Item 7: Adoption of the

Draft Financial Strategy

|

|

Council

18 February 2021

|

REPORT R22545

Adoption

of the Draft Financial Strategy

1. Purpose

of Report

1.1 To

adopt the draft Financial Strategy as part of the Long Term Plan 2021–31

(LTP) process.

2. Summary

2.1 Council

must, as part of the LTP, prepare and adopt a financial strategy for all of the

consecutive financial years covered by the LTP.

2.2 Section

101A of the Local Government Act 2002 sets out that the purpose of the

financial strategy is to:

2.2.1 Facilitate

prudent financial management by the Council by providing a guide for the

Council to consider proposals for funding and expenditure against; and

2.2.2 Provide

a context for consultation on the Council’s proposals for funding and

expenditure by making transparent the overall effects of those proposals on the

Council’s services, rates, debt and investments.

3. Recommendation

|

That the Council

1. Receives the report Adoption

of the Draft Financial Strategy (R22545) and its attachment (A2533099); and

2. Adopts the Draft Financial

Strategy (A2533099).

|

4. Background

4.1 The

key aspects of the amended Financial Strategy have been discussed with elected

members at LTP workshops in October and December 2020 and January and February

2021.

4.2 A

number of amendments have been made to the Financial Strategy. These are

represented in red in Attachment 1: A2574126

5. Discussion

Council needs to

consider requirements of section 101

5.1 Council

needs to consider the requirements of s101 of the LGA 2002 which requires that

Council “manage its revenues, expenses, assets, liabilities, investments,

and general financial dealings prudently and in a manner that promotes the

current and future interests of the community.”

5.2 Council

includes consideration of these matters through its usual decision making

processes, including the table on important considerations for decision making

appended to reports.

5.3 Council

must also make adequate and effective provision in its Long Term Plan to meet

the expenditure needs identified in the Plan. The proposed Financial Strategy

does this through its revenue and debt limits.

Multiple years

for budget recovery following COVID-19

5.4 Council

resolved in July 2020 to have a net zero rates increase and set an unbalanced

budget for 2020/21 given the COVID-19 pandemic and its effects on the local

economy and ratepayers. This was to enable the planned levels of services to continue.

5.5 It

was acknowledged during this process that Council’s finances would not

immediately recover in the following year. This is due to the effect that this

would have on rates and ongoing lower Council revenue streams. It was also

noted that any decrease in rates in one year would typically increase the

percentage increase in the following year, unless there was a permanent change

to levels of service.

Impact of

COVID-19 recognised

5.6 COVID-19

is one of the biggest challenges Council has had to face. A new paragraph has

been added to the Strategy to demonstrate that while this is an ongoing

situation, COVID-19 and the effects it has had on the community have been taken

into account throughout the document.

Three Waters

assumption added

5.7 An

addition of an assumption about the Three Waters Reform Programme (that there

will be a continuing provision of water services by Council) has been added.

Central government’s work programme proposed new entities be established

to manage the local government Three Waters’ assets. While this, once

implemented, will have a significant impact on Council’s Financial

Strategy, the detail of this work programme is not yet known and therefore it

is prudent to reflect this is in the Strategy.

Changes to

depreciation to spread costs of revaluations

5.8 Assets

are required to be revalued every two years under Council’s Accounting

Policies. As at 30 June 2020, a revaluation was performed and Council assets

increased in value by $130.5 million. The three water assets made up $105

million of this increase and Transport assets $24.3 million, with the remaining

$1.2 million being Flood protection and Solid Waste.

5.9 The

increase in rates funding of depreciation for the revaluation of these assets

is 3% on rates. Given COVID-19, other pressures on Council funding and

community affordability of increases in rates, it is proposed that Council

departs from its usual practice of funding depreciation from revaluations

commencing the year following the revaluation.

5.10 It

is proposed that the increase in depreciation costs be spread and phased in

over Year 2 to Year 6 of the LTP. The draft Strategy has been written to

reflect this change in practice.

