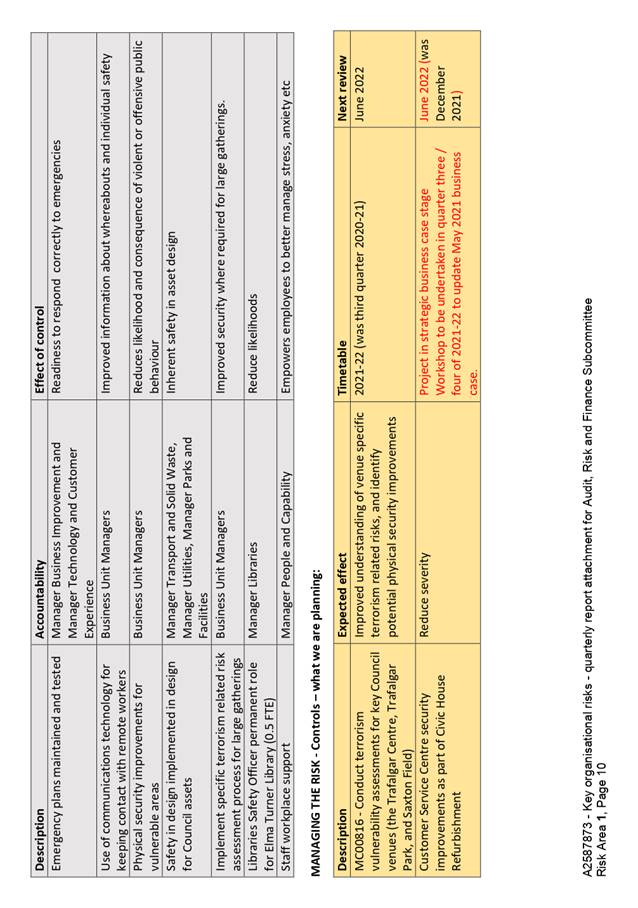

6.3 R1

- Central-government-led-reforms (Owner: Chief Executive). Three waters

reform is now mandatory. A strategic review to define the projects within the

program is in scoping and planning phase. The risk rating remains at High.

6.4 R2

- Lifeline services failure (Owner: Group Manager Infrastructure). No new

emerging risks to report at this time. The risk rating remains at Medium.

6.5 R3

- Illness, injury or stress from higher hazard work situations (Owner:

Group Manager Corporate Services). Staff vacancies across various operating

groups continue, impacting workloads and staff stress. The risk rating remains

at High.

