AGENDA

Ordinary meeting of the

Audit, Risk and Finance Subcommittee

Tuesday 14 November 2017

Commencing at 9.00am

Council Chamber

Civic House

110 Trafalgar Street, Nelson

Membership: Mr John Peters (Chairperson), Her Worship the

Mayor Rachel Reese, Councillor Ian Barker, Councillor Bill Dahlberg and Mr John

Murray

Guidelines for councillors

attending the meeting, who are not members of the Committee, as set out in

Standing Order 12.1:

·

All councillors, whether or not they are members of the

Committee, may attend Committee meetings

·

At the discretion of the Chair, councillors who are not Committee

members may speak, or ask questions about a matter.

·

Only Committee members may vote on any matter before the

Committee

It is good practice for both Committee members and

non-Committee members to declare any interests in items on the agenda.

They should withdraw from the room for discussion and voting on any of these

items.

Audit, Risk and Finance

Subcommittee

Audit, Risk and Finance

Subcommittee

14

November 2017

Page

No.

1. Apologies

Nil

2. Confirmation

of Order of Business

3. Interests

3.1 Updates

to the Interests Register

3.2 Identify

any conflicts of interest in the agenda

4. Public

Forum

5. Confirmation

of Minutes

5.1 28

September 2017 7 - 13

Document number M2963

Recommendation

That the

Audit, Risk and Finance Subcommittee

Confirms

the minutes of the meeting of the Audit, Risk and Finance Subcommittee, held on

28 September 2017, as a true and correct record.

6. Status

Report - Audit Risk and Finance Subcommittee -14 November 2017 14 - 17

Document number R8676

Recommendation

That the Subcommittee

Receives the Status Report Audit,

Risk and Finance Subcommittee 14 November 2017 (R8676) and its attachment (A1753947).

7. Chairperson's

Report

8. Report

from 28 September Works and Infrastructure Committee 18 - 20

Document number R8681

Recommendation

That the Audit, Risk and Finance

Subcommittee

Receives the Report from 28

September Works and Infrastructure Committee (R8681) and its attachment/s () and its attachment (A1839317).

9. Corporate

Report to 31 August 2017 21 - 34

Document number R7001

Recommendation

That the Committee

Receives the report Corporate

Report to 31 August 2017 (R7001)

and its attachments (A1854215, A1853357 and A1852936).

10. Health

and Safety: Quarterly Report 35 - 48

Document number R7022

Recommendation

That the Subcommittee

Receives the report Health and

Safety: Quarterly Report (R7022)

and its attachment (A1845583).

Recommendation to Council

That the

Council

Notes

the report Health and Safety: Quarterly Report (R7022) and its attachment (A1845583); and

Acknowledges

the assessment of critical health and safety risks contained in the attachment

(A1845583).

11. Insurance

renewal 2017/18 49 - 54

Document number R7525

Recommendation

That the Subcommittee

Receives the report Insurance

renewal 2017/18 (R7525) ; and

Notes

the decision made to exit Local Authority Protection Program (LAPP) and join

the Aon South Island Collective from 1 July 2017; and

Notes

the decision made to purchase an additional $125 million shared limit (to a

total limit of $250million) with a Council sublimit of $160m from 1 November

2017.

12. Internal

Audit Quarterly Report to 30 September 2017 55

- 59

Document number R7589

Recommendation

That the Subcommittee

Receives the report Internal Audit

Quarterly Report to 30 September 2017 (R7589).

13. Key

Organisational Risks 2017 - 3rd Quarterly Report 60

- 77

Document number R7681

Recommendation

That the Subcommittee

Receives the report Key

Organisational Risks 2017 - 3rd Quarterly Report (R7681) and its attachment (A1842185).

14. Section

17A Service Delivery Review progress report 78

- 123

Document number R8167

Recommendation

That the Subcommittee

Receives the report Section 17A

Service Delivery Review progress report (R8167)

and its attachment/s (A1824993, A1845758, A1844354, A1843923, A1837281,

A1633609, A1819898, A1844359, A1853049).

15. Tax

Risk Management Strategy 124 - 132

Document number R8585

Recommendation

That the Subcommittee

Receives the report Tax Risk

Management Strategy (R8585) and

its attachments (A1847439 and A1847460).

Recommendation to Council

That the

Council

Adopts

the Tax Risk Management Strategy (A1847439).

Note:

·

This meeting is expected to continue to lunchtime. (delete as appropriate)

·

Lunch will be provided. (delete as appropriate)

Minutes of a meeting of

the Audit, Risk and Finance Subcommittee

Held in the Council

Chamber, Civic House, 110 Trafalgar Street, Nelson

On Thursday 28 September

2017, commencing at 1.02pm

Present: Mr

J Peters (Chairperson), Her Worship the Mayor R Reese, Councillor I Barker, and

Mr J Murray

In Attendance: Councillors

M Courtney, P Matheson, B McGurk, G Noonan, M Rutledge , and S Walker, Group

Manager Corporate Services (N Harrison), Group Manager Community Services (C

Ward), Senior Strategic Adviser (N McDonald), Manager Communications (P

Shattock), Senior Accountant (T Hughes) and Governance Adviser (E-J Ruthven)

Apology: Councillor

B Dahlberg

1. Apologies

|

Resolved AUD/2017/056

That the Subcommittee

Receives and

accepts the apologies from Councillor Dahlberg.

Barker/Her Worship the Mayor Carried

|

2. Confirmation of Order of Business

There was no change to the order

of business.

3. Interests

There were no updates to the

Interests Register, and no interests with items on the agenda were declared.

4. Public Forum

There was no public forum.

5. Confirmation of Minutes

5.1 8

September 2017

Document number M2894, agenda

pages 7 - 15 refer.

|

Resolved AUD/2017/057

That the Committee

Confirms the

minutes of the meeting of the Committee, held on 8 September 2017, as a true

and correct record.

Barker/Her Worship the Mayor Carried

|

6. Status Report - Audit Risk and

Finance Subcommittee - 28 September 2017

Document number R8406, agenda

pages 16 - 18 refer.

|

Resolved AUD/2017/058

That the Subcommittee

Receives the Status Report

Audit, Risk and Finance Subcommittee 28 September 2017 (R8406) and its attachment (A1753947).

Murray/Barker Carried

|

7. Chairperson's Report

The Chairperson gave a verbal

report, and explained reasons for the July 2017 financial records not being

available for this meeting.

He added that the Annual Report

audit had become available this week, and Group Manager Corporate Services, Ms

Harrison, tabled a document (A1841934) outlining changes to the Annual Report

as a result of the audit process.

Senior Accountant, Tracey Hughes,

explained changes in the financial statements for the Annual Report and

answered questions.

|

Attachments

1 A1841934 - tabled

document

|

8. PWC Treasury advisor presentation

Brett Johanson and Jason Bligh,

from PriceWaterhouseCoopers, gave a power point presentation regarding the

treasury management update (A1838402).

Attendance: Councillor

Barker left the meeting from 1.11pm to 1.13pm.

Mr Johanson and Mr Bligh spoke

about Council’s financial management framework, short and longer term

interest rate profiles and Council’s ability to raise debt, and answered

questions.

|

Attachments

1 A1838402 - PWC

Power Point Presentation

|

9. Protected disclosure policy for

elected members

Document number R8402, agenda

pages 19 - 31 refer.

Group Manager Corporate Services,

Nikki Harrison, presented the report, and explained that a Separate Protected

Disclosure policy for elected members would be developed.

Manager People and Capability,

Stephanie Vincent spoke about the proposed policy development, and answered

questions.

|

Resolved AUD/2017/059

That the Subcommittee

Receives the report Protected

disclosure policy for elected members (R8402)

and its attachment (A1338935); and

Requests

the development of a separate Protected Disclosure Policy

for Elected Members, for review by the Subcommittee prior to submitting the

policy for approval by Council.

Barker/Her Worship the Mayor Carried

|

10. Results of 2017 Residents

Survey

Document number R8361, agenda

pages 32 - 125 refer.

Senior Strategic Adviser, Nicky

McDonald, presented the report, and answered questions.

|

Resolved AUD/2017/060

That the Subcommittee

Receives the report Results of

2017 Residents Survey (R8361)

and its attachment (A1789495); and

Notes

the 2017 Residents Survey results (A1789495) will be communicated to the

public.

Her Worship the Mayor/Barker Carried

|

11. Health and Safety Strategic

Plan 2017 - 2023

Document number R7718, agenda

pages 126 - 144 refer.

Health and Safety Adviser,

Malcolm Hughes, presented the report, and answered questions.

|

Resolved AUD/2017/061

That the Subcommittee

Receives the report Health and

Safety Strategic Plan 2017 - 2023 (R7718)

and its attachment (A1398549).

Barker/Murray Carried

|

|

Recommendation to Council

AUD/2017/062

That the Council

Approves

the Health and Safety Strategic Plan 2017 - 2023 (A1398549).

Barker/Murray Carried

|

12. Audit Engagement Letter 2017

- debenture trust deed

Document number R8254, agenda

pages 145 - 169 refer.

Group Manager Corporate Services,

Nikki Harrison, presented the report and answered questions.

|

Resolved AUD/2017/063

That the Subcommittee

Receives the report Audit

Engagement Letter 2017 - debenture trust deed (R8254) and its attachment (A1815606); and

Notes the Subcommittee can provide

feedback on the Audit Engagement letter – debenture trust deed to Audit

NZ if required, noting the Mayor will sign the letter once the

Subcommittee’s feedback has been incorporated.

Murray/Barker Carried

|

13. Revised Internal Audit

Annual Plan to June 2018

Document number R8408, agenda

pages 170 - 175 refer.

Internal Audit Analyst, Lynn

Anderson, presented the report, and noted changes made as a result of a

workshop on this subject. She explained that the plan included one

additional audit, and that another additional audit may be able to be

undertaken within the current budget.

|

Resolved AUD/2017/064

That the Subcommittee

Receives the report Revised

Internal Audit Annual Plan to June 2018 (R8408) and its attachment (A1800209).

Murray/Her Worship the Mayor Carried

|

|

Recommendation to Council

AUD/2017/065

That

the Council

Approves

the Internal Audit – Annual Audit Plan to 30 June 2018 (A1800209).

Murray/Her Worship the Mayor Carried

|

14. Exclusion of the Public

|

Resolved AUD/2017/066

That

the Subcommittee

Excludes

the public from the following parts of the proceedings of this meeting.

The

general subject of each matter to be considered while the public is excluded,

the reason for passing this resolution in relation to each matter and the

specific grounds under section 48(1) of the Local Government Official

Information and Meetings Act 1987 for the passing of this resolution are as

follows:

Murray/Her Worship the Mayor Carried

|

|

Item

|

General subject of each matter to be considered

|

Reason for passing this resolution in relation to

each matter

|

Particular interests protected (where applicable)

|

|

1

|

Audit, Risk and Finance

Subcommittee Meeting - Public Excluded Minutes - 8 September 2017

|

Section 48(1)(a)

The public conduct of this

matter would be likely to result in disclosure of information for which good

reason exists under section 7.

|

The withholding of the

information is necessary:

· Section 7(2)(i)

To enable the local

authority to carry on, without prejudice or disadvantage, negotiations

(including commercial and industrial negotiations).

|

The meeting went into public

excluded session at 2.45pm and resumed in public session at 2.47pm.

Please note that as the only

business transacted in public excluded was to confirm the minutes, this

business has been recorded in the public minutes. In accordance with the Local

Government Official Information Meetings Act 1987, no reason for withholding

this information from the public exists.

|

Resolved AUD/2017/067

That the Subcommittee

Confirms the

minutes of part of the meeting of the Audit, Risk and Finance Subcommittee,

held with the public excluded on 8 September 2017, as a true and correct

record.

Barker/Her Worship the Mayor Carried

|

15. Re-admittance of the Public

|

Resolved AUD/2017/068

That

the Subcommittee

Re-admits

the public to the meeting.

Barker/Murray Carried

|

There being no further business the

meeting ended at 2.45pm.

Confirmed as a correct record of proceedings:

Chairperson

Date

Chairperson

Date

|

|

Audit, Risk and Finance Subcommittee

14 November 2017

|

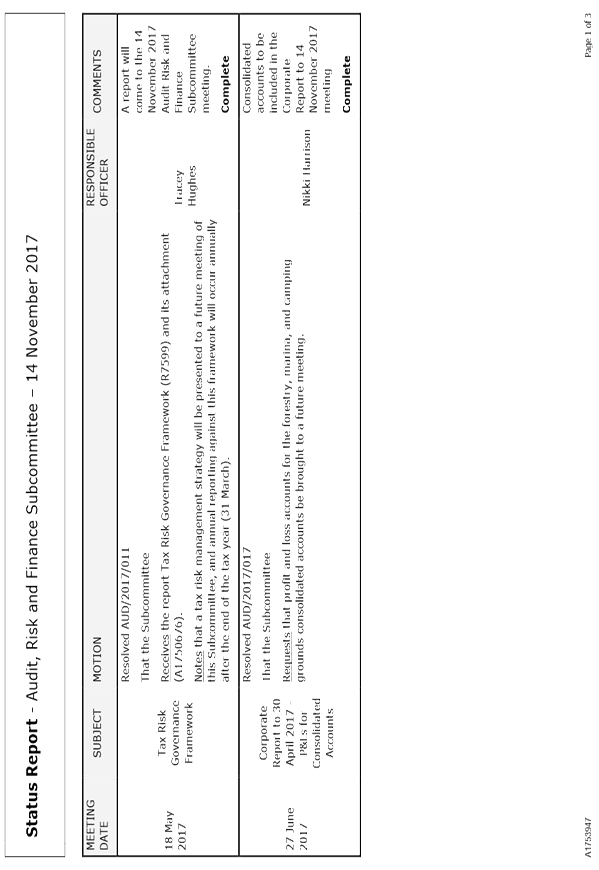

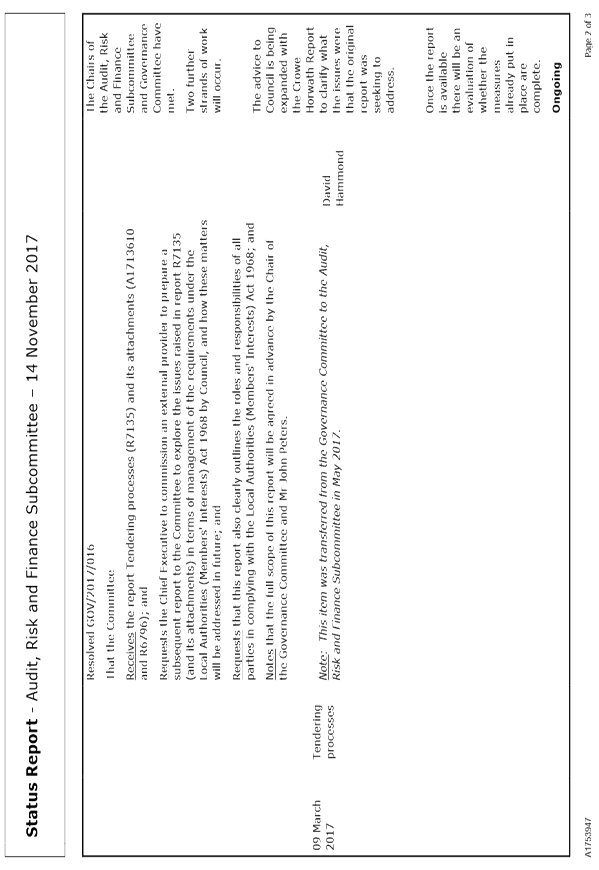

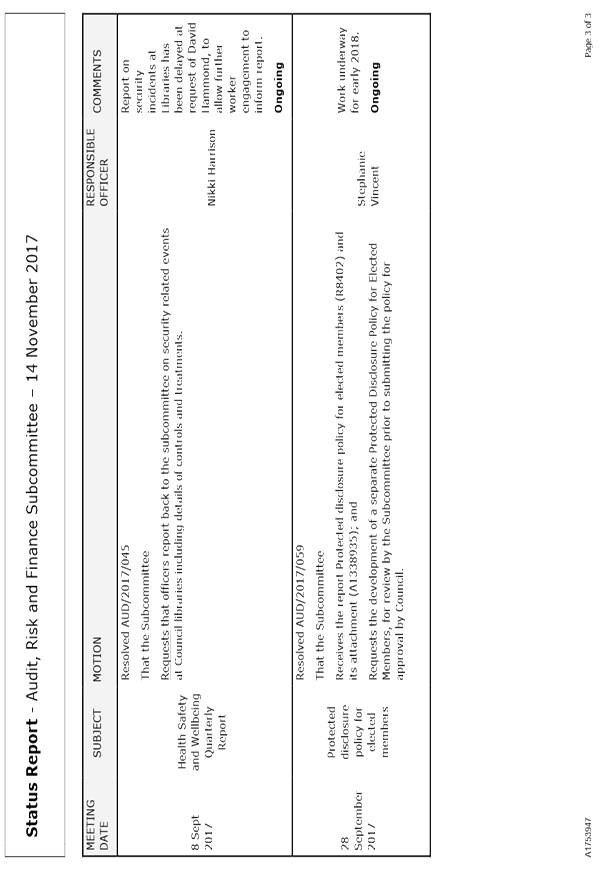

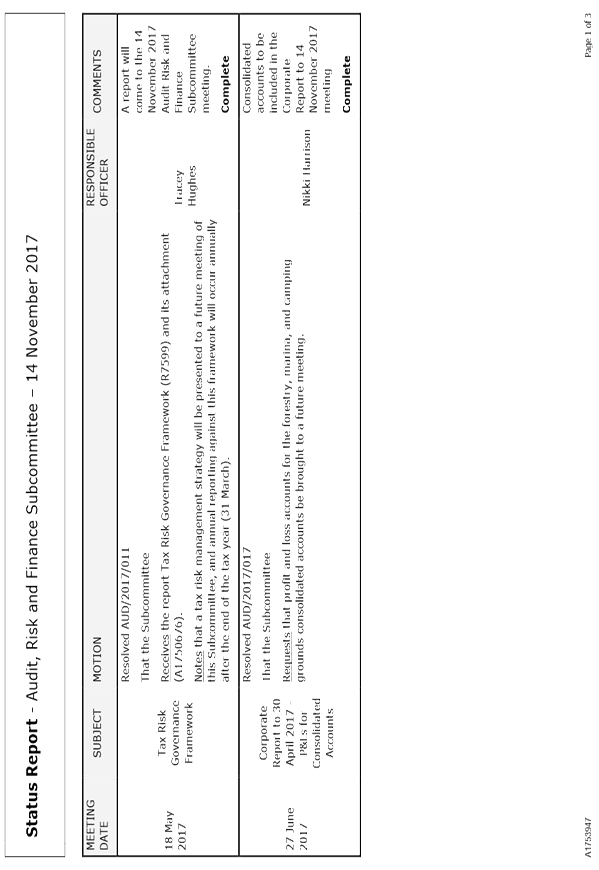

REPORT R8676

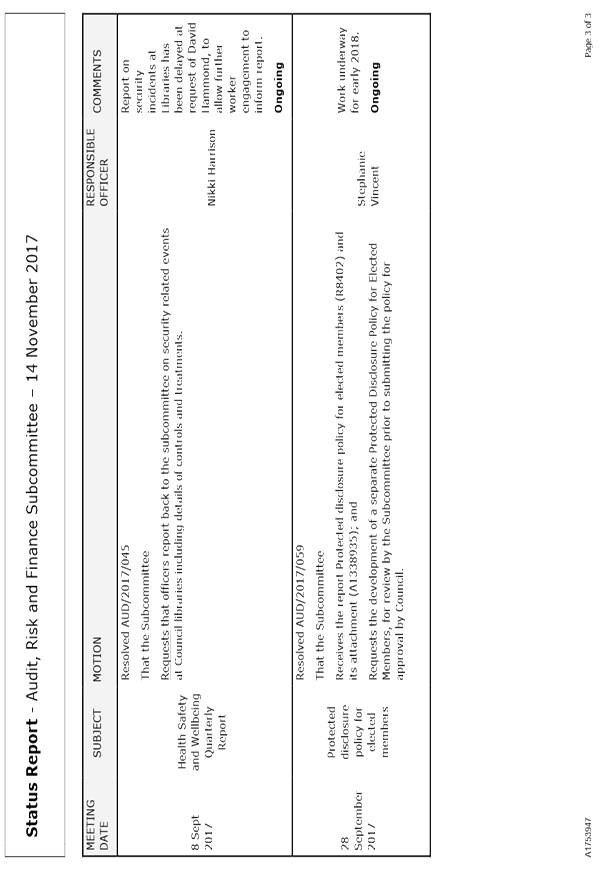

Status

Report - Audit Risk and Finance Subcommittee -14 November 2017

1. Purpose

of Report

1.1 To

provide an update on the status of actions requested and pending.

2. Recommendation

|

That the Subcommittee

Receives the Status Report

Audit, Risk and Finance Subcommittee 14 November 2017 (R8676) and its attachment (A1753947).

|

Attachments

Attachment 1: A1753947

- Audit and Risk Subcommittee Status Report 14 November 2017 ⇩

Item

6: Status Report - Audit Risk and Finance Subcommittee -14 November 2017:

Attachment 1

Item 8: Report from 28

September Works and Infrastructure Committee

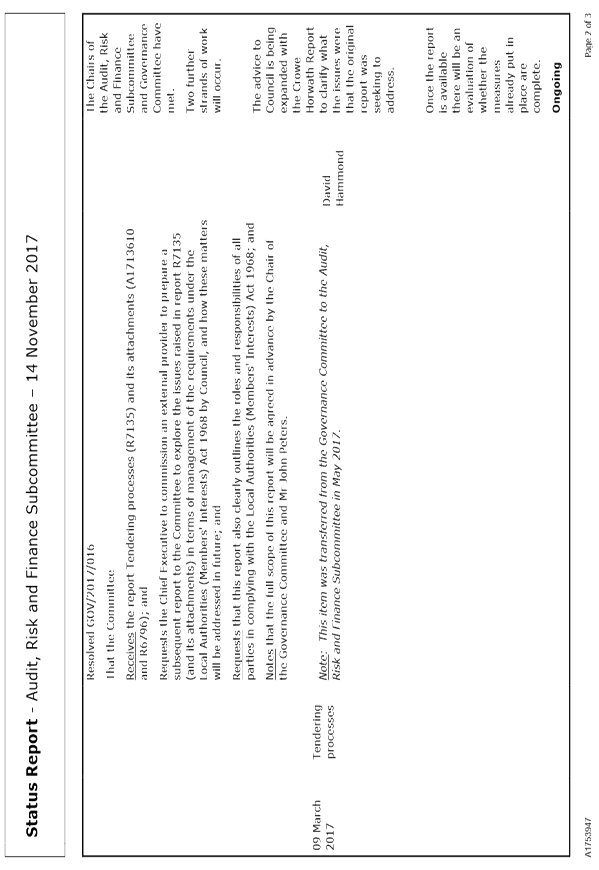

|

|

Audit, Risk and Finance Subcommittee

14 November 2017

|

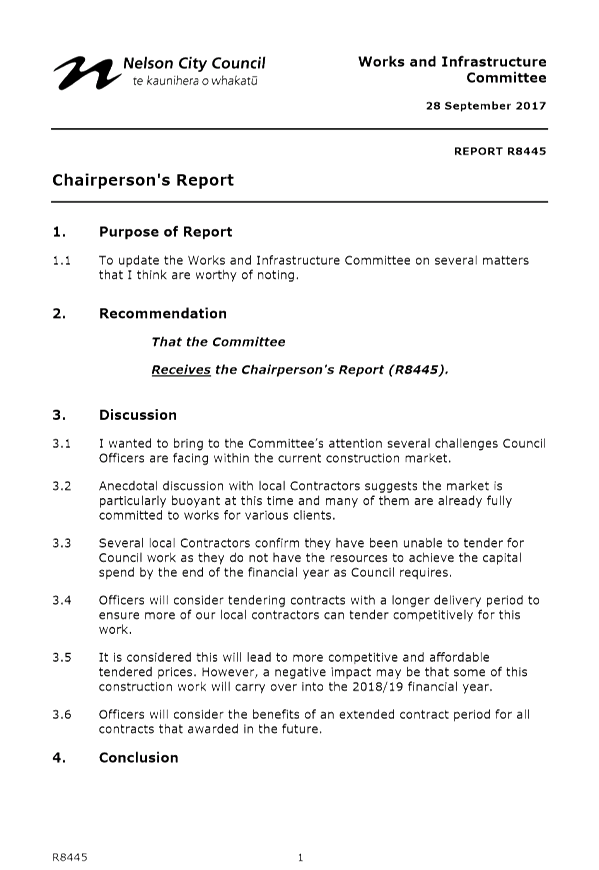

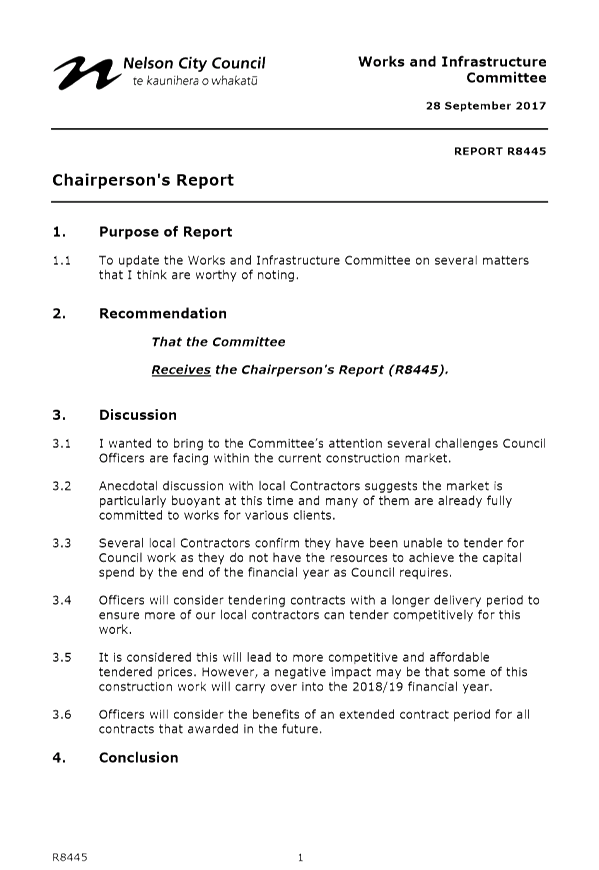

REPORT R8681

Report

from 28 September Works and Infrastructure Committee

1. Purpose

of Report

At its 28 September 2017

meeting, the Works and Infrastructure Committee resolved:

Resolved WI/2017/058

That the Committee

Receives the Chairperson's Report (R8445) and refers

the report to the Audit Risk and Finance Committee.

The 28 September 2017 Works and

Infrastructure Committee Chairperson’s report is attached as Attachment

1. (A1839317)

2. Recommendation

|

That the Audit, Risk and Finance

Subcommittee

Receives the Report from 28

September Works and Infrastructure Committee (R8681) and its attachment (A1839317).

|

Elaine

Stephenson

Governance

Adviser

Attachments

Attachment 1: A1839317 - 28 September

2017 Works and Infrastructure Chairperson's report ⇩

Item

8: Report from 28 September Works and Infrastructure Committee: Attachment 1

|

|

Audit, Risk and Finance Subcommittee

14 November 2017

|

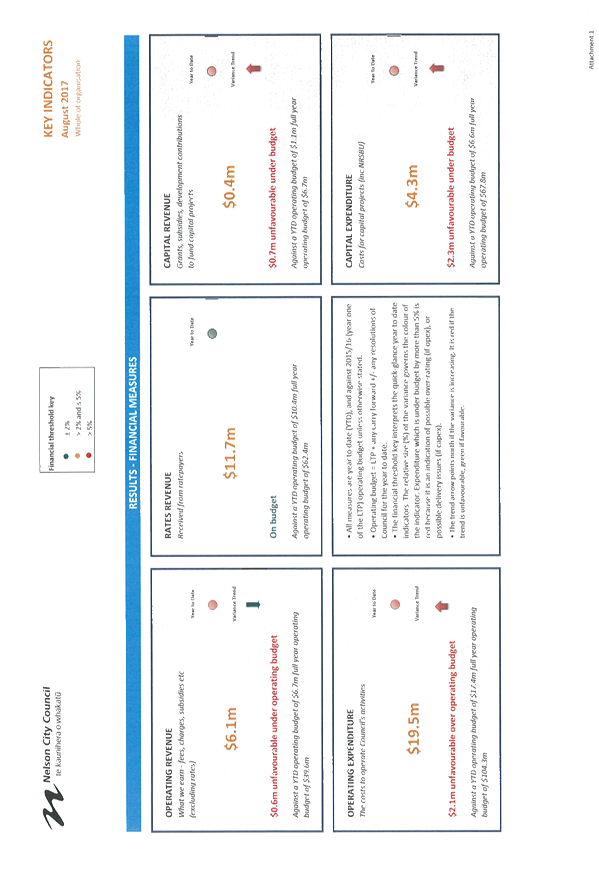

REPORT R7001

Corporate

Report to 31 August 2017

1. Purpose

of Report

1.1 To

inform the members of the Governance committee of the

financial results of activities for the two months ending 31 August 2017,

compared to the approved operating budget, and to highlight and explain any

permanent and material variations.

2. Recommendation

|

That the Subcommittee

Receives the report Corporate

Report to 31 August 2017 (R7001)

and its attachments (A1854215, A1853357 and A1852936).

|

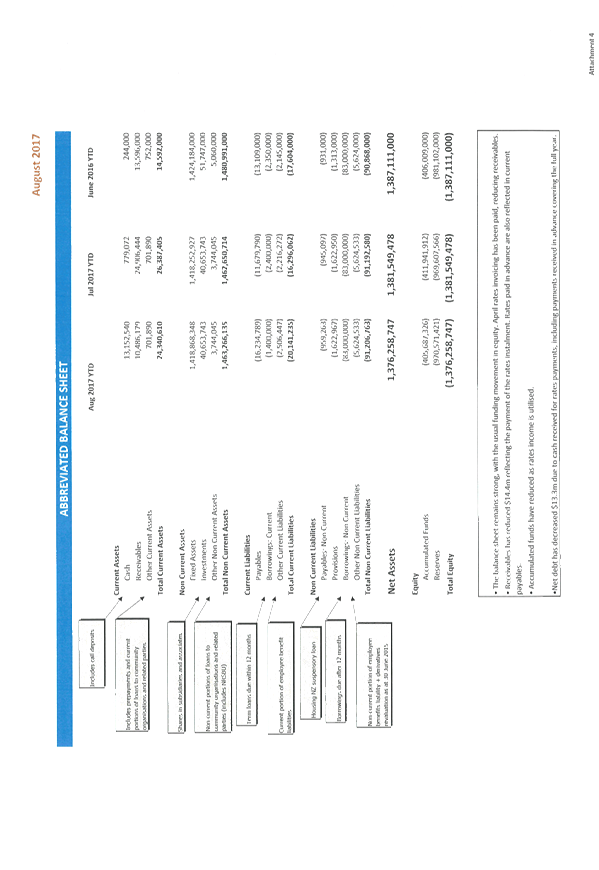

3. Background

3.1 The financial reporting focuses on the two month performance

compared with the year to date approved operating budget.

3.2 Unless

otherwise indicated, all measures are against approved operating budget, which

is 2017/18 Annual Plan budget plus any carry forwards, plus or minus any other

additions or changes as approved by Council throughout the year.

