Notice of the Ordinary meeting of

Audit and Risk Subcommittee

Kōmiti Iti mō te Tātari Kaute me te

Tūraru

|

Date: Tuesday

11 August 2020

Time: 1.00p.m.

Location: Council

Chamber, Civic House

110 Trafalgar Street, Nelson

|

Agenda

Rārangi take

Chairperson Mr

John Peters

Members Her

Worship the Mayor Rachel Reese

Cr Judene Edgar

Mr John Murray

Cr Rachel Sanson

Quorum 2 Pat

Dougherty

Chief

Executive

Nelson City Council Disclaimer

Please

note that the contents of these Council and Committee agendas have yet to be

considered by Council and officer recommendations may be altered or changed by

the Council in the process of making the formal Council decision. For enquiries

call (03) 5460436.

· Council’s Treasury policies

· Council’s Annual Report

· Audit processes and management of

financial risk

· Monitoring organisational risks,

including debtors and legal proceedings

· Internal audit

· Health and Safety

· Any matters raised by Audit New

Zealand or the Office of the Auditor-General

Powers to Decide

·

None

Powers to Recommend to Governance and Finance Committee

· To write off outstanding accounts

receivable or remit fees and charges of amounts over the Chief

Executive’s delegated authority

· Any matters within the areas of

responsibility or such other matters referred to it by the Council

Powers to Recommend to Council

· Adoption of

Council’s Annual Report

For the Terms of Reference for the Audit and Risk

Subcommittee please refer to document A1437349.

Audit

and Risk Subcommittee

Audit

and Risk Subcommittee

11

August 2020

Page

No.

1. Apologies

Nil

2. Confirmation

of Order of Business

3. Interests

3.1 Updates

to the Interests Register

3.2 Identify

any conflicts of interest in the agenda

4. Public Forum

5. Confirmation

of Minutes

5.1 21 May

2020 8 - 14

Document number M9879

Recommendation

|

That the Audit and Risk Subcommittee

1. Confirms the minutes of the meeting

of the Audit and Risk Subcommittee, held on 21 May 2020, as a true and

correct record.

|

6. Chairperson's Report 15 - 16

Document number R18151

Recommendation

|

That

the Audit and Risk Subcommittee

1. Receives

the report Chairperson's Report (R18151).

|

7. Audit New Zealand -

Audit Engagement Letter 17 - 31

Document number R18115

Recommendation

|

That

the Subcommittee

1. Receives

the report Audit New Zealand - Audit Engagement Letter (R18115) and its attachment (A2409696); and

2. Notes that

following feedback from the Audit and Risk Subcommittee,

Her Worship the Mayor will sign the Audit Engagement letter to

Audit NZ.

|

8. Annual Tax Update 32 - 83

Document number R14819

Recommendation

|

That

the Audit and Risk Subcommittee

1. Receives the report Annual Tax Update (R14819) and its attachments (A2415912,

A2358418 and A2417124).

|

9. Interim Audit Report

for the year ending 30 June 2020 84 - 108

Document number R14821

Recommendation

|

That the Audit and Risk Subcommittee

1. Receives the report Interim

Audit Report for the year ending 30 June 2020 (R14821) and its attachment (A2414826); and

2. Notes

the suggested responses to the recommendations (as per A2414826).

|

10. Health, Safety and Wellbeing

Report, January to June 2020 109 - 126

Document number R18135

Recommendation

|

That

the Audit and Risk Subcommittee

1. Receives

the report Health, Safety and Wellbeing Report, January to June 2020 (R18135) and its attachment (A2404161).

|

11. Key Organisational Risks Report

- 01 January to 30 June 2020 127

- 158

Document number R14813

Recommendation

|

That the Audit and

Risk Subcommittee

1. Receives the report Key Organisational Risks

Report - 01 January to 30 June 2020 (R14813) and its attachment (A2415845).

|

12. New and Outstanding Significant

Risk Exposures and Control Issues Identified from Internal Audits - 30 June

2020 159 - 162

Document number R14818

Recommendation

|

That

the Audit and Risk Subcommittee

1. Receives

the report New and Outstanding Significant Risk Exposures and Control Issues

Identified from Internal Audits - 30 June 2020 (R14818) and its attachment (A2417196).

|

13. Internal Audit - Quarterly

Progress Report to 30 June 2020 163

- 168

Document number R18111

Recommendation

|

That

the Audit and Risk Subcommittee

1. Receives

the report Internal Audit - Quarterly Progress Report to 30 June 2020 (R18111)

and its attachment (A2408483).

|

14. Bad

Debt Writeoff - Year Ending 30 June 2020 169 - 171

Document number R14820

Recommendation

|

That

the Audit and Risk Subcommittee

1. Receives

the report Bad Debt Writeoff - Year Ending 30 June 2020 (R14820).

|

Recommendation to Governance and

Finance Committee

|

That the Governance and Finance Committee

1. Approves the balance of

$20,462.37 excluding GST owing by Concrete & Metals Ltd be written off as

at 30 June 2020.

|

CONFIDENTIAL Business

15. Exclusion of the Public

Recommendation

That the Audit

and Risk Subcommittee

1. Excludes the public from the following

parts of the proceedings of this meeting.

2. The general subject of each matter to be considered while the public

is excluded, the reason for passing this resolution in relation to each matter

and the specific grounds under section 48(1) of the Local Government Official

Information and Meetings Act 1987 for the passing of this resolution are as

follows:

|

Item

|

General subject of each matter to be

considered

|

Reason for passing this resolution in

relation to each matter

|

Particular interests protected (where

applicable)

|

|

1

|

Audit and Risk Subcommittee Meeting -

Public Excluded Minutes - 21 May 2020

|

Section 48(1)(a)

The public conduct of this matter would

be likely to result in disclosure of information for which good reason exists

under section 7.

|

The withholding of the information is

necessary:

· Section 7(2)(a)

To protect the

privacy of natural persons, including that of a deceased person

· Section

7(2)(g)

To maintain

legal professional privilege

· Section

7(2)(h)

To enable the local authority to carry out, without prejudice or

disadvantage, commercial activities

|

|

2

|

Quarterly Update On Debts - 30 June 2020

|

Section 48(1)(a)

The public conduct of this

matter would be likely to result in disclosure of information for which good

reason exists under section 7

|

The withholding of the information is necessary:

· Section 7(2)(a)

To protect the privacy of

natural persons, including that of a deceased person

· Section

7(2)(g)

To maintain legal

professional privilege

|

|

3

|

Internal Audit Report - Transfer Station

Kiosk

|

Section

48(1)(a)

The public

conduct of this matter would be likely to result in disclosure of information

for which good reason exists under section 7

|

The withholding of the information is

necessary:

· Section

7(2)(a)

To protect the

privacy of natural persons, including that of a deceased person

|

|

4

|

Quarterly update on legal proceedings

|

Section 48(1)(a)

The public conduct of this

matter would be likely to result in disclosure of information for which good

reason exists under section 7

|

The withholding of the information is necessary:

· Section 7(2)(g)

To maintain legal

professional privilege

|

Audit and Risk Subcommittee Minutes

- 21 May 2020

Present: Mr

J Peters (Chairperson), Her Worship the Mayor R Reese, Councillors J Edgar and R

Sanson, and Mr J Murray

In Attendance: Chief

Executive (P Dougherty), Group Manager Environmental Management (C Barton),

Group Manager Corporate Services (N Harrison), Governance Adviser (E-J

Ruthven), and Governance Support (K McLean)

Apologies : Nil

1. Apologies

There were no apologies.

2. Confirmation of

Order of Business

There was no change to the order

of business.

3. Interests

There were no updates to the

Interests Register.

Her Worship the Mayor

subsequently declared an interest in relation to discussion regarding item 2 on

the confidential agenda, Reserves Contributions for Unit Titles –

Breakdown of Discrepancies.

4. Public Forum

4.1 Scott Syndicate

Development Company Ltd - The Calculation of Reserve Contribution for Unit

Title Developments

Mr

Craig Dennis spoke on behalf of Scott Syndicate Development Company Ltd.

He noted his concerns regarding the financial contribution methodologies in

relation to the Bett Carpark and Malthouse Lane developments he had been

involved with. He emphasised equity and fairness principles, and the need

for different parties to be treated in the same manner with regards to

financial contributions related to developments.

Mr Dennis also spoke about the 2018 updates to the Development Contributions

Policy. He explained that changes to the Policy acted as a disincentive

for inner city developments, aside from those at the highest end of the market.

5. Confirmation of

Minutes

5.1 18 February 2020

Document number M6695, agenda

pages 7 - 13 refer.

|

Resolved AR/2020/012

|

|

|

That

the Audit and Risk Subcommittee

1. Confirms

the minutes of the meeting of the Audit and Risk Subcommittee, held on 18

February 2020, as a true and correct record.

|

|

Murray/Edgar Carried

|

Attendance: Councillor Sanson left the meeting at 4.30p.m.

6. Chairperson's Report

|

Mr Peters gave a verbal Chairperson’s

Report.

He noted that risk factors now included the Covid-19

pandemic and its consequences, and spoke about the financial health and

resilience of Council and the Nelson community. He emphasised the need

for continued prudent financial oversight and high standards of governance as

Council responded to the Covid-19 pandemic.

|

|

Resolved AR/2020/013

|

|

|

That the Audit and Risk Subcommittee

1. Receives

the verbal Chairperson’s Report.

|

|

Peters/Murray Carried

|

7. Audit NZ: Audit Plan

for year ending 30 June 2020 and Audit Proposal Letter

Document number R14857, agenda

pages 14 - 41 refer.

Manager Finance, Clare Knox,

presented the report, and Auditor John Mackey, from the Office of the

Auditor-General, joined the meeting.

Mr Mackey spoke about how the

audit process would be affected as a result of Covid-19. He answered

questions regarding the challenges in establishing valuations, given the

uncertainties arising from Covid-19, the likely timeframe for the

Council’s audit process this year, and the proposed audit fee

increase. He undertook to provide further advice regarding mitigating and

managing construction contract risks, particularly with regards to Crown

Infrastructure Fund projects.

Attendance: Councillor

Sanson returned to the meeting at 4.55p.m.

Ms Knox answered further

questions regarding how Council Controlled Organisations were identified in the

Annual Report.

|

Resolved AR/2020/014

|

|

|

That

the Audit and Risk Subcommittee

1. Receives the report

Audit NZ: Audit Plan for year ending 30 June 2020 and Audit Proposal Letter

(R14857) and its attachments

(A2376650 and A2381428).

2. Notes

the Subcommittee can provide feedback on the Audit Proposal Letter to Audit

New Zealand if required, noting the Mayor will sign the letter once the

Subcommittee’s feedback has been incorporated.

|

|

Sanson/Murray Carried

|

8. COVID-19: Assessment

of Financial Risk to Annual Plan 2020/21

Document number R17017, agenda

pages 42 - 46 refer.

Group Manager Corporate Services,

Nikki Harrison, presented the report. She answered questions regarding

the proposed deferral of fee increases, the proposed drawdown on the Disaster

Recovery Fund, how the best and worst case scenario and base case assumptions

were reached, rates collection, and Council’s borrowing facilities.

|

Resolved AR/2020/015

|

|

|

That

the Audit and Risk Subcommittee

1. Receives the report

COVID-19: Assessment of Financial Risk to Annual Plan 2020/21 (R17017) and its attachment (A2372220).

|

|

Edgar/Sanson Carried

|

9. Health Safety and

Wellbeing Report, COVID-19 Response, April 2020

Document number R16993, agenda

pages 47 - 60 refer.

Health and Safety Adviser,

Malcolm Hughes, presented the report. He answered questions regarding

Council’s health and safety obligations and support available in relation

to officers and elected members working from home, the extensive hours worked

by some officers during the Covid-19 lockdown, and the consequential risks of

exhaustion, and mental health risks in relation to COvid-19.

The Subcommittee requested a vote

of thanks be recorded to Council’s Health and Safety officers for work

undertaken during the Covid-19 pandemic.

|

Resolved AR/2020/016

|

|

|

That

the Audit and Risk Subcommittee

1. Receives

the report Health Safety and Wellbeing Report, COVID-19 Response, April 2020

(R16993) and its attachment,

COVID – 19 Activities and Controls Overview (A2380485); and

2. Records

a vote of thanks to Council’s Health and Safety officers for the work

undertaken during the Covid-19 pandemic.

|

|

Sanson/Edgar Carried

|

10. Internal Audit Quarterly

Progress Report to 31 March 2020

Document number R14817, agenda

pages 61 - 65 refer.

Internal Audit Analyst, Lynn

Anderson, presented the report. She answered questions regarding audit

and business improvement work undertaken, and Manager Governance and Support

Services, Mary Birch, answered questions regarding Elected Members’

declarations of interests.

|

Resolved AR/2020/017

|

|

|

That

the Audit and Risk Subcommittee

1. Receives the report

Internal Audit Quarterly Progress Report to 31 March 2020 (R14817) and its

attachment (A2365059).

|

|

Edgar/Sanson Carried

|

11. Draft Internal Audit Plan for

year to 30 June 2021

Document number R14816, agenda

pages 66 - 73 refer.

Internal Audit Analyst, Lynn

Anderson, presented the report. She noted that the reference in paragraph

4.6.1 to a self-assessment being presented to this meeting should refer to the

next Subcommittee meeting.

Ms Anderson answered questions

regarding the proposed plan, taking into account the uncertainties created by

Covid-19.

|

Resolved AR/2020/018

|

|

|

That

the Audit and Risk Subcommittee

1. Receives the report

Draft Internal Audit Plan for year to 30 June 2021 (R14816) and its attachment (A2357411).

|

|

Murray/Sanson Carried

|

|

Recommendation to Governance and

Finance AR/2020/019

|

|

|

That the Governance and Finance Committee

1. Approves the Draft Annual

Internal Audit Plan for the year to 30 June 2021 (A2357411).

|

|

Murray/Sanson

|

The meeting was adjourned from

6.02p.m until 6.07p.m.

13. Reserves Contributions for Unit

Titles - Final Report

Document number R16954, late

items agenda pages 4 - 13 refer.

Internal Audit Analyst, Lynn

Anderson, presented the report. She answered questions regarding the

valuation process for quantifying Council’s loss of reserve

contributions, how the error in calculations was able to occur over a number of

years, and changes in practice to ensure the error would not occur again in the

future.

|

Resolved AR/2020/020

|

|

|

That

the Audit and Risk Subcommittee

1. Receives the report

Reserves Contributions for Unit Titles - Final Report (R16954) and its attachment (A2369193).

|

|

Her Worship the Mayor/Edgar Carried

|

14. Exclusion

of the Public

|

Resolved AR/2020/021

|

|

|

That the Audit and Risk

Subcommittee

1. Excludes the public from the

following parts of the proceedings of this meeting.

2. The general subject of each matter

to be considered while the public is excluded, the reason for passing this

resolution in relation to each matter and the specific grounds under section

48(1) of the Local Government Official Information and Meetings Act 1987 for

the passing of this resolution are as follows:

|

|

Sanson/Edgar Carried

|

|

Item

|

General subject of each matter to be

considered

|

Reason for passing this resolution in relation

to each matter

|

Particular interests protected (where

applicable)

|

|

1

|

Audit and Risk Subcommittee Meeting -

Public Excluded Minutes - 18 February 2020

|

Section 48(1)(a)

The public conduct of this matter would

be likely to result in disclosure of information for which good reason exists

under section 7.

|

The withholding of the information is

necessary:

· Section 7(2)(a)

To protect the

privacy of natural persons, including that of a deceased person

· Section 7(2)(g)

To

maintain legal professional privilege

|

|

2

|

Reserves Contributions for Unit Titles - Breakdown

of Discrepancies

|

Section 48(1)(a)

The public conduct of this

matter would be likely to result in disclosure of information for which good

reason exists under section 7

|

The withholding of the information is necessary:

· Section 7(2)(g)

To maintain legal

professional privilege

· Section

7(2)(h)

To enable the local authority to carry out, without prejudice or

disadvantage, commercial activities

|

|

3

|

Quarterly Update On Debts - 31 March

2020

|

Section

48(1)(a)

The public

conduct of this matter would be likely to result in disclosure of information

for which good reason exists under section 7

|

The withholding of the information is

necessary:

· Section

7(2)(a)

To protect the

privacy of natural persons, including that of a deceased person

· Section 7(2)(g)

To maintain

legal professional privilege

|

The meeting went into

public excluded session at 6.25p.m. and resumed in public session at 7.03p.m.

Restatements

It was resolved while the public was

excluded:

|

1

|

PUBLIC EXCLUDED: Reserves

Contributions for Unit Titles - Breakdown of Discrepancies

|

|

|

That

the Audit and Risk Subcommittee

2. Agrees that the report Reserves

Contributions for Unit Titles – Breakdown of Discrepancies (R16985); and its attachment (A2346183) remain confidential at

this time.

|

|

2

|

CONFIDENTIAL: Quarterly

Update On Debts - 31 March 2020

|

|

|

That

the Audit and Risk Subcommittee

2. Agrees that the Report (R16960) and

its attachment (A2216183) remain confidential at this time.

|

There being no further business the meeting ended at 7.04p.m.

Confirmed as a correct record of proceedings:

Chairperson

Date

Chairperson

Date

Item 6: Chairperson's

Report

|

|

Audit and Risk Subcommittee

11 August 2020

|

REPORT R18151

Chairperson's

Report

1. Purpose

of Report

1.1 In

accordance with 5.2.2 of Council’s Delegations Register, to report back

to the Committee on a matter within its areas of responsibility, that was

considered directly by Council, at its 25 June 2020 meeting.

1.2 This

report is for information only.

2. Recommendation

|

That the Audit and Risk Subcommittee

1. Receives

the report Chairperson's Report (R18151).

|

3. Discussion

3.1 The

Audit and Risk Subcommittee’s areas of responsibility include

Council’s Treasury policies.

3.2 However,

because of timing, the matter was considered by Council, in accordance with the

Delegations Register, as below:

5.5.2 On the recommendation of the Chief

Executive, and with the agreement of the Chair of the relevant committee,

subcommittee or subordinate decision-making body and Mayor, matters within the

area of responsibility of a particular committee, subcommittee or subordinate

decision-making body may be considered directly by Council instead. If

this occurs, the Chair of the relevant committee, subcommittee or subordinate

decision-making body will report to the following meeting of the committee,

subcommittee or subordinate decision-making body regarding the reason

for doing so, and the outcome of the matter at the Council meeting.

3.3 The

25 June 2020 Council meeting resolved:

|

Resolved CL/2020/001

|

|

|

That

the Council

1. Receives the report Nelson Plan:

Additional Funding (R18069); and

2. Approves unbudgeted expenditure of

$135,500 to progress the Draft Nelson Plan in 2019/2020.

|

|

McGurk/Sanson Carried

|

Author: John

Peters, Chairperson – Audit and Risk Subcommittee

Attachments

Nil

|

|

Audit and Risk Subcommittee

11 August 2020

|

REPORT R18115

Audit

New Zealand - Audit Engagement Letter

1. Purpose

of Report

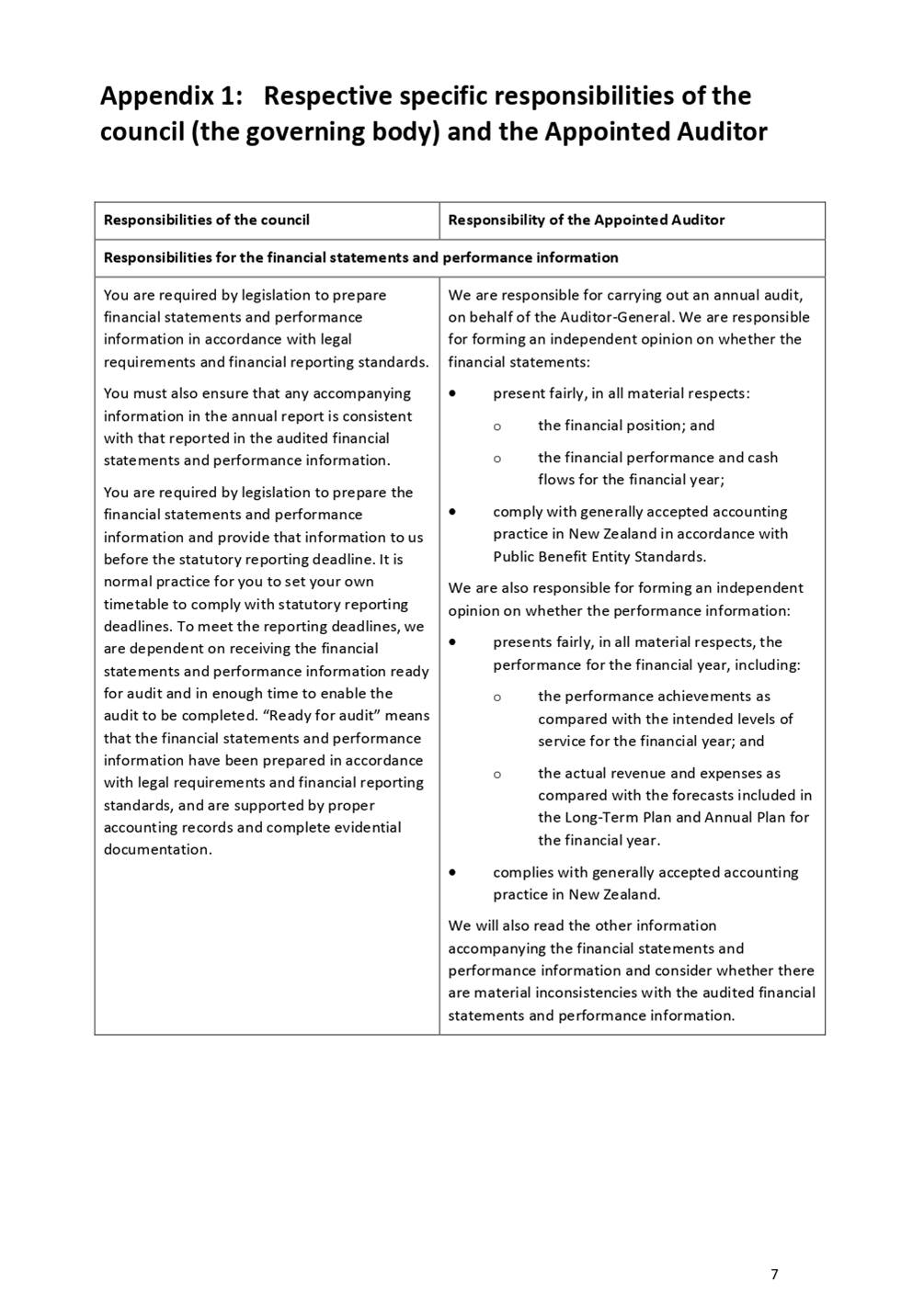

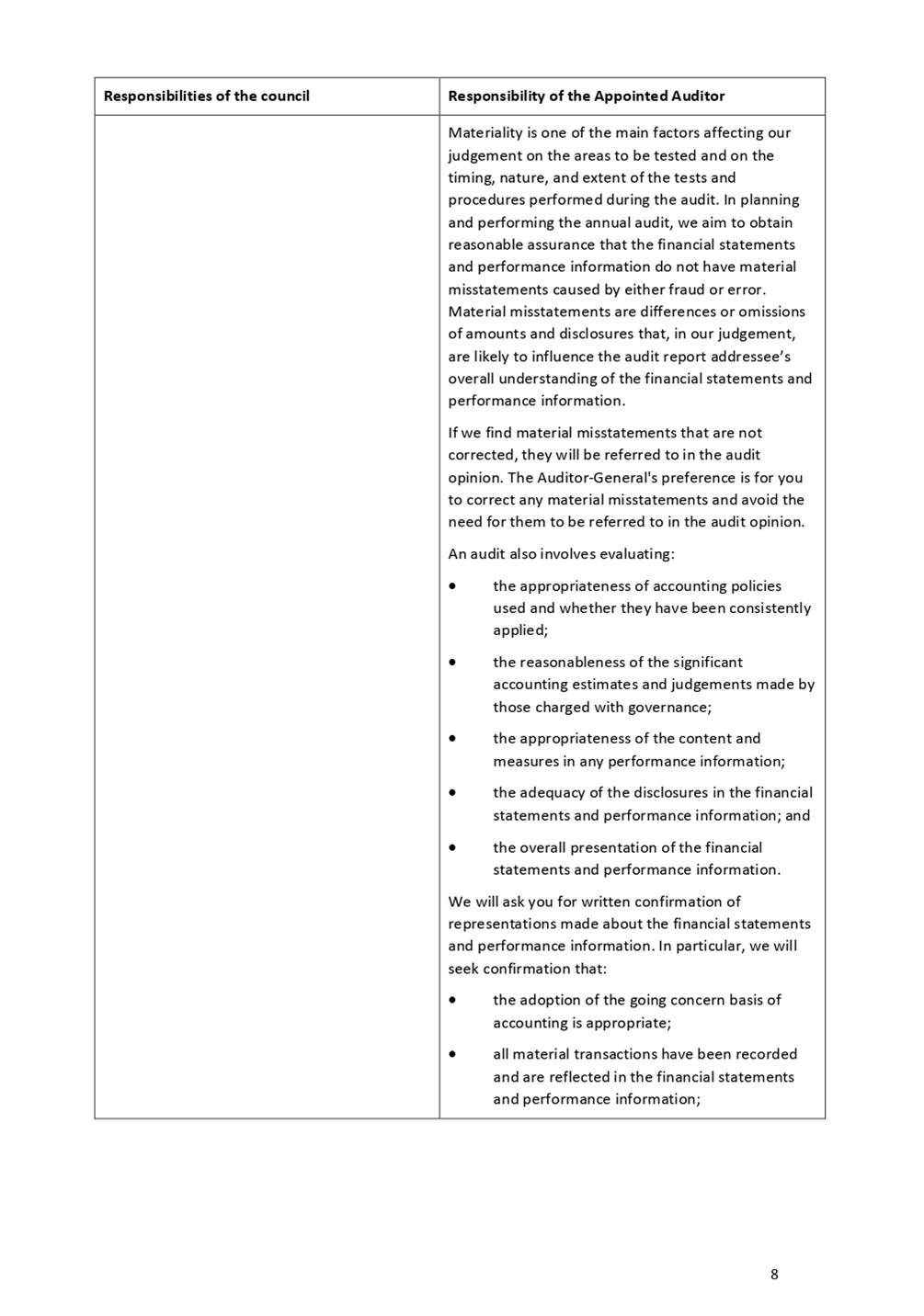

1.1

To provide the subcommittee with the Audit Engagement Letter for the years

ending 30 June 2020, 2021 and 2022 and ask for any feedback before the letter

is signed by Her Worship the Mayor.

2. Recommendation

|

That the Subcommittee

1. Receives

the report Audit New Zealand - Audit Engagement Letter (R18115) and its attachment (A2409696); and

2. Notes that following feedback from the

Audit and Risk Subcommittee, Her Worship the Mayor will sign

the Audit Engagement letter to Audit NZ.

|

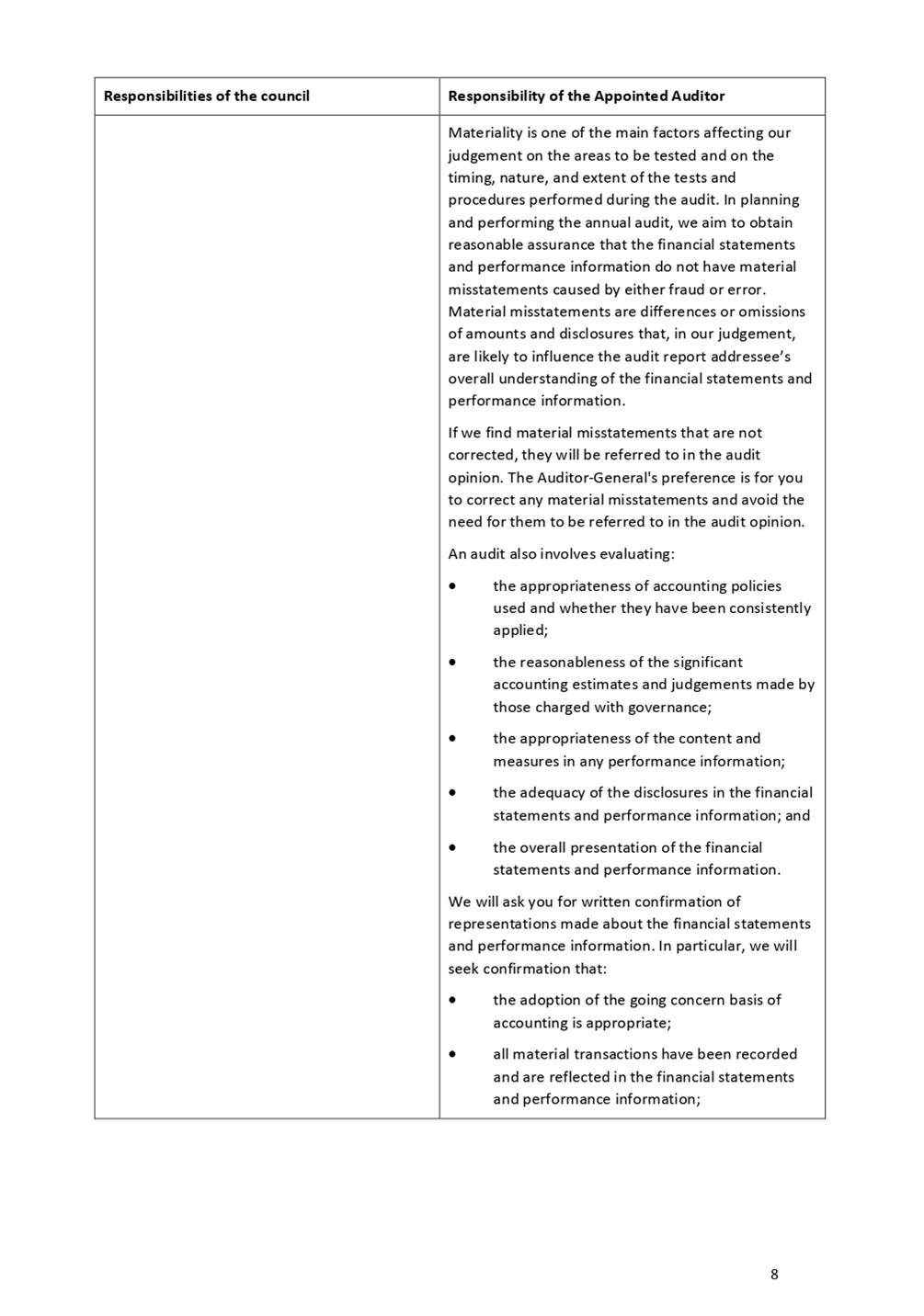

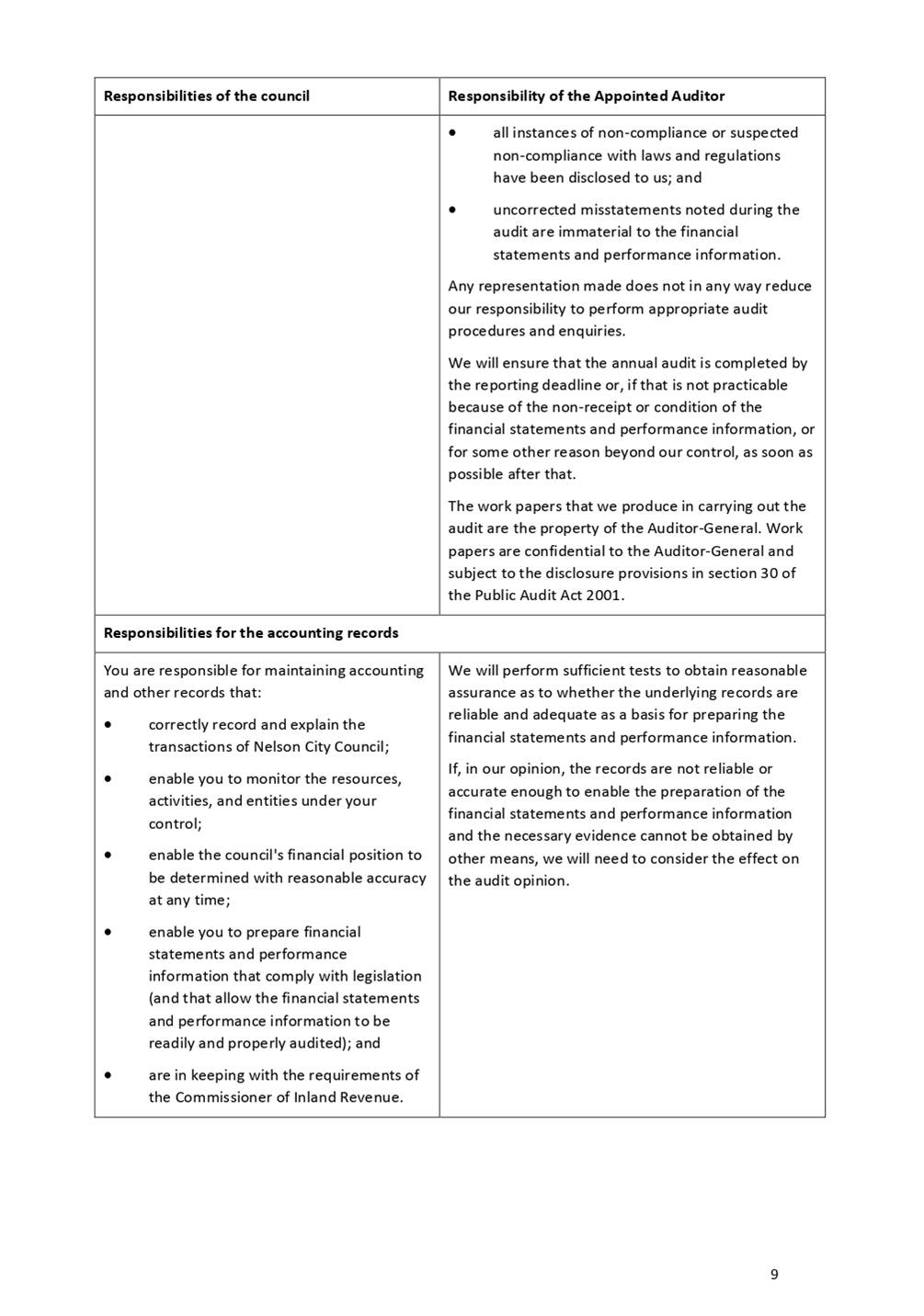

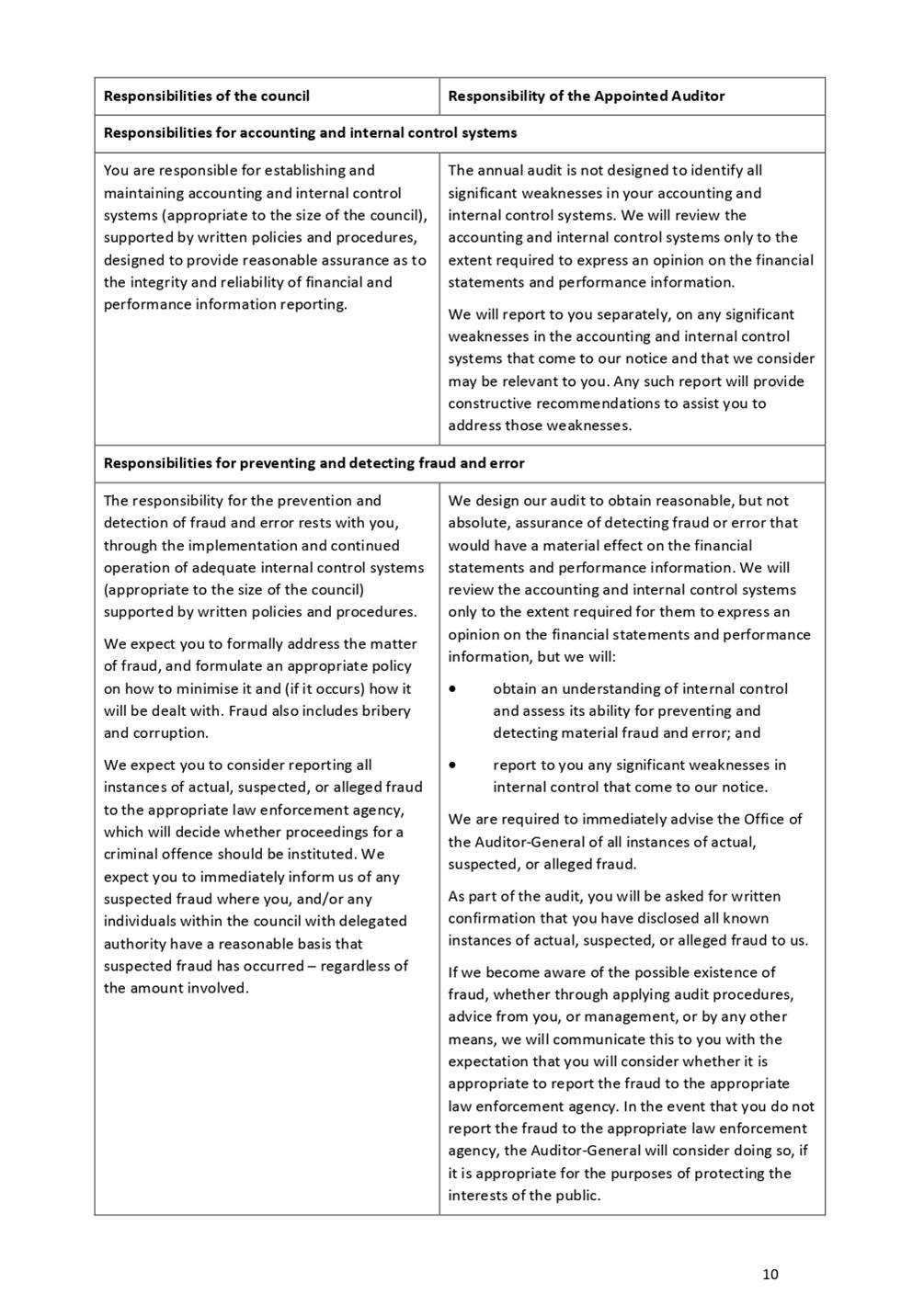

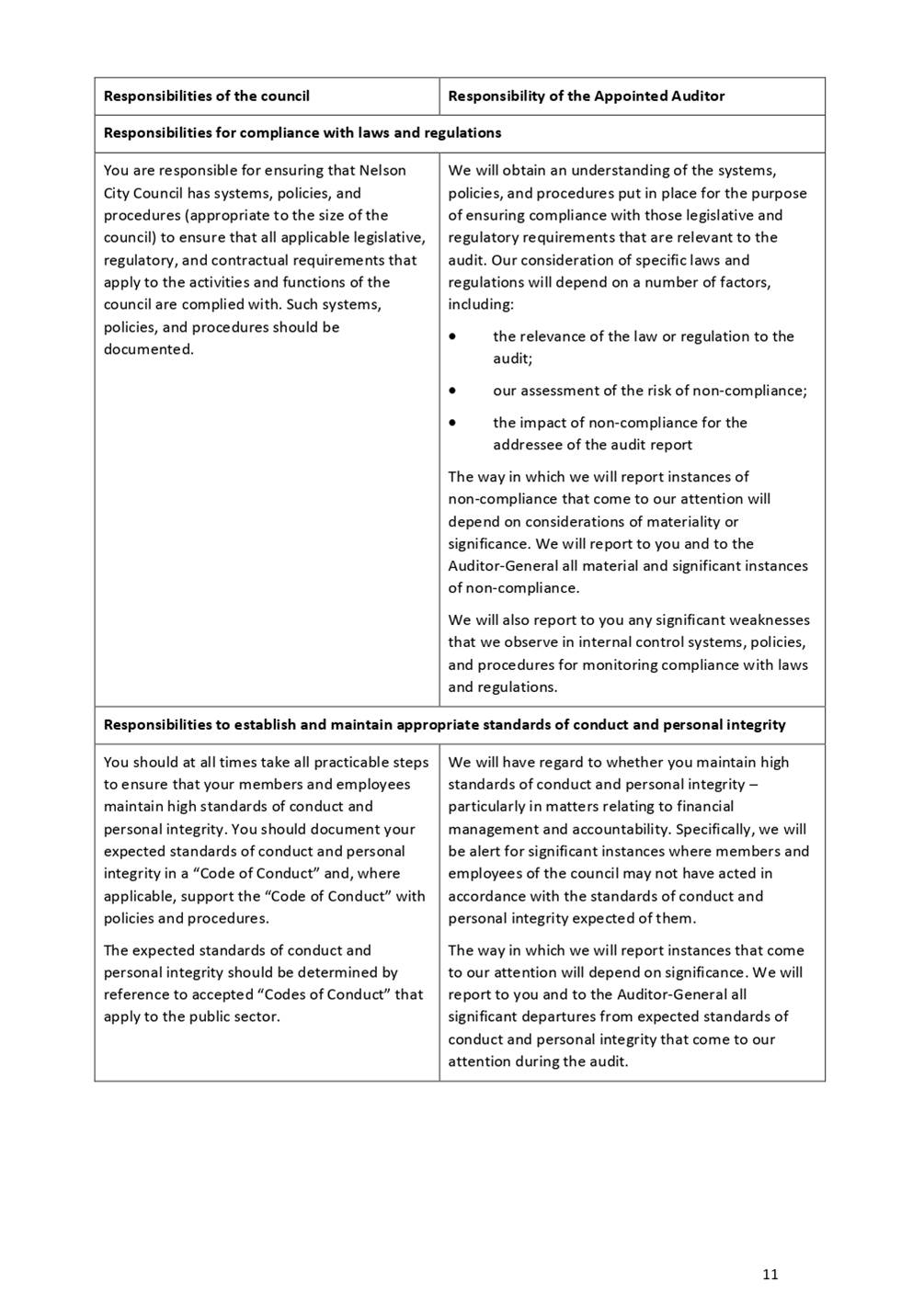

3. Discussion

3.1 The

Audit Engagement letter (Attachment 1) covers the years 30 June 2020, 2021 and

2022 and sets out the terms of the audit engagement and the respective

responsibilities of the council and Audit New Zealand.

3.2 This

letter is required to be signed by Her Worship the Mayor to confirm that the

details of the audit match Council’s understanding of the arrangements.

3.3 The

letter, dated 18 June 2020, was not received from Audit New Zealand in time for

the previous Subcommittee Meeting on 21 May 2020 and therefore was not included

along with the Audit Proposal Letter and Audit Plan.

4. Options

4.1 The

options are to provide feedback to Audit NZ prior to Her Worship the Mayor

signing the letter or not.

Author: Clare

Knox, Manager Finance

Attachments

Attachment 1: A2409696

- Audit NZ - Audit Engagement Letter ⇩

Item 7: Audit New Zealand - Audit Engagement Letter: Attachment 1

Item 8: Annual Tax

Update

|

|

Audit and Risk Subcommittee

11 August 2020

|

REPORT R14819

Annual

Tax Update

1. Purpose

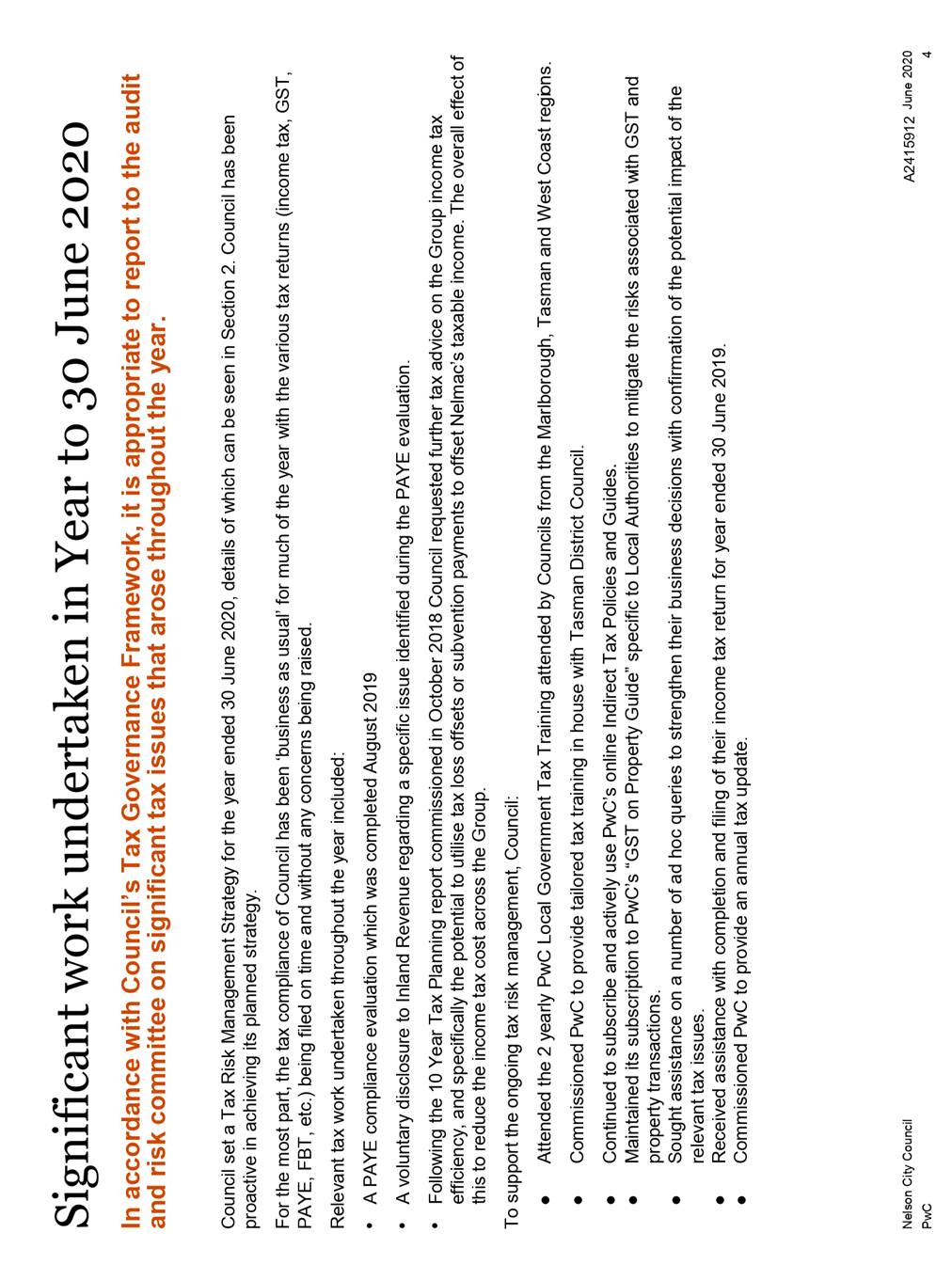

of Report

1.1 To

advise the Subcommittee of Council’s tax activities over the prior year

and provide some context for the current tax environment.

2. Recommendation

|

That the Audit and Risk Subcommittee

1. Receives the report Annual Tax Update (R14819) and its attachments (A2415912,

A2358418 and A2417124).

|

Do not

delete this line

2. Background

2.1 The

Tax Risk Governance Framework was adopted

by Council in May 2017 as a proactive step towards identifying and managing tax

risk to maintain its low risk profile. This Annual Tax Update has been prepared

as part of that framework.

2.2 This

report provides:

· A summary of the tax

advice that Council has sought during the period 1 July 2019 to 30 June 2020

· Commentary on tax

matters currently being addressed as at 30 June 2020

· A more general high

level update on the wider tax environment as it might affect Council

· An overview of the PAYE

compliance evaluation undertaken in the last financial year

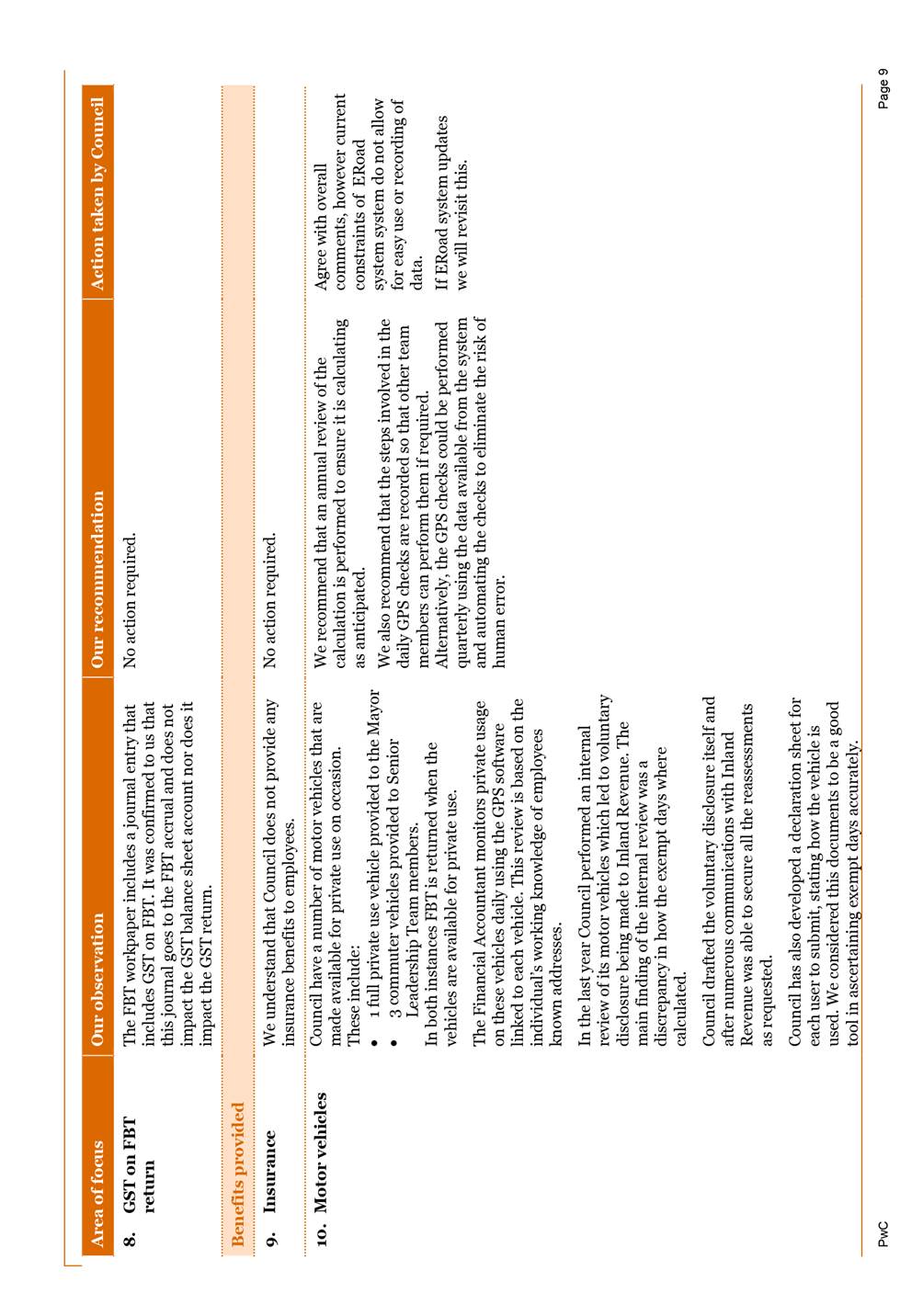

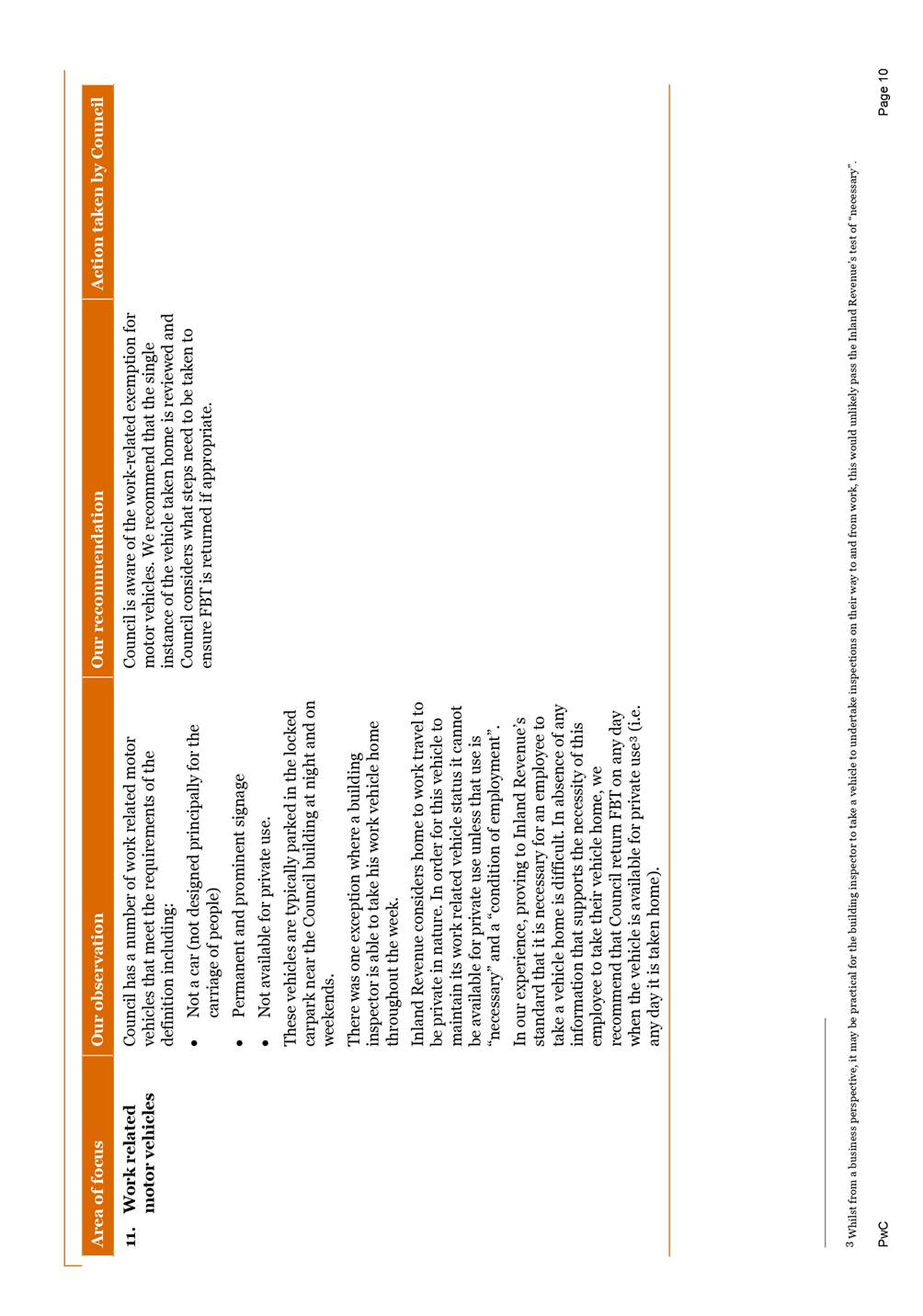

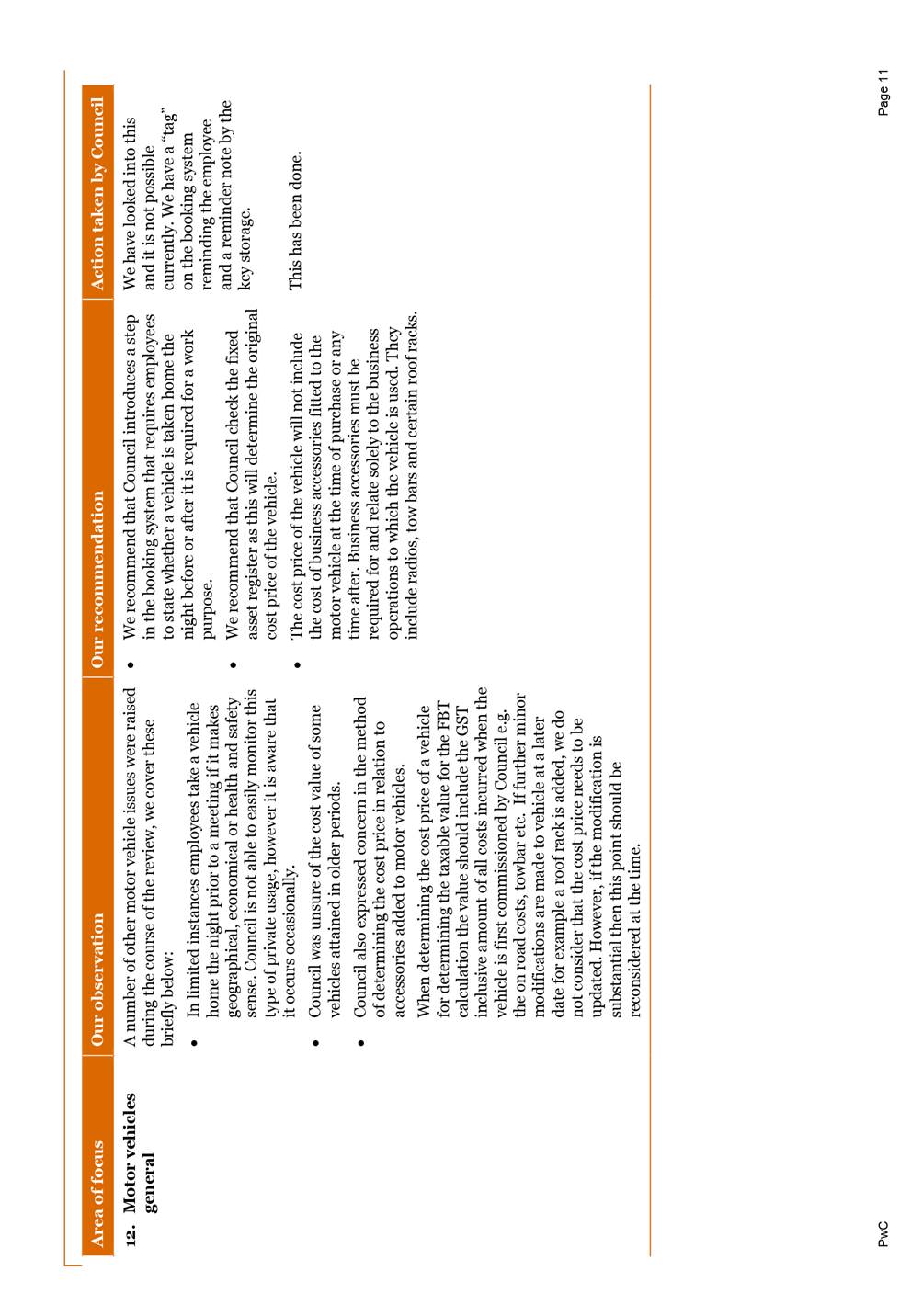

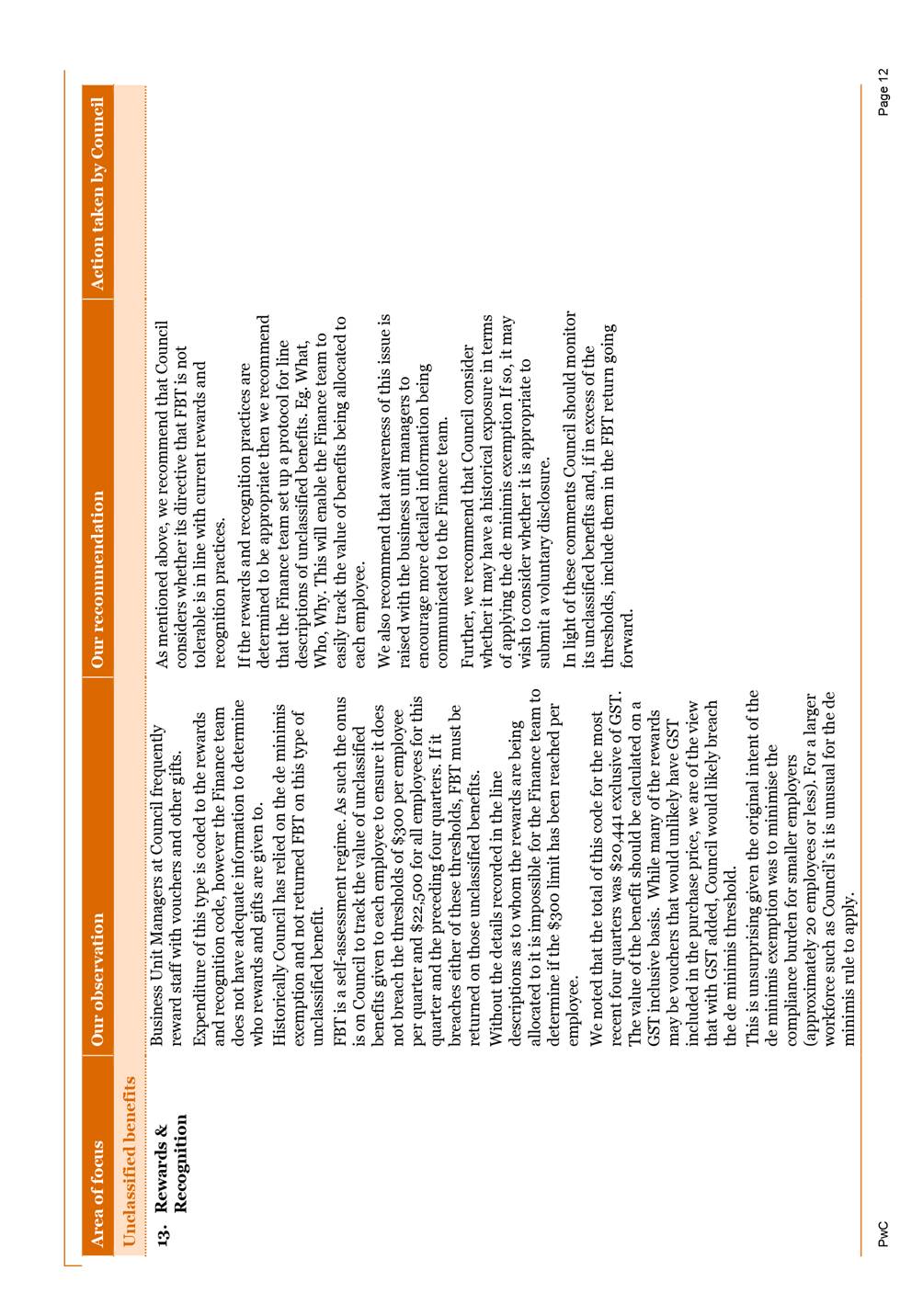

· An overview of the FBT compliance

evaluation undertaken in May 2019

2.3 The

Annual Tax Update report from Council’s tax advisors (PWC), the PAYE

compliance evaluation and FBT compliance evaluation are included with this

report as attachments 1, 2 and 3 respectively.

