Item 8: Nelson Marina

s17A Governance Review

|

|

Strategic Development and Property Subcommittee

3 December 2021

|

REPORT R26108

Nelson

Marina s17A Governance Review

1. Purpose

of Report

1.1 To

consider the various options available to Council for the future governance

structure of Nelson Marina.

1.2 To

approve the preferred option of the formation of a Council Controlled

Organisation (CCO) that manages the Marina with Council retaining ownership of

the assets.

2. Summary

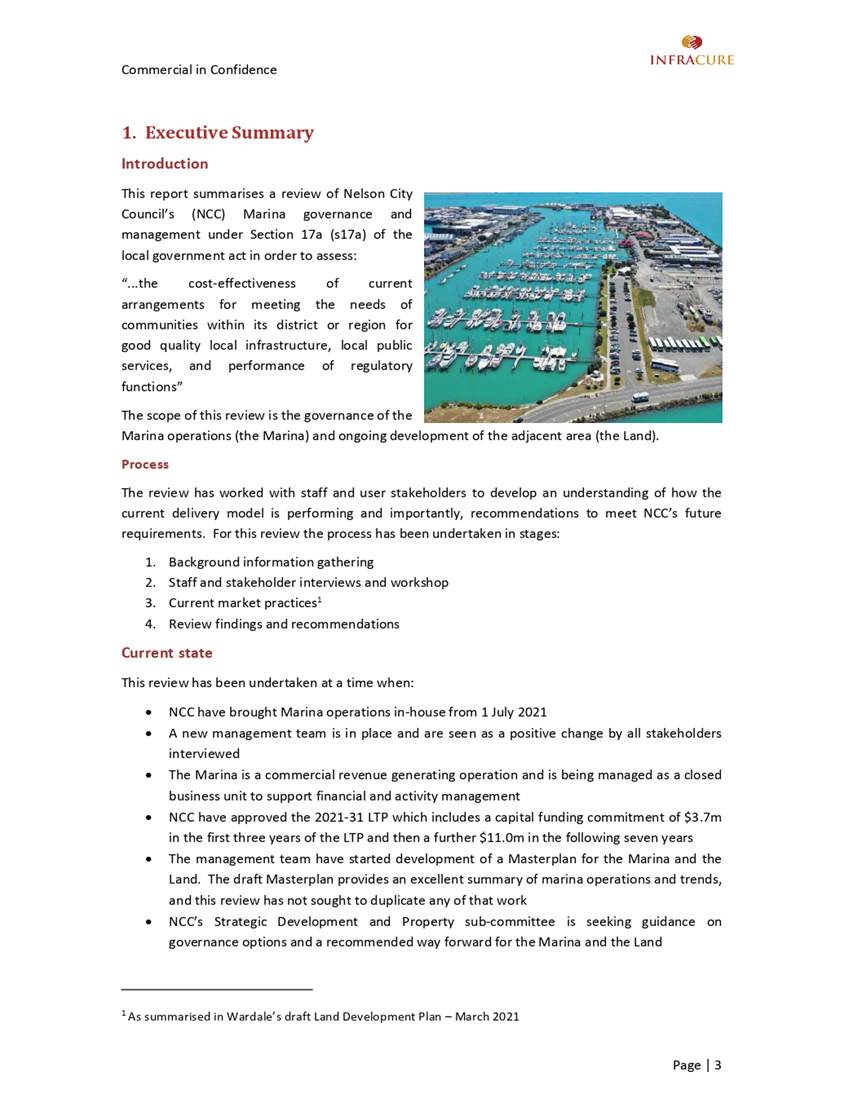

2.1 Nelson

Marina requires significant investment over the next 10 years due to an

historical lack of investment.

2.2 Council

has engaged Wardale Marine Consultants to develop a Masterplan to set out the

Marina Long Term Plan, as per the Nelson Marina Strategic Plan approved by

Council in December 2017.

2.3 Nelson

Marina is accountable to the community through Council, so should be adding

value with the view of providing a return on investment.

2.4 The

potential for the asset is community-wide through placemaking activation and

broader use of the precinct, as well as a return on investment.

2.5 On

July 1, 2021 the management of Nelson Marina was brought in house to Council

with the early termination of the Nelmac Management Contract.

2.6 The

current governance and delivery model is not commercially focused, nor dynamic

enough to fulfil the future development plans for Nelson Marina.

2.7 A

review of the various management options available to Council has therefore

been undertaken to ensure that the governance structure is fit for purpose and

will achieve Council’s goals (See, Attachment 1, Section 17a

Review).

2.8 Based

on the report findings, it is recommended that Council establish a CCO to

manage and operate Nelson Marina on behalf of Council.

2.9 Nelson

Marina is operated as a closed account with no income coming from Council

rates; an opportunity to enhance investment as well as return would be created

through this model.

2.10 Post

workshop further research was conducted on the option of establishing a Limited

Liability Partnership (LLP) as the framework within which the Management CCO

would operate.

3. Recommendation

|

That the Strategic Development and Property

Subcommittee

1. Receives

the report Nelson Marina s17A Governance Review (R26108) and its attachment (A2764091).

|

Recommendation to Council

|

That the

Council

1. Approves the recommendation

of a Council Controlled Organisation that manages the Marina as the preferred

governance model for Nelson Marina; and

2. Approves undertaking

consultation on the proposal to establish a Council Controlled Organisation

as per Section 56 of the Local Government Act; and

3. Notes that undertaking

consultation on a proposal to establish a Council Controlled Organisation

would require additional unbudgeted expense to a maximum of $65,000 in

addition to current budget ($40,000), to formulate the required documentation

and reviews for the new Council Controlled Organisation; and

4. Approves funds, if required

for undertaking consultation, to be sourced from the Marina closed account.

|

4. Background

4.1 Council

owns and has operated Nelson Marina (Marina) since 1 July 2021.

4.2 Prior

to 1 July 2021, Nelson Marina was operated by Nelmac Limited, a general

contracting Council Controlled Organisation (CCO), under a contract with the

Council. Council chose to cancel that contract early as it was determined

that more active management was needed.

4.3 The

Council anticipates significant development of the Marina in the

future. It is currently developing a Masterplan for the Marina,

which it expects to consult with the community at the end of 2021 and adopt in

early 2022.

4.4 Alongside

this, Council is considering the best approach for governance of the Marina

going forward. For this purpose, it engaged Infracure Ltd (Infracure) to

carry out a review under section 17A of the Local Government Act 2002 (LGA

2002).

4.5 Infracure

has now provided a report that recommends that Council establishes a Management

CCO for Marina governance. (Attachment 1 A2764091).

Section 17A

review summary

4.6 For

the review process, Infracure held several meetings and workshops with staff

and stakeholders.

4.7 Infracure’s

report identifies that there is consensus that the Marina needs development and

more proactive management. For example:

4.7.1 Marina

and Marina support services (e.g., parking, provisioning, repairs, fuelling)

are not integrated,

4.7.2 Current

facilities and services will not meet future demand as boat ownership and

profiles, environmental and health and safety standards evolve,

4.7.3 Land

is viewed as being under-utilised,

4.7.4 Fees

and charges are considered too low for the market, and collections have

historically been low.

4.8 Initial

master planning work suggests that there will be significant changes to both

current Marina operations and the Marina land to meet future need.

4.9 The

report also identified a risk that the Marina’s current governance model

is inadequate to manage the complexity of concurrent change initiatives across

several areas, including:

4.9.1 Marina-provided

services such as fuel, dry docking and storage,

4.9.2 Changing

approach to, and increasing, fees and charges,

4.9.3 Development

of new commercial operations to service all users (boat parts, repairs, food

and sea sports),

4.9.4 Increasing

recreational value for the community i.e., managing the Marina and land as a

destination,

4.9.5 Managing

consequent environmental, health and safety and reputational risks.

4.10 The

report identified that Council’s current reporting and decision making

isn’t appropriately structured or resourced to support:

4.10.1 Management

of the Marina as a commercial business,

4.10.2 Development

of the Marina and land as a mixed use destination for boat owners, associated

service providers and the wider community,

4.10.3 Effective

strategic integration and alignment with boat owning users, other recreational

users, neighbours, Iwi and the Nelson Regional Development Agency (NRDA).

4.11 Following

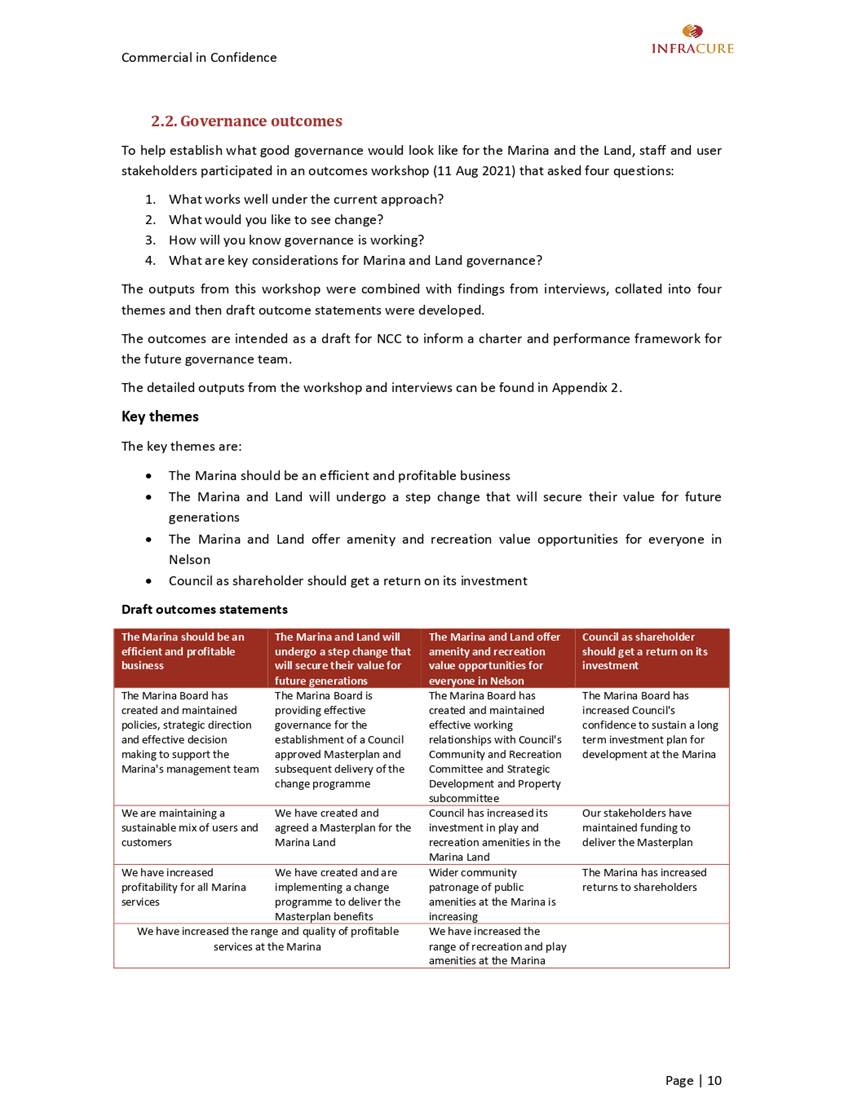

interviews and a stakeholder workshop, the review identified key themes that

stakeholders would like to see addressed. The key themes are:

4.11.1 The

Marina should be an efficient and profitable business,

4.11.2 The

Marina is undergoing a step change that will secure its value for future

generations,

4.11.3 The

Marina offers amenity and recreation value opportunities for everyone in

Nelson,

4.11.4 Council

as shareholder should get a return on its investment.

