|

That

the Council

1. Receives the report Adoption

of the Annual Plan 2019/20, amendment to the Long Term Plan 2018-28 and

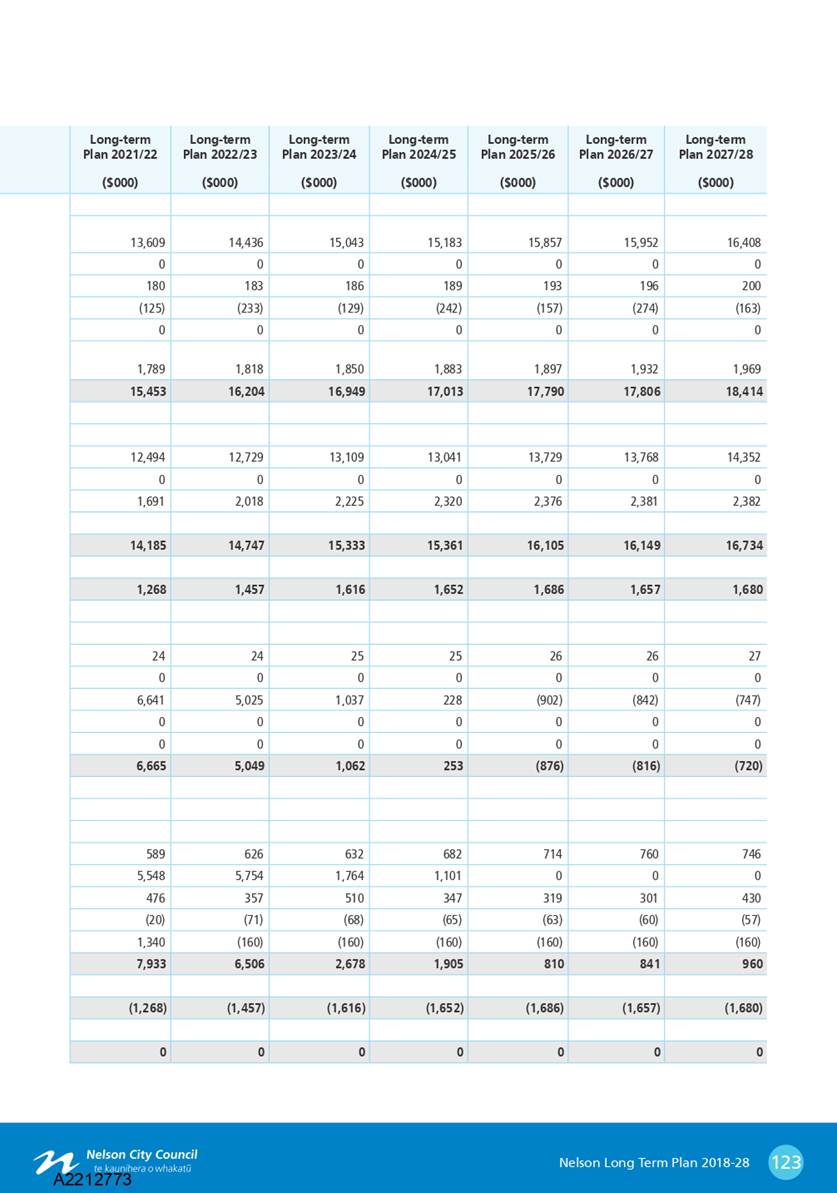

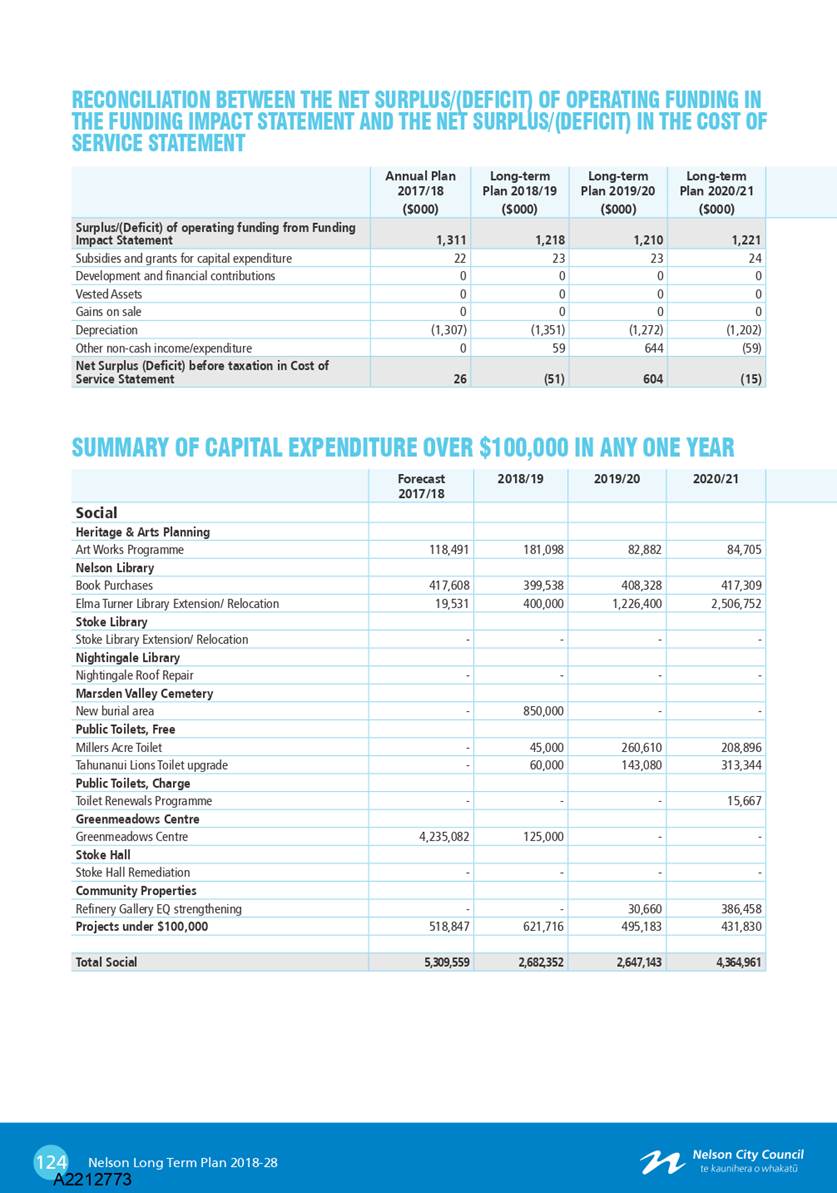

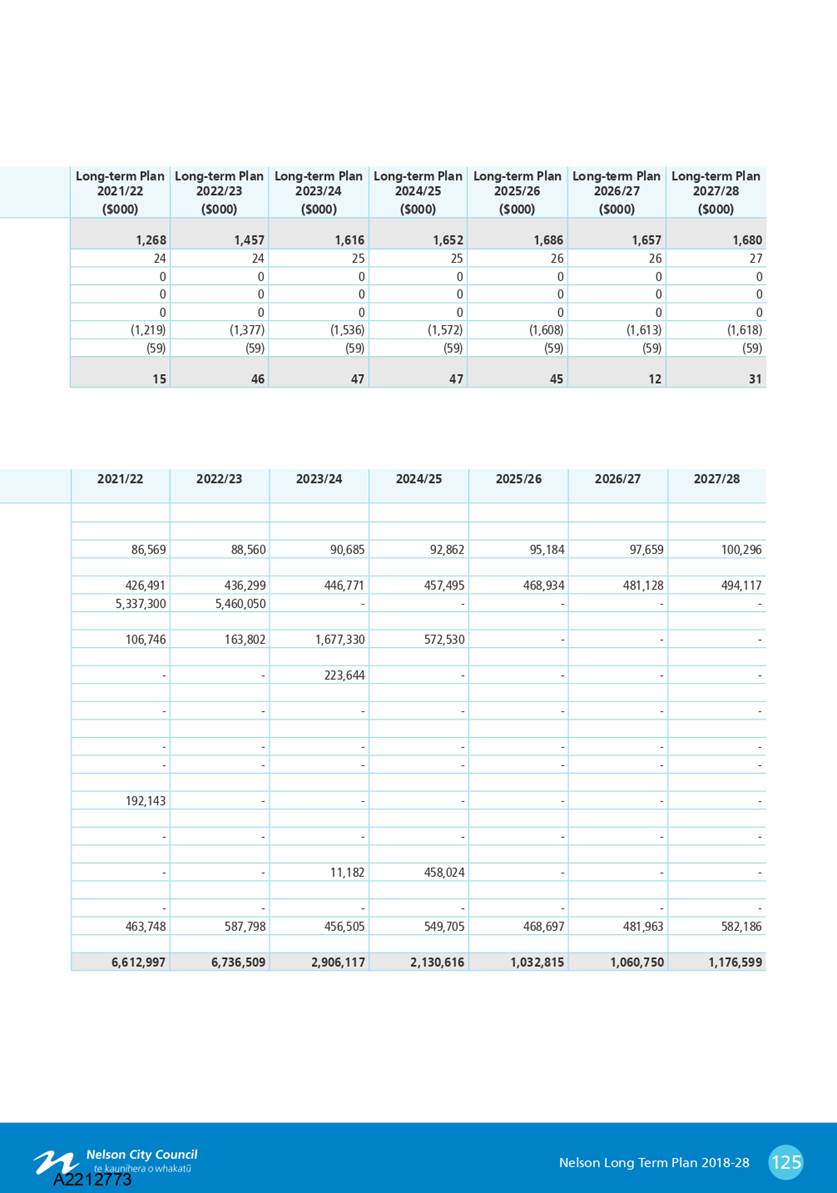

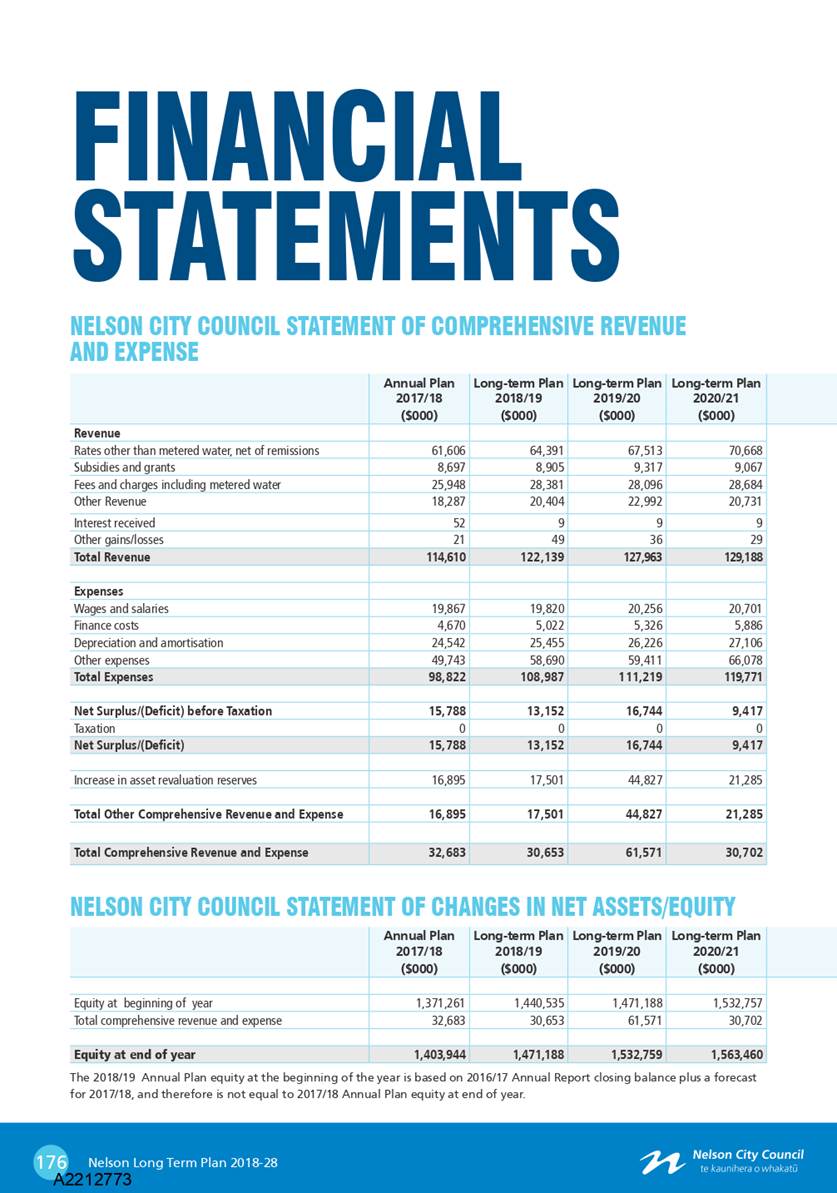

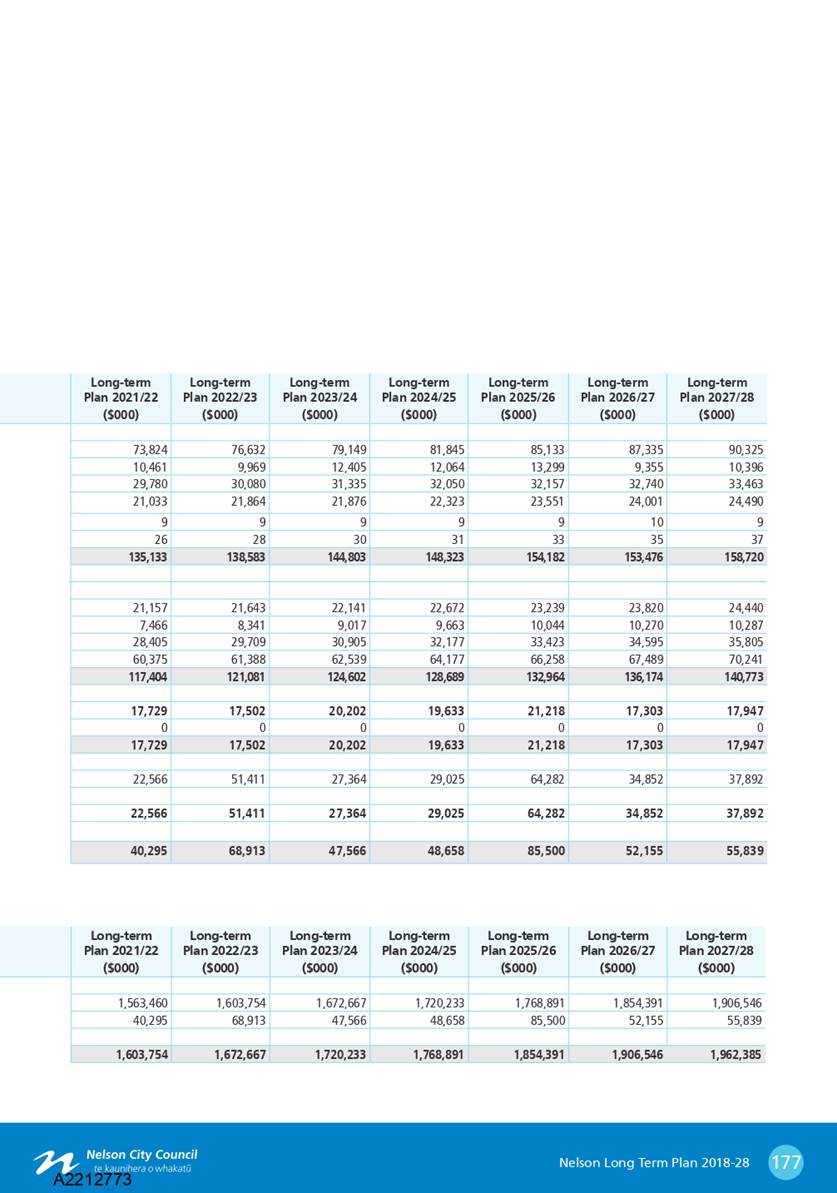

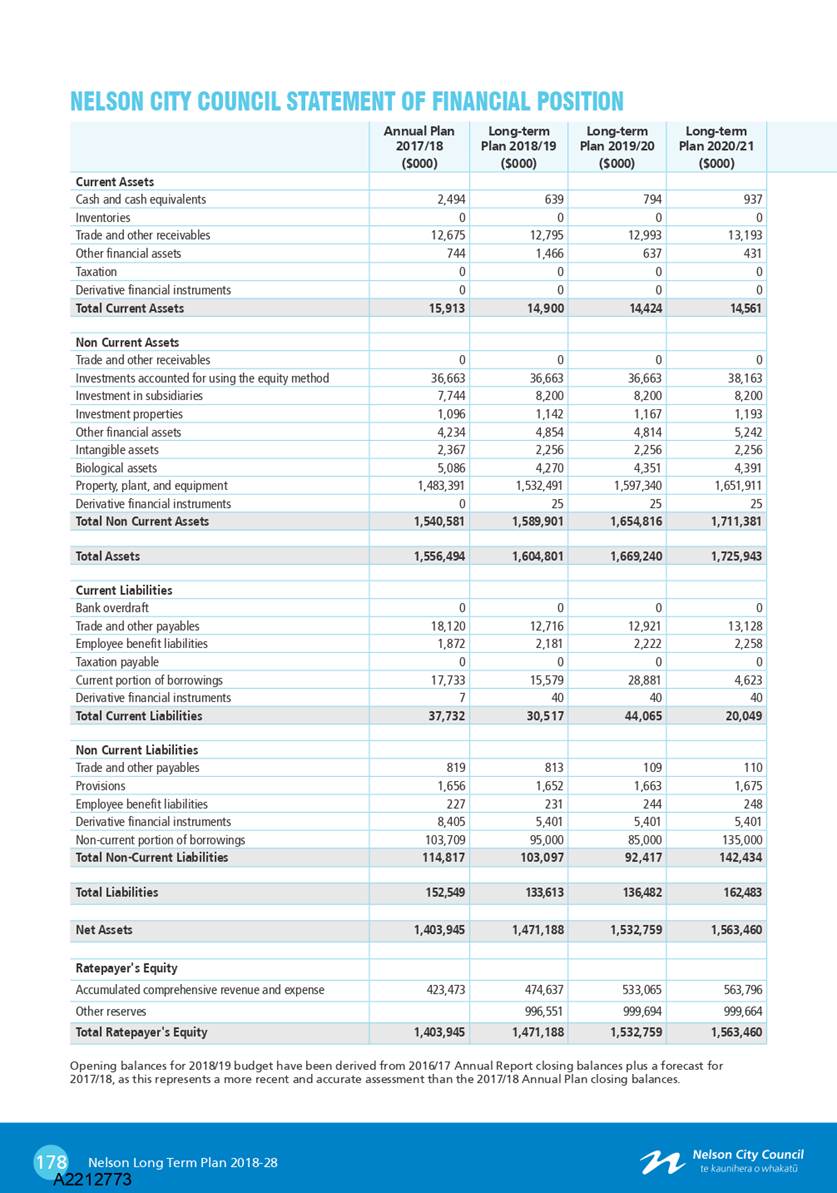

