AGENDA

Ordinary meeting of the

Audit, Risk and Finance Subcommittee

Thursday 18 February 2016

Commencing at the conclusion of Planning and

Regulatory Committee

Ruma Mārama, Floor 2A

Civic House

110 Trafalgar Street, Nelson

Membership: Mr John Peters (Chairperson), Her Worship the

Mayor Rachel Reese, Councillors Ian Barker and Brian McGurk, and Mr John Murray

Guidelines for councillors

attending the meeting, who are not members of the Committee, as set out in

Standing Orders:

·

All councillors, whether or not they are members of the

Committee, may attend Committee meetings (SO 2.12.2)

·

At the discretion of the Chair, councillors who are not Committee

members may speak, or ask questions about a matter.

·

Only Committee members may vote on any matter before the

Committee (SO 3.14.1)

It is good practice for both Committee members and

non-Committee members to declare any interests in items on the agenda. They

should withdraw from the room for discussion and voting on any of these items.

Audit, Risk and Finance

Subcommittee

Audit, Risk and Finance

Subcommittee

18

February 2016

Page

No.

1. Apologies

Nil

2. Confirmation

of Order of Business

3. Interests

3.1 Updates

to the Interests Register

3.2 Identify

any conflicts of interest in the agenda

4. Public

Forum

4.1 Hugh

Briggs, Melrose House Society

Hugh Briggs, Chair of Melrose

House Society, will speak about the Society’s request for a loan/grant to

undertake a bathroom upgrade in Melrose House.

5. Confirmation

of Minutes

5.1 12

November 2015 8 - 14

Document number M1593

Recommendation

THAT

the minutes of the meeting of the Audit, Risk and Finance Subcommittee, held on

12 November 2015, be confirmed as a true and correct record.

6. Status

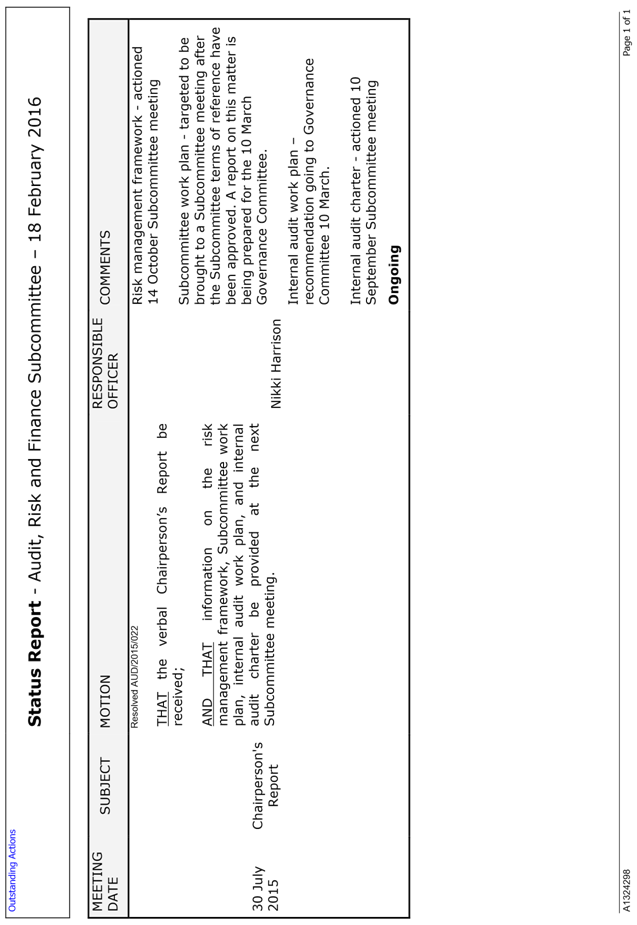

Report - Audit, Risk and Finance Subcommittee - 18 February 2016 15 - 16

Document number R5457

Recommendation

THAT the Status Report Audit, Risk

and Finance Subcommittee 18 February 2016 (R5457) and its attachment (A1324298) be received.

7. Chairperson's

Report

8. Corporate

Report to 31 December 2015 17 - 37

Document number R5375

Recommendation

THAT

the report Corporate Report to 31 December 2015 (R5375) and its attachments (A1489864, A1482829, A793514, A1498466

and A1486343) be received and the variations noted.

Recommendation to Governance

Committee and Council

THAT Council

resolves to fund the additional expenditure for Tasman Street from the

following activities; Roading subsidised budgets ($119,000), Roading

unsubsidised budgets ($117,000) and Stormwater budgets ($92,000), a total of

$328,000, from operational and capital expenditure budgets as appropriate,

noting that any individual project underspends which cover this overspend will

be reported by 30 June 2016;

AND

THAT funding of $100,000 for the Stoke Foothills Traffic

Study be deferred from 2015/16 to 2016/17;

AND

THAT funding of $100,000 for the Atawhai Hills Traffic Study

be brought forward from 2016/17 to 2015/16.

9. Letter

to the Council on the audit for the year ending 30 June 2015 38 - 48

Document number R5350

Recommendation

THAT the report Letter to the

Council on the audit for the year ending 30 June 2015 (R5350) and its attachment (A1499499) be received.

Recommendation to Governance

Committee and Council

THAT

Council notes Audit NZ’s comments (A1499499) and how officers intend to

address the issues raised.

10. Health

and Safety quarterly update to 31 December 2015 49 - 60

Document number R4967

Recommendation

THAT the report Health and Safety

quarterly update to 31 December 2015 (R4967)

and its attachments (A1483985 and A1485205)

be received.

11. Council's

Key Organisational Risk Progress Report 61 - 79

Document number R5395

Recommendation

THAT the Council's Key

Organisational Risk Progress Report (R5395)

and its attachment (A1461881) be

received.

12. Internal

Audit Report to 31 December 2015 80 - 86

Document number R5452

Recommendation

THAT the Internal Audit Report to

31 December 2015 (R5452) and its

attachments (A1485806 and A1498101) be

received.

Recommendation to Governance Committee

and Council

THAT

Council note the internal audit findings, recommendations and status of action

plans up to 31 December 2015 (R5452).