3.3 The phasing of budgets to better reflect the timing of anticipated

actual income and expenditure has not yet occurred due to resourcing

constraints. This should be done in time for the next corporate report.

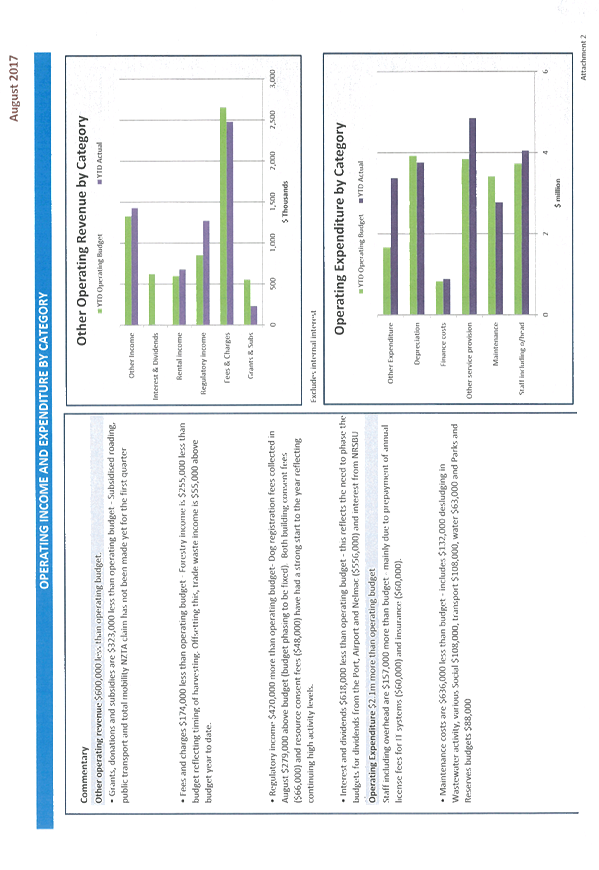

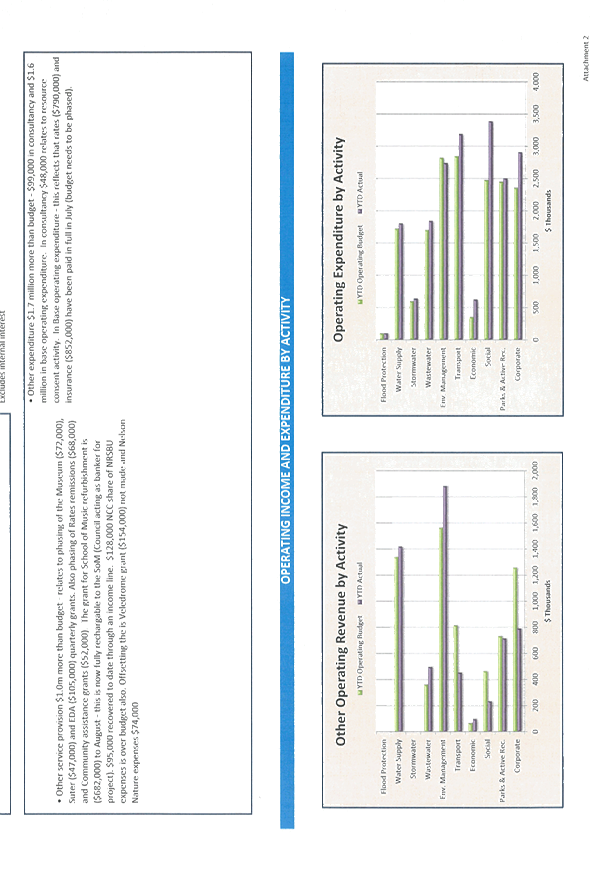

4. Discussion

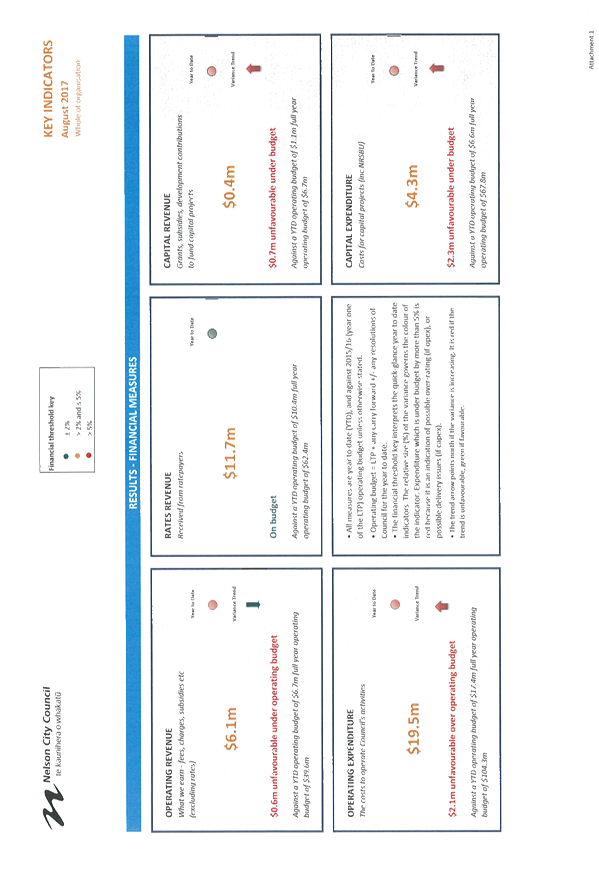

1.1 For the two months ending 31

August 2017, the activity surplus/deficits are $2.7 million unfavourable to budget.

All of the unfavourable variance is due to budgets not been phased yet and

costs such as insurance and rates being charged at the beginning of the year.

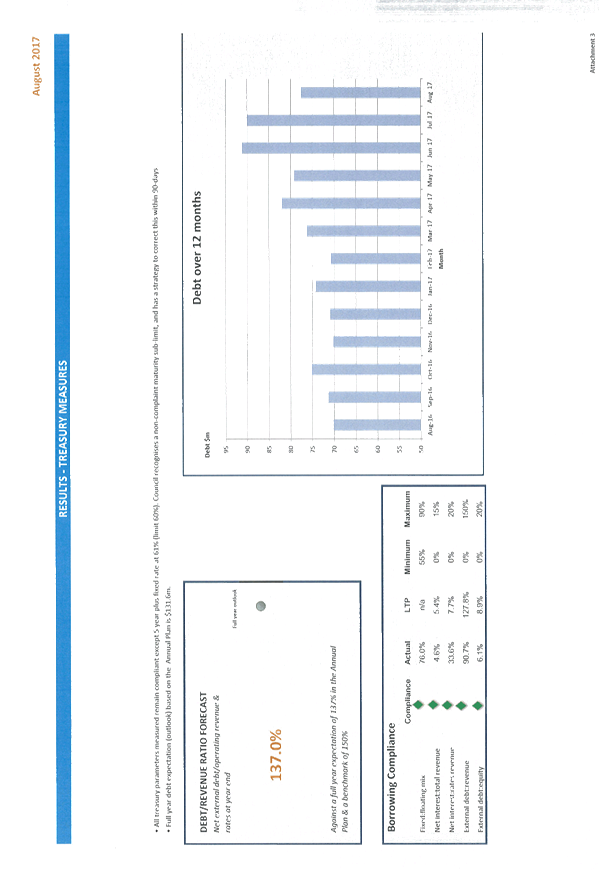

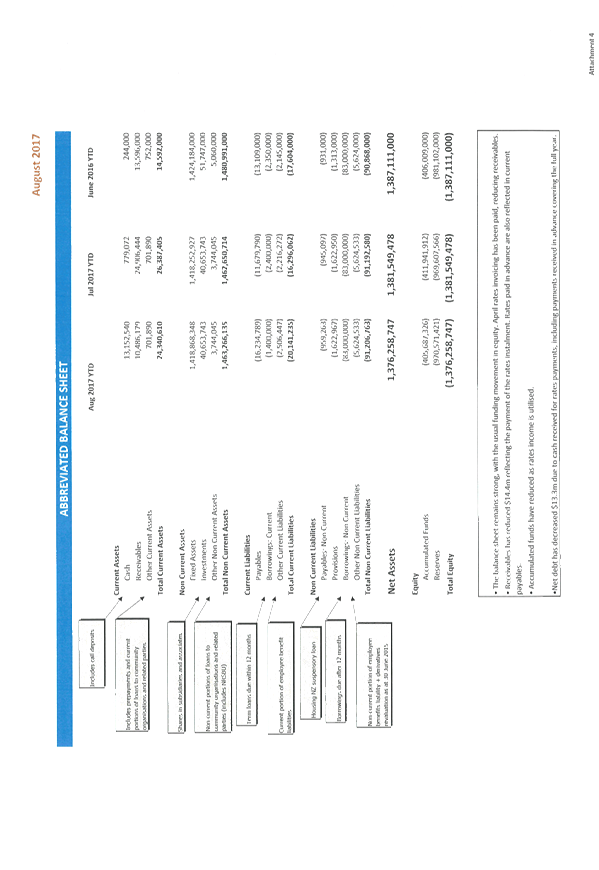

1.2 Financial

information provided in Attachment 1 to this report:

· A financial measures dashboard with information on rates revenue,

operating revenue and expenditure, and capital revenue and expenditure. The

arrow icon in each applicable measure indicates whether the variance is

increasing or decreasing and whether that trend is favourable or unfavourable

(green or red).

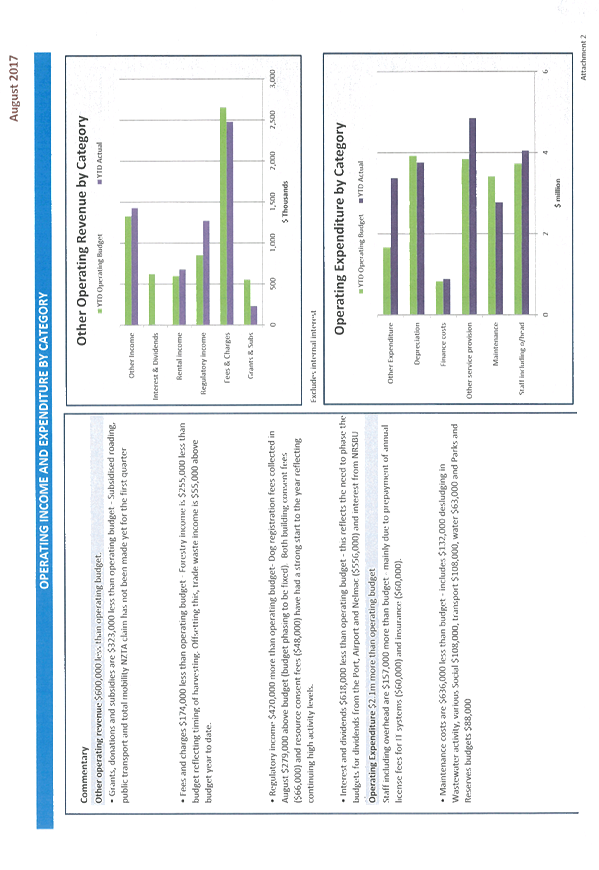

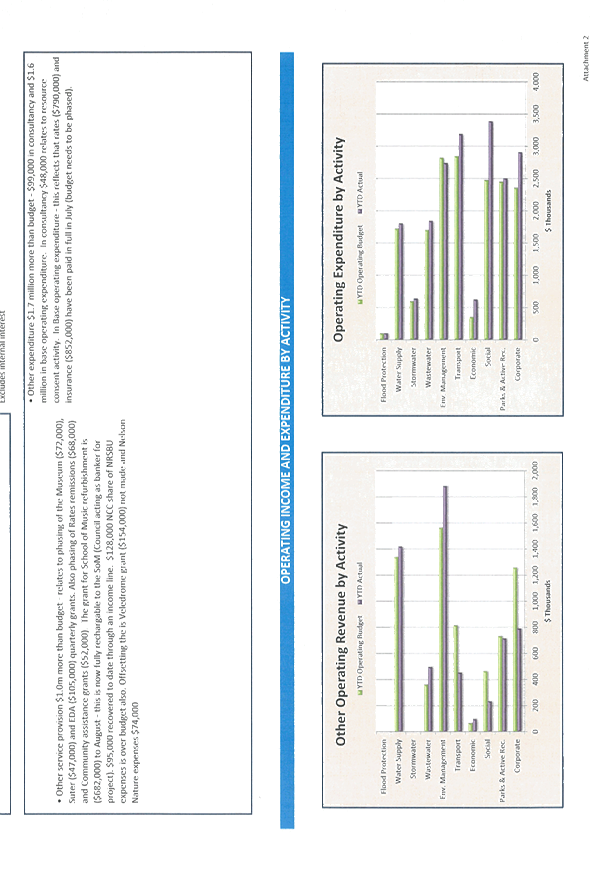

· A grouping of more detailed graphs and commentary for operating

income and expenditure. The first set of charts and the commentary is by

category (as in the annual report) and highlights significant permanent

differences and items of interest. Variances due to timing will not be itemised

unless they become permanent. The second set of charts are by activity.

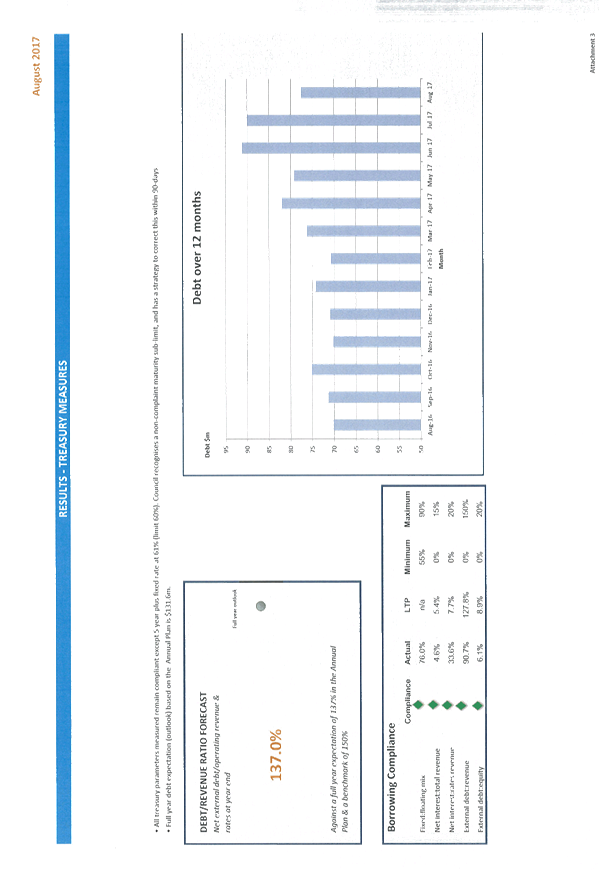

· A treasury measures dashboard with a compliance table (green =

compliant), a forecast of the debt/revenue ratio for the year where available,

and a graph showing debt levels over a rolling 13 month period.

· High level balance sheet. This does not include any consolidations.

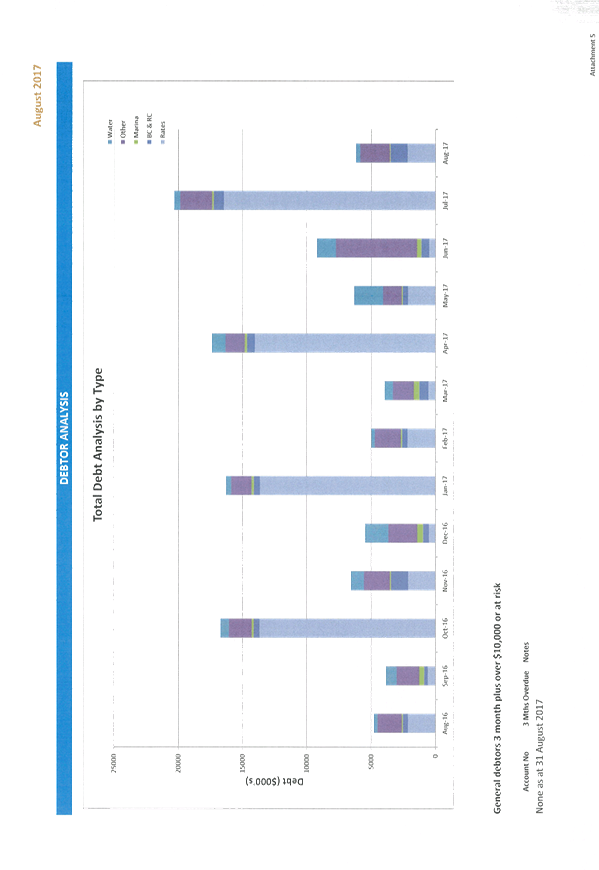

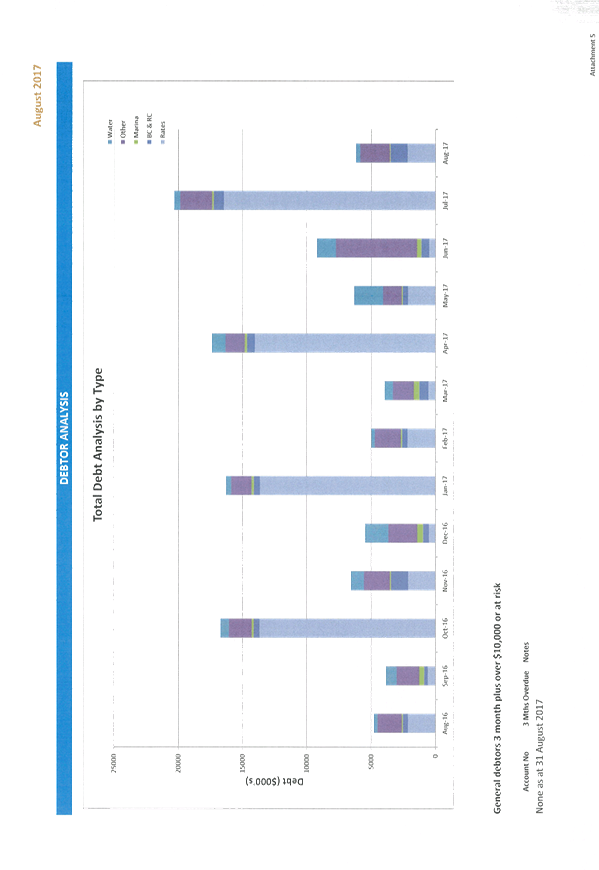

· A debtor analysis graph over 12 months, clearly showing outstanding

debt levels and patterns for major debt types along with a summary of general

debtors > 3 months and over $10,000 and other debtors at risk.

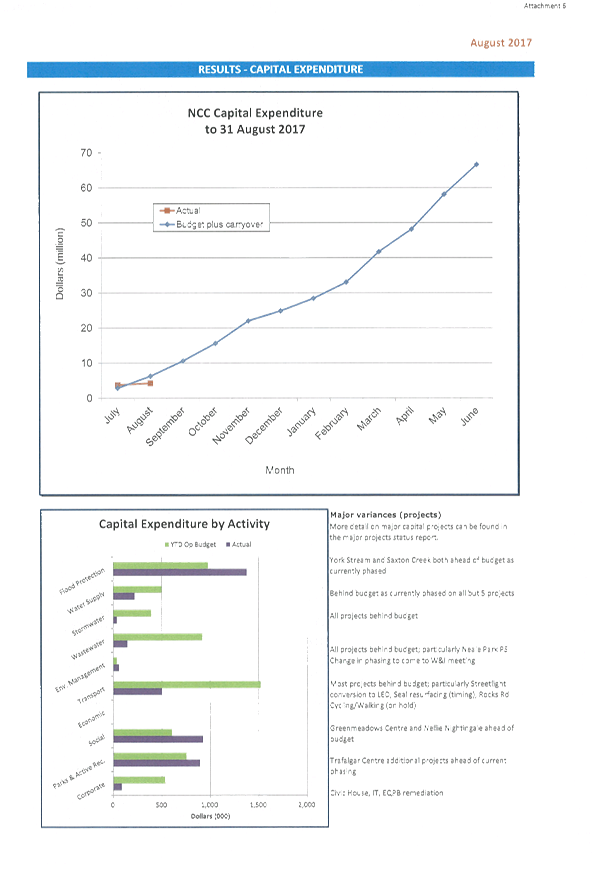

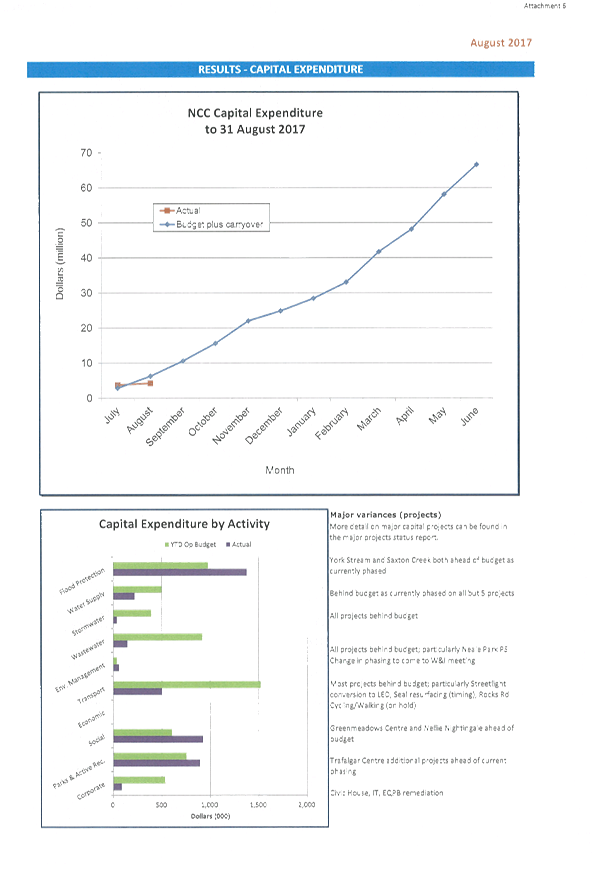

· Two capital expenditure graphs – actual expenditure against

operating budget for the financial year, and year to date expenditure against approved

operating budget by activity.

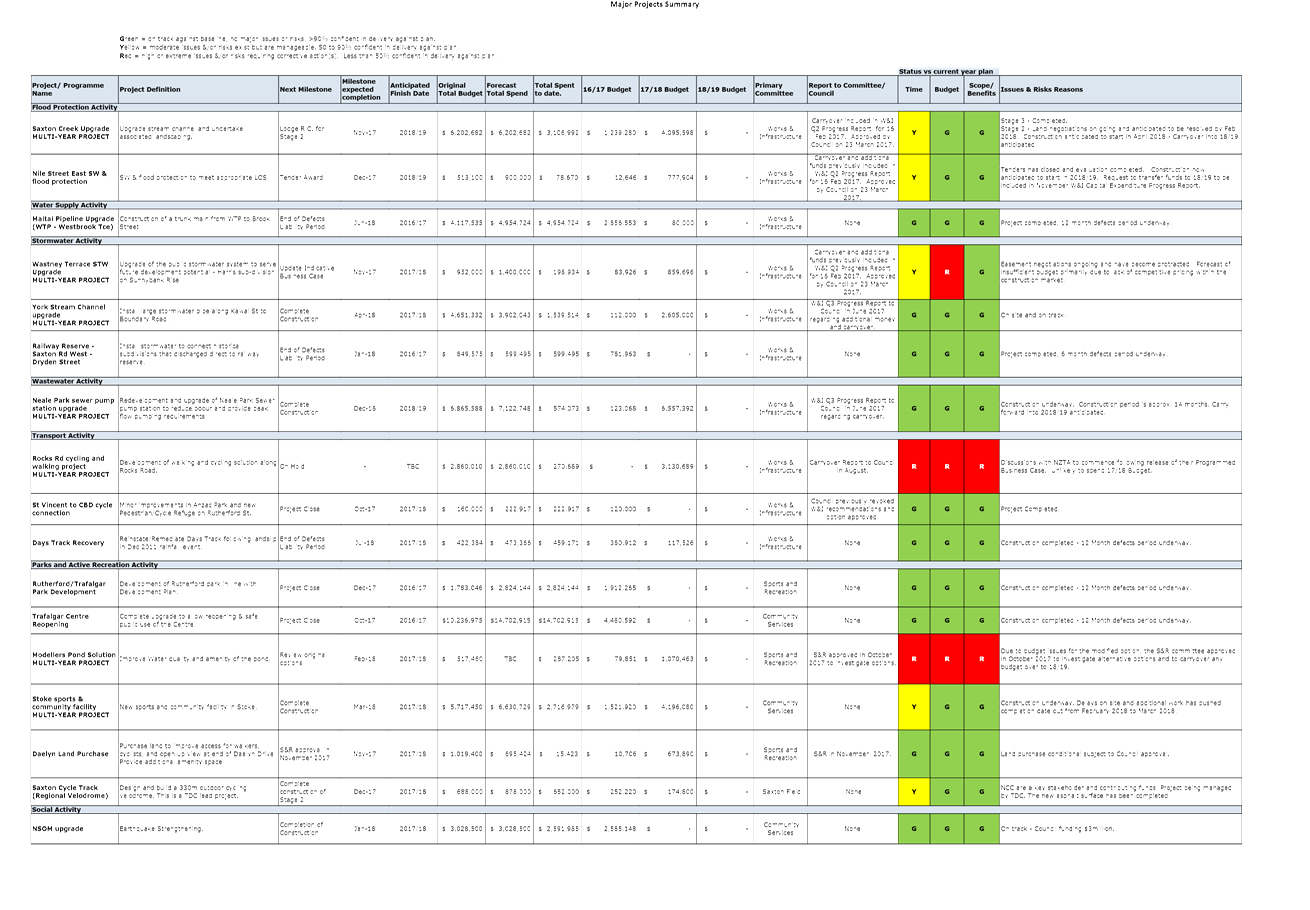

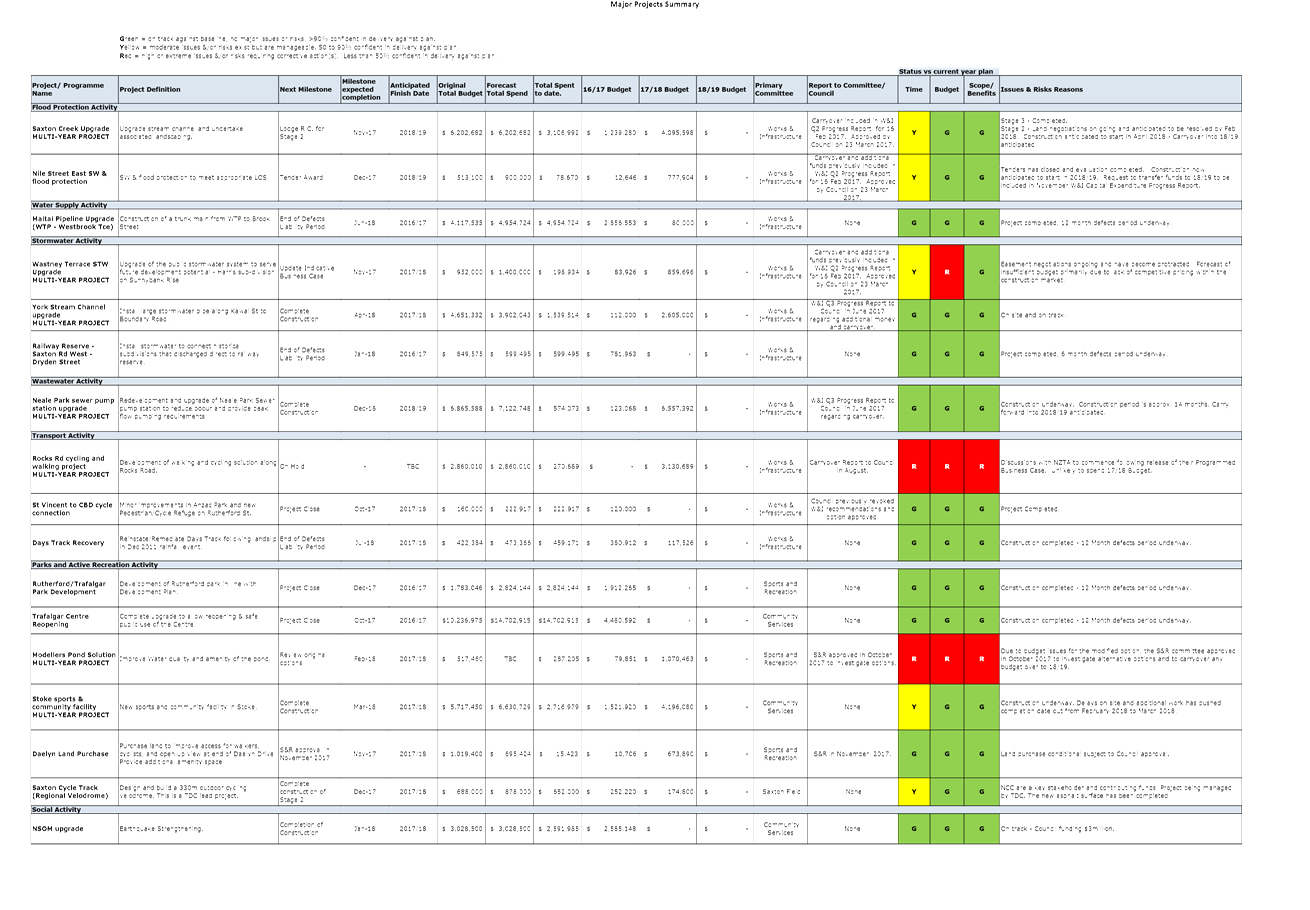

· A major projects summary including milestones, status, issues and

risks.

