|

|

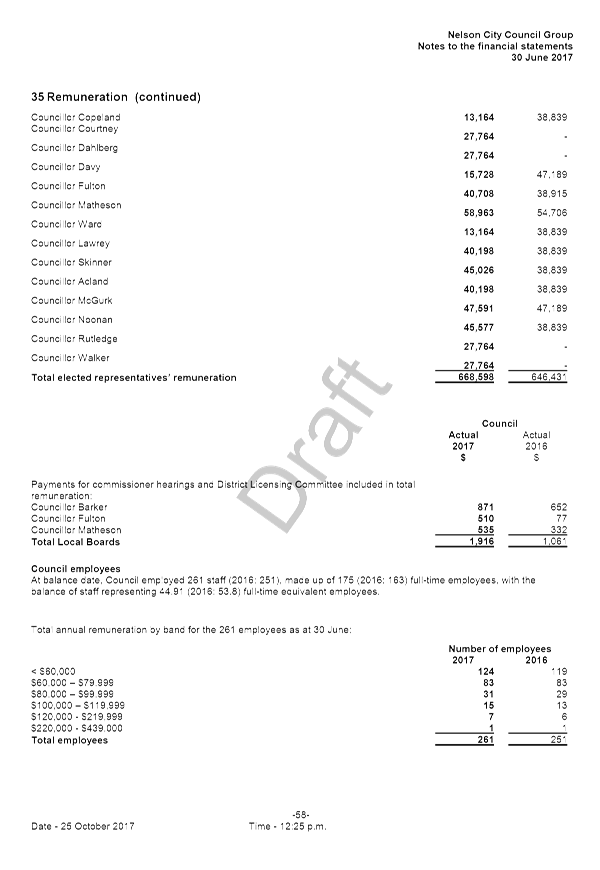

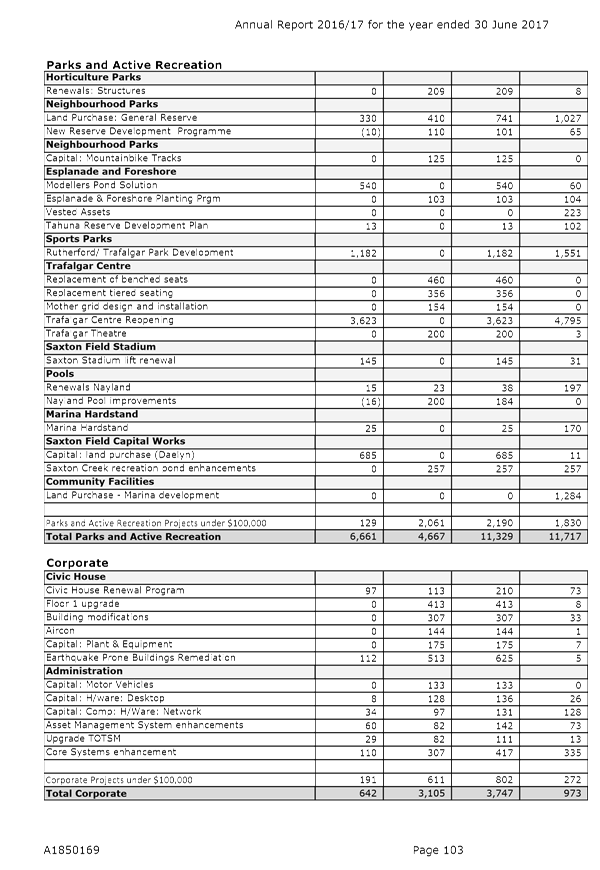

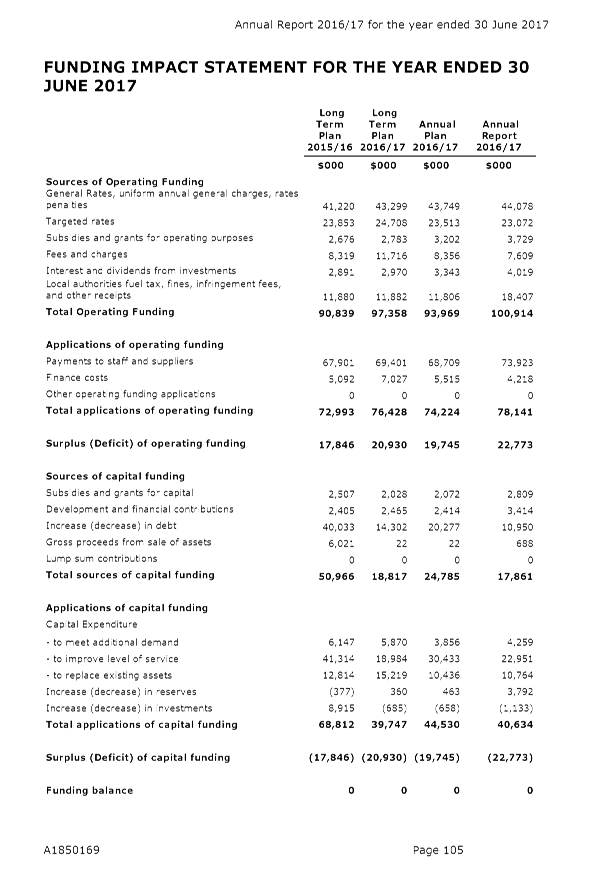

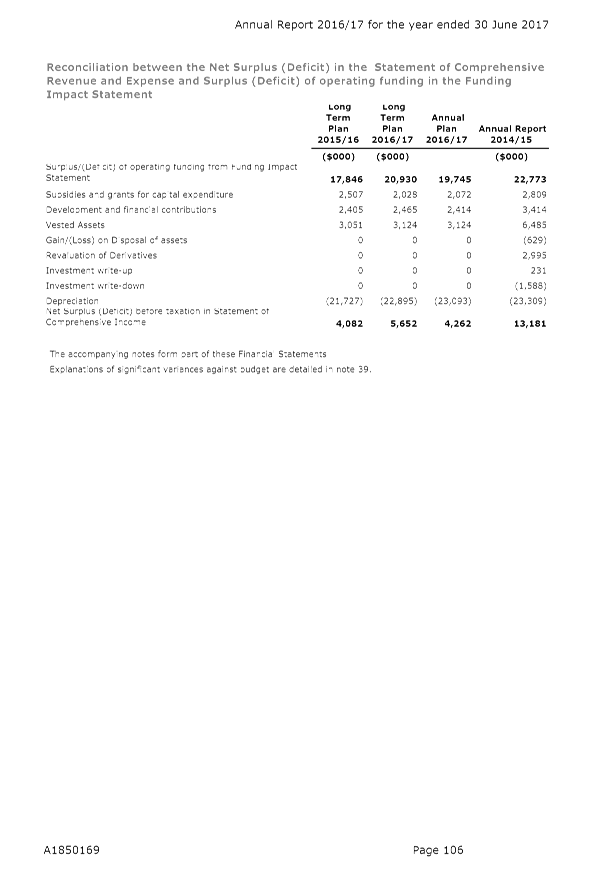

Council

31 October 2017

|

REPORT R8141

Adoption

of the Annual Report 2016/17

1. Purpose

of Report

1.1 To

adopt the Annual Report 2016/17 in accordance with section 98 of the Local

Government Act 2002.

2. Summary

2.1 The

audited Annual Report needs to be adopted by Council within four months of the

end of the financial year (by 31 October 2017). Audit has completed its testing

and an unmodified audit report is expected. Some minor editorial adjustments

may be required.

2.2 The

Annual Report 2016/17 presents a positive picture of both the financial and

non-financial performance of the Council over the previous year.

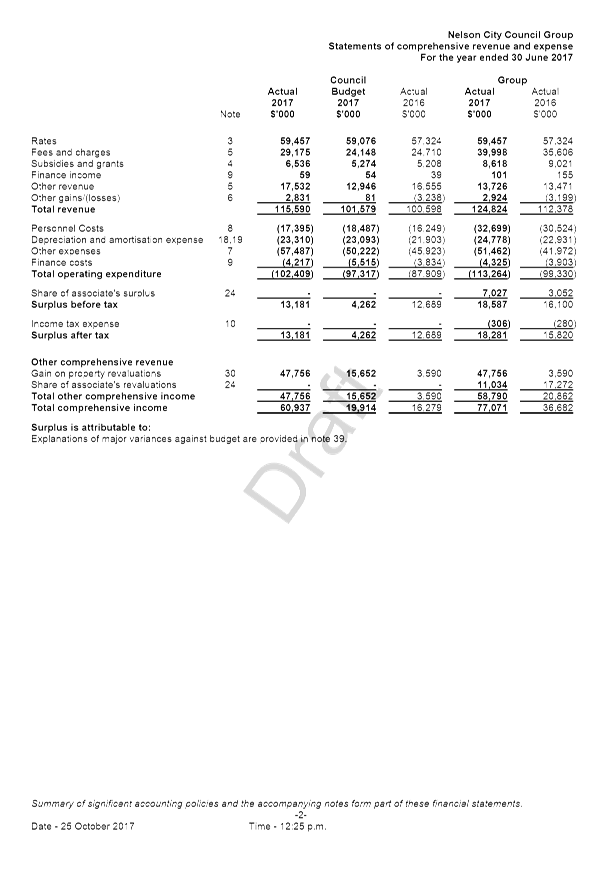

2.3 The

Annual Report shows that Council recorded a net surplus before revaluations for

the year ended 30 June 2017 of $13.2 million which was $8.9 million more than

budget. The surplus was $12.7 million for the 2015/16 financial year.

2.4 Borrowings

net of deposits were $92.1 million, compared to a budget of $131.6

million.

3. Recommendation

1.

|

That the Council

Receives the report Adoption of

the Annual Report 2016/17 (R8141)

and its attachments (A1853308 and A1850169); and

Adopts

the Annual Report for the year ended 30 June 2017 in accordance with s98 of

the Local Government Act 2002; and

Delegates the Mayor and Chief Executive to make minor editorial changes as

necessary.

|

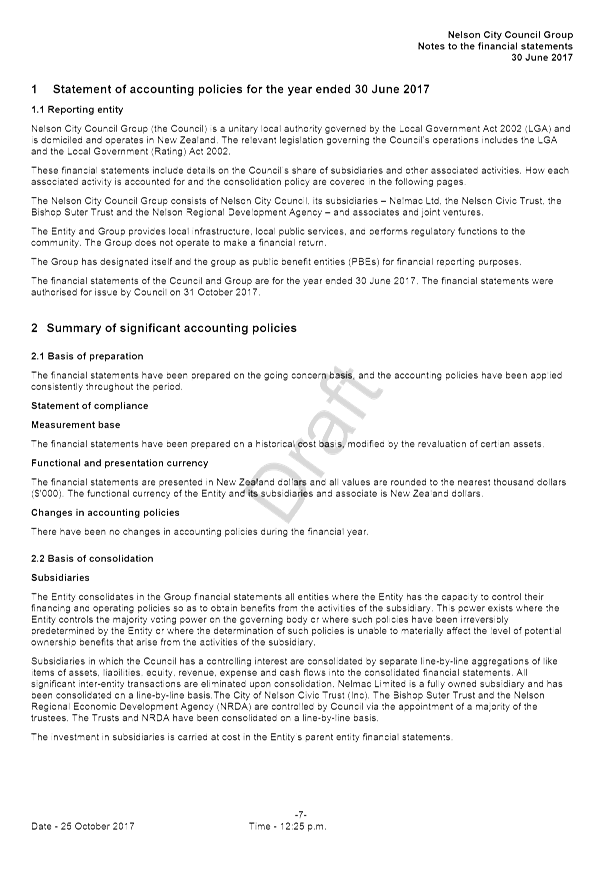

4. Background

4.1 The

purpose of an Annual Report is to compare the actual activities and performance

of the local authority with those intended, as set out in the applicable Long

Term Plan or Annual Plan (the Annual Report 2016/17 compares performance

against the 2016/17 Annual Plan). It also aims to promote the local

authority’s accountability to the community for the decisions made

throughout the year. An Annual Report is required under section 98 of the Local

Government Act 2002.

4.2 The

Annual Report includes both the parent (Nelson City Council) and the Nelson

City Council Group – which consists of Nelson City Council, its

subsidiaries Nelmac Limited, Nelson Civic Trust, Bishop Suter Trust,

Nelson Regional Development Agency and its associates and joint ventures.

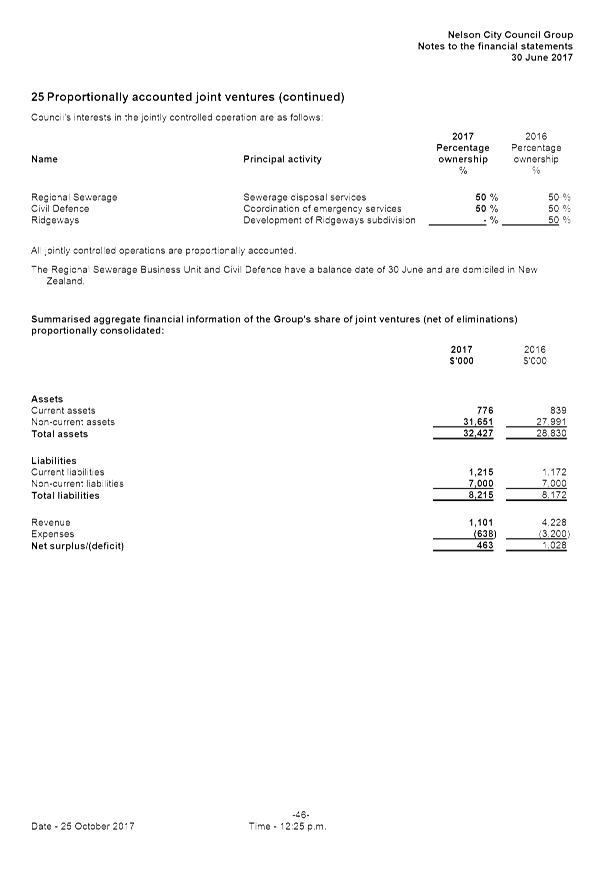

4.3 As

Council does not have a controlling interests in its associates (Nelson Airport

Limited, Tasman Bay Heritage Trust and Port Nelson Limited) these are equity

accounted. Joint ventures (Nelson Regional Sewerage Business Unit

(NRSBU) and Nelson Tasman Combined Civil Defence organisation) are

proportionately consolidated as these are not separate legal entities. Further

detail of the accounting treatment is included in Note 1 to the accounts.

4.4 The

Draft Annual Report 2016/17 was presented to Audit Risk and Finance

Subcommittee on 8 September 2017, where the following resolutions were passed:

Notes

the draft Annual Report 2016/17 has been prepared and will be audited before

being presented to Council for adoption; and

Notes

that if there are material changes to the draft resulting from the audit, these

will be brought back to the Audit Risk and Finance Subcommittee on 28 September

2017; and

Notes

that, if there are no material changes to the draft resulting from the audit,

due to timing constraints, the final Annual Report 2016/17 will be presented

directly to Council for adoption, rather than via the Audit, Risk and Finance

Subcommittee.

4.5 The

audited Annual Report needs to be adopted by Council within four months of the

end of the financial year (by 31 October 2017). The attached Annual Report

covers Council’s financial and service performance for the period from 1

July 2016 to 30 June 2017.

4.6 Council

is required to make publicly available a summary of the information contained

in the Annual Report within one month of its adoption. This year, as in

previous years, it is proposed to include an article in Council’s

fortnightly Our Nelson publication, which is delivered to every Nelson

household. A more comprehensive audited summary will also be available online,

at Council’s public libraries and at the Customer Service Centre.

