AGENDA

Ordinary meeting of the

Audit, Risk and Finance Subcommittee

Tuesday 27 June 2017

Commencing at 9.00am

Council Chamber

Civic House

110 Trafalgar Street, Nelson

Membership: Mr John Peters (Chairperson), Her Worship the

Mayor Rachel Reese, Councillor Ian Barker, Councillor Bill Dahlberg and Mr John

Murray

Guidelines for councillors

attending the meeting, who are not members of the Committee, as set out in

Standing Orders:

·

All councillors, whether or not they are members of the

Committee, may attend Committee meetings (SO 2.12.2)

·

At the discretion of the Chair, councillors who are not Committee

members may speak, or ask questions about a matter.

·

Only Committee members may vote on any matter before the

Committee (SO 3.14.1)

It is good practice for both Committee members and

non-Committee members to declare any interests in items on the agenda.

They should withdraw from the room for discussion and voting on any of these

items.

Audit, Risk and Finance

Subcommittee

Audit, Risk and Finance

Subcommittee

27

June 2017

Page

No.

1. Apologies

1.1 An

apology has been received from Her Worship the Mayor.

2. Confirmation

of Order of Business

3. Interests

3.1 Updates

to the Interests Register

3.2 Identify

any conflicts of interest in the agenda

4. Public

Forum

5. Confirmation

of Minutes

5.1 18

May 2017 10 - 15

Document number M2590

Recommendation

That the

Subcommittee

Confirms

the minutes of the meeting of the Committee, held on 18 May 2017, as a true and

correct record.

6. Status

Report - Audit, Risk and Finance Subcommittee - 27 June 2017 16 - 18

Document number R7943

Recommendation

That the Subcommittee

Receives the Status Report Audit,

Risk and Finance Subcommittee 27 June 2017 (R7943) and its attachment (A1753947).

7. Chairperson's

Report

8. Corporate

Report to 30 April 2017 19 - 31

Document number R6999

Recommendation

That the Committee

Receives the report Corporate

Report to 30 April 2017 (R6999)

and its attachments (A1766296 and A1771251).

9. Balance

Sheet reconciliation review 32 - 39

Document number R7002

Recommendation

Receives the report Balance Sheet

reconciliation review (R7002) and

its attachment (A1774923).

10. Liability

Management Policy review 40 - 57

Document number R7529

Recommendation

That the Subcommittee

Receives the report Liability

Management Policy review (R7529)

and its attachment (A1765543).

Recommendation to Council

That the

Council

Adopts

the amended Liability Management Policy (A1765543).

11. Carry

Forwards (Interim) 2016/17 58 - 66

Document number R7555

Recommendation

That the Subcommittee

Receives the report Carry Forwards

(Interim) 2016/17 (R7555) and its

attachments (A1770607).

Recommendation to Council

That the

Council

Approves

continuing work on 2016/17 projects within the 2016/17 approved budgets, noting

a final report on carry forwards will come to the Audit, Risk and Finance

subcommittee on 8 September 2017.

12. Council

Risk Management Policy and Risk Criteria 67

- 80

Document number R7572

Recommendation

That the Subcommittee

Receives the report Council Risk

Management Policy and Risk Criteria (R7572)

and its attachments: Risk Management Policy (A1553263) and Council Risk

Criteria (A1545157).

Recommendation to Council

That the

Council

Approves

the Risk Management Policy (A1553263); and

Adopts

the Council Risk Criteria (A1545157).

13. Internal

Audit - Annual Audit Plan to 30 June 2018 81

- 89

Document number R7587

Recommendation

That the Subcommittee

Receives the report Internal Audit

- Annual Audit Plan to 30 June 2018 (R7587)

and its attachment (A1748975);

Recommendation to Council

That the

Council

Approves

the Internal Audit – Annual Audit Plan to 30 June 2018 (A1748975).

14. Health

and Safety Governance Charter review 90

- 97

Document number R7622

Recommendation

That the Subcommittee

Receives the report Health and

Safety Governance Charter review (R7622)

and its attachment (A1767136);

Recommendation to Council

That the

Council

Approves

the revised Health and Safety Governance Charter (A1767136).

15. Protected

disclosure policy 98 - 109

Document number R7631

Recommendation

That the Subcommittee

Receives the report Protected

disclosure policy (R7631) and its

attachment (A1338935) ; and

Notes

the revised Protected Disclosure Policy (A1338935).

16. Trafalgar

Park Seating and Sale of the Punawai 110

- 136

Document number R7383

Recommendation

That the Subcommittee

Receives the report Trafalgar Park

Seating and Sale of the Punawai (R7383)

and its attachments (A345448, A1311242, R6448 and A1412442); and

Notes

that the purchase of the Trafalgar Park Seats complied with Council’s

Procurement Policy 2015 (A345448); and

Notes

that the Council approved the private sale of the Punawai for reasons of

timeliness and efficiency, and recognised at the time of the sale that this

approach departed from Council’s Asset Disposal Policy 2015 (A1412442).

17. Interim

audit letter for the year ending 30 June 2017 137

- 145

Document number R7627

Recommendation

That the Subcommittee

Receives the report Interim audit

letter for the year ending 30 June 2017 (R7627)

and its attachment (A1775216); and

Notes

the suggested responses to the recommendations.

Public Excluded Business

18. Exclusion

of the Public

Recommendation

That the Subcommittee

Excludes

the public from the following parts of the proceedings of this meeting.

The

general subject of each matter to be considered while the public is excluded,

the reason for passing this resolution in relation to each matter and the

specific grounds under section 48(1) of the Local Government Official

Information and Meetings Act 1987 for the passing of this resolution are as

follows:

|

Item

|

General subject of each matter to be considered

|

Reason for passing this resolution in relation to each matter

|

Particular interests protected (where applicable)

|

|

1

|

Bad debts

for the year ending 30 June 2017

|

Section 48(1)(a)

The public conduct of this

matter would be likely to result in disclosure of information for which good

reason exists under section 7

|

The

withholding of the information is necessary:

· Section 7(2)(a)

To protect the privacy of

natural persons, including that of a deceased person

· Section

7(2)(i)

To enable the local

authority to carry on, without prejudice or disadvantage, negotiations

(including commercial and industrial negotiations)

|

19. Re-admittance

of the public

Recommendation

That the Subcommittee

Re-admits

the public to the meeting.

Minutes of a meeting of

the Audit, Risk and Finance Subcommittee

Held in the Council

Chamber, Civic House, 110 Trafalgar Street, Nelson

On Thursday 18 May 2017,

commencing at 1.03pm

Present: Mr

J Peters (Chairperson), Her Worship the Mayor R Reese, Councillor I Barker and

Councillor B Dahlberg

In Attendance: Councillor

G Noonan, Chief Executive (C Hadley), Group Manager Community Services (C

Ward), Group Manager Corporate Services (N Harrison), Senior Strategic Adviser

(N McDonald), Manager Capital Projects (S Davies), Senior Accountant (T Hughes)

and Administration Adviser (S Burgess)

Apology: Mr

John Murray

1. Apologies

|

Resolved AUD/2017/001

That the Subcommittee

Receives and

accepts the apology from Mr John Murray.

Barker/Her Worship the Mayor Carried

|

2. Confirmation of Order of Business

The Chairperson advised that the

report Audit NZ – audit arrangement and engagement letters, would be

considered after the Chairperson’s Report.

3. Interests

There were no updates to the

Interests Register, and no interests with items on the agenda were declared.

4. Public Forum

There was no public forum.

5. Status Report - Audit Risk and

Finance Subcommittee - 18 May 2017

Document number R7639, agenda

pages 7 - 9 refer.

The Subcommittee directed that a

Subcommittee briefing on social enterprise principles was appropriate, and a

workshop was no longer required.

The Subcommittee noted that the

Chair of the Governance Committee and Mr John Peters would proceed to develop

the scope for the tendering processes report.

|

Resolved AUD/2017/002

That the Subcommittee

Receives the Status Report

Audit, Risk and Finance Subcommittee 18 May 2017 (R7639) and its attachment (A1753947).

Barker/Dahlberg Carried

|

6. Chairperson's Report

Document number R7716, agenda

pages 10 - 11 refer.

The Chairperson presented his report.

|

Resolved AUD/2017/003

That the Subcommittee

Receives the report

Chairperson's Report (R7716).

Peters/Barker Carried

|

7. Audit NZ - audit arrangement and

engagement letters

Document number R7513, agenda

pages 91 - 129 refer.

Bede Kearney and Jacques Coetzee

of Audit New Zealand joined the meeting. Mr Kearney presented the report and

responded to questions.

|

Resolved AUD/2017/004

That the Subcommittee

Receives the report Audit NZ -

audit arrangement and engagement letters (R7513); and attachments A1749598, A1749594 and A1752596; and

Notes the Subcommittee can provide

feedback on the Audit Arrangement, Audit Engagement and Audit Proposal

letters to Audit NZ if required, noting the Mayor will sign the letters once

the Subcommittee’s feedback has been incorporated.

Dahlberg/Barker Carried

|

8. Corporate Report to 31 March 2017

Document number R6998, agenda

pages 12 - 24 refer.

Manager Capital Projects, Shane

Davies, and Senior Accountant, Tracey Hughes, presented the report. Ms Hughes

provided updated information on debtors three months overdue.

Mr Davies, Ms Hughes, and Group

Manager Corporate Services, Nikki Harrison, responded to questions.

|

Resolved AUD/2017/005

That the Subcommittee

Receives the report Corporate

Report to 31 March 2017 (R6998)

and its attachments (A1750159 and A1753951).

Barker/Dahlberg Carried

|

9. Health and Safety: Quarterly

Report

Document number R7023, agenda

pages 25 - 35 refer.

Manager Organisational Assurance

and Emergency Management, Roger Ball, and Health and Safety Adviser, Malcolm

Hughes, presented the report and responded to questions.

The Chairperson asked that

officers look into whether any lessons could be learned from the recently

released Havelock water report. He also requested detail of Council’s

current precautions against malware.

|

Resolved AUD/2017/006

That the Subcommittee

Receives the report Health and

Safety: Quarterly Report (R7023)

and its attachment (A1753457).

Her Worship the Mayor/Barker Carried

|

|

Recommendation to Council

AUD/2017/007

That

the Council

Notes

the report Health and Safety Quarterly Report (R7023) and its attachment (A1753457); and

Confirms

the assessment of critical health and safety risks contained in the

attachment (A1753457).

Her Worship the Mayor/Barker Carried

|

10. Internal Audit Quarterly

Report to 31 March 2017

Document number R7569, agenda

pages 36 - 46 refer.

Internal Audit Analyst, Lynn

Anderson, presented the report and responded to questions.

|

Resolved AUD/2017/008

That the Subcommittee

Receives the report Internal

Audit Quarterly Report to 31 March 2017 (R7569); and its attachment (A1747023).

Her Worship the Mayor/Barker Carried

|

|

Recommendation to Council

AUD/2017/009

That the Council

Notes

the report Internal Audit Quarterly Report (R7569) and its attachment

(A1747023).

Her Worship the Mayor/Barker Carried

|

11. Service Delivery Review

Quarterly Progress Update - May 2017

Document number R6910, agenda

pages 47 - 90 refer.

Policy Adviser, Gabrielle Thorpe,

and Interim Manager Building, Chris Wood, presented the report and responded to

questions.

|

Resolved AUD/2017/010

That the Subcommittee

Receives the report Service

Delivery Review Quarterly Progress Update - May 2017 (R6910) and its attachments (A1737008,

A1732393, A1731928, A1731591, A1736351, A1642437, A1736093, A1732264 and A1753361); and

Notes

the update on progress with the programme of s17A reviews.

Dahlberg/Barker Carried

|

12. Tax Risk Governance

Framework

Document number R7599, agenda

pages 130 - 139 refer.

Senior Accountant, Tracey Hughes,

presented the report and responded to questions.

|

Resolved AUD/2017/011

That the Subcommittee

Receives the report Tax Risk

Governance Framework (R7599) and its attachment (A1750676).

Notes

that a tax risk management strategy will be presented to a future meeting of

this Subcommittee, and annual reporting against this framework will occur

annually after the end of the tax year (31 March).

Dahlberg/Barker Carried

|

|

Recommendation to Council

AUD/2017/012

That the Council

Adopts

the Tax Risk Governance Framework (A1750676) with immediate effect.

Dahlberg/Barker Carried

|

There being no further business the

meeting ended at 3.06pm.

Confirmed as a correct record of proceedings:

Chairperson

Date

Chairperson

Date

|

|

Audit, Risk and Finance Subcommittee

27 June 2017

|

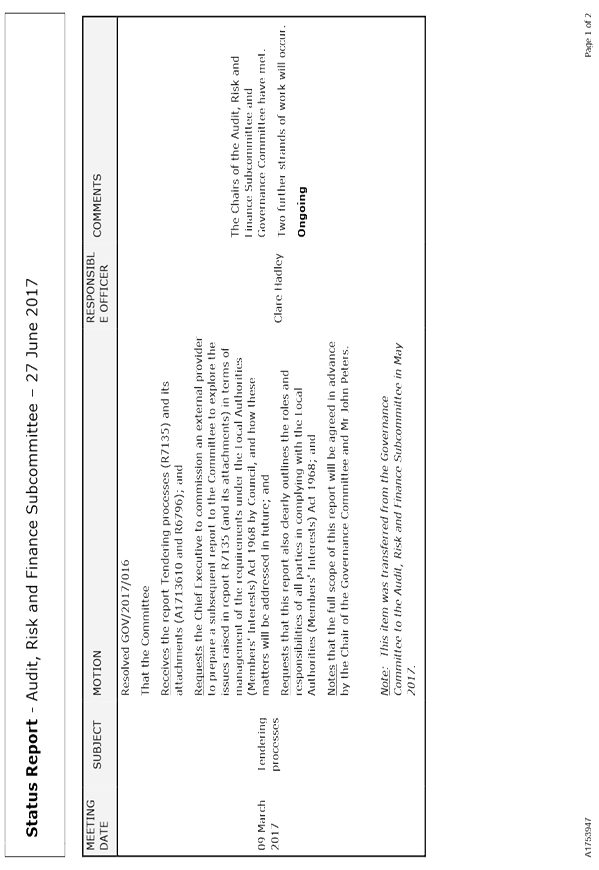

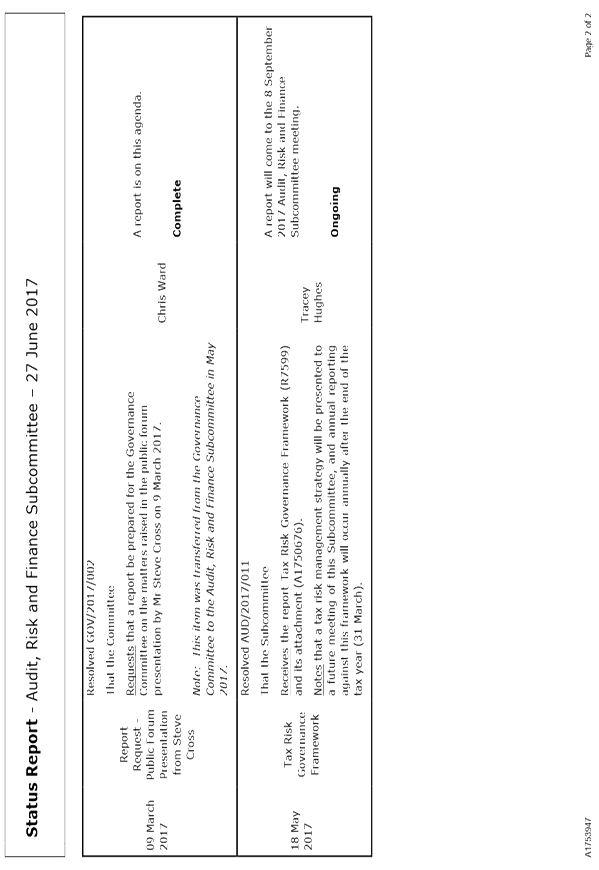

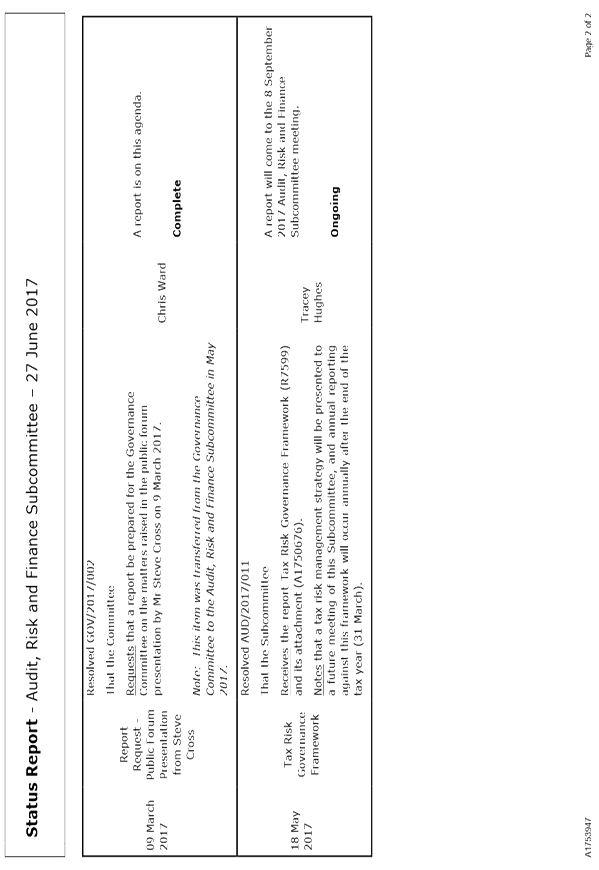

REPORT R7943

Status

Report - Audit, Risk and Finance Subcommittee - 27 June 2017

1. Purpose

of Report

1.1 To

provide an update on the status of actions requested and pending.

2. Recommendation

|

That the Subcommittee

Receives the Status Report

Audit, Risk and Finance Subcommittee 27 June 2017 (R7943) and its attachment (A1753947).

|

Attachments

Attachment 1: A1753947

- Audit, Risk and Finance Subcommittee Status Report ⇩

|

|

Audit, Risk and Finance Subcommittee

27 June 2017

|

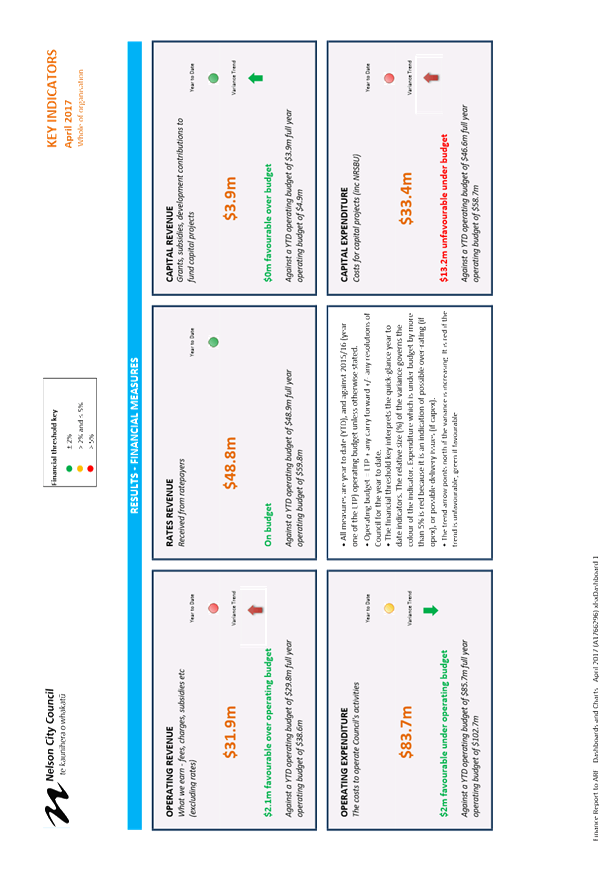

REPORT R6999

Corporate

Report to 30 April 2017

1. Purpose

of Report

1.1 To

inform the members of the Audit, Risk and Finance Subcommittee

of the financial results of activities for the 10 months ending 30 April 2017

compared to the approved operating budget, and to highlight and explain any

permanent and material variations.