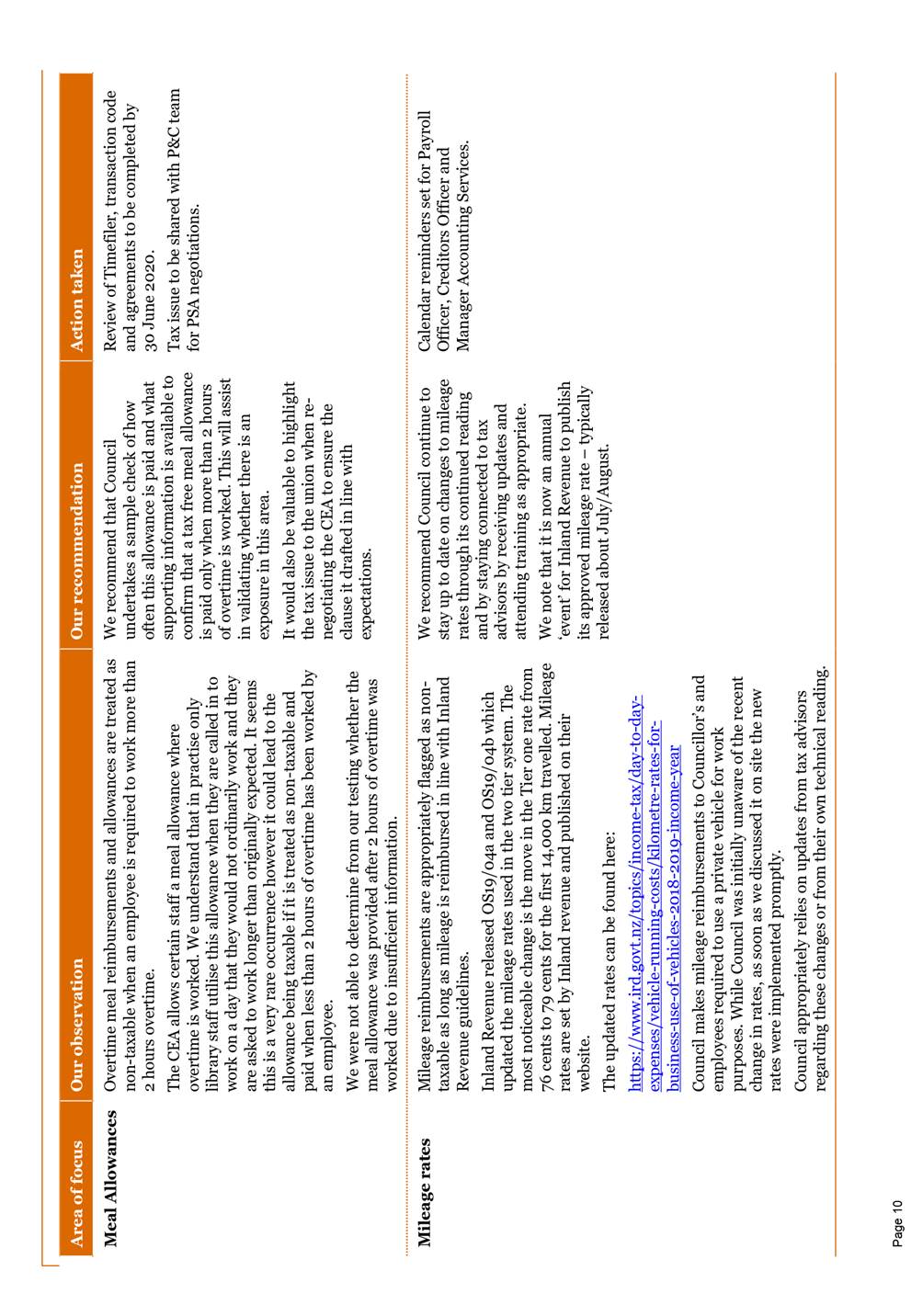

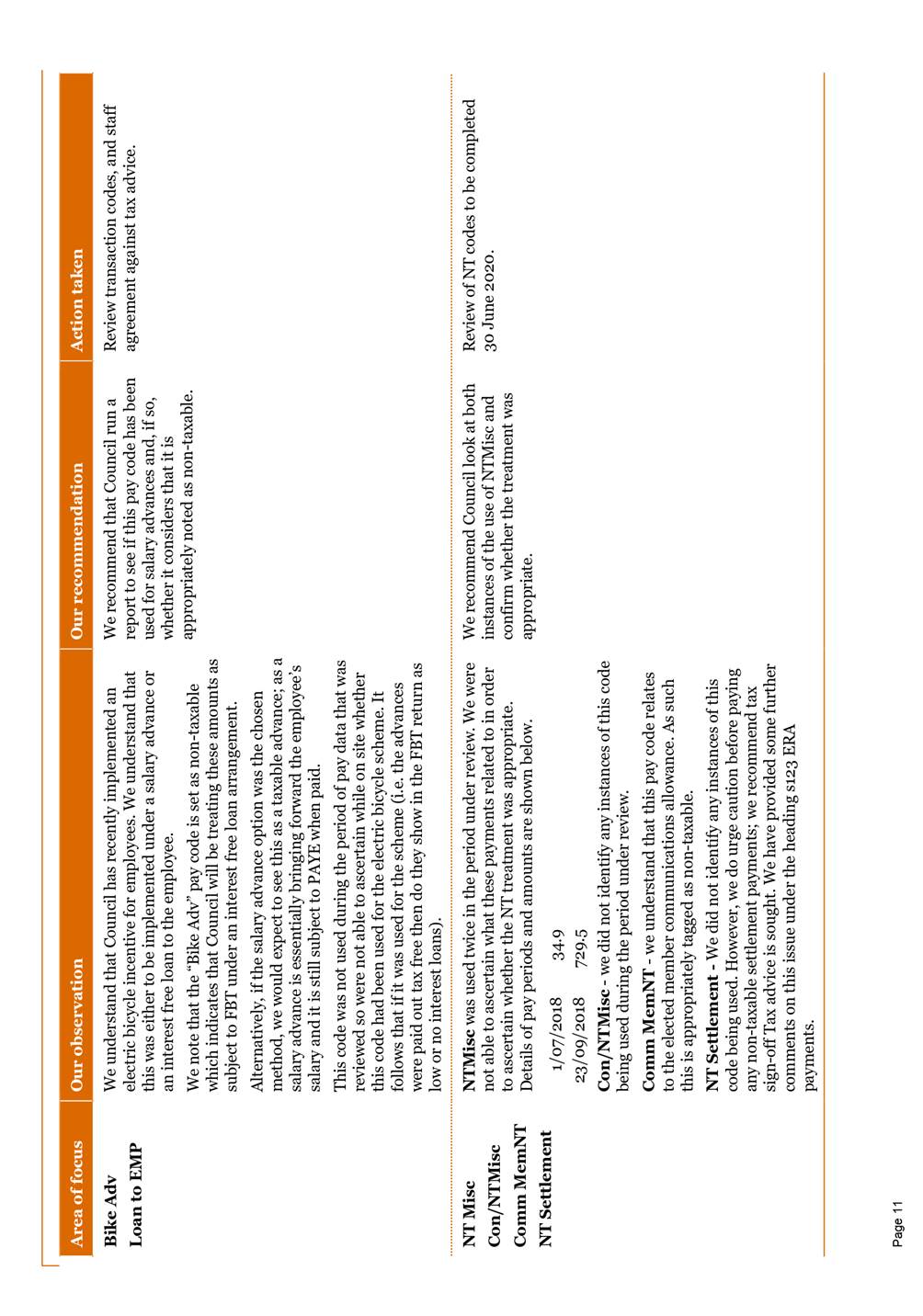

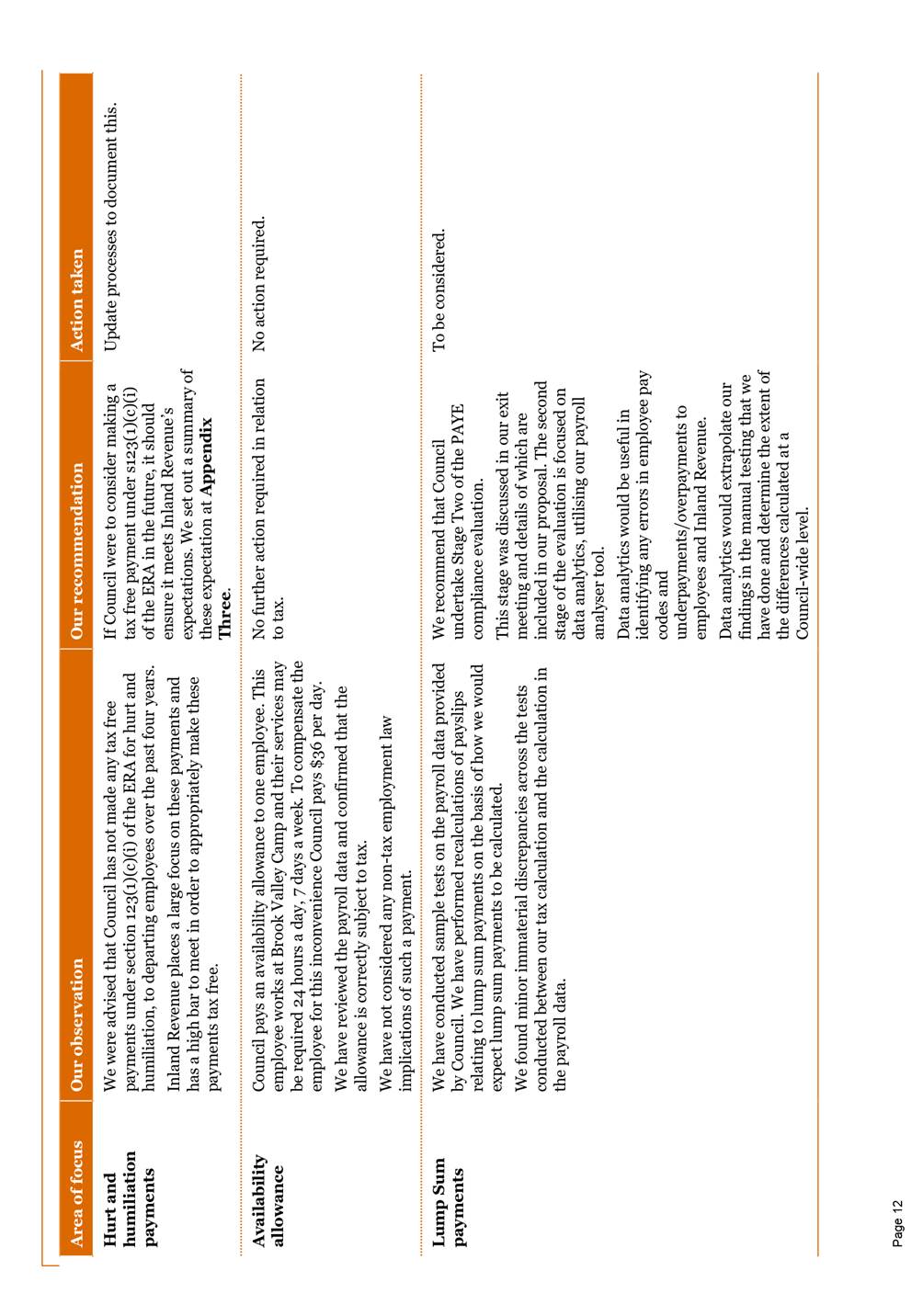

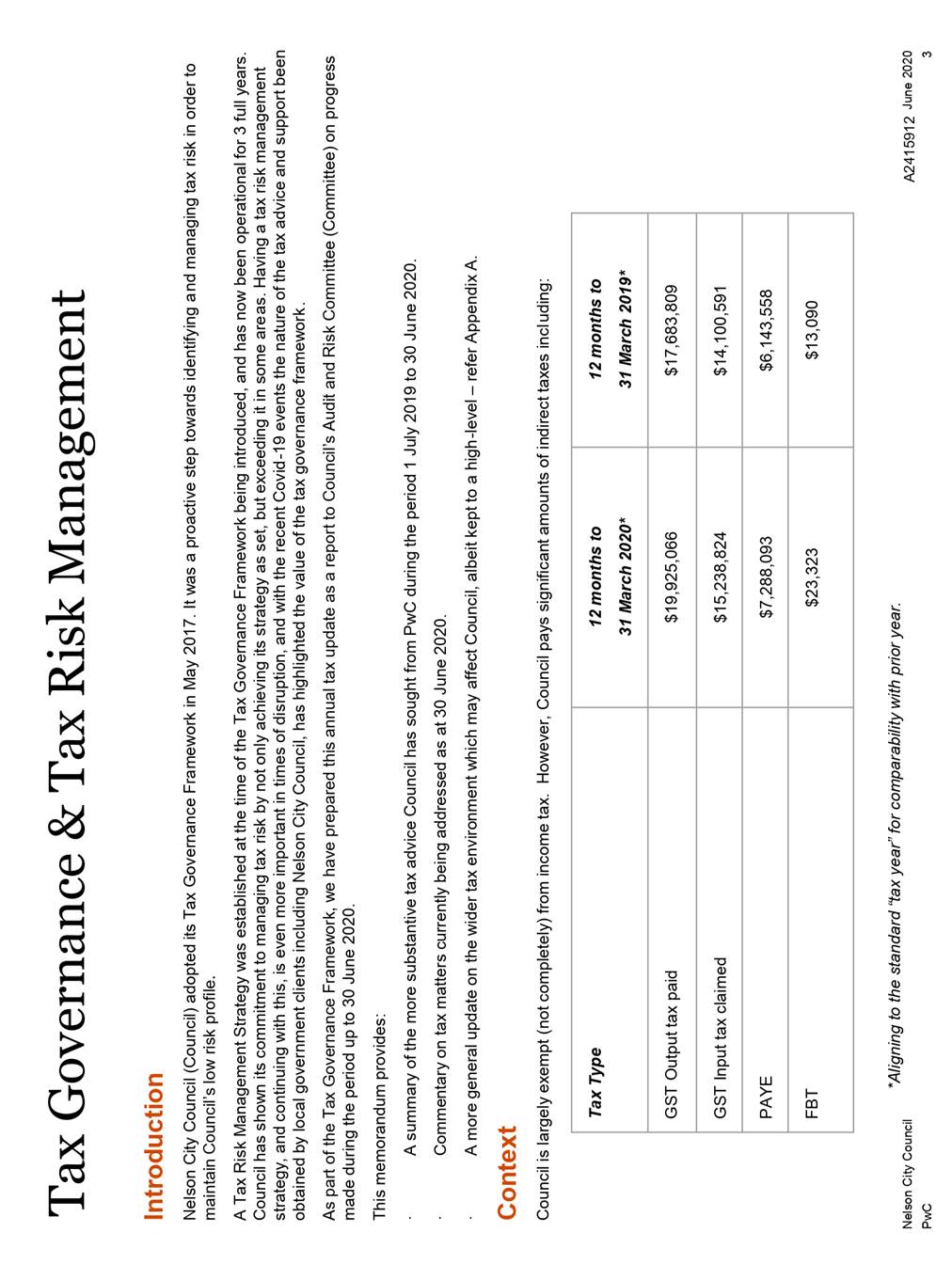

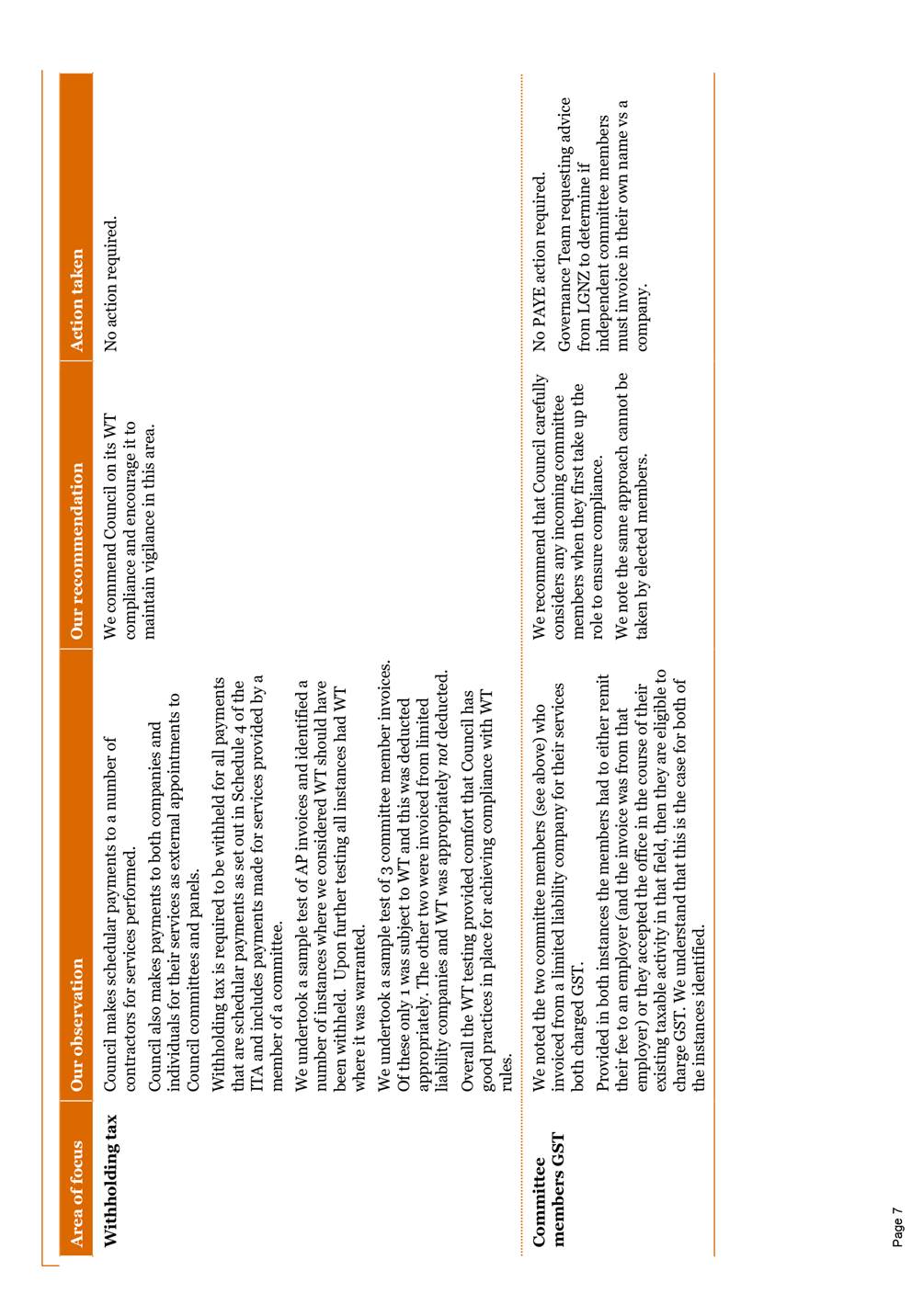

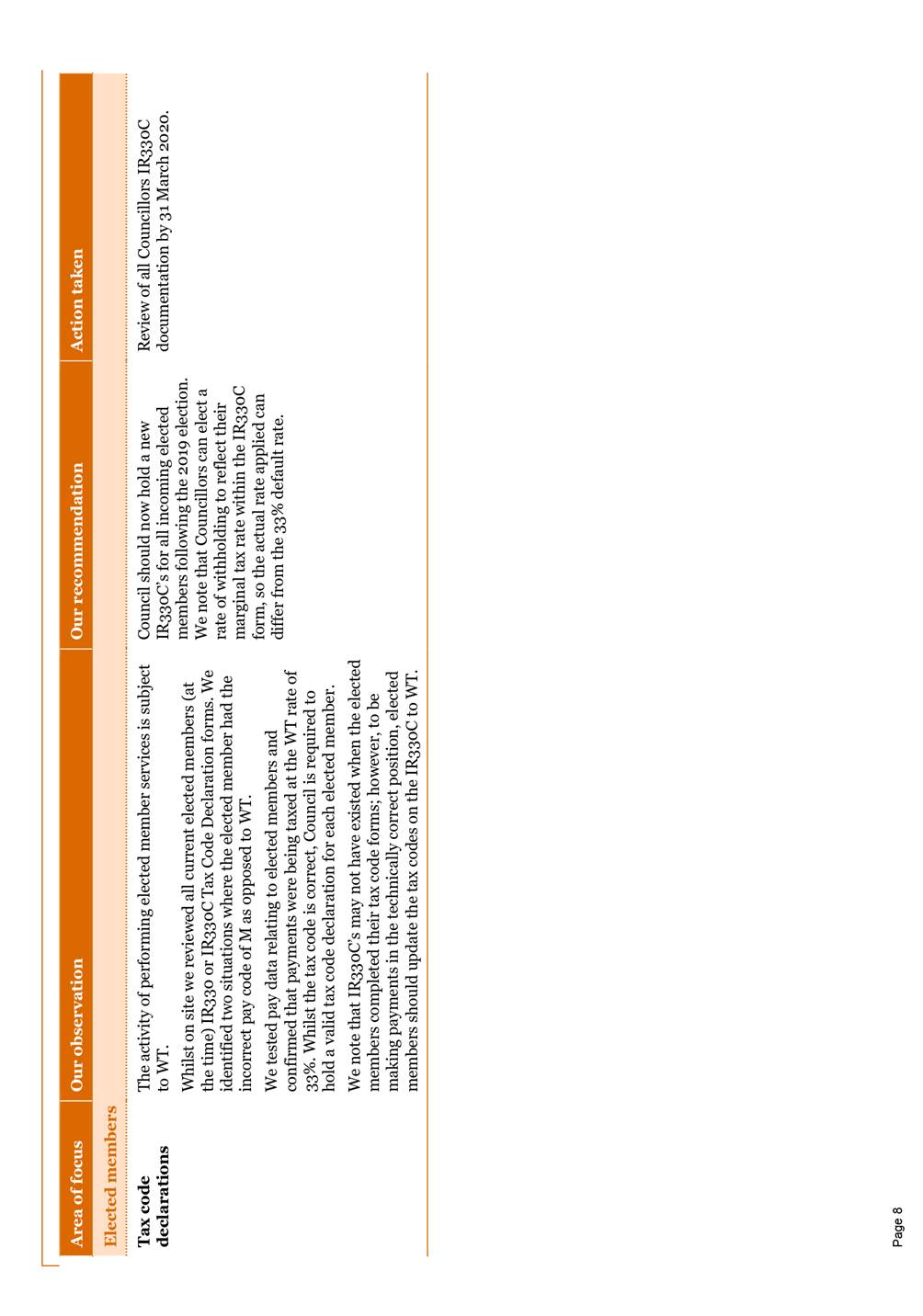

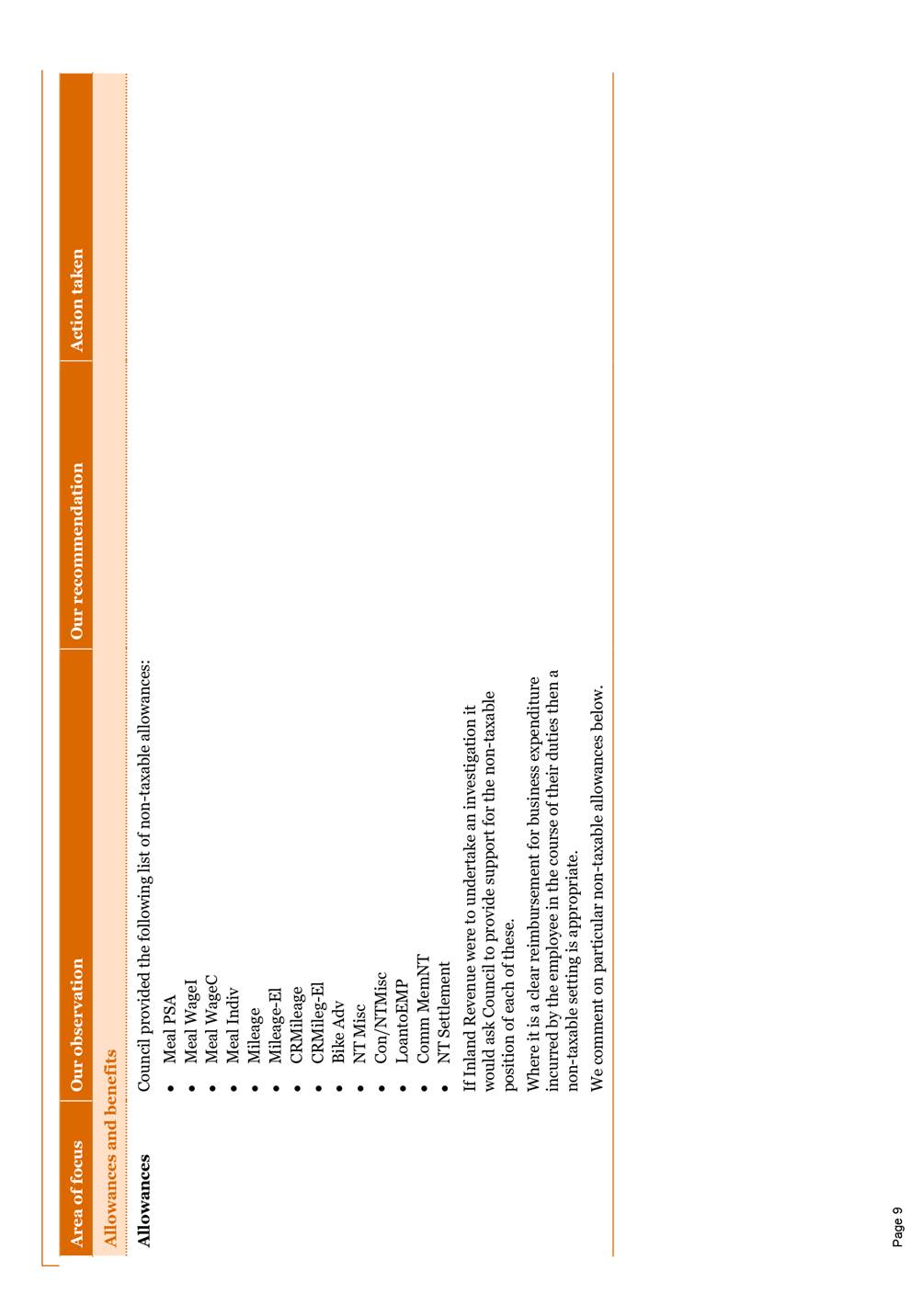

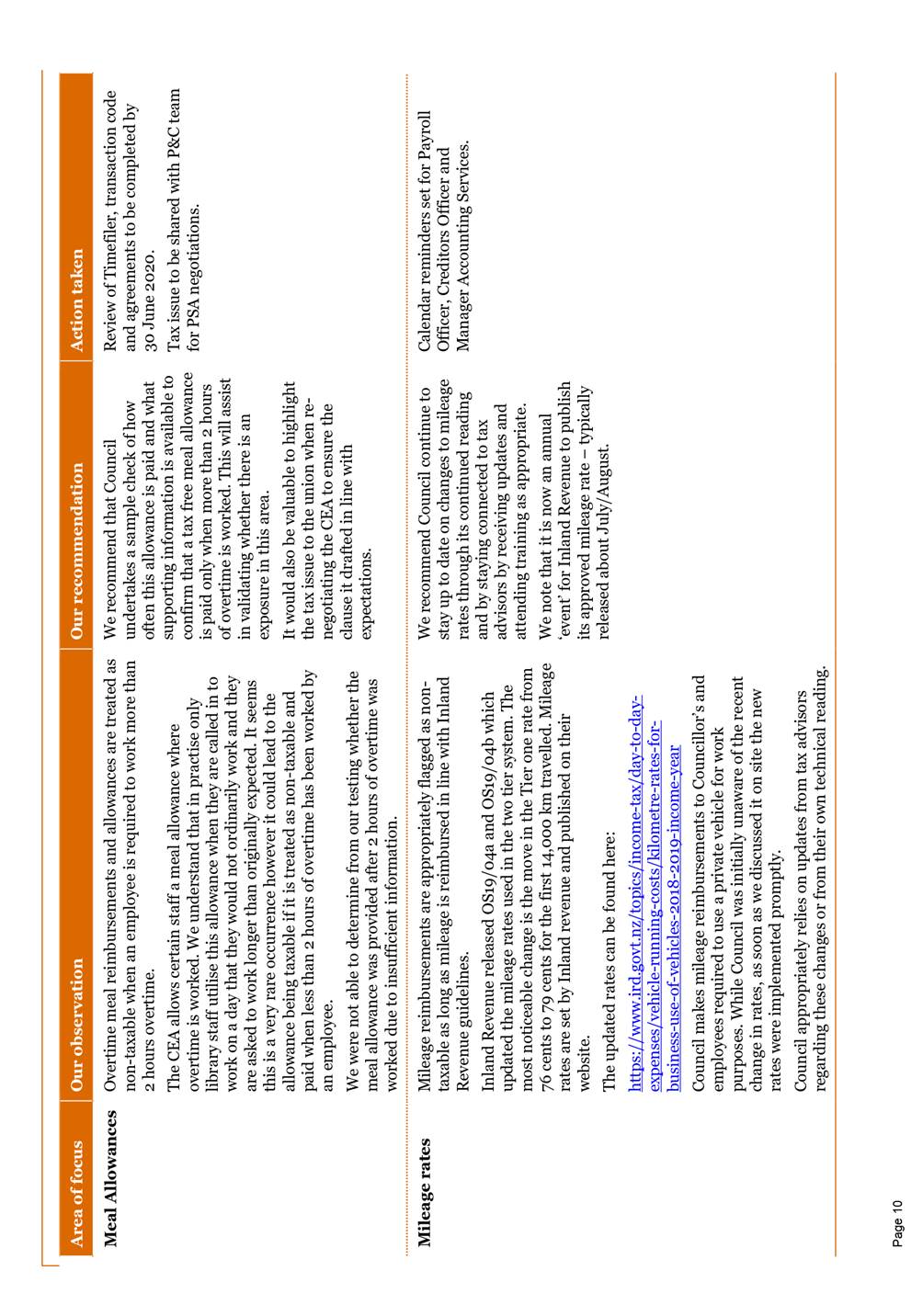

Tax Advice received and matters addressed

to 30 June 2020

2.3 For

the most part, the tax compliance of Council has been ‘business as

usual’ for much of the year with the various tax returns (GST, PAYE, FBT,

etc) being filed on time and without any concerns being raised.

2.4 That

said, it is appropriate to comment on the following areas where assistance has

been provided to Council:

· A PAYE compliance

evaluation was completed in August 2019.

· A FBT compliance

evaluation was performed in the May 2019 financial year and the report was finalised

in July 2019.

· A voluntary disclosure

was made to the Inland Revenue regarding a specific issue identified during the

PAYE evaluation.

· A voluntary disclosure

was made in relation to GST on Brook Camp accommodation.

2.5 As

per the tax risk strategy adopted by Council in 2017, a comprehensive PAYE compliance

evaluation was undertaken in August 2019. The finalised report (Attachment 2)

can be summarised as follows:

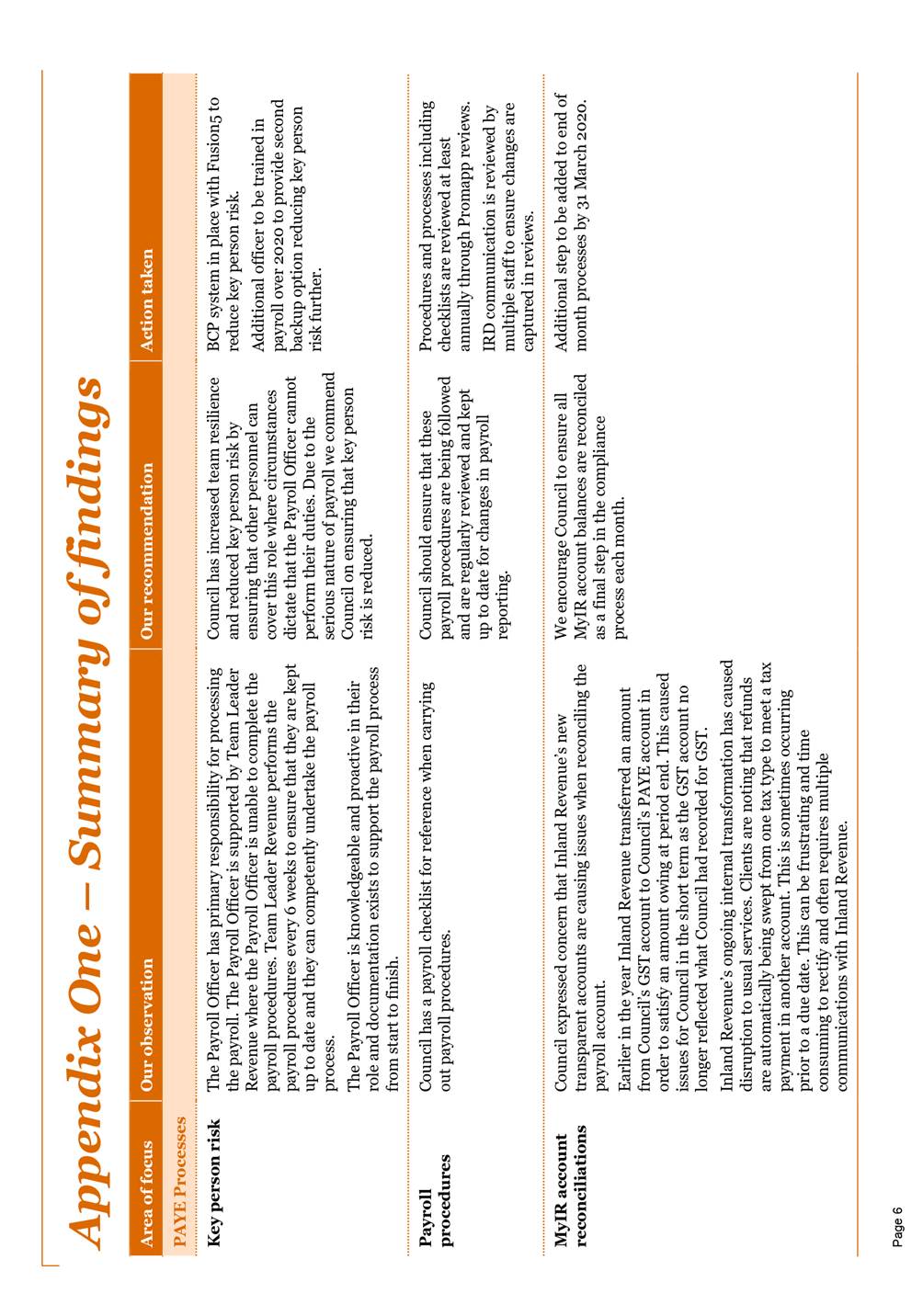

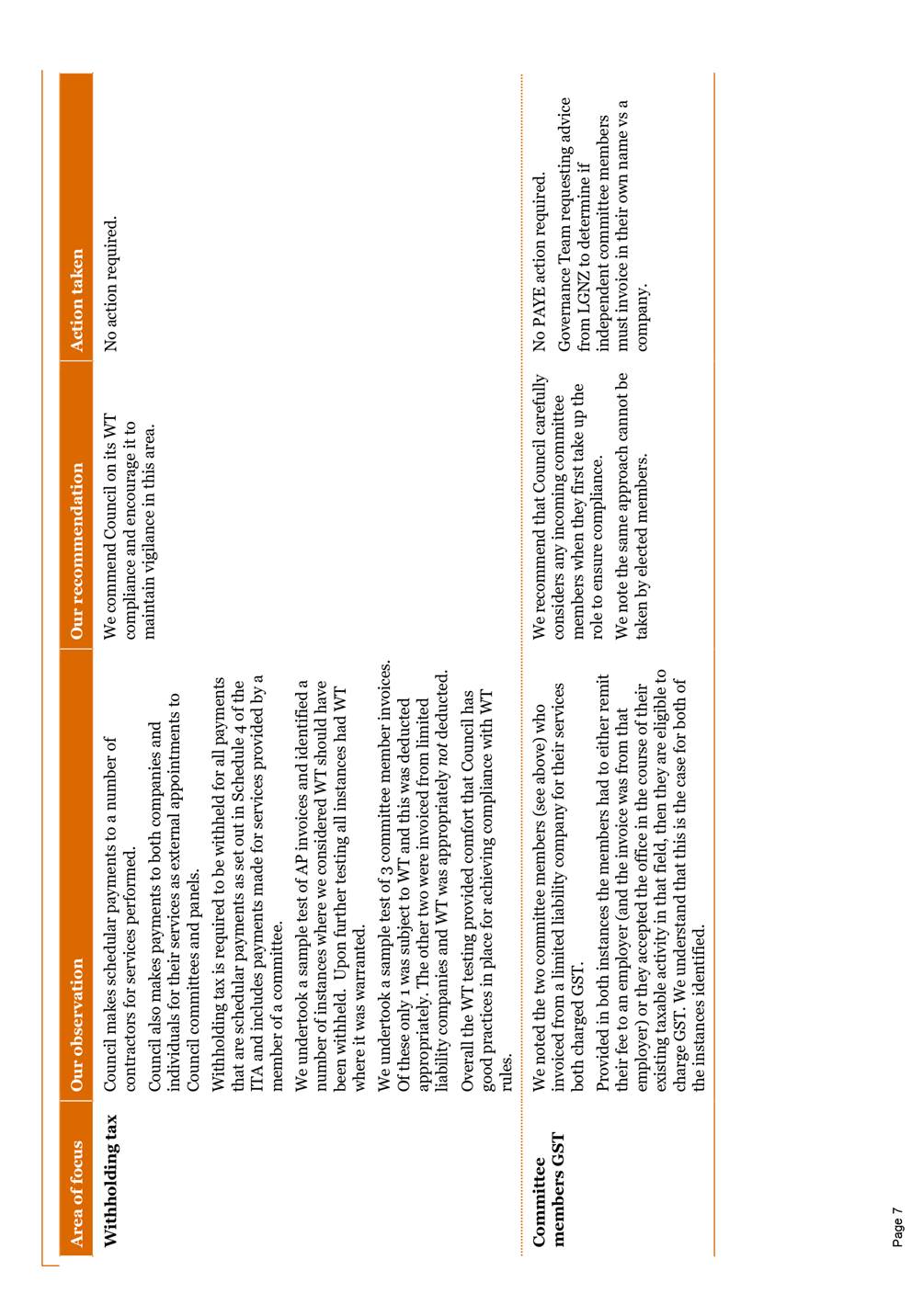

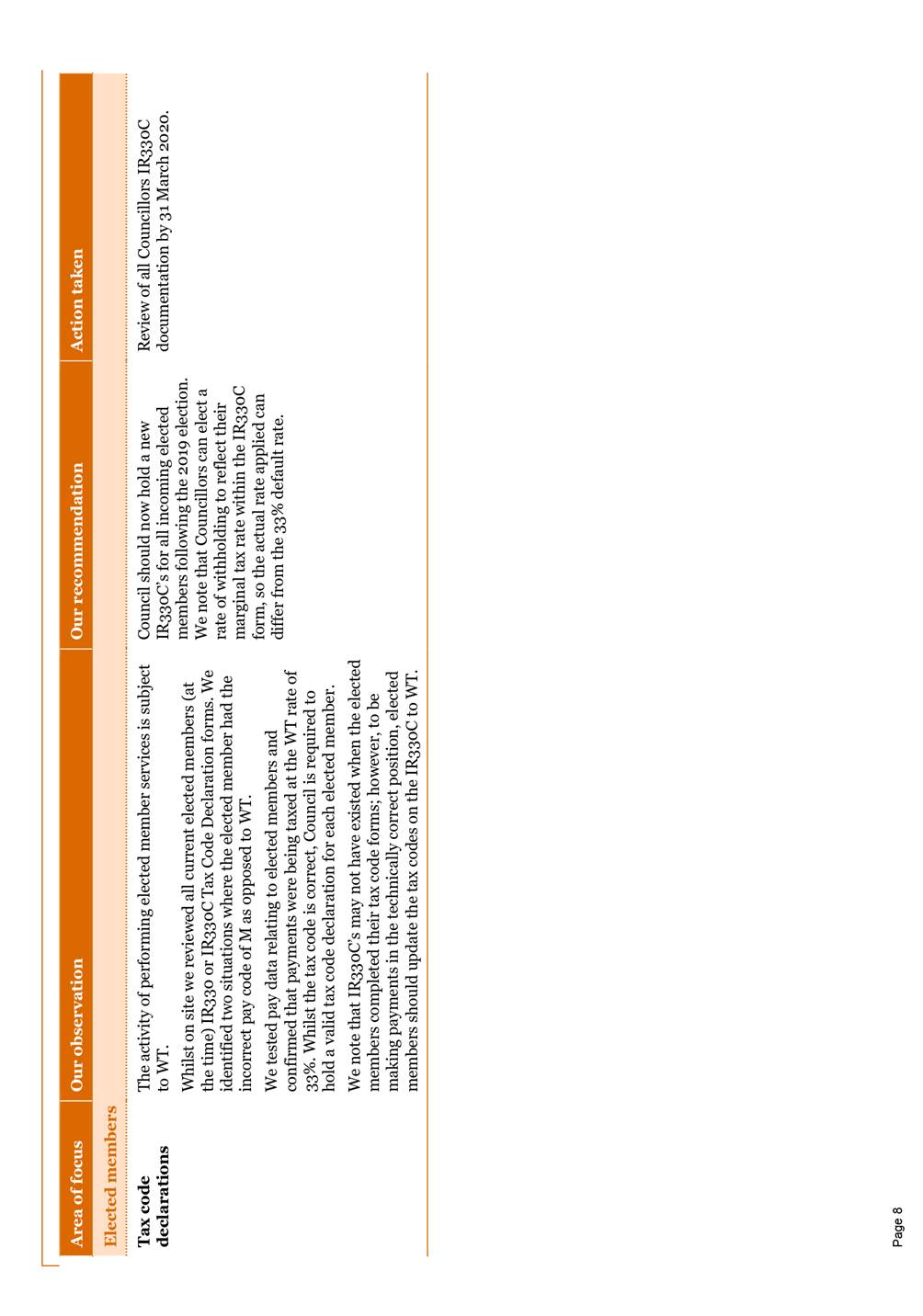

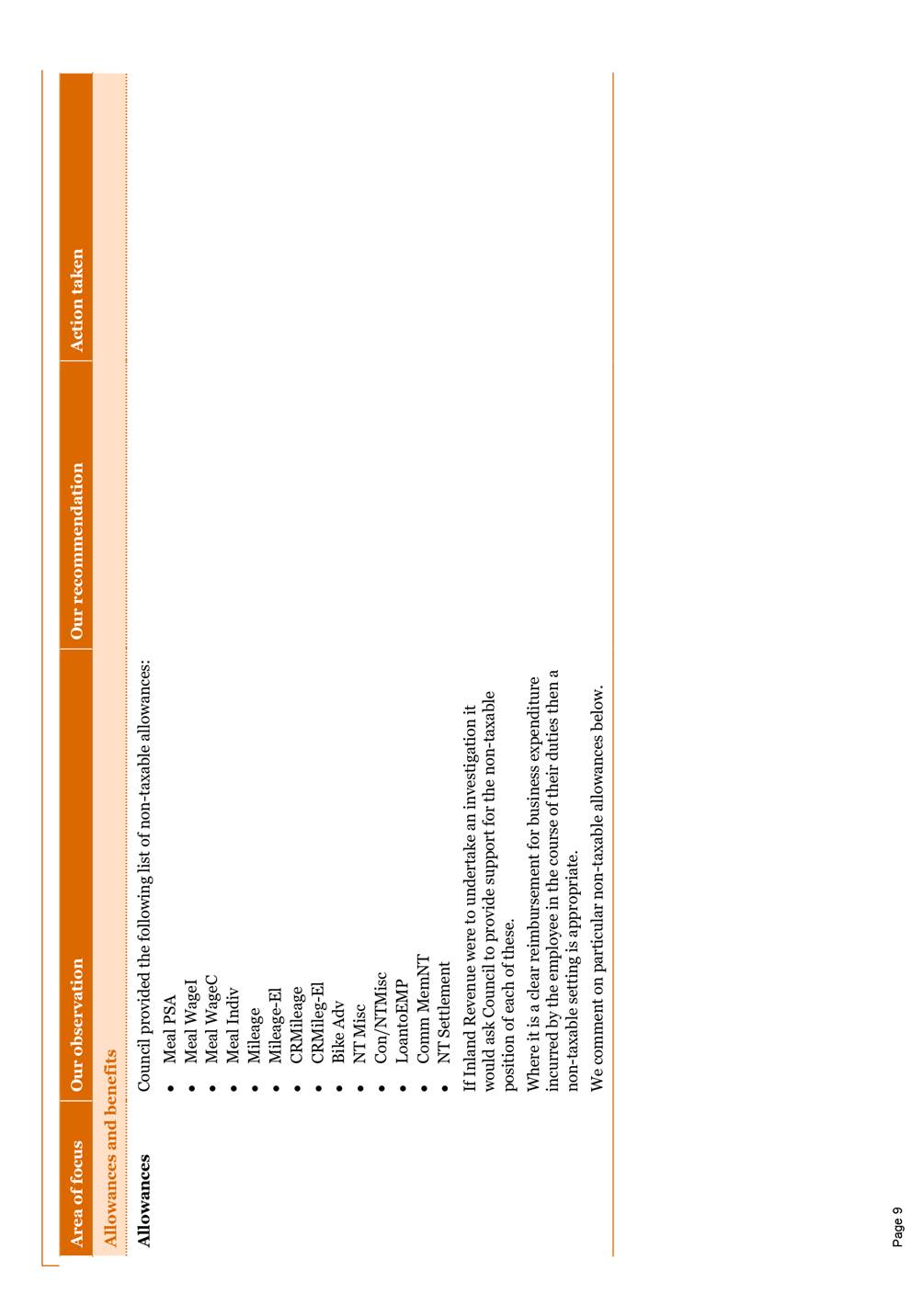

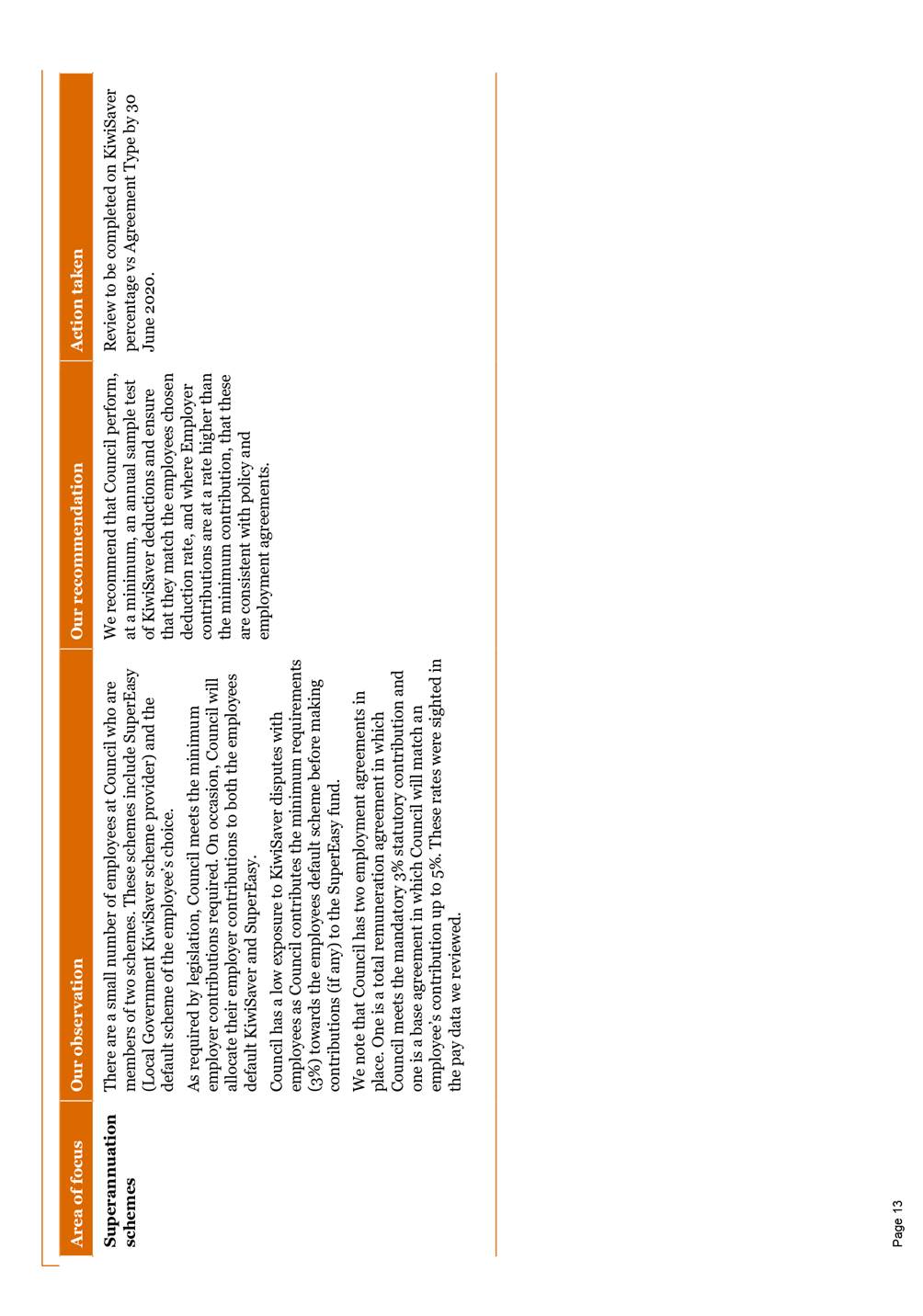

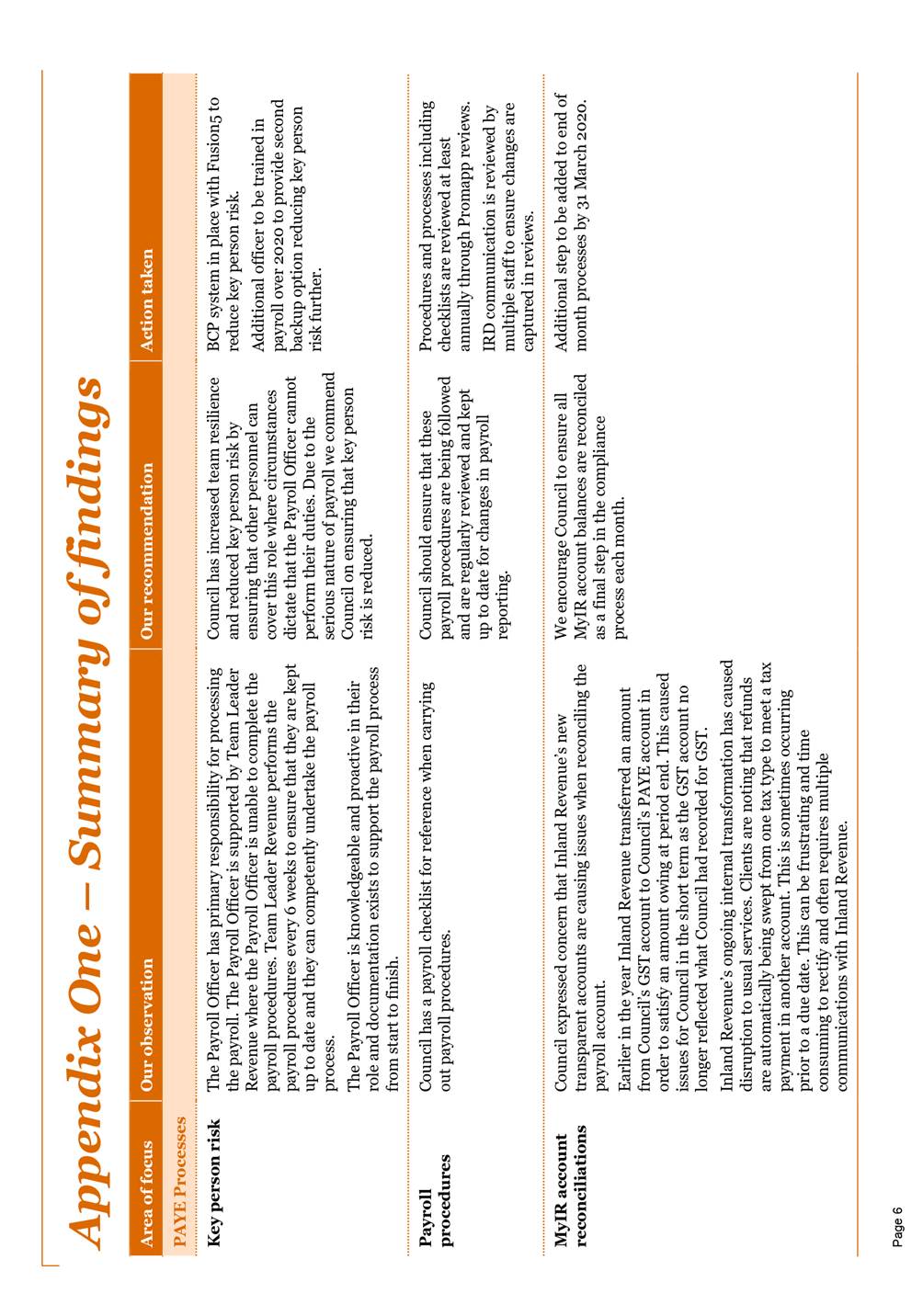

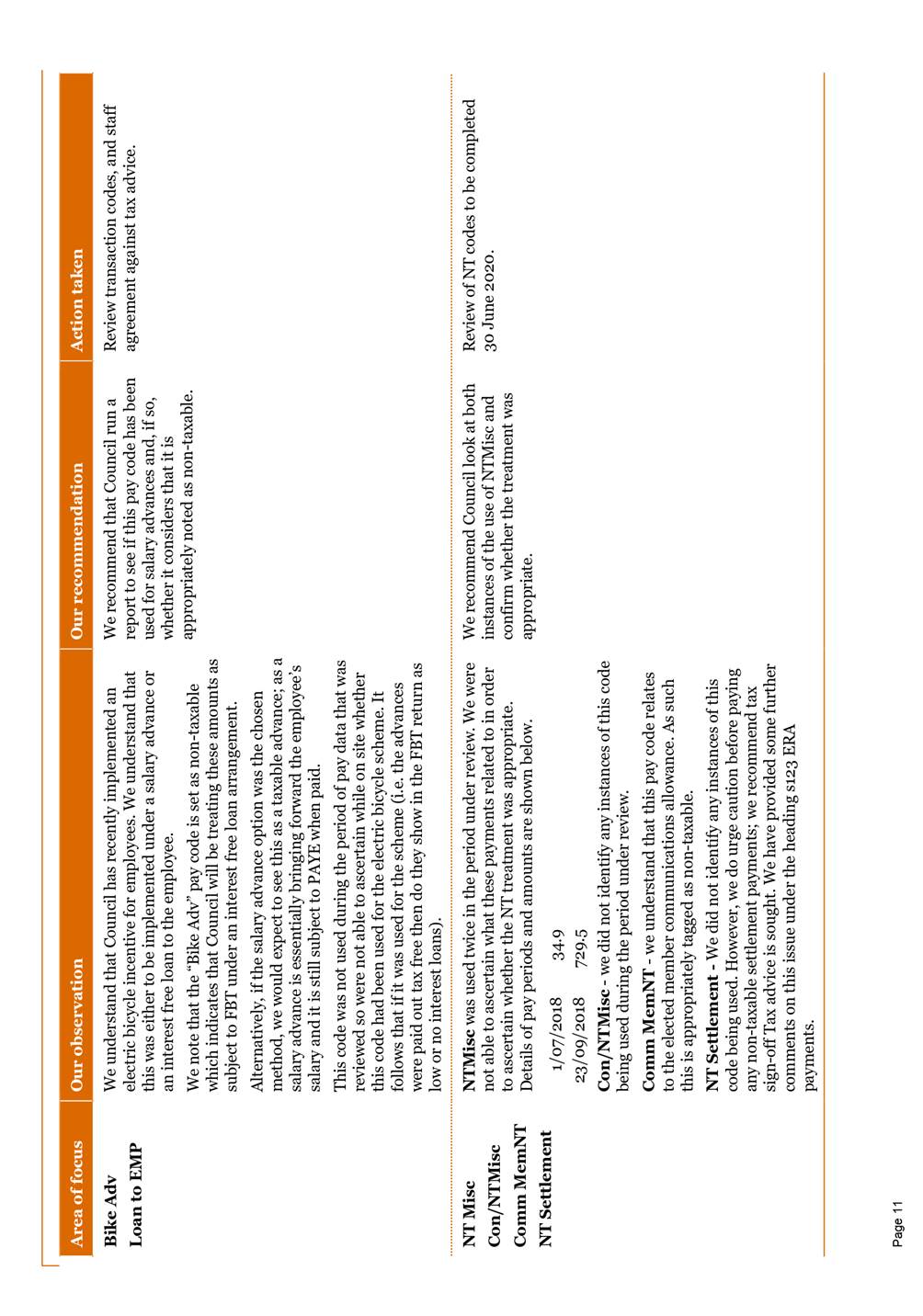

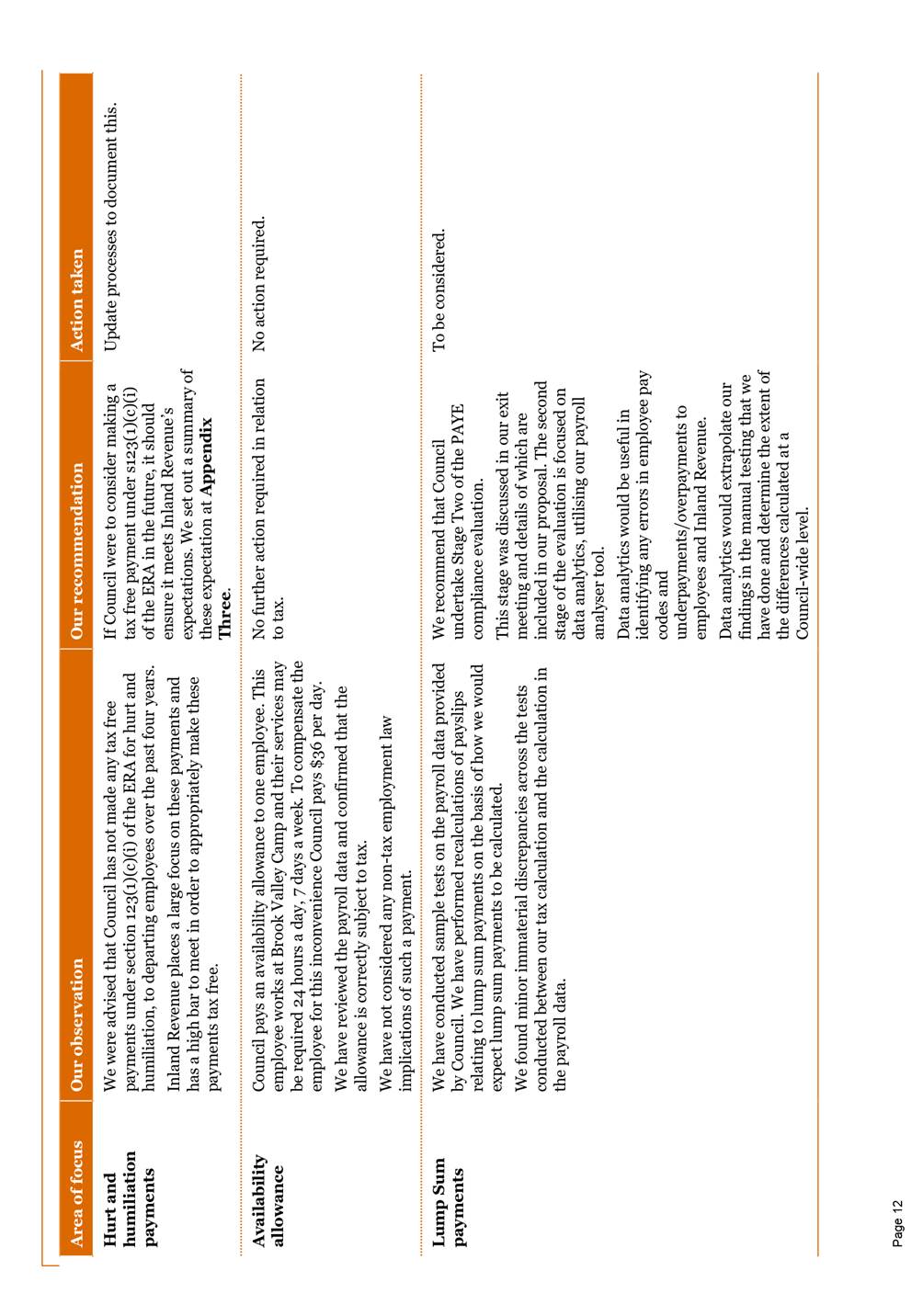

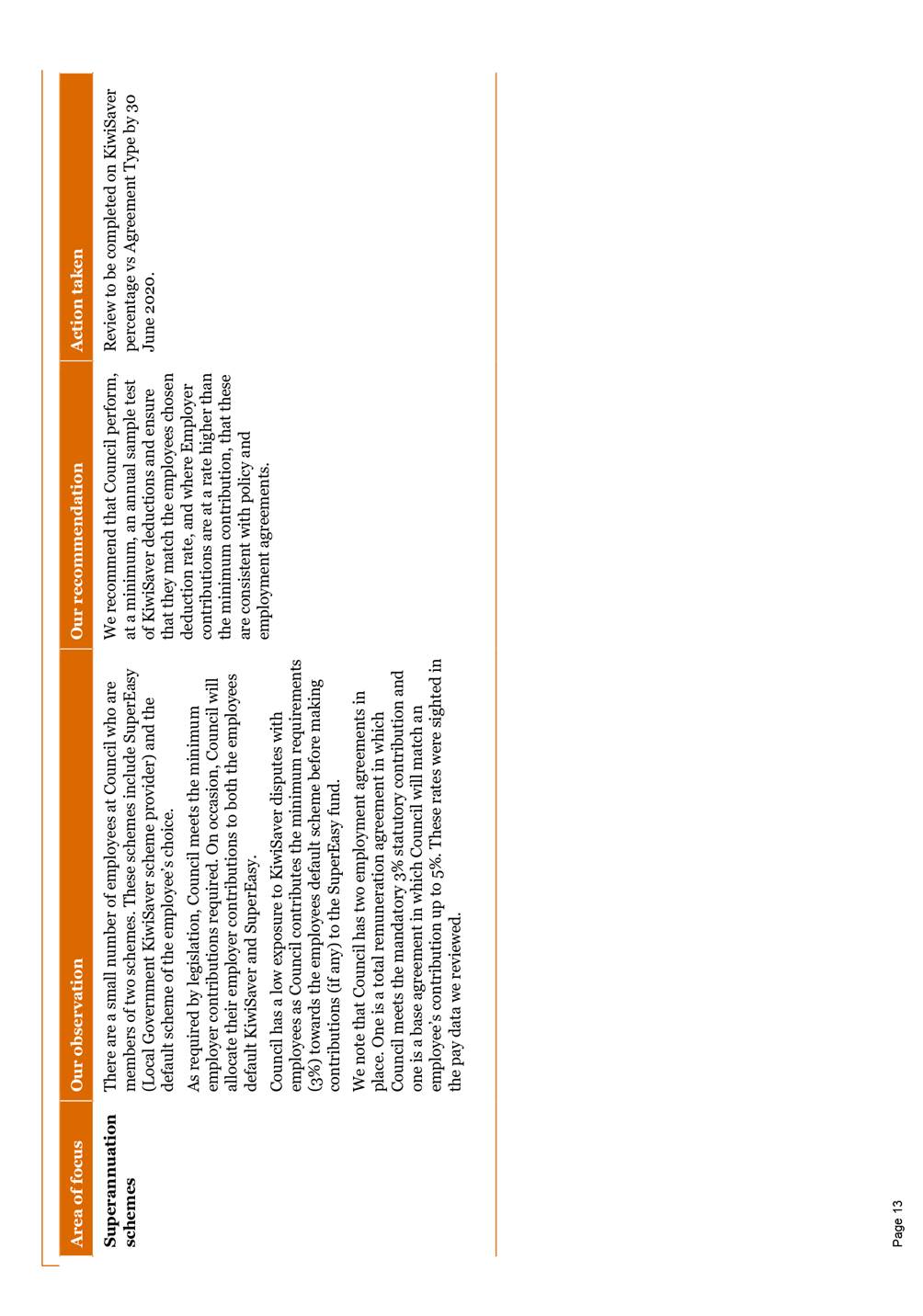

· Council has a high level

of PAYE compliance. The payroll risk areas often seen at other organisations

and targeted by Inland Revenue in investigations do not appear to be

significant risks for Council.

