AGENDA

Ordinary meeting of the

Governance Committee

Thursday 21 April 2016

Commencing at 9.00am

Council Chamber

Civic House

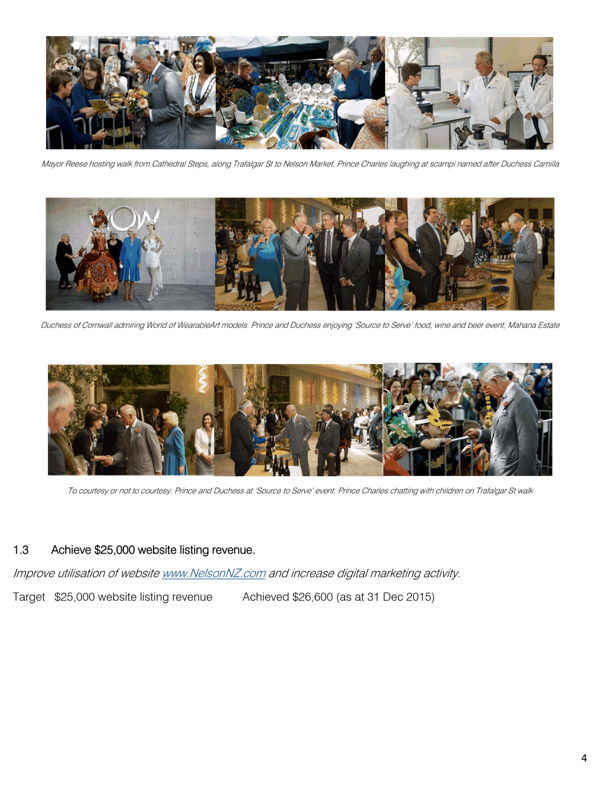

110 Trafalgar Street, Nelson

Membership: Councillor Ian Barker (Chairperson), Her Worship

the Mayor Rachel Reese, Councillors Luke Acland (Deputy Chairperson), Eric Davy,

Kate Fulton, Paul Matheson, Brian McGurk, Gaile Noonan, and Pete Rainey, Mr

John Murray and Mr John Peters

Guidelines for councillors

attending the meeting, who are not members of the Committee, as set out in

Standing Orders:

·

All councillors, whether or not they are members of the

Committee, may attend Committee meetings (SO 2.12.2)

·

At the discretion of the Chair, councillors who are not Committee

members may speak, or ask questions about a matter.

·

Only Committee members may vote on any matter before the

Committee (SO 3.14.1)

It is good practice for both Committee members and

non-Committee members to declare any interests in items on the agenda.

They should withdraw from the room for discussion and voting on any of these

items.

Governance Committee

Governance Committee

21

April 2016

Page

No.

1. Apologies

Nil

2. Confirmation

of Order of Business

3. Interests

3.1 Updates

to the Interests Register

3.2 Identify

any conflicts of interest in the agenda

4. Public

Forum

5. Confirmation

of Minutes

5.1 3

March 2016 10 - 17

Document number M1747

Recommendation

THAT

the minutes of the extraordinary meeting of the Governance Committee, held on 3

March 2016, be confirmed as a true and correct record.

6. Status

Report - Governance Committee 21 April

There is no status report.

7. Chairperson's

Report

Governance

8. Sister

Cities Update - April 2016 18 - 22

Document number R5529

Recommendation

THAT the report Sister Cities

Update - April 2016 (R5529) and

its attachment (A1523258) be

received.

9. The

Bishop Suter Trust draft Statement of Intent 2016/17 and Half Yearly Report 23 - 71

Document number R5352

Recommendation

THAT the report The Bishop Suter

Trust draft Statement of Intent 2016/17 and Half Yearly Report (R5352) and its attachments (A1512564, A1512571, A1463949 & A1512573) be received;

AND

THAT the Committee notes the delivery of the Bishop Suter

Trust Draft Statement of Intent 2016/17 (A1512571) as required under the Local

Government Act 2002.

Recommendation to Council

THAT the

Bishop Suter Trust Statement of Intent 2016/17 (A1512571) meets

Council’s expectations and is approved as the final Statement of Intent

for 2016/17;

AND THAT

a one off grant of $10,000 be allocated to the Suter to allow free entry for

locals for the 2016/17 year;

AND THAT

the Trust report back to Council as part of its preparation of the 2017/18

draft Statement of Intent on the positive and negative impacts of free entry

for locals.

