AGENDA

Ordinary meeting of the

Governance Committee

Thursday 9 March 2017

Commencing at the conclusion of the Council meeting

Council Chamber

Civic House

110 Trafalgar Street, Nelson

Membership: Councillor Ian Barker (Chairperson), Her Worship

the Mayor Rachel Reese, Councillors Mel Courtney, Bill Dahlberg (Deputy

Chairperson), Paul Matheson, Gaile Noonan, Mike Rutledge, and Tim Skinner, Mr

John Murray and Mr John Peters

Guidelines for councillors

attending the meeting, who are not members of the Committee, as set out in

Standing Orders:

·

All councillors, whether or not they are members of the

Committee, may attend Committee meetings (SO 2.12.2)

·

At the discretion of the Chair, councillors who are not Committee

members may speak, or ask questions about a matter.

·

Only Committee members may vote on any matter before the

Committee (SO 3.14.1)

It is good practice for both Committee members and non-Committee

members to declare any interests in items on the agenda. They should

withdraw from the room for discussion and voting on any of these items.

Governance Committee

Governance Committee

9

March 2017

Page

No.

1. Apologies

Nil

2. Confirmation

of Order of Business

3. Interests

3.1 Updates

to the Interests Register

3.2 Identify

any conflicts of interest in the agenda

4. Public

Forum

4.1 Steve

Cross - Nelson Residents Association

Steve Cross, on behalf of the

Nelson Residents Association, will speak about asset disposal and procurement

practices.

5. Confirmation

of Minutes

5.1 1

December 2016 11 - 23

Document number M2243

Recommendation

That the

Committee

Confirms

the minutes of the meeting of the Governance Committee, held on 1 December

2016, as a true and correct record.

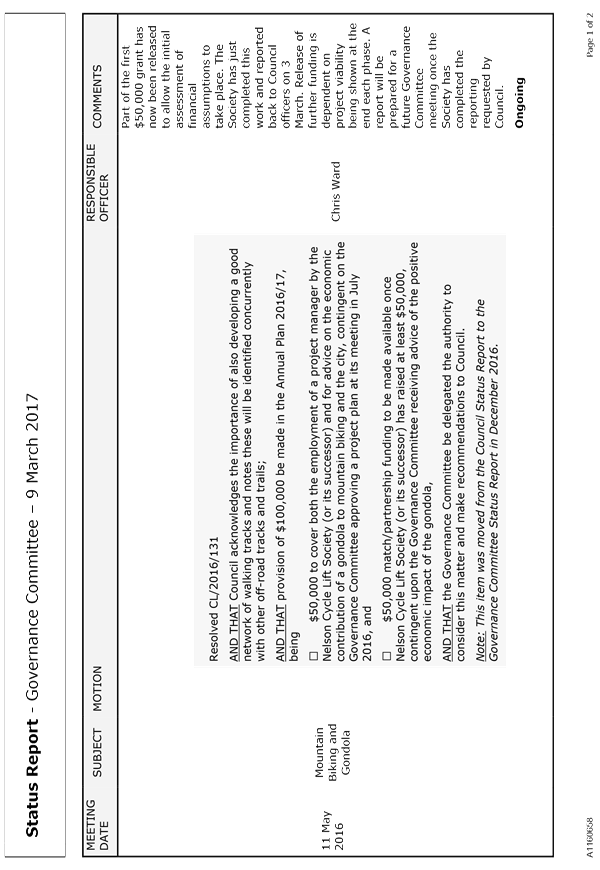

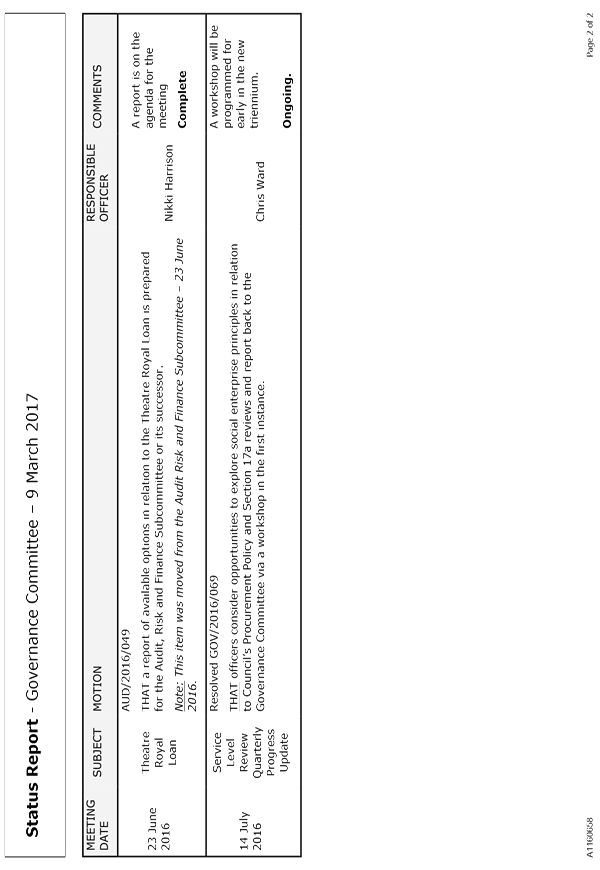

6. Status

Report - Governance Committee - 9 March 2017 24

- 26

Document number R7256

Recommendation

That the Committee

Receives the Status Report

Governance Committee 9 March 2017 (R7256)

and its attachment (A1160658)

7. Chairperson's

Report 27 - 29

Document number R7246

Recommendation

That the Committee

Receives the report Chairperson's

Report (R7246); and

Appoints

Councillor ……………. to the Councillor Liaison role

for the Nelson Tasman Business Trust for the 2016 – 2019 triennium.

Governance

8. Council

Controlled Organisations: Local Government Act 2002 Obligations and Exemption 30 - 34

Document number R6609

Recommendation

|

That the Committee

Receives the report Council Controlled

Organisations: Local Government Act 2002 Obligations and Exemptions (R6609).

|

Recommendation to Council

That the

Council

Approves

a continued exemption to the City of Nelson Civic

Trust for the purposes of Section 6(4)(i) of the Local Government Act 2002, in

accordance with Sections 7(3) and 7(6) of the Act and after considering the

matters in Section 7(5) of the Act.

9. Council's

Key Organisational Risks 2017 First Quarterly Report 35

- 52

Document number R7030

Recommendation

That the Committee

Receives the report Council's Key

Organisational Risks 2017 First Quarterly Report (R7030) and its attachment (A1695388); and

Notes

that a workshop will be held for all Councillors on 11 April 2017 encompassing

both core risk management concepts, and an overview of councillors’

health and safety obligations.

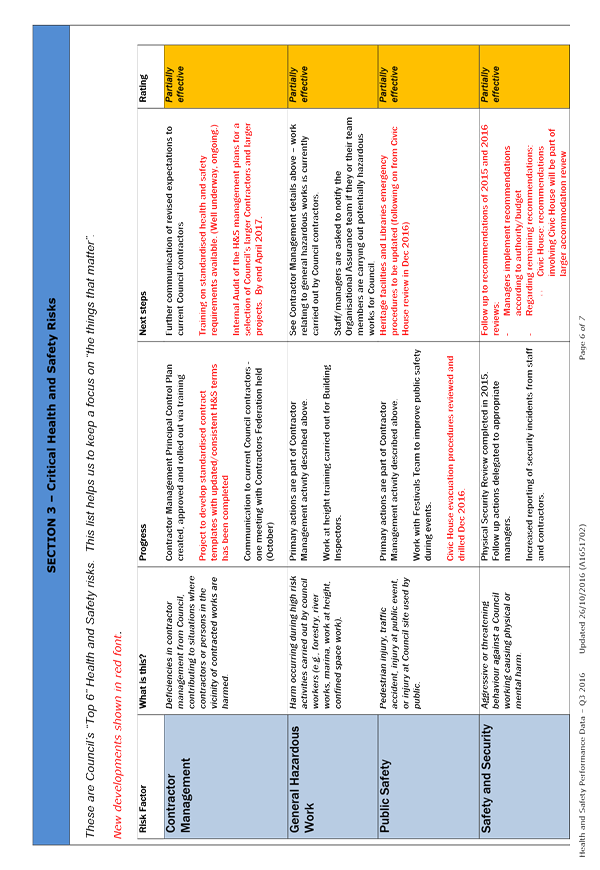

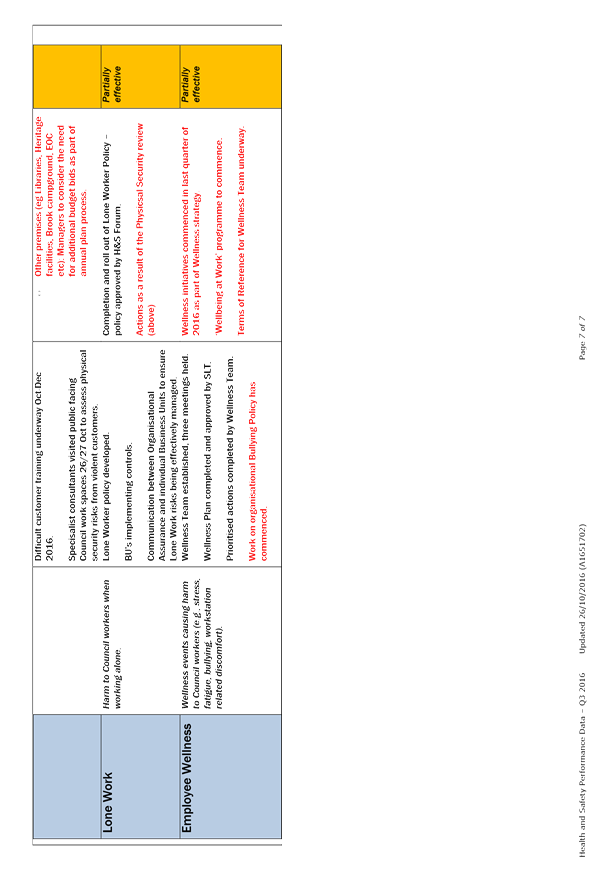

10. Health

and Safety: Quarterly Report 53 - 63

Document number R7020

Recommendation

That the Committee

Receives the report Health and

Safety: Quarterly Report (R7020)

and its attachment (A1710588).

Recommendation to Council

That the

Council

Notes

the report Health and Safety Quarterly Report (R7020) and its attachment (A1710588);

and

Confirms

the assessment of critical health and safety risks contained in the attachment

(A1710588).

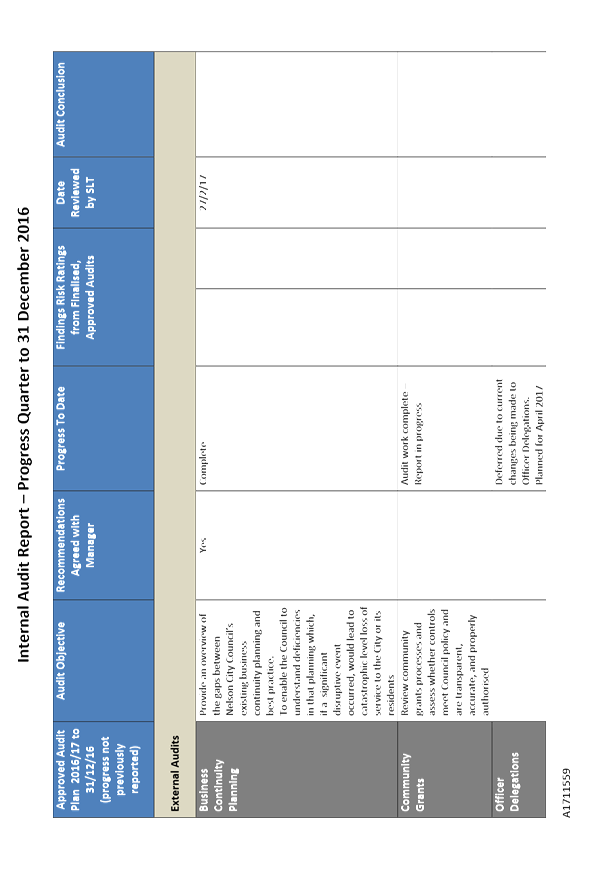

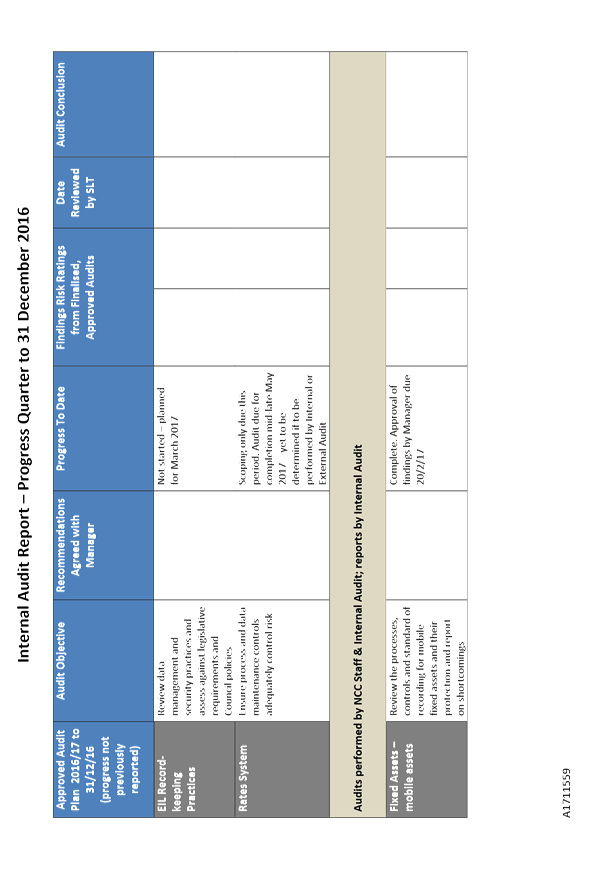

11. Internal

Audit Report to 31 December 2016 64 - 73

Document number R7185

Recommendation

That the Committee

Receives the report Internal Audit

Report to 31 December 2016 (R7185)

and its attachment (A1711559).

12. Remission

Of Rates To Compensate For Business Disruption 74

- 77

Document number R7193

Recommendation

That the Committee

Receives the report Remission Of

Rates To Compensate For Business Disruption (R7193).

Recommendation to Council

That the

Council

Confirms

not to develop a rates remission policy for businesses affected by civil works

undertaken by Council.

13. Insurance

renewal 2017/18 - Infrastructure Assets 78

- 82

Document number R7244

Recommendation

That the Committee

Receives the report Insurance

renewal 2017/18 - Infrastructure Assets (R7244);

and

Notes

that information is being collated to inform a decision

on whether to remain with the Local Authority Protection Program (LAPP) for

Council’s infrastructure insurance and also to understand the appropriate

level of insurance cover.

Recommendation

to Council

That the

Council

Approves

delegating authority to the Mayor, Chair of Governance and Chief Executive to

decide whether Nelson City Council should exit from the Local Authority

Protection Program for Council’s infrastructure insurance and the

appropriate level of insurance cover, by the end of May 2017 and take any

action required to give effect to the decision.

14. Tendering

processes 83 - 130

Document number R7135

Recommendation

That the

Committee

Receives the report Tendering

processes (R7135) and its

attachments (A1713610 and R6796); and

Notes

Crowe Horwath’s comments (A1713610) and how officers intend to address

the issues raised.

Finance

15. Letter

to the Council from Audit New Zealand on the audit for the year ended 30 June

2016 131 - 140

Document number R6978

Recommendation

That the Committee

Receives the report Letter to the

Council from Audit New Zealand on the audit for the year ended 30 June 2016

(R6978) and its attachment

(A1702571).