2. Recommendation

|

That the Committee

Receives the report Corporate

Report to 30 April 2017 (R6999)

and its attachments (A1766296 and A1771251).

|

3. Background

3.1 The financial reporting focuses on the 10 month performance compared

with the year to date approved operating budget.

3.2 Unless

otherwise indicated, all measures are against approved operating budget, which

is 2016/17 Annual Plan budget plus any carry forwards, plus or minus any other

additions or changes as approved by Council throughout the year.

3.3 For the 2016/17 financial year, officers have assessed budgets and

applied a range of phasing mechanisms to better reflect the timing of

anticipated actual income and expenditure. This should enable clearer analysis

of variances, and better highlight any real issues. Given that there are in

excess of 3,500 budget lines, officers have concentrated effort on more

material items so there will remain a (much smaller) element of timing

differences.

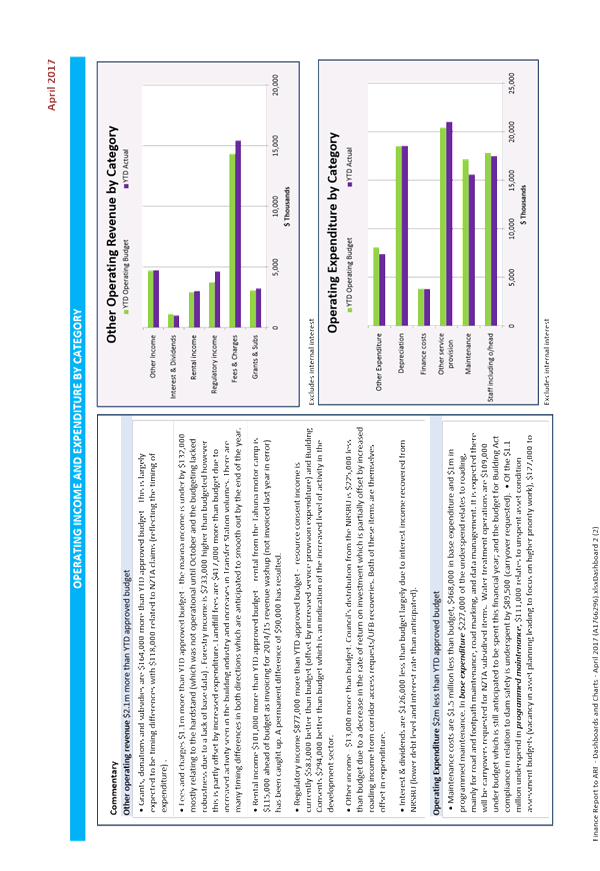

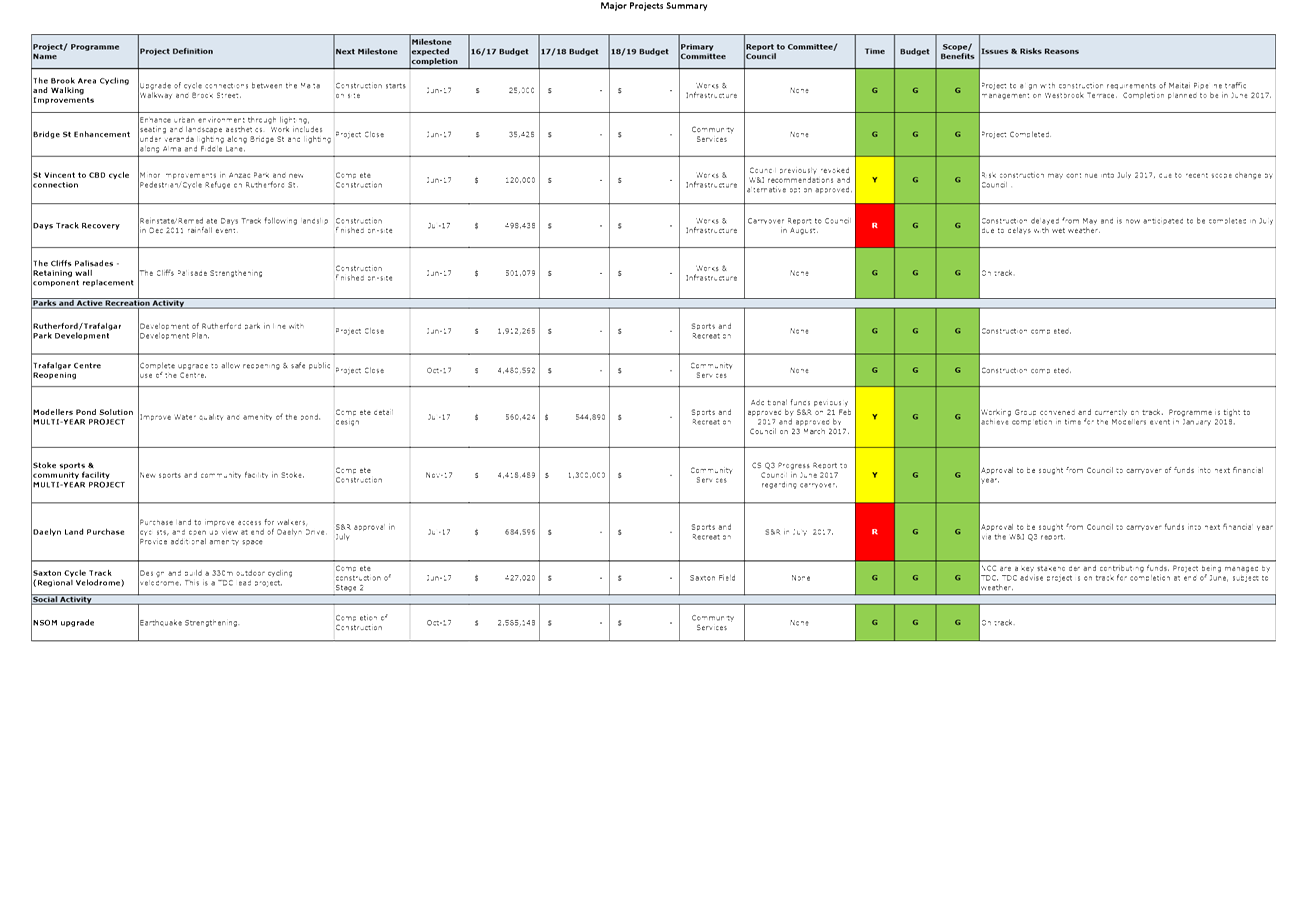

4. Discussion

4.1 For the 10 months ending 30 April

2017, the activity surplus/deficits are $4.1 million favourable to budget.

4.2 Financial

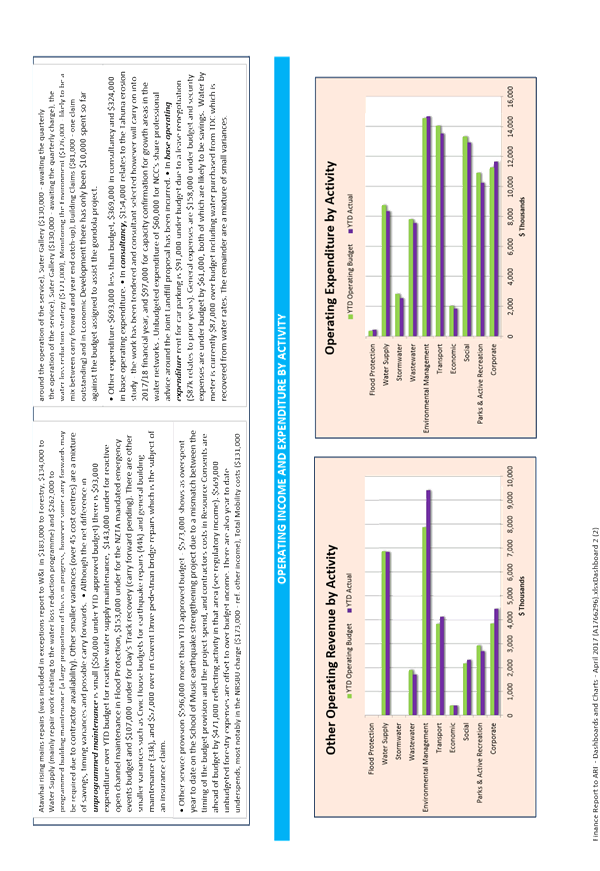

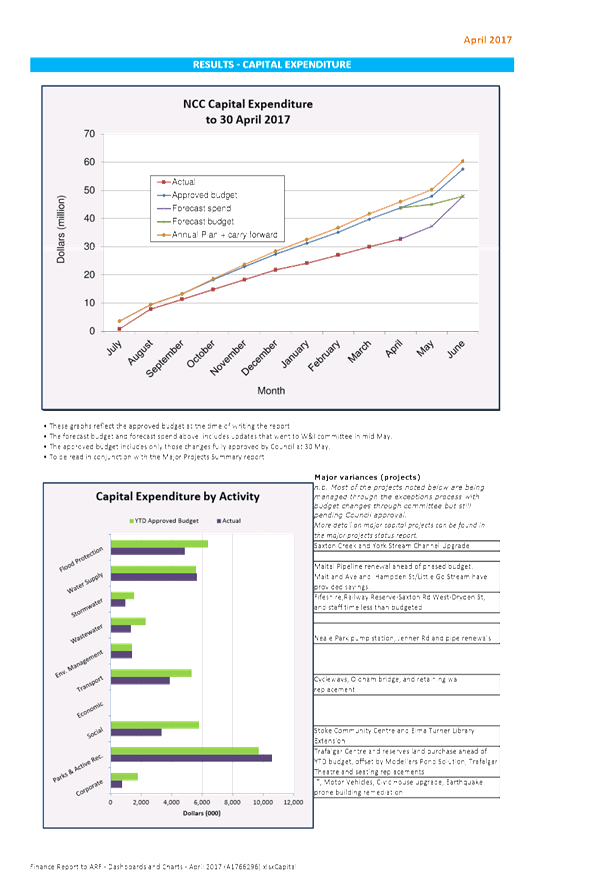

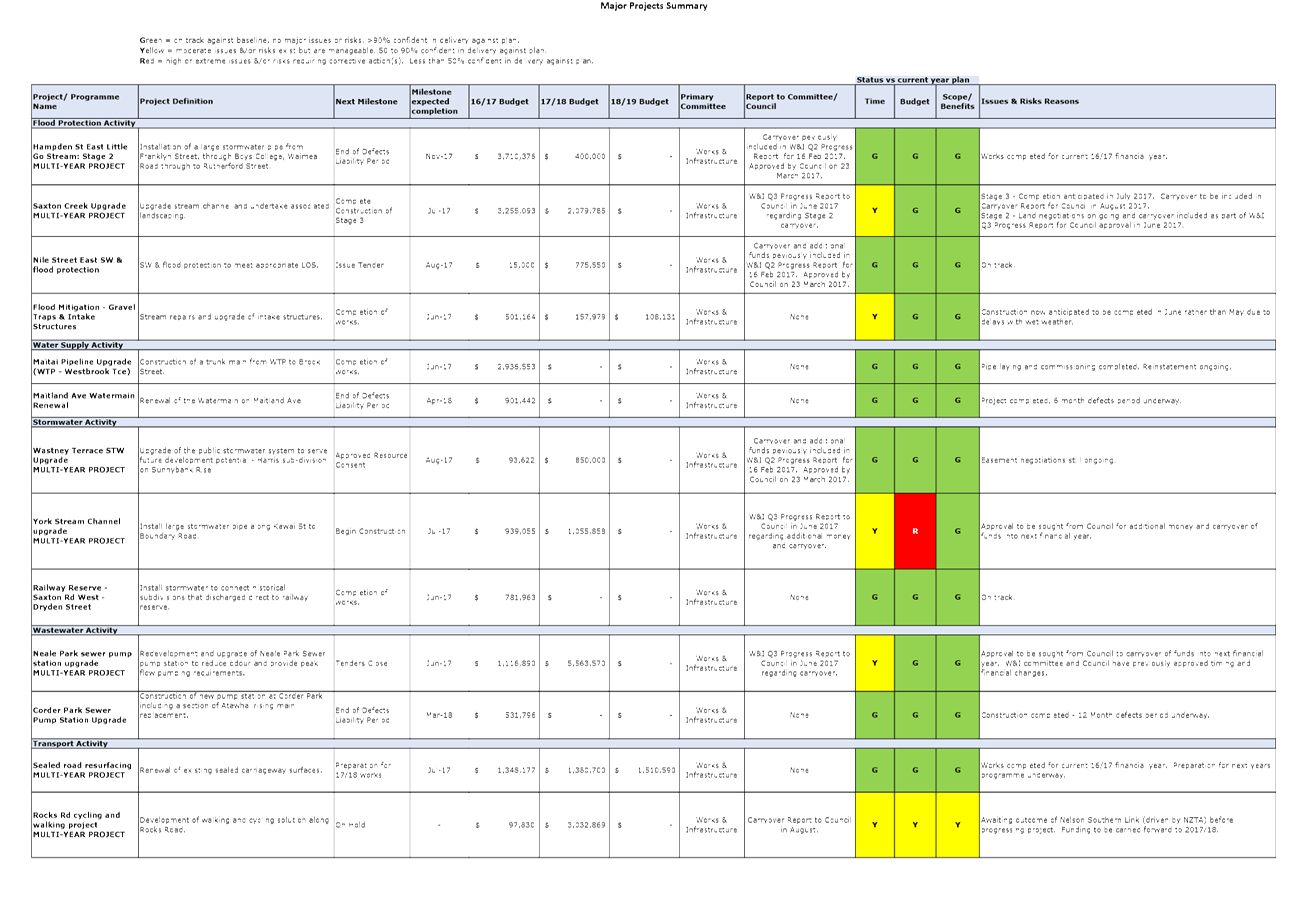

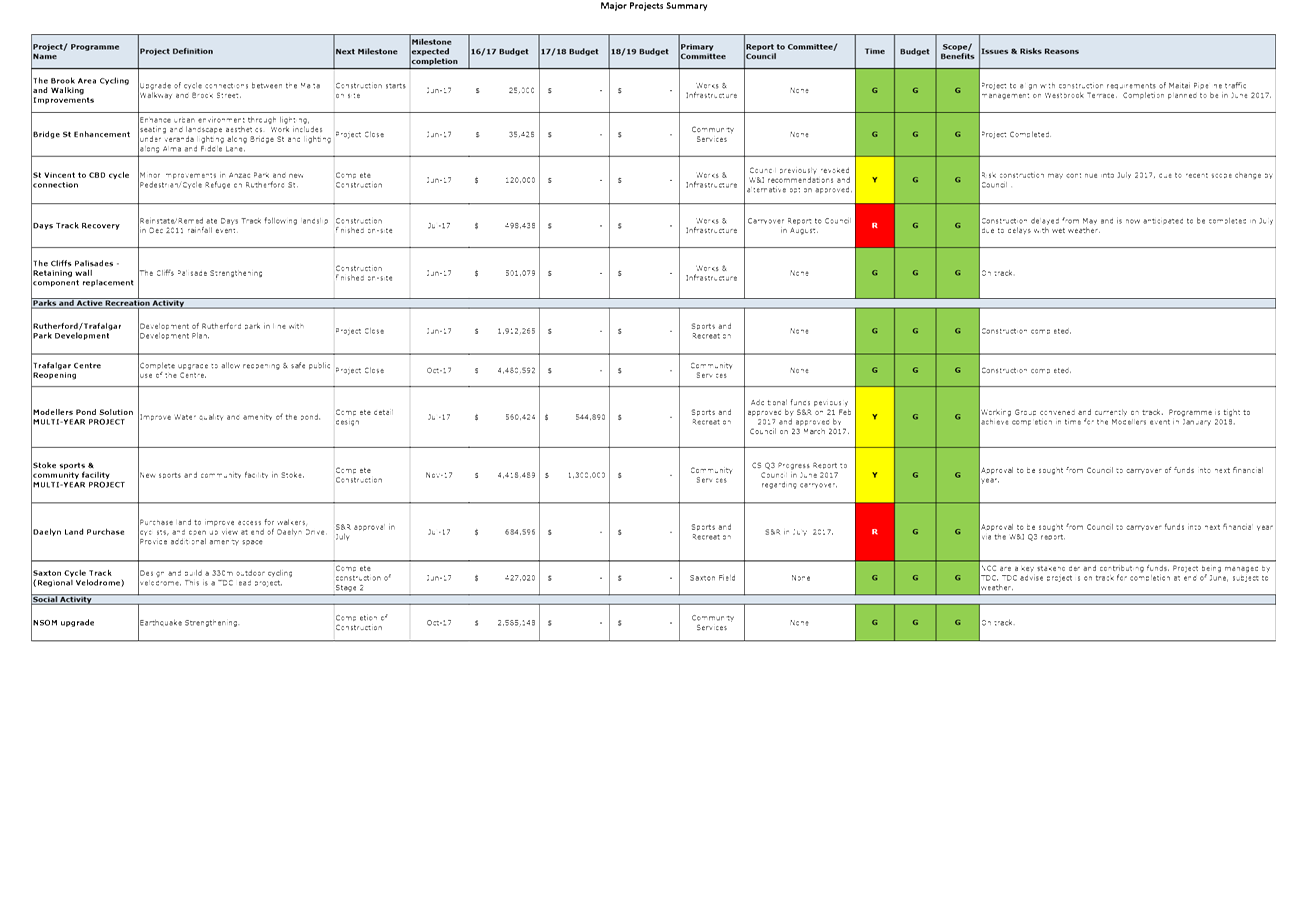

information provided in attachment 1 to this report are:

· A financial measures dashboard with information on rates revenue,

operating revenue and expenditure, and capital revenue and expenditure. The

arrow icon in each applicable measure indicates whether the variance is

increasing or decreasing and whether that trend is favourable or unfavourable

(green or red).

· A grouping of more detailed graphs and commentary for operating

income and expenditure. The first set of charts and the commentary is by

category (as in the annual report) and highlights significant permanent

differences and items of interest. Variances due to timing will not be itemised

unless they become permanent. The second set of charts are by activity.

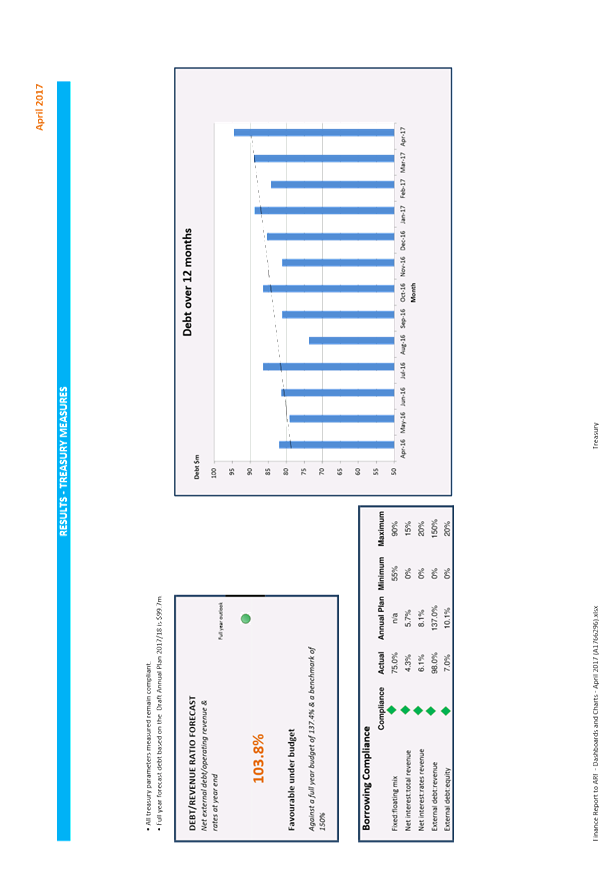

· A treasury measures dashboard with a compliance table (green =

compliant), a forecast of the debt/revenue ratio for the year where available,

and a graph showing debt levels over a rolling 13 month period.

