AGENDA

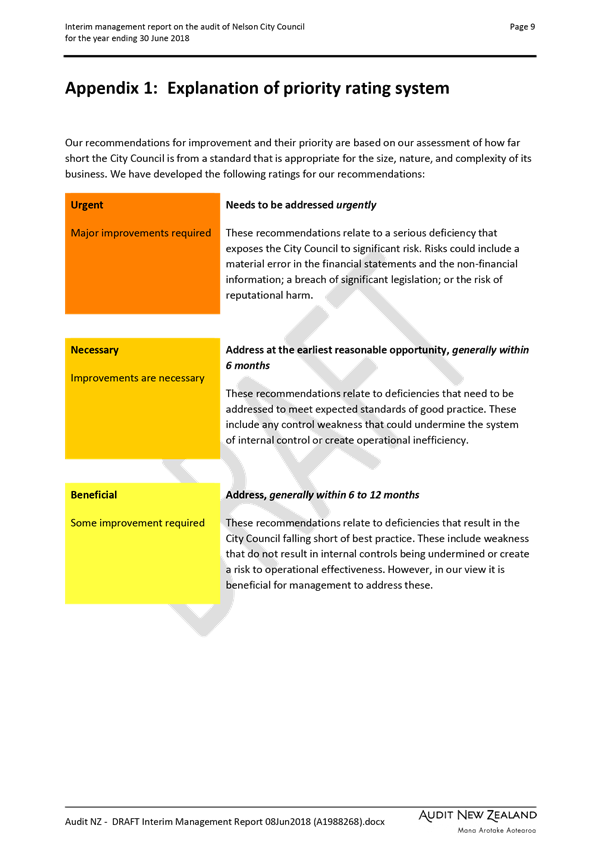

Ordinary meeting of the

Audit, Risk and Finance Subcommittee

Tuesday 26 June 2018

Commencing at 9.00a.m.

Council Chamber

Civic House

110 Trafalgar Street, Nelson

Membership: Mr John Peters (Chairperson), Her Worship the

Mayor Rachel Reese, Councillors Ian Barker, Bill Dahlberg and Mr John Murray

Guidelines for councillors

attending the meeting, who are not members of the Committee, as set out in

Standing Order 12.1:

·

All councillors, whether or not they are members of the

Committee, may attend Committee meetings

·

At the discretion of the Chair, councillors who are not Committee

members may speak, or ask questions about a matter.

·

Only Committee members may vote on any matter before the

Committee

It is good practice for both Committee members and

non-Committee members to declare any interests in items on the agenda.

They should withdraw from the room for discussion and voting on any of these

items.

Audit, Risk and Finance

Subcommittee

Audit, Risk and Finance

Subcommittee

26

June 2018

Page

No.

1. Apologies

Nil

2. Confirmation

of Order of Business

3. Interests

3.1 Updates

to the Interests Register

3.2 Identify

any conflicts of interest in the agenda

4. Public

Forum

5. Confirmation

of Minutes

5.1 15 May

2018 6 - 11

Document number M3483

Recommendation

That the

Audit, Risk and Finance Subcommittee

Confirms

the minutes of the meeting of the Audit, Risk and Finance Subcommittee, held on

15 May 2018, as a true and correct record.

6. Chairperson's Report

7. Annual Tax Review 12 - 23

Document number R9395

Recommendation

That the Audit, Risk and Finance

Subcommittee

Receives the report Annual Tax

Review (R9395) and its

attachments (A1847439 and A1985957).

8. Corporate Report to

30 April 2018 24 - 35

Document number R9396

Recommendation

That the Audit, Risk and Finance

Subcommittee

Receives the report Corporate

Report to 30 April 2018 (R9396)

and its attachments (A1969286 and A1986404).

9. Audit engagement

letter for year ending 30 June 2018 36 - 66

Document number R9208

Recommendation

That the Audit, Risk and Finance Subcommittee

Receives the report Audit

engagement letter for year ending 30 June 2018 (R9208) and its attachments (A1955165 and A1955166); and

Notes the Subcommittee can provide feedback

on the Audit engagement letter to Audit New Zealand if required, noting the

Mayor will sign the letter once the Subcommittee’s feedback has been

incorporated.

10. Interim

audit letter for the year ending 30 June 2018 67

- 83

Document number R9213

Recommendation

That the Audit, Risk and Finance

Subcommittee

Receives the report Interim audit

letter for the year ending 30 June 2018 (R9213)

and its attachment (A1988268); and

Notes

the suggested responses to the recommendations.

Note:

·

There is an Audit, Risk and Finance Subcommittee Workshop

following this meeting.

Audit, Risk and Finance

Subcommittee Minutes - 15 May 2018

Minutes of a meeting of

the Audit, Risk and Finance Subcommittee

Held in the Council

Chamber, Civic House, 110 Trafalgar Street, Nelson

On Tuesday 15 May 2018,

commencing at 9.10am

Present: Mr

J Peters (Chairperson), Councillors I Barker, B Dahlberg and Mr J Murray

In

Attendance: Councillor Courtney, Chief Executive (P Dougherty),

Group Manager Corporate Services (N Harrison) and Governance Adviser (Rebecca

Terry)

Apologies: Her

Worship the Mayor R Reese, and Councillor Barker for lateness.

1. Apologies

|

Resolved AUD/2018/018

That the Audit, Risk and

Finance Subcommittee

Receives and

accepts an apology from Her Worship the Mayor Rachel Reese, and Councillor

Barker for lateness.

Murray/Dahlberg Carried

|

2. Confirmation of Order of Business

The meeting was adjourned at

9.11am (at which time Her Worship the Mayor left the meeting, giving her

apologies for attendance). The meeting reconvened at 9.15am.

3. Interests

There were no updates to the

Interests Register, and no interests with items on the agenda were declared.

4. Public Forum

There was no public forum.

5. Confirmation of Minutes

5.1 13

February 2018

Document number M3252, agenda

pages 7 - 15 refer.

|

Resolved AUD/2018/019

That the Audit, Risk and

Finance Subcommittee

Confirms the

minutes of the meeting of the Audit, Risk and Finance Subcommittee, held on

13 February 2018, as a true and correct record.

Murray/Dahlberg Carried

|

6. Chairpersons

Report

There was no Chairperson’s report.

7. Status

Report - Audit Risk and Finance Subcommittee - 15 May 2018

Document number R9278, agenda

pages 16 - 17 refer.

Group Manager

Corporate Services, Nikki Harrison advised that Manager Governance and Support

Services, Mary Birch was currently investigating options for managing protected

disclosure for elected members. They would be collating information and working

with Tasman District Council to identify the most appropriate option.

|

Resolved AUD/2018/020

That the Audit, Risk and Finance

Subcommittee

Receives the report Status

Report - Audit Risk and Finance Subcommittee - 15 May 2018 (R9278) and its attachment (A1753947).

Dahlberg/Murray Carried

|

Attendance: Councillor Barker joined

the meeting at 9.20am.

8. Key

Organisational Risks - 1st Quarterly Report Calendar 2018

Document number R9223, agenda

pages 18 - 35 refer.

Risk and Procurement Analyst,

Steve Vaughan presented his report and answered questions in relation to how

risk was managed within business units, the effectiveness of risk management

controls and recruitment of staff.

|

Resolved AUD/2018/021

That the Audit, Risk and Finance

Subcommittee

Receives the report Key

Organisational Risks - 1st Quarterly Report Calendar 2018 (R9223) and its attachment (A1951823).

Murray/Dahlberg Carried

|

9. Corporate

Report to 31 March 2018

Document number R9198, agenda

pages 36 - 48 refer.

Senior Accountant, Tracey Hughes

and Manager Capital Projects, Shane Davies presented the report. Ms

Hughes noted a correction to the report, on page 37 at paragraph 4.2.6. The

last sentence should read: ‘The bar graph records year to date expenditure

against forecast expenditure by activity’.

Mr John Murray raised a question

about finances going to other committees. Group Manager Corporate

Services, Nikki Harrison confirmed this was not a requirement.

|

Resolved AUD/2018/022

That the Audit, Risk and Finance

Subcommittee

Receives the report Corporate

Report to 31 March 2018 (R9198)

and its attachments (A1958594 and A1956070).

Barker/Dahlberg Carried

|

10. Internal

Audit - Quarterly Progress Report to 31 March 2018

Document number R8842, agenda

pages 49 - 55 refer.

Internal Audit Analyst, Lynn

Anderson, presented the report.

|

Resolved AUD/2018/023

That the Audit, Risk and Finance

Subcommittee

Receives the report Internal

Audit - Quarterly Progress Report to 31 March 2018 (R8842) and its attachment (A1949842); and

Approves

the proposal to reduce the Internal Audit Plan to 30 June 2018 by three

audits.

Murray/Barker Carried

|

11. Internal

Audit - Summary of New or Outstanding Significant Risk Exposures and Control

Issues to 31 March 2018

Document number R9251, agenda

pages 56 - 61 refer.

Internal Audit Analyst, Lynn

Anderson, presented the report and responded to questions around business

continuity planning and delegations.

|

Resolved AUD/2018/024

That the Audit, Risk and Finance

Subcommittee

Receives the report Internal

Audit - Summary of New or Outstanding Significant Risk Exposures and Control

Issues to 31 March 2018 (R9251)

and its attachment (A1950727).

Dahlberg/Barker Carried

|

12. Health

Safety and Wellbeing Performance Report: January to March 2018

Document number R9216, agenda

pages 61 - 76 refer.

Health and Safety Adviser,

Malcolm Hughes presented the report.

Mr John Peters suggested a change

to the format of the Health Safety and Wellbeing Performance Report to include

a summary at the beginning of the report from the Health and Safety Adviser

outlining the main issues.

|

Resolved AUD/2018/025

That the Audit, Risk and Finance

Subcommittee

Receives the report Health

Safety and Wellbeing Performance Report: January to March 2018 (R9216) and its attachment (A1946126).

Dahlberg/Barker Carried

|

13. Exclusion

of the Public

|

Resolved AUD/2018/026

That

the Audit, Risk and Finance Subcommittee

Excludes

the public from the following parts of the proceedings of this meeting.

The

general subject of each matter to be considered while the public is excluded,

the reason for passing this resolution in relation to each matter and the

specific grounds under section 48(1) of the Local Government Official

Information and Meetings Act 1987 for the passing of this resolution are as

follows:

Barker/Dahlberg Carried

|

|

Item

|

General subject of each matter to be considered

|

Reason for passing this resolution in relation to

each matter

|

Particular interests protected (where applicable)

|

|

1

|

Current Legal

Proceedings

|

Section 48(1)(a)

The public conduct of this

matter would be likely to result in disclosure of information for which good

reason exists under section 7

|

The withholding of the

information is necessary:

· Section 7(2)(g)

To maintain legal

professional privilege

|

The meeting went into public

excluded session at 10.31am and resumed in public session at 10.52am.

14. Re-admittance

of the Public

|

Resolved AUD/2018/028

That

the Audit, Risk and Finance Subcommittee

Re-admits

the public to the meeting.

Barker/Dahlberg Carried

|

There being no further business the meeting ended at

10.53am.

Confirmed as a correct record of proceedings:

Chairperson

Date

Chairperson

Date

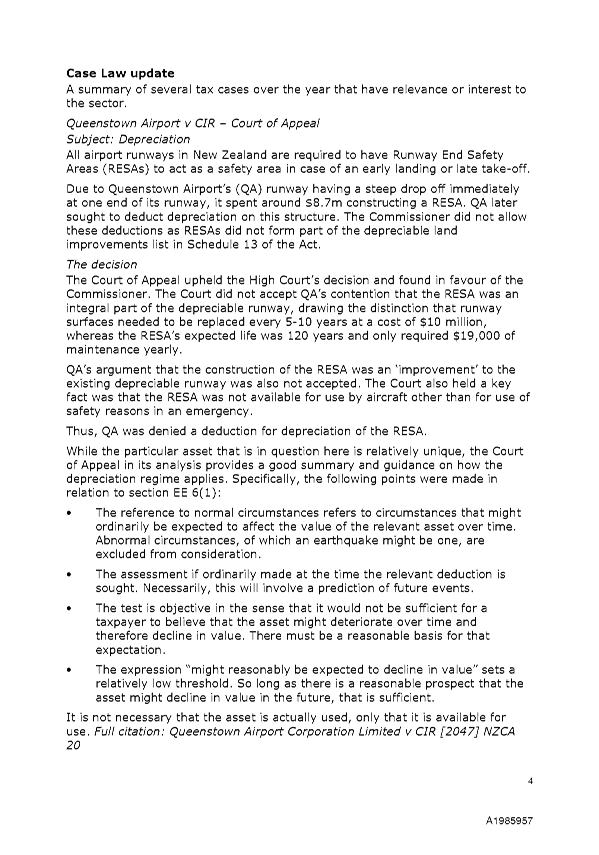

Item 7: Annual Tax

Review

|

|

Audit, Risk and Finance Subcommittee

26 June 2018

|

REPORT R9395

Annual

Tax Review

1. Purpose

of Report

1.1 To

advise the Subcommittee of Council’s tax activities over the prior year

and provide some context for the current tax environment.

2. Recommendation

1.

|

That the Audit, Risk and Finance

Subcommittee

Receives the report Annual Tax

Review (R9395) and its

attachments (A1847439 and A1985957).

|

2. Background

2.1 The

Tax Risk Governance Framework was adopted

by Council in May 2017 as a proactive step towards identifying and managing tax

risk to maintain its low risk profile. As part of the Tax Governance Framework,

staff have prepared this annual tax update.

2.2 This

report provides:

· A summary of the tax

advice that Council has sought during the period 1 July 2017 to 30 April 2018

· Commentary on tax

matters currently being addressed as at 30 April 2018

· A more general high

level update on the wider tax environment as it might affect Council.

Tax Advice received to 30 April

2018

2.3 For

the most part, the tax compliance of Council has been ‘business as

usual’ for much of the year with the various tax returns (GST, PAYE, FBT,

etc) being filed on time and without any concerns being raised.

2.4 That

said, it is appropriate to comment on the following areas where assistance has

been provided to Council:

· Council’s tax

advisors (PwC) submitted the voluntary disclosure (15 March 2018) on the

taxable income from a Council Controlled Trading Organisation (CCTO), being

Nelmac, and successfully applied for the adjustment to Council’s tax

losses without interest or penalties being applied;

· PwC prepared and filed

Council’s 2017 Income Tax Return on time in March 2018;

· Advice on the rules

around non-resident contractors tax (NRCT) and how the NRCT exemptions may

apply;

· In November 2017,

Council sought advice on the unclaimed money rules, how they apply to local

authorities and how a local authority might deal with funds not covered by the

rules; and

· In July 2017 PwC

provided advice in relation to the GST treatment currently adopted by Council,

as the Administering Authority in relation to the GST liabilities arising from

the Joint Committees with Tasman District Council.

Tax matters

currently being addressed

2.5 On

14 December 2017 the tax risk strategy was adopted by Council. This approach

supports Council to confidently demonstrate it is taking a proactive approach

in assessing its overall tax compliance and managing its tax risk effectively.

2.6 As

per that strategy, a comprehensive GST review will be undertaken in the second

week of June 2018. The scope of the review is as follows:

· Assess the extent to

which Council is compliant;

· Identify the level of

tax knowledge within the organisation as a whole;

· Determine the degree to

which Council has appropriate tax policies and procedures in place;

· Identify any instances

of non-compliance and advise on appropriate solutions to rectify past errors;

and

· Raise awareness of tax

compliance across the organisation and educate staff within the specific

organisational environment.

2.7 Two

Council officers attended the local government tailored ‘tax

update’ training held at St Arnaud by PwC in December 2017. These

training sessions not only ensure that personnel are aware of recent and

forthcoming developments, but also provide:

· A refresher of

fundamental tax principles that underpin all tax risk management; and

· An opportunity to

interact with personnel from other local authorities in the region (both

Nelson/Tasman and West Coast) which assists with overall collaboration.

2.8 A

Council officer also attended the tax session of the SOLGM strategic financial

management conference presented by PwC to hear about the latest tax updates.

2.9 Finally,

it is noted that Council has continued to obtain support via:

· Subscribing to

PwC’s online Indirect Tax Policies and Guides;

· Maintaining a Tax Risk

Governance Framework; and

· Adhering to a Tax Risk

Management Strategy.

Other relevant

matters

2.10 The

Department of Internal Affairs issued a paper on Better Local Government

Services. The discussion in this paper was converted into draft legislation,

contained in the Local Government Act 2002 Amendment Bill (No. 2) 2016 (the

Bill).

2.11 In

essence, this paper proposed changes to the legislation that would enable the

Local Government Commission to require local authorities to establish

substantive Council Controlled Organisations (CCOs) – in particular,

relating to the provision of water and transport services.

2.12 The

proposed changes had a number of impacts, and of note, potentially adverse

income tax compliance consequences. Submissions were prepared (primarily by

SOLGM) requesting that any substantive CCOs were exempt from income tax.

2.13 Following

Select Committee hearings, an update has been made to the Bill (i.e. per

Section CW 39B of the Income Tax Act 2007) which now provides local authorities

with an ability to allow certain CCOs to elect whether to be subject to income

tax or not. The Bill has yet to be enacted but further amendments are not

expected.

2.14 Inland

Revenue has been active in the Local Government sector over the last couple of

years and in the last 18 months, notified six local authorities that they are

considering undertaking an audit of their tax compliance. This is part of the

Inland Revenue’s general interest in encouraging organisations to be tax

compliant, and is part of their interest in the wider public sector. One of the

standard questions when Inland Revenue review any organisation is whether there

has been an independent assessment of tax compliance, and if so, to request any

reports issued.

2.15 Inland

Revenue’s ongoing internal transformation will have likely caused

disruption in this area. As such, an audit is not necessarily imminent and

indeed may never occur, but one cannot discount the possibility that it may. As

such it was timely to have in place a Tax Governance Framework and Tax Risk

Management Strategy to ensure that tax risk management is front of mind.