13. Extension

of loan facility to the Melrose Society 87 - 104

Document number R4814

Recommendation

THAT the report Extension of loan

facility to the Melrose Society (R4814)

and its attachments (A1450076 and A1416892)

be received.

Recommendation to Governance

Committee and Council

THAT

an interest free loan of $25,000 be made to the Melrose Society for the purpose

of toilet refurbishment, subject to:

- the Society receiving a

grant of $35,000 from the Rata Foundation for the same purpose;

- the designs being approved

by the Property and Facilities Asset Manager;

AND

THAT the loan is to be repaid in five annual instalments of

$5000 commencing 20 January 2017.

Public Excluded Business

14. Exclusion

of the Public

Recommendation

THAT

the public be excluded from the following parts of the proceedings of this

meeting.

The

general subject of each matter to be considered while the public is excluded,

the reason for passing this resolution in relation to each matter and the

specific grounds under section 48(1) of the Local Government Official Information

and Meetings Act 1987 for the passing of this resolution are as follows:

|

Item

|

General subject of each matter to be considered

|

Reason for passing this resolution in relation to each matter

|

Particular interests protected (where applicable)

|

|

1

|

Audit,

Risk and Finance Subcommittee Meeting - Public Excluded - 12 November 2015

|

Section

48(1)(a)

The public

conduct of this matter would be likely to result in disclosure of information

for which good reason exists under section 7.

|

The

withholding of the information is necessary:

· Section

7(2)(a)

To protect

the privacy of natural persons, including that of a deceased person.

|

|

2

|

Letter to

the Council on the audit for the year ending 30 June 2015 - Utilities

Contract

|

Section 48(1)(a)

The public conduct of this

matter would be likely to result in disclosure of information for which good

reason exists under section 7

|

The

withholding of the information is necessary:

· Section 7(2)(h)

To enable the local

authority to carry out, without prejudice or disadvantage, commercial

activities

|

15. Re-admittance

of the public

Recommendation

THAT

the public be re-admitted to the meeting.

Minutes of a meeting of

the Audit, Risk and Finance Subcommittee

Held in Ruma Mārama,

Level 2A, Civic House, 110 Trafalgar Street, Nelson

On Thursday 12 November

2015, commencing at 9.09am

Present: Mr

J Peters (Chairperson), Her Worship the Mayor R Reese, Councillors B McGurk and

Mr J Murray

In Attendance: Councillor

P Matheson (Deputy Mayor), Chief Executive (C Hadley), Group Manager

Infrastructure (A Louverdis), Group Manager Corporate Services (N Harrison),

Senior Accountant (T Hughes), Administration Adviser (E-J Ruthven)

Apology: Councillor

Ian Barker

By

agreement of all members present, Mr Murray assumed the Chair.

1. Apologies

|

Resolved AUD/2015/049

THAT an apology be

received and accepted from Councillor Ian Barker.

Reese/McGurk Carried

|

2. Confirmation of Order of Business

There

was no change to the order of business, although it was noted that the order of

business may alter to accommodate the Council’s Treasury Adviser, Brett

Johanson’s, presentation to the Subcommittee.

3. Interests

There were no updates to the

Interests Register, and no interests with items on the agenda were declared.

4. Public Forum

There was no public forum.

5. Confirmation of Minutes

5.1 14

October 2015

Document number M1529, agenda

pages 6 - 10 refer.

|

Resolved AUD/2015/050

THAT the minutes of

the meeting of the Audit, Risk and Finance Subcommittee, held on 14 October

2015, be confirmed as a true and correct record.

McGurk/Murray Carried

|

6. Status Report - Audit, Risk and

Finance Subcommittee - 12 November 2015

Document number R5107, agenda

pages 11 - 12 refer.

|

Resolved AUD/2015/051

THAT the Status Report Audit,

Risk and Finance Subcommittee 12 November 2015 (R5107) and its attachment (A1324298) be received.

McGurk/Murray Carried

|

Chairperson's

Report

7. Chairperson's Report

There

was no Chairperson’s report.

8. Internal Audit Plan and Procedure

Document number R5045, agenda

pages 13 - 22 refer.

Group Manager Corporate Services,

Nikki Harrison, presented the report. She explained that the risk register

captured organisational risks, and that an audit of the top ten organisational

risks was expected to be completed by 30 June 2016.

In response to questions, Ms

Harrison explained current internal checks in relation to financial policies

such as the payroll system. She added that the internal audit system

would involve a review of internal processes, and may include data

checking.

In response to a further

question, the Chief Executive explained that no issues had been raised through

the whistle-blowing system, and as a result, no review of this had been

undertaken. Ms Harrison added that any issues arising as a result of

internal audits would be brought to the subcommittee’s attention.

Attendance: Mr Peters joined the meeting at 9.21am, and

assumed the chair.

In response to a question, the

Chief Executive explained that regulatory risk was captured in the risk

register, but was not considered to be one of the top ten risks requiring

internal audit in the short term. She said that some elements of regulatory

risk were monitored via external auditing procedures, but that other aspects

would require internal audit.

In response to further questions,

Ms Harrison explained that the interest schedules for both elected members and

staff were updated on an on-going basis. She said that the schedule

recording elected members’ interests was carefully reviewed by Audit New

Zealand, but that an audit had not been undertaken regarding the staff

interests’ register.

Following discussion, it was

agreed that, in the Internal Audit Procedure under the heading ‘Extension

for Action Plans’, the words “or organisational risk” should

be added after the words “no safety-related issues”.

|

Resolved AUD/2015/052

THAT the report Internal Audit

Plan and Procedure (R5045) and

its attachments (A1452073 and A1428836)

be received.

Murray/McGurk Carried

|

|

Recommendation to Governance

Committee AUD/2015/053

THAT

the Internal Audit Plan to 30 June 2016 (A1452073) be approved, with the

amendment:

·

Under the heading ‘Extension for Action Plans’,

insert the words “or organisational risk” after the words

“no safety-related issues”.

McGurk/Murray Carried

|

9. Corporate Report to 30 September

2015

Document number R5067, agenda

pages 23 - 40 refer.

Group Manager Corporate Services,

Nikki Harrison, presented the report.

In response to a question, Group

Manager Infrastructure, Alec Louverdis, explained the quantum involved in

studies delayed until the New Zealand Transport Agency Southern Arterial

Investigation was released.