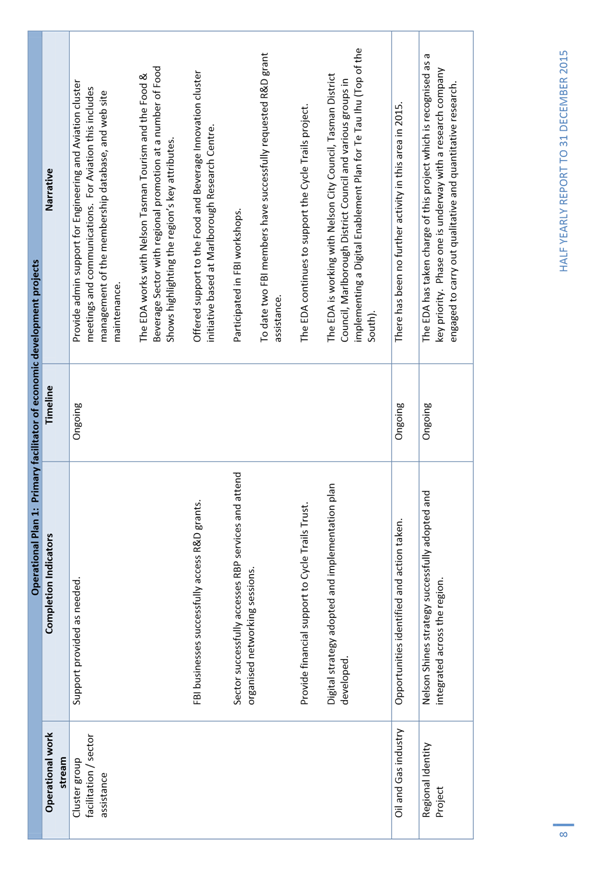

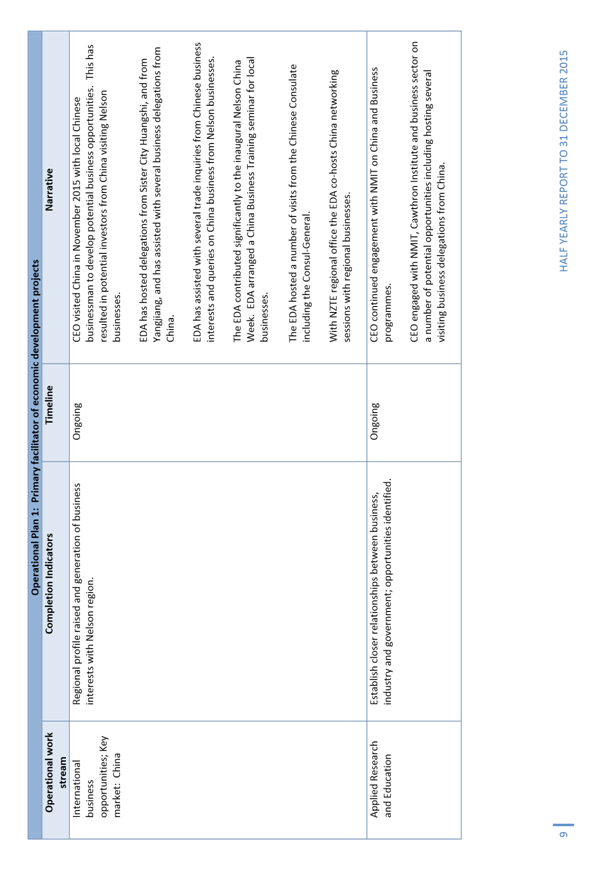

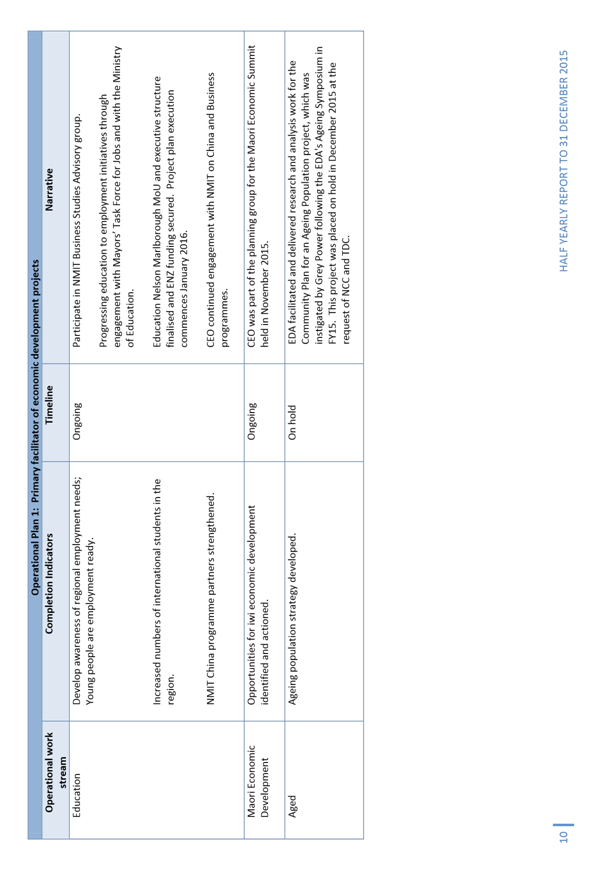

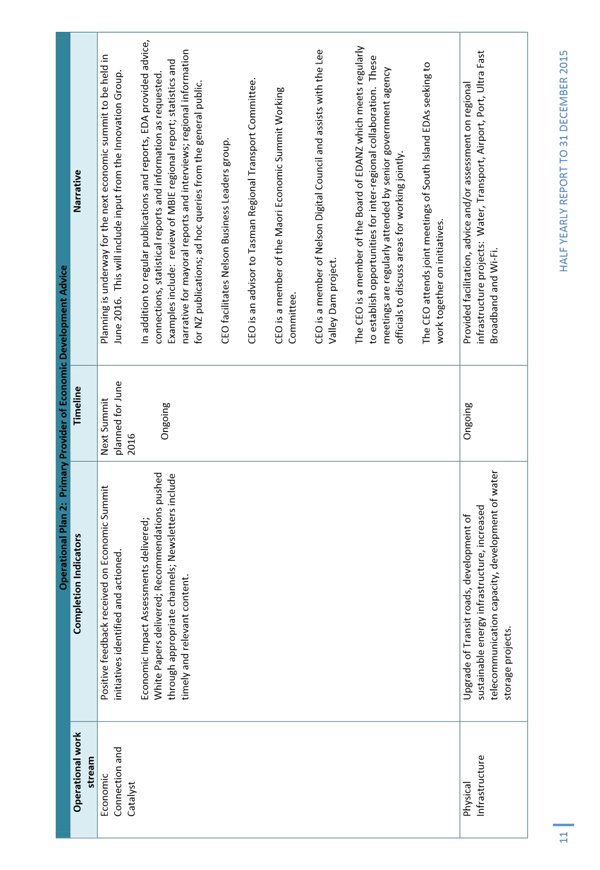

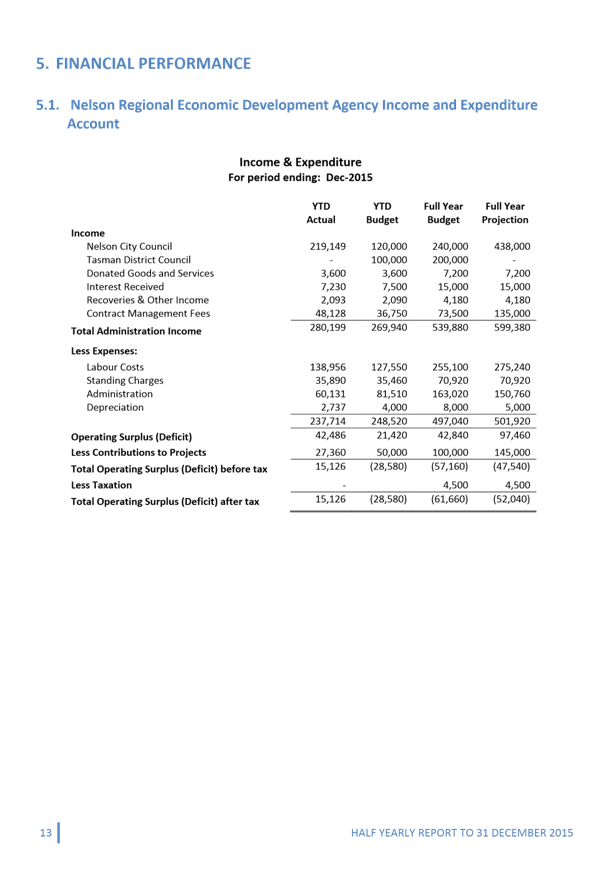

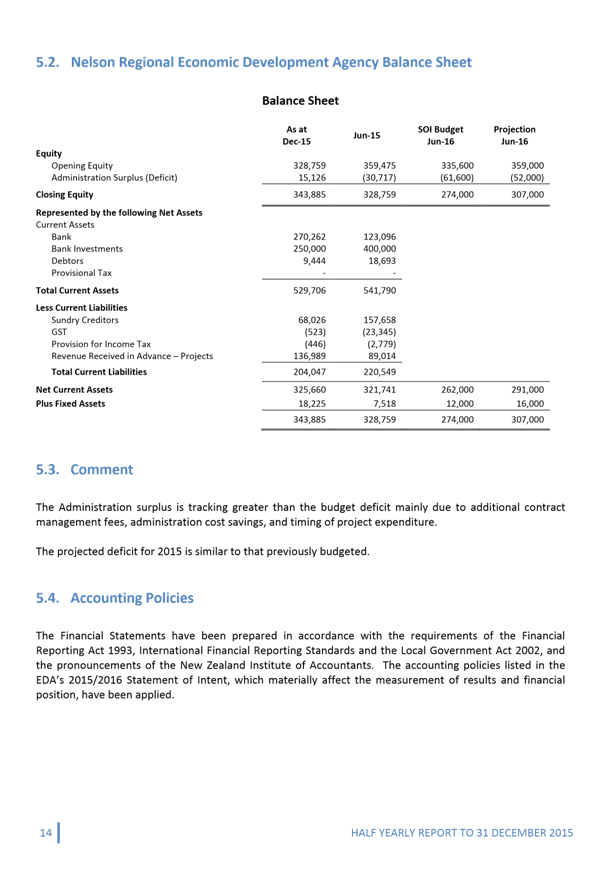

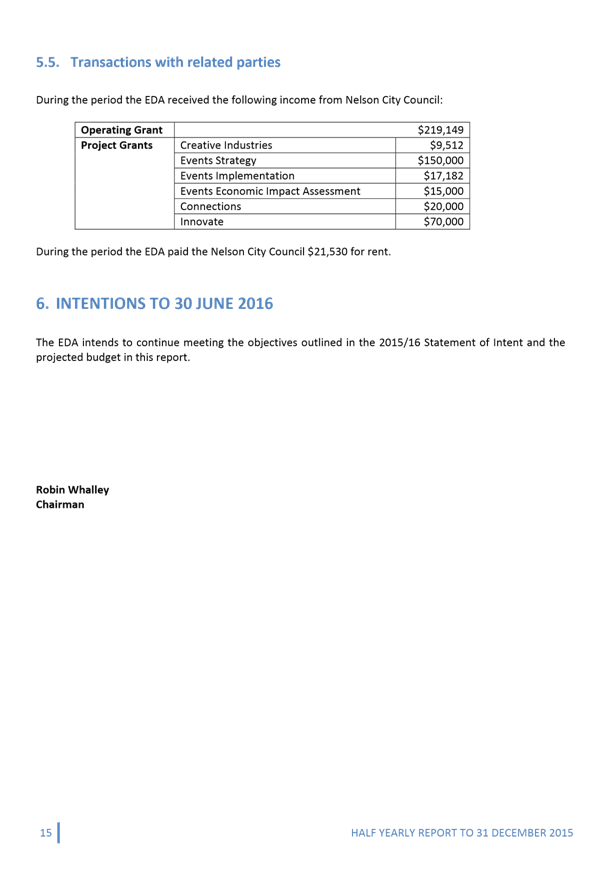

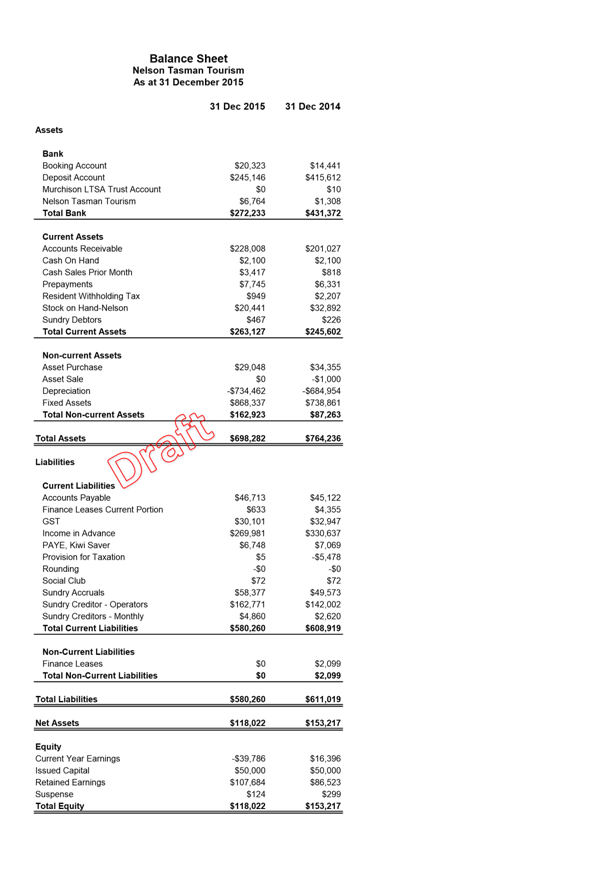

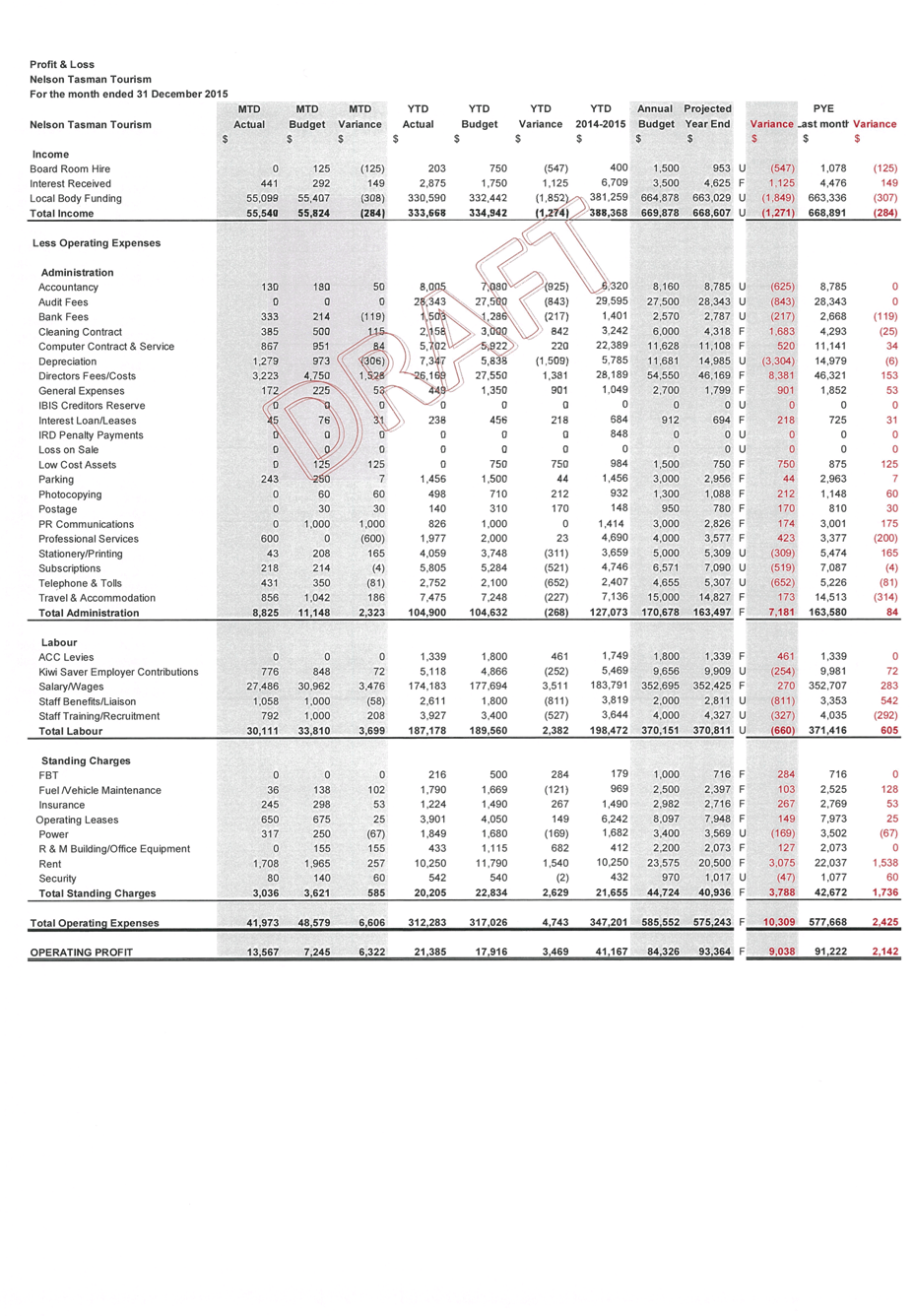

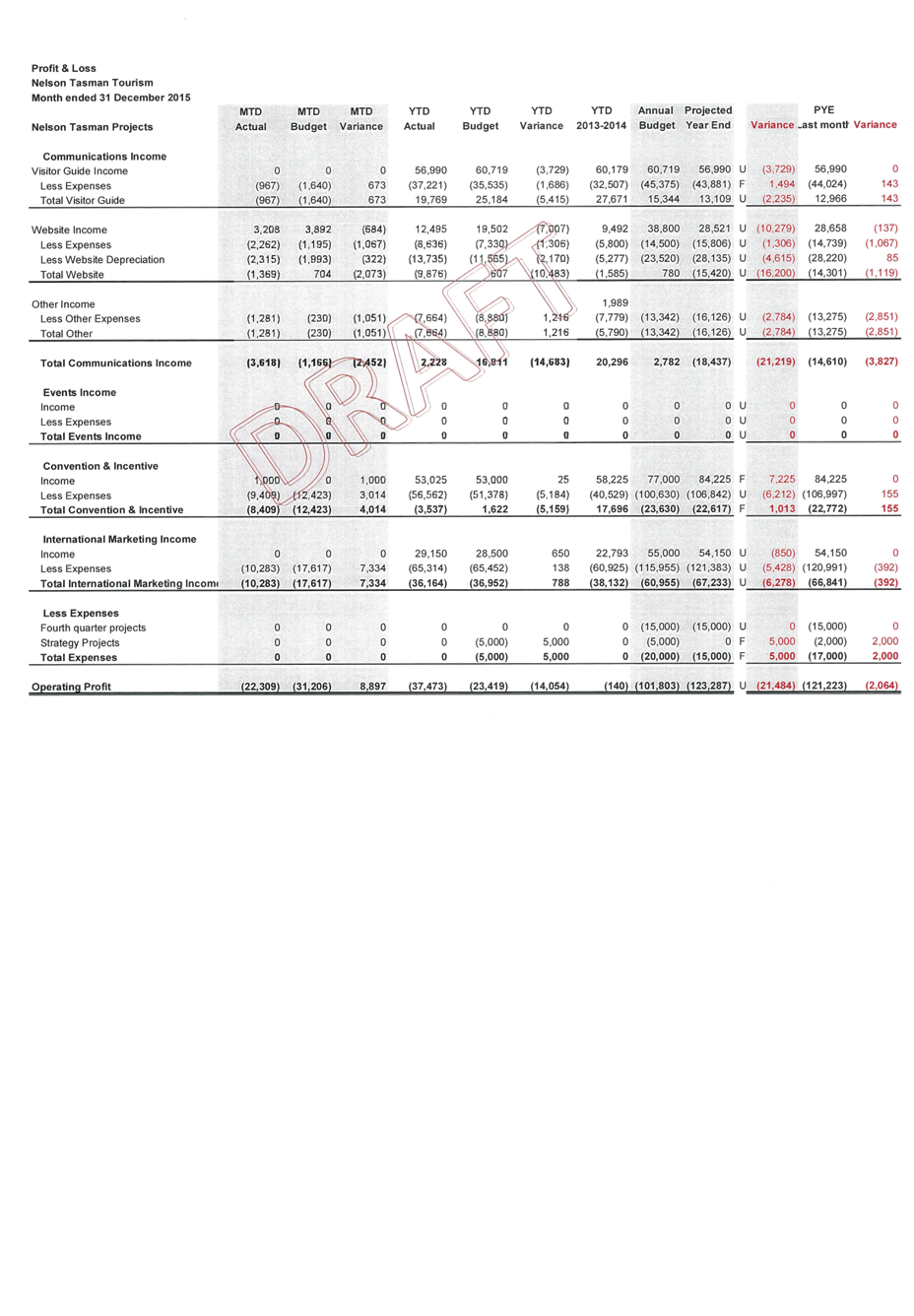

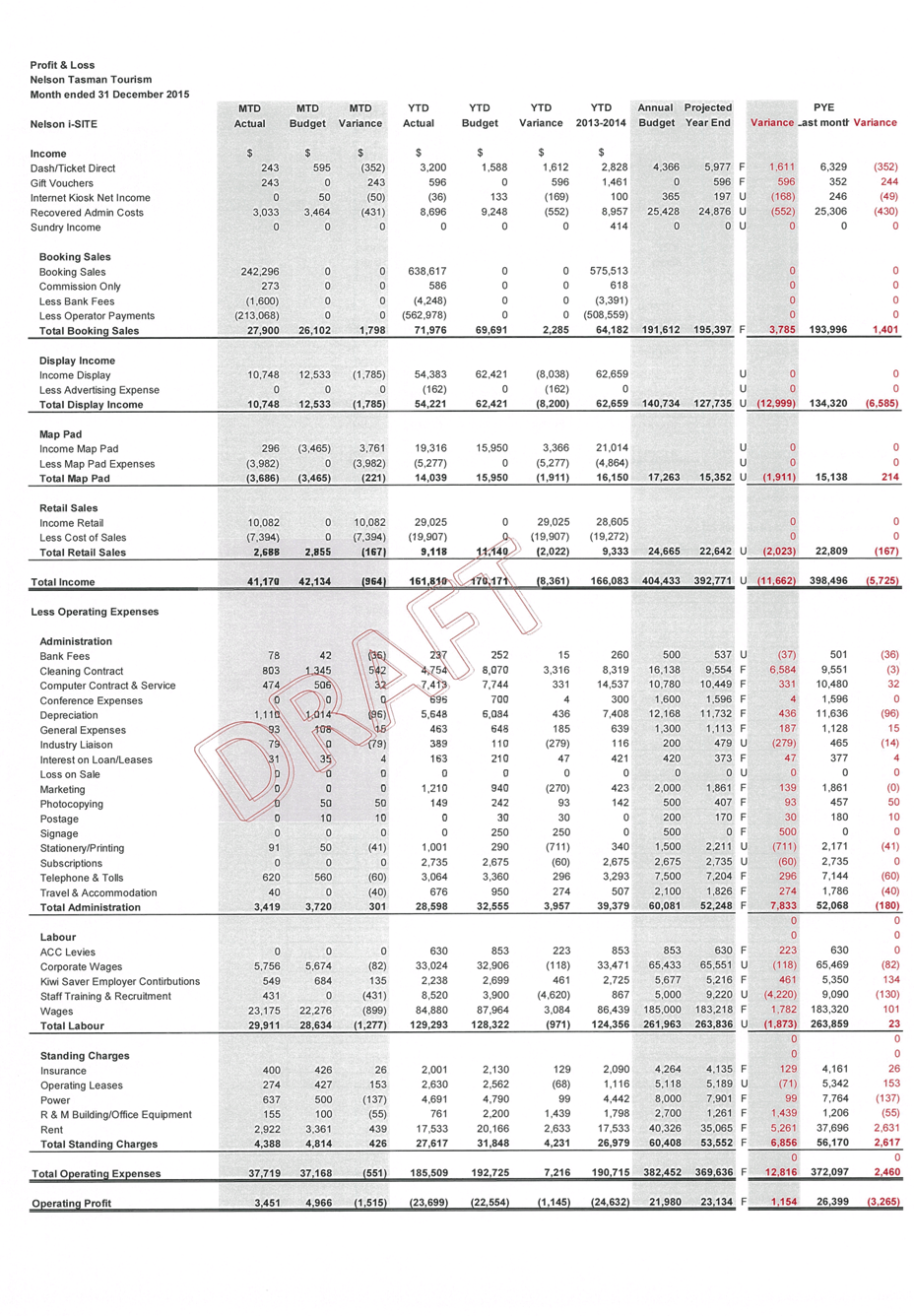

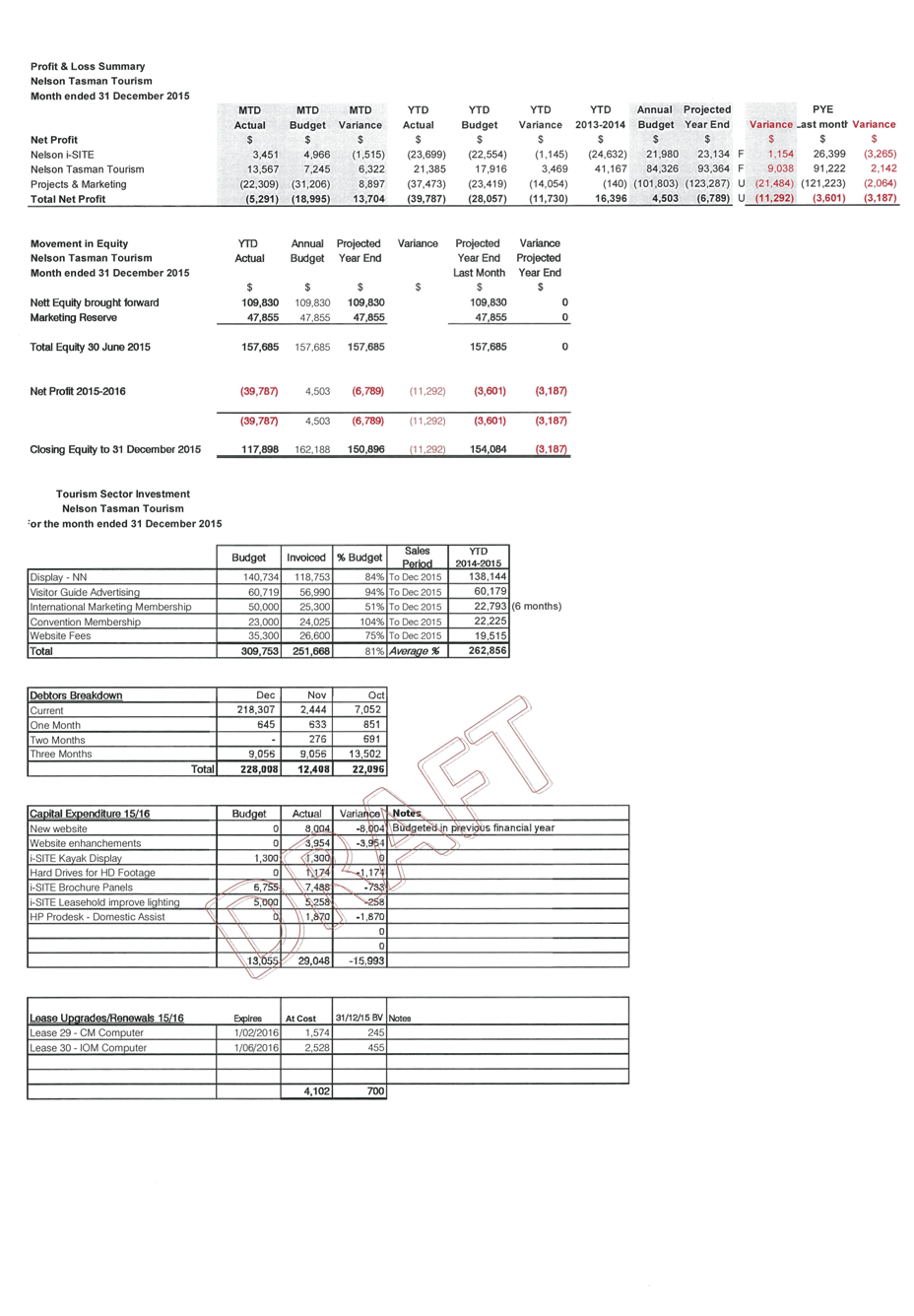

10. Half

Yearly Reports - Nelson Regional Economic Development Agency and Tourism Nelson

Tasman Ltd. 72 - 110

Document number R5589

Recommendation

THAT the report Half Yearly

Reports - Nelson Regional Economic Development Agency and Tourism Nelson Tasman

Ltd. (R5589) be received;

AND THAT

the Half Yearly report of the Nelson Regional Economic

Development Agency (A1511501) be received;

AND

THAT the Half Yearly report of Tourism Nelson Tasman Ltd.

(A1511411) be received.

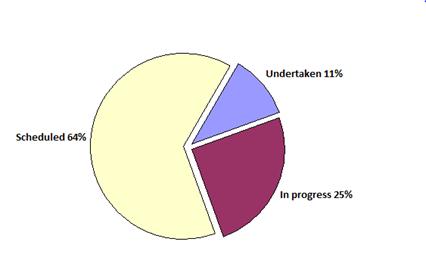

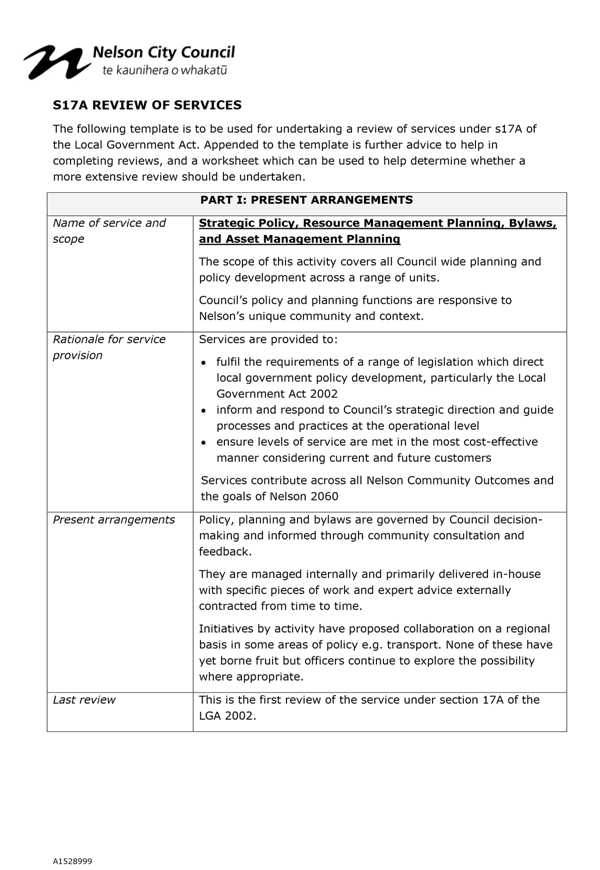

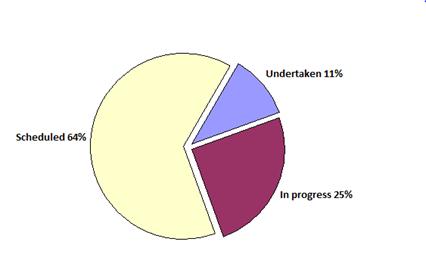

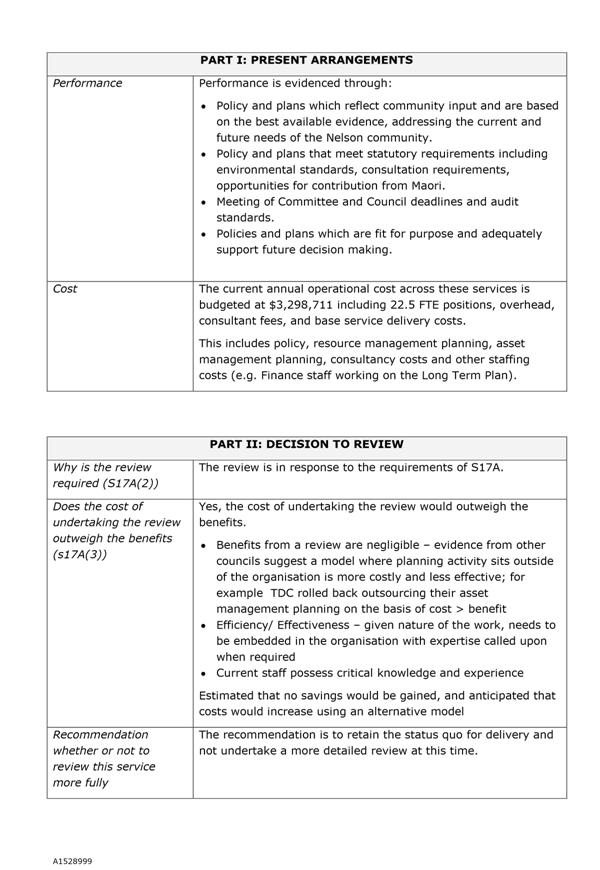

11. Service

Level Reviews Progress Update 111 - 117

Document number R5577

Recommendation

THAT the report Service Level

Reviews Progress Update (R5577)

and its attachment (A1528999) be received.