Council’s

tax figures

2.16 Generally

Council is exempt from income tax with the main exception being income from

CC(T)O’s. However, Council has significant tax obligations in relation to

GST and PAYE in particular. The quantum is highlighted in this section.

2.17 In

the 12 months ending 31 March 2018, Council has accounted for:

|

Tax

|

12 month period

ending

|

Amount

|

|

GST output tax

|

31 March 2018

|

$16,393,679

|

|

GST input tax

|

31 March 2018

|

$13,716,782

|

|

PAYE & ACC

|

31 March 2018

|

$5,329,908

|

|

FBT

|

31 March 2018

|

$9,555

|

2.18 Council

also acts as agent for the Nelson Regional Sewerage Business Unit, Nelson

Tasman Regional Landfill Business Unit and Nelson Tasman Civil Defence and

Emergency Management. The numbers above exclude these entities (except for the

NRSBU between July and December at which point NCC and NRSBU were separated for

GST return purposes).

3. Conclusion

3.1 Council

formally adopted the Tax Governance Framework on 18 May 2017 and the Tax Risk

Management Strategy on 14 December 2017. These form a solid foundation for

managing tax risk.

3.2 The

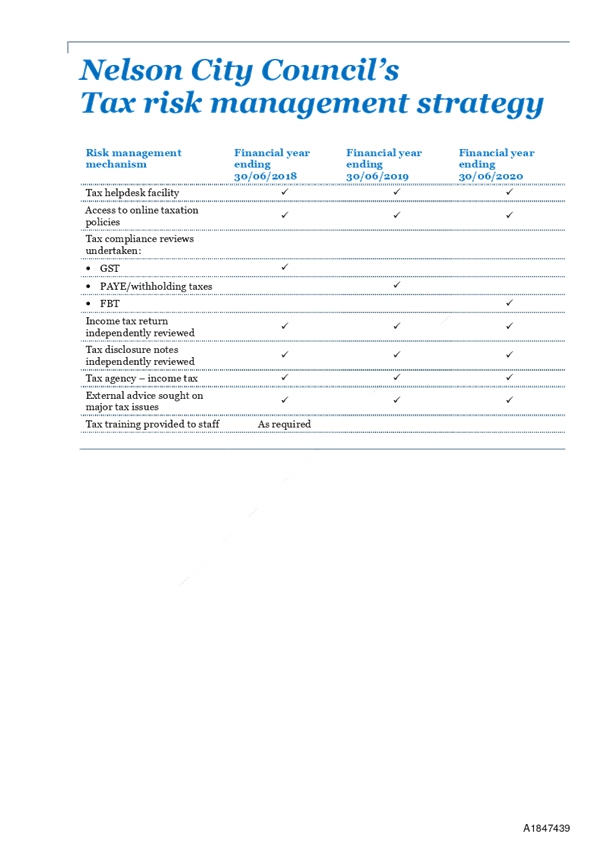

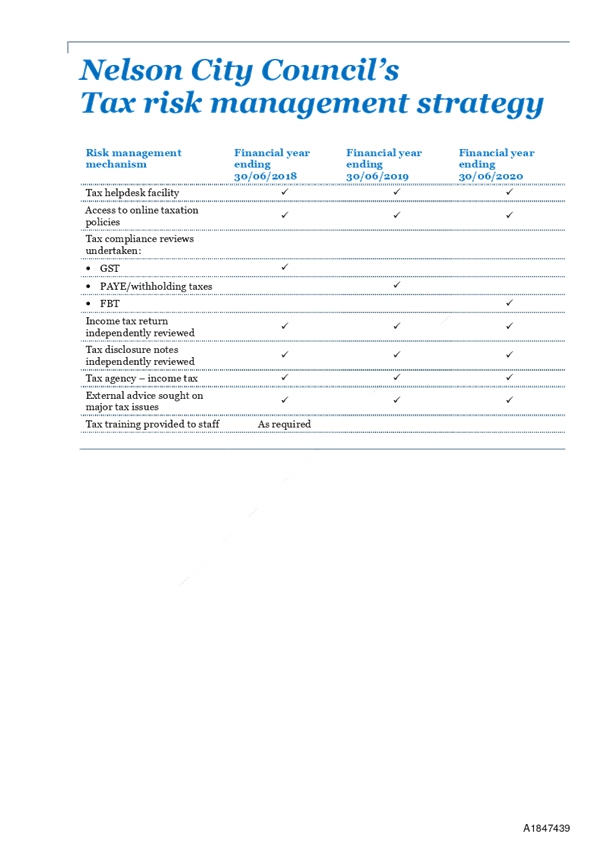

Tax Risk Management Strategy (attachment 1) is a simple tool to ensure that tax

risk is being identified and managed appropriately while providing the

Subcommittee with a quick visual tool to see the steps Council has taken to

manage tax risk and the forward looking strategy.

3.3 The

adoption of the Framework and the Strategy ensures that complacency does not

arise amongst the finance team, senior leadership team or those with oversight

for audit and risk.

Tracey

Hughes

Senior

Accountant

Attachments

Attachment 1: A1847439

- Tax risk management strategy ⇩

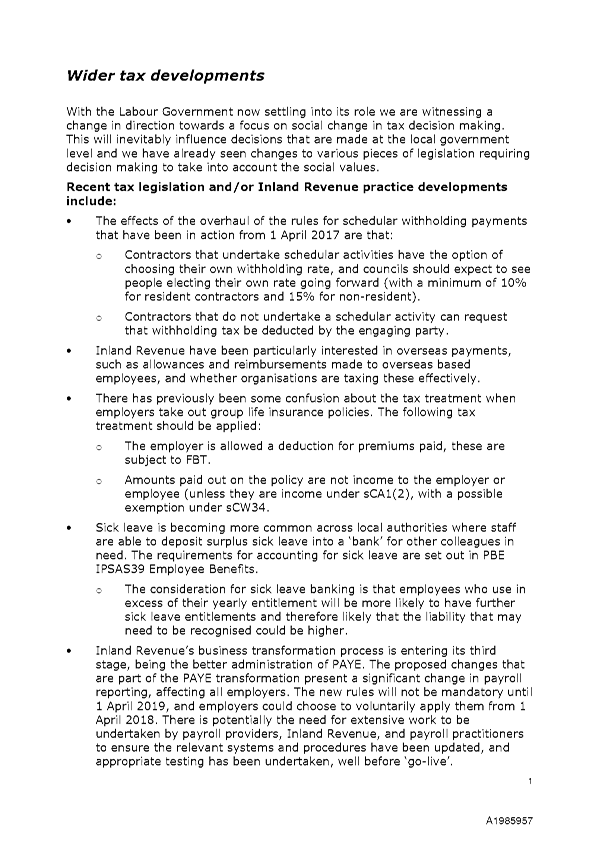

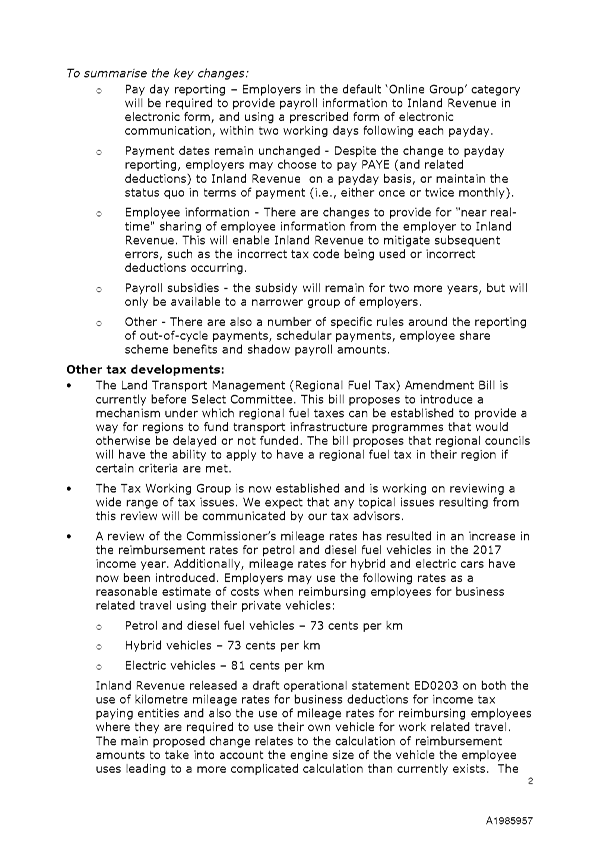

Attachment 2: A1985957

- Wider tax developments ⇩

Item

7: Annual Tax Review: Attachment 1

Item

7: Annual Tax Review: Attachment 2

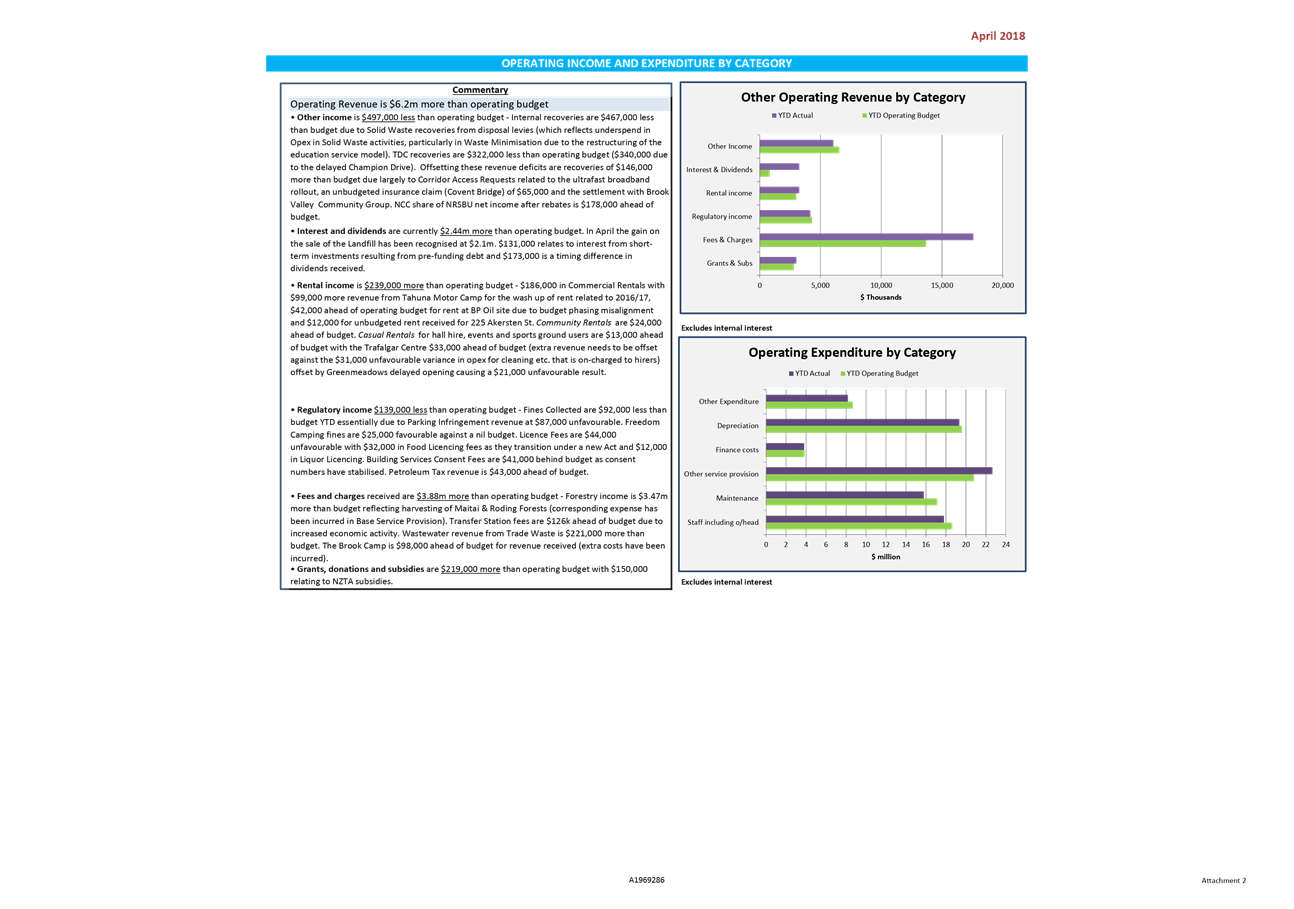

Item 8: Corporate

Report to 30 April 2018

|

|

Audit, Risk and Finance Subcommittee

26 June 2018

|

REPORT R9396

Corporate

Report to 30 April 2018

1. Purpose

of Report

1.1 To

inform the members of the Subcommittee of the financial

results of activities for the ten months ending 30 April 2018, compared to the

approved operating budget, and to highlight and explain any permanent and

material variations.

2. Recommendation

1.

|

That the Audit, Risk and Finance

Subcommittee

Receives the report Corporate

Report to 30 April 2018 (R9396)

and its attachments (A1969286 and A1986404).

|

3. Background

3.1 The financial reporting focuses on the ten month performance

compared with the year to date approved operating budget.

3.2 Unless

otherwise indicated, all measures are against approved operating budget, which

is the 2017/18 Annual Plan budget plus any carry forwards, plus or minus any

other additions or changes as approved by Council throughout the year.

3.3 Officers have assessed budgets and applied a range of phasing

mechanisms depending on the nature of the expenditure to reflect the timing of

anticipated actual income and expenditure.

4. Discussion

4.1 For the ten months ending 30 April 2018, the activity

surplus/deficits are $7.3 million favourable to budget.

4.2 The most significant variances are:

· $2.1m

unbudgeted income being the gain recognised on the transfer of the NCC landfill

assets to the joint landfill in exchange for a half share of the total assets

of the joint landfill. (This was accounted for differently in the

budget);

· $3.5m

income from forestry greater than budget, offset by $2.9m forestry harvesting

costs greater than budget (net income $0.6m favourable);

· Un-programmed

maintenance costs $0.9m more than budget mostly related to February storm

events;

· Other

maintenance $2.2m less than budget including some seasonal activities and the

delay of the desludging at the wastewater treatment plant;

· Invoicing

from TDC for the Velodrome and Saxton Drive projects behind budget $1m;

· Salaries

and overheads under budget $0.8m.