In response to a question

regarding the Nelson School of Music, Ms Harrison explained that the

expenditure being behind budget was largely a timing issue. She added

that there were a number of open purchase orders, which indicated work

underway.

In response to a question

regarding the Nelson Plan and the Air Plan, the Chief Executive explained that,

dependent on timing of hearings, there was likely to be an overspend in the Air

Plan as a result of bringing the Plan Change forward.

The Committee considered the

report attachments in turn.

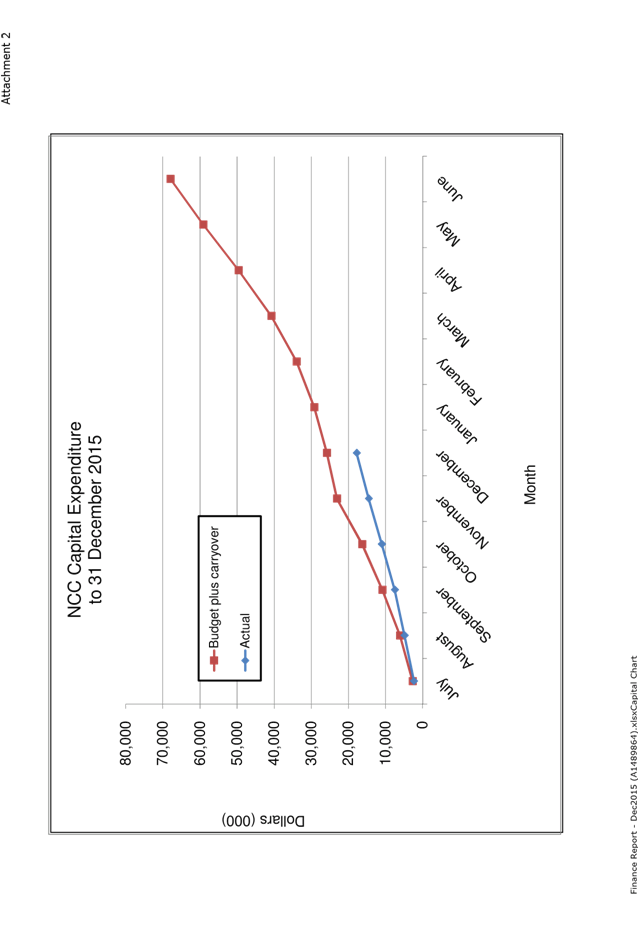

In response to a question

regarding the Capital Expenditure Graph, Ms Harrison explained that the actual

spend trending behind the budget was largely an invoicing timing issue.

