AGENDA

Ordinary meeting of the

Audit, Risk and Finance Subcommittee

Tuesday 27 August 2019

Commencing at 1.00p.m.

Council Chamber

Civic House

110 Trafalgar Street, Nelson

Pat Dougherty

Chief

Executive

Membership: Mr John Peters (Chairperson), Her Worship the

Mayor Rachel Reese, Councillors Ian Barker, Bill Dahlberg and Mr John Murray

Quorum: 3

Nelson

City Council Disclaimer

Please

note that the contents of these Council and Committee Agendas have yet to be

considered by Council and officer recommendations may be altered or changed by

the Council in the process of making the formal Council decision.

Guidelines for councillors

attending the meeting, who are not members of the Committee, as set out in

Standing Order 12.1:

·

All councillors, whether or not they are members of the

Committee, may attend Committee meetings

·

At the discretion of the Chair, councillors who are not Committee

members may speak, or ask questions about a matter.

·

Only Committee members may vote on any matter before the

Committee

It is good practice for both Committee members and

non-Committee members to declare any interests in items on the agenda.

They should withdraw from the room for discussion and voting on any of these

items.

Audit, Risk and Finance

Subcommittee

Audit, Risk and Finance

Subcommittee

27

August 2019

Page

No.

1. Apologies

Nil

2. Confirmation

of Order of Business

3. Interests

3.1 Updates

to the Interests Register

3.2 Identify

any conflicts of interest in the agenda

4. Public

Forum

5. Confirmation

of Minutes

5.1 25 June

2019 7 - 11

Document number M4310

Recommendation

|

That the Audit, Risk and Finance Subcommittee

1. Confirms the minutes of the meeting

of the Audit, Risk and Finance Subcommittee, held on 25 June 2019, as a true

and correct record.

|

6. Chairperson's Report

7. Quarterly Report to

30 June 2019 12 - 42

Document number R10331

Recommendation

|

That

the Audit, Risk and Finance Subcommittee

1. Receives

the report Quarterly Report to 30 June 2019 (R10331) and its attachments (A2224569, A2226256 and A2232140).

|

8. Annual Tax Review 43 - 78

Document number R10239

Recommendation

|

That

the Audit, Risk and Finance Subcommittee

1.

Receives the report Annual Tax Review (R10239) and its attachments (A2221879 and

A2221900).

|

9. Quarterly Key Risks

Report - 1 April to 30 June 2019 79 - 99

Document number R10217

Recommendation

|

That the Audit,

Risk and Finance Subcommittee

1. Receives the report Quarterly Key Risks Report

- 1 April to 30 June 2019 (R10217) and its attachment (A2233464).

|

10. Health Safety and Wellbeing

Performance Report 100 - 115

Document number R10385

Recommendation

|

That

the Audit, Risk and Finance Subcommittee

1. Receives

the report Health Safety and Wellbeing Performance Report (R10385) and its attachment (A2231288).

|

11. Internal Audit - Quarterly

Progress Report to 30 June 2019 116 - 119

Document number R10302

Recommendation

|

That

the Audit, Risk and Finance Subcommittee

1. Receives the report Internal Audit - Quarterly Progress

Report to 30 June 2019 (R10302) and its attachment (A2227441).

|

12. Internal Audit - Summary of New

or Outstanding Significant Risk Exposures and Control Issues to 30 June 2019 120 - 125

Document number R10303

Recommendation

|

That

the Audit, Risk and Finance Subcommittee

1. Receives the report Internal

Audit - Summary of New or Outstanding Significant Risk Exposures and Control

Issues to 30 June 2019 (R10303) and its attachment (A2227319).

|

Public Excluded Business

13. Exclusion

of the Public

Recommendation

That the Audit,

Risk and Finance Subcommittee

1.

Excludes the

public from the following parts of the proceedings of this meeting.

2.

The general subject of each matter to be

considered while the public is excluded, the reason for passing this resolution

in relation to each matter and the specific grounds under section 48(1) of the

Local Government Official Information and Meetings Act 1987 for the passing of

this resolution are as follows:

|

Item

|

General subject of each matter to be

considered

|

Reason for passing this resolution in

relation to each matter

|

Particular interests protected (where

applicable)

|

|

1

|

Audit, Risk and Finance Subcommittee Meeting -

Public Excluded Minutes - 25 June 2019

|

Section 48(1)(a)

The public conduct of this matter would be likely to

result in disclosure of information for which good reason exists under

section 7.

|

The withholding of the information is necessary:

· Section 7(2)(a)

To protect the

privacy of natural persons, including that of a deceased person

|

|

2

|

Quarterly Update on Legal Proceedings

|

Section 48(1)(a)

The public conduct of this

matter would be likely to result in disclosure of information for which good

reason exists under section 7

|

The withholding of the information is necessary:

· Section 7(2)(g)

To maintain legal

professional privilege

|

|

3

|

Quarterly Update On Debts - 30 June 2019

|

Section 48(1)(a)

The public conduct of this

matter would be likely to result in disclosure of information for which good

reason exists under section 7

|

The withholding of the information is necessary:

· Section 7(2)(a)

To protect the privacy of

natural persons, including that of a deceased person

|

Audit, Risk and Finance

Subcommittee Minutes - 25 June 2019

Present: Mr

J Peters (Chairperson), Her Worship the Mayor R Reese, Councillors I Barker, B

Dahlberg and Mr J Murray

In

Attendance: Councillors P Matheson, B McGurk and G Noonan, Chief

Executive (P Dougherty), Group Manager Corporate Services (N Harrison), and

Governance Adviser (E-J Ruthven)

Apologies : Nil

1. Apologies

There were no apologies.

2. Confirmation of

Order of Business

There was no change to the order

of business.

3. Interests

There were no updates to the

Interests Register, and no interests with items on the agenda were declared.

4. Public Forum

There was no public forum.

5. Confirmation of

Minutes

5.1 21

May 2019

Document number M4225, agenda

pages 6 - 13 refer.

|

Resolved AUD/2019/027

|

|

|

That the Audit, Risk and

Finance Subcommittee

1. Confirms the minutes of the meeting

of the Audit, Risk and Finance Subcommittee, held on 21 May 2019, as a true

and correct record.

|

|

Murray/Dahlberg Carried

|

6. Chairperson's Report

|

Mr Peters noted that the

interim audit letter had been received, with no significant issues raised.

He added that subcommittee

members would be asked to complete a survey, which would be used to provide

information to the incoming subcommittee following the Local Elections.

|

|

Resolved AUD/2019/028

|

|

|

That the Audit, Risk and Finance Subcommittee

1. Receives the oral

Chairperson’s Report.

|

|

Peters/Her Worship the Mayor Carried

|

7. Interim audit letter

for the year ending 30 June 2019

Document number R10240, agenda

pages 14 - 25 refer.

|

Group Manager Corporate Services, Nikki Harrison,

presented the report. She noted that Council and Audit New Zealand had

recently agreed to terminate annual audits of the Nelson Regional Sewerage

Business Unit, the Nelson Tasman Regional Business Unit, and Nelson Tasman

Civil Defence Emergency Management.

Ms Harrison answered questions regarding the assessment of

Council’s control environment, procurement procedures and policies,

system restrictions or controls to prevent unauthorised data editing for call

out time measures, third party contracts involving the collection of revenue,

such as the Parking Revenue contract, the Project Management Policy,

valuation of Council assets, and Council’s pursuit of bad

debtors.

It was noted that discussions regarding specific debtors

should be held in public excluded session, especially when Council was

receiving legal advice regarding appropriate next steps to take.

|

|

Resolved AUD/2019/029

|

|

|

That the Audit, Risk and Finance Subcommittee

1. Receives the report Interim

audit letter for the year ending 30 June 2019 (R10240) and its attachment (A2206215); and

2. Notes

the status updates to previous audit recommendations.

|

|

Murray/Dahlberg Carried

|

8. Draft Annual Internal

Audit Plan - 30 June 2020

Document number R10266, agenda

pages 26 - 31 refer.

|

Internal Audit Analyst, Lynn Anderson, presented the

report. She noted that the budget for the financial year was $40,000.

Ms Anderson answered questions regarding potential audits

that external contractors could be utilised for, and the corresponding

timeframes.

|

|

Resolved AUD/2019/030

|

|

|

That

the Audit, Risk and Finance Subcommittee

1. Receives the report Draft Annual

Internal Audit Plan - 30 June 2020 (R10266)

and its attachment (A2202709).

|

|

Barker/Dahlberg Carried

|

|

Recommendation to Council AUD/2019/031

|

|

|

That the Council

1. Approves

the Draft Annual Internal Audit Plan - 30 June 2020 (A2202709).

|

|

Barker/Dahlberg Carried

|

9. Exclusion

of the Public

There was a discussion regarding

whether items relating to bad debts should be considered in public excluded or

open session.

Committee members also requested

an update on legal proceedings be provided in public excluded session.

The meeting was adjourned from

9.38a.m to 9.43a.m.

10. Additional agenda item - Update

on legal proceedings

|

The Chairperson acknowledged

the subcommittee’s request for an additional item in public excluded

session for an update on legal proceedings. He said that, as a minor matter

not on the agenda, the sub-committee could discuss the item, but not make a

resolution, decision or recommendation about the item, except to refer it to

a subsequent meeting for discussion.

He added that a procedural

resolution should be passed to allow the item to be discussed.

|

|

Resolved AUD/2019/032

|

|

|

That the Audit, Risk and Finance Subcommittee

1. Considers

the public excluded item regarding Update on Legal Proceedings at this

meeting as a minor item not on the agenda, pursuant to Section 46A(7A) of the

Local Government Official Information and Meetings Act 1987.

|

|

Murray/Barker Carried

|

6. Exclusion of the

Public

|

Resolved AUD/2019/033

|

|

|

That the Audit, Risk and Finance Subcommittee

1. Excludes

the public from the following parts of the proceedings of this meeting.

2. The general subject of each matter

to be considered while the public is excluded, the reason for passing this

resolution in relation to each matter and the specific grounds under section

48(1) of the Local Government Official Information and Meetings Act 1987 for

the passing of this resolution are as follows:

|

|

Her Worship the Mayor/Barker Carried

|

|

Item

|

General subject of each matter to be

considered

|

Reason for passing this resolution in

relation to each matter

|

Particular interests protected (where

applicable)

|

|

1

|

Audit, Risk and Finance Subcommittee Meeting -

Public Excluded Minutes - 21 May 2019

|

Section 48(1)(a)

The public conduct of this matter would be likely to

result in disclosure of information for which good reason exists under

section 7.

|

The withholding of the information is necessary:

· Section 7(2)(a)

To protect the

privacy of natural persons, including that of a deceased person

· Section 7(2)(g)

To maintain legal

professional privilege

· Section 7(2)(h)

To enable the

local authority to carry out, without prejudice or disadvantage, commercial

activities

|

|

2

|

Bad debt write-off for year ending 30 June 2019

|

Section 48(1)(a)

The public conduct of this

matter would be likely to result in disclosure of information for which good

reason exists under section 7

|

The withholding of the information is necessary:

· Section 7(2)(a)

To protect the privacy of

natural persons, including that of a deceased person

|

|

3

|

Update on Legal Proceedings

|

Section 48(1)(a)

The public conduct of this

matter would be likely to result in disclosure of information for which good

reason exists under section 7

|

The withholding of the information is necessary:

· Section 7(2)(g)

To maintain legal professional privilege

|

The meeting went into public excluded session at 9.45a.m.

and resumed in public session at 11.06a.m.

There being no further business the meeting ended at 11.06a.m.

Confirmed as a correct record of proceedings:

Chairperson

Date

Chairperson

Date

Item 7: Quarterly

Report to 30 June 2019

|

|

Audit, Risk and Finance Subcommittee

27 August 2019

|

REPORT R10331

Quarterly

Report to 30 June 2019

1. Purpose

of Report

1.1 To

inform the Committee of the financial and non-financial results for the fourth

quarter for the activities under its delegated authority.

2. Recommendation

|

That the Audit, Risk and Finance Subcommittee

1. Receives

the report Quarterly Report to 30 June 2019 (R10331) and its attachments (A2224569, A2226256 and A2232140).

|

3. Background

3.1 Quarterly

reports on performance are being provided to each Committee on the performance

and delivery of projects and activities within their areas of responsibility.

3.2 The financial reporting focuses on the year to date performance (1

July 2018 to 30 June 2019) compared with the year-to-date (YTD) approved

capital and operating budgets.

3.3 Unless

otherwise indicated, all information is against approved operating budget,

which is the 2018/19 Long Term Plan budget plus any carry forwards, plus or

minus any other additions or changes as approved by the Committee or

Council.

3.4 Although this report covers the 12 months to 30 June 2019, these

results represent a point in time, prior to most of the analysis and

adjustments required for financial year end, and include a large number of

accruals. The draft annual report which will be in front of this subcommittee

in September may be significantly different to these results as:

· It will

include all year-end adjustments such as revaluations and impairments

· Almost all of the

accruals made for the purposes of this report will be reversed and actual data

reported

· It will include the

consolidation of NRSBU, NTRLBU and Civil Defence.

4. Key

developments for the twelve months to 30 June 2019

4.1 For the twelve months ending 30 June 2019, the activity

surplus/deficits are $1.5 million favourable to budget. This is mostly

due to income ahead of budget as expenditure overall is on budget.

4.2 The most significant variances to budget are:

· Dividends

are ahead of budget by $1.1 million reflecting:

- the unbudgeted special dividend of $750,000 declared by Port Nelson

Limited in September 2018

- the 2017/18 Nelson Airport Limited dividend of $375,000 that was

expected in the last financial year but declared too late to be accrued

· Interest income on short

term investments is ahead of budget by $505,000, as Council holds deposits to

offset the pre-funding of debt which is maturing in 2019.

· Forestry harvesting

income is behind budget by $760,000 as only the Roding Harvest was completed in

2018/19 as planned. Harvesting of the Maitai block has been moved out to the

winter of 2020. Expenditure is also behind budget ($684,000) largely for the

same reason.

· There

are numerous variances in staff operating costs in the activities, however

total staff operating costs are behind budget by $174,000. Opex staff and overhead

costs are over budget by $289,000 and capex staff and overheads are under

budget by $463,000. Overall this includes savings in salaries and wages of

$129,000, in training costs of $140,000, in depreciation of $178,000 and in

consultancy costs of $114,000. Relieving and contractor costs are over budget

by $387,000, offsetting salaries and wages, and recruitment costs are over by

$48,000 reflecting the busy year.

· Unbudgeted

recovery costs from the February 2018 storms have been incurred in the Parks and

Transport activities particularly, $395,000 in 2018/19 (note that this

expenditure is funded through the Disaster Recovery Fund and income from

insurance of $302,000 has been received in relation to these events against

expenditure over 2017/18 and 2018/19).

· Although

resource consent income is behind budget by $366,000 it is also 11% ahead of

2017/18. Expenditure is ahead of budget by $279,000, with consultancy costs

ahead by $280,000 offset by vacancies in staff costs of $200,000, and a new

contract price greater than budget by $174,000.

· Wastewater

income is greater than budget by $517,000 largely due to a catch up of trade

waste invoicing relating to 2017/18.

· Council’s

share of NRSBU costs is greater than budget by $450,000 resulting from an

increased share of greater than budget management and maintenance costs.

· Water

supply income is greater than budget by $237,000 including unbudgeted income

related to the supply of water to TDC during the drought.

4.3 Financial information provided in Attachment 1 includes:

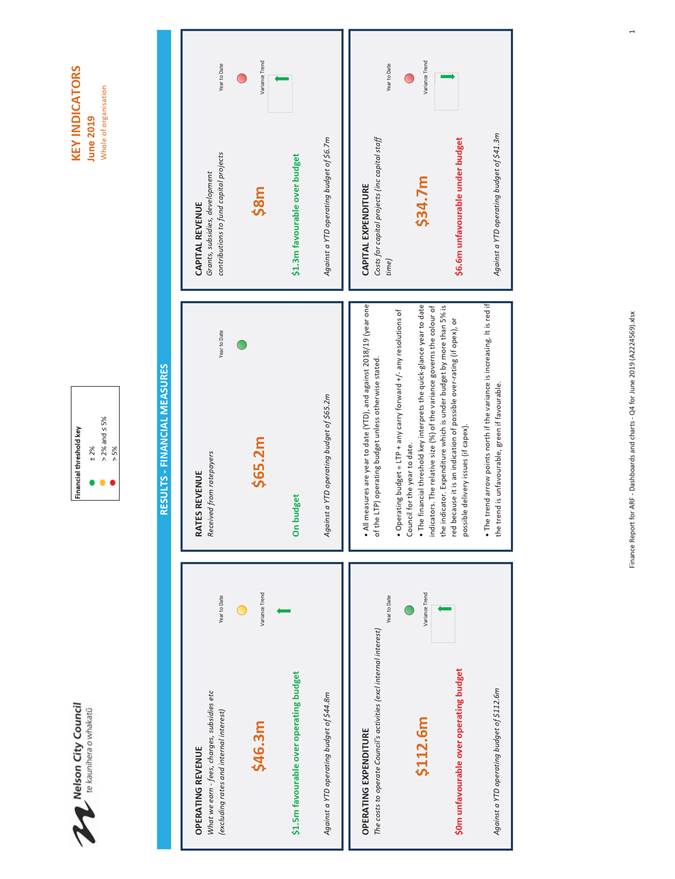

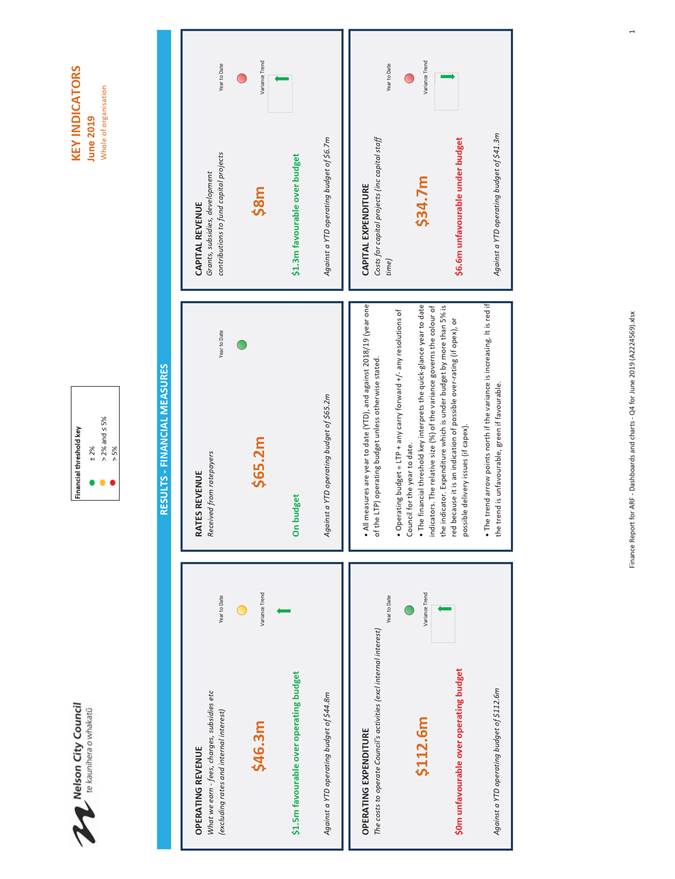

· A financial measures dashboard with information on rates revenue,

operating revenue and expenditure, and capital revenue and expenditure. The

arrow icon in each applicable measure indicates whether the variance is

increasing or decreasing and whether that trend is favourable or unfavourable

(green or red).

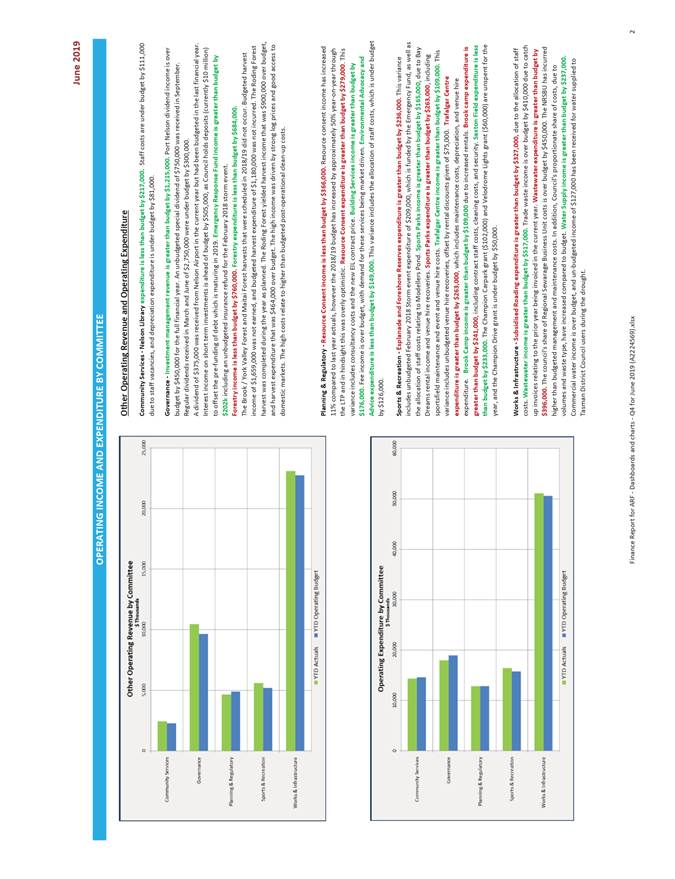

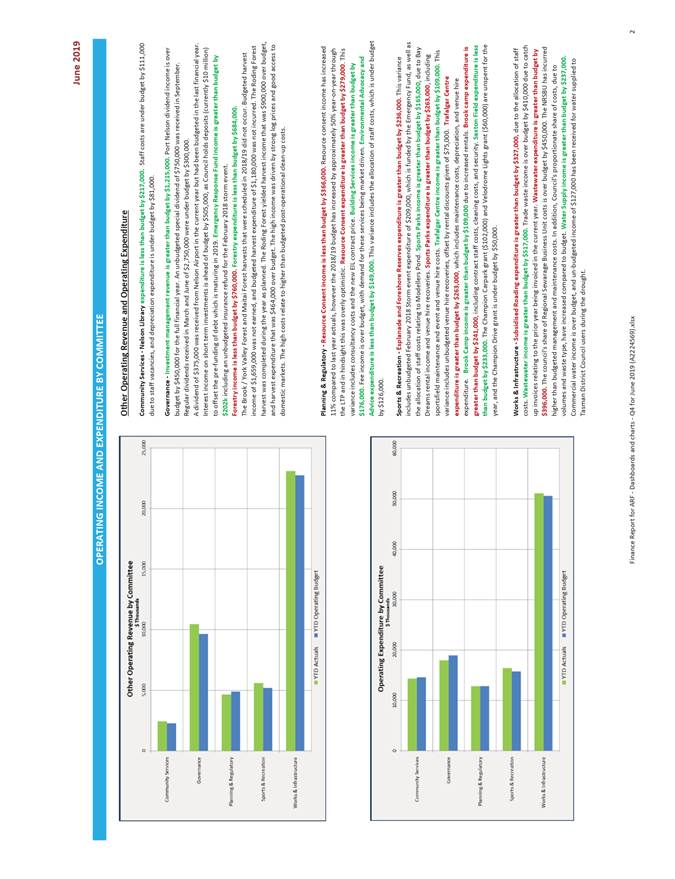

· Operating income and expenditure displayed against budget for both

committee and category. Significant variances are noted against committees.

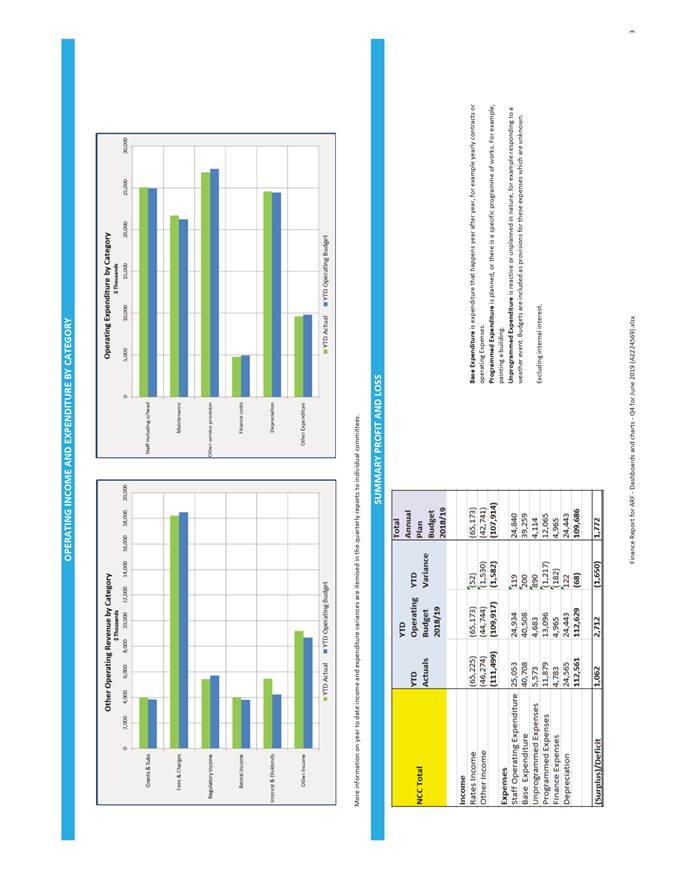

Each committee will receive a more detailed analysis of variances by cost

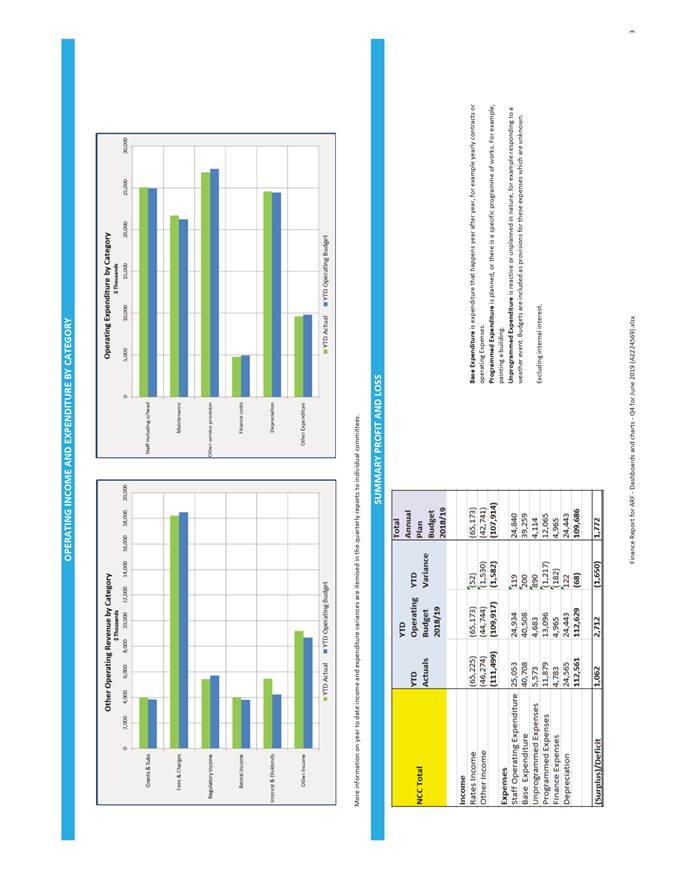

centre.

· A summary profit and loss statement also including the latest

forecast position.

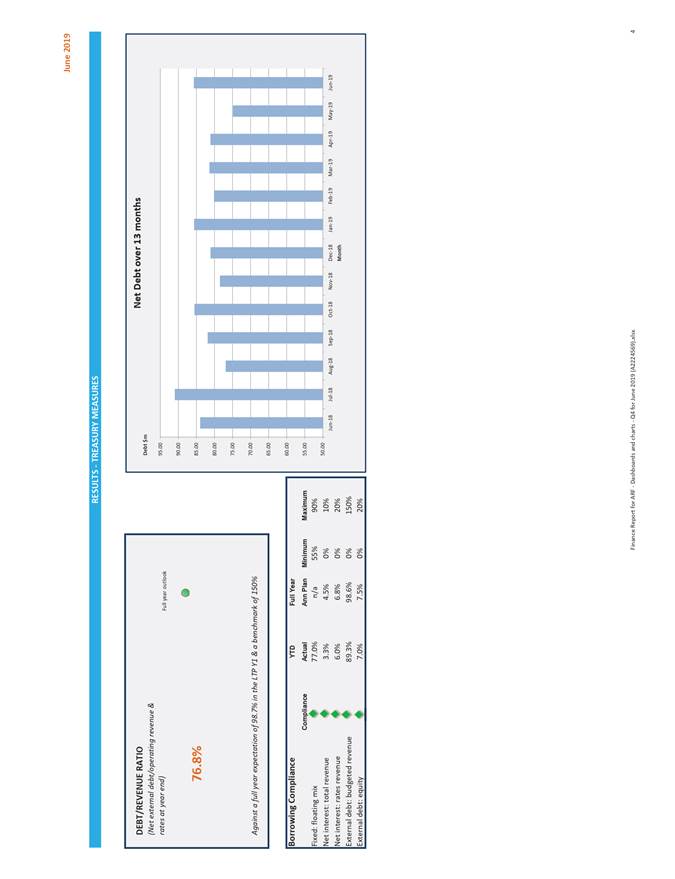

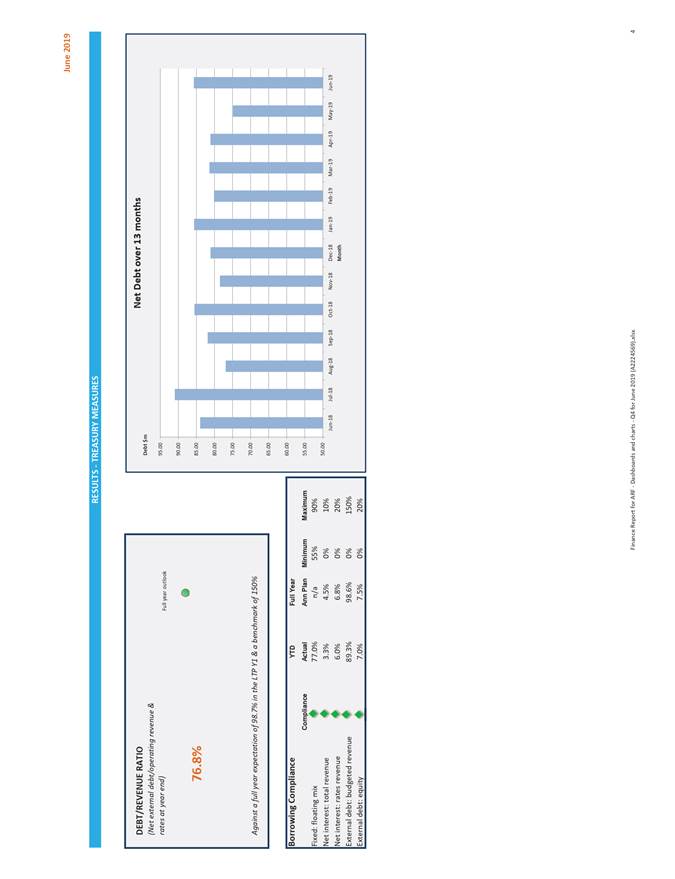

· A treasury measures dashboard with a compliance table (green =

compliant), a forecast of the debt/revenue ratio for the year where available,

and a graph showing debt levels over a rolling 13 month period.

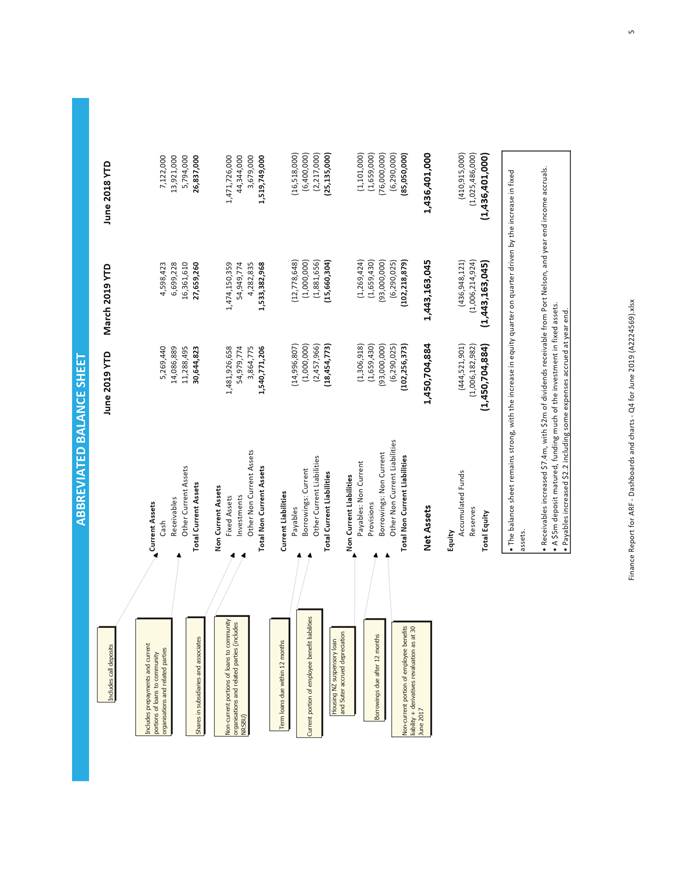

· High level balance sheet. The current year balance sheets do not

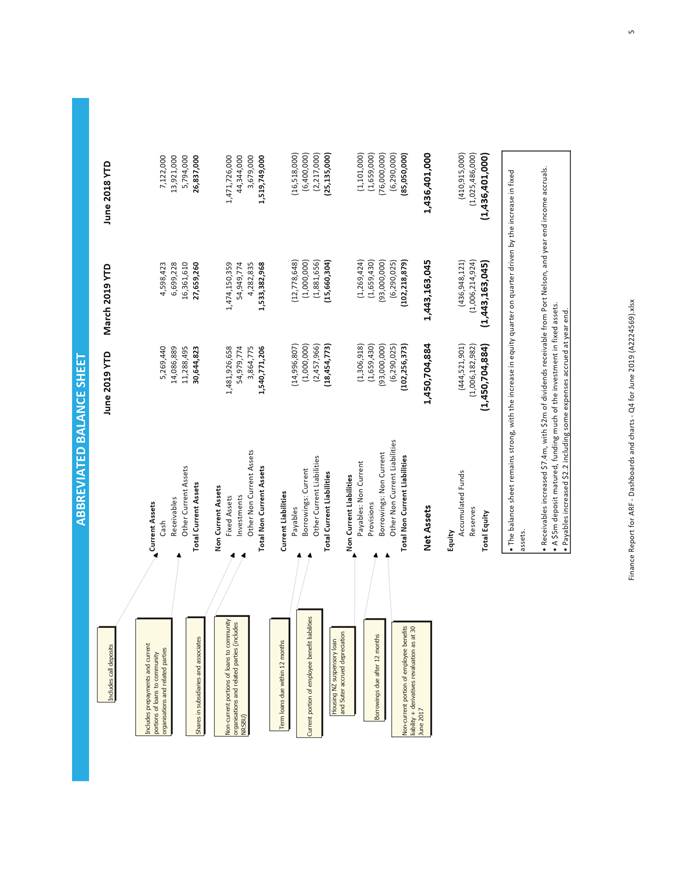

include consolidations.

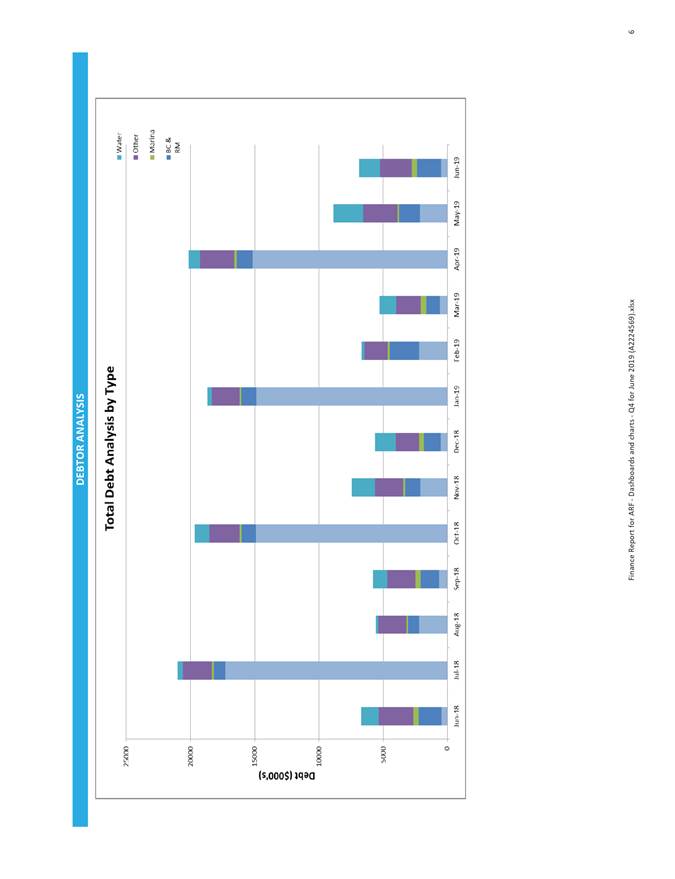

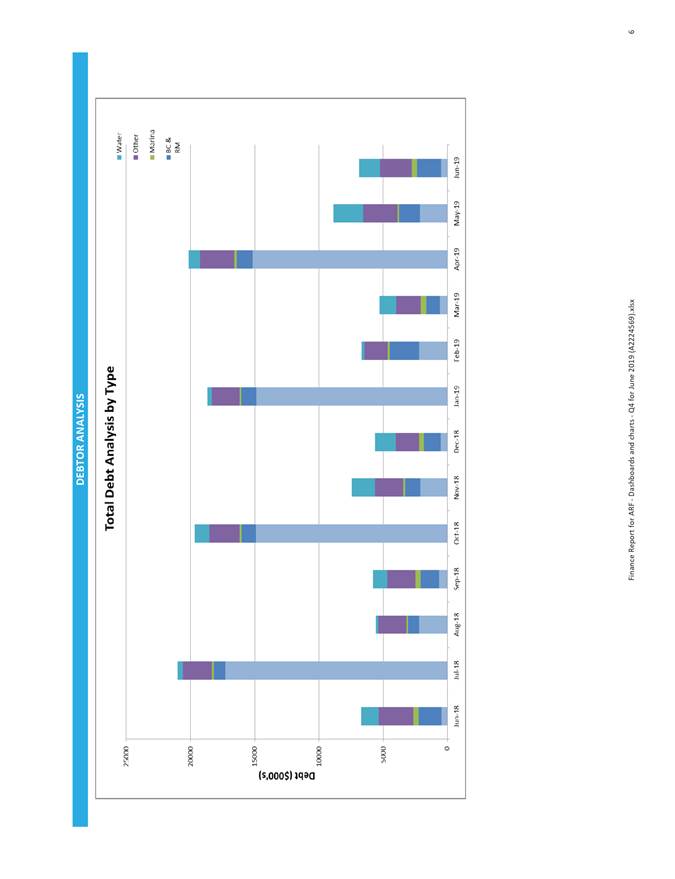

· A debtor analysis graph over 13 months, clearly showing outstanding

debt levels and patterns for major debt types along with a summary of general

debtors > 3 months and over $10,000 and other debtors at risk.