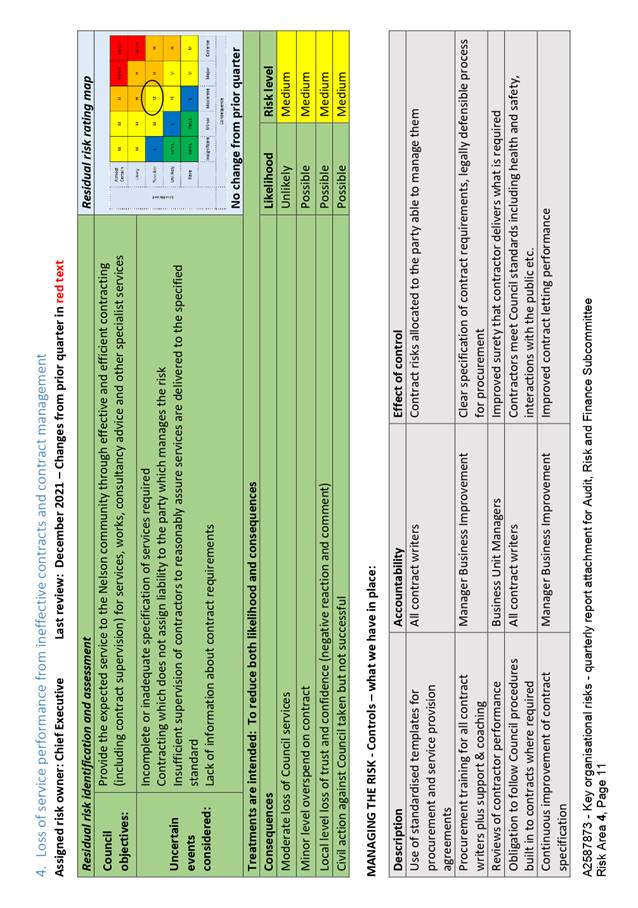

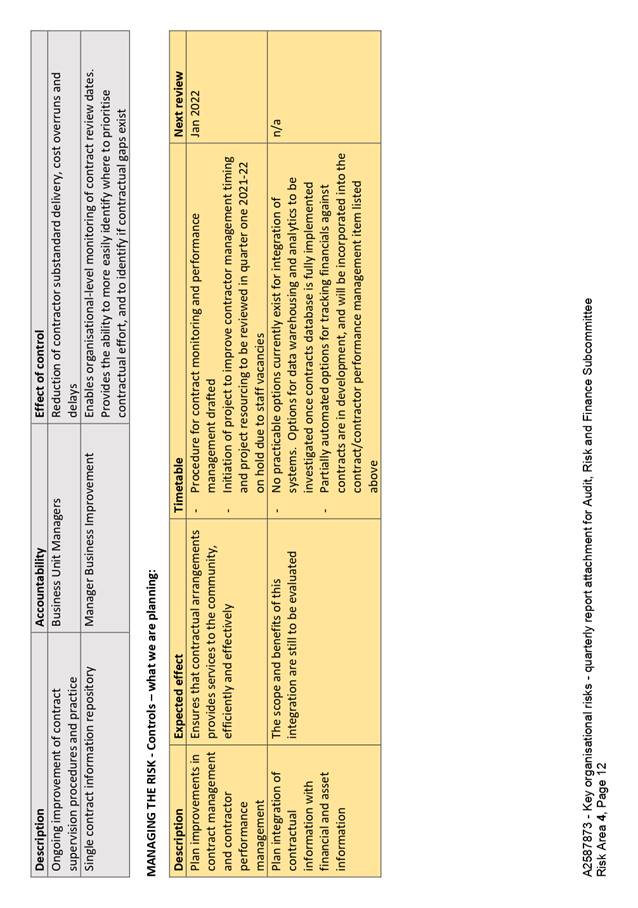

6.6 R4

- Loss of service performance from ineffective contracts and contract

management (Owner: Chief Executive). Completion of planned treatments

remain delayed due to staff vacancies.

6.7 R5

- Compromise of Council service delivery from information technology failures

(Owner: Group Manager Corporate Services). Council continues to monitor the

cyber risk landscape and respond accordingly as demonstrated by participation

in the local government cyber security continuous improvement programme.

6.8 R6

- Council work compromised by loss of and difficulties in replacing skilled

staff (Manager People and Capability). Plans for additional controls have

commenced in response to decreased “home advantage” and in light of

ongoing skilled staff vacancies. As the planned controls are not yet effective,

the organisational risk rating remains elevated at Medium.

6.9 R7

– Legal Risk (Group Manager Strategy and Communications). No new

emerging organisational risks to report at this time. The risk rating remains

at Medium.