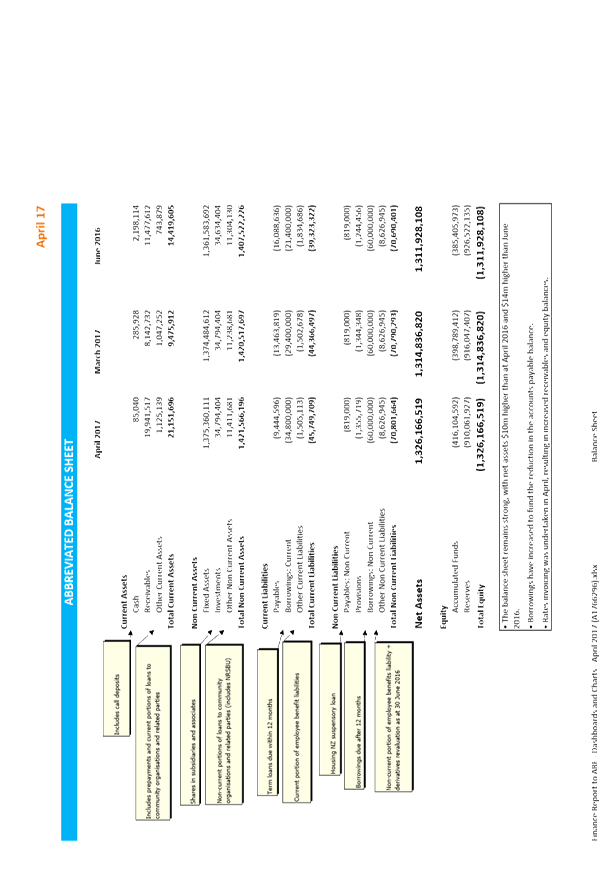

· High level balance sheet. This does not include any consolidations.

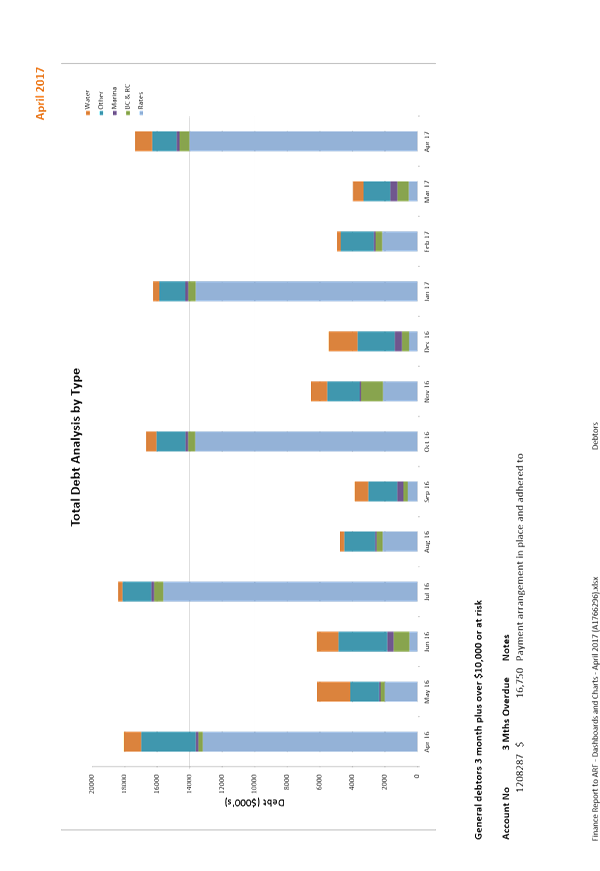

· A debtor analysis graph over 12 months, clearly showing outstanding

debt levels and patterns for major debt types along with a summary of general

debtors > 3 months and over $10,000 and other debtors at risk.

· Two capital expenditure graphs – actual expenditure against

operating budget for the financial year, now including forecast to year end,

and year to date expenditure against approved operating budget by activity.

· A major projects summary including milestones, status, issues and

risks.

4.3 Capital expenditure is $13.2 million under budget noting that $9.6

million of this variance is awaiting Council approval through the exceptions

process (already approved by other committees).

5. Options

5.1 Accept

the recommendation. This report is to inform the committee members, and no

further actions are required.

5.2 Do

not accept the recommendation.

Tracey

Hughes

Senior

Accountant

Attachments

Attachment 1: Financial information

(A1766296) ⇩

Attachment 2: Major

projects summary (A1771251) ⇩

|

Important considerations for decision making

|

|

1. Fit

with Purpose of Local Government

The Audit, Risk and Finance subcommittee receives an

update on financial matters at each meeting to inform them of items of

financial interest and potentially items of financial risk.

|

|

2. Consistency

with Community Outcomes and Council Policy

The financial reports are prepared comparing current

year performance against the year to date approved budget for 2016/17.

Presentation of these reports support the community outcome “Our

Council provides leadership and fosters partnerships, a regional perspective,

and community engagement”.

|

|

3. Risk

The recommendation carries no risk as the report is

for information only.

|

|

4. Financial

impact

The recommendation has no financial impact.

|

|

5. Degree

of significance and level of engagement

The recommendation is of low significance as there

are no decisions to be made.

|

|

6. Inclusion

of Māori in the decision making process

No consultation is required.

|

|

7. Delegations

The Audit Risk and Finance subcommittee has

oversight of Council’s financial performance and the management of

financial risks.