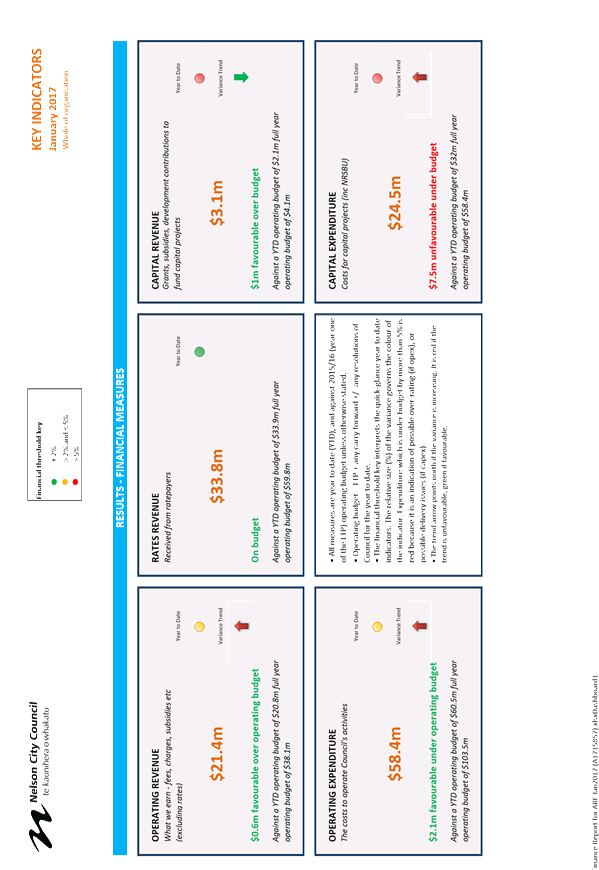

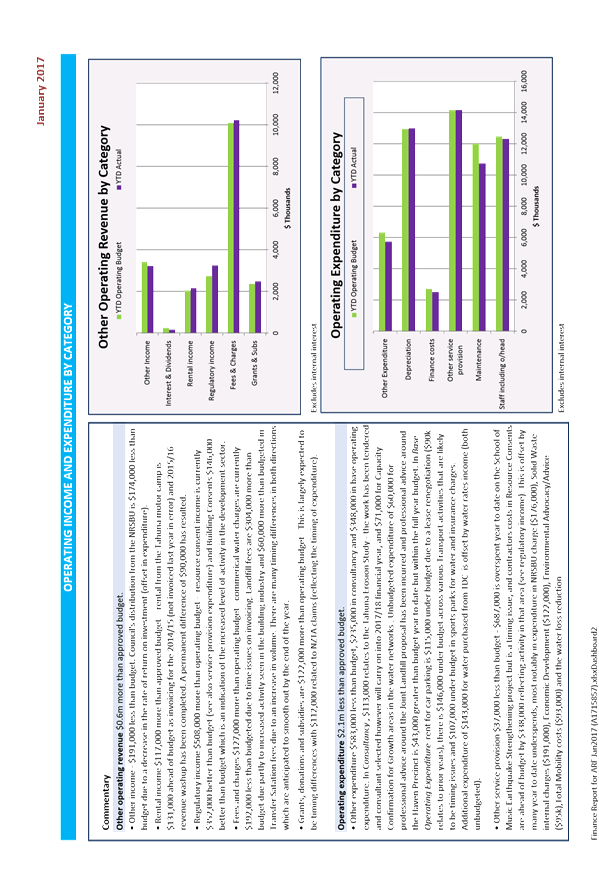

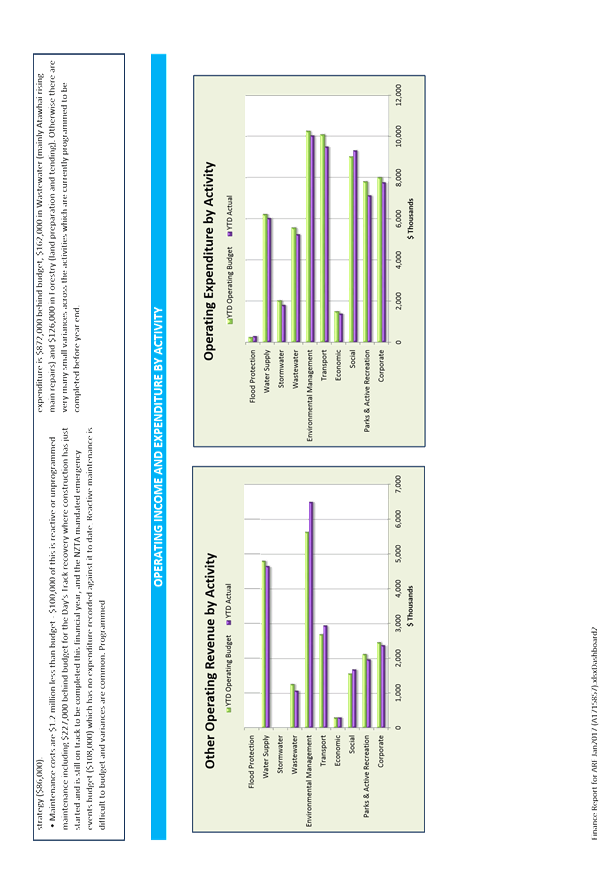

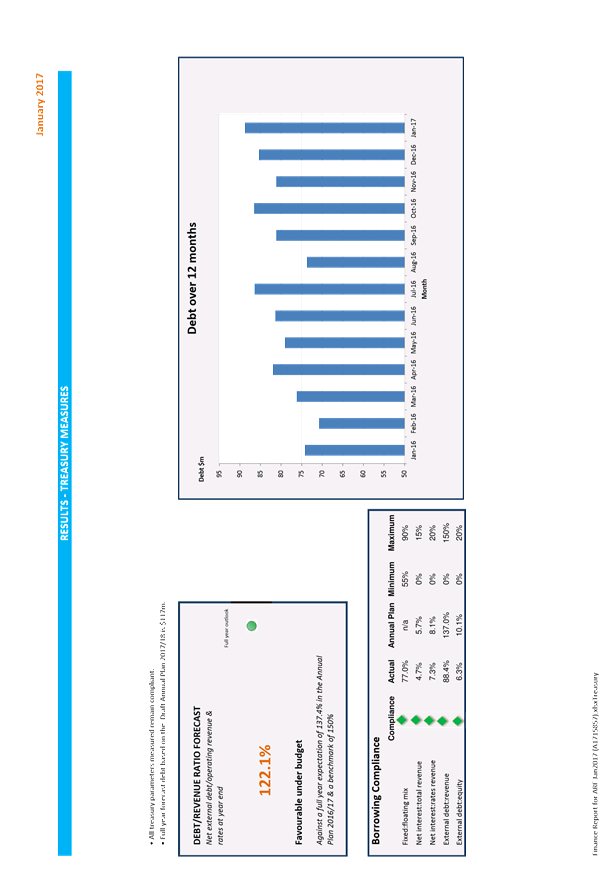

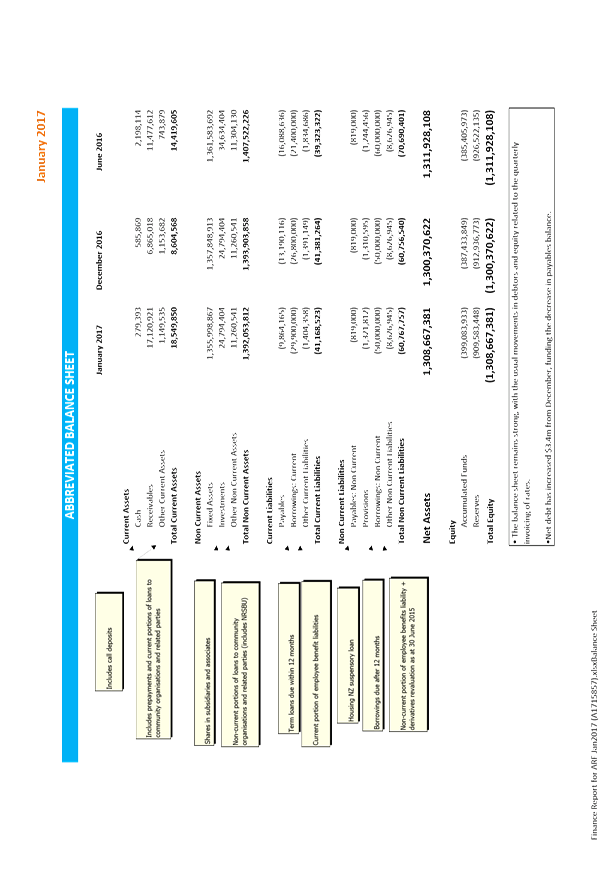

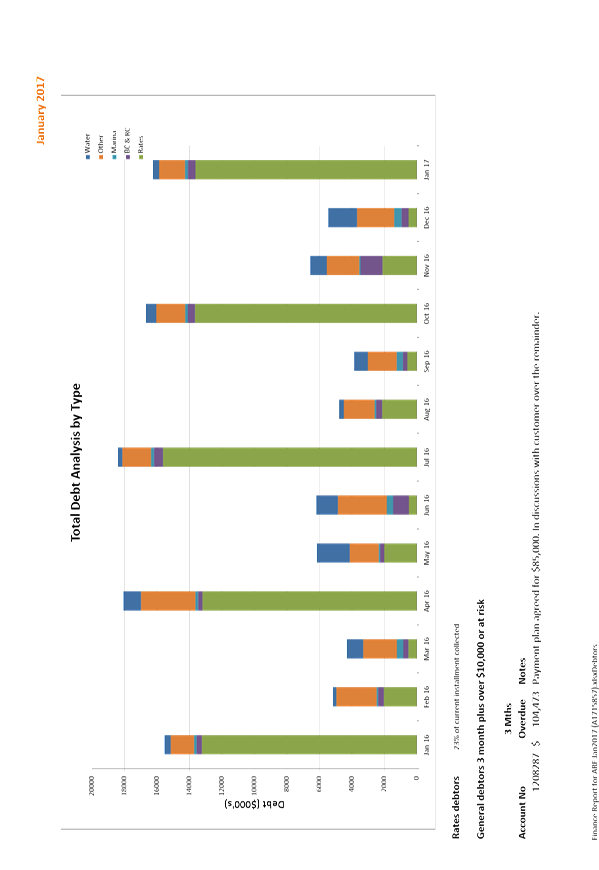

16. Corporate

Report to 31 January 2017 141 - 153

Document number R6996

Recommendation

That the Committee

Receives the report Corporate

Report to 31 January 2017 (R6996)

and its attachments (A1715857 and A1717092).

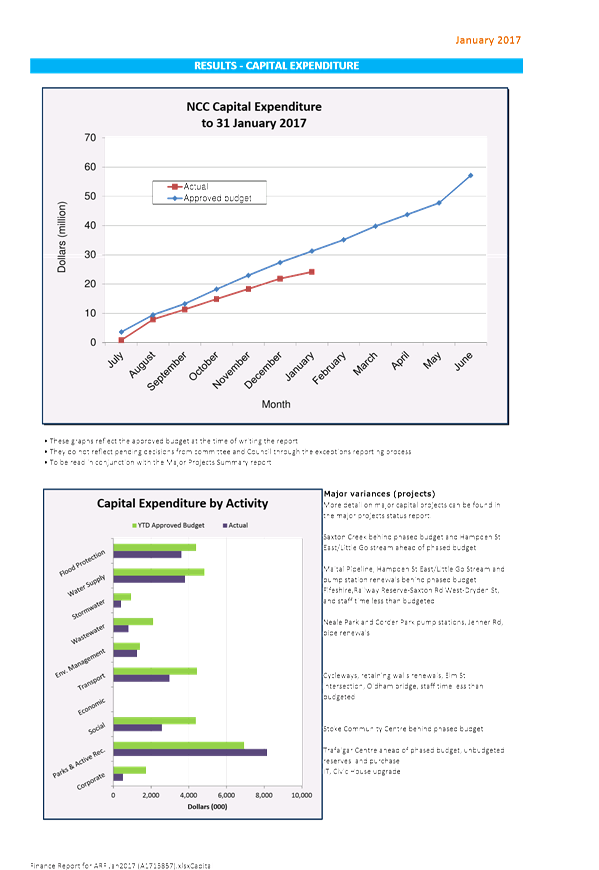

17. Capital

Expenditure Programme 2016-17 - Requests for Change 154 - 156

Document number R7065

Recommendation

That the Committee

Receives the report Capital

Expenditure Programme 2016-17 - Requests for Change (R7065).

Recommendation to Council

That the

Council

Approves,

with respect to project 1199 Civic House Renewal Programme (Lift Renewal), that

$225,816 be transferred from 2016/17 to 2017/18, to align with the scheduled

installation programme.

Public Excluded Business

18. Exclusion

of the Public

Recommendation

That the

Committee

Excludes

the public from the following parts of the proceedings of this meeting.

The

general subject of each matter to be considered while the public is excluded,

the reason for passing this resolution in relation to each matter and the

specific grounds under section 48(1) of the Local Government Official

Information and Meetings Act 1987 for the passing of this resolution are as

follows:

|

Item

|

General subject of each matter to be considered

|

Reason for passing this resolution in relation to each matter

|

Particular interests protected (where applicable)

|

|

1

|

Governance

Committee Meeting - Public Excluded Minutes - 1 December 2016

|

Section

48(1)(a)

The public

conduct of this matter would be likely to result in disclosure of information

for which good reason exists under section 7.

|

The

withholding of the information is necessary:

· Section

7(2)(b)(ii)

To protect information where the making

available of the information would be likely unreasonably to prejudice the

commercial position of the person who supplied or who is the subject of the

information.

· Section

7(2)(i)

To enable the local authority to carry

on, without prejudice or disadvantage, negotiations (including commercial and

industrial negotiations).

· Section

7(2)(a)

To protect the privacy of natural

persons, including that of a deceased person.

|

|

2

|

Theatre

Royal Loan

|

Section 48(1)(a)

The public conduct of this

matter would be likely to result in disclosure of information for which good

reason exists under section 7

|

The

withholding of the information is necessary:

· Section 7(2)(i)

To enable the local

authority to carry on, without prejudice or disadvantage, negotiations

(including commercial and industrial negotiations)

|

|

3

|

Internal

Audit - Summary of New and Outstanding Control Issues - Quarter to 31

December 2016

|

Section 48(1)(a)

The public conduct of this

matter would be likely to result in disclosure of information for which good

reason exists under section 7

|

The

withholding of the information is necessary:

· Section 7(2)(j)

To prevent the disclosure

or use of official information for improper gain or improper advantage

|

|

4

|

Status

Report - Governance Committee - 9 March 2017

|

Section 48(1)(a)

The public conduct of this

matter would be likely to result in disclosure of information for which good

reason exists under section 7

|

The

withholding of the information is necessary:

· Section 7(2)(i)

To enable the local

authority to carry on, without prejudice or disadvantage, negotiations

(including commercial and industrial negotiations)

|

|

5

|

Director

appointment for Nelson Airport Limited

|

Section 48(1)(a)

The public conduct of this

matter would be likely to result in disclosure of information for which good

reason exists under section 7

|

The

withholding of the information is necessary:

· Section 7(2)(a)

To protect the privacy of

natural persons, including that of a deceased person

|

19. Re-admittance

of the public

Recommendation

That the

Committee

Re-admits

the public to the meetings.

Note:

·

This meeting is expected to continue beyond lunchtime. (delete as appropriate)

·

Lunch will be provided at 12.30pm. (delete as appropriate)

·

Youth Councillors Liam Bloomfield and Luke Wilkes will be in

attendance at this meeting. (delete as appropriate)

Minutes of a meeting of

the Governance Committee

Held in the Council

Chamber, Civic House, 110 Trafalgar Street, Nelson

On Thursday 1 December

2016, commencing at 1.00pm

Present: Councillor

I Barker (Chairperson), Her Worship the Mayor R Reese, Councillors M Courtney,

B Dahlberg (Deputy Chairperson), P Matheson, G Noonan, M Rutledge, and T

Skinner, Mr J Murray and Mr J Peters

In Attendance: Councillors

B McGurk and S Walker, Chief Executive (C Hadley), Group Manager Community

Services (C Ward), Group Manager Corporate Services (N Harrison), Group Manager

Infrastructure (A Louverdis), Group Manager Strategy and Environment (C

Barton), Senior Strategic Adviser (N McDonald), Manager Communications (P

Shattock), Manager Administration (P Langley), Team Leader Administration

Advisers (R Byrne), and Administration Adviser (S Burgess)

1. Apologies

There were no apologies.

2. Confirmation of Order of Business

The

Chairperson advised that Item 10 (Health and Safety: Quarterly Report) and item

11 (Internal Audit Report to 30 September 2016) would be considered after item

7 (Sister City Report) to accommodate staff availability.

The

Chairperson advised of one late item for the public part of the meeting, and

that the following resolution needed to be passed for the items to be

considered:

2.1 Nelson

Events Strategy Funding Application South Island Masters Games 2017 (M2242)

|

Resolved GOV/2016/132

That

the Committee

Considers

the item regarding Nelson Events Strategy Funding Application South Island

Masters Games 2017 at this meeting as a major item not on the agenda,

pursuant to Section 46A(7)(a) of the Local Government Official Information

and Meetings Act 1987, to enable a timely decision to be made.

Dahlberg/Rutledge Carried

|

3. Interests

Deputy Mayor Matheson declared

an interest in the late item Nelson Events Strategy Funding Application South

Island Masters Games 2017.

4. Public Forum

There was no public forum.

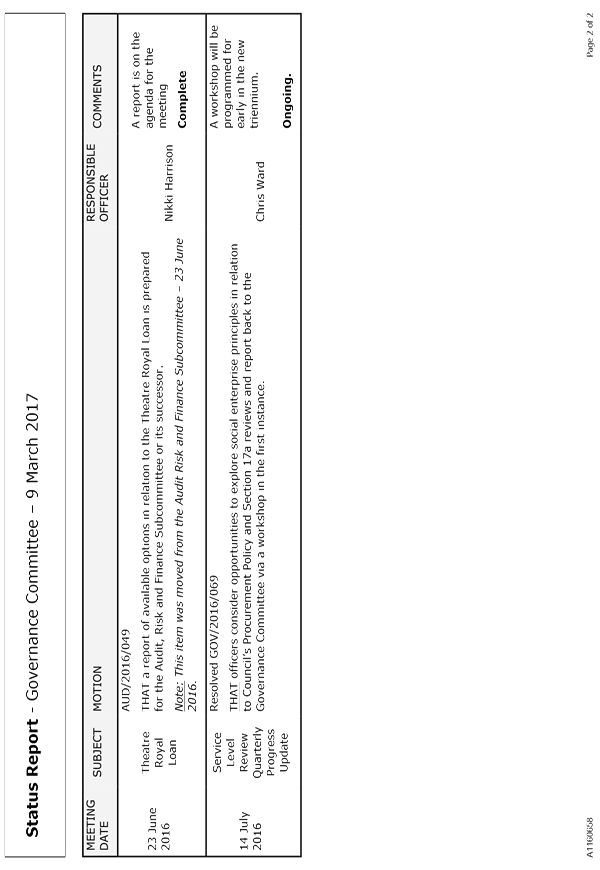

5. Status Report - Governance

Committee - 1 December 2016

Document number R6820, agenda

pages 9 - 10 refer.

The Audit, Risk and Finance

Subcommittee Status Report was tabled (A1324298)

It was requested that the report

regarding options for the Theatre Royal Loan be prepared for the first meeting

of the relevant committee in 2017.

|

Resolved GOV/2016/133

That the Committee

Receives

the Status Report Governance Committee 1 December 2016 (R6820) and its attachment (A1160658), and

the tabled Audit, Risk and Finance Subcommittee Status Report (A1324298).

Noonan/Courtney Carried

|

|

Attachments

1 A1324298 - Status

Report - Audit, Risk and Finance Subcommittee

|

6. Chairperson's Report

The Chairperson tabled and

presented his Chairperson’s Report (A1671957).

The Committee acknowledged the

achievement of Council retaining an AA credit rating with Standard and

Poor’s, and thanked senior officers for their efforts.

|

Resolved GOV/2016/134

That the Committee

Receives the

Chairperson’s Report (A1671957).

Barker/Dahlberg Carried

|

Governance

7. Sister City Report

Gail Collingwood, Sister City

Coordinator, tabled her report to the Committee (A1670966). She highlighted key

activities and responded to questions regarding China Week 2016.

The Committee noted the strength

of Council’s Sister City relationships.

|

Resolved GOV/2016/135

That the Committee

Receives the report

from the Sister Cities Coordinator (A1670966)

Matheson/Dahlberg Carried

|

|

Attachments

1 A1670966 - Nelson

City Council Sister Cities Coordinator Report

|

8. Health and Safety: Quarterly

Report

Document number R6491, agenda

pages 89 - 119 refer.

Manager Organisational Assurance

and Emergency Management, Roger Ball, presented the report. He provided an

update on health and safety activities in October and November 2016.

Mr Ball responded to questions

regarding site visits, reporting on actions under the Health and Safety

Management System Governance Charter, health and safety training for newly

elected members, contractor reporting, and whether health and safety reporting

needed to be enhanced to meet elected member obligations under legislation.

Mr Ball responded to further

questions regarding the definition of ‘director’ in reference to

annual self-assessments, the process of building assessments, and seasonality

of incident reporting.

|

Resolved GOV/2016/136

That the Committee

Receives the report Health and

Safety Quarterly Report (R6491)

and its attachments (A1394804 and A1651702).

Dahlberg/Skinner Carried

|

It was requested that newly

elected members be provided information by the end of 2016 regarding their

health and safety obligations under legislation. It was also requested that a

written engineering report regarding Civic House post the Kaikoura earthquake

be provided to the Committee by the end of 2016.

|

Recommendation to Council

GOV/2016/137

That the Council

Notes

the report Health and Safety Quarterly Report (R6491) and its attachments (A1394804 and A1651702).

Dahlberg/Skinner Carried

|

9. Internal Audit Report to 30

September 2016

Document number R6660, agenda

pages 120 - 130 refer.

Manager Organisational Assurance

and Emergency Management, Roger Ball, presented the report.

Mr Ball responded to questions

regarding external resource and prioritisation of internal audit reviews. He noted

the challenge in ensuring reviews were carried out by people with expertise who

held no conflict of interest.

Officers responded to questions

regarding the fixed asset review process and the community grants process

review.

|

Resolved GOV/2016/138

That the Committee

Receives the report Internal

Audit Report to 30 September 2016 (R6660)

and its attachment (A1642257); and

Notes internal audit findings and recommendations in the table

summarising Internal Audit activity to 30 September 2016 (A1642257).

Murray/Courtney Carried

|

Councillor Dahlberg, seconded by

Councillor Skinner, moved the recommendation to Council in the officer report.

It was suggested that internal

audit requirements were deeper and broader than audits by Audit New Zealand,

and that Council should take care to discharge its responsibilities in this

area. Concern was expressed regarding whether the audits of the Liability

Management Policy and the Investment Policy would be adequately considered by

Audit New Zealand, and whether those reviews should remain on the internal

audit work programme but be reprioritised.

Group Manager Corporate

Services, Nikki Harrison, explained that there would be reasonable duplication

of work between the internal and external audits of the Liability Management

Policy and the Investment Policy.

Her Worship the Mayor, seconded

by Mr Murray, proposed an amendment:

Recommendation to Council

That the Council

Approves

that the Internal Audit Plan to 30 June 2017 (A1562649) be amended to defer

internal audits for the Liability Management Policy and the Investment Policy

to 2017/18, and prioritise Business Continuity Planning.

The amendment was put and

carried, and became the substantive motion.

|

Recommendation to Council

GOV/2016/139

That

the Council

Approves

that the Internal Audit Plan to 30 June 2017 (A1562649) be amended to defer

internal audits for the Liability Management Policy and the Investment Policy

to 2017/18, and prioritise Business Continuity Planning.

Dahlberg/Skinner Carried

|

10. Service Delivery Review

Quarterly Update

Document number R6482, agenda

pages 11 - 46 refer.

Policy Adviser, Gabrielle Thorpe,

presented the report.

Officers responded to questions

regarding the contracts for community facilities, and the potential that the

statutory deadline of 8 August 2017 might not be met.

Senior Strategic Adviser, Nicky

McDonald, clarified that earlier discussions with Council had indicated

officers should work towards the deadline within existing resources but

recognised that other tasks may take precedence.

|

Resolved GOV/2016/140

That the Committee

Receives the report Service

Delivery Review Quarterly Update (R6482)

and its attachments (A1653452, A1653316, A1657534, A1608744, A1653640,

A1654605, A1657532, A1665363, and A1665280); and

Notes

the update on progress to achieving the statutory deadline of August 2017.

Courtney/Noonan Carried

|

11. 2016 Residents Survey

Document number R6720, agenda

pages 47 - 88 refer.