12. Draft

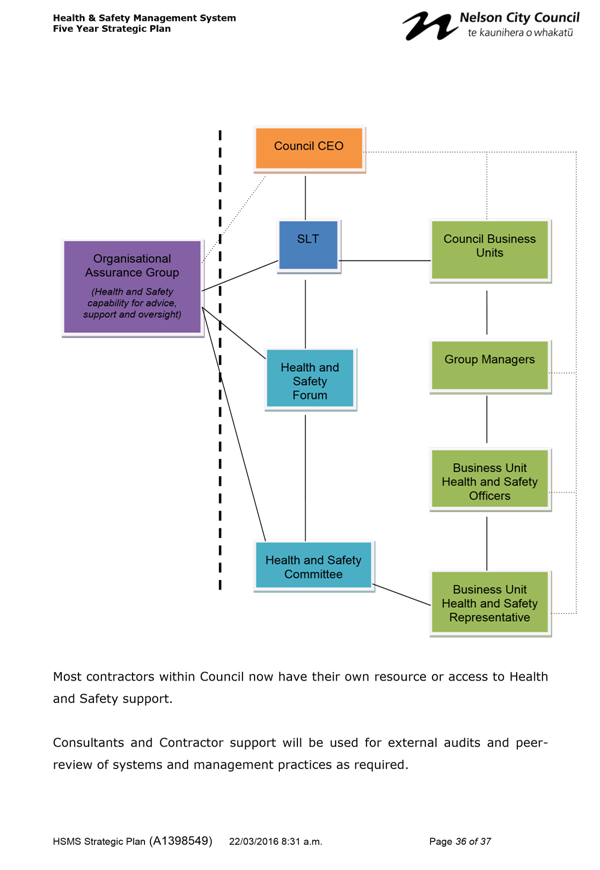

Health and Safety Management System Strategic Plan 118 - 157

Document number R4207

Recommendation

THAT the report Draft Health and

Safety Management System Strategic Plan (R4207)

and its attachment (A1398549) be

received.

Recommendation to Council

THAT the

Draft Health and Safety Management System Strategic Plan (A1398549) be approved.

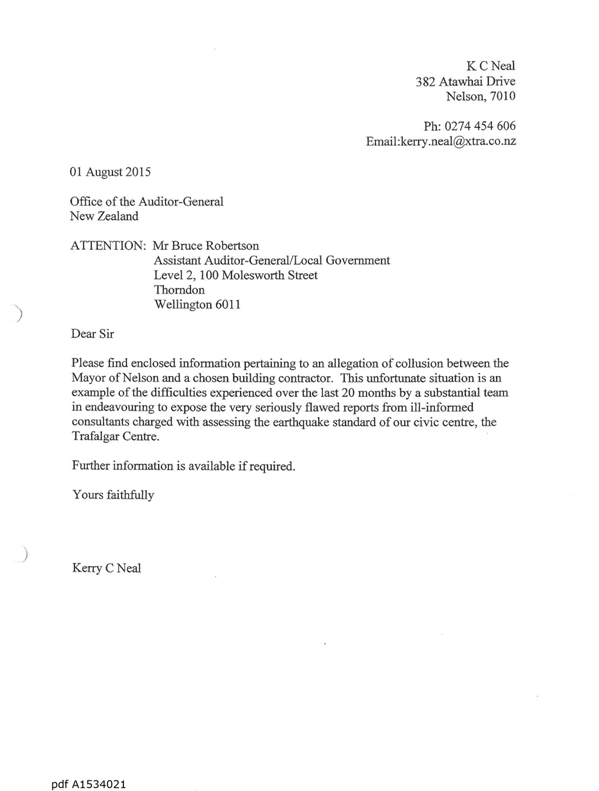

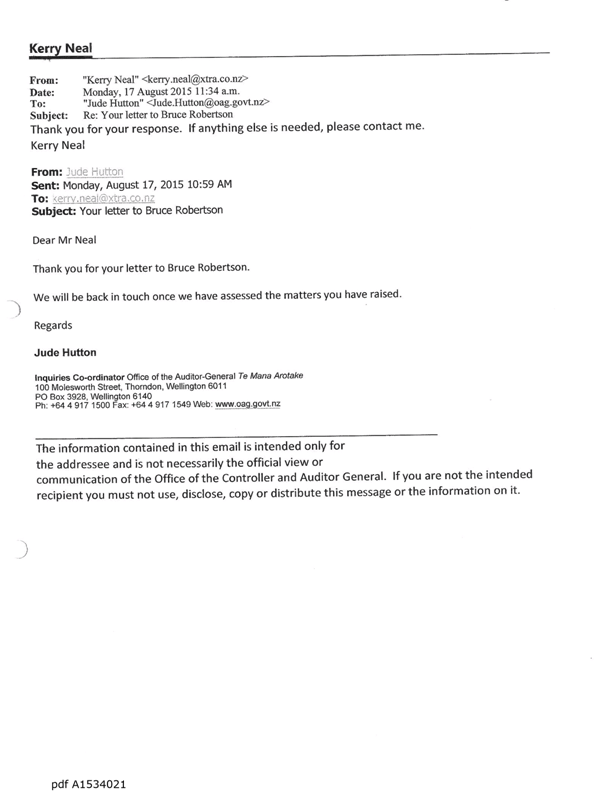

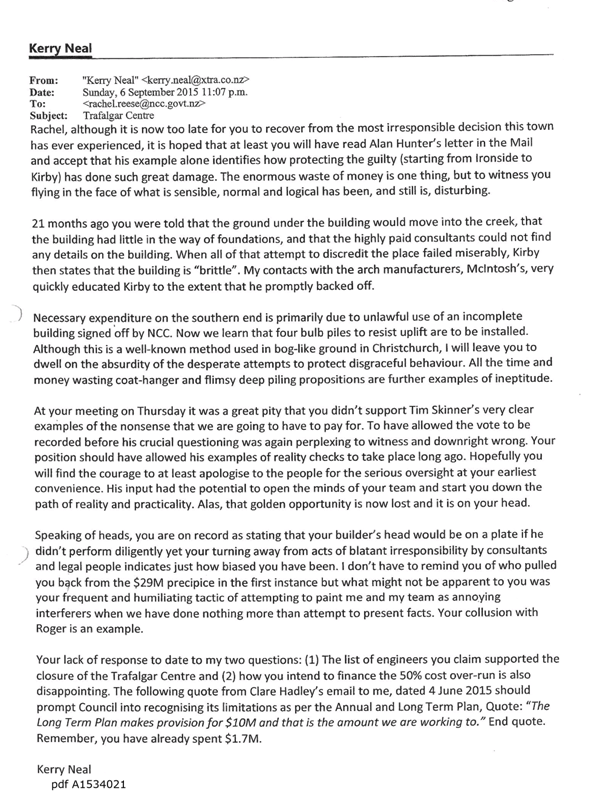

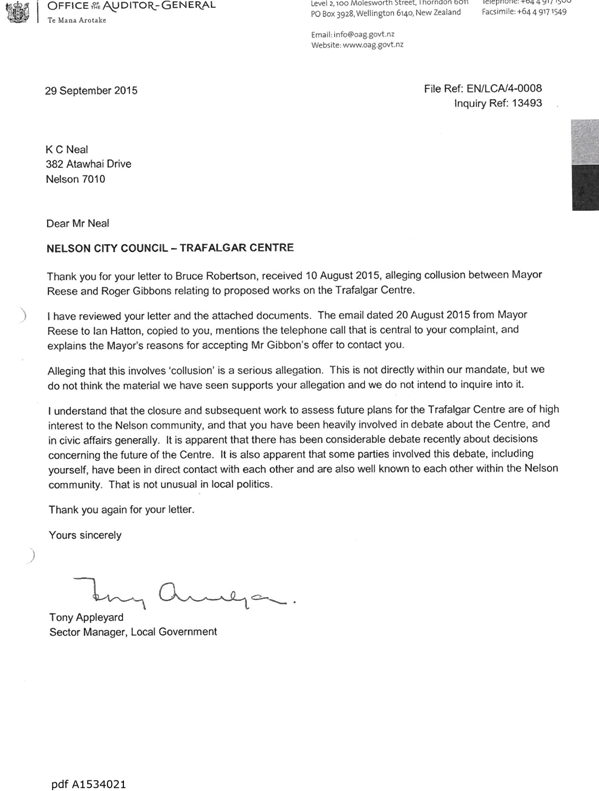

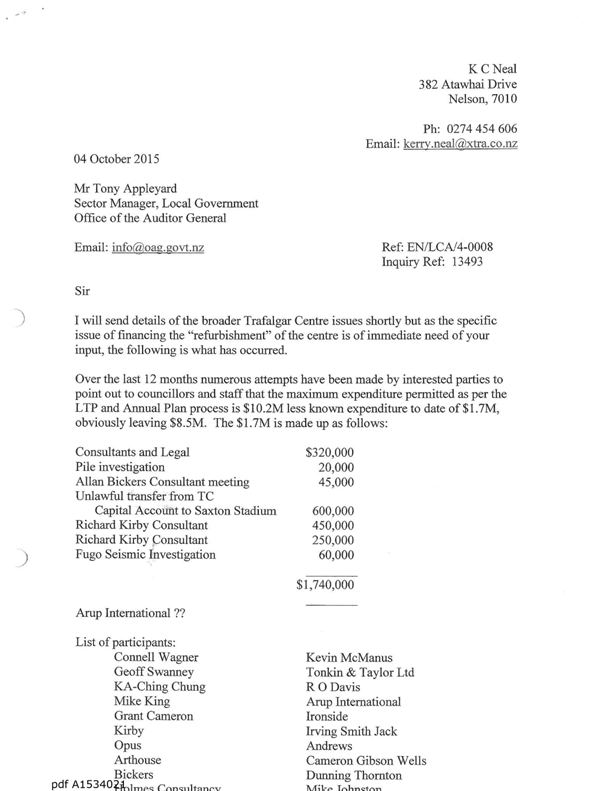

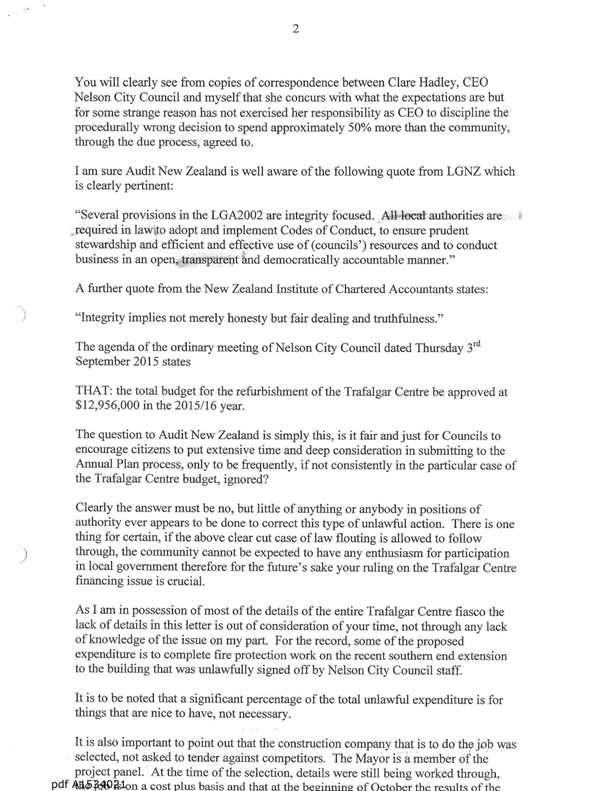

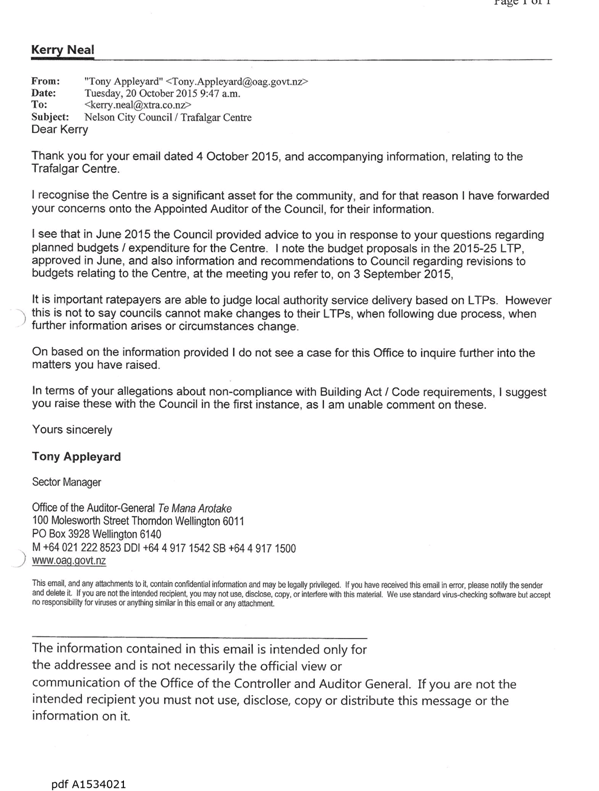

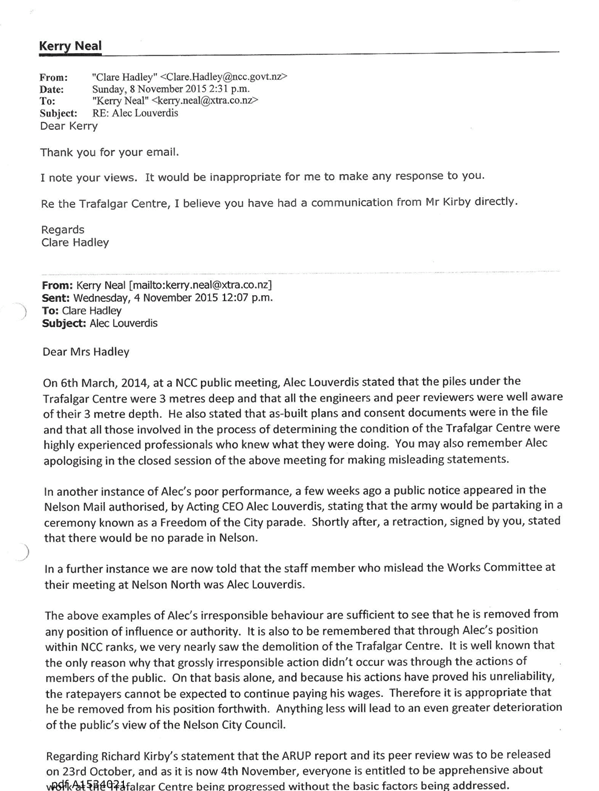

13. Responses

to Mr Neal's public forum, 3 March 2016 158 - 214

Document number R5726

Recommendation

THAT the report Responses to Mr Neal's

public forum, 3 March 2016 (R5726)

and its attachments (A1512793, A1530211, A1534021, and A1533960) be received;

AND THAT

it be noted that the allegation of collusion has been

considered and found to have no basis.

REPORTS FROM

COMMITTEES

14. Audit,

Risk and Finance Subcommittee - 31 March 2016 215 - 221

Document number M1801

Recommendation

THAT

the unconfirmed minutes of a meeting of the Audit, Risk and Finance

Subcommittee, held on 31 March 2016, be received.

Please note that as the only

business transacted in public excluded was to confirm the minutes, this

business has been recorded in the public minutes. In accordance with the Local

Government Official Information Meetings Act, no reason for withholding this

information from the public exists.

14.1 Extension

of loan facility to the Melrose Society

Recommendation to Governance Committee and Council

THAT

the $15,000 funding allocated towards asbestos remediation in Melrose House in

2016/17 be brought forward to 2015/16 and be used to grant fund the Melrose

Society for the purpose of toilet refurbishment;

AND THAT

an additional unbudgeted grant of up to $42,000 is provided to the

Melrose Society for the purpose of toilet renovations in the 2015/16 financial

year;

AND

THAT the Melrose Society be informed that no further grants

will be made by Council to the Melrose Society for the toilet refurbishment and

chiller installation project.

