Notice of the Ordinary meeting of

Audit, Risk and Finance Subcommittee

Te Kōmiti Āpiti, Kaute / Tūraru /

Pūtea

|

Date: Tuesday

25 May 2021

Time: 9.00a.m.

Location: Council

Chamber, Civic House

110 Trafalgar Street, Nelson

|

Agenda

Rārangi take

Chairperson Mr

John Peters

Members Her

Worship the Mayor Rachel Reese

Cr Judene Edgar

Cr Matt Lawrey

Cr Rachel Sanson

Mr John Murray

Quorum 3 Pat

Dougherty

Chief

Executive

Nelson City Council Disclaimer

Please

note that the contents of these Council and Committee agendas have yet to be

considered by Council and officer recommendations may be altered or changed by

the Council in the process of making the formal Council decision. For enquiries

call (03) 5460436.

Audit, Risk and Finance

Subcommittee

This is a subcommittee of Council

Areas of Responsibility

·

Any matters raised by Audit New Zealand or the Office of the

Auditor-General

·

Audit processes and management of financial risk

·

Chairperson’s input into financial aspects of draft

Statements of Expectation and draft Statements of Intent for Nelson City

Council Controlled Organisations, Council Controlled Trading Organisations and

Council Organisations

·

Council’s Annual Report

·

Council’s financial performance

·

Council’s Treasury policies

·

Health and Safety

·

Internal audit

·

Monitoring organisational risks, including debtors and legal

proceedings

·

Procurement Policy

Powers to

Decide

·

Appointment of a deputy Chair

Powers to

Recommend to Council

·

Adoption of Council’s Annual Report

·

To write off outstanding accounts receivable or remit fees and

charges of amounts over the Chief Executive’s delegated authority.

·

All other matters within the areas of responsibility or any other

matters referred to it by the Council

For

the Terms of Reference for the Audit, Risk and Finance Subcommittee please

refer to document A1437349.

Audit, Risk and

Finance Subcommittee

Audit, Risk and

Finance Subcommittee

25

May 2021

Page

No.

1. Apologies

Nil

2. Confirmation

of Order of Business

3. Interests

3.1 Updates

to the Interests Register

3.2 Identify

any conflicts of interest in the agenda

4. Public

Forum

5. Confirmation

of Minutes

5.1 23

February 2021 9 - 16

Document number M15441

Recommendation

|

That the Audit, Risk and Finance Subcommittee

1. Confirms the minutes of the

meeting of the Audit, Risk and Finance Subcommittee, held on 23 February

2021, as a true and correct record.

|

6. Chairperson's Report 17 - 18

Document number R25884

Recommendation

|

That

the Audit, Risk and Finance Subcommittee

1. Receives

the report Chairperson's Report.

|

7. Audit NZ: Audit Plan

for year ending 30 June 2021 19 - 58

Document number R24802

Recommendation

|

That

the Audit, Risk and Finance Subcommittee

1. Receives

the report Audit NZ: Audit Plan for year ending 30 June 2021 (R24802) and its attachments (A2638227 and

A2648347).

2. Notes the Subcommittee

can provide feedback on the Proposed Audit Fee letter to Audit New Zealand if

required, noting the Mayor will sign the letter once the Subcommittee’s

feedback has been incorporated.

|

8. Health Safety and Wellbeing

Report, January - March 2021 59 - 87

Document number R23731

Recommendation

|

That

the Audit, Risk and Finance Subcommittee

1. Receives

the report Health Safety and Wellbeing Report, January - March 2021 (R23731) and its attachment (A2621469).

|

9. Key Organisational

Risks Report - 1 January 2021 to 31 March 2021 88 - 125

Document number R23745

Recommendation

|

That the Audit,

Risk and Finance Subcommittee

1. Receives the report Key Organisational Risks

Report - 1 January 2021 to 31 March 2021 (R23745) and its attachment

(A2587873).

|

10. Internal Audit - Quarterly

Progress Report to 31 March 2021 126 - 139

Document number R23746

Recommendation

|

That

the Audit, Risk and Finance Subcommittee

1. Receives

the report Internal Audit - Quarterly Progress Report to 31 March 2021

(R23746) and its attachments

(A2601420, A2599893).

|

11. Draft Annual Internal Audit

Plan for year to 30 June 2022 140 - 146

Document number R24781

Recommendation

|

That

the Audit, Risk and Finance Subcommittee

1. Receives

the report Draft Annual Internal Audit Plan for year to 30 June 2022 (R24781) and its attachment (A2601457).

|

Recommendation to Council

|

That the Council

1. Approves the Draft

Annual Internal Audit Plan for the year to 30 June 2022 (A2601457).

|

12. Draft Treasury Management

Policy including Liability Management and Investment Policies 147 - 186

Document number R24767

Recommendation

|

That

the Audit, Risk and Finance Subcommittee

1. Receives

the report Draft Treasury Management Policy including Liability Management

and Investment Policies (R24767)

and its attachment (A2611223).

|

Recommendation to Council

|

That the Council

1. Adopts the Treasury

Management Policy (A2611223).

|

13. Service Delivery Reviews (s17A

reviews) 187 - 195

Document number R15914

Recommendation

|

That

the Audit, Risk and Finance Subcommittee

1. Receives

the report Service Delivery Reviews (s17A reviews) (R15914).

|

Recommendation to Council

|

That the Council

1. Approves an increase in

the value threshold that triggers a service delivery review under section 17A

of the Local Government Act 2002 from $100,000 to $500,000 per annum for

contracts and activity areas.

|

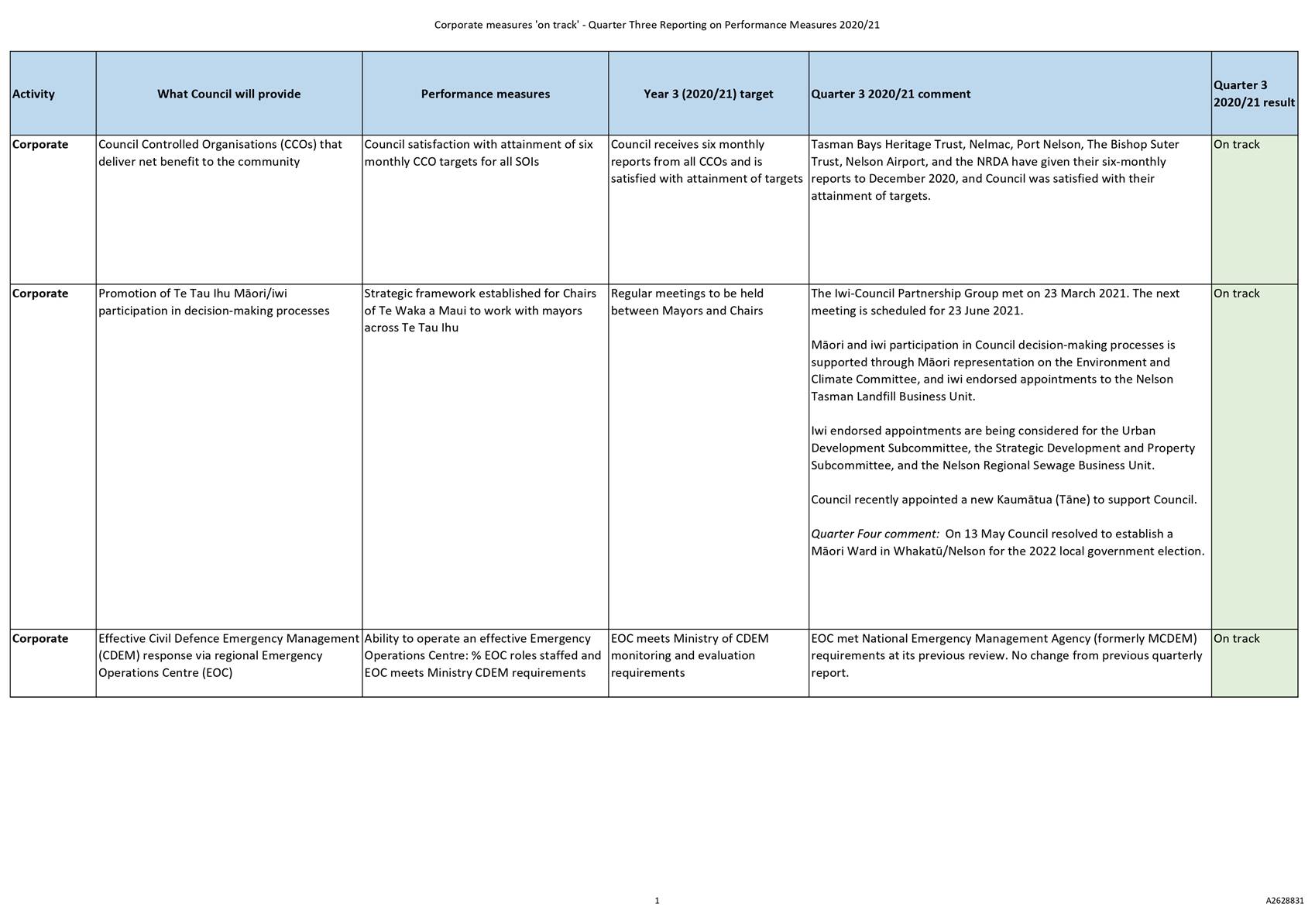

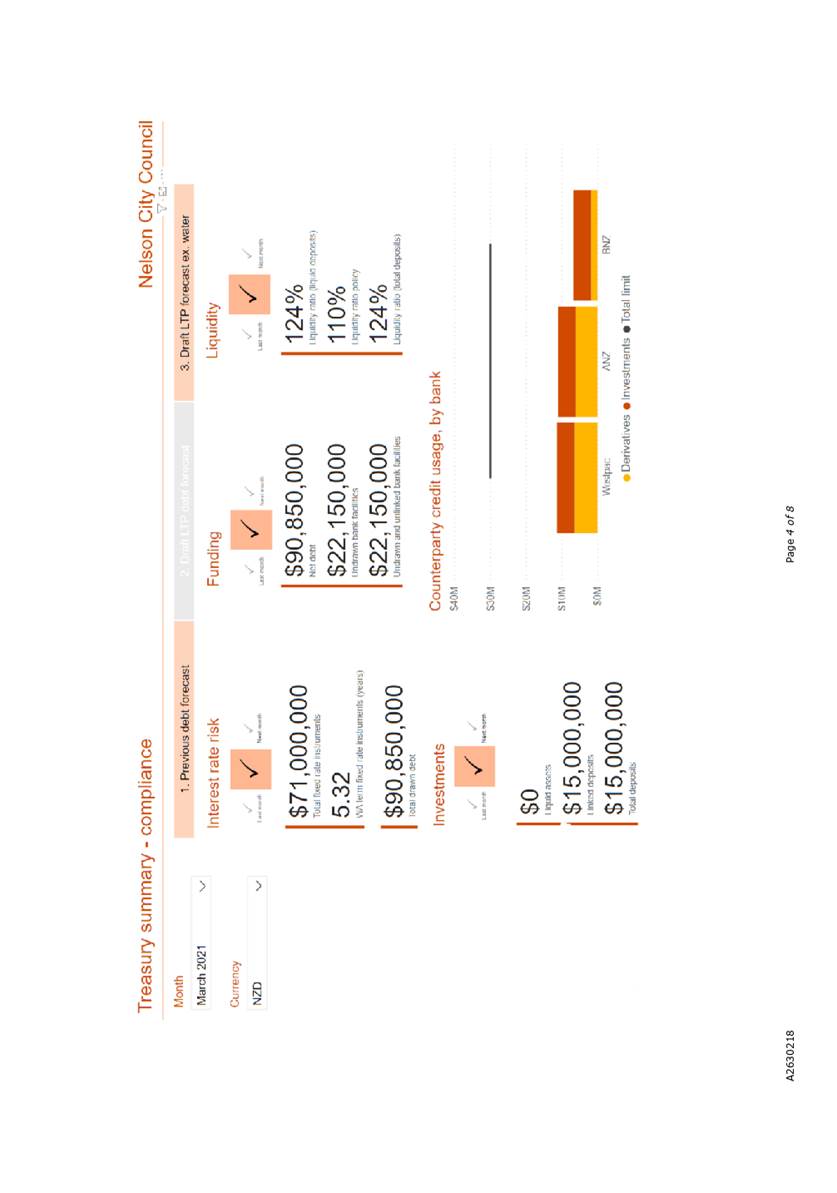

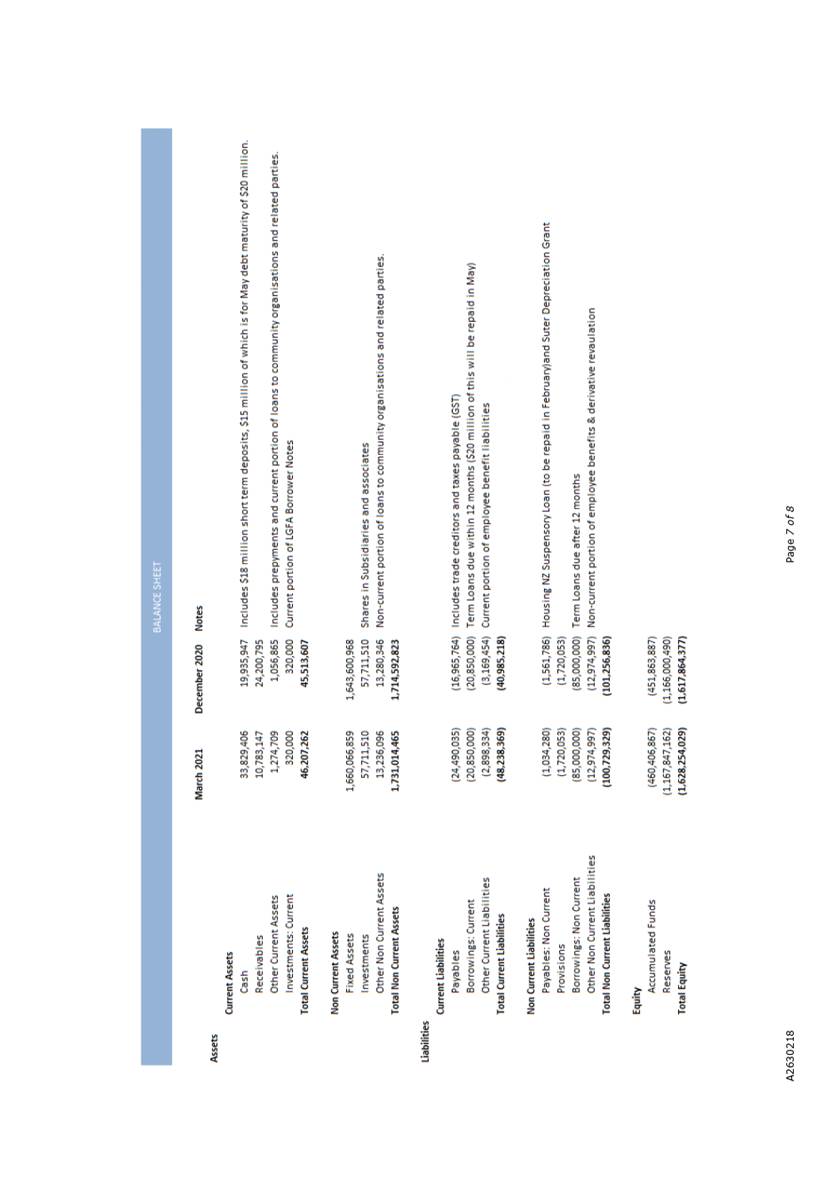

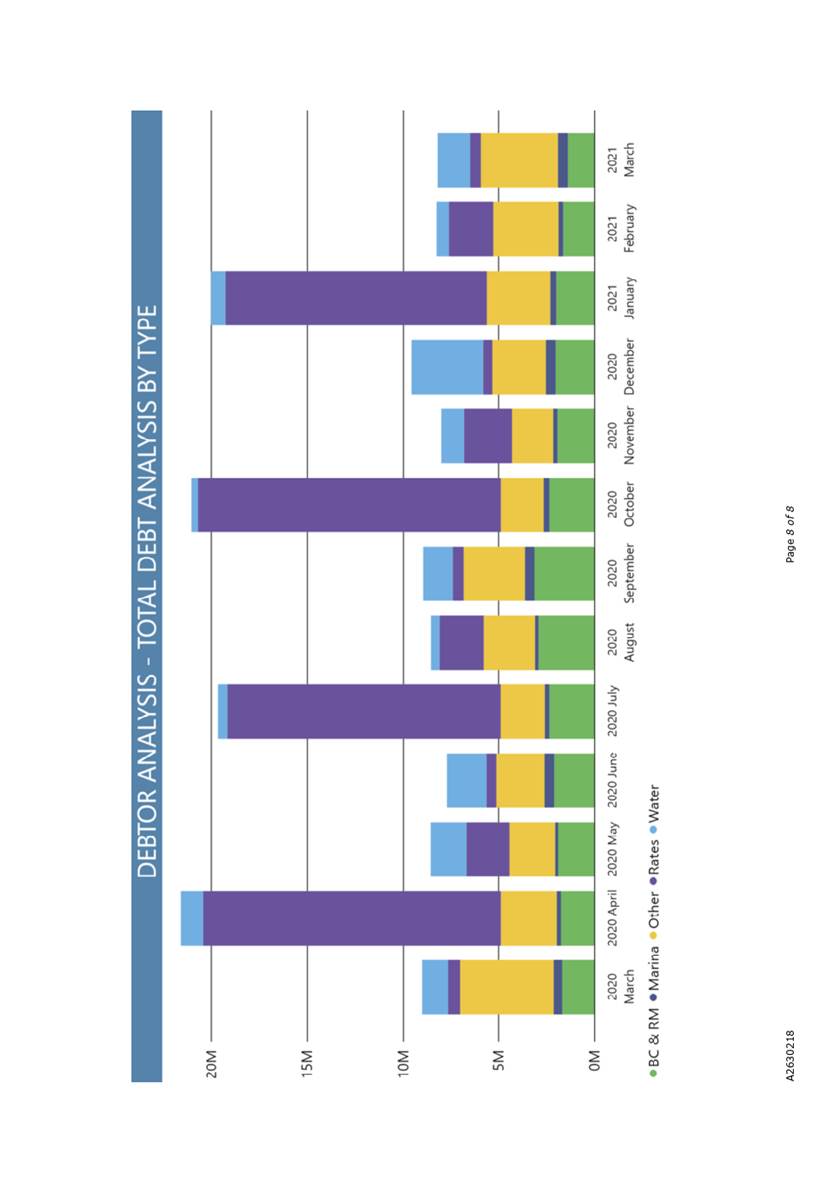

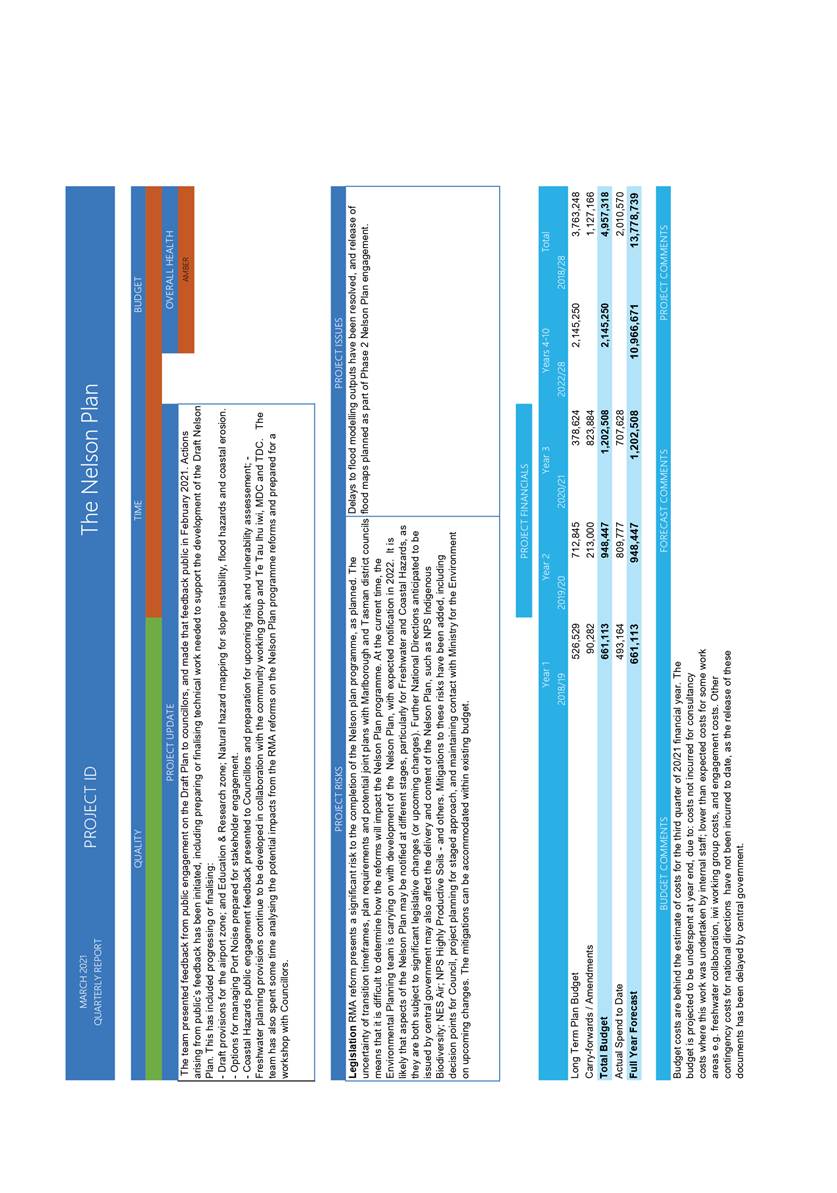

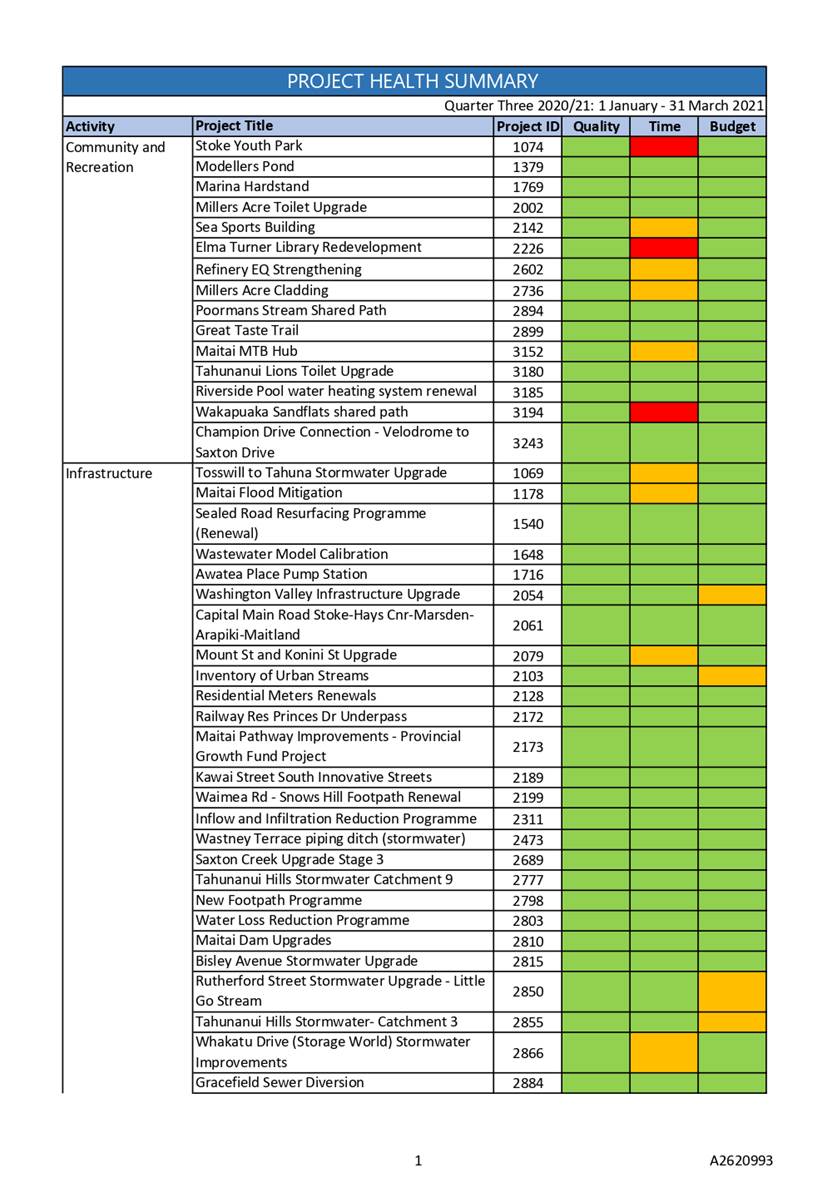

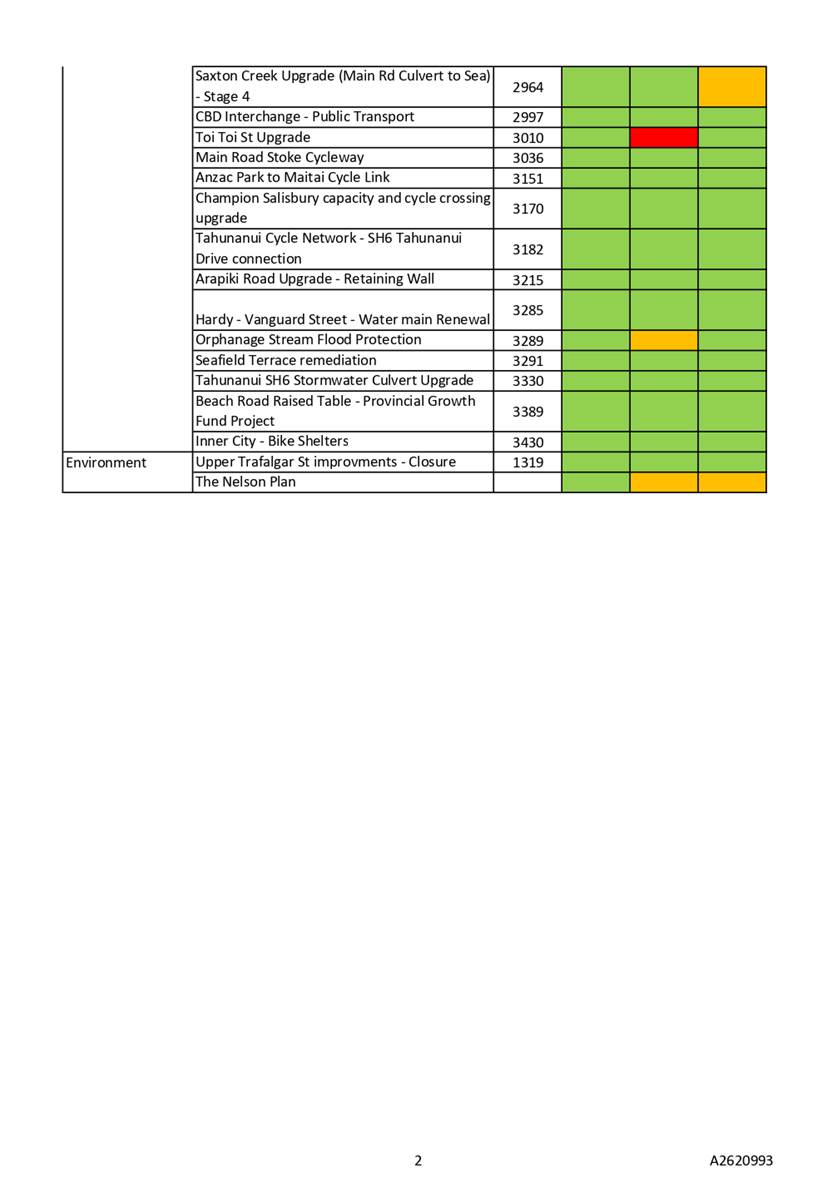

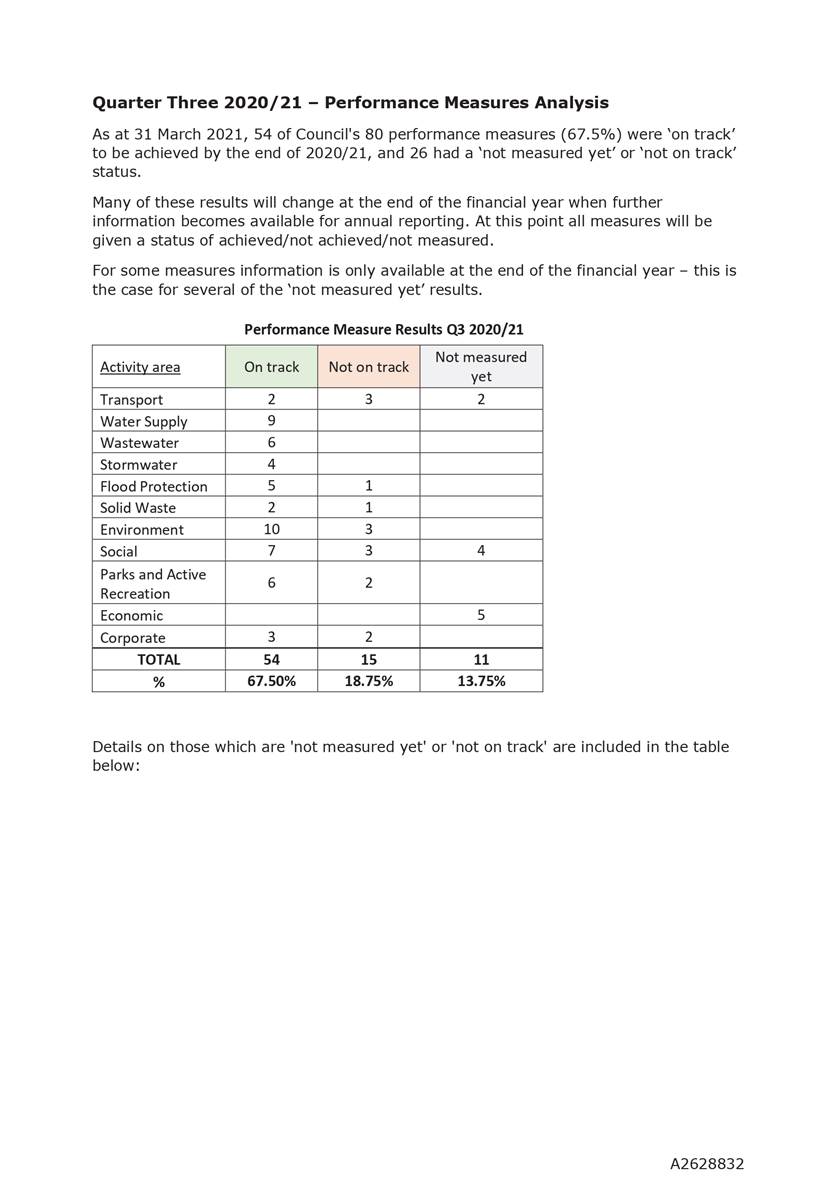

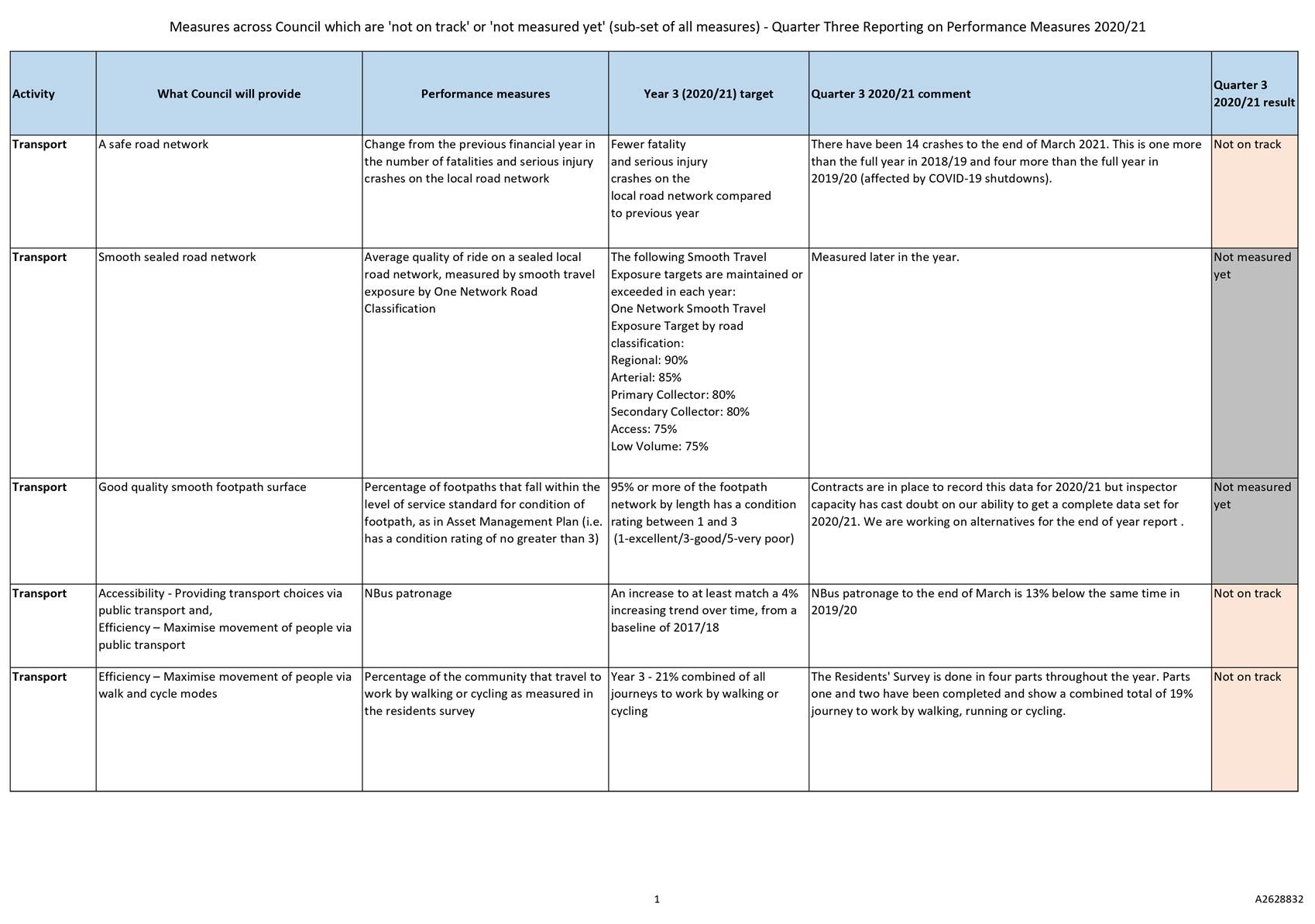

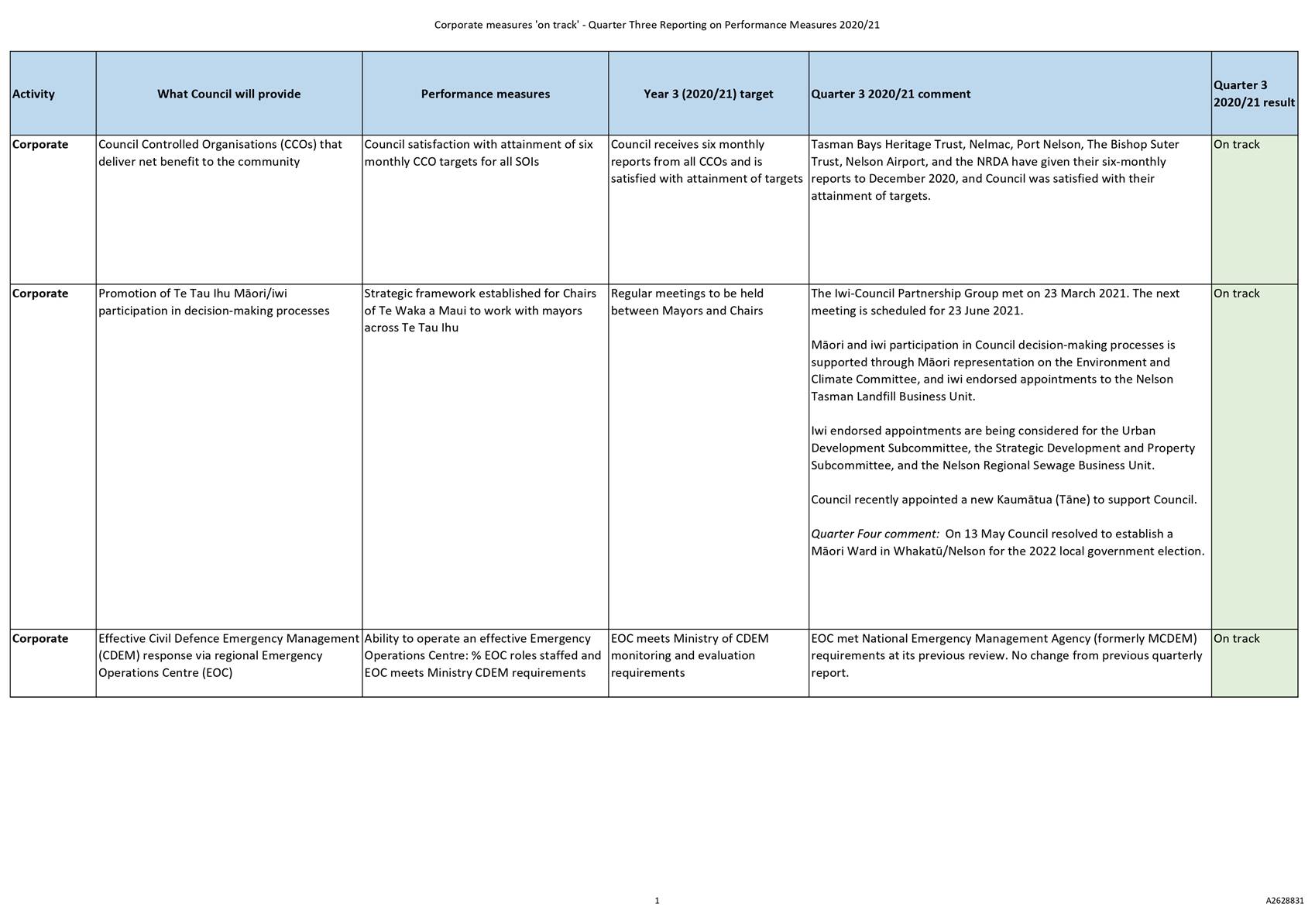

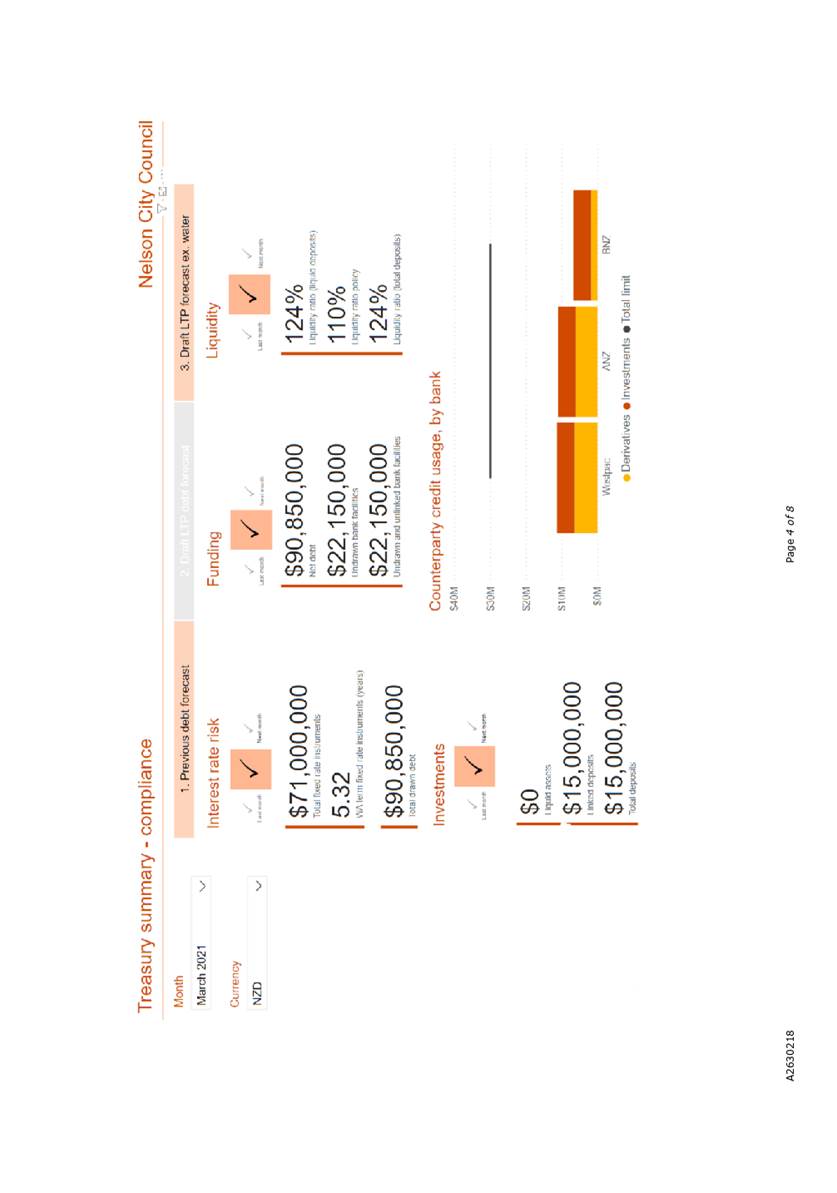

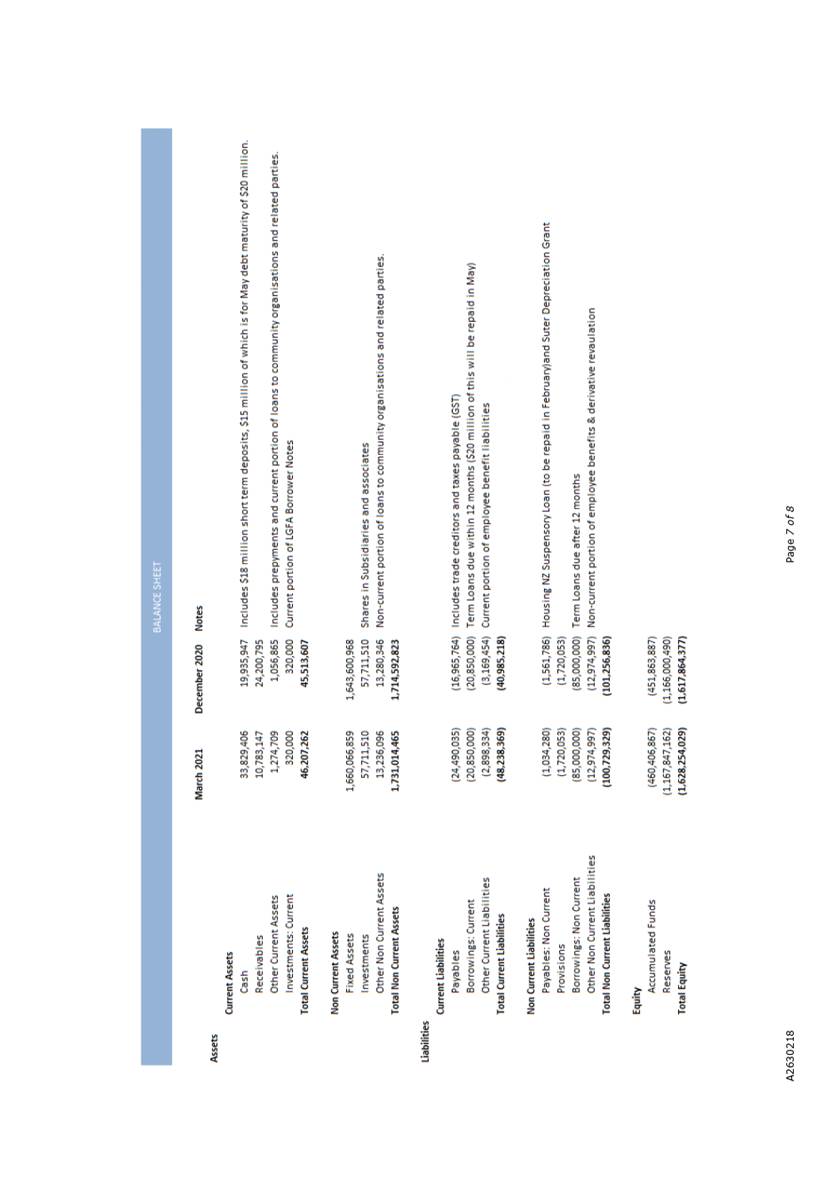

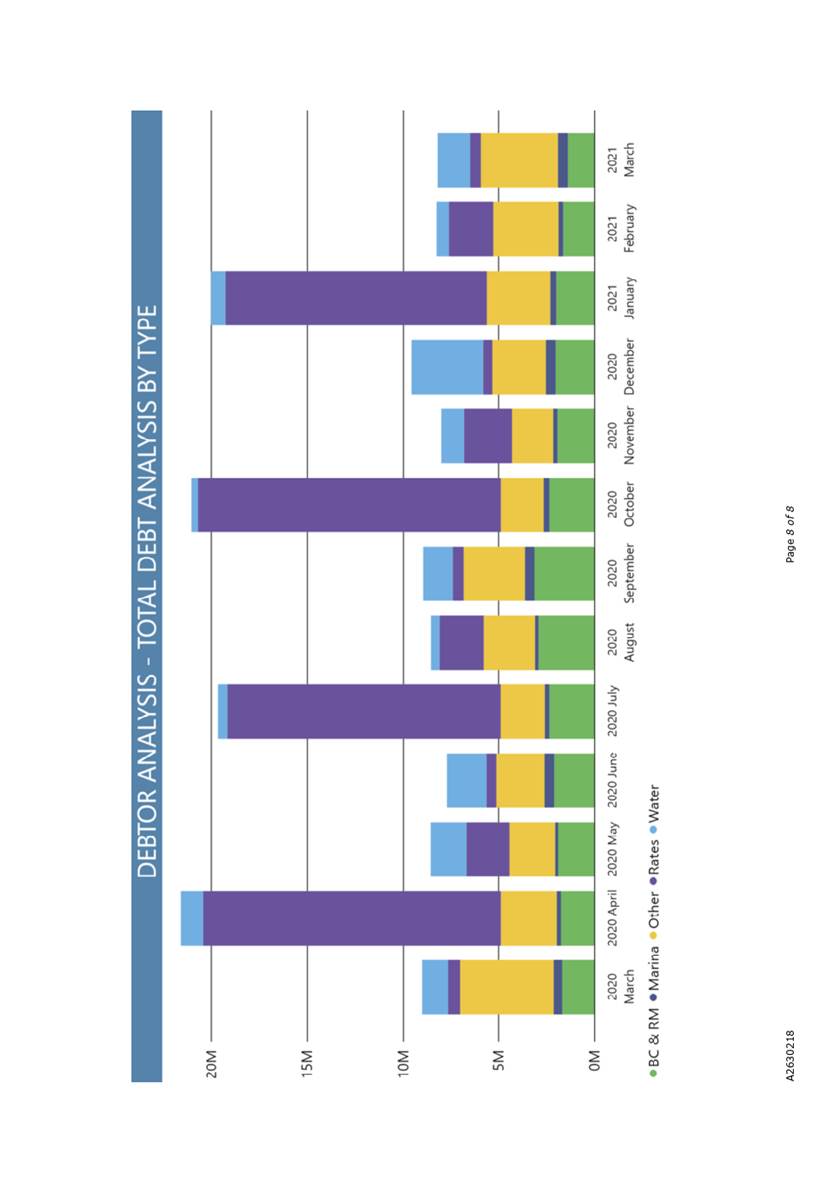

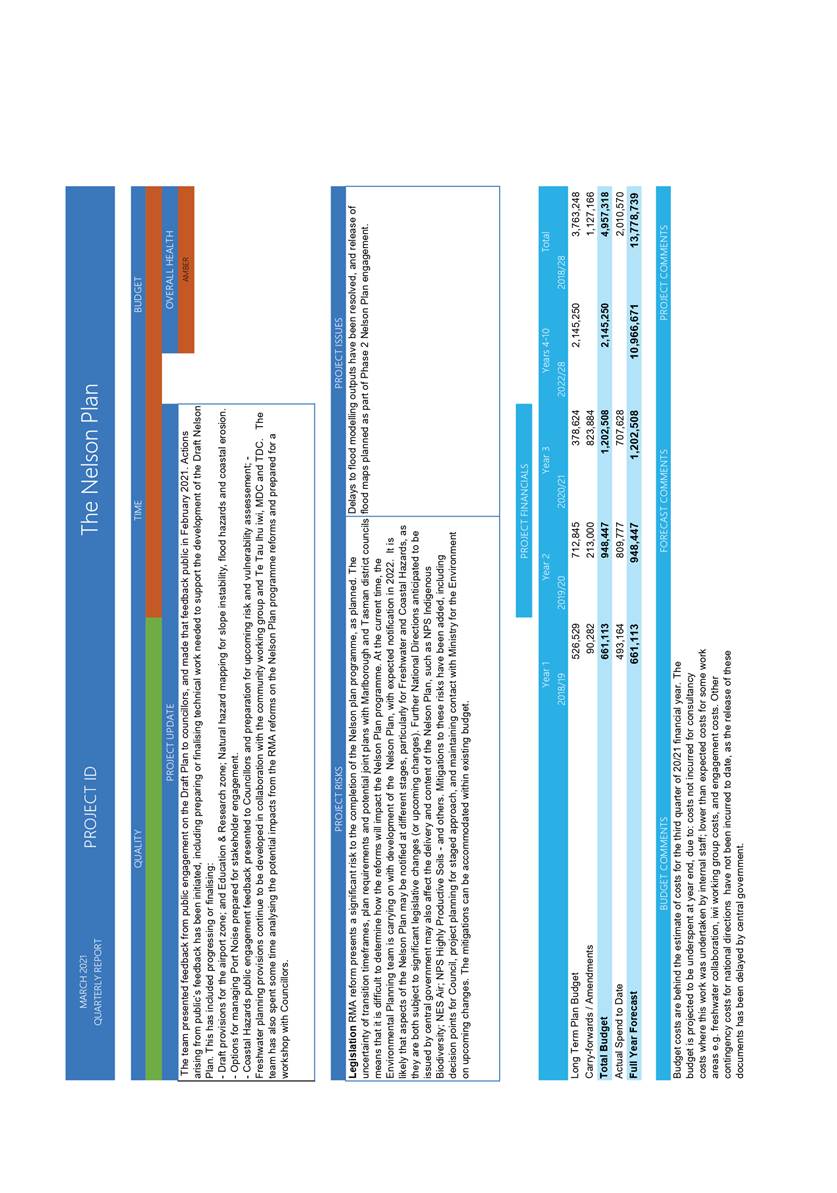

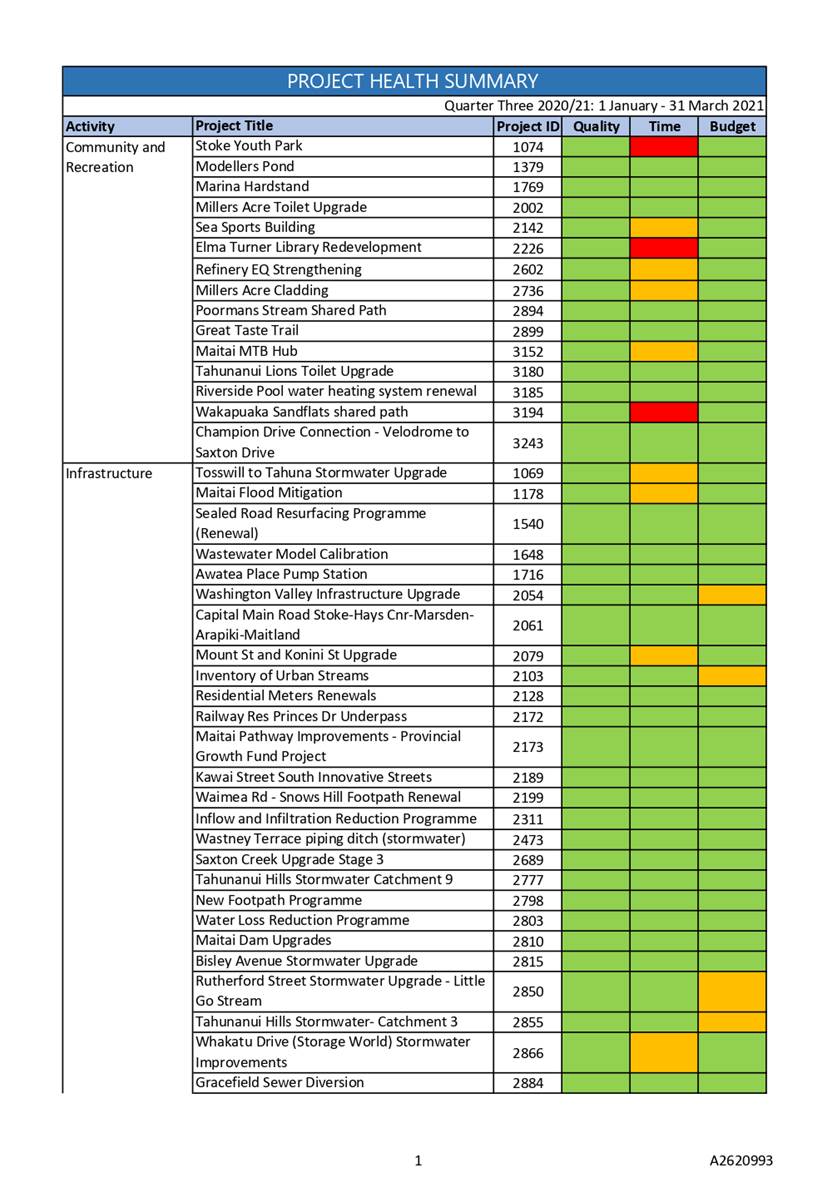

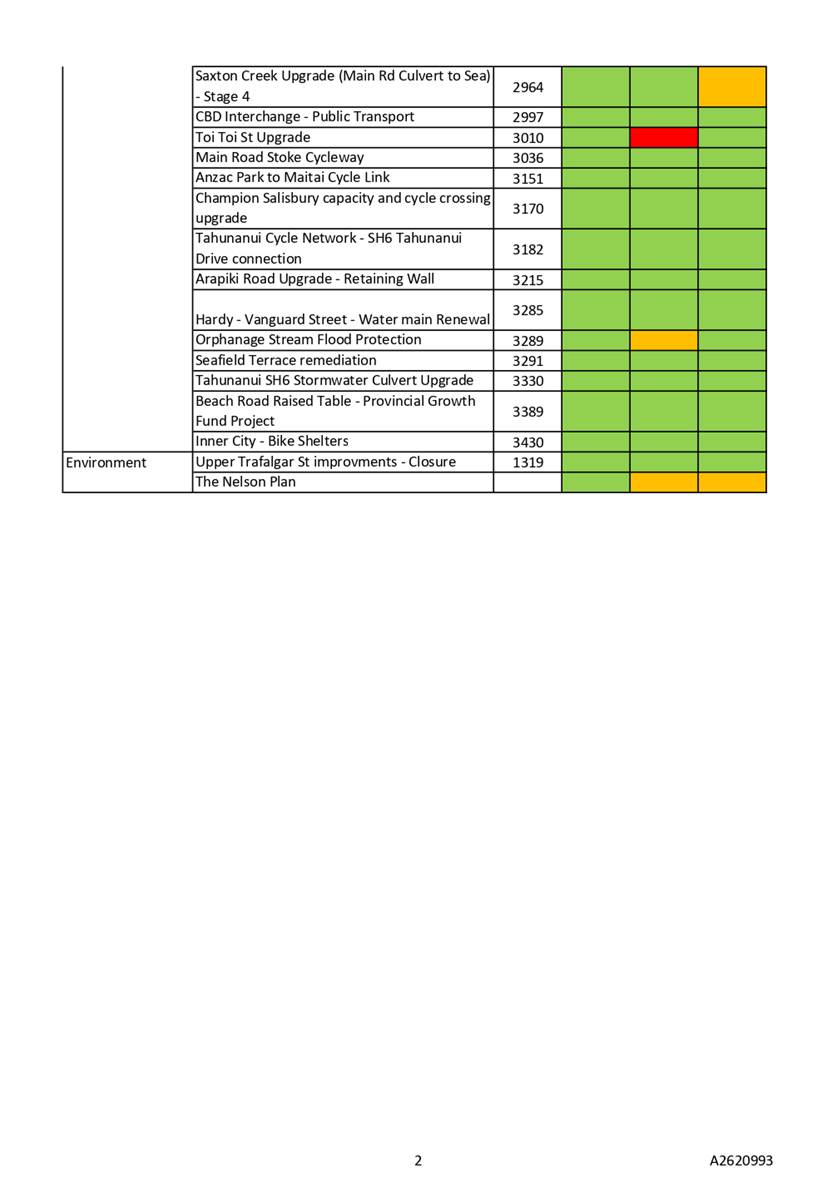

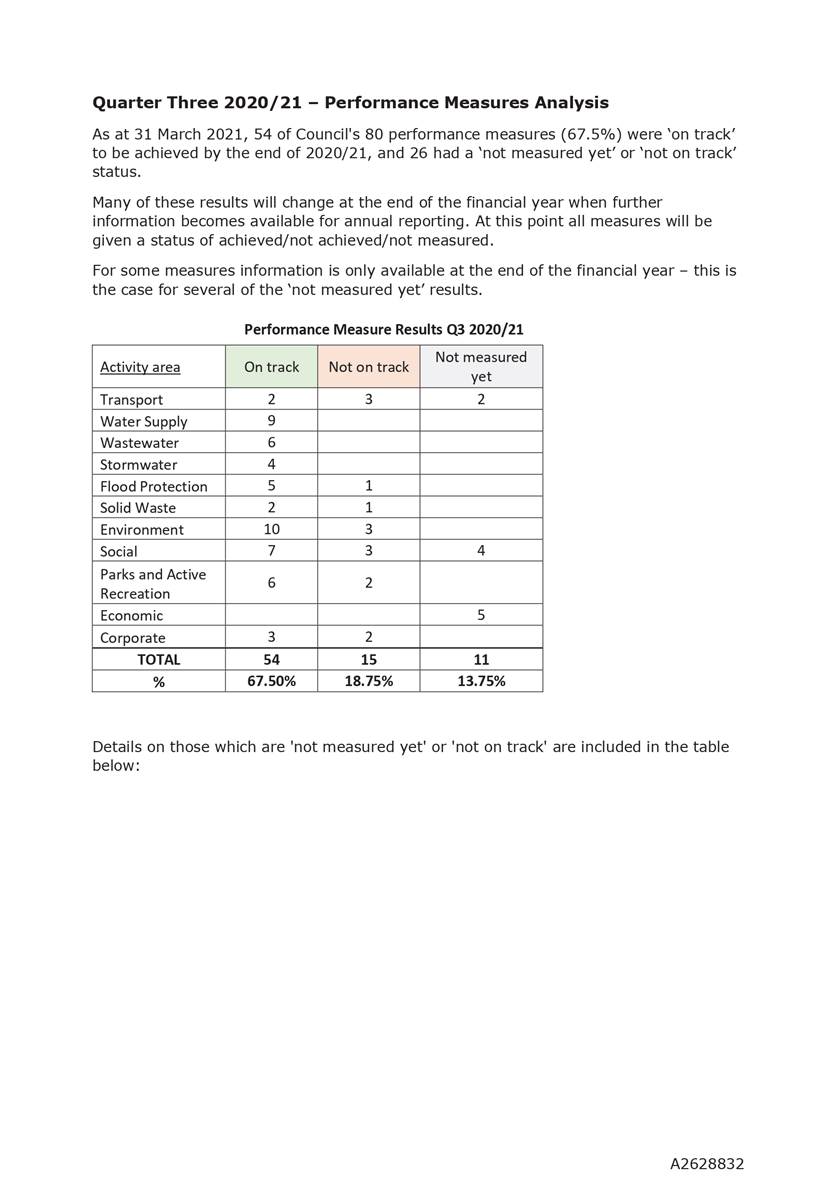

14. Quarterly Finance Report for

the nine months ending 31 March 2021 196 - 220

Document number R24820

Recommendation

|

That

the Audit, Risk and Finance Subcommittee

1. Receives

the report Quarterly Finance Report for the nine months ending 31 March 2021

(R24820) and its attachments

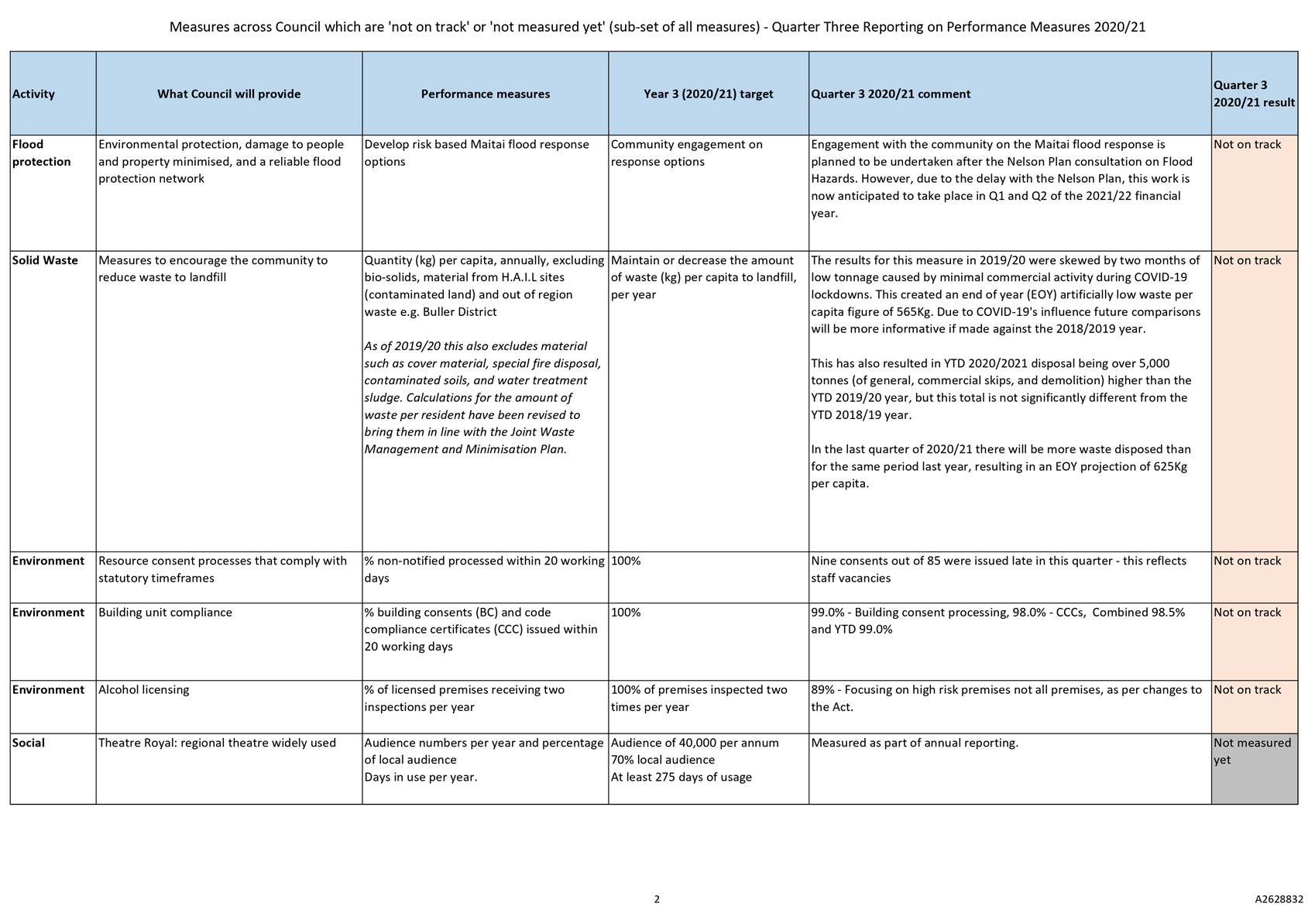

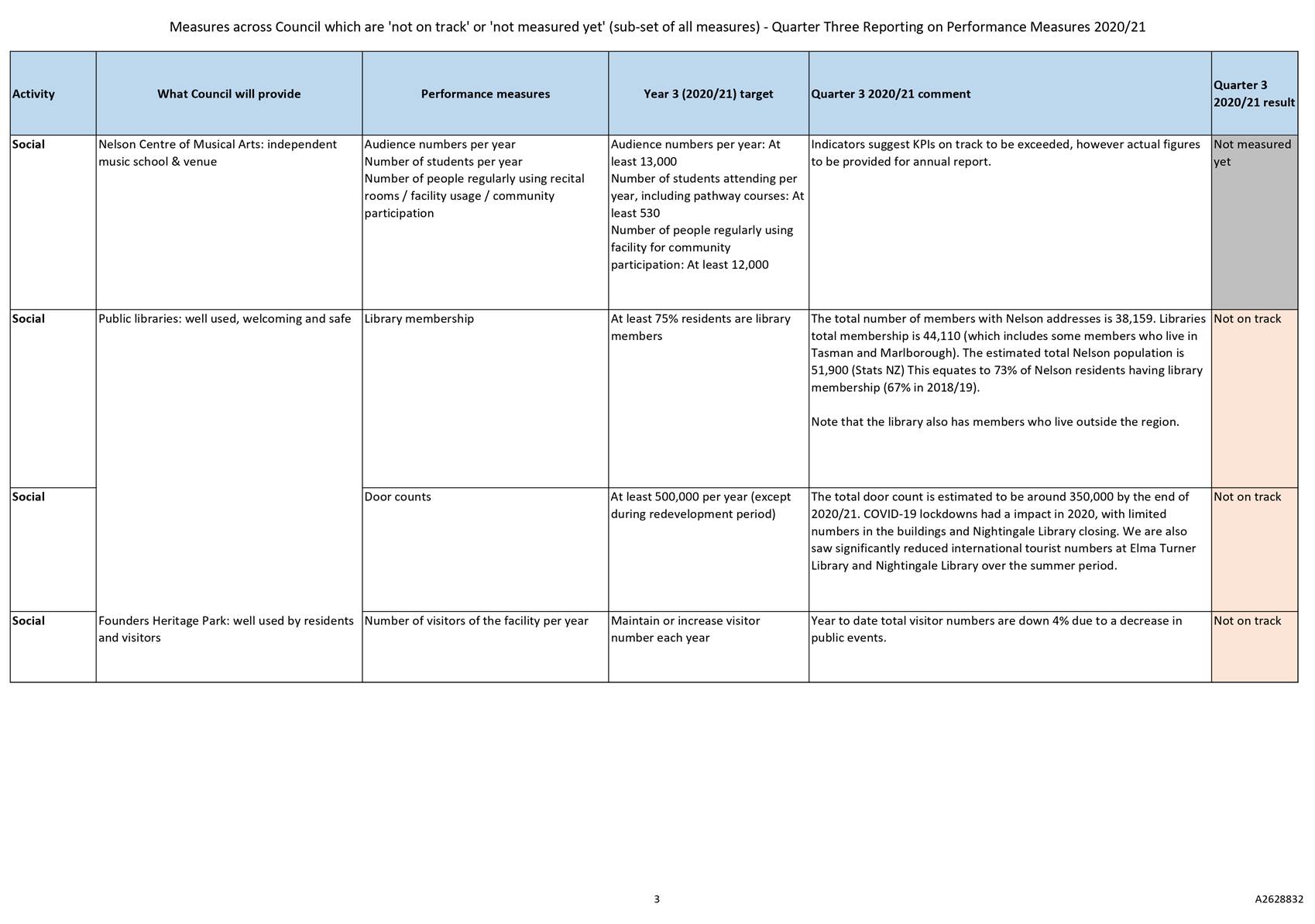

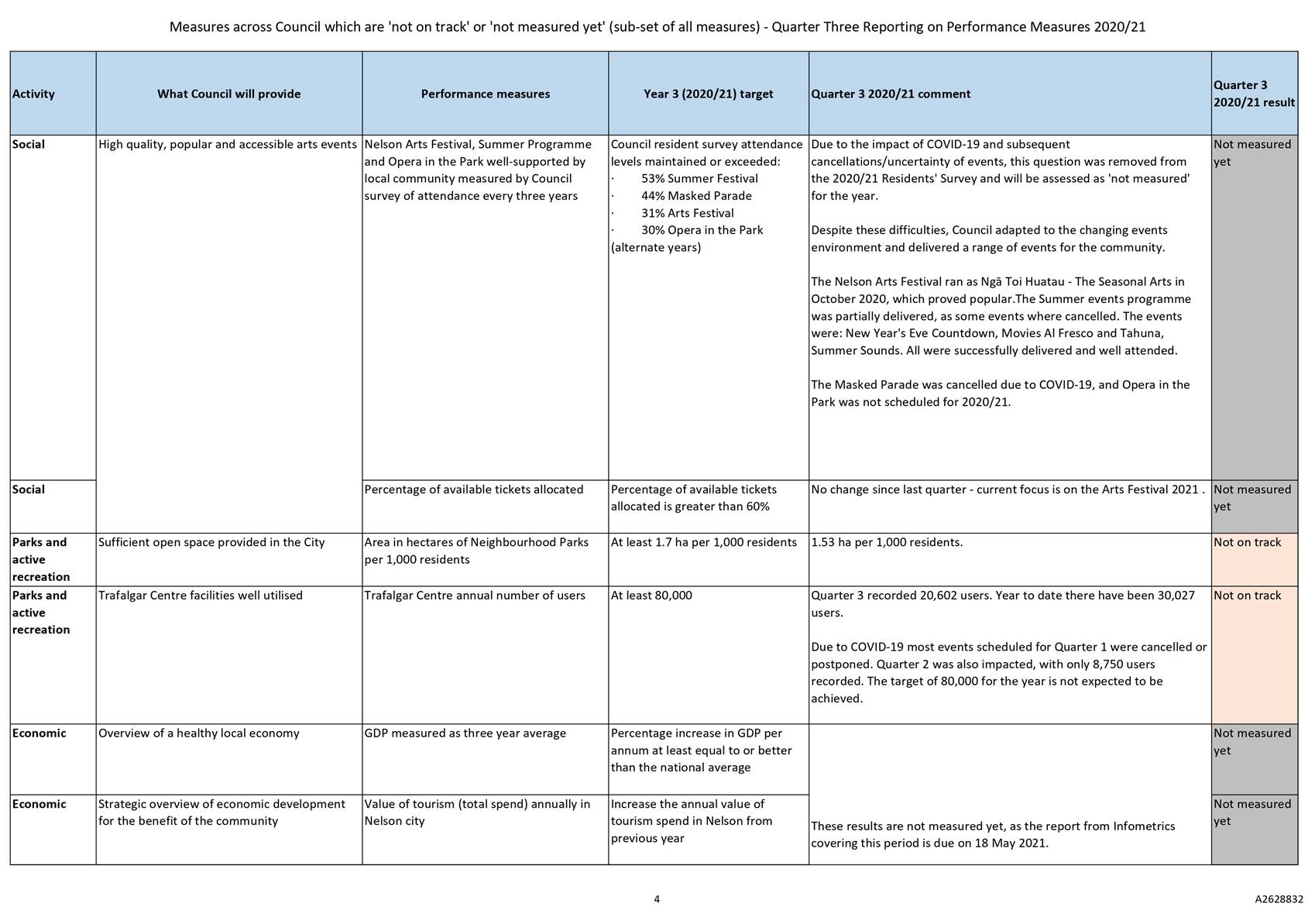

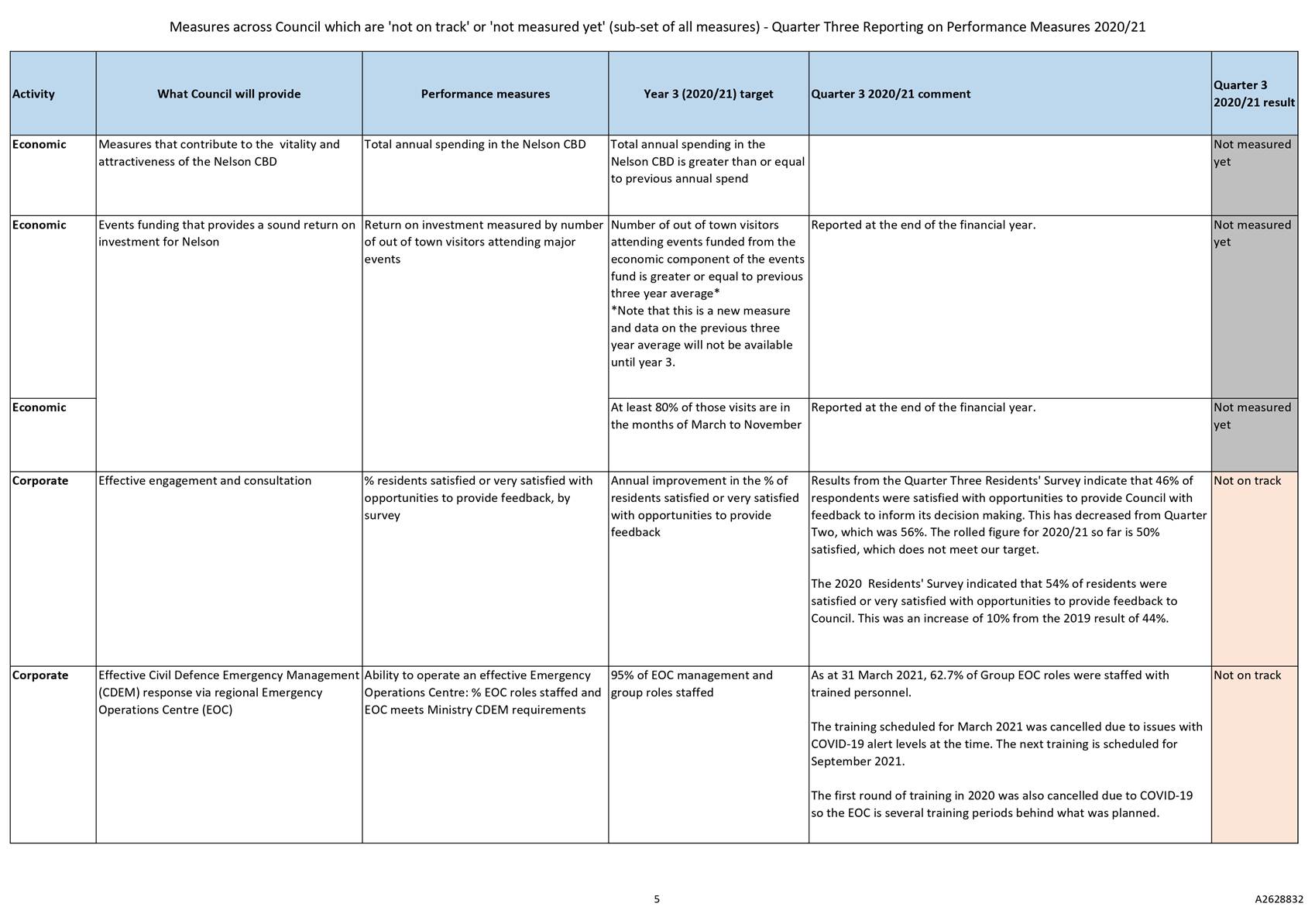

(A2630218, A2630198, A2620993, A2628832 and A2628831).