Strategy and Environment Analyst,

Brylee Wayman, presented the report.

Officers responded to questions

regarding sample sizes and reliability of statistics, survey responses to being

‘informed by Council and its services’, and the actions they were

taking to engage the under 40 years age group. It was noted that focus groups

could provide more detail regarding areas of importance. Officers advised that

alternative means of engaging with the community would be undertaken for the

2017 Residents Survey.

|

Resolved GOV/2016/141

That the Committee

Receives the report 2016 Residents Survey (R6720) and its attachment (A1580658); and

Notes the release of the

2016 Residents Survey results.

Her Worship the Mayor/Noonan Carried

|

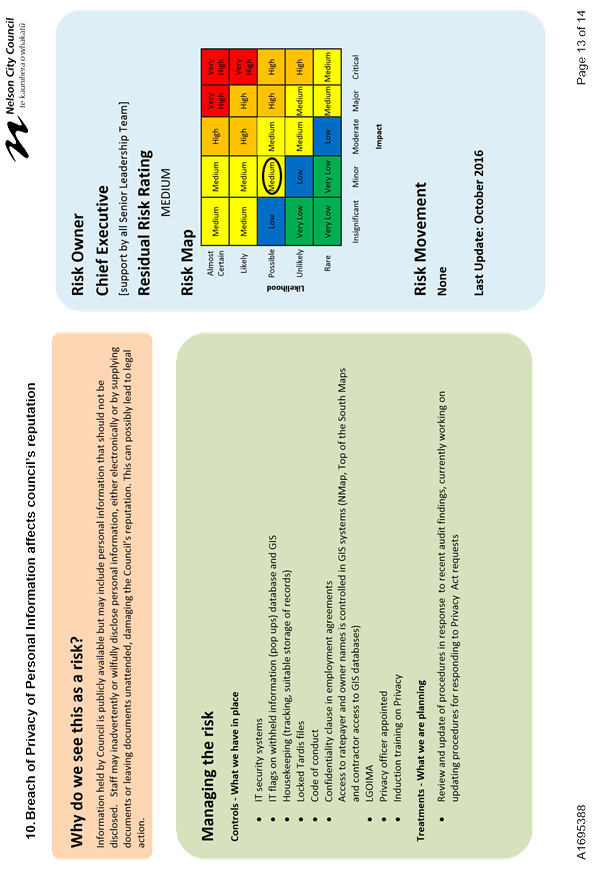

12. Council's Key Organisational

Risks: Progress Report

Document number R6681, agenda

pages 131 - 148 refer.

Risk and Procurement Analyst,

Steve Vaughan, presented the report.

Mr Vaughan responded to questions

regarding the officer conflicts of interest policy, the Report It Now service,

templates for contracts, management of contractors, and Council’s

Procurement Policy.

Attendance: Councillor Rutledge left the meeting from 3.13pm

to 3.15pm.

Committee members asked further

questions regarding the risk management policy, customer aggression, the

privacy officer appointment, and the risk rating for ‘Breach of Privacy

of Personal Information Affects Council’s Reputation’.

|

Resolved GOV/2016/142

That the Committee

Receives the report Council's

Key Organisational Risks: Progress Report (R6681) and its attachment (A1639927).

Rutledge/Murray Carried

|

Attendance: Her Worship the Mayor

left the meeting at 3.24pm.

Finance

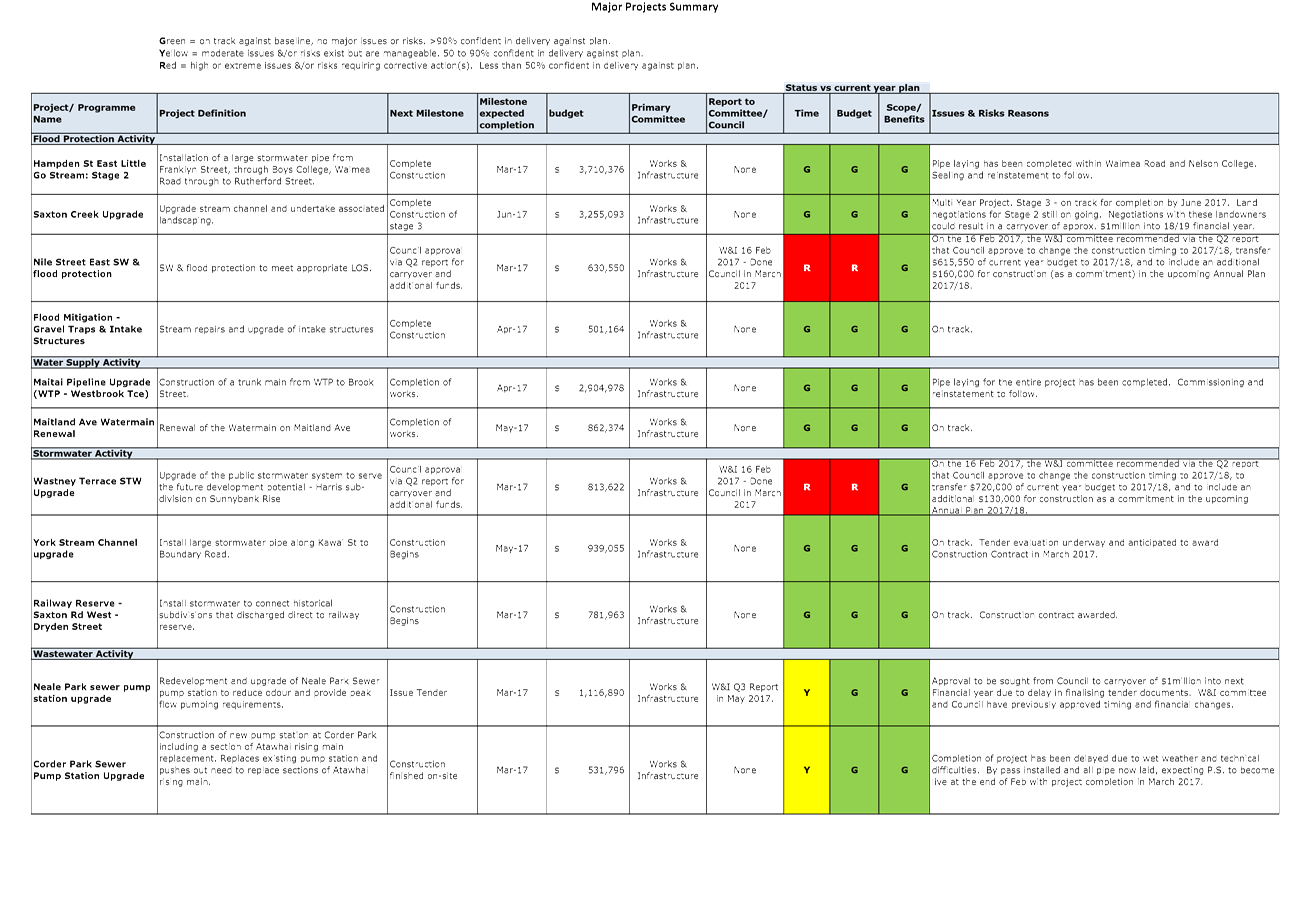

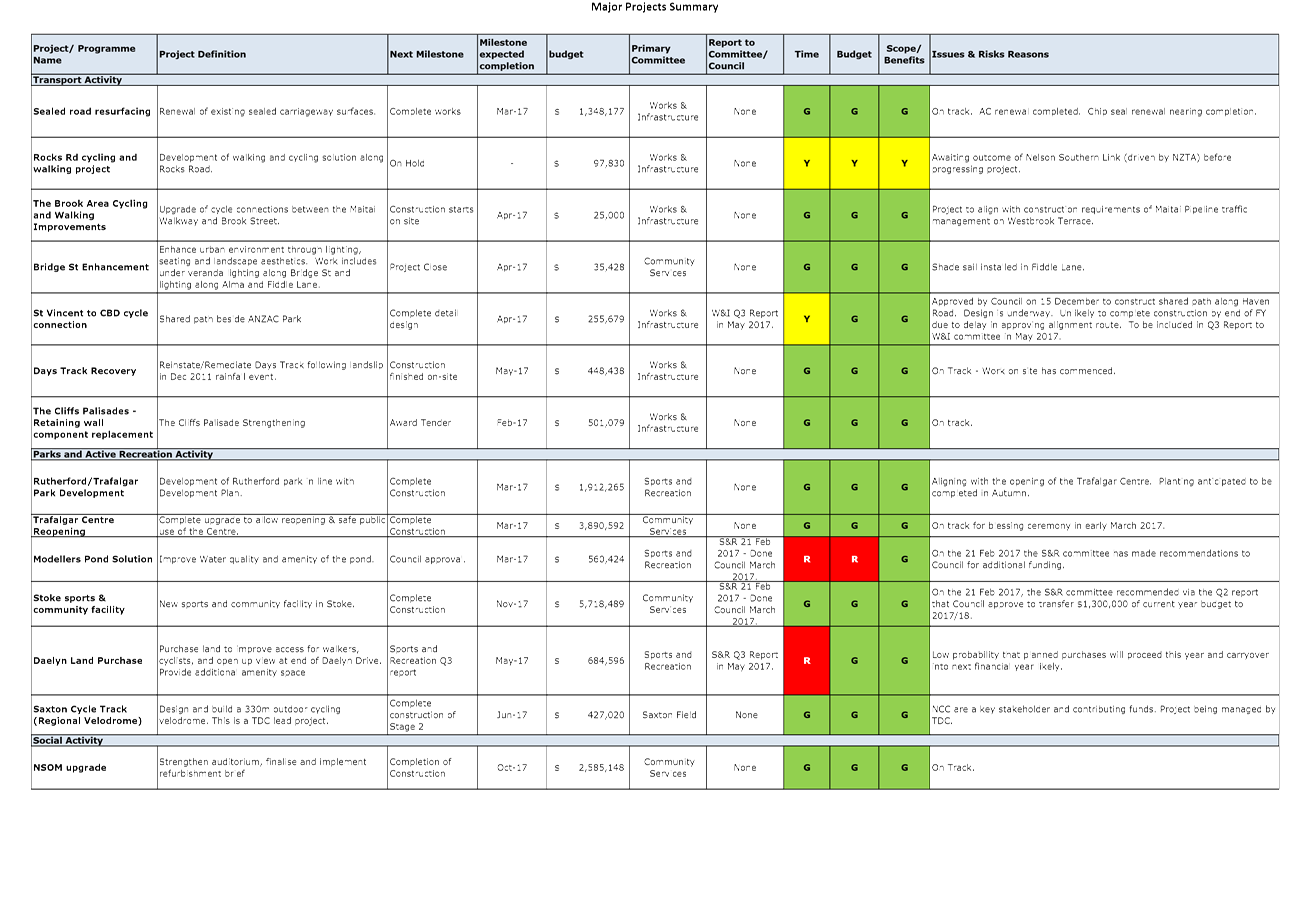

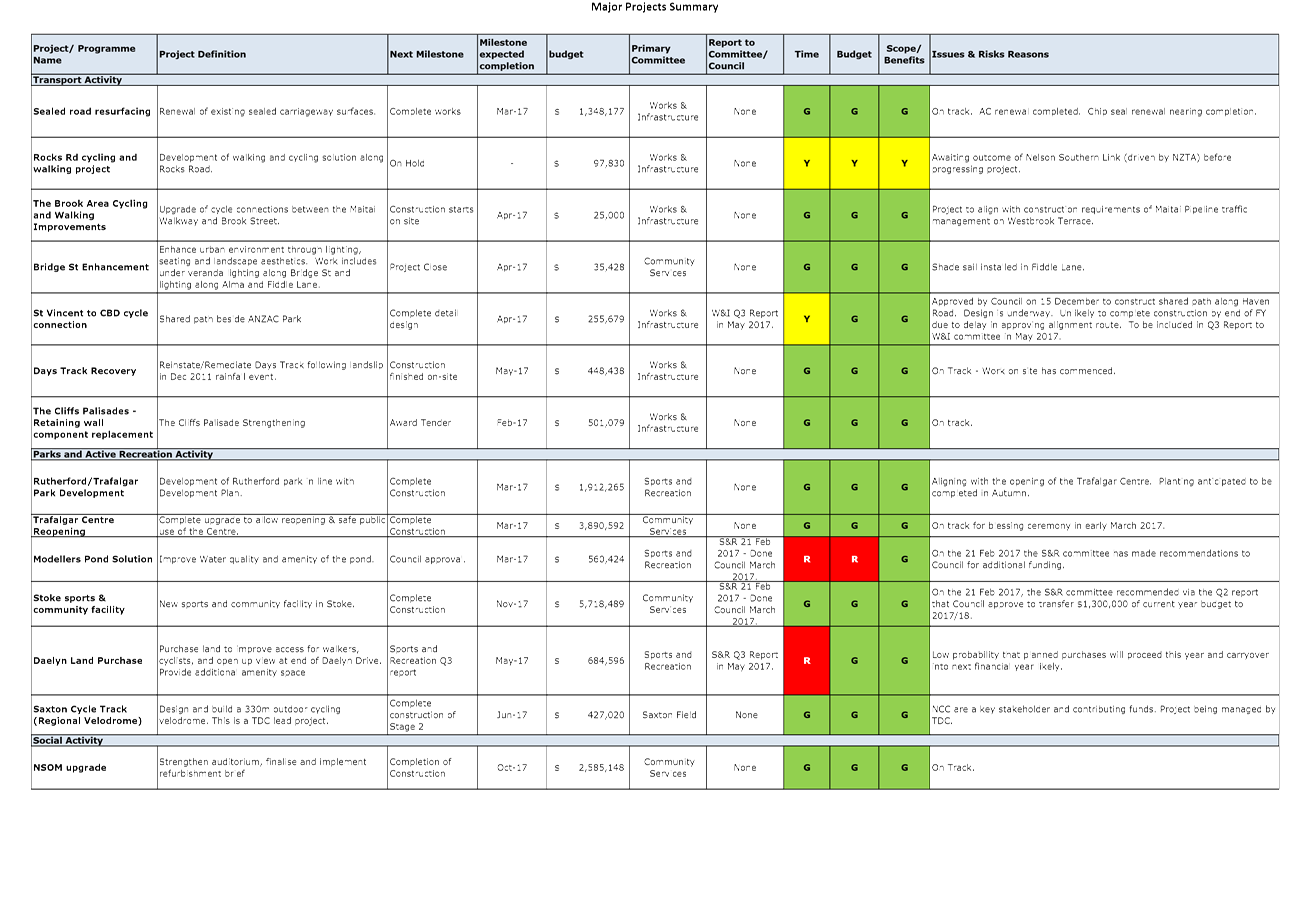

13. Corporate Report to 30

September 2016

Document number R6813, agenda

pages 149 - 163 refer.

Senior Accountant, Tracey Hughes,

presented the report. She noted that the commissioning of the Corder Park Sewer

Pump Station Upgrade was not quite complete (pg 161), and the Capital Revenue

arrow (page 153) should have been marked green.

Attendance: Her Worship the Mayor returned to the meeting at

3.25pm.

Officers responded to questions

regarding debtors, recent recommendations to Council from the Works and

Infrastructure Committee, the marina dredging resource consent, Days Track, the

Saxton Velodrome, and how jointly funded projects were reported to, and from,

Tasman District Council.

It was asked that in future the

Major Projects Summary reports showed further detail regarding amendments to

milestone dates and whether they had been confirmed by the relevant Committee

or Council, as well as showing the final overall project completion date.

|

Resolved GOV/2016/143

That the Committee

Receives the report Corporate

Report to 30 September 2016 (R6813)

and its attachments (A1655647 and A1651321).

Murray/Peters Carried

|

Attendance: Deputy Mayor Matheson

declared an interest and left the meeting at 3.55pm.

14. Nelson Events Strategy

Funding Application South Island Masters Games 2017

Document number R6858, late items

agenda pages 2 - 27 refer.

Senior Strategic Adviser, Nicky

McDonald, introduced Nelson Regional Development Agency Chief Executive, Mark

Rawson, who presented the report in his role as Chair of the Event Management

Committee.

Attendance: Councillor Skinner left the meeting at 3.58pm.

Mr Rawson highlighted that the

South Island Masters Games was a stepping stone to the World Masters Games. In

response to a question, it was clarified that the right to hold the event was

granted for two events at a time, before being re-bid.

The Committee asked questions

about whether Tasman District Council or other organisations would be providing

funding towards the event. Mr Rawson explained that this was not part of the

criteria that the event was assessed against.

Attendance: The meeting adjourned from 4.03pm to 4.05pm.

Mr Rawson responded to questions

regarding how Council would be recognised as a sponsor of the event. It was

suggested that the contract should list the ways in which Council would be

acknowledged as a sponsor.

It was suggested that a lower

level of funding for the event could be approved.

The Committee further discussed

funding from other organisations and the types of return that Council should

expect for its sponsorship.

|

Resolved GOV/2016/144

That the Committee

Receives the report Nelson

Events Strategy Funding Application South Island Masters Games 2017 (R6858)

and its attachments (A1671467,

a1671474 and A1671477).

Her Worship the Mayor/Barker Carried

|

It was suggested that the matter

be referred to Council, and that Council needed to clearly determine its expectations

when the matter was considered.

|

Resolved GOV/2016/145

That the Committee

Refers the item Nelson

Events Strategy Funding Application South Island Masters Games 2017 (R6858)

to Council for consideration at its meeting on 15 December

2016.

Noonan/Courtney Carried

|

15. Exclusion of the Public

It was noted that that Rob Gunn,

Lee Babe, and Robyn Curran of Nelmac Limited would be in attendance for Item 3

of the Public Excluded agenda to present and answer questions and, accordingly,

the following resolution was required to be passed:

|

Resolved GOV/2016/146

That the Committee

Confirms,

in accordance with section 48(5) of the Local Government Official Information

and Meetings Act 1987, that Rob Gunn, Lee Babe, and Robyn Curran remain after

the public has been excluded, for Item 3 of the Public Excluded agenda

(Nelmac Presentation on Strategic Direction), as they have knowledge that

will assist the Council;

Notes,

in accordance with section 48(6) of the Local Government Official Information

and Meetings Act 1987, the knowledge that Rob Gunn, Lee Babe, and Robyn

Curran posess relates to Nelmac Limited.

Noonan/Dahlberg Carried

|

|

Resolved GOV/2016/147

THAT

the public be excluded from the following parts of the proceedings of this

meeting.

The

general subject of each matter to be considered while the public is excluded,

the reason for passing this resolution in relation to each matter and the

specific grounds under section 48(1) of the Local Government Official

Information and Meetings Act 1987 for the passing of this resolution are as

follows:

Noonan/Courtney Carried

|

|

Item

|

General subject of each matter to be considered

|

Reason for passing this resolution in relation to

each matter

|

Particular interests protected (where applicable)

|

|

1

|

Nelmac Presentation on

Strategic Direction

|

Section 48(1)(a)

The public conduct of this

matter would be likely to result in disclosure of information for which good

reason exists under section 7

|

The withholding of the

information is necessary:

· Section 7(2)(b)(ii)

To protect information

where the making available of the information would be likely unreasonably to

prejudice the commercial position of the person who supplied or who is the

subject of the information

· Section

7(2)(i)

To enable the local authority

to carry on, without prejudice or disadvantage, negotiations (including

commercial and industrial negotiations)

|

|

2

|

Nelmac Ltd - matters for

Statement of Expectation 2017/18

|

Section 48(1)(a)

The public conduct of this

matter would be likely to result in disclosure of information for which good

reason exists under section 7

|

The withholding of the

information is necessary:

· Section 7(2)(i)

To enable the local

authority to carry on, without prejudice or disadvantage, negotiations

(including commercial and industrial negotiations)

|

|

3

|

Bishop Suter Trust -

Statement of Expectation 2017/18

|

Section 48(1)(a)

The public conduct of this

matter would be likely to result in disclosure of information for which good

reason exists under section 7

|

The withholding of the

information is necessary:

· Section 7(2)(i)

To enable the local

authority to carry on, without prejudice or disadvantage, negotiations

(including commercial and industrial negotiations)

|

|

4

|

Nelson Regional

Development Agency - Statement of Expectation 2017/18

|

Section 48(1)(a)

The public conduct of this

matter would be likely to result in disclosure of information for which good

reason exists under section 7

|

The withholding of the

information is necessary:

· Section 7(2)(i)

To enable the local

authority to carry on, without prejudice or disadvantage, negotiations

(including commercial and industrial negotiations)

|

|

5

|

Process For Awarding

Contracts for Council Festivals and Events

|

Section 48(1)(a)

The public conduct of this

matter would be likely to result in disclosure of information for which good

reason exists under section 7

|

The withholding of the

information is necessary:

· Section 7(2)(a)

To protect the privacy of

natural persons, including that of a deceased person

|

|

6

|

Commercial Lease -

Reliance Building

|

Section 48(1)(a)

The public conduct of this

matter would be likely to result in disclosure of information for which good

reason exists under section 7

|

The withholding of the

information is necessary:

· Section 7(2)(i)

To enable the local

authority to carry on, without prejudice or disadvantage, negotiations

(including commercial and industrial negotiations)

|

The meeting went into public

excluded session at 4.35pm and resumed in public session at 6.47pm.