14.2 Corporate

Report to 31 January 2016

Recommendation to Governance Committee and Council

THAT

the unspent 2015/16 Community Investment Fund operational budget of $21,300 be

carried forward to the 2016/17 financial year, bringing the total budget for

2016/17 for the Community Investment Fund to $327,000.

15. Commercial

Subcommittee - 31 March 2016 222 - 225

Document number M1803

Recommendation

THAT

the unconfirmed minutes of a meeting of the Commercial Subcommittee, held on 31

March 2016, be received.

Public Excluded Business

16. Exclusion

of the Public

Recommendation

|

THAT,

in accordance with section 48(5) of the Local Government Official Information

and Meetings Act 1987, Rob Gunn and Lee Babe remain after the public has been

excluded, for Item 5 of the Public Excluded agenda (Nelmac half yearly report

and draft Statement of Intent 2016/17), as they have knowledge that will

assist the Council;

AND THAT, in

accordance with section 48(6) of the Local Government Official Information

and Meetings Act 1987, the knowledge that Rob Gunn and Lee Babe posess

relates to Nelmac Limited.

|

Recommendation

THAT

the public be excluded from the following parts of the proceedings of this

meeting.

The

general subject of each matter to be considered while the public is excluded,

the reason for passing this resolution in relation to each matter and the

specific grounds under section 48(1) of the Local Government Official

Information and Meetings Act 1987 for the passing of this resolution are as

follows:

|

Item

|

General subject of each matter to be considered

|

Reason for passing this resolution in relation to each matter

|

Particular interests protected (where applicable)

|

|

1

|

Governance

Committee Meeting - Public Excluded Minutes - 3 March 2016

|

Section

48(1)(a)

The public

conduct of this matter would be likely to result in disclosure of information

for which good reason exists under section 7.

|

The

withholding of the information is necessary:

· Section

7(2)(b)(ii)

To protect information where the making

available of the information would be likely unreasonably to prejudice the

commercial position of the person who supplied or who is the subject of the

information.

· Section 7(2)(h)

To enable the local

authority to carry out, without prejudice or disadvantage, commercial

activities

|

|

2

|

Nelmac

half yearly report and draft Statement of Intent 2016/17

|

Section 48(1)(a)

The public conduct of this

matter would be likely to result in disclosure of information for which good

reason exists under section 7

|

The

withholding of the information is necessary:

· Section 7(2)(i)

To enable the local

authority to carry on, without prejudice or disadvantage, negotiations

(including commercial and industrial negotiations)

|

|

3

|

Potential

exit from Ridgeways Joint Venture

|

Section 48(1)(a)

The public conduct of this

matter would be likely to result in disclosure of information for which good

reason exists under section 7

|

The

withholding of the information is necessary:

· Section 7(2)(i)

To enable the local

authority to carry on, without prejudice or disadvantage, negotiations

(including commercial and industrial negotiations)

|

|

4

|

Commercial

Subcommittee Meeting - Public Excluded Minutes - 31 March 2016

These

minutes contain a recommendation to Governance Committee and Council

regarding Forestry

|

Section 48(1)(a)

The public conduct of this

matter would be likely to result in disclosure of information for which good

reason exists under section 7.

|

The

withholding of the information is necessary:

· Section 7(2)(b)(ii)

To protect information where the making available of

the information would be likely unreasonably to prejudice the commercial

position of the person who supplied or who is the subject of the information.

· Section

7(2)(h)

To enable the local authority to carry

out, without prejudice or disadvantage, commercial activities.

|

17. Re-admittance

of the public

Recommendation

THAT

the public be re-admitted to the meeting.

Note:

·

Youth Councillors Carys Collins and Taylah Shuker will be in

attendance at this meeting. (delete as appropriate)

Minutes of an

extraordinary meeting of the Governance Committee

Held in the Council

Chamber, Civic House, 110 Trafalgar Street, Nelson

On Thursday 3 March 2016,

commencing at 1.30pm

Present: Councillor

I Barker (Chairperson), Her Worship the Mayor R Reese, Councillors L Acland

(Deputy Chairperson), K Fulton, P Matheson, B McGurk, G Noonan, and Mr J Murray

and Mr J Peters

In Attendance: Councillor

M Lawrey, Chief Executive (C Hadley), Group Manager Infrastructure (A

Louverdis), Group Manager Community Services (C Ward), Group Manager Corporate

Services (N Harrison), Senior Strategic Adviser (N McDonald), Manager

Communications (P Shattock), Administration Adviser (S Burgess), and Nelson

Youth Councillors (F Sawyer and L Wilkes)

Apologies: Councillors

E Davy and P Rainey

1. Apologies

|

Resolved GOV/2016/001

THAT apologies be

received and accepted from Councillors Davy and Rainey.

McGurk/Noonan Carried

|

2. Confirmation of Order of

Business

The Chairperson advised that a

public forum presentation had been arranged since the agenda was distributed.

3. Interests

There were no updates to the

Interests Register, and no interests with items on the agenda were declared.

4. Public Forum

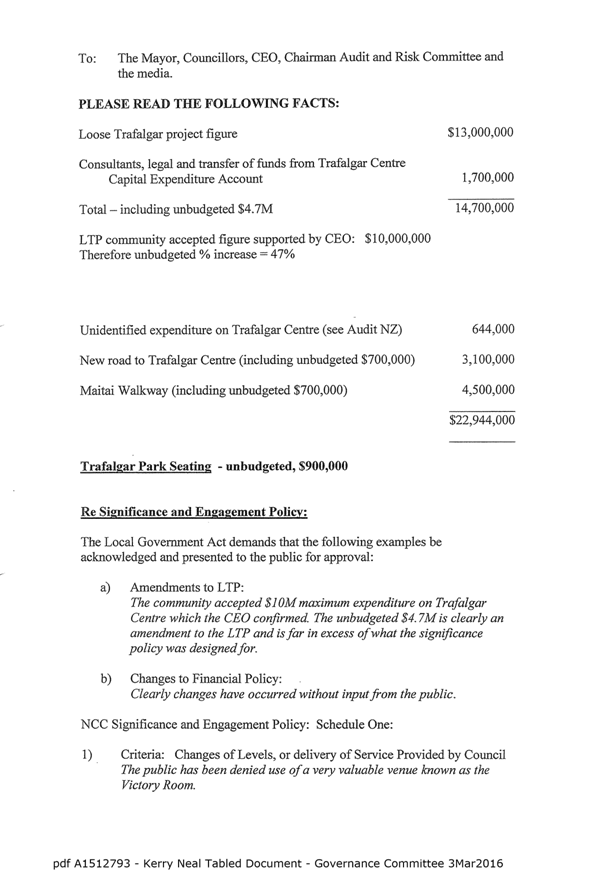

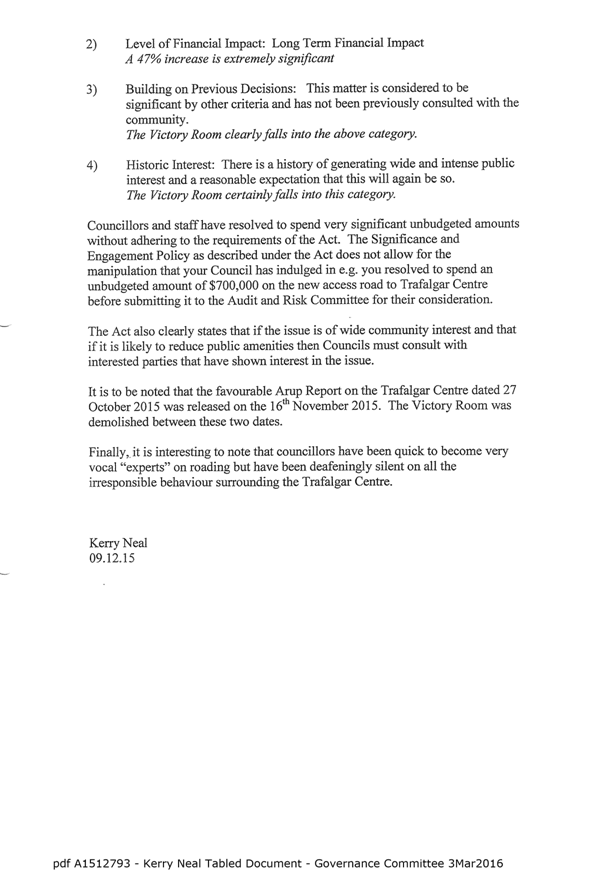

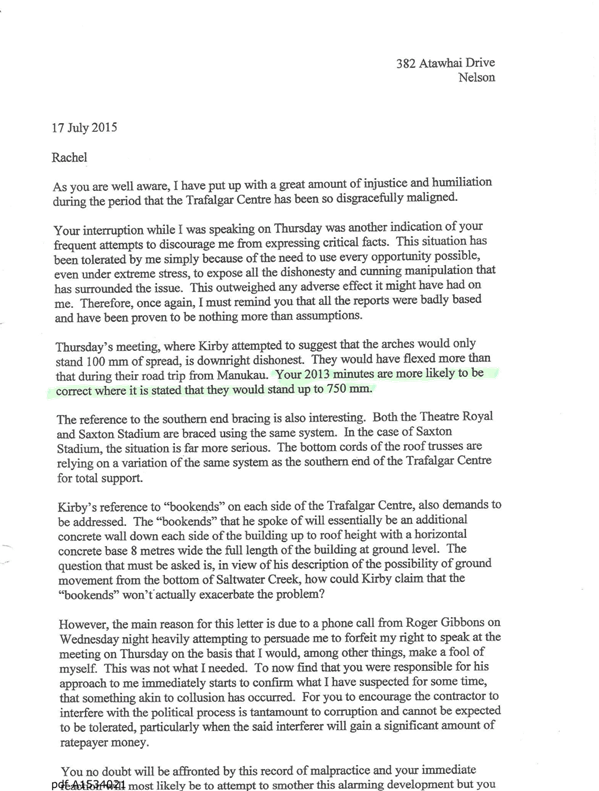

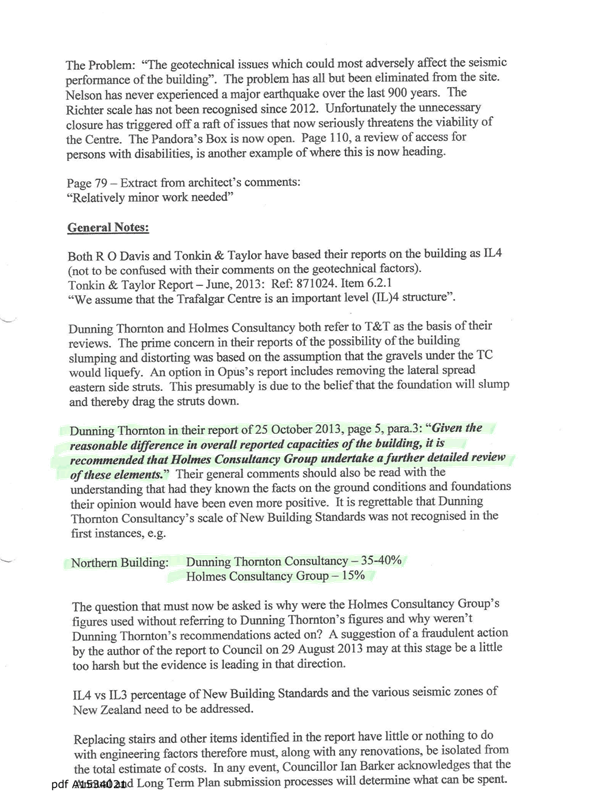

4.1 Kerry Neal

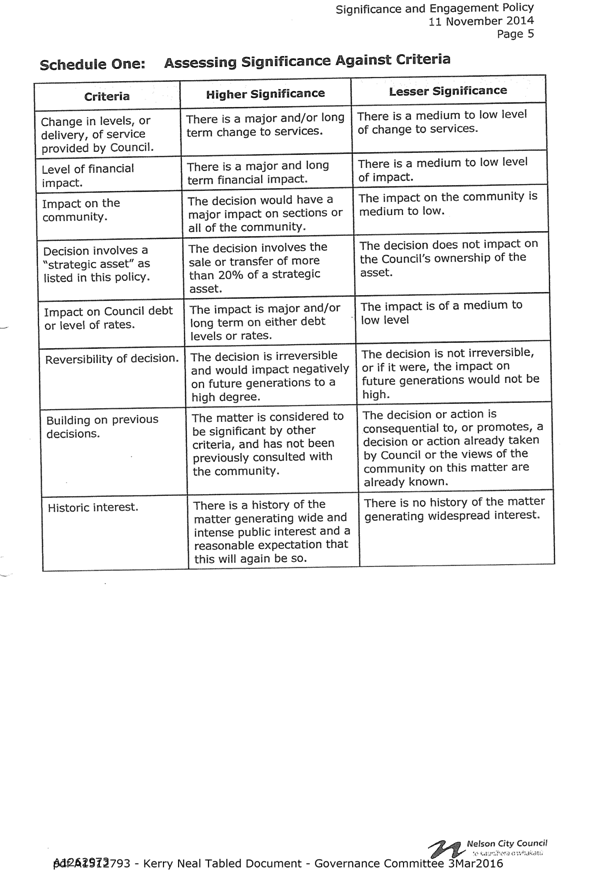

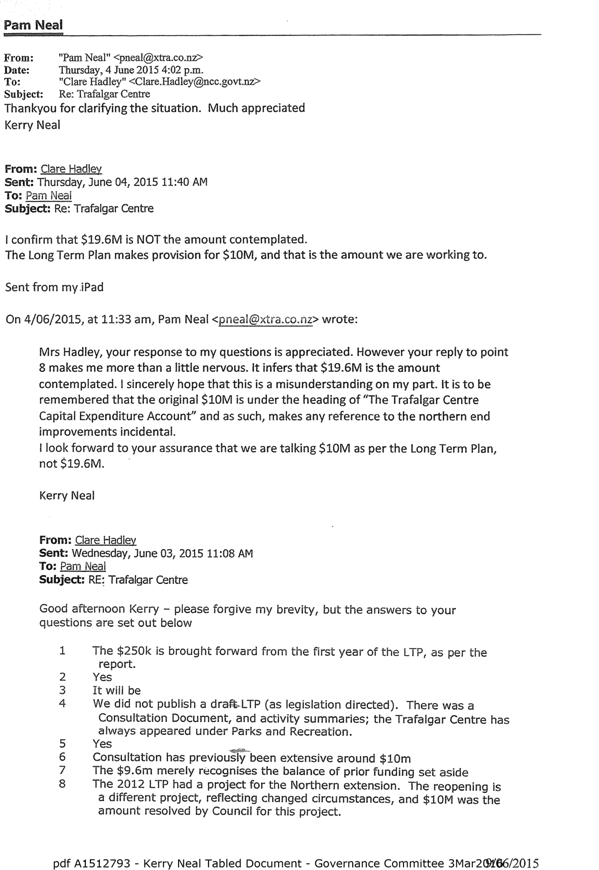

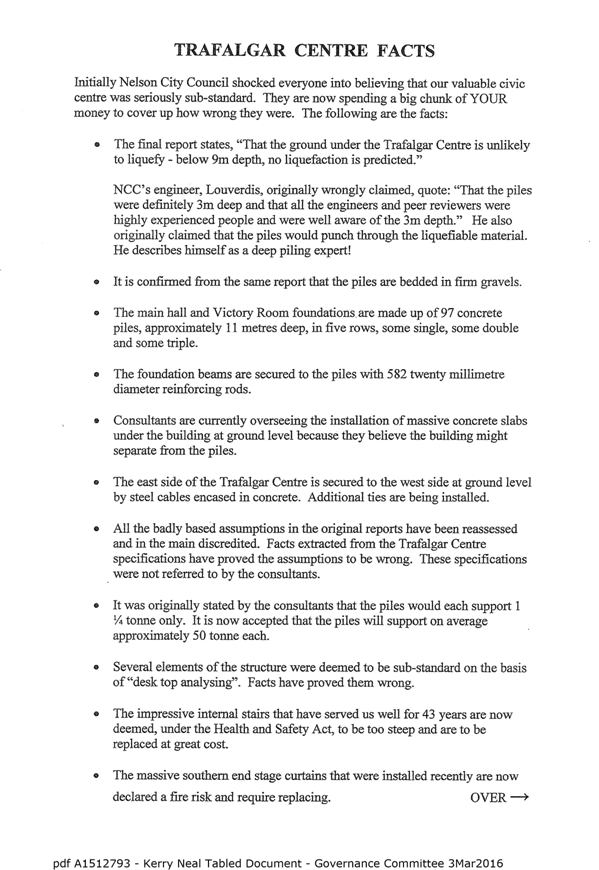

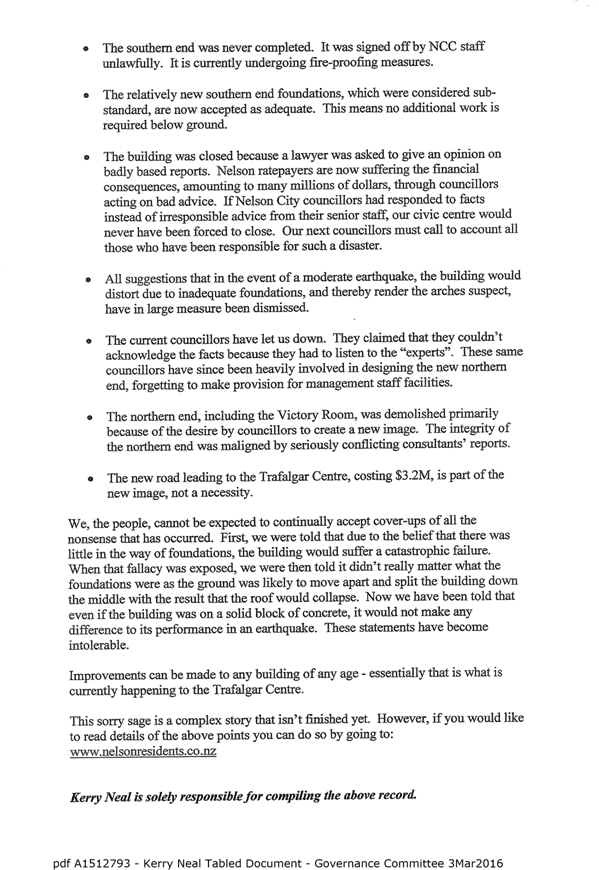

Mr Neal tabled a document

(A1512793) and spoke on behalf of the Nelson Residents Association, raising

concerns about the Trafalgar Centre budget and unbudgeted amounts for roading

for the Trafalgar Centre project. He spoke about health and safety in

employment versus safety provisions in the Building Act 2004. Mr Neal suggested

that the Victory Room at the Trafalgar Centre had been demolished without

adherence to Council’s Significance and Engagement Policy.