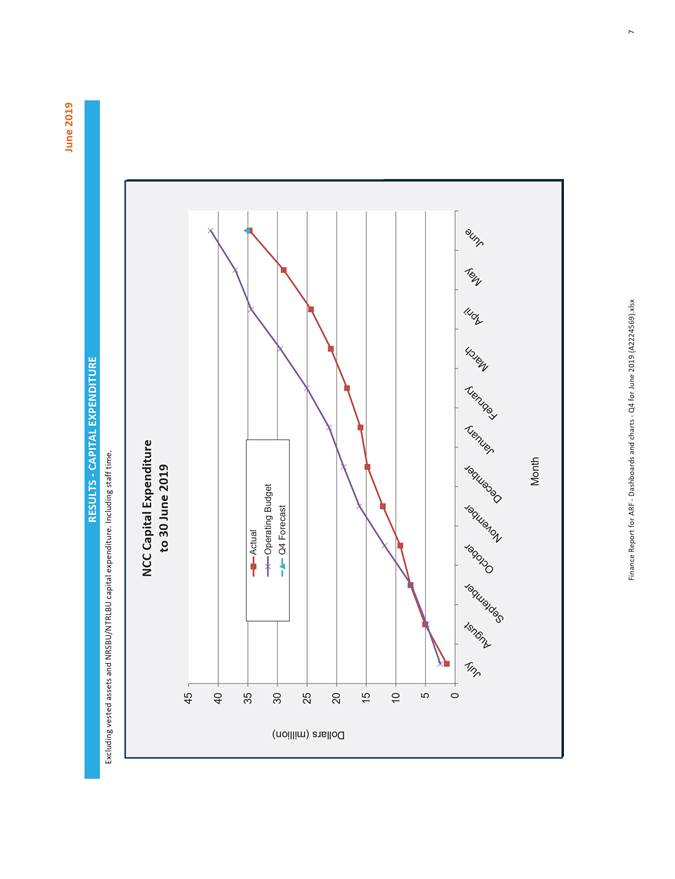

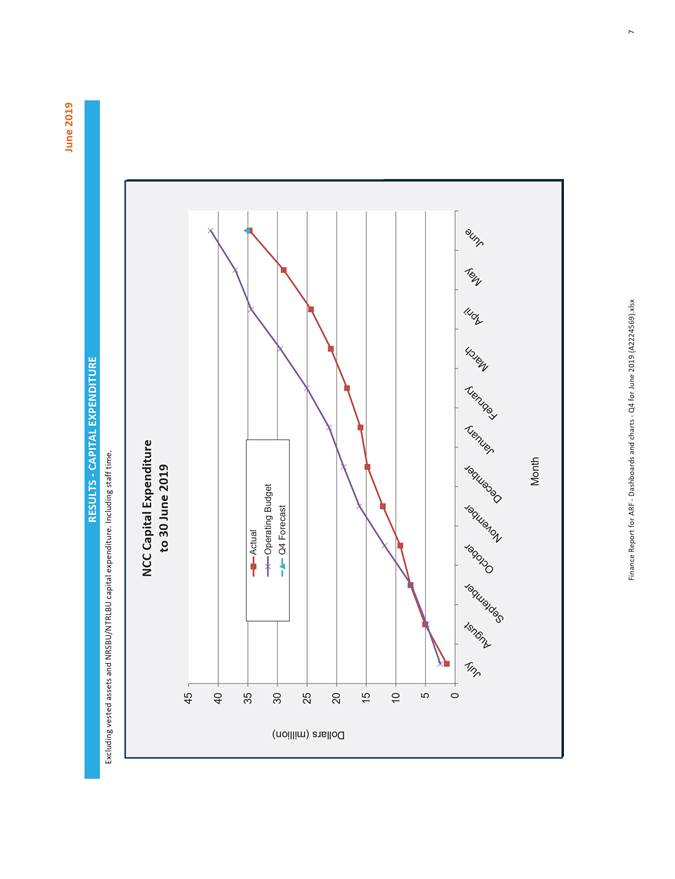

· Two capital expenditure graphs – The line graph records actual

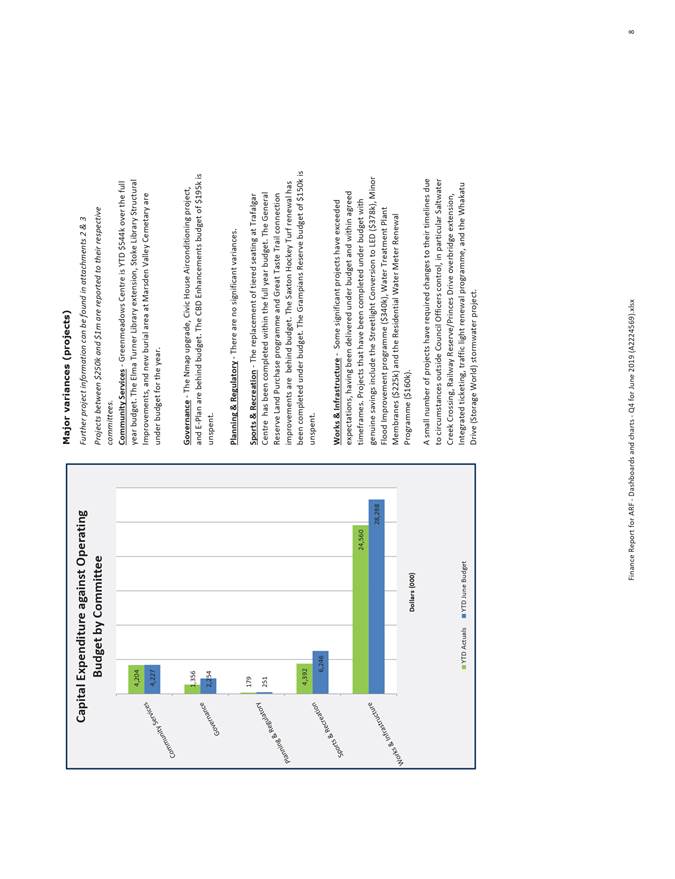

expenditure against approved budget, and quarter two forecast (current

understanding of most likely outcome). The bar graph records year to date

expenditure against approved budget by committee.

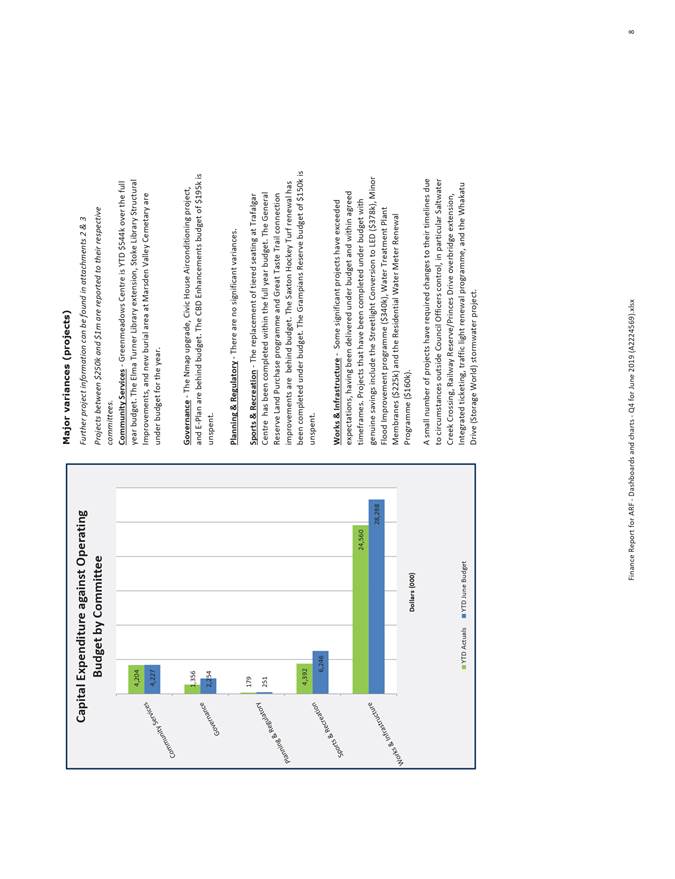

4.4 Capital expenditure is $6.6 million under approved budget year to

date.