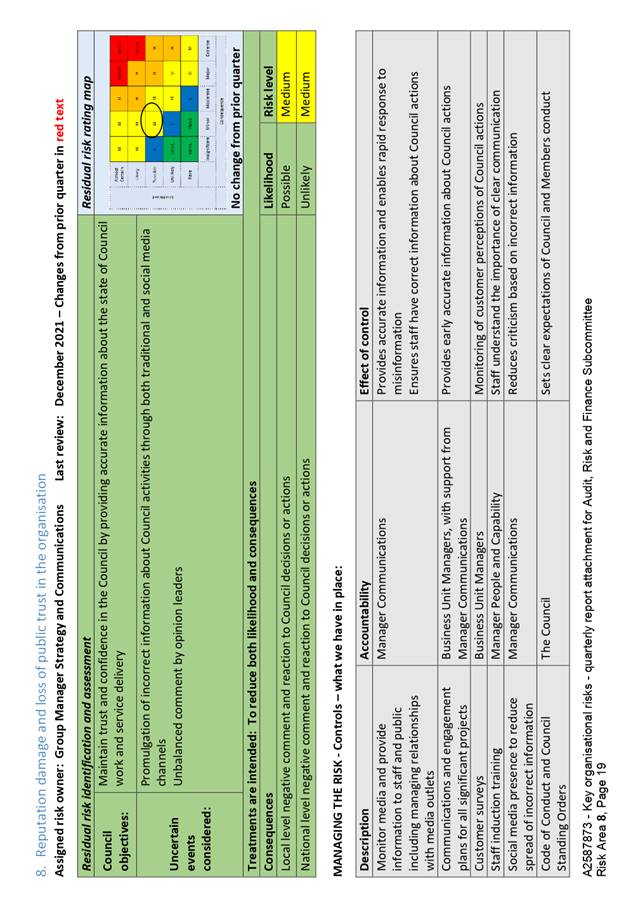

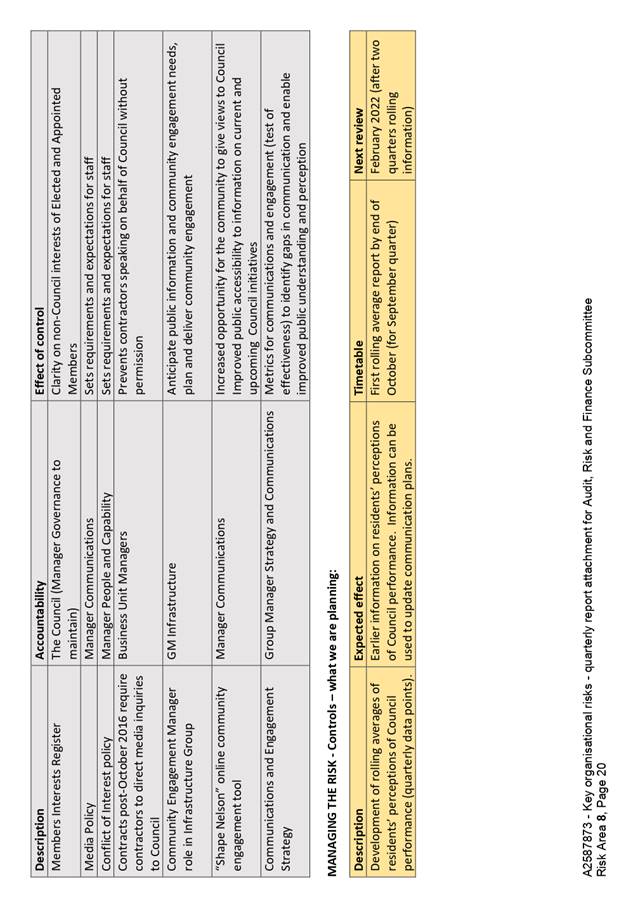

6.10 R8

- Reputation damage and loss of public trust in the organisation (Group

Manager Strategy and Communications). No new emerging risks to report at this

time. The risk rating remains at Medium.

6.11 R9

- Disruption to Council service delivery due to significant increase in

COVID-19 cases (Owner: Chief Executive). Council’s response readiness

measures enabled a smooth transition to the Orange Level in December.

Council services continued as far as possible within our interpretation of the

alert level restrictions.

7. Key

Risk Areas By Reporting Group

7.1 Infrastructure

Group: COVID-19 related supply chain risks are being realised, with

price increases and delays on material delivery (local and overseas). Work is

underway to look at streamlining processes to meet COVID-19 challenges with:

elected members’ input provided through a workshop held in December; and

oversight provided by a report (in progress) to Council. There is an emerging

infrastructure risk/uncertainty around roading maintenance costs due to the

up-coming procurement. More generally, there have been no reported exceptions

to the risk controls (as per the risk register). All treatments relating

to increased flood protection, water supply resilience, pump station capacity,

and reduction of wastewater overflows are progressing as planned.

7.2 Community Services

Group: Elevated risks around non-compliance of Council owned campgrounds

(one operated and two leased) resulted in a notification to the Chair of the

Audit, Risk and Finance subcommittee during this quarter. The risk has now

returned to previous levels noting that risks remain whilst remediation actions

are implemented.