· The principal risk areas

are MyIR account reconciliations, KiwiSaver employer contributions and Pay data

which are discussed in further detail in Appendix One - Summary of Findings.

· There were 13 areas of

focus identified in Appendix One - Summary of Findings and recommendations were

made for action to maximise efficiency and risk reduction. Six of the

recommendations have already been completed, three require no action and the

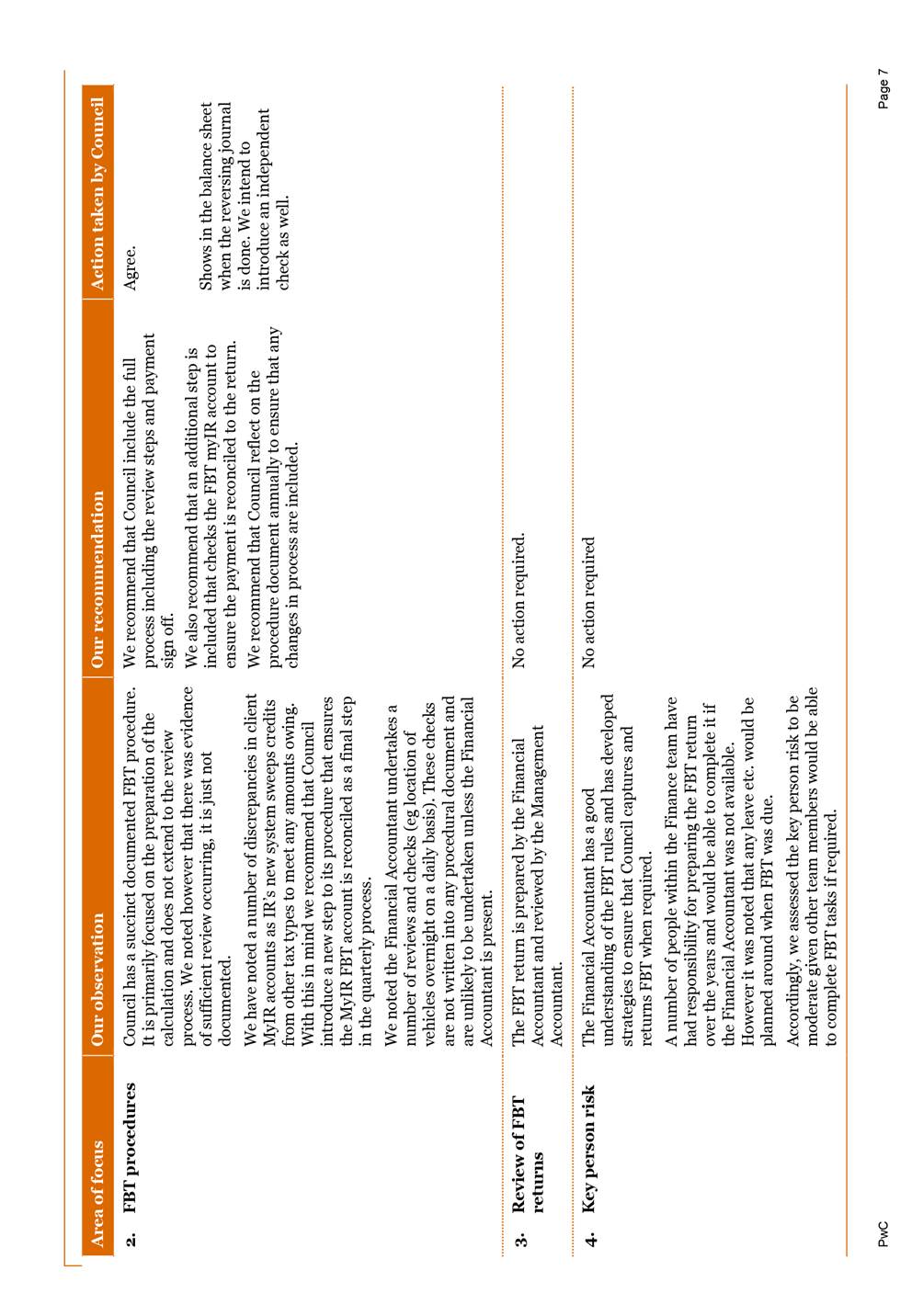

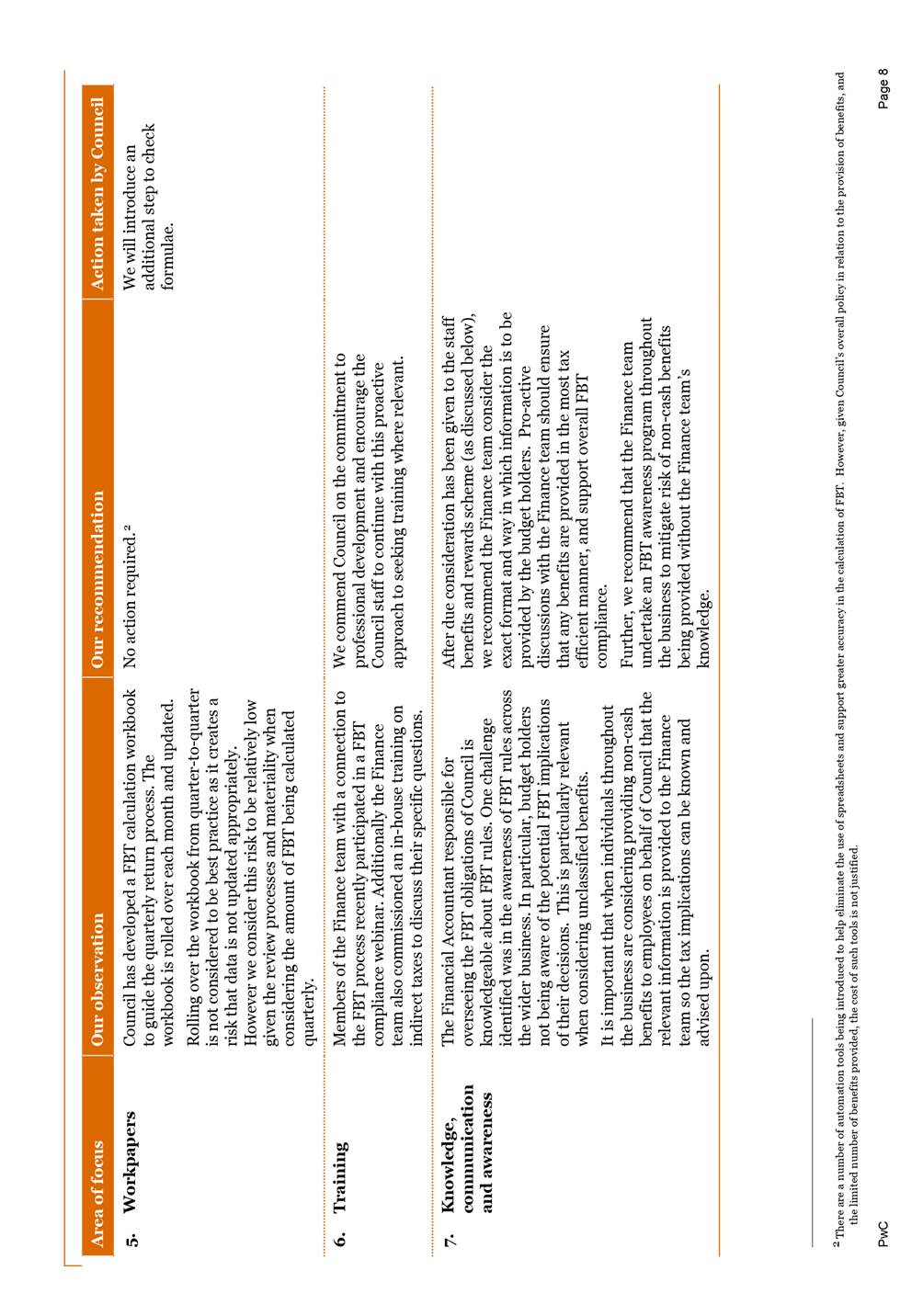

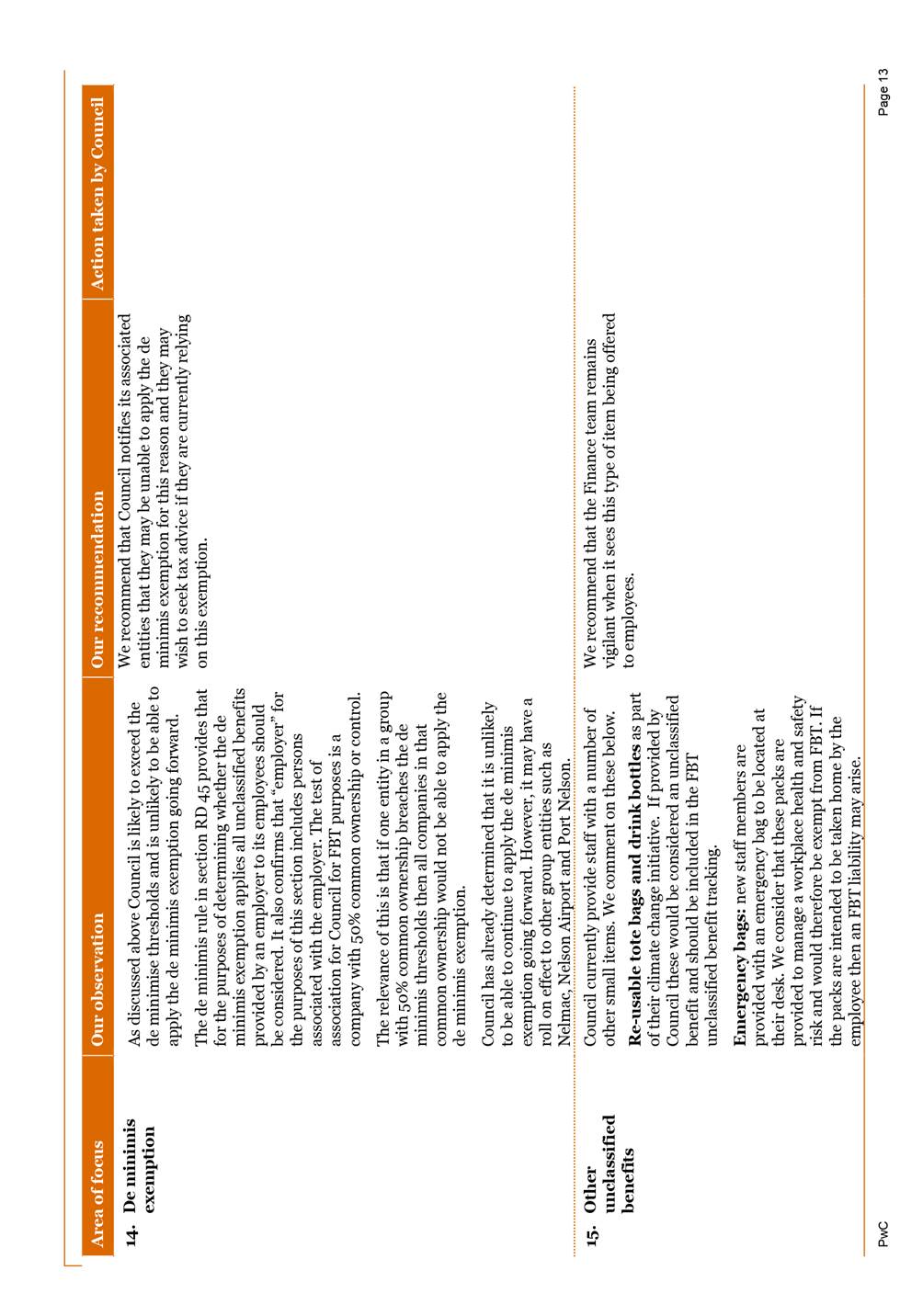

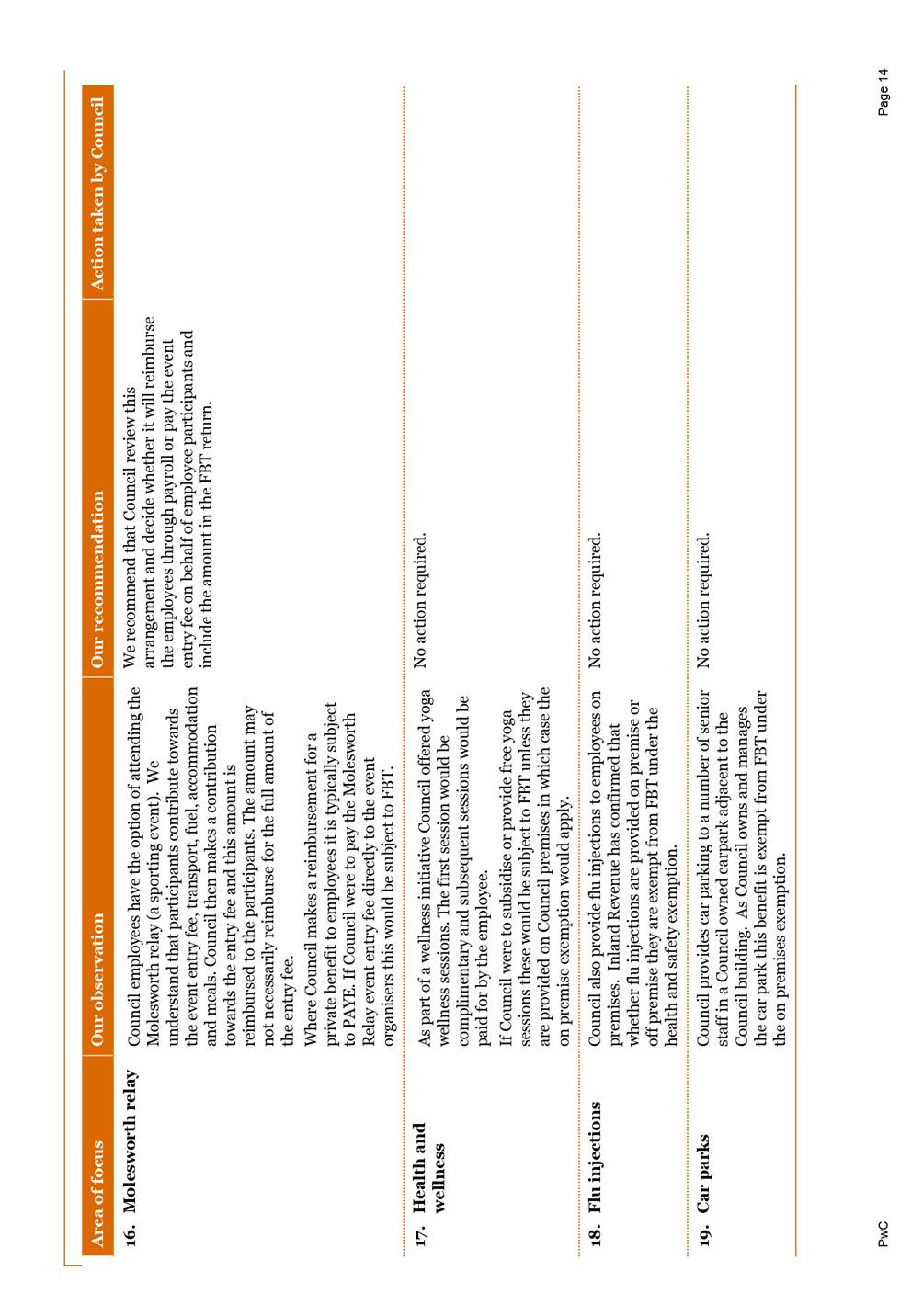

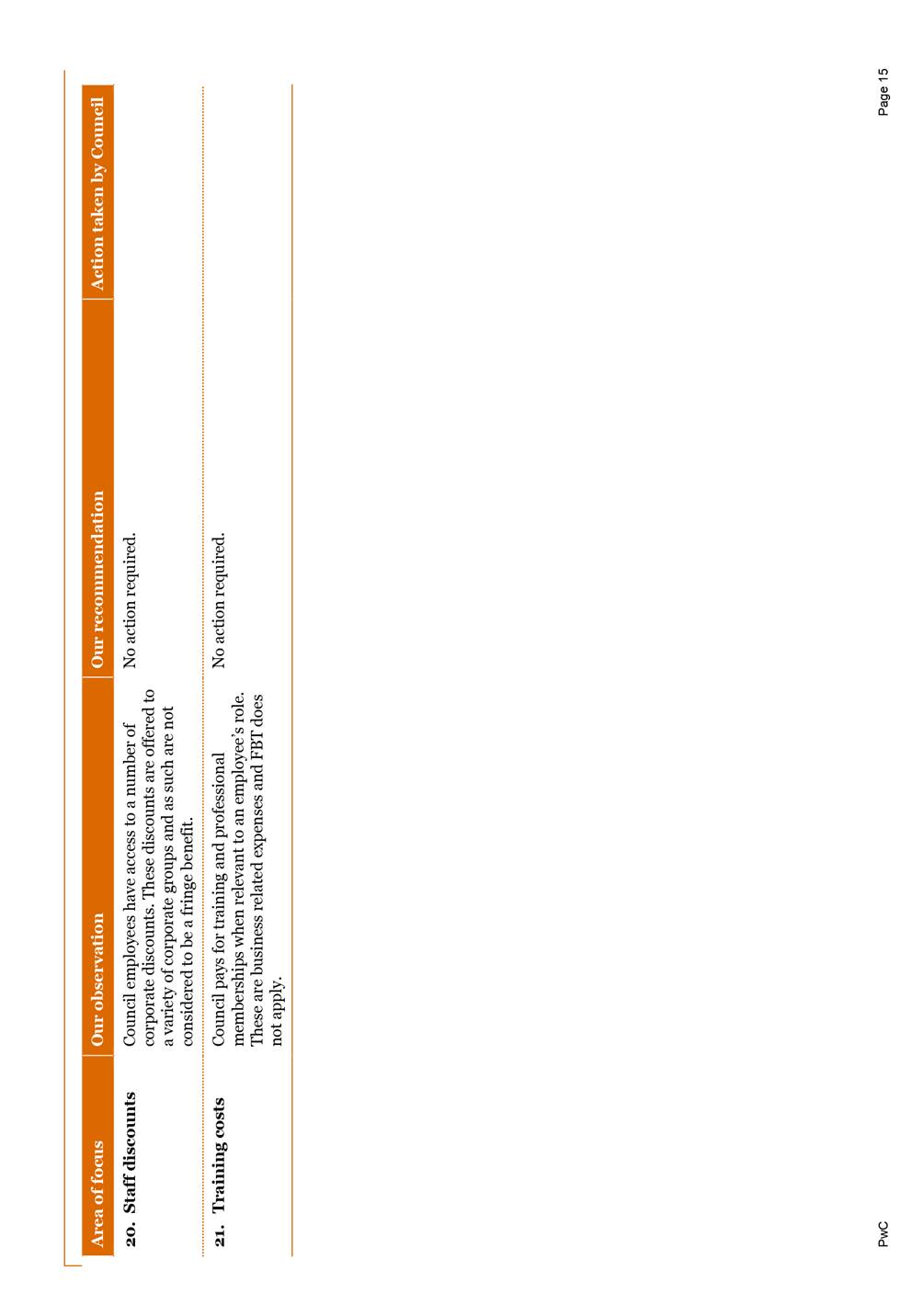

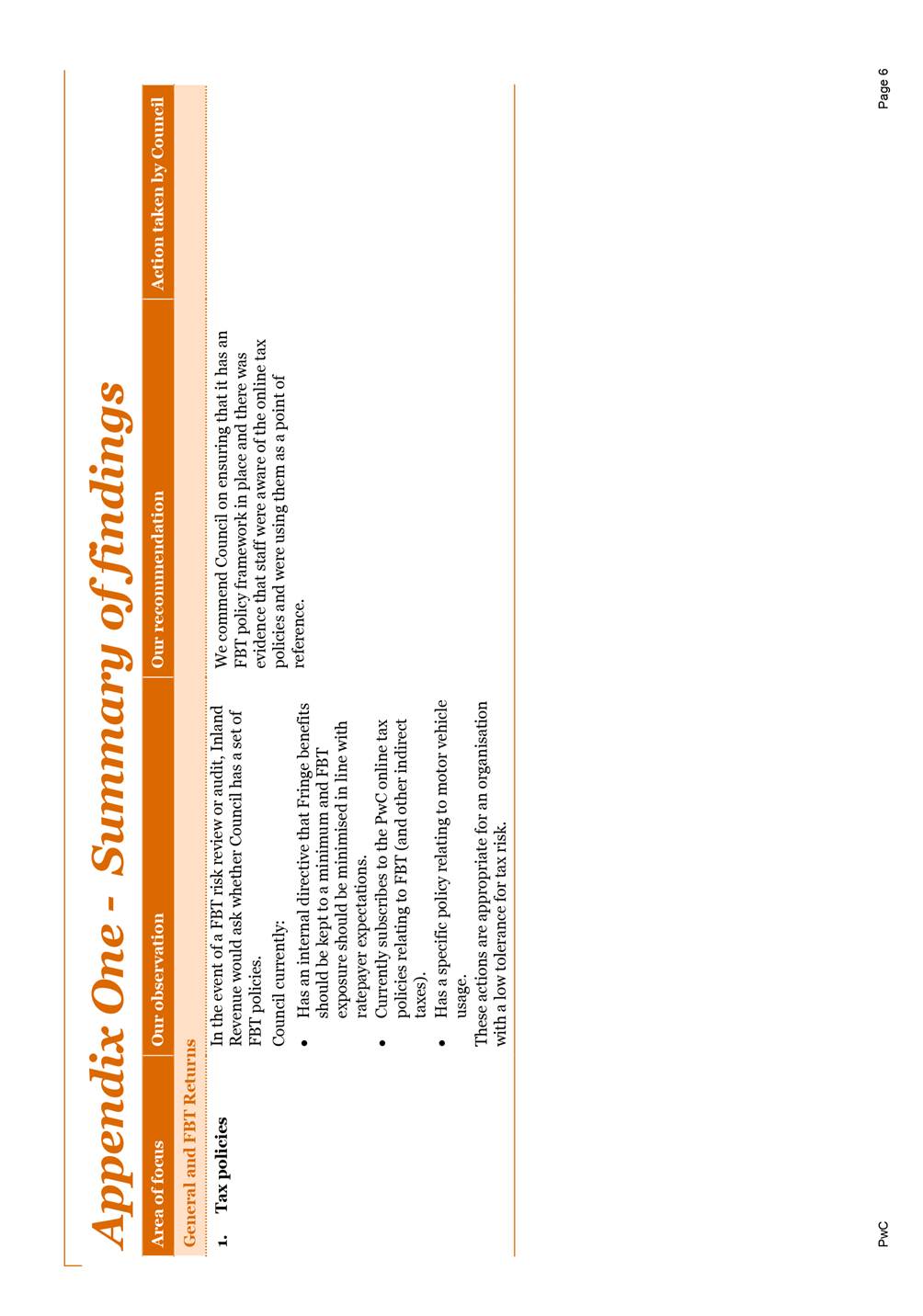

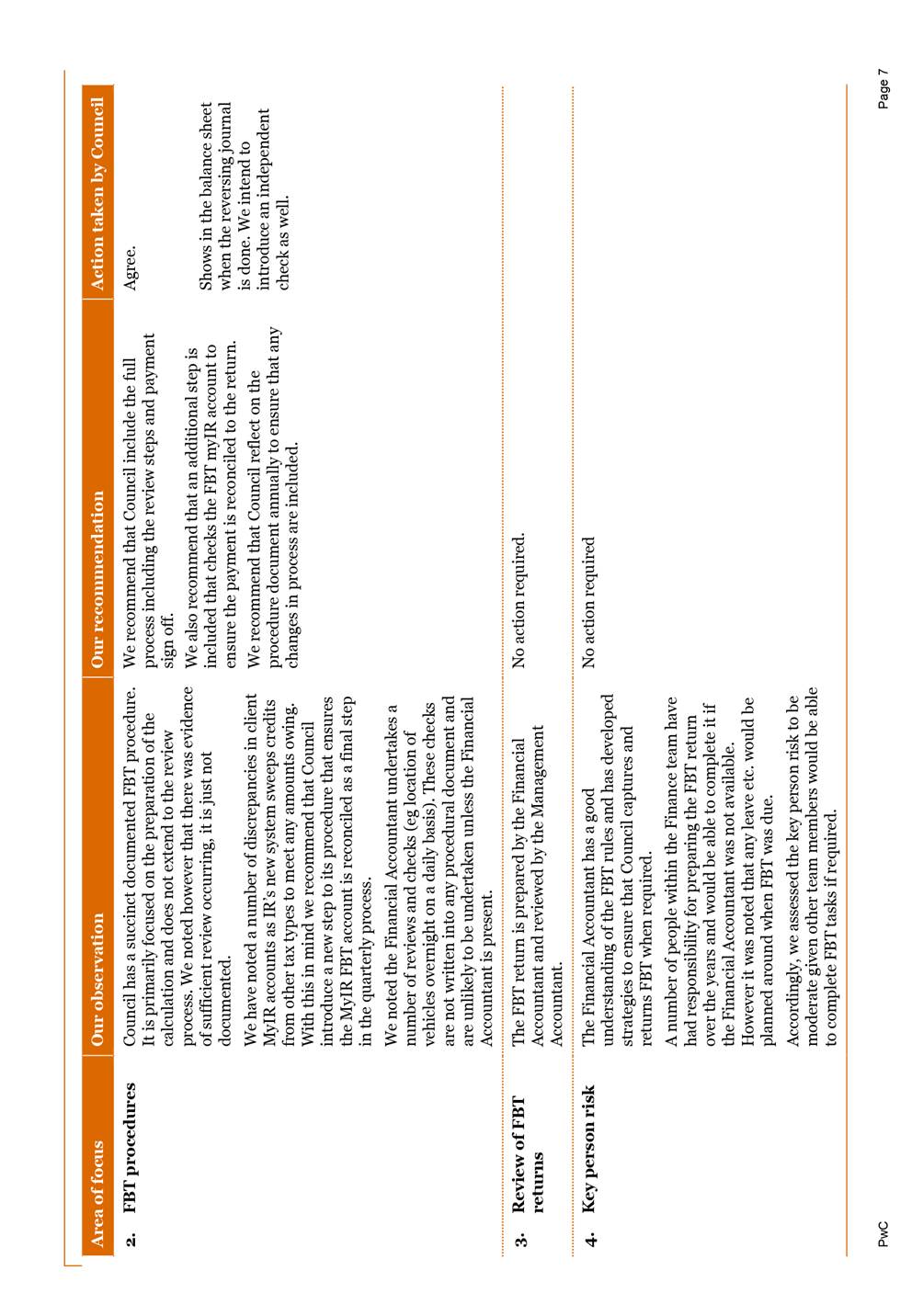

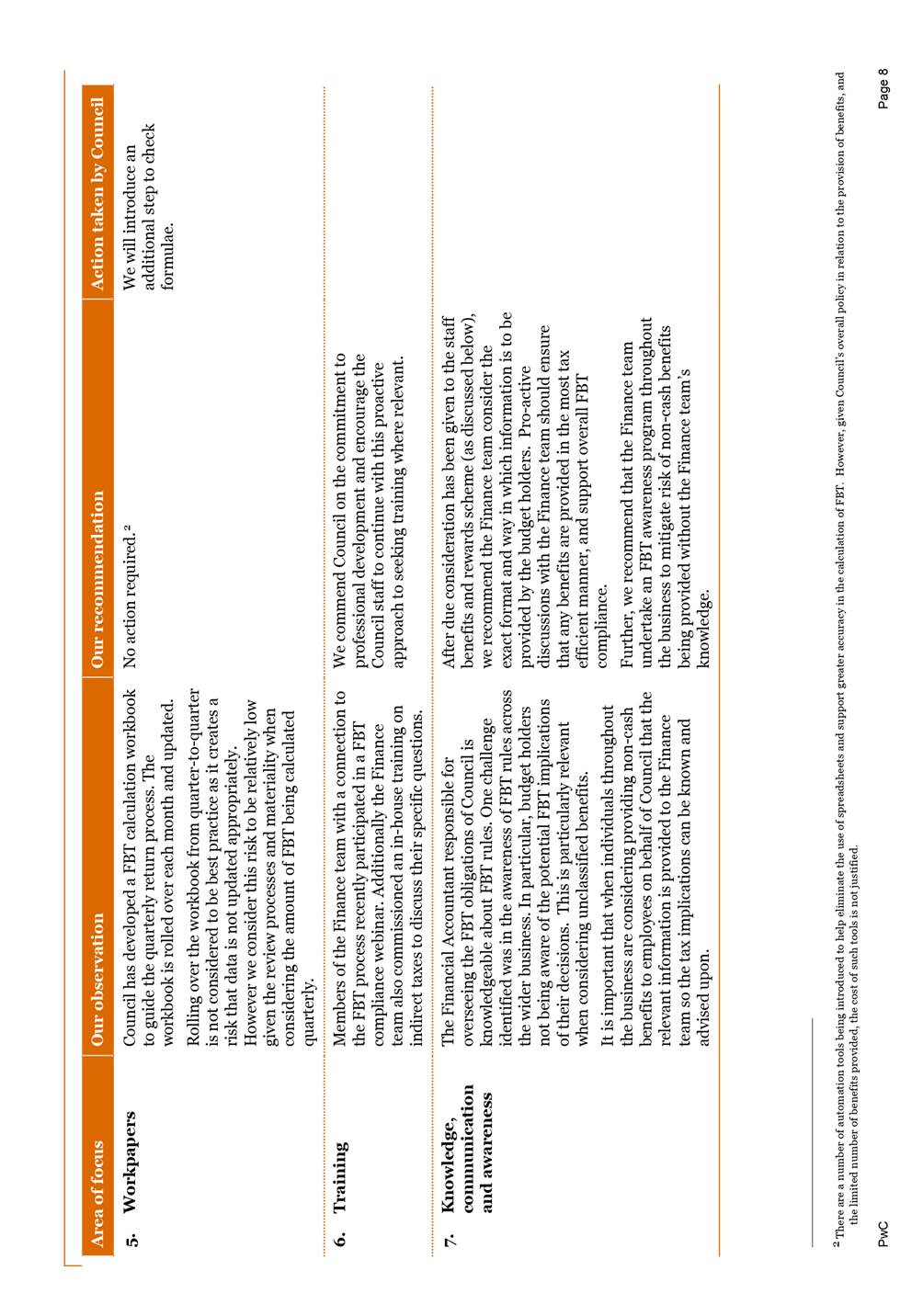

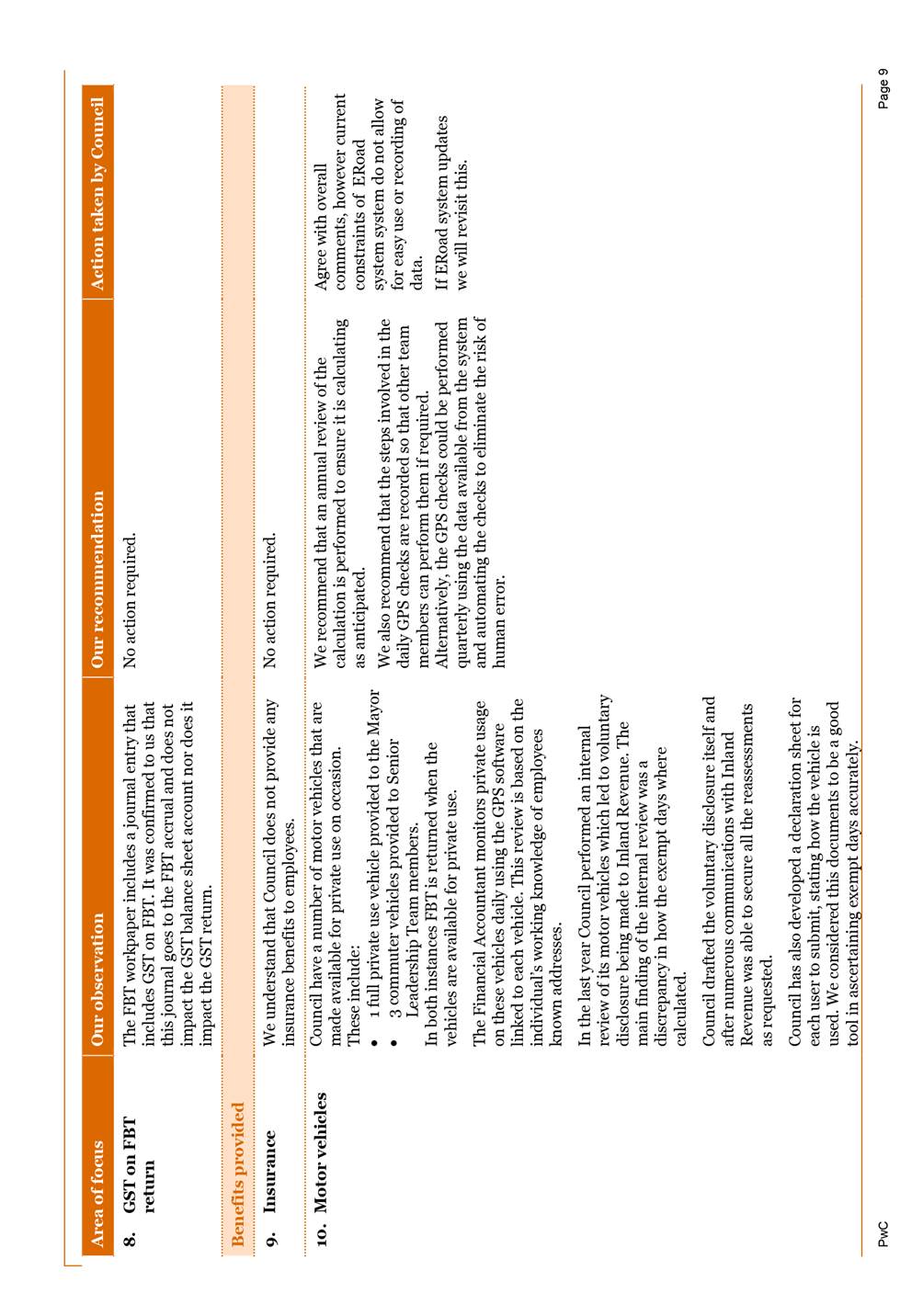

remaining four are in progress.

2.6 As

per the tax risk strategy adopted by Council in 2017, a FBT compliance

evaluation was undertaken in May 2019 with the finalised report (Attachment 3)

sent in July 2019 which can be summarised as follows:

· Council has a high level

of FBT compliance.

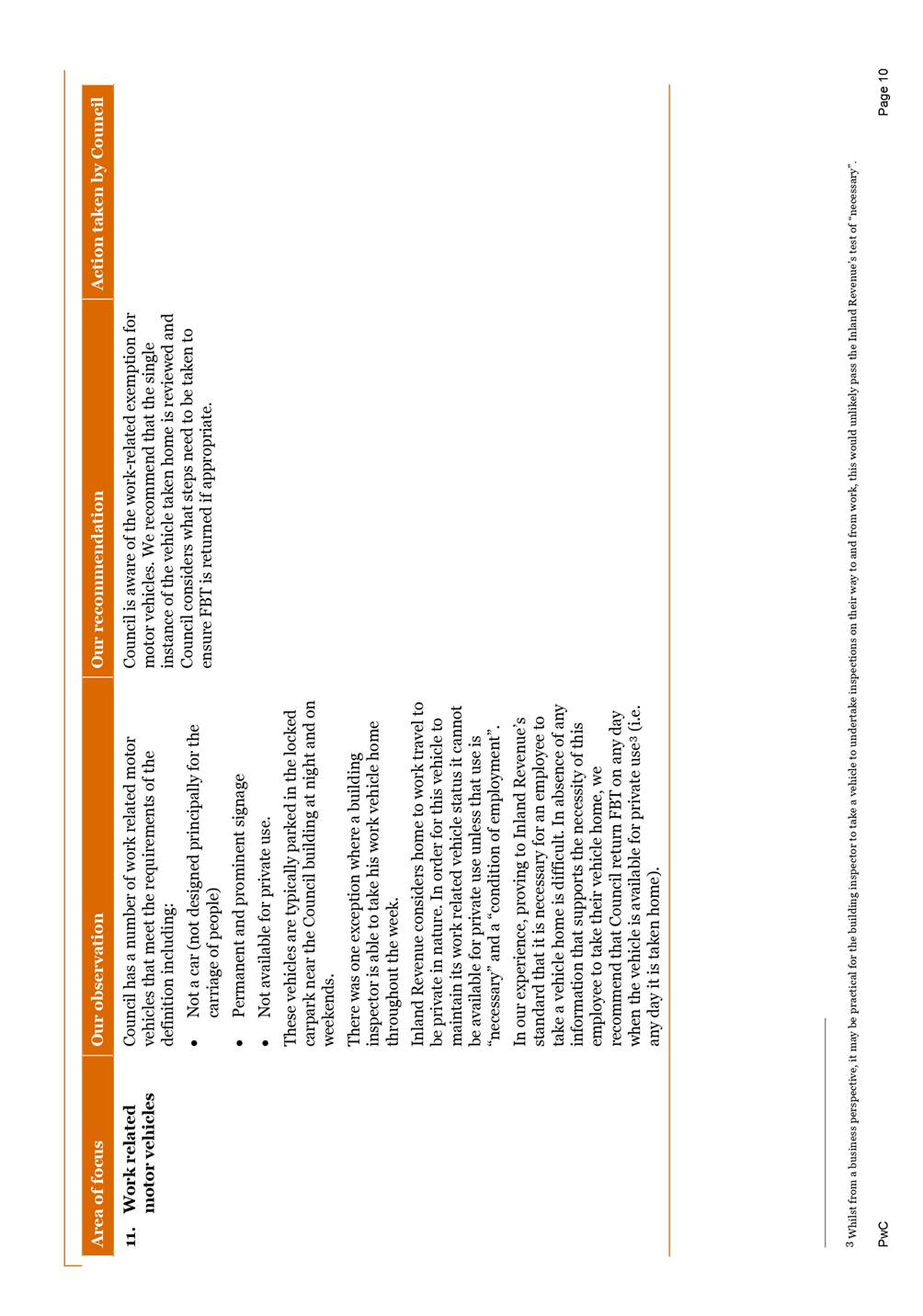

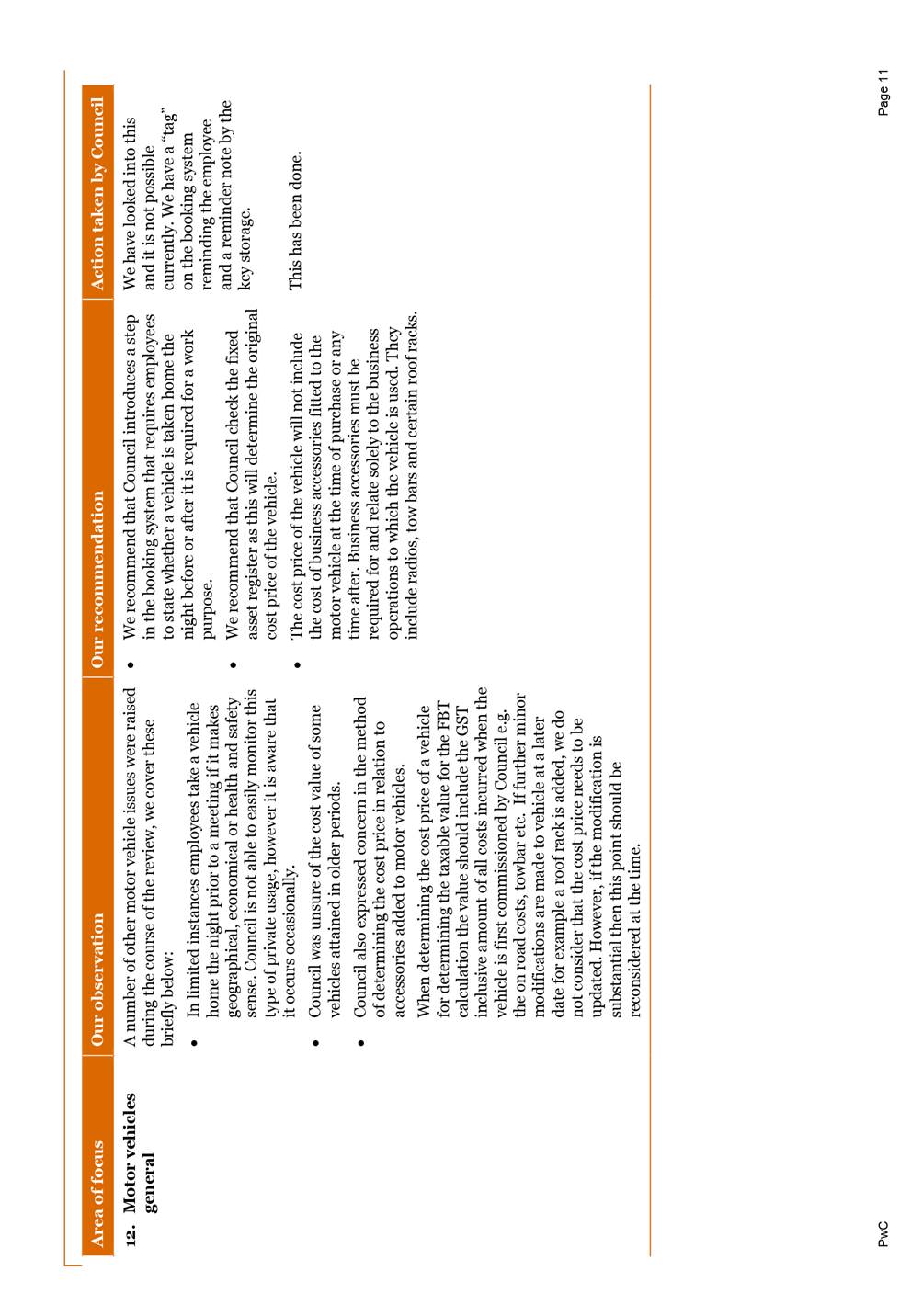

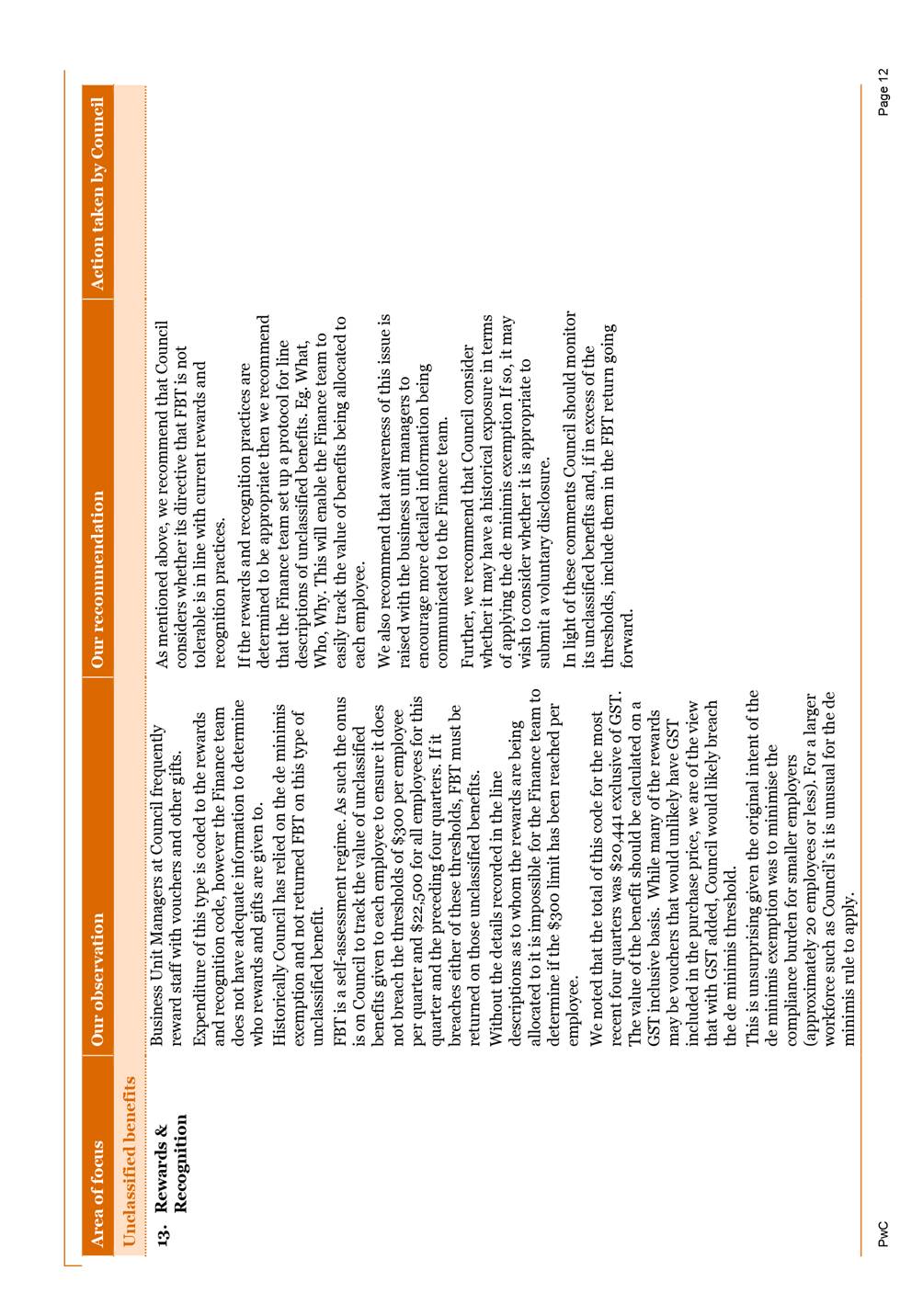

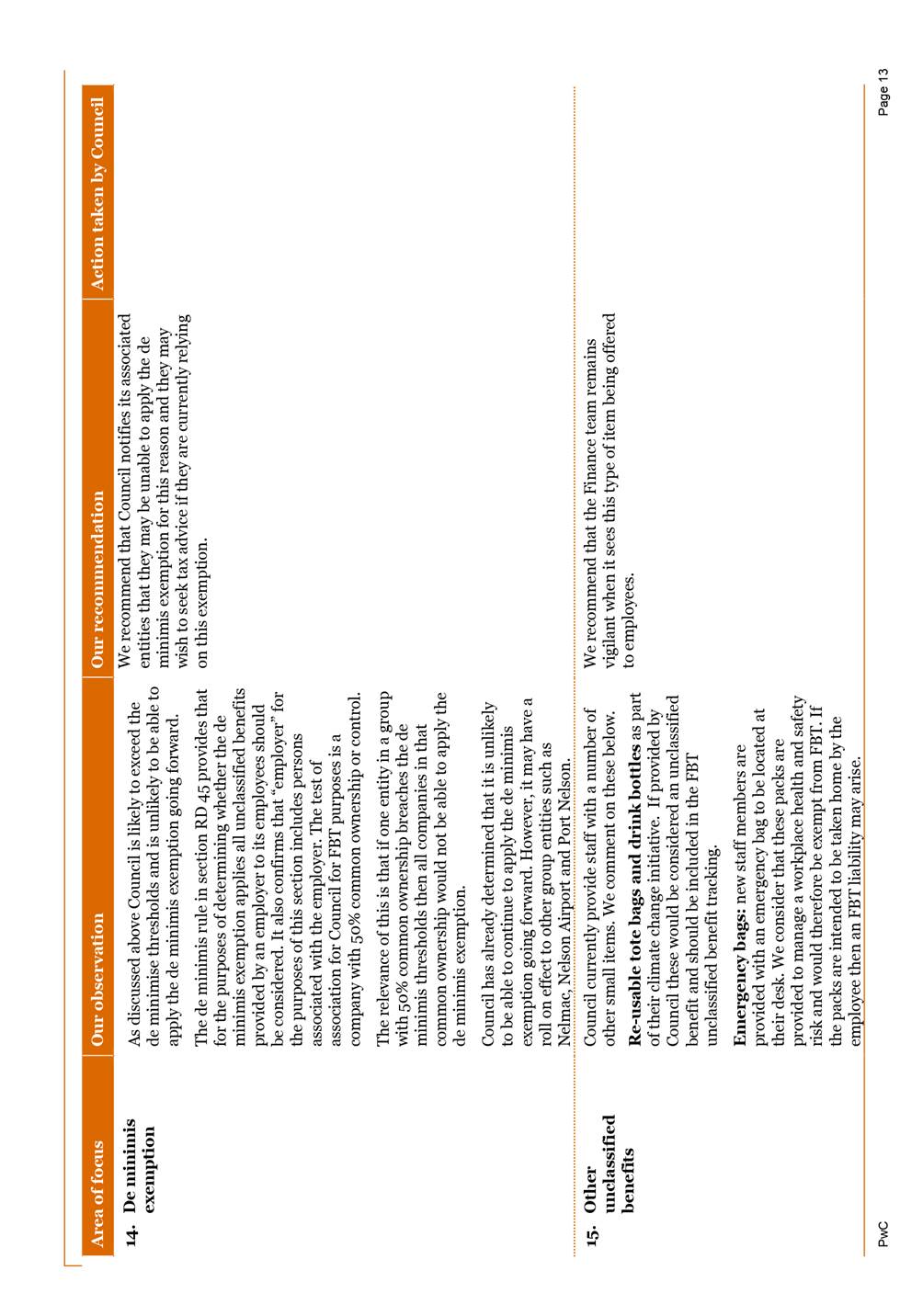

· The principal risk areas

are Rewards and Recognition, De Minimis Exemption (the

de-minimis exemption threshold for FBT is $300 per quarter per employee or

$22,500 per employer at Group Level) and Motor Vehicles, which are discussed in

further detail in Appendix One - Summary of Findings.

· There were 21 areas of

focus identified in Appendix One - Summary of Findings and recommendations were

made for action to maximise efficiency and risk reduction. One of the

recommendations has already been completed, eleven require no action and the

remaining nine are in progress.

2.7 Officers

have committed to remaining up to date with tax issues in the sector and have

attended tax updates as provided by SOLGM and PWC, as well as a refresher

overview of indirect taxes and specific training aimed at officers new to the

sector provided by PWC.

2.8 Finally,

it is noted that Council has continued to obtain support via:

· Subscribing to

PwC’s online Indirect Tax Policies and Guides;

· Maintaining a Tax Risk

Governance Framework; and

· Adhering to a Tax Risk

Management Strategy.

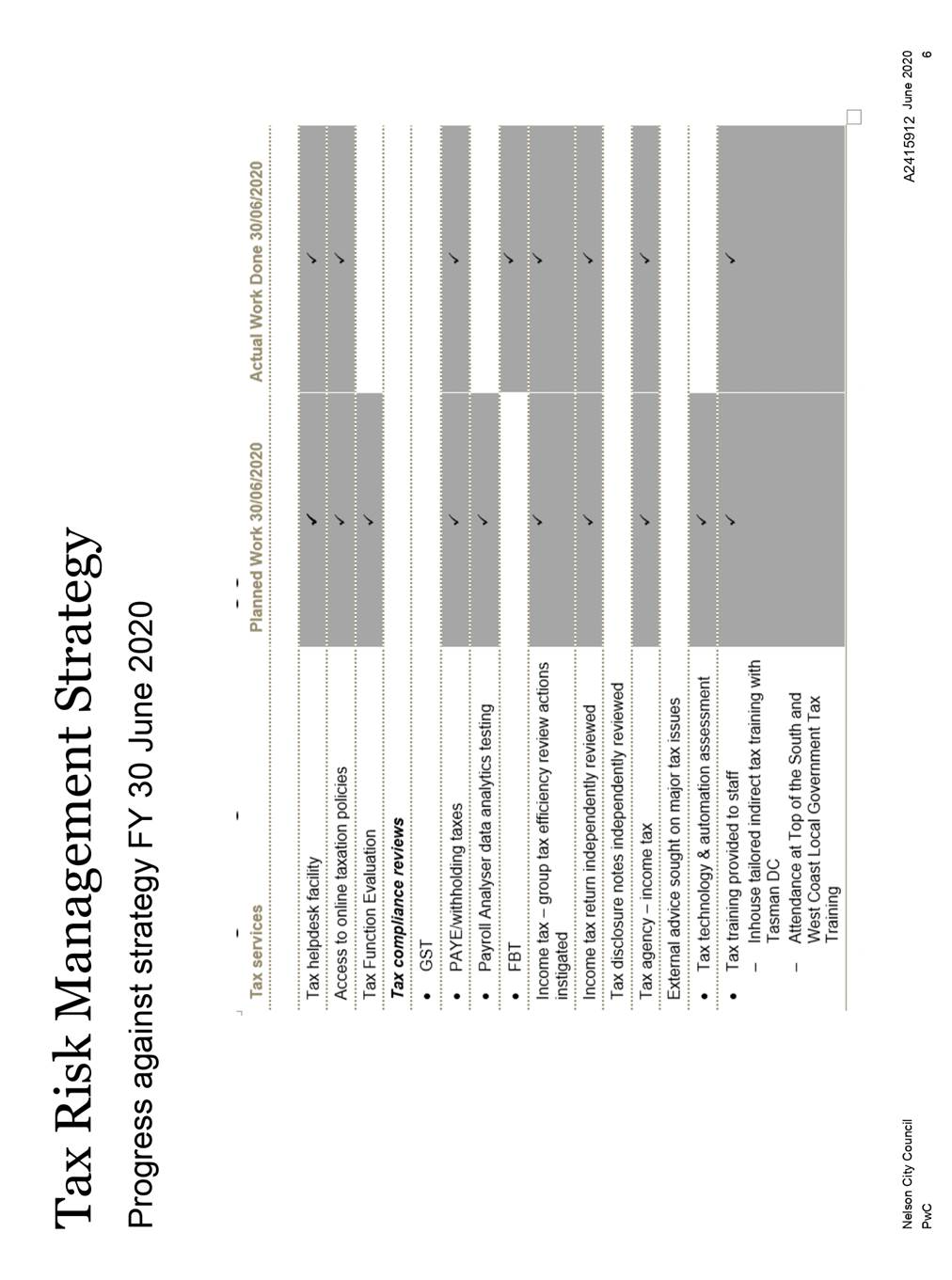

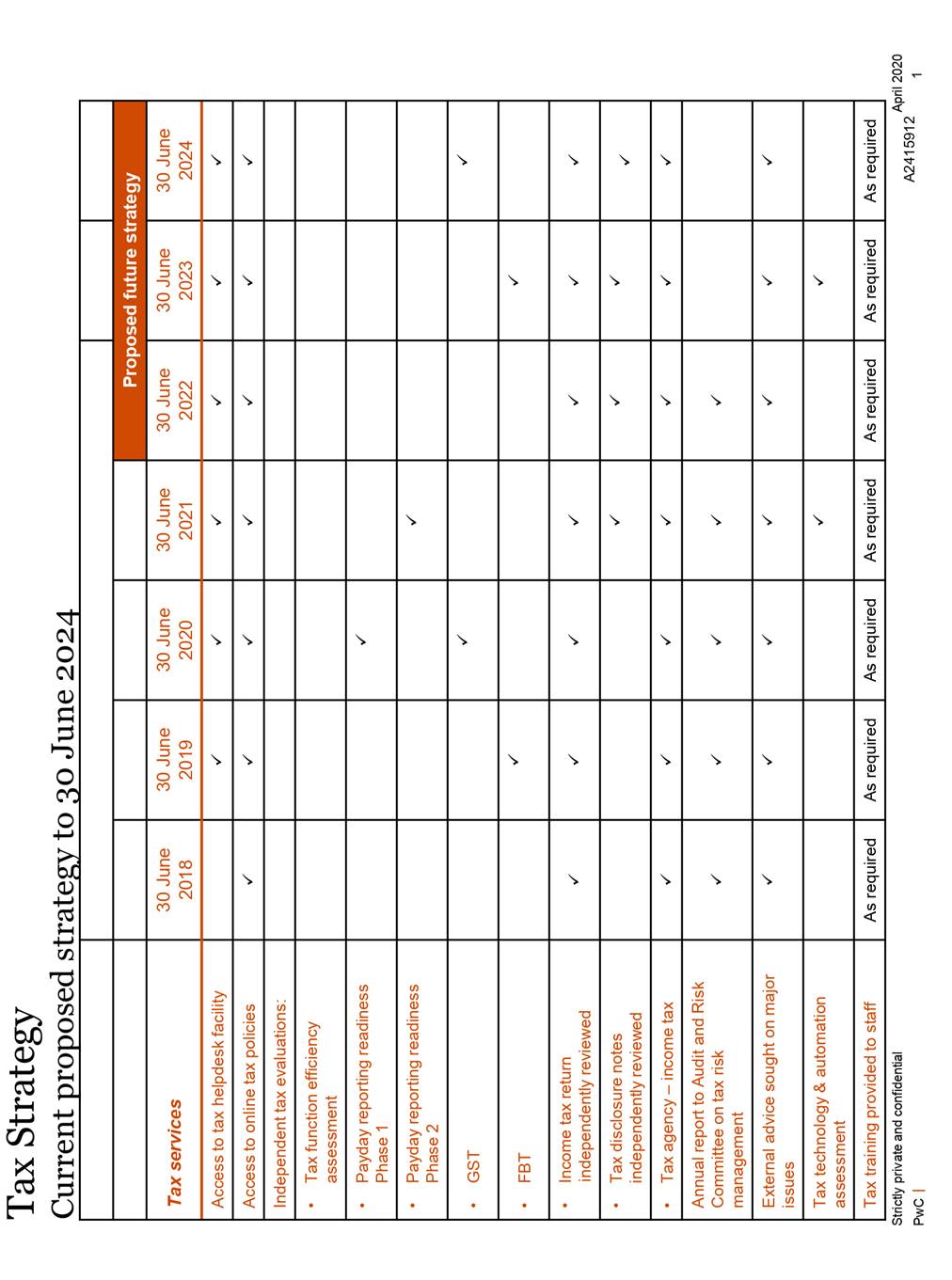

Tax

Strategy

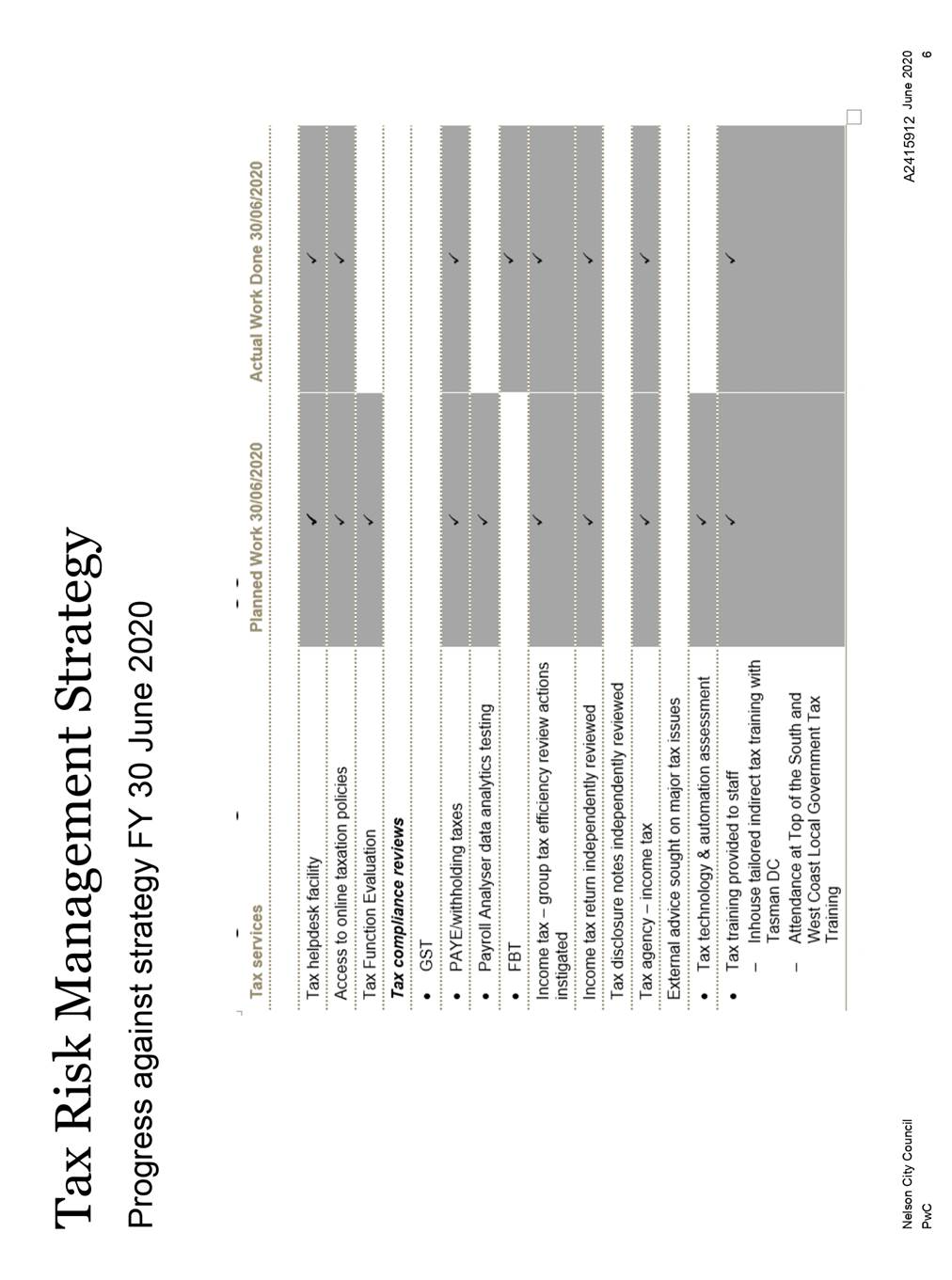

2.9 Page

6 of the Annual Tax Update (Attachment 1) outlines work planned for the 2019/20

financial year compared with work done. It has been a more active year than

anticipated illustrating that officers are mindful of retaining Council’s

low risk tax profile and seek to address risks before they crystallise.

