Item 5: Annual Report

2022/23

|

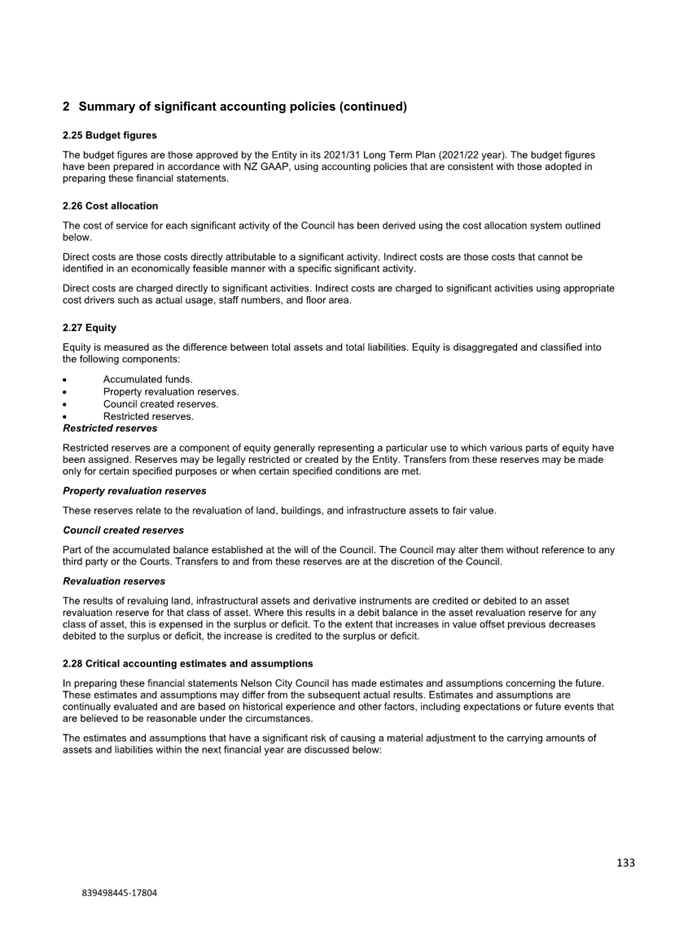

|

Council

26 October 2023

|

Report

Title: Annual

Report 2022/23

Report

Author: Nicky McDonald -

Group Manager Strategy and Communications

Report

Number: R27942

1. Purpose

of Report

1.1 To adopt the Annual

Report for the year ending 30 June 2023 in accordance with section 98 of the

Local Government Act 2002.

2. Summary

2.1 The Local Government

Act requires Council to adopt the final Annual Report within four months after

the end of the financial year (i.e. by 31 October).

2.2 Audit New Zealand

commenced auditing the draft Annual Report 2022/23 in September 2023, and audit

work will be complete by the date of this meeting. Any final amendments to the

draft Annual Report (Attachment 839498445-17804) will be tabled at the meeting,

along with the Audit report. No significant issues have been identified during

the audit.

2.3 The Annual Report

2022/23 presents the financial performance of the Council over the previous

year. Council recorded an accounting deficit before the revaluations for the

year ended 30 June 2023 of $14.6 million which was $21.5 million less than

budget. Net weather-related expenses amounted to $14.5 million which is the

majority of the variance to budget. Borrowings net of cash and LGFA borrower

notes were $168.8 million, compared to a budget of $161.0 million.

3. Recommendation

|

That

the Council

1. Receives the report Annual

Report 2022/23 (R27942) and its attachment (839498445-17804); and

2. Adopts the Annual Report for

the year ended 30 June 2023 in accordance with S98 of the Local Government

Act 2002 contained in Attachment 1 (839498445-17804); and

3. Receives the Audit New

Zealand Opinion as tabled at the meeting; and

4. Delegates the His Worship the

Mayor and Chief Executive authority to approve minor editorial changes to the

Annual Report 2022/23 as necessary.

|

4. Background

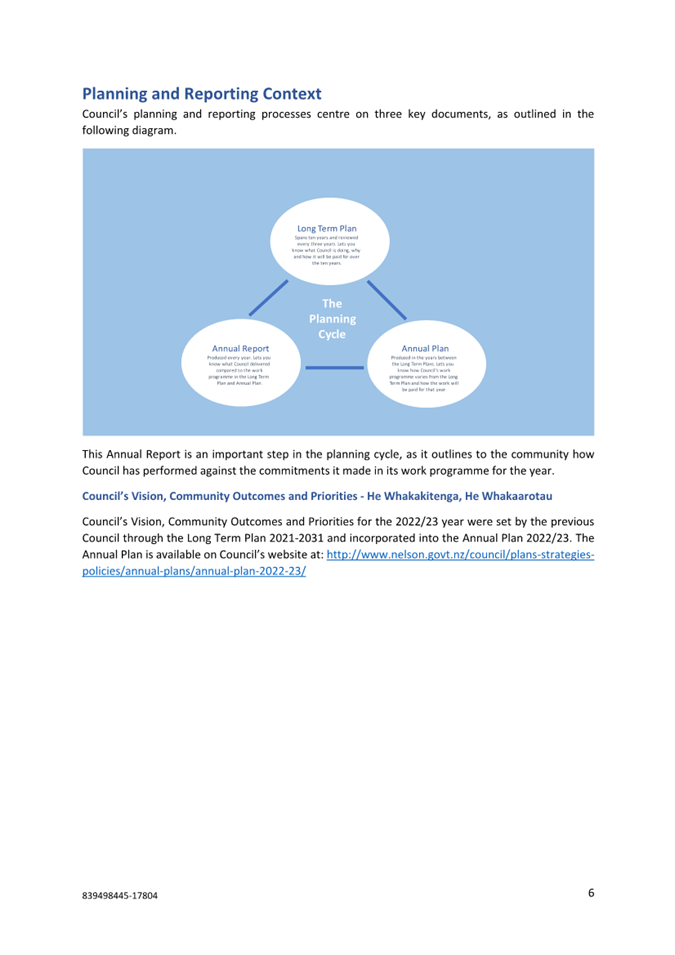

4.1 The purpose of the

Annual Report is to compare the actual activities and performance of Council

with those set out in the Annual Plan 2022/23. It is also a means to enable

accountability to the community for the decisions Council has made throughout

the year.

4.2 Progress

was made across a range of projects in line with Council’s Long Term Plan

2021-31, however the recovery from the August 2022 severe weather event impacted

all activities across Council. Council achieved 77.6% of its performance

measures in 2022/23 which is a decrease from the 2021/22 result of 83%. This

decrease can also be partly explained by the introduction of a new accounting

standard, which has changed the way we report on performance measures.

4.3 An initial draft of

the Annual Report 2022/23 was presented to the Audit, Risk and Finance Committee

on 15 September 2023 for information and to provide an opportunity for any

feedback. The committee passed the following resolution:

Resolved ARF/2023/010

That the Audit, Risk and

Finance Committee

3. Confirms

to Council that the Audit, Risk and Finance Committee has reviewed the Draft

Annual Report 2022/23 (839498445-17289) and the audit process and is satisfied

that the Annual Report is on track for Council adoption prior to 31 October

2023.

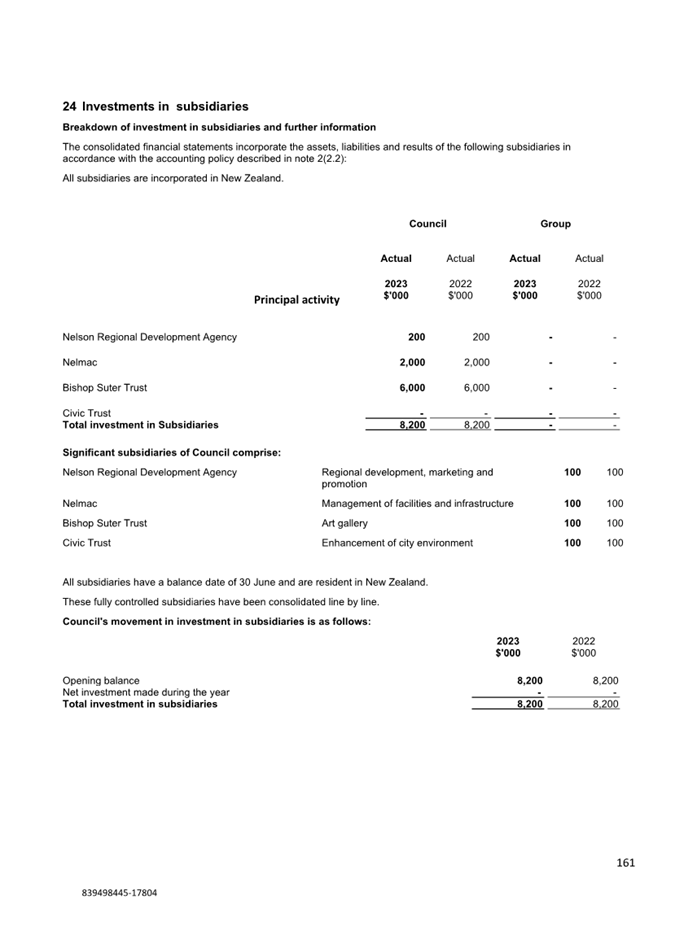

4.4 The Annual Report includes both the parent (Nelson City Council) and

the Nelson City Council Group – which consists of Nelson City Council,

its subsidiaries (Nelmac Limited, Nelson Civic Trust, Bishop Suter Trust,

Nelson Regional Development Agency) and its associates and joint ventures.