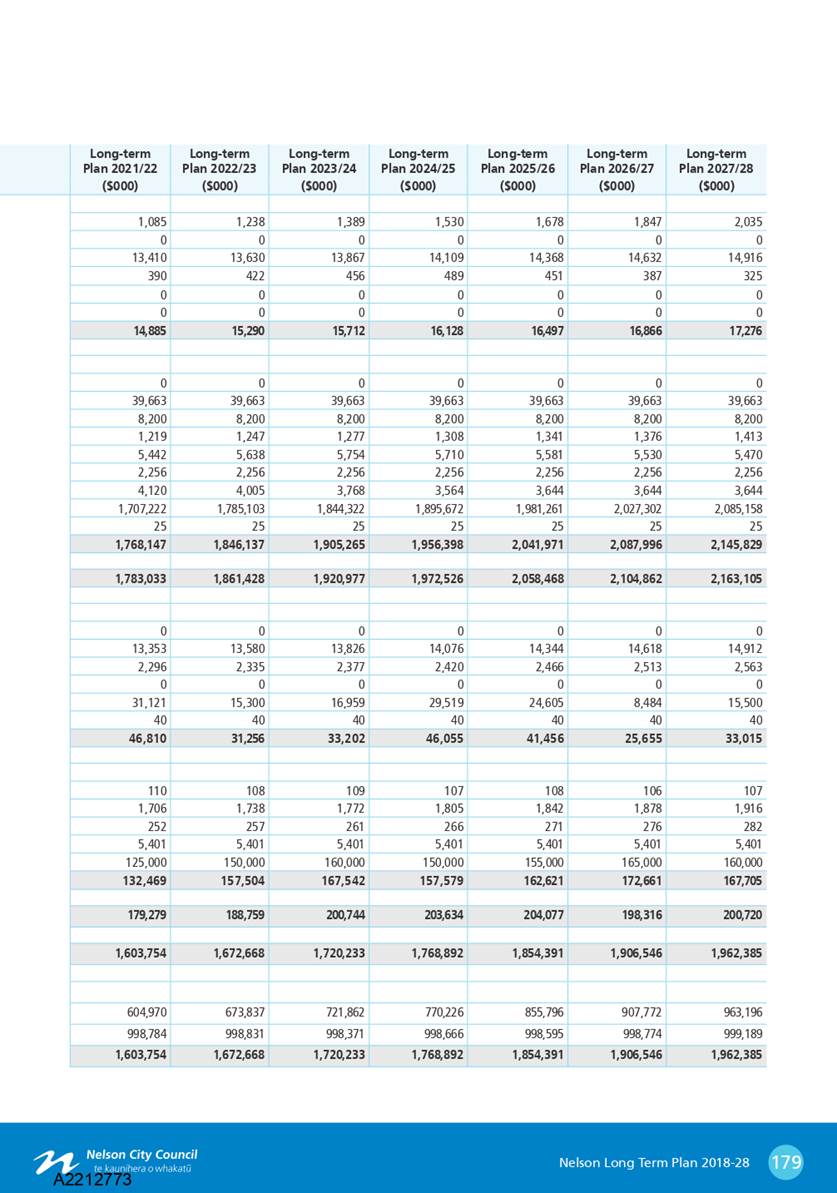

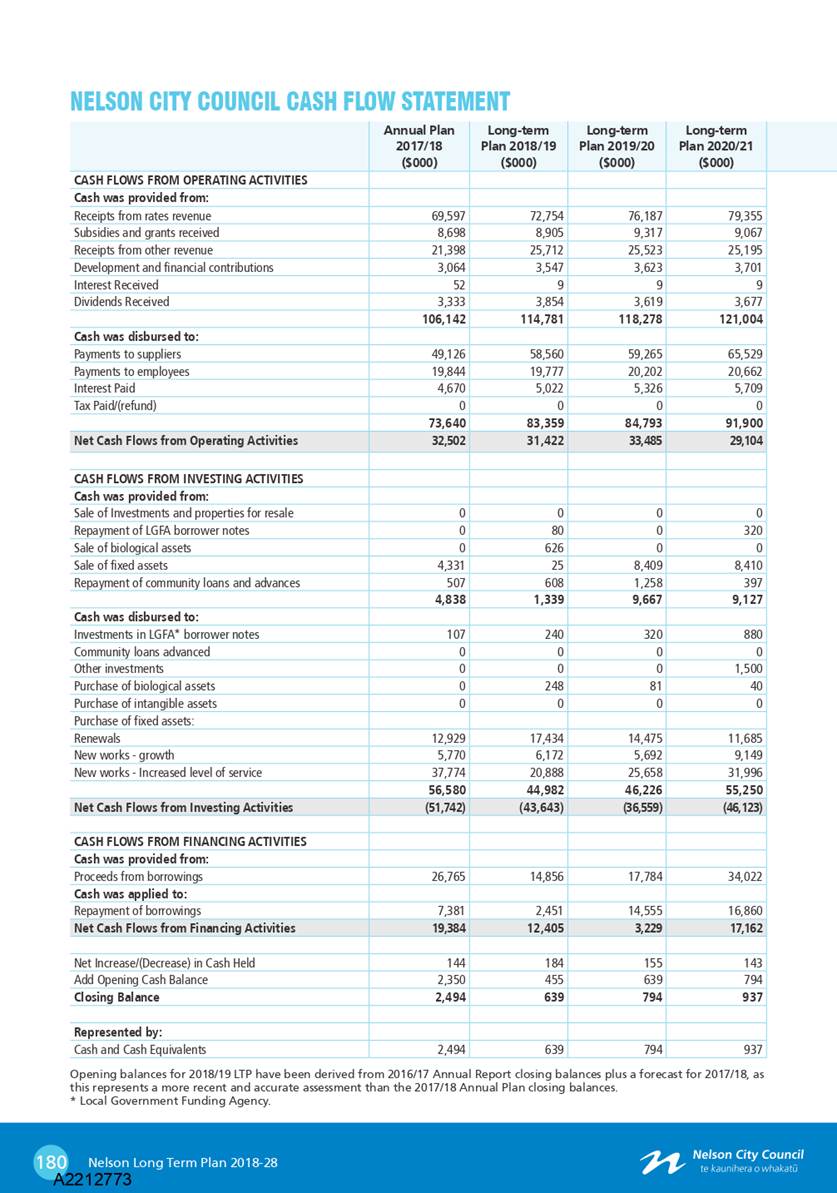

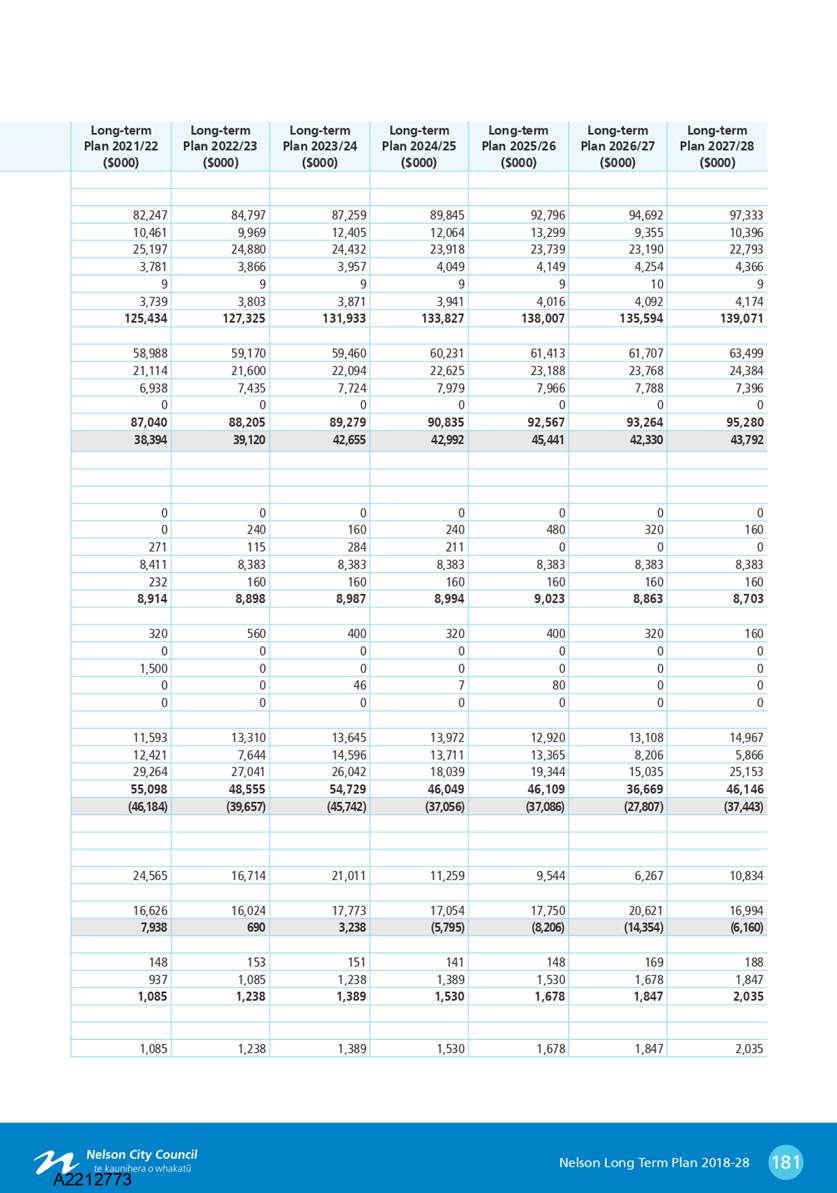

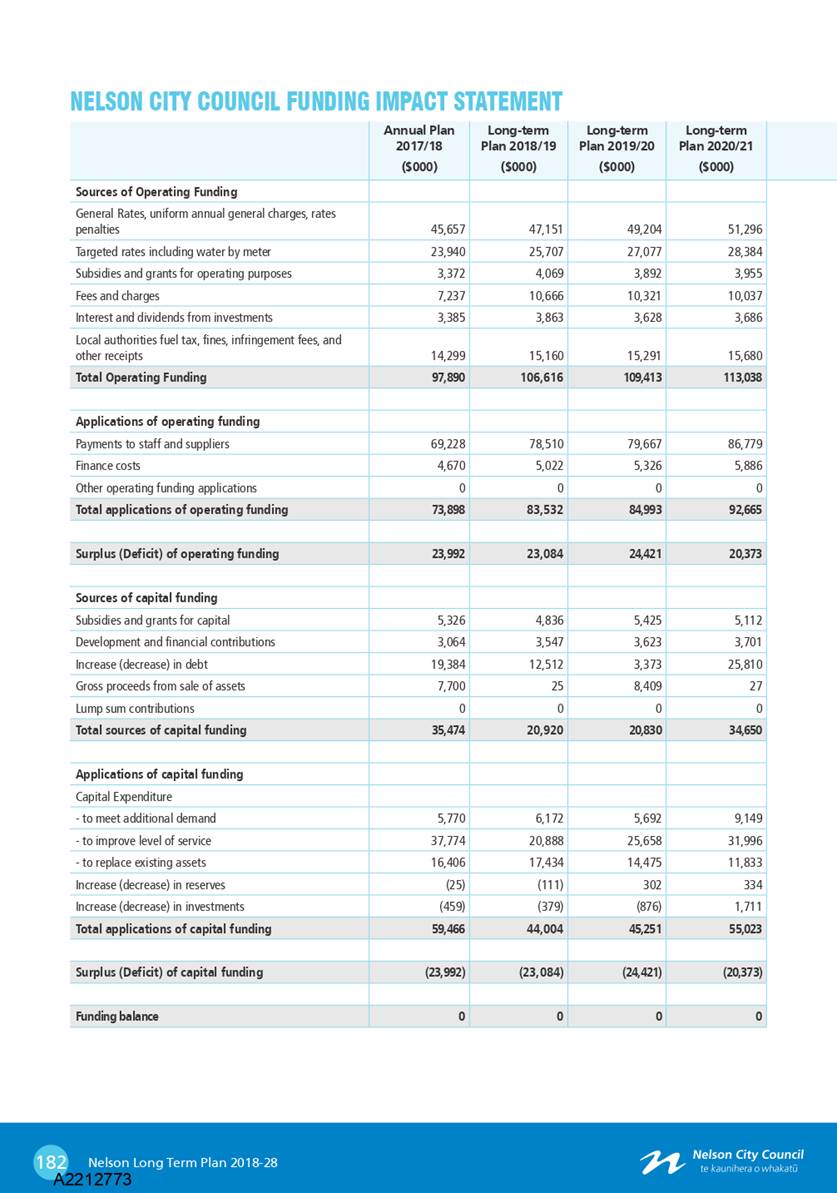

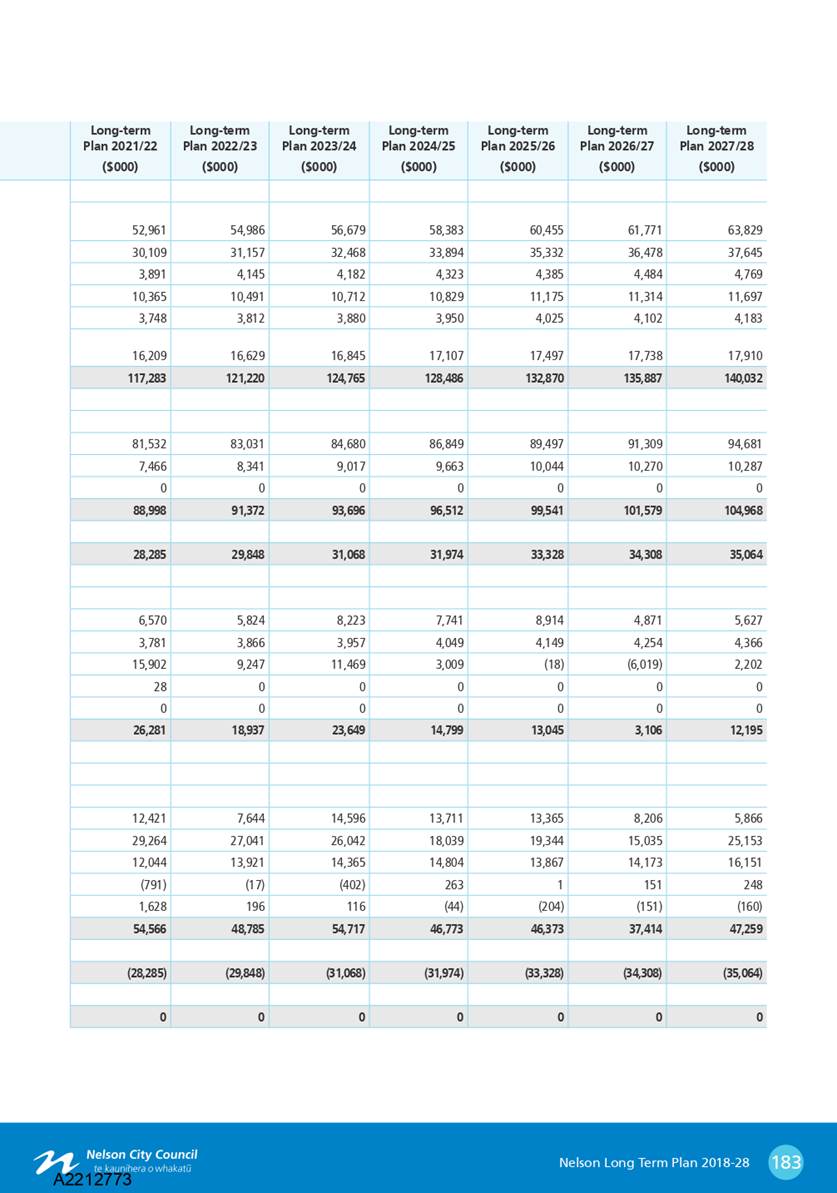

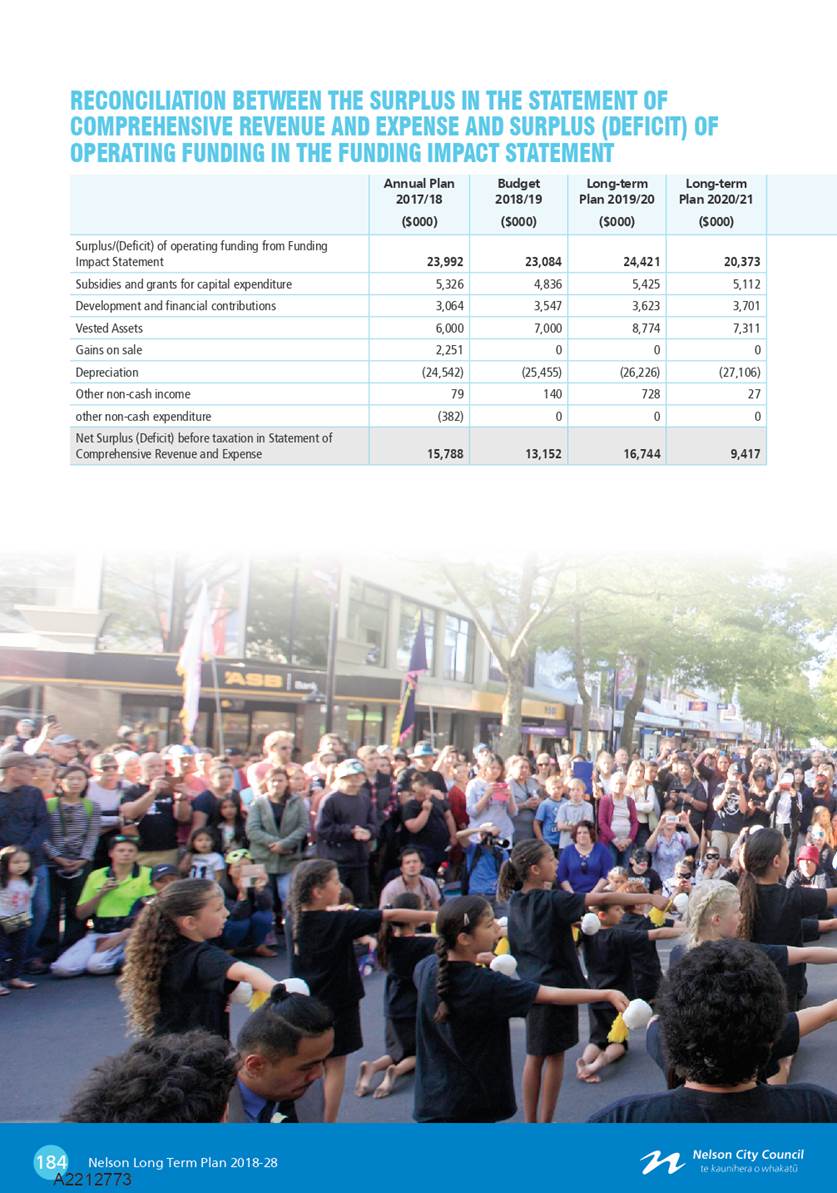

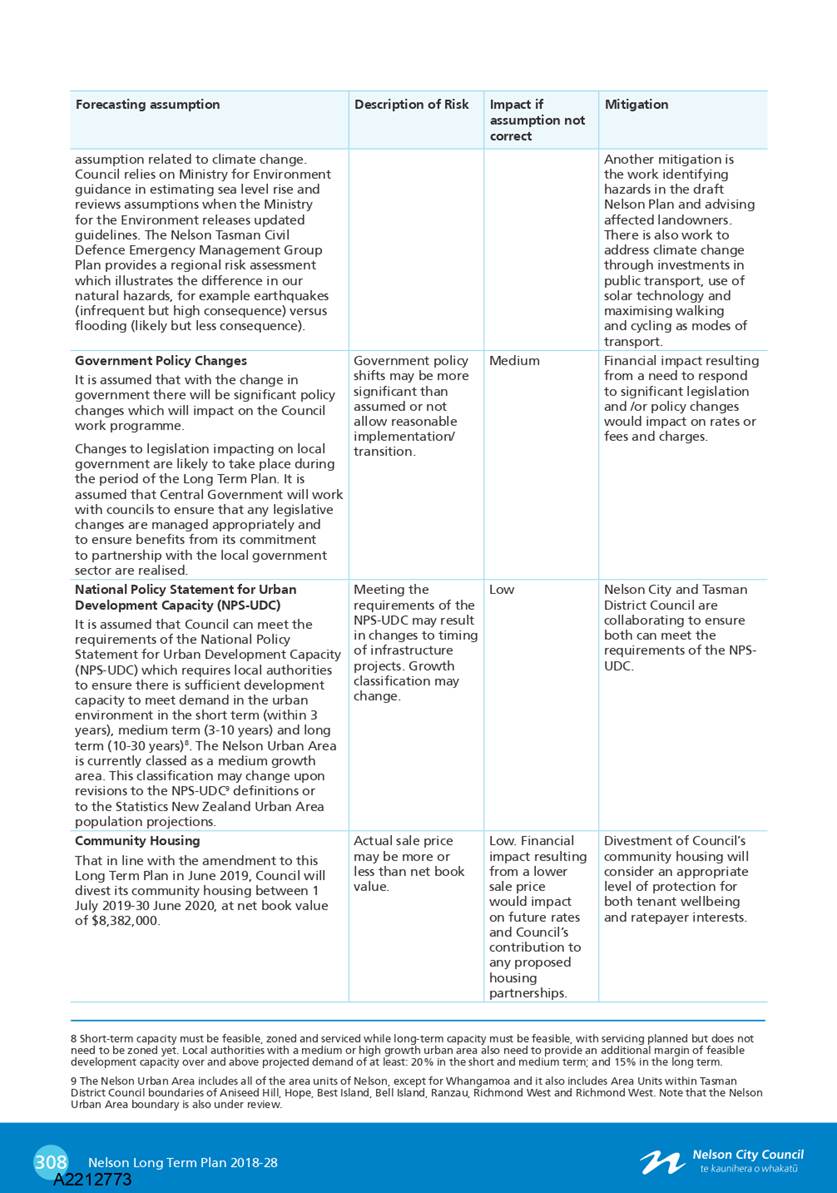

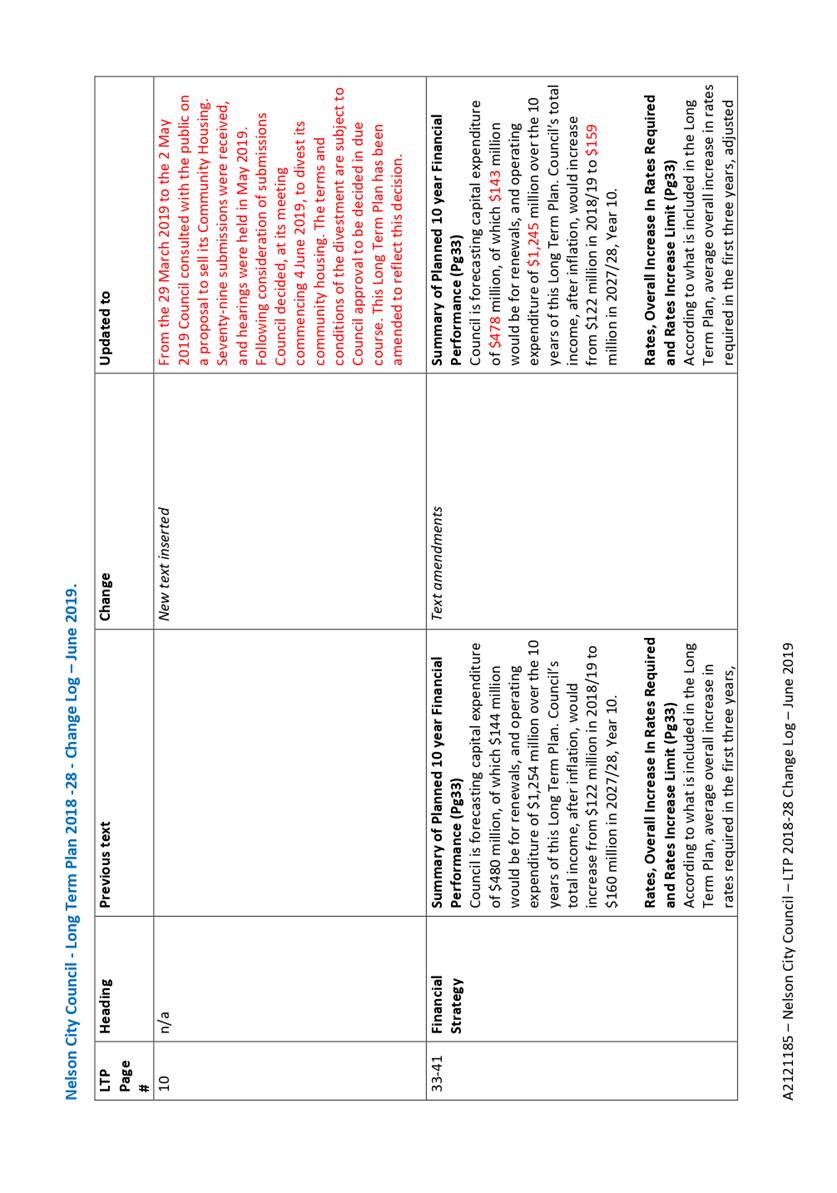

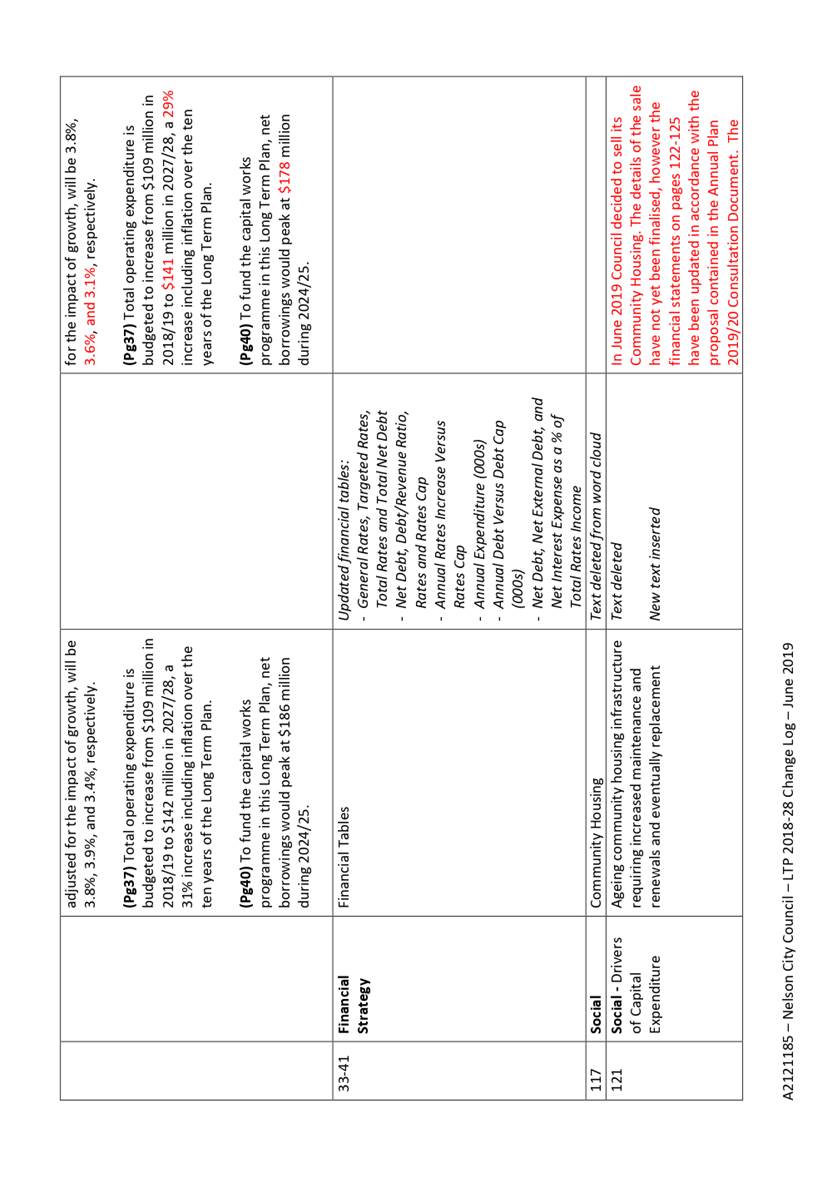