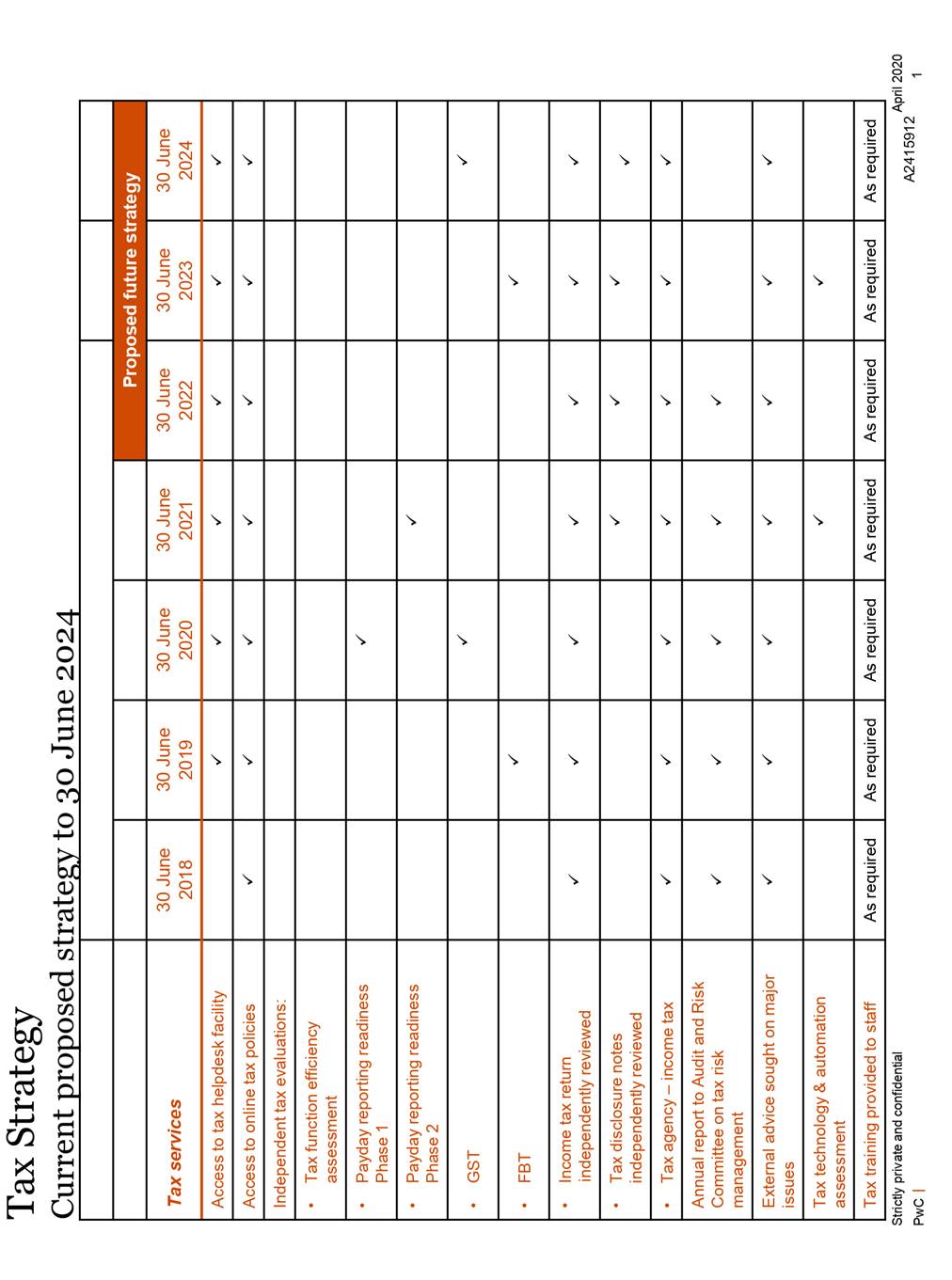

2.10 Page

7 sets out work planned for the 2020/21 financial year and up to 2023/24,

including a review of Council systems in relation to IRD’s payday

reporting readiness and a tax technology and automation assessment.

Other

relevant matters

2.11 Pages

9 to 10 of Attachment 1 itemise COVID-19 related income tax, tax administration

and social assistance proposals relevant to Council.

2.12 Pages

11 to 13 of Attachment 1 summarise other tax developments during the period. Of

particular interest or relevance to Nelson City Council:

· From 1 July

2019, dividends derived by local authority from a CCO will no longer be

excluded income for income tax purposes.

· The criteria

for self-correction of errors has been replaced with monetary and materiality

thresholds, being equal to or less than the lower of $10,000 of tax; and 2% of

GST output tax.

2.13 Page

14 of Attachment 1 gives an overview of sector specific developments. Of

particular interest or relevance to Nelson City Council:

· It is understood

that there are a total of 802 ‘shovel ready’ projects on the list

for government consideration. Depending on the project, there is an

inevitability that tax considerations will exist.

· Taumata Arowai

– The Water Services Regulator Bill establishes the agency that will act

as independent regulator of drinking water and the evolution of how Three

Waters are managed.

Council’s

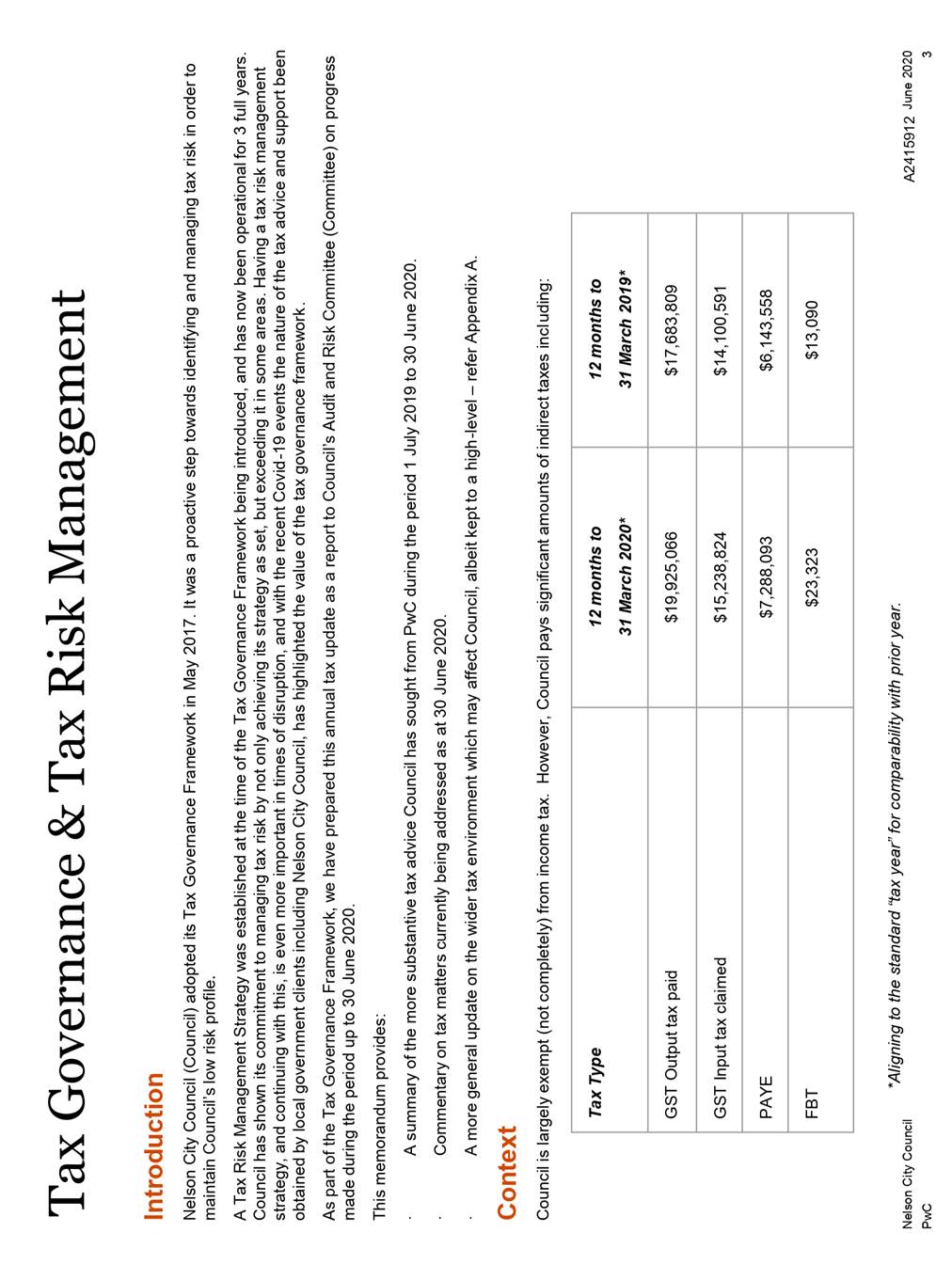

tax figures

2.14 Generally

Council is exempt from income tax with the main exception being income from

CCTOs. However, Council has significant tax obligations in relation to GST and PAYE

in particular. The quantum is highlighted in this section.

2.15 In

the 12 months ending 31 March 2020, Council has accounted for:

|

Tax

|

12 month period ending

|

Amount

|

|

GST output tax

|

31 March 2020

|

$19,925,066

|

|

GST input tax

|

31

March 2020

|

$15,238,824

|

|

PAYE & ACC

|

31

March 2020

|

$7,288,093

|

|

FBT

|

31

March 2020

|

$23,323

|

2.16 Council

also acts as agent for the Nelson Regional Sewerage Business Unit, Nelson

Tasman Regional Landfill Business Unit and Nelson Tasman Civil Defence and Emergency

Management. The numbers above exclude these entities.

3. Conclusion

3.1 Council

formally adopted the Tax Governance Framework on 18 May 2017 and the Tax Risk

Management Strategy on 14 December 2017. These form a solid foundation for

managing tax risk.

3.2 The

Tax Risk Management Strategy is a simple tool to ensure that tax risk is being

identified and managed appropriately while providing the Subcommittee with a

quick visual tool to see the steps Council has taken to manage tax risk and the

forward looking strategy.

3.3 The

adoption of the Framework and the Strategy ensures that complacency does not

arise amongst the finance team, senior leadership team or those with oversight

for audit and risk.

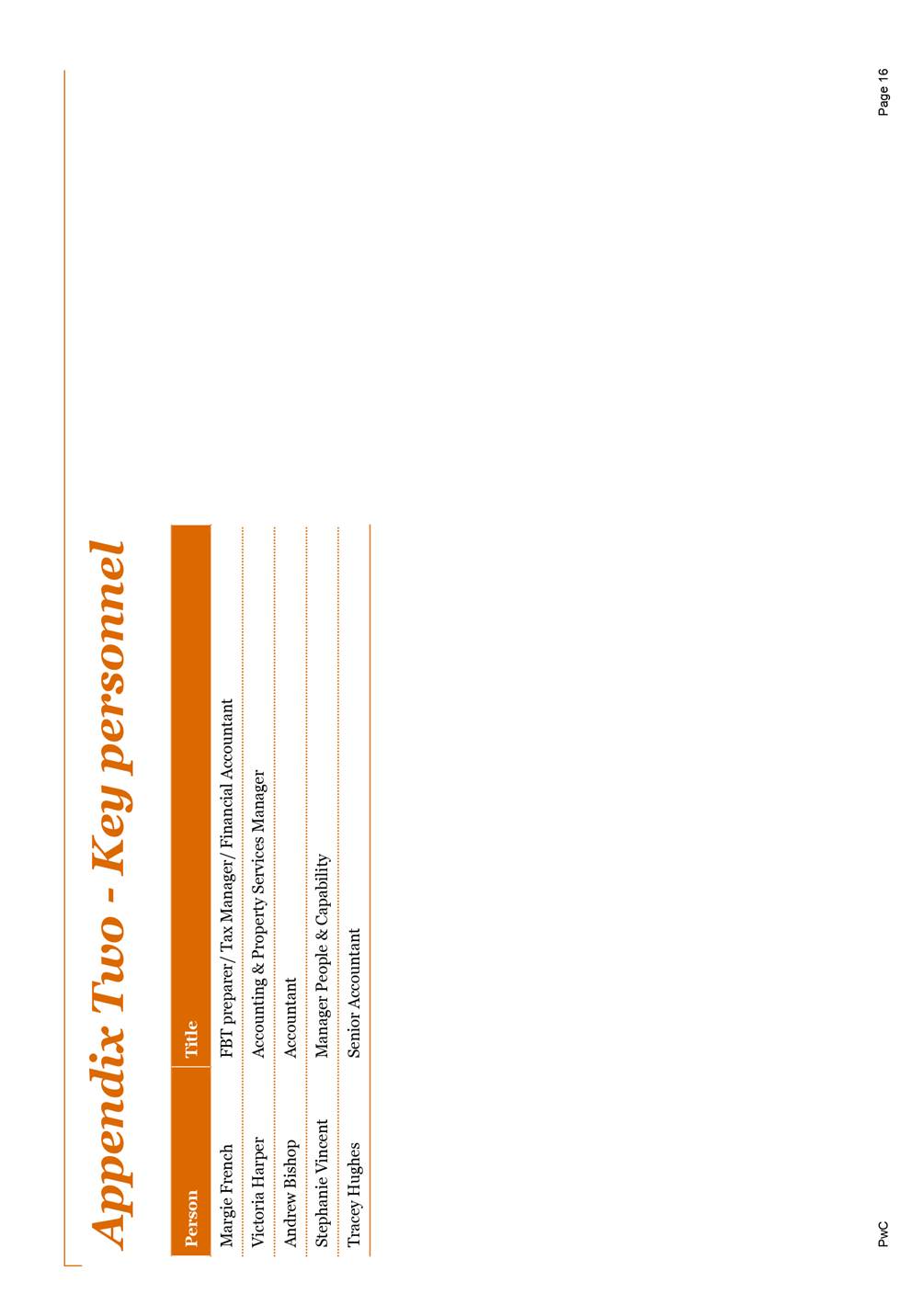

Author: Clare

Knox, Manager Finance

Attachments

Attachment 1: A2415912 Tax - PWC

- Annual Tax Review 2020 ⇩

Attachment 2: A2358418

Tax - PWC - PAYE Compliance Evaluation ⇩

Attachment 3: A2417124

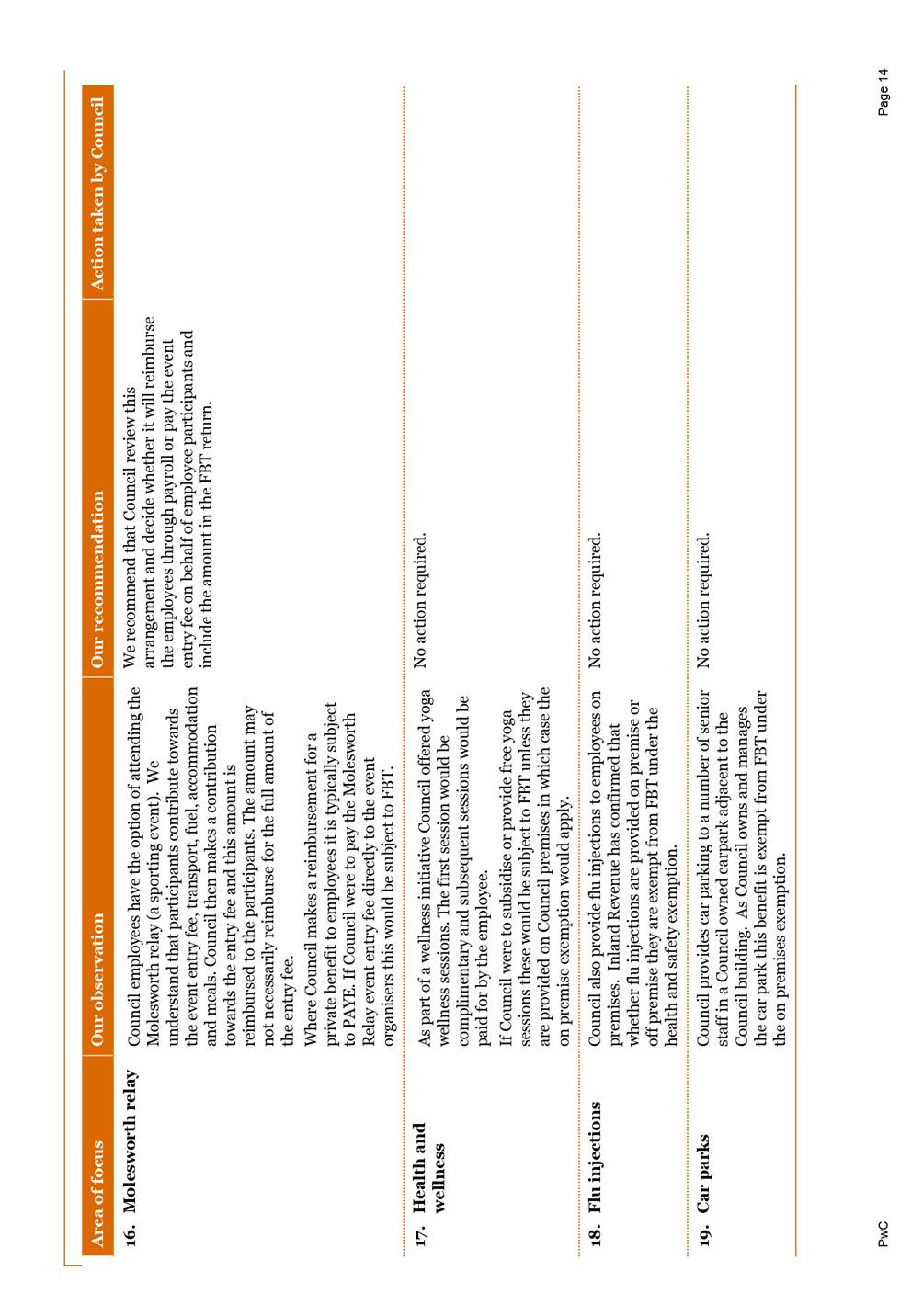

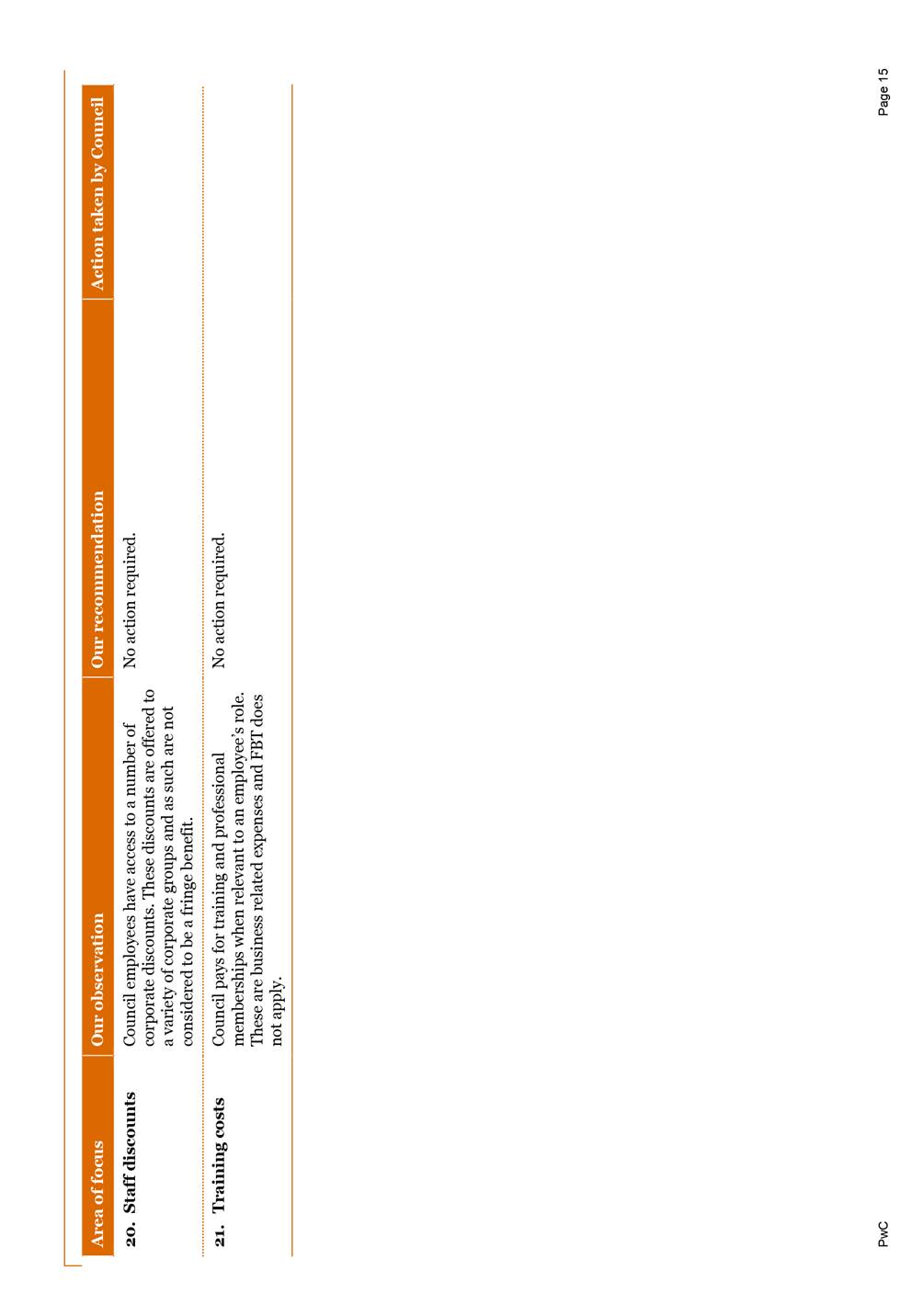

Tax - PWC - FBT Compliance Evaluation ⇩

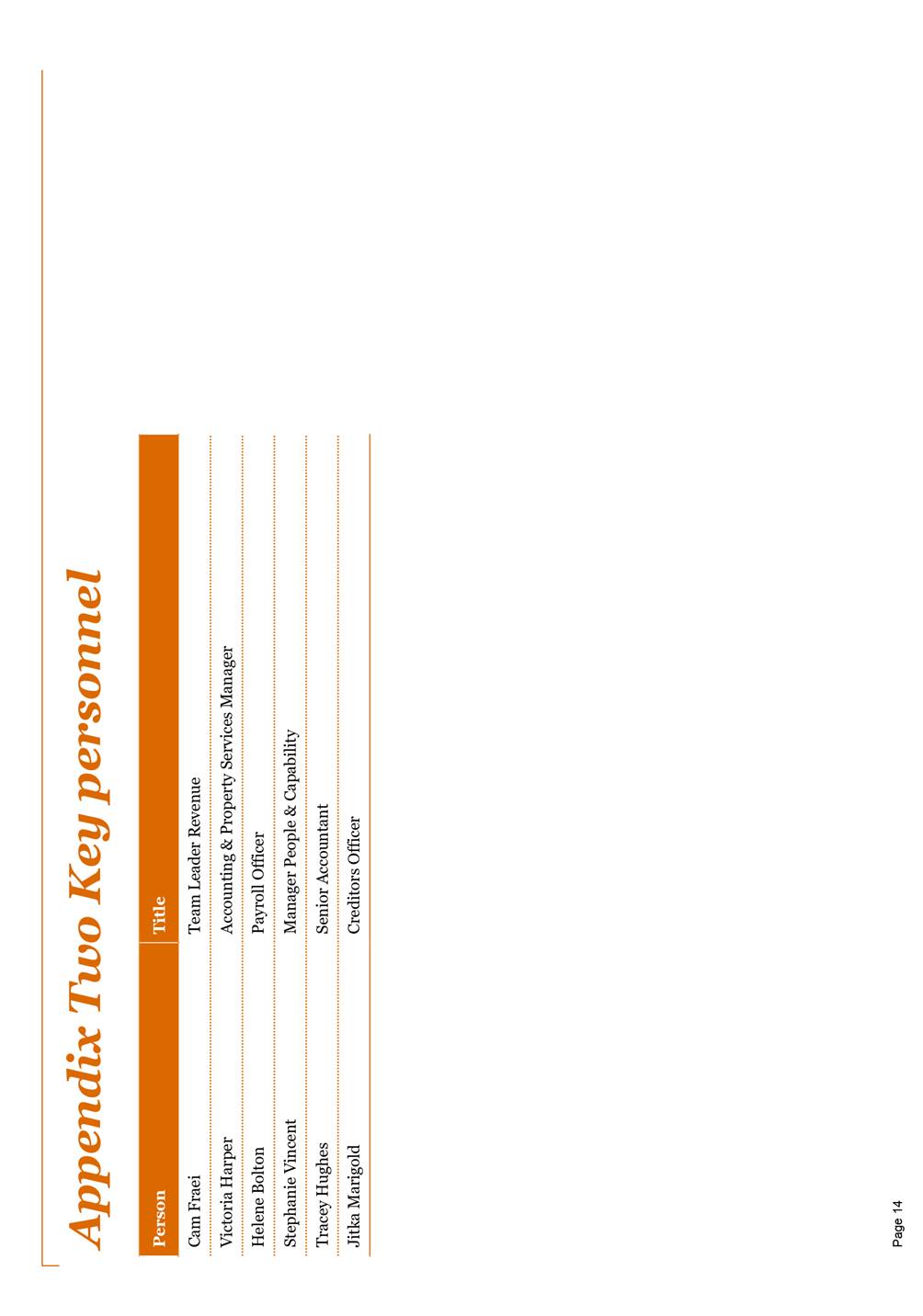

Item 8: Annual Tax Update: Attachment 1

Item 8: Annual Tax

Update: Attachment 2

Item 8: Annual Tax

Update: Attachment 3

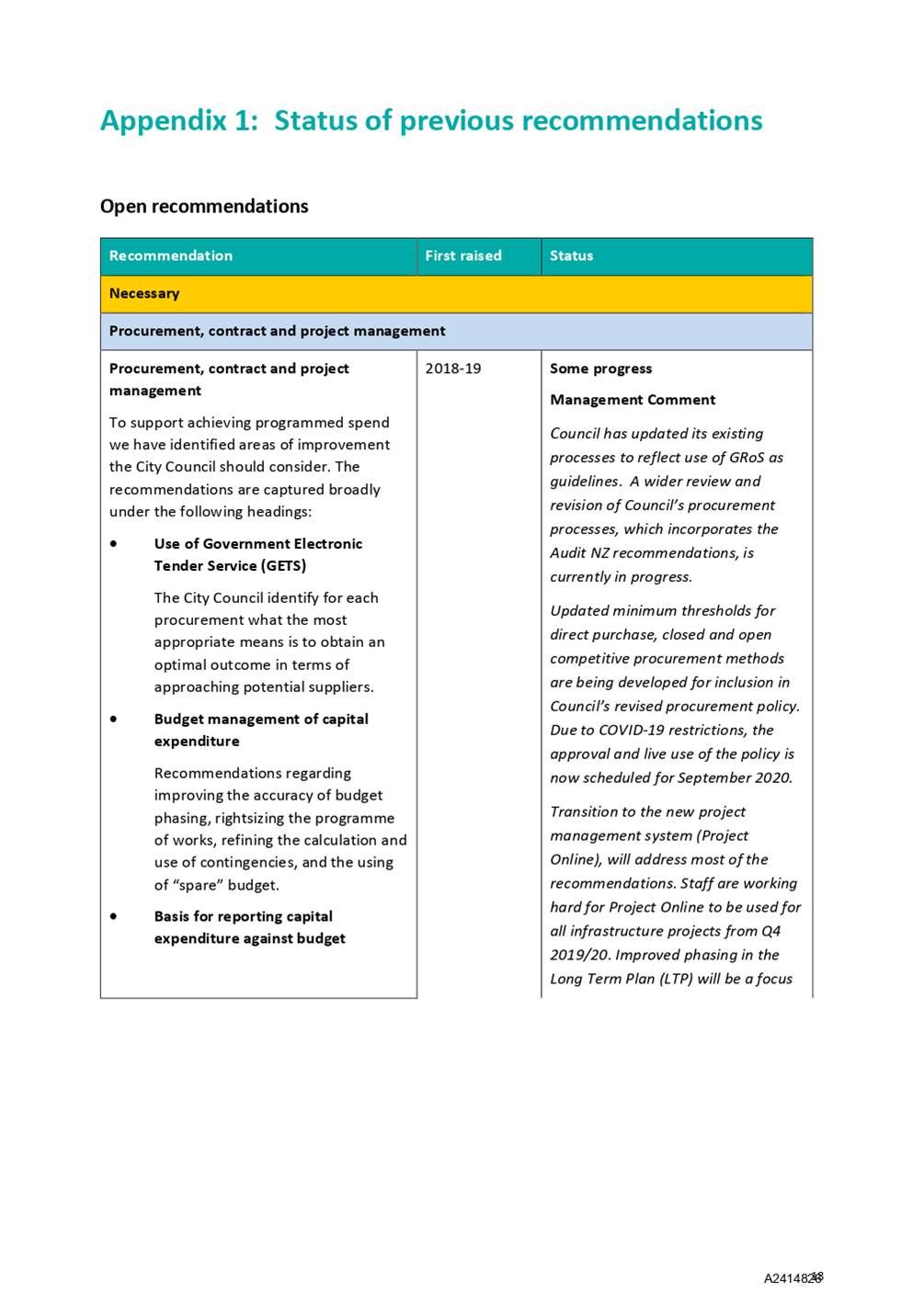

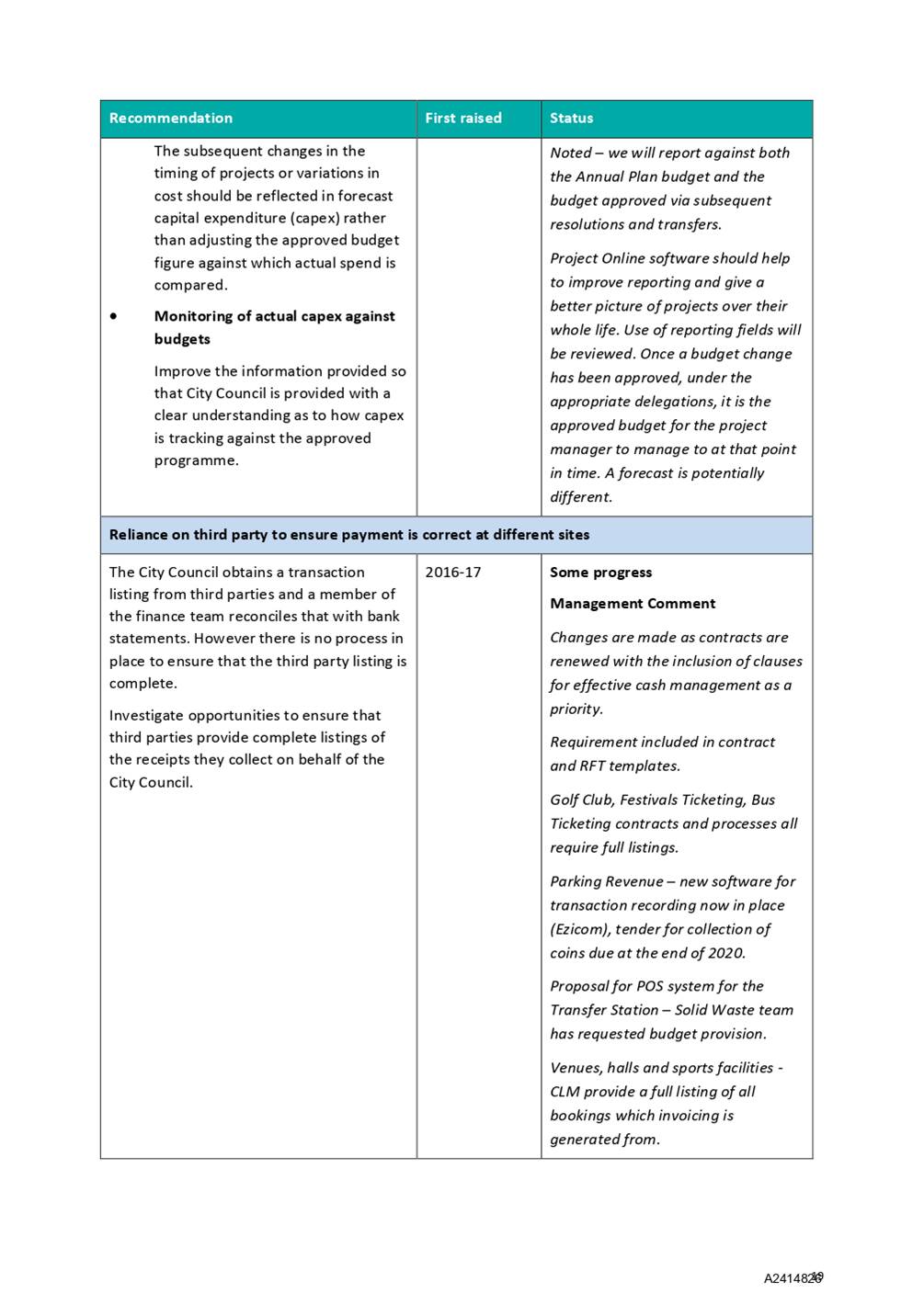

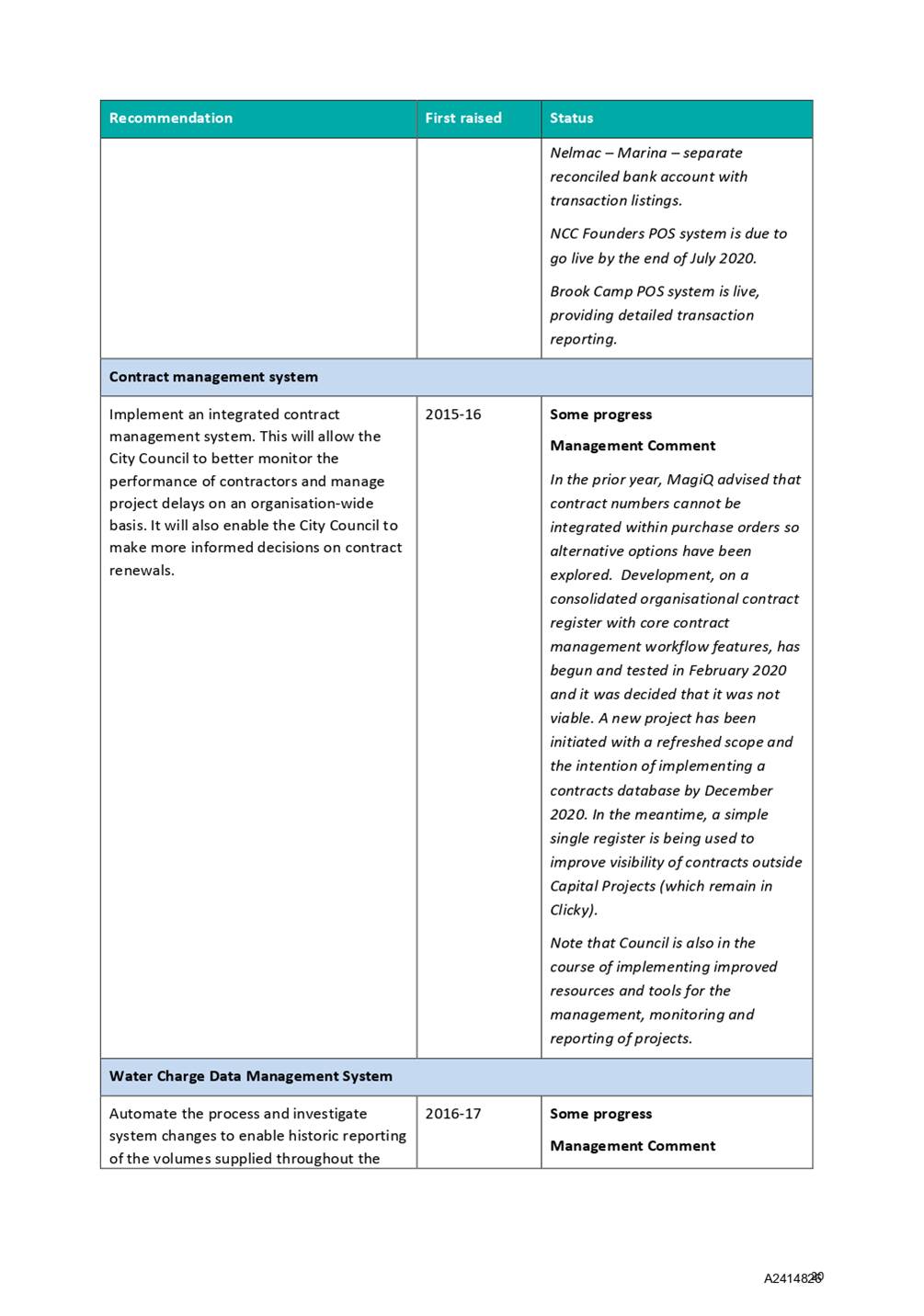

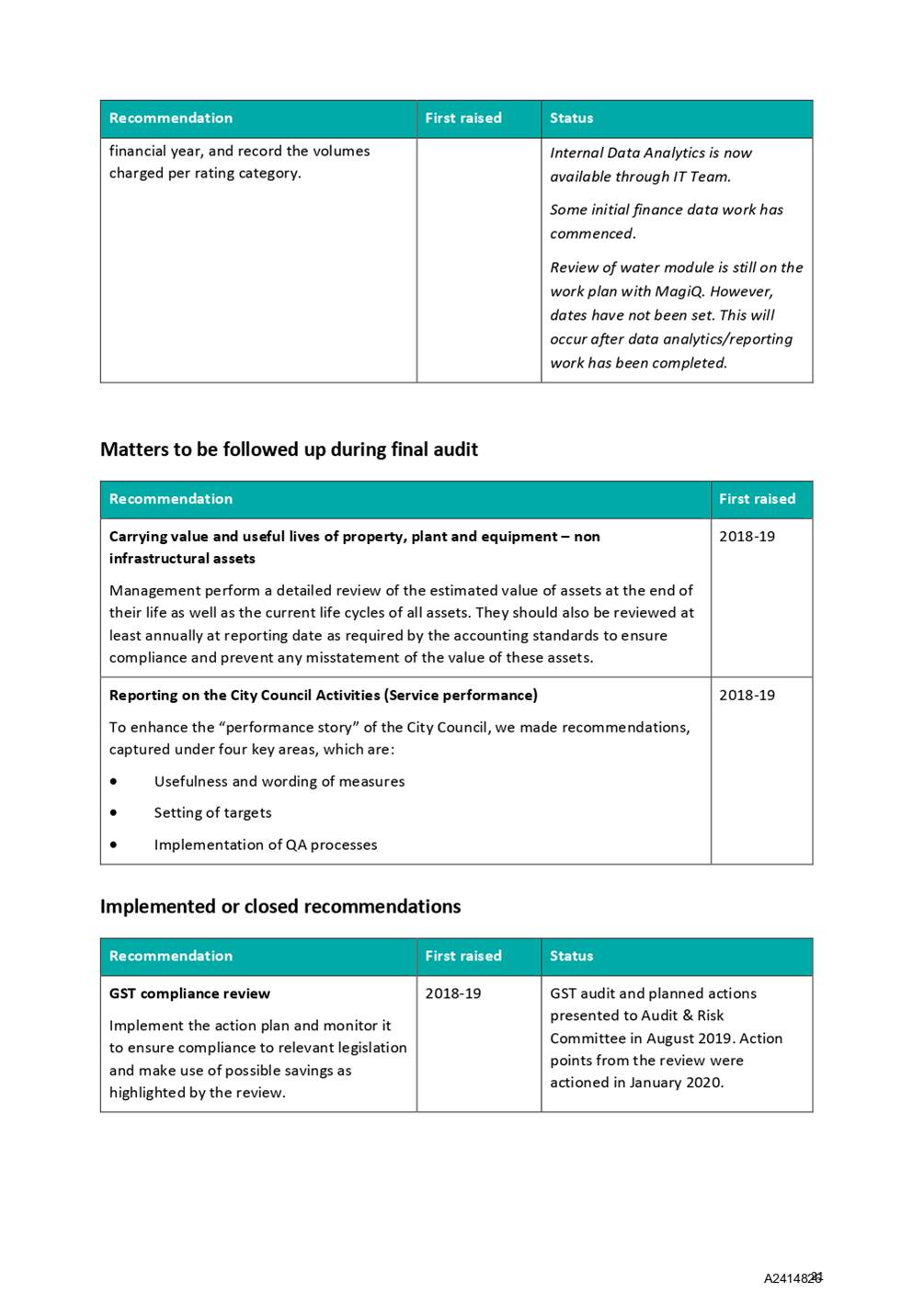

Item 9: Interim Audit

Report for the year ending 30 June 2020

|

|

Audit and Risk Subcommittee

11 August 2020

|

REPORT R14821

Interim

Audit Report for the year ending 30 June 2020

1. Purpose of Report

1.1 To provide the Interim

Audit Report to the Subcommittee for the year ending 30 June 2020 from Audit New

Zealand.

2. Recommendation

|

That the Audit and Risk Subcommittee

1. Receives the report Interim

Audit Report for the year ending 30 June 2020 (R14821) and its attachment (A2414826); and

2. Notes

the suggested responses to the recommendations (as per A2414826).