7.3 Environmental

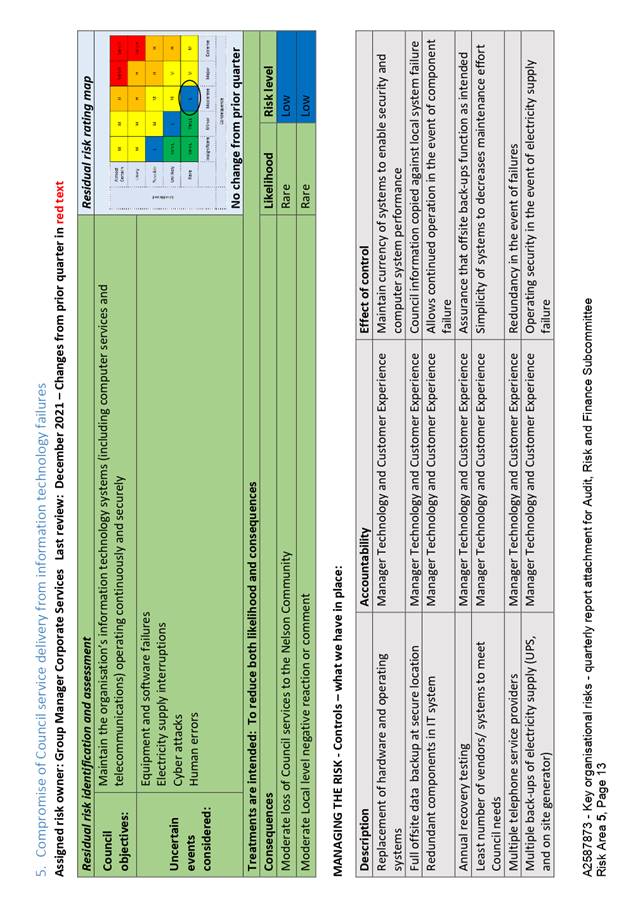

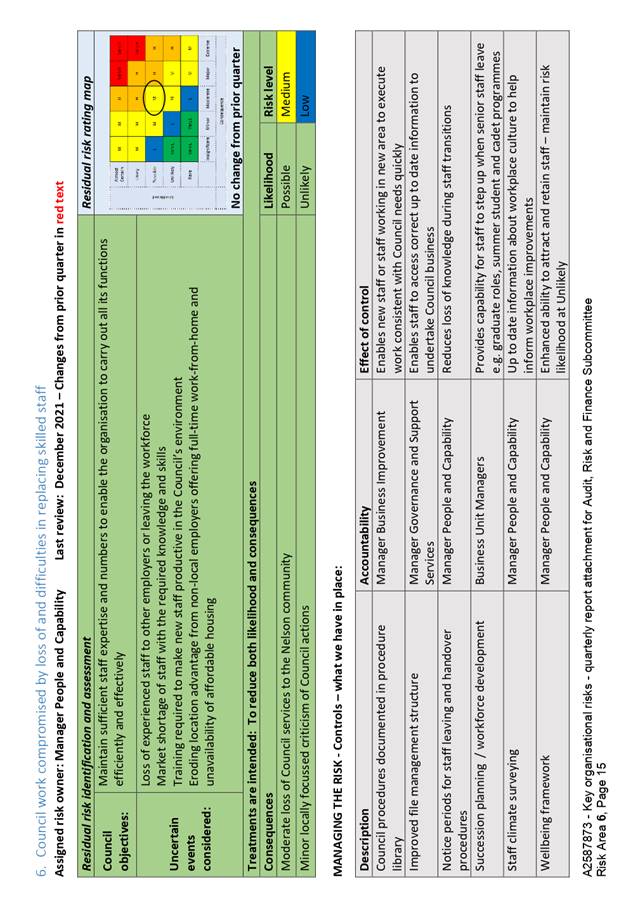