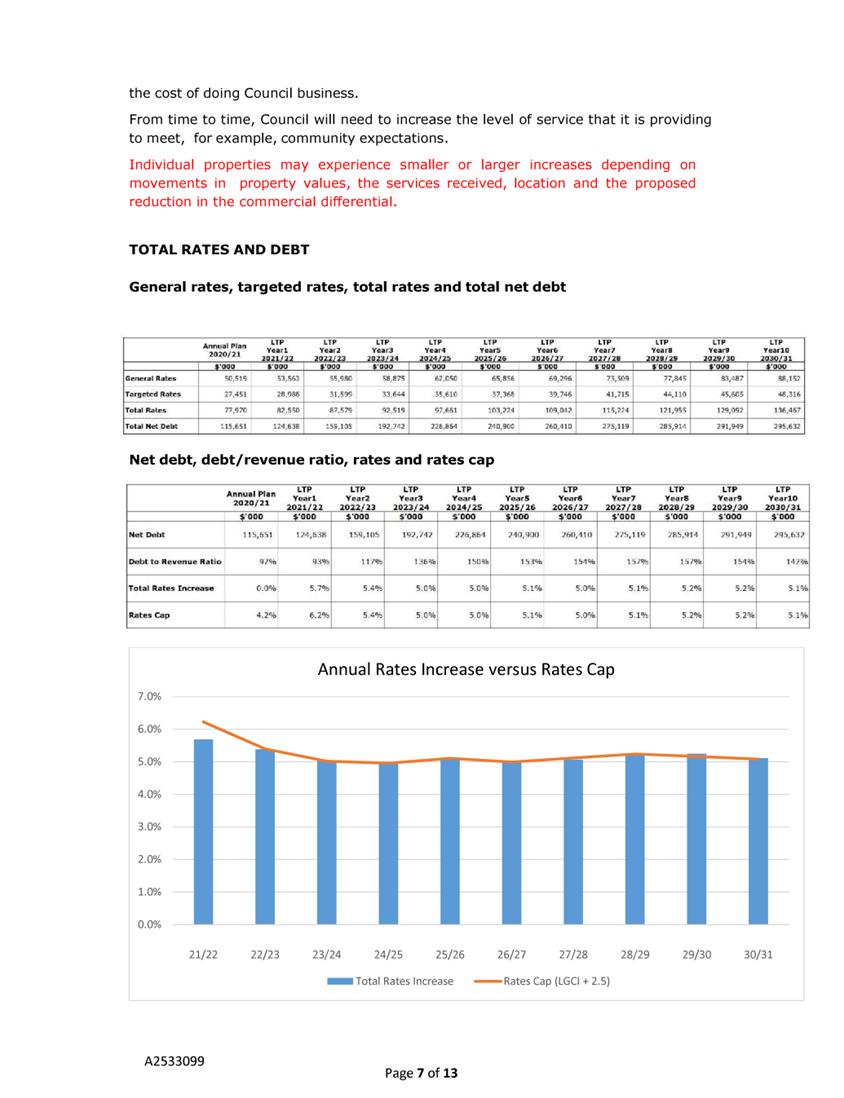

Net debt,

debt/revenue ratio, rates and rate cap

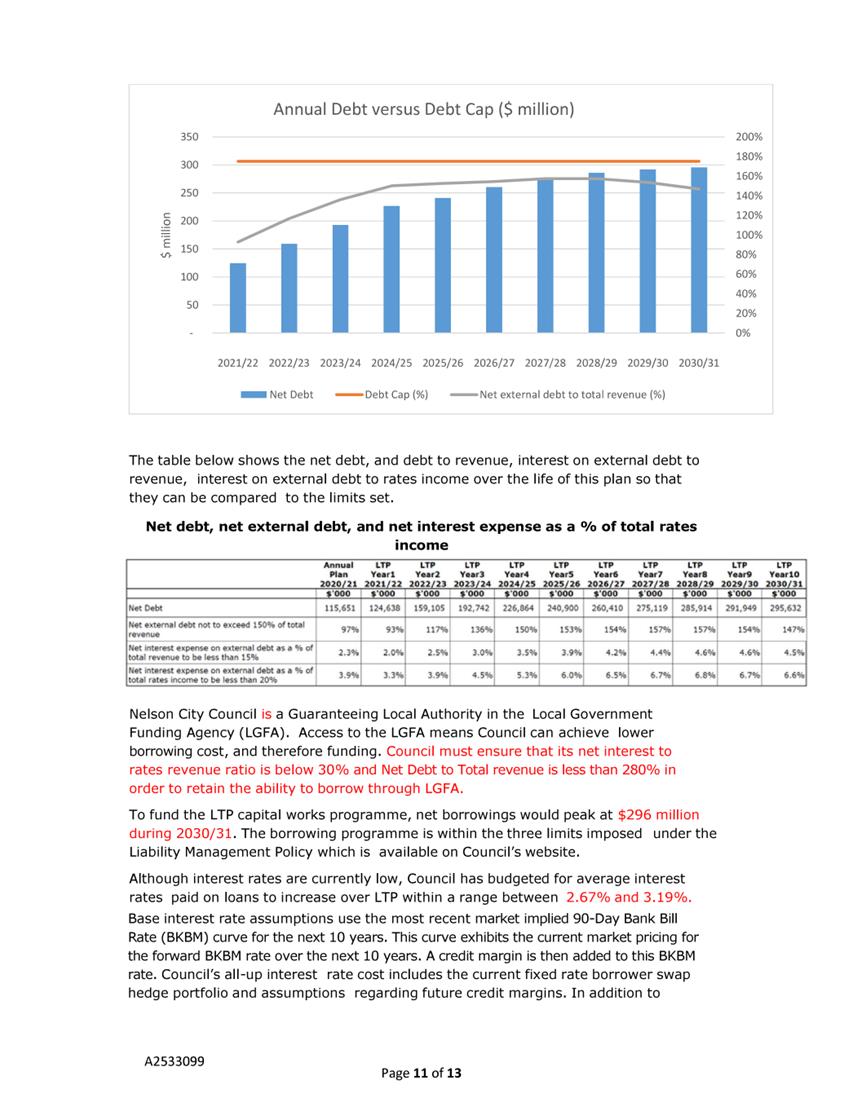

5.11 Due

to the increasing levels of capital expenditure, as outlined in the

Infrastructure Strategy, Council is proposing to increase its debt to revenue

ratio limits to 175% from 150%, to fund the investment. The capital expenditure

programme includes social and community infrastructure such as libraries and

other community facilities, transport and Three Waters infrastructure.

5.12 In

order to keep debt at lower levels than it would otherwise be, and under the

Debt to Revenue ratio of 175%, it is proposed to set annual rates increases at

the new rates cap of LGCI + 2.5% (previously LGCI + 2%), except for Year 1. In

Year 1 the overall rates increase is proposed to be 5.7% vs LGCI + 2.5% of

6.3%.

5.13 The

net debt, debt to revenue, rates and rate cap figures have been updated to

include the latest financial information. This is outlined on pages 7 and 8 of

the Strategy.

Forecasted

increase for capital and operational expenditure

5.14 The

ten year forecast capital expenditure was $462 million (including inflation,

excluding vested assets and the joint business units) in the 2018 LTP of which

$144 million is for renewals. This has been increased to $631 million for the

draft LTP 2021-2031, of which $230 million is for renewals. Overall capital

expenditure has increased by $169million.