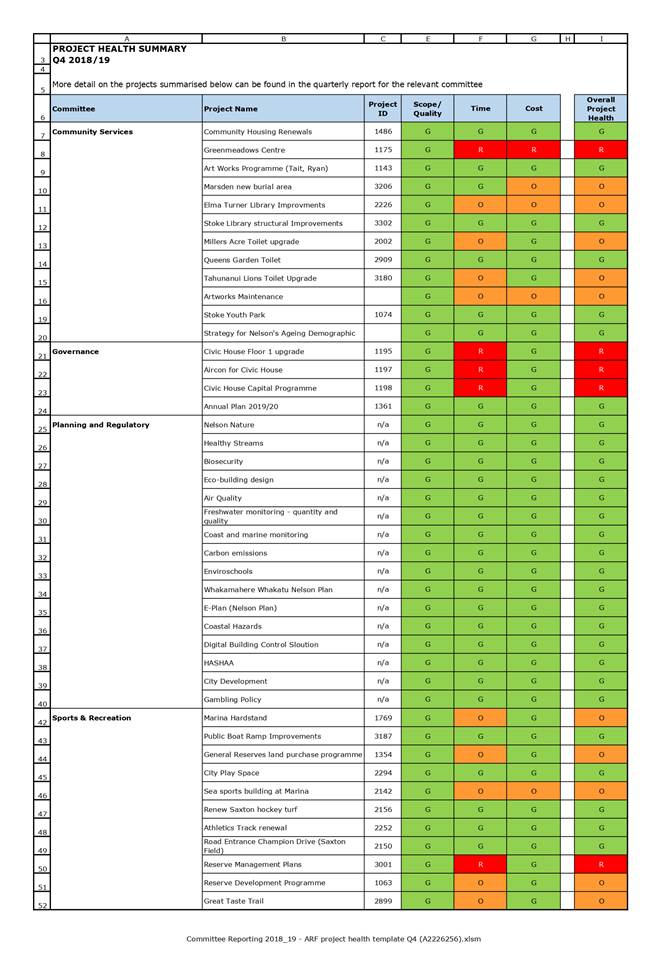

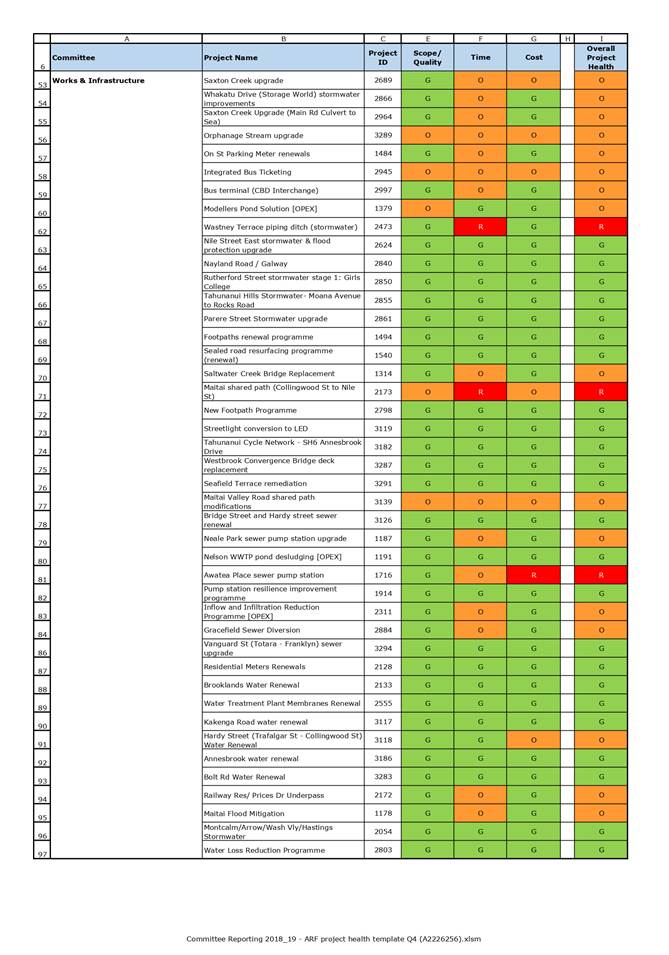

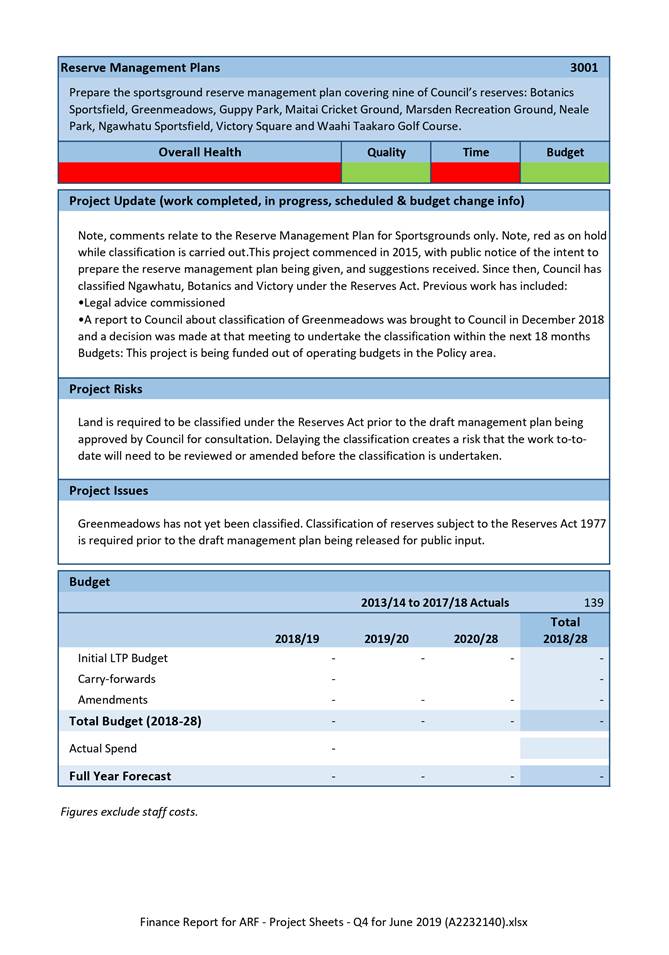

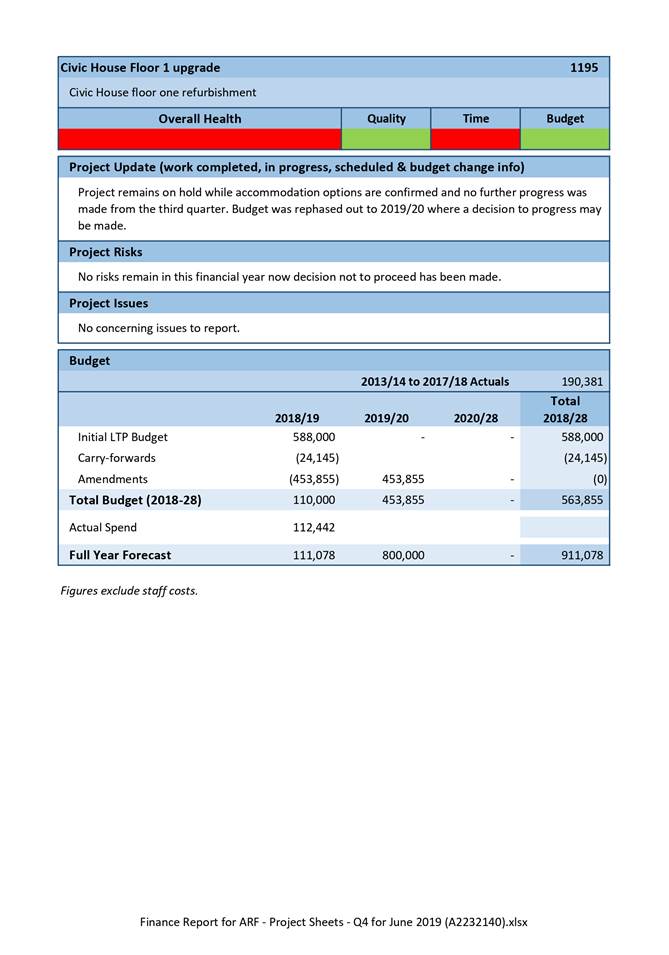

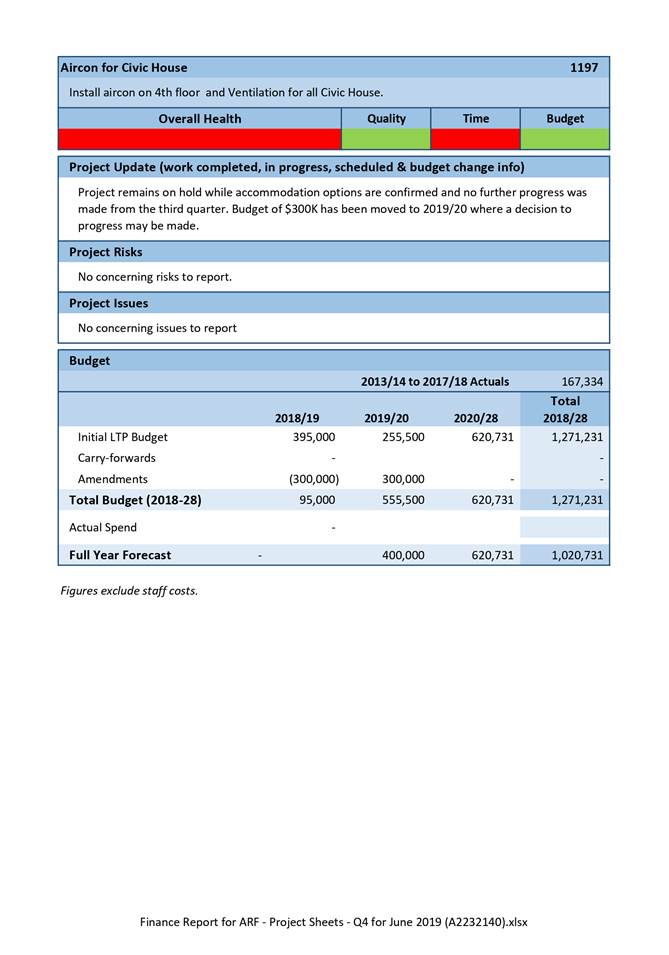

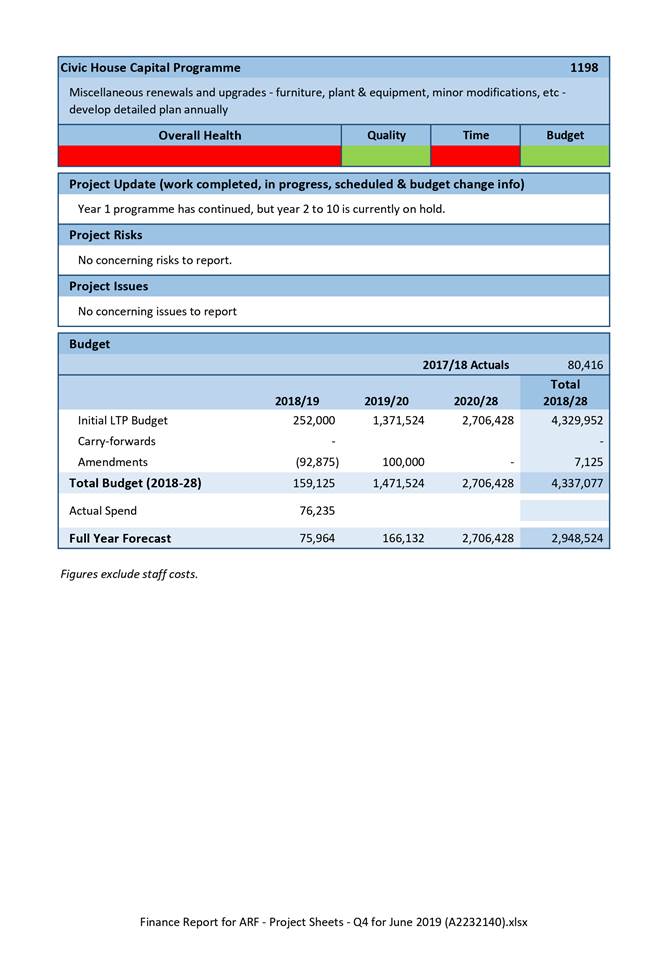

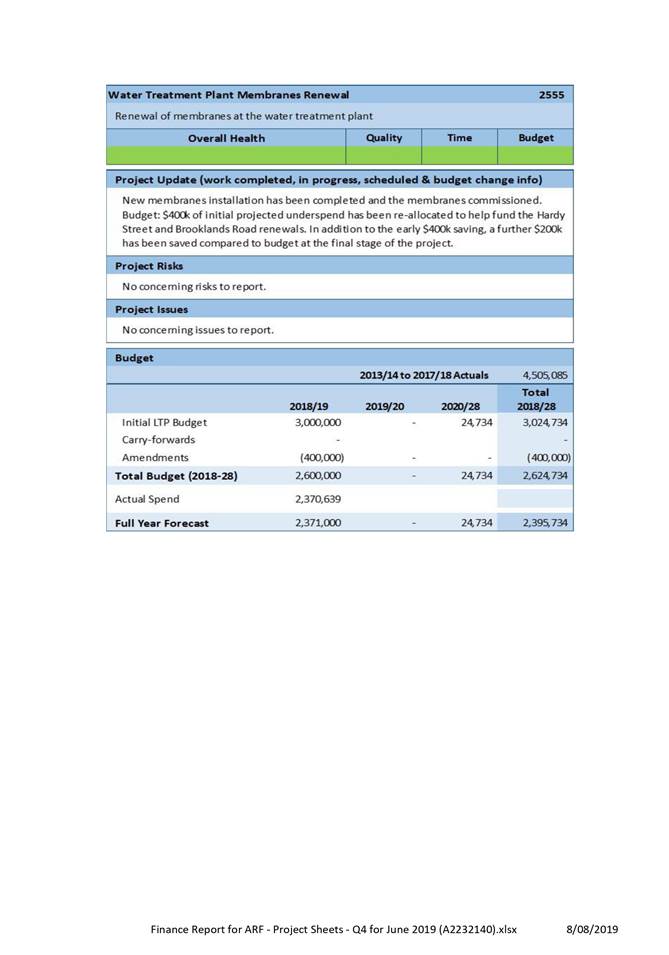

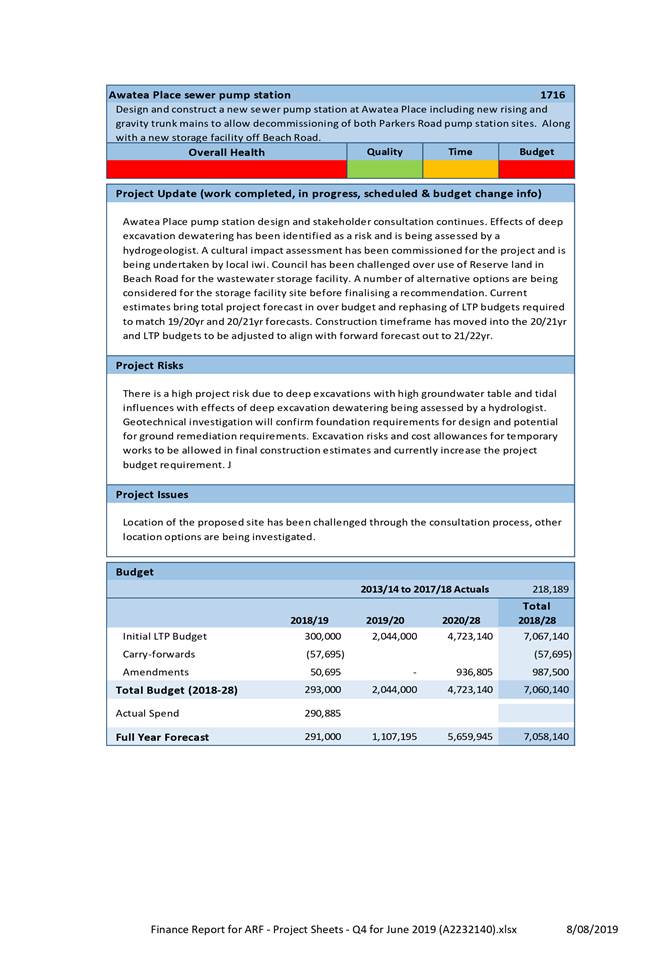

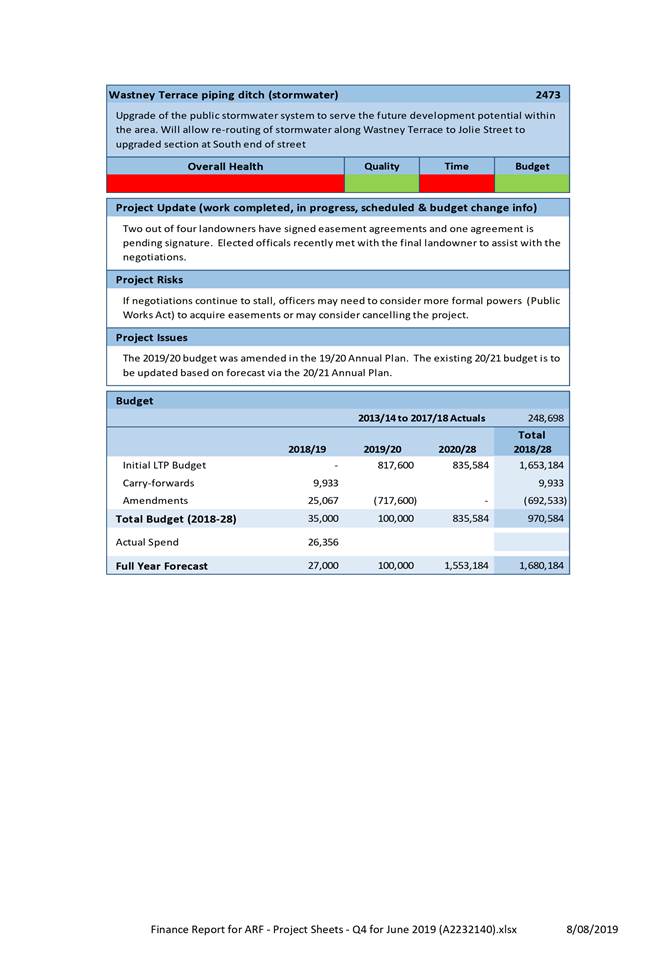

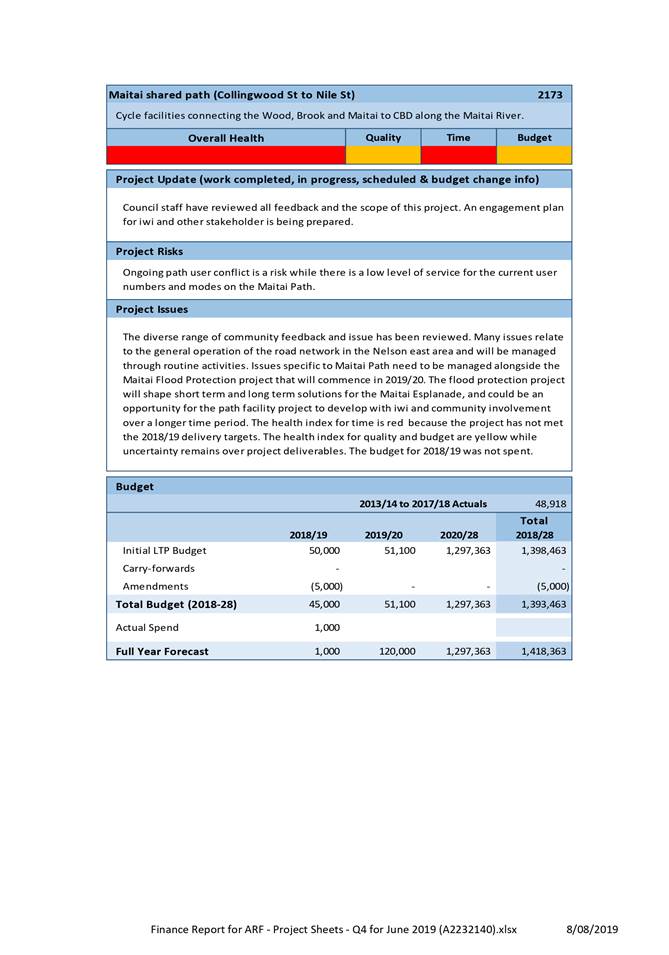

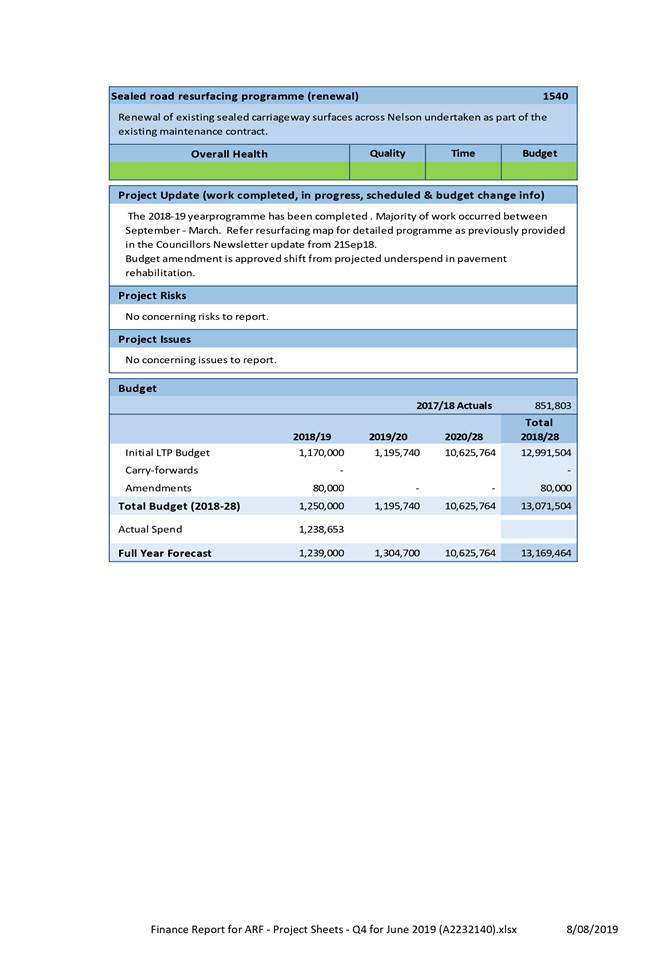

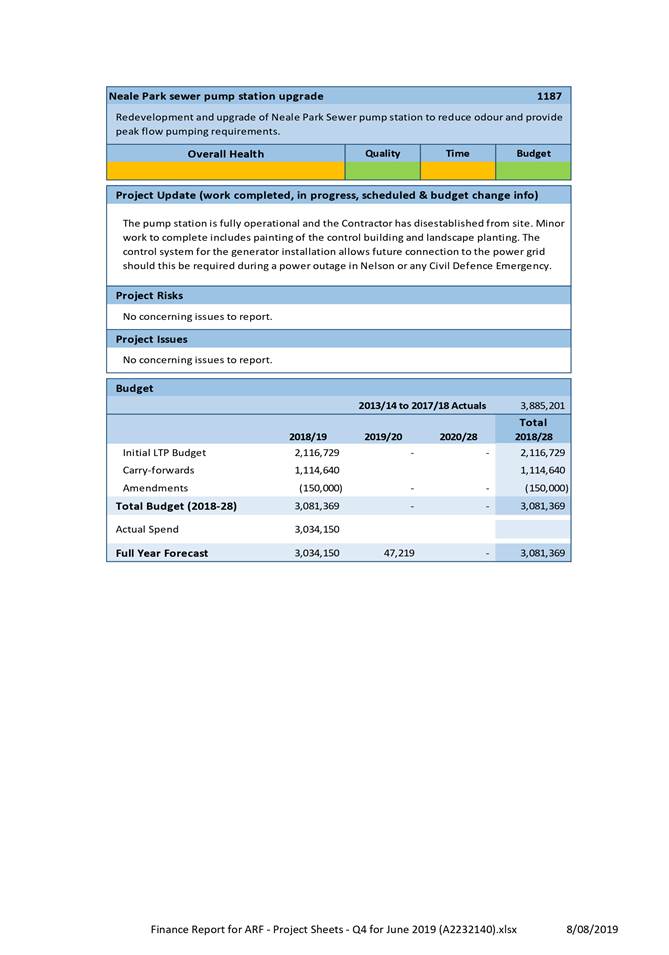

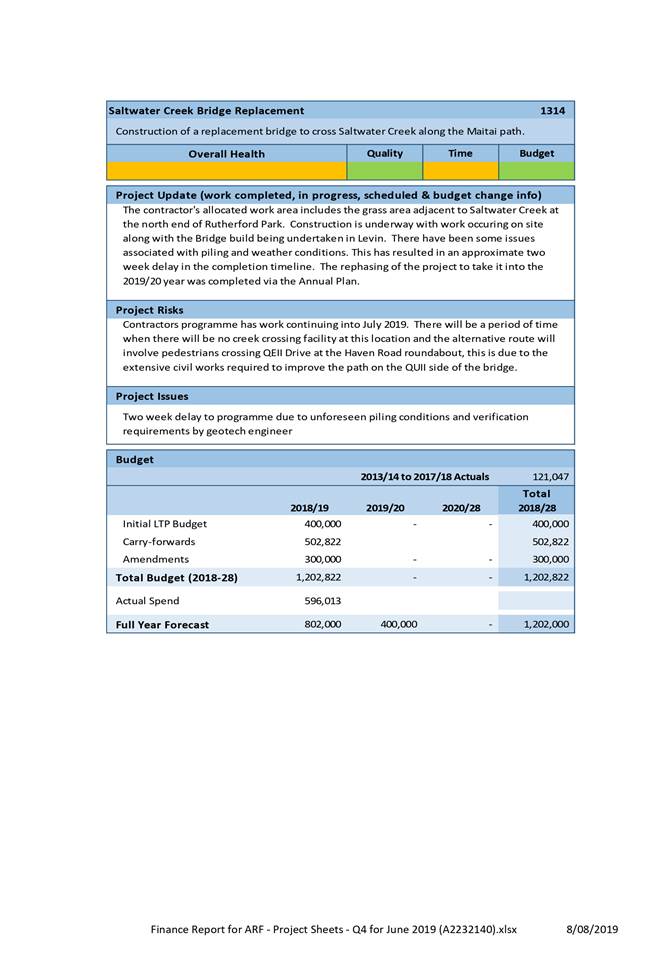

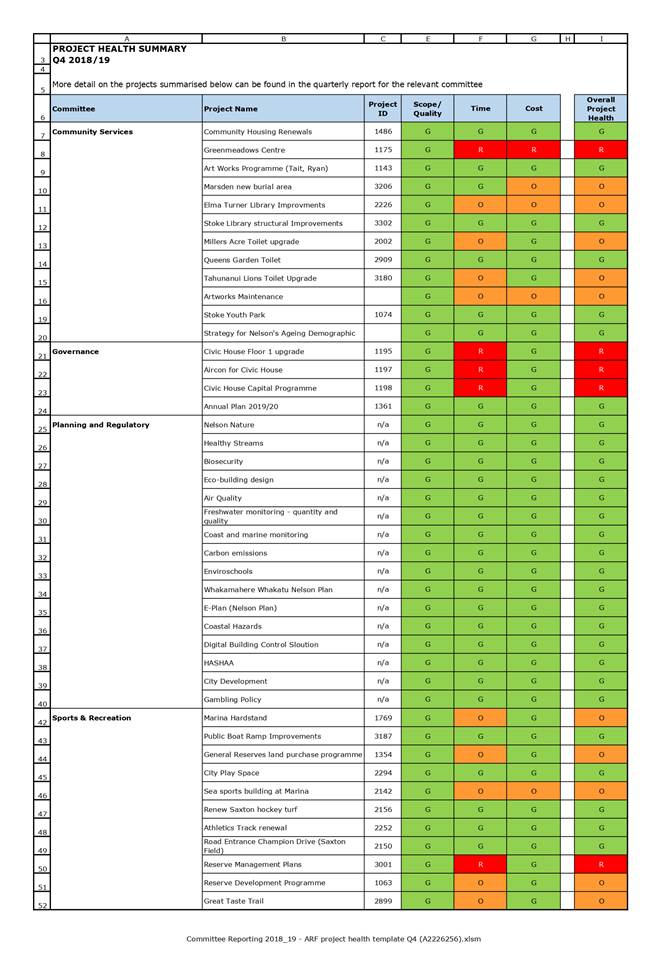

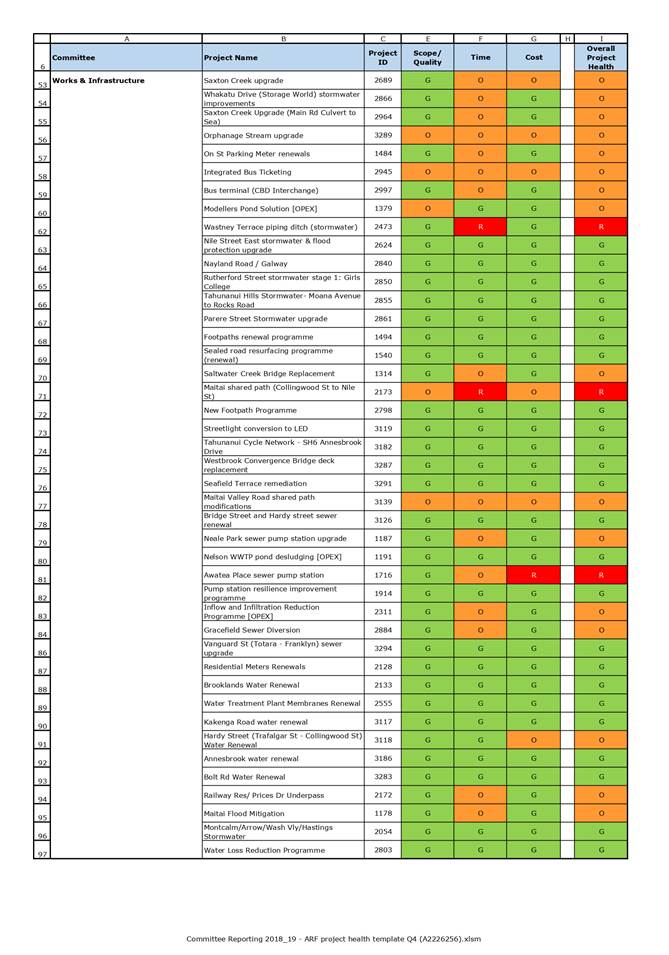

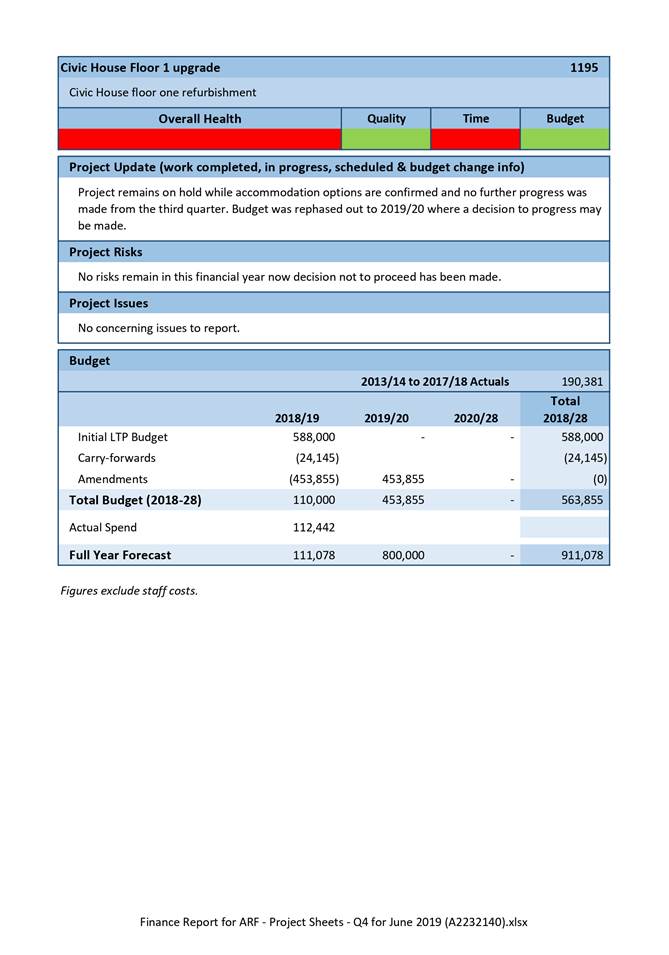

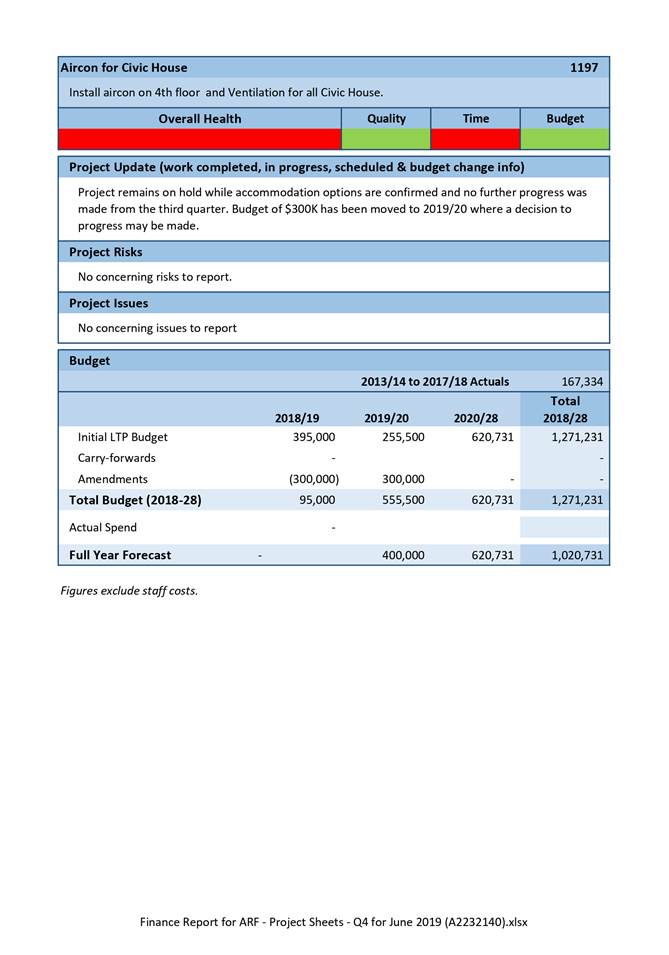

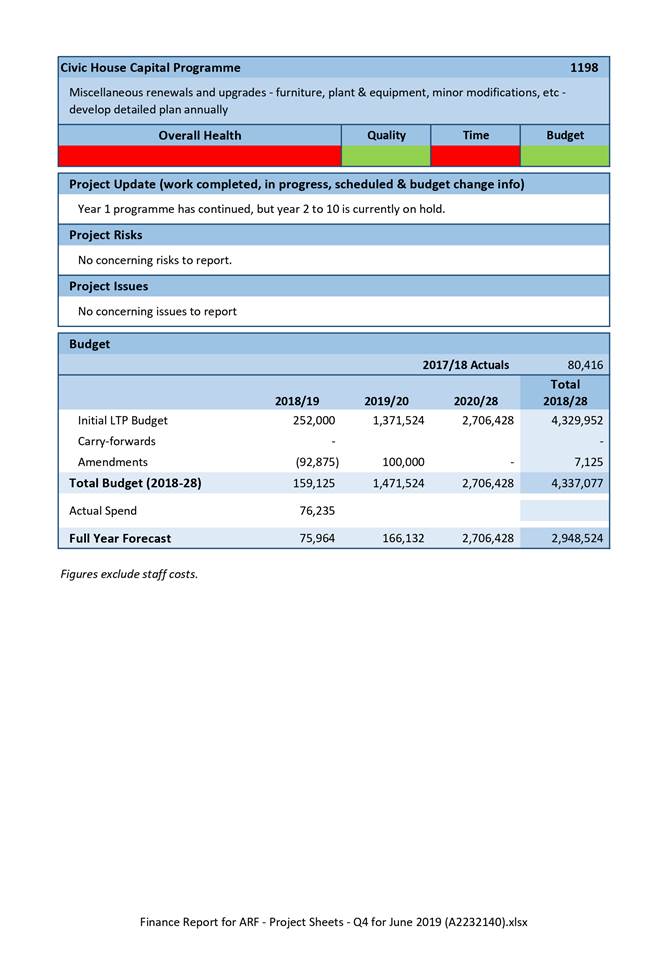

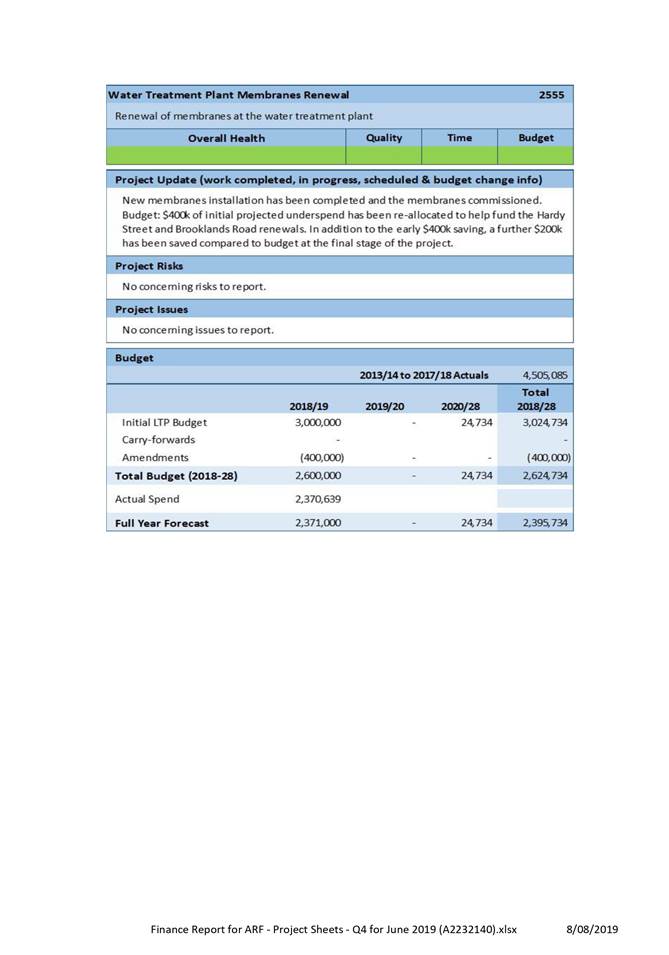

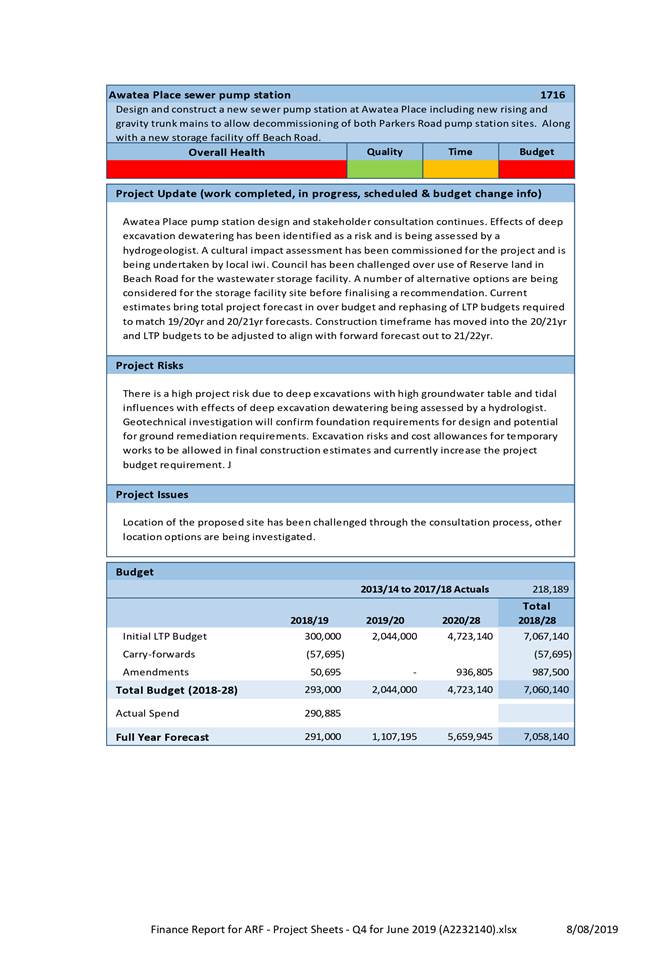

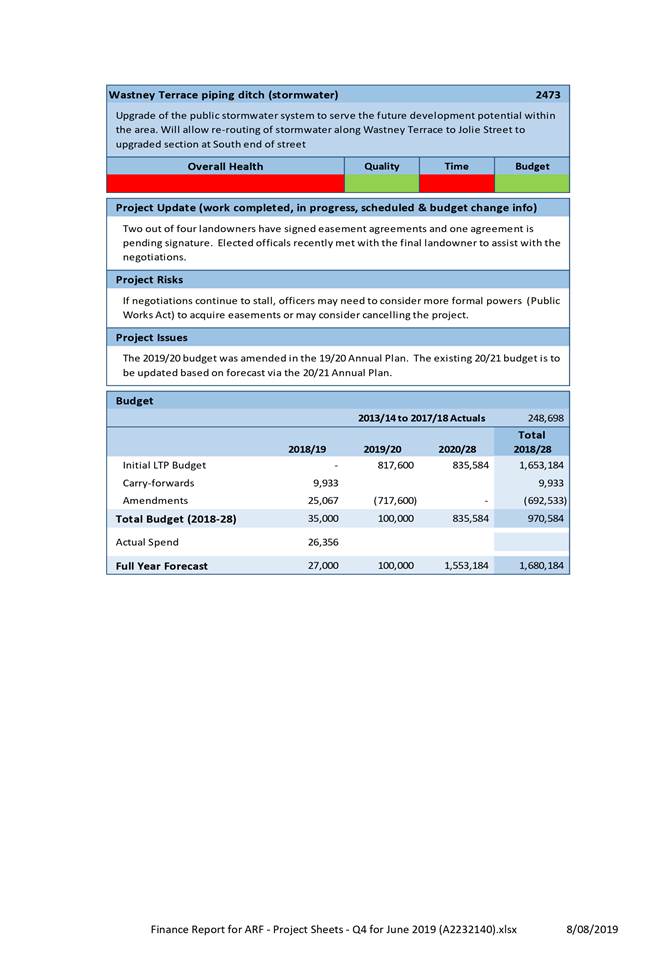

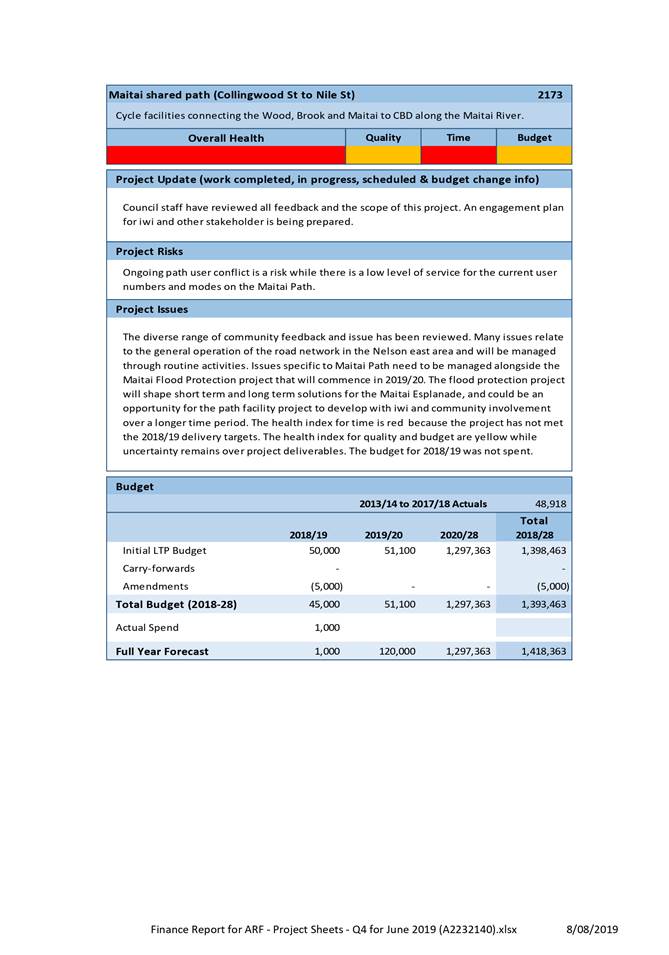

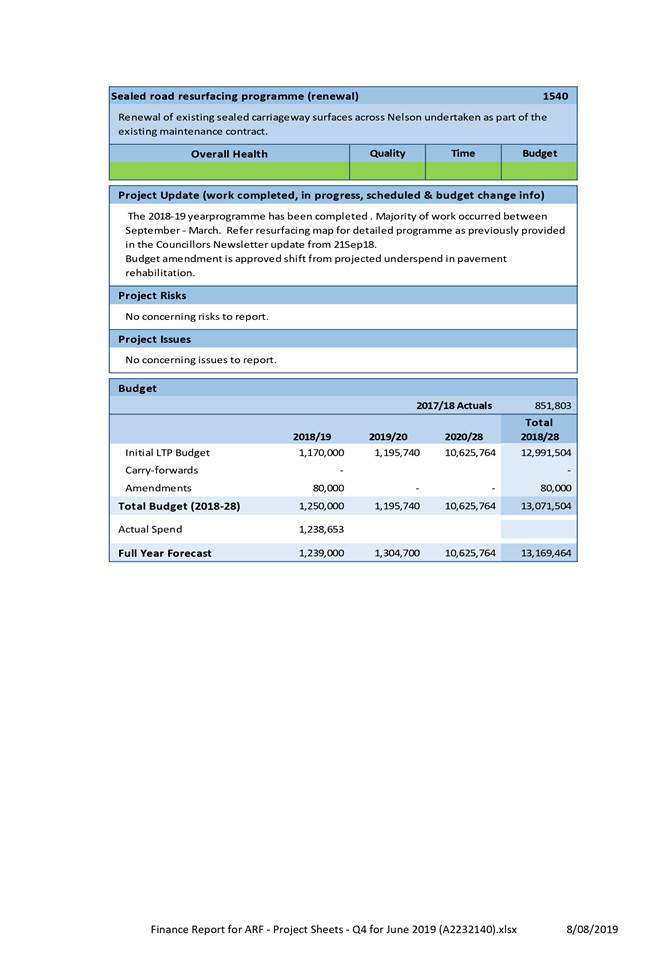

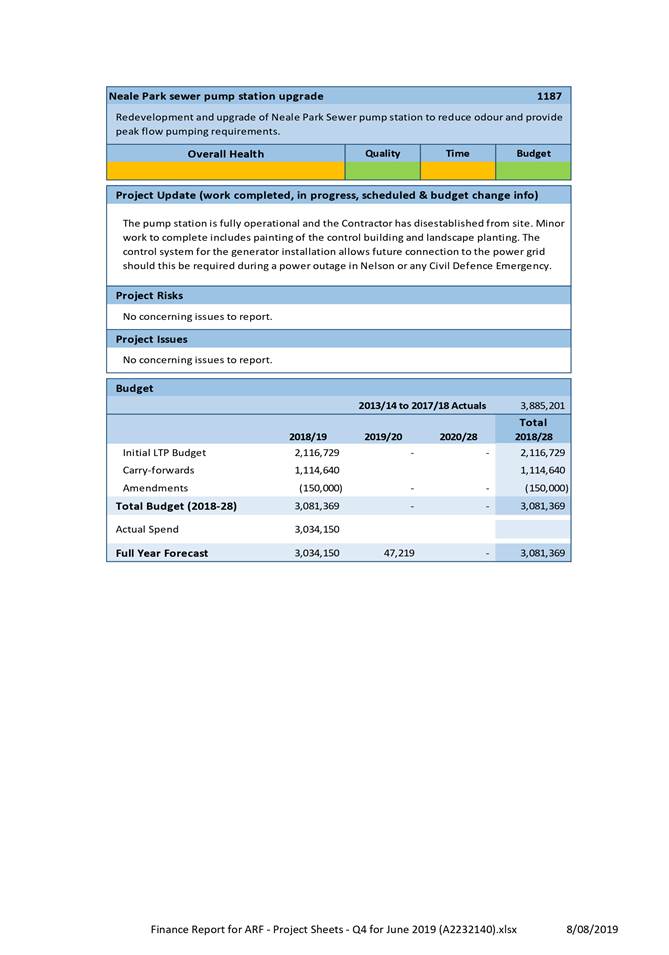

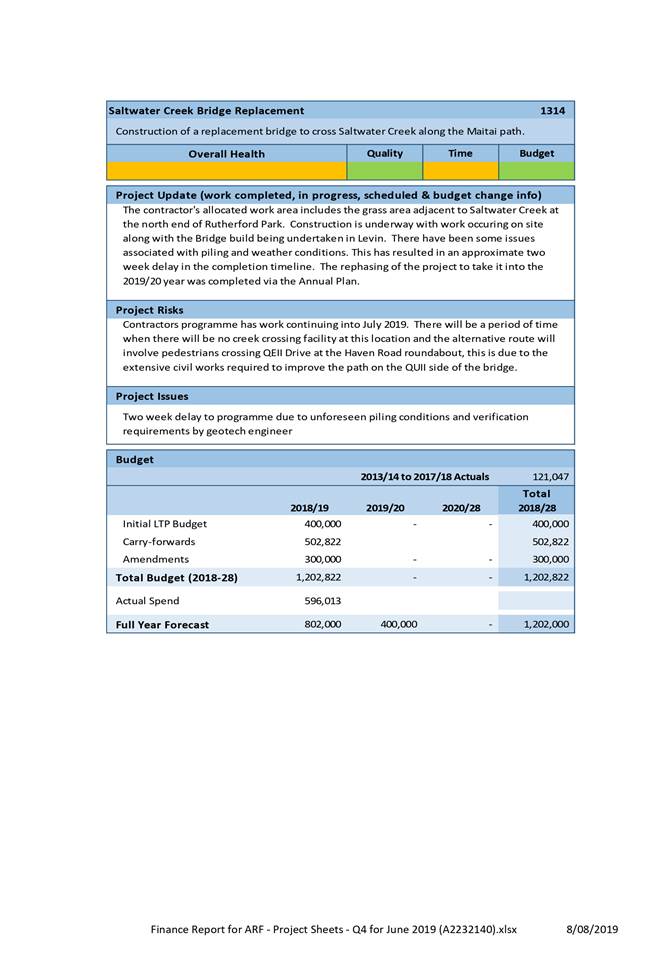

· The chart in Attachment 2 represents project health for all projects

reported to other committees.

· Project health is analysed based on three factors; quality, time and

budget. From the consideration of these three factors the project is summarised

as being on track (green), some issues/risks (yellow), or major issues/risks

(red). Projects that are within 5% of their total budget are considered to be

on track for the budget factor.

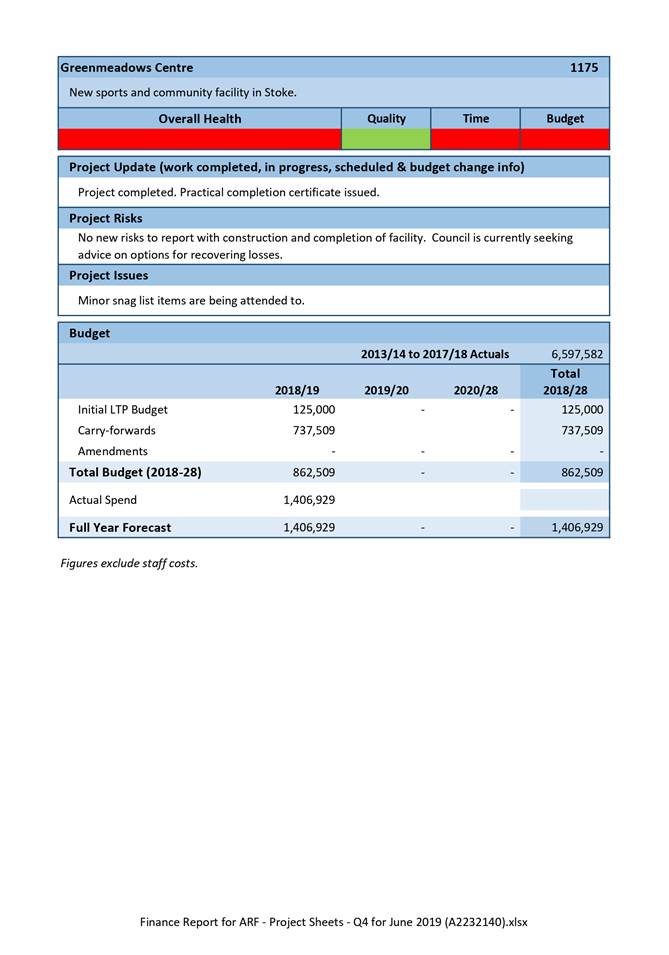

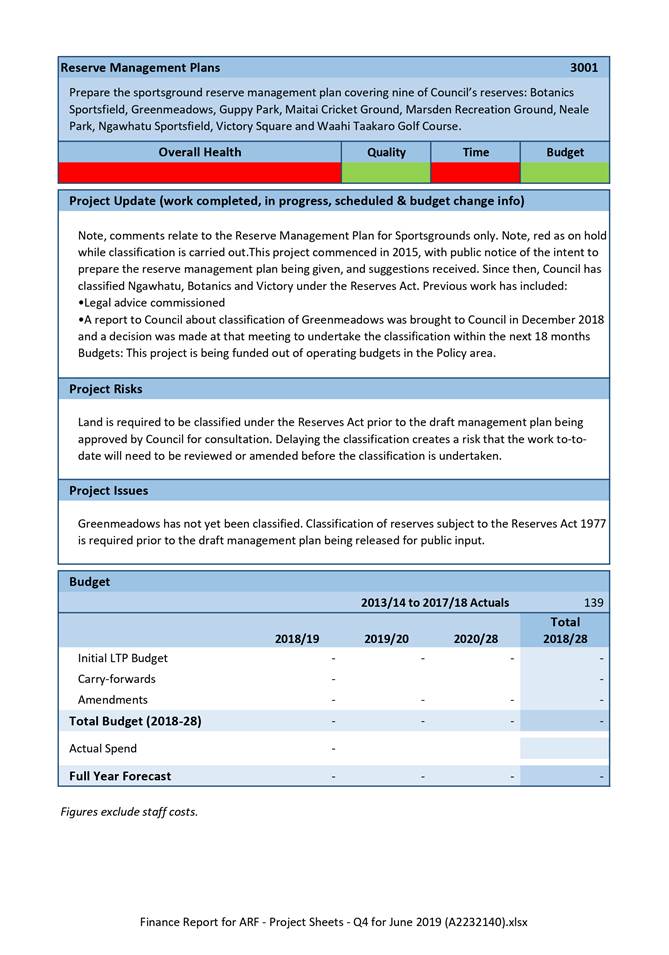

· More detailed project sheets are supplied in Attachment 3 for all

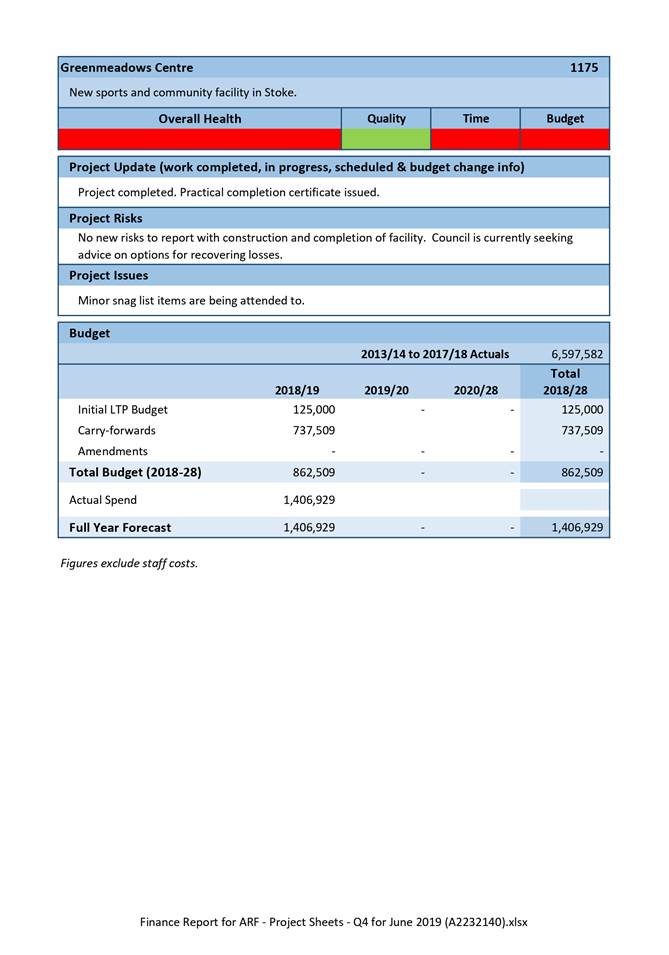

projects with a red health assessment along with all projects with a budget

greater than $1m in the current financial year.

· The quarter four forecast for capital expenditure is $6.1 million

less than approved budget ($35.2 million vs $41.3 million excluding NRSBU,

vested assets and consolidations). The approved budget of $41.3 million

includes $1.5 million of the carry-overs agreed through the annual plan

process.

· Total capital expenditure of $34.7 million is within half a million

(1%) of the quarter four forecast. Forecasting accuracy has predictably

increased as the year has progressed, from 18% at quarter one to 6% at quarter

three and 1% at quarter four.

5. Quarterly

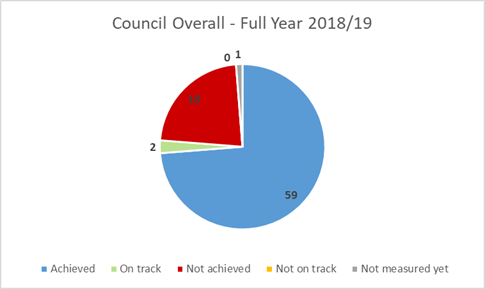

Review of Key Performance Indicators

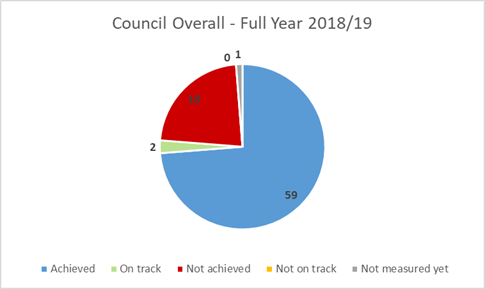

The pie chart below shows

overall Council performance to 30 June 2019 against performance measures set in

the Long Term Plan. To date, 74% of measures were achieved by the end of the

financial year, with some assessment remaining.

Insurance renewal

5.1 Nelson

City Council is part of the Top of the South Collective with Tasman District

Council and Marlborough District Council which was formed 1 July 2011.

The insurance broker is Marsh JLT (formerly Jardine Lloyd Thomson (JLT)) and

Nelson City Council has various insurance policies including:

· Material Damage –

commercial and residential

· Business Interruption

· Motor Vehicle

· Public and Professional

Indemnity

· Crime, Statutory and

Employers Liability

· Harbour Masters and

Wreck Removal Liability

· Hall Hirers Liability

· Personal Accident

· Forestry

5.2 The

insurance was successfully placed for 1 July 2019 for this programme. The

infrastructure asset insurance renewal is on 1 November 2019.

5.3 During

the year the members of the collective signed an agreement agreeing in advance

how any claim payments, which are subject to shared limits can be equitably

disbursed in situations where more than one member has a claim within the same

claim year and the shared limit is exceeded. This was signed by the Chief

Executives of the Councils. The intention is a similar agreement will be signed

for the infrastructure asset shared South Island collective prior to the

renewal on 1 November 2019.

5.4 The

policies held with a shared limit are currently:

· Business interruption

additional expenses ($10m)

· Public Liability and

Professional Indemnity ($300m)

· Statutory liability

($2.5m)

· Defence costs ($500,000)

· Employers liability

($1m)

5.5 Where

a second claim is made which would exceed the shared limit, then the

distribution would be shared on the same basis as the current premium

allocation.

5.6 Premiums

have increased overall by $210,000 (21%) mainly driven by increased material

damage premiums. The increase is related to the increasing value of property

insured (valuation and new assets) as well as premium increases. An allowance

for premium increases of $115,000 was included in the 2019/20 Annual Plan, and

there is still some risk around costs for the infrastructure renewal in

November given market conditions.

5.7 The

policies for crime (fraud), statutory liability, employer’s liability and

hall hirer’s liability have been provided by QBE for 2019/20 after Vero

ceased to offer the crime (fraud) cover. Members of the collective along with Council Insurance Brokers (Marsh JLT) spent some time

considering the new proposal and collectively decided that retention of the

Crime cover was important enough to outweigh an increase in premium.

5.8 PF

Olsen provided an alternative insurance quote to NCC to join their Standing Timber Insurance Policy group cover which

has been accepted.

5.9 The policy was reviewed by Marsh JLT and advice given was

to accept. The Policy is through Lloyd’s market with an Insurance rating

of A+ (Strong).

5.10 Cover limits have increased for wind damage ($1M from

$500k) and re-establishment ($1.6M from $870k) but the annual premium is lower

at $14,653 compared to the previous policy of $28,562 (with Primacy part of

Allianz).

Insurance

Market Summary in respect of Public Liability and Public Indemnity Insurance

for Local Government

5.11 The UK insurance market including Lloyds is currently going

through market reform, with the regulator requiring insurers to have acceptable

business plans in place in order to continue to offer insurance. One

outcome of this is that insurers are having to adopt a more risk based approach

to underwriting, including how they are identify and treating risk at a very

granular level. In terms of the Public Liability & Professional Indemnity

this has meant that underwriters have firstly looked to consider the LG litigation

environment in New Zealand, then they have focused on each individual council

and its risk profile, including prior claims.

5.12 In that respect there has been a deterioration of Local

Government’s liability risk profile, with a trend towards adverse judgements

where it is appears Councils are a convenient defendant to sheet a liability

home to. Councils are also exposed to inflated claims costs

through ‘joint & several’ liability where other liable parties

may have liquidated their business to avoid liability and/or professionals

significantly limiting their liability through contract. Significant claims are

also becoming far more frequent even from smaller Councils, and class

actions against Councils exacerbated by litigation funders, are all increasing

claims costs.

5.13 Local insurers also appear to be withdrawing from offering

this type insurance to Councils limiting long term reliable alternatives and

potentially leading towards more restrictive terms to exclude systemic failure

type of claims such as building defect claims.

6. Other

notable achievements, issues or matters of interest

Community Services

6.1 The

Community Funders Roadshow event was hosted by the Community Funders Network at

Greenmeadows Community Centre on 24 May. The Roadshow was targeted at community

organisations as a way of providing information on upcoming funding

opportunities. The programme included presentations from Nelson City Council,

Tasman District Council, Department of Internal Affairs, Rata Foundation, Te

Puni Kōkiri and Creative Communities. Approximately 90 people attended

with positive feedback received. Discussion is underway to look at repeating

the event next year.

6.2 The

Elmer Turner Library (ETL) has seen a significant increase in security related

incidents since the beginning of July, mainly relating to intoxication, mental

health and behavioural issues. Security guards have been engaged, a security

review is under way and Police are working closely with the library team to

mitigate this increase.

6.3 Broadgreen

House has also seen a spate of security related issues during May with a group

of young people lighting fires and abusing volunteers. Planned upgrades to the

CCTV system, improvements with vegetation and proactive attention on those

involved by Police appear to be resolving the issue.

6.4 Further

discussion in relation to security incidents at ETL and Broadgreen House is

contained in the Health and Safety report R10385.

6.5 Following

the Bay Dreams event on 4 January at Trafalgar Park, negotiations are well

advanced to confirm hosting the event in Nelson again. Negotiations include

discussion on a longer term arrangement (subject to certain conditions being

met).

6.6 A

new system to put up street flags more easily and at lower cost is in place.

The Flagtrax installation was started this quarter and sees a total of 80

installed on street light poles throughout the CBD.

Works and Infrastructure

6.7 The

utilities team and the transport operations and activity management teams are

now fully staffed, however there are six vacant positions in capital projects.

Stress due to workload is a concern as in addition to these vacancies the teams

have also had to cover time in lieu resulting from the Pigeon Valley fires.

6.8 The

contract for the operation and maintenance of the Nelson Water Treatment Plant

and its catchments was recently tendered and awarded to Fulton Hogan for a

price of $7,482,795.13. This price is spread over approximately 5 years with

the ability to be extended by a further 5+5 years depending on satisfactory

performance. Fulton Hogan is the current operator of the water treatment

plant and was the only contractor to tender for this contract. The price

tendered is within Council budgets. The new contract commences on 1 November

2019.

6.9 The

Joint Waste Management and Minimisation Plan review was scheduled for

completion in 2018. However, the late introduction of a per capita target, by

the joint NCC/TDC working party and the operational delays caused by the Pigeon

Valley fire, means that the plan will not be adopted by Nelson City Council

until September 2019. A waste minimisation Action Plan will be developed in

partnership with Tasman District Council once the plan has been adopted. In the

last year alongside a focus on promoting composting and recycling of e-waste,

the waste minimisation work programme has consisted of investigative work in

the construction, business and textile waste sector, along with trial funding

of projects to reduce waste at public events.

Planning and Regulatory

6.10 There has been a significant increase in the number of

building consents and amendments being granted in quarter 4 compared to quarter

3 (278 compared to 183). The

amendments have the effect of increasing the processing and inspections staff

workloads as there is an area of rework required to complete each one.

6.11 The

Future Development Strategy was adopted by the Joint Committee on the 26 July.

This strategy has been prepared in response to the issues raised in the Housing

and Business Capacity Assessment. The Strategy provides a framework for

planning and also future investment in infrastructure.

6.12 With

the help of funding from Maritime New Zealand the deputy harbourmaster

continued at full time hours and conducted over 1500 safety checks, a 50%

increase from last year’s total. Five search and rescue operations with

other organisations were successfully conducted. The deputy harbourmaster

initiated a Women on Water workshop that has seen over 40 participants learn

basic boating safety skills as a precursor to day skipper courses. School

visits on water safety have been very well received by over 800 students.

6.13 Recruiting

in the Planning and Regulatory teams continues to be challenging, mirroring the

experience of councils across the country. This has led to difficulties in

resourcing some projects and programmes.

6.14 Increased information reporting requirements by

central government and within the regional and unitary local government sector

have highlighted difficulties with current data systems to capture and report

on a range of regulatory activities.

Sports

and Recreation

6.15 Marina

fees and charges were set through the 23 July committee report in consultation

with the Marina Advisory Group. The Marina Advisory Group has subsequently

requested that for practical reasons the boat ramp fees stay at $5 rather than

the CPI adjusted figure of $5.20. The concern is that $5.20 may discourage

people from paying the fee altogether if they intend to use cash. The Marina

Advisory Group are currently reviewing the fees and charges and propose that

following further improvements to the boat trailer carpark in 2019/20 the ramp

fee should be set at $10 for the 2020/21 review.

6.16 Council

is undertaking a revaluation of the Marina assets which will inform future

funding for deprecation. Condition assessments are programmed this year which

will inform funding for renewals. Once these processes have been completed the

Marina Advisory Group will prepare proposed fees and charges for presentation

to the Sports and Recreation Committee for adoption of the new fees in 2020.

6.17 A

skate ramp has been installed at Marsden Recreation Reserve in Stoke. This is

the first step in development of youth facilities for Stoke. Designs for some

art work are currently being explored.

6.18 A

new stake ramp has been installed at Tahunanui Reserve beside the basketball

area. Officers have worked in partnership with an enthusiastic team of skaters,

who have volunteered their time to be involved in the design process. The

Arts Council is planning a project for the ramp. Both stake ramps have received

positive feedback from the community and are receiving high levels of use.

6.19 Several

public planting days have been undertaken this quarter including the Tahunanui

front and back beaches, Whakatu Reserve, Botanical Hill, Todd Stream, Saxton

Field and Paremata Flats Reserve. The planting days continue to be well

supported by the public.

6.20 Staff

and the Committee chairman met with the Waahi Taakaro Golf Club for its annual

report. A number of requests were received and are being considered. The Club

has reported a 30% increase in games played this year compared to last year

which brings it much closer to the revenue targets set within its contract. The

Chairman and Group Manager of Community Services have scheduled a visit to the

Club.

Governance

6.21 There

were 65 LGOIMA requests received between 1 April 2019 and 30 June 2019.

63 were responded to within the statutory timeframes, with one overdue and one

still open.

Author: Tracey

Hughes, Senior Accountant

Attachments

Attachment 1: A2224569

- Finance Report ⇩

Attachment 2: A2226256

- Project Health Summary ⇩

Attachment 3: A2232140

- Project Sheets ⇩

Item 7: Quarterly Report to 30 June 2019: Attachment 1

Item 7: Quarterly

Report to 30 June 2019: Attachment 2

Item 7: Quarterly

Report to 30 June 2019: Attachment 3

Item 8: Annual Tax

Review

|

|

Audit, Risk and Finance Subcommittee

27 August 2019

|

REPORT R10239

Annual

Tax Review

1. Purpose

of Report

1.1 To

advise the Subcommittee of Council’s tax activities over the prior year

and provide some context for the current tax environment.

2. Recommendation

|

That the Audit, Risk and Finance Subcommittee

1.