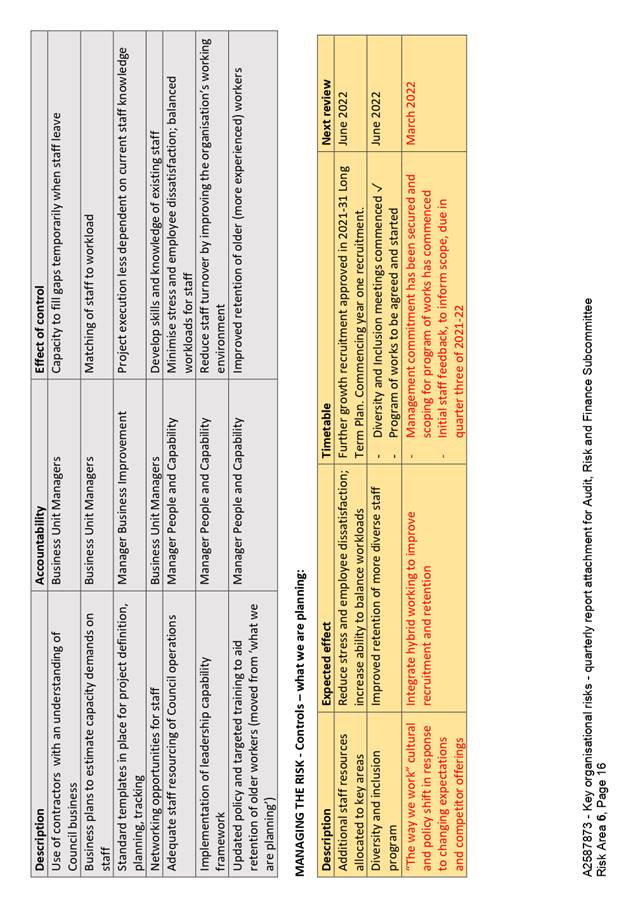

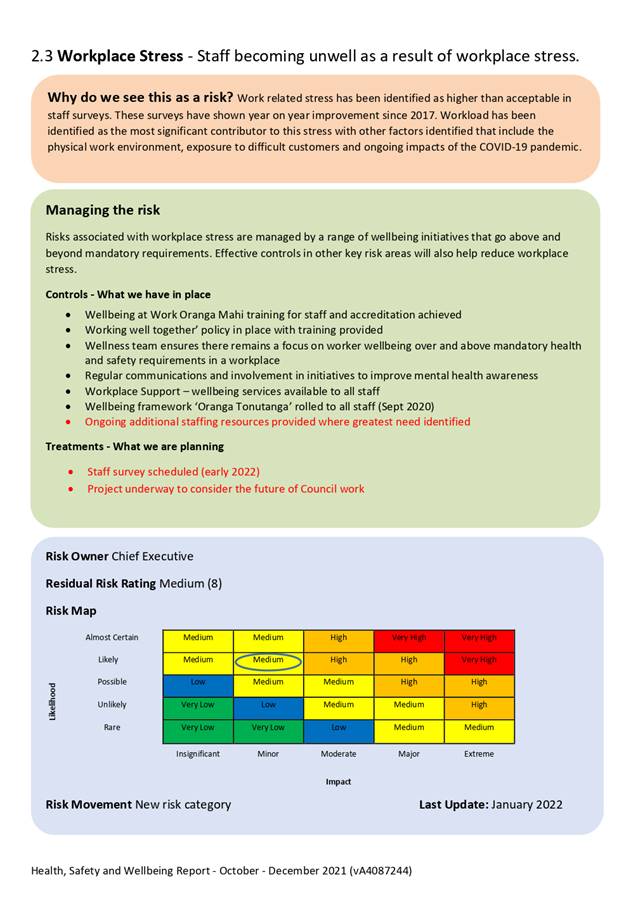

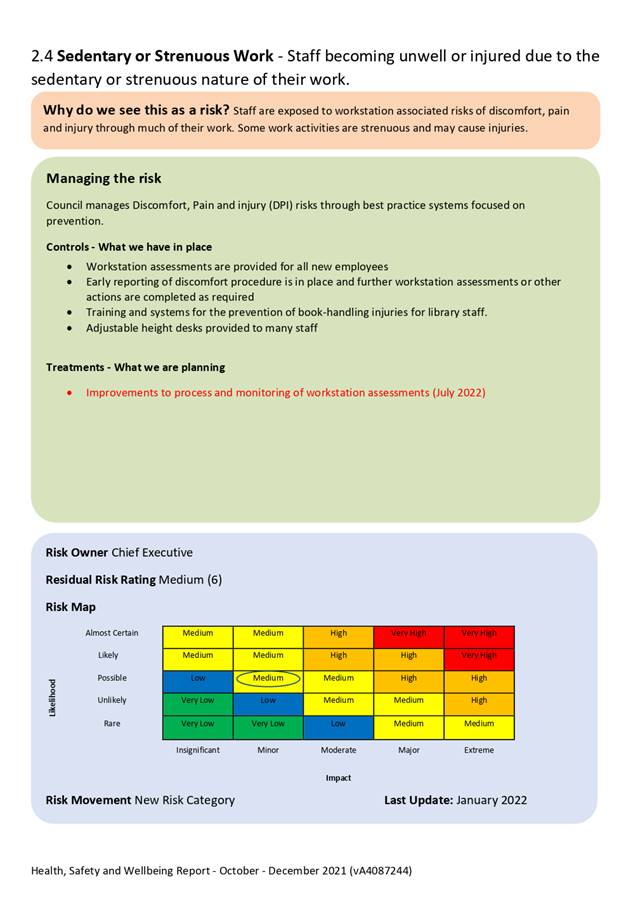