|

CONFIDENTIAL Business

15. Exclusion

of the Public

Recommendation

|

That

the Audit, Risk and Finance Subcommittee

1. Confirms, in accordance with sections

48(5) and 48(6) of the Local Government Official Information and Meetings Act

1987, that name and name remain after the public has been excluded, for Item#

of the Confidential agenda (item title), as he/she/they has/have knowledge relating

to (description) that will assist the meeting.

|

Recommendation

That the Audit,

Risk and Finance Subcommittee

1. Excludes the public from the following

parts of the proceedings of this meeting.

2. The general subject of each matter to be considered while the public

is excluded, the reason for passing this resolution in relation to each matter

and the specific grounds under section 48(1) of the Local Government Official

Information and Meetings Act 1987 for the passing of this resolution are as

follows:

|

Item

|

General subject of each matter to be

considered

|

Reason for passing this resolution in

relation to each matter

|

Particular interests protected (where

applicable)

|

|

1

|

Audit, Risk and Finance Subcommittee

Meeting - Confidential Minutes - 23 February 2021

|

Section 48(1)(a)

The public conduct of this matter would

be likely to result in disclosure of information for which good reason exists

under section 7.

|

The withholding of the information is

necessary:

· Section 7(2)(a)

To protect the

privacy of natural persons, including that of a deceased person

· Section 7(2)(g)

To

maintain legal professional privilege

|

|

2

|

Quarterly report on legal proceedings

|

Section 48(1)(a)

The public conduct of this

matter would be likely to result in disclosure of information for which good

reason exists under section 7

|

The withholding of the information is necessary:

· Section 7(2)(g)

To maintain legal

professional privilege

|

|

3

|

Quarterly Update On Debts - 31 March

2021

|

Section

48(1)(a)

The public

conduct of this matter would be likely to result in disclosure of information

for which good reason exists under section 7

|

The withholding of the information is

necessary:

· Section

7(2)(a)

To protect the

privacy of natural persons, including that of a deceased person

· Section 7(2)(g)

To maintain

legal professional privilege

|

Audit, Risk and Finance

Subcommittee Minutes - 23 February 2021

Present: Mr

J Peters (Chairperson), Her Worship the Mayor R Reese, Councillors J Edgar, M

Lawrey, R Sanson and Mr J Murray

In

Attendance: Group Manager Environmental Management (C

Barton), Group Manager Corporate Services (N Harrison) and Governance Adviser

(J Brandt) and Governance Support (P Boutle)

Apologies : Nil

1. Apologies

There were no apologies

2. Confirmation of

Order of Business

There was no change to the order

of business

3. Interests

There were no updates to the

Interests Register, and no interests with items on the agenda were declared.

4. Public Forum

There was no public forum.

5. Confirmation of

Minutes

5.1 2

December 2020

Document number M15319, agenda

pages 8 - 12 refer.

|

Resolved ARF/2021/001

|

|

|

That

the Audit, Risk and Finance Subcommittee

1. Confirms

the minutes of the meeting of the Audit, Risk and Finance Subcommittee, held

on 2 December 2020, as a true and correct record.

|

|

Edgar/Sanson Carried

|

6 Chairperson's

Report

|

Audit, Risk and Finance

Subcommittee Chairperson, John Peters gave a verbal report. He spoke about

the Officer of the Auditor General (OAG) online meetings he had attended in

2020. The first meeting addressed the Subcommittee’s role during

COVID-19, which was deemed appropriate, and the second, the

Subcommittee’s role in preparation of the 2021 Long Term Plan (LTP). Mr

Peters noted that for the 2024 LTP process, earlier and more appropriate

involvement of this Subcommittee would be sought.

A request was made for officers

to bring the next OAG review to the subcommittee in order for OAG

recommendations and timelines relating to the LTP to be noted.

|

|

Resolved ARF/2021/002

|

|

|

That the Audit, Risk and

Finance Subcommittee

1. Receives

the verbal Chairperson’s Report.

|

|

Peters/Lawrey Carried

|

7. Nelson Port and

Harbour Safety Management System

Document number R22563, agenda

pages 13 - 97 refer.

Manager, Consents and Compliance,

Mandy Bishop, and Harbourmaster, Andrew Hogg, presented the report. Mr Hogg

answered questions about steps taken to make improvements to address

shortcomings identified in the Nelson Port and Harbour Safety Management System

review. Mr Hogg noted that the frequency of external reviews was moving from

five to three years, and that working closely with Maritime New Zealand overall

would bring improvements.

Attendance: Her Worship the Mayor

Reese joined the meeting at 9.10a.m.

Group Manager Corporate Services,

Nikki Harrison, confirmed the process for reporting identified gaps in the Port

and Harbour Safety Management System via the Council’s Risk Register.

A request was made for officers

to provide progress updates to the following two Subcommittee meetings.

|

Resolved ARF/2021/003

|

|

|

That

the Audit, Risk and Finance Subcommittee

1. Receives the report

Nelson Port and Harbour Safety Management System (R22563) and its attachment (A2553588); and

2. Agrees

the identified gaps in the Port and Harbour Safety Management System are to

be included in Council’s Risk Register.

|

|

Sanson/Lawrey Carried

|

8. Health Safety and

Wellbeing Report, October to December 2020

Document number R22561, agenda

pages 98 - 112 refer.

Health and Safety Adviser,

Malcolm Hughes, presented the report. He answered questions about notifiable

events, mental health, threats made to officers, and safe work observation site

visits for Subcommittee members.

|

Resolved ARF/2021/004

|

|

|

That

the Audit, Risk and Finance Subcommittee

1. Receives the report

Health Safety and Wellbeing Report, October to December 2020 (R22561) and its attachment (A2552487).

|

|

Lawrey/Her Worship the Mayor Carried

|

9. Key Organisational

Risks Report - 01 September to 31 December 2020

Document number R22526, agenda

pages 113 - 143 refer.

Manager Business Improvement,

Arlene Akhlaq, presented the report. She noted a correction to paragraph 4.2,

i.e. that the review referred to for quarter 3 had been pushed out to quarter 4

(April 2021).

Ms Akhlaq answered questions

about the risk summary sheets in attachment 1 of the report, and took feedback

from members on how future reporting on the key organisational risks could be

improved.

|

Resolved ARF/2021/005

|

|

|

That the Audit, Risk and Finance Subcommittee

1. Receives the report Key Organisational Risks Report - 01

September to 31 December 2020 (R22526) and its attachment (A2547697).

|

|

Edgar/Sanson Carried

|

10. New and

Outstanding Significant Risk Exposures and Control Issues Identified from

Internal Audits - 31 December 2020

Document number R22532, agenda

pages 144 - 147 refer.

Newly appointed Audit and Risk

Analyst, Chris Logan, was introduced to the Subcommittee.

Group Manager Corporate Services,

Nikki Harrison, answered questions regarding asset management for council owned

property and facilities management, Information Management Maturity and cloud

based services.

|

Resolved ARF/2021/006

|

|

|

That

the Audit, Risk and Finance Subcommittee

1. Receives the report

New and Outstanding Significant Risk Exposures and Control Issues Identified

from Internal Audits - 31 December 2020 (R22532) and its attachment (A2538210).

|

|

Edgar/Murray Carried

|

11. Internal Audit - Quarterly

Progress Report to 31 December 2020

Document number R22531, agenda

pages 148 - 151 refer.

Manager Business Improvement,

Arlene Akhlaq, presented the report.

|

Resolved ARF/2021/007

|

|

|

That

the Audit, Risk and Finance Subcommittee

1. Receives the report

Internal Audit - Quarterly Progress Report to 31 December 2020 (R22531) and its attachment (A2537934).

|

|

Murray/Sanson Carried

|

12. Quarterly Finance Report for

the six months ending 31 December 2020

Document number R22575, agenda

pages 152 - 171 refer.

Manager Finance, Clare Knox,

presented the report and answered questions.

Manager Environmental Planning,

Maxine Day, gave a verbal update on upcoming legislative changes regarding the

Resource Management Act and anticipated major flow-on effects for the

Whakamahere Whakatū Nelson Plan. It was noted that there was an

expectation for significant risk change for Nelson City Council from this

legislative reform, especially in the areas of housing and freshwater and

thought would need to be given how to best monitor these risks.

Group Manager Corporate Services,

Nikki Harrison, answered questions about the Waimea Dam capital grant and

progress regarding economic development contributions.

|

Resolved ARF/2021/008

|

|

|

That

the Audit, Risk and Finance Subcommittee

1. Receives the report

Quarterly Finance Report for the six months ending 31 December 2020 (R22575) and its attachments (A2554847,

A2561298, A2561235 and A2563228).

|

|

Edgar/Sanson Carried

|

13. Letter from Audit NZ on Annual

Report for year ending 30 June 2020

Document number R22559, agenda

pages 172 - 199 refer.

Manager Finance, Clare Knox,

presented the report. She answered questions about the Nelson Airport land evaluation.

|

Resolved ARF/2021/009

|

|

|

That

the Audit, Risk and Finance Subcommittee

1. Receives the report

Letter from Audit NZ on Annual Report for year ending 30 June 2020 (R22559) and its attachment (A2570817); and

2. Notes

Audit NZ’s comments (A2570817) and how officers intend to address the

issues raised.

|

|

Sanson/Her Worship the Mayor Carried

|

14. Exclusion of the Public

Sarah Macky, of Heaney &

Partners, was in attendance for Item 1 of the confidential agenda to answer

questions and, accordingly, the following resolution was required to be passed:

|

Resolved ARF/2021/010

|

|

|

That

the Audit, Risk and Finance Subcommittee

1. Confirms, in accordance

with sections 48(5) and 48(6) of the Local Government Official Information

and Meetings Act 1987, that Sarah Macky, from Heaney &

Partners, remains after the public has been excluded, for Item 1 of the

Confidential agenda (Quarterly Report on Legal Proceedings), as she has

knowledge that will assist the meeting.

|

|

Sanson/Edgar Carried

|

|

Resolved ARF/2021/011

|

|

|

That the Audit, Risk and

Finance Subcommittee

1. Excludes the public

from the following parts of the proceedings of this meeting.

2. The general subject of each

matter to be considered while the public is excluded, the reason for passing

this resolution in relation to each matter and the specific grounds under section

48(1) of the Local Government Official Information and Meetings Act 1987 for

the passing of this resolution are as follows: Edgar/ Sanson

|

|

Edgar/Sanson Carried

|

|

Item

|

General subject of each matter to be

considered

|

Reason for passing this resolution in

relation to each matter

|

Particular interests protected (where

applicable)

|

|

1

|

Quarterly report on legal proceedings

|

Section

48(1)(a)

The public

conduct of this matter would be likely to result in disclosure of information

for which good reason exists under section 7

|

The withholding of the information is

necessary:

· Section

7(2)(g)

To maintain

legal professional privilege

|

|

2

|

Quarterly Update On Debts - 31 December 2020

|

Section 48(1)(a)

The public conduct of this

matter would be likely to result in disclosure of information for which good

reason exists under section 7

|

The withholding of the information is necessary:

· Section 7(2)(a)

To protect the privacy of

natural persons, including that of a deceased person

· Section

7(2)(g)

To maintain legal

professional privilege

|

The meeting went into confidential

session at 10.46a.m. and resumed in public session at 12.13p.m.

Restatements

It was resolved while the public was

excluded:

|

1

|

PUBLIC EXCLUDED: Quarterly

report on legal proceedings

|

|

|

That

the Audit, Risk and Finance Subcommittee

2. Agrees

that the Report (R22555) and its attachment (A2563217) remain confidential at

this time.

|

|

2

|

PUBLIC EXCLUDED: Quarterly

Update On Debts - 31 December 2020

|

|

|

That

the Audit, Risk and Finance Subcommittee

2. Agrees that the Report (R22568)

and its attachment (A2216183) remain confidential at this time.

|

There being no further business the meeting ended at 12.13p.m.

Confirmed as a correct record of proceedings:

Chairperson

Date

Chairperson

Date

Item 6: Chairperson's

Report

|

|

Audit, Risk and Finance Subcommittee

25 May 2021

|

REPORT R25884

Chairperson's

Report

1. Purpose

of Report

1.1 To

provide the Chairperson’s report to the Subcommittee.

2. Recommendation

|

That the Audit, Risk and Finance Subcommittee

1. Receives

the report Chairperson's Report.

|

2. Background

2.1 The

Local Government sector as a whole is facing a period of uncertainty, and this

is being felt here in Nelson. The ongoing effects of COVID-19 in

terms of the impact on revenue, planning and community expectation are still

very much with us, while additional challenges in the form of central government

changes in Three Waters, a recently announced but, as yet, unclear review of

Local Government as a whole and an extensive Long Term Plan (LTP) programme

will be prominent features for the next few years.

2.2 We

are already seeing the early consequences of these uncertainties in the

difficulty of recruiting the necessary asset managers and other key staff

necessary for Nelson City Council to meet this multi-faceted workload, and this

subcommittee will need to maintain a high focus on the associated risks, both

to the achievement of stated goals, achieving balanced budgets and the capacity

and wellbeing of staff.

2.3 As

a subcommittee we will need to ensure that the work focus and reporting are

consistent with the challenges the organisation is facing and the information

Council needs. This may require changes to the issues we focus on and the

reporting we receive, and I will welcome Members’ suggestions in this

regard as the issues evolve.

2.4 With

regard to Audit, I was pleased to hear that the Interim Audit progressed well,

and that the LTP Consultation Document Audit was well received by Audit New

Zealand. Appreciation to all concerned, and I look forward to hearing

more when John Mackey of Audit New Zealand joins the meeting shortly.

2.5 And

last, but by no means least, Councillors recently approved the appointment of

iwi representatives to various committees of Council, and I look forward to

warmly welcoming the successful iwi appointee to the Audit Risk and Finance

Subcommittee when that appointment is finalised.

Author: Elaine

Stephenson, Governance Adviser

Attachments

Nil

Item 7: Audit NZ: Audit

Plan for year ending 30 June 2021

|

|

Audit, Risk and Finance Subcommittee

25 May 2021

|

REPORT R24802

Audit

NZ: Audit Plan for year ending 30 June 2021

1. Purpose

of Report

1.1 To

provide the subcommittee with the Audit Plan from Audit New Zealand (Audit NZ)

for the year ending 30 June 2021.

2. Recommendation

|

That the Audit, Risk and Finance Subcommittee

1. Receives

the report Audit NZ: Audit Plan for year ending 30 June 2021 (R24802) and its attachments (A2638227 and

A2648347).

2. Notes the Subcommittee can provide feedback on the Proposed

Audit Fee letter to Audit New Zealand if required, noting the Mayor will sign

the letter once the Subcommittee’s feedback has been incorporated.

|

2. Background

2.1 The

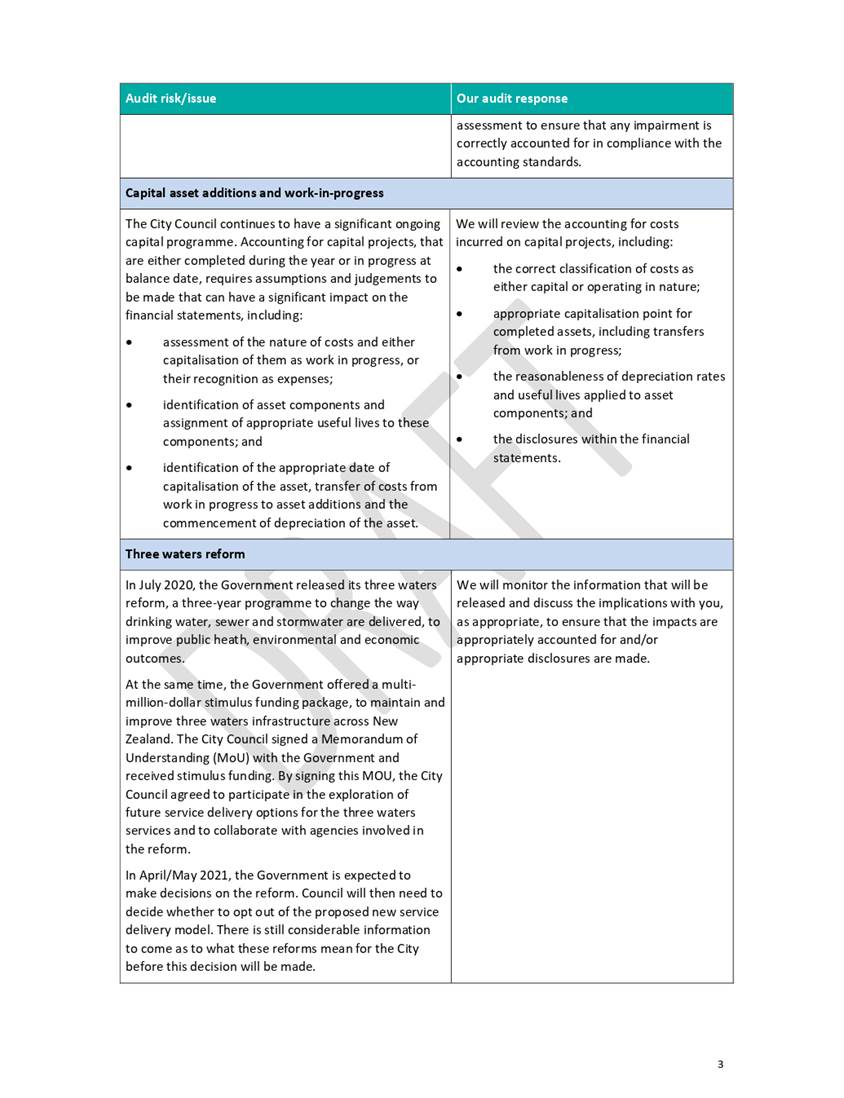

Audit Plan (Attachment 1) sets out the audit arrangements and covers:

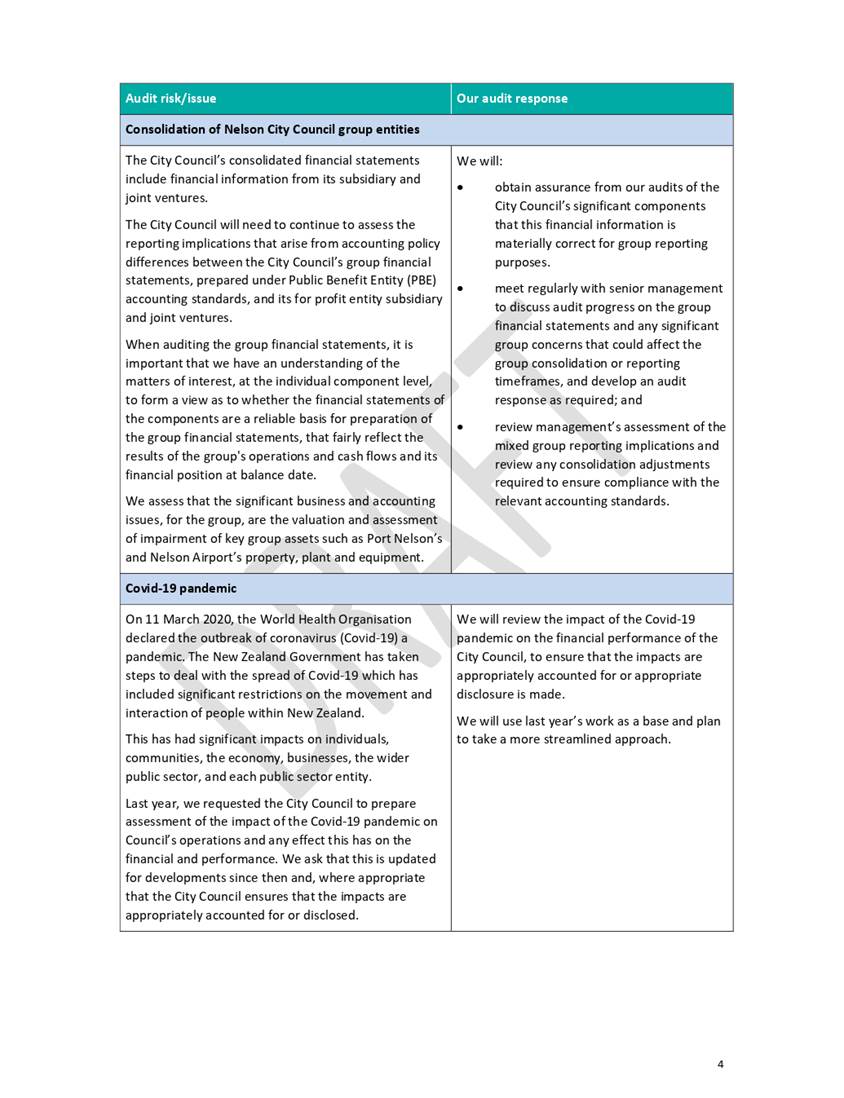

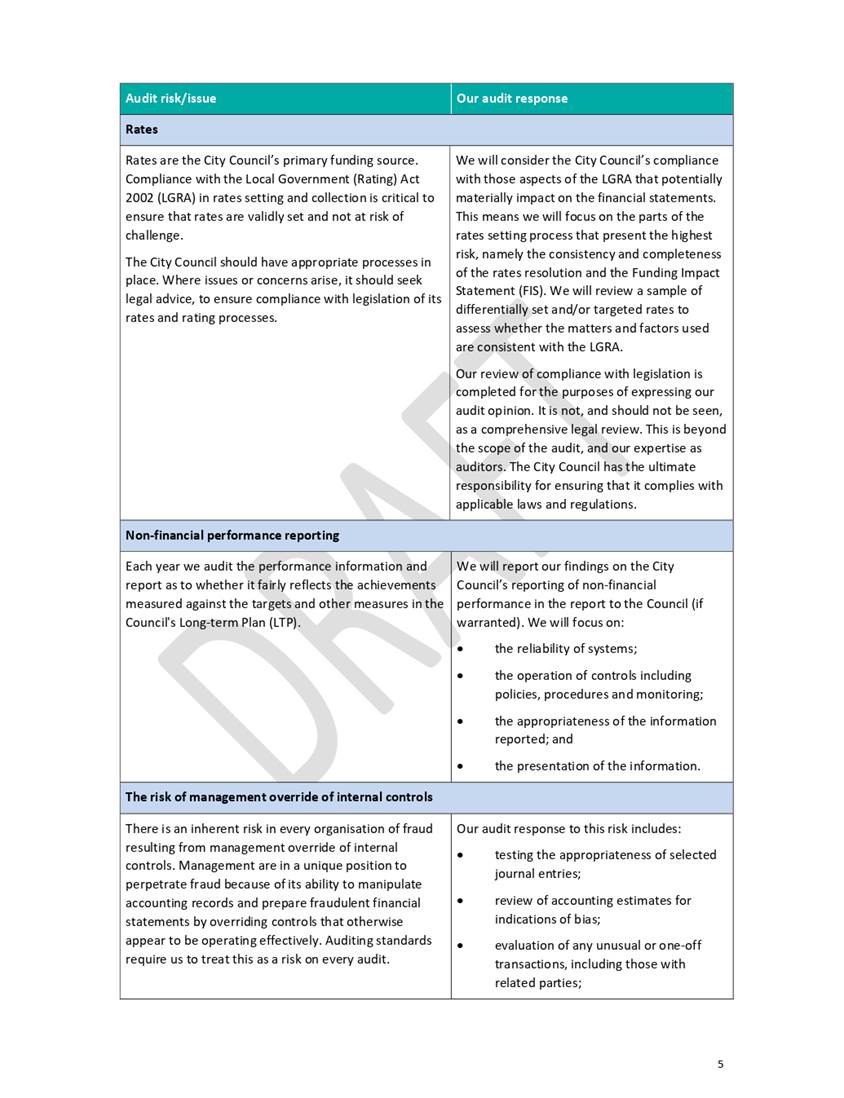

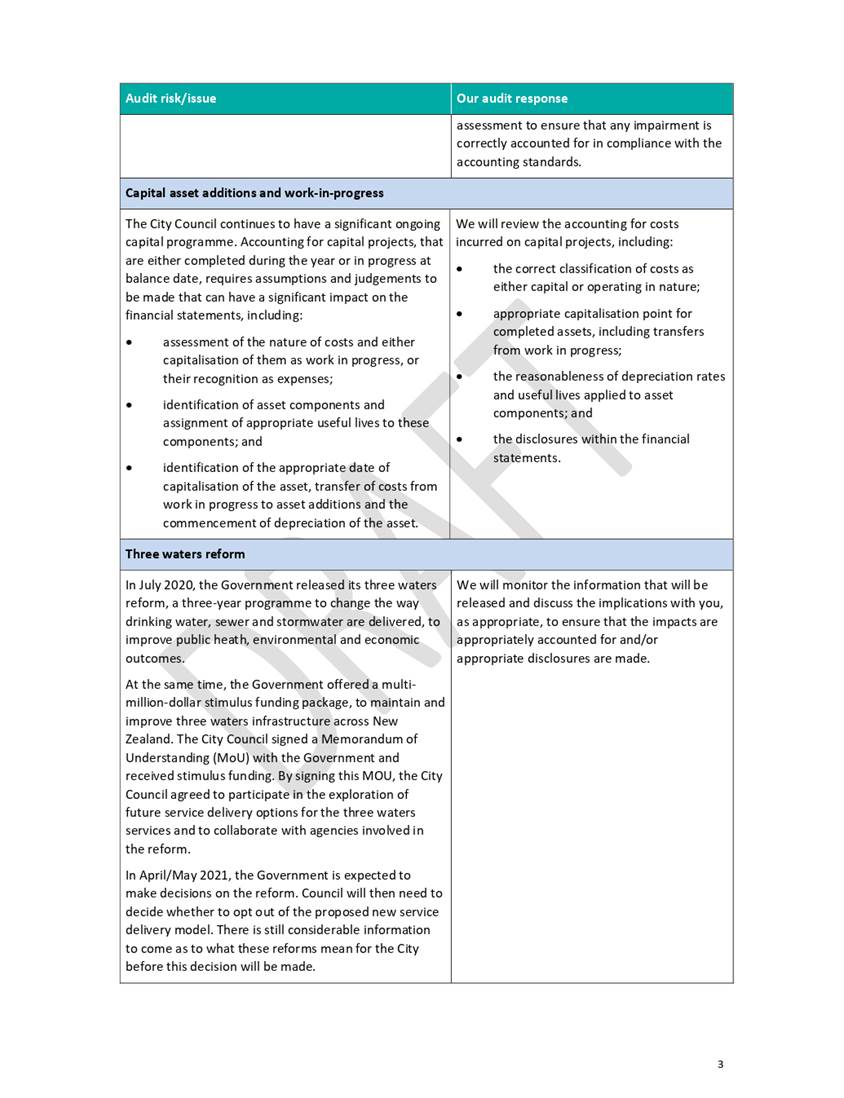

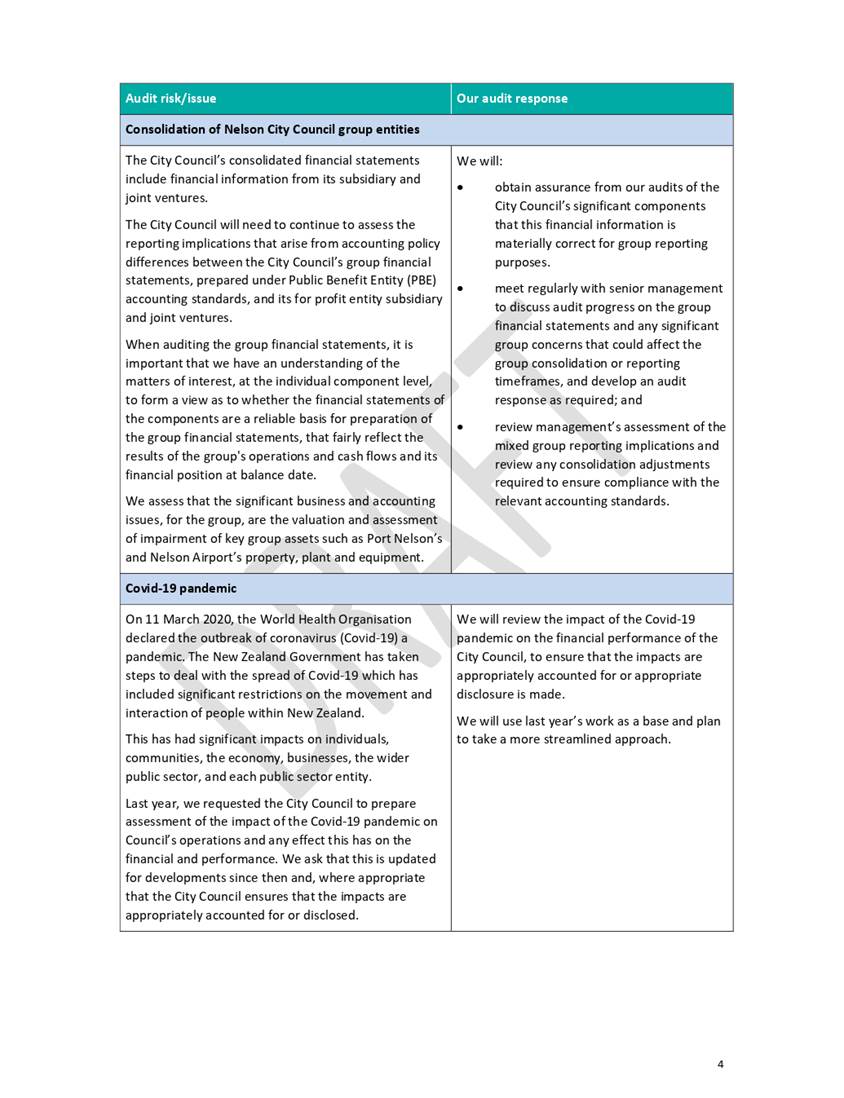

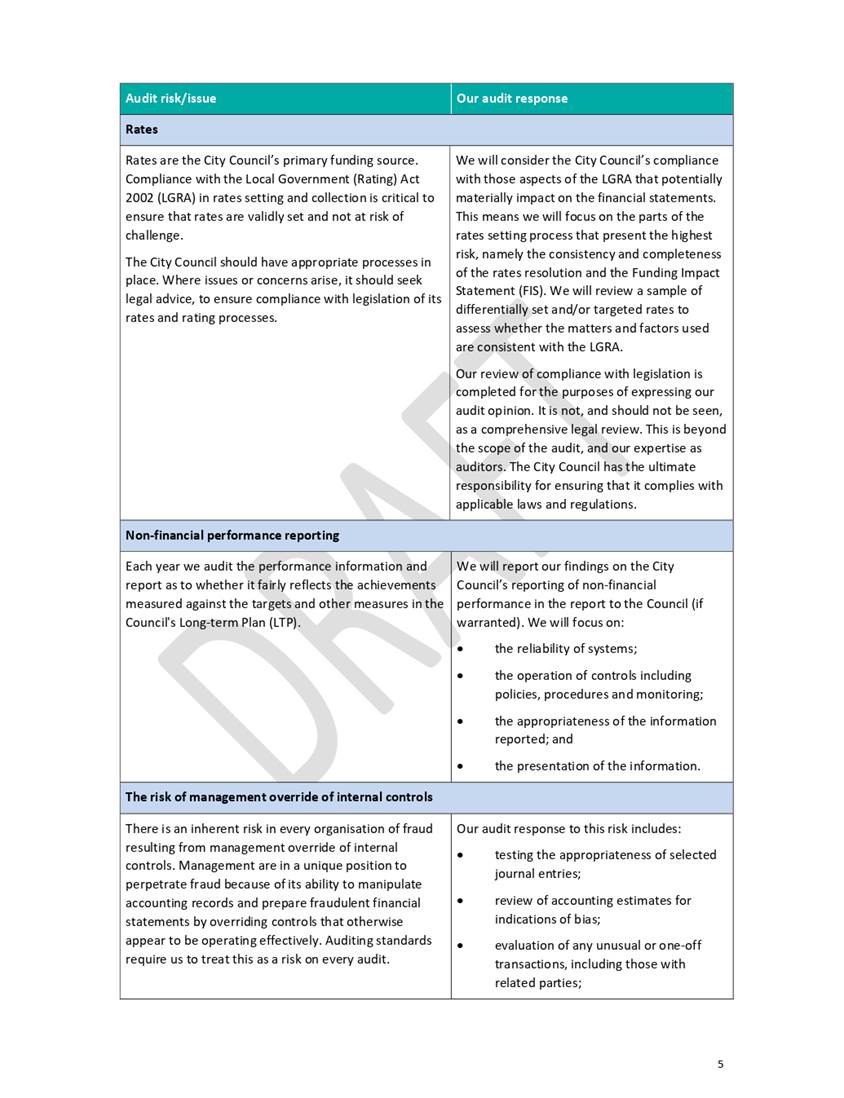

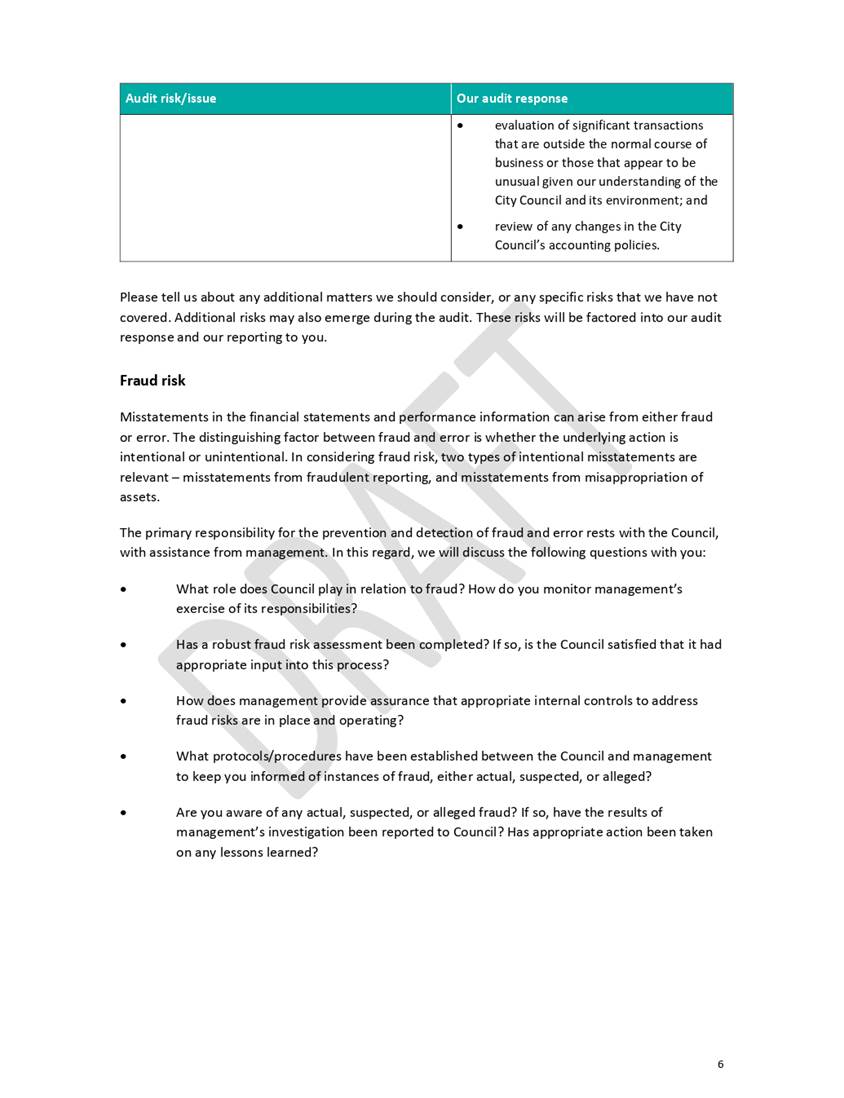

· Audit risks and issues,

both specific focus areas for council and areas of interest for all local

authorities

· Group audit

· Audit process

· Reporting protocols

· Audit logistics

· Expectations.

2.2 The

Proposed Audit Fees Letter (Attachment 2) outlines the proposed increased fees

for the 30 June 2021 and 30 June 2022 audits. In a letter received in May 2020,

the Auditor General considers the matter of annual audit fees. It was decided

that due to COVID-19, it was not the time to increase annual fees by the amount

that might be otherwise warranted and so for the 30 June 2020 audit, audit fees

were to be held to a 1.5% increase over the agreed fee for the 30 June 2019

audit. However, it was noted that audit fees would need to increase

substantially in the future and that the auditors would need to discuss this

with Council in due course.

2.3 The

fees are estimated to increase by 9% and 8% respectively for the 2020/21 and

2021/22 audits. The main reasons for the increase in fees are:

· Additional

hours required since last review (approximately 19 weeks on site compared with

14 previously)

· Engagement Quality

Review (EQR) hours – the audit meets the Office of the Auditor-General

criteria (audits greater than 750 hours) that requires an EQR Director on the

engagement

· More meeting

requirements (Finance team, Subcommittee and Council) since last review

· Consolidations and

Financial Reporting Standards results in more complex adjustments

· More focus on local

authority core services

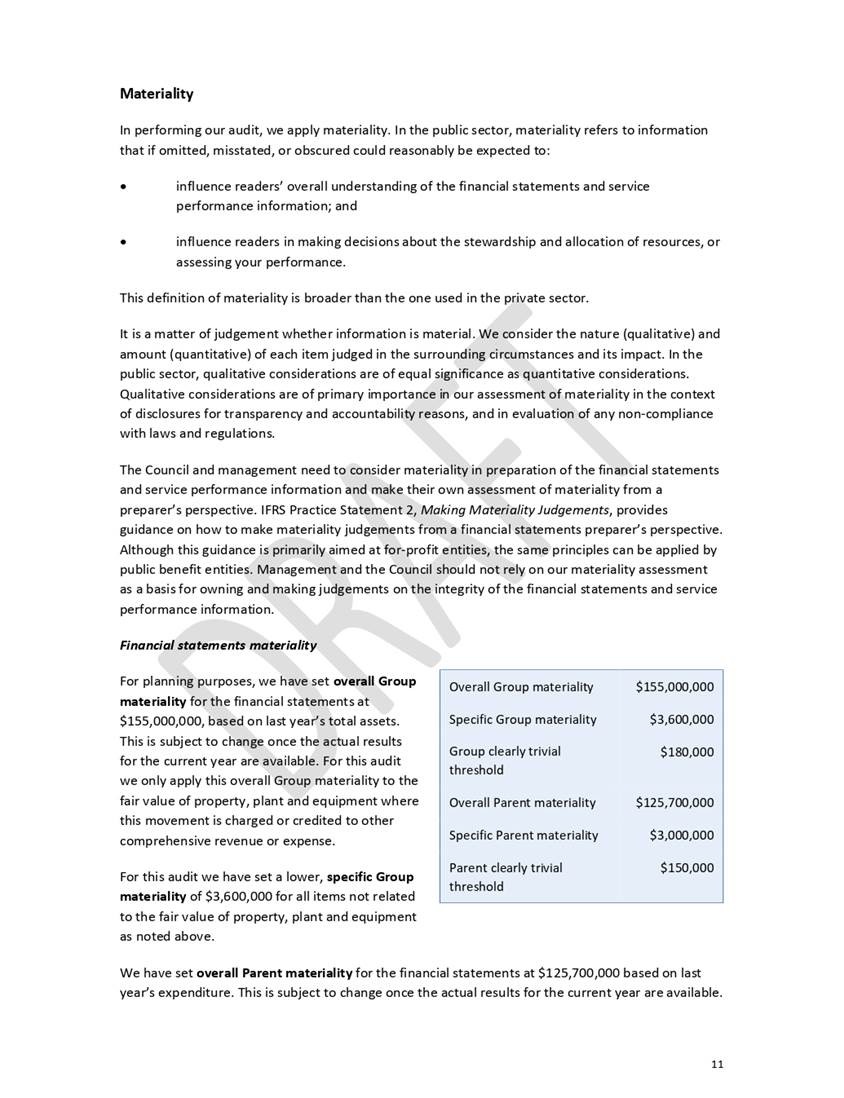

3. Materiality

3.1 A

new section has been added to the Audit Plan for the 2020/21 Audit in relation

to materiality which discusses materiality for both financial statements and

service performance information. Materiality refers to information that if

omitted, misstated, or obscured could influence readers’ overall

understanding of the financial statements.

3.2 For

financial statement materiality, Audit NZ has calculated Group and Parent

materiality thresholds into Overall, Specific and ‘clearly

trivial’. All uncorrected misstatements other than those that are clearly

trivial will be reported by Audit NZ.

3.3 For

service performance information materiality, Audit NZ has identified

materiality measures and presented them in a table. This will be reassessed

during the audit.

4. Timing

4.1 The

final audit is planned to commence on 13th September, which is later

than in previous years (2019/20 Audit commenced on 7th September

2020) and there has been no change to the statutory deadline for 2020/21 Audit

Opinions to be issued.

5. Other

5.1 There

is no Audit Proposal letter to be signed this year as there have been no

changes since it was signed after being brought to the subcommittee meeting on

21 May 2020.

5.2 There

is no Audit Engagement letter to be signed this year as there have been no

changes in circumstances since it was signed after being brought to the

subcommittee meeting on 11 August 2020.

5.3 John

Mackey, the appointed auditor, will be available on Zoom at this subcommittee

meeting to answer any questions that may arise.

Author: Clare

Knox, Manager Finance

Attachments

Attachment 1: A2638227

- Audit - Audit Plan 20-21 - Draft - 11May2021 ⇩

Attachment 2: A2648347

- Audit NZ Proposed Fee Increase Letter - Draft ⇩

Item 7: Audit NZ: Audit Plan for year ending 30 June 2021:

Attachment 1

Item 7: Audit NZ: Audit

Plan for year ending 30 June 2021: Attachment 2

Item 8: Health Safety

and Wellbeing Report, January - March 2021

|

|

Audit, Risk and Finance Subcommittee

25 May 2021

|

REPORT R23731

Health

Safety and Wellbeing Report, January - March 2021

1. Purpose

of Report

1.1

To provide the subcommittee with a report on health, safety and

wellbeing data collected over the period January to March 2021.

1.2

To update the subcommittee on key health and safety risks, including

controls and treatments.

2. Summary

2.1 Incident

and lead indicator data is unexceptional for this period.

2.2 There

has been an improvement in senior leader due diligence activities reported.

2.3 There

has been no change in the assessed risk ratings of key health and safety risks

since the previous report.

2.4 An

emerging risk has been added for this report relating to the Marina transition.

3. Recommendation

|

That the Audit, Risk and Finance Subcommittee

1. Receives

the report Health Safety and Wellbeing Report, January - March 2021 (R23731) and its attachment (A2621469).

|

4. Background

4.1 Elected members, as ‘Officers’ under the Health and

Safety at Work Act 2015 (HSWA), are required to undertake due diligence on

health and safety matters. Council’s Health and Safety Governance Charter

states that Council will receive quarterly reports regarding the implementation

of health and safety. Council has delegated the responsibility for health

and safety to the Audit, Risk and Finance Subcommittee.

4.2 Health,

safety and wellbeing performance data reports provide an overview based on key

lead and lag indicators. Where a concerning trend is identified more detail is

provided in order to better understand issues and implement appropriate

controls.

5. Discussion

5.1 Incidents

of note

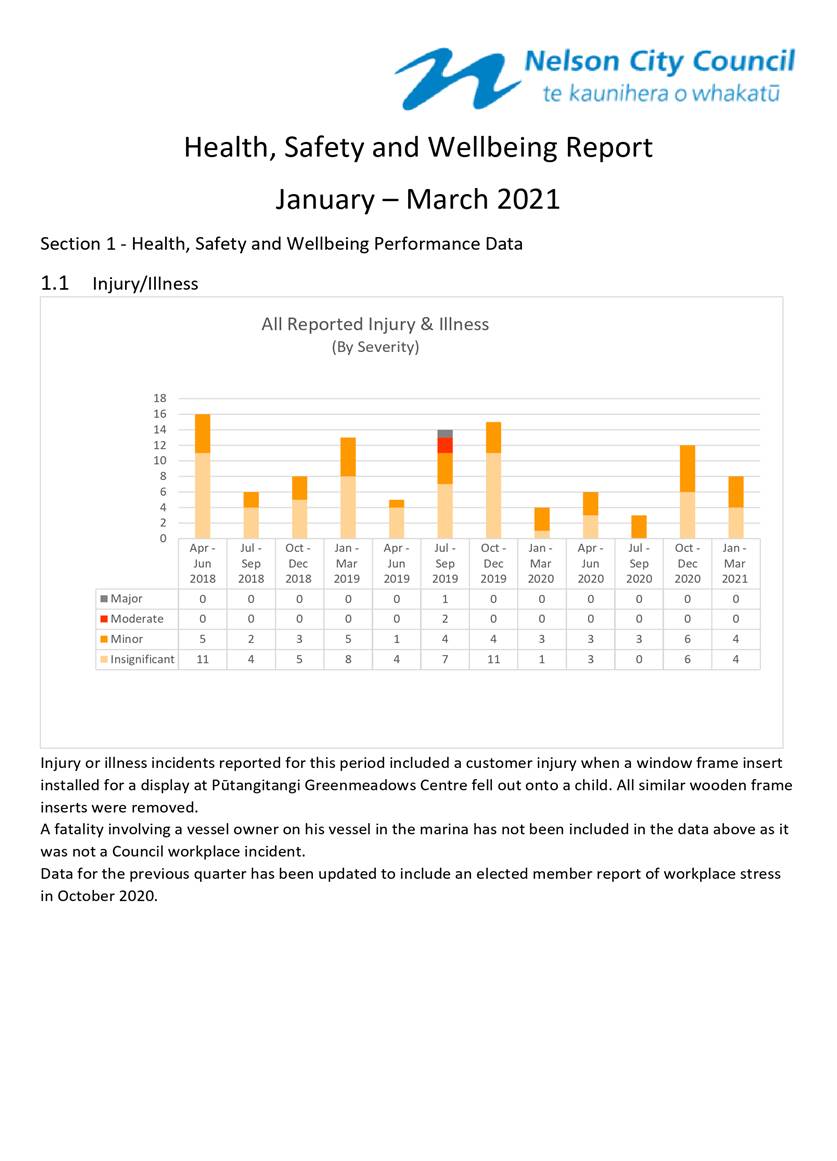

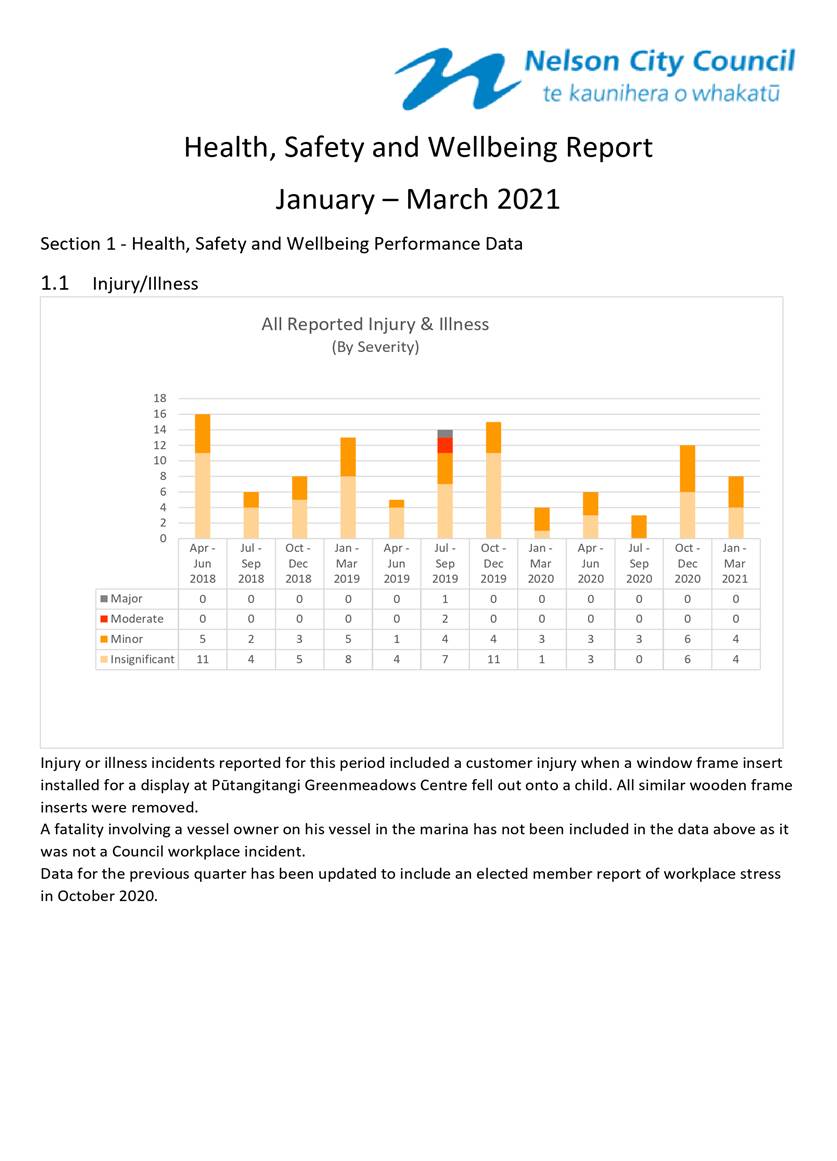

5.1.1 A

customer sustained a minor injury at Pūtangitangi Greenmeadows Centre when

a window frame insert installed for a display fell out. All similar wooden

frame inserts were removed.

5.1.2 A

vessel owner died in the Nelson marina following a medical event while working

up the mast on his vessel. This was not a Council workplace incident so does

not feature in the incident data.

5.1.3 An

elected member report of workplace stress in October 2021 has been added to the

data for the previous quarter, this was not included in the previous report for

privacy reasons, and was omitted from the data due to the category the incident

was recorded in.

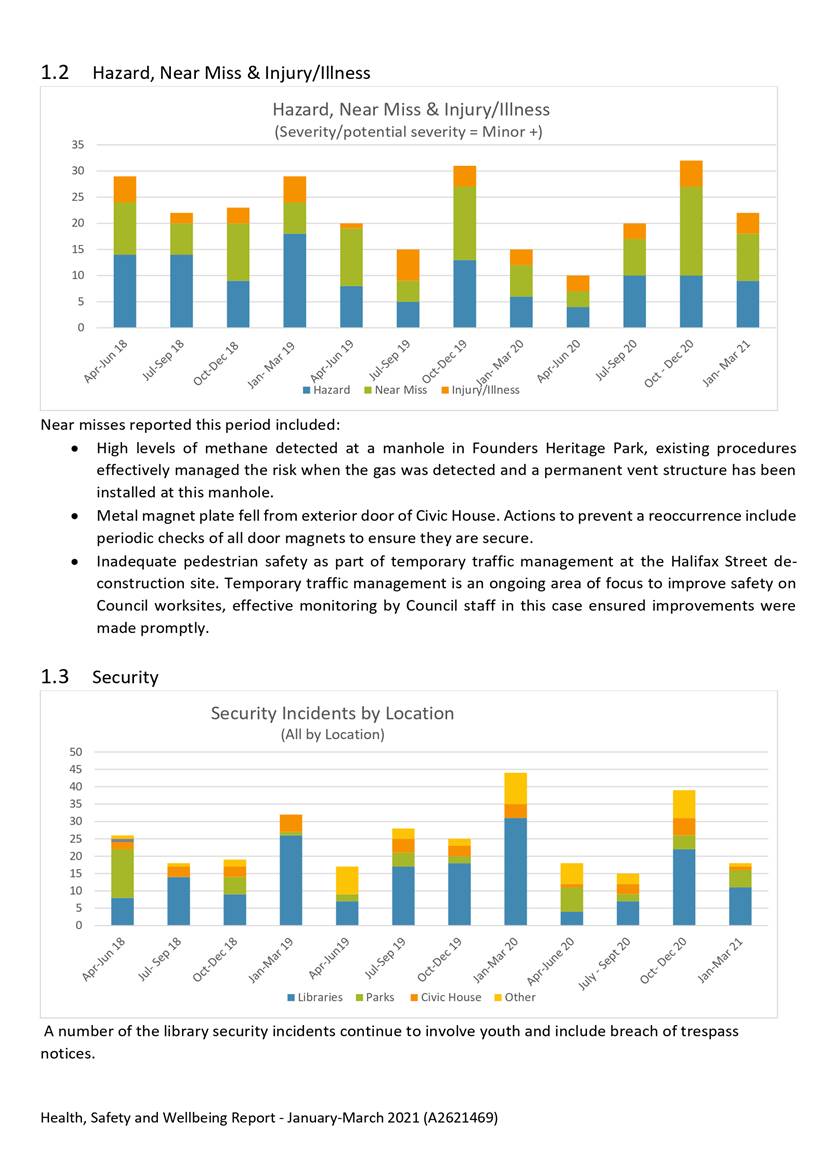

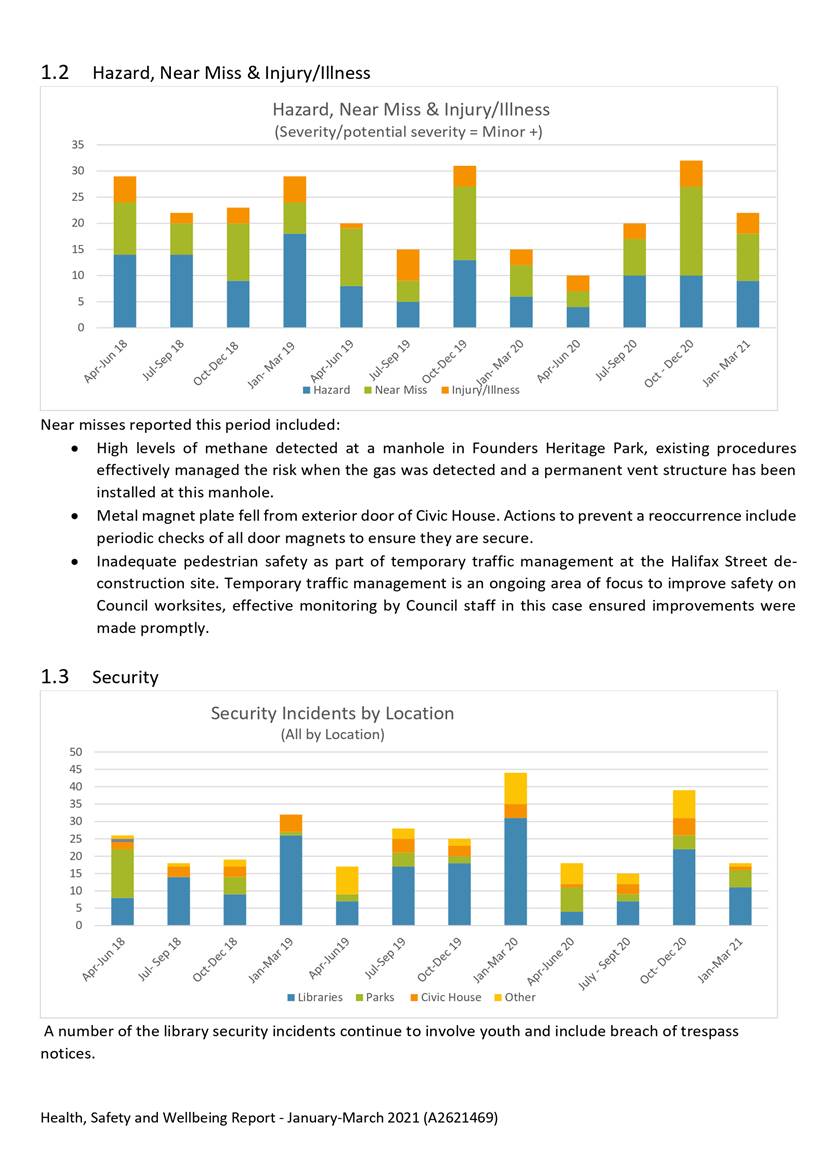

5.2 Security

Incidents

5.2.1 Security

incidents at libraries during this period continue to include a number of

previously trespassed persons entering libraries, primarily youth. The level of

reporting and ability to identify trespassed persons entering are indicators

that good process is being followed by library staff.

5.2.2 Three

security incidents occurred at the Brook Valley Holiday Park.

5.2.3 Two

security incidents occurred at ANZAC Park including an assault on a contractor.

Work is ongoing to reduce risks associated with the consumption of alcohol in

liquor ban areas and the establishment of homeless camps in Council parks and

reserves.