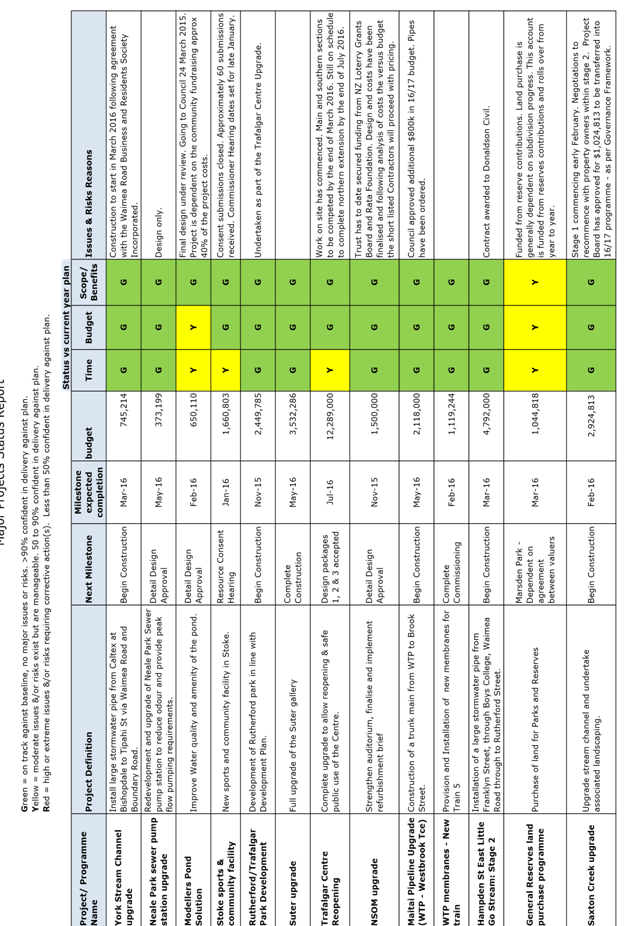

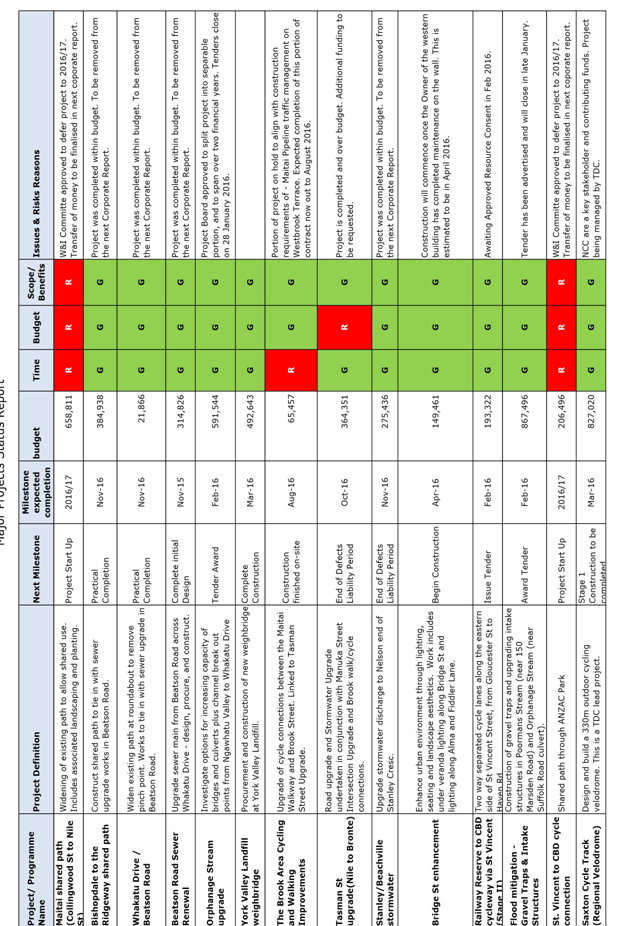

In response to questions

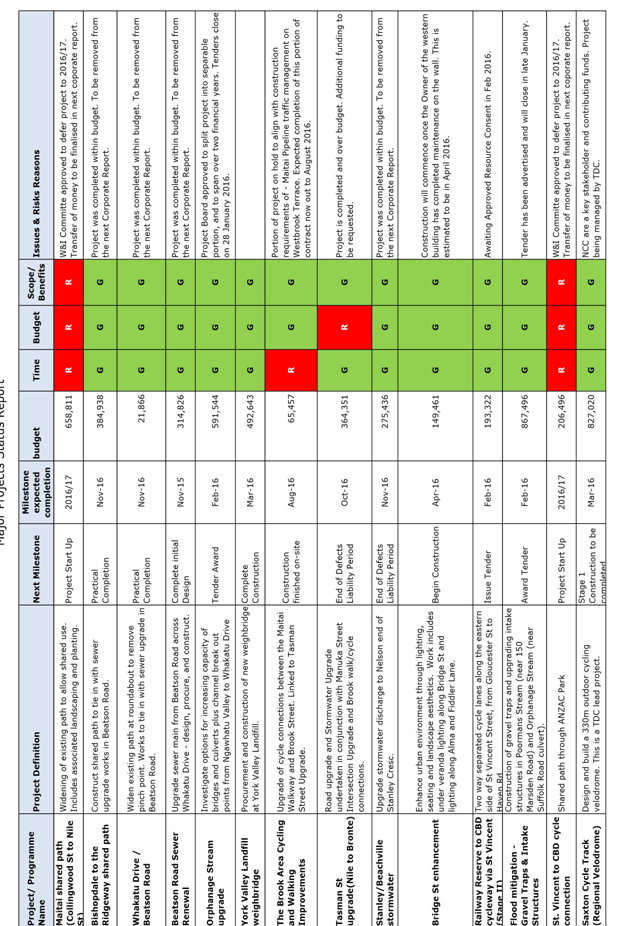

regarding the Major Projects Status Report, Mr Louverdis gave an update of the

process surrounding Cultural Impact Assessments. With regards to the

Trafalgar Centre re-opening, Mr Louverdis confirmed that the budget column

reflected stages 1-3, but that the next report would have updated costs.

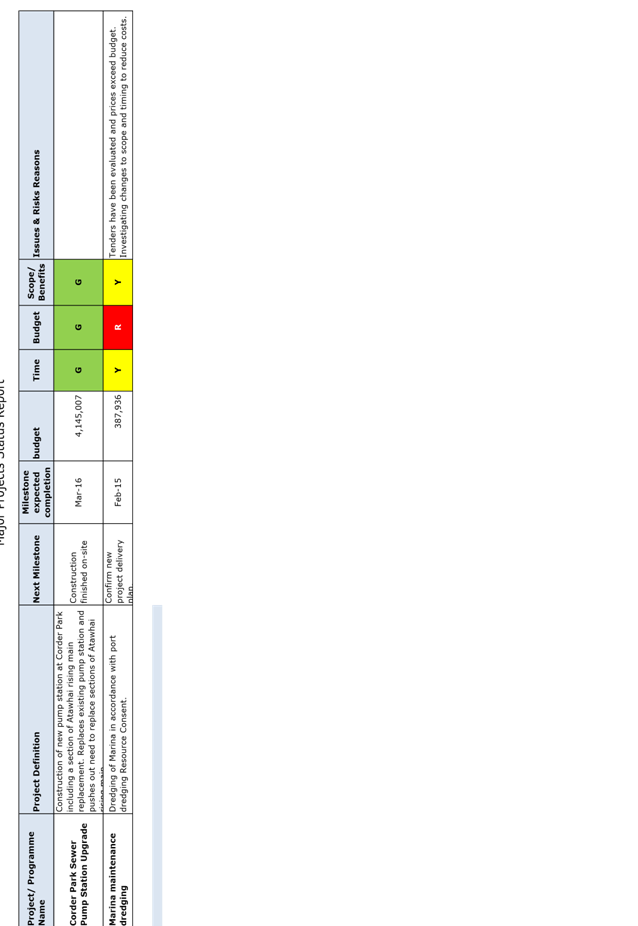

There was a discussion regarding

marina maintenance dredging. In response to a question, Mr Louverdis

explained the process of calling for tenders, and noted that responses to the

tender exceeded the available budget. He said that the next Corporate report

would address this issue.

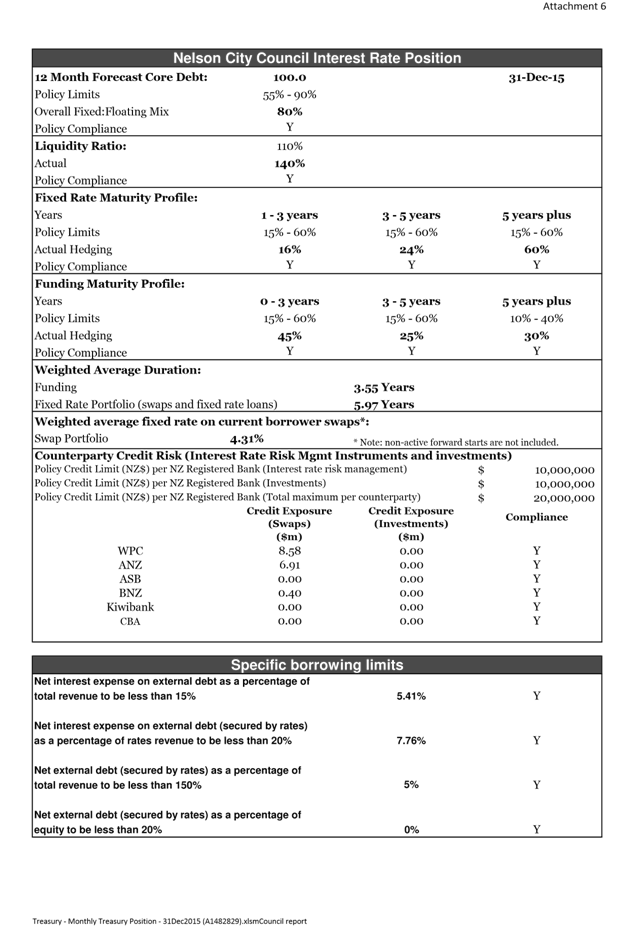

In response to a question

regarding debtors to Council, the Chief Executive advised that debt recovery

steps were being undertaken. She added that the meeting would need to

move into public excluded session in order to provide further details.

|

Resolved AUD/2015/054

THAT

the report Corporate Report to 30 September 2015 (R5067) and its attachments (A1448646,

A1311288, A793514, and A1437431) be received and the variations noted.