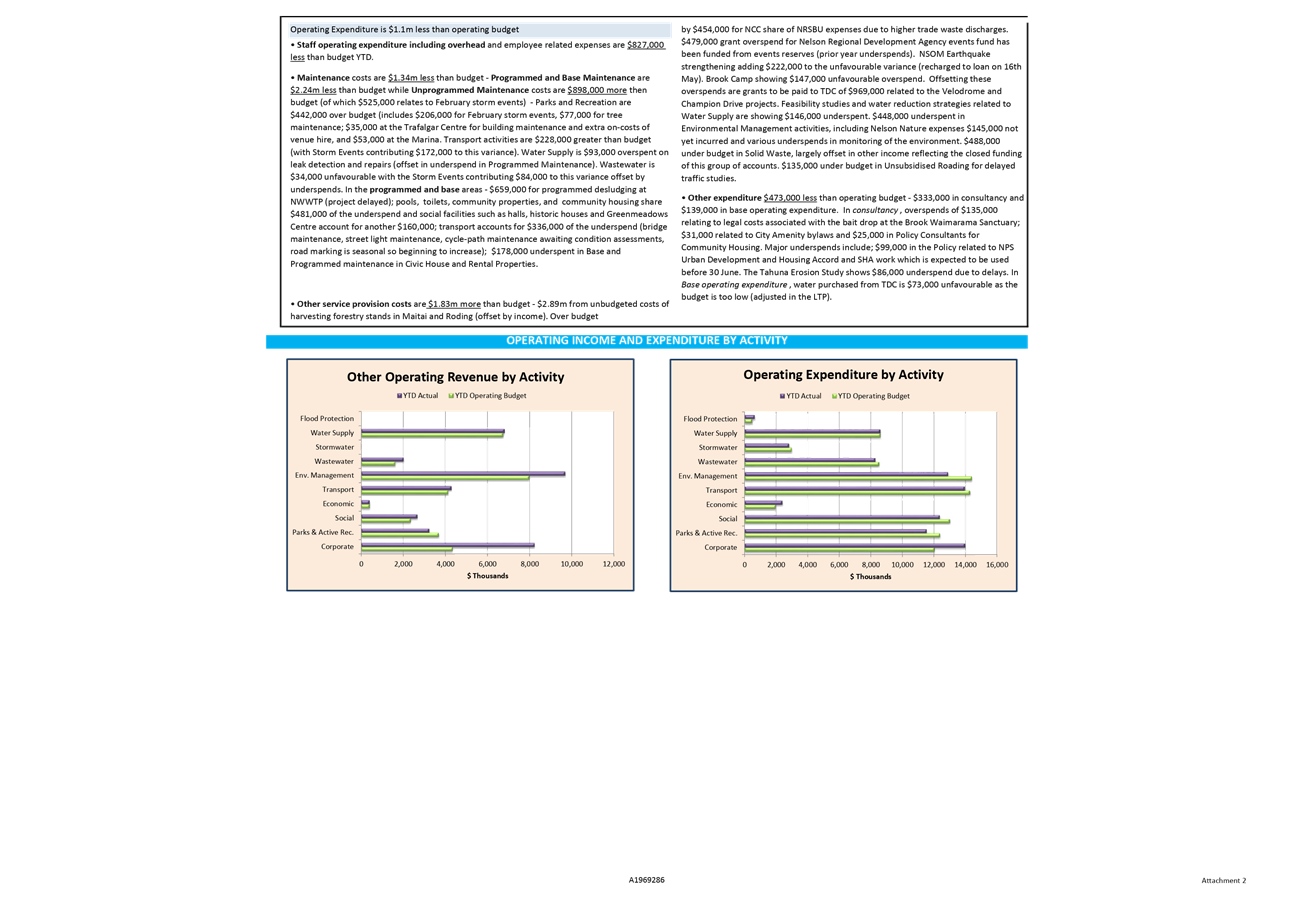

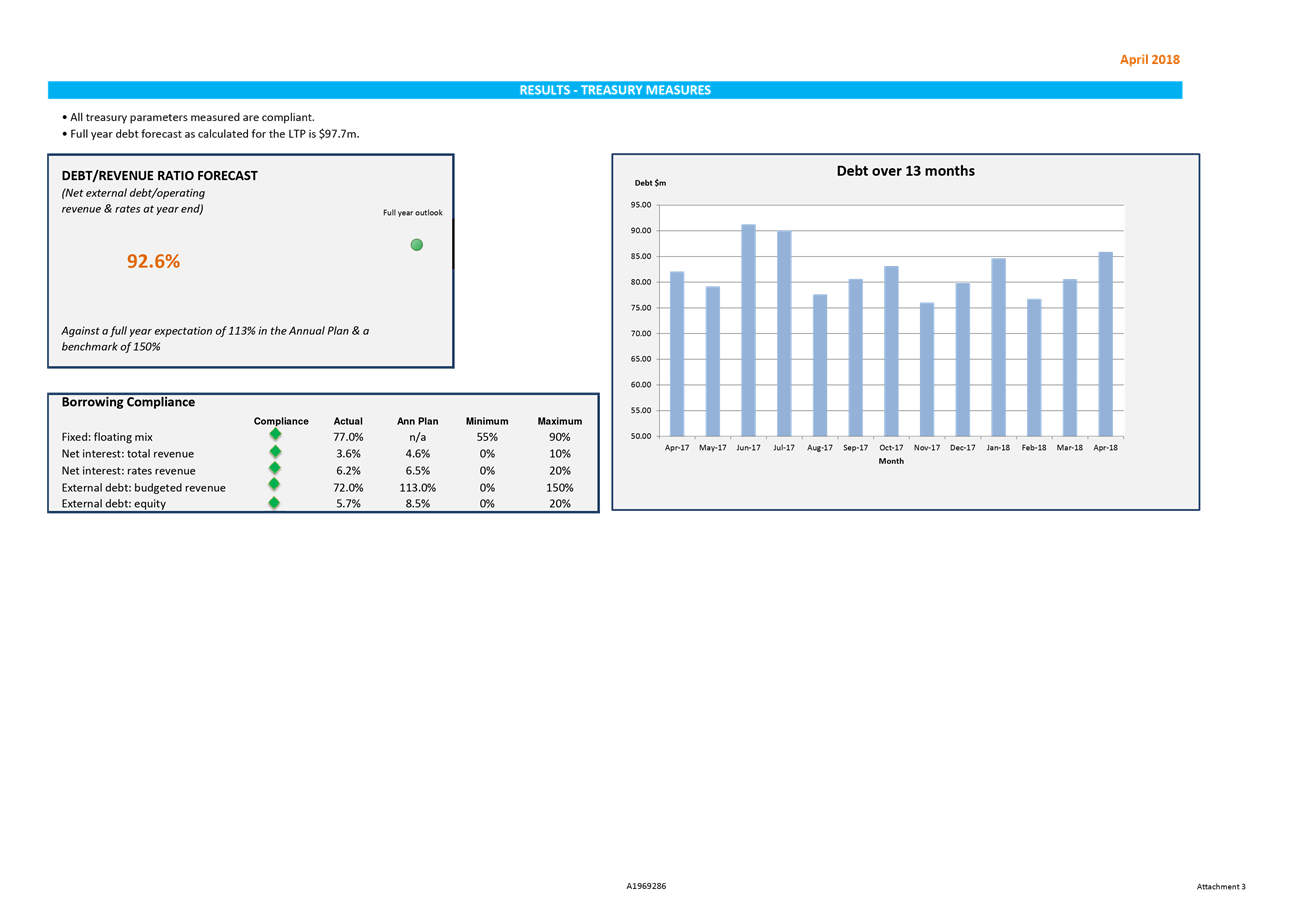

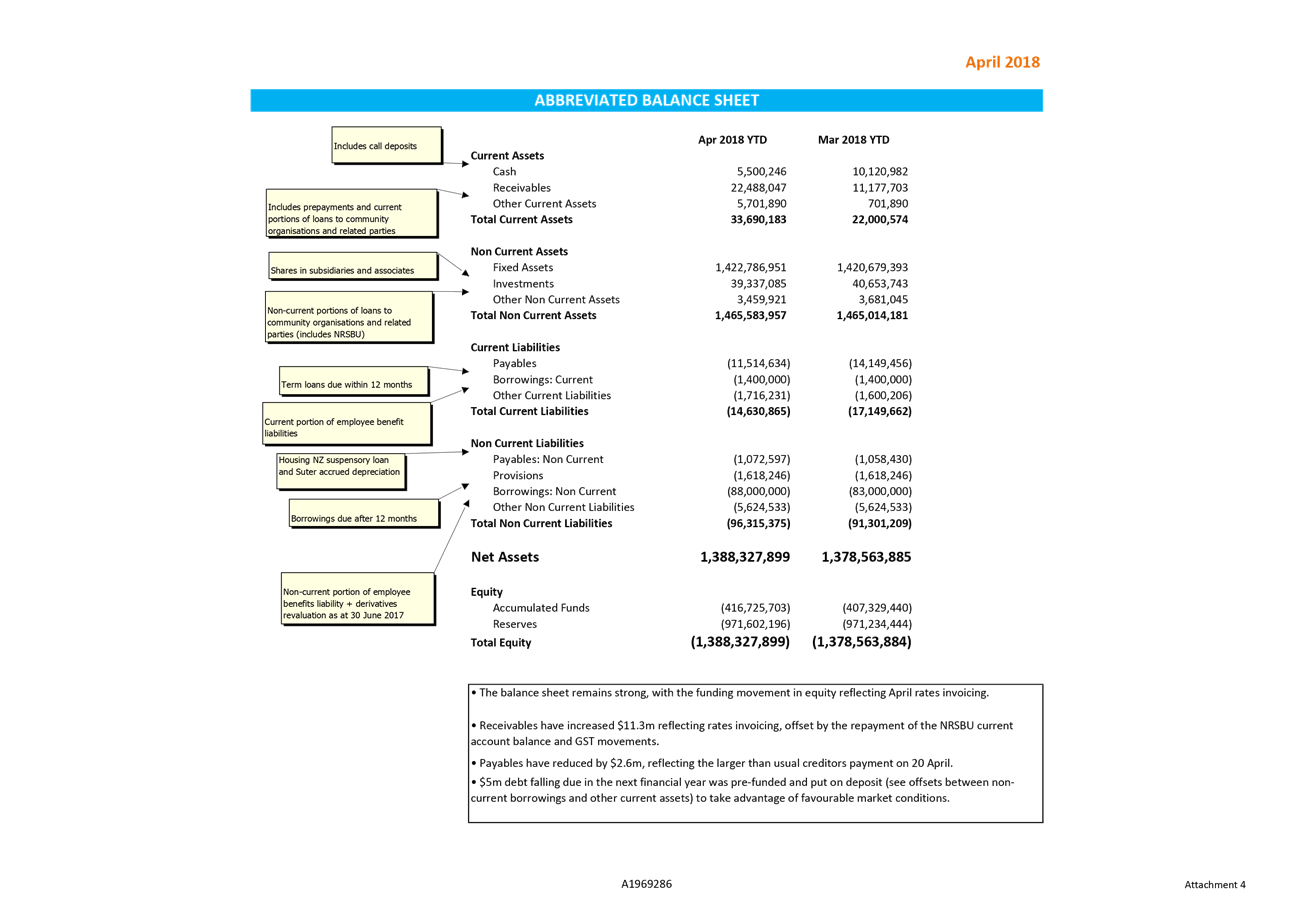

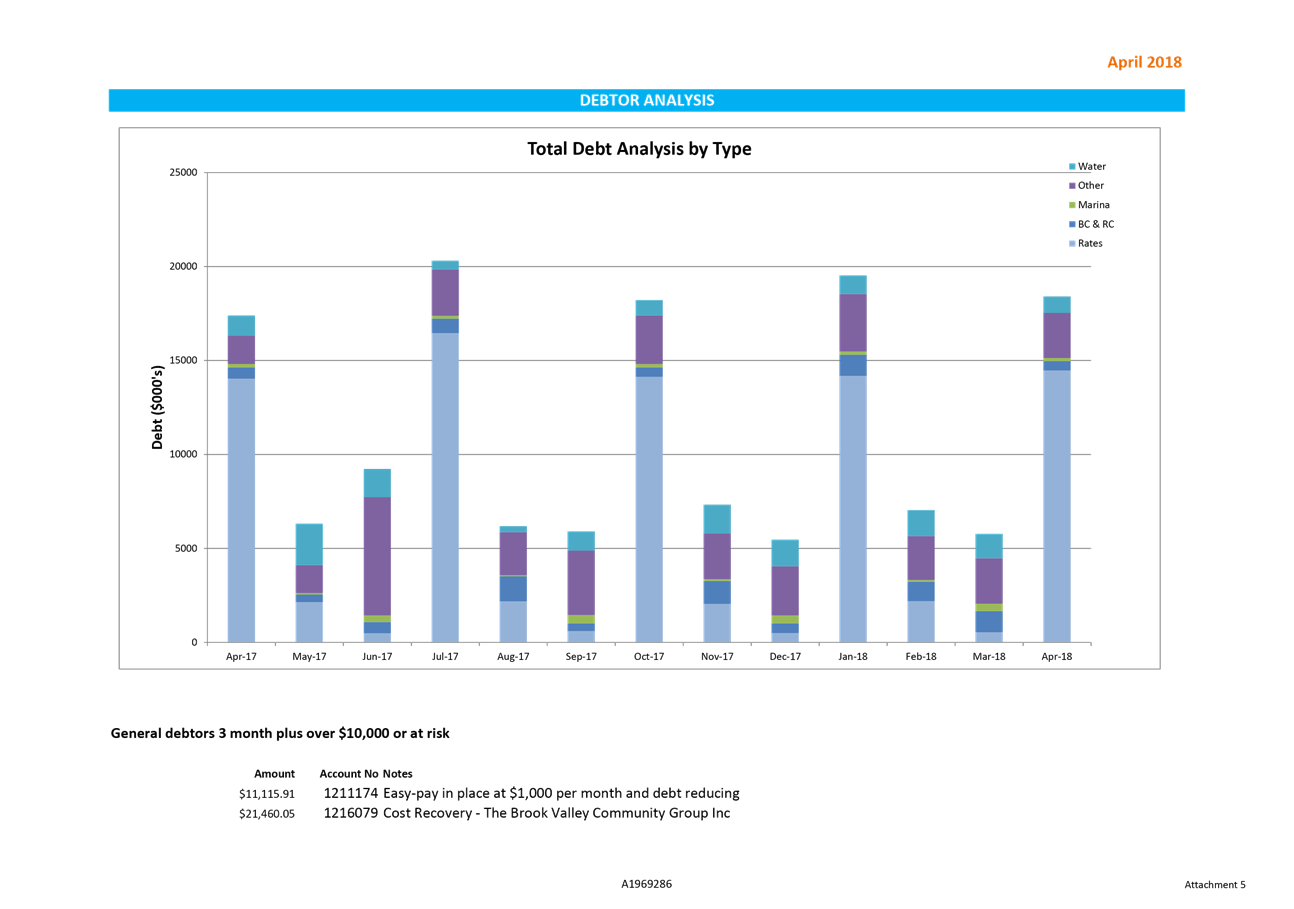

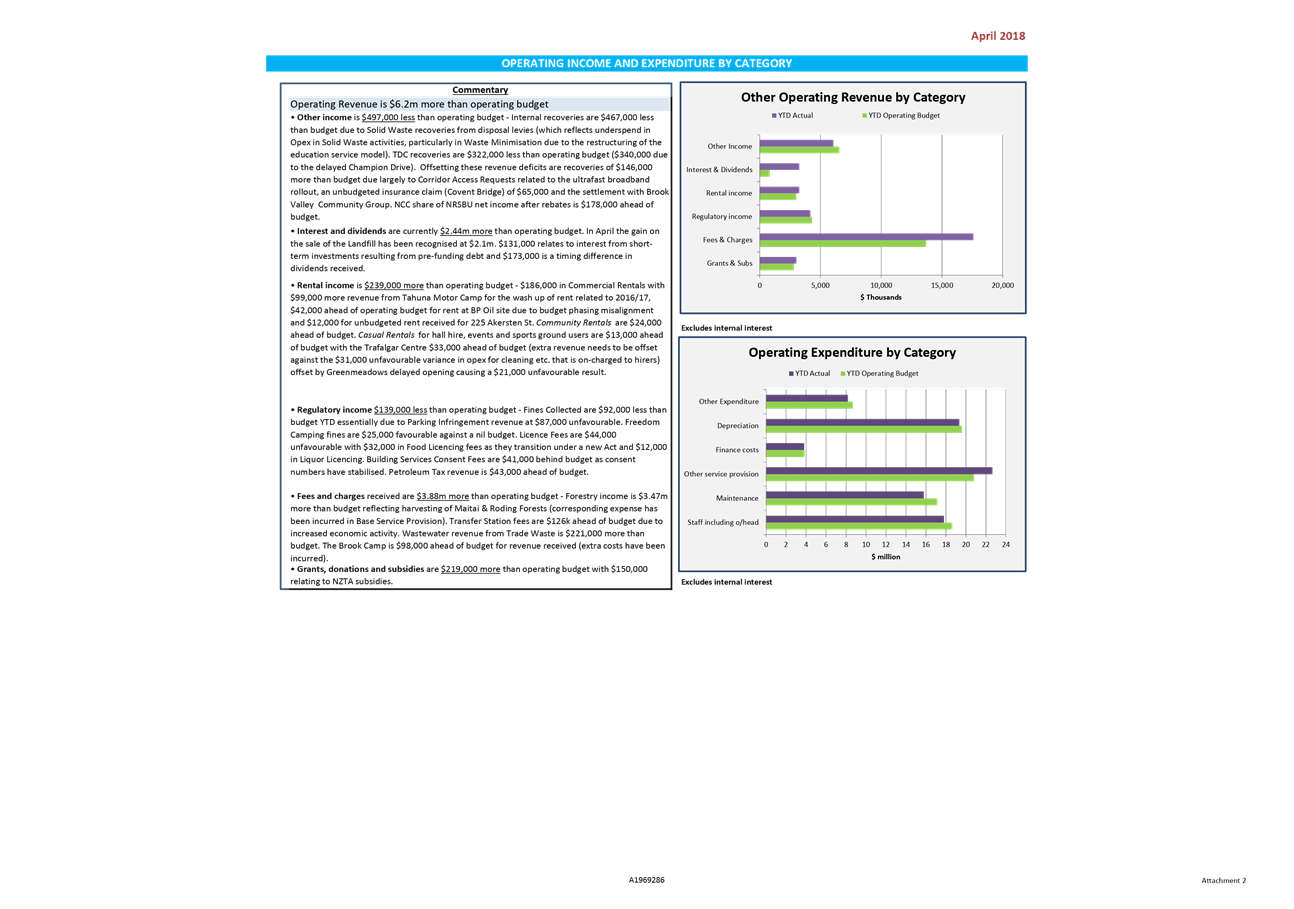

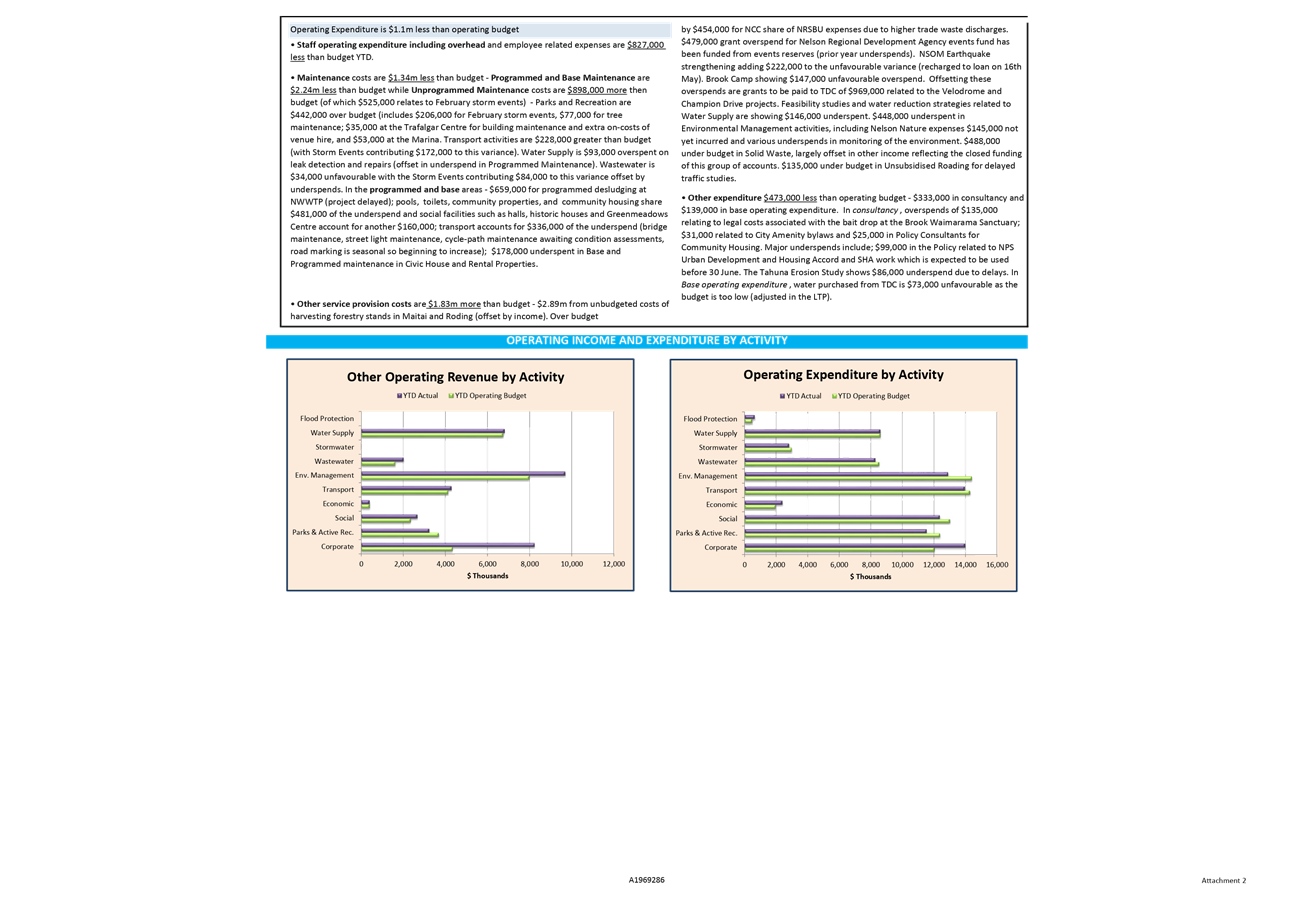

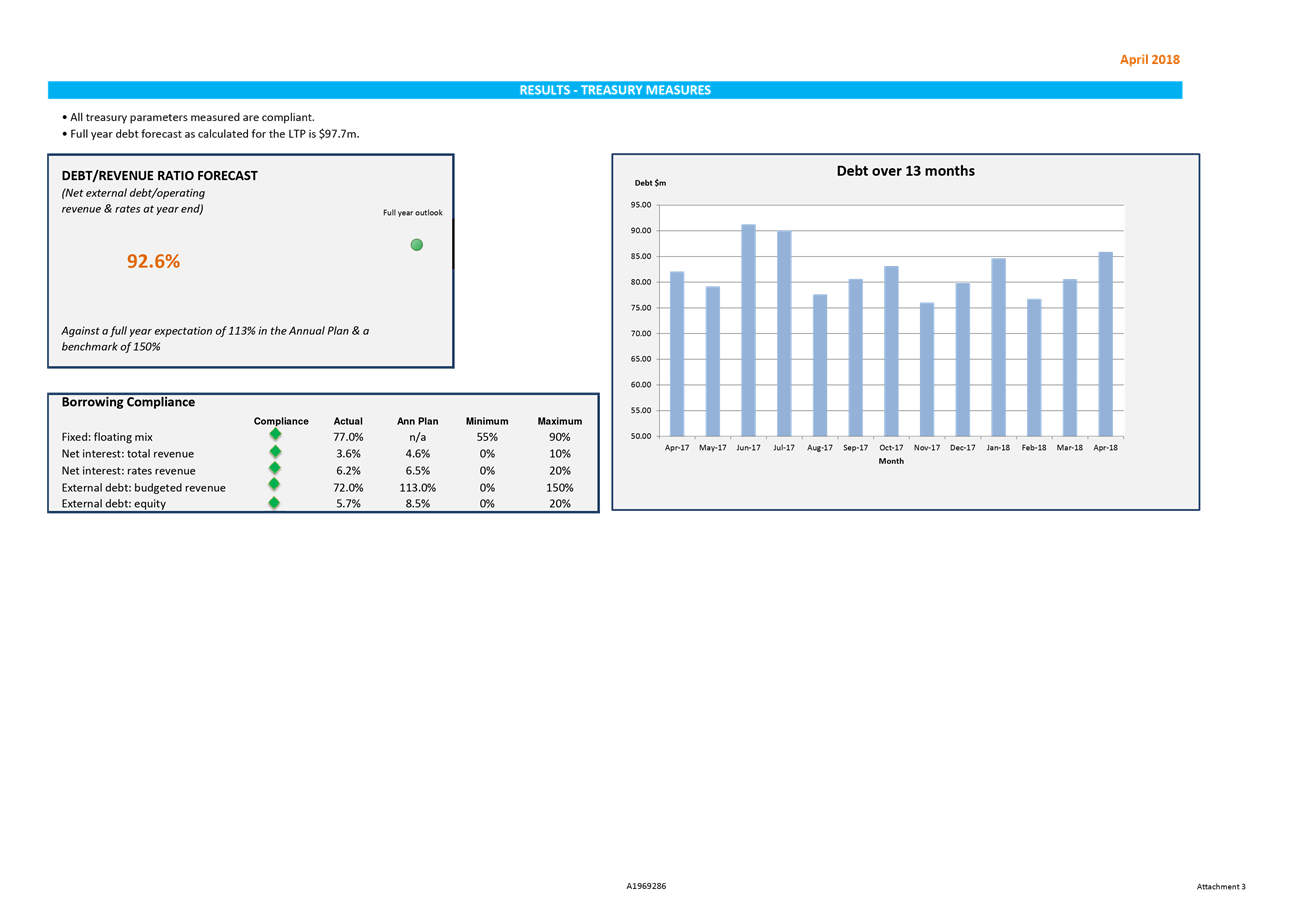

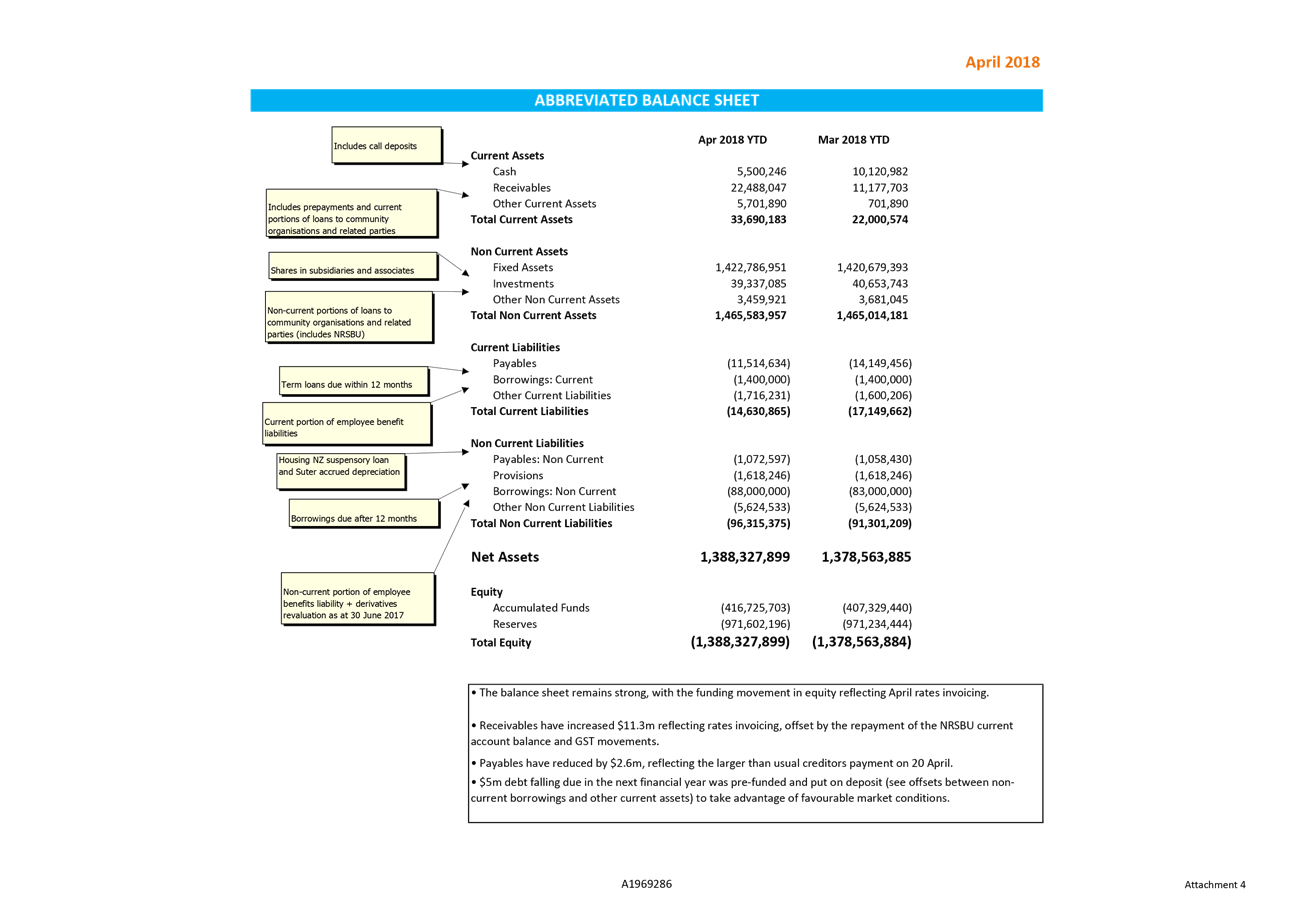

4.3 Financial information provided in Attachment 1 to this report

includes:

4.3.1 A financial measures dashboard with information on rates revenue,

operating revenue and expenditure, and capital revenue and expenditure. The

arrow icon in each applicable measure indicates whether the variance is

increasing or decreasing and whether that trend is favourable or unfavourable

(green or red).

4.3.2 A grouping of more detailed graphs and commentary for operating

income and expenditure. The first set of charts and commentary is by category

(as in the annual report) and highlights significant permanent differences and

items of interest. Variances due to timing will not be itemised unless they

