AGENDA

Ordinary meeting of the

Audit, Risk and Finance Subcommittee

Thursday 23 June 2016

Commencing at 1.00pm

Council Chamber

Civic House

110 Trafalgar Street, Nelson

Membership: Mr John Peters (Chairperson), Her Worship the

Mayor Rachel Reese, Councillors Ian Barker and Brian McGurk, and Mr John Murray

Guidelines for councillors

attending the meeting, who are not members of the Committee, as set out in

Standing Orders:

·

All councillors, whether or not they are members of the

Committee, may attend Committee meetings (SO 2.12.2)

·

At the discretion of the Chair, councillors who are not Committee

members may speak, or ask questions about a matter.

·

Only Committee members may vote on any matter before the

Committee (SO 3.14.1)

It is good practice for both Committee members and

non-Committee members to declare any interests in items on the agenda.

They should withdraw from the room for discussion and voting on any of these

items.

Audit, Risk and Finance

Subcommittee

Audit, Risk and Finance

Subcommittee

23

June 2016

Page

No.

1. Apologies

1.1 An

apology has been received from Her Worship the Mayor Rachel Reese

2. Confirmation

of Order of Business

3. Interests

3.1 Updates

to the Interests Register

3.2 Identify

any conflicts of interest in the agenda

4. Public

Forum

5. Confirmation

of Minutes

5.1 10

May 2016 7 - 12

Document number M1874

Recommendation

THAT

the minutes of the meeting of the Audit, Risk and Finance Subcommittee, held on

10 May 2016, be confirmed as a true and correct record.

6. Chairperson's

Report

7. Internal

Audit Plan - 2016/17 13 - 17

Document number R4216

Recommendation

THAT the report Internal Audit

Plan - 2016/17 (R4216) and its

attachment (A1562649) be received;

AND

THAT the Subcommittee note the changes in timeframes to the

Internal Audit Procedure.

Recommendation to Governance

Committee and Council

THAT the

Internal Audit Plan 2016/17 (A1562649) be approved;

AND

THAT it be noted there will be unbudgeted expenditure required,

which will be reported for approval to the Audit, Risk and

Finance Subcommittee through the Corporate Report once estimates have been

confirmed.

8. Accounting

Policies 18 - 34

Document number R5504

Recommendation

THAT the report Accounting

Policies (R5504) and its

attachment (A1554702) be received;

AND

THAT the Subcommittee notes the attached accounting policies

will be included in the Annual Report 2015/16.

9. Procurement

Policy 35 - 52

Document number R5507

Recommendation

THAT the report Procurement Policy

(R5507) and its attachment

(A1540508 and A345448) be

received.

Recommendation to Governance

Committee and Council

THAT the

revised Procurement Policy (A1540508) be adopted.

10. Employee

Conflicts of Interest Policy 53

- 58

Document number R5918

Recommendation

THAT the report Employee Conflicts

of Interest Policy (R5918) and

its attachment (A1288320) be

received.

11. Theatre

Royal Loan 59 - 95

Document number R6040

Recommendation

THAT the report Theatre Royal Loan

(R6040) and its attachments

(A1135204, A912504, and A1145163) be

received.

12. Interim

audit letter for year ending 30 June 2016 96 - 103

Document number R6064

Recommendation

THAT the report Interim audit letter

for year ending 30 June 2016 (R6064)

and its attachment (A1565622) be

received;

AND

THAT the suggested responses to the recommendations are

noted.

13. Capital

Projects Carry Forwards 2015/16 104

- 110

Document number R5992

Recommendation

THAT the report Capital Projects Carry

Forwards 2015/16 (R5992) and its

attachments (A1562956 and A1557401) be

received.

Recommendation to Governance

Committee and Council

THAT Council approves continuing work on 2015/16 capital

projects within the 2015/16 approved budgets, noting a final report on carry

forwards will come to the Governance Committee’s meeting on 25 August

2015.

14. Operating

Expenditure Carry Forwards 2015/16 111 - 116

Document number R6071

Recommendation

THAT the report Operating

Expenditure Carry Forwards 2015/16 (R6071)

and its attachment (A1557519) be received.

Recommendation to Governance

Committee and Council

THAT

Council approves continuing work on 2015/16 operating projects within the

2015/16 approved budgets, noting a final report on carry forwards will come to

the Governance Committee’s meeting on 25 August 2016.

15. Corporate

Report to 30 April 2016 117

- 130

Document number R5998

Recommendation

THAT the report Corporate Report

to 30 April 2016 (R5998) and its

attachments (A1557787 and A1563107) be received;

AND

THAT the Audit, Risk and Finance Subcommittee refer to the

Governance Committee its delegation for the review of the draft Annual Report

and the 2015/16 Carry Forwards Report.

Minutes of a meeting of

the Audit, Risk and Finance Subcommittee

Held in the Council

Chamber, Floor 2A, Civic House, 110 Trafalgar Street, Nelson

On Tuesday 10 May 2016,

commencing at 11.09am

Present: Mr

J Murray (Chairperson), Her Worship the Mayor R Reese, Councillors I Barker and

B McGurk

In Attendance: Councillors

P Matheson and G Noonan, Chief Executive (C Hadley), Group Manager Corporate

Services (N Harrison), Group Manager Infrastructure (A Louverdis), and

Administration Adviser (E-J Ruthven)

Apology: Mr

John Peters

It was noted that a resolution was

required to appoint a chairperson for the meeting.

|

Resolved AUD/2016/030

THAT Mr John Murray

chair the Audit, Risk and Finance Subcommittee meeting of 10 May 2016.

Barker/Her Worship the Mayor Carried

|

1. Apologies

|

Resolved AUD/2016/031

THAT an apology be

received and accepted from Mr John Peters.

Murray/Her Worship the Mayor Carried

|

2. Confirmation of Order of Business

There was no change to the order

of business.

3. Interests

There were no updates to the

Interests Register, and no interests with items on the agenda were declared.

4. Public Forum

There was no public forum.

5. Confirmation of Minutes

5.1 31

March 2016

Document number M1801, agenda

pages 6 - 12 refer.

|

Resolved AUD/2016/032

THAT the minutes of

the meeting of the Audit, Risk and Finance Subcommittee, held on 31 March

2016, be confirmed as a true and correct record.

McGurk/Her Worship the Mayor Carried

|

6. Status Report - Audit, Risk and

Finance Committee - 10 May 2016

Document number R5861, agenda

pages 13 - 14 refer.

|

Resolved AUD/2016/033

THAT the Status Report Audit,

Risk and Finance Subcommittee 10 May 2016 (R5861) and its attachment (A1324298) be received.

Barker/McGurk Carried

|

7. Chairperson's

Report

There was no Chairperson’s

Report.

8. Council's Key Organisational

Risks - Progress Report 2

Document number R5490, agenda

pages 15 - 31 refer.

Group Manager Corporate Services,

Nikki Harrison, and Manager Organisational Assurance and Emergency Management,

Roger Ball, presented the report.

In response to questions, Mr Ball

explained how the magnitude of risks was calculated, and the next steps

officers would be taking in this area.

|

Resolved AUD/2016/034

THAT the report Council's Key

Organisational Risks - Progress Report 2 (R5490) and its attachment (A1519755) be received.

Barker/McGurk Carried

|

9. Balance Sheet reconciliation

review

Document number R5505, agenda

pages 32 - 38 refer.

Group Manager Corporate Services,

Nikki Harrison, and Senior Accountant, Tracey Hughes, presented the

report. Ms Hughes explained that the risk column in the reconciliation

table related to accounting classifications.

There was a discussion regarding

the status of the loan to the Theatre Royal. In response to questions, Ms

Harrison noted this was an interest free loan, for which no repayments had been

received to date, and Ms Hughes explained that the risk column in the table did

not evaluate individual loans, but recognised all community loans as a risk.

Attendance: the meeting adjourned from 11.36am to

11.40am.

It was noted that a report would

be brought to the next subcommittee meeting regarding the status of the Theatre

Royal loan.

In response to further questions,

Ms Hughes explained the references on the table relating to the loan to Rainbow

Ski Field, reserve funds, a non-current suspensory loan, and holiday pay

accrual.

|

Resolved AUD/2016/035

THAT the report Balance Sheet

reconciliation review (R5505)

and its attachment (A1540192) be received.

McGurk/Barker Carried

|

10. Audit, Risk and Finance

subcommittee work plan

Document number R5654, agenda

pages 39 - 41 refer.

Group Manager Corporate Services,

Nikki Harrison, presented the report. She said that the task list

represented a three year work plan, but that items were only scheduled for

meetings until the end of the triennium.

In response to questions, Ms

Harrison gave updates relating to the tax governance framework, tax review,

sensitive expenditure policy, procurement policy and conflicts of interest

policy. She confirmed there was a current conflicts of interest policy

for officers, and said this would be brought to the next subcommittee meeting.

|

Resolved AUD/2016/036

THAT the report Audit, Risk and

Finance subcommittee work plan (R5654)

and its attachment (A1389278) be

received;

Her Worship the Mayor/Barker Carried

|

11. Internal Audit Report to 31

March 2016

Document number R5793, agenda

pages 42 - 48 refer.

Internal Audit Analyst, Lynn

Anderson presented the report. She said good progress had been made on a

number of internal audits, but that completing them was taking longer than

anticipated. She added that there had been few significant findings.

In response to questions, Ms

Anderson explained that issues noted as part of the cash handling internal

audit were unlikely to be linked to banking controls. She added that the

initial audits had a stronger focus on best practice, rather than being

compliance checking.

The subcommittee discussed the

timeframe for internal audits, and a suggestion was made that the Senior

Leadership Team consider resourcing constraints in the next Internal Audit

Annual Plan.

|

Resolved AUD/2016/037

THAT the Internal Audit Report

to 31 March 2016 (R5793) and

its attachments (A1533053 and A1532989)

be received.

Barker/McGurk Carried

|

|

Recommendation to Governance

Committee and Council AUD/2016/038

THAT

Council note the internal audit findings, recommendations and status of

action plans up to 31 March 2016 (R5793).

Barker/McGurk Carried

|

12. Corporate Report to 31 March

2016

Document number R5872, agenda

pages 49 - 61 refer.

Senior Accountant, Tracey Hughes,

presented the report.

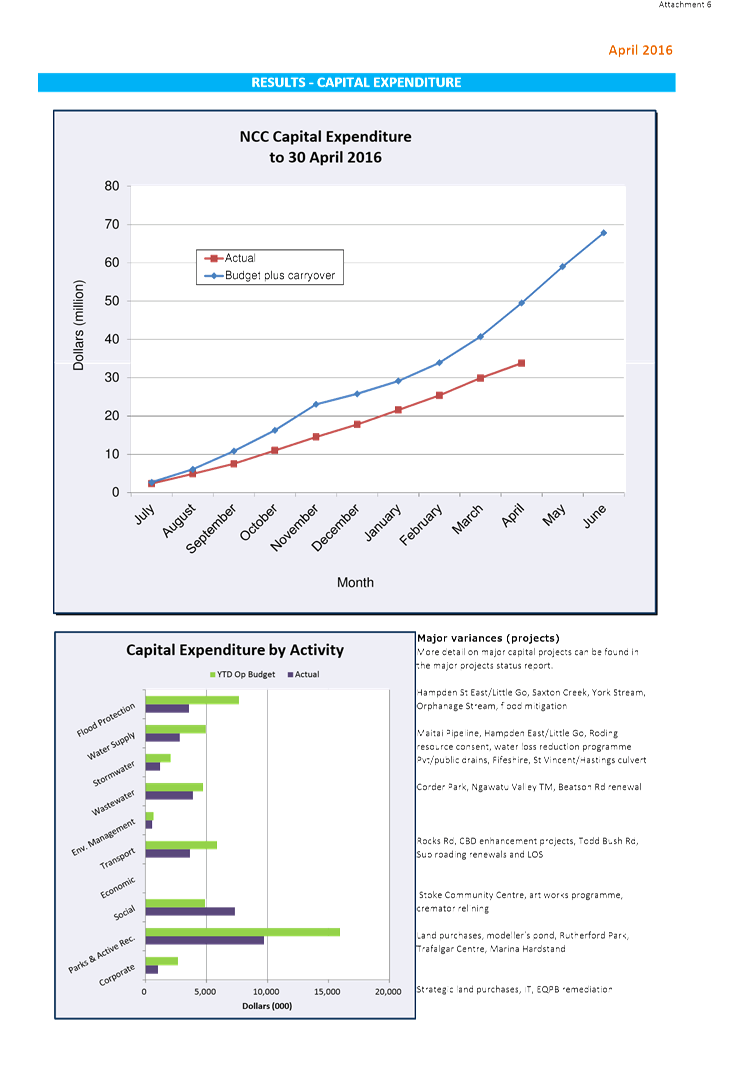

In response to questions

regarding operational expenditure, Ms Hughes said that the underspend would

likely be outside the 5% variance, as there were several large items that were

unlikely to attract full budgeted spend by the end of financial year.

In response to questions

regarding capital expenditure, Mr Louverdis explained that many projects

currently had work on-site, with invoices expected prior to the end of

financial year. He added that the KPI relating to completion of the

capital programme should be met.

In response to further questions,

Mr Louverdis gave updates relating to forestry, use of water for fire-fighting

purposes, installation of membranes at the water treatment plant, and the

Corder Park pump station, and Mrs Hadley explained the reasons for the delay in

backpay for officers on individual employment agreements.

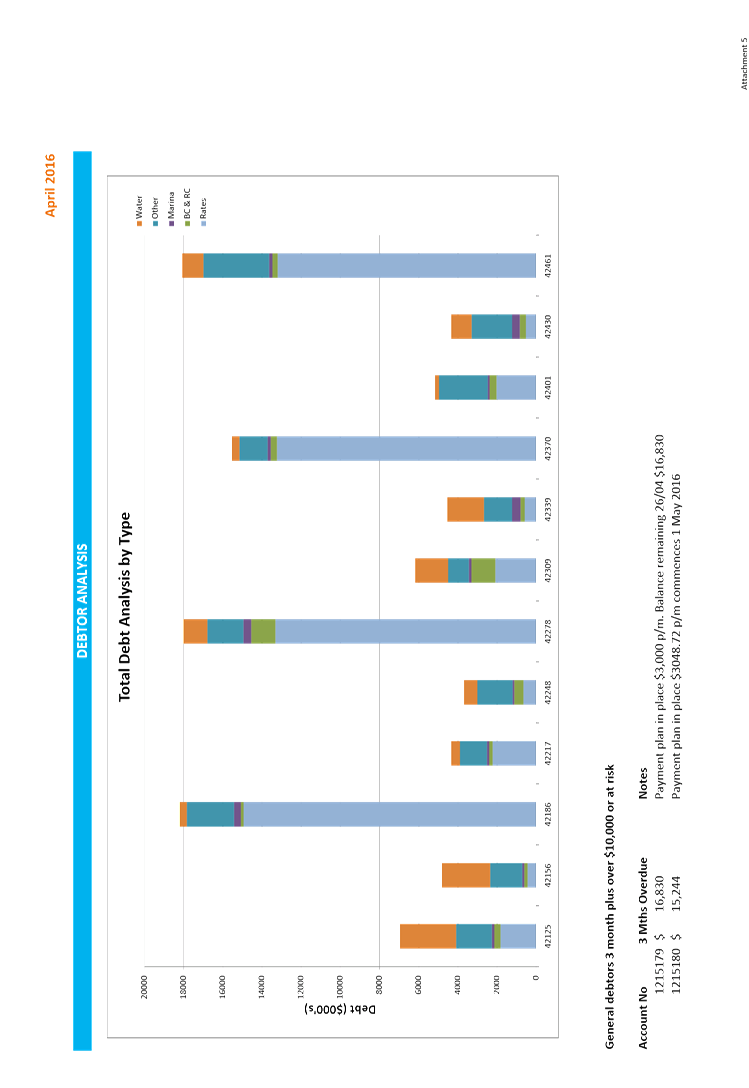

A question was raised about

debtors.

Attendance: The meeting adjourned from 12.29pm to

12.31pm, during which time Councillor Barker left the meeting.

It was noted that the four

general debtors listed were being managed, and had appropriate repayment plans

in place.

Attendance: Councillor Barker returned to the meeting

at 12.32pm.

There was a discussion regarding

the transfer of budget in relation to the proposed Progressive Enterprises

Limited private Plan Change, and Mrs Hadley explained the process and

requirement for expert economic and traffic evidence.

|

Resolved AUD/2016/039

THAT the report Corporate Report

to 31 March 2016 (R5872) and

its attachments (A1544370 and A1544028)

be received.

Her Worship the Mayor/McGurk Carried

|

|

Recommendation to Governance

Committee and Council AUD/2016/040

THAT

the transfer of legal budget from the Corporate activity to the Planning

activity in 2015/16 in order to obtain economic and traffic evidence for the

submission to Tasman District Council on the proposed Progressive Enterprises

Ltd Private Plan Change be noted.

Her Worship the Mayor/McGurk Carried

|

There being no further business the

meeting ended at 12.40pm.