Murray/McGurk Carried

|

|

Resolved AUD/2015/055

THAT the subcommittee notes that funding of $8,900 has been allocated

to Isel House in 2015/16 for the operational costs of running the House.

McGurk/Reese Carried

|

10. PwC Presentation

Brett Johanson, Council’s

Treasury Adviser, gave a Power Point presentation on treasury risk management

(A1458485).

He spoke about changes to the

domestic and global interest rate markets, and explained additional movements

in the financial market which impacted on the manner in which local authorities

managed their treasury functions.

Mr Johanson provided an update

regarding the Local Government Funding Agency (LGFA). He explained the

change in policy allowing bonds to be issued out to 12 years at a lower cost

than bank funding, and noted that there may be an even longer-term bond

offering in the future. He spoke about the effect that longer-term bonds

had on local authorities’ ability to manage debt risks.

The subcommittee discussed

whether Council was too risk adverse to taking on debt, given that current

market conditions were favourable to taking on further debt. In response

to a question, Ms Harrison explained that pre-funding future projects when

interest rates were low was not necessarily advantageous to Council, as margins

would be lost when such funds were re-invested. Mr Johanson added that

pre-funding also raised the risk of over-hedging and creating inflexibility,

and that external agencies, such as the LGFA and Standard and Poors,

appreciated local authorities behaving in a financially prudent manner. He

added that pre-funding activities by taking on debt now could potentially

affect Council’s credit rating, which would have flow on effects for

relative interest rates.

There was a further discussion

regarding whether asset management and deferred maintenance, particularly of

infrastructure assets, should be brought forward, in order to take advantage of

lower interest rates, and the capacity of Council to deliver such projects was

discussed. It was noted that Council’s current debt to total

revenue ratio was approximately 65%, well below Council’s policy limit of

150% and the Standard and Poor’s limit of 175%, at which a down-grade of

the credit rating would be indicated. In response to a question, Ms

Harrison explained that the Long Term Plan indicated a ratio of approximately

140% around years six to seven, and that this should be kept in mind if any

alterations to Council’s current debt management were to be considered.

Mr Johanson then explained

updates to Council’s Liability Management Policy. He said that this

was now managed out to 12 years, as a result of the longer term LGFA funding

available, but that any debt beyond this time period would require Council

approval.

He added that the 5-year-plus

limit had moved from 40% to 60%, as this provided the greatest flexibility for

Council to manage growing debt. There was a discussion regarding

Council’s exposure to banks through interest rate swaps, and whether it

was appropriate for local authorities to invest with local building societies

or credit unions. In response to a question, Ms Harrison clarified that

Council was a net borrower, and was not in a position to invest in such

agencies per se.

In response to questions, Mr

Johanson explained that prudent financial management was a key objective, and

that overall Council was fit for purpose and meeting best practice standards in

relation to its liability and investment policies, and disciplined approach to

managing risks.

|

Attachments

1 Power Point

Presentation - A1458485 - Treasury Management Update

|

11. Liability

Management Policy amendment

Document number R5077, agenda

pages 41 - 56 refer.

|

Resolved AUD/2015/057

THAT the report Liability

Management Policy amendment (R5077)

and its attachment (A1450461) be

received.

Murray/McGurk Carried

|

|

Recommendation to Governance

Committee AUD/2015/058

THAT

the amended Liability Management Policy (A1450461) be adopted.

Murray/McGurk Carried

|

12. Exclusion

of the Public

Recommendation

THAT

the public be excluded from the following parts of the proceedings of this

meeting.

The

general subject of each matter to be considered while the public is excluded,

the reason for passing this resolution in relation to each matter and the

specific grounds under section 48(1) of the Local Government Official

Information and Meetings Act 1987 for the passing of this resolution are as

follows:

|

Item

|

General subject of each matter to be considered

|

Reason for passing this resolution in relation to

each matter

|

Particular interests protected (where applicable)

|

|

1

|

Corporate Report to 30 September

2015 – discussion regarding debtor

|

Section 48(1)(a)

The public conduct of this

matter would be likely to result in disclosure of information for which good

reason exists under section 7.

|

The withholding of the

information is necessary:

· Section 7(2)(a)

To protect the privacy of

natural persons, including that of a deceased person.

|

The meeting went into public

excluded session at 11.20am and resumed in public session at 11.25am.

13. Re-admittance of the

Public

|

Resolved AUD/2015/059

THAT

the public be re-admitted to the meeting.

McGurk/Murray Carried

|

There being no further business the

meeting ended at 11.25am.

Confirmed as a correct record of proceedings:

Chairperson

Date

Chairperson

Date

|

|

Audit, Risk and Finance Subcommittee

18 February 2016

|

REPORT R5457

Status

Report - Audit, Risk and Finance Subcommittee - 18 February 2016

1. Purpose

of Report

1.1 To

provide an update on the status of actions requested and pending.