Receives the report Annual Tax Review (R10239) and its attachments (A2221879 and

A2221900).

|

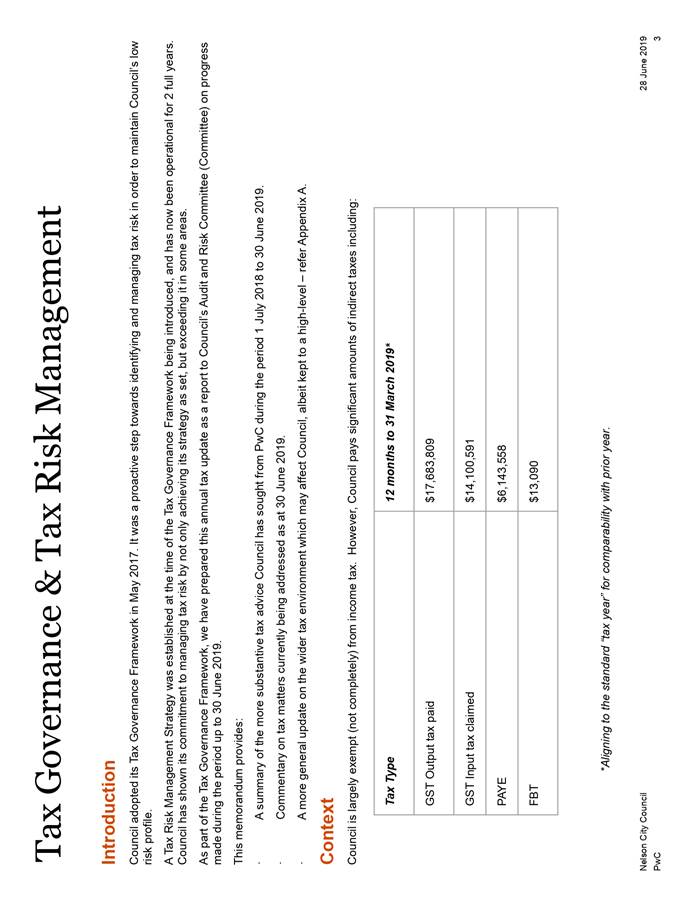

2. Background

2.1 The

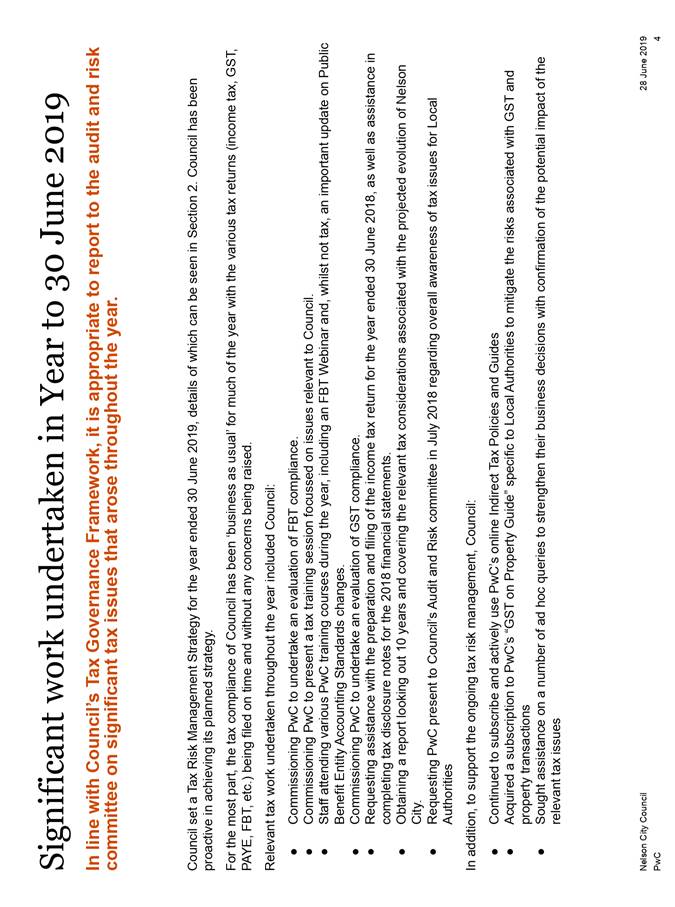

Tax Risk Governance Framework was adopted

by Council in May 2017 as a proactive step towards identifying and managing tax

risk to maintain its low risk profile. This annual update has been prepared as

part of that framework.

2.2 This

report provides:

· A summary of the tax advice

that Council has sought during the period 1 July 2018 to 30 April 2019

· Commentary on tax

matters currently being addressed as at 30 June 2019

· A more general high

level update on the wider tax environment as it might affect Council

· An overview of the goods

and services tax (GST) review undertaken in the last financial year.

2.3 The

annual tax review report from Council’s tax advisors (PWC) and the

detailed GST review are included with this report as attachments 1 and 2

respectively.

Tax Advice received and matters

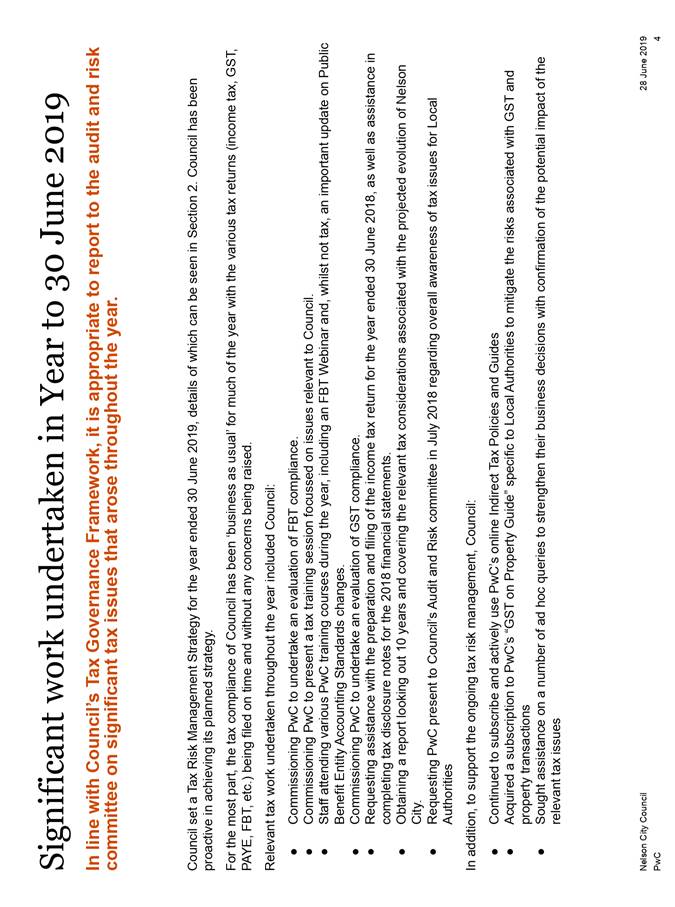

addressed to 30 June 2019

2.3 For

the most part, the tax compliance of Council has been ‘business as

usual’ for much of the year with the various tax returns (GST, PAYE, FBT,

etc) being filed on time and without any concerns being raised.

2.4 That

said, it is appropriate to comment on the following areas where assistance has

been provided to Council:

· Advice was sought in

relation to IRD’s updated guidelines around vehicle use for Fringe

Benefit Tax (FBT) and a voluntary disclosure was subsequently made.

· PwC prepared and filed

Council’s 2018 Income Tax Return on time in March 2019.

· In January 2019 PWC

sought an indicative view from Inland Revenue (IRD) on Council’s behalf

in relation to electronic bus ticketing and the time of supply rules for GST.

· A forward looking report

was commissioned covering tax considerations relating to the evolution of

Nelson City over a 10 year timeframe.

2.5 As

per the tax risk strategy adopted by Council in 2017, a comprehensive GST

review was undertaken toward the end of June 2018. The finalised report

(attachment 2) can be summarised as follows:

· The Finance team is

experienced and efficient in dealing with GST.

· Some risk arises where

one-off or unusual transactions have not involved the Finance team from early

stages.

· From 29 areas of focus

17 require no action and there are 12 recommendations for action to maximise

efficiency and risk reduction, mostly of a minor nature and which are in hand.

2.6 A

comprehensive FBT review was undertaken at the end of May 2019, and officers

are currently working through the findings with PWC. Officers have spent some

time recently considering various FBT issues and plan to do further work in

this area not least relating to organisational awareness during the 2019/20

financial year.

2.7 Officers

have committed to remaining up to date with tax issues in the sector and have

attended tax updates as provided by SOLGM and PWC, as well as a refresher

overview of indirect taxes and specific training aimed at officers new to the

sector provided by PWC.

2.8 Council

have now subscribed to PWC’s GST on Property Guide to support both

Property and Finance in this tricky area for GST.

2.9 Finally,

it is noted that Council has continued to obtain support via:

· Subscribing to

PwC’s online Indirect Tax Policies and Guides;

· Maintaining a Tax Risk

Governance Framework; and

· Adhering to a Tax Risk

Management Strategy.

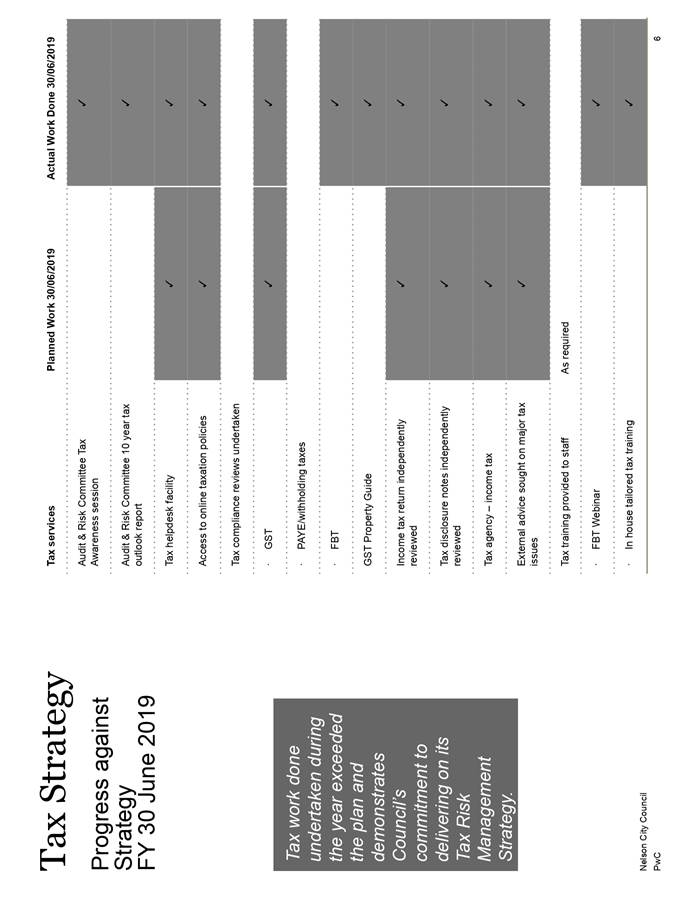

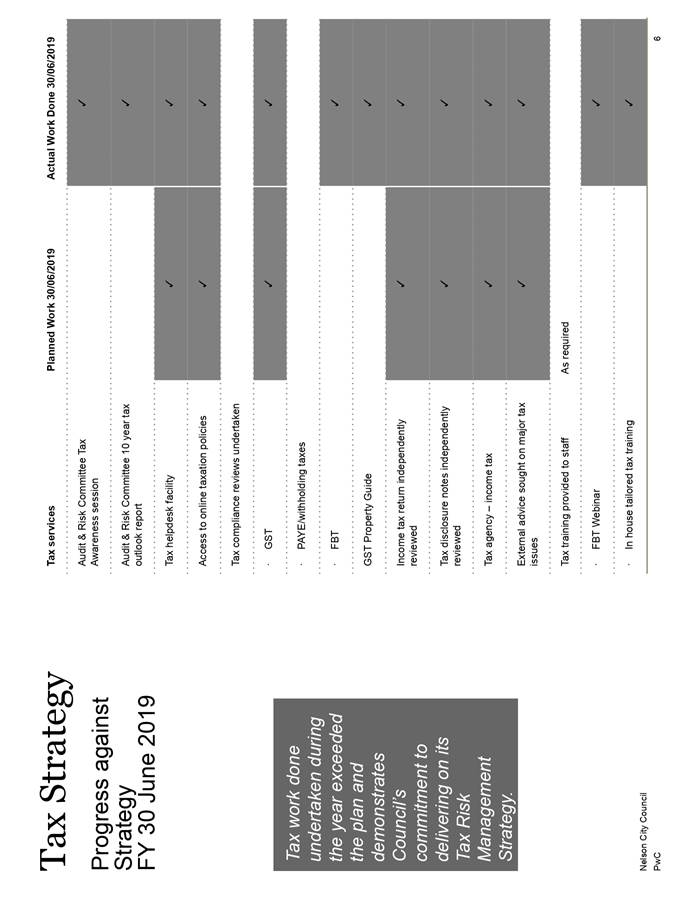

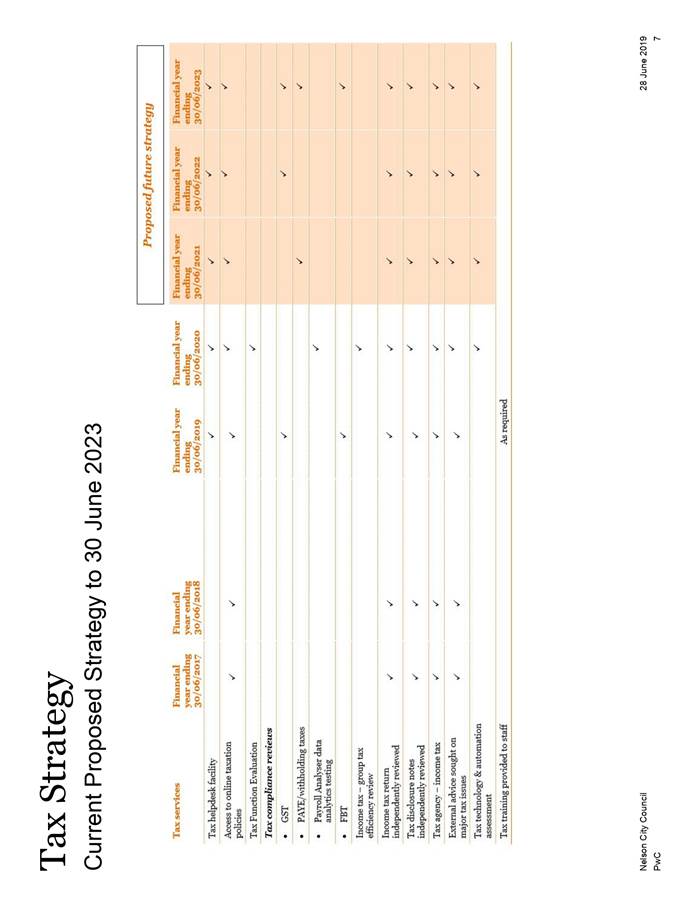

Tax Strategy

2.10 Page

6 of the PWC Tax Review (attachment 1) outlines work planned for the 2018/19

financial year and work done. It has been a more active year than anticipated

illustrating that officers are mindful of Council’s low risk tax profile

and seek to address risks before they crystallise.

2.11 Page

7 sets out work planned for the 2019/20 financial year, including a review of

our systems in relation to IRD’s payday filing requirements and a tax

technology and automation review.

Other relevant

matters

2.12 Pages

9 to 11 of attachment 1 itemise tax issues that are of interest to the sector

along with broader tax developments.

2.13 Of

particular interest or relevance to Nelson City Council:

· IRD’s ongoing

internal transformation has caused disruption to usual services. NCC has

experienced refunds in one tax type being swept to meet payments in another tax

type even before due date, causing reconciliation issues and potential

overpayments. Officers have addressed this with IRD and are hopeful that a

solution has been implemented.

· Once the IRD

transformation project is fully operational we can expect to see the results of

their ability to see significantly more data about each taxpayer. Before the

issuance of pre-populated accounts to taxpayers occurs en masse (31 March 2020

projected), an analysis of our payroll data since payday filing was introduced

will be performed to assess any risk areas. IRD have issued regulations

relating to how errors in payday filing may be corrected.

· Donee organisations must

now be either on Schedule 23 of the Income Tax Act 2007 as approved donee

organisations or listed on the charities register in a move to ensure greater

transparency of donations tax credits.

· IRD numbers are now

required on all property transactions.

Council’s

tax figures

2.14 Generally

Council is exempt from income tax with the main exception being income from

CC(T)O’s. However, Council has significant tax obligations in relation to

GST and PAYE in particular. The quantum is highlighted in this section.

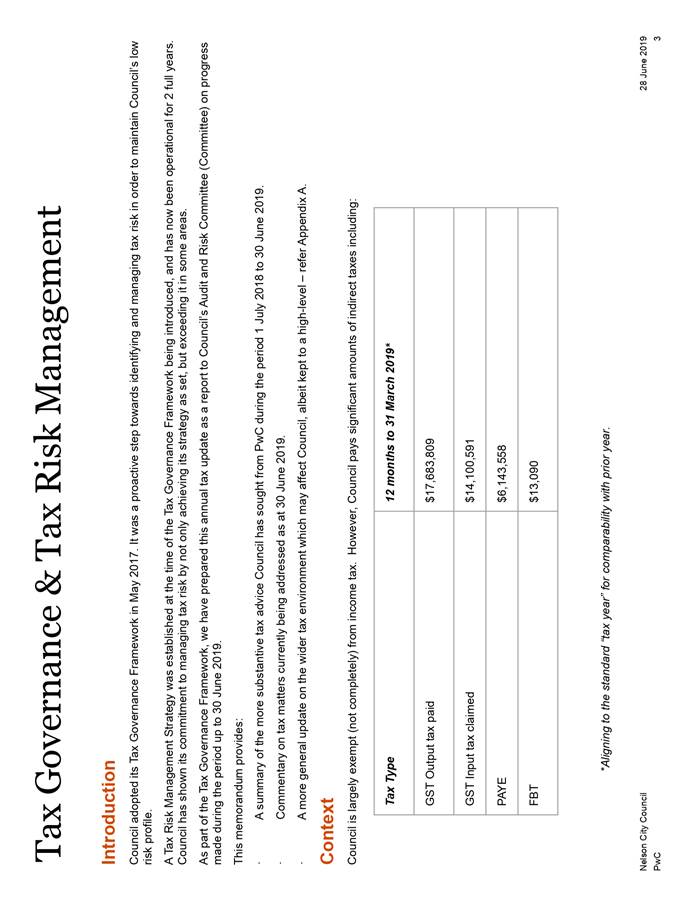

2.15 In

the 12 months ending 31 March 2019, Council has accounted for:

|

Tax

|

12 month period ending

|

Amount

|

|

GST output tax

|

31 March 2019

|

$17,683,809

|

|

GST input tax

|

31

March 2019

|

$14,100,591

|

|

PAYE & ACC

|

31

March 2019

|

$6,143,558

|

|

FBT

|

31

March 2019

|

$13,090

|

2.16 Council

also acts as agent for the Nelson Regional Sewerage Business Unit, Nelson

Tasman Regional Landfill Business Unit and Nelson Tasman Civil Defence and

Emergency Management. The numbers above exclude these entities.

3. Conclusion

3.1 Council

formally adopted the Tax Governance Framework on 18 May 2017 and the Tax Risk

Management Strategy on 14 December 2017. These form a solid foundation for

managing tax risk.

3.2 The

Tax Risk Management Strategy (included in attachment 1) is a simple tool to

ensure that tax risk is being identified and managed appropriately while

providing the Subcommittee with a quick visual tool to see the steps Council

has taken to manage tax risk and the forward looking strategy.

3.3 The

adoption of the Framework and the Strategy ensures that complacency does not

arise amongst the finance team, senior leadership team or those with oversight

for audit and risk.

Author: Tracey

Hughes, Senior Accountant

Attachments

Attachment 1: A2221879 - PWC Annual Tax

Review ⇩

Attachment 2: A2221900

- GST Compliance Review ⇩

Item 8: Annual Tax Review: Attachment 1

Item 8: Annual Tax

Review: Attachment 2

Item 9: Quarterly Key

Risks Report - 1 April to 30 June 2019

|

|

Audit, Risk and Finance Subcommittee

27 August 2019

|

REPORT R10217

Quarterly Key Risks Report - 1 April to 30 June 2019

1.

2. Purpose

of Report

1.1 To provide information to the

Audit, Risk and Finance Subcommittee on the key organisational risks.

3. Recommendation

|

That the Audit, Risk and Finance Subcommittee

1. Receives the report Quarterly Key Risks Report

- 1 April to 30 June 2019 (R10217) and its attachment (A2233464).

|

4. Background

4.1 Risk management activities during

quarter four include:

· A review of the risk management structure and process;

· The exploration of options to ensure risk management activity is

focussed on Council’s core service delivery objectives;

· The identification of a potential software tool to enable

consolidation of risk recording, to provide more effective risk ownership and

visibility, and to provide more efficient reporting on risk.

4.2 Anticipated

risk management activities during quarter one 2019-20 include:

· Planning a risk maturity benchmarking exercise;

· Planning a trial of the risk management software tool;

· Developing a revised risk management structure and related

processes.

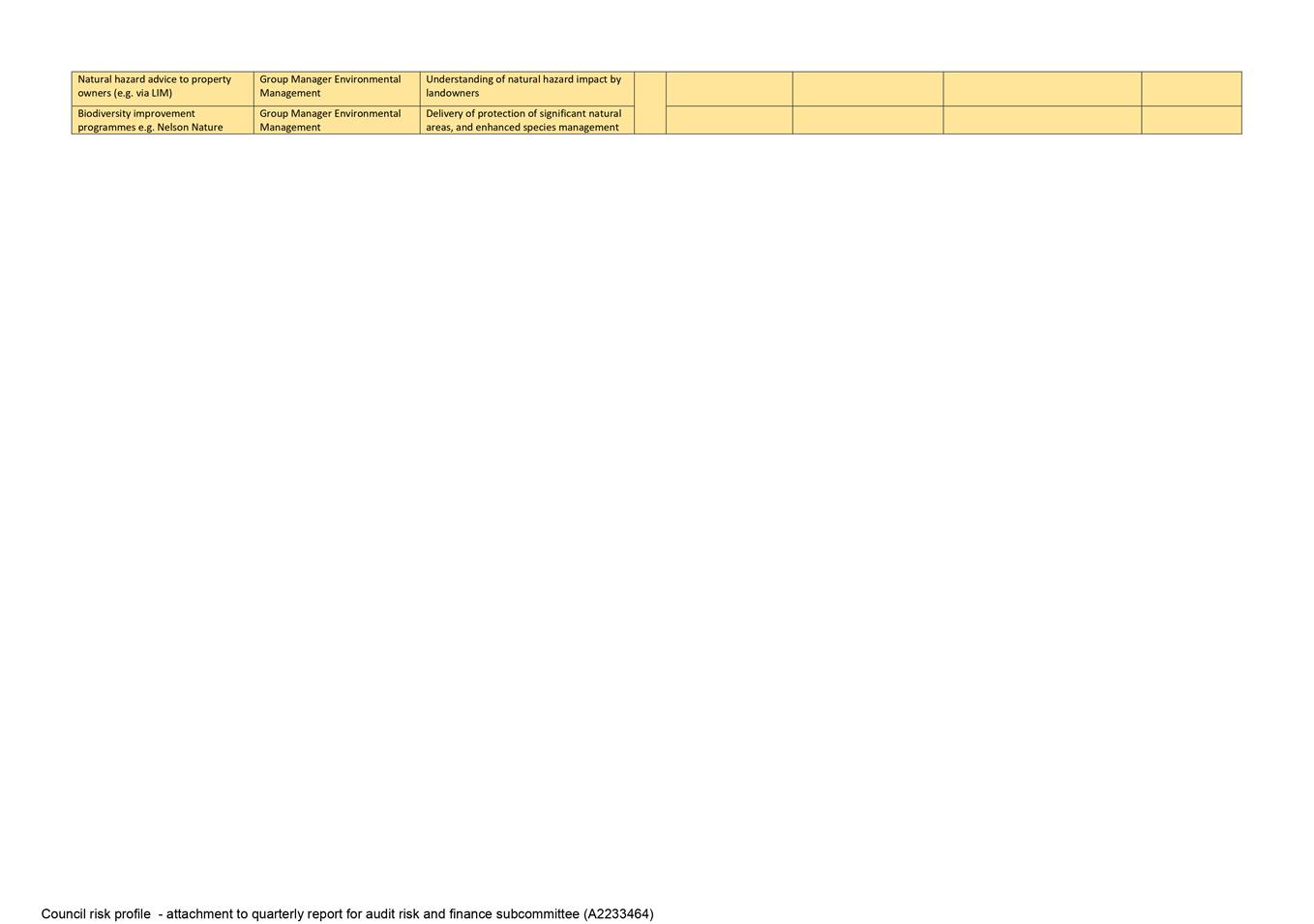

5. Risks to Achieving Council Long Term Plan

Top Priorities

5.1 Updated

information for quarter four is summarised below, with further detail on the

risk areas, their controls and treatments set out in attachment one.

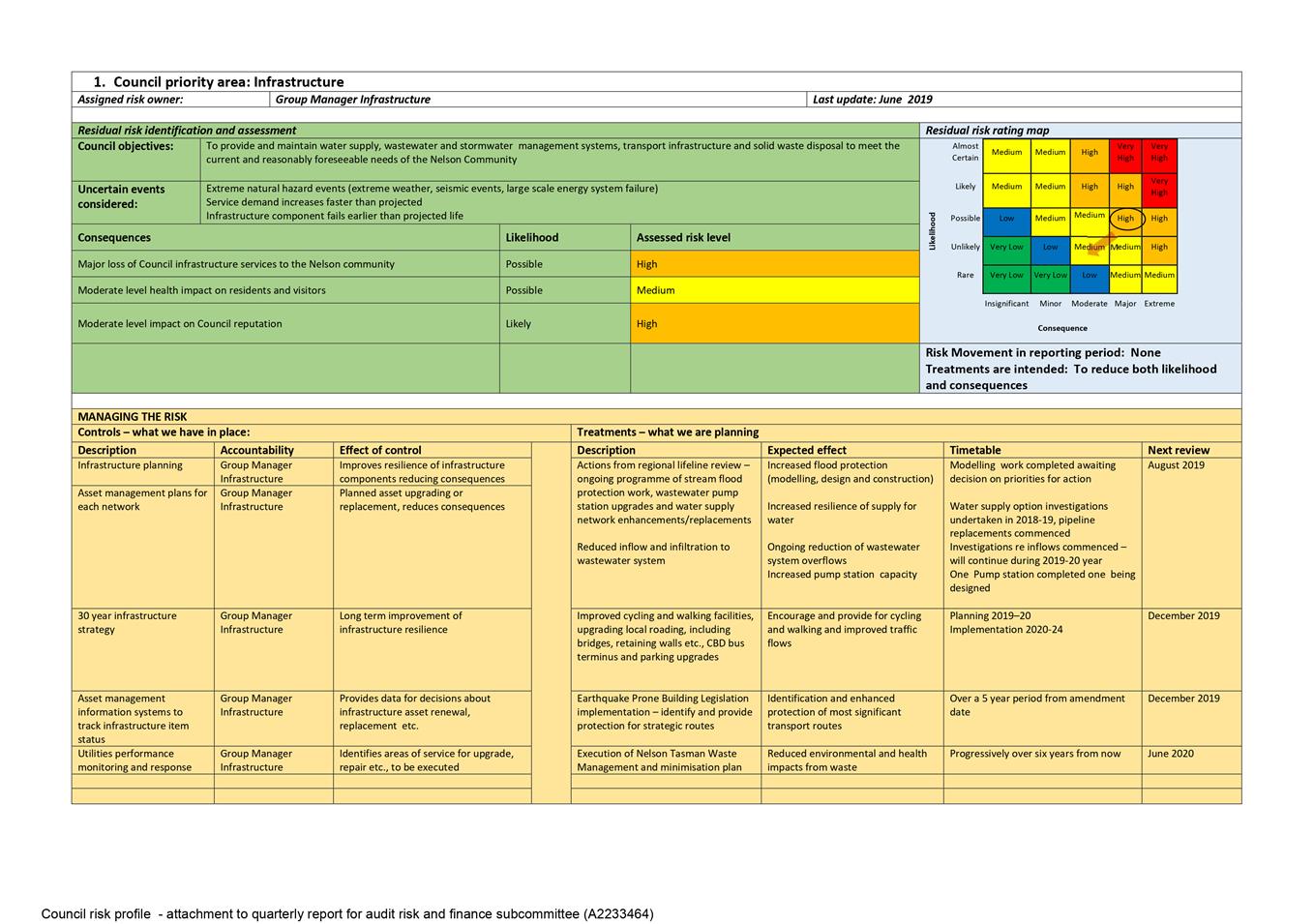

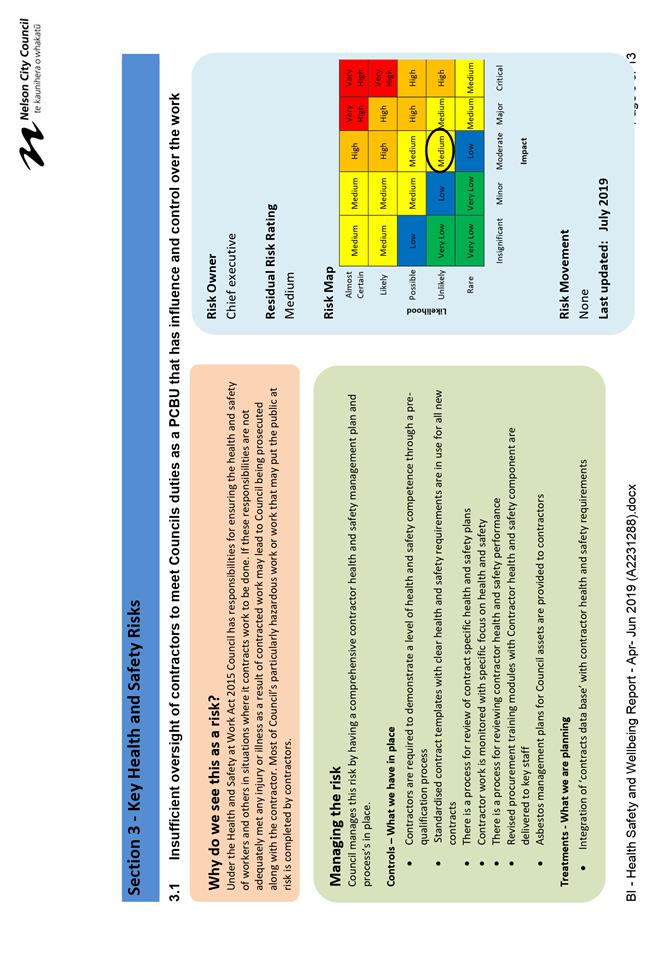

5.2 Priority area Infrastructure

(Risk 1). During quarter four, there were no

reported exceptions to the risk controls. The review dates for some

planned risk treatments have been brought forward to ensure progress of these

planned activities is reported through to the Audit Risk and Finance

Subcommittee in a timely manner.

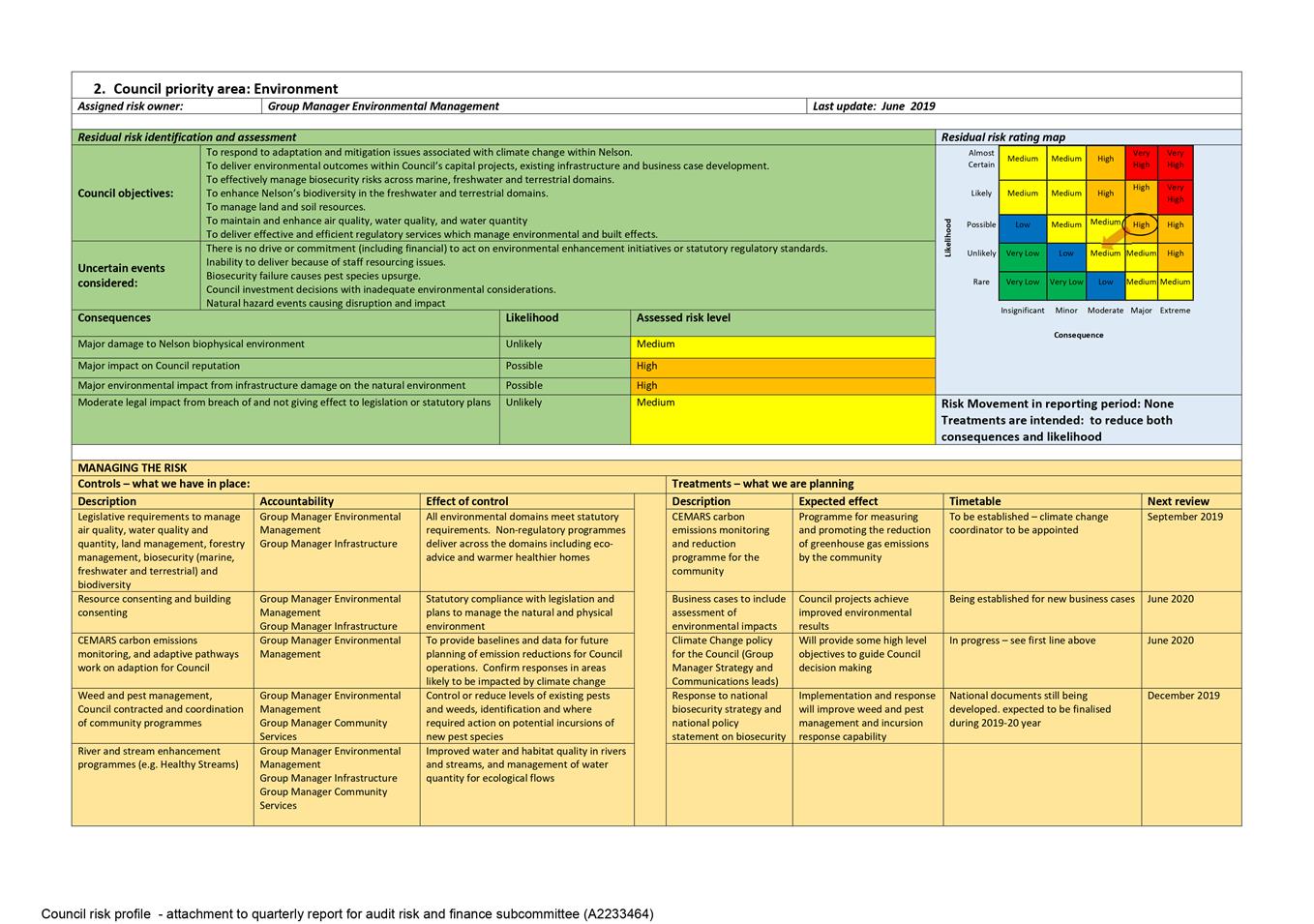

5.3 Priority area Environment (Risk 2). Planned risk

treatments were further developed during quarter four. The risk profile

for this priority area will be reviewed towards the end of quarter one 2019-20,

once the recent report on Council’s compliance,

monitoring and enforcement practices has been

considered by the Planning and Regulatory Committee.

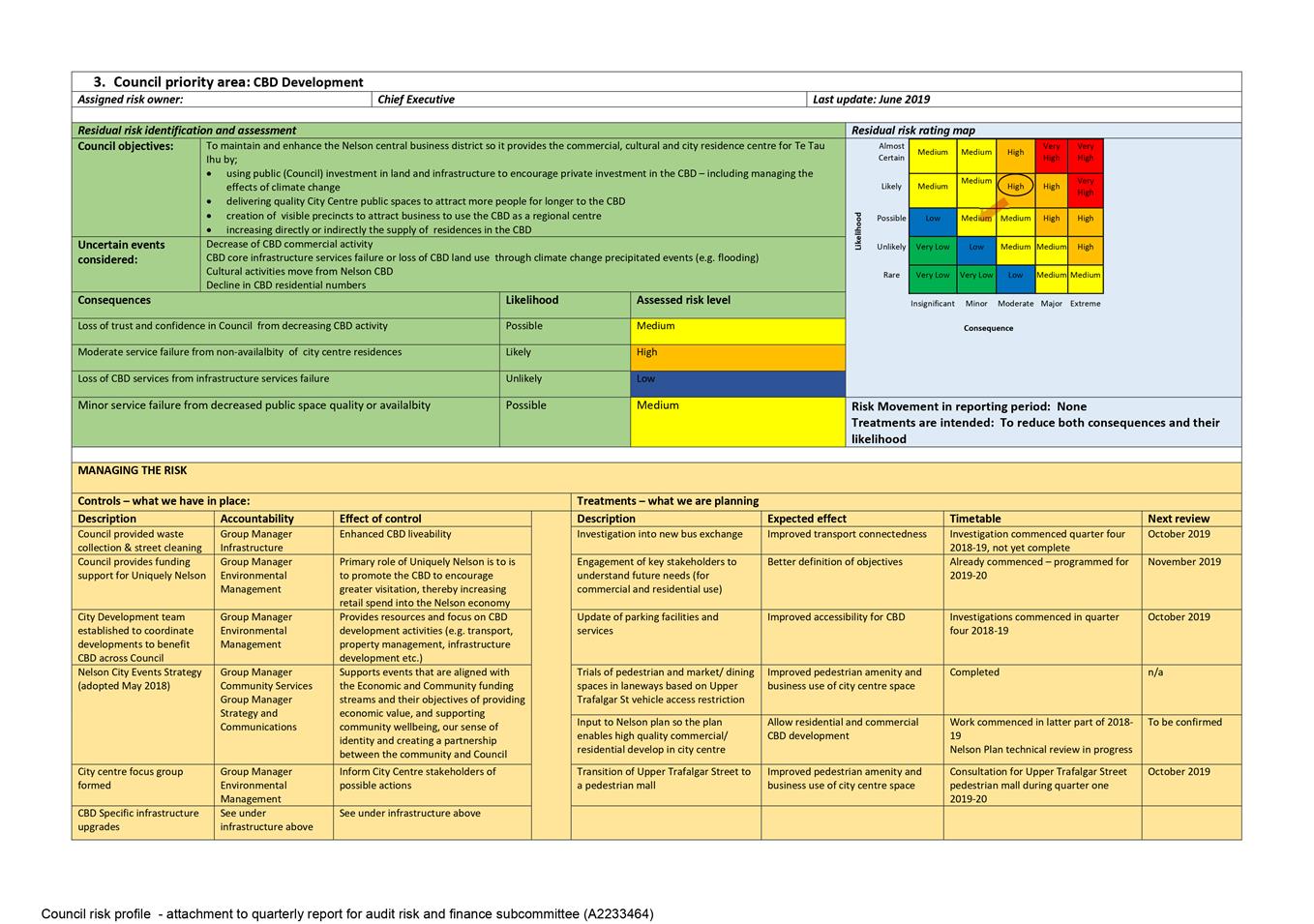

5.4 Priority area CBD Development (Risk 3). Planned risk

treatments have been updated during quarter four.

