Notice of the Ordinary meeting of

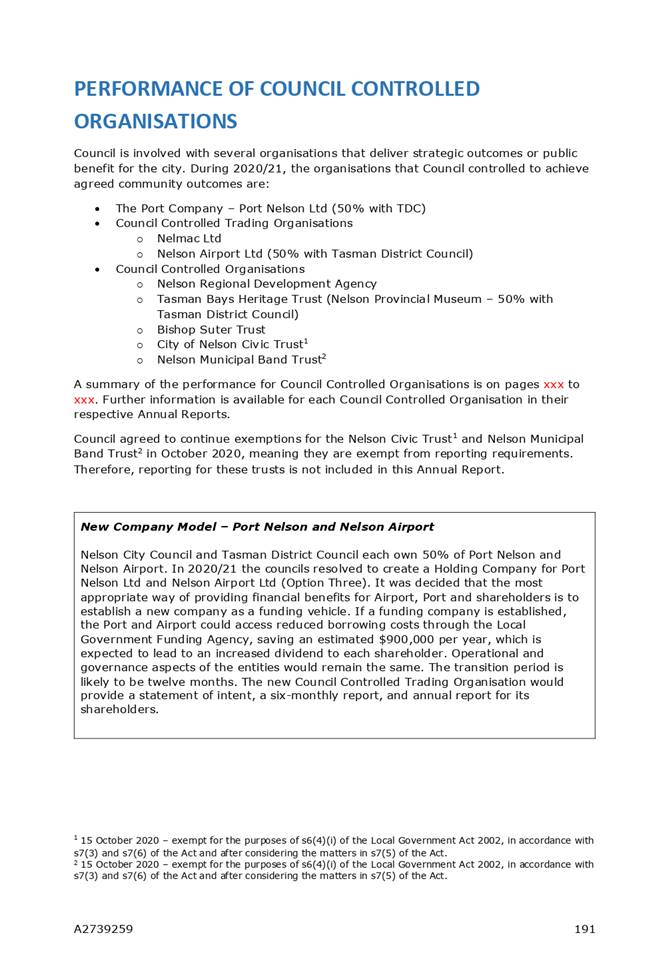

Audit, Risk and Finance Subcommittee

Te Kōmiti Āpiti, Kaute / Tūraru /

Pūtea

|

Date: Tuesday

14 September 2021

Time: 9.00a.m.

Location: via

Zoom

|

Agenda

Rārangi take

Chairperson Mr

John Peters

Members Her

Worship the Mayor Rachel Reese

Cr

Judene Edgar

Cr

Matt Lawrey

Cr

Rachel Sanson

Mr

John Murray

Quorum: 3 Pat

Dougherty

Chief Executive

Nelson City Council Disclaimer

Please note that the contents of these

Council and Committee agendas have yet to be considered by Council and officer

recommendations may be altered or changed by the Council in the process of

making the formal Council decision. For enquiries call (03) 5460436.

Audit, Risk and Finance Subcommittee

14

September 2021

Page

No.

1. Apologies

Nil

2. Confirmation

of Order of Business

3. Interests

3.1 Updates

to the Interests Register

3.2 Identify

any conflicts of interest in the agenda

4. Public

Forum

5. Confirmation

of Minutes

5.1 25 May

2021 6 - 14

Document number M17659

Recommendation

|

That the Audit, Risk and Finance Subcommittee

1. Confirms the minutes of the meeting

of the Audit, Risk and Finance Subcommittee, held on 25 May 2021, as a true

and correct record.

|

6. Chairperson's Report 15 - 17

Document number R26218

Recommendation

|

That

the Audit, Risk and Finance Subcommittee

1. Receives

the report Chairperson's Report (R26218).

|

7. Annual Report

2020/21 18 - 241

Document number R25905

Recommendation

|

That

the Audit, Risk and Finance Subcommittee

1. Receives the report Annual Report

2020/21 (R25905) and its attachment (A2739259); and

2. Notes the draft Annual Report

2020/21 has been prepared and will be audited before being presented to

Council for adoption following audit, prior to the 31 December 2021 statutory

deadline.

|

8. Audit Reports on the

Consultation Document and Long Term Plan 2021-31 242 - 265

Document number R26112

Recommendation

|

That

the Audit, Risk and Finance Subcommittee

1. Receives

the report Audit Reports on the Consultation Document and Long Term Plan

2021-31 (R26112) and its

attachments (A2720857 and A2718269); and

2. Notes Council’s

response to two recommendations from Audit New Zealand on asset planning

(‘Management Comment’), highlighted in section 3.10, pages 10 and

11 of Attachment 1 (A2720857).

|

9. Bad Debts Writeoff -

Year Ending 30 June 2021 266

- 269

Document number R25901

Recommendation

|

That the Audit, Risk and Finance Subcommittee

1. Receives the report Bad Debts Writeoff - Year

Ending 30 June 2021 (R25901).

|

Recommendation to Council

|

That the Council

1. Approves the balance of

$41,990.31 owed by the Brook Valley Community Group Inc be written off as at

30 June 2021.

|

10. Carry Forwards 2020/21 270 - 277

Document number R26143

Recommendation

|

That

the Audit, Risk and Finance Subcommittee

1. Receives

the report Carry Forwards 2020/21 (R26143)

and its attachment (A2724698).

|

Recommendation to Council

|

That the Council

1. Approves

the carry forward of $2.6 million unspent capital budget for use in 2021/22:

and

2. Notes

that this is in addition to the carry forward of $4.8 million approved during

the Long Term Plan 2021-31, taking the total carry forward to $7.4 million of

which $827,000 is for the 2022/23 year, $349,000 is for the 2023/24 year and

the balance of $6.2 million is for the 2021/22 year; and

3. Notes

that the total savings and reallocations in 2020/21 capital expenditure of

$1.7 million including staff time which is in addition to the $2.3 million

savings and reallocations already recognised in the May 2021 deliberations;

and

4. Notes that the total 2021/22 capital budget (including staff

costs and excluding consolidations and vested assets) will be adjusted by

these resolutions from a total of $67.1 million to a total of $69.7 million;

and

5. Approves the carry forward of

$567,000 unspent operating budget for use in 2021/22.

|

Confidential Business

11. Exclusion

of the Public

Recommendation

That the Audit,

Risk and Finance Subcommittee

1.

Excludes the

public from the following parts of the proceedings of this meeting.

2.

The general subject of each matter to be

considered while the public is excluded, the reason for passing this resolution

in relation to each matter and the specific grounds under section 48(1) of the

Local Government Official Information and Meetings Act 1987 for the passing of

this resolution are as follows:

|

Item

|

General subject of each matter to be

considered

|

Reason for passing this resolution in

relation to each matter

|

Particular interests protected (where

applicable)

|

|

1

|

Audit, Risk and Finance Subcommittee

Meeting - Confidential Minutes - 25 May 2021

|

Section 48(1)(a)

The public conduct of this matter would

be likely to result in disclosure of information for which good reason exists

under section 7.

|

The withholding of the information is

necessary:

· Section 7(2)(a)

To protect the

privacy of natural persons, including that of a deceased person

· Section 7(2)(g)

To

maintain legal professional privilege

|

|

2

|

IT Funding Request

|

Section 48(1)(a)

The public conduct of this

matter would be likely to result in disclosure of information for which good

reason exists under section 7

|

The withholding of the information is necessary:

· Section 7(2)(j)

To prevent the disclosure

or use of official information for improper gain or improper advantage

|

Audit, Risk and Finance Subcommittee

Minutes - 25 May 2021

Present: Mr

J Peters (Chairperson), Her Worship the Mayor R Reese, Councillors J Edgar, R

Sanson and Mr J Murray

In

Attendance: Chief Executive (P Dougherty), Group Manager

Infrastructure (A Louverdis), Group Manager Environmental Management (C

Barton), Group Manager Corporate Services (N Harrison), Group Manager Strategy

and Communications (N McDonald), Governance Adviser (E Stephenson) and

Governance Support (P Boutle)

Apology: Councillor

Lawrey

1. Apologies

|

Resolved ARF/2021/015

|

|

|

That the Audit, Risk and

Finance Subcommittee

1. Receives

and accepts an apology from Councillor Lawrey.

|

|

Edgar/Sanson Carried

|

2. Confirmation of

Order of Business

There was no change to the order

of business.

3. Interests

There were no updates to the

Interests Register, and no interests with items on the agenda were declared.

4. Public Forum

There was no public forum.

5. Confirmation of

Minutes

5.1 23

February 2021

Document number M15441, agenda

pages 9 - 16 refer.

|

Resolved ARF/2021/016

|

|

|

That

the Audit, Risk and Finance Subcommittee

1. Confirms

the minutes of the meeting of the Audit, Risk and Finance Subcommittee , held

on 23 February 2021, as a true and correct record.

|

|

Murray/Sanson Carried

|

6. Chairperson's Report

Document number R25884, agenda

pages 17 - 18 refer.

The Chairperson spoke to his

report, noting the future challenges and uncertainty relating to the central

government review of local government. He acknowledged the decision to appoint

an iwi representative to the Subcommittee, which he welcomed.

It was also noted that the repeal

of the Resource Management Act and the associated legislation that would change

as a result, would impact the organisation and the need for best practice

change management implementation was highlighted.

|

Resolved ARF/2021/017

|

|

|

That

the Audit, Risk and Finance Subcommittee

1. Receives the report

Chairperson's Report.

|

|

Peters/Sanson Carried

|

7. Audit NZ: Audit Plan

for year ending 30 June 2021

Document number R24802, agenda

pages 19 - 51 refer.

Group Manager Corporate Services,

Nikki Harrison, clarified the Annual Report process.

Audit NZ Appointed Auditor, John

Mackey, attended via Zoom. He explained the Audit opinion process and scope.

|

Resolved ARF/2021/018

|

|

|

That

the Audit, Risk and Finance Subcommittee

1. Receives the report

Audit NZ: Audit Plan for year ending 30 June 2021 (R24802) and its attachments (A2638227 and

A2648347).

2. Notes

the Subcommittee can provide feedback on the Proposed Audit Fee letter to

Audit New Zealand if required, noting the Mayor will sign the letter once the

Subcommittee’s feedback has been incorporated.

|

|

Murray/Sanson Carried

|

8. Health Safety and Wellbeing

Report, January - March 2021

Document number R23731, agenda

pages 52 - 68 refer.

Health and Safety Adviser,

Malcolm Hughes, provided an update on matters included in the Health Safety and

Wellbeing report and answered questions.

Chief Executive, Pat Dougherty,

noted that the Audit, Risk and Finance Subcommittee was the main mechanism for

health and safety issues, however, if an issue required governance attention,

it would go to the relevant Committee or Subcommittee.

|

Resolved ARF/2021/019

|

|

|

That

the Audit, Risk and Finance Subcommittee

1. Receives the report

Health Safety and Wellbeing Report, January - March 2021 (R23731) and its attachment (A2621469).

|

|

Murray/Her Worship the Mayor Carried

|

9. Key Organisational

Risks Report - 1 January 2021 to 31 March 2021

Document number R23745, agenda

pages 69 - 106 refer.

Manager Business Improvement,

Arlene Akhlaq, and Audit and Risk Analysist, Chris Logan, spoke to the report.

Discussion took place on

regarding the need for wide thinking about setting residual risk targets.

|

Resolved ARF/2021/020

|

|

|

That the Audit, Risk and Finance Subcommittee

1. Receives the report Key Organisational Risks Report - 1 January

2021 to 31 March 2021 (R23745) and its attachment (A2587873).

|

|

Her Worship the

Mayor/Edgar Carried

|

The meeting was adjourned from

10.48a.m. until 11.01a.m.

10. Internal Audit - Quarterly Progress

Report to 31 March 2021

Document number R23746, agenda

pages 107 - 119 refer.

Manager Business Improvement,

Arlene Akhlaq and Risk Analysist, Chris Logan, answered questions regarding the

internal audit progress.

Ms Akhlaq confirmed the risk management

maturity self-assessment had been completed during 2020 and the Subcommittee

requested a report following the next risk management maturity assessment.

|

Resolved ARF/2021/021

|

|

|

That

the Audit, Risk and Finance Subcommittee

1. Receives the report

Internal Audit - Quarterly Progress Report to 31 March 2021 (R23746) and its attachments

(A2601420, A2599893); and

2. Requests staff to

report back on the postponement of the planned audit ‘effectiveness of

crisis management response and business disruption planning and

management’ and the reviews performed by other councils.

|

|

Edgar/Sanson Carried

|

11. Draft Annual Internal Audit

Plan for year to 30 June 2022

Document number R24781, agenda

pages 120 - 126 refer.

Manager Business Improvement,

Arlene Akhlaq, and Audit and Risk Analysist, Chris Logan, answered questions

regarding choice of audit topics, contract review and renewal dates and the

central contracts register.

|

Resolved ARF/2021/022

|

|

|

That

the Audit, Risk and Finance Subcommittee

1. Receives the report

Draft Annual Internal Audit Plan for year to 30 June 2022 (R24781) and its attachment (A2601457).

|

|

Edgar/Her Worship the Mayor Carried

|

|

Recommendation to Council

ARF/2021/023

|

|

|

That the Council

1. Approves

the Draft Annual Internal Audit Plan for the year to 30 June 2022 (A2601457).

|

|

Edgar/Her Worship the Mayor Carried

|

12. Draft Treasury Management

Policy including Liability Management and Investment Policies

Document number R24767, agenda

pages 127 - 166 refer.

Group Manager, Nikki Harrison,

explained the policy changes and rationale. She answered questions regarding

the Nelmac services, policy review, landfill monitoring and reporting,

constraints of the Treasury Policy in relation to bidding in the Emissions

Trading Scheme Auction, natural hazards including climate change risks and

forestry. It was noted that the Carbon Risk Management Strategy, which was

specific to the Nelson Tasman Regional Landfill Busines Unit (NTRLBU), would be

reported to the next NTRLBU meeting.

The meeting was adjourned from

12.14p.m. until 12.19p.m.

Following discussion, it was

agreed to amend section 15 of the Policy to note that the Group Manager

Corporate Services is authorised to act on the NTRLBU’s behalf as bidder

in the auction in line with this policy and reporting will be to the NTRLBU.

Further discussion took place

regarding the closed forestry account and distribution of forestry profits. It

was noted that a clear mandate from Council was required for officers to

undertake analysis on this issue, which was not a matter for this Subcommittee.

|

Resolved ARF/2021/024

|

|

|

That

the Audit, Risk and Finance Subcommittee

1. Receives the report

Draft Treasury Management Policy including Liability Management and

Investment Policies (R24767)

and its attachment (A2611223).

|

|

Sanson/Edgar Carried

|

|

Recommendation to Council

ARF/2021/025

|

|

|

That the Council

1. Adopts

the updated Treasury Management Policy (A2611223) as amended at the 25 May

2021 Audit, Risk and Finance Subcommittee meeting.

|

|

Murray/Edgar Carried

|

13. Service Delivery Reviews (s17A

reviews)

Document number R15914, agenda

pages 167 - 175 refer.

Manager Strategy, Mark Tregurtha,

and Policy Adviser, Gareth Power Gordon, noted an amendment to paragraph 4.15

of the agenda report, in that there were 41 activities at the $100,000 and 26

at the $500,000 thresholds and answered questions regarding the rationale for

the thresholds.

Discussion took place on the

financial thresholds and it was noted that there were other significant

factors, rather than a singular financial metric, which was not required under

legislation.

It was agreed that the matter be

deferred pending discussion with the relevant Chairs and that a further report

be brought back for consideration.

14. Quarterly Finance Report for

the nine months ending 31 March 2021

Document number R24820, agenda

pages 176 - 200 refer.

|

Resolved ARF/2021/026

|

|

|

That

the Audit, Risk and Finance Subcommittee

1. Receives the report

Quarterly Finance Report for the nine months ending 31 March 2021 (R24820) and its attachments (A2630218,

A2630198, A2620993, A2628832 and A2628831).

|

|

Edgar/Murray Carried

|

15. Exclusion

of the Public

|

Resolved ARF/2021/027

|

|

|

That the Audit, Risk and

Finance Subcommittee

1. Excludes the public from the

following parts of the proceedings of this meeting.

2. The general subject of each matter

to be considered while the public is excluded, the reason for passing this

resolution in relation to each matter and the specific grounds under section

48(1) of the Local Government Official Information and Meetings Act 1987 for

the passing of this resolution are as follows:

|

|

Edgar/Sanson Carried

|

|

Item

|

General subject of each matter to be

considered

|

Reason for passing this resolution in relation

to each matter

|

Particular interests protected (where

applicable)

|

|

1

|

Audit, Risk and Finance Subcommittee

Meeting - Public Excluded Minutes - 23 February 2021

|

Section 48(1)(a)

The public conduct of this matter would

be likely to result in disclosure of information for which good reason exists

under section 7.

|

The withholding of the information is

necessary:

· Section 7(2)(a)

To protect the

privacy of natural persons, including that of a deceased person

· Section 7(2)(g)

To maintain

legal professional privilege

|

|

2

|

Quarterly report on legal proceedings

|

Section 48(1)(a)

The public conduct of this

matter would be likely to result in disclosure of information for which good

reason exists under section 7

|

The withholding of the information is necessary:

· Section 7(2)(g)

To maintain legal

professional privilege

|

|

3

|

Quarterly Update On Debts - 31 March

2021

|

Section

48(1)(a)

The public

conduct of this matter would be likely to result in disclosure of information

for which good reason exists under section 7

|

The withholding of the information is

necessary:

· Section

7(2)(a)

To protect the

privacy of natural persons, including that of a deceased person

· Section 7(2)(g)

To maintain

legal professional privilege

|

The meeting went into confidential session at 1.04p.m.

and resumed in public session at 1.48p.m.

Restatements

It was resolved while the public was

excluded:

|

1

|

CONFIDENTIAL: Quarterly

report on legal proceedings

|

|

|

That

the Audit, Risk and Finance Subcommittee

2. Agrees that the

report (R23759) and its

attachment (A2626174) remain confidential at this time.

|

|

2

|

CONFIDENTIAL: Quarterly

Update On Debts - 31 March 2021

|

|

|

That

the Audit, Risk and Finance Subcommittee

2. Notes that the application form for Outdoor Dining

Concession rent relief includes that businesses with either an outstanding

debt or who have not signed up to a payment plan will not be eligible for the

rent relief; and

3. Agrees that the Report (R24796)

and its attachment (A2216183) remain confidential at this time.

|

There being no further business the meeting ended at 1.48p.m.

Confirmed as a correct record of proceedings by resolution

on (date)

Item 6: Chairperson's

Report

|

|

Audit, Risk and Finance Subcommittee

14 September 2021

|

REPORT R26218

Chairperson's

Report

1. Purpose

of Report

1.1 To

update the Subcommittee on matters within its area of responsibility.

2. Recommendation

|

That the Audit, Risk and Finance Subcommittee

1. Receives

the Chairperson's Report (R26218).

|

3. Discussion

3.1 Two

key meetings of the Audit Risk and Finance sub-committee have been affected by

the recent lockdown levels. The meeting scheduled for 24th

August was cancelled, as was the Risk Management Workshop arranged for 7th

September.

3.2 The

papers for the August meeting, which include the financial year end results for

the July 2020 to June 2021 financial year, were completed prior to the

cancellation and distributed to members for information, and members were asked

to raise any queries online. Questions that were raised, and the

responses from officers are included here for information of all members.

All questions relate to the Quarterly Financial Report.

Question:

Para 2.4…… we sought advice about “salary advances and

loans”…….are we doing this for our employees as an

organisation?

3.3 We

have offered staff an interest free loan (repaid fortnightly) for the purchase

of personal bikes, to support Council’s active transport

initiatives. We have also offered staff an interest free loan (repaid

fortnightly) for the purchase of IT gear and office furniture through NCC for

the setup of their home offices to support the Working from Home Policy.

Advice was sought from PWC to ensure the schemes were set up correctly (i.e. to

determine which method was the most appropriate - a salary advance or interest

free loan) - and to ensure both GST and FBT were accounted for correctly.

Question:

Para 4.1…..was the internal Audit plan approved by the Finance and

Governance committee. I thought we did that in ARF?

3.4 The

audit plan was approved by the Audit and Risk subcommittee 21 May 2020 but

under the previous committee structure that was a recommendation through to the

Governance and Finance committee on 27 August 2020.

Question:

Para 4.3……who and how is a decision made to postpone an internal

audit? Shouldn’t this be ARF (or at least in conjunction with the

Chair)? I am not concerned about the postponement itself, but just

wondered about the process behind this decision?

3.5 The

wording in the report should have been better... instead of “indefinitely

postponed” it should have been “the audit was not delivered in FY21

as per the FY21 plan”.

Question:

What is the role of the new Internal Auditor and how is it structured? I

see that he is also a Risk Analyst as well as the internal auditor with a

business improvement lens. Have we lost the internal audit focus?

3.6 The

role is essentially a 50/50 time split between internal audit and risk, which

is the same amount of focus that the previous incumbent had for the internal

audit role. The key change is that risk and internal audit matters are

more closely interlinked than under the more generalised business improvement

focus that former role.

Cancelled

Risk Management Workshop

3.7 The

cancelled Risk Management Workshop was intended for all members, not just

Sub-Committee members. The intention was to provide an update on

Council’s Risk Management history, progress and intended approach to

risk, and was intended as a refresher for more experienced members and an

awareness and education opportunity about risk for first term members.

3.8 It

was also an opportunity to seek members’ input into the internal audit

programme and to review the current top risks monitored by the

Sub-committee. These activities will be pursued directly with

the Audit and Risk Analyst prior to the next meeting in order to meet reporting

deadlines.

4. Conclusion

4.1 My

thanks to officers for being in a position to present the draft Annual Report

Audit in timely fashion to this meeting, despite the pressures

experienced. I remain concerned, however, at the continuing uncertainty

relating to Audit New Zealand’s ability to meet the annual audit

commitment, and we await further information on this. In the meantime, I

am encouraged that staff will do everything possible to ensure that any delays

are not attributable to NCC.

Author: John

Peters, Chairperson - Audit Risk and Finance Subcommittee

Attachments

Nil

Item 7: Annual Report

2020/21

|

|

Audit, Risk and Finance Subcommittee

14 September 2021

|

REPORT R25905

Annual

Report 2020/21

1. Purpose

of Report

1.1 To

provide a copy of the draft Annual Report 2020/21.

2. Summary

2.1 The

draft Annual Report for the 2020/21 financial year has been prepared and is

provided as Attachment 1, for information. Audit is now scheduled to commence

in late September, and there are likely to be some changes as a result of the

audit process.

3. Recommendation

|

That the Audit, Risk and Finance Subcommittee

1. Receives the report Annual Report

2020/21 (R25905) and its attachment (A2739259); and

2. Notes the draft Annual Report

2020/21 has been prepared and will be audited before being presented to Council

for adoption following audit, prior to the 31 December 2021 statutory

deadline.

|

4. Background

4.1 The purpose of the Annual Report is

to compare Council’s actual performance against the targets as set out in

year three of the Long Term Plan 2018-28. It also provides accountability to

the Nelson community for the decisions made throughout the year.

4.2 An

Annual Report must be completed to comply with section 98 of the Local

Government Act 2002.

5. Discussion

5.1 The

attached draft Annual Report 2020/21 is intended to provide the Subcommittee

with information officers have to date. This is not the final Annual Report for

the year as it is yet to be audited. It is likely to require modification

through the auditing process.

5.2 The

Local Government Act usually requires Council to adopt the final Annual Report

within four months of the end of the financial year (31 October). In 2020,

central government amended the legislation to give a two month extension for

2019/20 reports to the end of December (due to the impacts of COVID-19). Similarly, in July 2021 a Bill was enacted to

extend the adoption deadline for 2020/21 and 2021/22 annual reports, to 31

December of 2021 and 2022 respectively. This decision was made in response to a

national shortage of auditors due to ongoing border closures.