5. Discussion

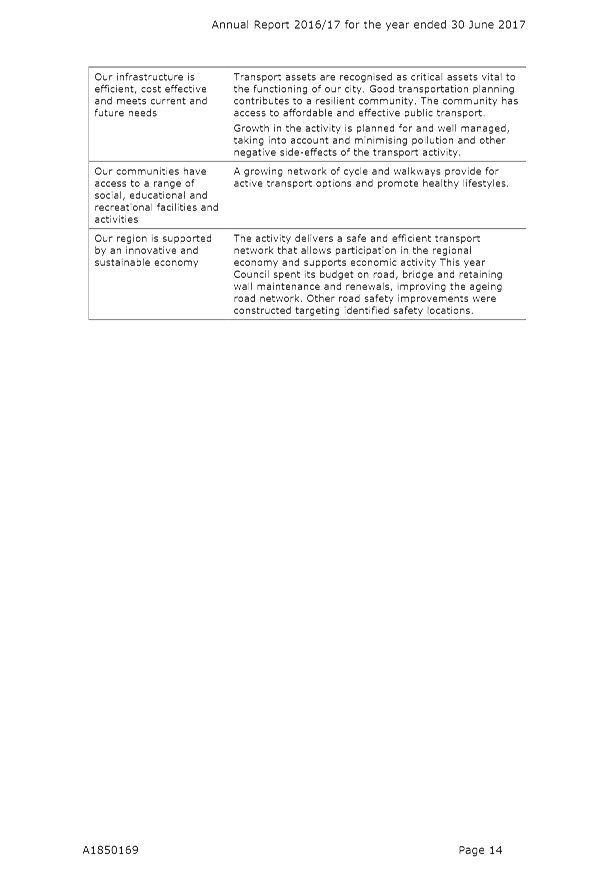

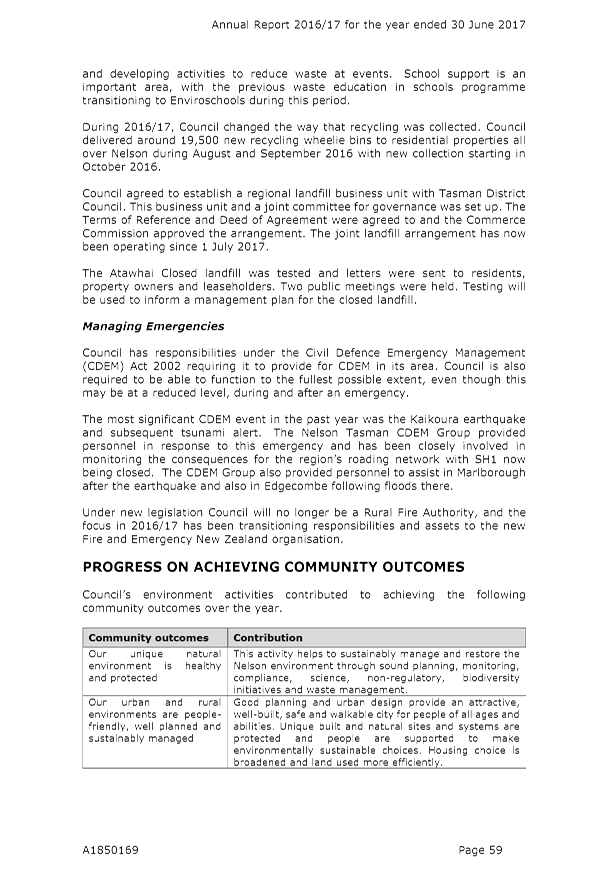

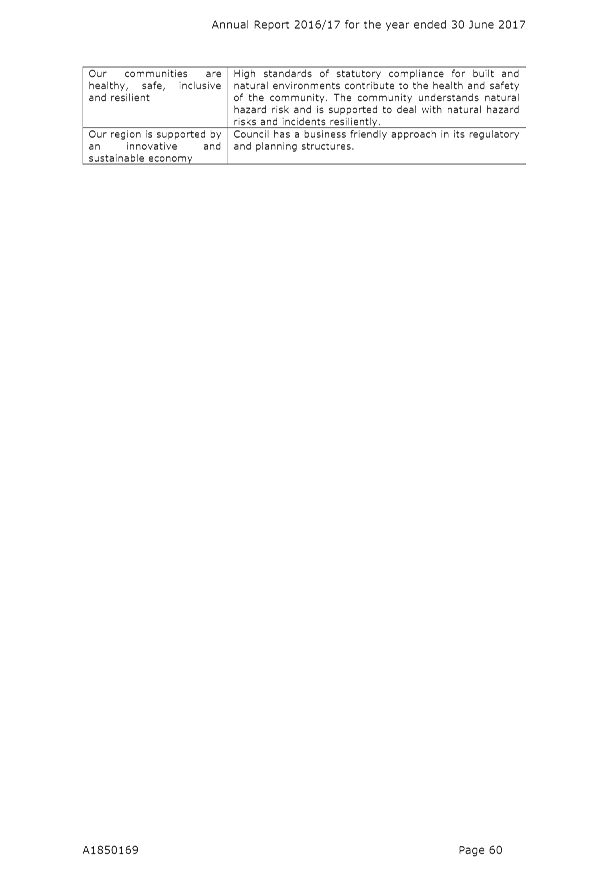

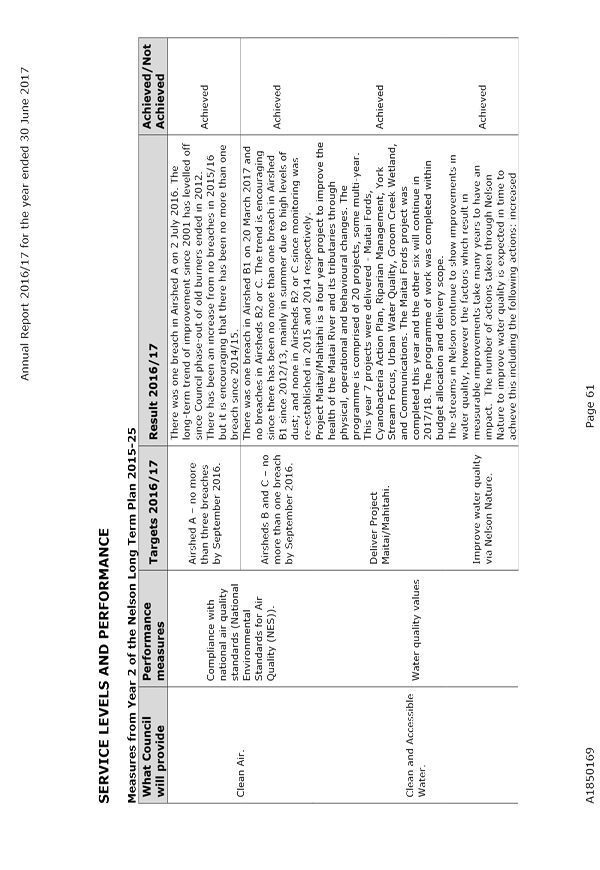

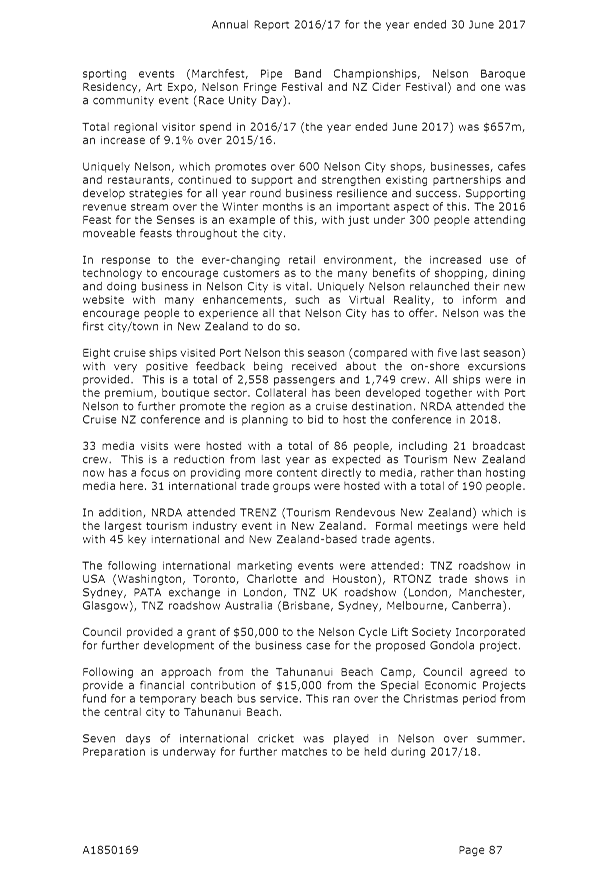

Non-financial performance

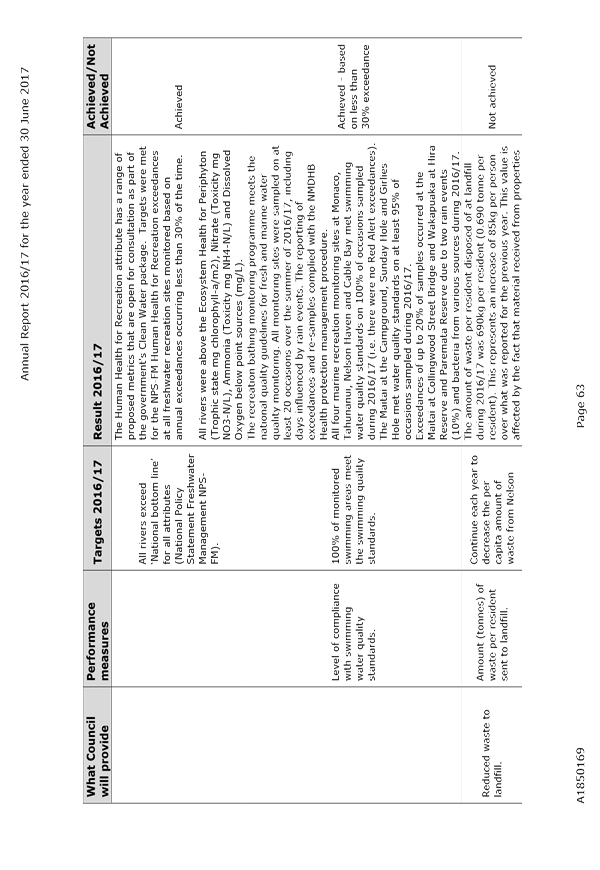

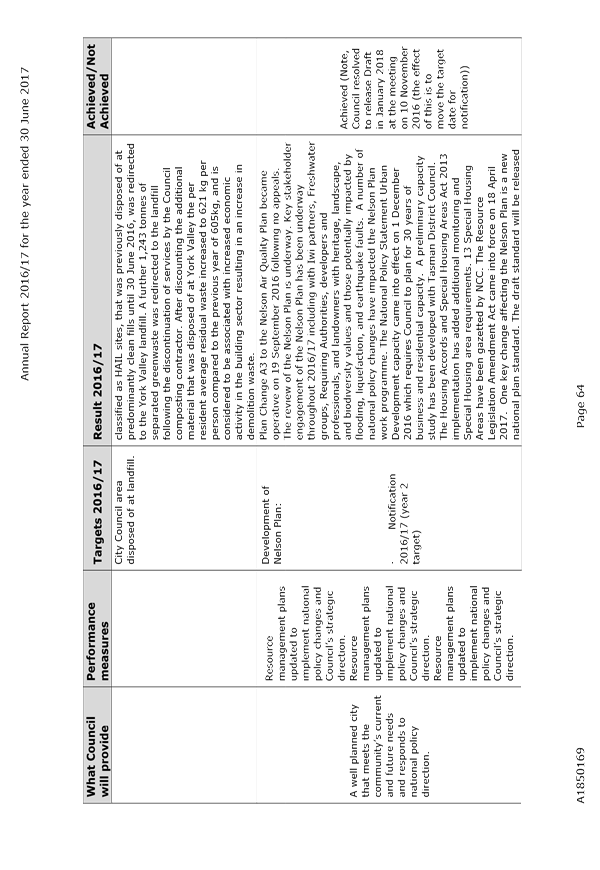

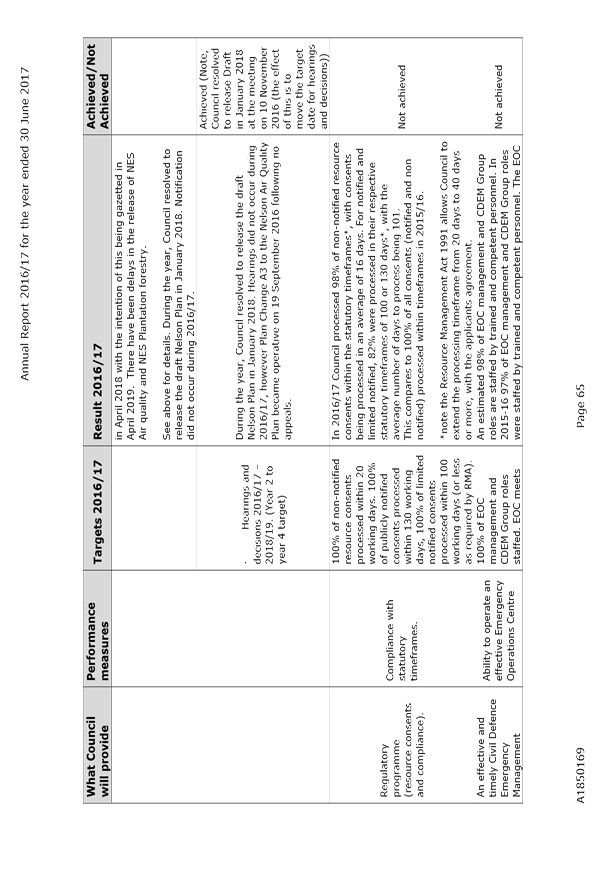

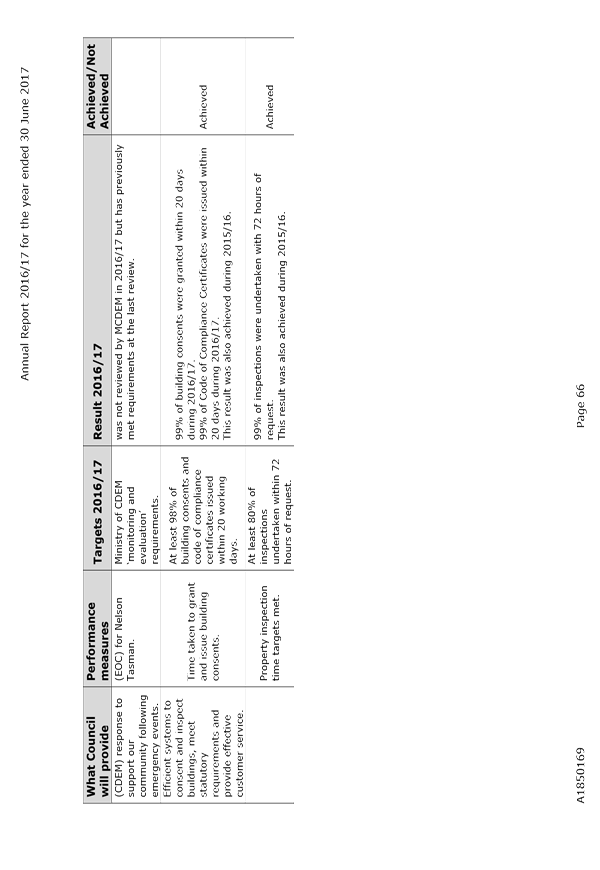

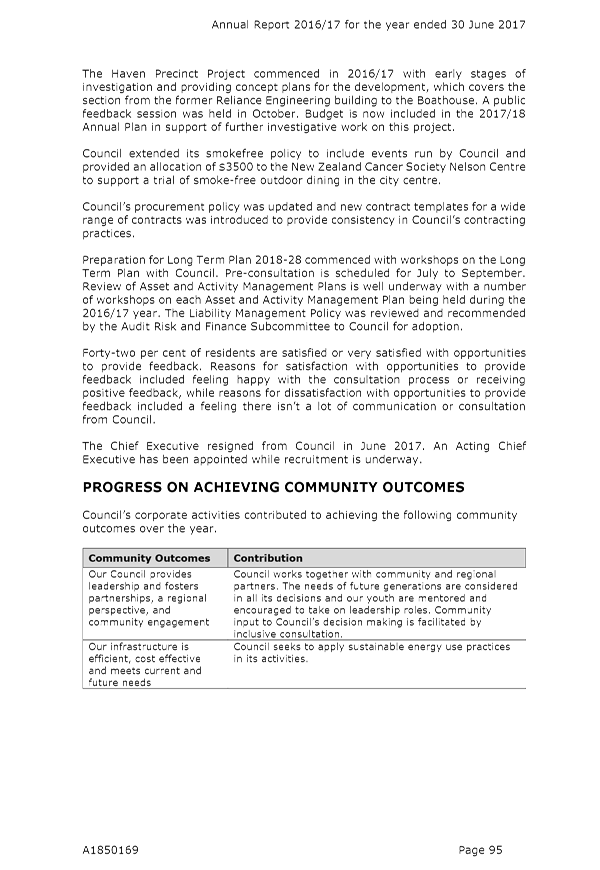

5.1 Council

measures its performance each year using a core set of indicators that are

determined through the Long Term Plan. The results present a high level view of

performance. A number of indicators are based on the Annual Residents’

survey. Officers reported the results from this survey at the Audit Risk and

Finance Subcommittee meeting on 28 September 2017.