Confirmed as a correct record of proceedings:

Chairperson

Date

Chairperson

Date

|

|

Audit, Risk and Finance Subcommittee

23 June 2016

|

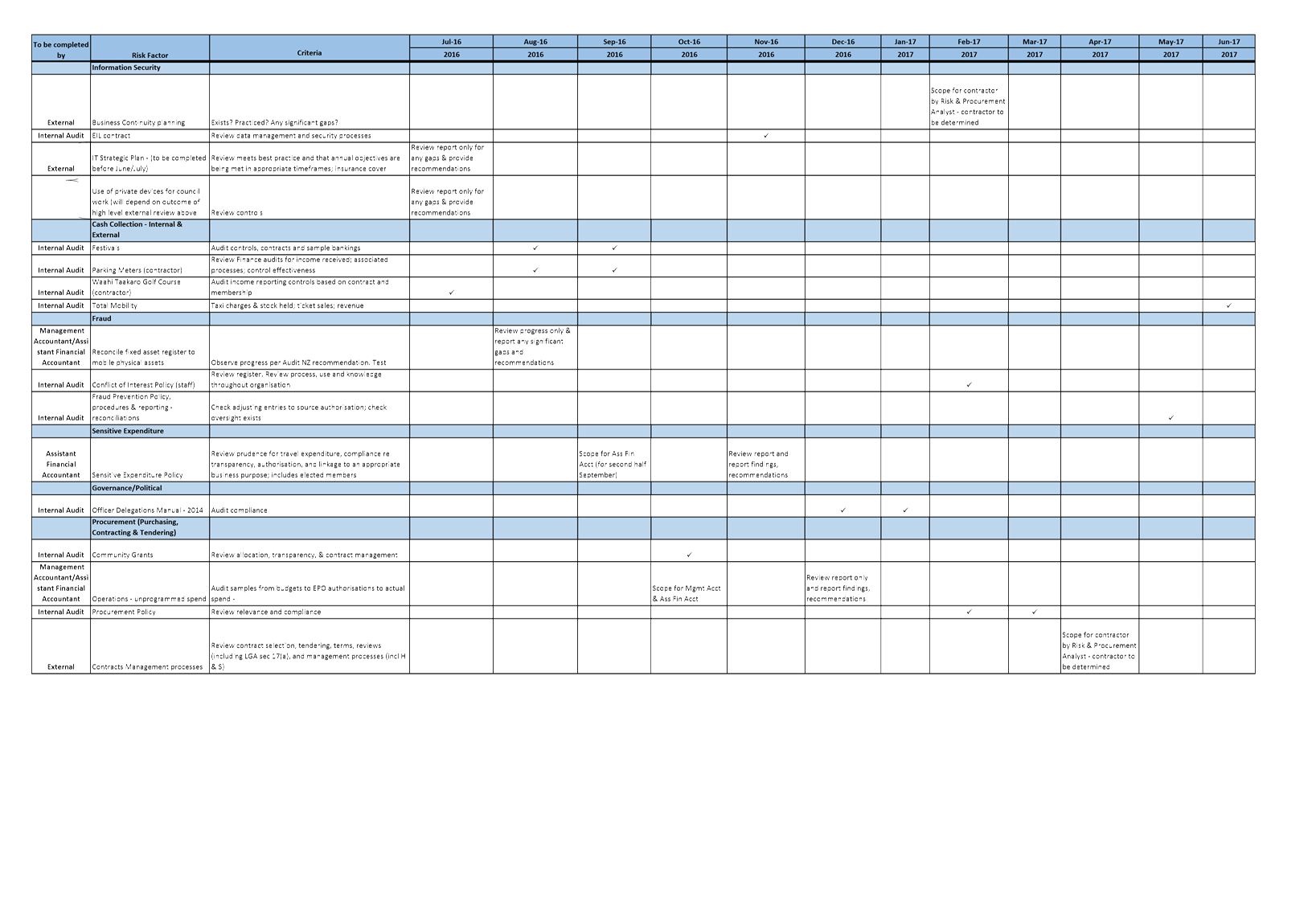

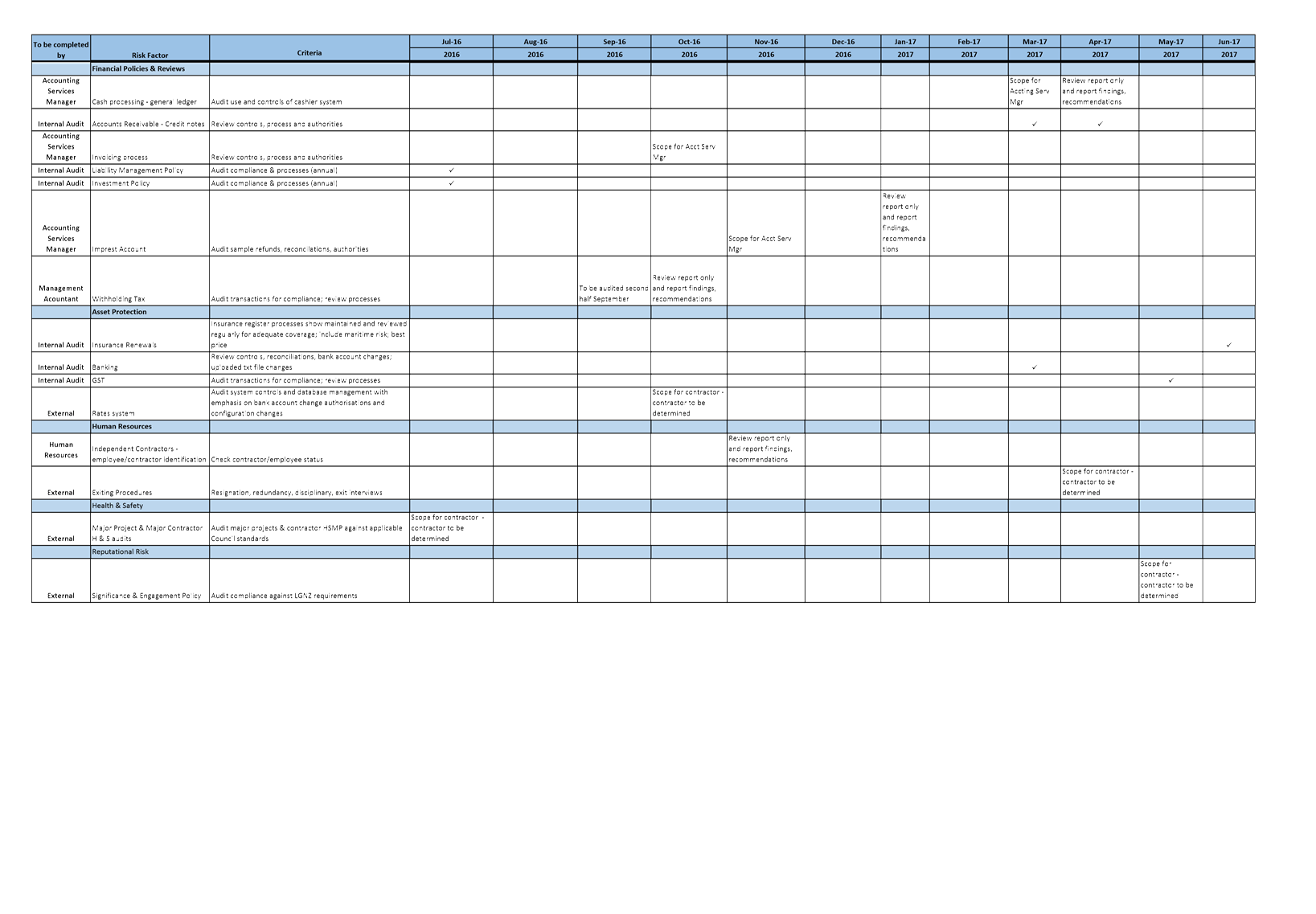

REPORT R4216

Internal

Audit Plan - 2016/17

1. Purpose of Report

1.1 To

approve the Internal Audit Plan through to 30 June 2017.

1.2 To

note change to the Internal Audit Procedure.

2. Delegations

2.1 The

Audit, Risk and Finance Subcommittee have responsibility for risk management

and internal control.

3. Recommendation

|

THAT the report Internal Audit

Plan - 2016/17 (R4216) and its

attachment (A1562649) be received;

AND THAT

the Subcommittee note the changes in timeframes to the Internal Audit

Procedure.

|

Recommendation

to Governance Committee and Council

|

THAT the Internal Audit Plan 2016/17

(A1562649) be approved;

AND THAT

it be noted there will be unbudgeted expenditure required, which will

be reported for approval to the Audit, Risk and Finance Subcommittee

through the Corporate Report once estimates have been confirmed.

|

4. Background

4.1 Under

the approved Internal Audit Charter a risk-based internal audit plan is to be

reviewed by the Subcommittee at least annually prior to the beginning of each

financial year.

4.2 The

Charter requires that in compiling the internal audit plan the impact of

resource limitations is to be considered. At the Audit, Risk and Finance

Subcommittee meeting of 10 May 2016, the Subcommittee suggested that the Senior

Leadership Team consider the resourcing constraints that had impacted on the

completion of planned audits for the 2015/16 year when approving the plan

through to 30 June 2017. This is addressed below under Implications.

5. Discussion

Compilation

of Internal Audit Plan

5.1 Using

risk-based methodology, and in addition to audits that were not completed in

the approved plan to 30 June 2016, the internal audit plan to 30 June 2017

includes audit topics according to priority. This includes any new topics which

have been identified during ongoing risk assessments across the organisation.

5.2 As

discussed at the Audit, Risk and Finance Subcommittee meeting on 10 May 2016,

one reason for planned audits not being completed in the previous plan included

the tight requisite response timeframes for Managers in the Internal Audit

Procedure. To make the annual audit plan more achievable, standardised audit

plan forms will be developed for Managers and an extension has been made to one

of the corrective action timeframes:

|

Risk Rating

|

Response Time for Corrective Action

(Original)

|

Response Time for Corrective Action

(New)

|

|

High

|

7 days

|

10 working days

|

Implications

5.3 The

Internal Audit Plan for the year to 30 June 2017 is considered more realistic

than the previous plan through to 30 June 2016. It allows for 31 audits to be

completed during the financial year. These will be spread - with internal audit

performing sixteen, external contractors performing seven, and other expert

officers within Council performing the remaining eight audits. Audits not

performed by internal audit will be assessed and reported according to the

Internal Audit Procedure and these reports will include any further

recommendations considered appropriate by internal audit.

5.4 When

compiling the plan, and where possible, there has been an attempt not to burden

one Business Unit with successive audits.

6. Options

6.1 Accept

the recommendation that the Internal Audit Plan 2016/17 be approved.

6.2 Reject

the recommendation.

7. Alignment with relevant Council policy

7.1 The

decision is not inconsistent with any other previous Council decision.

7.2 There

is unbudgeted and unknown cost associated with the use of external contractors

to perform some of the audits in this Plan. It is considered that specialised

knowledge and competence which is unavailable within Council, is necessary to

provide the degree of confidence needed for these audits. Once this audit plan

is approved, scoping can occur and estimated costs can be reported back for

approval to a future Subcommittee meeting.

8. Assessment of Significance against the Council’s

Significance and Engagement Policy

8.1 This

is not a significant decision under the Council’s Significance and

Engagement Policy.

9. Consultation

9.1 No

consultation has been undertaken in preparing this report.

10. Inclusion of Māori in the decision making process

10.1 No

consultation with Maori has been undertaken in preparing this report.

Lynn

Anderson

Internal

Audit Analyst

Attachments

Attachment 1: A1562649

- Internal Audit Plan 2016-17

|

|

Audit, Risk and Finance Subcommittee

23 June 2016

|

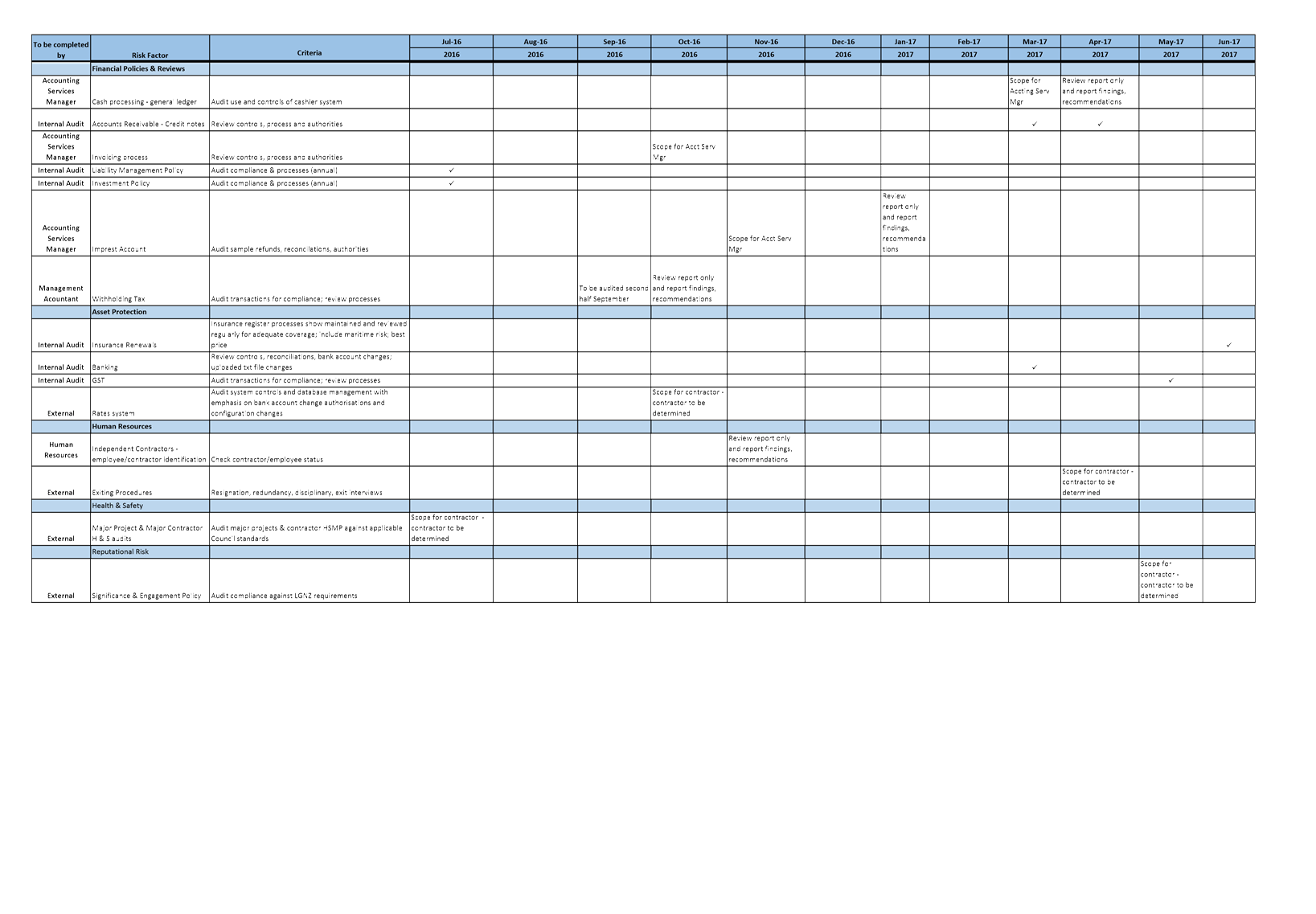

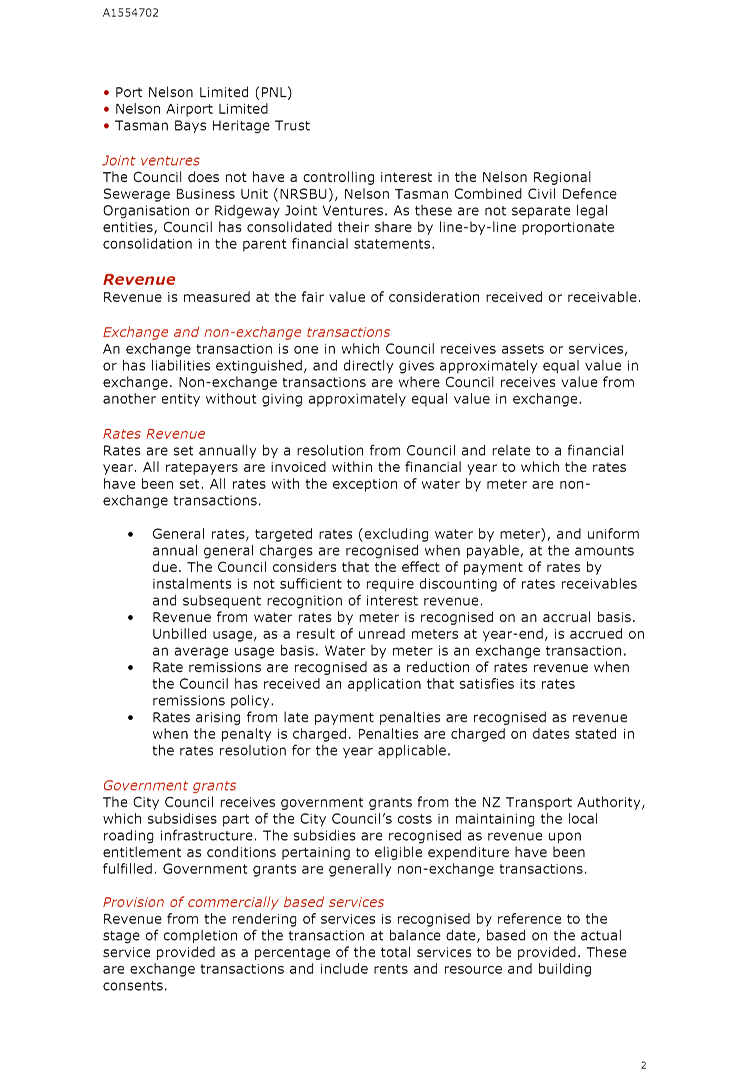

REPORT R5504

Accounting

Policies

1. Purpose

of Report

1.1 To present the current significant accounting

policies for review.

2. Delegations

2.1 The

Audit, Risk and Finance Subcommittee has the power to recommend to the

Governance Committee on matters related to the annual accounts, audit, internal

control and statutory compliance. The significant accounting policies of

Council impact all of these areas.

3. Recommendation

|

THAT the report Accounting

Policies (R5504) and its

attachment (A1554702) be received;

AND THAT

the Subcommittee notes the attached accounting policies will be included in

the Annual Report 2015/16.

|

4. Background

4.1 Council’s

significant accounting policies are presented to the public twice a year, as

they are included in the financials section of all Long Term Plans or Annual

Plans, and Annual Reports.

4.2 The

review of these policies is included in the work plan for this subcommittee in

the current financial year. These policies will now be presented for

consideration every three years or when there is a significant change.

4.3 This

is an opportunity for the subcommittee to consider the policies in isolation,

be informed of any current or prospective changes to the policies and identify

possible changes for consideration.

