AGENDA

Ordinary meeting of the

Audit, Risk and Finance Subcommittee

Tuesday 10 May 2016

Commencing at the conclusion of Works and

Infrastructure Committee

Council Chamber

Civic House

110 Trafalgar Street, Nelson

Membership: Mr John Peters (Chairperson), Her Worship the

Mayor Rachel Reese, Councillors Ian Barker and Brian McGurk and Mr John Murray

Guidelines for councillors

attending the meeting, who are not members of the Committee, as set out in

Standing Orders:

·

All councillors, whether or not they are members of the

Committee, may attend Committee meetings (SO 2.12.2)

·

At the discretion of the Chair, councillors who are not Committee

members may speak, or ask questions about a matter.

·

Only Committee members may vote on any matter before the

Committee (SO 3.14.1)

It is good practice for both Committee members and

non-Committee members to declare any interests in items on the agenda.

They should withdraw from the room for discussion and voting on any of these

items.

Audit, Risk and Finance

Subcommittee

Audit, Risk and Finance

Subcommittee

10

May 2016

Page

No.

1. Apologies

1.1 An

apology has been received from Mr John Peters

2. Confirmation

of Order of Business

3. Interests

3.1 Updates

to the Interests Register

3.2 Identify

any conflicts of interest in the agenda

4. Public

Forum

5. Confirmation

of Minutes

5.1 31

March 2016 6 - 12

Document number M1801

Recommendation

THAT

the minutes of the meeting of the Audit, Risk and Finance Subcommittee, held on

31 March 2016, be confirmed as a true and correct record.

Please

note that as the only business transacted in public excluded was to confirm the

minutes, this business has been recorded in the public minutes. In

accordance with the Local Government Official Information and Meetings Act, no

reason for withholding this information from the public exists.

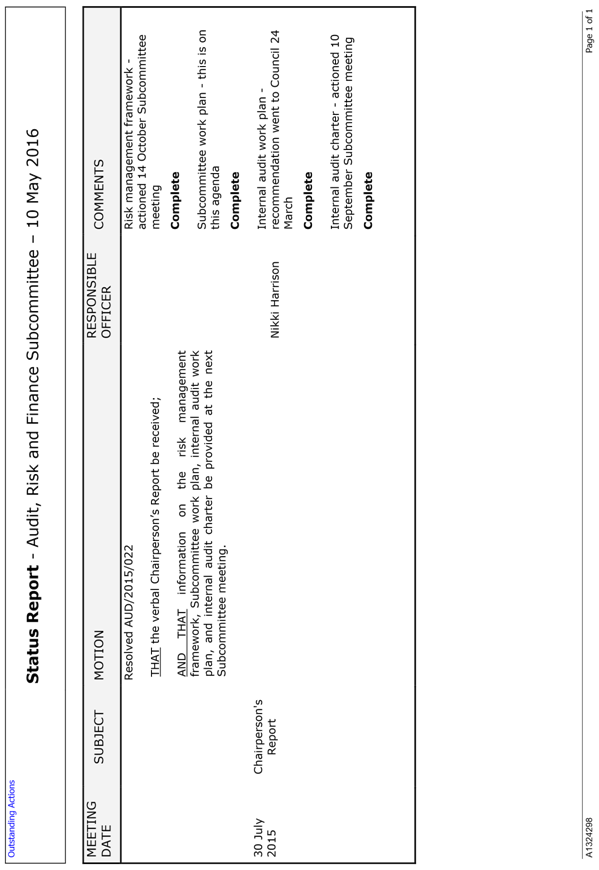

6. Status

Report - Audit, Risk and Finance Committee - 10 May 2016 13 - 14

Document number R5861

Recommendation

THAT the Status Report Audit, Risk

and Finance Subcommittee 10 May 2016 (R5861)

and its attachment (A1324298) be received.

7. Chairperson's

Report

8. Council's

Key Organisational Risks - Progress Report 2 15 - 31

Document number R5490

Recommendation

THAT the report Council's Key

Organisational Risks - Progress Report 2 (R5490) and its attachment (A1519755) be received.

9. Balance

Sheet reconciliation review 32 - 38

Document number R5505

Recommendation

THAT the report Balance Sheet

reconciliation review (R5505) and

its attachment (A1540192) be received.

10. Audit,

Risk and Finance subcommittee work plan 39 - 41

Document number R5654

Recommendation

THAT the report Audit, Risk and

Finance subcommittee work plan (R5654)

and its attachment (A1389278) be

received;

AND THAT

the Subcommittee provide feedback on the Subcommittee work

plan.

11. Internal

Audit Report to 31 March 2016 42 - 48

Document number R5793

Recommendation

THAT the Internal Audit Report to

31 March 2016 (R5793) and its

attachments (A1533053 and A1532989) be

received.

Recommendation to Governance

Committee and Council

THAT

Council note the internal audit findings, recommendations and status of action

plans up to 31 March 2016 (R5793).

12. Corporate

Report to 31 March 2016 49 - 61

Document number R5872

Recommendation

THAT the report Corporate Report

to 31 March 2016 (R5872) and its

attachments (A1544370 and A1544028) be

received;

Recommendation to Governance

Committee and Council

THAT

the transfer of legal budget from the Corporate activity to the Planning

activity in 2015/16 in order to obtain economic and traffic evidence for the

submission to Tasman District Council on the proposed Progressive Enterprises

Ltd Private Plan Change be noted.

Minutes of a meeting of

the Audit, Risk and Finance Subcommittee

Held in the Council

Chamber, Floor 2A, Civic House, 110 Trafalgar Street, Nelson (previously

advertised to take place in Ruma Marama, Floor 2A, Civic House)

On Thursday 31 March 2016,

commencing 12.21pm

Present: Mr

J Peters (Chairperson), Her Worship the Mayor R Reese, Councillors I Barker and

B McGurk, and Mr J Murray

In Attendance: Councillors

E Davy, M Lawrey, P Matheson, and G Noonan, Chief Executive (C Hadley), Group

Manager Infrastructure (A Louverdis), Group Manager Community Services (C

Ward), Group Manager Corporate Services (N Harrison), Manager Communications (P

Shattock), Manager Capital Projects (S Davies), Administration Adviser (S

Burgess), and Audit New Zealand Auditor (B Kearney)

1. Apologies

There were no apologies.

Attendance: The meeting adjourned for lunch from 12.22pm to

12.43pm.

2. Confirmation of Order of Business

The Chairperson advised that

item 10, Extension of loan facility to the Melrose Society, would be brought

forward and considered after item 7, Chairperson’s Report.

3. Interests

There were no updates to the

Interests Register, and no interests with items on the agenda were declared.

4. Public Forum

There was no public forum.

5. Confirmation of Minutes

5.1 18

February 2016

Document number M1712, agenda

pages 8 - 17 refer.

It was noted there was a spelling

error on page two of the minutes. It was asked that the final paragraph of the

minutes be amended to reflect the issue was raised in response to a question.

|

Resolved AUD/2016/018

THAT the amended

minutes of the meeting of the Audit, Risk and Finance Subcommittee, held on

18 February 2016, be confirmed as a true and correct record.

Murray/McGurk Carried

|

6. Status Report - Audit, Risk and

Finance Subcommittee - 31 March 2016

Document number R5657, agenda

pages 17 - 18 refer.

|

Resolved AUD/2016/019

THAT the Status Report Audit,

Risk and Finance Subcommittee 31 March 2016 (R5657) and its attachment (A1324298) be received.

Barker/Murray Carried

|

7. Chairperson's

Report

The Chairperson thanked officers

for the new format for the Corporate Report. He asked the Subcommittee to

provide feedback to ensure the reporting fulfilled the needs of the

Subcommittee.

8. Extension of loan facility to the

Melrose Society

Document number R5575, agenda

pages 56 - 74 refer.

Group Manager Community Services,

Chris Ward, presented the report.

A suggestion was made that the

full remaining cost of the toilet refurbishment, being up to $57,000, be

granted to Melrose House, and that no funding be provided for the chiller

installation. The Subcommittee supported this suggestion, highlighting that the

building was deserving of good bathroom facilities.

Mr Ward highlighted that Council,

through the current lease to the Melrose Society, had originally not supported

a grant towards the bathroom renovations. He added that the Heritage Asset

Management Plan was the mechanism for allocating funding in the area of

heritage facilities, and if additional funding was available this should be

prioritised from an asset management perspective.

Attendance: The meeting adjourned from 1.00pm to 1.04pm.

|

Resolved AUD/2016/020

THAT the report Extension of

loan facility to the Melrose Society (R5575)

and its attachments (A1509577 and A1416892) be received.

Her Worship the Mayor/Murray Carried

|

|

Recommendation to Governance

Committee and Council AUD/2016/021

THAT

the $15,000 funding allocated towards asbestos remediation in Melrose House

in 2016/17 be brought forward to 2015/16 and be used to grant fund the

Melrose Society for the purpose of toilet refurbishment;

AND

THAT an additional unbudgeted grant of up to $42,000 is

provided to the Melrose Society for the purpose of toilet renovations

in the 2015/16 financial year;

AND

THAT the Melrose Society be informed that no further grants

will be made by Council to the Melrose Society for the toilet refurbishment

and chiller installation project.

Her Worship the Mayor/Murray Carried

|

9. Corporate Report to 31 January

2016

Document number R5334, agenda

pages 19 - 33 refer.

Senior Accountant, Tracey

Hughes, and Manager Capital Projects, Shane Davies, presented the report

Mr Davies and Ms Hughes

explained the new format of the Corporate Report and Subcommittee members

provided feedback.

In response to questions, Ms

Hughes gave further detail on underspends and operating expenditure. Group

Manager Corporate Services, Nikki Harrison, further explained the variances in

staff costs.