4.1 Capital expenditure is $2.3 million under budget.

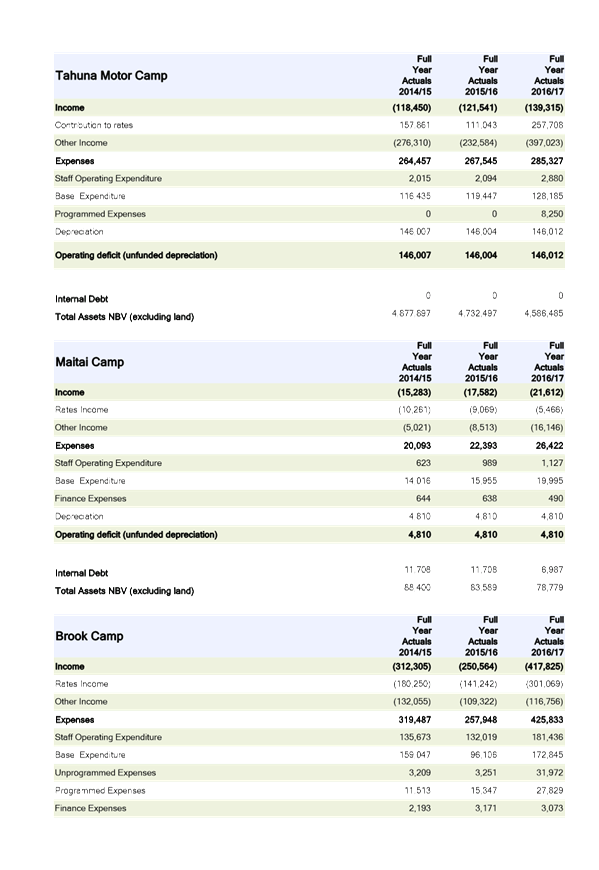

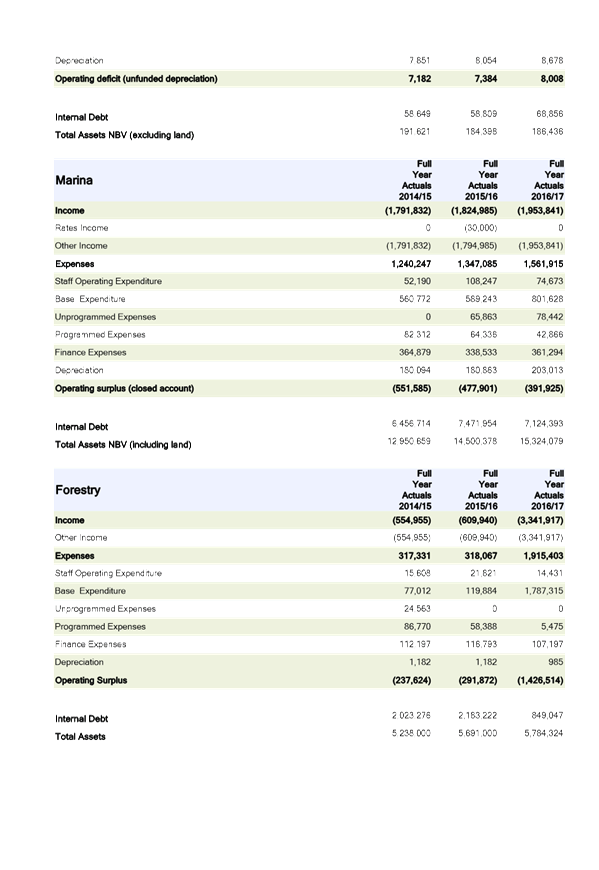

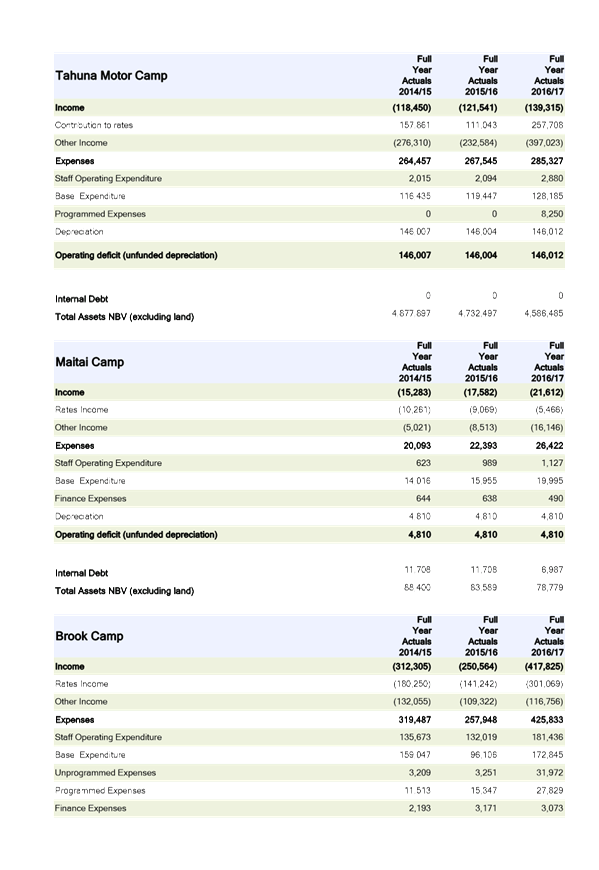

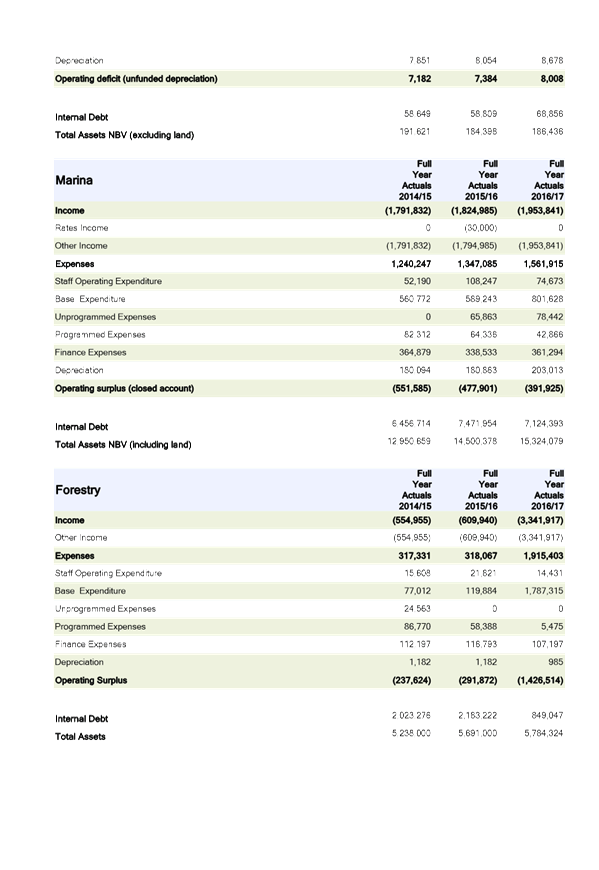

5. Accounts for camping grounds, marina and forestry

activities

5.1 At

the 27 June 2017 subcommittee meeting the following resolution was passed:

Resolved

AUD/2017/017

That the Subcommittee

Requests that profit and loss

accounts for the forestry, marina, and camping grounds consolidated accounts be

brought to a future meeting.

5.2 The

accounts are included as Attachment 3 which outline the separate activities of

the three motor camps, the marina and the forestry including asset value and

outstanding loans (if any).

6. Options

6.1 Accept

the recommendation. This report is to inform the committee members, and no

further actions are required.

6.2 Do

not accept the recommendation.

Tracey

Hughes

Senior

Accountant

Attachments

Attachment 1: A1854215 - Financial

information ⇩

Attachment 2: A1853357

- Major projects summary ⇩

Attachment 3: A1852936

- Analysis of Motor camps, Marina and forestry ⇩

|

Important considerations for decision making

|

|

1. Fit

with Purpose of Local Government

The Audit, Risk and Finance subcommittee receives an

update on financial matters at each meeting to inform them of items of

financial interest and potentially items of financial risk.

|

|

2. Consistency

with Community Outcomes and Council Policy

The financial reports are prepared comparing current

year performance against the year to date approved budget for 2017/18.

|

|

3. Risk

The recommendation carries no risk as the report is

for information only.

|

|

4. Financial

impact

The recommendation has no financial impact.

|

|

5. Degree

of significance and level of engagement

The recommendation is of low significance as there are

no decisions to be made.

|

|

6. Inclusion

of Māori in the decision making process

No consultation is required.

|

|

7. Delegations

The Audit Risk and Finance subcommittee has

oversight of Council’s financial performance and the management of

financial risks.

|

Item

9: Corporate Report to 31 August 2017: Attachment 1

Item

9: Corporate Report to 31 August 2017: Attachment 2

Item

9: Corporate Report to 31 August 2017: Attachment 3

|

|

Audit, Risk and Finance Subcommittee

14 November 2017

|

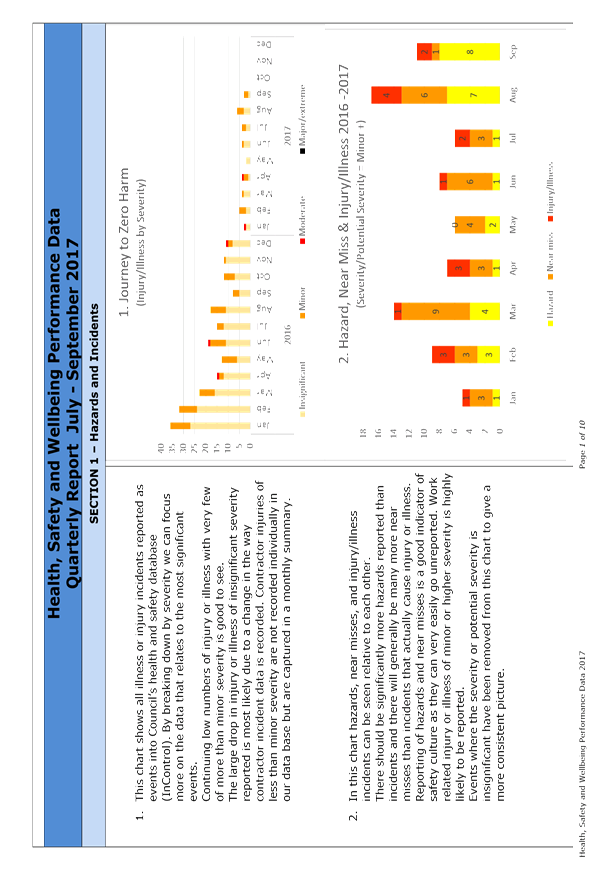

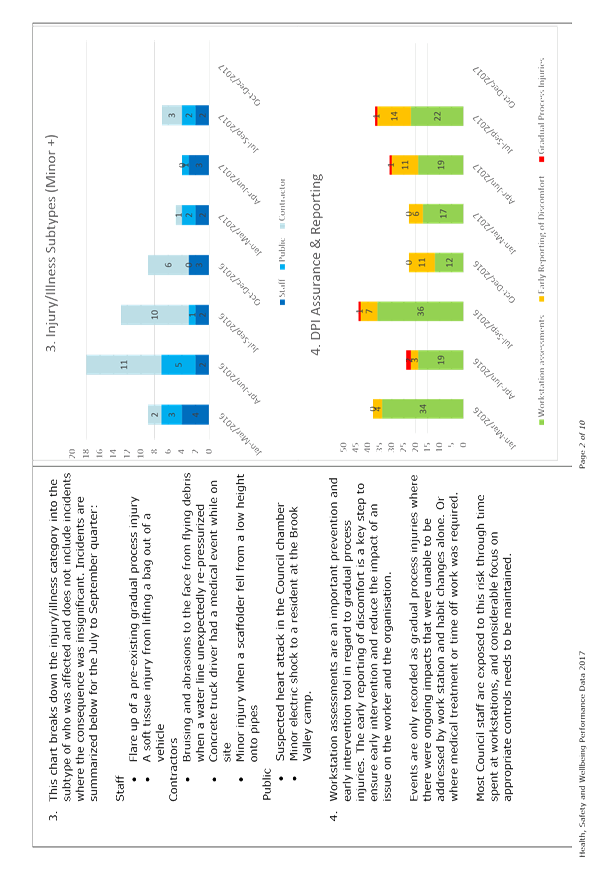

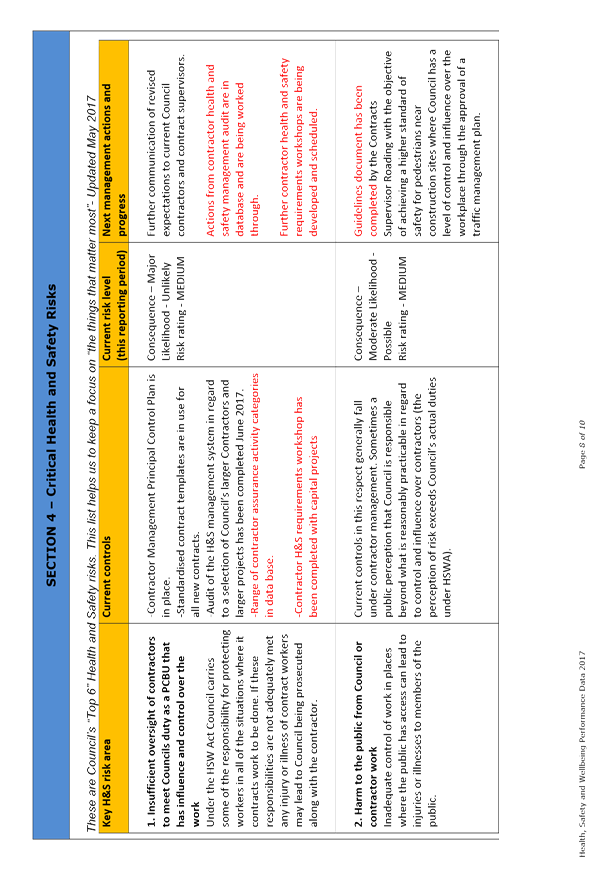

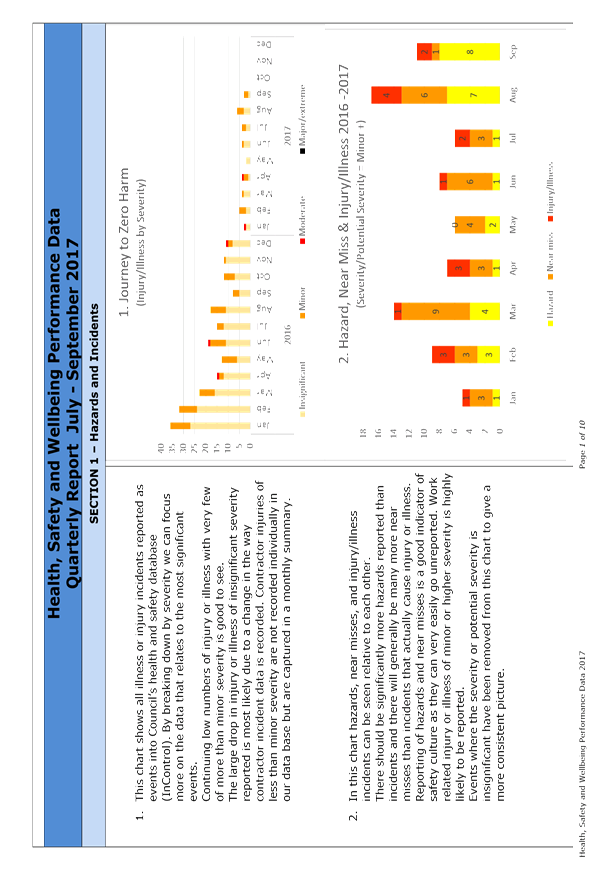

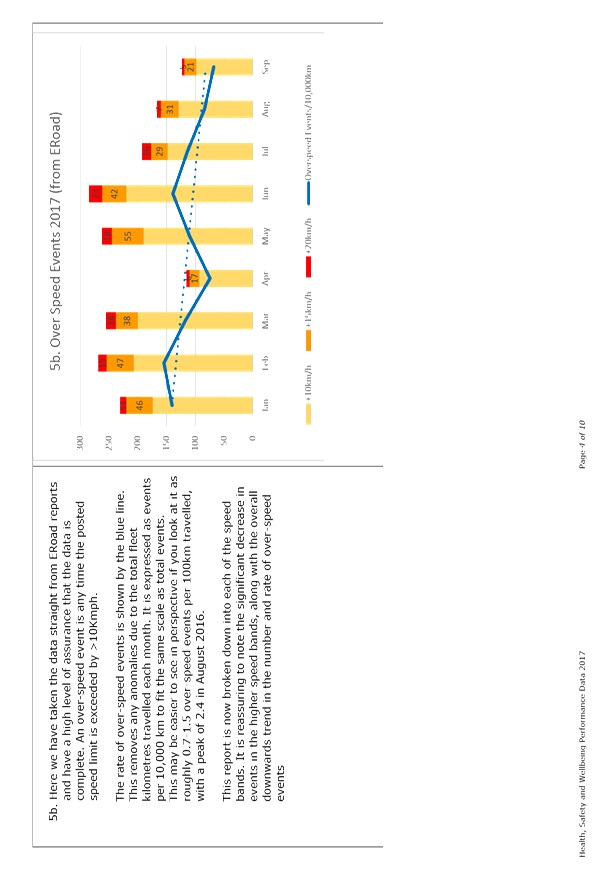

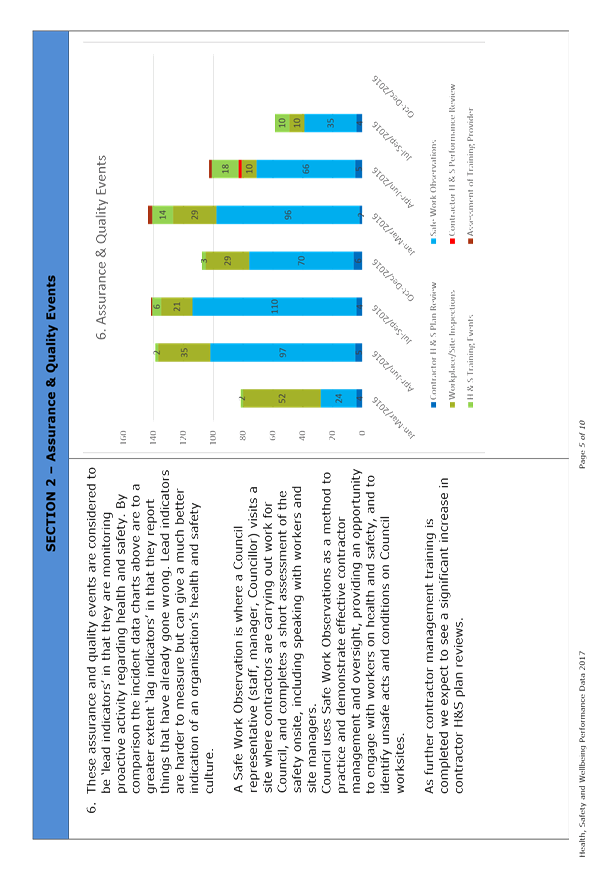

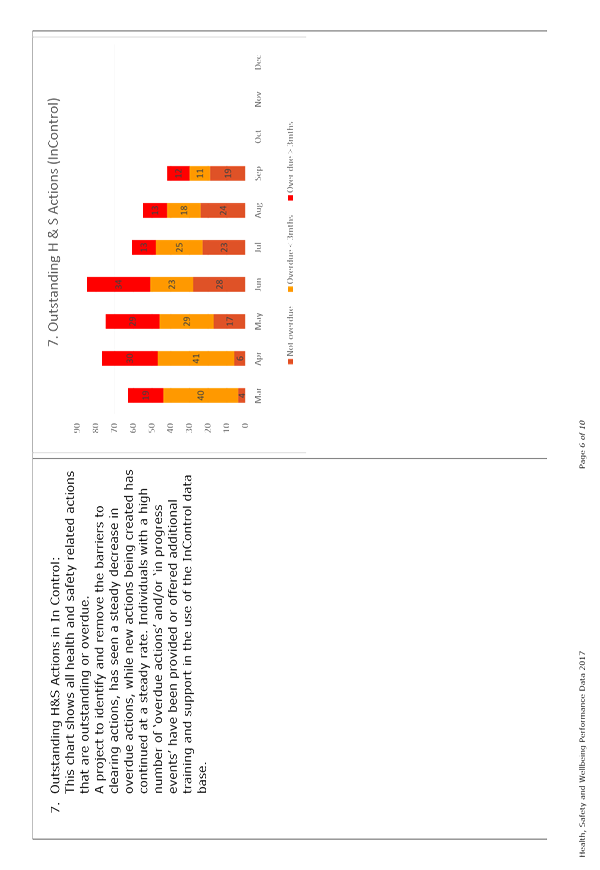

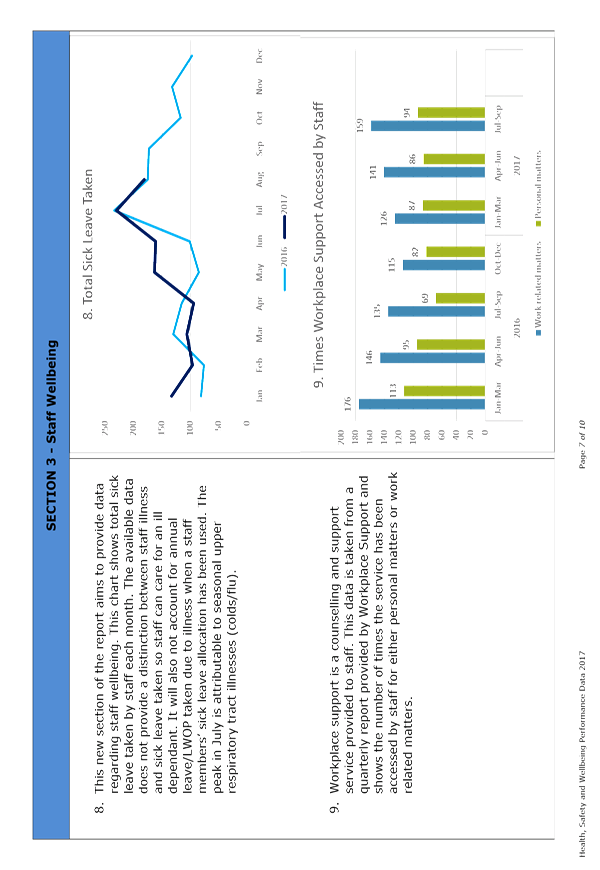

REPORT R7022

Health

and Safety: Quarterly Report

1. Purpose

of Report

1.1 To

provide the Subcommittee with a quarterly report of health, safety and

wellbeing data collected over the July to September quarter of 2017, and

an update on the health, safety and wellbeing work

programme.

2. Summary

2.1 Health

and safety performance reports are provided quarterly to the Subcommittee.

These reports provide an overview of health and safety performance based on key

lead and lag indicators. Where a concerning trend is identified more detail is

provided in order to better understand issues and implement appropriate

controls.

3. Recommendation

|

That the Subcommittee

Receives the report Health and

Safety: Quarterly Report (R7022)

and its attachment (A1845583).

|

Recommendation to Council

|

That the Council

Notes

the report Health and Safety: Quarterly Report (R7022) and its attachment (A1845583); and

Acknowledges

the assessment of critical health and safety risks contained in the

attachment (A1845583).

|

4. Background

4.1 Councillors, as ‘Officers’ under the Health and Safety

at Work Act 2015 (HSWA), are expected to undertake due diligence on health and

safety matters. Council’s Health and Safety Governance Charter

states that quarterly performance data reports will be presented to Council.

5. Discussion

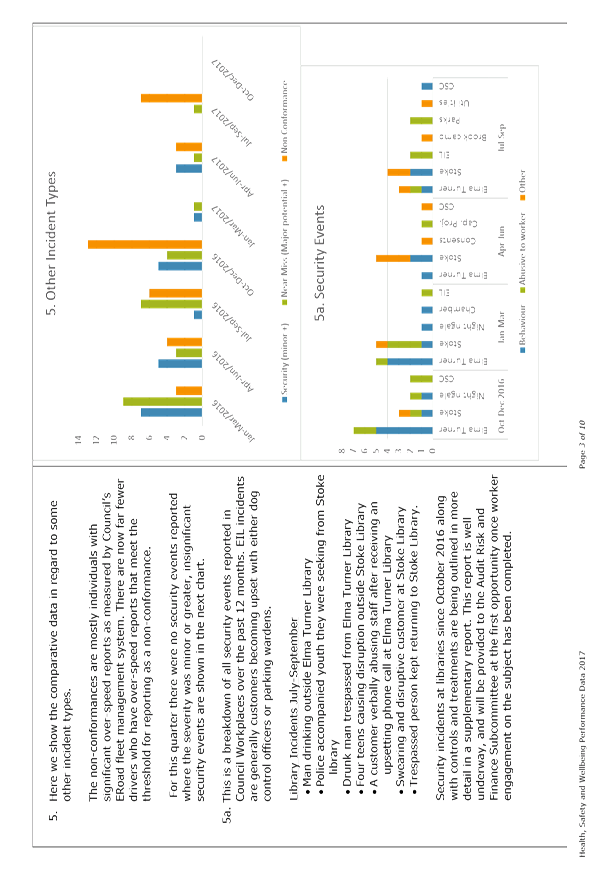

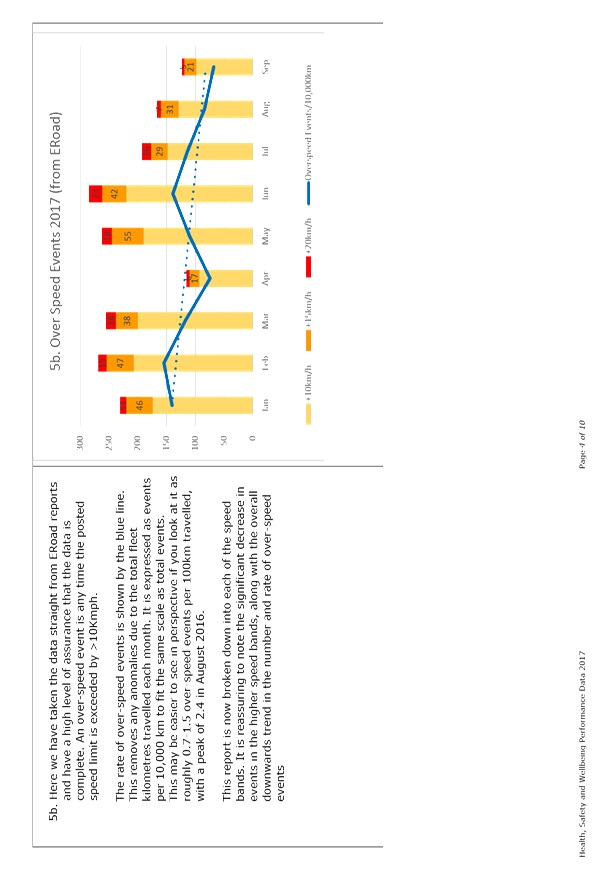

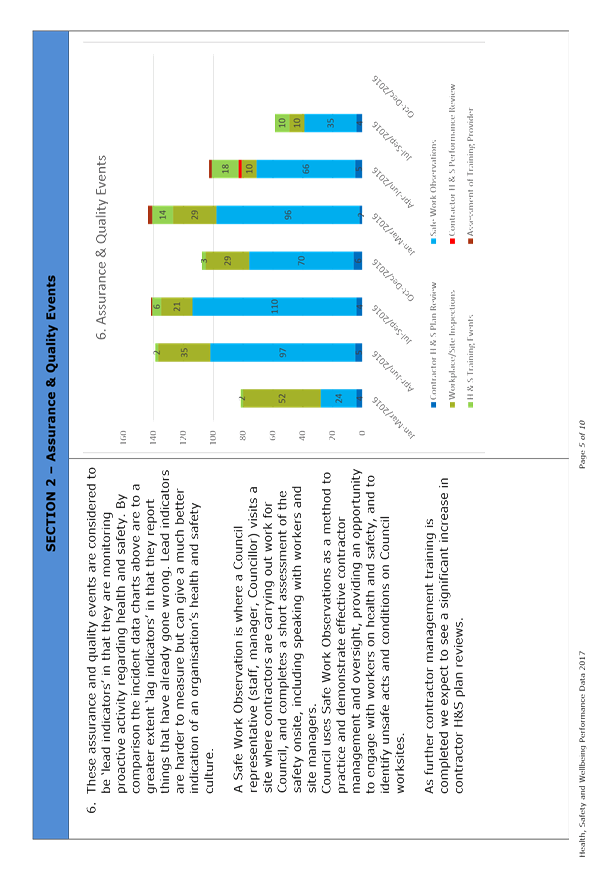

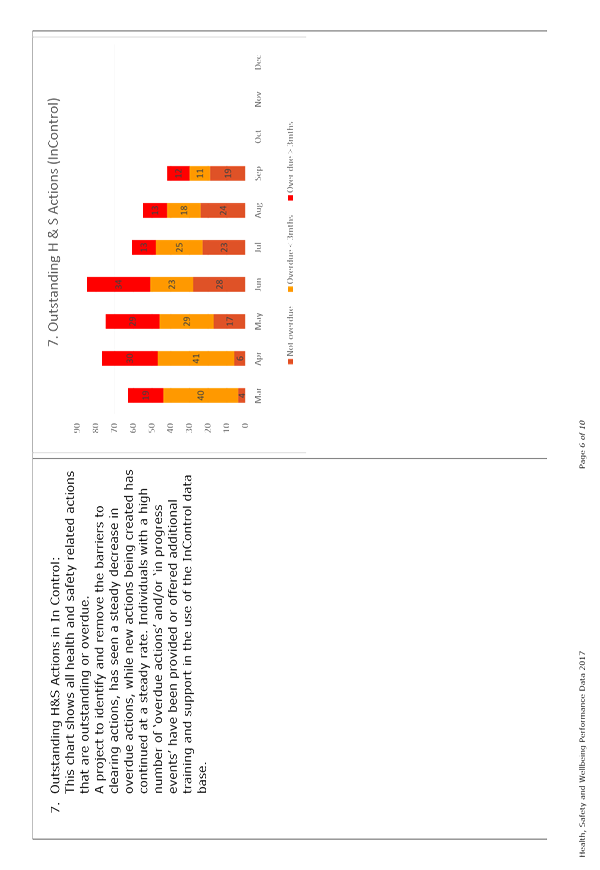

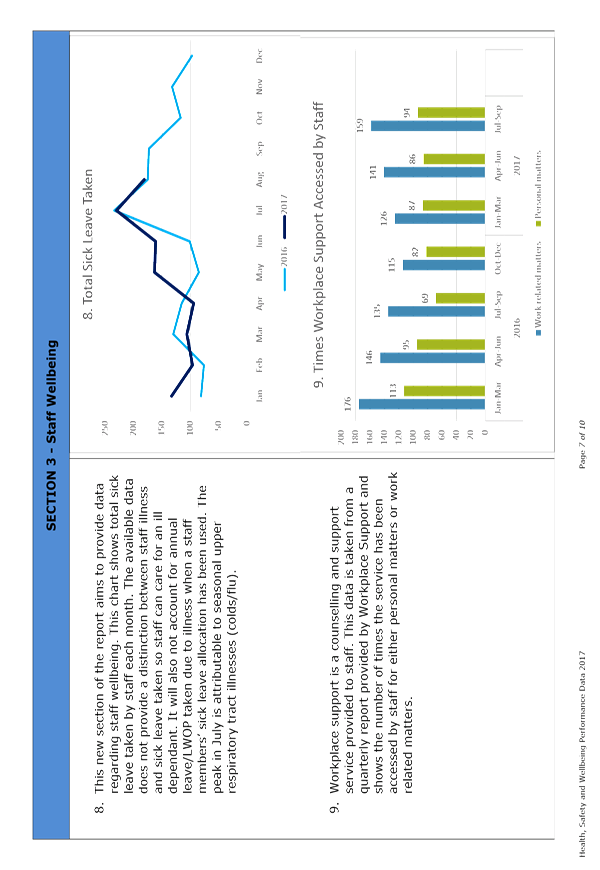

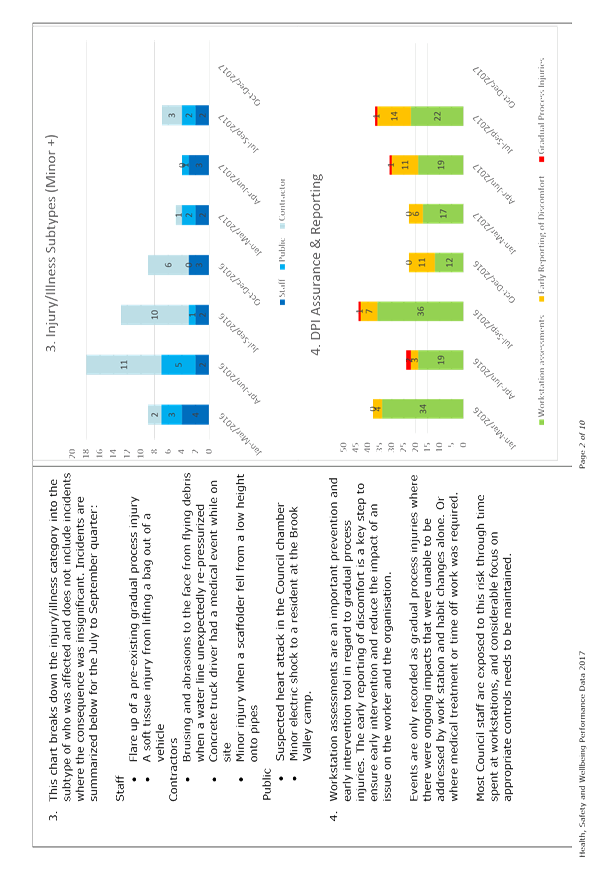

5.1 Attached

is a report outlining data on health, safety and wellbeing drawn from

Council’s health and safety system. The wellbeing section in this report

is new and shows the total number of sick days taken and the number of work or

non-work issues raised with workplace support. These provide an indication of

trends in the broadest sense only, as more detailed analysis is not practicable

due to data limitations or privacy.