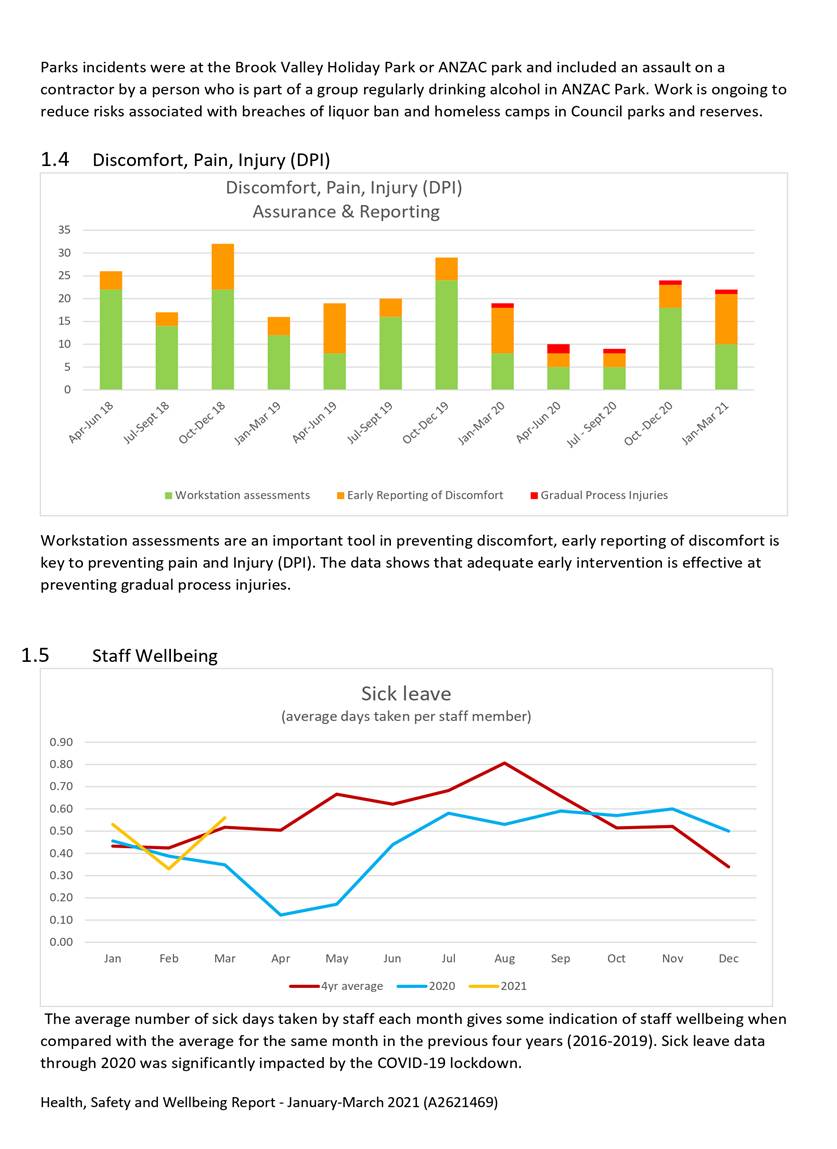

5.3 Lead

Indicators

5.3.1 Hazard

report and near miss incident data in the attachment continues to show good

rates of reporting. Improving hazard and near miss reporting to help prevent

injury and illness will remain a focus.

5.3.2 Workgroup

toolbox talk data shows an improvement in toolbox talks completed against

targets since mid 2020. All business unit managers and team leaders receive the

toolbox talk agenda each month.

5.4 Safe

Driving

5.4.1 ERoad

in vehicle monitoring data continues to show a very low rate of overspeed

events and no individual drivers had a concerning number of over speed events

during this period.

5.4.2 When

the ERoad system was first implemented in 2016 the rate of over speed events

was close to 2 per 100km travelled, for this quarter it is remains around 0.2

events per 100km.

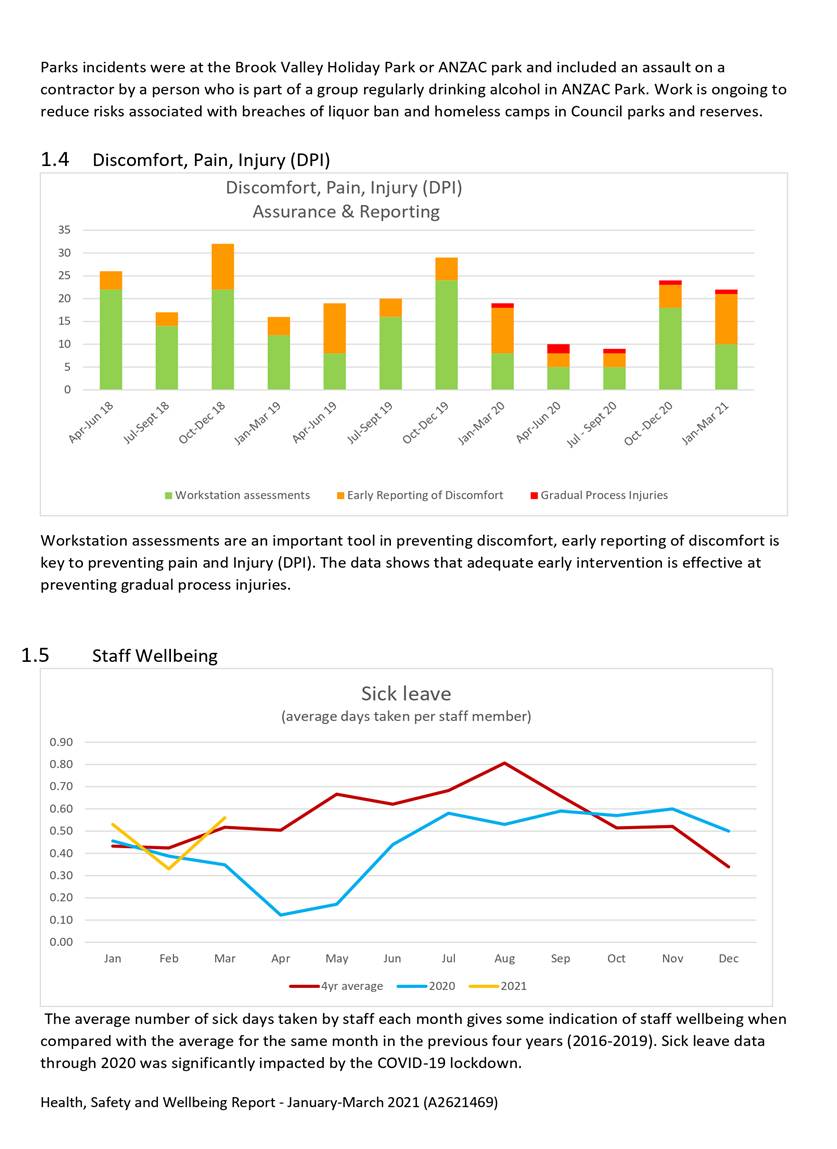

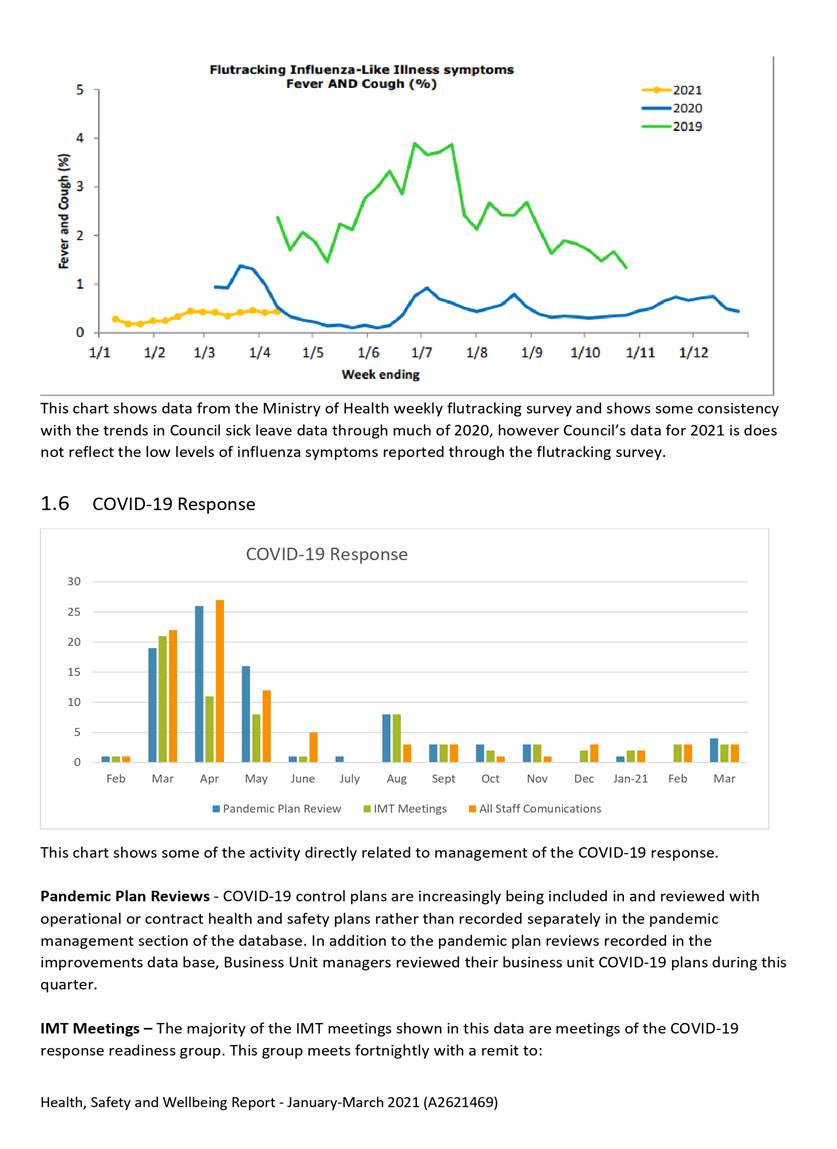

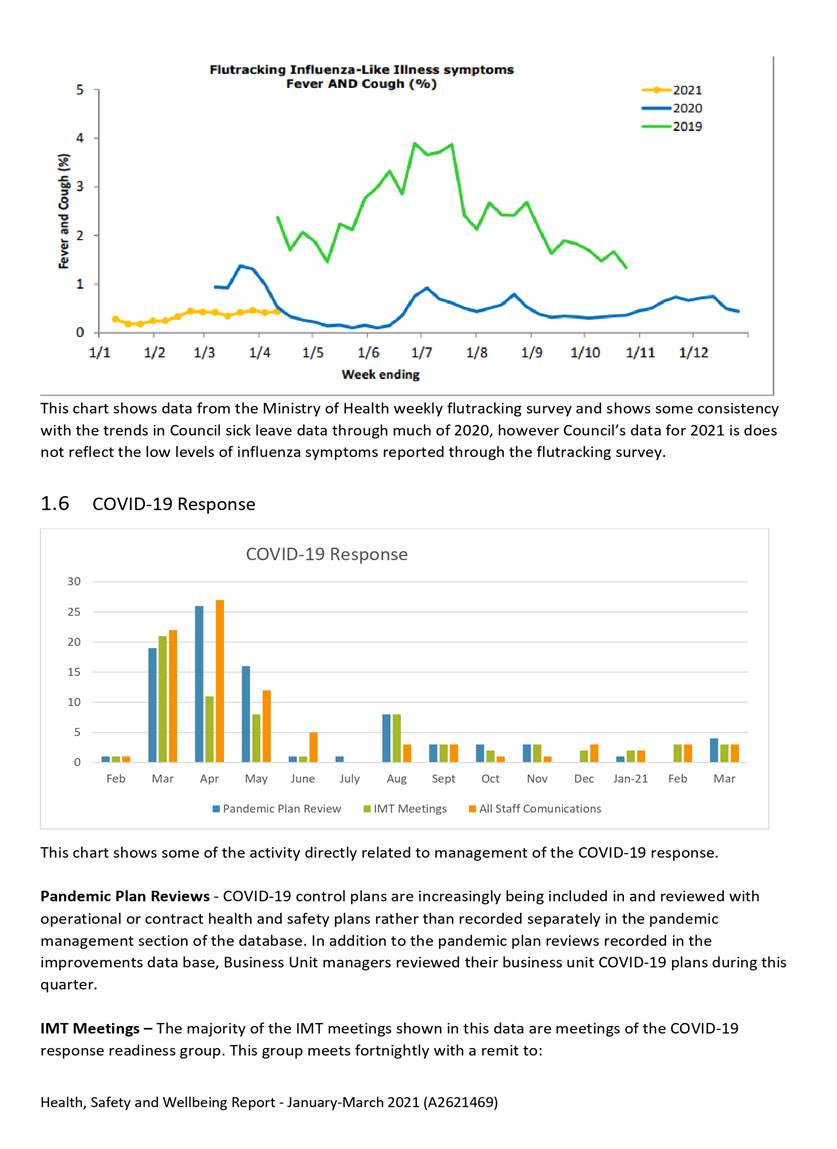

5.5 Staff

Wellbeing

5.5.1 Sick

leave data through much of 2020 showed the average number of sick days taken by

each staff member was less than for the same month in previous years, this was

somewhat consistent with Ministry of Health flutracking data.

5.5.2 Later

in 2020 and so far in 2021 there has been an increase in sick leave taken that

is at times above the average for the previous 4 years (2016-2019). No clear

explanation could be found for this from the data, however it may relate to the

increased expectation to stay home if unwell.

5.6 Contractor

Health and Safety

5.6.1 High

numbers of safe work observations (SWOs) or contractor monitoring reported has

continued.

5.7 Due

Diligence Activities

5.7.1 Five

safe work observations or safety tours for Elected Members have been reported

for this period and six for SLT members, these are detailed in the attachment.

5.7.2 Cr

Edgar attended a Workplace Health and Safety committee meeting as a due

diligence activity for the Audit Risk and Finance Subcommittee.

5.7.3 These

due diligence activities are currently occurring at a frequency that indicates

targets will be met or exceeded for this calendar year. Further work is planned

to better support due diligence activities.

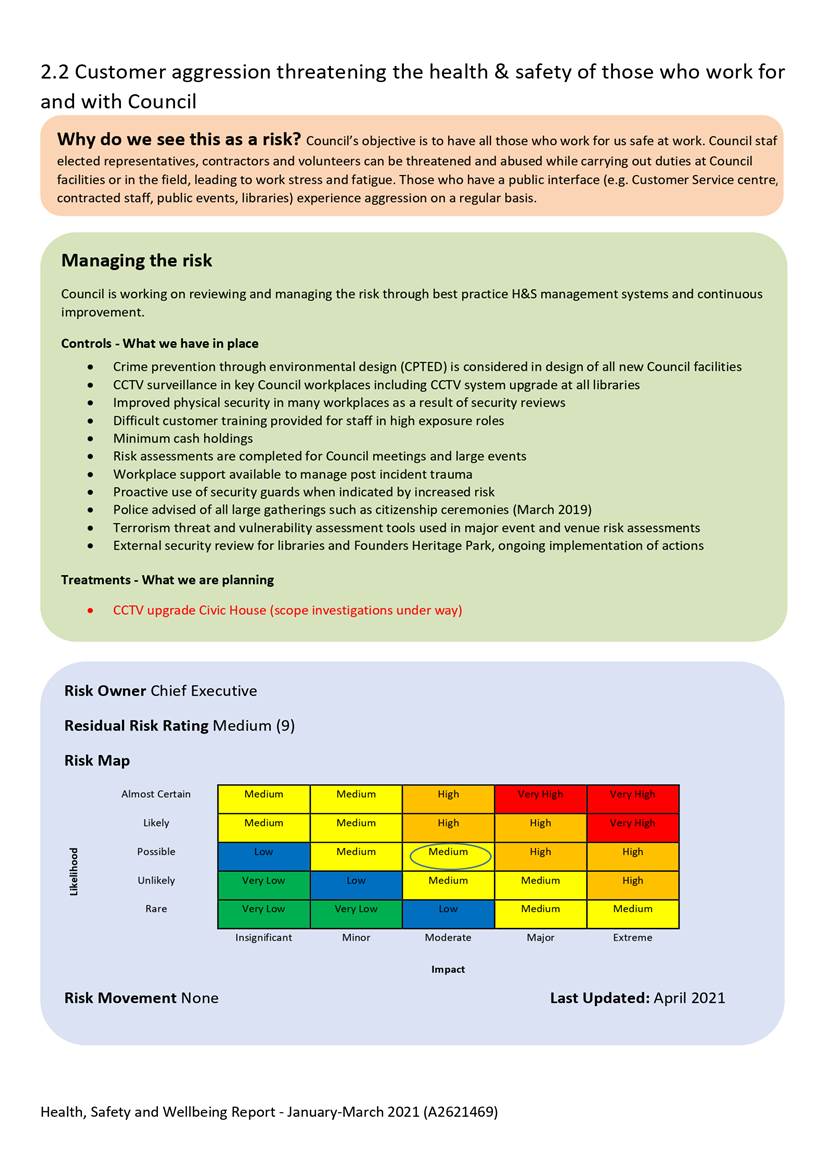

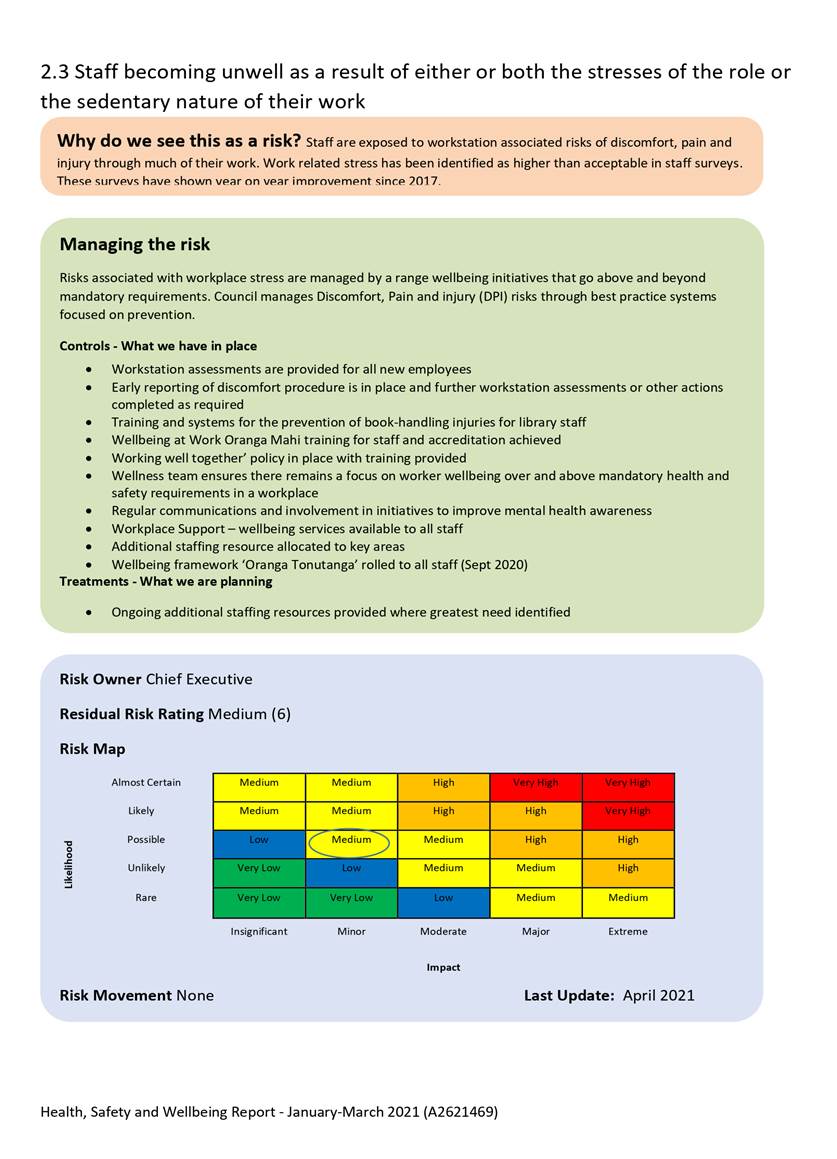

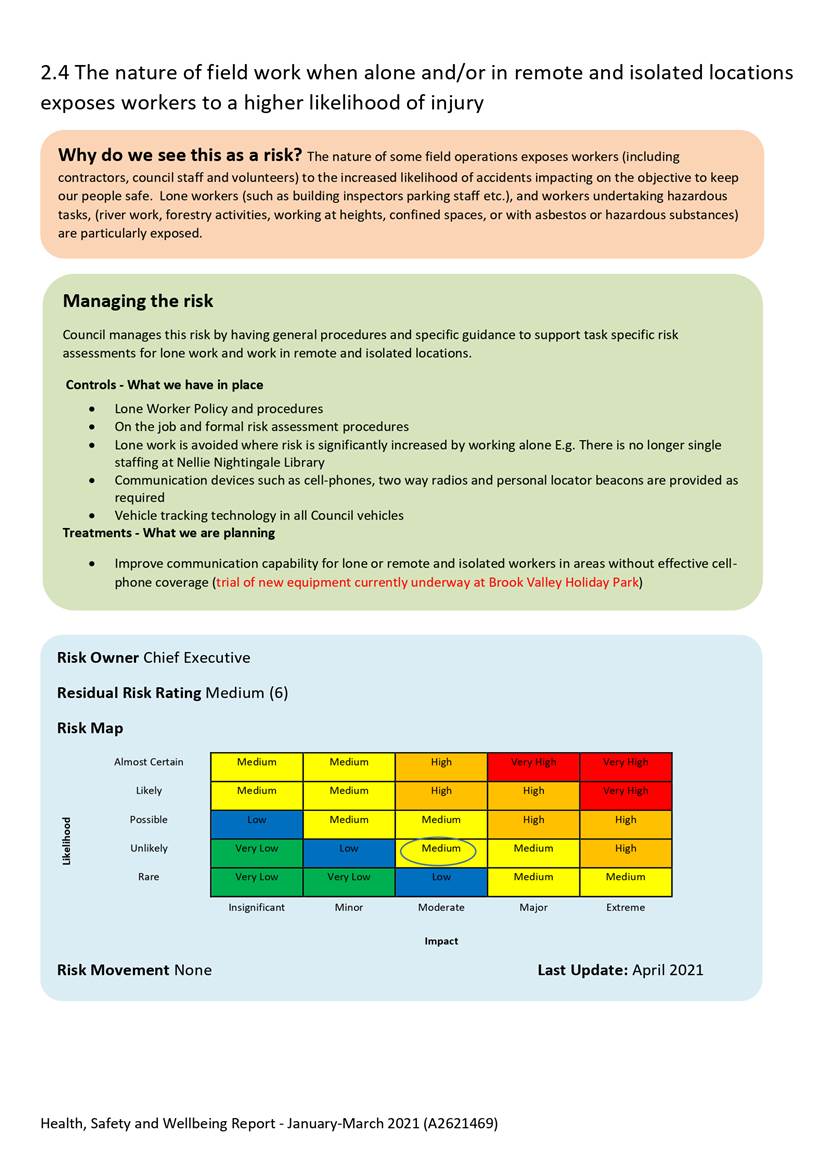

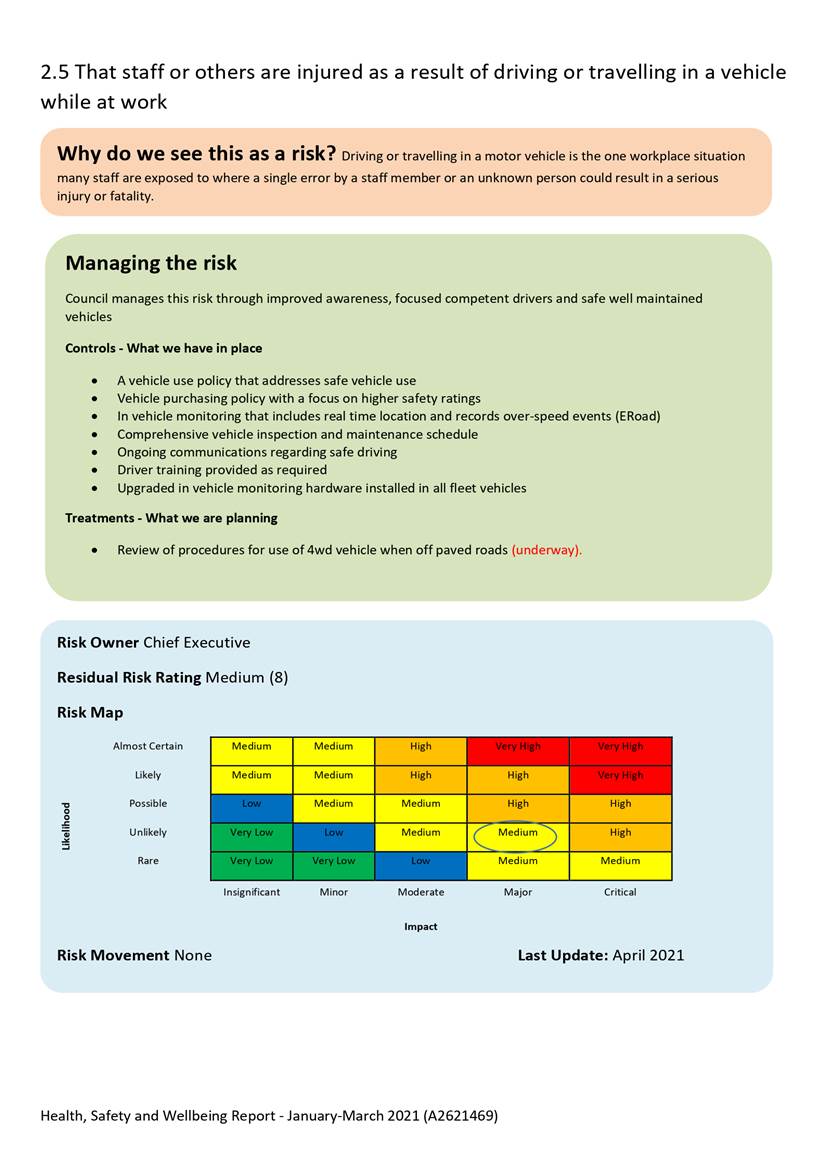

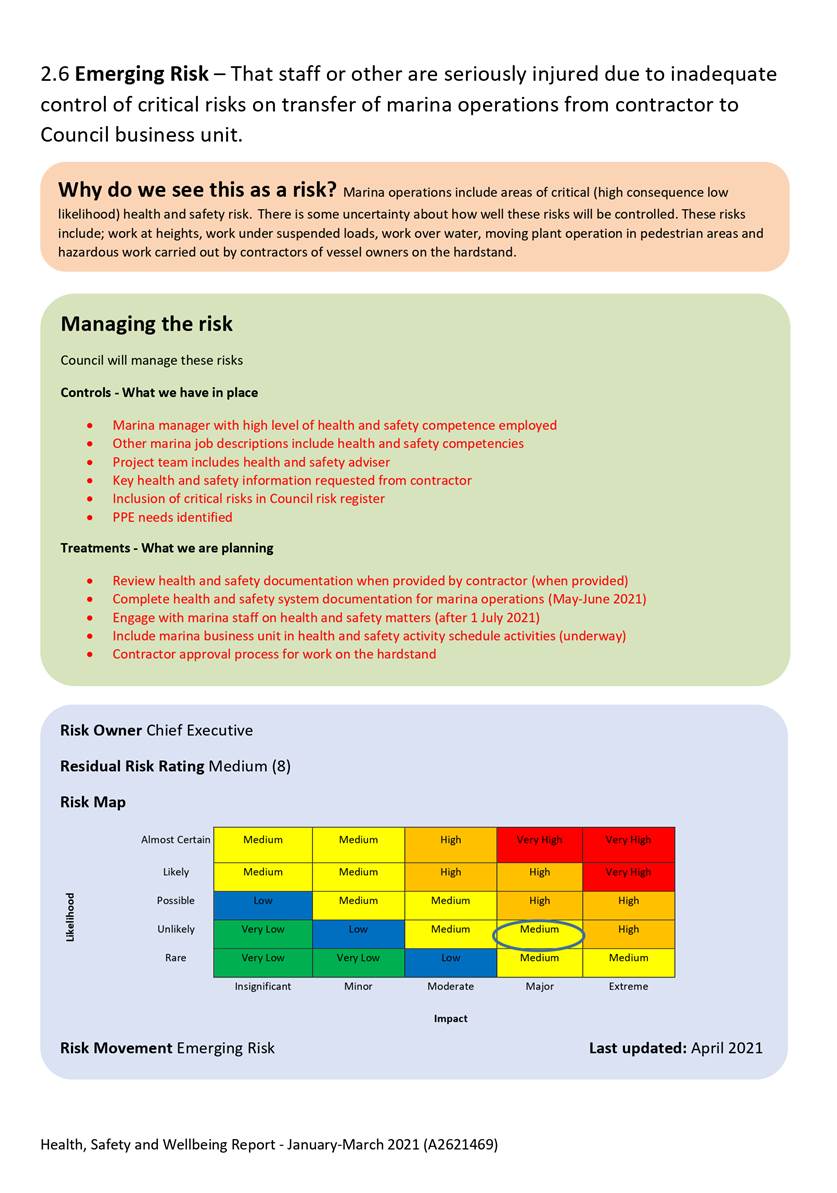

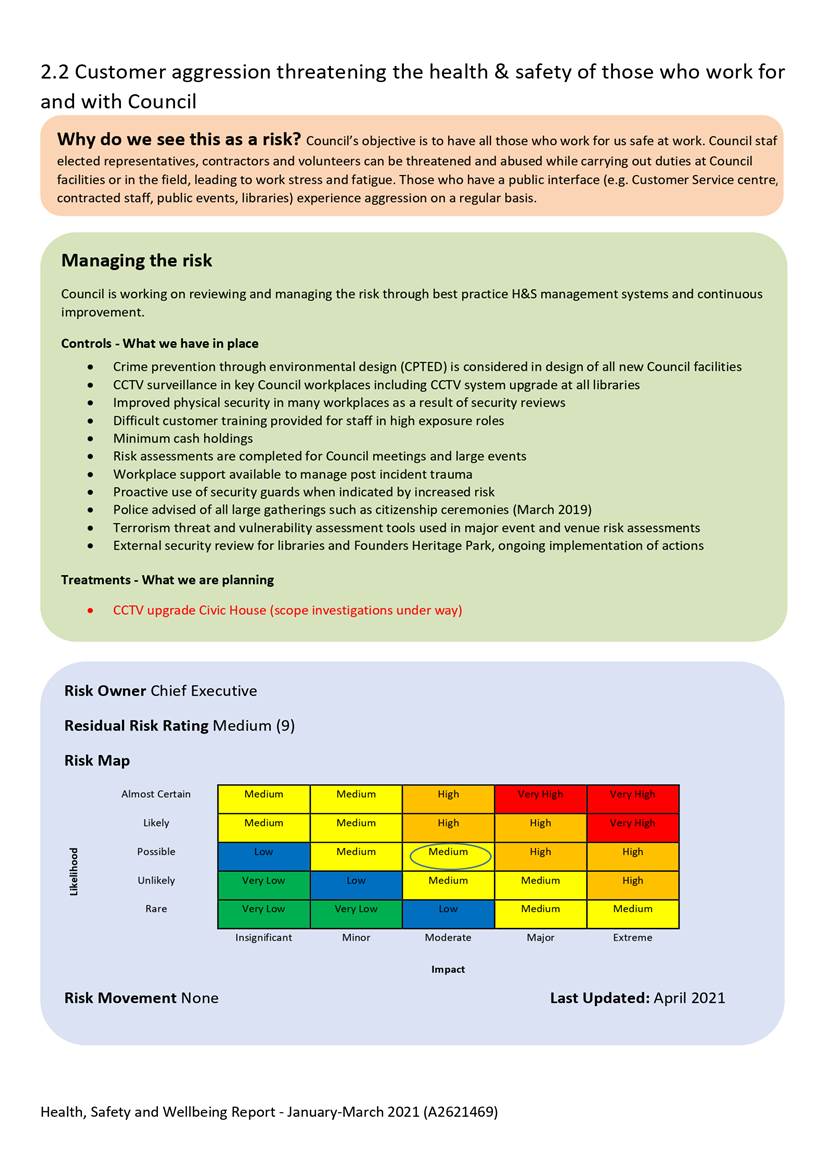

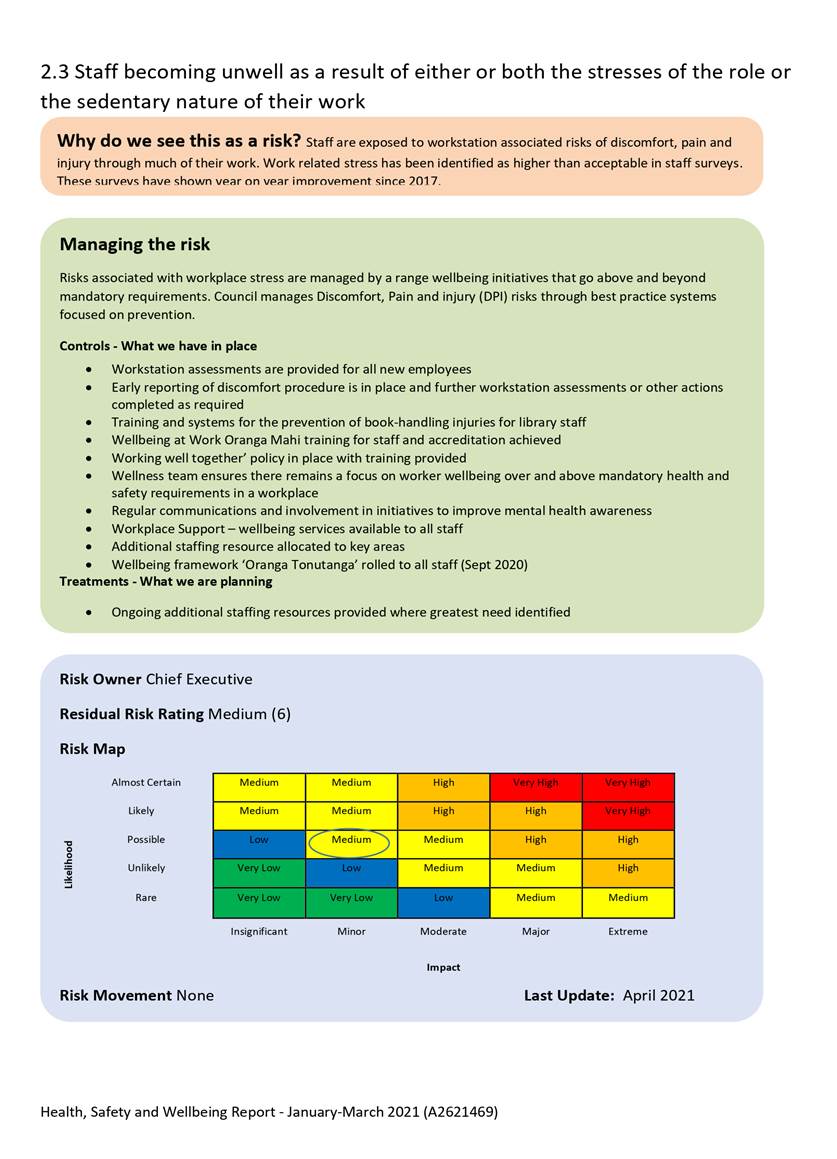

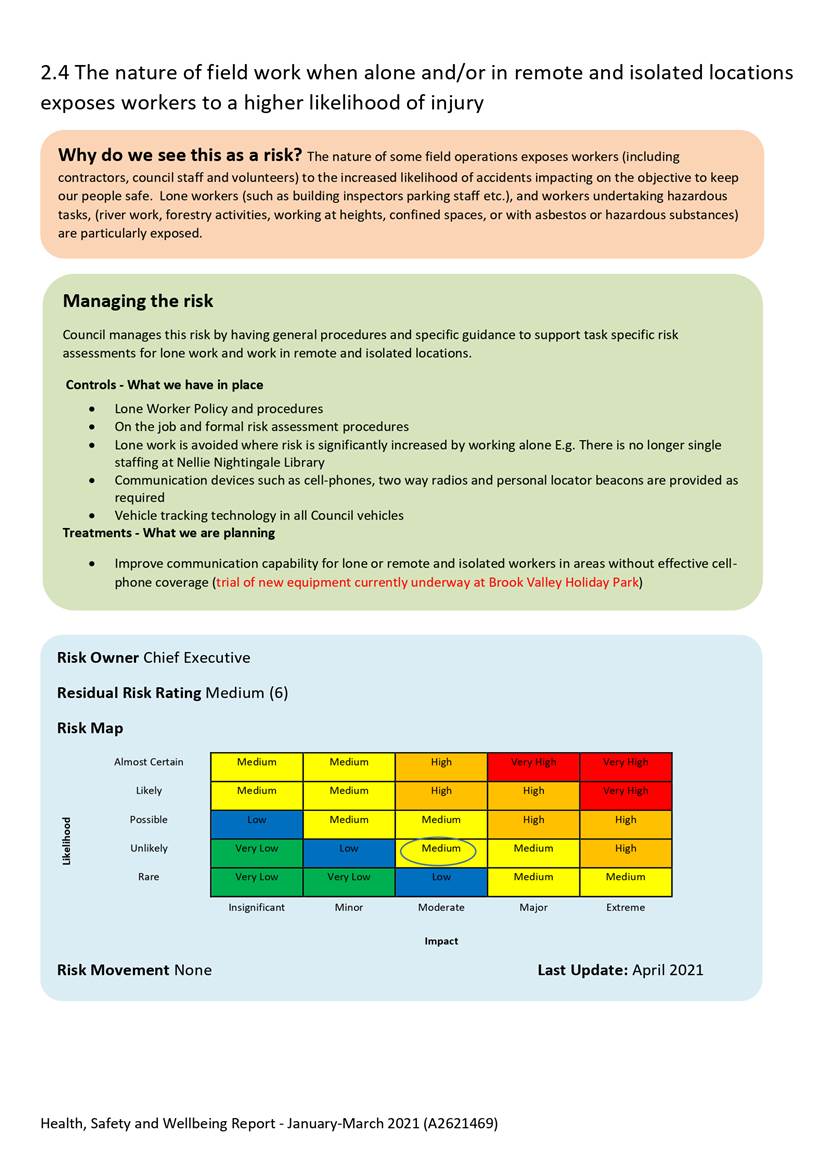

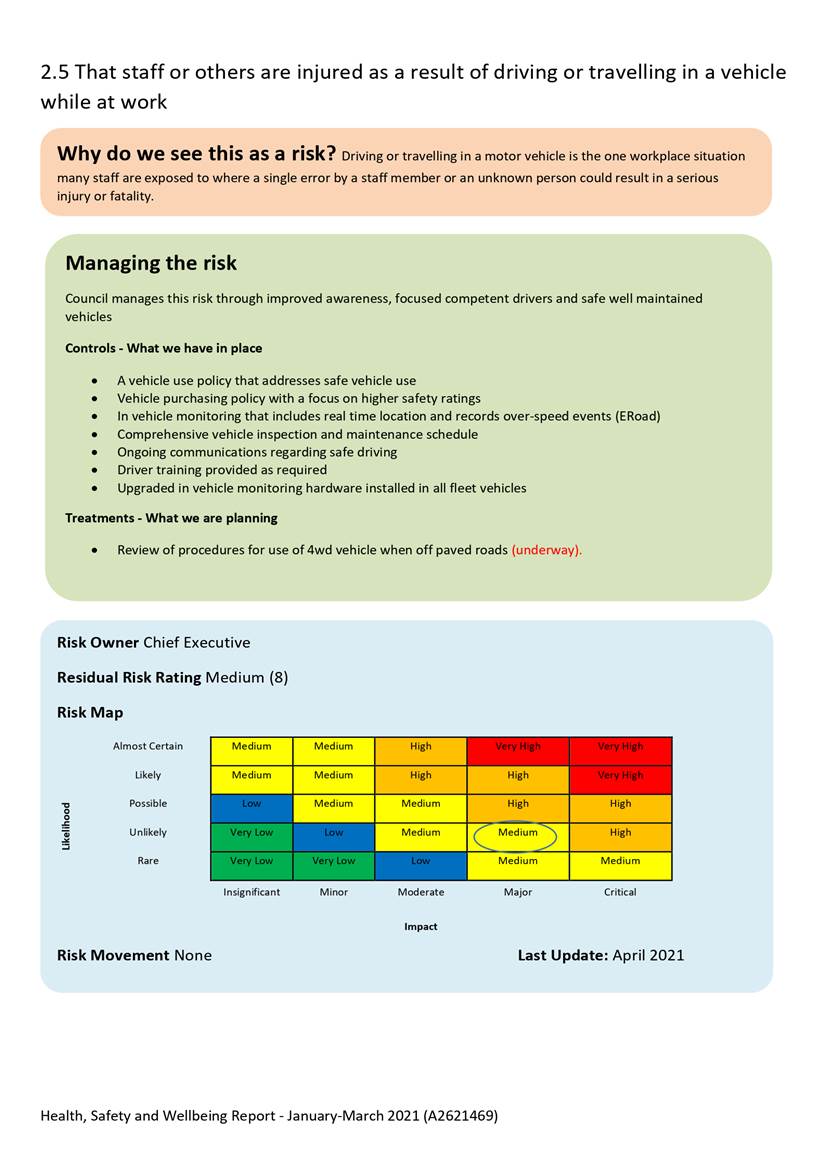

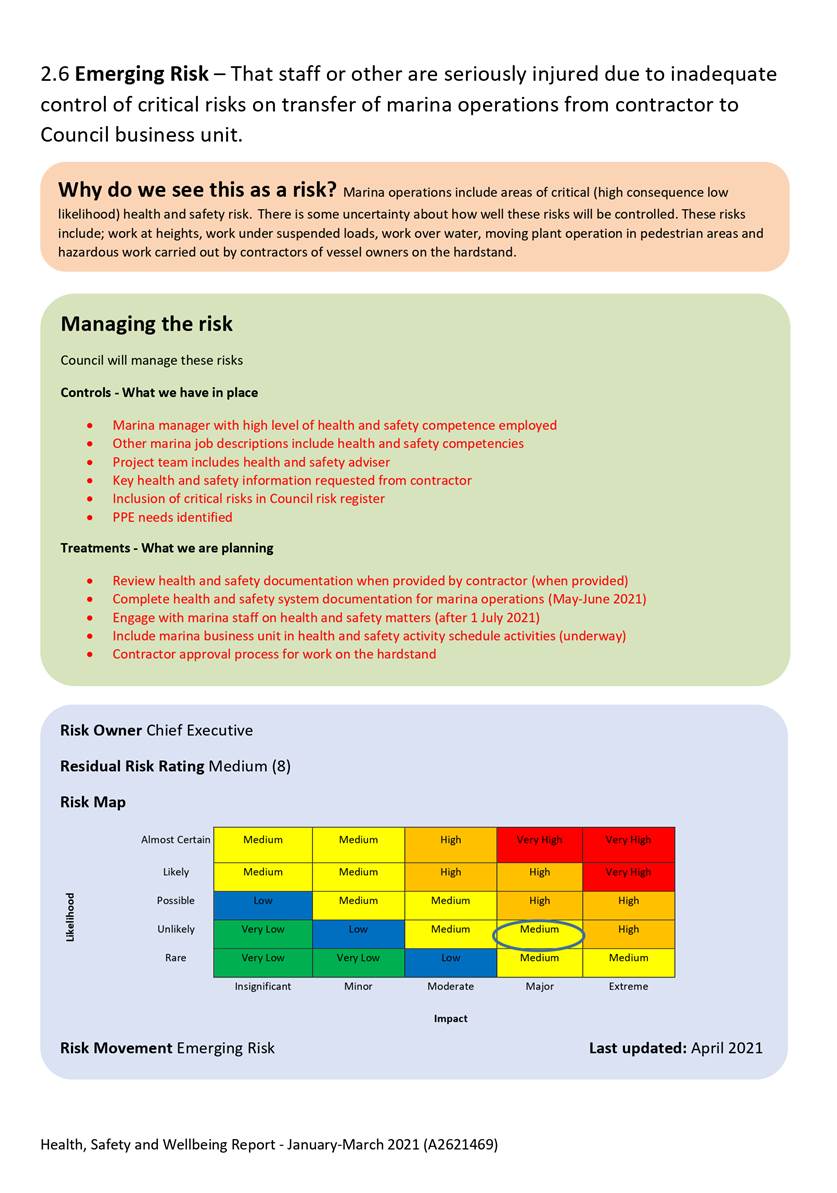

6. Key

Health and Safety Risk Update

6.1 All

of Council’s key health and safety risks previously reported are assessed

to remain as medium risks.

6.2 A

new emerging key risk area has been outlined in regard to the transition of

Marina operations from a contractor to Council staff. This has been assessed as

a medium health and safety risk.

6.3 With

the upcoming transfer of Marina operations the critical risks associated with

this work such as falls from height, work under suspended loads and vehicle

versus pedestrians will no longer be captured in key risk reporting as

‘insufficient oversight of Contractors’.

6.4 An

overview of controls and planned treatments are identified in the attachment.

There is some uncertainty regarding the ability to implement all required

treatments prior to the transition.

6.5 It

is anticipated that inclusion of this risk in reporting to the subcommittee as

a separate item relating to the marina is a temporary measure. As these are new

risk areas for Council staff operations inclusion in ongoing organisational

reporting will require a review of the key risk categories.

6.6 Where

new treatments have been planned or have been implemented as controls since the

last report this is indicated by red text in the attachment.

6.7 Where

possible timeframes are indicated for treatments.

Author: Malcolm

Hughes, Health and Safety Adviser

Attachments

Attachment 1: A2621469 ⇩ Health, Safety and Wellbeing Report,

January - March 2021

Item 8: Health Safety and Wellbeing Report, January - March 2021:

Attachment 1

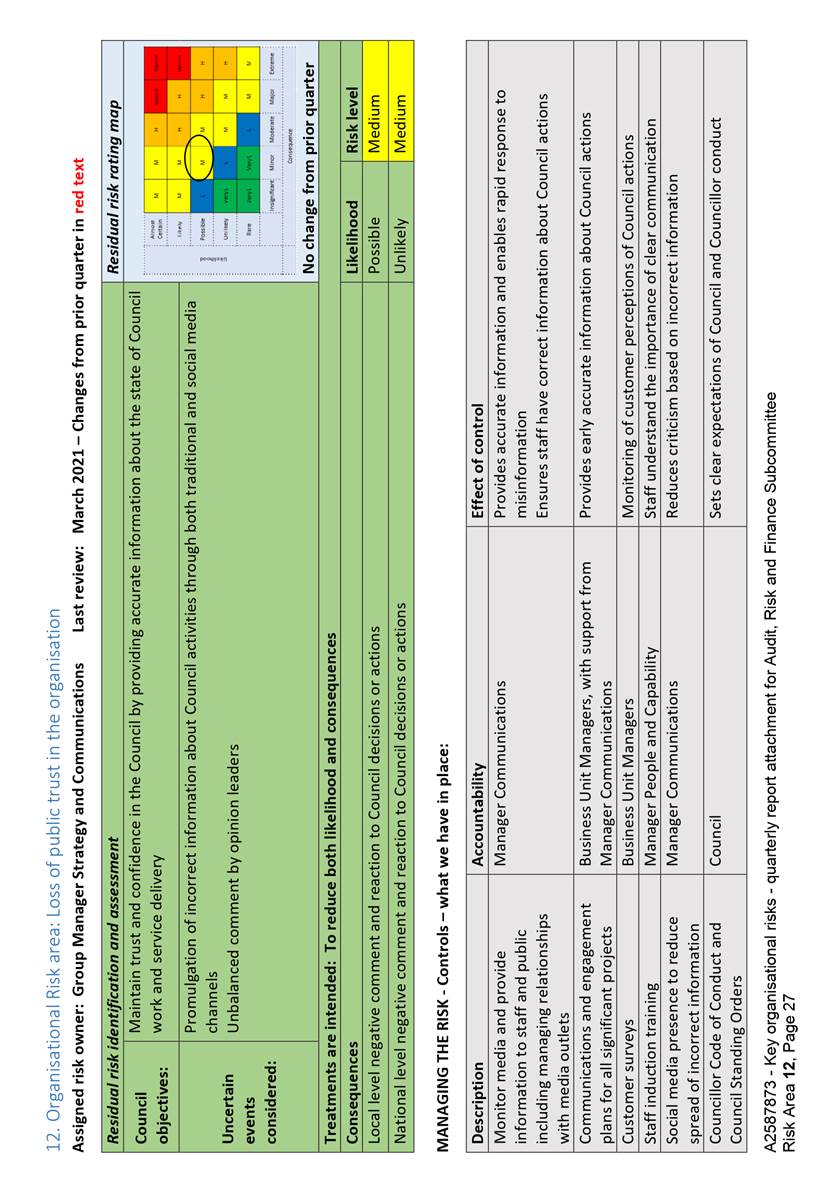

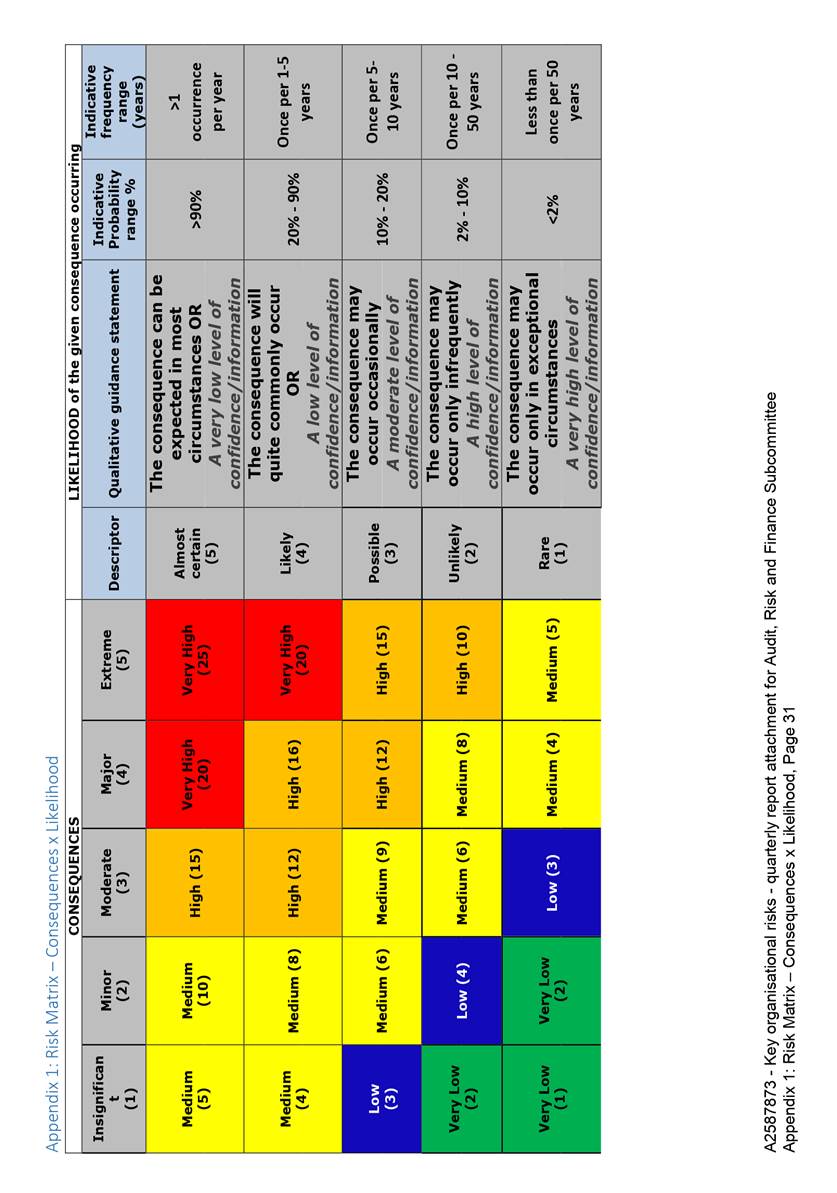

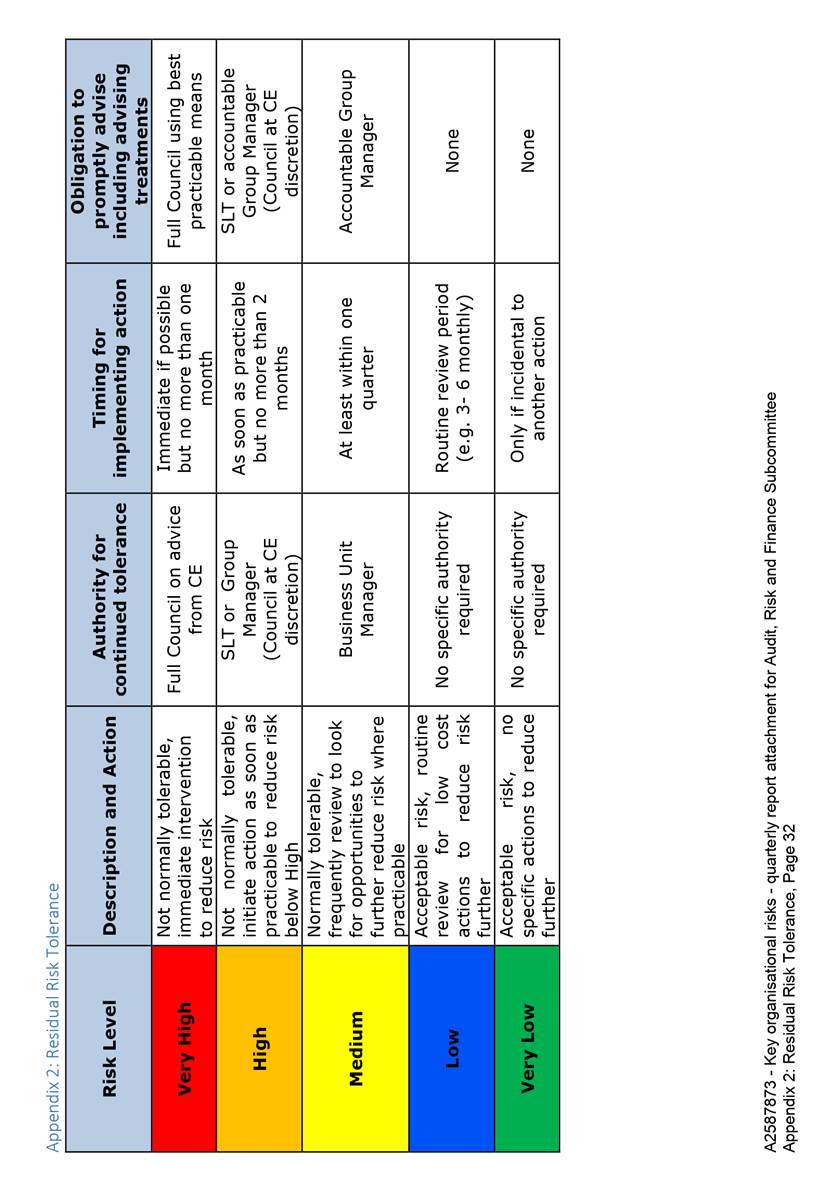

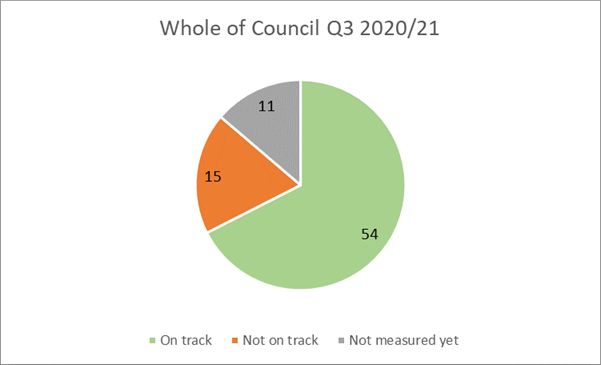

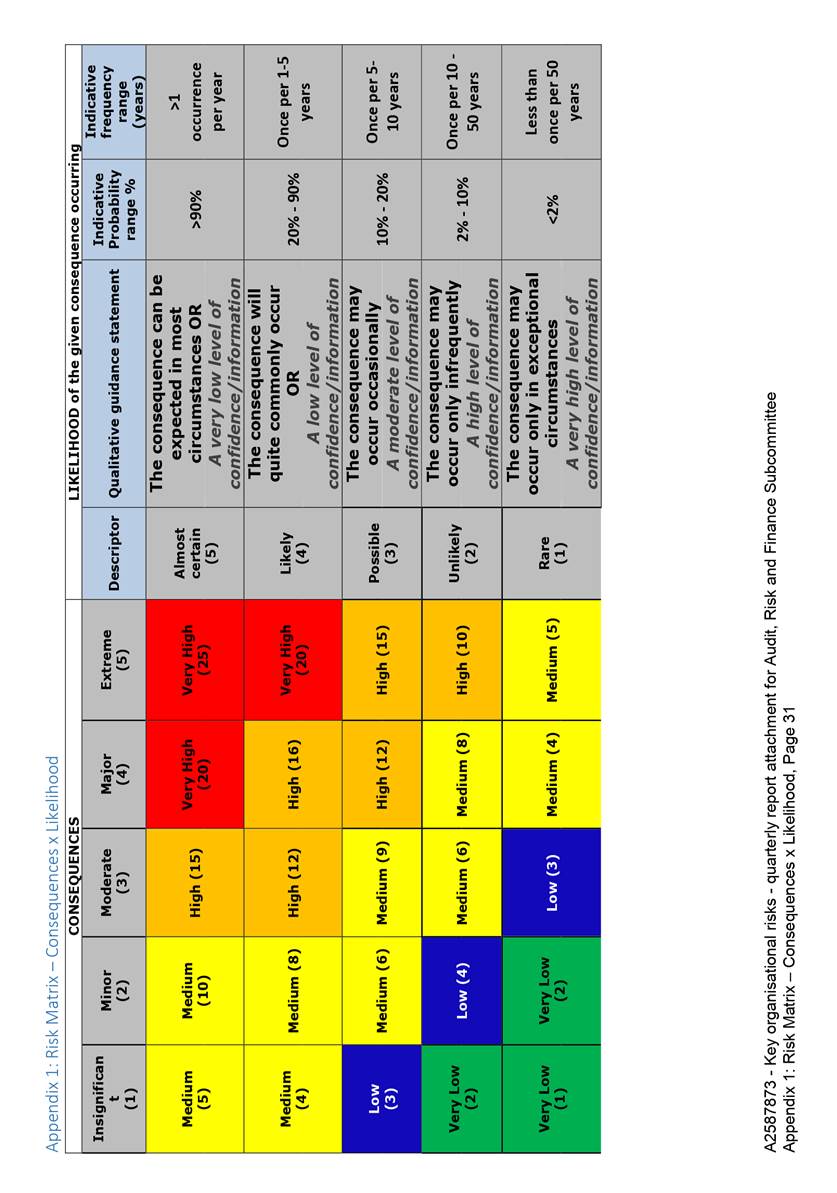

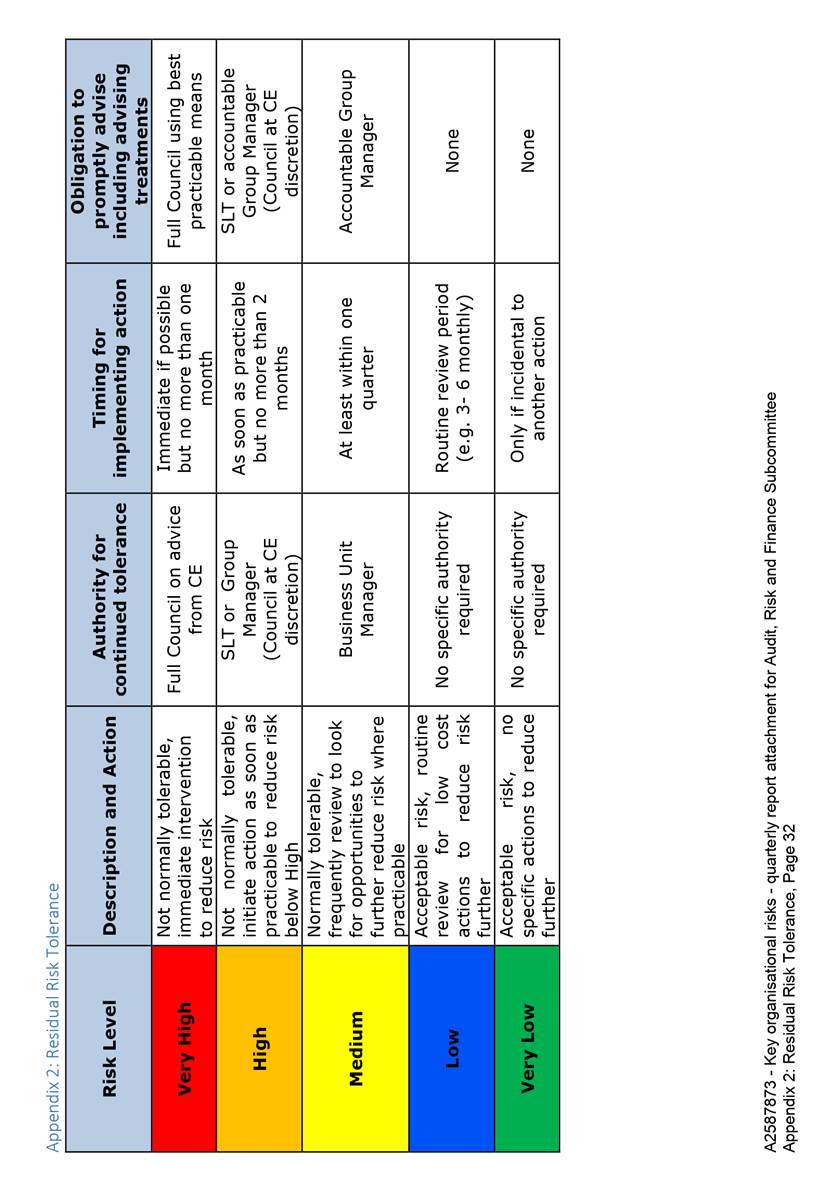

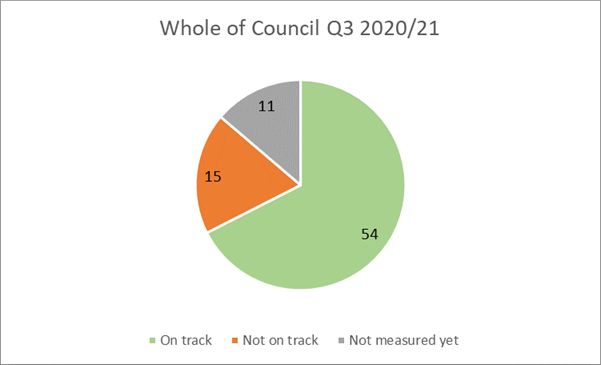

Item 9: Key

Organisational Risks Report - 1 January 2021 to 31 March 2021

|

|

Audit, Risk and Finance Subcommittee

25 May 2021

|

REPORT R23745

Key Organisational Risks Report - 1 January 2021 to 31

March 2021

1. Purpose

of Report

1.1 To provide information to

the Audit, Risk and Finance Subcommittee on the key organisational risks

through to end of quarter three 2020-21.