|

3. Discussion

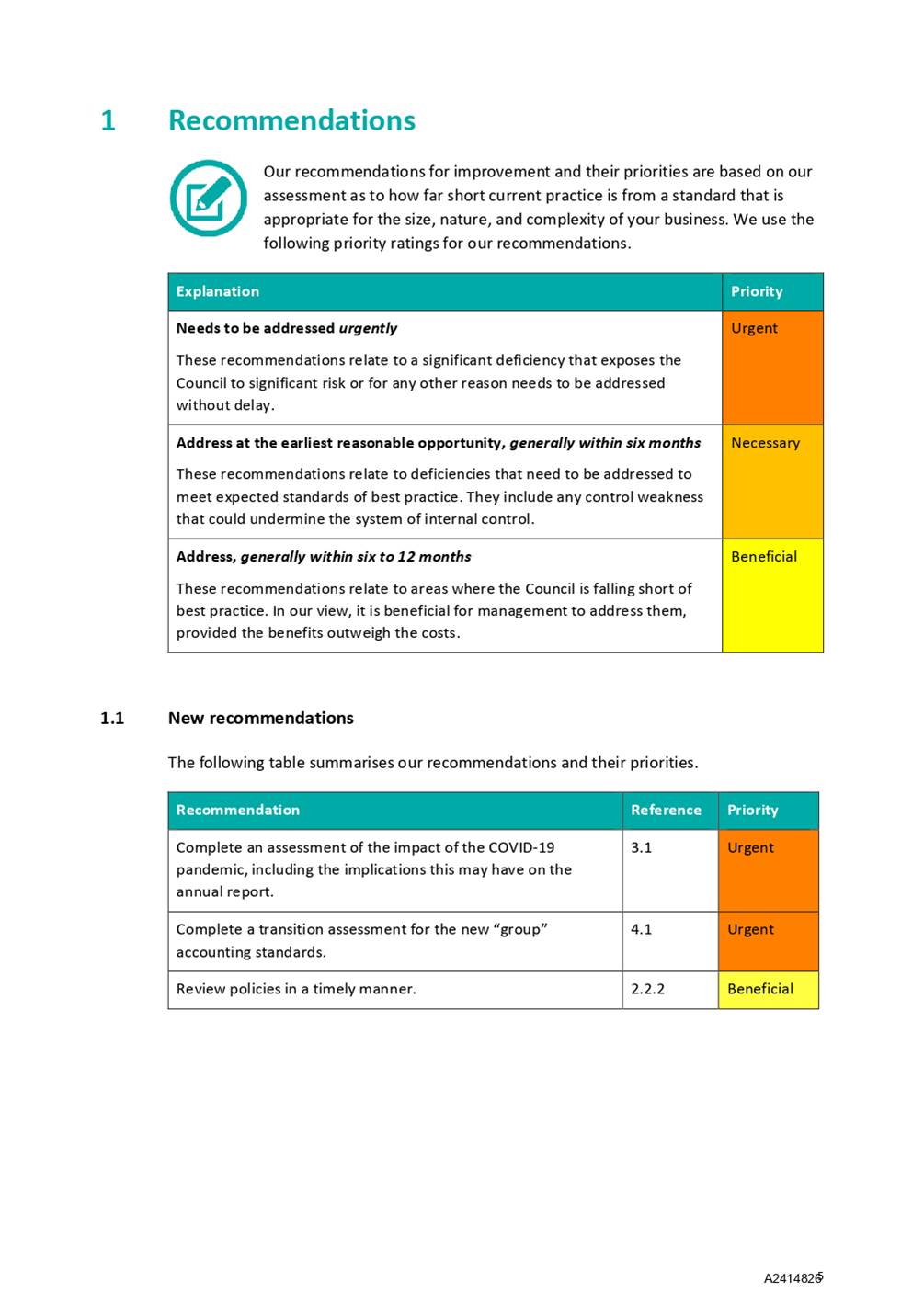

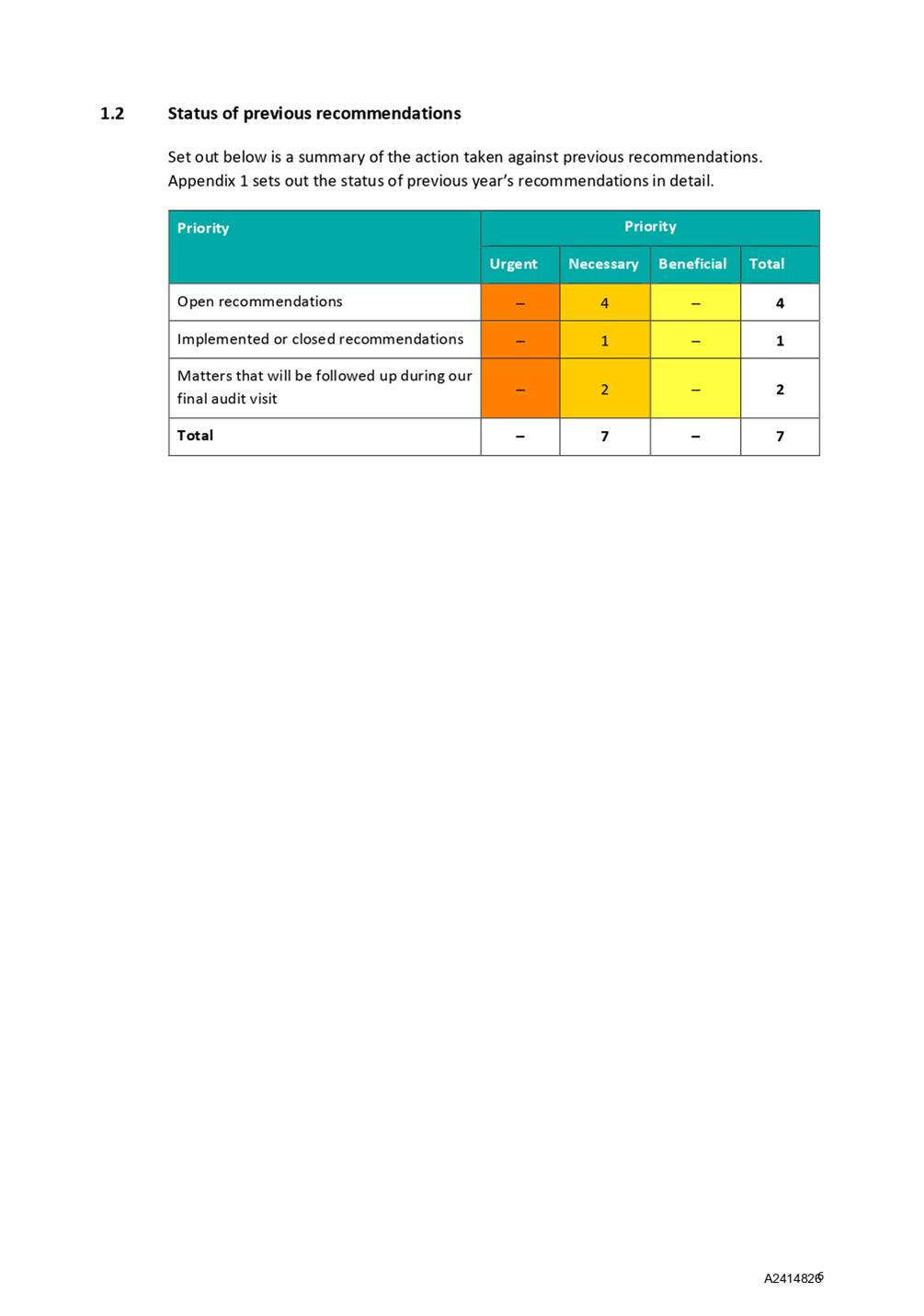

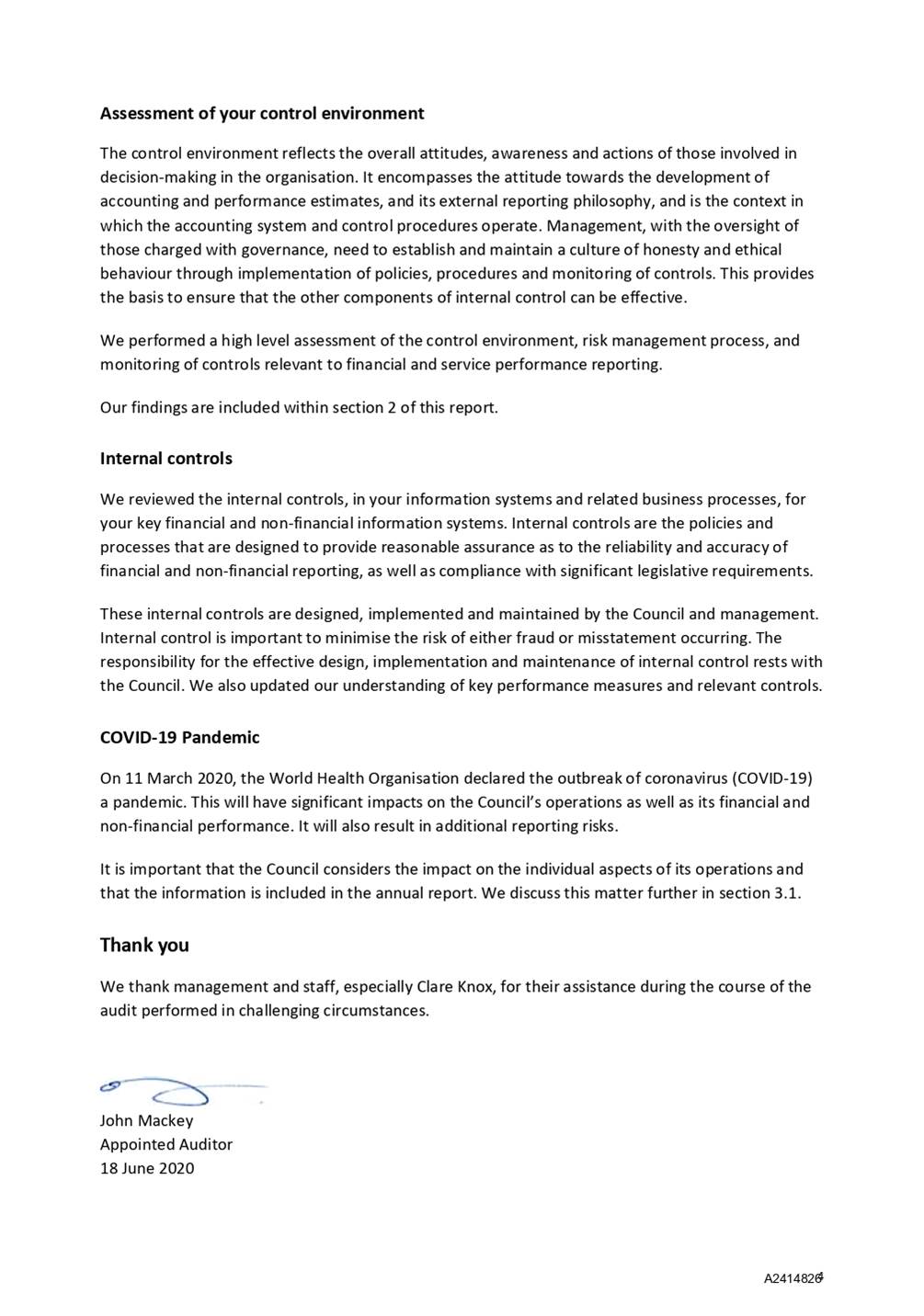

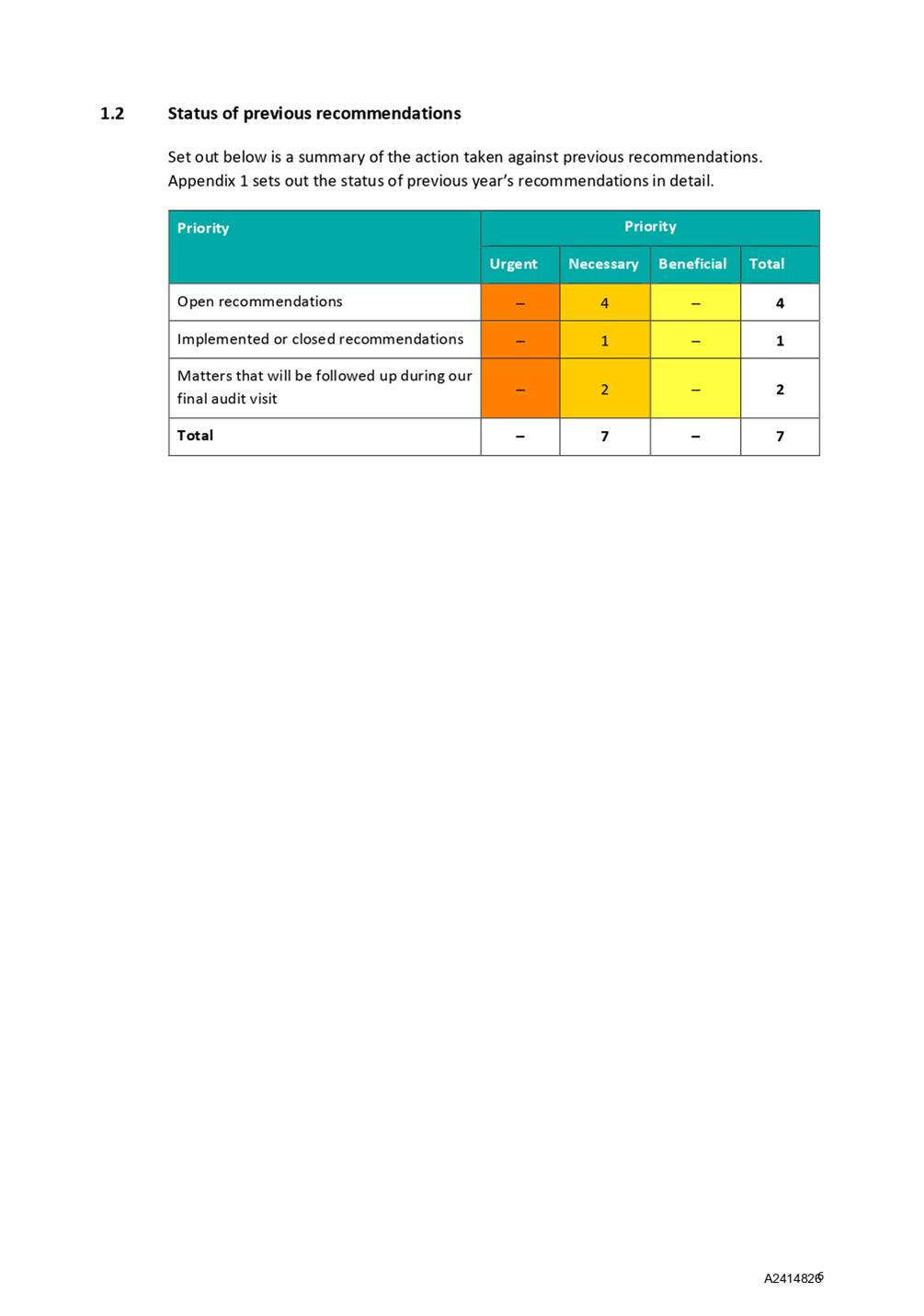

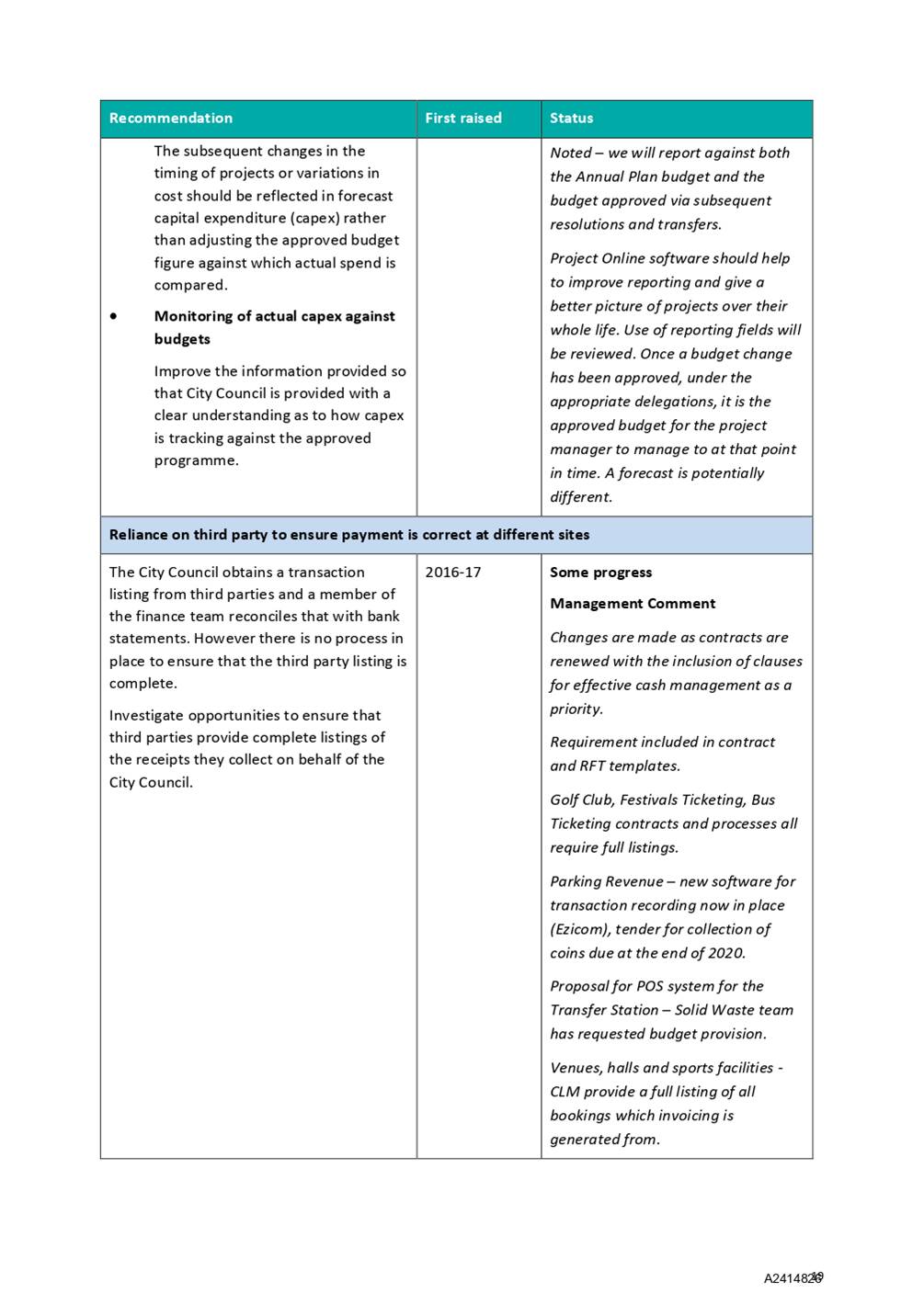

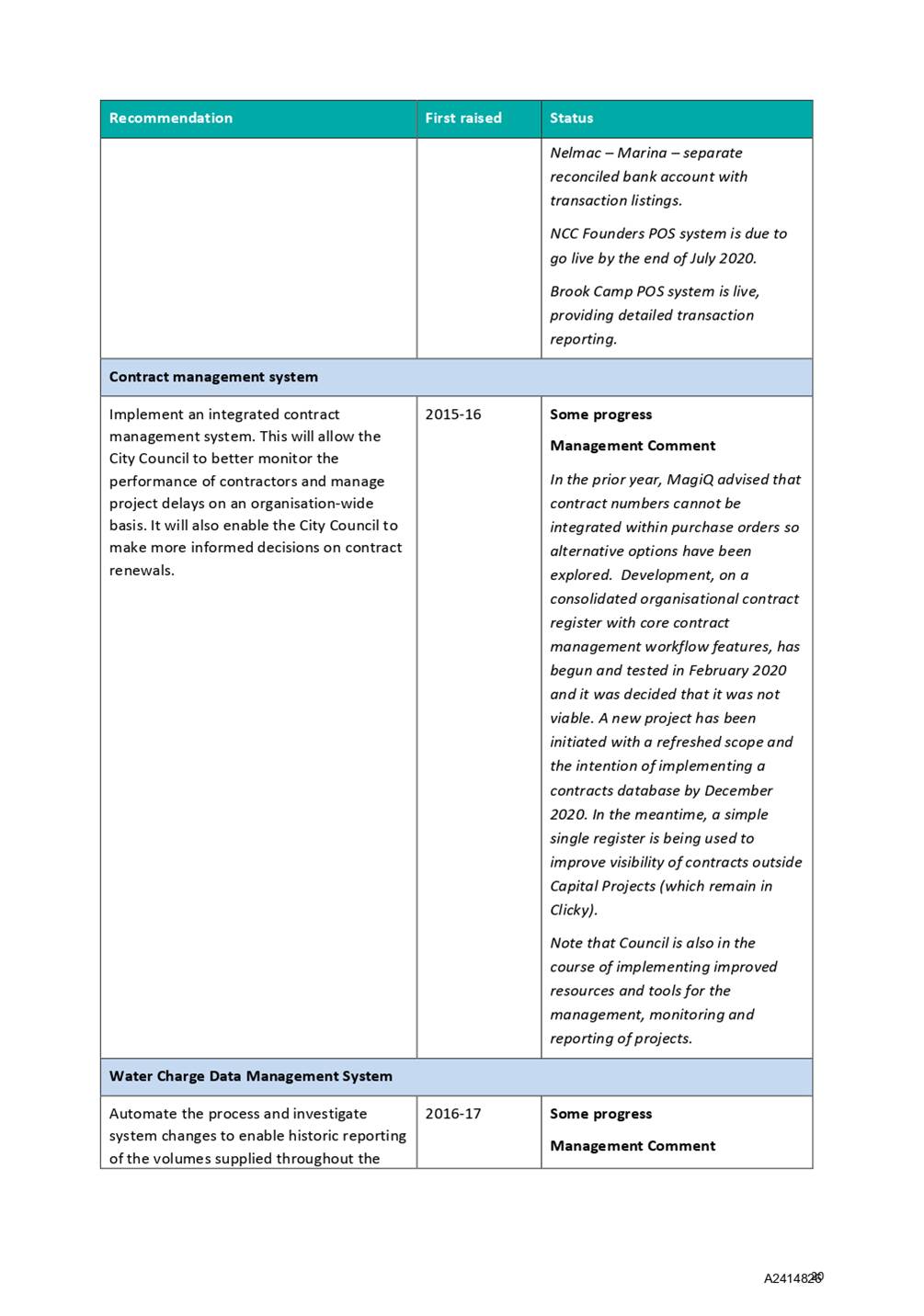

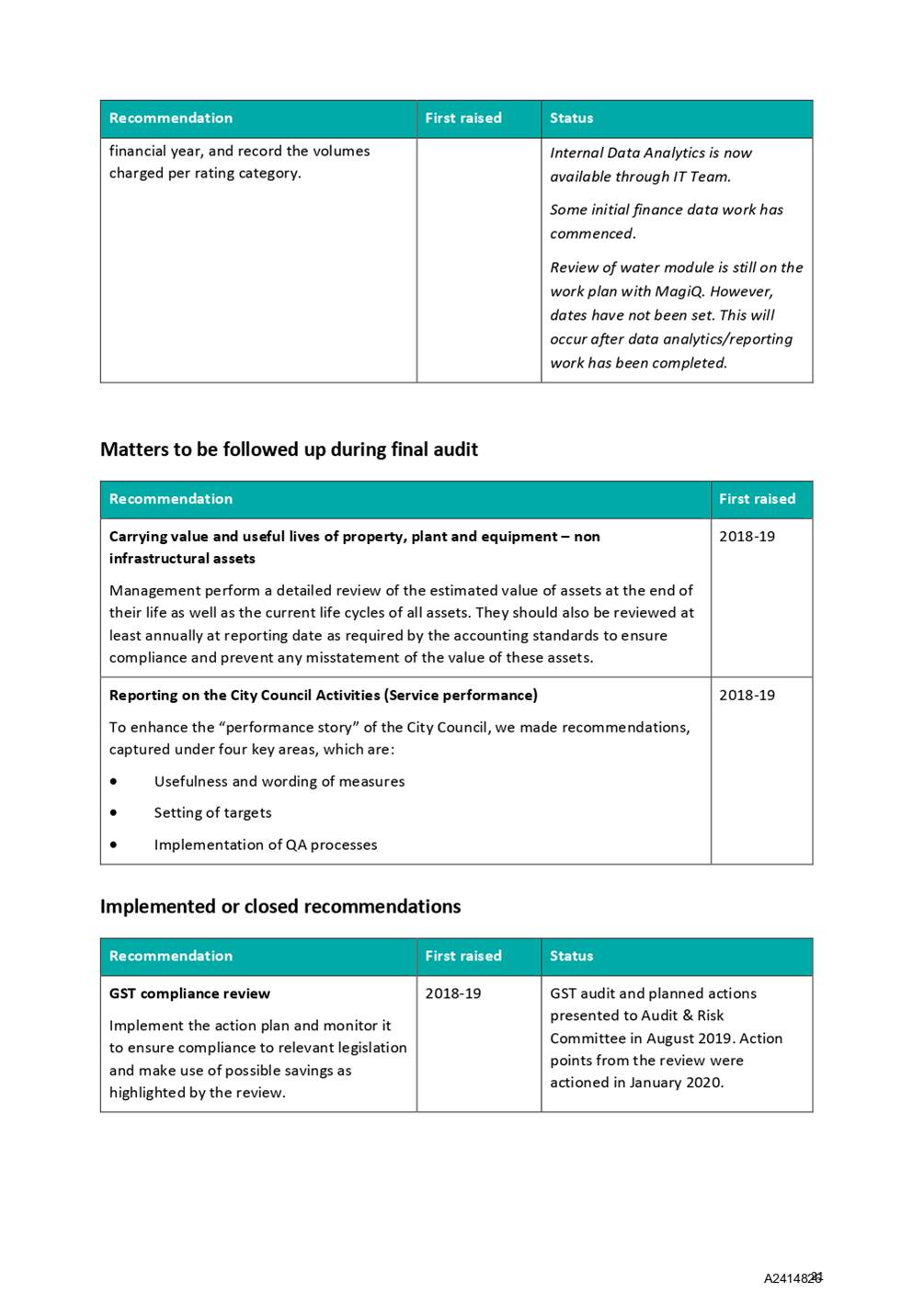

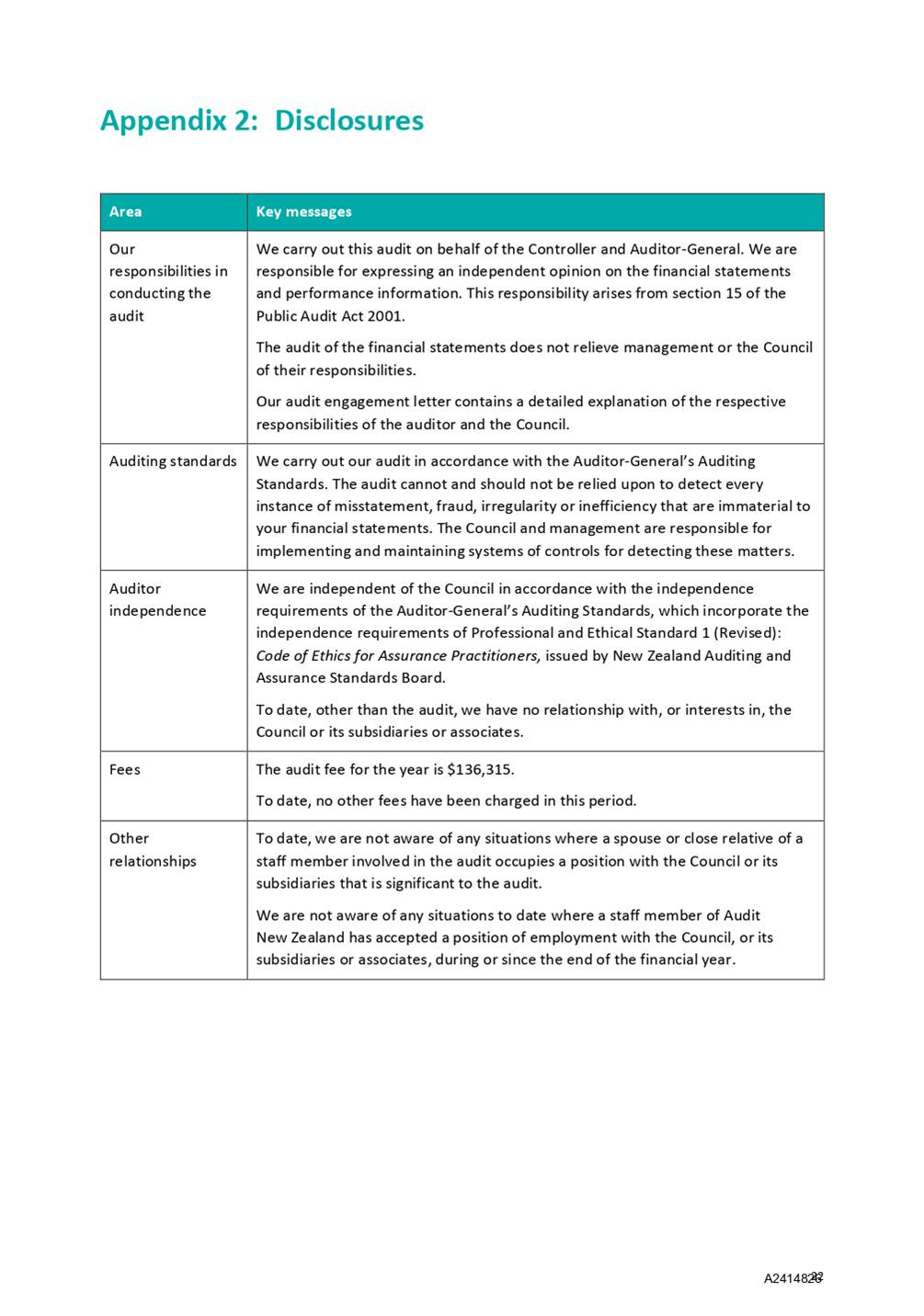

3.1 In April 2020, Audit

New Zealand carried out an interim audit for the year ending 30 June 2020 on

the Council's internal controls and the overall control environment. The interim

audit was done remotely due to COVID-19 and the Interim Audit Report was issued

on 18 June 2020 (Attachment 1).

3.2 There were two issues

requiring urgent attention, regarding an assessment of the impact of COVID-19

and the implications on the annual report and a transition assessment for the

new group accounting standards, which are already in progress by Council

officers.

3.3 The Audit New Zealand Interim

Audit Report also contains a section on previous recommendations made and an

update on the status of these recommendations. Officers are working to

resolve these issues as soon as practical, while weighing up the relative

priority to other business improvement initiatives and internal audit actions.

4. Options

4.1 That the Subcommittee

notes the matters raised in the Interim Audit Report for Nelson City Council

for the year ending 30 June 2020 and the manner in which officers propose to

address them.

Author: Clare

Knox, Manager Finance

Attachments

Attachment 1: A2414826 - Audit -

Audit New Zealand - Interim Audit Report ⇩

Item 9: Interim Audit Report for the year ending 30 June 2020:

Attachment 1

Item 10: Health, Safety

and Wellbeing Report, January to June 2020

|

|

Audit and Risk Subcommittee

11 August 2020

|

REPORT R18135

Health,

Safety and Wellbeing Report, January to June 2020

1. Purpose

of Report

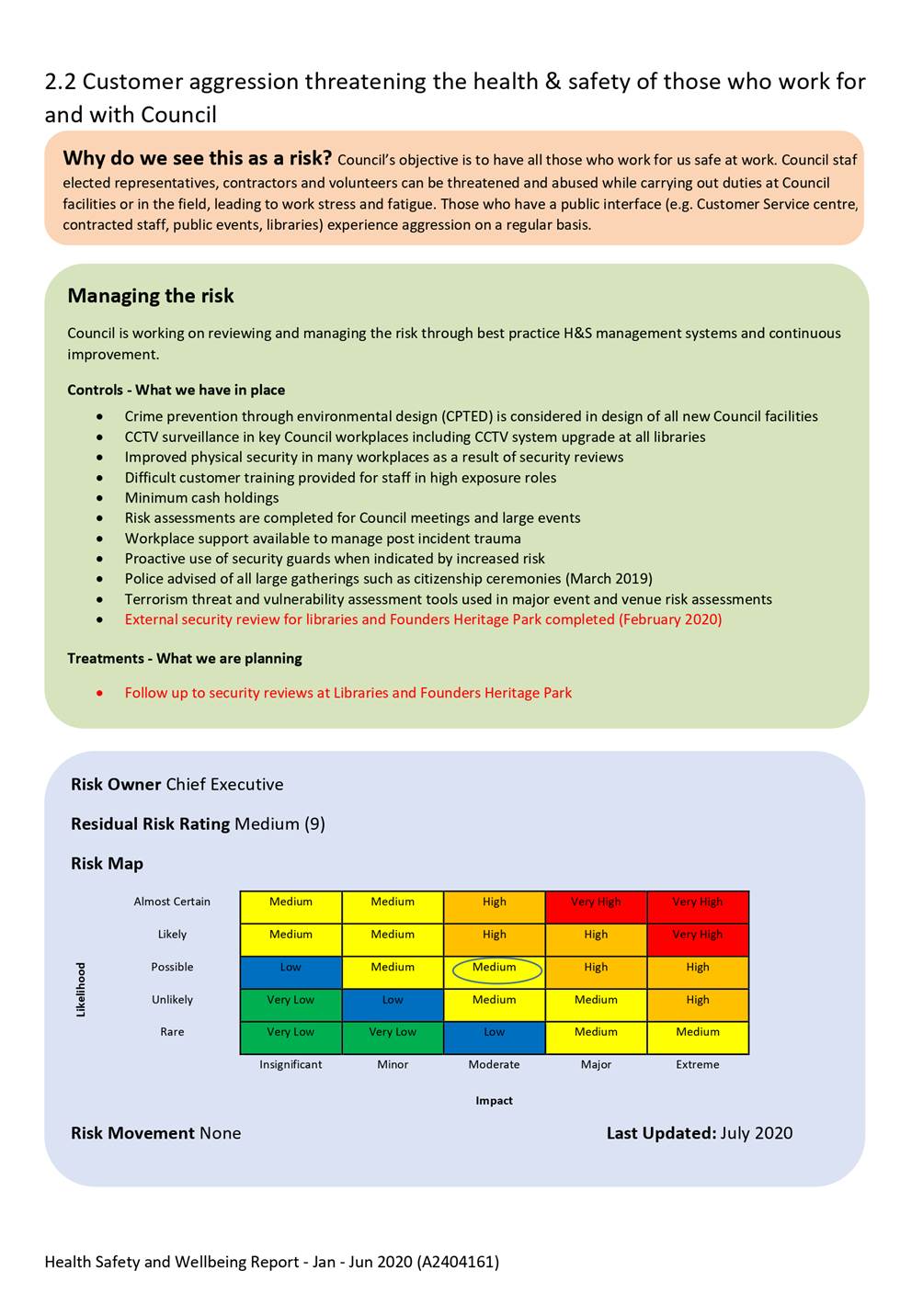

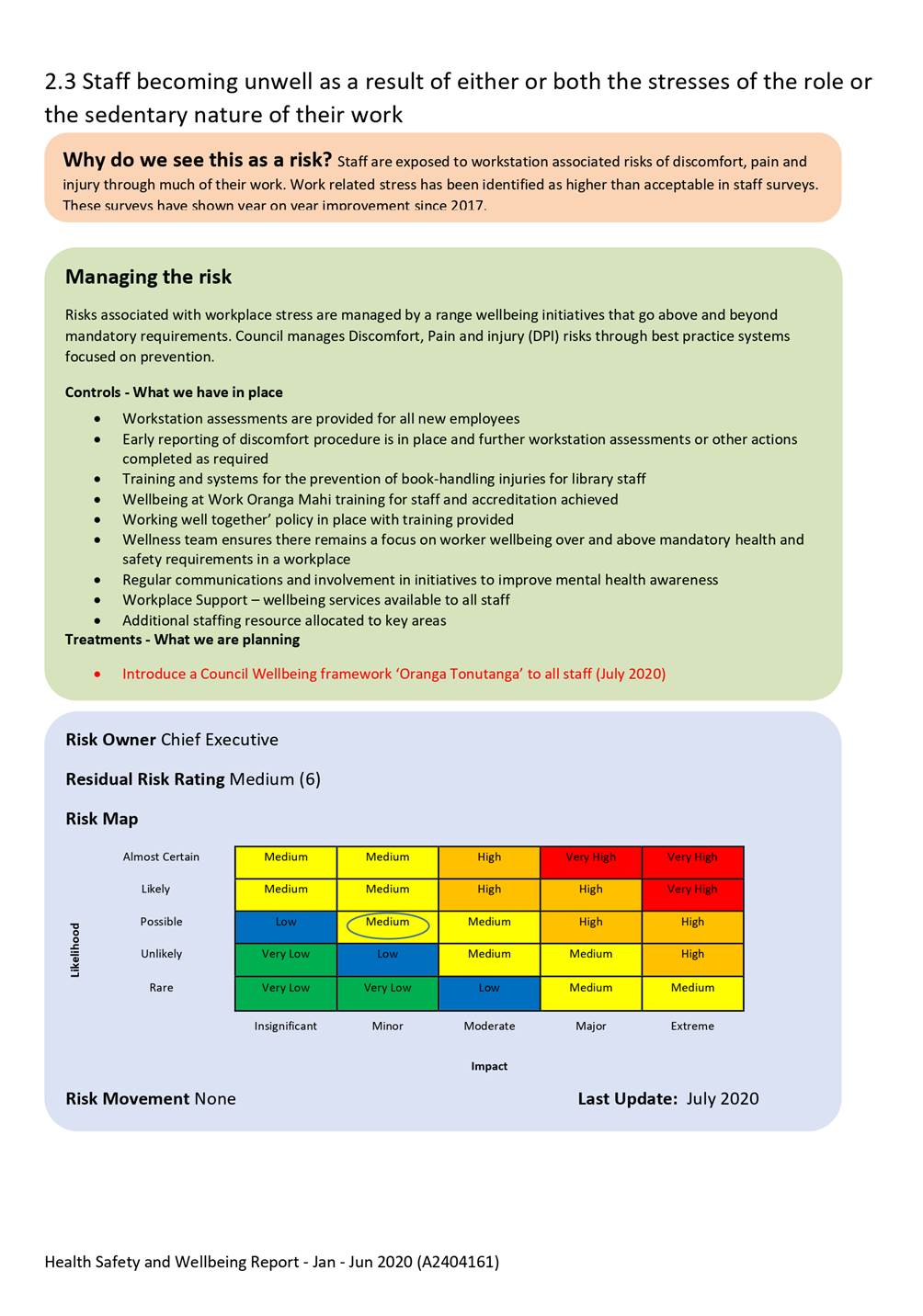

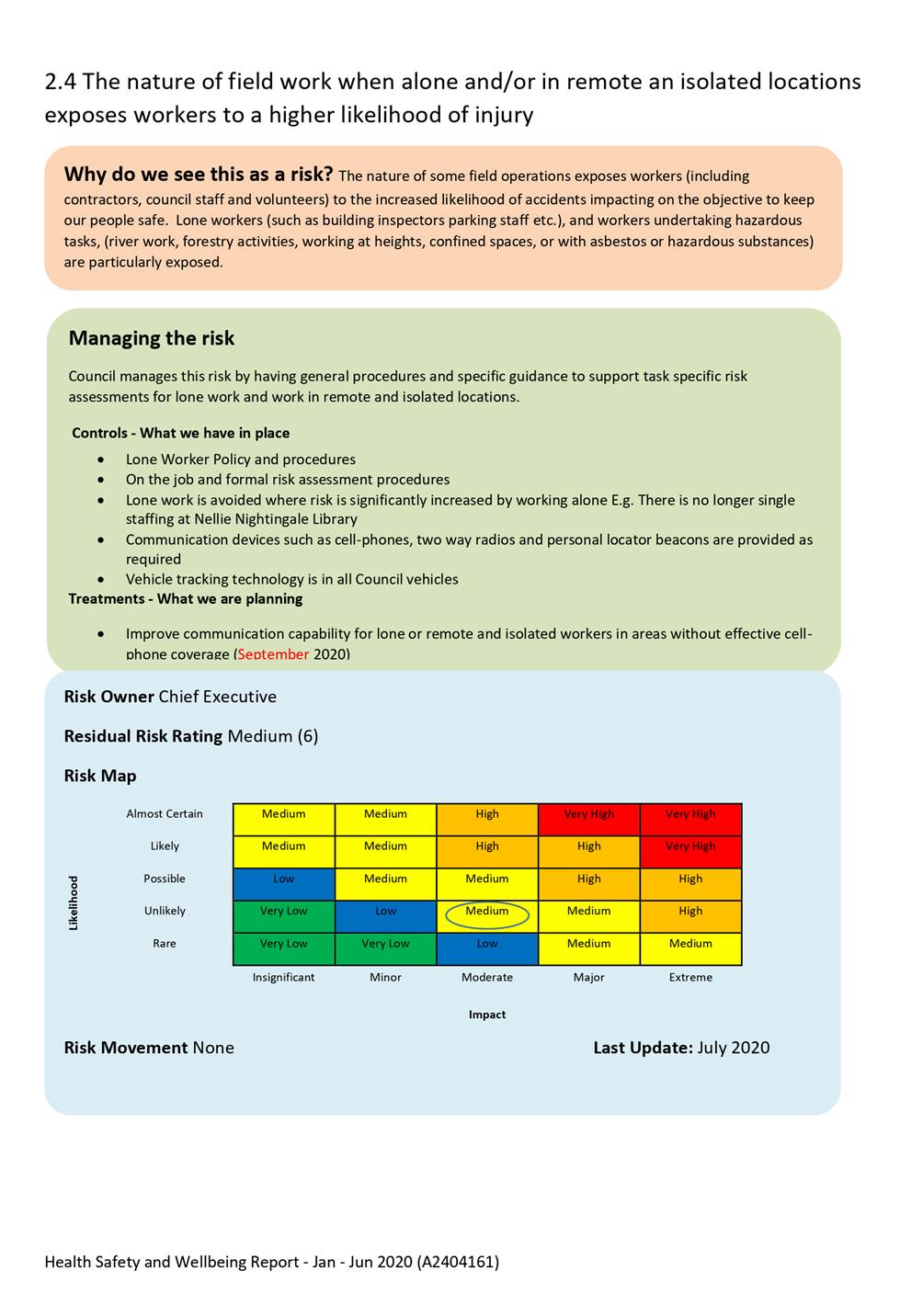

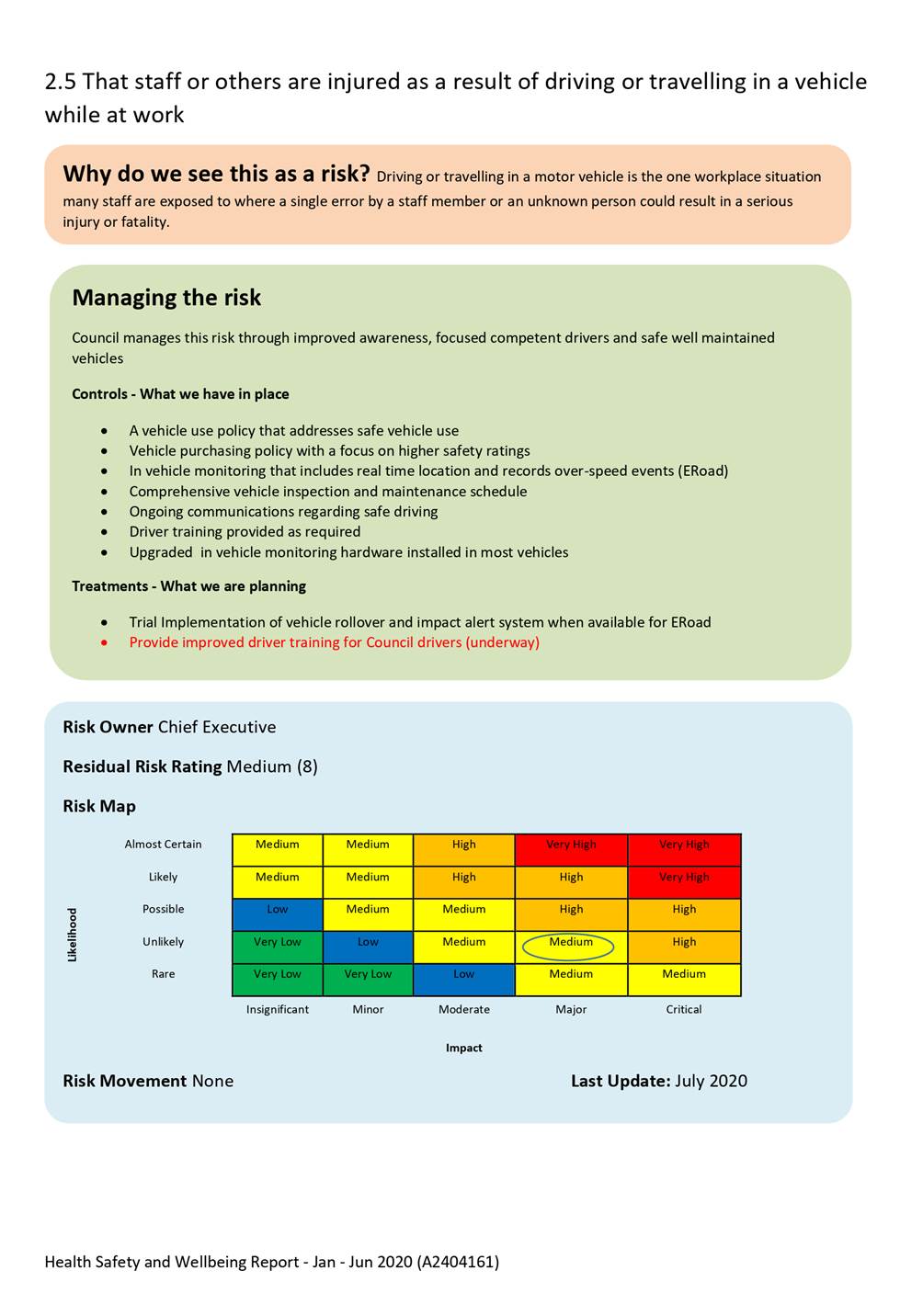

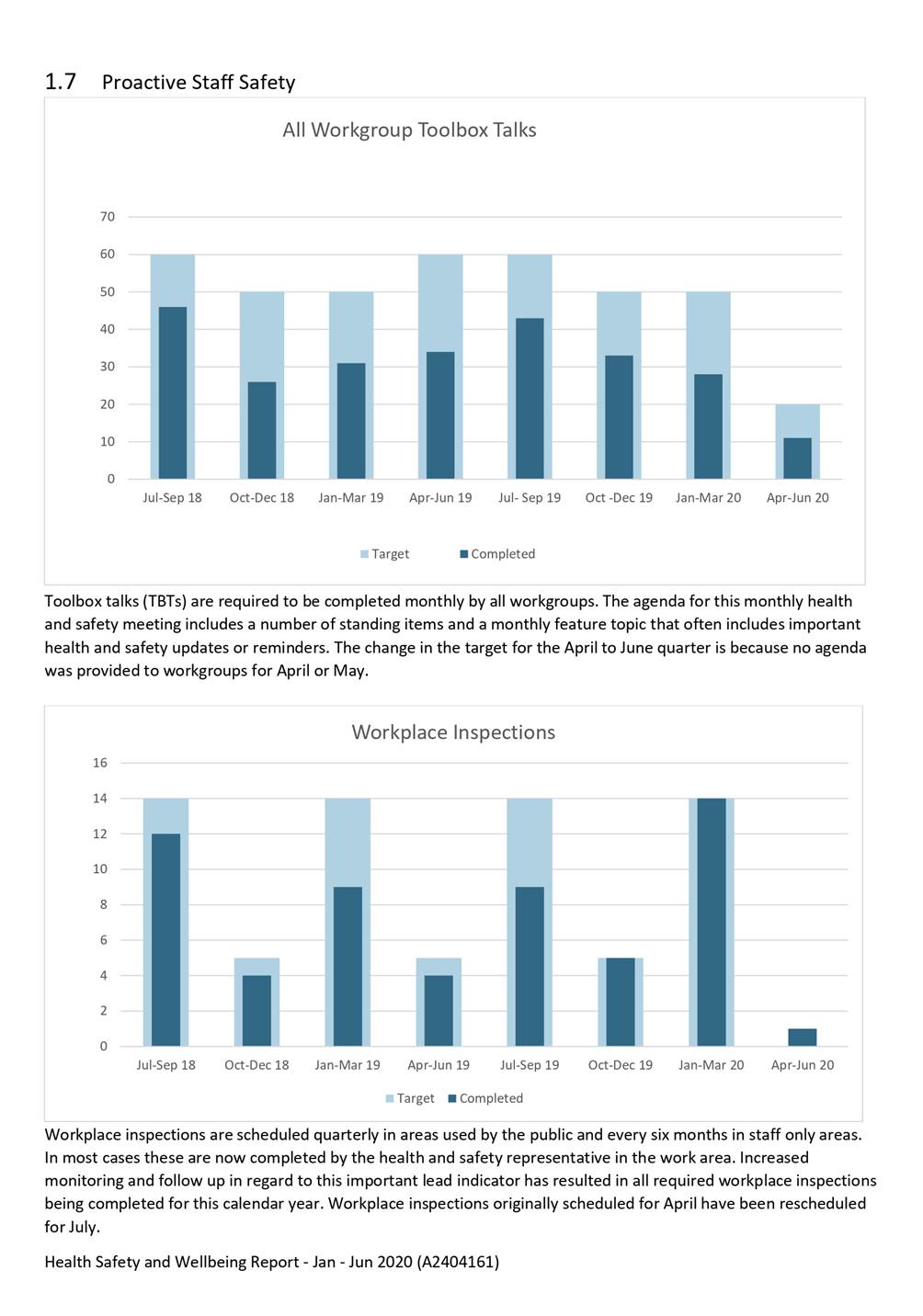

1.1 To

provide the subcommittee with a report on health, safety and wellbeing data

collected over the period January to June 2020

1.2 To

update the subcommittee on key health and safety risks, including controls and

treatments.

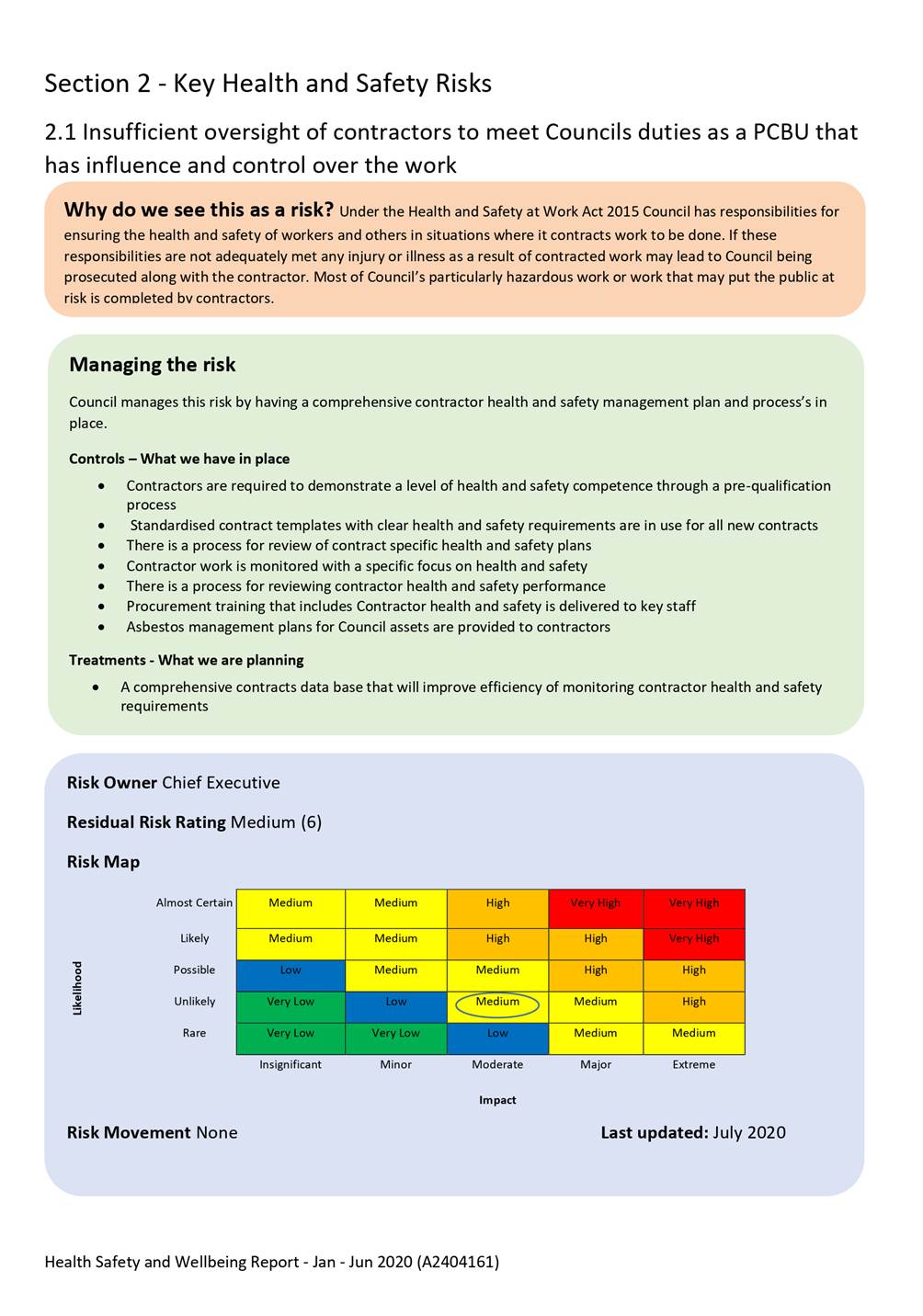

2. Summary

2.1 A

notable incident for this period was a contractor’s worker falling from

the marina wharf while relaunching a vessel.

2.2 Additional

data has been provided regarding the COVID-19 response in the wellbeing section

of the attachment.

2.3 There

has been no change in the assessed risk ratings of key health and safety risks

since the previous report.

2. Recommendation

|

That the Audit and Risk Subcommittee

1. Receives

the report Health, Safety and Wellbeing Report, January to June 2020 (R18135) and its attachment (A2404161).

|

3. Background

3.1 Elected members, as ‘Officers’ under the Health and

Safety at Work Act 2015 (HSWA), are expected to undertake due diligence on

health and safety matters. Council’s Health and Safety Governance

Charter states that Council will receive quarterly reports regarding the

implementation of health and safety. Council has delegated the

responsibility for health and safety to the Audit and Risk Subcommittee.

3.2 This

report covers a six month period as no report was provided to the subcommittee

following the January to March 2020 quarter due to Council’s COVID-19

response. However a COVID-19 specific report was provided to the subcommittee

in May 2020.

3.3 Health,

safety and wellbeing performance data reports provide an overview based on key

lead and lag indicators. Where a concerning trend is identified more detail is

provided in order to better understand issues and implement appropriate

controls.

3.4 Reporting

on key health and safety risks provides further depth and detail to the health

and safety risks reported in the organisational risk report.

4. Discussion

4.1 Incidents

of note

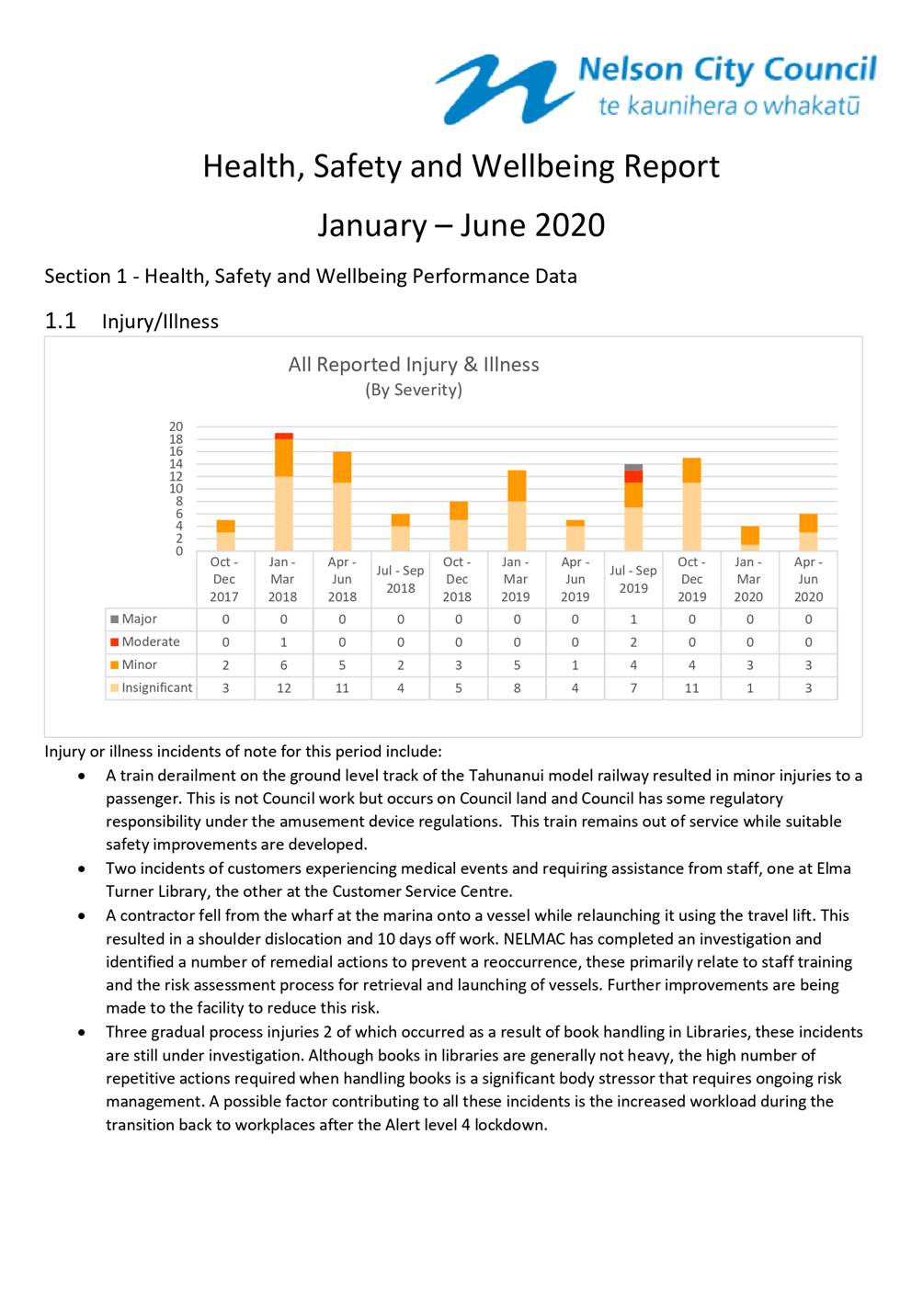

4.1.1 Injury

and illness incidents of note are outlined in the attachment.

4.1.2 The

most significant of these in regard to potential consequences was when a

contractor’s worker fell from the wharf at the marina while relaunching a

vessel. Once the vessel had been lowered into the water from the travel-lift

the worker was manoeuvring it along the wharf using a long aluminium boat hook.

The boat hook slipped causing the worker to over balance and trip, falling onto

the roof of the vessel several metres below. This resulted in a shoulder

dislocation requiring 10 days off work. The contractor has completed an

investigation and identified a number of remedial actions to prevent a

reoccurrence, these primarily relate to staff training and risk assessment

process for retrieval and launching of vessels. Further improvements are being

made to the facility to reduce this risk.

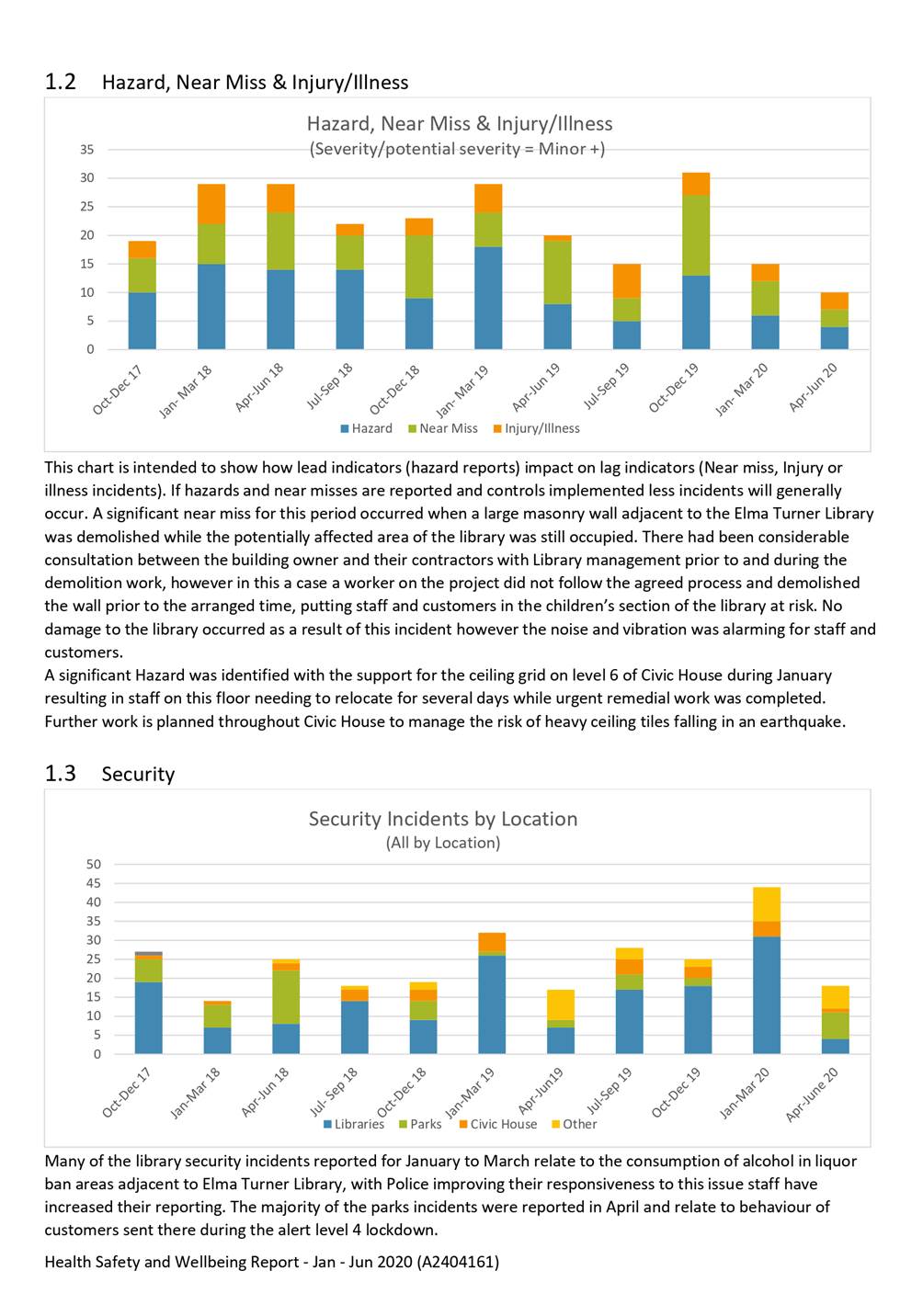

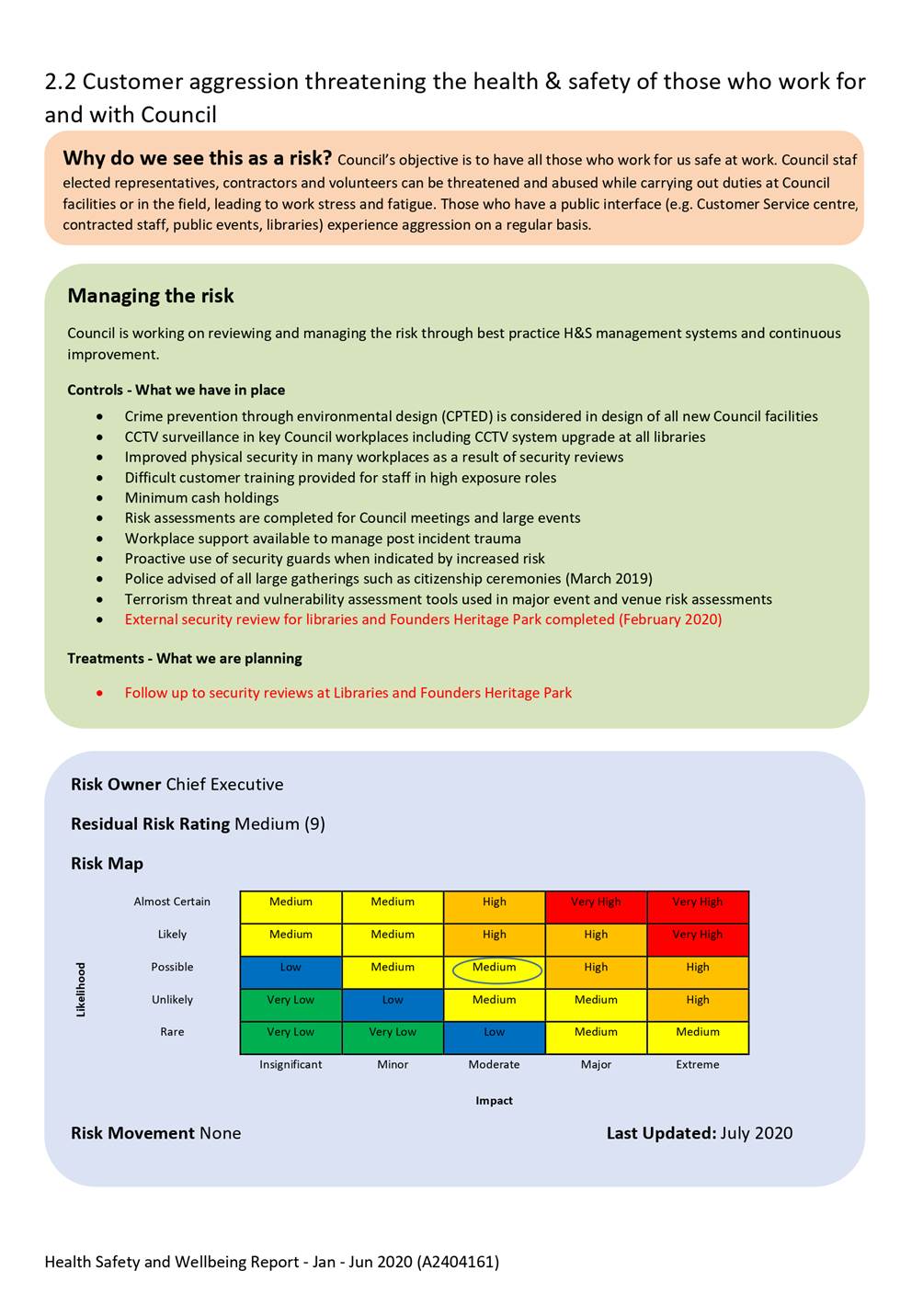

4.2 Security

Incidents

4.2.1 A

higher than average number of security incidents reported at the Elma Turner

Library occurred in the January to March period as also occurred in 2019.

However this year a large number of the reported incidents occurred in areas

surrounding the library rather than in the library itself. It has been reported

by staff that Police are now more responsive to these incidents, many including

the consumption of alcohol in a liquor ban area.

4.2.2 During

April there were a number of security incidents reported at the Brook Valley

Holiday Park involving customers sent there during the alert level 4 lockdown.

4.3 Lead

Indicators

4.3.1 Hazard

near miss and incident data in the attachment shows relatively low levels of

hazard and near miss reporting for this period. This will be an area for staff

to focus on as Health and Safety priorities are rebalanced following the

significant focus on Covid-19 controls since February.

4.3.2 A

significant Hazard was identified regarding the support for the ceiling grid

containing heavy plaster ceiling tiles on level 6 of Civic house during

January. This resulted in staff needing to relocate for several days while

urgent remedial work was completed. Further work is planned throughout Civic

House to manage the risk of heavy ceiling tiles falling in an earthquake.

4.3.3 Low

numbers of workstation assessments completed for January to March is possibly

due to variation in demand. Workstation assessments can be requested

proactively by any staff member at any time however they generally occur for

new starters, when the workstation changes or as a result of an early report of

discomfort. Those workstation assessments completed as a result of an early

report of discomfort are recorded as such and not as a separate workstation

assessment.

4.3.4 A

decrease in numbers of workstation assessments completed is to be expected for

April and May with most staff working from home. Self-assessment information

was provided to staff and remote support for discomfort was provided when

requested.

4.4 Safe

Driving

4.4.1 An

increase in over speed events per 100km travelled for April has been

investigated further. No individual has shown a concerning number of overspeed

events. Most of April was the level 4 lockdown with minimal distance travelled

by most fleet vehicles. Overspeed events occurred in vehicles driven by those

providing essential services. Busy work schedules and low traffic volumes are

not considered an excuse for speeding but do help to explain how it occurred

during lockdown.

4.4.2 During

June 16 staff completed either advanced driver training or 4wd training, this

training was with a new provider and was very well received. It is proposed to

deliver more of this training in the coming year with the addition of safe

driving seminars for most staff who drive regularly while working for Council.

4.5 Staff

Wellbeing

4.5.1 A

working from home survey sent to all staff after one week at Alert Level Four

had a response rate of 67%, with 94% of those who responded answering either

somewhat agree (23%), agree (50%), or strongly agree (21%) to the statement

“Overall, I’m feeling good about working remotely.” A second

survey was completed during the last week of alert level two at a time when

approximately 25% of staff had returned to the workplace. This showed an

increase in the level of agreement across all statements except for two

relating to connection with teams and discussion of wellbeing at team meetings,

this is understandable considering it was a transition stage with most teams

split between home and the workplace.

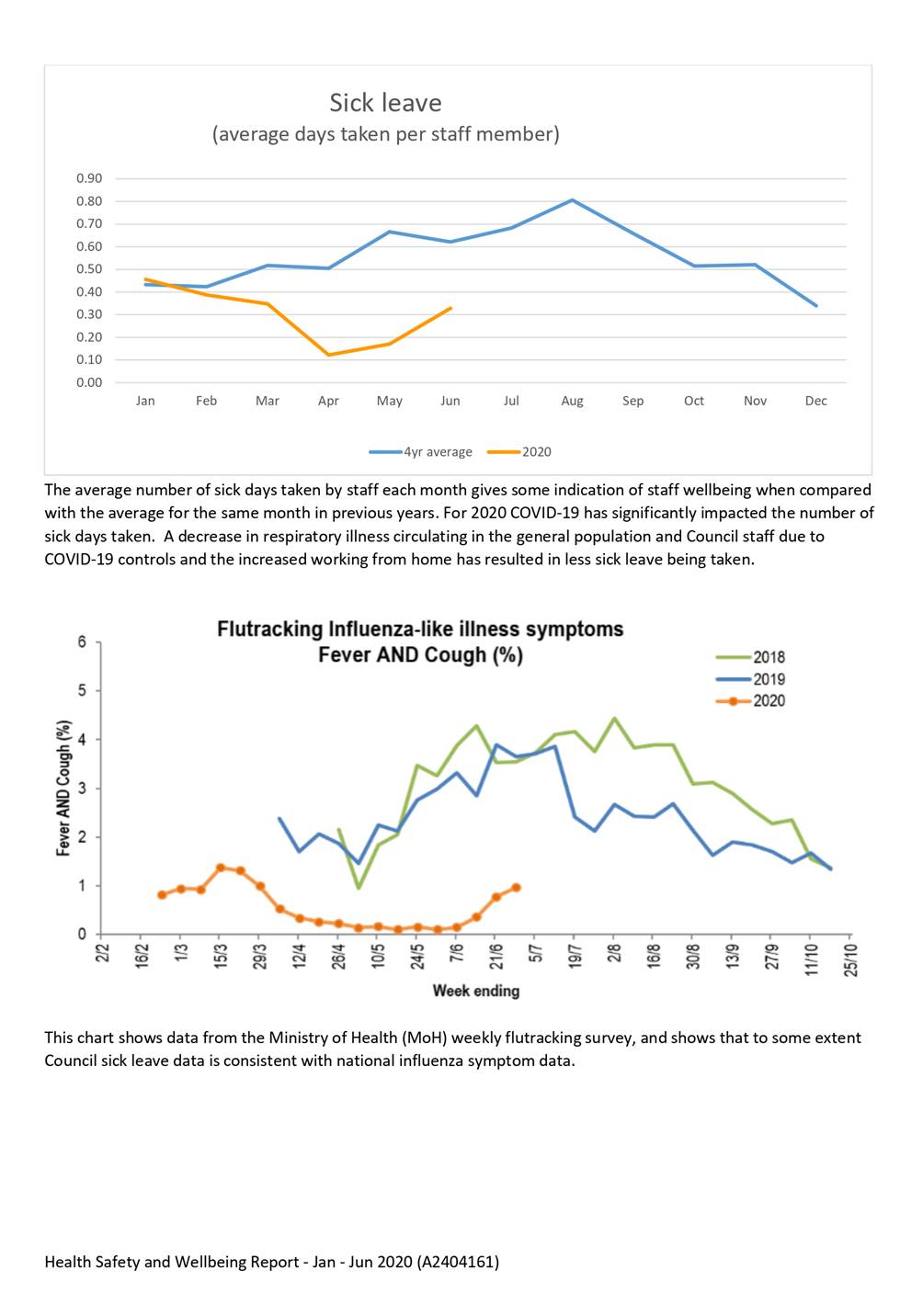

4.5.2 Sick

leave data shows a considerable reduction in sick leave taken since February

when compared to the average in the same month for the past four years. A

decrease in respiratory illness circulating in the general population and

Council staff due to COVID-19 controls and the increased working from home have

been identified as the cause of this. Ministry of Health data from their weekly

flutracking survey shows that influenza like symptoms reported nationally

follows a somewhat consistent pattern to the sick days taken by Council staff

for each month.

4.5.3 Increased

workloads and additional challenges as a result of the response to COVID-19

have been discussed previously. To provide some perspective on this data has

been included in the attachment showing some of additional work that was

directly related to management of the COVID-19 response. Although not

specifically reflected in the available data at this point, there is anecdotal

evidence of cumulative fatigue among staff that could have ongoing impacts on

wellbeing.

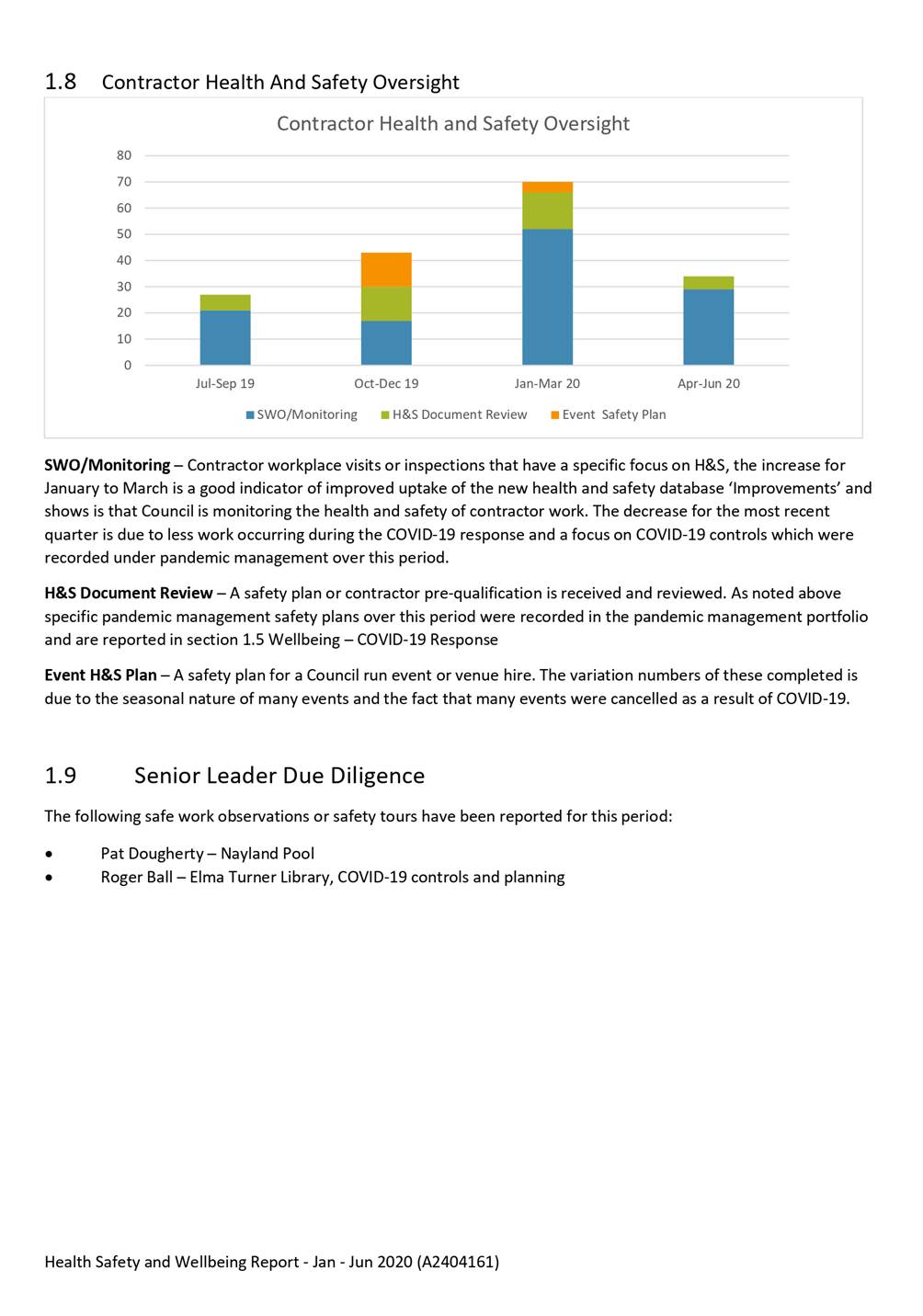

4.6 Contractor

Health and Safety

4.6.1 The

increase in Safe work observations (SWOs) reported for January to March is a

good indicator of improved uptake of the new health and safety database

‘Improvements’ and shows that Council is monitoring the health and

safety of contractors work. The decrease for the most recent quarter is due to

less work occurring during the COVID-19 response and a focus on COVID-19

controls. If the contractor Pandemic plan reviews shown in the COVID-19

response chart were included in this data the contractor H&S document

reviews for April to June would be considerably higher than the previous

quarter.