2. Recommendation

|

THAT the Status Report Audit,

Risk and Finance Subcommittee 18 February 2016 (R5457) and its attachment (A1324298) be received.

|

Shailey

Burgess

Administration

Adviser

Attachments

Attachment 1: A1324298

- Status Report - Audit, Risk and Finance Subcommittee

|

|

Audit, Risk and Finance Subcommittee

18 February 2016

|

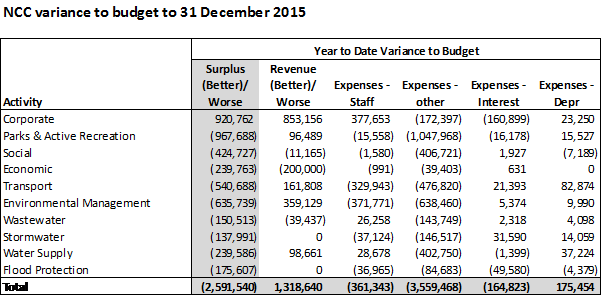

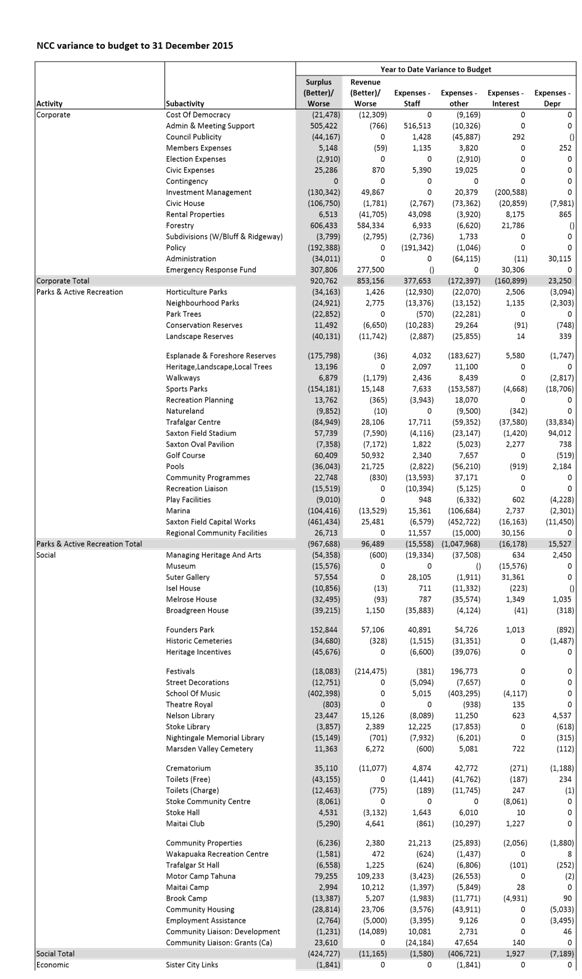

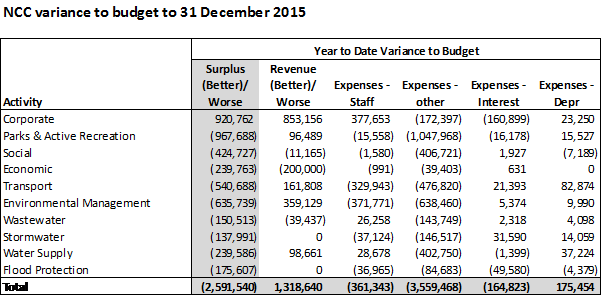

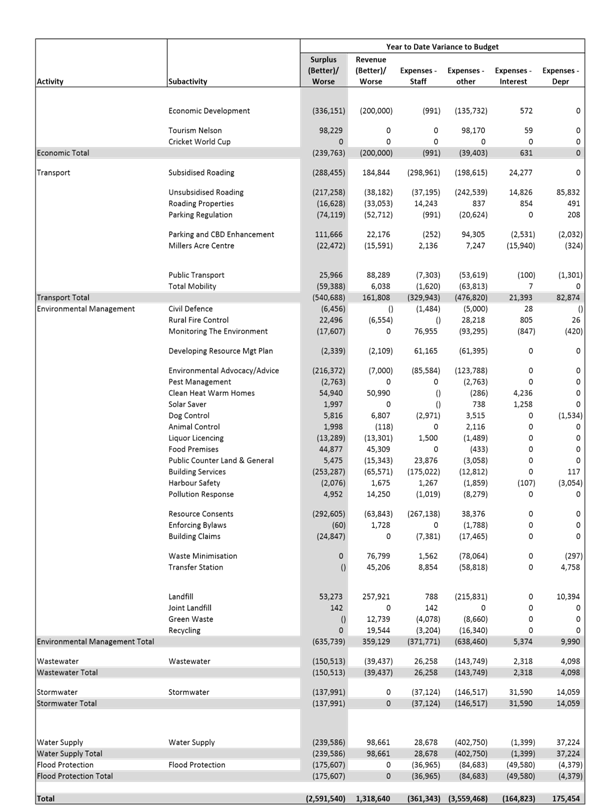

REPORT R5375

Corporate Report to 31 December 2015

1. Purpose of Report

1.1 To inform the members of the Audit, Risk and Finance Subcommittee of the

financial results of activities for the 6 months ending 31 December 2015

compared to the approved operating budget, and to highlight and explain any material

variations.

2. Delegations

2.1 The Audit, Risk and Finance Subcommittee has oversight of the management

of financial risks. Do not delete Do not delete this

li

3. Recommendation

|

THAT

the report Corporate Report to 31 December 2015 (R5375) and its attachments (A1489864, A1482829, A793514,

A1498466 and A1486343) be received and the variations noted.

|

Recommendation to Governance Committee and Council

|

THAT Council resolves to fund the additional

expenditure for Tasman Street from the following activities; Roading

subsidised budgets ($119,000), Roading unsubsidised budgets ($117,000) and

Stormwater budgets ($92,000), a total of $328,000, from operational and capital

expenditure budgets as appropriate, noting that any individual project

underspends which cover this overspend will be reported by 30 June 2016;

AND THAT

funding of $100,000 for the Stoke Foothills Traffic Study be deferred from

2015/16 to 2016/17;

AND THAT

funding of $100,000 for the Atawhai Hills Traffic Study be brought forward

from 2016/17 to 2015/16.