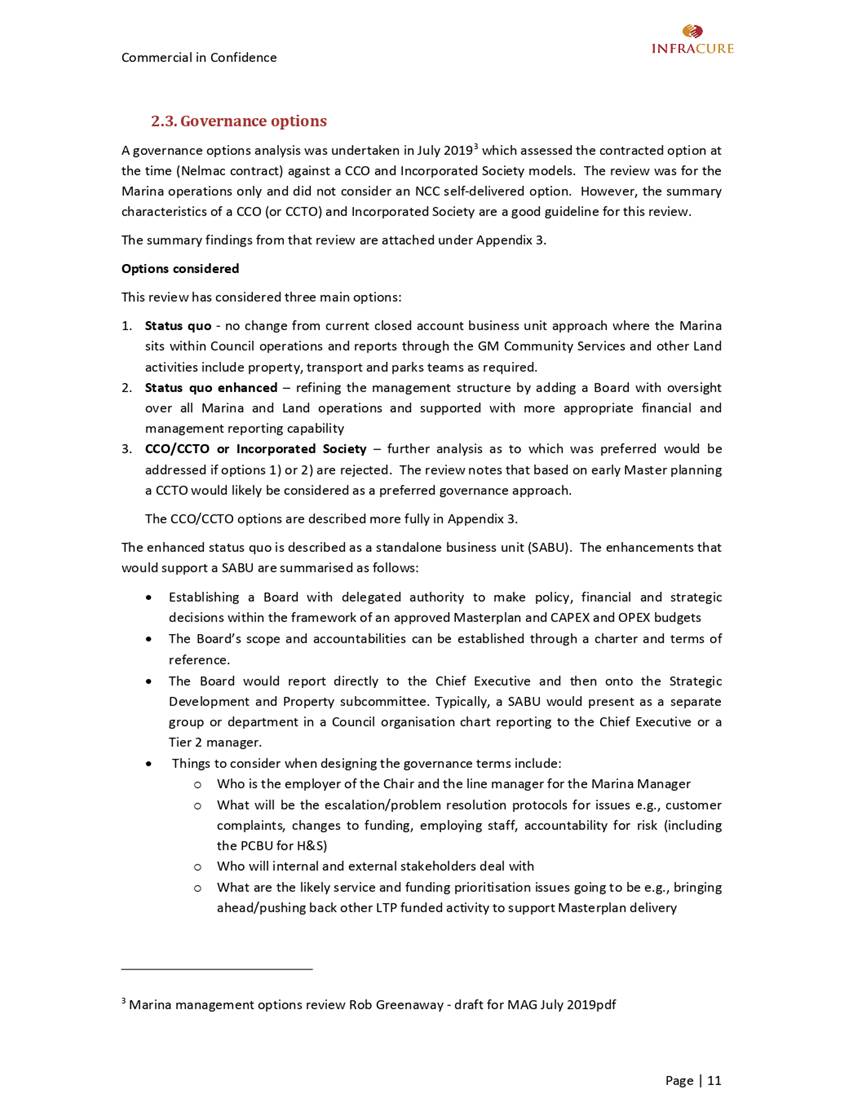

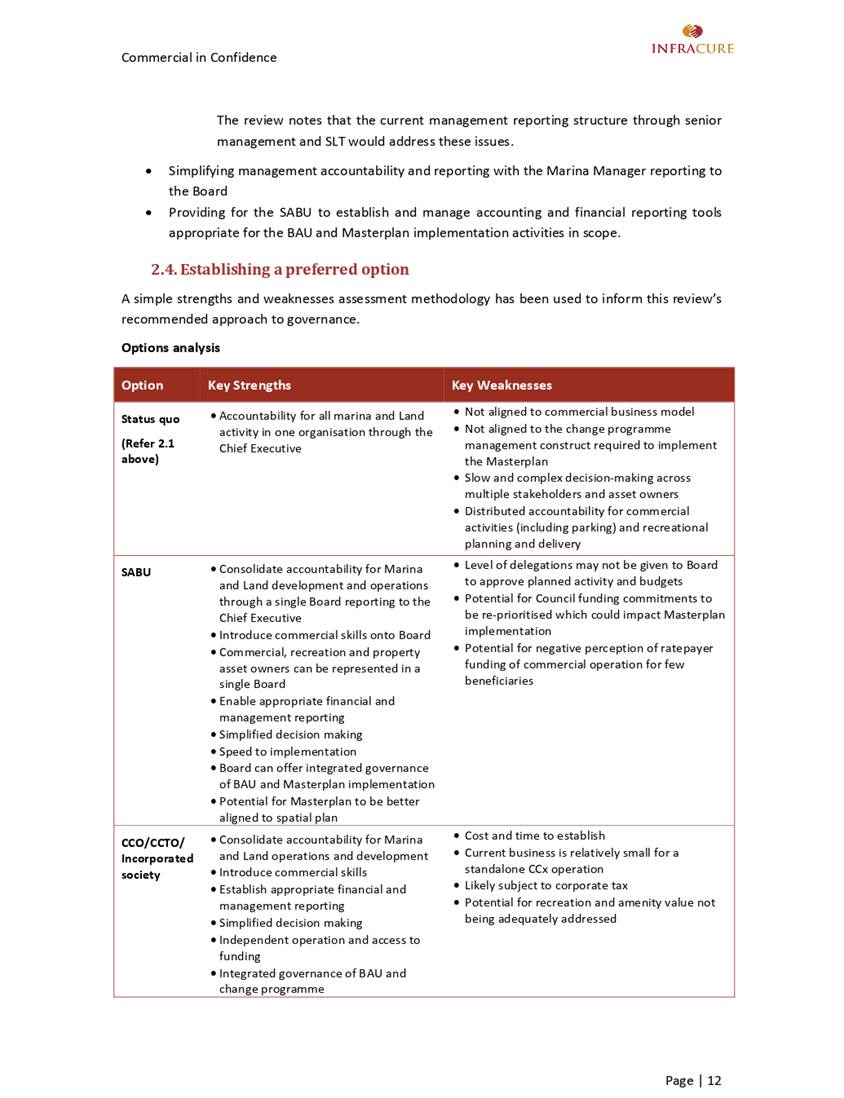

4.12 An

analysis was then undertaken of various options available to Council, with the

four options below being deemed to be the best fit for purpose:

4.12.1 Option

1: Council owns and operates the Marina (status quo),

4.12.2 Option

2: A “stand-alone business unit” (SABU) or “enhanced Status

quo” within Council that manages the Marina,

4.12.3 Option

3: A new CCO that manages the Marina with Council retaining ownership of the

assets (Management CCO) (Infracure and Report Recommendation),

4.12.4 Option

4: A new CCO that holds ownership of all assets and manages the Marina (Owner

CCO).

4.12.5 Option

5: A Limited Liability Partnership that holds ownership of all assets and

manages the Marina (LLP)

5. Discussion

5.1 The

status quo (Option 1) has serious limitations and is therefore not the recommended

option. The key issues are the relative complexity of the management of

the Marina, and the lack of commercial orientation and flexibility.

5.2 A

SABU (Option 2) was identified as intermediatory solution and would be an

enhanced status quo option while Council was assessing a CCO in the Section 17A

review.

5.3 While

the SABU model is an option and would go some way to solving the key issue of

the lack of commercial orientation for the management of the Marina, it is not

identified here as the preferred option for the following reasons:

5.3.1 A

significant amount of time and cost would need to be invested to establish a

SABU that would provide the benefits of a more commercial board structure but

would not achieve the goal of independence from Council. There is good

commercial, operating and reputational rationale to move ahead with expediency

to finalise and implement the Masterplan,

5.3.2 A

SABU model does not provide appropriately rigorous structure and is less

consistent with Council’s existing successful governance models and

entities (eg Nelmac, Port Nelson), which have a statutory basis and existing

rules around their establishment and operation,

5.3.3 There

would also be some on-going drawbacks of a SABU model, with the board of a

SABU, for example, being able to engage in contracts and statutory commitments

but with the liability being retained by Council.

5.4 Due

to the need to be commercially focussed, establishing a CCO to manage the

Marina is the recommended option (Option 3: Management CCO).

5.4.1 This

option has benefits as identified above (5.3.1 - 5.3.3), regarding expediency

and a rigorous structure for reporting and liability,

5.4.2 A

Management CCO also draws on a well-established CCO framework, regarding statements

of expectation, statements of intent, regular reporting and accountability,

5.4.3 This

option also means there would be a company structure with a board of directors

appointed by, and accountable to, the Council, along with means for the Council

to influence the way the CCO is operated and governed, with Council-appointed

Board members,

5.4.4 Fiduciary

duty, the duty of care and liability would be assumed by Board Members rather

than Council,

5.4.5 This

structure would provide a good balance between commerciality in the running of

the Marina as a business, and appropriate Council oversight and influence,

5.4.6 LGOIMA

applies but not to meetings,

5.4.7 Profits

derived through the operation of the Marina will be for the benefit of the

asset owners (Council) and will not be subject to corporate tax.

5.4.8 While

establishing a CCO requires consultation, this would not unduly slow down the

process. Establishing a management CCO and establishing a SABU would involve

about the same amount of time and cost (although the SABU could be slightly

more complex).

5.4.9 If

a Management CCO is established, this also leaves future flexibility for the

Marina land and assets to be transferred to the new CCO should Council consider

that to be appropriate in the future (Option 4: Owner CCO) or a Limited

Liability Partnership (LLP)(Option 5).

5.5 For

this reason, the Owner CCO (Option 4) and Limited Liability Partnership

(LLP)(Option5) are not the recommended options at this stage due to the tax

implications to Council. Both options are also more complex to establish,

would require more consultation, and Council’s commercial objectives with

respect to the Marina can be achieved without the transfer of assets at this

stage.

5.6 Option

3, a Management CCO is therefore the preferred option.

Other options that should be discounted because they are

not reasonably practicable:

5.7 Other

governance options for the Marina were also reviewed. On assessment,

these do not meet Council’s objectives and should be discounted as they

are not reasonably practicable options.

For

completeness, these options are:

5.7.1 Subcommittee

– The Council could establish a subcommittee (under clause 30(1),

Schedule 7 of the LGA 2002) to carry out a similar function to the board in

option 2 (stand-alone business unit option). The subcommittee

membership could include external appointees with relevant skills and knowledge

and Council employees and would not necessarily need to include elected members

(clause 31(3) and (4), Schedule 7 of the LGA 2002). This would not

be a reasonably practical option for the Council, as it would not allow for the

‘nimbleness’ and responsiveness in decision-making that the Council

wants to achieve for Marina operations.

5.7.2 Management

contract – The Council could contract out the management of the

Marina to a third party (such as was the case with its contract with Nelmac

Limited). The contract could be drafted to require a more commercial

focus for the Marina. This is not a reasonably practical option for the

Council: first, because this is essentially the structure that has been used to

date (with Nelmac Limited) and issues were identified with this; and second,

because achieving a more business-like operation would be difficult through a

contract only (with the Council ultimately still making any key decisions,

compared with, for example, the board of a CCO).

5.7.3 Incorporated

society – The Council could incorporate a society under the

Incorporated Societies Act 1908 to manage and/or own the Marina. This is

not a reasonably practicable option for the Council because there are serious

limitations with an incorporated society as a structure including that it

cannot operate for pecuniary gain of any of its members (including the Council

if the Council is a member), and there are minimum member requirements (so

parties other than the Council would need to be members of the society).

This structure would not align with the more commercial orientation the Council

wishes to achieve for the Marina.

Benefits of the SABU model

5.8 Benefits

of the SABU model that were identified in the Infracure report (Attachment 1,

p. 7), are also applicable to the preferred Management CCO option (Option

3). These include:

5.8.1 The

Board having an independent chair,

5.8.2 Wider

community recreation interests being represented on the Board e.g., passive and

active recreation, arts and culture,

5.8.3 The

Marina Manager being appointed to the Board as an ‘Executive

Director’…,

5.8.4 The

Chief Executive ensuring the Board has the delegated authority required to

develop and deliver the agreed Masterplan and CAPEX and OPEX budgets,

5.8.5 The

Masterplan being delivered using a benefit led change programme management

construct rather than an outputs driven project management

construct.

5.9 In

addition, it was identified in the report that a programme approach would help

support effective consideration of things such as:

5.9.1 Consolidation

of asset and activity management into a single Marina and Land precinct,

5.9.2 Dependency

management for infrastructure enhancements enabling new fees and charges and

their supporting systems,

5.9.3 Integration

of broader outcomes including environmental and social and cultural benefits

(Attachment 1, p. 7).

6. Options

Option 1:

Council owns and operates Marina (status quo)

6.1 Description

6.1.1 Council

owns the Marina land and associated assets.

6.1.2 Marina

operations are managed by a business unit within the Council, staffed by

officers employed by the Council, including the Manager Nelson Marina.

The officers act under delegated authority, which has been sub-delegated to them

by the Council’s Chief Executive.

6.1.3 The

Marina’s finances are managed through a ‘closed account’, as

the Marina has its own dedicated revenue streams and expenses.

6.1.4 The

following stakeholders have a role in the governance of the Marina:

· The Strategic

Development and Property Subcommittee has the “Marina Precinct” as

one of its areas of responsibility, and the Council has delegated to it the

power to make decisions on the development of policies and plan, and to

recommend these policies and plans to the Council for its approval.

· The Marina

Management Committee, established in 2015, has the purpose of discussing and

providing recommendations to the Council about the Marina facility.[1]

It provides a forum for communication and co-ordination between the Council,

Marina management, and the Marina Berth Holders Association, with its members

drawn from all these entities, as well as Port Nelson.

· The Nelson Marina

Advisory Group was established in 2017 to work with the Council on the

strategic plan for the Marina, but after completion of that plan, was retained

to act as the appointed management committee to undertake management duties at

the Marina (as described in the strategic plan). Aspirations were

to delegate powers for management and financial decisions to the Advisory

Group, but its current delegations are limited to making recommendations to the

Council only. Its members are individuals with appropriate skills

and expertise, who are appointed by, but independent to, the Council.

6.2 Process

This option is the status quo,

so no process is required. (Although the Council might want to consider whether

changes should be made to the Marina Management Committee and Nelson Marina

Advisory Group, to perhaps integrate some of their functions.) There is

obviously no implementation costs or timing implications of this

option.

6.3 Advantages

and disadvantages

|

Option 1: Council owns and operates Marina

(status quo)

|

|

Advantages

|

Disadvantages

and Risks

|

|

· No process is

required.

· The Council retains

direct control of all Marina land and assets, and operations.

This ensures ‘public ownership’ of the assets, and that any

returns from the Marina ultimately benefit the Nelson community.

|

· Less commercial

or nimble than a private sector agency, as the Council must comply with

decision-making requirements in the LGA 2002 and operate with transparency

and accountability as required under LGOIMA.

