AGENDA

Ordinary meeting of the

Audit, Risk and Finance Subcommittee

Thursday 18 May 2017

Commencing at 1.00pm

Council Chamber

Civic House

110 Trafalgar Street, Nelson

Membership: Mr John Peters (Chairperson), Her Worship the

Mayor Rachel Reese, Councillors Ian Barker and Bill Dahlberg, and Mr John

Murray

Guidelines for councillors

attending the meeting, who are not members of the Committee, as set out in

Standing Orders:

·

All councillors, whether or not they are members of the

Committee, may attend Committee meetings (SO 2.12.2)

·

At the discretion of the Chair, councillors who are not Committee

members may speak, or ask questions about a matter.

·

Only Committee members may vote on any matter before the

Committee (SO 3.14.1)

It is good practice for both Committee members and

non-Committee members to declare any interests in items on the agenda.

They should withdraw from the room for discussion and voting on any of these

items.

Audit, Risk and Finance

Subcommittee

Audit, Risk and Finance

Subcommittee

18

May 2017

Page

No.

1. Apologies

1.1 An

apology has been received from Mr John Murray

2. Confirmation

of Order of Business

3. Interests

3.1 Updates

to the Interests Register

3.2 Identify

any conflicts of interest in the agenda

4. Public

Forum

5. Status

Report - Audit Risk and Finance Subcommittee - 18 May 2017 7 - 9

Document number R7639

Recommendation

That the Subcommittee

Receives the Status Report Audit,

Risk and Finance Subcommittee 18 May 2017 (R7639) and its attachment (A1753947).

6. Chairperson's

Report 10 - 11

Document number R7716

Recommendation

That the Subcommittee

Receives the report Chairperson's

Report (R7716).

7. Corporate

Report to 31 March 2017 12 - 24

Document number R6998

Recommendation

That the Subcommittee

Receives the report Corporate

Report to 31 March 2017 (R6998)

and its attachments (A1750159 and A1753951).

8. Health

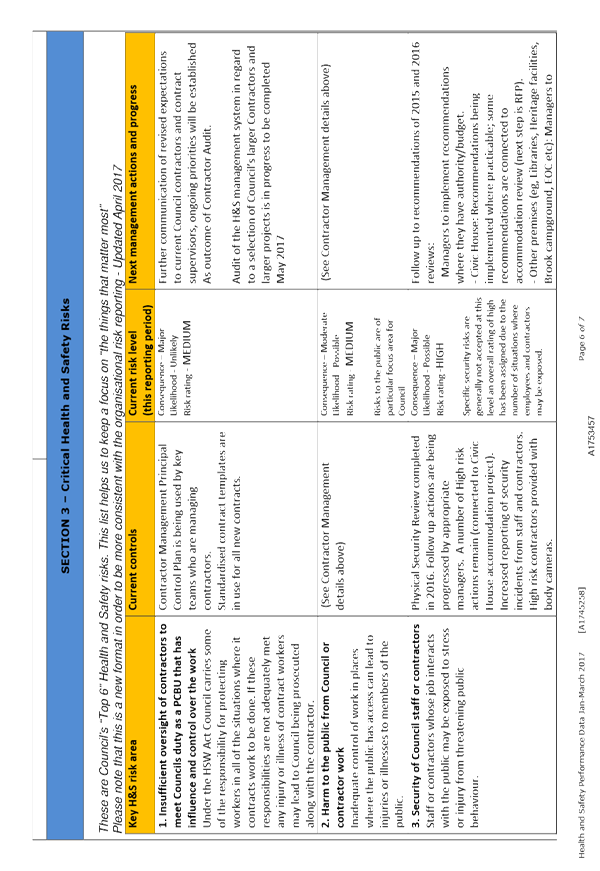

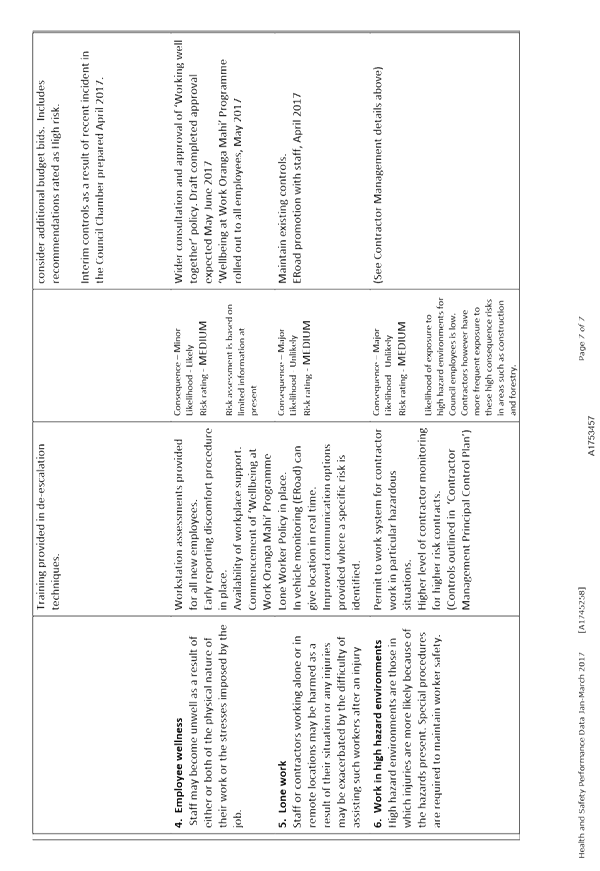

and Safety: Quarterly Report 25 - 35

Document number R7023

Recommendation

That the Subcommittee

Receives the report Health and

Safety: Quarterly Report (R7023)

and its attachment (A1753457).

Recommendation to Council

That the

Council

Notes

the report Health and Safety Quarterly Report (R7023) and its attachment (A1753457); and

Confirms

the assessment of critical health and safety risks contained in the attachment

(A1753457).

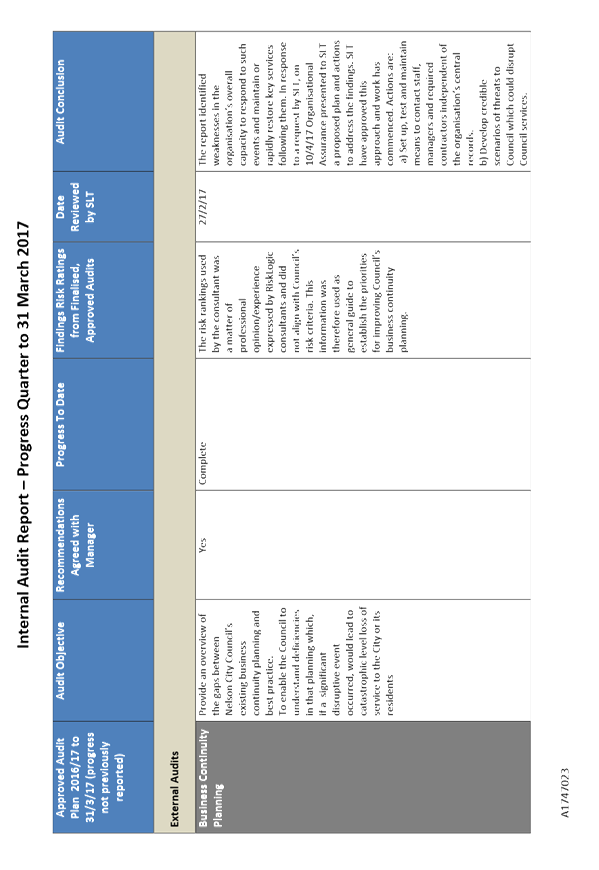

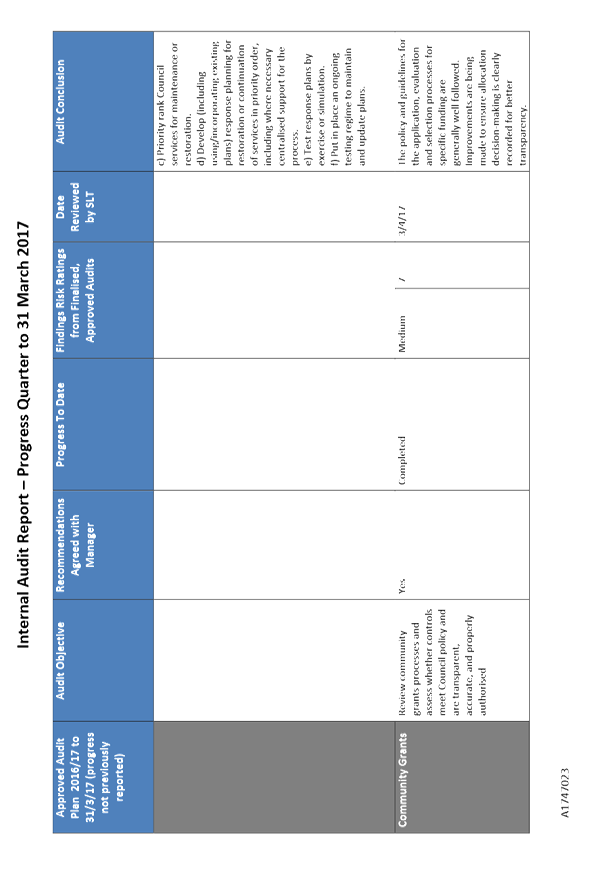

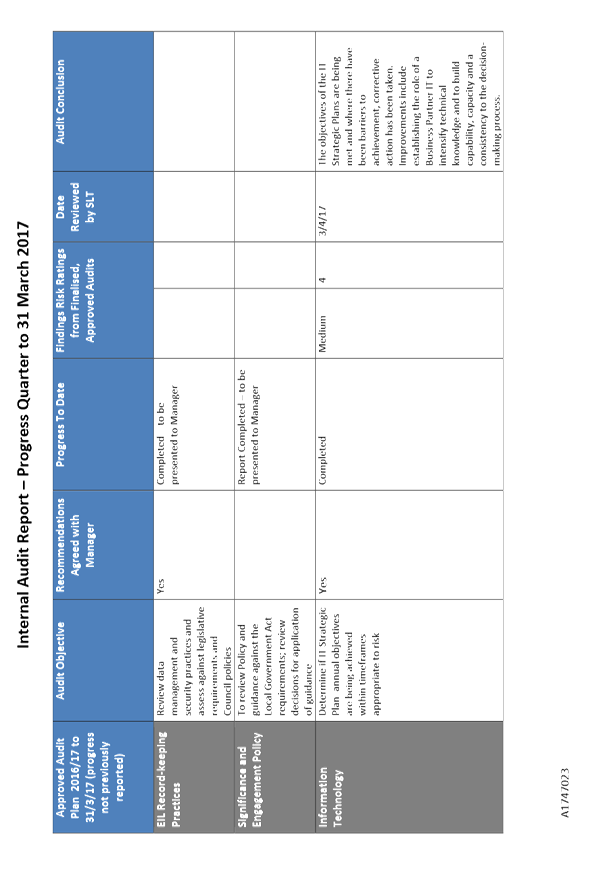

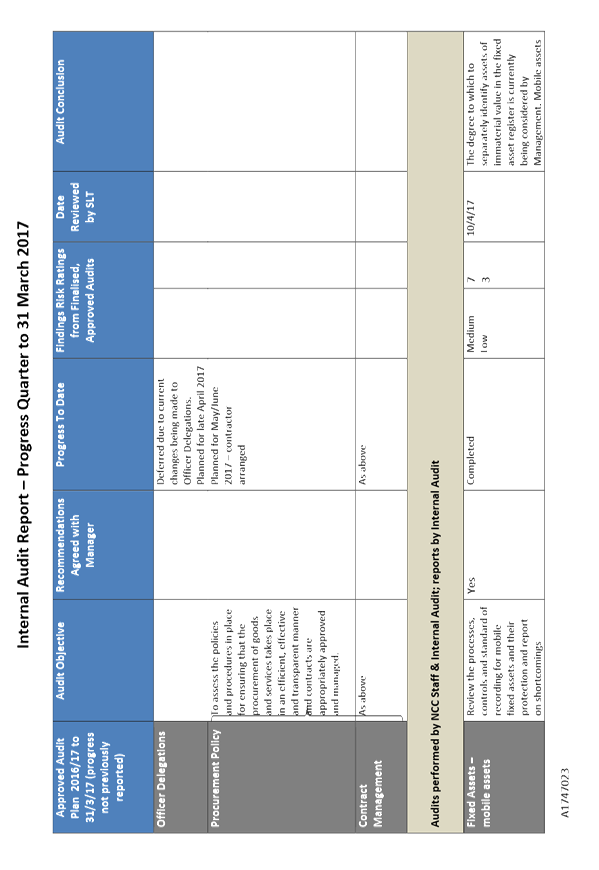

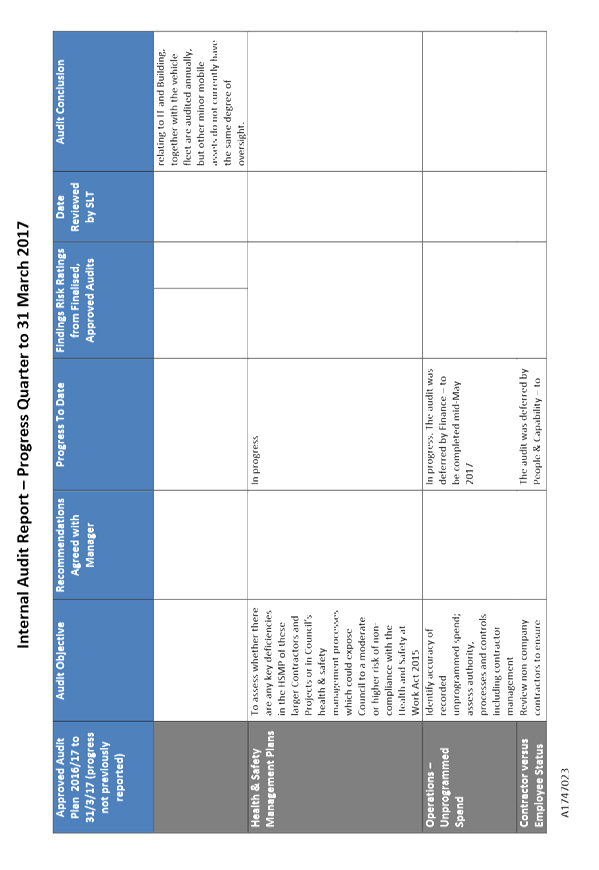

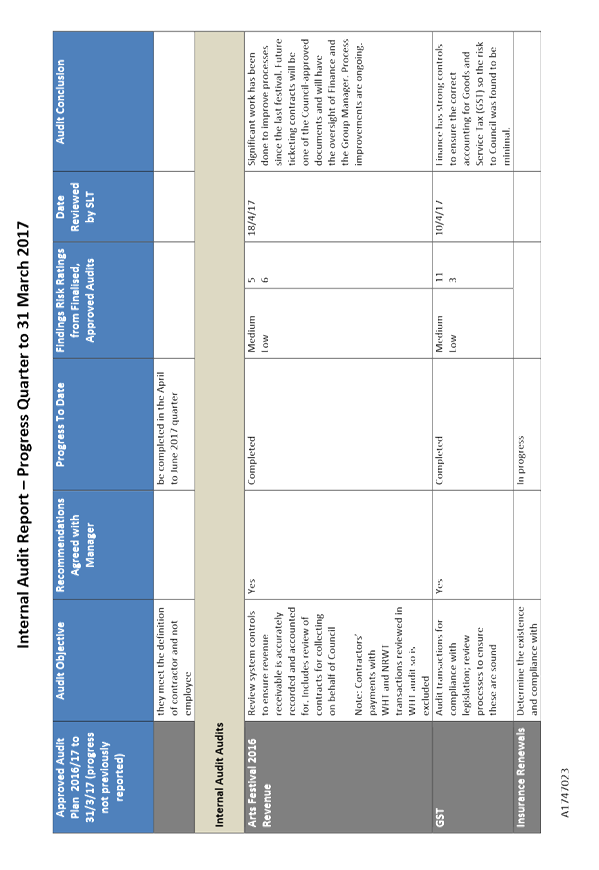

9. Internal

Audit Quarterly Report to 31 March 2017 36

- 46

Document number R7569

Recommendation

That the Subcommittee

Receives the report Internal Audit

Quarterly Report to 31 March 2017 (R7569);

and its attachment (A1747023).

Recommendation to Council

That the

Council

Notes

the report Internal Audit Quarterly Report (R7569) and its attachment

(A1747023).

50. Service

Delivery Review Quarterly Progress Update - May 2017 47 - 90

Document number R6910

Recommendation

That the Subcommittee

Receives the report Service

Delivery Review Quarterly Progress Update - May 2017 (R6910) and its attachments (A1737008,

A1732393, A1731928, A1731591, A1736351, A1642437, A1736093, A1732264 and A1753361); and

Notes

the update on progress with the programme of s17A reviews.

61. Audit

NZ - audit arrangement and engagement letters 91

- 129

Document number R7513

Recommendation

That the Subcommittee

Receives the report Audit NZ -

audit arrangement and engagement letters (R7513); and attachments A1749598, A1749594 and A1752596; and

Notes the Subcommittee can provide feedback

on the Audit Arrangement, Audit Engagement and Audit Proposal letters to Audit

NZ if required, noting the Mayor will sign the letters once the

Subcommittee’s feedback has been incorporated.

72. Tax

Risk Governance Framework 130 - 139

Document number R7599

Recommendation

That the Subcommittee

Receives the report Tax Risk

Governance Framework (R7599) and its attachment (A1750676).

Notes

that a tax risk management strategy will be presented to a future meeting of

this Subcommittee, and annual reporting against this framework will occur

annually after the end of the tax year (31 March).

Recommendation to Council

That the

Council

Adopts

the Tax Risk Governance Framework (A1750676) with immediate effect.

(delete as appropriate)

|

|

Audit, Risk and Finance Subcommittee

18 May 2017

|

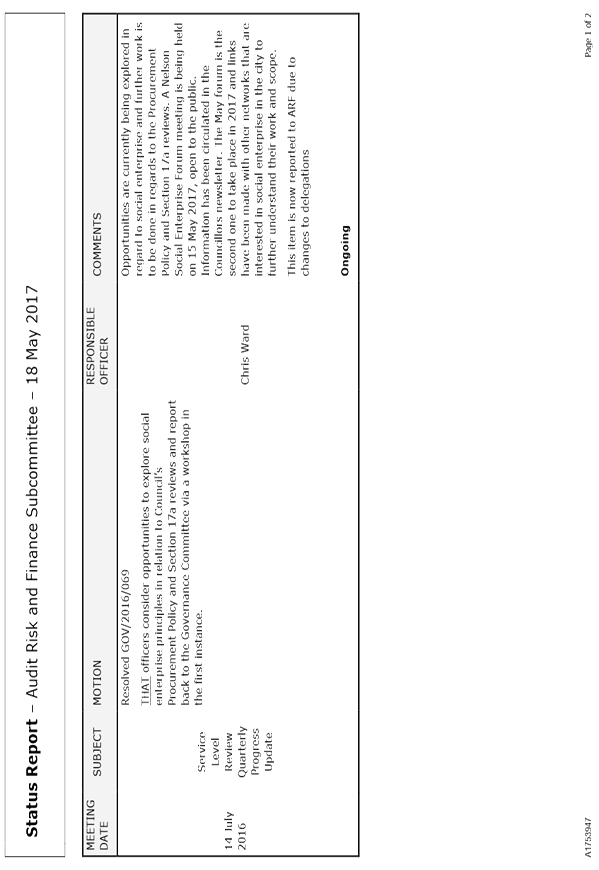

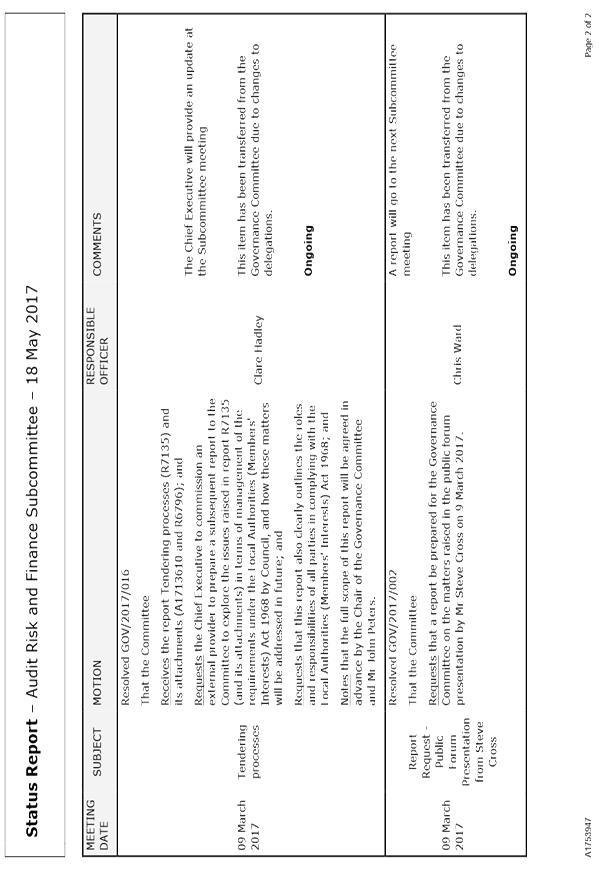

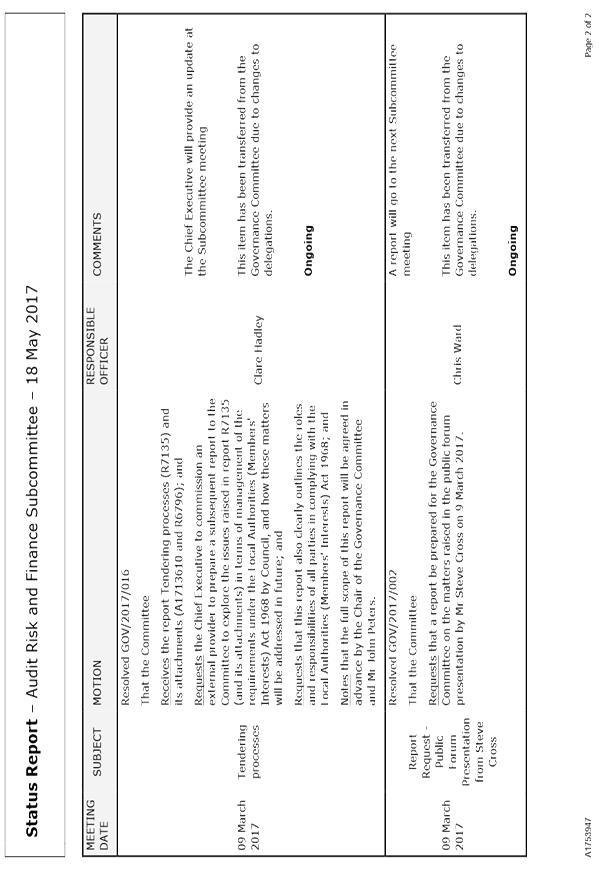

REPORT R7639

Status

Report - Audit Risk and Finance Subcommittee - 18 May 2017

1. Purpose of

Report

1.1 To

provide an update on the status of actions requested and pending.