5.2 Council’s

non-financial performance was on a par with last year. 74% of performance

targets were met (compared with 72% in 2015/2016) and 26% were not achieved,

with two measures not able to be reported on. These results demonstrate that

for the majority of its activities Council is meeting the expectations set out

in the Long Term Plan.

Highlights

5.3 Council

continues to demonstrate strong but prudent financial management in

2016/17.

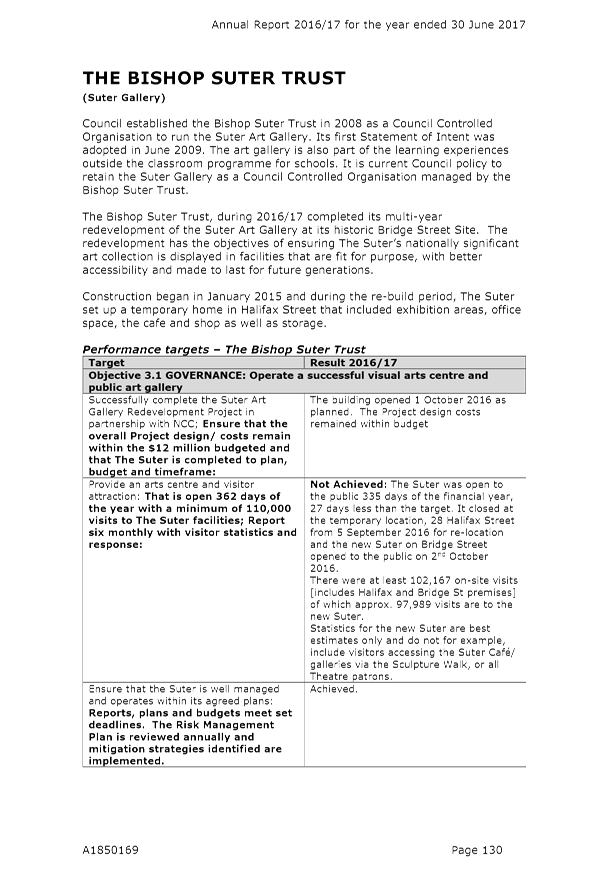

5.4 The

year saw the completion of two major city facilities and the commencement of

work on another. The Trafalgar Centre re-opened following major strengthening

and upgrading work. The $12 million Suter Art Gallery redevelopment

project was completed providing improved gallery space able to attract

travelling exhibitions, whilst respecting the long heritage of the institution

and building. During the year work started on the construction of the

Greenmeadows Centre in Stoke. This community centre will serve our fastest

growing area.

5.5 As

well as key renewal and maintenance programmes, core infrastructure

improvements took place including the last stage of the Maitai pipeline

duplication from the water treatment plant to the city improving resilience,

commissioning the Corder Park wastewater pump for and upgrading several

stormwater systems around the city to address flood risk. Roading safety

improvements continued with specific work on walking and cycling projects in

Tahuna and Haven Road.

5.6 Nelson’s

waterway health was supported and improved through work on the Nelson Nature

and Project Maitai/Mahitahi. This and other work such as the Top of the South

Marine Biosecurity Partnership has seen Council working with others to achieve

environmental outcomes. A major workstream for the planning team has been the

development of the Nelson Plan.

5.7 Reflecting

city growth, resource and building consent numbers were considerably up on the

previous year but statutory time limits targets continued to be met in the

majority of cases. 975 building consents were issued over the year for

works to a value of $177 million. This is compared to 763 building consents in

2015/16 at a value of $109 million. 597 resource consents were received this

year, with 469 decisions issued and close to $1.4 million income received from

charges for processing.

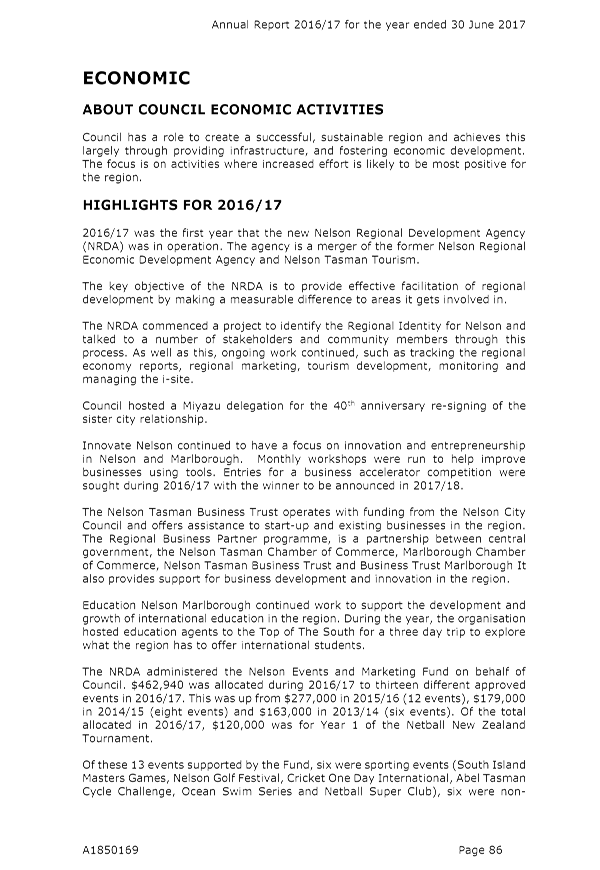

5.8 Supporting

economic growth has been an important focus in many areas of Council. Thirteen

Special Housing Areas were approved under the Housing Accord with central

government. The Nelson Regional Development Agency continued to partner with

the public and private sectors to attract and retain investment in Nelson. An

example of this was the completion and presentation to stakeholders of the

Regional Identity Project. In addition, over $460,000 was provided to a range

of events. Uniquely Nelson provided support to over 600 businesses.

5.9 Council

provided support in many ways to residents’ wellbeing. Work started on a

Youth Strategy and we partnered with Age Concern to look at social isolation.

The Arts Festival delivered record sales and the Founders Book Fair which

supports development at Founders Park was the largest to date.

5.10 Highlights

in the Parks & Active Recreation area included continued work on mountain

bike trails, development at Saxton Field including a new hammer throw cage and

drainage improvements, in-principle approval of the Brook Recreation Reserve

Management Plan and purchase of the Marina hardstand.

