AGENDA

Ordinary meeting of the

Audit, Risk and Finance Subcommittee

Tuesday 17 September 2019

Commencing at 9.00a.m.

Council Chamber

Civic House

110 Trafalgar Street, Nelson

Pat Dougherty

Chief

Executive

Membership: Mr John Peters (Chairperson), Her Worship the

Mayor Rachel Reese, Councillors Ian Barker, Bill Dahlberg and Mr John Murray

Quorum: 3

Nelson

City Council Disclaimer

Please

note that the contents of these Council and Committee Agendas have yet to be

considered by Council and officer recommendations may be altered or changed by

the Council in the process of making the formal Council decision.

Guidelines for councillors

attending the meeting, who are not members of the Committee, as set out in

Standing Order 12.1:

·

All councillors, whether or not they are members of the

Committee, may attend Committee meetings

·

At the discretion of the Chair, councillors who are not Committee

members may speak, or ask questions about a matter.

·

Only Committee members may vote on any matter before the

Committee

It is good practice for both Committee members and

non-Committee members to declare any interests in items on the agenda.

They should withdraw from the room for discussion and voting on any of these

items.

Audit, Risk and Finance

Subcommittee

Audit, Risk and Finance

Subcommittee

17

September 2019

Page

No.

1. Apologies

Nil

2. Confirmation

of Order of Business

3. Interests

3.1 Updates

to the Interests Register

3.2 Identify

any conflicts of interest in the agenda

4. Public

Forum

5. Confirmation

of Minutes

5.1 27 August

2019 7 - 13

Document number M4447

Recommendation

|

That the Audit, Risk and Finance Subcommittee

1. Confirms the minutes of the meeting

of the Audit, Risk and Finance Subcommittee, held on 27 August 2019, as a

true and correct record.

|

6. Chairperson's Report 14 - 16

Document number R11485

Recommendation

|

That

the Audit, Risk and Finance Subcommittee

1. Receives

the report Chairperson's Report (R11485).

|

7. Draft Annual Report

2018/19 17 - 20

Document number R10243

Recommendation

|

That

the Audit, Risk and Finance Subcommittee

1. Receives the report Draft Annual Report

2018/19 (R10243) and its

attachment (A2224087).

|

Recommendation to Council

|

That the Council

1. Notes

the draft Annual Report 2018/19 has been prepared and will be audited before

being presented to Council for adoption on 31 October 2019.

|

8. Carry Forwards

2018/19 21 - 30

Document number R10242

Recommendation

|

That

the Audit, Risk and Finance Subcommittee

1. Receives the report Carry Forwards 2018/19

(R10242) and its attachment

(A2240980).

|

Recommendation to Council

|

That the Council

1. Approves the carry

forward of $779,000 unspent capital budget for use in 2019/20; and

2. Approves the carry

forward of $58,000 unspent capital budget for use in future years; and

3. Notes that this is

in addition to the carry forward of $4,807,000 approved during the 2019/20

Annual Plan, taking the total carry forward to $5,644,000; and

4. Approves the

deferral due to reliance on external factors of $101,000 unspent capital

budget for use in 2019/20; and

5. Notes that this is

in addition to the deferral of $447,000 approved during the 2019/20 Annual

Plan, taking the total deferral to $548,000; and

6. Approves the carry

forward of $460,000 of unspent operating budget for use in 2019/20; and

7. Notes total savings

and reallocations in 2018/19 capital expenditure of $2,642,000 including

staff time; and

8. Notes that the total 2019/20 capital budget (including staff

costs and excluding consolidations and vested assets) will be adjusted by

these resolutions from a total of $43,898,000 to a total of $44,777,000.

|

9. Draft Treasury Management

Policy including Liability Management and Investment Policies 31 - 70

Document number R10282

Recommendation

|

That

the Audit, Risk and Finance Subcommittee

1. Receives

the report Draft Treasury Management Policy including Liability Management

and Investment Policies (R10282)

and its attachment (A2258406).

|

Recommendation to Council

|

That the Council

1. Adopts the Treasury

Management Policy (A2258406).

|

Public Excluded Business

10. Exclusion

of the Public

Recommendation

That the Audit,

Risk and Finance Subcommittee

1.

Excludes the

public from the following parts of the proceedings of this meeting.

2.

The general subject of each matter to be

considered while the public is excluded, the reason for passing this resolution

in relation to each matter and the specific grounds under section 48(1) of the

Local Government Official Information and Meetings Act 1987 for the passing of

this resolution are as follows:

|

Item

|

General subject of each matter to be

considered

|

Reason for passing this resolution in

relation to each matter

|

Particular interests protected (where

applicable)

|

|

1

|

Audit, Risk and Finance Subcommittee Meeting -

Public Excluded Minutes - 27 August 2019

|

Section 48(1)(a)

The public conduct of this matter would be likely to

result in disclosure of information for which good reason exists under

section 7.

|

The withholding of the information is necessary:

· Section 7(2)(a)

To protect the

privacy of natural persons, including that of a deceased person

·

Section 7(2)(g)

To maintain

legal professional privilege

|

Audit, Risk and Finance

Subcommittee Minutes - 27 August 2019

Present: Mr

J Peters (Chairperson), Councillors I Barker, B Dahlberg and Mr J Murray

In Attendance: Councillors

G Noonan, M Rutledge and S Walker, Chief Executive (P Dougherty), Group Manager

Corporate Services (N Harrison), Group Manager Strategy and Communications (N

McDonald), Group Manager Community Services (R Ball) and Governance Adviser (J

Brandt)

Apology: Her

Worship the Mayor R Reese

1. Apologies

|

Resolved AUD/2019/038

|

|

|

That the Audit, Risk and Finance Subcommittee

1. Receives

and accepts an apology from Her Worship the Mayor R Reese.

|

|

Barker/Murray Carried

|

2. Confirmation of Order

of Business

There was no change to the order

of business.

3. Interests

There were no updates to the

Interests Register, and no interests with items on the agenda were declared.

4. Public Forum

There was no public forum.

5. Confirmation of

Minutes

5.1 25

June 2019

Document number M4310, agenda

pages 7 - 11 refer.

|

Resolved AUD/2019/039

|

|

|

That the Audit, Risk and

Finance Subcommittee

1. Confirms the minutes of the meeting

of the Audit, Risk and Finance Subcommittee, held on 25 June 2019, as a true

and correct record.

|

|

Dahlberg/Murray Carried

|

6 Chairperson's

Report

|

The Chairperson noted that the

online review of the Audit Risk and Finance Subcommittee was still open, and

encouraged members to complete the survey, as the information would assist

Council in the next Council triennium should a similar body be formed.

|

|

Resolved AUD/2019/040

|

|

|

That the Audit, Risk and Finance Subcommittee

1. Receives the verbal

Chairperson’s report .

|

|

Peters/Murray Carried

|

7. Quarterly Report to

30 June 2019

Document number R10331, agenda

pages 12 - 42 refer.

Tracey Hughes, Senior Accountant,

presented the report and noted that this report was based on information

available at the end of July 2019 and would therefore differ from information

presented in the draft Annual Report at the 17 September 2019 Subcommittee

meeting.

Officers answered questions

regarding Nelson Regional Sewerage Business Unit costs, increases to insurance

premiums, self-insurance, official information requests received and the

revaluation of Marina assets. Further questions were answered regarding

council-owned forestry and market trends.

The format of project sheets were

discussed and members noted their preference to have the original project

budget and any approved changes recorded on the sheets for completeness.

|

Resolved AUD/2019/041

|

|

|

That

the Audit, Risk and Finance Subcommittee

1. Receives

the report Quarterly Report to 30 June 2019 (R10331) and its attachments (A2224569, A2226256 and A2232140).

|

|

Murray/Barker Carried

|

8. Annual Tax Review

Document number R10239, agenda

pages 43 - 78 refer.

Tracey Hughes, Senior Accountant,

answered questions regarding work undertaken since a GST review was carried out

earlier in the year.

Council’s ability to use

tax credits was discussed and noted for further exploration at a workshop in

the new triennium.

|

Resolved AUD/2019/042

|

|

|

That

the Audit, Risk and Finance Subcommittee

1. Receives the report Annual Tax Review (R10239) and its attachments (A2221879 and

A2221900).

|

|

Murray/Dahlberg Carried

|

9. Quarterly Key Risks

Report - 1 April to 30 June 2019

Document number R10217, agenda

pages 79 - 99 refer.

Manager Business Improvement,

Arlene Akhlaq, answered questions regarding the council priority areas in

attachment 1. The level of information provided in the report was commended.

|

Resolved AUD/2019/043

|

|

|

That the Audit,

Risk and Finance Subcommittee

1. Receives the report Quarterly Key Risks Report

- 1 April to 30 June 2019 (R10217) and its attachment (A2233464).

|

|

Dahlberg/Barker Carried

|

10. Health Safety and Wellbeing

Performance Report

Document number R10385, agenda

pages 100 - 115 refer.

Malcolm Hughes, Health and Safety

Adviser, gave an update regarding the security incidents at the Elma Turner

Library, noting a significant reduction of incidents since a security guard had

been engaged. Mr Hughes answered questions regarding the flu vaccine update and

sick leave data.

Attendance: Councillor Dahlberg

left the meeting from 2.01p.m. to 2.03p.m.

|

Resolved AUD/2019/044

|

|

|

That

the Audit, Risk and Finance Subcommittee

1. Receives

the report Health Safety and Wellbeing Performance Report (R10385) and its attachment (A2231288).

|

|

Murray/Barker Carried

|

11. Internal Audit - Quarterly

Progress Report to 30 June 2019

Document number R10302, agenda

pages 116 - 119 refer.

Lynn Anderson, Internal Audit

Analyst, presented the report.

The Chief Executive answered

questions regarding Alpha One software, noting that the software was intended

to bring improvements and consistency in how building consents are processed in

the Nelson Tasman region.

|

Resolved AUD/2019/045

|

|

|

That

the Audit, Risk and Finance Subcommittee

1. Receives the report Internal Audit - Quarterly Progress

Report to 30 June 2019 (R10302) and its attachment (A2227441).

|

|

Murray/Dahlberg Carried

|

12. Internal Audit - Summary of New

or Outstanding Significant Risk Exposures and Control Issues to 30 June 2019

Document number R10303, agenda

pages 120 - 125 refer.

Lynn Anderson, Internal Audit

Analyst, answered questions regarding the water contamination prevention in

attachment 1 of the report, noting that the training exercise for the Maitai

Dam was scheduled to occur in 2019, not 2018, and that a desktop exercise would

precede a full training exercise. Ms Anderson further noted that it was

expected that the risk of loss of life would be addressed in the Emergency

Action Plan.

|

Resolved AUD/2019/046

|

|

|

That

the Audit, Risk and Finance Subcommittee

1. Receives the report Internal

Audit - Summary of New or Outstanding Significant Risk Exposures and Control

Issues to 30 June 2019 (R10303) and its attachment (A2227319).

|

|

Dahlberg/Barker Carried

|

13. Exclusion

of the Public

|

Resolved AUD/2019/047

|

|

|

That the Audit, Risk and Finance Subcommittee

1. Excludes

the public from the following parts of the proceedings of this meeting.

2. The

general subject of each matter to be considered while the public is excluded,

the reason for passing this resolution in relation to each matter and the

specific grounds under section 48(1) of the Local Government Official

Information and Meetings Act 1987 for the passing of this resolution are as

follows:

|

|

Barker/Dahlberg Carried

|

|

Item

|

General subject of each matter to be

considered

|

Reason for passing this resolution in

relation to each matter

|

Particular interests protected (where

applicable)

|

|

1

|

Audit, Risk and Finance Subcommittee Meeting -

Public Excluded Minutes - 25 June 2019

|

Section 48(1)(a)

The public conduct of this matter would be likely to

result in disclosure of information for which good reason exists under

section 7.

|

The withholding of the information is necessary:

· Section 7(2)(a)

To protect the

privacy of natural persons, including that of a deceased person

|

|

2

|

Quarterly Update on Legal Proceedings

|

Section 48(1)(a)

The public conduct of this

matter would be likely to result in disclosure of information for which good

reason exists under section 7

|

The withholding of the information is necessary:

· Section 7(2)(g)

To maintain legal

professional privilege

|

|

3

|

Quarterly Update On Debts - 30 June 2019

|

Section 48(1)(a)

The public conduct of this

matter would be likely to result in disclosure of information for which good

reason exists under section 7

|

The withholding of the information is necessary:

· Section 7(2)(a)

To protect the privacy of

natural persons, including that of a deceased person

|

The meeting went into public excluded session at 2.20p.m.

and resumed in public session at 2.55p.m.

Restatements

It was resolved while the public was

excluded:

|

1

|

PUBLIC EXCLUDED: Quarterly

Update on Legal Proceedings

|

|

|

That the Audit, Risk and Finance Subcommittee

3. Agrees

that the Report (R10367) and its attachment (A2186227) be excluded from

public release at this time.

|

|

2

|

PUBLIC EXCLUDED: Quarterly

Update On Debts - 30 June 2019

|

|

|

That the Audit, Risk and Finance Subcommittee

2. Agrees that

Report (R10351) and its attachment (A2216183) be excluded from public

release at this time.

|

There being no further business the meeting ended at 2.55p.m.