4.7 Due

Diligence Activities

4.7.1 SLT

members reported completing two safe work observations during this period.

4.7.2 The

Audit and Risk Subcommittee attended a workshop and received a health and

safety report on the COVID-19 response.

4.8 Key

Health and Safety Risk Update

4.8.1 All

of Council’s key health and safety risks are assessed to remain as medium

risks.

4.8.2 Where

new treatments have been planned or have been implemented as controls since the

last report this is indicated by red text in the attachment.

4.8.3 Where

possible timeframes are indicated for treatments.

Author: Malcolm

Hughes, Health and Safety Adviser

Attachments

Attachment 1: A2404161 - Health,

Safety and Wellbeing Report, January - June 2020 ⇩

Item 10: Health, Safety and Wellbeing Report, January to June 2020:

Attachment 1

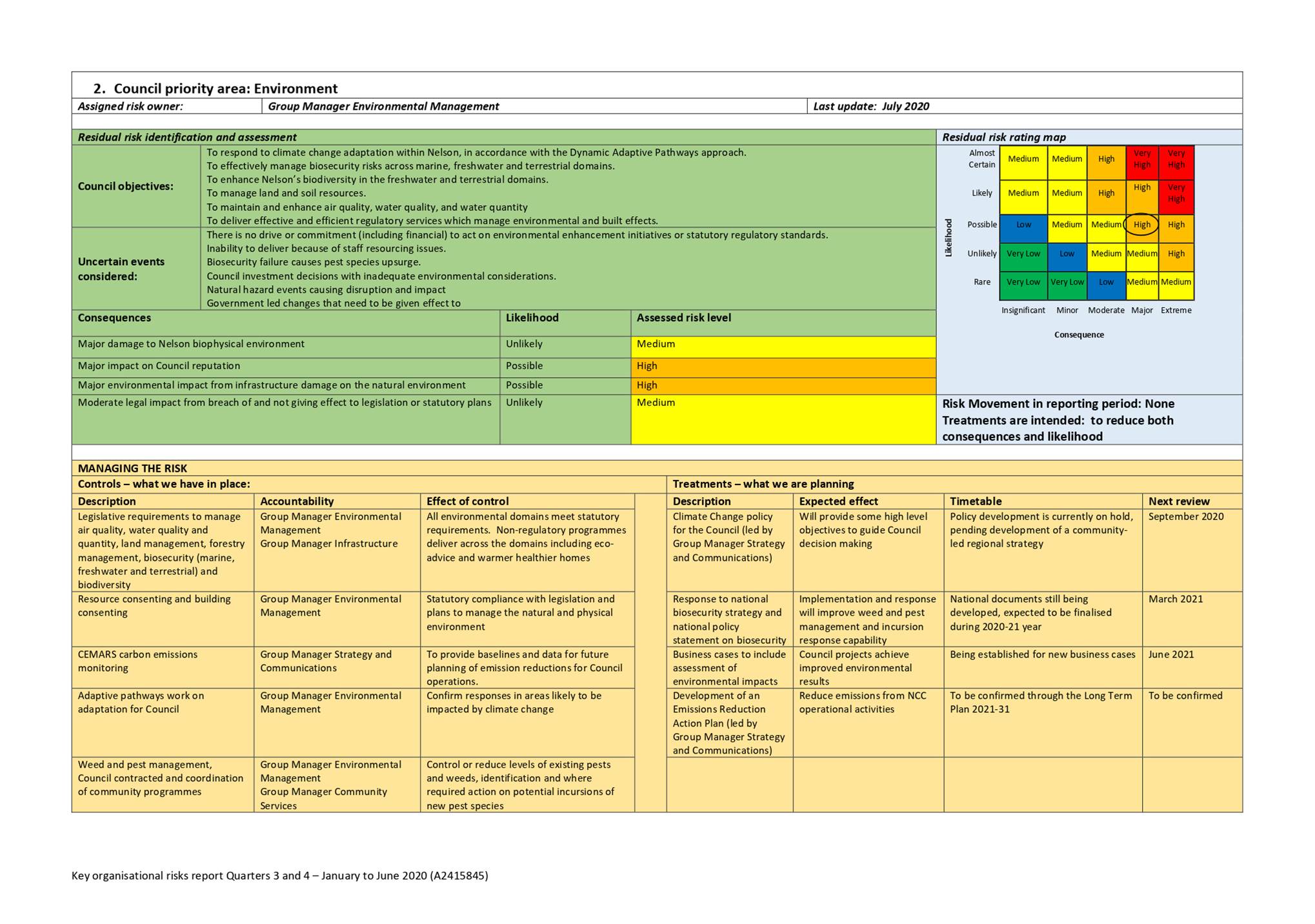

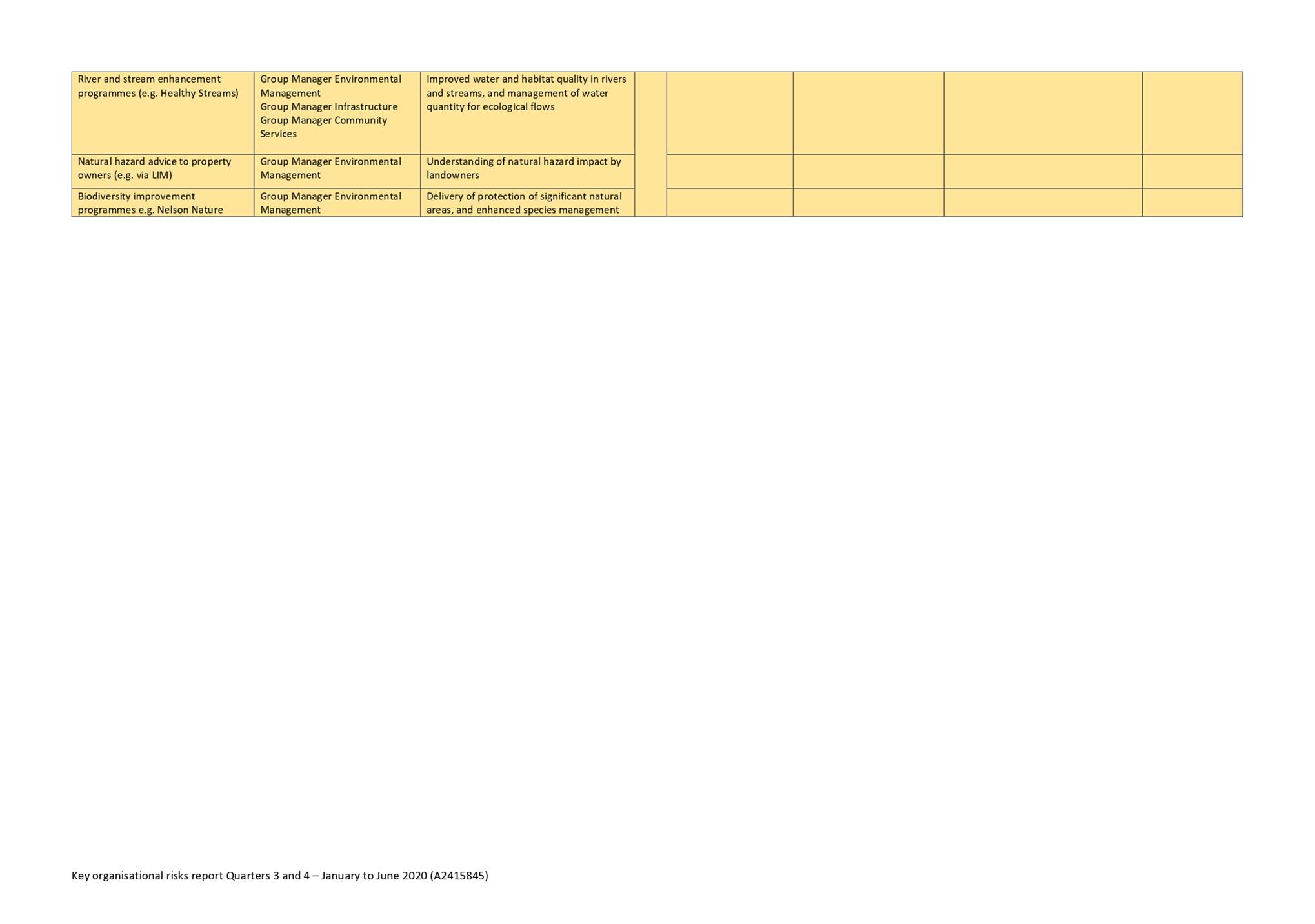

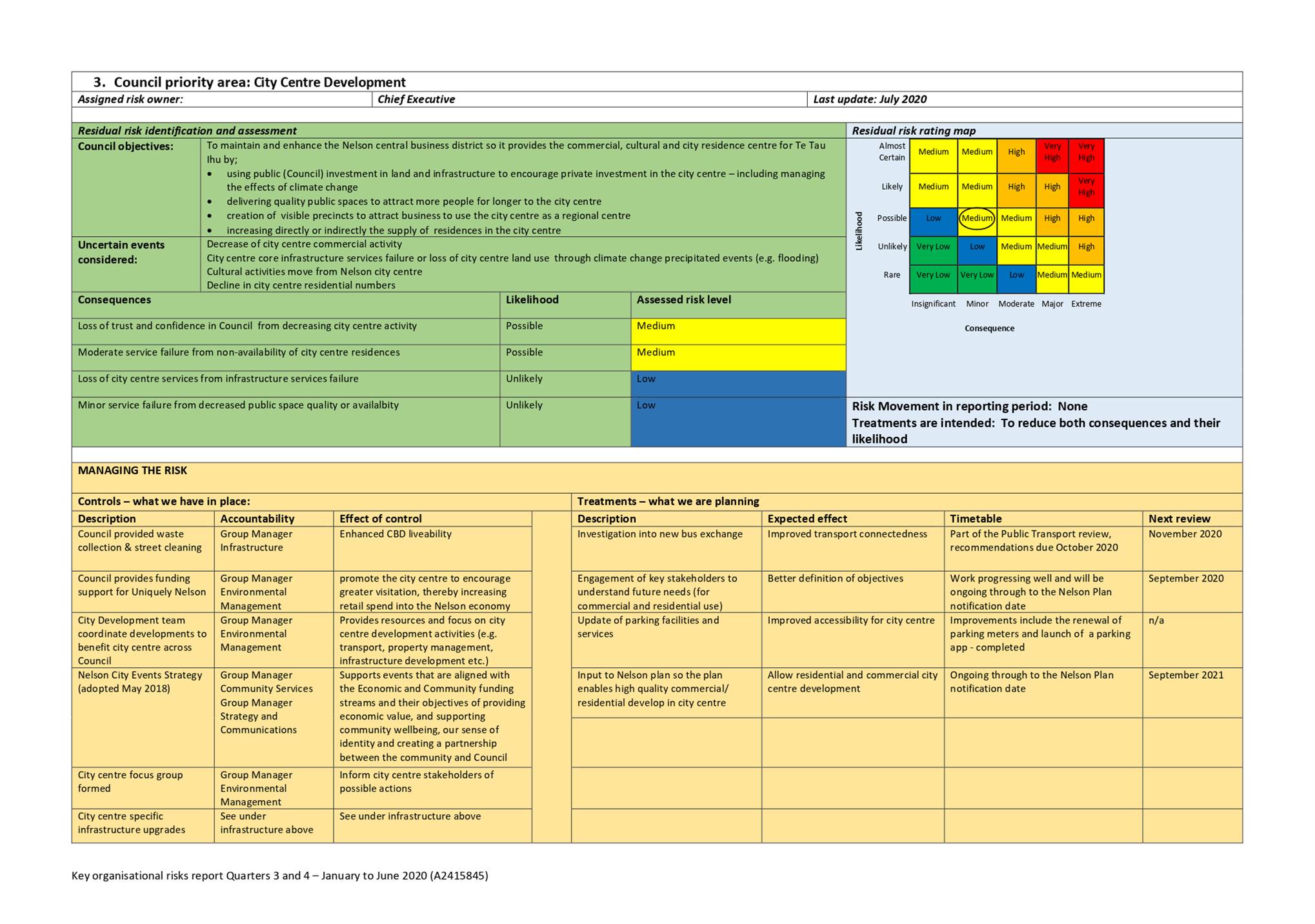

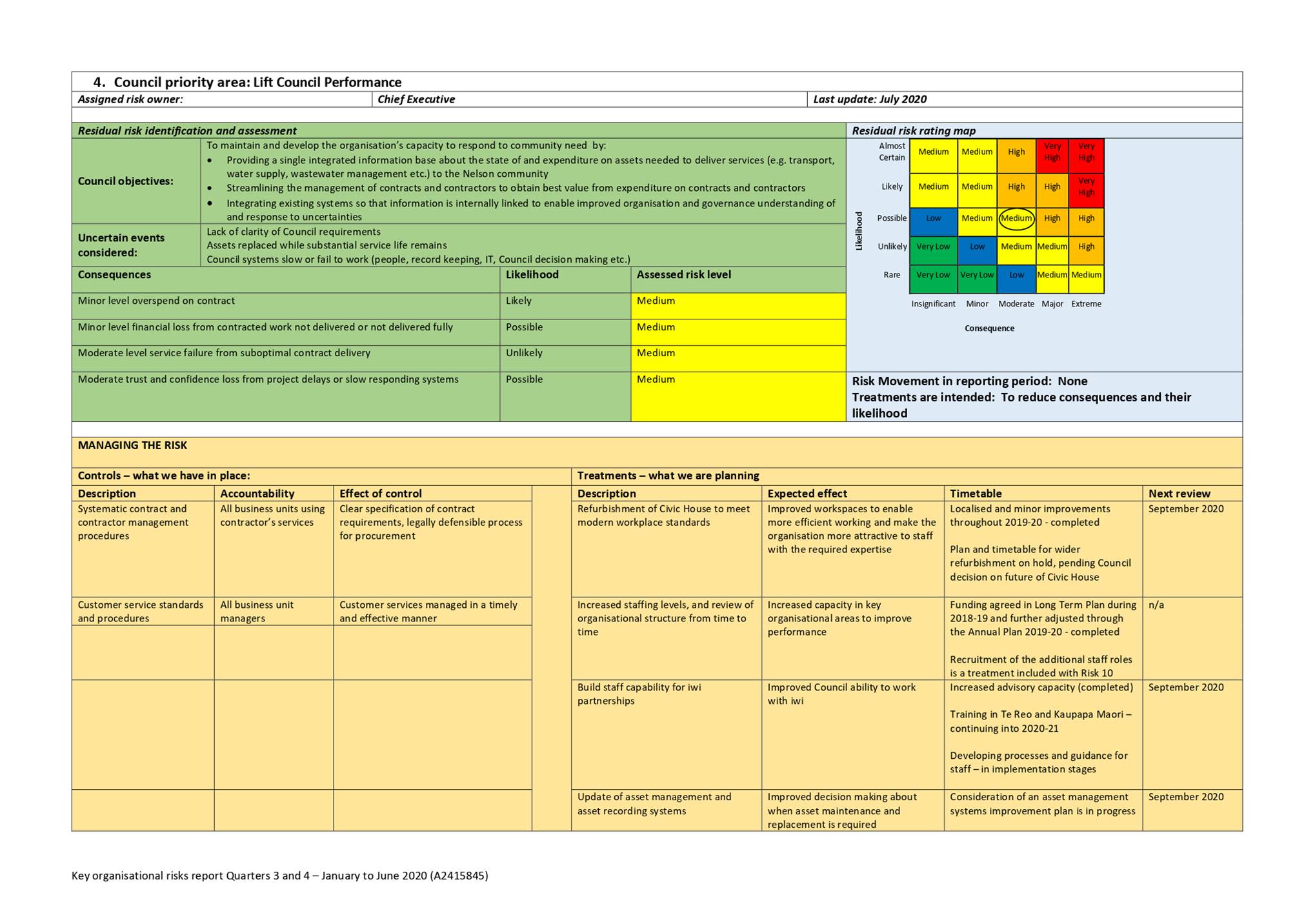

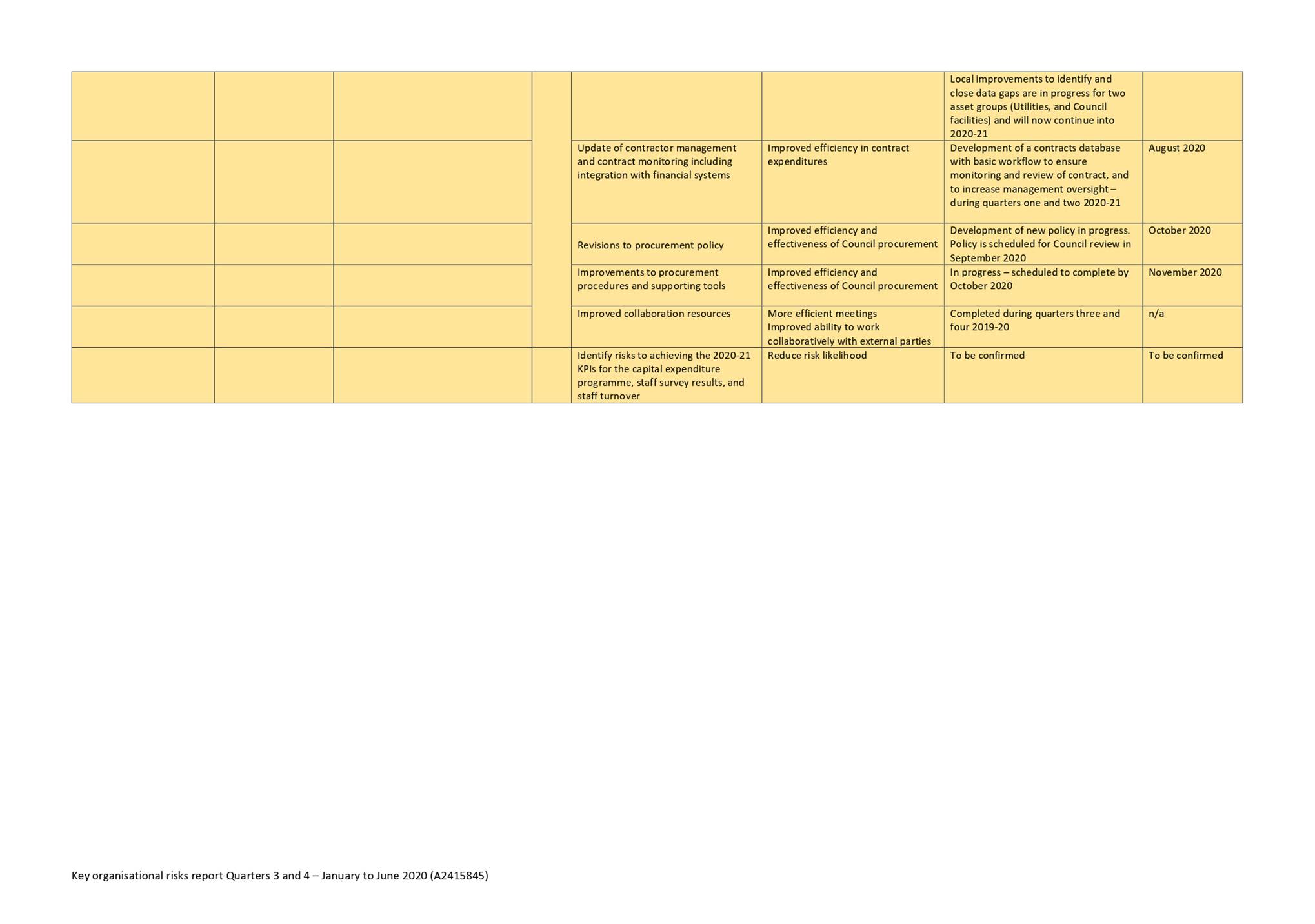

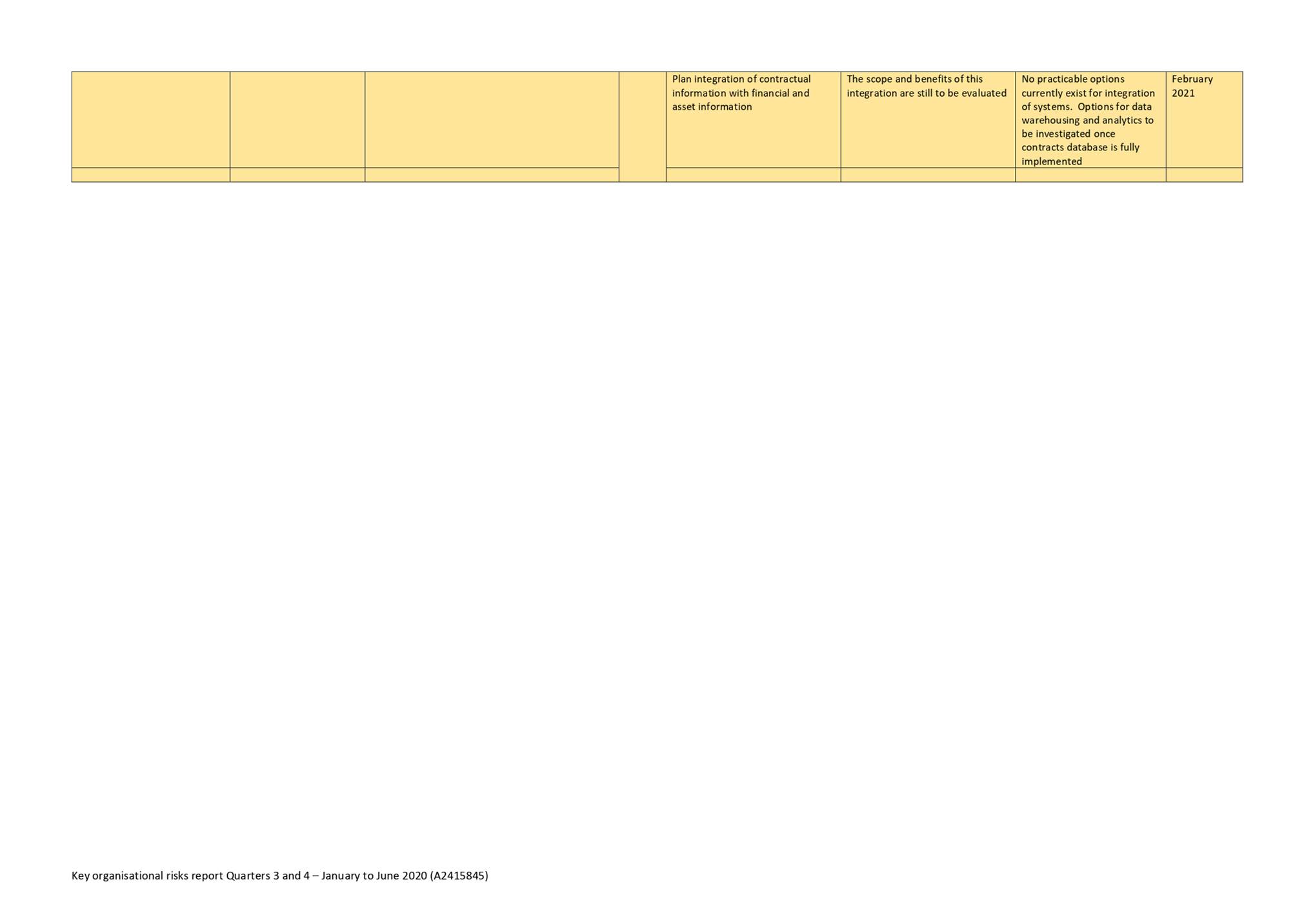

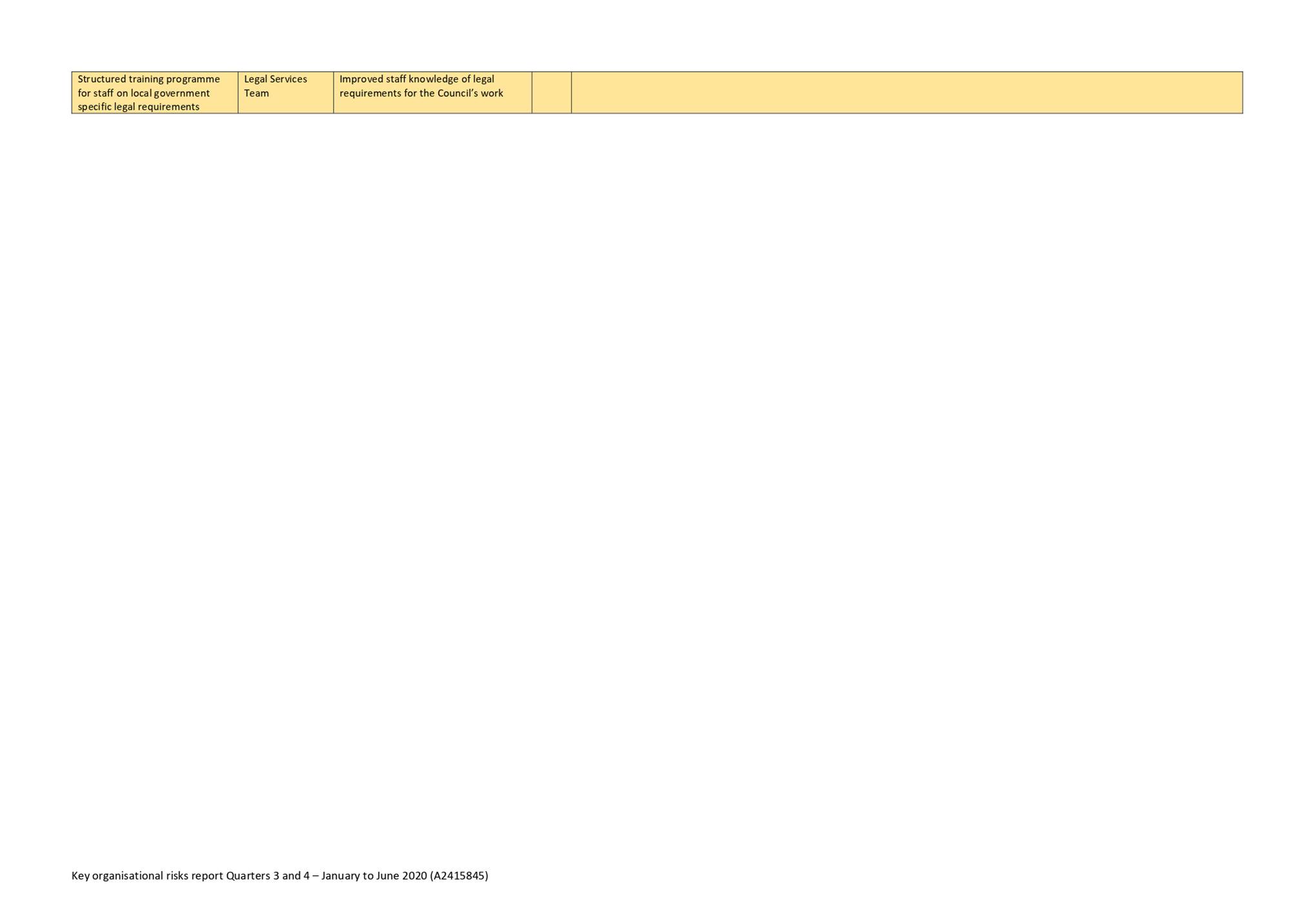

Item 11: Key

Organisational Risks Report - 01 January to 30 June 2020

|

|

Audit and Risk Subcommittee

11 August 2020

|

REPORT R14813

Key Organisational Risks Report - 01 January to 30

June 2020

1. Purpose

of Report

1.1 To provide information to the

Audit and Risk Subcommittee on the key organisational risks through to end of

quarter four 2019-20. This report covers risk management progress through

both quarter three and quarter four 2019-20.

2. Recommendation

|

That the Audit and Risk Subcommittee

1. Receives the report Key Organisational Risks

Report - 01 January to 30 June 2020 (R14813) and its attachment (A2415845).

|

3. Background

3.1 This report includes information

on risks to achieving Council’s priorities for the Long Term Plan 2018-28

(section 5), and the key organisational risks that could impact Council’s

wider ability to deliver core functions and services (section 6). Risks

related to specific assets, activities, or projects, are reported on a

quarterly basis to the relevant Committee, and any significant items are

summarised at section 7 of this report. In addition, section 7 provides a

brief summary from each Group Manager on emerging risks for their areas of

responsibility.

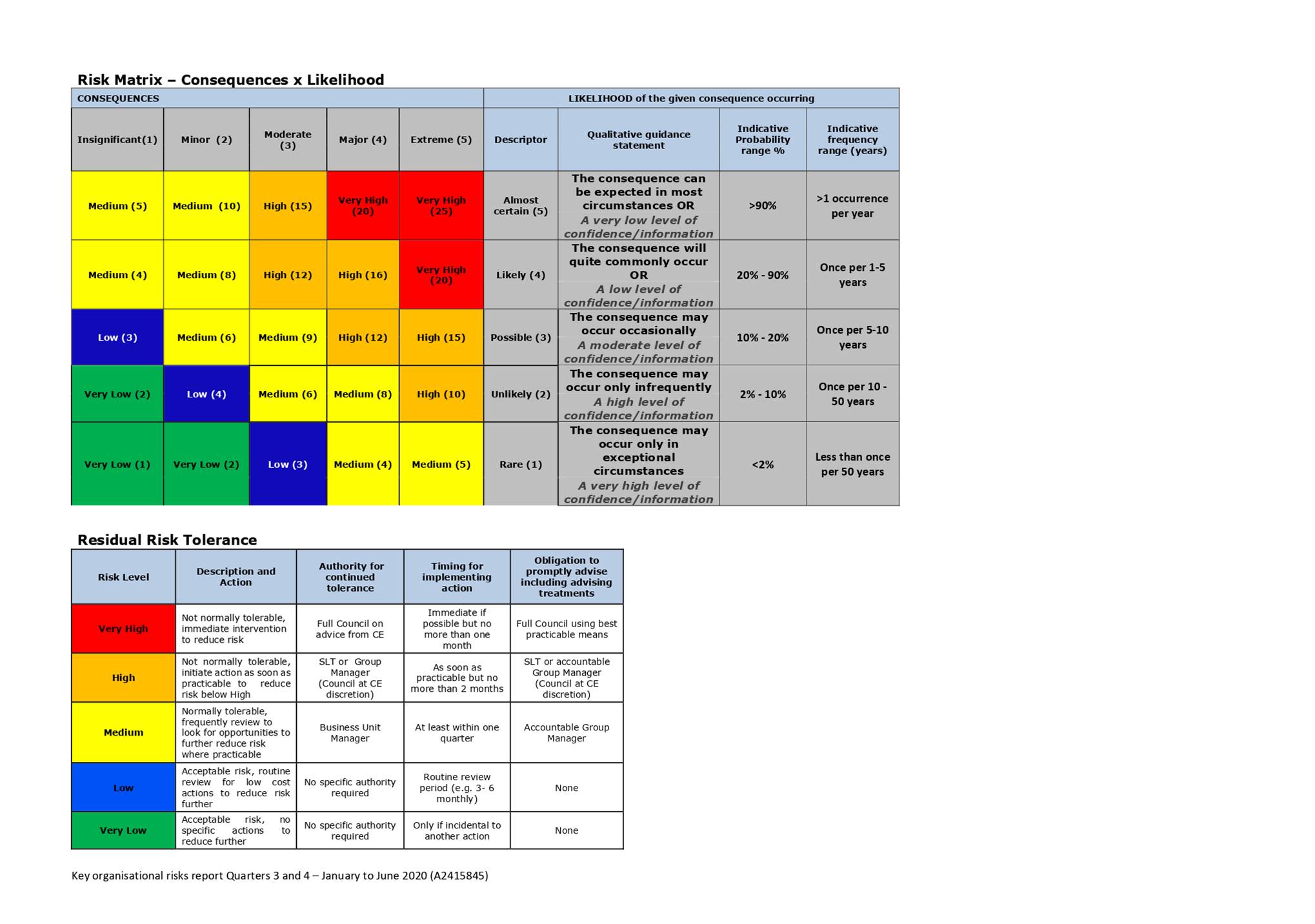

3.2 The attachment to this report

describes each risk in more detail, its existing controls and planned risk

treatments.

3.3 Note that the demands on staff

time to respond to the COVID-19 emergency has impacted the ability to complete

some planned risk treatments.

4. Risk

Management Practice

4.1 During

quarter three, a trial of software to support risk management was conducted,

with positive results, and software licences were purchased during quarter

four. A project to implement the risk management software across the

organisation was initiated towards the end of quarter four. The

advantages for Council are: consolidation of risk recording into a

central repository; more effective risk ownership and visibility, and more

efficient reporting on risk.

4.2 During

quarter four, Council’s risk management processes were reviewed and

updates completed to rationalise these processes.

4.3 A review and refresh of the key organisational risks for 2019-20 was

scheduled for quarter four; this work was delayed and has been rescheduled for

quarter one 2020-21.

4.4 The main

focus for risk management improvement activities for

quarter one 2020-21 is to complete configuration of the risk management

software and begin a phased rollout across the organisation.

4.5 At the

SOLGM Risk Management Forum in February 2020, the World

Economic Forum’s Global Risk Report, published 15 January 2020, was

presented. The report presents how key focus areas for risk management

are changing globally and nationally, and is publicly available on the World

Economic Forum’s website. The risk trends are summarised below for

information.

4.5.1 Over last 10 years the

biggest risk concerns globally have changed from mostly economic to mostly

environmental. In 2010, of the top 5 most likely risks, three were

economic, one was geopolitical and one was societal; in 2020 the top 5 most

likely risks were all environmental. These top 5 global risks, in terms

of likelihood are: extreme weather; climate action failure; natural

disasters; biodiversity loss; and human-made environmental disasters.

4.5.2 Similarly, in 2010, of the

top 5 most impactive risks, four were economic, and one was societal; in 2020,

three are environmental, with one societal and one geopolitical. These

top 5 global risks, in terms of impact are: climate action failure;

weapons of mass destruction; biodiversity loss; extreme weather; and water

crises.

4.5.3 In the World Economic

Forum’s report Regional Risks for Doing Business, published 01 October

2019, the top 5 risks for New Zealand were: natural disasters;

cyberattacks; failure of critical assets; failure of urban planning; and

extreme weather.

5. Risks to Achieving Council Long Term Plan

Top Priorities

5.1 Updated

information to the end of quarter four is summarised below, with further detail

on the risk areas, their controls and treatments set out in attachment

one.

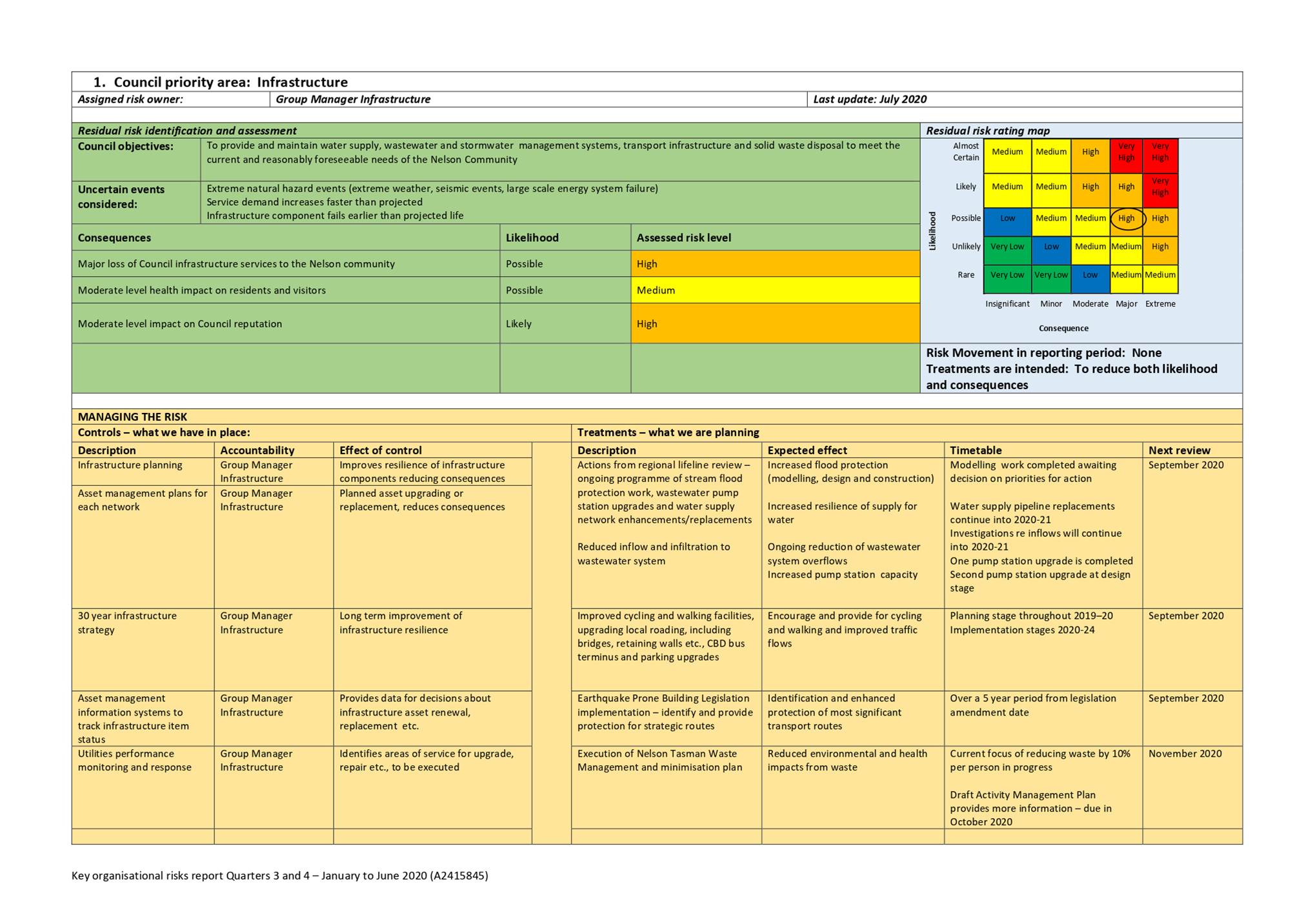

5.2 Priority area Infrastructure

(Risk 1). There have been no reported

exceptions to the risk controls. Some project and operational level work

was delayed due to COVID-19 alert level restrictions, and as such treatment

review dates have been adjusted. Treatments are being incorporated into

the relevant draft Activity Management Plans (AMPs) being presented to Council

during quarter two 2020-21. A review of the overall consequences and

likelihood for this priority area has been scheduled for quarter one 2020-21;

until then the risk rating remains at High, with no risk movement to report

during quarters three and four 2019-20.

5.3 Priority

area Environment (Risk 2). The residual risk rating remains at High, with no risk movement

during quarters three and four 2019-20.

5.4 Priority area City Centre Development (Risk 3). New

and improved parking meters were implemented during June 2020; at the

time of writing this report, it is too early to assess the impact of this

treatment on the risk rating. All other risk treatments are in

progress. The impact from COVID-19 on retail, tourism and hospitality

businesses may result in decreased city centre commercial activity, which could

slow down Council’s ability to achieve its objectives for the city centre

development.

There was no risk movement during quarters three and

four 2019-20, and the overall residual risk rating remains at

Medium.

5.5 Priority

area Lifting Council Performance (Risk 4). A

variety of collaboration tools and facilities have been completed as planned

– smartboards in meeting rooms, widespread rollout of zoom meeting

technology, and development of the innovation workspace. Some staff

recruitment was put on hold during the COVID-19 event, as was staff training in

Te Reo, and these treatments will now be reviewed in September 2020. Te

Kāhui Whiria, Māori Partnerships Team has made strong progress in

developing processes and guidance for staff, with the implementation of a

service request process for cultural guidance and advice, a weekly cultural

clinic drop-in session, and ongoing promotion of Te Ao Māori resources to

support staff development and understanding of te reo Māori me

ōnā tikanga. The risk rating remains at Medium, with no risk

movement during quarters three and four 2019-20.

6. Key

Organisational risks

6.1 A new risk has been identified,

relating to the potential for a significant future increase of COVID-19 cases

to disrupt delivery of Council services.

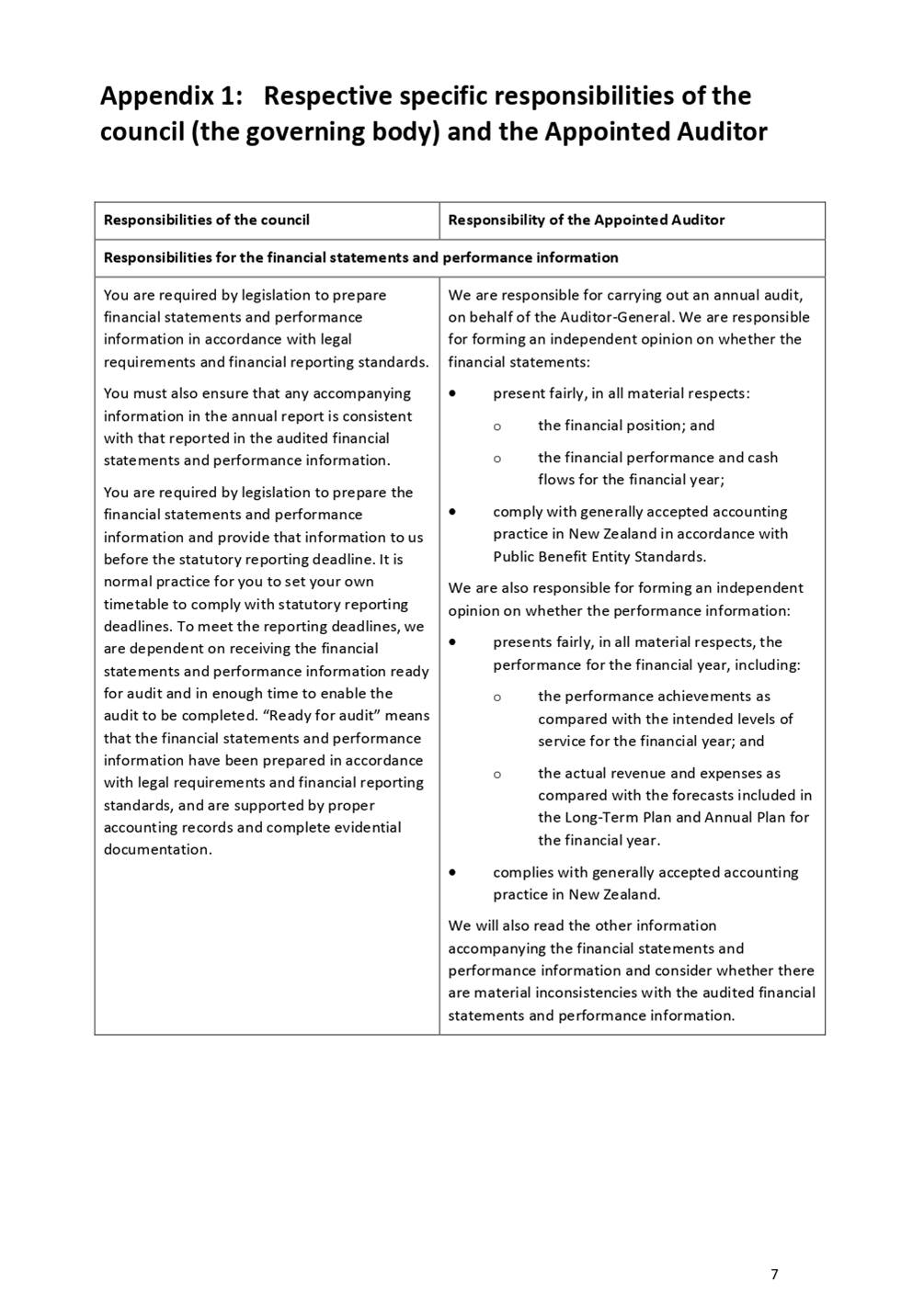

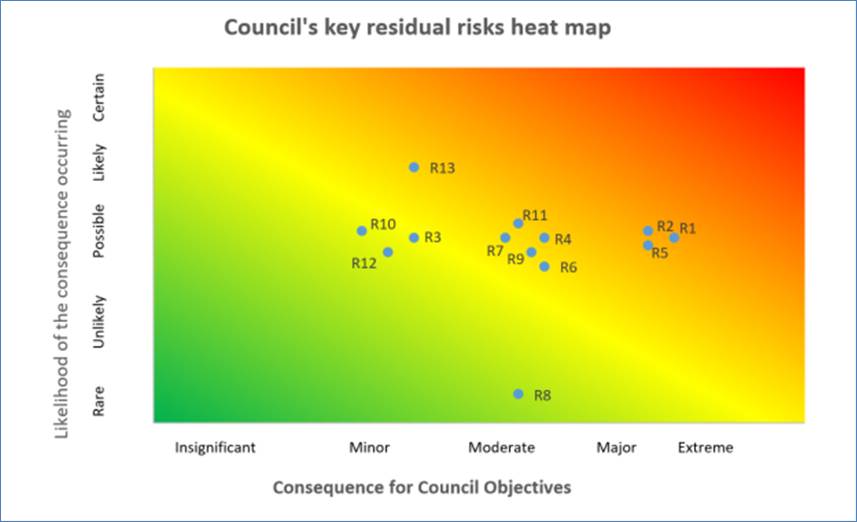

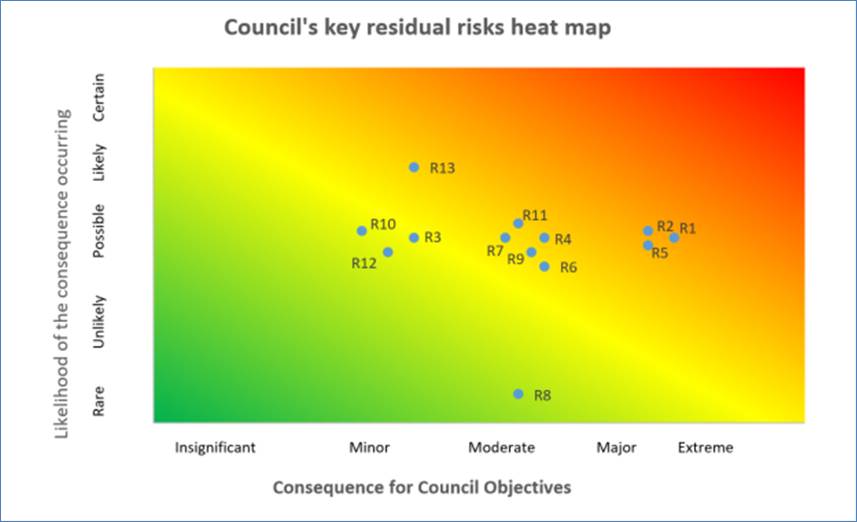

6.2 At the end of quarter four, the

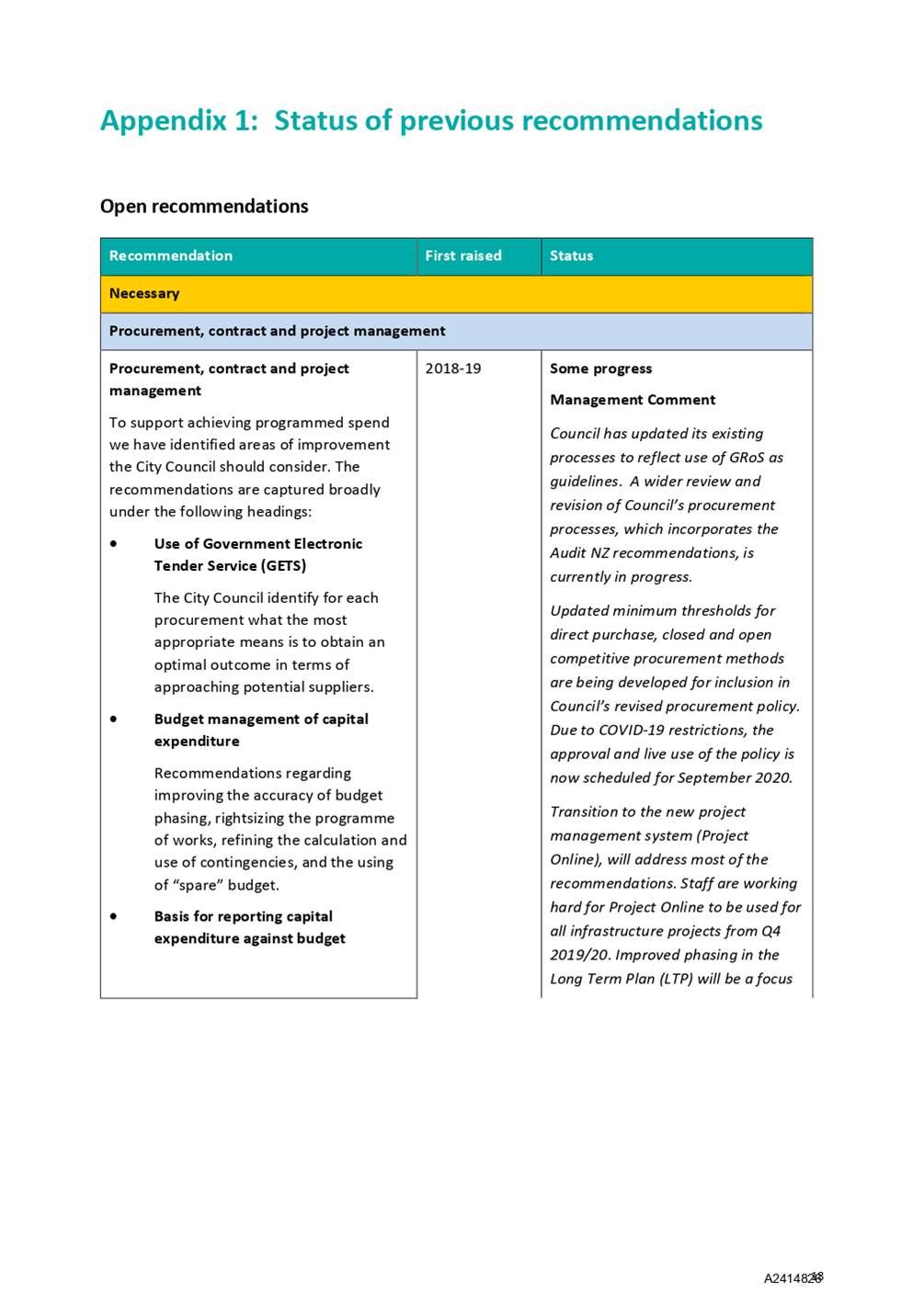

known key risk areas for the four Long Term Plan top priorities, and nine key

organisational risks, are as summarised in the heat map, and table below. Updates are provided below for the nine key organisational

risk areas, with further detail in attachment one.

|

ID

|

Risk Area

|

Rating

|

Owner

|

|

1

|

Council

priority area: Infrastructure

|

High

|

Group

Manager Infrastructure

|

|

2

|

Council

priority area: Environment

|

High

|

Group

Manager Environmental Management

|

|

3

|

Council

priority area: City Centre Development

|

Medium

|

Chief

Executive

|

|

4

|

Council

priority area: Lift Council Performance

|

Medium

|

Chief

Executive

|

|

5

|

Lifeline

service failure from natural hazards and similar events

|

High

|

Group

Manager Infrastructure

|

|

6

|

Illness,

injury or stress from higher hazard work situations

|

Medium

|

Group

Manager Corporate Services

|

|

7

|

Loss

of service performance from ineffective contracts and contract management

|

Medium

|

Chief

Executive

|

|

8

|

Compromise

of Council service delivery from information technology failures

|

Low

|

Group

Manager Corporate Services

|

|

9

|

Compromised

decision making and public information from incomplete and difficult to

access records

|

Medium

|

Group

Manager Strategy and Communications

|

|

10

|

Council

work compromised by loss of and difficulties in replacing skilled staff

|

Medium

|

Manager

People and Capability

|

|

11

|

Legal

liability and reputation loss from inadequate consideration of the law in

decision making

|

Medium

|

Group

Manager Strategy and Communications

|

|

12

|

Loss

of public trust in the organisation

|

Medium

|

Group

Manager Strategy and Communications

|

|

13

|

Disruption

to Council service delivery due to significant increase in COVID-19 cases

|

Medium

|

Chief

Executive

|

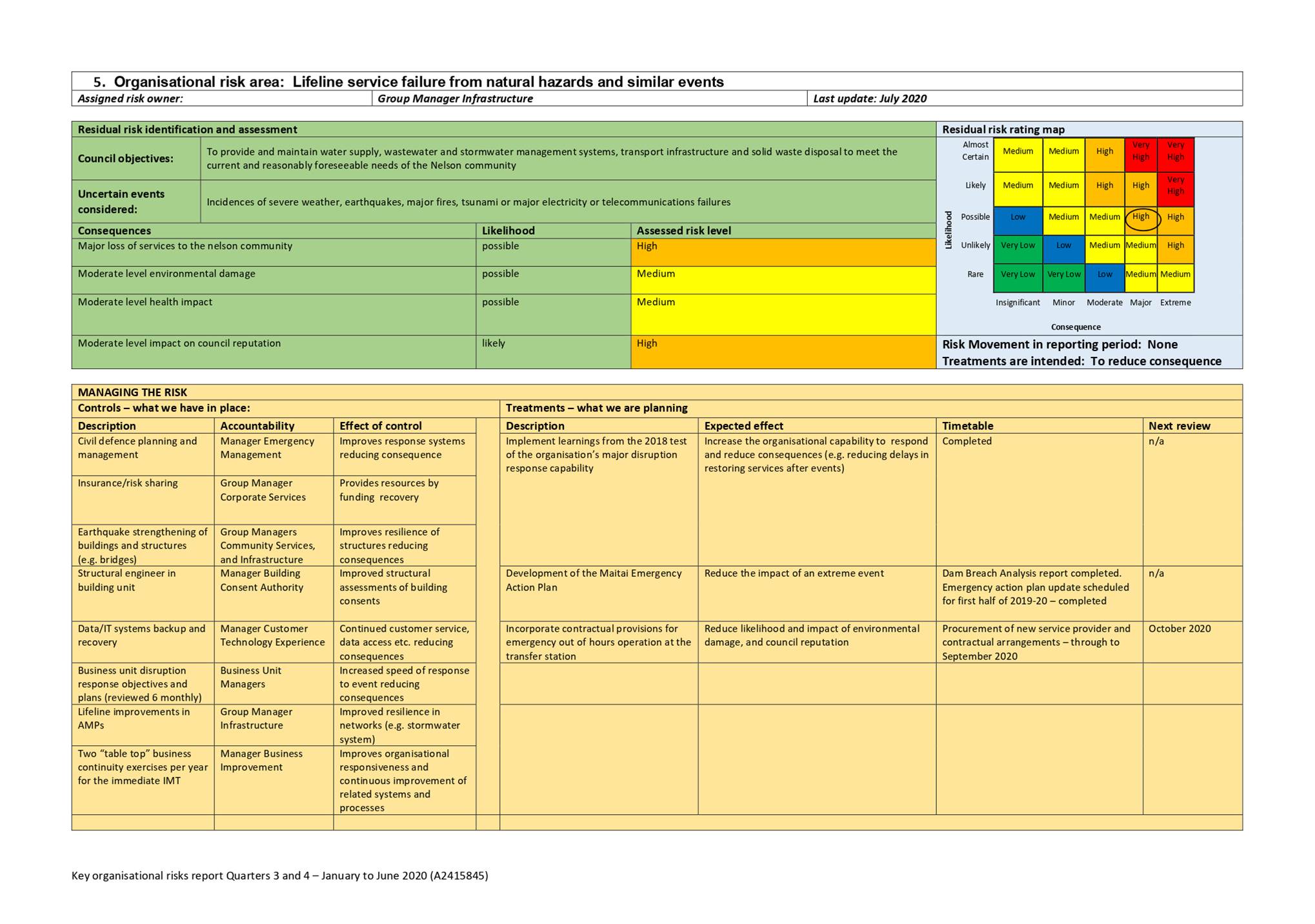

6.3 Lifeline service failure from natural hazards

and similar events (Risk 5). The remaining updates to the Maitai Dam Emergency Action Plan

were completed during quarter four. A new risk treatment is underway, to

ensure Council has the contractual ability to require emergency out of hours

operation of the transfer station. The overall risk profile for this risk

is scheduled for review during quarter one 2020-21, and this review will aim to

resolve areas of overlap with other risks; until then, the risk rating remains at High, with no risk movement to report during

quarters three and four 2019-20.

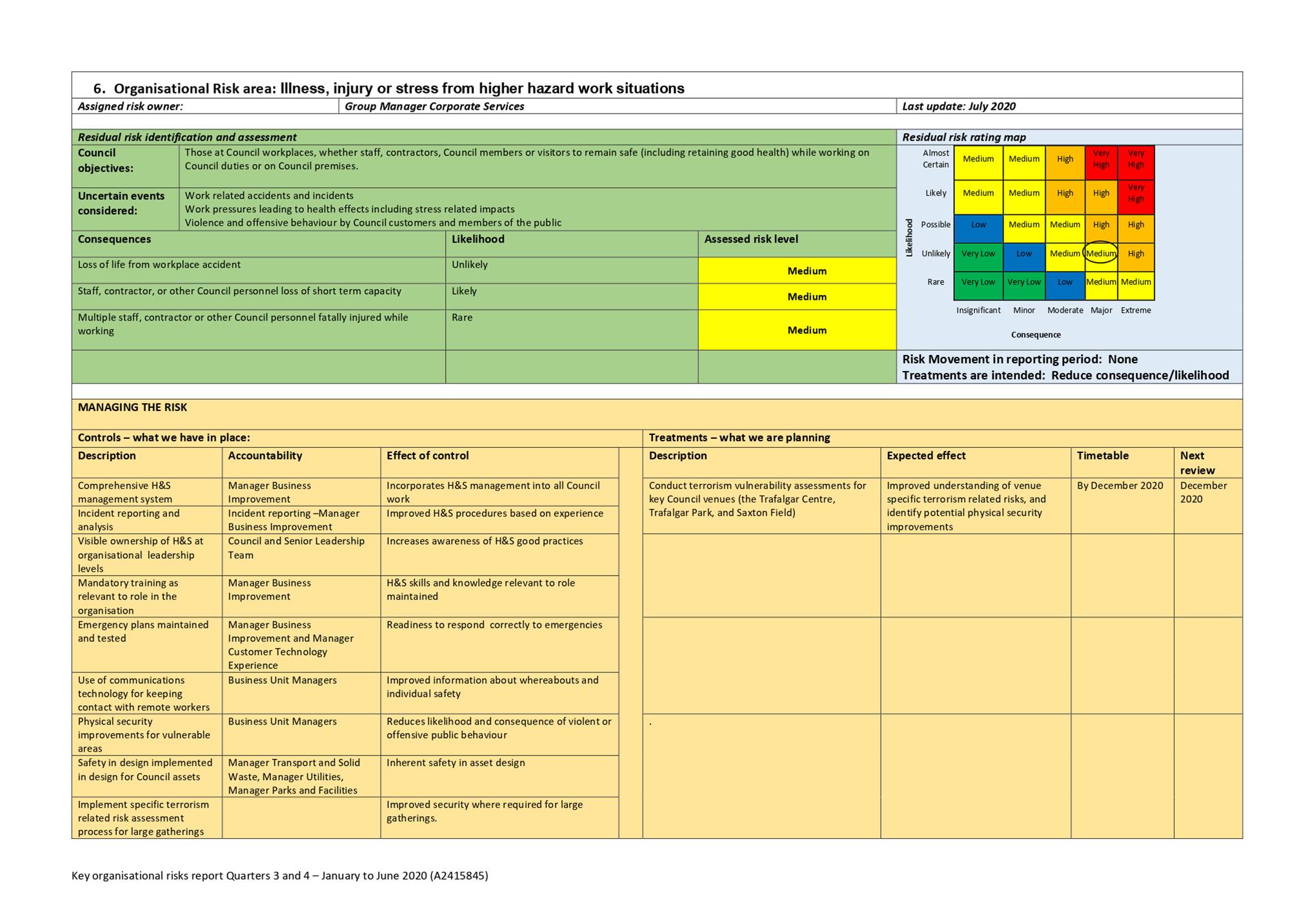

6.4 Illness, injury or stress from higher hazard work

situations (Risk 6). The

health, safety and wellbeing aspects of the recent COVID-19 event which

required prolonged working from home for all staff, has been monitored and

reported by Council’s Health and Safety Advisor throughout the

event. The remaining planned treatment could not be completed due to

COVID-19 alert level restrictions, and the terrorism vulnerability assessments

for key Council venues will now be rescheduled to complete by December

2020. Officers are exploring options to continue providing a level of

driver safety training to all staff who drive for work; this has been an

effective risk mitigation over the last year however there may be a more cost

effective option for delivering this training. There was no risk movement during quarters three and four 2019-20, and so the overall risk rating remains at Medium.