16. Re-admittance of the Public

|

Resolved GOV/2016/148

That

the Committee

Re-admits

the public to the meeting.

Murray/Rutledge Carried

|

There being no further business the

meeting ended at 6.47pm.

Confirmed as a correct record of proceedings:

Chairperson

Date

Chairperson

Date

|

|

Governance Committee

9 March 2017

|

REPORT R7256

Status

Report - Governance Committee - 9 March 2017

1. Purpose of

Report

1.1 To

provide an update on the status of actions requested and pending.

1. Recommendation

|

That the Committee

Receives the Status Report

Governance Committee 9 March 2017 (R7256)

and its attachment (A1160658)

|

Julie

McDougall

Administration

Advisers

Attachments

Attachment 1: A1160658

- Governance Committee - 9 March 2017 ⇩

|

|

Governance Committee

9 March 2017

|

REPORT R7246

Chairperson's

Report

1. Purpose

of Report

1.1 To

appoint an elected member to the Nelson Tasman Business Trust.

2. Recommendation

|

That the Committee

Receives the report

Chairperson's Report (R7246); and

Appoints

Councillor ……………. to the Councillor Liaison

role for the Nelson Tasman Business Trust for the 2016 – 2019

triennium.

|

3. Background

3.1 At

the Council meeting on 15 December 2016, in relation to the review of

appointments to external organisations, it was resolved that the Council

Delegates

the appropriate Committees of Council, as set out in document A1679884, to

determine Councillor Liaison appointments to external organisations and groups

that are within the committees’ areas of responsibility.

3.2 The

Governance Committee has responsibility for appointing one Councillor Liaison

role to the Nelson Tasman Business Trust.

4. Discussion

Nelson Tasman Business Trust

4.1 The

Nelson Tasman Business Trust offers free, confidential assistance to start up

and existing businesses and their services include business information,

referrals, training, mentoring, advice, networking opportunities and support.

5. Options

5.1 In

line with Council direction on the matter, it is recommended that one of

the Governance Committee members be appointed to the Councillor Liaison role

for the Nelson Tasman Business Trust for the 2016 – 2019 triennium.

5.2 There

is no risk associated with this option.

Ian

Barker

Chairperson

Attachments

Nil

|

Important considerations for decision making

|

|

1. Fit

with Purpose of Local Government

Engagement with external organisations and other

groups addresses a need for the community to communicate and interact with

Council.

|

|

2. Consistency

with Community Outcomes and Council Policy

The recommendation aligns with Council’s

Community Outcome of: Our Council provides leadership and fosters

partnerships, a regional perspective, and community engagement.

|

|

3. Risk

There is no risk associated with the recommendation.

|

|

4. Financial

impact

Nil

|

|

5. Degree

of significance and level of engagement

This matter is of low significance because it

relates to the appointment of a councillor liaison role to a community

organisation. No engagement with the community on this matter is therefore

recommended.

|

|

6. Inclusion

of Māori in the decision making process

Māori have not been consulted in regards to

this matter.

|

|

7. Delegations

This is a matter for the Governance Committee to

consider as decided at the 15 December 2016 Council meeting.

|

|

|

Governance Committee

9 March 2017

|

REPORT R6609

Council

Controlled Organisations: Local Government Act 2002 Obligations and Exemption

1. Purpose

of Report

1.1 To

outline the obligations the Local Government Act 2002 imposes on Council

Controlled Organisations (CCOs) and to recommend an exemption for the City of

Nelson Civic Trust.

2.

Recommendation

|

That the Committee

Receives the report Council Controlled

Organisations: Local Government Act 2002 Obligations and Exemptions (R6609).

|

Recommendation to Council

|

That the Council

Approves

a continued exemption to the City of Nelson Civic

Trust for the purposes of Section 6(4)(i) of the Local Government Act 2002,

in accordance with Sections 7(3) and 7(6) of the Act and after considering

the matters in Section 7(5) of the Act.

|

3. Background

3.1 CCO’s

are organisations in which one or more local authorities control 50% or more of

the voting rights or rights to appoint directors. There are several

organisations that currently come under this category:

· The

Tasman Bays Heritage Trust (TBHT);

· The

City of Nelson Civic Trust;

· The

Bishop Suter Trust (BST);

· The

Nelson Regional Development Agency (NRDA)

· Nelmac;

and

· Nelson

Airport Limited (NAL).

3.2 Unless

specifically exempted by Council resolution a CCO is required to:

· Prepare

a statement of intent in accordance with Schedule 8 of the Act;

· Prepare

a half yearly report and an annual report;

· Comply

with Parts I to VI of LGOIMA.

3.3 While

these are quite appropriate in relation to what could be termed Council businesses,

they could place an unreasonable burden on the smaller, less commercially

oriented organisations in which the Council has an interest.

3.4 Sections

6(4)(i) and Section 7(3) of the Local Government Act (2002, the

‘Act’) provide that the Council may grant small organisations an

exemption from the requirements of a CCO after considering:

· The

nature and scope of the activities provided by the organisation; and

· The

costs and benefits, if an exemption is granted, to the Council, the Council

Controlled Organisation, and the community.

3.5 Section

7(6) of the Act requires that a Local Authority must review an exemption within

three years after it is granted and thereafter at intervals of not more than

three years.

3.6 In

March 2014 the Council granted an exemption to the City of Nelson Civic Trust

and Council needs to decide if it wishes to again grant an exemption to the

Civic Trust, and/or grant a new exemption to any of its other CCOs.

4. Discussion

4.1 In

considering the list of organisations in section 3.1, only the City of Nelson

Civic Trust can reasonably be considered a small organisation.

4.2 Nelmac

and NAL are significant trading companies, with multi-million dollar turnovers.

4.3 TBHT

employs up to 20 staff, has a large operating budget and manages a collection

with a value in excess of $100 million and the Bishop Suter Trust employs a

number of staff, has a large operating budget and manages a collection with a

value in excess of $7 million. Neither can be considered small organisations.

4.4 The

NRDA was established as a CCO from 1 July 2016. The Council has delegated its

economic development activities to the NRDA and is providing it with over $1.2M

of funding each year. Given this and the importance of the NRDA’s

role to the region, it is not considered to be a small organisation, and it is

appropriate for the Council to receive regular reports and review the Statement

of Intent.

4.5 The

City of Nelson Civic Trust is a charitable organisation that exists to provide

amenities for the enhancement of the City and the benefit of the community as a

whole. The Council appoints all the trustees and provides administrative

support. An independent accountant provides the financial services.

4.6 The

Civic Trust is reliant on the return from investments for its income, typically

in the order of $80,000 per annum. It has limited resources to direct

towards the administrative and financial reporting type of work envisaged by

the Act. Meeting the CCO requirements would put more work on the trustees

and reduce the level of funding available for project works.

4.7 The

Civic Trust has current assets of around $200,000 and investments of $780,000.

4.8 Whilst

it holds a significant level of funds, given the administrative costs of

compliance; the subsequent reduction in grants available to the community if it

had to meet those compliance costs; and the straightforward nature of the

Trust’s activities, officers recommend that the Civic Trust continues to

be recognised as a small organisation and should be exempted from the

requirements of CCOs.

5. Options

5.1 Council

can either grant an exemption to the City of Nelson Civic Trust or not. If it

grants an exemption it is signalling that it considers the Trust to be a small

organisation which does not need to meet the reporting and monitoring

requirements of a CCO.

5.2 If

Council does not grant an exemption then the Trust will have to comply with the

relevant schedules in the Act. This will increase transparency in relation to

the Trust’s activities but come at a financial cost to the Trust.

6. Conclusion

6.1 There

are no recommendations to make any new exemptions, rather only to approve the

continuation of the Civic Trust’s exemption for another three years.

6.2 The

Civic Trust controls a significant amount of funds, but it does not trade and

merely distributes the proceeds of its investments. As such the

administrative overhead associated with withdrawal of the exemption would

simply reduce the amount distributed within the community.

Chris

Ward

Group

Manager Community Services

Attachments

Nil

|

Important considerations for decision making

|

|

1. Fit

with Purpose of Local Government

This is a statutory compliance matter.

|

|

2. Consistency

with Community Outcomes and Council Policy

The recommendation is not inconsistent with any

Council policy or strategic document.

|

|

3. Risk

This matter is of very low risk as the

recommendation is addressing a statutory compliance issue.

|

|

4. Financial

impact

If Council decides that the Civic Trust is not

exempt the financial costs of compliance will have to be borne by the Trust.

|

|

5. Degree

of significance and level of engagement

This matter is of low significance because it does

not have impact on any individuals in the community.

|

|

6. Inclusion

of Māori in the decision making process

Maori have not been specifically consulted on this

matter.

|

|

7. Delegations

The Governance Committee has the responsibility for

considering matters in relation to Nelson City Council Controlled

Organisations and Nelson City Council Controlled Trading Organisations. The

Governance Committee has the power to make a recommendation to Council on

this matter.

|

|

|

Governance Committee

9 March 2017

|

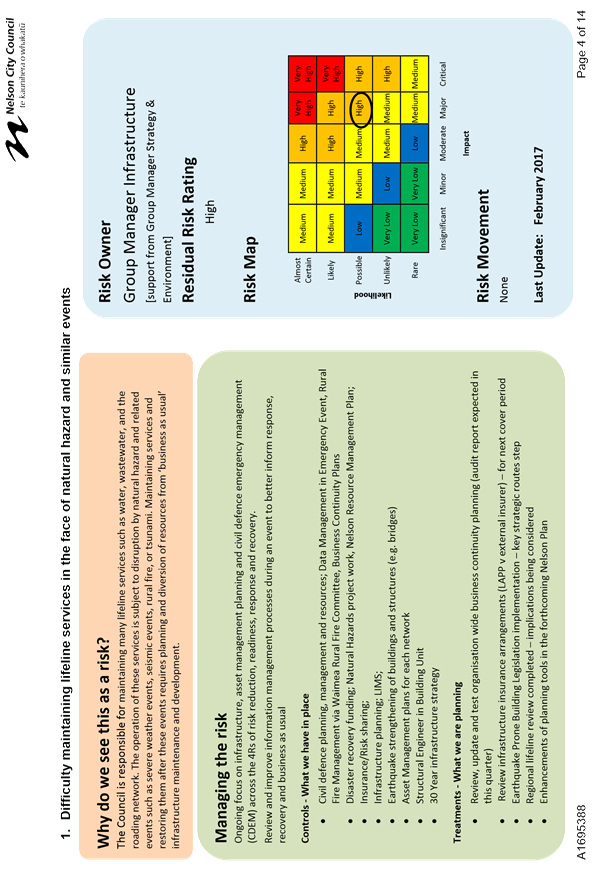

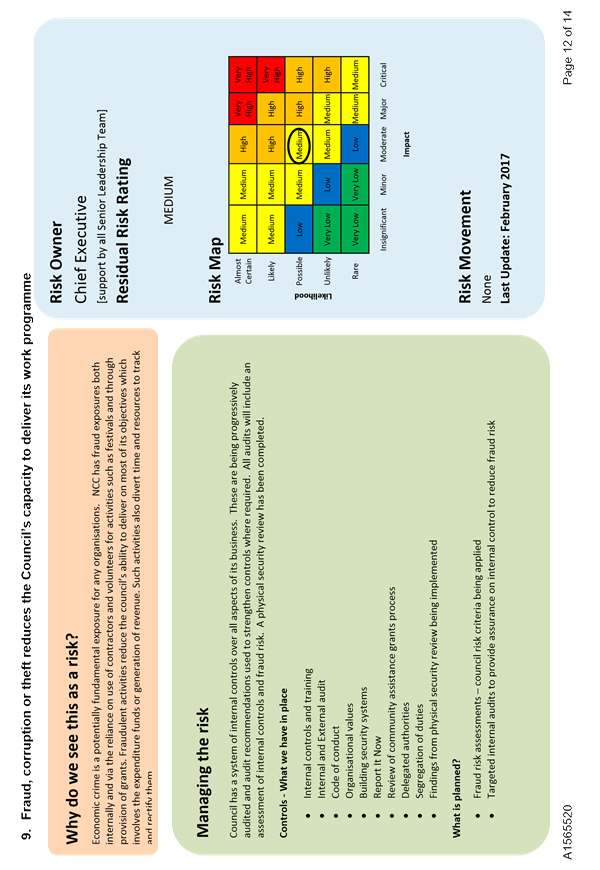

REPORT R7030

Council's

Key Organisational Risks 2017 First Quarterly Report

1. Purpose of

Report

1.1 To

update the Committee on progress with identifying and managing key risks to the

organisation’s objectives.

Recommendation

|

That the Committee

Receives the report Council's

Key Organisational Risks 2017 First Quarterly Report (R7030) and its attachment (A1695388); and

Notes

that a workshop will be held for all Councillors on 11 April 2017

encompassing both core risk management concepts, and an overview of

councillors’ health and safety obligations.

|

4. Background

1.2 At

its meeting on 1 December 2016 Governance Committee received and considered the

previous quarterly report on key organisational risks to Council’s

objectives. This reporting forms part of the development of Council’s

overall risk management capability. As noted in the previous report, this

capability is being developed using the organisation’s existing business

model – that is by basing risk management processes within each business

unit. This includes; business unit objectives which are, as far as possible,

specific, measurable and achievable within a defined timeframe, and use

organisationally consistent techniques and criteria.

1.3 Further

training in these techniques for senior staff will be run during this first

quarter, building on workshops developed in 2016. In addition a workshop is

being organised for Councillors encompassing both core risk management

principles (with an emphasis on governance needs) and the specific risk area of

Councillor’s health and safety obligations. This workshop is scheduled

for Tuesday 11 April.

2. Progress

in implementing risk treatments

2.1 Since

the last report, controls to manage risks in the following key risk areas have

been improved or further developed. This is occurring as part of actioning risk

treatments developed in Council’s ongoing programme of addressing risk

areas. (For clarity; risk treatments are actions to manage risks decided on but

not yet put in place (or partially put in place) whereas controls are already

in place.) Several previous treatment items are now fully in place and so

appear in the attached document as controls.

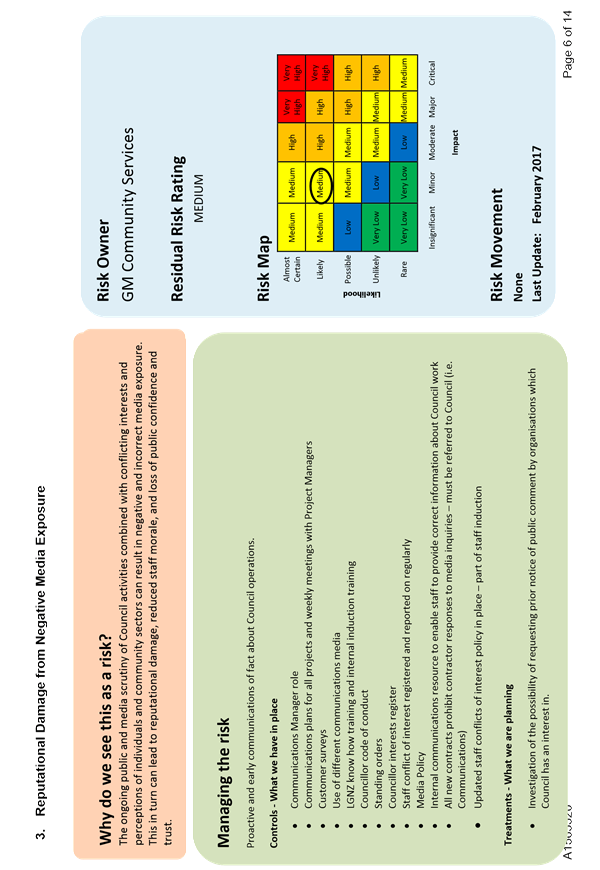

2.2 There

are also a number of areas where the treatments (planned controls) are becoming

shorter lists. This is because the corresponding risks are reaching a point

where the gain to be had from further action may not outweigh the work required

to undertake such action. For example; in the case of reputational damage from

negative media exposure, the risk is shown as medium, with a minor impact and

‘likely’ level of likelihood. Further action may reduce this likelihood,

but at substantial diversion of effort from other areas.