|

|

|

Audit, Risk and Finance Subcommittee

27 June 2017

|

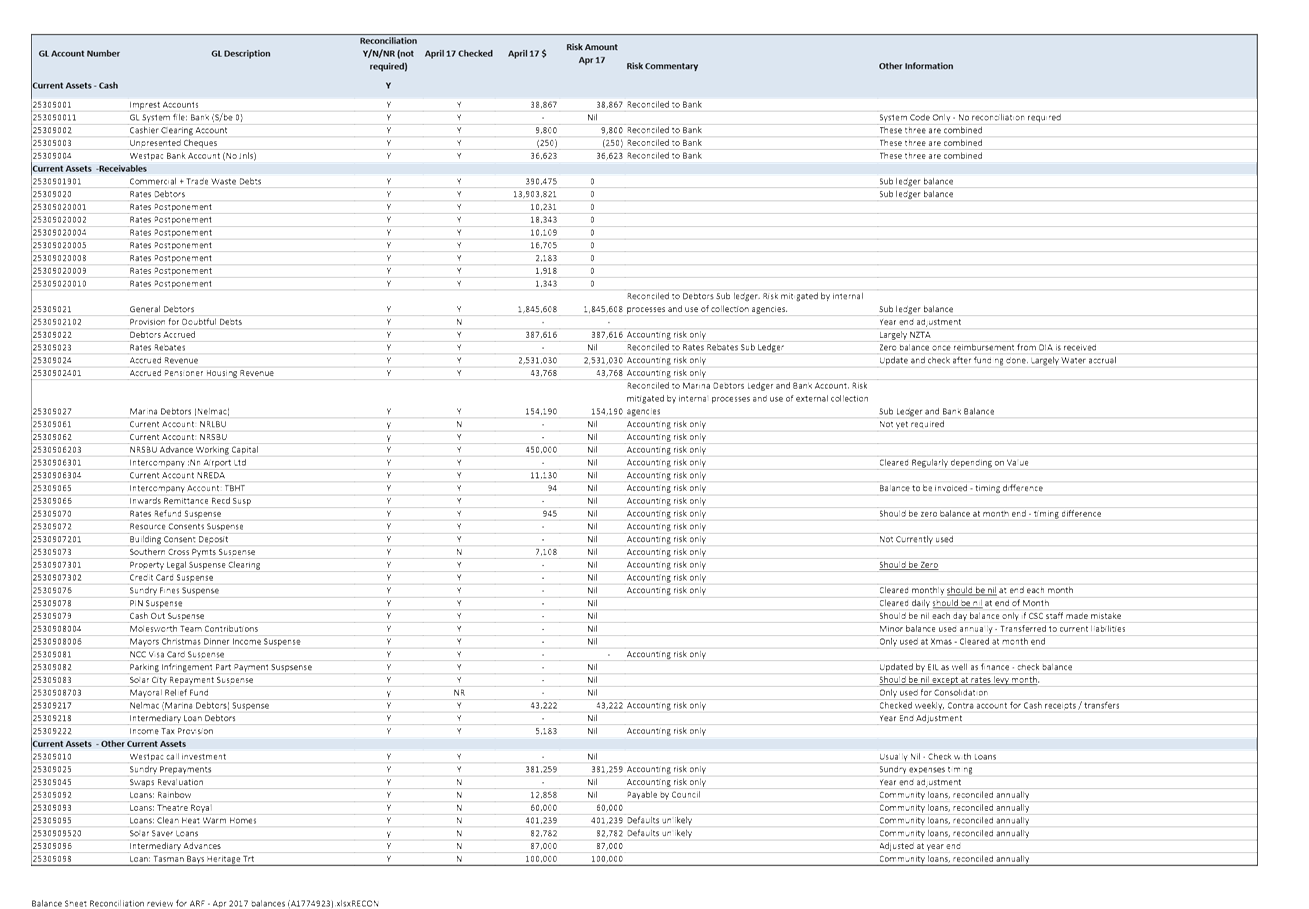

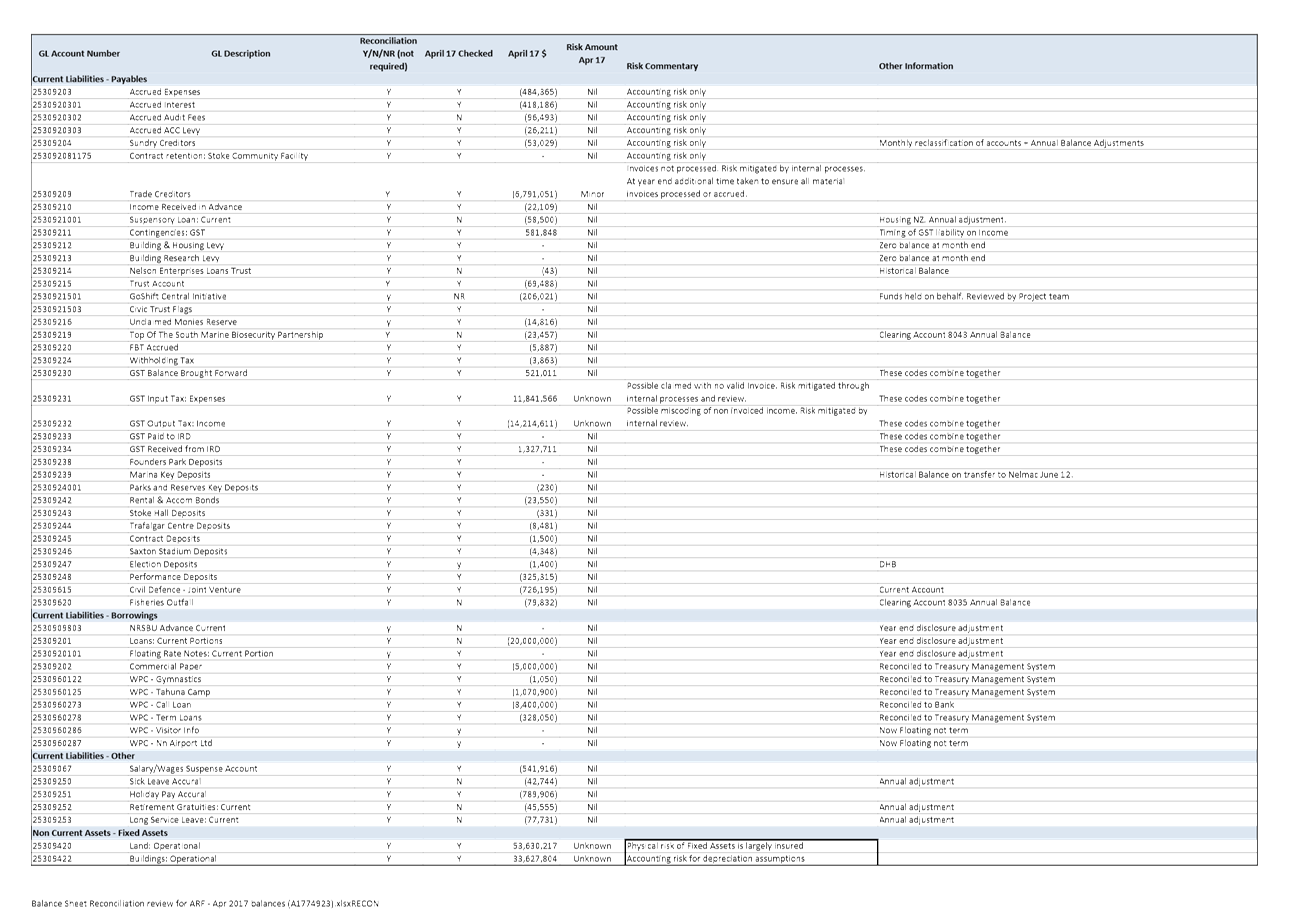

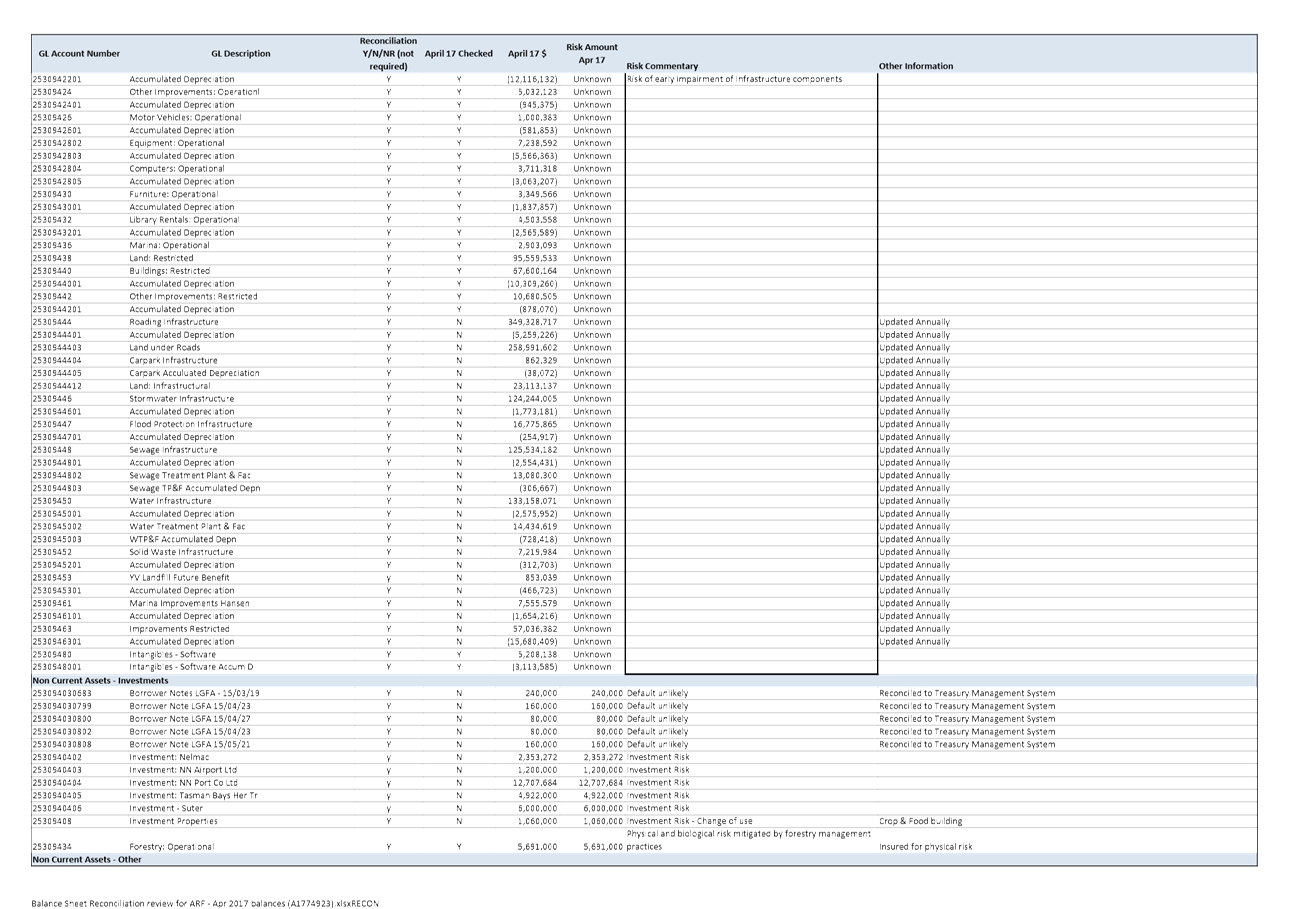

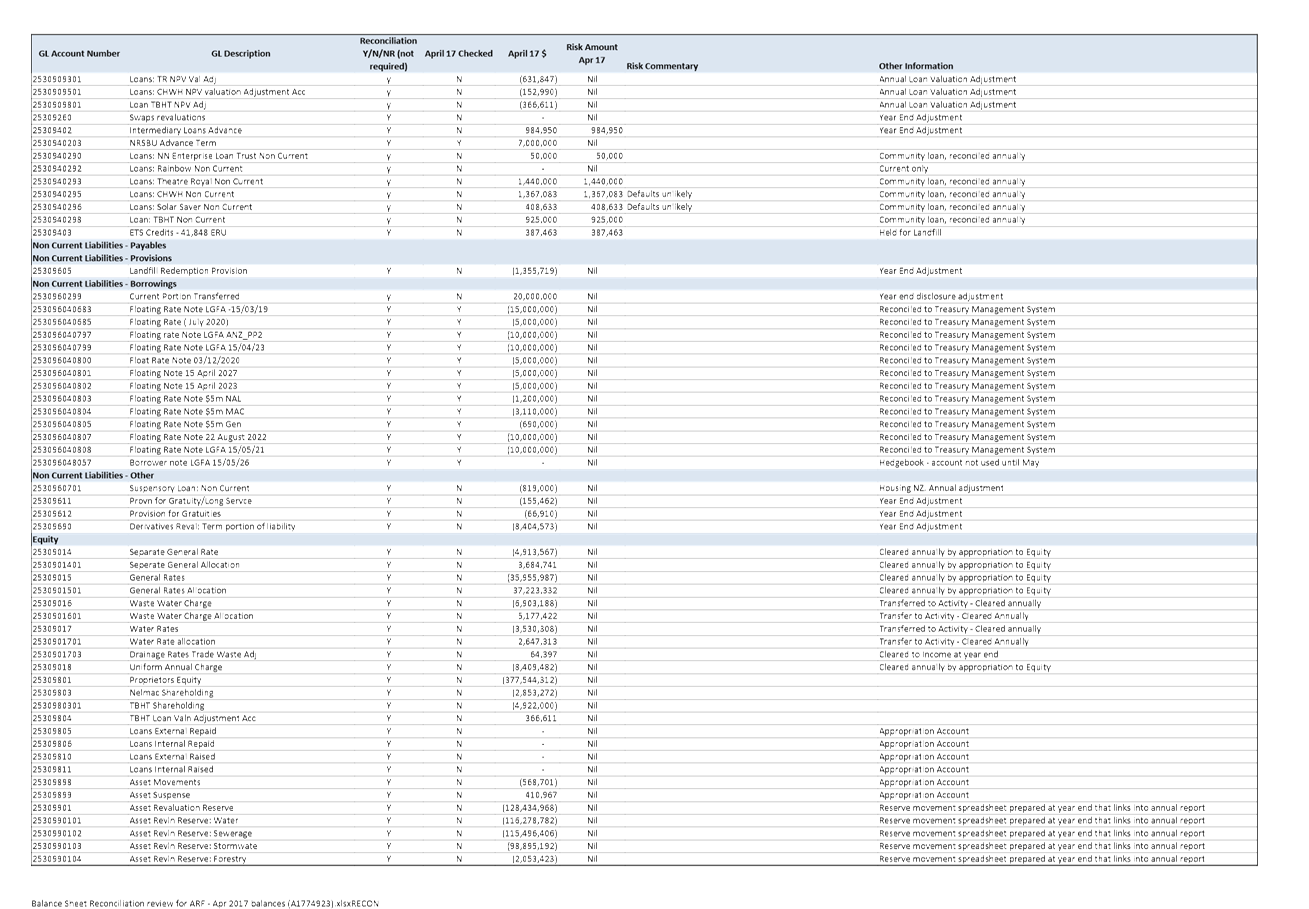

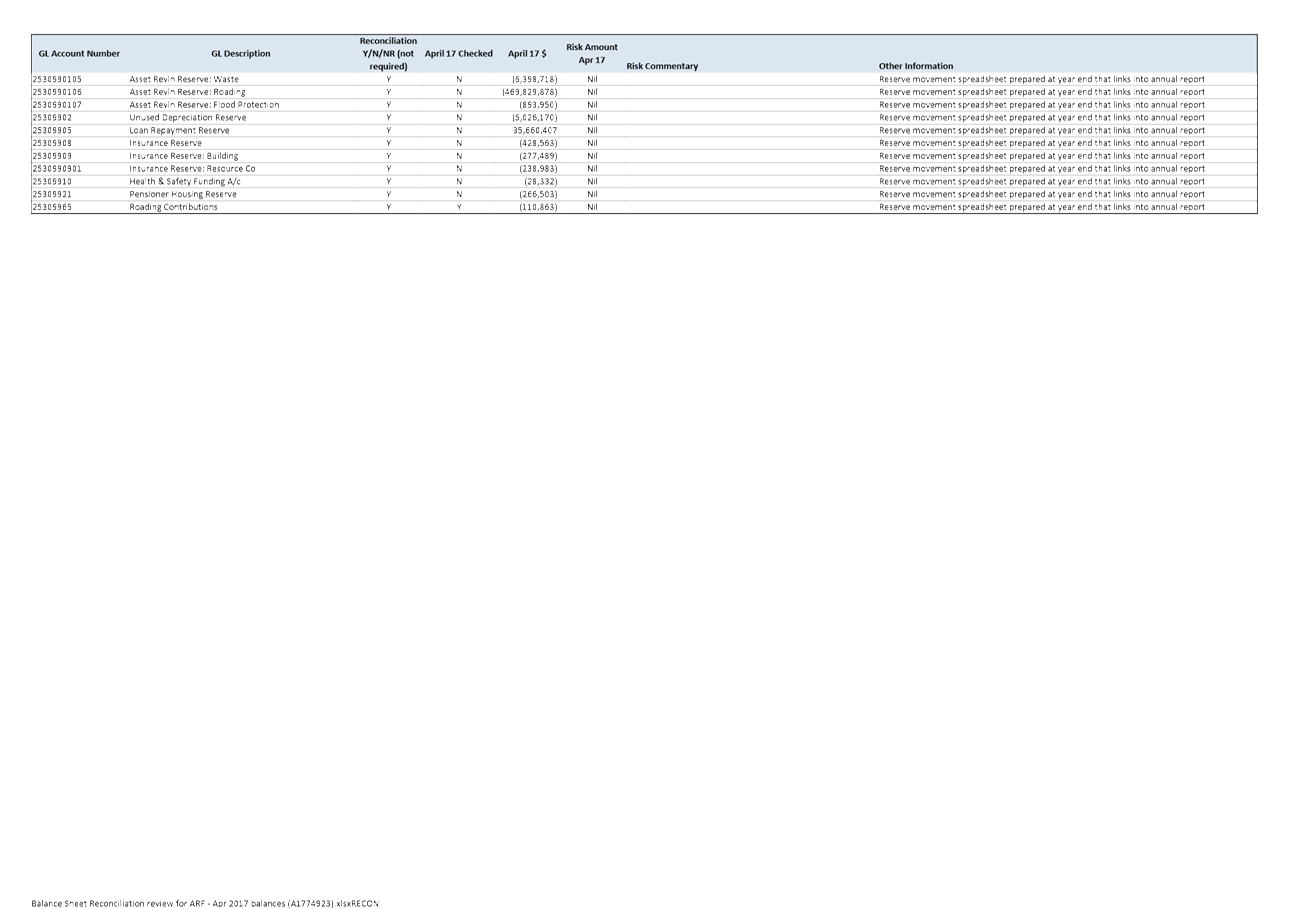

REPORT R7002

Balance

Sheet reconciliation review

1. Purpose

of Report

1.1 To

inform the subcommittee on the detail of the balance sheet, the status of

reconciliations and any areas of risk identified.

2. Recommendation

It is recommended that the

Subcommittee

|

Receives the report Balance

Sheet reconciliation review (R7002)

and its attachment (A1774923).

|

3. Background

3.1 As

part of the Corporate Report, the subcommittee is presented at every meeting

with a summarised balance sheet. The purpose of presenting the summarised

balance sheet is to identify and explain any significant differences month on

month.

3.2 The

balance sheet is otherwise known as a statement of financial position. Balance

sheet reconciliations are conducted to ensure the legitimacy of the organisations

reported financial position.

3.3 Attachment

1 allows the subcommittee to see the detail that lies beneath the summarised

balance sheet in the Corporate Report. For each account, the spreadsheet

indicates the balance at 30 April (the last month for which complete data is

available), whether the reconciliation has been completed in April and any risk

associated with the balance.

3.4 This

information is presented to the subcommittee on an annual basis.

4. Discussion

4.1 Accounts

with a large number of transactions (debtors, creditors, fixed assets) are

reconciled monthly or more frequently.

4.2 Some

accounts (largely equity and loans receivable) are reconciled quarterly or

annually as part of the annual report and audit process. These accounts may

have only one movement during the year.

4.3 Reconciliations

are completed by a named member of the finance team and are checked by a senior

member, or in some cases, audit.

4.4 As

part of its audit process, Audit NZ check some (but not all) reconciliations

either during its interim visit (which tends to focus on control and processes)

or its final visit (the reconciliation being in support of the results in the

Annual Report).

Options

4.5 Accept

the recommendation and receive the Balance Sheet reconciliation review report.

4.6 Reject

the recommendation.

Tracey

Hughes

Senior

Accountant

Attachments

Attachment 1: Balance Sheet

reconciliations (A1774923) ⇩

|

Important considerations for decision making

|

|

1. Fit

with Purpose of Local Government

This report allows for a detailed review of one of

the key elements of the Corporate Report; the balance sheet. The Corporate

Report provided to the Audit, Risk and Finance Subcommittee at each meeting

informs them of items of financial interest and potentially items of financial

risk.

|

|

2. Consistency

with Community Outcomes and Council Policy

This report supports the community outcome

“Our Council provides leadership and fosters partnerships, a regional

perspective, and community engagement”.

|

|

3. Risk

The recommendation carries no risk as the report is

for information only.

|

|

4. Financial

impact

The recommendation has no financial impact.

|

|

5. Degree

of significance and level of engagement

The recommendation is of low significance as there

are no decisions to be made.

|

|

6. Inclusion

of Māori in the decision making process

No consultation is required.

|

|

7. Delegations

The Audit, Risk and Finance Subcommittee has the

responsibility for considering financial performance and the management of

financial risk.

|

|

|

Audit, Risk and Finance Subcommittee

27 June 2017

|

REPORT R7529

Liability

Management Policy review

1. Purpose

of Report

1.1 To

adopt the amended Liability Management Policy.

2. Recommendation

1.

|

That the Subcommittee

Receives the report Liability

Management Policy review (R7529)

and its attachment (A1765543).

|

Recommendation to Council

|

That the

Council

Adopts the amended Liability

Management Policy (A1765543).

|

3. Background

3.1 The current Liability Management

Policy (Policy) was approved by Council in March 2016.

4. Discussion

4.1 The amended Policy, with the

proposed changes highlighted, is in Attachment 1. The following sections

set out further details in relation to the changes that are to be considered:

4.2 Review

date

4.2.1 The Policy has been on an annual review

cycle. It is proposed to move this to a formal three yearly review. It is

also proposed that the Policy be reviewed internally on an annual basis with

amendments being brought to the subcommittee, if necessary.

4.3 Glossary

of terms

4.3.1 It is proposed that the Policy be updated to

include a reference to a glossary of financial markets terms which is available

on request. As it is a lengthy document, it is not proposed that the

glossary be included as part of the Policy.

4.4 Net/gross

debt

4.4.1 Previously the Policy has referenced net debt when

managing interest rate risk. As Council does not hold any core investment

funds to provide an offset, it is proposed to amend the Policy to reflect that

interest rate risk is actually managed on a gross basis.

4.5 Risk

management instruments

4.5.1 It is proposed that collars be added to the table

of risk management instruments allowed, in order to make this clearer.

Previously, these were allowed in the wording below the table in certain

restricted circumstances and the proposed amendment aims to tidy this up.

4.6 Interest

rate swaps

4.6.1 Previously any interest rate swaps beyond 12 years

required approval of Council. It is proposed that this is moved to 15

years. The exception to this will be if Council raises Local Government

Funding Agency (LGFA) funding as fixed rate or as a swapped floating rate and

the maturity is beyond 15 years.

4.6.2 The main driver for this proposed change is that

the LGFA, which the Council uses for long term borrowing, is now issuing longer

dated debt (it has issued a bond out to April 2033) and the proposed amendment

will align with this longer term borrowing now available. In addition,

the swap market has become more liquid and actively traded beyond ten years.

4.6.3 The

propose amendment has been discussed with our treasury advisor, Price

Waterhouse Coopers (PWC) and it raised no concerns.

4.7 Liquidity

and funding risk management

4.7.1 This section has been updated at the request of the

LGFA to include the statement “To minimise concentration risk the LGFA

requires that no more than the greater of NZD 100 million or 33% of a Council's

borrowings from the LGFA will mature in any 12-month period”.

4.7.2 This

amendment is consistent across the local government sector and is not specific

to this Council.

4.8 Specific

borrowing limits

4.8.1 It is proposed that definitions for “cash”

and “cash equivalent” be included. The suggested definitions

are consistent with the manner in which these items are calculated.

4.9 Emissions

Trading Scheme

4.9.1 The proposed changes in relation Emissions Trading

Scheme include removal of any references to types of emission units which can

no longer be used and an amendment to the performance benchmarking based on the

view our treasury advisor. In order to simplify and describe the

benchmark more appropriately, the following is suggested “the actual

annual ETS cost for Council should be no worse than the budgeted ETS cost for

that year”.

4.10 Treasury

Performance

4.10.1 It is proposed that the performance benchmarking be simplified

to measure as follows: “the actual borrowing cost for Council (taking

into consideration costs of entering into interest rate risk management

transactions) should be below the budgeted borrowing costs”.

Previously, it was benchmarking the margin against an LGFA credit curve.

5. Options

5.1 The

recommendation is to adopt the amendments to the Liability Management Policy.

|

Option 1: Adopt the amended

Liability Management Policy

|

|

Advantages

|

· changes

are recommended by our treasury advisor and are considered current best

practice

|

|

Risks and Disadvantages

|

· none

|

|

Option 2: Not adopt the

amended Liability Management Policy

|

|

Advantages

|

· no

change from existing policy

|

|

Risks and Disadvantages

|

· policy

is due for review

· policy

will not conform to current best practice

|

Nikki

Harrison

Group

Manager Corporate Services

Attachments

Attachment 1: A1765543 - Liability

Management Policy May 2017 ⇩

|

Important considerations for decision making

|

|

1. Fit

with Purpose of Local Government

Risk management through having a Liability

Management Policy enables more efficient and effective provision of services

as set out in section 10(1)(b) of the Local Government Act.

|

|

2. Consistency

with Community Outcomes and Council Policy

The Liability Management and Investment Policies are

required by section 102 of the Local Government Act. Nothing in the

proposed Liability Management Policy is inconsistent with any other previous

Council decision or Council Policy. Updating the policy supports the

community outcome “Our Council provides leadership and fosters

partnerships, a regional perspective and community engagement”.

|

|

3. Risk

There is limited risk from the proposed changes

although one of the amendments allows officers to take out interest rate

swaps with maturity dates out to 15 years, rather than 12 years. However,

this would only occur to manage interest rate risk.

|

|

4. Financial

impact

There is no direct financial impact from adopting

the amended Liability Management Policy.

|

|

5. Degree

of significance and level of engagement

This matter is of low significance because it

includes minor amendments to an existing policy, therefore no consultation

has taken place.

|

|

6. Inclusion

of Māori in the decision making process

Maori have not been consulted in the preparation of

this report and policy.

|

|

7. Delegations

The Audit, Risk and Finance Subcommittee has the

responsibility for considering Council’s Treasury functions and

policies. The Audit, Risk and Finance Subcommittee has the power make a

recommendation to Council on this matter.

|

|

|

Audit, Risk and Finance Subcommittee

27 June 2017

|

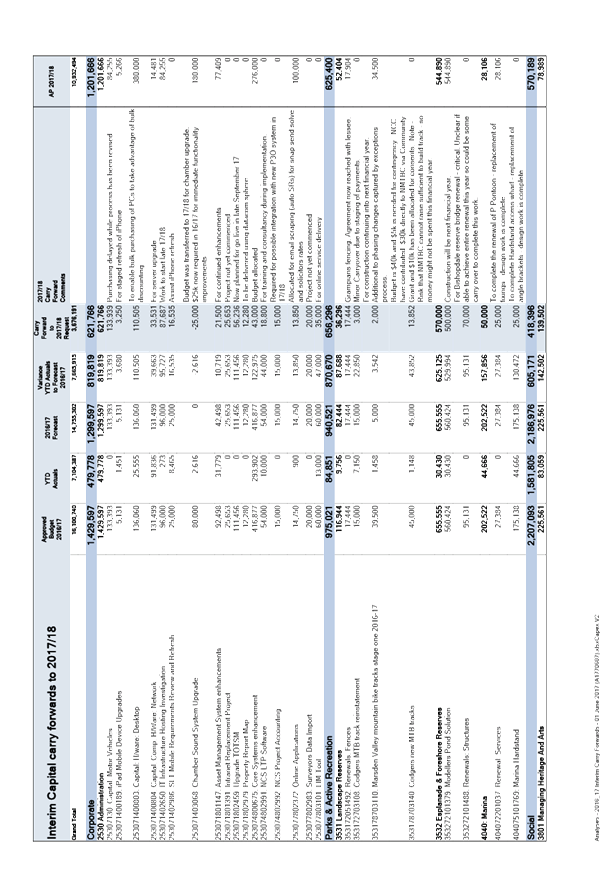

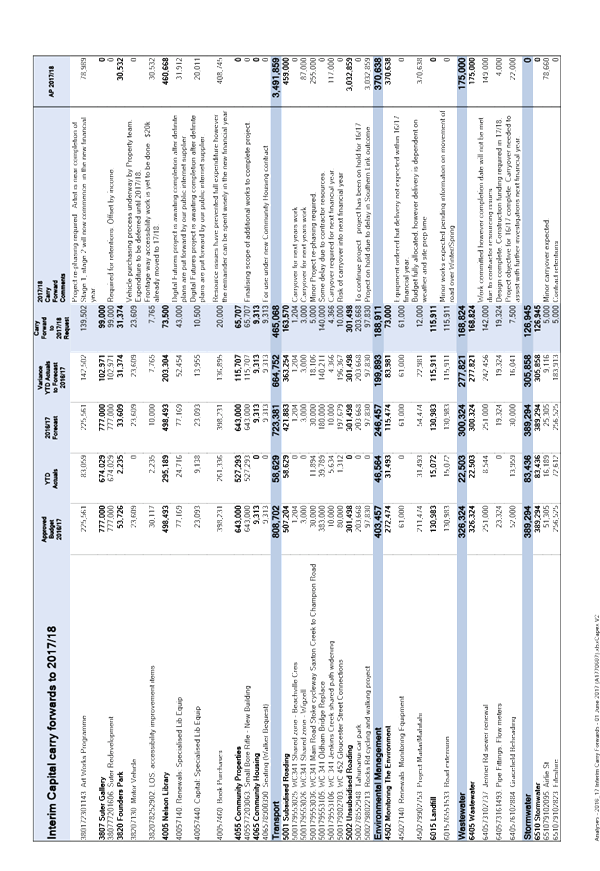

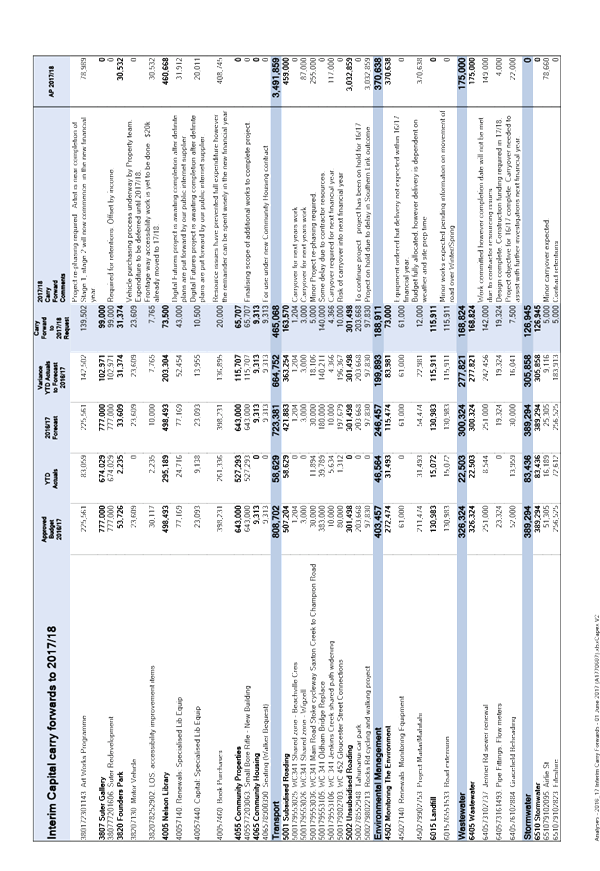

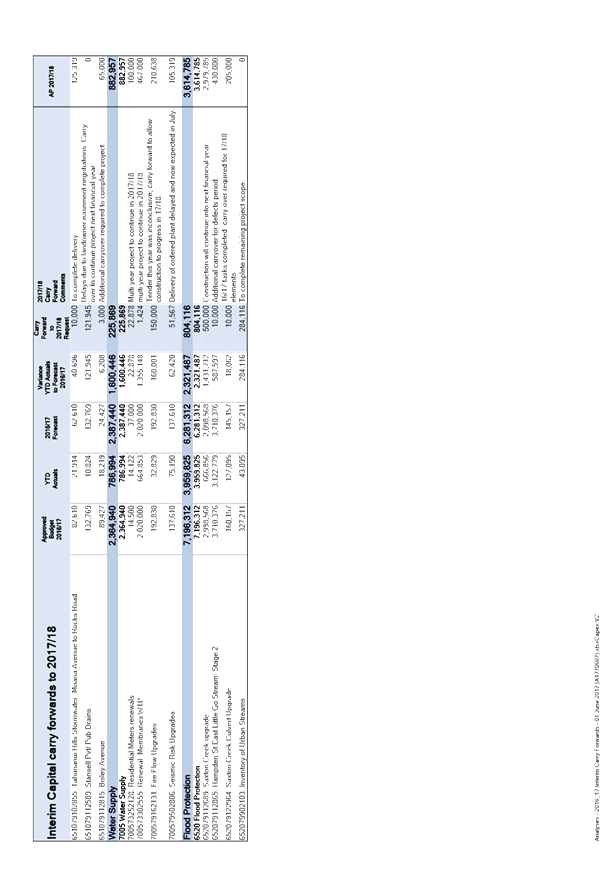

REPORT R7555

Carry

Forwards (Interim) 2016/17

1. Purpose

of Report

1.1 To

approve ongoing work using 2016/17 approved budgets until carry forwards are

formally approved at the 8 September 2017 meeting of this Subcommittee.

2. Recommendation

1.

|

That the Subcommittee

Receives the report Carry

Forwards (Interim) 2016/17 (R7555) and

its attachments (A1770607).

|

Recommendation to Council

|

That the

Council

Approves continuing work on

2016/17 projects within the 2016/17 approved budgets, noting a final report

on carry forwards will come to the Audit, Risk and Finance subcommittee on 8

September 2017.

|

3. Background

3.1 Projects

are dynamic, and project expenditure rarely aligns to budget phasing for any

number of reasons (e.g. weather, availability of internal or contractor

resources, reliance on third parties). The exceptions process has gone a long

way in 2016/17 to capture these phasing changes; nevertheless variations to

updated budgets are still expected before the end of the financial year as

circumstances continue to change.

3.2 As

the process for Committee and Council approval can take some time, any further

exception reporting will not be able to address these changes in a timely

enough manner for progress to continue across the end of one financial year and

into the next.

3.3 This

being the case, project managers have been asked for an indication of likely

carry forwards at 30 June, and Council approval is sought to enable work to

continue on unfinished 16/17 projects after 30 June, within 16/17 budgets.