Confirmed as a correct record of proceedings:

Chairperson

Date

Chairperson

Date

Item 6: Chairperson's

Report

|

|

Audit, Risk and Finance Subcommittee

17 September 2019

|

REPORT R11485

Chairperson's

Report

1. Purpose

of Report

1.1 To

provide an update on the Survey of the Audit Risk and Finance Sub-Committee

Review for the 2017-2019 term of Council.

2. Recommendation

|

That the Audit, Risk and Finance Subcommittee

1. Receives

the report Chairperson's Report (R11485).

|

2. Discussion

2.1 My

thanks to those members of the Sub-Committee, and others, who completed the

Survey of the Audit Risk and Finance Sub-Committee Review for the 2017-2019

term of Council.

2.2 Eight

responses were received, together with a number of helpful comments.

2.3 The

summary of results will be passed on to the Chief Executive and the Mayor, with

the intention that these provide input to the activities of the incoming Audit

Risk and Finance Committee, or any equivalent, in the next term of

Council. A copy will also be provided to Audit New Zealand.

2.4 Some

of the key findings and responses from the Survey are as follows:

2.5 The

overall average score was 3.4. The 2016 survey score was 3.3 - (3

means Progressing Satisfactorily, 4 means Achieved);

2.6 The

highest score was 3.75 for the question: Has ARF conformed to and

reflected its Terms of Reference?

2.7 The

lowest score was 3.0 for the question: Does ARF provide relevant advice and

respond in a timely fashion? Comments and suggestions for this question

included:

2.7.1 “Sufficient

notice and supporting material in timely fashion”

2.7.2 “Timing

of meetings and the age of the information provided can sometimes impede its

progress. Maybe the committee can consider how it convenes to make it

more able and quicker to get together… particularly if an issue quickly

escalates”

2.7.3 “It

is important to advise the committee when something arises. The committee

can only address items it is aware of. When advised they are very

proactive. It is important that elected members are conscious of items

that should be referred to the committee”

2.8 Further

to this last quote it is evident from some of the responses that there is not a

broad understanding of the role and scope of ARF. Consideration should be

given to making elected members fully aware of these, perhaps during their

orientation.

2.9 The

three base documents for the Committee (the Delegations, Terms of Reference and

Charter) should be reviewed at the start of the new triennium;

2.10 There were

also comments relating to:

· The level of expertise

on the committee

· Relationships with

relevant parties

· The extension of

Business Improvement into the role of Internal Audit

· The need for quality

legal advice

2.11 The

Committee’s key achievements during the current term were seen to be:

· Financial reporting

extended to committee level

· Improving risk

management processes

· Keeping an overall eye

on process

· Relationship with Audit

New Zealand

2.12 The areas

for suggested improvement next term included:

· Earlier involvement in

issues, e.g. Greenmeadows

· More participation from

other committee chairs and other councillors

· Broadening internal

organisational understanding.

2.13 Finally,

as this is the last meeting of this Audit Risk and Finance Sub-committee I would

like to record my sincere thanks to Councillors for giving me the opportunity

to Chair the Committee during this term, and my appreciation of the support I

have received from them. In particular my thanks to those elected members

of the Committee – Councillor Ian Barker, Councillor Bill Dahlberg and

Her Worship the Mayor, and to Mr John Murray as the other appointed external

member.

2.14 My sincere

thanks also to the Chief Executive and his team, for the support and attention

I have always received from them. In particular, my thanks to Nikki

Harrison, Tracey Hughes, Arlene Akhlaq, Mary Birch, Steve Vaughn, Lynn

Anderson, Malcolm Hughes, Fiona McLeod, Jasmin Brandt, Gina Fletcher, Ruth

Killman and other regular providers of reports, advice and assistance.

Author: John

Peters, Chairperson - Audit, Risk and Finance Subcommittee

Attachments

Nil

|

|

Audit, Risk and Finance Subcommittee

17 September 2019

|

REPORT R10243

Draft

Annual Report 2018/19

1. Purpose

of Report

1.1 To

provide a copy of the draft Annual Report 2018/19.

2. Summary

2.1 The

draft Annual Report for the 2018/19 financial year has been prepared and is

provided as Attachment 1, for information. It is in the process of being

audited and there are likely to be some changes as a result of the audit

process.

3. Recommendation

|

That the Audit, Risk and Finance Subcommittee

1. Receives the report Draft Annual Report

2018/19 (R10243) and its

attachment (A2224087).

|

Recommendation to Council

|

That the

Council

1. Notes

the draft Annual Report 2018/19 has been prepared and will be audited before

being presented to Council for adoption on 31 October 2019.

|

4. Background

4.1 The purpose of the Annual Report is

to compare Council’s actual performance against the targets as set out in

year one of the Long Term Plan 2018-28. It also provides accountability to the

Nelson community for the decisions made throughout the year.

5. Discussion

5.1 The attached draft Annual Report

2018/19 is intended to provide Council with information officers have to date.

This is not the final Annual Report for the year as it is in the process of

being audited. It is likely to require modification through the auditing

process.

5.2 As the final Annual Report 2018/19

is required to be adopted by Council within four months of the end of the

financial year, it is proposed that it be brought to Council for adoption at

Council’s 31 October meeting. Officers did explore whether an earlier

audit timeframe was achievable, to allow the Annual Report to be approved in

this triennium, however given the volume of work for Audit NZ at this time of

year it was not possible. Given the time constraints, it is recommended that

the Annual Report be presented directly to Council, rather than to the Audit,

Risk and Finance Subcommittee first.

5.3 The surplus before revaluation is

$8.1 million less than budgeted. The reasons for this variance will be

detailed in the final Annual Report but are mainly due to:

5.3.1 Development

contributions better than budget ($2.7 million).

5.3.2 Vested

assets less than budget ($3.9 million).

5.3.3 Unbudgeted

loss on the derivatives revaluation ($4.4 million), and unbudgeted

expenditure for abandoned assets ($1.9 million).

5.7 The rates surplus is $488,000.

5.4 Council’s

non-financial performance was 76.25% achieved, which is an improvement on the

60% achieved in 2017/18, noting that this is the first year of the performance

measures as set out in the 2018-28 Long Term Plan.

6. Options

6.1 This report is provided for

information. The Audit Risk and Finance Subcommittee has the option to either

receive or not to receive this report and attachment. It is recommended that

the Subcommittee receives this report and notes the final Annual Report

2018/19, with any changes resulting from the audit process, will be presented

directly to Council before the end of October.

7. Conclusion

7.1 An

Annual Report must be completed to comply with section 98 of the Local

Government Act 2002.

7.2 The

purpose of this report is to provide the Committee with a draft of the Annual

Report 2018/19. A final, audited report will be provided to Council for

adoption on 31 October 2019.

Author: Nicky

McDonald, Group Manager Strategy and Communications

Attachments

Attachment 1: A2224087

- Draft Annual Report 2018/19 (Circulated separately)

|

Important

considerations for decision making

|

|

1. Fit

with Purpose of Local Government

The Annual Report 2018/19 is a requirement of the Local

Government Act 2002 and fits the purpose of local government by providing

information about Council’s performance during 2018/19, thereby

promoting accountability.

|

|

2. Consistency

with Community Outcomes and Council Policy

The Annual Report 2018/19 contributes to the community

outcomes by measuring performance across the full range of Council

activities.

|

|

3. Risk

The content of the Annual Report is prescribed by statute

so there is a very low risk that it will not achieve the required outcome.

There is a risk that Council would not be able to adopt the Annual Report

2018/19 by 31 October and meet the requirements under the Local Government

Act 2002.

|

|

4. Financial

impact

Preparation and publication of the Annual Report can

be achieved within funding allocated in the Annual Plan.

|

|

5. Degree

of significance and level of engagement

The decision to receive this report is of low

significance. The final audited Annual Report will be provided to Council for

adoption in October. There will be a summary Annual Report available following

adoption of the final audited Annual Report and this will also be made

available to the public.

|

|

6. Inclusion

of Māori in the decision making process

No engagement with Māori has been undertaken in

preparing this report.

|

|

7. Delegations

The Audit Risk and Finance Subcommittee has the

following delegations to consider the Annual Report 2018/19.

Areas of Responsibility:

· Council’s

Annual Report

· Council’s

financial and service performance

Powers to Recommend:

· Adoption

of Council’s Annual Report

Powers to Decide: None

|

Item 8: Carry Forwards

2018/19

|

|

Audit, Risk and Finance Subcommittee

17 September 2019

|

REPORT R10242

Carry

Forwards 2018/19

1. Purpose of Report

1.1 To approve carry

forward of unspent budget to the new financial year.

2. Summary

2.1 Invoice processing is

complete for the 2018/19 financial year and officers have reviewed project

expenditure in order to identify savings and consider whether unspent budget is

still required.

|

That the Audit, Risk and Finance Subcommittee

1. Receives the report Carry Forwards 2018/19

(R10242) and its attachment

(A2240980).

|

Recommendation to Council

|

That the Council

1. Approves the carry

forward of $779,000 unspent capital budget for use in 2019/20; and

2. Approves the carry

forward of $58,000 unspent capital budget for use in future years; and

3. Notes that this is

in addition to the carry forward of $4,807,000 approved during the 2019/20

Annual Plan, taking the total carry forward to $5,644,000; and

4. Approves the

deferral due to reliance on external factors of $101,000 unspent capital

budget for use in 2019/20; and

5. Notes that this is

in addition to the deferral of $447,000 approved during the 2019/20 Annual

Plan, taking the total deferral to $548,000; and

6. Approves the carry

forward of $460,000 of unspent operating budget for use in 2019/20; and

7. Notes total savings

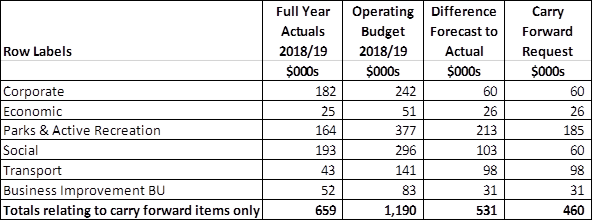

and reallocations in 2018/19 capital expenditure of $2,642,000 including

staff time; and

8. Notes that the total 2019/20 capital budget (including staff

costs and excluding consolidations and vested assets) will be adjusted by

these resolutions from a total of $43,898,000 to a total of $44,777,000.

|

3. Background

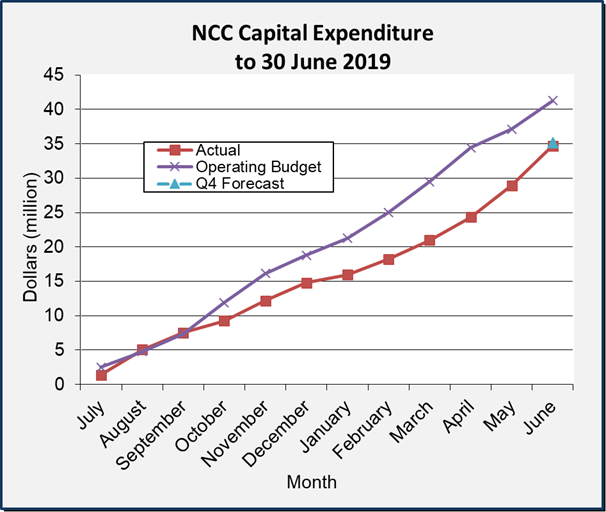

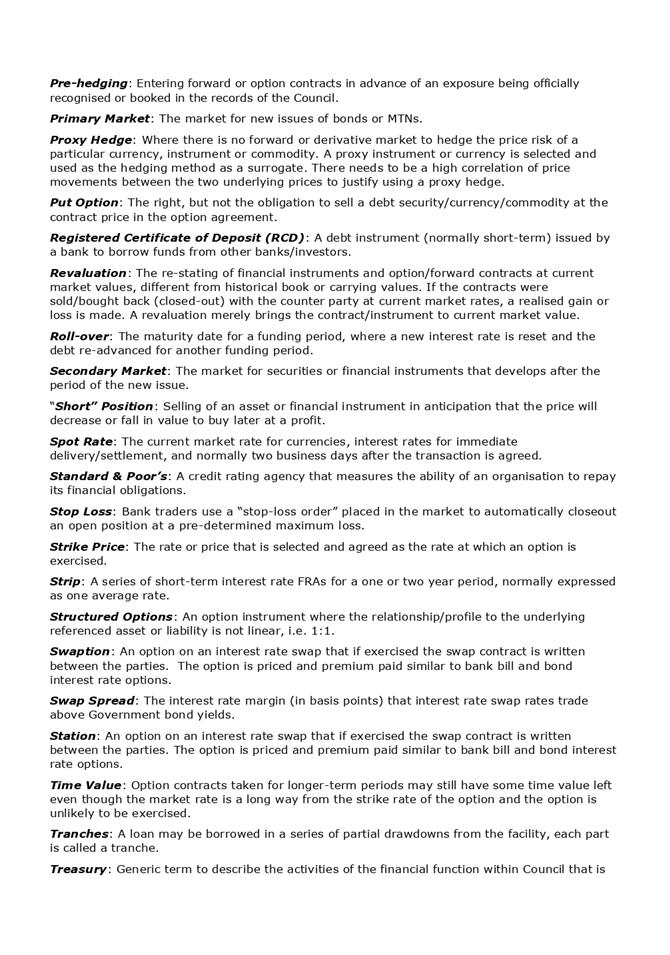

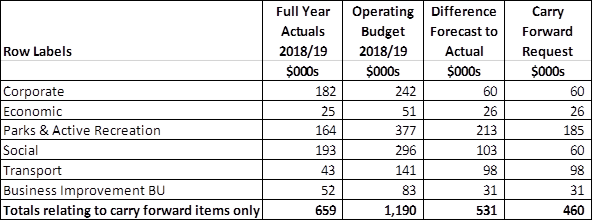

3.1 The capital programme

for 2018/19, as agreed in the Long Term Plan 2018-28, totalled $42.1 million,

including staff costs of $2.2 million and excluding Nelson Regional Sewerage

Business Unit (NRSBU), Nelson Tasman Regional landfill and vested assets.