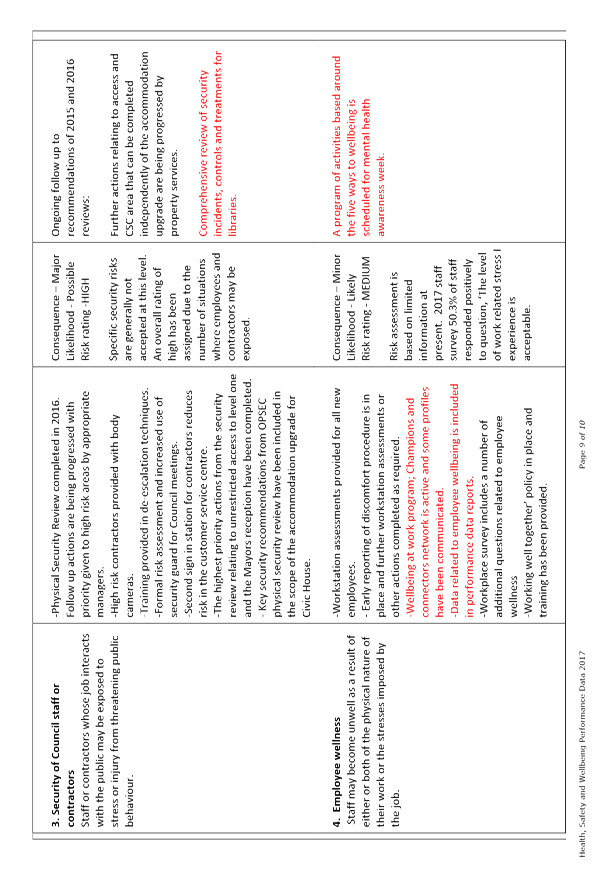

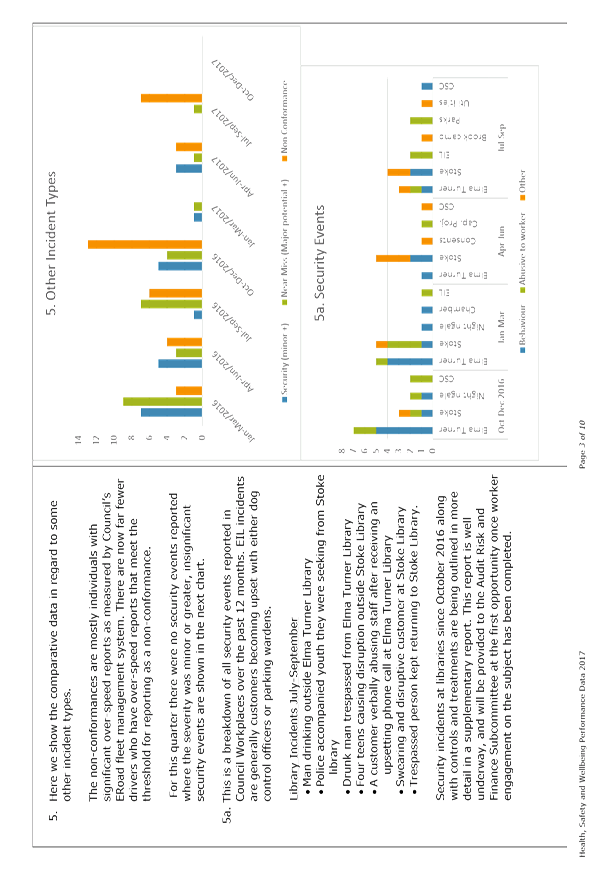

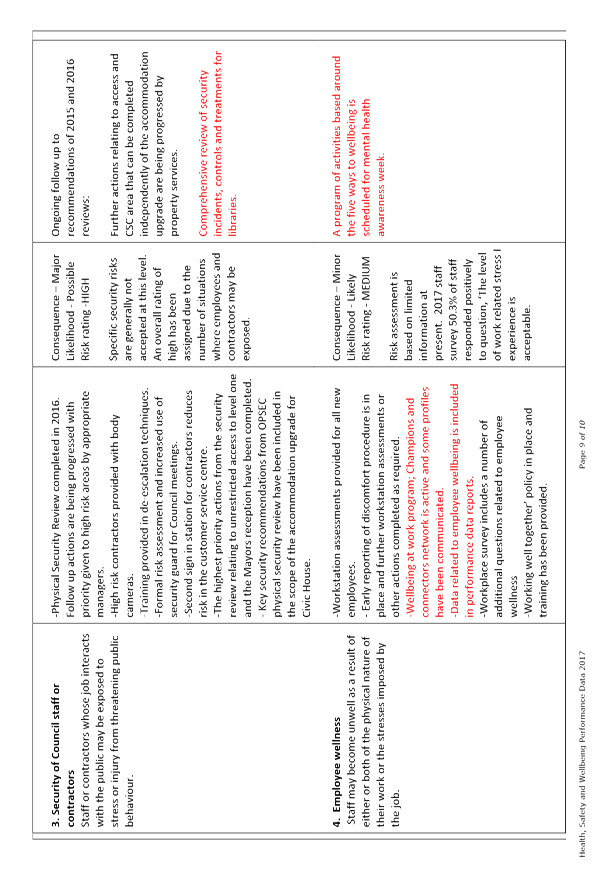

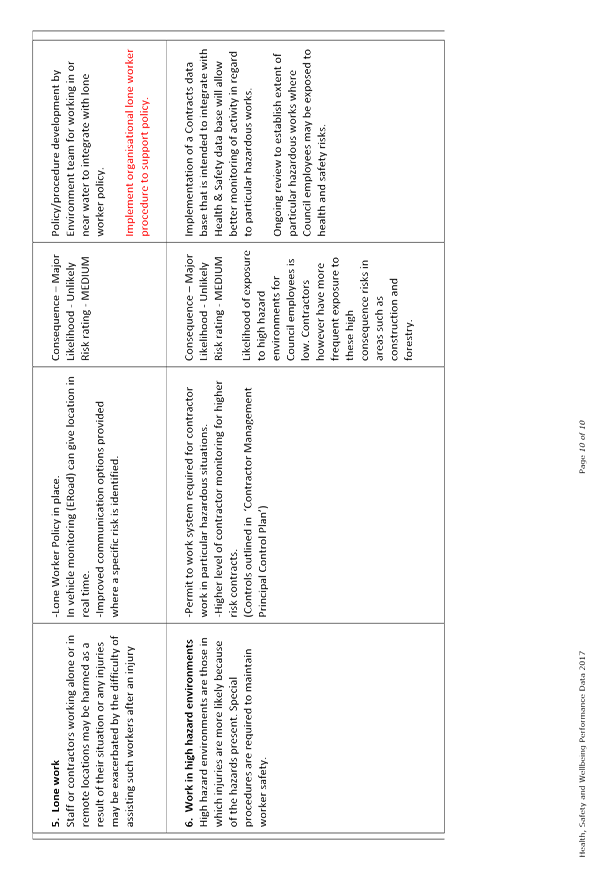

5.2 Physical

security continues to be rated as a High risk in the attached assessment. This

is due to the large number of areas where this risk is present and outstanding

actions relating to further controls. As this work is completed it is expected

that this will move to a Medium risk.

5.3 The

key health and safety risks as reported on are currently being reviewed by

Council officers to ensure we are focusing our energy on the right risks.

General work

programme

5.4 Governance

activities: Councillors have participated in site visits to the

Maitai dam, Tantragee water treatment plant and the Stoke Greenmeadows centre.

These visits help councillors to meet their due diligence obligations, and form

part of the governance due diligence plan, outlined in the Health and Safety

Governance Charter.

5.5 The

Health and Safety Strategic Plan was reviewed by the Audit Risk and Finance

(ARF) Subcommittee on 28 September 2017.

5.6 On

8 September 2017 it was requested that officers report back on security related

events at Council libraries, including details of controls and

treatments. This work is well underway and it is planned to have a report

for Subcommittee at its next meeting once worker engagement on security

controls and treatments has been completed.

Other activities:

5.7 The

contract with the provider of Council’s health and safety data base

(InControl) has been renewed. After careful consideration and worker

engagement it has been decided to upgrade to the latest version. A review

of the InControl platform is programmed for later in the financial year.

5.8 Further

training has been provided to the ‘Champions and Connectors’ as the

next steps in the ‘Wellbeing at Work’ programme.

5.9 Council’s

Health and Safety Policy has been reviewed.

5.10 The

health and safety forum received a presentation on safety in design (SID).

6. Options

6.1

|

Option 1: Receive the report and its attachment

|

|

Advantages

|

· Council demonstrates positive due diligence in relation to health

and safety matters in the Council workplace. This assists in meeting

councillors’ obligations as ‘Officers’ under the HSW Act 2015

|

|

Risks and Disadvantages

|

· Receiving the report alone is not sufficient. Positive diligence

(understanding, asking questions etc) is required.

|

|

Option 2: Decline to receive the report and its attachment

|

|

Advantages

|

· An advantage could not be identified

|

|

Risks and Disadvantages

|

· Council will not be able to use this report to help demonstrate

due diligence on health and safety matters.

|

Malcolm

Hughes

Health

and Safety Adviser

Attachments

Attachment 1: A1845583 - Quarterly

Health and Safety Performance Data July to September 2017 ⇩

|

Important

considerations for decision making

|

|

1. Fit

with Purpose of Local Government

This report forms part of

Council’s work to perform its regulatory functions. Council has

an obligation under the Health and Safety at Work Act 2015 because it is

classed as a Person Conducting a Business or Undertaking (PCBU), and both

councillors and Council’s senior management have obligations as

“Officers” under that Act.

|

|

2. Consistency

with Community Outcomes and Council Policy

The recommendations align with the

Community Outcome: Our communities are healthy, safe, inclusive and

resilient.

|

|

3. Risk

This report aims to help

councillors meet their due diligence obligations as “Officers”

under the Health and Safety at Work Act 2015. It is likely this

objective will be achieved when combined with other actions outlined in

‘Governance due diligence plan’ found at section 6 of the Health

and Safety Governance Charter (A1767136). The likelihood of adverse

consequences is assessed as low based on the current record of

Council’s health and safety systems and on-going monitoring of

them. However the consequences for Council could still be significant if

there were to be a serious harm incident to a Council worker, contractor or

other person. These consequences could include harm to people,

prosecution of the Council and/or its officers, financial penalties, and/or

reputational damage.

|

|

4. Financial

impact

There are no immediate budget

implications arising from this report.

|

|

5. Degree

of significance and level of engagement

This matter is of low significance because it is a quarterly progress report regarding the Council’s

health and safety data, and no engagement is required

|

|

6. Inclusion

of Māori in the decision making process

Maori have not been consulted in

the preparation of this report.

|

|

7. Delegations

The Audit, Risk and Finance

Subcommittee is delegated oversight of Health and Safety.

|

Item

10: Health and Safety: Quarterly Report: Attachment 1

|

|

Audit, Risk and Finance Subcommittee

14 November 2017

|

REPORT R7525

Insurance

renewal 2017/18

1. Purpose

of Report

1.1 To

update the subcommittee on the 2017/18 insurance renewal.

2. Summary

2.1 Nelson

City Council is part of the Top of the South Collective with Tasman District

Council and Marlborough District Council which was formed 1 July 2011.

The insurance broker is Jardine Lloyd Thomson (JLT) and Nelson City Council has

various insurance policies including material damage insurance for ‘above

ground’ assets ie buildings etc.

2.2 Separately,

Council was a member in the Local Authority Protection Programme (LAPP) scheme

which is a mutual scheme whose membership consists of 32 local

authorities. It is aimed at providing insurance cover for damage to

‘infrastructural assets’ from natural hazard events only (not fire

etc). It only covers the 40% of damage costs not covered by the National

Disaster Recovery Plan which currently covers 60%.

2.3 Aon

New Zealand has undertaken risk modelling on Council's flood and earthquake

risks using Tonkin and Taylor analysis and data on our infrastructure assets

(including location and value). Based on the latest risk assessment it would

appear that Council is underinsured; that the $125m loss limit is not

enough.

2.4 At

the Governance Committee meeting on 9 March 2017 (prior to the Audit, Risk and

Finance subcommittee being formed) a report was presented looking at the option

to exit LAPP for Council’s infrastructure insurance and the appropriate

level of insurance cover, given the risk modelling work undertaken by

Aon/Tonkin and Taylor. This decision was delegated to a small group of

councillors, the Chief Executive and the Chair of Audit, Risk and Finance

subcommittee to make the decision.

2.5 This

report is both an update to the subcommittee on those decisions and the 2017/18

insurance renewal.

3. Recommendation

|

That the Subcommittee

Receives the report Insurance

renewal 2017/18 (R7525) ; and

Notes

the decision made to exit Local Authority Protection Program (LAPP) and join

the Aon South Island Collective from 1 July 2017; and

Notes

the decision made to purchase an additional $125 million shared limit (to a

total limit of $250million) with a Council sublimit of $160m from 1 November

2017.

|

4. Background

4.1 Top

of the South Collective

4.2 Nelson

City Council is part of the Top of the South Collective with Tasman District

Council and Marlborough District Council which was formed 1 July 2011.

The insurance broker is Jardine Lloyd Thomson (JLT) and Nelson City Council has

various insurance policies including:

4.2.1 Material

Damage;

4.2.2 Business

Interruption;

4.2.3 Motor

Vehicle;

4.2.4 Public

and Professional Indemnity;

4.2.5 Crime,

Statutory and Employers Liability;

4.2.6 Harbour

Masters and Wreck Removal Liability;

4.2.7 Hall

Hirers Liability;

4.2.8 Personal

Accident;

4.2.9 Forestry.

Infrastructure insurance

4.3 Separately,

Council was a member in the Local Authority Protection Programme (LAPP) scheme

which is a mutual scheme whose membership consists of 32 local

authorities. It is aimed at providing insurance cover for damage to

infrastructural assets from natural hazard events only (not fire etc). It

only covers the 40% of damage costs not covered by the National Disaster

Recovery Plan which currently covers 60%. Council had $707 million of

infrastructure assets covered by the Local Authority Protection Programme

($719m 2015/16).

Risk modelling for infrastructure

assets

4.4 As

part of the presentation of our infrastructure asset portfolio to insurance

companies in London, Aon New Zealand has undertaken risk modelling on Council's

flood and earthquake risks using Tonkin and Taylor analysis and data on our

infrastructure assets (including location and value).

4.5 This

risk modelling was undertaken during 2016 and has been further refined

following the Kaikoura earthquake and similar modelling for Marlborough and

Tasman District Council.

4.6 Based

on the latest risk assessment it would appear that Council is underinsured;

that the $125m loss limit is not enough.

5. Discussion

Top

of the South Collective

1.1 Confirmation

was received from the brokers on 30 June 2017 that the insurance program was

successfully placed and cover was in place for the current financial year.

5.1 Material

Damage & Business Interruption – Lead insurer has now changed to QBE,

followed by AIG, Berkshire Hathaway Ltd, NZI (part of IAG New Zealand Ltd) and

XL Catlin Pty Ltd. QBE were the second co-insurer behind Vero in prior

year renewals so they are have agreed to accept the expiring wording and terms

so, other than the premiums, everything else remains unchanged. Material Damage

premiums have increased by $54,000 (8%) for 2017/18 which reflects the impact

on the insurance market from the Kaikoura earthquake as well as increased

insured valuations ($276m to $318m).

Infrastructure insurance

5.2 At

the Governance Committee meeting on 9 March 2017 (prior to the Audit, Risk and

Finance subcommittee being formed) a report was presented looking at the option

to exit LAPP for Council’s infrastructure insurance and the appropriate

level of insurance cover, given the risk modelling work undertaken by

Aon/Tonkin and Taylor. The following resolution was passed at Council:

Approves

delegating authority to the Mayor, Chair of Governance, Deputy Chair of

Governance, Chair of Audit, Risk and Finance Subcommittee and Chief Executive

to decide whether Nelson City Council should exit from the Local Authority

Protection Program for Council’s infrastructure insurance and the

appropriate level of insurance cover, by the end of May 2017 and take any

action required to give effect to the decision.

5.3 Meetings

were held with the group delegated with the decision and it was agreed to exit

LAPP from 1 July 2017 and join a South Island Collective through Aon with a

$125 million shared limit. As the renewal date for the South Island

collective is 1 November 2017 Council (along with Tasman District, Grey

District and Environment Southland Councils) joined the program for four months

on existing terms and pricing of the collective.

5.4 The

decision on the appropriate level of insurance cover was deferred while Aon

worked on placing and obtaining terms for an excess layer for Council above the

$125m limit and confirming other potential participants in time for the 1

November 2017 renewal date.

5.5 During

October, Aon confirmed that it would be able to place $125 million above the

$125 million (ie $250 million limit) as a shared limit with one right of

reinstatement for earthquake at nil additional premium. The overall programme

limit defines what is shared by the collective per loss and the maximum amount

payable.

5.6 Within

this shared program limit, Council has a sub-limit of $160 million plus AICOW

– Additional Increased Cost of Working – this allows for additional

costs to be paid over and above normal operating costs during a loss. The

$160m was deemed to be the mean 1 in 750 ARI (annual return interval) loss

estimate. This limit is one Council will need to review on an annual

basis.

5.7 The

group delegated with the decision on the appropriate level of insurance cover

met in late October and agreed to participate in the additional $125 million

shared limit from 1 November 2017 at an estimated cost of $75,000.

5.8 The

premium is based on historical losses/claims, inherent risk (i.e. likelihood of

loss), capacity requirements (as part of programme), sub limit and excess

level. The additional premium can be accommodated within the insurance

budget for the current year.

Other

matters

5.9 Treasury

has not yet put out a consultation document on the current 40/60% cost sharing

arrangement. This consultation document will include consideration of Central

Government contributing a lower percentage for smaller more frequent events,

introduction of risk management regulations etc. The Subcommittee will be

updated when this consultation is undertaken as the implications may be

substantial for Council.

6. Options

6.1 The

options are to receive the report or not, as the decisions outlined in the

report were delegated to a subgroup.

7. Conclusion

7.1 The

decisions to decide whether Nelson City Council should exit from the Local

Authority Protection Program for Council’s infrastructure insurance and

the appropriate level of insurance cover were delegated and this report updates

the subcommittee on these decisions.

Nikki

Harrison

Group

Manager Corporate Services

Attachments

Nil

|

Important considerations for decision making

|

|

1. Fit

with Purpose of Local Government

Risk management through using insurance is a tool to

enable more efficient and effective provision on services as set out in

section 10(1)(b) of the Local Government Act.

|

|

2. Consistency

with Community Outcomes and Council Policy

This recommendation is not inconsistent with any

previous Council decisions. It supports the Community Outcome ‘Our

Council provides leadership’.

|

|

3. Risk

Work by Aon in association with Tonkin and Taylor

highlighted to Council that it did not necessarily have the right level of

insurance cover for its infrastructure assets, if a large earthquake was to

occur.

|

|

4. Financial

impact

The financial impact from this decision is an

additional $75,000 insurance premium which has been budgeted.

|

|

5. Degree

of significance and level of engagement

This matter is of low significance because it is of

limited interest to ratepayers. Therefore no consultation has occurred.

|

|

6. Inclusion

of Māori in the decision making process

No consultation with Maori has been undertaken in

preparing this report.

|

|

7. Delegations

The Audit, Risk and Finance subcommittee has

responsibility for organisational risk management. The Audit, Risk and

Finance subcommittee has the power to make a recommendation to Council on

this matter.

|

|

|

Audit, Risk and Finance Subcommittee

14 November 2017

|

REPORT R7589

Internal

Audit Quarterly Report to 30 September 2017

1. Purpose

of Report

1.1 To

update the Audit, Risk and Finance Subcommittee on the internal audit activity

for the quarter to 30 September 2017.

2. Recommendation

|

That the Subcommittee

Receives the report Internal

Audit Quarterly Report to 30 September 2017 (R7589).

|

3. Background

3.1 The

Internal Audit Charter was approved by Council on 15 October 2015.

3.2 Under

the Internal Audit Charter, the Audit, Risk and Finance Subcommittee requires a

periodic update on the progress of internal audit activities relative to any

current Internal Audit Plan approved by Council, and to be informed of any

significant risk exposures and control issues identified from internal audits

completed.

3.3 The

current Annual Audit Plan period is to 30 June 2018. The Plan for this period

was initially received by the Audit, Risk and Finance Subcommittee on 27 June

2017.

4. Progress

Against Annual Audit Plan During the Quarter

4.1 Due

to the decision to review the Annual Audit Plan to 30 June 2018 at the Council

meeting of 10 August 2017, internal audit activity for the quarter has focussed

on:

a) Developing a revised Annual

Audit Plan

b) Improving processes

associated with internal audits.

4.2 This

has meant that only one audit has been in progress during the three month

period from 1 July 2017 to 30 September 2017. There are therefore no new risk

exposures and control issues to report from internal audits during this period.

5. Revised

Annual Audit Plan

Analysis of Internal Audit Programme since Inception

5.1 A

full analysis of the audit programme of work since inception was performed by

officers and this indicated that a closer alignment with Council’s

recently developed risk management principles would enhance the benefits to

Council from the internal audit work programme.

5.2 Positive

effects:

5.2.1 On

the upside, 33 audits have been performed since late 2015, and from these, 589 findings

were identified. Almost all the recommendations associated with the findings

have been actioned by officers, and these have positively contributed to

control and process improvements throughout Council.

5.2.2 As

there had previously been no internal audit function at Council, the approach

to focus initial audits on controls in areas where Council could be more

exposed to fraud was a prudent one. Areas such as cash handling, procurement,

credit notes, payroll, grants, and mobile fixed assets have been reviewed, as

well as fundamental controls such as segregation of duties, conflicts of

interest, access permissions to IT systems, and contract management. Having a

light shone on these fundamental controls has been invaluable to Council.

5.2.3 The

internal audit function is a key component of managing risk at Council and

officers are now familiar with the internal audit process.

5.3 Limitations

found:

5.3.1 To

date, and including the original Annual Audit Plan to 30 June 2018, audits have

had a strong financial focus. Council’s recently approved risk criteria

have now been incorporated into the internal audit programme, and this suggests

a need to widen the ambit of the audit programme to include more non-financial

topics.

5.3.2 As

a result, other important risk areas that Risk ratings from internal audits had

generally been recorded at a higher level than they would have been under

Council’s now-approved risk matrix.

5.3.3 The

sheer volume of audits and limited resources had meant that some audits could

not be performed to an ideal depth and breadth.

5.3.4 Organisational

capacity has not been able to match the flow-on effect of the large volume of

internal audits.

Audit, Risk and Finance Subcommittee Workshop

5.4 Following

the above analysis and then discussions with key stakeholders, including the

Acting Chief Executive and Acting Chair of the Audit, Risk and Finance

Subcommittee, a Council workshop was held to clarify direction on the future

compilation of an Annual Audit Plan that would ensure closer alignment to

Council’s risk management principles whilst matching organisational

capacity. This was held on 14 September 2017 and provided the guidance

necessary for officers to present the final Annual Audit Plan to the Audit,

Risk and Finance Subcommittee meeting of 28 September 2017.

6. Internal

Audit Process Improvements

Risk Management of Actions Recommended from Internal

Audits

6.1 As

part of the Annual Internal Audit Plan review process, risks from all

‘open’ recommended actions from internal audits that had been

performed were aligned to meet Council’s approved risk criteria. All

future risk assessments will be based on these criteria. In general, as the

impact statements in Council’s Risk Criteria have higher thresholds than

those in the original Internal Audit Procedure, this will lead to less

unnecessary treatment of risks from future internal audits that would have

previously been recorded as higher risks.

6.1.1 The

tolerance periods for treating risks were also aligned to meet Council’s approved

residual risk tolerance timeframes. These timeframes are more realistic than

those in the original Internal Audit Procedure.

6.1.2 Where

previously there was no requirement to formally record a decision to continue

tolerating a risk beyond the allowable period, there is now a process which

will require that there is evidence that the management of risk has been

properly considered in line with risk management principles.

Review of

Internal Audit Procedure

6.2 The

original Internal Audit Procedure which was approved in September 2015 is no

longer relevant and has been reviewed in its entirety. It had been based to a

large extent on processes mimicking those for Health and Safety audits. The

Senior Leadership Team approved the revised Procedure at its meeting of 16

October 2017.

7. Recommendation

Options

7.1 The

acceptance of the recommendation to receive the Internal Audit Quarterly Report

to 30 September 2017 outlining internal audit’s activity demonstrates

Council’s commitment to improving controls and practices that ensure the

prudent, effective and efficient management of Council resources. No advantage

could be identified from not receiving this report.

Lynn

Anderson

Internal

Audit Analyst

Attachments

Nil

|

Important considerations for decision making

|

|

1. Fit

with Purpose of Local Government

Council has chosen to undertake internal audits to

help improve systems, their controls and efficiencies, in order to help give

confidence that it will be able to meet its responsibilities cost effectively

and efficiently.

|

|

2. Consistency

with Community Outcomes and Council Policy

This report supports the community outcome that

Council provides leadership, which includes the responsibility for protecting

finances and assets through the minimisation of fraud, consistent with

guidance provided in Council’s Fraud Prevention Policy.

|

|

3. Risk

When considering planned audits collectively, there

is a high likelihood that Council could suffer a moderate level of negative

public reaction resulting from its failure to assess and implement strong

controls. According to Council’s Risk Criteria this corresponds to a

high risk.

|

|

4. Financial

impact

The recommendation will not have any significant

financial impact.

|

|

5. Degree

of significance and level of engagement

This matter is of low significance because it does

not affect the level of service provided by Council or the way in which

services are delivered and no engagement has been undertaken.

|

|

6. Inclusion

of Māori in the decision making process

There has been no consultation with Maori in the

preparation of this report.

|

|

7. Delegations

The Audit, Risk and Finance Subcommittee has

responsibility for audit processes and management of financial risks. The

Audit, Risk and Finance Subcommittee has the power to make a recommendation

to Council on this matter.