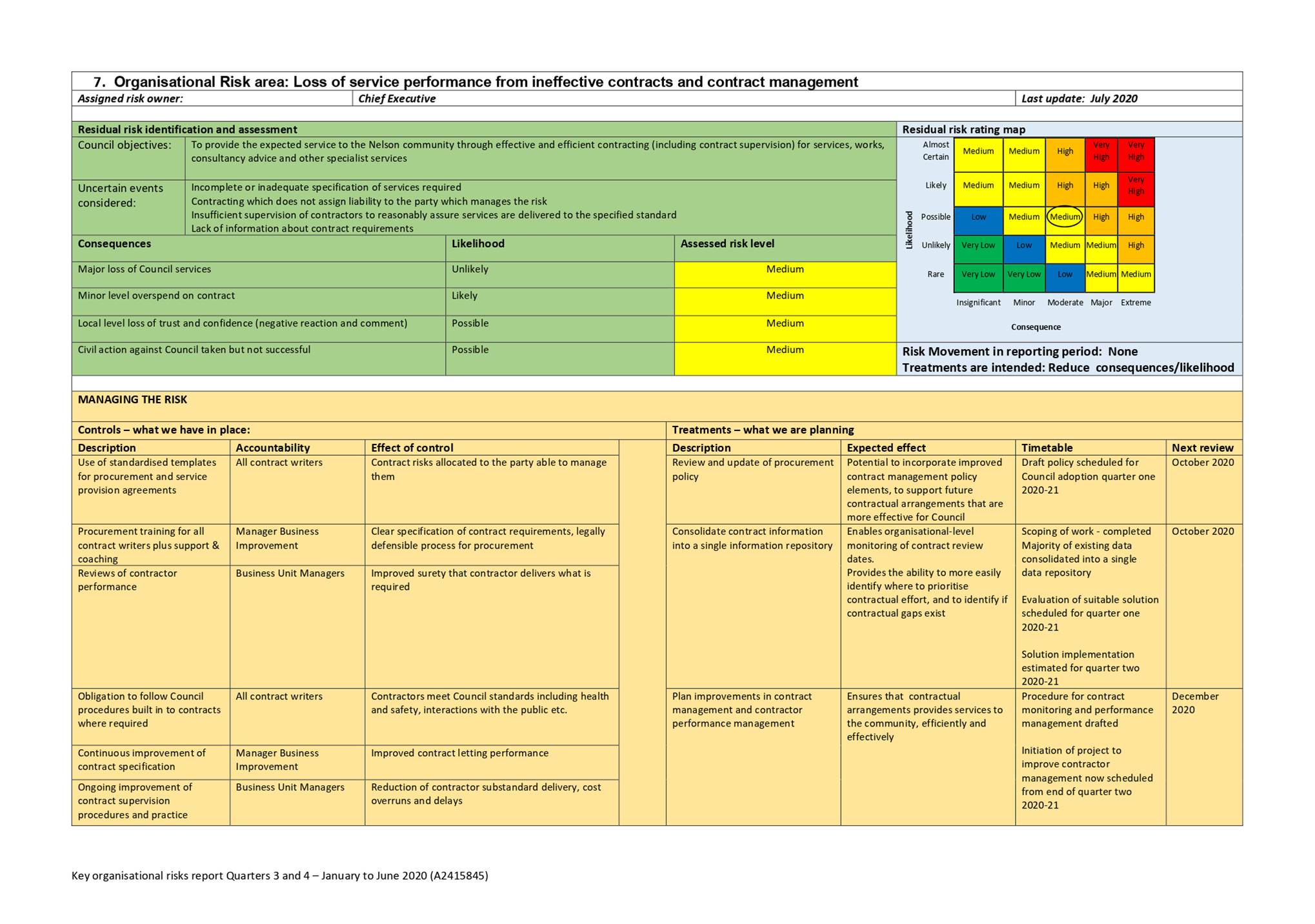

6.5 Loss of service performance from ineffective contracts and

contract management (Risk 7).

Delivery of the work programme in this area has been

impacted by previous staff vacancies, and diverting resources to the COVID-19

response. The contract management system being investigated during

previous quarters was not a feasible solution; alternative solutions are now

being assessed against prioritised requirements. A project to increase

contract management consistency and staff skills will now be initiated during

Q2 2020-21 once implementation of the contract management system is

underway. Additional legal support advising on procurement and contracting

matters is now available to staff. The risk

rating remains at Medium, with no risk movement during quarters three and four

2019-20.

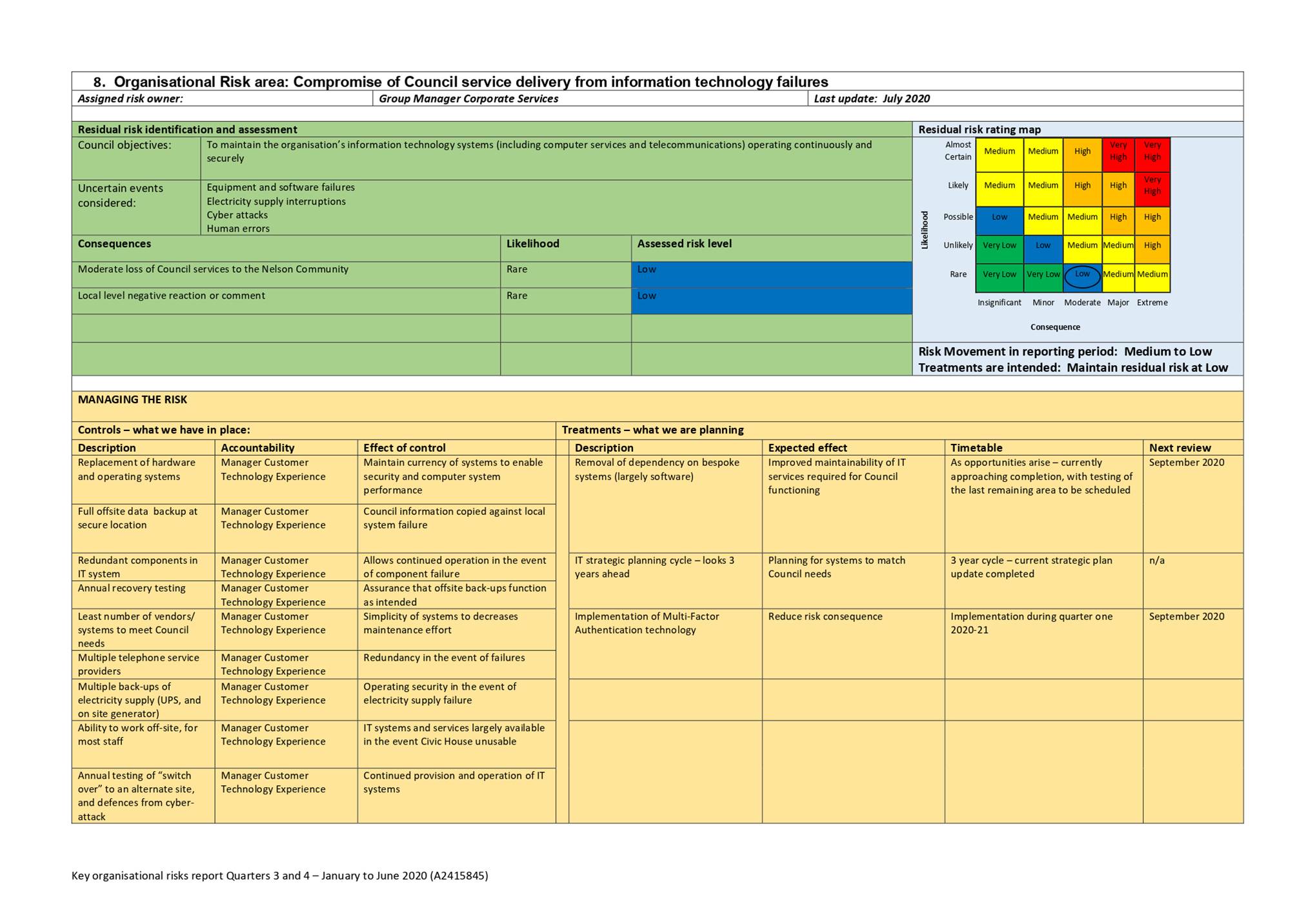

6.6 Compromise of Council service delivery from information

technology failures (Risk 8). Risk controls have been reviewed and are considered to

remain effective. Additional protections to further mitigate

cyber-attacks are being brought forward for implementation. There is a

robust incident management process triggered each time a cyber security

threat arises. The overall residual risk rating remains at Low

and as such, there is no risk movement during quarters

three and four 2019-20.

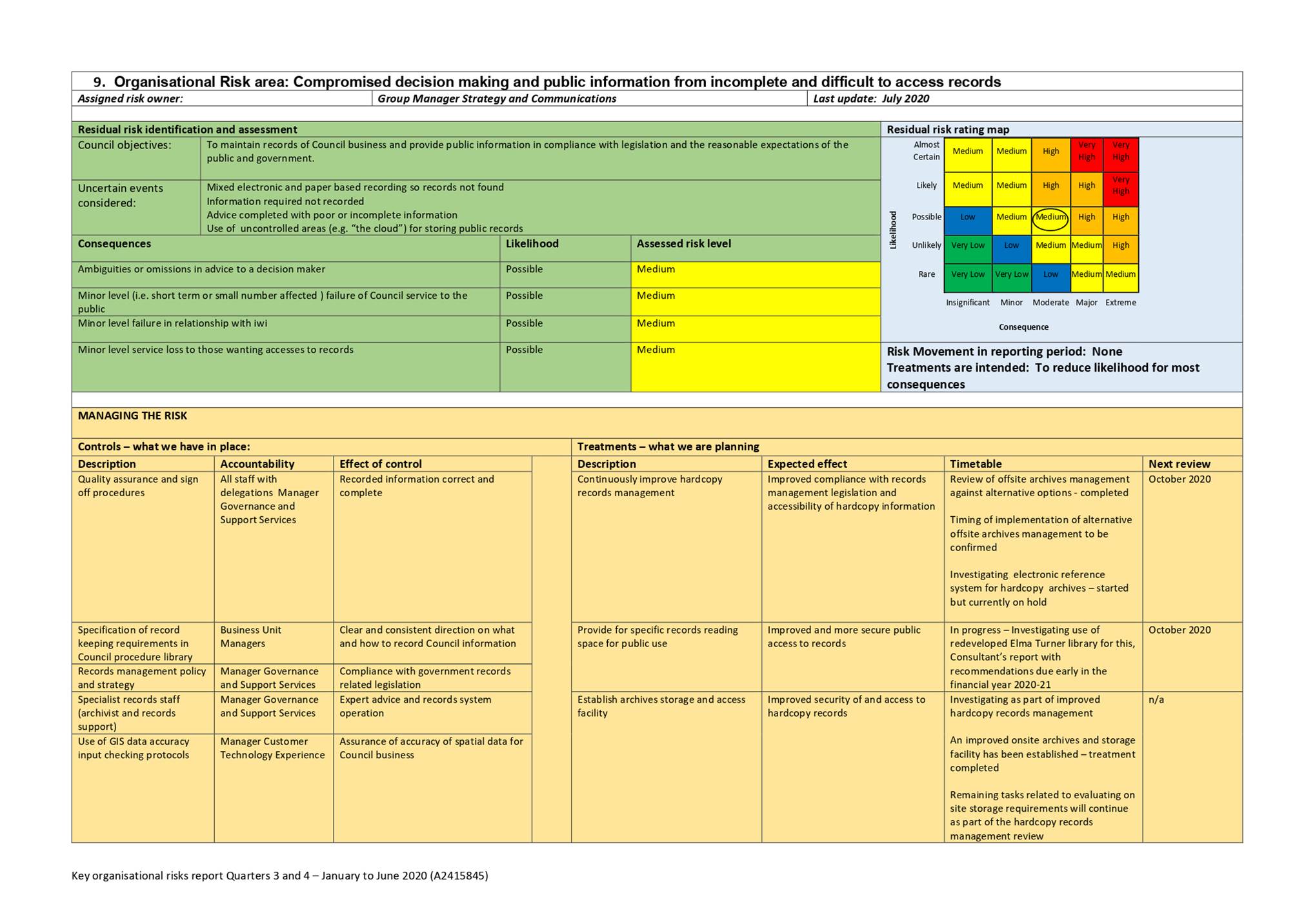

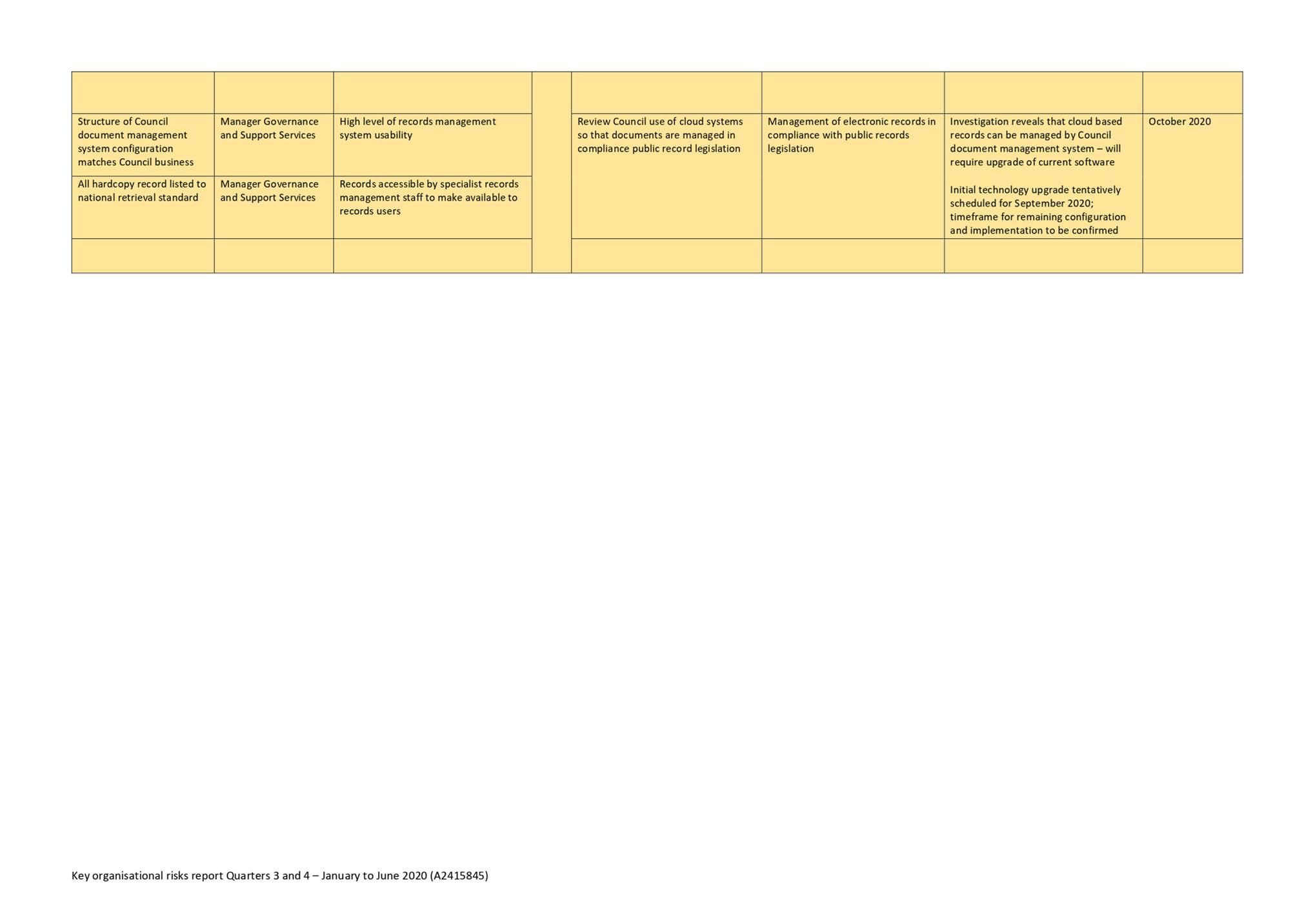

6.7 Compromised decision making and public information from

incomplete and difficult to access records (Risk 9). An “Information Asset Register” has

been drafted to collate information about hardcopy archives in a format which

is structured, and useable for most staff, however the eventual electronic

reference system for hardcopy archives has been put on hold whilst a staff vacancy

is filled, as have some other treatments. A temporary

public reading space has been created in the archive processing area, which provides an improved service and

privacy for customers. Improvements to the security and access to onsite

hardcopy records have been completed, resulting in secure archive rooms,

improved environmental controls, reduced exposure to some hazards and safer

manual handling for staff (space and shelving quality). Plans are

underway to address gaps in records management of information in cloud-based

repositories; the need for improvements in this known area of risk was further

highlighted in a recently completed internal audit. The risk rating

remains at Medium, with no risk movement during

quarters three and four 2019-20.

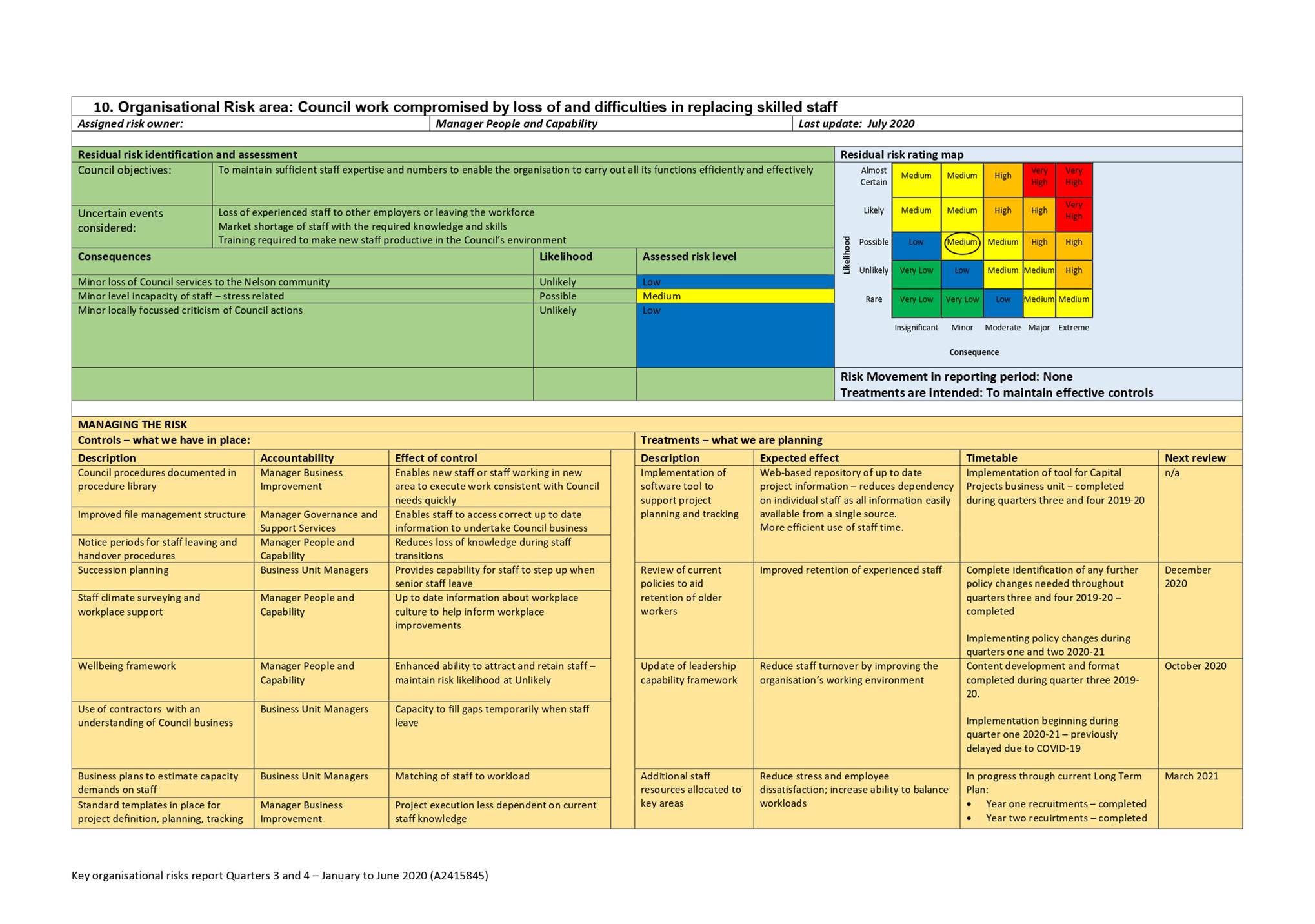

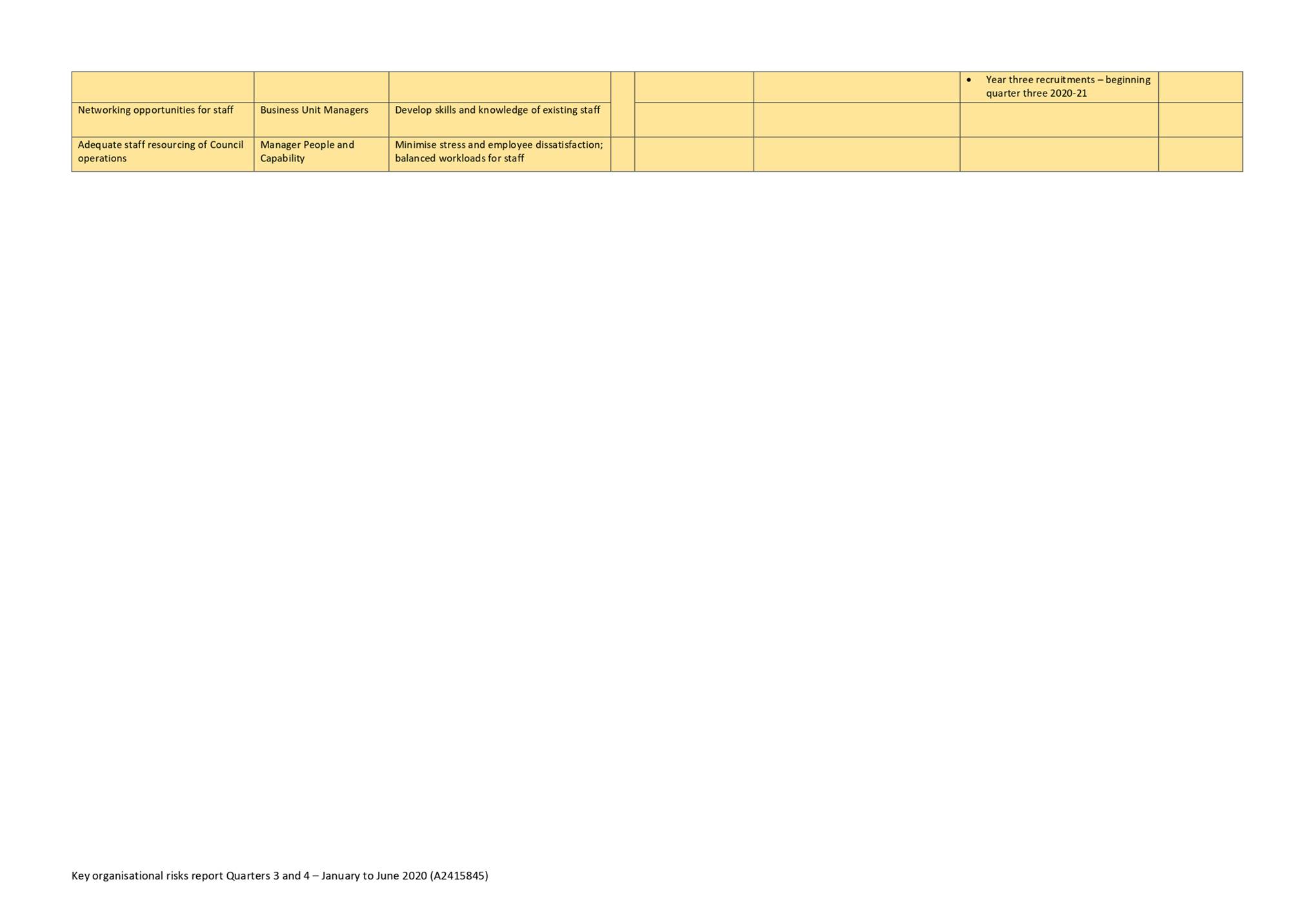

6.8 Council work compromised by loss of and

difficulties in replacing skilled staff (Risk 10). Due to improved processes, technology, and

information accessibility, our ability to replace staff in most roles has

increased. With planned risk treatments either complete or well underway,

the likelihood of some consequences has reduced, and these have been updated in

the detailed risk profile. There are some local pockets within Council

where recruitment and retention of qualified and skilled staff is more

problematic. Whilst the short term impact of COVID-19 is favourable for

Council recruitment, officers think it prudent to maintain the risk management

response in line with a Medium residual risk rating. The risk rating

therefore remains at Medium, with no risk movement

during quarters three and four 2019-20.

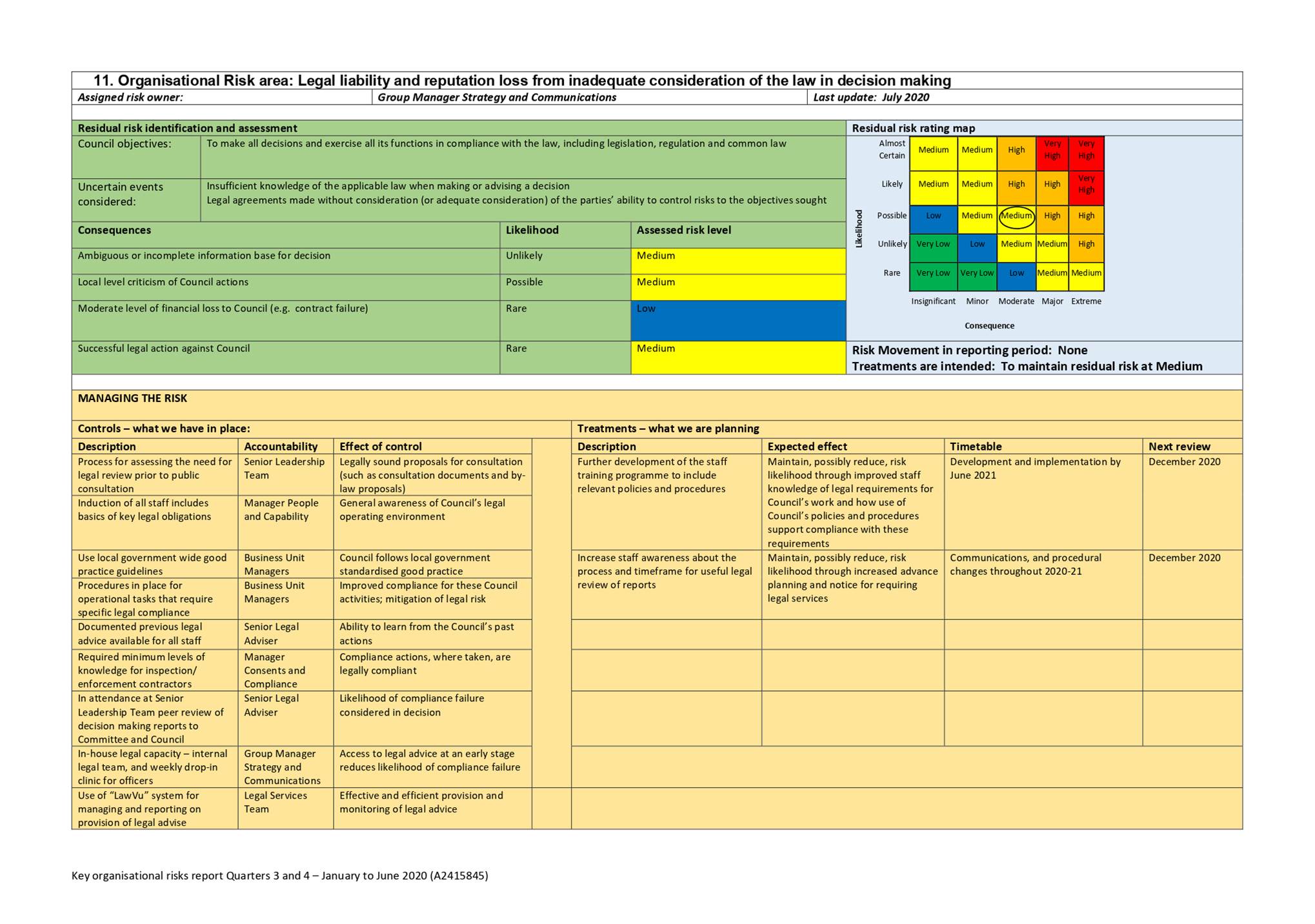

6.9 Legal liability and reputation loss from

inadequate consideration of the law in decision making (Risk 11). At the end of quarter two, the

“LawVu” tool was being used by the internal Legal Services

team. The planned implementation to other key officers, and the external

legal services panel, has been completed during quarter three. The

development of a structured training programme for staff, to ensure more

awareness and knowledge across the organisation on local government specific

legal requirements, has also been completed as planned, during quarter

four. This training programme will be further developed to include

content on relevant policies and procedures. A Legal Adviser has joined

the team part-time to strengthen the Legal Services team’s provision of

legal advice on procurement and contractual matters. The risk rating remains at Medium, with no risk movement during

quarters three and four 2019-20. The risk owner remains satisfied that the residual risk is

at a tolerable level.

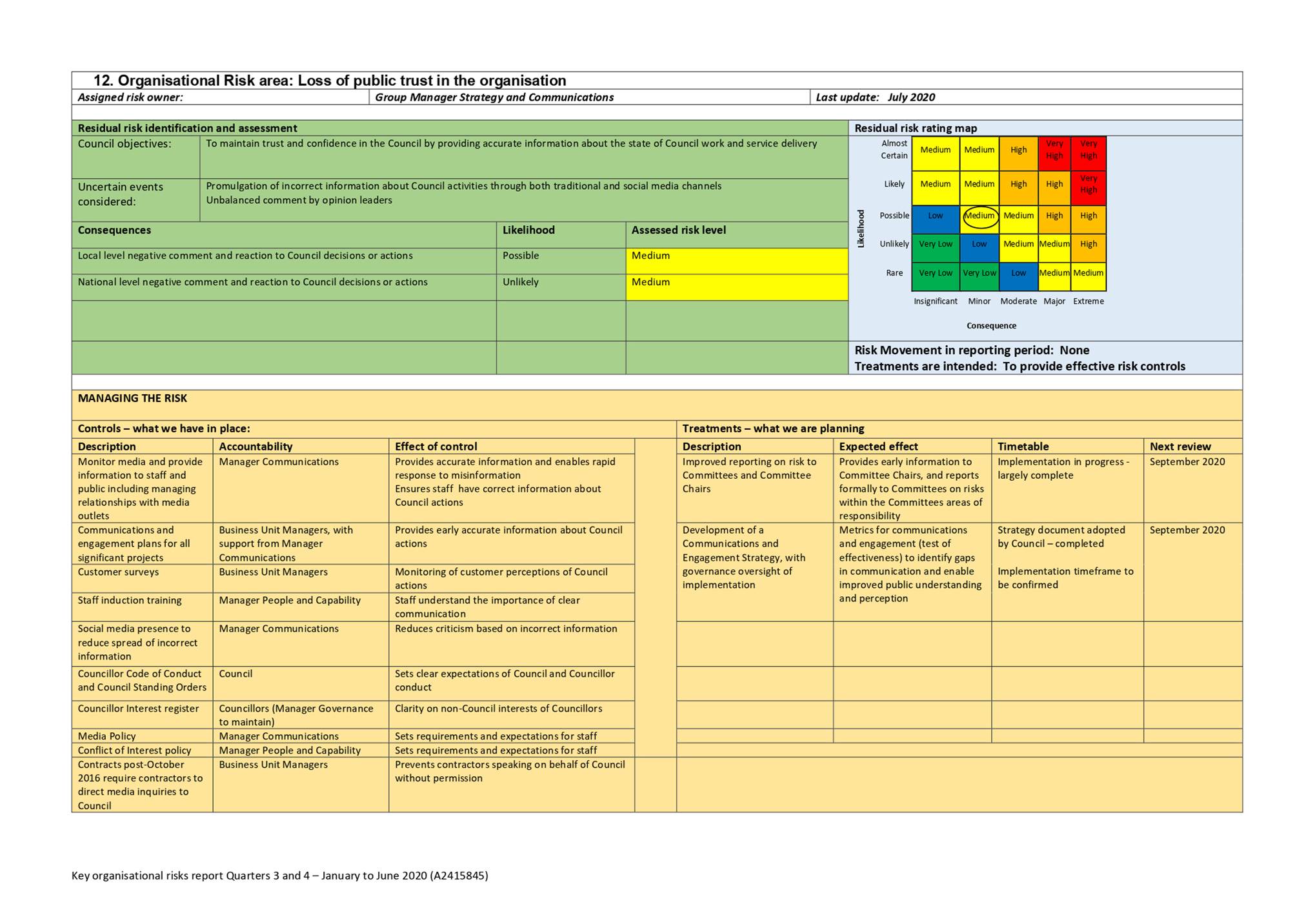

6.10 Loss

of public trust in the organisation (Risk 12). As previously reported, whilst it is unlikely that

further reduction in the residual risk rating can be achieved, the risk owner

is satisfied that the risk is at a tolerable level, considering the level of

effective controls that are in place. The risk

rating remains at Medium, with no risk movement during quarters three and four

2019-20.

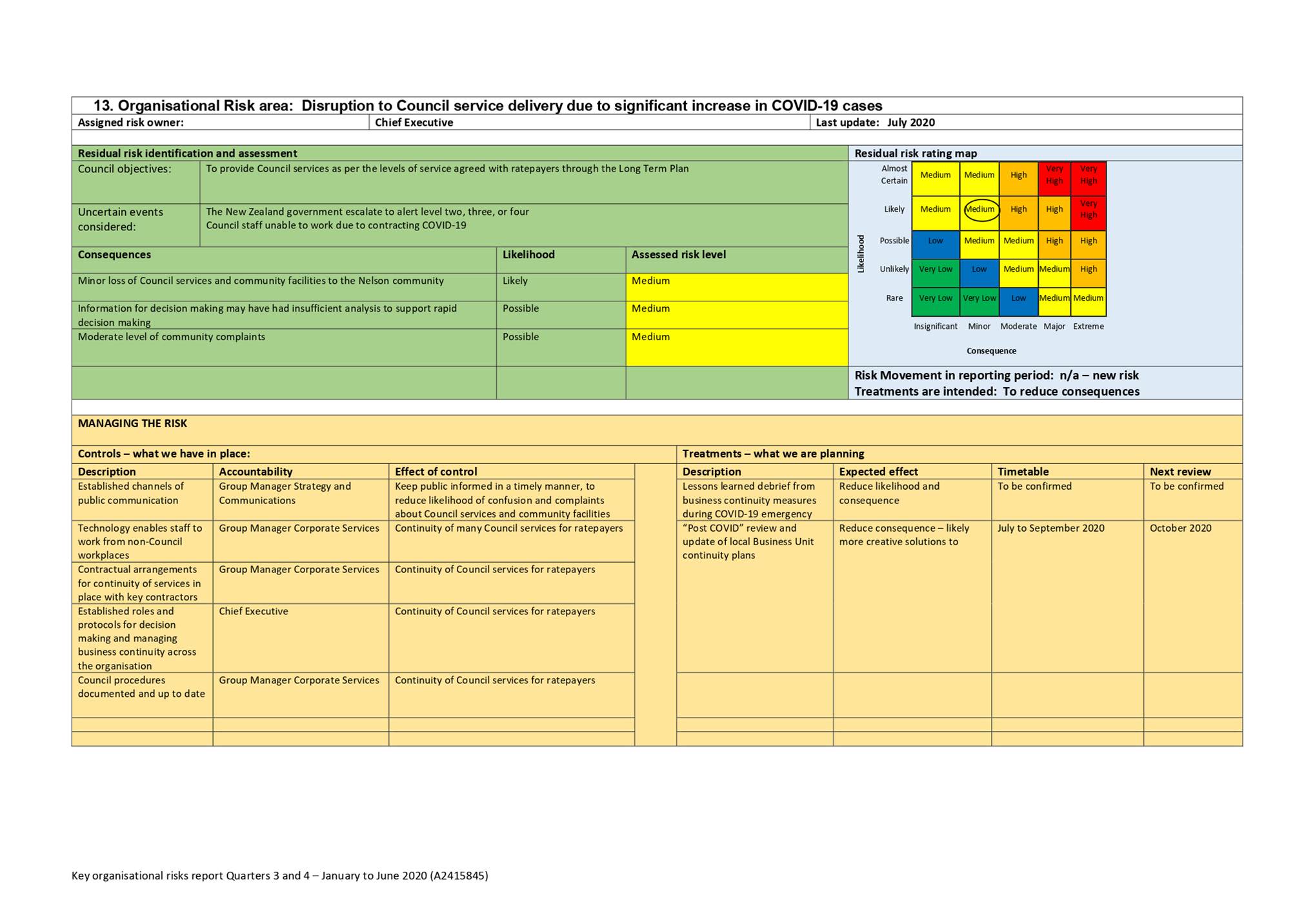

6.11 Disruption to Council service delivery due

to significant increase in COVID-19 cases (Risk 13). This is a new

risk that will remain in place for the foreseeable future, and relates to the

impact on delivery of Council services. Whilst the impact to the

provision of critical core services such as water and wastewater is considered

insignificant, the recent COVID-19 restrictions have shown that there would be

a moderate impact on Council’s ability to provide community

facilities.

7. Risk Areas for Each Group

7.1 Infrastructure Group:

COVID-19 implications for Infrastructure are being reported to each

meeting of the Infrastructure Committee - services are now operating as usual,

and officers continue to resolve the remaining time and financial impacts on

project delivery. The suspension of construction work during alert levels

four and three has created additional pressure on project delivery and local

contractors; a streamlined procurement approach has been implemented to help

mitigate the impact on project timeframes, however the impact on market pricing

for new work is unknown. This streamlined procurement approach will

remain in place through to the end of June 2021.

7.2 Community Services Group:

No new emerging risks to report at this time.

7.3 Environmental Management Group:

Council has requested that the Audit and Risk Subcommittee has oversight of

risks related to the Nelson Plan - the key risk being managed is a financial

risk. A Governance Liaison Group comprising Mayor Reese, Cllr McGurk and

Cllr Fulton is in place. Quarterly project level reporting to the

Environment Committee is being established, and is expected to be in place by

December 2020.

7.4 Strategy and Communications

Group: No new emerging risks to report at this time.

7.5 Corporate Services Group:

No new emerging risks to report at this time.

Author: Arlene

Akhlaq, Manager Business Improvement

Attachments

Attachment 1: A2415845

- Key organisational risks report Quarters 3 and 4 - January to June 2020 ⇩

Item 11: Key Organisational Risks Report - 01 January to 30 June

2020: Attachment 1

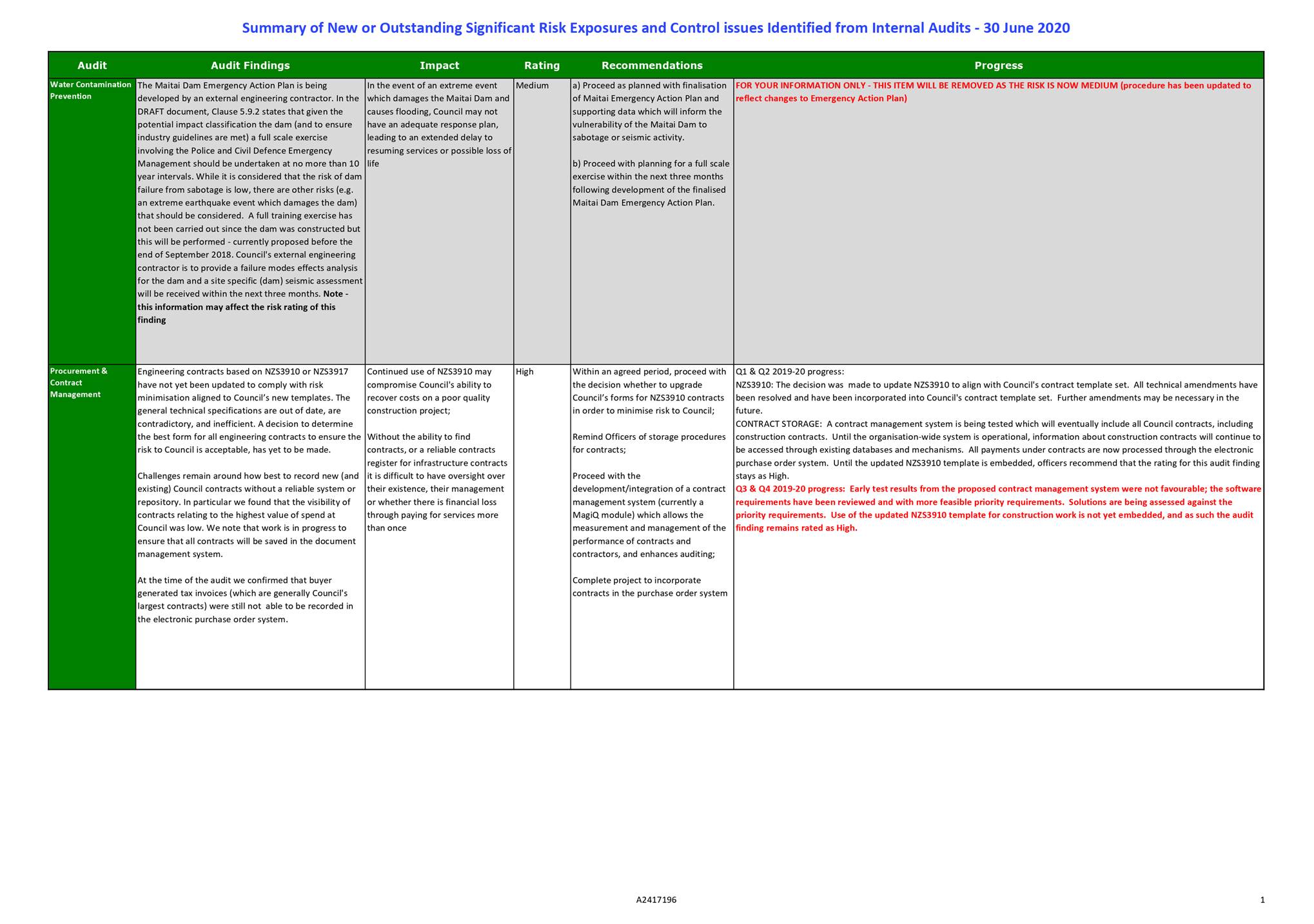

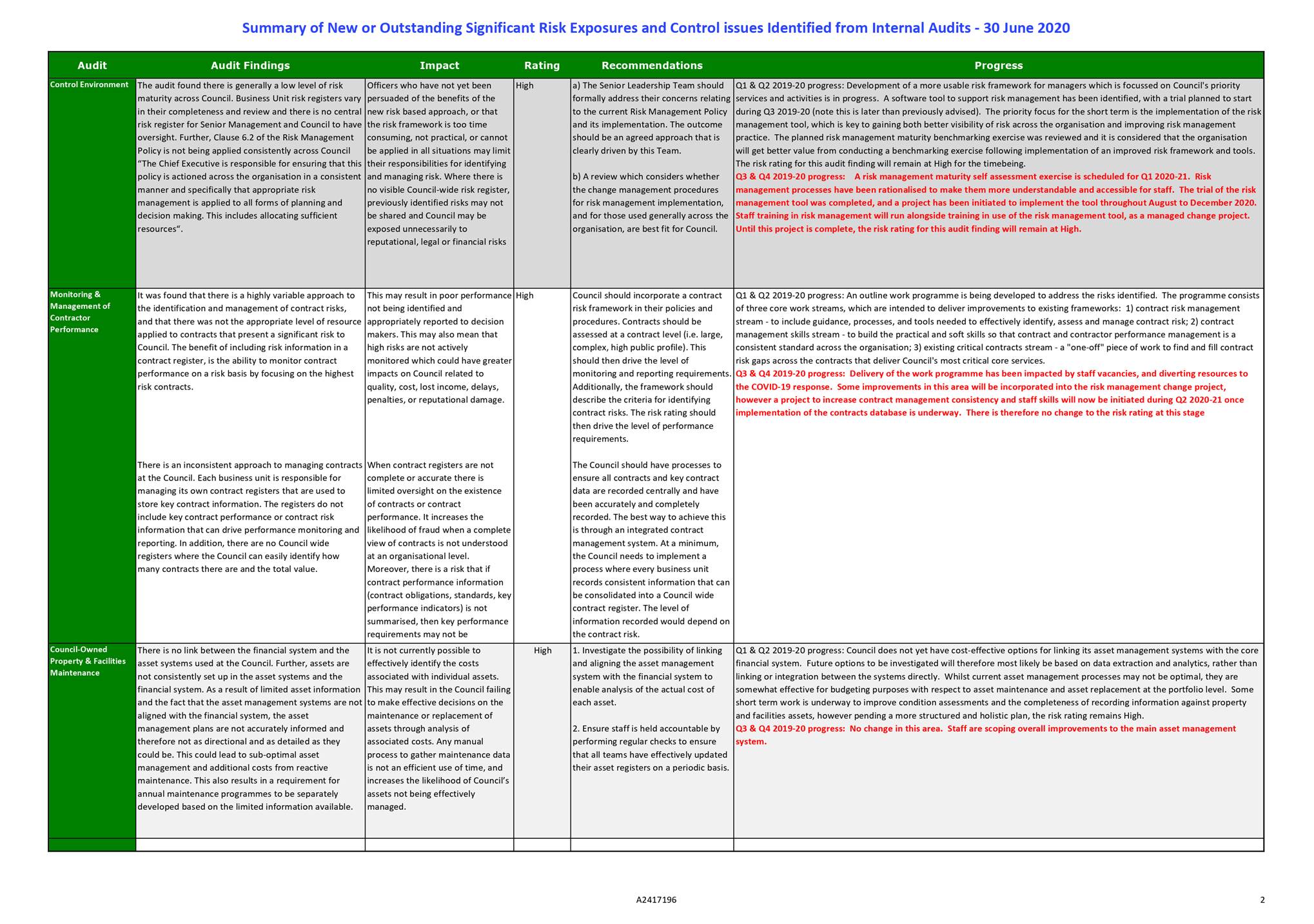

Item 12: New and

Outstanding Significant Risk Exposures and Control Issues Identified from

Internal Audits - 30 June 2020

|

|

Audit and Risk Subcommittee

11 August 2020

|

REPORT R14818

New

and Outstanding Significant Risk Exposures and Control Issues Identified from

Internal Audits - 30 June 2020

1. Purpose

of Report

1.1 To

update the Subcommittee on new or outstanding risk exposures following internal

audits included in the Internal Audit Plan to 30 June 2020.

2. Recommendation

|

That the Audit and Risk Subcommittee

1. Receives

the report New and Outstanding Significant Risk Exposures and Control Issues

Identified from Internal Audits - 30 June 2020 (R14818) and its attachment (A2417196).

|

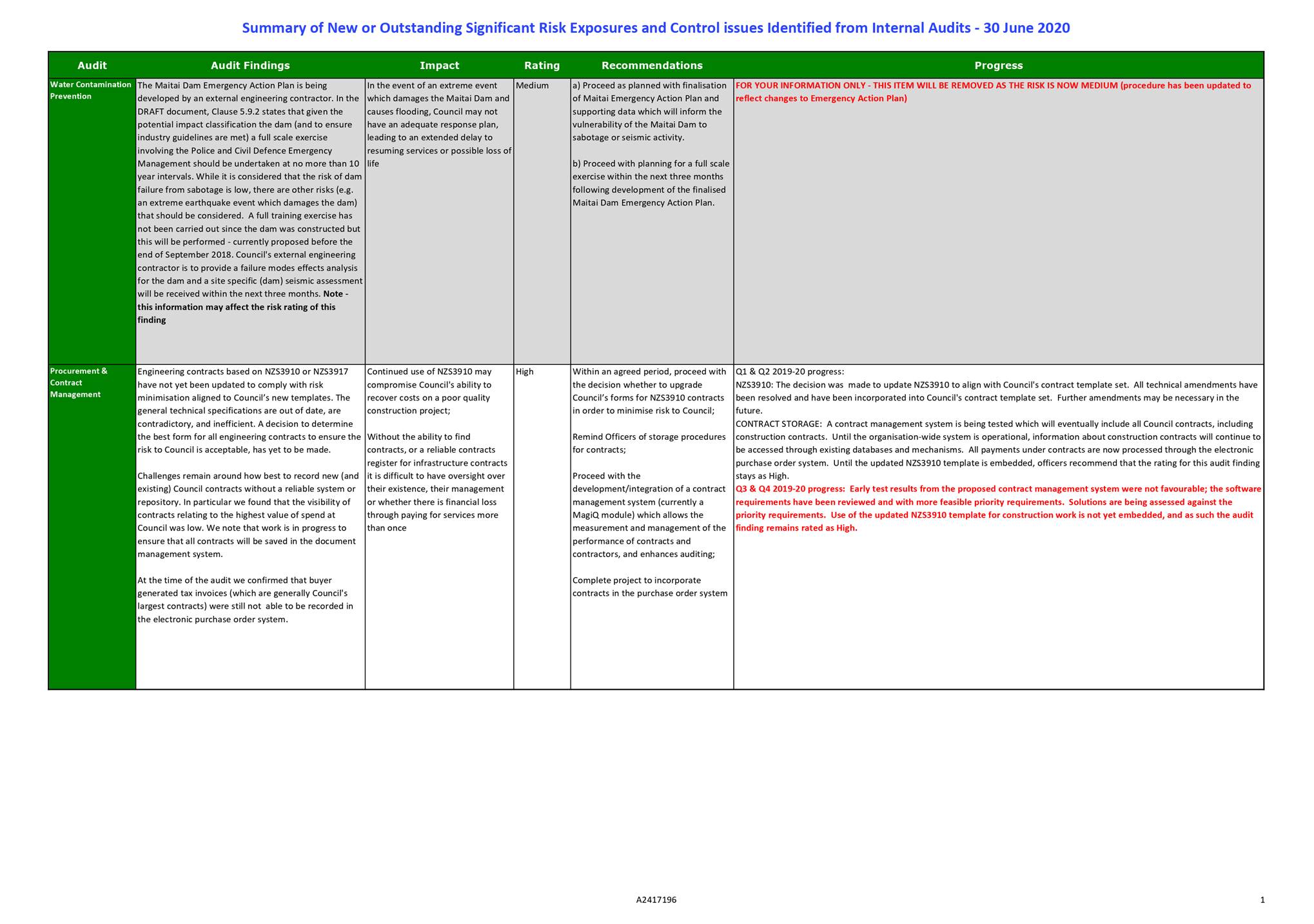

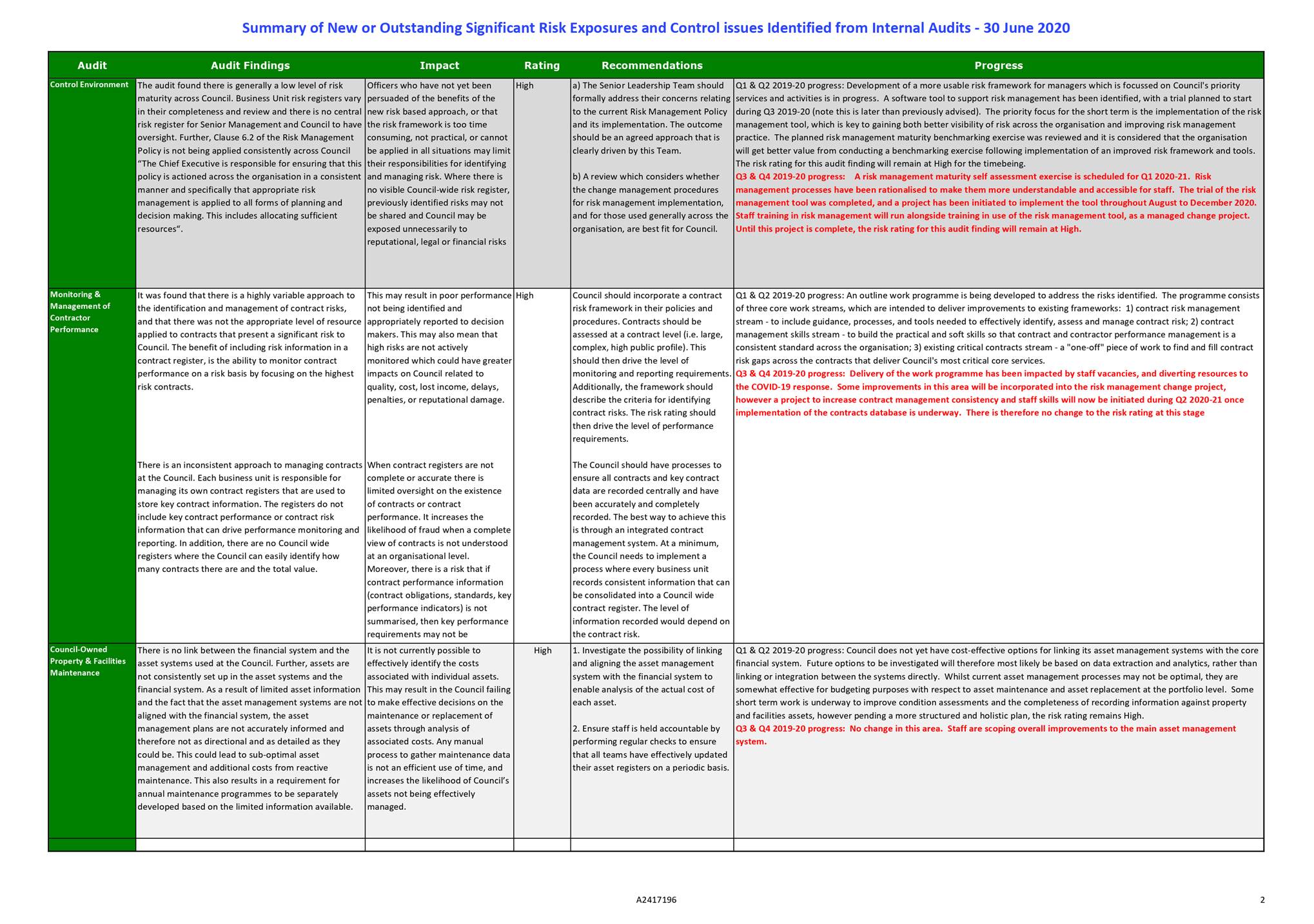

2. Background and Discussion

2.1 Under

section 9.1 of the Internal Audit Charter, the Audit and Risk Subcommittee and

the Governance and Finance Committee are to be informed of internal audit

results where appropriate.

2.2 Under

section 9.4, the Audit and Risk Subcommittee requires a periodic update of any

significant risk exposures and control issues identified from internal audits

completed.

2.3 This

report covers the six month period from 1 January 2020 to 30 June 2020, rather

than just for the latest quarter, as the report for the quarter to 31 March

2020 was not presented to the Subcommittee meeting held on 21 May 2020 due to

the impact of COVID-19.

2.4 The

attachment (A2417196), New and Outstanding Significant Risk Exposures and

Control Issues Identified from Internal Audits, shows five high risks

outstanding from the previous report presented to the Audit, and Risk

Subcommittee meeting of 18 February 2020. Of these, one has been removed as the

risk is no longer considered high.

2.5 There

are no new high risks from internal audits to report.

2.6 Details

of progress in Quarter 3 & 4 are shown in red for each action included in the 18 February 2020

report.

2.7 As

noted in the Internal Audit Quarterly Report, progress on addressing some of

the high risks identified in the previous report has been somewhat slowed by

staff vacancies and the impact of COVID-19, which saw some key staff reassigned

to the COVID-19 response.