Attendance: The meeting adjourned from 1.23pm to 1.25pm.

In response to questions,

further information was provided regarding staff vacancies, holiday pay, smart

metering, long term plan budgets, debtors and capital projects. In response to

a question, Mr Davies confirmed the $20,000 allocated to the Queens Garden

Toilet was for design work.

There was discussion about

funding being transferred from 2016/17 to 2015/16 for capital projects and the

delegated authority for these decisions. Group Manager Infrastructure, Alec

Louverdis, undertook to look into this matter to ensure the correct process was

being followed.

|

Resolved AUD/2016/022

THAT the report Corporate Report

to 31 January 2016 (R5334) and

its attachments (A1513082, A1311288, and A1514038) be received and the variations noted.

Barker/Murray Carried

|

|

Recommendation to Governance

Committee and Council AUD/2016/023

THAT

the unspent 2015/16 Community Investment Fund operational budget of $21,300

be carried forward to the 2016/17 financial year, bringing the total budget

for 2016/17 for the Community Investment Fund to $327,000.

Barker/Murray Carried

|

10. Audit Arrangement letter

2015/16

Document number R5508, agenda

pages 34 - 55 refer.

Group Manager Corporate Services,

Nikki Harrison, and Mr Bede Kearney of Audit New Zealand, presented the report.

In response to questions, Mr

Kearney provided detail on performance measures, audit fee negotiation,

sensitive expenditure, and Audit New Zealand’s use of baseline

information.

|

Resolved AUD/2016/024

THAT the report Audit

Arrangement letter 2015/16 (R5508)

and its attachment (A1511332) be

received;

AND THAT

the Subcommittee provide feedback on the Audit

Arrangement letter to Audit NZ if required, noting the Mayor will sign the

letter once the Subcommittee’s feedback has been incorporated.

McGurk/Murray Carried

|

11. Letter to Council on the

audit for the year ended 30 June 2015 - further information

Document number R5640, agenda

pages 75 - 84 refer.

Group Manager Corporate Services,

Nikki Harrison, presented the report.

|

Resolved AUD/2016/025

THAT the report Letter to

Council on the audit for the year ended 30 June 2015 - further information

(R5640) and its attachment

(A1493673) be received.

Barker/McGurk Carried

|

12. Insurance renewal 2016/17 -

infrastructure assets

Document number R5649, agenda

pages 85 - 88 refer.

Group Manager Corporate Services,

Nikki Harrison, presented the report.

In response to questions, Ms

Harrison provided further detail regarding the timing of the Treasury

consultation on insurance cost sharing arrangements. She clarified that,

although Council’s loss limit needed to be increased, the value of

Council’s asset pool was appropriately insured.

The Subcommittee agreed that

further information would be available in the coming months, therefore it would

be appropriate to refer the matter to the Governance Committee, for its

consideration and recommendation to Council.

Attendance: The meeting adjourned from 2.57pm to 3.00pm.

|

Resolved AUD/2016/026

THAT the report Insurance

renewal 2016/17 - infrastructure assets (R5649) be received;

AND

THAT the Subcommittee refers the matter of insurance

renewal for Council’s infrastructure insurance to the Governance

Committee for its consideration and recommendation to Council.

Barker/McGurk Carried

|

13. Exclusion of the Public

|

Resolved AUD/2016/027

THAT

the public be excluded from the following parts of the proceedings of this

meeting.

The

general subject of each matter to be considered while the public is excluded,

the reason for passing this resolution in relation to each matter and the

specific grounds under section 48(1) of the Local Government Official

Information and Meetings Act 1987 for the passing of this resolution are as

follows:

Her Worship the Mayor/Murray Carried

|

|

Item

|

General subject of each matter to be considered

|

Reason for passing this resolution in relation to

each matter

|

Particular interests protected (where applicable)

|

|

1

|

Audit, Risk and Finance

Subcommittee Meeting - Public Excluded Minutes - 18 February 2016

|

Section 48(1)(a)

The public conduct of this

matter would be likely to result in disclosure of information for which good

reason exists under section 7.

|

The withholding of the

information is necessary:

· Section 7(2)(b)(ii)

To protect information

where the making available of the information would be likely unreasonably to

prejudice the commercial position of the person who supplied or who is the

subject of the information.

· Section 7(2)(h)

To enable the local

authority to carry out, without prejudice or disadvantage, commercial

activities.

|

The meeting went into public

excluded session at 3.04pm and resumed in public session at 3.05pm.

14. Confirmation of Minutes

– Public Excluded

Please note that as the only

business transacted in public excluded was to confirm the minutes, this

business has been recorded in the public minutes. In accordance with the Local

Government Official Information Meetings Act, no reason for withholding this

information from the public exists.

Document number M1713, public

excluded agenda pages 3 - 5 refer.

A correction was requested to the

attendance section of the minutes.

|

Resolved AUD/2016/028

THAT the amended

minutes of part of the meeting of the Audit, Risk and Finance Subcommittee,

held with the public excluded on 18 February 2016, be confirmed as a true and

correct record.

Barker/McGurk Carried

|

15. Re-admittance of the Public

|

Resolved AUD/2016/029

THAT

the public be re-admitted to the meeting.

Reese/Barker Carried

|

There being no further business the

meeting ended at 3.05pm.

Confirmed as a correct record of proceedings:

Chairperson

Date

Chairperson

Date

|

|

Audit, Risk and Finance Subcommittee

10 May 2016

|

REPORT R5861

Status

Report - Audit, Risk and Finance Committee - 10 May 2016

1. Purpose

of Report

1.1 To

provide an update on the status of actions requested and pending.

2. Recommendation

|

THAT the Status Report Audit,

Risk and Finance Subcommittee 10 May 2016 (R5861) and its attachment (A1324298) be received.