5. Discussion

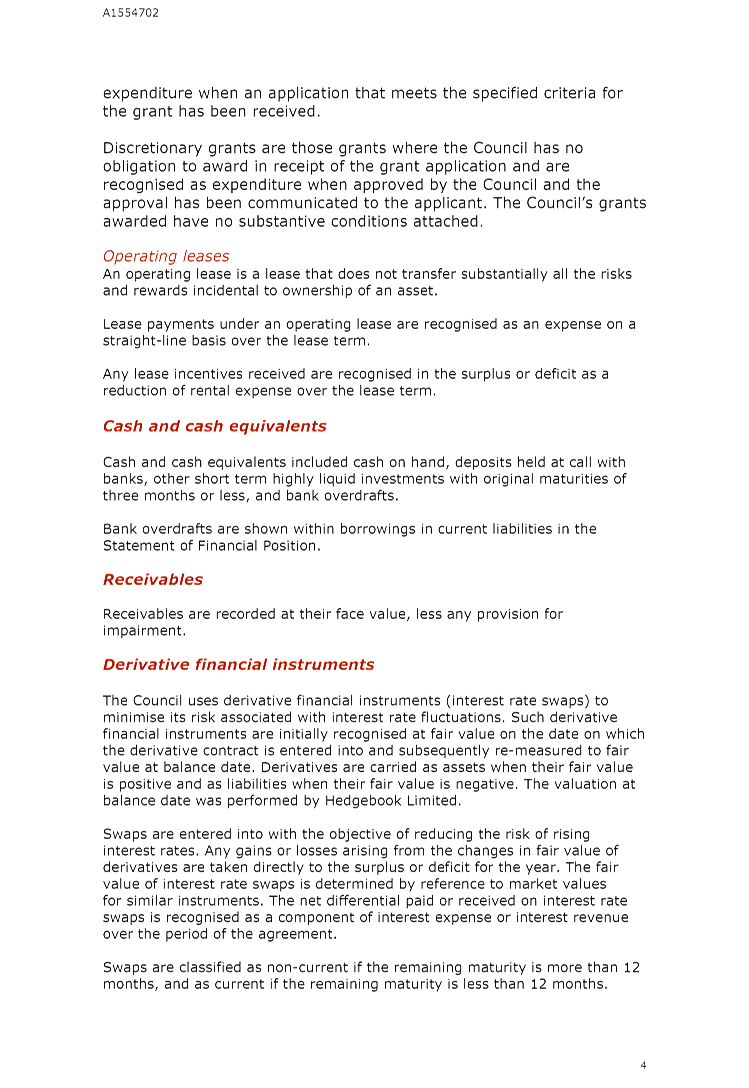

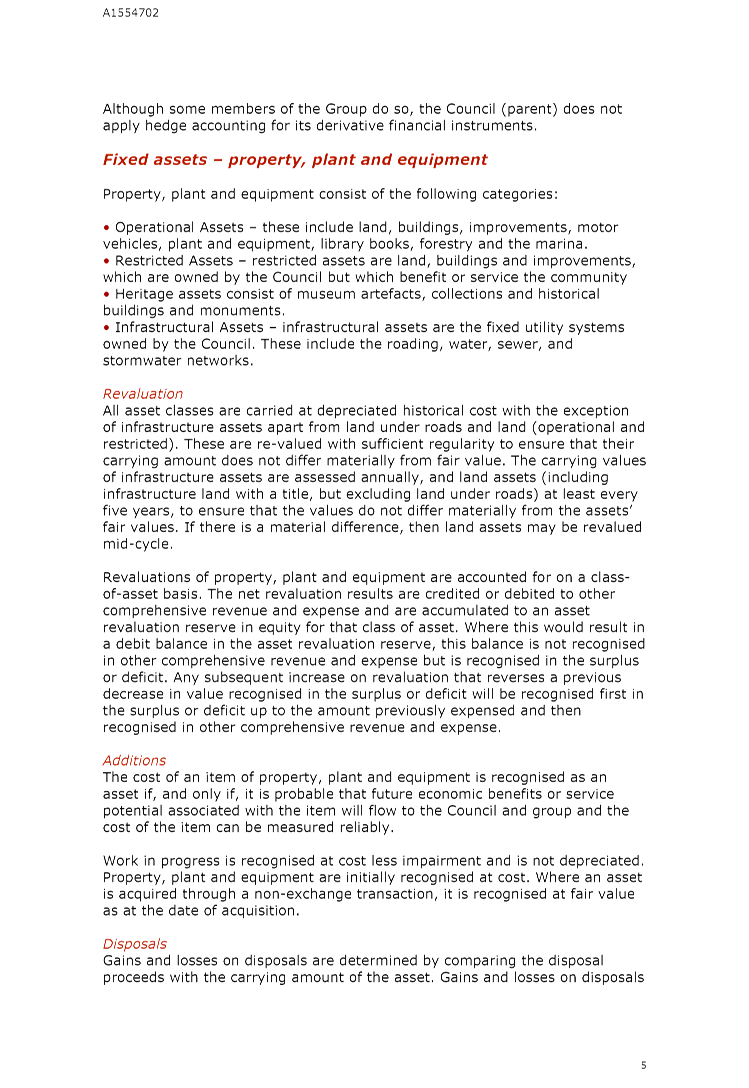

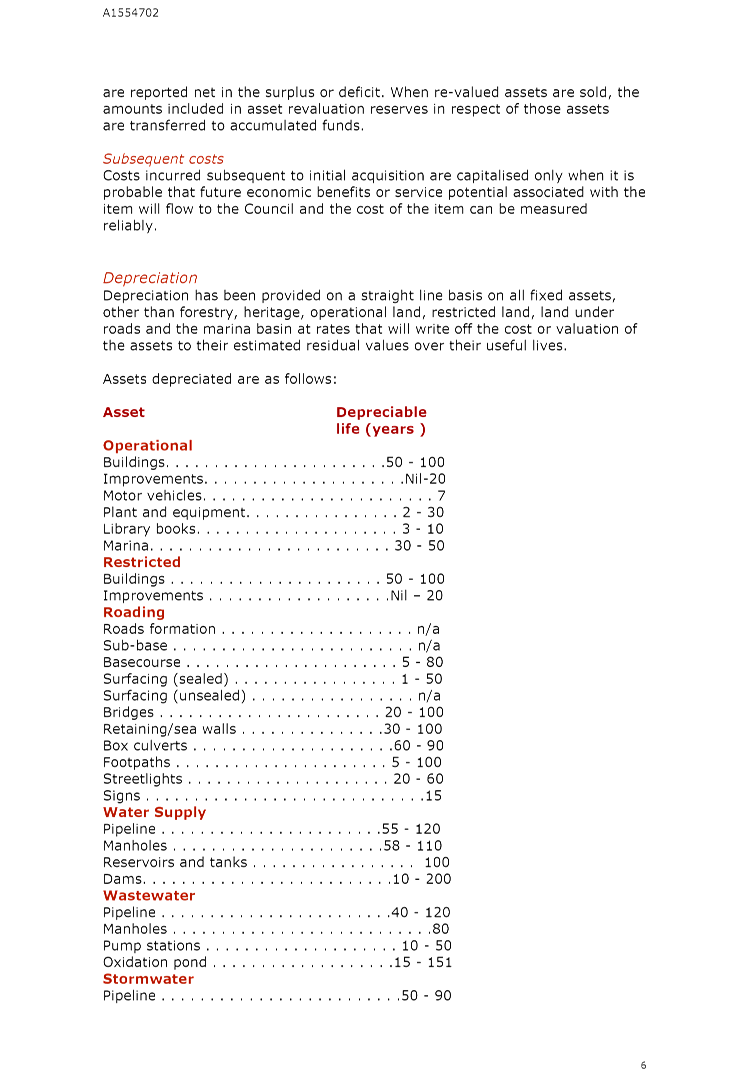

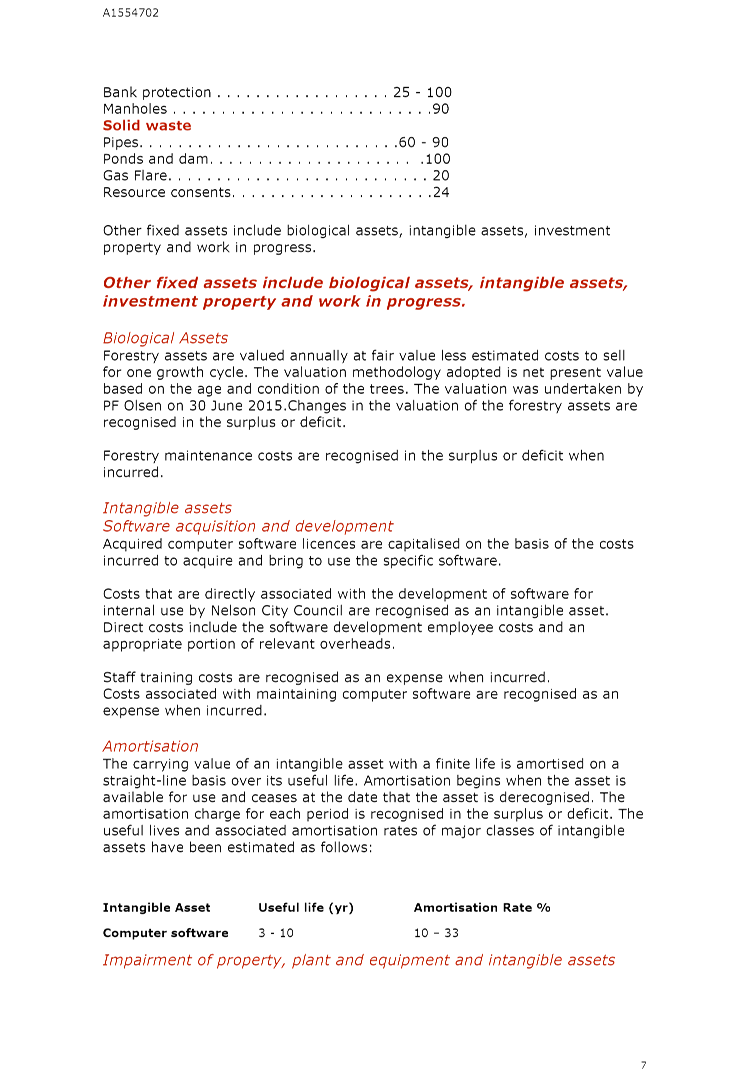

5.1 Significant

accounting policies describe the treatment of income and expenditure, assets

and liabilities and equity. They are not (and are not intended to be) processes

or procedures.

5.2 Nelson

City Council’s significant accounting policies are reviewed by the Senior

Accountant twice a year, in advance of being included in Annual or Long Term

Plan and the Annual Report. This review is required to ensure that the policies

reflect the latest requirements, arrangements, controls and practice.

5.3 The

policies underwent a significant revision in advance of the 2014/15 Annual

Report audit to reflect compliance under the new Public Benefit Entity

International Public Sector Accounting Standards (PBE IPSAS).

5.4 The

policies closely align to both PBE IPSAS and New Zealand generally accepted

accounting practice (NZ GAAP).

5.5 The

policies are part of the framework used by Audit NZ in their audits of Long

Term Plans and Annual Reports. Audit have not raised any issues with the

accounting policies in the past, and so long as they are compliant with NZ GAAP

and PBE IPSAS they are unlikely to do so.

5.6 Attachment

1 itemises the significant accounting policies as contained in the 2014/15

Annual Report. There have been no substantive changes to these policies since

and these are intended to be included in the 2015/16 Annual Report.

5.7 Over

the next year, officers will be investigating whether to recommend that Council

buildings are revalued. This would align our policies with our significant

Council Controlled Trading Organisations. However there will be ongoing costs

associated with doing this (valuations), including potentially a rating impact

so some work needs to be done.

6. Options

6.1 Accept

the recommendations – receive the Accounting Policies report and endorse

the policies for inclusion in the 2015/16 Annual Report.

6.2 Reject

the recommendation – not receive the Accounting Policies report or

endorse the policies for inclusion in the 2015/16 Annual Report.

7. Alignment

with relevant Council policy

7.1 Significant

accounting policies are presented to Council’s stakeholders twice a year

as part of annual and long term planning and reporting. A review by the

subcommittee is therefore appropriate.

8. Assessment

of Significance against the Council’s Significance and Engagement Policy

8.1 This

is not a significant decision under the Council’s Significance and

Engagement Policy.

9. Consultation

9.1 No

consultation has been undertaken in preparation of this report.

10. Inclusion

of Māori in the decision making process

10.1 There

has been no consultation with Maori in the preparation of this report.

Tracey

Hughes

Senior

Accountant

Attachments

Attachment 1: Significant

accounting policies (A1554702)

|

|

Audit, Risk and Finance Subcommittee

23 June 2016

|

REPORT R5507

Procurement

Policy

1. Purpose

of Report

1.1 To approve an updated procurement policy for the

Council as the foundation for further development of the Council’s

procurement systems and procedures.

2. Delegations

2.1 The

Audit Risk and Finance Subcommittee has oversight of the Council’s

management of risk and internal procedures including procurement and

procurement related risk.

3. Recommendation

|

THAT the report Procurement

Policy (R5507) and its

attachment (A1540508 and A345448) be

received.

|

Recommendation

to Governance Committee and Council

|

THAT the revised Procurement

Policy (A1540508) be adopted.

|

4. Background

4.1 The ongoing improvement of the Council’s

procurement systems and procedures, for which the attached revised policy forms

the foundation, is intended to clarify processes, provide for recent

innovations (e.g. use of whole of government purchasing arrangements), increase

flexibility and efficiency, and reduce contracting risks. The policy is to be

brought into effect on 1 October to allow time to put in place the required

procedures and templates (e.g. standardised Council contract templates) to

implement it.

4.2 The previous Procurement Policy is included for

information as Attachment 2.

5. Discussion

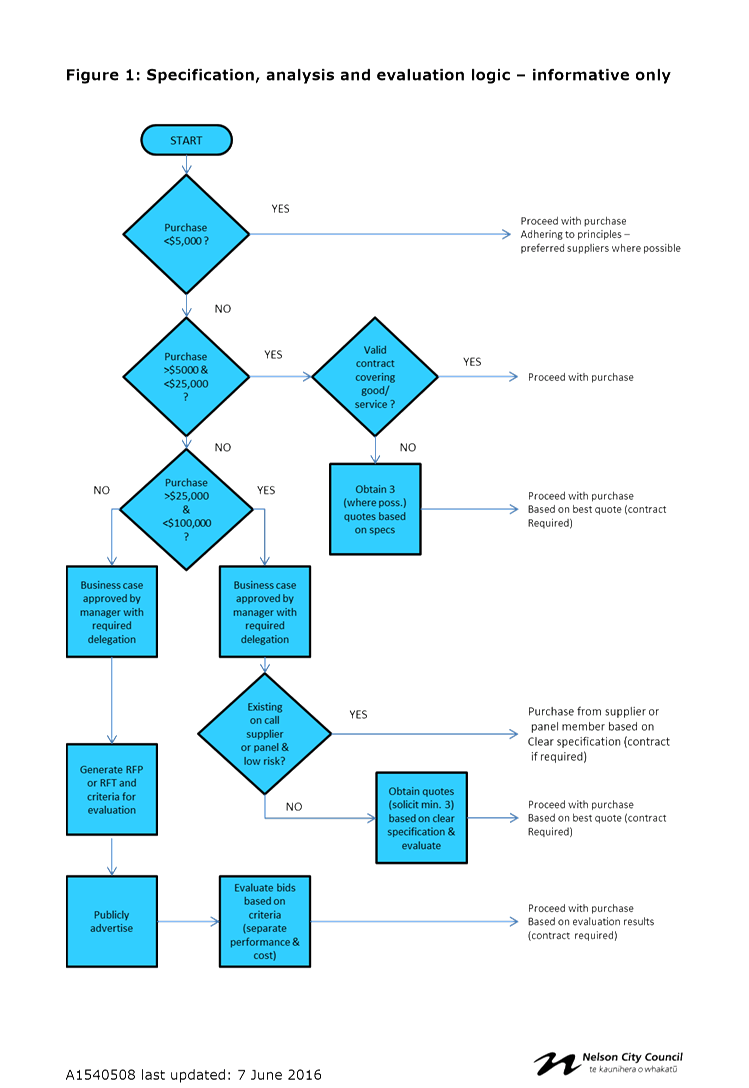

5.1 The

proposed updated procurement policy addresses the following matters.

Clarity and efficiency in selecting providers

5.2 The attached revised policy provides

for graduated steps of effort in selecting the best provider for a given job.

At the smaller job/lower cost item end, requirements have been streamlined so

that these items can be contracted with minimum effort. The policy also

provides for the use of preferred supplier arrangements which would be

specifically negotiated for a fixed term and provide items such as service

guarantees, discounts etc. Using preferred suppliers and supplier panels will

also help the Council to build up knowledge of suppliers who provide superior

levels of service.

5.3 At

a larger scale, provision is made for supplier panels which are prequalified

for specific types of work at agreed rates and then can be called upon rapidly.

Panels of this type will have a fixed duration and require resetting if

required for a further time.

5.4 Requirements

for open tender and proposal request remain for larger items of work.

Flexibility

within principles

5.5 It

is recognised that the many purchase decisions Council is required to make do

not always fit neatly into any structure. Accordingly the role of the

Procurement Steering Committee has been extended so it can make exceptions when

required for specific purchase situations while retaining adherence to the

principles of this policy. This authority is also provided for those to whom

the Steering Committee would report – i.e. the Senior Leadership Team

and/or Chief Executive.

Transparency

of review

5.6 All

organisations which contract for services face the possibility of being captured

by a single supplier whose existing arrangements may be rolled over without

proper consideration of alternatives. The attached revised policy considerably

beefs up existing review procedures, where the scale of the contract warrants

this. This is intended to lessen the likelihood of this type of roll over

occurring to the Council’s disadvantage.

Use

of Council originated contracts

5.7 Work done earlier this year has shown that, because

Council has not had the capacity to offer its own suite of standard contracts,

it has used many different contracts for services all of which have different

exclusions, arrangements for liability etc. Such a situation is clearly

undesirable for the organisation. We are now making arrangements to bring into

use a standardised set of council originated contracts. The policy therefore

requires the use of these except in limited cases, such as where roading subsidies

require use of the subsidiser’s contract.

Whole

of government purchase arrangements

5.8 The Council has already made considerable gains from

opting in to whole of government purchasing arrangements in areas as diverse as

banking services and motor vehicle purchases. The proposed policy provides a

formal basis for the use of these, consistent with current delegations.

6. Options

6.1 Approve

the attached updated procurement policy for Council, noting the advantages to

Council described above.

6.2 Do

not approve the updated procurement policy.

Alignment with relevant Council policy

6.3 This

policy updates an existing policy and is required for the efficient operation

of Council.

6.4 The updating of the Council’s procurement policy

will trigger a set of already planned updates to Council’s procedures and

systems. This will require staff time to develop and put in place.

6.5 Principle

(i) of the proposed policy requires consistency with the sustainability goals

of Nelson 2060.

7. Assessment

of Significance against the Council’s Significance and Engagement Policy

7.1 This

is not a significant decision under the Council’s Significance and

Engagement Policy.

8. Consultation

8.1 No

consultation has been undertaken in the development of this updated Procurement

Policy, although the updates were prepared making use of existing experience

and after considering the policies of other similar local authorities.

