AGENDA

Ordinary meeting of the

Audit, Risk and Finance Subcommittee

Tuesday 25 September 2018

Commencing at 9.00a.m.

Council Chamber

Civic House

110 Trafalgar Street, Nelson

Pat Dougherty

Chief

Executive

Membership: Mr John Peters (Chairperson), Her Worship the

Mayor Rachel Reese, Councillors Ian Barker, Bill Dahlberg and Mr John Murray

Quorum: 3

Nelson

City Council Disclaimer

Please

note that the contents of these Council and Committee Agendas have yet to be

considered by Council and officer recommendations may be altered or changed by

the Council in the process of making the formal Council decision.

Guidelines for councillors

attending the meeting, who are not members of the Committee, as set out in

Standing Order 12.1:

·

All councillors, whether or not they are members of the

Committee, may attend Committee meetings

·

At the discretion of the Chair, councillors who are not Committee

members may speak, or ask questions about a matter.

·

Only Committee members may vote on any matter before the

Committee

It is good practice for both Committee members and

non-Committee members to declare any interests in items on the agenda.

They should withdraw from the room for discussion and voting on any of these

items.

Audit, Risk and Finance

Subcommittee

Audit, Risk and Finance

Subcommittee

25

September 2018

Page

No.

1. Apologies

Nil

2. Confirmation

of Order of Business

3. Interests

3.1 Updates

to the Interests Register

3.2 Identify

any conflicts of interest in the agenda

4. Public

Forum

5. Confirmation

of Minutes

5.1 14 August

2018 7 - 13

Document number M3685

Recommendation

That the

Audit, Risk and Finance Subcommittee

Confirms

the minutes of the meeting of the Audit, Risk and Finance Subcommittee, held on

14 August 2018, as a true and correct record.

6. Draft Annual Report

2017/18 14 - 17

Document number R9204

Recommendation

That the Audit, Risk and Finance Subcommittee

Receives the report Draft Annual

Report 2017/18 (R9204) and its

attachment (A1983431); and

Refers

all powers of the Audit Risk and Finance Committee relating to the adoption of

the final Annual Report 2017/18 to Council provided that there are no material

changes to the draft resulting from the audit.

Recommendation to Council

That the

Council

Notes

the draft Annual Report 2017/18 (A1983431) has been prepared and will be

audited before being presented to Council for adoption on 25 October 2018; and

Notes

that if there are material changes to the draft resulting from the audit, these

will be brought back to a specially convened Audit, Risk and Finance

Subcommittee meeting prior to the Council meeting on 25 October 2018; and

Considers

all matters relating to the adoption of the final Annual Report 2017/18

directly if there are no material changes to the draft resulting from the

audit.

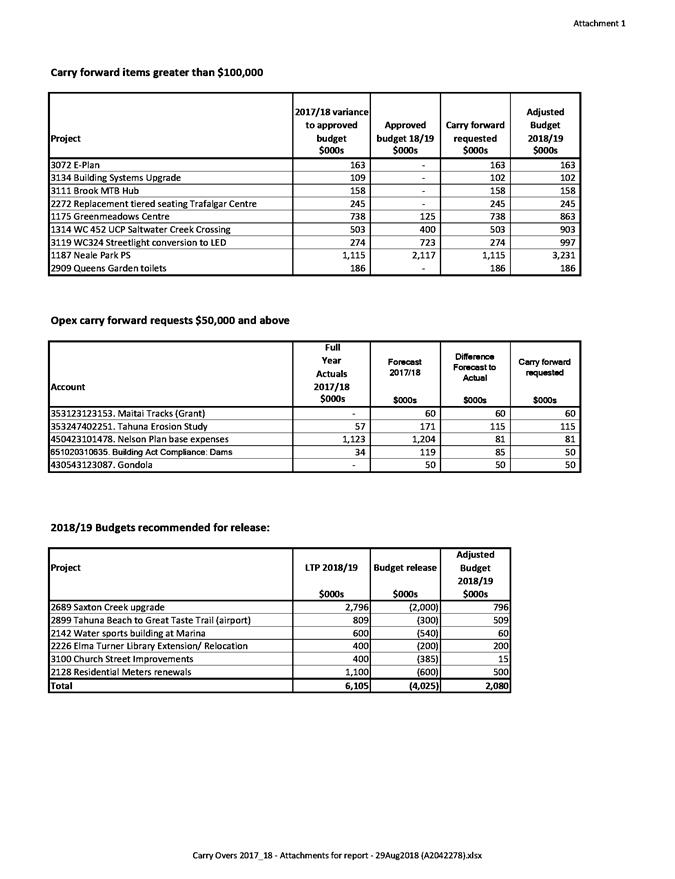

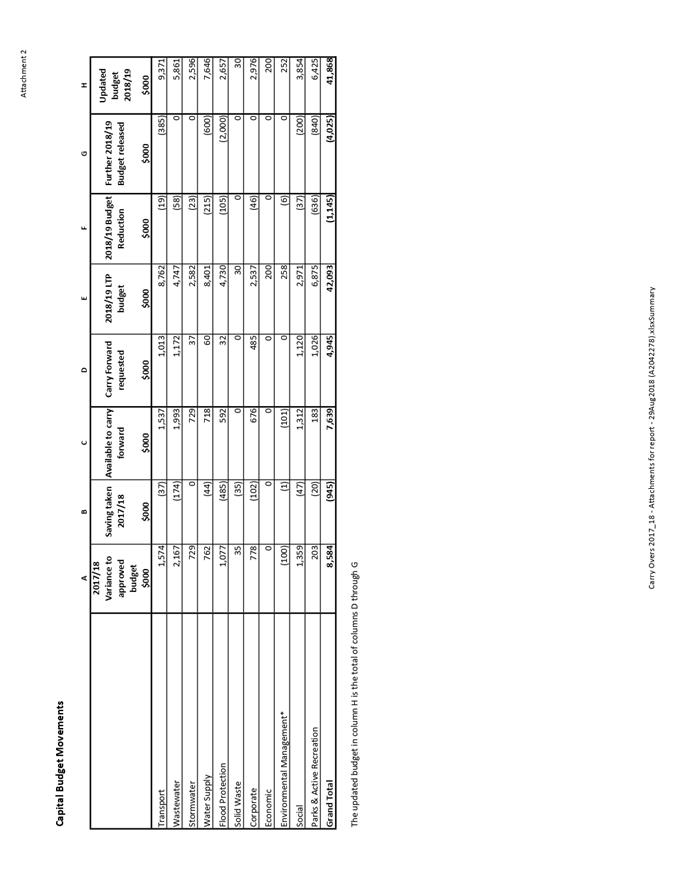

7. Carry Forwards

2017/18 18 - 26

Document number R9558

Recommendation

That the Audit, Risk and Finance

Subcommittee

Receives the report Carry Forwards

2017/18 (R9558) and its

attachment (A2042278).

Recommendation to Council

That the

Council

Approves

the carry forward of $4,945,000 unspent capital budget for use in 2018/19; and

Approves

the offsetting of $1,145,000 of capital spent in 2017/18 against 2018/19

budgets; and

Approves

the carry forward of $700,505 of unspent operating budget for use in 2018/19;

and

Approves

the release of $4,025,000 of 2018/19 capital budget unlikely to be spent as

itemised in attachment 1; and

Notes

savings in 2017/18 capital expenditure of $945,000; and

Notes

that the total capital budget (including staff costs but excluding

consolidations and vested assets) will be adjusted by these resolutions to a

total of $41,868,000.

8. Draft Internal Audit

Charter - Review September 2018 27 - 38

Document number R9637

Recommendation

That the Audit, Risk and Finance

Subcommittee

Receives the report Draft Internal

Audit Charter - Review September 2018 (R9637)

and its attachment (A2026584).

Recommendation to Council

That the

Council

Approves

the Draft Internal Audit Charter – Review September 2018 (A2026584).

9. Draft Annual

Internal Audit Plan - 30 June 2019 39 - 45

Document number R9657

Recommendation

That the Audit, Risk and Finance Subcommittee

Receives the report Draft Annual

Internal Audit Plan - 30 June 2019 (R9657)

and its attachment (A2026190).

Recommendation to Council

That the

Council

Approves

the Draft Annual Internal Audit Plan to 30 June 2019 (A2026190).

Public Excluded Business

10. Exclusion

of the Public

Recommendation

That the Audit,

Risk and Finance Subcommittee

Excludes

the public from the following parts of the proceedings of this meeting.

The

general subject of each matter to be considered while the public is excluded,

the reason for passing this resolution in relation to each matter and the

specific grounds under section 48(1) of the Local Government Official

Information and Meetings Act 1987 for the passing of this resolution are as

follows:

|

Item

|

General subject of each matter to be considered

|

Reason for passing this resolution in relation to each matter

|

Particular interests protected (where applicable)

|

|

1

|

Update on

Legal Proceedings Against Council

|

Section 48(1)(a)

The public conduct of this

matter would be likely to result in disclosure of information for which good

reason exists under section 7

|

The

withholding of the information is necessary:

· Section 7(2)(g)

To maintain legal professional

privilege

|

Audit, Risk and Finance

Subcommittee Minutes - 14 August 2018

Minutes of a meeting of

the Audit, Risk and Finance Subcommittee

Held in the Council

Chamber, Civic House, 110 Trafalgar Street, Nelson

On Tuesday 14 August 2018,

commencing at 9.04a.m.