1.2 Please

note that Council has recently amended delegations for the Governance

Committee, Commercial Subcommittee, and Audit, Risk and Finance Subcommittee.

This has resulted in several items being moved from the Governance Committee

status report, to the Subcommittee with the appropriate delegations for the

matter.

2. Recommendation

|

That the Subcommittee

Receives the Status Report

Audit, Risk and Finance Subcommittee 18 May 2017 (R7639) and its attachment (A1753947).

|

Shailey

Burgess

Administration

Adviser

Attachments

Attachment 1: A1753947

- Audit Risk and Finance Subcommittee - 18 May 2017 ⇩

|

|

Audit, Risk and Finance Subcommittee

18 May 2017

|

REPORT R7716

Chairperson's

Report

1. Purpose

of Report

1.1 To

welcome members to the first Audit, Risk and Finance Subcommittee meeting for

the 2016-2019 triennium.

2. Recommendation

|

That the Subcommittee

Receives the report

Chairperson's Report (R7716).

|

3. Chairperson’s

Report

3.1 Welcome

to the first Audit Risk and Finance (ARF) Subcommittee meeting of the new

Council term. I would like to express my appreciation at again

being asked to chair it.

3.2 In

the period since the Council elections a number of relevant reports have been

considered by the Governance Committee. However, in my opinion, it has

been a long gap for an organisation such as Nelson City Council to not have a

formal Audit Risk and Finance committee in place.

3.3 Having

said that I am pleased that this Council has decided that, in this term, the

ARF Subcommittee should report directly to Council. I believe this

reflects best practice, and provides a better opportunity for awareness and

oversight by all Councillors, especially in such key areas as Health and Safety

and Risk Management.

3.4 One

of the early tasks for this Subcommittee will be to establish a workplan for

this term. In October last year a letter recommending items of

carry over to the incoming ARF Subcommittee, together with the results of a

survey undertaken on the effectiveness of the Audit, Risk and Finance

Subcommittee, were sent to the Chief Executive. I suggest that these

documents might be a useful place to start on a workplan and, subject to the

Members’ agreement, I will ask officers to commence suitable arrangements

for the formulation of an appropriate workplan for this Subcommittee.

I look forward to working with

you all.

John

Peters

Chairperson

- Audit, Risk and Finance Subcommittee

Attachments

Nil

|

|

Audit, Risk and Finance Subcommittee

18 May 2017

|

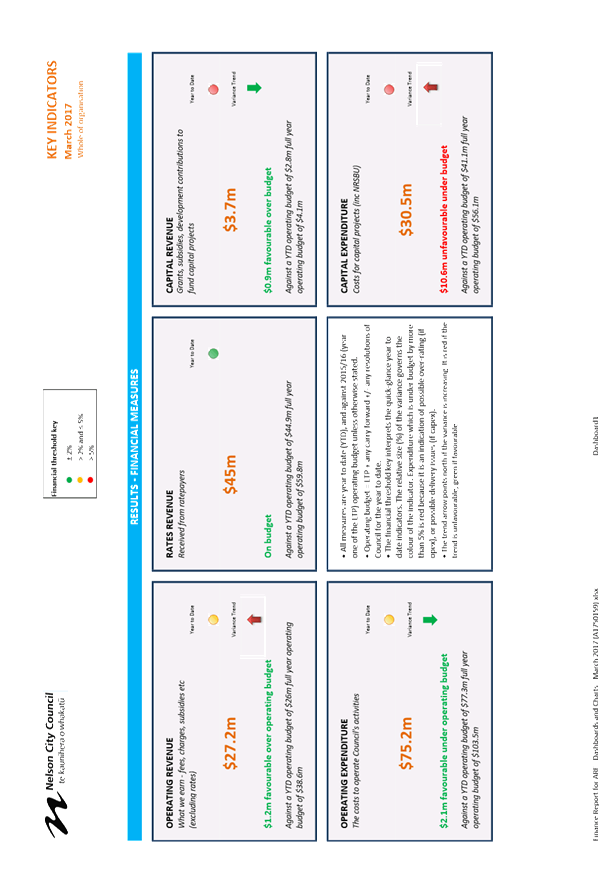

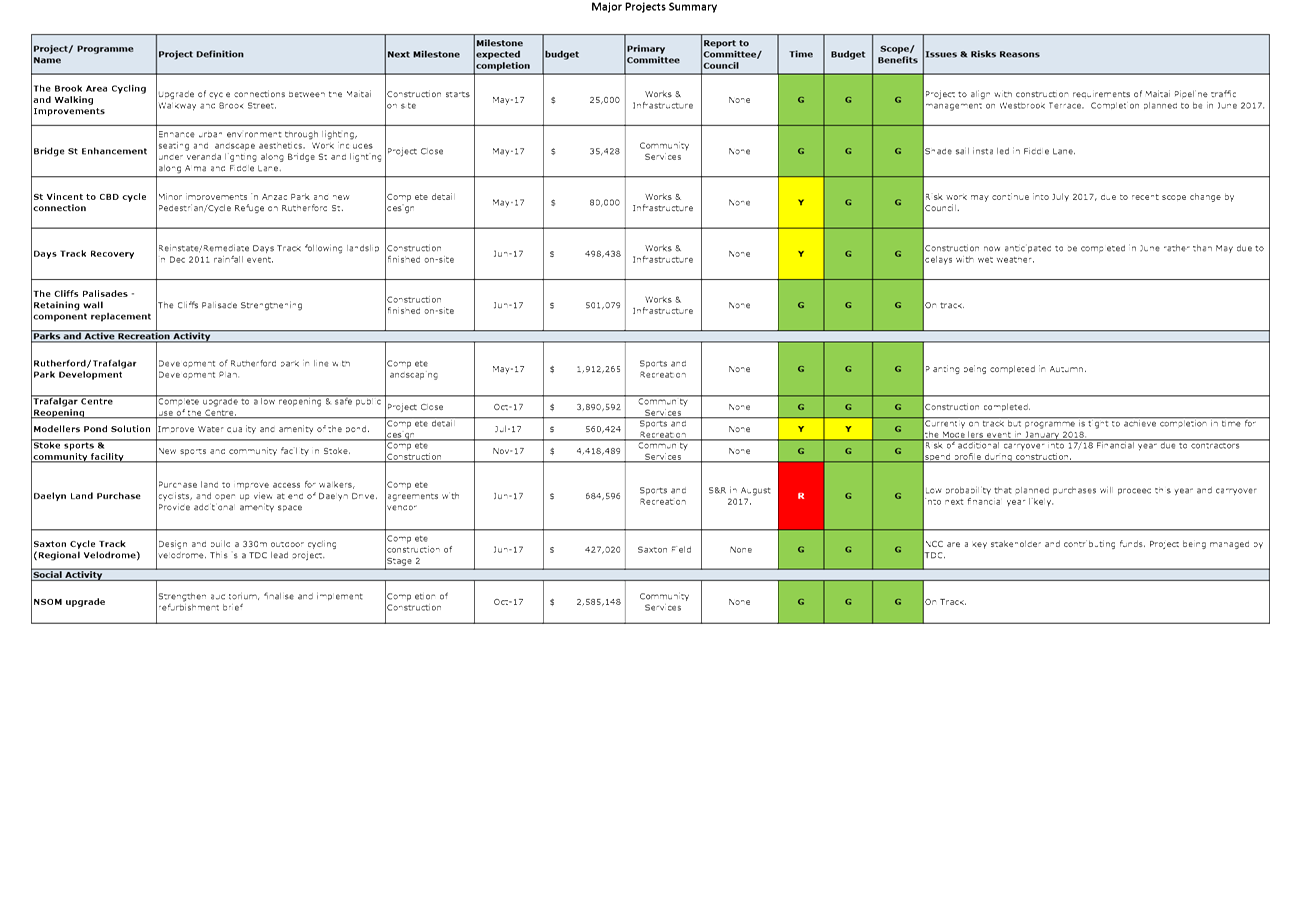

REPORT R6998

Corporate

Report to 31 March 2017

1. Purpose

of Report

1.1 To

inform the members of the subcommittee of the financial

results of activities for the 9 months ending 31 March 2017 compared to the

approved operating budget, and to highlight and explain any permanent and

material variations.

2. Recommendation

|

That the Subcommittee

Receives the report Corporate

Report to 31 March 2017 (R6998)

and its attachments (A1750159 and A1753951).

|

3. Background

3.1 The financial reporting focuses on the 9 month performance compared

with the year to date approved operating budget.

3.2 Unless

otherwise indicated, all measures are against approved operating budget, which

is 2016/17 Annual Plan budget plus any carry forwards, plus or minus any other

additions or changes as approved by Council throughout the year.

3.3 For the 2016/17 financial year, officers have assessed budgets and

applied a range of phasing mechanisms to better reflect the timing of

anticipated actual income and expenditure. This should enable clearer analysis

of variances, and better highlight any real issues. Given that there are in

excess of 3,500 budget lines, officers have concentrated effort on more

material items so there will remain a (much smaller) element of timing

differences.

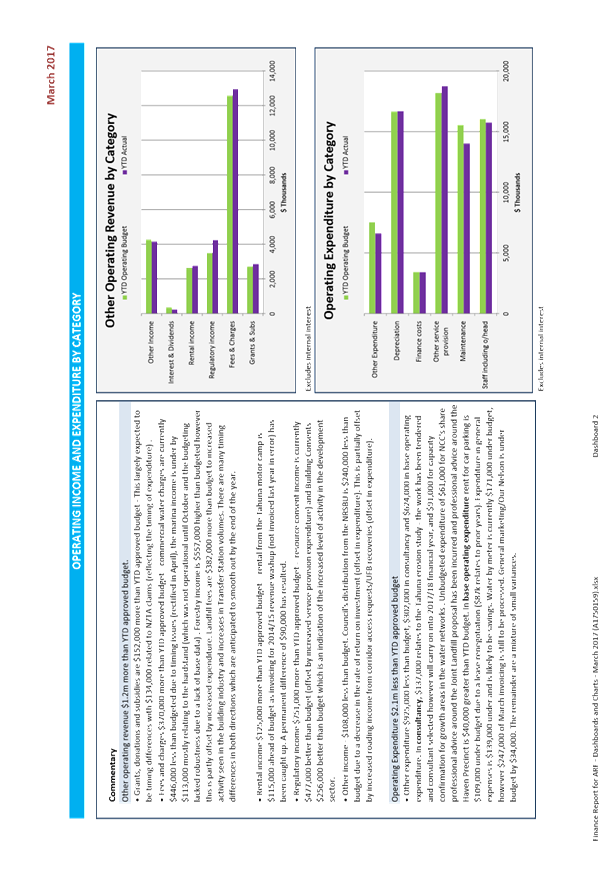

4. Discussion

4.1 For the 9 months ending 31 March

2017, the activity surplus/deficits are $3.3 million favourable to budget. At

this stage and at a high level, $1.6 million income and $111,000 expenditure

are considered permanent favourable variances against approved budget.

4.2 Financial

information provided in attachment 1 to this report are:

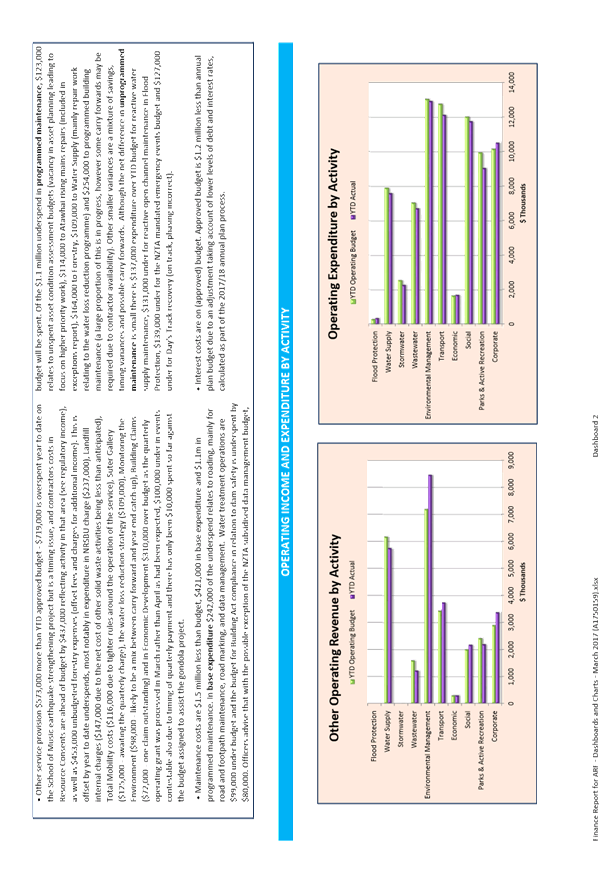

· A financial measures dashboard with information on rates revenue,

operating revenue and expenditure, and capital revenue and expenditure. The

arrow icon in each applicable measure indicates whether the variance is

increasing or decreasing and whether that trend is favourable or unfavourable

(green or red).

· A grouping of more detailed graphs and commentary for operating

income and expenditure. The first set of charts and the commentary is by

category (as in the annual report) and highlights significant permanent

differences and items of interest. Variances due to timing will not be itemised

unless they become permanent. The second set of charts are by activity.

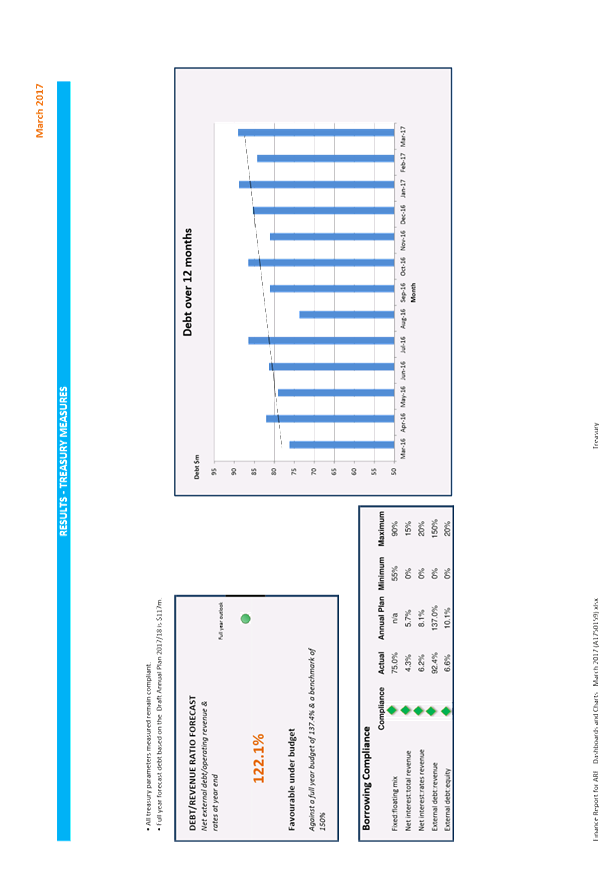

· A treasury measures dashboard with a compliance table (green =

compliant), a forecast of the debt/revenue ratio for the year where available,

and a graph showing debt levels over a rolling 13 month period.

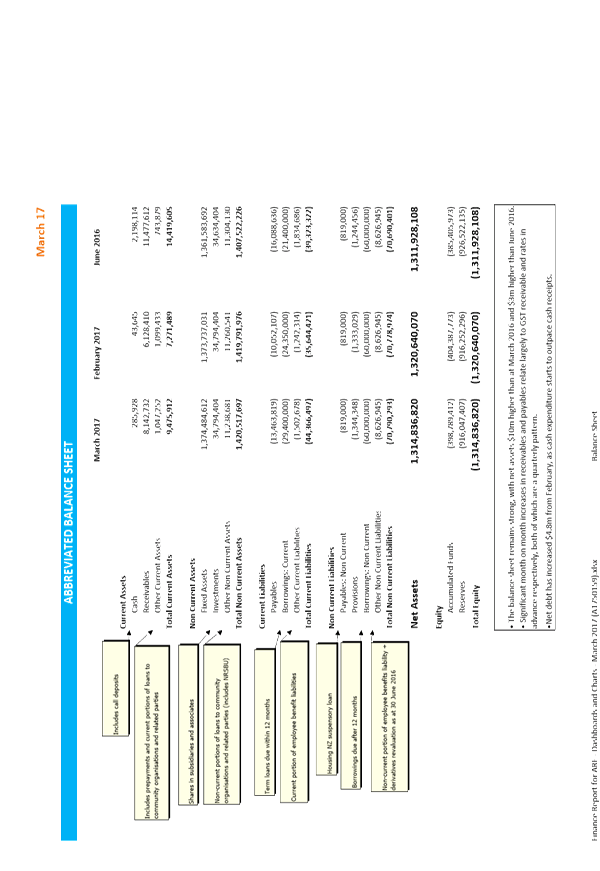

· High level balance sheet. This does not include any consolidations.

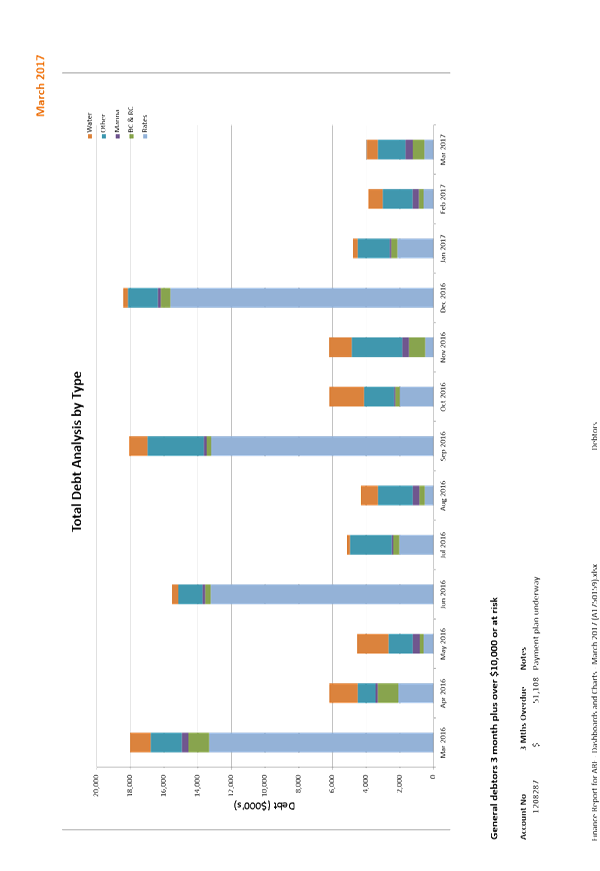

· A debtor analysis graph over 12 months, clearly showing outstanding

debt levels and patterns for major debt types along with a summary of general

debtors > 3 months and over $10,000 and other debtors at risk.