3.4 A

report on finalised carry forwards will be brought to the 8 September meeting

of the Subcommittee.

4. Discussion

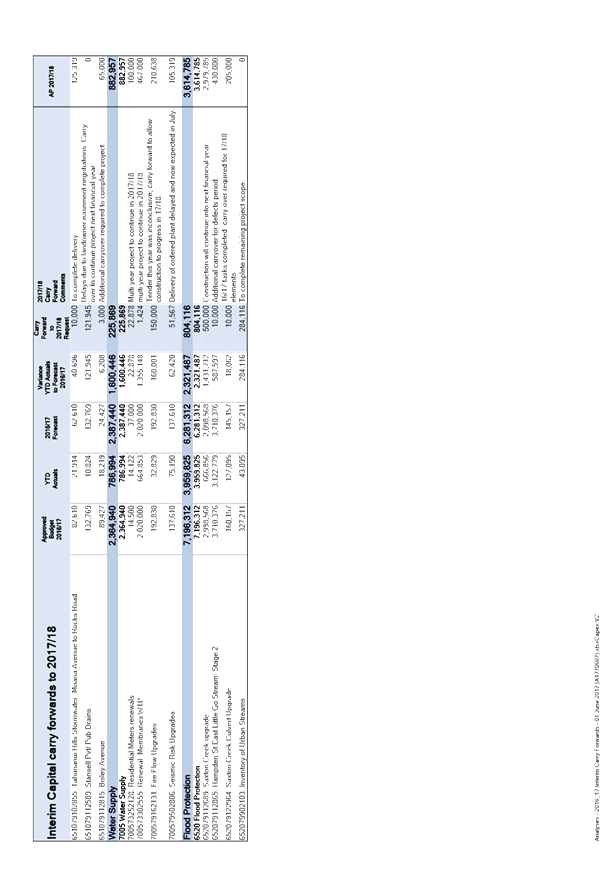

Capital

Expenditure

4.1 Capital

expenditure to 30 April 2017 was $33.4 million, $13.2 million (28%) below

approved budget year to date. This variance does not reflect the exceptions

reports recently approved by Committees but yet to be confirmed by Council.

Those exceptions will reduce the approved full year budget by $10.7 million

once confirmed.

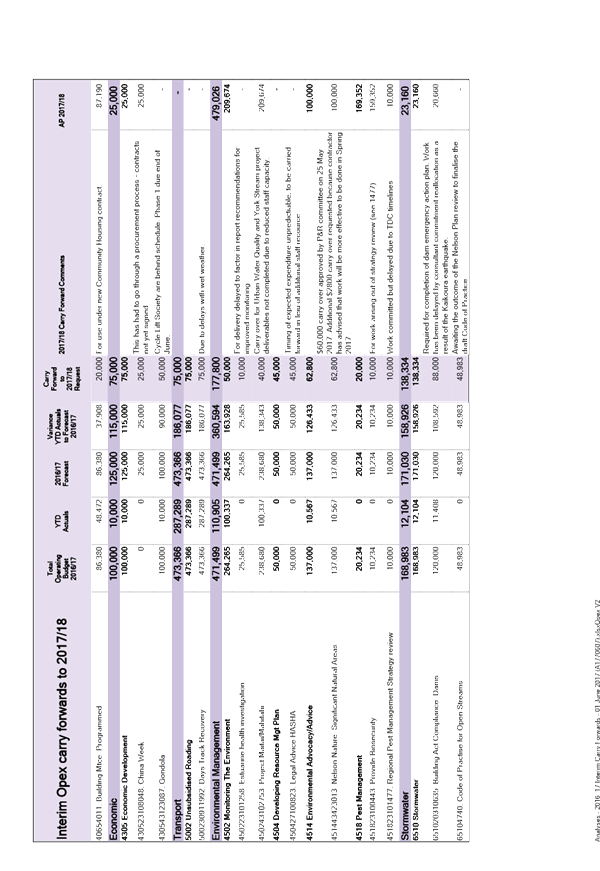

4.2 58

projects totalling approximately $3.6 million of budget have been identified as

likely to require a carry forward into 2017/18. Please see attachment 1.

4.3 22

projects totalling approximately $1.6 million are multi-year projects where the

timing of expenditure has changed. The Saxton Creek upgrade and the

Modeller’s Pond solution account for $1m of this.

4.4 36

projects totalling approximately $2.1 million were initially expected to be

completed in the current financial year.

4.5 43

projects with a carry forward total of approximately $2.8 million are currently

underway. Carry forward approval will ensure that the total project budget

remains available.

4.6 15

projects with a carry forward total of approximately $0.7 million were not

underway as at 30 April. Delays have occurred for a variety of reasons and

project managers have requested that the budget is carried over to allow the

projects to be undertaken in 2017/18.

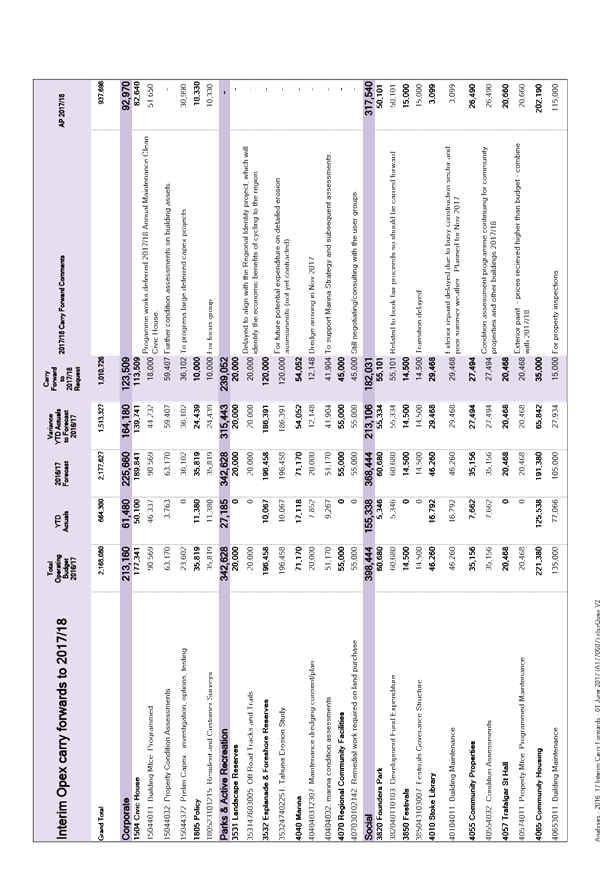

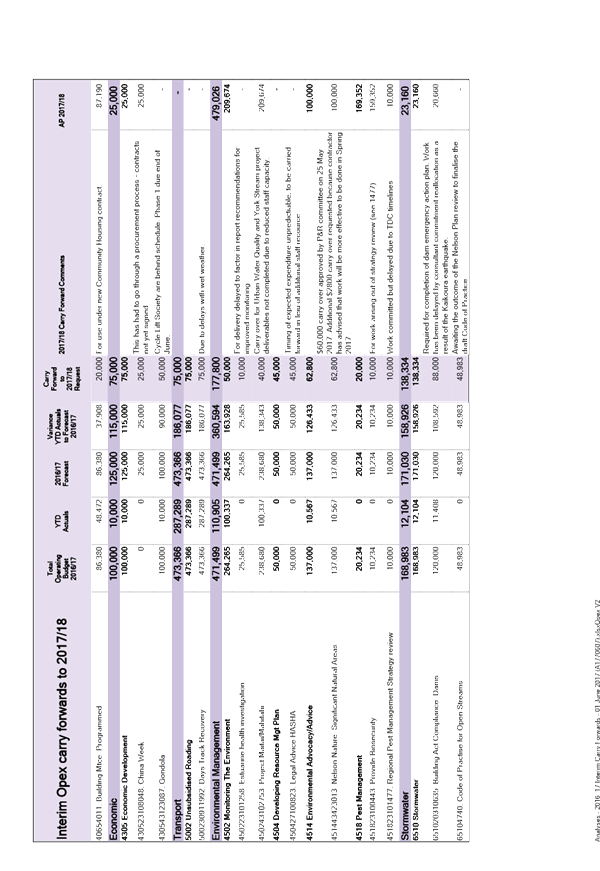

Operating

Expenditure

4.7 Based

on April 2017 year to date results, officers have been asked to identify

operating projects that will not be complete by 30 June 2017. Projected

carry forwards have been assessed for these projects, please see attachment 2.

4.8 39

projects totalling $1.1 million have been identified as likely to require a

carry forward into 2017/18.

4.9 In

order that staff can keep moving towards delivery of the 2016/17 work programme

in the meantime, officers seek approval for 2016/17 budgets to continue to be

used on 2016/17 projects as itemised in attachment 2.

5. Options

5.1 Option

1, approve the recommendation is recommended.

|

Option 1: Approve the

recommendation

|

|

Advantages

|

· Spending

is within 2016/17 approved budgets

· Total

project budget will remain available for those projects underway

· Work

can continue on those projects that do not have a 2017/18 annual plan budget

allocation

|

|

Option 2: Do not approve the

recommendation

|

|

Risks and Disadvantages

|

· Work

would need to cease on these projects after 30 June until such a time as the

formal report approving carry forwards has made its way through Council.

· Contractor

relationships may suffer

· May

introduce a health and safety risk with some projects

|

6. Conclusion

6.1 Most

of the projects indicating carry forward are either currently underway or

scheduled to be underway before 30 June 2017, and as the budget is approved for

spending in 2016/17, it is proposed that work continue on these projects in the

meantime.

6.2 A

report on final carry forwards will be on the agenda for the 8 September

meeting of this subcommittee.

Tracey

Hughes

Senior

Accountant

Attachments

Attachment 1: Interim capital carry

forwards requested (A1770607) ⇩

Attachment 2: Interim

opex carry forwards requested (A1770607) ⇩

|

Important considerations for decision making

|

|

1. Fit

with Purpose of Local Government

Approval of the recommendation will allow

progress/completion of approved projects without the risks associated with

unnecessary delay, supporting the efficiency of delivery of public

infrastructure and services.

|

|

2. Consistency

with Community Outcomes and Council Policy

Approval of this recommendation will allow projects

as approved in the Annual Plan 2016/17 and subsequent Council resolutions to

be delivered without delay.

|

|

3. Risk

Failure to approve the recommendation will introduce

risk (financial, contractor and community relationships, health and safety)

which does not currently exist.

|

|

4. Financial

impact

There is little financial impact from approving the

recommendation as budgets are already approved.

|

|

5. Degree

of significance and level of engagement

This matter is of low significance as budgets are

already approved and the recommendation confirms business as usual.

|

|

6. Inclusion

of Māori in the decision making process

No consultation has been undertaken.

|

|

7. Delegations

The Audit, Risk and Finance subcommittee has

oversight of the management of financial risk and makes recommendations to

Council.

