|

That

the Council

1. Receives

the report Adoption of the Annual Plan 2023/24 and setting of the rates (R27507)

and its attachment (839498445-14676); and

2. Notes

that staff have incorporated in the Annual Plan 2023/24 (839498445-14676) the

decisions made at the deliberations meeting on 25 May 2023, which followed

public consultation between 29 March and 30 April 2023; and

3. Notes,

in accordance with section 80 of the Local Government Act 2002, that:

a. aspects

of the work programme, rates increases, and debt projections in the Annual

Plan 2023/24 are significantly inconsistent with the Long Term Plan 2021-2031

and the Financial Strategy; and

b. the reasons for the inconsistency with Council’s

Long Term Plan and Financial Strategy are largely due to costs of recovery

from the August 2022 severe weather event, inflationary pressures, rising

interest costs, bringing forward funding for projects to take advantage of

available Government financial support, and decisions to respond to the

changing needs of the Nelson community; and

c. there

is no intention to amend the Long Term Plan or Financial Strategy to

accommodate the decisions at this time, as they will feed into the Long Term

Plan 2024-2034 process that has already commenced; and

4. Notes that, having had

regard to the matters in section 100(2) of the Local Government Act 2002, and

as approved in the Long Term Plan 2021-2031, the setting of an unbalanced

budget in the Annual Plan 2023/24 remains prudent given the ongoing effects

of the COVID-19 pandemic on the local economy and ratepayers and further

notes that, more recently, Council budgets have been impacted by unforeseen

additional costs associated with the August 2022 severe weather event and the

sharp rise in inflation and interest costs; and

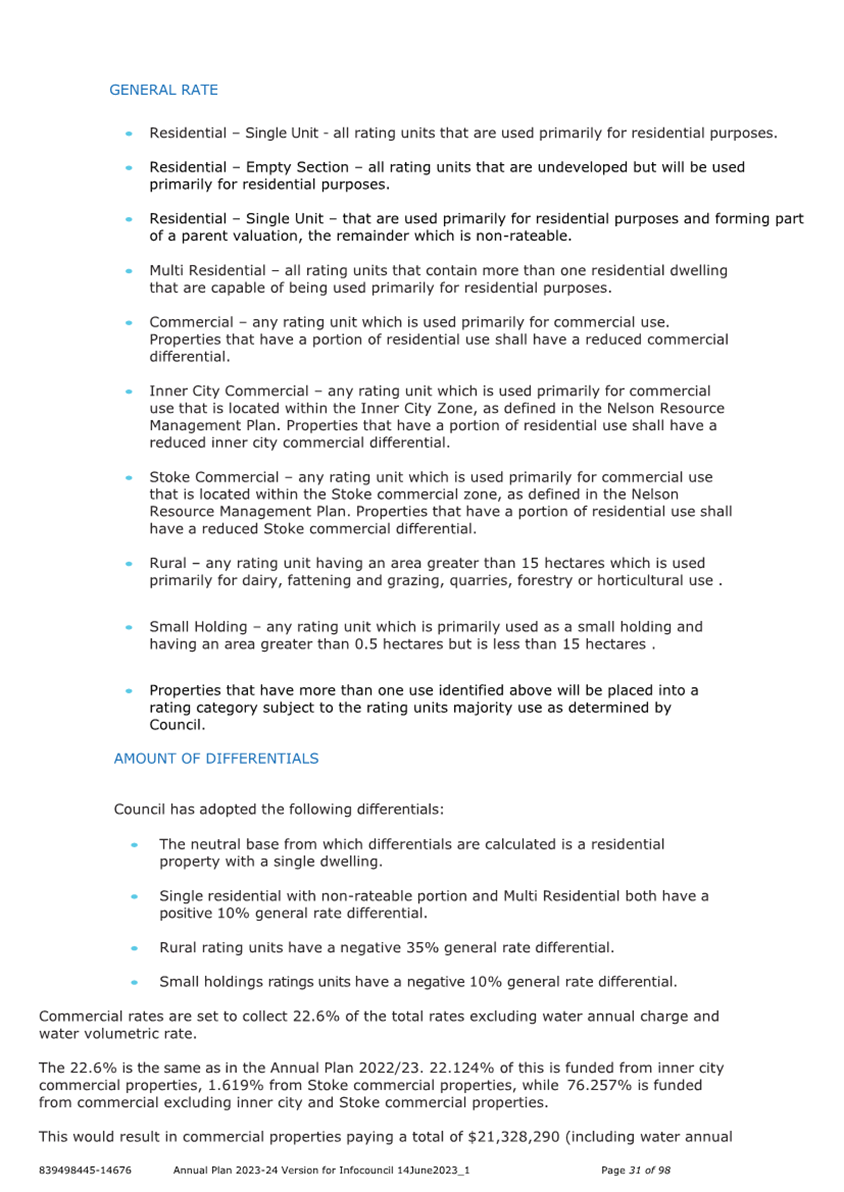

5. Approves maintaining

the commercial differential to collect 22.6% of total rates (excluding the

water annual charge and water volumetric rate) for 2023/24; and

6. Adopts the Annual Plan

2023/24 (839498445-14676) in accordance with section 95 of the Local

Government Act 2002; and

7. Delegates to the Mayor

and Chief Executive to make any necessary minor editorial amendments prior to

the public release of the Annual Plan 2023/24 ; and

8. Notes that staff will

notify submitters of Council’s decisions on the Annual Plan 2023/24;