|

Lucy

Halsall

Administration

Adviser

Attachments

Attachment 1: A1324298

- Status Report - Audit, Risk and Finance Subcommittee

|

|

Audit, Risk and Finance Subcommittee

10 May 2016

|

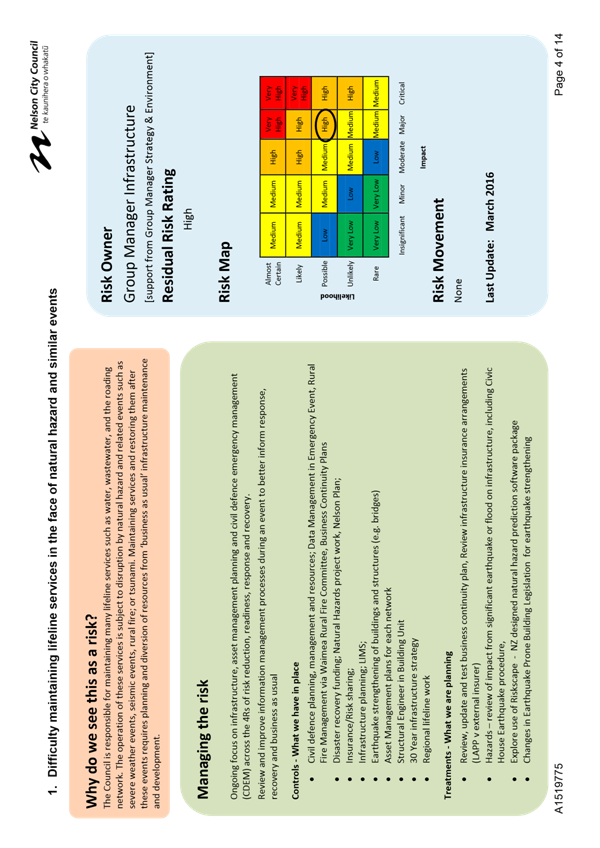

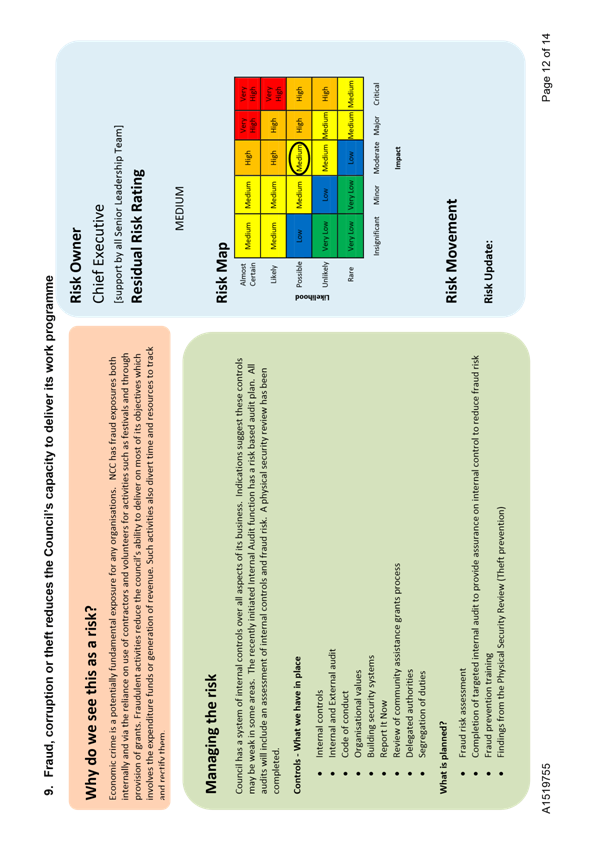

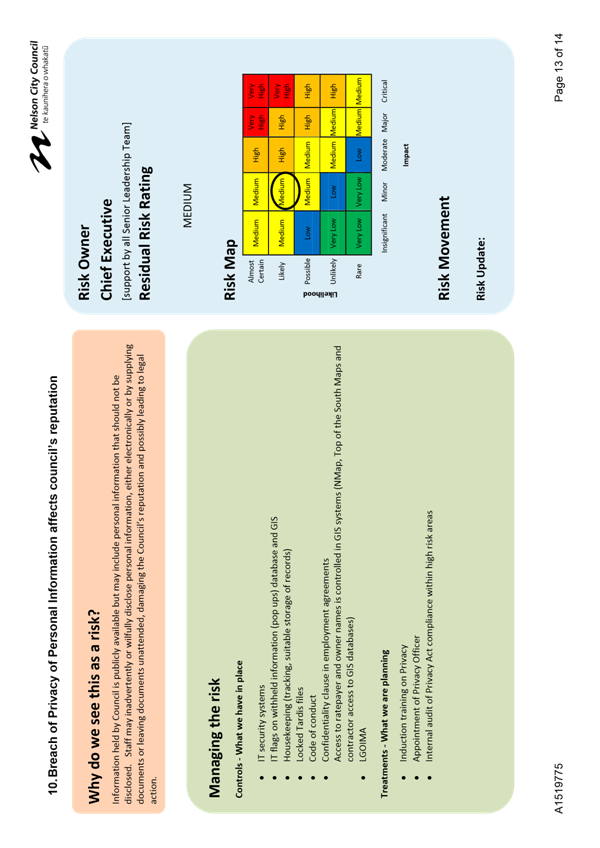

REPORT R5490

Council's

Key Organisational Risks - Progress Report 2

1. Purpose

of Report

1.1 To update the Subcommittee on progress with

identifying and managing key organisational risks.

2. Delegations

2.1 The

Audit Risk and Finance Subcommittee has oversight of the Council’s

management of risk.

3. Recommendation

|

THAT the report Council's Key

Organisational Risks - Progress Report 2 (R5490) and its attachment (A1519755) be received.

|

4. Background

4.1 At

its meeting on 18 February 2016 the subcommittee considered and received the

first progress report on the Council’s key organisational risks. This

report was based on a series of broad brush business unit risk assessments

conducted during the last quarter of calendar 2015. These risk assessments were

based on very broad statements of each business unit’s objectives so the

resulting aggregation of risks was also necessarily broad.

4.2 Since

then, the Council’s Risk and Procurement Analyst has commenced work and

begun working with each business unit to frame risk assessments on the basis of

objectives which are specific, measurable and achievable within specified

timeframes. Given the work already underway on the Council’s health and

safety management system, the focus for the Risk and Procurement Analyst has

been on risks other than health and safety related ones. This work is

on-going.

4.3 In parallel with this, and as promised to the

subcommittee at its February meeting, the previous report has been updated so

that the key organisational risks are stated in terms of the relevant Council

objectives. In this context, key risks are those which may have the largest

effect on the Council meeting its objectives, considering both magnitude of the

effect and likelihood of it occurring.

4.4 The report is also framed in standard risk management

language –i.e. following AS/NZS ISO 31000 2009 Risk Management -

Principles and Guidelines. An annex has been added to explain

these.

4.5 Given the short time since the last report, the

largely well established controls in place to manage risks, and the broad brush

nature of the earlier work, there has been no change in the key risks.

5. Discussion

5.1 At the February meeting of the subcommittee, members

made a number of salient points which have helped shape the development of both

the attached document and our thinking in relation to the risks the Council

faces. These points included:

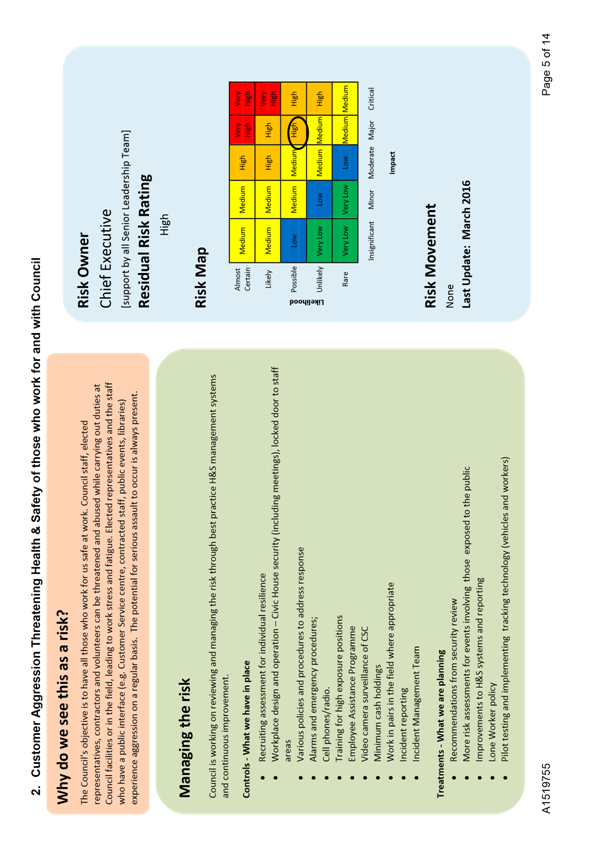

5.1.1 Extension

of customer aggression threats to include elected representatives acting on

Council business. This is acknowledged and the risk and its management (as

described in the attachment) have been modified accordingly.

5.1.2 The

critical importance of retaining key skills in ensuring that Council can

deliver on its programme. The fact that this is a key risk, especially

given the relatively small number of staff the Council has and its broad range

of functions, underlines its importance. Preliminary evidence suggests that

controls are working in this area and (for example) the staff turnover rate is

trending downward.

5.1.3 High

proportion of risks owned by the Chief Executive. Many of the key risks

extend across large parts of the organisation, so stated ownership by the CEO

in fact means that several senior managers carry some part of the ownership.

5.1.4 The

importance of risks in relation to core lifeline services (water supply,

wastewater etc.) The events triggering failures in this area are often

natural hazard related and risk #1 in the attached document has been modified

both to reflect Council’s role and respond to the point. It should also

be noted that reducing threats in this area requires long term and consistent

decision making on maintaining assets which are often less visible.

5.1.5 The

importance of risks around the many laws which Council acts under. Nearly

half of the current key risks relate directly to statutory obligations on the

Council. This will also be considered further in relation to risk criteria as

the Council’s risk profile is developed.

6. Options

6.1 Accept

the recommendation – receive the Council’s second Key

organisational Risks Progress Report.

6.2 Reject

the recommendation – not receive the Council’s second Key

organisational Risks Progress Report

7. Alignment

with relevant Council policy

7.1 This report is in alignment with the Council’s

Risk Management Framework approved in 2015.

8. Assessment

of Significance against the Council’s Significance and Engagement Policy

8.1 This

is not a significant decision under the Council’s Significance and

Engagement Policy.

9. Consultation

9.1 No

consultation has been undertaken in preparation of this report.

10. Inclusion

of Māori in the decision making process

10.1 There

has been no consultation with Maori in the preparation of this report.