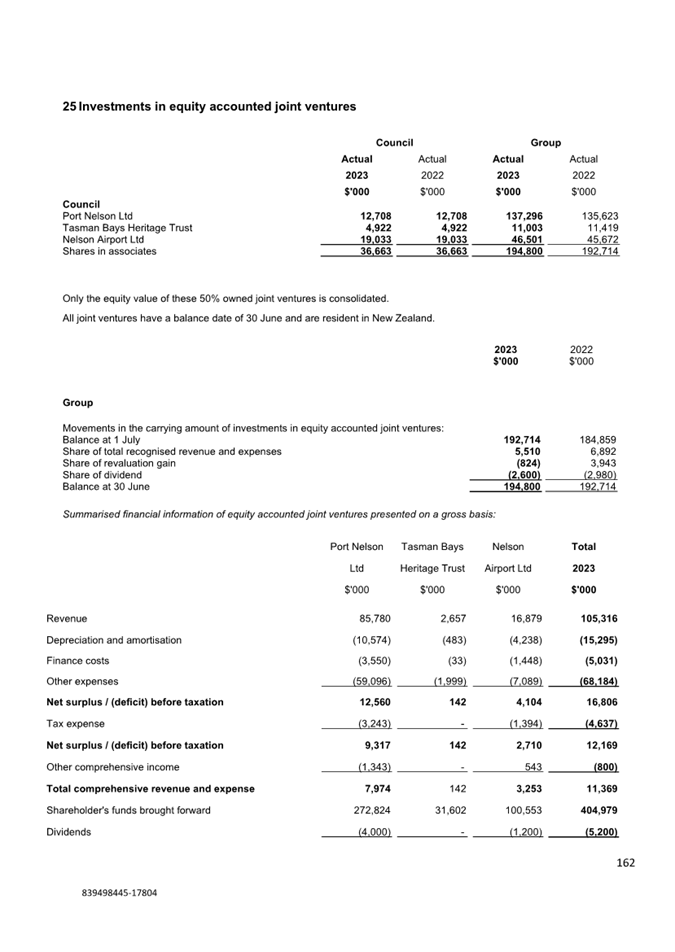

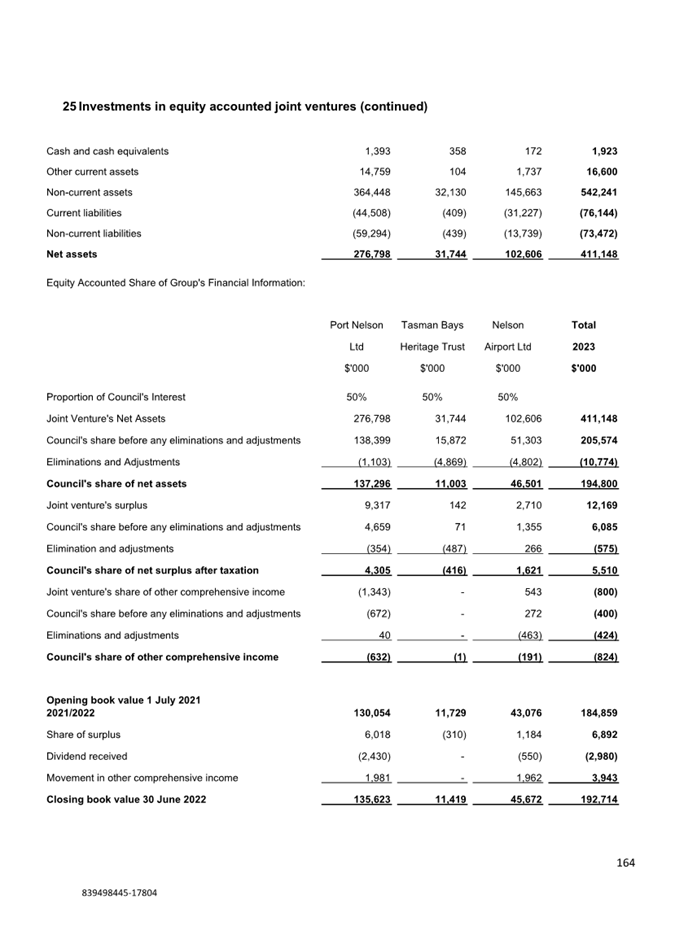

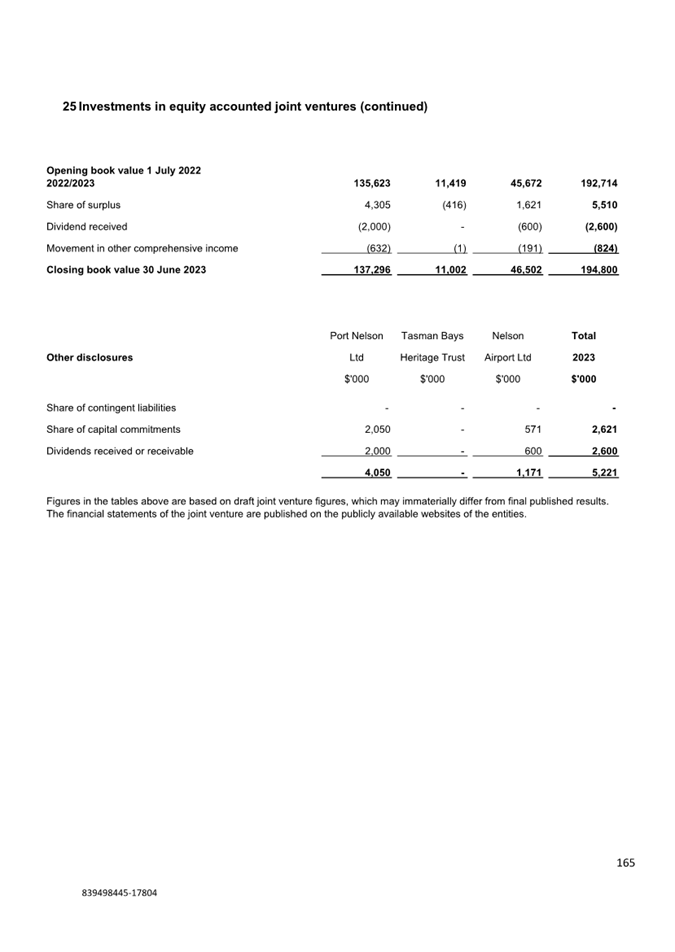

4.5 As Council does not have a controlling interest in its associates

(Nelson Airport Limited, Tasman Bays Heritage Trust and Port Nelson Limited)

these are equity accounted. Nelson Regional Sewerage Business Unit, Nelson

Tasman Regional Landfill Business Unit, and the Nelson Tasman Combined Civil

Defence Organisation are proportionately consolidated as these are not separate

legal entities. Further detail of the accounting treatment is included in Note

1 to the accounts.

5. Discussion

Highlights

for 2022/23

5.1 New

Public Transport System

2023 saw the

launch of 17 new electric buses to service the wider Nelson-Tasman region, with

work to enable this project being completed throughout 2022/23. This service

will provide more buses, more often, with a route now servicing the Nelson

Airport. The electric buses are quiet and clean and will contribute to

Nelson-Tasman reducing greenhouse gases associated with transport.

5.2 Saxton

Creek Upgrade

The Saxton

Creek upgrade project looks to improve how and where water flows during a major

weather event. The project is planned over four phases with stage four

progressing through 2022/23. The upgrade will mean that that the area will be

able to cater for a 1 in 100-year flood. This work has received $7.5 million

funding from Kānoa – Regional Economic Development and Investment

Unit, which has allowed Council to bring the project forward, creating new jobs

in the area.

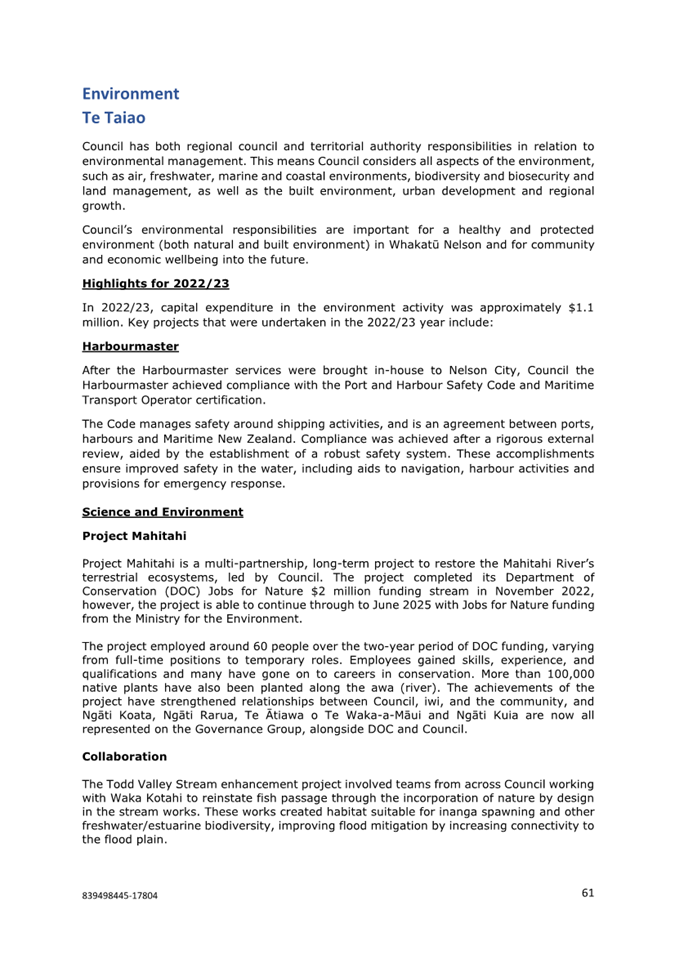

5.3 Project

Mahitahi

Led by

Council, Project Mahitahi is a multi-partnership, long-term project to restore

the Mahitahi River’s terrestrial ecosystems. This project has received

funding from the Department of Conservation (DOC) and Ministry for the

Environment Jobs for Nature programs, allowing the project to continue through

to June 2025. This project has employed over 60 people during the two-year

period of DOC funding, resulting in over 100,000 native trees being planted,

and strengthened relationships between all those involved in the project.