|

|

|

Audit, Risk and Finance Subcommittee

27 June 2017

|

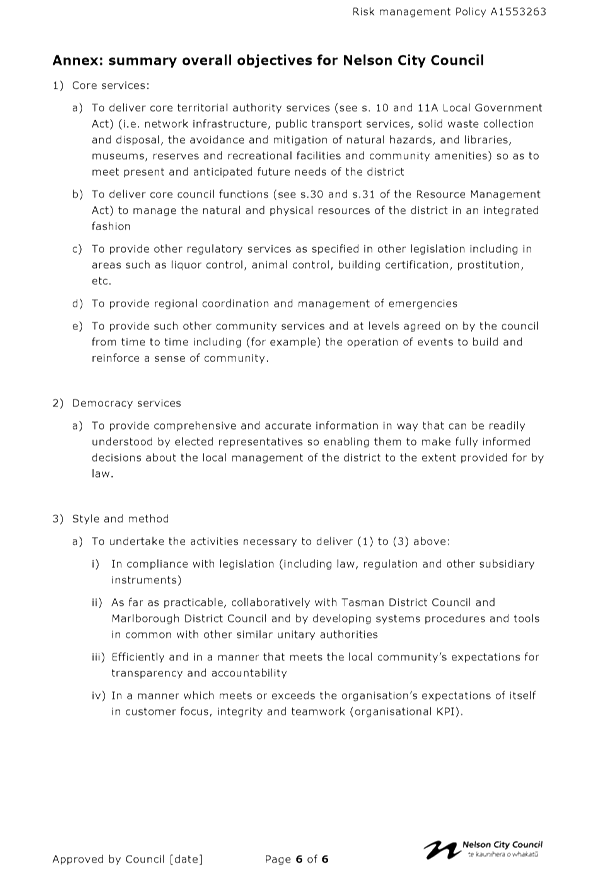

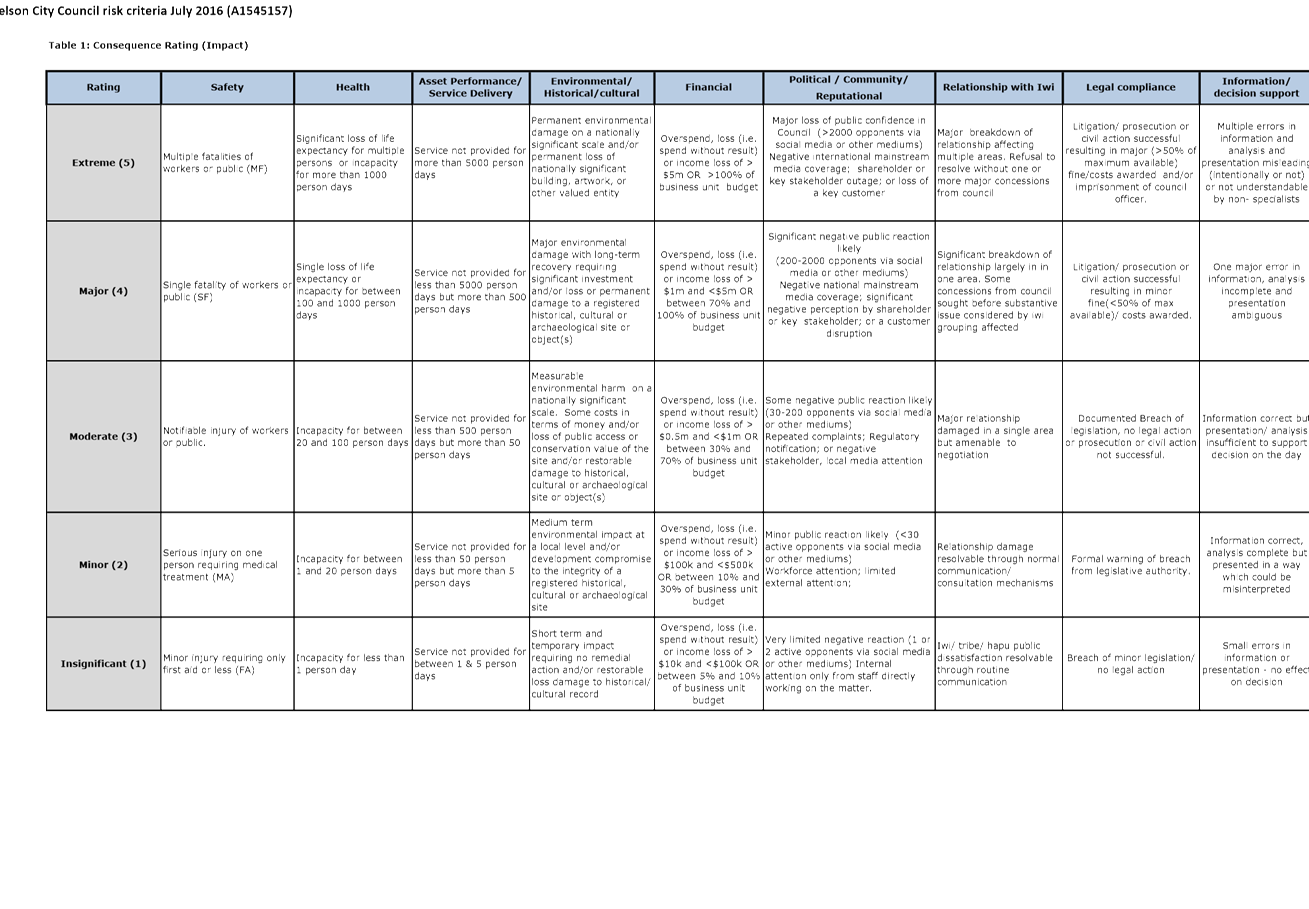

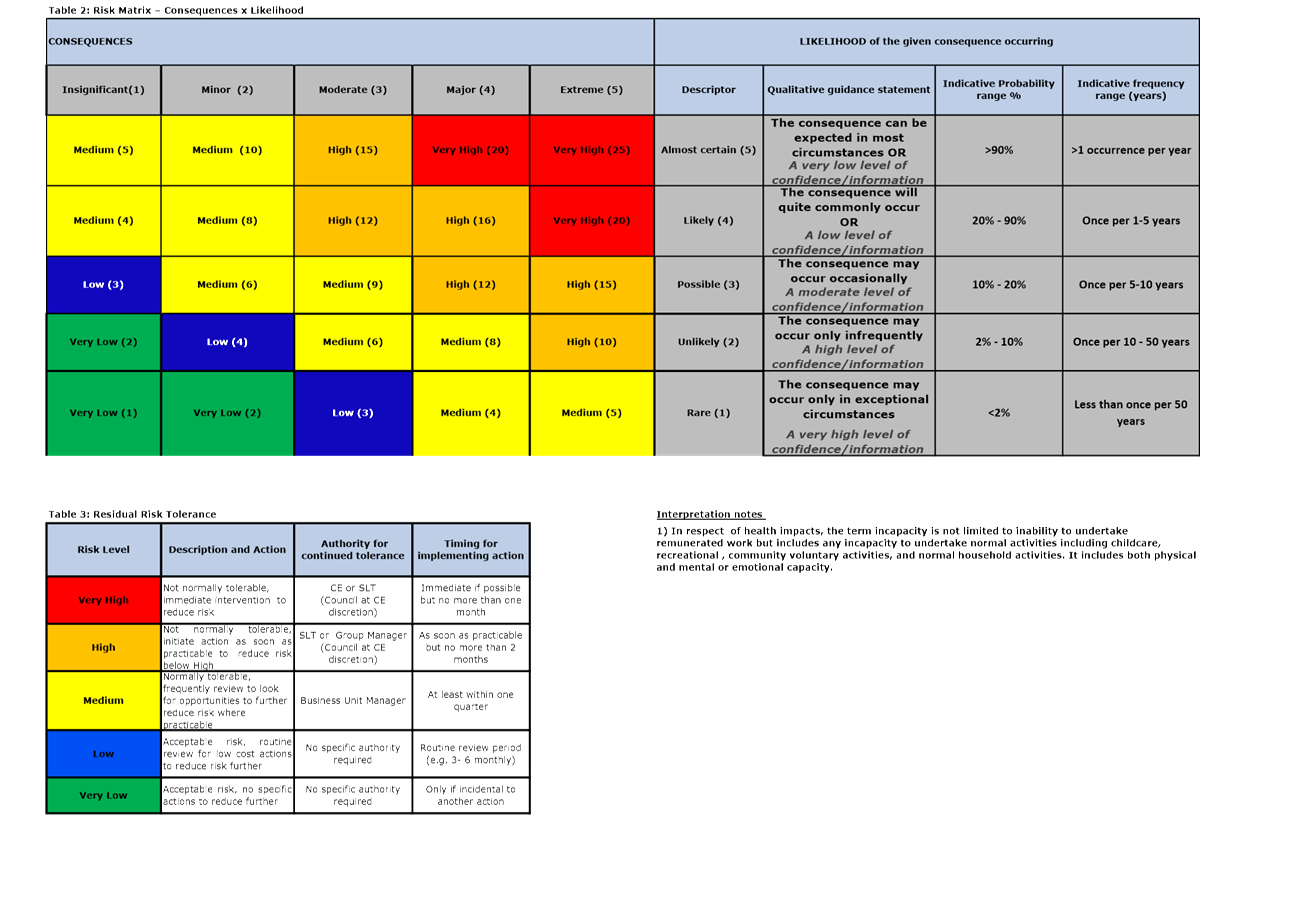

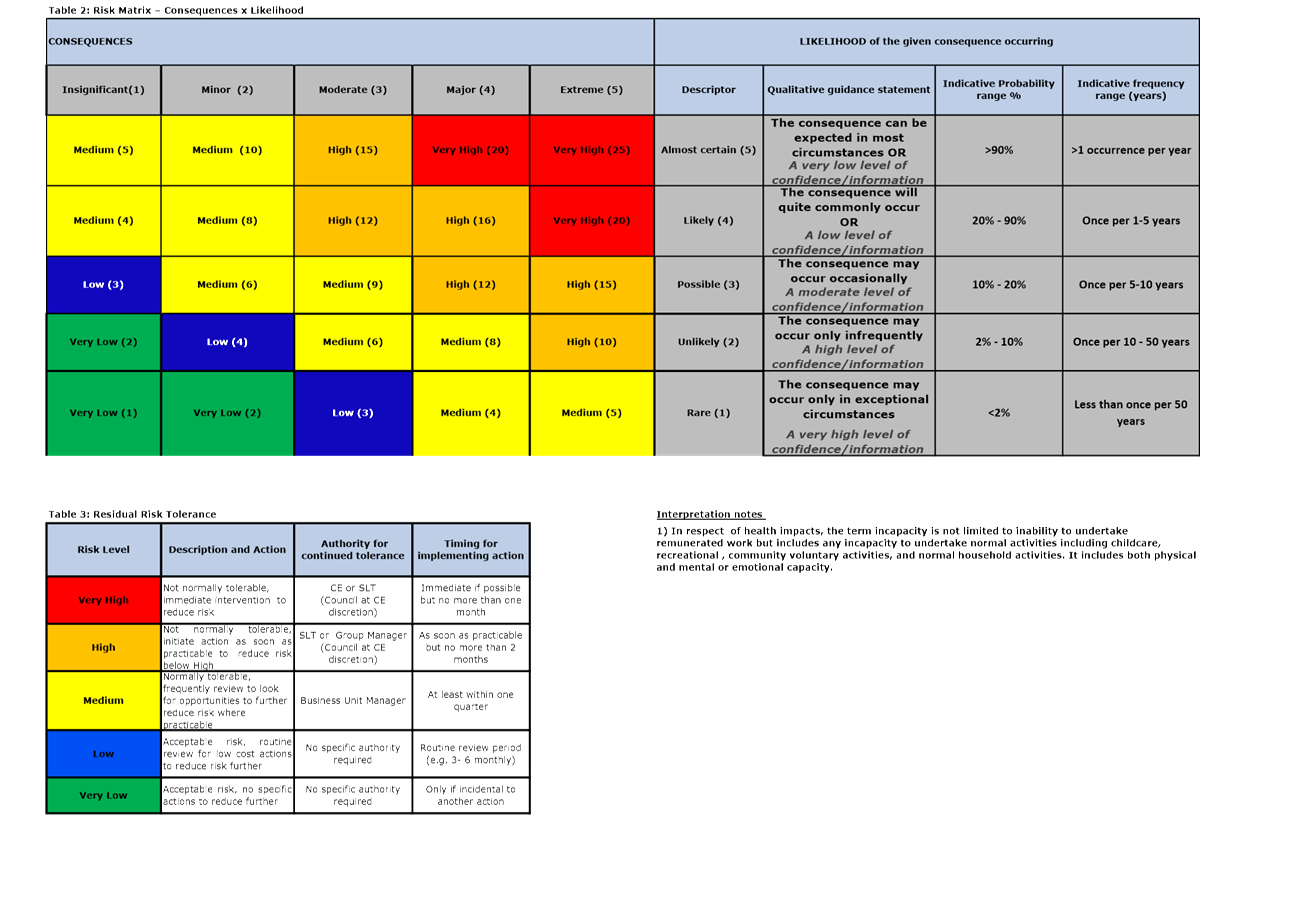

REPORT R7572

Council

Risk Management Policy and Risk Criteria

1. Purpose

of Report

1.1 To

receive and recommend to the Council for approval a risk management policy

tailored for Council, and for adoption criteria for judging risk tolerance.

2. Recommendation

1.

|

That the Subcommittee

Receives the report Council Risk

Management Policy and Risk Criteria (R7572)

and its attachments: Risk Management Policy (A1553263) and Council Risk

Criteria (A1545157).

|

Recommendation to Council

|

That the

Council

Approves

the Risk Management Policy (A1553263); and

Adopts

the Council Risk Criteria (A1545157).

|

3. Background

3.1 While

Council has always faced uncertainty in managing its activities, recent

developments across the organisation have sought to place managing risks on a

common and systematic basis. In 2015 this Committee approved a generic

‘Risk Management Framework’ document (A1431519). This document was intended

to form a foundation for this more systematic approach.

3.2 In

retrospect it is now clear that this generic document does not go far enough in

tailoring the risk management process to the Council’s specific context.

Major examples of this include;

· Clearly

specifying when risk management processes are to be applied

· Requiring

the use of clear, consistent criteria in assessing and acting on risks

· Clearly

defining roles and responsibilities for managing risks to the Council’s

objectives.

3.3 The

attached policy A1553263 is

intended to provide this direction.

3.4 In

addition, effectively managing risks at an organisation level requires

consistent criteria, including those for deciding when action should be taken.

These criteria need to include all of the types of risks faced by the

organisation. The attached risk criteria A1545157

are intended to provide this.

3.5 As

the Council’s risk management capacity is being developed in stages, the

criteria for approval include only criteria to rank and take action on threats

or negative risks. It is proposed to next develop criteria for assessing and

acting on uncertain opportunities. This is scheduled for the 2017-18 financial

year. This process is expected to include workshops for councillors.

4. Discussion

4.1 The

attached policy and risk criteria address the following matters.

Clear linkage to

objectives

4.2 The

internationally accepted definition of risk – the effect of uncertainty

on objectives – makes clear the fundamental importance of clarity of

objectives in any process of managing risks. This starts at the overall council

level and applies at any level in the organisation where risks are to be

managed. The draft policy makes this clear and refers back to the overall

objectives of the Council as provided in law and through our long term

plan.

Clear

accountabilities

4.3 The

attached draft policy sets out the specific roles of each decision maker in

implementing the policy. This extends from the governance and strategic

decision making role of Council and Committee members to those with technical

expertise in advisory and operational roles. At its most fundamental, risk

management is a management function so most of the accountabilities lie with

managers across the organisation.

Effort commensurate with the value at risk

4.4 A

core principle of good risk management practice is that risk management must add

value. While identifying, assessing and as needed acting on risks can reveal

ways to reach objectives more quickly and with more certainty, it is important

that the effort put in does not outweigh these advantages. Risk management work

must therefore be no more than the value at risk.

4.5 However

it is equally necessary to be clear that value at risk is measured

appropriately. In particular, value will not necessarily be financial or

measurable in financial terms.

Internationally standardised process

4.6 The

international standard ISO 31000: 2009 Risk Management – Principles and

Guidelines (formally adopted in New Zealand under the Standards Act as AS/NZS

ISO 31000) provides processes for risk management applicable to any situation.

The policy requires the Council to follow this process. As risk management is a

technical discipline, this requires the use of specifically defined terms

–even where such terms have different meanings in other contexts.

Clear linkage to decision making

4.7 One

fundamental reason for undertaking risk management activities is to improve

decisions made. For example to make better choices or to avoid methods of

reaching objectives which are more costly. The attached policy is therefore

clear that the risk management process is to be applied at the appropriate

level to all organisational decision making. This concept of level and

appropriate scale (and process complexity) is important in the proper

application of risk management. By way of illustration; aircraft pilots are

trained to use risk management in decision making and do so in seconds and

without formal documentation, while managers of large projects and operations

often require significant time and record keeping to use the tools effectively.

Clarity of risk criteria

4.8 In

reality most organisations’ risk management (both nationally and

internationally) is based on qualitative judgments by those with the necessary

expertise. This is also the case for Council.

4.9 With

an organisation as diverse as Nelson City Council, it is essential that these

judgments are made on a common basis. If this is not done decisions with

effects across the organisation will be biased.

4.10 The

attached risk criteria therefore form a key component in developing the

organisation’s risk management capacity. They are in three parts,

· A clear set of consequences (or levels of

organisational impact)

· A well-defined and internally consistent basis for

estimating likelihood

· A consistent set of resulting risk levels linked to

required actions

4.11 The last element is of considerable importance. Larger

risks require either a deliberate decision to tolerate, or take management

actions. A clear basis for doing this is where much of the decision making

value comes from.

5. Options

5.1 The

Subcommittee can choose to recommend approval of the attached policy and

adoption of the risk criteria or not.

Option1: Recommend policy approval and adoption of

criteria

5.2 The

attached risk management policy and risk criteria are key components in a suite

of tools designed to improve the organisation’s risk management

capability. More importantly they are intended to improve the consistency and

quality of decision making in the face of uncertainty.

5.3 The

option of ‘approve and adopt’ will enable this.

5.4 For

reasons set out in paragraph 3.5, the attached documents are an important half

way house in moving towards the long term goal of an organisation which has a

current complete and comprehensive understanding of its risks (i.e. to its

objectives) and actively manages these to within clear and consistent criteria.

Option2: Do not recommend

approval and adoption

5.5 Alternatively,

if the Subcommittee chooses not to recommend approval and adoption:

· Council

consideration of risks in decision making will continue to be driven by the

less specific risk management framework document (itself due for review in

2018)

· Criteria

will be needed for day today risk management but these may not be consistent

across the whole organisation.

Steve

Vaughan

Risk

& Procurement Analyst

Attachments

Attachment 1: Council Risk management

policy(A1553263) ⇩

Attachment 2: Council

Risk Criteria(A1545157) ⇩

|

Important considerations for decision making

|

|

1. Fit

with Purpose of Local Government

This report recommends improved tools for risk

management. Risk management is a tool to enable more efficient and effective

provision on services as set out in section 10(1)(b) of the LG Act.

|

|

2. Consistency

with Community Outcomes and Council Policy

Risk management tools as recommended in this report

are aimed at improving the clarity, efficiency and effectiveness with which

an organisation’s objectives (in this case as set out in Nelson City

Council’s planning documents) can be achieved.

|

|

3. Risk

The attached policy and risk criteria are key but

partial documents in developing the organisation’s overall capacity to

make better decisions in the face of uncertainty. Of themselves they will not

achieve this objective with certainty and must be backed up by

· Procedures

to consistently apply policy and criteria

· Willingness

at all levels of decision making from strategic to detailed to systematically

understand and consider risks

While not part of the decisions recommended in this

report, action to assist with these other matters is also underway through

coaching, workshops and procedure development.

|

|

4. Financial

impact

This report does not have any specific funding

implications

|

|

5. Degree

of significance and level of engagement

This is a decision of low significance under the

Council’s Significance and Engagement Policy. Therefore no external

consultation has been undertaken in the preparation of this report.

|

|

6. Inclusion

of Māori in the decision making process

There has been no consultation with Maori in the

preparation of this report which deals with internal Council processes.

|

|

7. Delegations

The Audit Risk and Finance Subcommittee has

oversight of the Council’s management of risk.