All figures quoted in this report are calculated on this basis.

3.2 The addition of 2017/18

carry forwards, and other resolutions of Council over the 2018/19 year adjusted

the total capital budget to $42.8 million.

3.3 The 2018/19 capital

budgets were forecast quarterly throughout 2019 with a view to what could

realistically be achieved in the remainder of the financial year. The total

capital budget was reforecast to $36.3 million at the end of quarter three (Q3)

which informed the Annual Plan 2019/20. The 2018/19 budget movements

incorporated in the Annual Plan 2019/20 were approved on adoption of the Annual

Plan on 27 June 2019. In particular, $4.8 million was carried forward from

2018/19 to 2019/20 during the Annual Plan process.

3.4 Total capital

expenditure for the 2018/19 year was $34 million, $8.8 million less than the

adjusted 2018/19 Long Term Plan budget of $42.8 million. Of this, $2.6 million

has been identified as savings or reallocations.

3.5 Reasons for capital

carry forwards and deferrals being requested include:

· alterations to the

phasing of multi-year projects

· reliance on

external funds

· delays created by

weather/season requirements, negotiations with external parties

· construction

delays

· lead time in

procuring materials and equipment

· projects running

behind time

3.6 Carry forwards for operating

budgets are presented for the approval of the sub-committee and are needed to

complete programmed work.

3.7 Once the 2018/19 year

was closed for invoice processing, officers collated data relating to the

projects undertaken during the year, identifying variances against the

reforecast. Project managers were asked to identify which variances represented

savings, and where they wished to carry forward budget into 2019/20 they were

asked to support their request. The Senior Leadership Team have reviewed the

resulting information to ensure that the requested carry forward is justified.

4. Discussion

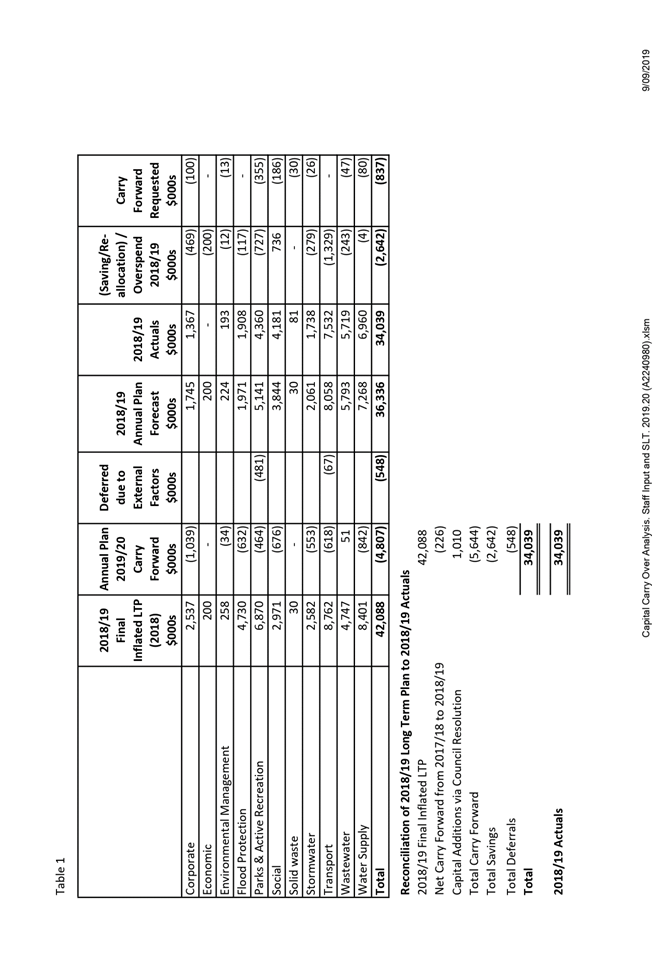

Capital

savings and reallocations

4.1 Officers identified $2.6

million of savings and reallocations in capital expenditure against the 2018/19

Long Term Plan. This figure includes key projects delivered under budget ($1.7

million), savings in capital staff time ($471,000), and a greater proportion of

expenditure relating to preliminary work, which is re-classified as operating

expenditure, than budgeted ($412,000). Projects delivered under Long Term Plan

budget include Water Treatment Plant Membrane renewals, streetlight conversion

to LED, and the hockey turf replacement.

4.2 In total this saving

will have a positive impact on interest, depreciation and debt levels, in

excess of that already identified in the 2019/20 Annual Plan.

Capital

carry forwards and deferrals

4.3 Officers have

requested that $837,000 be carried forward. Of this, $779,000 is requested to

be added to 2019/20 capital budgets, and $58,000 is requested to be carried

forward to future years.

4.4 Officers have

requested that $101,000 be deferred due to reliance on external factors. This

amount is requested to be added to the 2019/20 capital budgets. This is in

addition to the $447,000 deferred during the 2019/20 Annual Plan process,

taking the total deferral due to reliance on external factors to $548,000.

4.5 Together, the carry

forward and deferrals increase the total capital programme for 2019/20 by

$879,000 to $44.8 million, compared to the budget established through the

2019/20 Annual Plan of $43.9 million (excluding vested assets and NRSBU but

including staff time).

4.6 A breakdown of budget

movements in the total 2018/19 capital budgets is provided as Table 1.

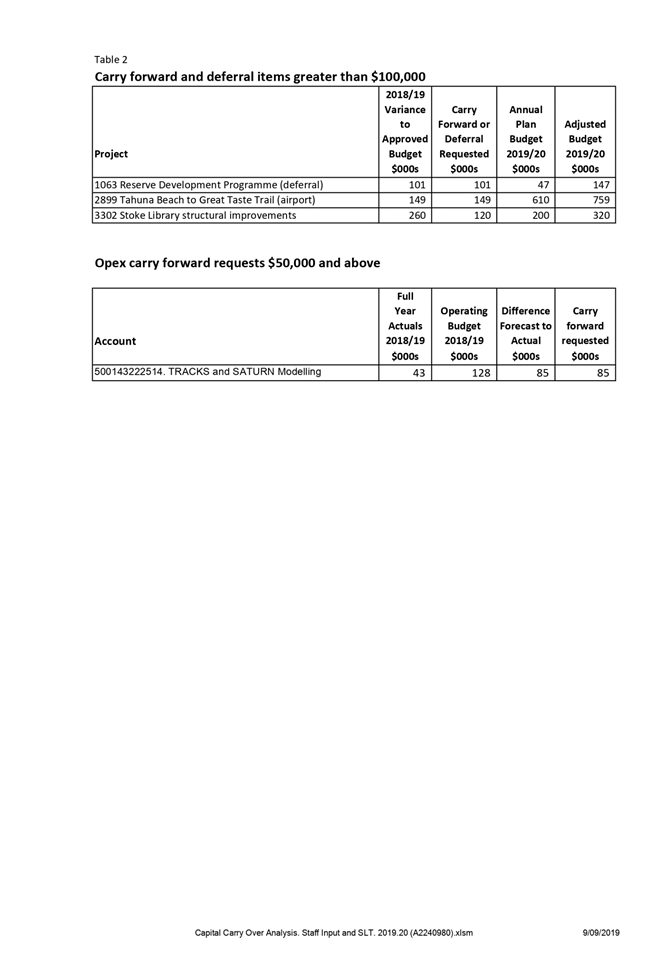

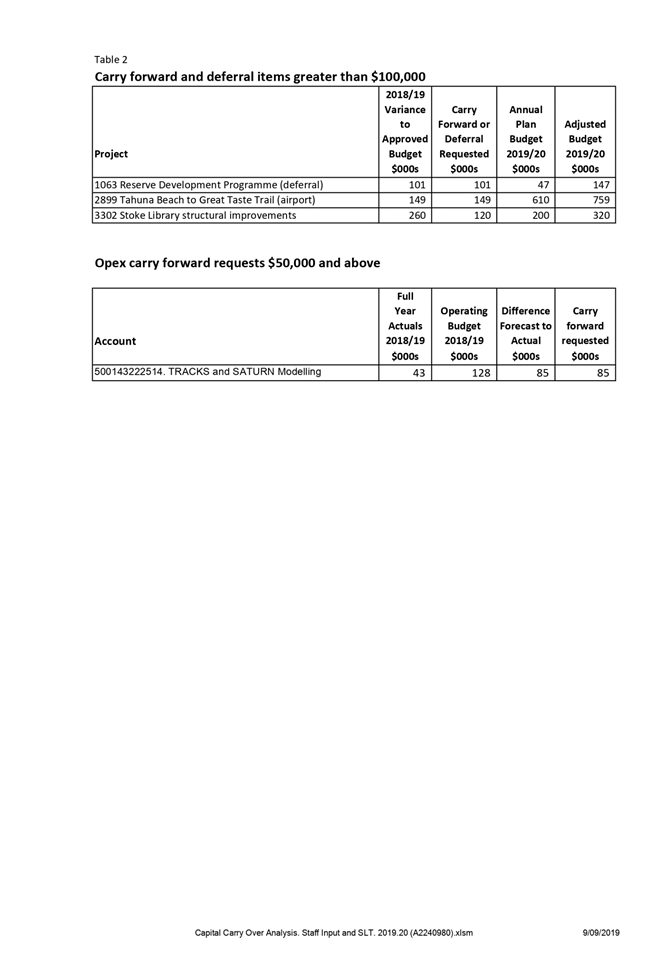

4.7 Table 2 itemises capital

projects with carry overs requested greater than $100,000. These are new carry

overs which have been requested in addition to those approved during the

2019/20 Annual Plan.

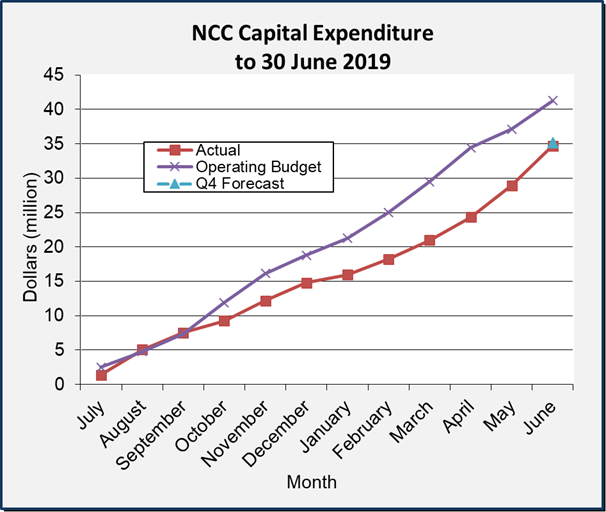

Operating expenditure carry

forwards

4.8 Officers were asked to

identify operating projects and programmes that will be completed in the new

financial year and which require a carry- over of funds in order to do so. A

total of $460,000 has been requested.

4.9 Totals by activity are

as follows:

4.10 Operating programmes/projects

with carry overs requested greater than $50,000 are itemised in Table 2.

Reasons for requesting operating

carry forwards include:

· Grants or

collaborative expenditure agreed to

· Work contracted

but not complete at 30 June

· Health and safety

items which cannot be funded from 2019/20 budgets

· Programmed

maintenance delayed due to weather or contractor availability some of which has

now been spent in 2019/20

· Operating projects

that span more than one year

· Opportunity to

take advantage of third party funding in 2019/20.

5. Options

5.1 Council officers

support Option 1, approve the recommendations. Not approving the

recommendations would be problematic as the future scope of some of these

projects has been agreed through Committee and Council resolutions including

Annual and Long Term Plans prior to this meeting. Work has continued on these

projects based on those decisions.

|

|

|

Advantages

|

· Work

has continued on 2018/19 capital projects and programmed operating projects

and costs have been incurred.

· The

carry forward spending is within previously approved budgets.

|

|

Risks and Disadvantages

|

· None

|

|

|

|

Advantages

|

· Council

could if they wished remove some items from the list of budgets to be carried

forward.

· Savings

in future debt, depreciation, interest and maintenance costs would occur.

|

|

Risks and Disadvantages

|

· The

projects concerned would then not have sufficient budget to be completed.

· Council

do not have complete information through this report to fully inform such a

decision.

|

6. Conclusion

6.1 An analysis of capital

and programmed operating expenditure against forecast for 2018/19 and

subsequent review by the Senior Leadership Team indicates:

· There are

savings and reallocations from the capital budget of $2.6 million compared to

the 2018/19 Long Term Plan.

· Additional capital

budget of $837,000 not spent should be carried forward, making a total carry

forward of $5.6 million. $779,000 should be carried forward into 2019/20 and

$58,000 should be carried forward to future years.

· Capital

budget of $101,000 not spent due to external factors should be deferred to

2019/20, making a total deferral of $548,000.

6.2 $460,000 of programmed

operating expenditure not spent should be carried forward into 2019/20 to

progress or complete programmed work that has already been rated for.