5.4 Bridge

Street Linear Park

Council

entered into a funding agreement with the Government in September 2022 after

being successful with the 2021/22 application to the Infrastructure

Acceleration Fund to enable the Bridge Street Linear Park project (Rutherford

Street to Collingwood Street) to proceed. This project will transform Bridge

Street into an active transport corridor and linear park, offering a high

amenity street scape to enable city centre revitalisation outcomes. The funding

includes the associated underground infrastructure, a flood gate and increased

capacity of the Paru Paru Road wastewater treatment pump station.

5.5 Te

Ramaroa

The city was

lit up with the lights of Te Ramaroa festival in June and July 2023. The free

community event brought together a collection of light installations spread

throughout the city, created by a diverse range of local and national artists.

The event provided a boost to the local economy, generating high numbers of

visitors.

5.6 Te

Pā Harakeke

In November

2023 Te Pā Harakeke was officially opened, welcoming Nelsonians to a new

play area situated over the disestablished modeller’s pond. This allowed

for the remediation of contaminated land and accommodated a stormwater

discharge system which is built to adjust to waters of the king tide. The

Nelson Society of Modellers railway track remains in place for people to enjoy,

and the park won the healthy park of the year award at the Recreation Aotearoa

Conference in 2023.

Non-financial

performance

5.7 Council measures its

non-financial success against performance measures that are set through the

LTP. The LTP established 67 performance measures across Council’s eleven

activity areas. The measures are recorded as ‘achieved’, ‘not

achieved’, or ‘not measured’ (where insufficient data is

available to determine a result) at the end of the year.

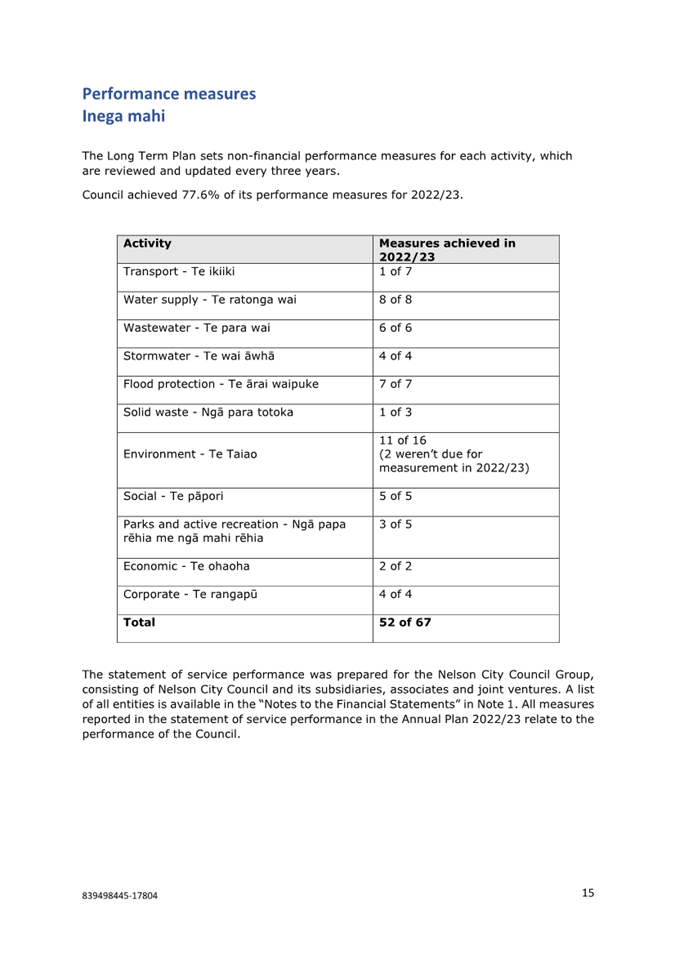

5.8 Council achieved 52

(77.6%) of its non-financial performance measures in 2022/23. In 2021/22

Council achieved 55 (83%) of its non-financial performance measures. Commentary

on all measures is provided in the activity sections of Attachment 1.

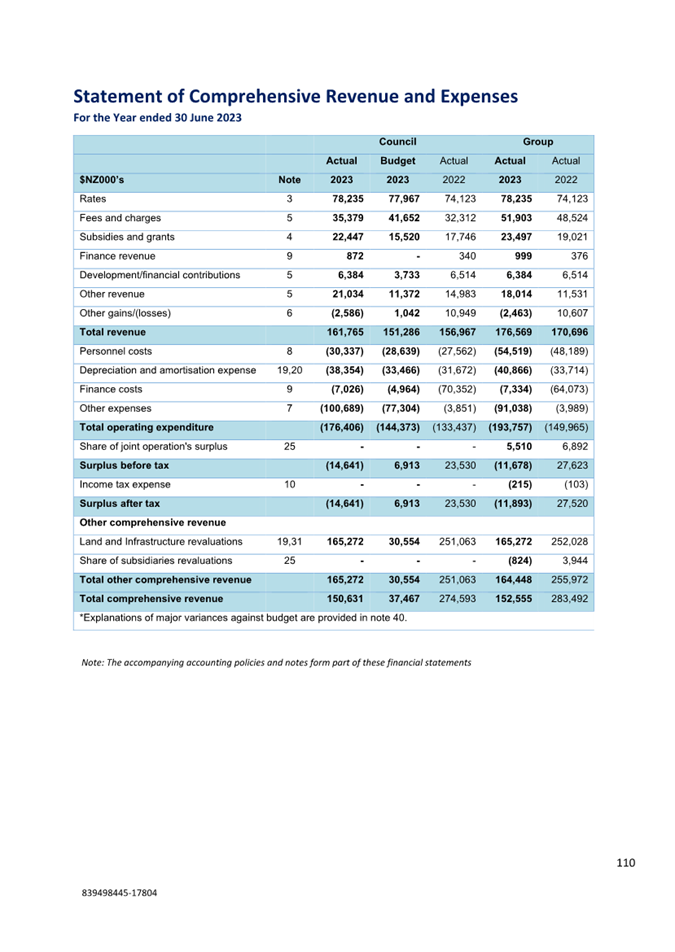

Surplus/Deficit

5.9 The

Annual Report shows that Council recorded a net deficit before revaluations for

the year ended 30 June 2023 of $14.6 million which was $21.5 million less than

budget. Net weather-related expenses amounted to $14.5 million (including

abandoned assets), which is the majority of the $21.5 m variance to budget. In

the 2021/22 financial year, this was a surplus of $23.5 million. More detail

for the variance is explained in the Annual Report Note 40, however the reasons

for this variance are mainly due to:

5.10 Fees

and charges are $6.3 million lower than budget, which is mainly due to the

following:

5.10.1 TDC recovery income is

nil against a budget of $2.8 million due to a reclassification to other revenue

for external reporting purposes (section 5.14).

5.10.2 Harvesting income is

lower than budget by $3.0 million as a result of the changes to the planned

timing of harvesting as well accounting adjustments for external reporting,

where only the movement in forestry fair value is considered as income for

external reporting purposes.

5.11 Subsidies

and grants are $6.9 million higher than budget mainly due to the following:

5.11.1 Waka Kotahi income is

$3.4 million greater than budget. $3.9 million of this relates to flood

recovery, $1.2 million relates to public transport, and $0.5 million relates to

other transport cost recoveries. This is offset by a reduction of $2.3 million

in grants for capital expenditure due to delays in the capital expenditure

programme due to the August 2022 weather event.

5.11.2 There is $3.1 million

of accrued income for the NEMA claim for the August 2022 weather event.

5.11.3 This is offset by a

reduction of $0.8 million in Waste Minimalisation income, due to the kitchen

waste service commencing later than anticipated (refer 5.19).

5.12 Finance

income is $0.9 million greater than budgeted. This is due to interest on

short-term investments (i.e. pre-funding of debt).

5.13 Development/financial

contributions are $2.7 million greater than budget due to more development

activity in the community than budgeted.

5.14 Other

revenue is $9.7 million greater than budget due to the following reasons:

5.14.1 Vested asset income

was $5.5 million more than budgeted.

5.14.2 Dividend/subvention

income was $0.8 million less than budgeted.

5.14.3 $1.8 million of accrue

insurance recoveries on the August 2022 weather event.

5.14.4 $2.8 million

reclassification from Fees and Charges above (section 5.10).

5.15 Other

gains/losses are less than budget by $3.6 million due to the following:

5.15.1 $2.4 million of

abandoned assets as a result of the August 2022 weather event (across roading,

water supply, wastewater and storm water).

5.15.2 $2.2 million

difference is due to a loss in the forestry activity of $0.7 million as a

result of the revaluation of forestry asset and an accounting adjustment at the

year end.

5.15.3 This is partially

offset by a higher than planned gain of $1.0 million on the revaluation of

swaps – due to interest rate rises.

5.16 Personnel

costs were $1.7 million higher than budgeted, which is mainly due to higher

(5%) than budgeted (3%) average salary increase (Costs additional 0.9m), less

capitalized wages than budgeted (by $0.9m) as the recovery programme being

operating expenditure rather than capital expenditure and higher Contractor/Temp

and Training Staff costs.