· Viewed as less

able to respond quickly and effectively by berth holders and other

stakeholders.

· Given the

significant amount of investment that is likely to occur at the Marina over

the next 10 years or so, it would be beneficial to have involvement from

individuals with expertise and experience in significant capital projects,

and the commercialisation of them. Elected members may or may not

have such expertise and experience.

· Elected members

may be more subject to pressure from those opposing increases to fees and

charges, as compared to independent non-elected individuals. If

pressure campaigns were successful, this could limit the potential returns

from the Marina, and the consequent financial benefits for the community.

· Management of

the Marina is one of many functions carried out by the Council, meaning it

may not get as much attention or dedicated focus, as it would under an entity

that’s sole purpose is to deal with the Marina.

|

|

Time

to establish

|

Costs

to establish

|

|

· The model is

already established

|

· There are no

costs to establish.

|

Option 2: Stand-alone

business unit within Council (Enhanced Status Quo/SABU option)

6.4 Description

6.4.1 Council

continues to own the Marina land and associated assets.

6.4.2 The

Marina’s finances are dealt with through a ‘closed account’,

given the Marina has its own dedicated revenue streams and expenses.

6.4.3 Marina

operations and finances are managed by a dedicated business unit within the

Council, staffed by officers employed by the Council, including the Manager

Nelson Marina. The officers act under delegated authority, which

has been sub-delegated to them by the Council’s Chief Executive.

6.4.4 The

full Council establishes a “board” to provide direction to the

dedicated business unit. The board is, legally, part of the Council

and does not have a separate legal status. It is a subordinate decision-making

body of the Council, which the Council is empowered to establish under clause

30(1), Schedule 7 of the LGA 2002. A subordinate decision-making body does not

have an established statutory regime as a committee or CCO does, so it is

necessarily a bespoke body designed wholly by the Council.

6.4.5 The

board exercises powers delegated to it by the full Council (under

clause 32(1), Schedule 7 of the LGA 2002), enabling it to develop and

implement the masterplan for the Marina, as well as manage its day-to-day

operations.

6.4.6 The

board is comprised of independent individuals with appropriate expertise and

experience, who are appointed and remunerated by the Council. They

are ultimately accountable to the Council, and can be removed by the Council at

its discretion.

6.4.7 The

Strategic Development and Property Subcommittee would have oversight of the

board, and the board would report to it on a regular basis. The Marina

Management Committee and the Nelson Marina Advisory Group would likely not have

any involvement.

6.5 Process

|

Steps to implement Option 2: Stand-alone business unit within

Council (Enhanced Status Quo/SABU option)

|

|

This process would require three sequential reports going

to full Council for decisions.

1. The

first report would require Council to make an in-principle decision to pursue

the stand-alone business unit option (based on recommendation from the

Strategic Development and Property Subcommittee).

2. Following

this first Council decision, the Council would need to:

a) Develop

a draft terms of reference for the board. This would be a bespoke document,

involving the creation of a unique subordinate decision-making

body. There would be significant work in preparing the terms of

reference. Not only would there need to be substantial involvement from lawyers,

but officers would also be called on to make decisions about the design of

the board. The terms of reference would need to address the role

of the board, including the scope of its authority, and set out all its rules

for operation (For example, membership, remuneration, meetings, voting,

application of LGOIMA, reporting, stakeholder relationships, communications

etc.).

b) Develop

draft terms of appointment for members (effectively serving as a contract

between the Council and the members).

c) Develop

a draft delegation to the board, identifying the powers that should

appropriately sit with the board. In doing so, it may be

necessary to clarify the Strategic Development and Property

Subcommittee’s delegations, as the Council’s Delegations Register

currently provides that any cross-over in delegations must be referred back

to full Council.[2]

It would also be sensible to consider what, if any, role there should be for

the Marina Management Committee and the Nelson Marina Advisory Group going

forward.

d) Develop

a draft policy for the appointment and remuneration of board

members. The Council’s policies for appointing and

remunerating committee members,[3]

and directors of CCOs,[4]

would not apply, making it necessary for the Council to develop a one-off

policy to apply to the board (covering qualifications, expertise

etc.).

e) Organise

insurance cover for the board. While the Council should check its own policy,

council policies are unlikely to cover this type of arrangement, making it

necessary to negotiate and agree an extension to the Council’s cover

(likely providing an indemnity to board members, equivalent to what is

provided to elected members). Given the board would be a unique

creation, it is likely that brokers would require additional explanatory

material to understand the board’s status and role.

3. The

second report to full Council would seek, for the purposes of initiating a

recruitment process for board members, approval of the draft terms of

reference, terms of appointment, and delegation, and also recommend adoption

of a policy on the appointment and remuneration of members of the board.

4. Following

this second meeting, the recruitment process for board members would

commence. It might be necessary to negotiate remuneration, and possibly some

of the terms of appointment, with candidates.

5. The

third report would ask the full Council to:

· establish the

board as a subordinate decision-making body, including giving final approval

of the terms of reference;

· appoint the

preferred candidates as members of the board, subject to the terms of

appointment;

· make appropriate

delegations to the board, and effect any necessary consequential changes (For

example, amend delegations to the Subcommittee, and amend delegations or

dis-establish the Management Committee and Advisory Group).

6. There

are no specific consultation requirements in the LGA 2002 for any of these

Council decisions, although the Council would be subject to its standard

obligation in section 78 of the LGA 2002 to consider the views and

preferences of interested and affected persons. It is a judgement

call for the Council to make, but it would likely be appropriate to carry out

some targeted engagement with affected stakeholders (for example, berth

holders) on relevant aspects of its proposals. It may also be

appropriate to seek advice from the Nelson Marina Advisory Group on the

proposals.

|

|

Time

to establish

|

Costs

to establish

|

|

Likely to take about the same

amount of time as the management CCO (but less than the owner CCO option).

Matters that could have an impact

on the timeframe include:

· Likely necessary

for full Council decisions on at least three occasions.

· Creation of all

the draft documents plus engagement with stakeholders.

· The recruitment

process and availability of good candidates.

· Negotiations

with insurance brokers

|

Probably similar cost to set up as

the management CCO but result has few benefits (so less

cost-effective).

· The bespoke

nature of the board as a subordinate decision-making body could require more

work from legal advisors as compared to a CCO establishment.

· If the Council

were to use consultants for the recruitment process, it would incur

consultant costs.

· There would be

some additional premium costs for the Council’s insurance.

|

6.6 Advantages

and disadvantages

|

Option 2: Stand-alone business unit within

Council (Enhanced Status Quo/SABU option)

|

|

Advantages

|

Disadvantages

and Risks

|

|

· The Council

retains ownership of all Marina land and assets, and operations.

This ensures ‘public ownership’ of the assets.

· In contrast to

the status quo, this option would likely allow for greater speed in some

decision-making. The board would not be subject to the meetings requirements

in Part 7 of LGOIMA, and so could be nimbler that an equivalent committee

could be.

· The board would

enable the Council to have independent individuals, with relevant commercial

expertise and experience, involved in decisions concerning the masterplan for

the Marina.

|

· Less commercial

or nimble than a private sector agency, as the “board” would have

to comply with decision-making requirements in the LGA 02.

· The board would

be a bespoke entity, requiring work to design and establish it.

· The Council will

still have overall responsibility for the marina. As outlined for

option 1 above, this means the marina will still be one of a multitude of

functions being carried out by the Council, and there is still some potential

for political pressure being brought to bear on elected members in relation

to fees and charges.

· There is a risk

that members of the board, who are not familiar with working in a Council,

might not always comply with all the relevant statutory obligations that

apply to councils and their subordinate decision-making bodies

(eg decision-making requirements in the LGA 02, compliance with relevant

council plans and policies etc.). Given the board does not have a

separate legal status to the Council, it is the Council that will bear the

responsibility (and liability) for any mistakes made by the board.

· Having delegated

powers to the board, the Council cannot typically unwind or overrule board

decisions, but will instead be bound by them (eg it will be bound by any

contracts entered into by the board). Again, it is the Council that

will bear responsibility (and liability) for the board’s actions.

· The option

cannot be implemented immediately, even though no particular consultation

obligations apply.

· There are costs

to implementing this option, including legal costs, recruitment costs, and

insurance costs. These to be about the same as for the management CCO option

but less than the owner CCO option.

|

Option 3: Establish a CCO to

manage the Marina (Management CCO) – Recommended Option

6.7 Description

6.7.1 Council

owns the Marina land and associated assets.

6.7.2 The

Council establishes a CCO to manage the Marina operations under contract.

6.7.3 The

CCO has a board and employs staff (including the Manager Nelson Marina).

The staff of the CCO report to the board, and the board is accountable to the

Council as shareholder.

6.7.4 The

CCO manages the marina’s finances (based on the marina’s own

revenue streams and expenses), with Council input as required (eg through

annual budget). Any borrowing for marina development would be Council borrowing

(not the management CCO’s).

6.7.5 The

CCO would incur staff costs, board member fees, some other management costs

(such as IT equipment and directors & officers insurance premiums) which it

would recover (likely on a breakeven basis) from the Council through the

management contract.

6.7.6 The

intention would be that the CCO itself would not return any profits to the

Council through distributions.

6.7.7 The

extent of the CCO’s role and powers in relation to the Marina can be

well-defined through the drafting of the CCO’s constitution, the

management contract, and using mechanisms such as the statement of

intent. Council oversight could be through the existing Strategic

Development and Property Subcommittee.

6.7.8 The

CCO could have a direct relationship with the Nelson Marina Advisory Group.

6.8 Process

|

Steps to implement Option 3:

Establish a CCO to manage the Marina (Management CCO) – Recommended

Option

|

|

This process will require two or

three decisions by Council (depending on how extensive/complete the first

decision is):

1. The

first step would require Council to make the decision decide to pursue the

management CCO option and begin consultation.

2. Following

this first Council decision, the Council would need to:

a) Undertake

consultation in accordance with the principles of section 82 of the LGA 2002

(as required by section 56) to establish the new CCO including developing a

statement of proposal (section 82A of the LGA 2002).

b) Arrange

for the preparation of a constitution for the new CCO and a Management

Agreement to be entered into between the CCO and the Council.

c) Review

and prepare any changes required to existing policies and delegations in

relation to the Marina (including the policy about the appointment of

directors to CCOs under section 57 of the LGA 2002).

d) Post-consultation

(and assuming the outcome of the consultation is favourable to the

establishment of the management CCO), a second report to the Council would

seek approval of the draft constitution and Management Agreement, any changes

required to existing policies and delegations, and for formal approval to

establish the CCO (For example, incorporate a new company and become a

shareholder of it).

3. Following

this second meeting, the recruitment process for board members of the CCO

would commence. It might be necessary to negotiate remuneration,

and possibly some of the terms of appointment, with candidates.

4. At

around the same time, the company would be incorporated, and the management

contract could be entered into.

|

|

Time

to establish

|

Costs

to establish

|

|

This option is likely to take about

the same amount of time (or less) than the SABU option (and less than the

owner CCO option).

Matters that could have an impact

on the timeframe include:

· Two or three

Council meetings are likely required.

· Mandatory

consultation (but unlikely to unduly delay the process).

· Drafting the

constitution, management agreement, and reviewing any changes to the

Council’s existing policies/delegations.

· The recruitment

process for the board.

|

More costly than the status quo,

and about the same cost as the SABU option. Less cost than the Owner CCO

option.

· CCO

establishment is relatively straightforward. The drafting of the new

company’s constitution and the management agreement need not be overly

complex or costly because precedents will be available.

· If the Council

were to use consultants for the recruitment process, it would incur

consultant costs.

|

6.9 Advantages

and disadvantages

|

Option 3: Establish a CCO to

manage the Marina (Management CCO) – Recommended

Option

|

|

Advantages

|

Disadvantages

and Risks

|

|

· Well-known and

established structure used in local government.

· More

commercially oriented structure (For example, most Council decision-making

obligations do not apply to the CCO’s board) with flexibility to

respond to Council’s non-commercial drivers (including through the

statement of intent).

· LGOIMA applies

but not to meetings.

· CCO would be

able to borrow in its own right (either from the Council or third-party

lenders).

· Council will be

able to appoint board members with relevant expertise and experience.

· Process is

straightforward and requires less bespoke drafting compared with SABU option

(because company law and the CCO provisions of the LGA 2002 provide a clear

regime).

· In the future if

desired the Council could potentially pivot to the “owner CCO”

model by transferring the Marina assets to the CCO.

· Profits derived

through the operation of the Marina will be for the benefit of the asset

owners (Council) and will not be subject to corporate tax.

|

· Consultation

required (although this is unlikely to create any undue delay in

establishment).[5]

· If the CCO is a

company then it would be taxable (although if operated at, or near,

break-even it would have nil or minimal taxable profit).

· The cost of

managing the governance of the Marina through the formation of a Board of

Directors will increase the operating costs of the Marina.

|

Option 4: Establish a CCO to

own and manage the Marina (Owner CCO)

6.10 Description

This option is the same as

Option 3 (Management CCO) with the key difference being a transfer of the

Marina land and associated assets to the new CCO.