6.3 The 2017/18 carry

forwards were made during the Long Term Plan 2018-28 (when $19.7 million was

removed from the capex program) and additionally at year end. The additional

end of year movements approved in the Carry Forwards Report 2017/18 were as

follows:

· $4.9 million

capital carry forward

· $701,000 operating

carry forward

· $945,000 capital

savings

Author: Laura

Papp, Management Accountant

Attachments

Attachment 1: A2240980 - Tables 1 &

2 - Carry Over Report ARF 17Sept2019 ⇩

|

Important

considerations for decision making

|

|

1. Fit with Purpose of

Local Government

Approval of the recommendation will allow

progress/completion of approved projects, supporting the delivery of public

infrastructure and services.

|

|

2. Consistency with

Community Outcomes and Council Policy

Approval of this recommendation will allow projects

as approved in the Annual Plan 2018/19 and subsequent Council resolutions to

be delivered.

|

|

3. Risk

Failure to approve the recommendation will introduce

risk (financial, contractor and community relationships, health and safety)

which does not currently exist.

|

|

4. Financial impact

There is little financial impact from approving the

recommendation as budgets are already approved and funded.

|

|

5. Degree of significance

and level of engagement

This matter is of low significance as budgets are

already approved and the recommendation confirms business as usual. Therefore

no engagement is required.

|

|

6. Inclusion of

Māori in the decision making process

No engagement with Māori has been undertaken in

preparing this report.

|

|

7. Delegations

The Audit, Risk and Finance Subcommittee has the

following delegations to consider the 2018/19 Carry Forwards.

Areas of Responsibility:

· Management

of financial risk

· Council’s

financial and service performance

Powers to Decide: None

Powers to Recommend:

· Any

matters within the areas of responsibility or such other matters referred to

it by the Council

|

Item 8: Carry Forwards 2018/19: Attachment 1

Item 9: Draft Treasury

Management Policy including Liability Management and Investment Policies

|

|

Audit, Risk and Finance Subcommittee

17 September 2019

|

REPORT R10282

Draft

Treasury Management Policy including Liability Management and Investment

Policies

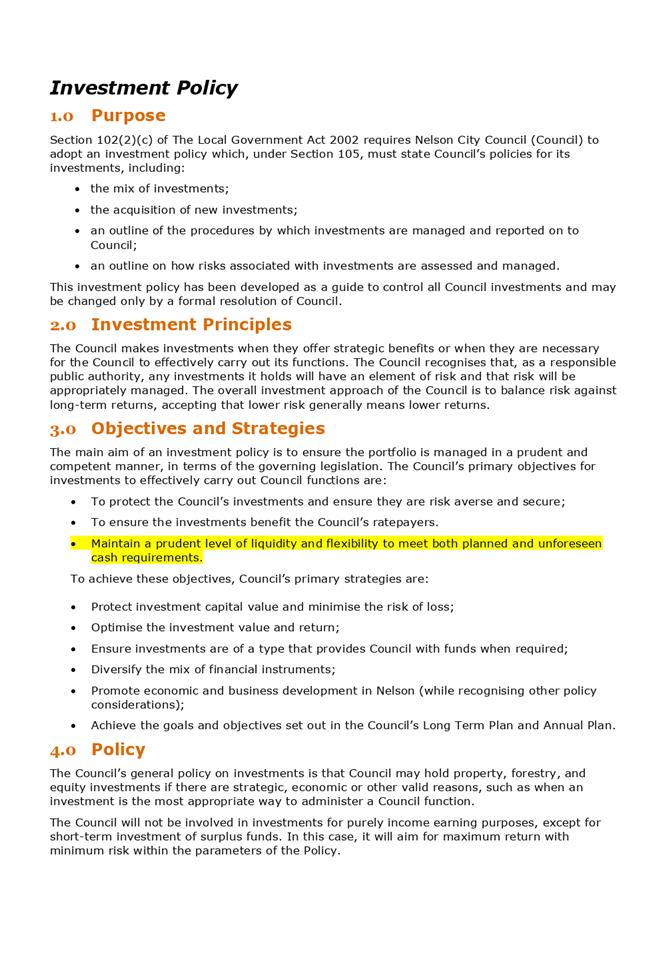

1. Purpose

of Report

1.1 To

adopt the new Treasury Management Policy including the amended Liability

Management and Investment Policies.

2. Recommendation

|

That the Audit, Risk and Finance Subcommittee

1. Receives

the report Draft Treasury Management Policy including Liability Management

and Investment Policies (R10282)

and its attachment (A2258406).

|

Recommendation to Council

|

That the

Council

1. Adopts the Treasury Management

Policy (A2258406).

|

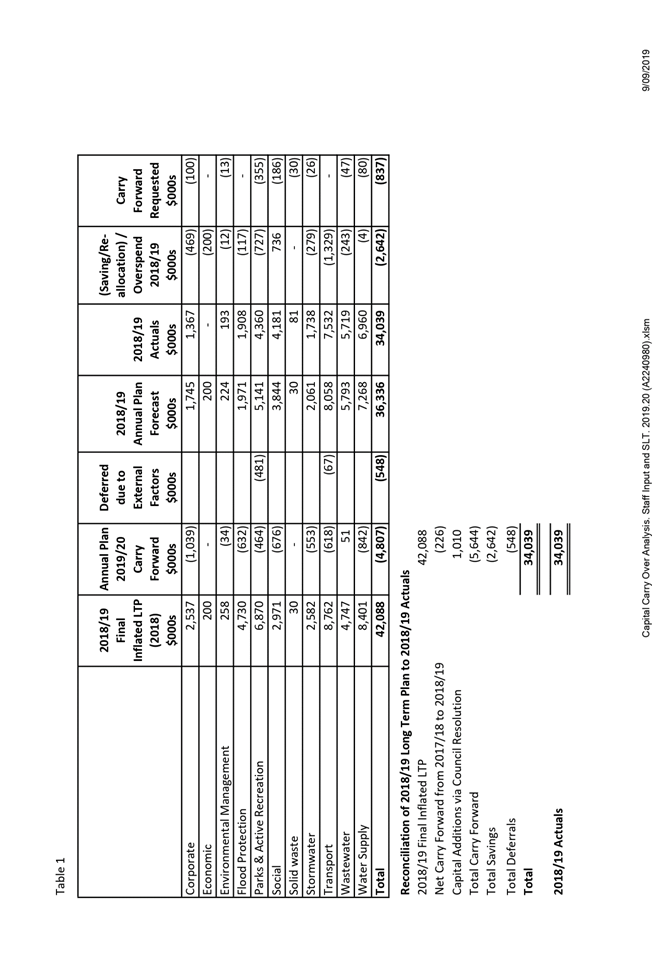

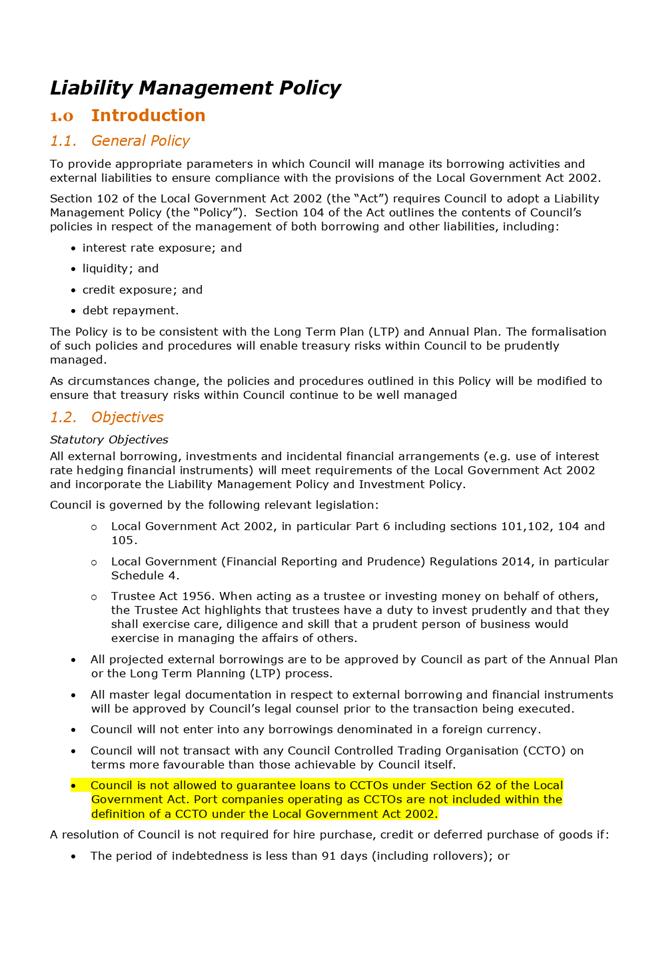

3. Background

3.1 Under

the Local Government Act 2002 (LGA) section 102(2)(b) Council must adopt a

Liability Management Policy. The current Liability Management Policy was

adopted in August 2017 and is due for review August 2020. Recent changes

in the sector have prompted an earlier review of this policy.

3.2 Under

the LGA section 102 (2)(c) Council must adopt an Investment Policy. The

current Investment Policy was adopted by Council in April 2015 and was due for

review in 2018. This did not occur due to workload constraints.

3.3 The

attached draft Treasury Management Policy combines the amended Liability

Management and Investment Policies for efficiency and ease of reading.

4. Discussion

4.1 The

Council’s treasury advisors, Price Waterhouse Cooper (PWC), have reviewed

and updated the Council’s Liability Management and Investment Policies

and proposed that these are combined as one document in the draft Treasury

Management Policy (Attachment 1) including an index and glossary of terms for

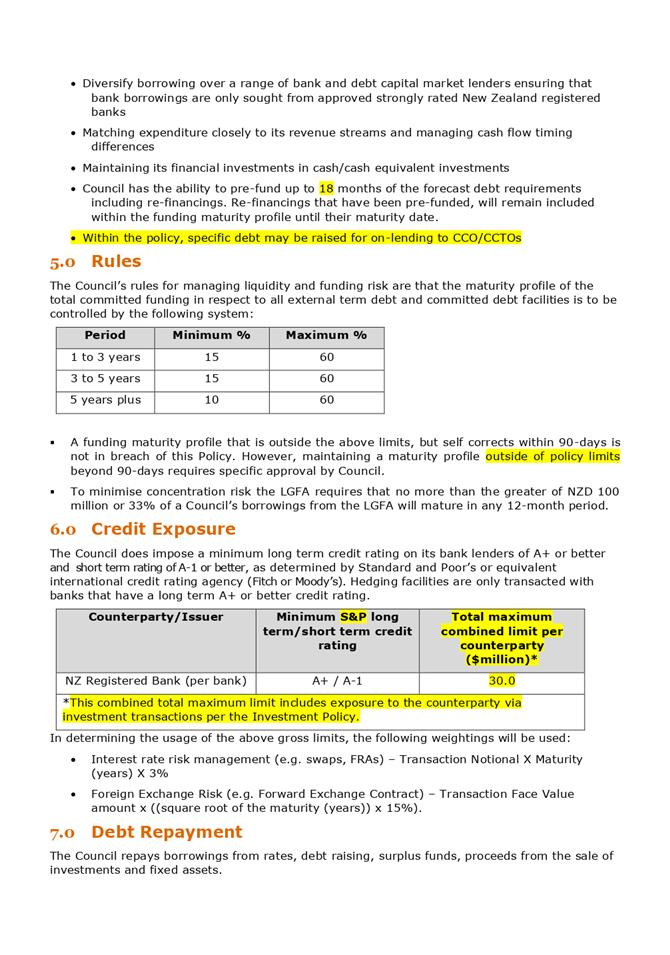

ease of reading. Changes to the policies are highlighted in yellow.