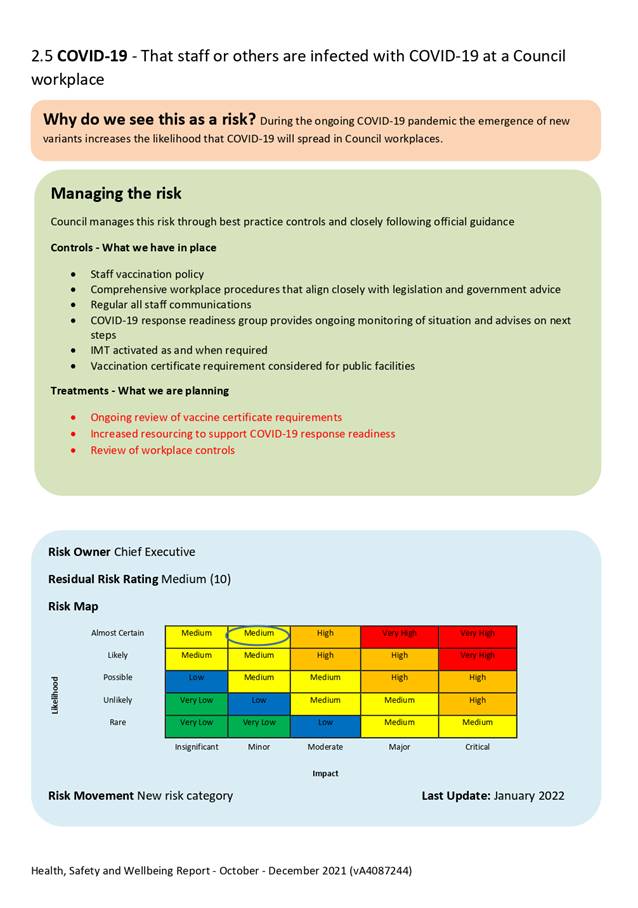

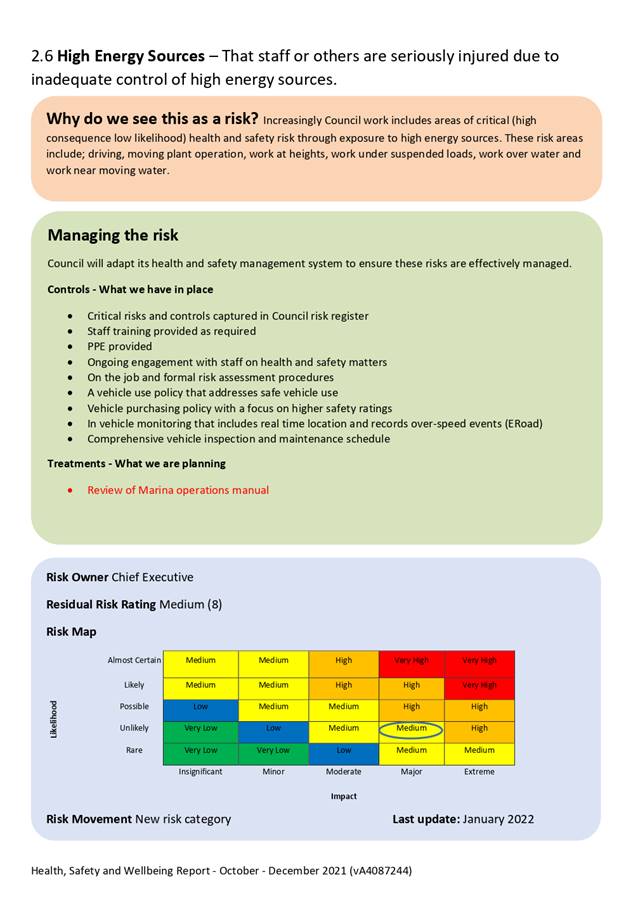