2. Recommendation

|

That the Audit, Risk and Finance Subcommittee

1. Receives the report Key Organisational Risks

Report - 1 January 2021 to 31 March 2021 (R23745) and its attachment

(A2587873).

|

3. Background

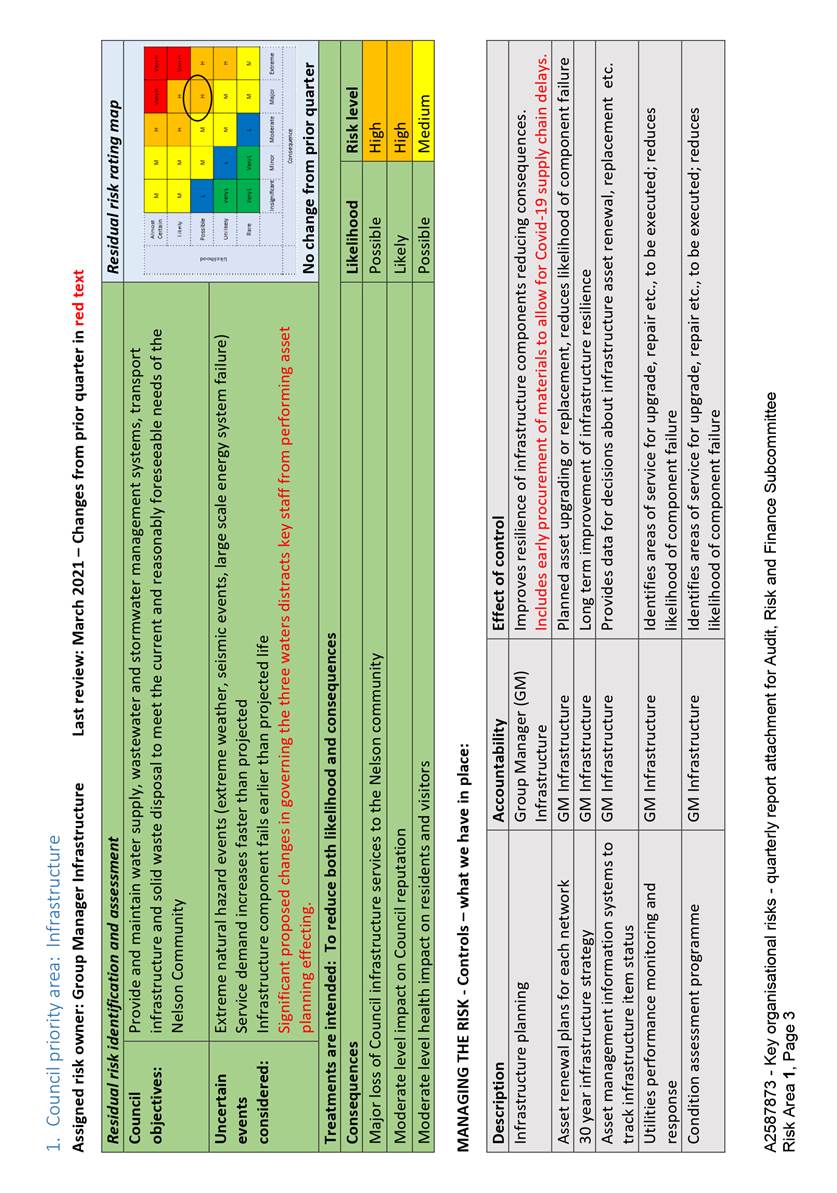

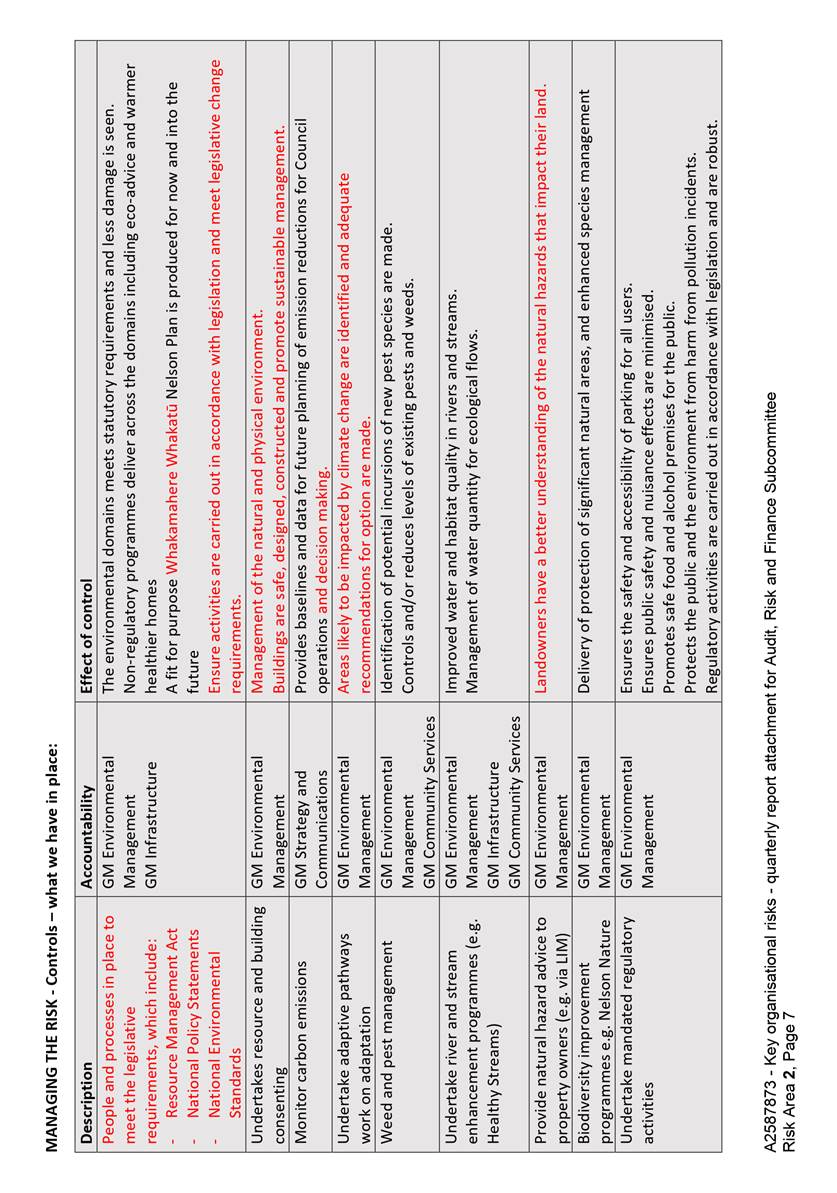

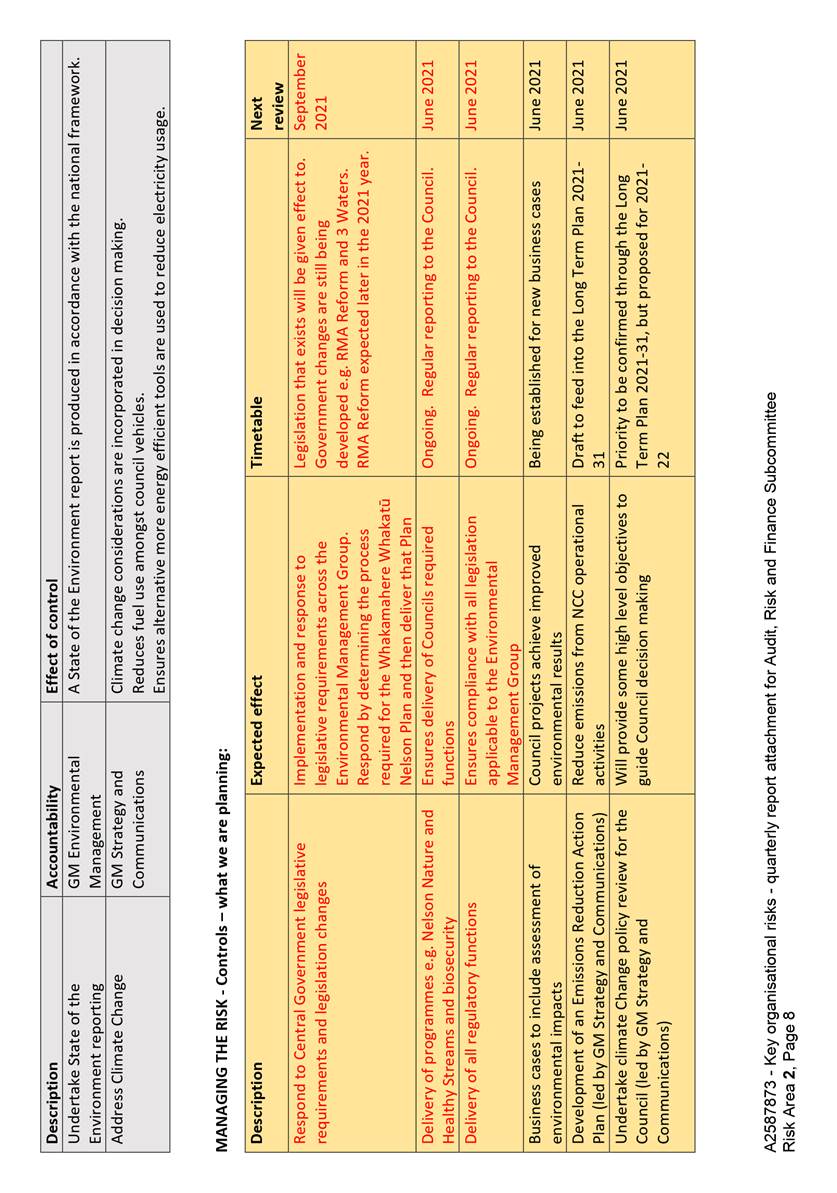

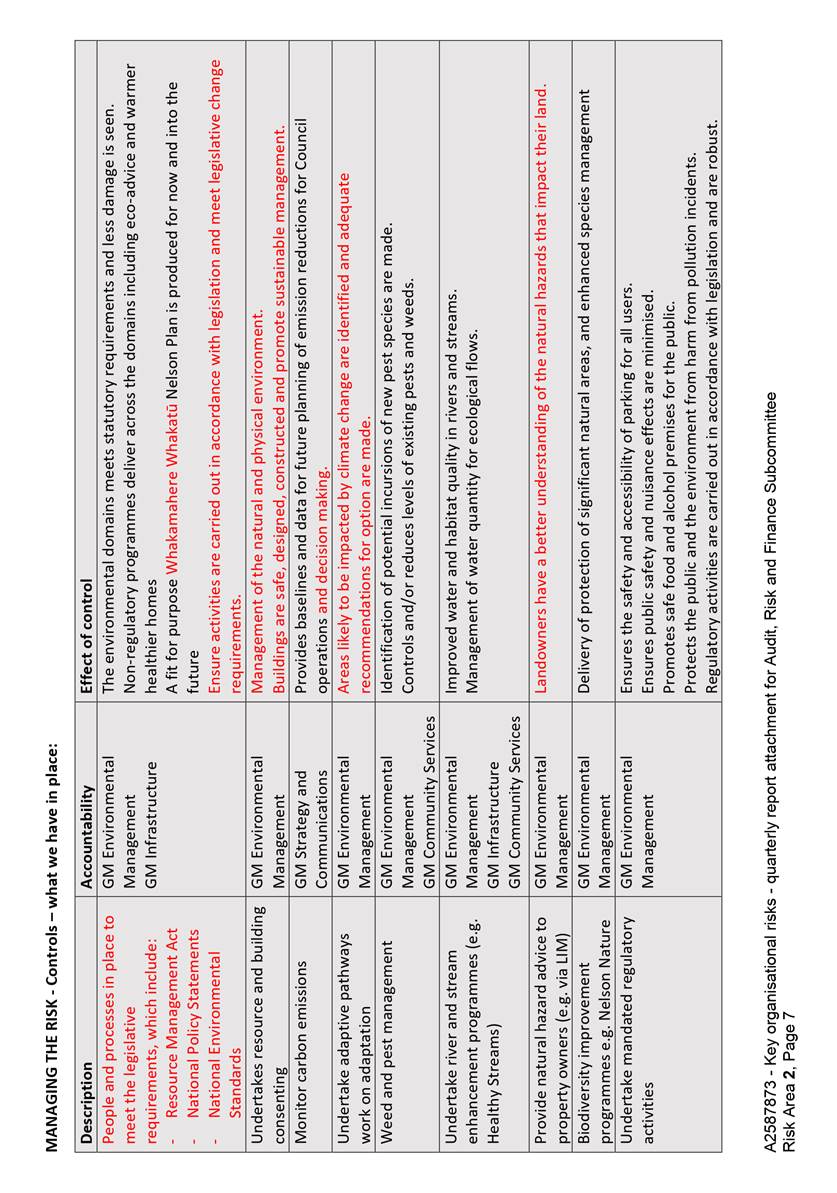

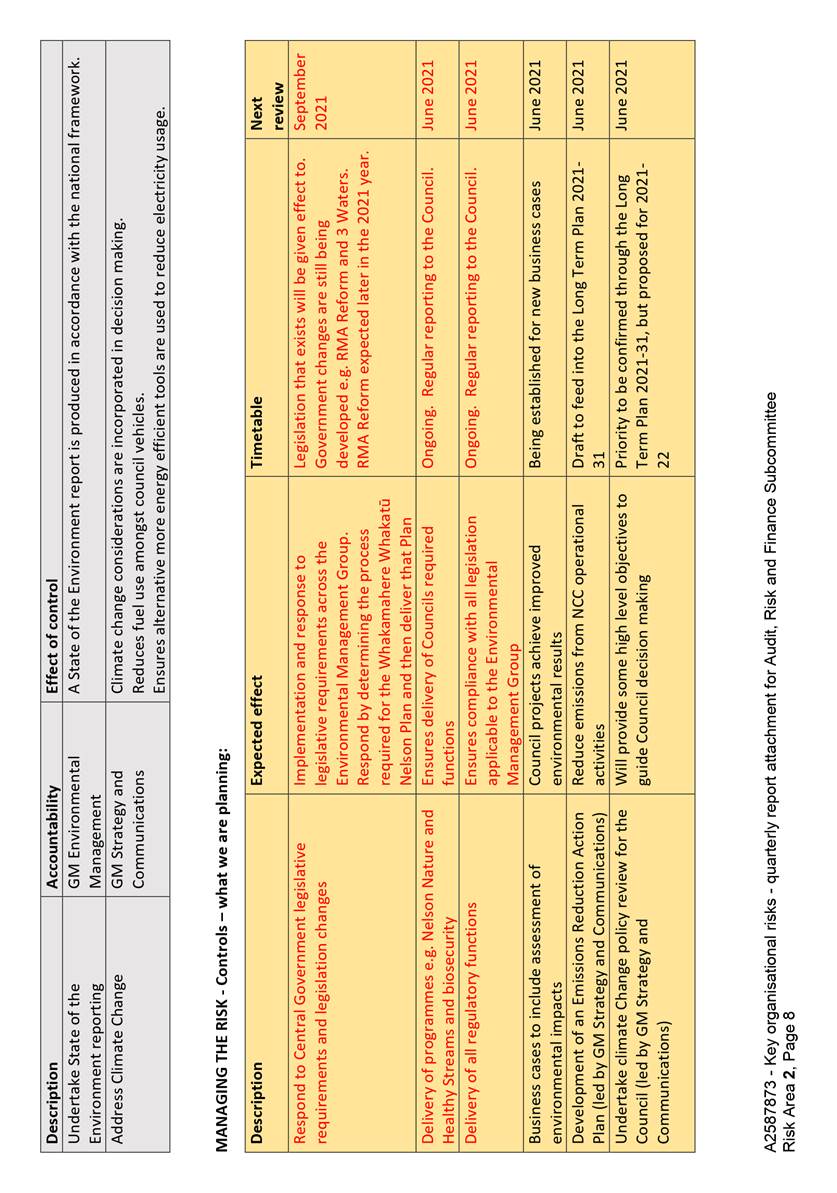

3.1 This report includes

information on risks to achieving Council’s priorities for the Long Term

Plan 2018-28 (section 5), and the key organisational risks that could impact

Council’s wider ability to deliver core functions and services (section

6). Risks related to specific assets, activities, or projects, are

reported on a quarterly basis to the relevant committee, and any significant

items are summarised at section 7 of this report. In addition, section 7

provides a brief summary from each Group Manager on emerging

risks for their areas of responsibility.

3.2 The thirteen risk areas are

unchanged from last quarter. In the fourth quarter of 2020-21 the

categorisation and the set of organisational risks is being reviewed by the

Senior Leadership Team.

3.3 The attachment to this

report describes each risk in more detail, its existing controls and planned

risk treatments. For ease of comparison to the prior quarter, new text in the

attachment has been coloured red.

4. Risk

Management Practice

4.1 Implementation

of the risk management software began during quarter two 2020-21, and is on track. The planned implementation will

continue throughout quarters three and four, with the focus on transferring all

medium and low rated risks from legacy risk registers, embedding use of the

module to support risk management activity, and decommissioning the existing

set of risk registers.

4.2 In

2021-22 there are plans to develop regular risk reporting for business unit

managers to assist in further embedding use of the

module to support risk management activity.

5. Special-request reporting

5.1 On the 23rd of February, the

Audit, Risk and Finance Committee requested reporting on the progress on risk

R00322 - Port and Harbour Safety Management System is not compliant with the NZ

Port and Harbour Marine Safety Code. The residual risk for R00322 is rated Low,

so would normally not appear in this report however by exception, R00322 is

included and will also be included for fourth quarter of 2020-21 reporting.

5.2 The harbourmaster has

confirmed good progress is being made on the Risk Assessment for the harbour.

Information has been prepared and provided to the external reviewers

(representatives of Maritime New Zealand, a port and a Harbourmaster). Their

review will conclude in May 2021 with findings on the Nelson Harbour’s

consistency with the Port and Harbour Marine Safety Code due mid-year. This

will allow full appreciation of our current trajectory towards becoming Code

compliant.

6. Risks to Achieving Council Long Term Plan

Top Priorities

6.1 Updated

information to the end of quarter three is summarised below, with further

detail on the risk areas, their controls and treatments set out in attachment

one.

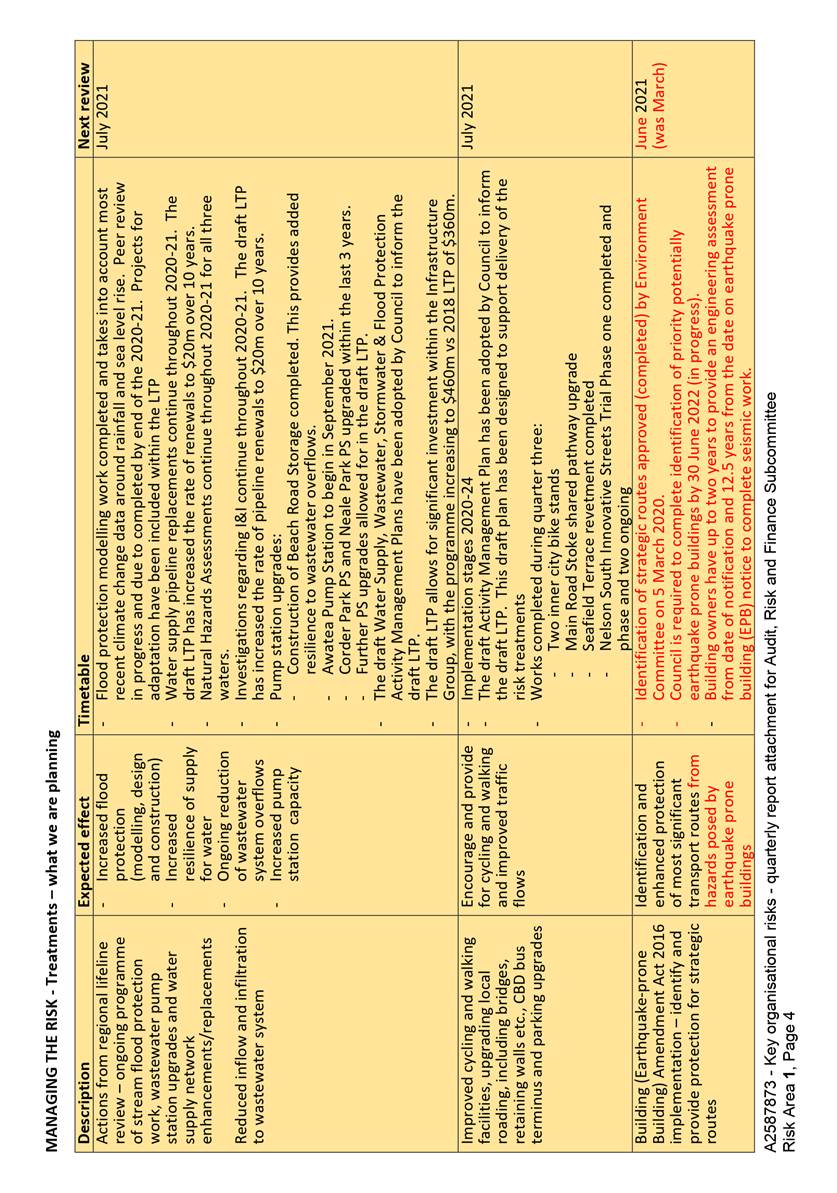

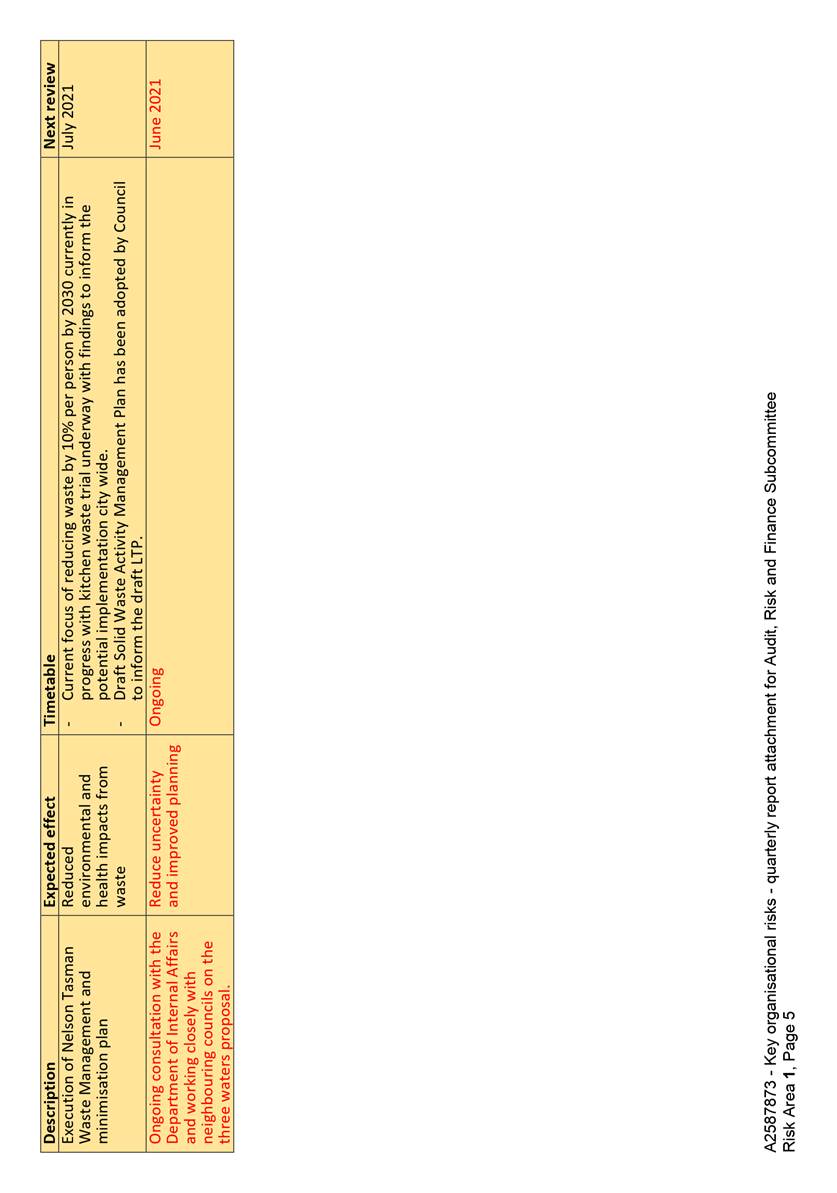

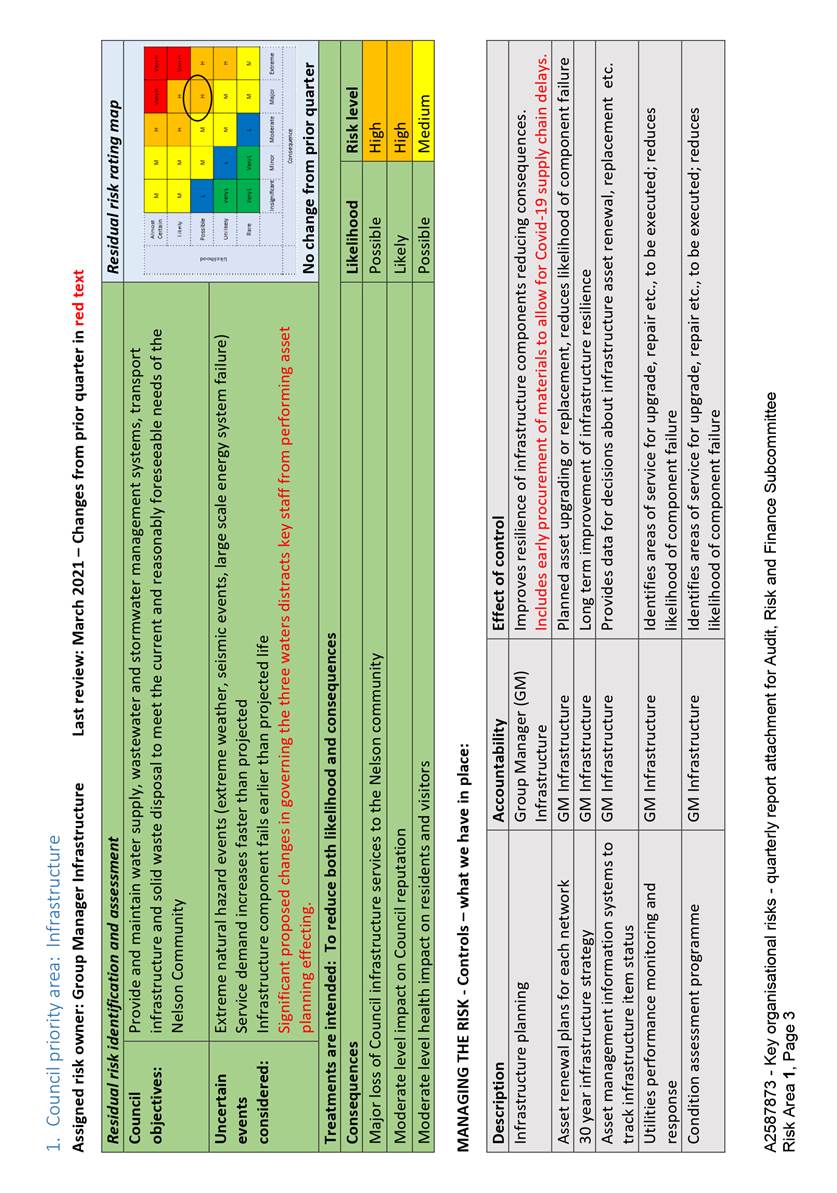

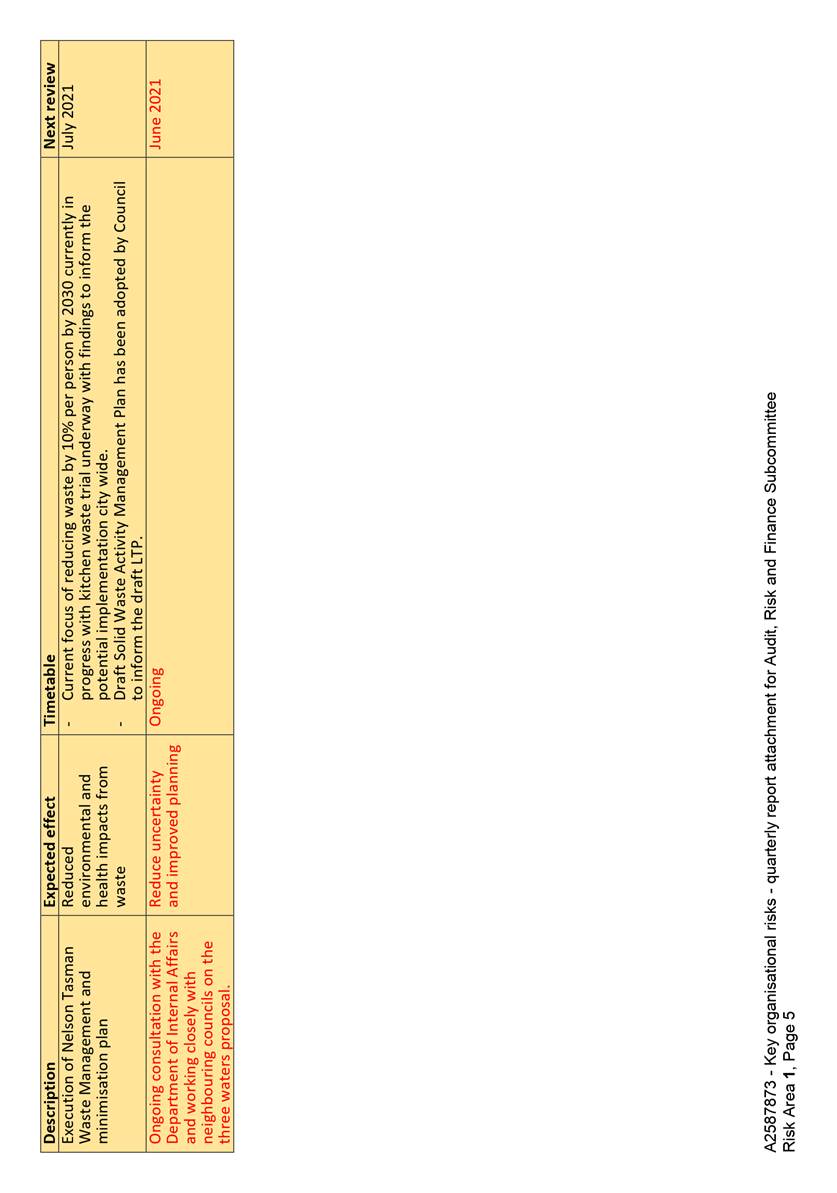

6.2 Priority area

Infrastructure (Risk 1). There have been no reported exceptions to the risk

controls. All treatments relating to increased flood protection, water

supply resilience, pump station capacity, and reduction of wastewater overflows

are progressing as planned. Planning and confirmation of the forward

works programmes for transport and solid waste is a focus for quarter

four. The risk rating remains at High, with no risk movement to report

during quarter three 2020-21.

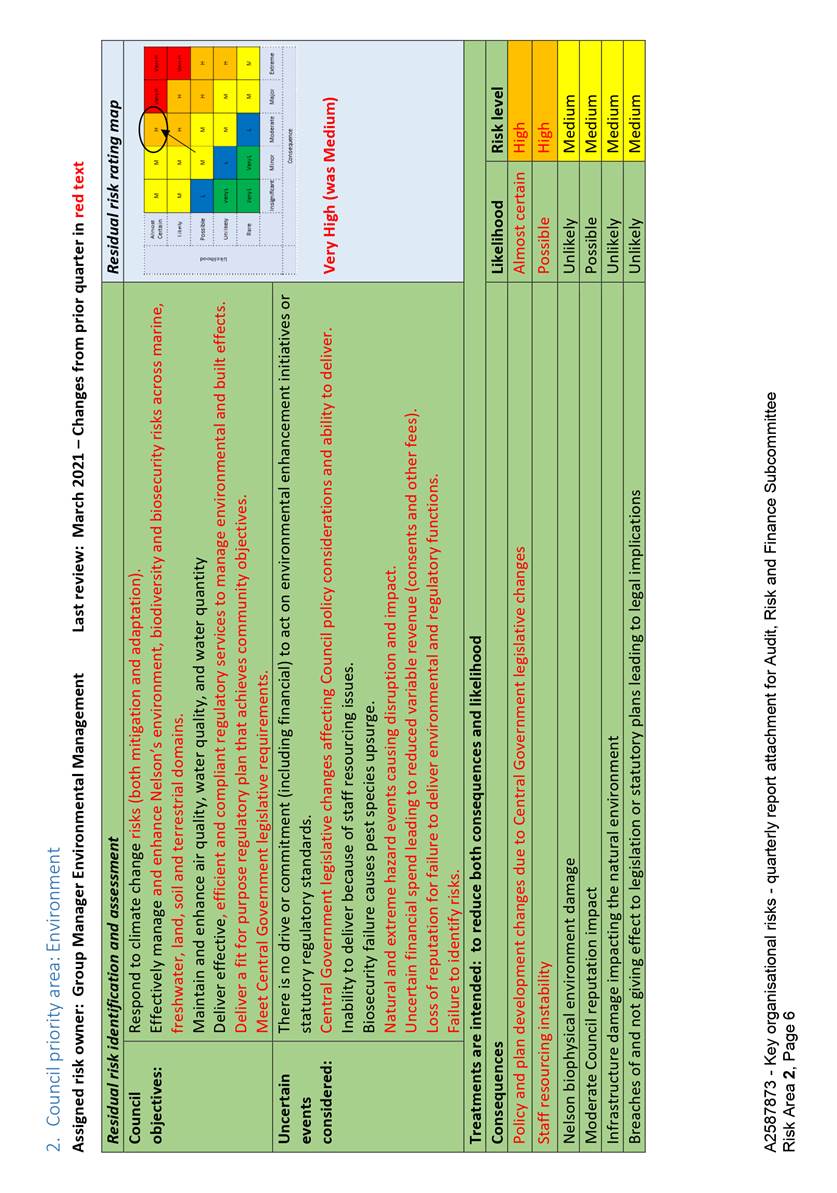

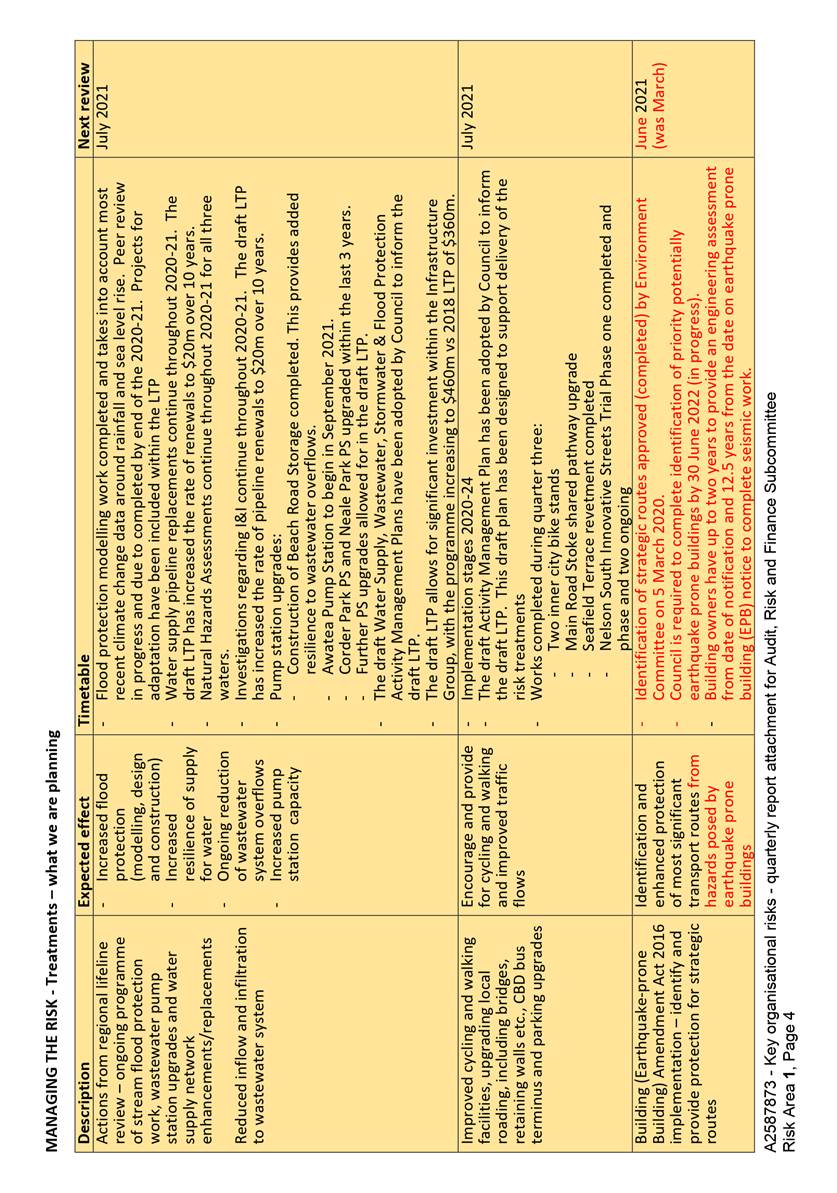

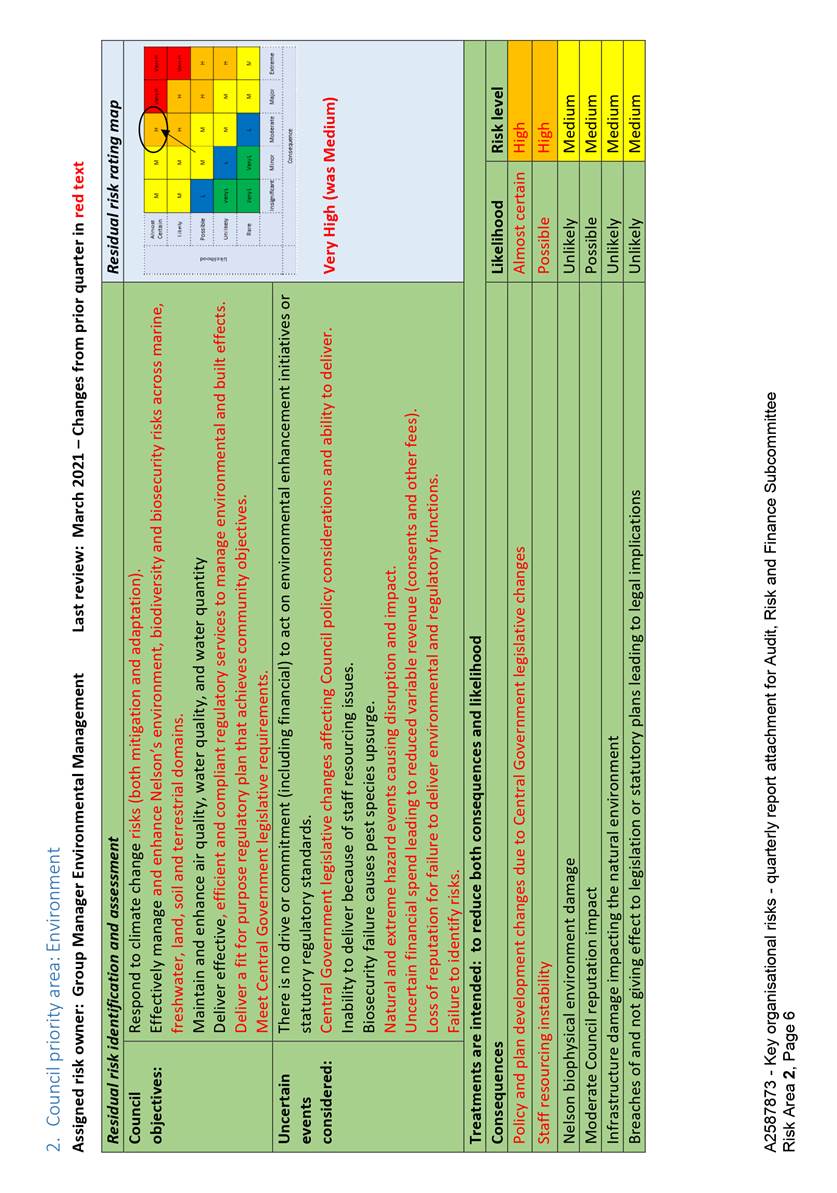

6.3 Priority

area Environment (Risk 2). Recent changes in central government’s National Policy

Statements and National Environmental Standards, combined with proposed

significant changes to legislation, including Resource Management Act reform,

has increased staff workload and is creating uncertainty in the deliverability

of this priority area particularly as it relates to the development of the

Nelson Plan. The residual risk level has been increased from Medium to High.

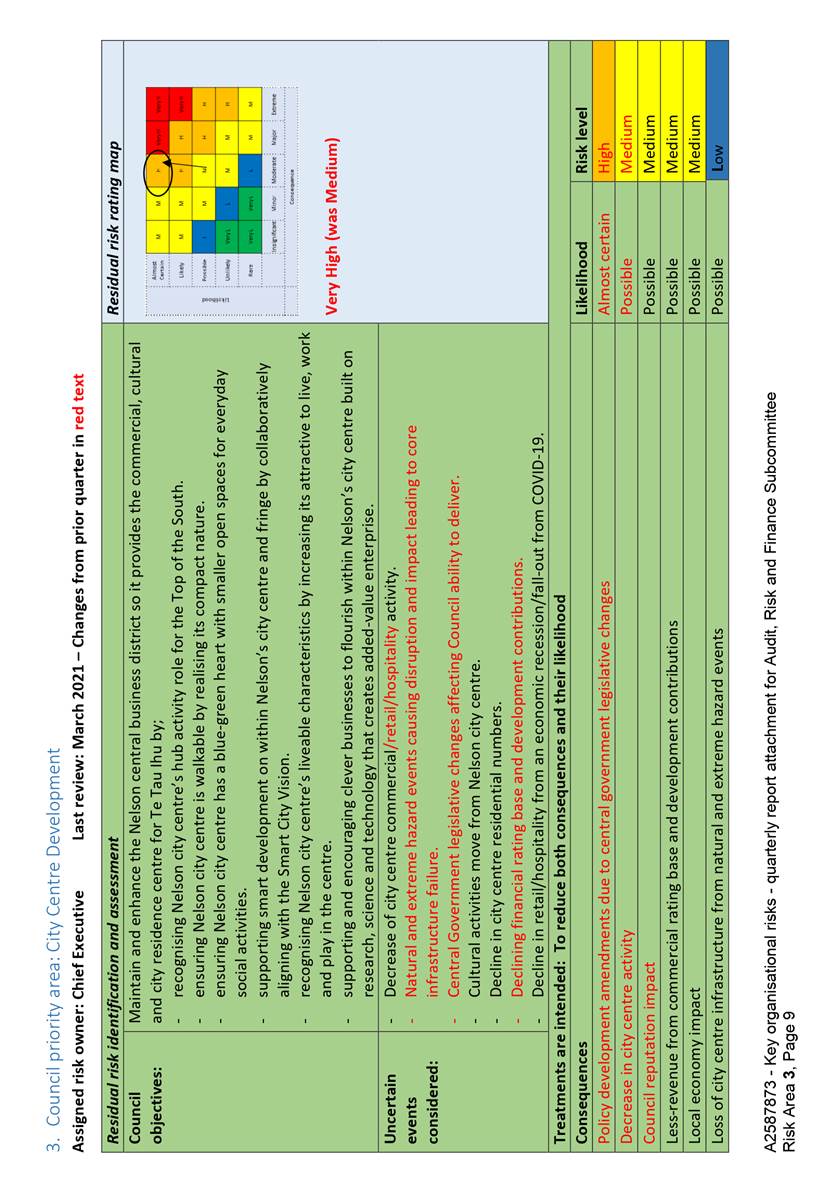

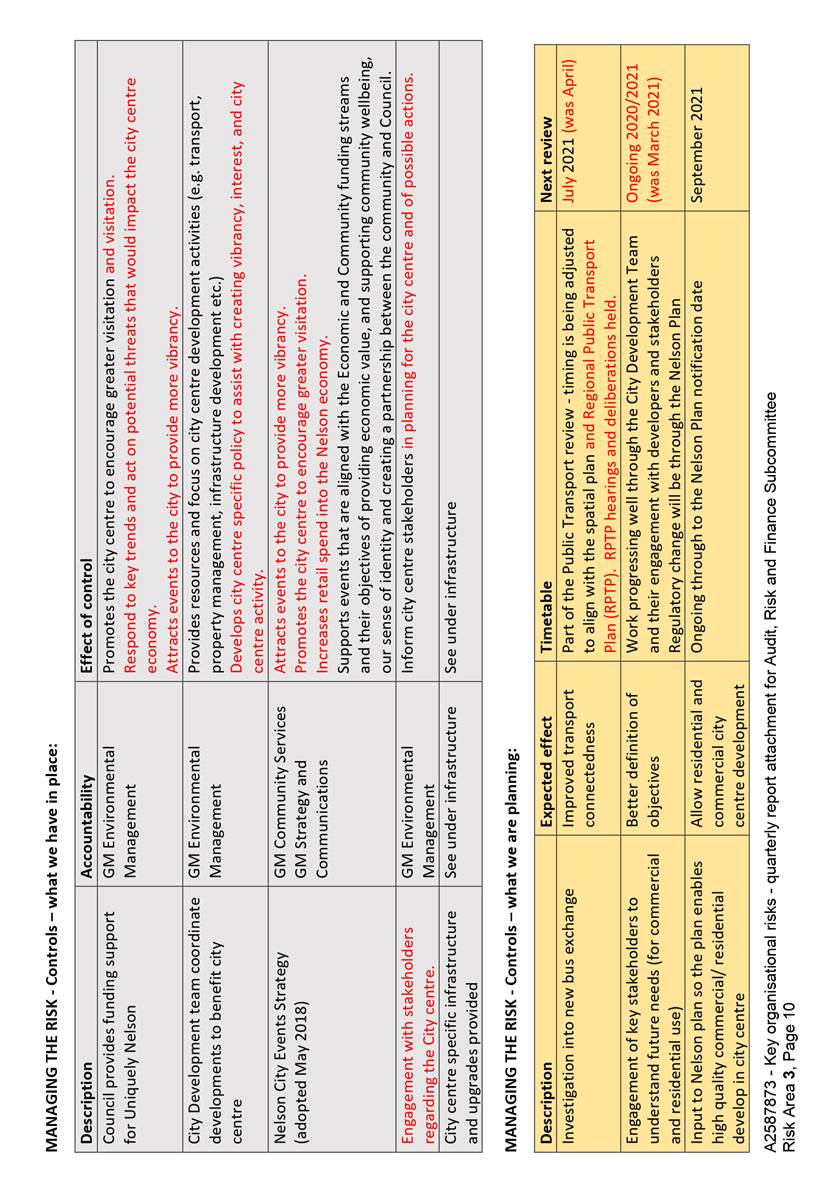

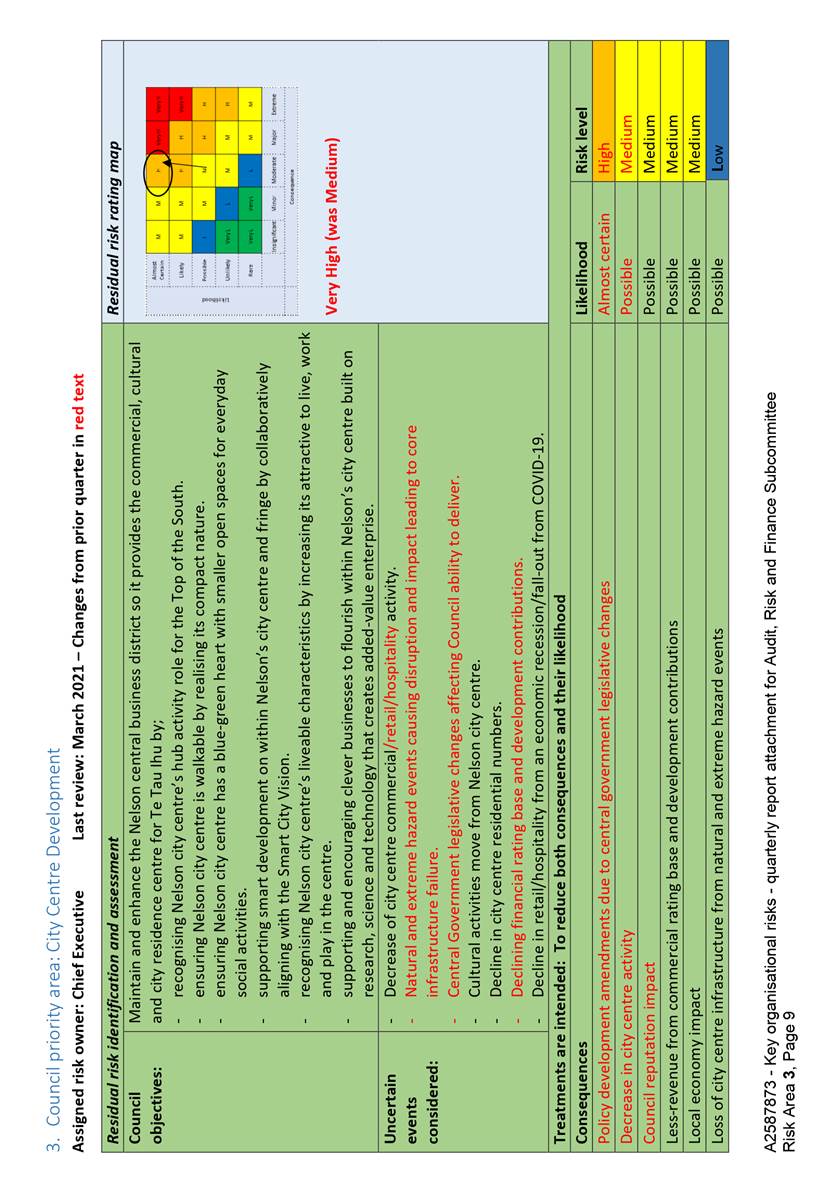

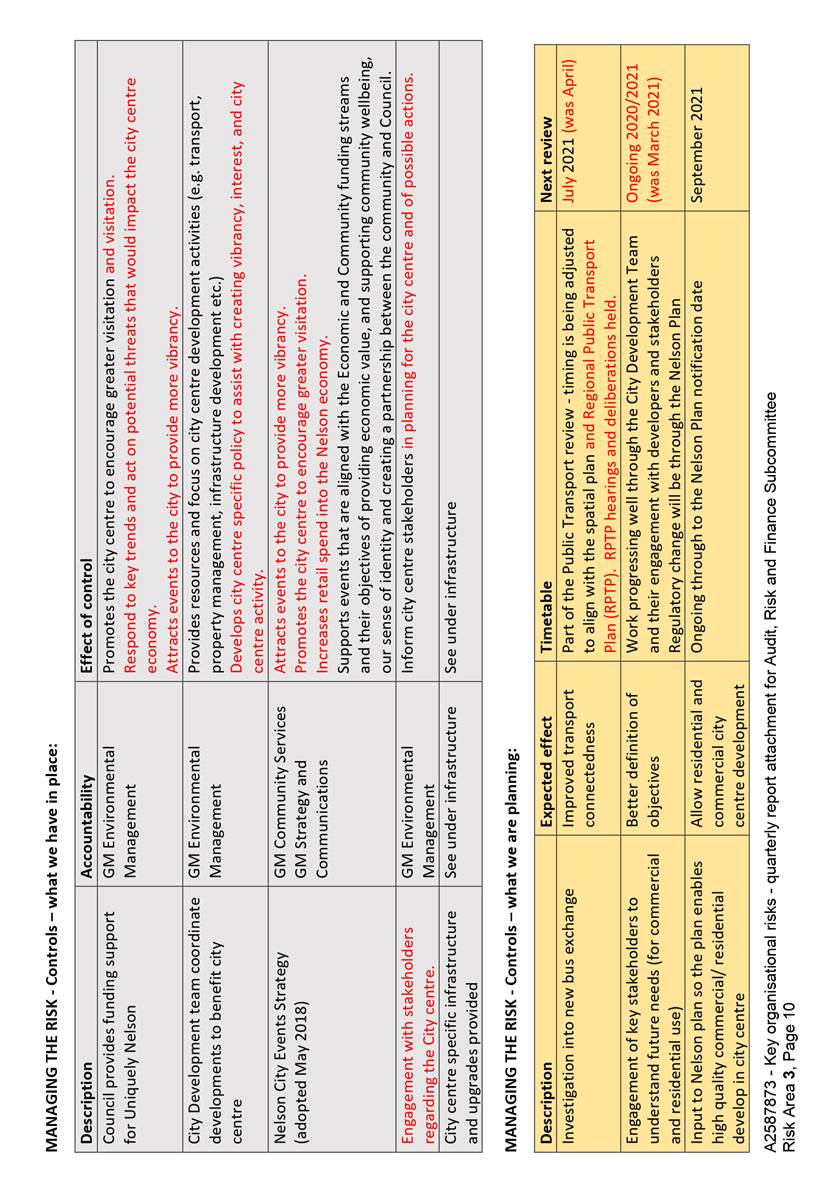

6.4 Priority area City Centre Development (Risk 3). The

priority for Council for delivering housing outcomes is now sitting with the

City Development Team. The scope of the housing work is being confirmed

and then two additional staff resources will be sought. Recruitment will

be critical for delivery so while this is outstanding the residual risk level

has been increased from Medium to High.

6.5 Priority

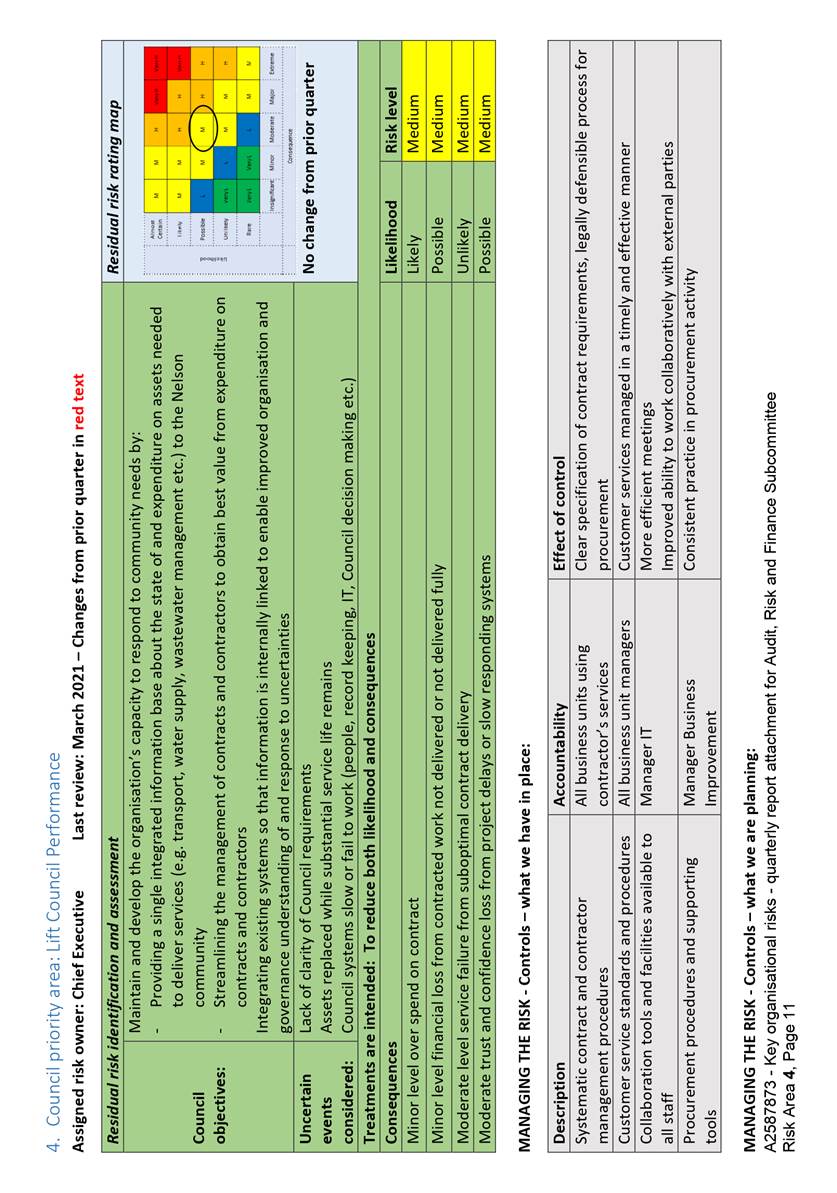

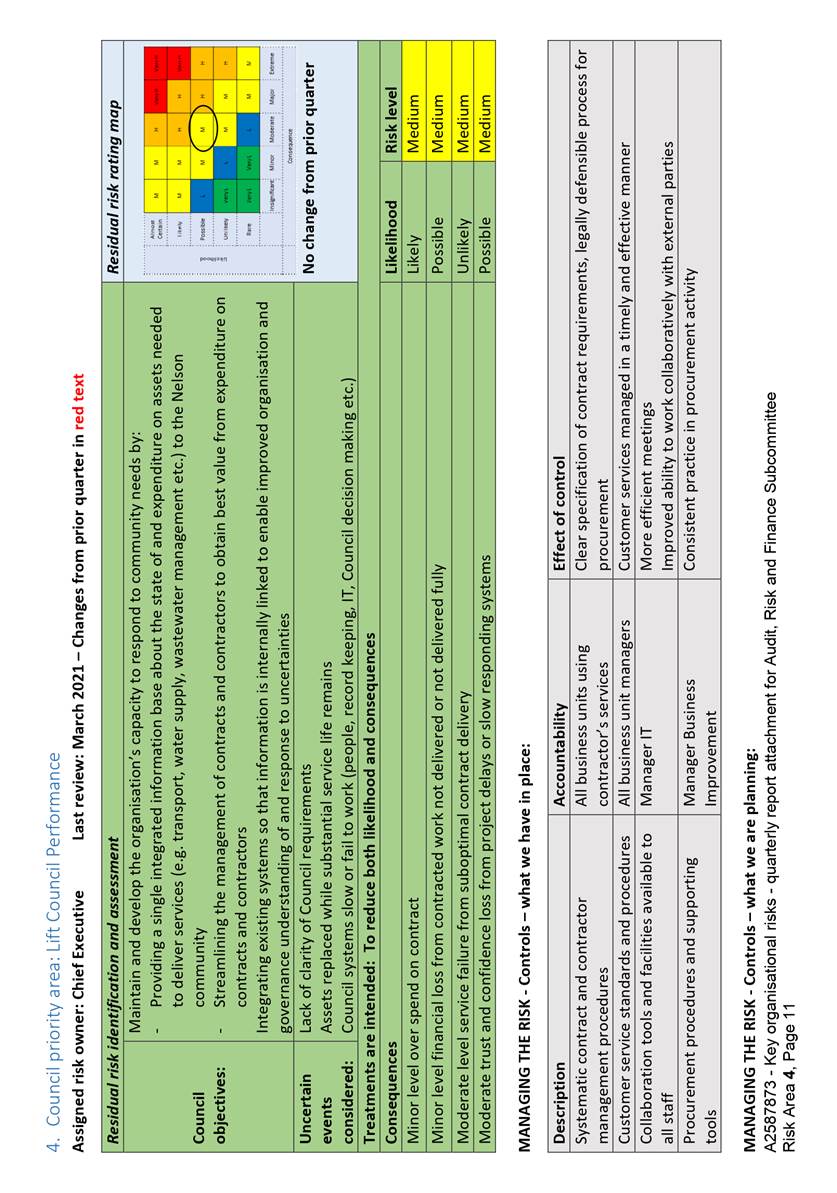

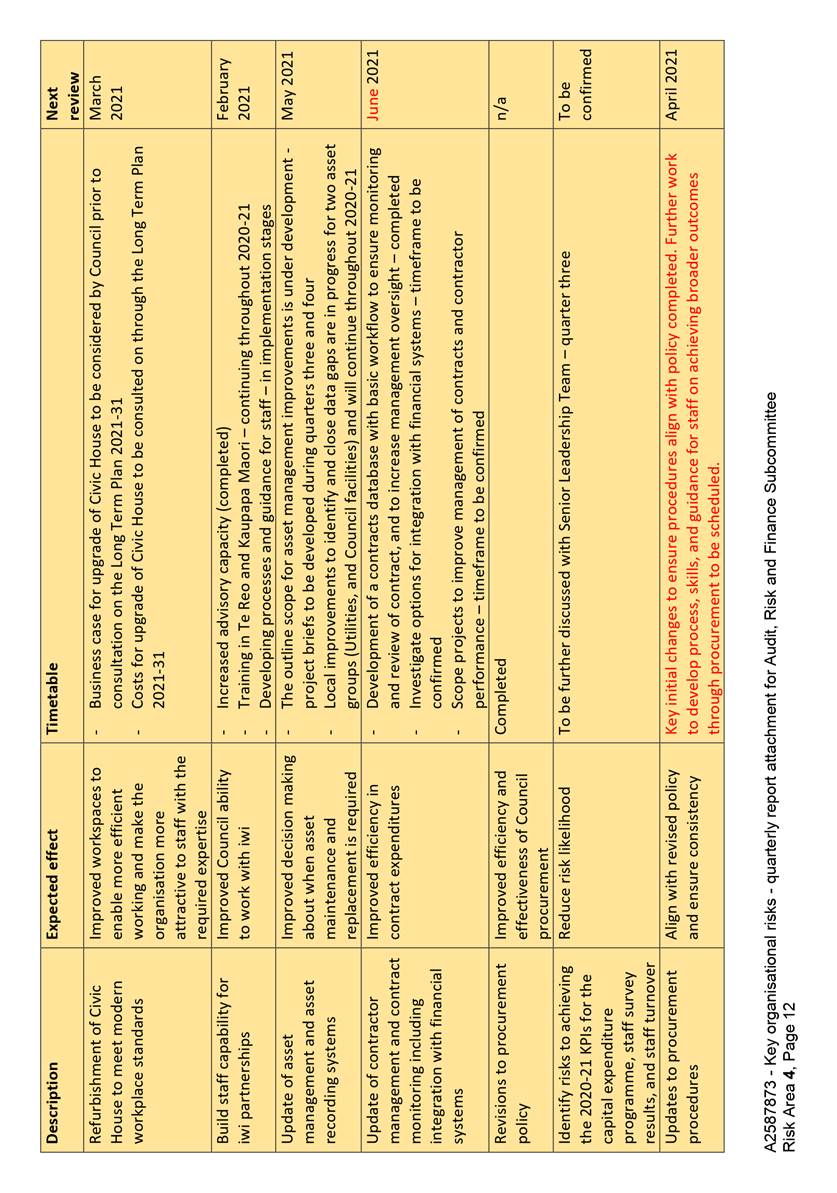

area Lifting Council Performance (Risk 4).

The risk rating remains at Medium, with no risk movement during quarter two

2020-21.