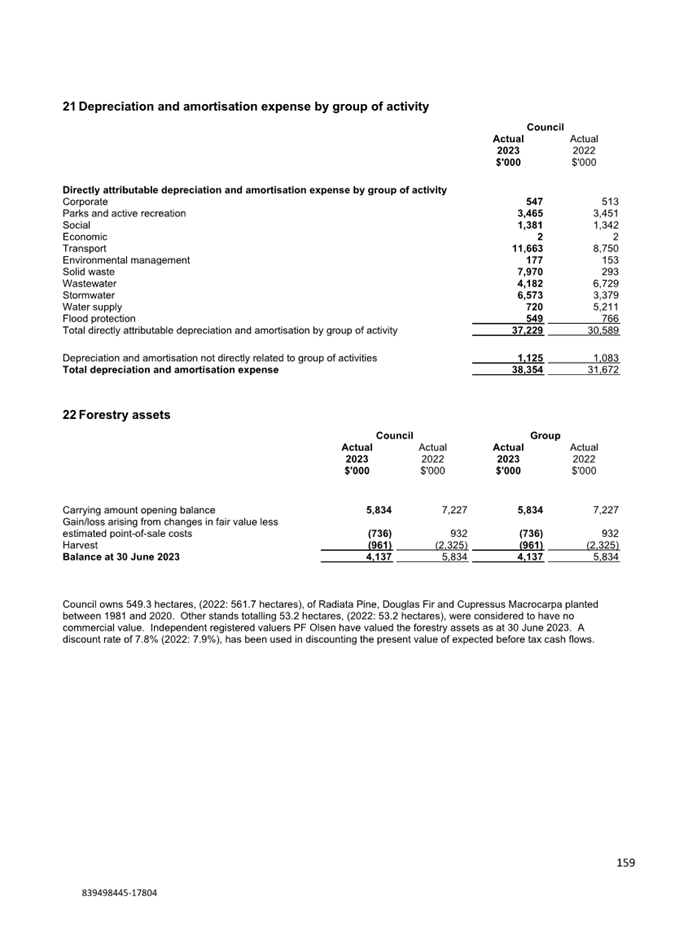

5.17 Depreciation

and amortisation expense was $4.9 million greater than budgeted. In the 2021/22

financials, the asset valuations saw significant increases. This resulted in a

much higher depreciation expense than budgeted for. This was especially evident

in Roads, Wastewater, Stormwater, and Water Supply.

5.18 Finance

costs are greater than budget by $2.0 million. $0.9 million is due to an

increase in interest from additional pre-funding of debt (see 5.12). The

remaining $1.1 million is due to both interest rate increases and higher

borrowings due to the weather event.

5.19 Other

expenses were $23.4 million greater than budget mainly due to $21.2 million

spent on the August 2022 weather event. Other major variances include:

5.19.1 $1.0 million increase

in transport-related expenditure (offset by Waka Kotahi grants in 5.11 above).

5.19.2 $0.5 million decrease

in kerbside kitchen waste service due to the delayed deployment of this

initiative (see 5.11 above).

5.19.3 $0.5 million increase

in green waste and recycling levies.

5.19.4 $2.5 million decrease

in forestry expenses compared to the budget due to an accounting adjustment to

move net profit to other gains/losses.

5.19.5 A $3.45 million

accrual has been added for the Tahunanui Beach sawdust remediation. This is

made up of $0.45m for short-term solution, and the $3.0m for long-term

solution. These figures were based on estimations provided by staff in the

report to Council on 10 August 2023. As the condition at Tahunanui Beach

existed at balance date, accounting standards requires that the Council

provides for this.

All other increases/decreases in operating expenditure are less than $0.5

million.

5.20 The

final Land and Infrastructure Revaluations was $165.3 million; $134.7 million

over budget:

5.20.1 Infrastructure assets

are revalued every year to smooth out the large fluctuations and accounted for

all of the overall revaluation. This is against a budget of $30.6 million.

5.20.2 Land is revalued every

five years or when its fair value diverges materially from its carrying value.

Land was not revalued in 2022/23 due to movements not being material from the

2021/22 financial year, when it was last revalued.

External

Debt

5.21 At 30

June 2023 Council’s borrowings, net of deposits, cash and LGFA borrower

notes were $168.8 million compared to a budget of $161.0 million. This variance

of $7.8 million is mainly due to:

5.21.1 The additional

weather-related expenditure of $21.2 million.