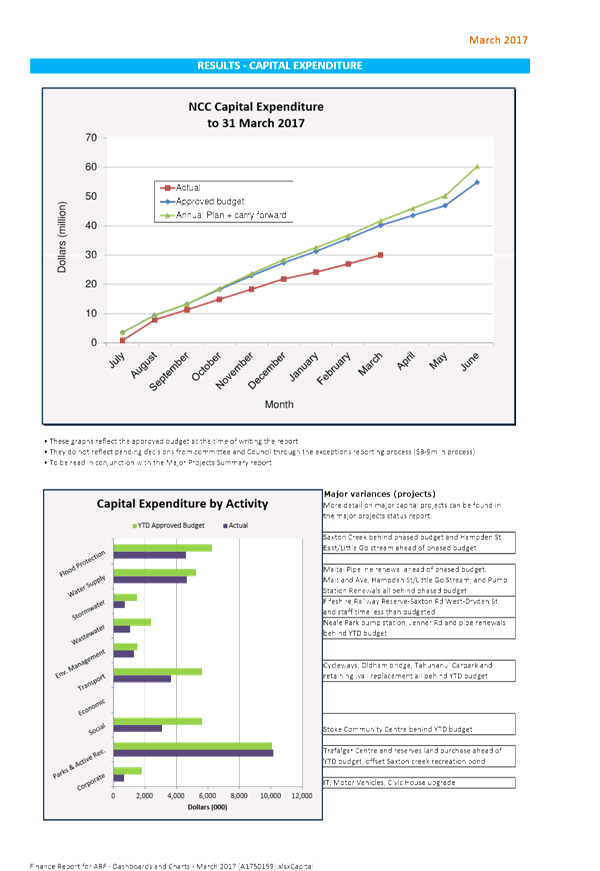

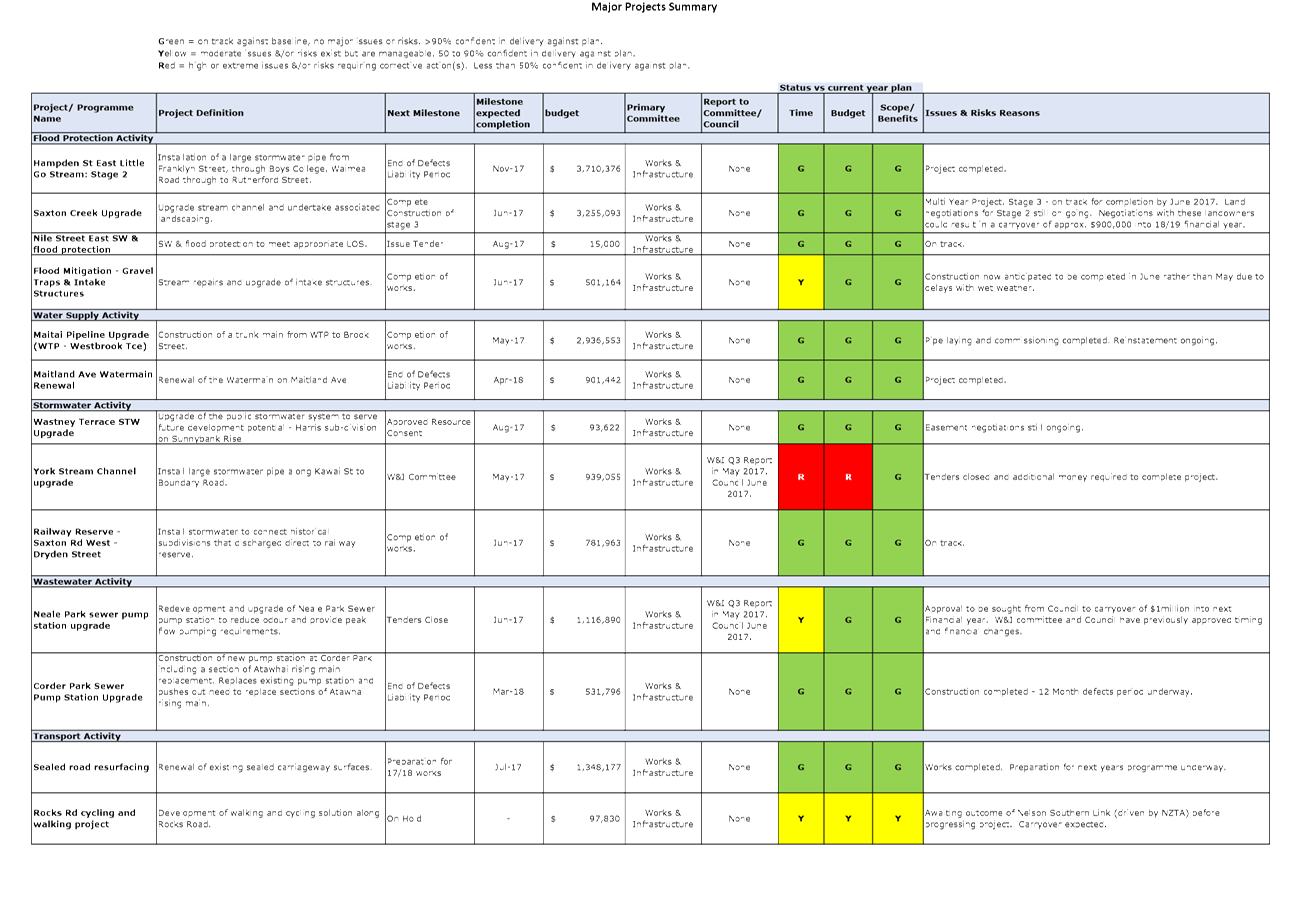

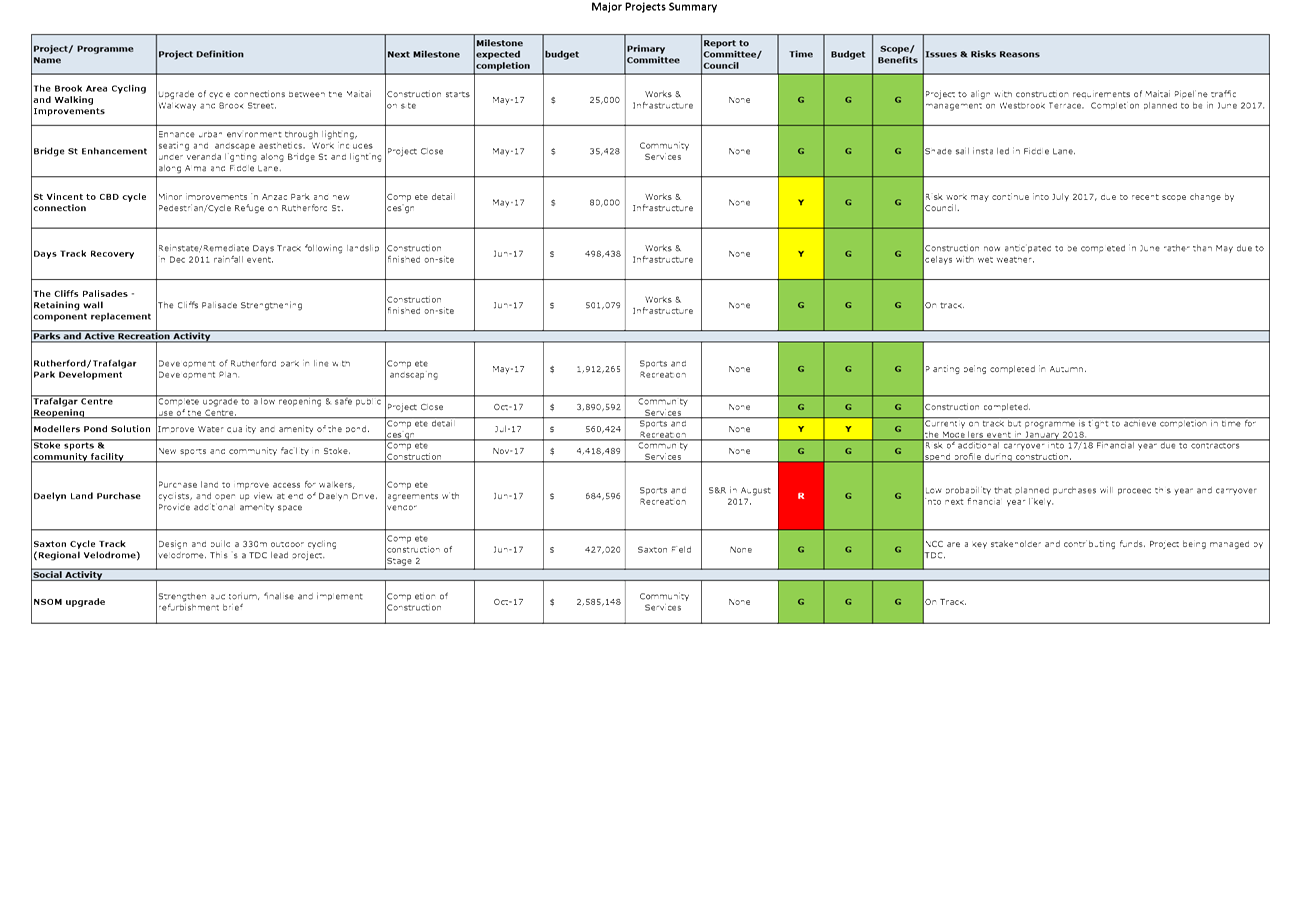

· Two capital expenditure graphs – actual expenditure against

approved budget for the financial year, and year to date expenditure against

approved budget by activity.

· A major projects summary including milestones, status, issues and

risks.

4.3 Capital expenditure is $10.6 million under approved budget, noting

that $8-9 million of this variance is the subject of current exceptions reports

(in process).

5. November

2016 earthquake costs update

5.1 A

total of $87,145 has been incurred including staff time and overhead. Remaining

work is expected to be in the region of $23,600. Quotes for this work have now

been received. These costs will be met from unprogrammed maintenance

budgets.

6. Options

6.1 Accept

the recommendation. This report is to inform the subcommittee members, and no

further actions are required.

6.2 Do

not accept the recommendation.

Tracey

Hughes

Senior

Accountant

Attachments

Attachment 1: Financial information

(A1750159) ⇩

Attachment 2: Major

projects report (A1753951) ⇩

|

Important considerations for decision making

|

|

1. Fit

with Purpose of Local Government

The Audit, Risk and Finance subcommittee receives an

update on financial matters at each meeting to inform them of items of

financial interest and potentially items of financial risk.

|

|

2. Consistency

with Community Outcomes and Council Policy

The financial reports are prepared comparing current

year performance against the year to date approved budget for 2016/17. Presentation

of these reports support the community outcome “Our Council provides

leadership and fosters partnerships, a regional perspective, and community

engagement”.

|

|

3. Risk

The recommendation carries no risk as the report is

for information only.

|

|

4. Financial

impact

The recommendation has no financial impact.

|

|

5. Degree

of significance and level of engagement

The recommendation is of low significance as there

are no decisions to be made.

|

|

6. Inclusion

of Māori in the decision making process

No consultation is required.

|

|

7. Delegations

The Audit Risk and Finance subcommittee has

oversight of Council’s financial performance and the management of

financial risks.

|

|

|

Audit, Risk and Finance Subcommittee

18 May 2017

|

REPORT R7023

Health

and Safety: Quarterly Report

1. Purpose

of Report

1.1 To

provide the Subcommittee with a quarterly report of health and safety data

collected over the first quarter of 2017, and an update on the health and

safety work programme.

2. Recommendation

Recommendation

|

That the Subcommittee

Receives the report Health and

Safety: Quarterly Report (R7023)

and its attachment (A1753457).

|

Recommendation to Council

|

That the Council

Notes

the report Health and Safety Quarterly Report (R7023) and its attachment (A1753457); and

Confirms the assessment of critical health and safety risks

contained in the attachment (A1753457).

|

3. Background

3.1 Councillors, as ‘Officers’ under the Health and Safety

at Work Act (HSWA) 2015, are expected to undertake due diligence on health and

safety matters. Council’s Health and Safety Governance Charter

states that quarterly performance data reports will be presented to Council.

4. Discussion

Quarterly health and safety data

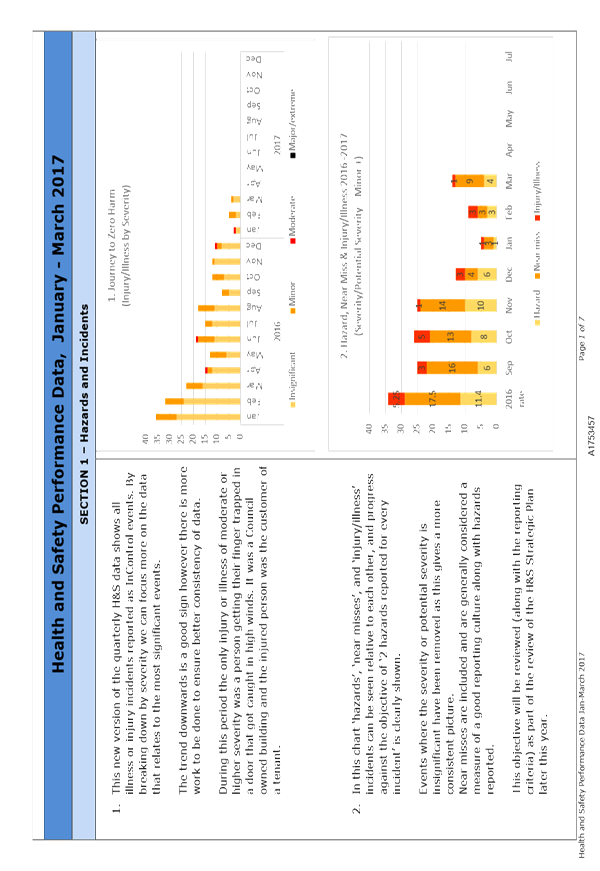

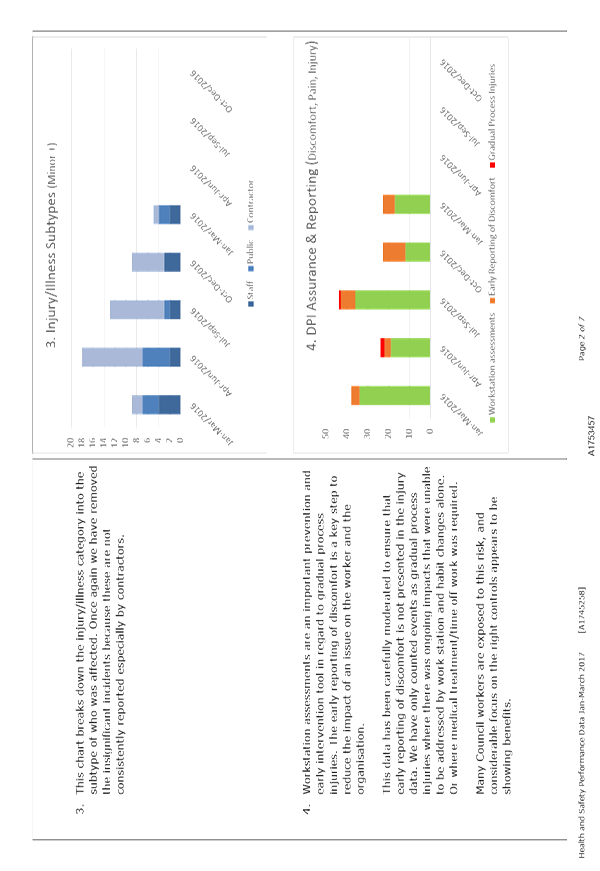

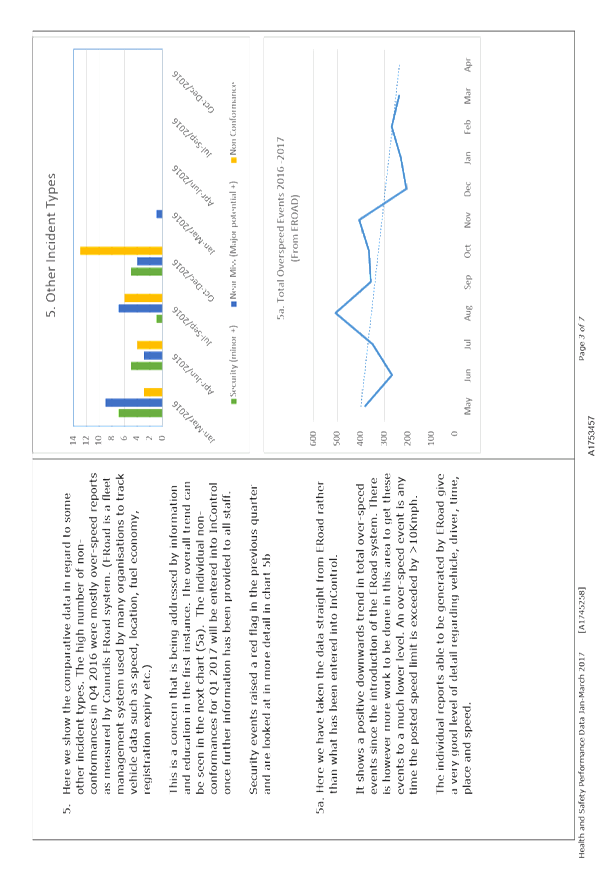

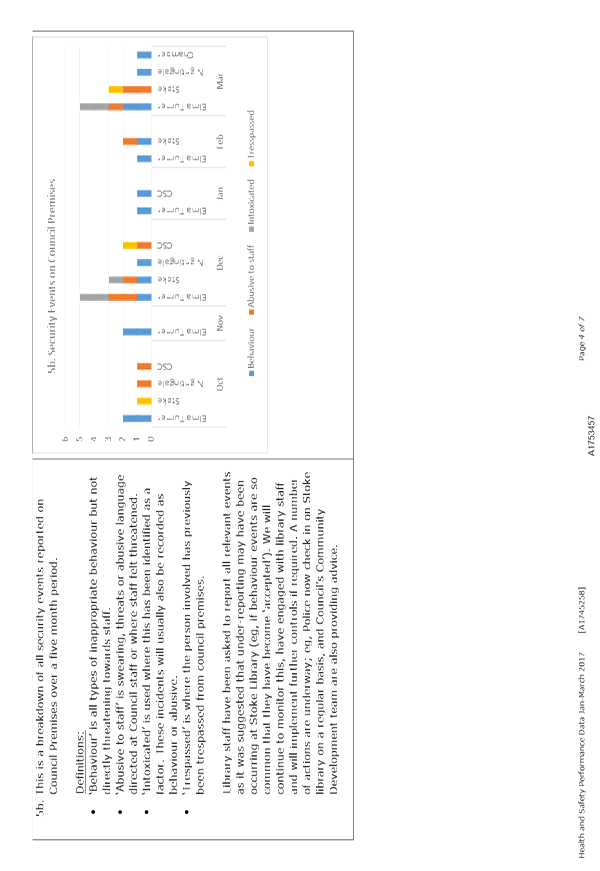

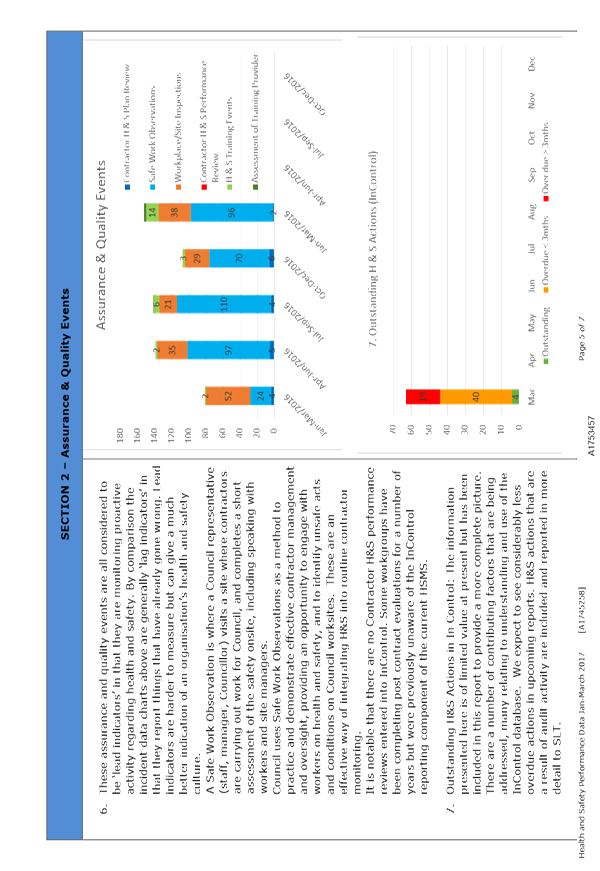

4.1 Attached

is a report outlining data on health and safety drawn from Council’s

health and safety system. Changes have been made to the presentation of

the data, which it is hoped will add detail and understanding. For

example, following discussion on the previous Health and Safety Quarterly

Report, detail has been added on security events at Council premises.