Steve

Vaughan

Risk

& Procurement Analyst

Attachments

Attachment 1: A1519755 Key

organisational risks Report April 2016

|

|

Audit, Risk and Finance Subcommittee

10 May 2016

|

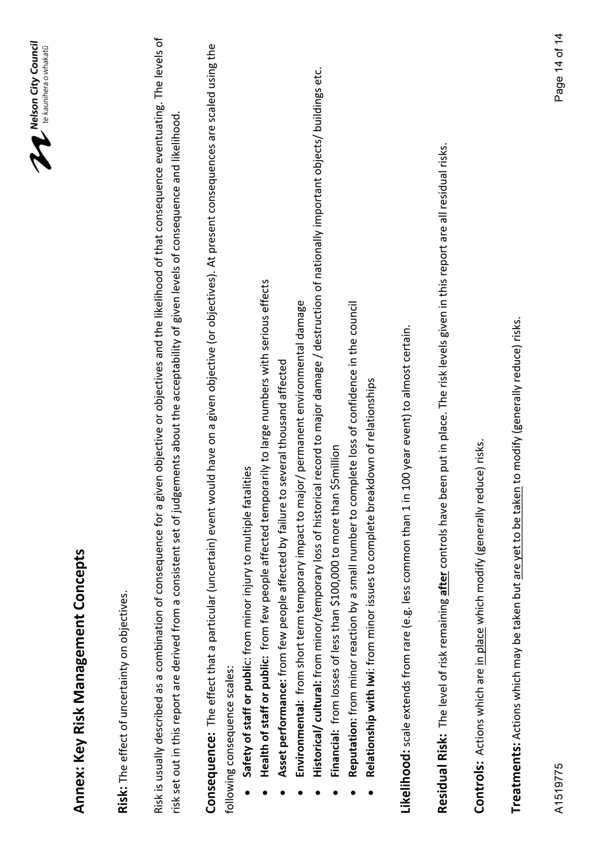

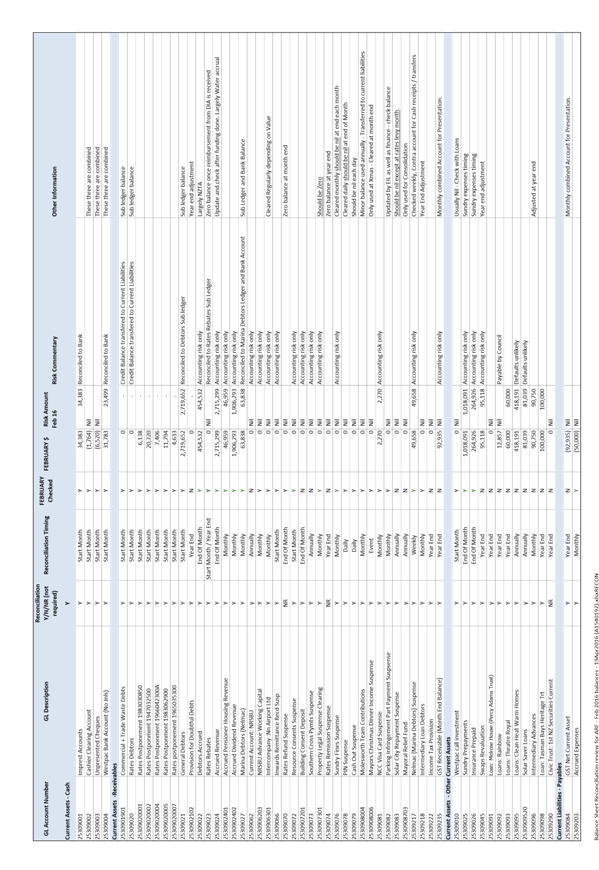

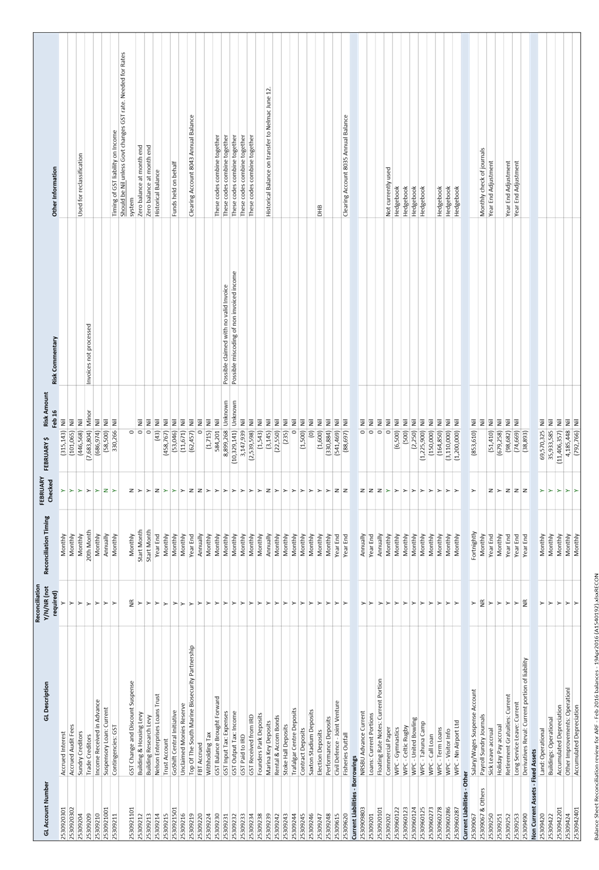

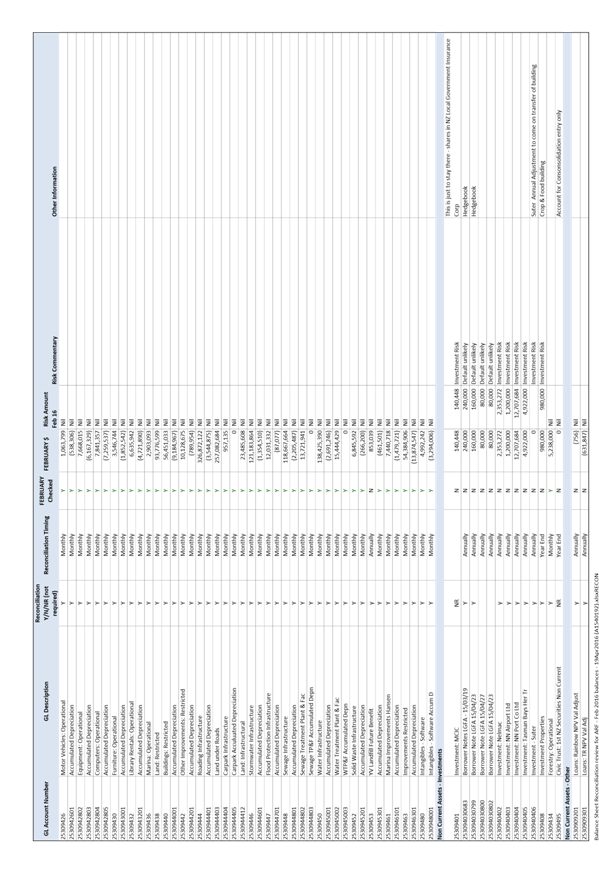

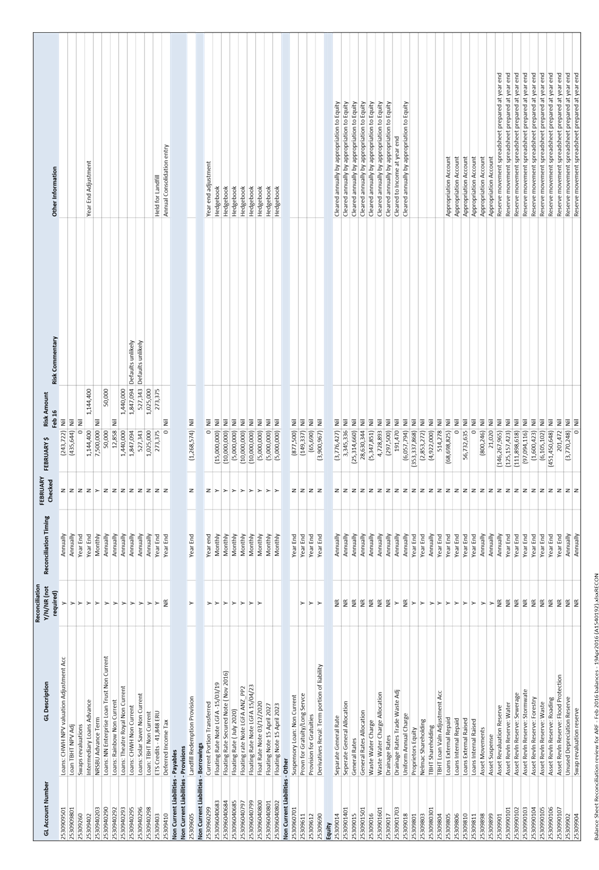

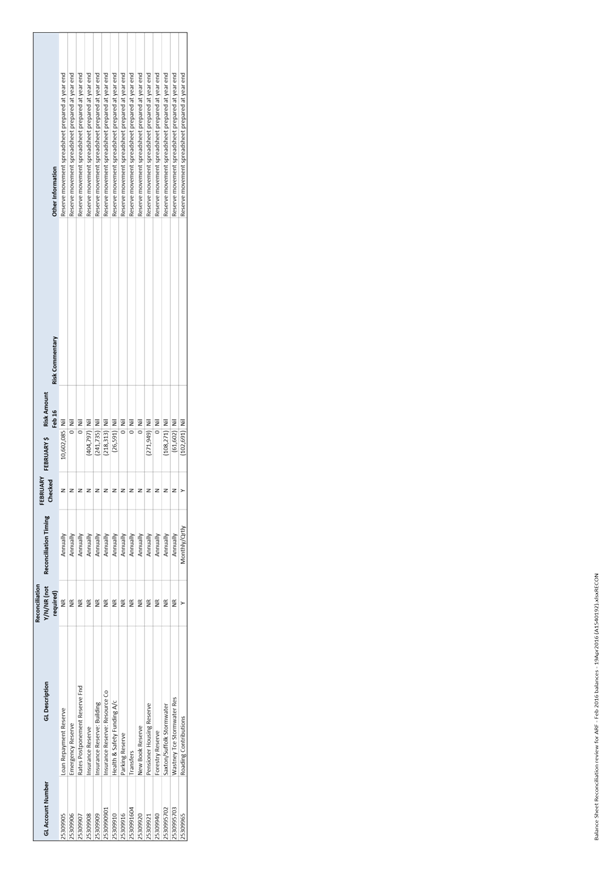

REPORT R5505

Balance

Sheet reconciliation review

1. Purpose

of Report

1.1 To inform the subcommittee on the detail of the

balance sheet, the status of reconciliations, and any areas of risk identified.

2. Delegations

2.1 The

Audit, Risk and Finance Subcommittee has oversight of the Council’s

management of risk.

3. Recommendation

|

THAT the report Balance Sheet

reconciliation review (R5505)

and its attachment (A1540192) be received.

|

4. Background

4.1 As

part of the Corporate Report, the subcommittee is presented at every meeting

with a summarised balance sheet. The purpose of presenting the summarised

balance sheet is to identify and explain any significant movements month on

month.

4.2 The

balance sheet is otherwise known as a statement of financial position. Balance

sheet reconciliations are conducted to ensure the legitimacy of the

organisation’s reported financial position.

4.3 Attachment 1 allows the subcommittee to see the detail

that lies beneath the summary balance sheet. For each account, the spreadsheet

indicates the balance at February (the latest month for complete data), the

frequency that reconciliations are required, whether the reconciliation has

been completed in February and any risk associated with balance.

5. Discussion

5.1 Accounts

with a large number of transactions (debtors, creditors, fixed assets) are

reconciled monthly or more frequently.

5.2 Some

accounts (largely equity and loans receivable) are reconciled quarterly or

annually as part of the annual report and audit process. These accounts may

have only one movement during the year.

5.3 Reconciliations

are completed by a named member of the finance team and are checked by a senior

member, or in some cases, Audit.

5.4 As

part of their audit process, Audit NZ check some (but not all) reconciliations

either during their interim visit (which tends to focus on control and process)

or their final visit (the reconciliations being in support of the final

results).

6. Options

6.1 Accept

the recommendation – receive the Balance Sheet Reconciliation Review

report.

6.2 Reject

the recommendation – not receive the Balance Sheet Reconciliation Review

report.

7. Alignment

with relevant Council policy

7.1 This

section is not applicable.