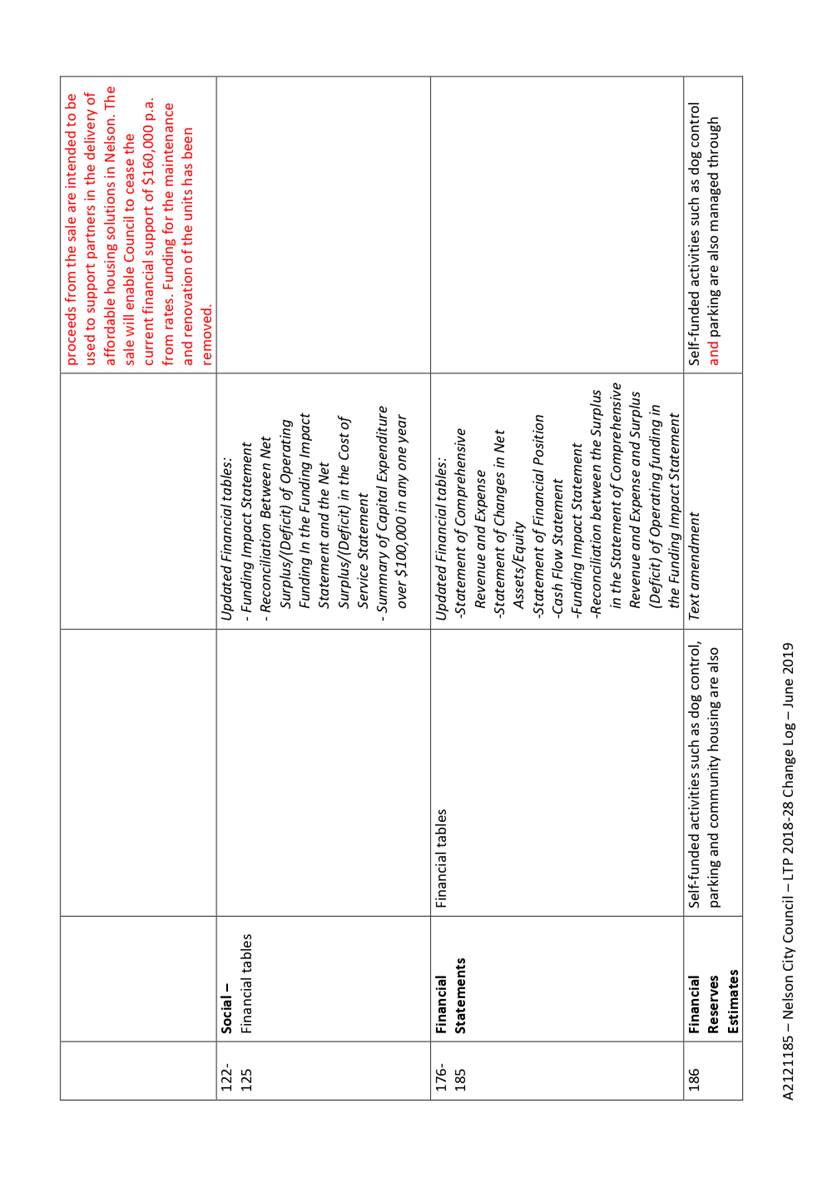

setting of the rates for 2019/20 (R10278) and its attachments

(A2213052, A2212773 and A2121185); and

2. Adopts the Annual Plan

2019/20 (A2213052) pursuant to Section 95 of the Local Government Act 2002;

and

3. Delegates the Mayor and Chief

Executive to make any necessary minor editorial amendments prior to the