Areas of non-performance

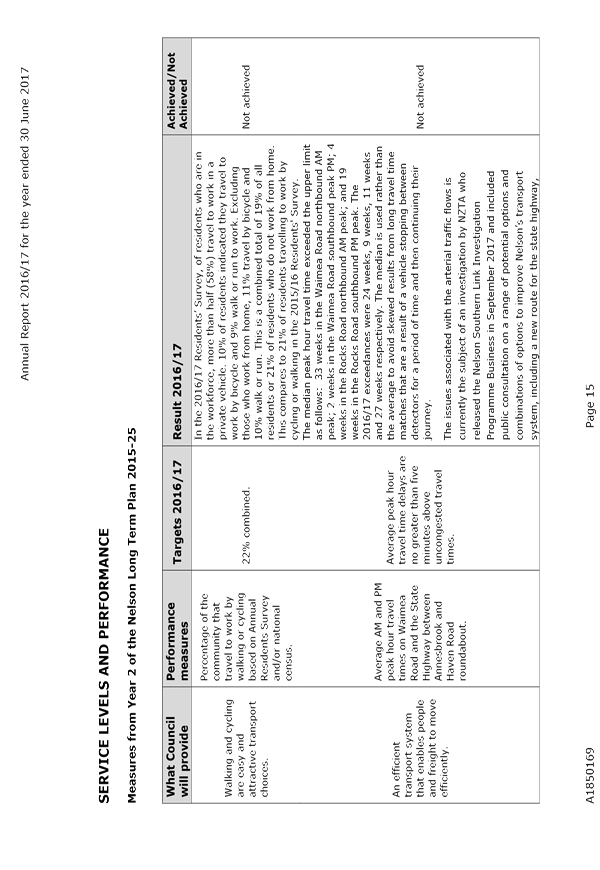

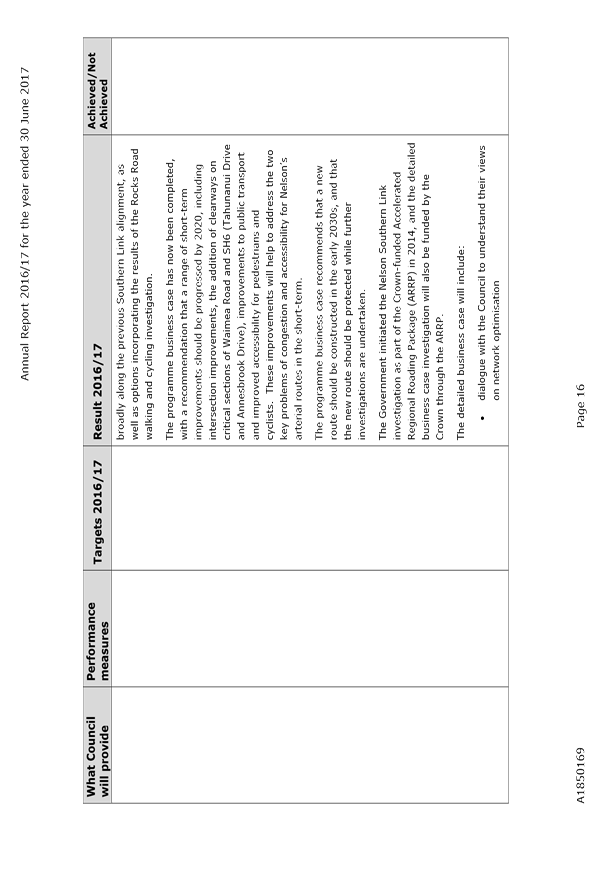

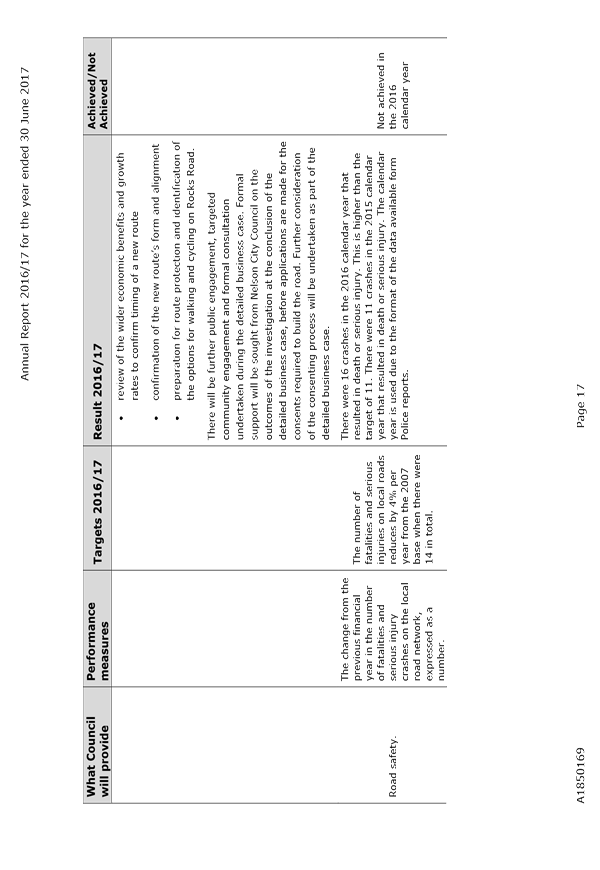

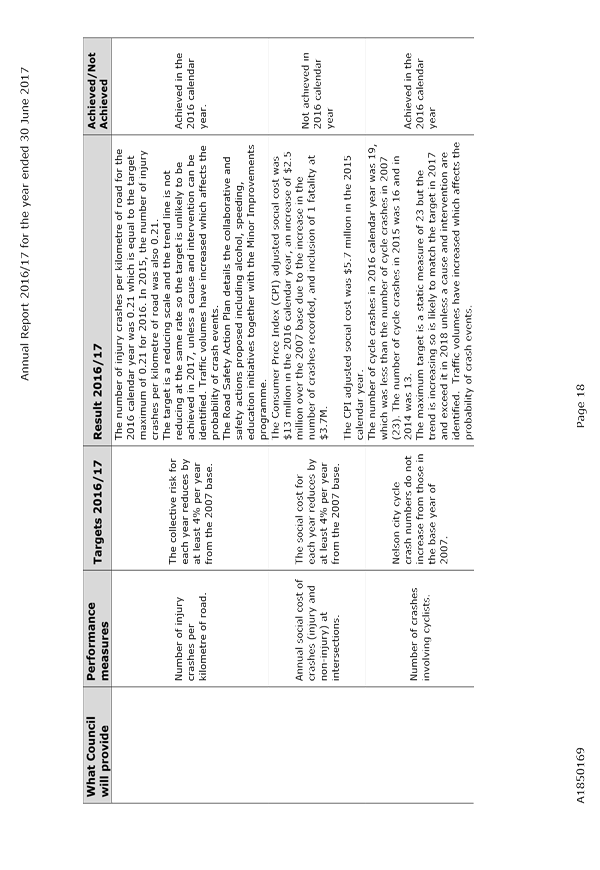

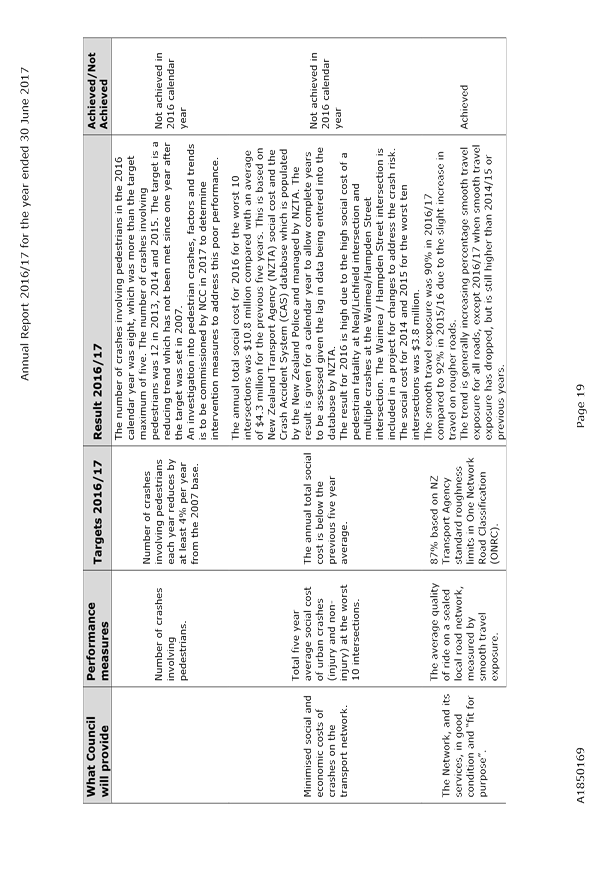

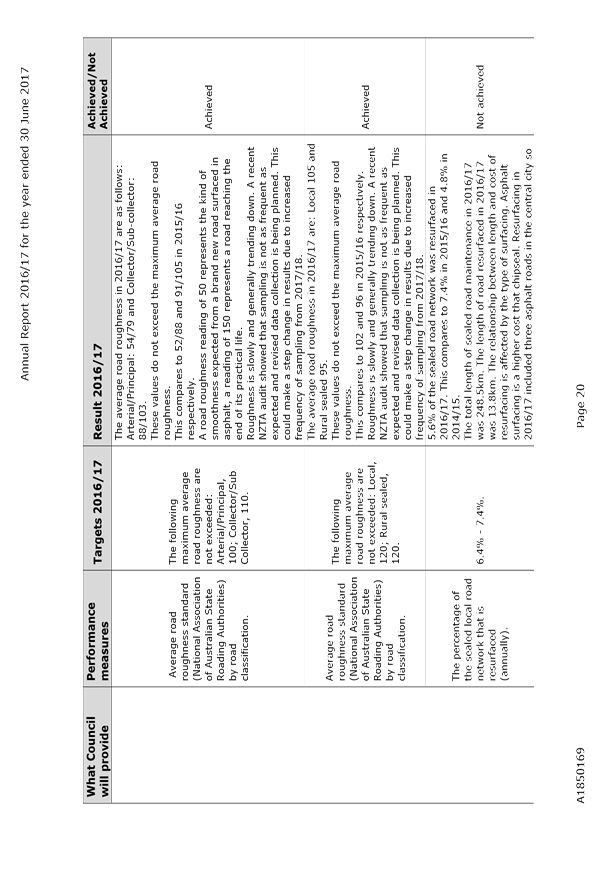

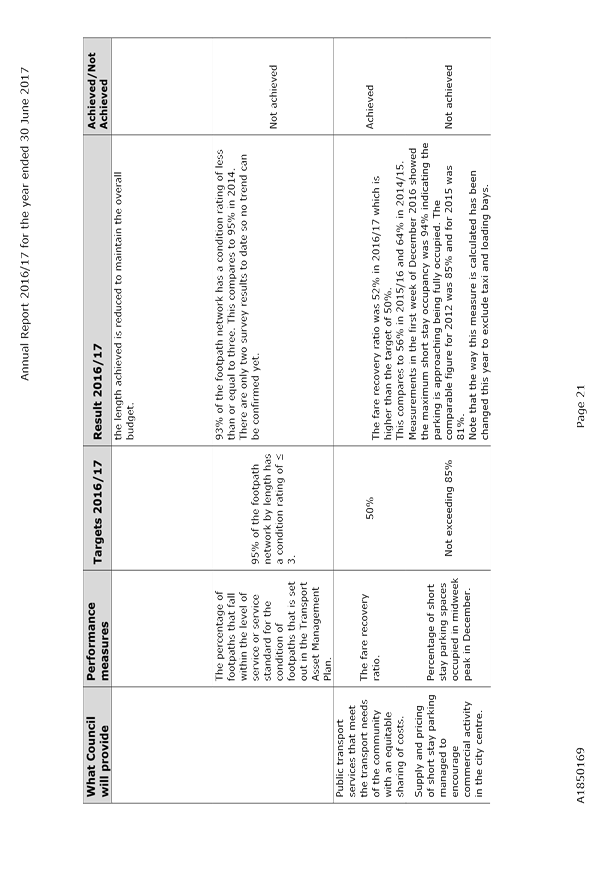

5.11 The

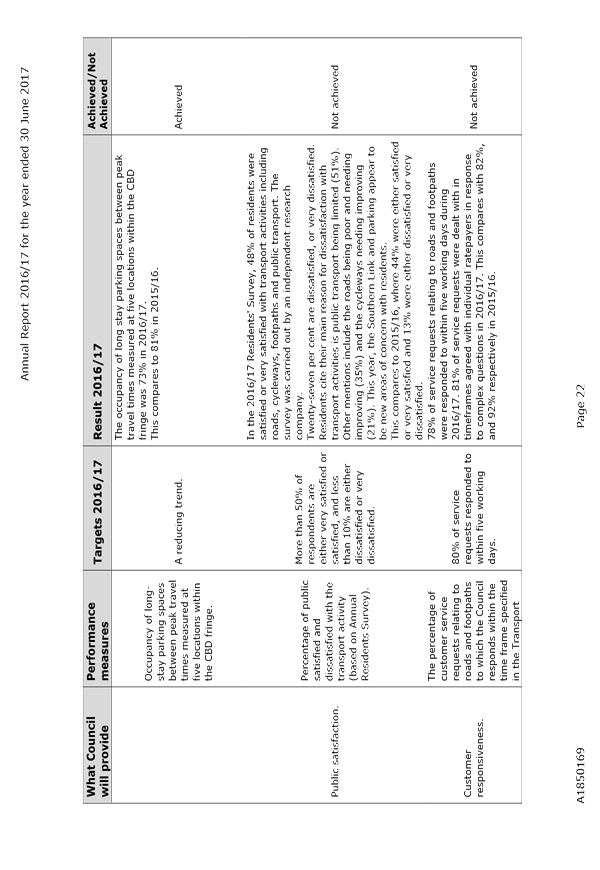

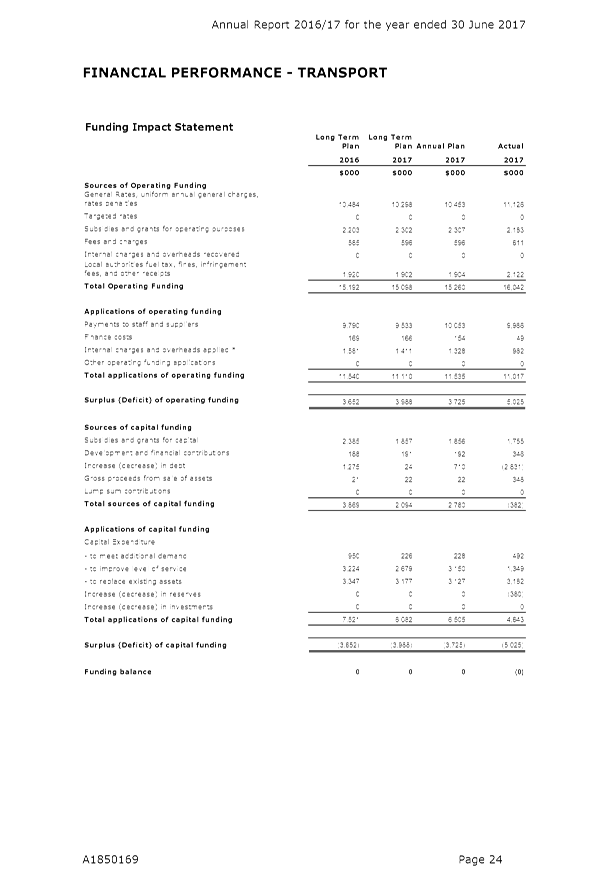

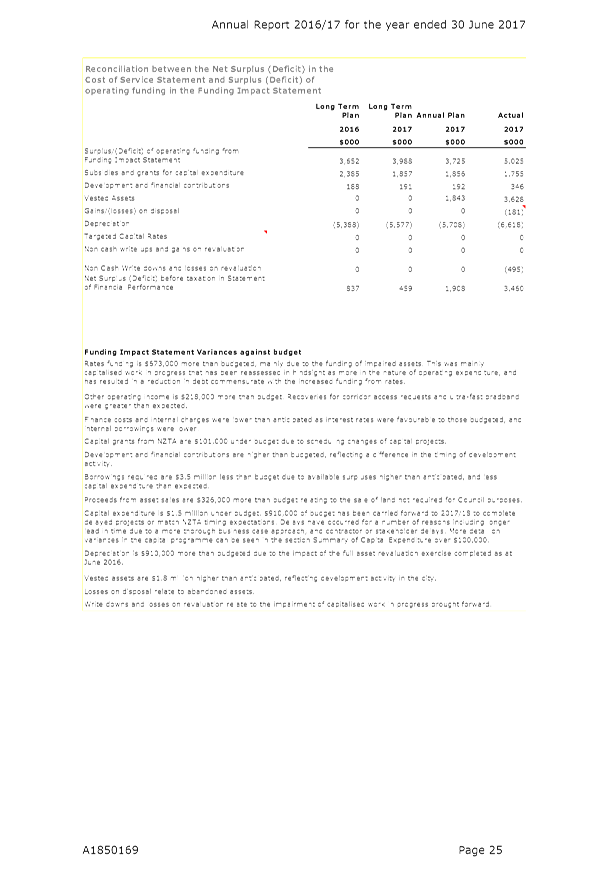

transport activity had the highest proportion of measures that were not

achieved (61%). Issues included peak travel times, road safety, the social cost

of crashes and the number of crashes involving pedestrians. Arterial road

traffic options and cause and intervention analysis will be key to achieving

targets in the future. Measures of short stay parking supply and pricing

suggest that maximum short stay occupancy is being reached. The lowest

levels of satisfaction related to public transport, with residents feeling the

service is not extensive enough and more buses are needed.

5.12 The

environment activity was the next lowest in terms of achievement with a third

of measures not met. Targets that were not met included some for freshwater

quality, for volumes of waste to landfill and meeting statutory timeframes for

resource consent processing. The Civil Defence and Emergency Management area

fell 2% short of achieving its target.

5.13 Some

areas did not meet targets, for example provision of recreational

opportunities, but showed an increase in the result from last year. For the

Trafalgar Centre, targets could not be met as the facility was closed during

the renovation project.

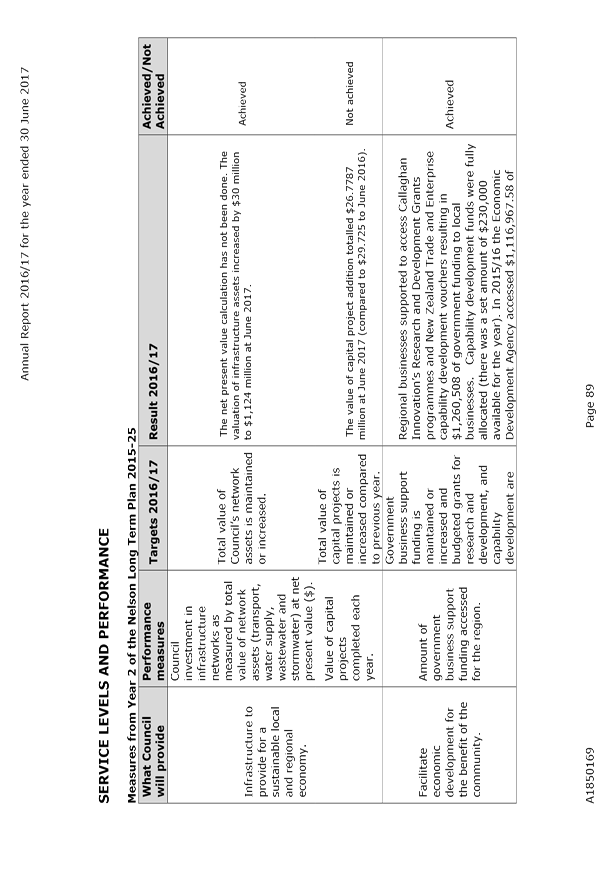

5.14 The

target set in the economic activity for the value of capital projects completed

to rise year on year was not met. However the KPI for the 2016/17 year

with respect to capital projects was to deliver 85% of projects by June 2017.

After taking into account approved exceptions and approvals by the relevant

Committee/Council on aspects such as genuine delays and the re-phasing of

projects, the percentage achieved was 84.6%.

5.15 According

to the 2017 Residents Survey 55% of residents were satisfied or very satisfied

with Council’s overall performance this year, which is similar to the

last result (from the survey in 2014). For residents who had direct contact

with Council staff satisfaction increased to 67%. Figures for satisfaction with

engagement have moved around significantly over the past three years from 53%

in 2014/15, down to 37% in 2015/16 and up again to 42% in 2016/17. The target

to better the 2014/15 levels of satisfaction with engagement has not been met

for the last two years.

Audit

Report

5.16 Audit

New Zealand is expected to issue an unmodified audit report. The final audit

report will be issued once the document is adopted, and will be included in the

published Annual Report.

Surplus

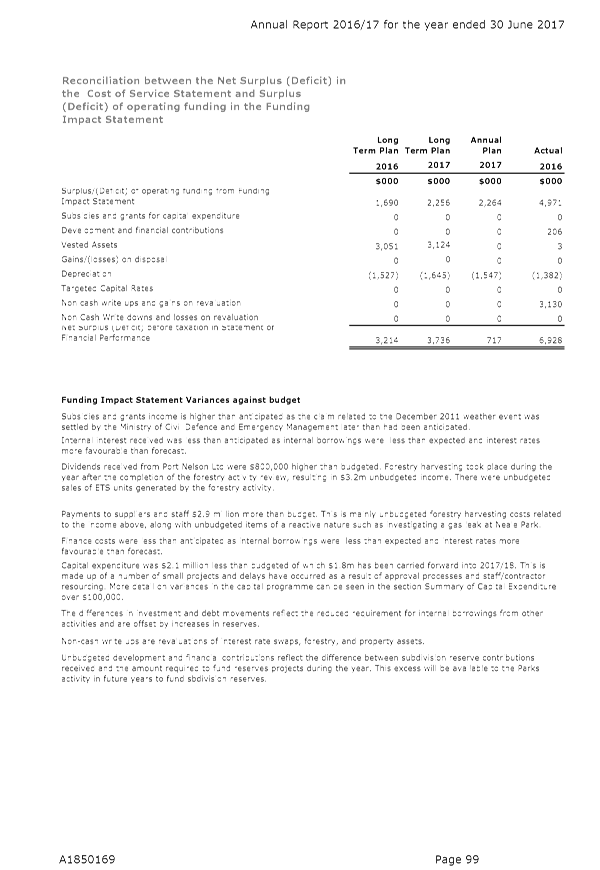

5.17 The

Annual Report shows that Council recorded a net surplus before revaluations for

the year ended 30 June 2017 of $13.2 million which was $8.9 million more than

budget. The surplus was $12.7 million for the 2015/16 financial year.

5.18 It

should be noted that the word “surplus” is an accounting term, and

is different from the rating surplus which is referred to in paragraph 5.23.

The accounting surplus includes capital items such as roading subsidies and

other grants related to capital projects, development contributions,

revaluations and vested assets which are required to be treated as income for

accounting purposes.

5.19 While

it is pleasing that the net surplus is significantly higher than budgeted, the

surplus includes some sizeable non-cash items that we do not budget for such as

derivative revaluations ($3 million income), along with items that we have

little direct control over in terms of timing (vested assets and

development/subdivision reserves income ahead of budget $4.2 million). Vested

assets and development/subdivision reserves income have been high and well

above budget for the last two years reflecting good development activity.