8. Assessment

of Significance against the Council’s Significance and Engagement Policy

8.1 This

is not a significant decision under the Council’s Significance and

Engagement Policy.

9. Consultation

9.1 No

consultation has been undertaken in preparation of this report.

10. Inclusion

of Māori in the decision making process

10.1 There

has been no consultation with Maori in the preparation of this report.

Tracey

Hughes

Senior

Accountant

Attachments

Attachment 1: Balance Sheet

reconciliations summary February 2016 (A1540192)

|

|

Audit, Risk and Finance Subcommittee

10 May 2016

|

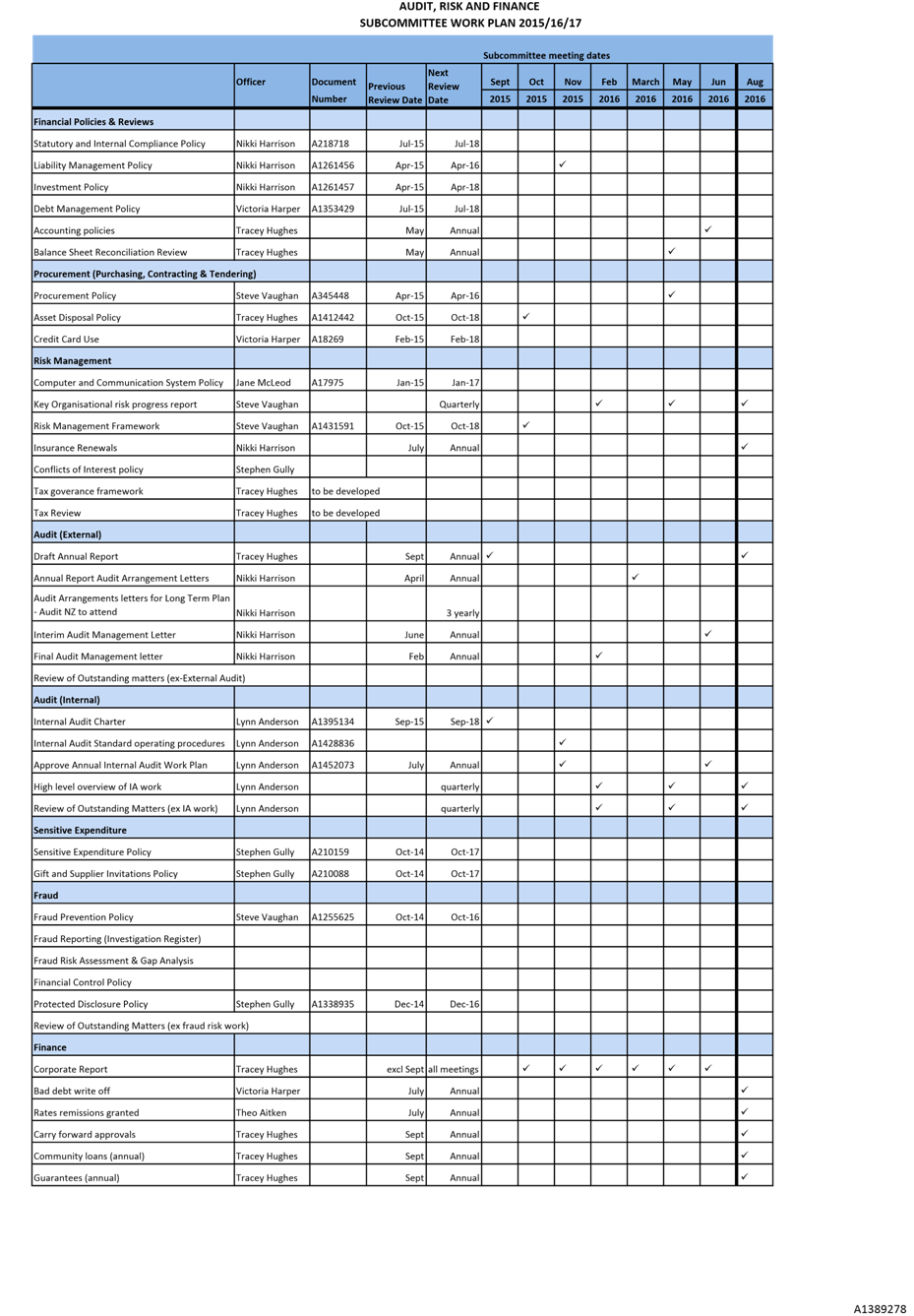

REPORT R5654

Audit,

Risk and Finance subcommittee work plan

1. Purpose

of Report

1.1 To present and seek feedback on the

Subcommittee work plan.

2. Delegations

2.1 The

subcommittee work plan is within the Subcommittees delegations to consider.

3. Recommendation

|

THAT the report Audit, Risk and

Finance subcommittee work plan (R5654)

and its attachment (A1389278) be

received;

AND THAT

the Subcommittee provide feedback on the Subcommittee

work plan.

|

4. Background

4.1 The

Chair of the Subcommittee has requested that the work plan be presented to the

Subcommittee.

5. Discussion

5.1 Officers

have collated a work plan for the Audit, Risk and Finance Subcommittee which

covers the areas of:

5.1.1 Financial

policies and reviews;

5.1.2 Procurement;

5.1.3 Risk

management;

5.1.4 Audit

(external);

5.1.5 Audit

(internal);

5.1.6 Sensitive

expenditure;

5.1.7 Fraud;

and

5.1.8 Finance

5.2 Officers

seek feedback from the Subcommittee on the specific items being brought to the

Subcommittee over a three year program (Attachment 1).

6. Options

6.1 Accept

the work plan or provide feedback to be incorporated into the work plan.

7. Alignment

with relevant Council policy

7.1 This

recommendation is not inconsistent with any previous Council decision.

8. Assessment

of Significance against the Council’s Significance and Engagement Policy

8.1 This

is not a significant decision.

9. Consultation

9.1 No

consultation has been undertaken in preparing this report.

10. Inclusion

of Māori in the decision making process

10.1 No

consultation with Maori has been undertaken in preparing this report.

Nikki

Harrison

Group

Manager Corporate Services

Attachments

Attachment 1: A1389278 -

Audit, Risk and Finance Subcommittee workplan

|

|

Audit, Risk and Finance Subcommittee

10 May 2016

|

REPORT R5793

Internal

Audit Report to 31 March 2016

1. Purpose

of Report

1.1 To update the Subcommittee on the Internal

Audit activity relative to the Internal Audit Plan to 30 June 2016, and to

provide information on significant or high risks identified from audits

completed to 31 March 2016.

2. Delegations

2.1 The

Audit, Risk and Finance Subcommittee have oversight of the internal audit

activity.

3. Recommendation

|

THAT the Internal Audit Report

to 31 March 2016 (R5793) and

its attachments (A1533053 and A1532989)

be received.

|

Recommendation

to Governance Committee and Council

|

THAT

Council note the internal audit findings, recommendations and status of

action plans up to 31 March 2016 (R5793).

|

4. Background

4.1 The

Audit, Risk and Finance Subcommittee require a periodic update on the progress

of internal audit activities relative to the Internal Audit Plan to 30 June

2016 and to be informed of any significant risk exposures and control issues

identified from internal audits completed.

4.2 The Internal Audit Charter was approved by the Audit,

Risk & Finance Subcommittee on 12 November 2015.

4.3 Under section 9.4, the Charter requires that the

Internal Audit & Procurement Analyst report periodically to the Senior

Leadership Team and Audit, Risk and Finance Subcommittee on performance

relative to the Internal Audit Plan. A table summarising activity against the

workplace, which shows progress slower than planned, is attached. Under section

9.1 of the Charter, the Audit, Risk & Finance and the Governance Committees

are to be informed of internal audit results where appropriate.

4.4 To strike the right balance between significant

findings and minor recommendations, significant and high findings only are

reported to the Subcommittee.

5. Discussion

5.1 In March, the Senior Leadership Team requested that

the audit on compliance with the Privacy Act be brought forward following

concern that there may be issues of non-compliance. This has now been planned

for April/May 2016, in place of the review of the Rates Modelling Processes

which has been extended to the next financial year.

5.2 Some of the turnaround timeframes in the Audit Charter

are proving challenging for officers. This will be monitored during the next

quarter, and any recommended changes to the timeframes will be referred back to

the Subcommittee later in the year.

6. Options

6.1 The

recommendation is to receive the report and note the internal audit findings,

recommendations and status of action plans.

7. Alignment

with relevant Council policy

7.1 This

report is in alignment with the Council’s Internal Audit Charter approved

in 2015.

8. Assessment

of Significance against the Council’s Significance and Engagement Policy

8.1 This

is not a significant decision under the Council’s Significance and

Engagement Policy.

9. Consultation

9.1 No

consultation has been undertaken in preparation of this report.

10. Inclusion

of Māori in the decision making process

10.1 There

has been no consultation with Maori in the preparation of this report.