9. Inclusion

of Māori in the decision making process

9.1 There

has been no consultation with Maori in the preparation of this policy.

Steve

Vaughan

Risk

& Procurement Analyst

Attachments

Attachment 1: A1540508 -

Procurement Policy 2016

Attachment 2: A345448

- Procurement Policy 2015

|

|

Audit, Risk and Finance Subcommittee

23 June 2016

|

REPORT R5918

Employee

Conflicts of Interest Policy

1. Purpose

of Report

1.1 To receive the Employee Conflicts of Interest

Policy.

2. Delegations

2.1 The

Audit, Risk and Finance Subcommittee has responsibility for risk management and

internal control.

3. Recommendation

|

THAT the report Employee

Conflicts of Interest Policy (R5918)

and its attachment (A1288320) be

received.

|

4. Background

4.1 It

is best practice to have an Employee Conflicts of Interest Policy. This

ensures that employee conflicts of interest are promptly disclosed and managed

carefully in order to maintain the integrity and reputation of Nelson City

Council (Council) and its employees, and to avoid reputational damage. The

reputational risk that Council has potential exposure to is the reason this

policy is being brought to the Sub-Committee.

5. Discussion

5.1 Historically,

conflicts of interests for employees have been managed within certain areas of

Council. Conflicts of interest registers are held for a number of

business units including Senior Leadership Team, Building and Resource Consents

and conflicts are noted through the recruitment process.

5.2 Building

on this good work, a formal Employee Conflicts of Interest Policy has now been

developed with a centralised system designed to hold this data. The

Health and Safety System – InControl – has been adapted to record

and report the conflicts. The Policy is included as Attachment 1.

6. Options

6.1 Accept

the recommendation - receive Employee Conflicts of Interest Policy.

6.2 Reject

the recommendation - not receive the Employee Conflicts of Interest Policy.

7. Alignment

with relevant Council policy

7.1 This

decision is not inconsistent with any other previous Council decision.

8. Assessment

of Significance against the Council’s Significance and Engagement Policy

8.1 This

is not a significant decision under the Council's Significance and Engagement

Policy.

9. Consultation

9.1 No

consultation has been undertaken in preparing this policy.

10. Inclusion

of Māori in the decision making process

10.1 No

consultation with Maori has been undertaken in preparing this policy.

Nikki

Harrison

Group

Manager Corporate Services

Attachments

Attachment 1: A1288320 -

Employee Conflicts of Interest Policy

|

|

Audit, Risk and Finance Subcommittee

23 June 2016

|

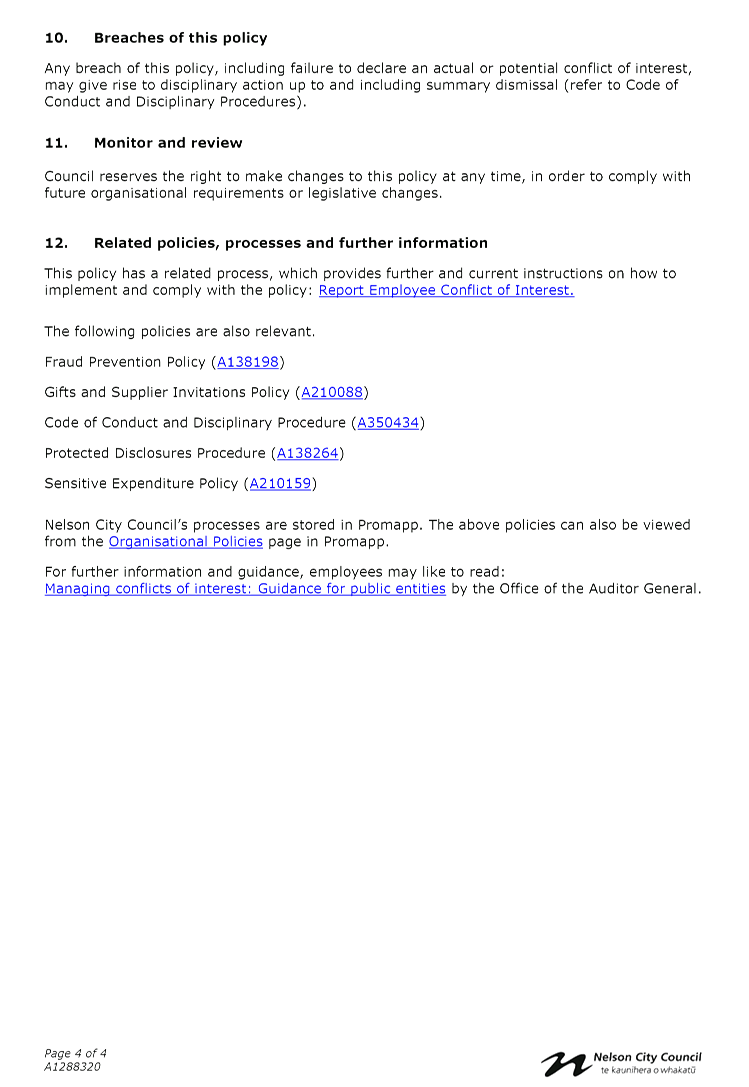

REPORT R6040

Theatre

Royal Loan

1. Purpose

of Report

1.1 To update the Subcommittee on the Theatre Royal

loan as requested at the last Subcommittee meeting.

2. Delegations

2.1 The

Audit, Risk and Finance Subcommittee is responsible for oversight and

management of financial risk.

3. Recommendation

|

THAT the report Theatre Royal

Loan (R6040) and its

attachments (A1135204, A912504, and A1145163) be received.

|

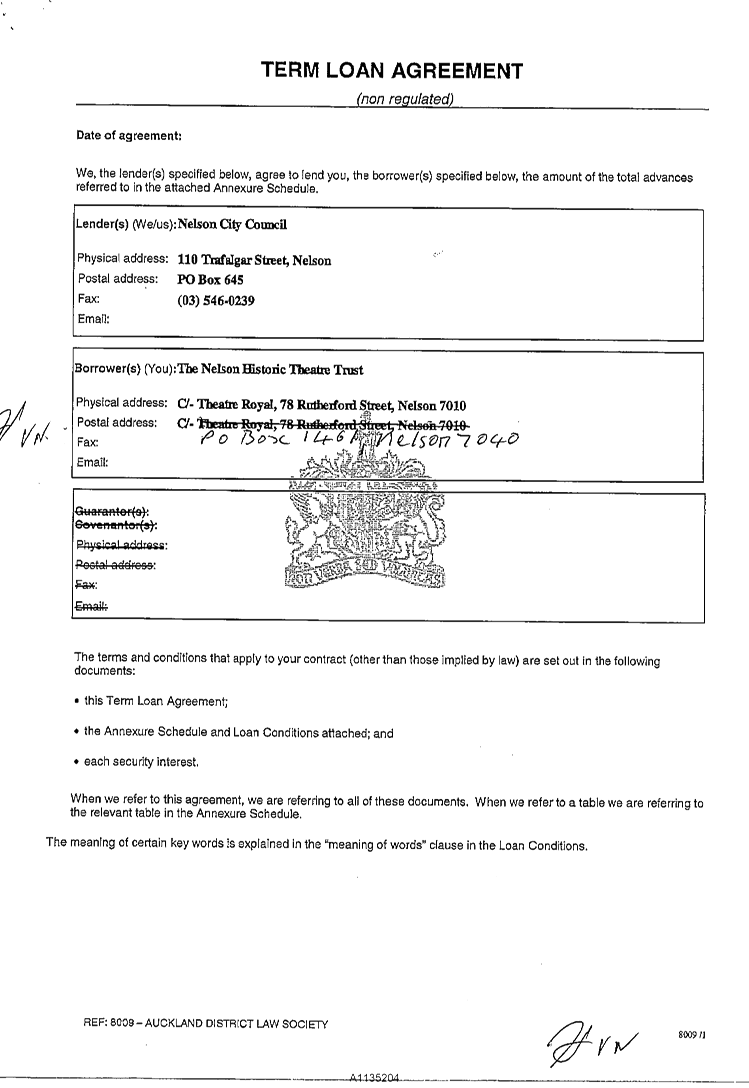

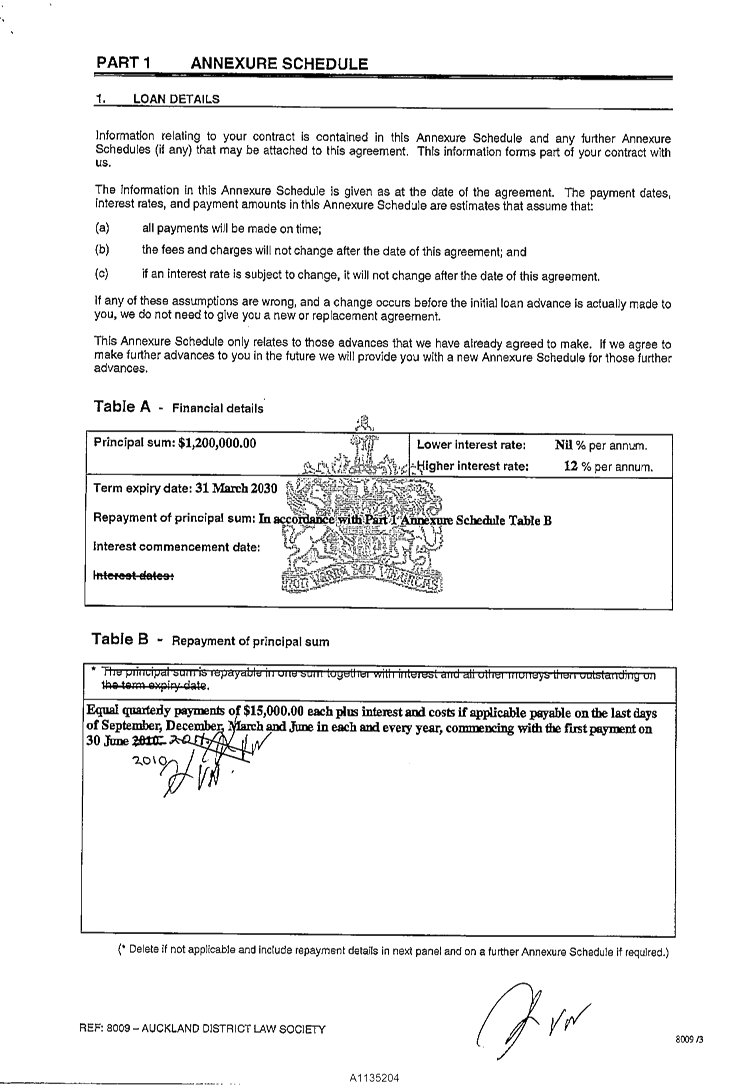

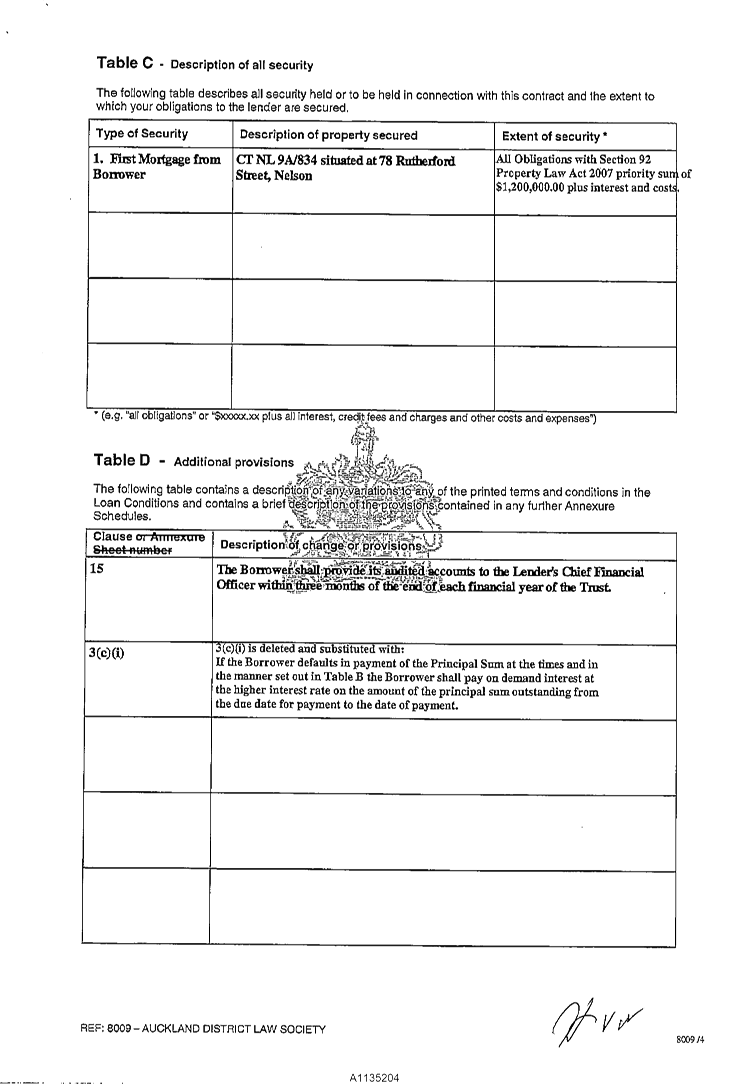

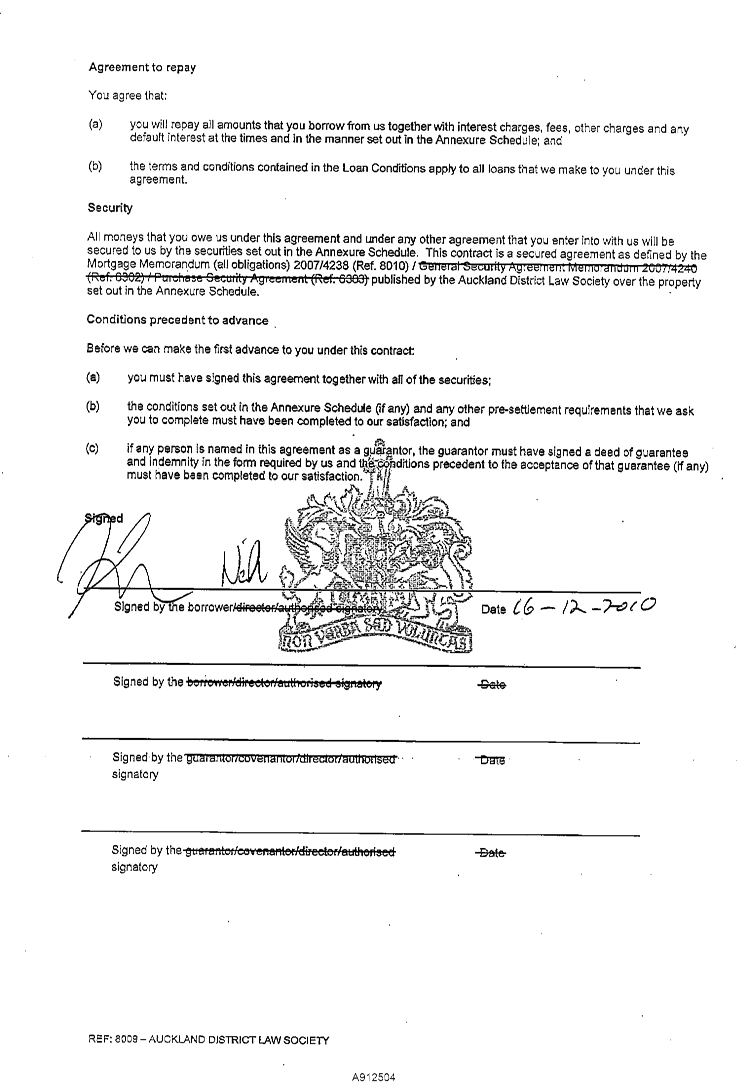

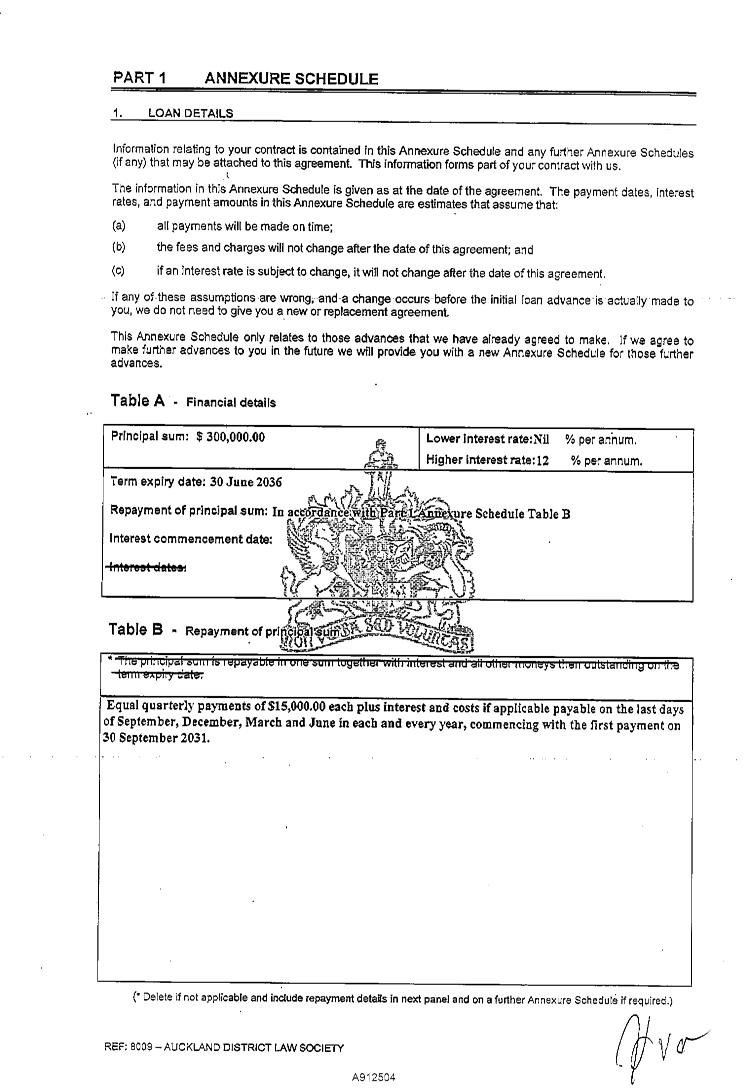

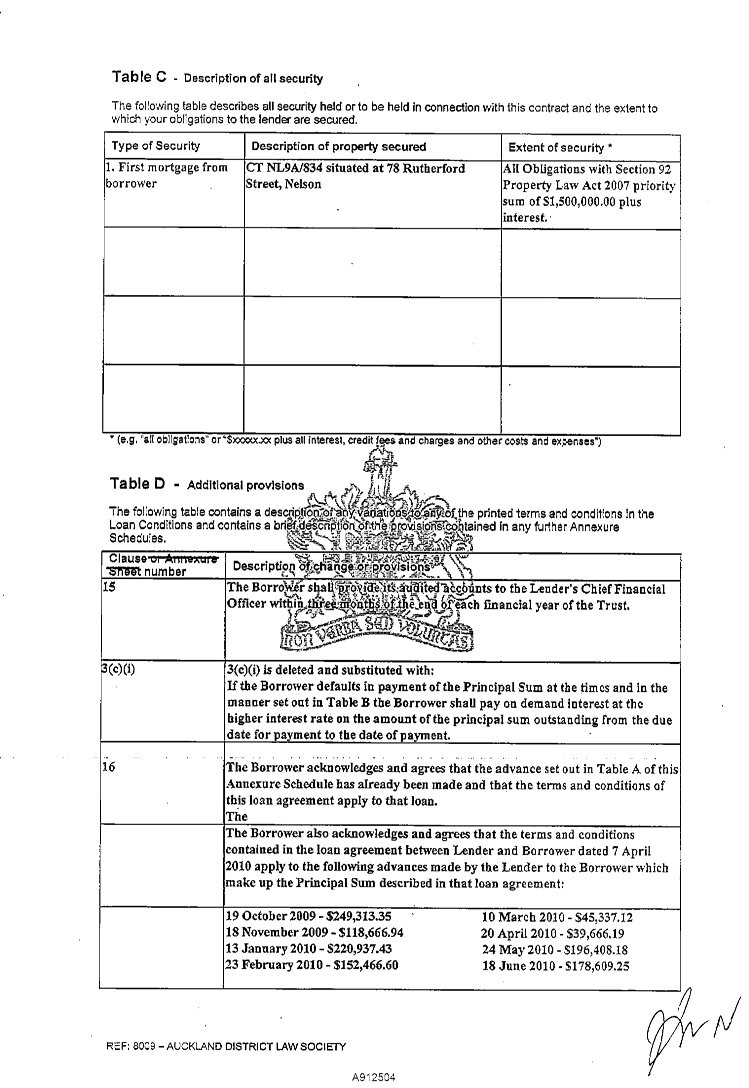

4. Background

4.1 During the finalisation of the 2009/19 Community Plan

it was agreed that a loan of $1.2 million to the Theatre Royal Trust be

provided to assist with the refurbishment of the Theatre Royal but no terms and

conditions for the loan were discussed.