|

|

|

Audit, Risk and Finance Subcommittee

14 November 2017

|

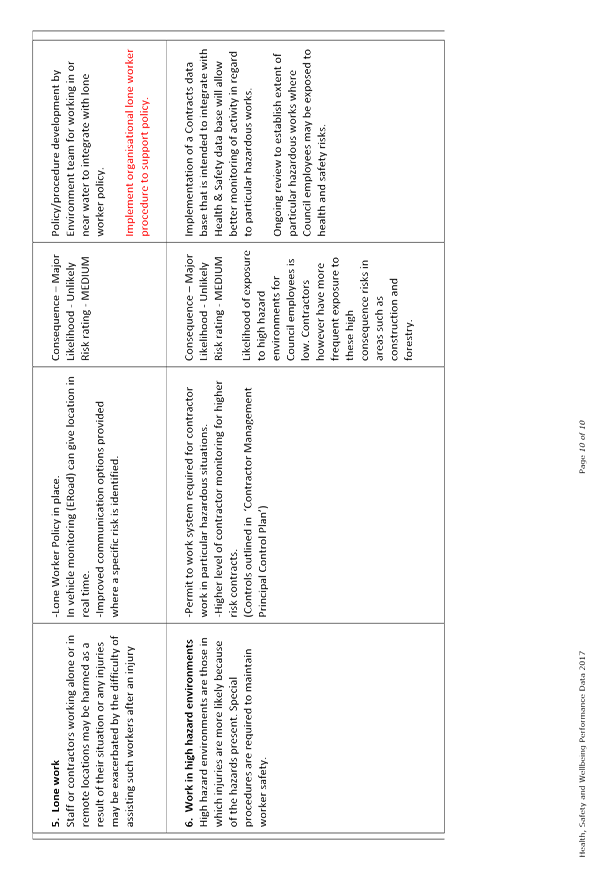

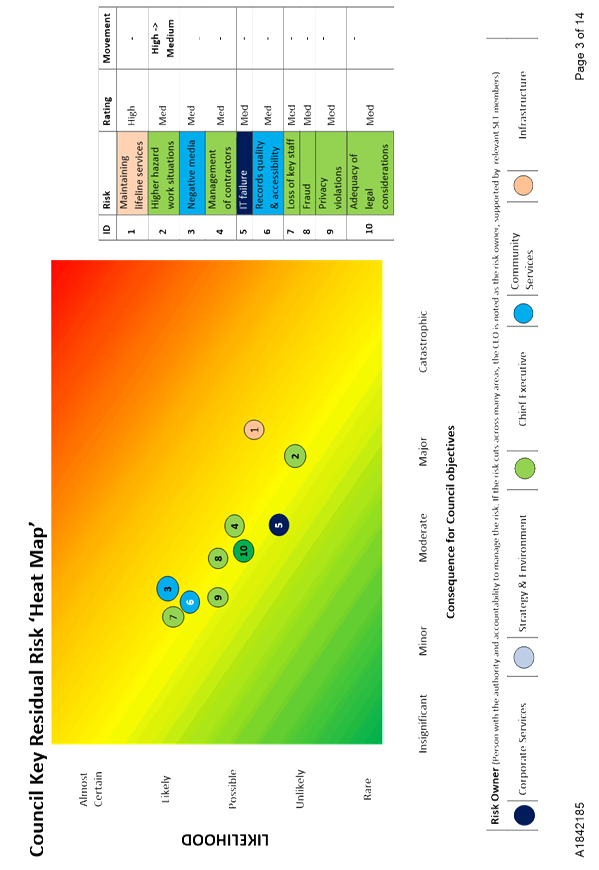

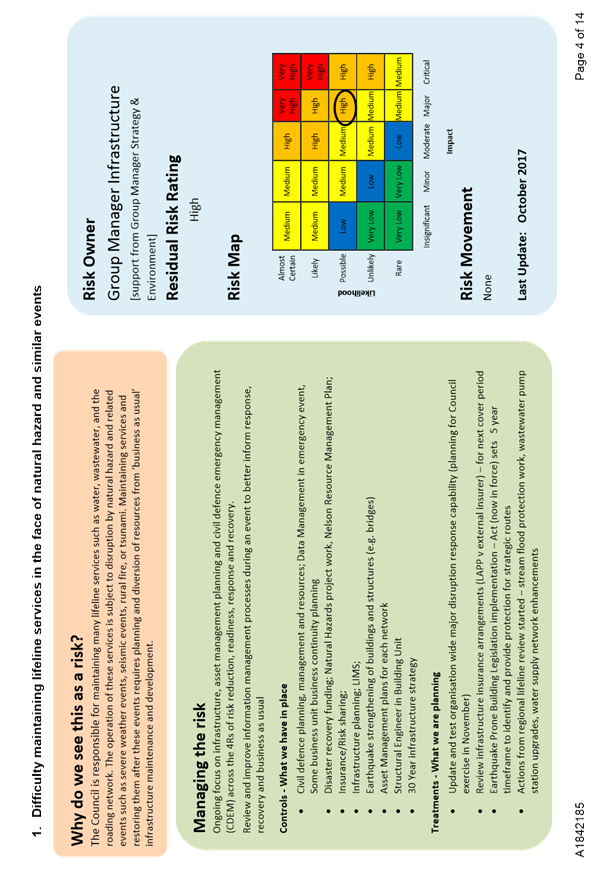

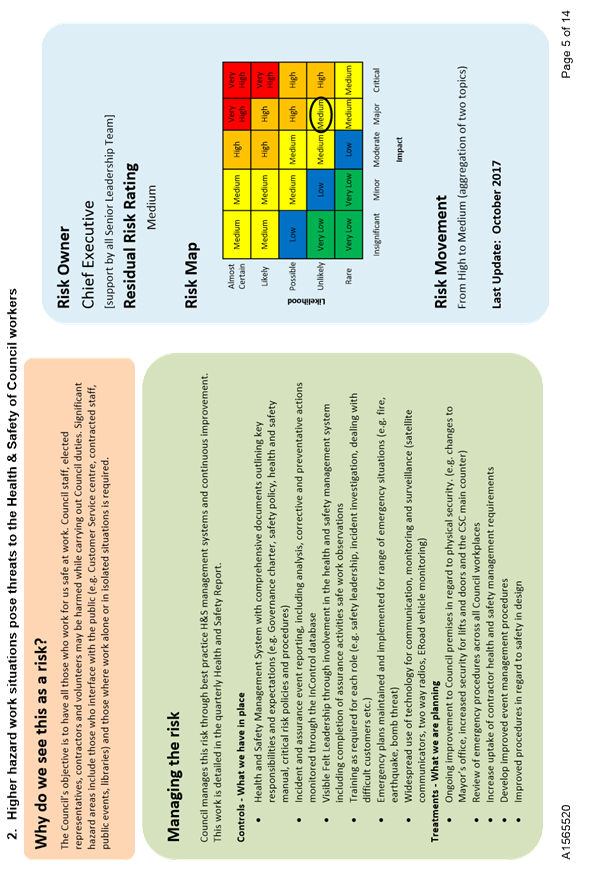

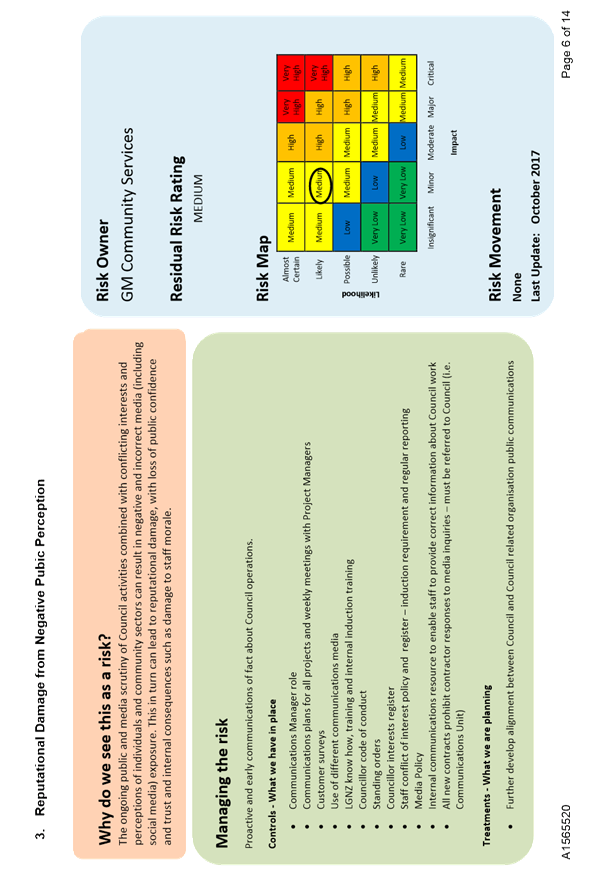

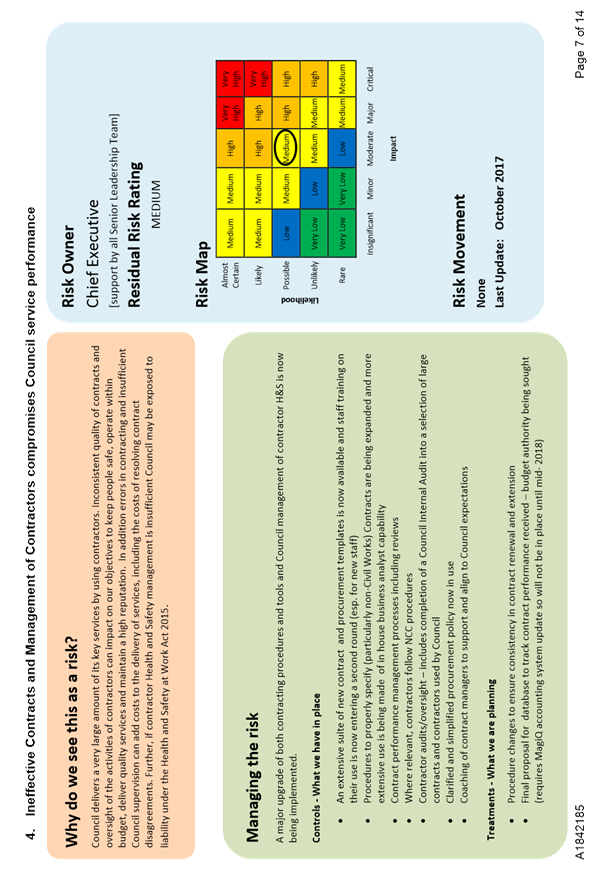

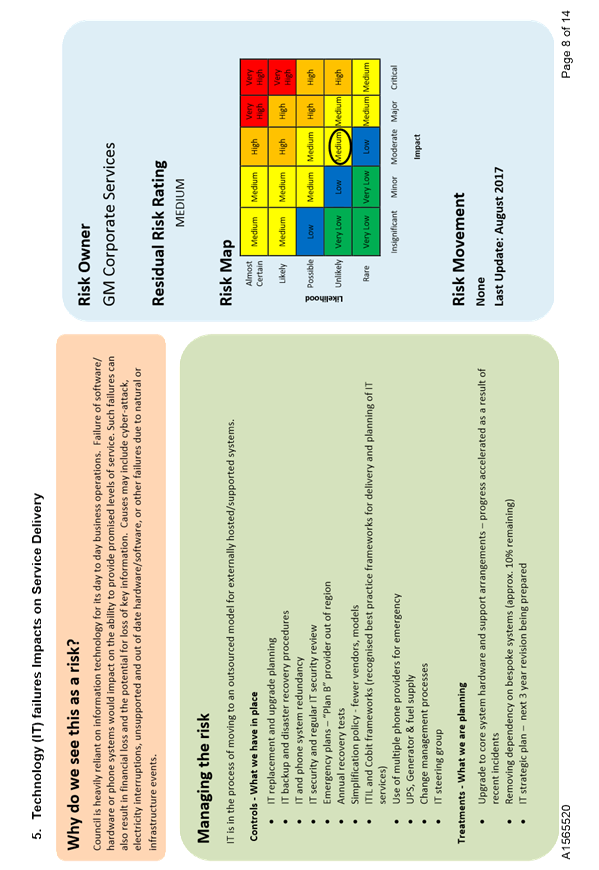

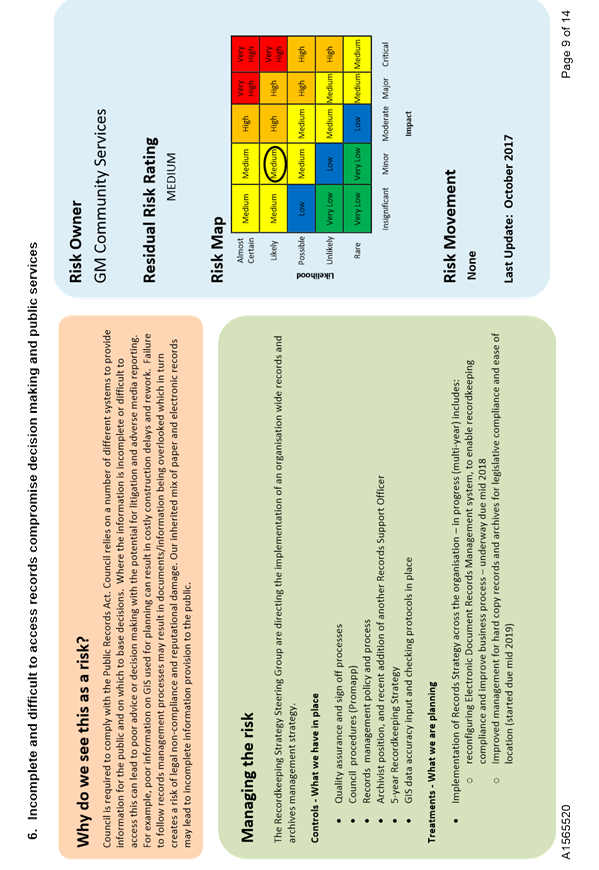

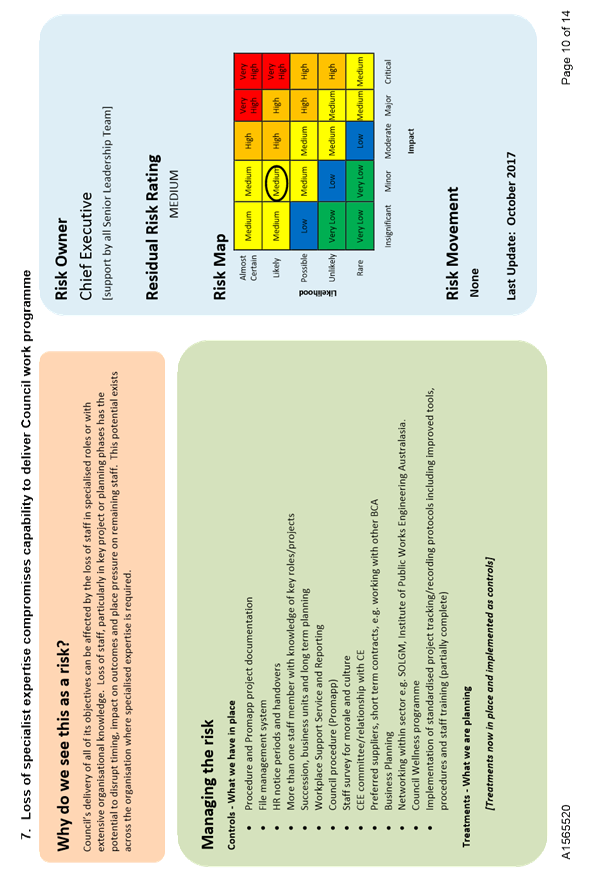

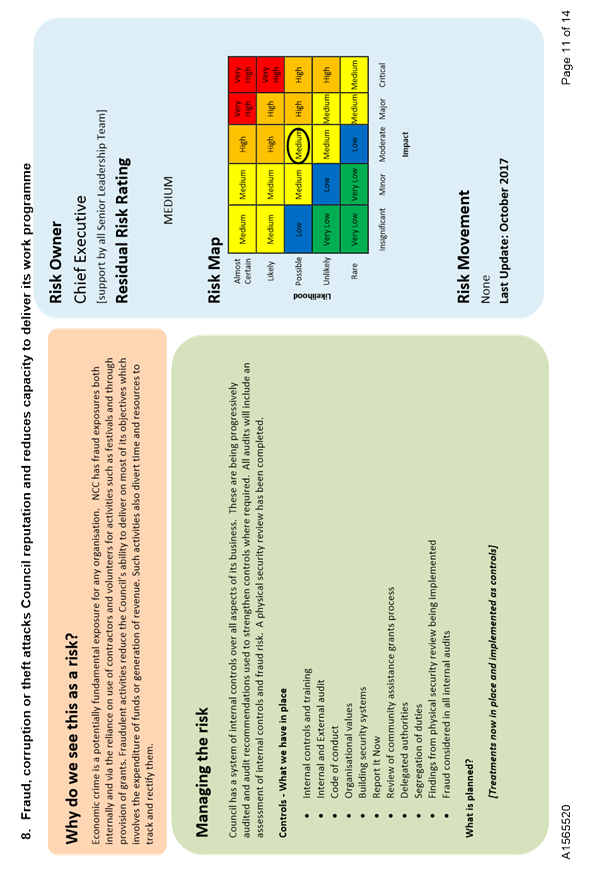

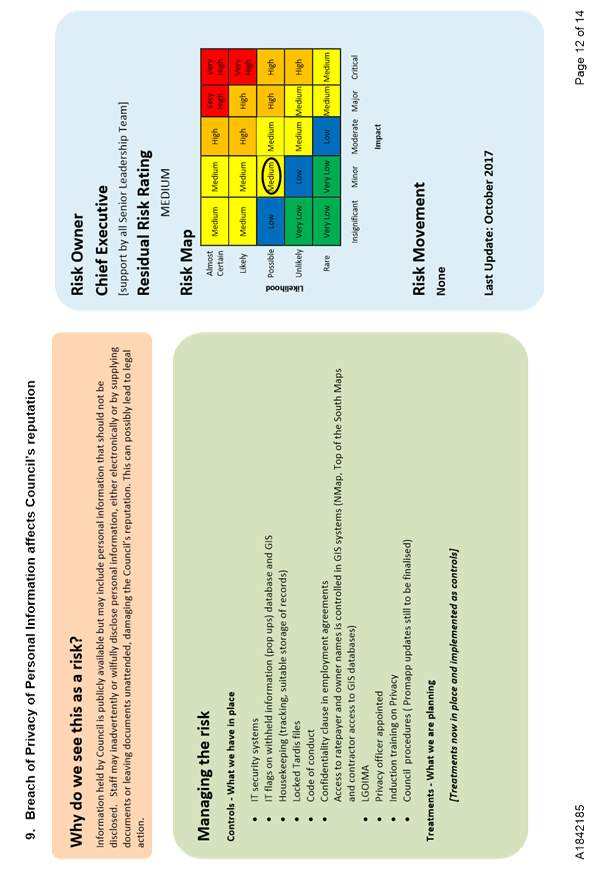

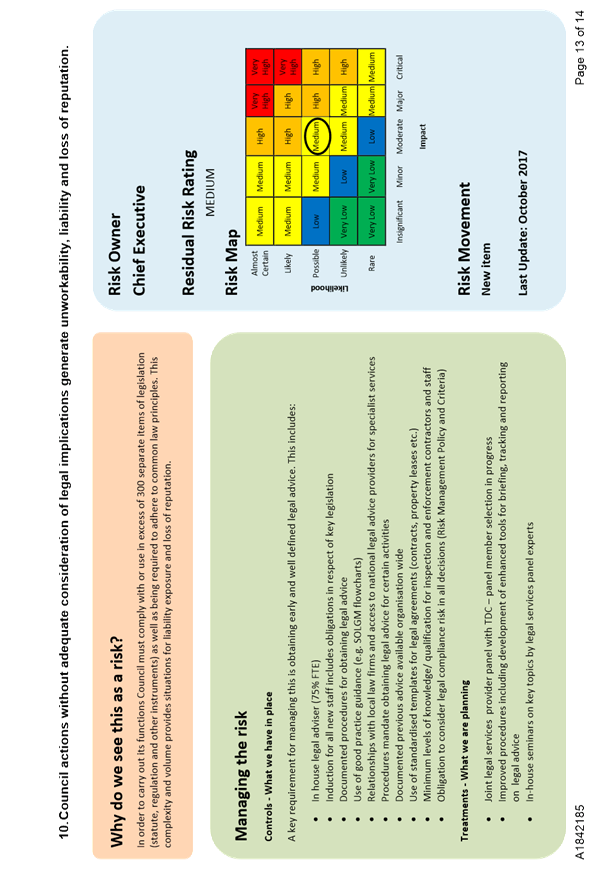

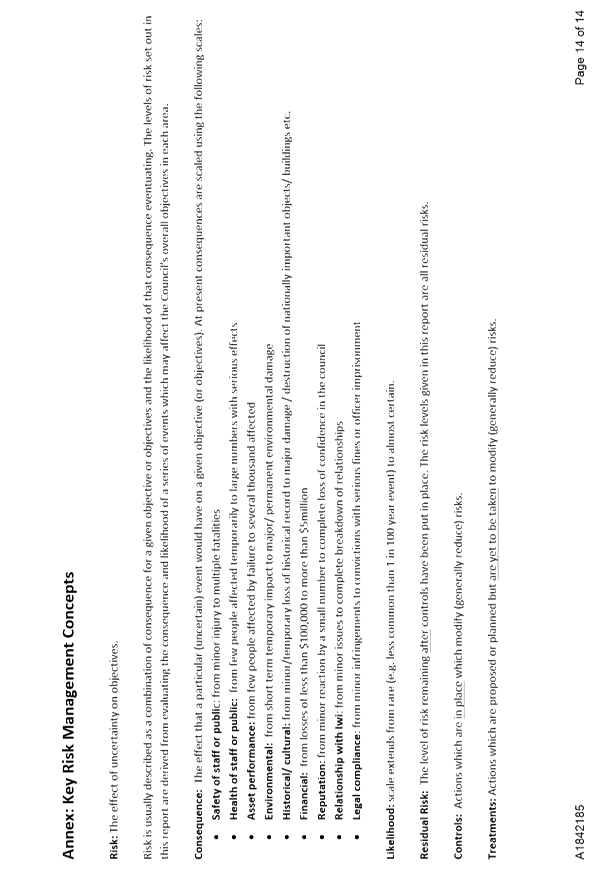

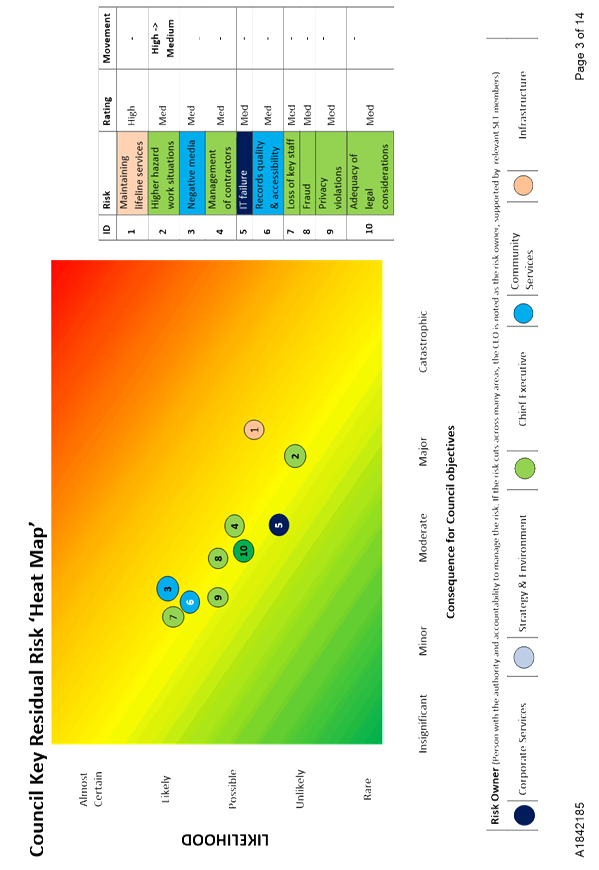

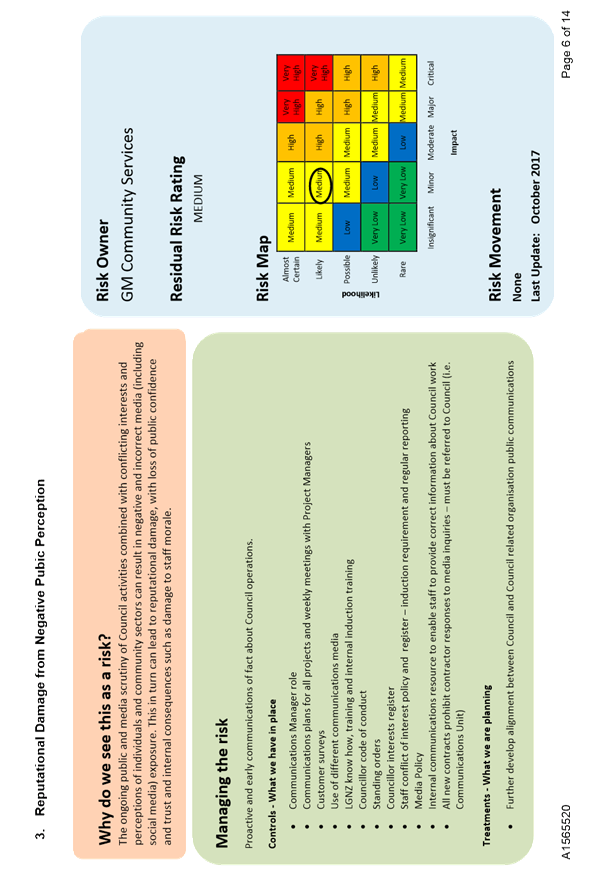

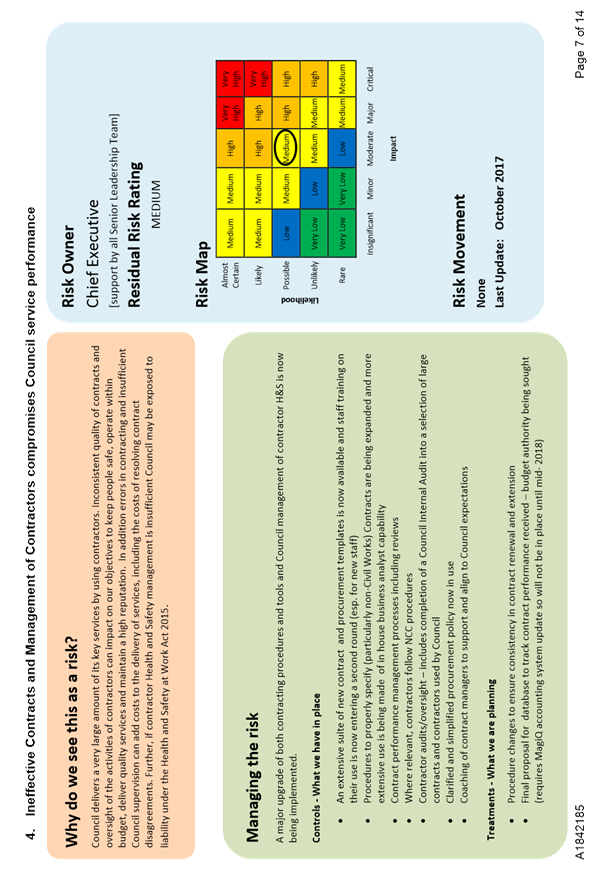

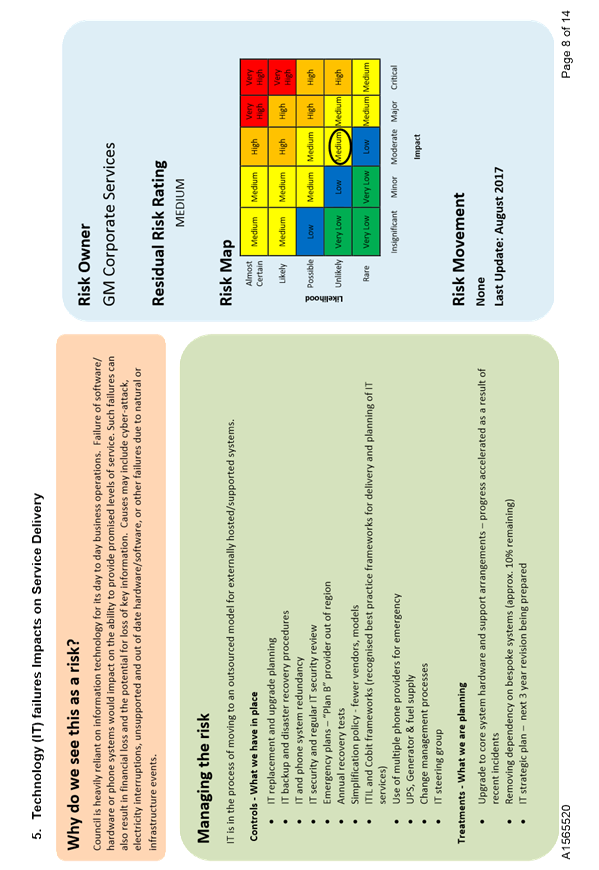

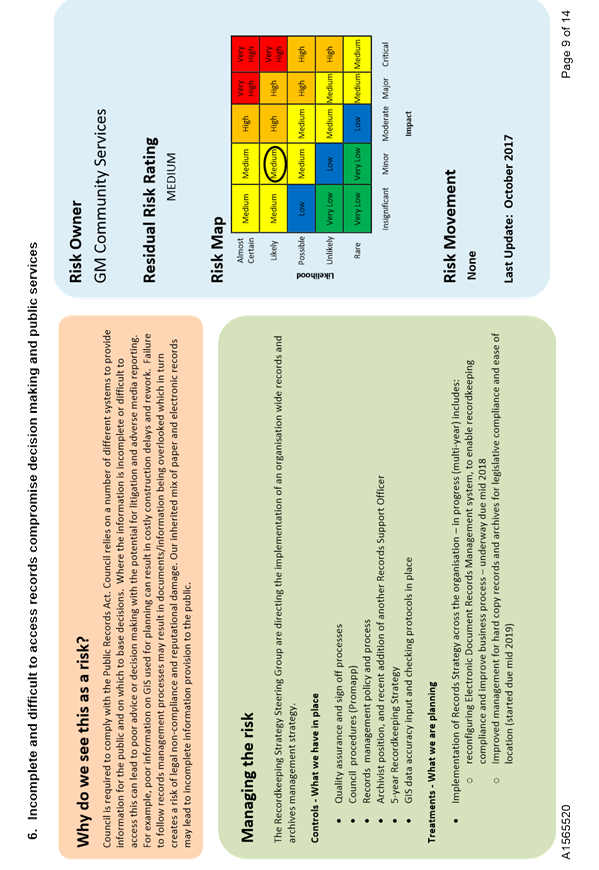

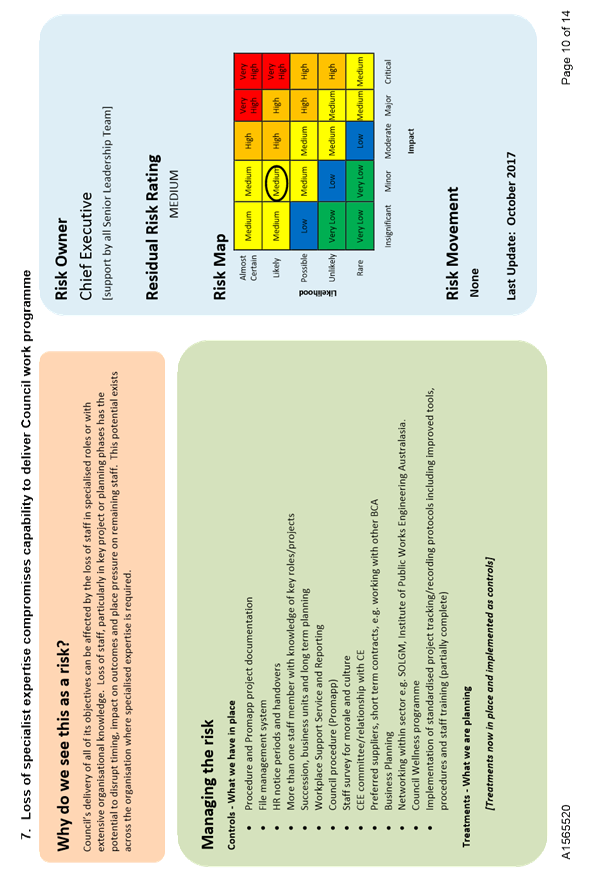

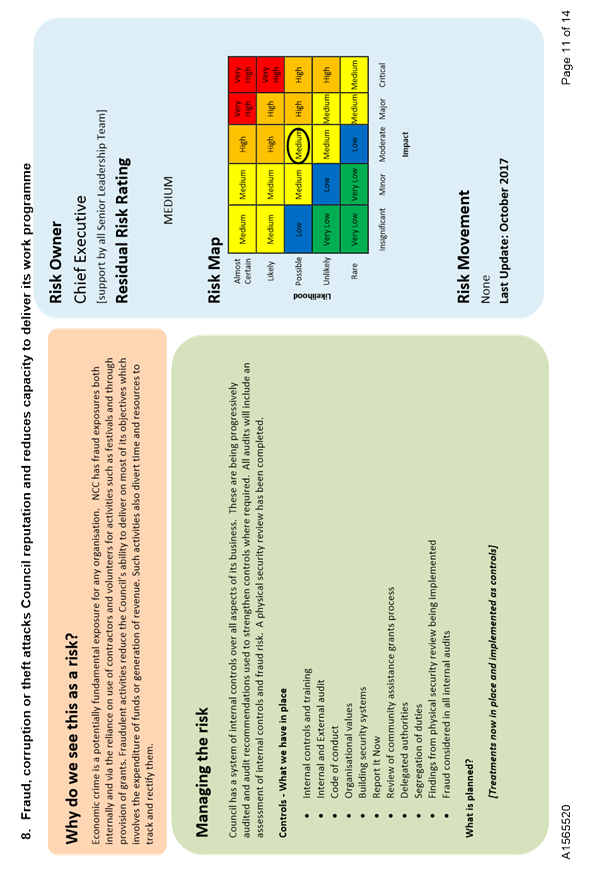

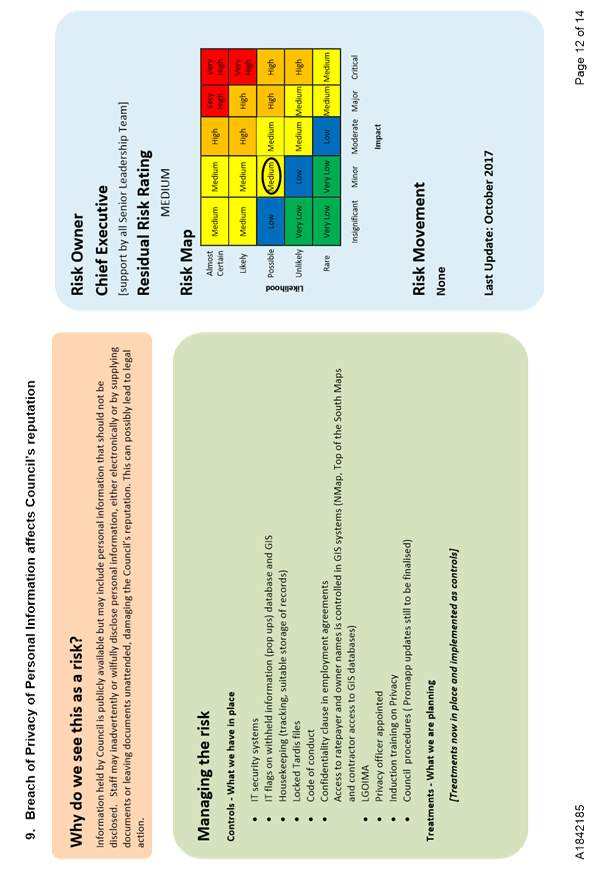

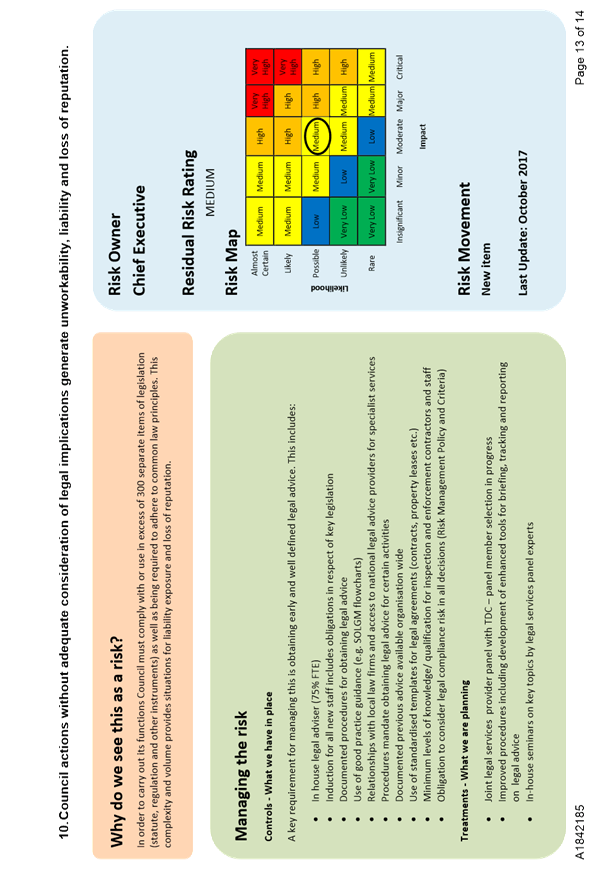

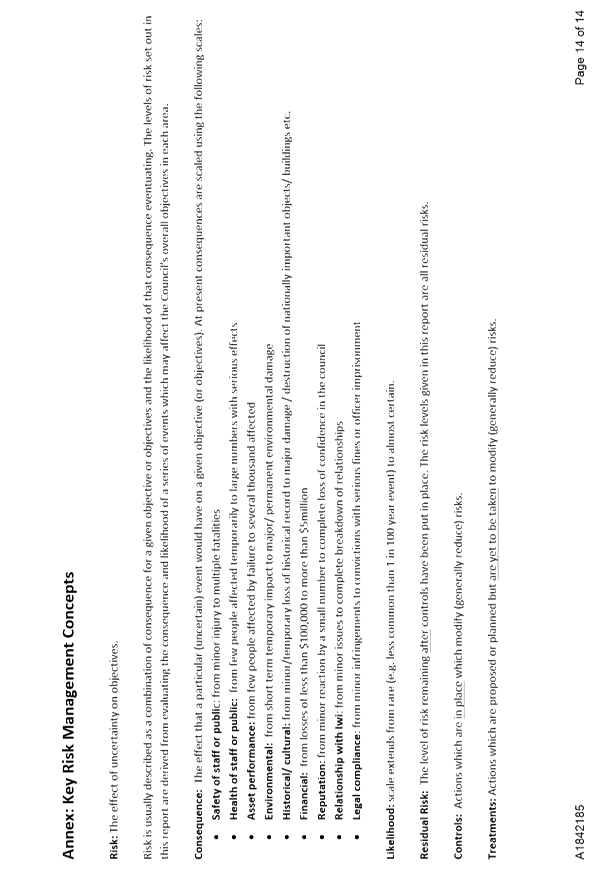

REPORT R7681

Key

Organisational Risks 2017 - 3rd Quarterly Report

1. Purpose

of Report

To update the Subcommittee on

progress with identifying and managing key risks to the organisation’s

objectives. The report is intended to assist the governance role of the

Subcommittee in overseeing the organisation’s risk management.