Mr Neal advised the Nelson

Residents Association had no intention of organising at considerable cost any

local government candidates meetings in 2016. On a personal note, he raised

concerns about the Mayor’s interaction with a contractor.

|

Attachments

1 A1512793 - Kerry

Neal Tabled Document

|

5. Confirmation of Minutes

5.1 5 November

2015

Document number M1580, agenda

pages 9 - 15 refer.

|

Resolved GOV/2016/002

THAT the minutes of

the meeting of the Governance Committee, held on 5 November 2015, be

confirmed as a true and correct record.

McGurk/Matheson Carried

|

5.2 24

December 2015 - Extraordinary Meeting

Document number M1670, agenda

pages 16 - 18 refer.

|

Resolved GOV/2016/003

THAT the minutes of

the extraordinary meeting of the Governance Committee, held on 24 December

2015, be confirmed as a true and correct record.

Matheson/Fulton Carried

|

6. Status Report - Governance

Committee- 3 March 2016

Document number R5557, agenda

pages 19 - 20 refer.

|

Resolved GOV/2016/004

THAT the Status Report

Governance Committee 3 March 2016 (R5557)

and its attachment (A1160658) be

received.

Noonan/McGurk Carried

|

7. Chairperson's

Report

The Chairperson noted the recent

release of the draft Annual Plan 2016/17 for consultation.

|

Resolved GOV/2016/005

THAT

the verbal Chairperson’s Report be received.

Barker/Noonan Carried

|

8. Audit, Risk and Finance

Subcommittee Terms of Reference and Delegations Update

Document number R4931, agenda

pages 21 - 28 refer.

The Chief Executive, Clare

Hadley, presented the report.

|

Resolved GOV/2016/006

THAT the report Audit, Risk and

Finance Subcommittee Terms of Reference and Delegations Update (R4931) and its attachments (A1437349 and

A1507355) be received.

Peters/Murray Carried

|

|

Recommendation to Council

GOV/2016/007

THAT

the Audit Risk and Finance Subcommittee draft Terms of Reference (A1437349)

be adopted;

AND

THAT the Delegations Register be updated as illustrated in

(A1507355) to:

- include a reference to the Audit, Risk and Finance

Subcommittee Terms of Reference;

- remove Health and Safety from the Audit, Risk and

Finance Subcommittee’s area of responsibility.

Peters/Murray

|

|

|

9. Audit, Risk and Finance

Subcommittee - 12 November 2015

Document number M1593, agenda

pages 29 - 35 refer.

|

Resolved GOV/2016/008

THAT

the minutes of a meeting of the Audit, Risk and Finance Subcommittee, held on

12 November 2015, be received.

Peters/Murray Carried

|

9.1 Internal

Audit Plan and Procedure

|

Recommendation to Council

GOV/2016/009

THAT

the Internal Audit Plan to 30 June 2016 (A1452073) be approved, with the

amendment:

·

Under the heading ‘Extension for Action

Plans’, insert the words “or organisational risk” after the

words “no safety-related issues”.

Peters/McGurk

|

9.2 Liability

Management Policy amendment

|

Recommendation to Council

GOV/2016/010

THAT

the amended Liability Management Policy (A1450461) be adopted.

Peters/Murray

|

10. Commercial

Subcommittee - 24 December 2015

Document number M1664, agenda

pages 36 - 38 refer.

|

Resolved GOV/2016/011

THAT

the unconfirmed minutes of an extraordinary meeting of the Commercial

Subcommittee, held on 24 December 2015, be received.

Murray/Noonan Carried

|

11. Audit, Risk and

Finance Subcommittee - 18 February 2016

Document number M1712, agenda

pages 39 - 47 refer.

It was advised there had also

been discussion at the Subcommittee meeting regarding risks to elected members.

Attendance: Councillor Matheson left the meeting from 1.50pm

to 1.52pm.

|

Resolved GOV/2016/012

THAT

the unconfirmed minutes of a meeting of the Audit, Risk and Finance

Subcommittee, held on 18 February 2016, be received.

Peters/Murray Carried

|

11.1 Corporate Report to

31 December 2015

|

Recommendation to Council

GOV/2016/013

THAT Council

resolves to fund the additional expenditure for Tasman Street from the

following activities; Roading subsidised budgets ($119,000), Roading

unsubsidised budgets ($117,000) and Stormwater budgets ($92,000), a total of

$328,000, from operational and capital expenditure budgets as appropriate,

noting that any individual project underspends which cover this overspend

will be reported by 30 June 2016;

Peters/Matheson Carried

|

|

Recommendation to Council

GOV/2016/014

AND

THAT funding of $100,000 for the Stoke Foothills Traffic

Study be deferred from 2015/16 to 2016/17;

AND

THAT funding of $100,000 for the Atawhai Hills Traffic

Study be brought forward from 2016/17 to 2015/16.

Peters/Murray Carried

|

11.2 Letter to the Council

on the audit for the year ending 30 June 2015

|

Recommendation to Council

GOV/2016/015

THAT

Council notes Audit NZ’s comments (A1499499) and how officers intend to

address the issues raised.

Peters/Her Worship the Mayor

|

11.3 Internal Audit Report

to 31 December 2015

|

Recommendation to Council

GOV/2016/016

THAT

Council note the internal audit findings, recommendations and status of

action plans up to 31 December 2015 (R5452).

Peters/Murray

|

12. Exclusion of the

Public

|

Resolved GOV/2016/017

THAT

the public be excluded from the following parts of the proceedings of this

meeting.

The

general subject of each matter to be considered while the public is excluded,

the reason for passing this resolution in relation to each matter and the

specific grounds under section 48(1) of the Local Government Official

Information and Meetings Act 1987 for the passing of this resolution are as

follows:

Acland/Matheson Carried

|

|

Item

|

General subject of each matter to be considered

|

Reason for passing this resolution in relation to

each matter

|

Particular interests protected (where applicable)

|

|

1

|

Governance

Committee Meeting - Public Excluded Minutes - 5 November 2015

|

Section

48(1)(a)

The

public conduct of this matter would be likely to result in disclosure of information

for which good reason exists under section 7.

|

The

withholding of the information is necessary:

· Section 7(2)(i)

To enable the local

authority to carry on, without prejudice or disadvantage, negotiations

(including commercial and industrial negotiations).

· Section 7(2)(a)

To protect the privacy of

natural persons, including that of a deceased person.

|

|

2

|

Extraordinary

Governance Committee Meeting - Public Minutes - 24 December 2015

|

Section

48(1)(a)

The

public conduct of this matter would be likely to result in disclosure of

information for which good reason exists under section 7.

|

The

withholding of the information is necessary:

· Section 7(2)(h)

To enable the local

authority to carry out, without prejudice or disadvantage, commercial

activities.

· Section 7(2)(j)

To prevent the disclosure

or use of official information for improper gain or improper advantage.

|

|

3

|

Audit,

Risk and Finance Subcommittee Meeting - Public Excluded Minutes - 12

November 2015

These

minutes do not contain a recommendation to the Governance Committee

|

Section

48(1)(a)

The

public conduct of this matter would be likely to result in disclosure of

information for which good reason exists under section 7.

|

The

withholding of the information is necessary:

· Section 7(2)(a)

To protect the privacy of

natural persons, including that of a deceased person.

|

|

4

|

Extraordinary

Commercial Subcommittee Meeting Minutes - Public Excluded Minutes - 24

December 2015

The

recommendation to the Governance Committee in these minutes was considered at

the extraordinary Governance Committee meeting on 24 December 2015

|

Section

48(1)(a)

The

public conduct of this matter would be likely to result in disclosure of

information for which good reason exists under section 7.

|

The

withholding of the information is necessary:

· Section 7(2)(h)

To enable the local

authority to carry out, without prejudice or disadvantage, commercial

activities.

· Section 7(2)(j)

To prevent the disclosure

or use of official information for improper gain or improper advantage.

|

|

5

|

Audit,

Risk and Finance Subcommittee Meeting - Public Excluded Minutes - 18

February 2016

These

minutes contain a recommendation to the Governance Committee regarding

‘Letter to the Council on the audit for the year ending 30 June 2015

– Utilities Contract’

|

Section

48(1)(a)

The

public conduct of this matter would be likely to result in disclosure of

information for which good reason exists under section 7.

|

The

withholding of the information is necessary:

· Section 7(2)(b)(ii)

To protect information

where the making available of the information would be likely unreasonably to

prejudice the commercial position of the person who supplied or who is the

subject of the information.

· Section 7(2)(h)

To enable the local

authority to carry out, without prejudice or disadvantage, commercial

activities.

|

The meeting went into public

excluded session at 1.57pm and resumed in public session at 2.04pm.

13. Re-admittance of the

Public

|

Resolved GOV/2016/018

THAT

the public be re-admitted to the meeting.

Peters/Acland Carried

|

There being no further business the

meeting ended at 2.04pm.

Confirmed as a correct record of proceedings:

Chairperson

Date

Chairperson

Date

|

|

Governance Committee

21 April 2016

|

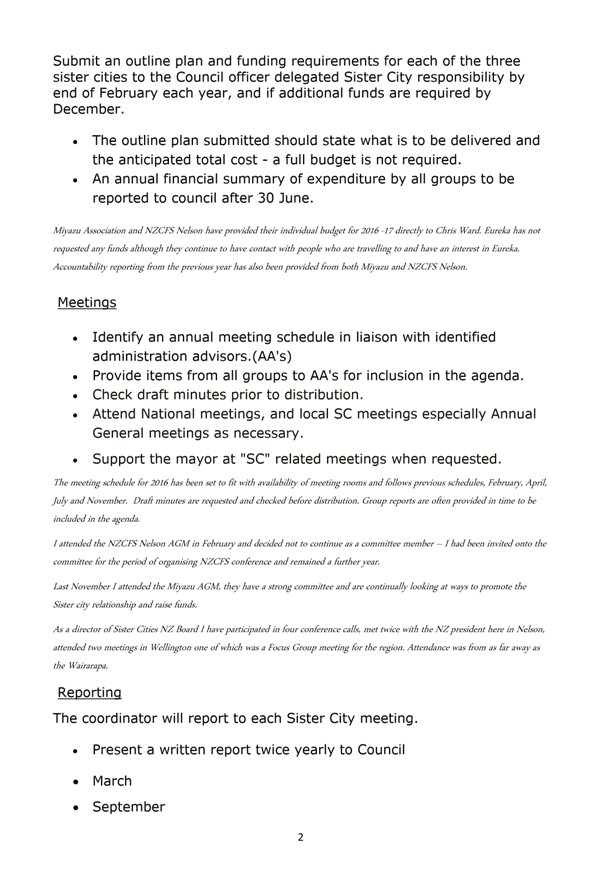

REPORT R5529

Sister

Cities Update - April 2016

1. Purpose of Report

1.1 To receive the report from the Sister Cities

Coordinator.

2. Delegations

2.1 Sister

City relationships are an area of responsibility of the Governance Committee.

3. Recommendation

|

THAT the report Sister Cities

Update - April 2016 (R5529) and

its attachment (A1523258) be

received.

|

4. Background

4.1 Nelson

has three Sister City relationships and one friendly city relationship:

· Miyazu, Japan

· Huangshi, Hubei, People's Republic of China

· Eureka, California, United States

· Yangjiang, People’s Republic of China (friendly city).

4.2 Council has

appointed a Sister City Co-ordinator to oversee community activity in relation

to Sister Cities.

5. Discussion

5.1 Sister

City relationships can deliver social, cultural

and economic outcomes. It is important that Councillors are aware of these relationships

and of opportunities to further enhance them.

5.2 The

Sister Cities co-ordinator reports to the

Governance Committee twice each year. The attached report (Attachment 1) covers

the last six months worth of activities.

6. Alignment with relevant Council policy

6.1 Provision

has been made in the Long Term Plan for Sister Cities activities and these are

consistent with the Council outcome of Our communities are healthy, safe,

inclusive and resilient.

7. Assessment of Significance against the Council’s

Significance and Engagement Policy

7.1 This

is not a significant decision in terms of the Significance and Engagement

Policy.

8. Consultation

8.1 No

consultation has been carried out in preparing this report.

9. Inclusion of Māori in the decision making process

9.1 Maori

have not been consulted on this report.

Chris

Ward

Group

Manager Community Services

Attachments

Attachment 1: A1523258

- Sister City Coordinator Report March 2016

|

|

Governance Committee

21 April 2016

|

REPORT R5352

The

Bishop Suter Trust draft Statement of Intent 2016/17 and Half Yearly Report

1. Purpose

of Report

1.1 To seek Council approval of the Bishop Suter Trust

Statement of Intent 2016/17 (Attachment 1).

1.2 To receive the Bishop Suter Trust half yearly report

(Attachment 2).

2. Delegations

2.1 The Governance Committee is responsible for all

matters relating to Council Controlled Organisations and Council Controlled

Trading Organisations.

3. Recommendation

|

THAT the report The Bishop Suter

Trust draft Statement of Intent 2016/17 and Half Yearly Report (R5352) and its attachments (A1512564, A1512571, A1463949 & A1512573) be received;

AND THAT

the Committee notes the delivery of the Bishop Suter Trust Draft Statement of

Intent 2016/17 (A1512571) as required under the Local Government Act 2002.

|

Recommendation

to Council

|

THAT the

Bishop Suter Trust Statement of Intent 2016/17 (A1512571) meets

Council’s expectations and is approved as the final Statement of Intent

for 2016/17;

AND

THAT a one off grant of $10,000 be allocated to the Suter

to allow free entry for locals for the 2016/17 year;

AND

THAT the Trust report back to Council as part of its

preparation of the 2017/18 draft Statement of Intent on the positive and

negative impacts of free entry for locals.

|

4. Background

4.1 The Bishop Suter Trust, along with the other Council

Controlled Organisations (CCO’s), must deliver a half yearly report to

Council (s66 of the Local Government Act 2002). This should report on the

organisation’s operations during that half year, and include any

information required by its Statement of Intent (SOI). The report allows the

Council an opportunity to monitor the performance of the CCO in relation to its

set objectives and Council’s overall aims and outcomes.

4.2 The half yearly report of the Bishop Suter Trust for

the period ending 31 December 2015 is attached (attachment 1).

4.3 Each CCO must also submit a draft Statement of Intent

(SOI) to Council by 1 March indicating its proposed activities for the

following financial year (s). The draft SOI prepared by the Trust is attached

(attachment 2).

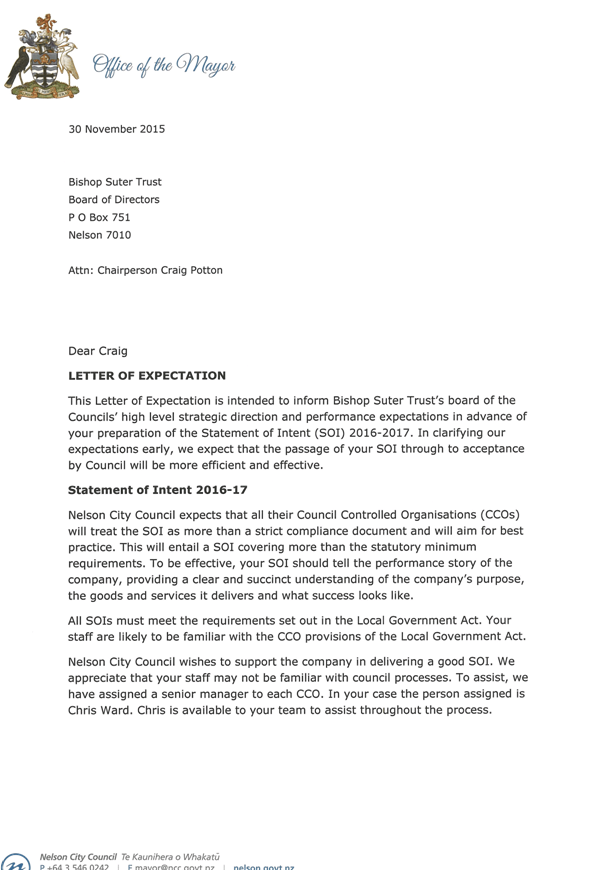

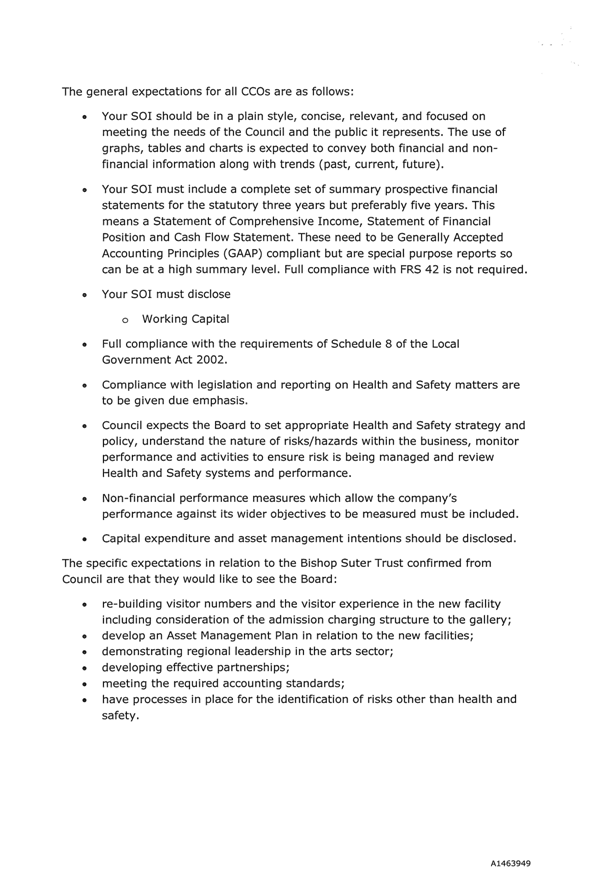

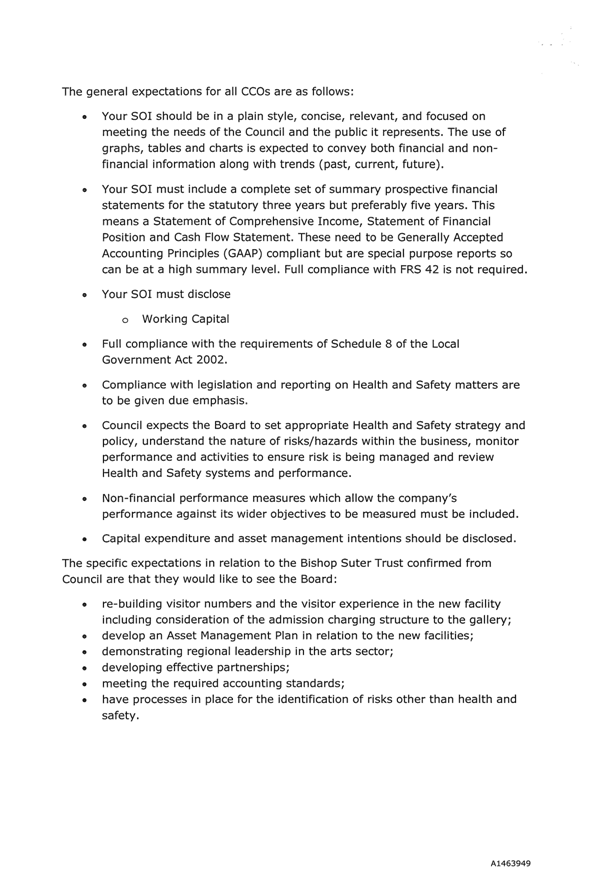

4.4 The Mayor wrote to the Trust in November of last year

with the Council’s expectations for matters to be addressed by the Trust

in the 2016/17 SOI . A copy of the Letter of Expectation that was sent to the

Trust is attached (attachment 3). The specific expectations were:

· re-building visitor numbers and the visitor experience

in the new facility including consideration of the admission charging structure

to the gallery;

· develop an Asset Management Plan in relation to the

new facilities;

· demonstrating regional leadership in the arts sector;

· developing effective partnerships;

· meeting the required accounting standards;

· have processes in place for the identification of

risks other than health and safety.

4.5 The Chairperson, Craig Potton, and Suter Director,

Julie Catchpole, will be in attendance at the meeting to present the

information and answer questions. The Trust has chosen to present a three year

draft SOI. This is useful in that it helps show the strategic direction the Trust

is taking over the medium term, however the SOI will still need to be reviewed

and updated annually.

5. Discussion

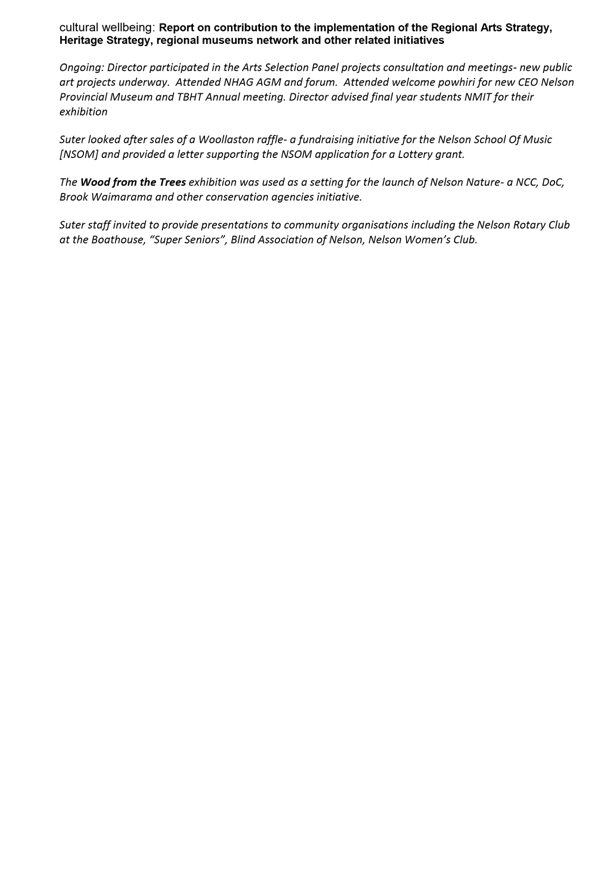

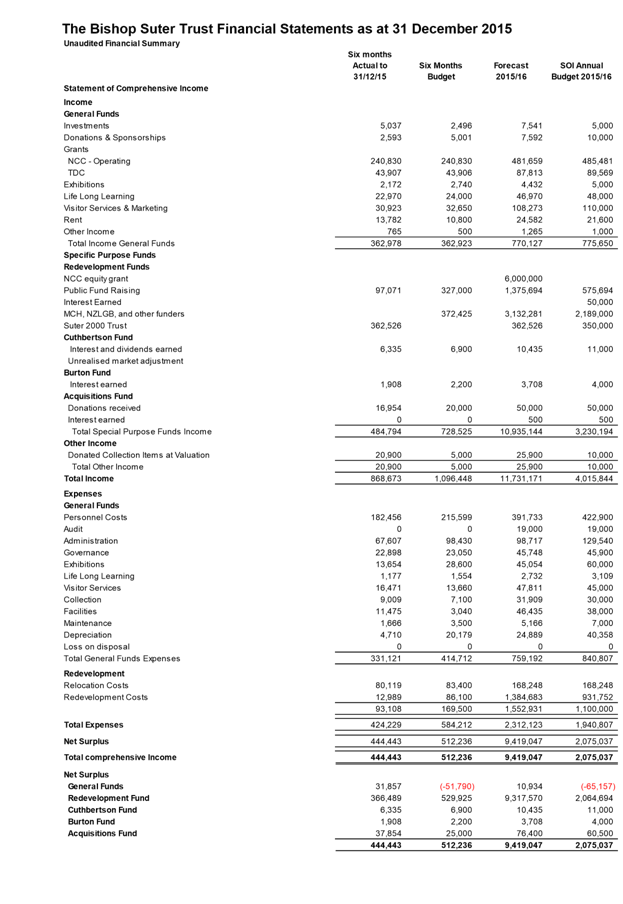

Half Yearly Report

5.1 The

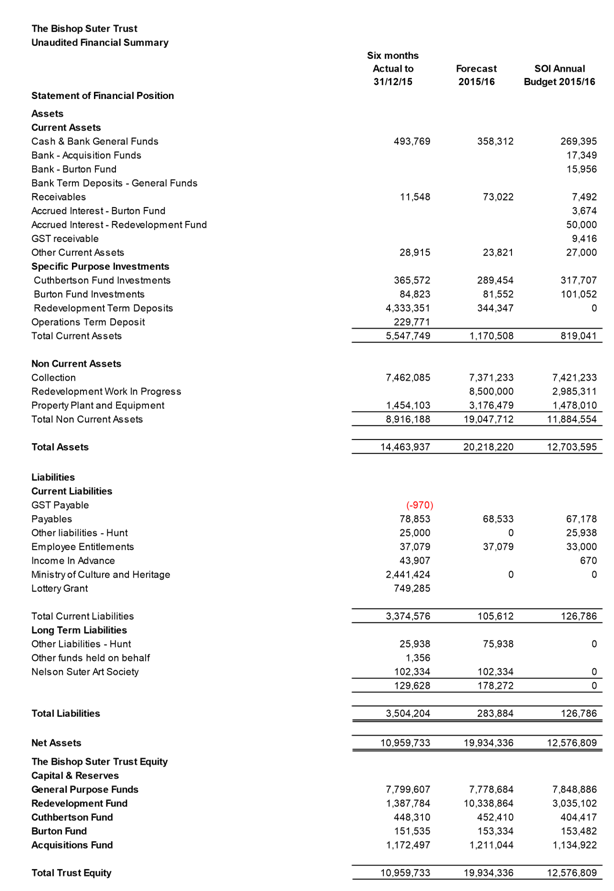

Suter continues to operate from its temporary premises in Halifax Street and

has held a number of exhibitions over the reporting period. The Trust has

worked with collaboratively with the Provincial Museum and the Elma Turner

Library and is on track to meet its public programmes targets.

5.2 It

is pleasing to note that the Trust has been awarded a 3 year contract by the

Ministry of Education to fund a half time educator.

5.3 The focus of the Trust has been on the Suter

redevelopment, which is has progressed well.

Draft Statement of Intent

2016/17

5.4 The Trust’s focus is now turning from the

construction of the building towards the activities and operation of the new

building. This includes the celebration launch planned for 1 October 2016.

5.5 The Trust’s key priorities identified in the

draft SOI are to:

5.5.1 Operate

a successful visual arts centre and public art gallery

5.5.2 Engage,

educate and entertain the regional community and visitors through visual arts

programmes, exhibitions and life-long learning opportunities

5.5.3 Collect,

record, interpret and preserve the artistic heritage of the Nelson/Tasman

region and New Zealand

5.5.4 Build

Partnerships that sustain the Suter.

5.6 The Trust highlights some uncertainties in relation to

the year ahead, and notes that there will be disruption to its activities as it

transitions between the temporary premises and the redeveloped Suter between

August and October 2016.

Entry

Fees

5.7 The Suter has requested an additional $20,000 funding

from Council to allow general admission to the Suter (attachment 4). Previously

all visitors were charged, although entry was free on Saturdays.

5.8 Both Founders Heritage Park and the Provincial Museum

currently offer free general admission to locals, with visitors to Nelson being

charged. Officers recommend that the Suter pilots that approach for one year

and reports back to Council, and reports back to Council on the impacts of that

change both positive and negative. Local visitor numbers would be expected to

increase, donations may increase, and admission charge revenue may decrease.

5.9 A consistent approach would be to allow for free entry

for locals whilst retaining the entry charge for visitors.

6. Options

6.1 There is no decision to be made on the half yearly

report. The Trust has complied with the legislation in preparing and presenting

the report to Council.

6.2 In relation to the SOI, the Committee can choose to

either submit feedback to the Trust Board or to recommend to Council that the

draft SOI be adopted as the final version (with any minor amendments). If the

Committee does submit substantive feedback then the amended SOI will be brought

back to the Governance Committee in July.

6.3 Officers believe that the draft Statement of Intent is

sufficiently developed to be approved as the final version.

6.4 In relation to admission charges, the Committee can

indicate to the Trust if it supports free entry to all, free entry to locals or

the status quo. Officers recommend that the free entry to locals be the

preferred option, given current practice at Founders and the Museum, and given

the contribution ratepayers have made to the redevelopment and to the core

operating costs of the Suter. This could be trialled for one year to allow an

assessment of the benefits and impacts of the changes on visitor numbers,

donations and income from admission charges.

6.5 The Committee could recommend that Council increase

funding to the Suter to cover these costs, or not. There is some uncertainty

over the impact of removing admission fees on the ability of the Trust to

increase revenue through donations. Officers recommend that a one off additional

grant of $10,000 be allocated to allow a pilot period to proceed.

7. Alignment

with relevant Council policy

7.1 This decision is a statutory process. Support for the

Suter is consistent with the Council’s outcome of ‘Our communities

have opportunities to celebrate and explore their heritage, identity and

creativity.’

8. Assessment

of Significance against the Council’s Significance and Engagement Policy

8.1 This is not a significant decision in terms of

Council’s Significance and Engagement Policy.

9. Consultation

9.1 No consultation has been carried out in relation to

the recommendations.

10. Inclusion

of Māori in the decision making process

10.1 No

specific consultation has been carried out with Maori. Local iwi are

represented on the Trust Board.

11. Conclusion

11.1 The

Bishop Suter Trust has complied with the Local Government Act 2002 in preparing

a half yearly report and draft SOI. The Committee has the opportunity to

request changes or additions to the draft SOI. Officers are not recommending

that any substantive change be made, and the Committee may decide to recommend

to Council that the draft SOI be approved as the final SOI for the 2016/17

year.

Chris

Ward

Group

Manager Community Services

Attachments

Attachment 1: A1512564 - Bishop Suter

Trust Half Yearly Report

Attachment 2: A1512571

- Bishop Suter Trust Statement of Intent 2016-19

Attachment 3: A1463949

- Letter of Expectation sent to Bishop Suter Trust

Attachment 4: A1512573

- Cover letter to Statement of Intent - Bishop Suter

1.

2.

STATEMENT

OF INTENT

2016/2019

THE

BISHOP SUTER TRUST

Registered

Office: Temporary

Office (2015/16)

208

Bridge Street, Nelson 28

Halifax Street, Nelson

P.O.

Box 751, Nelson 7040

www.thesuter.org.nz

CONTENTS

1. The Bishop

Suter Trust Statement of Intent 2016-2019

1.1. Executive Summary: 2016 | 2019 An

Exceptional Year 3

1.2 Organisation

Description 4

2. Nature and

Scope of the activities to be undertaken 4

2.1 Trust’s

Purpose, Mission & Values 4

2.2 Key priorities 5

2.3 Alignment

with NCC outcomes

8

3. Objectives,

Performance Measures and Targets 9

4. Operating

Framework 11

4.1 Background 11

4.2 Governance,

Stakeholders and Staffing 12

5. Operating

Environment 12

6. Accountability 14

6.1 Information

to be provided to the

NCC

14

7 Prospective

Financial Statements 15

7.1 Introduction 15

7.2 Statement

of Significant Assumptions 15

Appendices:

I. Financial

Budgets 17

II. The

Bishop Suter Trust Statement of Accounting Policies 21

i. Reporting

Entity 21

ii. Basis

of preparation 21

iii. Significant

Accounting Policies 22

III. The

Trust’s Approach to Governance 26

1. The

Bishop Suter Trust Statement of Intent 2016-2019

As

a Nelson City Council (NCC), council-controlled organisation(CCO) and in

accordance with statutory obligations of Section 64 of the Local

Government Act 2002, this Statement of Intent is for the forthcoming financial

year 2016/17 and the following two financial years, ending 30 June 2019.

The

purpose of this Statement of Intent is to promote public accountability and it

is intended as a base against which performance can be assessed.

Executive

Summary: 2016 | 2017 An Exceptional Year

In

October 2016 The Suter will re-open its significantly larger, state-of-the-art

complex on its historical site at 208 Bridge Street. Early on in the 2016/17

financial year The Suter Art Gallery will cease operating from temporary

premises at 28 Halifax St, Nelson to relocate to the redeveloped site. We

will, however continue to run an exhibitions programme, provide educational

services and a retail outlet as long as is feasibly possible at the temporary

site, whilst packing the collection and preparing the opening suite of

exhibitions and related festivities alongside completing the fit-out of the

Bridge Street premises.

As

this document has been prepared ahead of the completion of the building and

activation of the services within the redeveloped site, some of the running

costs for the new facilities can only be a best estimate based on current

information available. The configuration of the new building will necessitate

new ways of working to provide good customer service, safety of visitors and

staff alike and ensure security of exhibits.

The

Gallery re-launch will be a time of celebration, and promoted widely to

generate awareness and encourage as many of the community as possible to come

and visit their public art gallery and theatre, and encounter treasured art

works from the collection. Thereafter word-of-mouth should become a powerful

promotional method.

Free

entry to The Suter exhibition galleries will be key to boosting visitor numbers

and which philosophically fulfils the desire of major funders of the

redevelopment project; - that the Gallery remove as many barriers to

accessibility as possible, be they physical or financial.

There

are challenges in achieving these aspirations, not the least financial,

particularly since there will be by necessity, a period in 2016 where the

revenue generating activities of The Suter will be impacted due to relocation,

and unavoidably, a period of time before lease and rental income streams can be

re-established.

The

2016/17 financials will include some one off costs associated with the

transition and opening. The next two years’ financials are our best

estimates of the shape of the operational financials in normal operating mode.

1.2.

Organisational description:

The

Suter Art Gallery Te Aratoi o Whakatū is governed by the Bishop Suter

Trust, incorporated under the Charitable Trusts Act 1957, and is a not-for-

profit entity established to deliver a public art gallery service for residents

of Nelson and Tasman and visitors to the region. The Bishop Suter Trust

has charitable status with the Inland Revenue Department and is registered with

the Charities Commission.

The

Suter is a council-controlled organisation whereby the NCC has the right to

directly appoint 1 or more of the trustees.

|

Abbreviations

used in this document:

|

|

The

Suter Art Gallery

|

The

Suter

|

The

Bishop Suter Trust

|

The

Trust

|

|

Nelson

City Council

|

NCC

|

Tasman

District Council

|

TDC

|

|

Council

Controlled Organisation

|

CCO

|

Long

Term Council Plan

|

LTP

|

|

Nelson

Suter Art Society

|

NSAS

|

Ko

Te Pouaranga

|

KTP

|

2 Nature

and Scope of the Activities to be undertaken

The NCC’s expectation is that

the activities of The Suter will engage the regional community and provide a

service that is of value to that community as both the owners and

customers. Further, the NCC expects that the activities of The Suter will

support the objectives of the Nelson Tasman Regional Arts Strategy (2007), Arts

Policy (July 2010) and Arts Activity Management Plan 2015 – 2025 (2015)

The Trust’s purpose is

described by our Maori name Te Aratoi o Whakatū, which may be interpreted

as “the pathway of art of/ for the Nelson region”

Our Mission:

The Suter Te Aratoi o Whakatū is where we make art matter, by honouring

our artistic heritage and proactively bringing new perspectives to our visitors

through programmes of exhibitions, projects and the permanent collection,

underpinned by a dedication to informed interpretation, learning opportunities

and participation.