6.10.1 The

Council establishes a CCO (For example, a company) specifically to own and

manage the Marina assets and operations.

6.10.2 The

CCO has a board and employs staff (including the Manager Nelson Marina).

The staff of the CCO report to the board, and the board is accountable to the

Council as shareholder.

6.10.3 The

CCO owns and manages the Marina as an operation separate to the Council. The

CCO could borrow in its own right (either from the Council or third parties).

6.10.4 The

Council is able to influence the CCO through well-established channels (including

through the statement of intent).

6.10.5 The

board of the CCO could establish a relationship with the existing Nelson Marina

Advisory Group.

6.11 Process

|

Steps to implement Option 4:

Establish a CCO to own and manage the Marina (Owner CCO)

|

|

This process will require two or three Council decisions

(depending on how extensive/complete the first decision is).

1. The

first step would require Council to make a decision to pursue the

“owner CCO” option and begin consultation.

2. Following

this first Council decision, the Council would need to:

a) Prepare

and undertake consultation in accordance with the principles of section 82 of

the LGA 2002 (as required by section 56) to establish the new CCO including

developing a statement of proposal (section 82A of the LGA 2002).

b) Arrange

for the preparation of a draft constitution for the new CCO and a draft Deed

of Transfer (or equivalent document) for the transfer of the Marina land and

assets to the new CCO.

c) Review

what changes would be required to existing policies and delegations in

relation to the Marina (including the policy about the appointment of

directors to CCOs under section 57 of the LGA 2002).

3. Post-consultation

(and assuming the outcome of the consultation is favourable to the

establishment of the “owner CCO”), the Council would then need to

deliberate on the results of the consultation, make a decision to approve the

draft constitution and Deed of Transfer, and any changes required to existing

policies and delegations, and formally establish the CCO.

4. Following

the second (or third) meeting, the recruitment process for board members

would commence. It might be necessary to negotiate remuneration,

and possibly some of the terms of appointment, with candidates.

5. Once

the CCO is established, the Deed of Transfer would need to be entered into by

the Council and the new CCO, and the Marina land and assets would then be

transferred.[6]

In relation to the Deed of Transfer and due diligence, there could be some

complexities to work through, including the definition of the land (given it

involves reclaimed land, the coastal Marina area, and public reserves).

|

|

Time to establish

|

Costs

to establish

|

|

This option is likely to take the

longest (mostly due to any complexities with the transfer of assets).

Matters that could have an impact on the timeframe

include:

· Two or three

Council meetings are likely required.

· Mandatory

consultation (but unlikely to unduly slow down the process).

· Drafting the

constitution, Deed of Transfer, and reviewing any changes to the

Council’s existing policies/delegations.

· Recruitment

process for the board.

· Due diligence

process (for transfer of assets).

|

The costliest of the options.

· CCO

establishment is relatively straightforward. The drafting of the new

company’s constitution and the Deed of Transfer need not be overly

complex or costly.

· Some cost

associated with any due diligence process required as part of the transfer of

land and assets.

· If the Council

were to use consultants for the recruitment process, it would incur

consultant costs.

|

6.12 Advantages

and disadvantages

|

Advantages

|

Disadvantages and

Risks

|

|

· CCOs are a

well-known and established structure used in local government.

· More

commercially oriented structure (For example, Council decision-making

obligations do not apply to the CCO’s board) with flexibility to

respond to Council’s non-commercial drivers (For example, through the

statement of intent).

· LGOIMA applies

but not to meetings.

· CCO would be

able to borrow in its own right (either from the Council or third-party

lenders).

· Council will be

able to appoint board members with relevant expertise and experience.

· Process is

straightforward and requires less bespoke drafting compared with SABU option.

· Marina would be

a completely standalone entity able to be dealt with separately from the

Council.

|

· Consultation

required by section 56 of the LGA 2002 (although this is unlikely to create

any undue delay in establishment).

· May be political

implications if the transfer of the Marina land the assets has the appearance

of “privatisation”.

· If the CCO is a

company or a CCTO (which it would be if it owns and operates the marina on a

commercial basis), then it would be taxable

· The transfer of

land and assets would likely involve more cost and time to achieve (compared

with the management CCO option). For example, it may be a complex issue

to define the land (because it will likely involve reclaimed land, the

coastal marine area, and reserve land etc) and there are requirements in the

LGA 2002 about transferring undertakings to CCOs.[7]

· There may be

complexities around the operation of the Council’s bylaws and other

regulations if the Marina is owned by a CCO, and the role of the

harbourmaster would need to be considered. This would add some cost and

time to this option.

|

Option 5: Establish a Limited Liability Partnership

(LLP)

6.13 This

option is similar to Option 4 (Owner CCO) with the key difference being the

establishment of a limited partnership in addition to a new company, with the

limited partnership to own and control the marina land and associated assets.

6.14 The

Council establishes a CCO (eg a company) to become the “general

partner” in the limited partnership.

6.15 The

Council (as the “limited partner”) and the new CCO become partners

in a limited partnership. This includes entering into a limited partnership

agreement. The limited partnership is itself a separate legal entity (separate

from the Council as limited partner and the other CCO as general partner) and

therefore a CCO in its own right.

6.16 The

Council then transfers the marina land and assets to the newly established

limited partnership to own and manage the marina and its operations.

6.17 The

CCO general partner has a board and employs staff for the limited partnership

(including the Manager Nelson Marina). The limited partnership staff report to

the board of the CCO general partner, and the board is accountable to the

Council as limited partner in the partnership and shareholder of the CCO

general partner.

6.18 The

CCO general partner would be responsible for the day-to-day management of the

limited partnership (and therefore the marina) and, unless the limited

partnership agreement provides otherwise, would be responsible for all the

debts and liabilities of the limited partnership to the extent the limited

partnership cannot meet such debts and liabilities.

6.19 The

Council as limited partner would not be responsible for the day-to-day

management of the limited partnership and would not be responsible for the debts

and liabilities of the limited partnership, provided that the Council does not

take part in the management of the partnership (in the sense set out in the

Limited Partnerships Act 2008).

6.20 The

limited partnership owns and manages the marina as an operation separate to the

Council. The limited partnership could borrow in its own right (either from the

Council or third parties).

6.21 The

Council is able to influence the general partner CCO through well-established

channels (including through the statement of intent) and therefore influence

the way that the general partner manages the operation of the limited

partnership. The limited partnership could also establish a relationship with

the existing Nelson Marina Advisory Group.

6.22 To

maintain the Council’s limited liability position, care would need to be

taken to ensure that such arrangements would not cause the Council to be viewed

as taking part in the management of the limited partnership under the Limited

Partnerships Act 2008.

6.23 Process

|

Steps to implement Option 5:

Establish a LLP to own and manage the Marina (Owner CCO)

|

|

1. This process will require two or three Council

decisions (depending on how extensive/complete the first decision is). The

first step would require Council to make a decision to pursue the

“limited partnership” option and begin consultation.

2. Following this first Council decision, the

Council would need to:

a) Prepare and undertake consultation in accordance with

the principles of section 82 of the LGA 02 (as required by section 56) to

establish the new general partner CCO and the limited partnership itself,

including developing a statement of proposal (section 82A of the LGA 02).

b) Arrange for the preparation of a draft constitution for

the new general partner CCO, a draft limited partnership agreement for the

limited partnership, and a draft Deed of Transfer (or equivalent document)

for the transfer of the marina land and assets to the limited partnership.

c) Review what changes would be required to existing

policies and delegations in relation to the marina (including the policy

about the appointment of directors to CCOs under section 57 of the LGA 02).

3. Post-consultation (and assuming the outcome of the

consultation is favourable to the establishment of the limited partnership),

the Council would then need to deliberate on the results of the consultation,

make a decision to approve the draft constitution, limited partnership

agreement and Deed of Transfer, and any changes required to existing policies

and delegations, and formally establish both the general partner CCO and the

limited partnership.

4. Following the second (or third) meeting, the recruitment

process for board members of the general partner CCO would commence. It might

be necessary to negotiate remuneration, and possibly some of the terms of

appointment, with candidates.

5. Once the general partner CCO is established, and the

limited partnership agreement entered into (with the limited partnership then

being formally established), the Deed of Transfer would need to be entered

into by the Council and the new limited partnership, and the marina land and

assets would then be transferred. In relation to the Deed of Transfer

and due diligence, it is expected that there could be some complexities to

work through, including the definition of the land (given it may involve

reclaimed land, the coastal marina area, and possibly reserves)

|

|

Time

to establish

|

Costs

to establish

|

|

This option is likely to take about the same time as the

Owner CCO option, but there may be some additional time involved in

establishing the limited partnership.

Matters that could have an impact on the timeframe

include:

· Two or three

Council meetings are likely required.

· Mandatory

consultation (but unlikely to unduly slow down the process).

· Drafting the

constitution, limited partnership agreement, Deed of Transfer, and reviewing

any changes to the Council’s existing policies/delegations.

· Recruitment

process for the board.

· Due diligence

process (for transfer of assets).

|

About the same costs to set up as the Owner CCO option,

but there would be some additional cost involved in establishing the limited

partnership.

· The CCO company

establishment is relatively straightforward, and the drafting of the new

company’s constitution and the Deed of Transfer need not be overly

complex or costly.

· The need for a

separate limited partnership agreement and registration of the limited

partnership may add to the cost of this option compared with the Owner CCO

option.

· Some cost

associated with any due diligence process required as part of the transfer of

land and assets.

· If the Council

were to use consultants for the recruitment process, it would incur

consultant costs.

|

6.24 Advantages

and Disadvantages

|

Advantages

|

Disadvantages

and Risks

|

|

Same as for Option 4 Owner CCO, except the

following:

· Limited

partnerships are less common and well-known in the local government sector

than simple company CCOs.

· The

establishment process and overall complexity would be higher than the Owner

CCO option.

|

Same as for Option 4 Owner CCO, except the

following:

· This option

involves the establishment of two CCOs (the general partner and the limited

partnership itself), and the application of both company and limited

partnership legislation in addition to the LGA 2002, and this adds to the

overall complexity of the establishment process and governance arrangements

for the marina.

· Although the CCO

general partner may be operated at, or near, break-even so that it would have

nil or minimal taxable profit (comparable to the Management CCO option), the

limited partnership itself will likely be a CCO for income tax purposes (Tax

CCO) if it is a CCTO under the LGA (if it would own and operate the marina on

a commercial basis). This means that marina income attributed to the Council

(as limited partner under the ‘flow through’ income tax rules

that apply to limited partnerships) would most likely be viewed as taxable

income of the Council. The proposed local authority tax changes in the

tax bill that is currently before Parliament would not alter this position.

|

7. Recommended

Option Development

7.1 The

recommended option for the future governance of Nelson Marina is through the

formation of a Management Council Controlled Organisation (Management CCO) (Option

3).

7.2 Option

3 (Management CCO) will provide the Marina with a dedicated board of directors

allowing the marina to move forward under the guidance of specialist knowledge

and advice through a more dynamic commercially orientated framework.

7.3 Option

3 (Management CCO) structure does not produce any tax implications to Council

(not subject to company tax).

7.4 The

increased cost of operating a management CCO is estimated at approximately

$107,000 per annum, this would be offset by increased efficiency and operating

revenue.

7.5 Management

Agreement – under a management agreement the new CCO would operate the

Marina on behalf of Council’s interests as the asset owner. The

agreement would have a specific Statement of Intent and provide Delegations

from Council to the Board of Directors of the CCO. The Board of Directors

would report back to the Strategic Development and Properties Subcommittee

and/or Council directly and Council would still have ultimate control over the

management of their assets.

8. Conclusion

8.1 The

recommended option for the future governance of Nelson Marina is through the

formation of a Management Council Controlled Organisation (Management CCO) (Option

3).

9. Next

Steps

9.1 If

the recommended option is approved by the Council, then Officers will undertake

the steps as outlined above.

9.2 This

would include consultation with community and stakeholders, as per Section 56

of the LGA 2002.

9.3 Further

updates will be reported to upcoming Strategic Development and Property

Sub-committee meetings.

9.4 Present

to Council an analysis and recommendation for the best asset owning company

structure for further analysis.

Author: Nigel

Skeggs, Manager Nelson Marina

Attachments

Attachment 1: A2764091 Marina

Governance s17a Review - Infracure - Final ⇩

|

Important considerations for decision making

|

|

1. Fit

with Purpose of Local Government

Approving the recommended change to a Management CCO

will support local democratic decision making and action to promote the

social, economic, environmental, and cultural well-being of the Nelson

community.

|

|

2. Consistency

with Community Outcomes and Council Policy

The recommendation is consistent with

Council’s objectives to provide effective governance of community assets.

It will also allow the Marina to enhance the

community Marina assets and provide a return to the shareholders (Nelson rate

payers). The board of the Marina will still be guided by and

accountable to the Council. Council will still retain full ownership of

the assets.

|

|

3. Risk

The primary risks for Council in not changing the

Governance model of the Marina to a Management CCO are both financial and

reputational.

Having a suitably qualified, commercially orientated

Board of Directors with direct responsibility for financial performance of

the Marina will significantly reduce these risks to Council.