2. Recommendation

|

That the Subcommittee

Receives the report Key

Organisational Risks 2017 - 3rd Quarterly Report (R7681) and its attachment (A1842185).

|

3. Background

3.1 At

its meeting on 8 September 2017, the Audit Risk and Finance Subcommittee

received and considered the previous quarterly report on key organisational

risks to Council’s objectives. This reporting forms part of the

development of Council’s overall risk management capability. As noted in

the previous report, this capability is being developed using the

organisation’s existing business model – that is by basing risk

management processes within each business unit. This includes business unit objectives

which are, as far as possible, specific, measurable and achievable within a

defined timeframe, and using organisationally consistent techniques and

criteria.

3.2 At

its meeting of 10 August 2017, the Council adopted an updated Risk Management

Policy (A1553263) and Risk Criteria

(A1545157). These documents had

been in use for some time across the organisation but the Subcommittee

recommended and Council agreed to some changes to both the Policy and the Risk

Criteria. As a result (and because of some internal changes to business unit

function over the last several months) business unit risk management is not yet

fully aligned to the recently adopted policy and criteria. In particular

because of business unit function changes, some business unit risk registers

are no longer aligned to business unit function and some updating will be

required.

4. Key

risk reporting and management

4.1 Staff

have taken the opportunity presented by the above changes, and by the evolving

practice in health and safety risk management to:

· Better

align this report with the quarterly report to the subcommittee on health and

safety

· Review

and consider in the light of Council activities so far this year whether or not

the key risk areas in previous reports are still appropriate.

4.2 The

attached document outlining key risk areas has been updated to reflect this. In

particular the attached document now:

· Condenses

all health and safety related risks into a single topic area (detail on these

risks is contained in the quarterly health and safety report to the

Subcommittee)

· Adds a

new key risk area related to timing and extent of legal advice used in Council

decision making.

4.3 The

Subcommittee’s attention is also formally drawn to the fact that this

report does not deal with financial risks or with insurance matters. This has

always been the case on the basis that the Subcommittee receives more detailed

reporting on both of these matters.

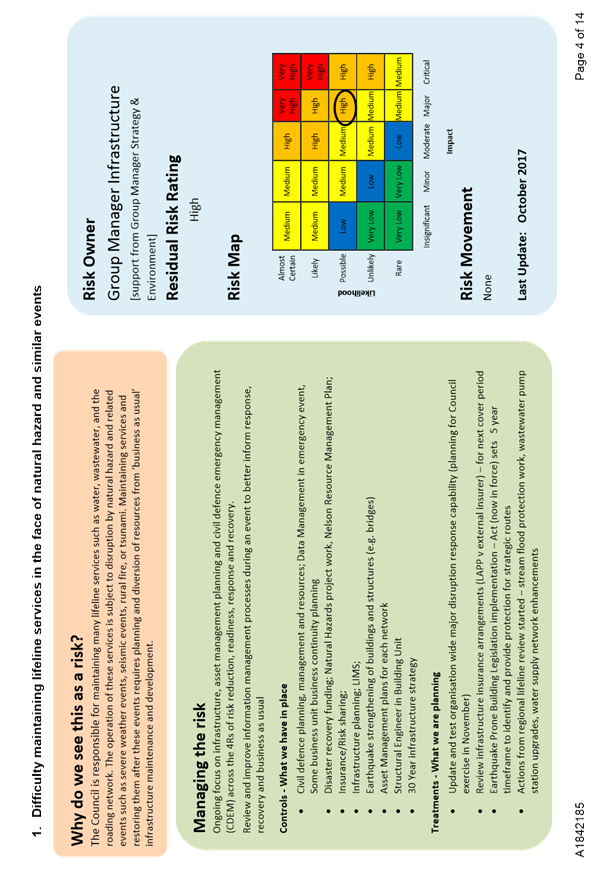

Summary of

control changes since last report

4.4 The

table below summarises areas where controls on key risks have been progressed.

|

Key risk area

|

Progress on risk treatments since last report

|

|

1 Maintaining

lifeline services …

|

· Exercise to test and improve responding to

major disruptions scheduled for 15 November

· Action from regional lifelines review commenced

including enhancements to stream flood protection, water supply and

wastewater management

|

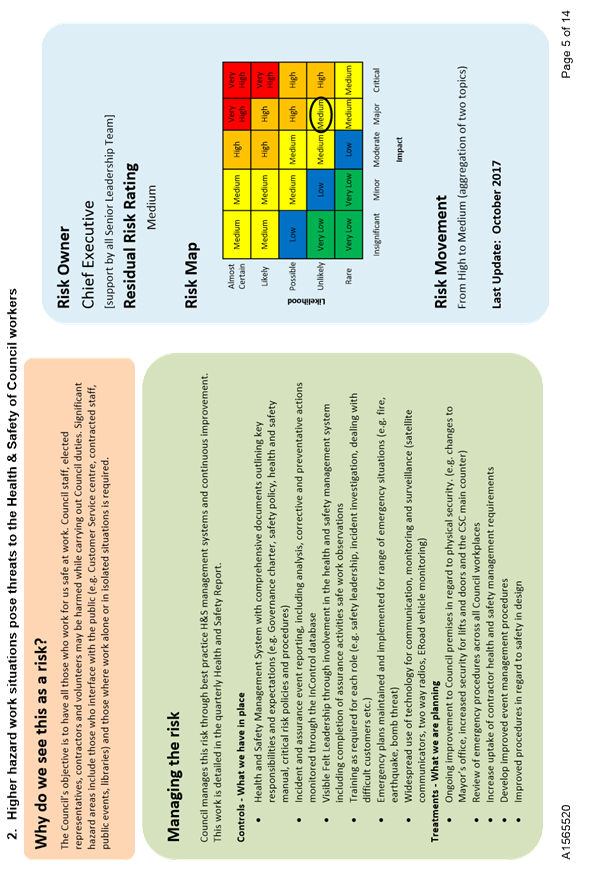

|

2 H&S

risks from higher hazard work situations …

|

[Condensed from two previous risk

areas, detail of actions in health and safety report]

|

|

10 Lack

of adequate consideration of legal implications …

|

[New

area]

|

Capital works

programme risk

4.5 In

the previous report to this Subcommittee, officers noted a risk that may have

consequences large enough to warrant corporate action. In summary this risk arises from mechanisms for reconsidering

expenditure in cases where fixed sums are allocated to projects by Council

decision (often substantially ahead of time). When these projects come to

execution, changes in the market can alter the real cost of these projects. The

experience from the capital works programme suggests that the time required to

revisit a specific Council decision (which may be in the order of 90 days) can

lead to significant time delays for the total work programme.

4.6 Council

agreed that this matter was significant and has requested action to resolve

this, which is in progress.

5. Options

5.1 It

is recommended that this report be received as it will further improve the

Subcommittee’s understanding of the risks faced by Council and the

actions being taken to manage them.

5.2 There

can be value from a discussion of the factors contributing to risks and the

Subcommittee may consider such a discussion useful.

Steve

Vaughan

Risk

& Procurement Analyst

Attachments

Attachment 1: Key Risks Report Quarter 3

Calendar 2017 (A1842185) ⇩

|

Important considerations for decision making

|

|

1. Fit

with Purpose of Local Government

This report describes risk management activity. Risk

management is a tool to enable more efficient and effective provision of

services as set out in section 10(1)(b) of the LG Act.

|

|

2. Consistency

with Community Outcomes and Council Policy

This report describes risk management activity. Risk

management at its most fundamental is about achieving an organisation’s

objectives (in this case as set out in Nelson City Council’s planning

documents) with increased clarity, efficiency and effectiveness.

|

|

3. Risk

The report does not recommend a particular goal or

objective to which risks may be considered. It serves to provide information

about Council’s work in addressing those risks judged to be key to the

organisation achieving its objectives.

|

|

4. Financial

impact

This is a report on work already underway as part of

Council’s regular management activity. Therefore there are no

additional funding implications.

|

|

5. Degree

of significance and level of engagement

This is of low significance decision under the

Council’s Significance and Engagement Policy. Therefore no external

consultation has been undertaken in the preparation of this report.

|

|

6. Inclusion

of Māori in the decision making process

There has been no consultation with Māori in

the preparation of this report, which deals with internal Council processes.

|

|

7. Delegations

The Audit, Risk and Finance Subcommittee has

responsibility for overseeing the Council’s risk management systems.