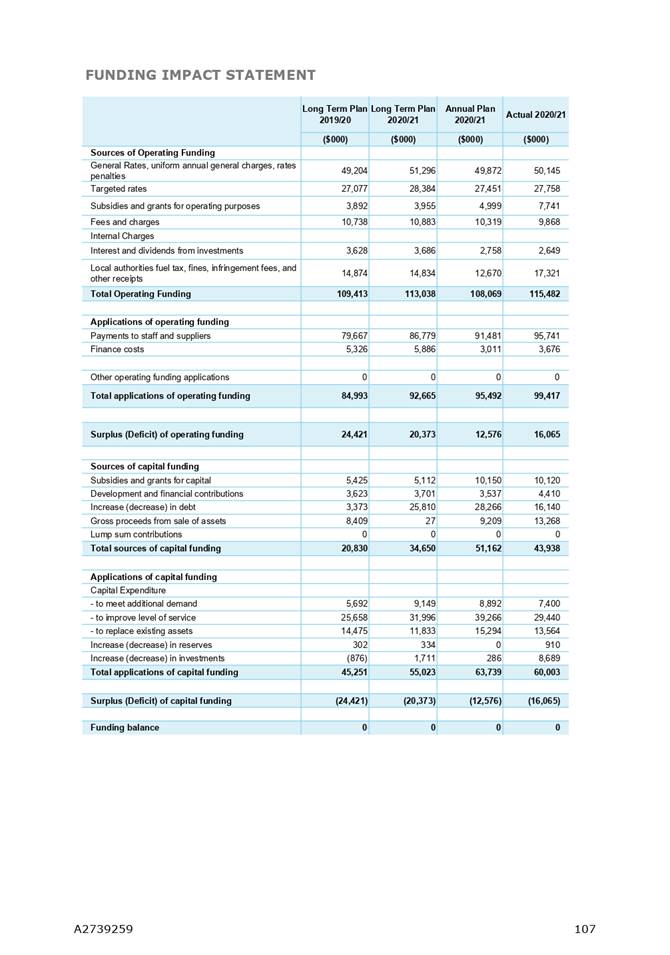

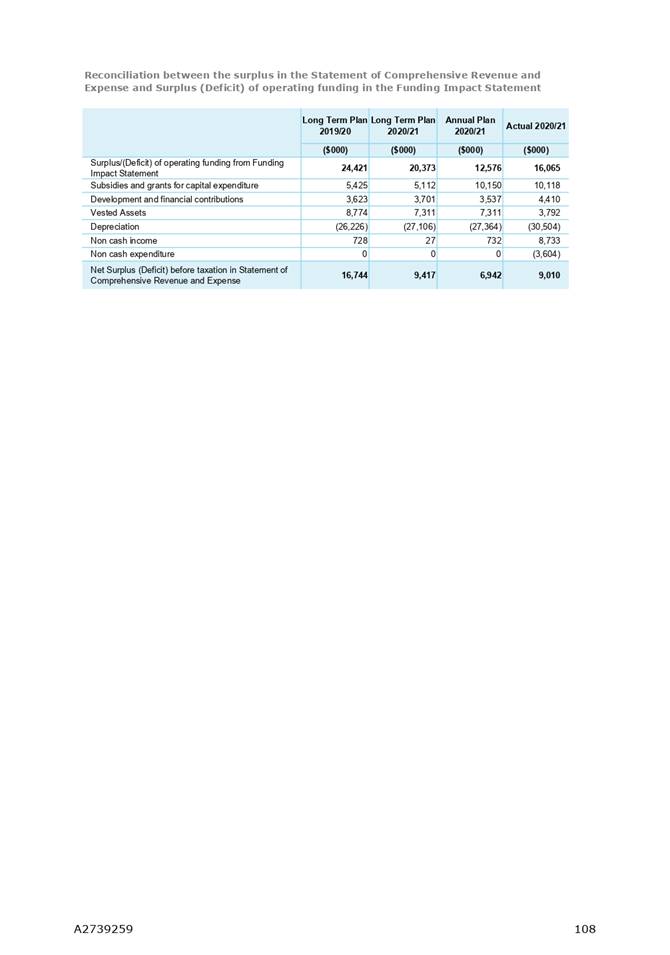

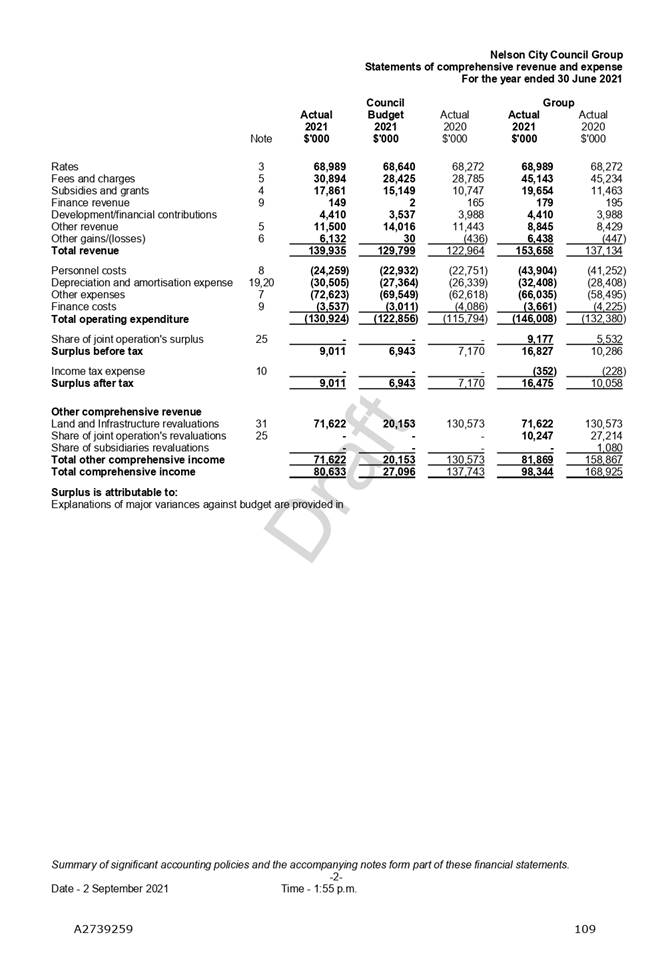

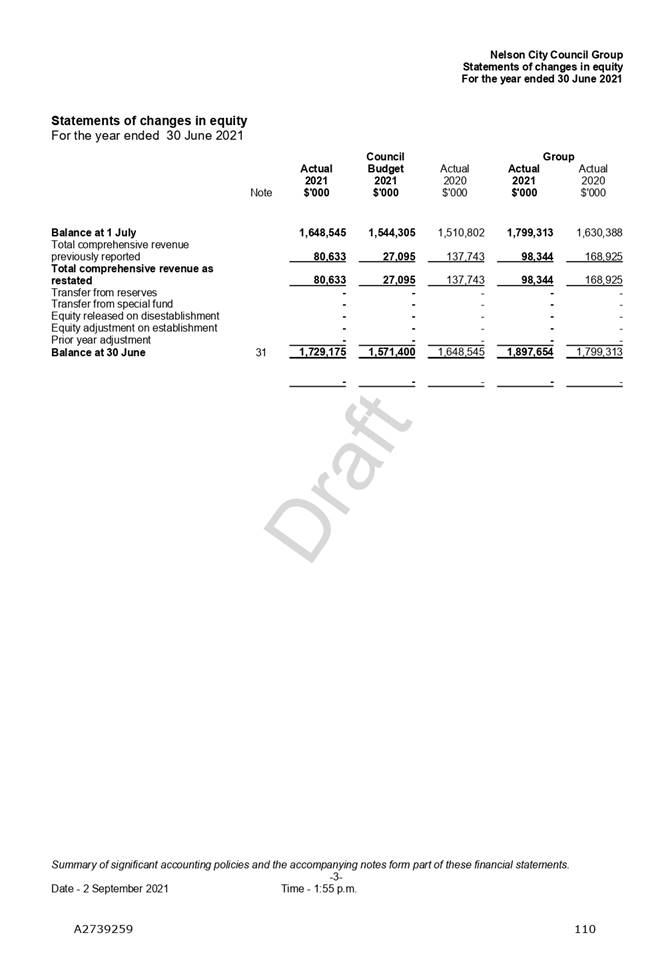

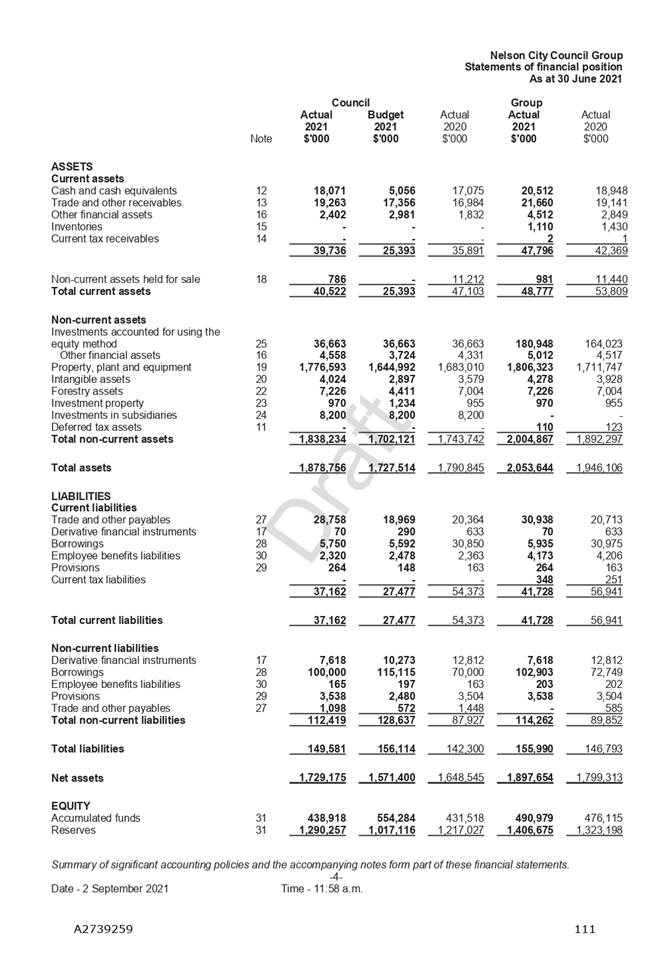

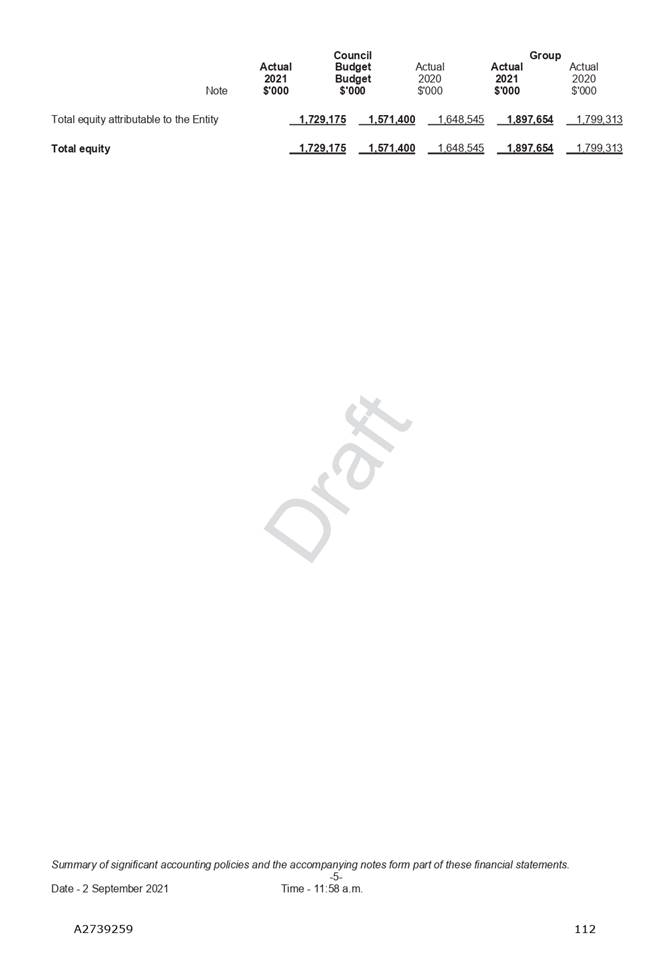

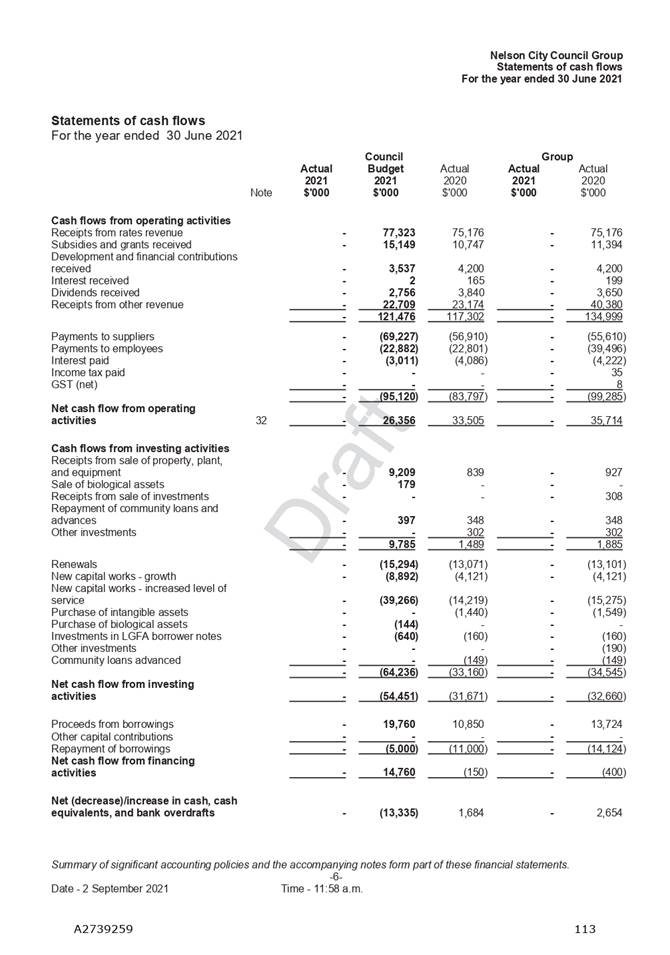

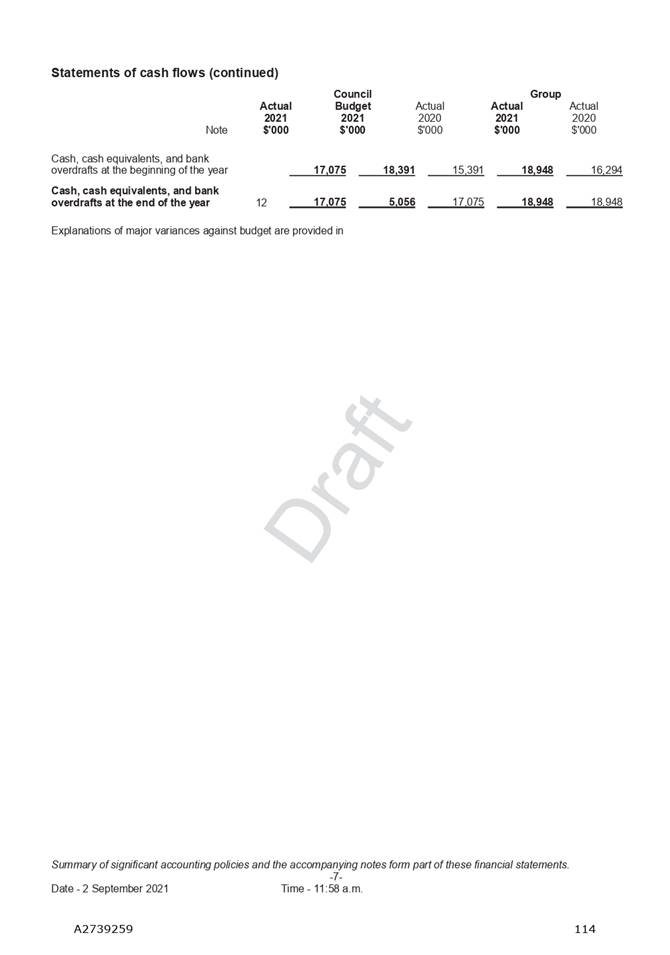

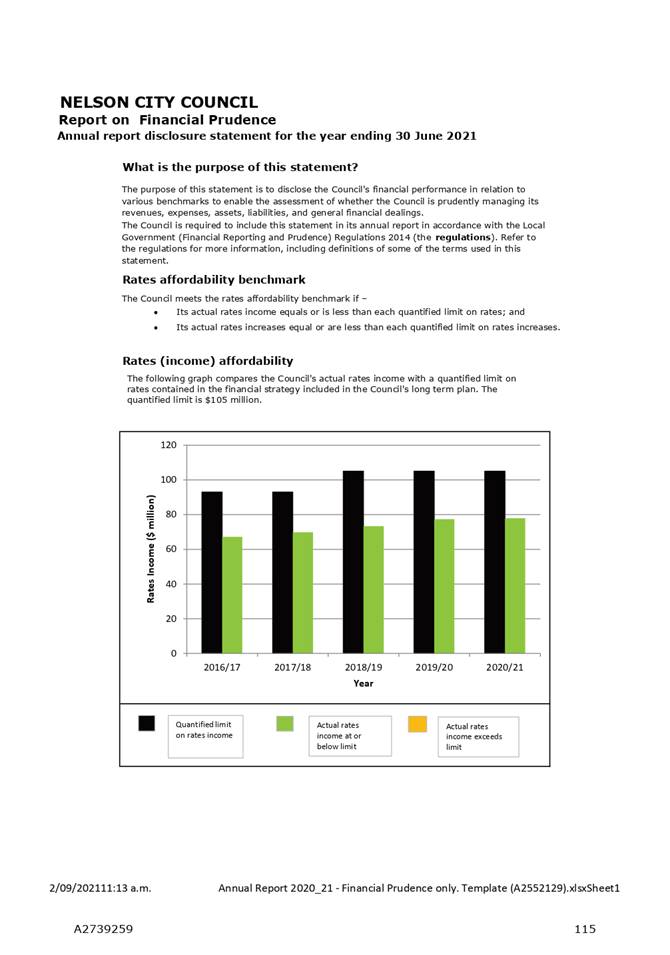

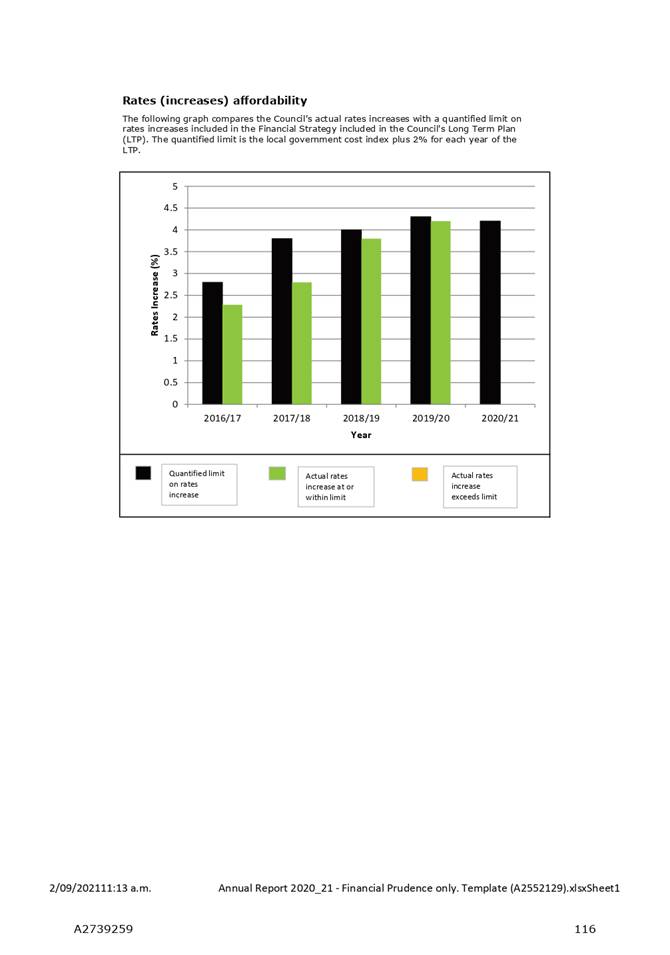

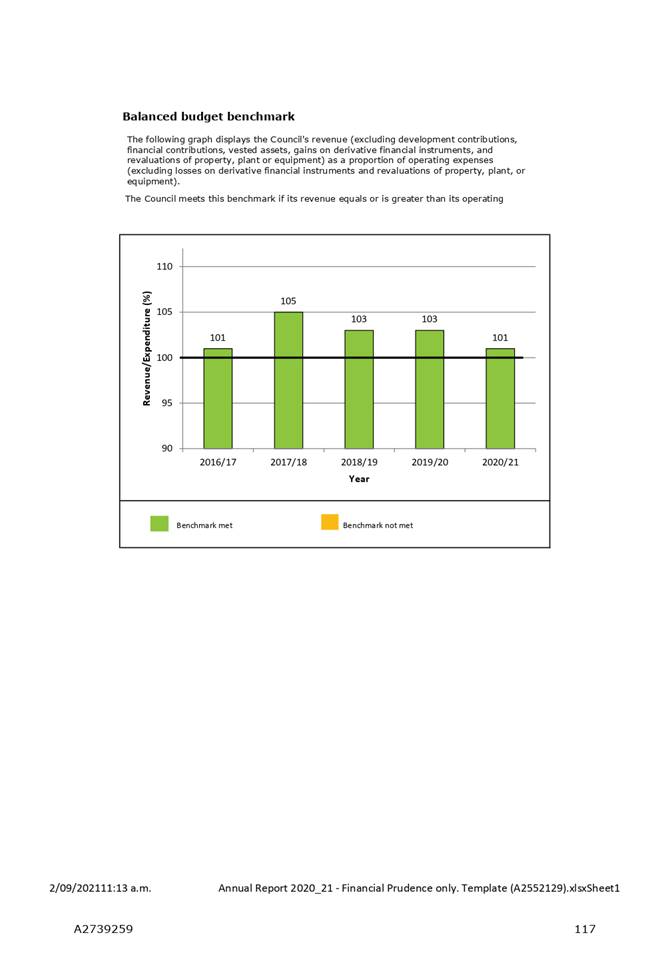

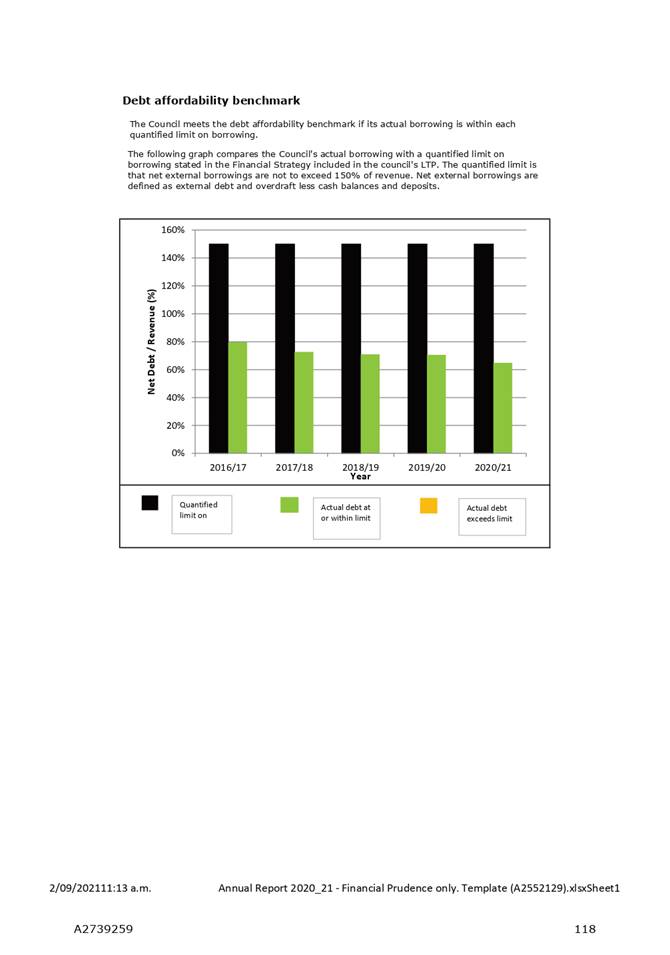

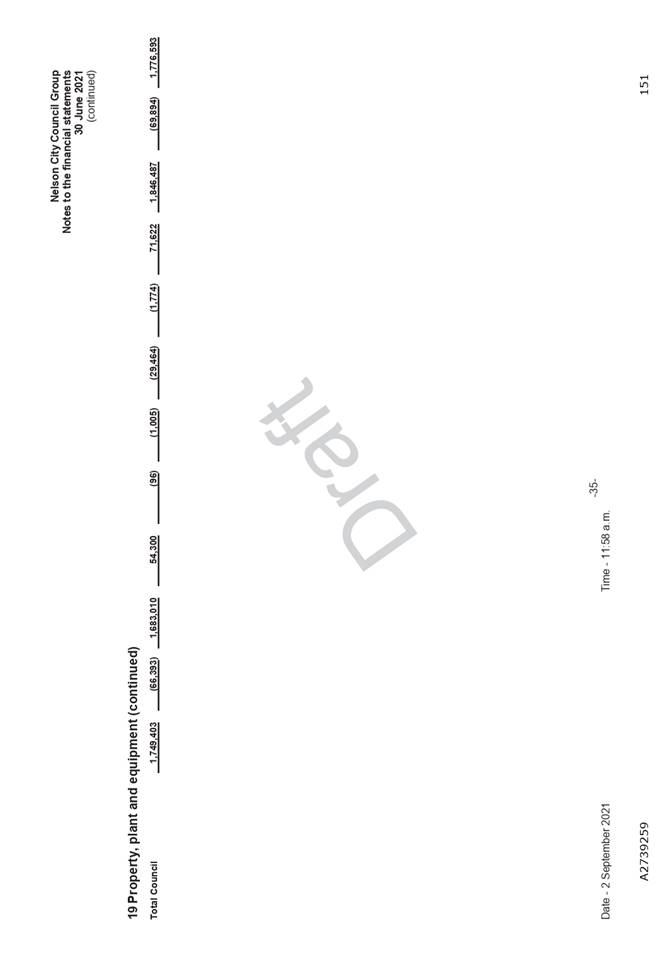

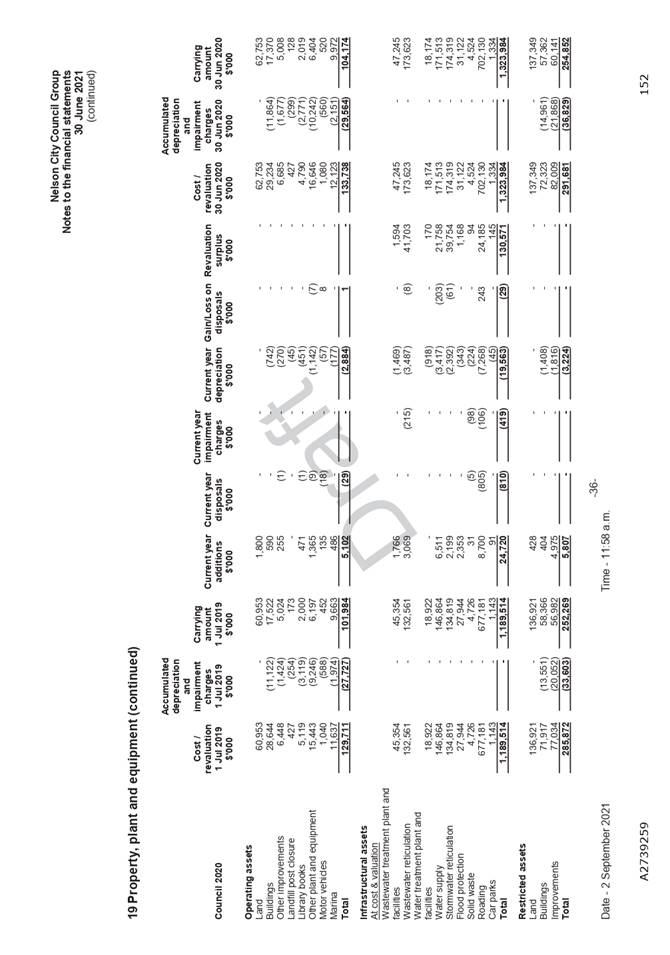

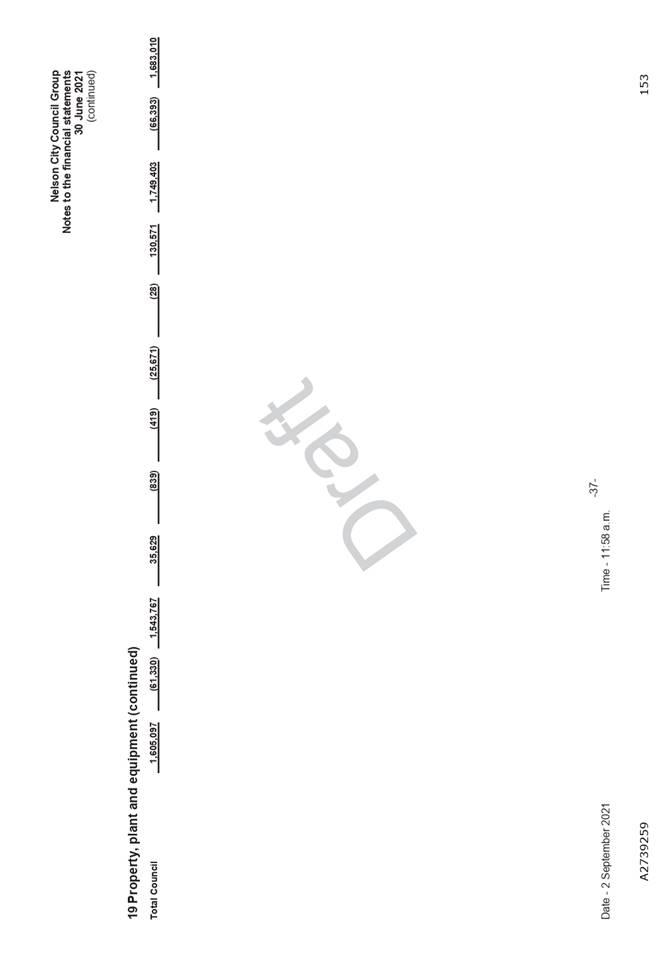

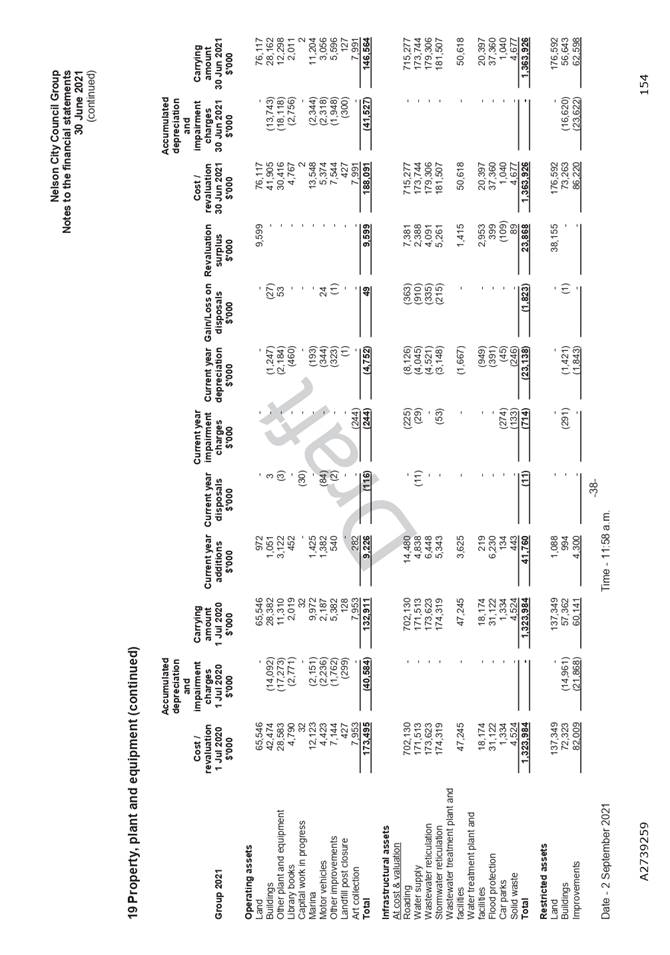

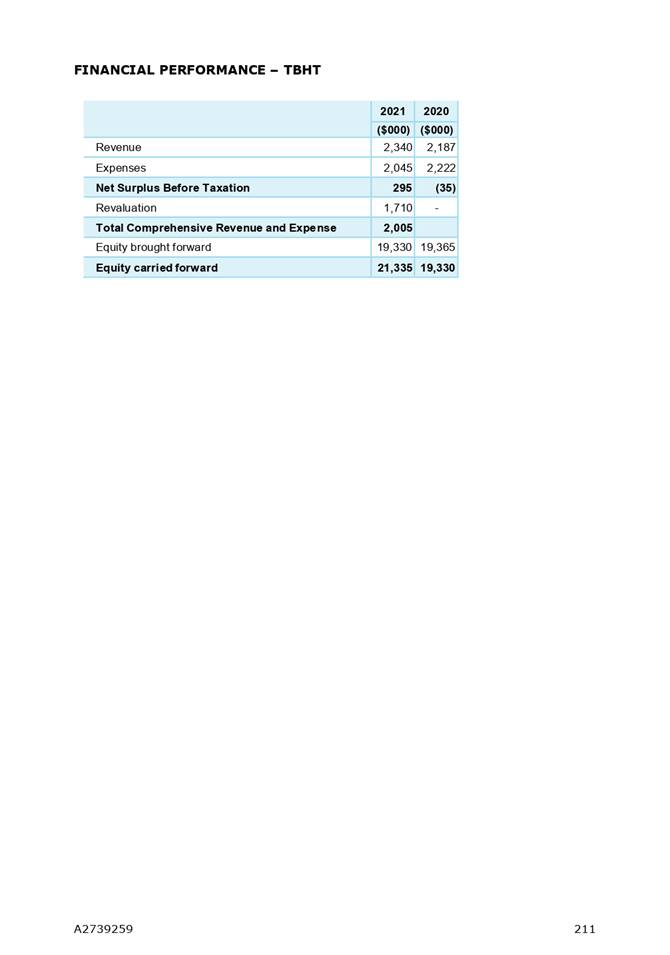

Financials

5.3 At the time of writing this report,

Council is currently waiting to receive finalised draft financial statements

from some of its CCOs and CCTOs. Draft financial statements have been prepared

based on what has been received and therefore the draft financials will be

different from the version that will be made available to Audit New Zealand to

perform the year end audit.