A Management CCO model will allow for accountability

of performance through a third party to Council and ensure that a model is in

place to be dynamic enough to achieve said goals in the desired timeframes.

As the Marina develops prices charged for services

will increase. Having a commercial board will help to shelter

elected members from the likely political pressure exerted by some customers

who do not want to see change or prices increase.

|

|

4. Financial

impact

The immediate costs of setting up a Management COO

will come through the cost of consultants, additional Council staff hours,

internal legal advice and outside legal counsel. This will be offset by

improved financial and operational performance into the future.

Ongoing additional costs will come in the form of

Directors Fees, Company Secretary fees and the costs associated with running

the board.

|

|

5. Degree of significance and level of engagement

This matter is of medium significance as it requires

the formation of a new Governance structure to manage and control a rate

payer owned asset. Regardless of the perceived level of significance

however, consultation is required under Section 56 of the Local Government Act

before a Council Controlled Organisation (CCO) is established.

|

|

6. Climate

Impact

This decision does not have an impact on climate

change. Responsiveness to climate impact would become a performance measure

for a new Board.

|

|

7. Inclusion

of Māori in the decision making process

No engagement with Māori has been undertaken in

preparing this report. Iwi would be advised of any upcoming consultation

through usual avenues.

|

|

8. Delegations

The Strategic Property and Development Subcommittee

has the following delegations to consider the future Governance of Nelson

Marina:

Areas of Responsibility:

· Marina

Precinct

Delegations:

· Powers

to decide the developing, monitoring and reviewing of strategies, policies

and plans, with final versions to be recommended to Council for

approval.

Powers to Recommend to Council:

· Approval

of final versions of strategies, policies and plans;

· All

other matters within the areas of responsibility or any other matters

referred to it by Council.

|

Item

9: Strategic Development and Property Quarterly Report to 30 September

2021

|

|

Strategic Development and Property Subcommittee

3 December 2021

|

REPORT R26108

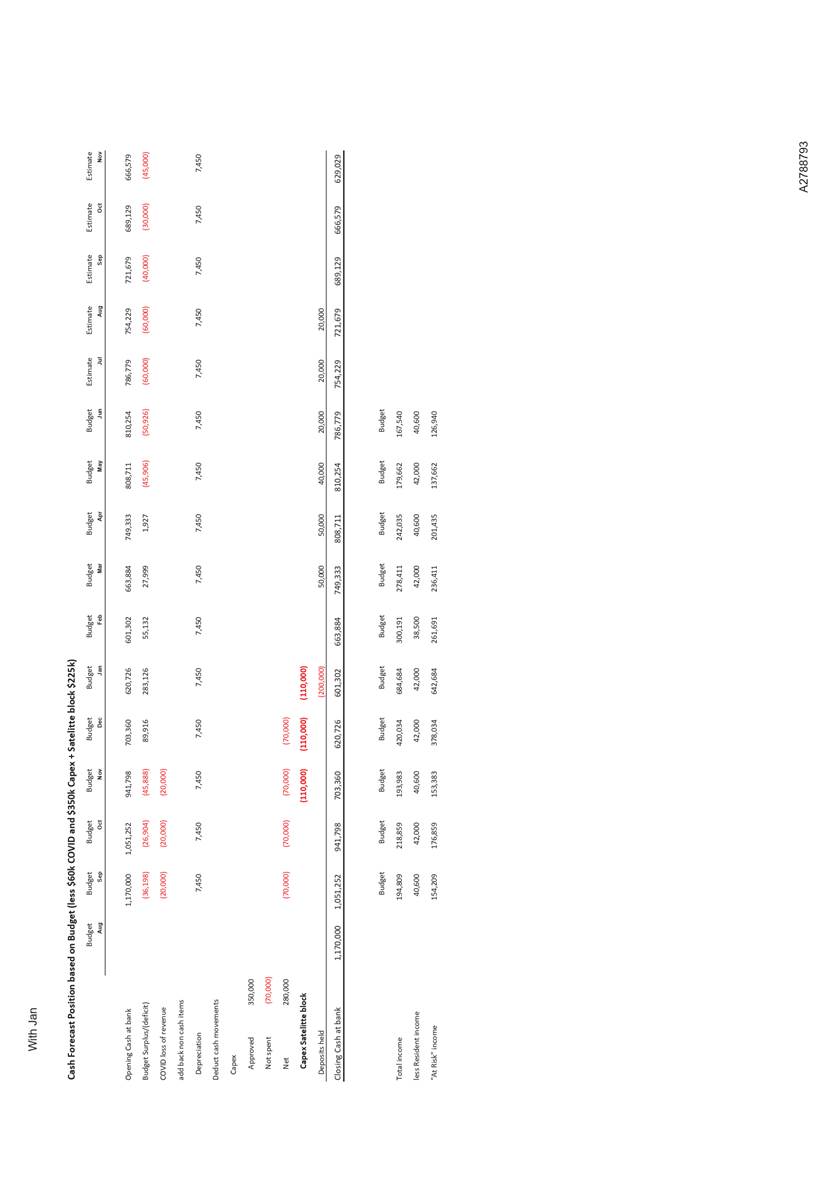

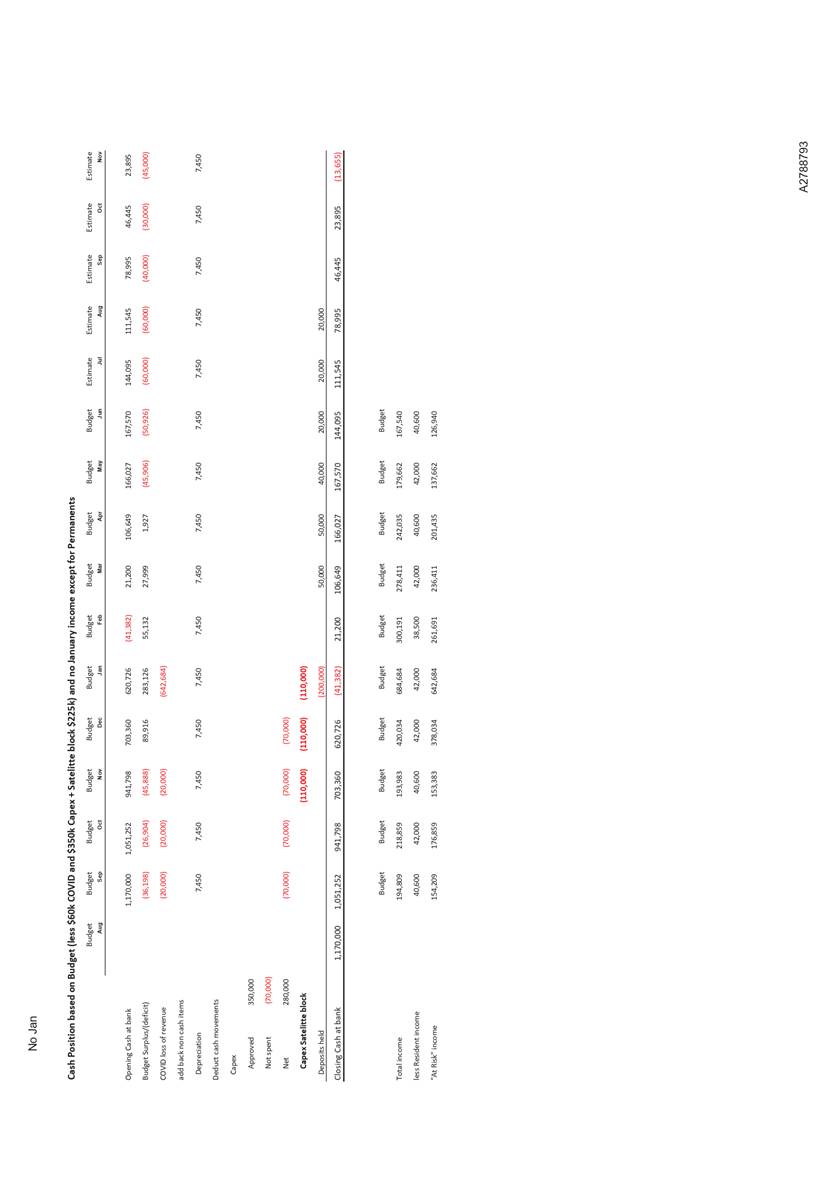

1.

Purpose of Report

1.1

To inform the Subcommittee of the financial and non-financial results for the first quarter of 2021/22 financial year for the

activities under the Strategic Development and Property Subcommittee’s delegated

authority.

2.

Recommendation

|

That the Strategic Development and Property

Subcommittee

2.

Receives the report (R26108) and its attachment (A2660062).

|

3. Background

3.1 Quarterly reports on performance are provided to each

Committee on the performance and delivery of projects and activities within

their areas of responsibility.

3.2 The

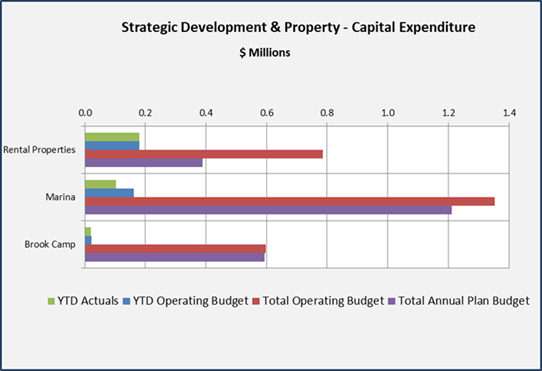

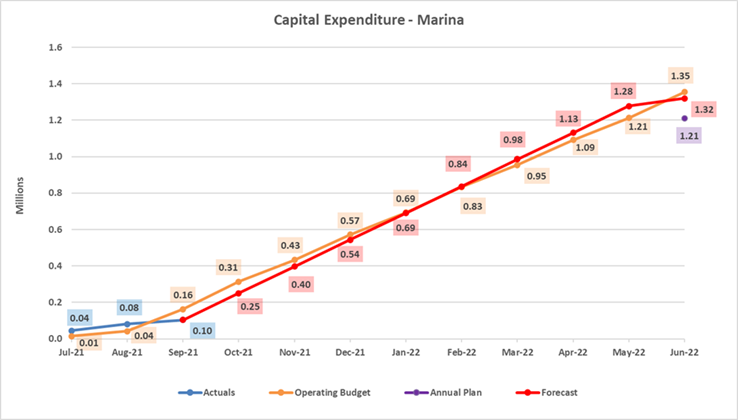

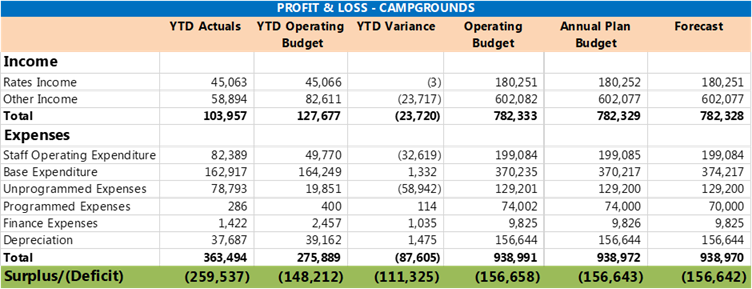

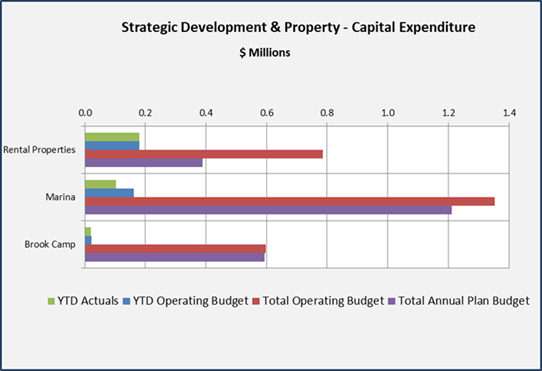

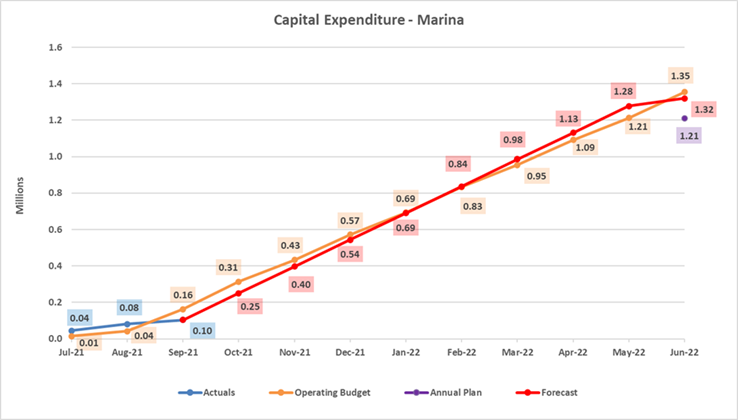

financial reporting focuses on the year to date performance (1 July 2021 to 30

September 2021) compared with the year-to-date (YTD) approved capital and

operating budgets.

3.3 Unless

otherwise indicated, all information is against “Approved Budget”,

which is the 2021/22 annual budget plus any carry forwards, plus or minus any

other additions or changes as approved by the appropriate Committee or Council.