5.5 Priority

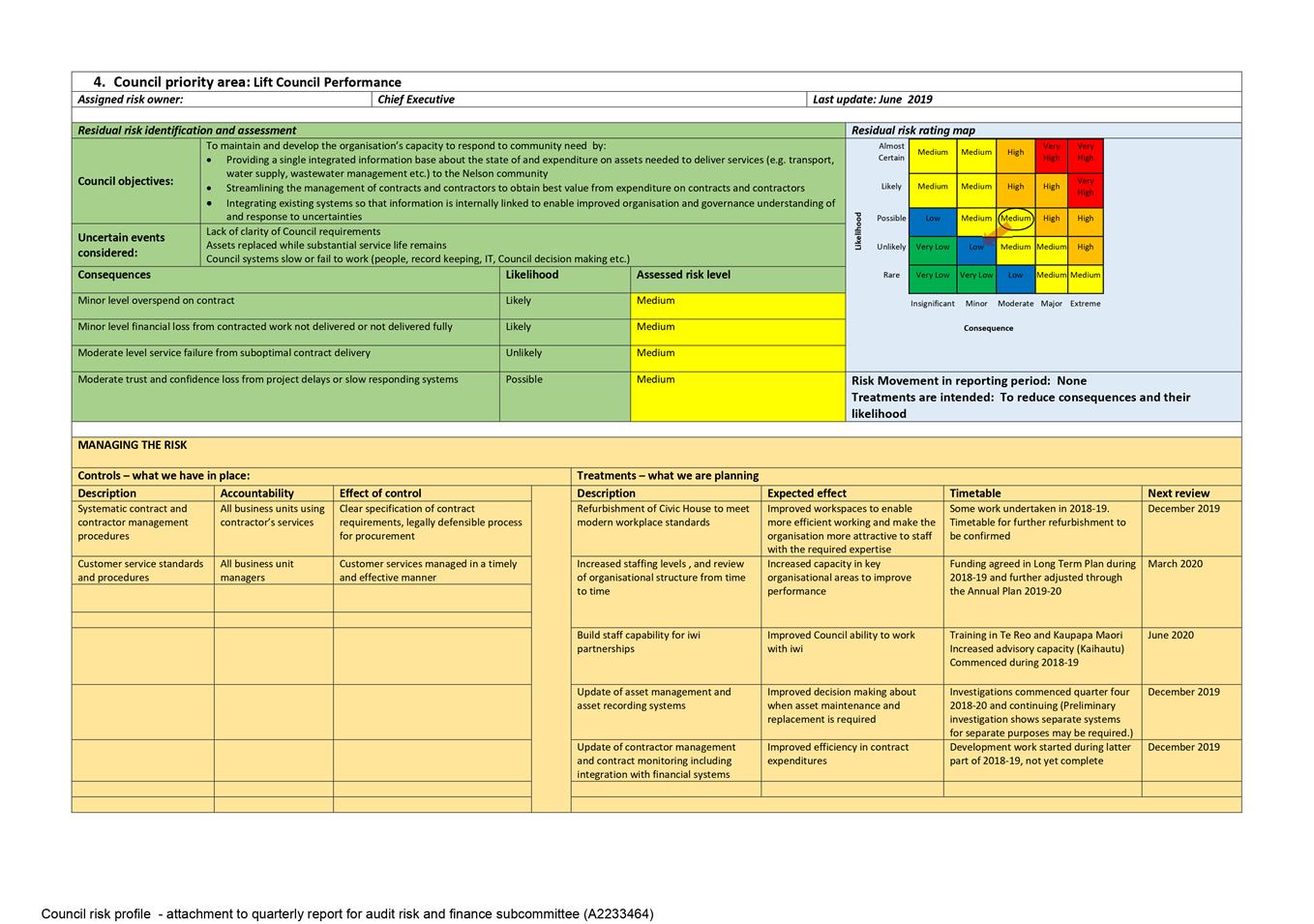

area Lifting Council Performance (Risk 4). Planned

risk treatments were further developed during quarter four. During

quarter one 2019-20, the controls will be reviewed to provide more extensive

and complete information, followed by a review of the risk profile.

6. Key

Organisational risks

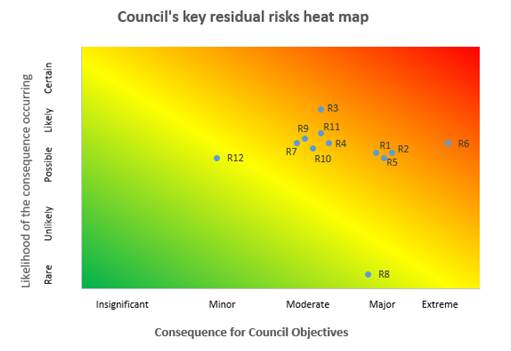

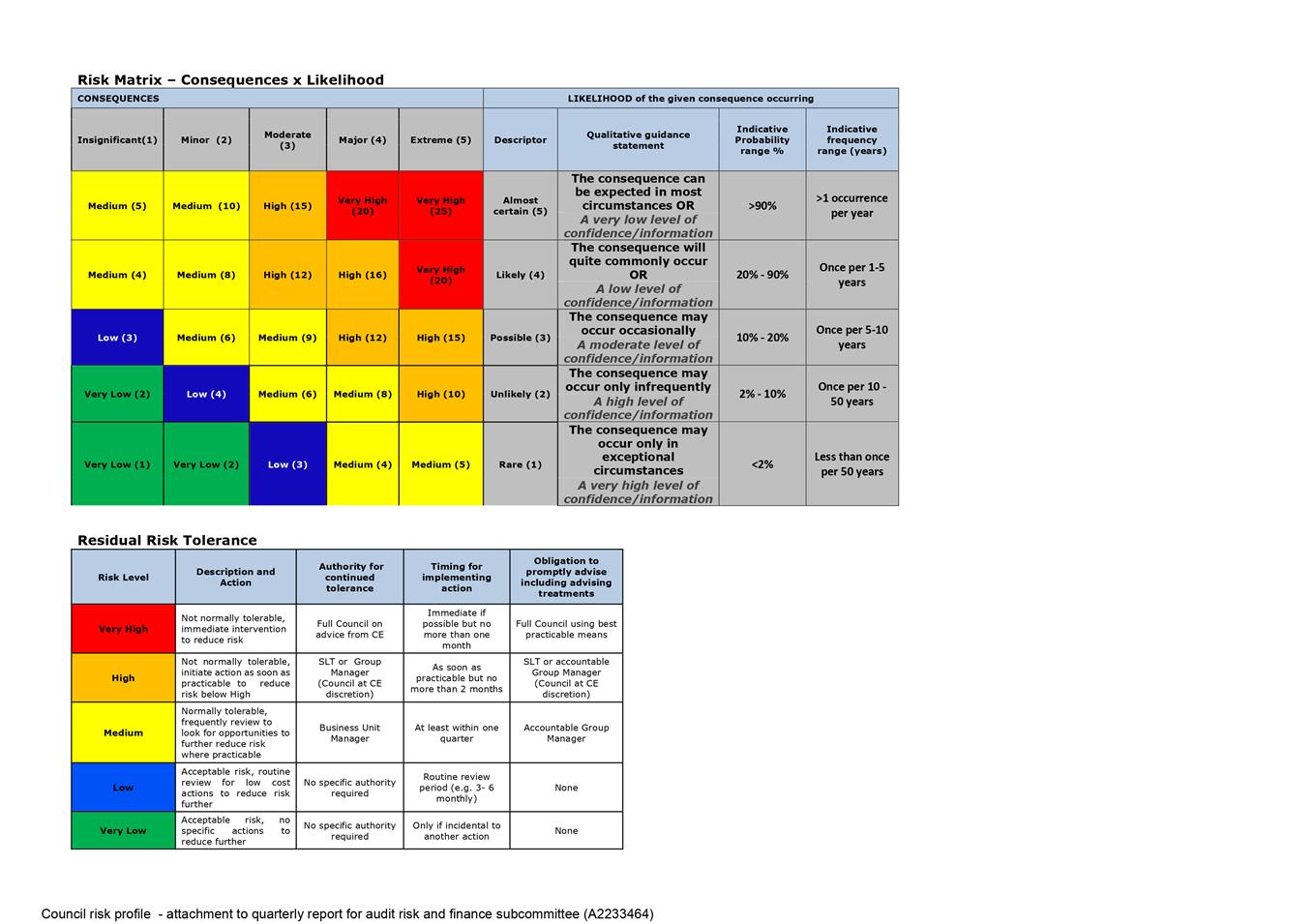

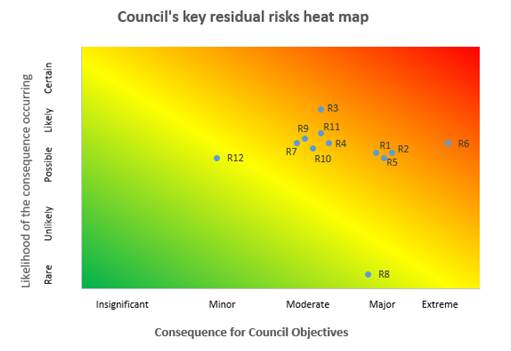

6.1 At end of quarter four, the known

key risk areas for the four Long Term Plan top priorities, and the eight key

organisational risks, are as summarised in the heat map, and table below. Brief updates are provided for the eight key organisational

risk areas, with further detail in attachment one.

|

ID

|

Risk Area

|

Rating

|

Owner

|

|

1

|

Council

priority area: Infrastructure

|

High

|

Group

Manager Infrastructure

|

|

2

|

Council

priority area: Environment

|

High

|

Group

Manager Environmental Management

|

|

3

|

Council

priority area: CBD Development

|

High

|

Chief

Executive

|

|

4

|

Council

priority area: Lift Council Performance

|

Medium

|

Chief

Executive

|

|

5

|

Lifeline

service failure from natural hazards and similar events

|

High

|

Group

Manager Infrastructure

|

|

6

|

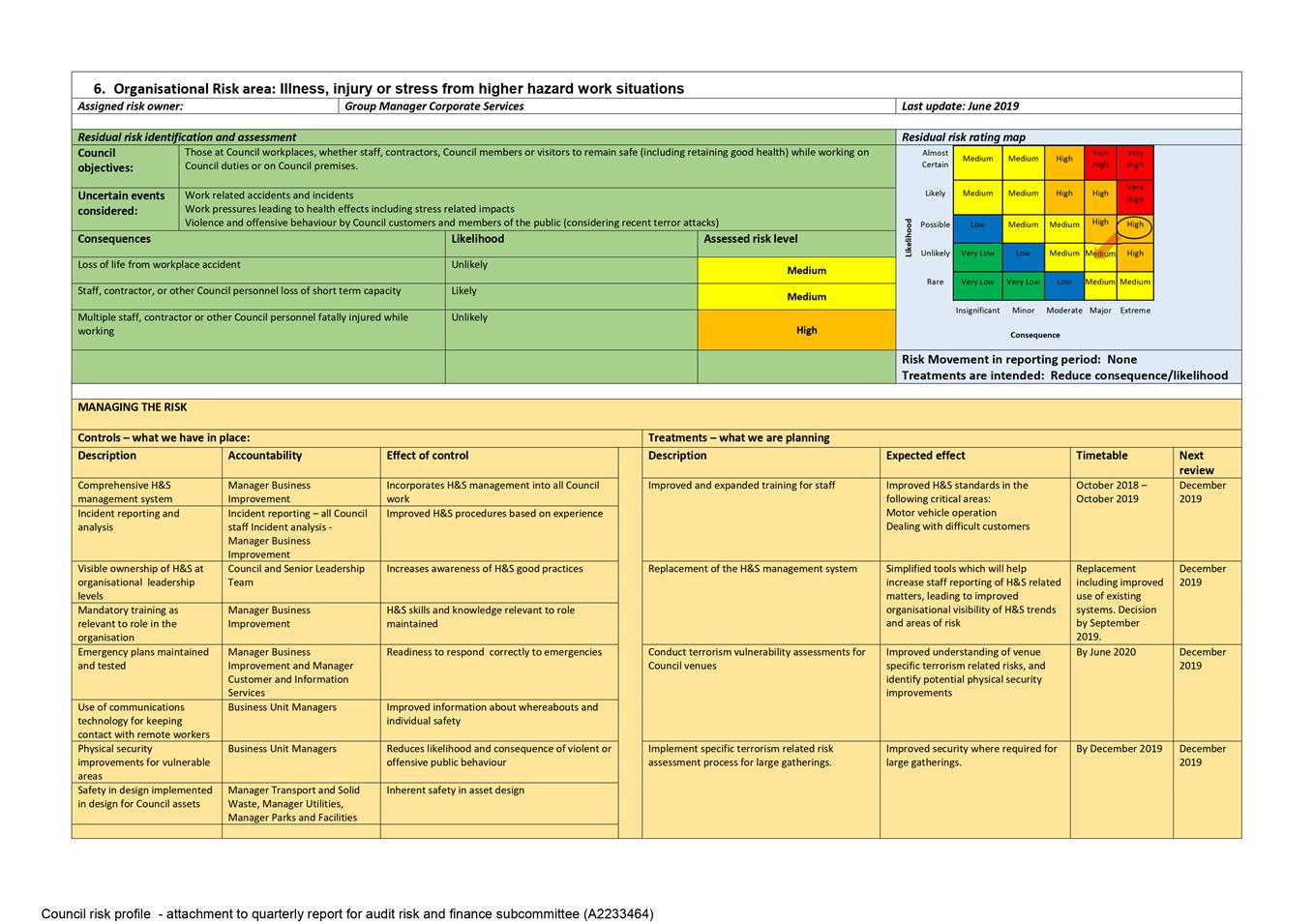

Illness,

injury or stress from higher hazard work situations

|

High

|

Group

Manager Corporate Services

|

|

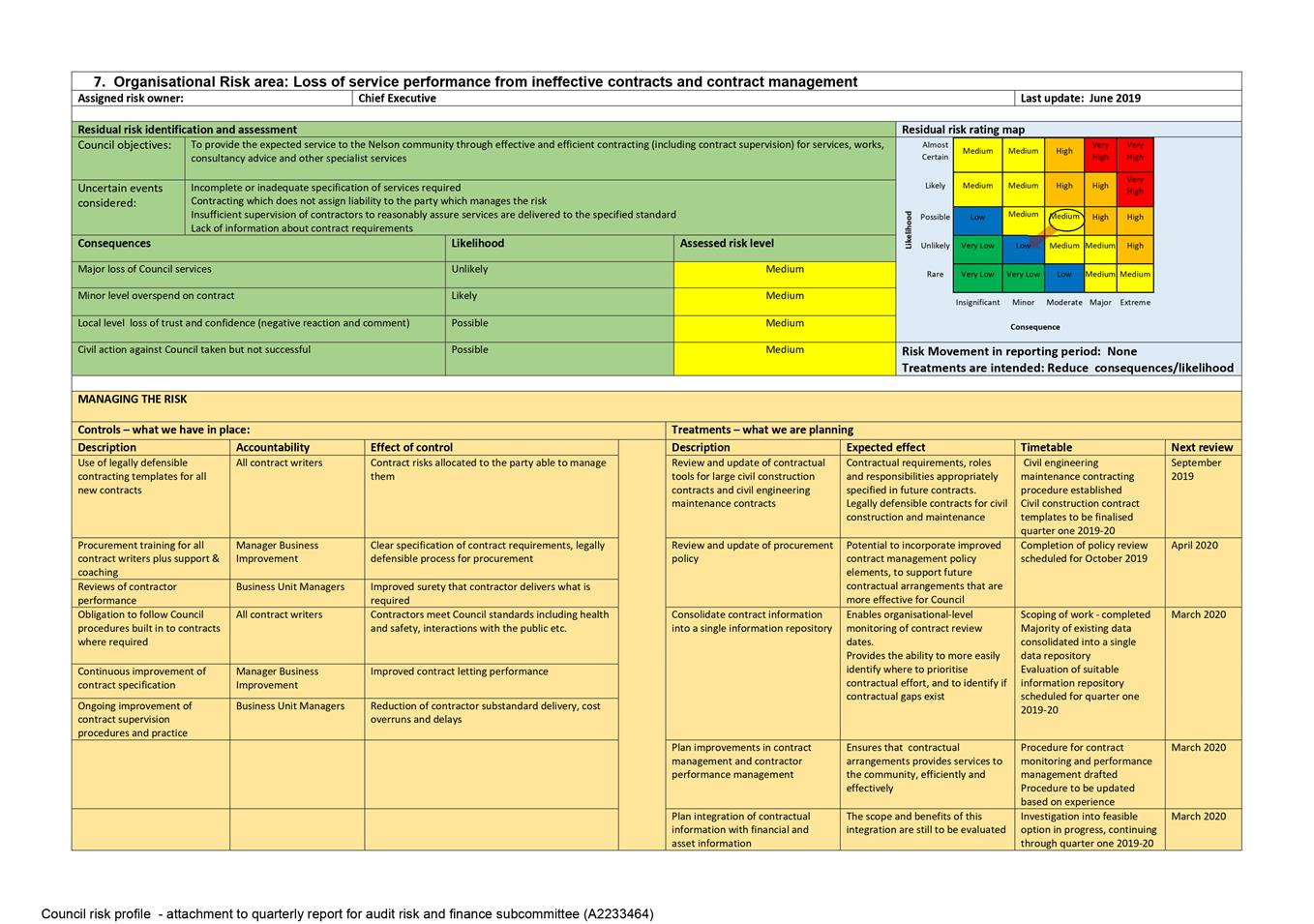

7

|

Loss

of service performance from ineffective contracts and contract management

|

Medium

|

Chief

Executive

|

|

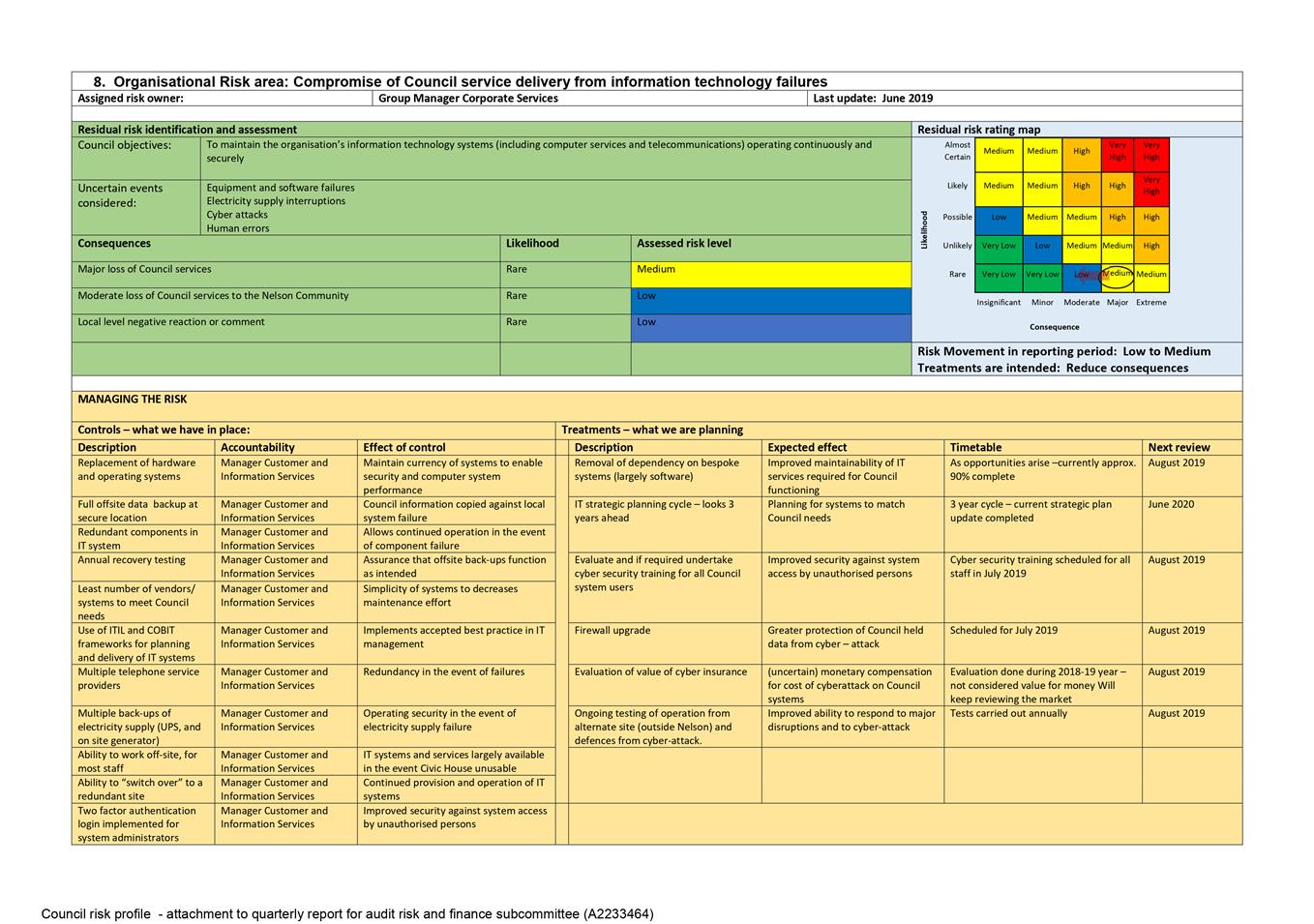

8

|

Compromise

of Council service delivery from information technology failures

|

Medium

|

Group

Manager Corporate Services

|

|

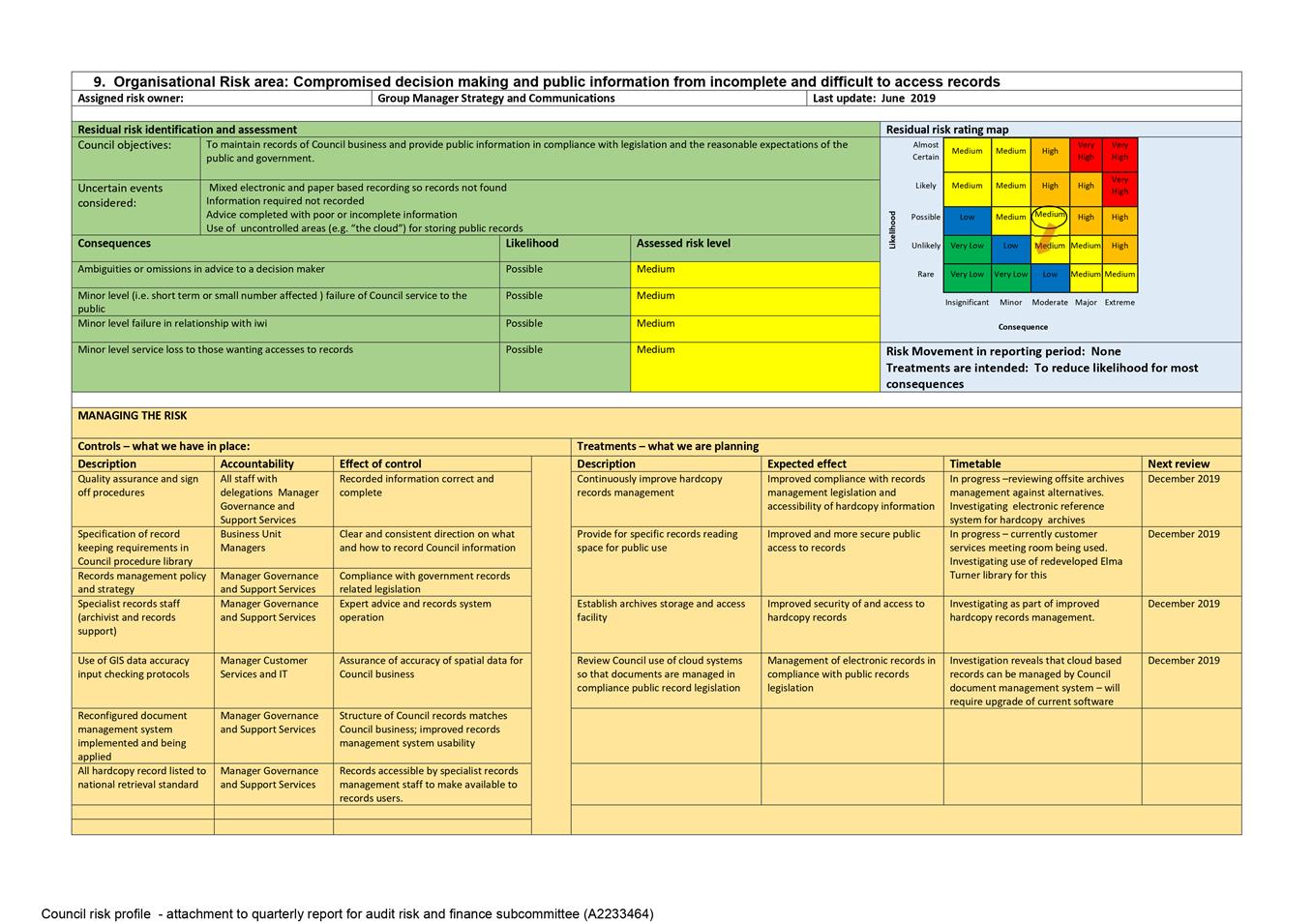

9

|

Compromised

decision making and public information from incomplete and difficult to

access records

|

Medium

|

Group

Manager Strategy and Communications

|

|

10

|

Council

work compromised by loss of and difficulties in replacing skilled staff

|

Medium

|

Manager

People and Capability

|

|

11

|

Legal

liability and reputation loss from inadequate consideration of the law in

decision making

|

Medium

|

Group

Manager Strategy and Communications

|

|

12

|

Loss

of public trust in the organisation

|

Medium

|

Group

Manager Strategy and Communications

|

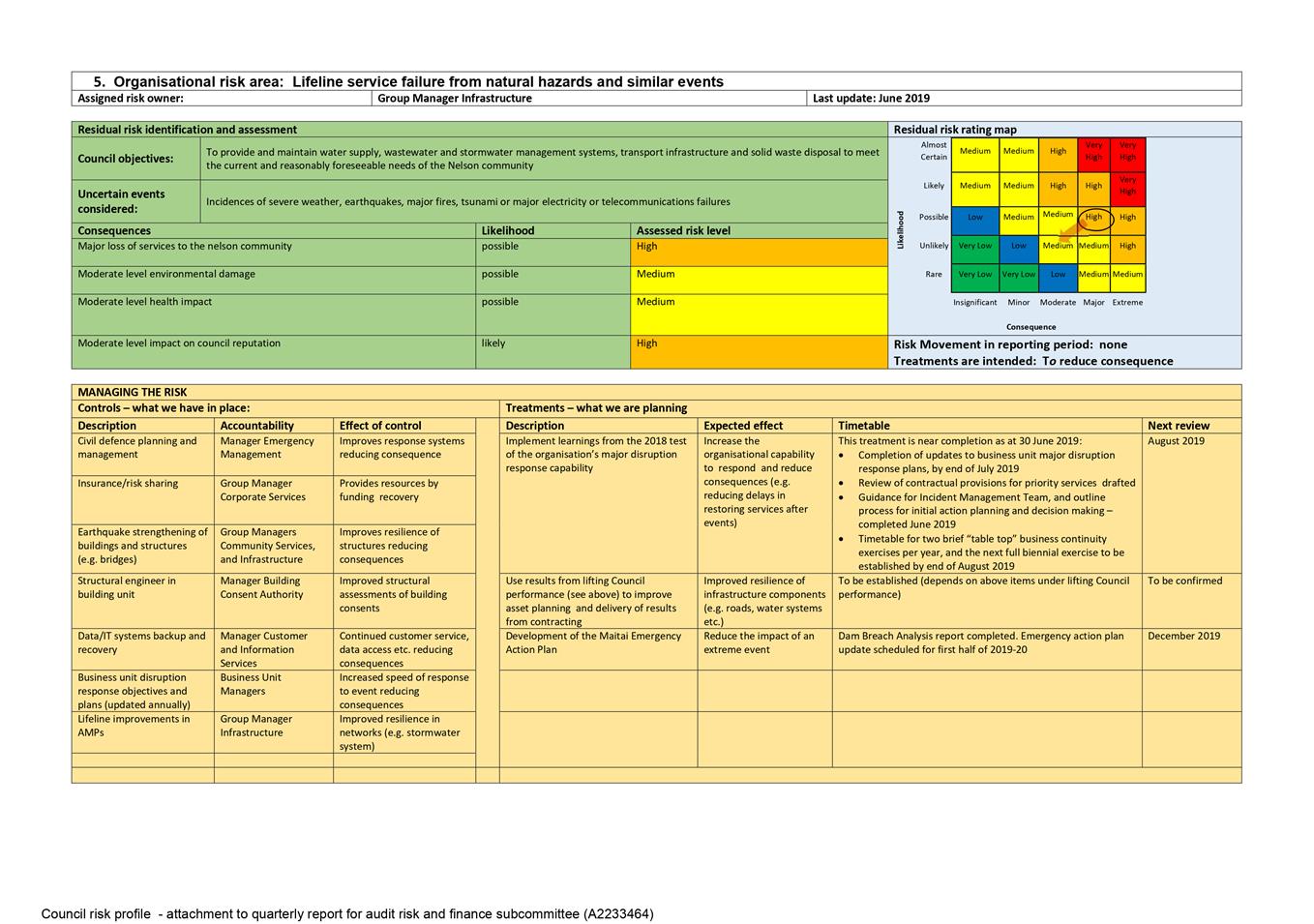

6.2 Lifeline service failure from natural hazards and similar

events (Risk 5). The risk profile for this area will be reviewed towards the end of

August 2019, to assess the impact of risk treatments that were completed or

were in progress during quarter 4 2018-19. Risk treatments completed

include a test of the organisation’s major disruption response

capability; actions resulting from the regional lifeline review; and

development of the Maitai Emergency Action Plan is in progress.

6.3 Illness, injury or stress from higher hazard work

situations (Risk 6). The residual risk rating in this area moved from Medium at the start

of the year to High. The risk rating was reviewed and revised to High

after taking into consideration public spaces and events provided by Council,

in light of the attacks in Christchurch, and has remained as High whilst

officers work through requirements for enhanced security awareness and physical

controls at key Council workplaces. Risk treatments have been progressed

throughout the year though most will not be completed until December

2019.

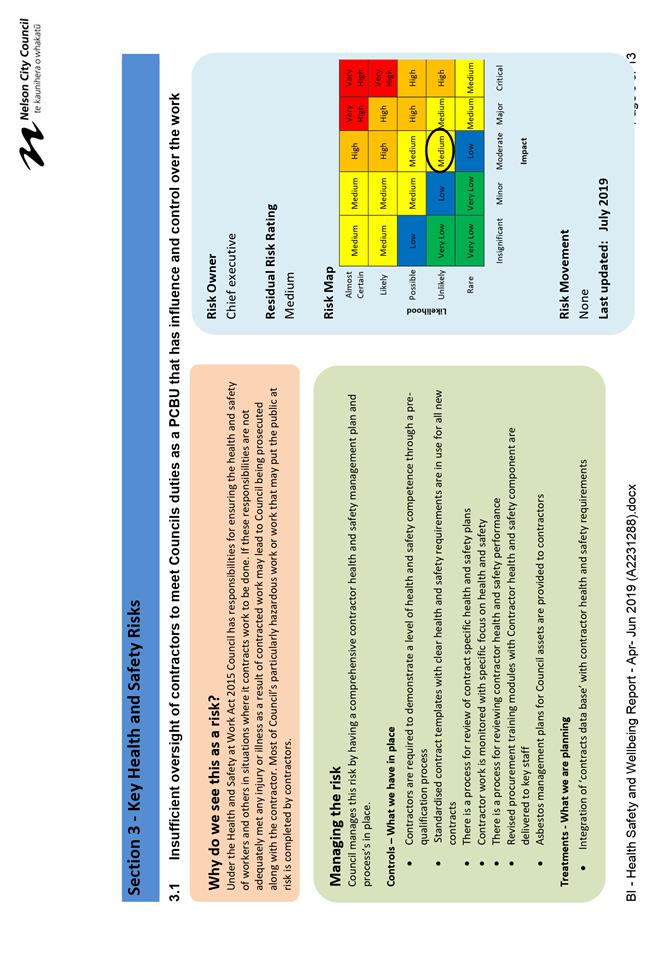

6.4 Loss of service performance from ineffective contracts and

contract management (Risk 7).

Treatments are underway, with progress being made on

contract data consolidation and software tools to evaluate for suitability to

support more effective contract management.

6.5 Compromise of Council service delivery from information

technology failures (Risk 8). A number of planned treatments scheduled for quarter

four were unable to be completed until July 2019. The effect of these

completed treatments will be evaluated during quarter one 2019/20, and the

residual risk profile will be updated accordingly.

6.6 Compromised decision making and public information from

incomplete and difficult to access records (Risk 9). Risk treatments have been expanded and the review

timetable updated.

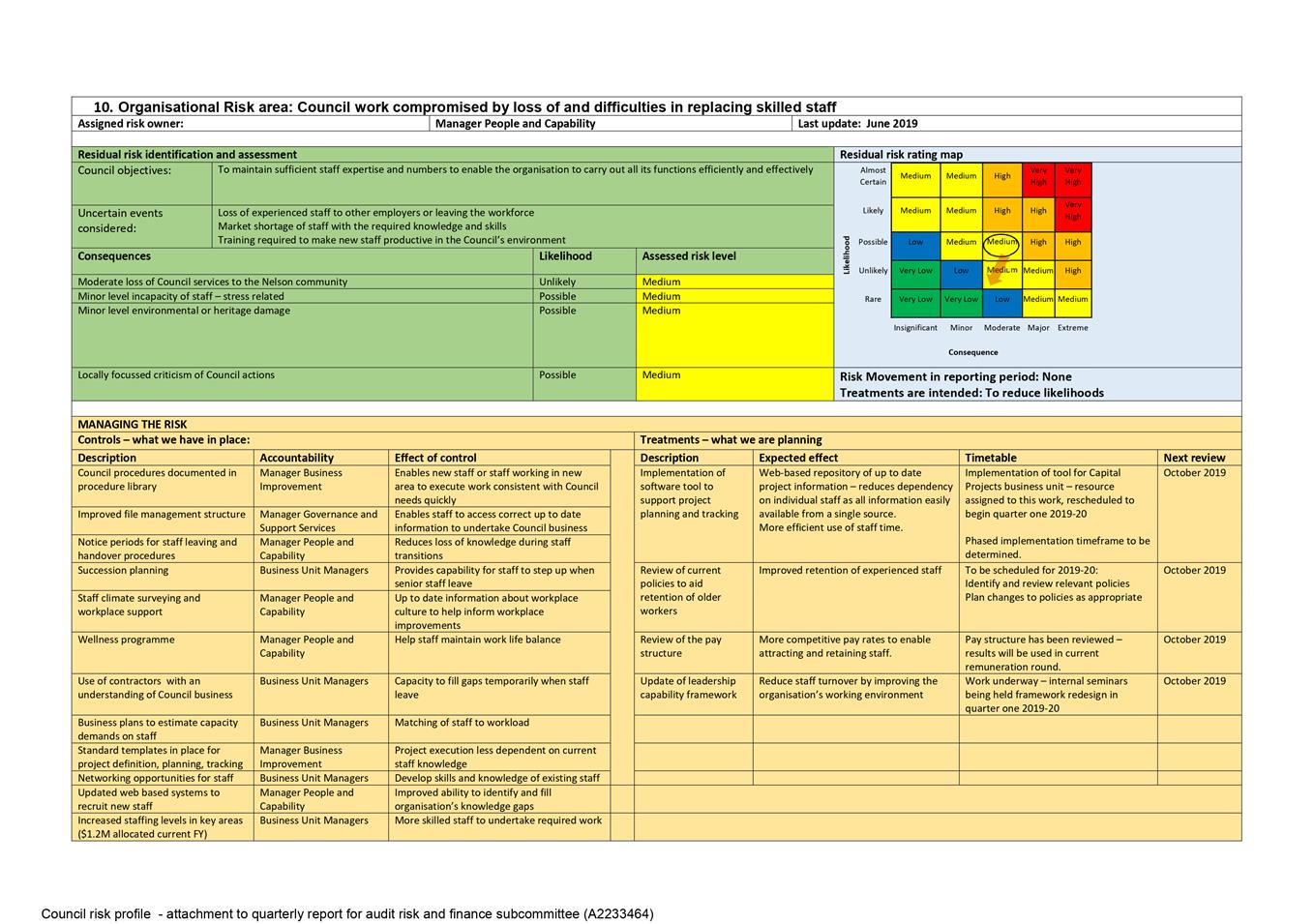

6.7 Council work compromised by loss of and difficulties in

replacing skilled staff (risk 10).

Risk treatments have been further developed and the review timetable updated.

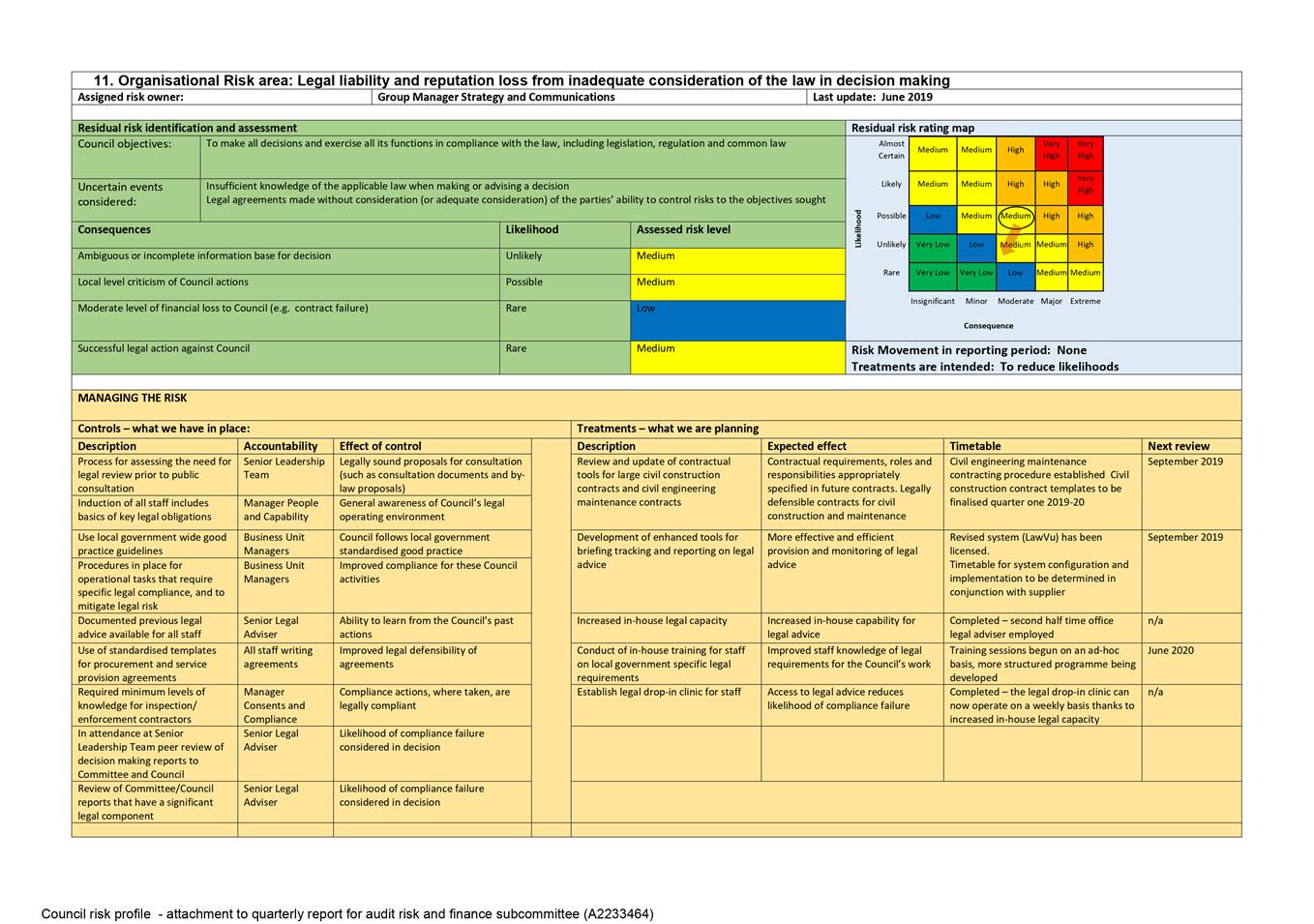

6.8 Legal liability and reputation loss from inadequate

consideration of the law in decision making (Risk 11). Risk treatments have been further

developed and the review timetable updated. Some treatments are

completed, and the effect of these on the residual risk profile will be

evaluated during quarter 2 2019-20, along with other treatments that are

planned to be completed by then.