Lynn

Anderson

Internal

Audit Analyst

Attachments

Attachment 1: A1533053 -

Internal Audit Plan Progress Report to 31 March 2016

Attachment 2: A1532989

- Summary of New or Overdue High or Significant Risk Exposures and Control

Issues at 31 March 2016

|

Audit Plan – All Audits on 30 June 2016 plan to Third

Quarter 31 March 2016

|

Audits Not Included in Audit Plan

|

Recommendations Agreed with Manager

|

Progress

|

Findings Risk Ratings from Finalised, Approved Audits

|

Date Reviewed by SLT

|

Audit Conclusion

|

Audits Proposed April/May 2016

|

|

Payroll

|

|

Yes

and agreed actions entered in

InControl

|

InControl

actions

Open

Overdue

|

22

9

|

Significant 0

High

Moderate

Minor

|

0

0

21

18

|

|

With few minor

exceptions, payroll has strong controls which give reasonable assurance that

payroll is being accurately processed

|

|

|

Electronic Purchase Orders –

controls

|

|

With Managers

|

|

|

|

|

|

|

IT Systems controls

|

|

|

Report

being finalised

|

|

|

|

|

|

Segregation of Duties

|

|

|

Report

being finalised

|

|

|

|

|

|

Cash Handling – Civic House

|

|

Yes and agreed recommend-ations

entered in InControl

|

Report

waiting for final approval by Managers

|

Significant

High

Moderate

Minor

|

0

2

26

7

|

2/5/16

|

|

|

|

Accounts Payable – new

suppliers

|

|

|

Report

being finalised

|

|

|

|

|

|

Cash

Handling – Founders

|

|

|

|

|

|

|

Cash Handling – Founders

|

|

Banking controls

|

|

|

|

|

|

|

Time permitting*

|

|

Privacy Act (request by GMCS to

complete earlier than on plan)

|

|

|

|

|

|

|

Privacy Act (request by GMCS to

complete earlier than on plan)

|

|

Accounts Receivable – credit

notes

|

|

|

|

|

|

|

Time

permitting*

|

|

Insurance Renewals

|

|

|

|

|

|

|

Time

permitting*

|

|

Community Grants

|

|

|

|

|

|

|

Community Grants

|

|

Reconciliations

|

|

|

|

|

|

|

Time

permitting*

|

|

Cash Processing – General

Ledger

|

|

|

|

|

|

|

Time

permitting*

|

|

Festivals controls & contracts

|

|

|

|

|

|

|

Time

permitting*

|

|

Parking Meter collections

|

|

|

|

|

|

|

Time

permitting*

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Internal Audit Plan to 30 June 2016

approved by Audit, Risk & Finance 12 November 2015

*Time

permitting –

These

audits are on the Internal Audit Plan for the quarter to 31 March 2016 but have

not yet been started.

The

approved Internal Audit Plan to 30 June 2016 has proven to be unrealistic for a

number of reasons which include the initial ‘embedding’ period;

unrealistic timeframes for Officers to turnaround their responses to audit; and

some aspects of the reporting of audit findings and recommendations, which are

not turning out as well as expected. We are looking to improve these in the

near future.

The

intention is to have as many of these “Time Permitting” audits

completed by the 30 June 2016 or soon thereafter.

|

Summary

of New or Outstanding High & Significant Risk Exposures and Control

Issues Identified from Internal Audits at 31 March 2016

|

|

Audit

|

New/ Overdue

|

Findings

|

Rating

|

Recommendations

|

Progress

|

|

York Valley Weighbridge

|

Overdue

|

The Solid Waste Procedures Manual is a very comprehensive

practical document, and is the primary document used by operations staff, but

is not up to date in places; there has been no attempt to create processes to

match the new weighbridge operation

|

High

|

As the main source of truth, and to ensure compliance with best

practice procedure, the Solid Waste Procedures Manual, which identifies the

'what' should be done and 'who' is responsible for this, should be updated;

It should be available for use when the new weighbridge system is functional

and matches agree operating practices – this may require input

from a business analyst; Align Promapp to agreed improvements from this

review.

|

Now completed. The high risk, high level documentation has been completed and

in Promapp.

|

|

|

|

|

Low

|

Internal Audit considers the high risk relating to this finding

has been resolved but the action remains open (with a lower risk rating) as

the functional 'how to' aspects (Work Instructions) development is still

ongoing.

|

In Progress.

Contracts Supervisor working with Business Analyst on a comprehensive review

of the Work Instructions.