5.20 More

meaningful is the operational control measure (see paragraph 5.25) which

compares actual net cashflow from operations against budget. As capital and

financing activities and non-cash items are filtered out, it gives a clearer

picture of how Council is managing its operational budget. Under 100% and

Council would not be living within its means. Over 100% and Council is

collecting more income than it needs to deliver (non capital) services to the

community. While there are inevitably unforeseen circumstances that may affect

this measure, along with variances against budget for any number of income and

expenditure items, a result close to 100% overall is ideal.

Council’s result of 101% is therefore very positive.

5.21 Note

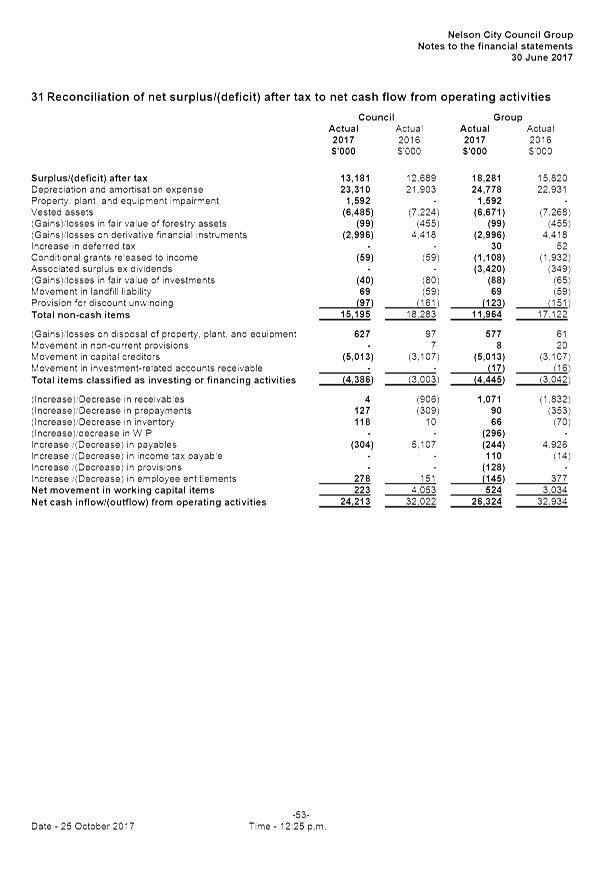

39 explanation of major variances is included below:

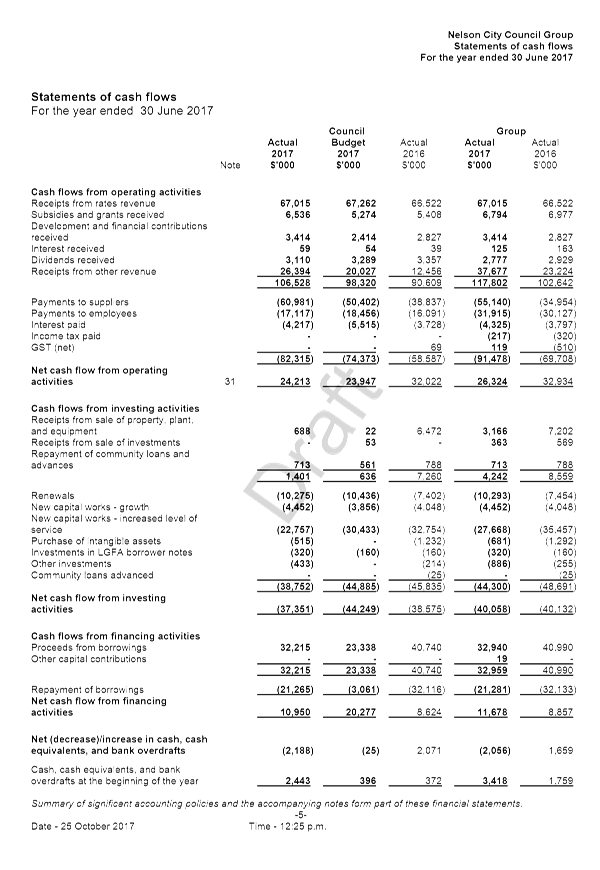

Statements of comprehensive

revenue and expense

5.22 Total

operating income $14 million more than budget:

5.22.1 Fees

and charges are $5 million more than budget. More details can be seen in the

activities section, however the most significant items are:

· $3.2 million

unbudgeted income from forestry harvesting after the completion of the forestry

activity review.

· $943,000 extra

income from resource and building consents, reflecting activity in the sector.

· Unbudgeted sale of

Emissions Trading Scheme units $520,000.

5.22.2 Subsidies

and grants are $1.3 million more than budget reflecting the timing of the

subsidy received from the Ministry of Civil Defence and Emergency Management

for expenditure around the 2011 emergency event ($555,000), the receipt of

donations for the indoor cricket/smallbore rifle facility at Saxton Field

($493,000) and contributions from utilities providers for infrastructure

($184,000).

5.22.3 Other

revenue is $4.6 million more than budget with both vested assets and

development/subdivision reserves contributions well ahead of budget ($3.4

million and $794,000 respectively) reflecting development activity around the

city.

5.22.4 Other

gains of $2.8 million with no budget reflect the revaluation of interest rate

swaps ($3 million gain) along with unbudgeted gains and losses on sale and

revaluations.

5.23 Total

operating expenditure was $5.1 million more than budget:

5.23.1 Personnel

costs were $1.1 million less than budget. Some vacancies were backfilled using

unbudgeted temporary or consultancy resource at the cost of $534,000,

reflected in other expenses.

5.23.2 Other

expenses were over budget by $7.3 million. More details can be seen in the

activities section, however the most significant items are:

· maintenance

expenditure under budget by $849,000. $539,000 of budget has been carried

forward to 2017/18 for items programmed but not completed within the 2016/17

financial year.

· service provision

over budget by $4.8 million, including $1.7 million unbudgeted forestry

harvesting costs, $1.1m for the rollout of the new recycling bins (change in

accounting treatment from that assumed in budget), $1 million relating to

timing differences in the Nelson School of Music earthquake strengthening

project, and $574,000 unbudgeted expenditure for contracting resource to

support increased workflows through the Resource Consents activity.

· $1.5 million over

budget relates to a consolidation adjustment in respect of the Nelson Regional

Sewerage Business Unit.

· unbudgeted

expenditure for temporary/consultancy resource $534,000.

5.24 Other

comprehensive income

5.24.1 The

infrastructure assets are revalued every year to smooth out the large

fluctuations, and land is revalued when it’s fair value diverges

materially from its carrying value. The revaluation as at 30 June 2017 resulted

in a total increase in asset value of $47.8 million, $32.1 million more than

budget. Council revalued land as at 30 June 2017, amounting to $28.3 million of

the total revaluations.

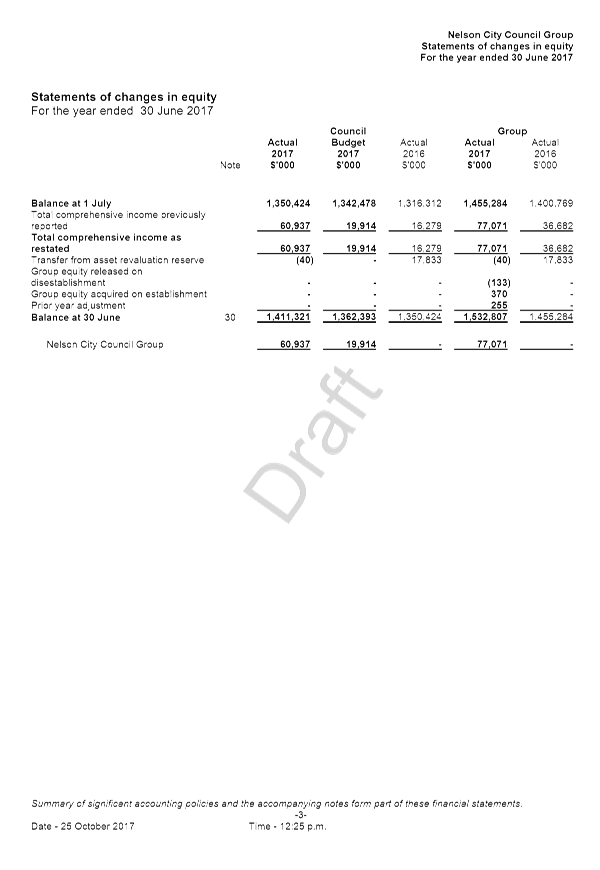

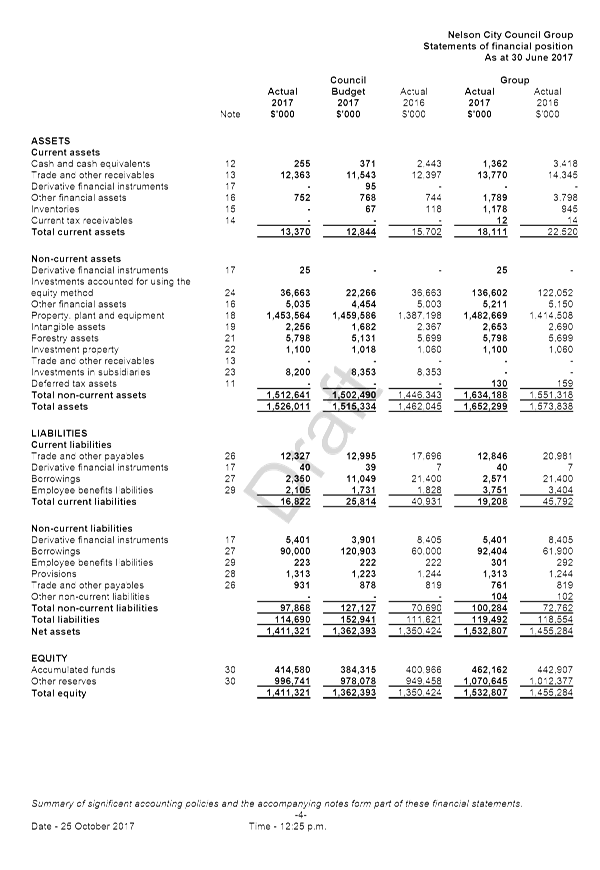

Statements of financial

position

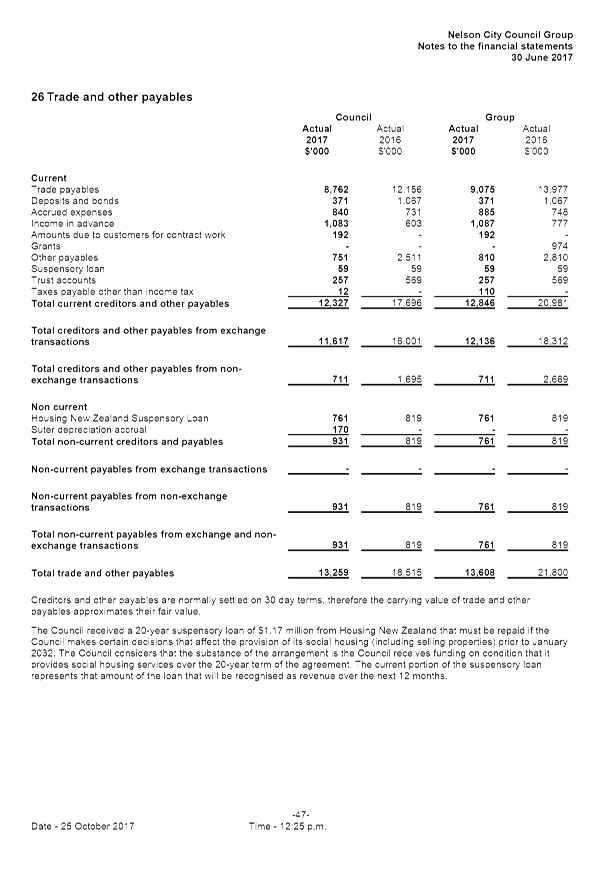

5.25 Trade

and other receivables $820,000 more than budget with dividends receivable and

accrued revenue both higher than had been anticipated.