Present: Mr

J Peters (Chairperson), Her Worship the Mayor R Reese, Councillors I Barker, B

Dahlberg and Mr J Murray

In

Attendance: Councillors G Noonan, M Rutledge, S Walker, Chief

Executive (P Dougherty), Group Manager Infrastructure (A Louverdis), Group

Manager Community Services (R Ball), Group Manager Corporate Services (N

Harrison), Manager Communications (P Shattock), Manager Governance and Support

Services (M Birch), Team Leader Governance (R Byrne) and Governance Adviser (R

Terry).

Apologies: Nil

1. Apologies

2. Confirmation of Order of

Business

There was no change to the order

of business.

3. Interests

There were no updates to the

Interests Register, and no interests with items on the agenda were declared.

4. Public Forum

There was no public forum.

5. Confirmation of Minutes

5.1 26 June

2018

Document number M3580, agenda

pages 6 - 9 refer.

|

Resolved AUD/2018/034

That the Audit, Risk and

Finance Subcommittee

Confirms the

minutes of the meeting of the Audit, Risk and Finance Subcommittee, held on

26 June 2018, as a true and correct record.

Murray/Dahlberg Carried

|

6. Chairperson's

Report

The

Chair noted that the Council was obtaining legal advice for the Greenmeadows

project and the Chief Executive would be conducting internal and external

reviews. The Terms of Reference for the reviews would be signed off by the

Mayor and Chair of Audit, Risk and Finance, Mr John Peters.

It was

noted that an external review was appropriate to determine how Council could

improve their processes moving forward. Confidence was expressed in the Chief

Executive.

Clarification

of the committee’s responsibilities and confirmation of governance

oversight of the reviews and reports was requested.

7. Quarterly Key Risks

Report - Quarter 2 Calendar 2018

Document number R9523, agenda

pages 10 - 26 refer.

Risk and Procurement Analyst,

Steve Vaughan presented the report. He advised the Council had

completed a test scenario for major disruptions on 27 July 2018 and observers

notes were being worked through. He noted that internal communications

and clarification of roles would be an area of focus.

There was discussion regarding

risk assessments and reporting, including:

·

Project delays were not being reported in detail to committees

·

Issues highlighted needed to be reported to the relevant Chair or

committee as soon as possible

·

The risk rating was spread across all projects, balancing out

ratings so that Council may not be aware of any individual issues.

It was noted that with some

capital projects significantly behind schedule, performance and delivery of

projects resolved in the Long Term Plan, 2018 – 28 could be compromised.

In response, it was advised that

there would be quarterly performance reporting to committees. It would include

a section on risks, current issues and activity budgets so that each committee

could review any potential risk to Council. Any projects over $1million

would still also be reported to Audit, Risk and Finance for review. These

changes would be introduced from the September quarter.

The subcommittee requested the

following amendments for risk assessments and reporting of organisational risks

to this subcommittee:

·

Greater clarity relating to risk for individual projects

·

Greater transparency of risk management and controls

·

Measuring and reporting on the effectiveness of the controls

·

Confirmation risk is being minimised and controlled

Mr Murray also requested a

separate report to cover Council’s risk management framework. This

would include the processes for risk identification and management, allocation

of risk to the correct person, and improvement of controls to ensure they are

effective.

The meeting was adjourned at

9.25am and reconvened at 9.32am.

|

Resolved AUD/2018/035

That the Audit, Risk and Finance

Subcommittee

Receives the report Quarterly

Key Risks Report - Quarter 2 Calendar 2018 (R9523) and its attachment Key

Organisational Risks Report Quarter 2 Calendar 2018 (A2011772).

Requests

a report that looks at the risk management framework and escalation of risks;

and

Requests

a report which provides more detail around the controls in place and

treatments including who is responsible and how effective the controls are

and the timeframes of treatments;

Requests

that the quarterly key risk report be revised so it is fit for the Audit,

Risk and Finance Subcommittee’s purpose, reflecting the feedback and

discussion at the current meeting.

Peters/Dahlberg Carried

|

8. Internal Audit -

Quarterly Progress Report to 30 June 2018

Document number R9533, agenda

pages 27 - 30 refer.

Internal Audit Analyst, Lynn

Anderson presented the report.

Ms Anderson said that there had

been an update to the contract renewals item on page 29; contract payments had

now been added to an electronic purchase order system. Work was being completed

to bring historic contracts in to the document management system. This

work was on-going and additional resources may be required.

The audit reports for monitoring

and management of contractor performance were currently being drafted and would

be presented to the Senior Leadership Team when complete. If any

high-risk findings were identified during the audit, the Chair would be

notified.

Group Manager Corporate Services,

Nikki Harrison provided an update on the annual audit plan, noting a new audit

programme would be presented at the next meeting in September after discussions

with Audit New Zealand and the Chair.

|

Resolved AUD/2018/036

That the Audit, Risk and Finance

Subcommittee

Receives the report Internal

Audit - Quarterly Progress Report to 30 June 2018 (R9533) and its attachment (A2008536).

Dahlberg/Barker Carried

|

9. Internal Audit - Summary

of New or Outstanding Significant Risk Exposures and Control Issues to 30 June

2018

Document number R9534, agenda

pages 31 - 34 refer.

Internal Audit Analyst, Lynn

Anderson presented the report.

There was discussion around the

significant risk exposures. Ms Anderson noted that the new contract

templates had improved the quality of the contracts and would assist to reduce

risk.

Ms Anderson said that work was

being done to prevent water contamination and sabotage of waterways, including

international research, controls and filters. There had been a duplication of

lines for any at-risk areas at the water treatment plant and frequent testing

and recording of data.

The new contracts template had

decreased risk going forward, but it was noted that a number of contracts in

the old template format were still in the system. It was decided that the Chair

of each committee would have a meeting with the relevant Group Manager to

understand any residual risk from older contracts.

In response to a question, Ms

Anderson noted that the control environment item at 3.2 was still current and

advice was being sought from the risk analyst to confirm the current risk

rating.

|

Resolved AUD/2018/037

That the Audit, Risk and Finance

Subcommittee

Receives the report Internal

Audit - Summary of New or Outstanding Significant Risk Exposures and Control

Issues to 30 June 2018 (R9534)

and its attachment (A2006732).

Barker/Murray Carried

|

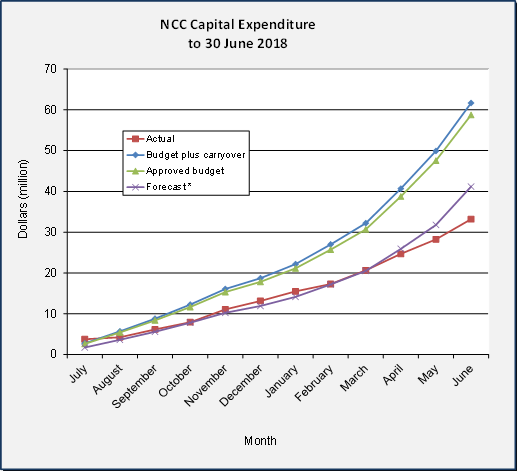

10. Corporate Report to 31 May 2018

Document number R9200, agenda

pages 35 - 45 refer.

Senior Accountant, Tracey Hughes

and Manager Capital Projects, Shane Davies presented the report.

Mr Davies advised there had been

an underspend on capital projects due to construction delays. A break-down of

the underspend, by project, was requested, including timeframes for staging and

completion.

The committee expressed its

concern regarding the capital underspend only becoming apparent at this stage.

It was agreed that the Chairs would be informed of any project issues at their

weekly meetings with the Group Manager and any issues would be further reported

to the Mayor.

Group Manager Corporate Services,

Nikki Harrison noted an underspend of $700,000 within the IT space on three

projects.

Further information would be

included in the carry forward report at the next meeting.

Attendance: Her Worship the Mayor Reese left the meeting at

12.08p.m and returned to the meeting at 12.15p.m.

|

Resolved AUD/2018/038

That the Audit, Risk and Finance

Subcommittee

Receives the report Corporate

Report to 31 May 2018 (R9200)

and its attachments (A2023685 and A2025408).

Murray/Barker Carried

|

11. Health, Safety and Wellbeing

Performance Report

Document number R9217, agenda

pages 46 - 60 refer.

Health and Safety Adviser,

Malcolm Hughes presented the report.

Mr Hughes noted a correction on

page 47. Item 5.3 should read that ‘during this reporting period,

no councillors participated in a safe work observation’.