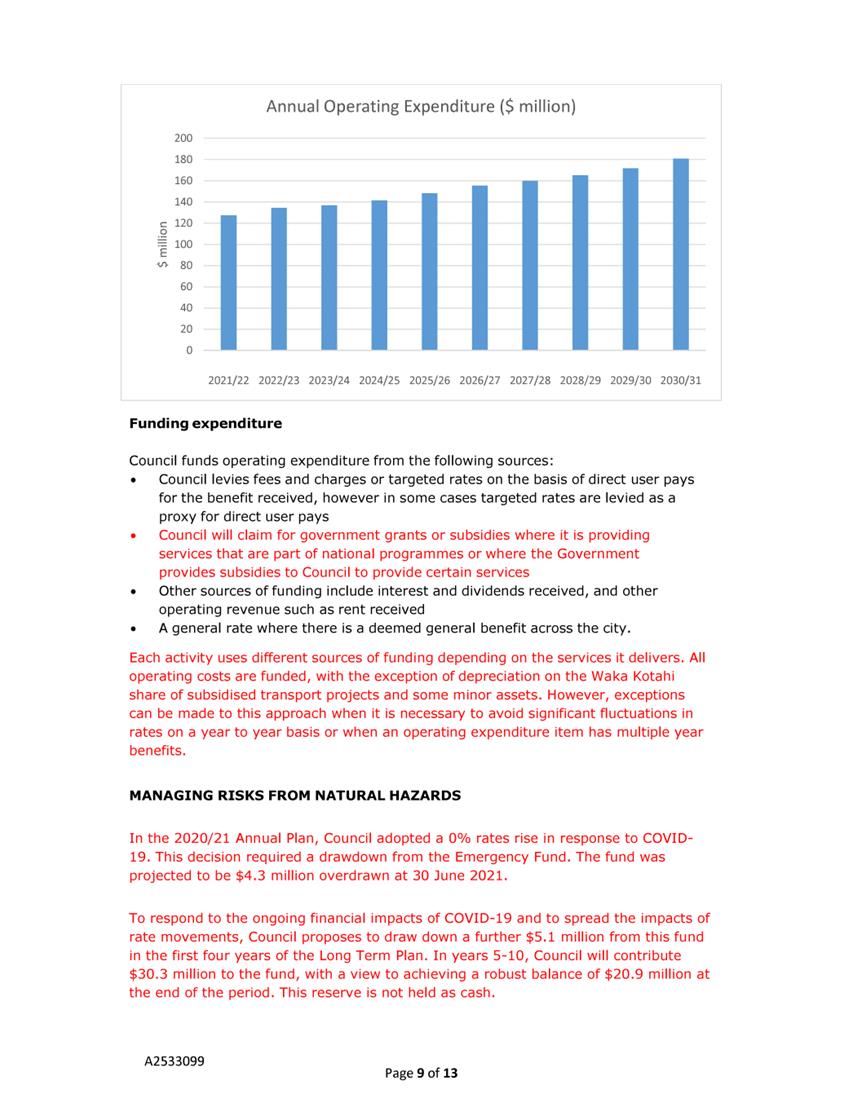

5.15 The

forecast 10 year operational expenditure has increased from $1,254 million in

2018 to $1,522 million in 2021.

Shortfall funded

through the Emergency Fund

5.16 At

the Extraordinary Meeting held on 23 April 2020, Council agreed to address the

2020/21 Annual Plan unbalanced budget by drawing down against the Emergency

Fund (previously named the Disaster Recovery Fund). The fund was projected to

be $4.3 million overdrawn at 30 June 2021.

5.17 To

respond to the ongoing financial impacts of COVID-19 and to spread the impacts

of rate movements, Council proposes to draw down a further $5.1 million from

this fund in the first four years of the Long Term Plan. In years 5-10, Council

will contribute $30.3 million to the fund, resulting in a projected balance of

$20.9 million at the end of the ten year period.

Contingency

Funding

5.18 Council

builds contingency funding into capital expenditure projects. Contingency

funding manages the risk of cost escalations and covers potential cost estimate

shortfalls which may arise as a result of unexpected delays or complexities.

Contingency funding is used to improve our financial stability and our ability

to fund projects within their budgets. When projects go through their

lifecycle, and as the designs are refined, the need for contingency funding is

reduced.

5.19 Council

has made an overall downward adjustment to the total capital programme of

approximately 10% per year. This adjustment acknowledges that Council is

unlikely to use the full amount of contingency in the programme for every

project and enables Council to avoid overfunding the activities.

6. Options

|

Option 1: Adopt the proposed

policy (Recommended)

|

|

Advantages

|

· Reflects

Council’s view in prudent financial management

· Ensures

a clear governance position on financial matters is available for auditors

|

|

Risks and Disadvantages

|

· No

significant risks or disadvantages

|

|

Option 2: Do not adopt the

proposed policy (Not recommended)

|

|

Advantages

|

· None

known

|

|

Risks and Disadvantages

|

· Lack

of clarity about the governance view of appropriate financial management

· Fails

to fulfil statutory requirements to adopt a Financial Strategy for the LTP

|

7. Next

Steps

7.1 The

Strategy will be updated if necessary to reflect any changes through the audit

process and will form part of the supporting documents for the LTP 2021-31

consultation process.