|

|

|

Audit, Risk and Finance Subcommittee

27 June 2017

|

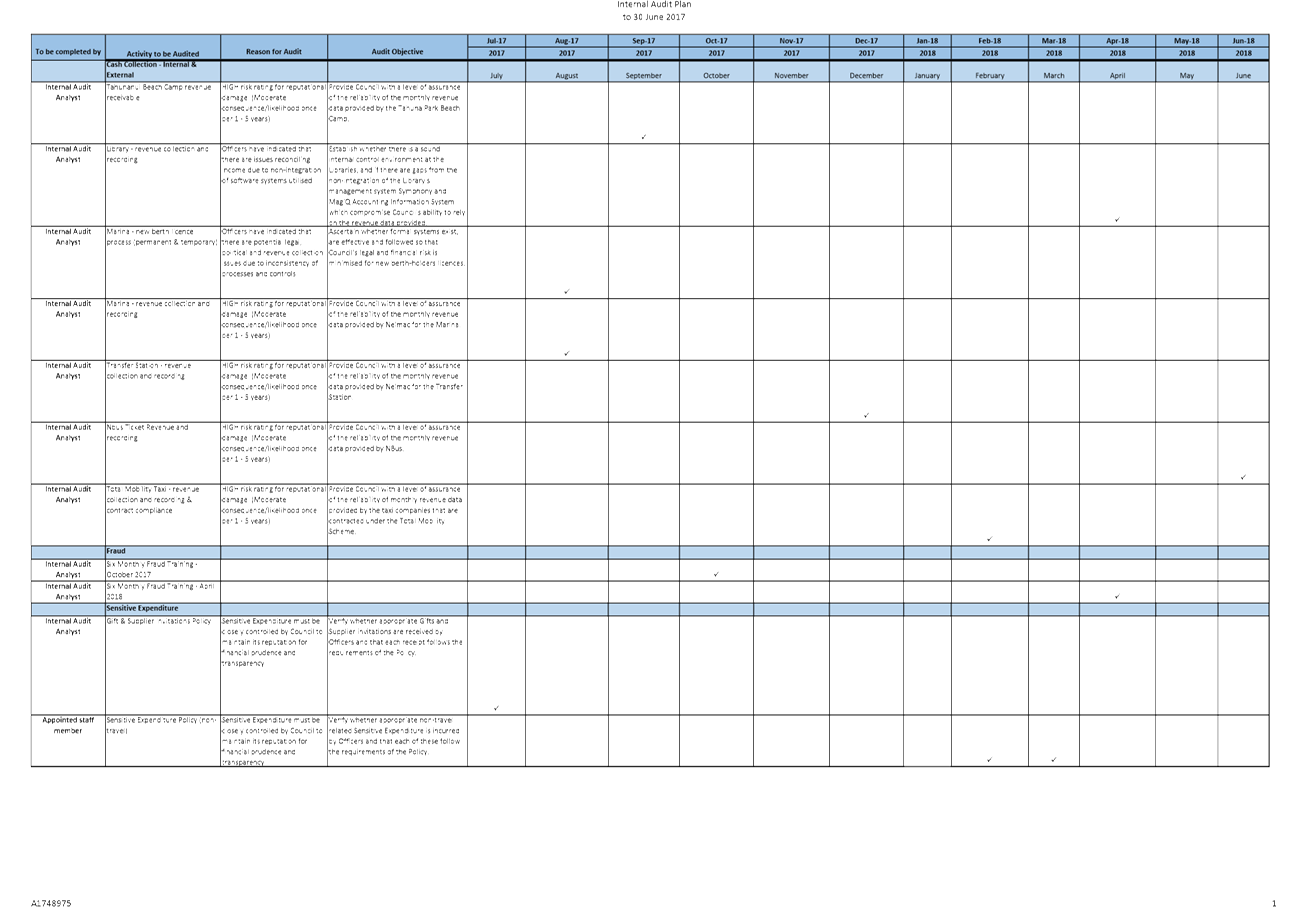

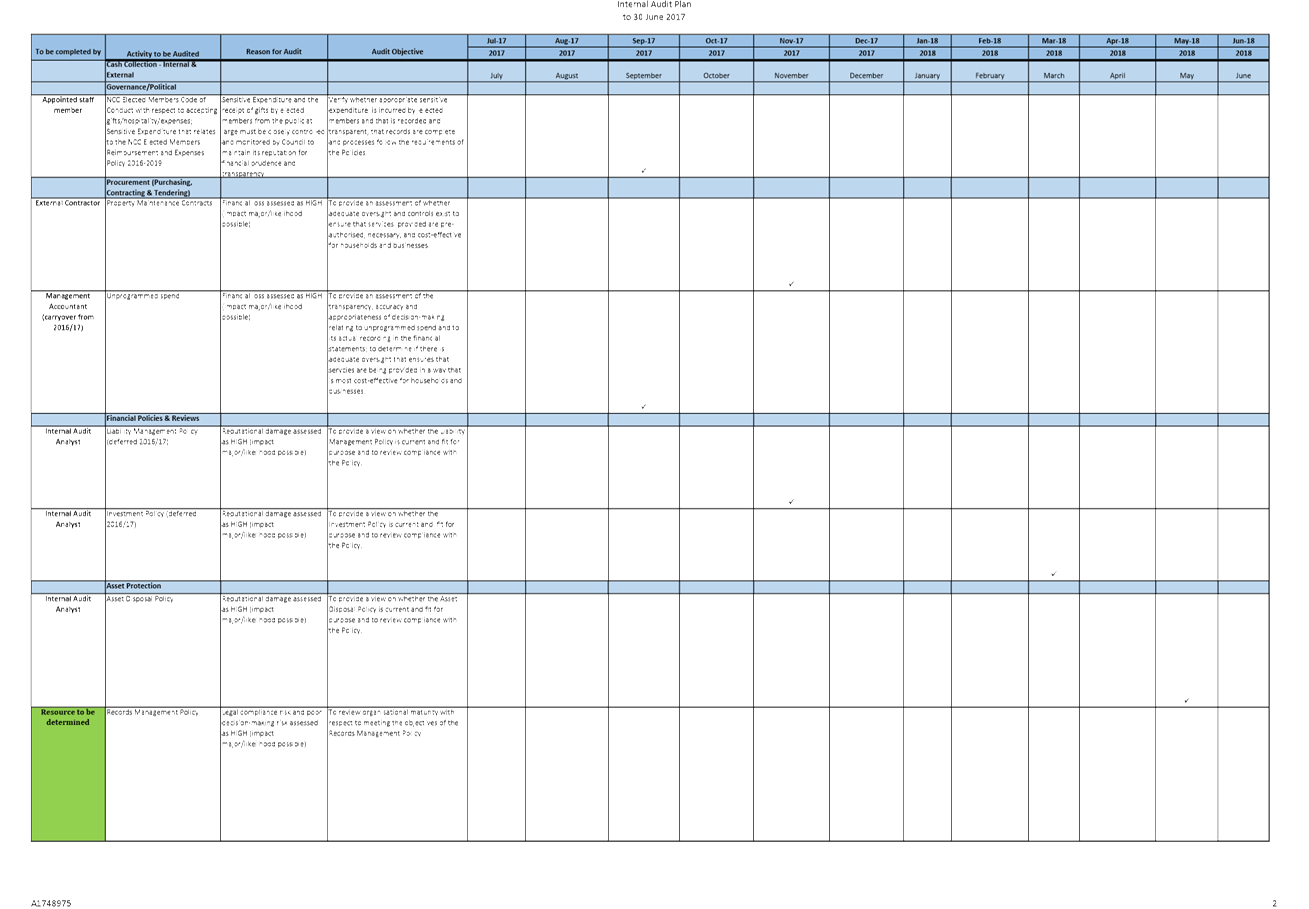

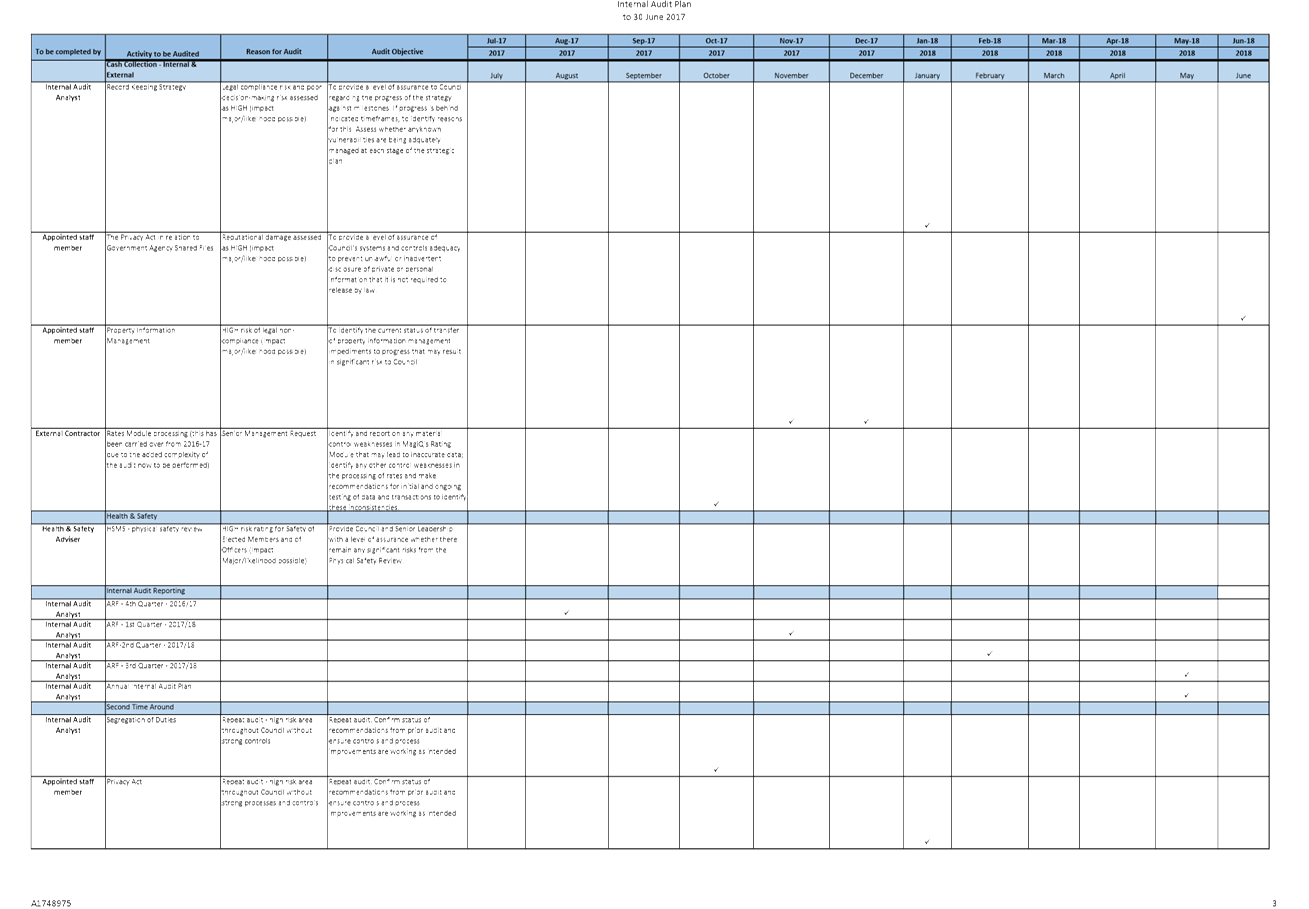

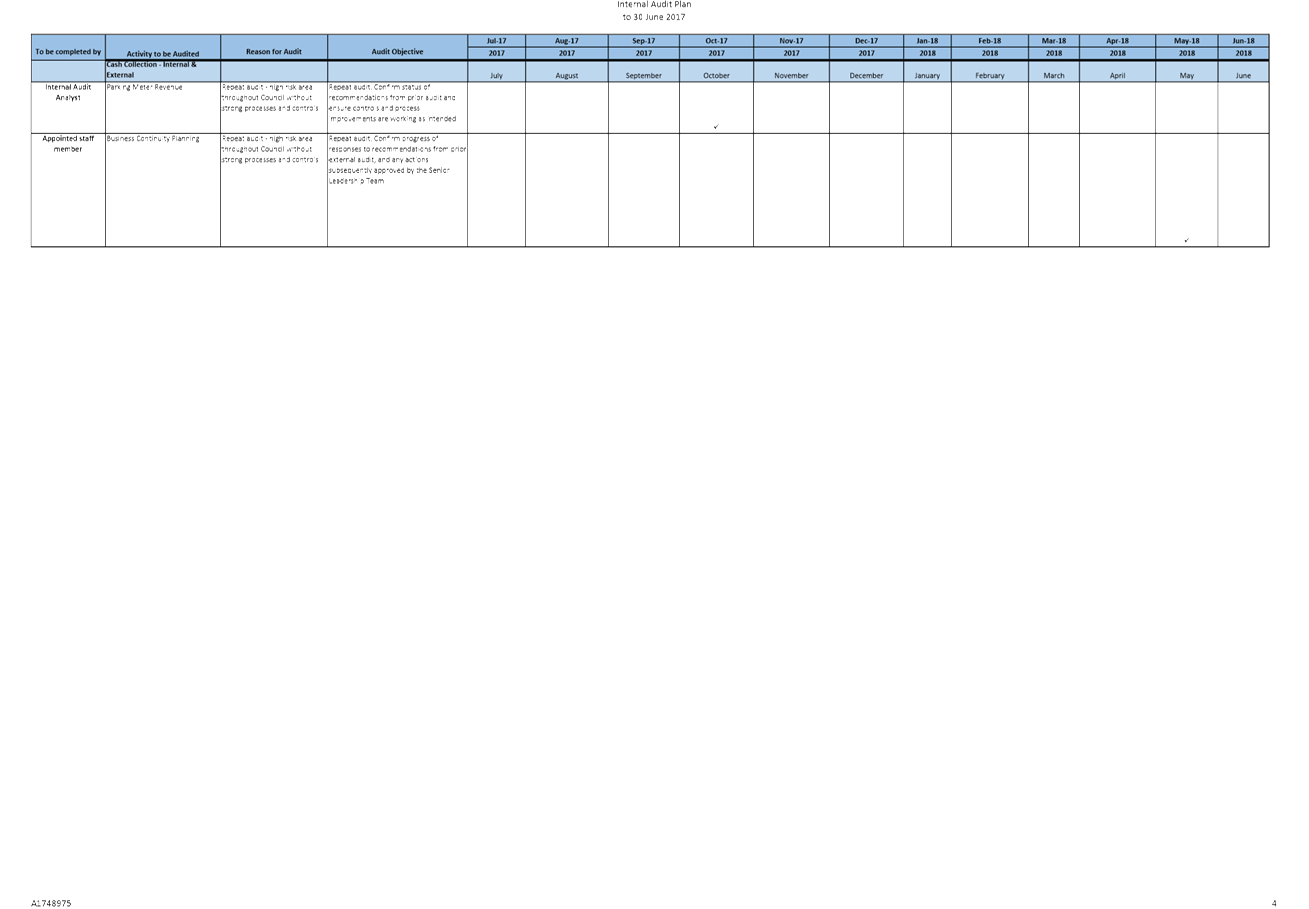

REPORT R7587

Internal

Audit - Annual Audit Plan to 30 June 2018

1. Purpose

of Report

1.1 To

approve the Internal Audit Plan for the year to 30 June 2018.

2. Recommendation

1.

|

That the Subcommittee

Receives the report Internal

Audit - Annual Audit Plan to 30 June 2018 (R7587) and its attachment (A1748975);

|

Recommendation to Council

|

That the

Council

Approves the Internal Audit

– Annual Audit Plan to 30 June 2018 (A1748975).

|

3. Background

3.1 Under

the approved Internal Audit Charter a risk-based internal audit plan is to be

reviewed by the Subcommittee at least annually prior to the beginning of each

financial year.

3.2 The

Charter requires that in compiling the internal audit plan the impact of

resource limitations is to be considered.

4. Discussion

4.1 The

Council’s risk criteria has been applied in compiling the Internal Audit

Plan to 30 June 2018, with topics assessed as having the highest risks given

priority.

4.2 Audits

which were unable to be completed in the approved plan to 30 June 2017 are also

included, as are the two deferred audits approved by Council on 15 December

2016 (Liability Management Policy and Investment Policy audits).

4.3 Two

complex audits which require specialist knowledge are proposed for the Internal

Audit Plan to 30 June 2018. These are in areas where it is considered Council

should obtain expert opinion to satisfy itself that there are no risks beyond

an accepted level. Note that $40,000 has been budgeted for this purpose.

4.4 In

determining the number of audits to be performed to 30 June 2018, each audit

has been assessed by complexity – a) complex; b) standard; c) minor. Each

of these categories requires an estimated number of hours, based on time taken

for audits of similar complexity during the 2016/17 year.

Resource

Limitations

4.5 The

internal audit plan to 30 June 2017 which allowed for 32 audits to be performed

proved to be unrealistic. To help remedy this, Council approved non-budgeted

funds of $50,000 for external consultancy engagements (actual costs will fall

within budget), and some audits were reallocated to non-audit Council staff. A

further four audits were combined into two audits, reducing the total audits to

be performed to 30.

4.6 Of

the eight audits allocated to non-audit staff, only two of these are expected

to be completed by 30 June 2017 due to the staff member’s

non-availability after performing their own formal responsibilities. Looking

ahead to the 2017/18 plan, we have therefore set a more realistic target for

audits undertaken by non-audit Council staff.

4.7 There

were 26 audits completed (or soon to be) for the year to 30 June 2017:

|

Auditor

|

Audits Completed

|

|

Internal Audit Analyst

|

15

|

|

Non-audit Council Staff

|

2

|

|

External Consultants

|

9

|

|

Total Audits Completed for 2016/17

|

26

|

4.8 The

proposed plan for the year to 30 June 2018 provides for 25 audits:

|

Auditor

|

Audits Proposed

|

|

Internal Audit Analyst

|

14

|

|

Appointed Staff Member

|

6

|

|

Non-audit Council Staff

|

2

|

|

Not yet assigned

|

1

|

|

External Consultants

|

2

|

|

Total Audits Proposed for 2017/18

|

25

|

5. Quantity

and Assignment of Proposed Audits

5.1 The

number of audits proposed for 2017/18 is comparable to that accomplished for

2016/17 and is considered realistic.

5.2 From

1 July, a staff member to formally assist the internal audit function has been

will be assigned to provide hours towards the plan. This will eliminate

the need to secure external consultants for standard or minor audits and reduce

the number of non-audit Council staff required.

5.3 The

undertaking of two audits by non-audit staff is considered more realistic than

the eight provided for in 2016/17.

6. Options

6.1 Accept

the recommendation to approve the proposed Internal Audit Plan to 30 June 2018.

6.2 Reject

the proposed Internal Audit Plan to 30 June 2018.

|

Option 1: Accept the Proposed

2017/18 Internal Audit Plan

|

|

Advantages

|

· Council

can demonstrate its commitment to improving controls and practices that

ensure the prudent, effective and efficient management of Council resources.

|

|

Risks and Disadvantages

|

· The

audit plan might not be achieved due to unexpected factors, such as the

complexity of audits or the non-availability of personnel.

· The

audit plan is finite in scope and therefore functions outside the scope of

the plan are not audited.

|

|

Option 2: Reject the Proposed

2017/18 Internal Audit Plan

|

|

Advantages

|

· The

resources applied to this audit plan could be diverted to other Council priorities.

|

|

Risks and Disadvantages

|

· Council

may suffer reputational damage and financial losses that could lead to the

public losing confidence in Council’s ability to function effectively

on its behalf and to meet its obligations under the Local Government Act

2002.

|

7. Conclusion

7.1 The

Internal Audit Plan to 30 June 2018 is recommended for approval.

Lynn

Anderson

Internal

Audit Analyst

Attachments

Attachment 1: A1748975 - Internal Audit

- Annual Audit Plan 2017/18 ⇩

|

Important considerations for decision making

|

|

1. Fit

with Purpose of Local Government

Council has chosen to undertake internal audits to

help improve systems, their controls and efficiencies, in order to help give

confidence that it will be able to meet its responsibilities cost-effectively

and efficiently.

|

|

2. Consistency

with Community Outcomes and Council Policy

This report supports the community outcome that

Council provides leadership, which includes the responsibility for protecting

finances and assets through the minimisation of fraud, consistent with

guidance provided in Council’s Fraud Prevention Policy.

|

|

3. Risk

There is more risk that Council may not meet its

responsibilities cost-effectively and efficiently if this recommendation is

not accepted.

|

|

4. Financial

impact

The recommendation will not have any significant

financial impact.

|

|

5. Degree

of significance and level of engagement

This matter is of low significance because it does

not affect the level of service provided by Council or the way in which

services are delivered. Therefore no engagement has been undertaken.

|

|

6. Inclusion

of Māori in the decision making process

There has been no consultation with Maori in the

preparation of this report.

|

|

7. Delegations

The Audit, Risk and Finance Subcommittee has the

responsibility for audit processes and the management of financial risks. The

Audit, Risk and Finance Subcommittee has the power to make a recommendation

to Council on this matter.

|

|

|

Audit, Risk and Finance Subcommittee

27 June 2017

|

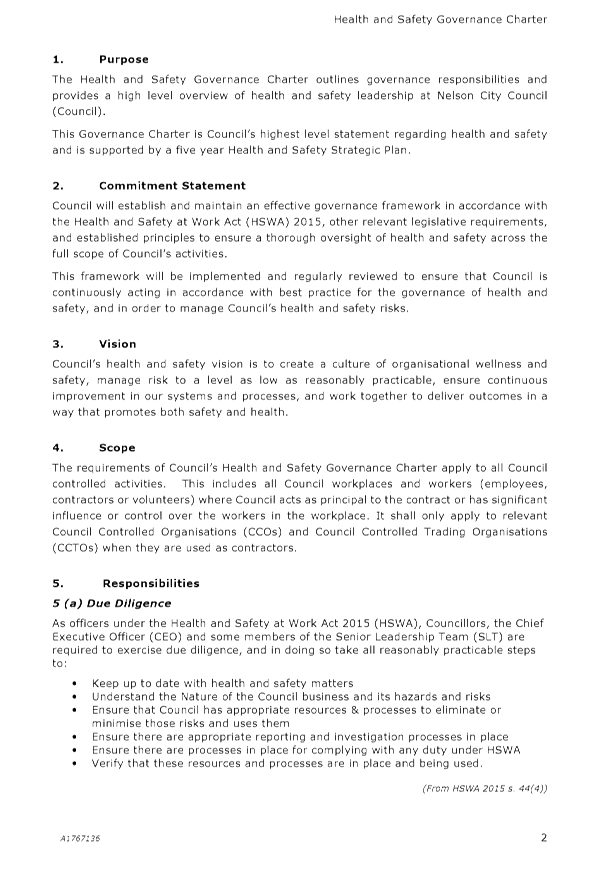

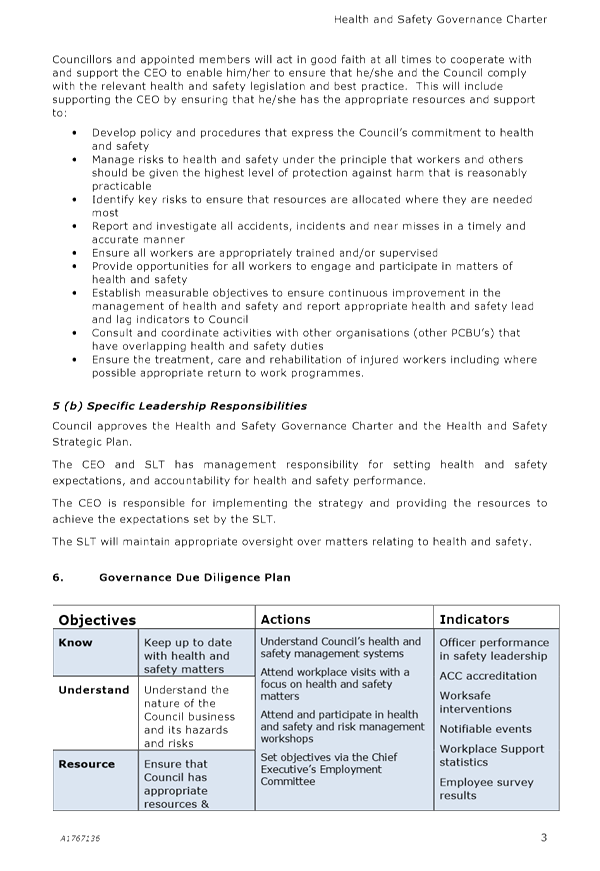

REPORT R7622

Health

and Safety Governance Charter review

1. Purpose

of Report

1.1 To

review and approve the Health and Safety Governance Charter.

2. Recommendation

1.

|

That the Subcommittee

Receives the report Health and

Safety Governance Charter review (R7622) and its attachment (A1767136);

|

Recommendation to Council

|

That the

Council

Approves the revised Health and Safety Governance Charter (A1767136).

|

3. Background

3.1 Council

has implemented a Health and Safety Management System following adoption of the

Health and Safety at Work (HSW) Act 2015. The Health and Safety

Governance Charter is Council’s ‘peak’ document relating to

health and safety. It defines how Council sets health and safety

expectations and, in particular, sets out governance expectations in relation

to health and safety. The Health and Safety Governance Charter was first

adopted by Council on 17 December 2015.

3.2 The

Governance Charter is supported by the Health and Safety Strategic Plan

(2015-2020) also approved by Council. Both documents are now due for

review. This report attaches a revised Governance Charter for

consideration (Attachment 1). A review of the Health and Safety Strategic

Plan is programmed for the September meeting of the Audit, Risk and Finance

Subcommittee.

4. Discussion

4.1 Under

the HSW Act 2015, the Council and members of the Senior Leadership Team assume

many of the standard responsibilities that would normally sit with a Board of

Directors. They are classed as “officers” under the

Act.

4.2 Under

Section 18 of the Act, an officer of a PCBU (a person conducting a business or

undertaking), is either a director of that company or any other person

occupying a position that has significant influence over the management of that

company e.g. elected members, and certain members of the Senior Leadership

Team. Such officers have a duty of due diligence.

4.3 Section

44 (4) of the HSW Act 2015 outlines the due diligence expectations of officers,

which includes keeping up to date in health and safety matters; understanding

the business, its hazards and risks; allocating appropriate resources to health

and safety; and ensuring that the business has appropriate processes for

collecting and considering health and safety data.

4.4 The

New Zealand Institute of Directors Good Governance Practices Guideline for

Managing Health and Safety Risks has been adopted as the guiding principles for

health and safety governance.

5. Review

and changes

5.1 The

current Health and Safety Governance Charter has been reviewed in light of progress

made by Council since the HSW Act was introduced. The current Governance

Charter appears to have served its purpose well and has provided a basis for

measuring Council’s performance. For example, health and safety

observations have become a regular part of Councillor visits to work sites,

regular reporting to Council on health and safety takes place, and councillors

and appointed members actively participate in risk and health and safety

workshops.

5.2 Since

the HSWA 2015 was introduced, Council’s health and safety documentation

has been updated, notably the Health and Safety Manual, which is a

comprehensive 90 page document covering all aspects of Council’s health

and safety management system. In light of that work, the attached update

of the Health and Safety Governance Charter has focused the document more

specifically on governance responsibilities. The document has been

reduced from 22 pages to four pages. The general material previously

found in the Governance Charter (e.g. describing the health and safety

management system at all levels) can still be read in the Health and Safety

Strategic Plan and the Health and Safety Manual. The revised Governance

Charter contains a Governance Due Diligence Plan by which Council will be able to

measure its progress. It is proposed to include a section in the regular health

and safety quarterly reports to report against the Governance Due Diligence

Plan.

5.3 The

revised Health and Safety Governance Charter is attached for approval.

6. Options

|

Option 1: Approve the H&S

Governance Charter

|

|

Advantages

|

· Council

demonstrates positive due diligence in relation to health and safety matters

in the Council workplace. This assists in meeting councillors’

obligations as ‘Officers’ under the HSW Act 2015.

|

|

Risks and Disadvantages

|

· Receiving

the report alone is not sufficient. Positive diligence (understanding, asking

questions etc) is required.

|

|

Option 2: Decline to approve

H&S Governance Charter

|

|

Advantages

|

· Further

changes or improvements to the proposed Charter could be made.

|

|

Risks and Disadvantages

|

· Council

will not be able to use the revised Charter to help demonstrate due diligence

on health and safety matters.

|

Roger

Ball

Manager

Organisational Assurance and Emergency Management

Attachments

Attachment 1: Revised Health and Safety

Governance Charter (A1767136) ⇩

|

Important considerations for decision making

|

|

1. Fit

with Purpose of Local Government

This report forms part of Council’s work to

perform its regulatory functions. Council has an obligation under the

Health and Safety at Work (HSW) Act 2015 because it is classed as a Person

Conducting a Business or Undertaking (PCBU), and Councillors, appointed

members, and Council’s senior management have obligations as

“Officers” under that Act.

|

|

2. Consistency

with Community Outcomes and Council Policy

The recommendations align with the Community

Outcome: Our communities are healthy, safe, inclusive and resilient.

|

|

3. Risk

This report aims to help councillors meet their due

diligence obligations as “Officers” under the Health and Safety

at Work Act 2015. The likelihood of adverse consequences is assessed as

low based on the current record of Council’s health and safety systems

and our on-going monitoring of them. However the consequences for

Council could still be significant if there were to be a serious harm

incident to a Council worker, contractor or other person. These

consequences could include harm to people, prosecution of the Council and/or

its officers, financial penalties, and/or reputational damage.

|

|

4. Financial

impact

There are no immediate budget implications arising

from this report.

|

|

5. Degree

of significance and level of engagement

This matter is of low significance because it is

reporting providing high level guidance on Council’s health and safety

governance, and no engagement is required.

|

|

6. Inclusion

of Māori in the decision making process

Maori have not been consulted in the preparation of

this report.

|

|

7. Delegations

The Audit Risk and Finance Subcommittee has

responsibility for Health and Safety and has the power to make

recommendations to Council about any matters within its areas of

responsibility.

|

|

|

Audit, Risk and Finance Subcommittee

27 June 2017

|

REPORT R7631

Protected

disclosure policy

1. Purpose

of Report

1.1 To

note the updated Protected Disclosure Policy.