and

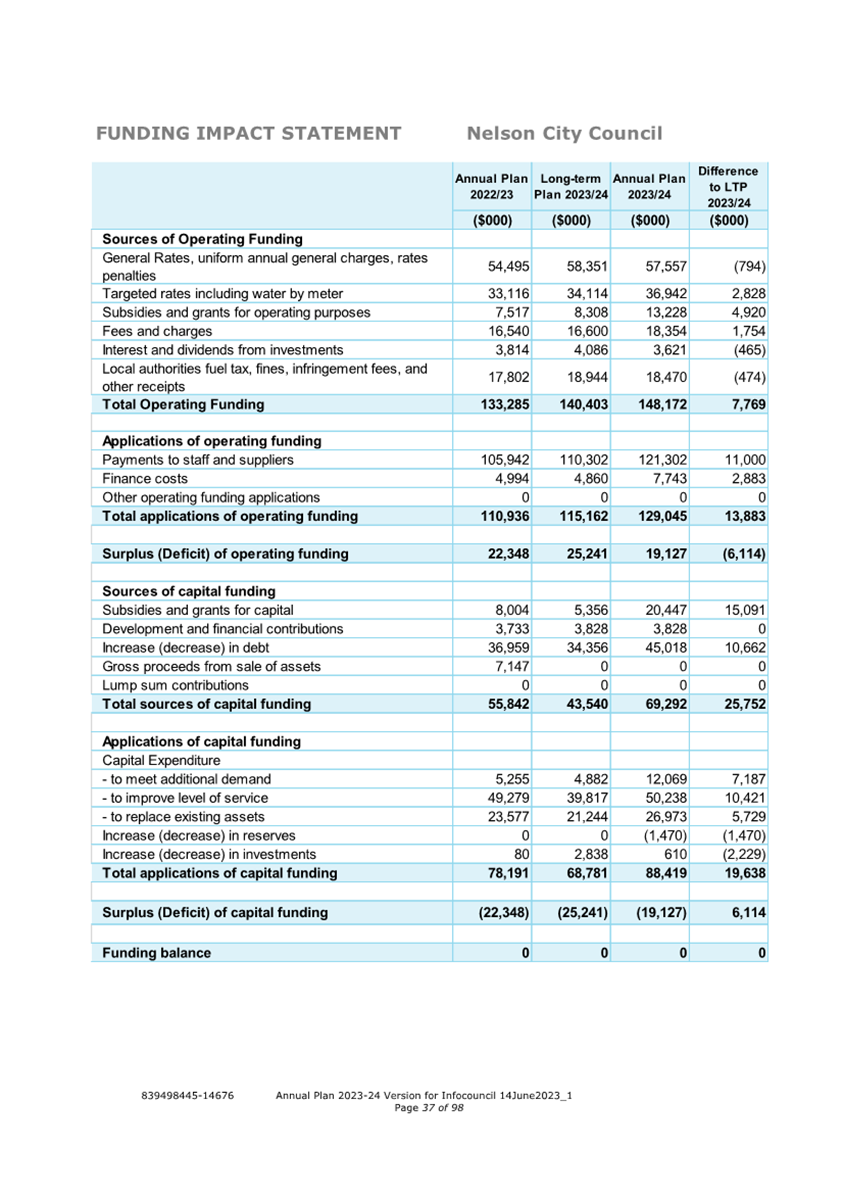

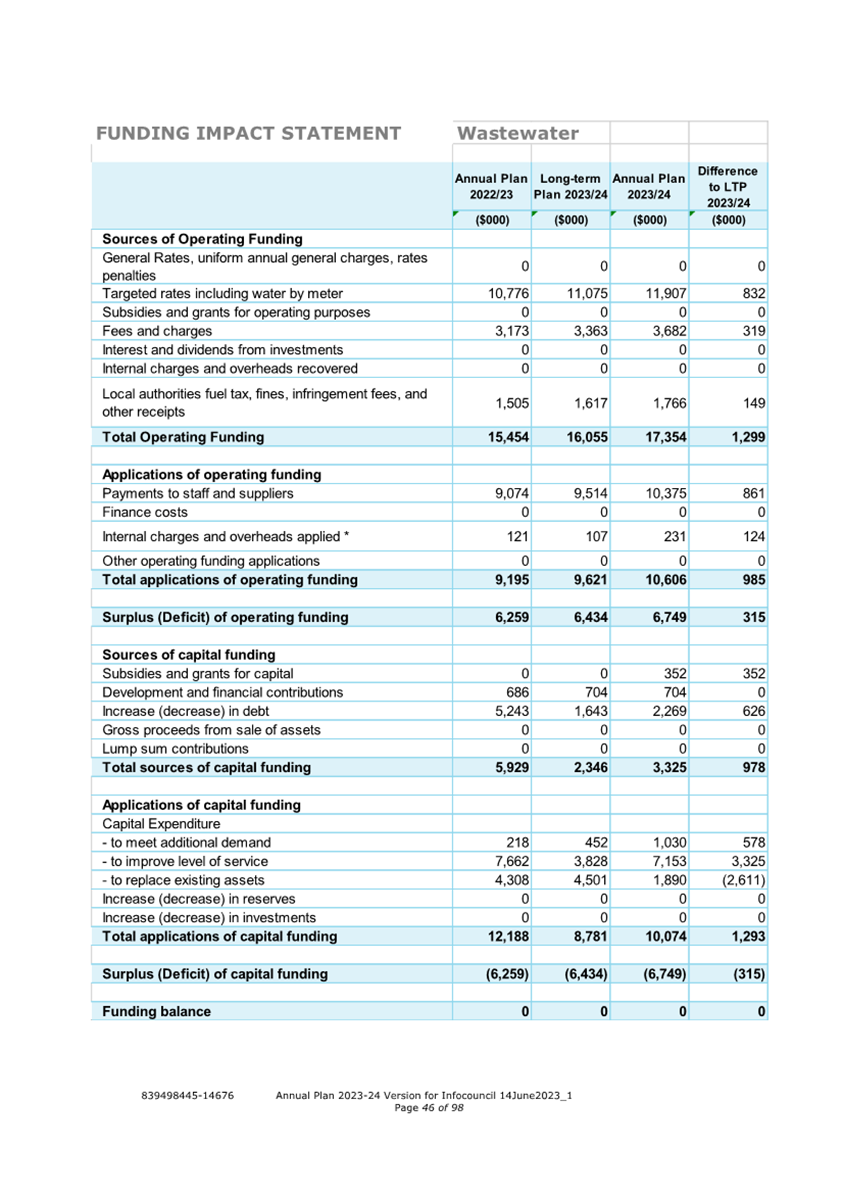

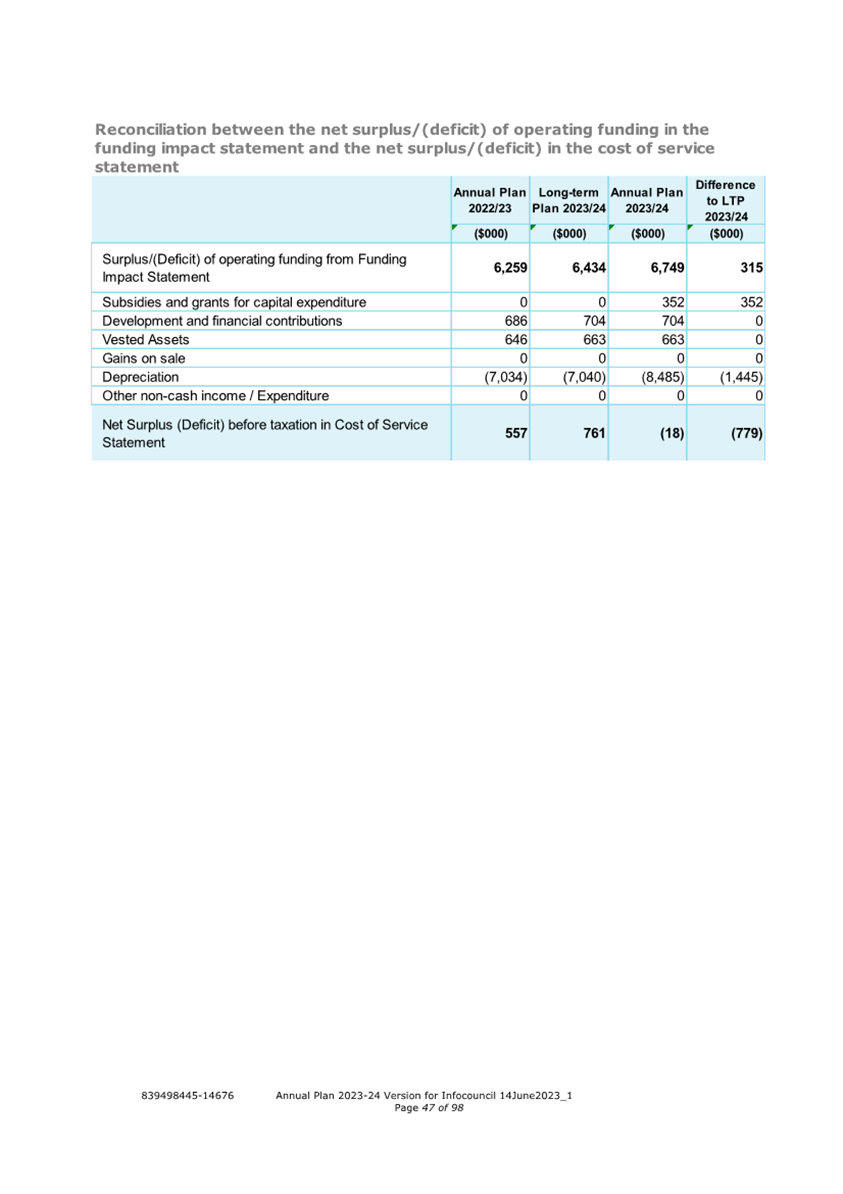

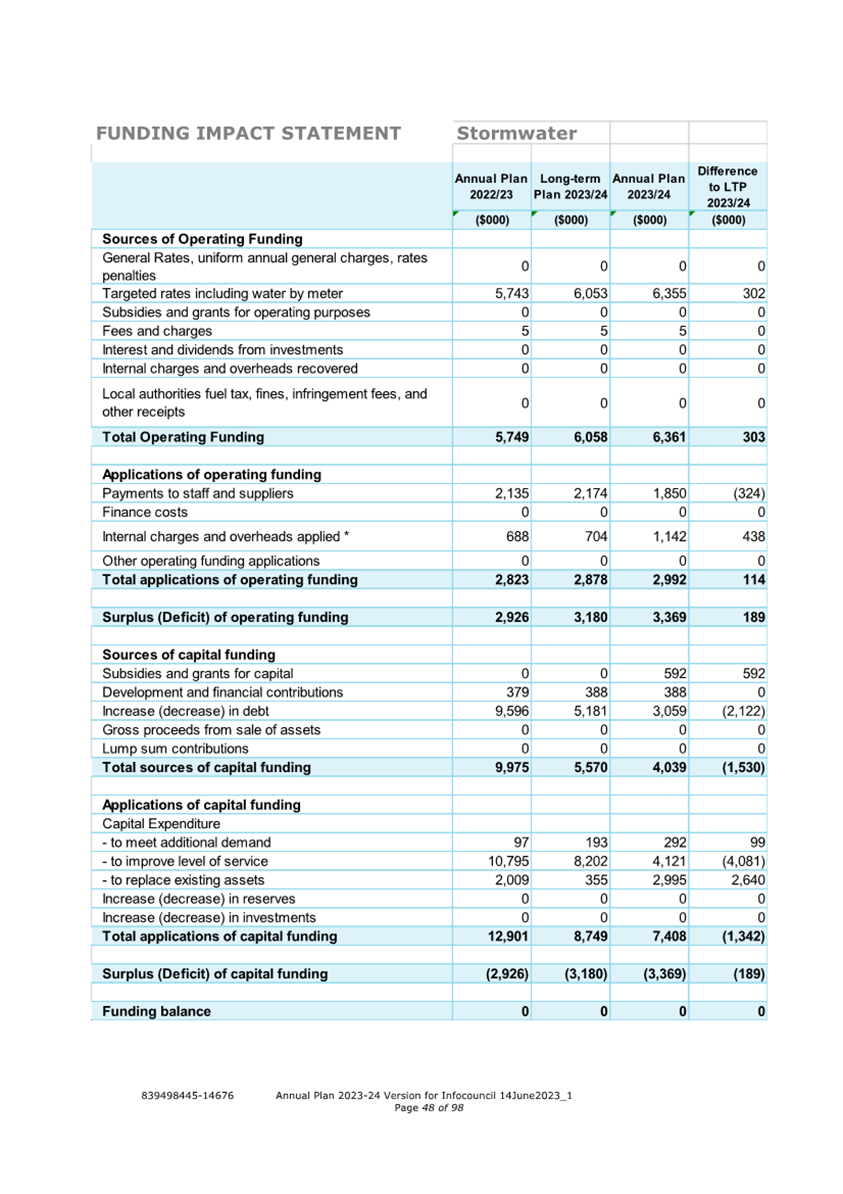

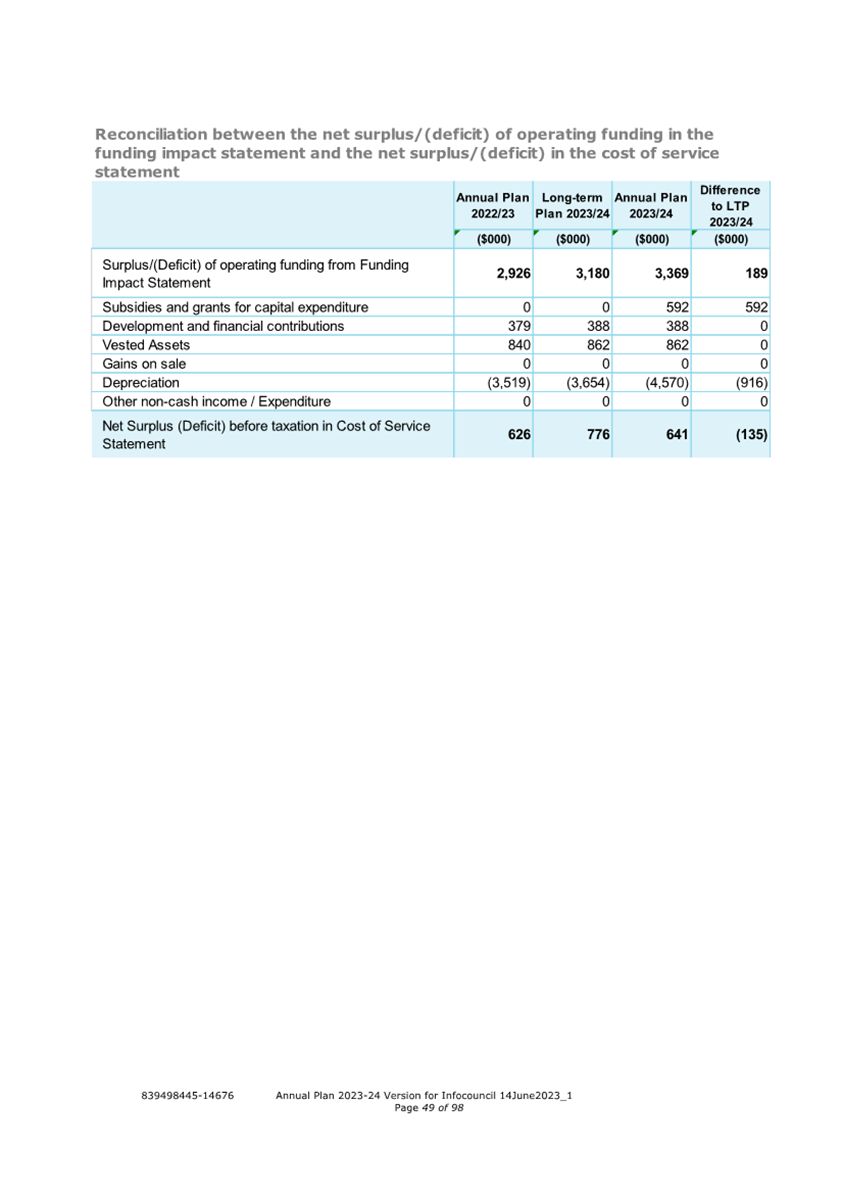

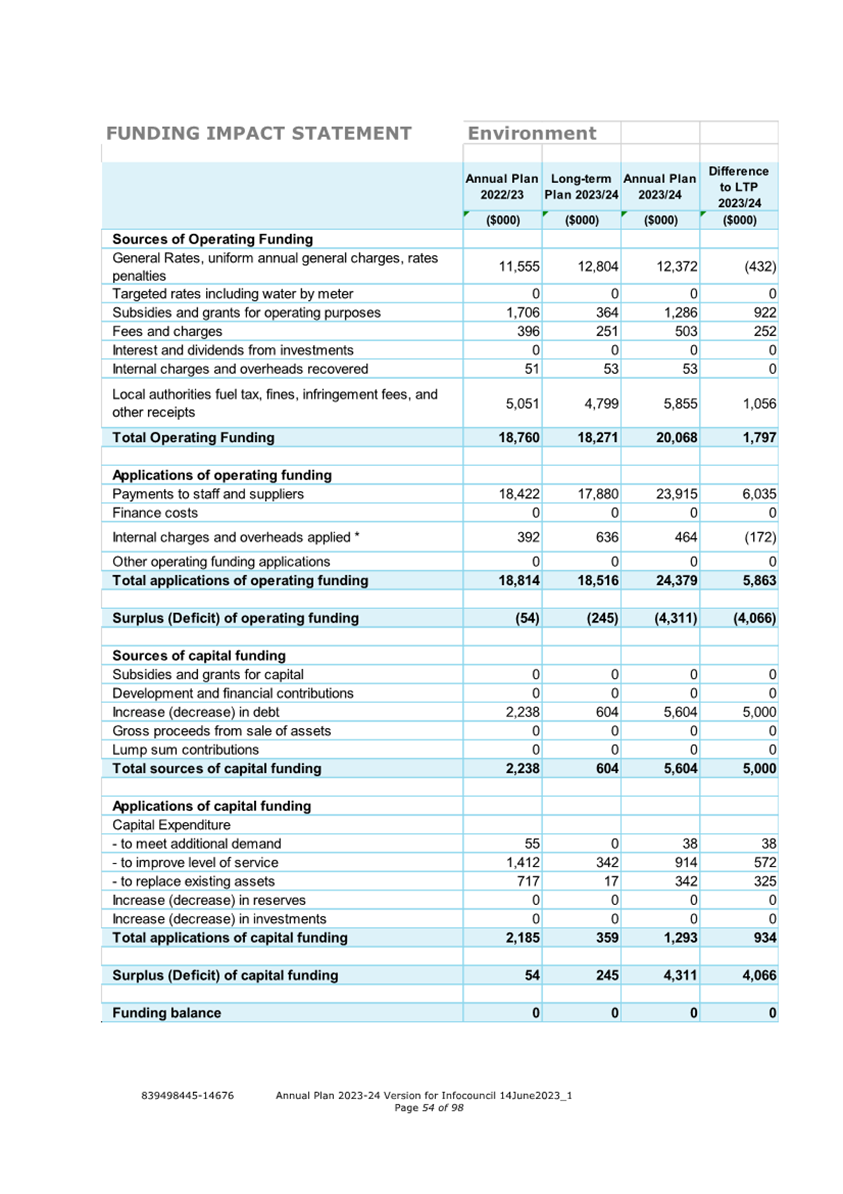