|

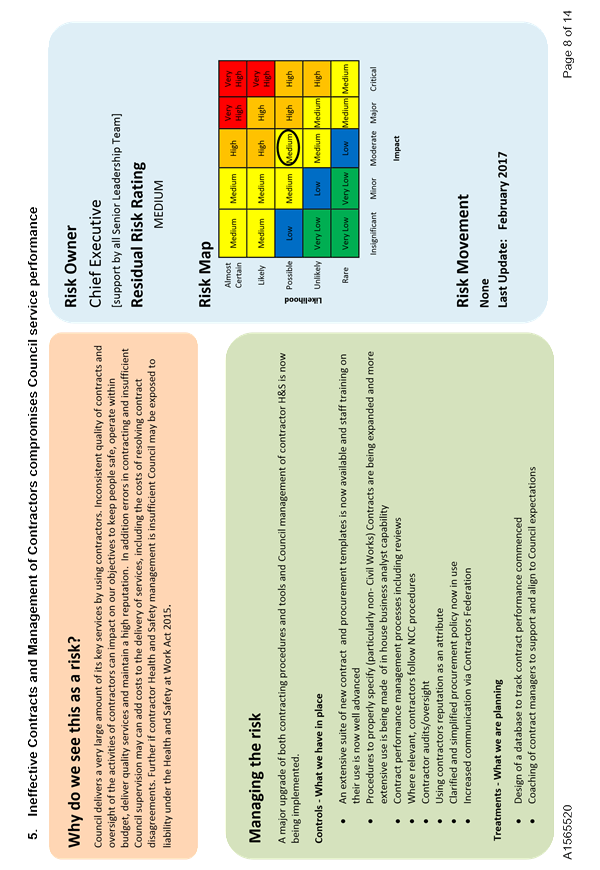

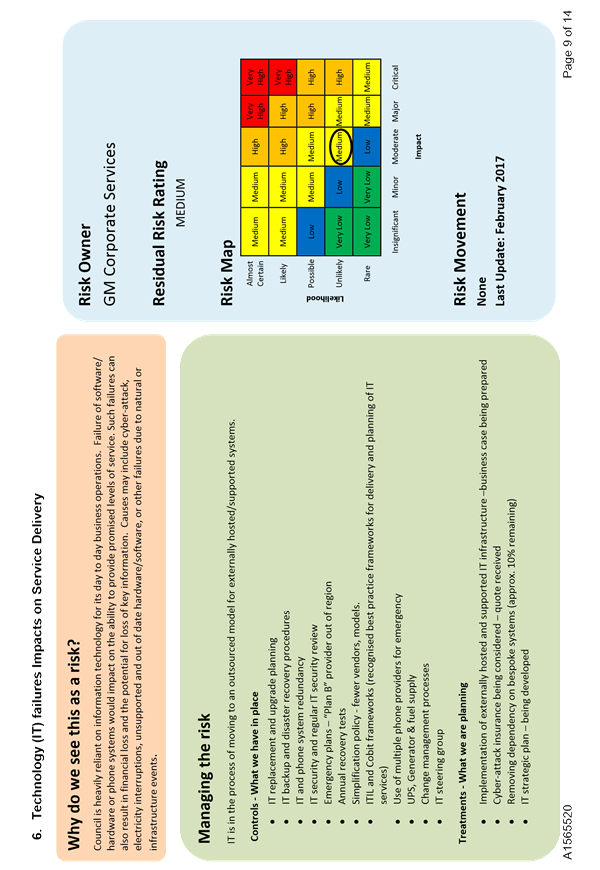

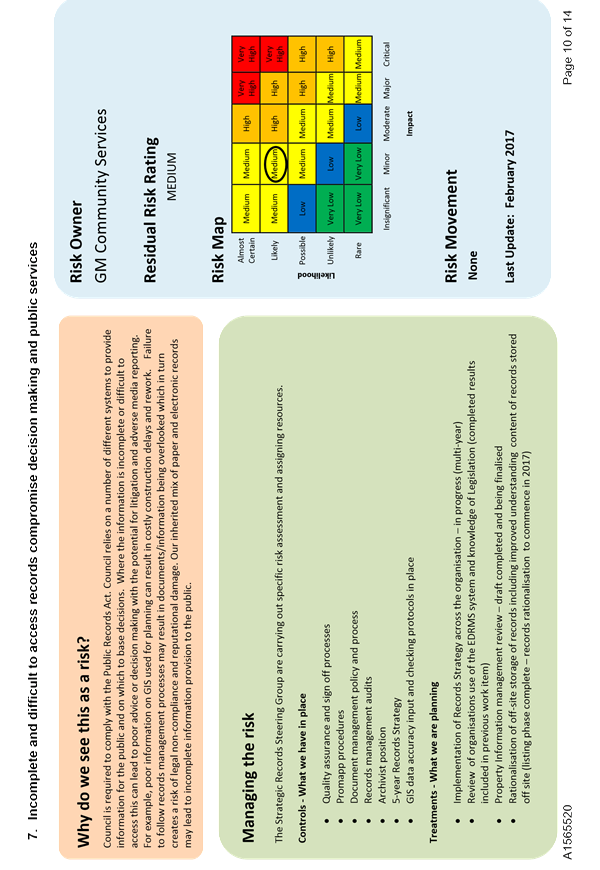

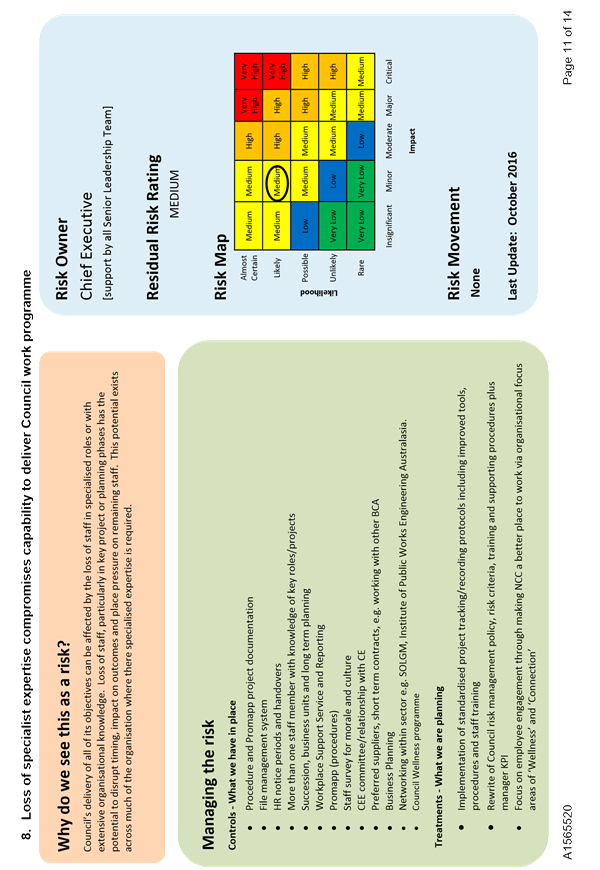

Key risk area

|

Progress on risk treatments since last report

|

|

1 Maintaining

lifeline services …

|

· Review and update of organisation wide business

continuity planning in progress

· Contribution to regional lifeline utility report

· Strategic route investigations begun to meet

requirements of Earthquake Prone Building amendments

|

|

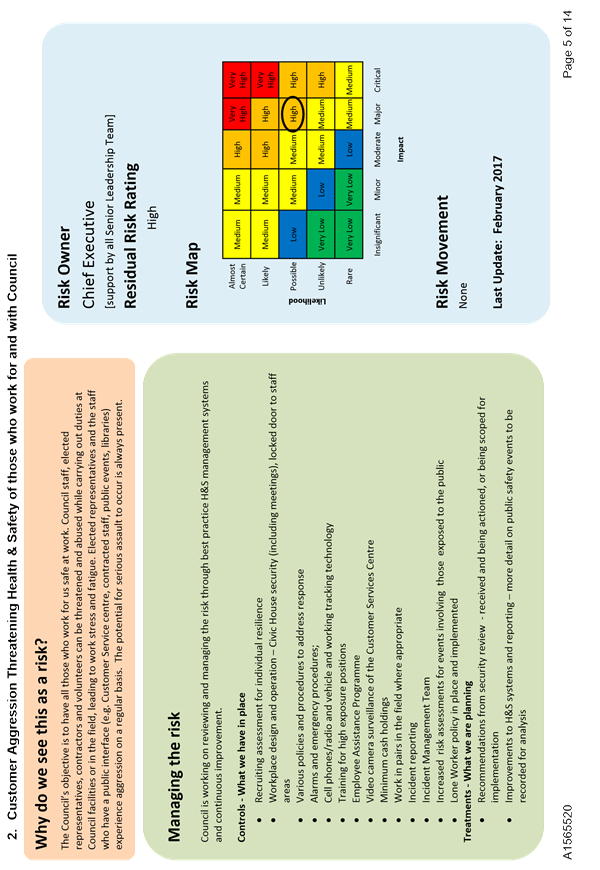

2 Customer

aggression causing threats to health and safety…

|

· Lone worker policy implemented (controls in place)

· Security review recommendations agreed to and either

being implemented in priority order, or folded into wider staff accommodation

project

· Expanded reporting (more detail on public safety

event reporting)

|

|

3 Reputational

damage from negative media exposure…

|

· All new contracts require contractors to direct

media inquiries to Council communications group (control in place)

|

|

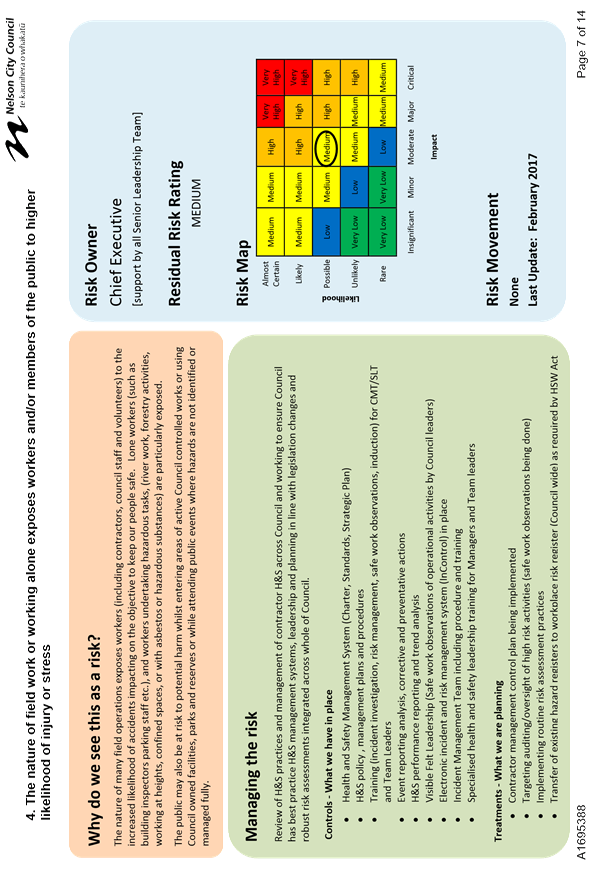

5 Ineffective

contract management…

|

· Extensive suite of contract templates in place and

being used for all new contracts (except NZS3910 – large civil works -

which is still to complete)

· Improved procedures for specifying contract

requirements being rolled out

|

|

7 Incomplete and

difficult to access records…

|

· GIS data input accuracy checking protocols in place

· Rationalisation of off-site records to commence this

year

|

Options

2.3 It

is recommended that this report be received as it will further improve the

Committee’s understanding of the risks faced by Council and the actions

being taken to manage them.

2.4 There

can be value from a discussion of the factors contributing to risks and the

Committee may consider such a discussion useful.

Steve

Vaughan

Risk

& Procurement Analyst

Attachments

Attachment 1: A1695388 - Key

organisational risks - quarter 1 calendar 2017 ⇩

|

Important considerations for decision making

|

|

1. Fit

with Purpose of Local Government

This report describes risk management activity. Risk

management is a tool to enable more efficient and effective provision on

services as set out in section 10(1)(b) of the LG Act.

|

|

2. Consistency

with Community Outcomes and Council Policy

This report describes risk management activity. Risk

management at its most fundamental is about achieving an organisation’s

objectives (in this case as set out in Nelson City Council’s planning

documents) with increased clarity, efficiency and effectiveness.

|

|

3. Risk

The report does not recommend a particular goal or

objective to which risks may be considered. It serves to provide information

about Council’s work in addressing those risks judged to be key to the

organisation achieving its objectives.

|

|

4. Financial

impact

This is a report on work already underway as part of

Council’s regular management activity. Therefore there are no

additional funding implications at this stage.

|

|

5. Degree

of significance and level of engagement

This is not a significant decision under the

Council’s Significance and Engagement Policy. Therefore no external

consultation has been undertaken in the preparation of this report although

information from the Council’s developing risk management systems has

been used in preparing it.

|

|

6. Inclusion

of Māori in the decision making process

There has been no consultation with Maori in the

preparation of this report which deals with internal Council processes.

|

|

7. Delegations

At the date of writing of this report the Governance

Committee has oversight of the Council’s management of risk.

|

|

|

Governance Committee

9 March 2017

|

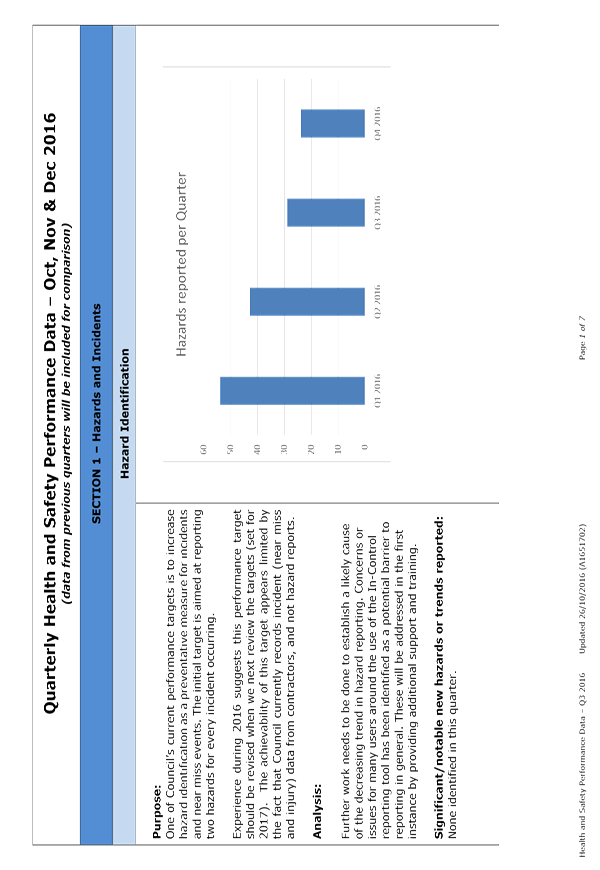

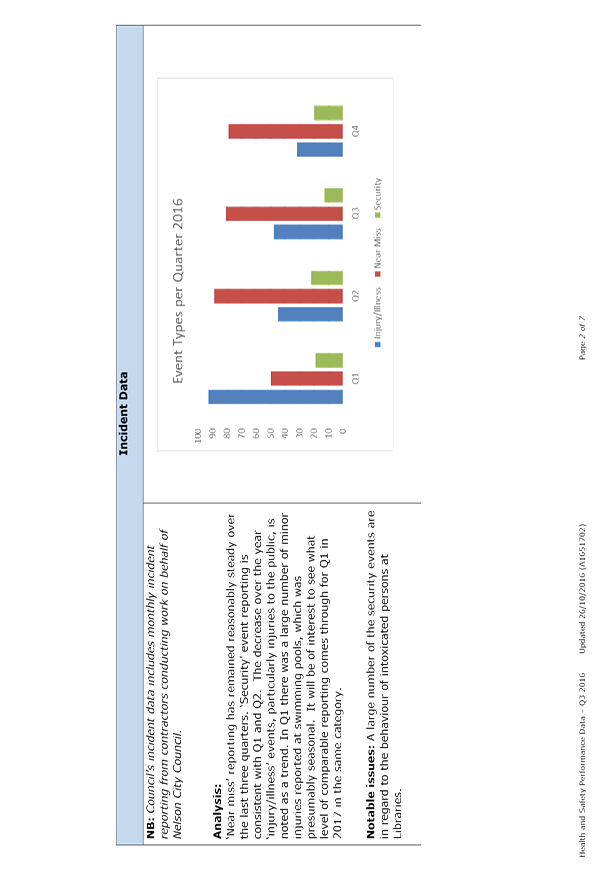

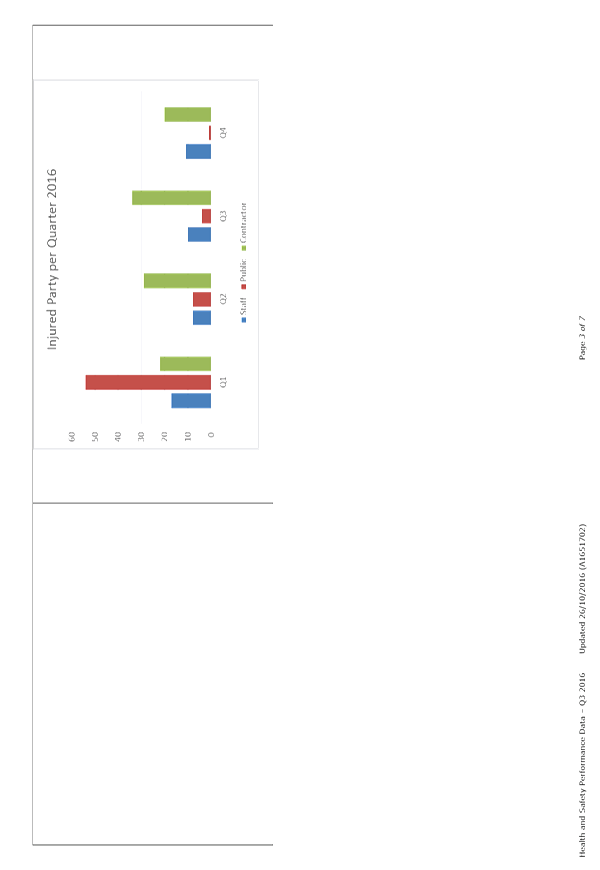

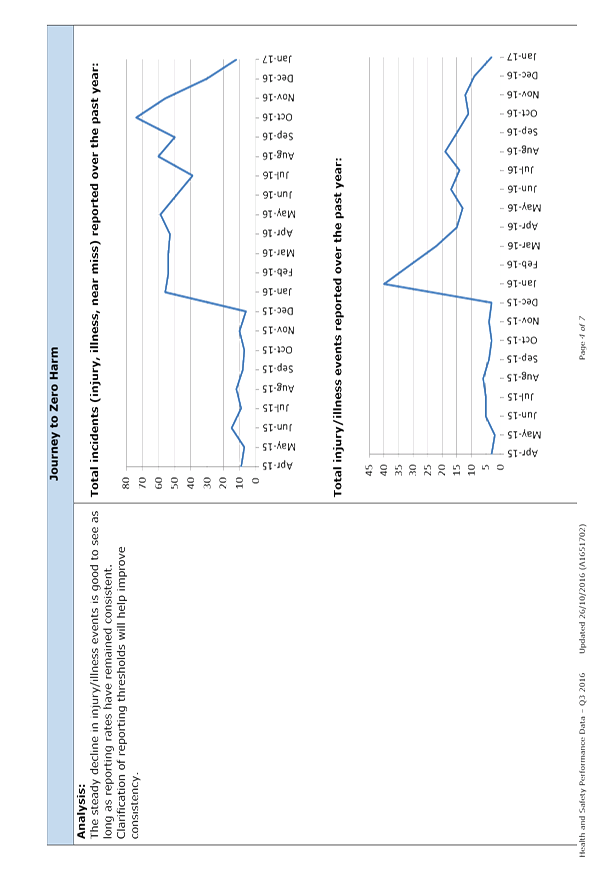

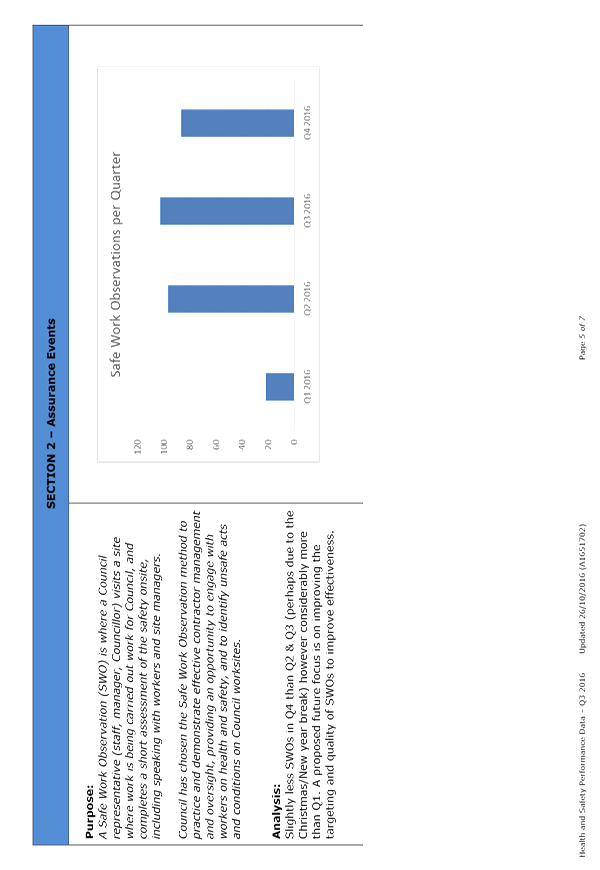

REPORT R7020

Health

and Safety: Quarterly Report

1. Purpose

of Report

1.1 To

provide the Committee with a quarterly report of health and safety data

collected over the period October-December 2016.

Recommendation

|

That the Committee

Receives the report Health and

Safety: Quarterly Report (R7020)

and its attachment (A1710588).

|

Recommendation to Council

|

That the Council

Notes

the report Health and Safety Quarterly Report (R7020) and its attachment (A1710588);

and

Confirms

the assessment of critical health and safety risks contained in the attachment

(A1710588).

|

2. Background

2.1 Council is continuing to implement a programme to ensure its health

and safety management system meets the higher expectations contained within the

Health and Safety at Work (HSW) Act 2015.

2.2 Councillors, as ‘Officers’ under the HSW Act 2015, are

expected to undertake due diligence on health and safety matters.

Council’s Health and Safety Governance Charter states that quarterly

performance data reports will be presented to Council.

3. Discussion

Performance data

3.1 This report provides the Committee with a summary of quarterly data

on the health and safety performance of Council (Attachment 1). It

includes information on both leading (preventative) and lagging health and

safety management system indicators. It also identifies progress in

addressing our top six critical health and safety risks. To help meet the

‘positive due diligence’ expectations of the HSW Act 2015,

Councillors are asked to confirm the assessment of our top health and safety

risks provided in the attachment.

3.2 In brief, there were no major incidents over the quarter.

There was one incident notified to Worksafe New Zealand by a Council

Contractor. (This was a near miss that in fact probably did not need to be

notified.)

Other matters

3.3 As

requested at the last Governance Committee meeting (1 December 2016), a

selection of documentation has been circulated by email to Councillors

providing an introduction to Council’s health and safety

obligations. To support the induction of new Councillors, and as a

refresher for returning Councillors, a workshop is proposed for the morning of

11 April to provide Councillors with an overview of (a) Council’s risk

management framework and (b) Council’s health and safety management

system, including Councillors’ specific obligations under the HSW Act. (A

resolution relating to the workshop is contained in the separate report

“Council's Key Organisational Risks 2017 First Quarterly Report”

(R7030).)