5.4 Although Council’s CCOs and

CCTOs were expected to deliver finalised draft financial statements by 20

August 2021, this has been delayed due to constraints that arose as a result of

the recent lockdown. At this stage, we do not know when the CCO and CCTO audits

will be finalised due to travel restrictions impacting Audit NZ.

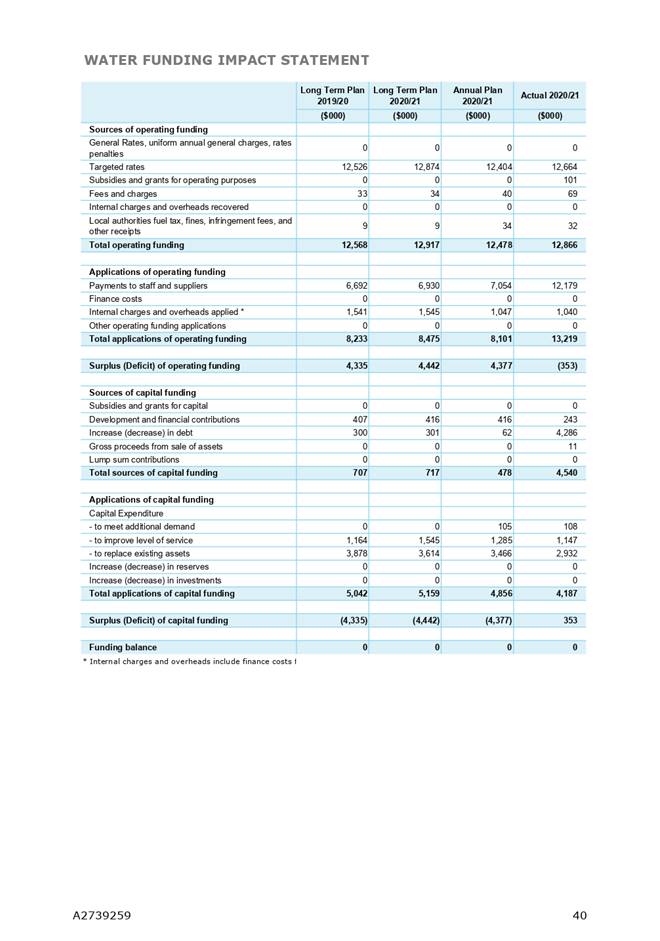

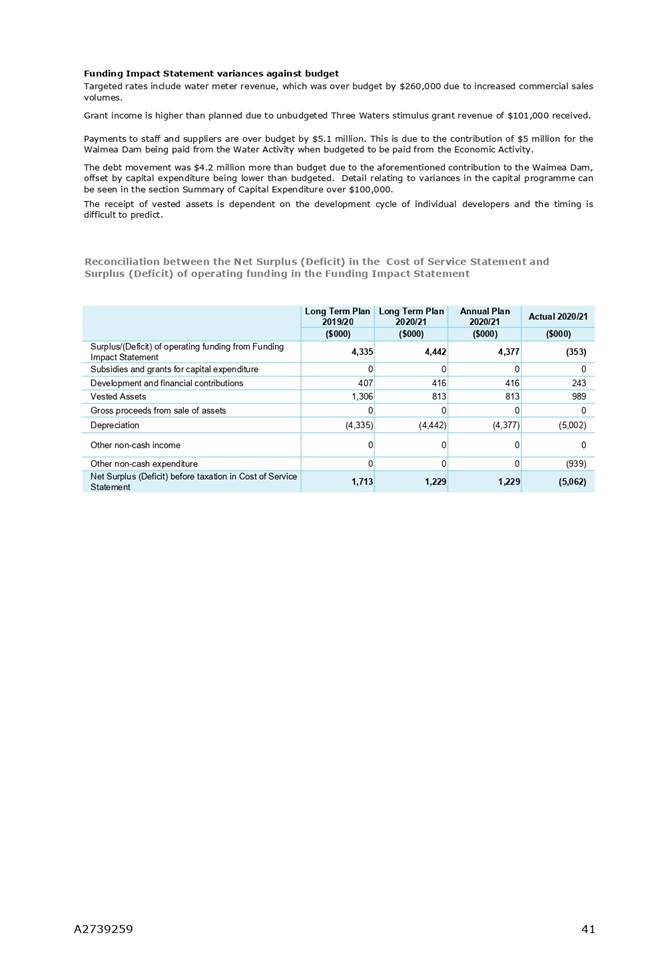

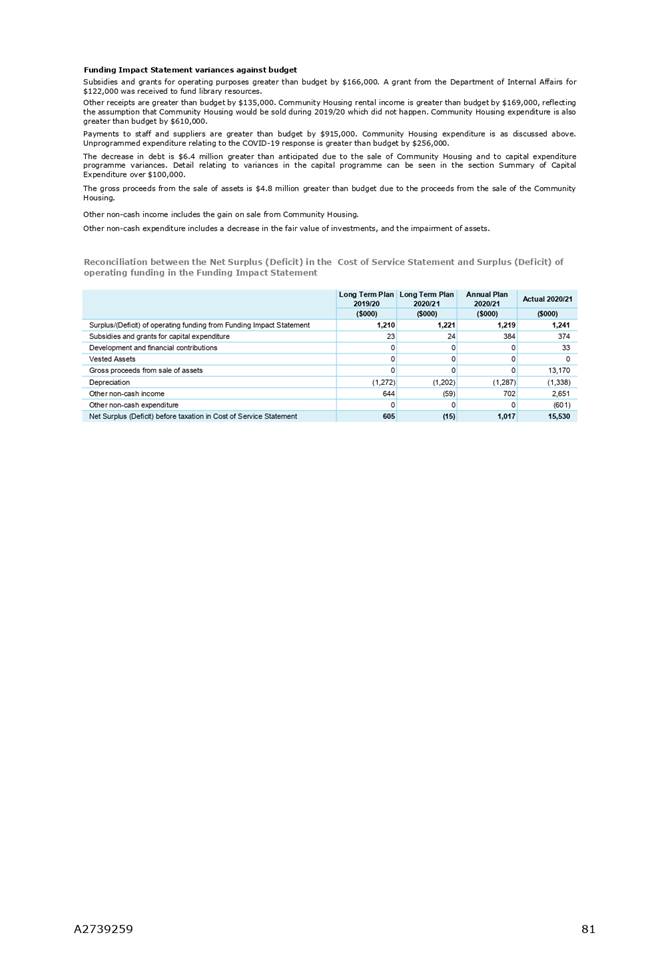

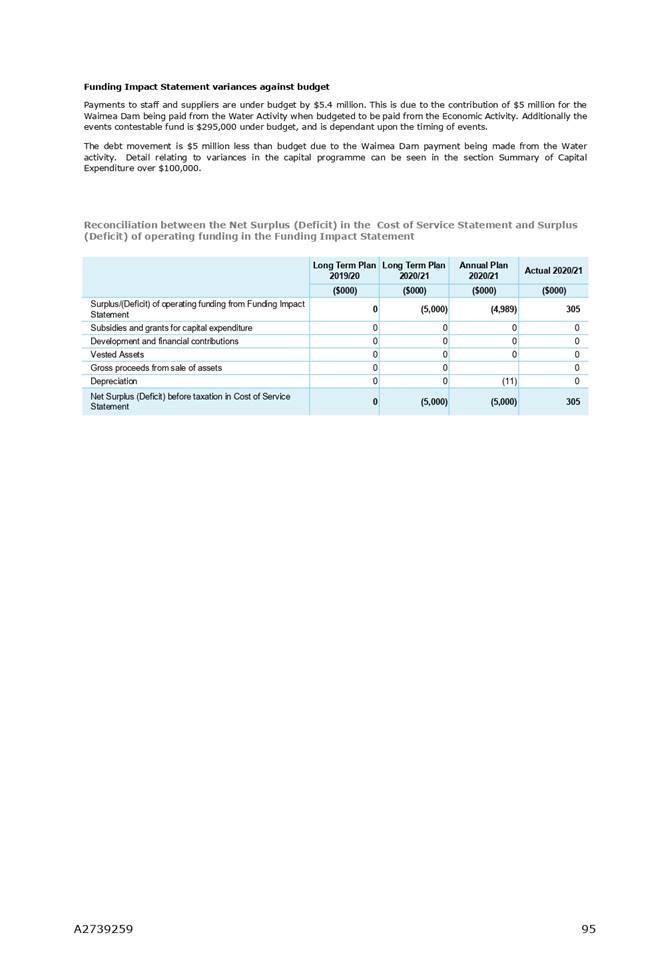

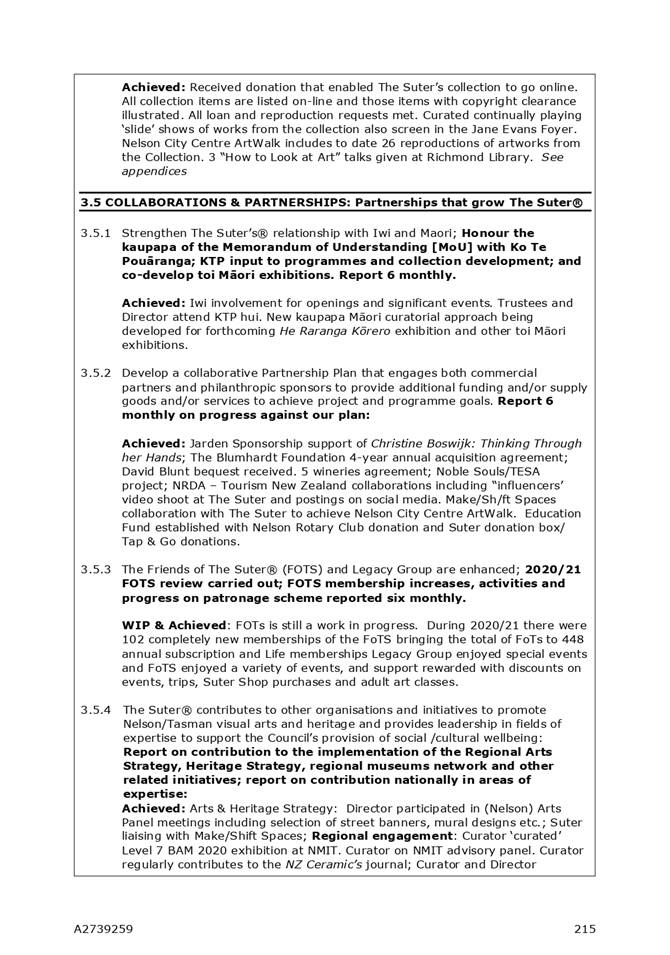

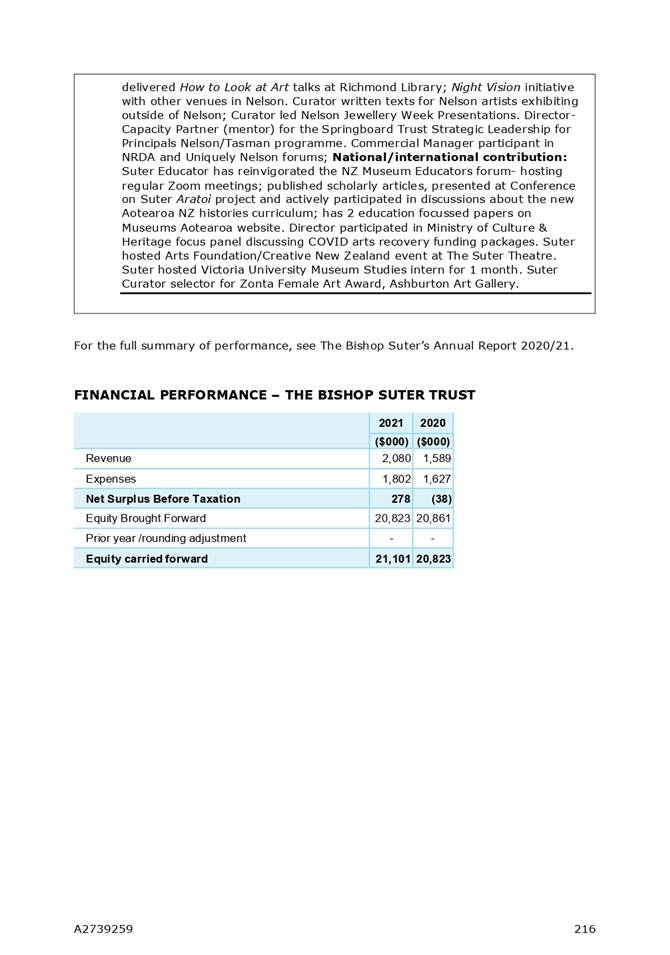

Financial Commentary

5.5 The surplus before revaluation is

$2.1 million greater than budgeted. The reasons for this variance will be

explained in the draft Annual Report Note 40. This is yet to be completed

however the variances are mainly due to following reasons.

5.6 Fees and charges are $2.5 million

greater than budget, this is mainly due to the Building Consent activity income

being $927,000 over budget. The driver behind higher income is increased levels

of activity in the building sector during the recovery from

COVID-19 compared with budgeted estimates which were conservative.

5.7 Subsidies and grants are $2.7

million greater than budget mainly due to unbudgeted grants received from

Central Government largely to offset the economic effects in the community

caused by COVID-19 which are offset by additional expenditure. Some examples of

this include:

· Waka Kotahi

provided $565,000 for the Public Transport COVID-19 response;

· Ministry for the

Environment and Department of Conservation provided $671,000 for the Ecological

Restoration Programme;

· Waka Kotahi

provided $852,000 for Kawai Street Innovative Streets.

5.8 Other

revenue is $2.5 million under budget mainly due to vested assets being $3.5

million under budget.

5.9 Other

gains/losses are greater than budget by $6.1 million due to below reasons:

· Gain

on Derivatives are $5.7 million greater than budget due to movement in interest

rates;

· Gain

on sale of Community Housing of $2.6 million;

· Loss

on Disposal on Infrastructure assets of $1.8 million with some assets removed

from the network earlier than anticipated in conjunction with our work programme.

5.10 Depreciation is greater than budget by $3.1

million mainly due to depreciation on Three Waters assets being $2.3 million

greater than budget due to an increase in replacement values at 30 June 2020

with water supply assets increasing by an average of 13%, wastewater assets

increasing by an average of 25%, and stormwater assets increasing by an average

of 29% when compared with values at 1 July 2019.

5.11 Other expenses are $3.0 million greater than

budget mainly due to the unbudgeted expenditure incurred due to the additional

grant income received, including:

· $828,000 for Kawai

Street Innovative Streets project.

· $715,000 for

Ecological Restoration Programme.

· $212,000 for

Public Transport COVID-19 response.

5.12 Land

and Infrastructure Revaluations were $51.5 million over budget;

· Infrastructure

assets are revalued every year to smooth out the large fluctuations and

accounted for $23.9 million of the overall revaluation. This was against a

budget of $20.2 million.

· Land

is revalued every five years or when its fair value diverges materially from

it’s carrying value. There were material movements in the 2020/21 year

and the revaluation at 30 June 2021 resulted in a total increase in land value

of $47.8 million. As this was not budgeted to be a land revaluation year, this

movement was against a nil budget.

5.13 At 30 June 2021 Council’s borrowings,

net of deposits, cash and LGFA borrower notes were $85.9 million compared to a

budget of $114.6 million. This variance from the budget is mainly due to

following reasons;

· Borrowings

were lower due to Capital Expenditure not reaching the full programme and

ending less than forecasted by $10.0 million.

· Proceeds

received from selling community housing were $17.0 million against a budget of

$8.0 million, with $5.0 million of this required to be held in a reserve for

potential use by Kāinga Ora.

Rating Deficit

5.14 The rates deficit is $2.55 million against an

Annual Plan budget of $2.57 million.

5.15 The quarterly report

presented to Audit Risk and Finance Subcommittee held on 24th August

2021 reported the rating deficit as $1.8 million whereas it is now $2.55

million. This difference is mainly due to the year-end adjustments to fixed

assets but also multiple late creditor and debtor accruals.