release of the Annual Plan 2019/20 to the public; and

4. Sets the following rates

under the Local Government (Rating) Act 2002, on rating units in the district

for the financial year commencing on 1 July 2019 and ending on 30 June 2020.

The revenue approved below will be raised by the

rates and charges that follow.

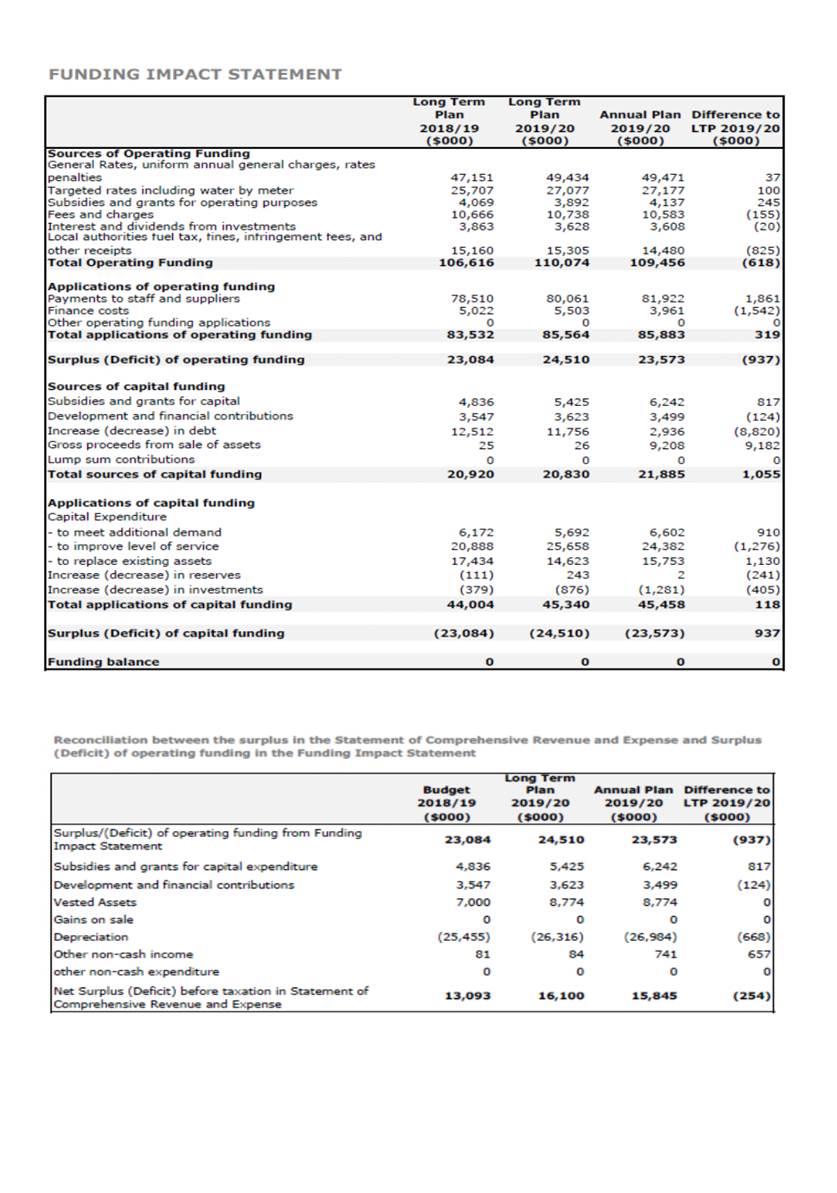

Revenue approved:

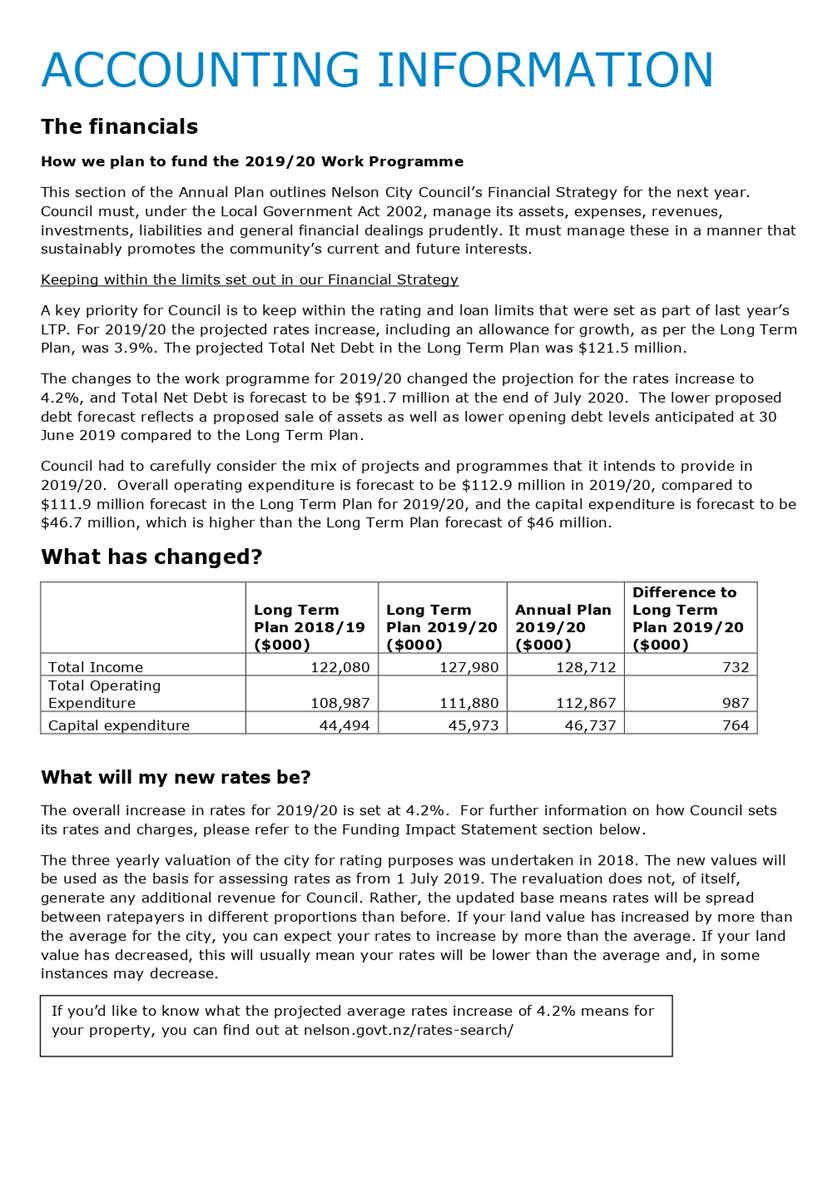

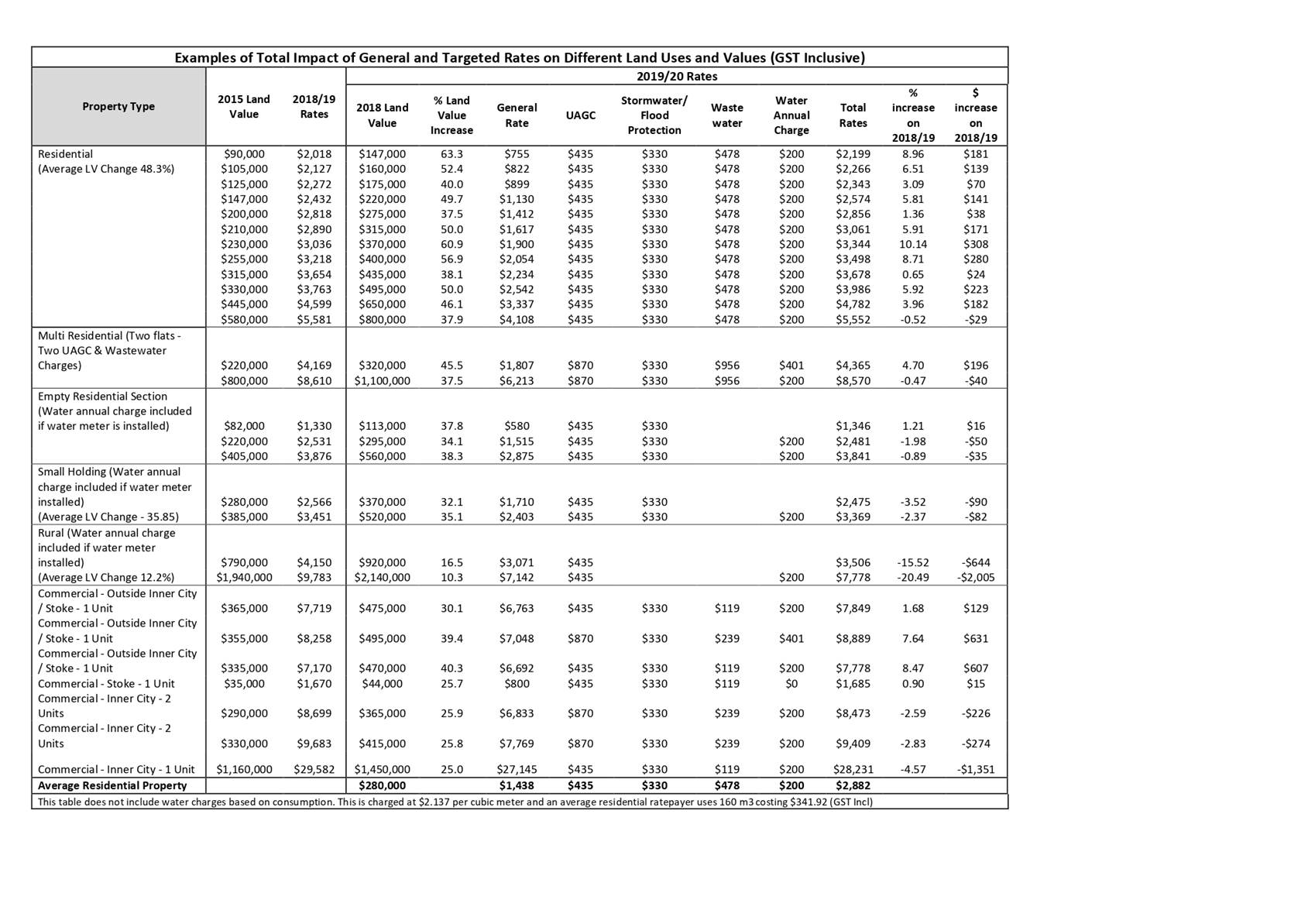

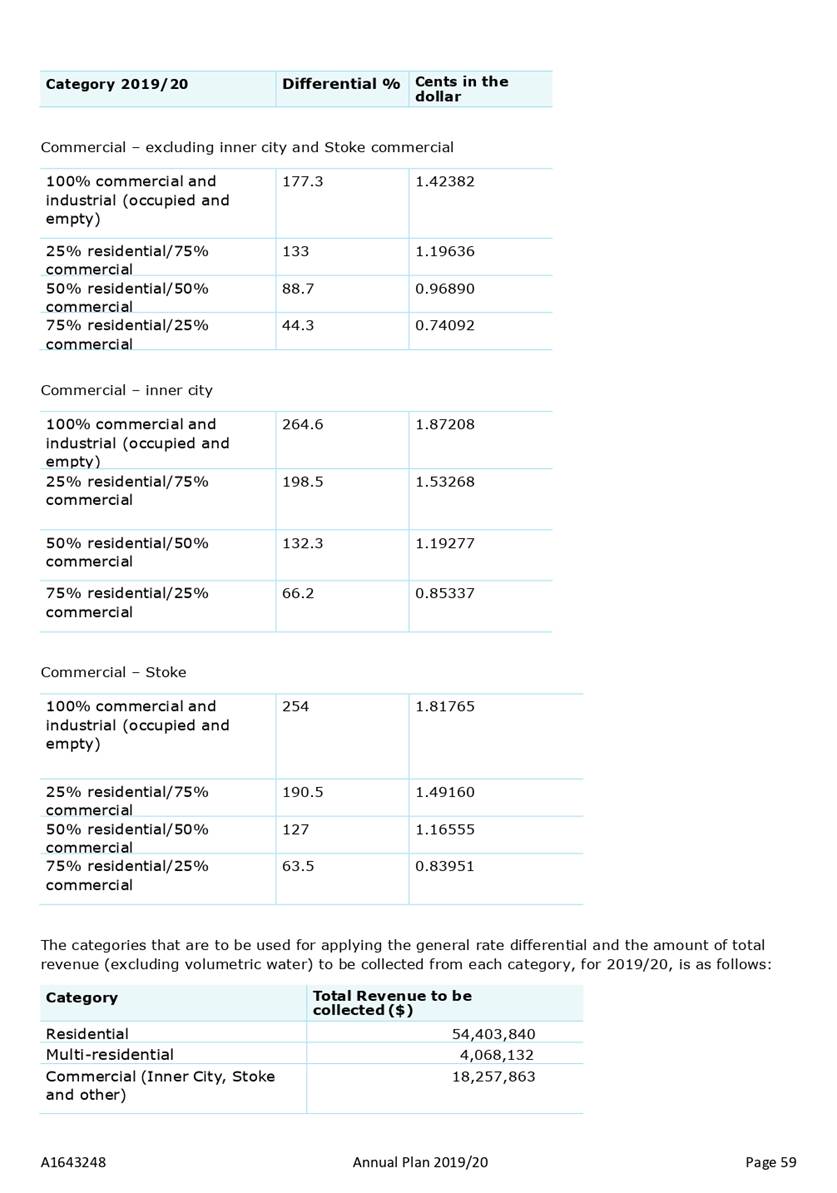

General Rate $40,737,232

Uniform Annual General Charge $9,043,450

Stormwater and Flood Protection Charge $6,096,208

Waste Water Charge $8,719,184

Water Annual Charge $3,705,207

Water Volumetric Charge $8,645,483

Clean Heat Warm Homes and Solar Saver $402,996

Rates and Charges (excluding GST) $77,349,760

Goods and Services Tax

(at the current rate) $11,602,464

Total Rates and Charges $88,952,224

The rates and charges below are GST inclusive.