·

Values:

The

following principles underpin decision making and set the standard for

performance and interactions with The Suter’s communities of interest:

· Inclusive &

accessible: Celebrating Aotearoa/New Zealand’s cultural heritage of

Tangata Whenua and Tangata Tiriti; and all ages and abilities

· Innovative: Apply

imaginative approaches to all our activities

· Customer focussed:

Responsive and respectful of our visitors’ needs

· Professional:

Upholding quality museum practices, underpinned with sound scholarship

· Dedicated to

learning and participation

· Making a meaningful

contribution to the region, and the country

· Sustainable:

Able to attract resources, support for our activities and be a responsible

‘corporate’ citizen.

The activities of The Trust are:

· To

manage and operate The Suter for the benefit of the residents of the

Nelson/Tasman region and visitors.

· To promote the

study, creation and appreciation of all forms of visual arts.

· To acquire, manage,

interpret and preserve the Collection and taonga for the benefit of the

residents and future generations of the Nelson/Tasman region and visitors.

· To develop and

maintain partnerships for the mutual benefit of The Suter, the community and allied

organisations.

2.2 Key

Priorities:

2.2.1 Operate

a successful visual arts centre and public art gallery

To be

achieved by:

· Optimising

the use of The Suter’s facilities and resources, in order to achieve its

objectives.

· Working

in partnership with the Nelson City Council to complete and open the

redeveloped Suter as a visual arts centre; and continue to work with other

potential funders and supporters to realize objectives.

· Undertaking

arts related activities that will attract and engage the public increasing

visitor numbers.

· Building the

capability - people, facilities, funding streams and processes - to ensure

operational sustainability and programme innovation.

The Redevelopment Project building phase

will conclude in the 2015/16 financial year. After fit-out and a commissioning

period, The Suter will be re-launched, planned to occur at the beginning of

October 2016

Meanwhile

The Suter will primarily operate out of its temporary site at 28 Halifax Street

holding exhibitions, education programmes, storing its collection and operating

its shop, until sometime in August 2016.

Staff

will have also been working to build a new on-line presence for The Suter,

researching and preparing the opening suite of exhibitions for the new Suter,

as well as scoping out the programmes for following years.

The

Trust will also be refreshing its methods of marketing and communication and

looking to increase benefaction, patronage, membership (Friends and Patrons)

and looking to build other supportive relationships.

Financial

implications of the redevelopment have included the curtailing of The Suter’s

capacity to earn revenue from some of its traditional sources such as leases,

venue hire[1]

and admission charges. There was also increased costs from renting the Halifax

Street facilities [covered within the Redevelopment Project budget].

In

the longer term, the redeveloped facilities will provide some additional

revenue generating opportunities from venue hire, of areas such as the Foyer,

and through activities in the Education Room.

The

Project also impacted the value of building assets initially through

impairment of existing building values due to the demolition of the majority of

the complex (2014/2015) and the need to write down book values to reflect

that. There will be a consequential increase in depreciation costs from investment

in the rebuild project.

During

the transition period staffing levels of The Suter dropped. The new premises

will however, require staffing at the very least equivalent to, if not greater

than pre-Redevelopment, in order to deliver a level of service commensurate

with the new expansive facilities, to mitigate risk (e.g. security of the

premises, exhibits and collection) and for health and safety reasons[2].

2.2.2. Engage,

educate and entertain the regional community and visitors through visual

arts’ projects and programmes:

To be achieved by:

Ø Providing a programme of exhibitions

that appeal to a variety of audiences, and that present the visual arts in its

many forms by local, national and where possible, international artists.

The Suter provides a programme of regularly changing

exhibitions and these will be mounted in 3 large exhibition galleries, the

intimate Contemplation Gallery and an outdoors sculpture walk and in other

spaces including the Foyer. A further gallery space is planned for the NSAS

for the purpose of running their own programme of changing exhibitions[3].

Ø Encouraging

life-long learning by being a respected provider of curriculum relevant

learning experiences outside the classroom [LEOTC] for the school sector, and

provider of visual arts experiences for diverse audiences.

The

Suter has been awarded a 3 year contract by The Ministry of Education for

Provision of Learning Experiences Outside the Classroom for years 1-13 students

of the Nelson/Tasman region. This resources a .5 Educator position.

The

Suter delivers after-school programmes through the Suter Kids Club [SKC], and

intends to develop further activity based art related classes and courses for

audiences of various ages and abilities. These may be delivered in

partnership with NSAS, NMIT or other organisations or individuals and will be

held in the new Education Room, studio and other areas as appropriate.

Illustrated

talks, lectures, floor-talks, opening previews, workshops and other events are

held to complement and support projects and the exhibitions’ programme.

2.2.3 Collect,

record, interpret and preserve the artistic heritage of the Nelson/Tasman

region, and New Zealand

To be achieved by:

Ø Being

the recognised custodian of Nelson/Tasman region’s artistic heritage by

developing the Collection, disseminating information and increasing knowledge

of the Collection.

Ø By

profiling aspects of the Collection and Nelson/Tasman regions’ artists

through exhibitions, loans, public programmes, publications, websites and other

means.

Work

will continue on making as many copyright cleared collection records as

possible available on-line via www.nzmuseums.co.nz (a link from the

Suter’s website will take visitors there). Some aspects of this project

involve the community and volunteers

It

is intended to publish a book featuring landscape and figurative works –

highlights from the Suter’s collection, to coincide with the opening

suite of exhibitions

New

interpretative means will be investigated for implementation- to stimulate

interest in the history of The Suter, its site, setting and the architecture,

past and present.

2.2.4 Develop

partnerships that sustain The Suter

To be

achieved by:

Ø Developing

partnerships which contribute to the delivery of programmes, development of the

Collection, resources and other projects: - in particular the ongoing operational

and collectionacquisitions’ funding of The Suter.

The

Suter is supported through memberships: of The Friends of The Suter and the

recently established Legacy Group. We will seek to increase memberships,

expand membership categories and will provide activities to engage those who

are generous in their support for the Gallery.

Ø Contributing

to the fulfilment of the Nelson Tasman Regional Arts Strategy and Arts Policy

by providing leadership in the area of visual arts.

Suter

staff and Trustees have expertise that can be called upon to contribute to arts

endeavours that enhance Nelson’s reputation and achieve economic,

cultural and social outcomes.

2.3 Alignment with Nelson

City Council Outcomes

People friendly places: By providing an arts

centre in which inspiring art, heritage and cultural activities take place.

A strong economy: By encouraging a thriving

arts, heritage and cultural community, through employment, exhibitions,

promotion of Nelson region’s arts, and as a tourism attraction.

Kind, healthy people: By

contributing to social well-being.

A fun, creative culture By providing

opportunities for social engagement and recreation

Good leadership: By

demonstrating leadership in the arts community, promoting the development of

Nelson arts and being the recognised custodian of Nelson/Tasman region’s

artistic heritage.

3.

Objectives, Performance Measures and Targets

NOTE: The following chart indicates objectives and

goals for The Bishop Suter Trust for three years and the target levels of

performance. The Suter will re-open in the 2016/17 financial year and there

will potentially be a period when neither the temporary or new facility is

open. This may or may not impact on the achievement of performance targets;

also targets for future years may need to be adjusted in light of trends that

emerge.

___________________________________________________________________________

3.1 GOVERNANCE: Operate a successful

visual arts centre and public art gallery:

3.1.1. Successfully

complete The Suter Art Gallery Redevelopment Project in partnership with NCC; Ensure that the

overall Project design/ costs remain within the $12 million budgeted and that

The Suter is completed to plan, budget and timeframe.

3.1.2 Provide

an arts centre and visitor attraction: That is open 362 days of the year with a minimum of

110,000 visits to The Suter facilities. Report six monthly with

visitor statistics and response.

3.1.3 Ensure

that The Suter is well managed and operates within its agreed plans: Reports, plans and budgets

meet set deadlines. The Risk Management Plan is reviewed annually and

mitigation strategies identified are implemented.

3.1.4 Develop and

implement a Marketing Plan which focusses on the attracting visitors and

developing resourcing for The Suter (refer also 3.4); Report on progress.

3.1.5 Develop an asset

management plan in relation to the new Suter facilities; Plan prepared 2016/17

for the ongoing maintenance of the redeveloped Suter.

3.1.6 Be a good employer

by maintaining good employer policies and practices; Report on observance of

policies, health & safety, turnover and related statistics.

3.2

VISITOR EXPERIENCE: Engage, educate and entertain the regional community and

visitors through visual arts’ programmes: Exhibitions and life-long

learning opportunities:

3.2.1 Provide a

programme of regularly changing exhibitions: Report 6 monthly on

progress.

3.2.2 Develop a forward

exhibition programme that is diverse and stimulating, including internally

produced and externally sourced exhibitions; Exhibitions scheduled that meet

the needs and interests of a broad audience. Report 6 monthly on progress.

3.2.3 Provide

public programmes which enhance appreciation and enjoyment of the visual arts; A minimum of 20

talks/ events/ activities are held per annum

3.2.4 Provide

learning experiences for regional school students that support their NZ

curriculum studies based on the Suter’s programmes and resources; Target is 3,000

students from 25 schools as per the Ministry of Education LEOTC Contract

Milestones & post visit evaluations indicate 90% satisfaction ratings of

“fine” to “great”. At least one Education Advisory

Committee meeting held per annum.

3.2.5 Provide

out-of-school art educational activities; Minimum 50 sessions of Suter

Kids Club are delivered per annum.

3.2.6 Develop and provide

other activity based learning opportunities: 2016/17 initiate programmes and

report 6 monthly on progress.

3.3

COLLECTION: Collect, record, interpret and preserve the artistic heritage of

the Nelson/Tasman region and New Zealand.

3.3.1 Develop the

Suter’s Collection in accordance with The Suter’s Collection

Policy; All

acquisitions and de-accessions comply with the Collection Policy and related

procedures. All acquisitions/de-accessions approved by the Trust and reported 6

monthly.

3.3.2 Maintain and

develop the Acquisitions Fund & Collection Bequests to allow active

collecting to occur;

The acquisitions’ funds meet or exceed budget and all such funds are

used for the purposes so designated.

3.3.3 The Collection,

post- redevelopment is safely moved and installed into new storage systems; The

Collection is stored in environmental conditions that are in line with accepted

museum practice (including temperature 18-22˚C/ relative humidity 50-55%,

pest control, archival materials, security and fire monitoring). There

are no handling mishaps or other damage occurs to Collection items.

3.3.4 Collection records

are significantly upgraded to increase accessibility and usability, as a part

of a long term strategy to provide on-line access to copyright cleared

Collection items and to enhance the reputation of the Collection; Collection

items are uploaded to the internet site www.nzmuseums.co.nz; Loan and other

collection requests are met; Progress reported six monthly.

3.3.5 Initiate collection

related research projects, involving the community where possible, to enhance

knowledge about the Collection. Continue subject indexing of the

Collection. Disseminate knowledge of the Collection: Collection

related items in media; Produce publication of Collection highlights to

coincide with opening exhibitions; Participate in compiling the Nelson

‘craft’ story as a contribution to a NZ craft history project

administered by Auckland Museum; Progress reported six monthly.

3.4

PARTNERSHIPS: Partnerships that sustain The Suter

3.4.1 Strengthen

The Suter’s relationship with Iwi and Maori; Honour the kaupapa of the

Memorandum of Understanding [MoU] with Ko Te Pouāranga; the Redevelopment reflects

the relationship; KTP input to programmes and collection development. Report 6

monthly.

3.4.2 Actively

engage in collaborative partnerships to support the projects and programmes of

The Suter (refer to 3.2.1 and 3.3.2); Sufficient resources are achieved to support

projects.

3.4.3 The Friends of The

Suter (FOTS) and Legacy Group are enhanced; FOTS membership increases,

activities and progress on patronage scheme reported 6 monthly.

3.4.4 The

Suter contributes to other organisations and initiatives to promote

Nelson/Tasman visual arts and heritage and provides leadership in fields of

expertise to support the Council’s provision of social /cultural

wellbeing: Report

on contribution to the implementation of the Regional Arts Strategy, Heritage

Strategy, regional museums network and other related initiatives; report on

contribution nationally in areas of expertise.

4. Operating

Framework

4.1.

Background

The

history of The Suter goes back to 1895 when Amelia Suter, widow of Bishop

Andrew Burn Suter, gave a collection of art works and land to encourage the

establishment of an art gallery, as a memorial to her late husband. Bishop

Suter initiated the Bishopdale Sketching Club in 1889, the forerunner of the

Nelson Suter Art Society Inc. whose Grabham Studio and McKee Gallery were later

a part of The Suter. In 1896 the Bishop Suter Art Gallery Board of Trustees was

formed, and a private Act of Parliament passed allowing the transfer and

acquisition of property including the Gallery’s Queen’s Gardens

site, the Matthew Campbell School buildings upon it and establishing a self-

perpetuating form of trust.

The

Bishop Suter Art Gallery Restructuring Act (2008) repealed The Bishop Suter Art

Gallery Trustees Act (1896) and with the new Bishop Suter Trust established,

the way was paved for The Suter to become a CCO of the Nelson City Council.

In

May 1899 the Frederick de Jersey Clere designed Bishop Suter Memorial Art

Gallery opened[4]

adjoined to the former Matthew Campbell School building. On the 108th

anniversary of the opening of the Original Gallery it was recognised as a

Category II Historic Place. Later alterations and additions included

further gallery spaces, workshop and studio, Theatre, foyer shop and

café, the latter designed by Warren and Mahoney.

In

early 2015 everything bar the Original Gallery and Suter Theatre were

demolished to enable new state-of-the art facilities to be built. The lead

architects for the Redevelopment were Jerram Tocker Barron, a Nelson based firm

and the Project was a partnership between the Trust and Nelson City Council.

Community involvement in The Suter is very evident in the significant financial

contributions to the Redevelopment and to the Collection.

Over

90% of items in The Suter’s collection have been donated or acquired

through benefaction. Of national significance, the Collection includes

historical and contemporary art works and ceramics by New Zealand artists, plus

some international works.

4.2 Governance,

stakeholders and staffing

The Bishop Suter Trust has been formed by the

NCC, as a charitable trust, and incorporated under the Charitable Trust Act

(1957) to manage and operate The Suter Art Gallery Te Aratoi o Whakatū. As

a CCO, the NCC are responsible for appointing the majority of the members of

the Board, comprising 7 trustees, including a representative of Ko Te

Pouāranga and ex-officio, Chair of the NSAS. Trustees are appointed for

three year terms.

The Bishop Suter Art Gallery Trust Board has a

longstanding relationship with the Nelson Suter Art Society Inc., a

voluntary incorporated society which has traditionally occupied part of The

Suter premises.

Friends

of The Suter

comprises between 400-500 memberships of which about a third are Life

memberships. It is not an incorporated society. Members receive

regular e-newsletters, and talks and other events are held to advance

Friends’ appreciation of art in general as well as support for The

Suter. Reciprocal Friends’ benefits have been agreed with

Christchurch Art Gallery and Auckland Art Gallery.

The

Legacy Group

are patrons of The Suter who contribute to the 5 x 40 Acquisitions Fund / 10

x 10 Acquisitions Fund or otherwise choose to provide significant support

for specific Suter programmes or projects such as the Suter Biennale

Contemporary Art Project. They receive regular updates and have involvement in

projects, plus events are held especially for them, in recognition of their

generosity, interest and support.

Ko Te Pouāranga is the name of the group

comprising representatives from each of the six recognised manawhenua Iwi

organisations of Whakatu, Motueka and Mohua. A Memorandum of

Understanding signed on 29/ 09/2014 with Ko Te Pouāranga establishes

principles of partnership and confirms full, permanent as of right, Maori

representation on the Board of The Suter as outlined in the Trust Deed.

Staffing:

The

Suter’s staffing complement in the temporary premises is 6.6 F.T.E.s and

regular volunteer contribution equates to 24 hours per week on average. The

proposed staffing complement for the new Suter is 7.9 F.T.Es

5. Operating

Environment

The

following factors are likely to influence The Suter over the next three years:

Visitor

trends:

Statistics

for the past few financial years show an average of 30,000 visits to the

exhibitions. It is anticipated that this level of visitation will be improved

upon in the new Suter by at the very least, 20%. With a successful café

and theatre operating, approximately 90,000 people used aspects of The Suter

complex prior to redevelopment and these activities make a significant

contribution to awareness of and funding of the operation. The new facilities

are more expansive and are fully accessible. These factors and The Suter

being sited adjacent to the Queen’s Gardens and within a heritage

precinct should make it a ‘destination attraction’ that see more

people using the facilities and staying longer.

It

is also very likely that there will be a surge in visits in the 2016/17

financial year, and as the novelty factor wears off visitor numbers should

settle, but at a higher level than prior to the redevelopment.

In

the past over 60% of visitors have been from the Nelson/Tasman area, the

balance being tourists - the greatest proportion domestic travellers.

Efforts have been made to increase awareness of The Suter through tourism

media, at I-Sites, and crucially by re-developing www.thesuter.org.nz.

There

is a seasonal pattern to visitation - with numbers of visits increasing notably

through the tourist season (November-April) and The Suter being one of a

relatively limited number of wet weather activities available to visitors in

the region. It will also be an attractive and comfortable place to spend

time with more exhibitions, activities of interest to families, air

conditioning, longer opening hours and barrier-free access to all public

areas. Other initiatives include programming that coincides with drawcard

events such as the Adam Music Festival, Nelson Arts Festival and Light Nelson.

Technology:

As

indicated above the internet is increasingly widely used to research places to

visit, to provide virtual experiences, and to search collections. The

Suter can further connect with audiences by mounting virtual exhibitions and

having the Collection on line. Social media is also increasingly used to

spread the word about what to see and do and we continue to work on providing

Suter experiences ‘virtually’ as resources allow.

Technologies

are increasingly an expected part of exhibitions- either as part of art works

(new media, moving image/sound works) or to provide interaction opportunities and interpretation.