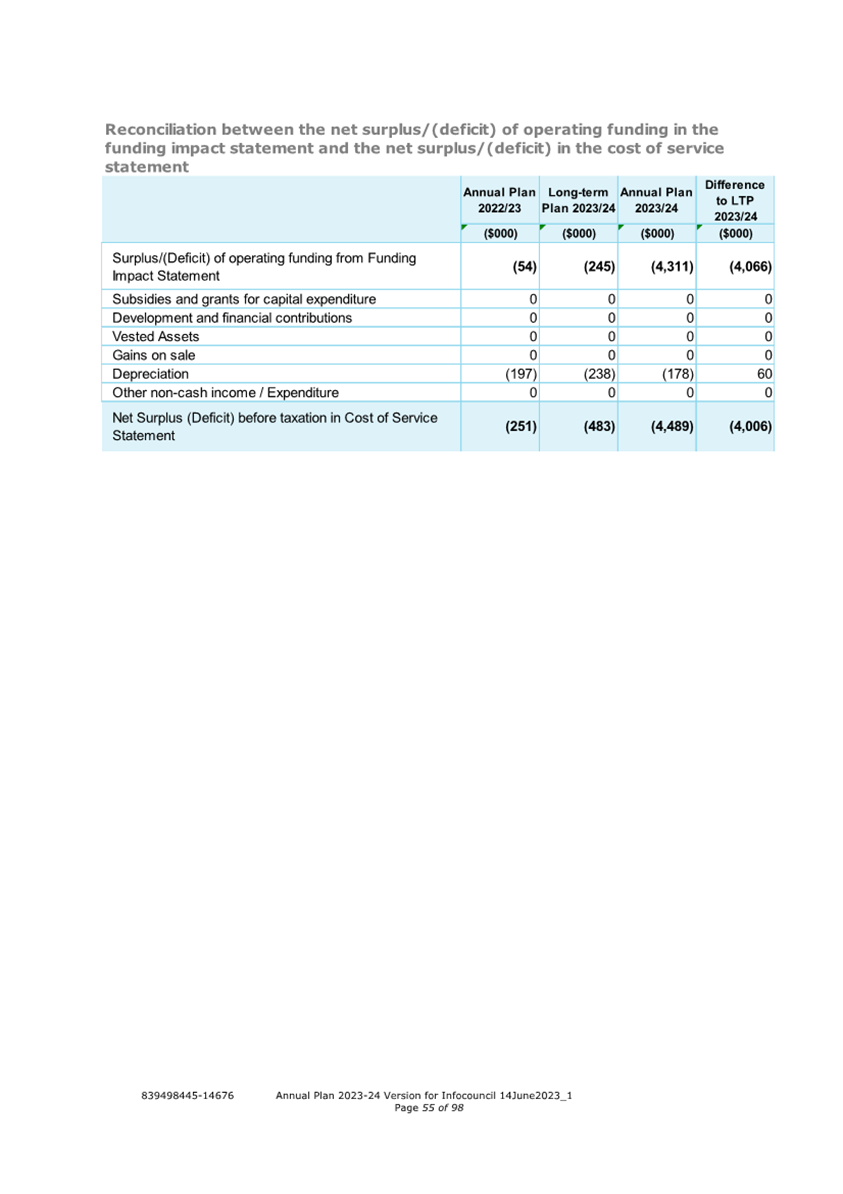

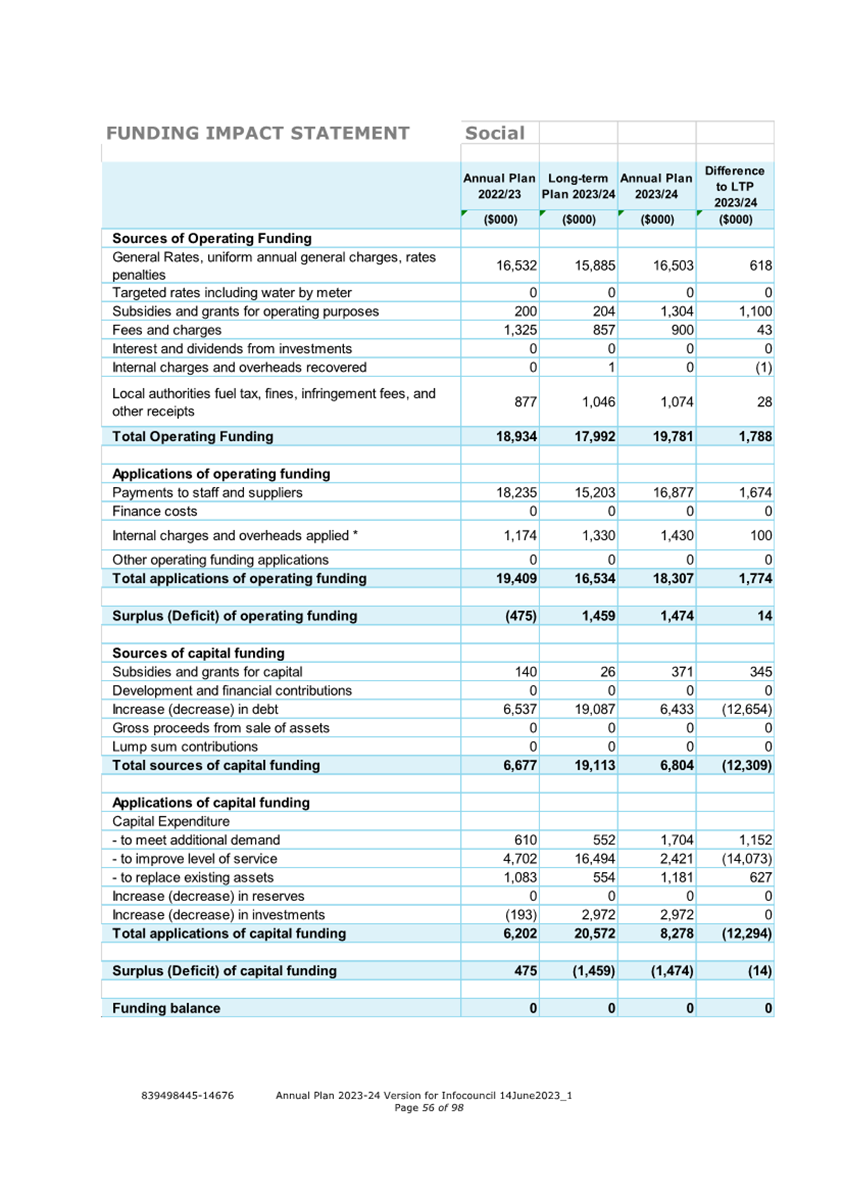

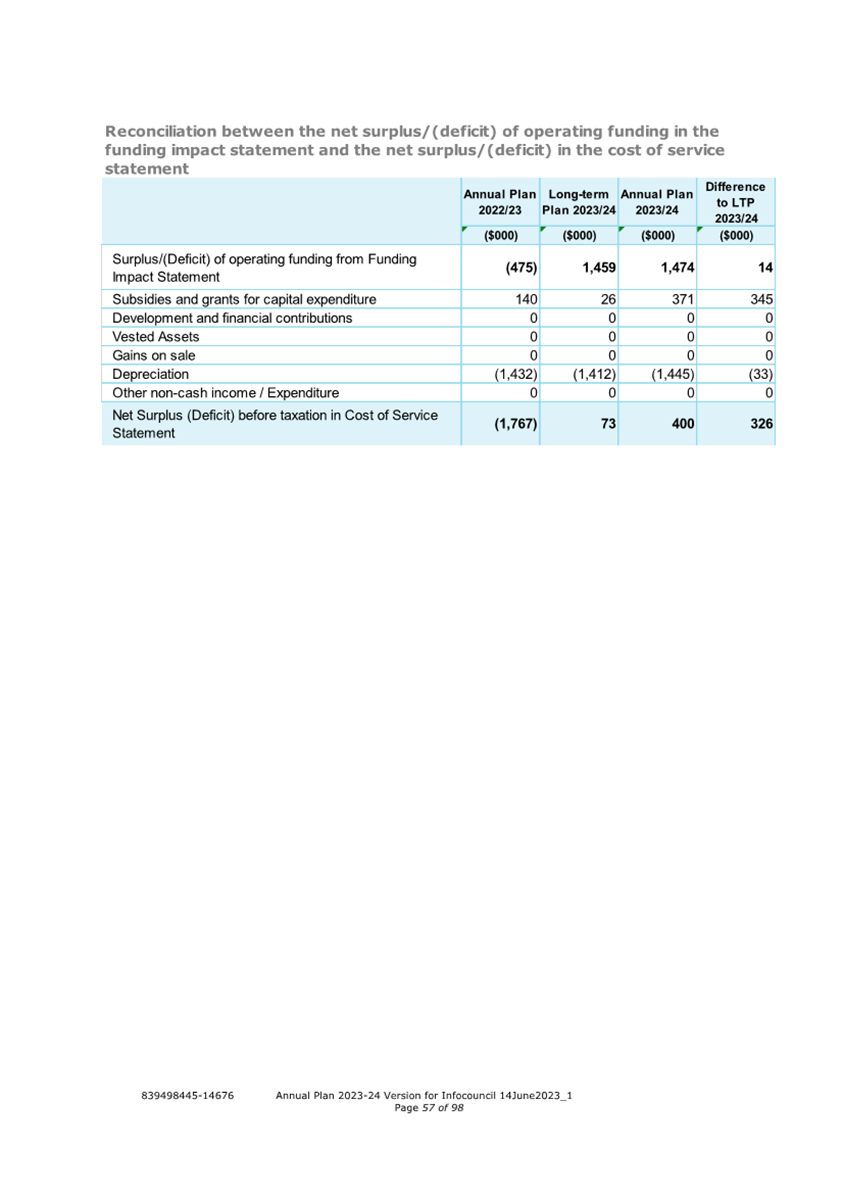

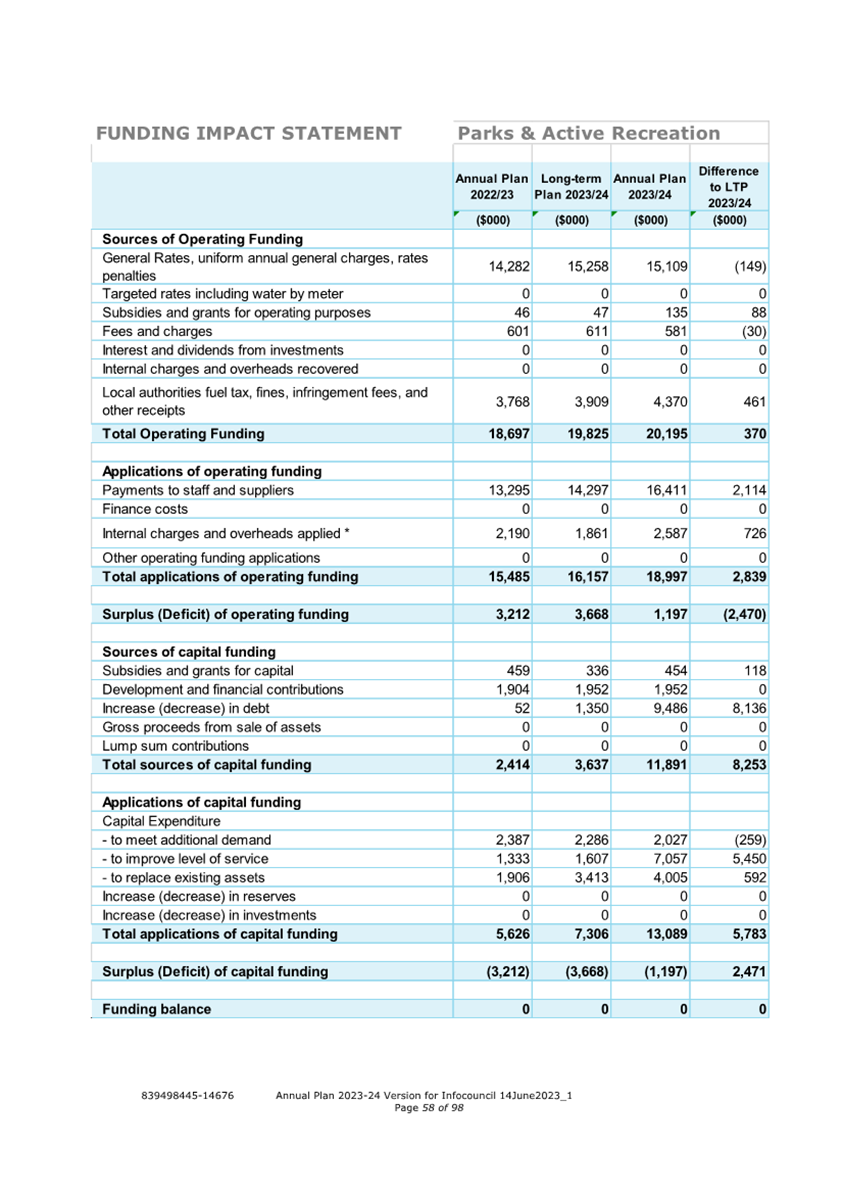

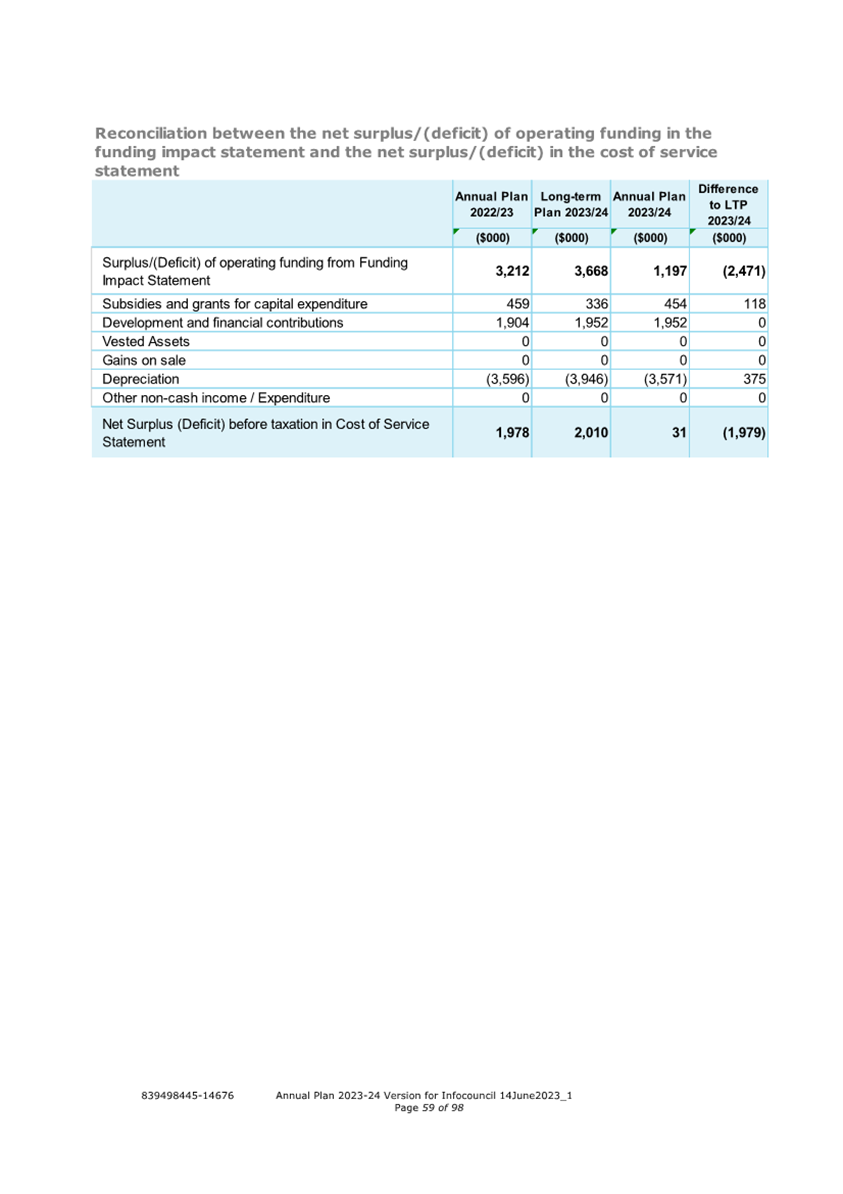

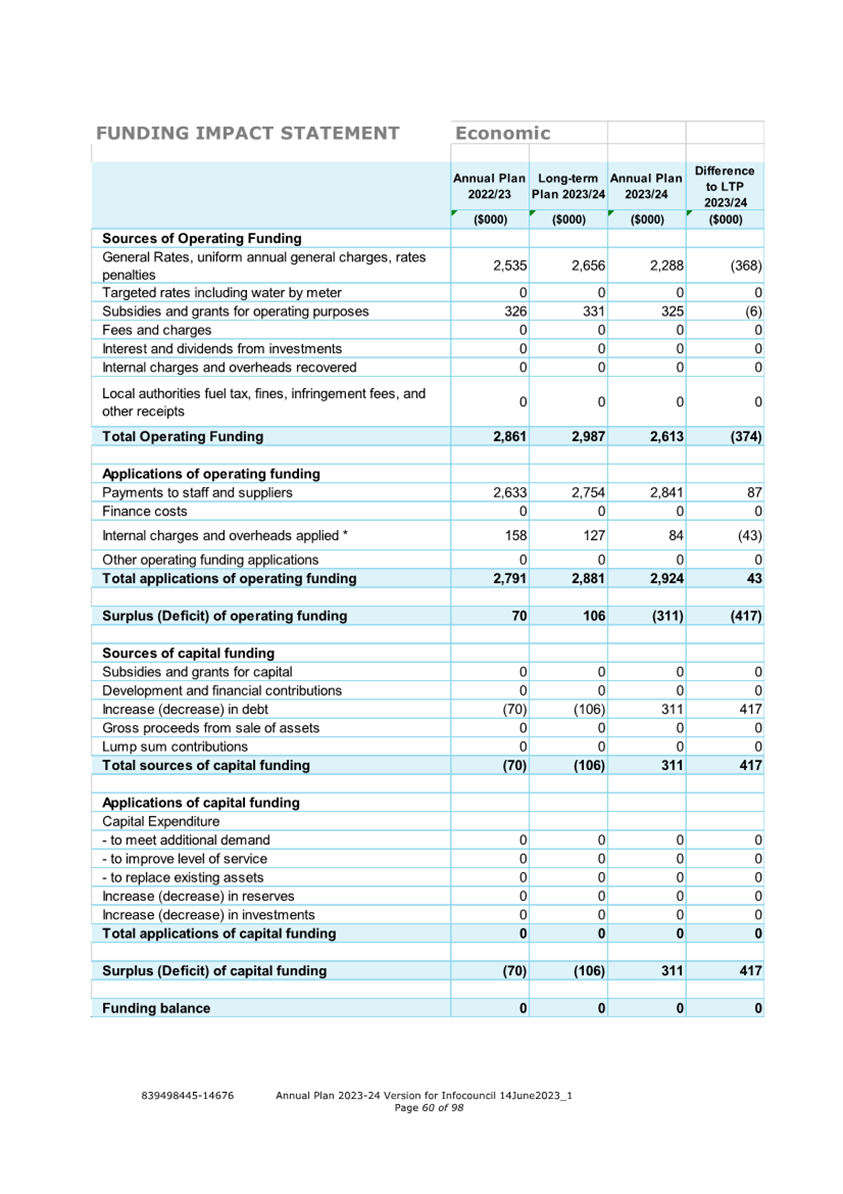

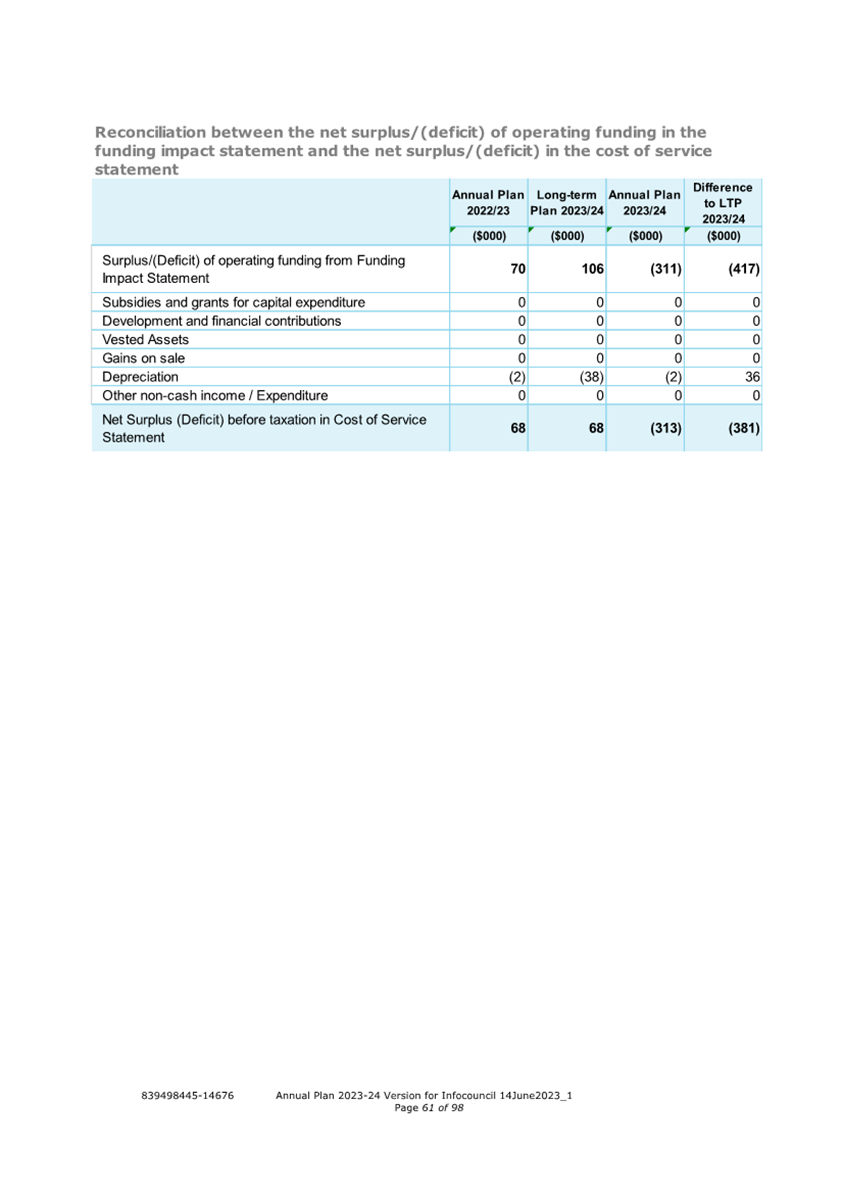