5.21.2 This was offset by a

reduction in the Capital Expenditure not reaching the full programme and ending

less than budgeted by $7.1 million against Annual Plan budget of $72.9 million

(excluding vested assets and joint operations but including capital staff time

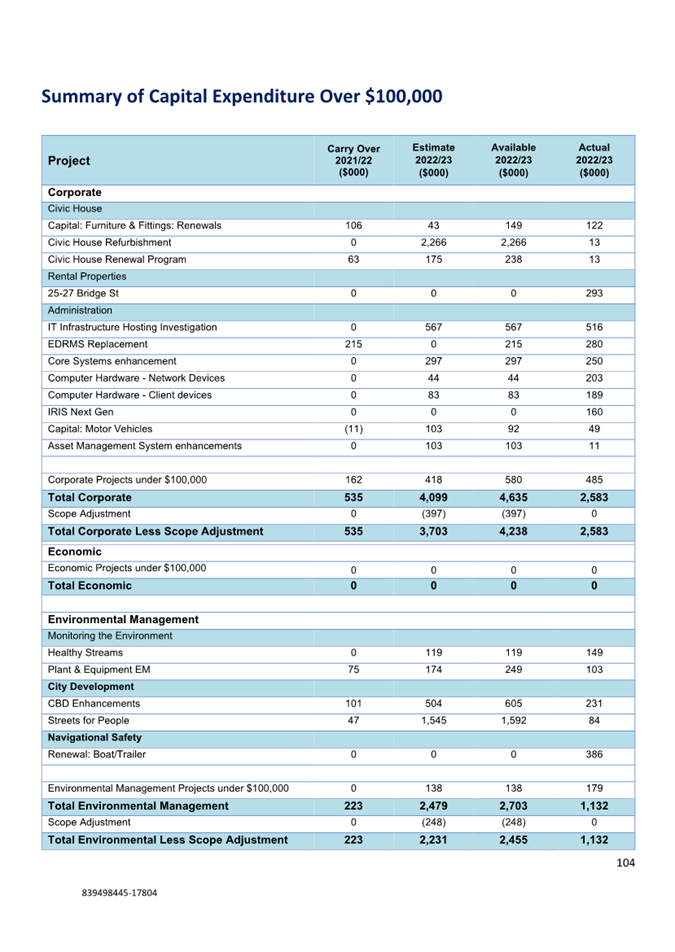

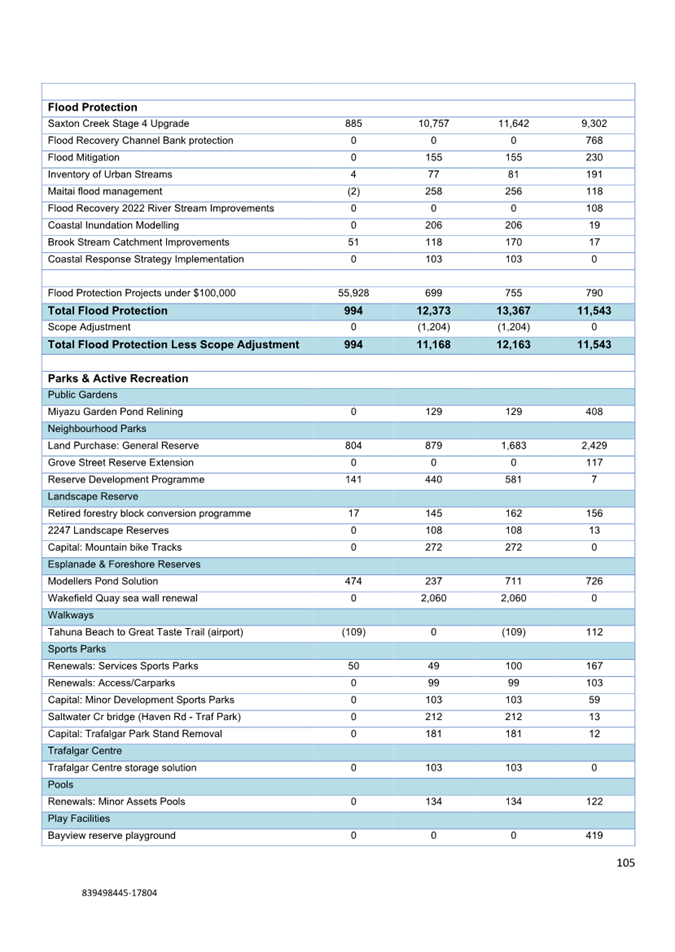

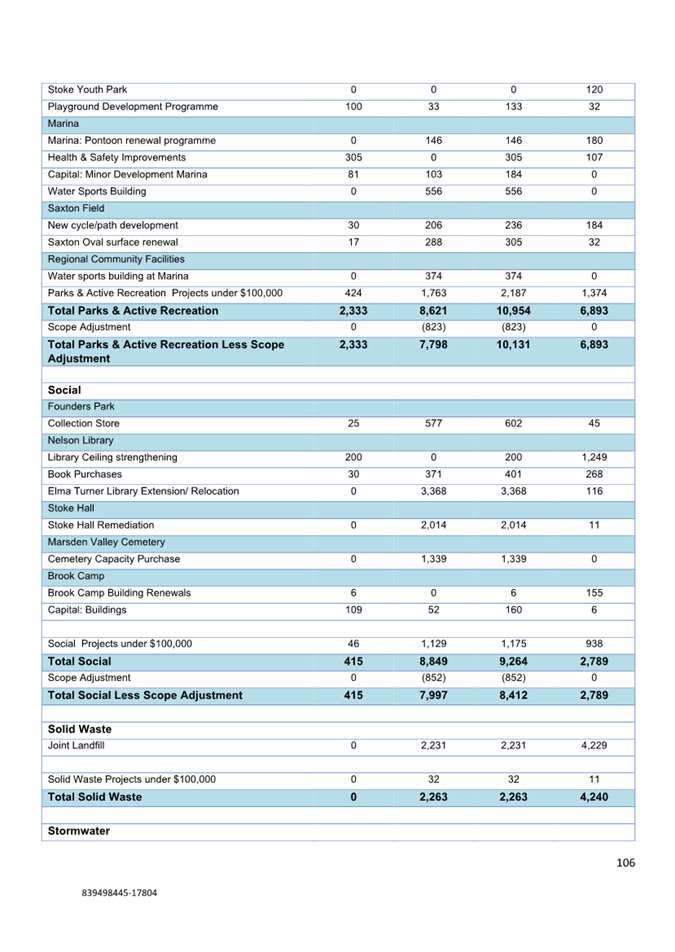

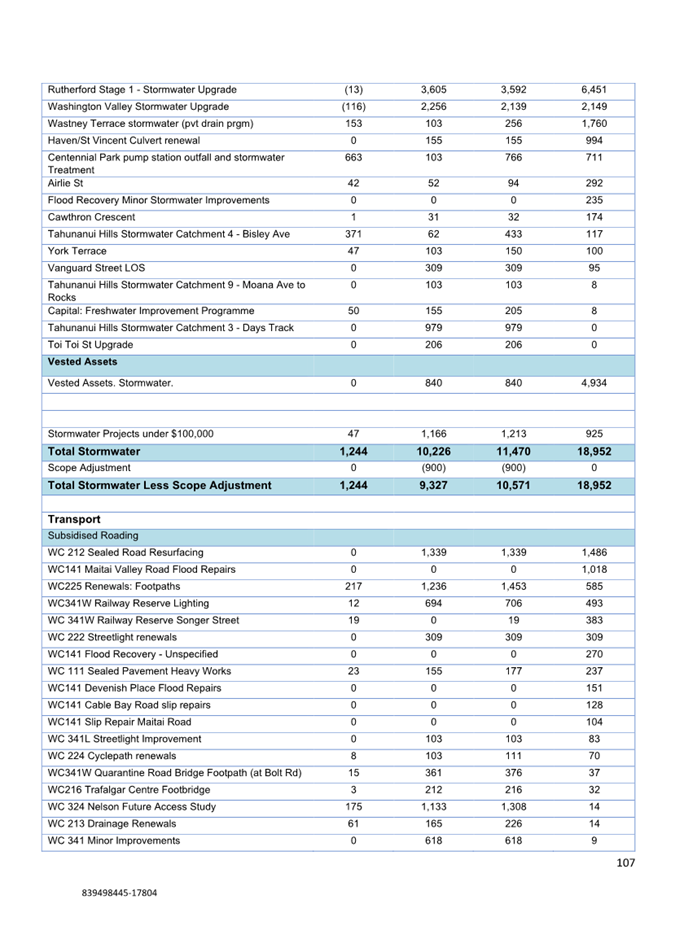

and weather-related capital expenditure). Detail relating to variances in the

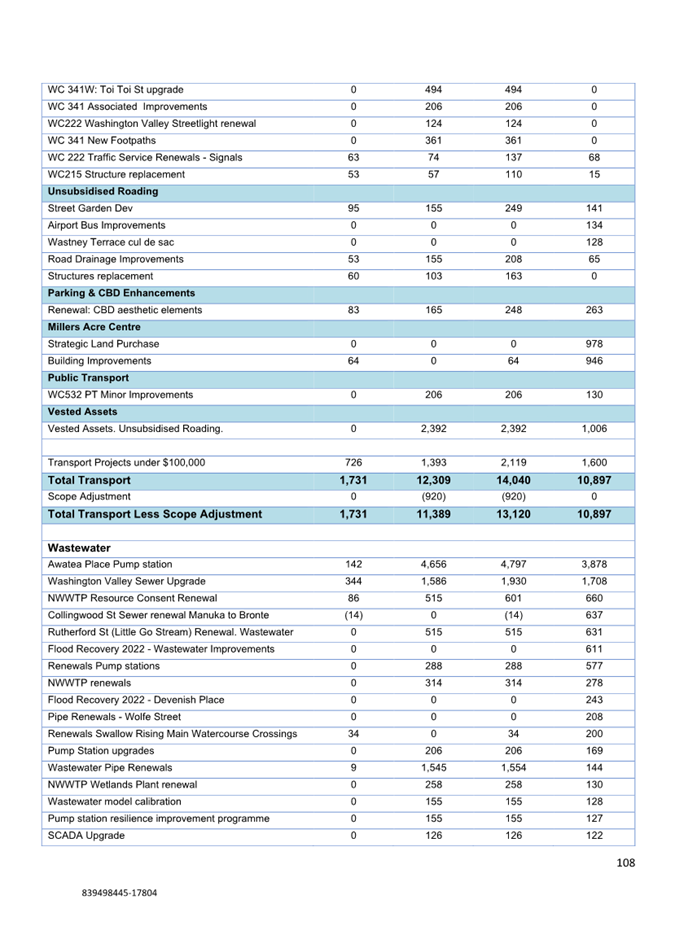

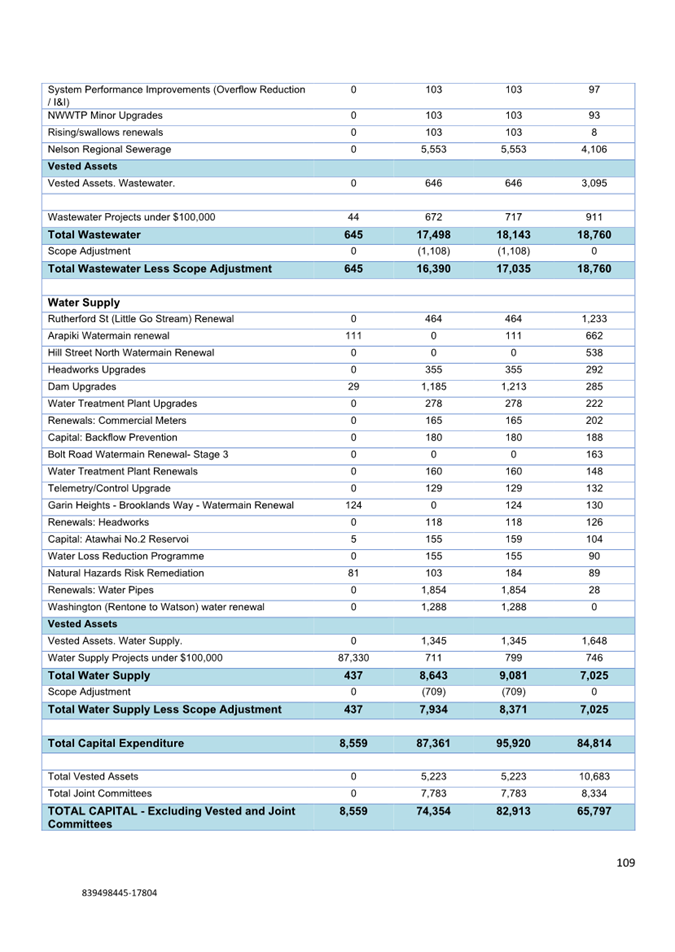

Capital Programme can be seen in the section of “Summary of Capital

Expenditure over $100,000”.

5.21.3 This was offset by additional

weather-related revenue received of $4.3 million.

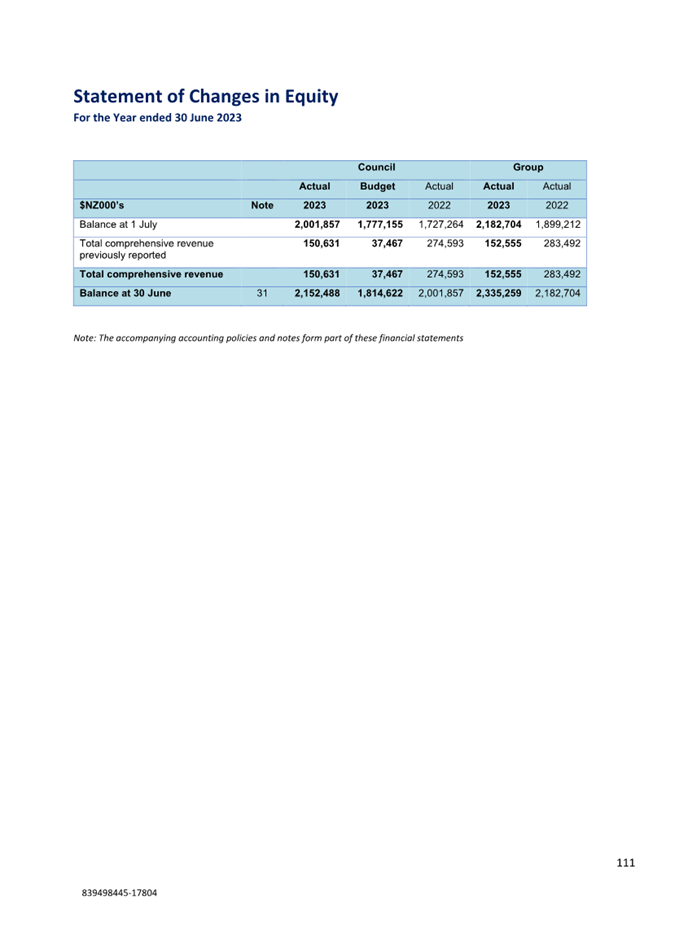

Rating

Surplus/(Deficit)

5.22 The rates

deficit was $2.2 million and has increased the balance of the Emergency

Response Fund.