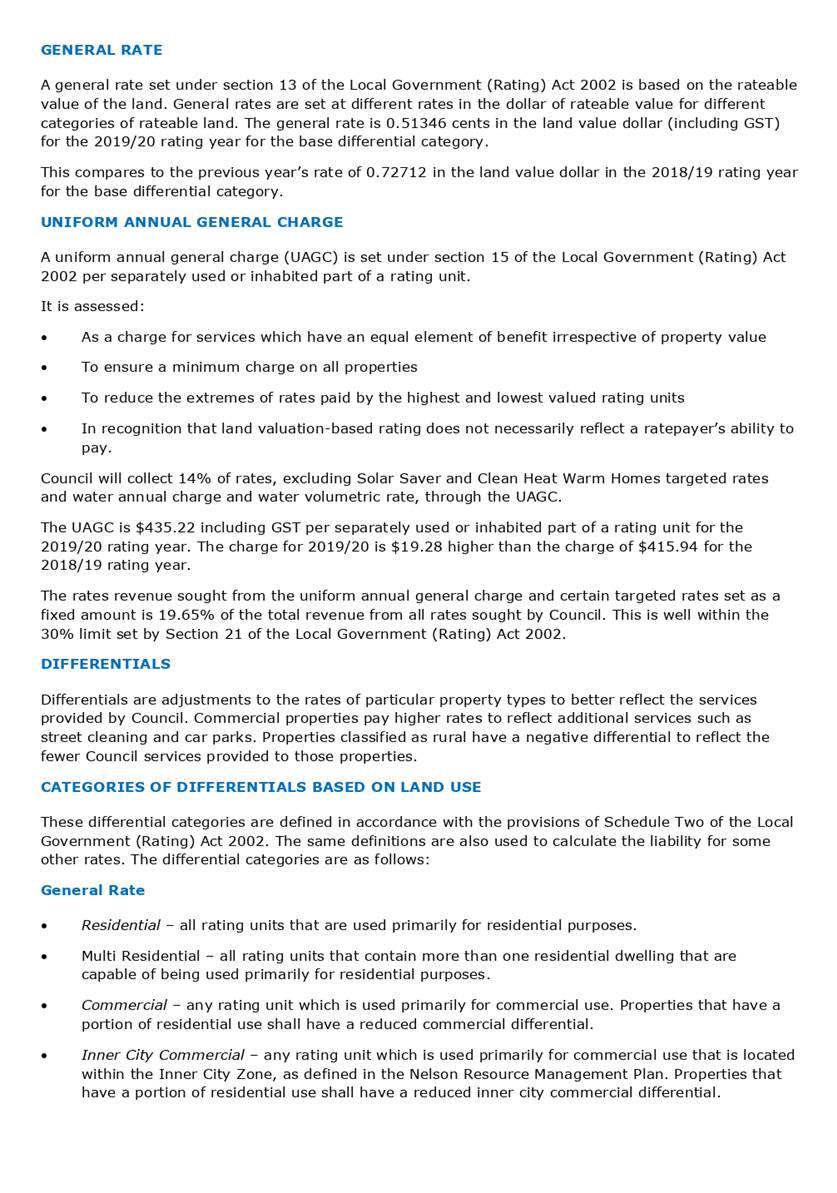

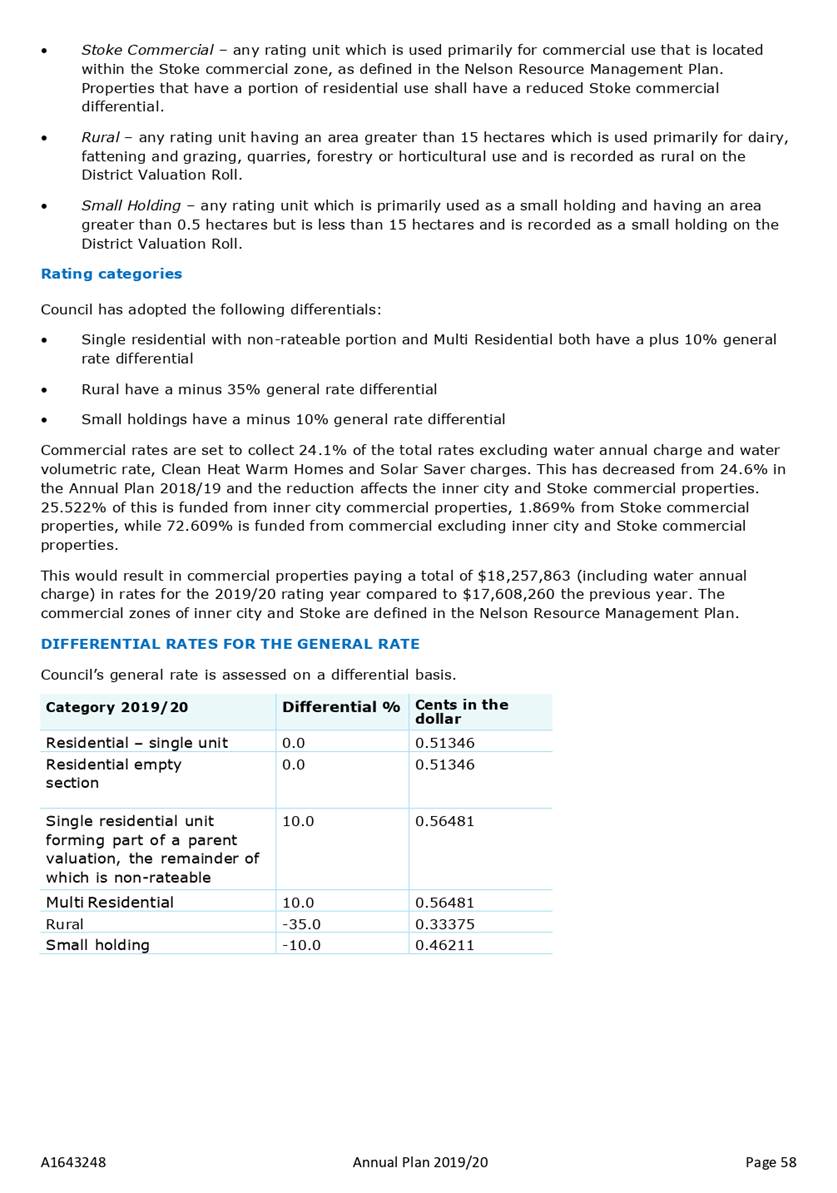

(1) General Rate

A general rate set under section 13 of the Local

Government (Rating) Act 2002, assessed on a differential land value basis as

described below:

• a rate of 0.51346 cents in the

dollar of land value on every rating unit in the “residential –

single unit” category.

• a

rate of 0.51346 cents in the dollar of land value on every rating unit in the

“residential empty section” category.

• a

rate of 0.56481 cents in the dollar of land value on every rating unit in the

“single residential unit forming part of a parent valuation, the remainder

of which is non-rateable” category. This represents a plus 10%

differential on land value.

• a rate of 0.56481 cents in the

dollar of land value on every rating unit in the “multi

residential” category. This represents a plus 10% differential on land

value.

• a

rate of 1.42382 cents in the dollar of land value on every rating unit in the

“commercial – excluding inner city and Stoke commercial”

subject to 100% commercial and industrial (occupied and empty) category. This

represents a plus 177.3% differential on land value.

• a

rate of 1.19636 cents in the dollar of land value on every rating unit in the

“commercial – excluding inner city and Stoke commercial”

subject to 25% residential and 75% commercial” category. This

represents a plus 133% differential on land value.

• a

rate of 0.96890 cents in the dollar of land value on every rating unit in the

“commercial – excluding inner city and Stoke commercial”

subject to 50% residential and 50% commercial” category. This

represents a plus 88.7% differential on land value.

• a

rate of 0.74092 cents in the dollar of land value on every rating unit in the

“commercial – excluding inner city and Stoke commercial”

subject to 75% residential and 25% commercial” category. This

represents a plus 44.3% differential on land value.

· a

rate of 1.87208 cents in the dollar of land value on every rating unit in the

“commercial inner city” subject to 100% commercial and industrial

(occupied and empty) category. This represents a plus 264.6% differential on

land value.

· a

rate of 1.53268 cents in the dollar of land value on every rating unit in the

“commercial inner city subject to 25% residential and 75%

commercial” category. This represents a plus 198.5% differential on

land value.

· a

rate of 1.19277 cents in the dollar of land value on every rating unit in the

“commercial inner city subject to 50% residential and 50%

commercial” category. This represents a plus 132.3% differential on

land value.

· a

rate of 0.85337 cents in the dollar of land value on every rating unit in the

“commercial inner city subject to 75% residential and 25%

commercial” category. This represents a plus 66.2% differential on land

value.

· a

rate of 1.81765 cents in the dollar of land value on every rating unit in the

“Stoke commercial subject to 100% commercial and industrial (occupied

and empty)” category. This represents a plus 254% differential on land

value.

· a

rate of 1.49160 cents in the dollar of land value on every rating unit in the

“Stoke commercial subject to 25% residential and 75% commercial”

category. This represents a plus 190.5% differential on land value.

· a

rate of 1.16555 cents in the dollar of land value on every rating unit in the

“Stoke commercial subject to 50% residential and 50% commercial”

category. This represents a plus 127% differential on land value.

· a

rate of 0.83951 cents in the dollar of land value on every rating unit in the

“Stoke commercial subject to 75% residential and 25% commercial”

category. This represents a plus 63.5% differential on land value.

· a

rate of 0.33375 cents in the dollar of land value on every rating unit in the

“rural” category. This represents a minus 35% differential on

land value.

· a

rate of 0.46211 cents in the dollar of land value on every rating unit in the

“small holding” category. This represents a minus 10%

differential on land value.

(2) Uniform Annual

General Charge

A uniform annual general

charge under section 15 of the Local Government (Rating) Act 2002 of $435.22

per separately used or inhabited part of a rating unit.

(3) Stormwater and Flood

Protection Charge

A targeted rate under

section 16 of the Local Government (Rating) Act 2002 of $330.47 per rating

unit, this rate is payable by all ratepayers excluding rural rating units,

rating units east of the Gentle Annie saddle, Saxton’s Island and

Council’s stormwater network.

(4) Waste Water Charge

A targeted rate for waste

water disposal under section 16 of the Local Government (Rating) Act 2002 of:

· $477.93

per separately used or inhabited part of a residential, multi residential,

rural and small holding rating units that is connected either directly or

through a private drain to a public waste water drain.

· For

commercial rating units, a waste water charge of $119.48 per separately used

or inhabited part of a rating unit that is connected either directly or

through a private drain to a public waste water drain. Note: a

“trade” waste charge will also be levied.

(5) Water Annual Charge

A targeted rate for water

supply under Section 16 of the Local Government (Rating) Act 2002, of:

Water charge (per

connection) $200.40

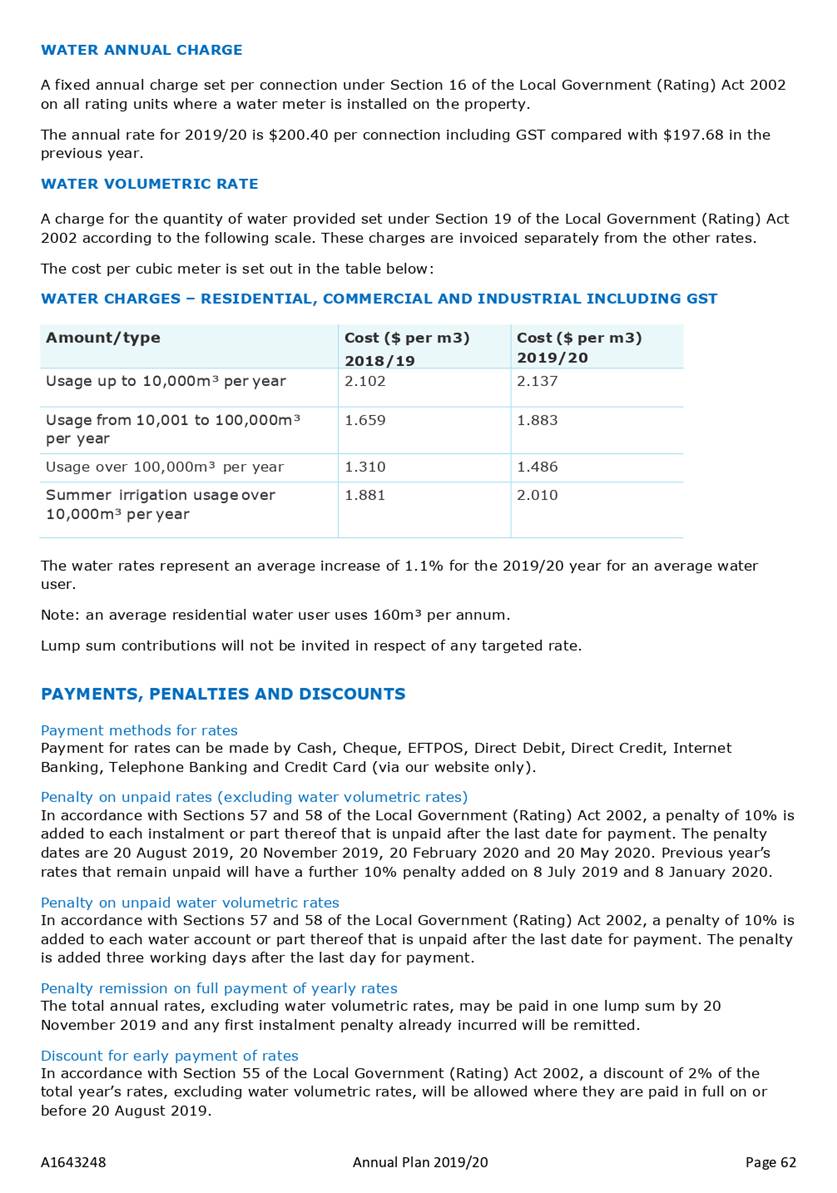

(6) Water Volumetric Rate

A targeted rate for water

provided under Section 19 of the Local Government (Rating) Act 2002, of:

Price of water:

Usage up to 10,000

cu.m/year $2.137 per m³

Usage from 10,001 – 100,000

cu.m/year $1.883

per m³

Usage over 100,000

cu.m/year $1.486 per m³

Summer irrigation usage over

10,000 cu.m/year $2.010

per m³

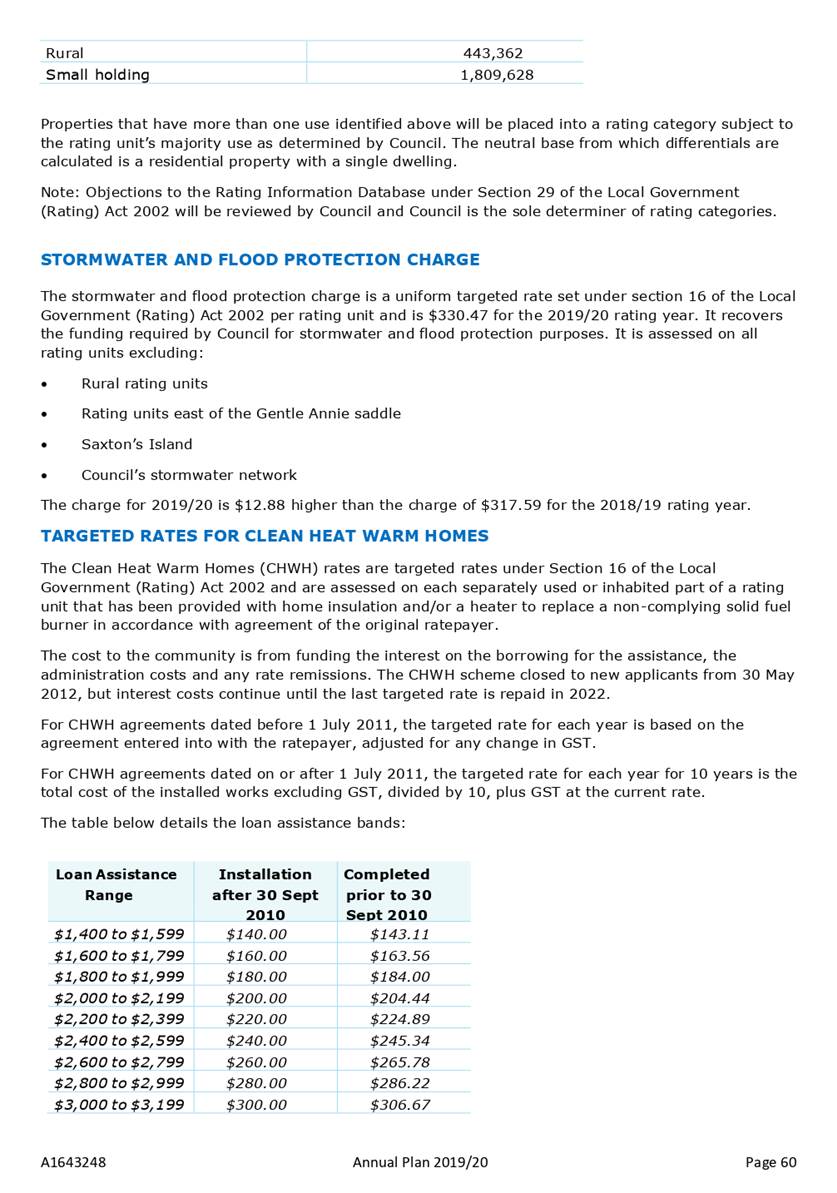

(7) Clean Heat Warm Homes

A targeted rate per

separately used or inhabited part of a rating unit that has been provided

with home insulation and/or a heater to replace a non-complying solid fuel

burner under Section 16 of the Local Government (Rating) Act 2002 in

accordance with agreement of the original ratepayer, of:

· For

properties levied the Clean Heat Warm Homes as a result of agreements entered

into after 1 July 2011, the targeted rate for each year for 10 years will be

the total cost of the installed works excluding GST, divided by 10, plus GST.

· For

properties levied the Clean Heat Warm Homes as a result of agreements entered

into prior to 1 July 2011 the targeted rate of:

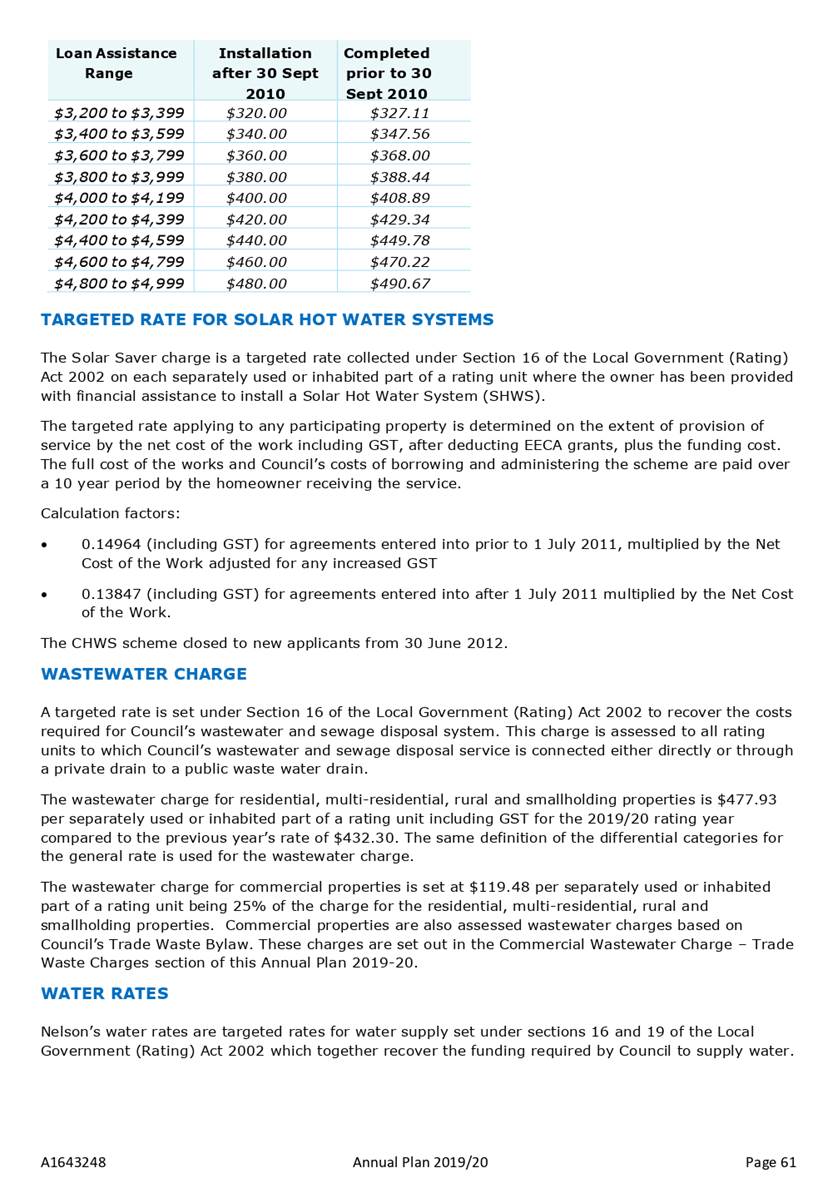

|

Loan Assistance Range

|

Installation after

30 Sept 2010

|

Completed prior to

30 Sept 2010

|

|

$1,400 to $1,599

|

$140.00

|

$143.11

|

|

$1,600 to $1,799

|

$160.00

|

$163.56

|

|

$1,800 to $1,999

|

$180.00

|

$184.00

|

|

$2,000 to $2,199

|

$200.00

|

$204.44

|

|

$2,200 to $2,399

|

$220.00

|

$224.89

|

|

$2,400 to $2,599

|

$240.00

|

$245.34

|

|

$2,600 to $2,799

|

$260.00

|

$265.78

|

|

$2,800 to $2,999

|

$280.00

|

$286.22

|

|

$3,000 to $3,199

|

$300.00

|

$306.67

|

|

$3,200 to $3,399

|

$320.00

|

$327.11

|

|

$3,400 to $3,599

|

$340.00

|

$347.56

|

|

$3,600 to $3,799

|

$360.00

|

$368.00

|

|

$3,800 to $3,999

|

$380.00

|

$388.44

|

|

$4,000 to $4,199

|

$400.00

|

$408.89

|

|

$4,200 to $4,399

|

$420.00

|

$429.34

|

|

$4,400 to $4,599

|

$440.00

|

$449.78

|

|

$4,600 to $4,799

|

$460.00

|

$470.22

|

|

$4,800 to $4,999

|

$480.00

|

$490.67

|

(8) Solar Hot Water

Systems

A targeted rate for any

separately used or inhabited parts of a rating unit that has been provided

with financial assistance to install a solar hot water system under Section

16 of the Local Government (Rating) Act 2002 in accordance with agreement of

the original ratepayer, of the following factors on the extent of provision

of service (net cost of the work including GST after deducting EECA grant, plus

funding cost):

· 0.14964

(including GST) for agreements entered into prior to 1 July 2011, multiplied

by the Net Cost of the Work adjusted for any increased GST.

· 0.13847

(including GST) for agreements entered into after 1 July 2011 multiplied by

the Net Cost of the Work.

Other Rating Information:

Due Dates for Payment of

Rates

The above rates

(excluding water volumetric rates) are payable at the Nelson City Council

office, 110 Trafalgar Street, Nelson and shall be payable in four instalments

on the following dates:

|

Instalment Number

|

Instalment Due Date

|

Last Date for Payment

|

Penalty Date

|

|

Instalment 1

|

1 August 2019

|

20 August 2019

|

26 August 2019

|

|

Instalment 2

|

1 November 2019

|

20 November 2019

|

26 November 2019

|

|

Instalment 3

|

1 February 2020

|

20 February 2020

|

26 February 2020

|

|

Instalment 4

|

1 May 2020

|

20 May 2020

|

26 May 2020

|

Rates instalments not

paid on or by the Last Date for payment above will incur penalties as

detailed in the section “Penalty on Rates”.

Due Dates for Payment of

Water Volumetric Rates

Residential water

volumetric rates are payable at the Nelson City Council office, 110 Trafalgar

Street, Nelson and shall be payable on the following dates:

|

Billing Month

|

Last Date for Payment

|

Penalty Date

|

|

July 2019

|

20 September 2019

|

26 September 2019

|

|

August 2019

|

20 September 2019

|

26 September 2019

|

|

September 2019

|

21 October 2019

|

25 October 2019

|

|

October 2019

|

20 December 2019

|

8 January 2020

|

|

November 2019

|

20 December 2019

|

8 January 2020

|

|

December 2019

|

20 January 2020

|

24 January 2020

|

|

January 2020

|

20 March 2020

|

26 March 2020

|

|

February 2020

|

20 March 2020

|

26 March 2020

|

|

March 2020

|

20 April 2020

|

24 April 2020

|

|

April 2020

|

22 June 2020

|

26 June 2020

|

|

May 2020

|

22 June 2020

|

26 June 2020

|

|

June 2020

|

20 July 2020

|

24 July 2020

|

Special (final) water

volumetric rates will be payable 14 days from the invoice date of the special

(final) water reading as shown on the water invoice.

Commercial water

volumetric rates are payable at the Nelson City Council office, 110 Trafalgar

Street, Nelson and shall be payable on the following dates:

|

Billing Month

|

Last Date for Payment

|

Penalty Date

|

|

July 2019

|

20 August 2019

|

26 August 2019

|

|

August 2019

|

20 September 2019

|

26 September 2019

|

|

September 2019

|

21 October 2019

|

25 October 2019

|

|

October 2019

|

20 November 2019

|

26 November 2019

|

|

November 2019

|

20 December 2019

|

8 January 2020

|

|

December 2019

|

20 January 2020

|

24 January 2020

|

|

January 2020

|

20 February 2020

|

26 February 2020

|

|

February 2020

|

20 March 2020

|

26 March 2020

|

|

March 2020

|

20 April 2020

|

24 April 2020

|

|

April 2020

|

20 May 2020

|

26 May 2020

|

|

May 2020

|

22 June 2020

|

26 June 2020

|

|

June 2020

|

20 July 2020

|

24 July 2020

|

Penalty on Rates

Pursuant to Sections 57

and 58 of the Local Government (Rating) Act 2002, the council authorises the

following penalties on unpaid rates (excluding volumetric water rate

accounts) and delegates authority to the Group Manager Corporate Services to

apply them:

· a

charge of 10% of the amount of each rate instalment remaining unpaid on the

penalty date as shown in the above table and also shown on each rate

instalment notice.

· a

charge of 10% will be added on 5 July 2019 to any balance from a previous

rating year (including penalties previously charged) remaining outstanding on

4 July 2019.

· a

further additional charge of 10% will be added on 8 January 2020 to any

balance from a previous rating year (including penalties previously charged)

remaining outstanding on 7 January 2020.

Penalty on Water

Volumetric Rates

Pursuant to Sections 57

and 58 of the Local Government (Rating) Act 2002, the council authorises the

following penalties on unpaid volumetric water rates and delegates authority

to the Group Manager Corporate Services to apply them:

• a charge of

10% of the amount of each volumetric water rate account remaining unpaid on

the penalty date as shown in the above table and also shown on each

volumetric water rate account.

Penalty Remission

In accordance with

Council’s rate remission policy, the Council will approve the remission

of the penalty added on instalment one due to late payment provided the total

annual rates are paid in full by 20 November 2019. If full payment of the

annual rates is not paid by 20 November 2019 the penalties relating to the

first instalment outlined above will apply.

The above penalties will

not be charged where Council has agreed to a programme for payment of

outstanding rates.

The Group Manager

Corporate Services is given discretion to remit rates penalties either in

whole or part in accordance with Council’s approved rates remission

policy, as may be amended from time to time.

Discount on Rates

Pursuant to Section 55 of

the Local Government (Rating) Act 2002, the Council will allow a discount of

2.0 percent of the total rates (excluding volumetric water rates) where a

ratepayer pays the year’s rates in full on or before the Last Date for

Payment for instalment one being 20 August 2019.