4.2 At the Council meeting dated 1 October 2009 the

following resolution was passed.

Approve an interest free loan

of up to $1.2 million; and

That the repayment be set at

$15,000 per quarter commencing on 30 June 2010 for the quarter ending on that

day.

That the Trust provide audited

accounts to the Council's Chief Financial Officer within three months of the

Trust's balance date.

4.3 During the Annual Plan 2010/11 the Theatre Royal Trust

requested a further $300,000 to complete the building refurbishment with repayments

deferred to July 2011 and this was approved following consultation.

4.4 The loan documentation are included as Attachment 1

($1.2m) and 2 ($300,000).

5. Discussion

5.1 The

Council proposed in its Long Term Plan 2012/22 to take over ownership of the Theatre

Royal (and the Nelson School of Music) and allow the entity to focus on

operating the facility. It was also proposed in the Plan that Council

clear the Theatre Royal debts of $2.1 million - $1.5 million owed to Council

and the remaining $600,000 to a bank.

5.2 In the 2013/14 Annual Plan, Council affirmed existing

funding levels for the Theatre Royal and Nelson School of Music until a new

entity was formed to bring both institutions together into a new entity for the

performing arts. Additional transition funding of $125,000 was set aside

for the new entity to help establish its operations, and this was to reduce to

$75,000 in 2014/15.

5.3 At a Council meeting 27 February 2014 (see Attachment

3) Council reallocated some of the transition funding of $100,000 to be an

operating grant for 2013/14. This amount was to be sufficient to allow

the Trust to operate independently and sustainably, and a clear expectation was

set that the business should be managed without use of overdraft. Then, through

the Annual Plan 2014/15 Council adjusted the ongoing operating grant funding to

$220,000pa.

5.4 It was clear in the report to Council (Section 7.8 and

9.4) that the operating grant of $220,000 would not allow the Theatre Royal

Trust to make any capital repayments to either Council or the bank.

6. Options

6.1 Accept

the recommendation - receive the report.

6.2 Reject

the recommendation - not receive the report.

7. Alignment

with relevant Council policy

7.1 This

decision is not inconsistent with any other previous Council decision.

8. Assessment

of Significance against the Council’s Significance and Engagement Policy

8.1 This

is not a significant decision under the Council's Significance and Engagement

Policy.

9. Consultation

9.1 No

consultation has been undertaken in preparing this report.

10. Inclusion

of Māori in the decision making process

10.1 No

consultation with Maori has been undertaken in preparing this report.

11. Conclusion

11.1 The

Audit, Risk and Finance Sub-committee requested a report on the Theatre Royal

Loan.

Nikki

Harrison

Group

Manager Corporate Services

Attachments

Attachment 1: A1135204 -

Term Loan Agreement - Nelson Historic Theatre Trust ($1.2M)

Attachment 2: A912504

- Term Loan Agreement - The Nelson Historic Theatre Trust ($300K)

Attachment 3: A1145163

- Council report 27Feb2014 - Theatre Royal - funding and other issues

|

|

Audit, Risk and Finance Subcommittee

23 June 2016

|

REPORT R6064

Interim

audit letter for year ending 30 June 2016

1. Purpose

of Report

1.1 To provide the Subcommittee with the letter to

the Council on the interim audit for the year ending 30 June 2016 from Audit

NZ.

2. Delegations

2.1 The

Subcommittee is responsible for the oversight of the audit process and the

audit of Council's Annual Report and annual accounts.

3. Recommendation

|

THAT the report Interim audit

letter for year ending 30 June 2016 (R6064)

and its attachment (A1565622) be

received;

AND THAT

the suggested responses to the recommendations are noted.

|

4. Discussion

4.1 Audit

NZ carried out the interim audit for the year ending 30 June 2016 in mid-April

2016 which focused on the Council's internal controls and the overall control

environment. They issued two letters - a letter to the Council which covers governance

issues (Attachment 1) and a letter to the Chief Executive which covers

management issues.

4.2 Overall

Audit NZ found that the Council's internal controls were operating

effectively. However they have identified areas where the Council could

consider enhancing its internal controls which are outlined in the letter to

the Chief Executive.

Contract

Management

4.3 Audit

NZ notes that there is no integrated system for recording and monitoring

contracts and recommends that a system be implemented.

4.4 Officers

suggested response to this issue - agree that a centralised system should be

developed. The new Risk and Procurement Analyst role has been tasked with

considering the appropriate tool to fulfil the need.

Project

Management

4.5 Audit NZ notes the significant changes made in the

Capital Projects team in the way it approaches projects. Audit recommends that

a project management policy be implemented to ensure all projects are managed

consistently and appropriately in line with good practice.

4.6 Officers suggested response to this issue – the

focus has been on the Capital Projects team processes and systems and work is

starting on rolling out Project management training across the

organisation. The focus needs to be on ‘right sizing’ the

Project management tools for the size, risk and complexity of the

projects. Consideration will be given to principles for project

management across the organisation.

Supplementary

letter

4.7 Audit

NZ notes the matters raised in the supplementary letter to management.

The Chief Executive accepts these comments and will address these matters prior

to the 2015/16 Annual Report.

5. Options

5.1 That

the Subcommittee note the matters raised in the letter to the Council on the

interim audit of Nelson City Council for the year ending 30 June 2016 and the manner in which officers propose to

address them.

6. Alignment

with relevant Council policy

6.1 This

recommendation is not inconsistent with any previous Council decision.

7. Assessment

of Significance against the Council’s Significance and Engagement Policy

7.1 This

is not a significant decision in terms of the Council’s significance and

engagement policy.

8. Consultation

8.1 No

consultation has occurred in preparation of this report.

9. Inclusion

of Māori in the decision making process

9.1 No

consultation with Maori has occurred in preparation of this report.

Nikki

Harrison

Group

Manager Corporate Services

Attachments

Attachment 1: A1565622 -

Audit NZ - Letter to the Council on the interim audit of NCC for the year

ending 30 June 2016

|

|

Audit, Risk and Finance Subcommittee

23 June 2016

|

REPORT R5992

Capital

Projects Carry Forwards 2015/16

1. Purpose

of Report

1.1 To approve continuing work on 2015/16 capital

projects in the interim until the carry forwards are formally approved.

2. Delegations

2.1 The

Audit, Risk and Finance Subcommittee has oversight of the management of

financial risk and makes recommendations to the Governance Committee and to

Council.

3. Recommendation

|

THAT the report Capital Projects

Carry Forwards 2015/16 (R5992)

and its attachments (A1562956 and A1557401)

be received.

|

Recommendation

to Governance Committee and Council

|

THAT Council approves continuing work on 2015/16 capital

projects within the 2015/16 approved budgets, noting a final report on carry

forwards will come to the Governance Committee’s meeting on 25 August

2015.

|

4. Discussion

4.1 Capital

expenditure to 30 April 2016 was $34.2 million, $14.4 million (30%) below

operating budget (approved budget including Council resolutions). The operating

budget for capital for the full year is $66.4 million. Large capital payments

are anticipated for May and June.

4.2 An

assessment has been done to provide an indication of year end carry forwards.

As at 1 June 2016, approximately $15.8 million has been identified as potential

carry forwards.

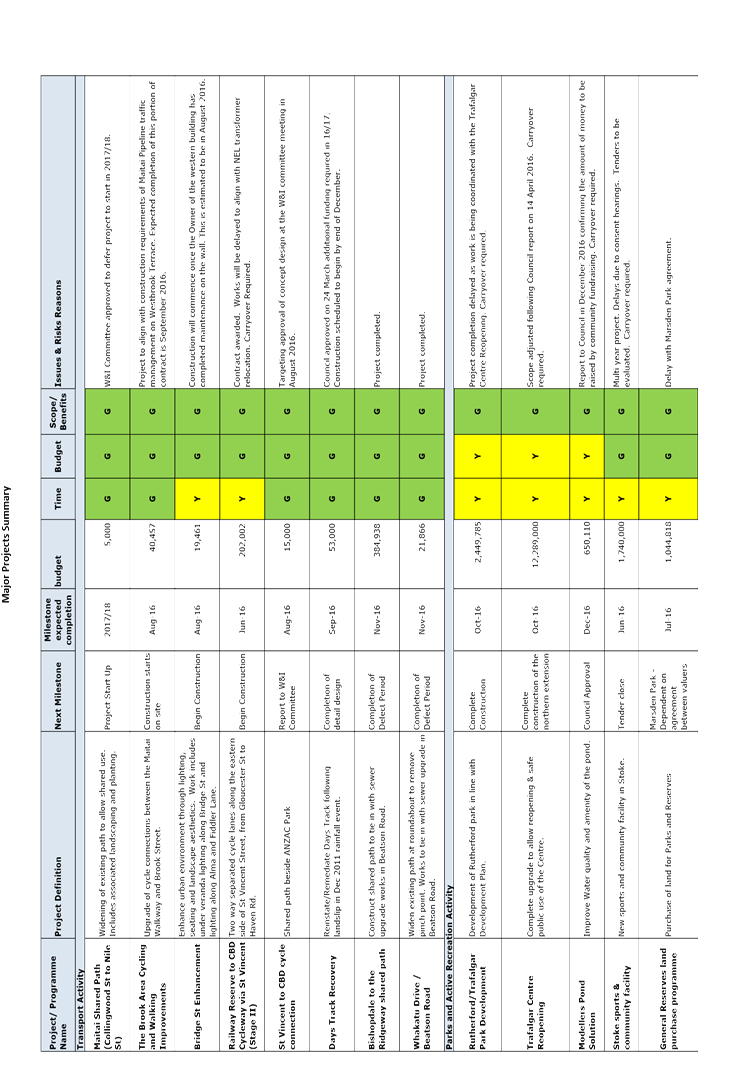

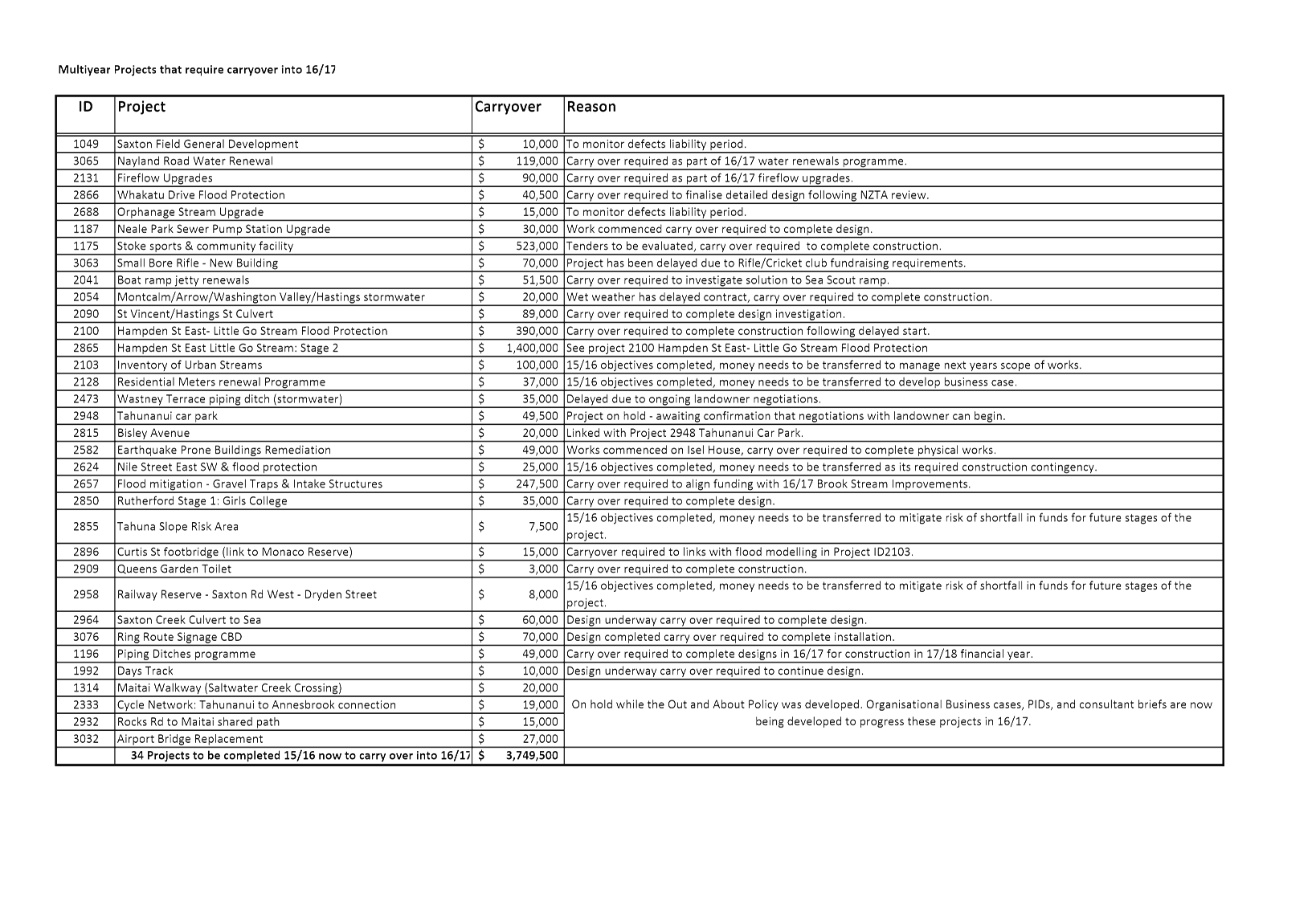

5. Projects

managed by the Capital Projects team

5.1 The

Capital Projects Team has identified 47 projects totalling approximately $11.3

million of budget that will need to be carried forward into 2016/17. Please see

attachment 1.

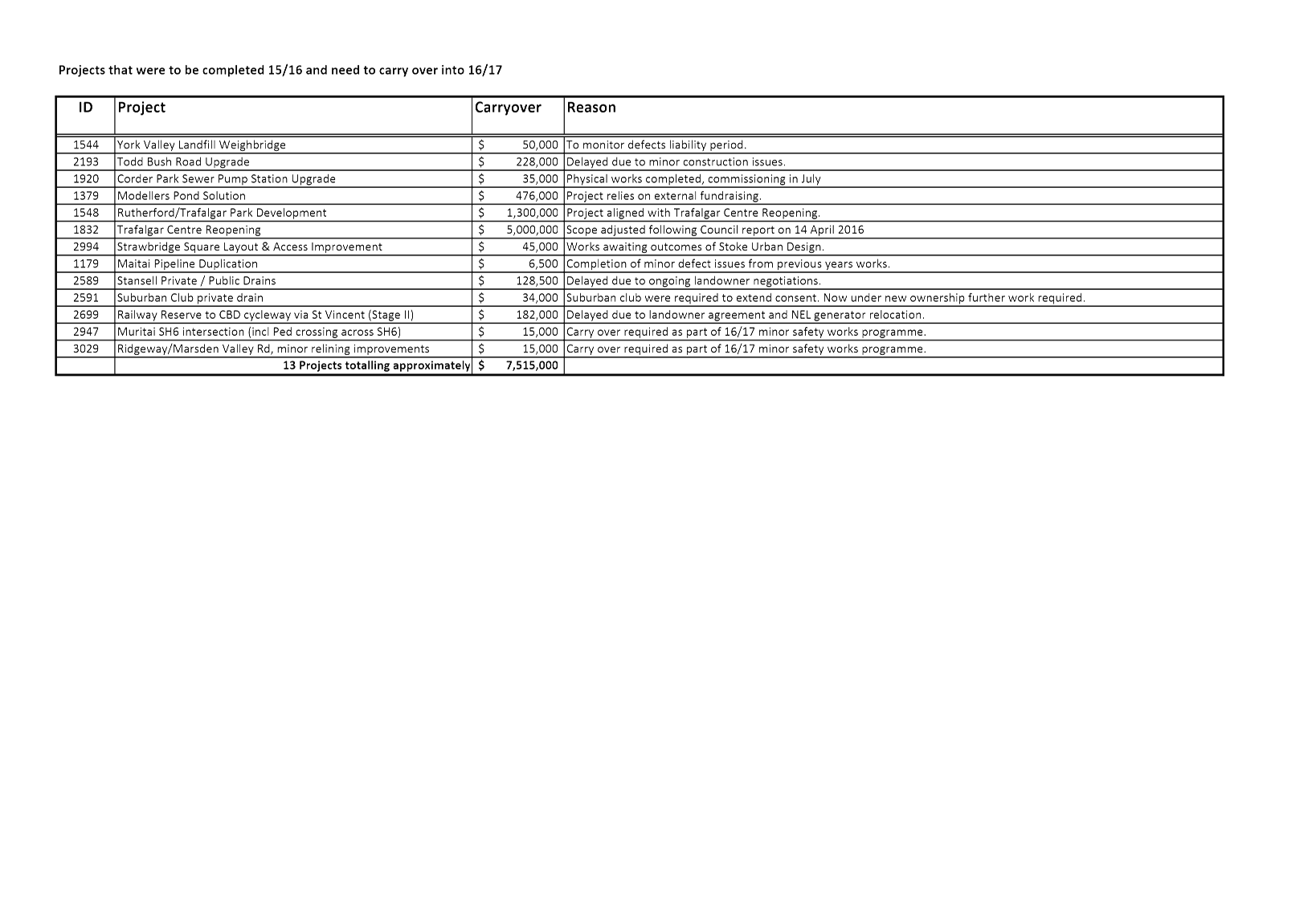

5.2 13

projects totalling approximately $7.5 million were initially expected to be

completed in the current financial year. The bulk of this budget is related to

the Trafalgar Centre/Rutherford Park projects.