Feedback is always welcome on the format of these reports.

4.2 The

period under review includes an incident in the Council Chamber in which a

member of the public vaulted the Council tables. This is being followed

up as a health and safety event, and procedures for the Council Chamber are

being reviewed. In the meantime, an interim procedure has been established to

address security concerns at Council meetings. The issue of physical

security continues to be rated as a High risk in the attached assessment.

General work

programme

4.3 Governance

activities: a number of Councillors participated in a visit to Corder

Park and the Nelson Waste Water Treatment Plant. The visit helped to meet

Councillors’ objective, set out in the Health and Safety Governance

Charter, to make site visits in order to meet its due diligence

obligations. A visit for Councillors to Stoke Green Meadows is proposed

as the next Councillor site visit.

4.3.1 On

11 April 2017 Councillors took part in a Risk and Health and Safety Workshop,

which incorporated an induction on Council’s health and safety framework

and, in particular, Councillor obligations as Officers.

4.3.2 Other

activities: An internal audit is currently being conducted as part of

Council’s audit programme, looking at contractor management processes

across a selection of Council contractors, and a number of larger

projects.

4.3.3 Council

is currently rolling out a programme for staff entitled ‘Wellbeing at

Work’, led by the Health Action Trust. The programme focuses on

promoting mental health in the workplace, and provides tools to develop

organisations that are safe, productive and compliant in regard to mental

health issues.

4.3.4 A

review of Council’s Health and Safety Governance Charter is programmed

for May and a review of the Health and Safety Strategic Plan is programmed for

June, both to be reported to future meetings of the Audit, Risk and Finance

Subcommittee.

5. Options

|

Option 1: Receive the report

and its attachment

|

|

Advantages

|

· Council

demonstrates positive due diligence in relation to health and safety matters

in the Council workplace. This assists in meeting Councillors’

obligations as ‘Officers’ under the HSW Act 2015.

|

|

Risks and Disadvantages

|

· Receiving

the report alone is not sufficient. Positive diligence (understanding, asking

questions etc) is required.

|

|

Option 2: Decline to receive

the report and its attachment

|

|

Advantages

|

· An

advantage could not be identified.

|

|

Risks and Disadvantages

|

· Council

will not be able to use this report to help demonstrate due diligence on

health and safety matters.

|

Roger

Ball

Manager

Organisational Assurance and Emergency Management

Attachments

Attachment 1: A1753457 - HSMS -

Quarterly Performance Data - Jan to Mar 2017 ⇩

|

Important considerations for decision making

|

|

1. Fit

with Purpose of Local Government

This report forms part of Council’s work to

perform its regulatory functions. Council has an obligation under the

Workplace Health and Safety Act 2015 because it is classed as a Person

Conducting a Business or Undertaking (PCBU), and both Councillors and

Council’s senior management have obligations as “Officers”

under that Act.

|

|

2. Consistency

with Community Outcomes and Council Policy

The recommendations align with the Community

Outcome: Our communities are healthy, safe, inclusive and resilient.

|

|

3. Risk

This report aims to help Councillors meet their due

diligence obligations as “Officers” under the Health and Safety

at Work Act 2015. It is likely this objective will be achieved when

combined with other actions outlined in Appendix 2 of Council’s Health

and Safety Management System Governance Charter (A1394804). The

likelihood of adverse consequences is assessed as low based on the current

record of Council’s health and safety systems and our on-going

monitoring of them. However the consequences for Council could still be

significant if there were to be a serious harm incident to a Council worker,

contractor or other person. These consequences could include harm to

people, prosecution of the Council and/or its officers, financial penalties,

and/or reputational damage.

|

|

4. Financial

impact

There are no immediate budget implications arising

from this report.

|

|

5. Degree

of significance and level of engagement

This matter is of low significance because it is a

quarterly progress report regarding the Council’s health and safety

data, and no engagement is required.

|

|

6. Inclusion

of Māori in the decision making process

Maori have not been consulted in the preparation of

this report.

|

|

7. Delegations

The Audit, Risk and Finance Sub-Committee is

delegated oversight of Health and Safety.

|

|

|

Audit, Risk and Finance Subcommittee

18 May 2017

|

REPORT R7569

Internal

Audit Quarterly Report to 31 March 2017

1. Purpose

of Report

1.1 To

update the Subcommittee on the Internal Audit activity relative to audits

included in the Internal Audit Plan to 31 March 2017.

2. Recommendation

|

That the Subcommittee

Receives the report Internal

Audit Quarterly Report to 31 March 2017 (R7569); and its attachment (A1747023).

|

Recommendation to Council

|

That the

Council

Notes the report Internal Audit

Quarterly Report (R7569) and its attachment (A1747023).

|

3. Background

3.1 The

Internal Audit Charter was approved by Council on 15 October 2015.

3.2 Under

the Charter, the Audit, Risk and Finance Subcommittee requires a periodic

update on the progress of internal audit activities relative to any current

Internal Audit Plan approved by Council, and to be informed of any significant

risk exposures and control issues identified from internal audits completed.

3.3 The

Annual Internal Audit Plan relative to the year to 30 June 2017 was approved by

Council on 28 July 2016.

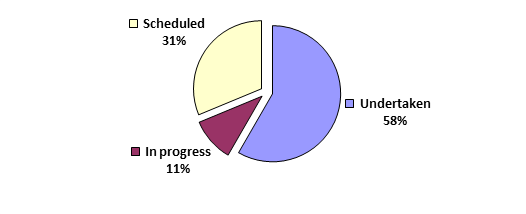

4. Discussion

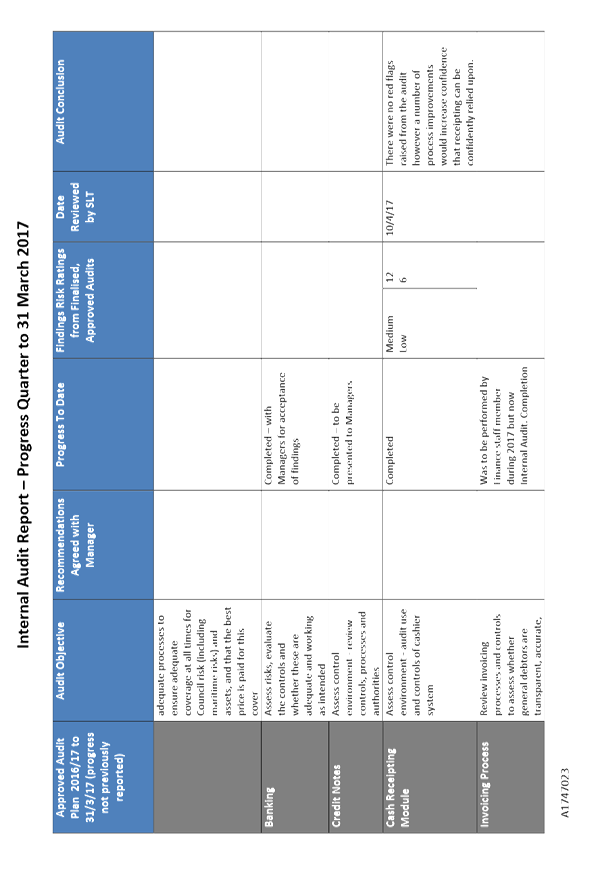

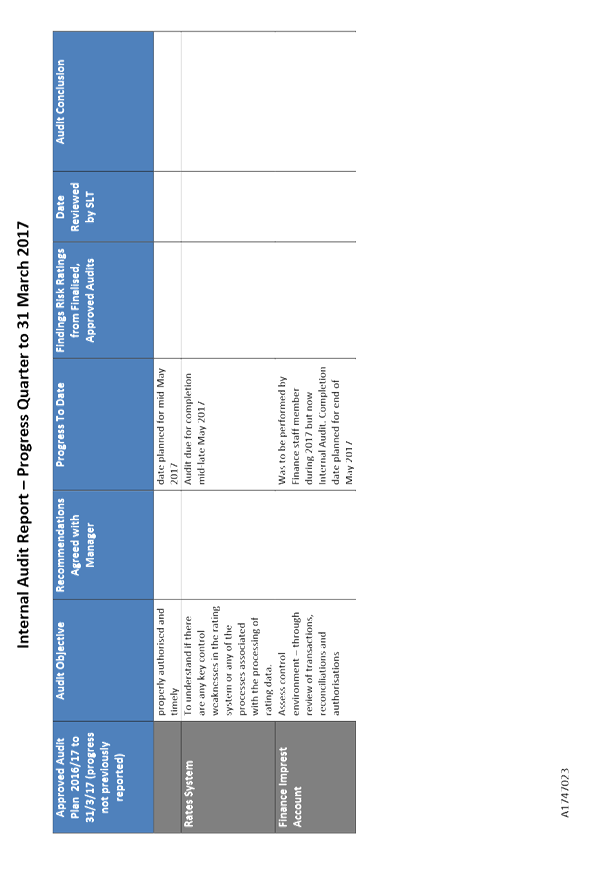

4.1 Progress

on internal audits is reported in the attached table. This is for information

only and reflects approved audits for the Annual Audit Plan to 30 June 2017

which were due for completion during the period from 1 January 2017 to 31 March

2017. Where an audit may have been reported as incomplete in prior periods, up

to date information is provided.

4.2 The

table separates and summarises approved audit activity into three groupings: a)

external audits; b) internal audits - staff and internal audits and c) internal

audits.

5. Options

5.1 The

recommendation is to receive the report and its attachments outlining progress

of internal audits included in the Annual Audit Plan to 30 June 2017 so that

Council can demonstrate its commitment to improving controls and practices that

ensure the prudent, effective and efficient management of Council resources. No

advantage could be identified from rejecting this report and its attachment.

Lynn

Anderson

Internal

Audit Analyst

Attachments

Attachment 1: A1747023 - Internal Audit

- Quarterly Report to 31 March 2017 ⇩

|

Important considerations for decision making

|

|

1. Fit

with Purpose of Local Government

Council has chosen to undertake internal audits to

help improve systems, their controls and efficiencies, in order to help give

confidence that it will be able to meet its responsibilities cost-effectively

and efficiently.

|

|

2. Consistency

with Community Outcomes and Council Policy

This report supports the community outcome that

Council provides leadership, which includes the responsibility for protecting

finances and assets through the minimisation of fraud, consistent with

guidance provided in Council’s Fraud Prevention Policy.

|

|

3. Risk

There is more risk that Council may not meet its

responsibilities cost-effectively and efficiently if this recommendation is

not accepted.

|

|

4. Financial

impact

The recommendation will not have any significant

financial impact.

|

|

5. Degree

of significance and level of engagement

This matter is of low significance because it does

not affect the level of service provided by Council or the way in which

services are delivered and no engagement has been undertaken.

|

|

6. Inclusion

of Māori in the decision making process

There has been no consultation with Maori in the

preparation of this report.

|

|

7. Delegations

The Audit, Risk and Finance Subcommittee has

responsibility for audit processes and management of financial risks. The

Audit, Risk and Finance Subcommittee has the power to make a recommendation

to Council on this matter.

|

|

|

Audit, Risk and Finance Subcommittee

18 May 2017

|

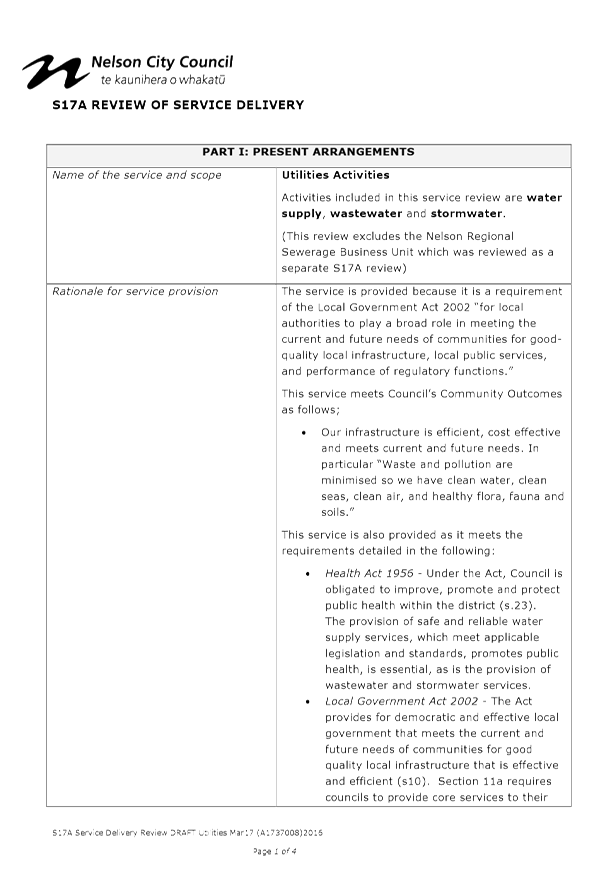

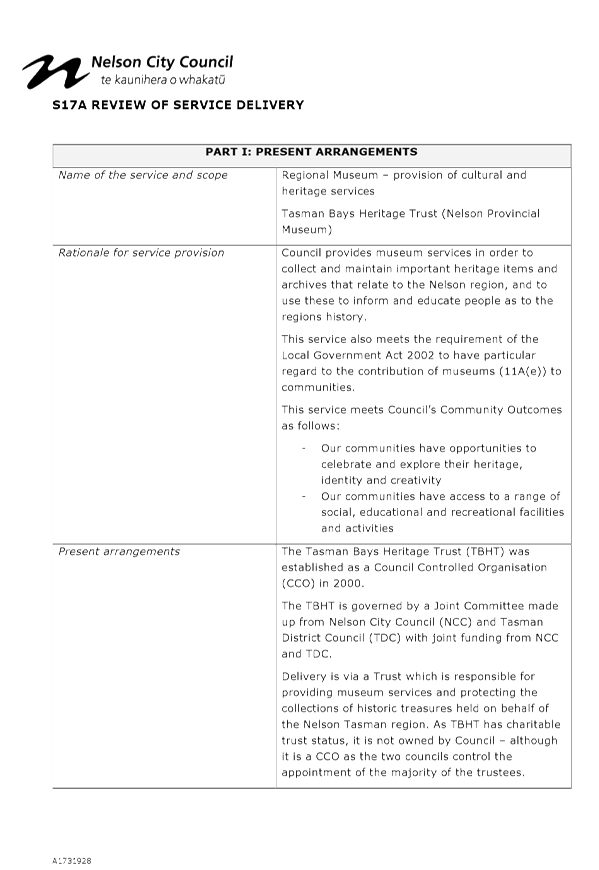

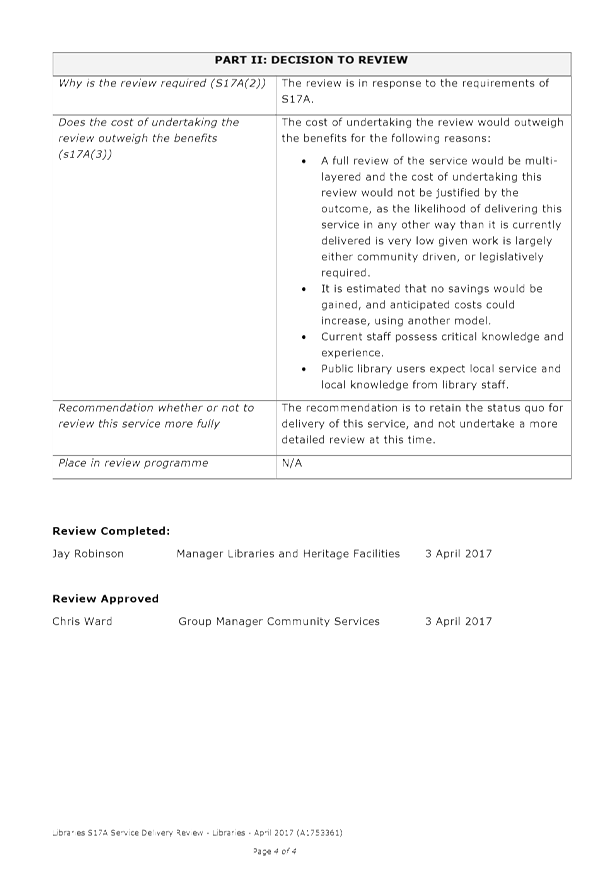

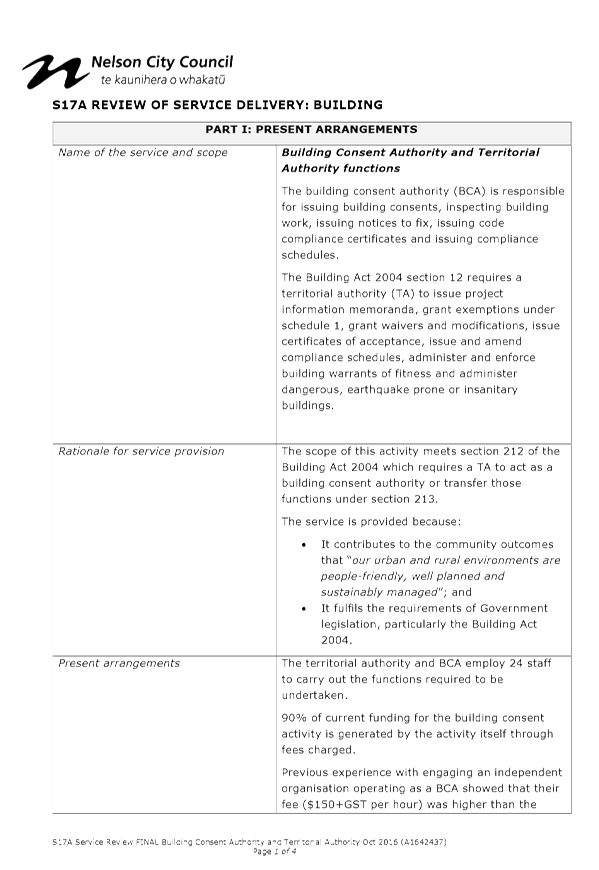

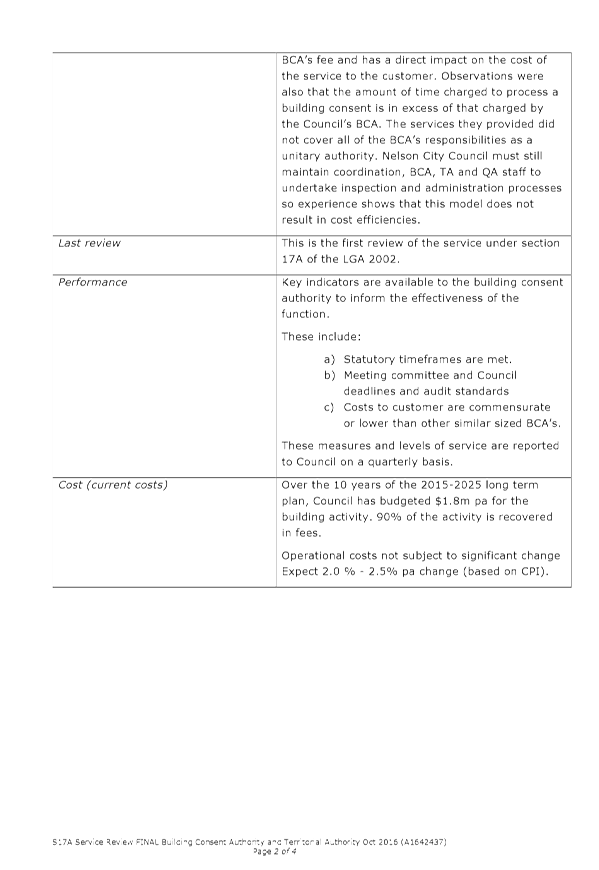

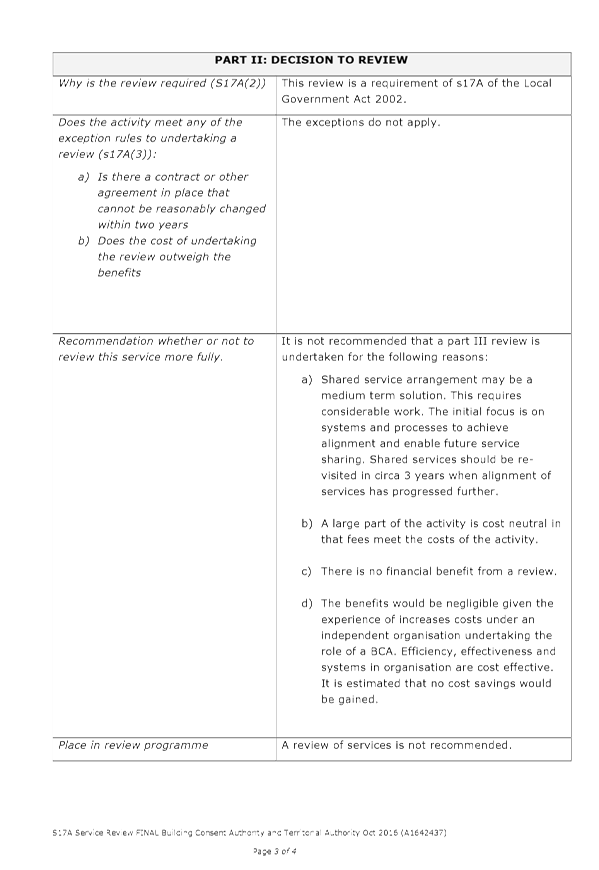

REPORT R6910

Service

Delivery Review Quarterly Progress Update - May 2017

1. Purpose

of Report

1.1 To

receive a quarterly report on progress under section 17A Local Government

service delivery reviews.