3.4 It

is also noted that Council’s health and safety systems were reviewed by

the Accident Compensation Corporation (ACC) staff in December 2016. This

was part of the process to renew Council’s membership in ACC’s

Workplace Safety Management Practices (WSMP) incentive scheme. Council

was re-accredited as a Tertiary member of ACC’s WSMP incentive scheme,

reducing our ACC Work Levy by 20% (a net saving of around $7,000 over the next

two years).

4. Options

|

Option 1: Receive the report

and its attachment

|

|

Advantages

|

· Council

demonstrates positive due diligence in relation to health and safety matters

in the Council workplace. This assists in meeting Councillor’s

obligations as ‘Officers’ under the HSW Act 2015.

|

|

Risks and Disadvantages

|

· Receiving

the report alone is not sufficient. Positive diligence (understanding, asking

questions etc) is required.

|

|

Option 2: Decline to receive

the report and its attachment

|

|

Advantages

|

· An

advantage could not be identified.

|

|

Risks and Disadvantages

|

· Council

will not be able to use this report to help demonstrate due diligence on

health and safety matters.

|

Roger

Ball

Manager

Organisational Assurance and Emergency Management

Attachments

Attachment 1: A1710588 - Health and

Safety Quarterly Data October-December 2016 ⇩

|

Important considerations for decision making

|

|

1. Fit

with Purpose of Local Government

This report forms part of Council’s work to

perform its regulatory functions. Council has an obligation under the

Workplace Health and Safety Act 2015 because it is classed as a Person

Conducting a Business or Undertaking (PCBU), and both Councillors and

Council’s senior management have obligations as “Officers”

under that Act.

|

|

2. Consistency

with Community Outcomes and Council Policy

The recommendations align with the Community

Outcome: Our communities are healthy, safe, inclusive and resilient.

|

|

3. Risk

This report aims to help Councillors meet their due

diligence obligations as “Officers” under the Health and Safety

at Work Act 2015. It is likely this objective will be achieved when

combined with other actions outlined in Appendix 2 of Council’s Health

and Safety Management System Governance Charter (A1394804). The

likelihood of adverse consequences is assessed as low based on the current

record of Council’s health and safety systems and our on-going

monitoring of them. However the consequences for Council could still be

significant if there were to be a serious harm incident to a Council worker,

contractor or other person. These consequences could include harm to

people, prosecution of the Council and/or its officers, financial penalties,

and/or reputational damage.

|

|

4. Financial

impact

There are no immediate budget implications arising

from this report.

|

|

5. Degree

of significance and level of engagement

This matter is of low significance because it is a

quarterly progress report regarding the Council’s health and safety

data, and no engagement is required.

|

|

6. Inclusion

of Māori in the decision making process

Maori have not been consulted in the preparation of

this report.

|

|

7. Delegations

The Governance Committee is delegated oversight of

Health and Safety.

|

|

|

Governance Committee

9 March 2017

|

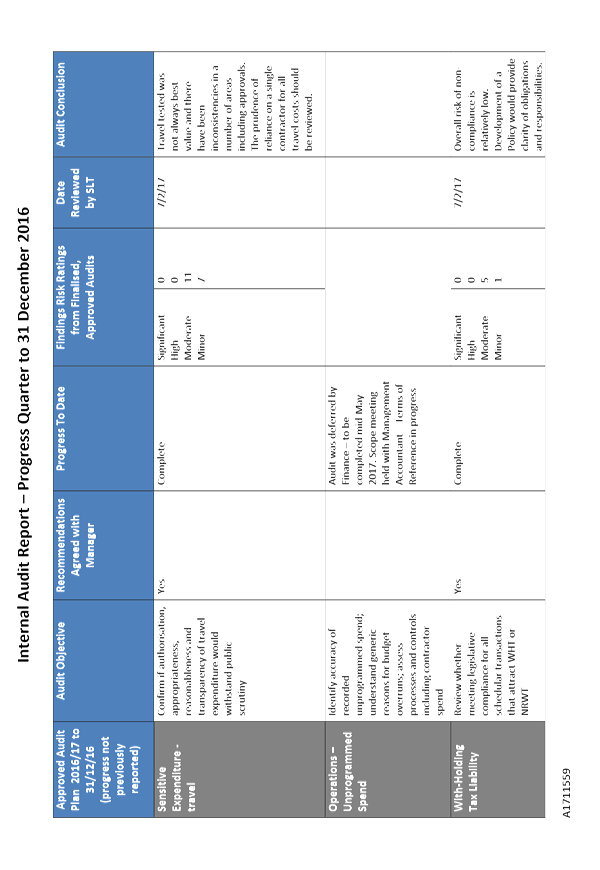

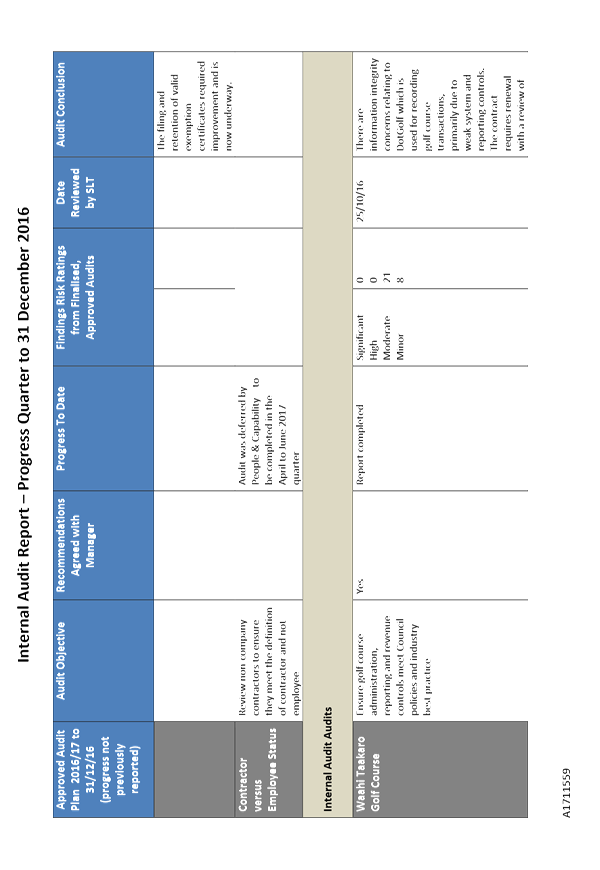

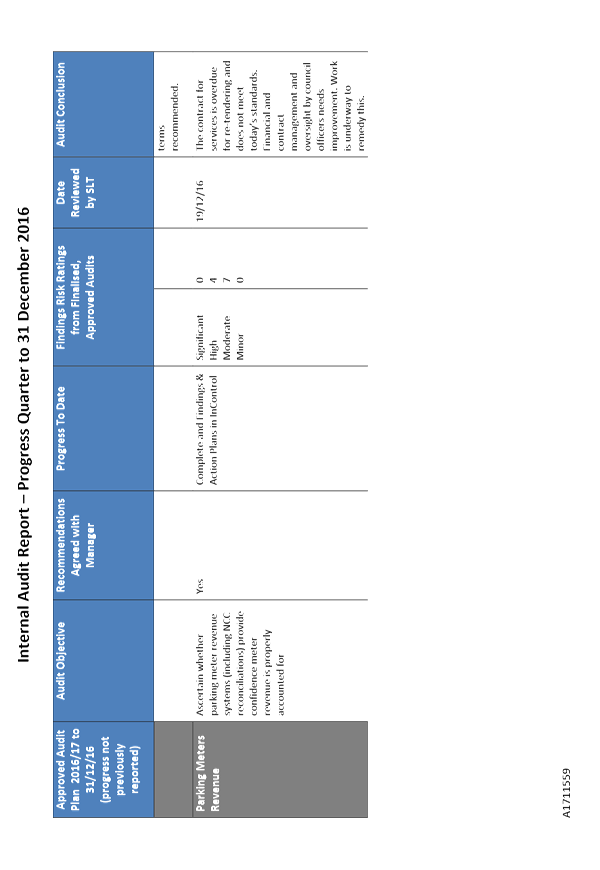

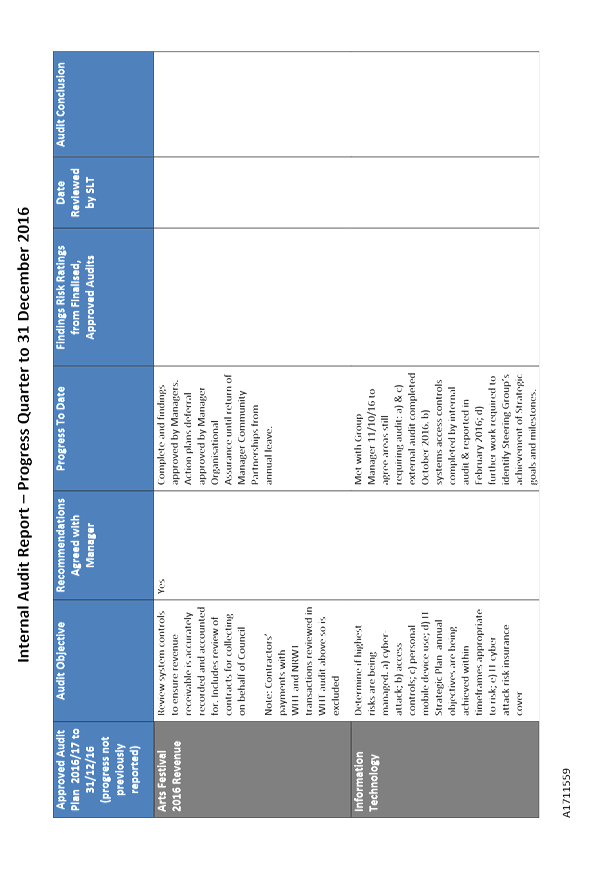

REPORT R7185

Internal

Audit Report to 31 December 2016

1. Purpose

of Report

1.1 To

update the Committee on the Internal Audit activity relative to audits included

in the Internal Audit Plan to 31 December 2016.

2. Recommendation

|

That the Committee

Receives the report Internal

Audit Report to 31 December 2016 (R7185)

and its attachment (A1711559).

|

3. Background

3.1 The

Internal Audit Charter was approved by Council on 15 October 2015.

3.2 Under

the Charter, the Audit, Risk and Finance Subcommittee requires a periodic

update on the progress of internal audit activities relative to any current

Internal Audit Plan approved by Council, and to be informed of any significant

risk exposures and control issues identified from internal audits completed. As

there is no Audit, Risk and Finance Subcommittee at present, this is being

reported direct to the Governance Committee.

3.3 The

Annual Internal Audit Plan relative to the year to 30 June 2017 was approved by

Council on 28 July 2016.

4. Discussion

Items reported on the

attached Internal Audit Report to 31 December 2016

4.1 Progress

on internal audits is reported in the attached table. This is for information

only and reflects approved audits for the Annual Audit Plan to 30 June 2017

which were due for completion during the period from 1 October 2016 to 31

December 2016. Where an audit may have been reported as incomplete in prior

periods, up to date information is provided.

4.2 The

table separates and summarises approved audit activity into three groupings: a)

external audits; b) internal audits - staff and internal audits and c) internal

audits.

5. Options

5.1 The

recommendation is to receive the report and its attachments outlining progress

of internal audits included in the Annual Audit Plan to 30 June 2017.

Lynn

Anderson

Internal

Audit Analyst

Attachments

Attachment 1: A1711559 - Internal Audit

- Quarterly Progress Report to 31 December 2016 ⇩

|

Important considerations for decision making

|

|

1. Fit

with Purpose of Local Government

Council has chosen to undertake internal audits to

help improve systems, their controls and efficiencies, in order to help give

confidence that it will be able to meet its responsibilities cost-effectively

and efficiently.

|

|

2. Consistency

with Community Outcomes and Council Policy

This report supports the community outcome that

Council provides leadership, which includes the responsibility for protecting

finances and assets through the minimisation of fraud, consistent with

guidance provided in Council’s Fraud Prevention Policy.

|

|

3. Risk

There is more risk that Council may not meet its

responsibilities cost-effectively and efficiently if this recommendation is

not accepted.

|

|

4. Financial

impact

The recommendation will not have any significant

financial impact.

|

|

5. Degree

of significance and level of engagement

This matter is of low significance because it does

not affect the level of service provided by Council or the way in which

services are delivered and no engagement has been undertaken.

|

|

6. Inclusion

of Māori in the decision making process

There has been no consultation with Maori in the

preparation of this report.

|

|

7. Delegations

The Governance Committee has responsibility for

audit processes and management of financial risks.

|

|

|

Governance Committee

9 March 2017

|

REPORT R7193

Remission

Of Rates To Compensate For Business Disruption

1. Purpose

of Report

1.1 To

consider whether to develop a rates remission policy for businesses affected by

civil works undertaken by Council.

2. Summary

2.1 Council

has received a request to consider remitting rates for businesses affected by

its civil works.

3. Recommendation

|

That the Committee

Receives the report Remission Of

Rates To Compensate For Business Disruption (R7193).

|

Recommendation

to the Council

|

That the Council

Confirms

not to develop a rates remission policy for businesses affected by civil

works undertaken by Council.

|

4. Background

4.1 John Gourdie of Gourdie Automotive

Ltd, attended the public forum of the Works and Infrastructure Committee

meeting on 17 November 2016 to request a rates remission due to the substantial

loss to his business as a result of works conducted along Waimea Road in 2016.

4.2 The works on Waimea Road were

undertaken in order to upgrade flood protection pipes, renew wastewater pipes

and water supply pipes in the area from the Boys College to the Girls College

playing field in lower Waimea Road. The project ran through a large

portion of 2016 with various parts of the road being worked on during different

times. There was extensive pre-consultation as well as consultation

during the physical works.

4.3 The

Works and Infrastructure Committee resolved as follows:

Requests

the Chief Executive to provide a report to the appropriate committee on the

matter of a rates remission policy for businesses affected by large-scale civil

works.

This report

has considered large-scale works but also all other public works as there may

be disruption due to maintenance and other smaller projects.

5. Discussion

5.1 Council frequently undertakes

projects that cause disruption to businesses and residents, but these projects

also bring benefits to the community. The city accommodates a level of

disruption to allow necessary works to be undertaken.

5.2 Businesses do not have any right

under law to any particular level of passing trade. Businesses are expected to

manage the risk of loss due to temporary civil works along with all the other

various risks of running a business. Trade may fluctuate for a variety of

reasons, and accurately assessing the losses directly attributable to the civil

works would be extremely difficult.

5.3 In researching this issue, officers

found no precedent in local government for the provision of rates remissions to

businesses affected by civil works.

5.4 At central government level, the

New Zealand Transport Agency (NZTA) does not provide monetary relief to

businesses inconvenienced by road works. Any right to compensation

arising from a major NZTA construction project is dealt with under the Public

Works Act 1981. It is only relevant in relation to land in circumstances

where land is taken or land suffers damage or substantial loss of value.

5.5 While Council tries to minimise the

impact of works, it is not appropriate to extend that by attempting, through a

reduction in rates, to compensate those affected.

6. Options

6.1 The

Governance Committee may choose to proceed no further with the matter or decide

to develop a rates remission policy for businesses affected by large-scale

civil works.

|

Option 1: decide to proceed no

further with the matter (status quo)

|

|

Advantages

|

· Requires

no further resourcing

· Maintains

a consistent approach across local government

|

|

Risks and Disadvantages

|

· Businesses

affected by disruptions will be disappointed Council has not considered the

matter further

|

|

Option 2: develop a draft

policy for public consultation

|

|

Advantages

|

· Allows

Council to hear community views

|

|

Risks and Disadvantages

|

· Requires

additional resourcing to develop the draft policy

· Indicates

a willingness to establish a precedent that would create a significant

financial burden for ratepayers

|

7. Conclusion

7.1 Officers recommend the status quo

as the most appropriate option.

Nikki

Harrison

Group

Manager Corporate Services

Attachments

Nil

|

Important considerations for decision making

|

|

1. Fit

with Purpose of Local Government

A decision not to amend the rates remission policy

is the most cost effective outcome for ratepayers as it avoids creating an

unwarranted financial burden.

|

|

2. Consistency

with Community Outcomes and Council Policy

The recommendation in this report is consistent with

Council’s Community Outcome “Our Council provides leadership and

fosters partnerships, a regional perspective, and community

engagement”.

|

|

3. Risk

A decision not to develop a rates remission policy

for businesses affected by civil works is likely to disappoint affected

businesses.

|

|

4. Financial

impact

There is no financial impact from deciding not to

pursue a policy. The ongoing financial impact of remitting rates for

disruption would be significant.

|

|

5. Degree

of significance and level of engagement

A decision not to adopt a policy is of low

significance as it is in keeping with standard practice in local and central

government and, so far, has only been an issue raised by one business.

|

|

6. Inclusion

of Māori in the decision making process

Māori have not been specifically consulted on

this report.

|

|

7. Delegations

The Governance Committee has the area of

responsibility of rating systems and policies. The Governance Committee has

the power to make a recommendation to Council on this matter.

|

|

|

Governance Committee

9 March 2017

|

REPORT R7244

Insurance

renewal 2017/18 - Infrastructure Assets

1. Purpose

of Report

1.1 To

update the committee on the 2017/18 insurance renewal for infrastructure assets

and to seek delegated authority to decide whether Council should exit from the

Local Authority Protection Program (LAPP).

Recommendation

|

That the Committee

Receives the report Insurance

renewal 2017/18 - Infrastructure Assets (R7244); and

Notes

that information is being collated to inform a decision

on whether to remain with the Local Authority Protection Program (LAPP) for

Council’s infrastructure insurance and also to understand the

appropriate level of insurance cover.

Recommendation to Council

Approves

delegating authority to the Mayor, Chair of Governance and Chief Executive to

decide whether Nelson City Council should exit from the Local Authority

Protection Program for Council’s infrastructure insurance and the

appropriate level of insurance cover, by the end of May 2017 and take any

action required to give effect to the decision.

|

3. Background

3.1 Council

has been a member in the Local Authority Protection Programme (LAPP) scheme

since it started in 1993. It is a mutual scheme whose membership now consists

of 32 local authorities; prior to the Christchurch earthquakes this was around

60. It provides insurance cover for damage to infrastructural assets from

natural hazard events. It only covers the 40% of damage costs not covered

by the National Disaster Recovery Plan which currently provides 60% cover from

Central Government. Council has $719 million of infrastructure assets

covered by the Local Authority Protection Programme ($696m 2015/16).

3.2 Council

gave notice last year that it was considering withdrawing from the LAPP scheme

(as it did in the prior year) and investigated alternate options for insurance

cover. Council was in discussion with Aon New Zealand (insurance brokers)

about joining a collective of local authorities to obtain insurance cover for

our infrastructure assets. As part of this process, Aon New Zealand undertook

risk modelling on Council’s flood and earthquake risks using Tonkin and

Taylor analysis and data on our infrastructure assets (including location and

value).

3.3 The

decision was made to remain with LAPP for another year, primarily because the

claim for the December 2011 rainfall event had not been settled and the risk

modelling work was not far enough developed to make a final decision on the

appropriate level of insurance cover.

4. Discussion

4.1 Council,

along with TDC and MDC, has been in discussion with Aon New Zealand about

joining a collective of local authorities to obtain insurance cover for our

infrastructure assets. This would be a separate arrangement to the Top of

the South collective which Council is part of with Tasman and Marlborough

District Council for material damage and other insurance policies (business

interruption, motor vehicle, public and professional indemnity, crime,

statutory and employers liability, harbour masters and wreck removal liability,

hall hirers liability, personal accident and forestry).

4.2 Aon

is sourcing some quotes for 2017/18 insurance cover for Council’s

infrastructure assets. Initial comparisons with LAPP are, for a similar

deductible (amount Council would have to pay itself before claiming any funds)

of $1.8million the annual premium quoted was $215,000, 15% lower than 2016/17

LAPP premium. This would be subject to a limit for any one event of $125million

total (including the central government 60% component) and one automatic

reinstatement of insurance cover for earthquake per year for nil premium.