|

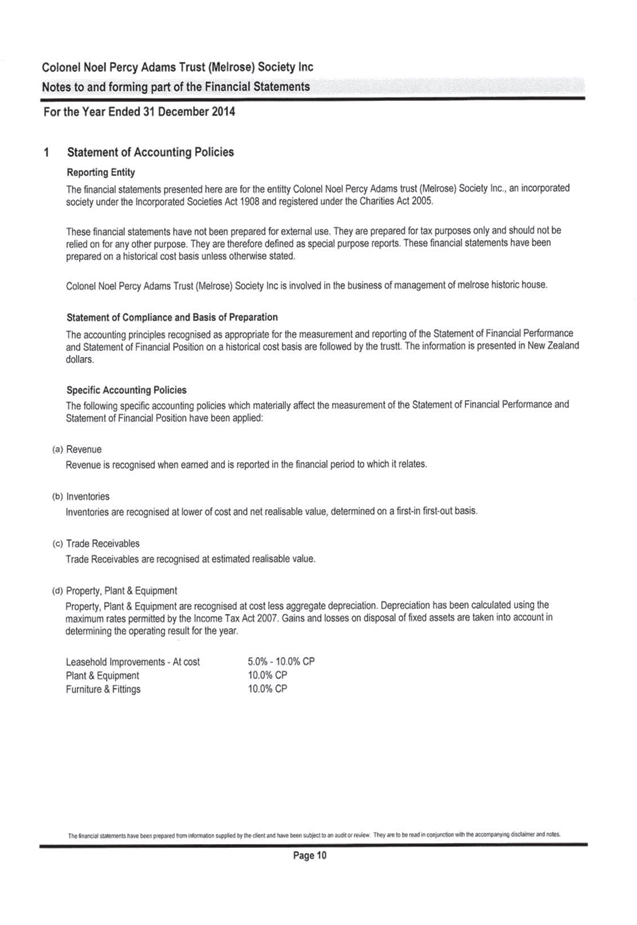

4. Background

4.1 The report focuses on the 6 month performance compared

with the year to date approved operating budget. Budgets for operating income

and expenditure are phased evenly through the year, whereas capital expenditure

budgets are phased to occur mainly in the second half of the year.

4.2 Some definitions of terms used within this report:

· Approved operating budget – Annual plan plus carry forwards

plus any other additions or changes approved by Council;

· Operating income – all income other than rates including

metered water, grants, fees, rentals, and recoveries;

· Rates – includes the general rate, wastewater, stormwater and

flood protection rates, and targeted rates for Solar Saver;

· Staff costs – salaries plus overheads such as training, super,

professional fees and office accommodation expenses;

· Depreciation – includes all depreciation, and any losses on

asset disposal/retirement;

· Interest – includes debt interest, bank fees, interest rate

swap margins, treasury and rating agency fees.

5. Discussion

5.1 The report focuses on performance to date compared with the year to date

approved operating budget. More detailed financials by sub-activity are in

Attachment 2.

5.2 It is anticipated that this will be the last corporate

report in this format. Officers are working with the Subcommittee

external appointees to streamline reporting to better meet the needs of the

sub-committee.

5.3 For the 6 months ending 31 December 2015, the activity surplus/deficits

are $2.6 million favourable to budget.

5.4 Revenue and expenditure variances are discussed by activity. Many

variances are a mismatch in timing between the budget phasing and actual

expenditure. The Christmas/New Year break has also delayed receipt and

processing of regular expenses. Finance will investigate more tailored budget

phasing for the upcoming financial year.

5.5 Staff expenses are $361,000 in total favourable to budget. Variances in

activities illustrate where staff time has actually been spent against where it

was expected to be spent at the time of setting the 2015/16 Annual Plan.

5.6 Depreciation is $175,000 unfavourable to budget. This is as a result of

a $94,000 write down for retired assets along with depreciation on unbudgeted

assets added to the register.

5.7 Finance expenses are $165,000 favourable to budget as 2014/15 capital

expenditure was less than projected and interest rates remain favourable to

those anticipated.

5.8

Corporate

5.9 The Corporate activity is $921,000 unfavourable to budget.

5.9.1 Revenue – $853,000 less than budgeted.

Internal interest income is $186,000 less than budgeted as 2014/15 capital

expenditure was less than projected and interest rates remain favourable to

those anticipated. Forestry income is $584,000 as revenue and costs related to

the harvest of the Brook stand are yet to be finalised. We are also still

awaiting reimbursement from the Ministry of Civil Defence and Emergency Management

for a claim lodged in July last year for the 2011 emergency event (278,000 year

to date, total claim $555,000).

5.9.2 Expenses - $172,000 less than budgeted.

There are timing differences in Civic House outgoings such as cleaning,

and delays in commencing programmed maintenance. A loss on disposal of $80,000

was recorded on the retirement of the old phone system from the fixed asset

register.

Parks and Active Recreation

5.10 The

Parks and Active Recreation activity is $968,000 favourable to budget due to:

5.10.1 Expenses – other - $1,048,000 less than

budget. Water by meter is $162,000 below budget – seasonality is a

major driver of this variance with the March quarter generating heavier

expenditure. Grants for capital projects at Saxton’s Field have not yet

been made to Tasman District Council ($440,000 - timing), and maintenance

expenditure is behind budget by $376,000 including $150,000 for the Marina

dredging. The scope and timing (originally November) for the Marina dredging is

being revised as the submitted tender price exceeds the existing budget. Some

maintenance expenditure in this activity is very seasonable, and a large number

of purchase orders have been raised.

Social

5.11 The

Social activity is $425,000 favourable to budget due to:

5.11.1 Revenue - $11,000 more than budget. Festivals income is

$216,000 more than year to date budget (offset by expenditure). Founders book

fair proceeds ($53,000 behind year to date budget) will be received in June,

and motor camp income ($124,000 behind year to date budget) should be caught up

in January/February. All timing issues.

5.11.2 Expenses – other - $407,000 less than budget.

Expenditure for the earthquake strengthening and refurbishment of the Nelson

School of Music is behind budget by $403,000 (timing). Maintenance expenditure

is $118,000 less than budget although again there are a large number of open

purchase orders awaiting invoices. Festivals are overspent $195,000 year to

date (offset by income, a timing issue).

Economic

5.12 The

Economic activity is $240,000 favourable to budget due to:

5.12.1 Revenue - $200,000 more than budget. The unbudgeted

half year contribution from TDC has been received against unbudgeted

expenditure incurred in Economic Development and Tourism Nelson.

5.12.2 Expenditure – the Events Contestable Fund has not

yet been accessed ($167,000, timing), and $41,000 expenditure budgeted for

investigating a business incubator is not expected until year end (timing). EDA

and NTT service provision is $200,000 overspent year to date (offsetting

revenue in EDA from TDC).