In response to questions, Mr

Hughes advised:

·

there were still a range of security measures in place at the

Stoke Library and that the youth worker’s contract would be extended

·

an update on the Elma Turner library upgrade and on the review of

procedures and practice in river monitoring work would be presented at the next

subcommittee meeting

·

a diving contractor had received a minor injury from a stingray

strike. This was a seasonal issue as they were attracted to shallow water in

the warmer weather. Mr Hughes would research and establish if further

precautions were required to ensure Council was following industry best

practice

·

worksafe observations - target measures would be set for

completion of observations

·

the possibility of driver training or withdrawing access to

vehicles for repeat offenders of speeding.

|

Resolved AUD/2018/039

That the Audit, Risk and Finance

Subcommittee

Receives the report Health,

Safety and Wellbeing Performance Report (R9217) and its attachment (A2011373).

Barker/Dahlberg Carried

|

12. Draft Governance Members' Protected

Disclosure Policy

Document number R9579, agenda

pages 61 - 73 refer.

Manager Governance and Support

Services, Mary Birch presented the report, noting this was a stand-alone policy

and would not need to be referenced in Standing Orders.

|

Resolved AUD/2018/040

That the Audit, Risk and Finance

Subcommittee

Receives the report Draft

Governance Members' Protected Disclosure Policy (R9579) and its attachment (A2013157).

Barker/Dahlberg Carried

|

|

Recommendation to Council

AUD/2018/041

That

the Council

Adopts

the Governance Members’ Protected Disclosure Policy (R9579).

Barker/Dahlberg Carried

|

There being no further business the meeting ended at

12.36pm.

Confirmed as a correct record of proceedings:

Chairperson

Date

Chairperson

Date

|

|

Audit, Risk and Finance Subcommittee

25 September 2018

|

REPORT R9204

Draft

Annual Report 2017/18

1. Purpose

of Report

1.1 To

provide a copy of the draft Annual Report 2017/18.

2. Summary

2.1 The

draft Annual Report for the 2017/18 financial year has been prepared and is

provided as Attachment 1, for information. It is in the process of being

audited and there are likely to be some changes as a result of the audit

process.

3. Recommendation

|

That the Audit, Risk and Finance Subcommittee

Receives the report Draft Annual

Report 2017/18 (R9204) and its

attachment (A1983431); and

Refers

all powers of the Audit Risk and Finance Committee relating to the adoption

of the final Annual Report 2017/18 to Council provided that there are no

material changes to the draft resulting from the audit.

|

Recommendation to Council

|

That the

Council

Notes the draft Annual Report

2017/18 has been prepared and will be audited before being presented to

Council for adoption on 25 October 2018; and

Notes that if there are

material changes to the draft resulting from the audit, these will be brought

back to a specially convened Audit, Risk and Finance Subcommittee meeting

prior to the Council meeting on 25 October 2018; and

Considers all matters relating

to the adoption of the final Annual Report 2017/18 directly if there are no

material changes to the draft resulting from the audit.

|

4. Background

4.1 The

purpose of the Annual Report is to compare Council’s actual performance

against the targets as set out in year three of the Long Term Plan 2015-25 and

Annual Plan 2017/18. It also provides accountability to the Nelson community

for the decisions made throughout the year.

5. Discussion

5.1 The

attached draft Annual Report 2017/18 is intended to provide Council with

information officers have to date. This is not the final Annual Report for the

year, and has not yet been audited. It is likely to require modification

through the auditing process. Some sections are still to be completed.

5.2 As

the final Annual Report 2017/18 is required to be adopted by Council within

four months of the end of the financial year, it is proposed that it be brought

to be brought to Council for adoption at Council’s 25 October meeting.

Given the time constraints, it is recommended that the Annual Report be

presented directly to Council, rather than to the Audit, Risk and Finance Subcommittee

first.

5.3 However,

if there are material changes to the draft Annual Report resulting from the

audit, these will be brought to a specially convened meeting of the Audit Risk

and Finance subcommittee prior to the Council meeting for information.

5.4 The

surplus before revaluation is $11.4 million more than budgeted. There are

multiple reasons for this variance which will be detailed in the final Annual

Report.

5.5 The

following items are better than budgeted – Development Contributions

($1.2 million) and salaries ($0.7 million). The following items are worse

than budgeted – Vested assets ($1.1 million), storm events ($0.8

million), other un-programmed maintenance ($0.6 million), unbudgeted

impairments, losses on disposal, abandoned assets ($1.7 million) and

derivatives revaluation ($0.8 million).

6. Options

6.1 This

report is provided for information. The Audit Risk and Finance Subcommittee has

the option to receive this report and attachment or not to receive this report

and attachment. It is recommended that the Subcommittee receives this report

and notes the final Annual Report 2017/18, with any changes resulting from the

audit process, will be presented directly to Council before the end of October.

7. Conclusion

7.1 An

Annual Report must be completed to comply with section 98 of the Local

Government Act 2002.

7.2 The

purpose of this report is to provide the Committee with a draft of the Annual

Report 2017/18. A final, audited report will be provided to Council for

adoption on 25 October 2018.

Author: Nicky

McDonald, Group Manager Strategy and Communications

Attachments

Attachment 1: A1983431

- Draft Annual Report 2017/18 - unaudited (Circulated separately) ⇨

|

Important considerations for decision making

|

|

1. Fit

with Purpose of Local Government

The Annual Report 2017/18 is a requirement of the Local

Government Act 2002 and fits the purpose of local government by providing

information about Council’s performance during 2017/18, thereby

promoting accountability.

|

|

2. Consistency

with Community Outcomes and Council Policy

The Annual Report 2017/18 contributes to the community

outcomes by measuring performance across the full range of Council

activities.

|

|

3. Risk

The content of the Annual Report is prescribed by statute

so there is a very low risk that it will not achieve the required outcome.

There is a risk that Council would not be able to adopt the Annual Report

2017/18 by 31 October and meet the requirements under the Local Government

Act 2002 if the final Annual Report is presented to the Audit Risk and

Finance Subcommittee first, rather than going directly to Council.

|

|

4. Financial

impact

Preparation and publication of the Annual Report can

be achieved within funding allocated in the Annual Plan.

|

|

5. Degree

of significance and level of engagement

The decision to receive this report is of low

significance. The final audited Annual Report will be provided to Council for

adoption in October. There will be a summary Annual Report available

following adoption of the final audited Annual Report and this will also be

made available to the public.

|

|

6. Inclusion

of Māori in the decision making process

No engagement with Māori has been undertaken in

preparing this report.

|

|

7. Delegations

The Audit Risk and Finance Subcommittee has the

following delegations to consider the Annual Report 2017/18.

Areas of Responsibility:

· Council’s

Annual Report

· Council’s

financial and service performance

Powers to Recommend:

· Adoption

of Council’s Annual Report

|

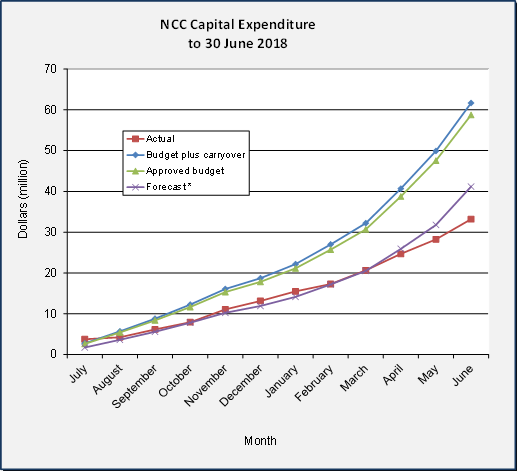

Item

7: Carry Forwards 2017/18: Attachment 1

|

|

Audit, Risk and Finance Subcommittee

25 September 2018

|

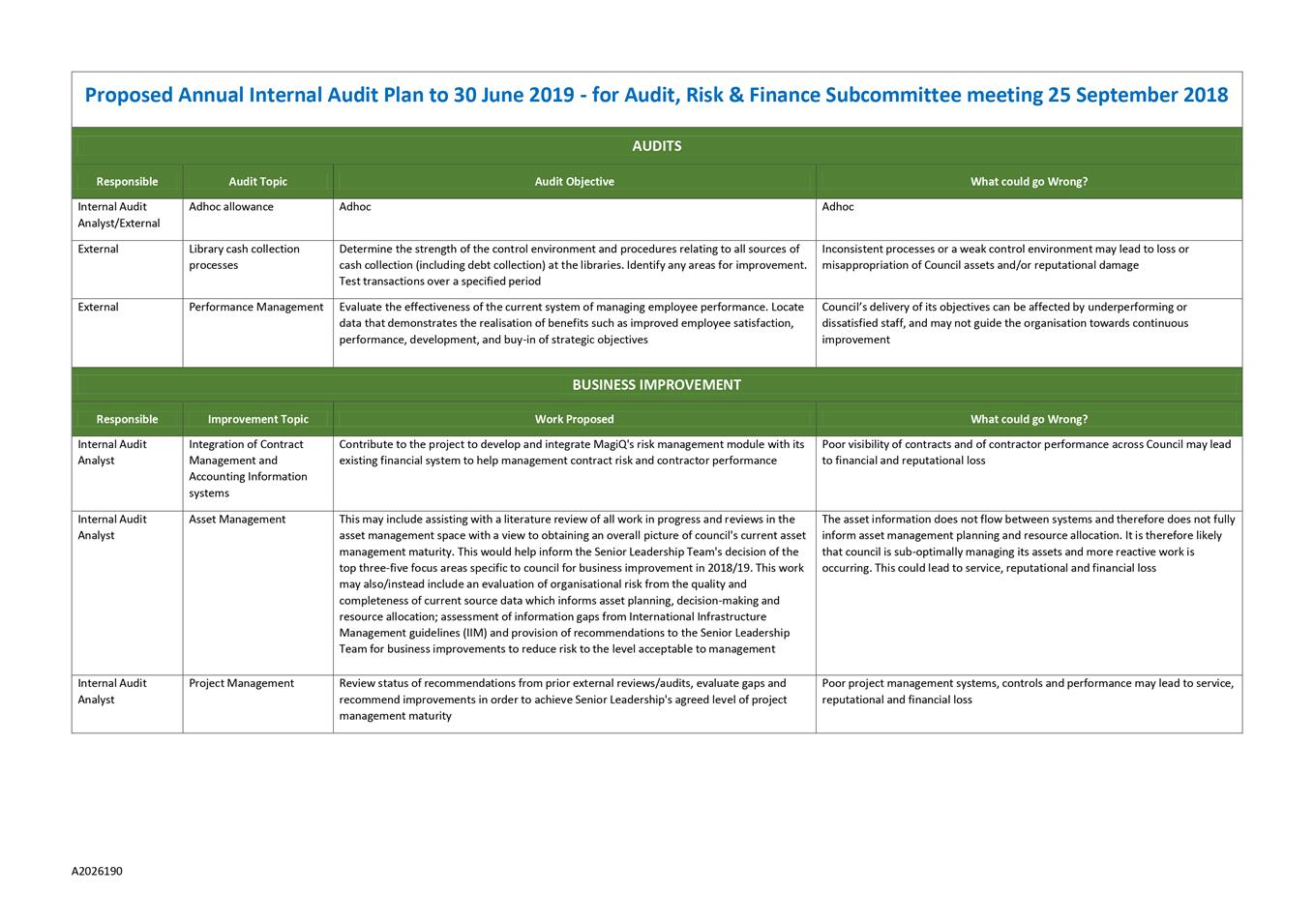

REPORT R9558

Carry

Forwards 2017/18

1. Purpose

of Report

1.1 To

approve carry forward of unspent budget to the new financial year.

2. Summary

2.1 Invoice

processing is complete for the 2017/18 financial year and officers have

reviewed project expenditure in order to identify savings and consider whether

unspent budget is still required.

3. Recommendation

1.

|

That the Audit, Risk and Finance

Subcommittee

Receives the report Carry

Forwards 2017/18 (R9558) and

its attachment (A2042278).

|

Recommendation to Council

|

That the Council

Approves

the carry forward of $4,945,000 unspent capital budget for use in 2018/19;

and

Approves

the offsetting of $1,145,000 of capital spent in 2017/18 against 2018/19

budgets; and

Approves

the carry forward of $700,505 of unspent operating budget for use in 2018/19;

and

Approves

the release of $4,025,000 of 2018/19 capital budget unlikely to be spent as

itemised in attachment 1 (A2042278); and

Notes

savings in 2017/18 capital expenditure of $945,000; and

Notes

that the total capital budget (including staff costs but excluding

consolidations and vested assets) will be adjusted by these resolutions to a

total of $41,868,000.

|

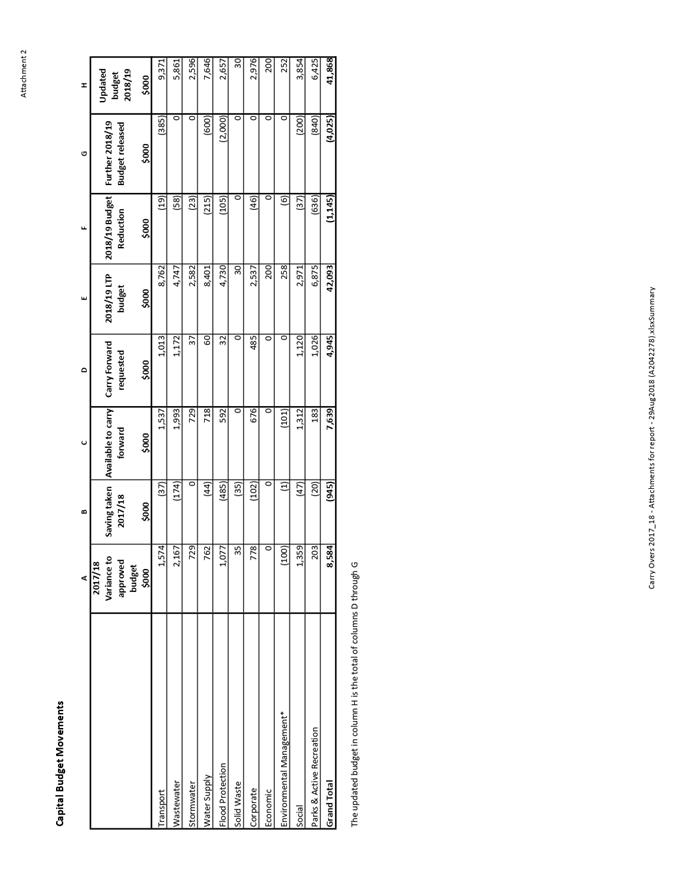

4. Background

4.1 The

capital programme for 2017/18, as agreed in the Annual Plan 2017/18, totalled

$55.7 million, including staff costs of $2.2 million and excluding Nelson

Regional Sewerage Business Unit (NRSBU). All figures quoted in this

report do not include vested assets.

4.2 The

addition of 2016/17 carry forwards, and other resolutions of Council over the

2017/18 year adjusted the total capital budget to $56.2 million.

4.3 The

2017/18 capital budgets were reforecast in January 2018 with a view to what

could realistically be achieved in the remainder of the financial year, to

inform the Long Term Plan process. The total capital budget was reforecast to

$39.4 million. Decisions made subsequent to that forecast brought the budget to

$41 million.

4.4 Total

capital expenditure for the 2017/18 year was $32.4 million, $8.6 million less

than forecast. Of this, $945,000 has been identified as savings.

4.5 Reasons

for capital carry forwards being requested include:

· alterations to the

phasing of multi-year projects

· reliance on external

funds

· delays created by

weather/season requirements, negotiations with external parties

· construction

delays

· lead time in

procuring materials and equipment

· projects running

behind time

4.6 Carry

forwards for operating budgets are presented for the approval of the

sub-committee and are requested to complete programmed work.

4.7 Once

the 2017/18 year was closed for invoice processing, officers collated data

relating to the projects undertaken during the year, identifying variances

against the reforecast. Project managers were asked to identify which variances

represented savings, and where they wished to carry forward budget into 2018/19

they were asked to support their request. The Senior Leadership Team have

reviewed the resulting information to ensure that the requested carry forward

is justified.

4.8 The

Corporate report presented at the 14 August 2018 subcommittee meeting indicated

an under-spend of $8.1 million against 2017/18 projections. After

revisions only $5 million carry forward has been requested. The

difference is essentially phasing changes on multi-year projects – for

projects where there is sufficient budget in 2018/19, the 2017/18 underspend

will need to be added down the line (2019/20 or even later) to maintain the total

project budget.

5. Discussion

Capital savings

5.1 Officers

identified $945,000 of net savings in capital expenditure against forecast.

This will have a positive impact on interest, depreciation and debt levels, in

excess of that already identified in the 2018/19 annual plan.

5.2 Savings

have been identified as follows:

5.2.1 On

completion of projects or stages of projects, for example:

· $165,000 renewal Jenner Road

wastewater

· $340,000 for York Stream

channel upgrade

· $141,000 Hampden St East Little

Go Stream stage 2

Capital carry

forwards

5.3 For

renewals budgets and multi-year projects, any spend over the 2017/18 projection

is considered a timing variance and is offset against the 2018/19 budget,

thereby reducing it in the amount of $1.1 million.

5.4 Officers

have requested that $5 million be carried forward and a total of $1.1 million

deducted from 2018/19. In addition, $4.0 million of 2018/19 budget should also

be deducted as project delays indicate that the budget will not be spent in

this financial year. This revises the total capital programme for 2018/19 to

$41.9 million (excluding vested assets and NRSBU but including staff time),

equivalent to the budget established through the long term plan of $42.1

million. Interest, depreciation, and debt relating the requested carry forward

amount was already built into year one of the 2018/28 Long Term Plan.

5.5 A

breakdown of budget movements in capital budgets is provided as Attachment 2.

5.6 Attachment

1 itemises capital projects with carry overs requested greater than $100,000

along with budget identified for release.