2. Summary

2.1 Changes

to the Local Government Act 2002 (LGA) saw the introduction of new requirements

under section 17A to review the cost-effectiveness of current arrangements for

meeting the needs of communities within its district or region for good

quality local infrastructure, local public services, and performance of

regulatory functions.

2.2 The

LGA has a transitional provision that requires all services to be reviewed by 8

August 2017.

2.3 These

quarterly reports are brought to the Committee in order for it to have

oversight of the progress with reviews undertaken.

3. Recommendation

|

That the Subcommittee

Receives the report Service

Delivery Review Quarterly Progress Update - May 2017 (R6910) and its attachments (A1737008,

A1732393, A1731928, A1731591, A1736351, A1642437, A1736093, A1732264 and A1753361); and

Notes

the update on progress with the programme of s17A reviews.

|

4. Background

4.1 Section

17A service delivery reviews seek to determine whether cost effectiveness gains

can be made by adopting an alternative funding, governance or service delivery

option by considering a variety of arrangements including having services

delivered by a council controlled organisation, or by another local authority

or other party.

4.2 Reviews

must be undertaken;

· In conjunction

with the consideration of any significant change to service levels

· Within two years

before the expiry of any legislation, contract or other binding agreement

affecting the service

· No later than six

years after any previous review

4.3 A

review need not be undertaken if;

· Delivery is

governed by legislation, contract or other binding agreement that cannot be

reasonably altered in the next two years

· The benefits to be

gained do not justify the cost of the review

5. Discussion

Progress update

5.1 In

November 2015 Council agreed to the approach staff would take to addressing the

new requirement for s17A reviews. This included a schedule of review areas,

template and timeline.

5.2 The

scheduled timeline for reviews is flexible, and the need for additional

reviews, or amalgamation of existing review areas continues to be considered on

a case by case basis.

5.3 Reviews

either come as part of a larger piece of work through the relevant committee or

are attached to these progress reports. Eighteen reviews have been presented to

Council previously. A further ten reviews are included with this report.

5.4 Officers

have sought feedback from other councils across New Zealand as to their

progress on s17A reviews. Feedback received indicates that Nelson City Council

is in a similar position to other councils. None of the councils responding

were expecting to achieve 100% compliance by August except where large parts of

the work programme had been exempted from review.

5.5 Given

the current rate of progress officers consider it likely that Nelson City

Council will not achieve the deadline of 8 August 2017. At the 1 December 2016

Governance Committee meeting it was indicated that achieving the August

deadline should be prioritised and that officers should bring a report

requesting extra resources to enable this.

5.6 Should

the Committee wish to complete the review schedule by the statutory deadline of

August 2017 additional resourcing will be required and delays to other work

will be experienced. It is estimated the extra resources needed would

cost up to $23,000. There would also be delays to other work so that officers

could prioritise s17A reviews. In the infrastructure group, where most reviews

are scheduled, this is expected to affect development of asset management plans

and other work contributing to the Long Term Plan, including the Infrastructure

Strategy, and input to and work flowing from the 2017/18 Annual Plan.

5.7 Officers

recommend the current process continues as to accelerate the programme of

reviews will cause delays in higher priority projects and require extra funding

for little return to ratepayers. Outsourcing of reviews to an external

contractor would also lead to a loss of institutional knowledge about the

review process which would be unfortunate given they are to be a regular part

of the work programme in the future. This approach would not be in line with

the intent of the legislation to encourage greater efficiency and cost saving

within local authorities.

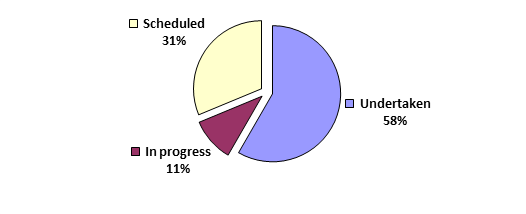

5.8 Progress

to date of s17A service delivery reviews is highlighted below:

5.9 Reviews

that have been undertaken since the previous report are noted in the table

below:

|

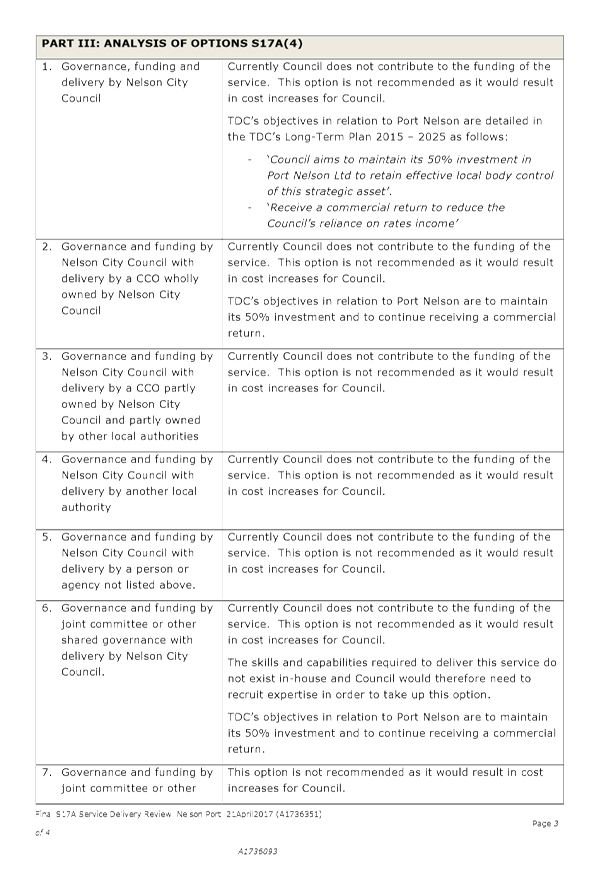

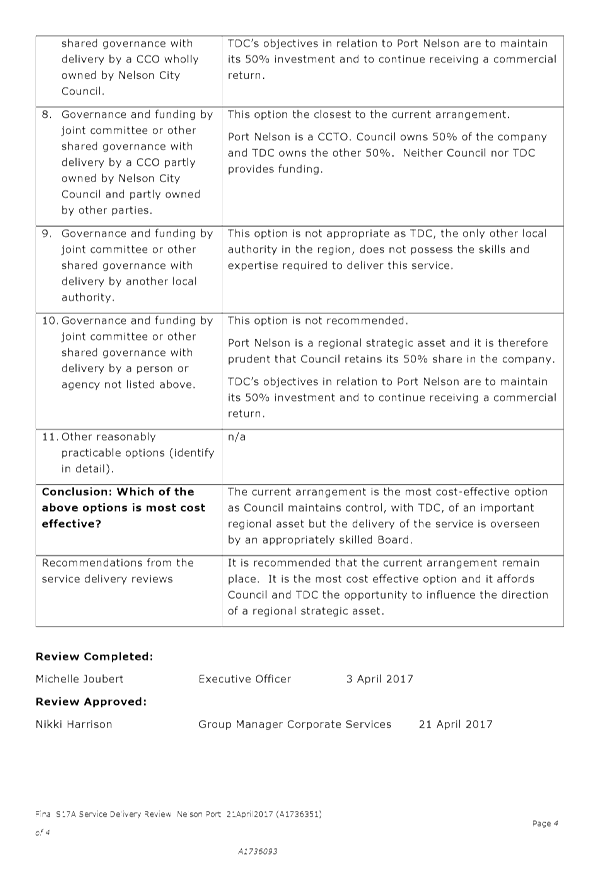

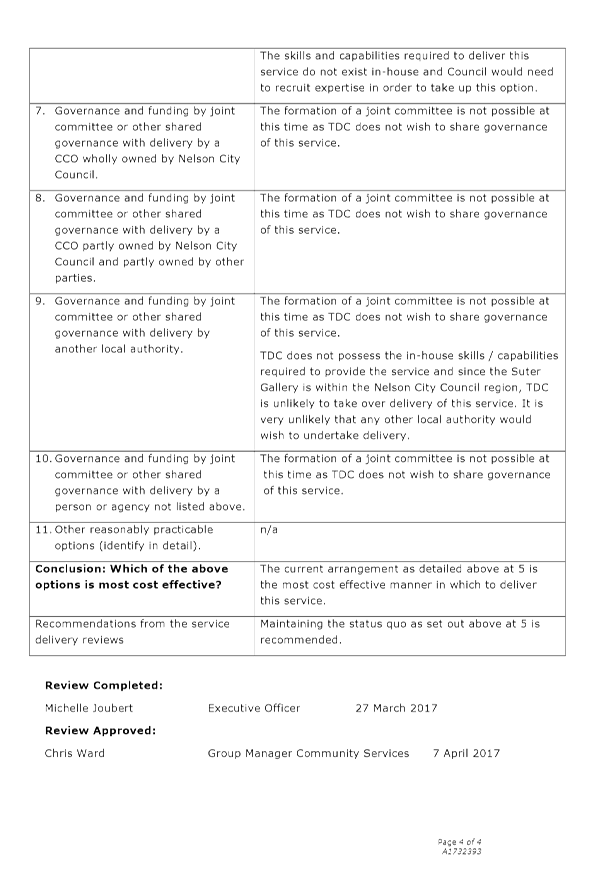

Service

|

Outcome

|

|

Saxton Field Governance

|

Establish a joint committee in conjunction with Tasman

District Council

|

|

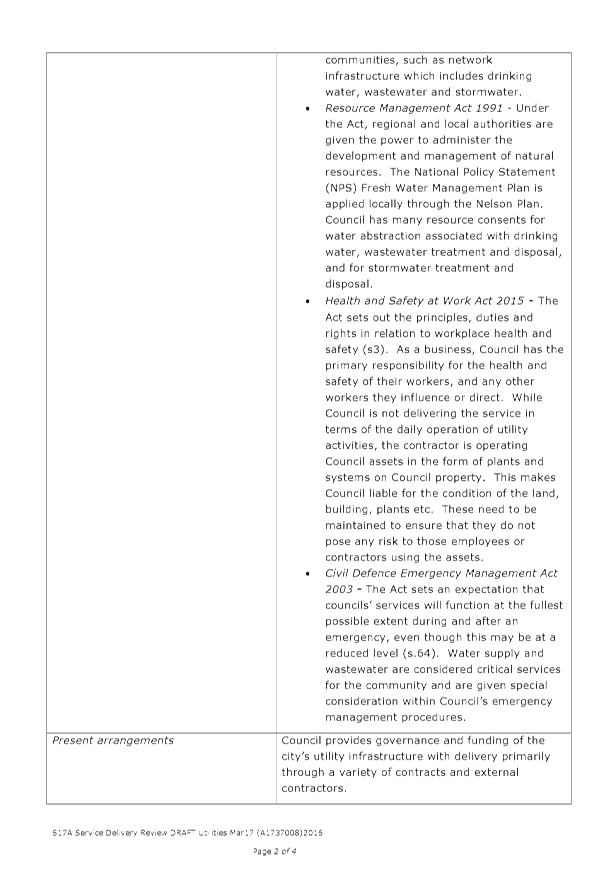

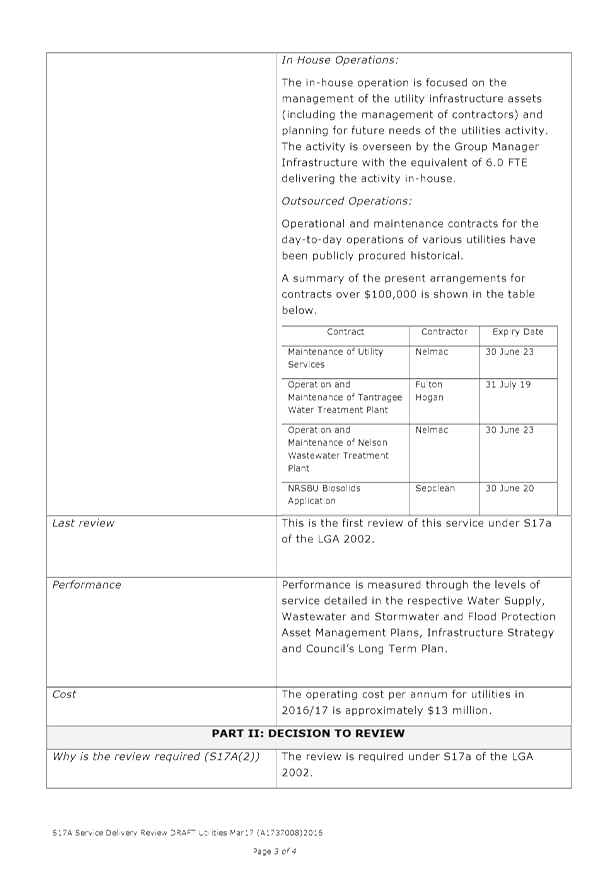

Utilities

|

Continue with Council governance, funding and delivery

|

|

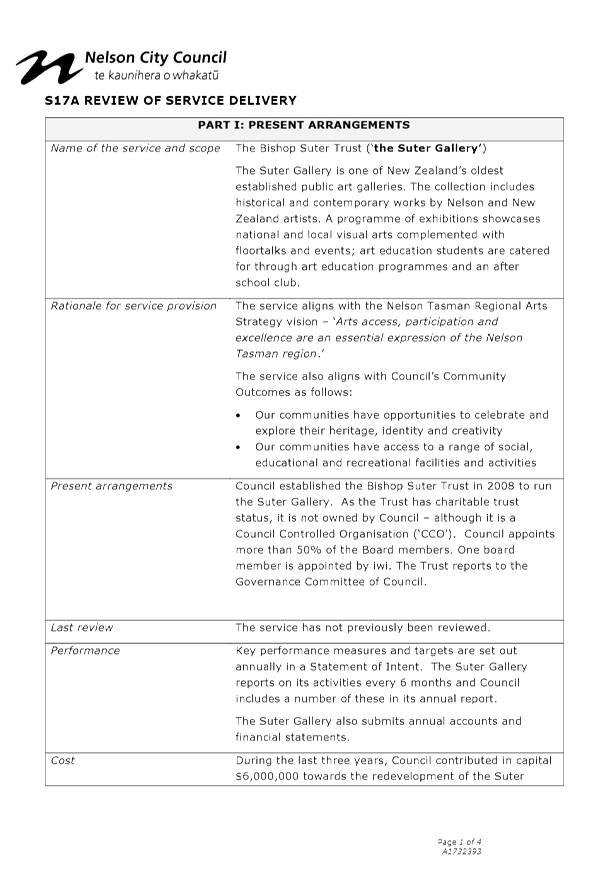

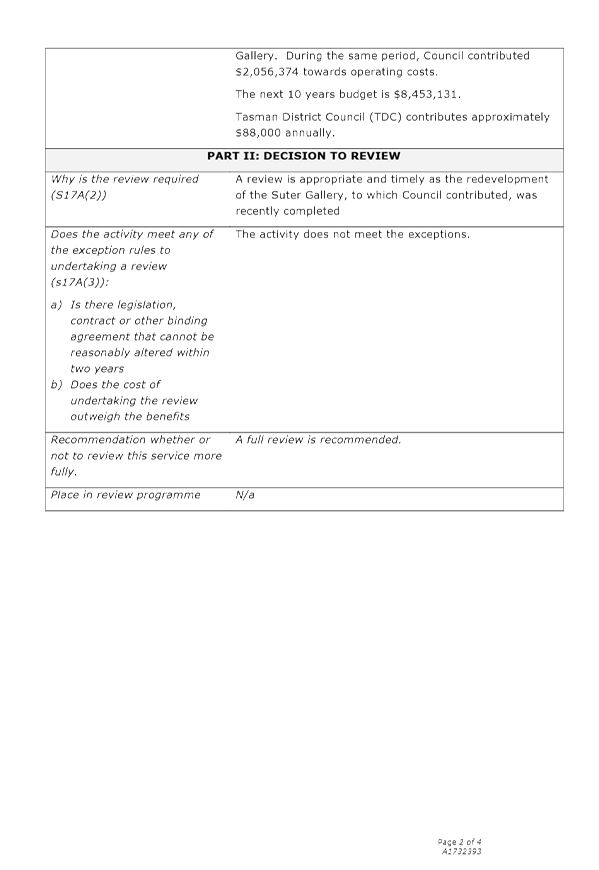

Suter Gallery

|

Continue with Council governance and funding and delivery

by a CCO

|

|

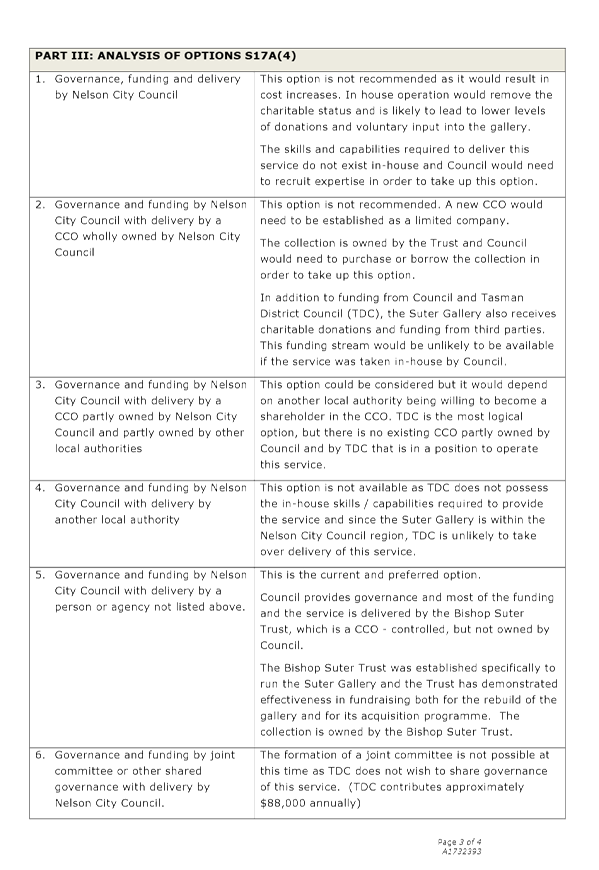

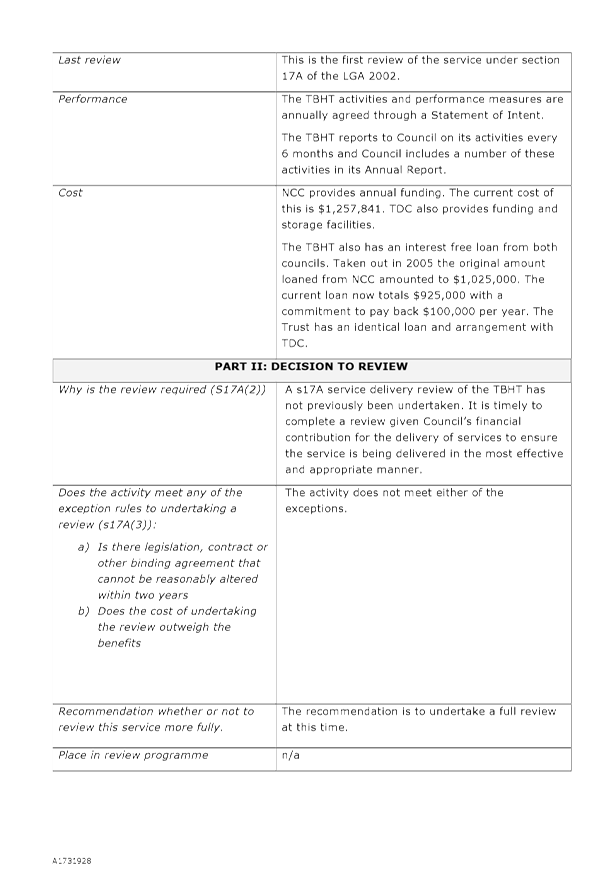

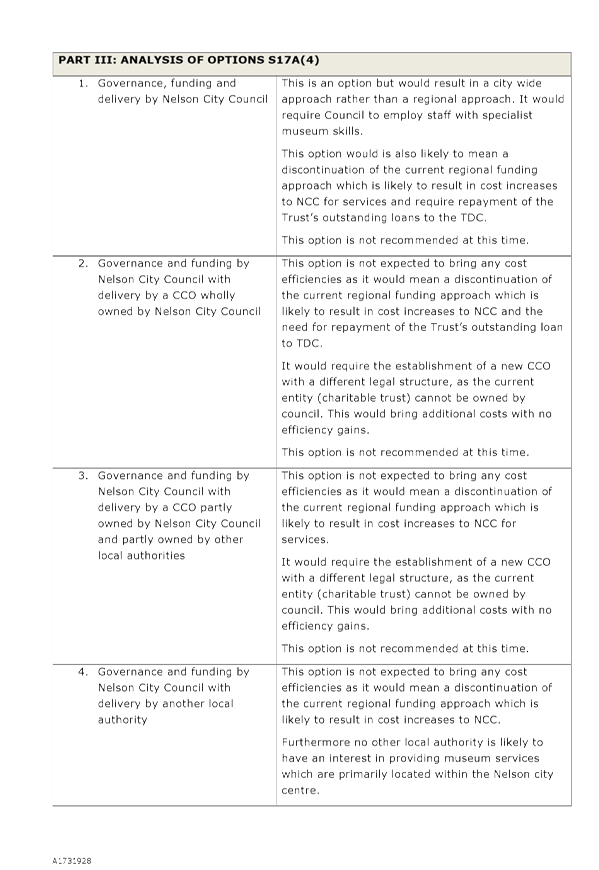

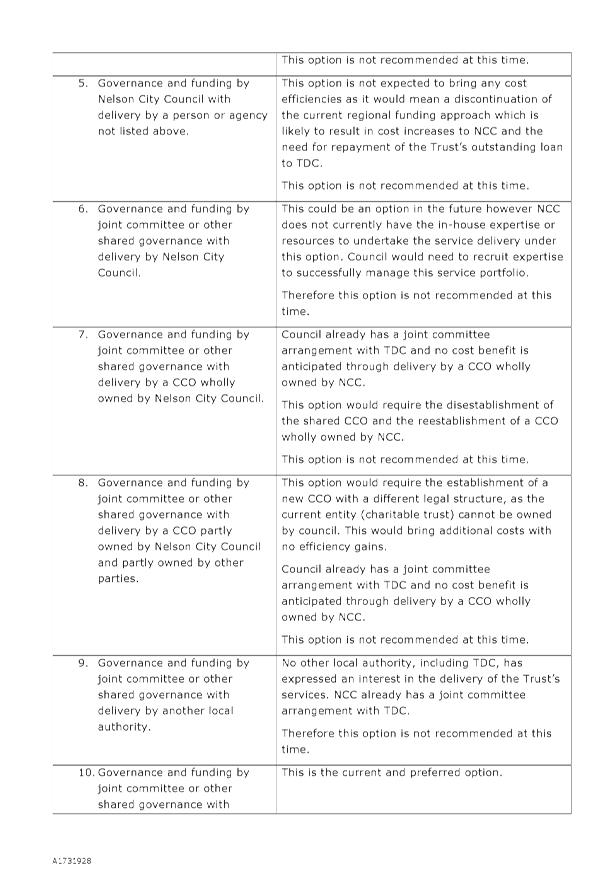

Tasman Bays Heritage Trust and Nelson Museum

|

Continue with joint governance and funding in

collaboration with Tasman District Council and delivery by a CCO

|

|

Economic Services

|

Continue with Council governance, funding and delivery by

a CCO

|

|

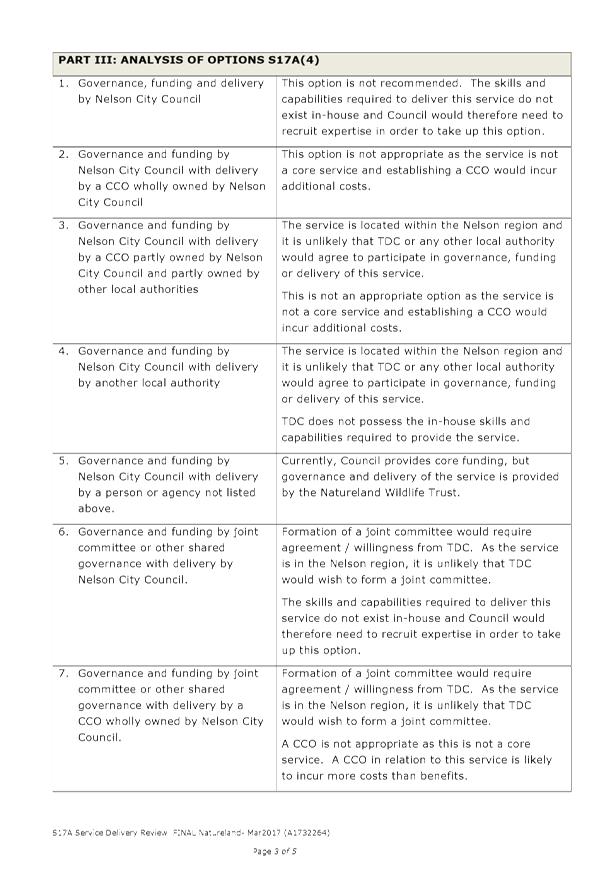

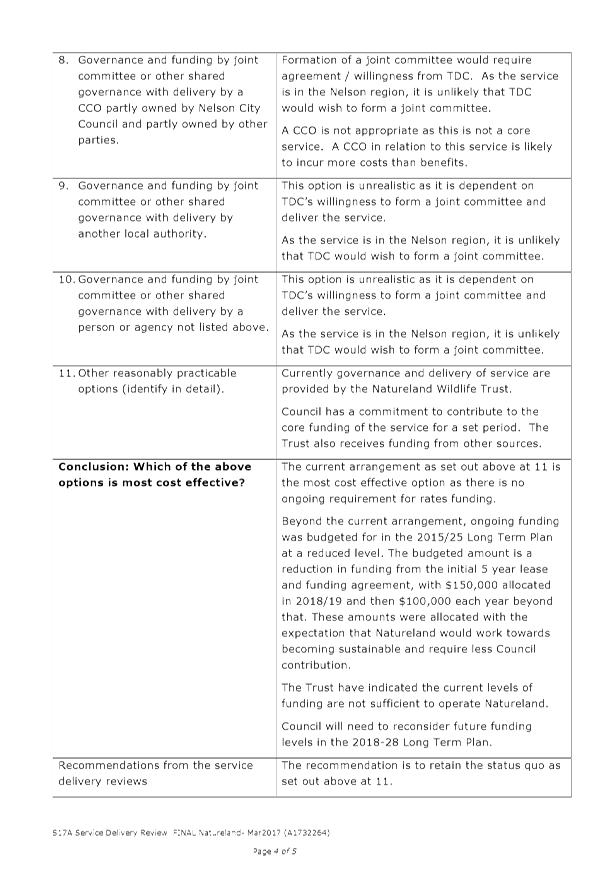

Natureland

|

Continue with funding with governance and delivery by an

external provider.

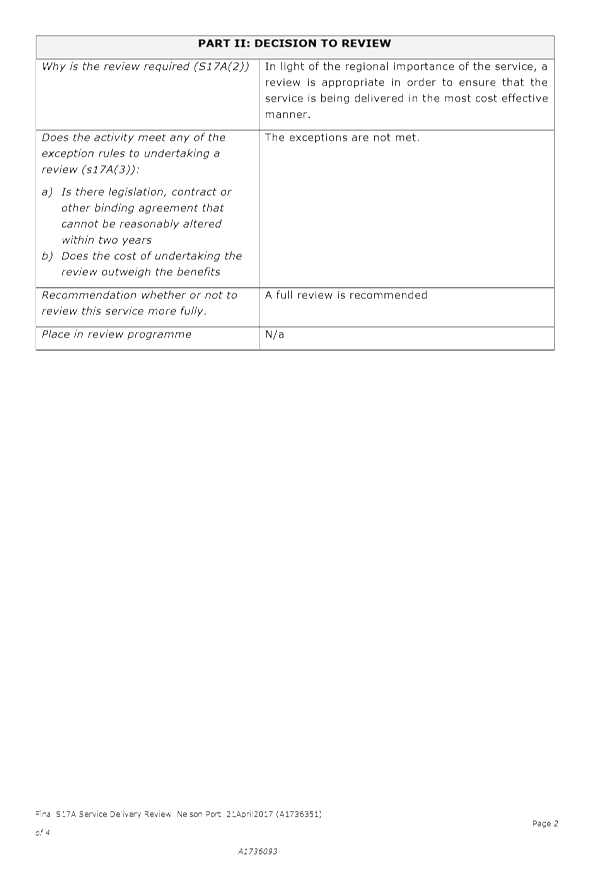

|

|

Port Nelson

|

Continue with joint governance in collaboration with

Tasman District Council and delivery by CCTO

|

|

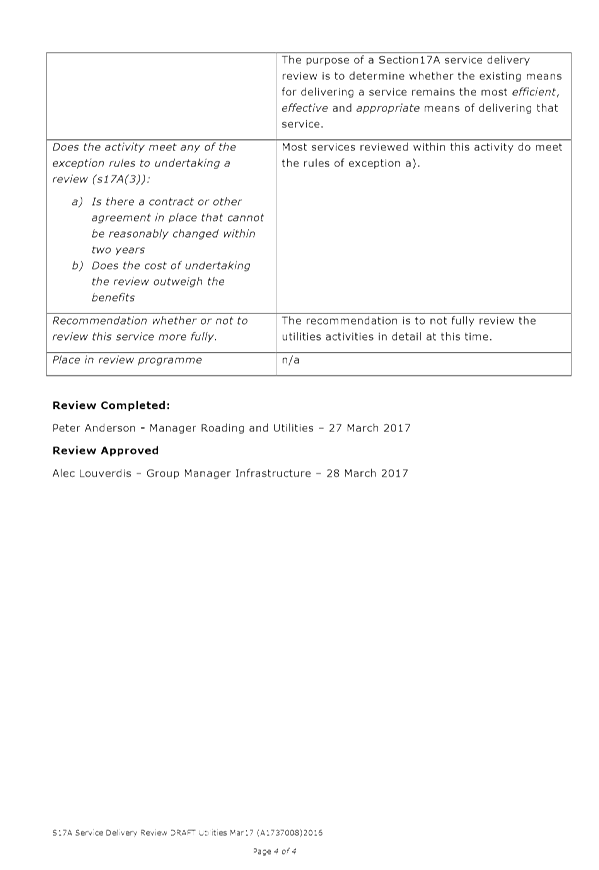

Nelson Airport

|

Continue with joint governance in collaboration with

Tasman District Council and delivery by CCTO

|

|

Libraries

|

Continue with Council governance, funding and delivery

|

|

Building Consents and Building Inspection Services

|

Continue with Council governance, funding and delivery

|

5.10 Reviews

that have not already been before Council are attached.

6. Conclusion

6.1 It

is recommended the Committee note the progress towards completion of the first

round of s17A reviews.

Gabrielle

Thorpe

Policy

Adviser

Attachments

Attachment 1: A1737008 - s17A Service

Delivery Review - Utilities ⇩

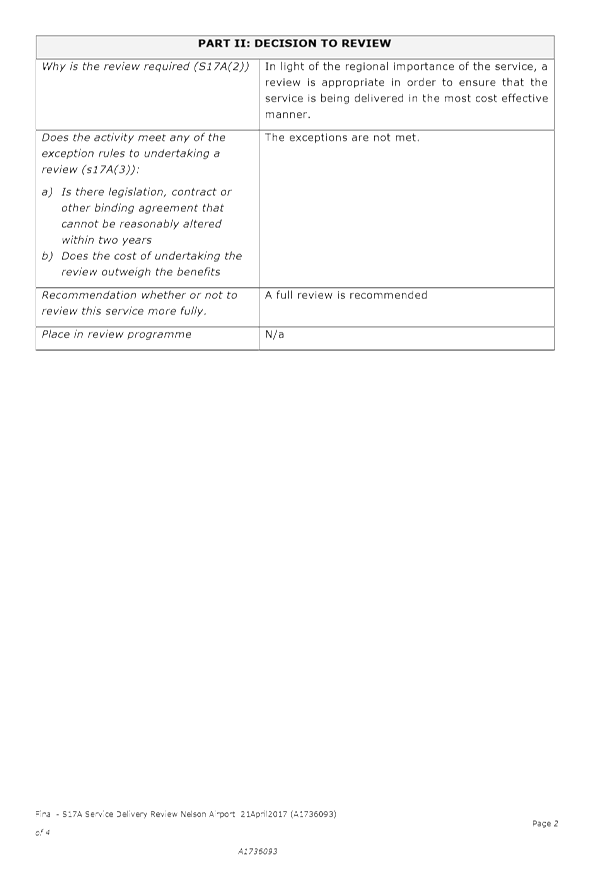

Attachment 2: A1736093

- s17A Service Delivery Review - Nelson Airport ⇩

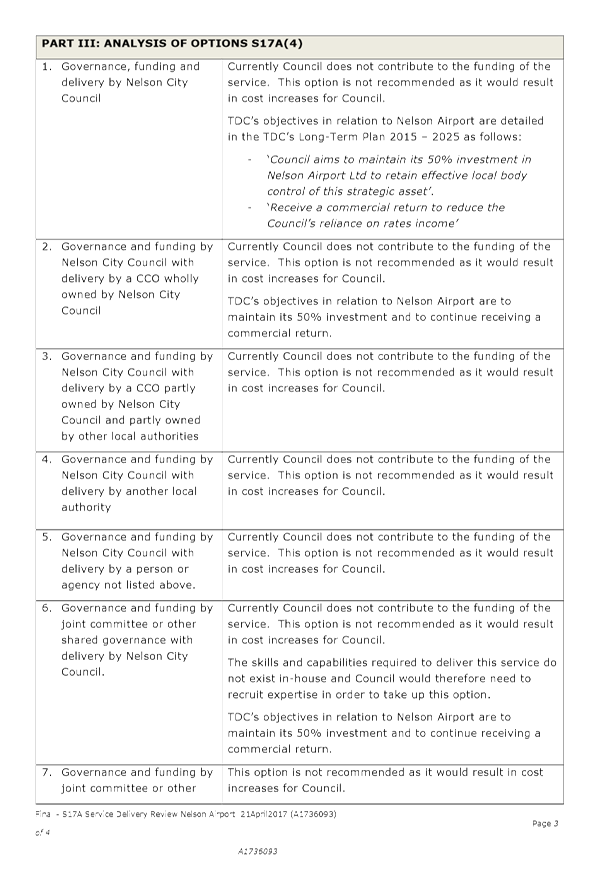

Attachment 3: A1736351

- s17A Service Delivery Review - Port Nelson ⇩

Attachment 4: A1732393

- s17A Service Delivery Review - Suter Gallery ⇩

Attachment 5: A1731928

- s17A Service Delivery Review - Regional Museum ⇩

Attachment 6: A1731591

- s17A Service Delivery Review - Economic Services ⇩

Attachment 7: A1732264

- s17A Service Delivery Review - Natureland ⇩

Attachment 8: A1753361

- s17A Service Delivery Review - Libraries ⇩

Attachment 9: A1642437

- s17A Service Delivery Review - Building Consent Authority and Territorial

Authority functions ⇩

|

Important considerations for decision making

|

|

1. Fit

with Purpose of Local Government

Section 17A service delivery reviews are a statutory

requirement of the LGA 2002.

|

|

2. Consistency

with Community Outcomes and Council Policy

The service delivery review process aligns with

Council’s due diligence obligations and regular reviews of contract

performance that are part of business as usual. This work also supports the

following Community Outcomes:

- That our

infrastructure is efficient, cost effective and meets current and future

needs

- Our

Council provides leadership and fosters partnerships, a regional perspective

and community engagement

|

|

3. Risk

It is likely that the scheduled reviews will not be

completed by the statutory deadline of 8 August 2017 without additional

resourcing. This is considered a low risk outcome and there is no penalty if

a territorial authority does not achieve the deadline. Elevating the

completion of reviews to a priority will result in delays to other higher

priority work.

|

|

4. Financial

impact

The process of reviewing service delivery functions

may bring cost savings in some areas. Staff resources required to complete

reviews are currently within existing budgets. Additional resourcing of up to

$23,000 unbudgeted operational expenditure will be required to achieve the

statutory deadline of 8 August 2017.

|

|

5. Degree

of significance and level of engagement

This quarterly update is of low significance and no

community engagement has been undertaken.

|

|

6. Inclusion

of Māori in the decision making process

Māori have not been consulted in preparation of

this report.

|

|

7. Delegations

The Audit, Risk and Finance Committee has the

responsibility for the Council’s financial and service performance. The

Audit, Risk and Finance Committee has the power to make a recommendation to

Council on this matter.