|

Item

13: Key Organisational Risks 2017 - 3rd Quarterly Report: Attachment 1

|

|

Audit, Risk and Finance Subcommittee

14 November 2017

|

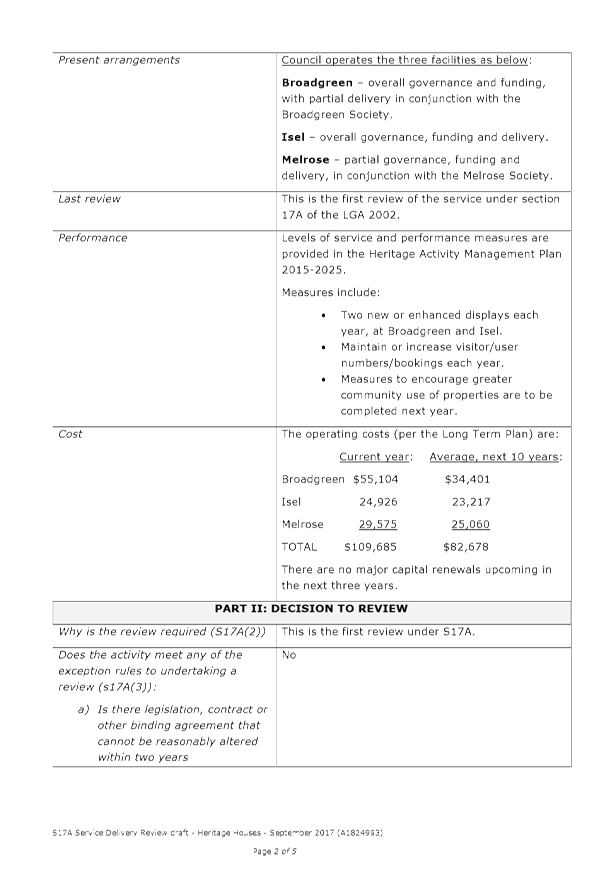

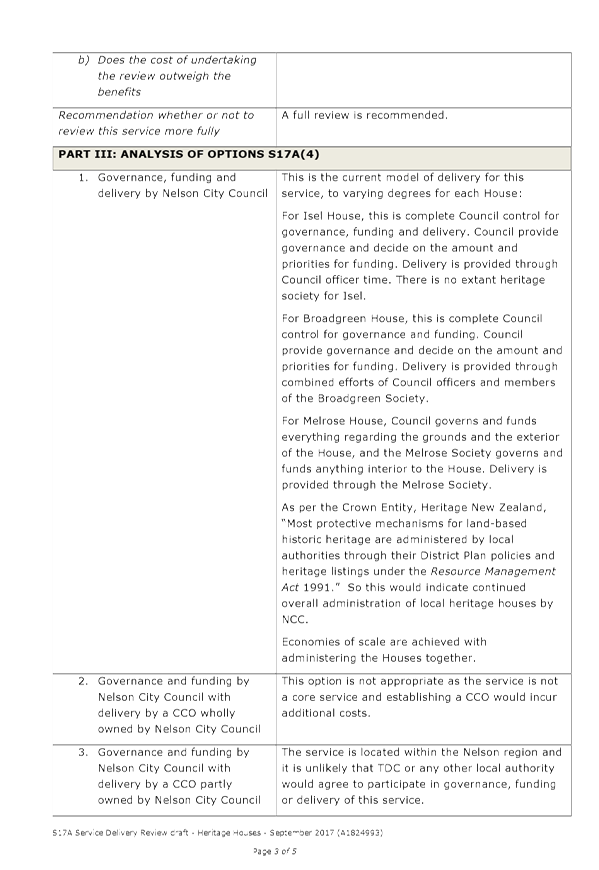

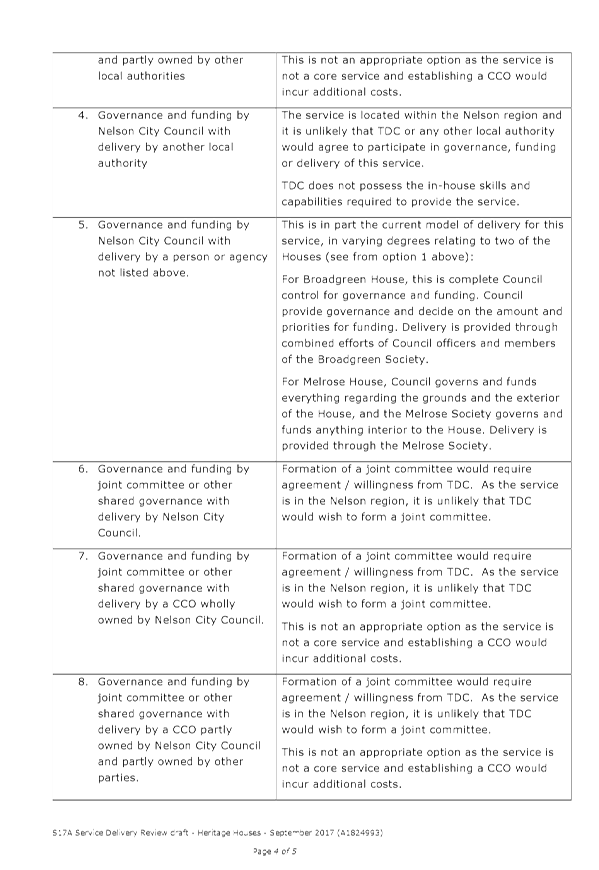

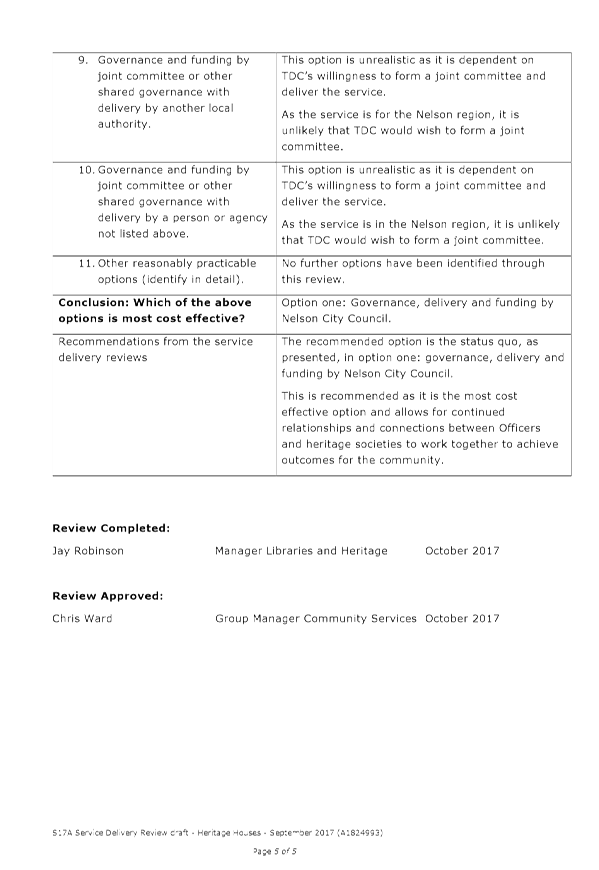

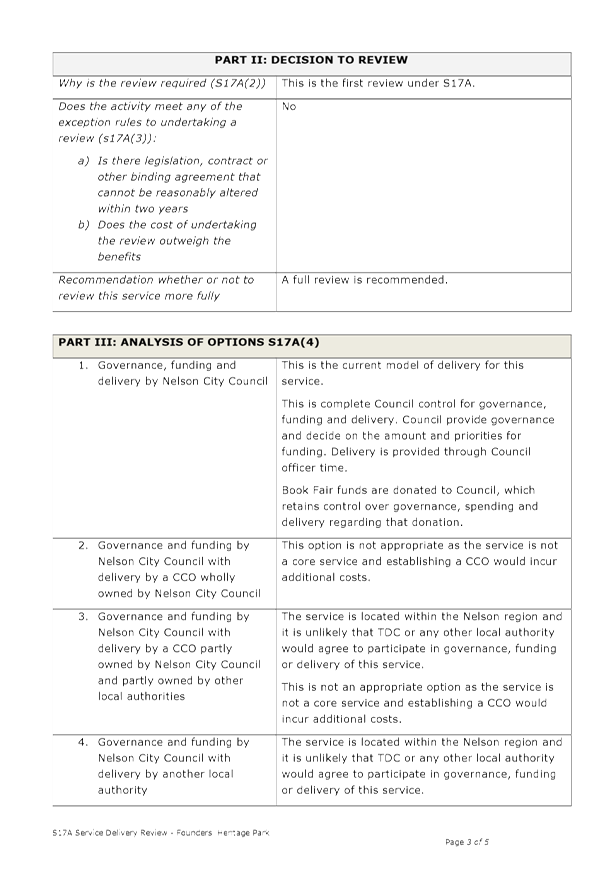

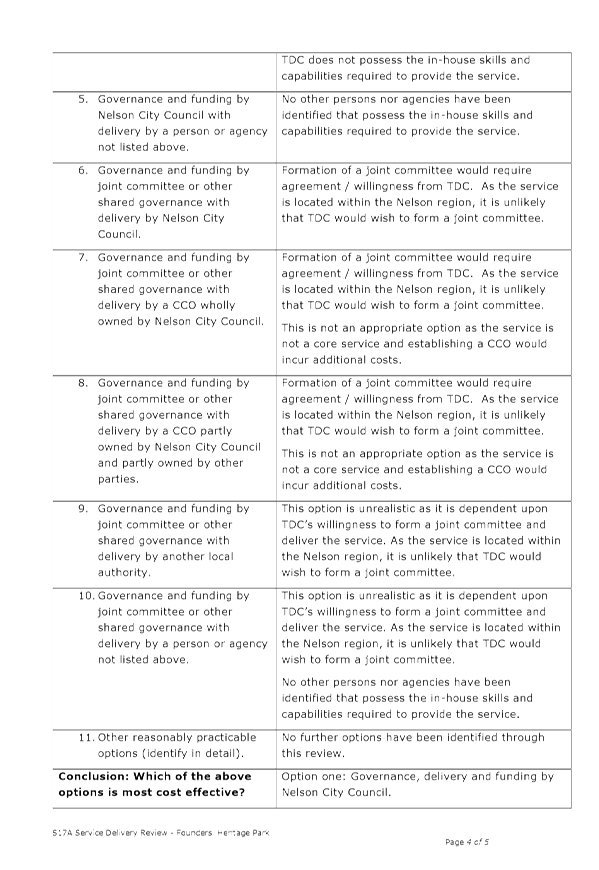

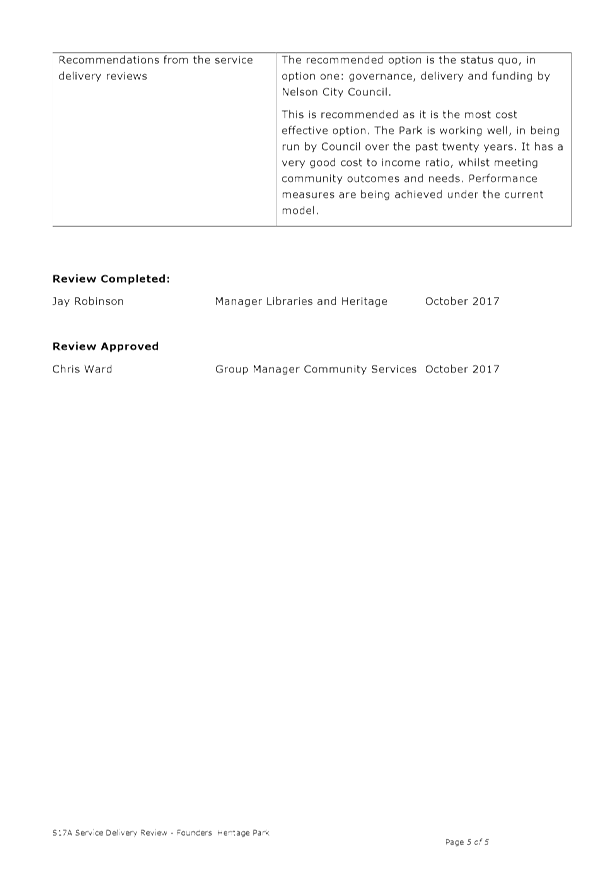

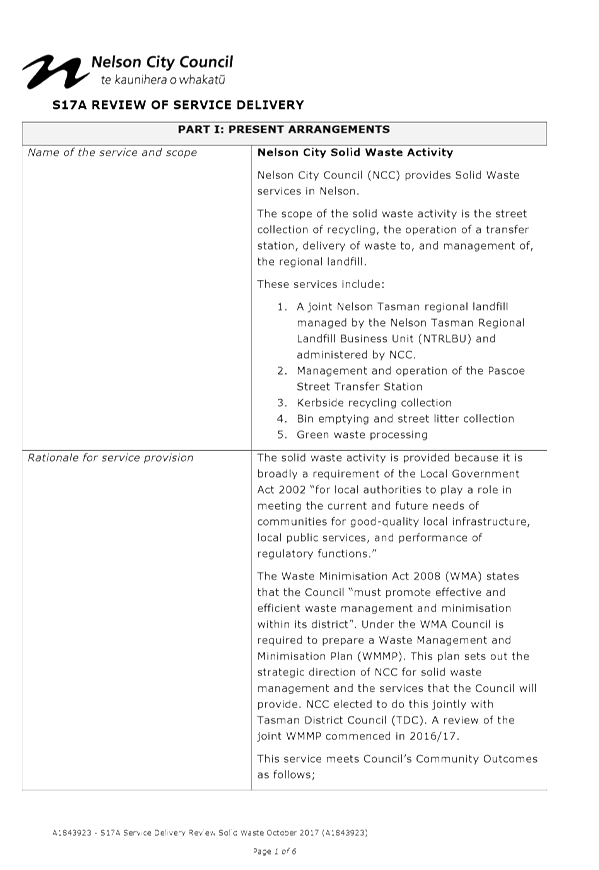

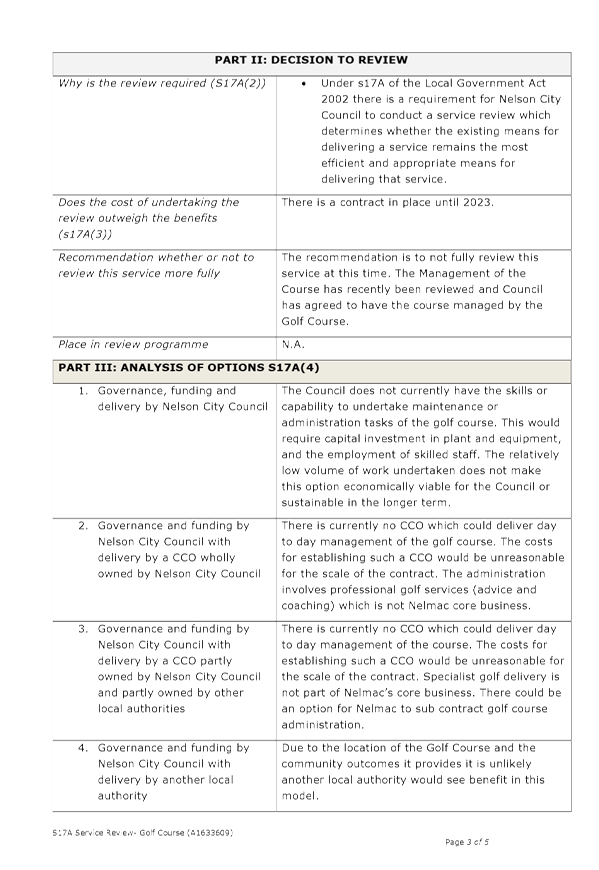

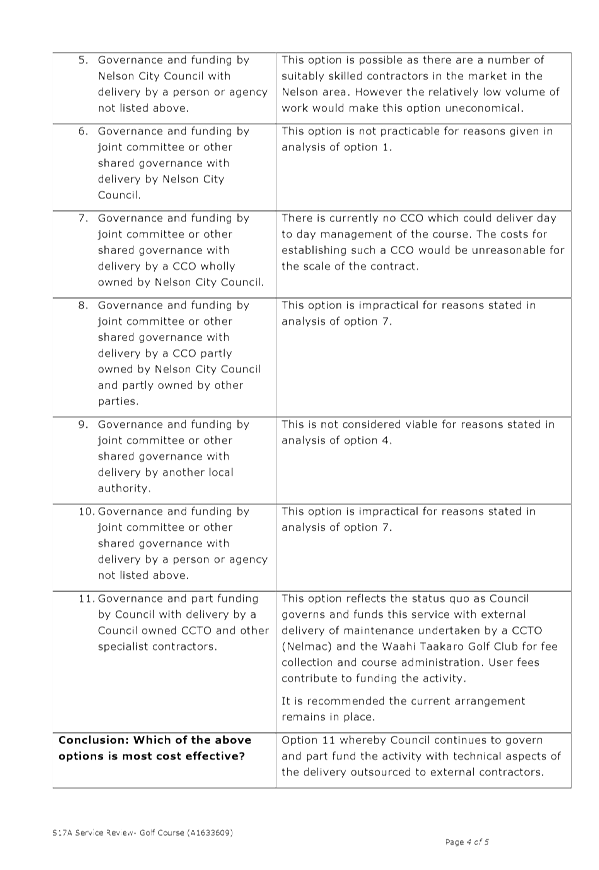

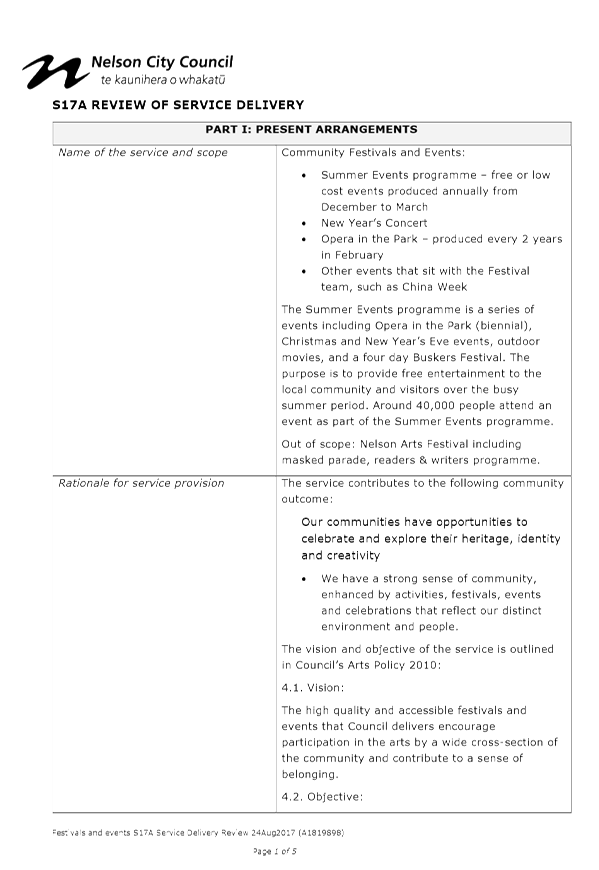

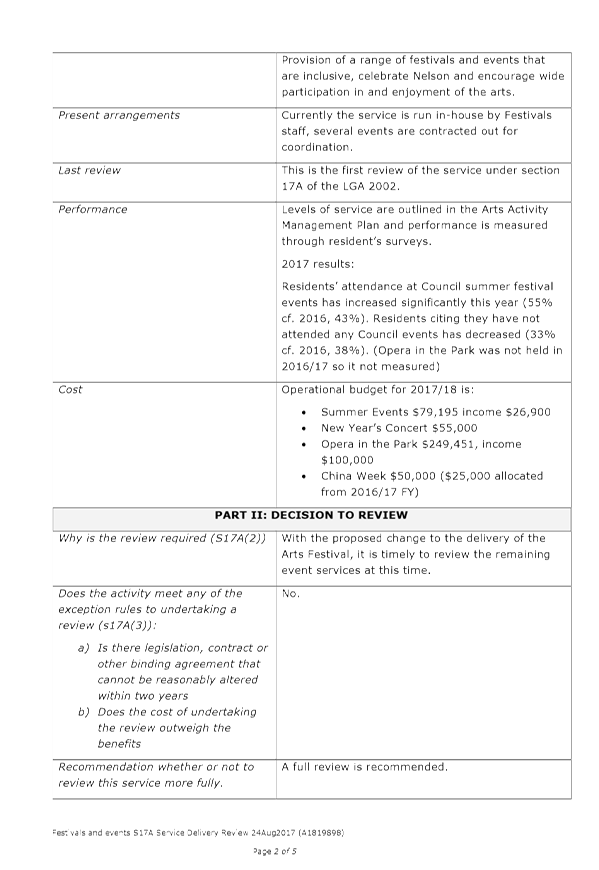

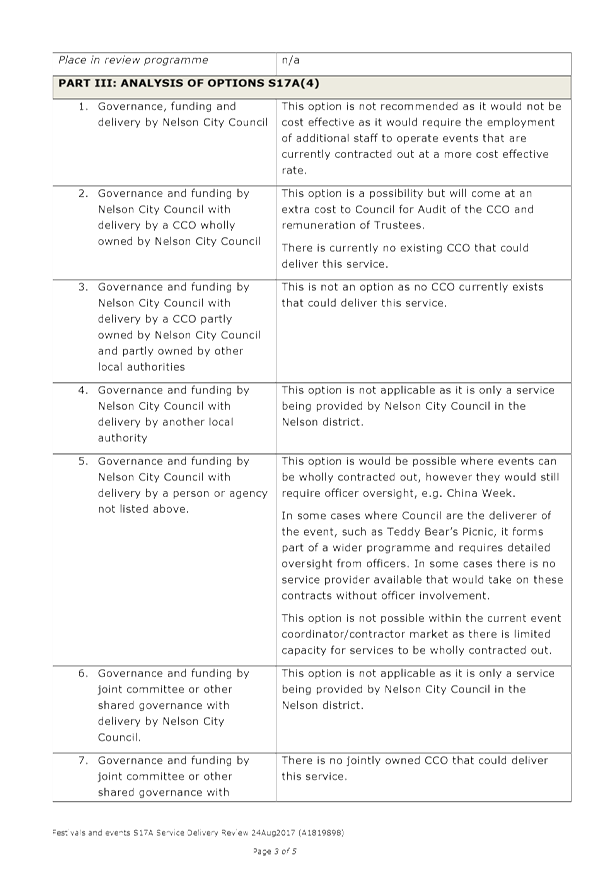

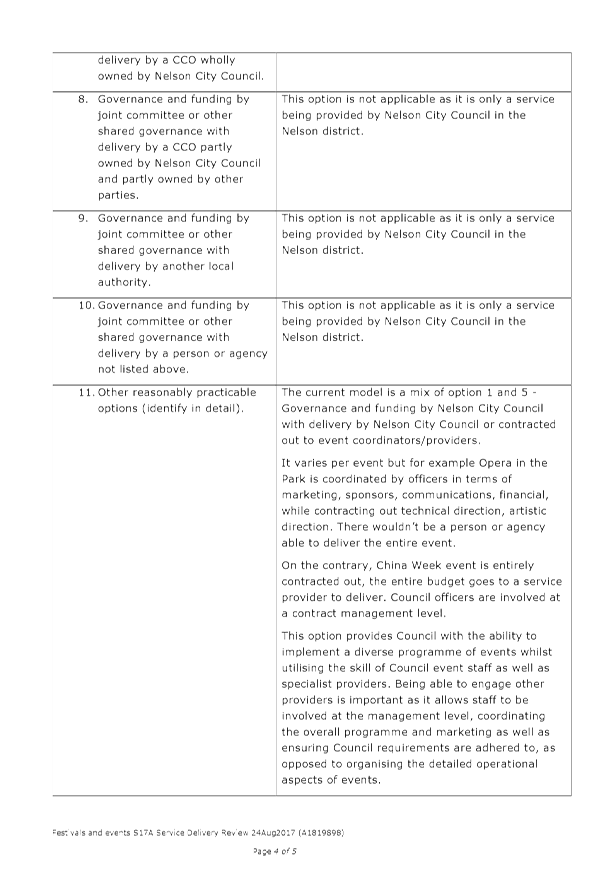

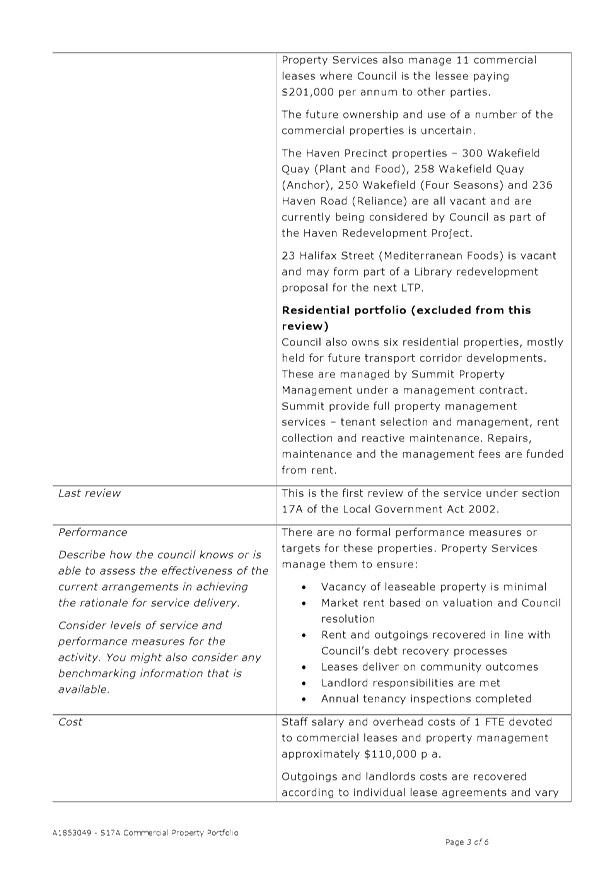

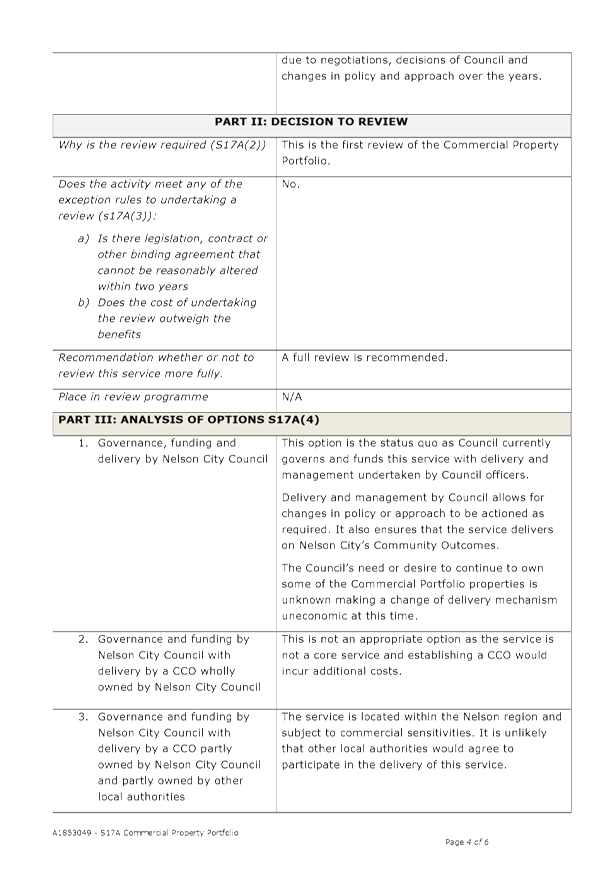

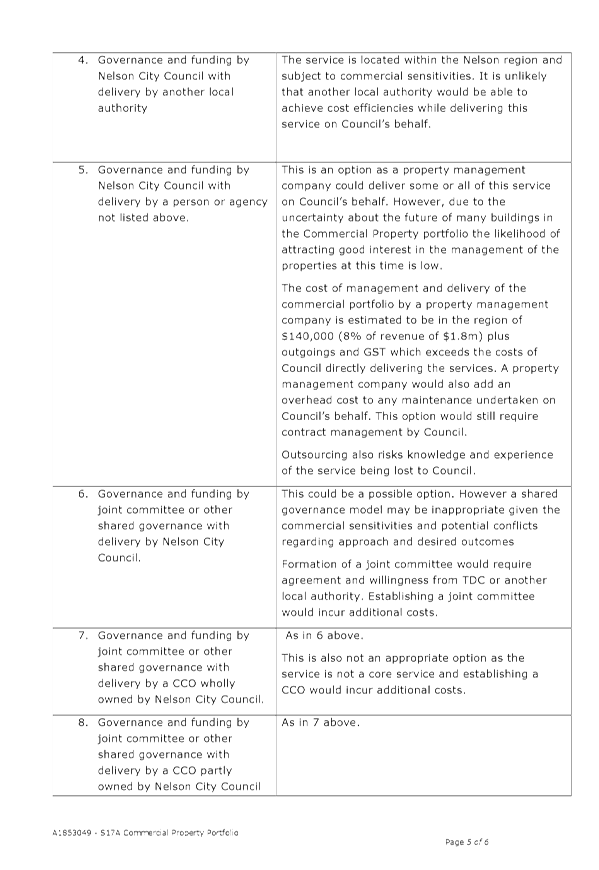

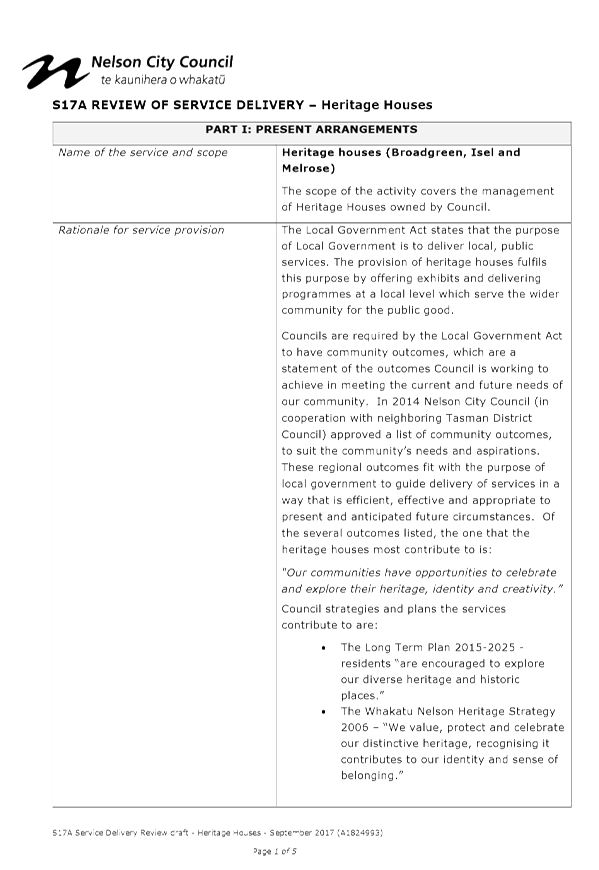

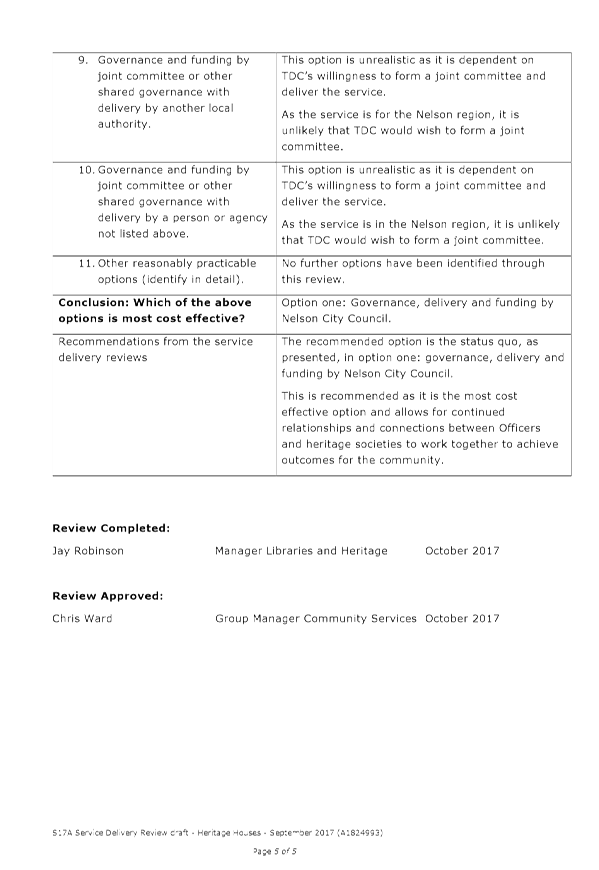

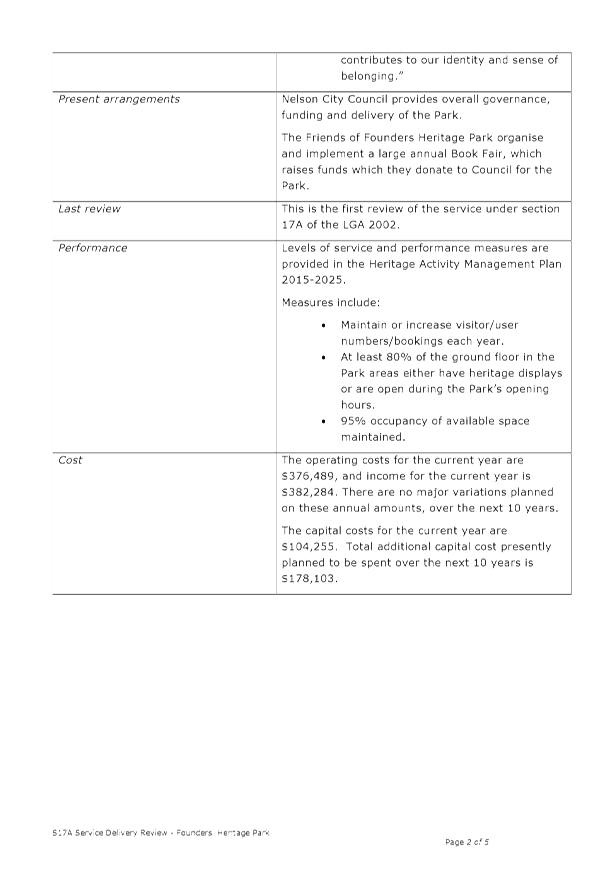

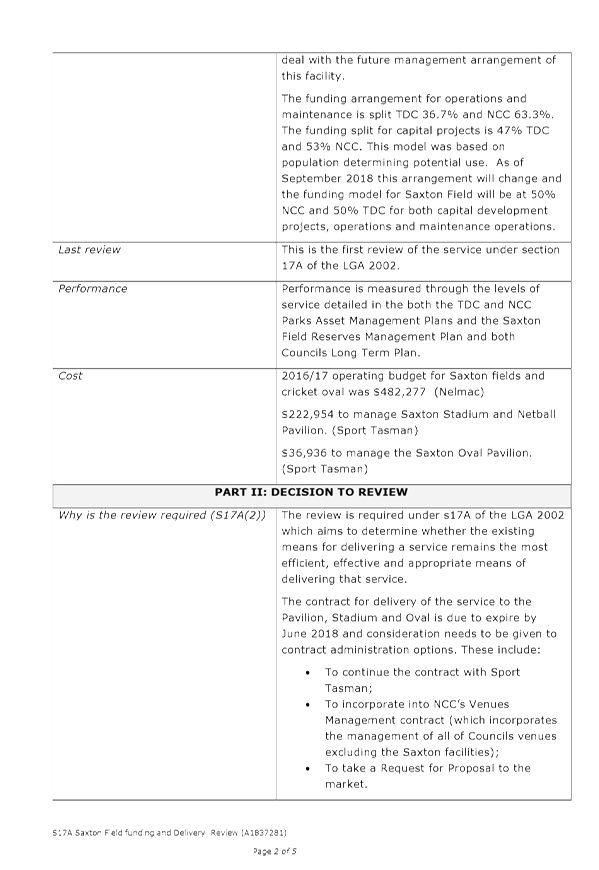

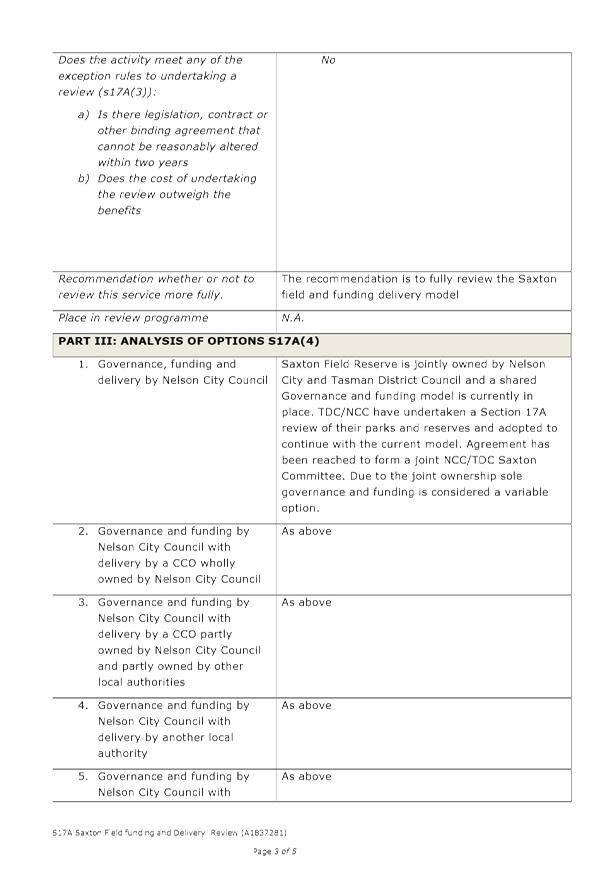

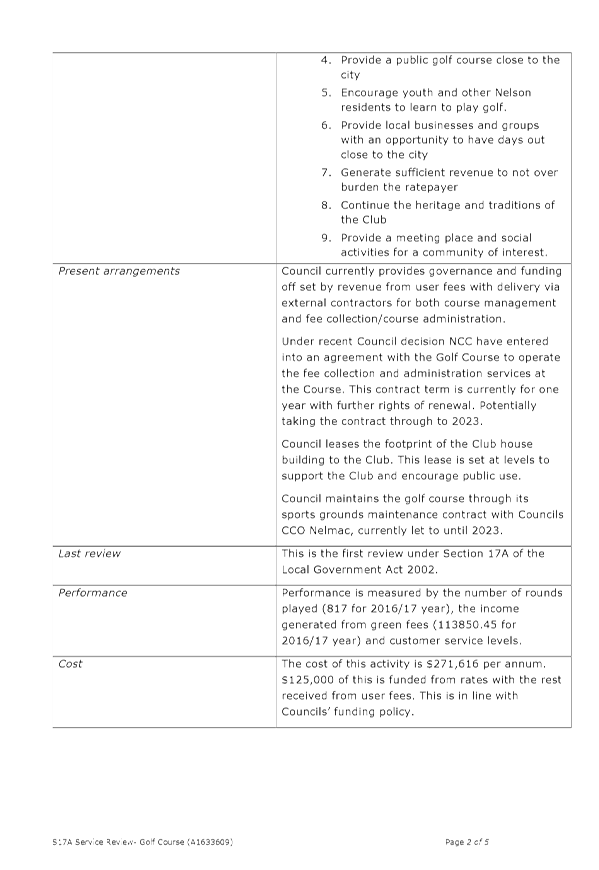

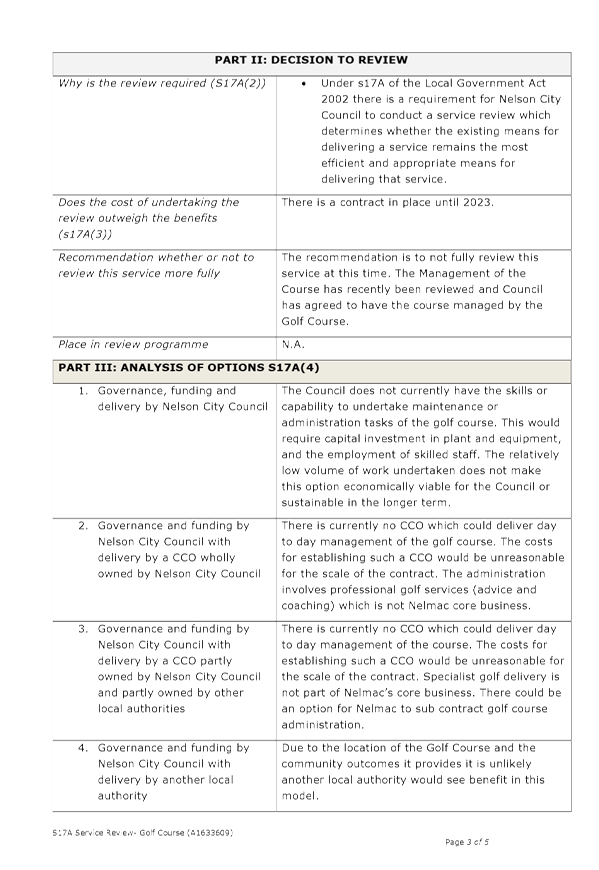

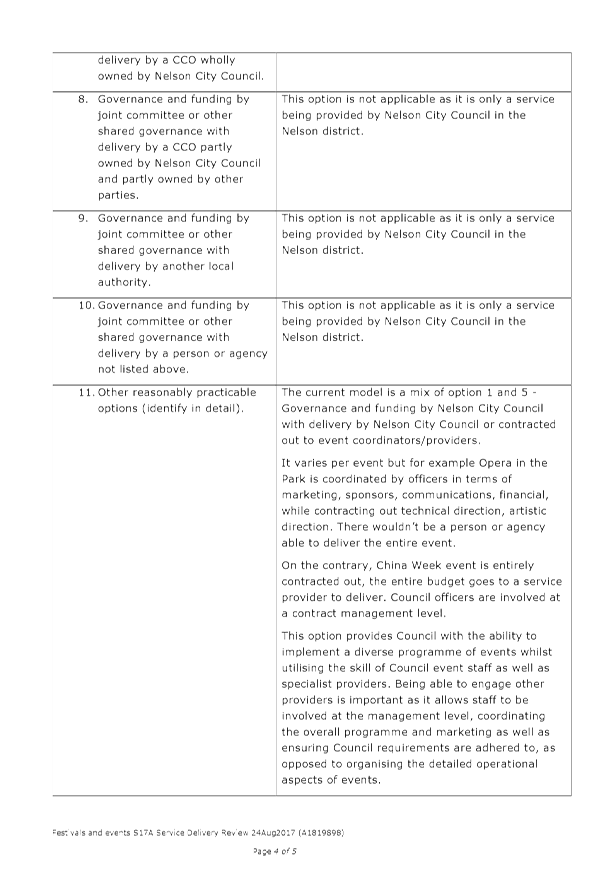

REPORT R8167

Section

17A Service Delivery Review progress report

1. Purpose

of Report

1.1 To

receive a quarterly report on progress for service delivery reviews subject to

section 17A of the Local Government Act (LGA) 2002.

2. Summary

2.1 Changes

to the LGA saw the introduction of new requirements under section 17A to review

the cost-effectiveness of current arrangements for meeting the needs of

communities within a district or region for good quality local infrastructure,

local public services, and performance of regulatory functions.

2.2 The

LGA has a transitional provision that requires all services to be reviewed by 8

August 2017, however the Subcommittee, at its meeting on 18 May 2017, granted

an extension for the completion of reviews until the end of the 2017 year. This

decision recognised that it was more efficient to continue to progress reviews

within existing resources than to redirect officers from other higher priority

areas of work.

2.3 These

quarterly reports are brought to the Subcommittee in order for it to have

oversight of the progress of reviews.

3. Recommendation

|

That the Subcommittee

Receives the report Section 17A

Service Delivery Review progress report (R8167) and its attachments (A1824993, A1845758, A1844354,

A1843923, A1837281, A1633609, A1819898, A1844359, A1853049).

|

4. Purpose

of reviews

4.1 Section

17A service delivery reviews seek to determine whether cost effectiveness gains

can be made by adopting an alternative funding, governance or service delivery

option by considering a variety of arrangements including having services

delivered by a council controlled organisation, or by another local authority

or other party.

4.2 A

review need not be undertaken if;

· Delivery

is governed by legislation, contract or other binding agreement that cannot be

reasonably altered in the next two years

· The

benefits to be gained do not justify the cost of the review.

5. Resource

Consent update

5.1 At

the last Subcommittee meeting in September the Subcommittee asked for more

information to be provided in the area of Resource Consents (recovery targets,

costs and performance as well mixed model delivery arrangement such as in-house

- contracting out ratios) and this is set out below.

5.2 Consultants

processed 116 resource consents in the 2016/17 financial year, with 36 of these

outsourced due to conflict of interest issues. This represents a quarter (25%)

of the total consents processed over the last year. Over the previous five

years the average number of consents processed by consultants has been 11% of

total consents issued.

5.3 The

main factors leading to the higher number of consents being outsourced last

year are: a sustained increase in the level of applications received; more

complex consents to process including notified applications; and staff

vacancies. One planner can process up to 100 straightforward consents a year or

approximately 50-60 consents of mixed complexity. The number of consents

outsourced last year has prompted the increase in staff numbers to reduce

reliance on external consultants and recruitment for this position is currently

underway.

5.4 Last

financial year the resource consent activity achieved a 68% cost recovery from

consent fees. The year before the recovery was 59%. The amount spent on

consultants more than doubled in this timeframe but the higher level of income

gained, mainly from the more complex consents last year, will have offset the

cost of consultants. It is not expected this higher level of income will be

sustained going forward so a reduction in consultant costs will be required to

maintain the required level of cost recovery between 40 and 60%.

6. Review

progress update

6.1 In

November 2015, Council agreed to the approach staff would take to address the

new requirement for s17A reviews. This included a schedule of review areas,

template and timeline. Reviews either come as part of a larger piece of work through

the relevant committee or are attached to these progress reports.

6.2 Since

the last progress report, the review of Nelmac as a CCTO, which had been

previously scheduled, has been removed as all contracts with Nelmac have been

reviewed within existing business unit activity areas under the s17A process

and reported to Council.