Author: Clare

Knox, Manager Finance

Attachments

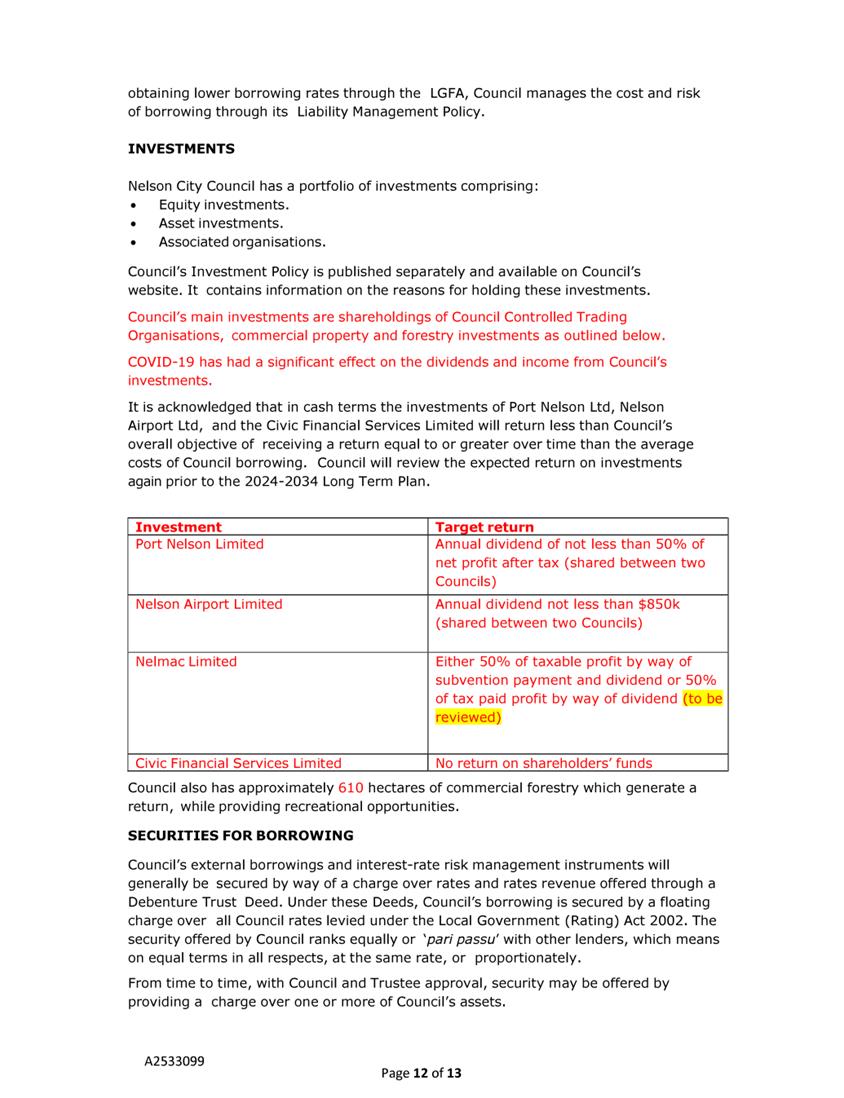

Attachment 1: A2533099

- Long Term Plan 2021-31 - Draft Financial Strategy ⇩

|

Important

considerations for decision making

|

|

1. Fit

with Purpose of Local Government

Section 101A of the Local Government Act 2002

requires Council, as part of the Long Term Plan, to prepare and adopt a

Financial Strategy.

|

|

2. Consistency

with Community Outcomes and Council Policy

The Financial Strategy aligns with the LTP

Consultation Document supporting documents and adoption of the Financial

Strategy supports all of the community outcomes.

|

|

3. Risk

There is a

risk that some in the community may not support changes to the Financial

Strategy. However, the public have an opportunity to submit on the Strategy

as part of the LTP consultation process.

|

|

4. Financial

impact

Adoption of the Financial Strategy will determine

the level of funding, rates, rates cap, funding of depreciation and other

financial impacts. The Strategy needs to cover the ten years of the LTP.

|

|

5. Degree

of significance and level of engagement

This matter is of high significance as it determines

the financial strategy of the Council for the next ten years. As a LTP

supporting document, the public will be consulted as part of the wider LTP

consultation process. The Strategy is reviewed every three years.

|

|

6. Climate

Impact

The impacts on the climate have been considered as

part of the development of the Activity Management Plans and Infrastructure

Strategy. The information from this and other processes has been checked for

consistency with the Financial Strategy limits and policy.

|

|

7. Inclusion

of Māori in the decision making process

No engagement with Māori has been undertaken in

preparing this report, although the LTP and Financial Strategy has been

discussed in broad terms at the Iwi-Council partnership hui.

|

|

8. Delegations

The Council has the responsibility for development

of the Long Term Plan and its related processes.

|