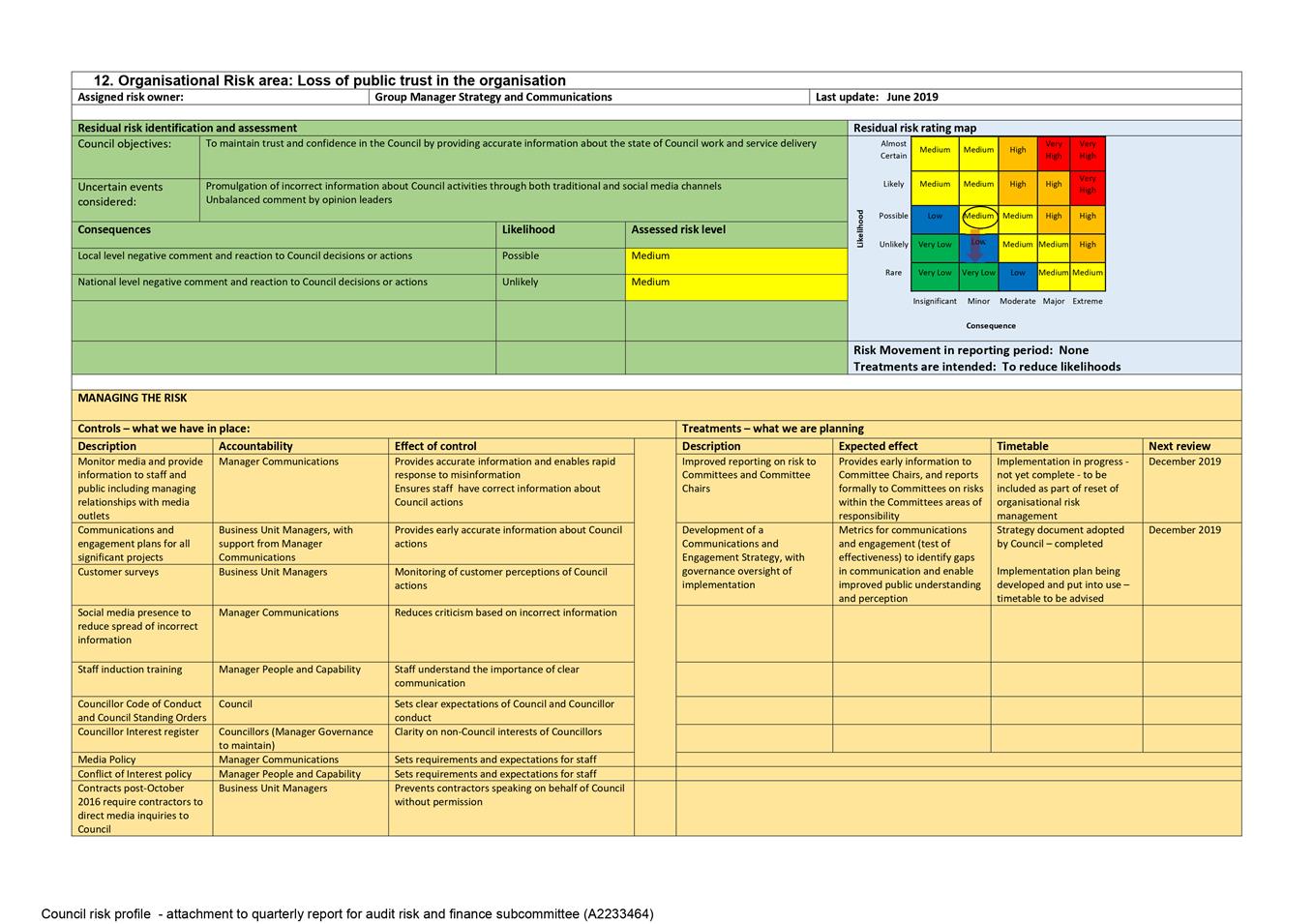

6.9 Loss of public trust in the organisation (Risk 12). The risk treatments and timetable have

been updated, most of note is the adoption of the Communications and Engagement

Strategy.

7. Risk Areas for Each Group

7.1 Infrastructure Group:

The key risks being reported to the Works and Infrastructure Committee this

quarter relate to delivery of the capital programme. Issues arising

during the year such as issues with land negotiations, increased project costs

that required additional funding, inability to attract tenderers, the fire

emergency, and drought, all contributed to changes in the programmed timeline

for some projects.

7.2 Community Services Group:

No new emerging risks to report at this time.

7.3 Environmental Management Group:

At the end of quarter four, risks to statutory timeframes and inefficiencies in

building consent processing are the biggest concern, whilst necessary changes

to the “AlphaOne” software system are implemented.

7.4 Strategy and Communications

Group: No new emerging risks to report at this time. Previously

reported risks relating to the management of social media, and the volume of

reactive work, continue to be managed.

7.5 Corporate Services Group:

No new emerging risks to report at this time.

Author: Arlene

Akhlaq, Manager Business Improvement

Attachments

Attachment 1: A2233464

Key organisational risks report Quarter 4 April to June 2019 ⇩

Item 9: Quarterly Key Risks Report - 1 April to 30 June 2019:

Attachment 1

Item 10: Health Safety

and Wellbeing Performance Report

|

|

Audit, Risk and Finance Subcommittee

27 August 2019

|

REPORT R10385

Health

Safety and Wellbeing Performance Report

1. Purpose

of Report

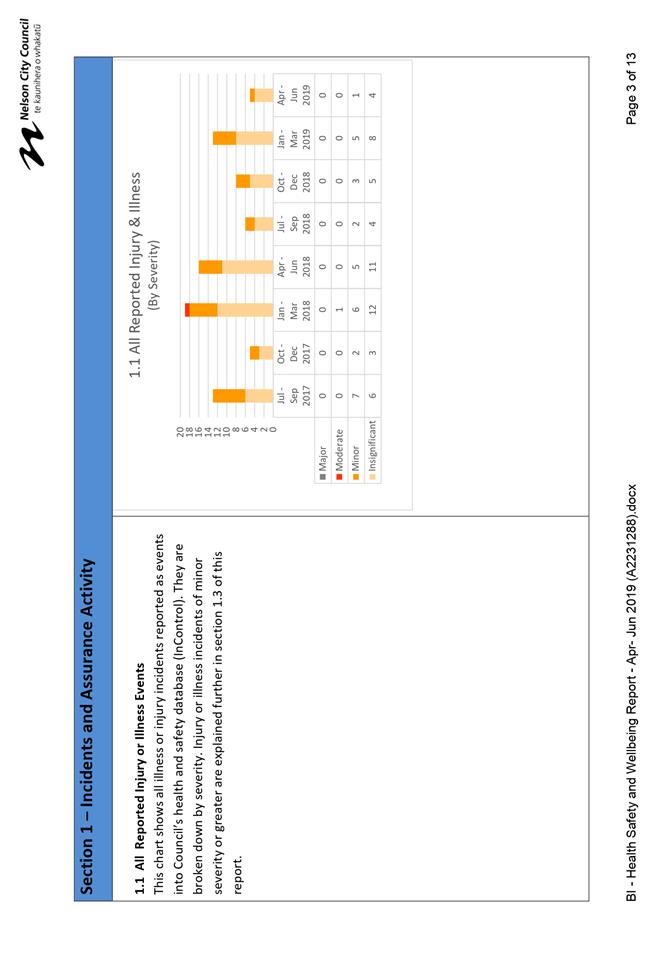

1.1 To

provide the subcommittee with a quarterly report of health, safety and

wellbeing data collected over the April to June quarter of 2019.

1.2 To

update the subcommittee on key health and safety risks, including controls and

treatments.

2. Summary

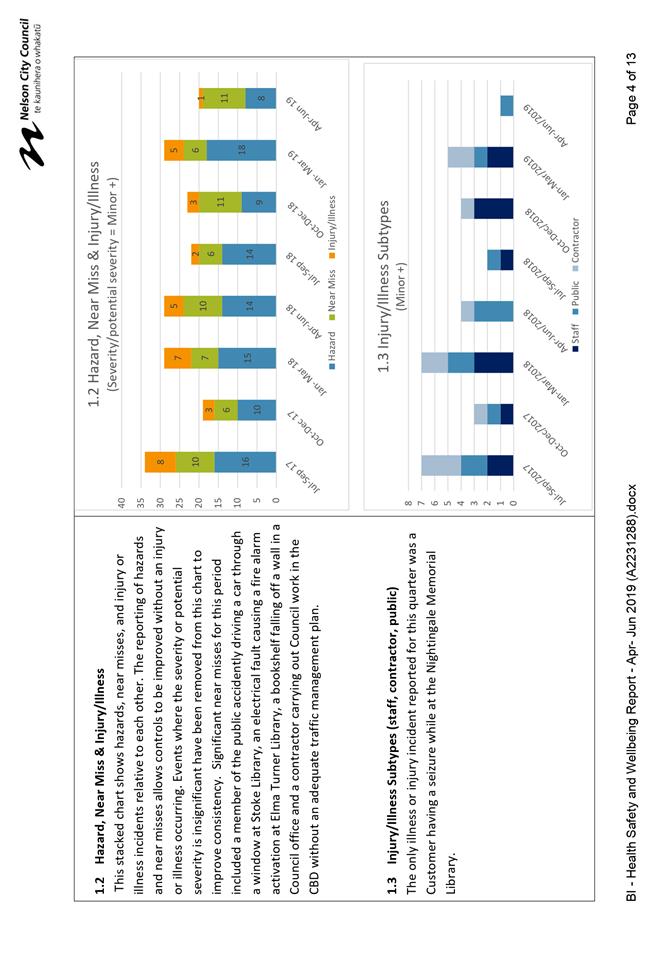

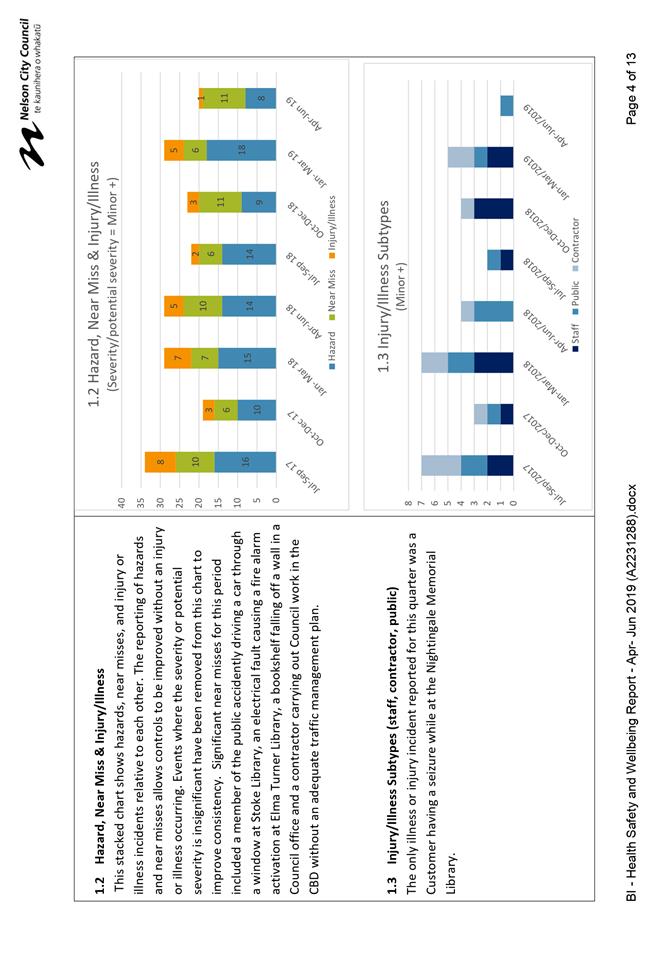

2.1 Notable

incidents for this period were a vehicle being accidently driven through a

window at Stoke Library and an electrical fault generating enough heat and

smoke to cause a fire alarm activation at Elma Turner Library.

2.2 Security

incidents reported for this quarter included seven incidents at Broadgreen

House.

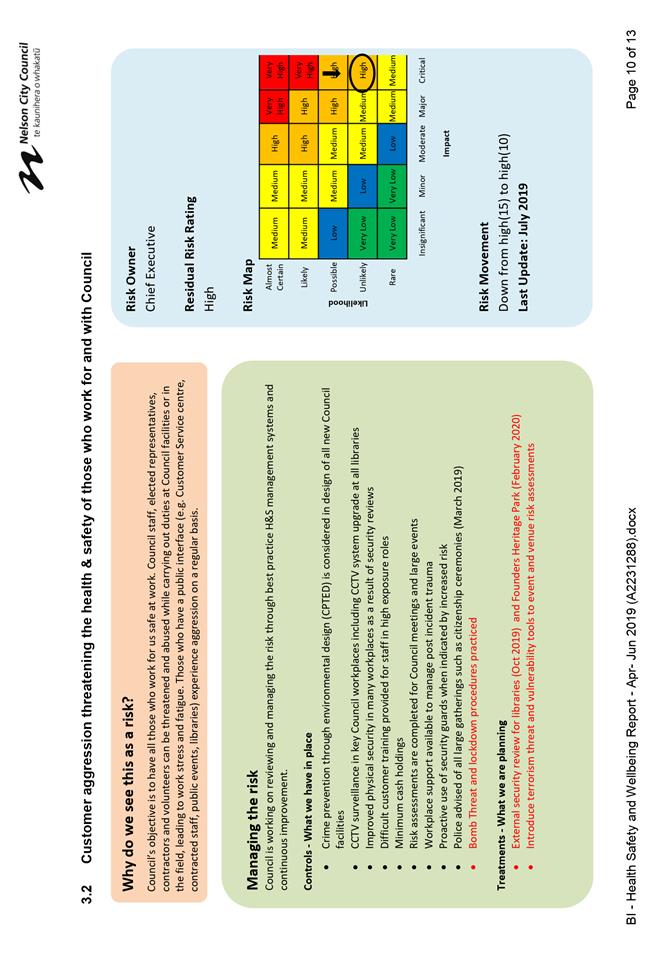

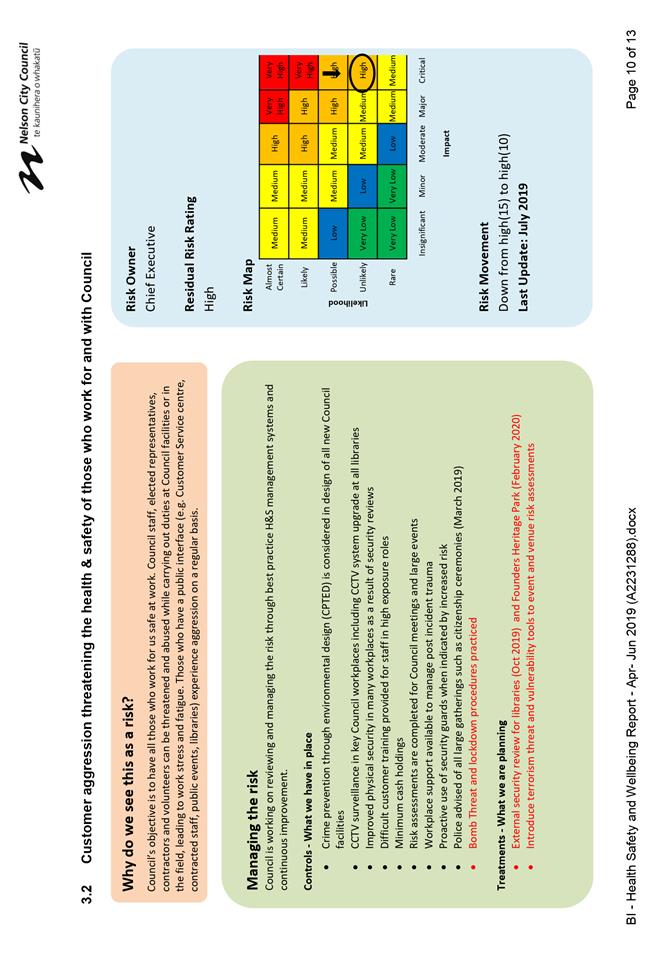

2.3 Council’s

key risk ‘Customer aggression threatening the health & safety of

those who work for and with Council’ remains assessed as high.

3. Recommendation

|

That the Audit, Risk and Finance Subcommittee

1. Receives

the report Health Safety and Wellbeing Performance Report (R10385) and its attachment (A2231288).

|

4. Background

4.1 Elected members, as

‘Officers’ under the Health and Safety at Work Act 2015, are

expected to undertake due diligence on health and safety matters.

Council’s Health and Safety Governance Charter states that Council will

receive quarterly reports regarding the implementation of health and safety.

Council has delegated the responsibility for health and safety to the Audit,

Risk and Finance Subcommittee.

4.2 Health,

safety and wellbeing performance data reports provide an overview of health and

safety performance based on key lead and lag indicators. Where a concerning

trend is identified more detail is provided in order to better understand

issues and implement appropriate controls.

4.3 Reporting

on key health and safety risks provides further depth and detail to the health

and safety risks reported in the organisational risk report.

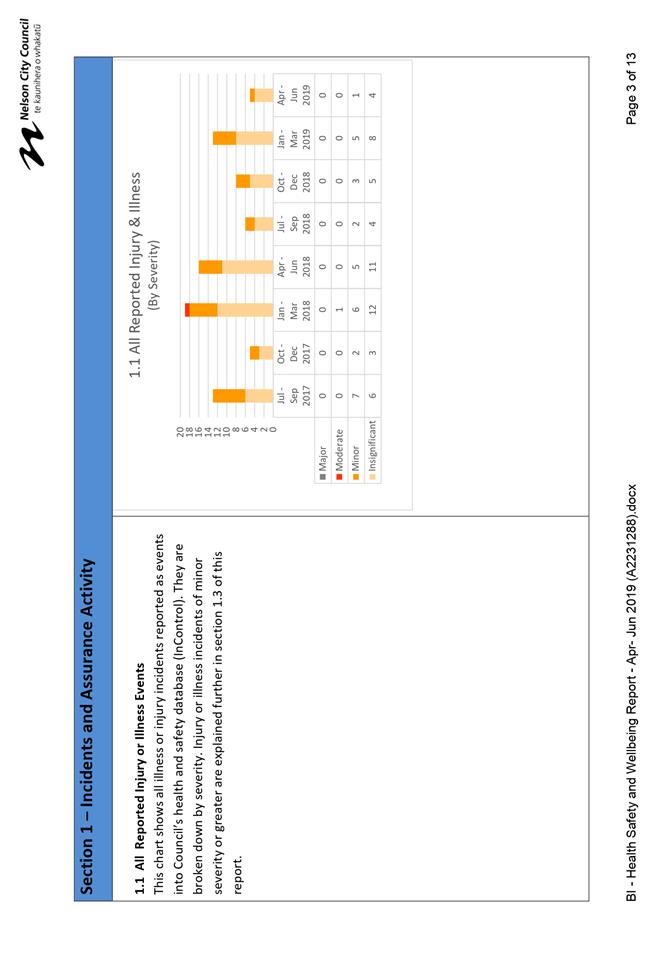

5. Discussion

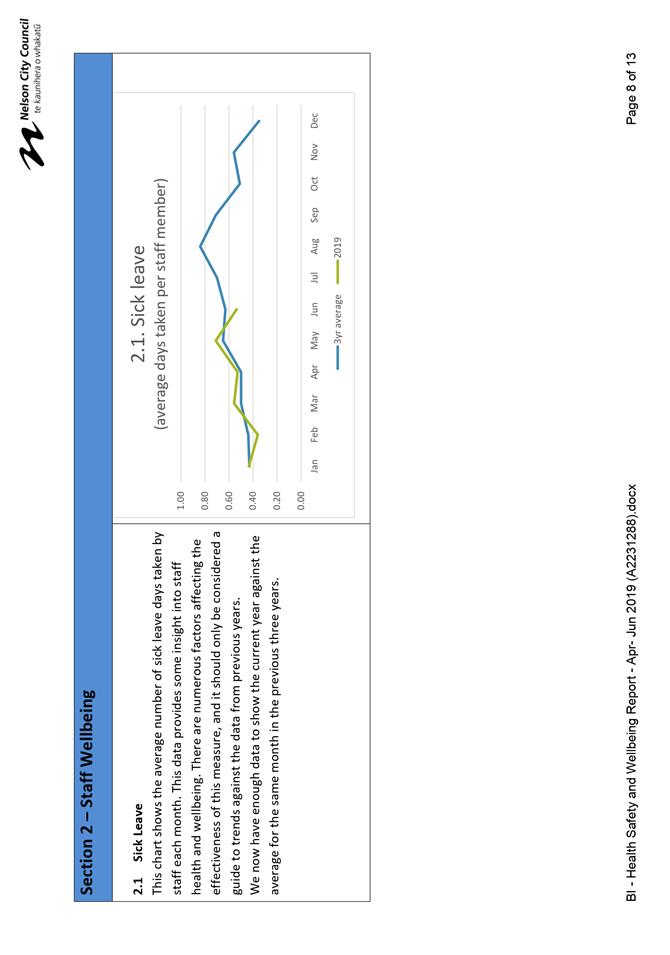

5.1 Data

Reports

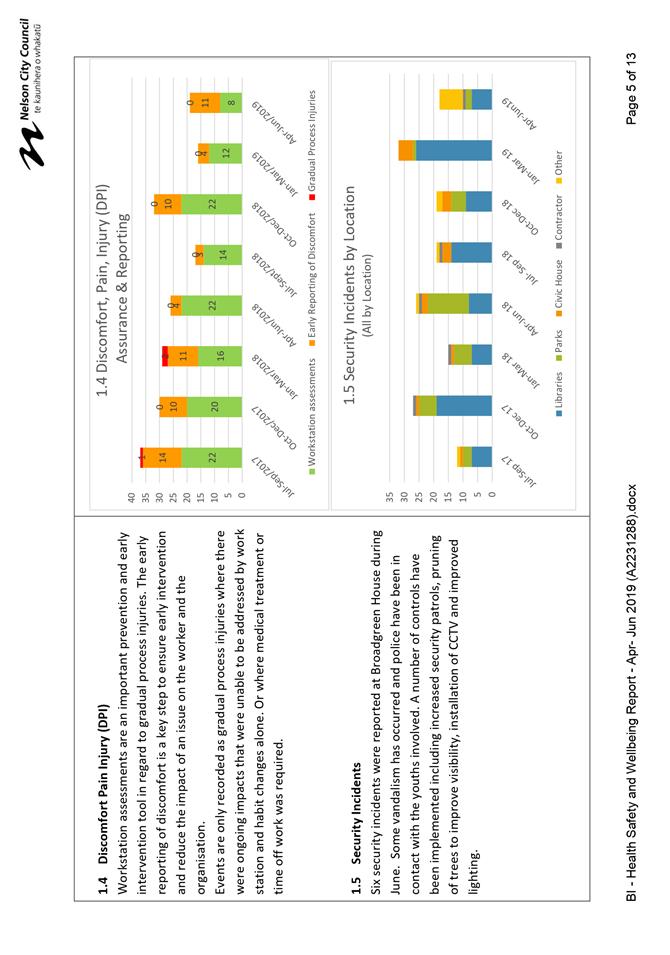

5.1.1 Six

of the 18 security incidents reported for the period occurred at Broadgreen

House during June. Some vandalism has occurred and police have been in contact

with the youths involved. A number of controls have been implemented including

increased security patrols, pruning of trees to improve visibility,

installation of CCTV and improved lighting. The controls appear to have been

effective and no further incidents were reported at Broadgreen House during

July.

5.1.2 The

increase in security incidents at libraries reported for February 2019 did not

continue during the quarter covered by this report. It should be noted that, at

the time of writing this report, there had been 15 security incidents reported

at Elma Turner Library during July 2019, compared with 32 incidents for all

libraries in the first six months of the year. This resulted in a security

guard being engaged for 30 hours per week as a temporary control. These

incidents primarily related to the behaviour of intoxicated customers or those

with mental health issues.

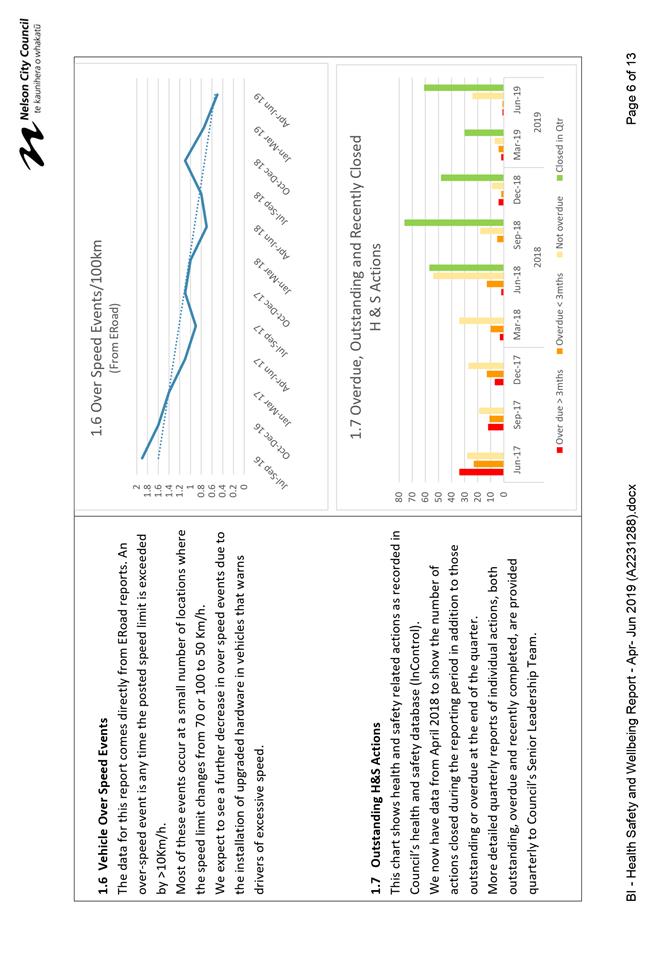

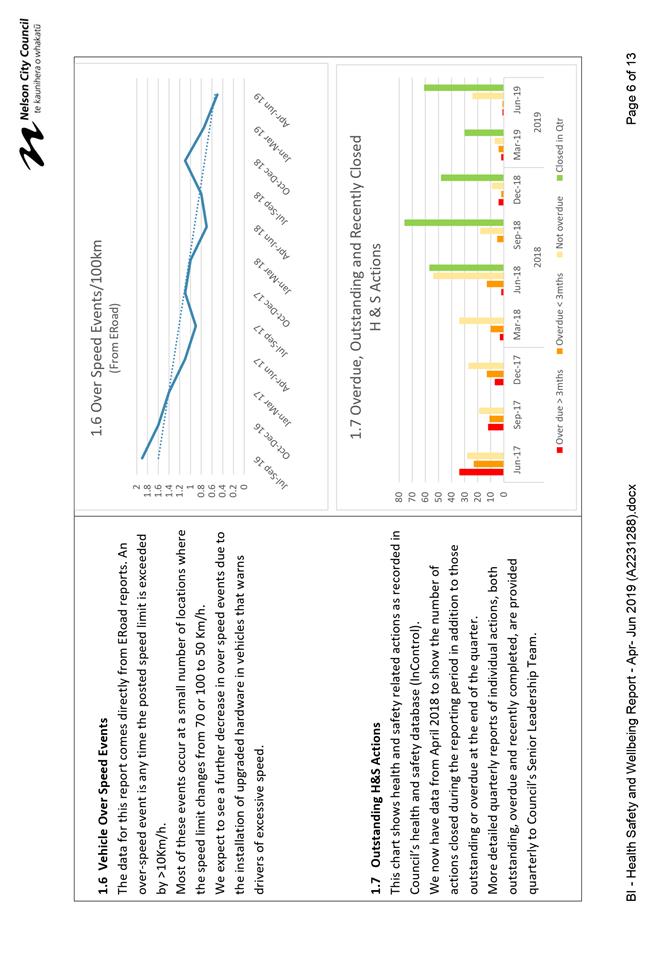

5.1.3 The

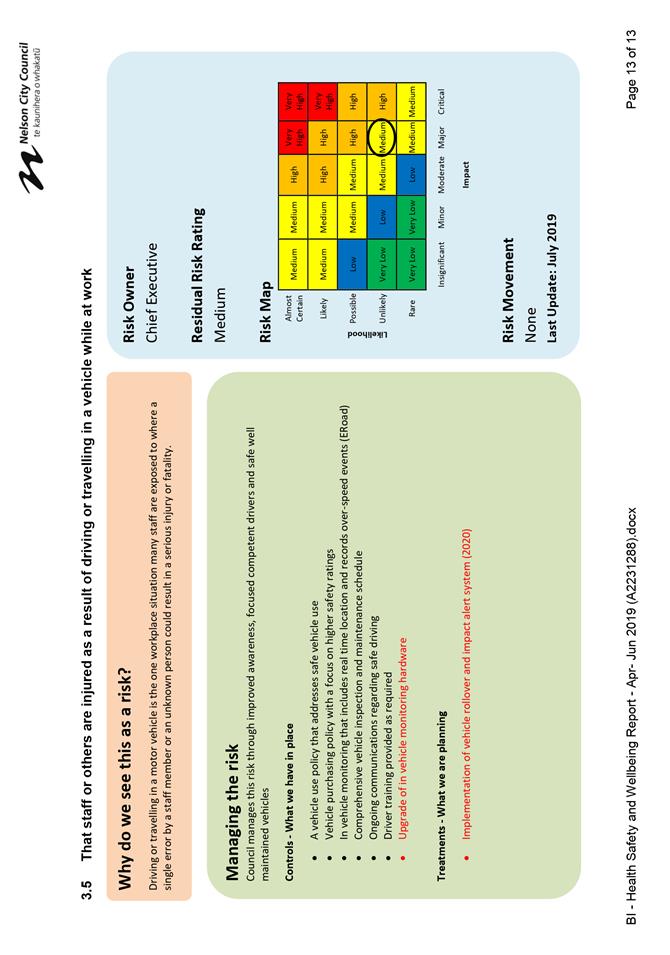

number of over-speed events for the period as recorded by the E-Road in vehicle

monitoring system is at the lowest rate since the system was installed in

Council vehicles.

5.2 Incidents

of note

5.2.1 A

significant near miss occurred during April when a member of the public

accidentally drove a vehicle through a window at Stoke Library. There were no

injuries resulting from this incident.

5.2.2 An

electrical fault in a switchboard at Elma Turner Library generated enough heat

and smoke to cause a fire alarm activation. The switchboards in the library

have since had upgrade work completed to prevent similar incidents happening in

the future.

5.2.3 Although

occurring outside this reporting period, it should be noted that there was a

fatality at Stoke Library in early July as a result of a customer medical event.

Staff actions in responding to this incident were commendable. Support for

affected staff was provided following the incident by Workplace Support.

5.3 Key

Health and Safety Risk Update

5.3.1 The

key health and safety risk ‘Customer aggression threatening the health

& safety of those who work for and with Council’ has been assessed as

remaining a high risk. The assessed likelihood of an extreme consequence

incident has reduced from possible to unlikely, however the risk remains a high

risk using Council’s risk criteria.

5.3.2 New

Zealand’s national terrorism threat level has been reduced to medium

after being raised from low to high immediately following the Christchurch

mosque shootings. The national terrorism threat level and the type and

frequency of security incidents recently reported are key considerations in

completing this risk assessment.

5.3.3 Existing

controls such as risk assessments for meetings already consider the national

terrorism threat level. Police are now advised of large Council run gatherings

such as citizenship ceremonies. Work is underway to include terrorism threat

and venue vulnerability assessments in event and venue safety management plans.

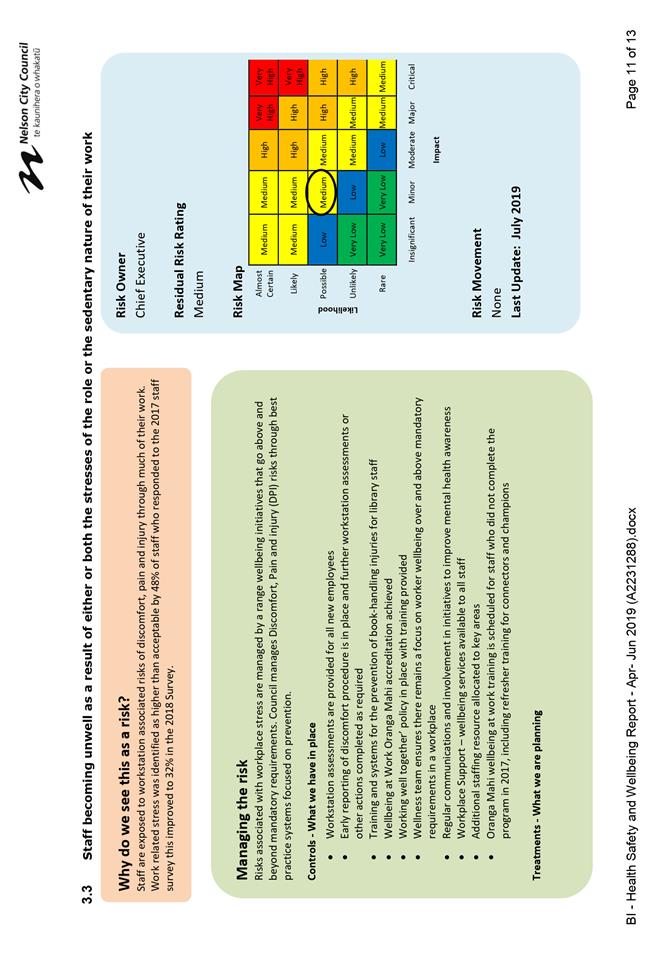

5.3.4 All

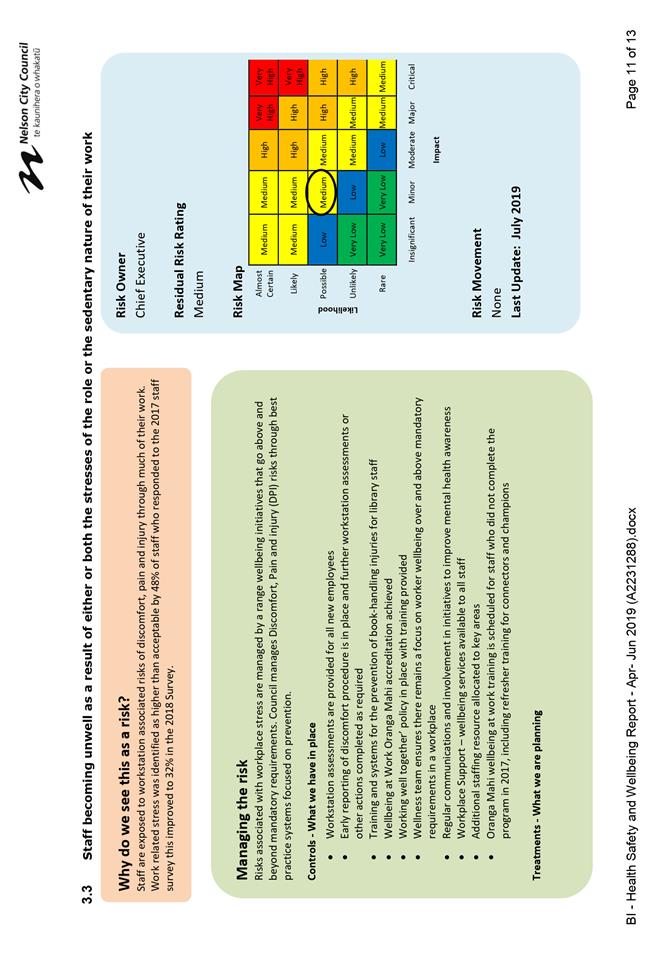

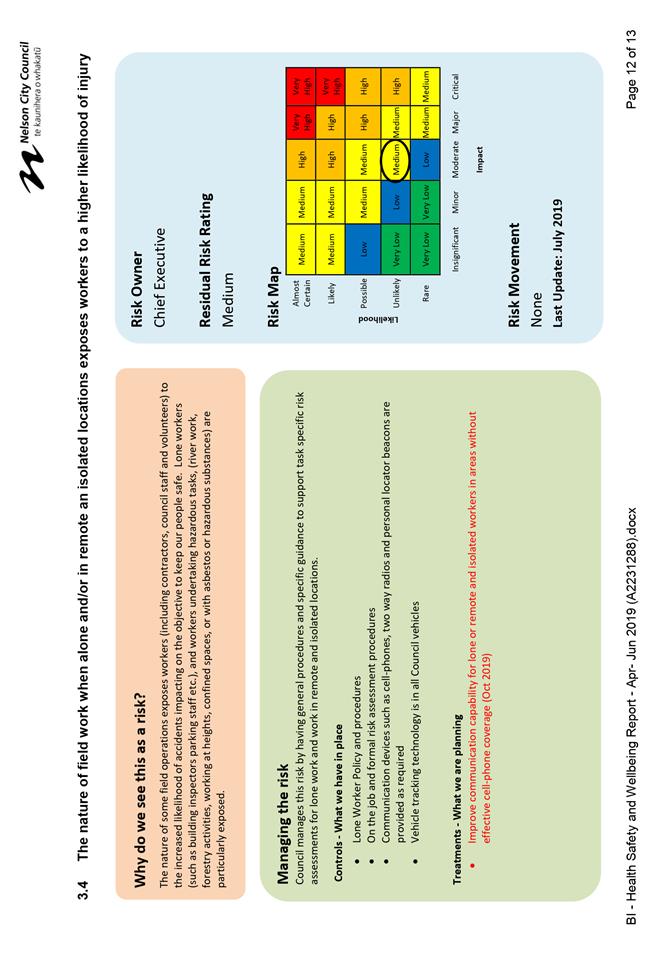

other key health and safety risks are assessed to remain as medium risks.

5.3.5 Where

new treatments have been planned or have been implemented as controls since the

last report this is indicated by red text in the attachment.

5.3.6 Where

possible timeframes are indicated for treatments.