Financial

prudence results

5.23 Council is required to include

information on financial performance in relation to various benchmarks in the

Annual Report.

5.24 A summary of this information in

the Annual Report is included in the following table:

|

Measure

|

Result

|

Benchmark

|

|

|

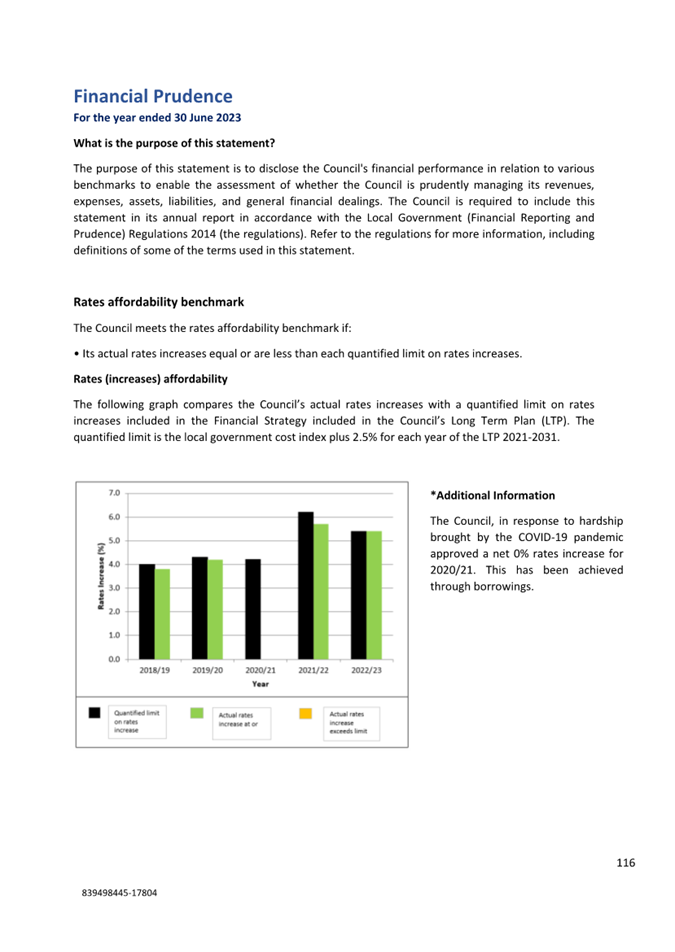

Rates (increases) affordability

|

5.4%

|

<5.4%

|

Achieved

|

|

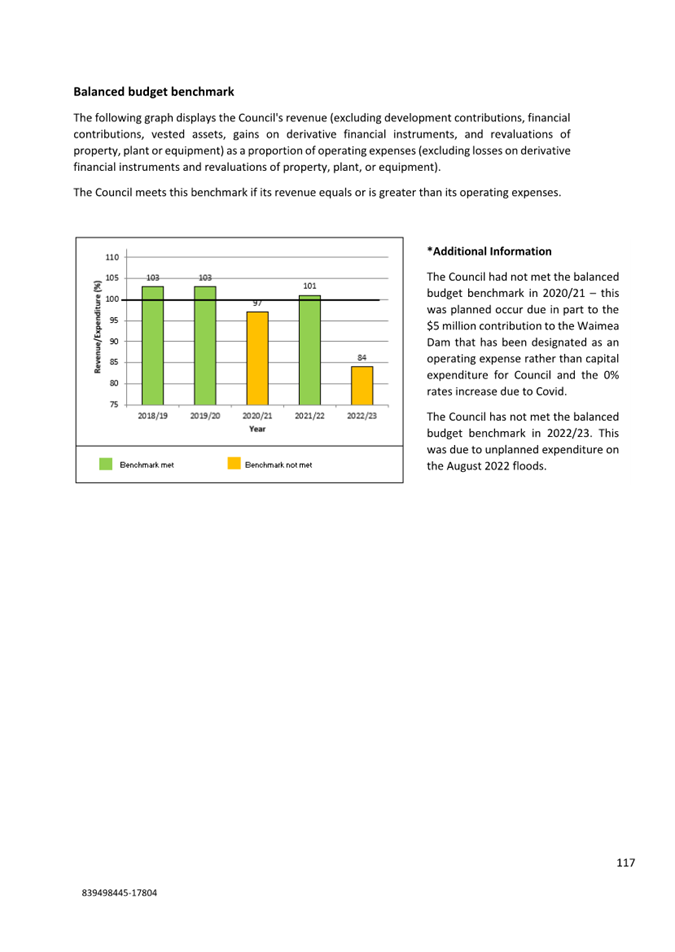

Balanced Budget (revenue:expenditure)

|

84%

|

>100%

|

Not achieved

|

|

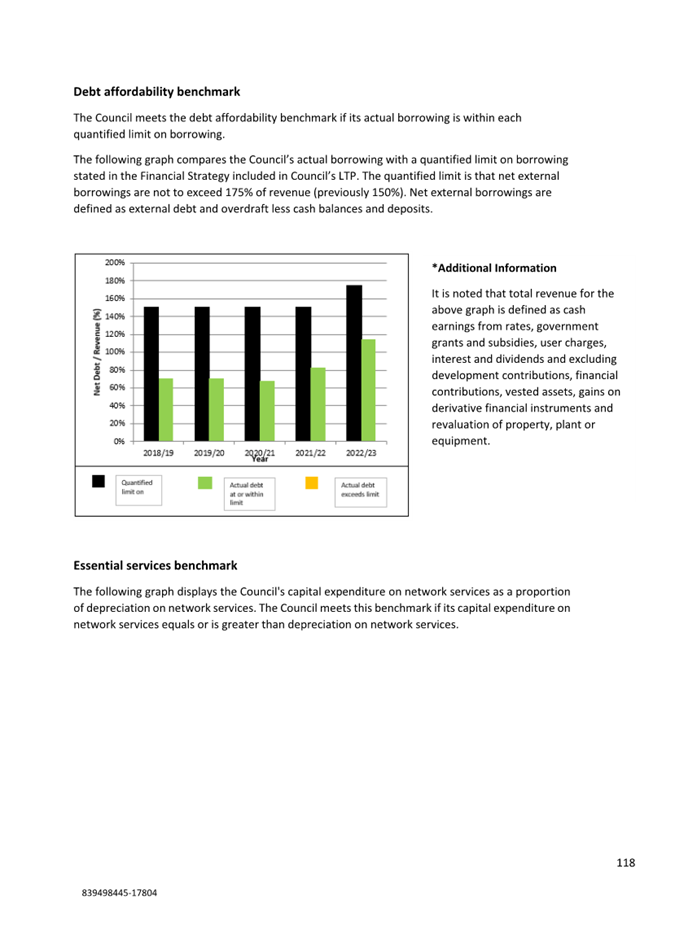

Debt affordability (% of revenue)

|

115%

|

<150%

|

Achieved

|

|

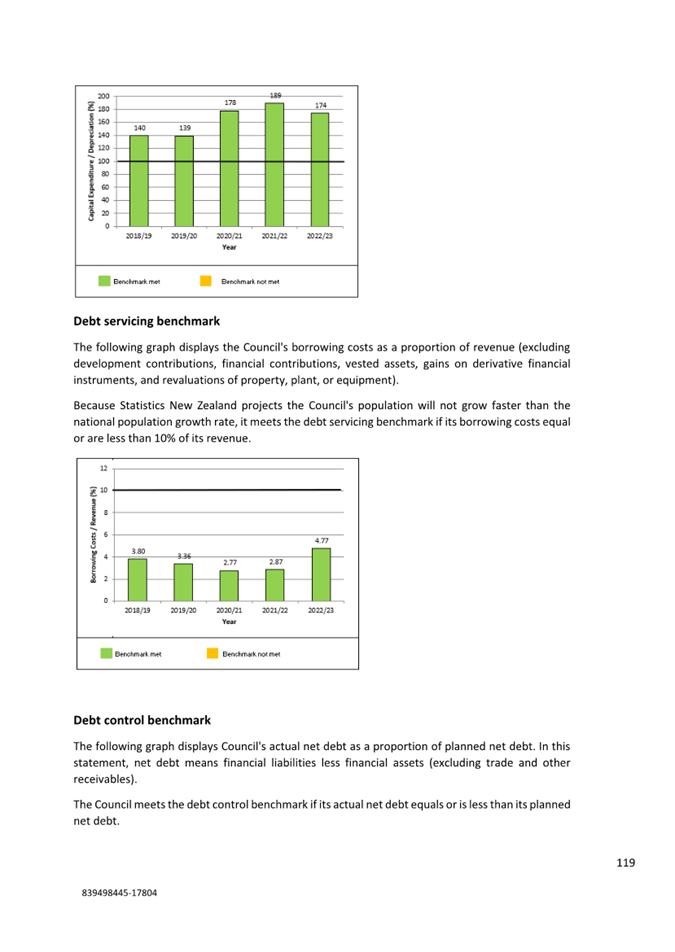

Essential services (capital

expenditure:depreciation)

|

174%

|

>100%

|

Achieved

|

|

Debt Servicing (interest:revenue)