Liability

Management Policy

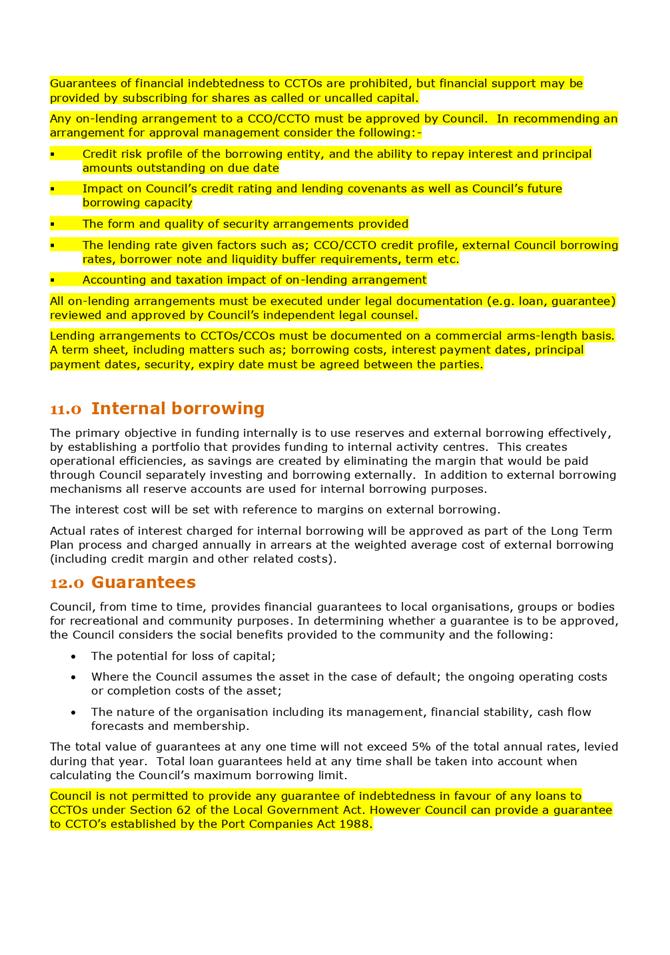

4.2 The

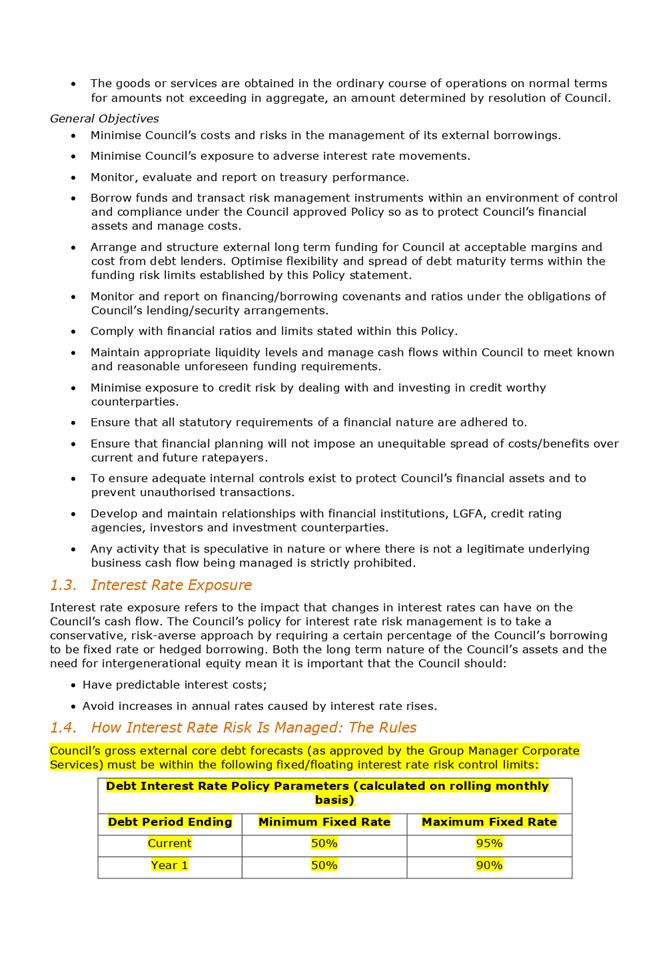

review focused on the following main areas:

4.3 Changing

the interest rate risk management policy framework (Section 1.4).

4.3.1 The

recommended framework provides greater flexibility in forward managing

long-term interest rate exposures given the Council’s long term planning

horizon.

4.3.2 The

policy approach maintains a minimum and maximum percentage band for each

independent year of the 15-year forecast debt horizon.

4.4 Incorporating

the delegations and procedures upon which the Council on-lends to Council

Controlled Organisations (CCOs) and Council Controlled Trading Organisations

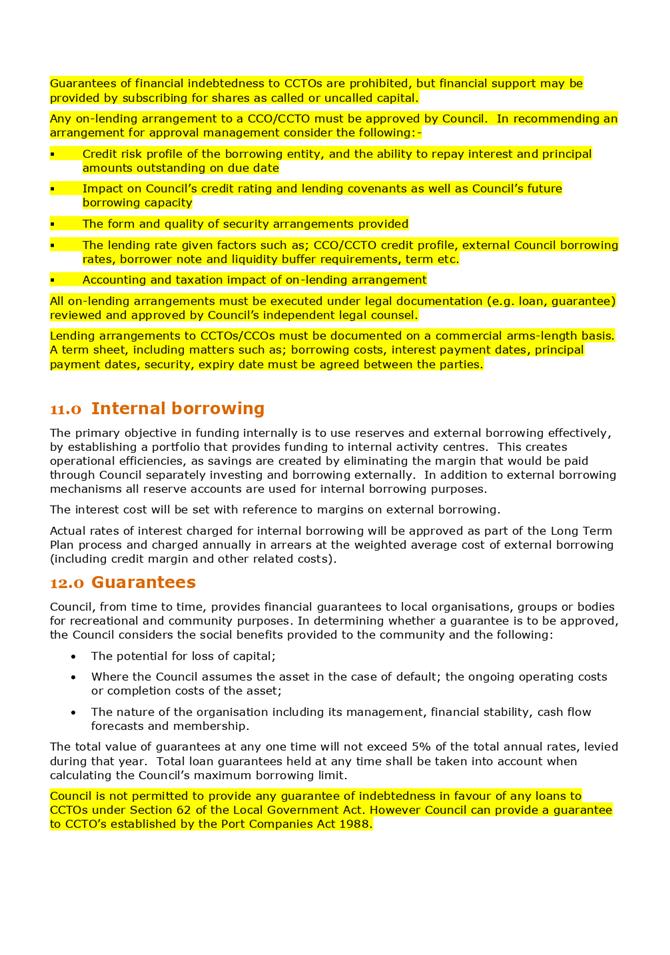

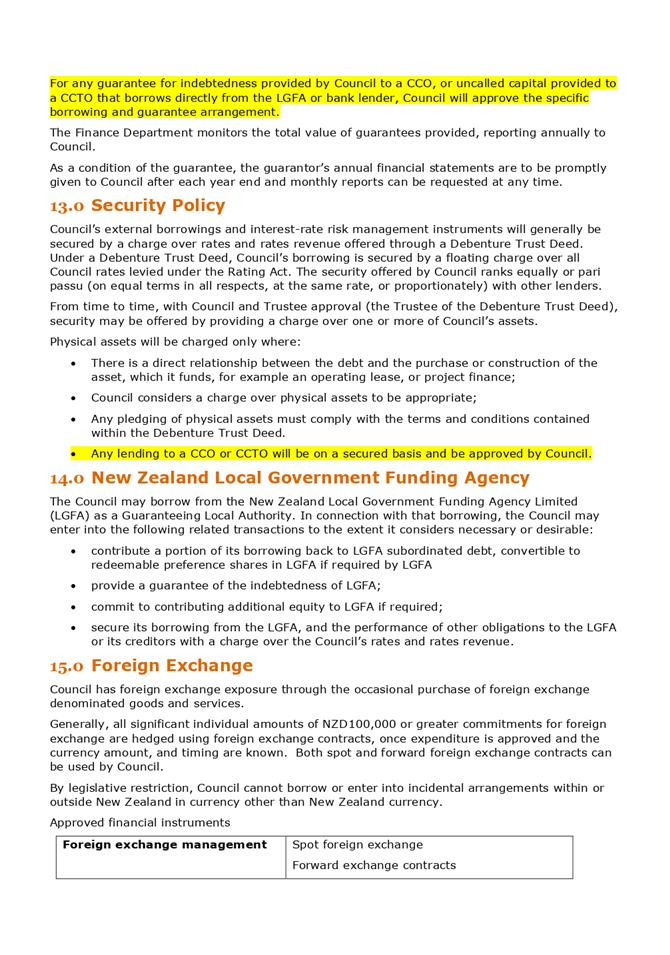

(CCTOs). These changes impact section 4, 10, 12 and 13.

4.4.1 This

update has been incorporated due to the Local Government Funding Agency’s

(LGFA’s) change in its lending policies to allow direct funding to these

entities. Any lending will require credit support from the Council, whether

through the provision of a guarantee or uncalled capital.

4.5 A

recommendation that the Council increases the timeframe for entering into debt

pre-funding strategies to manage debt re-financing risk from 12 months to 18

months (Section 4).

4.5.1 This

is in light of proposed changes to the credit rating methodology announced by

the Standard & Poor’s Global Ratings Agency (S&P).

4.6 PWC

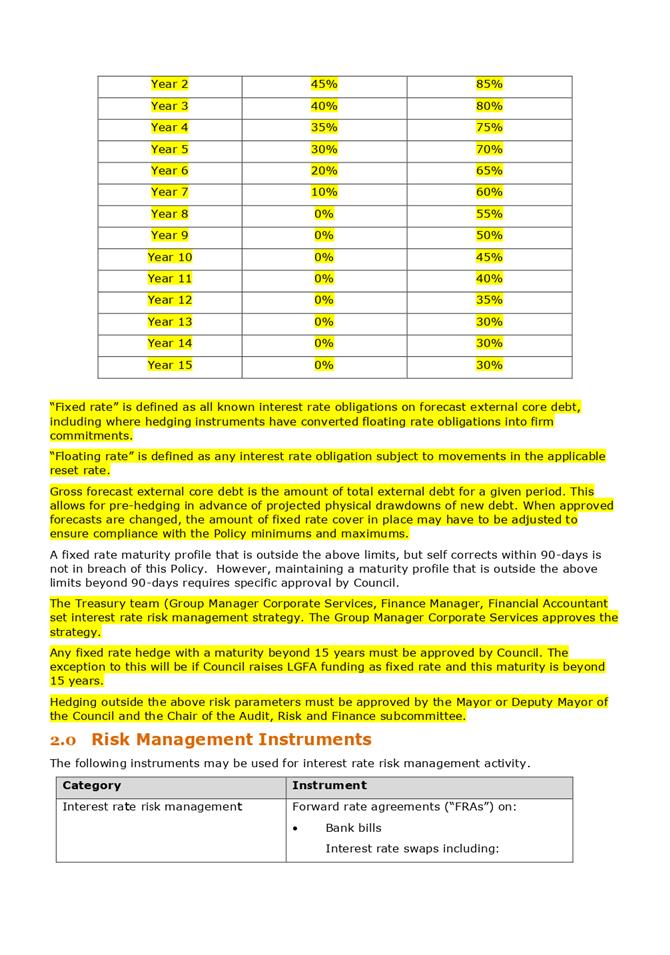

also recommends some other changes as follows:

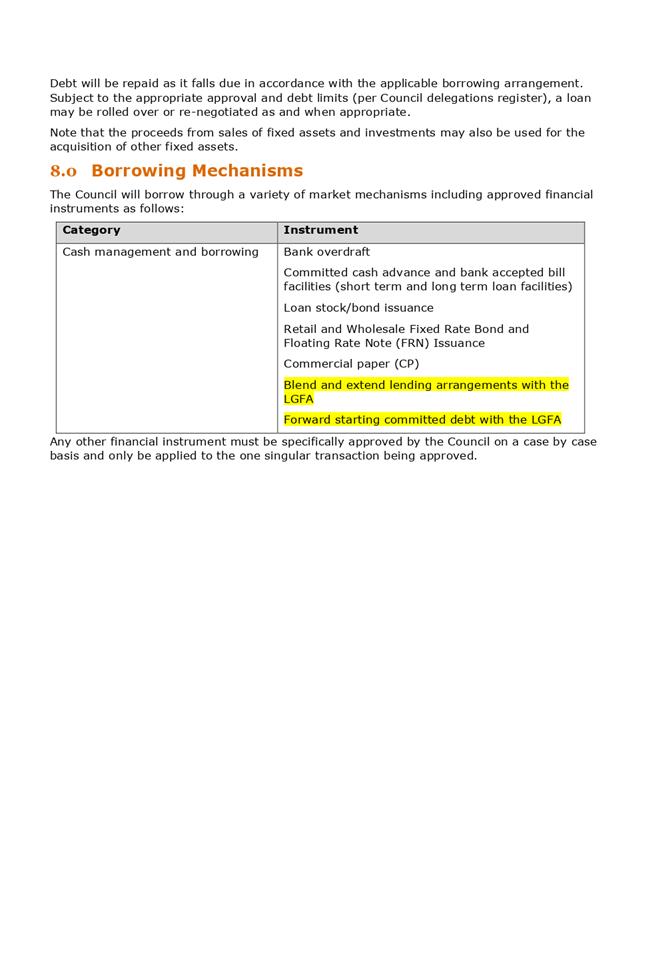

4.6.1 Debt

Management Instruments (Section 8) - two additional debt management instruments

are recommended to be incorporated into the Policy as allowable

‘Borrowing Mechanisms’ in light of proposed changes to S&P

methodology and corresponding offering from the LGFA. These instruments are

Blend and extends via the LGFA and a forward starting committed bonds with the

LGFA. Both mechanisms will avoid the grossing up of the balance sheet that

usually occurs with the pre-funding of maturing core debt.

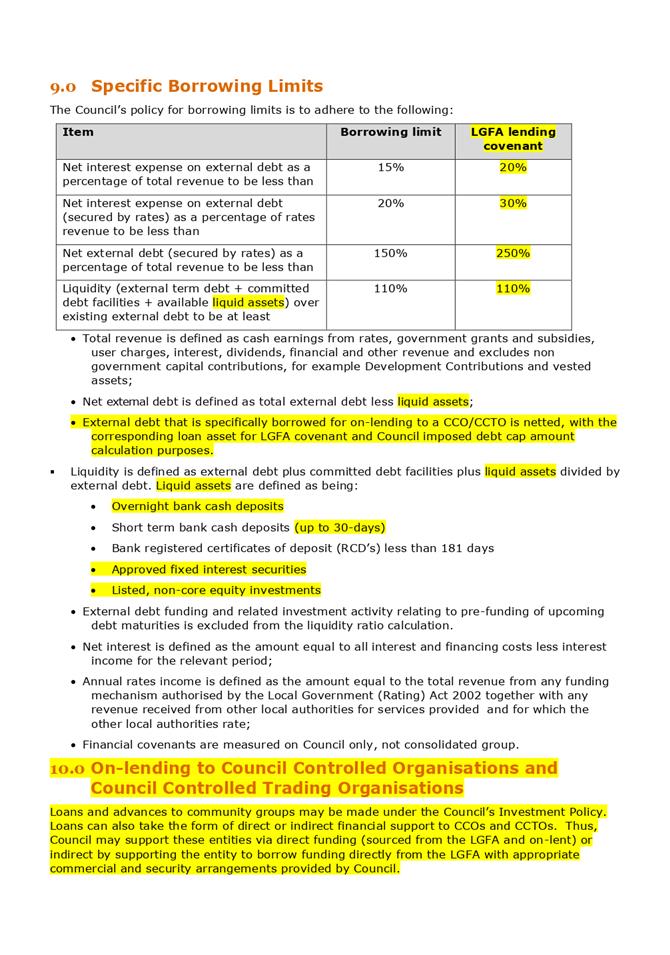

4.6.2 Specific

borrowing limits (Section 9) - Inclusion of the LGFA lending covenants

alongside the Specific Borrowing Limits Council sets for internal risk

management.