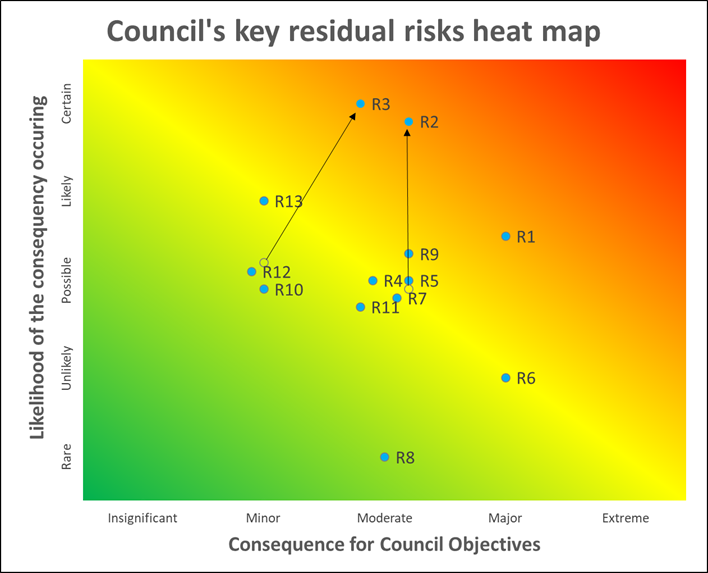

7. Key

Organisational risks

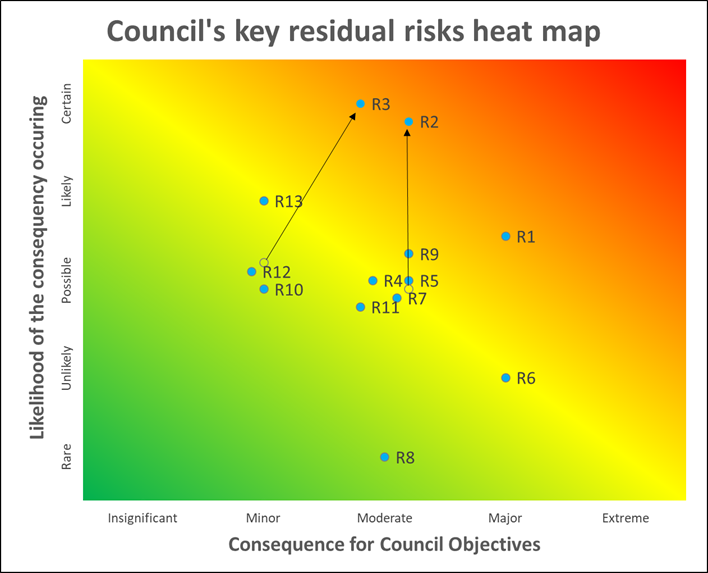

7.1 At the end of quarter three,

the known key risk areas for the four Long Term Plan top priorities, and nine

key organisational risks, are as summarised in the heat map, and table below. Updates are provided below for the nine key organisational risk

areas, with further detail in attachment one.

|

ID

|

Risk Area

|

Rating

|

Owner

|

|

1

|

Council

priority area: Infrastructure

|

High

|

Group

Manager Infrastructure

|

|

2

|

Council

priority area: Environment

|

Very

High

|

Group

Manager Environmental Management

|

|

3

|

Council

priority area: City Centre Development

|

Very

High

|

Group

Manager Environmental Management

|

|

4

|

Council

priority area: Lift Council Performance

|

Medium

|

Chief

Executive

|

|

5

|

Lifeline

service failure from natural hazards and similar events

|

Medium

|

Group

Manager Infrastructure

|

|

6

|

Illness,

injury or stress from higher hazard work situations

|

Medium

|

Group

Manager Corporate Services

|

|

7

|

Loss

of service performance from ineffective contracts and contract management

|

Medium

|

Chief

Executive

|

|

8

|

Compromise

of Council service delivery from information technology failures

|

Low

|

Group

Manager Corporate Services

|

|

9

|

Compromised

decision making and public information from incomplete and difficult to

access records

|

Medium

|

Group

Manager Strategy and Communications

|

|

10

|

Council

work compromised by loss of and difficulties in replacing skilled staff

|

Medium

|

Manager

People and Capability

|

|

11

|

Legal

liability and reputation loss from inadequate consideration of the law in

decision making

|

Medium

|

Group

Manager Strategy and Communications

|

|

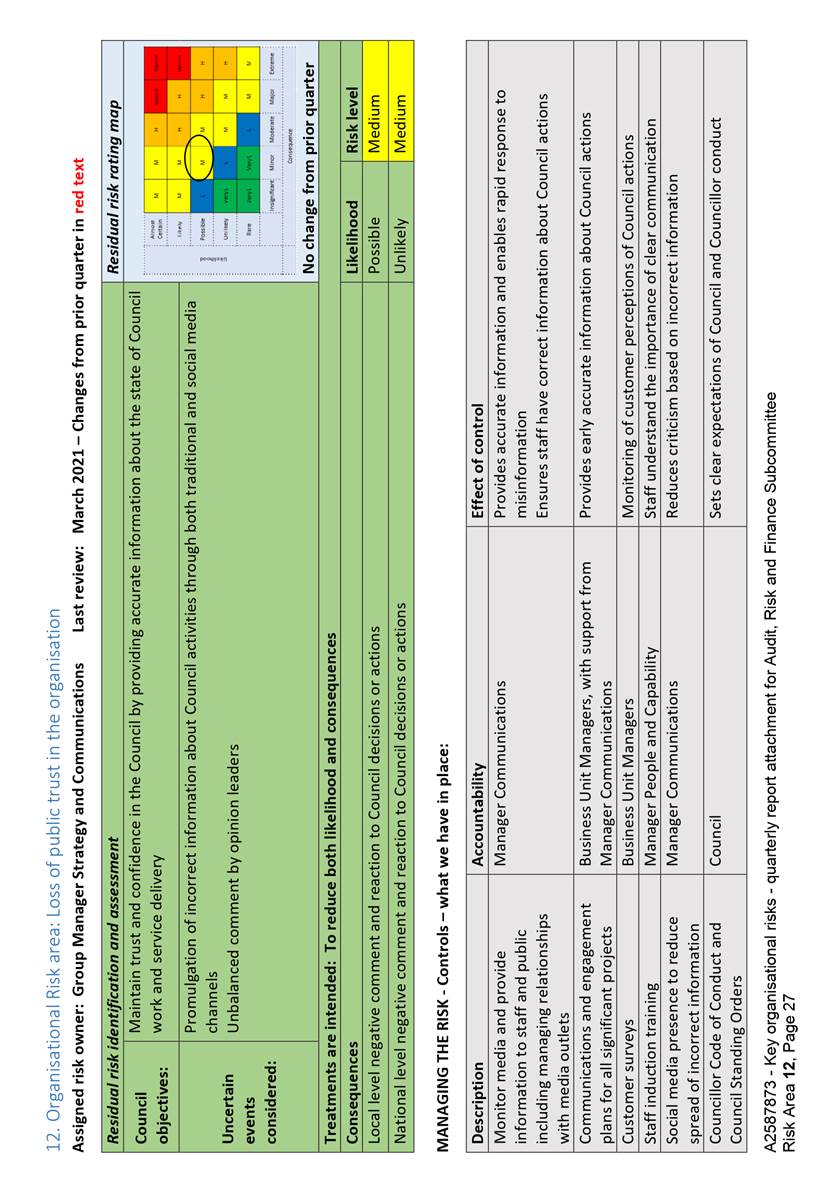

12

|

Loss

of public trust in the organisation

|

Medium

|

Group

Manager Strategy and Communications

|

|

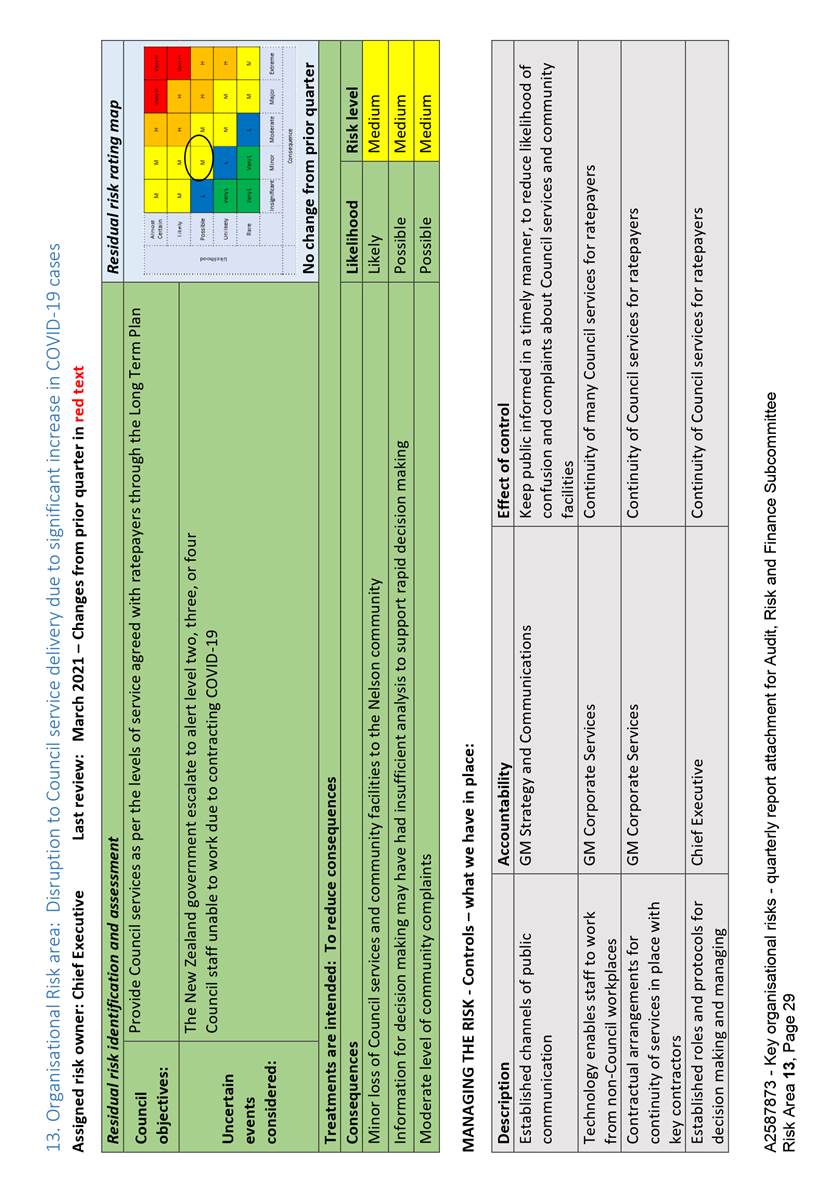

13

|

Disruption

to Council service delivery due to significant increase in COVID-19 cases

|

Medium

|

Chief

Executive

|

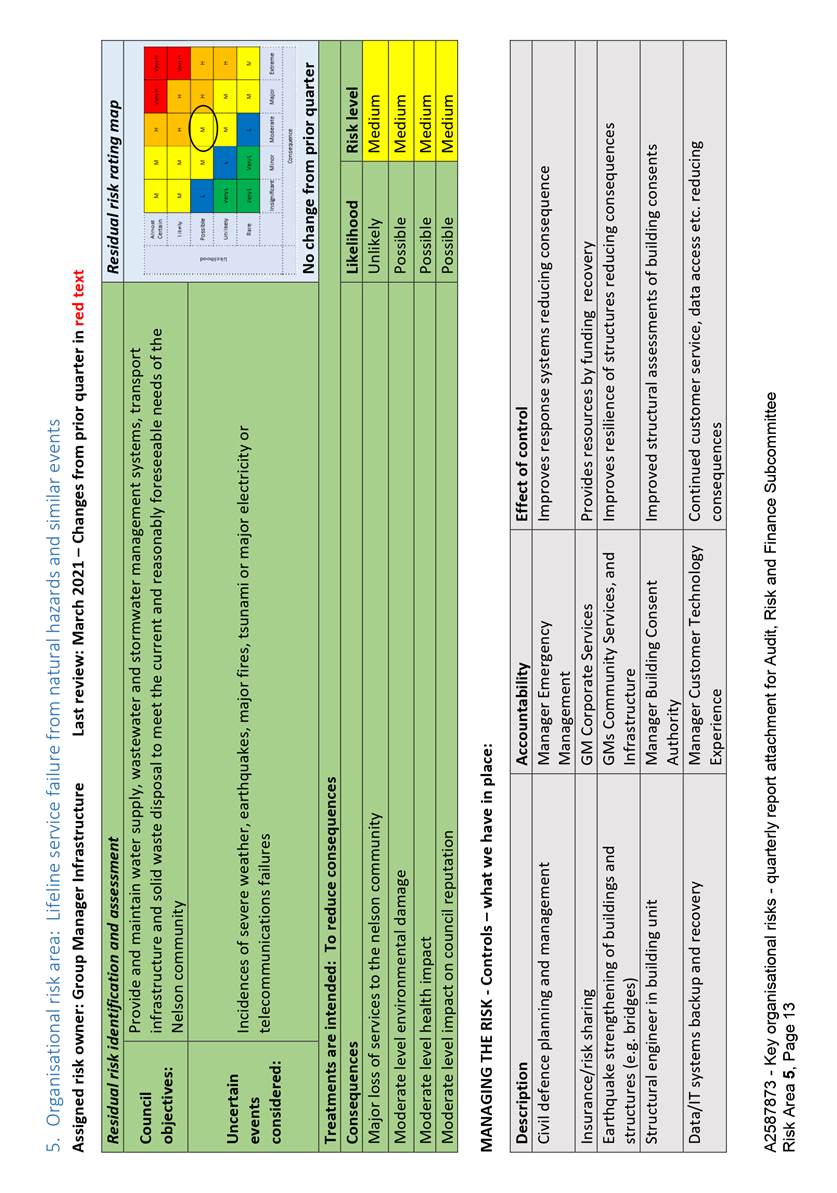

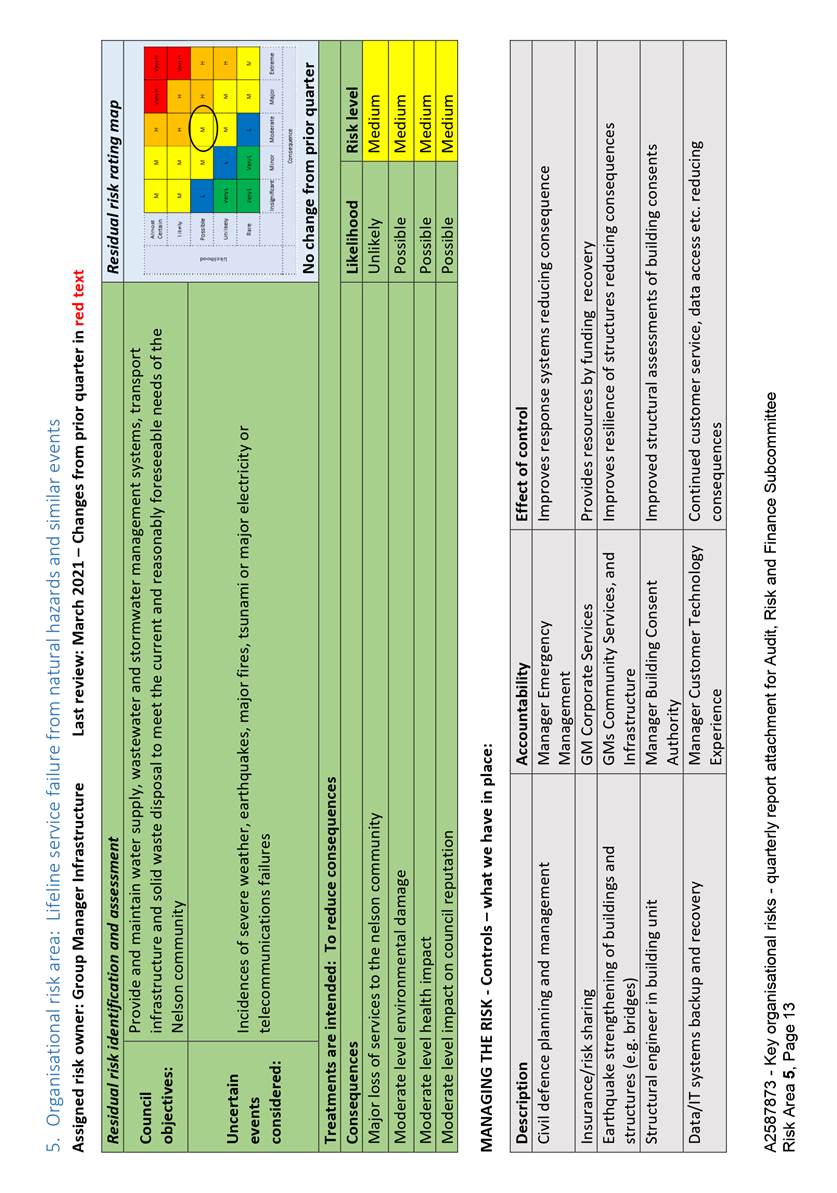

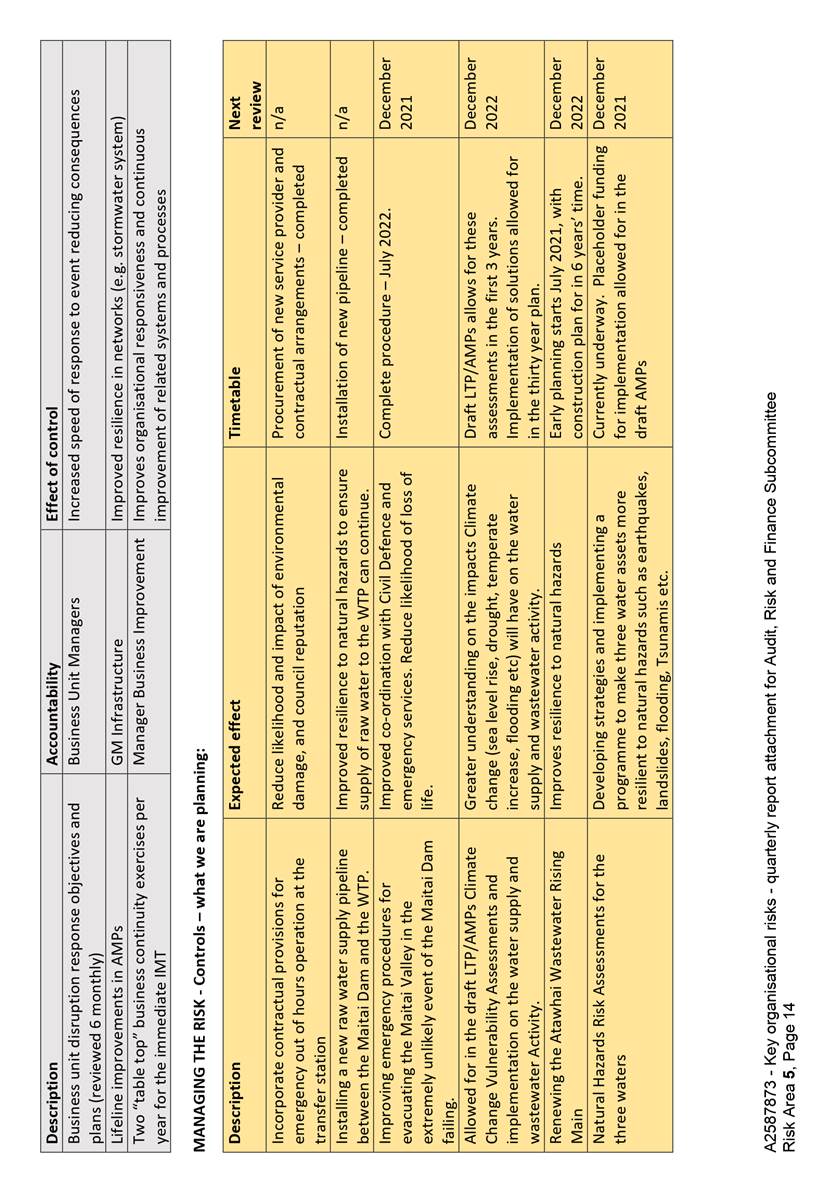

7.2 Lifeline service failure from natural hazards and similar

events (Risk 5). All planned risk treatments have been completed. The overall

residual risk rating remains at Medium.

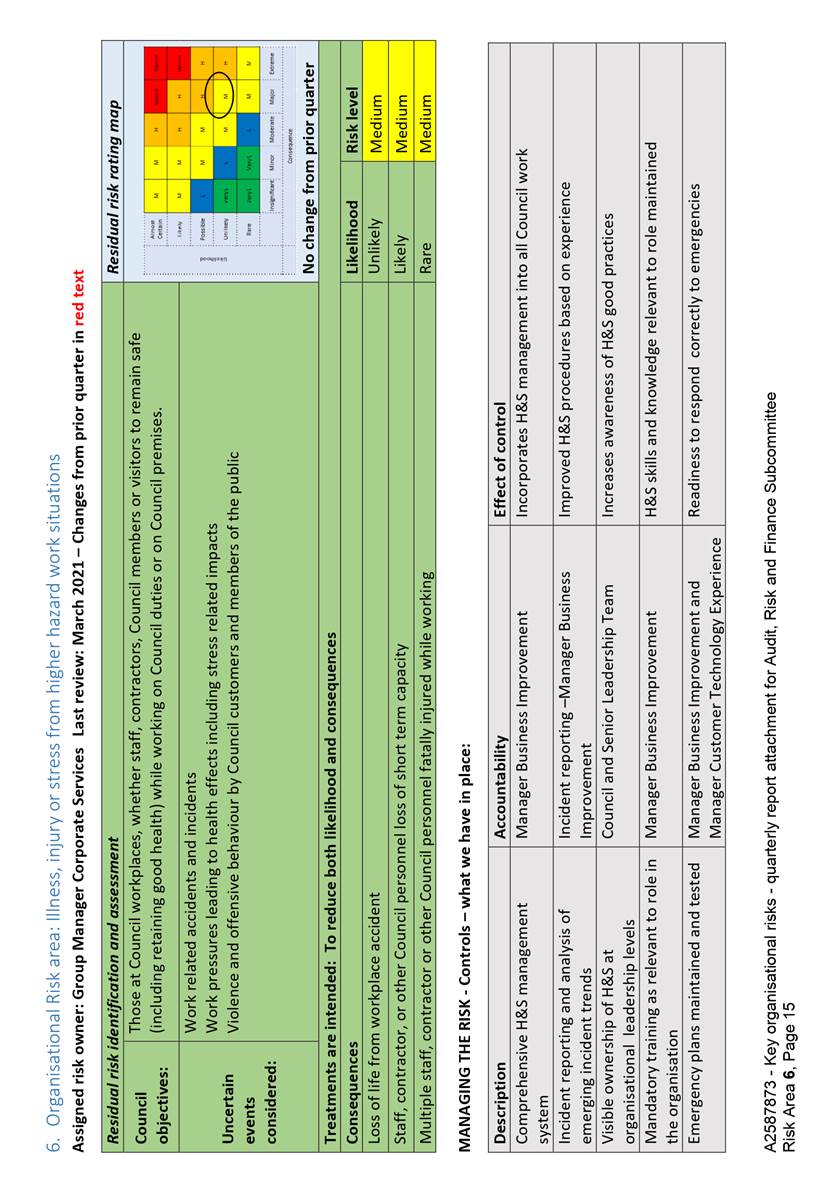

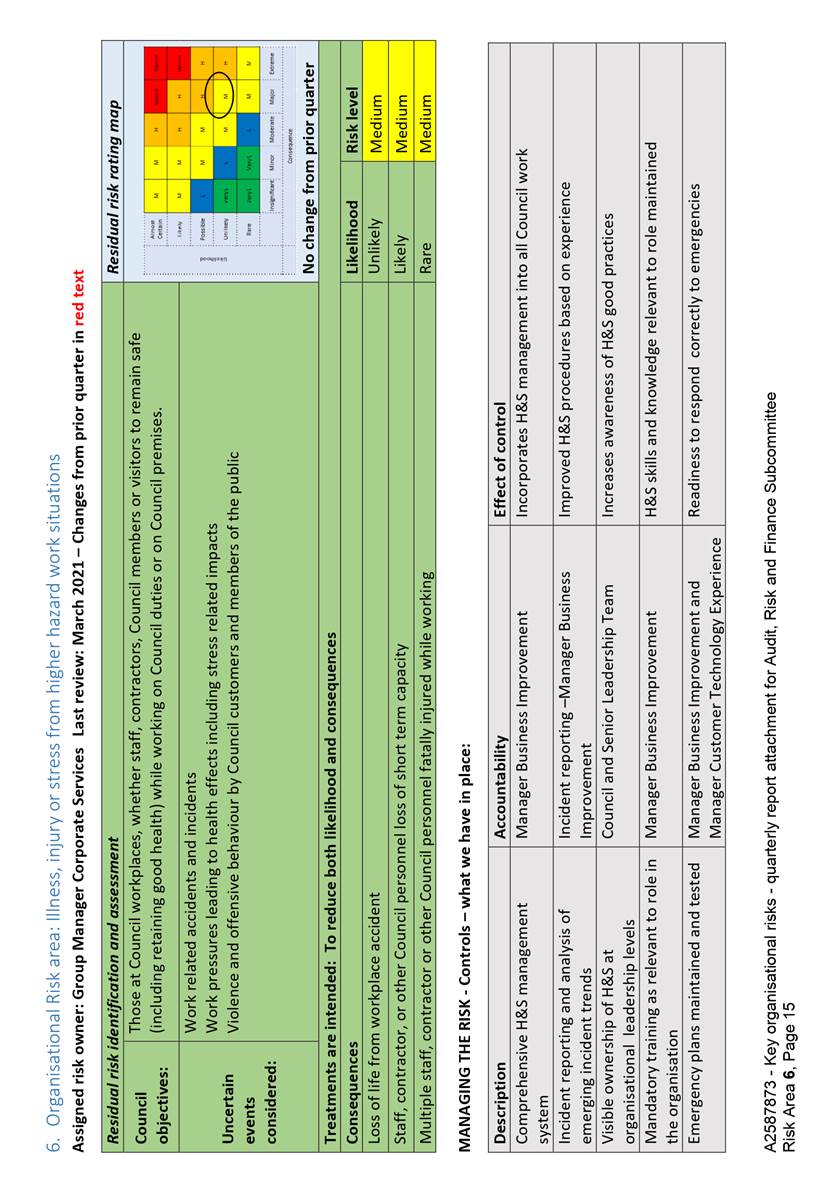

7.3 Illness, injury or stress from higher hazard work

situations (Risk 6). There was no risk

movement during quarter two 2020-21, and so the overall risk rating remains at

Medium.

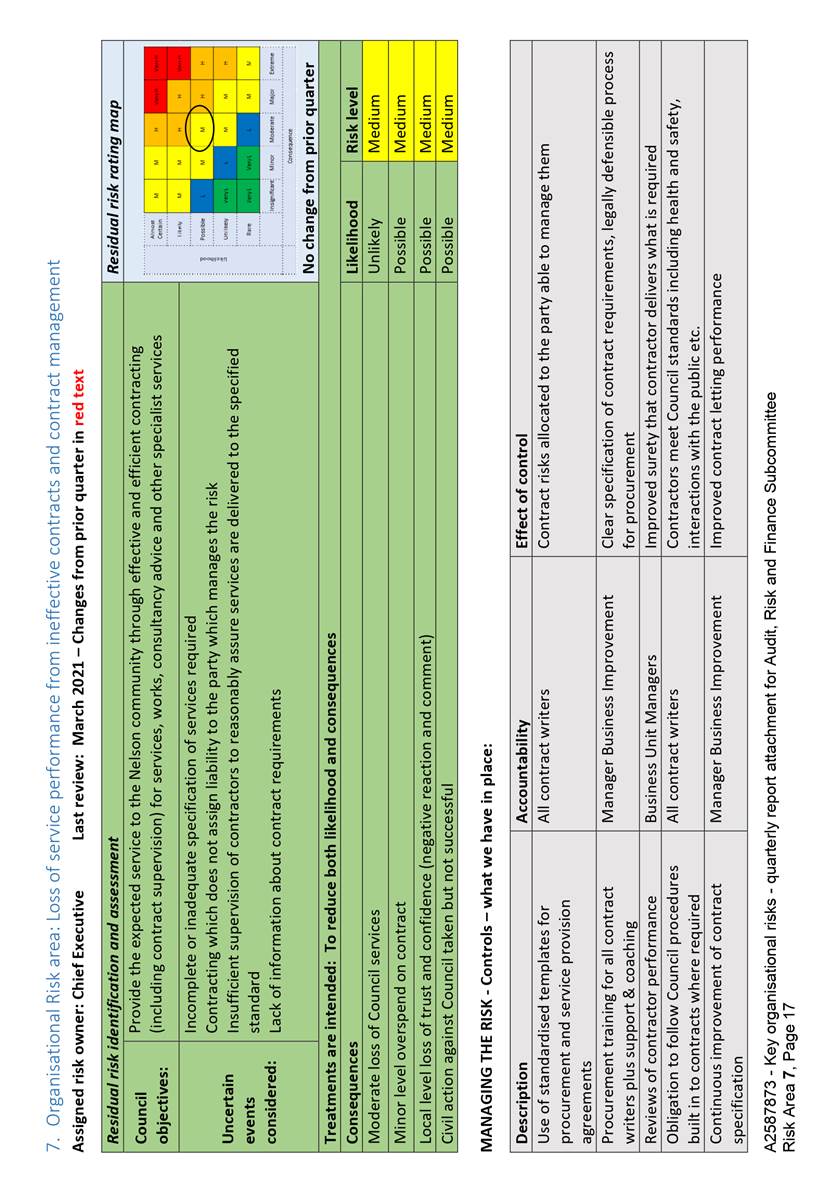

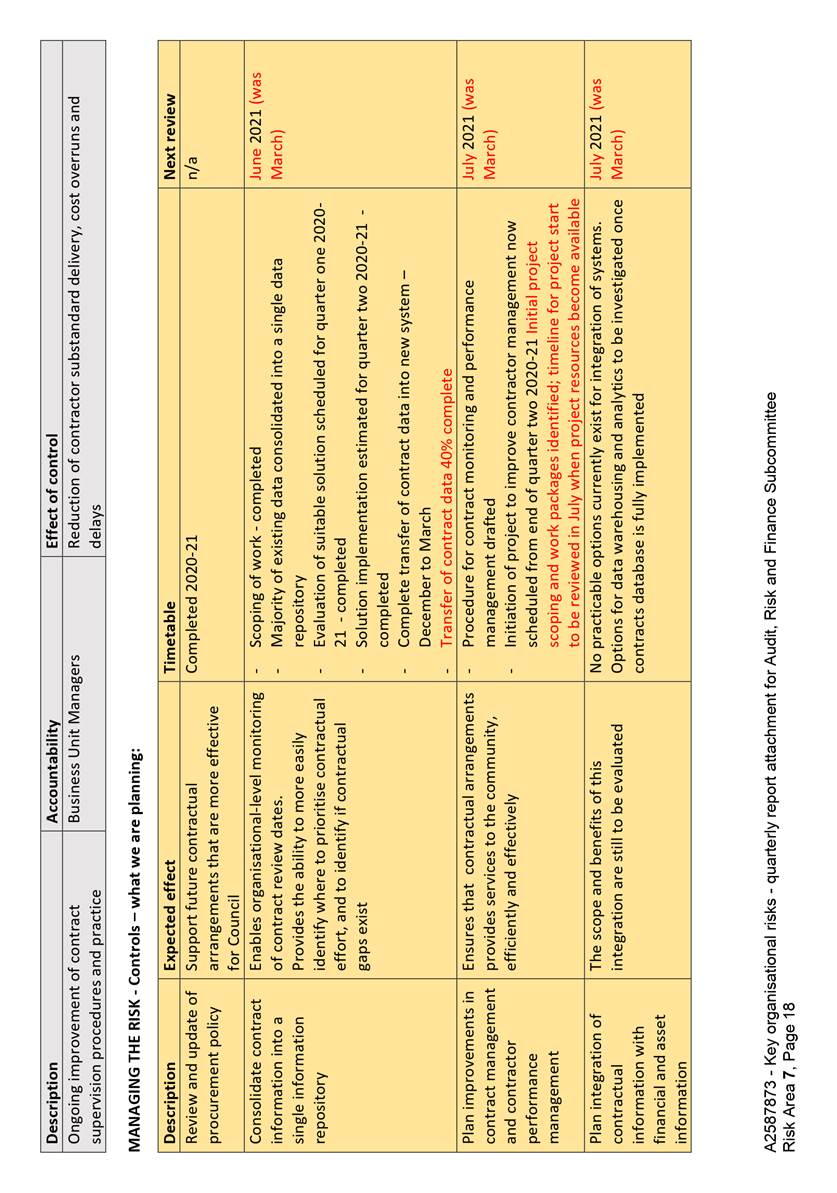

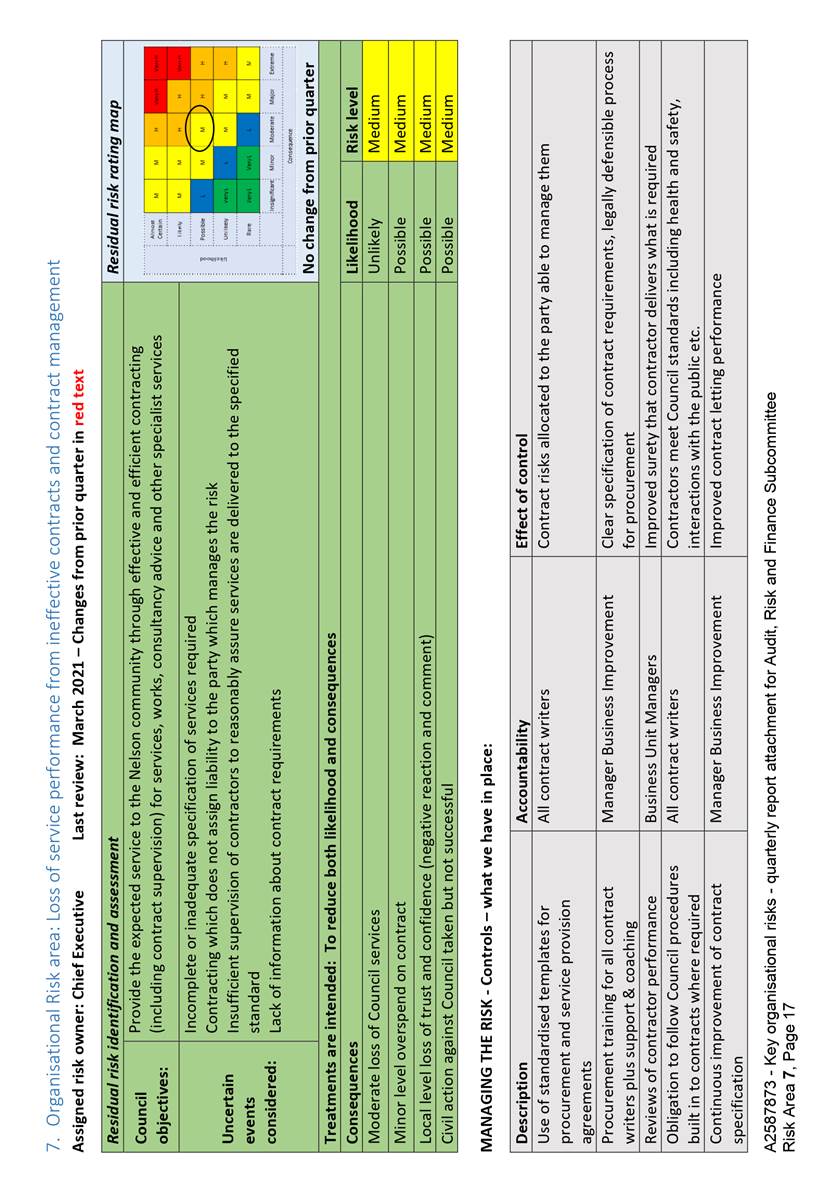

7.4 Loss of service performance from ineffective contracts and

contract management (Risk 7).

Transfer of contract data into the contract management

system is in progress continued in quarter three. The overall residual risk rating remains at Medium, with no risk movement to report

during quarter three 2020-21.

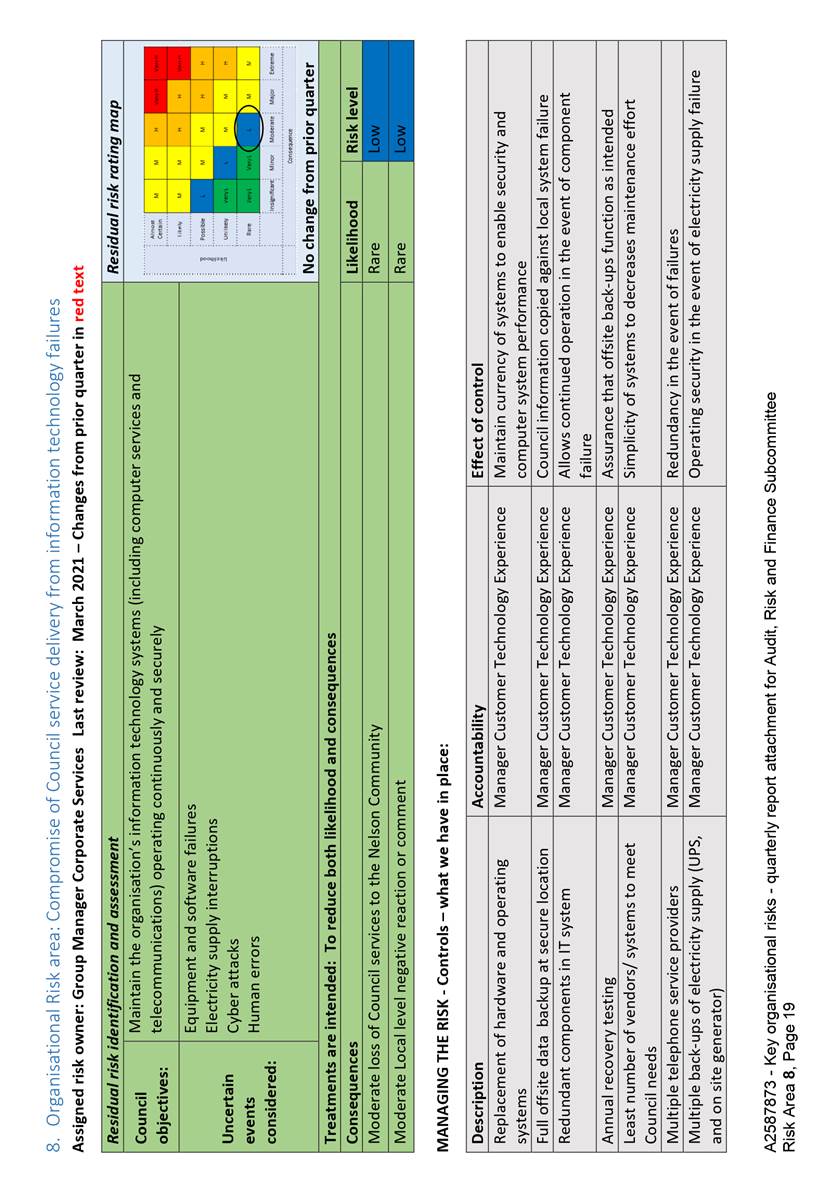

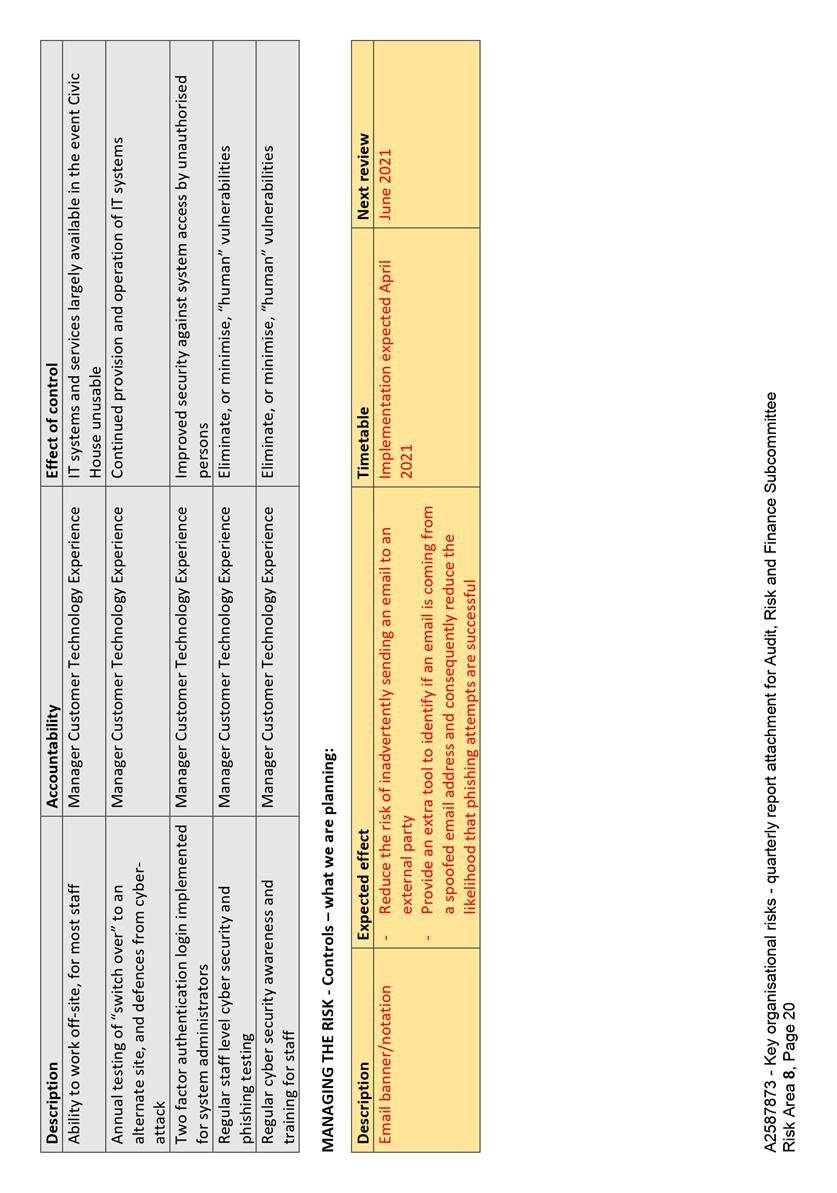

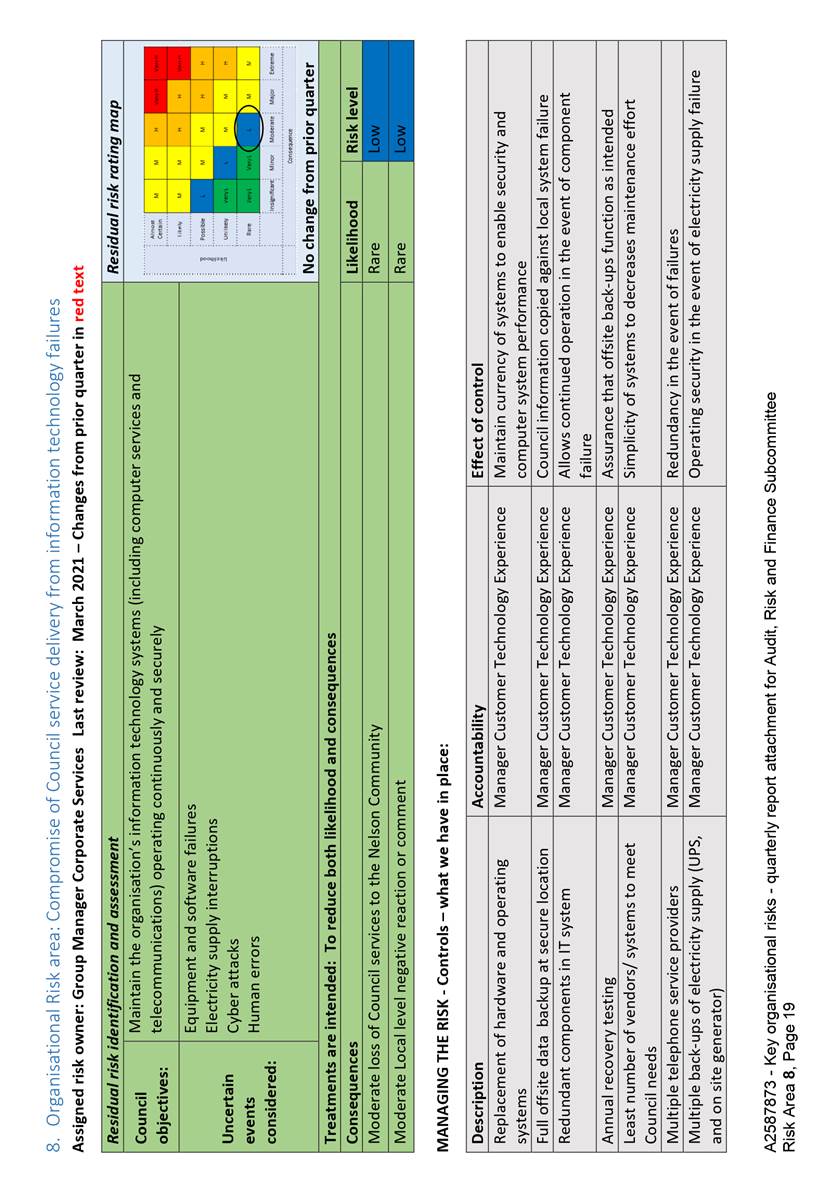

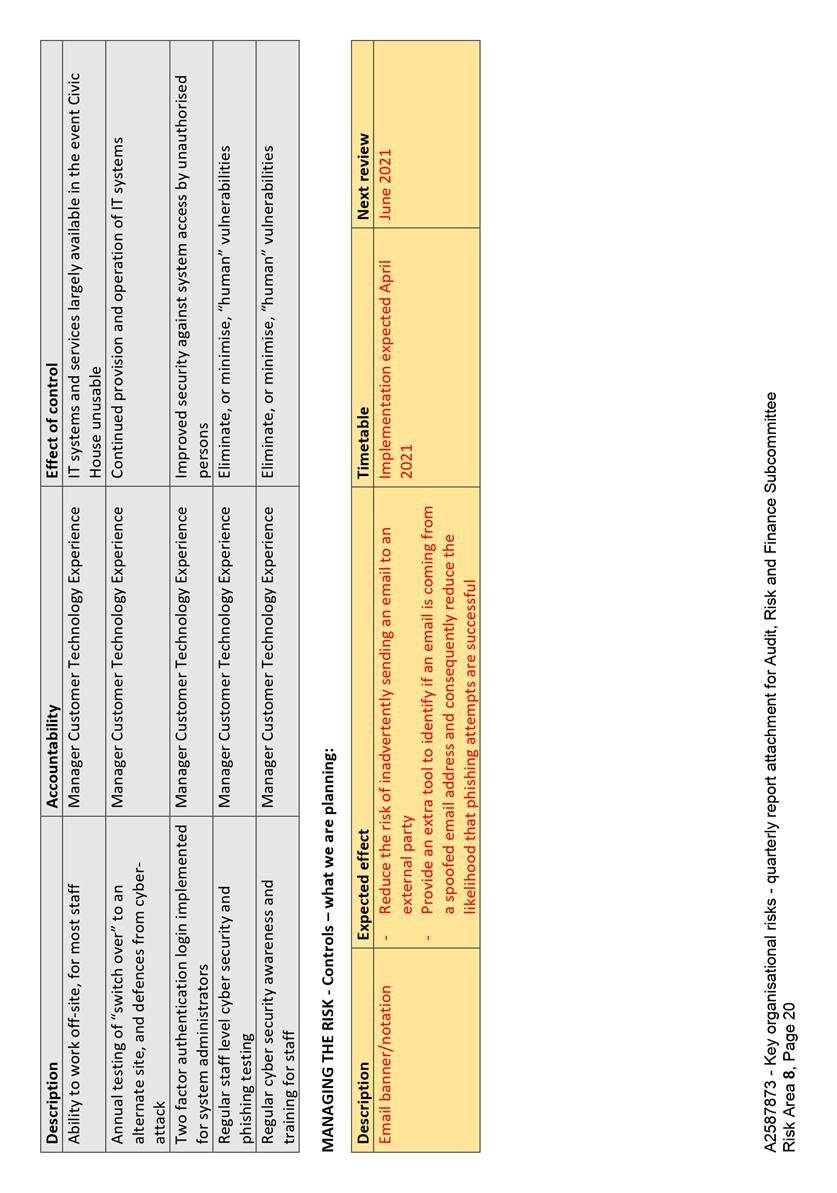

7.5 Compromise of Council service delivery from information

technology failures (Risk 8). Email notation (warning banners) will go live in April reducing the risk of a data breach. Other controls are being

monitored and remain effective. The residual risk rating remains at Low,

with no risk movement to report during quarter three 2020-21.

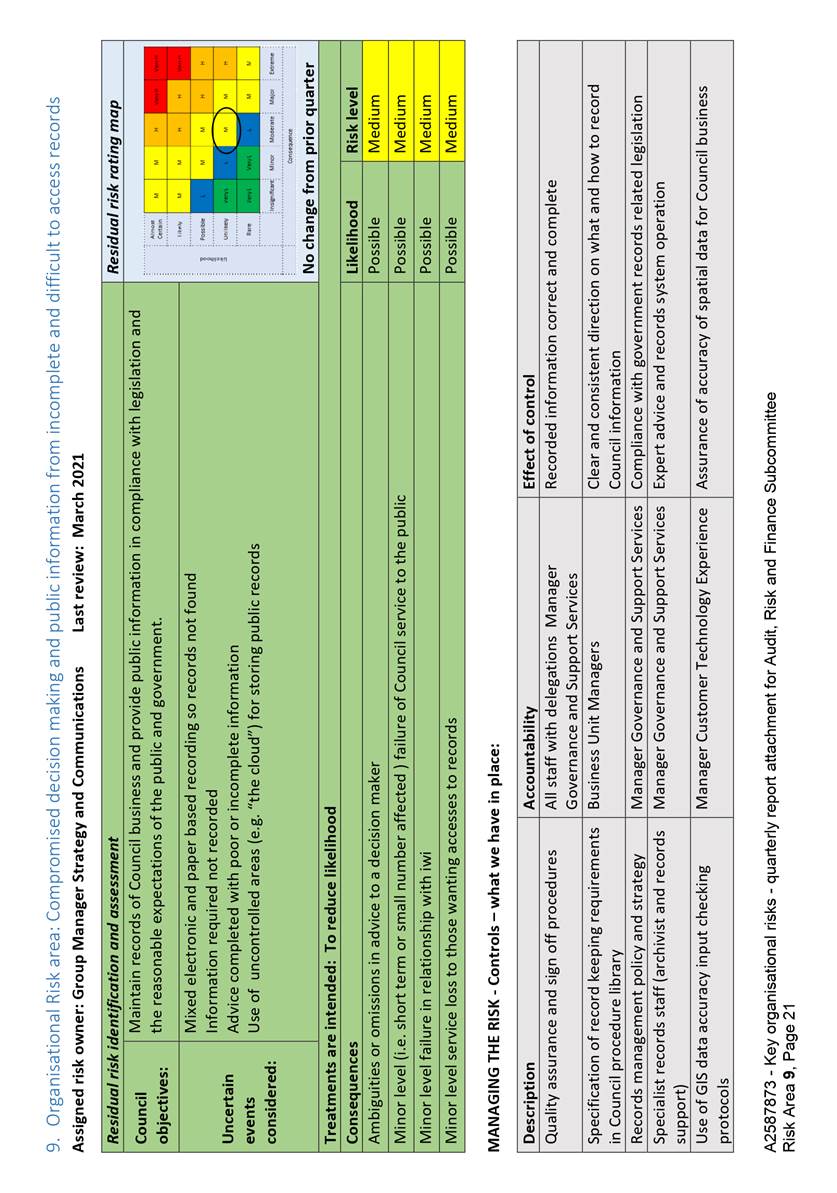

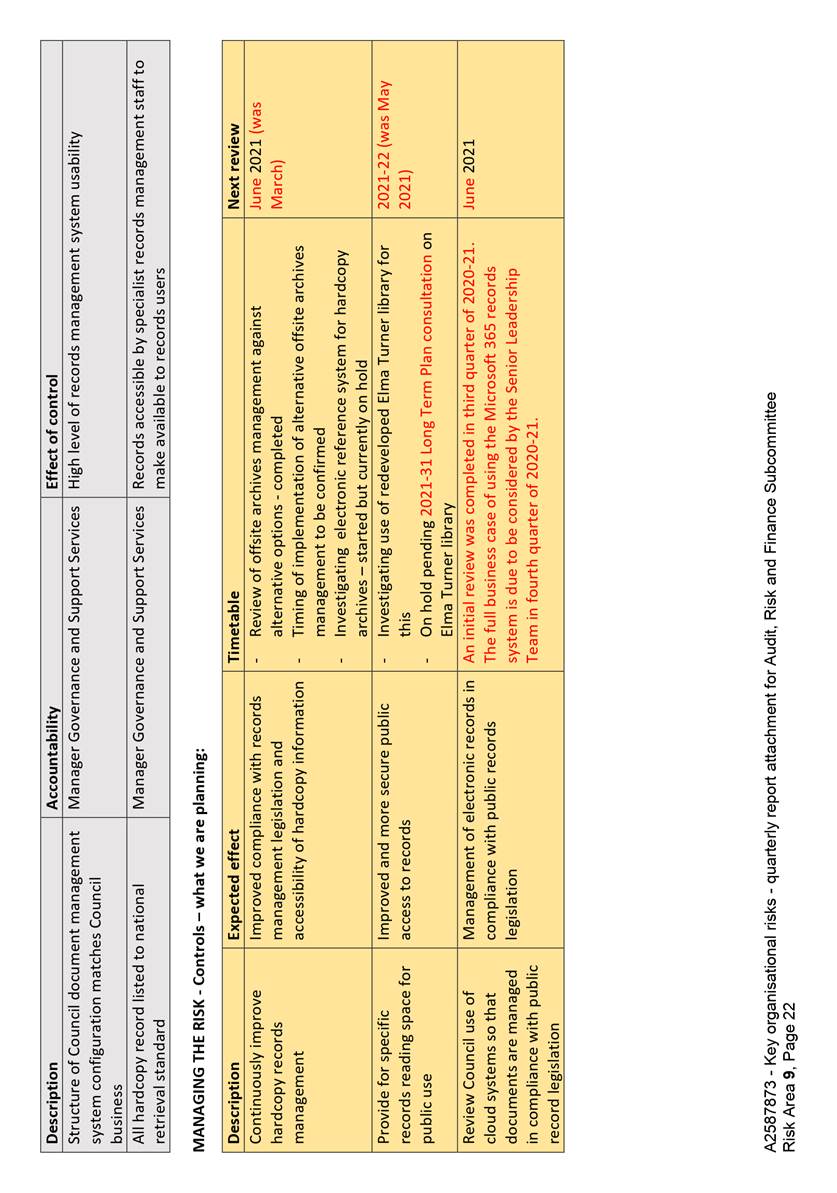

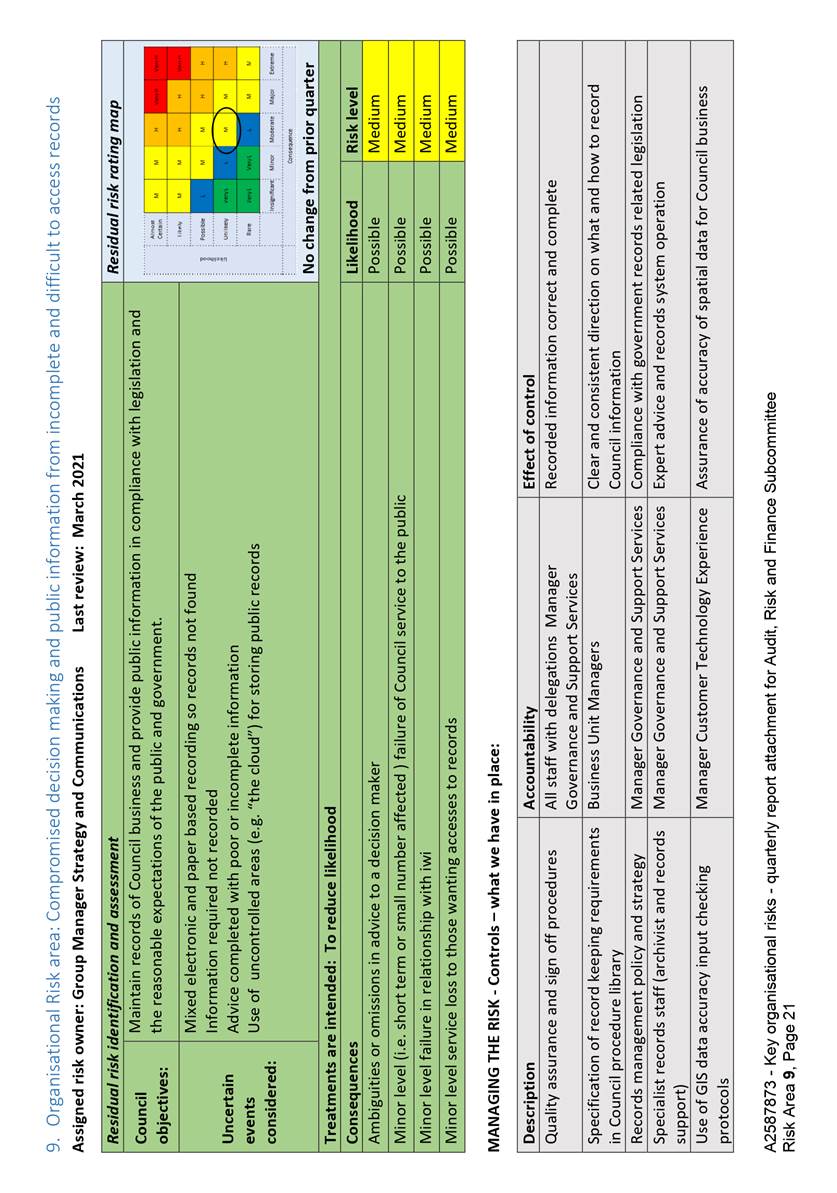

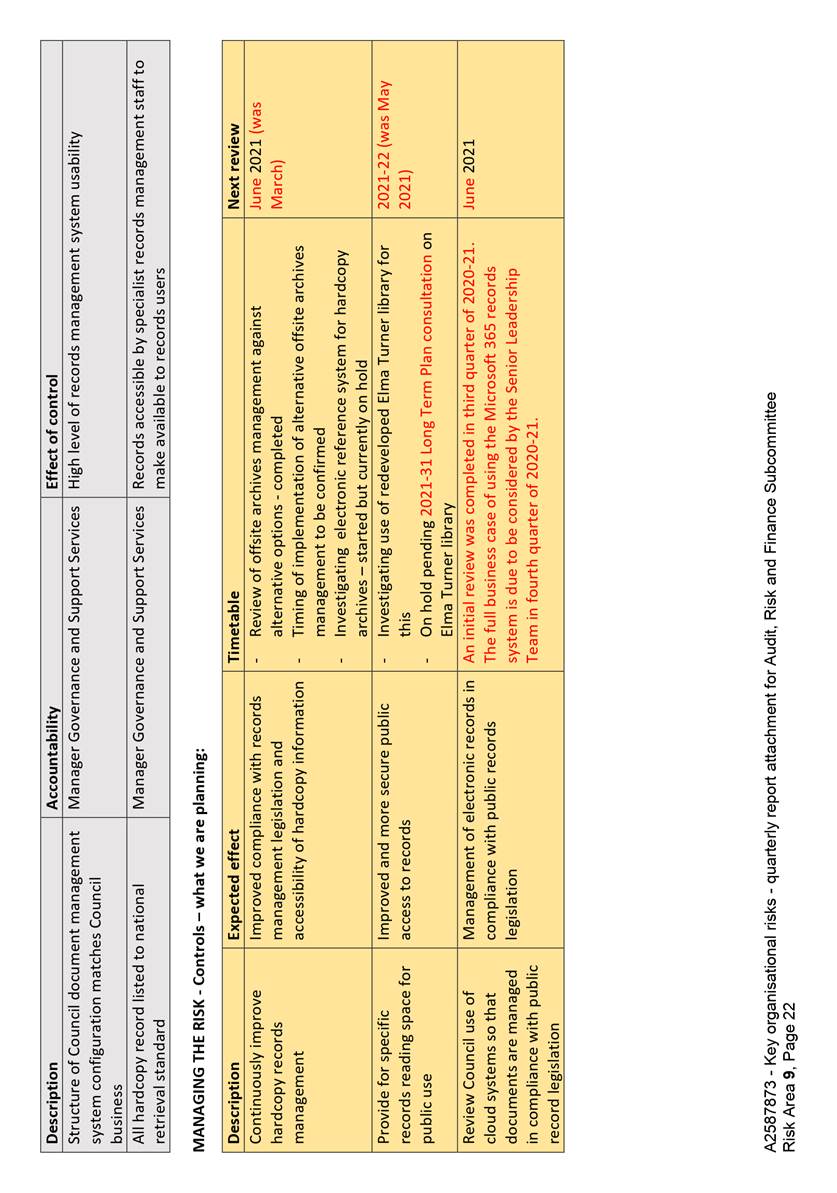

7.6 Compromised decision making and public information from

incomplete and difficult to access records (Risk 9). Business case scoping for

consolidating the electronic document and records management system, with the

current cloud-based Office 365 technology was approved in quarter three. The overall residual risk rating remains at

Medium, with no risk movement during quarter three

2020-21.

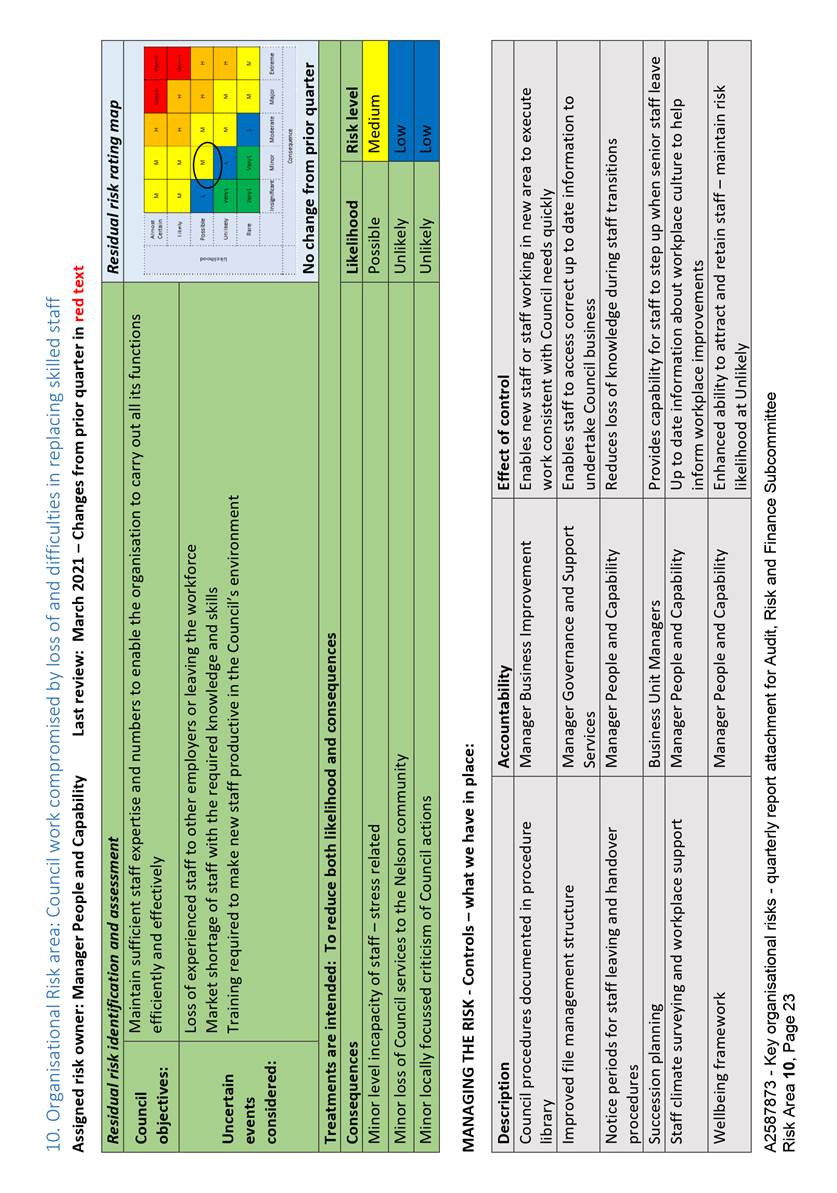

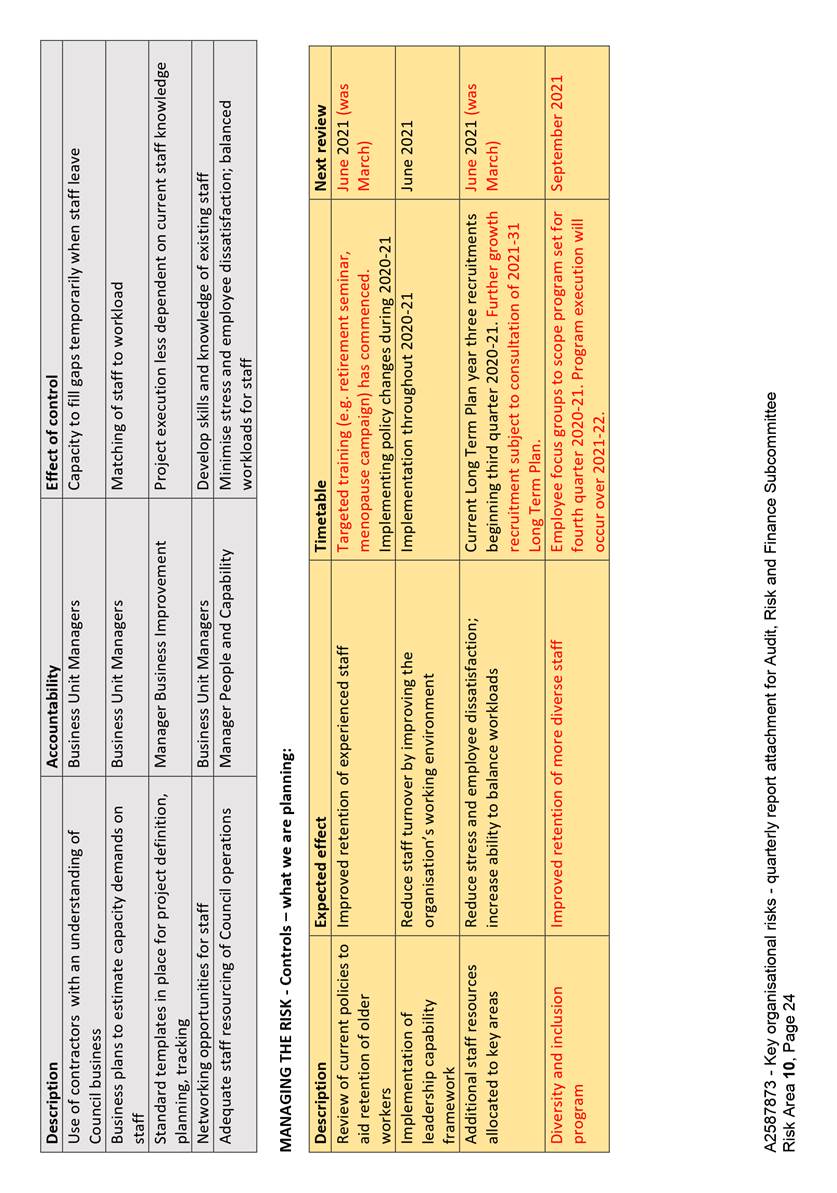

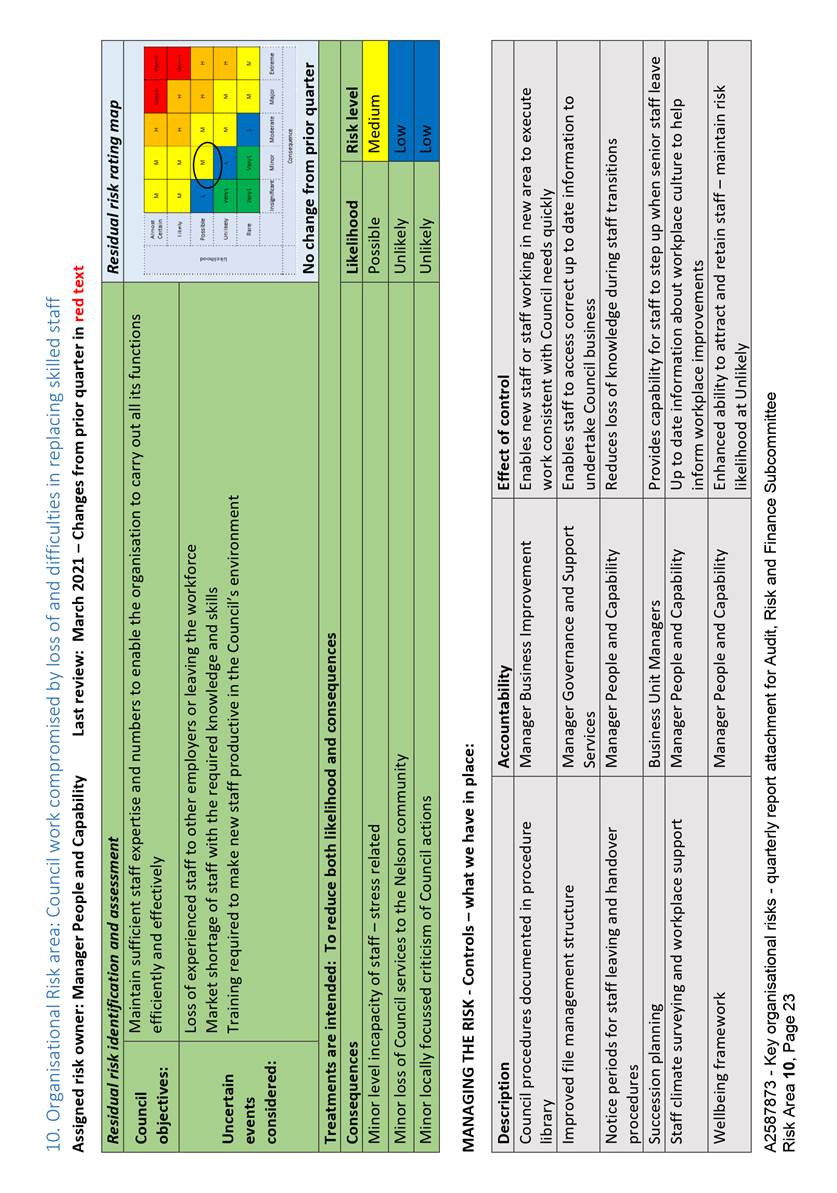

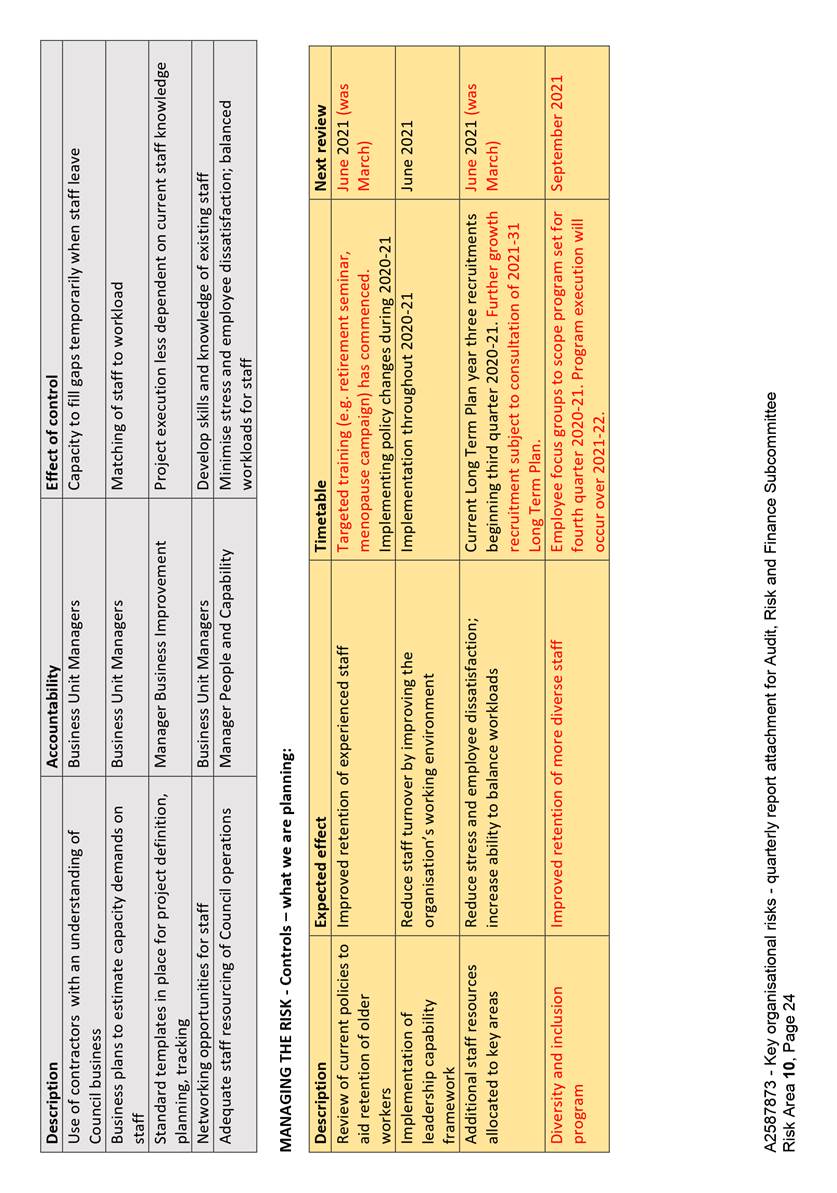

7.7 Council work compromised by loss of and

difficulties in replacing skilled staff (Risk 10). The leadership capability

framework was launched during quarter two, with implementation continuing

throughout the remainder of 2020-21. Oranga Tonutanga –

Council’s new wellbeing framework – has also been launched.