2. Recommendation

1.

|

That the Subcommittee

Receives the report Protected

disclosure policy (R7631) and

its attachment (A1338935) ; and

Notes

the revised Protected Disclosure Policy (A1338935).

|

3. Background

3.1 The

Audit, Risk and Finance Subcommittee has oversight of the Council’s

management of risk and internal procedures including those related to

disclosure of serious wrongdoing.

3.2 The

Protected Disclosure Policy is an organisational policy outlining how an

employee of Nelson City Council may lodge a disclosure of serious wrongdoing

under the Protected Disclosures Act 2000, and how the organisation must respond

to such a disclosure. As the policy is an organisational policy rather than a

Council policy, approval from the Subcommittee and Council is not required.

3.3 The

policy is scheduled for review every three years, and a review is due.

3.4 There

have been no legislative changes or internal procedure changes since the policy

was last reviewed in 2014. The policy provides a robust mechanism for

disclosure which meets legislative and good practice requirements.

3.5 Minor

amendments have been made to reflect changes in designated Disclosure Officers.

The policy does not require more substantial amendment at this time.

4. Options

4.1 It

is recommended that the Subcommittee receive and note the reviewed Policy.

Stephanie

Vincent

Manager

People and Capability

Attachments

Attachment 1: A1338935 - Protected

Disclosure Policy 2017 ⇩

|

Important considerations for decision making

|

|

1. Fit

with Purpose of Local Government

Fit-for-purpose organisational policies are required

to ensure that organisational performance is efficient, effective and appropriate

to present and anticipated future circumstances.

|

|

2. Consistency

with Community Outcomes and Council Policy

Fit-for-purpose organisational policies are required

to ensure the Community Outcome of Our Council provides leadership and

fosters partnerships, a regional perspective, and community engagement.

|

|

3. Risk

Effective implementation of this policy is likely to

reduce the potential for adverse consequences for employees who use the

provisions outlined by policy.

|

|

4. Financial

impact

There is no financial impact associated with this

policy.

|

|

5. Degree

of significance and level of engagement

This matter is of low significance because it is an

organisational policy.

|

|

6. Inclusion

of Māori in the decision making process

No consultation has occurred with Māori.

|

|

7. Delegations

No decision is required from the Subcommittee as the

matter is an organisational policy, which falls within the delegations of the

Chief Executive.

|

|

|

Audit, Risk and Finance Subcommittee

27 June 2017

|

REPORT R7383

Trafalgar

Park Seating and Sale of the Punawai

1. Purpose

of Report

1.1 To

provide information requested at the Governance Committee meeting of 9 March

2017 in relation to the purchase of seating for Trafalgar Park and the sale of

the harbourmaster vessel, the Punawai.

Recommendation

2.

|

That the Subcommittee

Receives the report Trafalgar

Park Seating and Sale of the Punawai (R7383)

and its attachments (A345448, A1311242, R6448 and A1412442); and

Notes

that the purchase of the Trafalgar Park Seats complied with Council’s

Procurement Policy 2015 (A345448); and

Notes

that the Council approved the private sale of the Punawai for reasons of

timeliness and efficiency, and recognised at the time of the sale that this

approach departed from Council’s Asset Disposal Policy 2015 (A1412442).

|

2. Background

2.1 At

public forum on 9 March 2017, Mr Steve Cross suggested that Council had not

followed its own procurement policies for the purchase for the seating for

Trafalgar Park in 2015, and that it had not followed its Asset Disposal Policy

for the sale of the Punawai in 2016.

Trafalgar Park Seating

2.2 On

12 February 2015, Council received a report in the public excluded section of

the agenda entitled ‘Temporary seating for events’ (Attachment 1).

2.3 Council

had previously discussed the possible purchase of 4000 new seats for Trafalgar

Park at a workshop on 22 January 2015, and had been considering putting a

budget line in the Long Term Plan 2015-25 for such a purchase. At the time,

Council was advised that 4000 new seats would cost between $500,000 and

$1,000,000.

2.4 Council

heard that the cost of seat hire was significant. For example, during the Rugby

World Cup 2011, Council hired in approximately 10,000 seats for $350,000.

Council has had feedback from other event organisers that the costs of overlay

(particularly temporary seating) were a barrier to bringing events to Trafalgar

Park.

2.5 On

3 February 2015 Council officers were made aware of an opportunity to purchase

used seats of the same make as the temporary seats owned by Tasman District

Council. The initial information provided indicated that the seats were owned

by Acrow and were available in New Zealand as a result of the Cricket World

Cup. It later transpired that the seats were indeed owned by Acrow but located

in Australia.

2.6 There

was no direct contact between Acrow and Council as it was felt that a

negotiation on a commercial basis between two businesses with experience and

skills in scaffold seating (Acrow and Nayland Scaffold Ltd) would result in a

better value proposition for Council.

2.7 Nayland

Scaffold provided construction services to Council for temporary seating for

both the Rugby World Cup and the Cricket World Cup in 2015. It is a locally

owned company with specific expertise in scaffold construction. Given the

nature of the opportunity, Nayland Scaffold was approached to negotiate

purchase of the seating on Council’s behalf.

2.8 The

initial price quoted for the seats was $125 per seat (including supporting

infrastructure) with transport additional. Council was advised that the total

purchase price would be $750,000 with transport of the seats to Nelson of up to

$60,000.

2.9 For

comparison, the Tasman District Council paid $470,000 for 3000 new seats ($157

per seat), of the same type, in 2007.

2.10 A

Nayland Scaffold representative visited the storage location in Australia and

negotiated a final price of $695,895 for 6000 seats inclusive of

delivery to Nelson ($116 per seat).

2.11 Nayland

Scaffold passed on the negotiated price direct to Council. It received no

commission or mark up from the price it negotiated with Acrow Ltd.

2.12 Nayland

did receive payment for acting as Council’s agent, and for the time taken

to inspect the seats in Australia. That payment was less than $5,000.

2.13 Nayland

were contracted to construct the seats at Trafalgar Park. The value of this

contract was less than $50,000.

2.14 There

was some urgency around this issue as there was a major sporting event booked

in to use Trafalgar Park on 29 May 2015 which required seating to be available.

2.15 Council’s

procurement policy at the time is attached (Attachment 2)

2.16 The

purchase of the seats is in line with the procurement policy as:

· The

procurement of the seats, constituting a purchase of over $100,000, did not

require a publicly advertised tender as there were exceptional circumstances

and there was a Council resolution (from the February 12 Council 2015 meeting)

to take an alternative approach.

· There

were exceptional circumstances that allowed for the approval of the procurement

of specialist services from Nayland Scaffold by a Group Manager, specifically:

· Specialist knowledge of

scaffold construction for temporary seats

· Specific knowledge of

temporary seating configurations for Trafalgar Park

· Timeliness.

2.17 The

use of Nayland Scaffold to negotiate the purchase of the seats involved a low

value transaction (less than $5000) from a supplier of a specialist nature.

Sale of the Punawai

2.18 On

8 September 2016 the Council received a report in the public excluded section

of the agenda entitled “Proposed asset sale of the Punawai”

(Attachment 3).

2.19 The

report identified that Council’s Asset Disposal Policy (attachment 4)

requires Council approval for sale by public auction or trade in for assets

valued over $50,000. The Punawai was valued between $55,000 and $60,000 in one

valuation and $60,000 to $65,000 by a second valuation.

2.20 Attached

to the report was the offer to purchase the Punawai for $60,000. The offer was

made on a standard sale and purchase agreement form obtained from NZ Marine

Brokers Ltd.

2.21 The

report requested the Council approve a change of process by way of a private

sale that is an exception to the Asset Disposal Policy and provided reasons why

this was the preferred option.

2.22 Mr

Cross raised three issues with this process:

· If the purchase of

the Punawai included a spare outboard the value could be much greater than the

Council were informed;

· The legal review

of the Sale and Purchase Agreement was poor or non-existent given the reference

to NZ Marine Brokers Ltd; and

· The process falls

short of the Council’s Asset Disposal Policy introduction that states

disposals are transparent, accountable, maximise value for money for Council

and minimise opportunities for exploitation.

3. Discussion

Trafalgar Park Seating

3.1 Council

officers at all times were working under some considerable time pressure to

deliver, in a cost effective way, the outcomes desired by Council.

3.2 Nayland

Scaffold provided specialist services that helped Council achieve a good price

for the seating and enabled the seating to be installed in a timely manner.

3.3 All

transactions were within appropriate delegations and complied with the

procurement policy.

Sale of the Punawai

3.4 The

spare outboard is a standard piece of safety equipment to provide an

alternative means of returning to shore should the main engine fail. In this

case it was a Mercury 6 horsepower motor purchased in 2009 for $2,100 and may

have been worth $1,000. It is standard practice for safety equipment to remain

with the boat when sold.

3.5 A

legal review of the purchase agreements occurred with more changes made to the

purchase of the replacement vessel agreement than the offer to purchase the

Punawai. The reference to NZ Marine Brokers Ltd was not relevant to the

purchase of the Punawai and should have been deleted.

3.6 The

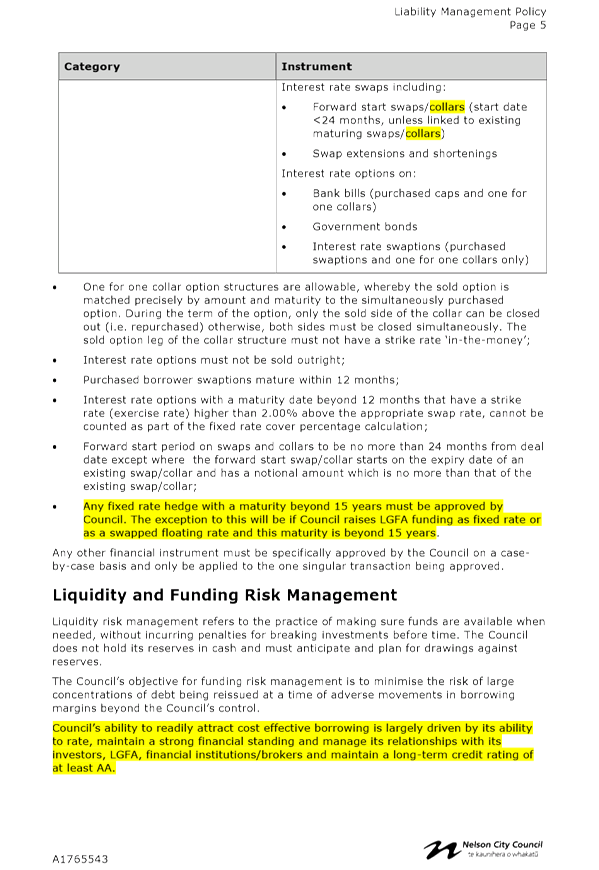

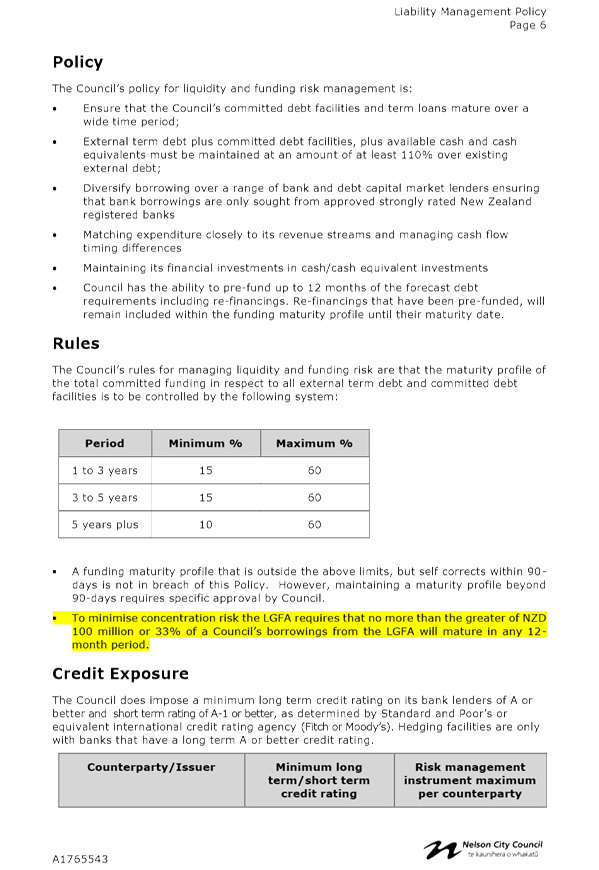

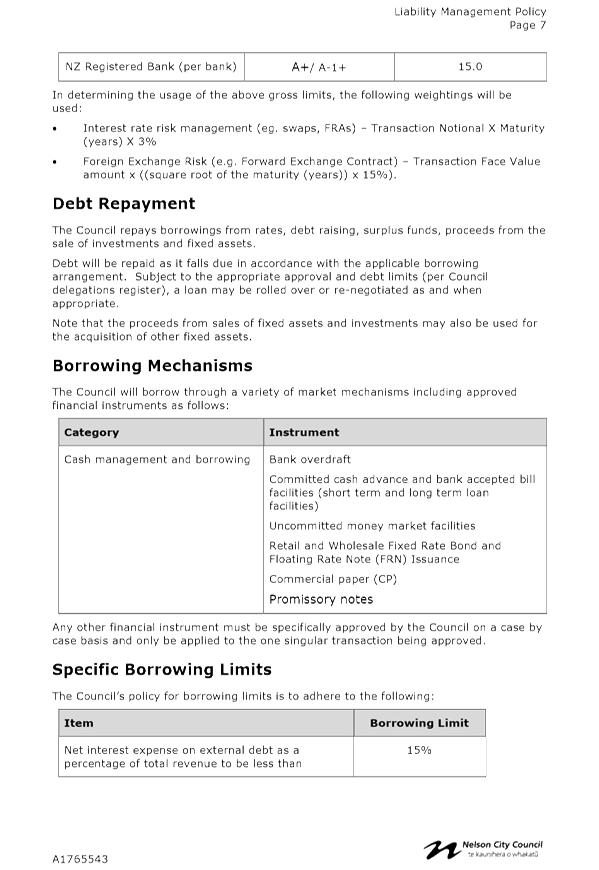

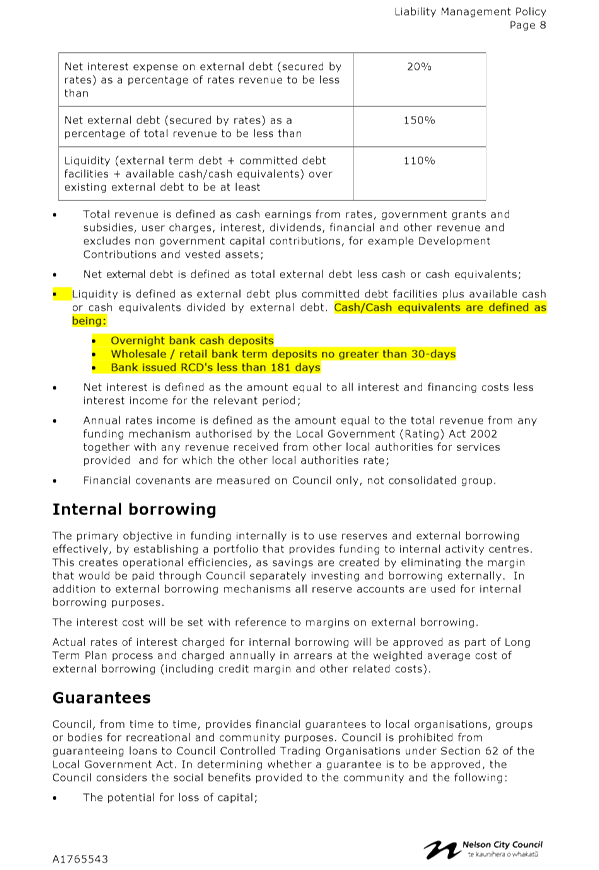

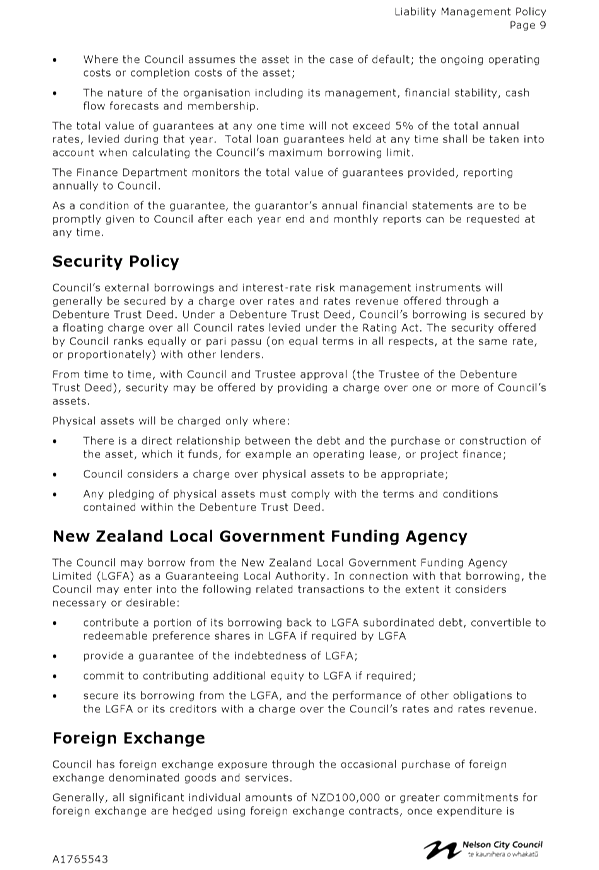

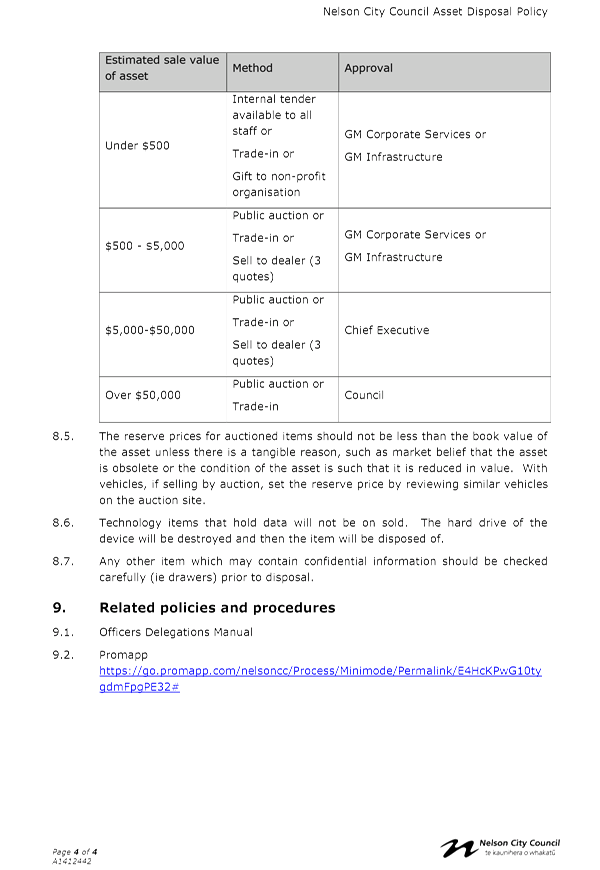

Council agreed to depart from the Policy on this occasion to ensure the outcome