|

4.77%

|

<10%

|

Achieved

|

|

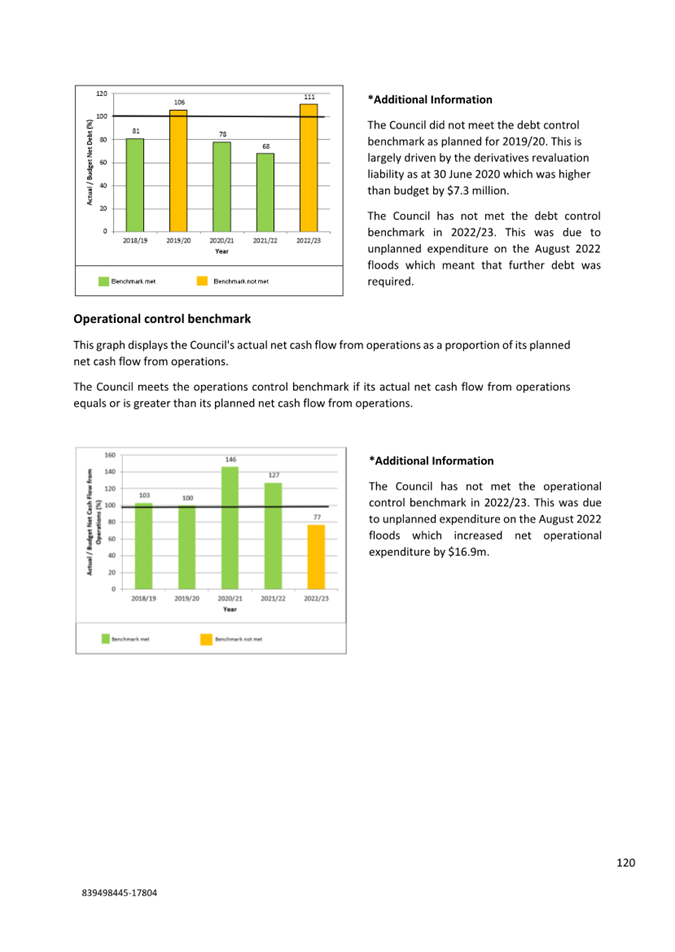

Debt Control (actual:budget)

|

111%

|

<100%

|

Not achieved

|

|

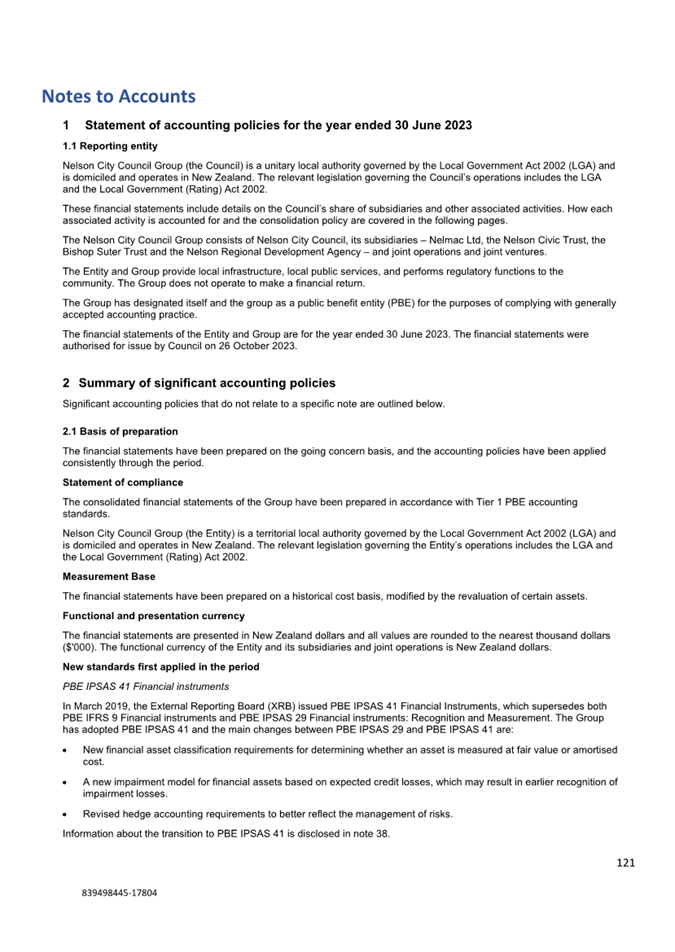

Operational Control (actual:budget net

cashflow from operations)

|

77%

|

>100%

|

Not achieved

|

5.25 The following benchmarks were not

achieved:

5.25.1 Balanced budget was not achieved due to the spend

on the August 2022 weather event.

5.25.2 Debt control was not achieved due to the

unbudgeted borrowings in 2022/23 due to the spend on the August 2022 weather

event.

5.25.3 Operational control was not met due to the

unbudgeted spend on the August 2022 weather event.

Material

differences from the draft Annual Report presented to the Audit, Risk and

Finance Committee

5.26 The draft Annual Report went to

the Audit, Risk and Finance Committee on 15 September 2023. Since that time,

the audit has been undertaken.

5.27 The table below shows the

difference between the two versions of the Annual Report presented to the

Audit, Risk and Finance Committee.

|

|

|

Council

|

|

|

|

Final

|

Draft

|

Variance

|

|

$NZ000’s

|

Notes

|

2023

|

2023

|

2023

|

|

Rates

|

3

|

78,235

|

78,235

|

-

|

|

Fees and charges

|

|

35,379

|

35,388

|

(9)

|

|

Subsidies

and grants

|

4

|

22,447

|

23,814

|

(1,367)

|

|

Finance

revenue

|

9

|

872

|

872

|

-

|

|

Development/financial

contributions

|

5

|

6,384

|

6,384

|

-

|

|

Other

revenue

|

5

|

21,034

|

21,933

|

(799)

|

|

Other

gains/(losses)

|

6

|

(2,586)

|

(5,014)

|

2,428

|

|

Total

revenue

|

|

164,351

|

161,612

|

2,739

|

|

Personnel

costs

|

8

|

(30,337)

|

(30,337)

|

-

|

|

Depreciation

and amortisation expense

|

19,20

|

(38,354)

|

(38,354)

|

-

|

|

Finance

costs

|

9

|

(7,026)

|

(6,996)

|

(30)

|

|

Other

expenses

|

7

|

(100,689)

|

(97,343)

|

3,346

|

|

Total operating

expenditure

|

|

(176,406)

|

(173,030)

|

3,376

|

|

Share of

joint operation's surplus

|

25

|

-

|

-

|

-

|

|

Surplus

before tax

|

|

(14,641)

|

(11,418)

|

3,223

|

|

Income tax

expense

|

10

|

-

|

-

|

-

|

|

Surplus

after tax

|

|

(14,641)

|

(11,418)

|

3,223

|

|

Other

comprehensive revenue

|

|

|

|

|

|

Land and

Infrastructure revaluations

|

31

|

165,272

|

253,214

|

(87,942)

|

|

Share of

subsidiaries revaluations

|

|

-

|

-

|

-

|

|

Total

other comprehensive revenue

|

|

165,272

|

253,214

|

(87,942)

|

|

Total

comprehensive revenue

|

|

150,631

|

241,796

|

(91,165)

|

5.28 Subsidies

and grants have reduced by $1.4 million due to a reduction in the NEMA accrual

for the initial claim, which has now been finalised.

5.29 Other

revenue has reduced by $0.8 million, which is mainly due to a $0.8 million

reduction in vested assets due to changes in the valuation of these assets.

5.30 Other

gains/(losses) have reduced by $2.4 million which is mainly due to a

reclassification of abandoned assets to revaluation expense.

5.31 Other

expenses have increased by $3.4 million which is mainly due to an accrual of

$3.5 million for the Tahunanui Sawdust remediation.

5.32 Land

and Infrastructure revaluations reported to Audit, Risk and Finance Committee

(ARF) on 15 September was $253.2 million whereas it is $165.2 million in the

final Annual Report. This difference is due to the final valuation not being

available at the time the draft Annual Report was provided to the Committee.

5.33 There

have been no other material changes to the draft Annual Report presented to

ARF. There have, however, been some minor changes to the results in the

statement of comprehensive revenue and expense and in the statement of

financial position (and associated notes).

6. Options

6.1 Option 1 is the

recommended option.

|

|

|

Advantages

|

· Meets

statutory timeframes.

· Allows

timely production and distribution of the Annual Report

|

|

Risks and Disadvantages

|

· No further opportunity for Council to review minor amendments

prior to publishing.

|

|

|

|

Advantages

|

· None

identified

|

|

Risks and Disadvantages

|

· Adoption of the Annual Report will not meet statutory timeframes.

· Not meeting statutory timeframes may be a consideration by

Standard and Poor’s for the Council credit rating.

· The Annual Report will not be available to the public in a timely

manner.

|

7. Conclusion

7.1 It is recommended that

Council adopts the Annual Report for the 2022/23 year.

8. Next Steps

8.1 Following adoption by

Council the Annual Report 2022/23 will be made available online, and printed

copies provided for reference at Council’s public libraries and the

Customer Service Centre. An article on the Annual Report will be included in an

upcoming edition of Our Nelson.

8.2 Council is required to

make publicly available a summary of the information

contained in the Annual Report within one month of its adoption. An audited

Summary Annual Report 2022/23 will be made available online, as well as at

Council’s public libraries and the Customer Service Centre.

Attachments

Attachment 1: 839498445-17804

- Draft Annual Report 2022 2023 - 19Oct2023 ⇩

|

Important considerations for decision making

|

|

Fit with Purpose of Local Government

The Annual Report 2022/23 is a requirement of the

Local Government Act 2002 and fits the purpose of local government by

providing information about Council’s performance during the year

– this contributes to democratic local decision-making on behalf of the

community.

|

|

Consistency with Community Outcomes

and Council Policy

The decision to adopt the Annual Report aligns

with the following community outcome:

Our Council provides leadership and fosters

partnerships, a regional perspective and community engagement.

|

|

Risk

The content of the Annual Report is prescribed by

statute so there is a very low risk that it will not achieve the required

outcome.