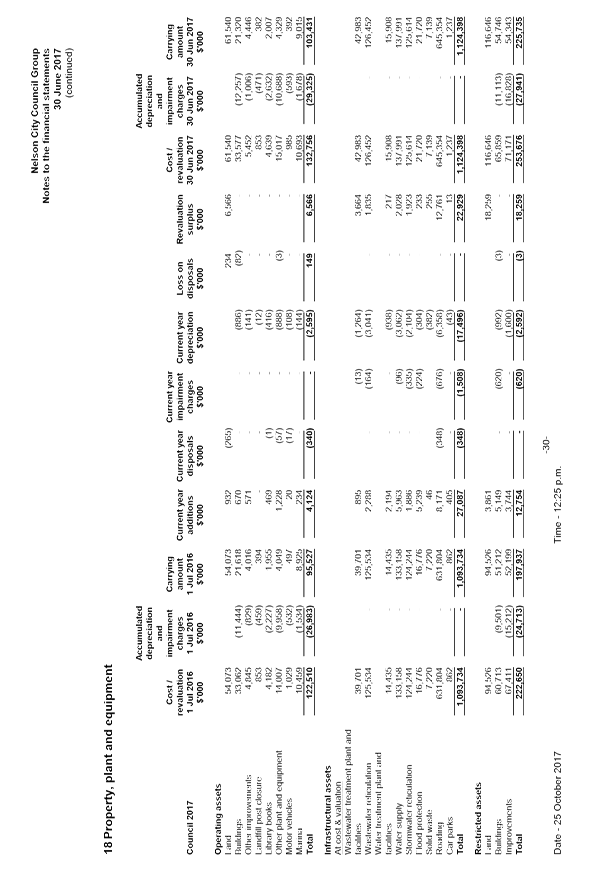

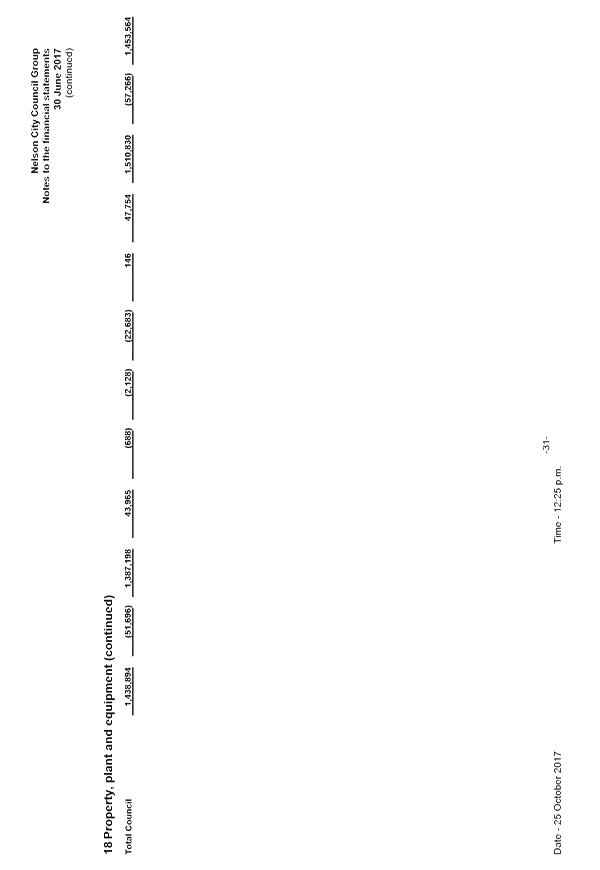

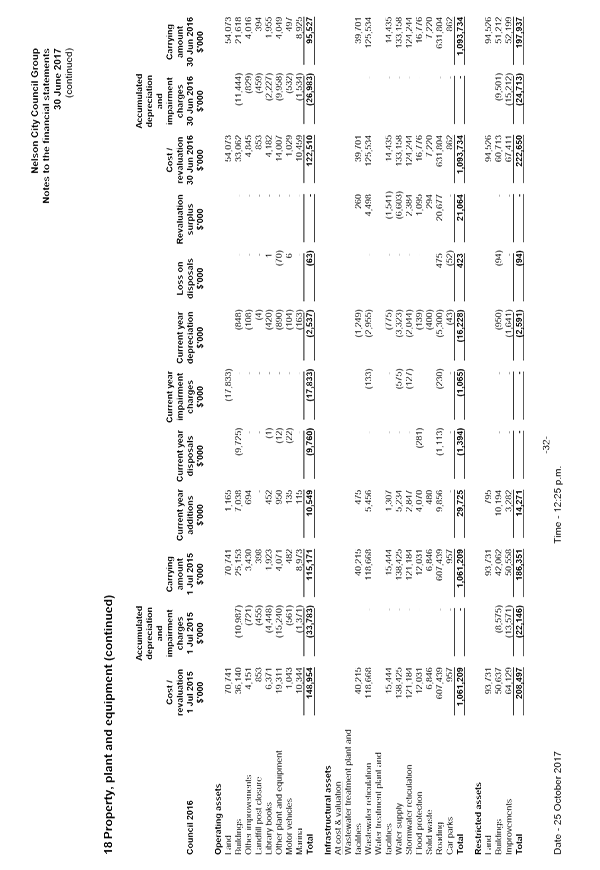

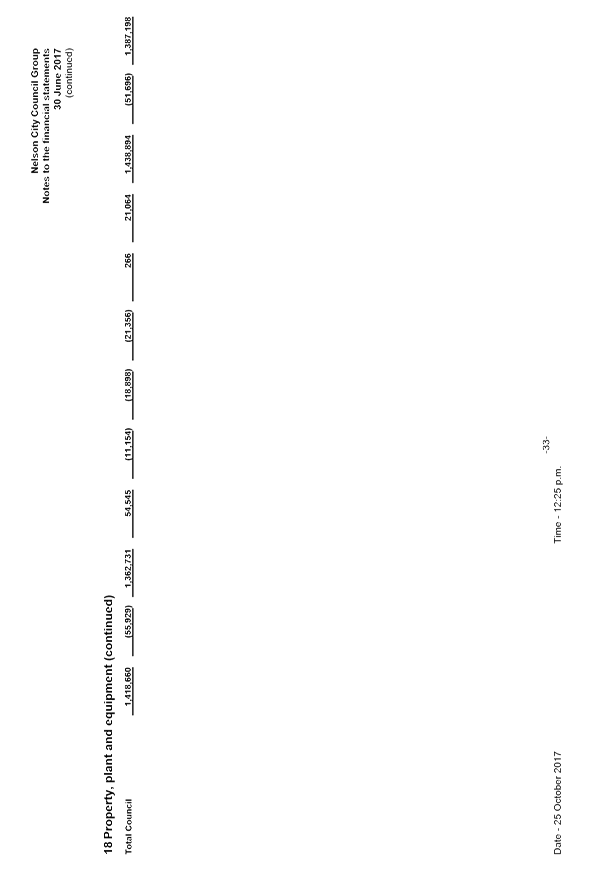

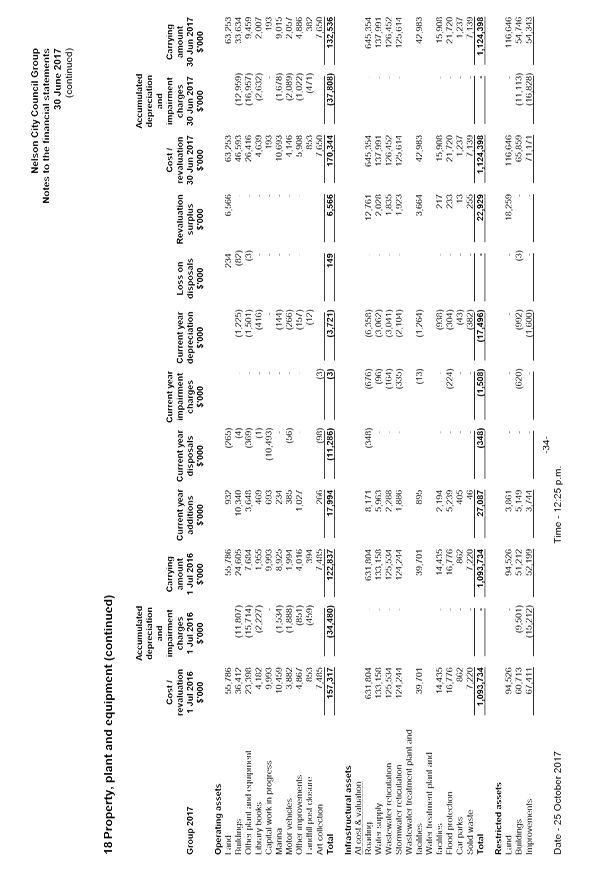

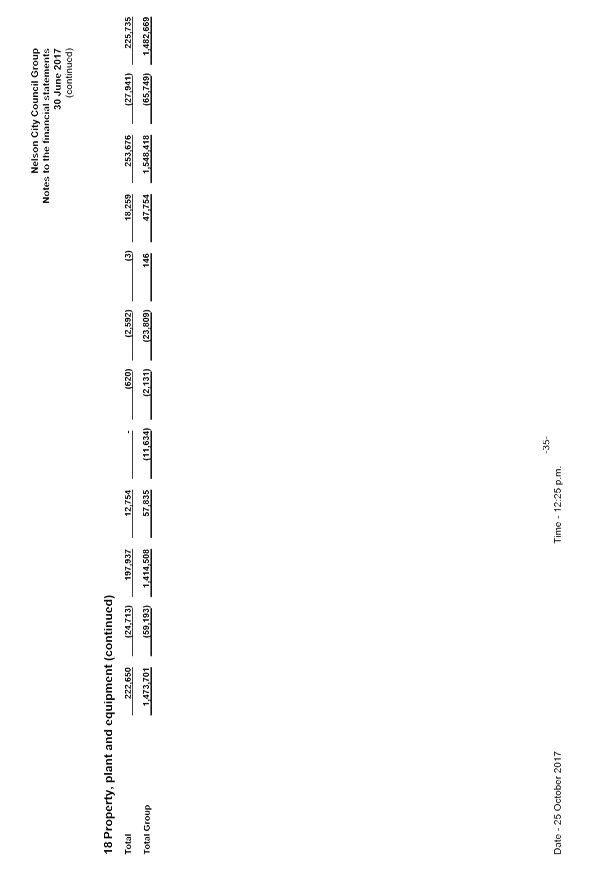

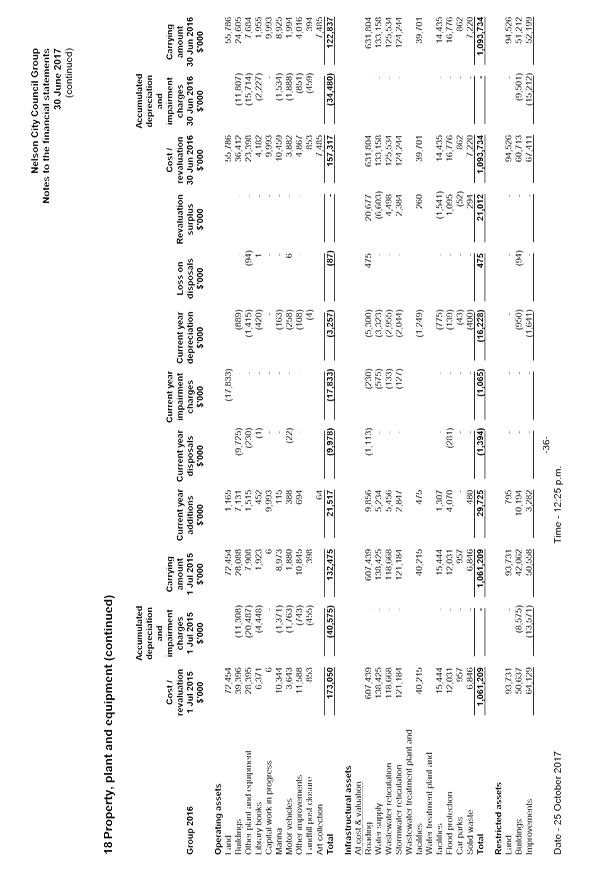

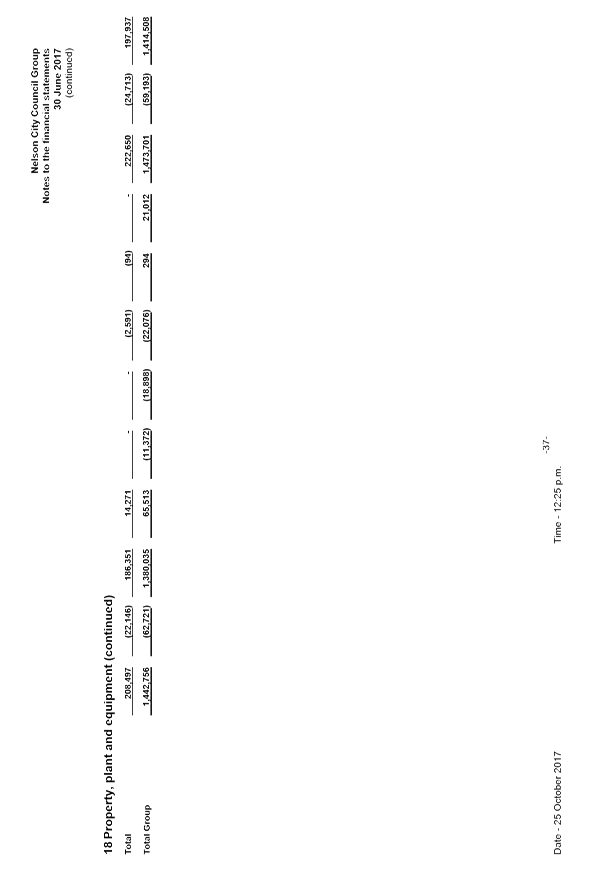

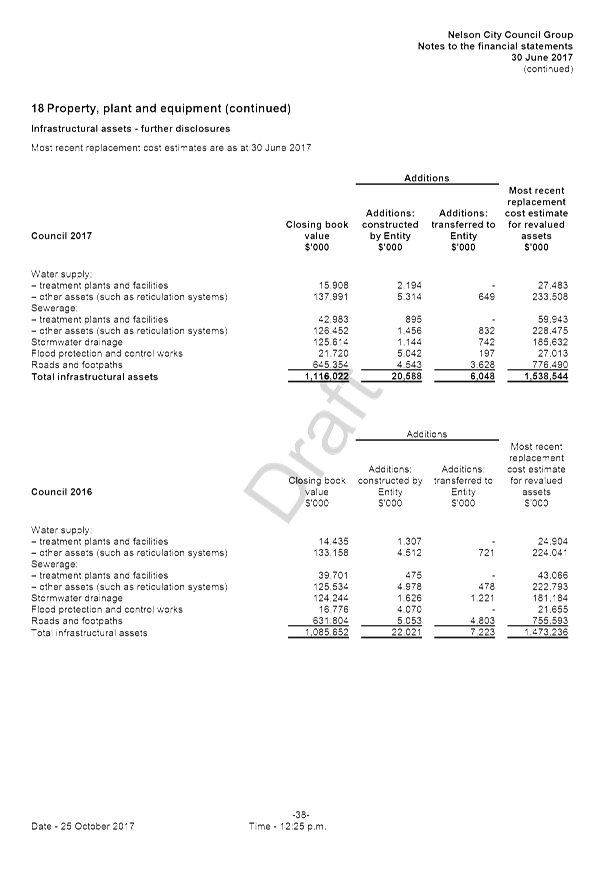

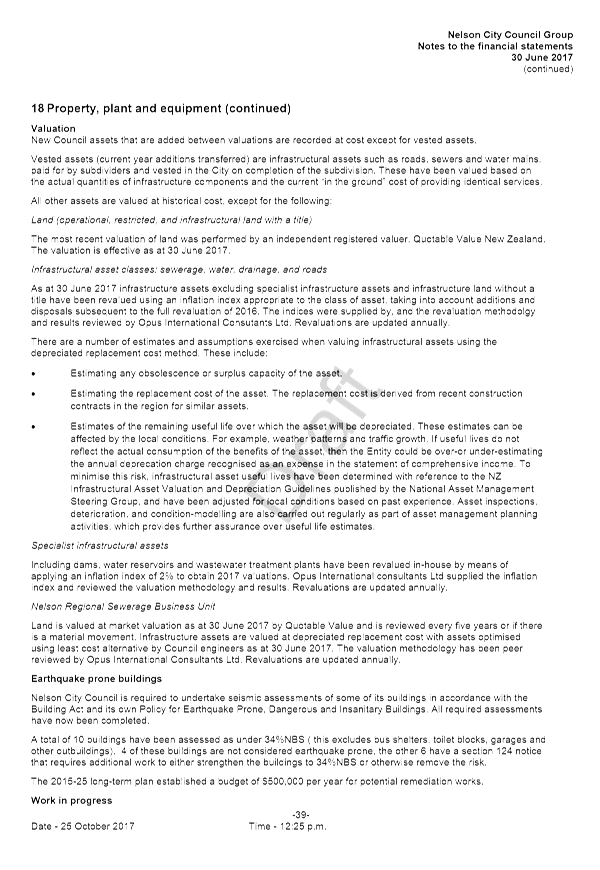

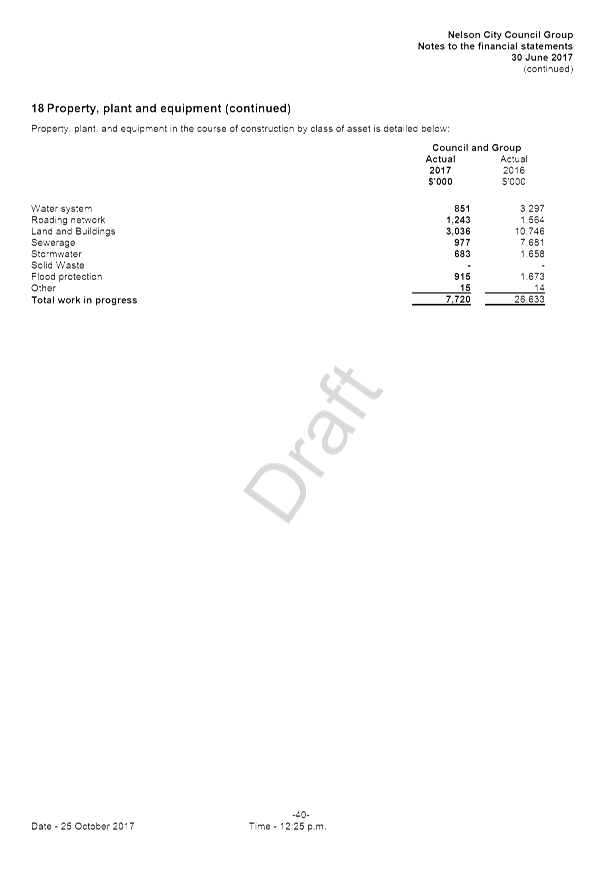

5.26 Property,

plant, and equipment was $6 million less than budget. The opening balance at 1

July was $32 million less than forecast at the time of setting the 2016/17

budget, asset revaluations were $32.1 million more than budget, capital

additions were $6.7 million less than budget, disposals and impairments were

$2.8 million more than budget, and vested asset additions were $3.4 million

more than budget.