There continues to be isolated difficulties in replacing some specialist roles

in part due to uncertainty from COVID-19 and central government reforms

including three waters. The overall residual risk

rating remains at Medium, with no risk movement

during quarter three 2020-21.

7.8 It is unlikely in the future that the risk

can be mitigated to a low or very low rating, as this is more dependent on

market and economic factors – in particular recruiting to Council vacancies

in a competitive market. Future programmed work is intended to ensure

Council is a competitive and sought after employer, rather than further reduce

risk.

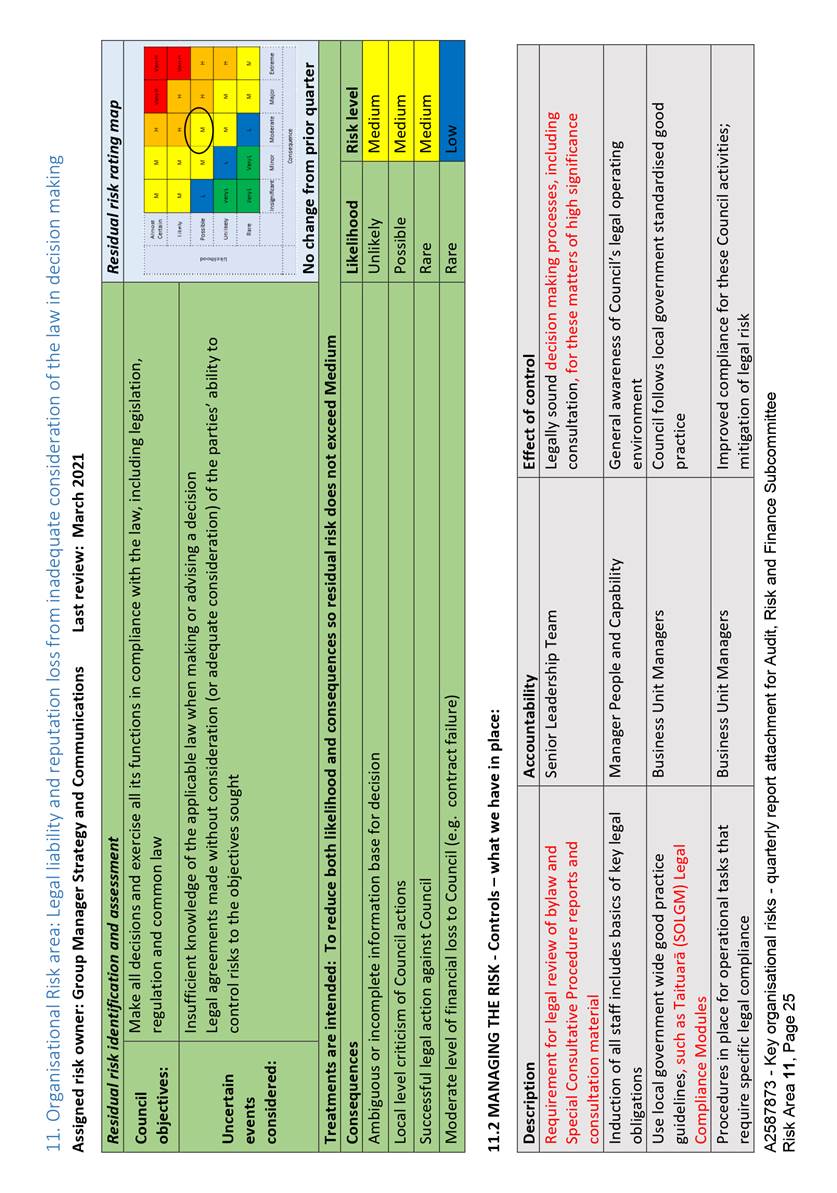

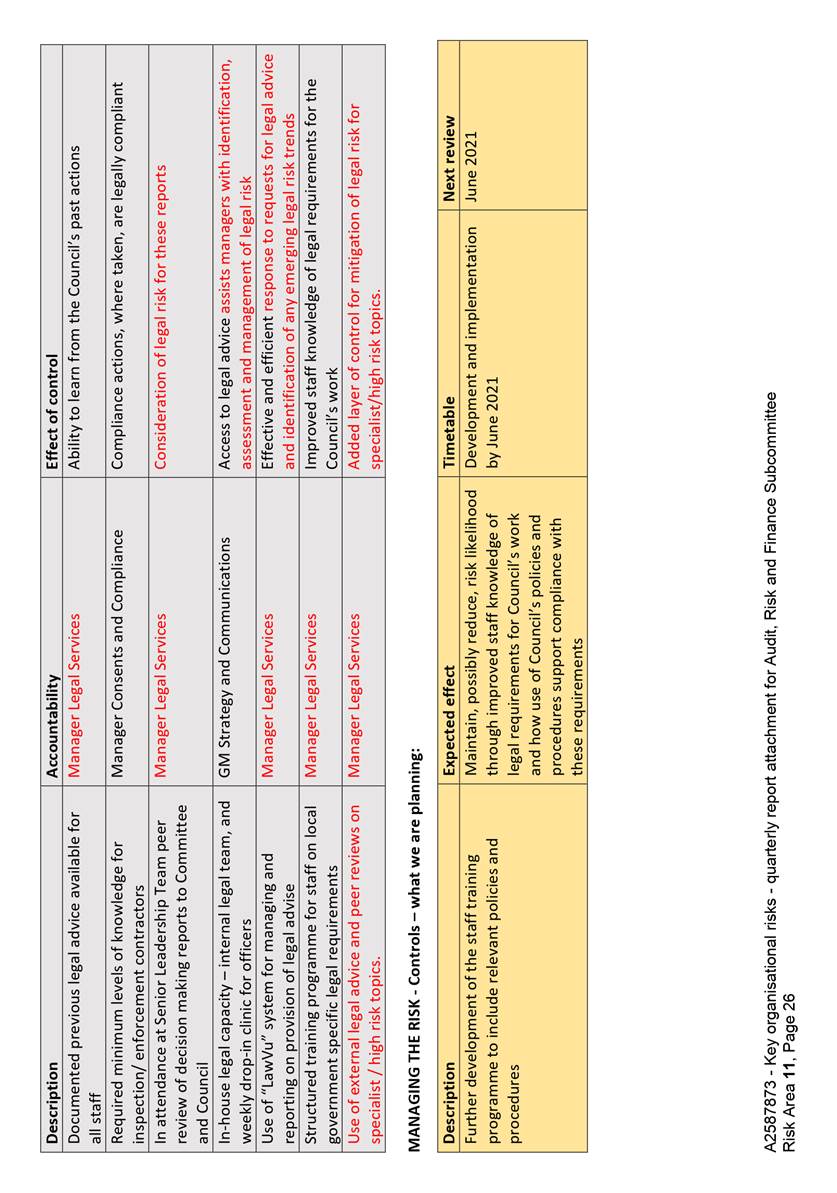

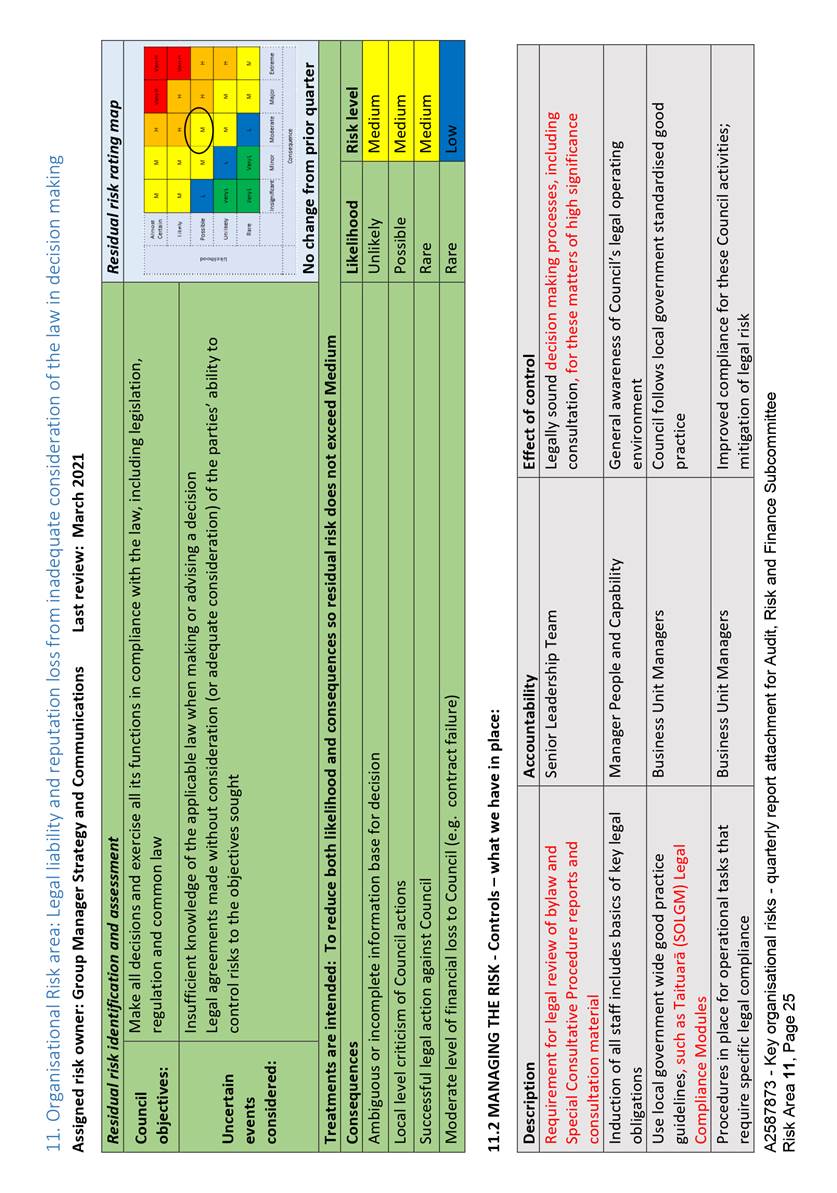

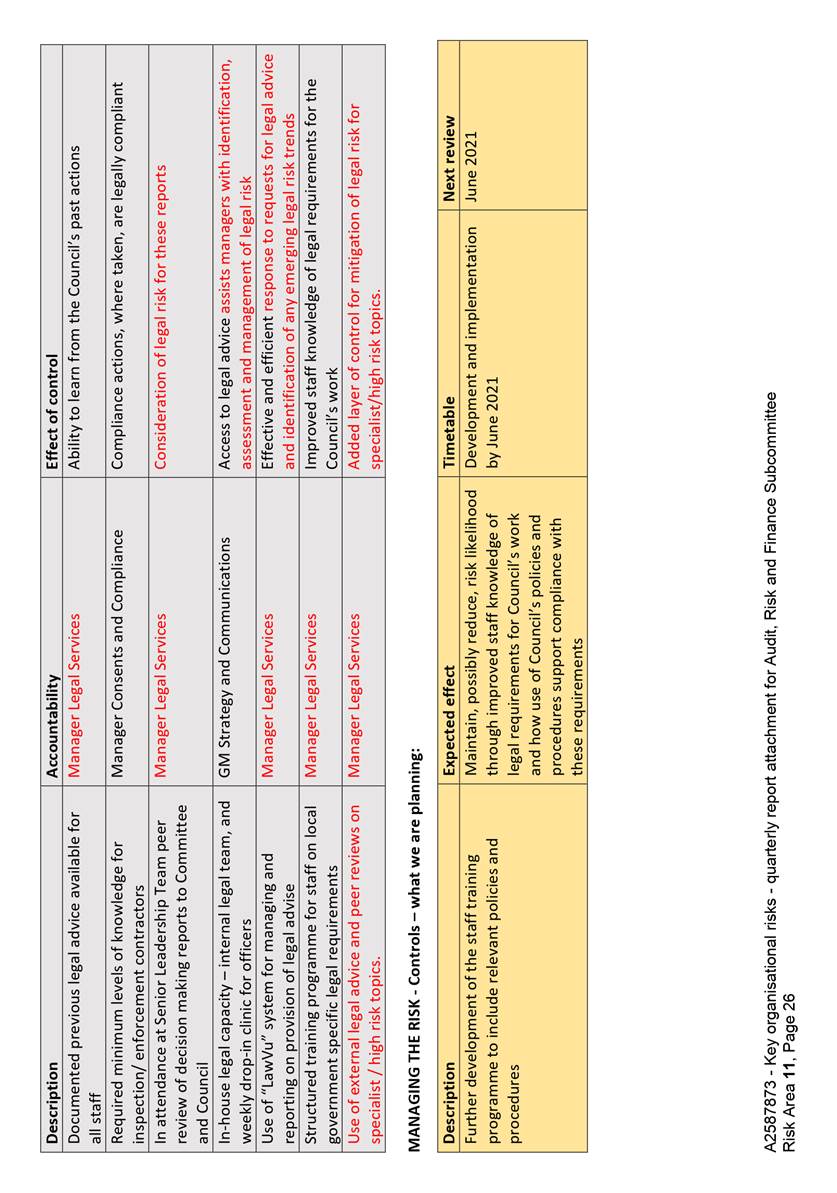

7.9 Legal liability and reputation loss from

inadequate consideration of the law in decision making (Risk 11). There are no changes to existing controls or

treatments to report. The risk owner remains satisfied that the residual risk is

at a tolerable level. The risk rating remains at

Medium.

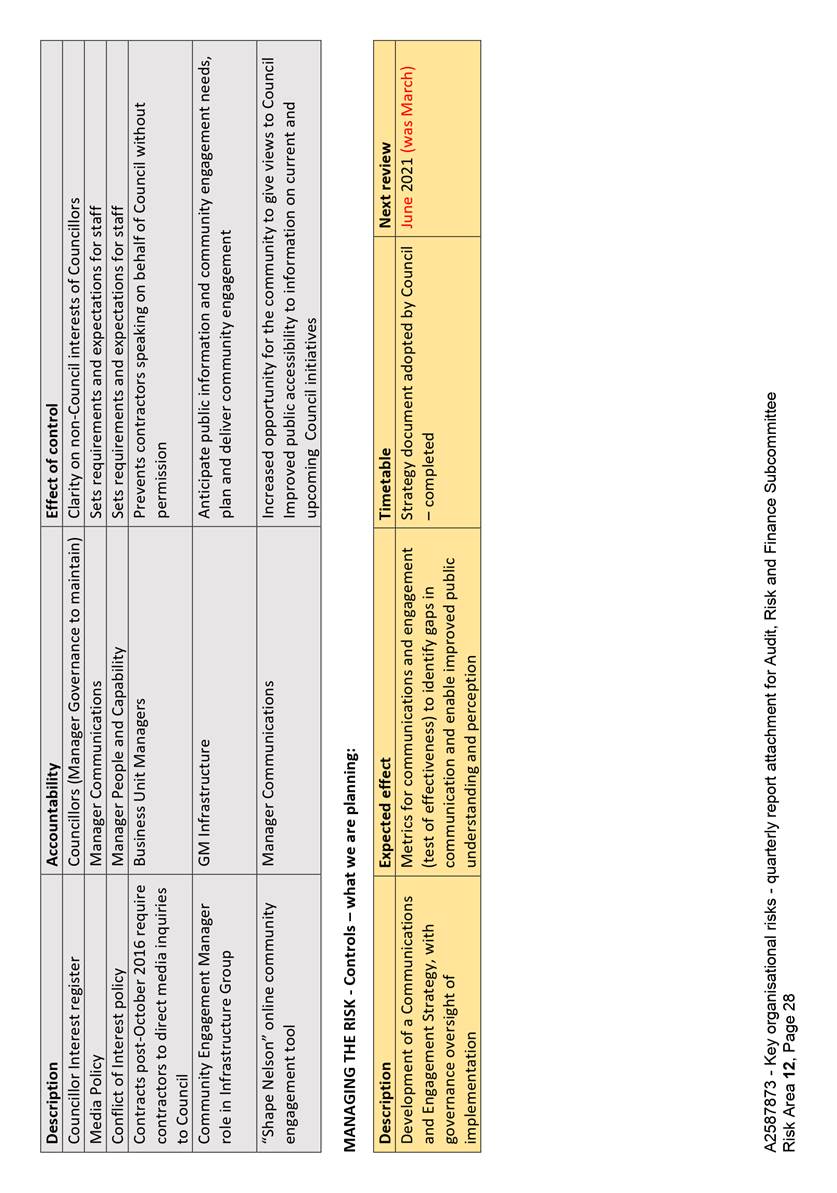

7.10 Loss of public trust in the organisation (Risk 12). The risk owner remains satisfied that

the residual risk is at a tolerable level. The

risk rating remains at Medium, with no risk movement during quarter two

2020-21.

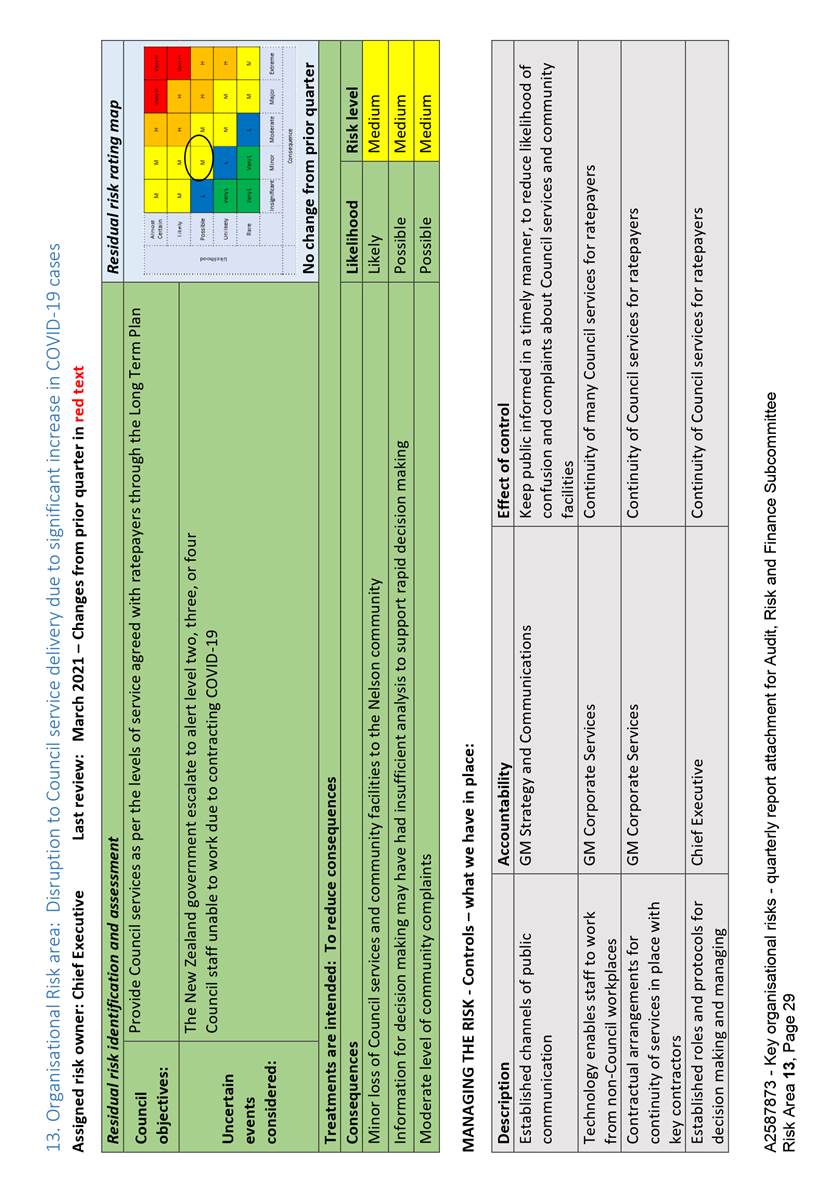

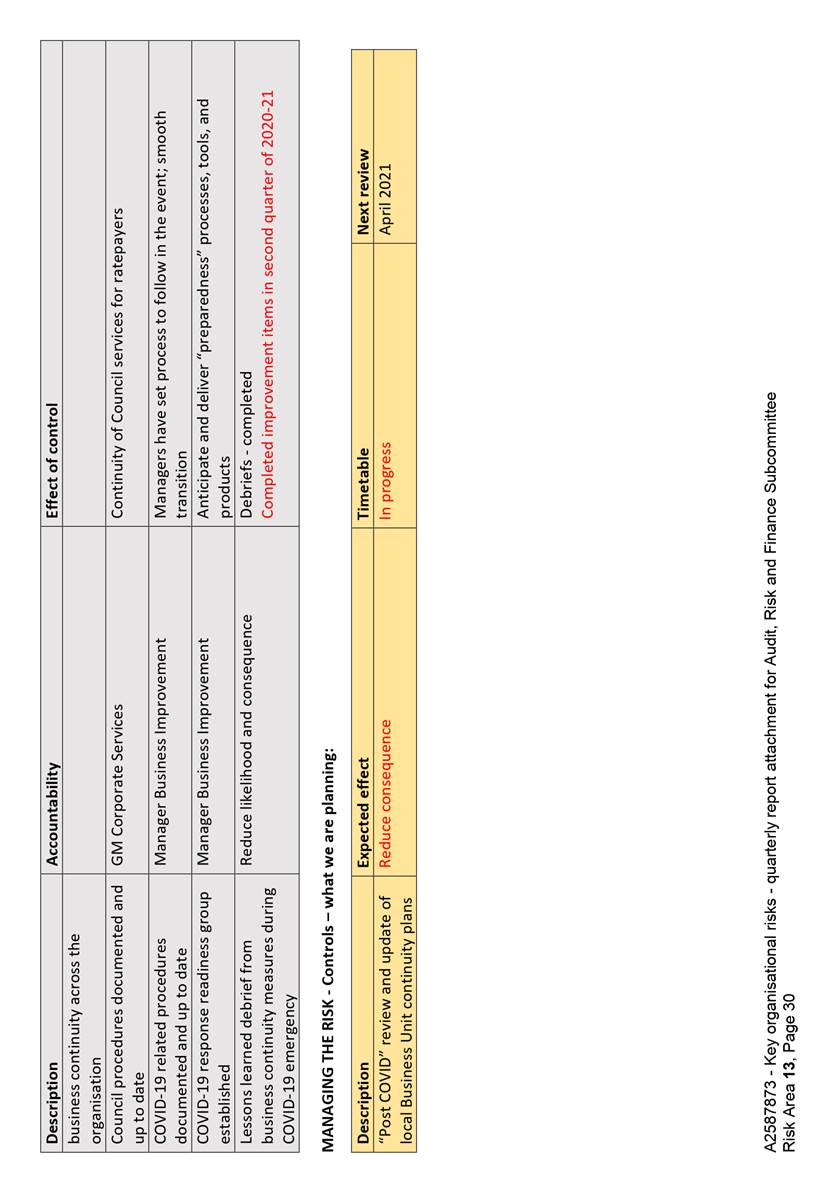

7.11 Disruption to Council service

delivery due to significant increase in COVID-19 cases (Risk 13). The

COVID-19 response readiness group continues to operate, and has implemented

various initiatives to ensure COVID-19 controls are in place and adhered to. A

review and update of local Business Unit continuity plans remains in progress.

The risk rating is Medium, with no risk movement during quarter two

2020-21.

8. Risk Areas for Each Group

8.1 Infrastructure Group:

As reported to the Infrastructure Committee in November, delivery of the

capital programme is moving at pace; this carries some risks which are being

monitored.

8.2 There is currently

significant uncertainty regarding proposed changes in governing the three

waters. There is also some uncertainty around roading projects:

8.2.1 Shorter term, additional regulation from

Waka Kotahi, which comes into force 1st May 2021, has potential to delay the

start of new projects in road reserve. The delay risk relates to a lack of

locally qualified Temporary Traffic Management Planners who will be able to

write and submit Traffic Management Plans.

8.2.2 Longer term, there is risk that

Council’s preferred transport programme over 2024-27 will not be

delivered in full. The delivery risk relates to the unknown level of funding

subsidy provided by Waka Kotahi. Waka Kotahi has signalled that the 2024-27

National Land Transport Fund (NLTF) has significant financial pressure.

Officers expect to have an indication of funding subsidy levels in April

2021.

8.3 Community Services Group:

Some workload pressures are emerging, related to increasing community

expectations on Council to deliver social and recreational services. The

risk of a positive COVID-19 case amongst attendees at large scale Nelson events

continues to be monitored – officers are working closely with event

organisers to ensure health advice and best practice is being followed, with

appropriate contingency planning in place. Compliance issues related to

Council operated campgrounds represent some ongoing risks whilst remediation

actions are developed and implemented; further information will be provided

once risk identification and analysis has been completed.

8.4 Environmental

Management Group: There is currently significant uncertainty

regarding the Resource Management Act and three water reforms which could

potentially have a wide reaching impact.

8.5 Strategy and

Communications Group: There are continued workload pressures for

governance support and administration teams. The draft Long Term Plan 2021-31

includes funding for extra resource to address this.

8.6 Corporate

Services Group: No new emerging risks to report at this time.

Author: Chris

Logan, Audit and Risk Analyst

Attachments

Attachment 1: A2587873

Council risk profile - key organisational risks - A4 attachment to

quarterly report for audit risk and finance subcommittee ⇩

Item 9: Key Organisational Risks Report - 1 January 2021 to 31 March

2021: Attachment 1

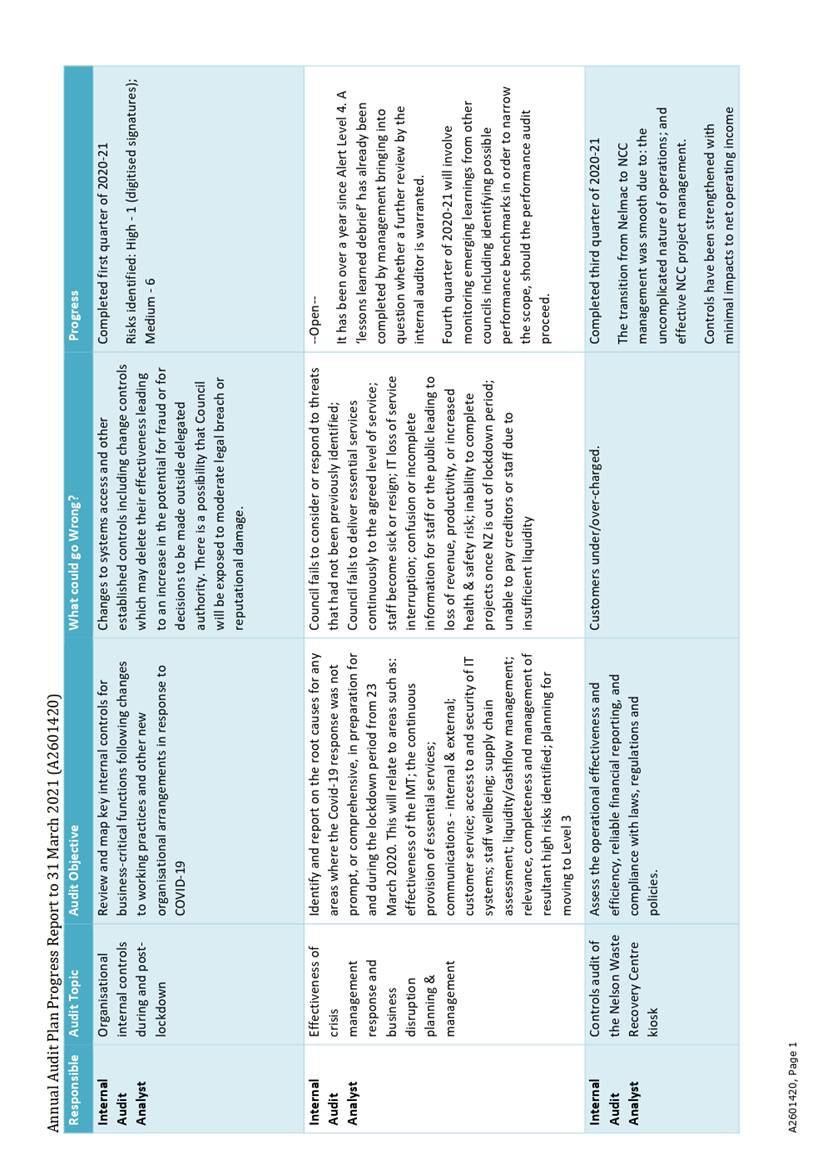

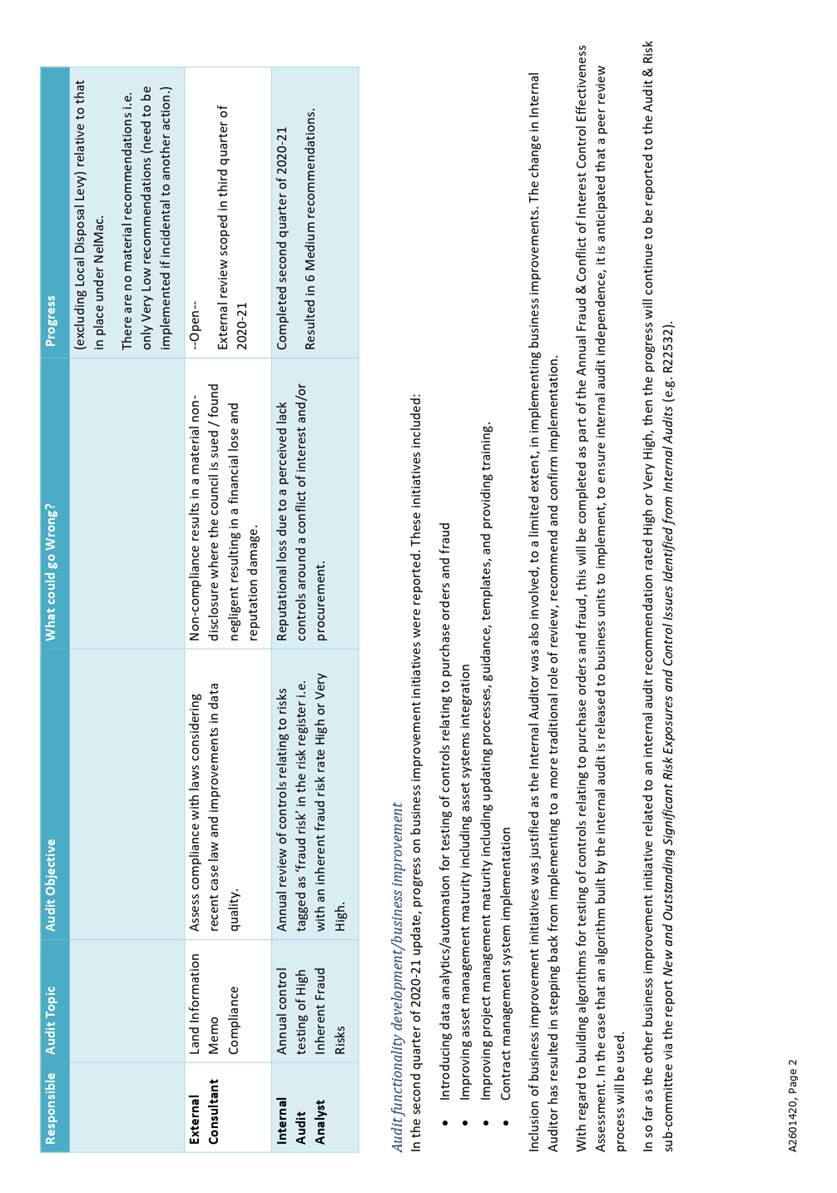

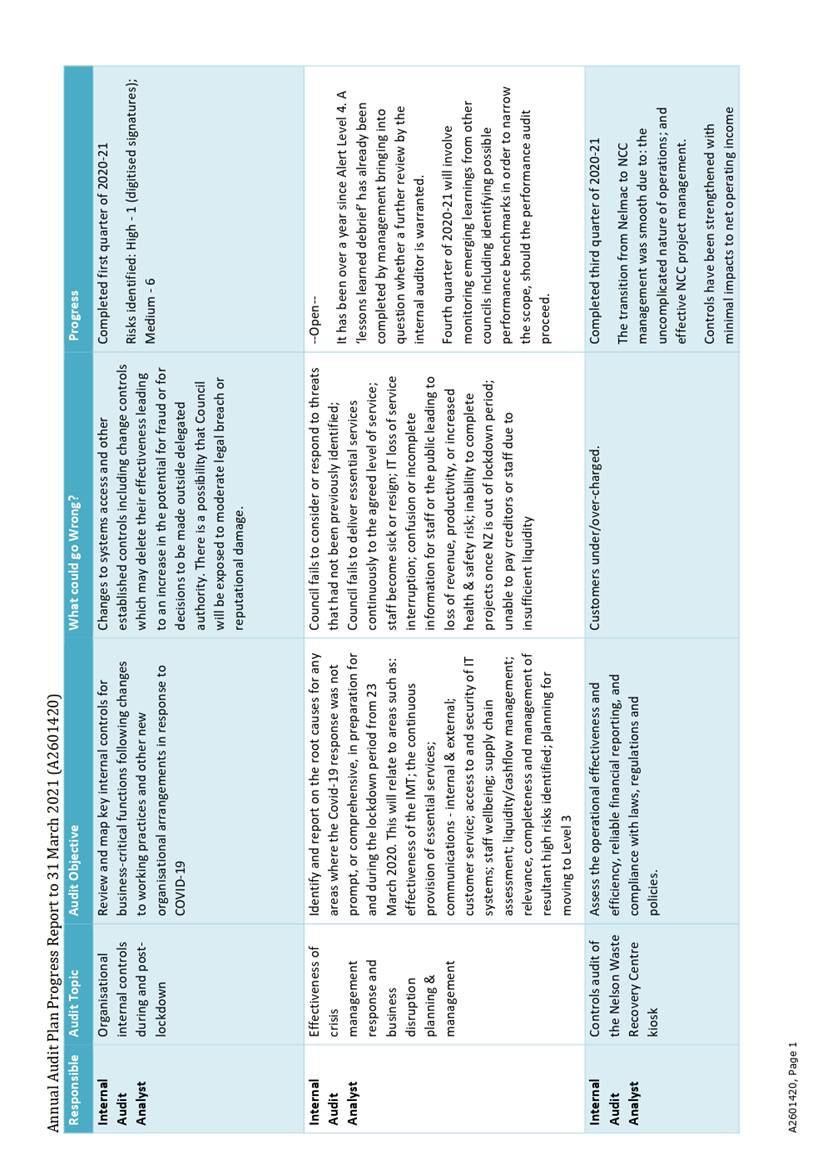

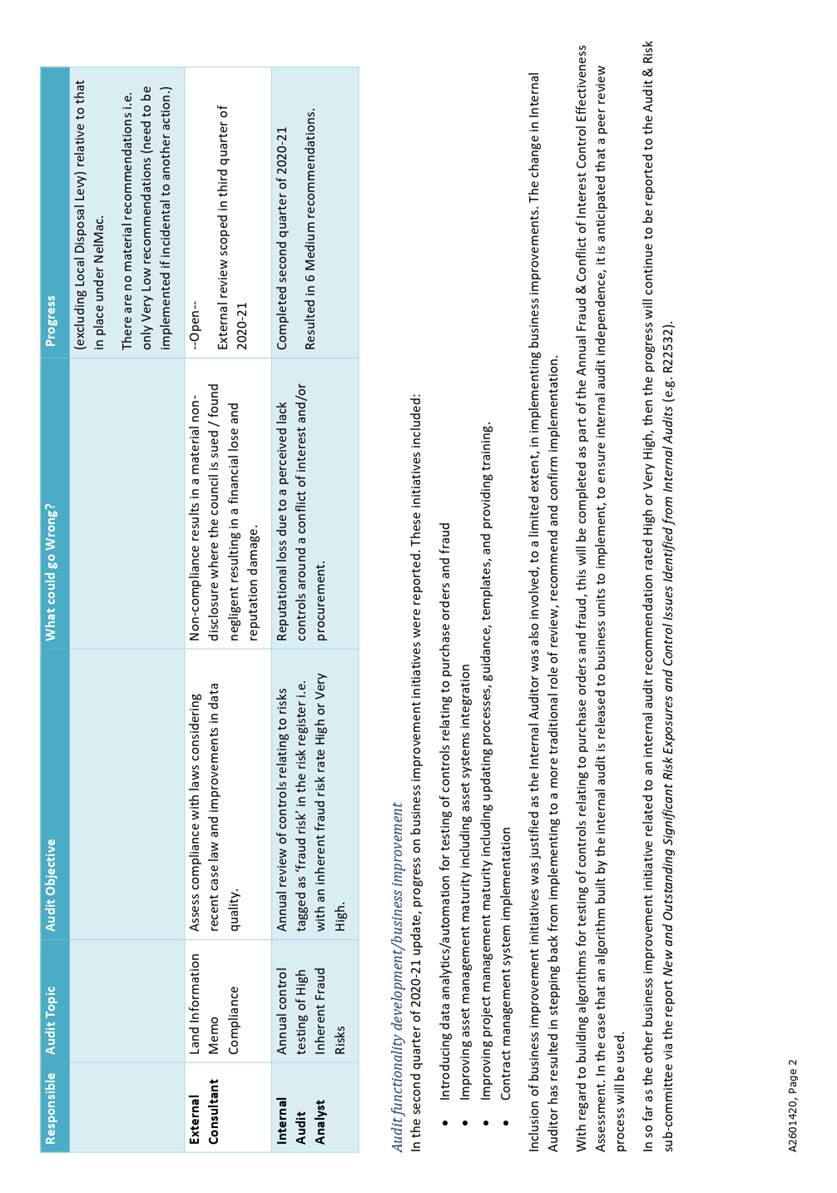

Item 10: Internal Audit

- Quarterly Progress Report to 31 March 2021

|

|

Audit, Risk and Finance Subcommittee

25 May 2021

|

REPORT R23746

Internal

Audit - Quarterly Progress Report to 31 March 2021

1. Purpose

of Report

1.1 To

update the Audit, Risk and Finance Subcommittee on the internal audit activity

for the quarter to 31 March 2021.

2. Background

2.1 Under

Council’s Internal Audit Charter approved by Council on 15 November 2018

the Audit, Risk and Finance Subcommittee requires a periodic update on the

progress of internal audit activities.

2.2 Business

improvement progress is no longer being reported due to the change in Internal

Auditor and noting that it falls outside the scope of Internal Audit function.

3. Recommendation

|

That the Audit, Risk and Finance Subcommittee

1. Receives

the report Internal Audit - Quarterly Progress Report to 31 March 2021

(R23746) and its attachments

(A2601420, A2599893).

|

4. Overview

of Progress on the 2020-21 Internal Audit Plan

4.1 The

2020-21 Internal Audit Plan (the Plan) was approved by the Governance and

Finance Committee on 27 August 2020. The Plan provides for two planned audits,

with an allowance for a further four unplanned audits.

4.2 Three

audit items have been completed as at 31 March 2021. Further details of

progress on the plan is provided in attachment Annual Audit Plan Progress to

31 March 2021 (A2601420), and an overview provided below.

4.3 The

planned audit ‘effectiveness of crisis management response and business

disruption planning & management’ has been postponed. The decision to

proceed or indefinitely postpone this planned audit will be informed in quarter four 2020-21 by assessing the strength of

recommendations of similar reviews performed by other councils.

4.4 In

the quarter two 2020-21, the placeholder ad hoc audit topics had yet to be

defined. Three topics have now been considered:

4.4.1 Nelson

Waste Recovery Centre Kiosk - Post Management Change (described in 4.4 to 4.6)

4.4.2 Land

and Information Memo review to assess compliance with legislation (scoped in

quarter three 2020-21 for external review in quarter four 2020-21)

4.4.3 Development

Contributions follow-up (considered in Draft Annual Audit Plan 2021-22).

4.5 During

quarter three 2020-21, the Nelson Waste Recovery Centre Kiosk operation was

audited. Areas of consideration included operational effectiveness and

efficiency, reliable financial reporting, and compliance with laws,

regulations, and policies.

4.6 The

audit found that the transition from Nelmac to Council management was smooth

due to the uncomplicated nature of operations, and effective project management

by Council. Controls have been strengthened with minimal impacts to net

operating income (before Local Waste Disposal Levy ‘top-up’) relative

to that in place under Nelmac.

4.7 The

audit resulted in five Very Low rated recommendations (need only be implemented

if incidental to another action).