6.3 This

brings the total of review areas on the schedule to 47 with 36 of these having

been previously reported to Council in a progress report. Since then a further

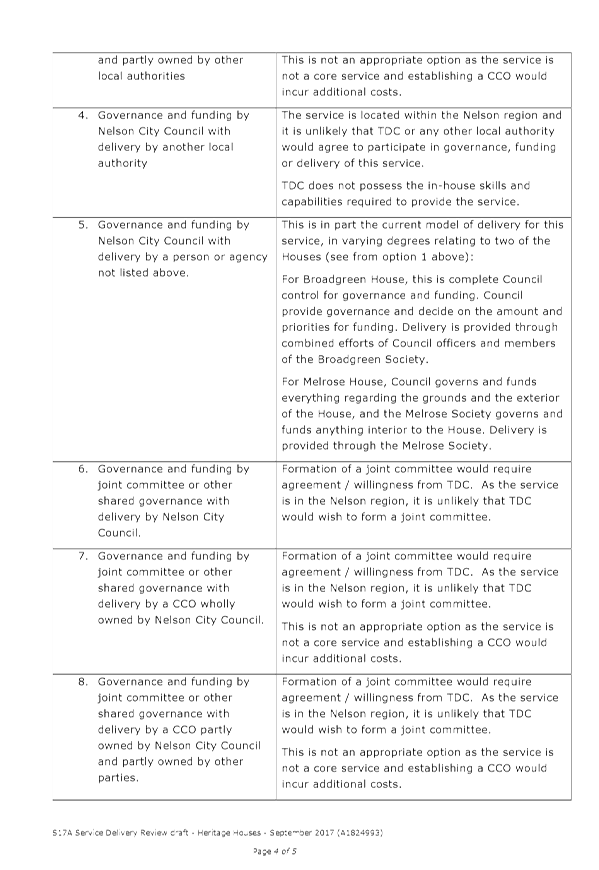

10 reviews have been undertaken and these are noted in the table below:

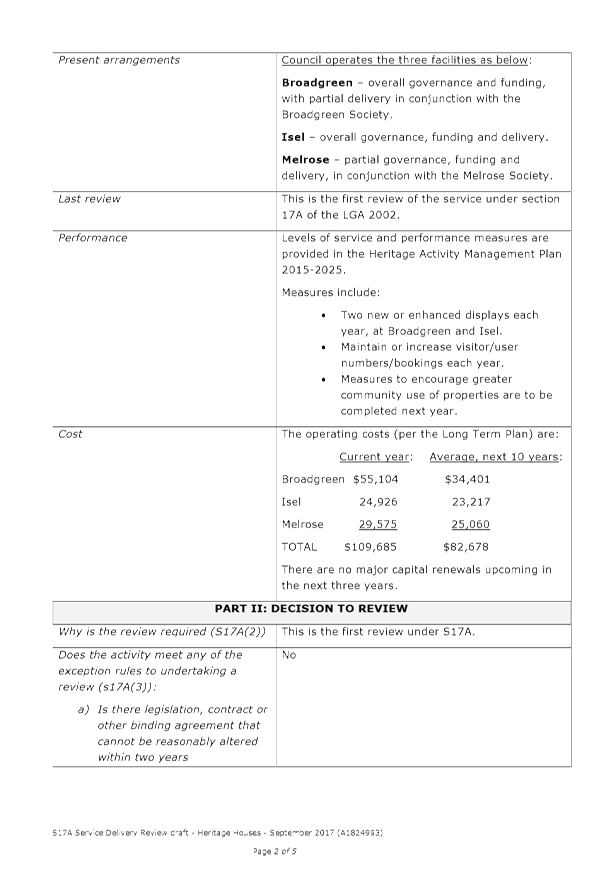

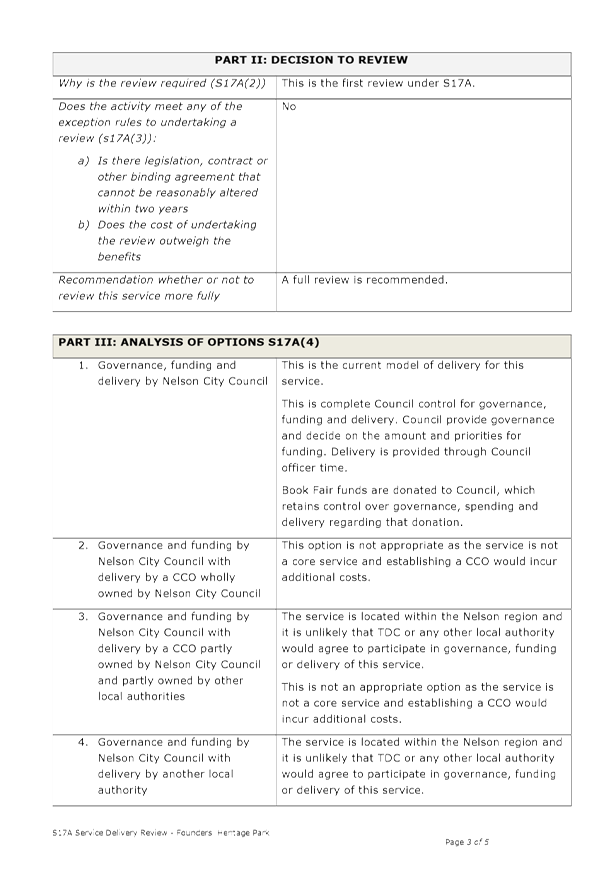

|

Service

|

Outcome

|

|

Heritage Houses

|

Continue with Council governance, funding and delivery

|

|

Commercial Property Portfolio

|

Continue with Council governance, funding and delivery

|

|

Community Health and Safety

|

Report to Planning and Regulatory Committee 3 October

(Public Excluded)

|

|

Corporate Services

|

Continue with Council governance, funding and delivery

|

|

Founders Heritage Park

|

Continue with Council governance, funding and delivery

|

|

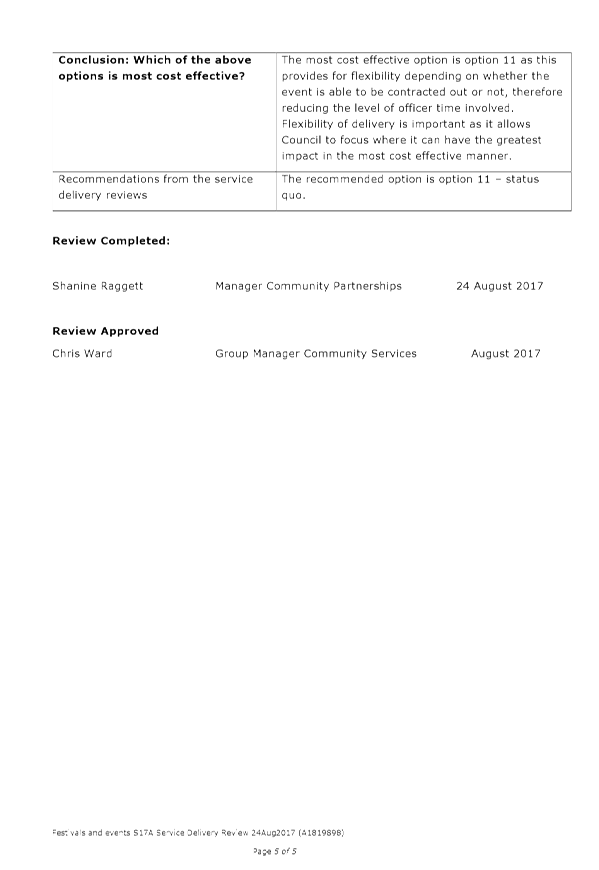

Nelson Marina

|

Continue with Council governance, funding and delivery by

Council’s CCTO

|

|

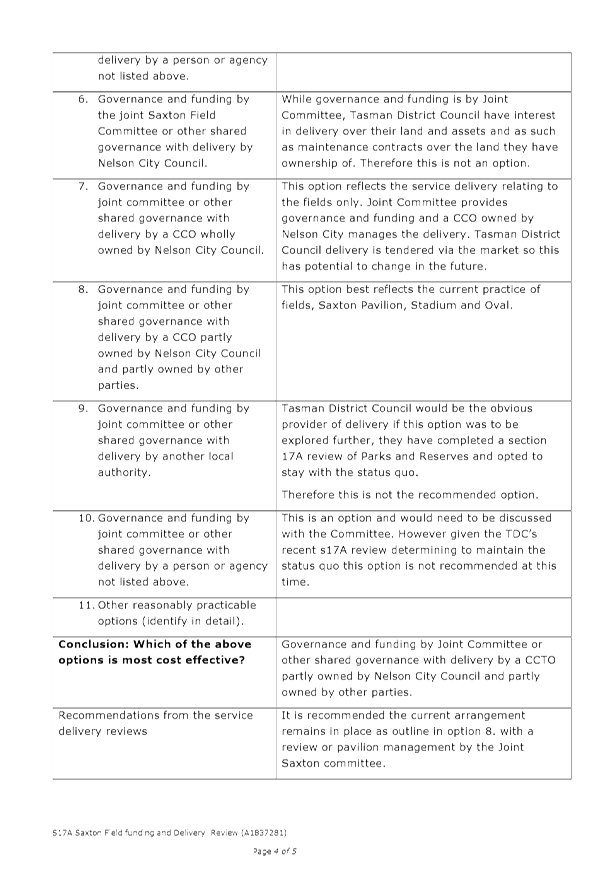

Saxton Field and Pavilion - funding and delivery only

|

Continue with shared funding with Tasman District Council

and delivery by a CCTO

|

|

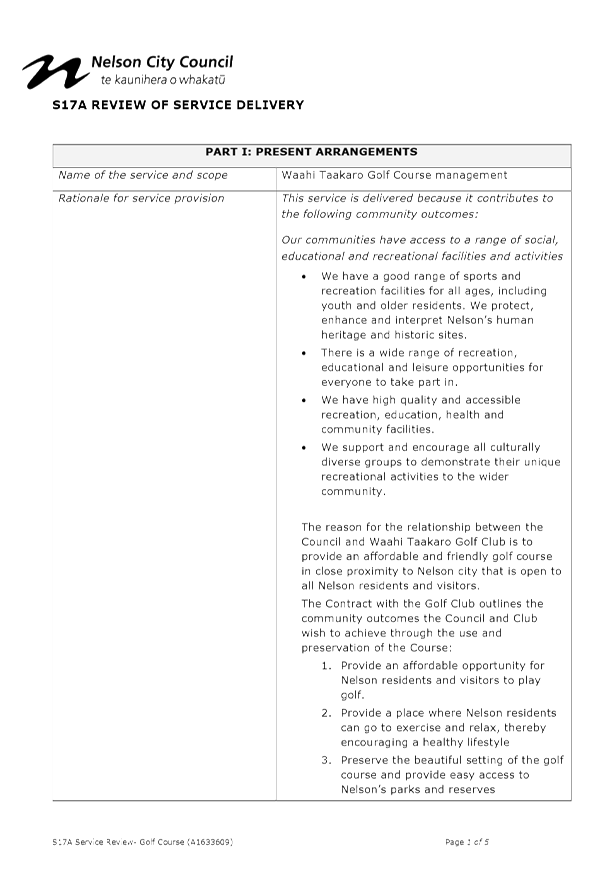

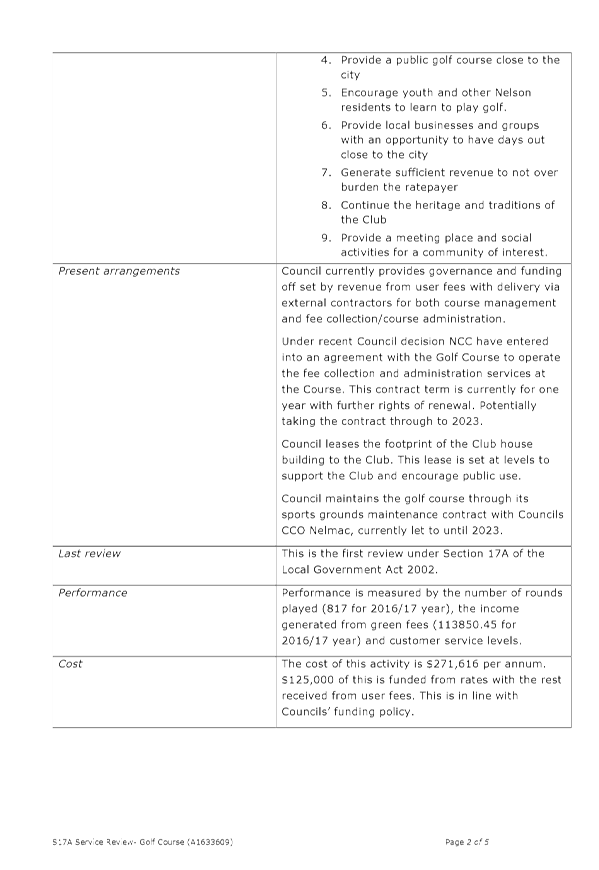

Golf Course

|

Continue with Council governance and funding and delivery

by a mix of external providers and Council’s CCTO

|

|

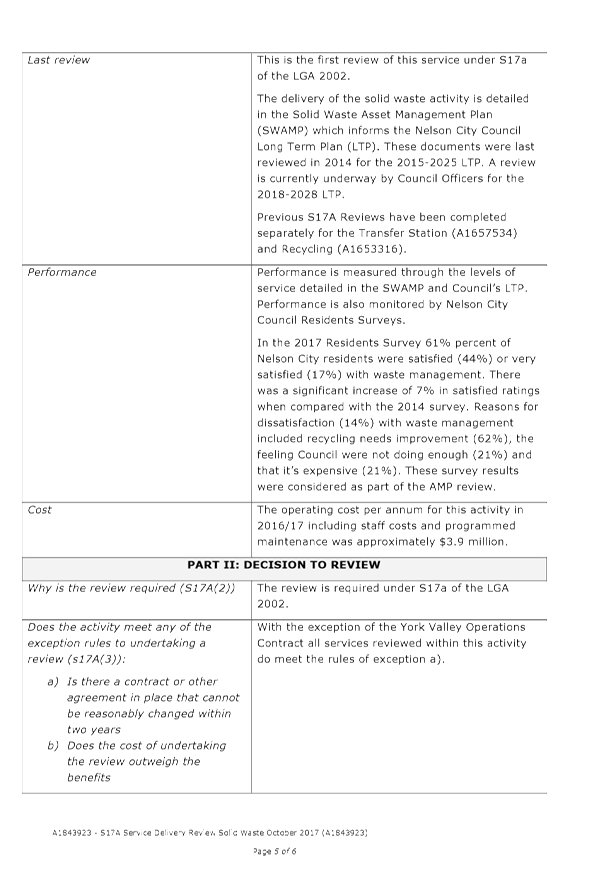

Solid Waste

|

Continue with Council governance, funding and delivery

noting that this activity is self-funding

|

|

Festivals and Events - excluding Nelson Arts Festival

|

Continue with Council governance, funding and delivery

with some delivery by external providers

|

6.4 Reviews

that have not already been before Council are attached. (Please note that the

Community Health and Safety review has not been attached as this has already

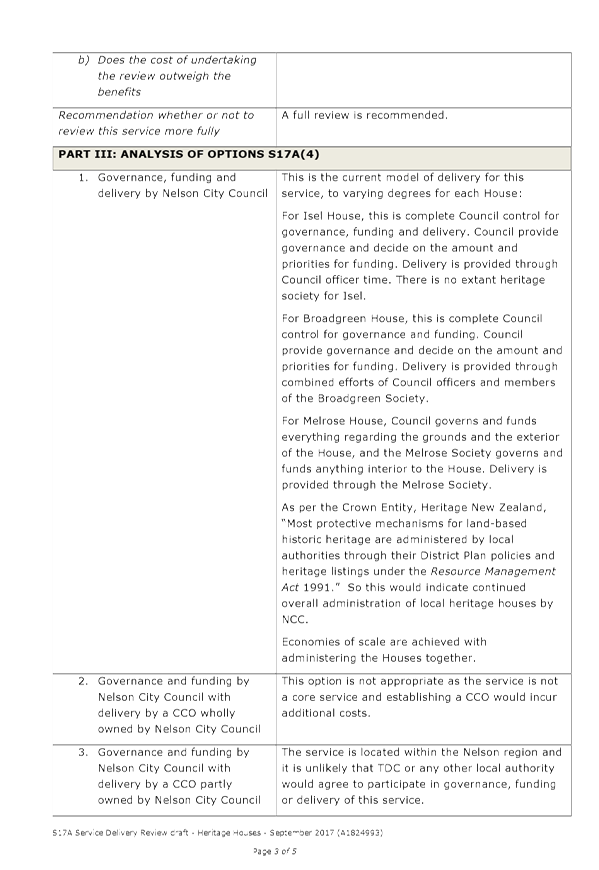

been before Council).

6.5 One

further review has been completed (Listed Trees) and will be coming to the

Subcommittee with a report detailing the recommended approach and seeking a

decision.

6.6 Including

the one review detailed in 6.5, the status of the first round of service

delivery reviews is that all reviews have been completed.

7. Future

review process

7.1 The

LGA requires reviews to continue to be undertaken;

· In conjunction

with the consideration of any significant change to service levels

· Within two years

before the expiry of any legislation, contract or other binding agreement

affecting the service

· No later than six

years after any previous review.

7.2 In

line with this requirement, officers will continue to undertake reviews within

their existing work programmes and will bring these via the relevant Committee

as required. There will be no further progress reports to the Audit Risk and

Finance Subcommittee as s17A reviews will become part of business as usual and

the responsibility of Business Unit Managers.

8. Conclusion

8.1 It

is recommended the Subcommittee receives this report, noting the completion of

the first round of s17A reviews and the future approach for reviews to come to

relevant Committees as required.

Gabrielle

Thorpe

Policy

Adviser

Attachments

Attachment 1: A1824993 - s17A Service

Delivery Review - Heritage Houses ⇩

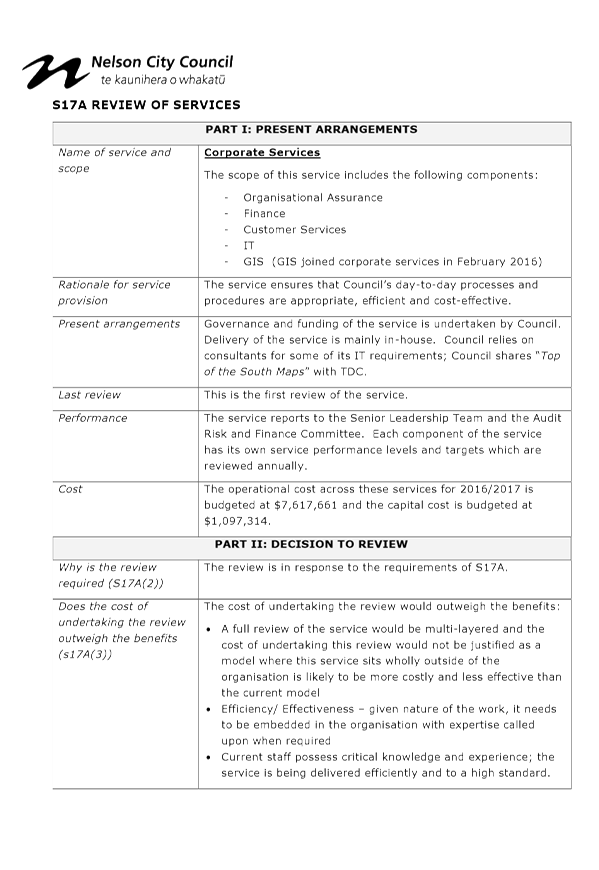

Attachment 2: A1845758

- s17A Service Delivery Review - Corporate Services ⇩

Attachment 3: A1844354

- s17A Service Delivery Review - Founders Heritage Park ⇩

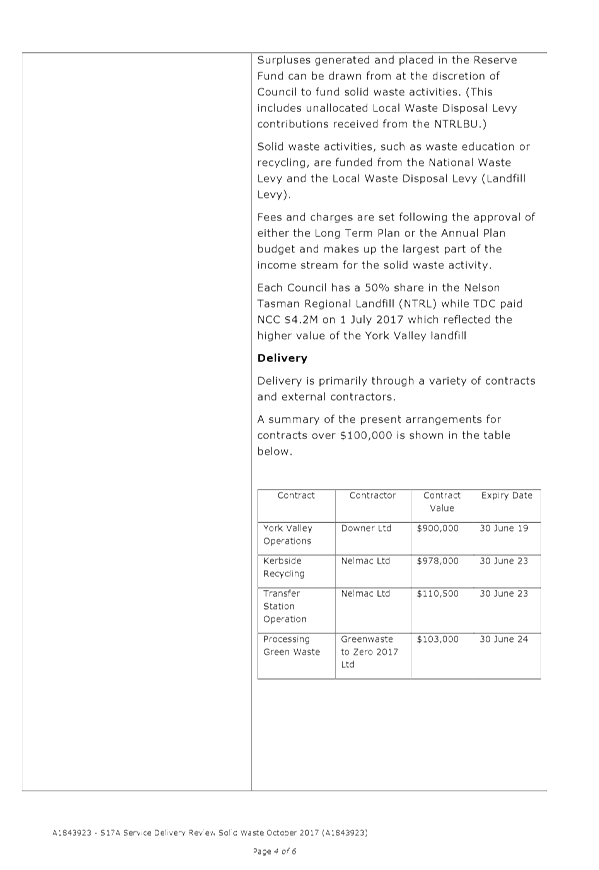

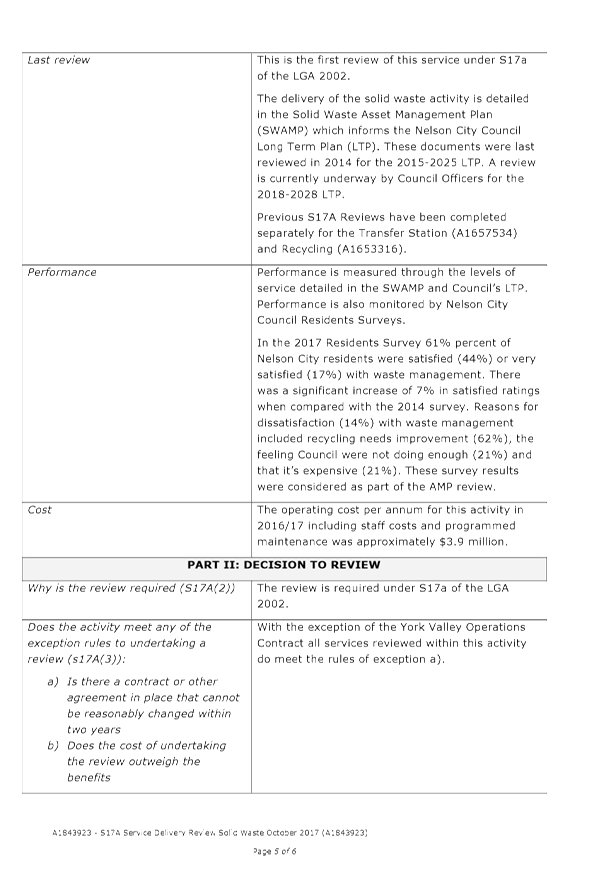

Attachment 4: A1843923

- s17A Service Delivery Review - Solid Waste ⇩

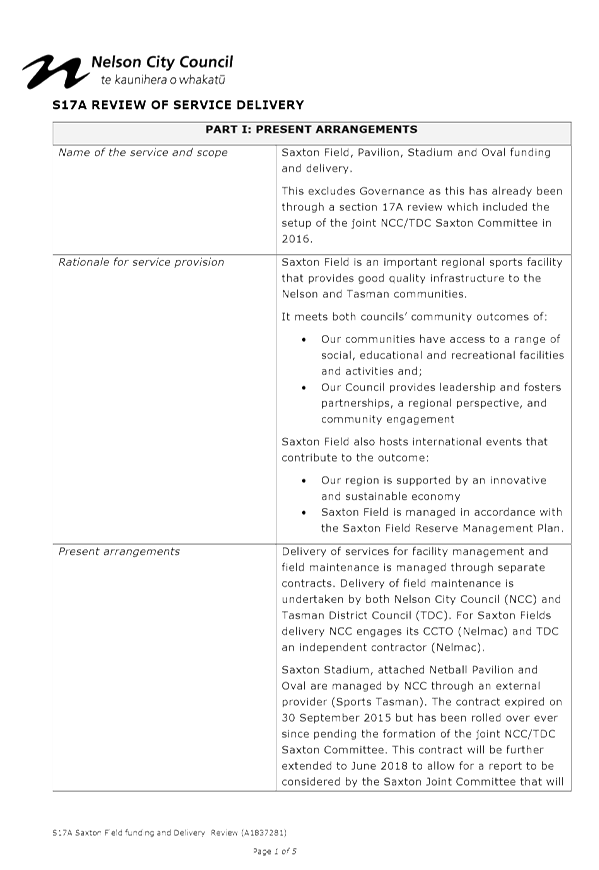

Attachment 5: A1837281

- s17A Service Delivery Review - Saxton Field ⇩

Attachment 6: A1633609

- s17A Service Delivery Review - Golf Course ⇩

Attachment 7: A1819898

- s17A Service Delivery Review - Festivals and Events ⇩

Attachment 8: A1844359

- s17A Service Delivery Review - Nelson Marina ⇩

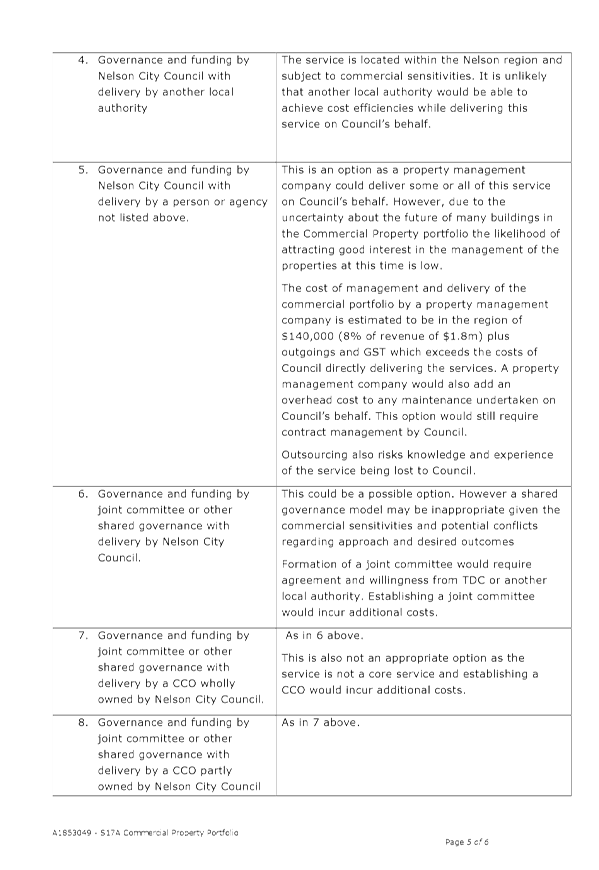

Attachment 9: A1853049

- s17A Service Delivery Review - Commercial Property Portfolio ⇩

|

Important

considerations for decision making

|

|

1. Fit

with Purpose of Local Government

Section 17A service delivery reviews are a statutory

requirement of the LGA 2002.

|

|

2. Consistency

with Community Outcomes and Council Policy

The service delivery review process aligns with

Council’s due diligence obligations and regular reviews of contract

performance that are part of business as usual. This work also supports the

following Community Outcomes:

- That our

infrastructure is efficient, cost effective and meets current and future

needs

- Our

Council provides leadership and fosters partnerships, a regional perspective

and community engagement

|

|

3. Risk

There is some risk that officers may not continue to

undertake reviews as per legislated requirements however it is anticipated

that workflow enhancements as part of a contract monitoring addition to

MagicQ scheduled for early 2018 will provide a means of automatic reminder

for reviews. A review schedule will also be disseminated to staff who

have responsibility for review areas detailing information for them to

programme.

|

|

4. Financial

impact

The process of reviewing service delivery functions

may bring cost savings in some areas. Staff resources required to complete

reviews are currently within existing budgets.

|

|

5. Degree

of significance and level of engagement

This quarterly update is of low significance and no

community engagement has been undertaken.

|

|

6. Inclusion

of Māori in the decision making process

Māori have not been consulted in preparation of

this report.

|

|

7. Delegations

The Audit, Risk and Finance Subcommittee has the

responsibility for the Council’s financial and service performance. The

Audit, Risk and Finance Subcommittee has the power to make a recommendation

to Council on this matter.

|

Item

14: Section 17A Service Delivery Review progress report: Attachment 1

Item

14: Section 17A Service Delivery Review progress report: Attachment 2

Item

14: Section 17A Service Delivery Review progress report: Attachment 3

Item

14: Section 17A Service Delivery Review progress report: Attachment 4

Item

14: Section 17A Service Delivery Review progress report: Attachment 5

Item

14: Section 17A Service Delivery Review progress report: Attachment 6

Item

14: Section 17A Service Delivery Review progress report: Attachment 7

Item

14: Section 17A Service Delivery Review progress report: Attachment 8

Item

14: Section 17A Service Delivery Review progress report: Attachment 9

Item 15: Tax Risk

Management Strategy

|

|

Audit, Risk and Finance Subcommittee

14 November 2017

|

REPORT R8585

Tax

Risk Management Strategy

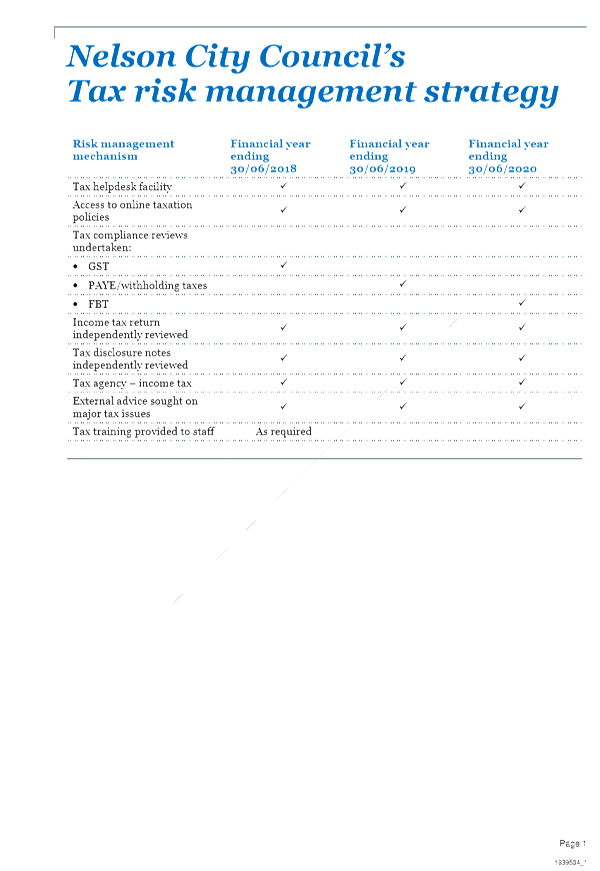

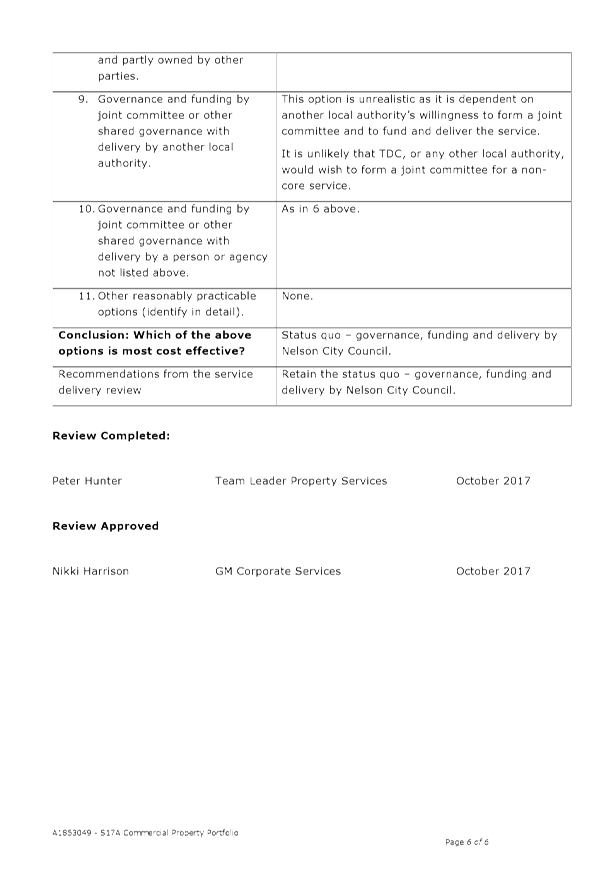

1. Purpose

of Report

1.1 To

adopt the Tax Strategy as recommended by the Tax Governance Framework.

2. Recommendation

|

That the Subcommittee

Receives the report Tax Risk

Management Strategy (R8585) and

its attachments (A1847439 and A1847460).

|

Recommendation to Council

|

That the Council

Adopts

the Tax Risk Management Strategy (A1847439).

|

3. Background

3.1 On

June 22 2017, Council adopted the Tax Risk Governance Framework (Attachment 2),

as recommended by this subcommittee at its meeting of 18 May2017.

3.2 The

report noted that a tax risk management strategy would be presented to a future

meeting of this subcommittee.

4. Discussion

4.1 The

finance department has a number of process and procedures detailing how tax is

calculated and when and how it is paid. While there is a small risk that these

processes are not followed or that the payments are not made on time, there are

well established controls in place to minimise that risk.

4.2 The

tax risk management strategy seeks to address the complexity of tax compliance.

This is an area that is constantly evolving, and remaining fully up to date

with the intricacies is challenging.

4.3 The

strategy outlines the mechanisms that we have in place for managing that

challenge, and when those mechanisms will be implemented.

4.4 The

strategy is a formal understanding of some things we already do to mitigate our

tax risk (such as seeking external advice and having our tax return reviewed),

along with some recommendations from our tax advisors to keep us on the front

foot.

4.5 Where

additional costs are likely to be incurred as a result of the strategy, this

will be assessed as part of the annual/long term planning process.

Options

4.6 It

is recommended that the Tax Risk Management Strategy is adopted. The strategy

formalises our approach to managing tax risk, is a key component of the Tax

Risk Governance Framework that was adopted in June, and supports the

expectation that Council will maintain exemplary tax compliance standards.

There are no disadvantages to adopting the strategy.

4.7 If

the strategy is not adopted, tax risk would continue to be managed in an ad hoc

manner, contrary to the recommendations of the Tax Risk Governance Framework.

Tracey

Hughes

Senior

Accountant

Attachments

Attachment 1: Tax risk management

strategy (A1847439) ⇩

Attachment 2: Tax

governance framework (A1847460) ⇩

|

Important considerations for decision making

|

|

1. Fit

with Purpose of Local Government

The Tax Risk Management Strategy promotes

transparency of Council’s tax operations to all stakeholders including

the community.

|

|

2. Consistency

with Community Outcomes and Council Policy

Supports the community outcome “Our Council

provides leadership and fosters partnerships, a regional perspective and

community engagement”.

|

|

3. Risk

Adoption of this strategy mitigates tax risk in line

with Council’s low tax risk profile.

|

|

4. Financial

impact

Adoption of this strategy may result in minor costs

over time for cyclical compliance reviews. Failing to conduct such reviews

may be more expensive in the long run.

|

|

5. Degree

of significance and level of engagement

The decision to adopt the framework is of low significance

as it is an administrative matter that enhances and formalises existing

processes.

|

|

6. Inclusion

of Māori in the decision making process

There has been no consultation with Maori on this

item.

|

|

7. Delegations

The Audit, Risk and Finance Subcommittee has the

responsibility for considering financial and other risk management, internal

control and statutory compliance. The Audit, Risk and Finance Subcommittee

has the power to make a recommendation to Council on this matter.

|

Item

15: Tax Risk Management Strategy: Attachment 1

Item

15: Tax Risk Management Strategy: Attachment 2

Audit, Risk and Finance

Subcommittee

Audit, Risk and Finance

Subcommittee