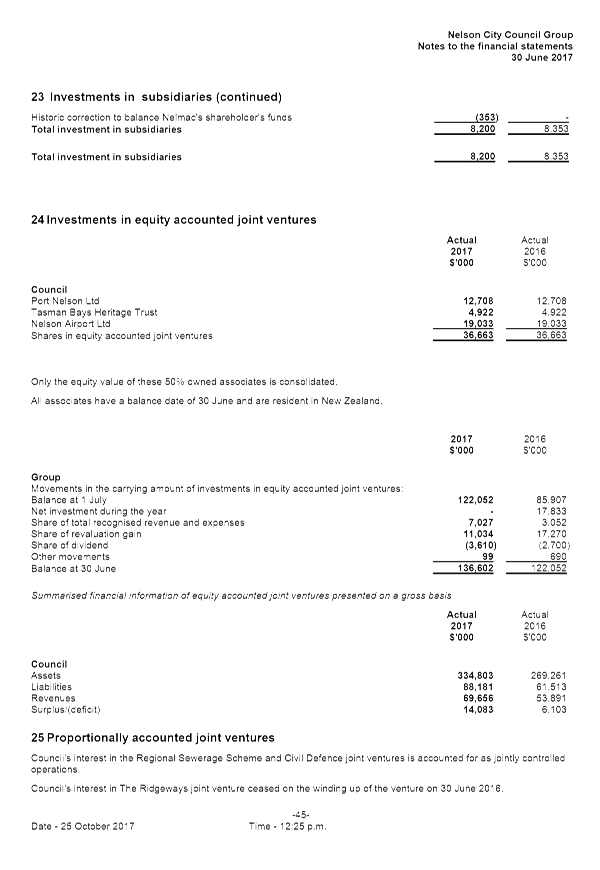

5.27 Investments

accounted for using the equity method are $14.4 million greater than budget due

to the difference in the opening balance at 1 July.

5.28 Borrowings

net of cash and cash equivalents, were $39.5 million below budget due to the

difference in the opening balance at 1 July ($30.3 million), the utilisation

of brought forward cash balances ($2.2 million) and lower capital investment.

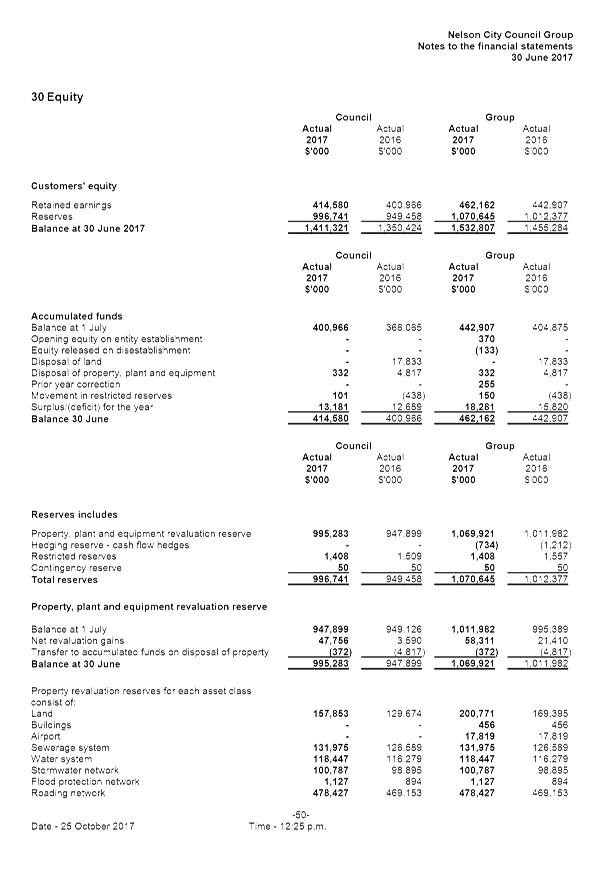

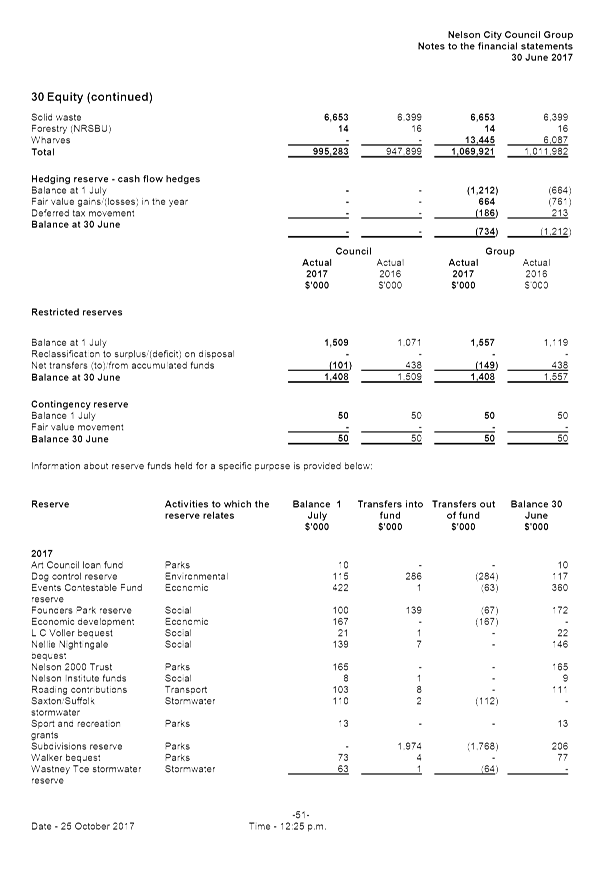

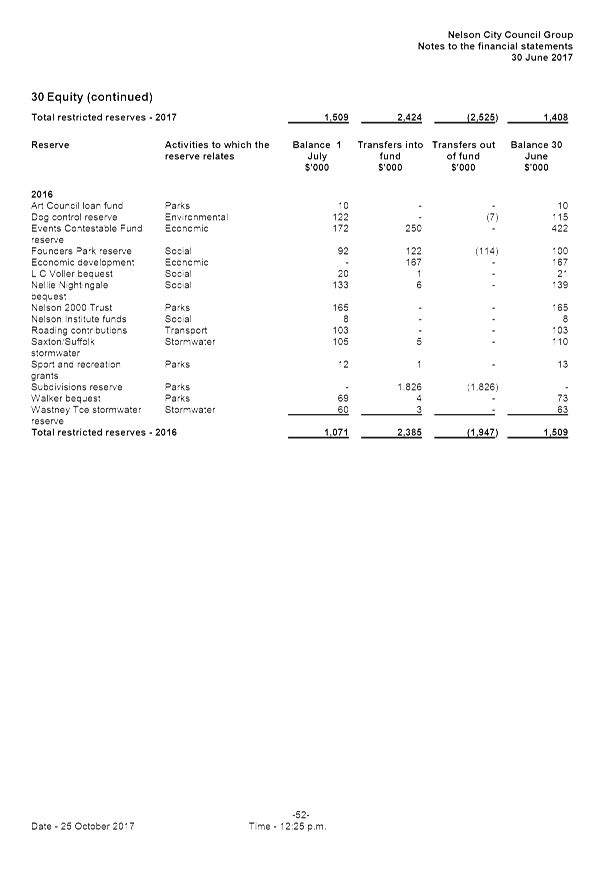

5.29 Reserves

are $18.7 million more than budgeted. The opening balance at 1 July was $13.6

million less than forecast at the time of setting the 2016/17 budget, the asset

revaluation was $32.1 million less than budget, and $372,000 of revaluation

reserve was released to equity relating to the disposal of assets.

5.30 Accumulated

funds are $30.3 million more than budget. The surplus for the year is $8.9

million more than budget, and the 1 July opening balance was $21.5 million more

than forecast at the time of setting the 2016/17 budget.

External

Debt

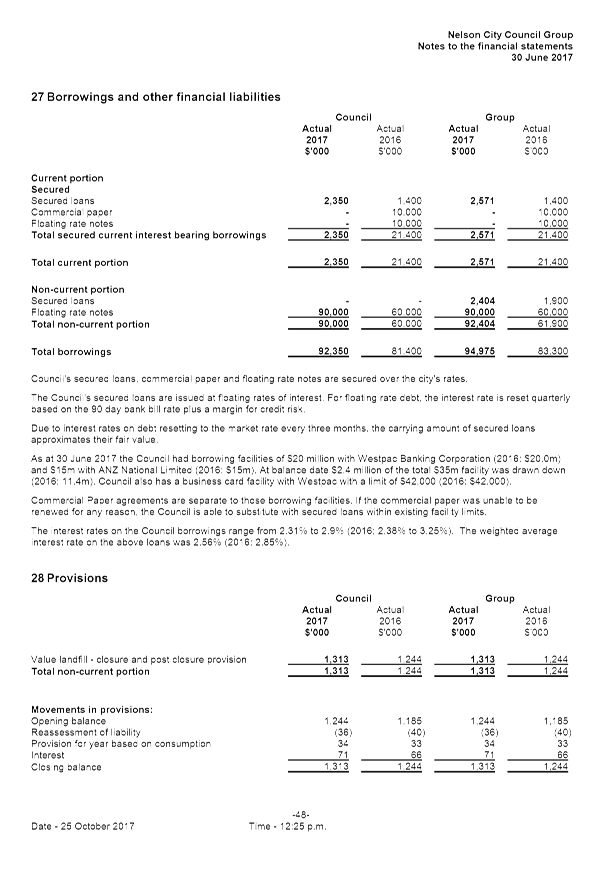

5.31 The

Council’s borrowings as at 30 June 2017 were $92.4 million, ($81.4

million in 2015/16) summarised in Note 27 of the financial statements.

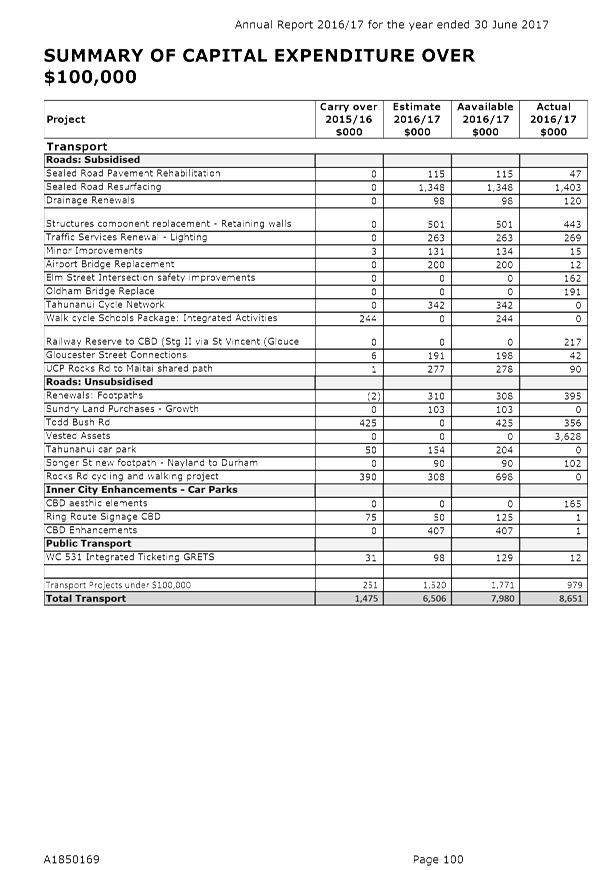

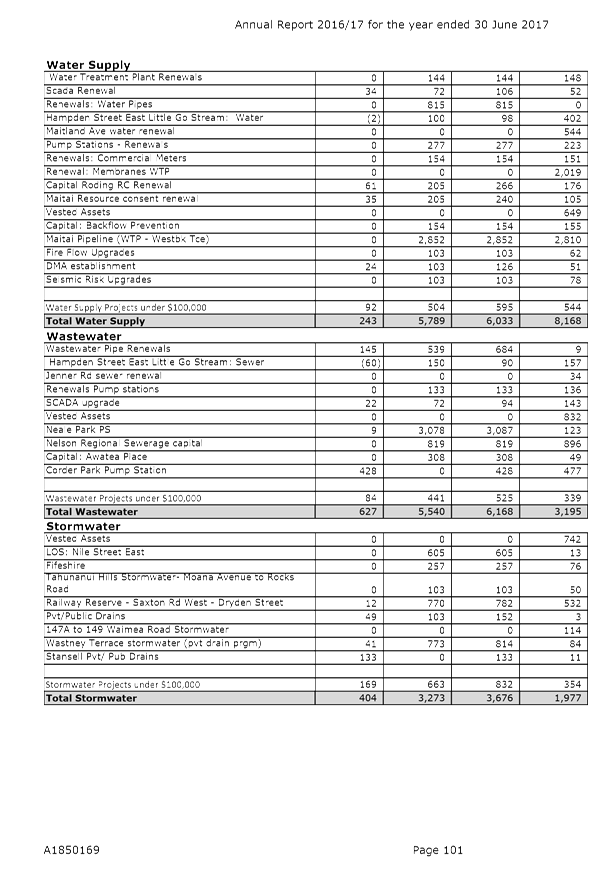

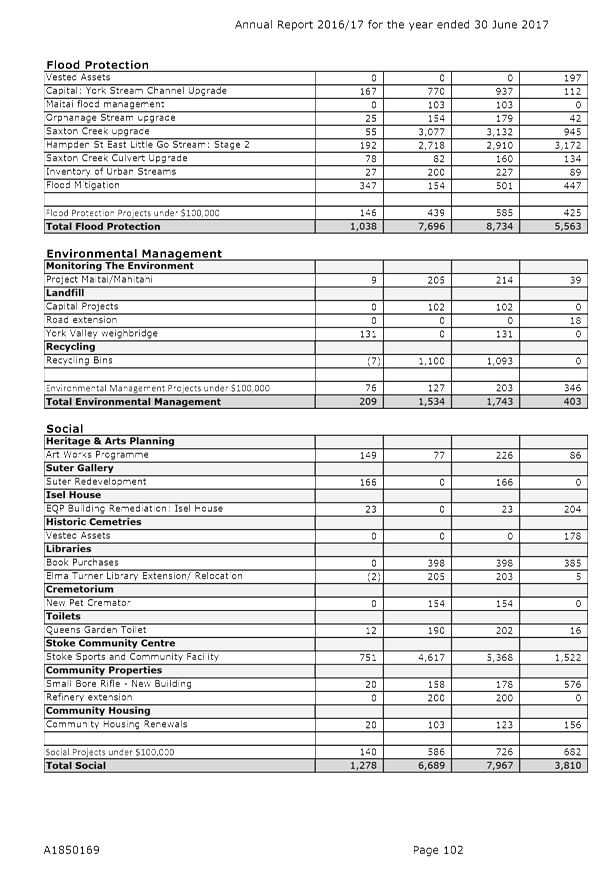

Council overall debt increases primarily as a result of the capital expenditure

program.

5.32 Borrowings

net of deposits were $92.1 million, compared to a budget of $131.6 million.

$30.3 million of that variance is due to lower brought forward debt balances.

5.33 Other

capital income from subsidies, development contributions and asset sales were

in excess of budget by $2.4 million and capital expenditure was less than

planned by $6.8 million resulting in a smaller increase in debt than

anticipated ($11 million rather than $20.3 million).

Rating

surplus

5.34 Rating

income was overspent by $381,000 in 2016/17. This was overspent as a result of

unbudgeted asset impairments and is effectively funded by prior years’

surpluses. Asset impairments arise when assets are replaced earlier than

anticipated or when work in progress that has been budgeted and recorded as

capital is reassigned as operating in nature when reviewed.

5.35 Rates

required to fund operations were within 0.6% of rates collected which is closer

than in recent years. This is positive as Council should only be rating for

what it needs to operate in that particular year.