become permanent. The second set of charts is by activity.

4.3.3 A treasury measures dashboard with a compliance table (green =

compliant), a forecast of the debt/revenue ratio for the year where available,

and a graph showing debt levels over a rolling 13 month period.

4.3.4 High level balance sheet. This does not include any consolidations.

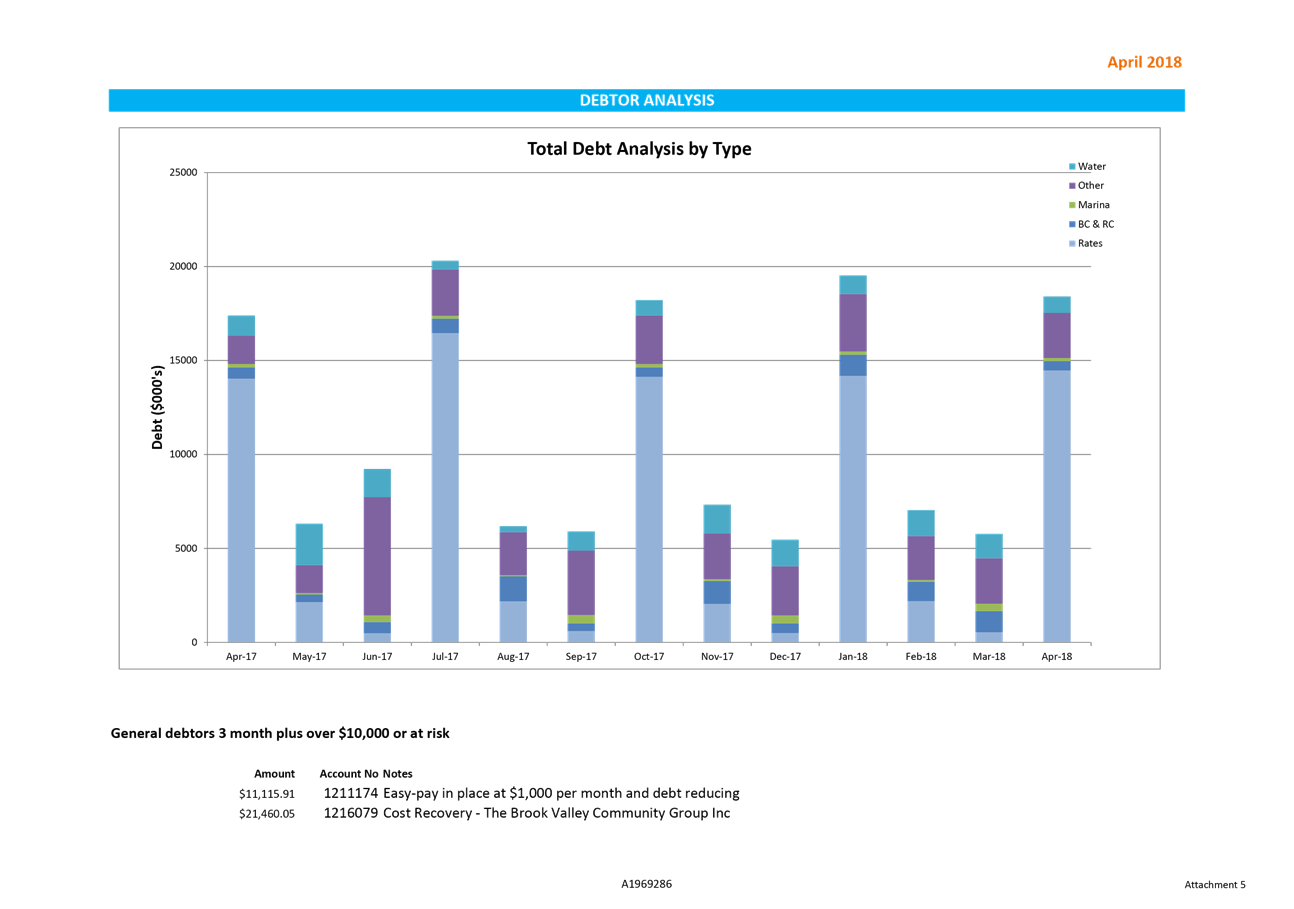

4.3.5 A debtor analysis graph over 13 months, clearly showing outstanding

debt levels and patterns for major debt types along with a summary of general

debtors > 3 months and over $10,000 and other debtors at risk.

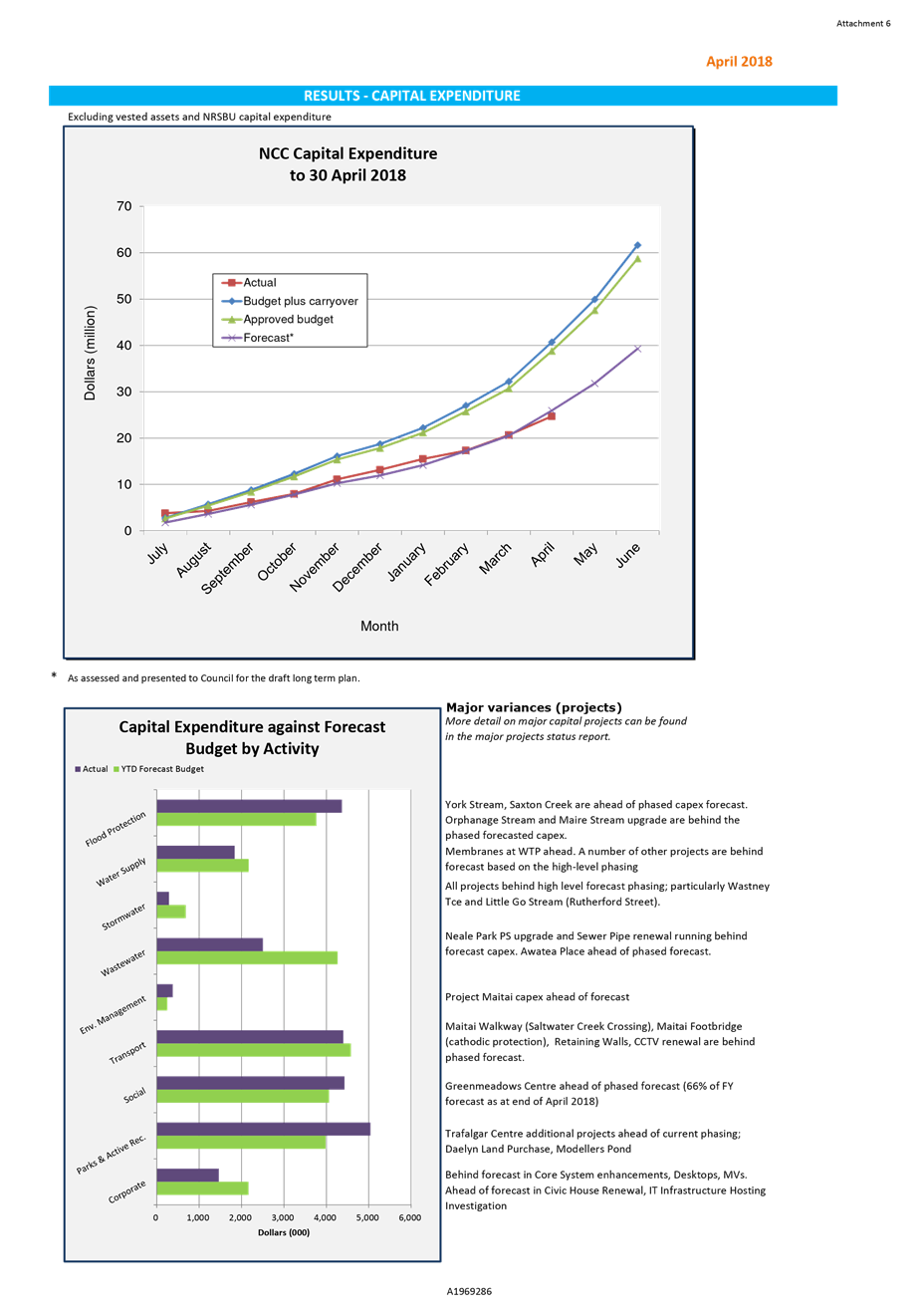

4.3.6 Two capital expenditure graphs – The line graph records actual

expenditure against budget plus carryover (the initial budget), approved budget

(as amended by subsequent Council decisions), and forecast (current

understanding of most likely outcome). The bar graph records year to date

expenditure against forecast by activity.