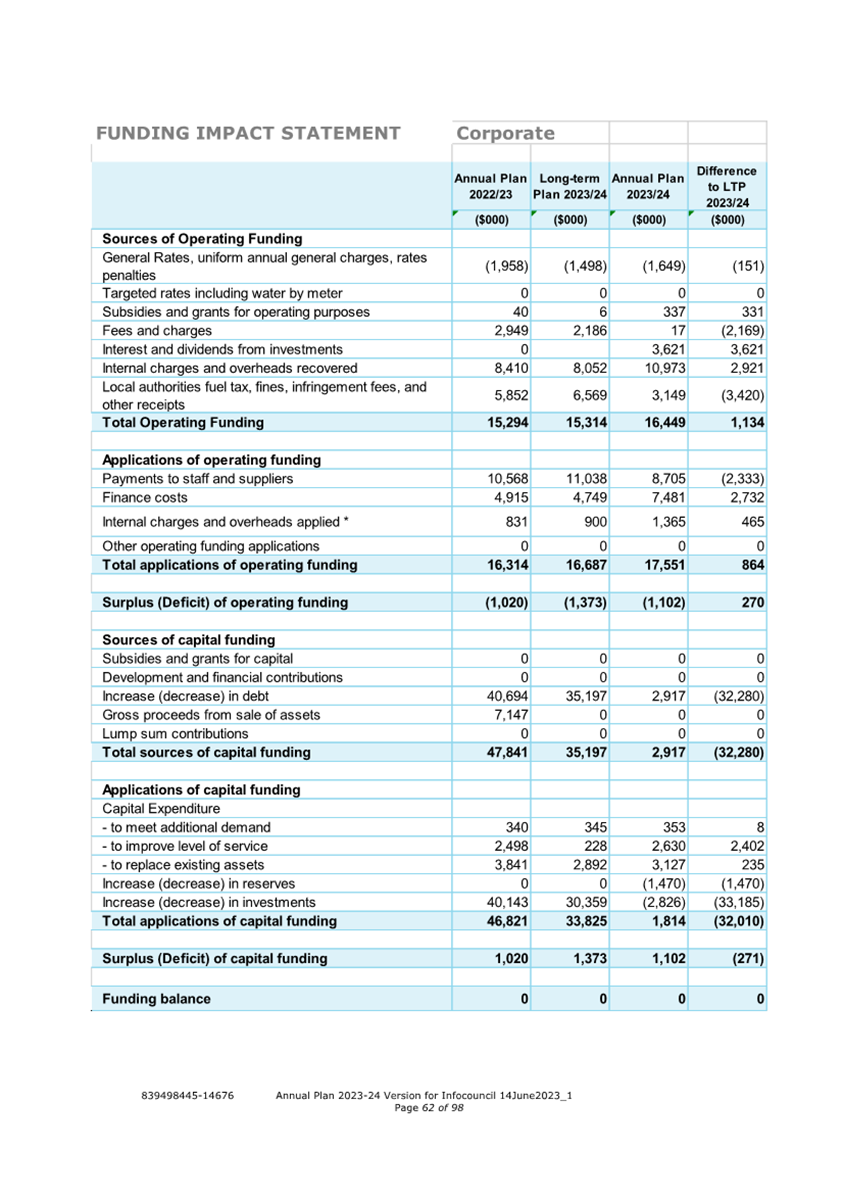

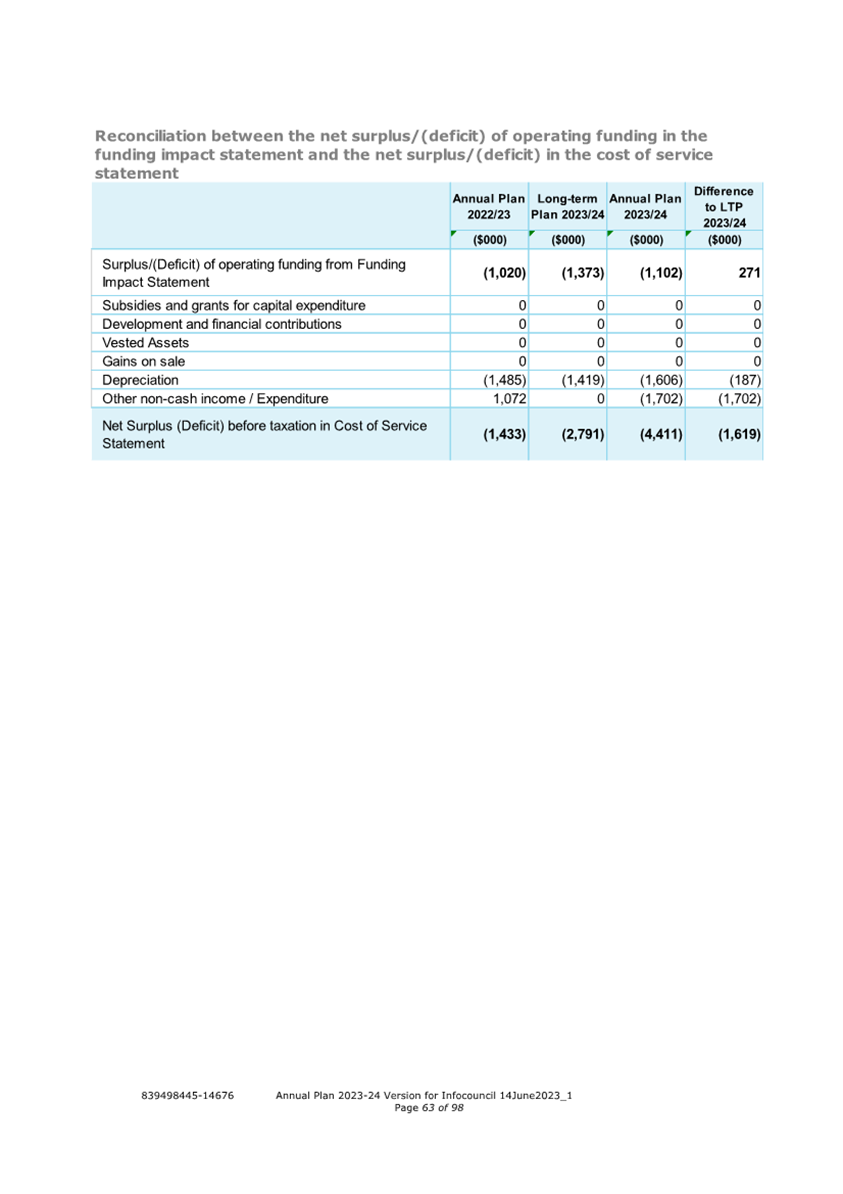

9. Notes that Council must

adopt the Funding Impact Statement for the 2023/24 financial year contained

within the Annual Plan 2023/24, prior to setting the rates; and

10. Sets the following rates under the

Local Government (Rating) Act 2002, on rating units in the district for the

financial year commencing on 1 July 2023 and ending on 30 June 2024.

The revenue approved below will be raised by the rates and charges

that follow.

Revenue approved:

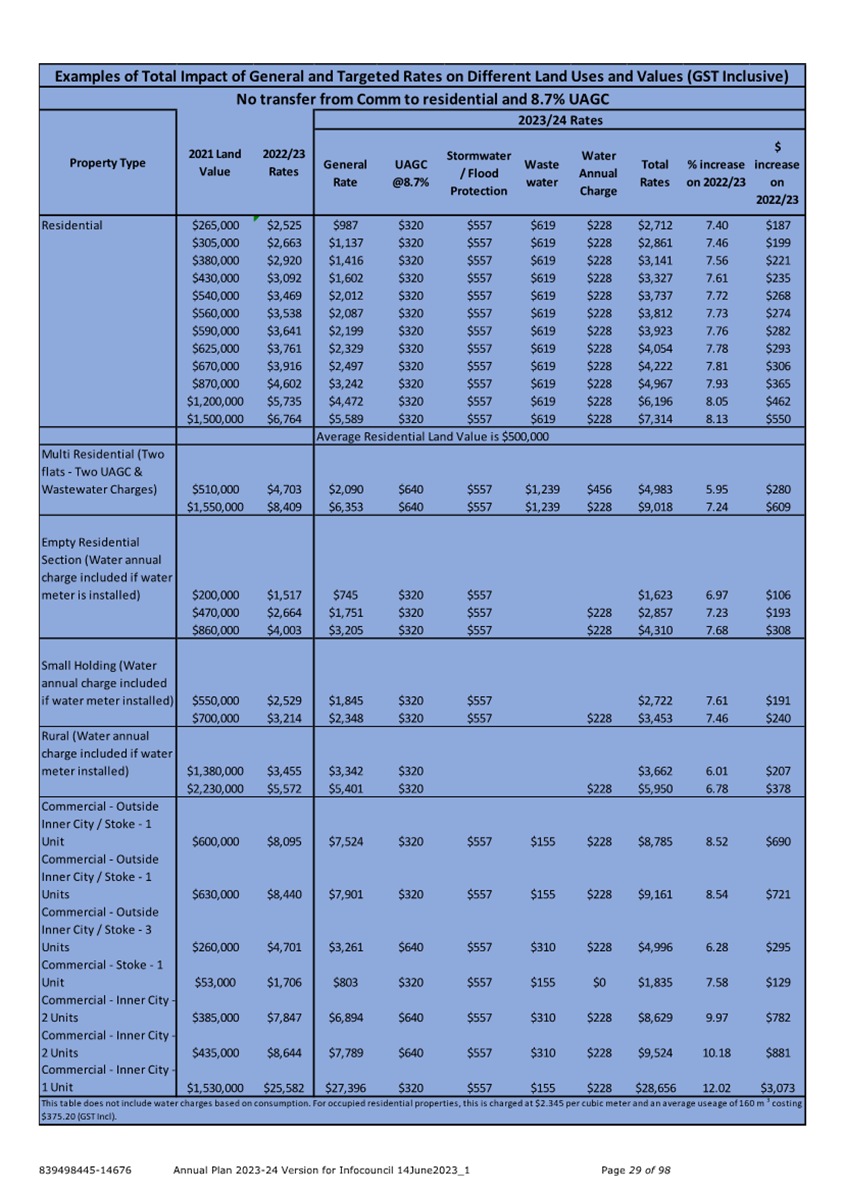

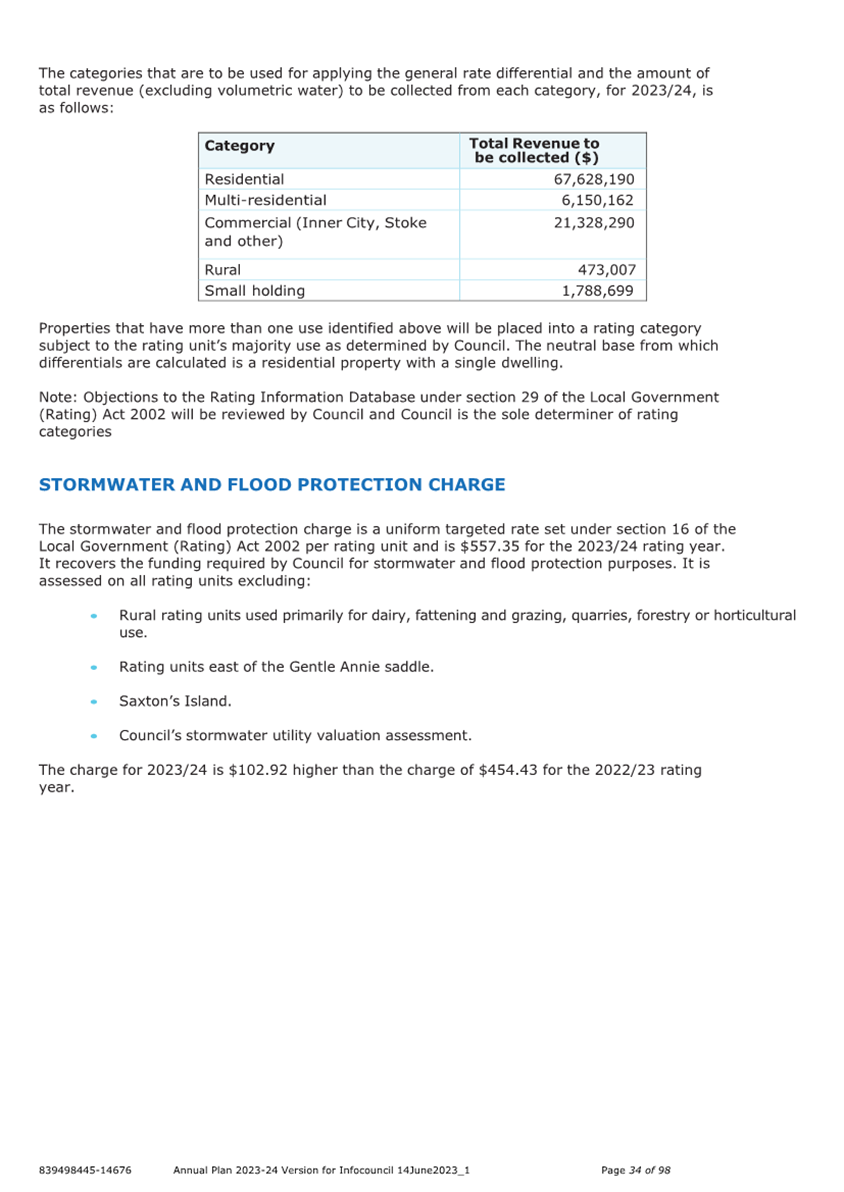

General Rate $50,875,552

Uniform Annual General Charge $6,991,104

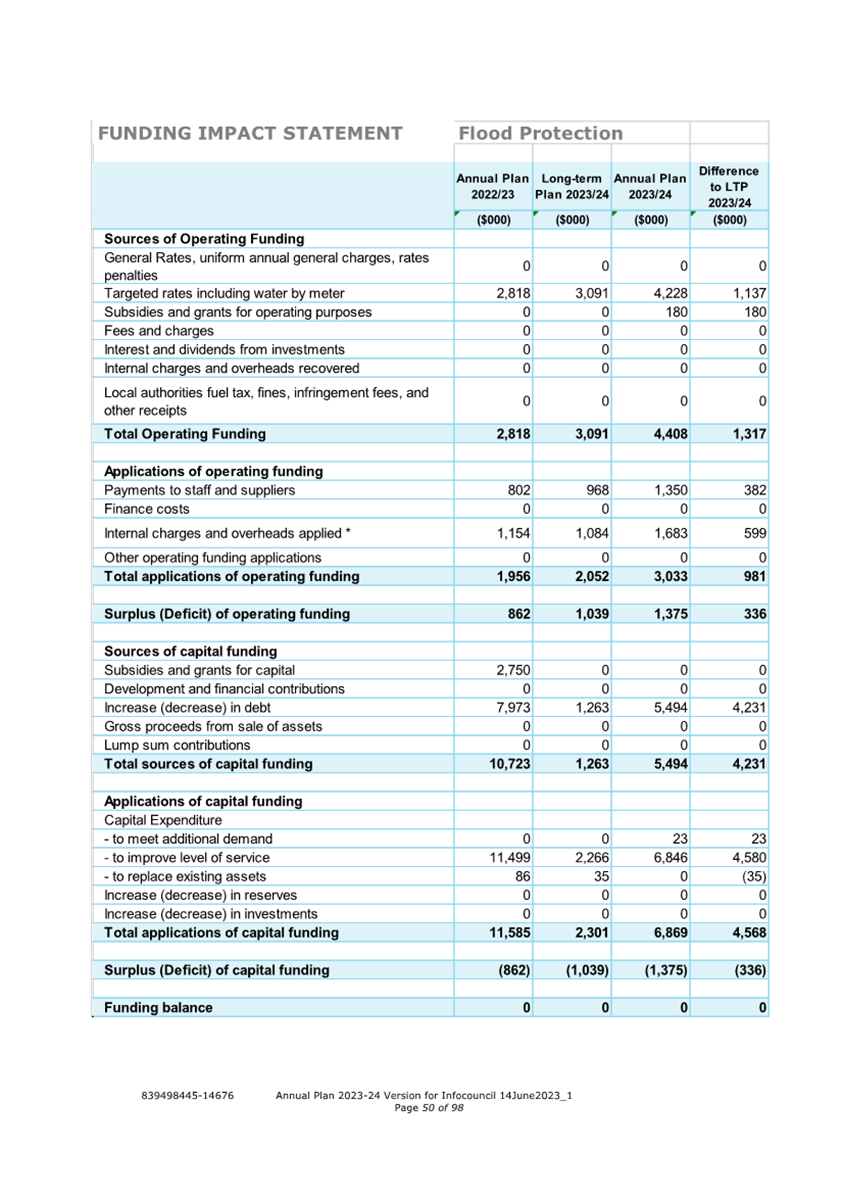

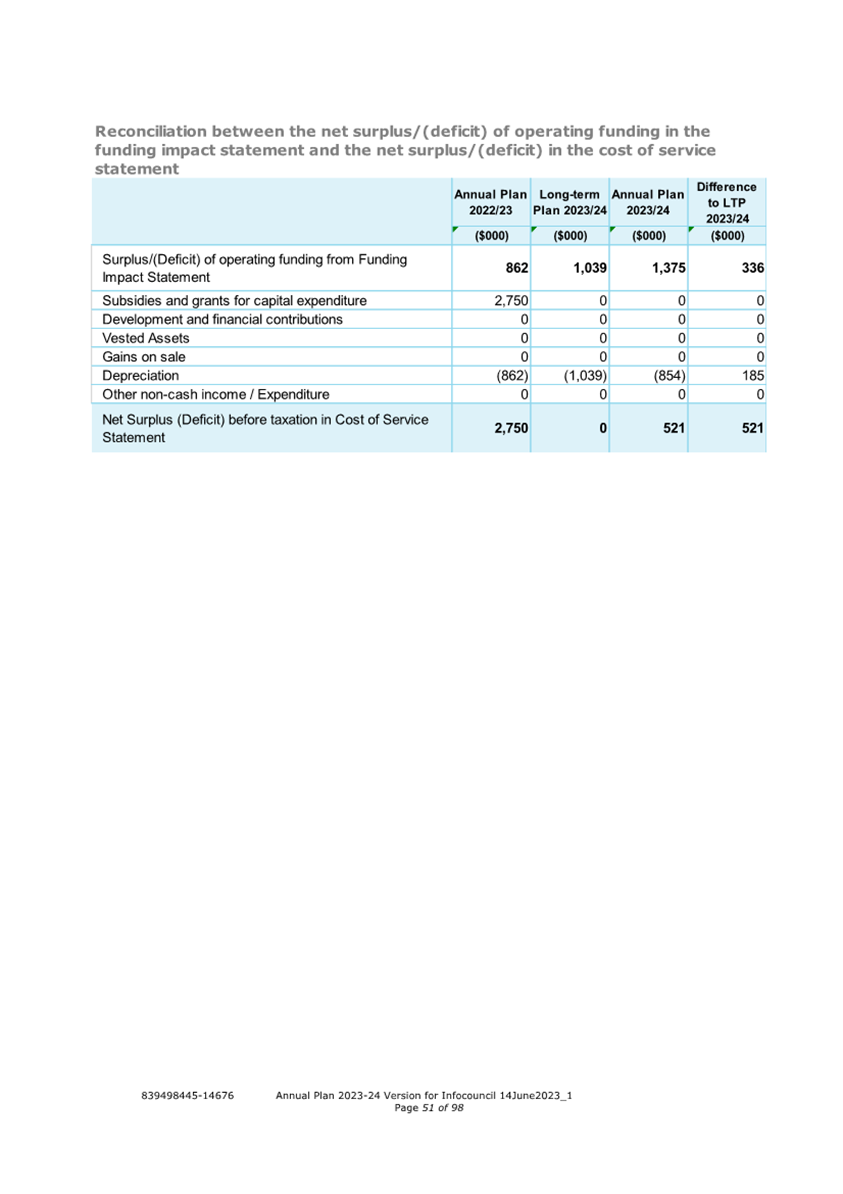

Stormwater and Flood Protection Charge $10,583,927

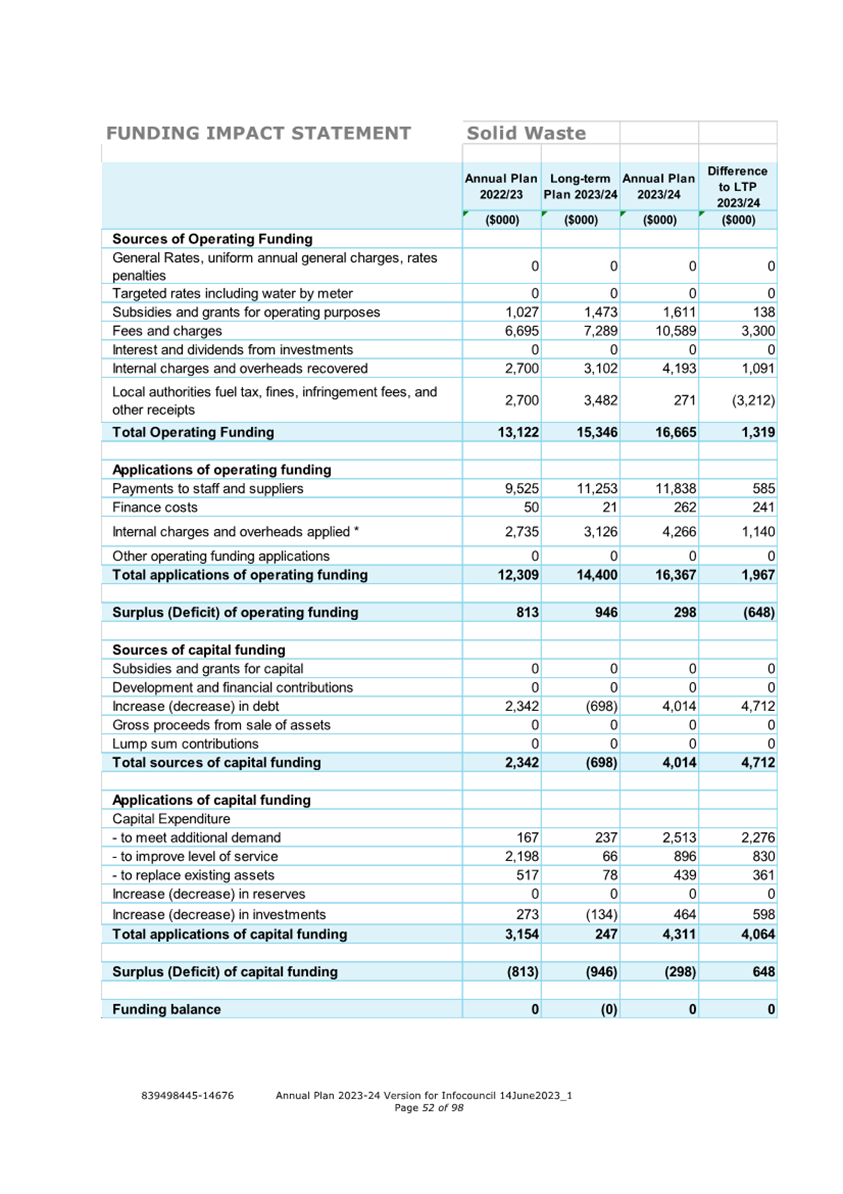

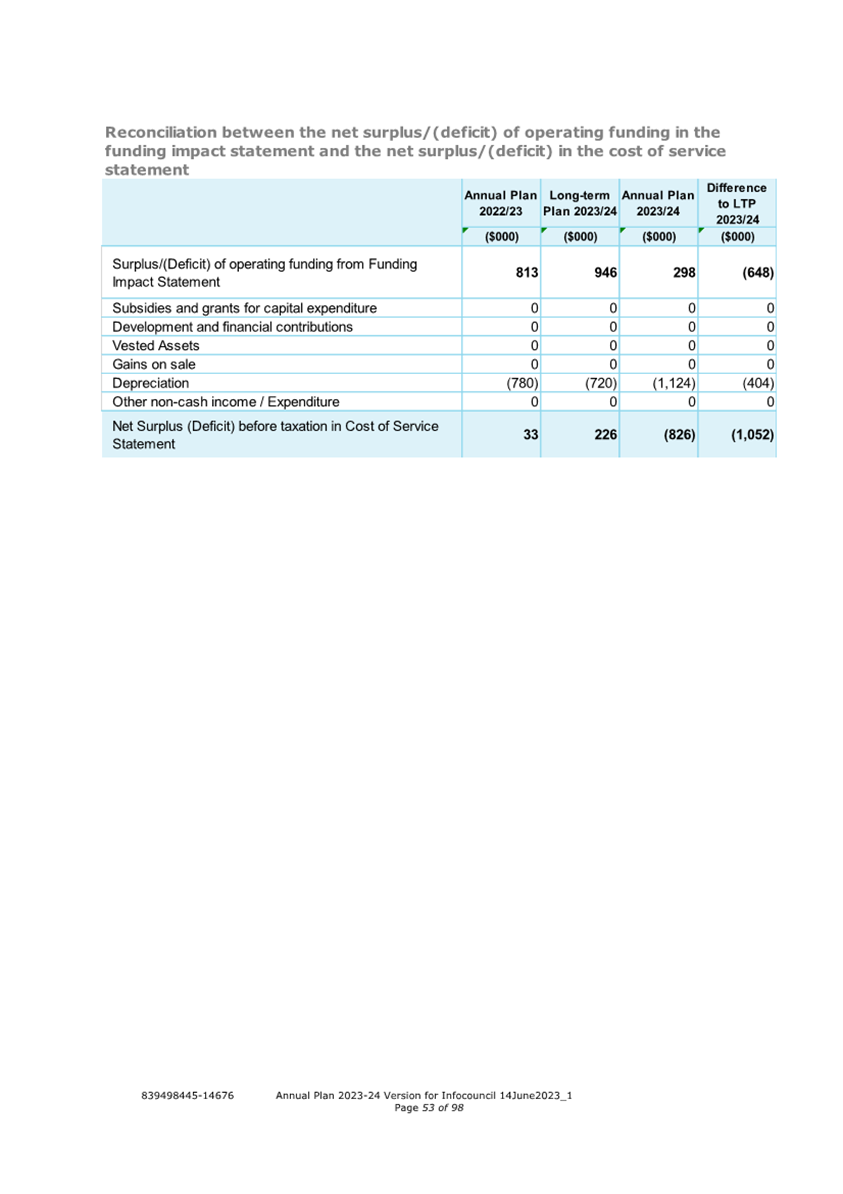

Waste Water Charge $11,906,937

Water Annual Charge $4,335,443

Water Volumetric Charge $10,116,034

Rates and Charges (excluding GST) $94,808,997