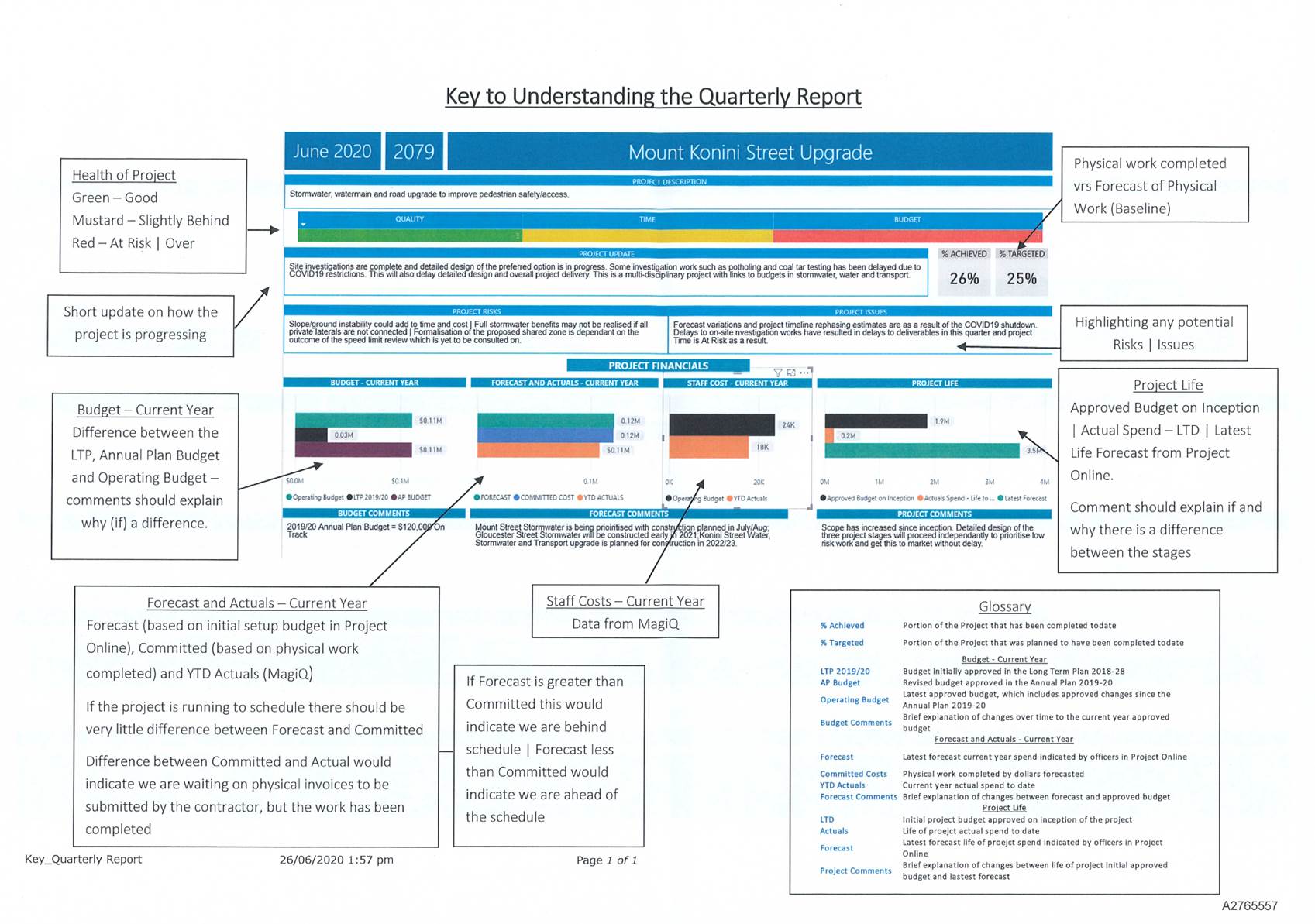

3.4 Detailed

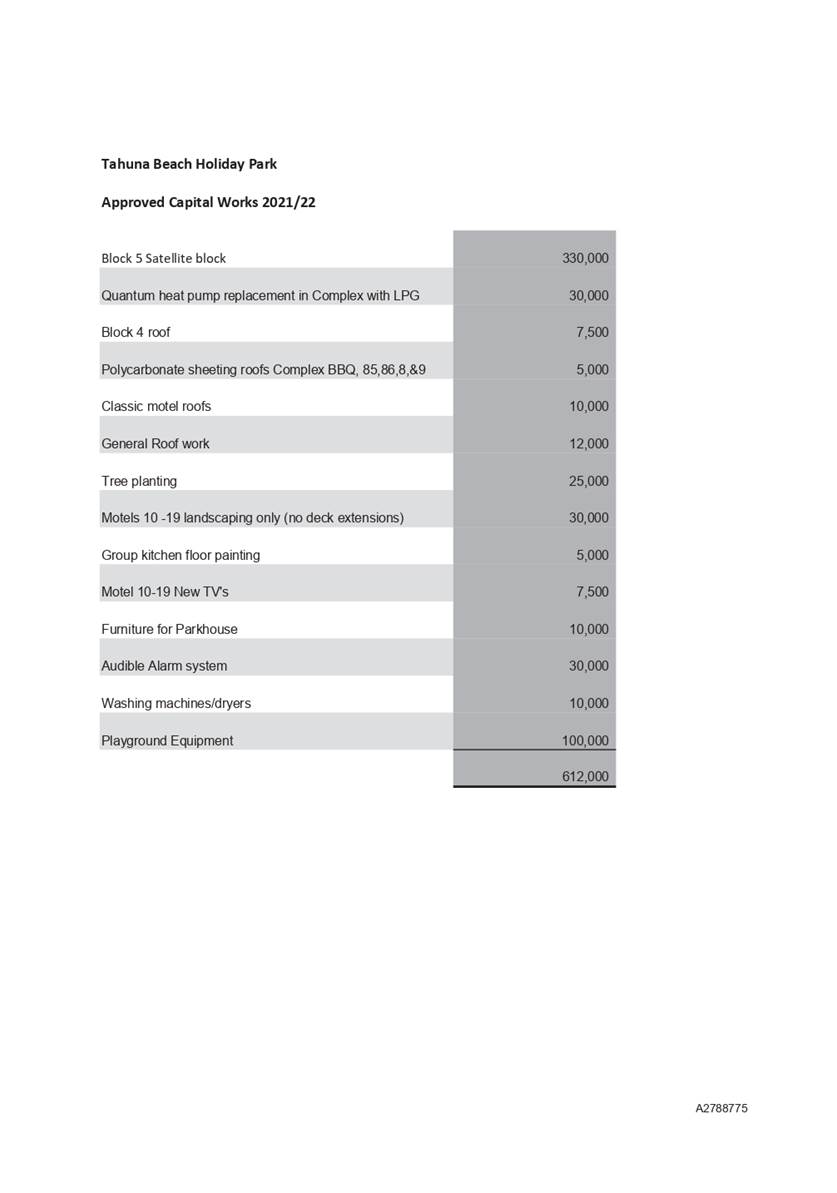

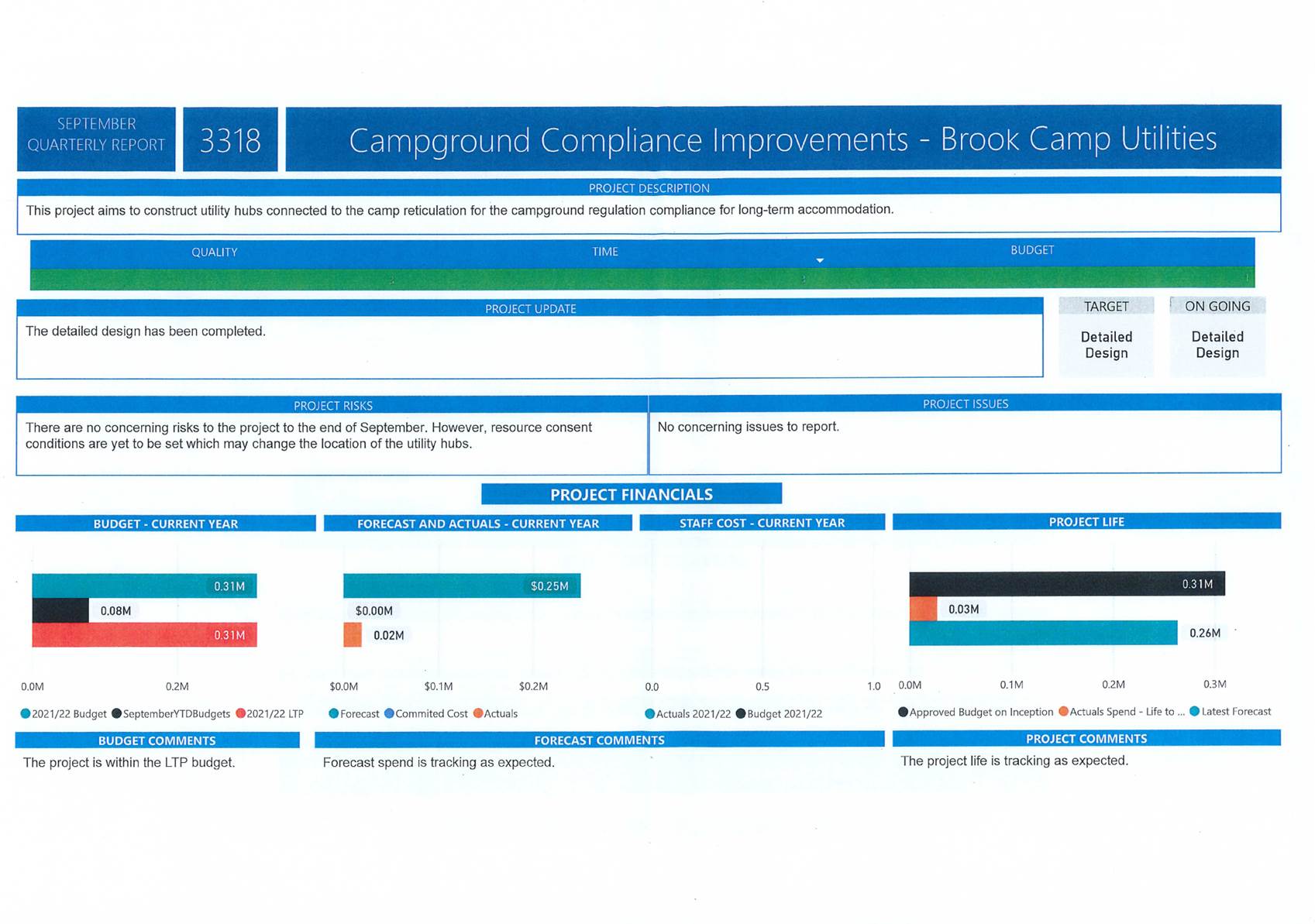

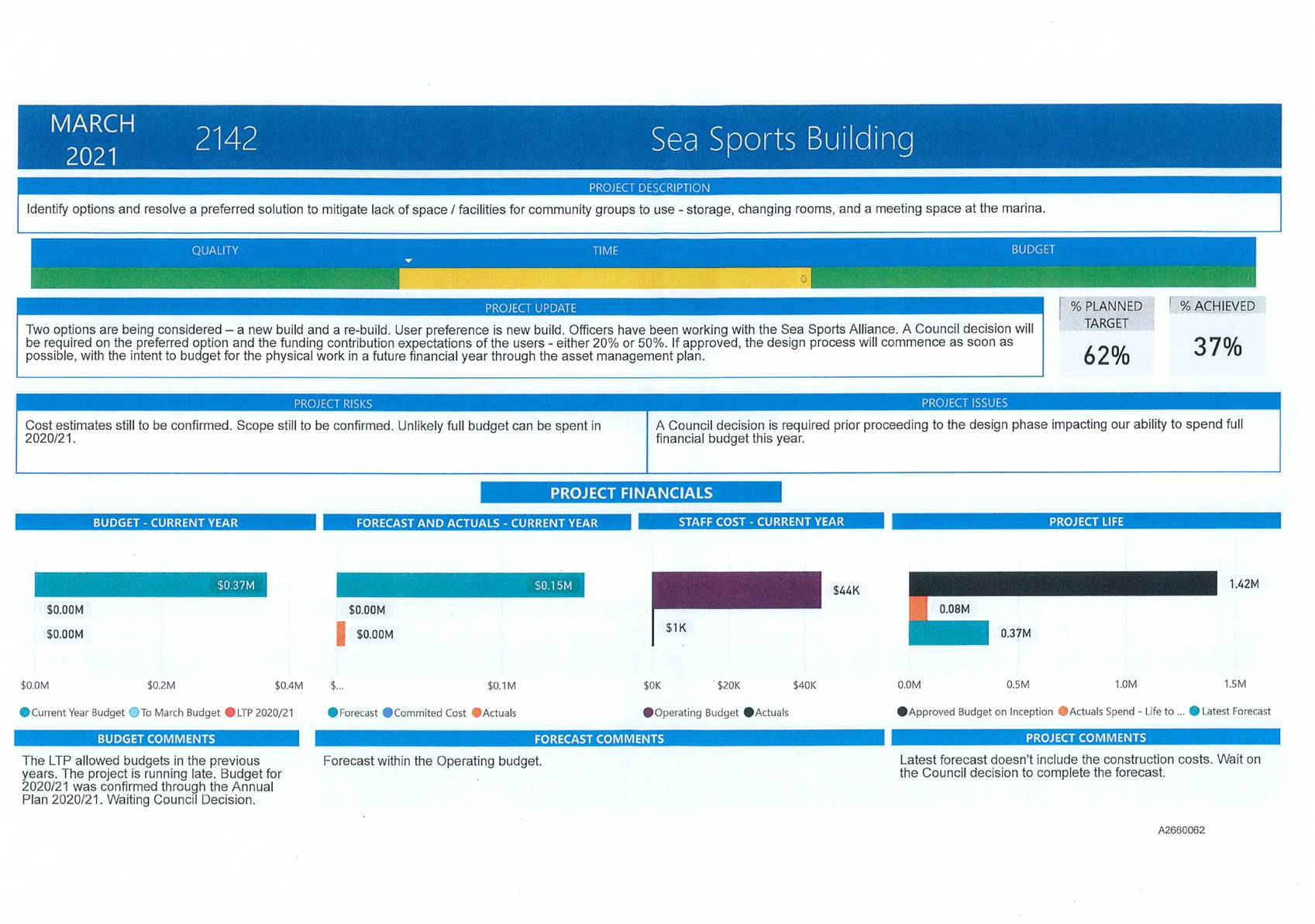

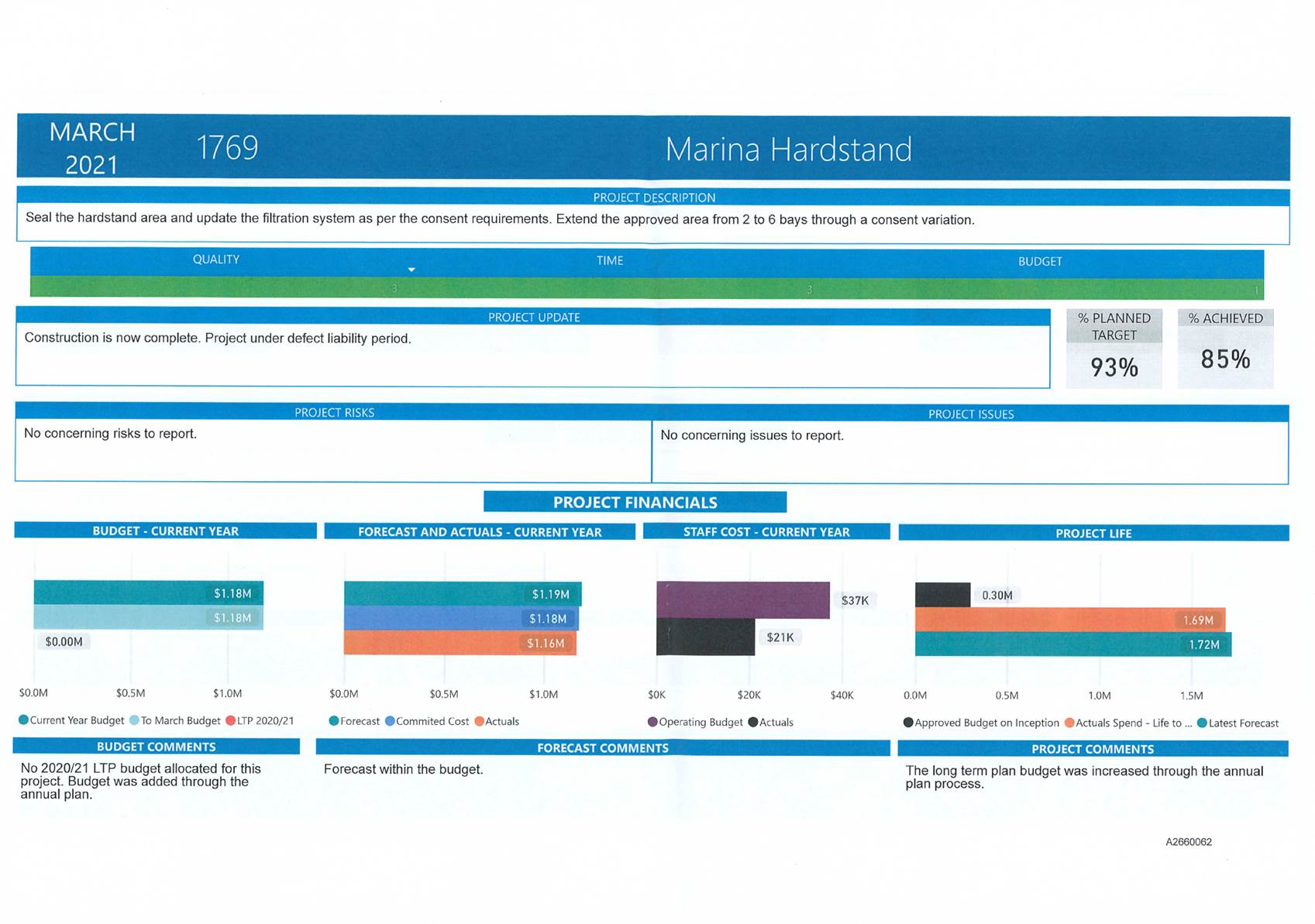

capital project sheets are included in Attachment 1 (A2660062). Capital project

sheets have been selected if their budget is at least $250,000 for 2021/22, are

multi-year projects with a budget over $1 million, or have been assessed to be

of particular interest to the Committee.

3.5 Capital

project status is analysed based on three factors: quality, time, and budget.

From the consideration of these three factors the project is summarised as

being on track (green), some issues/risks (orange), or major issues/risks

(red). Projects that are within 5% of their budget are considered to be on

track in regard to the budget factor.

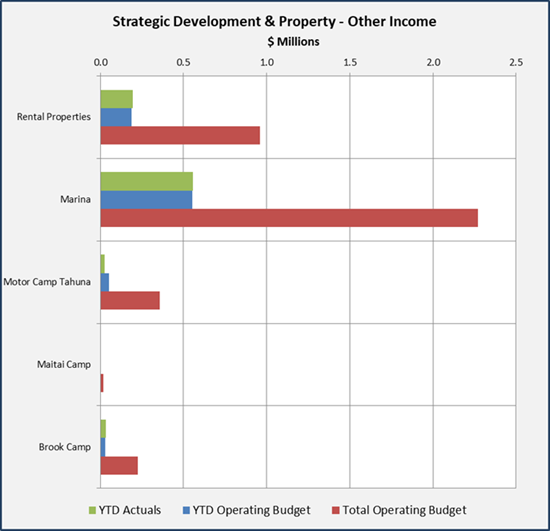