4.3.7 A major projects summary including milestones, status, issues and

risks.

4.4 Capital expenditure is $14.9 million under approved budget and $1.2m

less than current forecast for the Long Term Plan 2018-28 as presented to

Council workshops in late January (including vested assets and NRSBU capital).

5. Bad

debt write offs for the year ending 30 June 2018

5.1 There

are no bad debts over $2,500 to be written off for the year ending

30 June 2018.

5.2 A

number of accounts under $2,500 per debtor have been written off by the Group

Manager Corporate Services under officer delegation. These totalled

$3,516 excluding GST. The main areas of write-offs are $1,238 for 7

separate debts for dog impounding fees, $1,030 for crematorium/internment fees

and $913 for compliance schedule fees.

5.3 The

decision is an administrative one and although the debts are written off from

an accounting point of view, a record is still kept and if an opportunity to

recover the debt arises, action will be taken. $1,572 of this balance is with

Credit Recoveries Limited, our debt recovery agency, who will continue recovery

activities. Every possible effort has been made to locate and obtain

payment from these debtors.

5.4 A

summary of this year's write-off compared to last year's is as follows:

|

|

Write-off 2018

$

|

Write-off 2017

$

|

|

Over $2,500

|

0

|

3,128

|

|

Under $2,500

|

3,516

|

5,822

|

|

Cost for year

|

3,516

|

8,950

|

Tracey

Hughes

Senior

Accountant

Attachments

Attachment 1: A1969286 - Finance Report

to 30 April 2018.pdf ⇩

Attachment 2: A1986404

- Major projects summary ⇩

Item

8: Corporate Report to 30 April 2018: Attachment 1

Item

8: Corporate Report to 30 April 2018: Attachment 2

Item 9: Audit

engagement letter for year ending 30 June 2018

|

|

Audit, Risk and Finance Subcommittee

26 June 2018

|

REPORT R9208

Audit

engagement letter for year ending 30 June 2018

1. Purpose

of Report

1.1 To

provide the subcommittee with the Audit Engagement Letter for the year ending

30 June 2018 and ask for any feedback before the letter is signed by the Mayor.

2. Recommendation

1.

|

That the Audit, Risk and Finance

Subcommittee

Receives the report Audit

engagement letter for year ending 30 June 2018 (R9208) and its attachments (A1955165 and A1955166); and

Notes the Subcommittee can provide

feedback on the Audit engagement letter to Audit New Zealand if required,

noting the Mayor will sign the letter once the Subcommittee’s feedback

has been incorporated.

|

3. Discussion

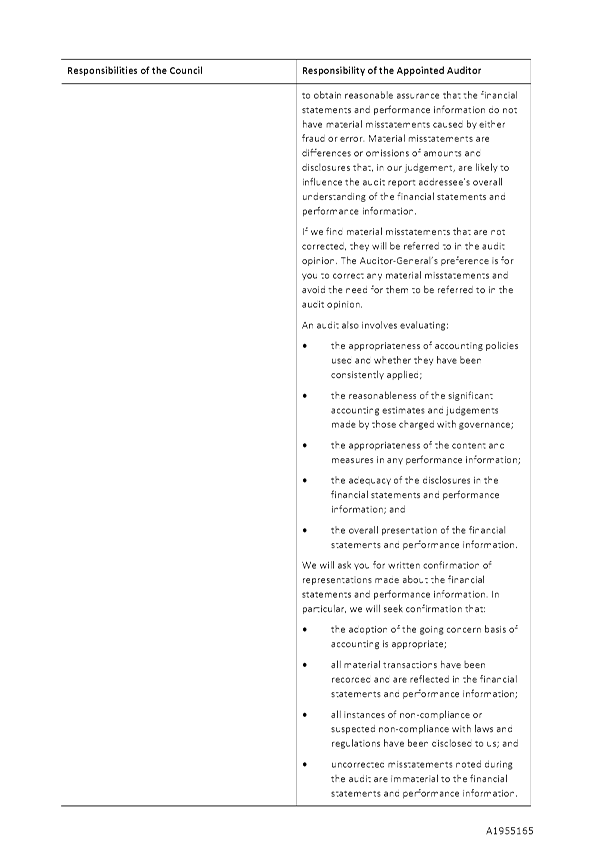

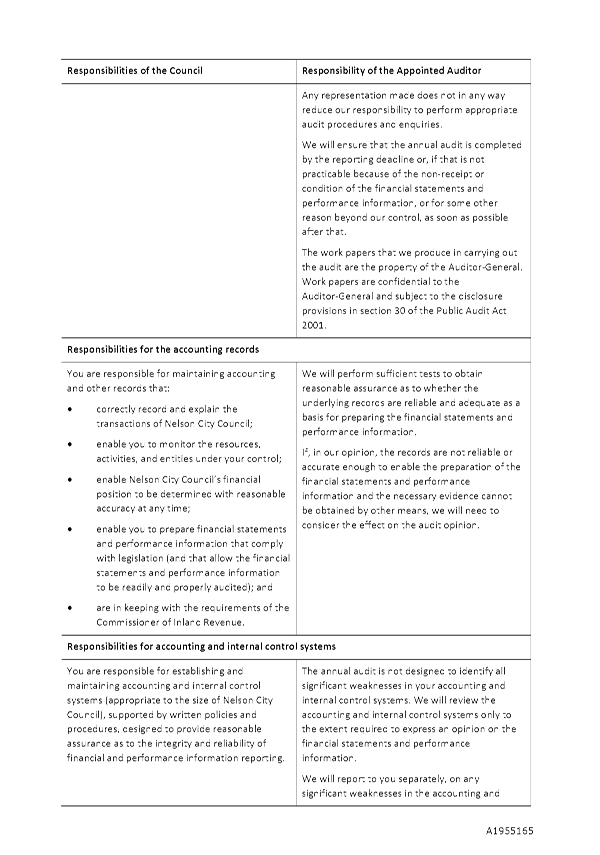

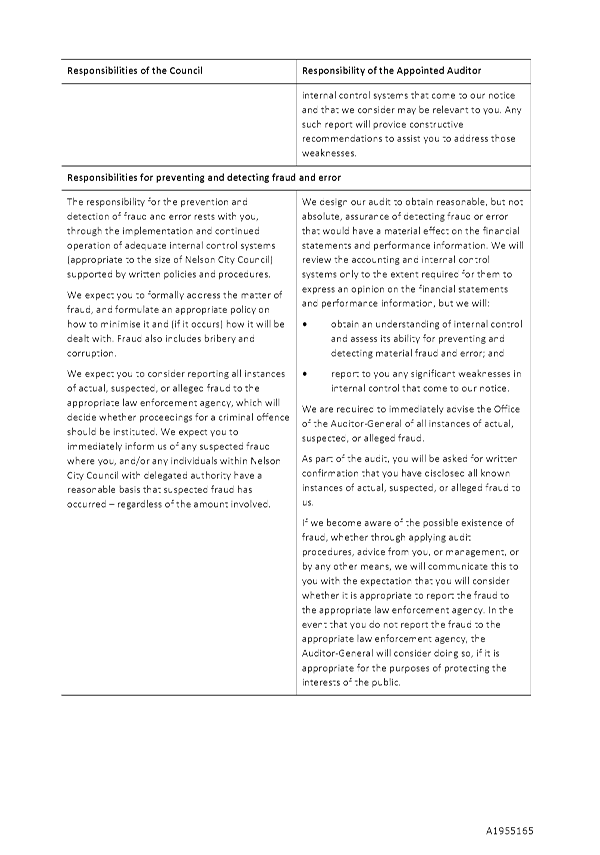

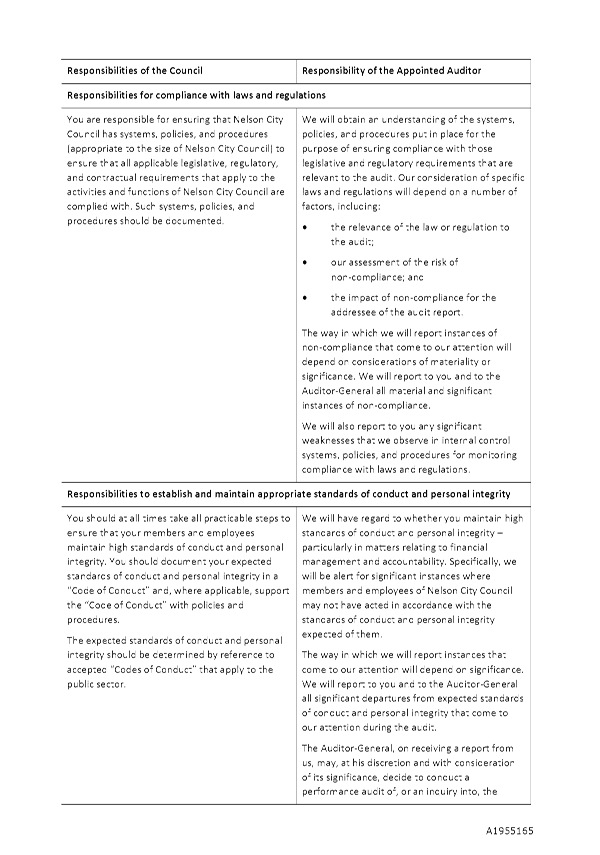

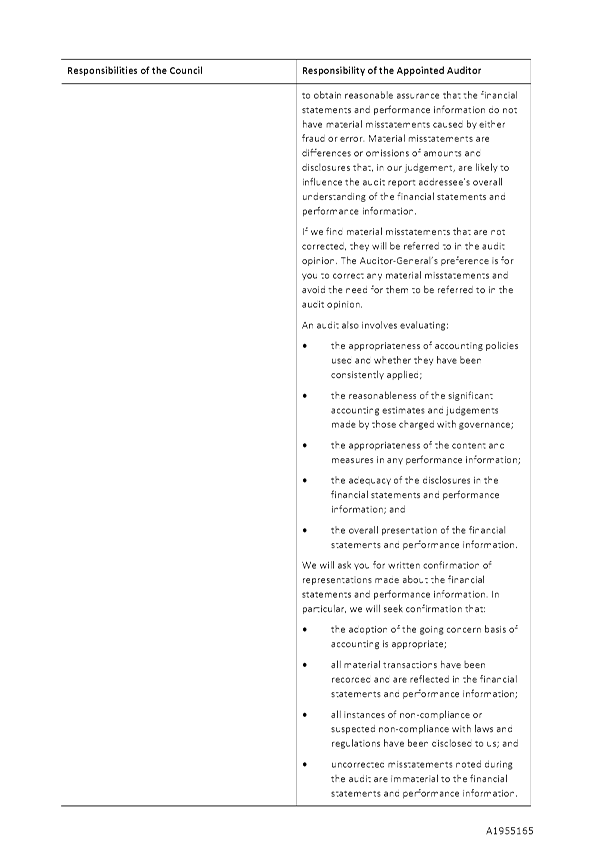

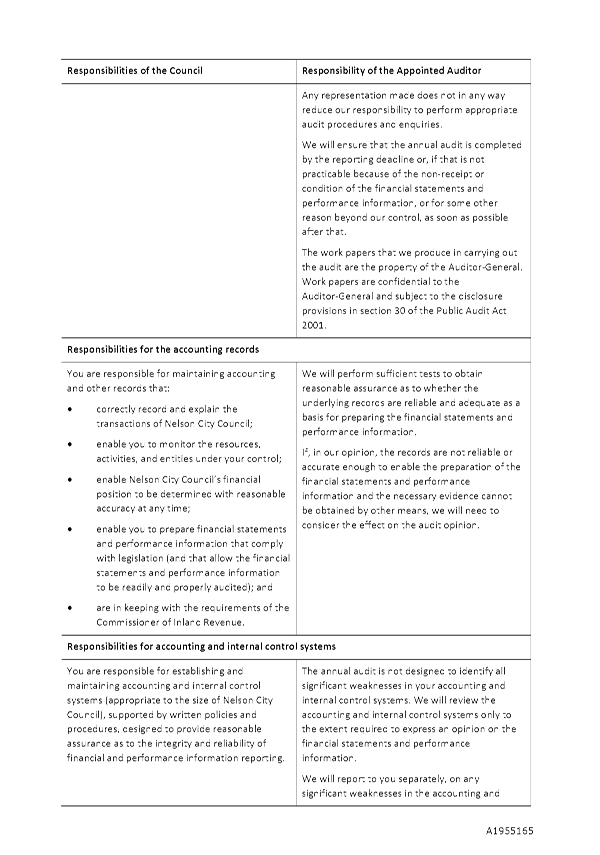

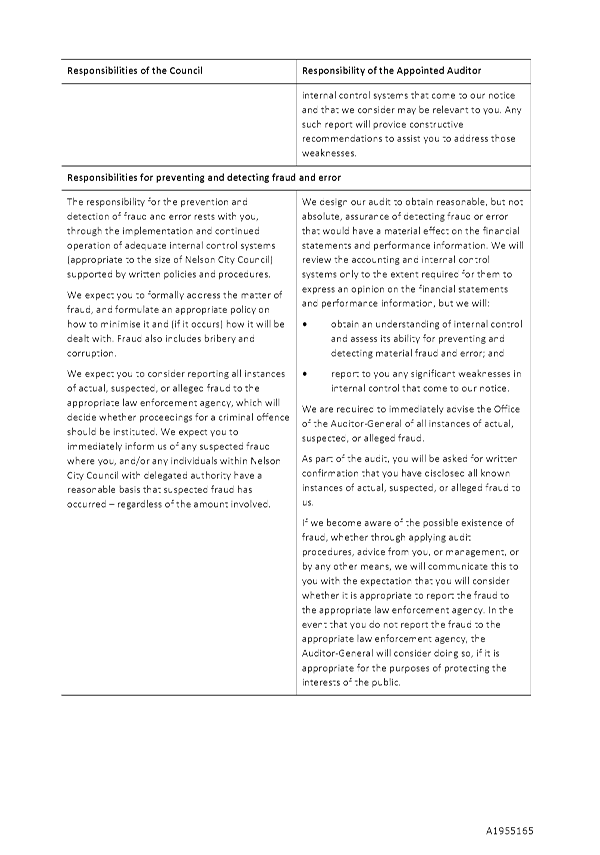

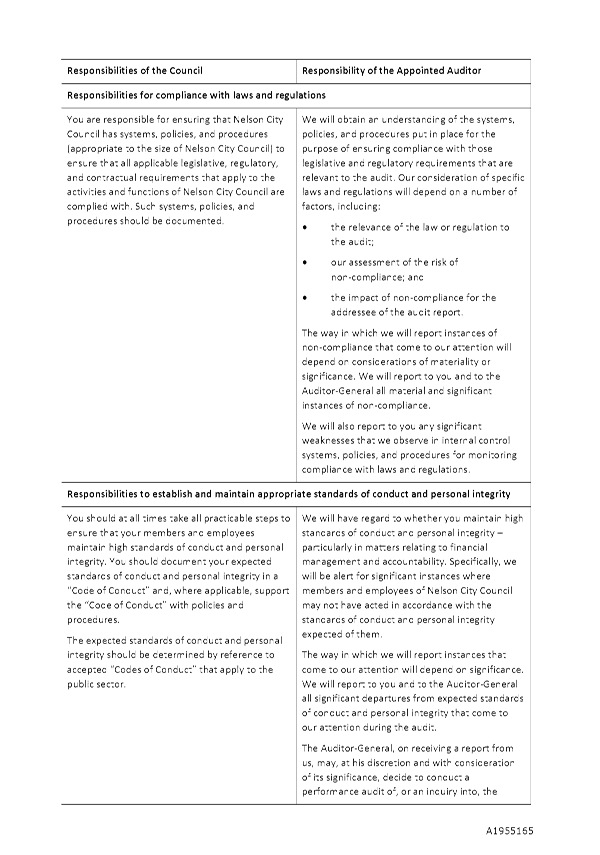

3.1 The

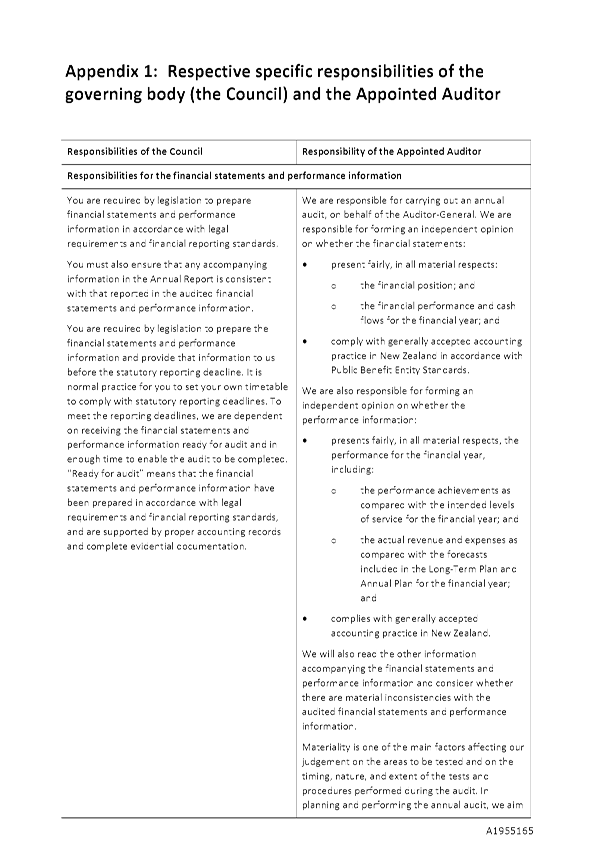

Audit Engagement letter for the year ended 30 June 2018 (Attachment 1) sets out

the respective responsibilities for the 2017/18 audit of the Council, including

Nelson Tasman Combined Civil Defence Organisation.