Goods and Services Tax (at the current rate) $14,221,350

Total Rates and Charges $109,030,347

The rates and charges below are GST inclusive.

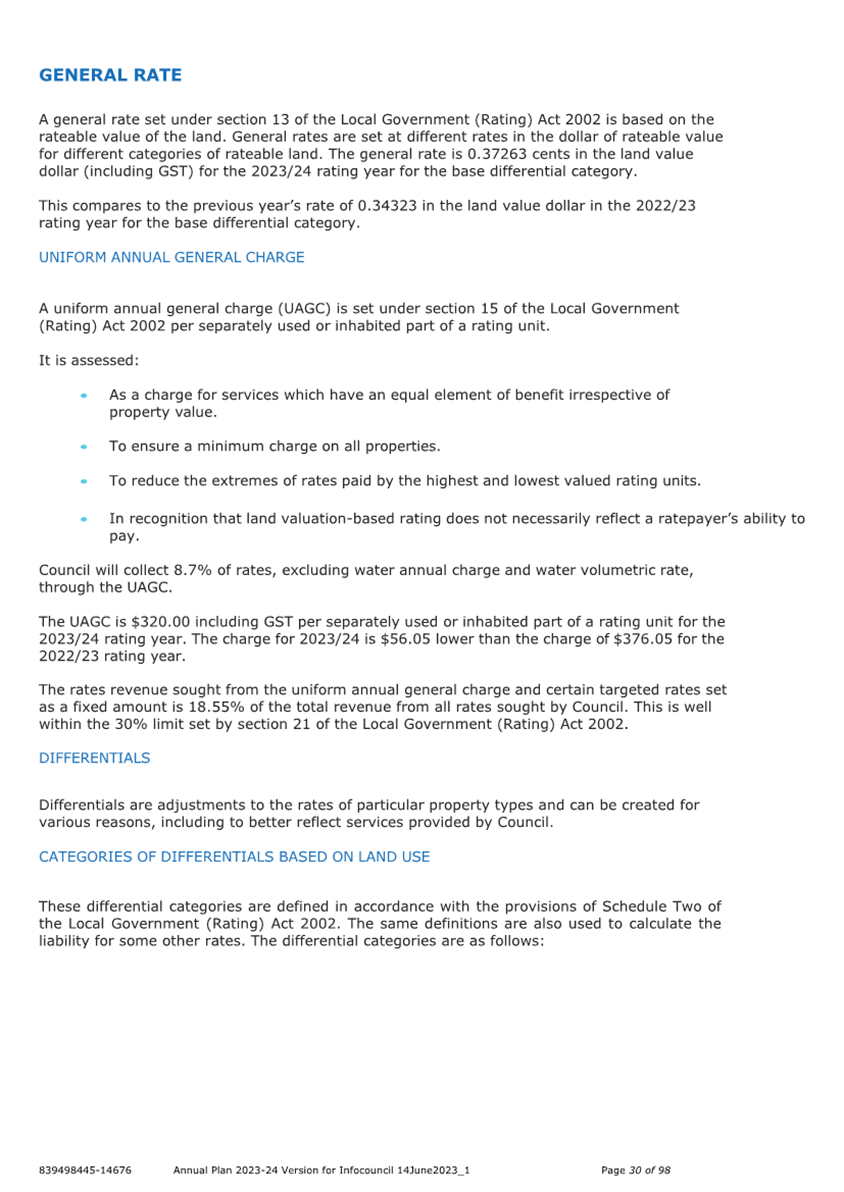

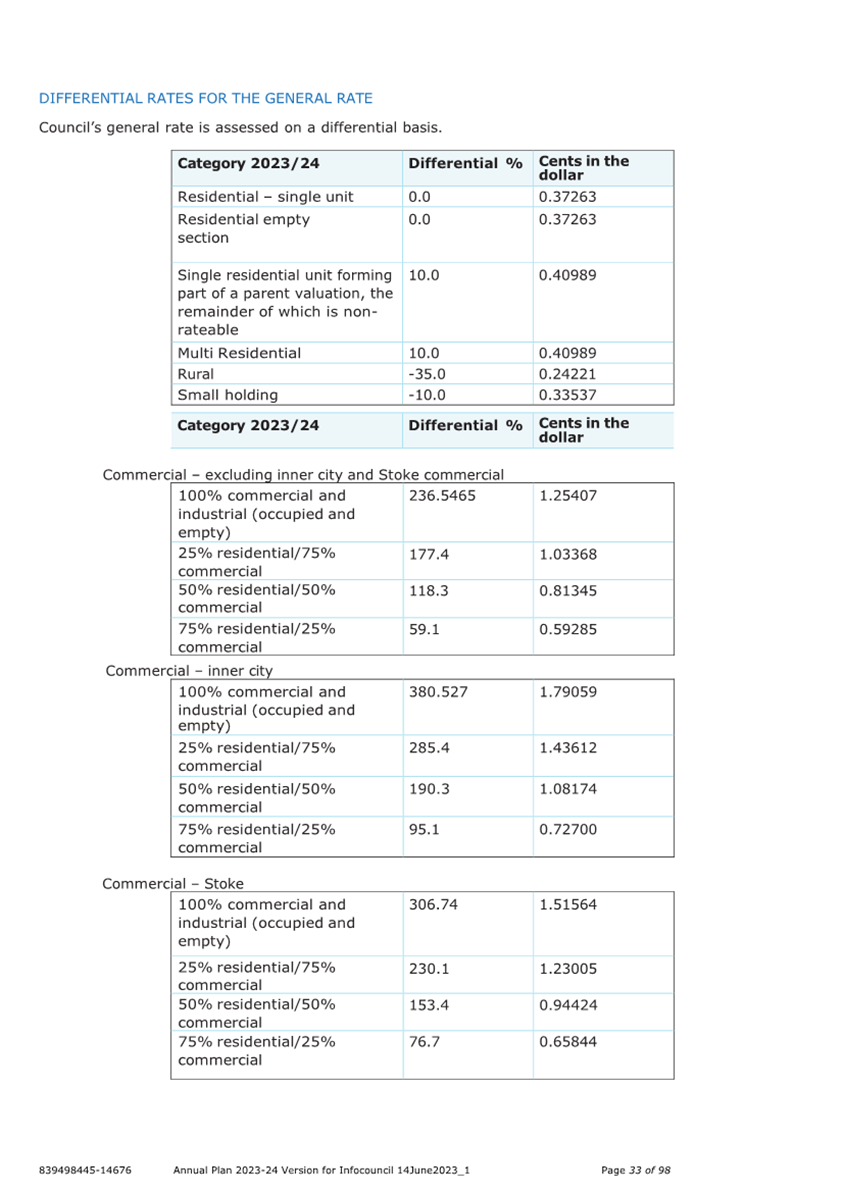

(1) General Rate

A general

rate set under section 13 of the Local Government (Rating) Act 2002, assessed

on a differential land value basis as described below:

· a rate of 0.37263 cents in the dollar of land value on every

rating unit in the “residential – single unit” category.