Infrastructure to facilitate use of new technologies has been incorporated in

the redevelopment of The Suter.

Collecting:

The

Suter intends to continue developing its collection. Well over 90% of The

Suter’s Collection has been acquired by donation- either of art works or

funds, reflecting community input and ownership and it is intended that we

continue to grow the Collection using funds raised. It is desirable for The

Suter to actively collect if the Gallery is to provide a comprehensive record

of the visual arts of Nelson/Tasman, contextualised in relation to developments

in New Zealand art. A collection of national significance is both a

drawcard and a source of local pride.

Contributors

to the Acquisitions Fund will be actively involved in The Suter’s

collection development and as our acquisitions’ programme gains momentum

The Suter will continue to enhance our Collection of national significance.

The

Trust’s philosophy is that the more Collection items are known and

recognised, the more they will be sought out and treasured. To that end The

Suter prioritises requests for loans or reproductions from its collection; is

endeavouring to get as many items on line as possible and will be developing a

series of quality publications featuring highlights of the Collection.

During

the rebuild as much cataloguing and research information as could be

practically gathered, was undertaken to facilitate development of online

collection access, publishing and future exhibition preparation.

Resourcing:

The

Suter’s main income streams are local government grants, leases, LEOTC

Contract and life-long leaning activities, sales (retail and commissions),

grants and sponsorships. Additional revenue comes from memberships, donations

and events/activities. Venue hire opportunities post- Redevelopment

include the refurbished Theatre, a new Café, the expansive Foyer and

Education Room. A retail area is situated in the Foyer and features Suter

related merchandise and hand crafted work by Nelson/Tasman region’s

artists; all of which will contribute to increased income.

The

Suter as a tourist attraction is vulnerable to any downturn in domestic or

international tourism. Another area of vulnerability is in relation to its

leases.

6. Accountability

6.1 Information

to be provided to Nelson City Council

Half Yearly

By

28 February a six month report covering Statement of Financial Performance and

Statement of Financial Position, performance against targets, commentary on

activities, cash flow statement, and other such information as the Trustees

consider necessary to enable an informed assessment of the Trust’s

performance during the period being reported.

Annually:

Within

three months of the end of the financial year (i.e. 30 September) the Trustees

shall deliver to NCC an annual report which fulfils the requirements of Section

67 of the Local Government Act 2002, prepared to comply with International

Financial Reporting Standards and audited financial statements in respect of

the financial year, containing the following information as a minimum:

· A Trustees’ Report including a summary of the

financial results, a review of operations, and a comparison of planned and

actual performance in relation to objectives.

· A financial statement disclosing actual and budgeted

revenue and expenditure and comparative figures from the previous financial

report.

· A statement of financial position as at the financial

year end.

· A statement of cash flows.

· An Auditor’s Report on the above statements and

the measures of performance in relation to objectives.

· Any other matters that NCC and the Trustees agree shall

be disclosed as appropriate.

This

Annual Report shall be made available for inspection at Council offices.

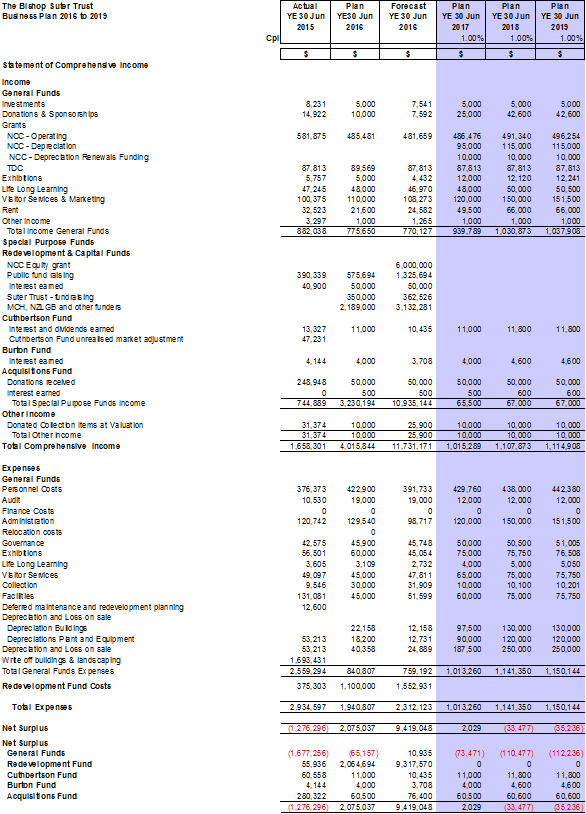

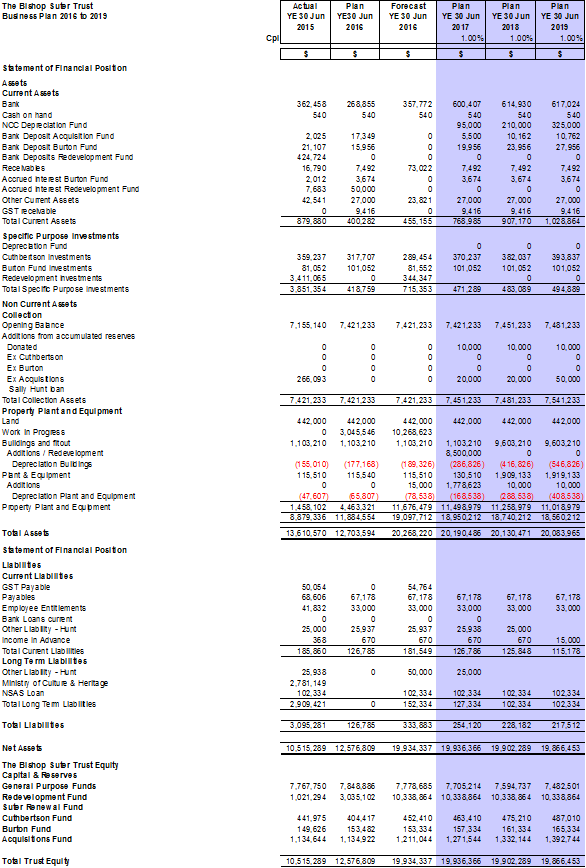

7. Prospective

Financial Statements

7.1. Introduction:

The

Suter’s Statement of Intent covers the period 1 July 2016 to 30 June

2019. The financial information contained in the Statement of Intent has

been prepared to assist the NCC consider The Suter’s planned performance.

The

prospective financial statements are based on assumptions as to future events

that The Suter may reasonably expect to occur at the time when this information

was prepared. Actual results may vary, and this variation may be material,

arising for instance from the redevelopment of The Suter.

7.2 Statement of

Significant Assumptions

7.2.1. Fiscal support from local

authorities: The

Suter is a NCC CCO with the NCC’s commitment to long term funding support

set out in a Memorandum of Understanding. The TDC also provides an annual

contribution, and the basis of this commitment is set out in the TDC’s

LTP, [previously annually adjusted for CPI]. To the extent the actual money

allocated is less or more than that set out The Suter will need to adjust its

activity levels.

7.2.2.

Other revenues:

Other revenues reflect forecast visitor activity levels consistent with

historic trends, obligations of lessees and the restrictions and requirements

of the Redevelopment Project.

7.2.3. Special Purpose Funds

The Suter has historic and ongoing bequests, gifts and contributions that

generally have restrictions on use. These funds are shown separately on the

balance sheet.

7.2.4.

Operating Expenditure

Operating expenditure is forecast to continue at historic levels adjusted for

inflation and the requirements of the Redevelopment Project.

7.2.5.

Capital Expenditure

The majority of Capital Expenditure during the period will relate to the

Redevelopment of the Gallery and associated replacement of furniture and

fittings.

7.2.6. Inflation: 1.6 % CPI adjustment was applied in

the 2015/2016 financial year and 2% for the subsequent financial years’

projected revenue from the NCC.

7.2.7. Trustees’ Estimate of

Trust Value: The

Trustees estimate that the opening balance of funds in the annual accounts will

represent the value of the Trust. The Trustees will advise NCC on an

annual basis if they believe the value to differ materially from this state.

The audited opening equity at 9 August 2008 is $9,593,656[5].

7.2.8.

Heritage Assets: This

is represented by the Collection. Additions to the Collection will be

recorded at either purchase price or market valuation for donated art works.

The Collection is not regarded as a realisable financial asset and valuation is

carried out for the purposes of insurance and compliance with NZ IFRS.

7.2.9.

Dividend Policy: It

is important to note that the shareholders of the Trust do not expect, nor

anticipate, the Trust to pay dividends in the usual commercial manner.

However the Trust anticipates, through appropriate performance measures, to

review annually the non-financial dividend which will be returned to our wider

regional community.

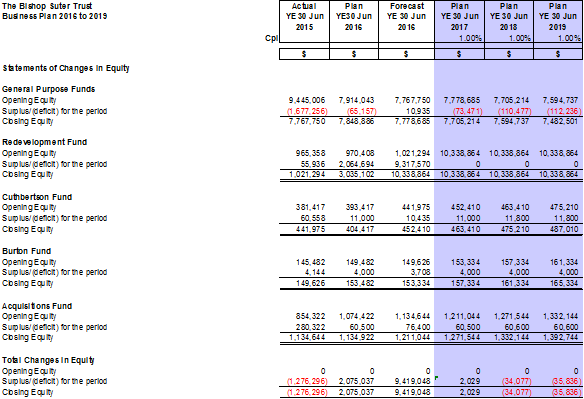

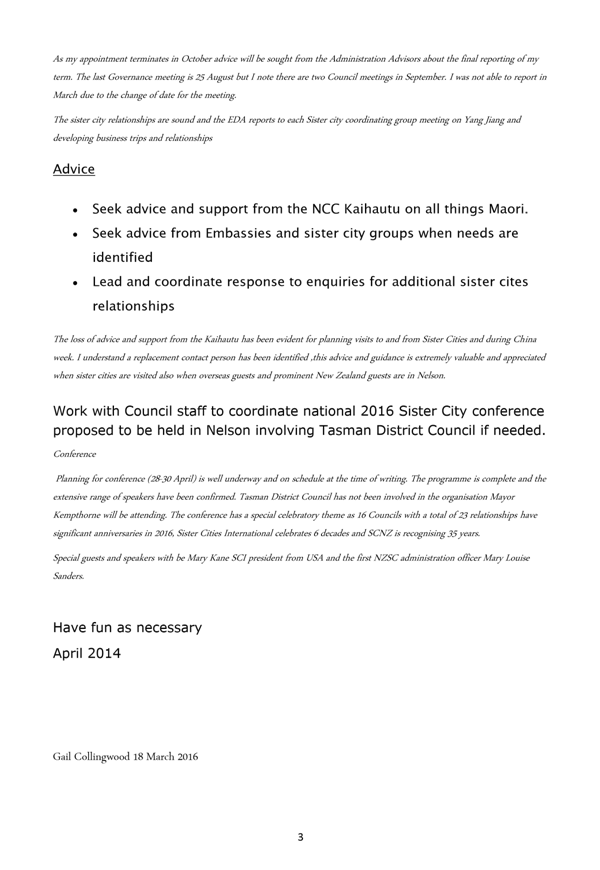

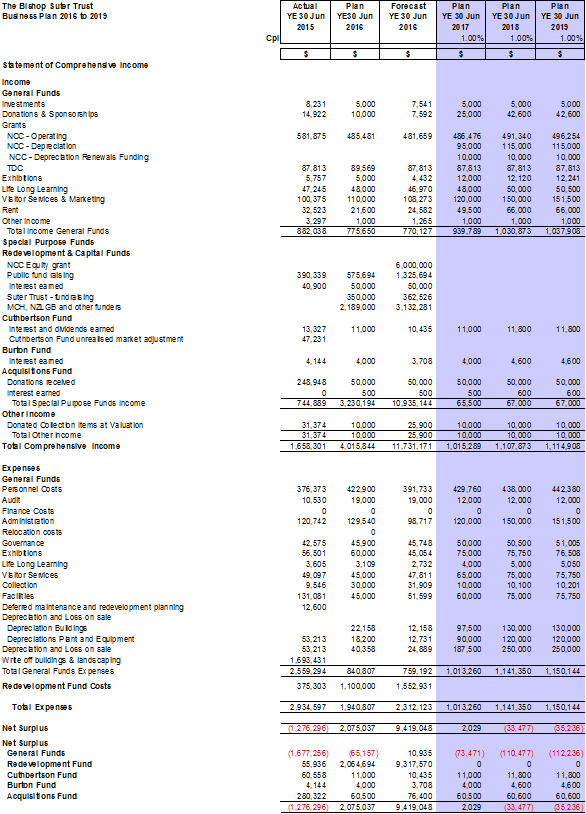

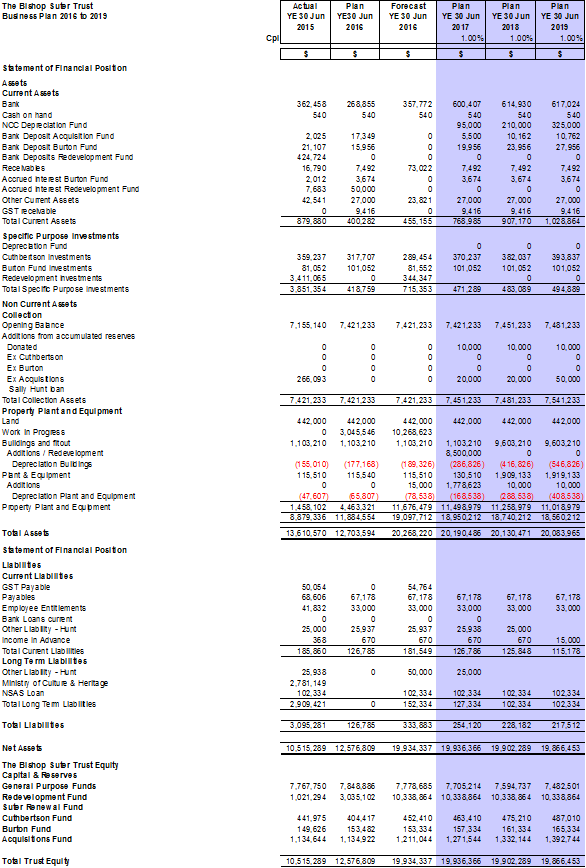

aPPENDIX I:

Financial BUDGETS

APPENDIX I: Financial Budgets continued

APPENDIX I: Financial Budgets continued

Notes to the 2016-2019 SOI Budgets:

§ The budgets clearly separate activities between operating

and Special Purpose Funds which have independent and tagged purposes; these

are:

o Cuthbertson Fund – a historic

bequest whose capital is invested and growth tagged to purchase and care for

collections items.

o Burton Fund – a historic bequest

whose capital is invested and growth tagged to purchase collections items.

o 5 x 40 &10X10 Acquisitions Fund

– Specific funds sought and held in trust to purchase collection items.

o Redevelopment Fund – This is the

specific purpose fund raising that has enabled The Suter to implement a

Redevelopment Plan and Project which physically commenced 12 January 2015.

APPENDIX II:

The Bishop Suter Trust Statement of Accounting

Policies

Statement

of significant accounting policies

|

i. REPORTING

ENTITY

The Bishop Suter Trust (the Trust)

is a charitable trust incorporated in New Zealand under the Charitable Trusts

Act 2005 on 5 April 2008 and is domiciled in New Zealand. The Trust is

controlled by Nelson City Council as a Council Controlled Organisation as

defined under section 6 of the Local Government Act 2002, by virtue of the

Council’s right to appoint the Board of Trustees

The primary objective of the Trust

is to provide the people of Nelson and visitors to the region access to our

cultural heritage and to the many forms of contemporary cultural expression.

This means communicating the diverse ideas and experiences that art offers to

the widest possible audience by the presentation of quality visual arts

programmes and by developing and caring for the permanent collection.

Accordingly, the Trust has

designated itself as a public benefit entity for the purposes of New Zealand

Equivalents to International Financial Reporting Standards (NZ IFRS).

ii. BASIS

OF PREPARATION

Compliance

The financial statements of the

Trust will be prepared in accordance with the requirements of the Local

Government Act 2002, which includes the requirement to comply with New

Zealand generally accepted accounting practice (NZ GAAP).

Financial statements will be

prepared in accordance with NZ GAAP and comply with NZ IFRS, and other

applicable Financial Reporting Standards, as appropriate for public benefit

entities.

Measurement base

The financial statements will be

prepared on a historical cost basis.

Functional and

presentation currency

The financial statements will be

presented in New Zealand dollars and all values rounded to the nearest

dollar. The functional currency of the Trust is New Zealand dollars.

Changes in

accounting policies

No changes in accounting policies

are anticipated. In the event there are, they will be disclosed.

iii. SIGNIFICANT

ACCOUNTING POLICIES

Revenue

Revenue is measured at the fair

value of consideration received.

Grants

Grants received from Nelson City

Council and Tasman District Council are the primary sources of funding to the

Trust and are restricted for the purposes of the Trust meeting its objectives

as specified in the Trust’s Trust Deed. The Trust also receives grants

from bodies such as Creative New Zealand, and these grants have restrictions

on their use.

Council, government and

non-government grants are recognized as revenue when they become receivable

unless there is an obligation to return the funds if conditions of the grant

are not met. If there is such an obligation, the grants are initially

recorded as grants received in advance and recognised as revenue when

conditions of the grant are satisfied.

Other revenue

Products held for sale are

recognized when a product is sold to the customer.

Where art works are donated in the

Trust for nil consideration, the fair value of the work is recognised as

income.

Interest income is recognized on

receipt.

Volunteer services received are not recognized

as revenue or expenditure as the Trust is unable to reliably measure the fair

value of the services received.

Advertising costs

Advertising costs are expensed when

the related service has been rendered.

Borrowing costs

Borrowing costs are recognized as an

expense in the period in which they are incurred.

Income Tax

The Trust has been granted

Charitable status by the Inland Revenue Department, and therefore is exempt

from income tax.

Leases

Finance Leases

The Trust has no finance leases.

Operating leases