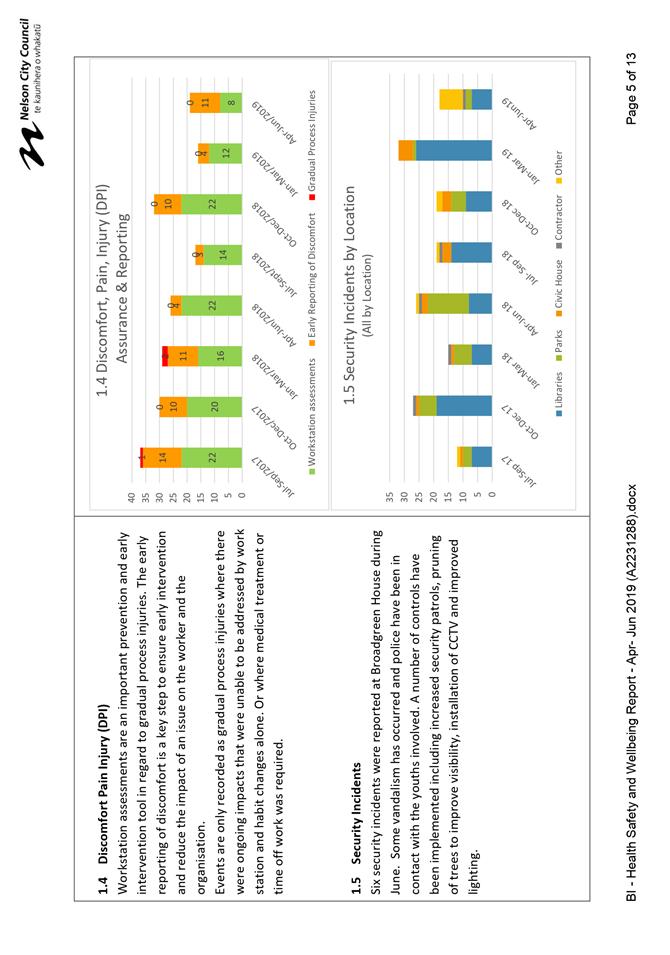

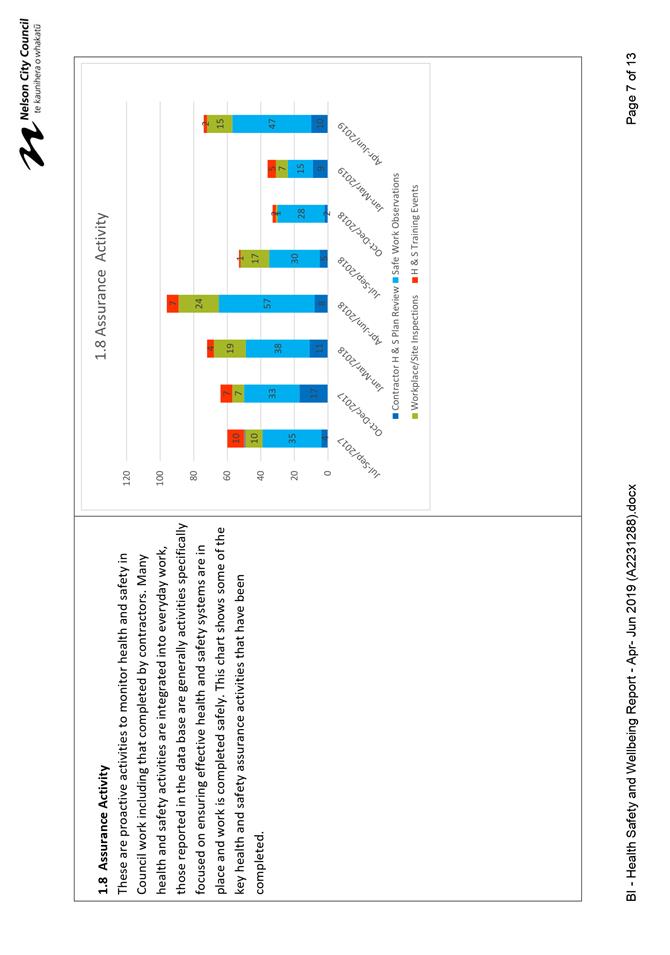

5.4 Due

Diligence Activities

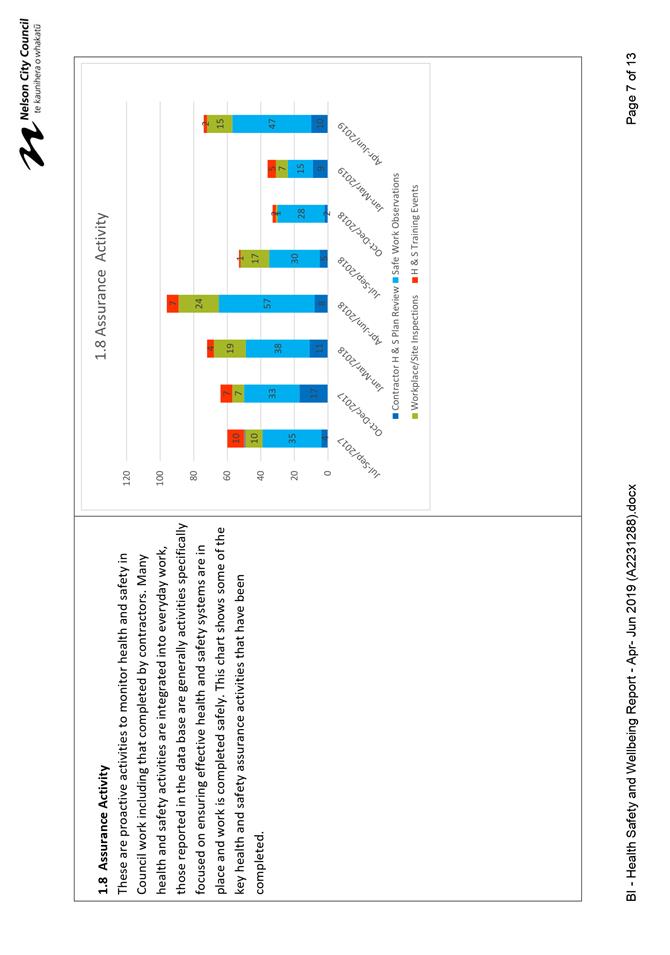

5.4.1 SLT

members completed four safe work observations during this quarter.

5.4.2 Councillor

Dahlberg participated in a safe work observation at the Tantragee water

treatment plant.

5.5 Staff

Wellbeing Initiatives

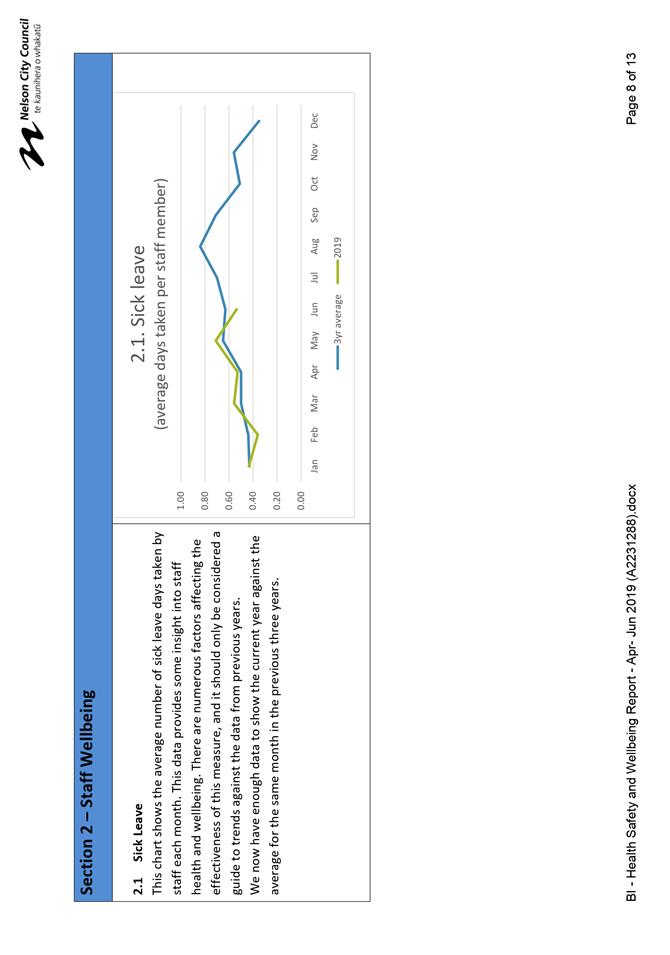

5.5.1 76

staff attended the Oranga Mahi wellbeing at work program that was completed by

most other staff in 2017.

5.5.2 50%

of staff received influenza vaccinations.

Author: Malcolm

Hughes, Health and Safety Adviser

Attachments

Attachment 1: Health, Safety and

Wellbeing Report, April - June 2019 (A2231288) ⇩

Item 10: Health Safety and Wellbeing Performance Report: Attachment

1

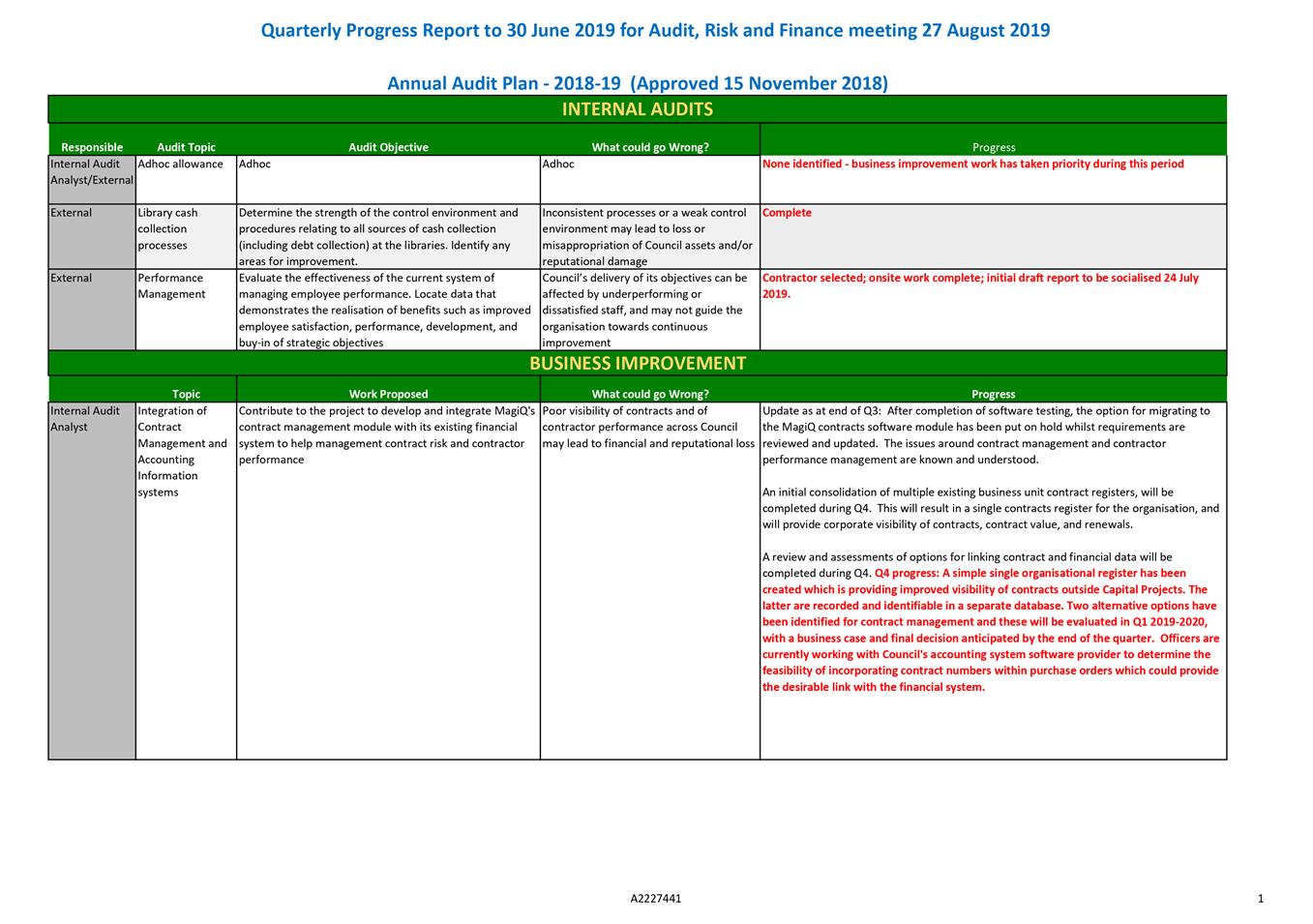

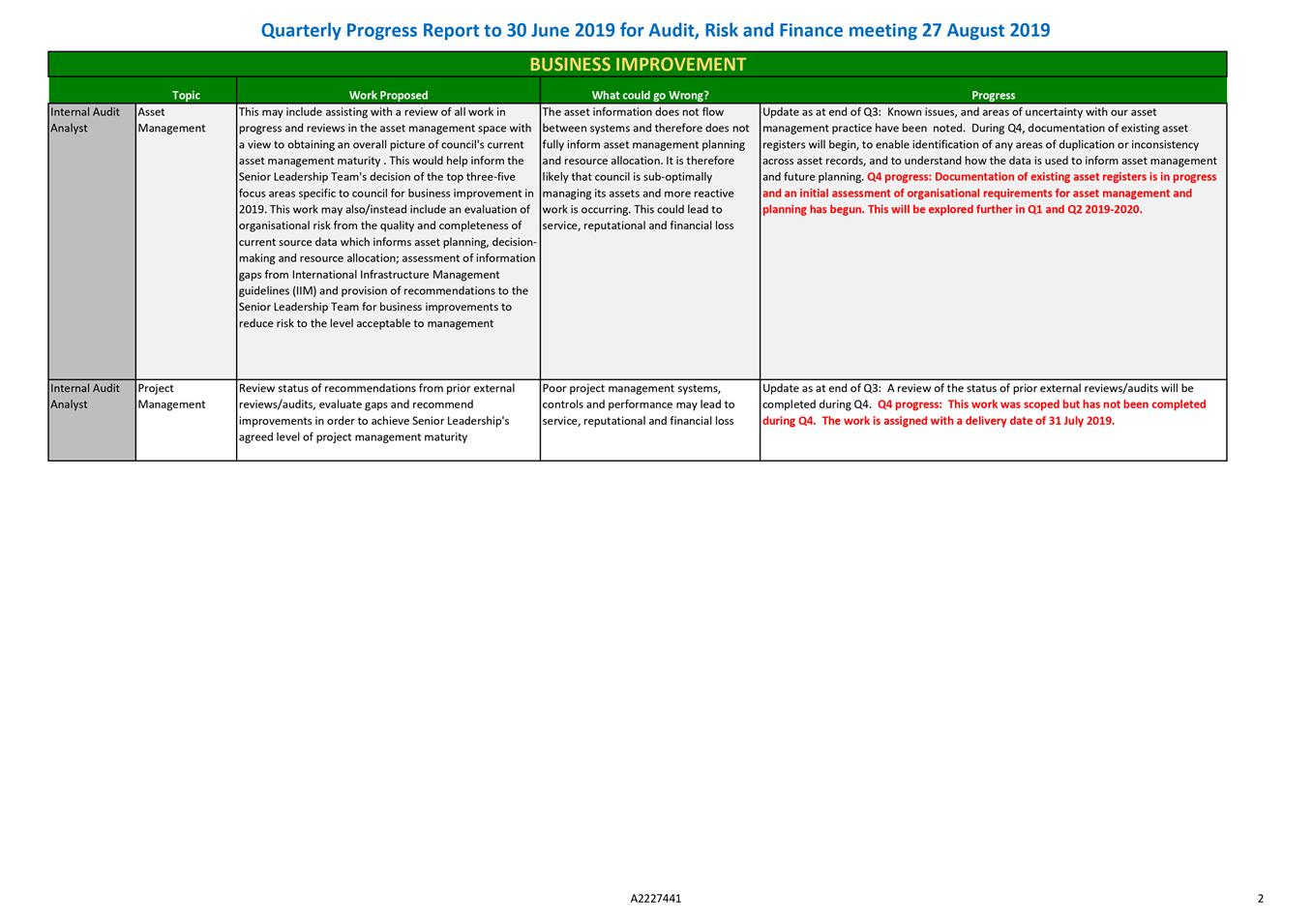

Item 11: Internal Audit

- Quarterly Progress Report to 30 June 2019

|

|

Audit, Risk and Finance Subcommittee

27 August 2019

|

REPORT R10302

Internal

Audit - Quarterly Progress Report to 30 June 2019

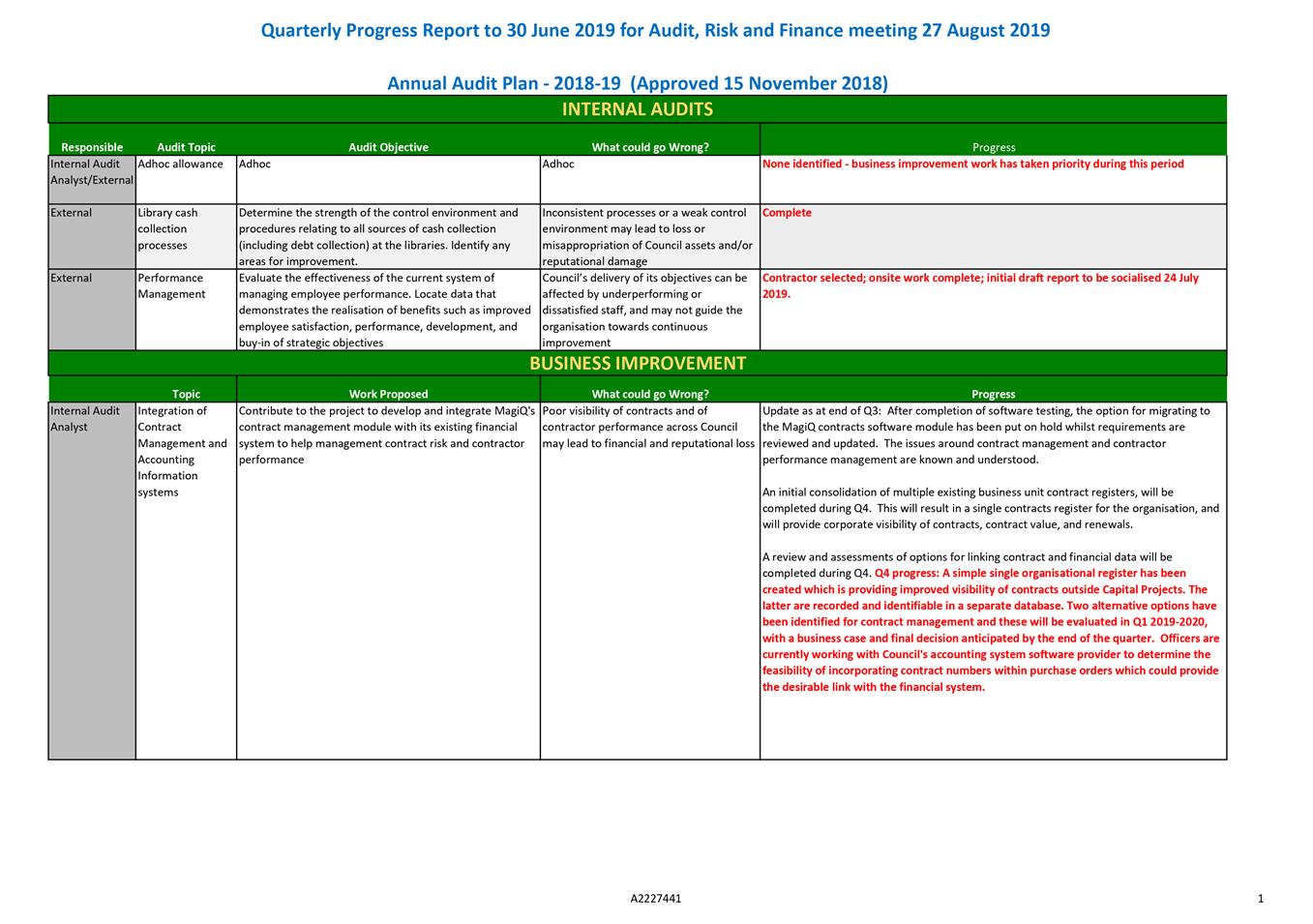

1. Purpose of Report

1.1 To update the Audit,

Risk and Finance Subcommittee on the internal audit activity for the quarter to

30 June 2019.

2. Recommendation

|

That the Audit, Risk and Finance Subcommittee

1. Receives the report Internal Audit - Quarterly Progress Report

to 30 June 2019 (R10302) and its attachment (A2227441).

|

3. Background

3.1 Under Council’s

Internal Audit Charter approved by Council on 15 November 2018, the Audit, Risk

and Finance Subcommittee requires a periodic update on the progress of internal

audit activities relative to any current Internal Audit Plan approved by

Council.

3.2 The current Internal

Audit Plan for the year to 30 June 2019 was approved by Council on 15 November

2018. It provides for up to three audits - two planned, with an allowance for a

third unplanned audit. As there was no urgent concern raised during the year

that could have resulted in the third audit, the time set aside for this

contingency was spent on much-needed business improvements.

3.3 Included in the

attached report (A2227441) is an update on the progress of the performance

management system review, and on business improvement initiatives that form

part of the current Internal Audit Plan.

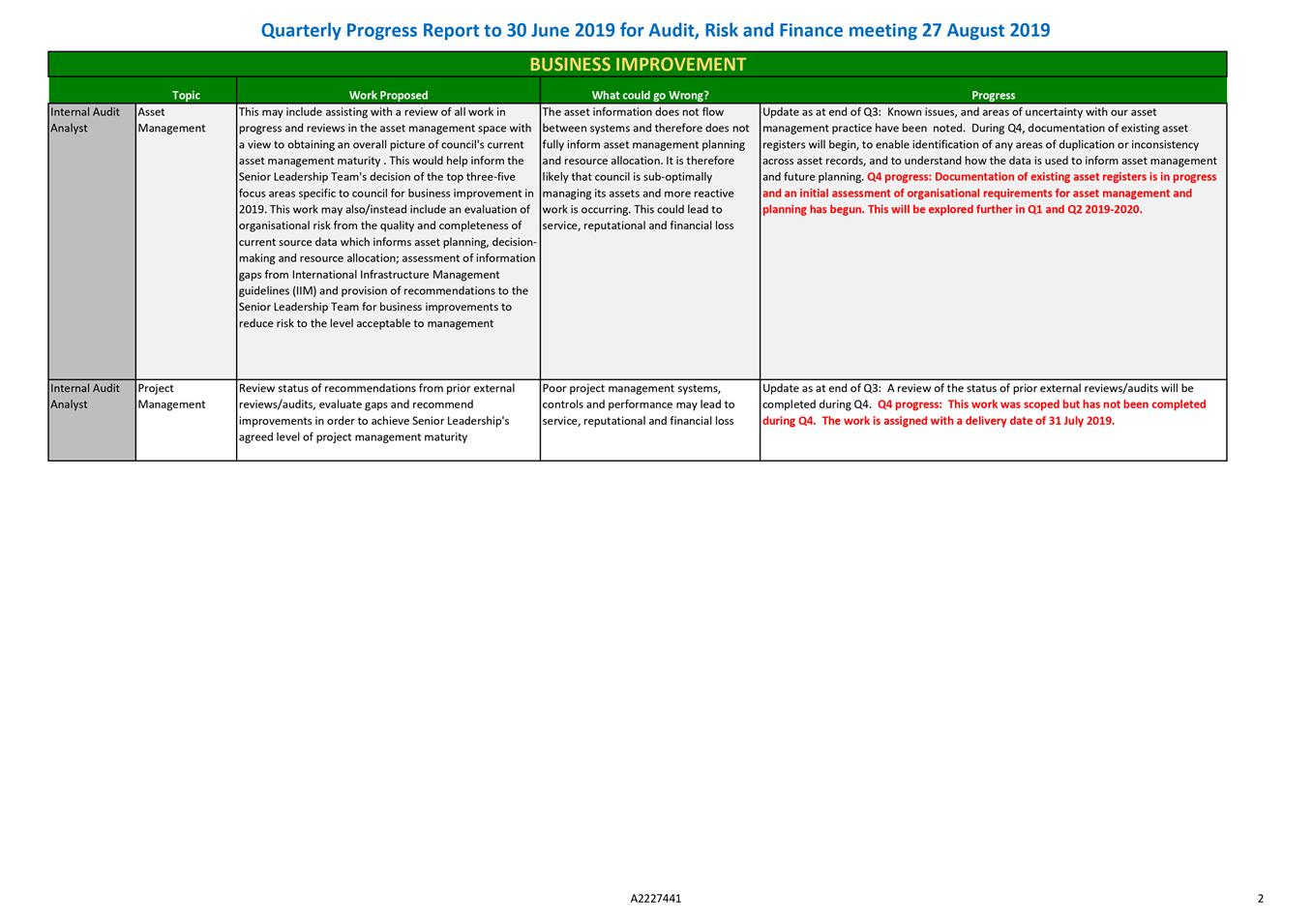

4. Conclusion

4.1 Apart from the target

completion date being stretched from 30 June 2019 to 31 July 2019 for the

review of the status of recommendations from prior external reviews/audits

relating to project management, there has been good progress made on planned

activities related to the Internal Audit Plan for the year ended 30 June 2019.

4.2 The foundations for

sound business improvements are in place over the primary areas of concern

identified by Council.

4.3 Also worthy of note,

by having one focus on corrective solutions to mitigate high risks identified

from internal audits, the Business Improvement team has been able to progress

these (as noted in R10303 Internal Audit – Summary of New or

Outstanding Significant Risk Exposures and Control Issues to 30 June 2019

and its attachment A2227319).

Author: Lynn

Anderson, Internal Audit Analyst

Attachments

Attachment 1: A2227441 - Internal Audit

- Quarterly Progress Report to 30 June 2019 ⇩

Item 11: Internal Audit - Quarterly Progress Report to 30 June 2019:

Attachment 1

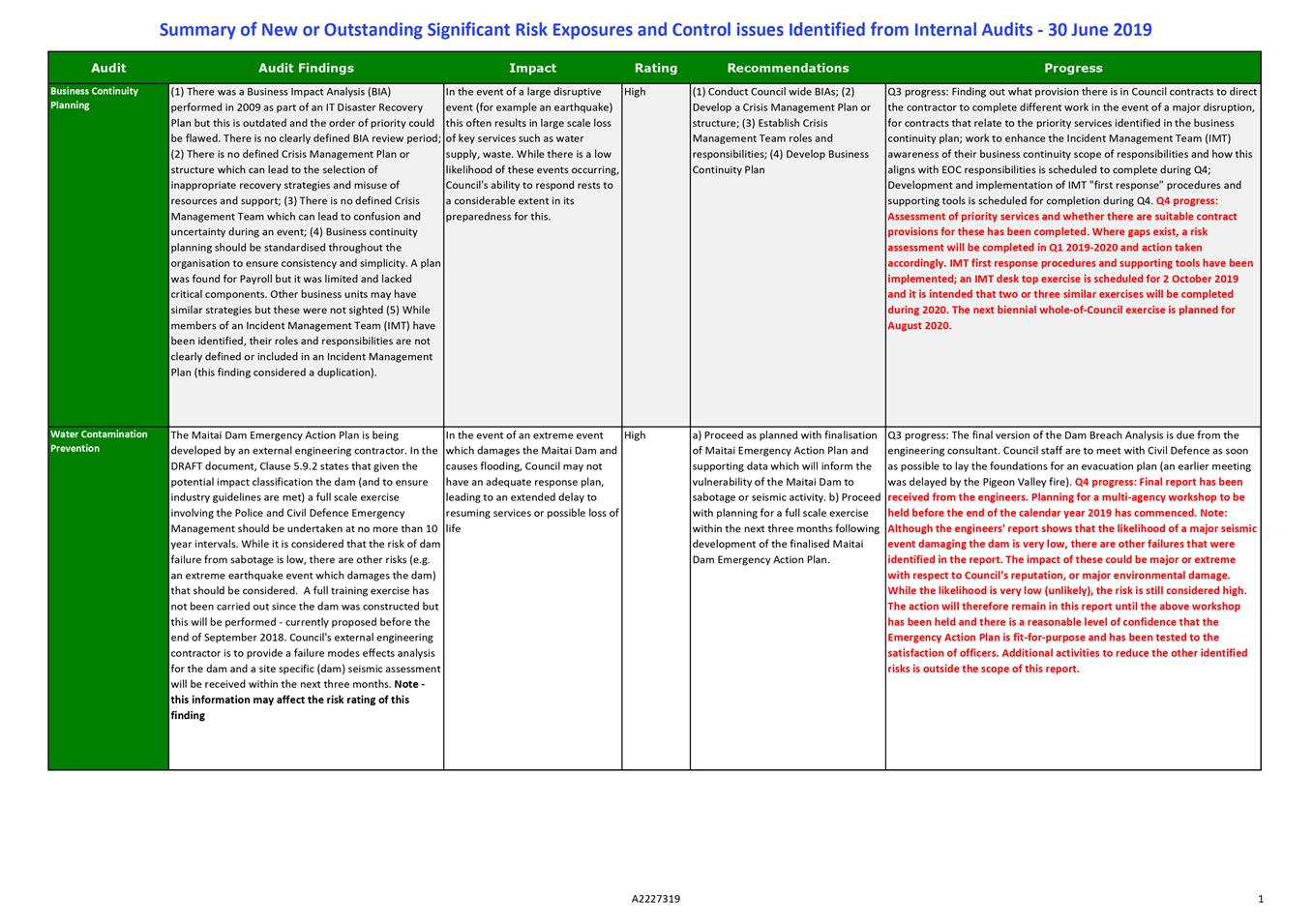

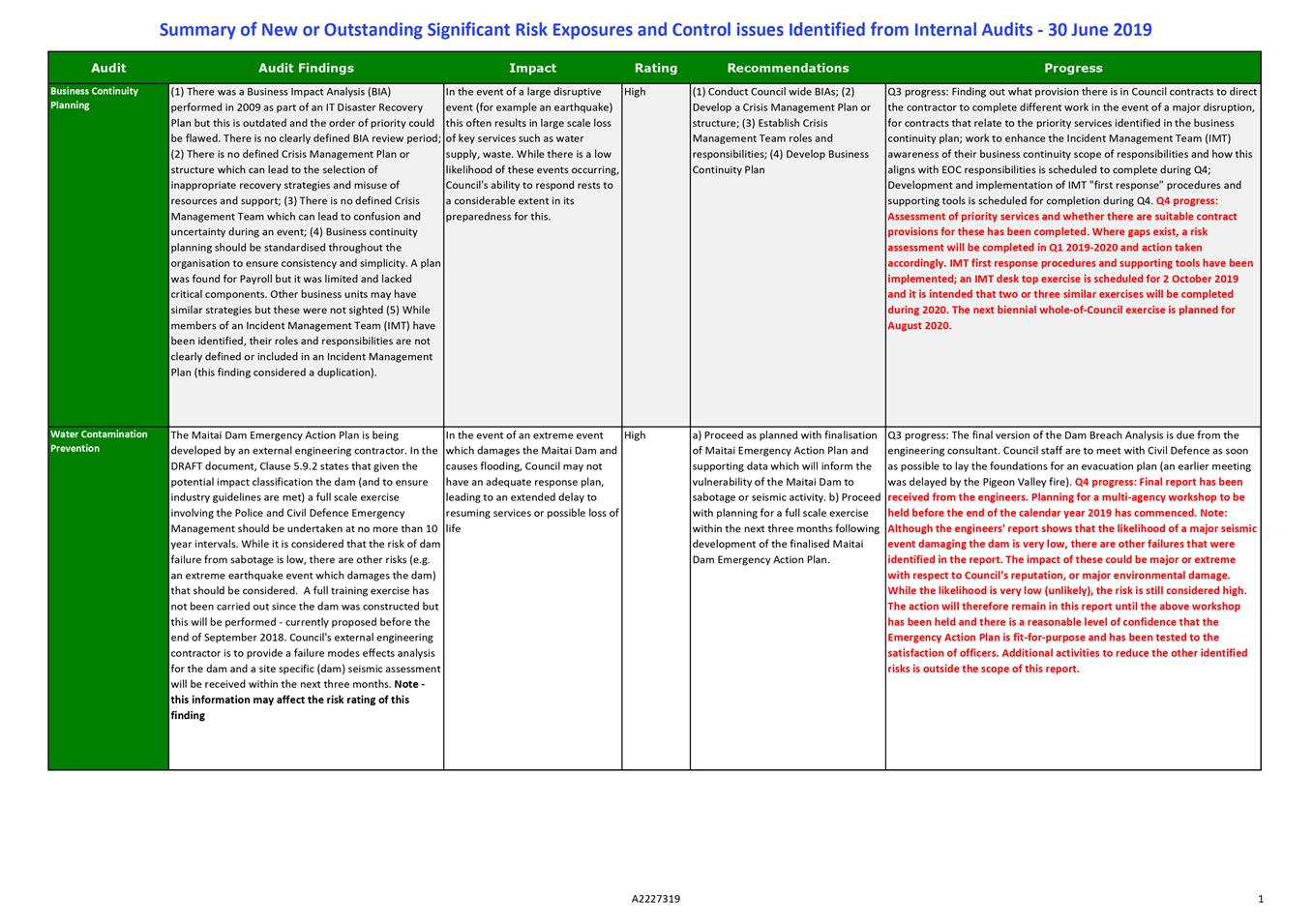

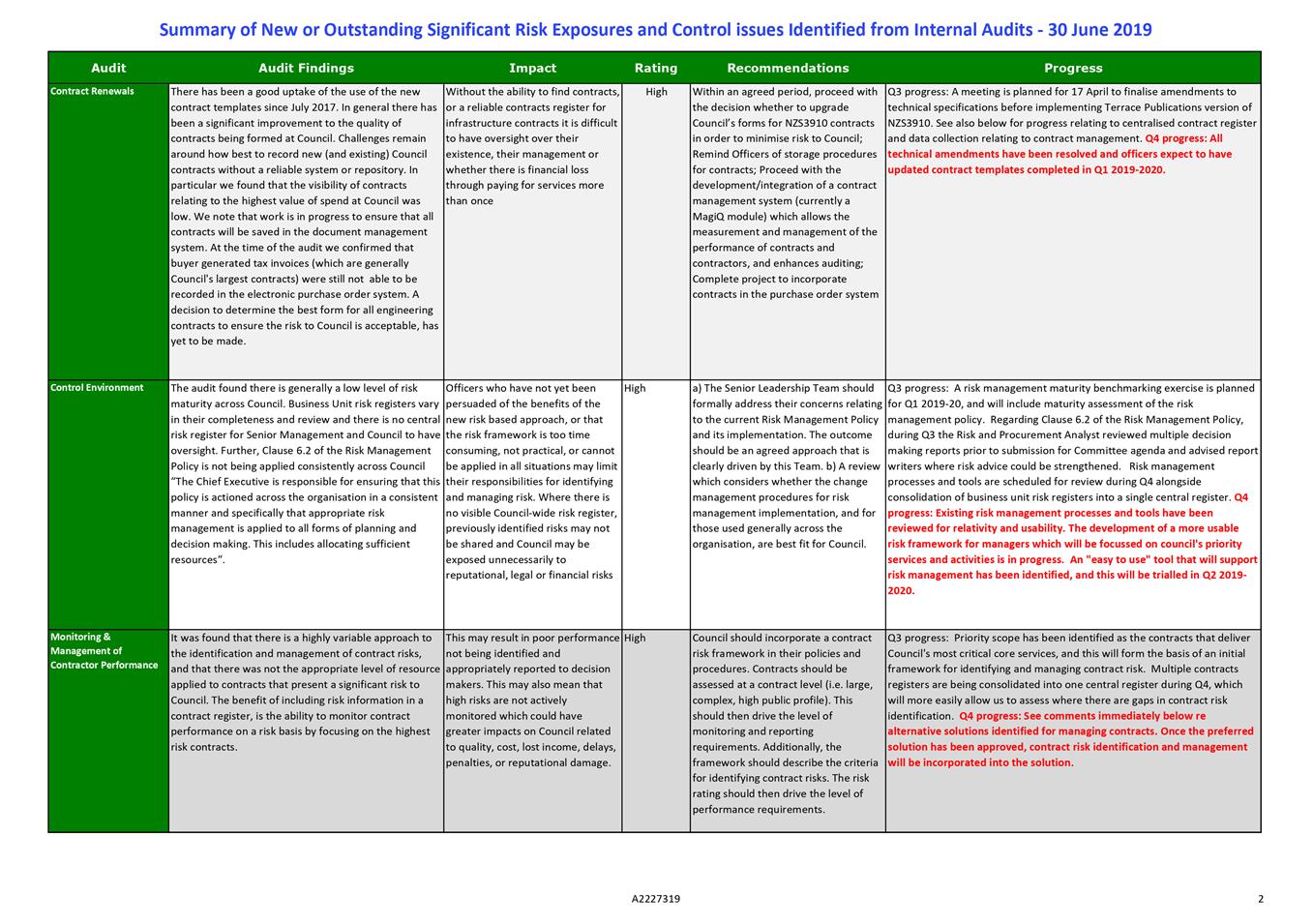

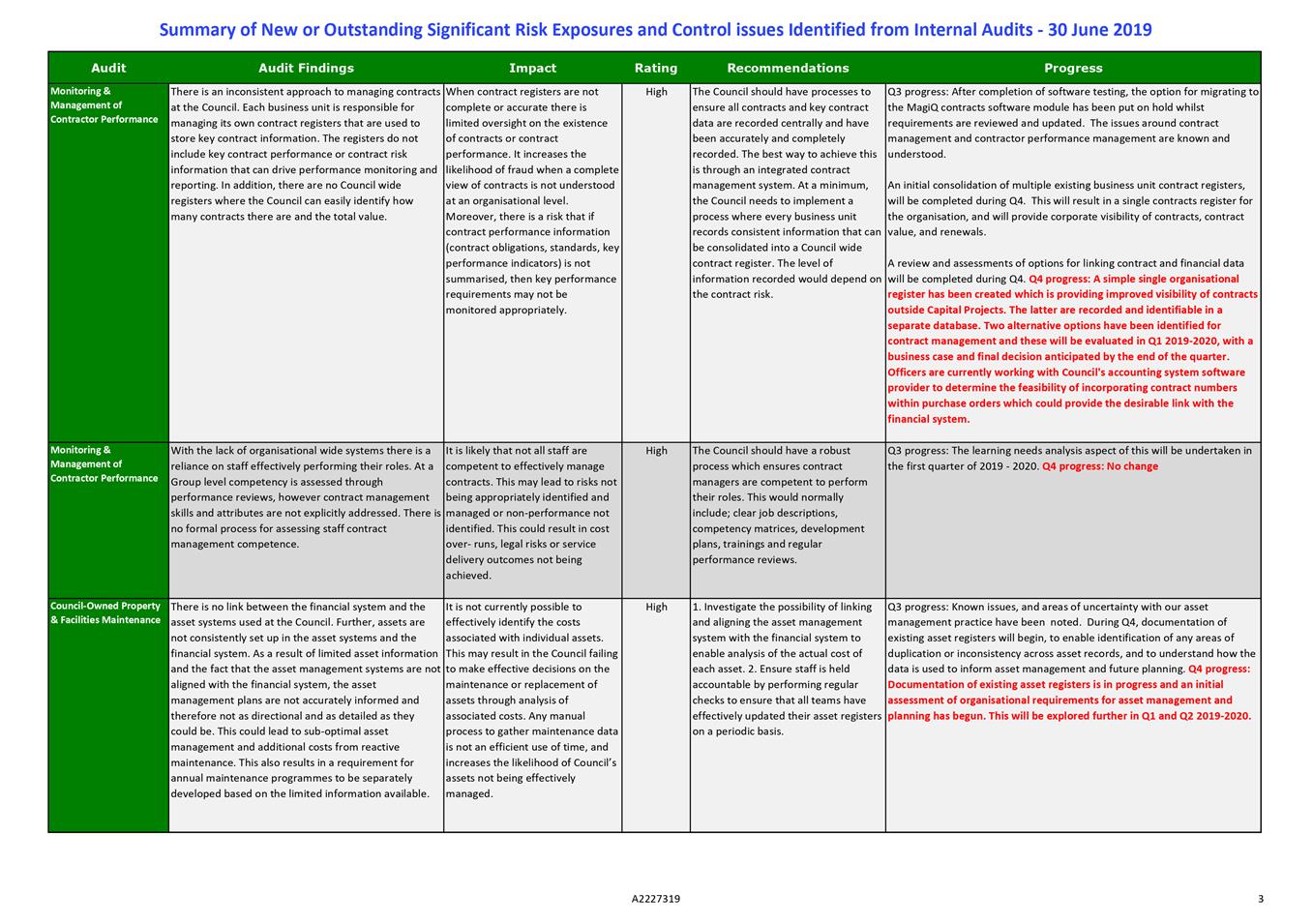

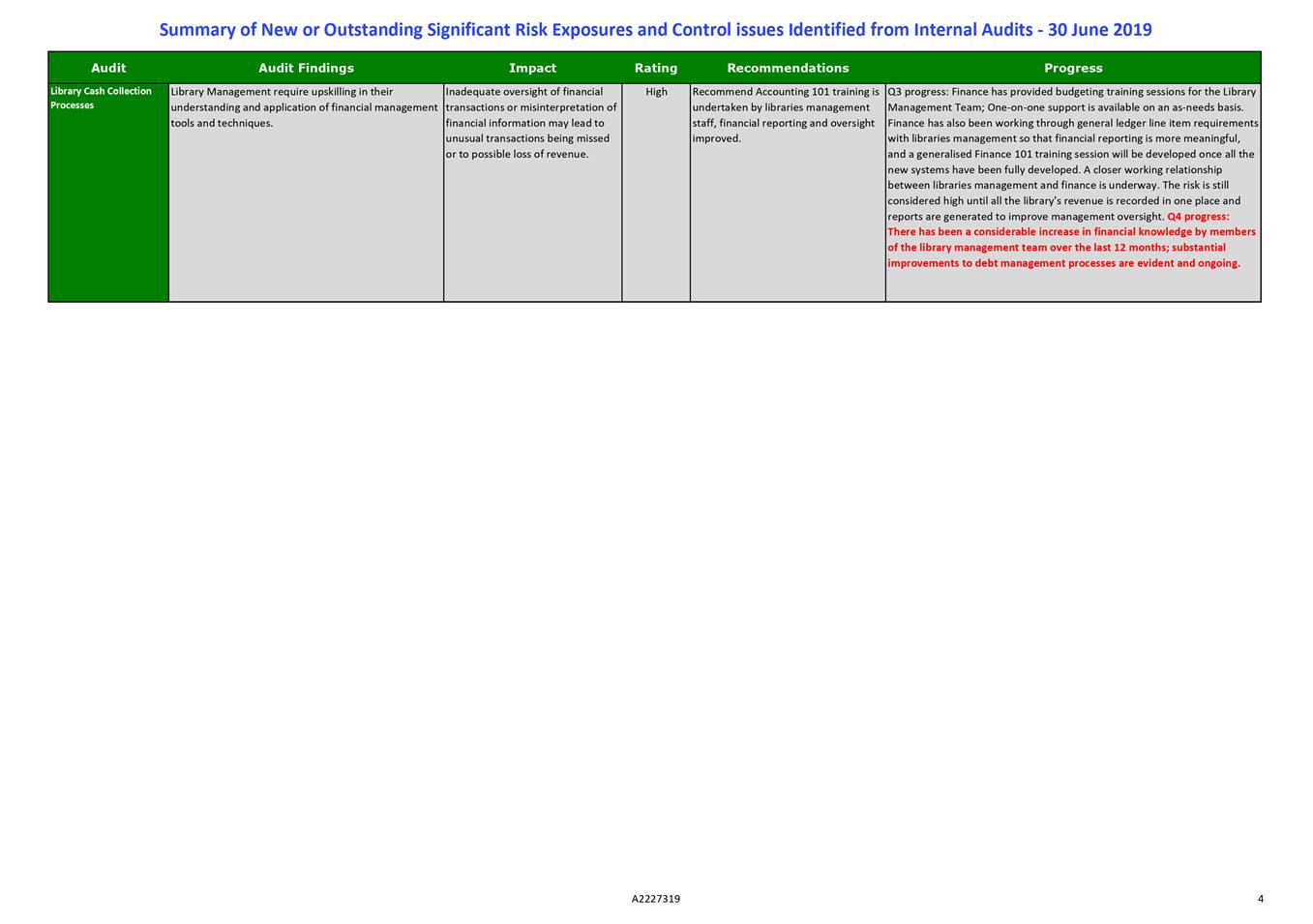

Item 12: Internal Audit

- Summary of New or Outstanding Significant Risk Exposures and Control Issues

to 30 June 2019

|

|

Audit, Risk and Finance Subcommittee

27 August 2019

|

REPORT R10303

Internal

Audit - Summary of New or Outstanding Significant Risk Exposures and Control

Issues to 30 June 2019

1. Purpose of Report

1.1 To update the

Subcommittee on new or outstanding risk exposures following internal audits

included in the Internal Audit Plan to 30 June 2019.