3.2 The

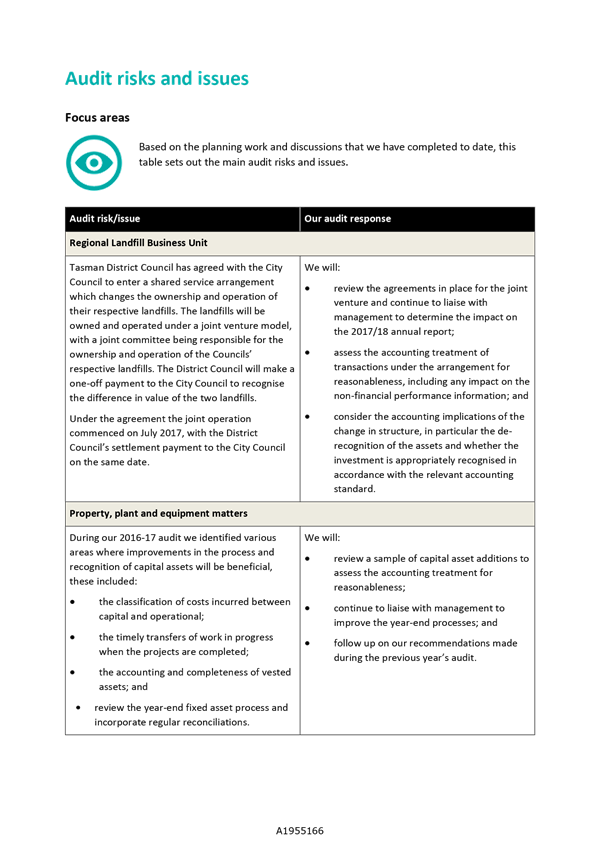

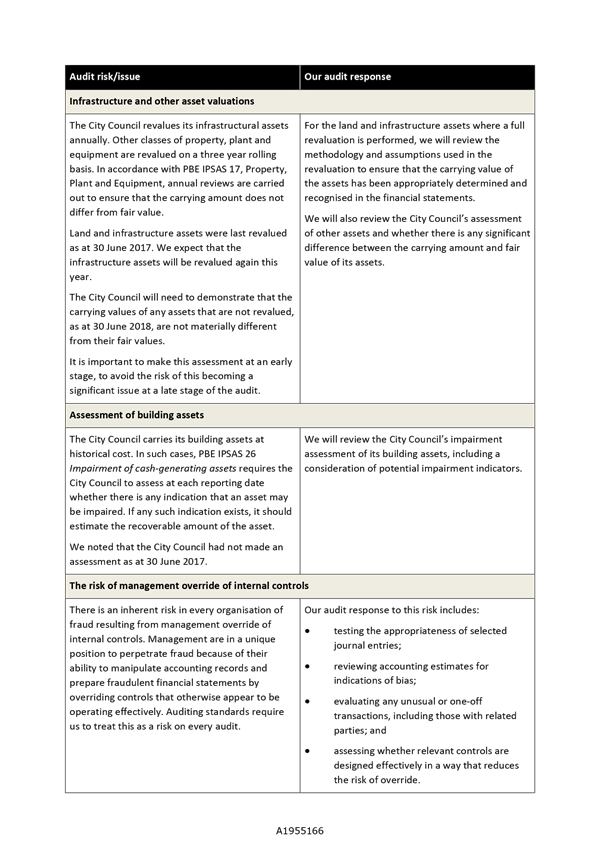

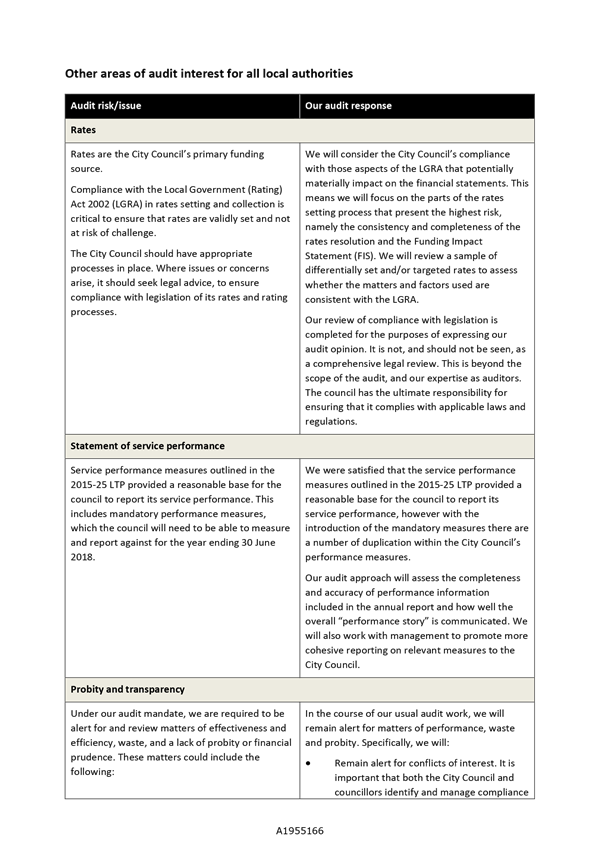

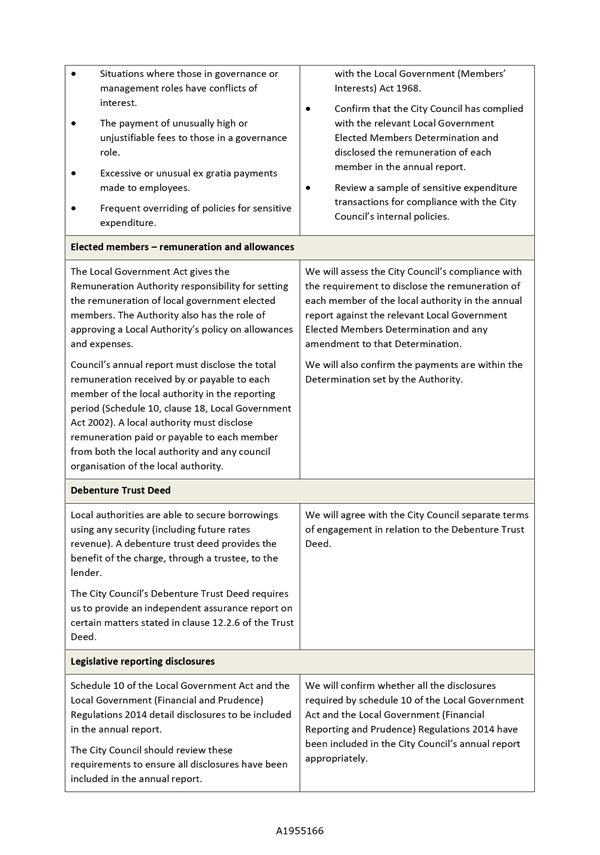

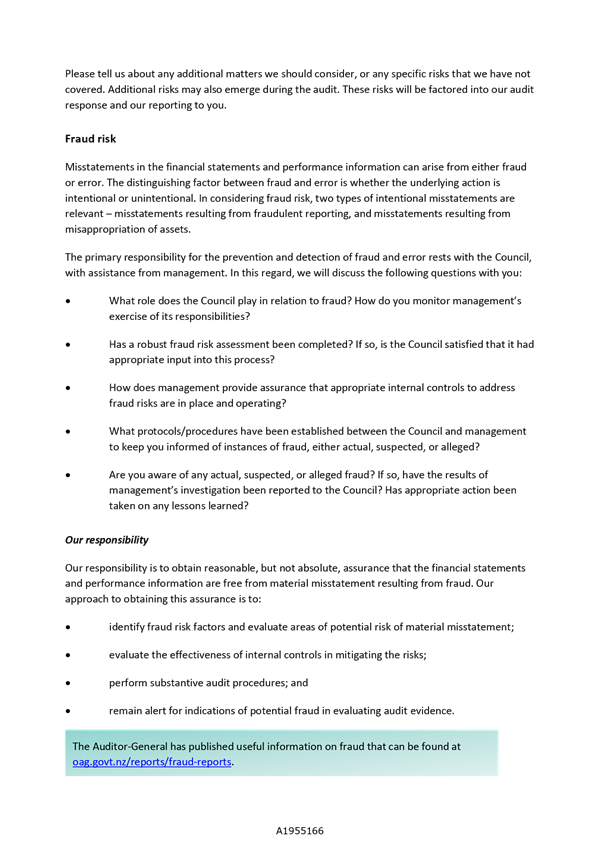

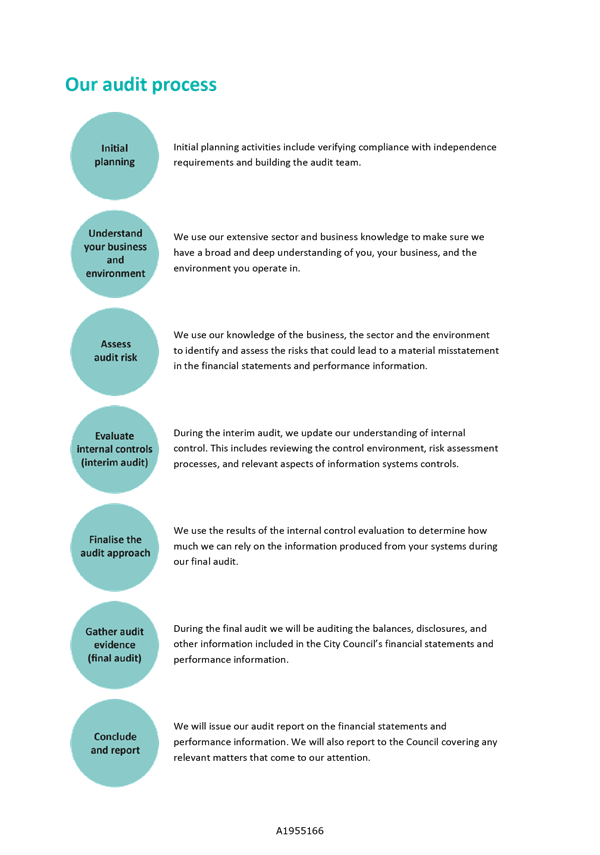

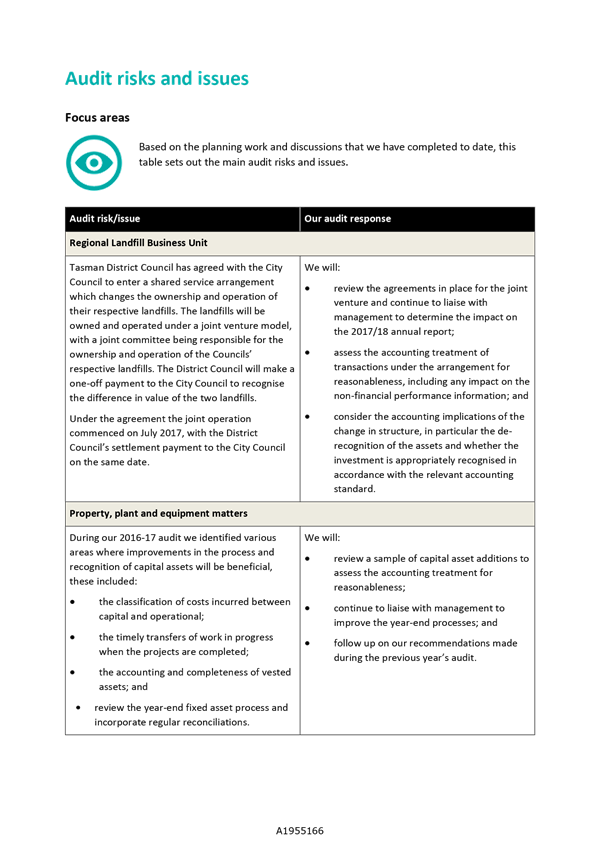

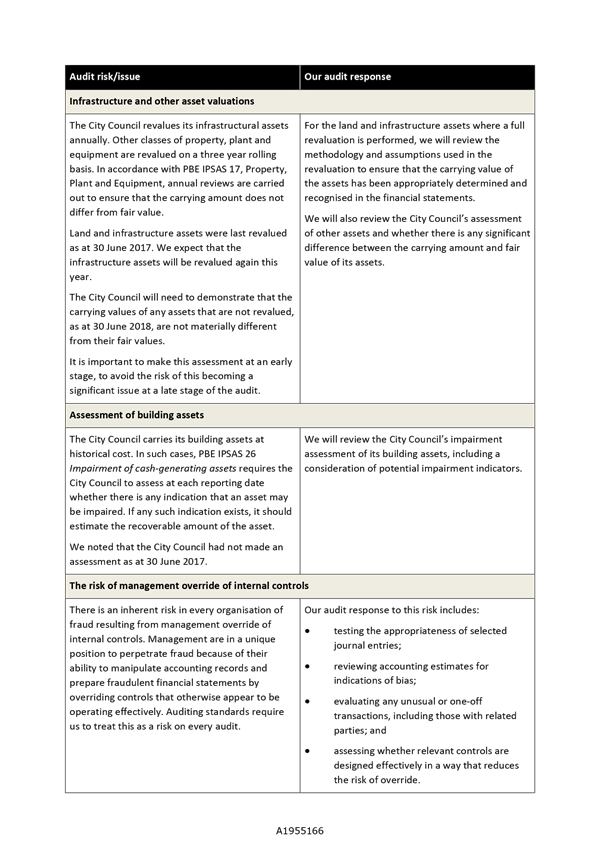

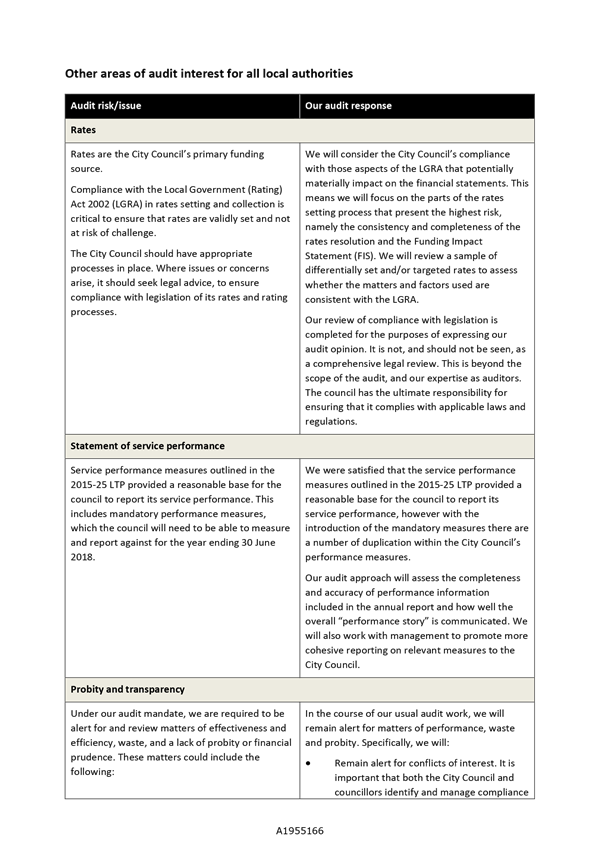

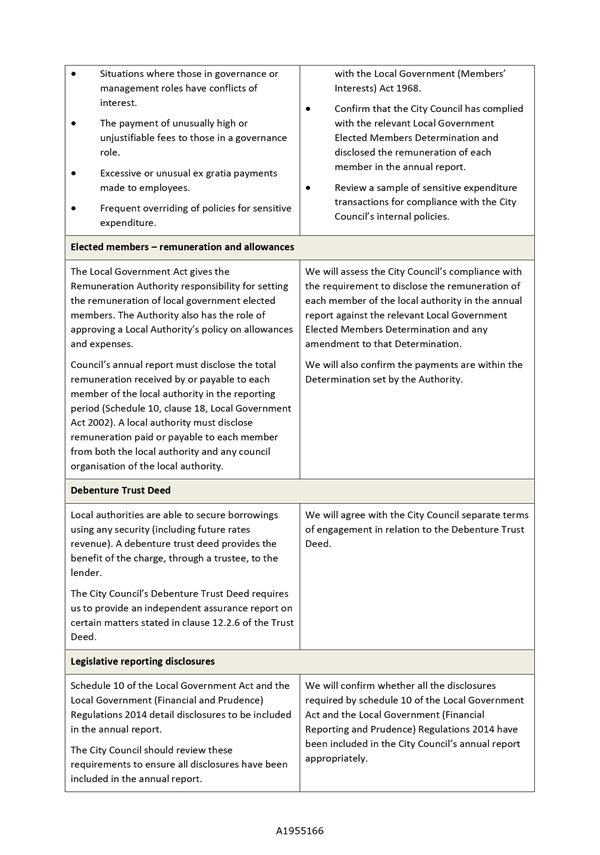

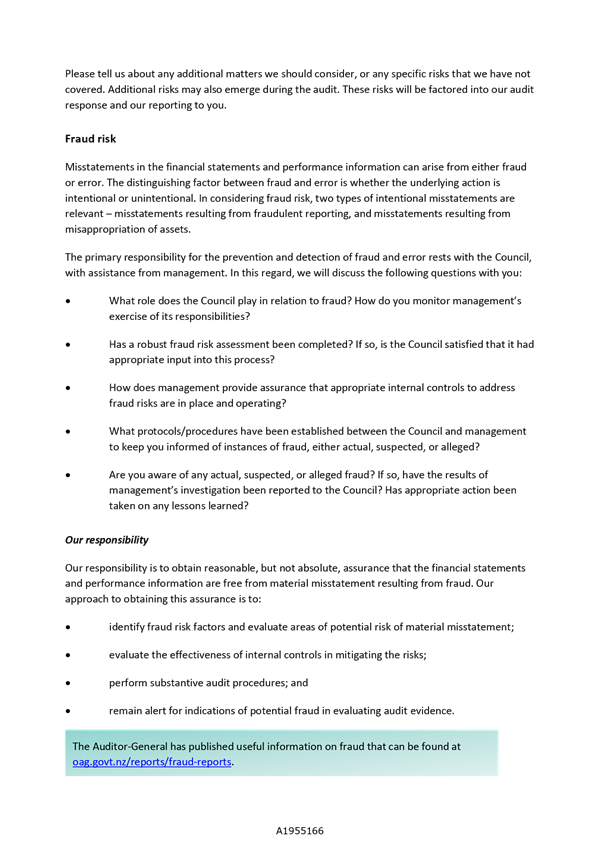

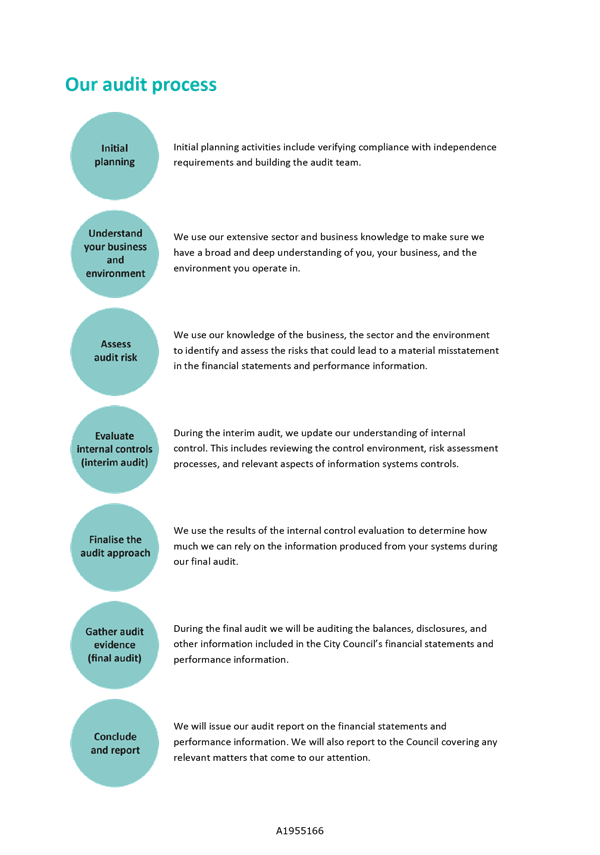

Audit Plan (Attachment 2) sets out the audit arrangements and covers:

· Audit risks and issues,

both specific focus areas for council and areas of interest for all local

authorities

· Audit approach

· Reporting protocols

· Audit logistics.