4.6.3 Specific

borrowing limits (Section 9) - some changes to the definition of liquid assets

to reflect changes made recently to how the LGFA will view liquidity and in

light of changes to the S&P ratings methodology framework.

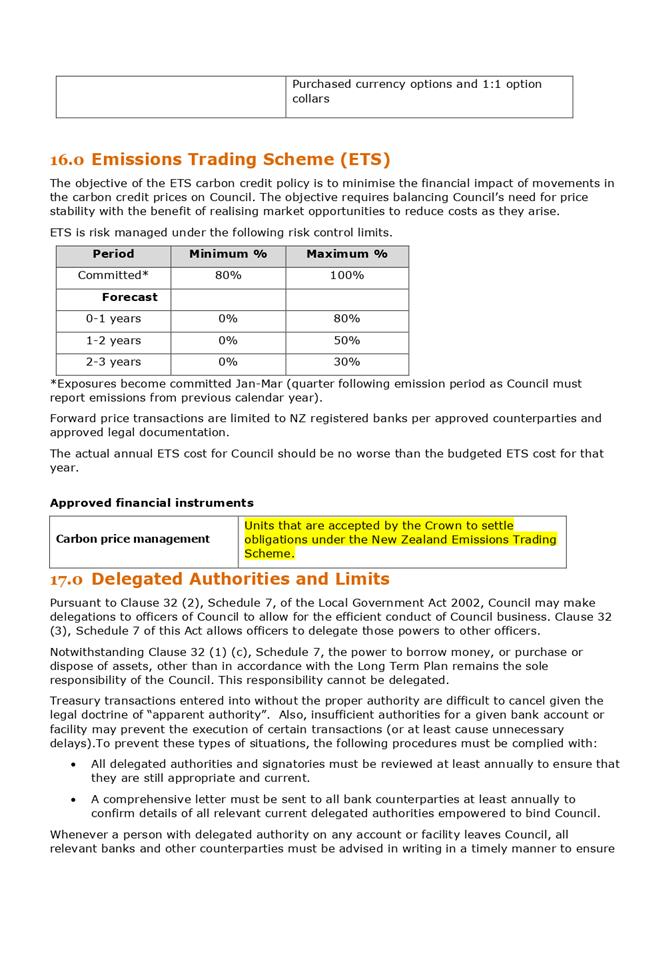

4.6.4 Approved

financial instruments (Section 16) – a change to the wording of allowable

instruments used to manage carbon price risk in light of continuing uncertainly

around the NZ Emissions Trading Scheme (ETS).

Investment Policy

4.7 Key

updates from the previous Policy are:

4.7.1 Updating

the Objectives and Strategies (section 3) of the policy to include

“Maintain a prudent level of liquidity and flexibility to meet both

planned and unforeseen cash requirements”.

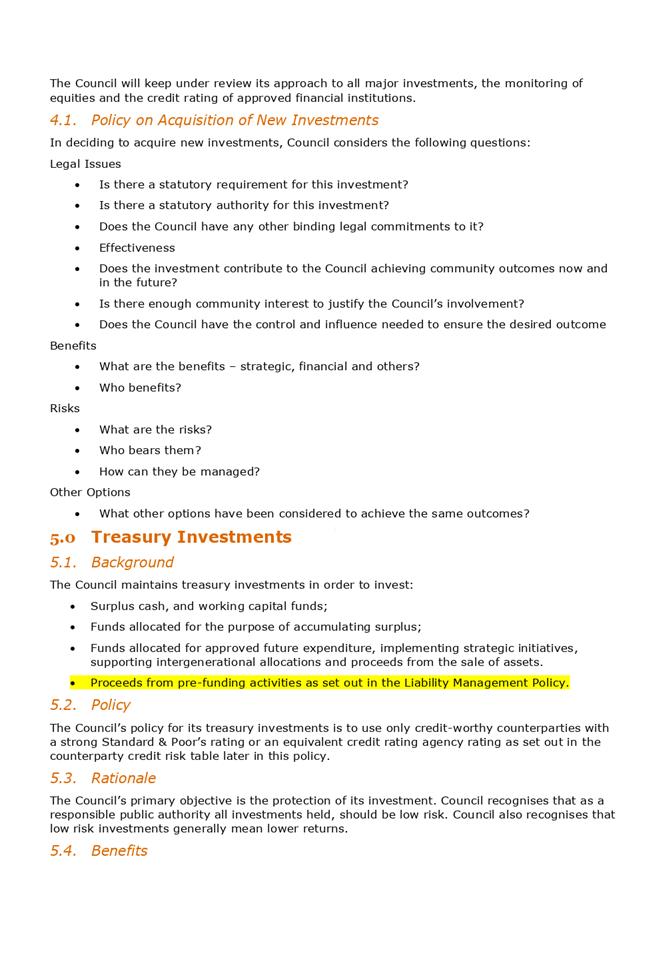

4.8 Treasury

Investments

4.8.1 Updating

the Background (section 5.1) and risks to deal with the fact that Council is

now pre-funding debt maturities with investments allowable up to 18 months.

4.8.2 Clarification

of definitions of counterparty credit risk and liquidity risk by referring to

definitions within the Liability Management Policy.

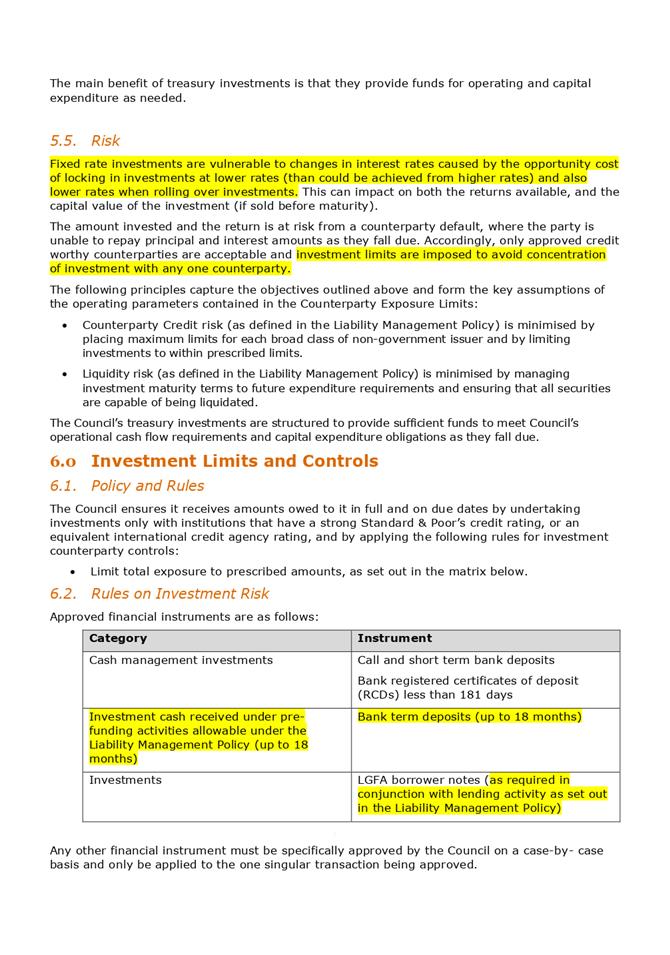

4.8.3 Section

6.2 - expressly excluding investment securities (1) Structured debt where

issuing entities are not primary borrower/issuers; (2) Subordinated debt (other

than borrower notes subscribed from the LGFA), junior debt, perpetual notes and

debt/equity hybrid notes such as convertibles.

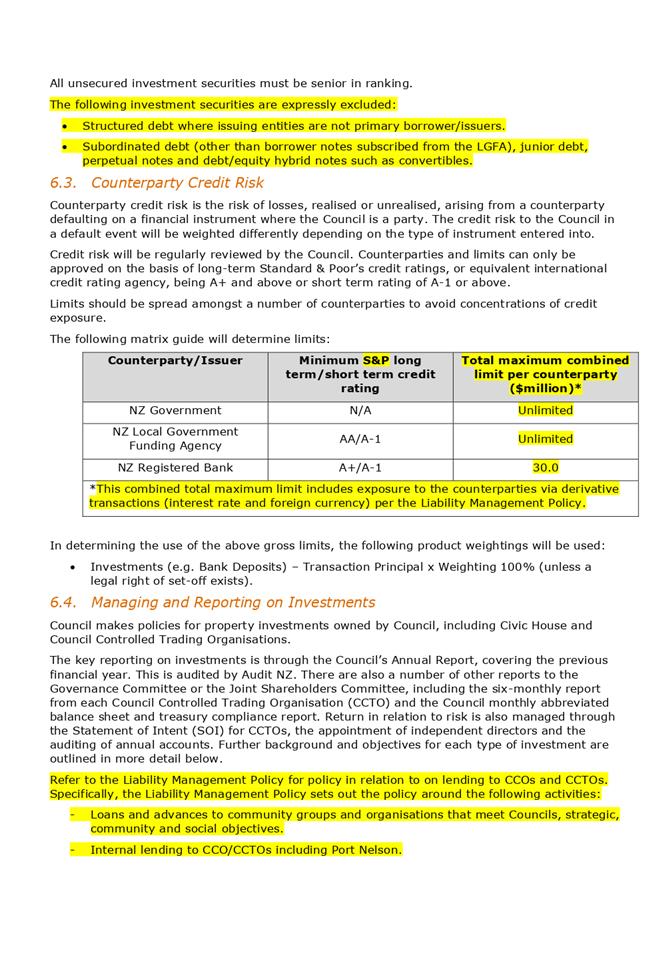

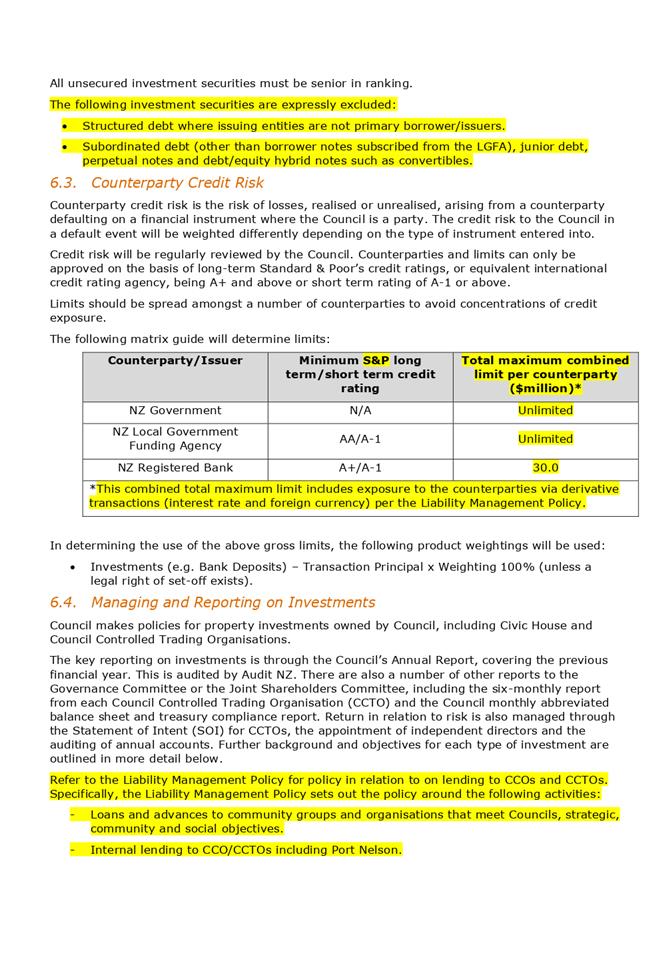

4.8.4 Section

6.3 - Counterparty credit risk – The main change recommended relates to

the makeup of the counterparty credit limit. Under the existing policy, a limit

is built up of a set amount for investments and an additional amount for the

impact of derivative transactions (foreign currency and interest rates) with

this second part currently residing in the Liability Management Policy.

· For Counterparty credit

risk PWC has recommended a single limit is applied for each counterparty bank

and the makeup of that limit is flexible within the approved limit amount

– i.e. there aren’t set sub-limits for each exposure.

· The rationale for this

change is due to the following: (1) provides Council with the flexibility to

vary the mix of transactions in order to get the best outcomes from each bank

counterparty (2) maintains a spreading of risk amongst bank counterparties (3)

given the changes to S&P methodology, to increase prefunding activity to 18

months (see the Liability Management changes section below), this approach

allows additional investment where required for prefunding activity. Council

will meet the counterparty credit risk spreading requirements with the increased

allowance under the new policy recommendation.