Non-financial

Performance

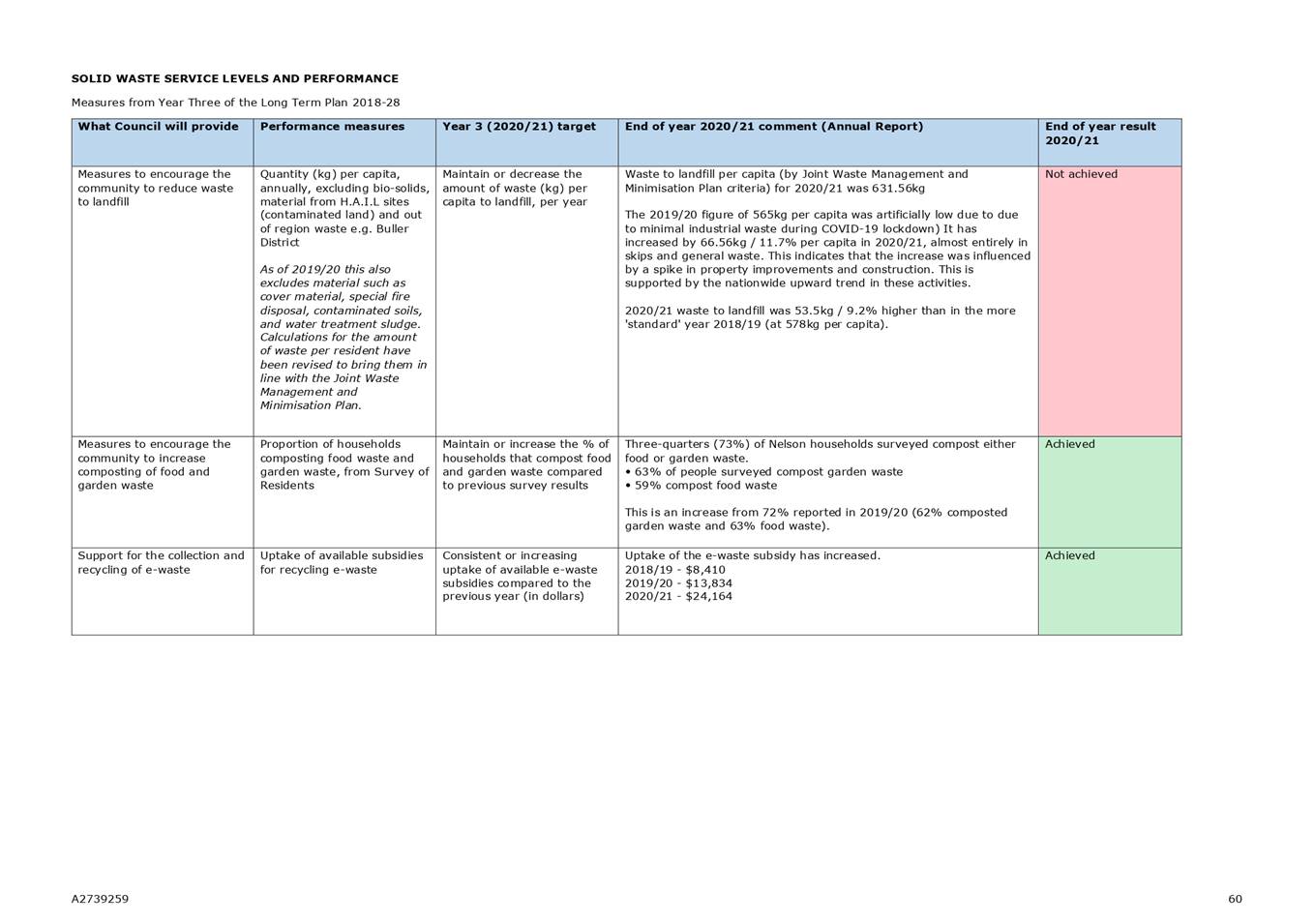

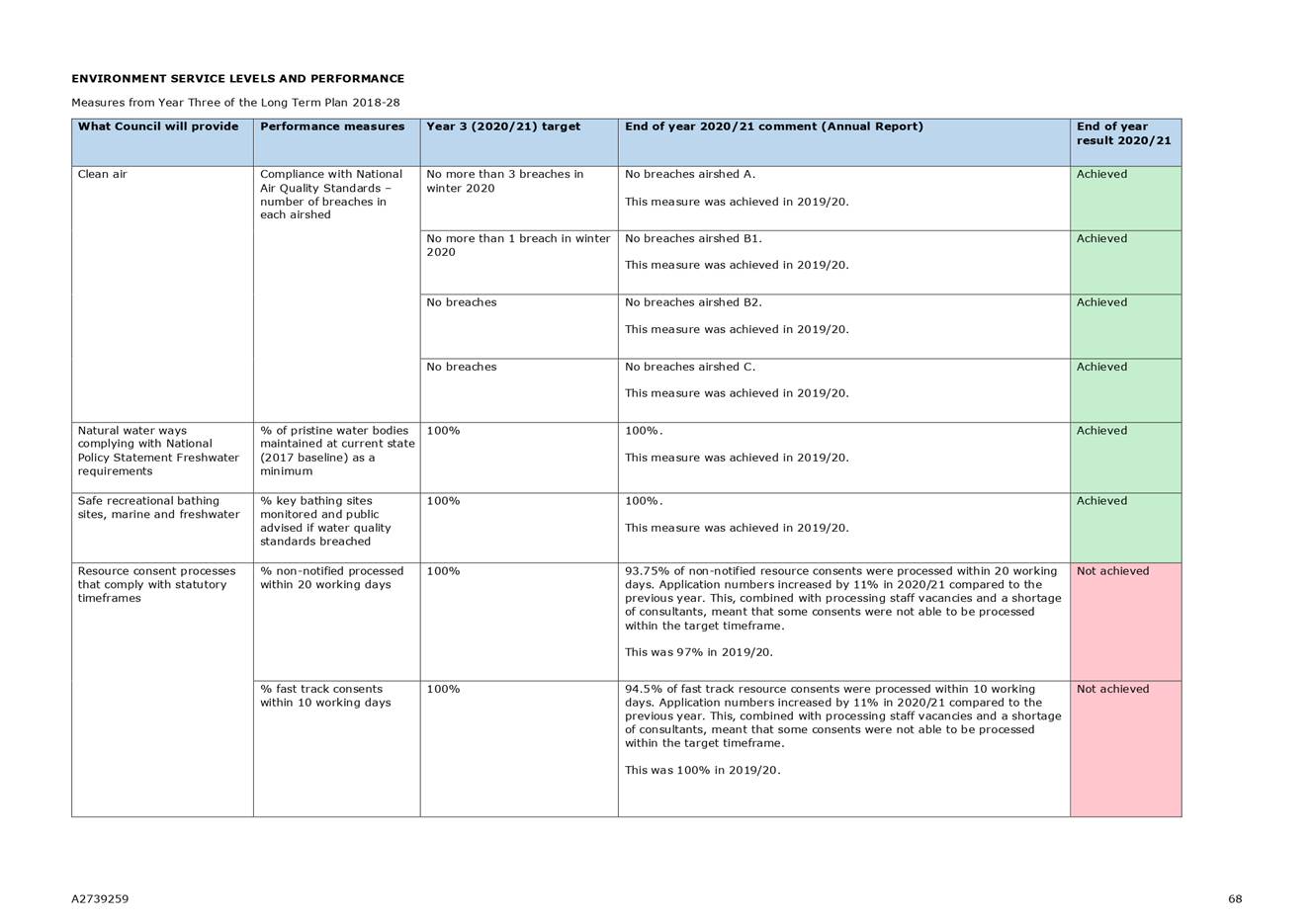

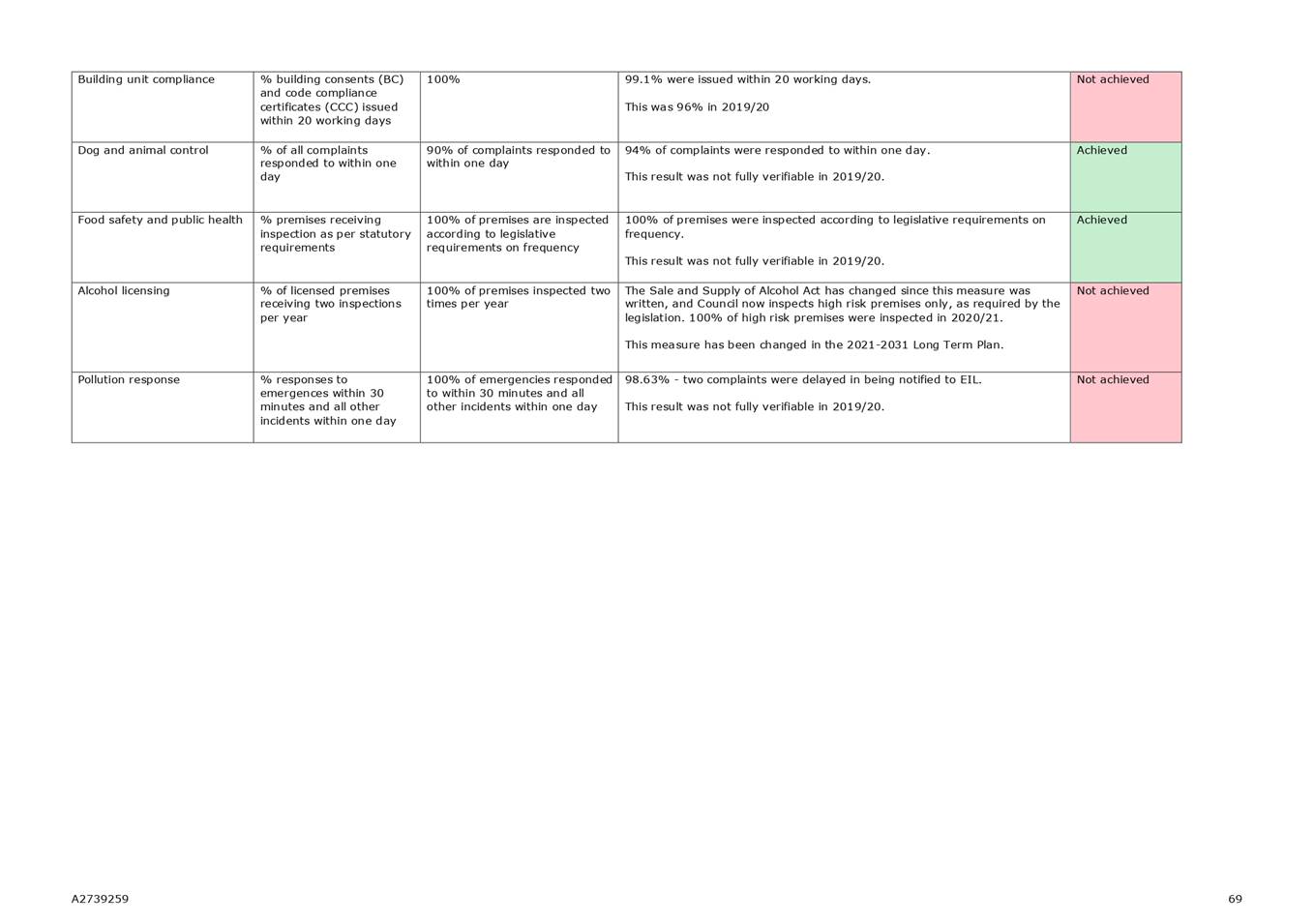

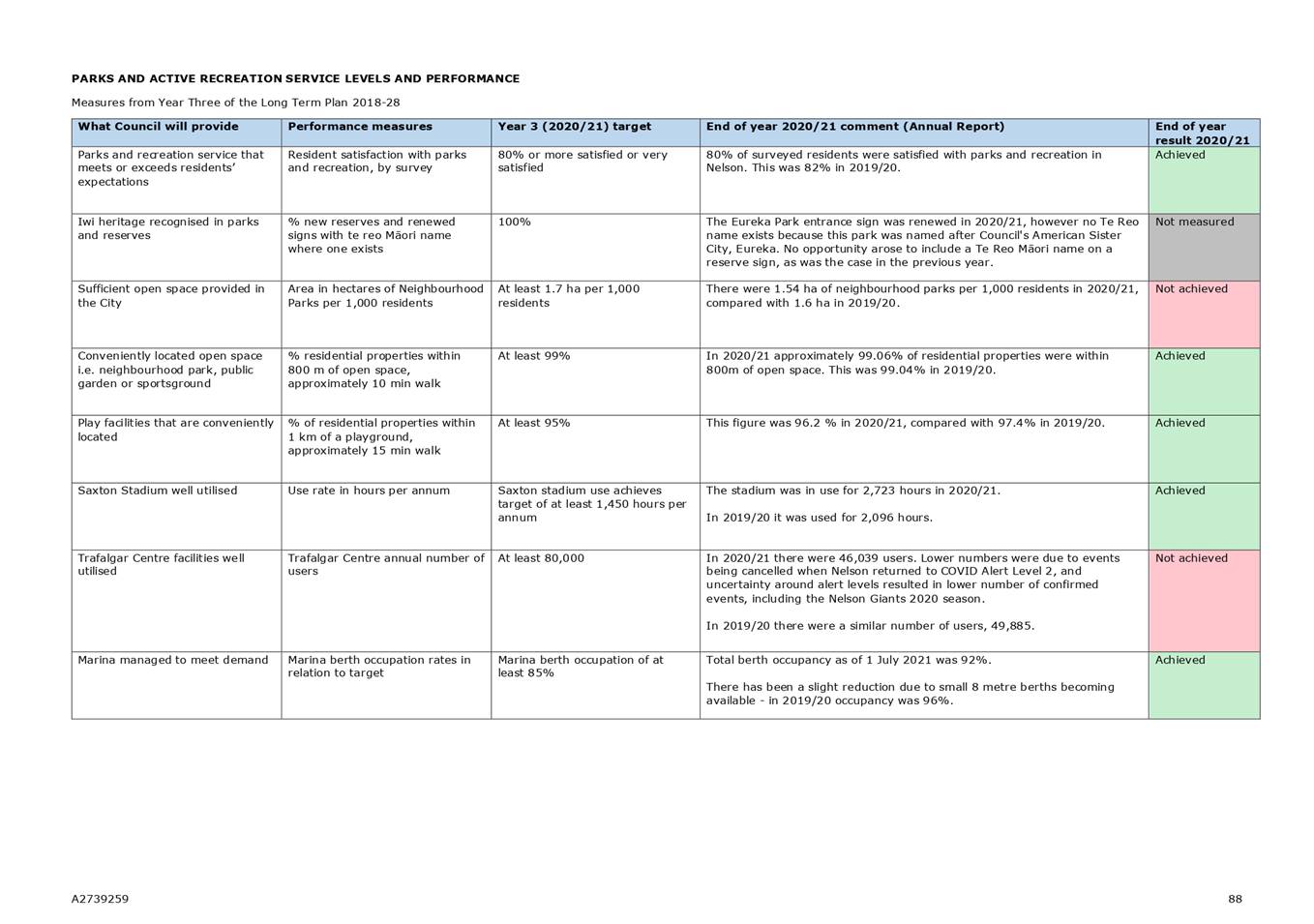

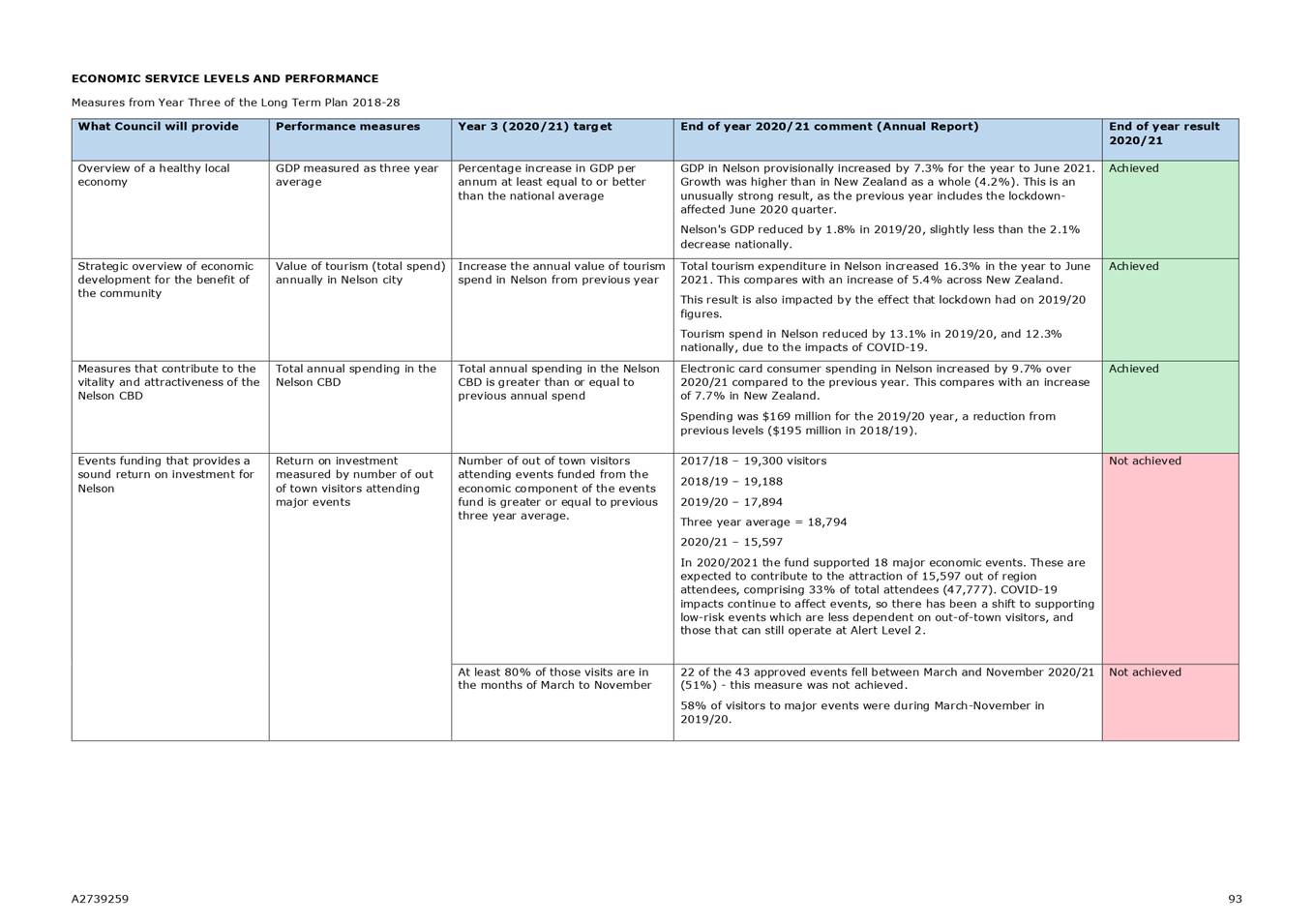

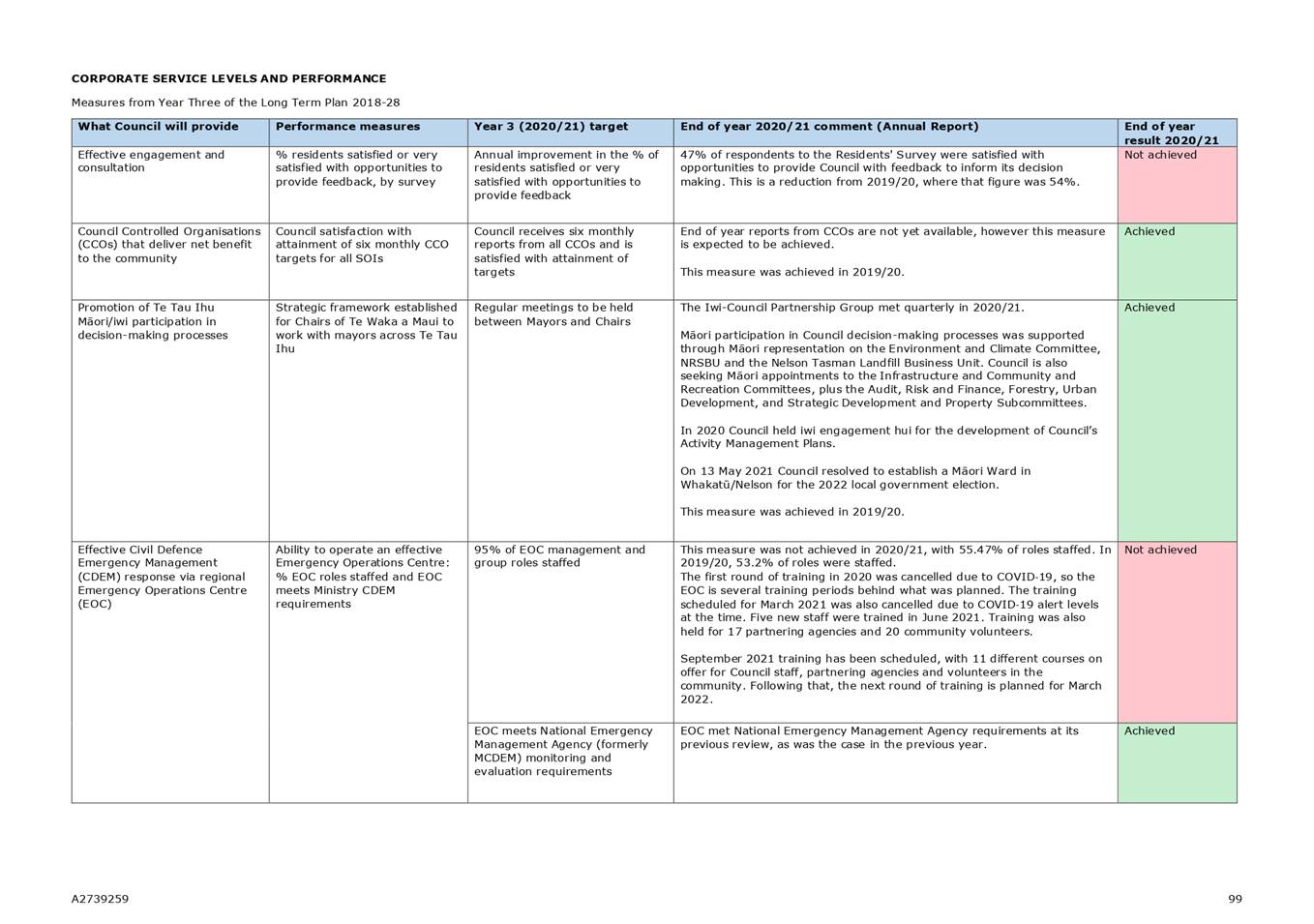

5.16 Council measures its non-financial success

against performance measures that are set through the Long Term Plan. The Long

Term Plan 2018-28 established 80 performance measures across Council’s 11

activity areas. The measures are recorded as ‘achieved’, ‘not

achieved’, or ‘not measured’ (where insufficient data is

available to determine a result) at the end of the year.

5.17 Council’s non-financial

performance was 66.25% achieved in 2020/21, which is equal to its performance

in 2019/20. Commentary on all measures is provided in the activity sections

of Attachment 1.

5.18 As was the case in the previous year,

Council’s ability to achieve many of its performance measures was

impacted by COVID-19. In 2020/21 Nelson was fortunate to stay at Alert Level 1

for the majority of the year, with some relatively short periods at Level 2.

However, the uncertainty and socioeconomic impacts of the post-COVID

environment, particularly the lack of international visitors and

cancellation/scaling down of events, is reflected in the achievement of

targets. This is particularly notable in the social activity, which has many

events-based measures, but across other areas too, such as bus patronage.

5.19 As annual reporting was undertaken over the

period of the Long Term Plan 2018-28, staff found that several of the measures

set in 2018 no longer align with changing data collection methods and

legislated performance requirements (e.g. required inspection of licenced

premises). This results in measures like these being listed as ‘not

achieved’ against the targets set in 2018, which does not accurately

reflect Council’s actual achievements in these areas. Similarly, numerous

measures selected in 2018 relate to the performance of other organisations

(such as the Theatre Royal and Suter Art Gallery), which Council has little

control over. It also has limited influence on overarching measures such as

Nelson’s GDP. To address this, Council’s performance measures were

revised in the Long Term Plan 2021-31, to give a more accurate, relevant

picture of Council’s non-financial performance over the next three years.

6. Options

6.1 This report is provided for

information. The Audit, Risk and Finance Subcommittee has the option to either

receive or not to receive this report and attachment. It is recommended that

the Subcommittee receives this report and notes the final Annual Report

2020/21, with any changes resulting from the audit process, will be presented

directly to Council before 31 December 2021.

Authors:

Nicky McDonald, Group Manager

Strategy and Communications

Nikki Harrison, Group Manager

Corporate Services

Attachments

Attachment 1: A2739259 - Draft

Annual Report 2020/21 ⇩

|

Important considerations for decision making

|

|

1. Fit

with Purpose of Local Government

The Annual Report 2020/21 is a requirement of the Local

Government Act 2002 and fits the purpose of local government by providing

information about Council’s performance during 2020/21, thereby

promoting accountability.

|

|

2. Consistency

with Community Outcomes and Council Policy

The Annual Report 2020/21 contributes to all the

community outcomes by measuring performance across the full range of Council

activities.

|

|

3. Risk

The content of the Annual Report is prescribed by statute

so there is a very low risk that it will not achieve the required outcome.

The Local Government Act 2002 normally requires Council

to adopt the final Annual Report within four months of the end of the

financial year (31 October). Under the Annual Reporting and Audit Time Frames

Extensions Legislation Bill 2021, the new date for councils to meet reporting

timeframes is 31 December 2021. There is low risk that the Annual Report will

not be adopted by this date.

|

|

4. Financial

impact

Preparation and publication of the Annual Report

can be achieved within existing budgets.

|

|

5. Degree

of significance and level of engagement

The decision to receive this report is of low

significance. The final audited Annual Report will be provided to Council for

adoption after the audit opinion is given, before 31 December 2021. There

will be a summary Annual Report available following adoption of the final

audited Annual Report, and this will also be made available to the public, as

well as an Our Nelson feature.

|

|

6. Climate

Impact

The draft Annual Report

(Attachment 1) contains a summary of Council’s climate change actions

in 2020/21.

|

|

7. Inclusion

of Māori in the decision making process

No engagement with Māori has been undertaken

in preparing this report.

|

|

8. Delegations

The Audit, Risk and Finance Subcommittee has the

following delegations to consider the draft Annual Report 2020/21.

Areas of Responsibility:

· Council’s

Annual Report

· Council’s

financial and service performance

|

Item

7: Annual Report 2020/21: Attachment 1

Item 8: Audit Reports

on the Consultation Document and Long Term Plan 2021-31

|

|

Audit, Risk and Finance Subcommittee

14 September 2021

|

REPORT R26112

Audit

Reports on the Consultation Document and Long Term Plan 2021-31

1. Purpose

of Report

1.1 To

provide Audit New Zealand’s Audit Reports on the Long Term Plan

Consultation Document 2021-31 and final Long Term Plan 2021-31.

2. Recommendation

|

That the Audit, Risk and Finance Subcommittee

1. Receives

the report Audit Reports on the Consultation Document and Long Term Plan

2021-31 (R26112) and its

attachments (A2720857 and A2718269); and

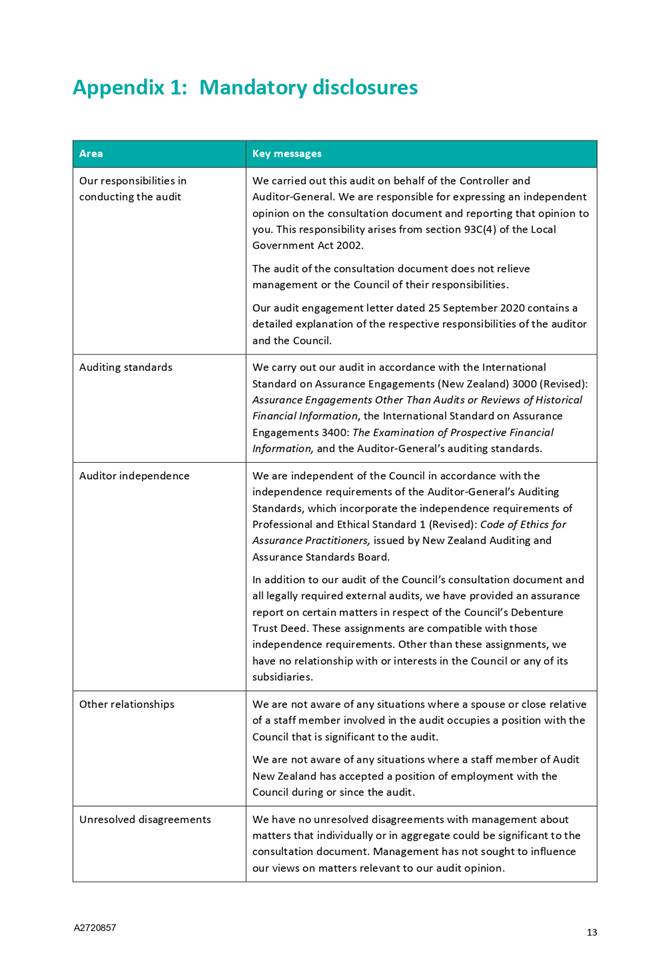

2. Notes Council’s response to two recommendations from

Audit New Zealand on asset planning (‘Management Comment’),

highlighted in section 3.10, pages 10 and 11 of Attachment 1 (A2720857).

|

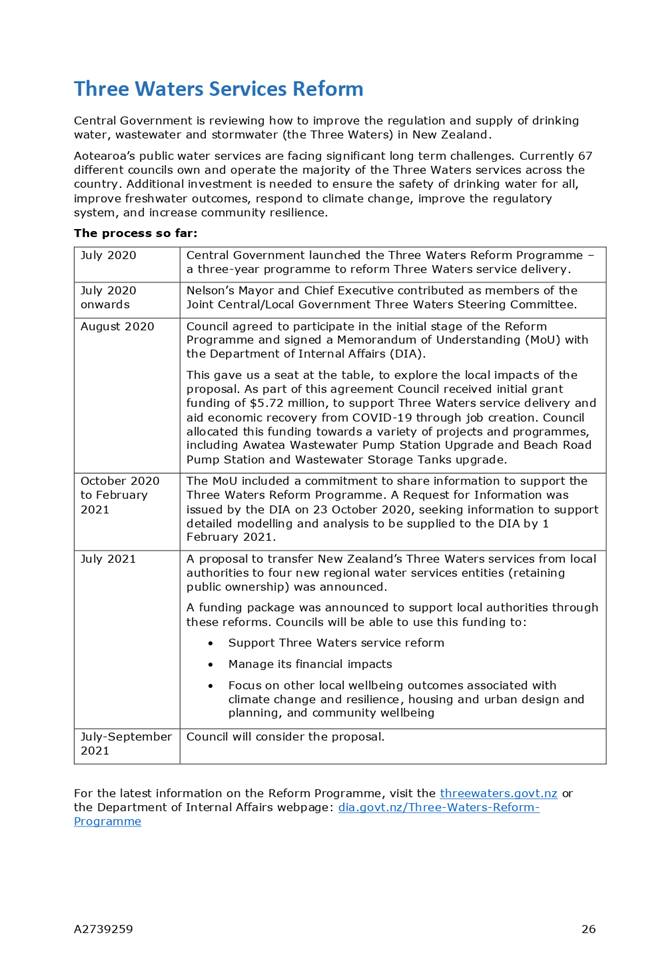

3. Background

3.1 The

Long Term Plan 2021-31 Consultation Document was adopted by Council in March

2021. Following consultation, hearings and deliberations, the Long Term Plan

2021-31 was adopted by Council in June 2021.

3.2 Both

the Consultation Document and the Long Term Plan 2021-31 were audited by Audit

New Zealand prior to Council adopting them. Unmodified opinions were issued by

Audit New Zealand for both documents.

3.3 Following

the audit, Audit New Zealand provided Council with reports which outlined

findings from the audit. These reports are attached for information.

Consultation Document

3.4 In

relation to the Consultation Document, the Audit Report (Attachment 1) outlines

the process that was followed in order to reach an unmodified audit opinion.

Key points and recommendations are listed below:

3.4.1 The

process to develop the Consultation Document and underlying information was

generally well managed. Some delays were experienced with the activity

management plans and Infrastructure Strategy, including clarification of the

implications for the status of the Nelson Future Access (NFA) project.

· The

audit identified a risk that levels of service may decrease for transport if

the NFA project does not go ahead. Based on Audit’s recommendation,

Council included a disclosure of this uncertainty.

· It was

recommended for the future that Council evaluate whether additional resources

should be deployed in planning and management of its transport infrastructure,

and have future infrastructure strategies and AMPs peer reviewed.

Council’s response to these recommendations is included in the attached

report, highlighted in section 3.10 on pages 10-11.

3.4.2 It

was confirmed that Council’s Financial Strategy is financially prudent,

and that the capital programme proposed is achievable.

3.4.3 No

issues were found with the forecasting assumptions, though it was recommended

that key assumptions be reassessed when finalising forecasts for the final Long

Term Plan.

3.4.4 Council’s

climate change assumptions were assessed as reasonable and supportable, with a

stated high level of uncertainty. Audit concluded that Council has been taking

appropriate steps to identify and mitigate climate change, and that this was

clearly set out in the Consultation Document and Infrastructure Strategy.

3.5 One

emphasis of matter drew attention to Council’s disclosure around the

Government’s intention to make Three Waters Reform decisions during 2021.

It acknowledged the uncertainty around the impacts of future reforms and

decisions on Council’s provision of three waters services, and that

significant changes would affect the information on which the Consultation

Document was based.

3.6 These

comments are outlined in more detail in Attachment 1 and will be considered by

staff in preparation of the 2024-34 Long Term Plan.

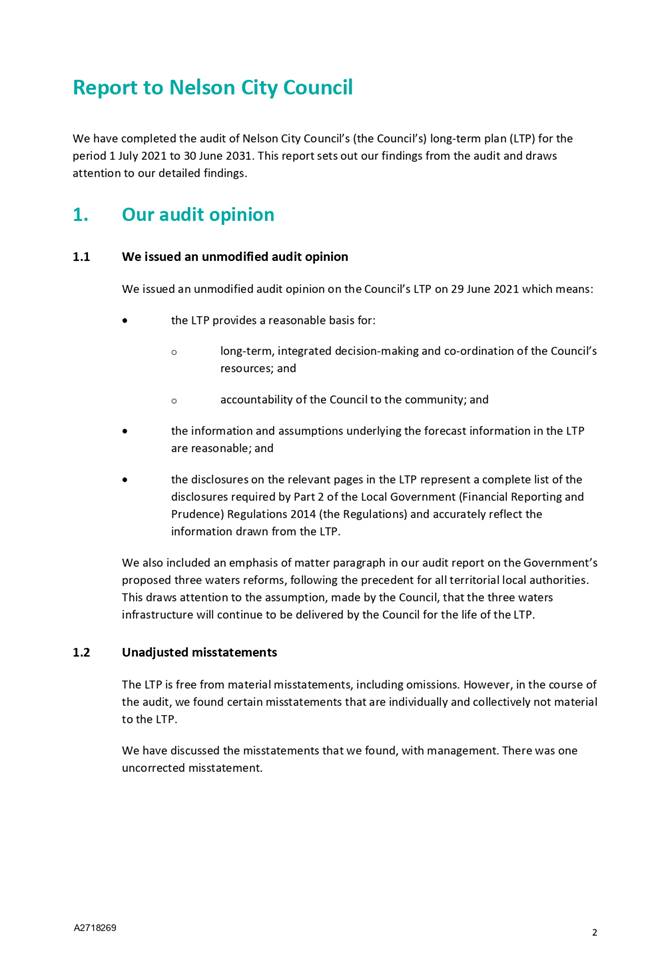

Long Term Plan 2021-31

3.7 In

relation to the full Long Term Plan, the Audit Report (Attachment 2) notes that

the opinion issued was unmodified. At the Long Term Plan stage, further

consideration was given to the following items (page four of Attachment 2):

3.7.1 Waka

Kotahi funding assumption

3.7.2 Delivery

of capital programme assumption

3.7.3 Impact

of the growth assumption

3.8 An

emphasis of matter paragraph on the Government’s proposed Three Waters

Reforms was included in the Audit Report, as was the case for all territorial

local authorities. This drew attention to the assumption made by Council that

three waters infrastructure will continue to be delivered by Council for the

life of the Long Term Plan 2021-31.