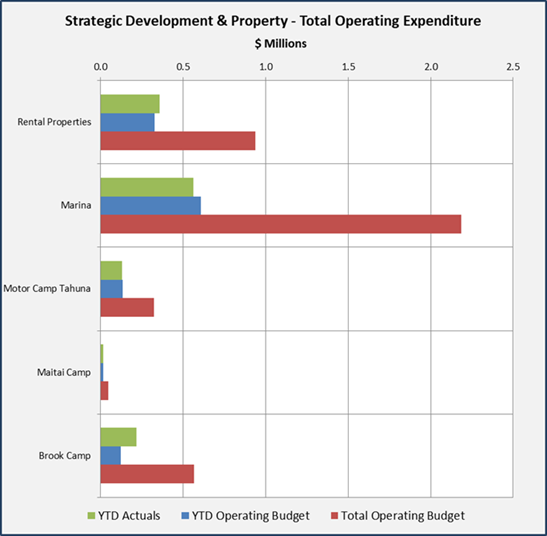

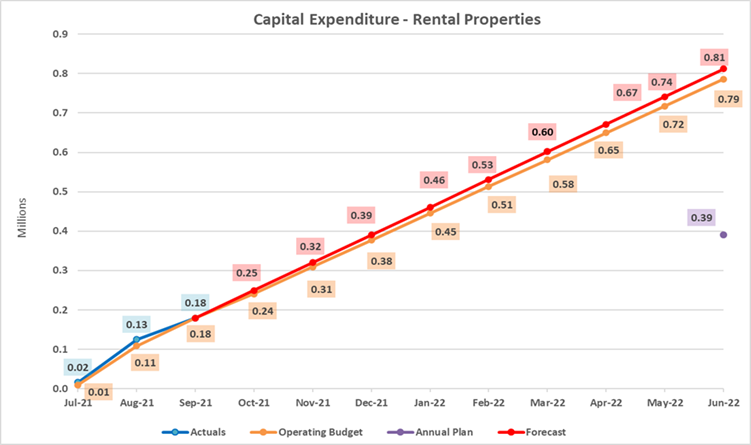

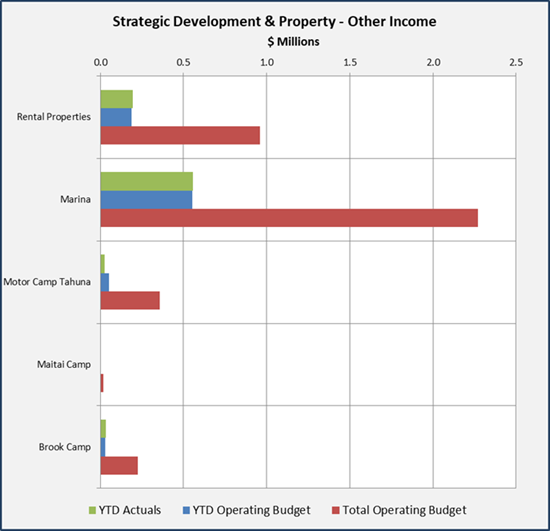

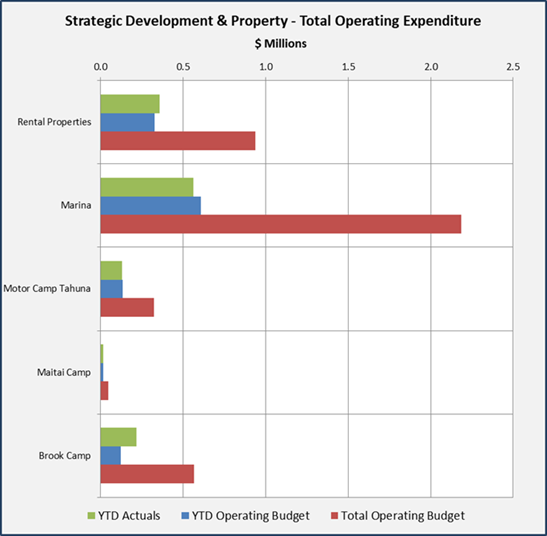

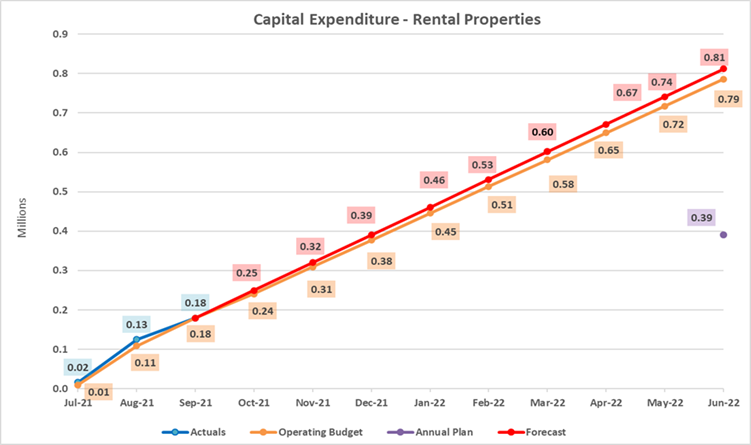

4. Financial Results

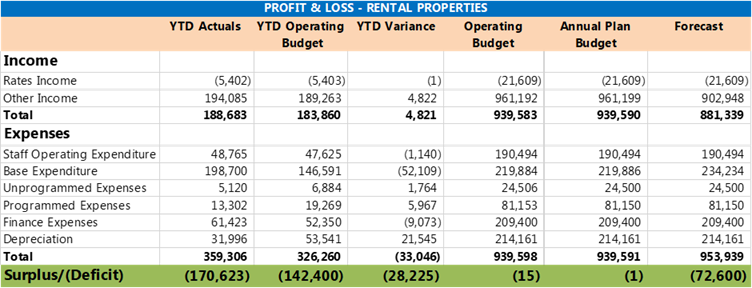

Profit and Loss by Activity

4.1 Rental

Properties graphs include the following properties:

· Millers

Acre Centre

· 157

Haven Road

· 48

Pascoe Street

· 163

Haven Road

· 199

Bridge Street

· 101

Achilles Avenue

· 225

Atkerson Street

· 81

Achilles Avenue

· Nursery

Land – Atawhai Drive

· 11

Cross Quay

· 252

Haven Road

· 236-250

Haven Road

4.2 Brook

Camp operating expenditure is greater than budget by $94,000. Analysis on these

costs needs to be undertaken, as a portion can be capitalised, as well as spilt

with the Maitai Camp. This work will be undertaken in time for the next

quarterly report.