Operating expenditure carry forwards

5.7 Officers

were asked to identify operating projects and programmes that will be completed

in the new financial year and which require a carry- over of funds in order to

do so. A total of $0.7 million has been requested.

5.8 Totals

by activity are as follows:

5.9 Operating

programmes/projects with carry overs requested greater than $50,000 are

itemised in Attachment 1.

Reasons for requesting operating

carry forwards include:

· Grants or

collaborative expenditure agreed to

· Work contracted

but not complete at 30 June

· Health and safety

items which cannot be funded from 2018/19 budgets

· Programmed

maintenance delayed due to weather or contractor availability some of which has

now been spent in 2018/19

· Operating projects

that span more than one year

2. Other capital expenditure matters

5.10 The

sub-committee’s attention is drawn to the following two projects, namely

Saltwater Creek Bridge and Queens Gardens Toilets that will require additional

funding to ensure successful delivery. The reasons for this additional funding

is briefly covered below for each item, but separate more detailed reports will

be presented to the Works and Infrastructure and Community Services Committees

respectively.

5.10.1 Saltwater

Creek Bridge – Following closing of tenders and detailed evaluation, the

overall budget has been exceeded. This project attracts Urban Cycleway Funding

that needs to be spent by the end of June 2019.

5.10.2 Queens

Gardens Toilets – Following the withdrawal of the contractor from this

project and re-assessment of the estimate additional funding is required prior

to the project having to be re-tendered this financial year.

6. Options

6.1 Council

officers recommend Option 1, approve the recommendations. Not approving the

recommendations would be problematic as the future scope of some of these

projects has been agreed through Committee and Council resolutions including

Annual and Long Term Plans prior to this meeting. Work has continued on these

projects based on those decisions.

|

Option 1: Approve the

recommendations

|

|

Advantages

|

· Work

has continued on 2017/18 capital projects and programmed operating projects

and costs have been incurred.

· The carry

forward spending is within previously approved budgets.

|

|

Risks and Disadvantages

|

· None

|

|

Option 2: Approve carry

forwards with exceptions

|

|

Advantages

|

· Council

could if they wished remove some items from the list of budgets to be carried

forward.

· Savings

in future debt, depreciation, interest and maintenance costs would occur.

|

|

Risks and Disadvantages

|

· The

projects concerned would then not have sufficient budget to be completed.

· Council

do not have complete information through this report to fully inform such a

decision.

|

7. Conclusion

7.1 An

analysis of capital and programmed operating expenditure against forecast for

2017/18 and subsequent review by the Senior Leadership Team indicates:

· There are

savings from the capital budget of $945,000

· Renewals and

multi-year projects overspent by $1.1 million should be offset against 2018/19

budgets

· 2018/19

capital budgets should be further reduced by $4.0 million to acknowledge budget

that will not be spent

· $5 million

of capital budget not spent should be carried forward into 2018/19.

7.2 $0.7

million of programmed operating expenditure not spent should be carried forward

into 2018/19 to progress or complete programmed work that has already been

rated for.

Author: Tracey

Hughes, Senior Accountant

Attachments

Attachment 1: A2042278 - Carry forward

items ⇩

Attachment 2: A2042278

- Budget breakdown ⇩

|

Important considerations for decision making

|

|

1. Fit

with Purpose of Local Government

Approval of the recommendation will allow

progress/completion of approved projects, supporting the delivery of public

infrastructure and services.

|

|

2. Consistency

with Community Outcomes and Council Policy

Approval of this recommendation will allow projects as

approved in the Annual Plan 2017/18 and subsequent Council resolutions to be

delivered.

|

|

3. Risk

Failure to approve the recommendation will introduce risk

(financial, contractor and community relationships, health and safety) which

does not currently exist.

|

|

4. Financial

impact

There is little financial impact from approving the

recommendation as budgets are already approved and funded.

|

|

5. Degree

of significance and level of engagement

This matter is of low significance as budgets are

already approved and the recommendation confirms business as usual. Therefore

no engagement is required.

|

|

6. Inclusion

of Māori in the decision making process

No engagement with Māori has been undertaken in

preparing this report.

|

|

7. Delegations

The Audit, Risk and Finance Subcommittee has the

following delegations to consider the 2017/18 Carry Forwards.

Areas of Responsibility:

· Management

of financial risk

· Council’s

financial and service performance

Powers to Decide:

· None

Powers to Recommend:

· Any

matters within the areas of responsibility or such other matters referred to

it by the Council

|

Item

7: Carry Forwards 2017/18: Attachment 2

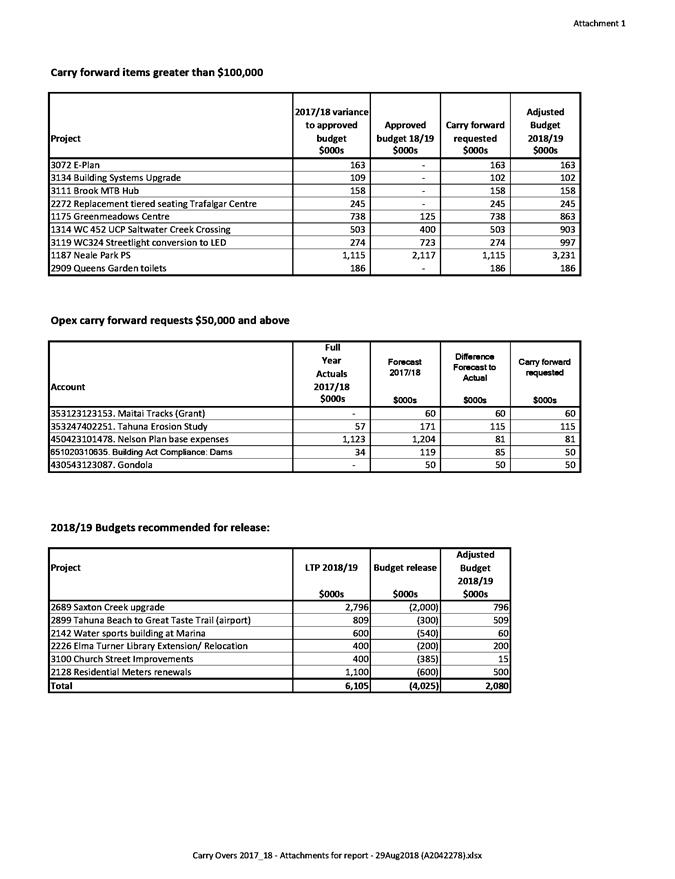

Item 8: Draft Internal

Audit Charter - Review September 2018

|

|

Audit, Risk and Finance Subcommittee

25 September 2018

|

REPORT R9637

Draft

Internal Audit Charter - Review September 2018

1. Purpose

of Report

1.1 To

seek approval for proposed changes to the Internal Audit Charter which will

enhance its relevance whilst upholding compliance with international internal

auditing standards.

2. Summary

2.1 Under

the International Standards for the Professional Practice of Internal

Auditing (Standards) and Nelson City Council’s Internal Audit

Charter, the Internal Audit Charter requires periodic review to ensure

relevance.

2.2 Changes

to the Charter must be considered by the Audit, Risk and Finance Subcommittee

and approved by Council.

2.3 The

proposed Internal Audit Plan to 30 June 2019, to be considered by the Audit,

Risk and Finance Subcommittee on 27 September 2018, includes activities to be

performed by internal audit that fall outside the internal audit function.

2.4 This

additional role for internal audit is considered necessary to respond to the

organisation’s current need to expedite business improvements

particularly in areas considered high risk.

2.5 The

blend of activities for internal audit has the potential to impair internal audit

objectivity, unless carefully managed.

2.6 The

attached proposed changes to the Charter are intended to address objectivity

concerns, comply with Standards, and assist the organisation to make business

improvements considered high priority.

3. Recommendation

|

That the Audit, Risk and Finance

Subcommittee

Receives the report Draft

Internal Audit Charter - Review September 2018 (R9637) and its attachment (A2026584).

|

Recommendation to Council

|

That the Council

Approves

the Draft Internal Audit Charter – Review September 2018 (A2026584).

|

4. Background

4.1 The

Internal Audit Charter was approved by Council on 15 October 2015. There is a

requirement under the Charter for periodic revision to ensure relevance.

This is the first revision since establishment.

4.2 The

International Standards for the Professional Practice of Internal Auditing

(Standards) require that a review of an internal audit Charter should include

any changes in roles or responsibilities that may affect the internal audit

activity, particularly those that have the potential to impair objectivity,

either in fact or appearance.

4.3 The

proposed Internal Audit Plan to 30 June 2019 incorporates activities to be

undertaken by internal audit that fall outside the area of internal audit.

4.4 The

existing Internal Audit Charter states that any changes require consideration

by the Audit, Risk and Finance Subcommittee and the approval of Council (by

recommendation of the Governance Committee), after taking into account the

recommendation of the Chief Executive.