4.9 Other

Investments

4.9.1 Port

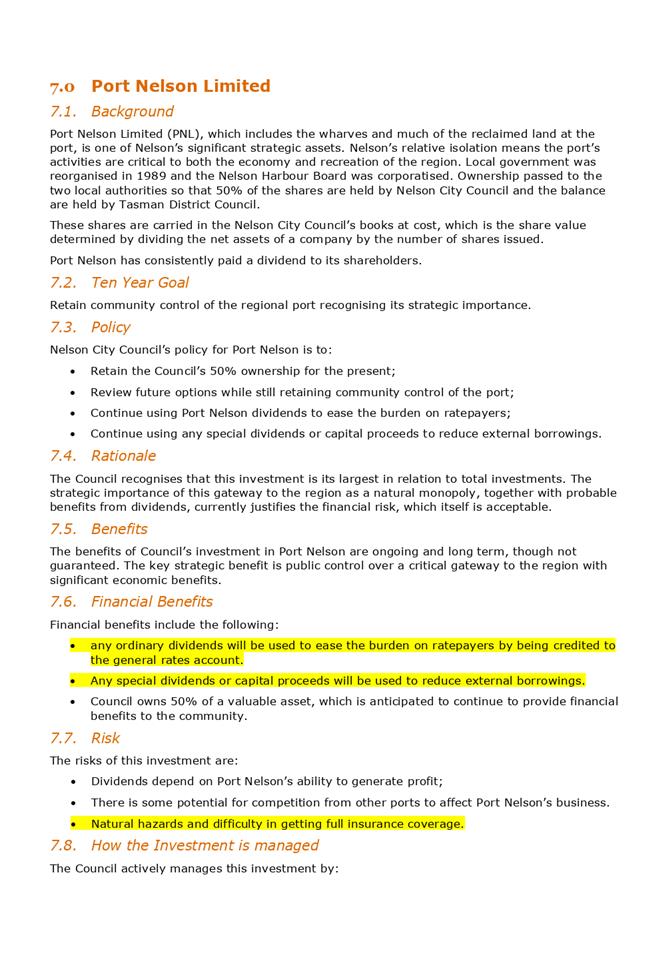

Nelson Limited (Section 7.6) – in the Financial Benefits section the

wording about the use of ordinary and special dividends has been changed to

bullet points consistent with Nelson Airport Limited but this doesn’t

change the policy intent.

4.9.2 Port

Nelson Limited (Section 7.7) risks updated to include natural hazards and

difficulty in getting full insurance coverage.

4.9.3 Nelson

Airport Limited (Section 8.7) risks updated to include natural hazards.

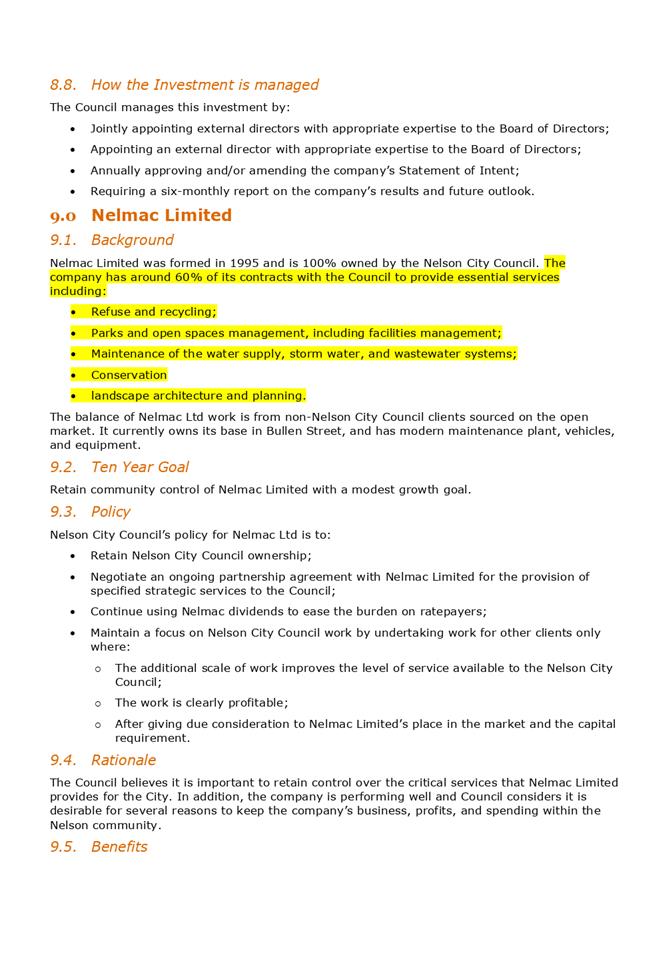

4.9.4 Nelmac

Limited (Section 9.1) – updated the Background section to align with

Nelmac’s current Statement of Intent.

4.9.5 Remove

the section on Nelson Tasman Tourism which was a CCTO but has ceased operating

and was merged to form Nelson Regional Development Agency on 1 July 2016.

4.9.6 Forestry

(Section 10) – updated the rationale for holding the forestry assets to

reflect the strategic review in 2016. Council reviewed the forestry

strategy in 2016 and resolved to retain productive commercial forests that can

be managed sustainably and retire some 140ha of forests and consider alternate

use. There are some other minor wording changes.

4.9.7 Property

investment – deleting Betts carpark which was sold in 2018.

4.9.8 Ridgeway

Joint Venture – deleting reference to this entity as it was sold in 2017.

4.9.9 Civic

Financial Services Limited (Section 13) – updating the section for the

name change from New Zealand Local Government Insurance Corporation Limited

(Trading As Civic Assurance) and background and rationale as the company is no

longer in the insurance market.

4.10 Finance

staff have conducted a review of the changes in depth, page by page, and are

satisfied with the recommendations. Council’s Treasury advisor PWC will

be at the meeting to answer any questions.

5. Options

|

Option 1: Adopt the Treasury

Management Policy

|

|

Advantages

|

· changes

are recommended by Council’s treasury advisor and are considered

current best practice

· can

continue to proactively manage treasury risk

|

|

Risks and Disadvantages

|

· none

|

|

Option 2: do not adopt the

Treasury Management Policy

|

|

Advantages

|

· no

change from existing policy

|

|

Risks and Disadvantages

|

· policy

will not conform to current best practice

· Investment

Policy section is overdue for review.

|

6. Next

Steps

6.1 On

approval at Council the adopted Treasury Management Policy will come into

effect and will be updated on the Council website.

6.2 Future

compliance reporting to the Audit Risk and Finance committee will be against

the new framework.

6.3 Active

daily monitoring of compliance against the policies are the responsibility of

the Group Manager Corporate Services and the Finance Manager.

Author: Nikki

Harrison, Group Manager Corporate Services

Attachments

Attachment 1: A2258406 - Treasury

Management Policy including the Liability Management and Investment Policy -

Sept 2019 ⇩

|

Important

considerations for decision making

|

|

1. Fit

with Purpose of Local Government

Risk management through having an Investment Policy

and Liability Management Policy enables more efficient and effective

provision of services as set out in section 10(1)(b) of the Local Government

Act.

|

|

2. Consistency

with Community Outcomes and Council Policy

The Liability Management and Investment Policies are

required by section 102 of the Local Government Act. Nothing in the

proposed Treasury Management Policy (including the Investment Policy and

Liability Management Policy) is inconsistent with any other previous Council

decision or Council Policy. Updating the policy supports the community

outcome “Our Council provides leadership and fosters partnerships, a

regional perspective and community engagement”.

|

|

3. Risk

There is limited risk from the proposed changes.

|

|

4. Financial

impact

There is no direct financial impact from adopting

the Treasury Management Policy.

|

|

5. Degree

of significance and level of engagement

This matter is of low significance because it

includes minor amendments to existing policies, therefore no consultation has

taken place.

|

|

6. Inclusion

of Māori in the decision making process

No engagement with Māori has been undertaken in

preparing this report.

|

|

7. Delegations

The Audit Risk and Finance Subcommittee has the

following delegations to consider Investment and Liability Management

Policies:

Areas of Responsibility:

· Council’s

Treasury functions and policies

Powers to Decide: None

Powers to Recommend:

· Any

matters within the areas of responsibility

|

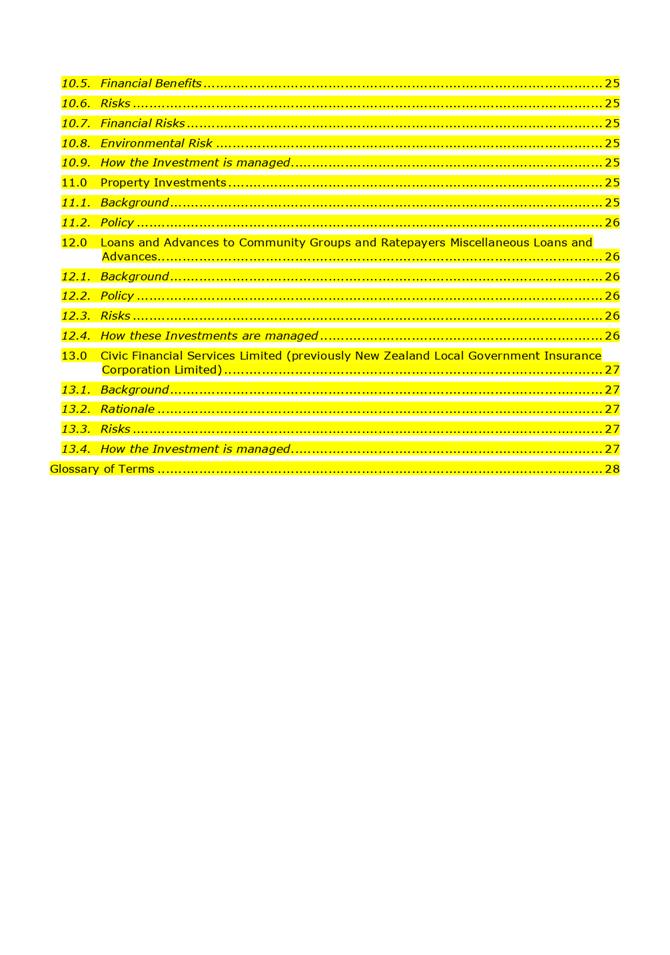

Item 9: Draft Treasury Management Policy including Liability

Management and Investment Policies: Attachment 1

Audit, Risk and Finance

Subcommittee

Audit, Risk and Finance

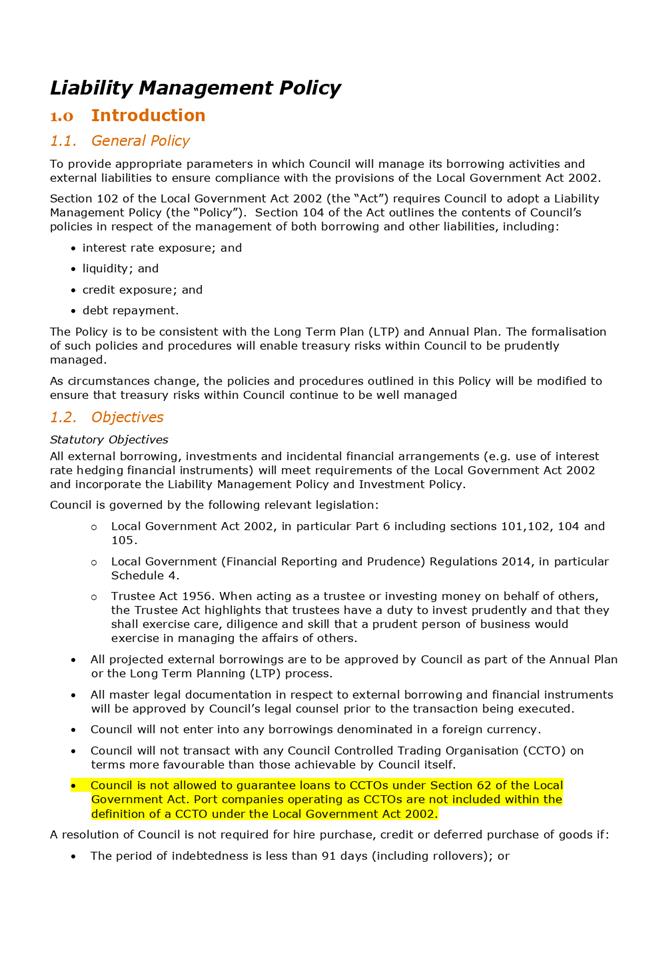

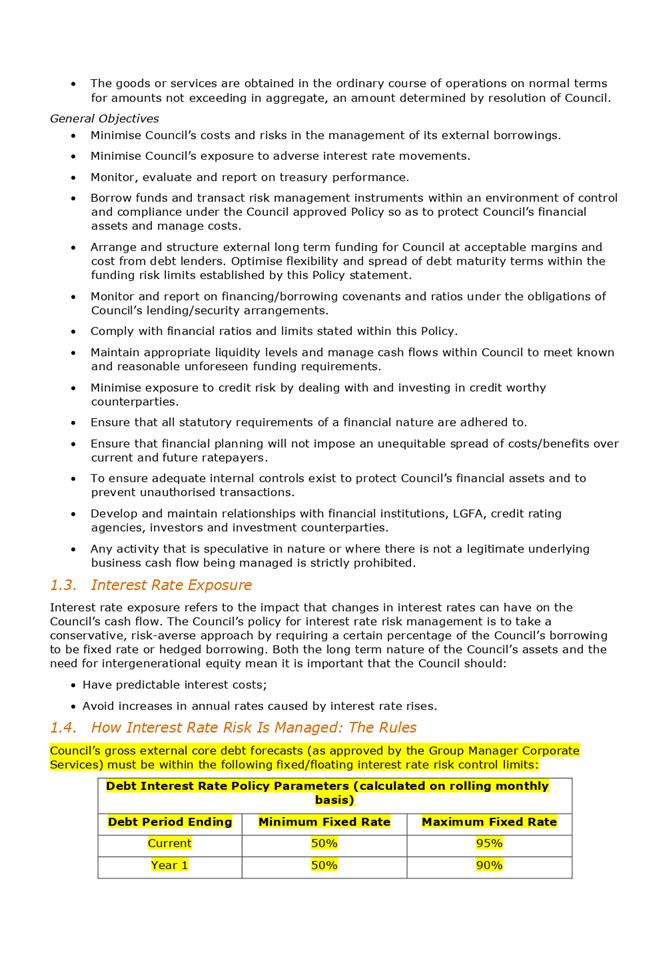

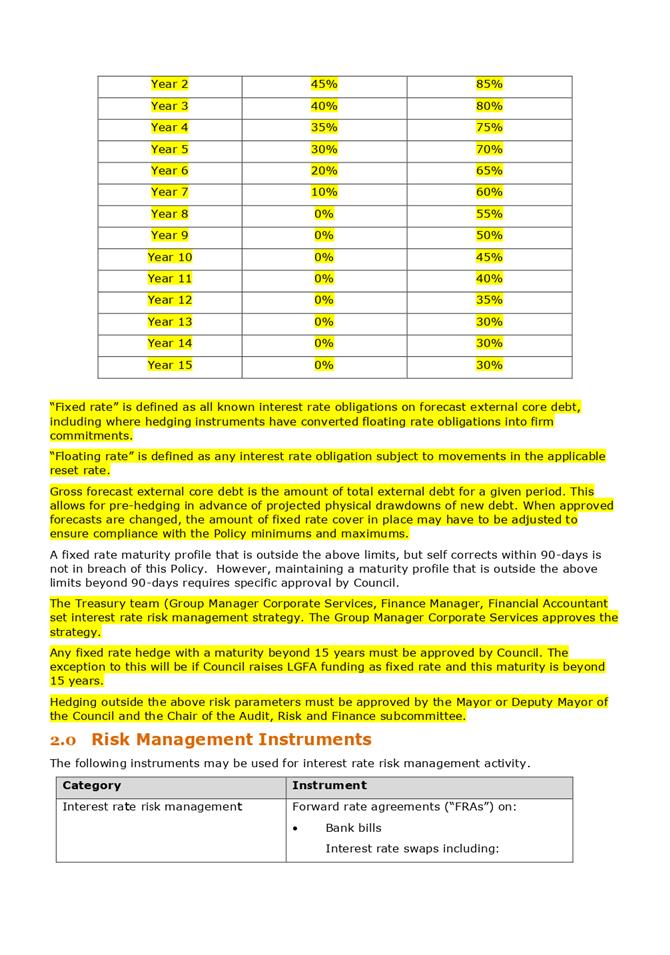

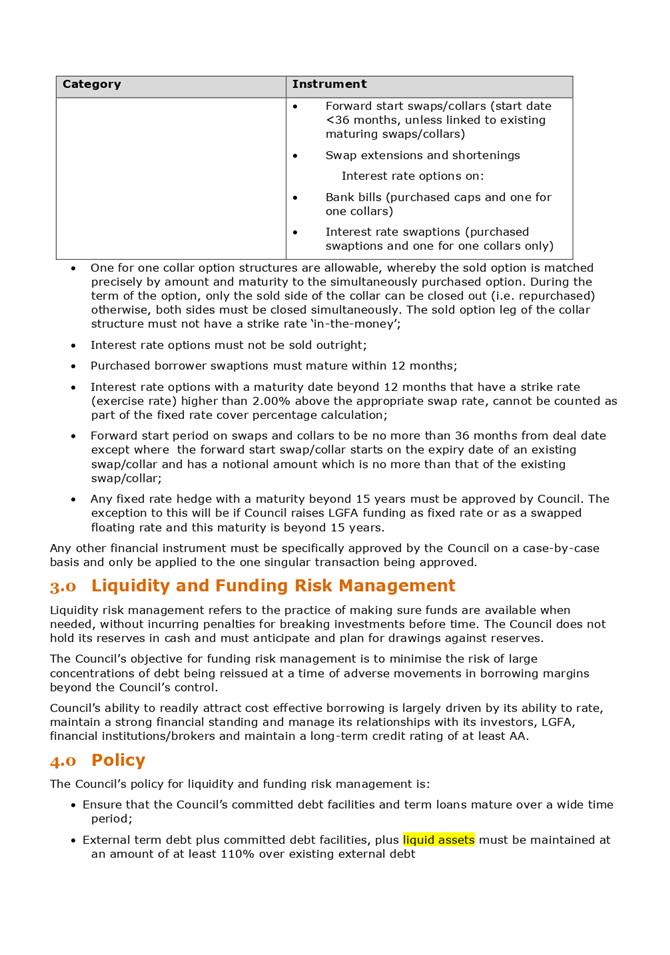

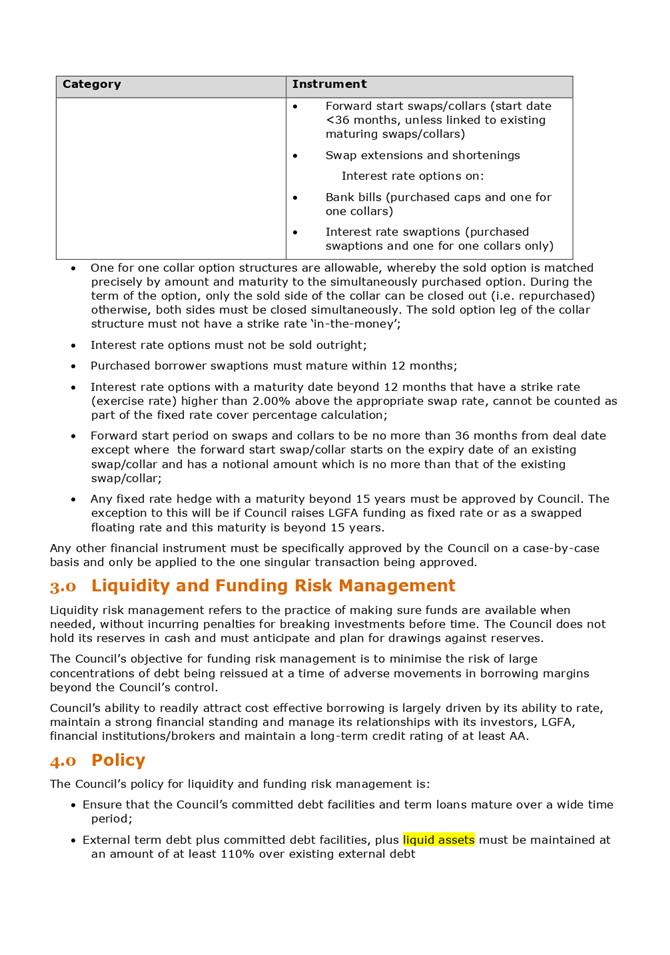

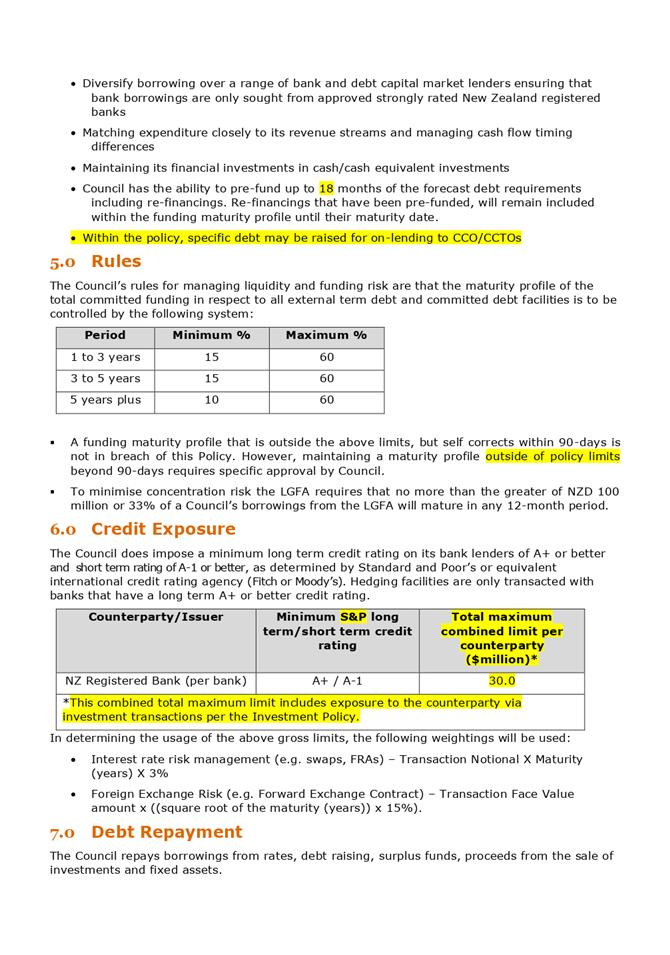

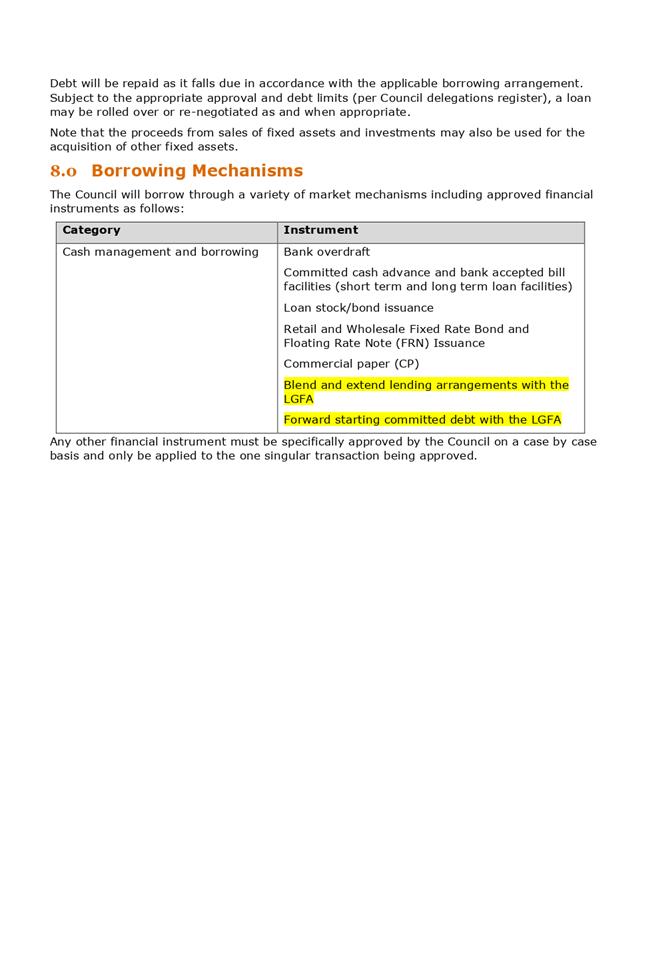

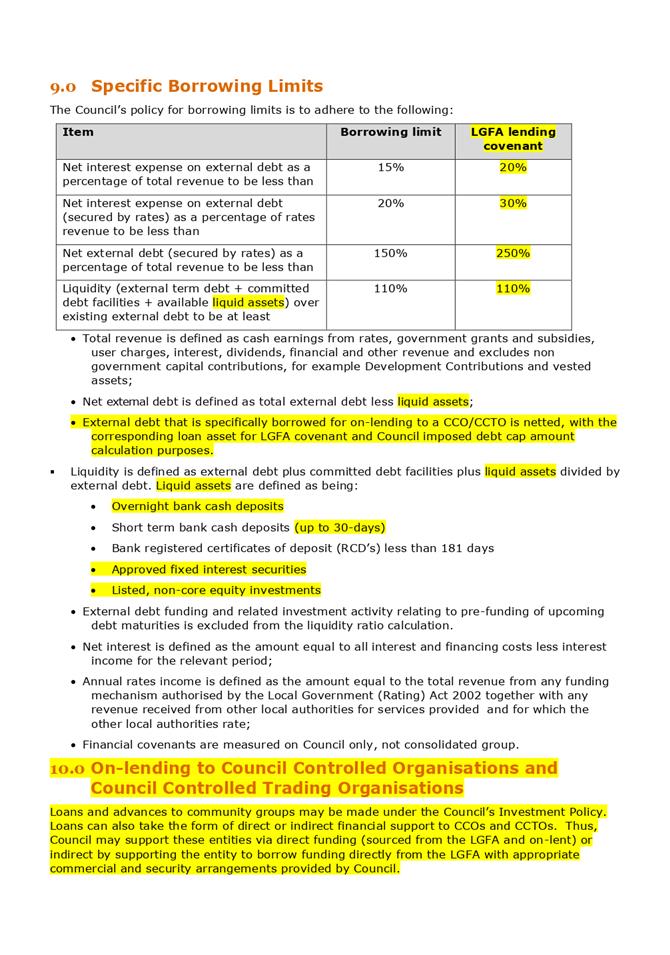

Subcommittee