4. Conclusion

4.1 The

Audit Reports from Audit New Zealand on the Long Term Plan 2021-31 and

Consultation Document are attached for information.

Author: Nikki

Harrison, Group Manager Corporate Services

Attachments

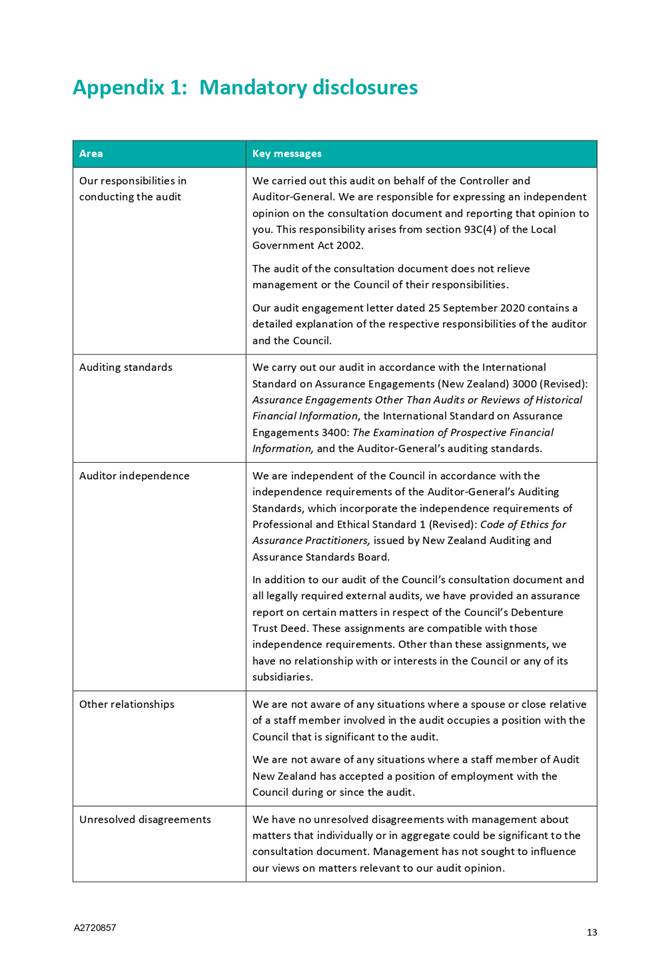

Attachment 1: A2720857 - Audit

Report - Long Term Plan Consultation Document 2021-31 ⇩

Attachment 2: A2718269

- Audit Report - Long Term Plan 2021-31 ⇩

Item

8: Audit Reports on the Consultation Document and Long Term Plan 2021-31:

Attachment 1

Item 8: Audit Reports on the

Consultation Document and Long Term Plan 2021-31: Attachment 2

Item 9: Bad Debts

Writeoff - Year Ending 30 June 2021

|

|

Audit, Risk and Finance Subcommittee

14 September 2021

|

REPORT R25901

Bad

Debts Writeoff - Year Ending 30 June 2021

1. Purpose

of Report

1.1 To

inform the Audit and Risk Subcommittee of the level of bad debts written off,

and to seek approval to write off one debt over $10,000 for the year ending 30

June 2021.

2. Recommendation

|

That the Audit, Risk and Finance Subcommittee

1. Receives

the report Bad Debts Writeoff - Year Ending 30 June 2021 (R25901).

|

Recommendation to Council

|

That the

Council

1. Approves the balance of $41,990.31

owed by the Brook Valley Community Group Inc be written off as at 30 June

2021.

|

3. Discussion

3.1 There

is one bad debt over $10,000 to be written off for the year ending

30 June 2021. The Brook Valley Community Group Inc (BVCG) was liquidated

in 2020 with the final liquidators report received in August 2020.

Council as an unsecured creditor was owed $41,990.31 (no GST).

3.2 The

debt owed by the BVCG was for court awarded costs incurred throughout an

unsuccessful legal challenge taken against Council.

3.3 The

BVCG has been removed from the Register of Incorporated Societies and was

dissolved on the 26 May 2021.

3.4 As

the BVCG was an incorporated society, members cannot be held personally liable

for its debts, except in exceptional circumstances. The only exceptions

are where members have done acts for pecuniary gain or have incurred a debt through

unlawful action, neither of which applies in this situation.

3.5 The

debt has been reported to the Audit, Risk and Finance Subcommittee in the

Quarterly Update on Debts since 30 September 2020, as requiring write off.

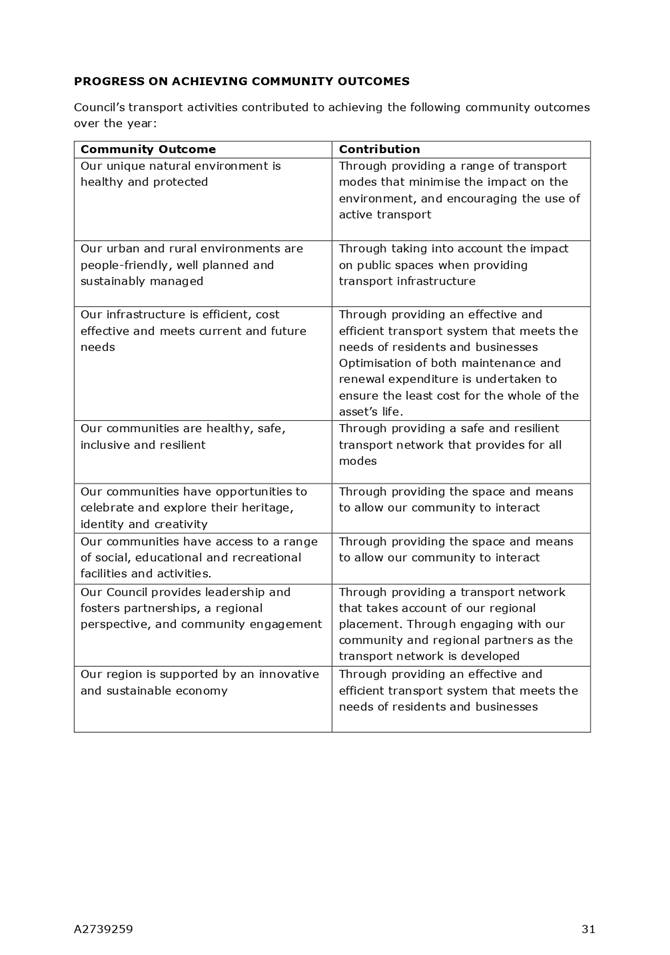

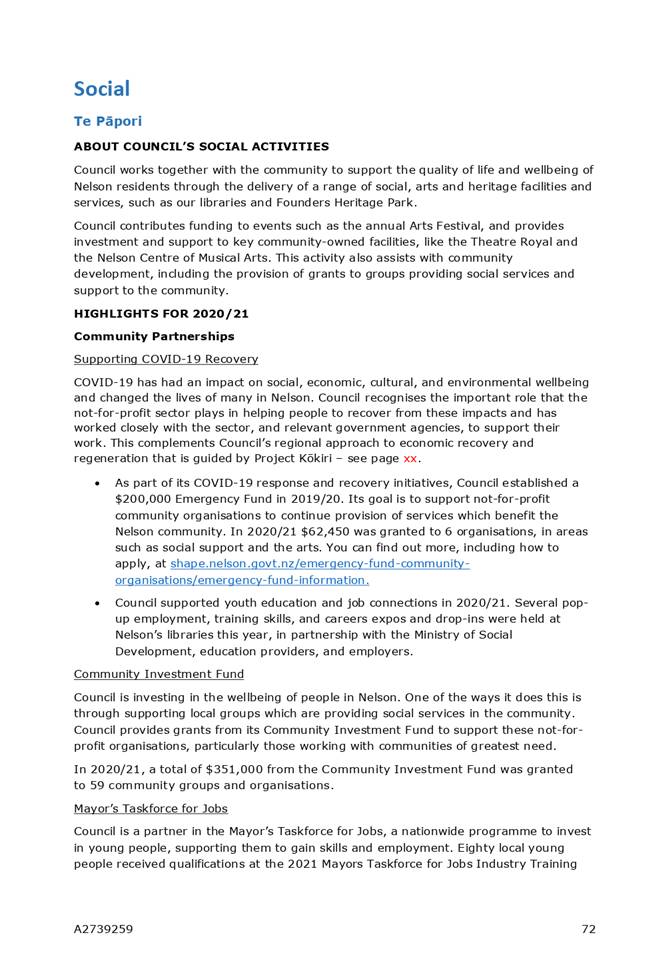

3.6 Under

officer delegation, the Group Manager Corporate Services has written off 23

debts under $10,000 per debtor at 30 June 2021 (excluding GST).

|

|

Write-off 2021

|

|

Write-off 2020

|

|

|

$

|

No.

|

$

|

No.

|

|

Dog

Impounding

|

$ 2,322

|

9

|

$ 3,885

|

14

|

|

Marina

Fees

|

$ 440

|

7

|

$ 2,112

|

1

|

|

General

Debtors

|

$ 688

|

3

|

$ 1,266

|

2

|

|

Regulatory

|

$ 1,099

|

4

|

$ 638

|

3

|

|

Total

|

$4,551

|

23

|

$7,901

|

20

|

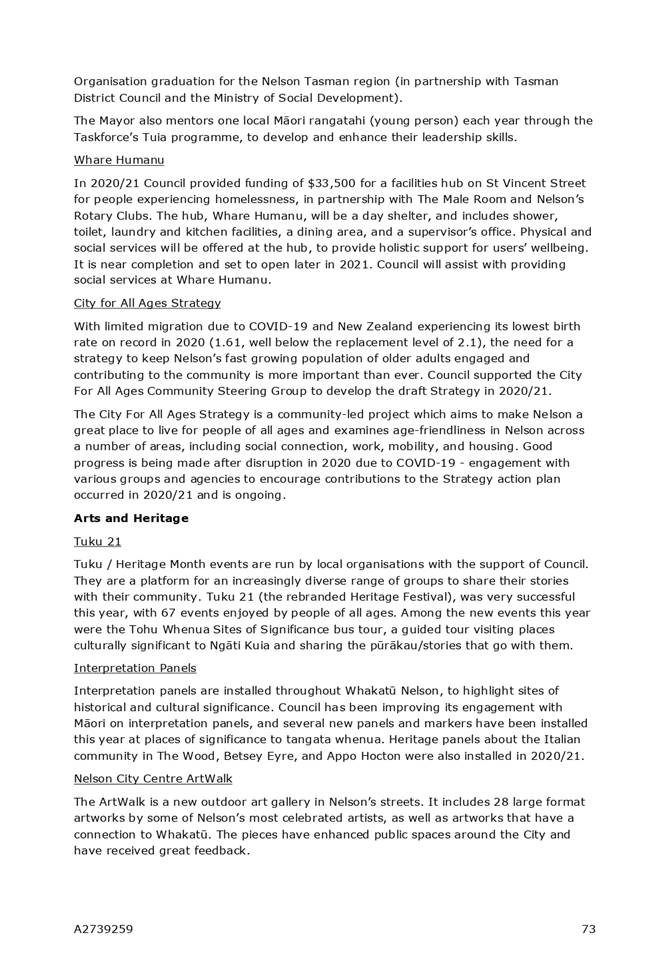

3.7 A

comparison of debts to be written off between 20/21 and 19/20 is as follows:

|

|

Write-off 2021

$

|

Write-off 2020

$

|

|

Over $10,000

|

41,990

|

20,462

|

|

Under $10,000

|

4,551

|

7,901

|

|

Cost for year

|

$46,541

|

$28,363

|

3.8 The

decision to write off debt over $10,000 is an administrative one.

Although the debts are written off from an accounting point of view, a record

is kept and if an opportunity to recover the debt arises, action will be taken.

Most of this balance sits with Credit Recoveries Limited, Council’s debt

recovery agency, which continues recovery activities. Every possible

effort has been made to locate and obtain payment from these debtors.

4. Options

4.1 The

recommendation is to receive the report and write off one bad debt over $10,000

for accounting purposes.

Author: Victoria

Harper, Accounting Services Manager

Attachments

Nil

|

Important

considerations for decision making

|

|

1. Fit

with Purpose of Local Government

This report deals with process matters in relation

to cost effective service delivery which benefits the economic wellbeing of

the community.

|

|

2. Consistency

with Community Outcomes and Council Policy

This report supports the community outcome that

Council provides leadership, which includes the responsibility for protecting

finances and assets.

|

|

3. Risk

There is limited risk from writing off these bad

debts as most will continue to be followed up by the credit recovery agency.

|

|

4. Financial

impact

Writing off the debts has a one-off impact on

revenue of $41,990.31.

|

|

5. Degree

of significance and level of engagement

This matter is of low significance because the amounts

being written off are immaterial.

|

|

6. Climate

Impact

There is no climate impact in writing off these

debts.

|

|

7. Inclusion

of Māori in the decision making process

No engagement with Māori has been undertaken in

preparing this report.

|

|

8. Delegations

The Audit Risk and Finance Subcommittee has the

following delegations to consider [subject]

Areas of Responsibility:

· Audit

processes and management of financial risk

Powers to Decide:

· None

Powers to Recommend to Council

· To write

off outstanding accounts receivable or remit fees and charges of amounts over

the Chief Executive’s delegated authority

|

Item 10: Carry Forwards

2020/21

|

|

Audit, Risk and Finance Subcommittee

14 September 2021

|

REPORT R26143

Carry

Forwards 2020/21

1. Purpose

of Report

1.1 To

approve the carry forward of unspent budget to the new financial year.

2. Summary

2.1 Invoice processing is complete for

the 2020/21 financial year and officers have reviewed project expenditure to

identify savings and consider whether unspent budget is still required.

3. Recommendation

|

That the Audit, Risk and Finance Subcommittee

1. Receives

the report Carry Forwards 2020/21 (R26143)

and its attachment (A2724698).

|

Recommendation to Council

|

That the

Council

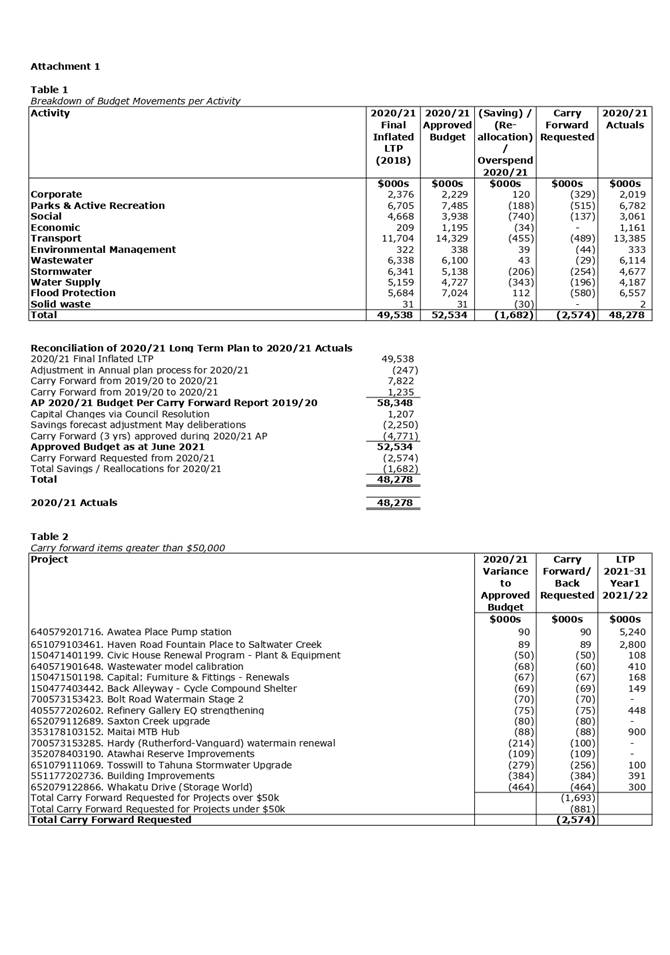

1. Approves

the carry forward of $2.6 million unspent capital budget for use in 2021/22:

and

2. Notes

that this is in addition to the carry forward of $4.8 million approved during

the Long Term Plan 2021-31, taking the total carry forward to $7.4 million of

which $827,000 is for the 2022/23 year, $349,000 is for the 2023/24 year and

the balance of $6.2 million is for the 2021/22 year; and

3. Notes

that the total savings and reallocations in 2020/21 capital expenditure of

$1.7 million including staff time which is in addition to the $2.3 million

savings and reallocations already recognised in the May 2021 deliberations;

and

4. Notes that the total 2021/22 capital budget (including staff

costs and excluding consolidations and vested assets) will be adjusted by

these resolutions from a total of $67.1 million to a total of $69.7 million;

and

5. Approves the carry forward of $567,000 unspent operating budget

for use in 2021/22.

|

4. Background

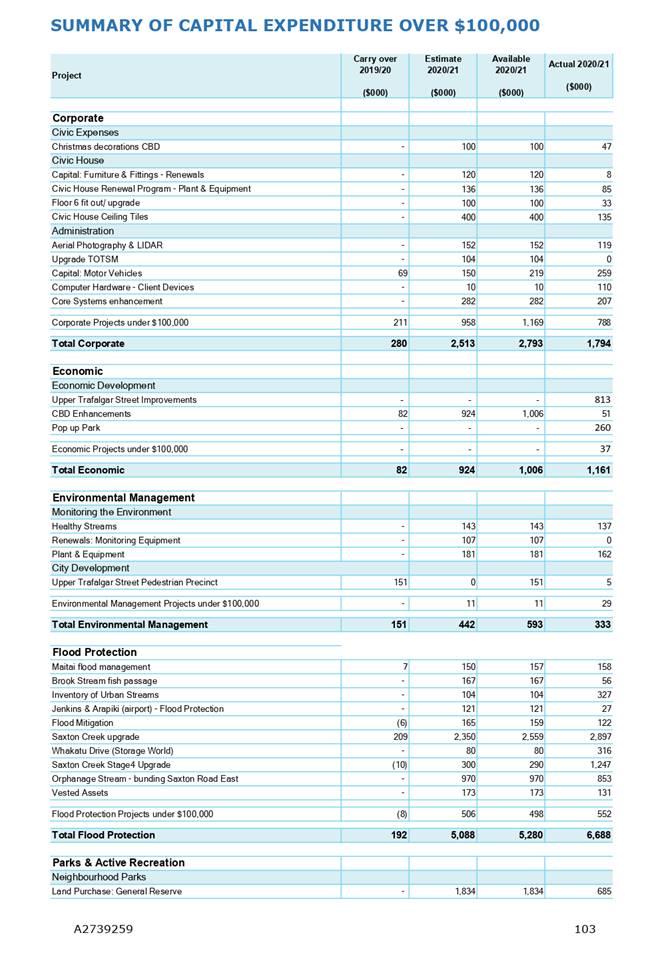

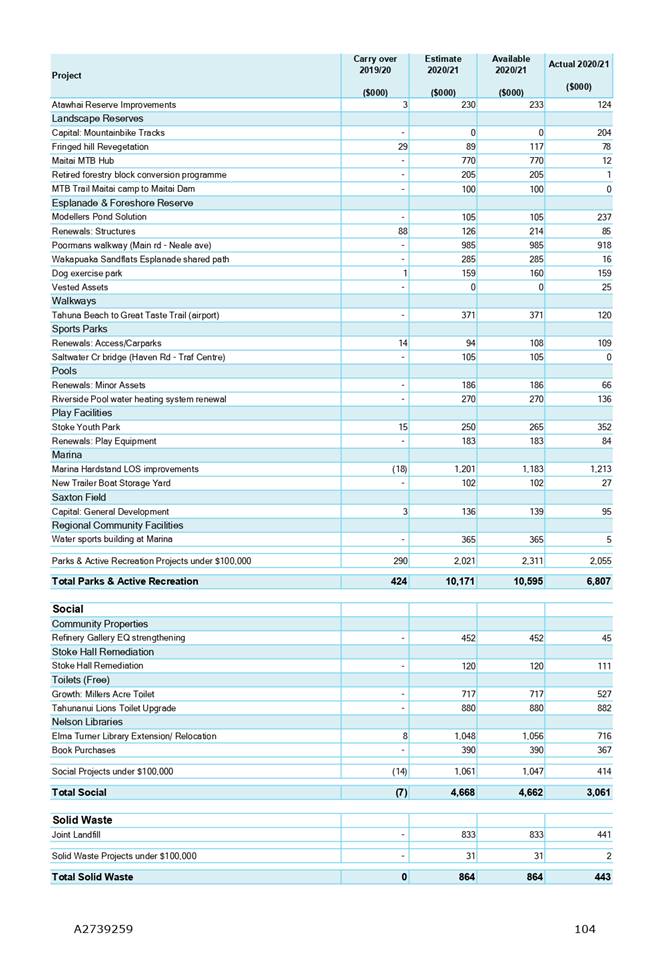

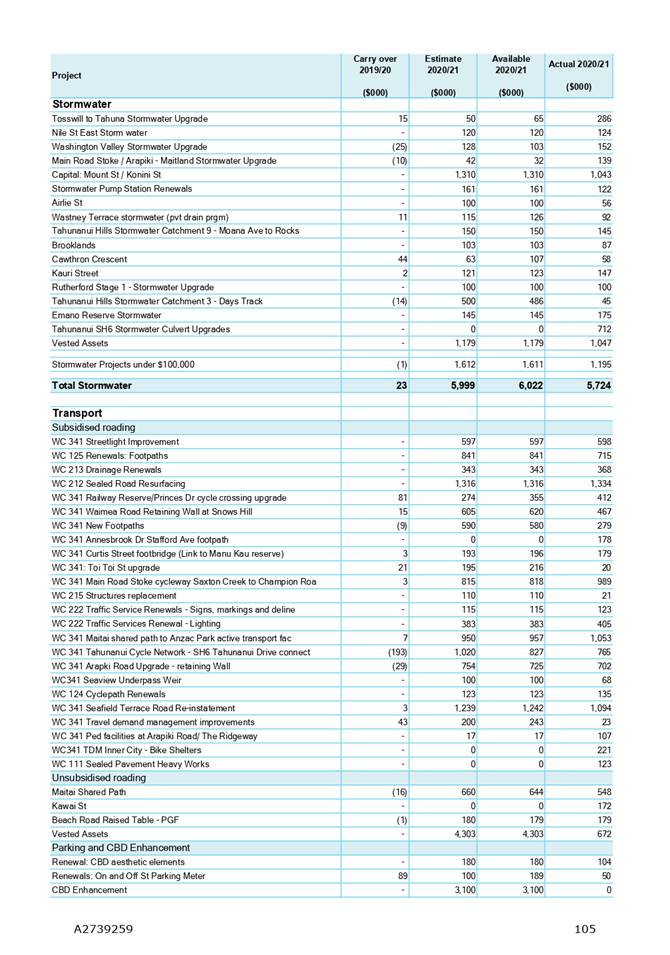

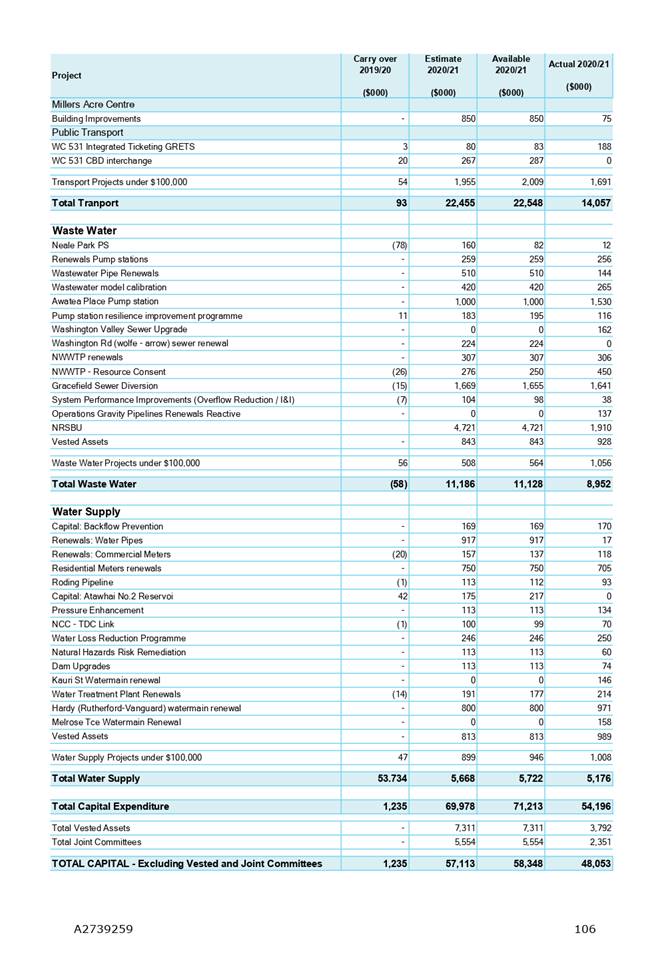

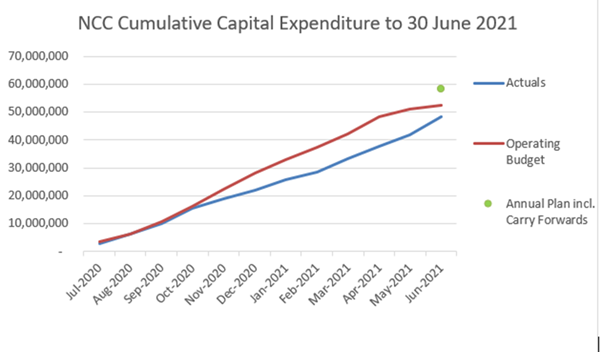

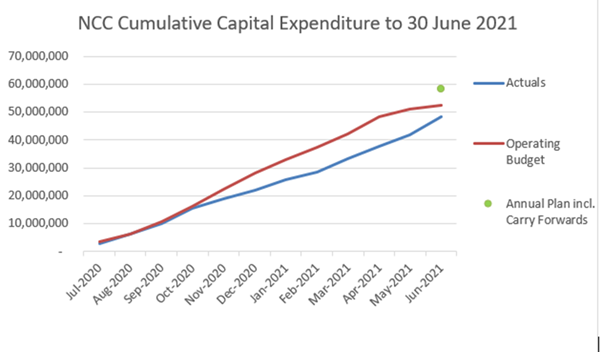

4.1 The capital programme for 2020/21,

as agreed in the Annual plan 2020/21 totalled $57.1 million, including staff

costs and excluding Nelson Regional Sewerage Business Unit (NRSBU), Nelson

Tasman Regional landfill and vested assets. All figures quoted in this report

are calculated on this basis.

4.2 The addition of 2019/20 carry

forwards, and other resolutions of Council over the 2020/21 year adjusted the

total capital budget to $59.6 million.

4.3 The 2020/21 capital budgets were

forecast quarterly throughout 2020/21 with a view to what could realistically

be achieved in the remainder of the financial year. The capital budget was

reforecast to $52.5 million in May 2021. The 2020/21 budget movements

incorporated in year one of the 2021-2031 Long Term Plan (LTP) were approved on

adoption of the LTP on 24 June 2021. In particular, $4.8 million was carried

forward from 2020/21 to 2021/22 and future years during the LTP process.

4.4 Total capital expenditure for the

2020/21 year was $48.3 million, $10 million less than the Annual plan 2020/21

including carry forwards of $58.3 million. Of this, $4.8 Million has already

been carried forward in the LTP process and $2.3 million was already re-forecast

as savings or reallocations, $1.7 million has been identified as further

savings or reallocations.