5. Overview

of New and Outstanding Significant Risk Exposures and Control Issues Identified

from Internal Audits

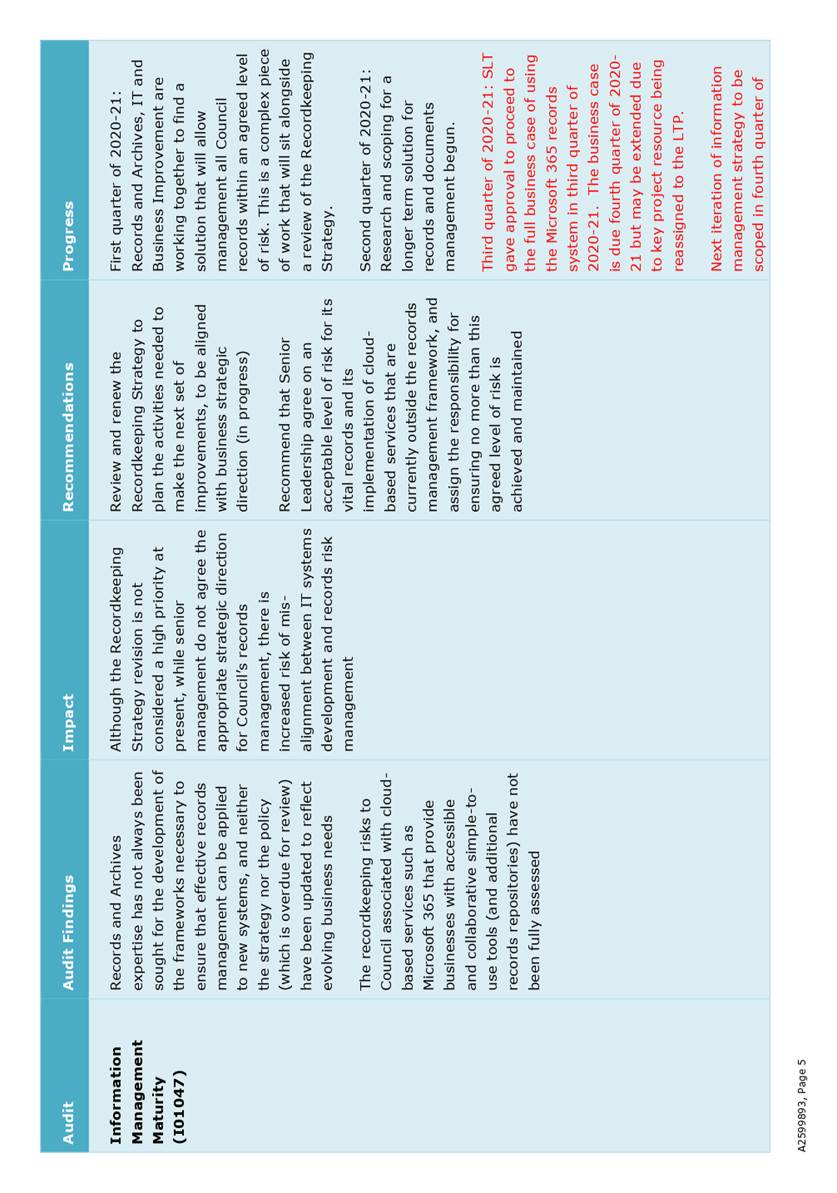

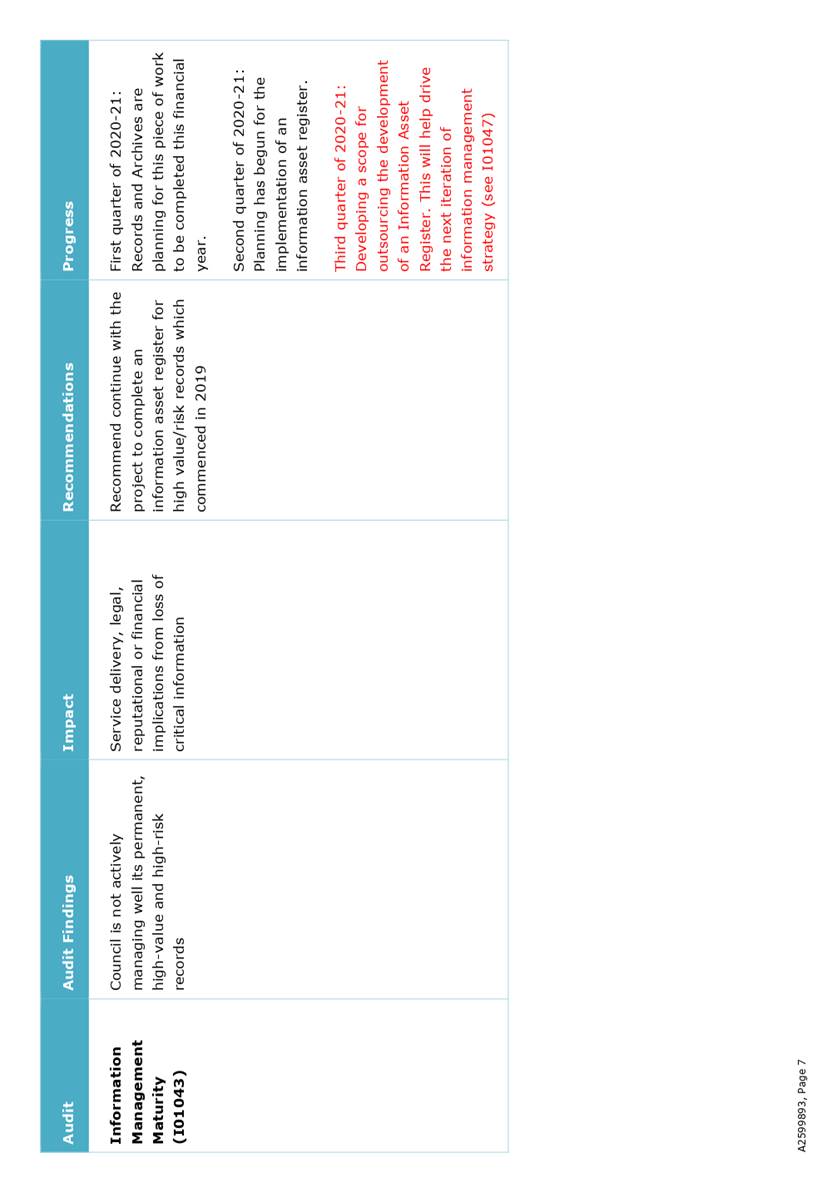

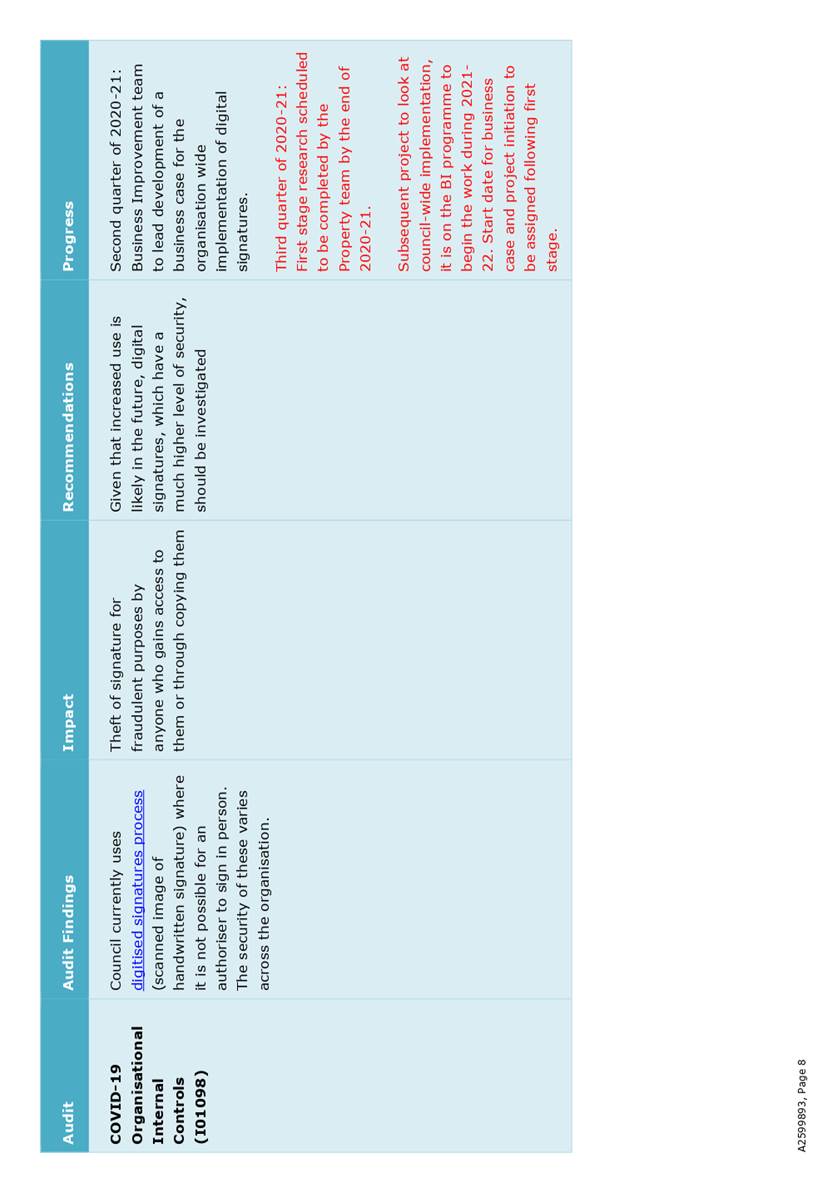

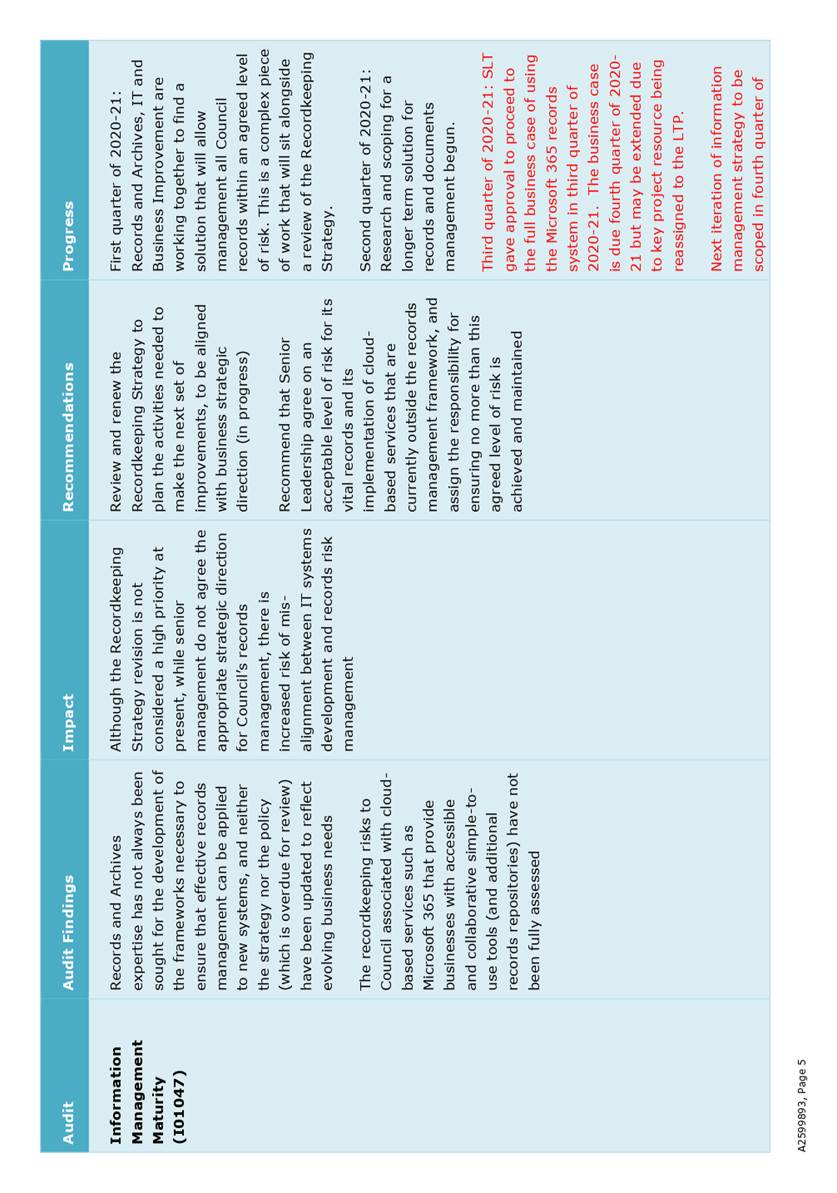

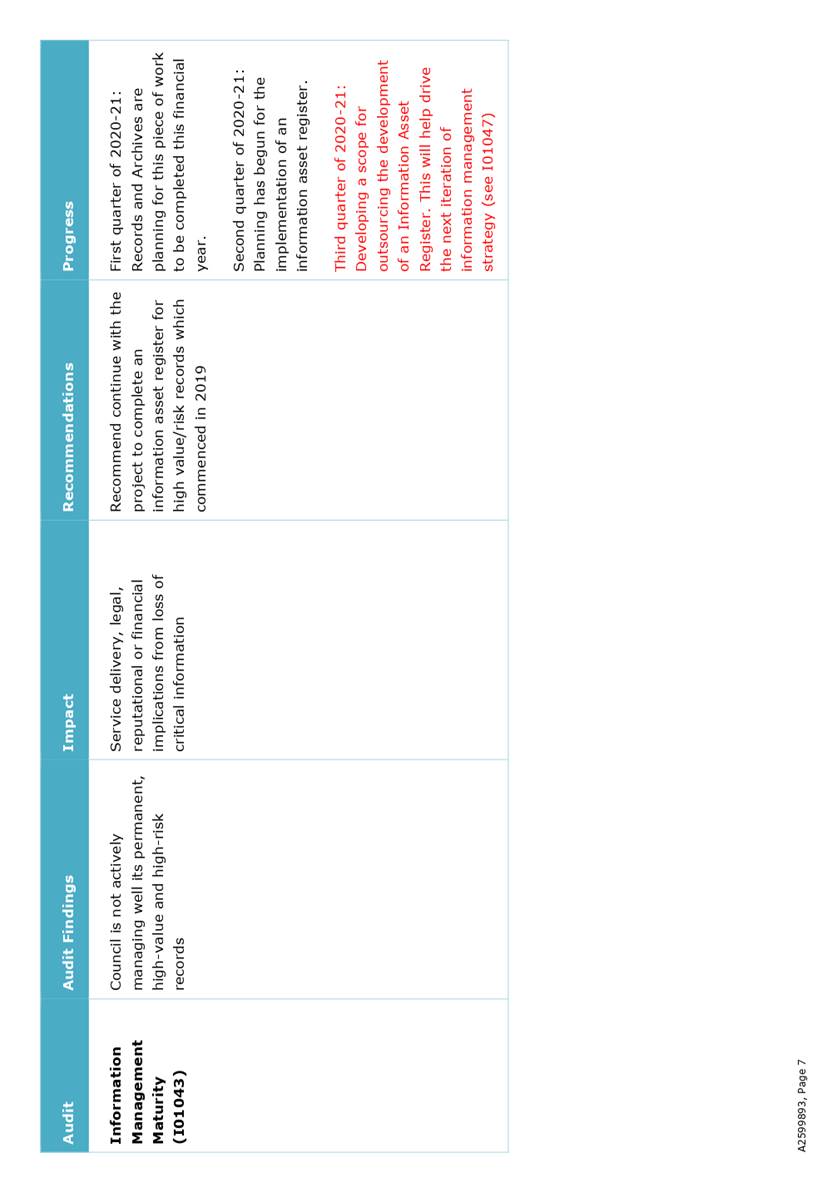

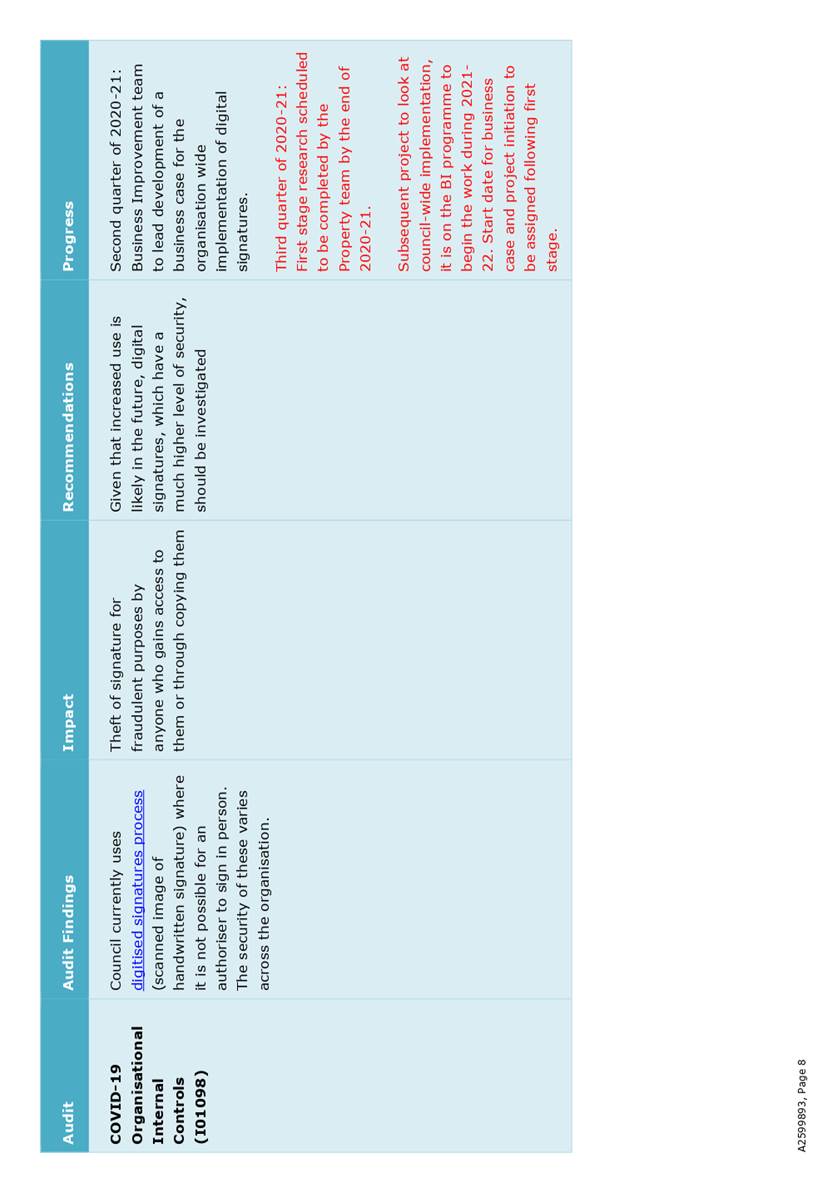

5.1 This

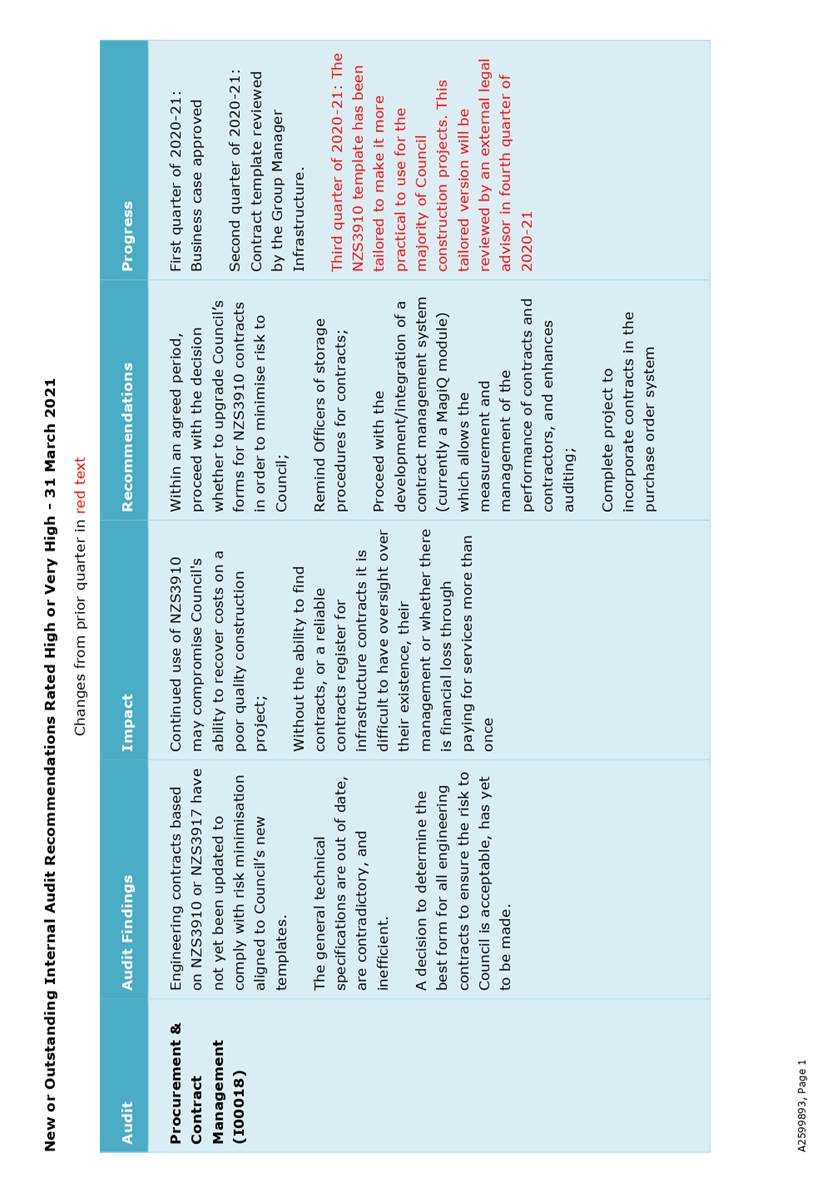

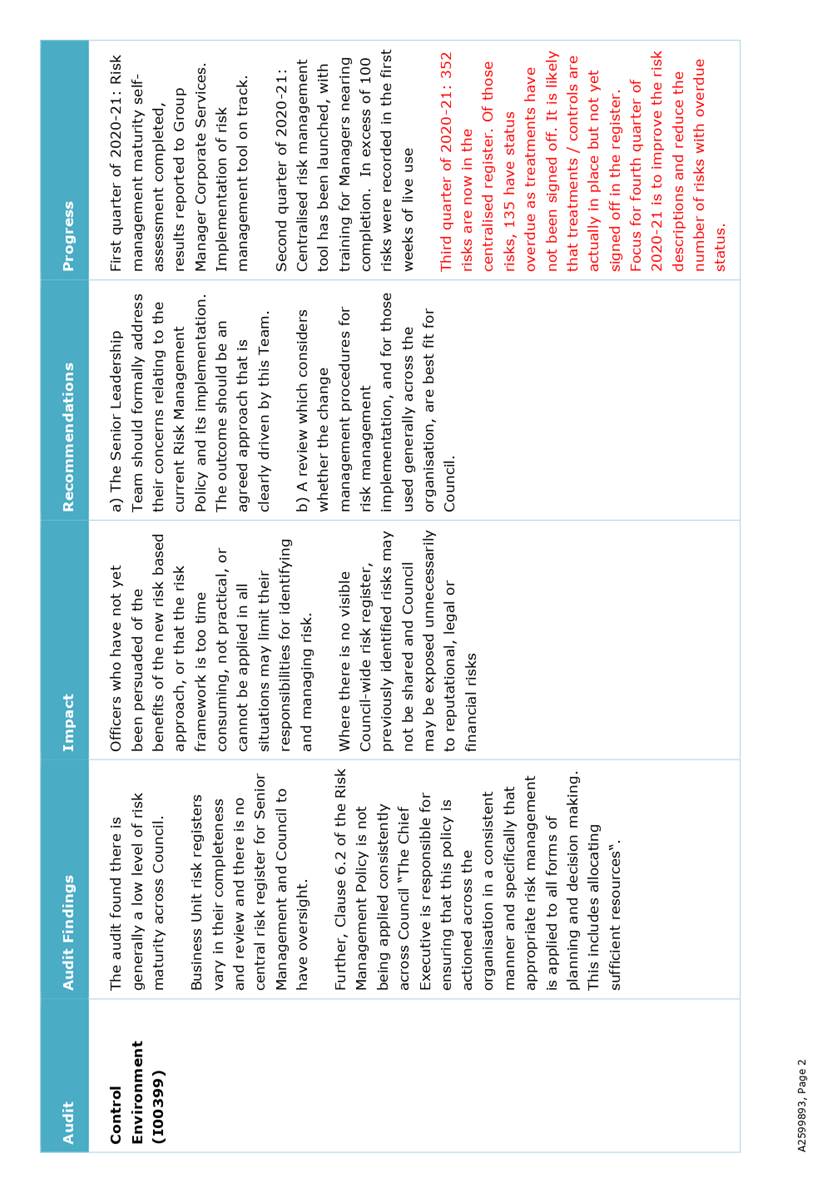

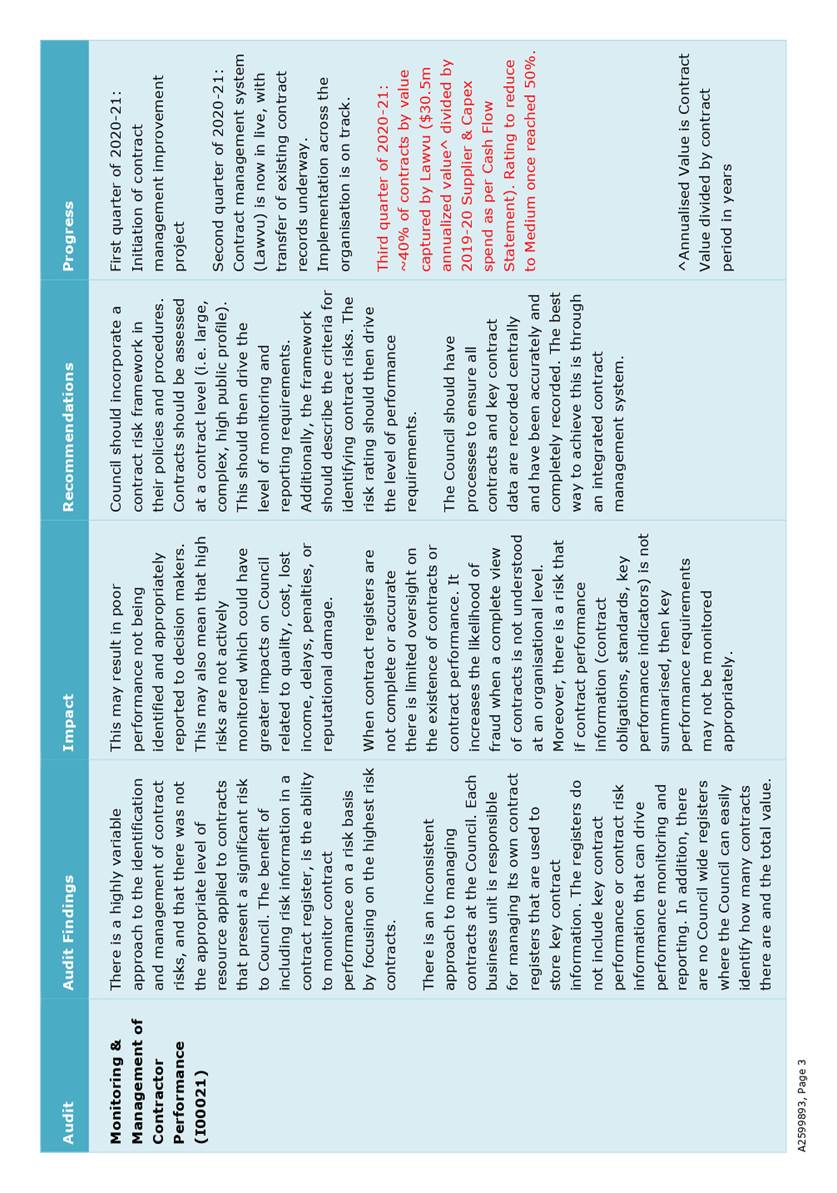

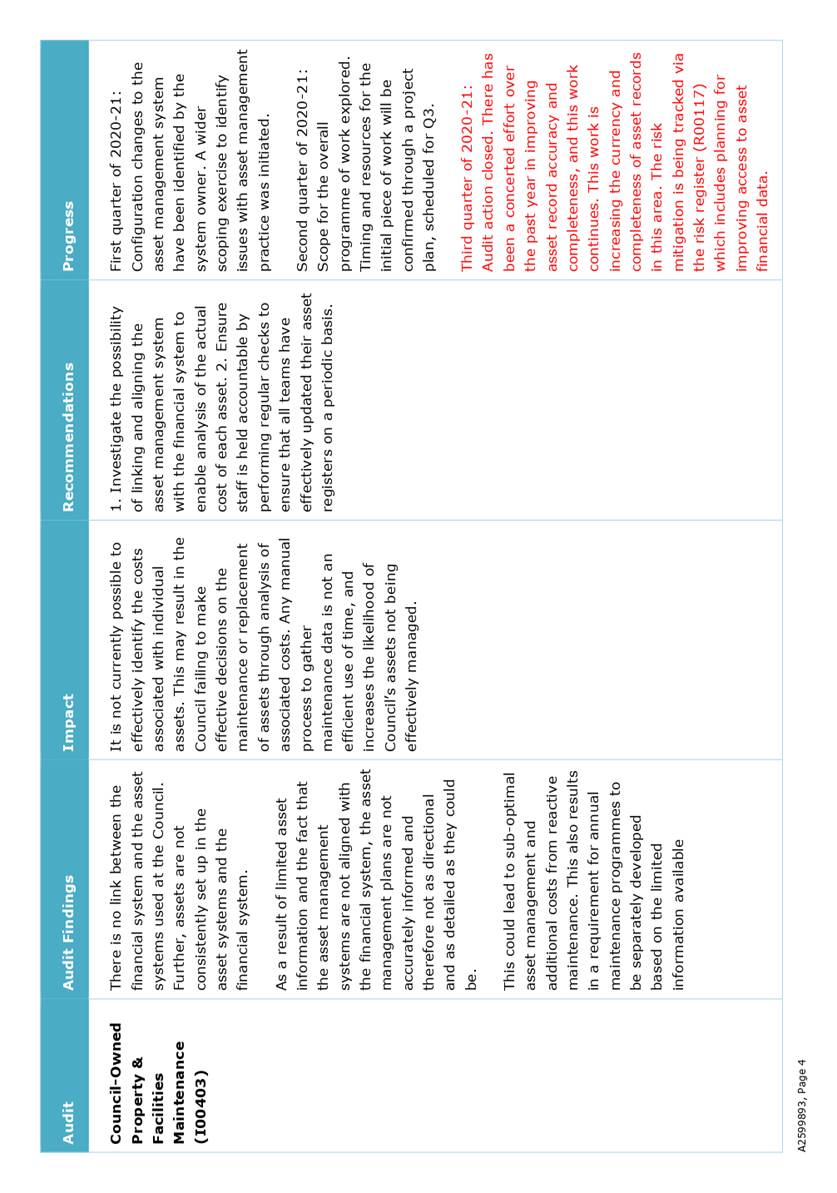

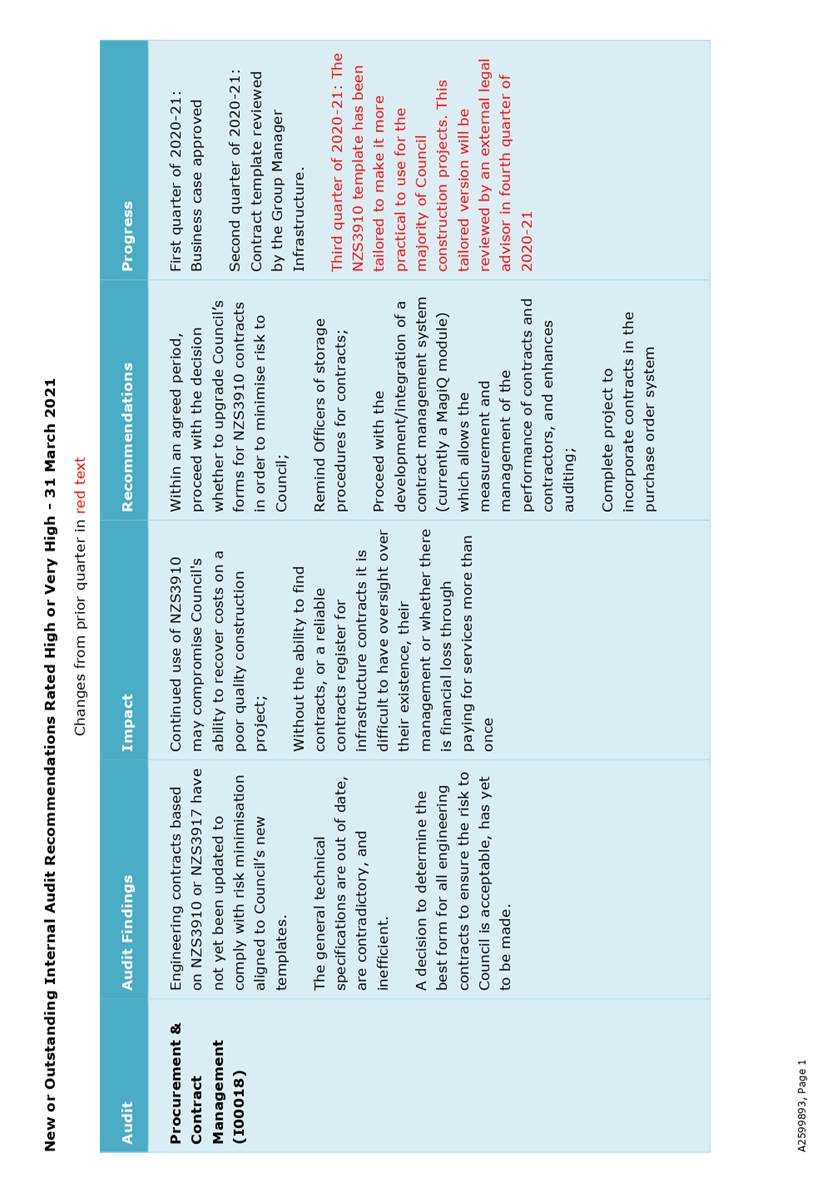

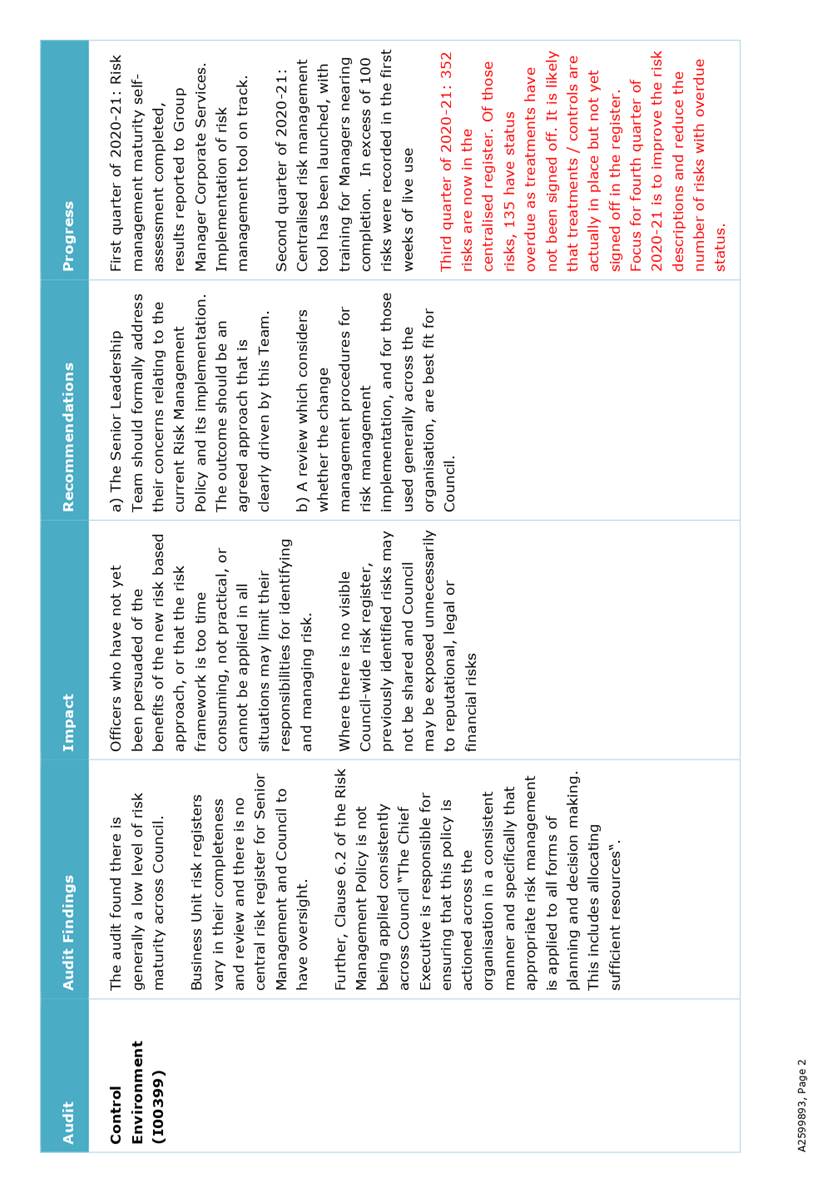

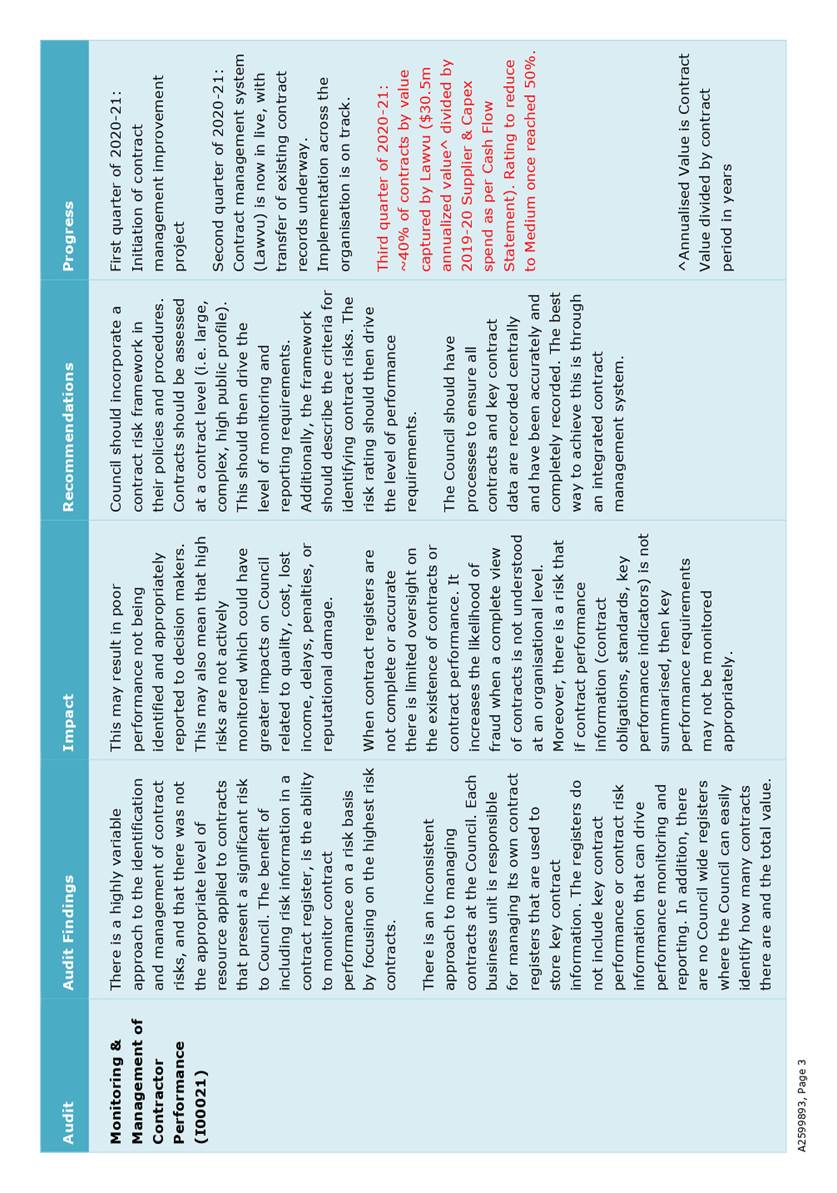

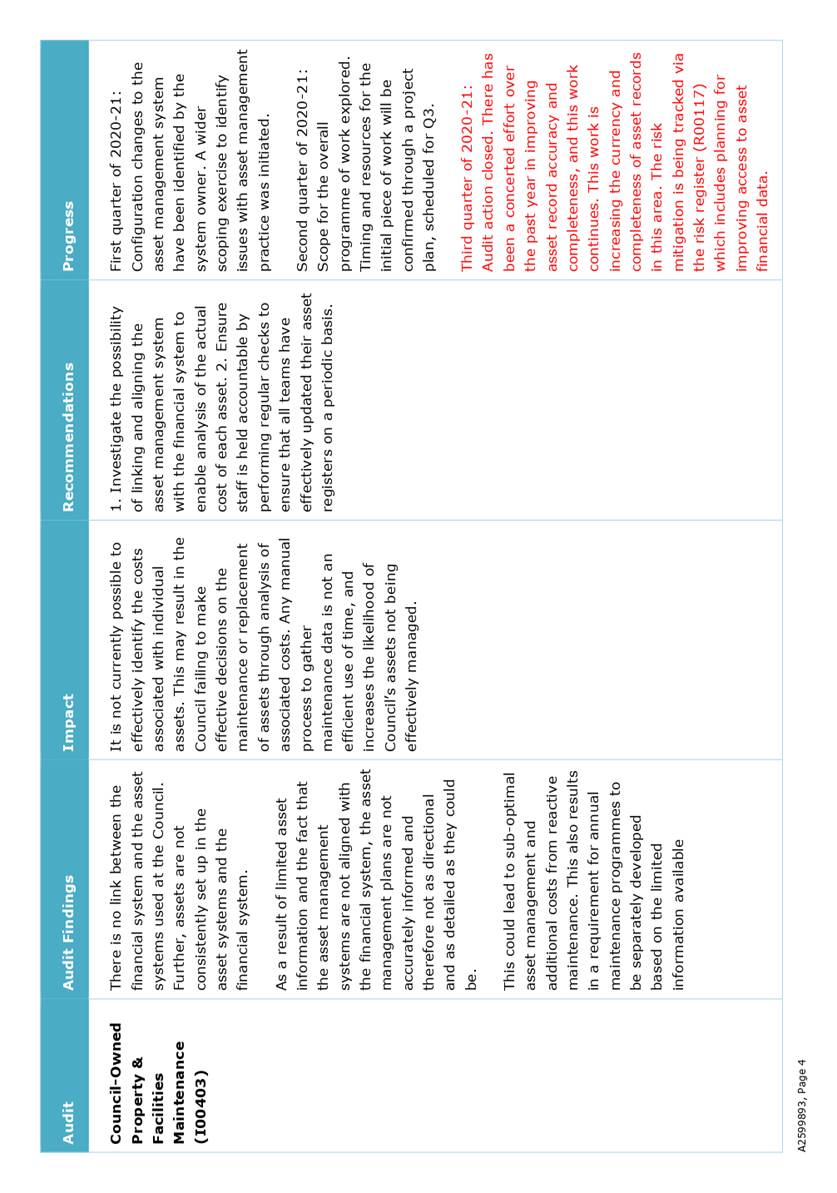

section, including attachment New or Outstanding Internal Audit

Recommendations Rated High or Very High - 31 March 2021 (A2599893),

replaces the stand-alone report, that was included in previous Audit, Risk and

Finance Subcommittee agendas.

5.2 There

are no new significant risk exposures identified from internal audits and of

the seven outstanding items at end of quarter three 2020-21, one has been

closed. Of the remaining six outstanding items, it

is anticipated that one, Monitoring & Management of Contractor

Performance (I00021), will be closed in the next quarter.

Author: Chris

Logan, Audit and Risk Analyst

Attachments

Attachment 1: A2601420

Annual Audit Plan Progress to 31 March 2021 ⇩

Attachment 2: A2599893

New or Outstanding Internal Audit Recommendations Rated High or Very High - 31

March 2021 ⇩

Item 10: Internal Audit - Quarterly Progress Report to 31 March

2021: Attachment 1

Item 10: Internal Audit

- Quarterly Progress Report to 31 March 2021: Attachment 2

Item 11: Draft Annual

Internal Audit Plan for year to 30 June 2022

|

|

Audit, Risk and Finance Subcommittee

25 May 2021

|

REPORT R24781

Draft

Annual Internal Audit Plan for year to 30 June 2022

1. Purpose

of Report

1.1 To

approve the Draft Annual Internal Audit Plan to 30 June 2022.

2. Summary

2.1 The

Internal Audit Charter, approved by Council on 15 November 2018, requires that

at least annually, internal auditor submits to the Audit, Risk and Finance Subcommittee

(ARF) an internal audit plan for review and recommendation to the Council for

approval.

3. Recommendation

|

That the Audit, Risk and Finance Subcommittee

1. Receives

the report Draft Annual Internal Audit Plan for year to 30 June 2022 (R24781) and its attachment (A2601457).

|

Recommendation

to Council

|

That the

Council

1. Approves the Draft Annual

Internal Audit Plan for the year to 30 June 2022 (A2601457).

|

4. Background

4.1 The

internal audit plan consists of a work schedule as well as budget and resource

requirements for the next fiscal year. These items are described in the

attachment Draft 2021-22 Internal Audit Plan – 21 March 2021

(A2601457)

4.2 The

internal audit plan has been developed based on a prioritisation of a list of

all potential audit topics using a risk-based methodology.

5. Discussion

5.1 Like

prior years, the draft annual audit plan contains two to three planned topics

and a placeholder for two ad hoc audit topics. A budget of $25,000 has been

allowed for should the ad hoc audit topics require external specialists.

5.2 The

planned topics are:

5.2.1 ‘Streamlined

procurement’ probity & value for money audit (first half year of

2021-22)

5.2.2 Marina

controls assessment (second half year of 2021-22)

5.2.3 Annual

Fraud & Conflict of Interest Control Effectiveness Assessment (first half

year of 2021-22)

6. Options

6.1 Option

1 – Preferred Option – Approve draft plan.

6.2 Option

2 – Less Agile Option - involves removing one of the placeholder ad hoc

audit topics and replacing it with an item, selected by the Subcommittee, from

the list of potential ad-hoc audit topics as per attachment Draft 2021-22

Internal Audit Plan – 21 March 2021 (A2601457).

|

Option 1: Approve Draft Internal Audit Plan (Preferred)

|

|

Advantages

|

· In line

with Senior Leadership Team (SLT) expectations

· Flexibility

to audit emerging risks.

|

|

Risks and Disadvantages

|

· A loss

occurs that may have been avoided had an audit taken place for one of the

potential ad-hoc audit topics.

|

|

Option

2: Approves an amended, less agile Internal Audit Plan

|

|

Advantages

|

· Greater

certainty of the audit plan.

|

|

Risks and Disadvantages

|

· Increased

delivery risk as placeholder ad hoc audit topics not fully scoped.

|

Author: Chris

Logan, Audit and Risk Analyst

Attachments

Attachment 1: A2601457 -

Draft 2021-22 Internal Audit Plan - 31 March 2021 ⇩

|

Important considerations for decision making

|

|

1. Fit

with Purpose of Local Government

This report provides a plan to assess whether

certain areas of Council's risk management, governance and internal control

processes are operating effectively.

Execution of the plan provides assurance that

Council is effectively promoting the social, economic, environmental, and

cultural well-being of communities in the present and for the future.

|

|

2. Consistency

with Community Outcomes and Council Policy

This report aligns with the Internal Audit Charter,

approved by Council on 15 November 2018.

The review of the ‘Streamlined

procurement’ speaks directly to the Community Outcomes identified in

the Long Term Plan 2018-28 that “our infrastructure is efficient, cost

effective and meets current and future needs.”

|

|

3. Risk

If internal audits are not approved: the cost of

external audits may increase, the frequency and severity of internal control

failures may increase and it may become more difficult to retain

Council’s current credit rating.

|

|

4. Financial

impact

This decision will fit within existing budgets.

|

|

5. Degree

of significance and level of engagement

This matter is of low significance because it does

not directly impact financial decisions, or the levels of services provided.

Therefore no consultation is required.

|

|

6. Climate

Impact

There has been no specific climate change impact

considered in the preparation of this report.

|

|

7. Inclusion

of Māori in the decision making process

No engagement with Māori has been undertaken in

preparing this report.

|

|

8. Delegations

The Audit, Risk and Finance Subcommittee has the

following delegations to consider the Annual Internal Audit Plan and the

resourcing for this each year.

Areas of Responsibility:

· Internal

audit

Powers to Decide

· Appointment

of a deputy Chair

Powers to Recommend to Council

· All

other matters within the areas of responsibility or any other matters

referred to it by the Council:

|

Item 11: Draft Annual Internal Audit Plan for year to 30 June 2022:

Attachment 1

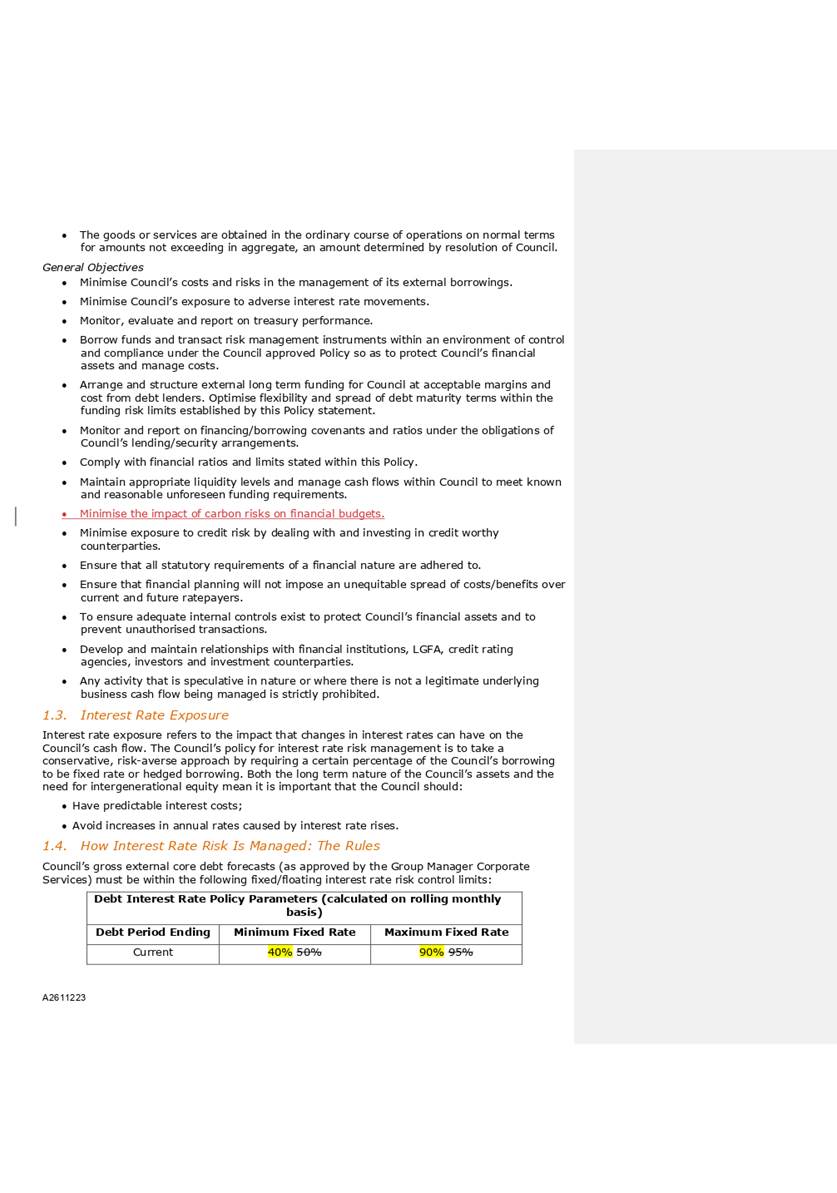

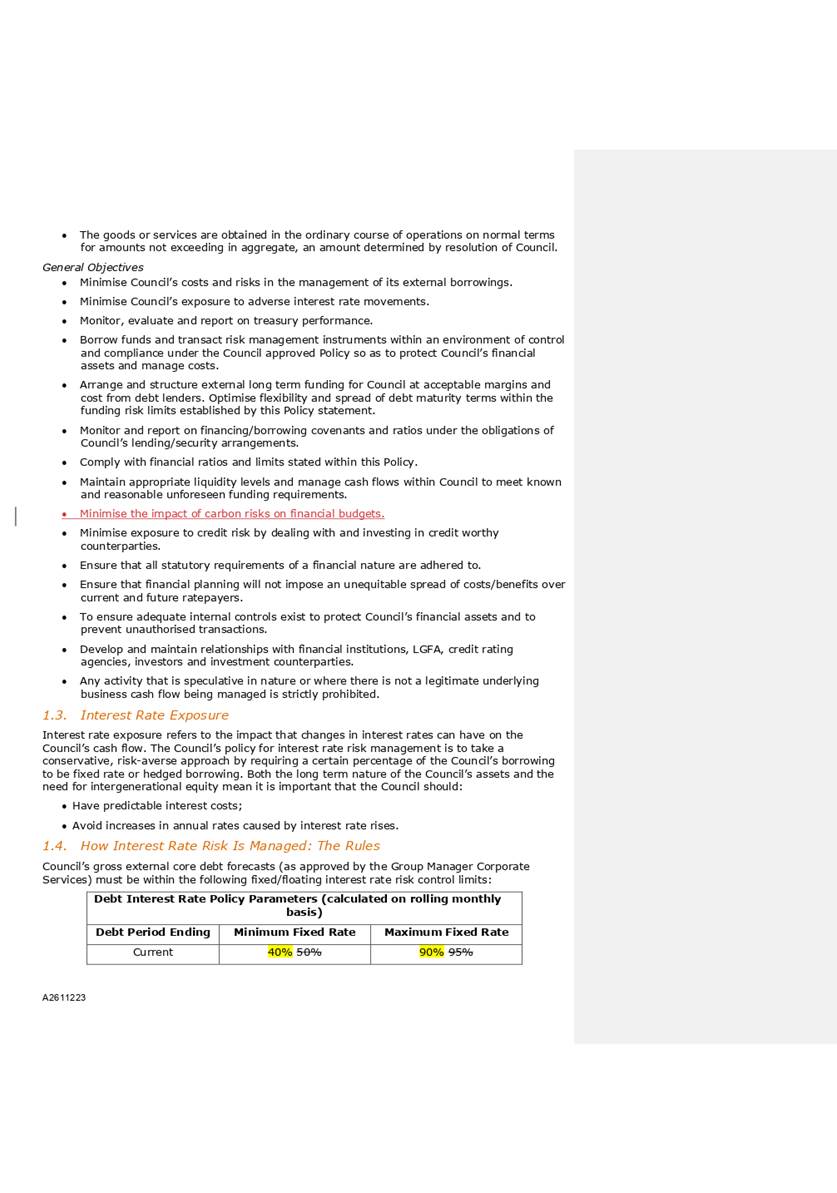

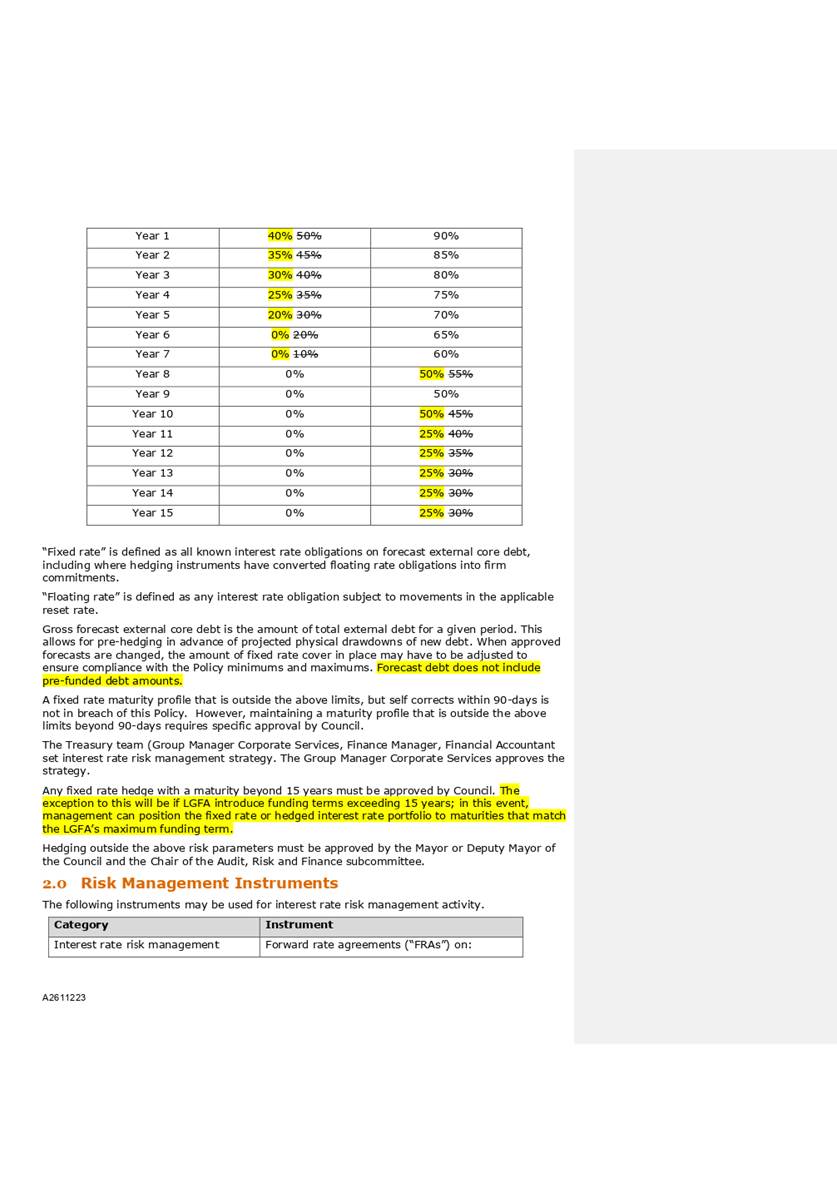

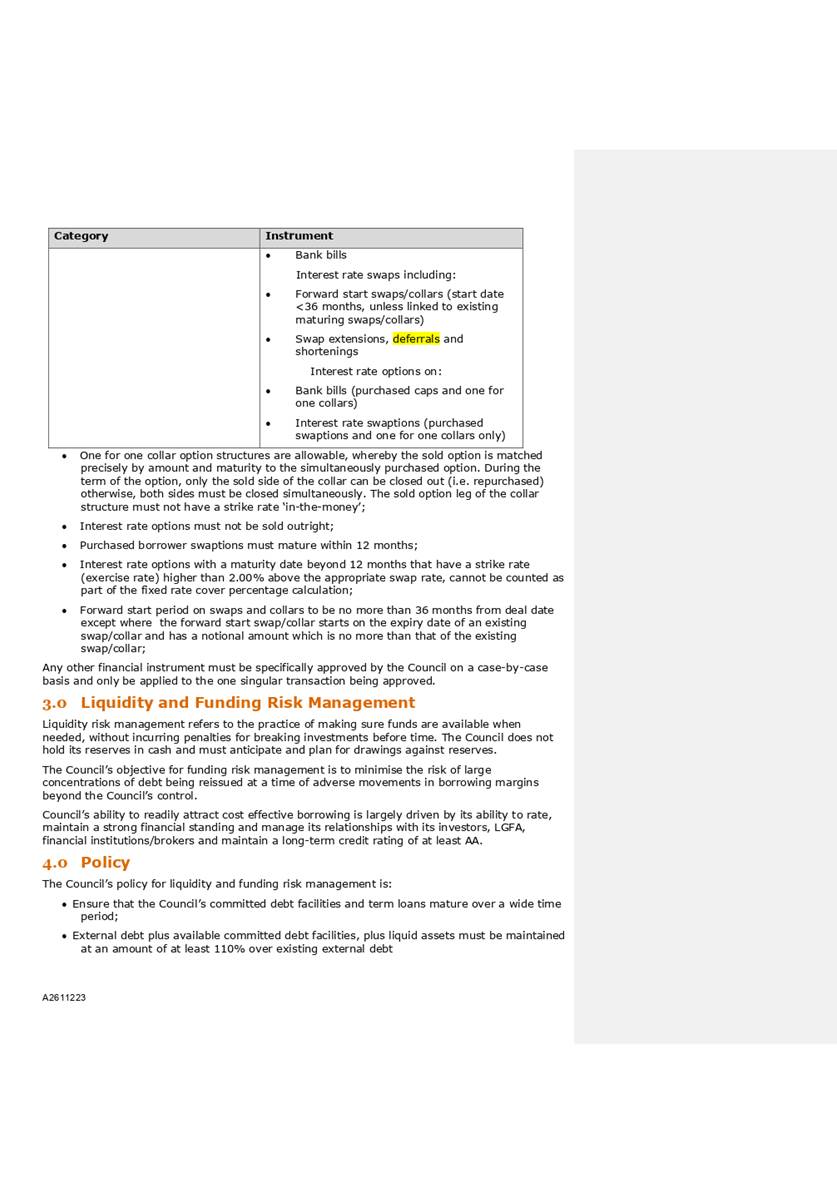

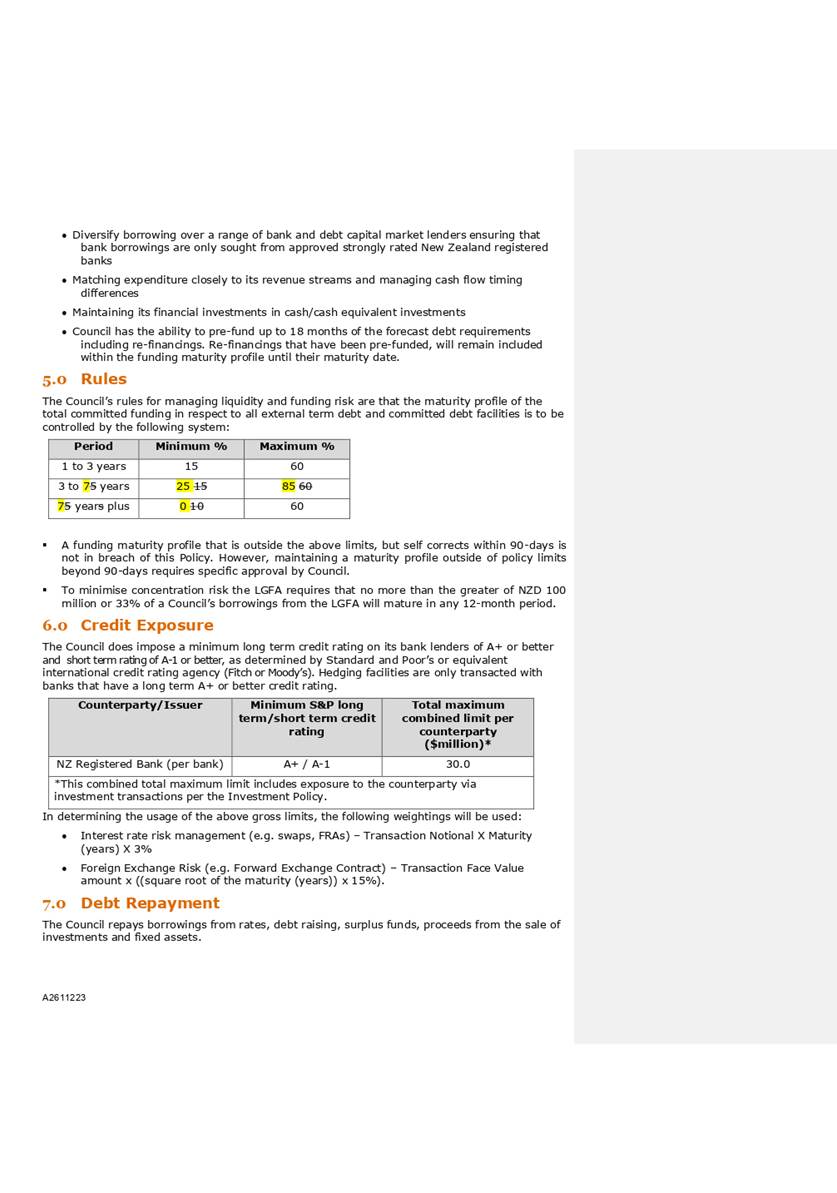

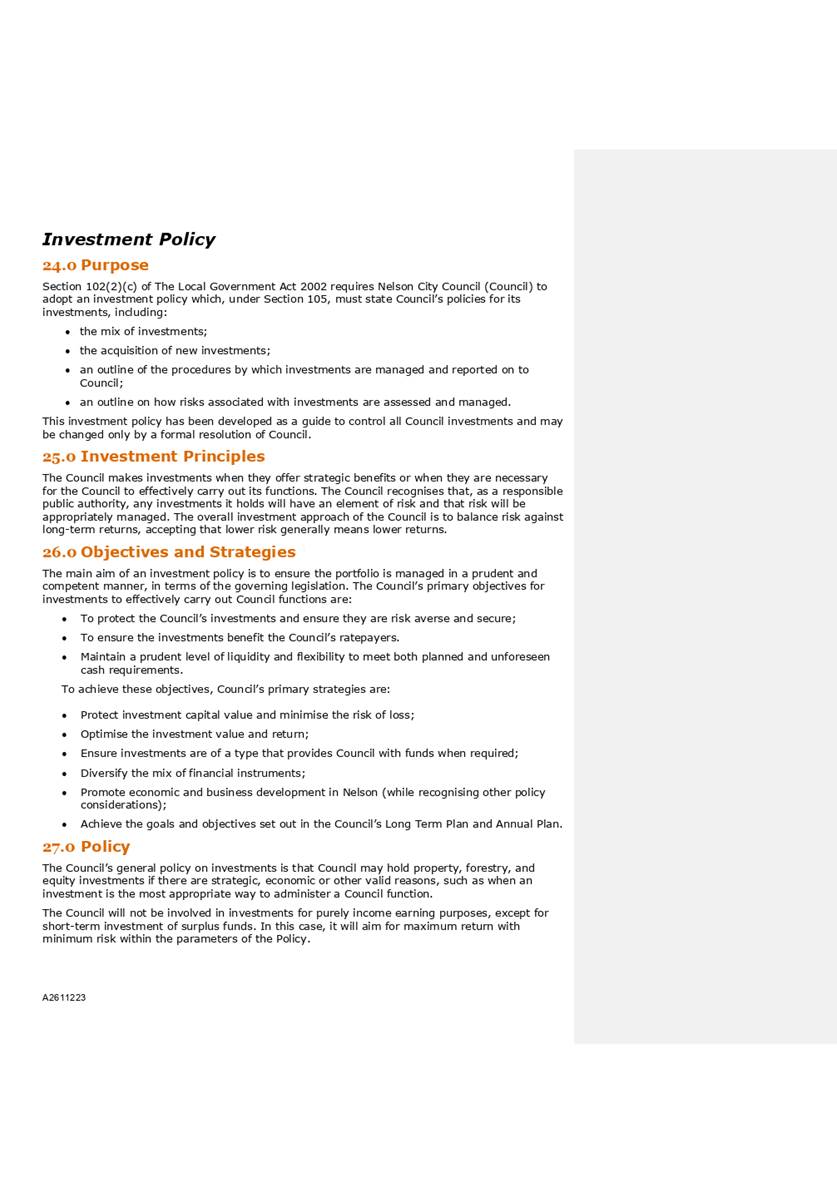

Item 12: Draft Treasury

Management Policy including Liability Management and Investment Policies

|

|

Audit, Risk and Finance Subcommittee

25 May 2021

|

REPORT R24767

Draft

Treasury Management Policy including Liability Management and Investment

Policies

1. Purpose

of Report

1.1 To

adopt the new Treasury Management Policy including the amended Liability

Management and Investment Policies.

2. Recommendation

|

That the Audit, Risk and Finance Subcommittee

1. Receives

the report Draft Treasury Management Policy including Liability Management

and Investment Policies (R24767)

and its attachment (A2611223).

|

Recommendation to Council

|

That the

Council

1. Adopts the Treasury

Management Policy (A2611223).

|

3. Background

3.1 Under

the Local Government Act 2002 (LGA) section 102(2)(b) and (c) Council must

adopt a Liability Management Policy and an Investment Policy. The current

Treasury Management Policy including Liability Management and Investment

Policies was adopted in September 2019 and is due for review in September 2022.

However, recent changes in the sector including a lower interest rate

environment, a new Local Government Funding Agency (LGFA) standby facility, and

changes to the Financial Strategy through the Long Term Plan (LTP), have

prompted an earlier review of this policy.

3.2 In

order to manage Council’s proposed work programme in the LTP 2021-31, the

debt to revenue ratio is proposed to be changed from 150% to 175%. This

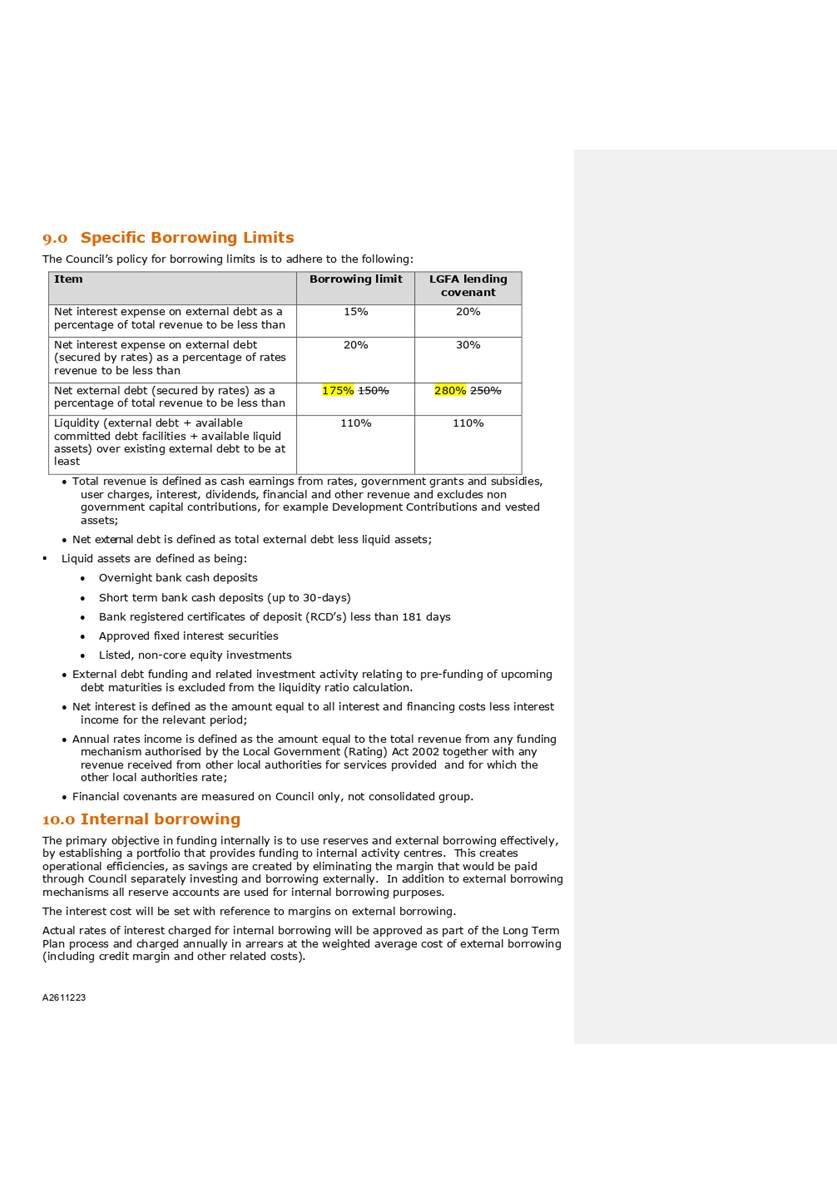

change to the Financial Strategy needs to be also changed in the Treasury

Management Policy.

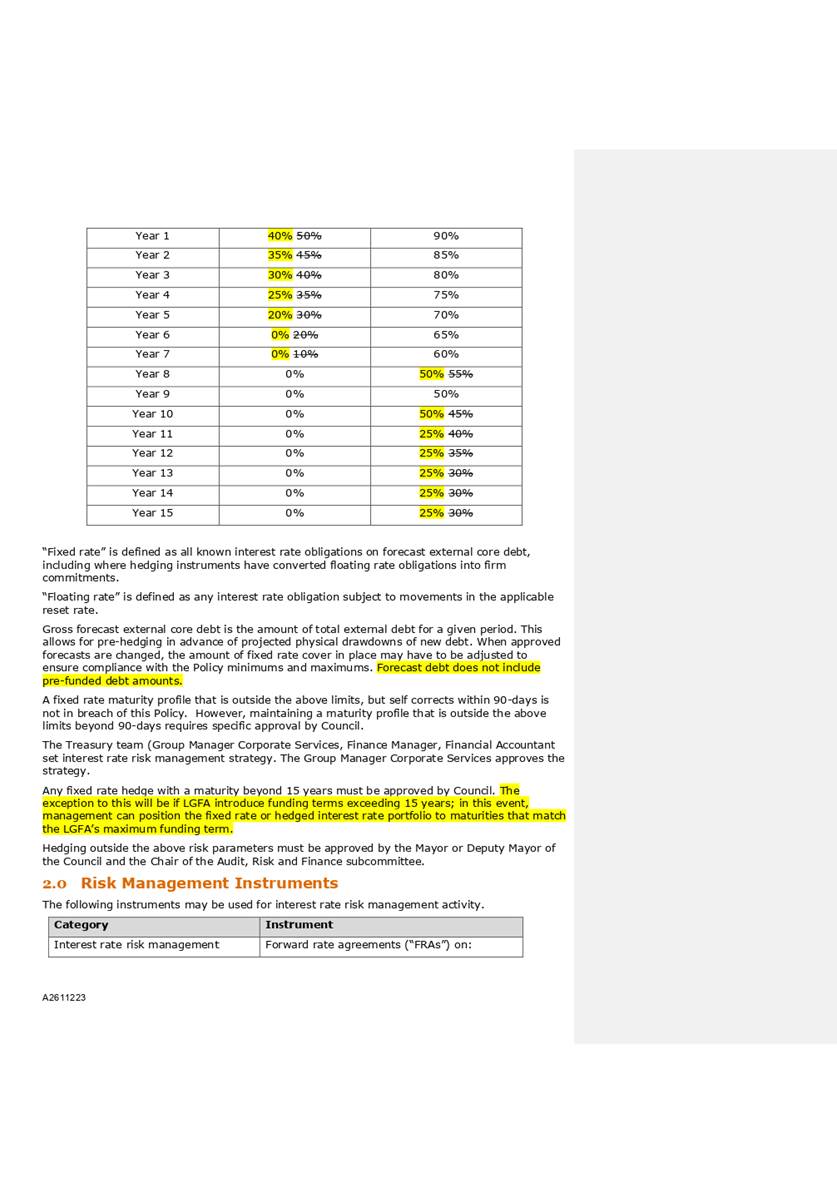

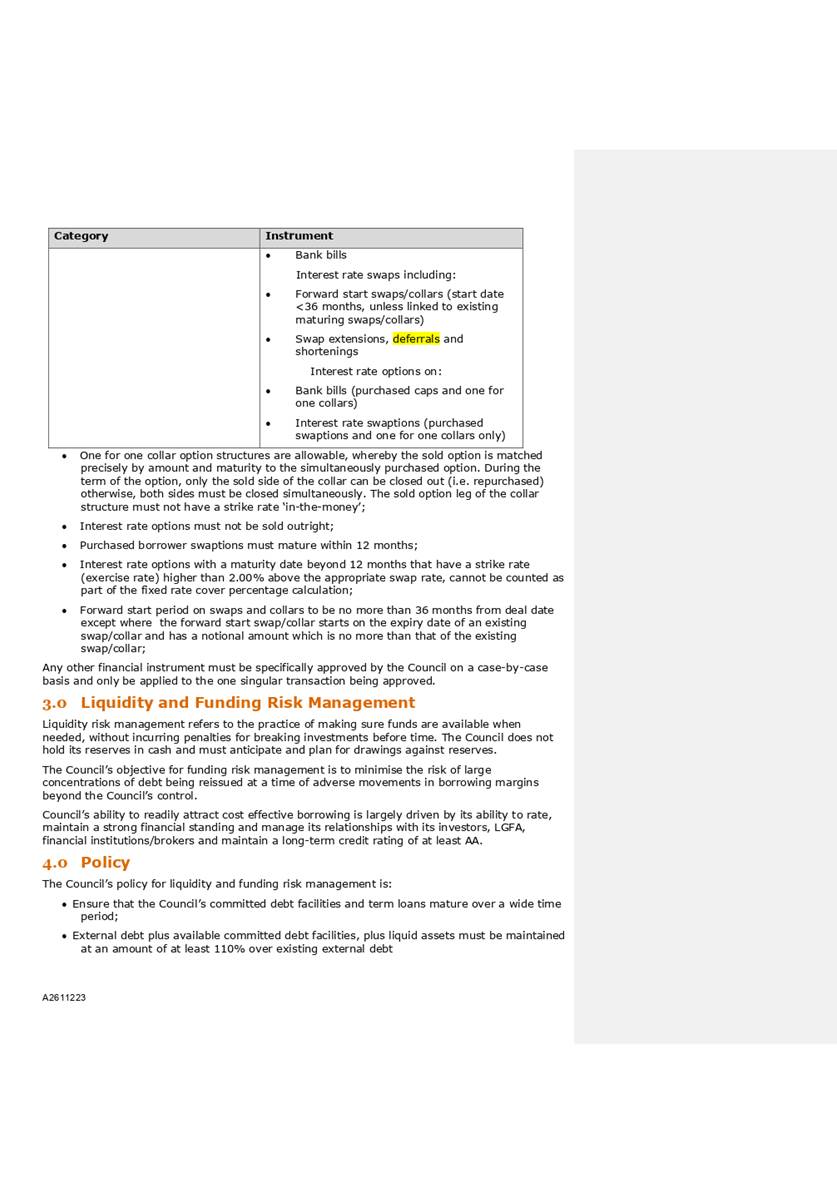

4. Discussion

4.1 The

Council’s treasury advisors, Price Waterhouse Cooper (PWC), have reviewed

and updated the Council’s draft Treasury Management Policy to continue to

align with sound treasury management sector practice. Changes to the policies

are highlighted in yellow.

Liability

Management Policy

4.2 The

following recommendations were made based on the review:

4.3 Changing

the interest rate risk management policy framework to provide greater

flexibility in managing interest rate risk positions (Section 1.4):

4.3.1 The

policy approach reduces the minimum amount of interest rate fixing over the

medium term to allow management greater discretion in managing Council’s

exposure to market wholesale interest rates.

4.3.2 This

will allow Council to benefit from the current lower interest rate environment.

4.3.3 There

is an ongoing requirement to have a portion of interest rate risk managed

through fixing with approved interest rate instruments.

4.3.4 Interest

Rate risk positions will continue to be reviewed monthly by staff and PWC.

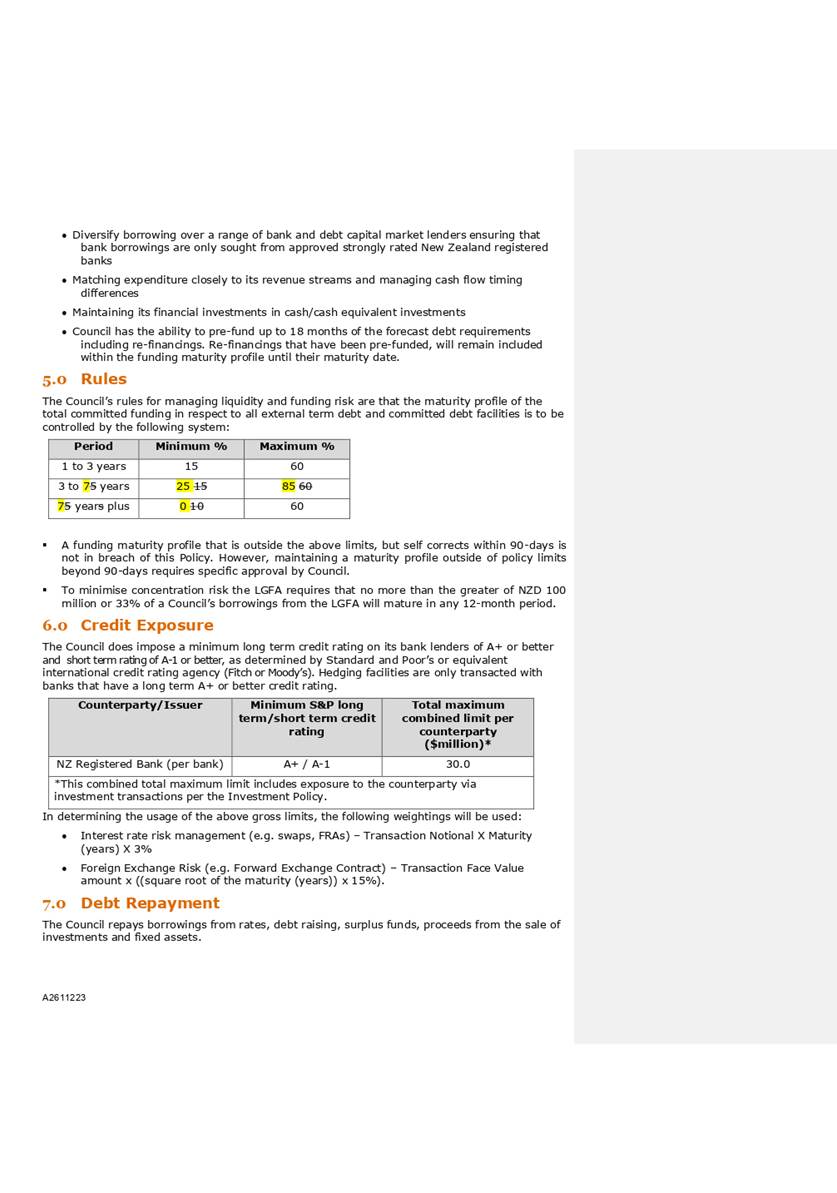

4.4 Changes

to the funding risk control limits are recommended to provide more flexibility

in Council’s debt management (Section 5):

4.4.1 An

adjustment to the maturity bands within the framework will allow for a

3–7 year and 7 year + timeframe. LGFA

currently lend up to 15 years.

4.4.2 The

policy continues to encourage a spreading of debt maturities with a minimum of

40% of the debt portfolio spread across the 0-3 year and 3-7 year time bands

and no more than 60% of the debt portfolio maturing in the next 3 years.

4.4.3 Whilst

maintaining consistency with Council’s treasury objectives and recognising

the debt management and liquidity support of the LFGA, the recommended funding

maturity limits create additional flexibility, allowing existing debt to mature

naturally whilst providing Council with the ability to strategically manage its

debt portfolio over time.

4.5 The

Policy includes the new debt instrument that is now on offer from the LGFA.

These are committed stand-by facilities that will replace a portion of existing

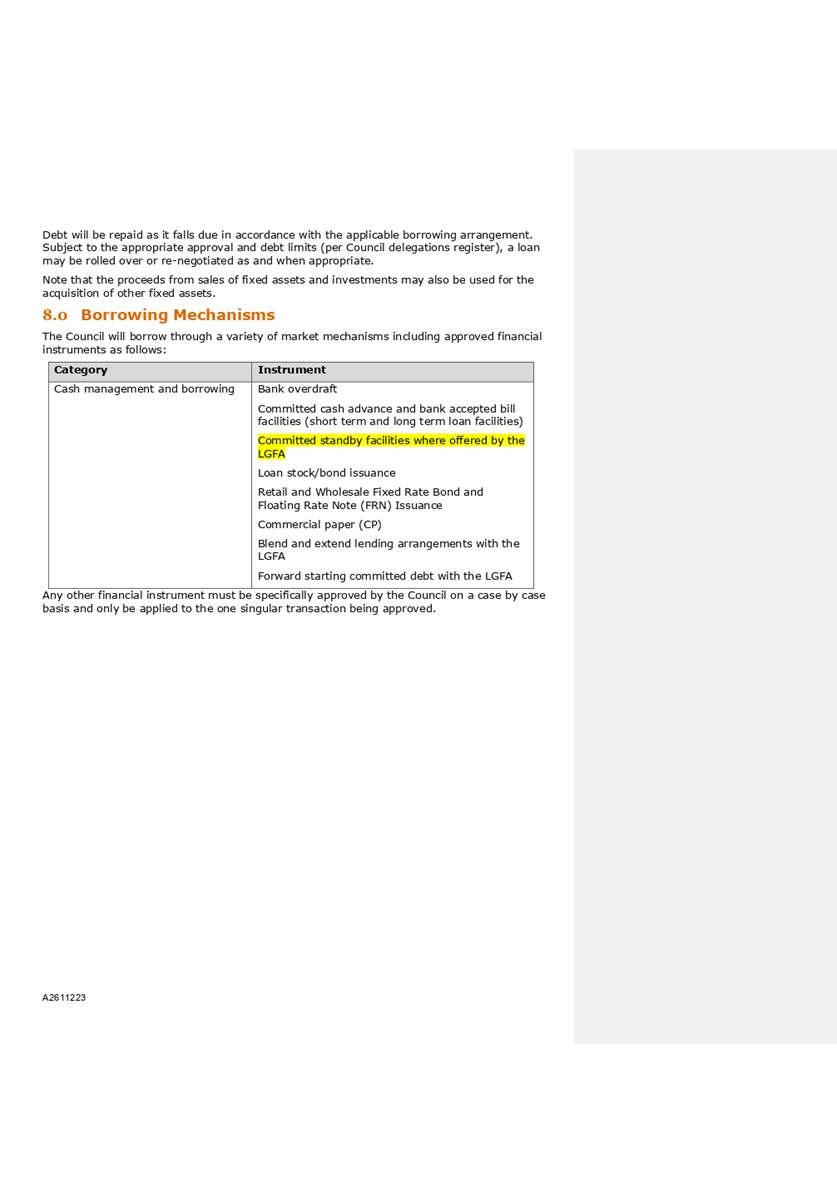

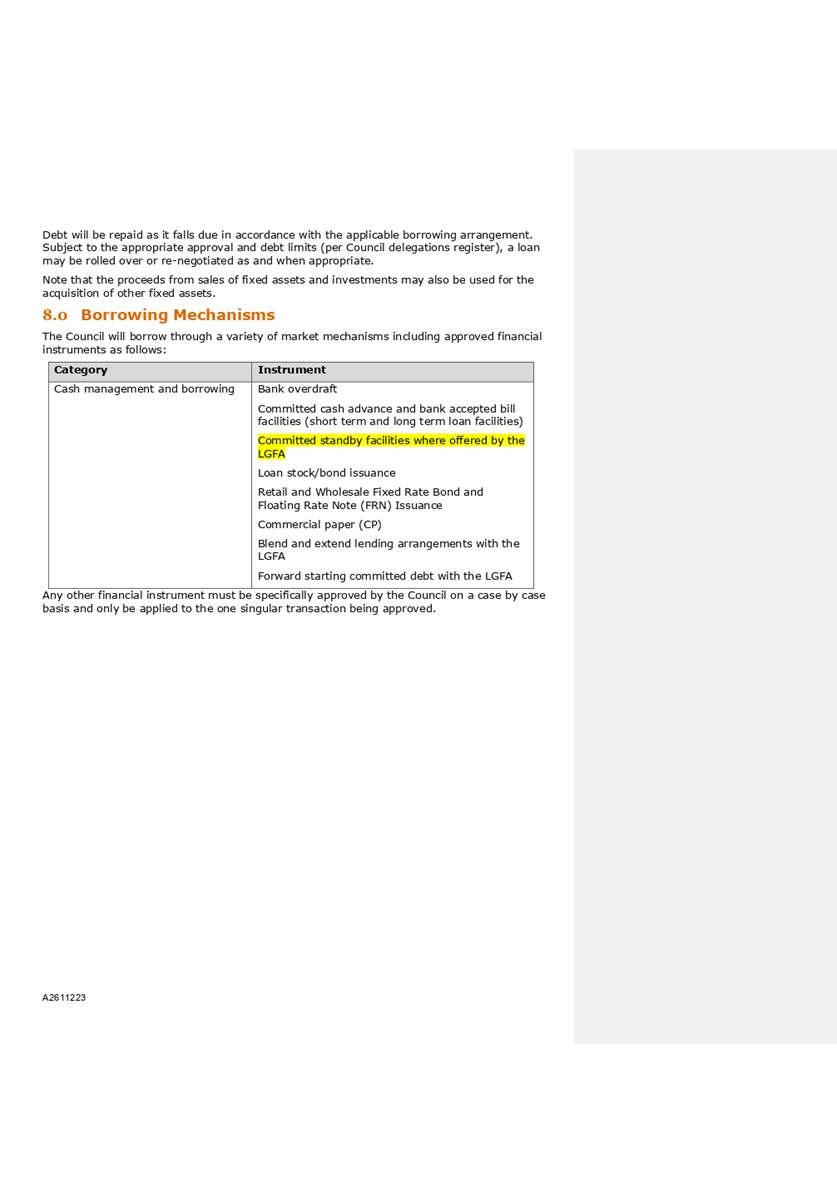

committed bank facilities (Section 8).