2. Recommendation

|

That the Audit, Risk and Finance Subcommittee

1. Receives the report Internal

Audit - Summary of New or Outstanding Significant Risk Exposures and Control

Issues to 30 June 2019 (R10303) and its attachment (A2227319).

|

2. Background

2.1 Under section 9.1 of

the Internal Audit Charter, the Audit, Risk & Finance Subcommittee and the

Governance Committee are to be informed of internal audit results where

appropriate.

2.2 Under section 9.4, the

Audit, Risk and Finance Subcommittee requires a periodic update of any

significant risk exposures and control issues identified from internal audits

completed.

3. Summary

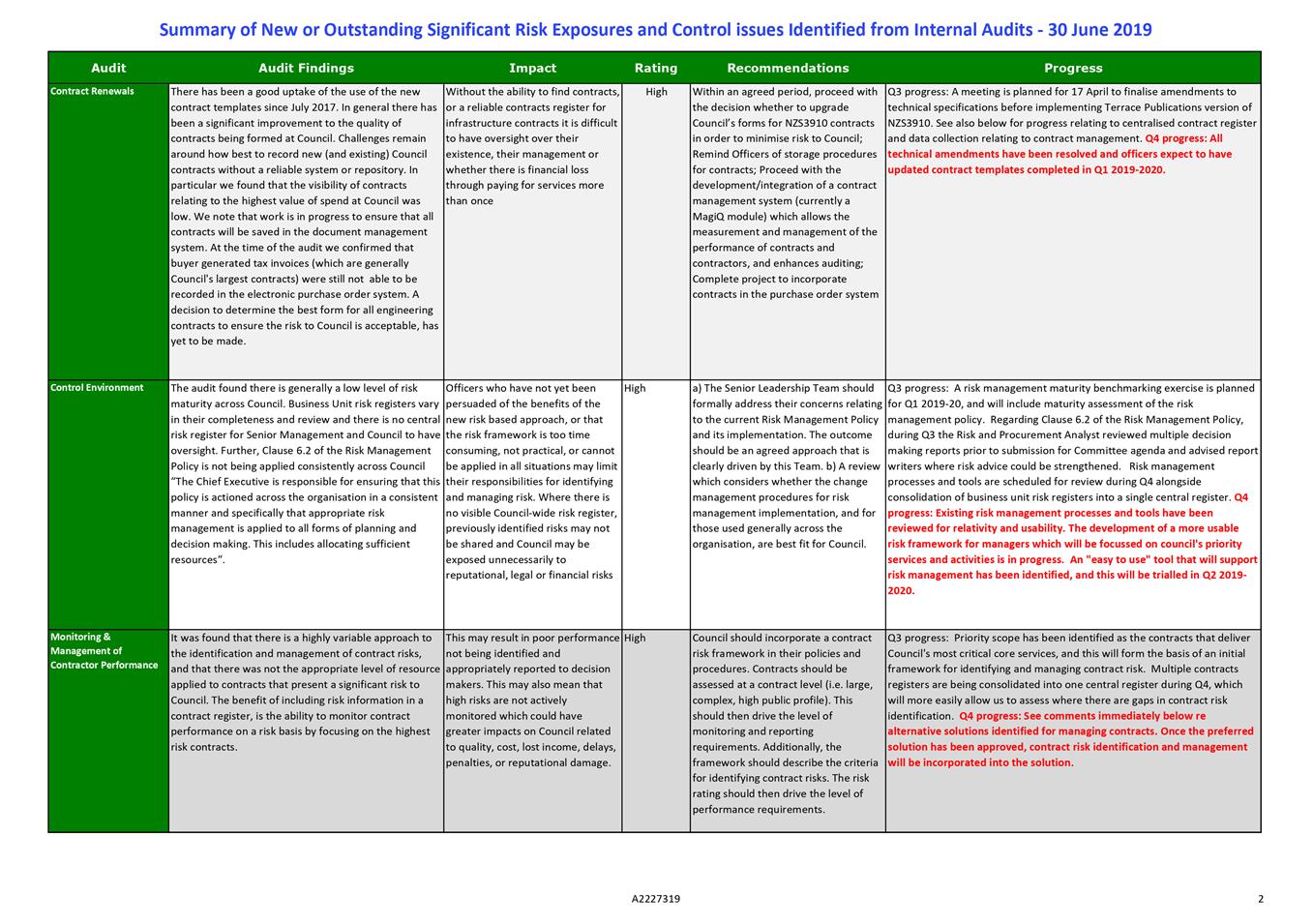

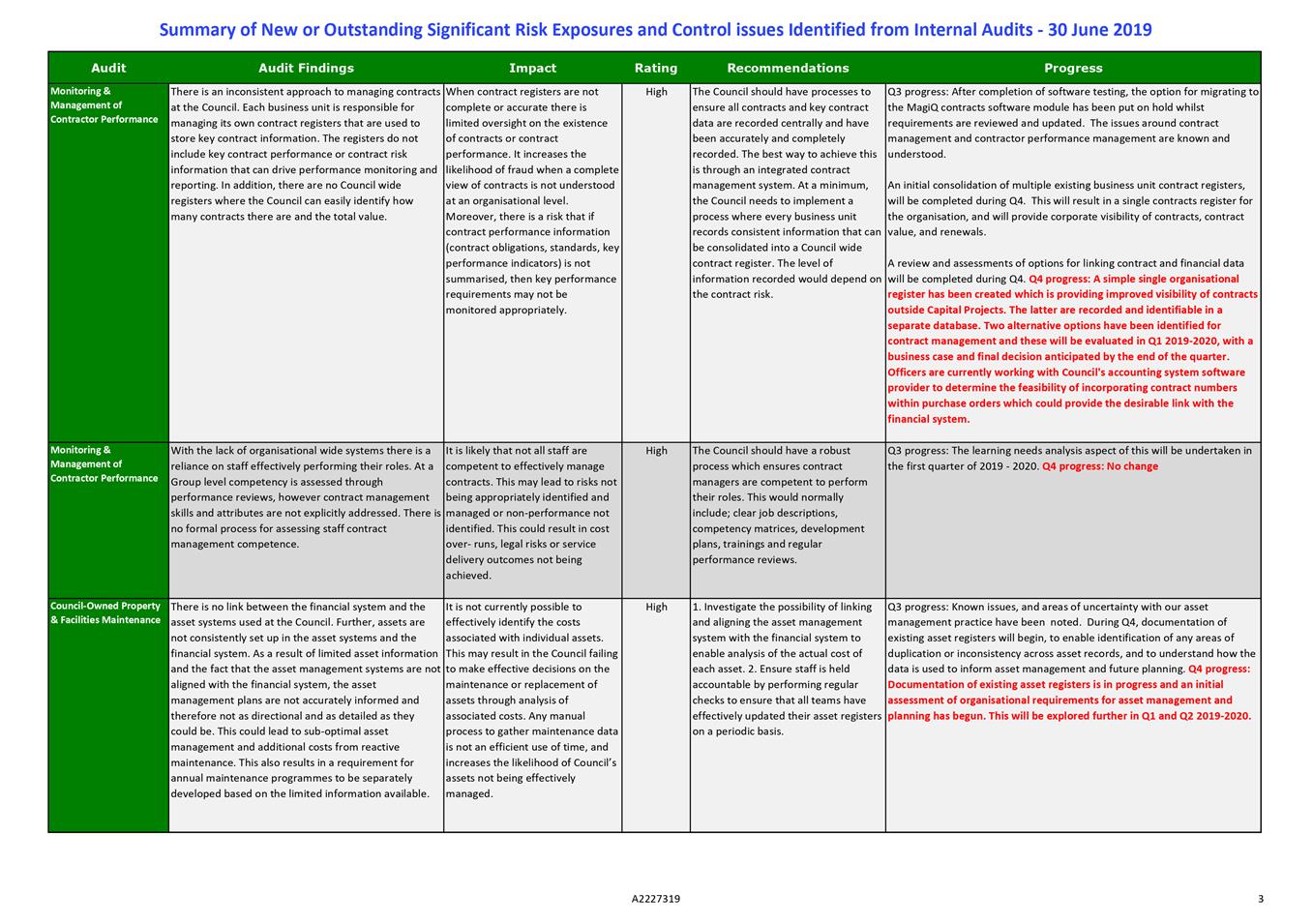

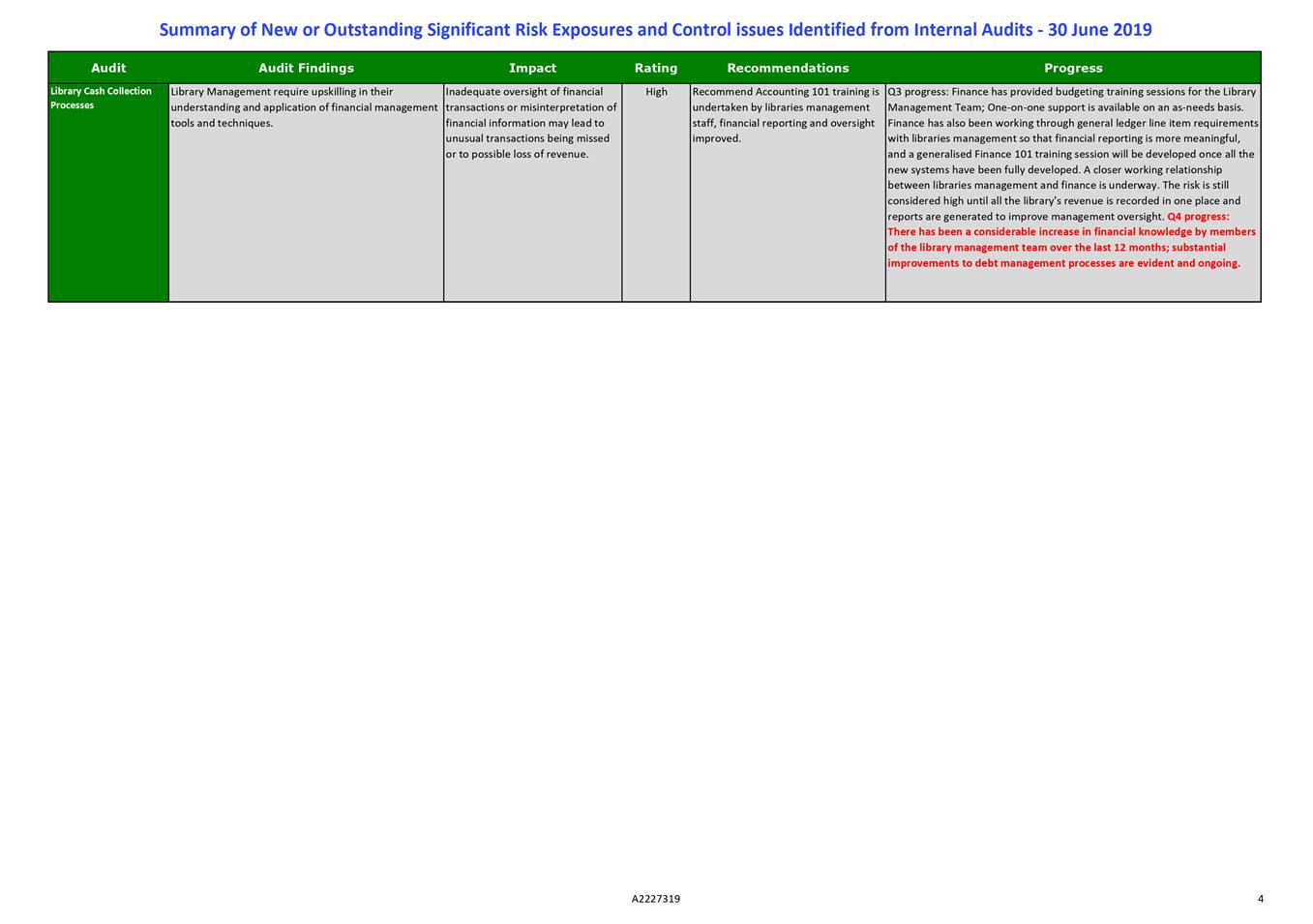

3.1 Issues identified in

the attachment (A2227319), Summary of New and Outstanding Significant Risk

Exposures and Control Issues Identified from Internal Audits, relate to

internal audits performed to 30 June 2019.

3.2 The attached report shows

nine high risks outstanding from the previous report presented to the Audit,

Risk and Finance Subcommittee meeting of 21 May 2019. Details of progress in

Quarter 4 (Q4) for each are shown in red.

3.3 No new high risks have

been identified.

3.4 The Business

Improvement team has been assigned many of these corrective actions and has

made good progress addressing mitigations.

Author: Lynn

Anderson, Internal Audit Analyst

Attachments

Attachment 1: A2227319 - Internal Audit

- New or Outstanding Significant Risk Exposures and Control Issues to 30 June

2019 ⇩

Item 12: Internal Audit - Summary of New or Outstanding Significant

Risk Exposures and Control Issues to 30 June 2019: Attachment 1

Audit, Risk and Finance

Subcommittee

Audit, Risk and Finance

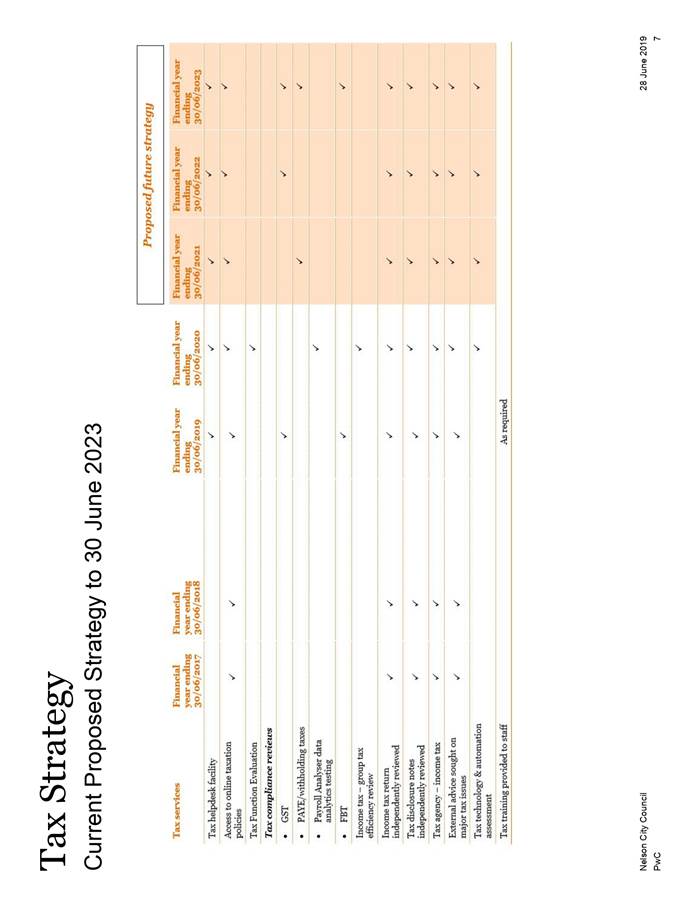

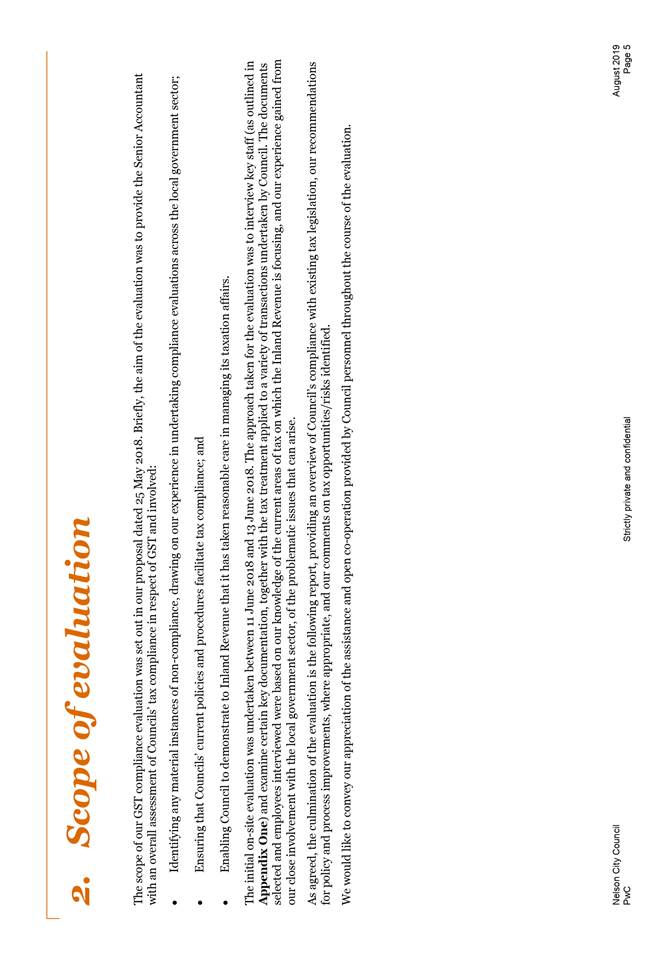

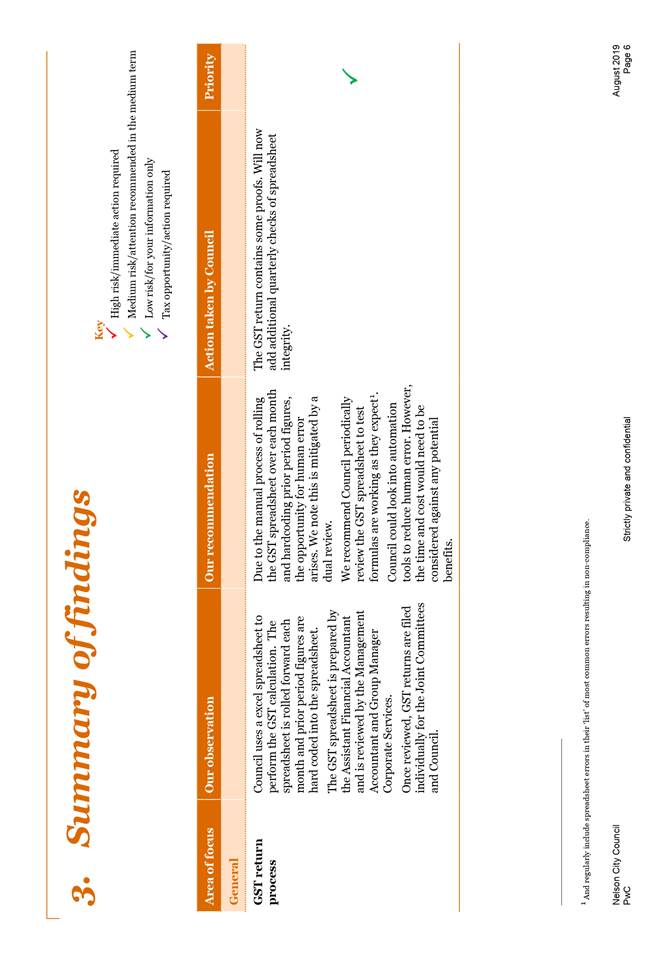

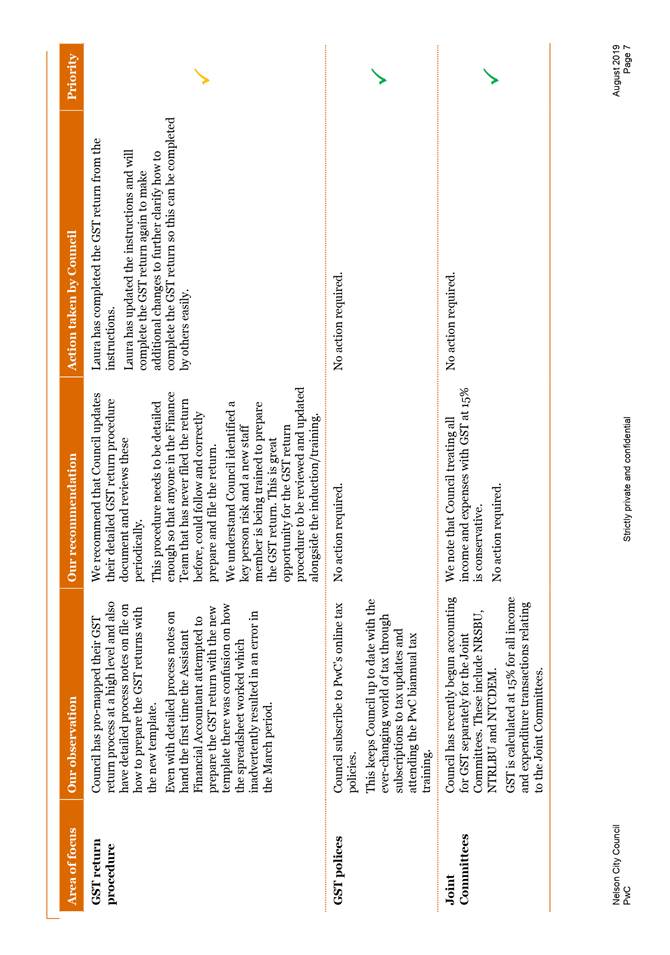

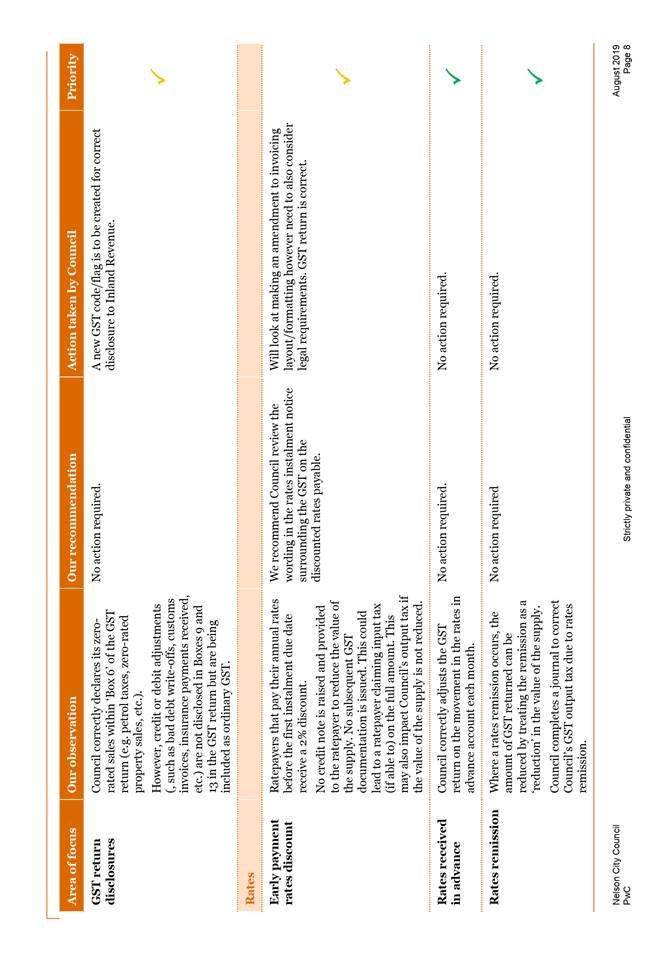

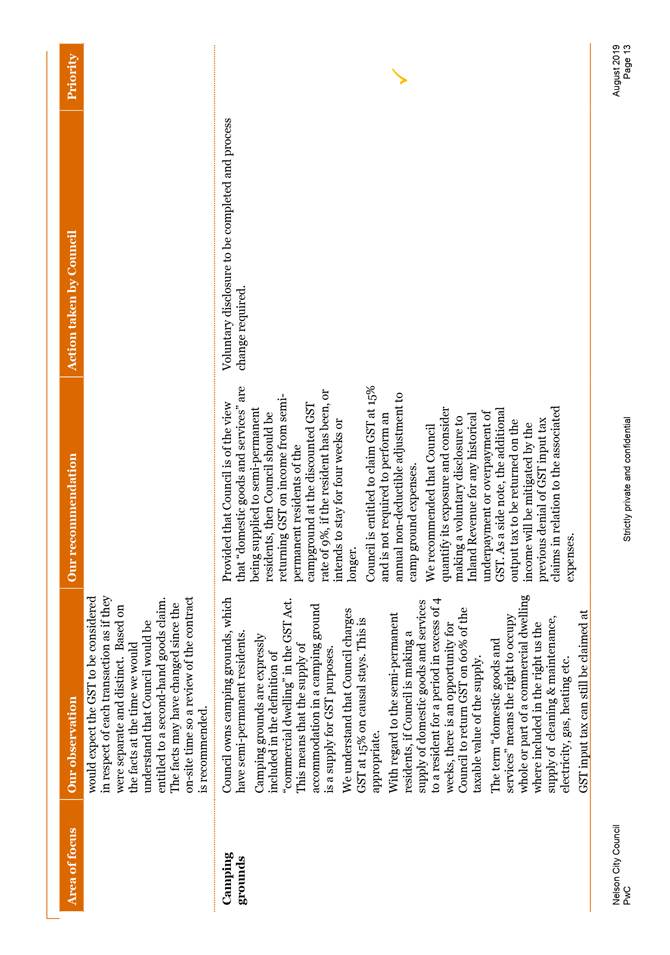

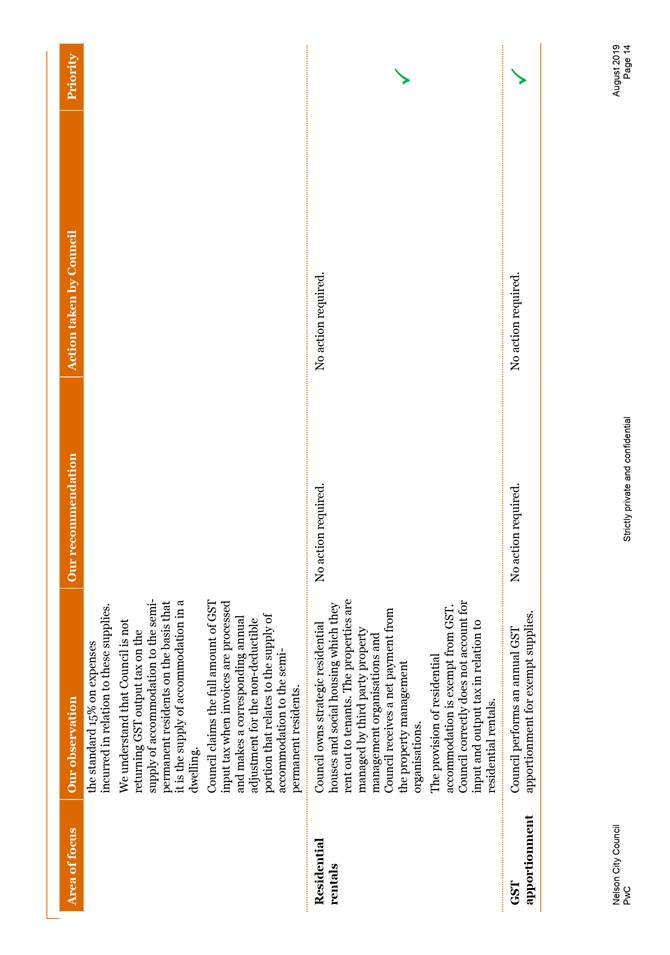

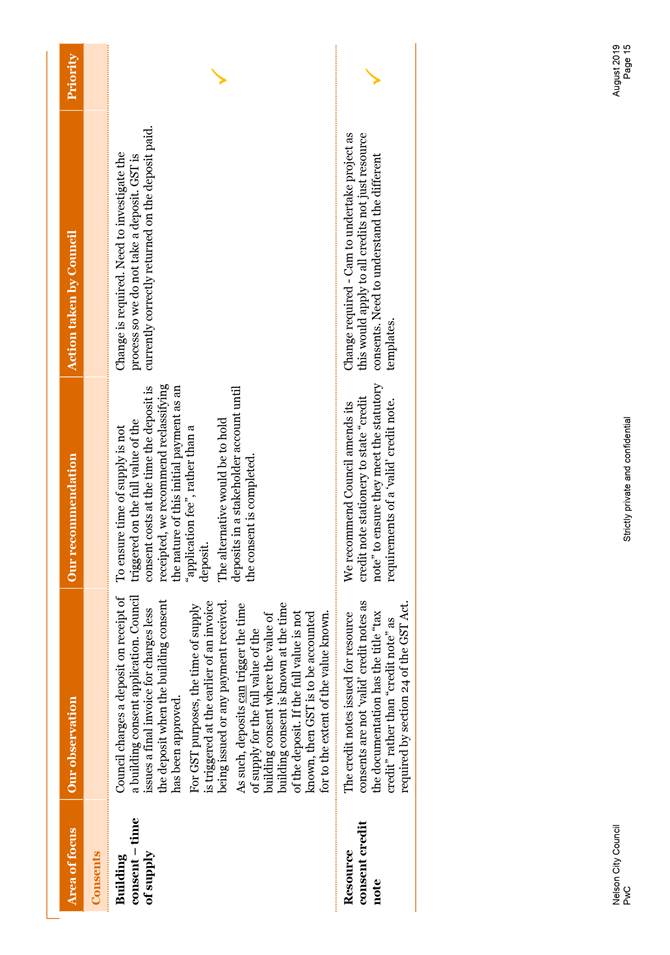

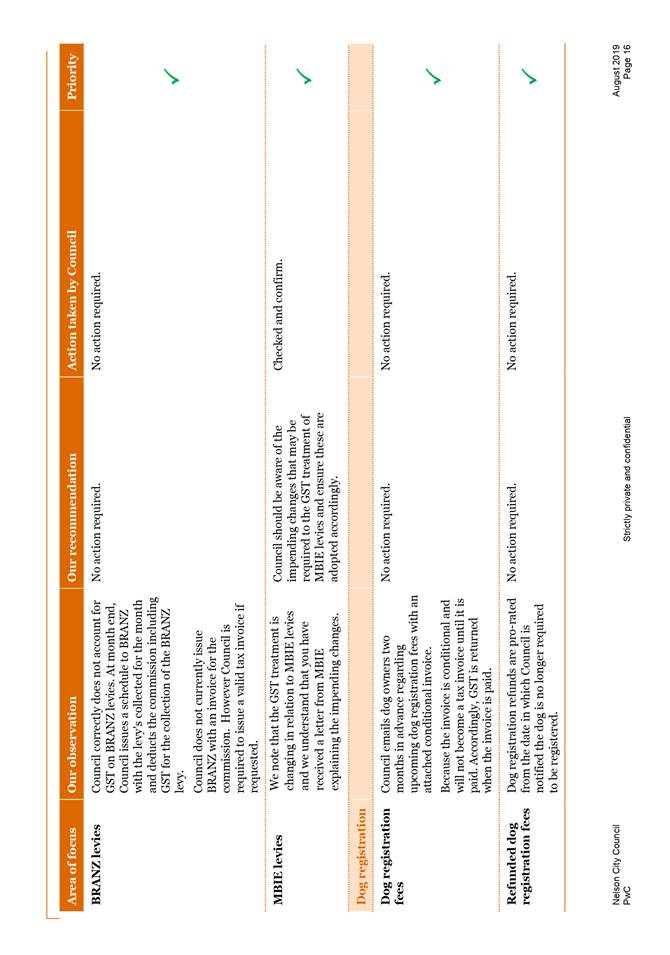

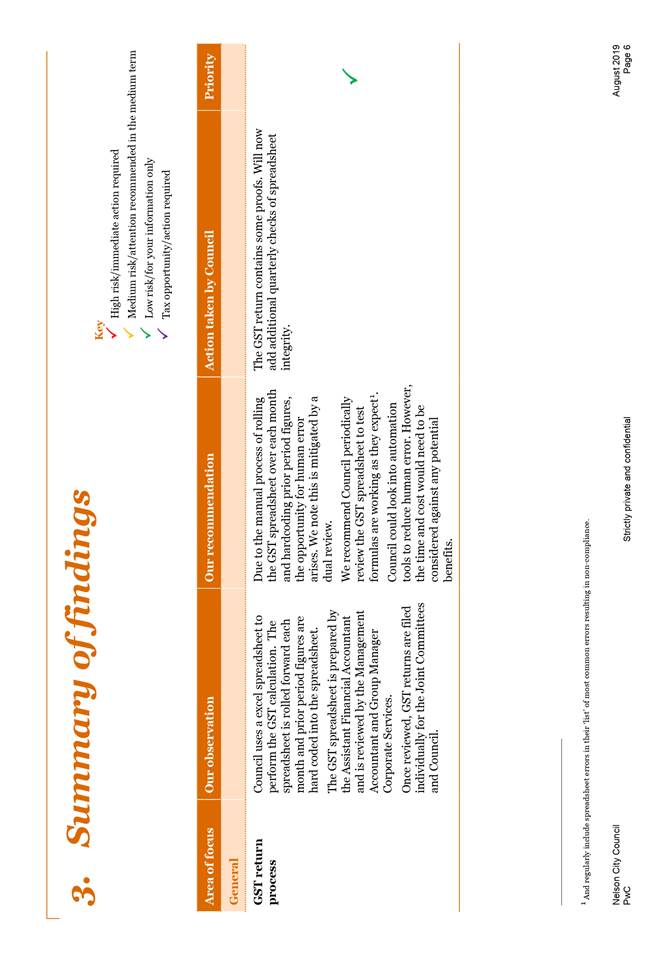

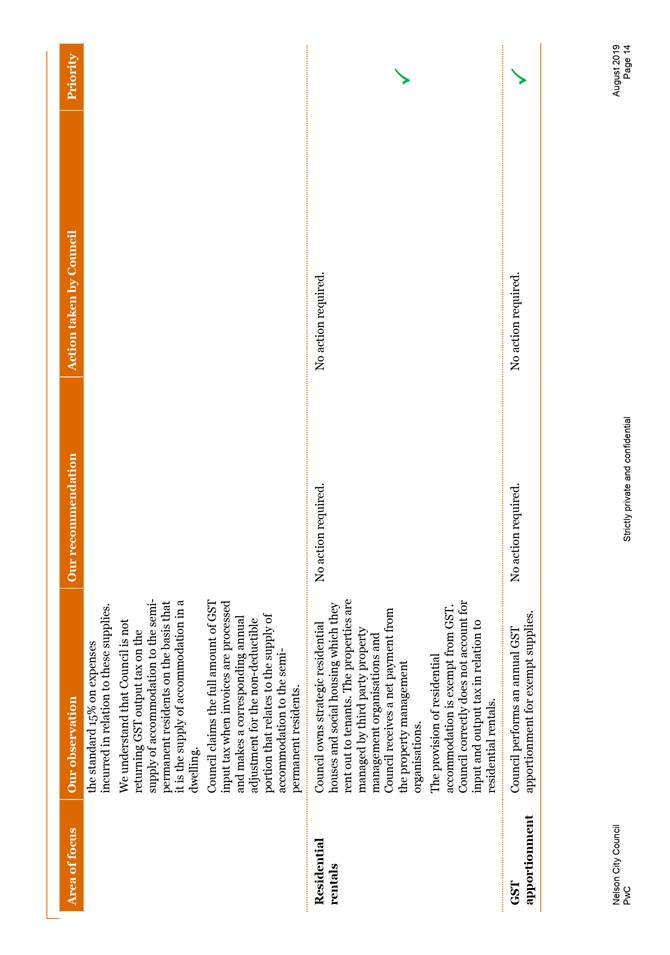

Subcommittee