4.5 Reasons

for capital carry forwards being requested include project delivery delays due

to:

· alterations to the

phasing of multi-year projects resulting from wet weather and negotiations with

external parties;

· delay in lead time

in procuring materials and equipment as a result of Covid-19.

4.6 A large percentage of the

infrastructure carry-over relate to projects that were well underway on site

before the end of the financial year and hence committed but were delayed by

wet weather and negotiations to accommodate businesses.

4.7 As reported to the Infrastructure

Committee recently, Council are experiencing higher than expected additional

costs on some of its projects that will in all likelihood continue for the

foreseeable future. Costs are rising at a level that officers could not have

anticipated. These additional costs are a direct result of the COVID-19

lockdown, specifically its effect on the supply chain and the delay in

materials and equipment and increased installation costs.

4.8 Once the 2020/21 year was closed

for invoice processing, officers collated data relating to the projects

undertaken during the year, identifying variances against the reforecast.

4.9 Project managers were asked to

identify which variances represented savings, and where they wished to carry

forward budget into 2021/22, or subsequent years, they were asked to support

their request.

4.10 The capital expenditure programme will be

re-assessed during Quarter 1 2021/22 to gain a better understanding of projects

that will not go ahead as planned in 2021/22.

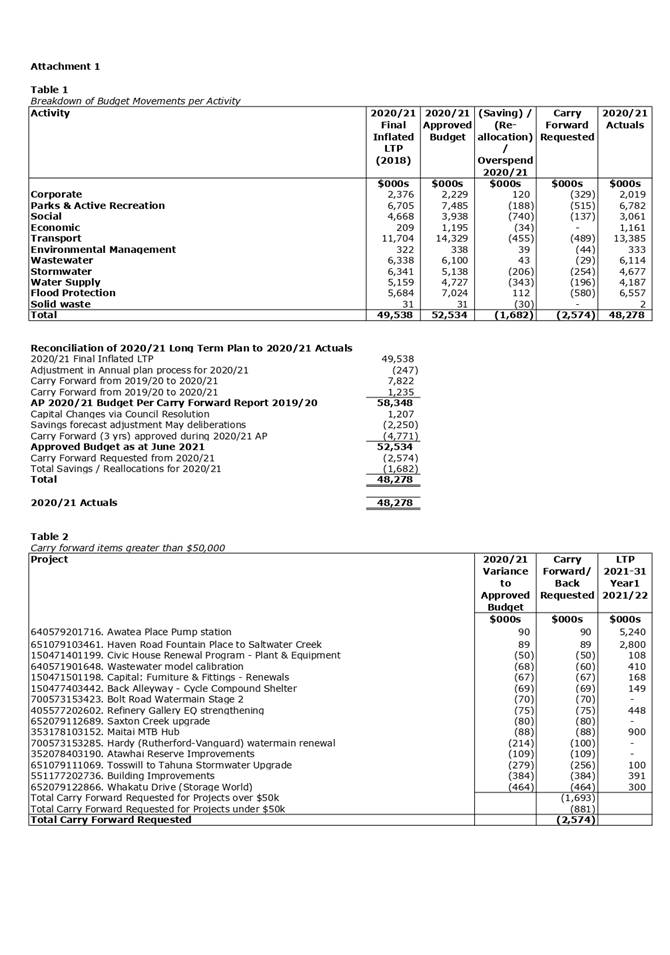

5. Discussion

Capital savings and

reallocations

5.1 Officers identified savings and

reallocations of $1.7 million in capital expenditure in 2020/21. In total, this

saving will have a positive impact on interest, depreciation and debt levels,

in excess of that already identified in year 1 of the LTP 2021-2031.

Capital

carry forwards

5.2 Officers

have requested that $2.6 million be carried forward. All of this is requested

to be added to 2021/22 capital budgets.

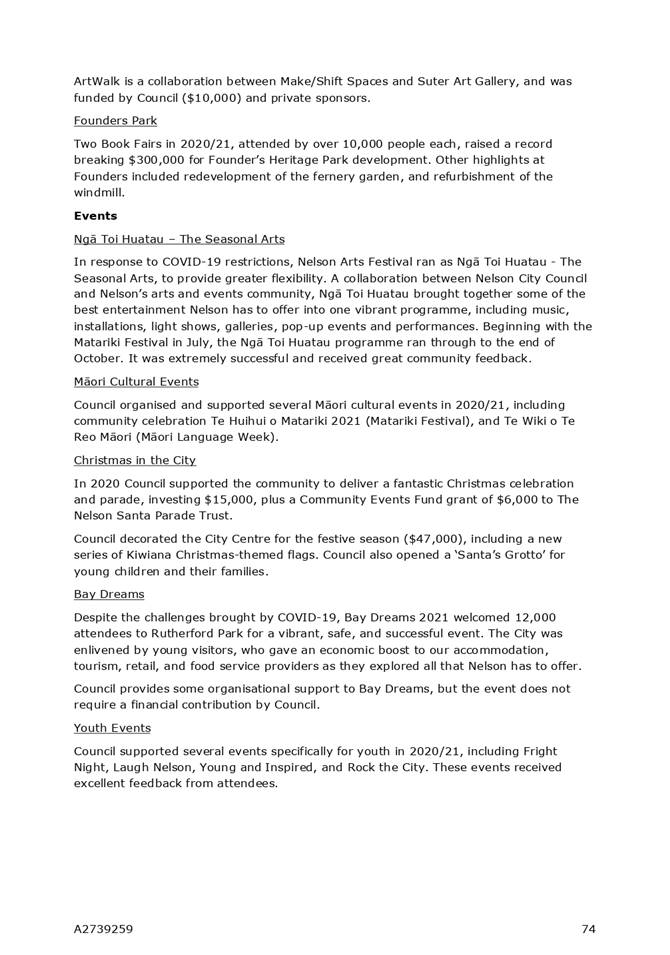

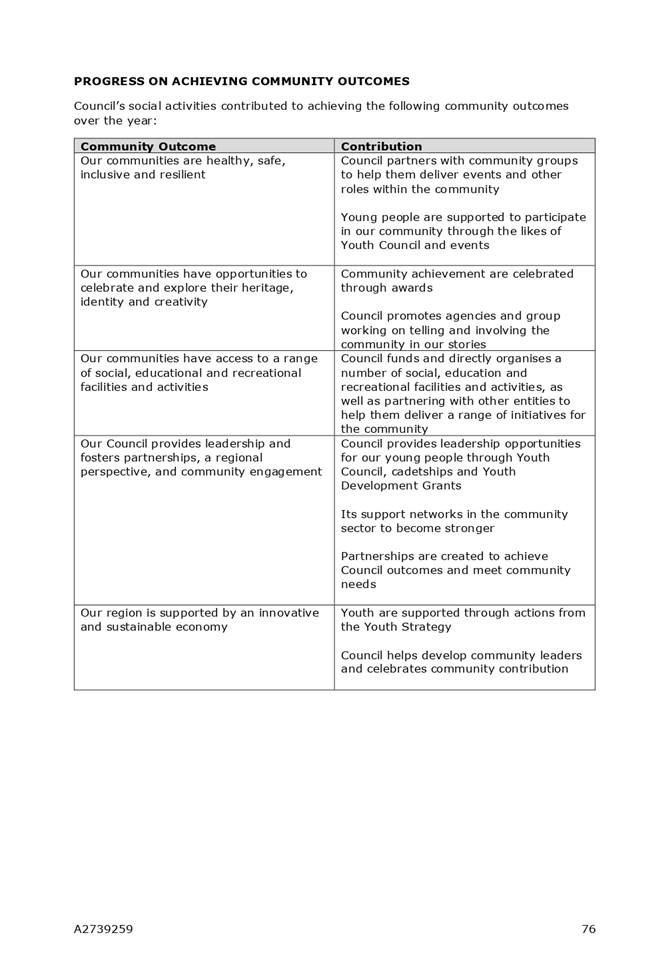

5.3 A

breakdown of budget movements in total 2020/21 capital budgets is provided as

Table 1.

5.4 Table 2 itemises capital projects

with carry overs requested greater than $50,000. These are new carry forwards

which have been requested in addition to those approved during the LTP

2021-2031.

Operating

carry forwards

5.5 In addition to the Capital carry

forward requests, there are four Operating Expense budgets, totalling $567,000,

that have been requested by staff to carry forward to 2021/22:

· Provision of

rental relief for the effects of COVID 19 $500,000 ($180,000 of a $1.1 million

provision had been spent in 2020/21). It would be prudent to carry forward

a portion of the unspent budget for 2021/22 given the recent Level 4 lockdown.

· Emergency Fund

(for COVID Recovery in community) $56,000

· Mayoral

Discretionary Fund $6,000

· NN Youth Council

– Pride Crossing $5,000

6. Options

6.1 Council officers support Option 1,

approve the recommendations. Not approving the recommendations would be

problematic as the future scope of some of these projects has been agreed

through Committee and Council resolutions including Annual and Long Term Plans

prior to this meeting. Work has continued on these projects based on those

decisions.

|

Option 1: Approve the

recommendations

|

|

Advantages

|

· Work

has continued on 2020/21 capital projects and costs have been incurred.

· The

carry forward spending is within previously approved budgets.

· The

majority of carry forward requests are for projects that are in process and

carry forward of budget is required to realise expected council outcomes.

|

|

Risks and Disadvantages

|

· None

|

|

Option

2: Approve carry forward with exceptions

|

|

Advantages

|

· If

Council wished, it could remove some items from the list of budgets to be

carried forward.

· Savings

in future debt, depreciation, interest and maintenance costs would occur.

|

|

Risks and Disadvantages

|

· The

projects concerned would then not have sufficient budget to be completed.

· Council

does not have complete information through this report to fully inform such a

decision.

|

7. Conclusion

7.1 An

analysis of capital expenditure against forecast for 2020/21 indicates:

· There are

savings and reallocations from the capital budget of $1.7 million compared to

the approved budget for 2020/21.

· Additional

capital budget of $2.6 million not spent should be carried forward to the

2021/22 year.

· Operating

Expenses totalling $567,000 have been requested by staff to carry forward to

2021/22.

8. Next

Steps

8.1 Once

approved, budgets will be updated to reflect the approved resolutions.

Author: Alistair

Roper, Management Accountant

Attachments

Attachment 1: A2724698 - Carry

Forward Report 2020/21 ⇩

|

Important considerations for decision making

|

|

1. Fit

with Purpose of Local Government

Approval of the recommendation

will allow progress/completion of approved projects. This will promote

social, economic and environmental wellbeing in the present and future

through employment, stimulus of the local economy and delivery of public

infrastructure and community services.

|

|

2. Consistency

with Community Outcomes and Council Policy

This decision supports all the

community outcomes but most particularly that our infrastructure is

efficient, cost effective and meets current and future needs.

|

|

3. Risk

Failure to approve the

recommendation will introduce risk (financial, contractor and community

relationships) which does not currently exist.

|

|

4. Financial

impact

There is little financial impact

from approving the recommendation as budgets are already approved and funded.

|

|

5. Degree

of significance and level of engagement

This matter is of low

significance as budgets are already approved and the recommendation confirms

business as usual. Therefore no engagement is required.

|

|

6. Climate

Impact

Adaptation

This decision will have no

impact on the ability of the Council or District to proactively respond to

the impacts of climate change now or in the future.

The decision is not sensitive to

higher emission scenarios or more rapid climate changes.

Mitigation

This decision is likely to

result in no impact in greenhouse gas emissions.

|

|

7. Inclusion

of Māori in the decision making process

No engagement with Māori has been undertaken in

preparing this report.

|

|

8. Delegations

The Audit Risk and Finance subcommittee has the

following delegations to consider the 2020/21 Carry Forwards.

Areas of Responsibility:

· Council’s financial

performance

Powers to Recommend:

· All other matters within the areas

of responsibility or any other matters referred to it by the Council

|

Item

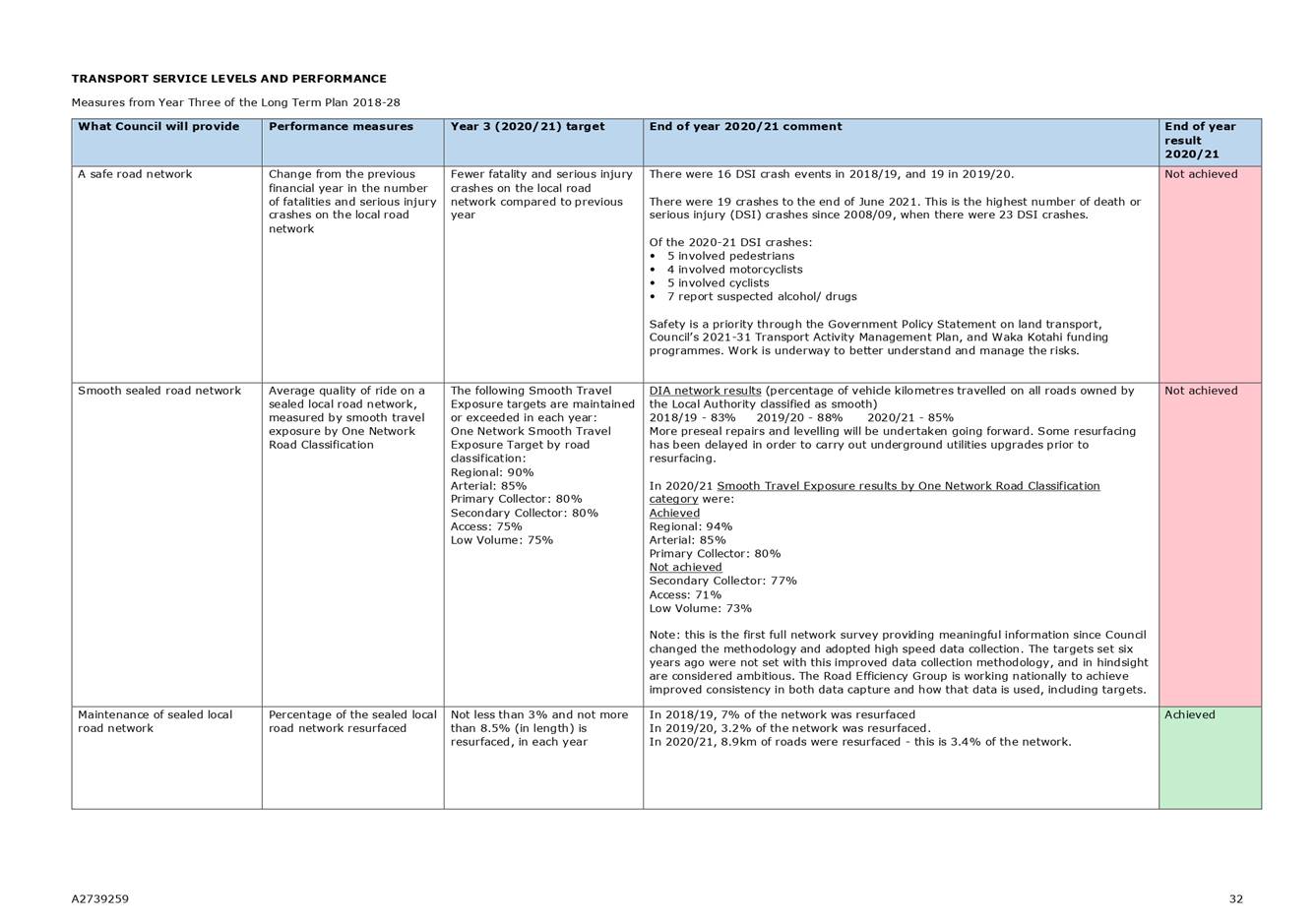

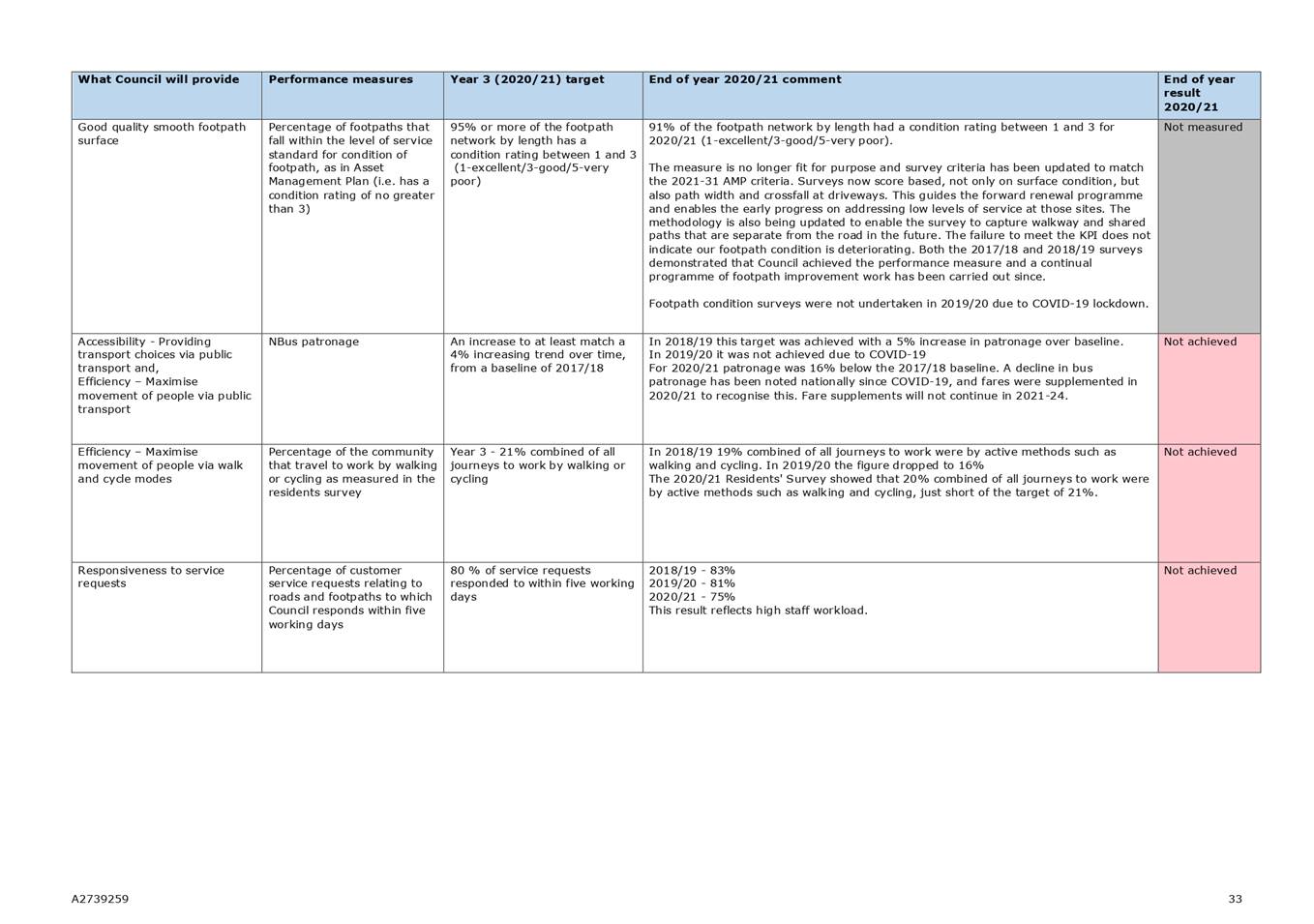

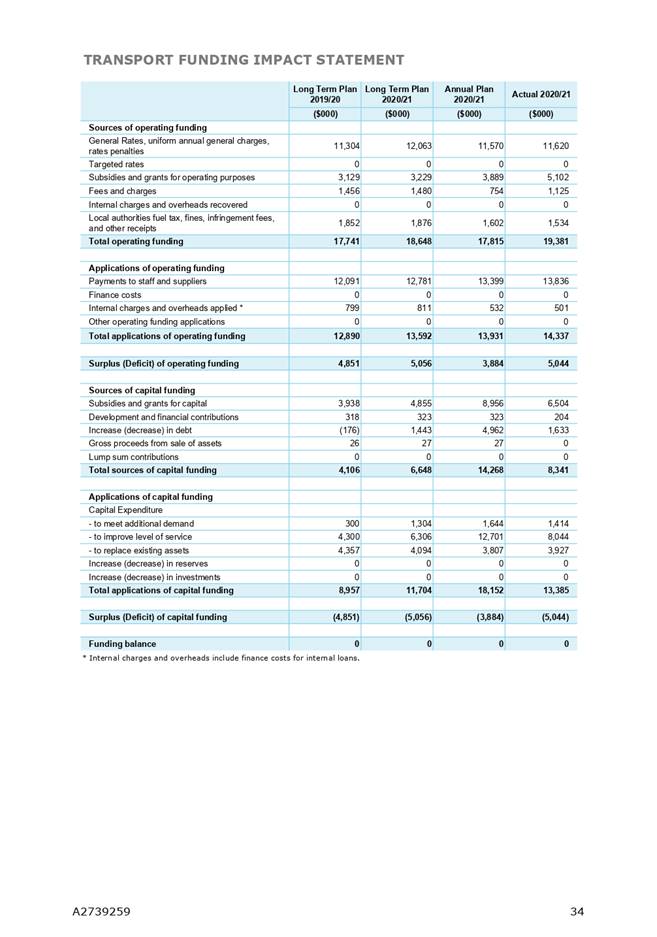

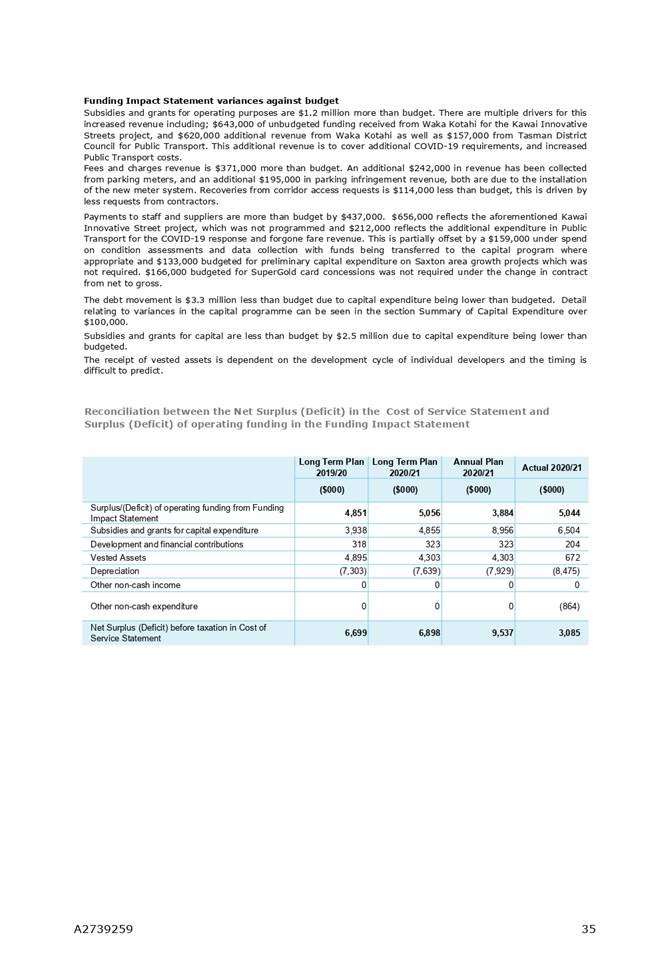

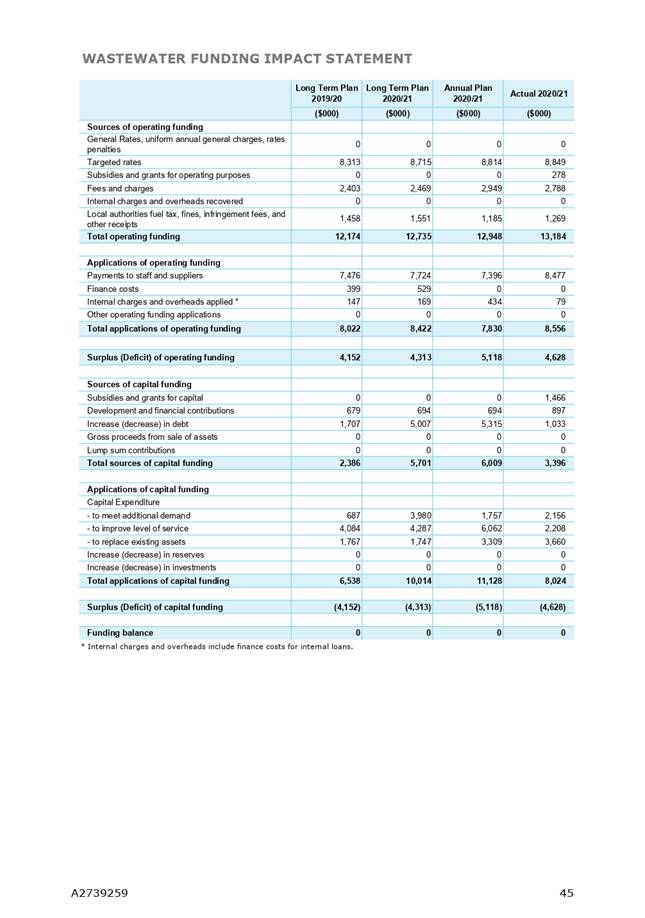

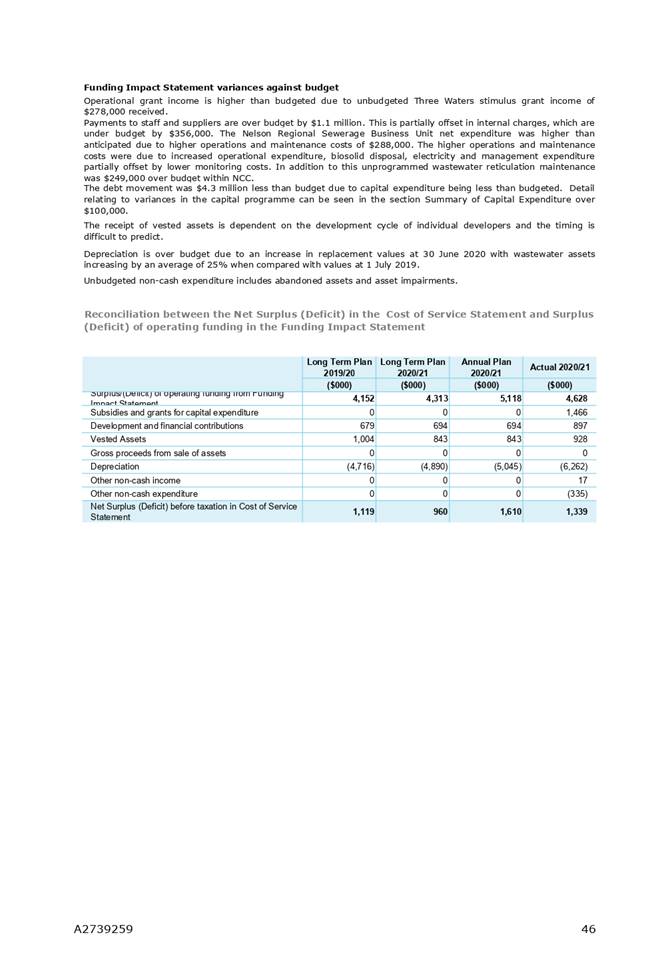

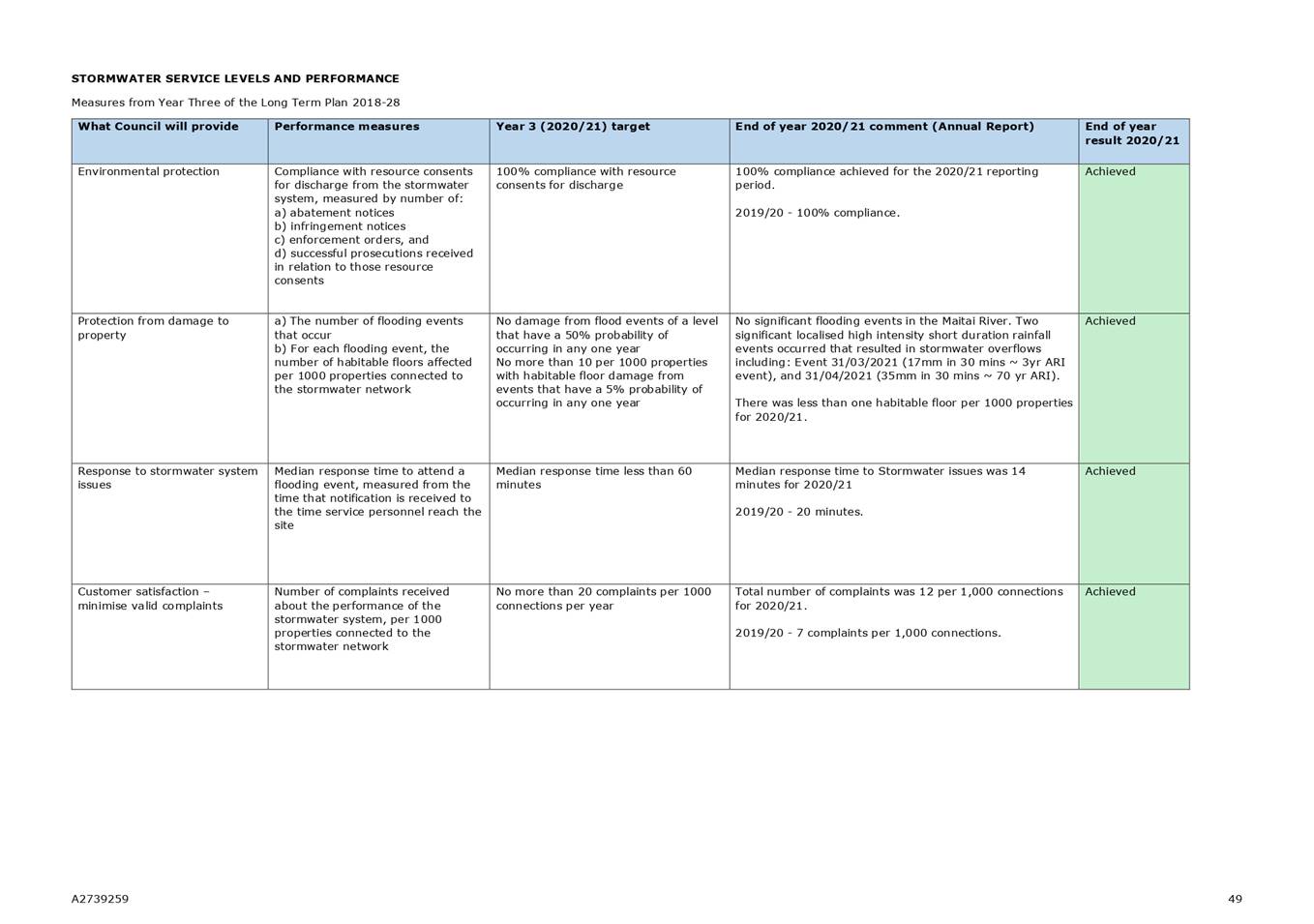

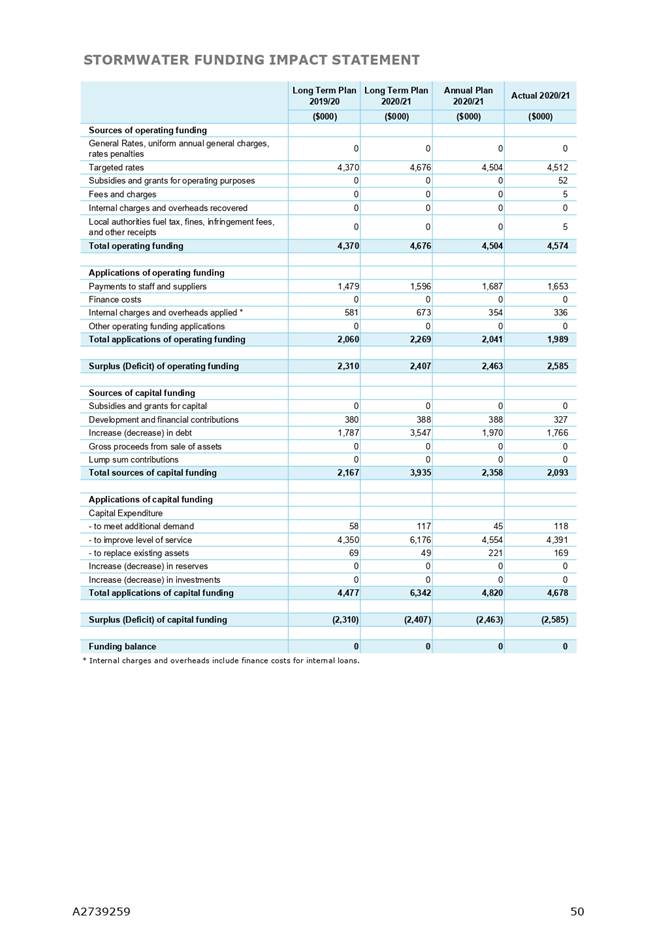

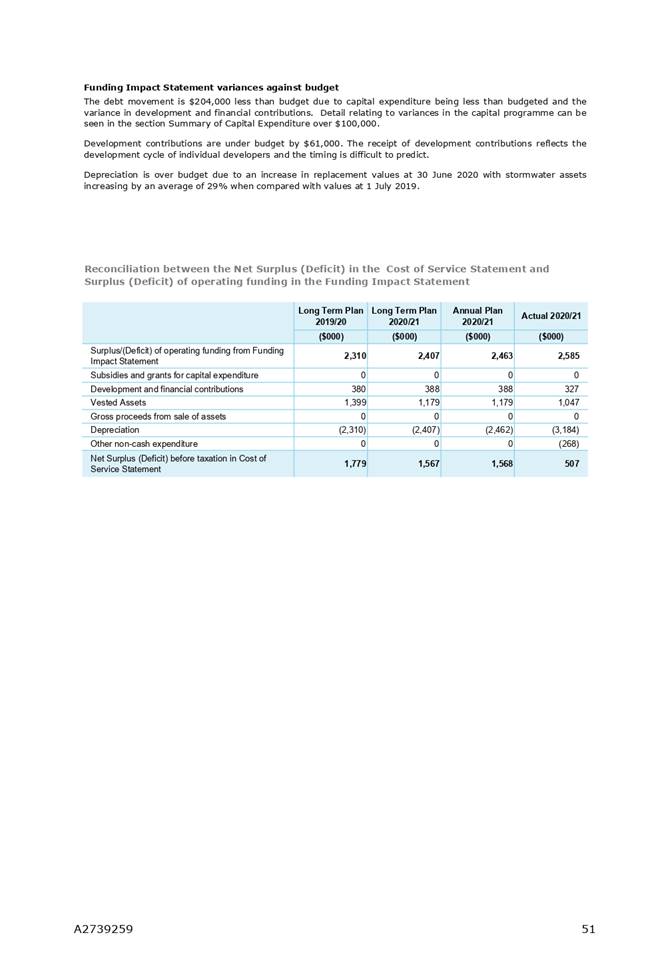

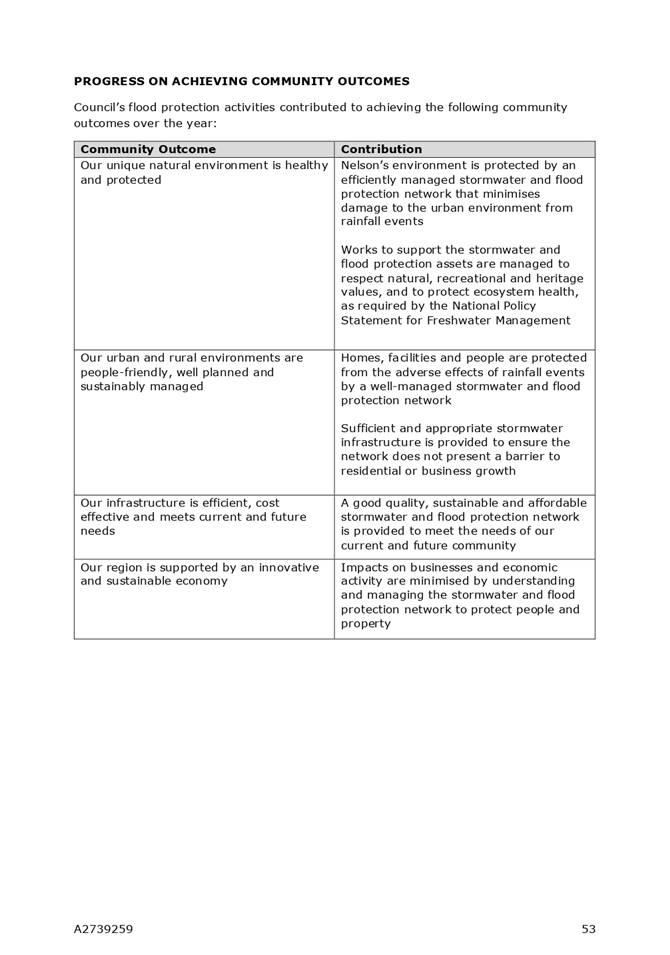

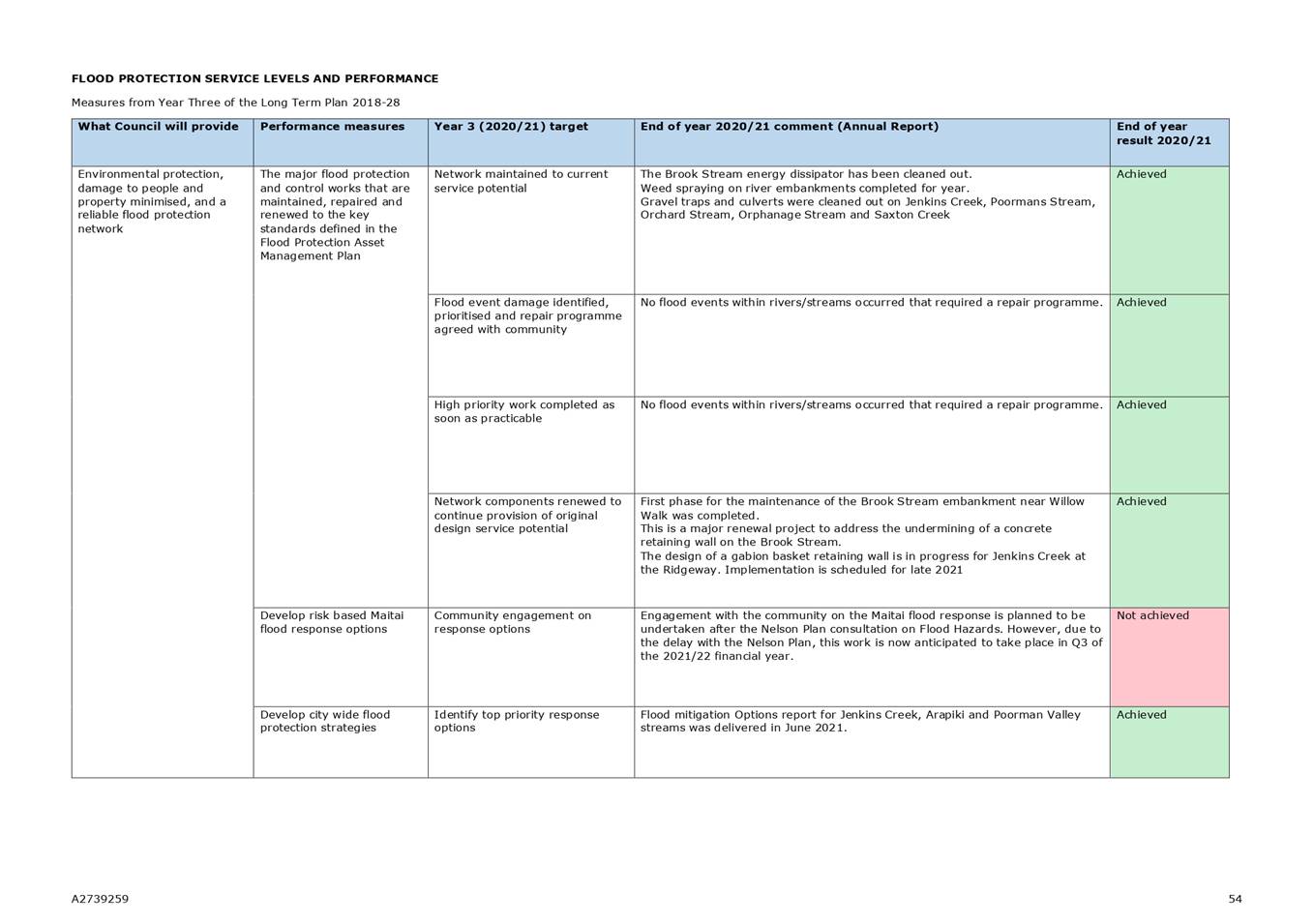

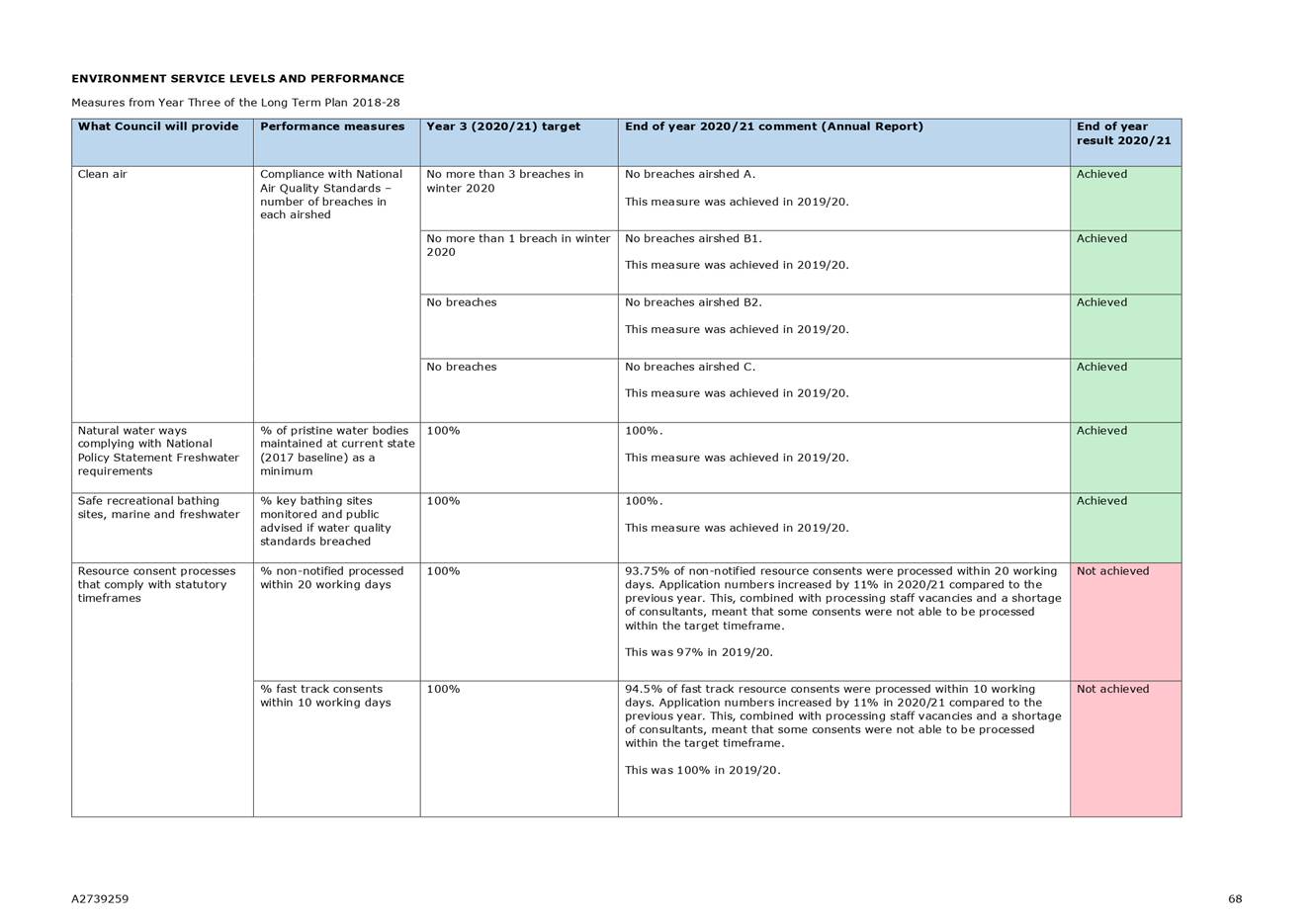