4.6 In

order to reflect changes made to the Financial Strategy as part of the draft

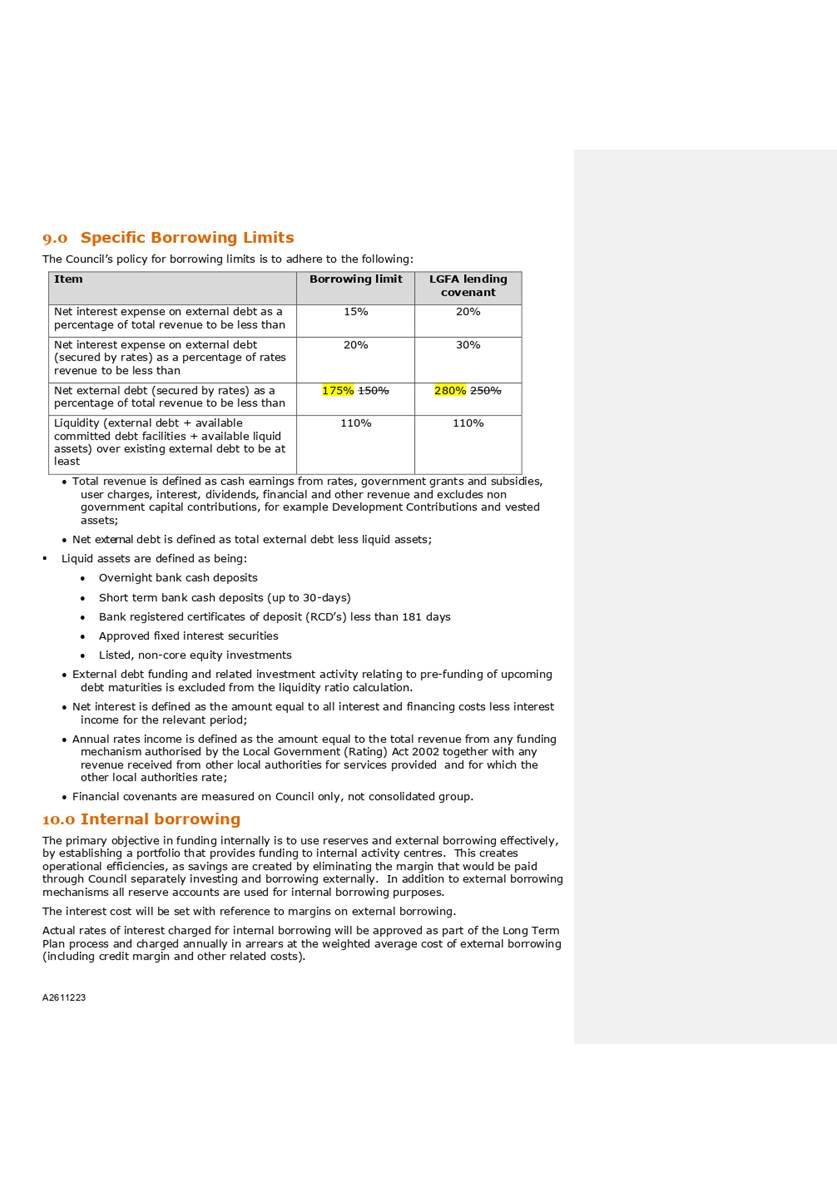

2021-31 LTP, the net external debt as a percentage of total revenue has been

changed to 175% (previously 150%) in Section 9. The Policy has also been

updated to reflect the LGFA lending covenant of 280% (previously 250%)

following an update by the LGFA in 2020 (Section 9).

4.7 The

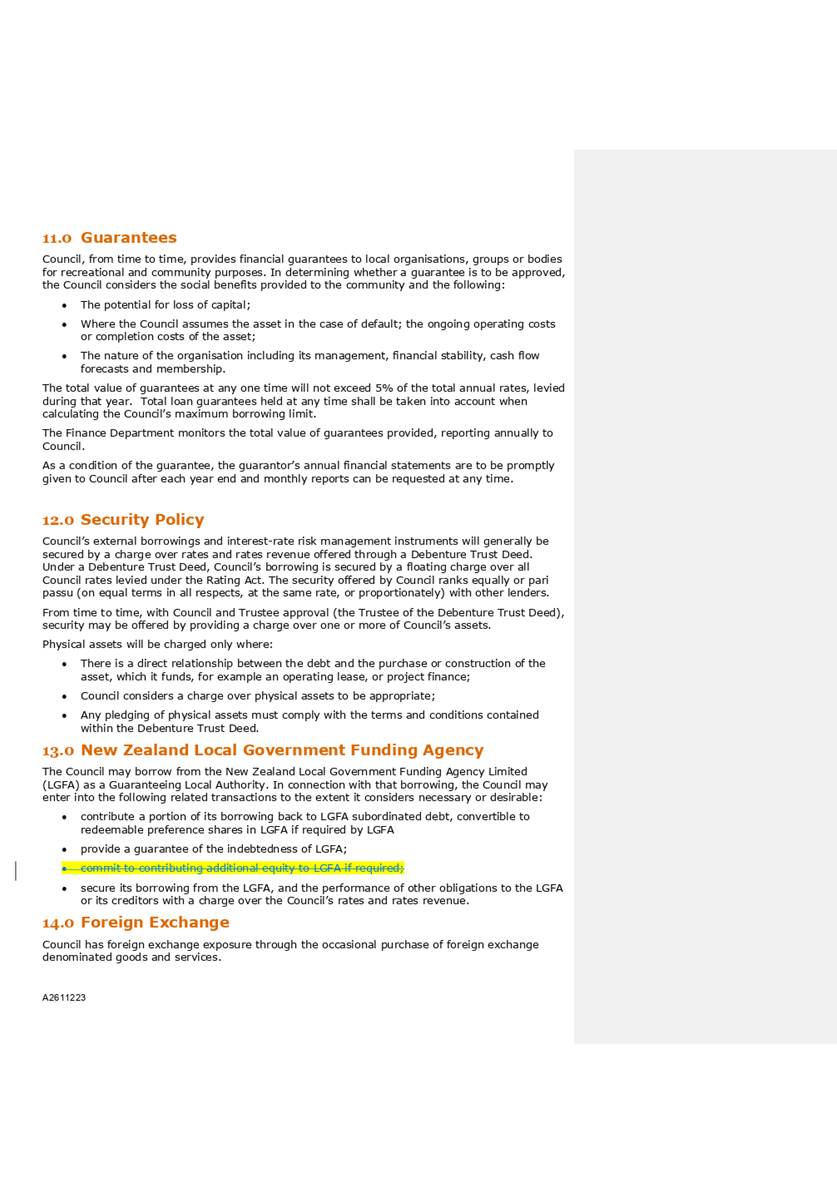

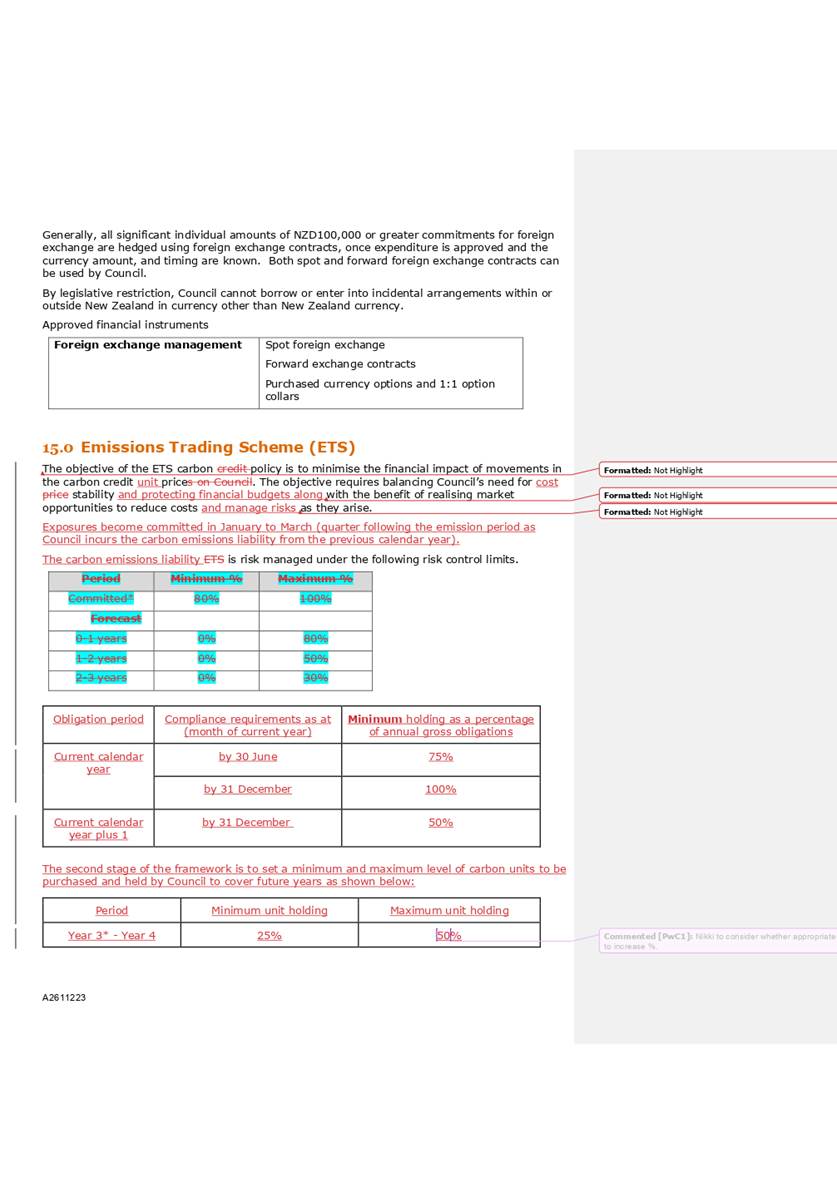

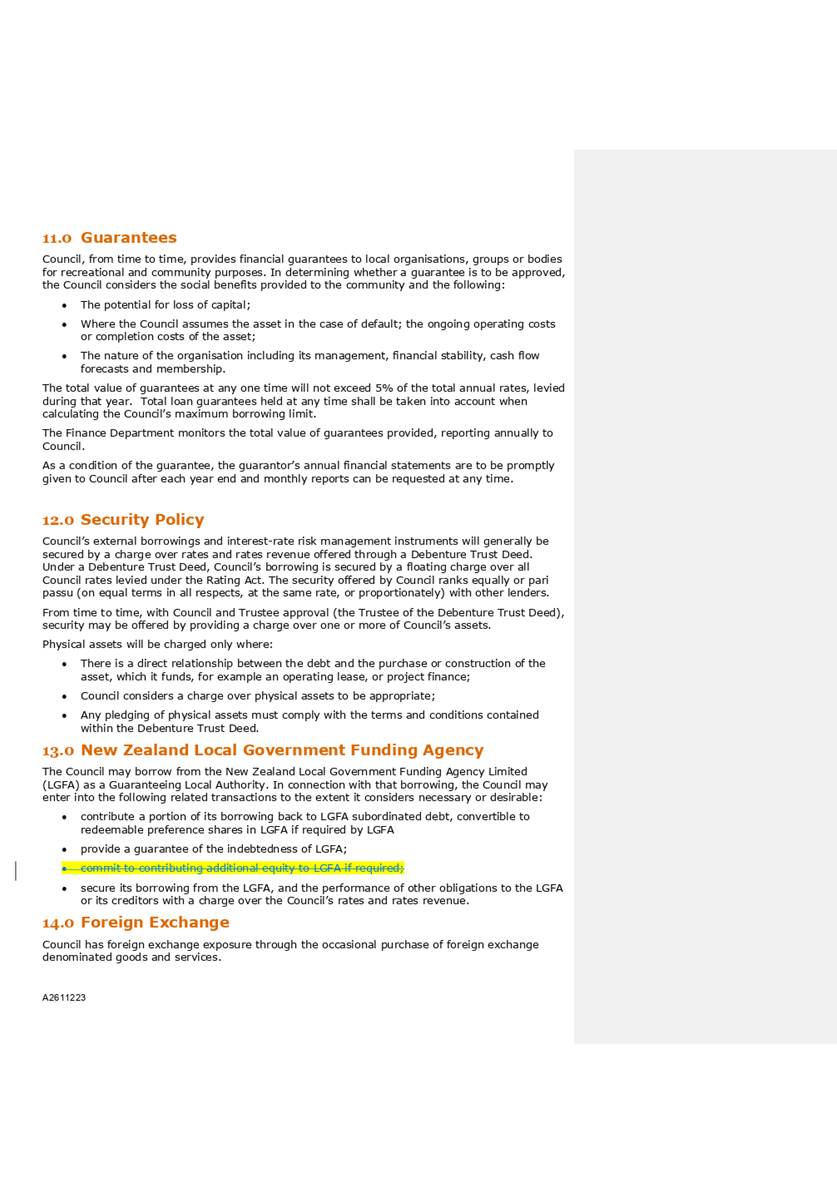

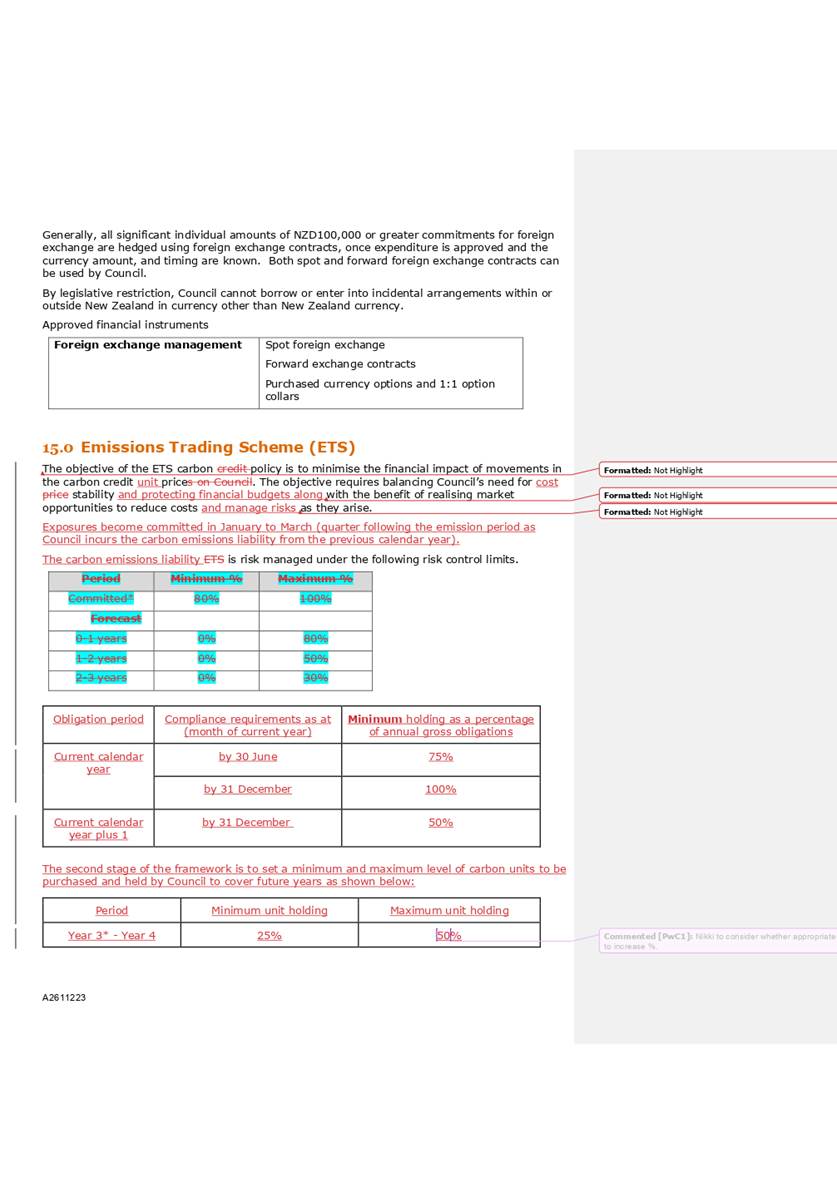

Emission Trading Scheme section has been reviewed to amend the minimum and

maximum hedging allowed for the Landfill ETS liability. This is primarily

to allow the Nelson Tasman Regional Landfill Business Unit (NTRLBU) to provide

more ETS hedging cover for their Business Plan. In addition, the

Government has changed the way it delivers carbon credits to NZETA participants

from a cash option to auction. Changes to the policy have been made to allow

the Landfill to use the NZ ETS auctions to obtain credits to meet its

obligations.

4.8 Any

changes required to the Treasury Management Policy from the Holding Company

proposal will be brought back to a future Subcommittee meeting.

Investment Policy

4.9 The

changes to the Investment Policy are:

4.10 Updated

wording for Nelmac investment reflecting Council’s resolution on 22

September 2020 confirming Nelmac’s position as a strategic partner

delivering key services to Council.

4.11 The

forestry section has been updated to reflect the revised Goal in the forestry

AMP including recognising the protection of environmental and recreational

values and recognition of Council’s Forest Stewardship Council (FSC)

accreditation.

4.12 The

Property Investment section has been updated to remove the list of Council

properties as the list is not comprehensive and having some properties listed

may hinder decision making.

4.13 Finance

staff have conducted a review of the changes in depth and are satisfied with

the recommendations.

5. Options

|

Option 1: Adopt the Treasury

Management Policy

|

|

Advantages

|

· changes

are recommended by Council’s treasury advisor and are considered

current best practice

· can

continue to proactively manage treasury risk

· will

allow for holding company/funding vehicle to borrow directly from LGFA

|

|

Risks and Disadvantages

|

· none

|

|

Option

2: Do not adopt the Treasury Management Policy

|

|

Advantages

|

· no

change from existing policy

|

|

Risks and Disadvantages

|

· policy

will not conform to current best practice

· will

not allow for holding company/funding vehicle to borrow directly from LGFA

|

6. Next

Steps

6.1 On

approval by Council the adopted Treasury Management Policy will come into

effect and will be updated on the Council website.

6.2 Future

compliance reporting to the Audit Risk and Finance subcommittee will be against

the new framework.

6.3 Active

daily monitoring of compliance against the policies is the responsibility of

the Group Manager Corporate Services and the Finance Manager.

Author: Nikki

Harrison, Group Manager Corporate Services

Attachments

Attachment 1: A2611223

Treasury Management Policy - April 2021 ⇩

|

Important considerations for decision making

|

|

1. Fit

with Purpose of Local Government

Risk management through having an Investment Policy

and Liability Management Policy ensures Council is effectively promoting the

social, economic, environmental, and cultural well-being of communities in

the present and for the future.

|

|

2. Consistency

with Community Outcomes and Council Policy

The Liability Management and Investment Policies are

required by section 102 of the Local Government Act. Nothing in the

proposed Treasury Management Policy (including the Investment Policy and

Liability Management Policy) is inconsistent with any other previous Council

decision or Council Policy. Updating the policy supports the community

outcome “Our Council provides leadership and fosters partnerships, a

regional perspective and community engagement”.

|

|

3. Risk

There is

limited risk from the proposed changes.

|

|

4. Financial

impact

There is no direct financial impact from adopting

the Treasury Management Policy.

|

|

5. Degree

of significance and level of engagement

This matter is of low significance because it

includes minor amendments to existing policies, therefore no consultation has

taken place.

|

|

6. Climate

Impact

|

|

7. Inclusion

of Māori in the decision making process

No engagement with Māori has been undertaken in

preparing this report.

|

|

8. Delegations

The Audit Risk and Finance Subcommittee has the

following delegations to consider Investment and Liability Management

Policies:

Areas of Responsibility:

· Council’s

Treasury policies

Powers to Decide:

· none

Powers to Recommend:

· Any

matters within the areas of responsibility

|

Item 12: Draft Treasury Management Policy including Liability

Management and Investment Policies: Attachment 1

Item 13: Service Delivery

Reviews (s17A reviews)

|

|

Audit, Risk and Finance Subcommittee

25 May 2021

|

REPORT R15914

Service

Delivery Reviews (s17A reviews)

1. Purpose

of Report

1.1 To

propose efficiencies in the service delivery review work programme and consider

increasing the internal threshold requirements for reviews undertaken in

meeting the requirements of section 17A of the Local Government Act 2002.

2. Recommendation

|

That the Audit, Risk and Finance Subcommittee

1. Receives

the report Service Delivery Reviews (s17A reviews) (R15914).

|

Recommendation to Council

|

That the

Council

1. Approves an increase in the

value threshold that triggers a service delivery review under section 17A of

the Local Government Act 2002 from $100,000 to $500,000 per annum for

contracts and activity areas.

|

3. Background

3.1 Changes to the Local

Government Act 2002 (LGA) in 2014 saw the introduction of requirements under a

new section, 17A, for councils to review the cost-effectiveness of arrangements

for meeting the needs of communities within their district or region. This is

to encourage good quality local infrastructure, local public services, and

performance of regulatory functions.

3.2 The intention behind the

change was to encourage local authorities to explore opportunities to improve

effectiveness and make efficiency gains through mechanisms such as joint

services and shared arrangements.

3.3 There

are two types of reviews:

3.3.1 Review

of service areas, such as a business activity, within Council (activity

reviews)

3.3.2 Review

of services which are delivered via contract, such as maintenance (contract

reviews)

3.4 In

November 2015, Council agreed to the approach staff would take to meet

legislative requirements. This included an agreed schedule of review areas, use

of a review template, and a review timeline. As provided for under the Act,

Council also set its financial threshold, exempting from review activities and

contracts below $100,000 in value.

3.5 The

first round of service reviews concentrated on 42 service delivery areas to

cover the breadth of Council’s activities. Reviews in these areas were

completed in 2017 and overseen by Council’s Audit and Risk Committee.

4. Discussion

The legislation and triggers

for review

4.1 A

service delivery review is the process of determining whether the existing

means of delivering a service remains the most efficient, effective and

appropriate means for delivering that service. This includes consideration of

the current method of governance, funding and delivery of services alongside

the alternative options that are available.

4.2 Section

17A(2) states that service delivery reviews must be undertaken:

In conjunction with

consideration of any significant change to relevant service levels; and

17(A)(2)(a) Within 2 years before

the expiry of any contract or other binding agreement relating to the delivery

of that infrastructure, service, or regulatory function; and

17(A)(2)(b) At such times as the

local authority considers desirable, but not later than 6 years following the

last review under subsection (1).

4.3 Section

17A(3) also provides two exemptions to these requirements:

17A(3)(a) A local authority is not

required to undertake the review in respect of a function to the extent that

delivery arrangements are bound by legislation, contract or binding agreement

so that they cannot be changed within the next two years;

(17(3)(b) A local authority is not

required to undertake the review if it is satisfied that the potential benefits

do not justify the cost of the review.

4.4 The

legislation does not limit the consideration of costs and benefits to only

financial matters. Other costs and benefits, such as staffing resources, can

also be considered. The second exclusion is designed for circumstances where

the service is small or where cost savings may be minor.

4.5 It

is important to note that the review of services covers how the services are

delivered, not the quality of the services, most of which are reviewed as part

of the development of activity management plans.

4.6 It

is also noted that if a change to the way a service is delivered is proposed,

that decision in itself will need to consider Council’s Policy on

Significance and Engagement and any consequential public engagement.

Current status of review

programme

4.7 Under

the current process, the threshold is $100,000. Most service review areas have

been scheduled for their next review in 2021/22 or 2022/23.

4.8 Staff

have completed a reassessment of the process. Values attributed to contracts

and activity areas is based on their current value, but will be reviewed again

following the adoption of the Long Term Plan (LTP) 2021-2031, when budgets may

have changed.

4.9 Since

the completion of first round of reviews in 2017, staff have undertaken several

activity and contract reviews, including:

· Listed Trees - May

2018

· Navigation Safety

- May 2020

· Nelmac

Infrastructure Contract - February 2020

· General Building

Maintenance of NCC Owned Buildings/Facilities – General Maintenance and

Physical Works Contract - August 2020

Proposed increase in review

limit to $500,000 per annum

4.10 The majority of the first round of reviews

were undertaken using existing staff resources. Reviews are time consuming and

rarely result in changes that have not already emerged from the activity

management process.

4.11 Many variables apply in relation to the

time required to complete a review, however a broad estimation of the time

required is somewhere between five to 30 hours per review. Under the current

system there are several business units with full work programmes that have a

multiple contracts and services valued at $100,000 or over (the current

threshold).

4.12 Staff are recommending the threshold that

triggers the need for either an activity or contract review be increased to

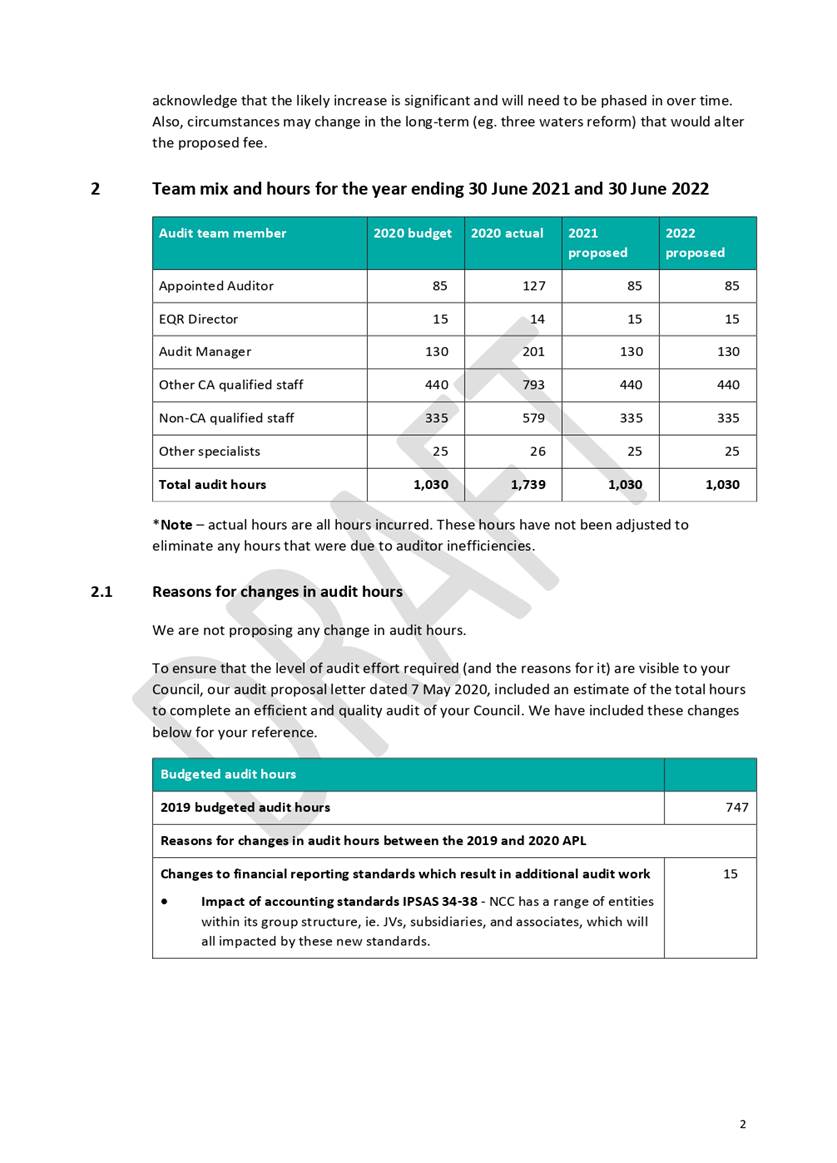

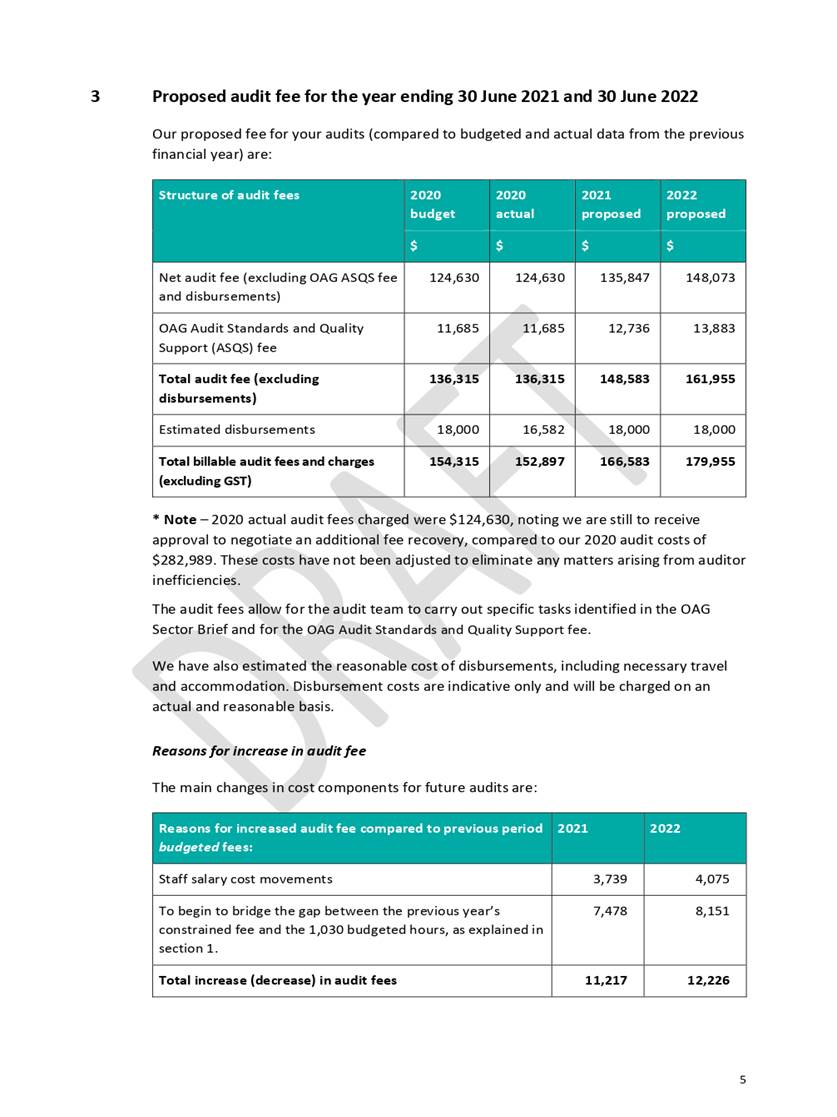

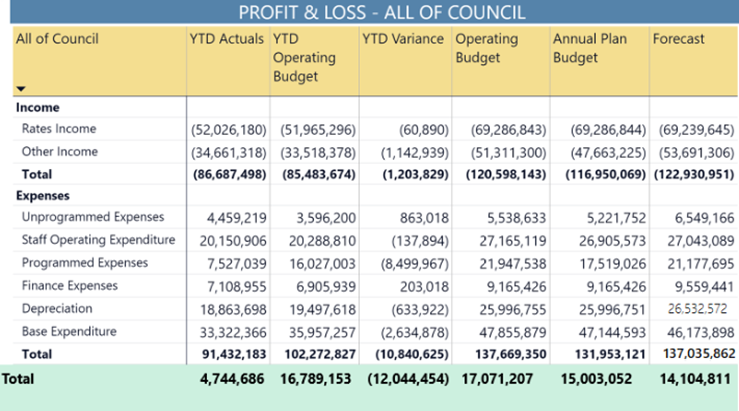

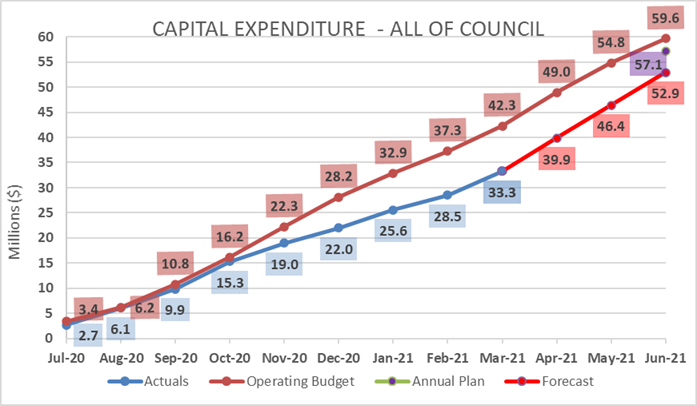

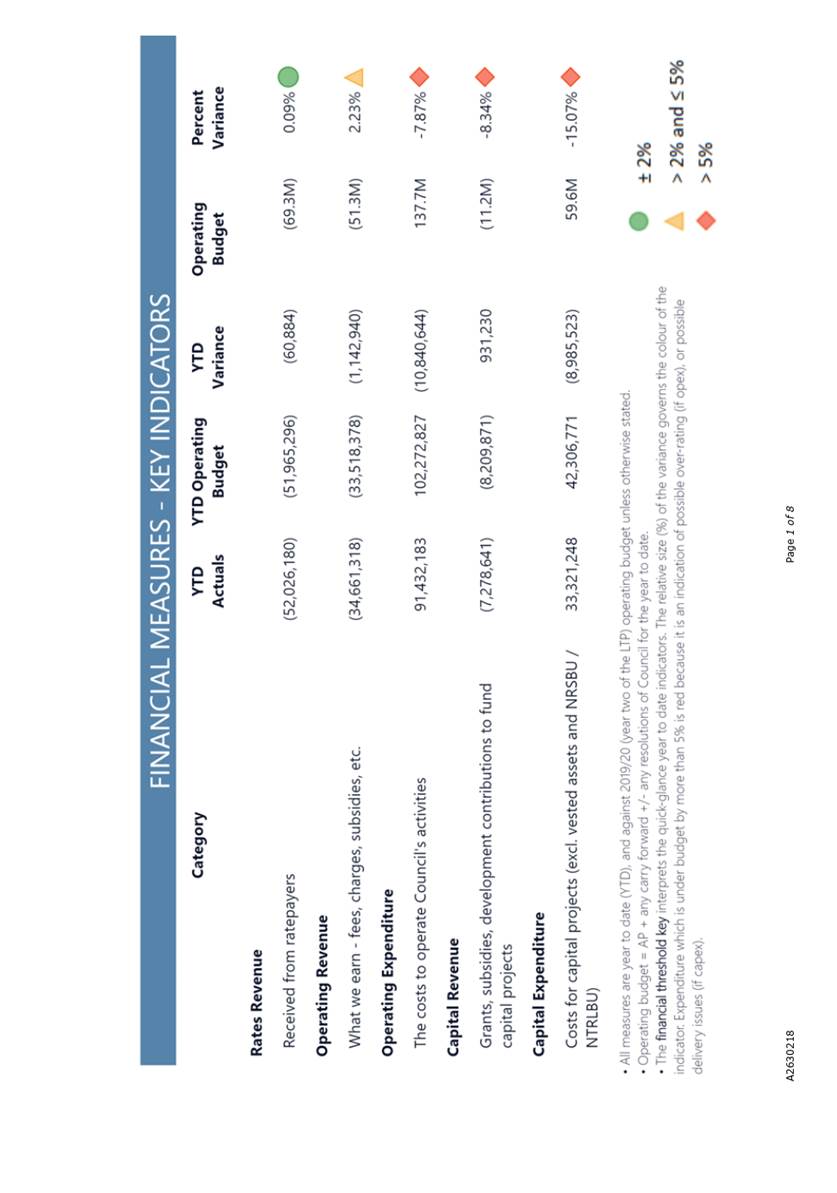

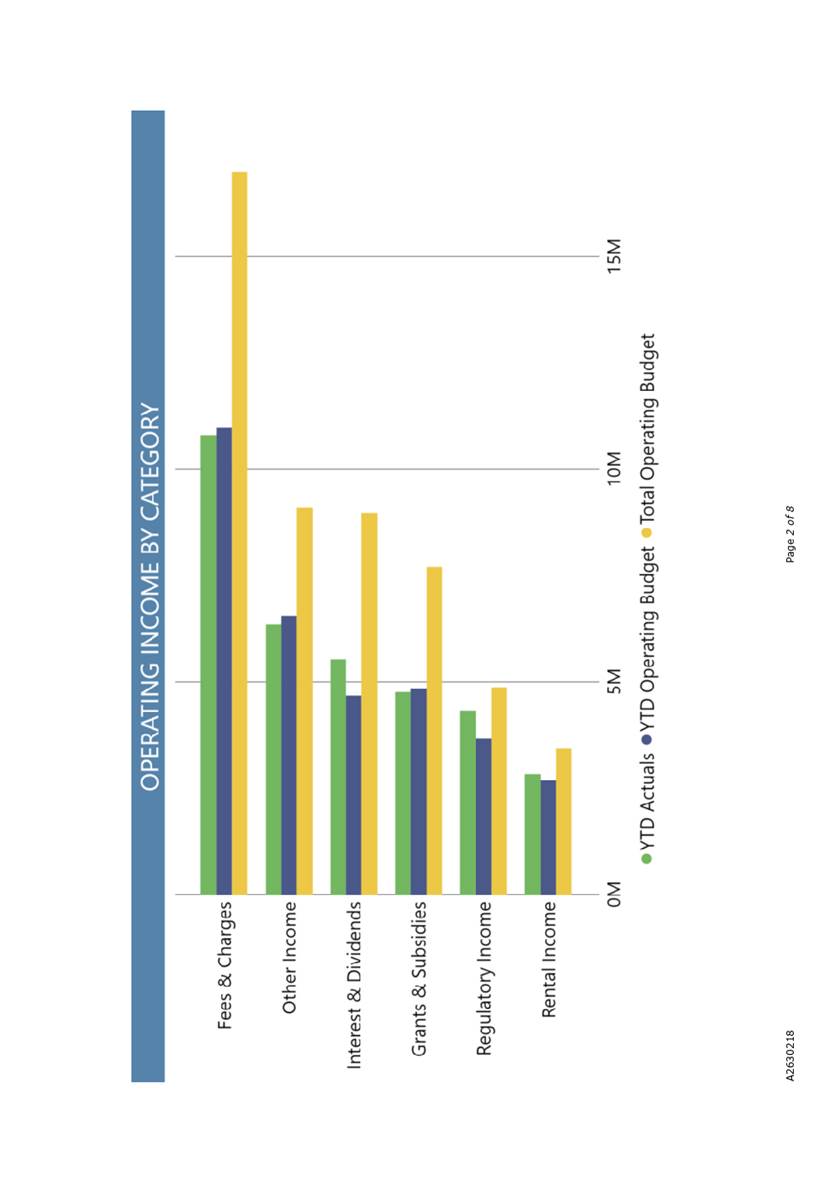

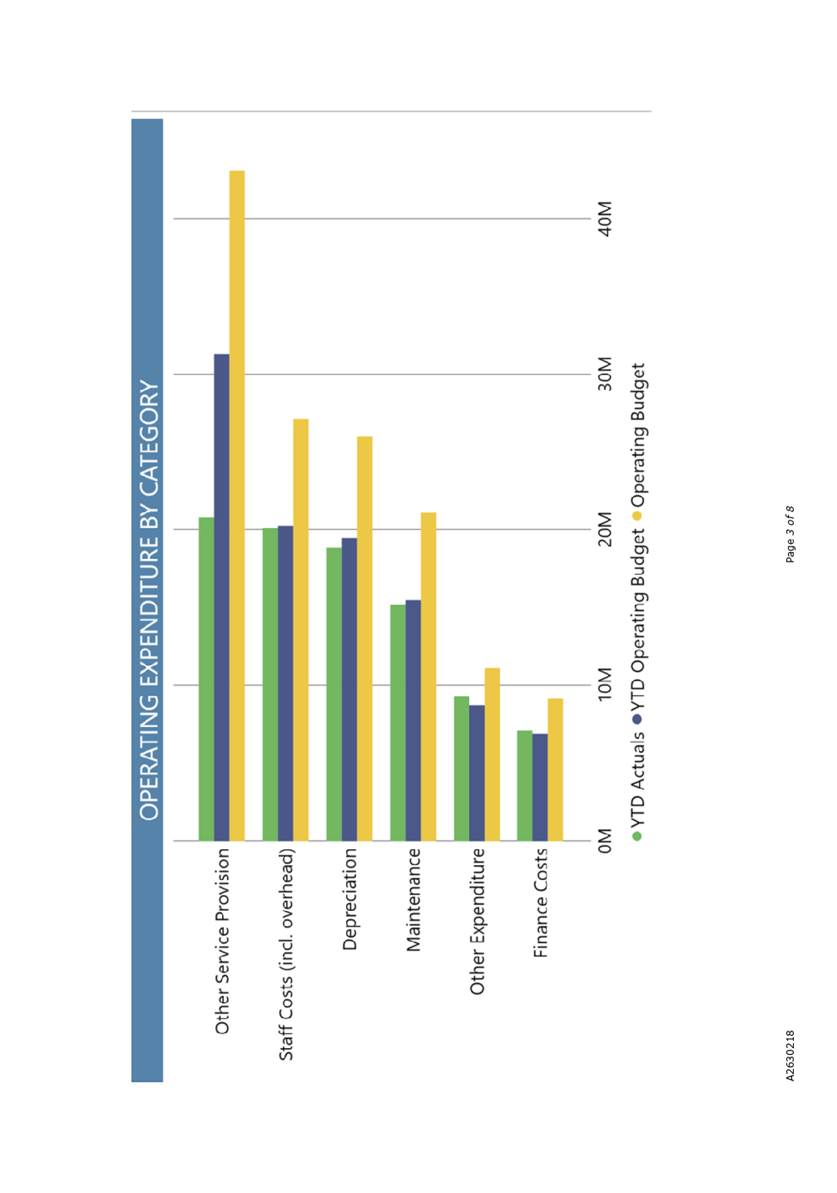

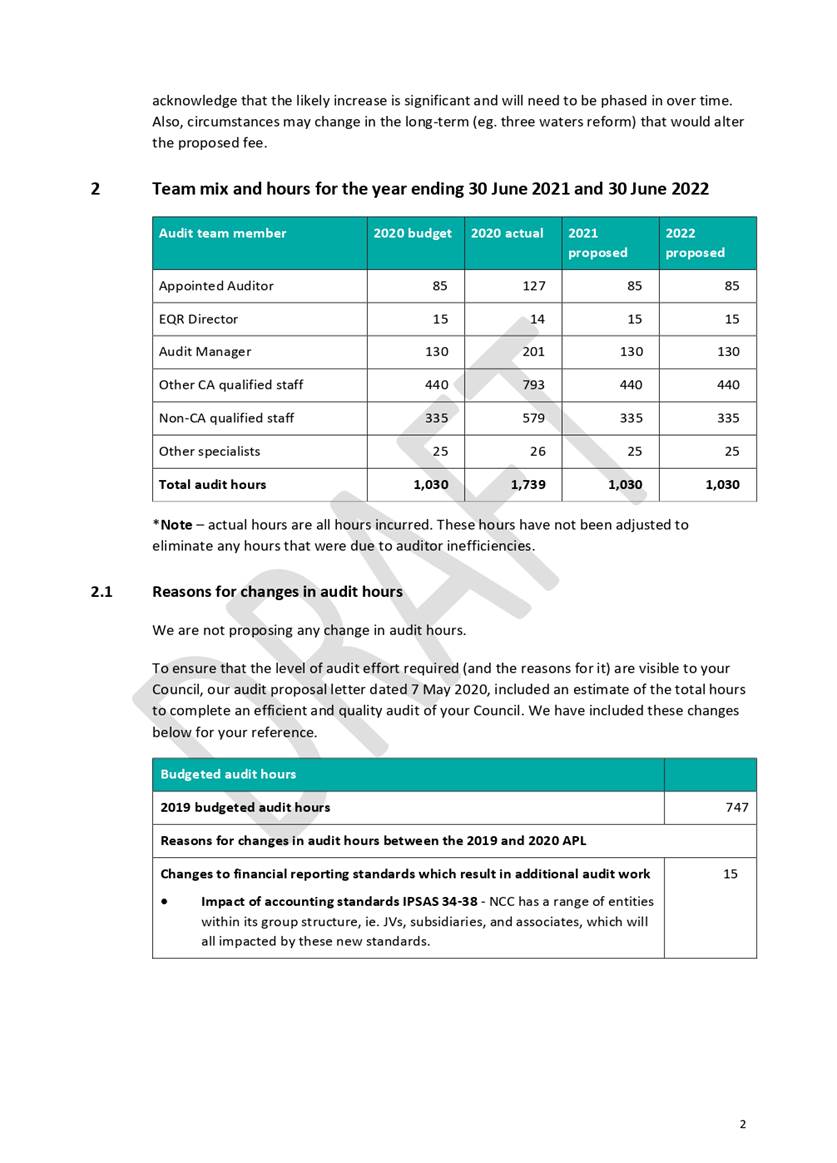

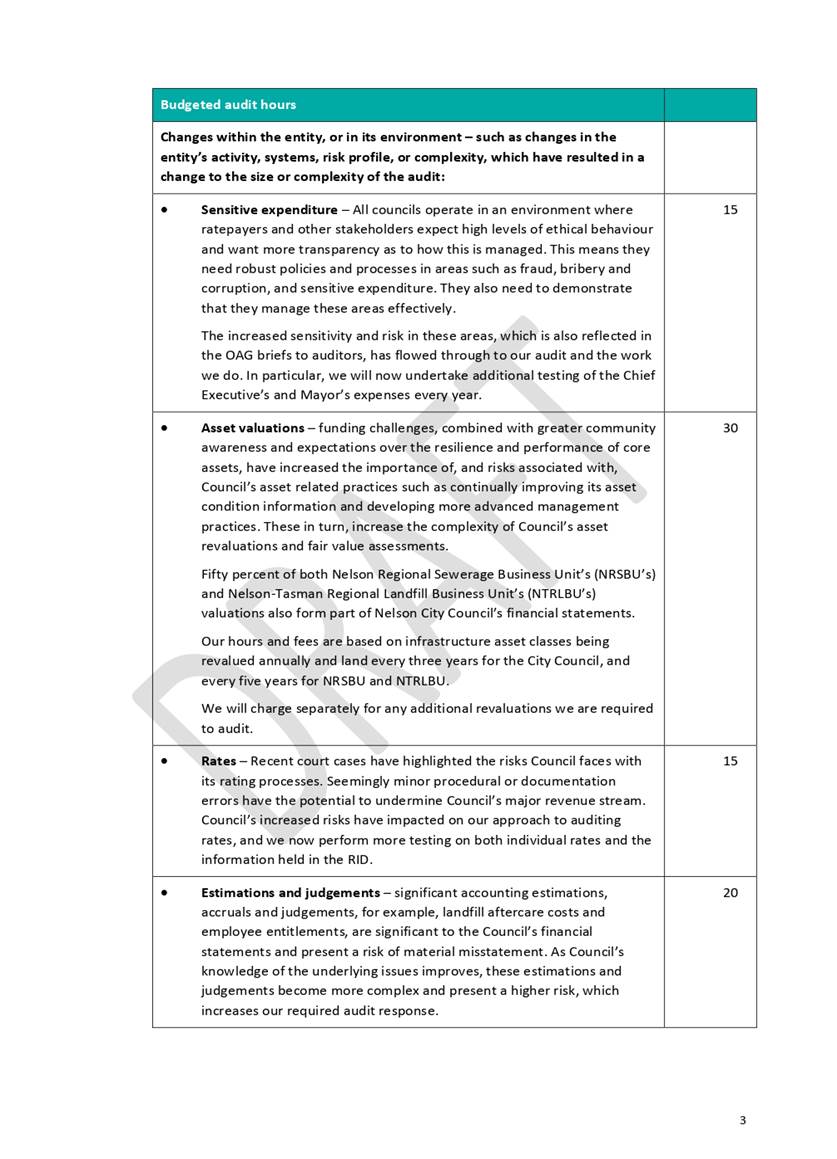

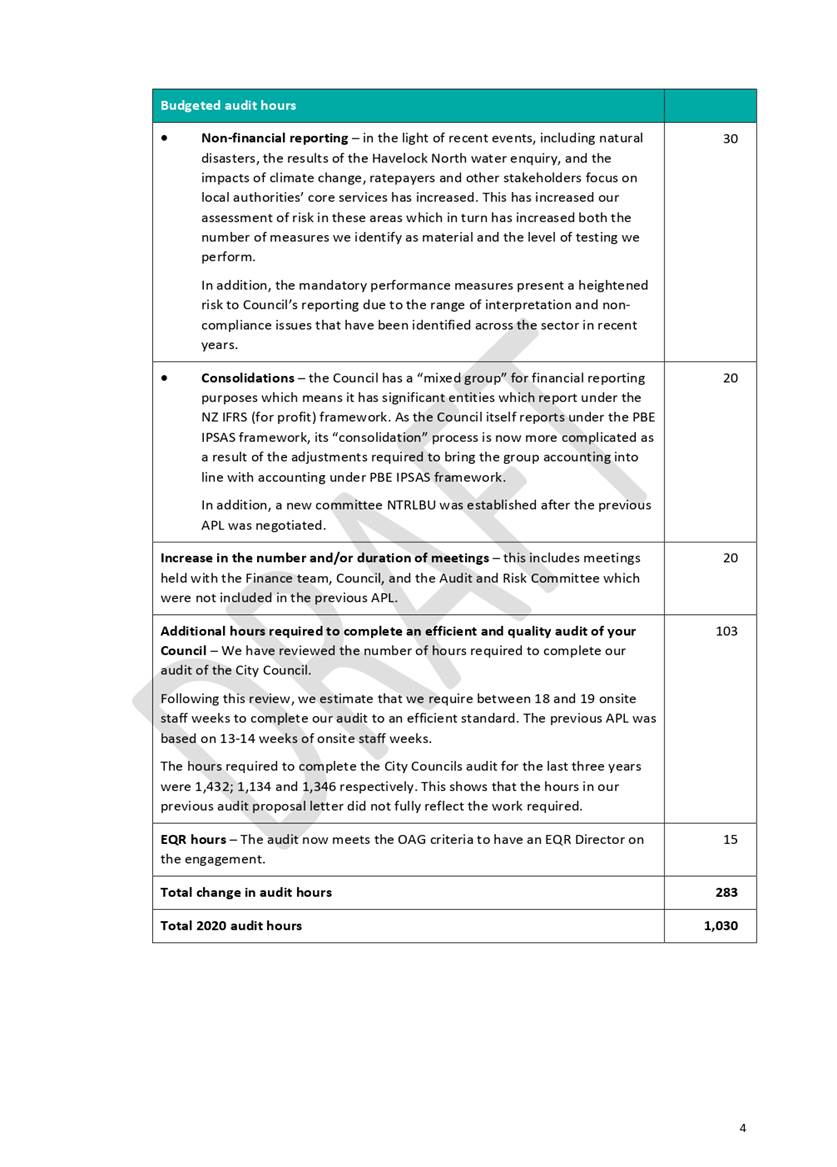

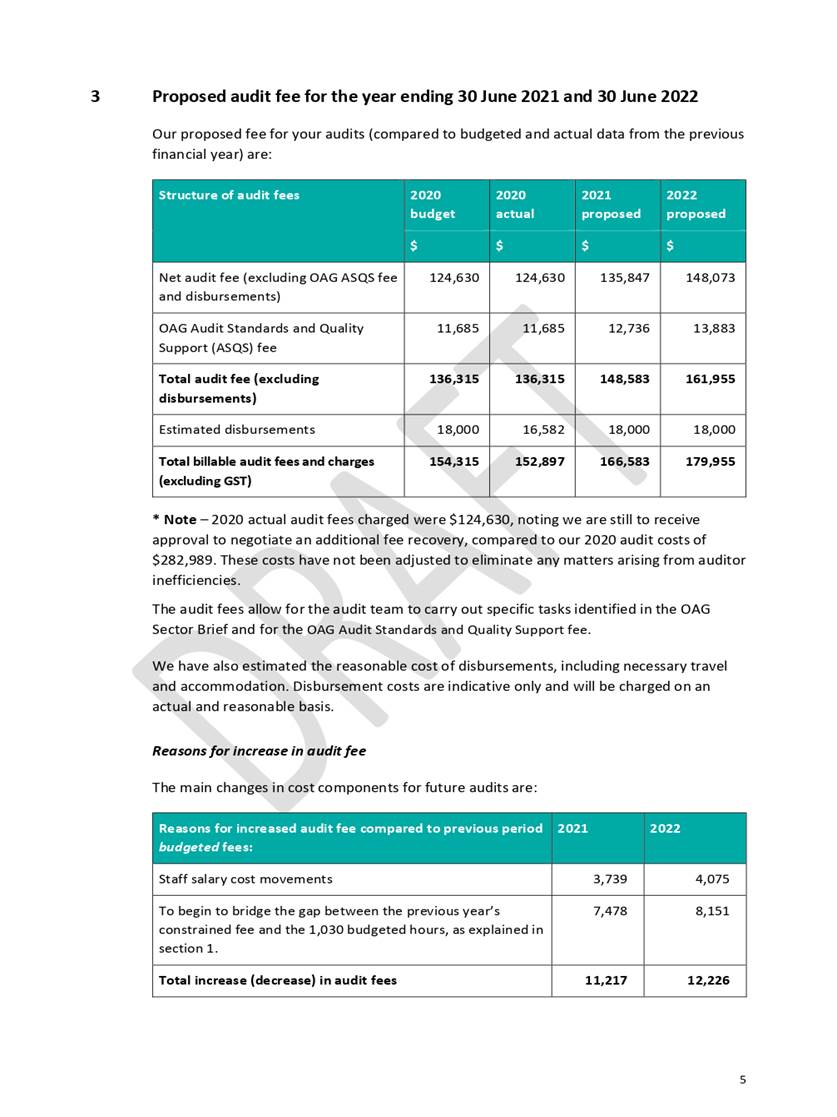

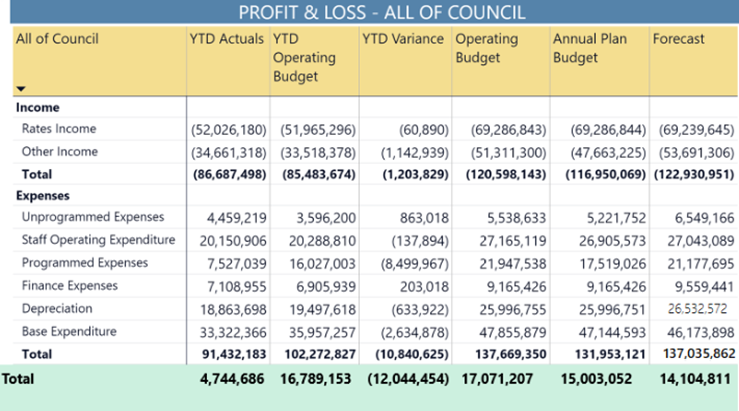

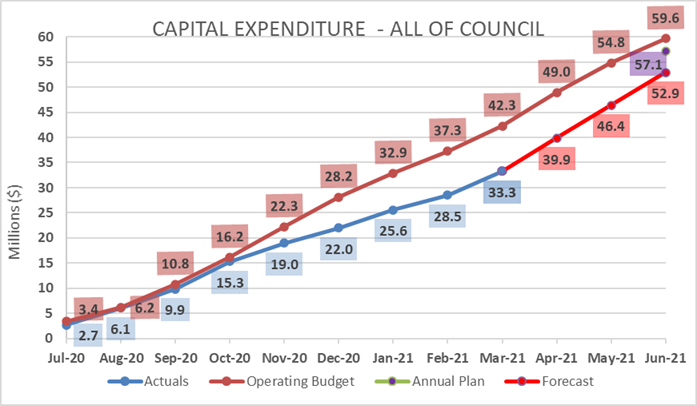

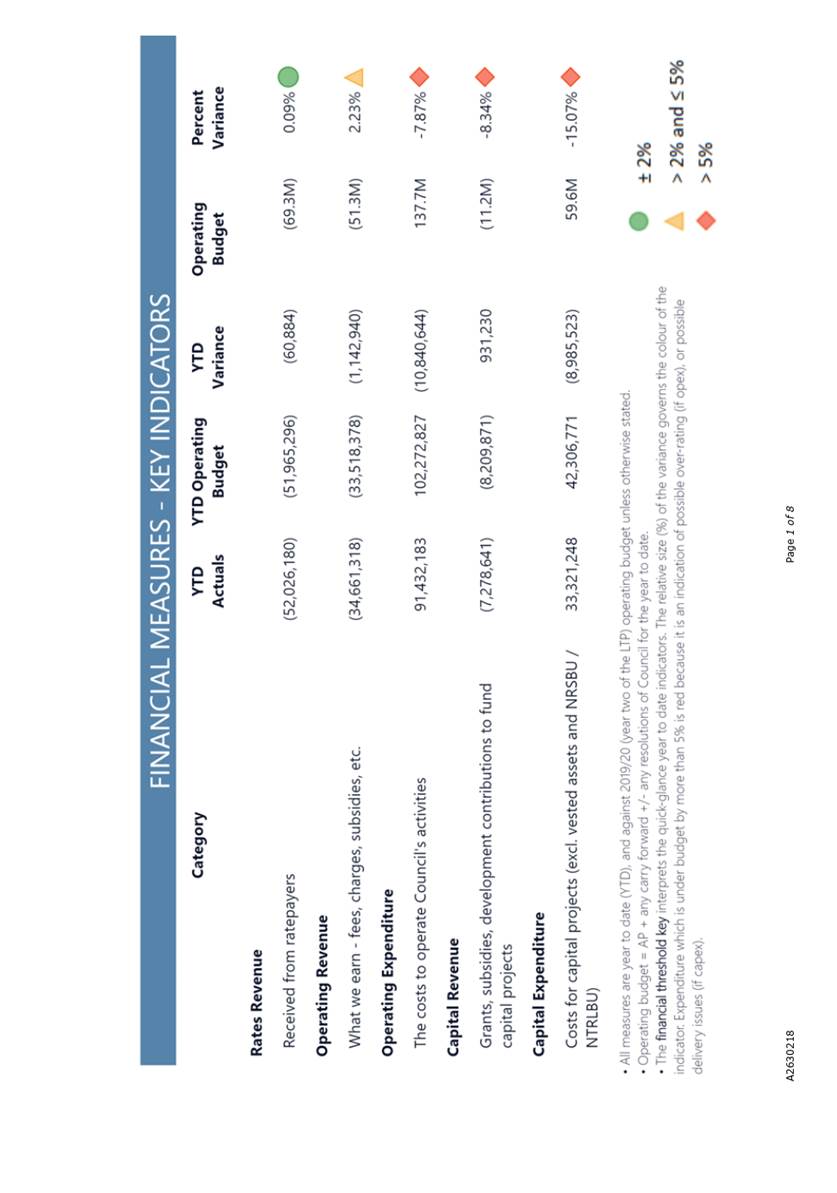

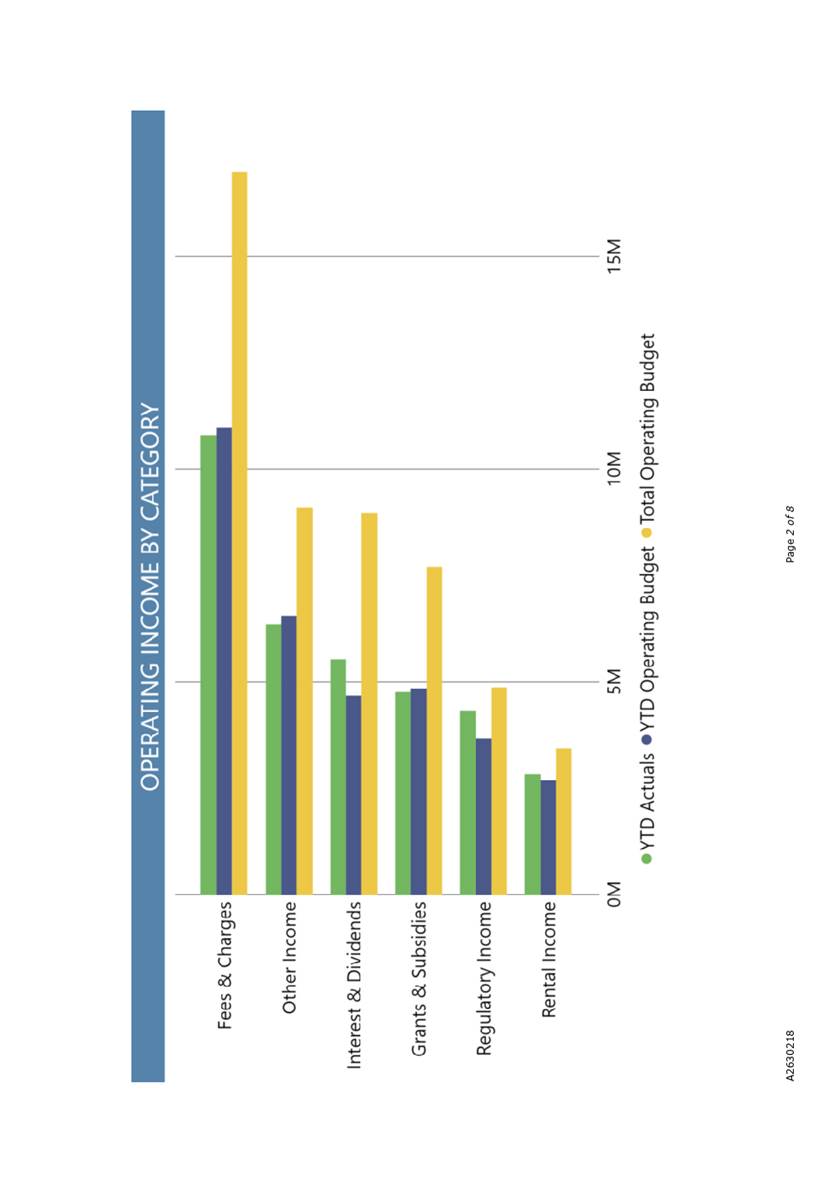

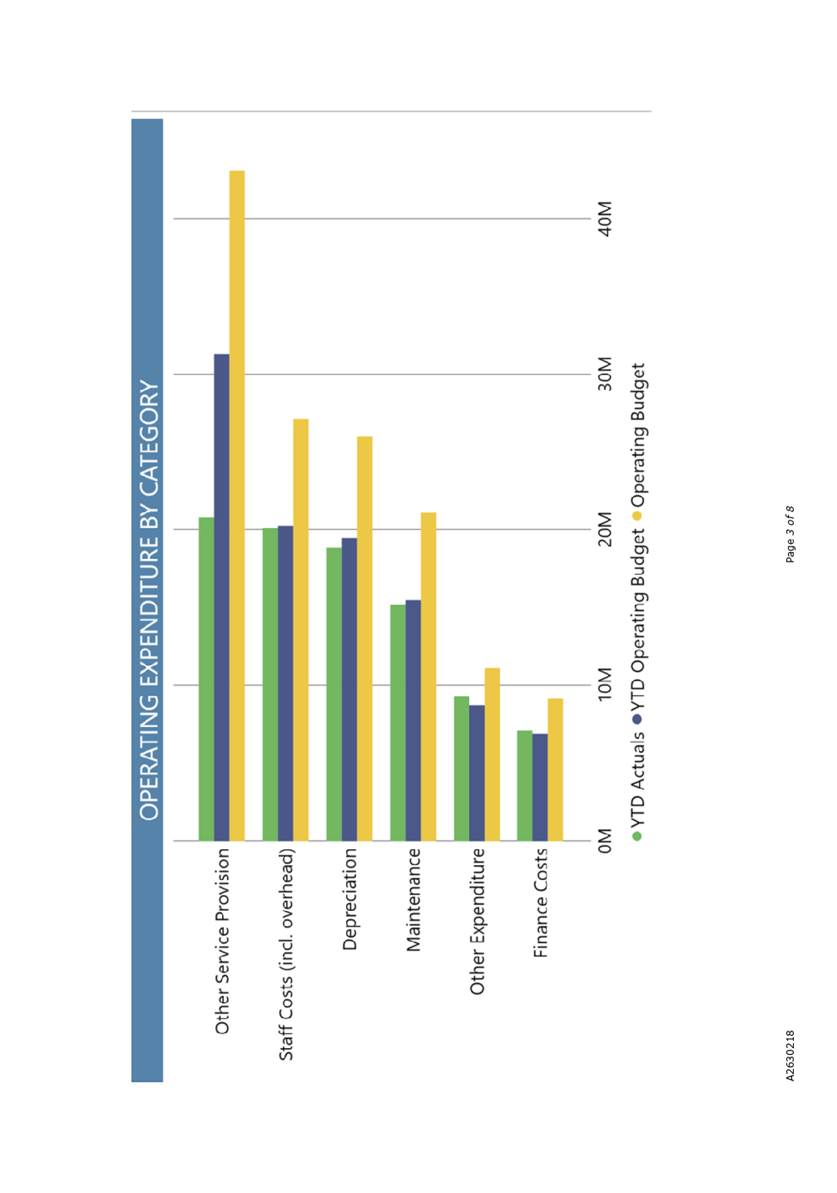

$500,000 per annum. As shown below, a $500,000 per annum threshold will