|

|

|

Audit, Risk and Finance Subcommittee

18 May 2017

|

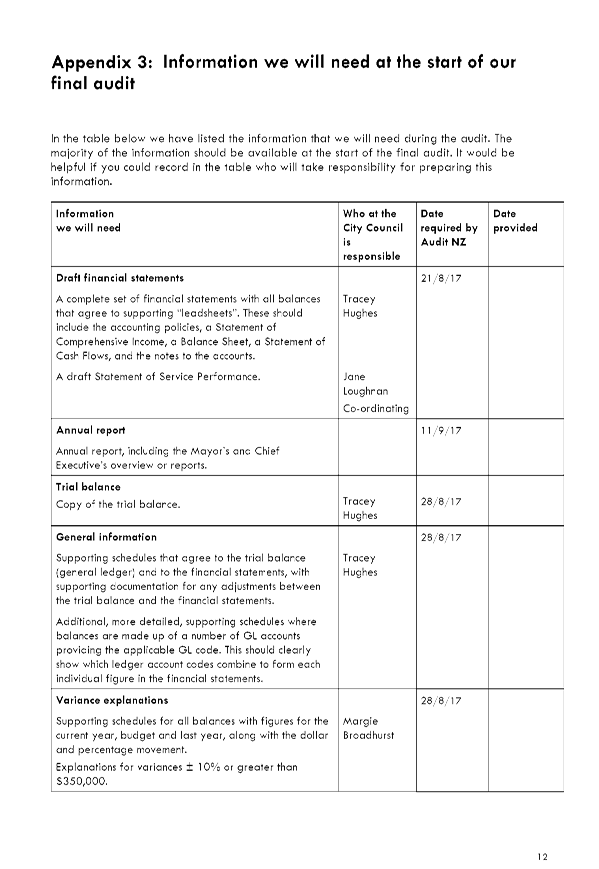

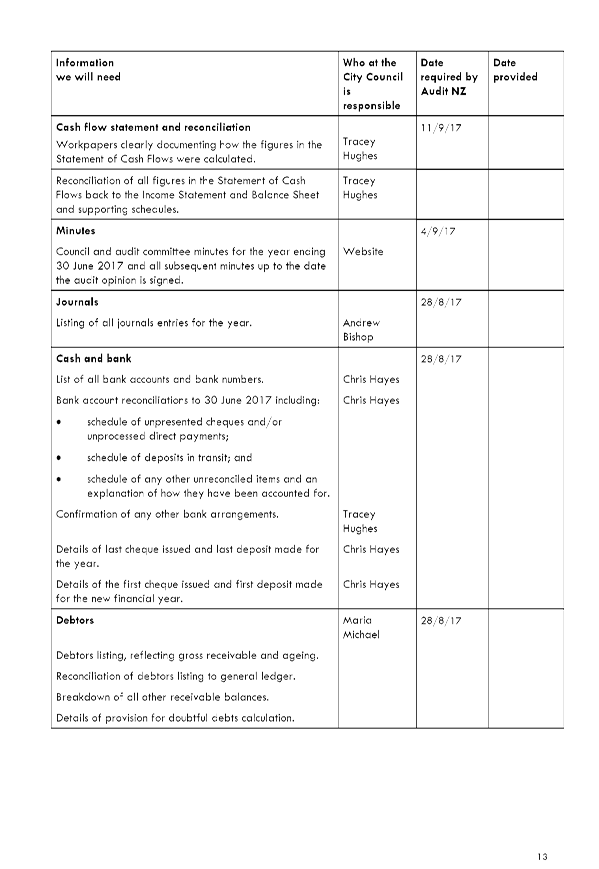

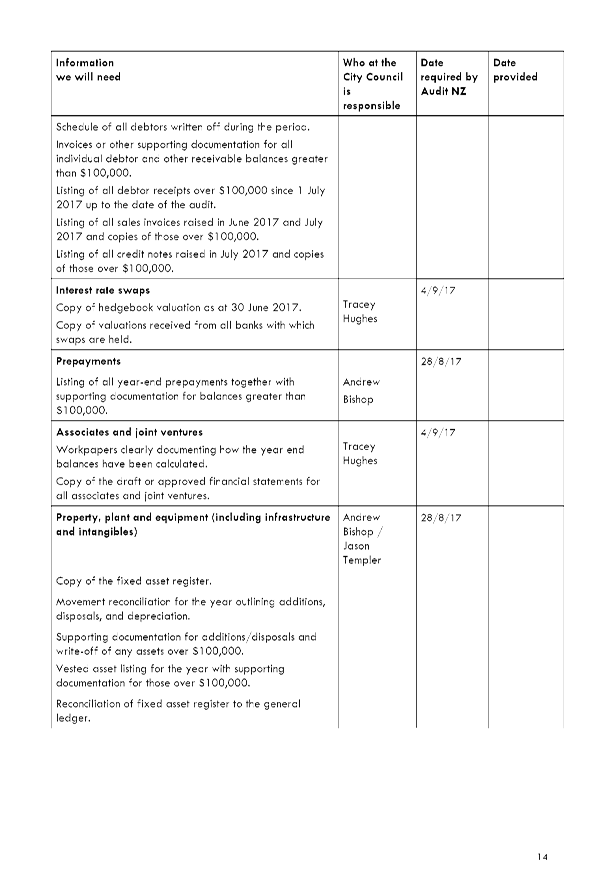

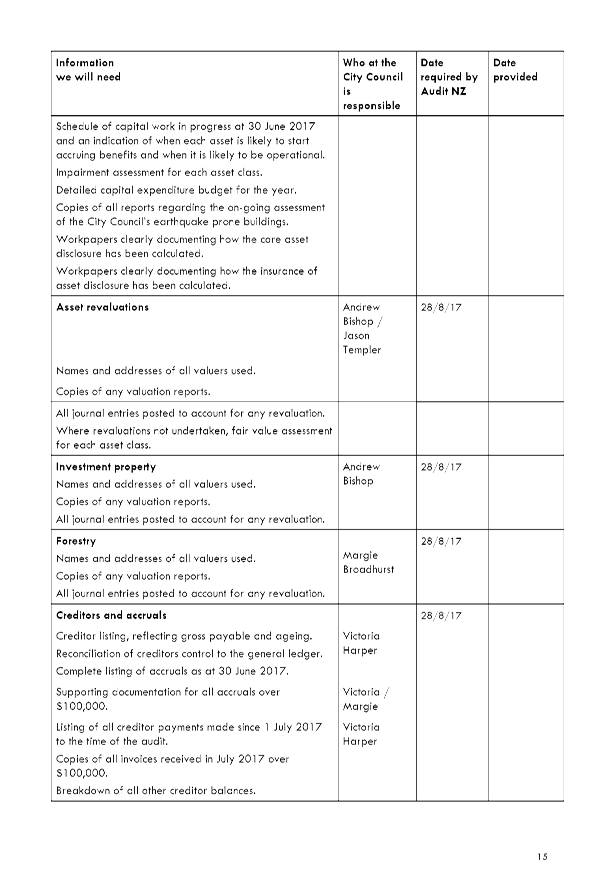

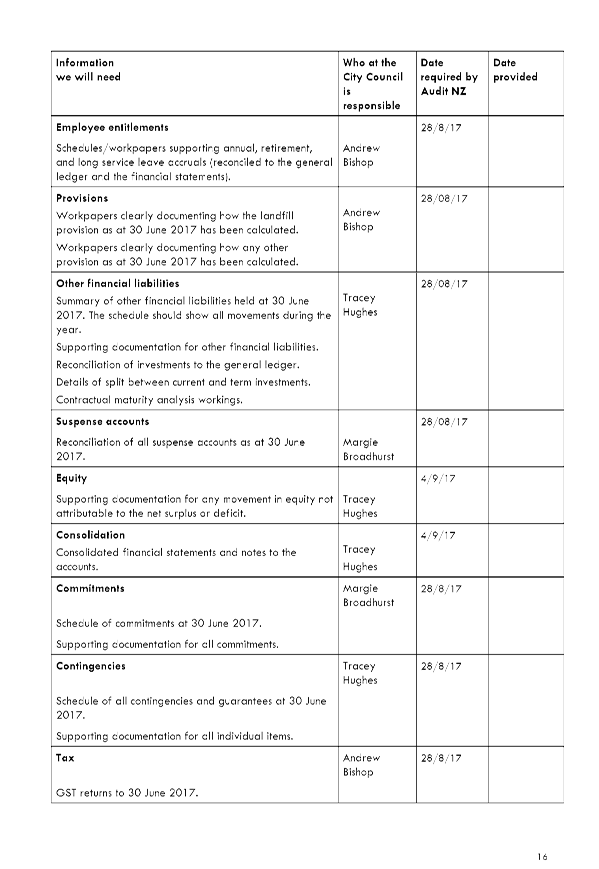

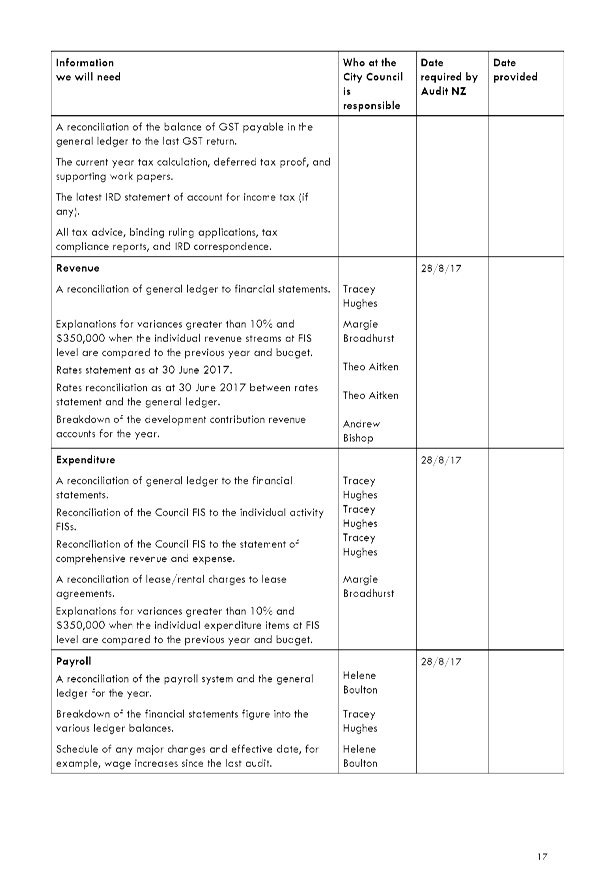

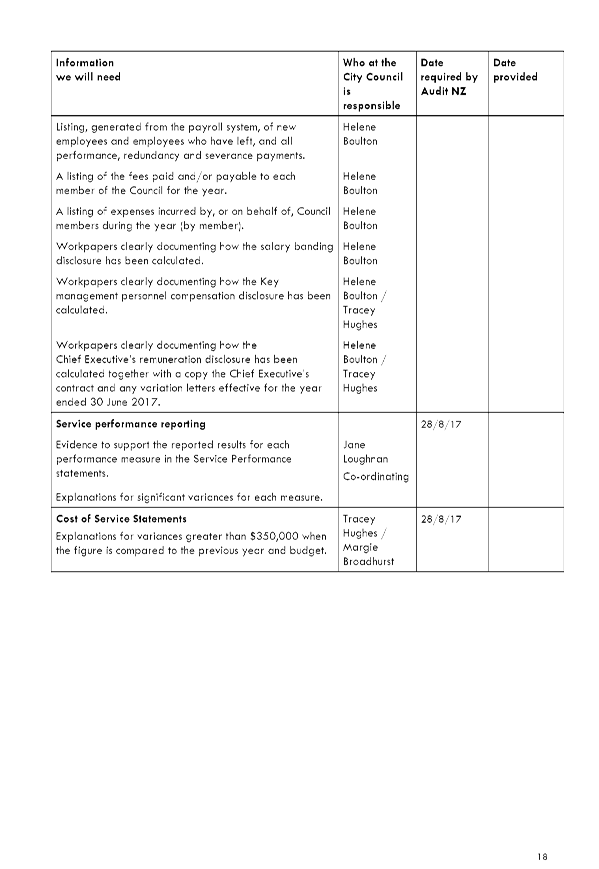

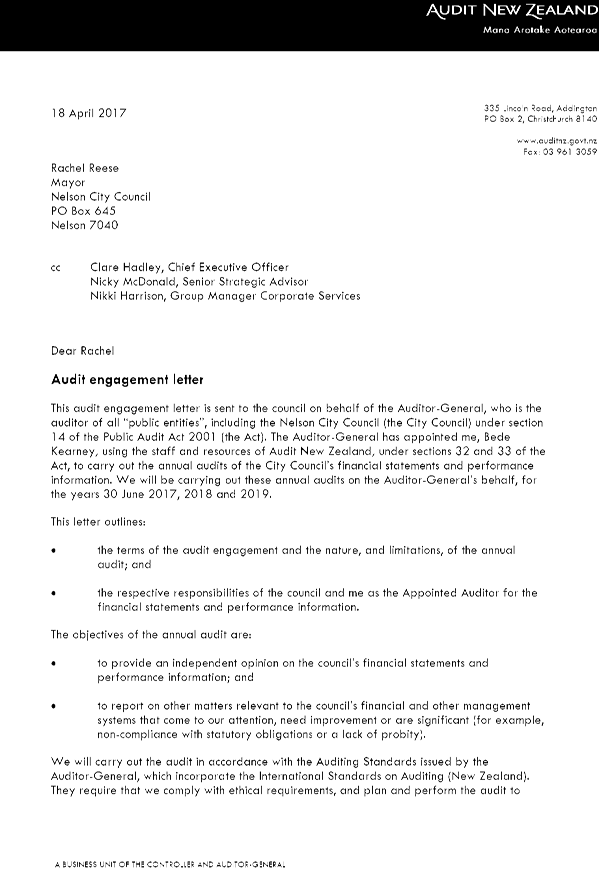

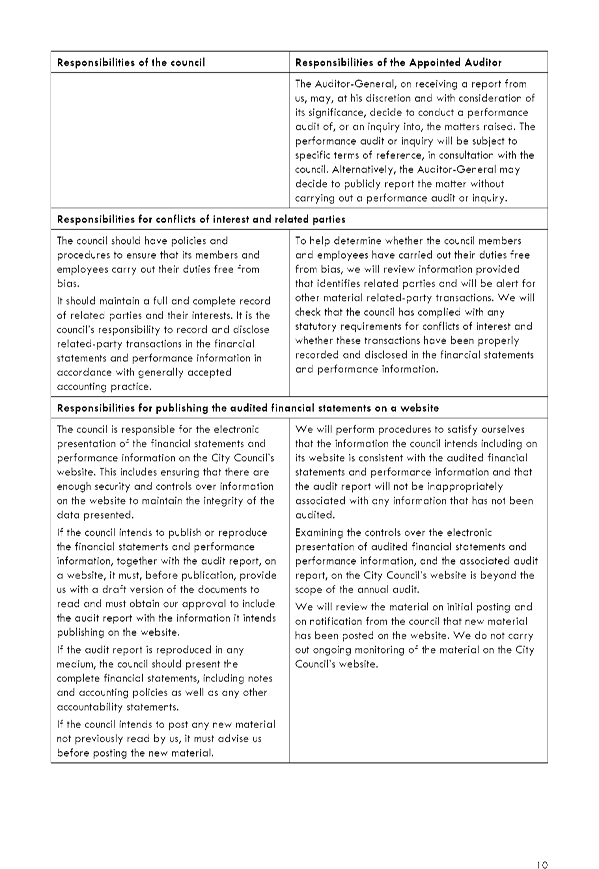

REPORT R7513

Audit

NZ - audit arrangement and engagement letters

1. Purpose

of Report

1.1 To

provide the subcommittee with the Audit Arrangement Letter for the year ending

30 June 2017 and ask for any feedback before the letter is signed by the Mayor.

1.2 To

provide the subcommittee with the Audit Engagement and Audit Proposal Letters

for the years ending 30 June 2017, 2018 and 2019 and ask for any feedback

before the letters are signed by the Mayor.

2. Recommendation

1.

|

That the Subcommittee

Receives the report Audit NZ -

audit arrangement and engagement letters (R7513); and attachments A1749598, A1749594 and A1752596; and

Notes the Subcommittee can provide

feedback on the Audit Arrangement, Audit Engagement and Audit Proposal

letters to Audit NZ if required, noting the Mayor will sign the letters once

the Subcommittee’s feedback has been incorporated.