5.3 34 projects totalling approximately $3.7 million are

multi-year projects where the timing of expenditure has changed. Hampton St

East/Little Go Stream and the Stoke Community Centre projects account for more

than half of this total.

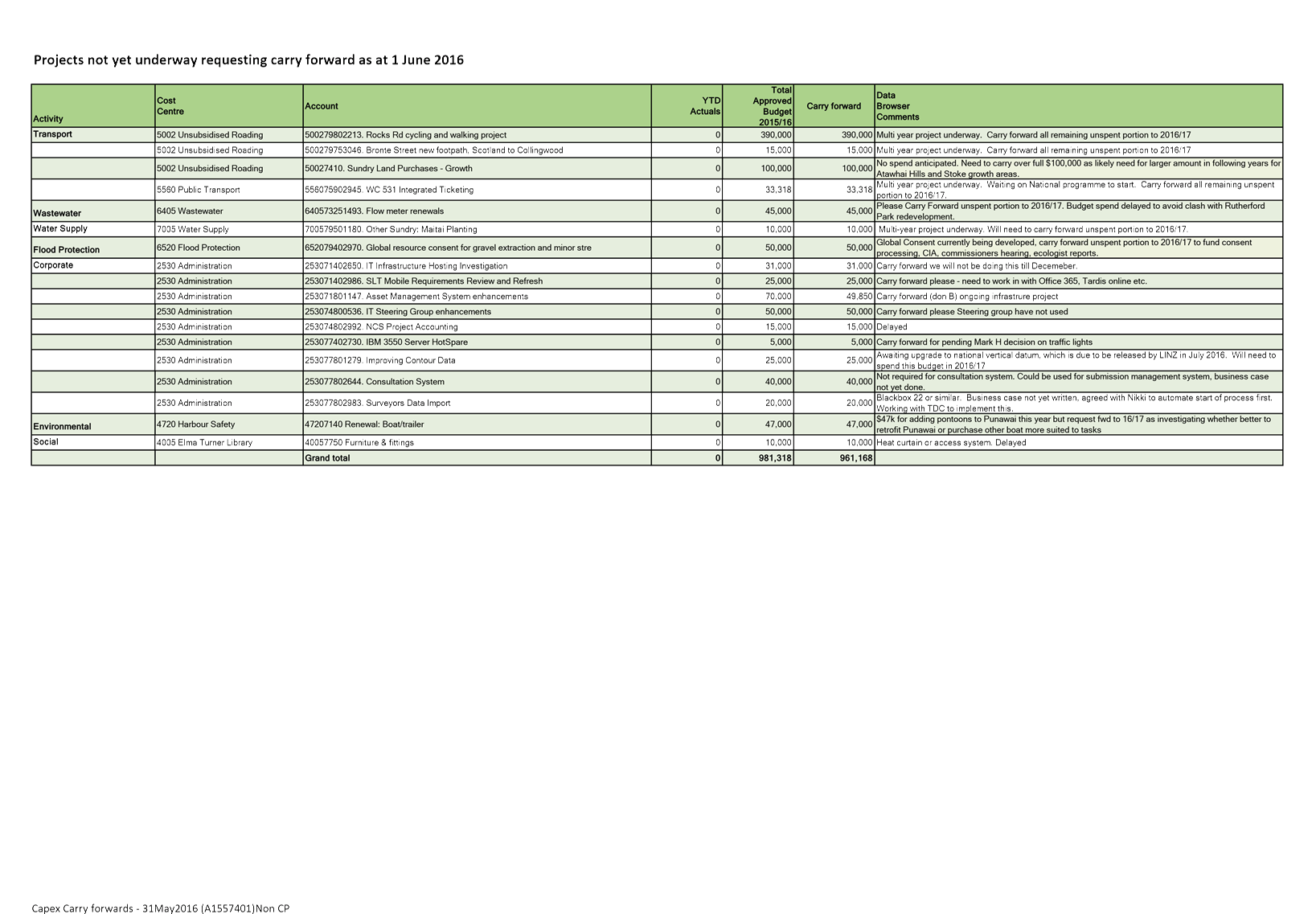

6. Other

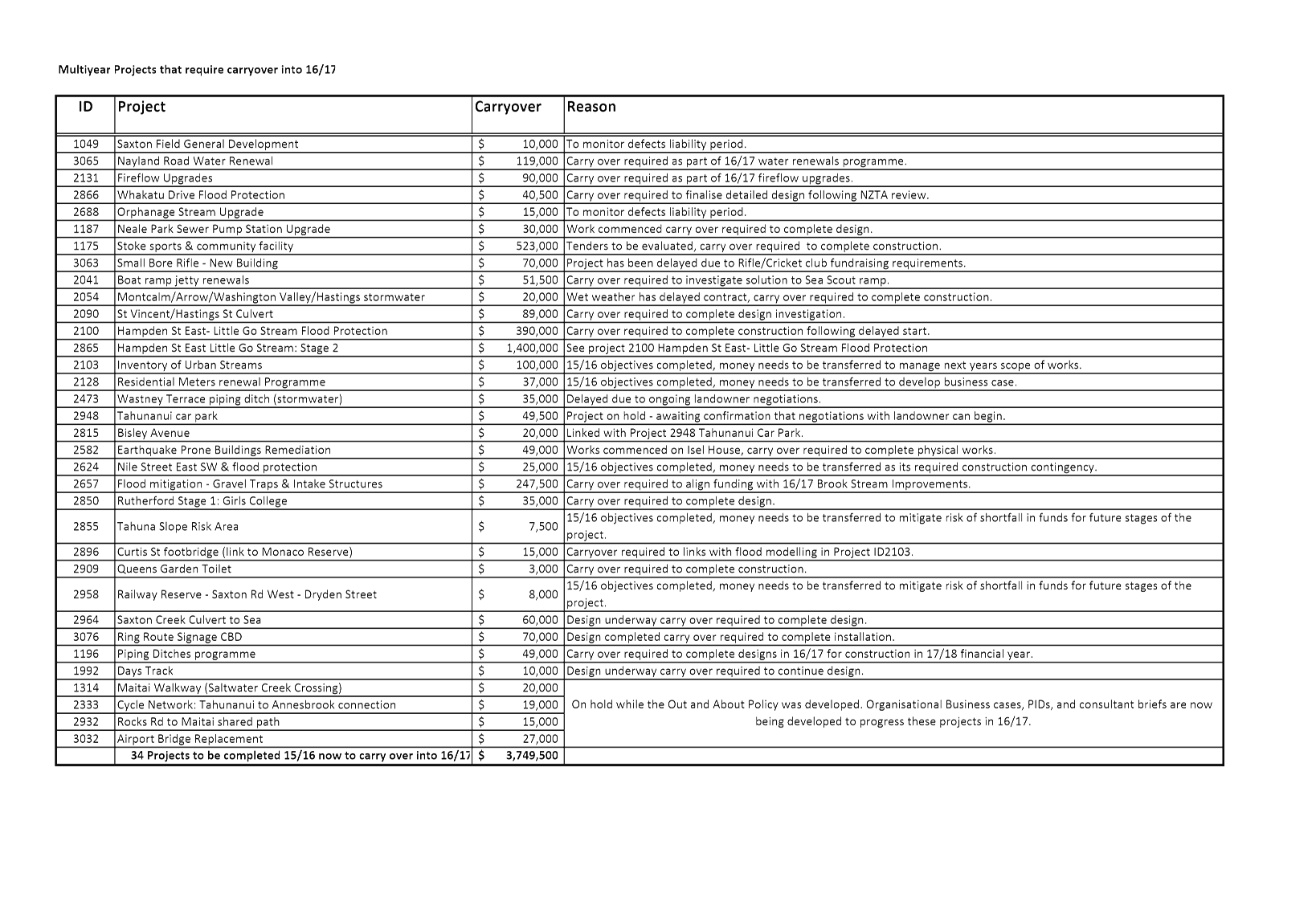

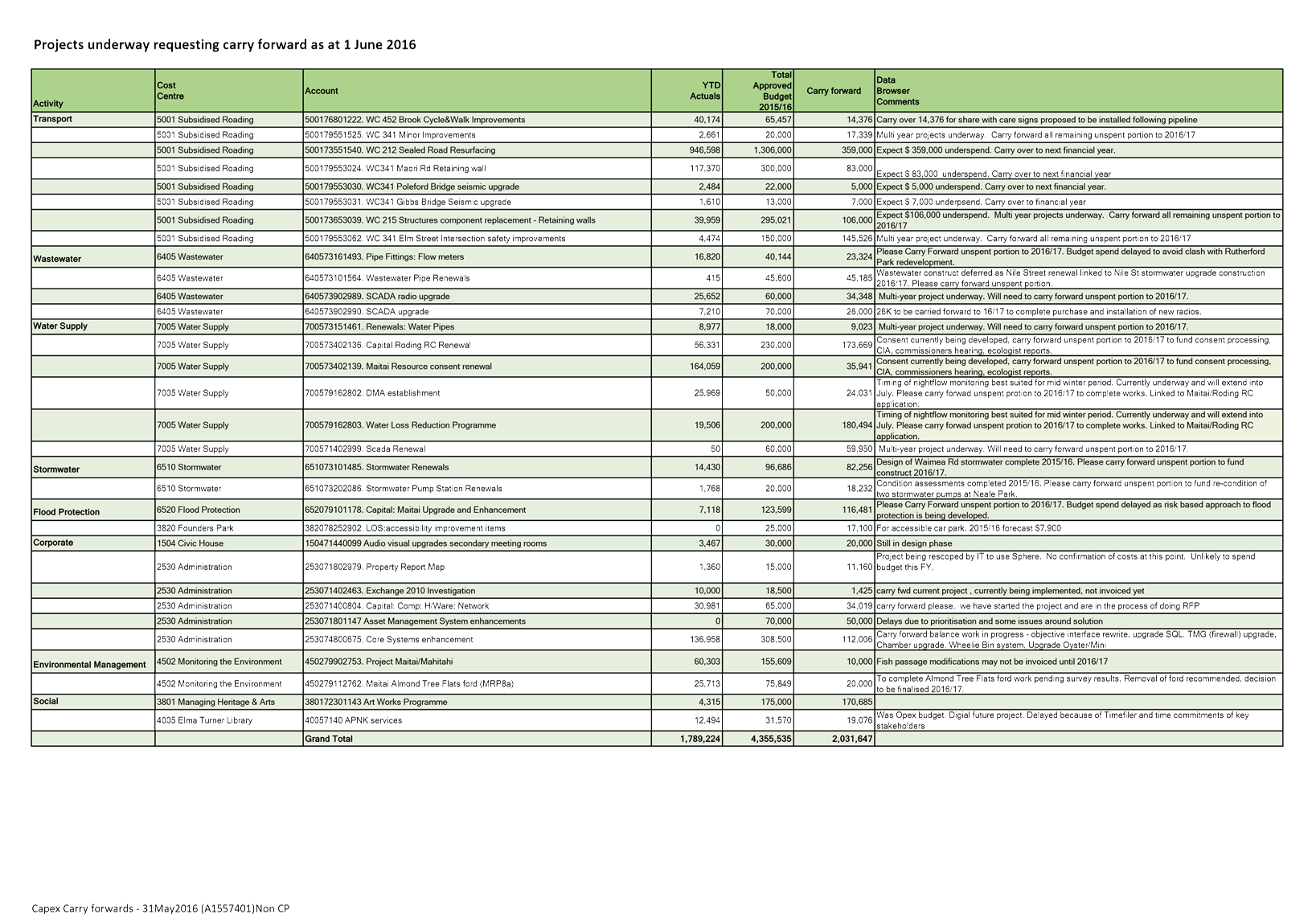

capital projects carry forwards requested

6.1 A

further 50 projects totalling approximately $3.0 million of budget have been

identified as requiring/requesting carry over. Please see attachment 2.

6.2 32

projects with a carry forward total of approximately $2.0 million are currently

underway. These projects include $737,000 for roading projects for which a

subsidy will be claimed.

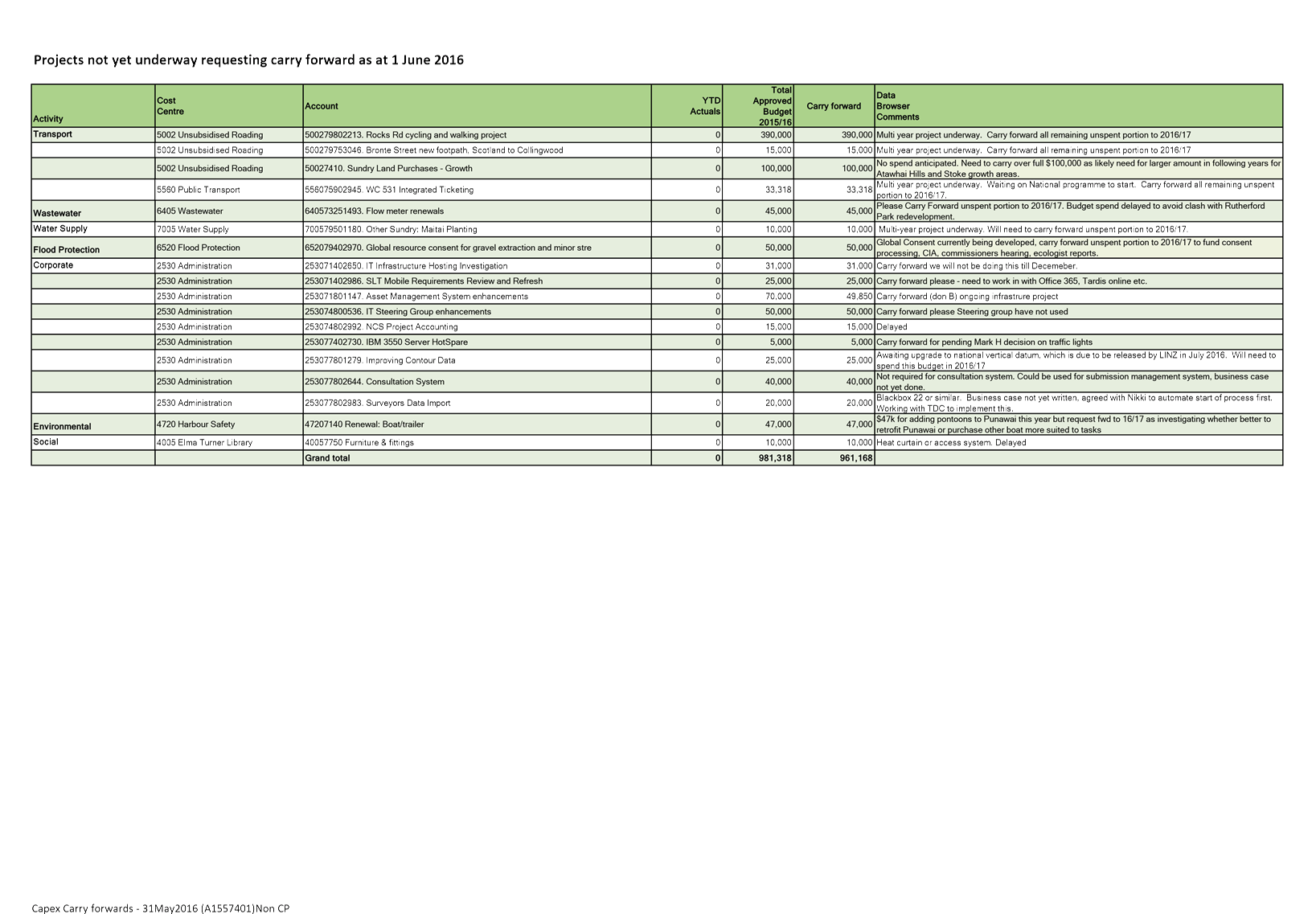

6.3 18 projects with a carry forward total of

approximately $961,000 were not underway as at 30 April. Delays have occurred

for a variety of reasons and project managers have requested that the budget is

carried over to allow the projects to be undertaken in 2016/17.

7. Conclusion

7.1 Most

of the projects indicating carry forward are either currently underway or

scheduled to be underway before 30 June 2016, and as the budget is approved for

spending in 2015/16, it is proposed that work continue on these projects in the

meantime.

7.2 A

report on requested carry forwards will be on the agenda for the 25 August

meeting of the Governance committee (as the information will not be finalised

in time for the 4 August meeting of this subcommittee).

8. Options

8.1 Approve

the recommendation – the spending is within 2015/16 approved budgets.

8.2 Not

approve the recommendation. Work would need to cease on these projects

until such time as the formal report approving carry forwards has made its way

through the Council processes.

9. Alignment

with relevant Council policy

9.1 Budgets

were approved in the Annual Plan 2015/16 and subsequent Council resolutions but

are currently not forecast to be fully spent by 30 June 2016.