5. Proposed

Changes to Charter

5.1 Minor

Changes

5.1.1 The

Introduction is now a Purpose Statement with a high-level description of how

that purpose will be achieved.

5.1.2 The

business unit Organisational Assurance no longer exists and is replaced with

Business Improvement.

5.1.3 Reference

to the Governance Committee in clause 4.2 has been removed.

5.2 More

Substantive Changes

5.2.1 Clause

5.1.1 now identifies that the reporting line to the business unit manager is

for administrative purposes. This is to clarify that the relationship does not

compromise independence.

5.2.2 Clause

5.1.2 now includes direct communication with the Chief Executive and Group

Manager Corporate Services (as well as the Chair of Audit, Risk and Finance).

This is to ensure matters of significant concern are promptly communicated to

the highest level.

5.2.3 Clause

5.1.3 strengthens the notion that, for the internal audit to function for

Council as intended, compliance with the international internal audit Code of

Ethics is paramount.

5.2.4 New

clauses have been added under section 5 (Organisation) which refer to the

responsibilities of the Senior Leadership Team in relation to internal audit.

Included is the provision of sufficient and timely resources to enable the

achievement of any approved Annual Internal Audit Plan; and clarification of

the overall responsibility for managing risks identified during internal

audits.

6. Proposed

Changes to the Internal Audit Plan Which May Impact on Objectivity

6.1 Internal

auditors must be objective in performing their work. For the first time since

the internal audit function was established, the proposed Annual Internal Audit

Plan to 30 June 2019 includes a blend of internal audit and business improvement

activities. This is not expected to be a permanent arrangement but may raise

objectivity concerns. The Chief Executive considers that in order to make real

business improvement gains this arrangement should extend to 30 June 2020.

6.2 The

Standards do not prohibit roles and responsibilities outside internal audit for

internal auditors. To counter possible objectivity impairment from this, there

is a requirement (Standard 1112) that where these roles or responsibilities

“may impair, or appear to impair, the organisational independence of

the internal audit activity or individual objectivity of the internal auditor”,

safeguards must be put in place. These include oversight activities, and may

include such activities as “periodically evaluating reporting lines

and responsibilities and developing alternative processes to obtain assurance

related to the areas of additional responsibility”.

6.3 Changes

to the Charter which are intended to address objectivity concerns (noting

applicable Standards) are:

6.3.1 Clause

6.2 specifies that objectivity impairment occurs when an internal auditor

performs an audit on an activity over which they had direct authority or

responsibility within the previous 12 months (Standards guidance 1130.A1).

6.3.2 Clause

6.3 requires that work to be performed by internal audit that falls outside the

internal audit function be pre-approved by Management and the Audit, Risk and

Finance Subcommittee.

6.3.3 Clause

6.3.1 provides the level of detail that may be required in order for that

approval to be properly considered. This includes a risk assessment, proposed

mitigations, and a plan to transition from this type of work (Standards 1000,

1130).

6.3.4 Clause

6.3.2 provides the option to obtain an independent assessment of the areas where

internal audit had undertaken roles outside internal auditing (Standard

1130.A2).

7. Options

7.1 The

preferred option is option 3 - that all proposed changes are accepted.

|

Option 1: Accept no changes

|

|

Advantages

|

· All

internal audit resource can be allocated to performing internal audits.

|

|

Risks and Disadvantages

|

· The

current Internal Audit Charter includes detail which is no longer accurate

and it does not clearly identify responsibilities. This could limit the effectiveness

of the internal audit activity.

· The

flow-on organisational impact from internal audits cannot be easily

accommodated with current organisational resourcing levels.

· Some

critical process improvements will be delayed without the assistance available

from internal audit.

|

|

Option 2: Accept all changes

except those which provide for a dual role for internal audit

|

|

Advantages

|

· All

internal audit resource can be allocated to performing internal audits.

|

|

Risks and Disadvantages

|

· The

flow-on organisational impact from internal audits cannot be easily

accommodated with current organisational resourcing levels.

· Some

critical process improvements will be delayed without the assistance

available from internal audit.

|

|

Option 3: Accept all changes

|

|

Advantages

|

· Allows

alignment to the organisation’s current business improvement needs and

organisational capacity.

· Provides

Council with the flexibility to best utilise the skills available in the

internal audit activity as business conditions change.

|

|

Risks and Disadvantages

|

· There

may be instances where an urgent audit is required but internal audit skills

are not available internally.

· This

risk is mitigated to an acceptable level in the Annual Audit Plan, with

allowance for an adhoc audit. Further, careful selection of both planned

internal audits, and of the business improvement areas proposed, ensure that

known high risk areas are being attended to.

|

Author: Lynn

Anderson, Internal Audit Analyst

Attachments

Attachment 1: A2026584 - DRAFT Internal

Audit Charter - 8Aug 2018 ⇩

|

Important considerations for decision making

|

|

1. Fit

with Purpose of Local Government

This decision will help to ensure the resources

available in internal audit contribute optimally to business improvement and

internal auditing that will help give confidence that Council will be able to

meet its responsibilities cost-effectively and efficiently.

|

|

2. Consistency

with Community Outcomes and Council Policy

This report supports the community outcome that

Council provides leadership, which includes the responsibility for protecting

finances and assets, and to have an infrastructure which is efficient and

cost effective.

|

|

3. Risk

There is more

risk that Council may not meet its responsibilities cost-effectively and

efficiently if this recommendation is not accepted.

|

|

4. Financial

impact

There is no financial impact from this decision.

|

|

5. Degree

of significance and level of engagement

This matter is of low significance because it does

not affect the level of service provided by Council or the way in which

services are delivered. Therefore no engagement has been undertaken.

|

|

6. Inclusion

of Māori in the decision making process

No engagement with Māori has been undertaken in

preparing this report.

|

|

7. Delegations

The Audit, Risk and Finance Subcommittee has the

delegation to consider changes to the Internal Audit Charter:

Area of Responsibility includes:

· The

internal audit function

Powers to Recommend:

· To

Council any matters within the areas of their responsibility

|

Item

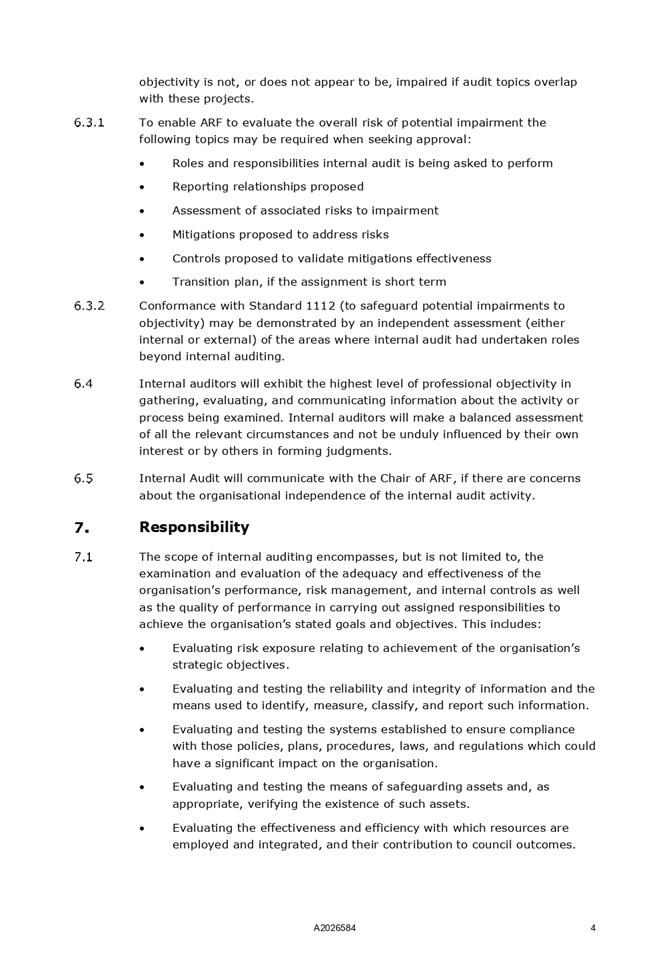

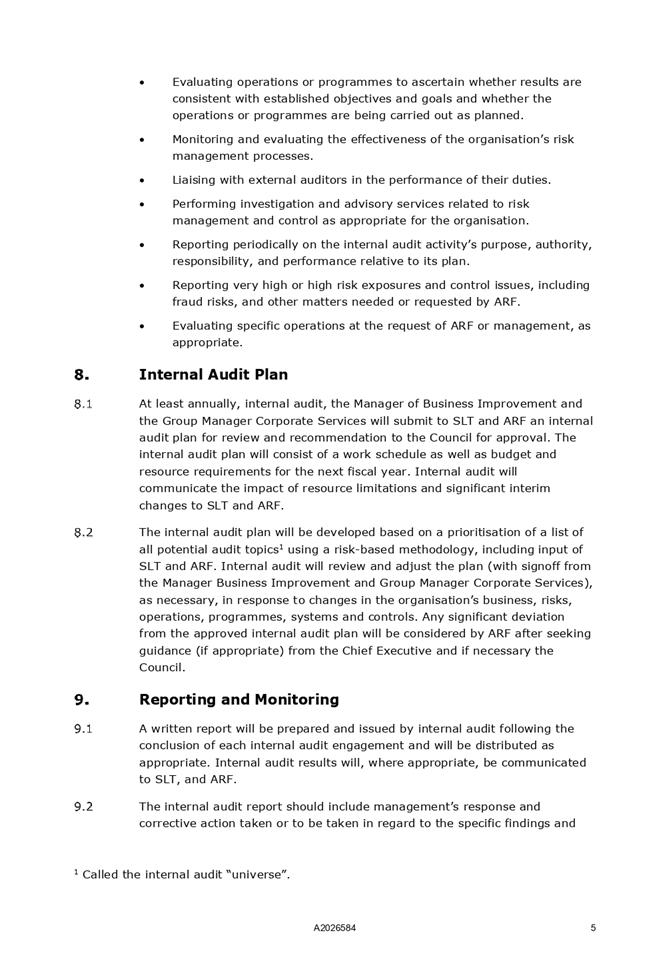

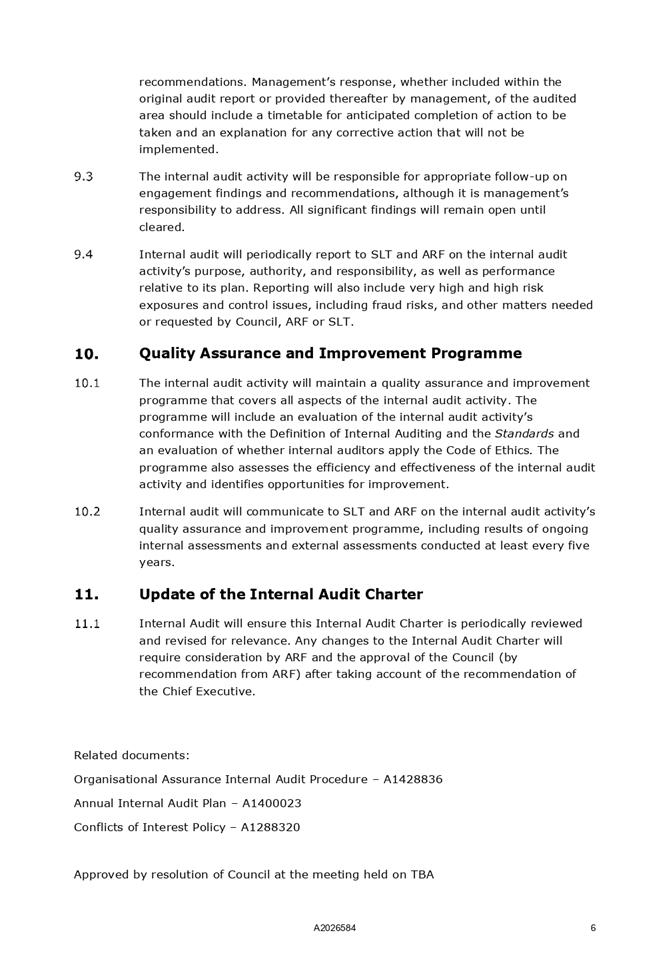

8: Draft Internal Audit Charter - Review September 2018: Attachment 1

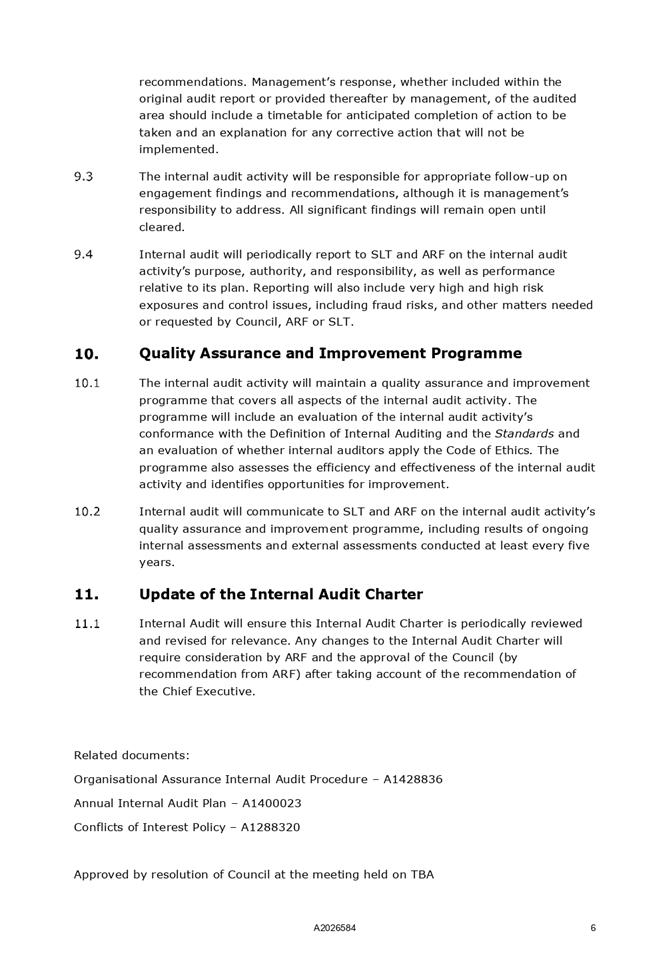

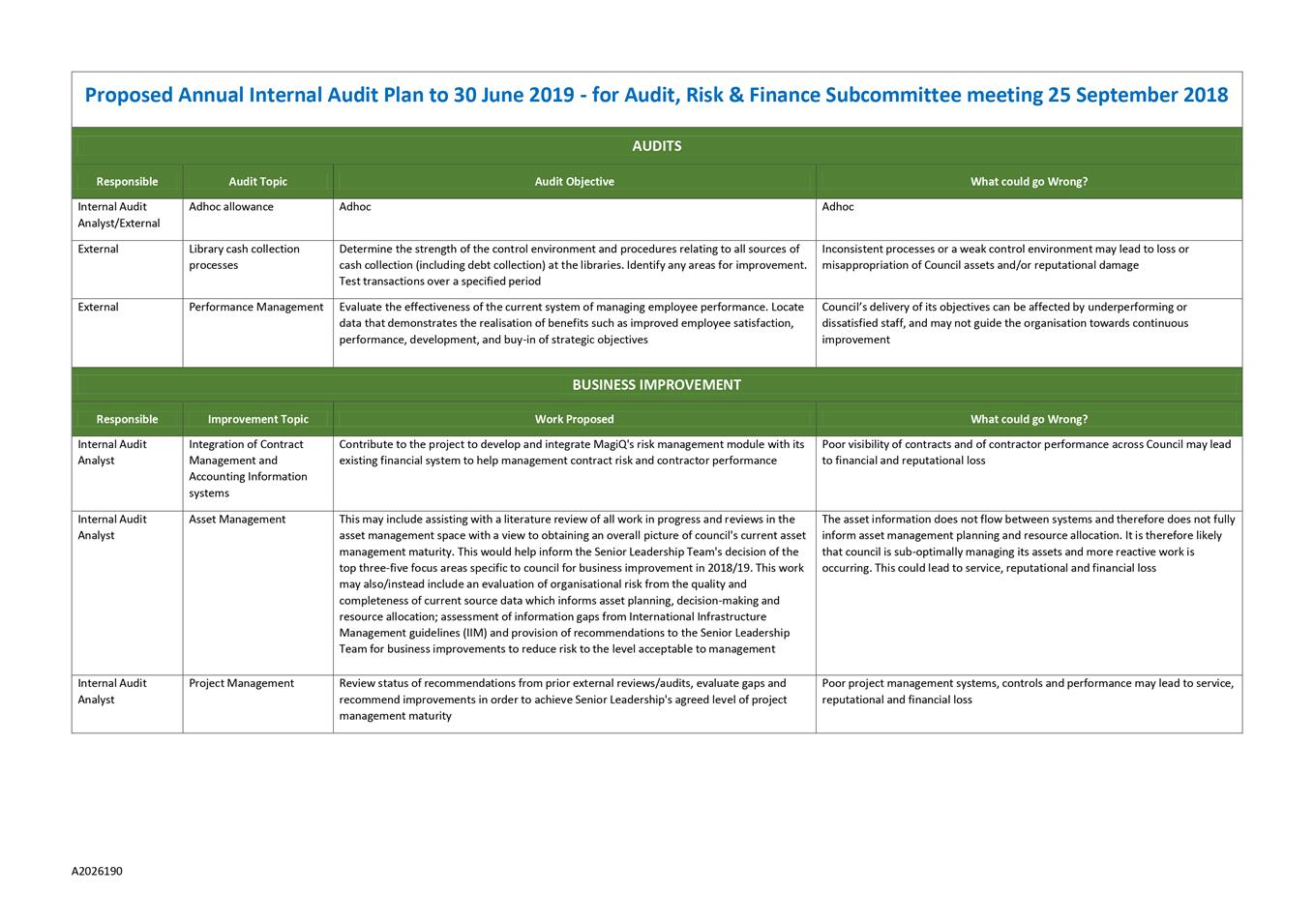

Item 9: Draft Annual

Internal Audit Plan - 30 June 2019

|

|

Audit, Risk and Finance Subcommittee

25 September 2018

|

REPORT R9657

Draft

Annual Internal Audit Plan - 30 June 2019

1. Purpose

of Report

1.1 To

approve the Draft Annual Internal Audit Plan to 30 June 2019.