|

|

|

Audit, Risk and Finance Subcommittee

10 May 2016

|

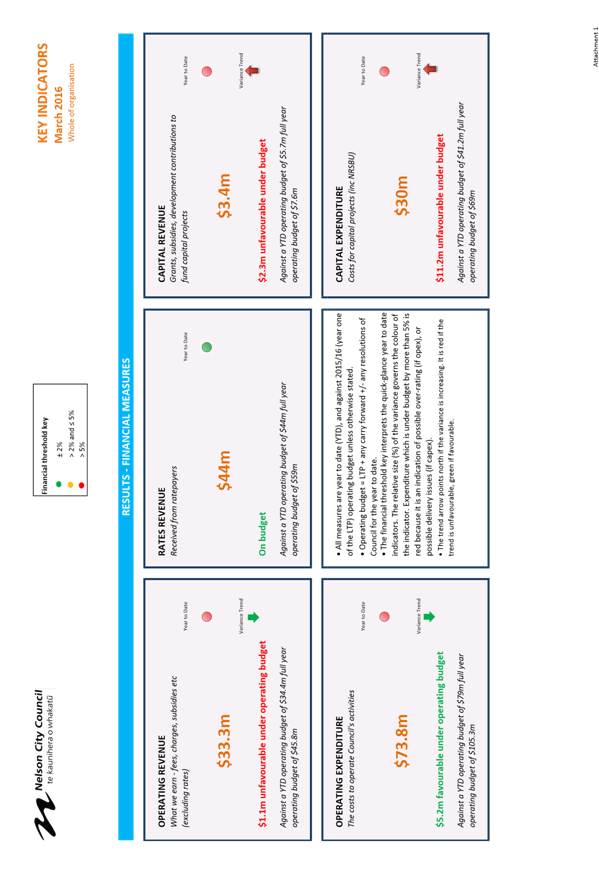

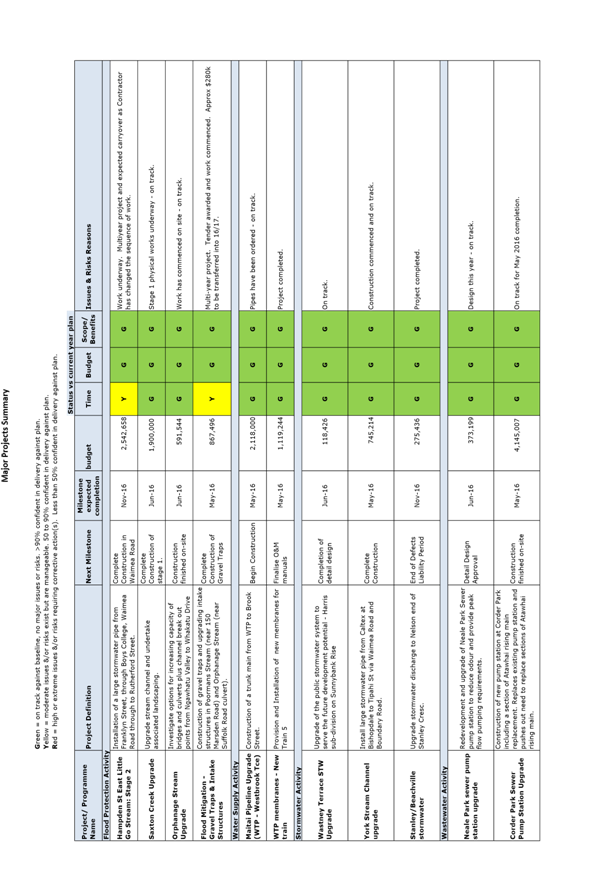

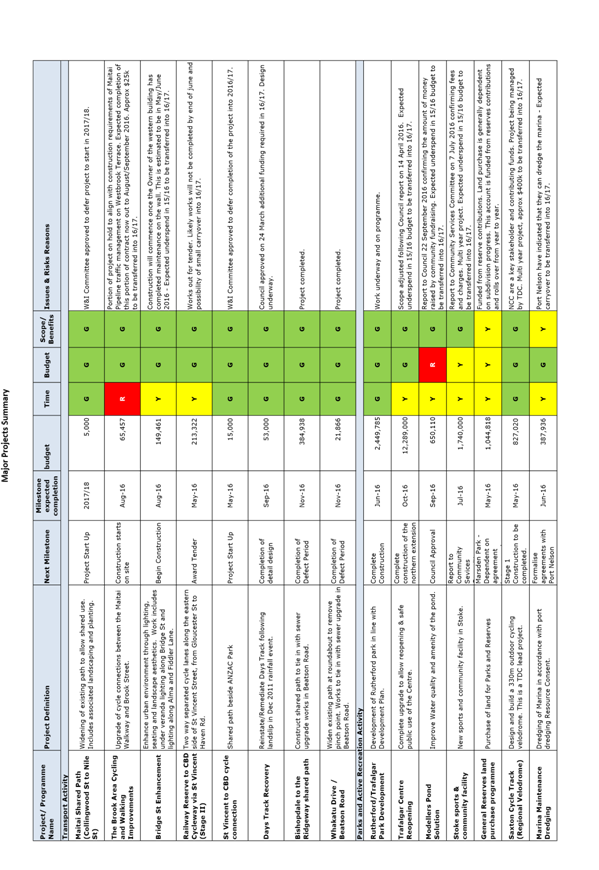

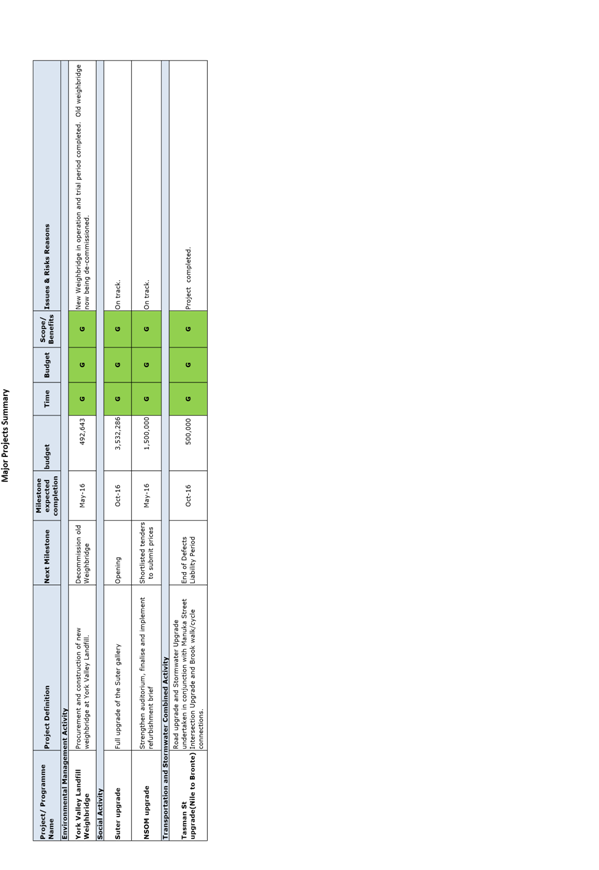

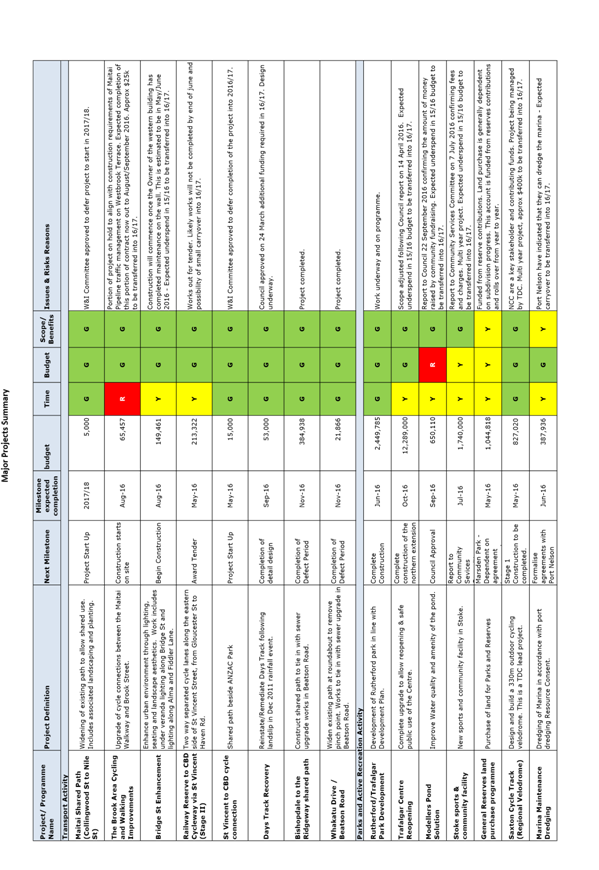

REPORT R5872

Corporate

Report to 31 March 2016

1. Purpose

of Report

1.1 To inform

the members of the Audit, Risk and Finance Subcommittee of the financial

results of activities for the 9 months ending 31 March 2016 compared to the

approved operating budget, and to highlight and explain any permanent and

material variations.

2. Delegations

2.1 The Audit, Risk and Finance Subcommittee

has oversight of the management of financial risks.

3. Recommendation

|

THAT the report Corporate Report

to 31 March 2016 (R5872) and

its attachments (A1544370 and A1544028)

be received;

|

Recommendation

to Governance Committee and Council

|

THAT the

transfer of legal budget from the Corporate activity to the Planning activity

in 2015/16 in order to obtain economic and traffic evidence for the

submission to Tasman District Council on the proposed Progressive Enterprises

Ltd Private Plan Change be noted.

|

4. Background

4.1 The financial reporting focuses on the 9

month performance compared with the year to date approved operating budget.

4.2 The intention of this redesigned report is

to provide information that is more visual and more focussed, and high-level

commentary that is better aligned with variance information as provided in the

annual report. Feedback from the last meeting of the sub-committee has been

incorporated into this report.

4.3 Unless otherwise indicated, all measures are against

approved operating budget, which is LTP budget plus any carry forwards, plus or

minus any other additions or changes as approved by Council throughout the

year.

4.4 Budgets for operating income and

expenditure are phased evenly through the year, whereas capital expenditure

budgets are phased to occur mainly in the second half of the year.

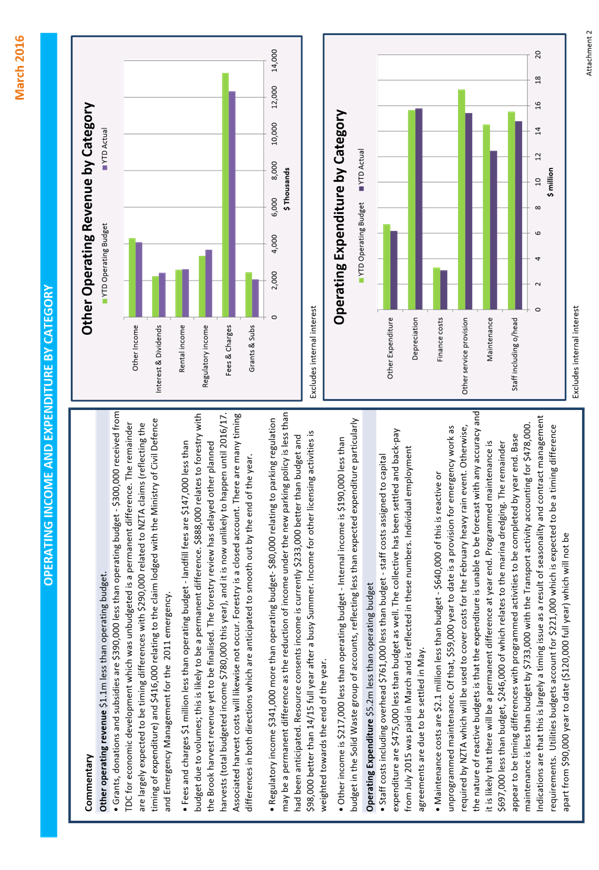

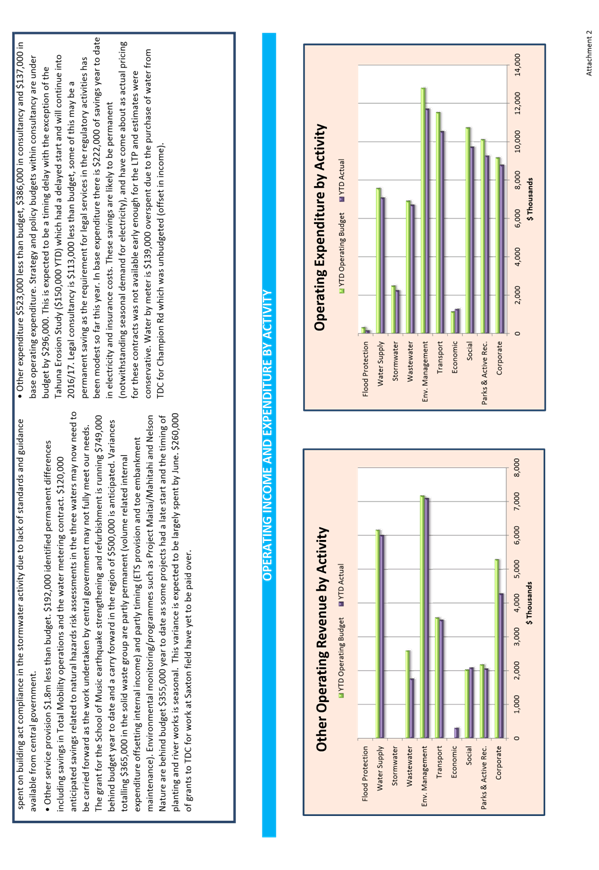

5. Discussion

5.1 For the 9 months ending 31 March 2016, the activity surplus/deficits are

$4.1 million favourable to budget.

5.2 Financial information provided in attachment 1 to this

report are:

· A financial measures dashboard with information on rates revenue,

operating revenue and expenditure, and capital revenue and expenditure. A new

icon has been added to each applicable measure, indicating whether the variance

is increasing or decreasing (arrows) and whether that trend is favourable or

unfavourable (green or red).

· A grouping of more detailed graphs and commentary for operating

income and expenditure. The first set of charts and the commentary is by

category (as in the annual report) and highlights significant permanent

differences and items of interest. Variances due to timing will not be itemised

unless they become permanent. The second set of charts are by activity.

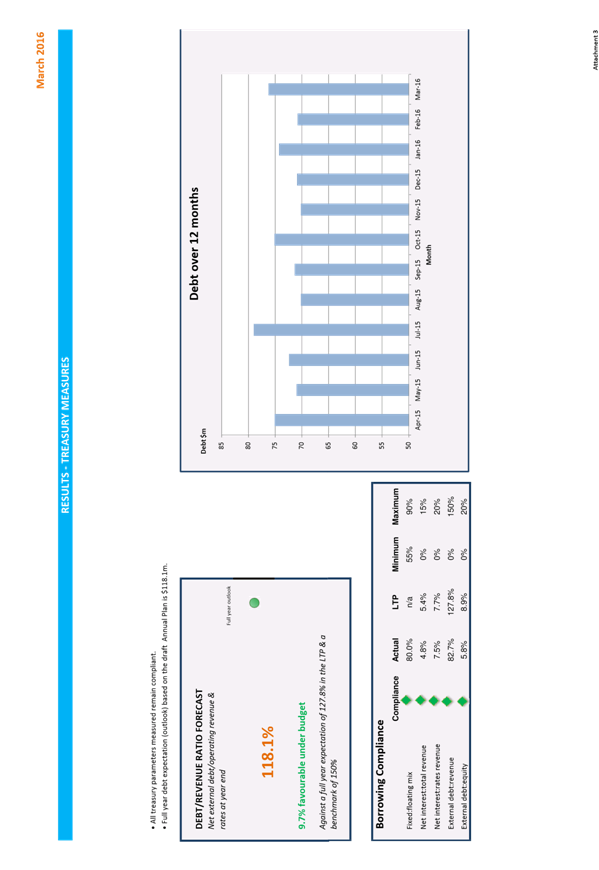

· A treasury measures dashboard with a compliance table (green =

compliant), a forecast of the debt/revenue ratio for the year, and a graph

showing debt levels over a rolling 12 month period.