· a rate of 0.37263 cents in the dollar of land value on every

rating unit in the “residential empty section” category.

· a rate of 0.40989 cents in the dollar of land value on every

rating unit in the “single residential unit forming part of a parent

valuation, the remainder of which is non-rateable” category. This

represents a plus 10% differential on land value.

· a rate of 0.40989 cents in the dollar of land value on every

rating unit in the “multi residential” category. This represents

a plus 10% differential on land value.

· a rate of 1.25407 cents in the dollar of land value on every

rating unit in the “commercial – excluding inner city and Stoke

commercial” subject to 100% commercial and industrial (occupied and

empty) category. This represents a plus 236.5465% differential on land value.

· a rate of 1.03368 cents in the dollar of land value on every

rating unit in the “commercial – excluding inner city and Stoke

commercial” subject to 25% residential and 75% commercial”

category. This represents a plus 177.4% differential on land value.

· a rate of 0.81345 cents in the dollar of land value on every

rating unit in the “commercial – excluding inner city and Stoke

commercial” subject to 50% residential and 50% commercial”

category. This represents a plus 118.3% differential on land value.

· a rate of 0.59285 cents in the dollar of land value on every

rating unit in the “commercial – excluding inner city and Stoke

commercial” subject to 75% residential and 25% commercial”

category. This represents a plus 59.1% differential on land value.

· a rate of 1.79059 cents in the dollar of land value on every

rating unit in the “commercial inner city” subject to 100%

commercial and industrial (occupied and empty) category. This represents a

plus 380.527% differential on land value.

· a rate of 1.43612 cents in the dollar of land value on every

rating unit in the “commercial inner city subject to 25% residential

and 75% commercial” category. This represents a plus 285.4%

differential on land value.

· a rate of 1.08174 cents in the dollar of land value on every

rating unit in the “commercial inner city subject to 50% residential

and 50% commercial” category. This represents a plus 190.3%

differential on land value.

· a rate of 0.72700 cents in the dollar of land value on every

rating unit in the “commercial inner city subject to 75% residential

and 25% commercial” category. This represents a plus 95.1% differential

on land value.

· a rate of 1.51564 cents in the dollar of land value on every

rating unit in the “Stoke commercial subject to 100% commercial and

industrial (occupied and empty)” category. This represents a plus

306.74% differential on land value.

· a rate of 1.23005 cents in the dollar of land value on every

rating unit in the “Stoke commercial subject to 25% residential and 75%

commercial” category. This represents a plus 230.1% differential on

land value.

· a rate of 0.94424 cents in the dollar of land value on every

rating unit in the “Stoke commercial subject to 50% residential and 50%

commercial” category. This represents a plus 153.4% differential on

land value.

· a rate of 0.65844 cents in the dollar of land value on every

rating unit in the “Stoke commercial subject to 75% residential and 25%

commercial” category. This represents a plus 76.7% differential on land

value.

· a rate of 0.24221 cents in the dollar of land value on every

rating unit in the “rural” category. This represents a minus 35%

differential on land value.

· a rate of 0.33537 cents in the dollar of land value on every

rating unit in the “small holding” category. This represents a

minus 10% differential on land value.

(2) Uniform Annual

General Charge

A uniform annual general charge under section 15 of the Local

Government (Rating) Act 2002 of $320.00 per separately used or inhabited part

of a rating unit.

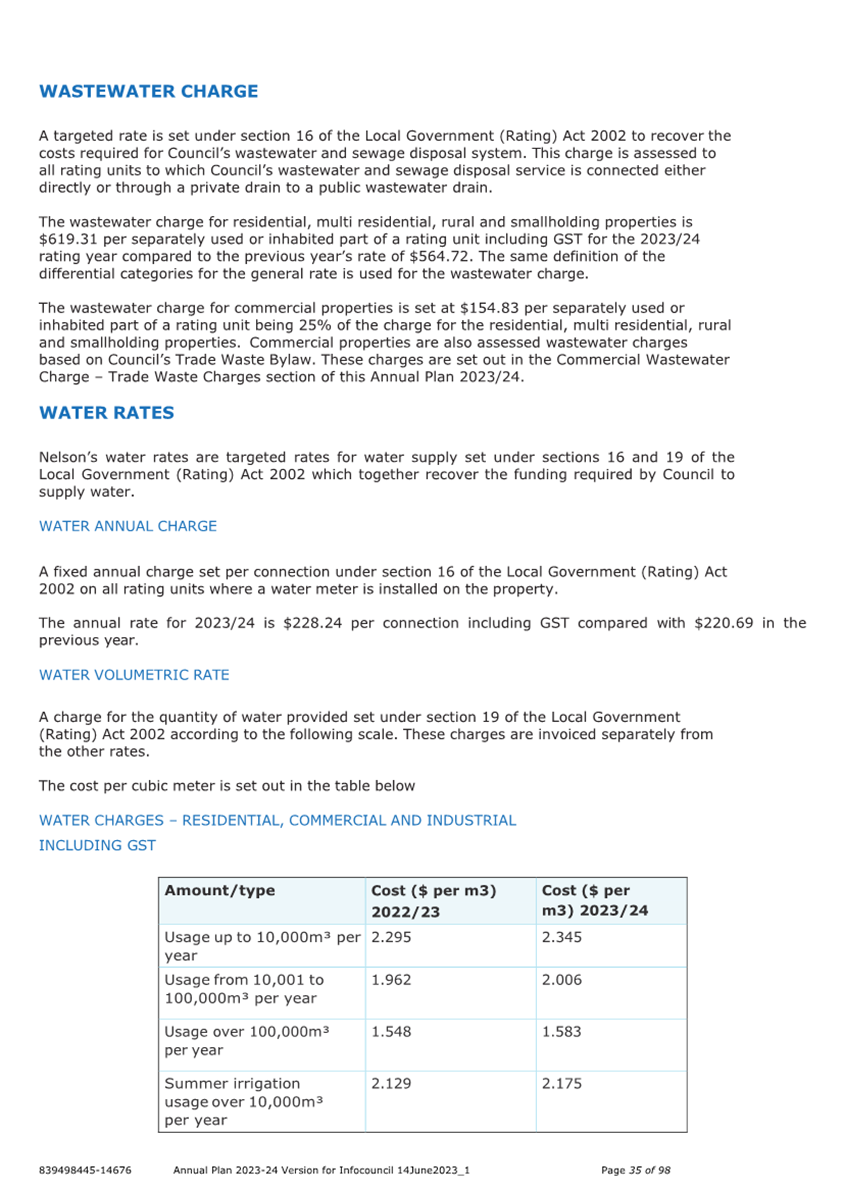

(3) Stormwater and Flood Protection Charge

A targeted rate under section 16 of the Local Government (Rating)

Act 2002 of $557.35 per rating unit, this rate is payable by all ratepayers

excluding rural rating units, rating units east of the Gentle Annie saddle,

Saxton’s Island and Council’s stormwater network.

(4) Waste Water Charge

A

targeted rate for waste water disposal under section 16 of the Local

Government (Rating) Act 2002 of:

· $619.31 per separately used or inhabited part of a residential,

multi residential, rural and small holding rating units that is connected

either directly or through a private drain to a public waste water drain.

· For commercial rating units, a waste water charge of $154.83 per

separately used or inhabited part of a rating unit that is connected either

directly or through a private drain to a public waste water drain. Note: a

trade waste charge will also be levied.

(5) Water Annual Charge

A targeted rate for water supply under section 16 of the Local

Government (Rating) Act 2002 on each rating unit connect to the water supply, of:

Water charge (per connection) $228.24

(6) Water Volumetric Rate

A targeted rate for water provided under section 19 of the Local

Government (Rating) Act 2002, of:

Price of water:

Usage up to 10,000 cu.m/year

$2.345 per m³

Usage from 10,001 – 100,000 cu.m/year

$2.006 per m³

Usage over 100,000 cu.m/year

$1.583 per m³

Summer irrigation usage over 10,000 cu.m/year

$2.175 per m³

(7) Low Valued Properties Remission Value

In accordance section 85 of the Local Government (Rating) Act 2002

and Council’s Rates Remission Policy, Council sets the land value for

the Low Valued Properties Rates Remission at $10,000.

Other Rating Information:

Due Dates for Payment of Rates

The above

rates (excluding water volumetric rates) shall be payable in four instalments

on the following dates:

|

Instalment

Number

|

Instalment Date

|

Due Date for Payment

|

Penalty Applied

|

|

Instalment

1

|

25 July

2023

|

21

August 2023

|

25

August 2023

|

|

Instalment

2

|

25

October 2023

|

20

November 2023

|

24

November 2023

|

|

Instalment

3

|

25

January 2024

|

20

February 2024

|

26

February 2024

|

|

Instalment

4

|

26 April

2024

|

20 May

2024

|

24 May

2024

|

Rates instalments not paid on or by the Due Date for Payment above

will incur penalties as detailed in the section “Penalty on

Rates”.

Due Dates for Payment of Water Volumetric Rates

Water

volumetric rates shall be payable on the following dates:

|

Billing Month

|

Due Date for Payment

|

|

July 2023

|

21 August 2023

|

|

August 2023

|

20 September 2023

|

|

September 2023

|

20 October 2023

|

|

October 2023

|

20 November 2023

|

|

November 2023

|

20 December 2023

|

|

December 2023

|

22 January 2024

|

|

January 2024

|

20 February 2024

|

|

February 2024

|

20 March 2024

|

|

March 2024

|

22 April 2024

|

|

April 2024

|

20 May 2024

|

|

May 2024

|

20 June 2024

|

|

June 2024

|

22 July 2024

|

Penalty on Rates

Pursuant

to Sections 57 and 58 of the Local Government (Rating) Act 2002, the council

authorises the following penalties on unpaid rates (excluding volumetric

water rate accounts) and delegates authority to the Group Manager Corporate

Services to apply them:

· a charge of 10% of the amount of each rate instalment remaining

unpaid after the due date stated above, to be added on the penalty date as

shown in the above table and also shown on each rate instalment notice.

· a charge of 10% will be added on 10 July 2023 to any balance from

a previous rating year (including penalties previously charged) remaining

outstanding on 1 July 2023.

· a further additional charge of 10% will be added on 11 January

2024 to any balance from a previous rating year (including penalties

previously charged) to which a penalty has been added according to the bullet

point above, remaining outstanding on 10 January 2024.

Penalty Remission

In accordance with section 85 of the Local Government (Rating) Act

2002 and Council’s Rates Remission Policy, the Council will approve the

remission of a penalty where the criteria of the policy has been met.

Payment of Rates

Rates shall be payable at the Council offices, Civic House, 110

Trafalgar Street, Nelson between the hours of 8.30am to 5.00pm Monday,

Tuesday, Thursday and Friday and 9.00am to 5.00pm Wednesday.

Where any payment is made by a ratepayer that is less than the

amount now payable, the Council will apply the payment firstly to any rates

outstanding from previous rating years and then to current year rates due.

|