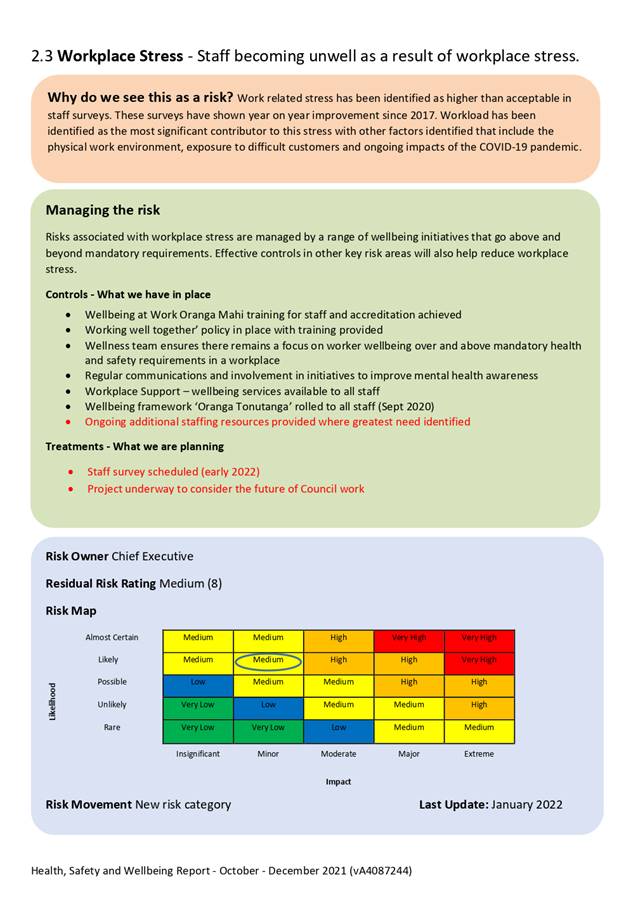

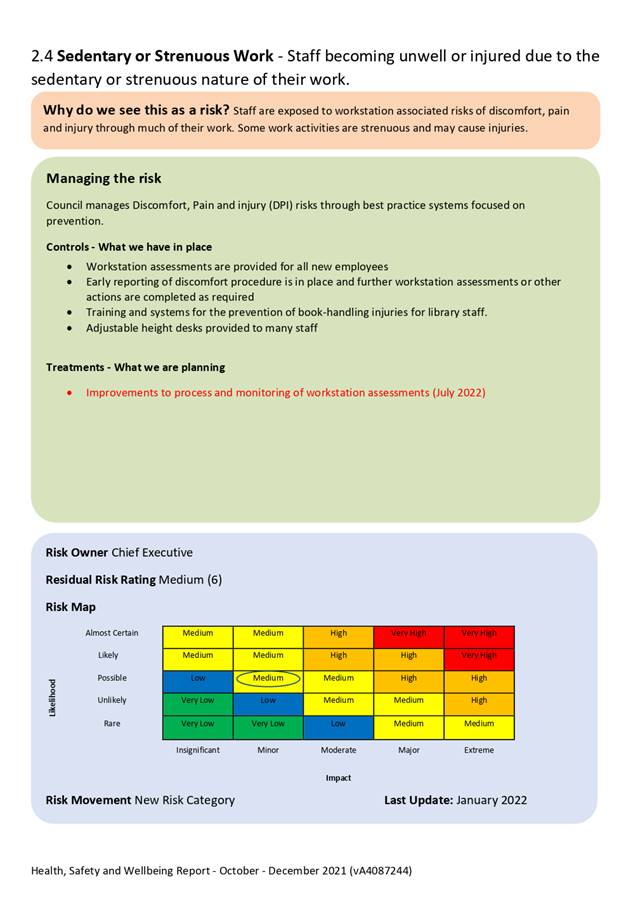

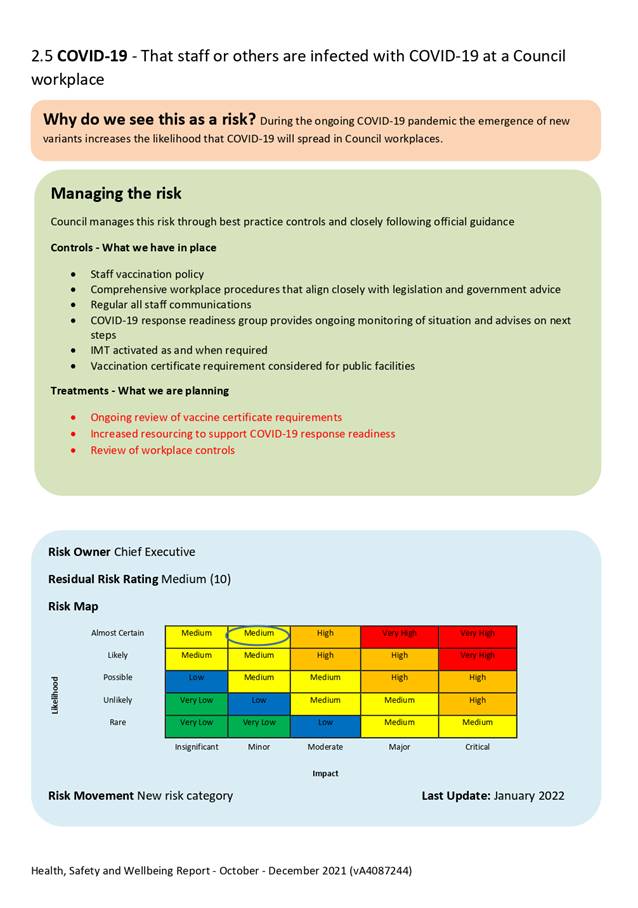