4.3 LAPP

is unable to provide an estimate of contributions for 2017/18 (will be

available later in April). The premium in 2016/17 was $251,000 with a

$1.8m deductible. This policy is subject to the same limit as the Aon proposal ie

a limit for any one event of $125m total including the central government 60%

component with one reinstatement per year.

4.4 The

Top of South collective are also sourcing a quote from JLT, the insurance

broker for the material damage policies.

Risk modelling

4.5 As

part of the presentation of our infrastructure asset portfolio to insurance

companies in London, Aon New Zealand has undertaken risk modelling on

Council’s flood and earthquake risks using Tonkin and Taylor analysis and

data on our infrastructure assets (including location and value).

4.6 This

risk modelling was undertaken during 2016 and has been further refined

following the Kaikoura earthquake and similar modelling for Marlborough and

Tasman District Council.

4.7 Based

on a risk assessment it would appear that Council is underinsured; that the

$125m loss limit (set by LAPP and therefore quoted on for comparison) is not

enough. Pricing indications of the potential shortfall, for an additional

$75m above the current $125m loss limit (i.e. $200m for any one loss) is likely

to be in the region of $100,000.

Other matters

4.8 Local

Government New Zealand (LGNZ) commissioned a report in 2013 to review the

insurance market for the local authority sector post Christchurch earthquakes

and leaky homes and the impact thereof on the three sector-owned entities

Civic, LAPP and Riskpool. The report made recommendations which included

establishing a Local Government Risk Agency (LGRA) and reassessing the role of

Central Government in meeting the 60% not covered by local authorities.

4.9 Contrary

to initial commentary, the LGRA is likely not to affect the LAPP scheme but

provide support to local authorities, particularly smaller ones, in

understanding risk management processes.

4.10 It

is uncertain when Treasury will put out a consultation document on the current

40/60% cost sharing arrangement. However it is likely to include consideration

of Central Government contributing a lower percentage for smaller more frequent

events, introduction of risk management regulations etc. This will potentially

mean Council will need to obtain additional insurance cover in the future, over

and above the current 40% share.

5. Options

5.1 This

report recommends that the Mayor, Chair of Governance and Chief Executive are

given delegated authority to decide whether Council should exit from the LAPP.

If this option was not supported, a decision could not be made in time to meet

the mid May deadline for exiting LAPP and Council would need to commit to a

further year’s membership.

|

Option 1: Delegate authority

to Mayor, Chair of Governance and CE

|

|

Advantages

|

· Allows

fully informed decision making to occur in a timely manner

|

|

Risks and Disadvantages

|

· Not a

decision of full Council

|

|

Option 2: Not delegate

authority

|

|

Advantages

|

· Any

decision would be by full Council

|

|

Risks and Disadvantages

|

· Unlikely

that decision timeframes will line up with committee and Council meetings

potentially leading to a sub-optimal outcome and further delays in achieving

appropriate insurance cover.

|

6. Conclusion

6.1 It

is recommended that the Mayor, Chair of Governance and Chief Executive are

given delegated authority to decide whether Council should exit from the LAPP

by the end of May 2017 and also to decide the appropriate level of cover and

agree a provider.

Nikki

Harrison

Group

Manager Corporate Services

Attachments

Nil

|

Important considerations for decision making

|

|

1. Fit

with Purpose of Local Government

Risk management through using insurance is a tool to

enable more efficient and effective provision on services as set out in

section 10(1)(b) of the Local Government Act.

|

|

2. Consistency

with Community Outcomes and Council Policy

This recommendation is not inconsistent with any

previous Council decisions.

|

|

3. Risk

The decision to delegate reduces the risk of renewal

timings being out of step with committee and Council meetings.

|

|

4. Financial

impact

There is no financial impact from the

recommendation.

|

|

5. Degree

of significance and level of engagement

This matter is of low significance because it is a

decision to delegate authority to a small group. Therefore no

engagement will occur.

|

|

6. Inclusion

of Māori in the decision making process

No consultation with Maori has been undertaken in

preparing this report.

|

|

7. Delegations

The Governance Committee has the responsibility for

considering organisational risk management. The Governance Committee has the

power to make a recommendation to Council on this matter.

|

|

|

Governance Committee

9 March 2017

|

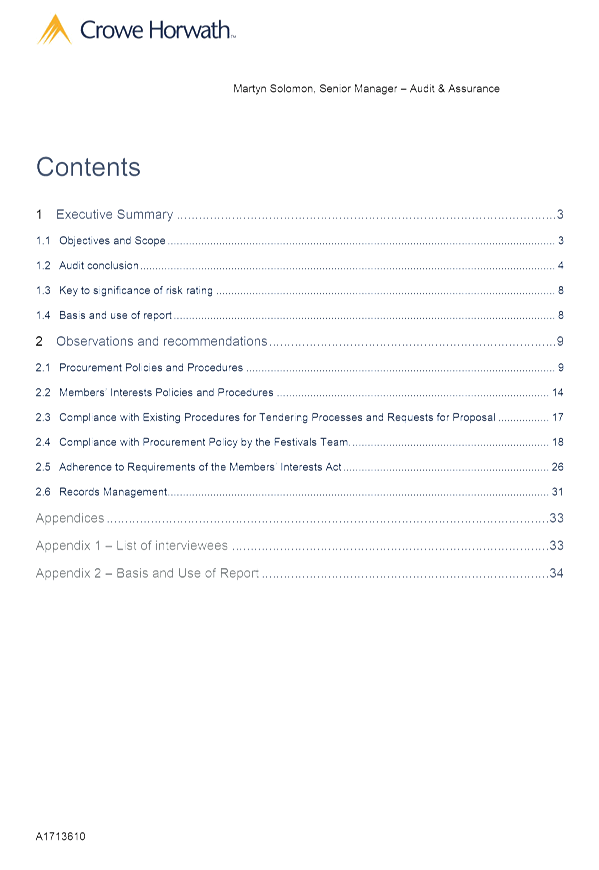

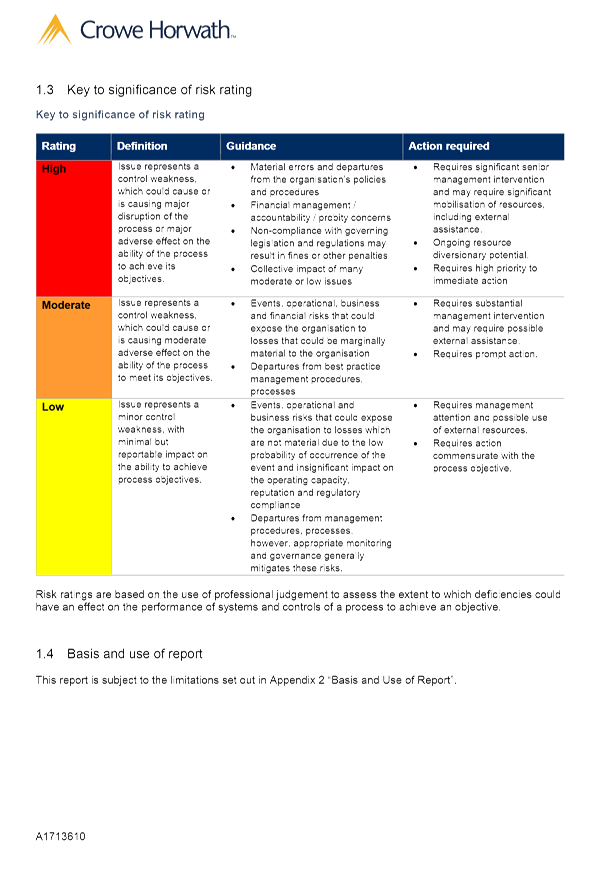

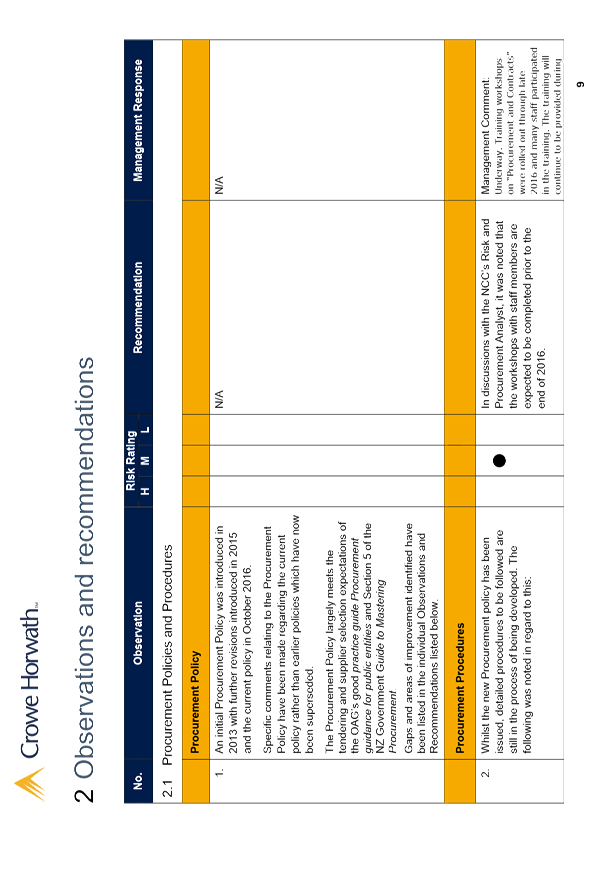

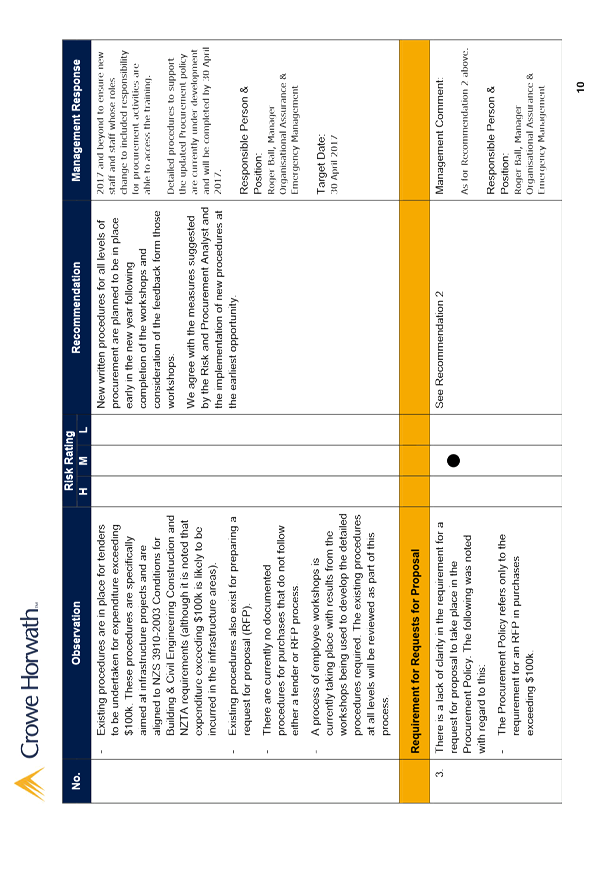

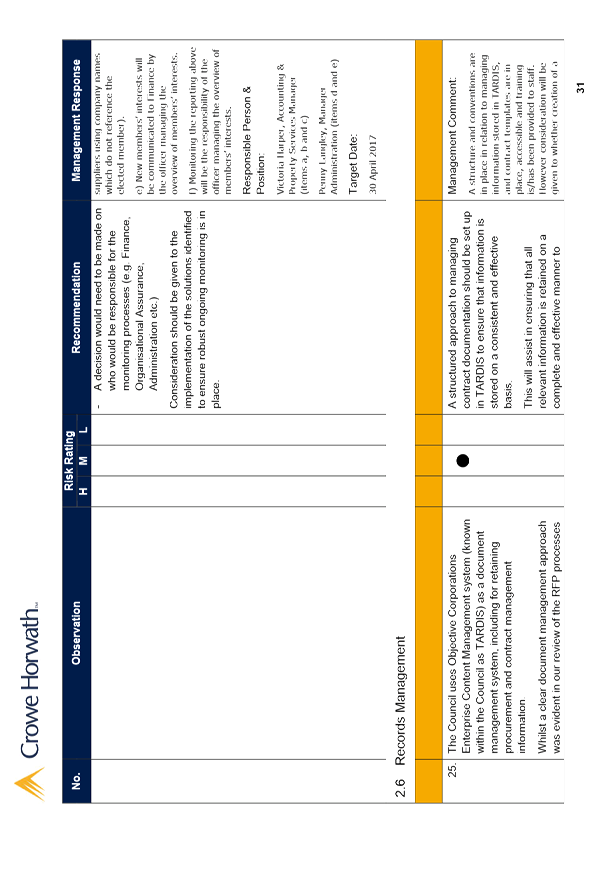

REPORT R7135

Tendering

processes

1. Purpose

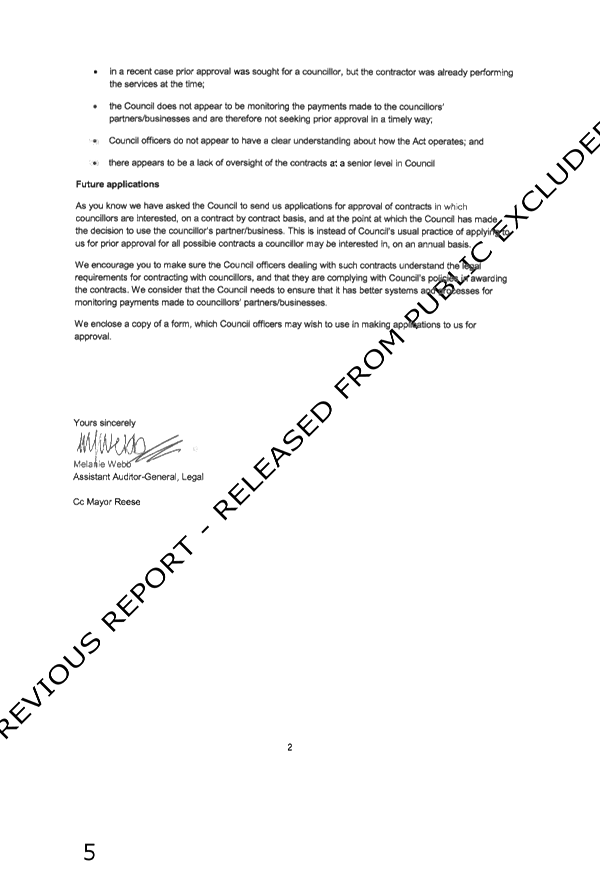

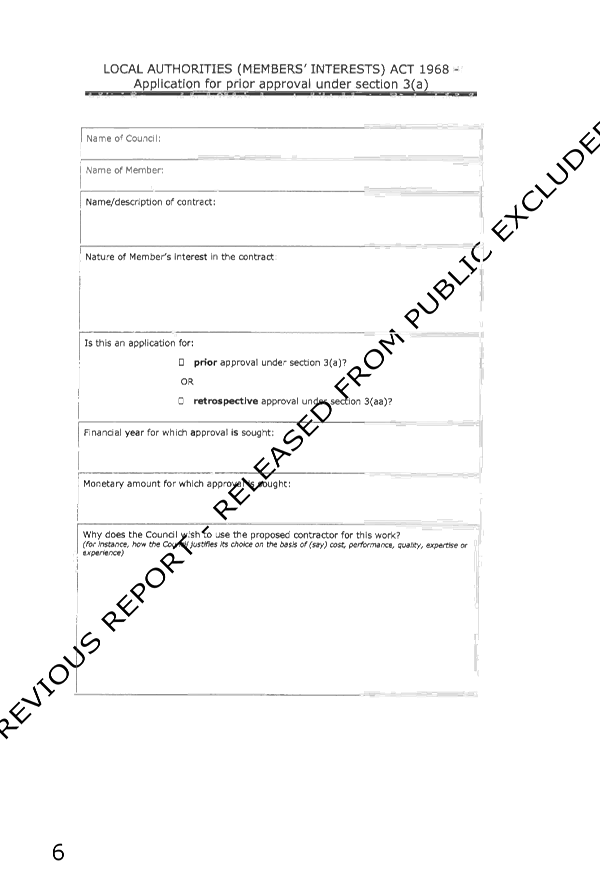

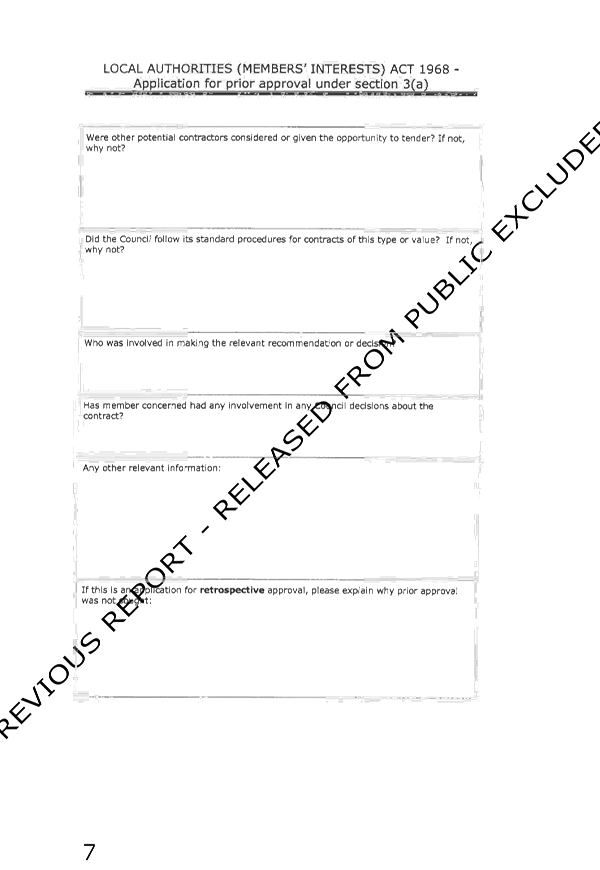

of Report

1.1 To

provide the Committee with the outcome of the external audit report undertaken

by Crowe Horwath, in response to concerns raised by the Office of the

Auditor-General.