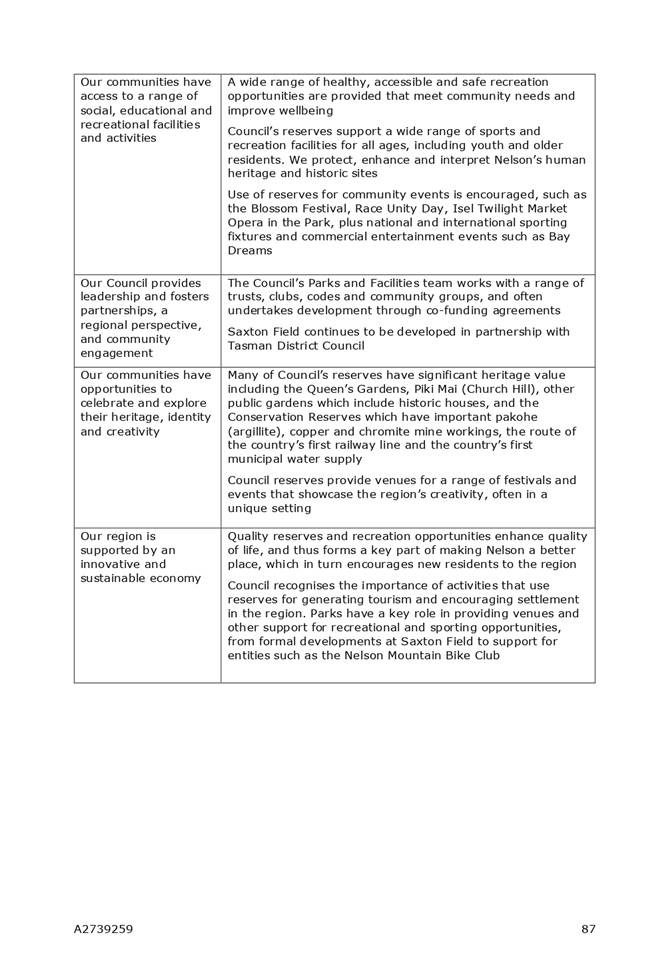

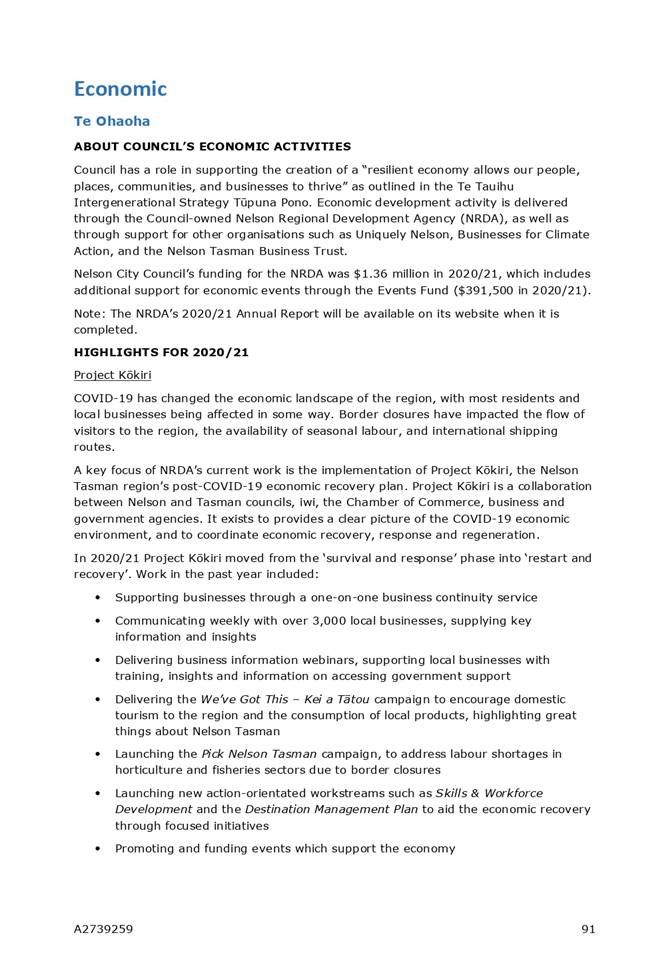

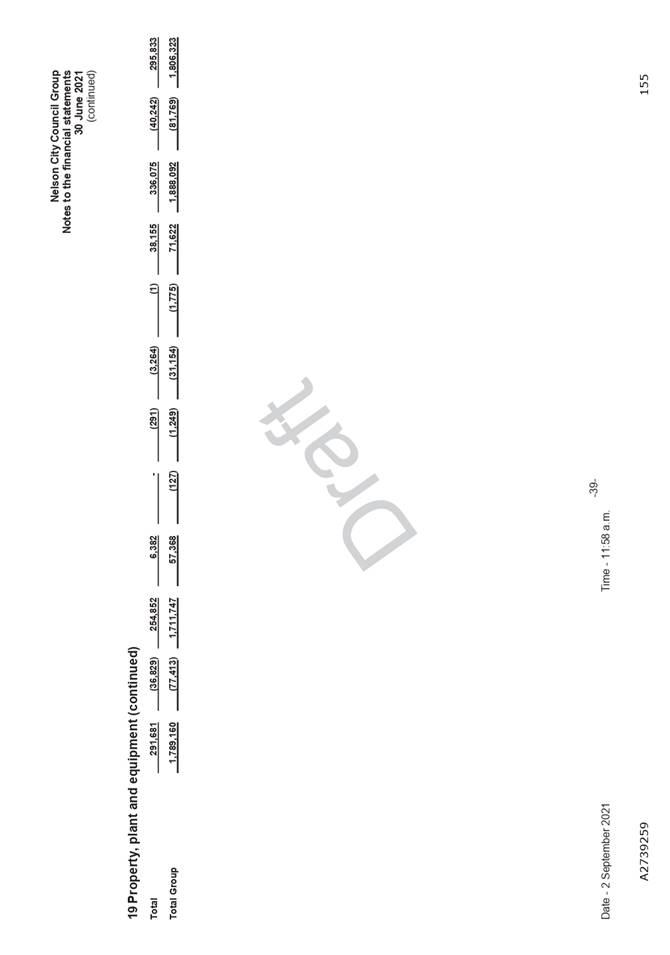

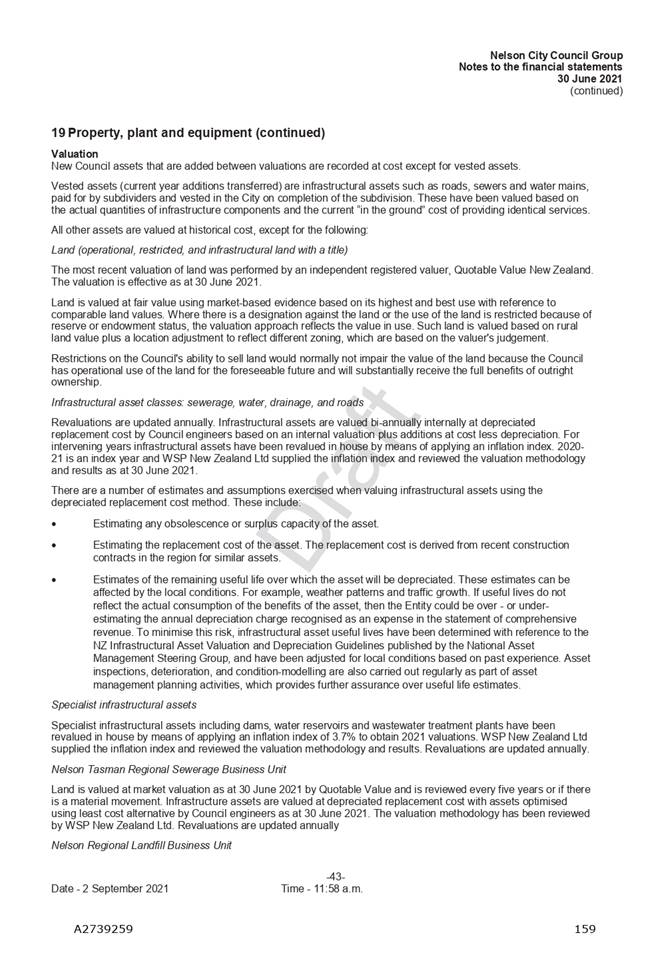

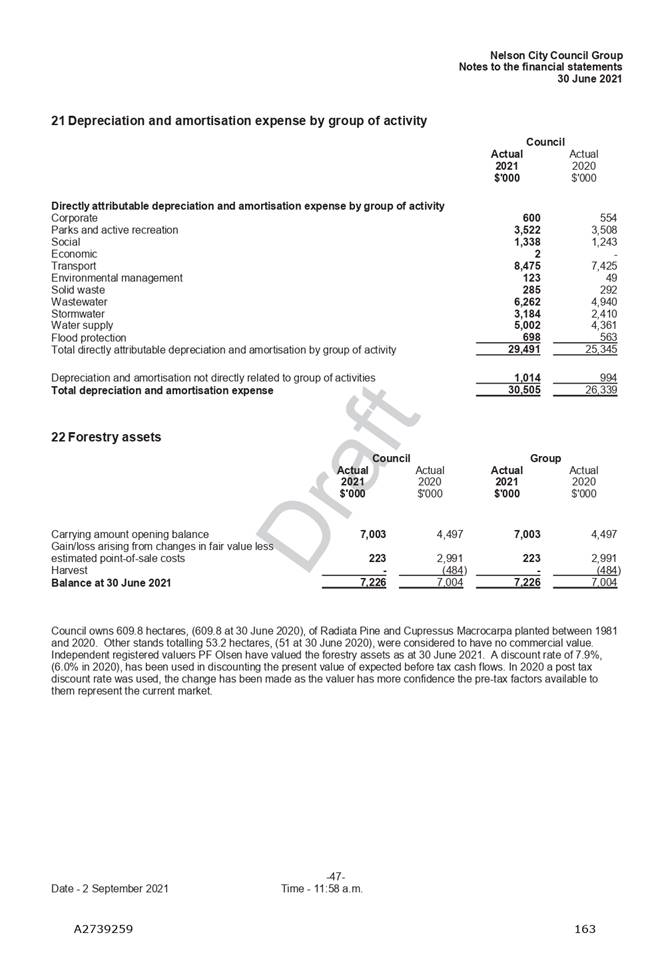

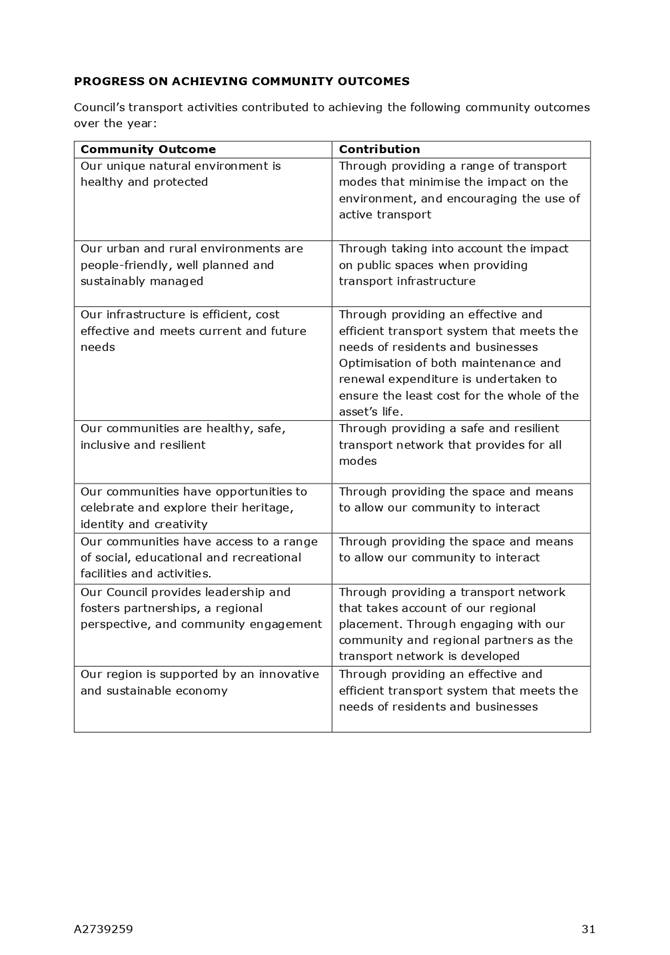

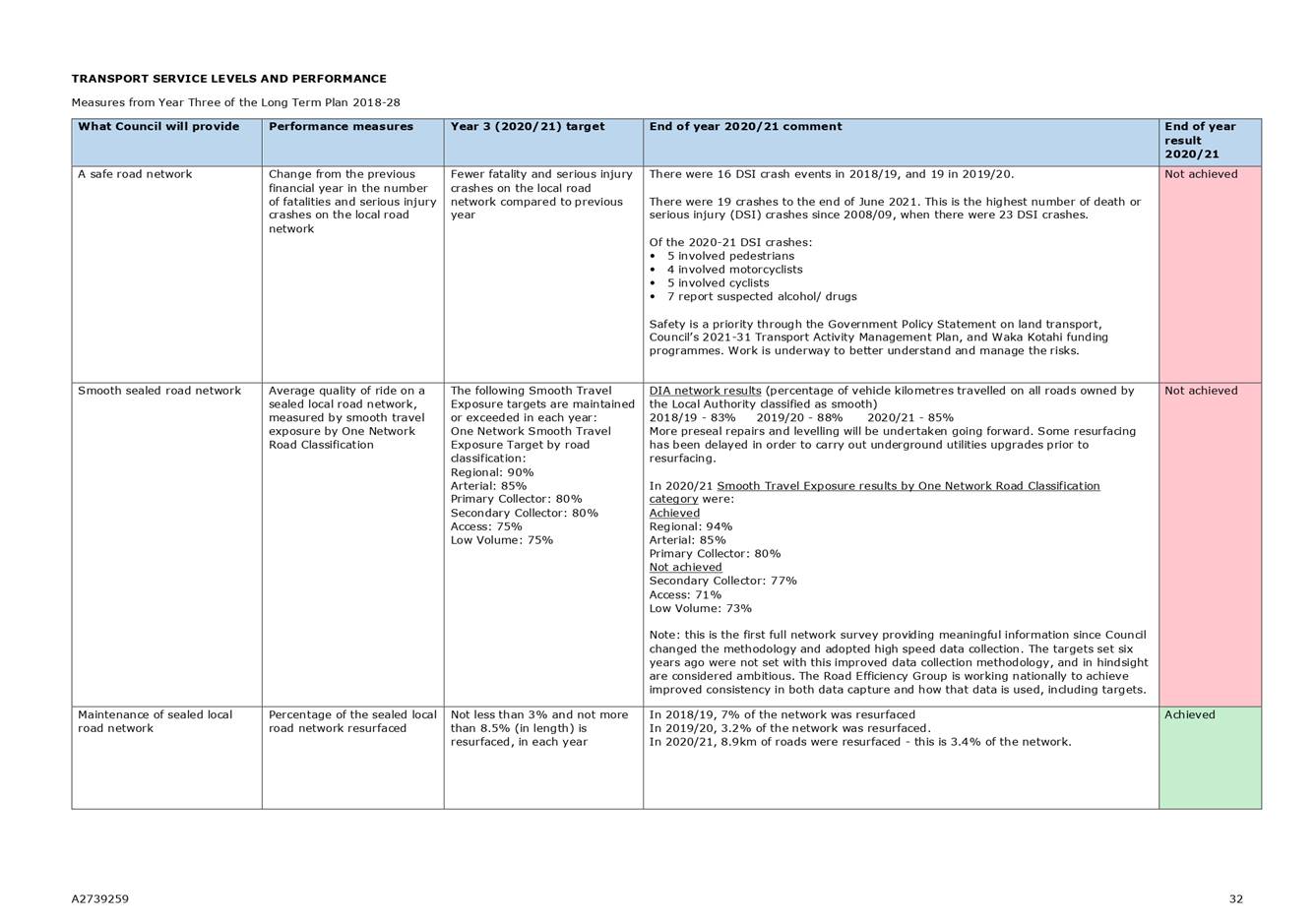

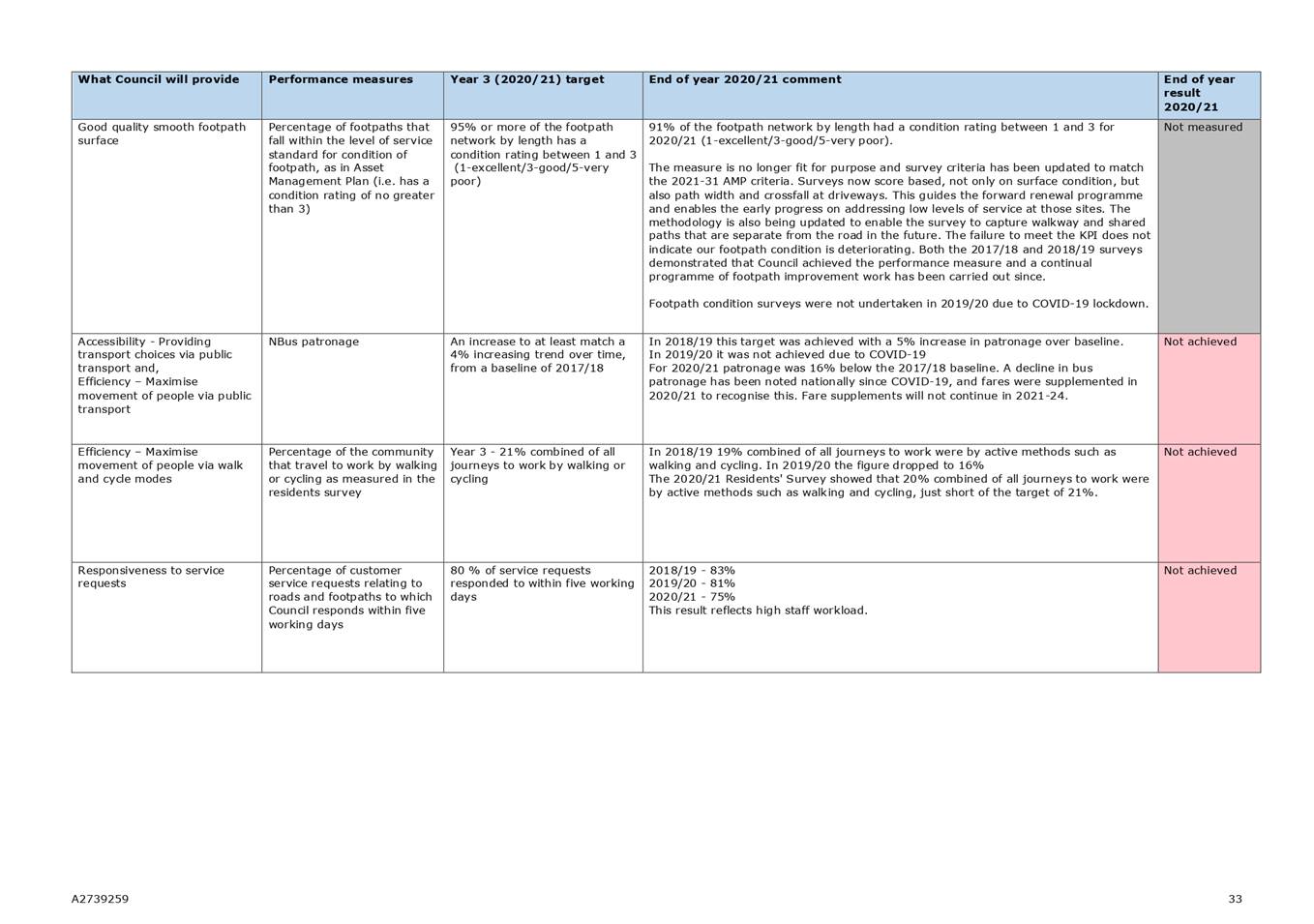

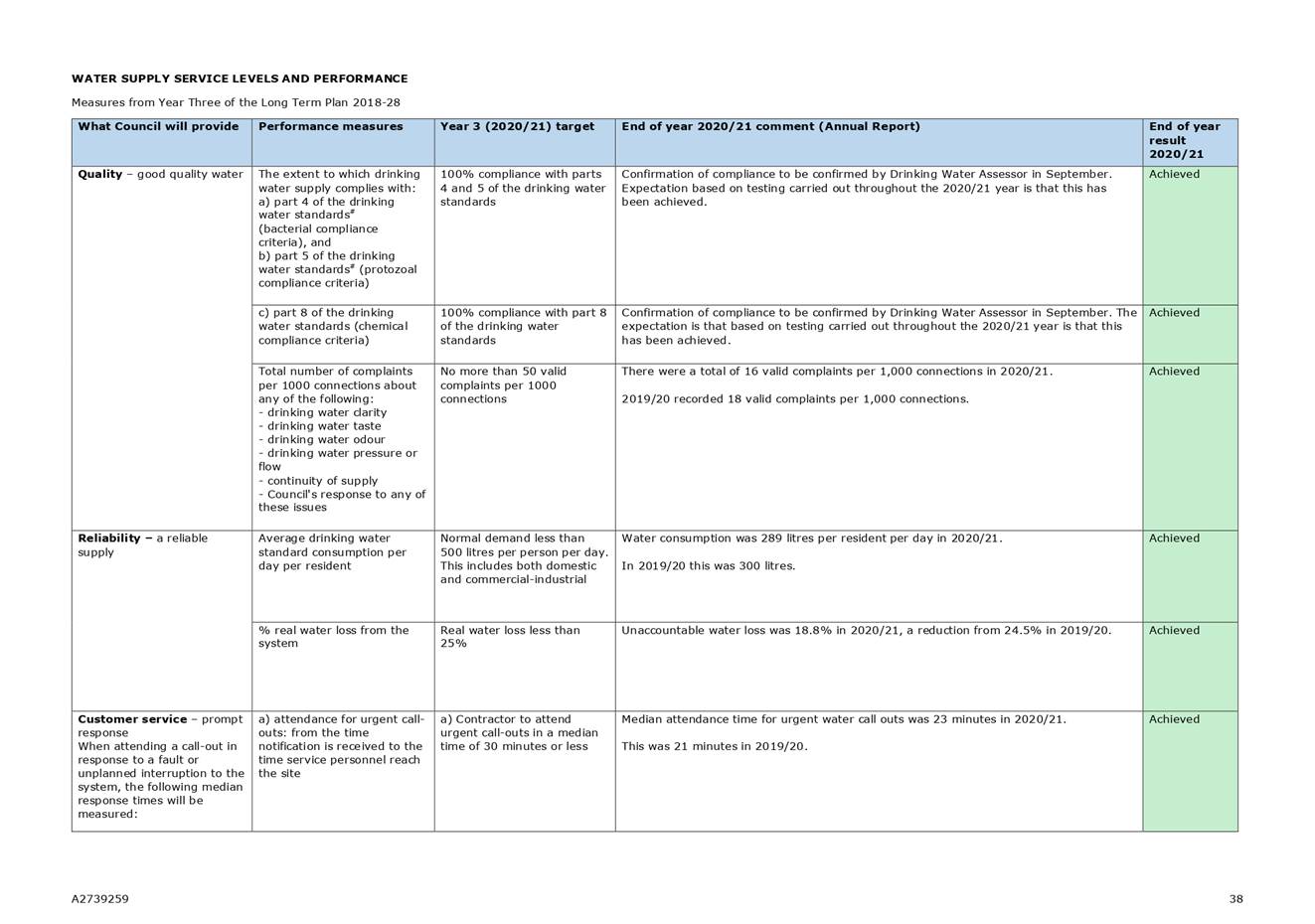

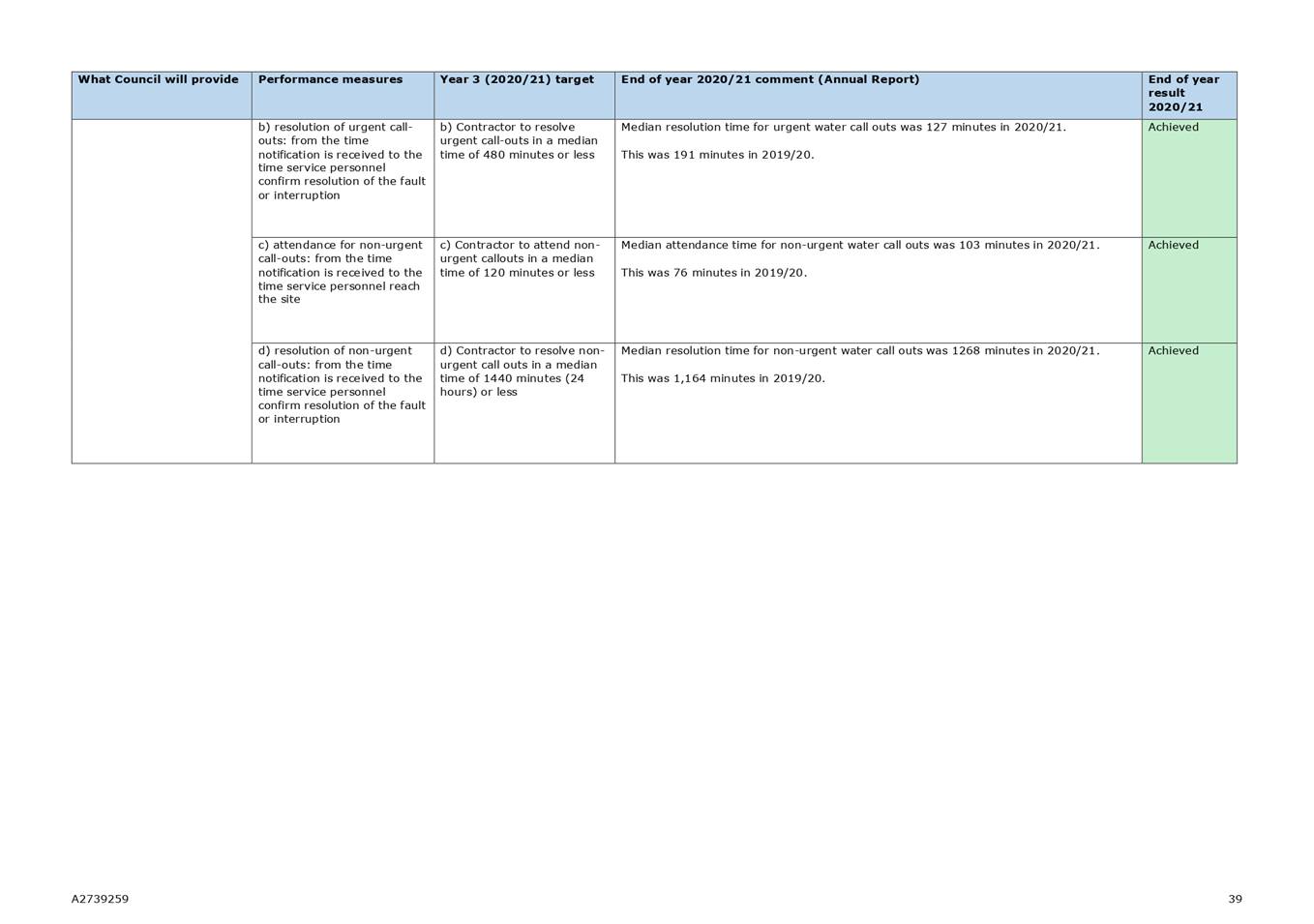

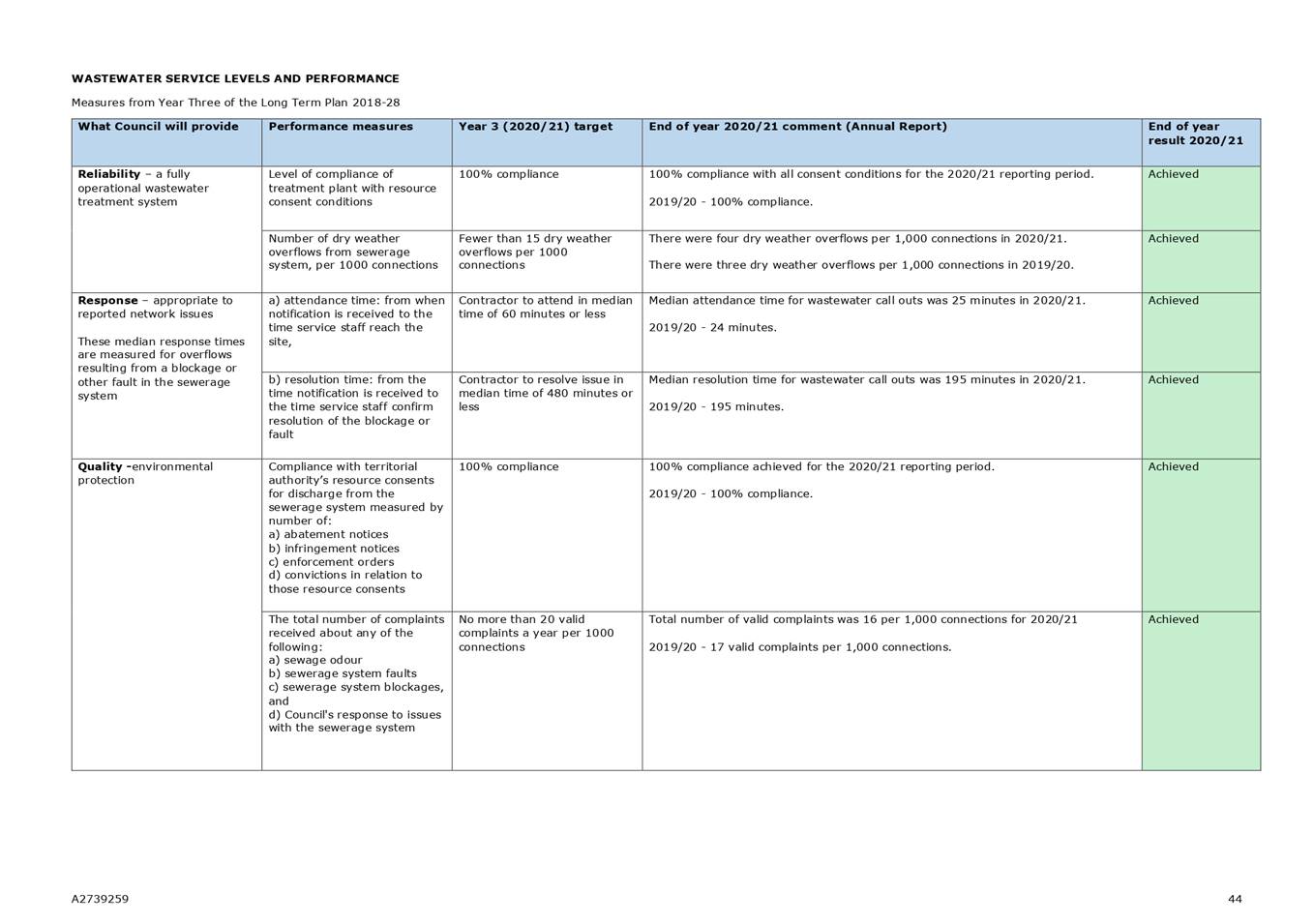

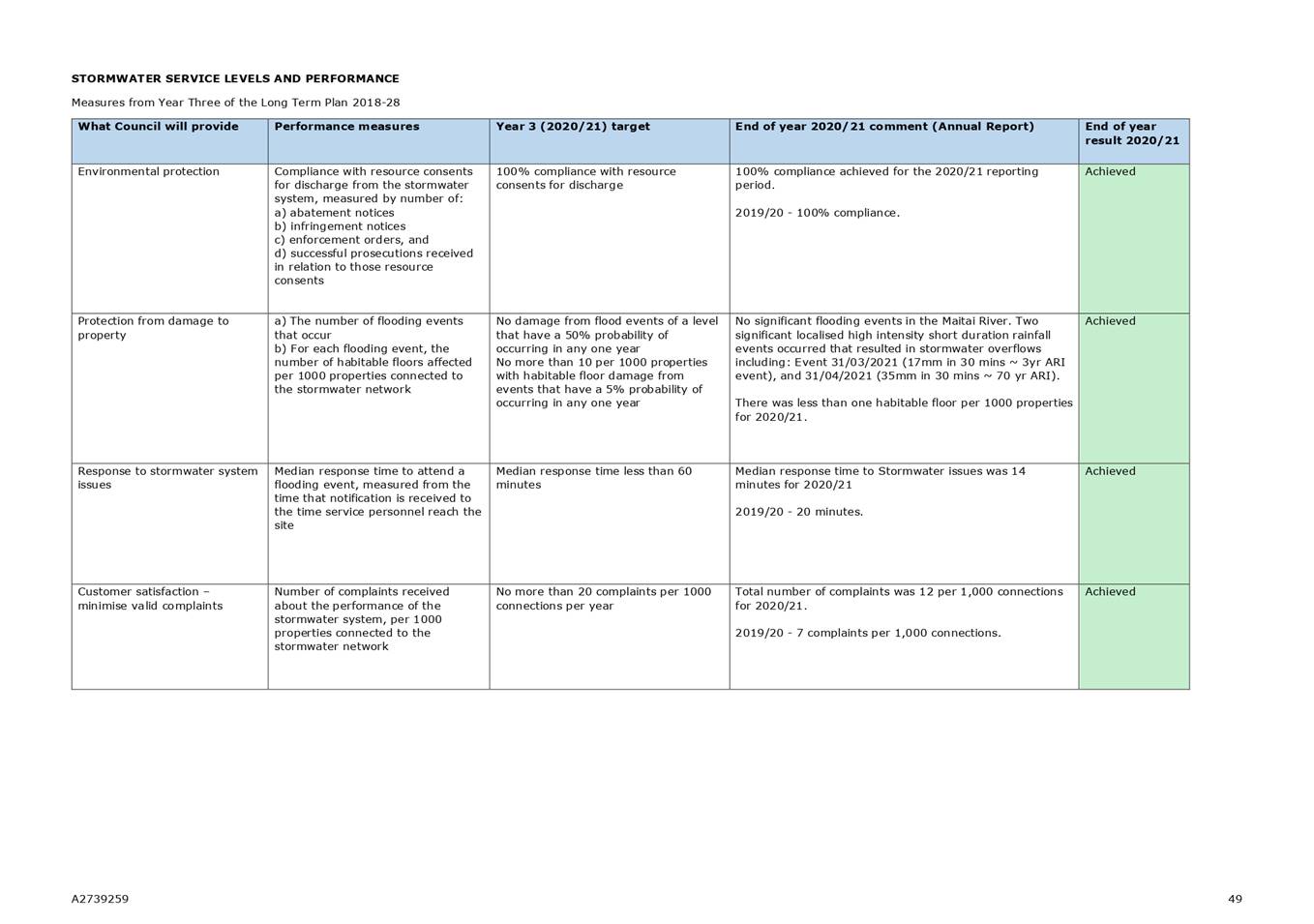

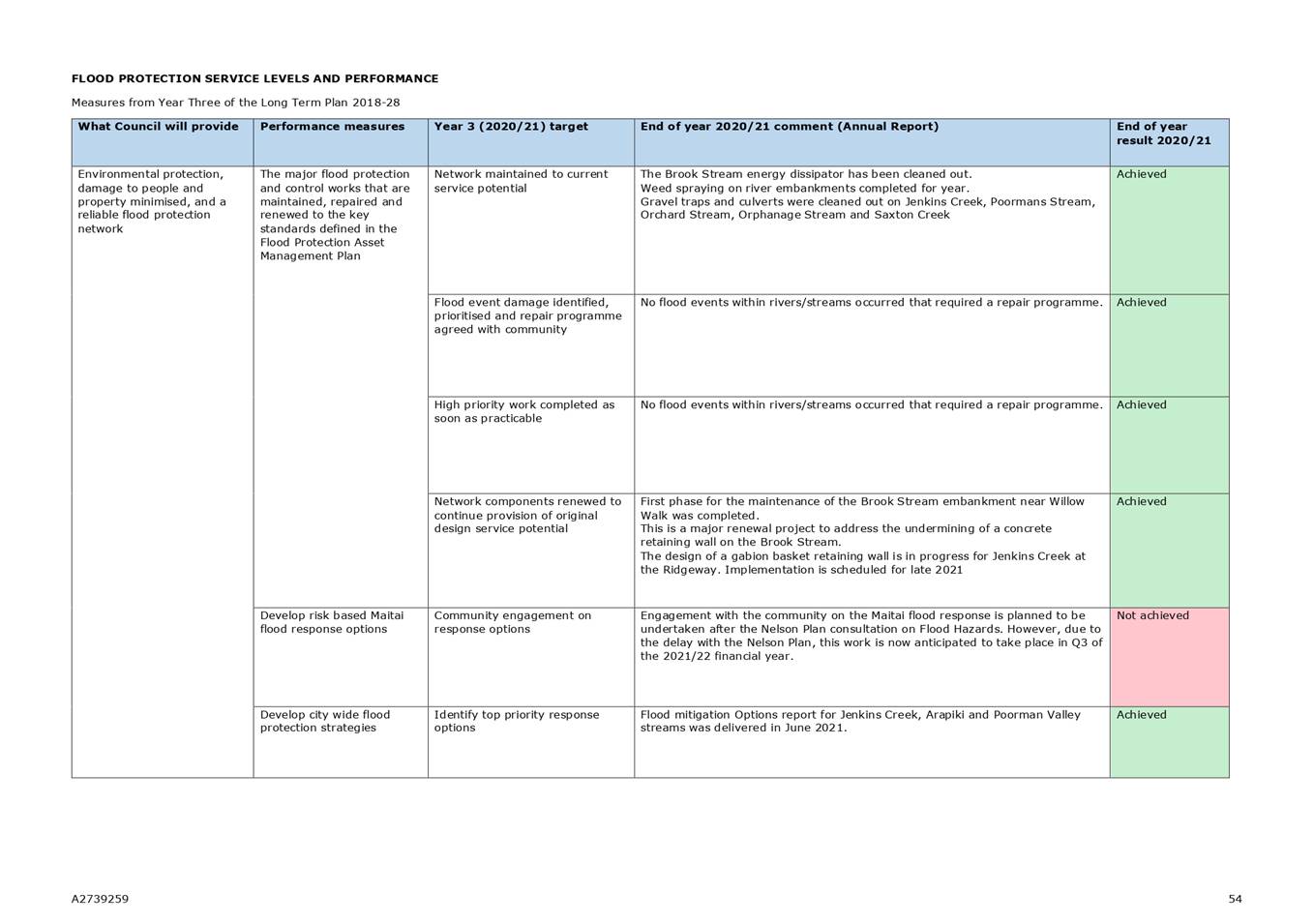

10: Carry Forwards 2020/21: Attachment 1