Payment of Rates

The rates shall be

payable at the Council offices, Civic House, 110 Trafalgar Street, Nelson

between the hours of 8.30am to 5.00pm Monday, Tuesday, Wednesday and Friday

and 9.00am to 5.00pm Thursday.

Where any payment is made

by a ratepayer that is less than the amount now payable, the Council will

apply the payment firstly to any rates outstanding from previous rating years

and then proportionately across all current year rates due; and

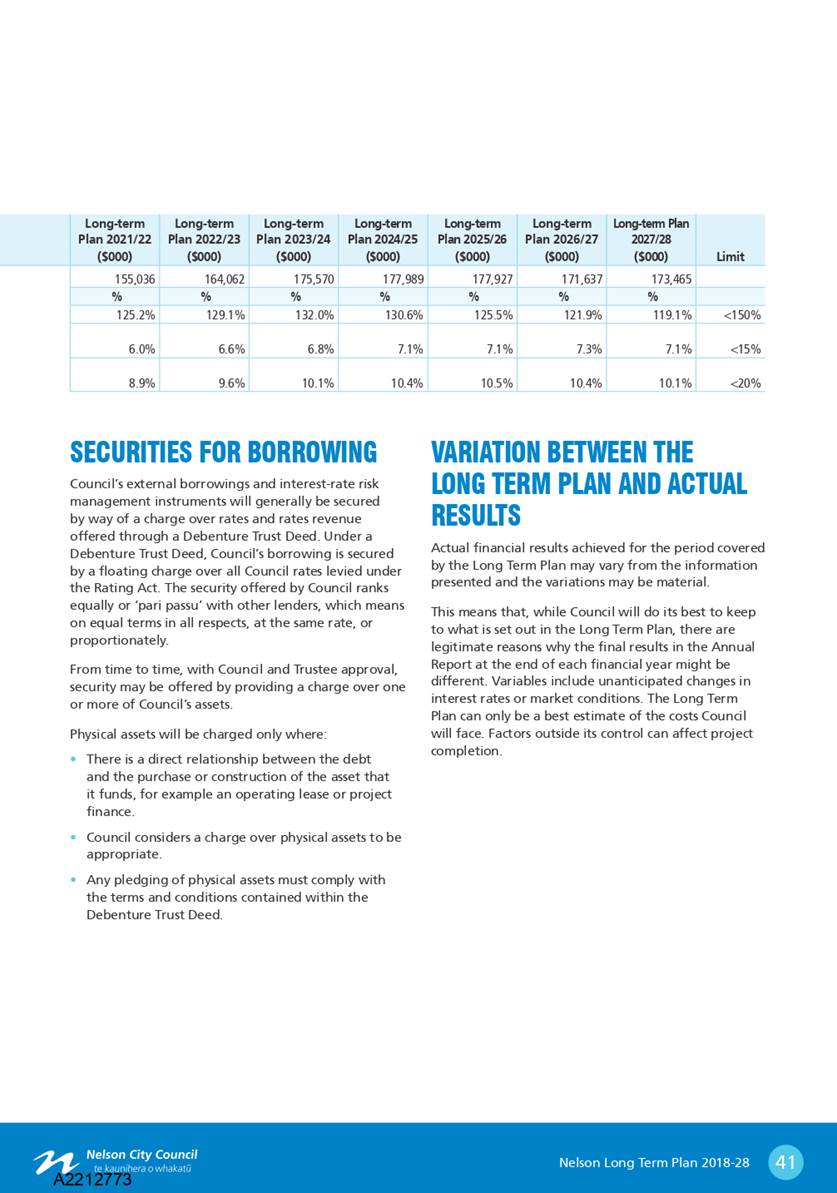

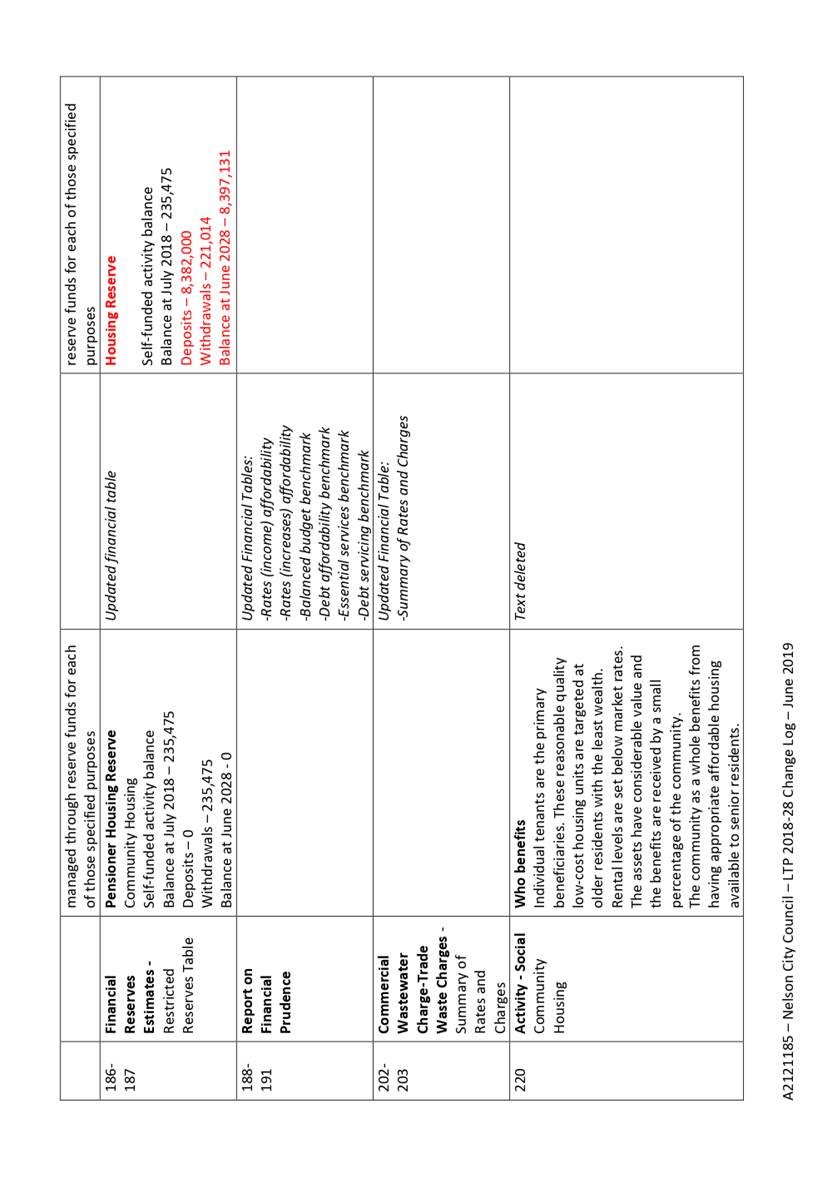

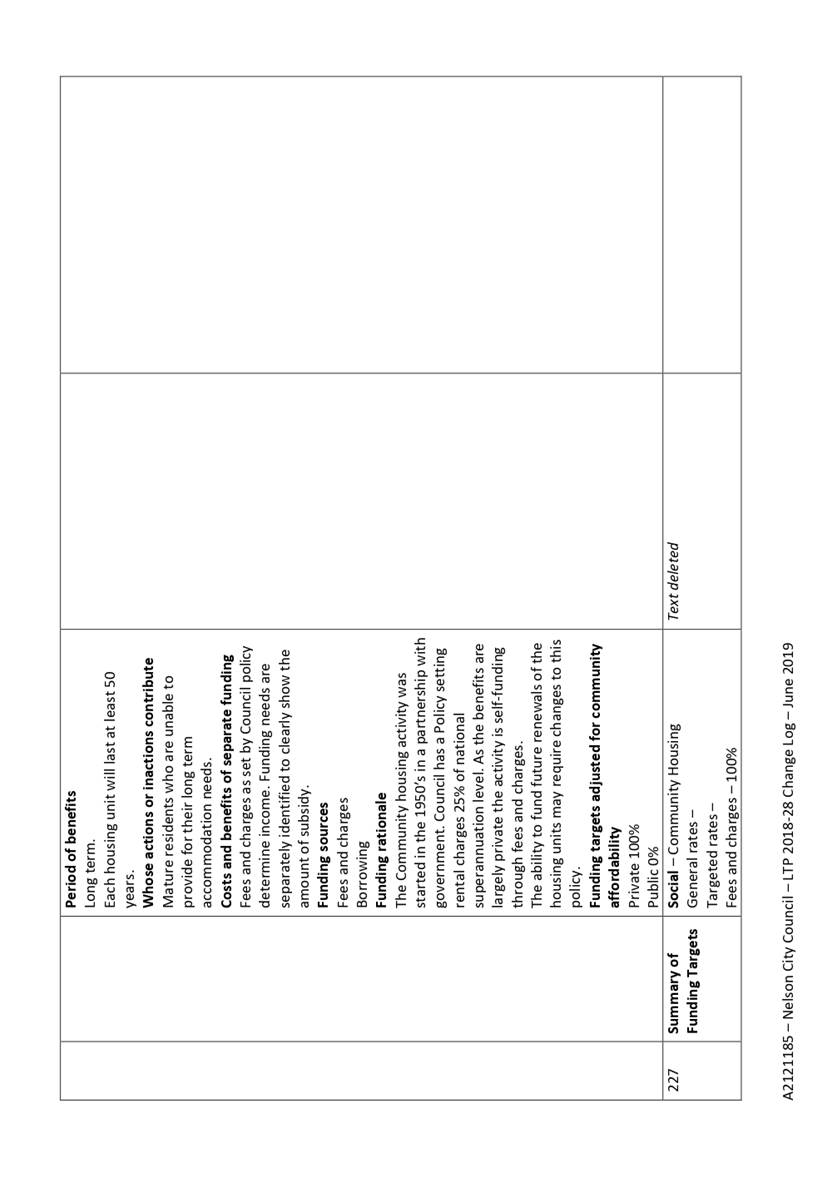

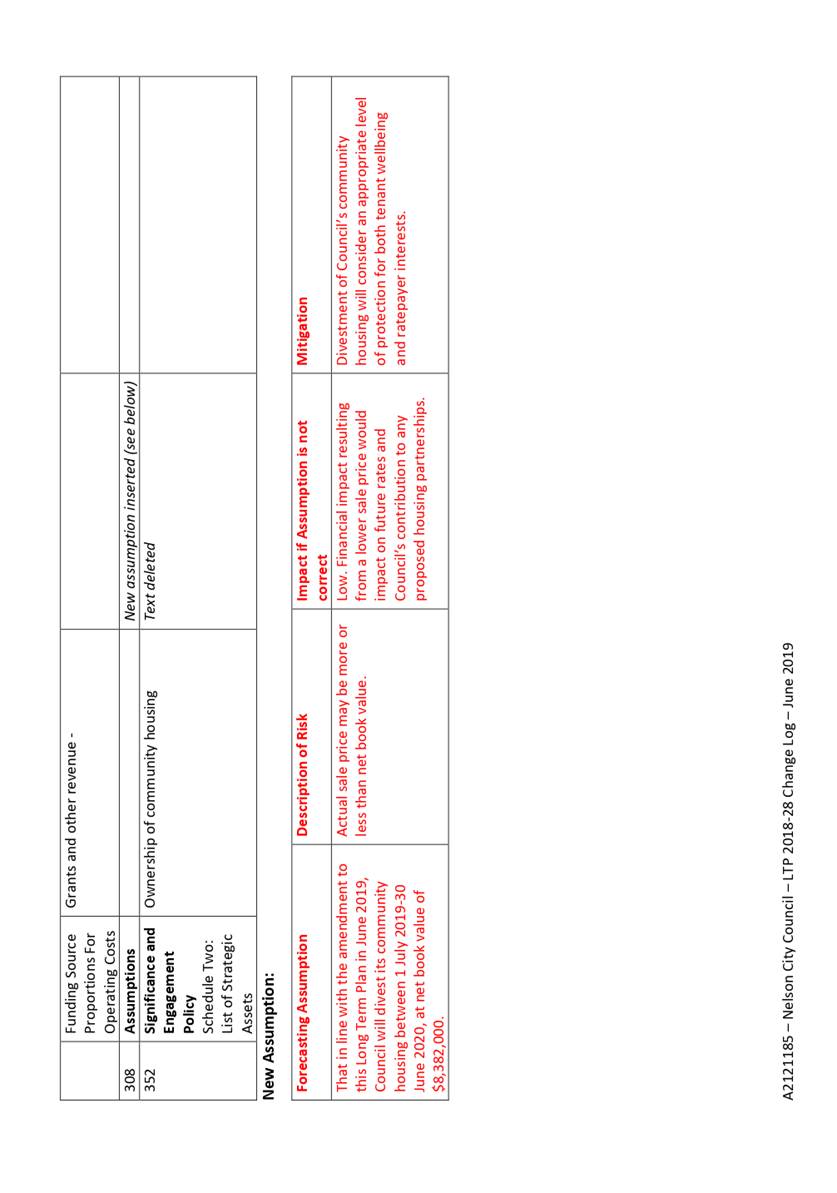

5. Adopts the amendments to the

Long Term Plan 2018-28 (A2212773) pursuant to Section 93 of the Local

Government Act 2002; and

6. Delegates the Mayor and

Chief Executive to make any necessary minor editorial amendments prior to the

release of the amended Long Term Plan 2018-28 to the public.

|

Nelson City Council

Nelson City Council