2 Recommendation

|

That

the Committee

Receives the report Tendering

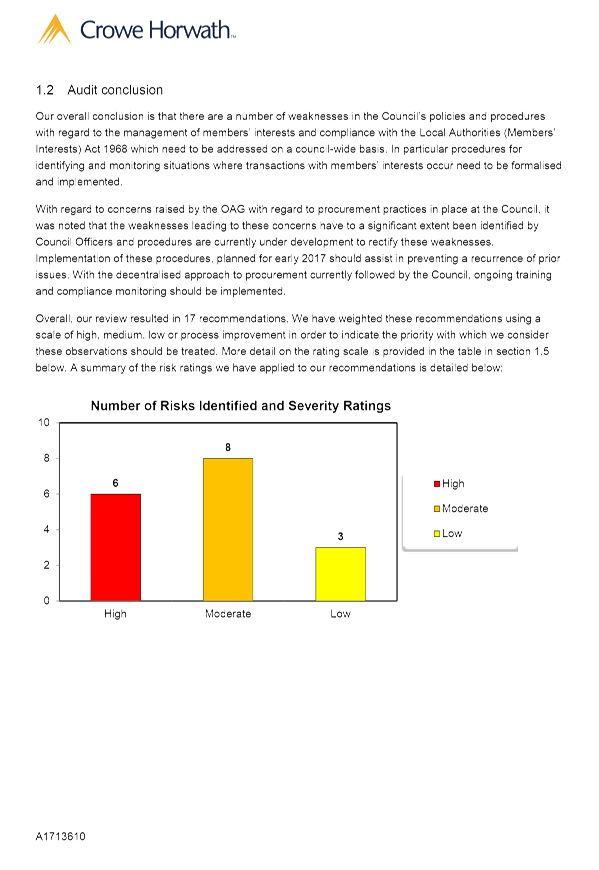

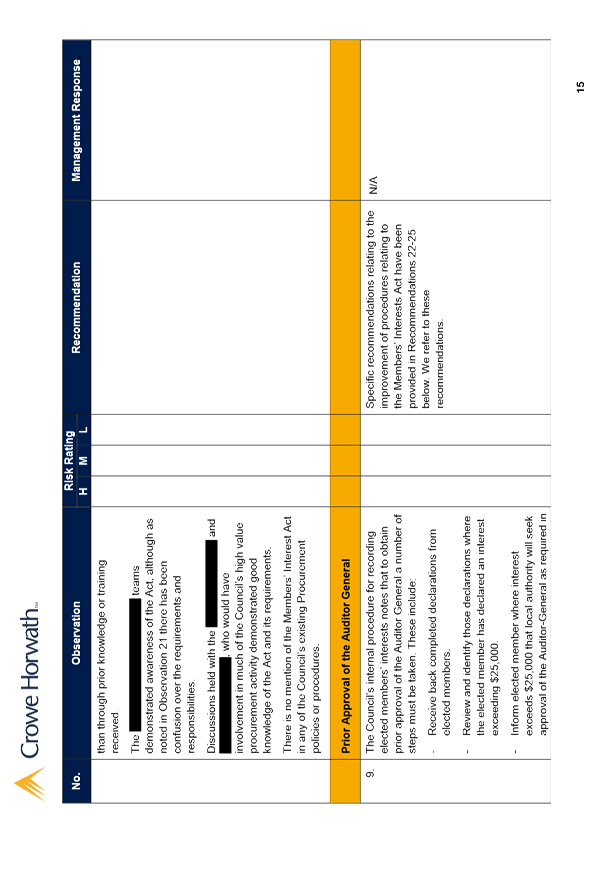

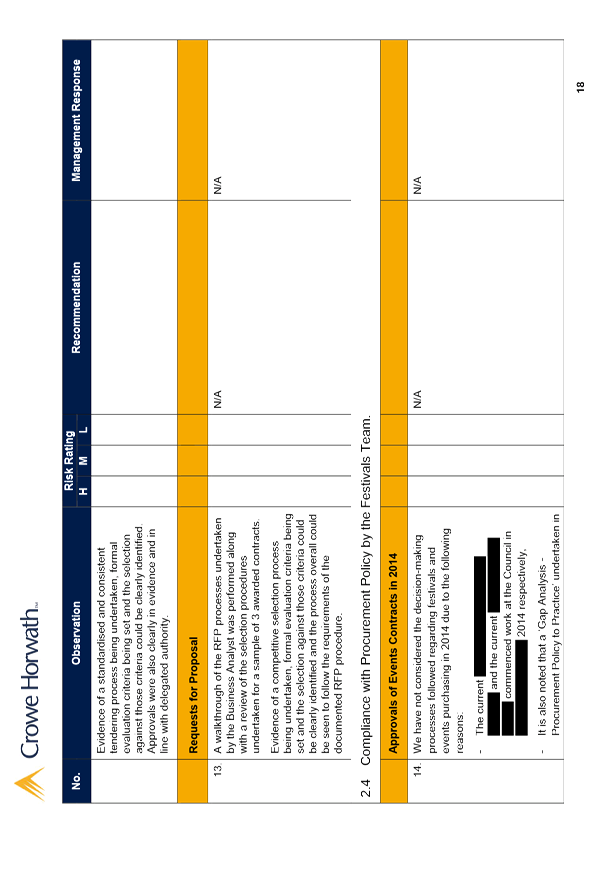

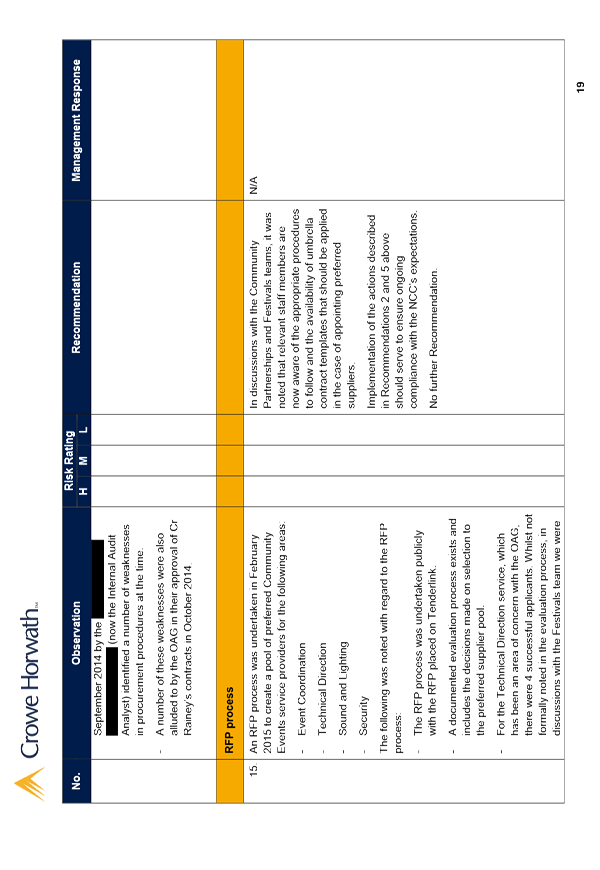

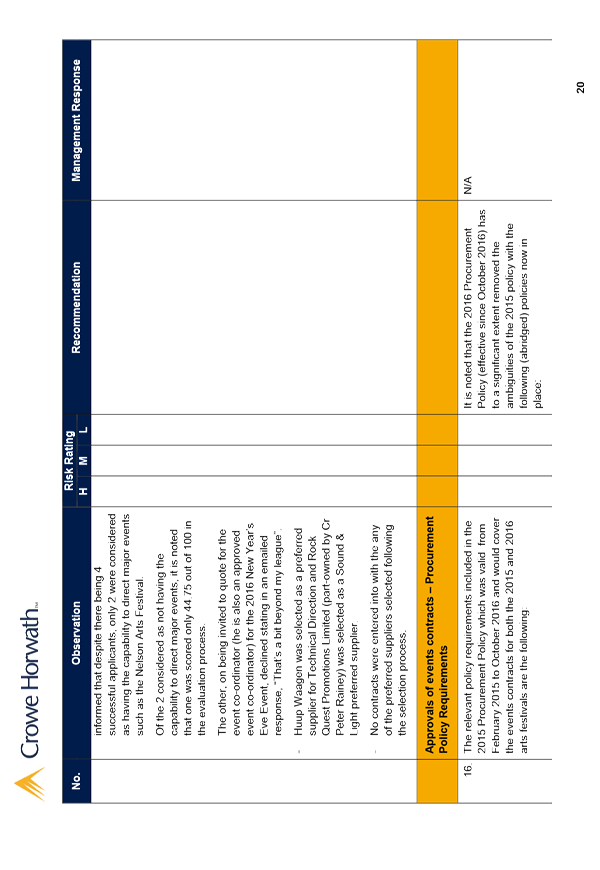

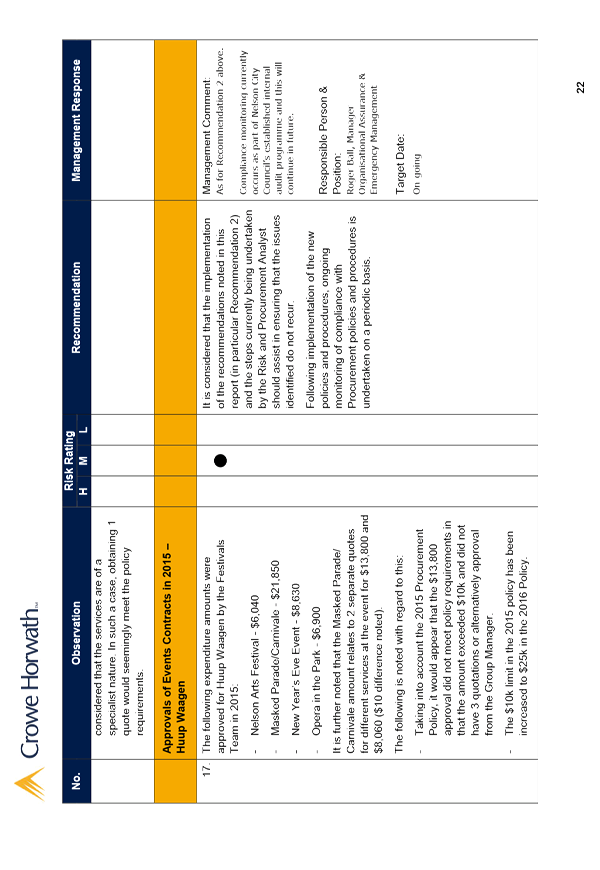

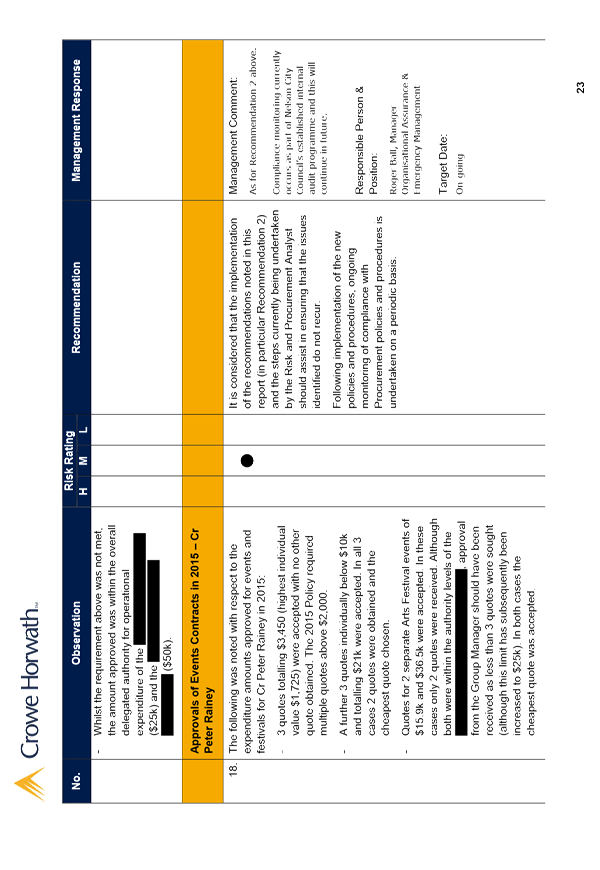

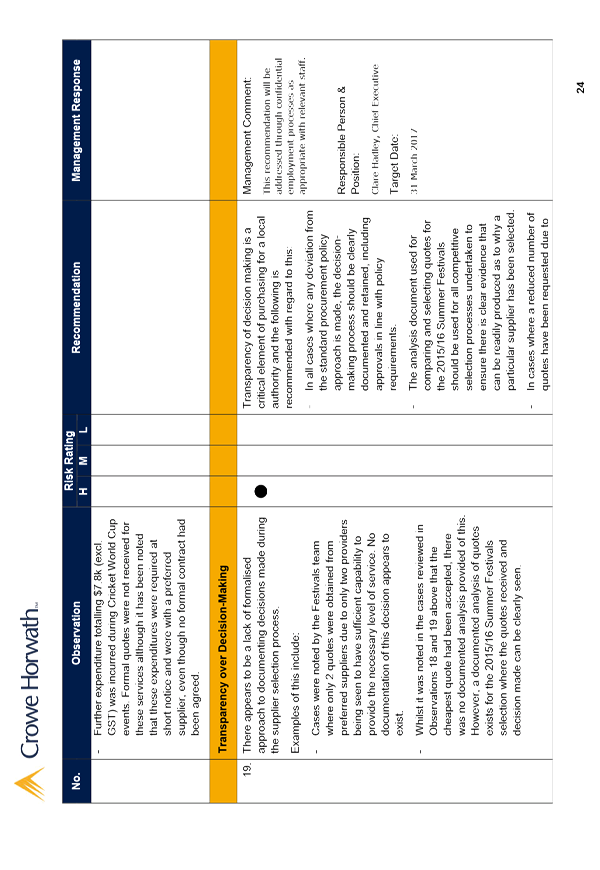

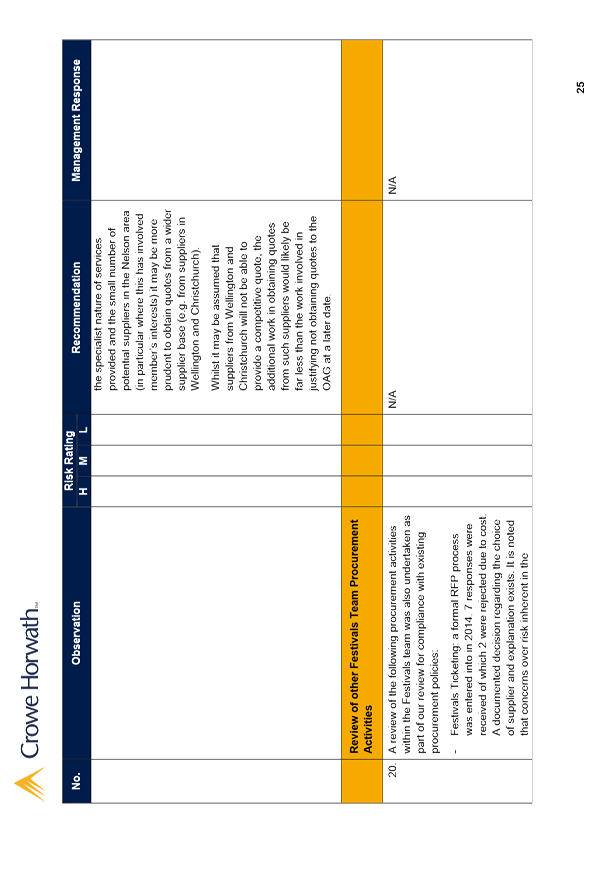

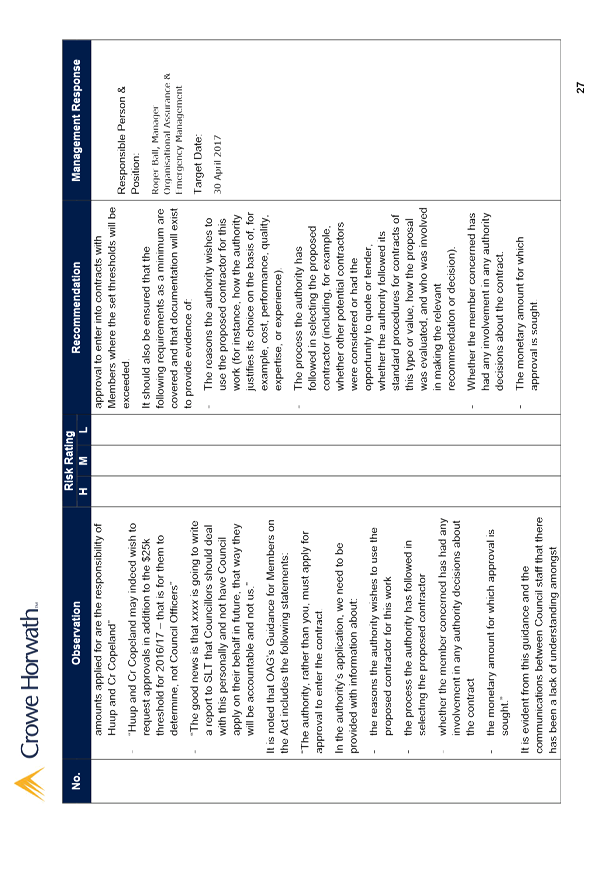

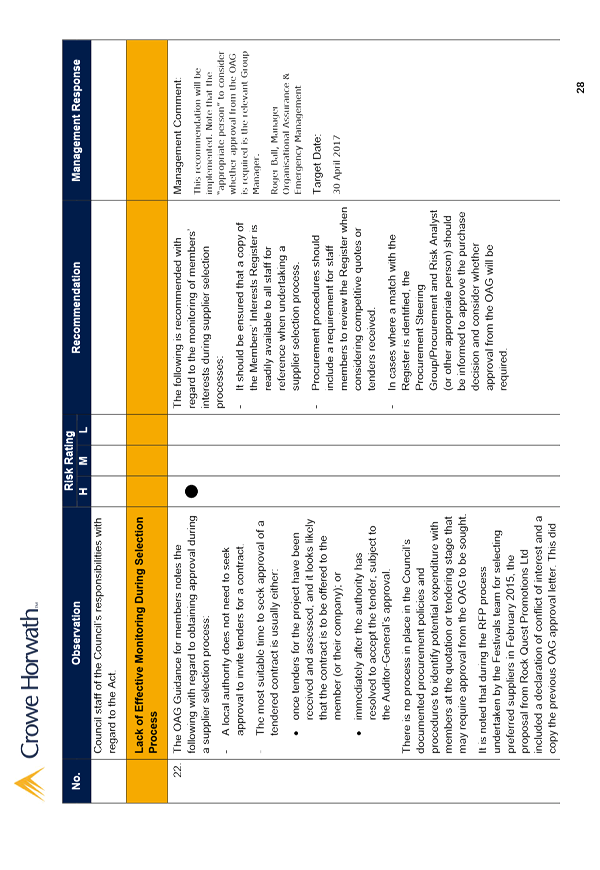

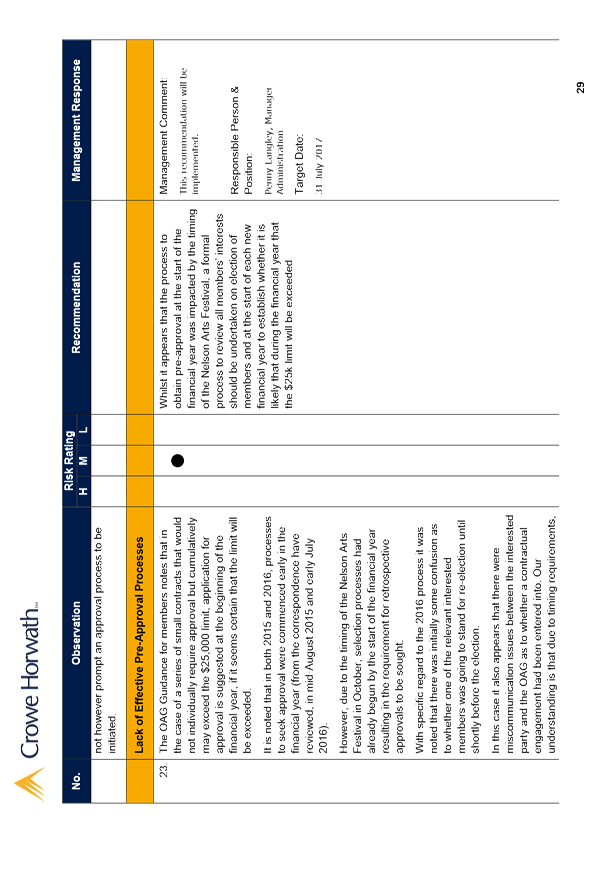

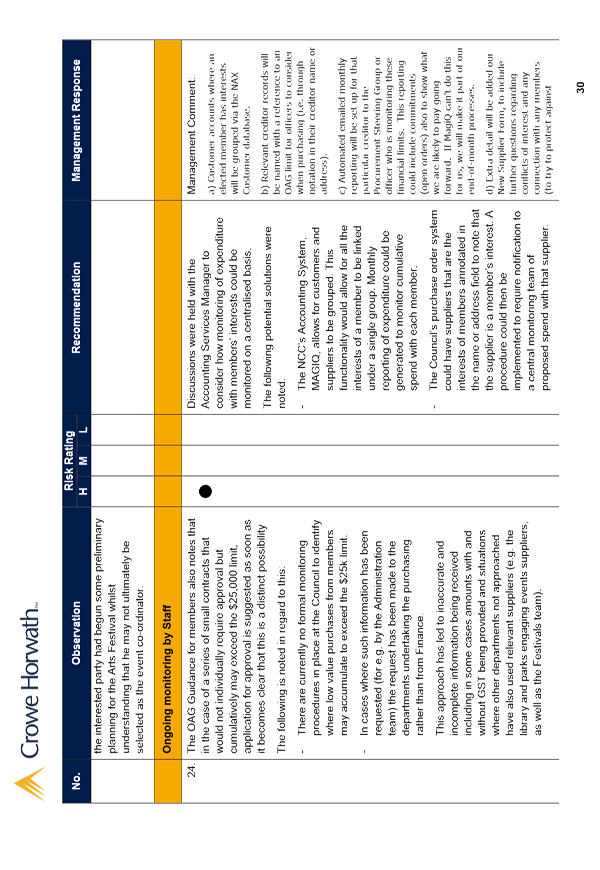

processes (R7135) and its