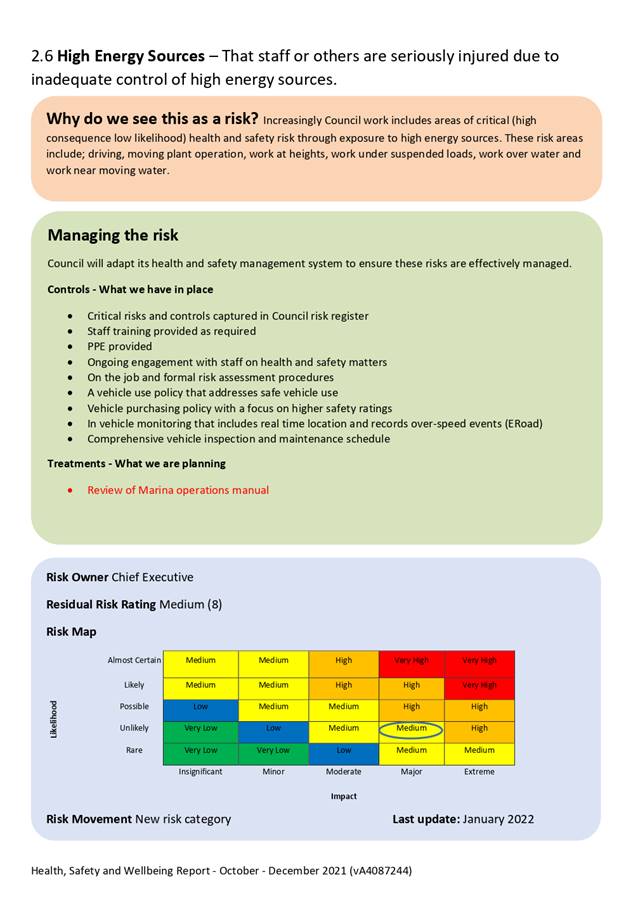

Management Group: All but one business unit in this group has at least one