10. Assessment

of Significance against the Council’s Significance and Engagement Policy

10.1 This

is not a significant decision.

11. Consultation

11.1 No

consultation has been undertaken.

12. Inclusion

of Māori in the decision making process

12.1 No

consultation has been undertaken.

Tracey

Hughes

Senior

Accountant

Attachments

Attachment 1: Capital

Projects team carry forwards (A1562956)

Attachment 2: Other

capital carry fowards (A1557401)

|

|

Audit, Risk and Finance Subcommittee

23 June 2016

|

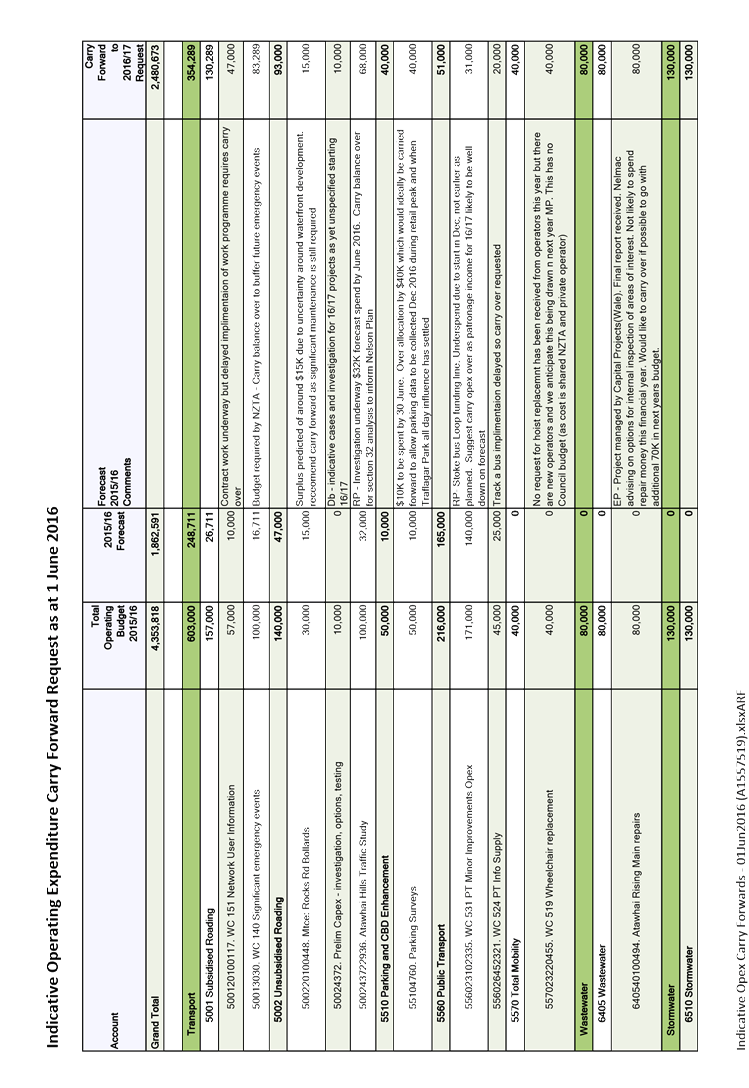

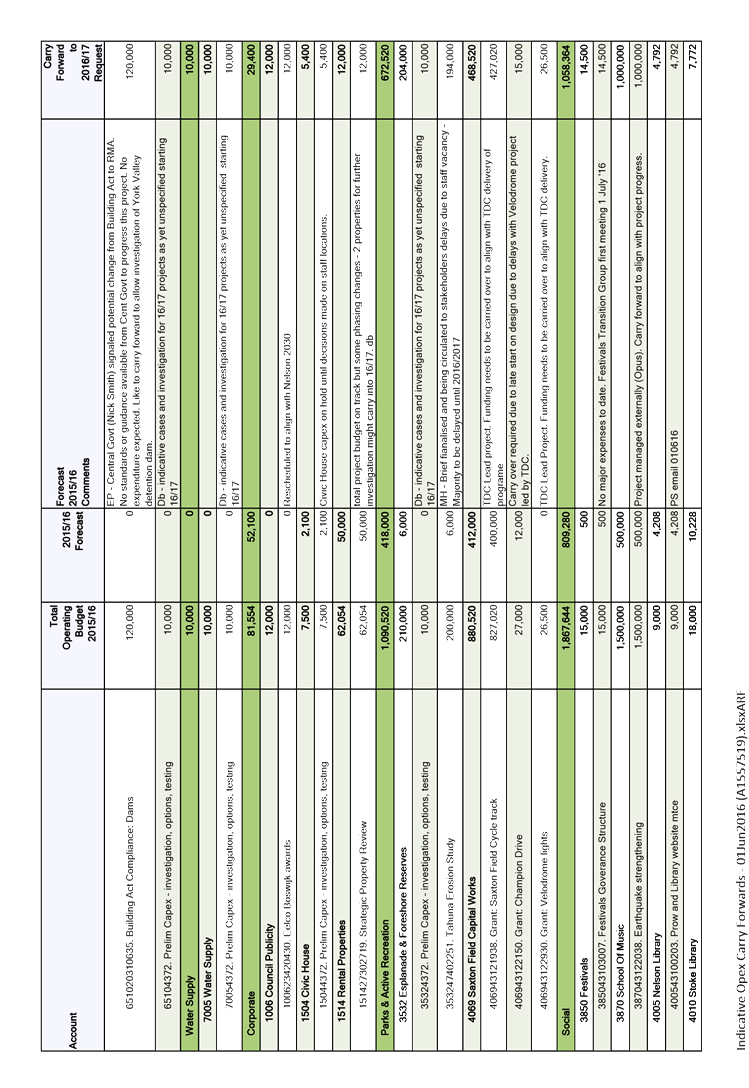

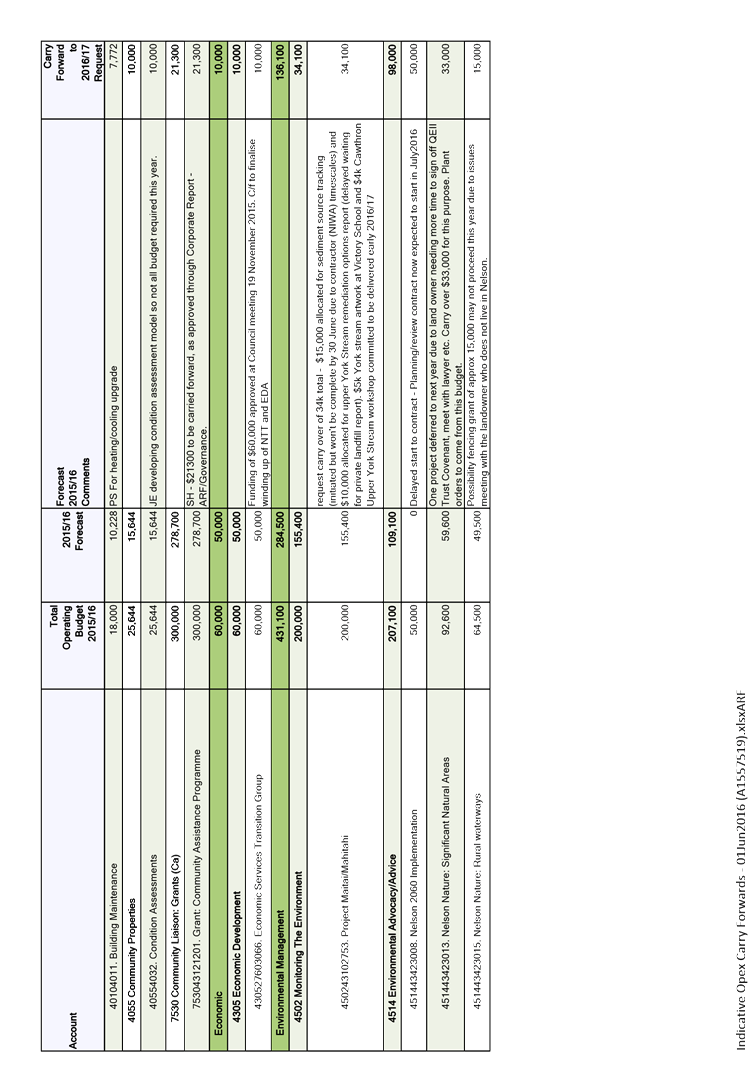

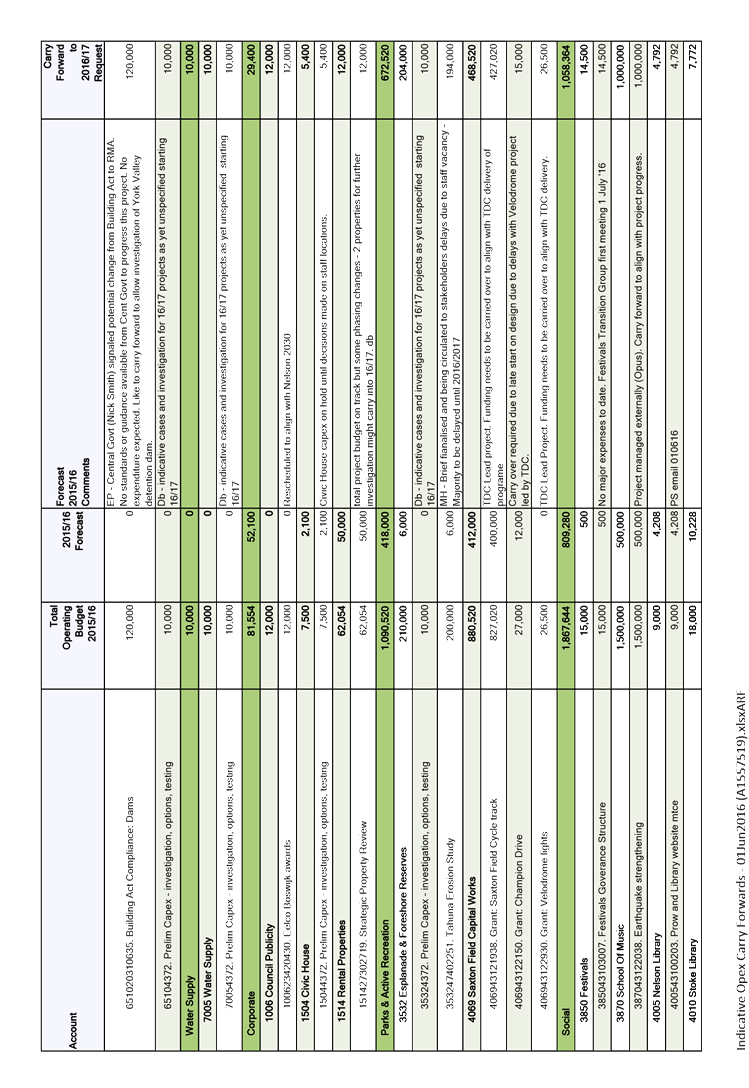

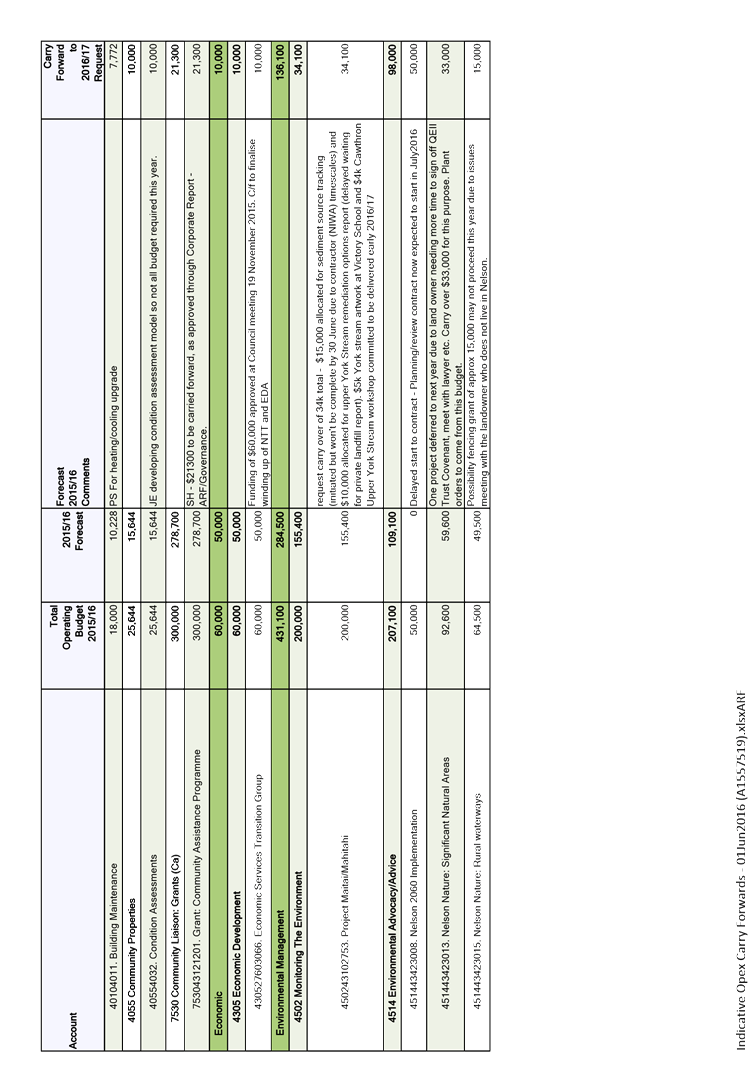

REPORT R6071

Operating

Expenditure Carry Forwards 2015/16

1. Purpose

of Report

1.1 To approve ongoing work using 2015/16 operating

budgets until carry forwards are formally approved on 25 August 2016.

2. Delegations

2.1 The

Audit, Risk and Finance Subcommittee has oversight of the management of

financial risk and makes recommendations to the Governance Committee and to

Council.

3. Recommendation

|

THAT the report Operating

Expenditure Carry Forwards 2015/16 (R6071)

and its attachment (A1557519) be received.

|

Recommendation

to Governance Committee and Council

|

THAT

Council approves continuing work on 2015/16 operating projects within the

2015/16 approved budgets, noting a final report on carry forwards will come

to the Governance Committee’s meeting on 25 August 2016.

|

4. Background

4.1 In

prior years, as part of the LTP/Annual Plan preparation, officers were asked to

formally make projections or forecasts of their current year spending. In some

cases, unused budget from the current year was transferred to the forthcoming year

in order to complete programmed pieces of work. The rating carry forward from

the current year would (with a few specific exceptions) fund that work.

4.2 In

the current year, officers were not asked to complete formal projections for

reasons of efficiency. When that decision was made it was acknowledged that the

organisation may have to consider carry forwards of operating expenditure in

order to complete pieces of work without rating for it twice.

4.3 The

practical result, at this stage of the year, is that there is currently budget

in the current year that will not be used, and there is no budget in 2016/17 to

complete various 2015/16 work that has been delayed.

5. Discussion

5.1 Based

on April 2016 year to date results, officers have been asked to identify

operating projects that will not be complete by 30 June 2016. A current year

forecast and projected carry forward have been assessed for these projects,

please see attachment 1. Including the School of Music and Saxton Field grants

for capital works, nearly $2.5 million has been requested to be carried

forward. Approval of finalised carry forwards is on the agenda for the 25

August Governance Committee.

5.2 In

order that staff can keep moving towards delivery of the 2015/16 work

programme, in the meantime officers request approval for 2015/16 budgets to

continue to be used on 2015/16 projects as itemised in attachment 1.

Options

5.3 Option

1 – approve the recommendation – the spending is within 2015/16

approved budgets.

5.4 Option

2 – not approve the recommendation. Work would need to cease on these

projects until such a time as the final report approving carry forwards has

made its way through Council meeting processes.

6. Alignment

with relevant Council policy

6.1 Budgets

were approved in the Long Term Plan 2015-2025 year one (2015/16) but are

currently not forecast to be fully spent by 30 June 2016.

7. Assessment

of Significance against the Council’s Significance and Engagement Policy

7.1 This

is not a significant decision.

8. Consultation

8.1 No

consultation has been undertaken.

9. Inclusion

of Māori in the decision making process

9.1 No

consultation has been undertaken.

10. Conclusion

10.1 Attachment 1 itemises requested budget carry forwards

for operating expenditure. As the budgets are approved for spending in 2015/16,

it is proposed that work continue on these projects.

10.2 A report on requested carry forwards will be on the

agenda for the 25 August meeting of the Governance Committee (as the

information will not be finalised in time for the 4 August meeting of the

Audit, Risk and Finance Subcommittee).