The Local Government Act 2002 requires Council to

adopt the final Annual Report within four months of the end of the financial

year (31 October). If Council does not adopt the Annual Report at this

meeting, there is a risk of not meeting the statutory timeframe.

|

|

Financial impact

There is no immediate financial impact from this

decision - preparation and publication of the Annual Report can be achieved

within existing budgets. The Annual Report itself outlines the financial

position of Council at the end of the 2022/23 financial year.

|

|

Degree of significance and level of

engagement

This decision is of low significance and does not

require engagement.

|

|

Climate Impact

The Annual Report (Attachment

1) contains a summary of Council’s climate change actions in 2022/23,

promoting awareness of Council’s work in this area.

|

|

Inclusion of Māori in the

decision making process

No engagement with Māori has been

undertaken in preparing this report.

|

|

Legal

context

Council has power to make

this decision under section 98 of the Local Government Act 2002. Part 3

of Schedule 10 of the Act outlines the information which must be included in

the Annual Report. Staff have ensured that the document complies with

these requirements.

|

|

Delegations

The adoption of the Annual Report is a decision that

can only be made by the Council.

|

Item 6: Draft Arts,

Heritage and Events Activity Management Plan 2024-2034

|

|

Council

26 October 2023

|

Report

Title: Draft

Arts, Heritage and Events Activity Management Plan 2024-2034

Report

Author: Mark

Preston-Thomas - Manager Community Partnerships

Report

Authoriser: Andrew White - Group Manager Community Services

Report

Number: R27926

1. Purpose

of Report

To recommend that Council adopts

the Draft Arts, Heritage and Events Activity Management Plan 2024-2034, as the

version to inform the Long Term Plan 2024-2034.

2. Recommendation

|

That

the Council

1. Receives the report Draft

Arts, Heritage and Events Activity Management Plan 2024-2034 (R27926) and its

attachment (636019211-1682); and

2. Approves the Draft Arts,

Heritage and Events Activity Management Plan 2024-2034 (636019211-1682) as

the version to inform the development of the Long Term Plan 2024-2034; and

3. Notes that the financial

tables in the Draft Arts, Heritage and Events Activity Management Plan

2024-2034 (636019211-1682) are subject to change as draft budgets are

developed; and

4. Notes that the Draft Arts,

Heritage and Events Activity Management Plan 2024-2034 (636019211-1682) will

be updated and the final Activity Management Plan will be approved by Council

after the adoption of the Long Term Plan 2024-2034.

|

3. Background

3.1 Draft Activity

Management Plans (AMPs) are prepared for the approval of Council to inform

development of the Long Term Plan (LTP). This draft AMP will inform the

development of the 2024-2034 LTP.

3.2 Following consultation

and adoption of the LTP, the draft AMPs will be updated to align with the

adopted LTP. The final updated AMPs will then be brought back to Council after

the 2024-2034 LTP has been adopted.

3.3 The draft AMP takes

account of previous Council resolutions and feedback at workshops affecting the

proposed work programme and budgets. A workshop was held with Council on August

2023 to discuss the draft AMP.

3.4 Officers have also

undertaken a high-level review of budgets across all Council activities.

4. Discussion

4.1 The Draft AMP sets out

the background to Council’s Arts, Heritage and Events activities and

includes details of the following:

· Proposed arts,

heritage and event priorities for 2024 to 2034.

· Proposed future

levels of service.

· The proposed

activity budgets for activities.

4.2 Iwi provided feedback

on proposed Arts and Heritage activities primarily as part of the engagement

for He Tātai Whetū (Arts Strategy) and Taonga Tuku Iho (Heritage

Strategy), and through the quarterly Te Ohu Toi Ahurea (Arts and Heritage)

forum.

4.3 The management of the

heritage capital assets such as buildings is covered in the draft Properties

Asset Management Plan which will be considered by Council via a separate

report.

Key

Issues and Priorities

4.4 A workshop was held

with Council on 11 August 2023 to inform this draft Arts, Heritage and Events

AMP. Feedback received from Elected Members at this workshop included:

· Discussion of the

implementation of the He Tātai Whetū Arts and Creativity Strategy,

and an action plan for the Taonga Tuku Iho Heritage Strategy.

· The importance of hosting

of Te Matatini.

· A need to engage

the community on issues such as NCMA’s proposed debt remission.

· Events are an

essential part of community wellbeing, and that Council should continue to

support a diverse events calendar.

· Volunteers are

critical to maintain levels of services at heritage facilities.

4.5 Iwi engagement to

inform the AMP occurred through the Te Ohu Toi Ahurea (arts, heritage, and events

forum) with iwi cultural managers. The following are key themes from iwi

engagement:

· A request to

rename Founders Heritage Park.

· The importance of Te

Matatini.

· Māori representation

in Arts and Heritage needs to be rebalanced.

4.6 Due to economic

constraints, Council’s available budget is restricted. This has resulted

in taking the following approach for the Draft AMP:

· Implementation of the He

Tatai Whetu (Arts) and Taonga Tuku Iho (Heritage) strategies will be phased

over an extended time period.

· Essential customer

service functions at heritage facilities will be prioritised (for example by

increasing volunteer capacity) over longer term projects such as upgrading

venues.

· Delivering new events

will need to be offset by no longer delivering some legacy events.

4.7 Changes to Levels Of

Service (LOS) are proposed in this AMP compared to the previous AMP. The

previous 2021-31 AMP had 38 levels of service to capture the breadth and depth

of work across the portfolios, and to capture the activity of selected external

organisations. Previous LOS included;

· Public art.

· Community Arts and Arts

Services – including Arts Council and Creative Communities.

· Arts Facilities and

Venues – including Suter, Theatre Royal and NCMA.

· Heritage Facilities

– including museum, iwi māori partnerships, collections, Founders

Heritage Park, Tuku Heritage Festival, Heritage Information Panels, Heritage

Project Fund and Heritage Rates Remissions.

· Events – including

Nelson Arts Festival, Community Events, Te Matatini, Council requested events

and Facilities Marketing.

4.8 To simplify reporting

and provide indicators to align with the principles of He Tatai Whetu (Arts)

and Taonga Tuku Iho (Heritage) strategies, this AMP has three proposed LOS

covering;

· Events: Provision of at

least 12 accessible events that achieve high community satisfaction.

· Heritage Activities:

Heritage facilities receive high levels of visitors, and the annual Tuku

festival attracts widespread community participation.

· Arts Activities: One

public artwork is installed every three years.

Options

4.9 The preferred option

is for Council to adopt the Draft Arts, Heritage, and Events Activity

Management Plan 2024-2034 as the version to inform the Draft LTP 2024-2034.

|

|

|

Advantages

|

· Will

continue to meet requirements of the Local Government Act 2002

· Aligns

with timeframes to meet AMP and LTP deadline obligations

|

|

Risks and Disadvantages

|

· Nil

– there will be a further opportunity for Council to consider the

content of the draft AMP following adoption of the 2024-34 LTP

|

|

|

|

Advantages

|

· Will

continue the process to meet requirements of the Local Government Act 2002

· Will

allow for further elected member considerations to be included at an early

stage of the process

|

|

Risks and Disadvantages

|

· May

delay timeframes to meet AMP and LTP deadline obligations if significant

changes are requested

|

|

|

|

Advantages

|

· Nil

|

|

Risks and Disadvantages

|

· May

fail to meet requirements of Local Government Act 2002

· May

delay timeframes to meet AMP and LTP deadline obligations if significant

changes are requested

|

5. Conclusion

5.1 The Draft Arts,

Heritage and Events Activity Management Plan 2023-2034 has been prepared to

inform the 2024-2034 LTP and will support Council in meeting its obligations

under section 93 and Schedule 10 of the Local Government Act 2002.

Attachments

Attachment 1: 636019211-1682 -

Draft Arts, Heritage and Events Activity Management Plan 2024-2034

(Circulated separately) ⇨

|

Important considerations for decision making

|

|

Fit with Purpose of Local Government

The development of an Arts, Heritage, and Events AMP

for Whakatū Nelson fits with the purpose of Local Government as it will

deliver outcomes to our local area and contribute to the social and cultural

wellbeing of our community.

|

|

Consistency with Community Outcomes

and Council Policy

This draft AMP supports Council’s Community

Outcomes being to;

· Support our

communities to be prosperous, connected, and inclusive

· Transform our

city and commercial centres to be thriving, accessible and people-focused

· Foster a healthy

environment and a climate resilient, low-emissions community

|

|

Risk

There is a moderate risk that Council’s

reputation may be damaged by delaying implementation of the He Tātai

Whetū Arts and Creativity Strategy 2022-2032 and Taonga Tuku Iho Heritage Strategy 2022–2032.

Significant risks are identified and documented in the

AMP.

|

|

Financial impact

There are no direct funding implications from the

recommendation. The draft AMP guides the funding in the draft LTP and will be

subject to further discussion with Council and a consultation process with

the community.

|

|

Degree of significance and level of

engagement

This matter is of high significance because the

adoption of an LTP is a statutory requirement under the Local Government Act

2002. Therefore, consultation with the community will occur in the form of

publicly advertising the Draft LTP and calling for submissions.

|

|

Climate Impact

The draft AMP

considers potential impacts and risks of climate change regarding Arts,

Heritage and Events activities.

|

|

Inclusion of Māori in the

decision making process

Iwi feedback was obtained during the development of

the He Tātai Whetū and Taonga Tuku Iho strategies that inform much

of the AMP activity. Iwi feedback has been received through the Te Ohu Toi

Ahurea / iwi cultural managers and council forum.

|

|

Legal

context

This report allows Council to

meet the requirements of the Local Government Act regarding the progress of

the 2024-34 Long Term Plan.

|

|

Delegations

This is a matter for Council to approve.

|