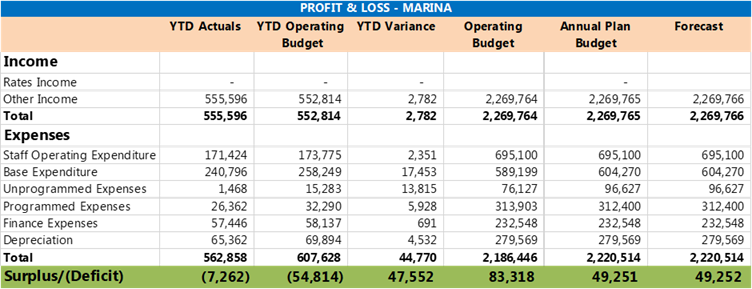

4.3 Nelson

Marina income is over budget by $3,000 despite being unable to operate the

hardstand during the COVID-19 lockdown period. Expenses are below budget

by $45,000, resulting in an operating deficit of $3,000, compared to a budgeted

operating deficit of $45,000.

4.4 Nelson

City Council uses phased budgets so budget and actual are shown in the same

month ie rates and insurance are all paid and accounted for in July of each

year rather than being accrued or split equally between all 12 months. For

reporting this has been corrected for the monthly operating accounts by profit

centre below. In Q1 Nelson Marina made an accrued operating profit of

$100,000.

4.6 Quarter 1

Commentary by Profit Centre:

Berthing

– Berthing has made a profit of $160,000 in the first quarter. August

income was up by $30,000 as this was accounted for in some annual payments and

adjustments were made on missed billing from Nelmac.

Boat Yard

– the boat yard (or hardstand) made a Q1 loss of $25,000. The team

are working very hard to increase efficiencies in the yard and the results of this

were seen in September, where the yard has made a profit. This is the first

month that a profit has been turned over for the yard in the last three

years. Income was down significantly for August due to COVID-19 lockdown,

when the yard was closed.

Boat

Storage – the boat storage yard has been operating to budget and is

running at 100% occupancy.

Boat Ramp

– In Q1 the boat ramp made a operating loss of $36,000. This is in

keeping with historical figures and is the result of both non-payment of ramp

fees by casual users and the low price for use of the ramp and parking. This

will be addressed by legal enforcement and a proposed increase in fees and

charges for the 2022/23 year.

Commercial

Property – In Q1 the loss from commercial properties was $5,000. This

is the holding cost for the vacant land around the marina that is deriving very

little income.

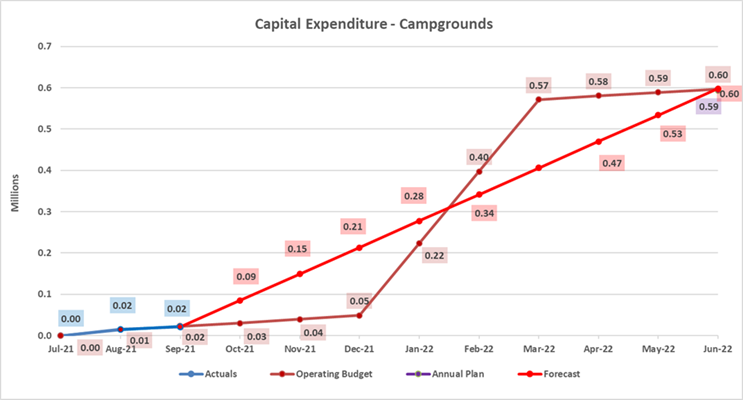

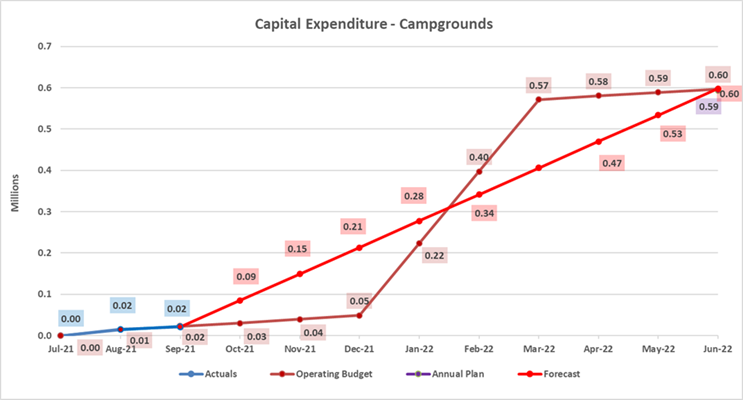

5. Updates

Campgrounds

5.1 Staff provided an update to the subcommittee on 21 October

2021, which covered an update on the Brook Valley Holiday Park compliance

capital. There is no further update to report on this project.

5.2 Staff have been meeting with the leasee of the Maitai Camp

to discuss the implications of the abatement notice for long term residential

activity.

5.3 The Housing Hui with social agencies continues to meet

fortnightly to discuss progress with compliance at the campgrounds.

5.4 A new lease for Tahuna Beach Camp incorporated was prepared

and adopted for the 28 October Council meeting.

The

Marina

5.5 The

management of the Marina was brought back in house, with new management team

taking over from Nelmac on 1 July 2021. This is the first quarterly report

under the new management.

5.6 Nelson

Marina is now run with eight full-time employees.

5.7 The Nelson Marina office is now manned from 8:00am to 7:00pm, seven

days per week, and is now a full-service marina with dockside assistance during

work hours. Staff are rostered on call for 24-hour emergency cover.

5.8 Q1 was a busy period for the marina from both an operational and

strategic perspective. Key highlights are set out below:

· Reconciled all old outstanding accounts, recovered $32,000 in

outstanding debt, placed 237 customers on direct debit for monthly invoicing.

· Audited all vessels for insurance documents, EWOF, and tag and test

of shore power cables.

· Increased occupancy of underutilised 8m, 9m, and Pile berths, reduced

10m waitlist from 18 months to 9 months.

· Improved compliance, updated security and cleaning contracts.

· Reviewed and amended Fees and Charges for the 2022/23 year.

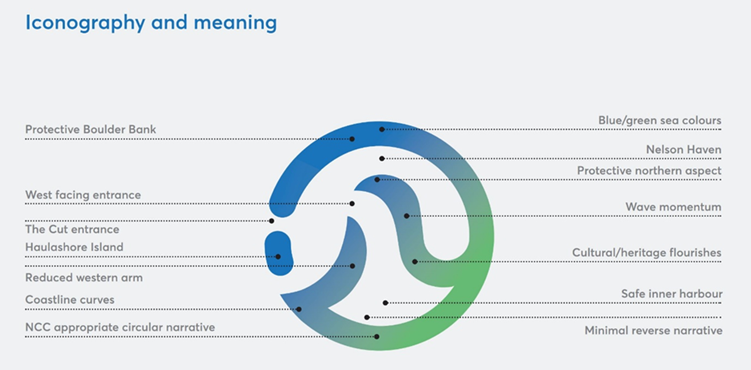

· Developed new Nelson Marina Logo (see below).

5.9 Quarter 1

Strategic Highlights:

· Masterplan

– the Masterplan process is ongoing and nearing completion. A survey was

released to all marina users with data now received and collated. A full review

of all land-based options has been completed, and work is ongoing to finalise

various options for reconfiguring the marina’s wharves and jetties.

· S17a Governance

review – This has been completed and will be reported separately at

this Strategic Development and Property Subcommittee.

5.10 Quarter 1 Capital Projects

and Improvements

· Reconfigured

marina office with new reception and reception desk in old customer lounge,

repainted office and set up new meeting room with AV system. Installed new

pathways to office and sun protection.

· Gutted old

marina supervisor’s office, that had been abandoned for the previous

eight years, and converted to a new customer lounge with 24-hour swipe card

access and a staff room upstairs.

5.11 Quarter 1 Compliance:

· Reviewed all

resource consents to ensure full compliance.

· Reviewed

Navigational Safety Bylaw.

· Developed and

implemented Hardstand Activity Management Plan to conform with our resource

consent.

· Developed

news rules and health and safety induction process for the safe operation of

the hardstand.

Strategic Properties

5.12 Staff

provided a verbal update to the subcommittee in the public excluded portion of

the Strategic Development and Property Subcommittee meeting on 21 October 2021,

which covered activity for the duration of this first quarter report. There are

no further updates to provide in this report.

Activity Management Plan

5.13 The

marina, campgrounds and strategic properties are assets contained within the

Property and Facilities Activity Management Plan (AMP). The final AMP will be

presented to Council on 9 December 2021 for adoption. The final AMP will be

reported directly to Council as the issues it covers sit across more than one

Committee.

6. Key Performance

Measures

6.1 As part of the development of the Long-Term Plan 2021-31,

Council approved levels of service, performance measures and targets for each

activity. There is one performance measure that is within the Strategic

Development and Property Subcommittee’s delegation, Marina berth holder

occupancy, which is reported in this quarterly report.

6.2 Performance

measures are reported on quarterly, with an annual result of

‘achieved’, ‘not achieved’, or ‘not

measured’ given at the end of the financial year. The scale to report on

the performance measures during the year is as follows:

· On track

· Not on track

· Not measured yet

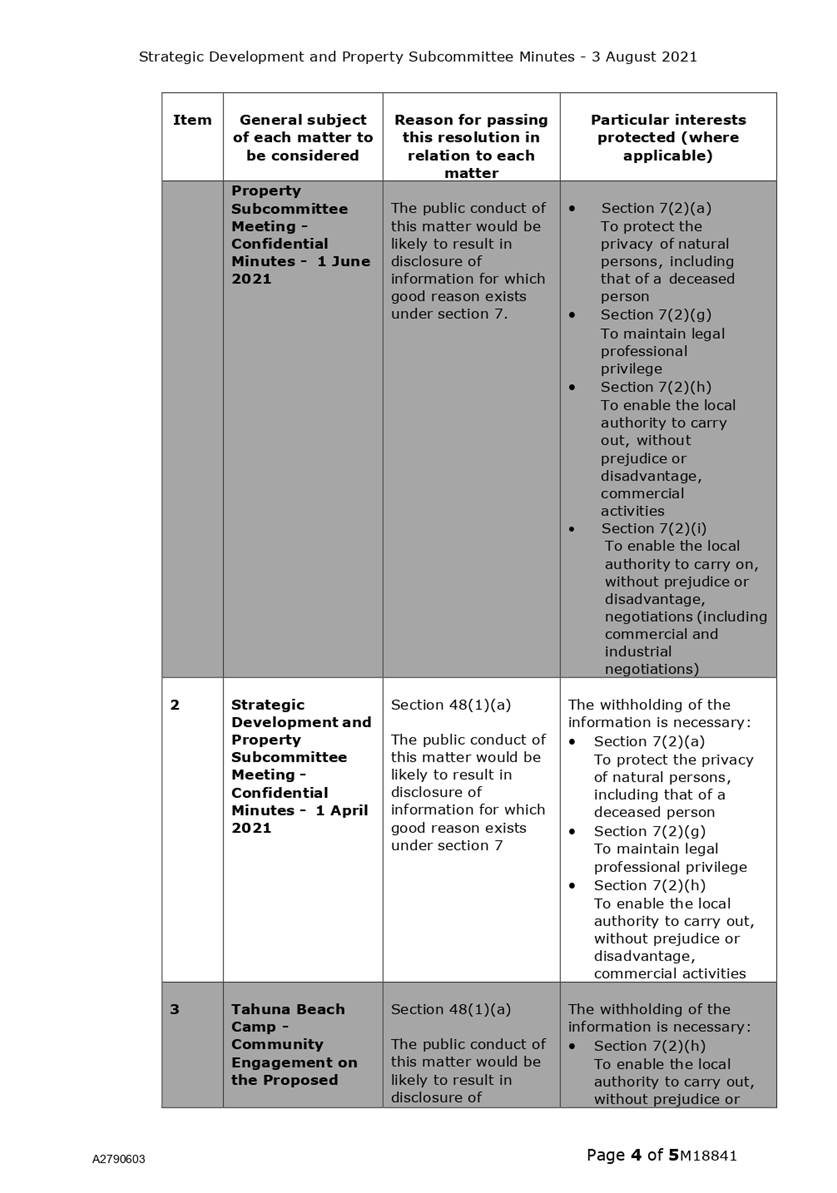

|

What Council will provide

|

Performance Measure

|

Target Year 1 (2021/22)

|

Staff comment

Q1 2021/22

|

Achievement Q1 2021/22

|

|

Marina managed to meet demand

|

Occupation for marina berths

(both permanent and visitors)

|

Greater than 95%

|

Achievement for quarter one is 93%. It is

under the target as there was a berth reshuffle in this quarter. Several

small (9 and 10 metre) berths are now available. All permanent berths over 10

metres are fully occupied.

|

Not on track

|

7. Conclusion

7.1 The

review of performance for the first quarter of 2021/22

for the Strategic Development and Property Subcommittee is included in this

report, with project reports and a performance measure attached.

Author: Rosie

Bartlett, Manager Parks and Facilities

Attachments

Attachment 1: A2660062 -

Strategic Development and Property - Quarterly Report Project Sheets