|

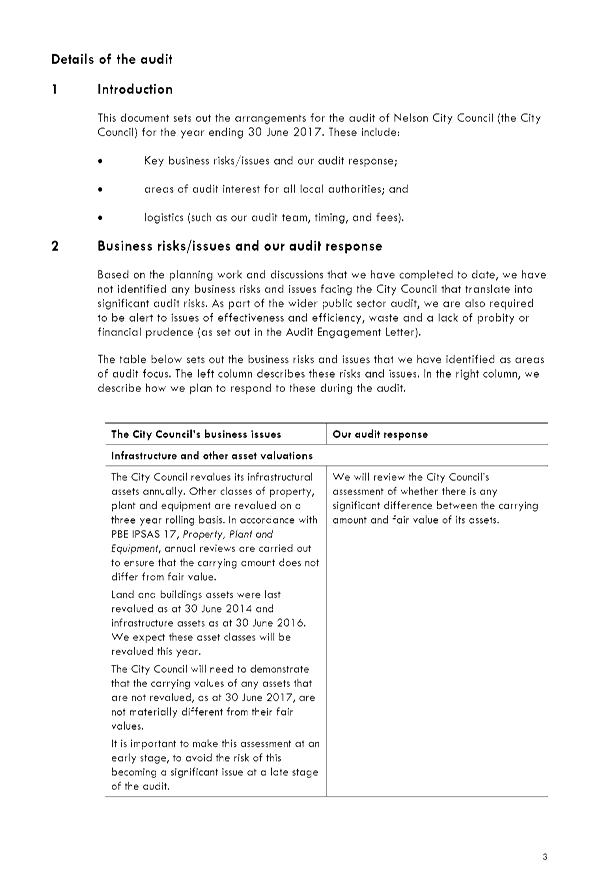

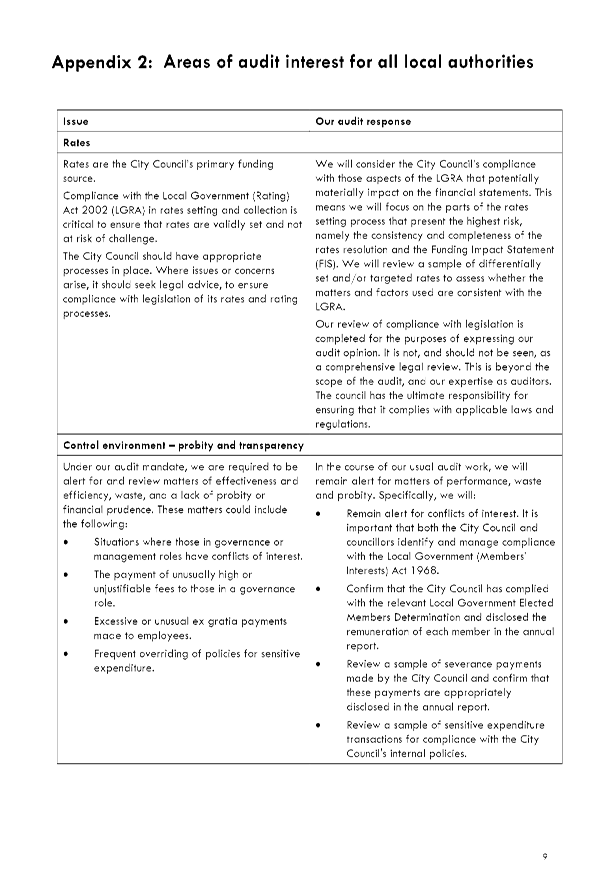

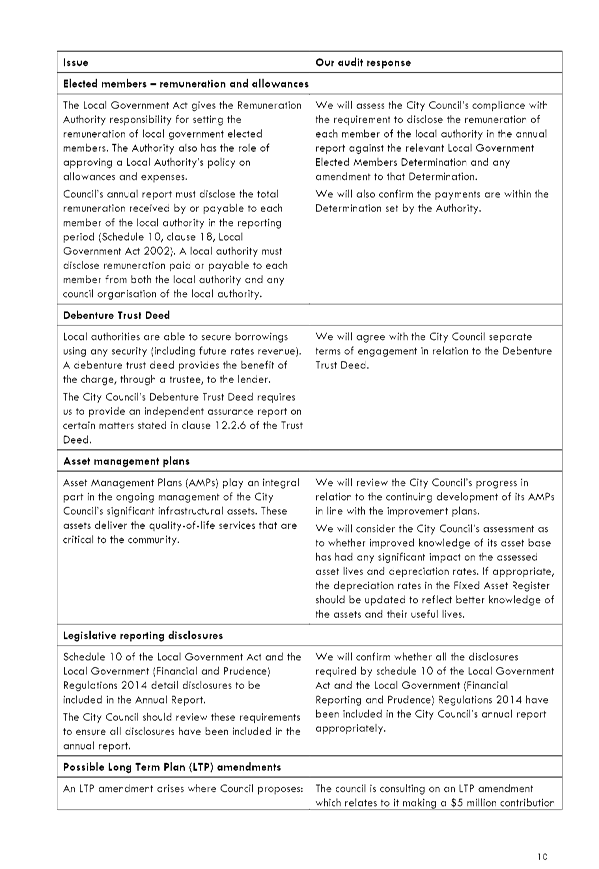

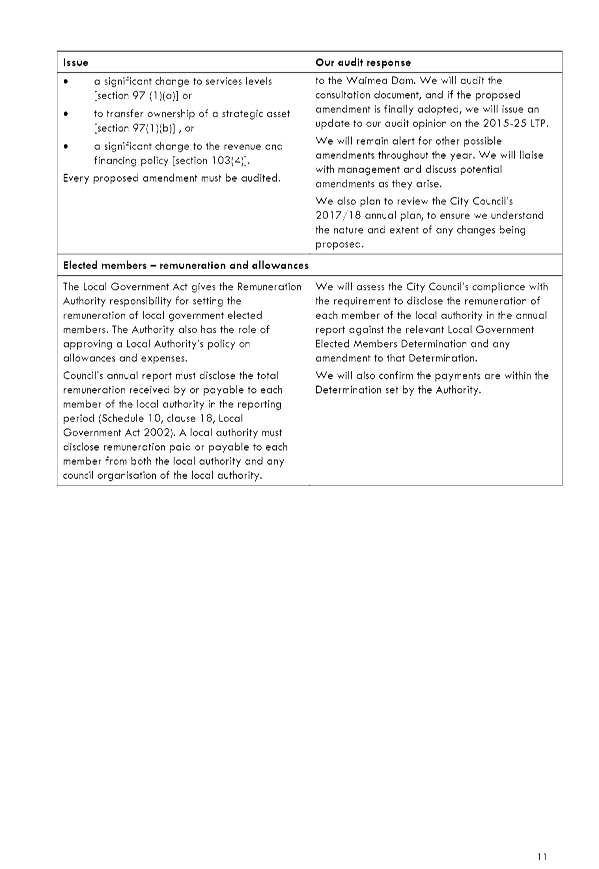

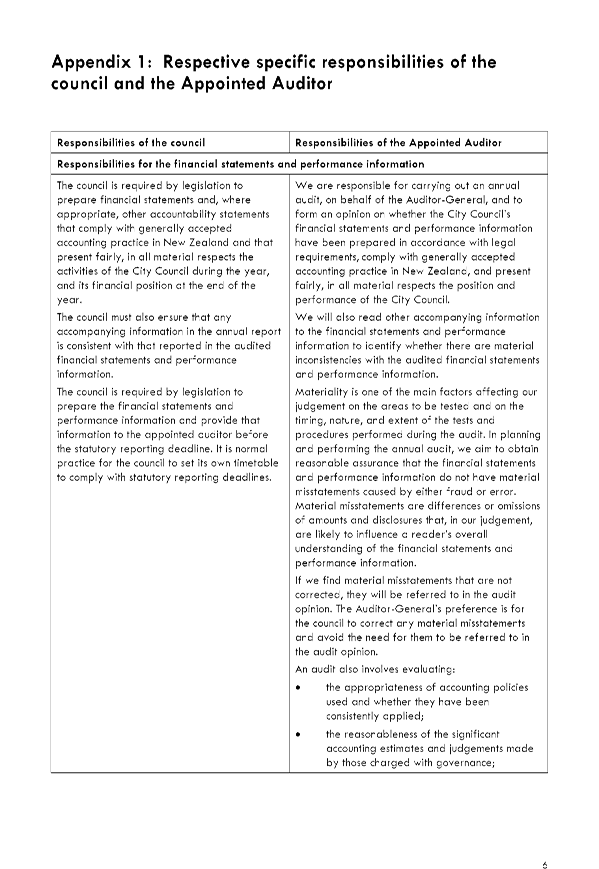

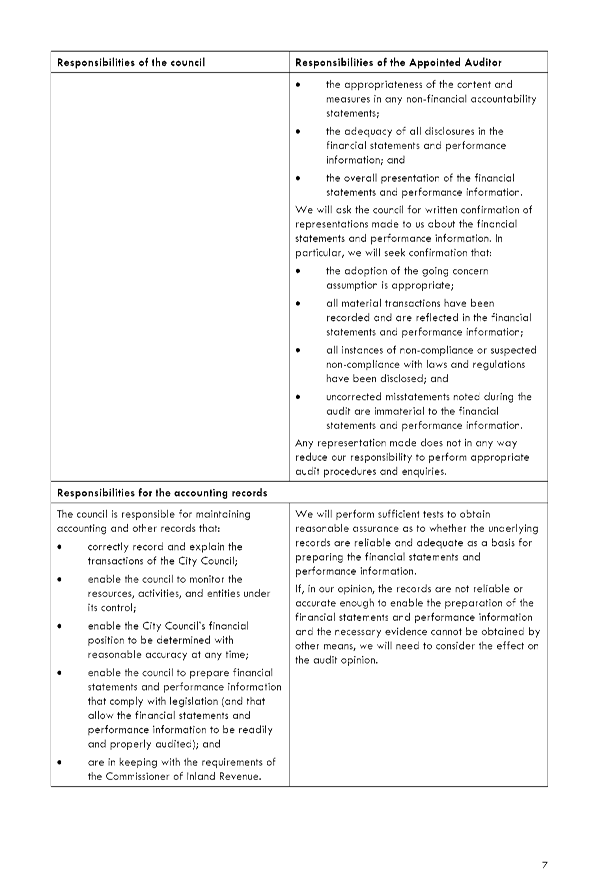

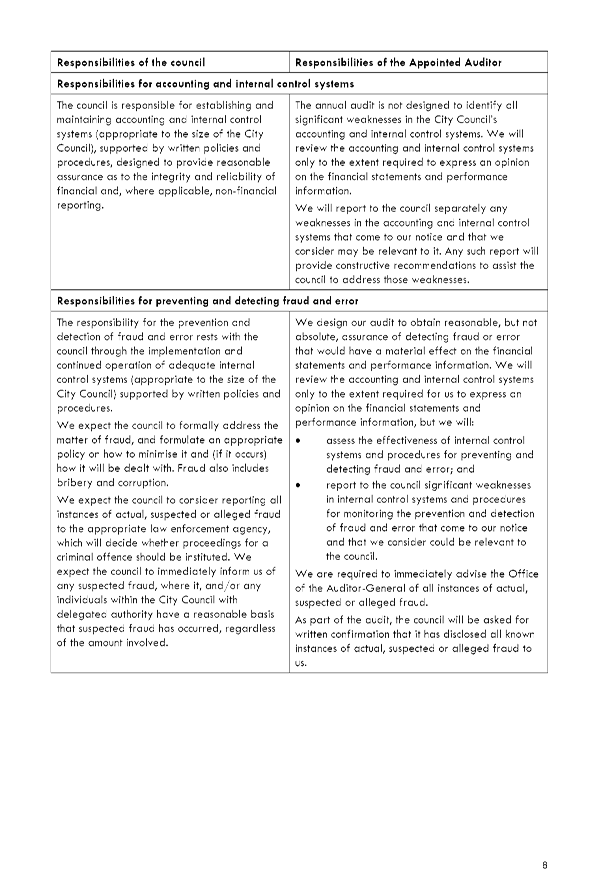

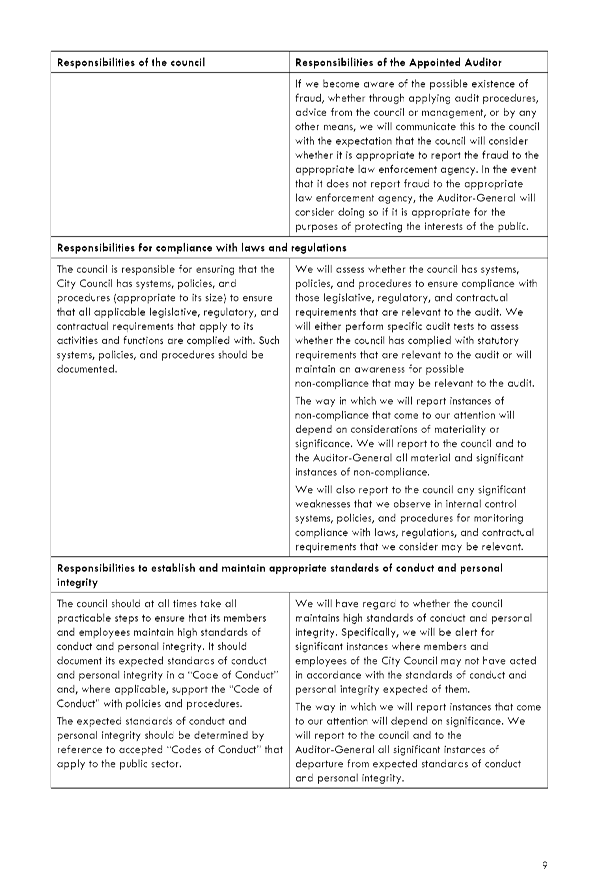

3. Discussion

3.1 The

Audit Arrangement letter for the year ended 30 June 2017 (Attachment 1) sets

out the proposed arrangements for the 2016/17 audit of the Council, including

Nelson Tasman Combined Civil Defence Organisation.

3.2 The

audit arrangement letter sets out the proposed arrangements for this

year’s audit. These include:

3.2.1 Business

risks/issues and the audit response

3.2.2 Areas

of interest for all local authorities; and

3.2.3 Logistics

and professional fees.

3.3 There

is a separate audit arrangement letter for the debenture trust deed but this is

not yet available from Audit NZ and will be brought to a future subcommittee

meeting.

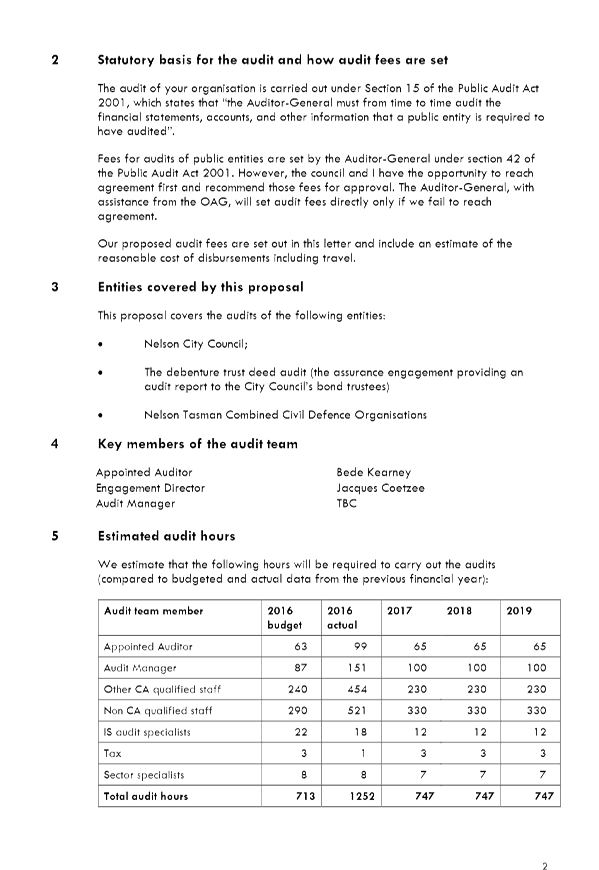

3.4 The

Audit Engagement letter (Attachment 2) covers the years 30 June 2017, 2018 and

2019 and sets out the terms of the audit engagement and the respective

responsibilities of the council and Audit NZ.

3.5 The

Audit Proposal letter sets out the proposed audit fees and audit hours covering

the years 30 June 2017, 2018 and 2019 agreed with the Office of the Auditor

General (Attachment 3). Section 6.1 and 6.2 of this letter outline the reasons

for the proposed increase in the audit fees.

3.6 Bede

Kearney, the appointed auditor, will be in attendance at this subcommittee

meeting to answer any questions that may arise.

3.7 These

letters are required to be signed by the Mayor to confirm that the details of

the audit match Council’s understanding of the arrangements.

4. Options

4.1 The

options are to provide feedback to Audit NZ prior to the Mayor signing the

letters or not.

Nikki

Harrison

Group

Manager Corporate Services

Attachments

Attachment 1: A1749598 - Audit NZ -

Audit arrangement letter - Audit for year ending 30 June 2017 ⇩

Attachment 2: A1749594

- Audit NZ - Audit Engagement Letter 2017, 2018, 2019 ⇩

Attachment 3: A1752596

- Audit NZ - Proposal to conduct audit of NCC and controlled entities 2017,

2018, 2019 ⇩

|

Important considerations for decision making

|

|

1. Fit

with Purpose of Local Government

Section 99 of the Local Government Act 2002 requires

the audit of information contained in the Annual Report and Summary.

|

|

2. Consistency

with Community Outcomes and Council Policy

This report supports the community outcome that

Council provides infrastructure that is efficient, cost effective and meets

current and future needs of our community.

|

|

3. Risk

There is no risk in approving this recommendation.

|

|

4. Financial

impact

The recommendation will not have any significant

financial impact.

|

|

5. Degree

of significance and level of engagement

This matter is of low significance because it does

not affect the level of service provided by Council or the way in which

services are delivered and no engagement has been undertaken.

|

|

6. Inclusion

of Māori in the decision making process

There has been no consultation with Maori in the

preparation of this report.

|

|

7. Delegations

The Audit, Risk and Finance Subcommittee has

responsibility for audit processes and management of financial risks. The

Audit, Risk and Finance Subcommittee has the power to make a recommendation

to Council on this matter.

|

|

|

Audit, Risk and Finance Subcommittee

18 May 2017

|

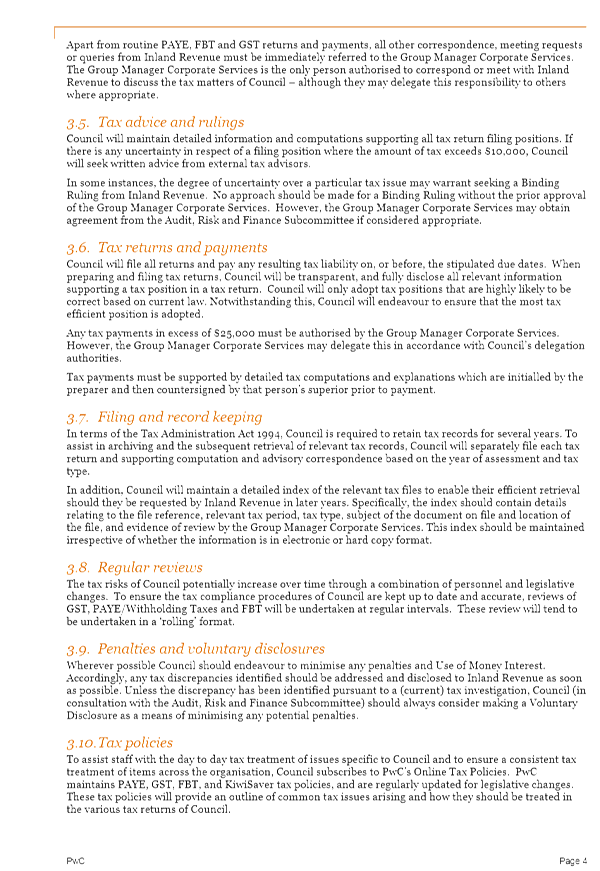

REPORT R7599

Tax

Risk Governance Framework

1. Purpose

of Report

1.1 To

adopt the Tax Risk Governance Framework as the guiding document in relation to

tax governance within Council.

2. Summary

2.1 Council’s

payments to the Inland Revenue (IRD) are in the region of $9 million per annum

and a degree of formal governance oversight is therefore desirable.

2.2 The

IRD and Council’s tax advisors (PriceWaterhouseCoopers (PWC)) recommend

the adoption of a tax control framework supported by a tax risk management

strategy and regular reporting at a governance level.

2.3 The

transparency, discipline and oversight resulting from the implementation of

such a strategy provides ssurance to stakeholders that tax risks are subject to

proper control and outputs such as tax returns can be relied upon.

2.4 Council

officers and PWC have worked together to produce the attached Tax Risk

Management Framework and recommend its adoption.

3. Recommendations

|

That the Subcommittee

Receives the report Tax Risk

Governance Framework (R7599) and its attachment (A1750676).

Notes

that a tax risk management strategy will be presented to a future meeting of

this Subcommittee, and annual reporting against this framework will occur

annually after the end of the tax year (31 March).

|

Recommendation to Council

|

That the

Council

Adopts

the Tax Risk Governance Framework (A1750676) with immediate effect.

|

4. Background

4.1 The

Inland Revenue (IRD) is one of Council’s largest creditors, if not the

largest. Payments to the department for the 2015/16 financial year totalled

$8.9 million. These payments covered GST, PAYE and FBT. Council has little or

no income tax exposure.

4.2 A

degree of oversight from this subcommittee is therefore appropriate.

4.3 In

2016, IRD endorsed the guidance on tax control frameworks (TCF) as published by

the OECD’s Forum on Tax Administration.

4.4 The

following ‘building block’ approach to a TCF was recommended:

· Tax strategy –

should be clearly documented and owned by the senior management and governors

of the organisation

· Comprehensive –

needs to be able to govern the full range of the organisation’s

activities and should be embedded in the day-to-day management of operations

· Responsibility –

the governing body of the organisation is accountable for the design,

implementation and effectiveness of the TCF

· Governance – there

needs to be a system to identify deviations from norms and potential risks of

non-compliance should be recognised and managed

· Testing –

compliance with the TCF should be the subject of regular reporting, testing,

and maintenance

· Assurance – the

TCF should be capable of providing assurance to stakeholders, including the

IRD, that tax risks are subject to proper control and that outputs such as tax

returns can be relied upon.

4.5 Council’s

tax advisors, PWC, recommended that Council adopt a Tax Risk Governance

Framework, along the lines of a TCF, to increase the transparency of its tax

operations and establish appropriate oversight.

4.6 It

is PWC’s opinion that the IRD has begun to look more closely at the local

government sector recently and that operating under such a framework can make a

tax review easier to manage.

4.7 The

risk of such a review is not so much that it will uncover non-compliance, with

the attendant financial penalties (Council’s tax positions and operations

are quite straightforward), more that the resource required to respond to such

a review is onerous (a recent review of a not dissimilar council utilised

approximately 90 full days of staff time - 0.4 FTE over the department - and 14

days of consultant’s time).

5. Discussion

5.1 Council

officers have worked with PWC to produce a tailored Tax Risk Governance

Framework (attachment 1).

5.2 Once

this framework is adopted, Council will develop a tax risk management strategy

to be adopted by this subcommittee.

5.3 Reporting

to this subcommittee (attachment 1, section 3.2) will likely be annual, after

the end of the tax year (31 March).

Options

5.4 Officers

recommend option one, adopt the framework.

|

Option 1: Adopt the Tax Risk

Governance Framework

|

|

Advantages

|

· International

best practice and endorsed by IRD and Council’s tax advisors

· Increases

transparency and oversight of Council’s tax operations

· The

first step to formalising a tax risk strategy

· Supports

the expectation that Council will maintain exemplary governance and tax

compliance standards

|

|

Risks and Disadvantages

|

· None

|

|

Option 2: Do not adopt the

framework

|

|

Advantages

|

· Status

quo

|

|

Risks and Disadvantages

|

· Lack

of transparency and governance oversight may negatively impact the progress

or result of any future tax review (and would likely be a recommendation from

such a review)

|

Tracey

Hughes

Senior

Accountant

Attachments

Attachment 1: Tax Risk Governance

Framework (A1750676) ⇩

|

Important considerations for decision making

|

|

1. Fit

with Purpose of Local Government

The Tax Governance Framework promotes transparency

of Council’s tax operations to all stakeholders including the

community.

|

|

2. Consistency

with Community Outcomes and Council Policy

Supports the community outcome “Our Council

provides leadership and fosters partnerships, a regional perspective and

community engagement”.

|

|

3. Risk

Adoption of this framework mitigates potential minor

risks of perception and encourages tax risk mitigation in line with

Council’s low tax risk profile.

|

|

4. Financial

impact

Adoption of this framework has no financial impact.

|

|

5. Degree

of significance and level of engagement

The decision to adopt the framework is of low

significance as it is an administrative matter that enhances and formalises

existing processes.

|

|

6. Inclusion

of Māori in the decision making process

There has been no consultation with Maori on this

item.

|

|

7. Delegations

The Audit, Risk and Finance Subcommittee has the

responsibility for considering financial and other risk management, internal control

and statutory compliance. The Audit, Risk and Finance Subcommittee has the

power to make a recommendation to Council on this matter.

|

Audit, Risk and Finance

Subcommittee

Audit, Risk and Finance

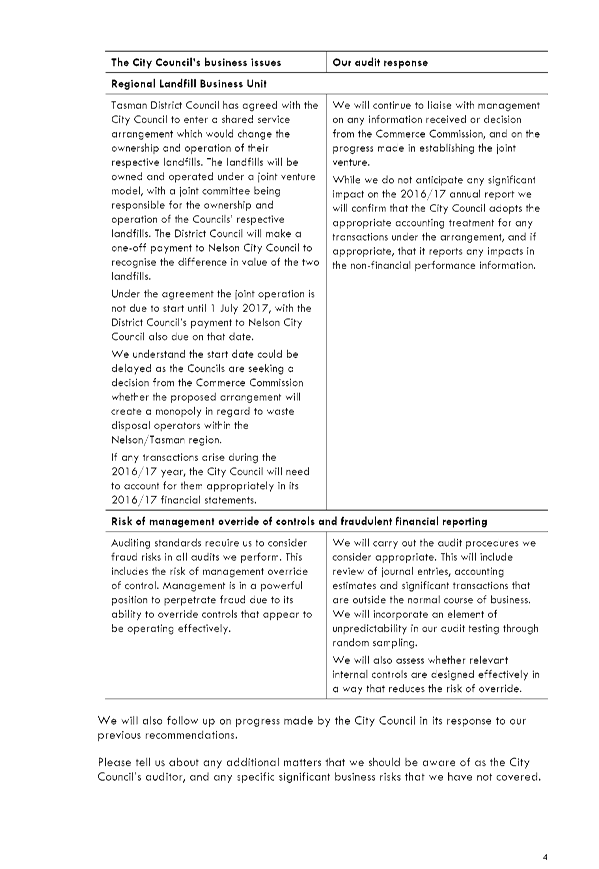

Subcommittee