Tracey

Hughes

Senior

Accountant

Attachments

Attachment 1: Operating

expenditure carry forward request (A1557519)

|

|

Audit, Risk and Finance Subcommittee

23 June 2016

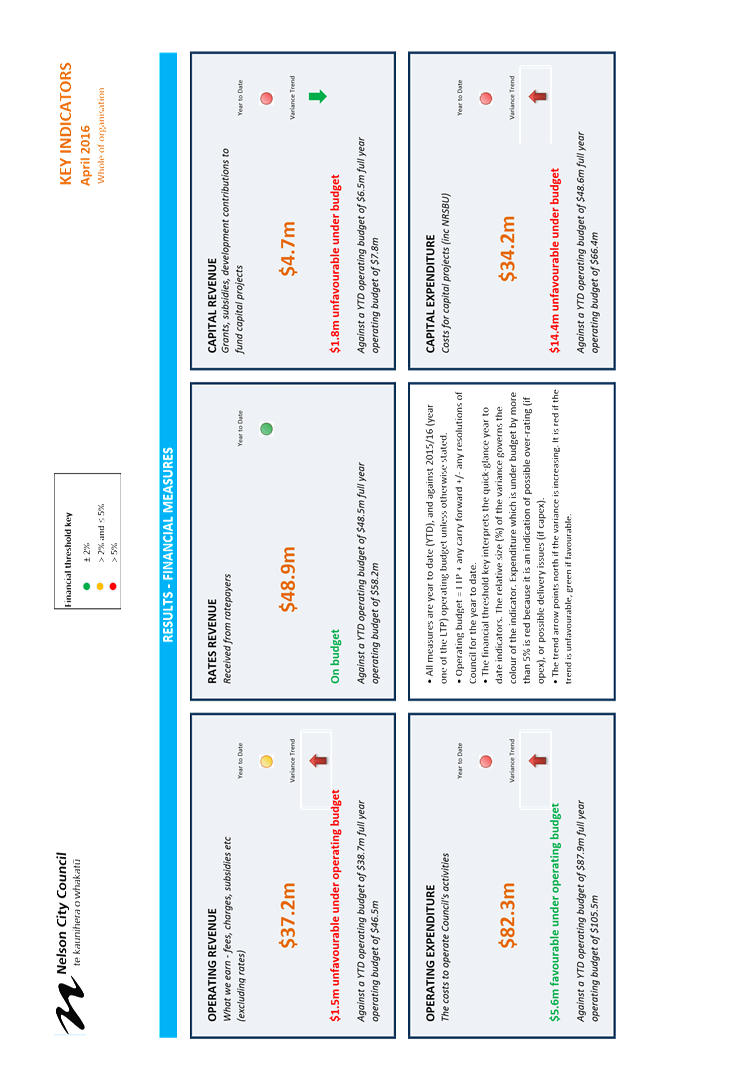

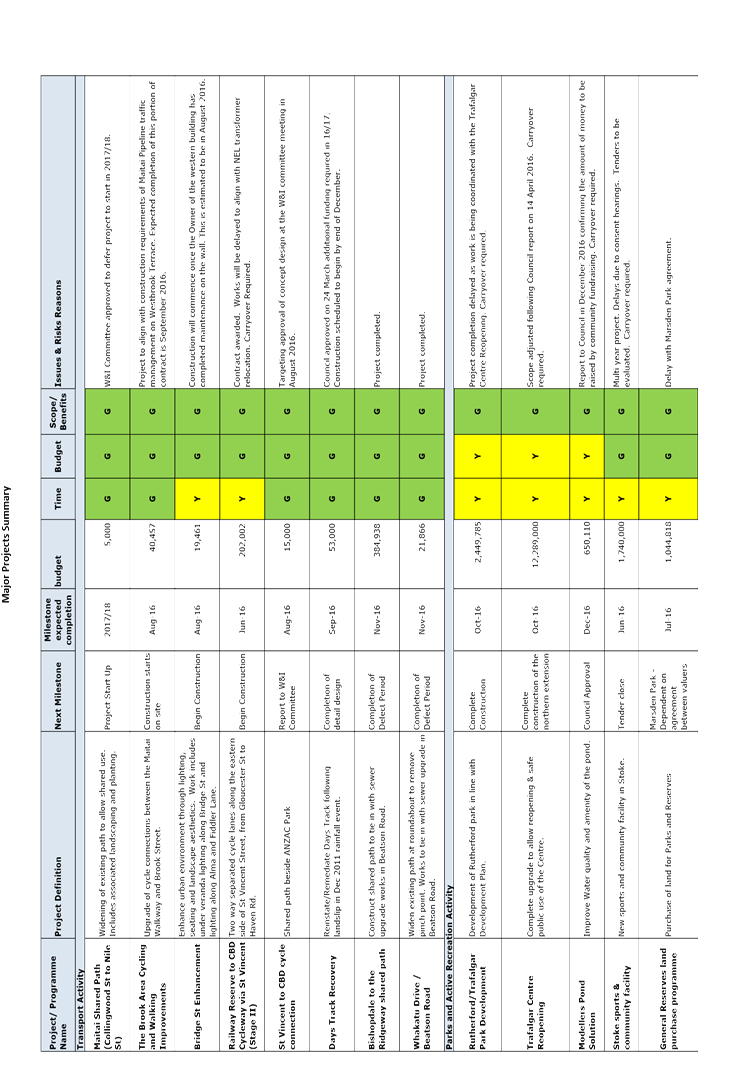

|

REPORT R5998

Corporate

Report to 30 April 2016

1. Purpose

of Report

1.1 To inform

the members of the Audit, Risk and Finance Subcommittee of the financial

results of activities for the 10 months ending 30 April 2016 compared to the

approved operating budget, and to highlight and explain any permanent and

material variations.

2. Delegations

2.1 The Audit, Risk and Finance Subcommittee

has oversight of the management of financial risks.

3. Recommendation

|

THAT the report Corporate Report

to 30 April 2016 (R5998) and

its attachments (A1557787 and

A1563107) be received;

AND THAT

the Audit, Risk and Finance Subcommittee refer to the Governance Committee

its delegation for the review of the draft Annual Report and the 2015/16

Carry Forwards Report.

|

4. Background

4.1 The financial reporting focuses on the 10

month performance compared with the year to date approved operating budget.

4.2 Unless otherwise indicated, all measures are against

approved operating budget, which is LTP budget plus any carry forwards, plus or

minus any other additions or changes as approved by Council throughout the

year.

4.3 Budgets for operating income and

expenditure are phased evenly through the year, whereas capital expenditure

budgets are phased to occur mainly in the second half of the year.

5. Discussion

5.1 For the 10 months ending 30 April 2016, the activity surplus/deficits

are $4.1 million favourable to budget.

5.2 Financial information provided in attachment 1 to this

report are:

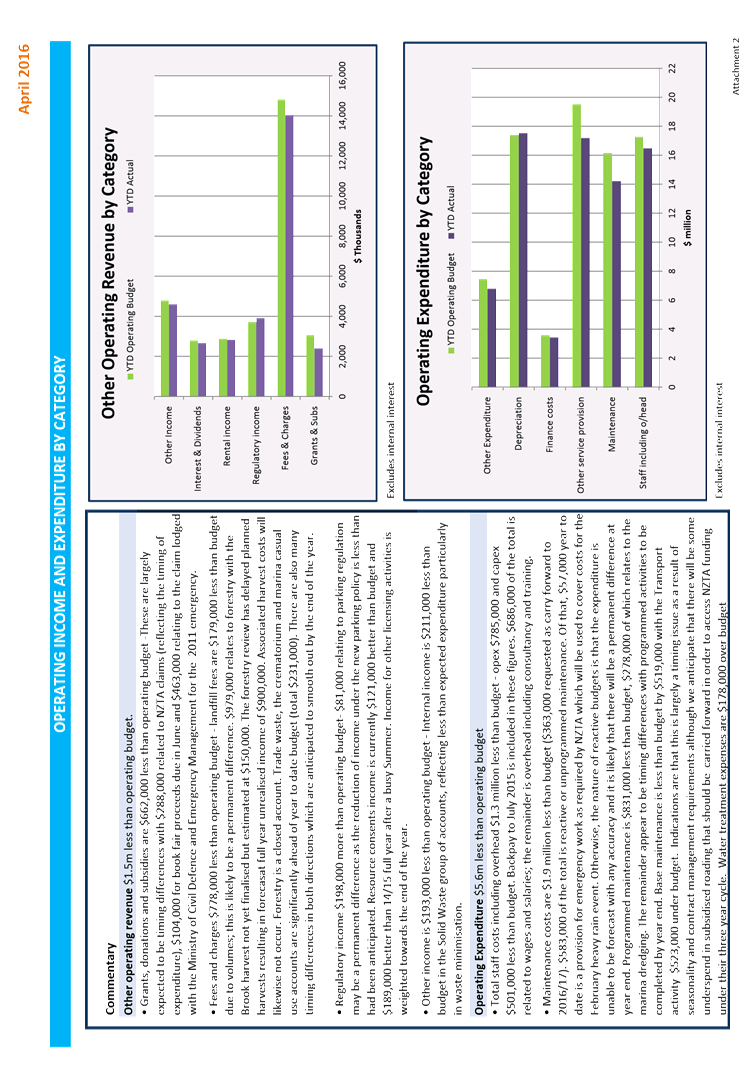

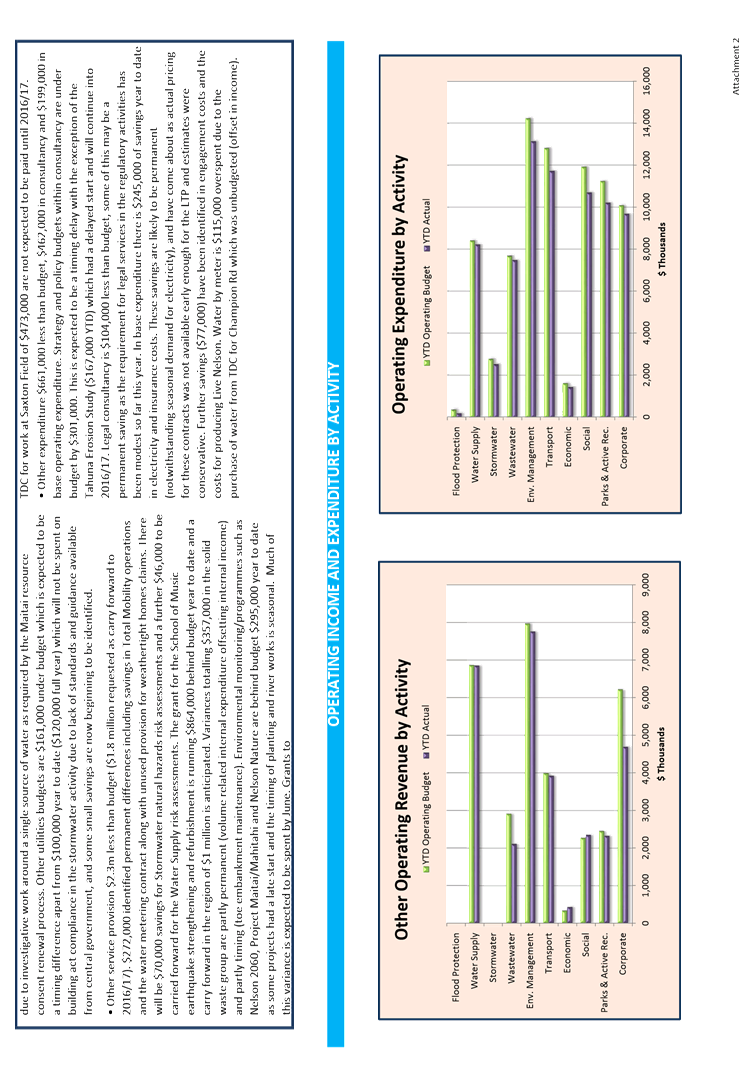

· A financial measures dashboard with information on rates revenue,

operating revenue and expenditure, and capital revenue and expenditure. A new

icon has been added to each applicable measure, indicating whether the variance

is increasing or decreasing (arrows) and whether that trend is favourable or

unfavourable (green or red).

· A grouping of more detailed graphs and commentary for operating

income and expenditure. The first set of charts and the commentary is by

category (as in the annual report) and highlights significant permanent

differences and items of interest. Variances due to timing will not be itemised

unless they become permanent. The second set of charts are by activity.

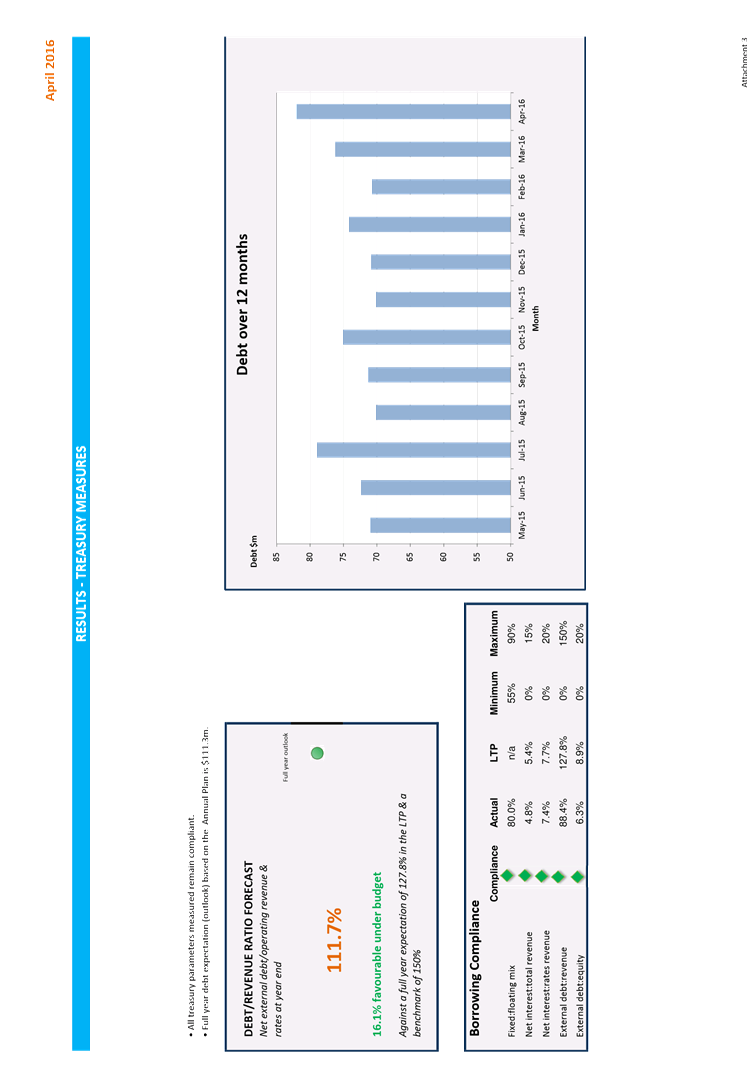

· A treasury measures dashboard with a compliance table (green =

compliant), a forecast of the debt/revenue ratio for the year, and a graph

showing debt levels over a rolling 12 month period.

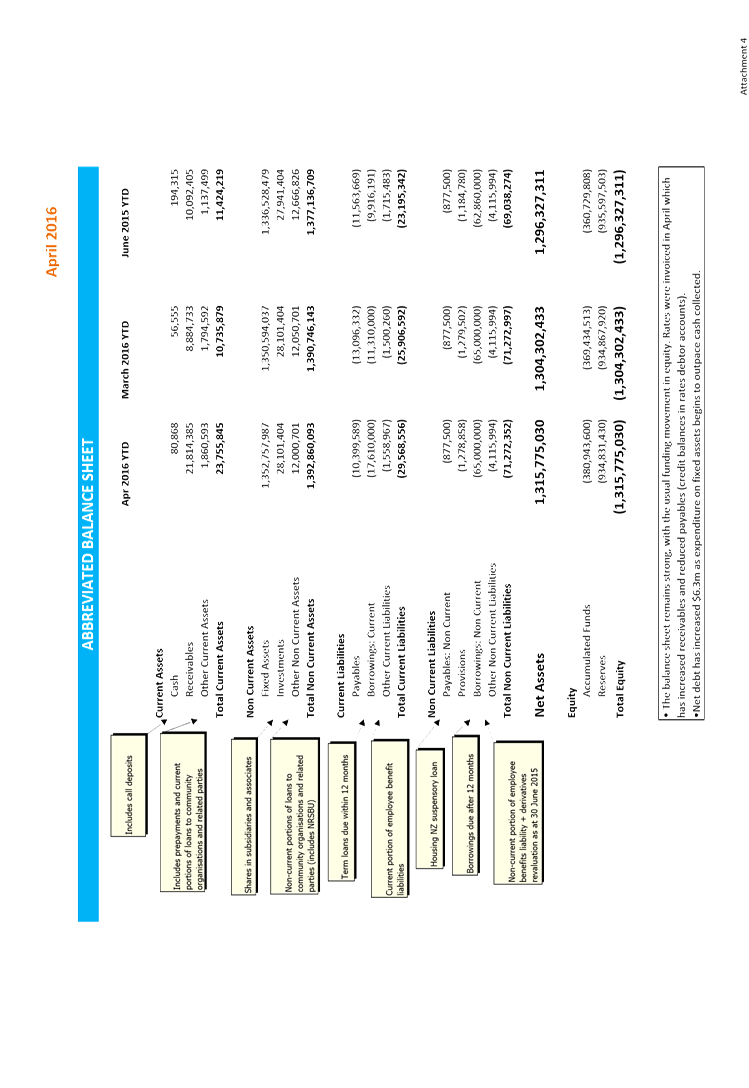

· High level balance sheet (no change to that provided previously).

· A debtor analysis graph over 12 months, clearly showing outstanding

debt levels and patterns for major debt types along with a summary of general

debtors > 3 months and over $10,000 and other debtors at risk.

· Two capital expenditure graphs – actual expenditure against

operating budget for the financial year (no change), and year to date

expenditure against operating budget by activity.

5.3 Operating income and expenditure variances have

increased since the March report to this committee. The current indication is

that $3.0 million of the variance will be carried forward to 2016/17 to fund

work that has been delayed. $1.5 million of that variance is loan-funded

(grants for capital works). See the report on this agenda on operating

expenditure carry forwards R6071.

5.4 The capital revenue variance is decreasing as

invoicing for expenditure in excess of Council’s contribution to the

Suter redevelopment is catching up to the budget.

5.5 Capital expenditure is $14.4 million under budget,

please see report R5992 on this agenda indicating potential carry forwards of

$14.3 million.

6. Transfers

of delegation

6.1 The last meeting of this Sub-committee in this

triennium of Council is 4 August 2016. There are two matters delegated to this

Sub-committee which will not be ready for review by 4 August due to extended

year end close off, and cannot wait until the first meeting of the new

Sub-committee. Officers therefore request that the delegations for review of

the draft Annual Report and the Carry Forwards report be transferred to the

Governance Committee for consideration at its 25 August 2016 meeting.

7. 1903

site shade sail

7.1 As discussed at the Annual Plan deliberations meeting

on 11 and 12 May, a further section of shade sail will be ordered to ensure

there is cover for the audience as well as performers at events on the 1903

site. The cost estimate is $3,600 and will be a charge against the CBD Enhancement

fund. Funding covers the cost of fabric as well as fixtures to anchor it to.

The shade sail will only remain in place during events and erection and removal

will be the responsibility of event organisers.

8. Charter

Parade

8.1 Council incurred costs of $2,891 for the NZ Army

Charter Parade of 2 April 2016. Costs were for the provision of seating, PA,

lectern etc along with a Mayoral afternoon tea provided for guests. This

expenditure is covered from the Civic Expenses budget.

9. Alignment

with relevant Council policy

9.1 The

financial reporting is prepared comparing current year performance against the

year to date approved budget for 2015/16.

10. Assessment

of Significance against the Council’s Significance and Engagement Policy

10.1 There

are no significant decisions.

11. Consultation

11.1 No

consultation is required.

12. Inclusion

of Māori in the decision making process

12.1 No

consultation is required.

Tracey

Hughes

Senior

Accountant

Attachments

Attachment 1: Corporate

Report Attachments (A1557787)

Attachment 2: Major

projects summary (A1563107)

Audit, Risk and Finance

Subcommittee

Audit, Risk and Finance

Subcommittee