3.3 There

is a separate audit arrangement letter for the debenture trust deed but this is

not yet available from Audit New Zealand.

3.4 Jacques

Coetzee, the appointed auditor, will be in attendance at this subcommittee

meeting to answer any questions that may arise.

3.5 This

letter is required to be signed by the Mayor to confirm that the details of the

audit match Council’s understanding of the arrangements.

4. Options

4.1 The

options are to provide feedback to Audit New Zealand prior to the Mayor signing

the letter or not.

Nikki

Harrison

Group

Manager Corporate Services

Attachments

Attachment 1: A1955165 - Audit NZ

Engagement Letter Annual Report 30 June 2018.pdf ⇩

Attachment 2: A1955166

- Audit NZ Annual Report Audit Plan_1.pdf ⇩

|

Important considerations for decision making

|

|

1. Fit

with Purpose of Local Government

Section 99 of the Local Government Act 2002 requires

the audit of information contained in the Annual Report and Summary.

|

|

2. Consistency

with Community Outcomes and Council Policy

This report supports the community outcome that

Council provides infrastructure that is efficient, cost effective and meets

current and future needs of our community.

|

|

3. Risk

There is no risk in approving this recommendation.

|

|

4. Financial

impact

The recommendation will not have any significant

financial impact.

|

|

5. Degree

of significance and level of engagement

This matter is of low significance because it does

not affect the level of service provided by Council or the way in which

services are delivered and no engagement has been undertaken.

|

|

6. Inclusion

of Māori in the decision making process

There has been no consultation with Maori in the

preparation of this report.

|

|

7. Delegations

The Audit, Risk and Finance Subcommittee has

responsibility for audit processes and management of financial risks.

|

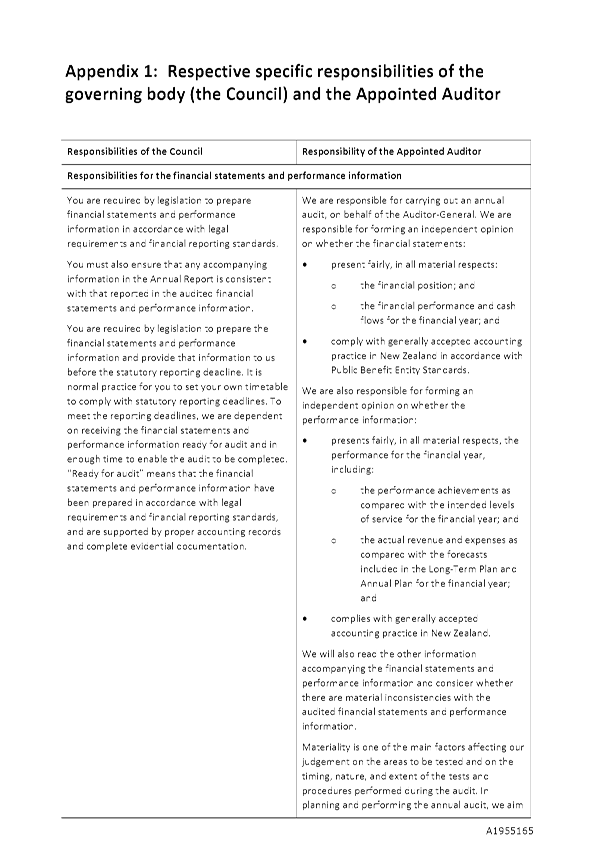

Item

9: Audit engagement letter for year ending 30 June 2018: Attachment 1

Item

9: Audit engagement letter for year ending 30 June 2018: Attachment 2

Item 10: Interim audit

letter for the year ending 30 June 2018

|

|

Audit, Risk and Finance Subcommittee

26 June 2018

|

REPORT R9213

Interim

audit letter for the year ending 30 June 2018

1. Purpose

of Report

1.1 To

provide the letter to the Subcommittee on the interim audit for the year ending

30 June 2018 from Audit New Zealand.

2. Recommendation

1.

|

That the Audit, Risk and Finance

Subcommittee

Receives the report Interim

audit letter for the year ending 30 June 2018 (R9213) and its attachment (A1988268); and

Notes

the suggested responses to the recommendations.

|

3. Discussion

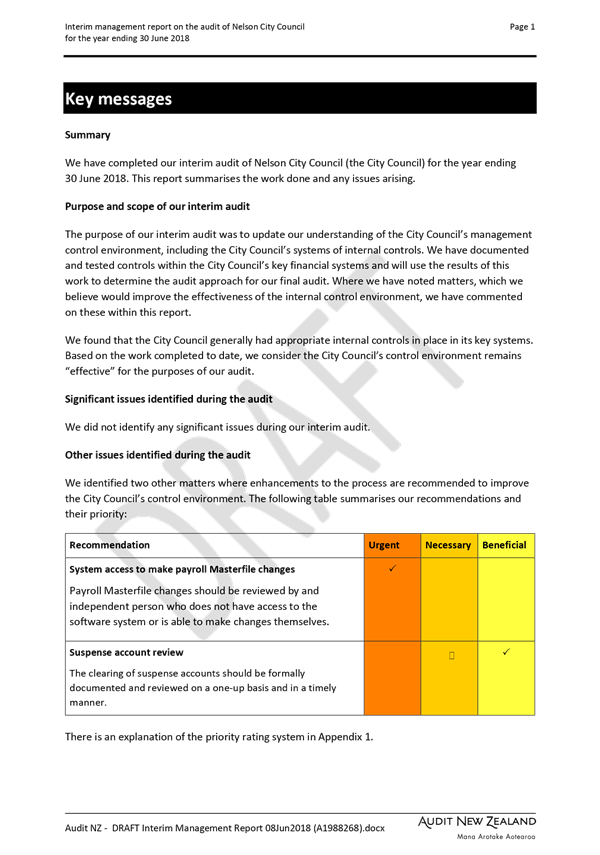

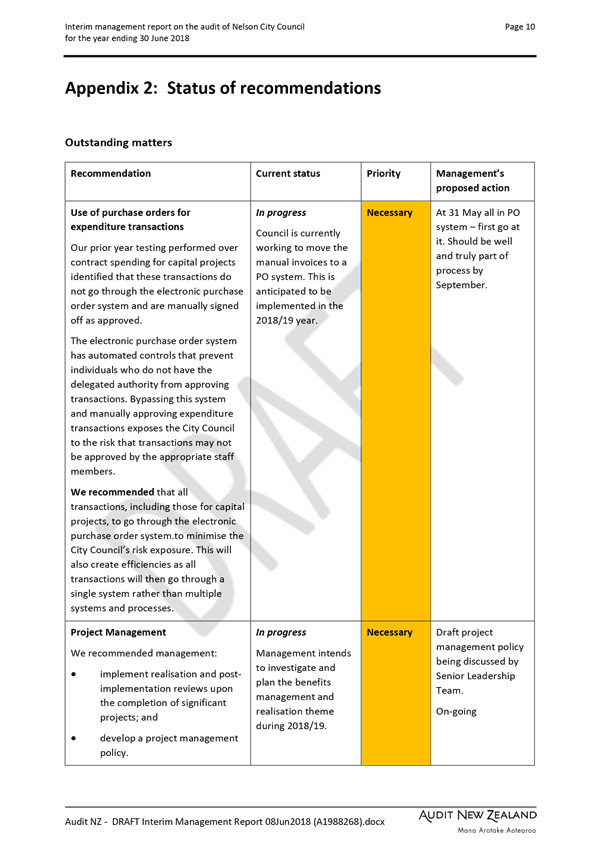

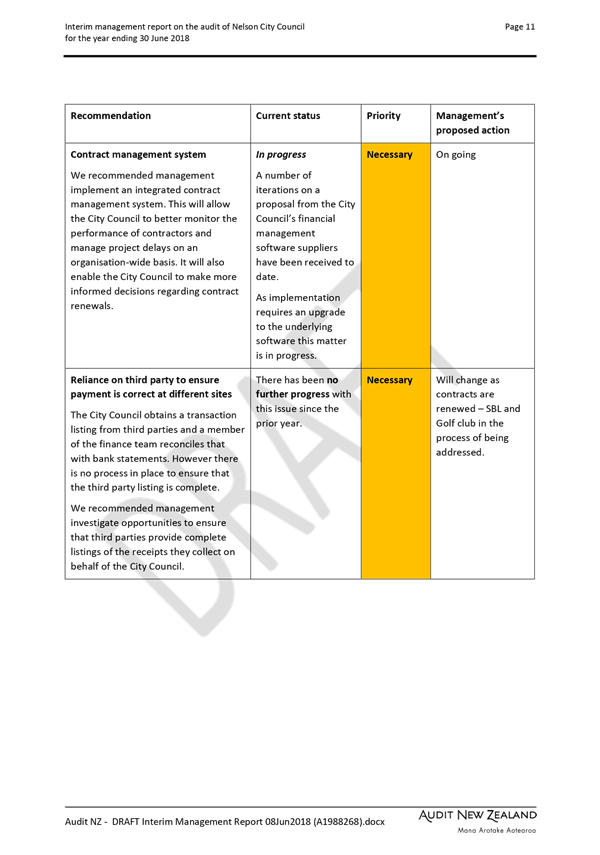

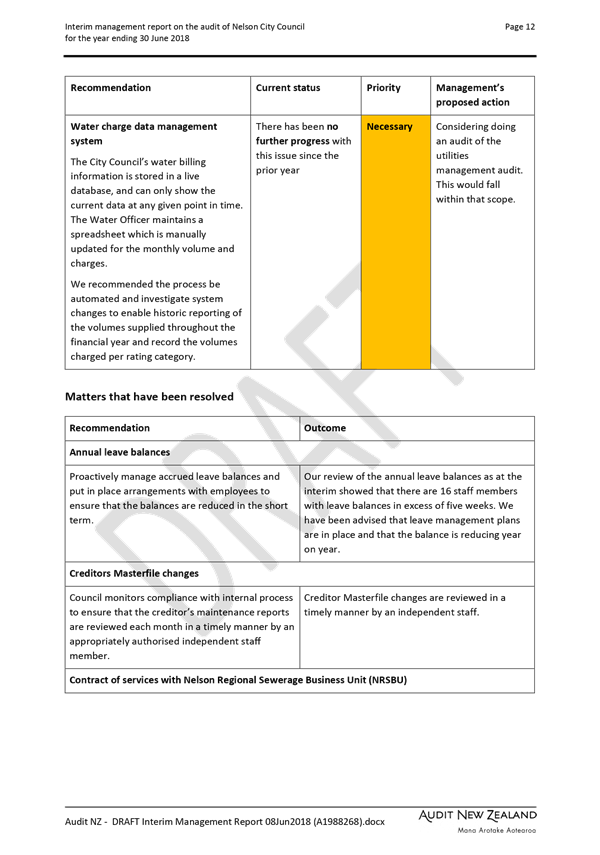

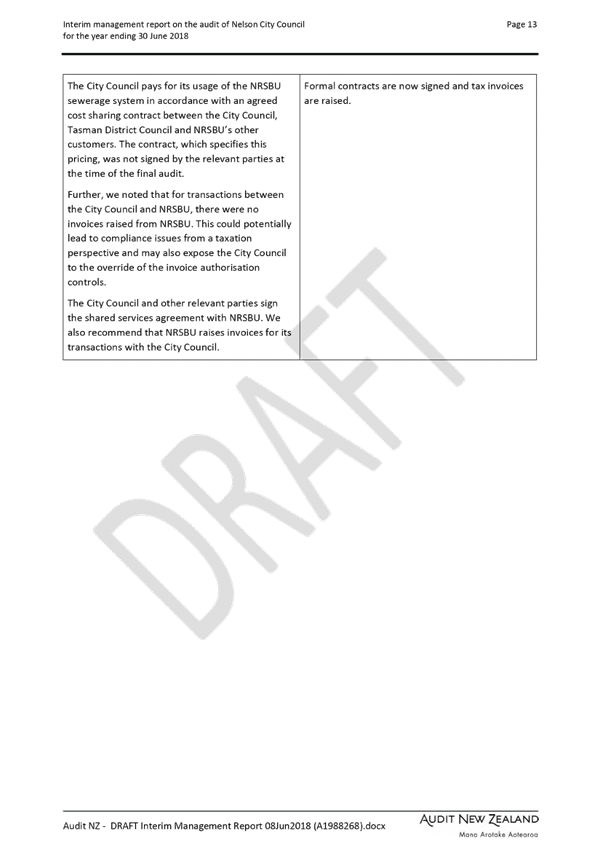

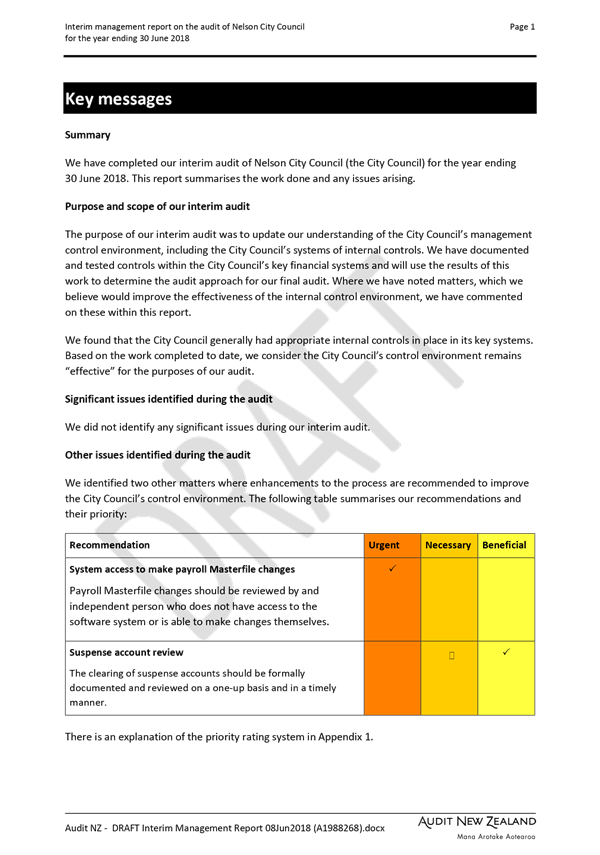

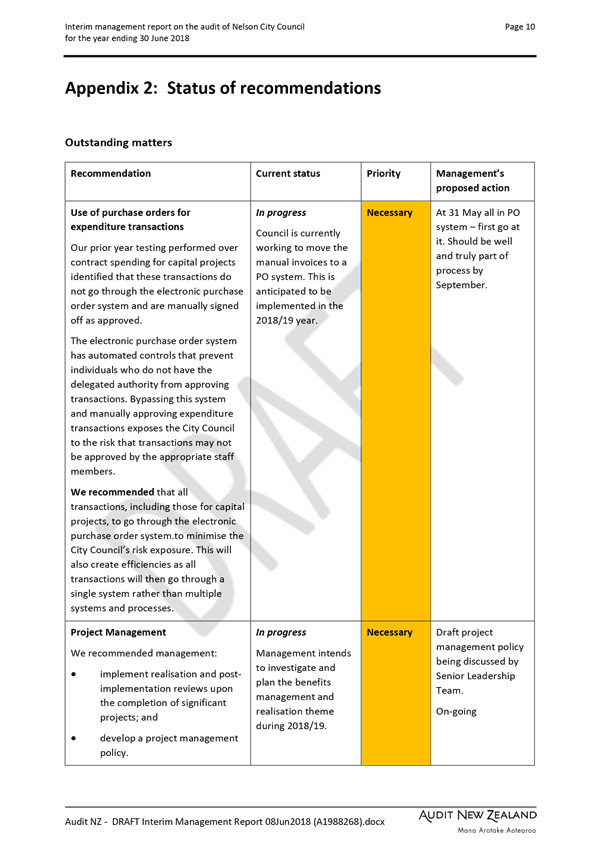

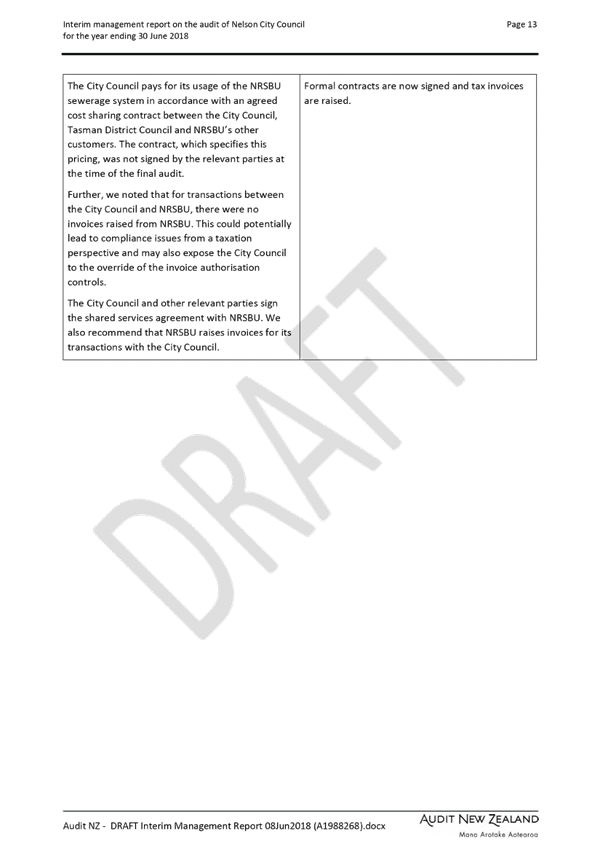

3.1 Audit

New Zealand carried out the interim audit for the year ending 30 June 2018 in

mid-April 2018 which focused on the Council's internal controls and the overall

control environment. They issued the draft letter on 7 June 2018 (Attachment

1).