2. Recommendation

|

That the Audit, Risk and Finance

Subcommittee

Receives the report Draft Annual

Internal Audit Plan - 30 June 2019 (R9657)

and its attachment (A2026190).

|

Recommendation to Council

|

That the Council

Approves

the Draft Annual Internal Audit Plan to 30 June 2019 (A2026190).

|

3. Background

3.1 The

Internal Audit Charter approved by Council on 15 October 2015 requires that

at least annually, the Audit, Risk and Finance Subcommittee consider the Annual

Internal Audit Plan.

3.2 The

Internal Audit Charter cl. 8.2 requires the Internal Audit Plan to respond

to changes in the business.

3.3 Historically,

approval for the following year’s Draft Internal Audit Plan (Draft Plan)

would have been sought prior to year-end. The Draft Plan for the year to 30

June 2019 has been delayed to allow Management to assess how to allocate the

internal audit resource to provide most benefit to the organisation. This

report reflects Management’s decision.

4. Discussion

4.1 The

Draft Plan (Attachment 1) was compiled following discussions with the Chief

Executive, Group Manager Corporate Services, Manager Business Improvement,

Chair of Audit, Risk and Finance and information provided by Audit NZ.

Council’s Top 10 risks, together with the accompanying discussion at the

14 August Audit, Risk and Finance Subcommittee meeting, have also been

considered.

4.2 Due

to the organisation’s current business improvement needs and stretched

capacity throughout, the Draft Plan incorporates a combination of internal

audits and business improvement activities. The Chief Executive considers that

currently this is the best use of the internal audit resource.

4.3 This

blending of internal audit and business improvement is not intended to be

permanent, however in order to make real business improvement gains the Chief

Executive is of the view that this arrangement should extend to 30 June 2020.

4.4 Council

approval for internal audit to have responsibilities outside the internal audit

function which do not compromise objectivity is being sought contemporaneously

through the Draft Internal Audit Charter.

Compilation of the Draft Internal Audit Plan and Best

Use of Internal Audit

4.5 Council

was made aware that the flow-on impact from internal audits places an

additional burden on management staff and therefore a high-volume internal

audit programme was unsustainable. A much-reduced Internal Audit Plan for the

year to 30 June 2018 was approved at the Council meeting of 9 November 2017.

4.6 The

Chief Executive has confirmed that the availability of staff to respond to

internal audits and their outcomes remains limited. Alongside this, Council has

a stated key goal in the Long Term Plan 2018-28 to lift Council performance.

4.7 The

Internal Audit Charter clause 8.2 requires the Internal Audit Plan to

respond to changes in the business.

4.8 The

Chief Executive believes that the best use of internal audit for this and next

financial year is to place some focus on business improvements which will

contribute to the achievement of the goal to lift Council performance. The key

activities for internal audit in this year’s plan therefore primarily

relate to business improvement, while proposed internal audits have been

allocated to contractors.

4.9 This

proposal will not require additional budget this financial year.

4.10 The

Draft Plan allows for one unexpected audit and two pre-determined audits (one

of which to focus on opportunities for the misappropriation of Council’s

assets).

4.11 Audit

NZ have flagged the delivery of projects and contract performance as an issue

for Council. We believe this has been (or will be) to some extent covered by

the management and monitoring of contractor performance audit performed late in

the 2017/18 financial year; the review of project management in 2014; and the

recently announced review to be commissioned for the Greenmeadows project.

There is undoubtedly business improvement required in this area and a review is

required to determine the status of recommendations from both the 2014 review

and from Audit NZ. This has been included in the business improvement section.

4.12 The

selection of audit topic to assess the opportunities for the misappropriation

of Council’s assets was supported by online data provided by the Office

of the Auditor General (last updated 23 July 2018) relating to such incidents

reported for 2017/18.

Note:

these incidents were discovered through internal tip-offs (2), external (2) tip-offs

(neither through whistle blower systems available), internal controls (7) or

internal audit (2).

|

|

Theft of Cash

|

Theft of Inventory

|

Credit or Fuel Card

Fraud

|

False Invoicing

|

Other Theft

|

Other

|

|

CCOs

|

|

1

|

3

|

|

|

|

|

Licencing &

Community Trusts

|

2

|

2

|

|

|

|

|

|

Local Authorities

|

2

|

|

|

1

|

1

|

1

|

4.13 The

Chief Executive considers that there are key business improvement projects to

help lift Council performance which internal audit could contribute to. These

include the development and alignment of a new contract management database to

the accounting information system, improvements to asset management systems and

processes, and an assessment of the status of project management improvements.

Time has been provided for these in the Draft Plan.

5. Options

5.1 Options

provided are to proceed with a level of internal audits based on previous

Plans, or for internal audit to concentrate on contributing to business

improvements. A reasonable level of internal audits will be performed in this

second option through the use of contractors.

5.2 Option

1, which proposes a higher level of audits, is not favoured. This will

overwhelm the organisation and resources will be diluted, compromising delivery

of the most critical improvements.

5.3 The

preferred option is Option 2. There are known improvement areas to lift Council

performance which require significant effort and the organisation currently has

limited resource for this work.

5.4 The

combination of performing a small number of audits to give the Audit, Risk and

Finance Subcommittee reasonable confidence that important controls are

performing as intended, and of contributing to business improvement, is

considered the most valuable use of the internal audit resource. Further, the

likelihood of an audit in which the objectivity of internal audit may be

compromised is low and mitigations have been addressed in the Draft Internal

Audit Charter. The arrangement proposed is for a relatively short period.

|

Option 1: Undertake a Higher

Level of Audits

|

|

Advantages

|

· Council

will have a greater knowledge of areas across the organisation where there

have been systems or control failures.

|

|

Risks and Disadvantages

|

· A

higher volume of internal audits impacts on the organisation, taking scarce

resources away from performing other key responsibilities, which may have

higher consequences to the organisation than those of the risks found from an

audit.

· While

control weaknesses are likely to be identified from an internal audit, the

ability to treat these is limited due to scarce resources.

|

|

Option 2: Approve Draft

Internal Audit Plan proposal

|

|

Advantages

|

· The

effort required to make business improvements that address these areas for

improvement is significant, and the impact of additional audits would take

resources available across the organisation away from these key improvement

areas.

· Remedying

some of the already known weaknesses as soon as practicable is in

Council’s best interests.

· The primary goal of business improvement is to increase effectiveness and efficiency to improve the

organisation’s ability to deliver services. A good improvement plan

will focus on the organisation’s most important activities and

any associated risks, and will address any necessary mitigations. This is

closely aligned to the internal audit process but is forward-looking, while

internal audit informs past performance.

|

|

Risks and Disadvantages

|

· There

may be future costs where external audits are required in areas where

internal audit has had some responsibility or involvement in the previous 12

months.

|

Author: Lynn

Anderson, Internal Audit Analyst

Attachments

Attachment 1: A2026190 - DRAFT Internal

Audit Plan to 30 June 2019 ⇩

|

Important considerations for decision making

|

|

1. Fit

with Purpose of Local Government

This decision will help to ensure the resources

available in internal audit contribute optimally to business improvement and

internal auditing that will help give confidence that Council will be able to

meet its responsibilities cost-effectively and efficiently.

|

|

2. Consistency

with Community Outcomes and Council Policy

This report supports the community outcome that

Council provides leadership, which includes the responsibility for protecting

finances and assets, and to have an infrastructure which is efficient and cost

effective.

|

|

3. Risk

It is more likely that Council may not meet its

responsibilities cost-effectively and efficiently if this recommendation is

not accepted.

|

|

4. Financial

impact

This decision will fit within existing budgets.

|

|

5. Degree

of significance and level of engagement

This matter is of low significance because it does

not affect the level of service provided by Council or the way in which

services are delivered. Therefore no engagement has been undertaken.

|

|

6. Inclusion

of Māori in the decision making process

No engagement with Māori has been undertaken in

preparing this report.

|

|

7. Delegations

The Audit, Risk and Finance Subcommittee has the

delegation to consider the Annual Internal Audit Plan and the resourcing for

this each year.

Areas of Responsibility:

· The

internal audit function

Powers to Recommend:

· To

Council any matters within the areas of their responsibility

|

Item

9: Draft Annual Internal Audit Plan - 30 June 2019: Attachment 1

Audit, Risk and Finance

Subcommittee

Audit, Risk and Finance

Subcommittee