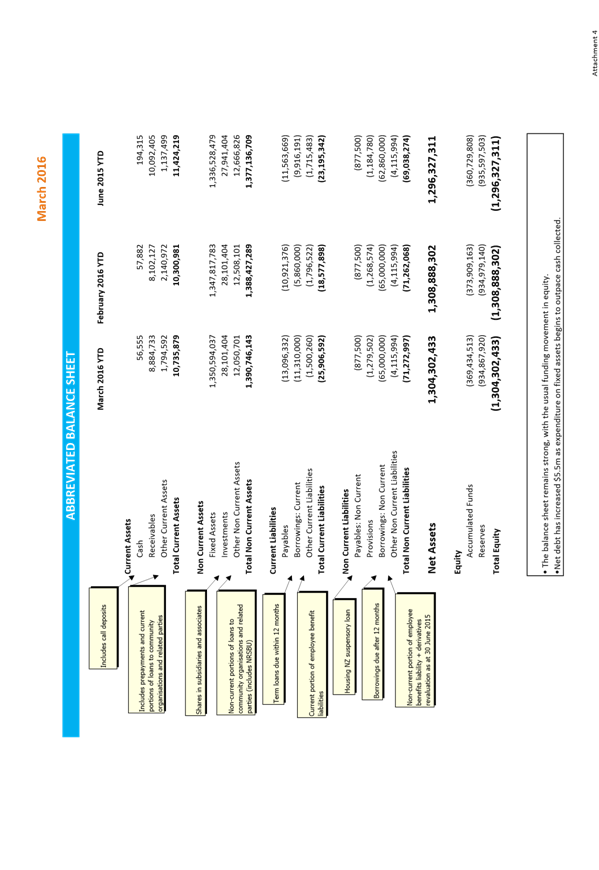

· High level balance sheet (no change to that provided previously).

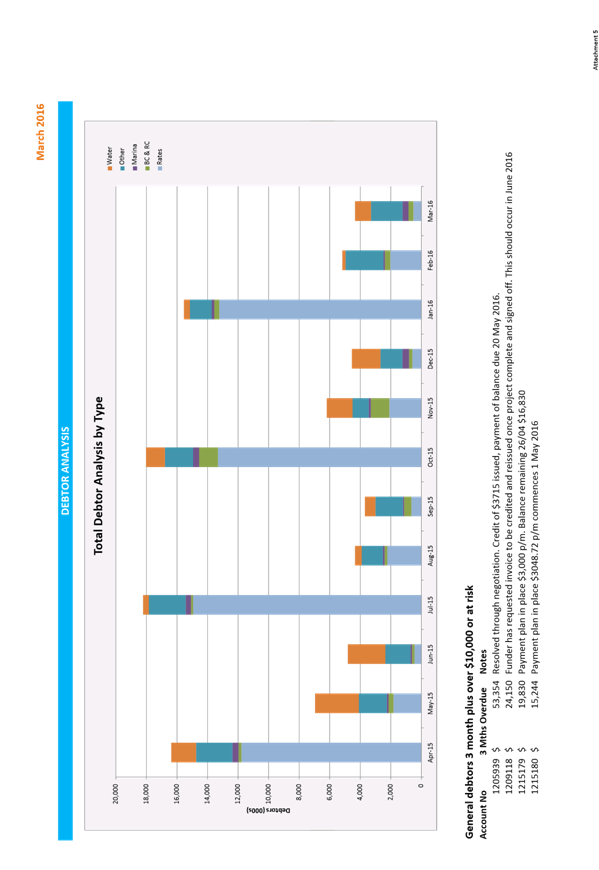

· A debtor analysis graph over 12 months, clearly showing outstanding

debt levels and patterns for major debt types along with a summary of general

debtors > 3 months and over $10,000 and other debtors at risk.

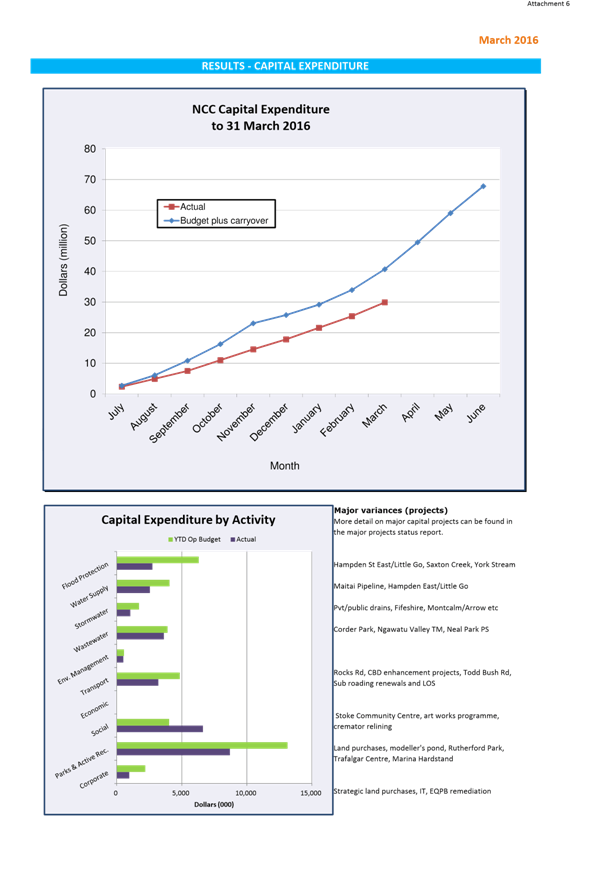

· Two capital expenditure graphs – actual expenditure against

operating budget for the financial year (no change), and year to date

expenditure against operating budget by activity.

5.3 Although operating income and expenditure variances

have increased from the last report to this sub-committee (January figures)

they have both decreased slightly from the February figures. Information from

staff indicates that these variances (particularly in expenditure) will

continue to decrease, and at a faster rate for the remainder of the year.

5.4 Capital revenue was on budget in January, and is now

$2.3 million under budget. This is because the budget has been adjusted to

reflect the fact that Council is now invoicing the Suter Gallery for their

share of the redevelopment costs and the invoicing has not caught up to the

phasing of the budget.

6. Progressive

Enterprises Ltd Private Plan Change

6.1 The Planning and Regulatory Committee agreed on 21

April 2016 to approve the lodging of a submission to Tasman District Council on

the proposed Progressive Enterprises Ltd Private Plan Change. As advised

at the Committee meeting, economic and traffic evidence would be

required. There was no advice provided regarding budget requirements to

obtain the traffic and economic evidence. There is no contingency budget

for these matters. $30,000 has been reallocated from the Corporate legal

budget to the planning team budget to allow this evidence to be obtained.

7. Alignment

with relevant Council policy

7.1 The

financial reporting is prepared comparing current year performance against the

year to date approved budget for 2015/16.

8. Assessment

of Significance against the Council’s Significance and Engagement Policy

8.1 There

are no significant decisions.

9. Consultation

9.1 No

consultation is required.

10. Inclusion

of Māori in the decision making process

10.1 No

consultation is required.

Tracey

Hughes

Senior

Accountant

Attachments

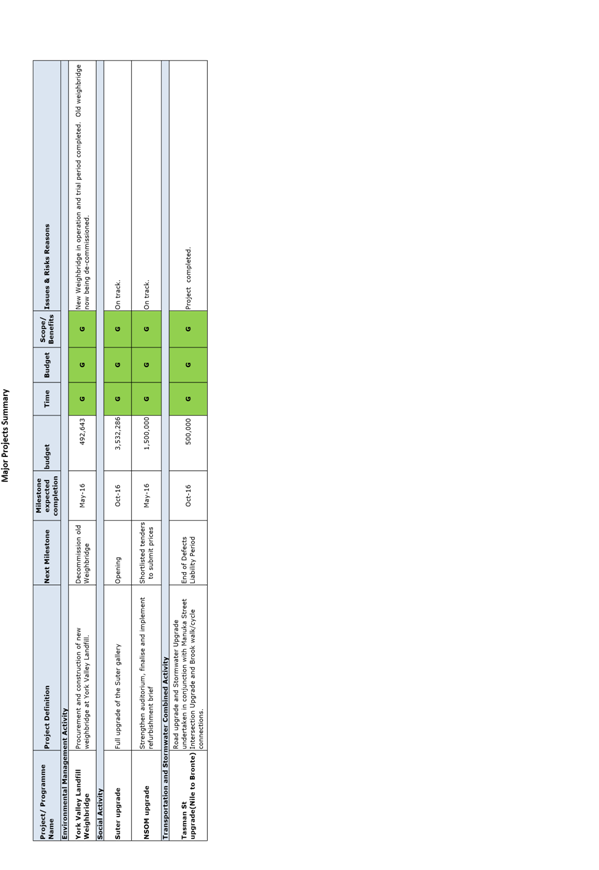

Attachment 1: A1544370 -

Consolidated information for corporate report

Attachment 2: A1544028

- Major Projects Status Report

Audit, Risk and Finance

Subcommittee

Audit, Risk and Finance

Subcommittee