3.2 There

were no significant issues identified during the audit. Two other matters

were identified during the audit.

3.3 System

access to make payroll Masterfile changes

3.3.1 Audit

New Zealand raise that Payroll Masterfile changes should be reviewed by an

independent person who does not have access to the software system or is able

to make changes themselves. This issue has been addressed.

3.4 Suspense

account review

3.4.1 Audit

New Zealand raise that the clearing of suspense accounts should be formally

documented and reviewed on a one-up basis and in a timely manner.

3.4.2 The

payroll suspense account reconciliation lapsed due to staff leave; arrangements

will be made in future for this to be reviewed in the event of absence. A

record of the other suspense accounts (zero balances) will be kept in future.

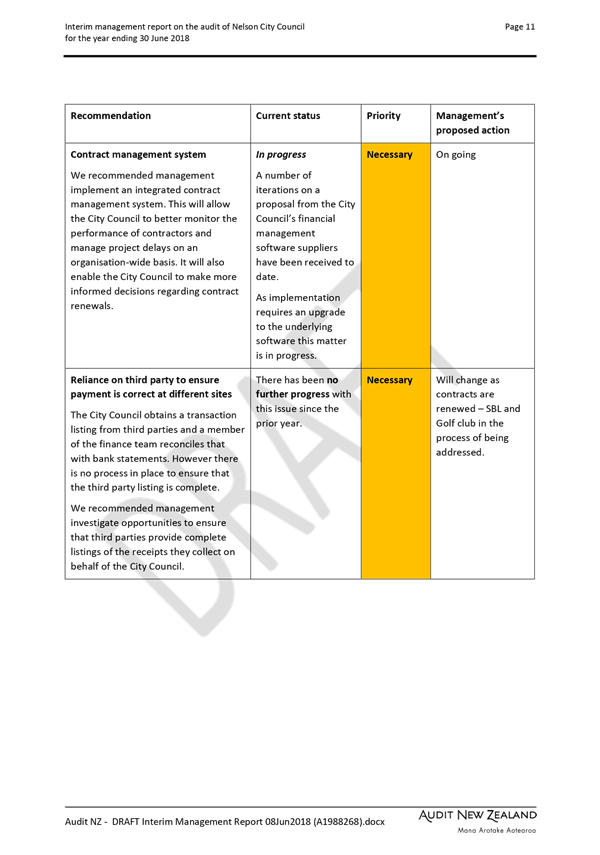

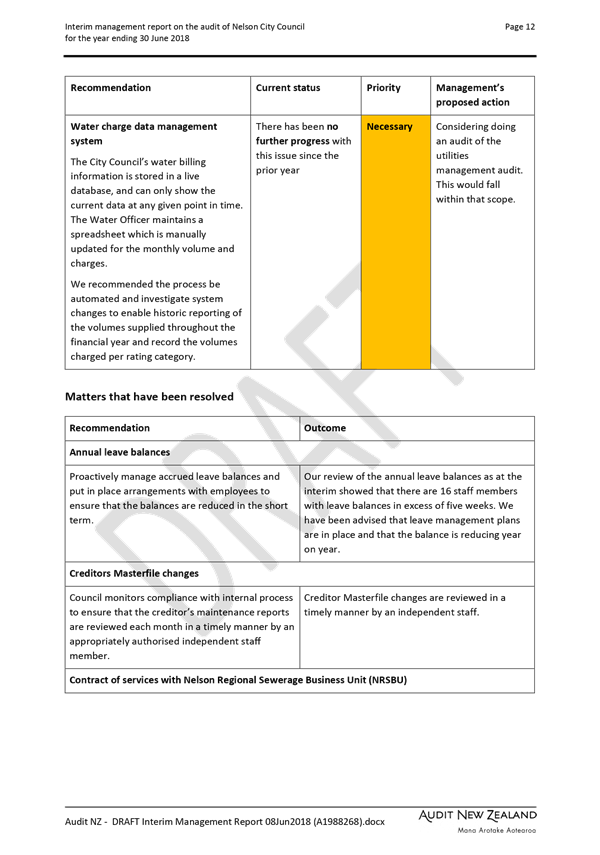

3.5 The

Audit New Zealand interim letter also contains a section of previous

recommendations made and an update on the status of the recommendations.

4. Options

4.1 That

the Subcommittee note the matters raised in the letter to the Council on the

interim audit of Nelson City Council for the year ending 30 June 2018 and the

manner in which officers propose to address them.

Tracey

Hughes

Senior

Accountant

Attachments

Attachment 1: A1988268 - Audit NZ -

draft interim audit letter for the year ending 30 June 2018 ⇩

|

Important considerations for decision making

|

|

1. Fit

with Purpose of Local Government

Section 99 of the Local Government Act 2002 requires

the audit of information contained in the Annual Report and Summary and the

interim audit forms part of that audit process.

|

|

2. Consistency

with Community Outcomes and Council Policy

This report supports the community outcome that

Council provides leadership.

|

|

3. Risk

There is more risk that Council will not meet all

its responsibilities if the recommendations from Audit NZ are not accepted

and actioned.

|

|

4. Financial

impact

There is no financial impact.

|

|

5. Degree

of significance and level of engagement

This matter is of low significance because there are

no decisions to be made. Therefore no engagement has occurred.

|

|

6. Inclusion

of Māori in the decision making process

Maori have not been consulted in preparation of this

report.

|

|

7. Delegations

The Audit, Risk and Finance Subcommittee has the

responsibility for considering audit processes and management of financial

risk.

|

Item

10: Interim audit letter for the year ending 30 June 2018: Attachment 1

Audit, Risk and Finance

Subcommittee

Audit, Risk and Finance

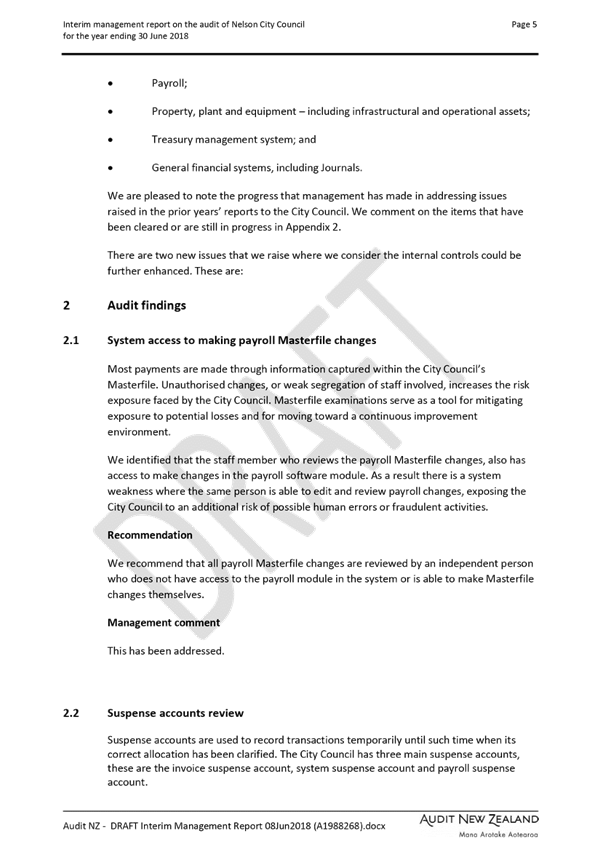

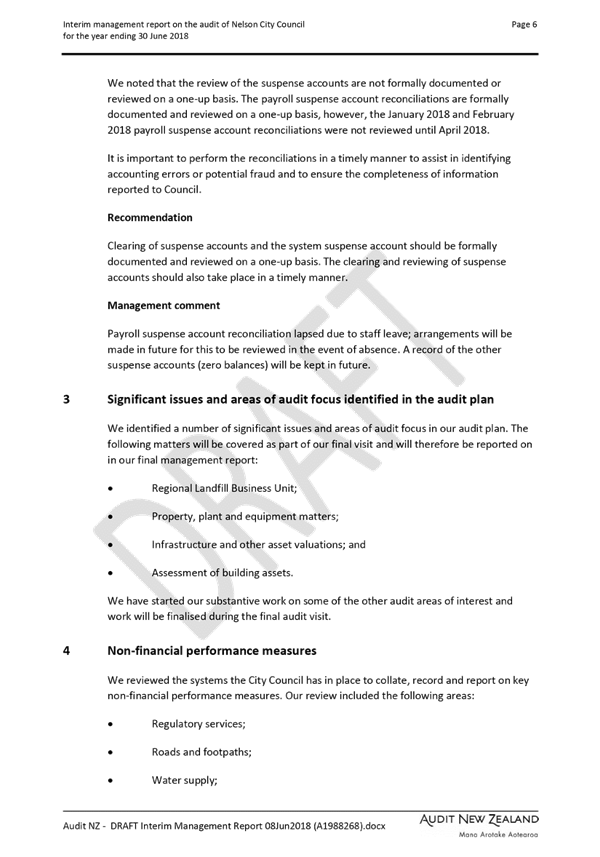

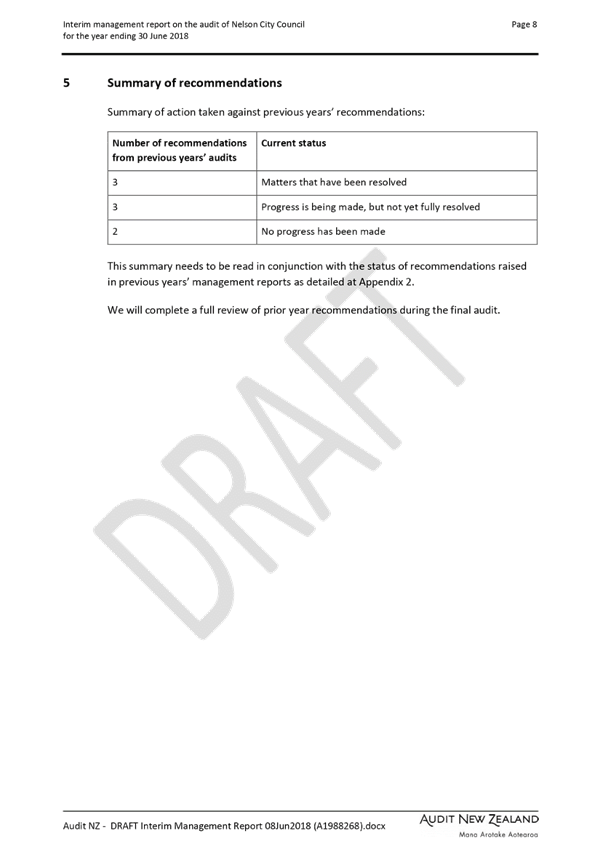

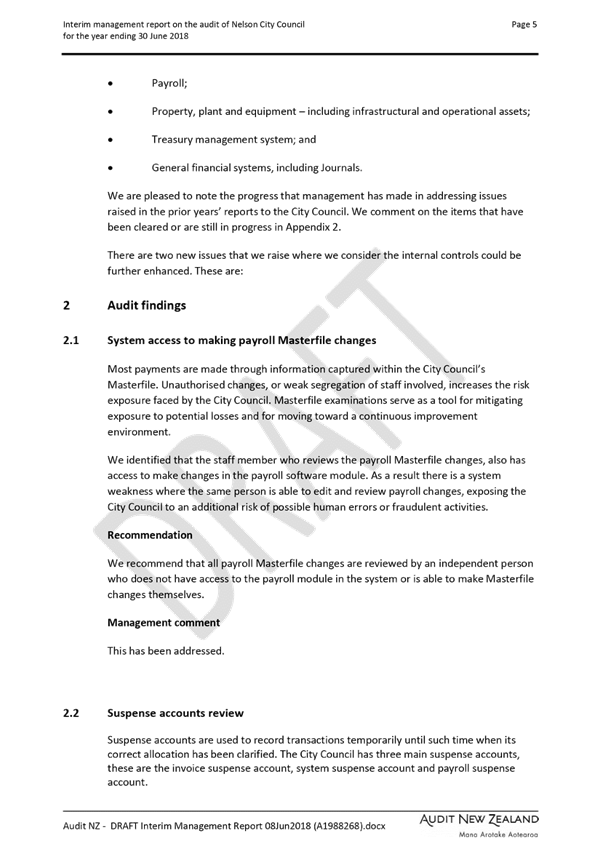

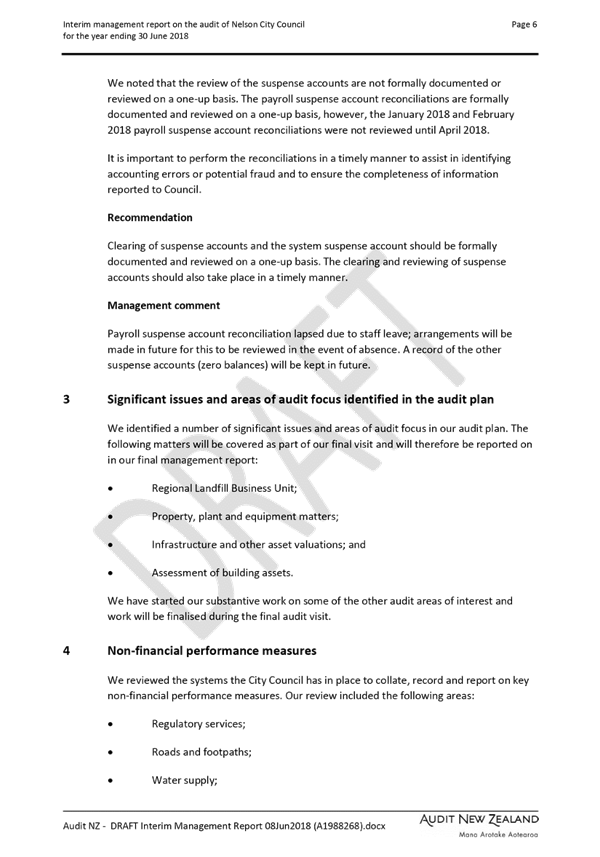

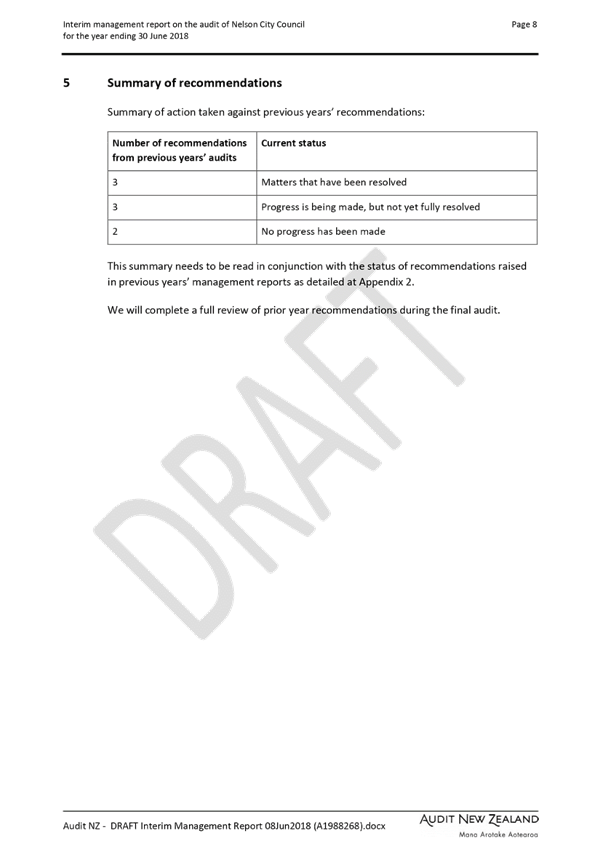

Subcommittee