Author: Lynn

Anderson, Internal Audit Analyst

Attachments

Attachment 1: A2417196 - New and

Outstanding Significant Risks and Control Issues Identified from Internal

Audits ⇩

Item 12: New and Outstanding Significant Risk Exposures and Control

Issues Identified from Internal Audits - 30 June 2020: Attachment 1

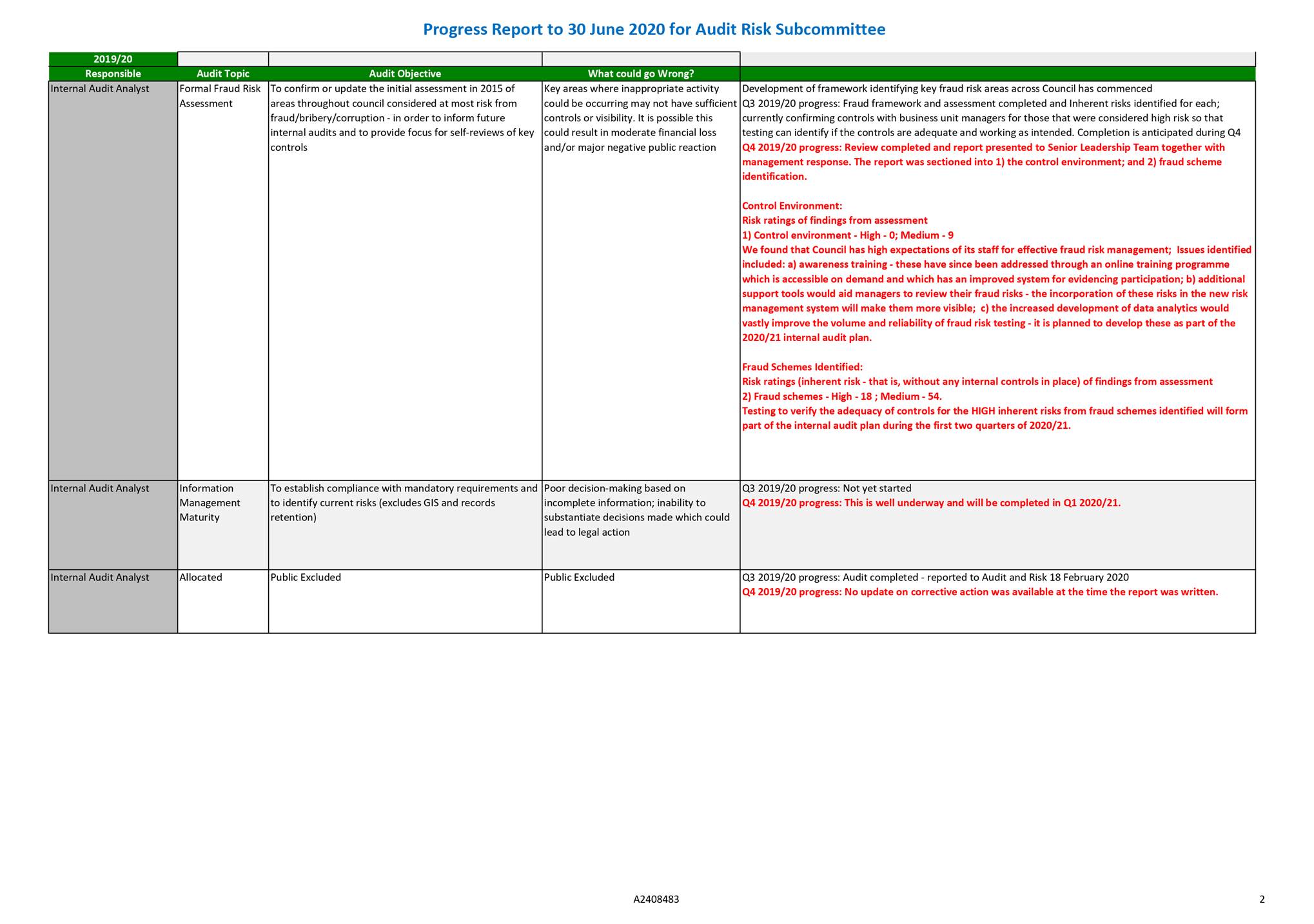

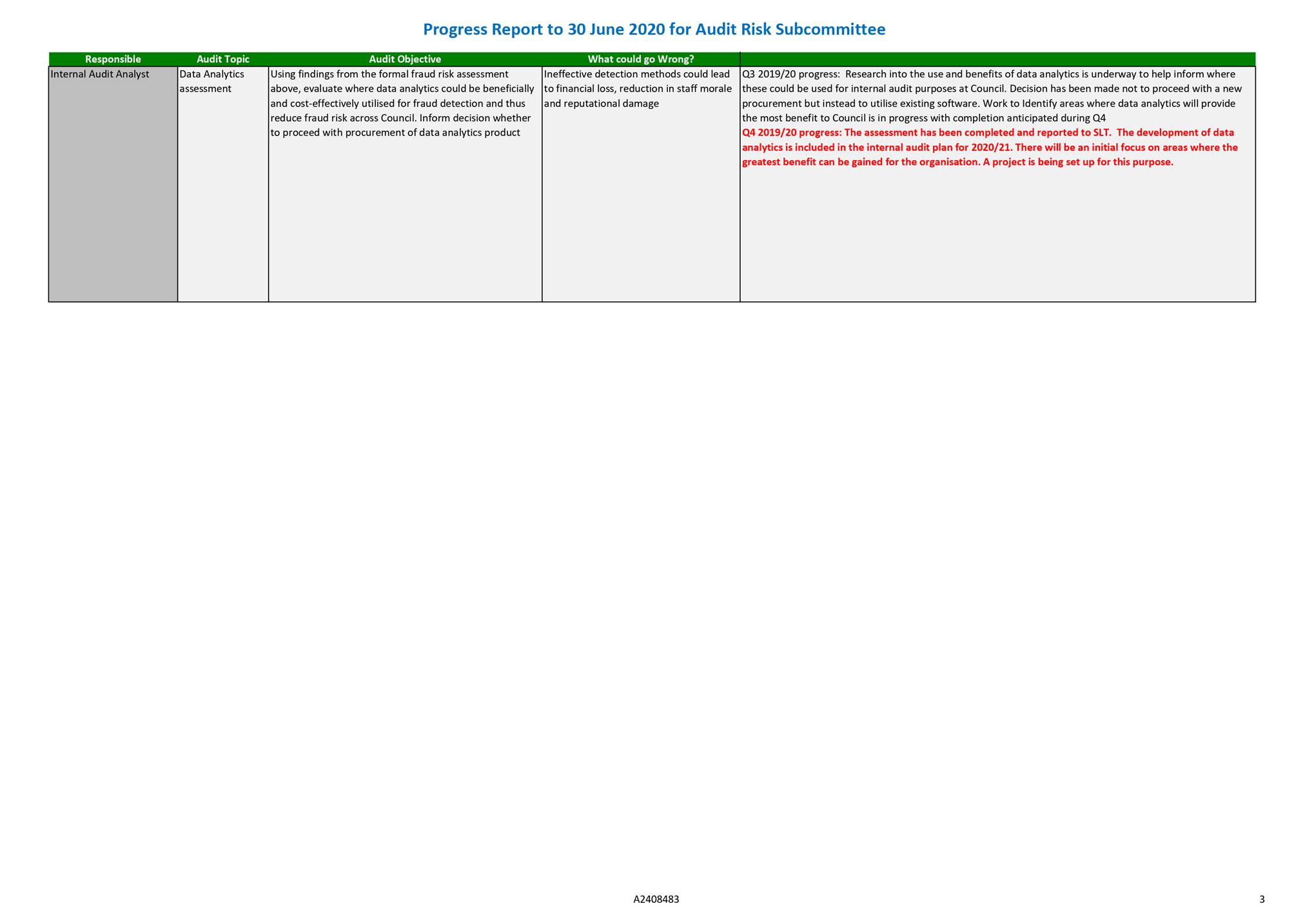

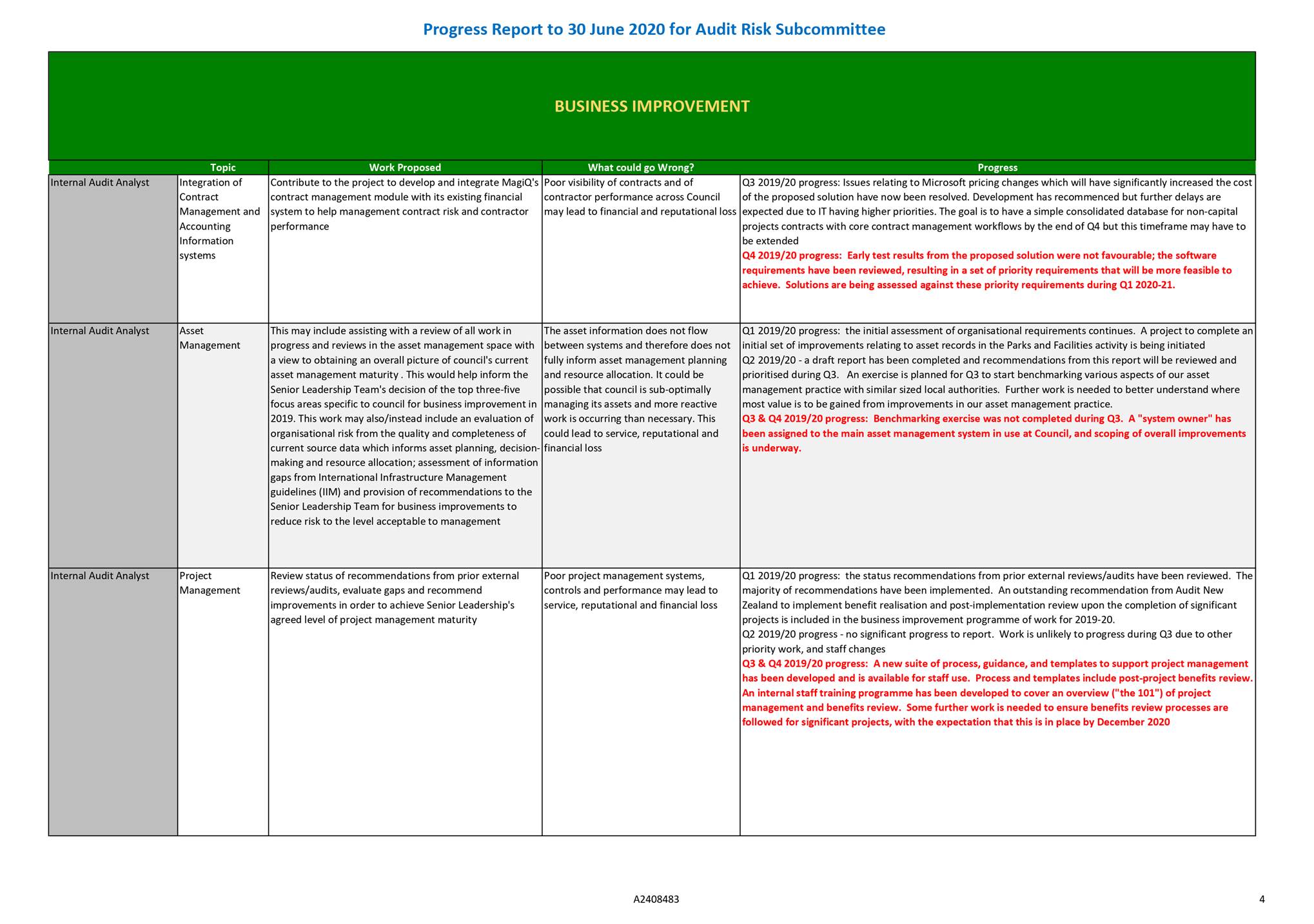

Item 13: Internal Audit

- Quarterly Progress Report to 30 June 2020

|

|

Audit and Risk Subcommittee

11 August 2020

|

REPORT R18111

Internal

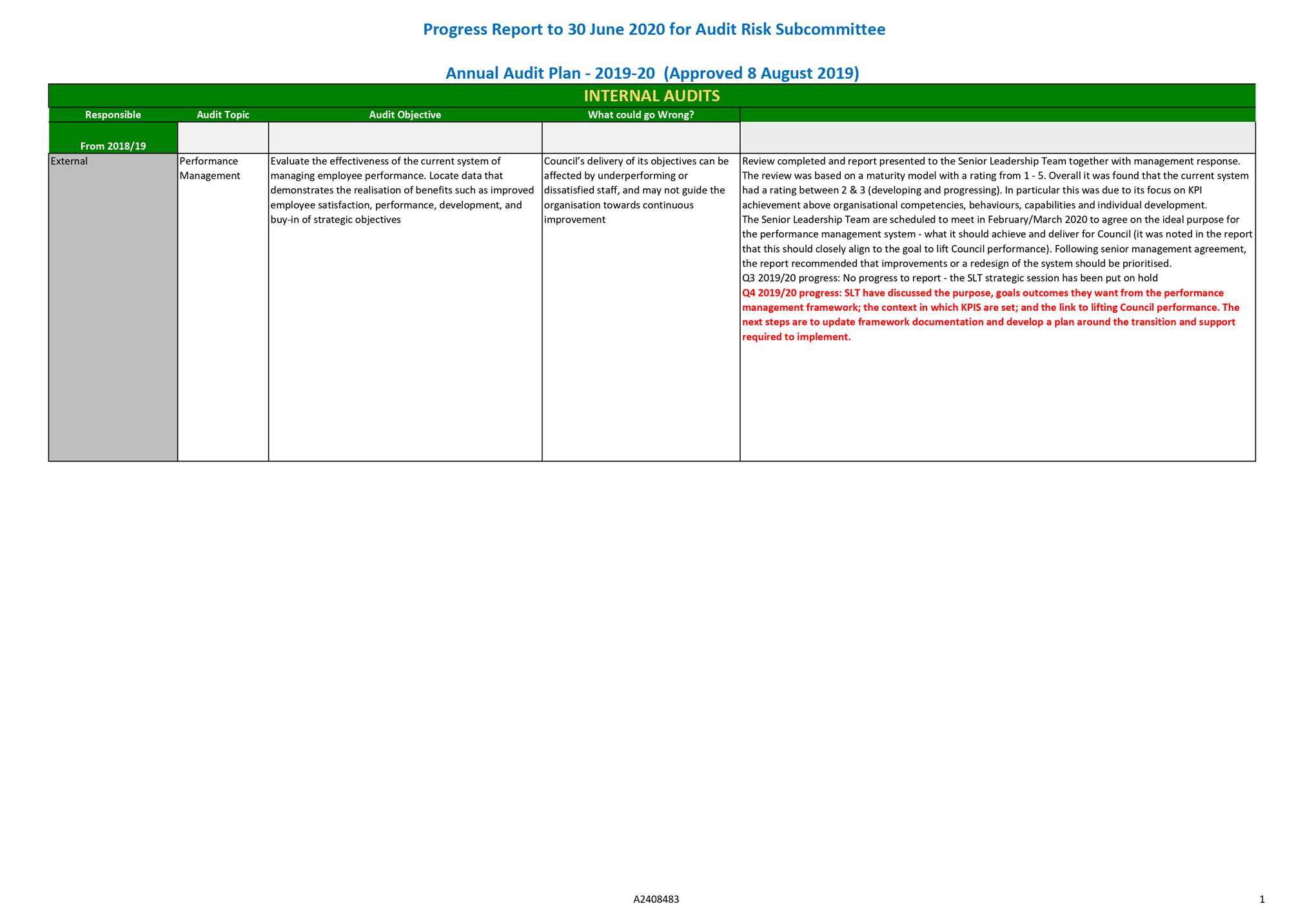

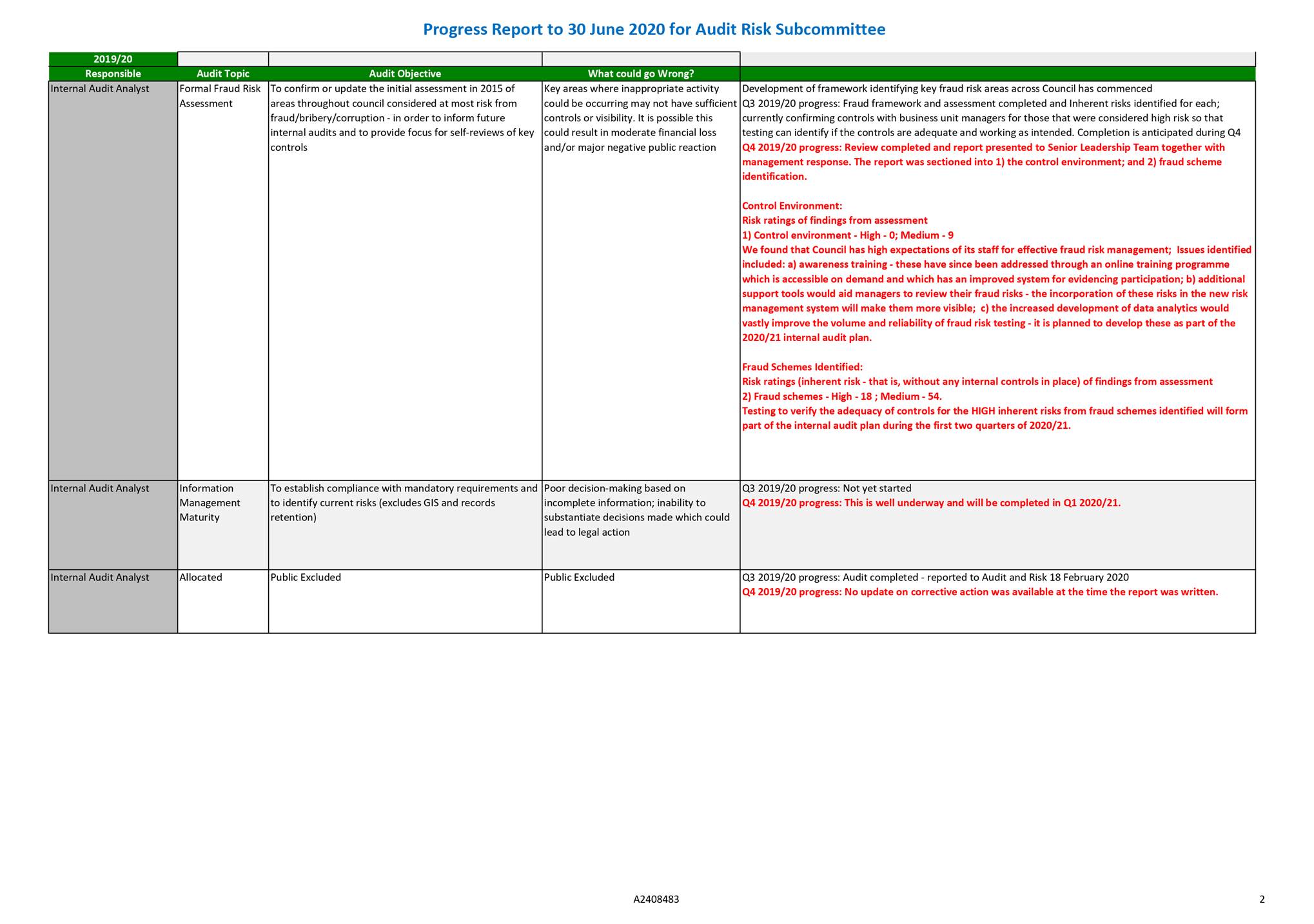

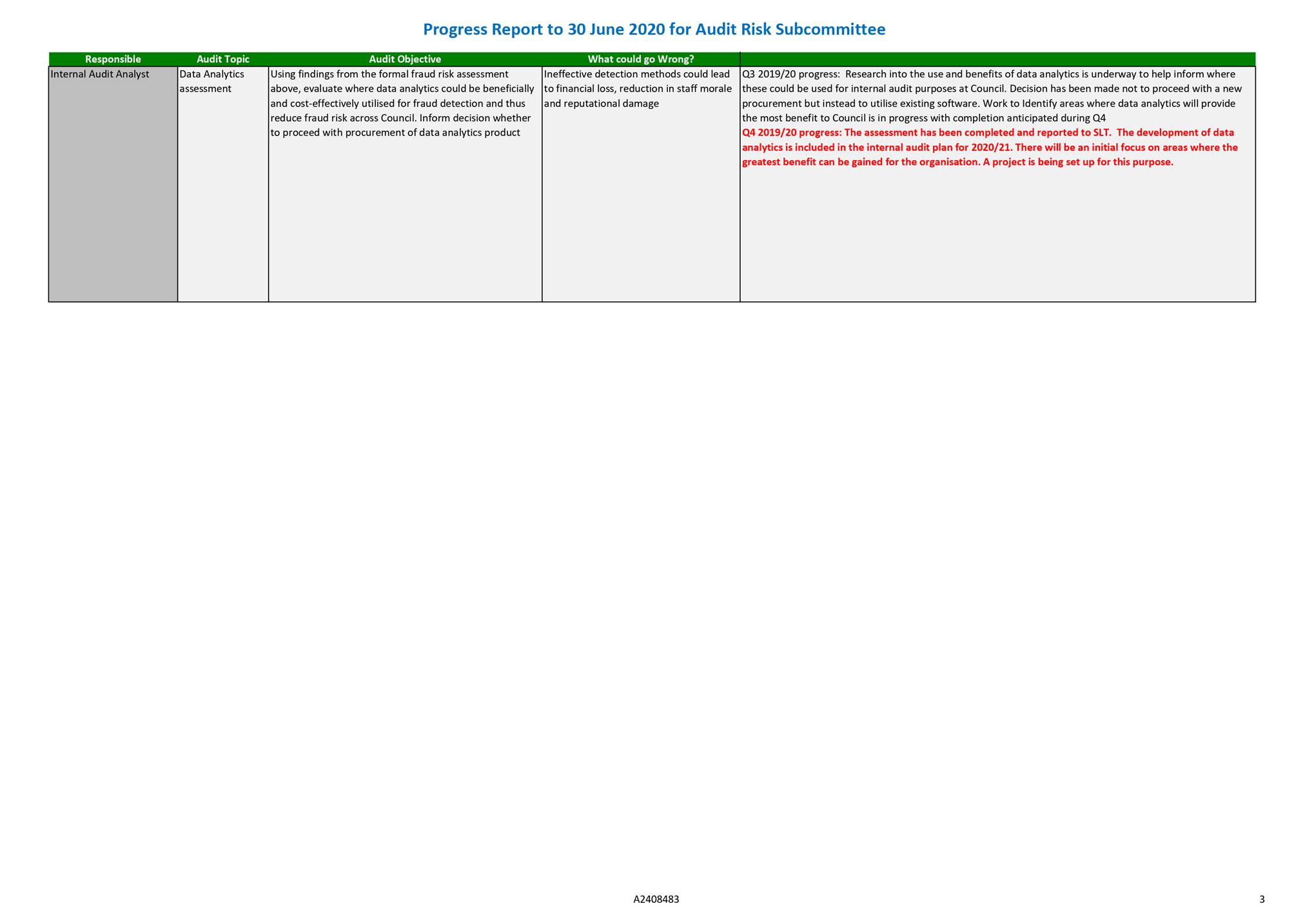

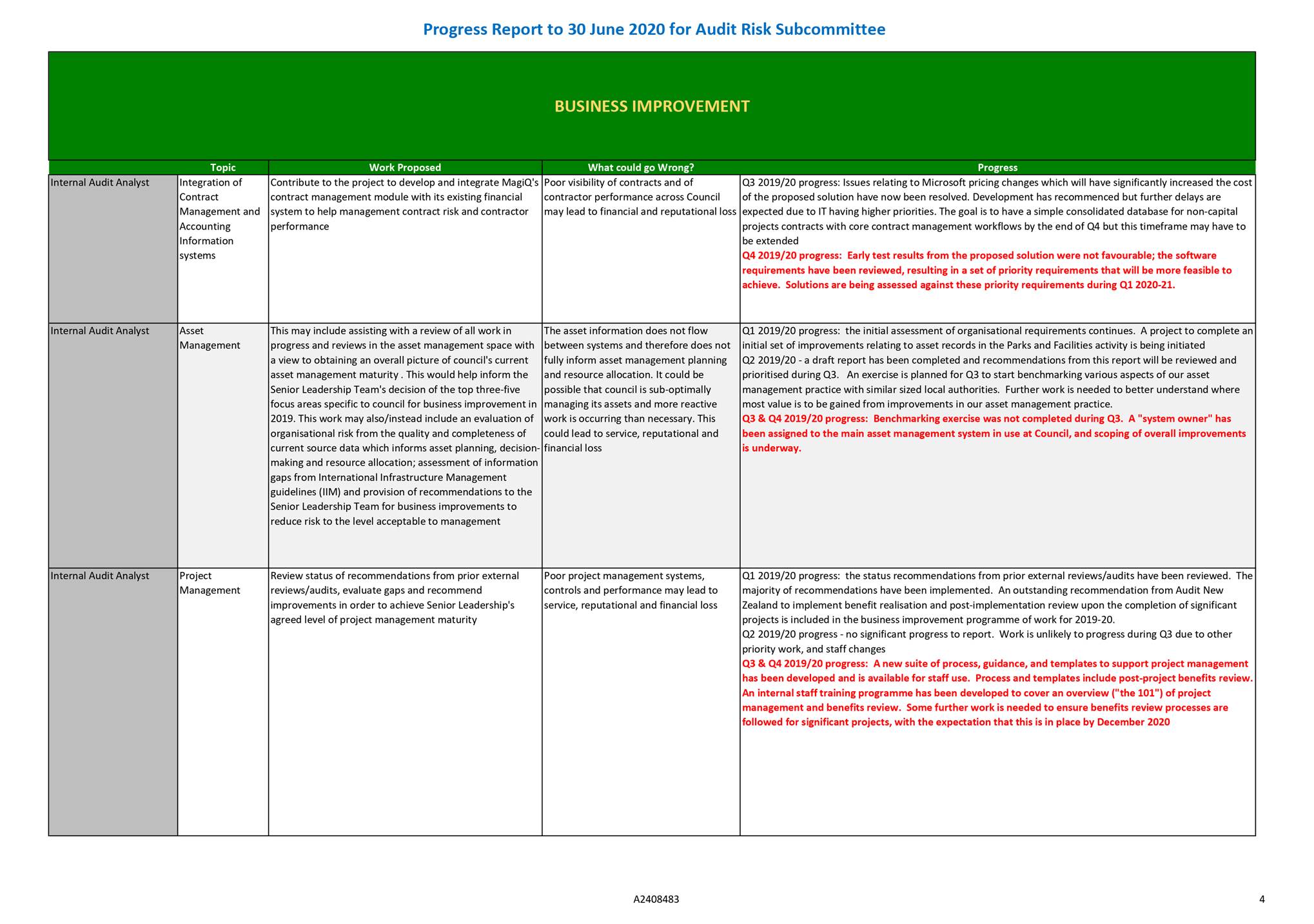

Audit - Quarterly Progress Report to 30 June 2020

1. Purpose

of Report

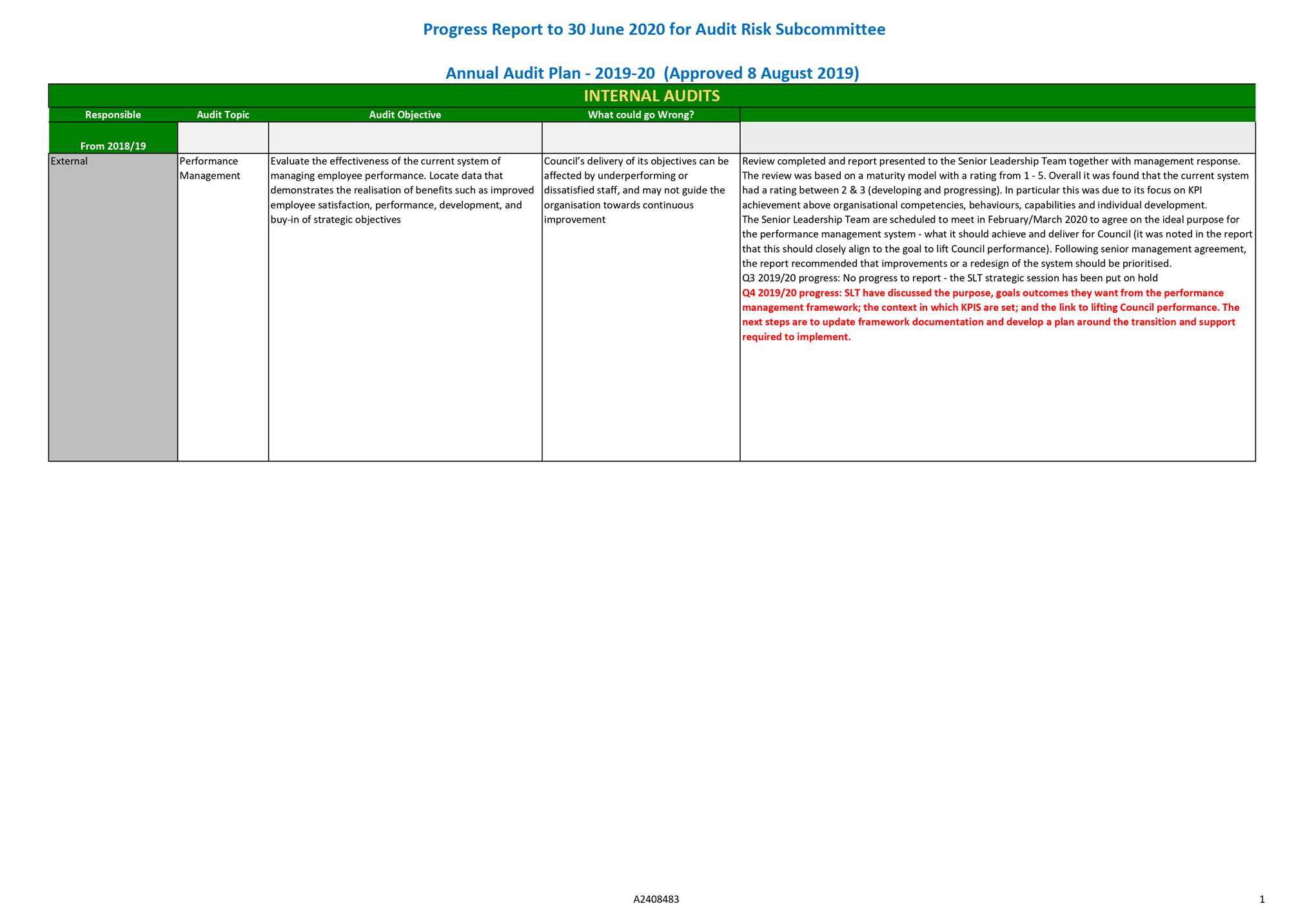

1.1 To

update the Audit and Risk Subcommittee on the internal audit activity for the

quarter to 30 June 2020.

2. Background

2.1 Under

Council’s Internal Audit Charter approved by Council on 15 November 2018,

the Audit and Risk Subcommittee requires a periodic update on the progress of

internal audit activities relative to any current Internal Audit Plan approved

by Council.

2.2 The

current Internal Audit Plan (the Plan) for the year to 30 June 2020 was

approved by Council on 8 August 2019. The Plan provides for two planned audits,

with an allowance for a further two unplanned audits. As well, it provides for

a contribution towards business improvement work programmes.

3. Recommendation

|

That the Audit and Risk Subcommittee

1. Receives

the report Internal Audit - Quarterly Progress Report to 30 June 2020

(R18111) and its attachment (A2408483).

|

4. Summary

4.1 For

the second quarter in a row, activity focused primarily on internal audits.

That enabled two planned audits to be completed while the final audit for

2019-2020 is well underway. An additional audit which had not been provided for

in the Plan was also performed during the quarter.

4.2 Other

related activity completed in the last two quarters included a quality

assurance self-assessment for the internal audit activity.

4.3 Fraud

awareness training, including conflicts of interest, was also upgraded and can

now be accessed online on demand. Completion of the training programme and its

effectiveness can be monitored digitally.

4.4 In

the business improvement realm, there has been some progress relating to the

consolidated contracts database, minimal progress relating to asset management

improvements at the organisational level, and robust progress relating to

improving project management processes and related support for staff.

Progress has been somewhat slowed by staff vacancies and the impact of COVID-19,

which saw some key staff reassigned to the COVID-19 response, and an IT systems

change freeze through to 2 June 2020. Following the COVID-19 event, it is

important to avoid overloading the organisation with change initiatives.

Author: Lynn

Anderson, Internal Audit Analyst

Attachments

Attachment 1: A2408483 - Internal

Audit Progress Report to 30 June 2020 ⇩

Item 13: Internal Audit - Quarterly Progress Report to 30 June 2020:

Attachment 1

Item 14: Bad Debt

Writeoff - Year Ending 30 June 2020

|

|

Audit and Risk Subcommittee

11 August 2020

|

REPORT R14820

Bad

Debt Writeoff - Year Ending 30 June 2020

1. Purpose

of Report

1.1 To

inform the Audit and Risk Subcommittee on the level of bad debts written off,

and to seek approval to write off one debt over $10,000 for the year ending 30

June 2020.

2. Recommendation

|

That the Audit and Risk Subcommittee

1. Receives

the report Bad Debt Writeoff - Year Ending 30 June 2020 (R14820).

|

Recommendation to Governance and

Finance

|

That the

Governance and Finance Committee

1. Approves the balance of $20,462.37

excluding GST owing by Concrete & Metals Ltd be written off as at 30 June

2020.

|

3. Discussion

3.1 There

is one bad debt over $10,000 to be written off for the year ending

30 June 2020. Concrete and Metals Ltd (Director Carolyn Margaret Wiffen)

was liquidated with the Final Liquidators Report dated 28 January 2020.

Council as an unsecured creditor was owed $25,529.85 however proceeds from the

liquidation of $5,067.48 excluding GST were received. The remaining debt

of $20,462.37 is to be written off.

3.2 The

debt with Concrete and Metals was incurred through York Valley Landfill

charges, therefore the cost is borne jointly by TDC & NCC.

3.3 Through

the liquidation process, Concrete & Metals Ltd was sold as a going concern.

There appears to be no connection between Concrete & Metals Ltd and

the new company Concrete & Metals Tasman Bay Ltd which has different

directors and shareholders.

3.4 The

debt has been reported to the Audit and Risk Subcommittee in the Quarterly Update

on Debts since June 2019, as at risk and requiring write off.

3.5 A

number of accounts under $10,000 per debtor have been written off by the Group

Manager Corporate Services under officer delegation. These totalled

$7,901 excluding GST with the write-offs being $3,885 for 14 separate debts for

dog impounding fees, $2,112 for marina fees, $1,266 for two debts for

liquidated companies and $638 for a regulatory debt.

3.6 The

decision is an administrative one and although the debts are written off from

an accounting point of view, a record is still kept and if an opportunity to

recover the debt arises, action will be taken. Most of this balance is with

Credit Recoveries Limited Council’s debt recovery agency, who will

continue recovery activities. Every possible effort has been made to

locate and obtain payment from these debtors.

3.7 A

summary of this year's write off compared to last year's is as follows:

|

|

Write-off 2020

$

|

Write-off 2019

$

|

|

Over $2,500

|

20,462

|

4,829

|

|

Under $2,500

|

7,901

|

4,902

|

|

Cost for year

|

$28,363

|

$9,731

|

4. Options

4.1 The

recommendation is to receive the report and write off one bad debt over $10,000

for accounting purposes.

Author: Victoria

Harper, Accounting Services Manager

Attachments

Nil

|

Important considerations for decision making

|

|

1. Fit

with Purpose of Local Government

This report deals with process matters in relation

to cost effective service delivery.

|

|

2. Consistency

with Community Outcomes and Council Policy

This report supports the community outcome that

Council provides leadership, which includes the responsibility for protecting

finances and assets.

|

|

3. Risk

There is

limited risk from writing off these bad debts as most of the bad debts will

continue to be followed up by the credit agency.

|

|

4. Financial

impact

Writing off the debts has a one off impact on

revenue of $28,362.

|

|

5. Degree

of significance and level of engagement

This matter is of low significance because the

amounts being written off are immaterial.

|

|

6. Inclusion

of Māori in the decision making process

No engagement with Māori has been undertaken in

preparing this report.

|

|

7. Delegations

The Audit and Risk Subcommittee has the following

delegations to consider bad debts.

Areas of Responsibility:

· Audit processes

and management of financial risk

Powers to Decide:

· None

Powers to Recommend to Governance and Finance

Committee

· To write off

outstanding accounts receivable or remit fees and charges of amounts over the

Chief Executive’s delegated authority

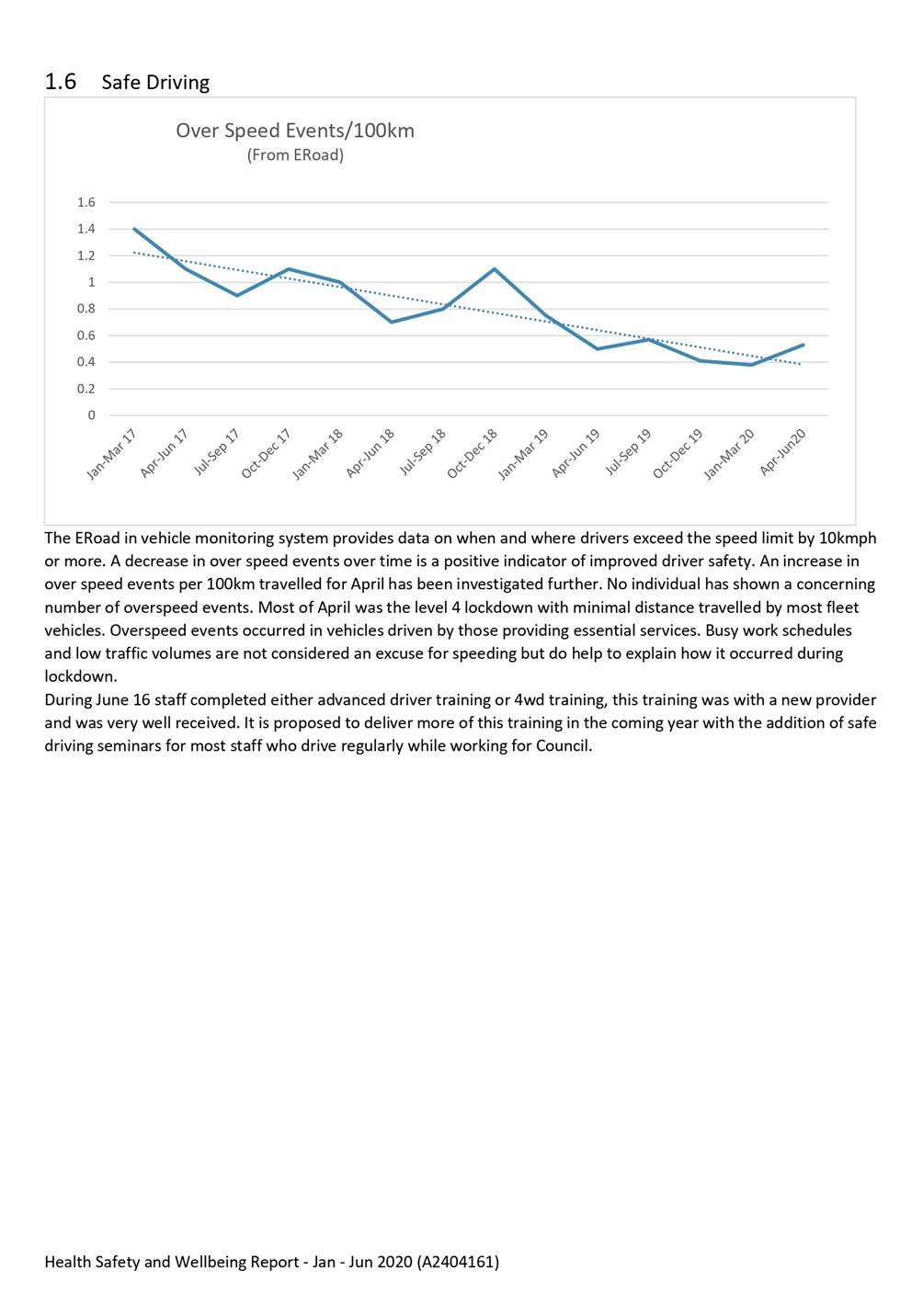

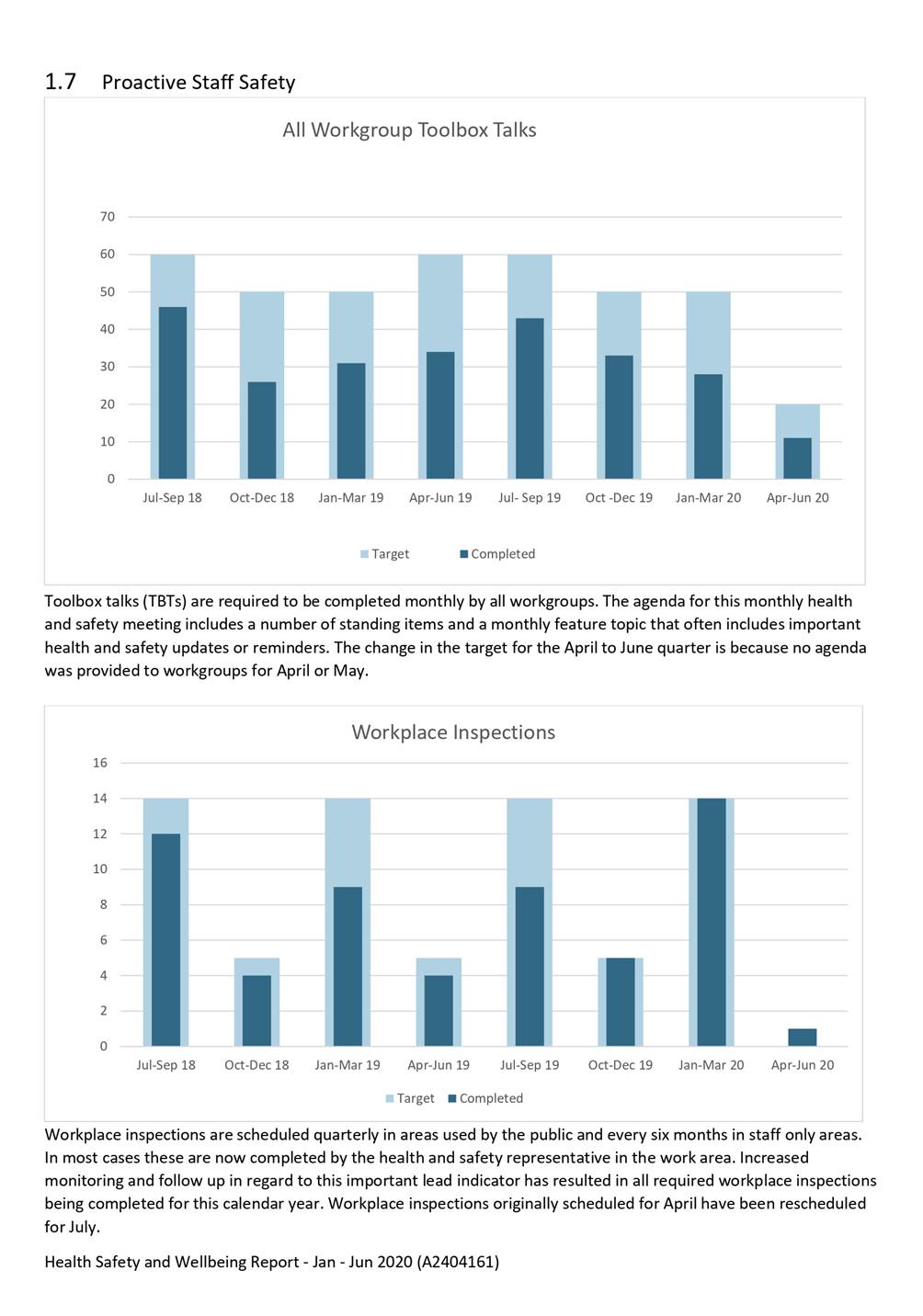

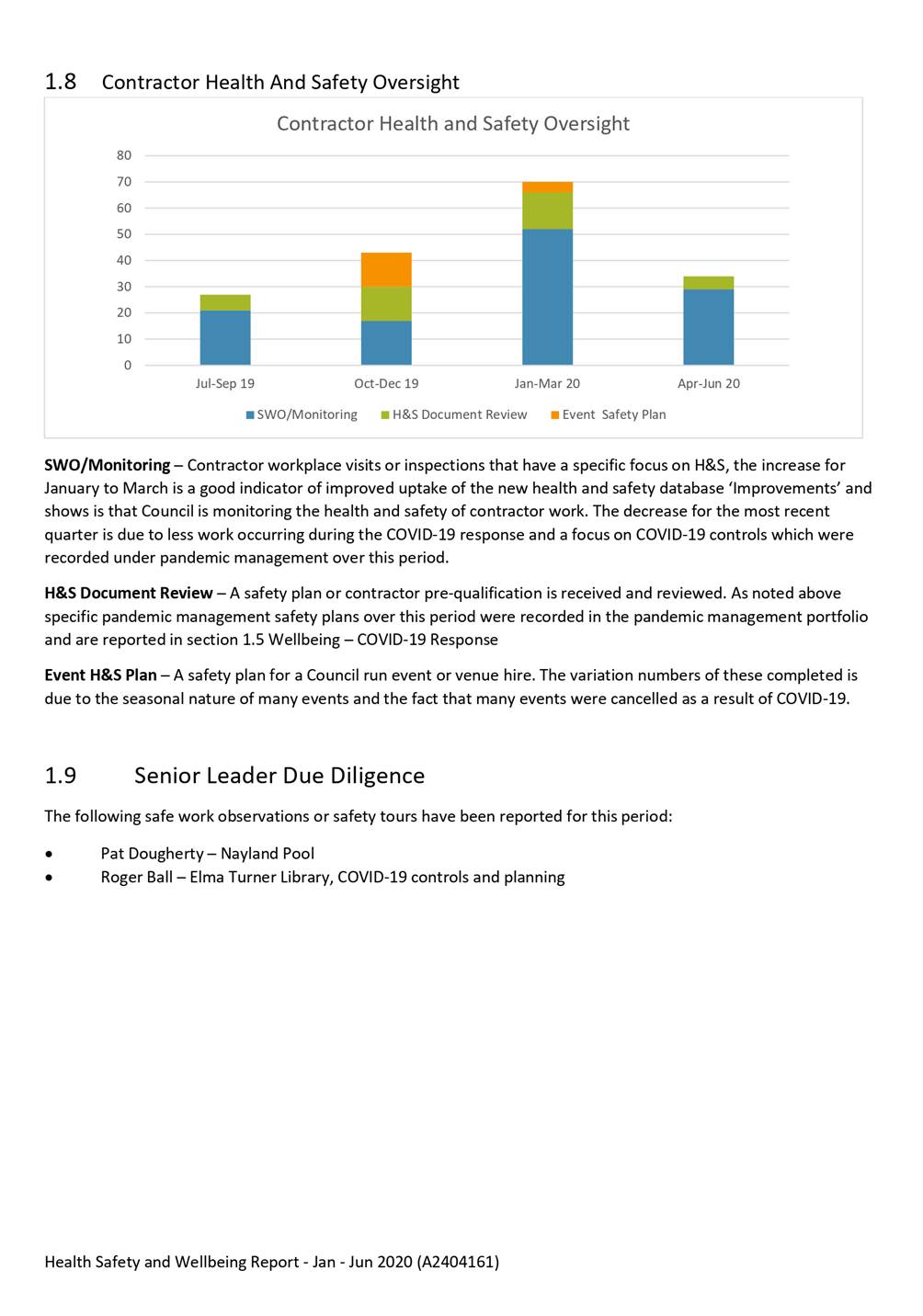

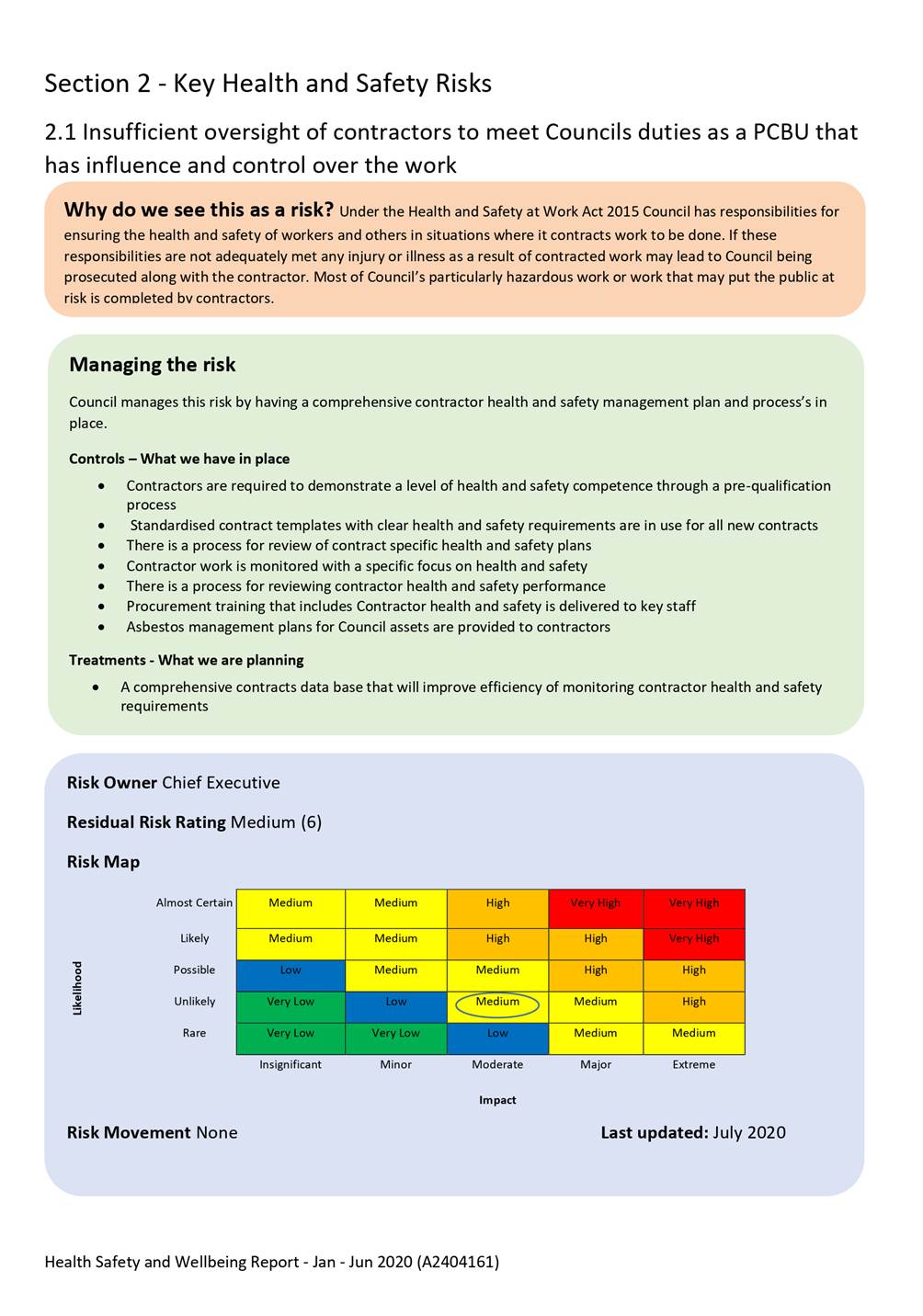

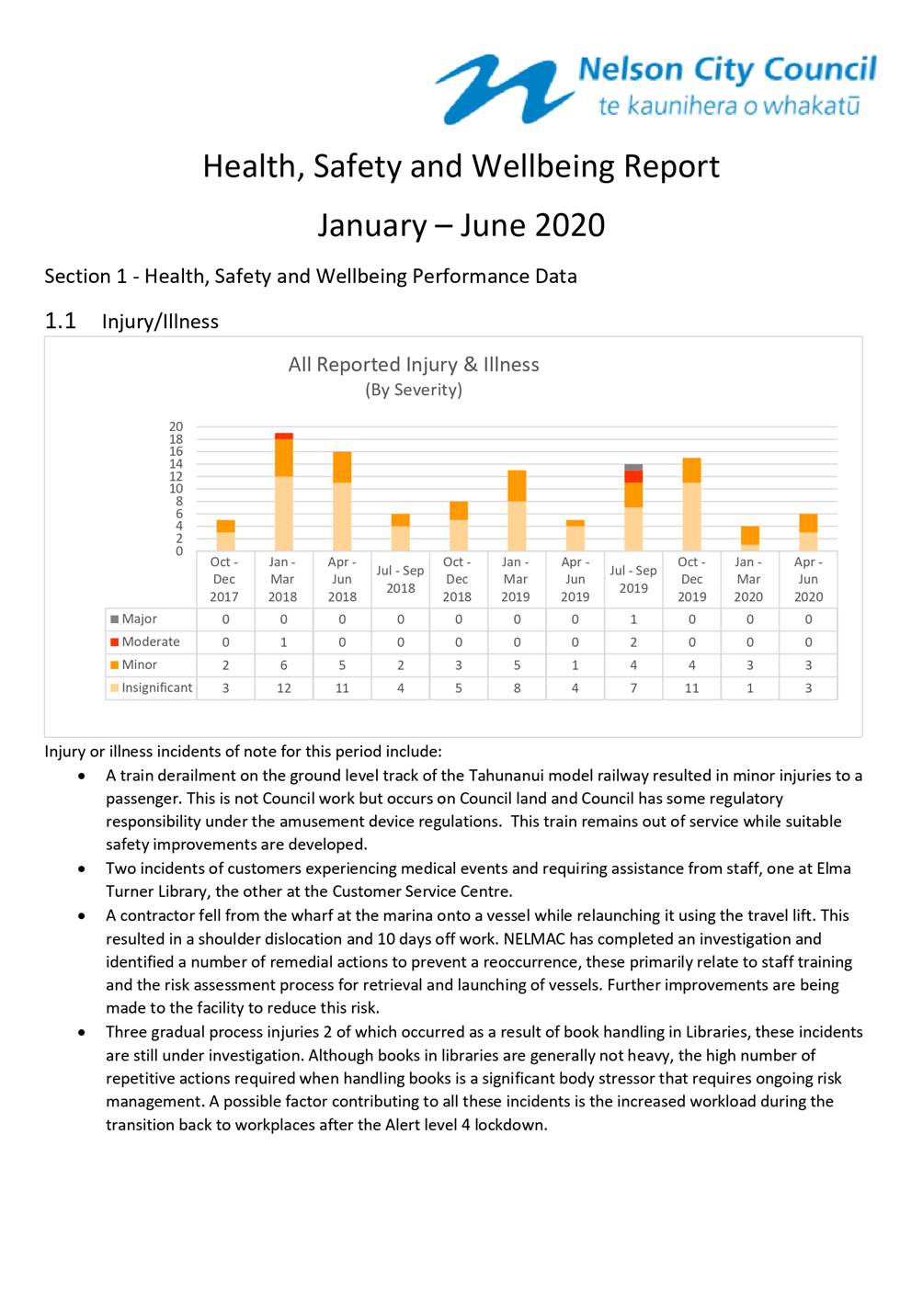

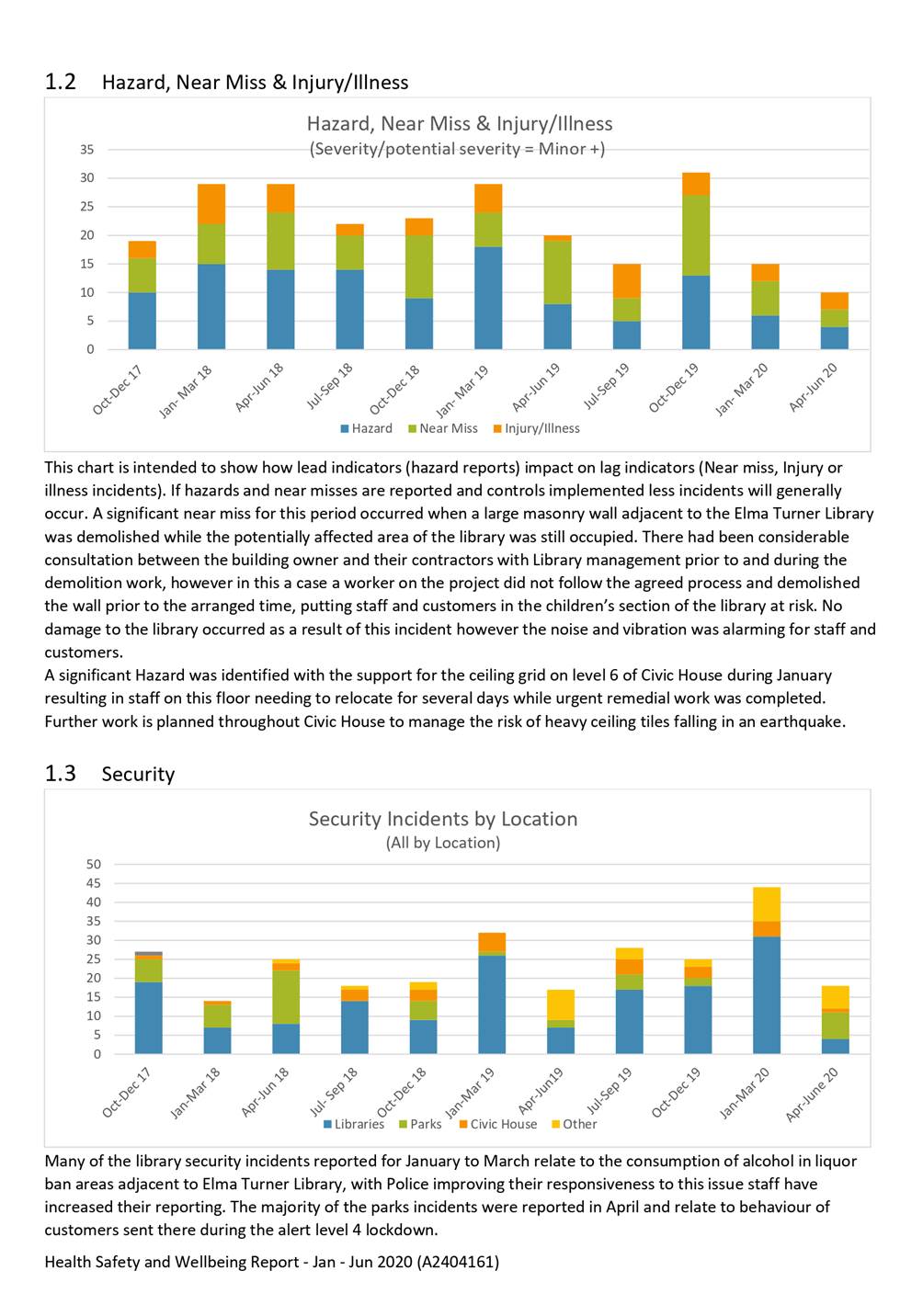

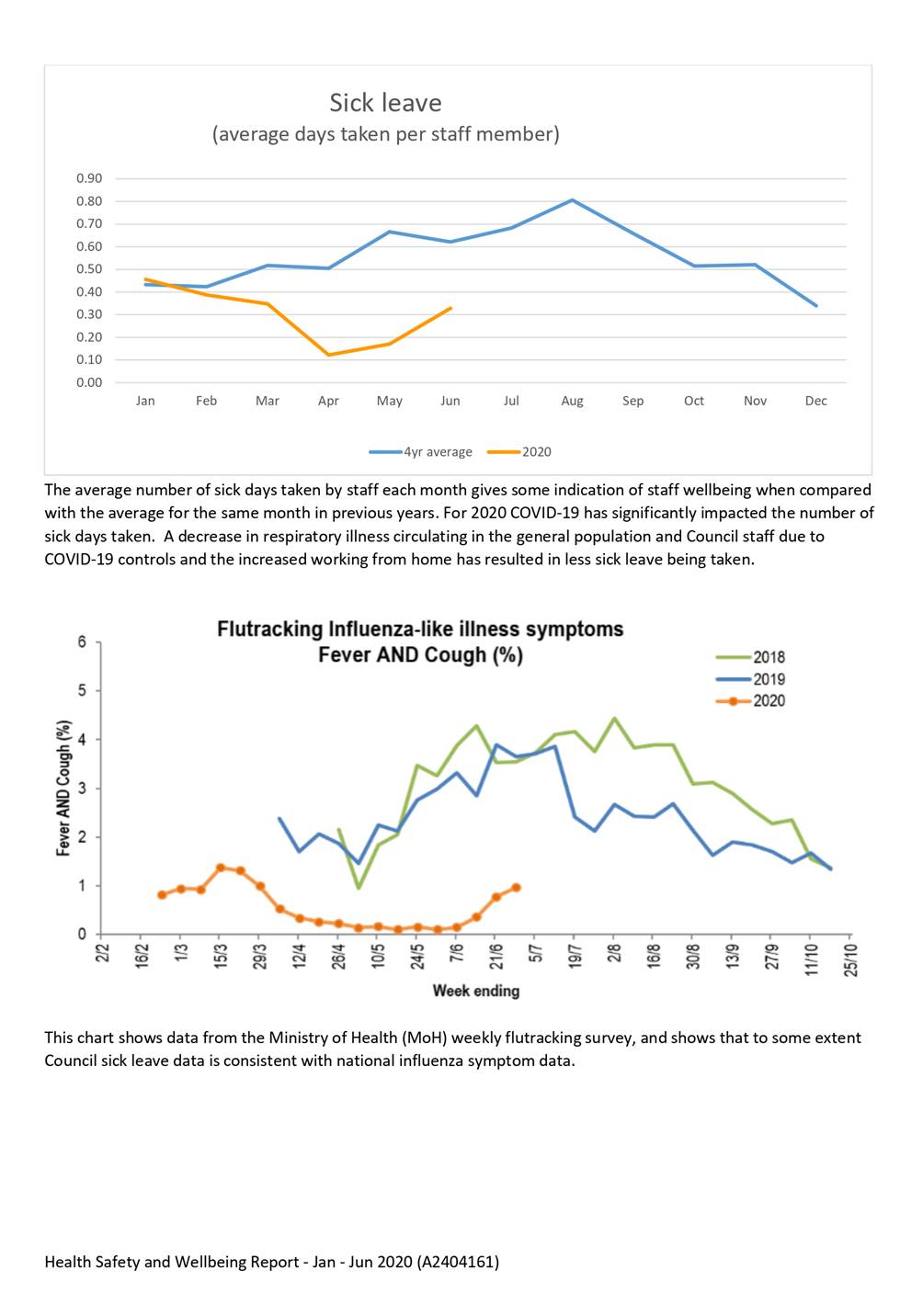

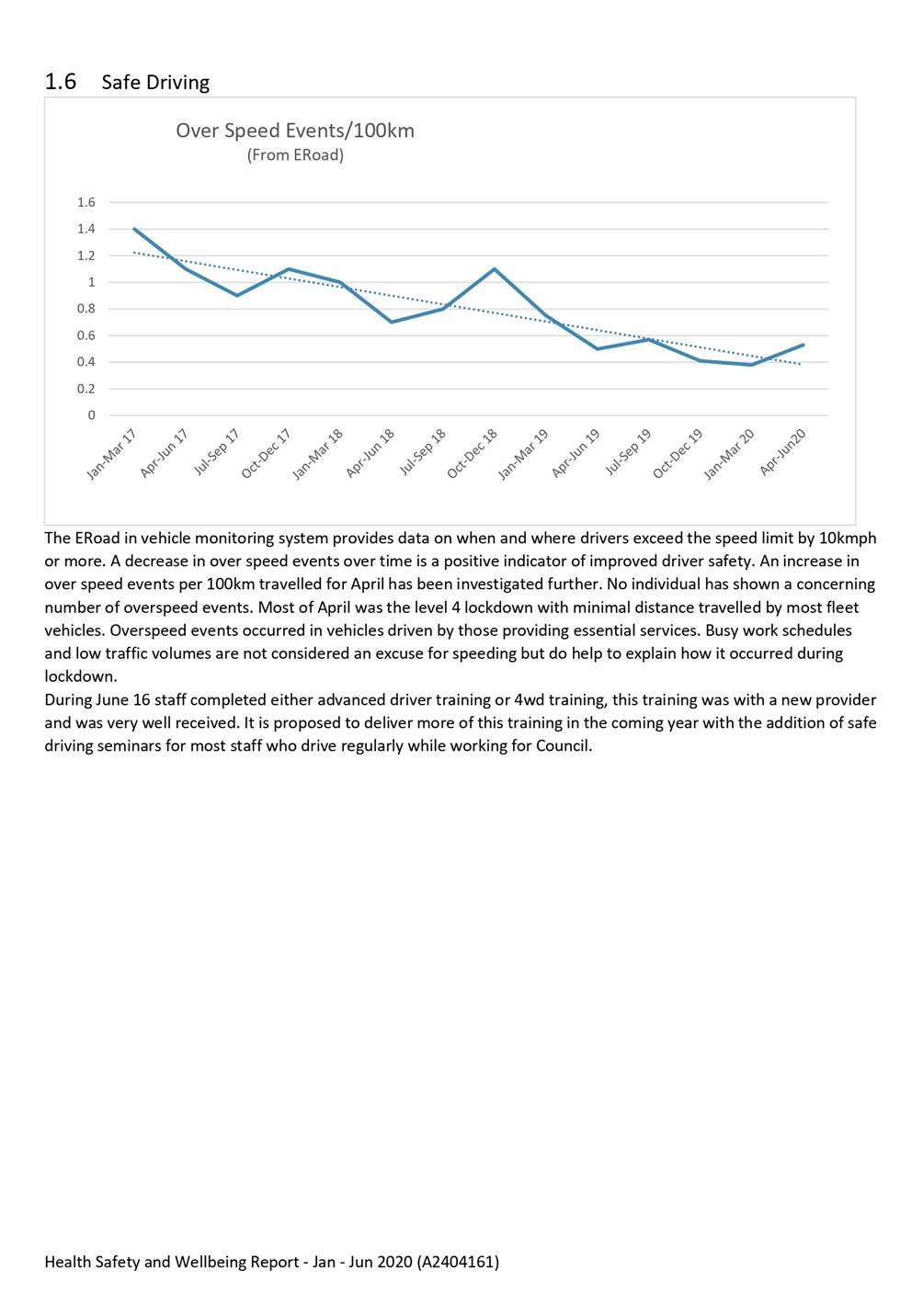

|