Financial

prudence results

5.36 Council

is required to include information on financial performance in relation to

various benchmarks in the annual report. Here’s a summary of the

information found on pages 107 to 111 in the Annual report:

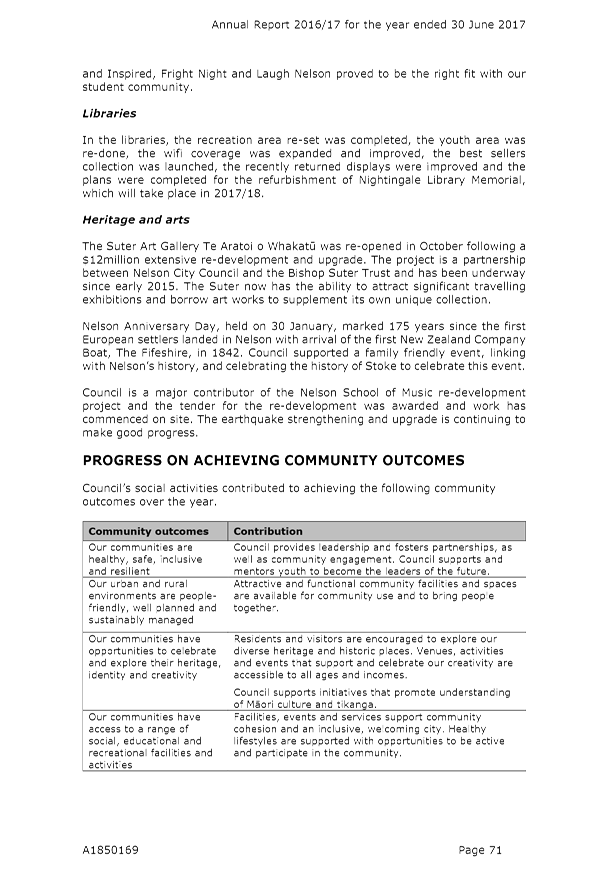

|

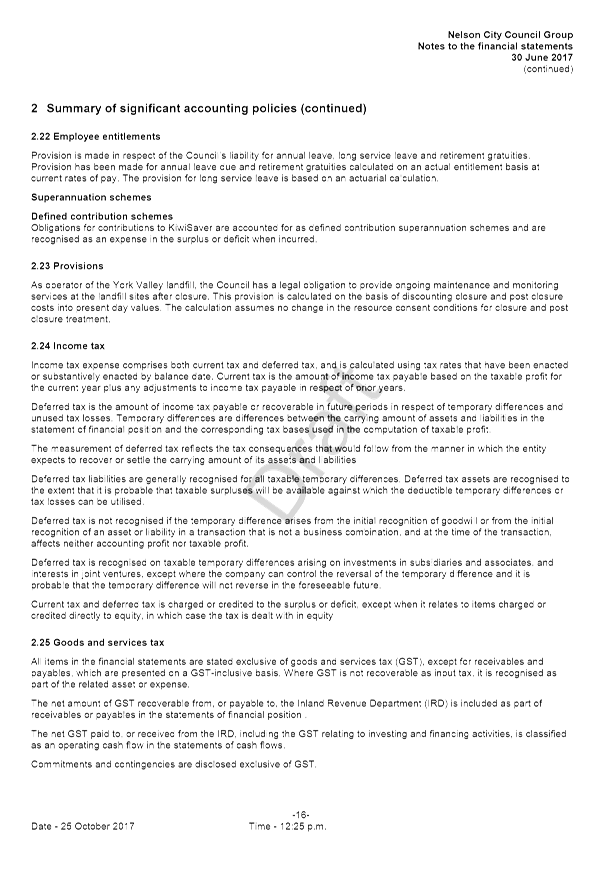

Measure

|

Result

|

Benchmark

|

|

|

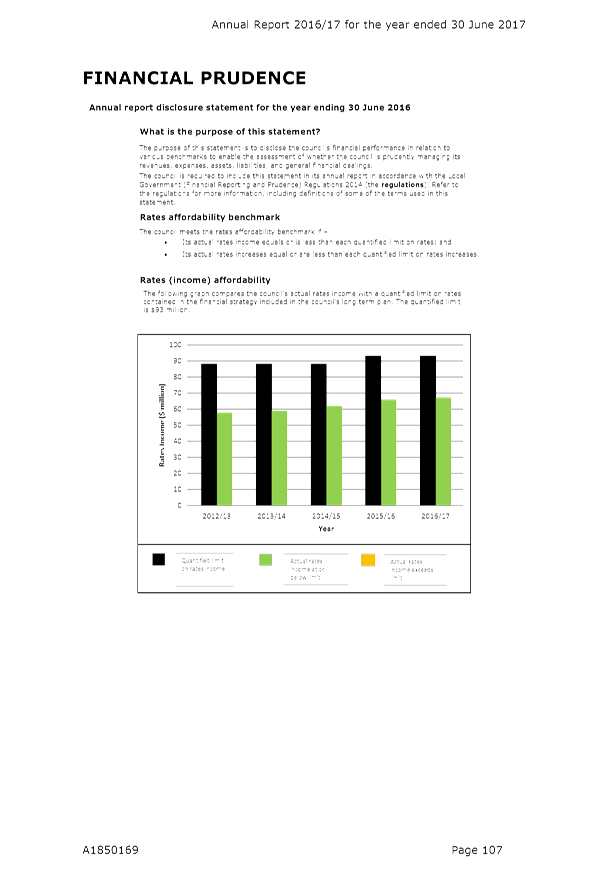

Rates (income) affordability

|

$67m

|

$93m

|

Achieved

|

|

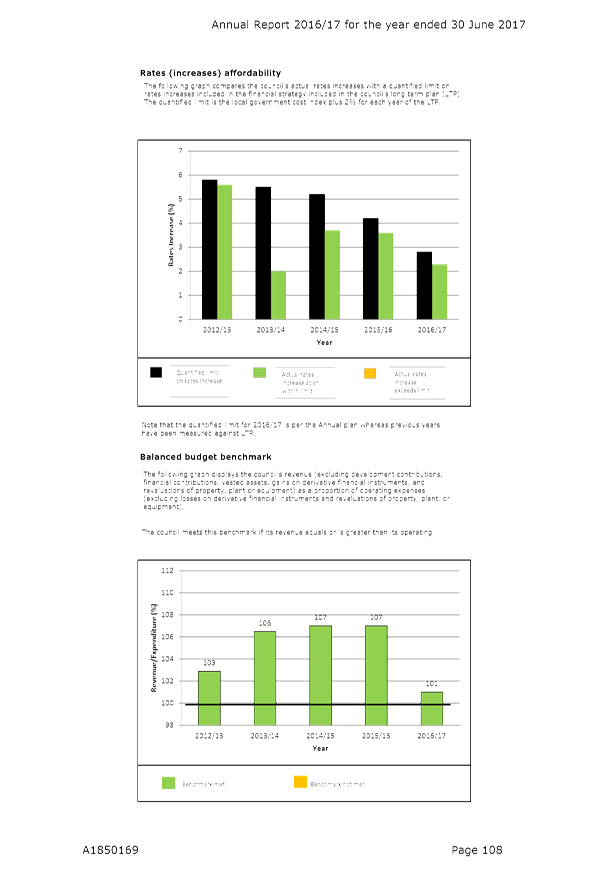

Rates (increases) affordability

|

2.3%

|

2.8%

|

Achieved

|

|

Balanced budget (revenue:expenditure)

|

101%

|

100%

|

Achieved

|

|

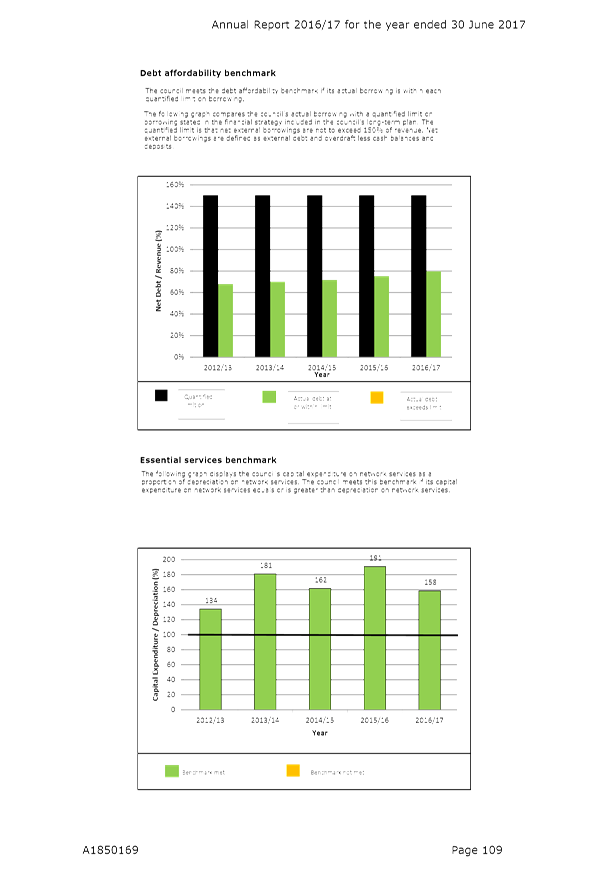

Debt affordability (% of revenue)

|

80%

|

150%

|

Achieved

|

|

Essential services (capital expenditure:depreciation)

|

158%

|

100%

|

Achieved

|

|

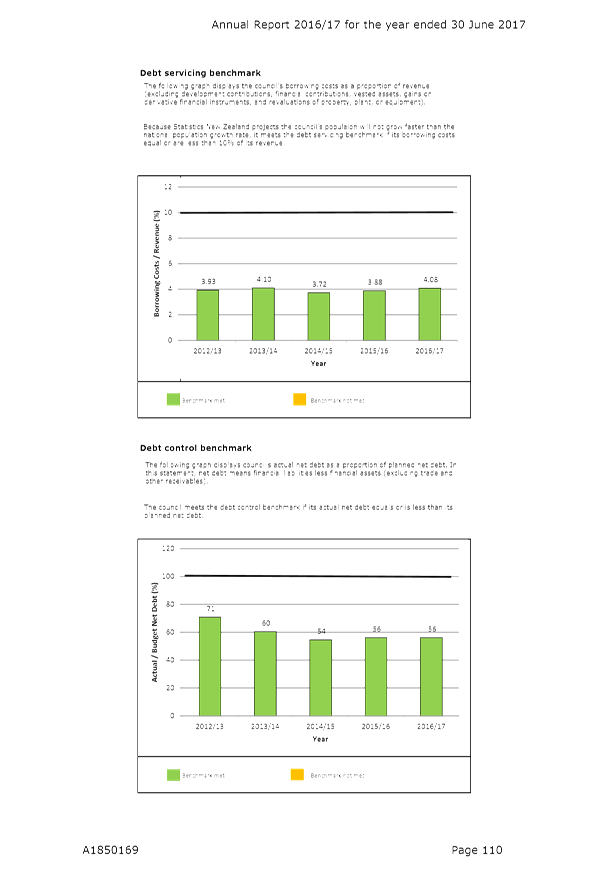

Debt servicing (interest:revenue)

|

4.08%

|

10%

|

Achieved

|

|

Debt control (actual:budget)

|

56%

|

100%

|

Achieved

|

|

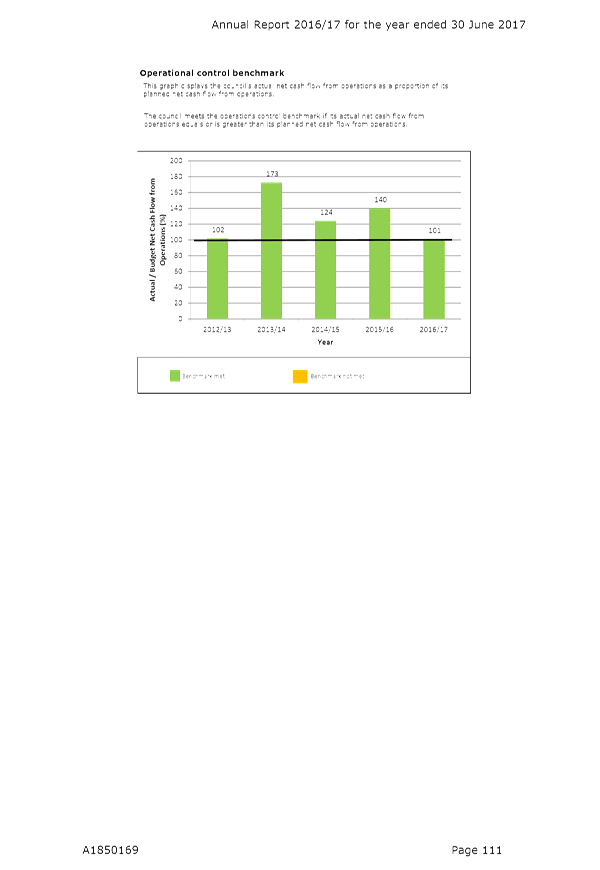

Operational control (actual:budget net cashflow from

operations)

|

101%

|

100%

|

Achieved

|

Material differences from draft Annual Report

5.37 The

draft Annual Report went to the Audit Risk and Finance Subcommittee on 8

September August. Since that time, further information has become available,

and the audit has been completed.

5.38 There

were some material changes to the Statement of Comprehensive Income and

Statement of Financial Position which were tabled at the 28 September 2017

Audit, Risk and Finance Subcommittee. These mainly related to the asset

revaluation and fixed assets and the subcommittee was comfortable with the

changes agreed with Audit NZ.

6. Options

6.1 Option

1 is the preferred option.

|

Option 1: Accept the recommendations

|

|

Advantages

|

· Meets statutory

timeframes

· Allows timely

production and distribution of the Annual Report

|

|

Risks and Disadvantages

|

· There will be no

further opportunity for Council to review any minor amendments prior to publishing.

|

|

Option 2: Not accept the recommendations

|

|

Advantages

|

· None

|

|

Risks and Disadvantages

|

· Adoption of the

annual report will not meet statutory timeframes.

· Annual Report

will not be available to the public in a timely manner

· Not meeting statutory

timeframes may be a consideration by Standard and Poor’s for the

Council credit rating.

|

7. Conclusion

7.1 It

is recommended that Council adopt the Annual Report for the 2016/17 year.

Tracey

Hughes

Senior

Accountant

Attachments

Attachment 1: Financial

Statements (A1853308) ⇩

Attachment 2: Annual

Report 2016/17 for the year ended 30 June 2017 (A1850169) ⇩

|

Important considerations for decision making

|

|

1. Fit

with Purpose of Local Government

The Annual Report is Council’s major

accountability document and is required under s98 of the Local Government

Act.

|

|

2. Consistency

with Community Outcomes and Council Policy

The Annual Report informs the community of

Council’s performance against the Long Term Plan.

|

|

3. Risk

The adoption of the Annual Report carries little

risk as it is a procedural matter required under legislation.

|

|

4. Financial

impact

There is no immediate financial impact from this

decision. If Council does not adopt the Annual Report before the statutory

deadline of 31 October 2017 it may be a consideration for Standard and

Poor’s in its annual credit rating assessment.

The Annual Report itself outlines the financial

position of Council at the end of the 2016/17 financial year.

|

|

5. Degree

of significance and level of engagement

This decision is of lower significance and does not

require consultation.

The Annual Report, once adopted, will be made

available for the public to view and a summary of the Annual Report will also

be prepared.

|

|

6. Inclusion

of Māori in the decision making process

Maori have not been consulted on this decision.

|

|

7. Delegations

The adoption of the Annual Report is a decision of

Council.

|

Nelson City Council

Nelson City Council