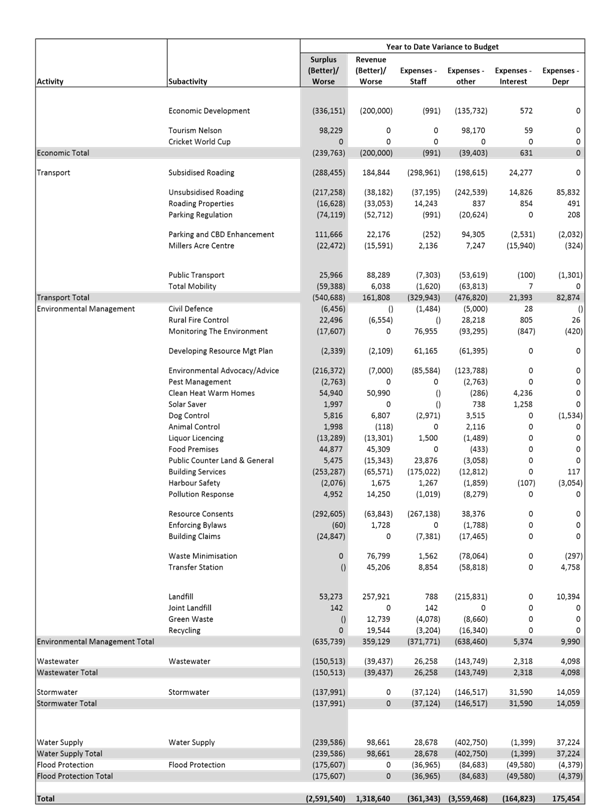

Transport

5.13 The

Transport activity is $541,000 favourable to budget due to:

5.13.1 Revenue - $162,000 less than budget as the timing of

income from NZTA ($179,000) reflects the timing of expenditure. Income from

Parking Regulation is tracking ahead of budget year to date ($53,000) as the

anticipated reduction in fines relating to changes in parking enforcement has

not eventuated.

5.13.2 Expenses – other - $477,000 less than budget,

mainly in subsidised and unsubsidised roading. The most significant underspends

in that activity are:

· Base maintenance $346,000 less than budget in the roading accounts.

Year to date underspend is a result of seasonality and contract management

requirements. Budgets are expected to be spent by the end of the financial

year.

· $52,000 more than budget in off-street parking meter maintenance as

paper usage has significantly increased with 1 hour free parking.

· $95,000 underspent year to date in recovery works from the 2011

emergency event relating to Days Track. This work has been carried forward from

2014/15. A report on this project will be coming to a Works and Infrastructure

committee meeting in the New Year.

· There

has been no spend year to date on the Southern Arterial corridor management

Plan. This is delayed until the findings of the NZTA Southern Arterial

Investigation are released. This money will not be spent in the current

financial year.

· The

Stoke Foothills Traffic Study has been delayed from 15/16 to 16/17 so that the model

that is under development for the NZTA Southern Link project and its outputs

can be utilised which will result in more robust outcomes/better value for

money.

· The

Atawhai Hills Traffic Study is proposed to be brought forward from 16/17 to

15/16 (this year) so the outputs of the study can be incorporated into the

Nelson Plan and landscape value work currently underway.

Environmental

Management

5.14 This

activity includes Civil Defence and Rural Fire activities, Consents and

Compliance, Environmental Programmes, and Solid Waste activities. The

Environmental Management activity is $636,000 favourable to budget due to:

5.14.1 Revenue - $359,000 less than budget. Landfill fees and

levies (including hazardous waste levies) are $258,000 (15%) less than year to

date budget as waste volumes are less than anticipated. Income recorded

in other solid waste accounts is $154,000 less than budget as expenditure in

these accounts is correspondingly less than budgeted. Building income is

$66,000 above budget (8%). Volumes are roughly the same as first quarter

2014/15, the increased revenue is a result of higher value building

applications. Resource consent income is $64,000 ahead of budget and tracking

ahead of prior year to date.

5.14.2 Expenses – other - $638,000 less than budget.

Environmental advocacy and advice (mainly Nelson Nature) is $127,000 behind

budget. A monitoring programme has now been agreed and expenditure has

been committed. A partnership with the Department of Conservation (DoC)

has been announced and work direction is now being confirmed which will require

expenditure.

5.14.3 Solid waste expenditure is $377,000 less than budget

including $154,000 internal transfer in the closed accounts (offsetting

income). There has been little expenditure in Waste Minimisation due to a

programme delivery review and timing of expected invoices; service provision

for the transfer station and landfill are under budget as December has only

been partly invoiced; and Toe embankment maintenance and ETS levies in the

landfill account will not be spent until the end of the year.

Wastewater

5.15 The

Wastewater activity is $151,000 favourable to budget due to:

5.15.1 Expenses – other - $144,000 less than budget.

Maintenance expenditure is $131,000 behind budget with a review of this

expenditure to be undertaken in February. There has been no expenditure on

natural hazards risk assessment to date – a report is currently being prepared on the impact of natural hazards on the

NWWTP, rising main and primary pump stations. This work complements development

of projects such as Nelson Plan, Land Development Manual and civil defence

planning.

Stormwater

5.16 The

Stormwater activity is $138,000 favourable to budget due to:

5.16.1 Expenses – other - $144,000 better than budget.

There has been no expenditure year to date against budgets for studies and

strategies including natural hazards risk assessment (see Wastewater

comment). Work has been commissioned for the project on network capacity

confirmation for growth areas and is likely to be completed by May. The budget

for Building Act compliance in relation to dams ($60,000 year to date) is

unlikely to be spent due a delay from central government required to progress

the project.

Water

5.17 The

Water activity is $240,000 favourable to budget due to:

5.17.1 Revenue - $99,000 less than budget (timing).

5.17.2 Expenses – other - $403,000 less than budget

relates to $307,000 maintenance expenditure including $178,000 for reactive

maintenance, $82,000 for head-works maintenance (timing), and $35,000 for

projects linked to the resource consents (to be reviewed in February). There

has been no expenditure year to date against budgets for studies and strategies

including natural hazards risk assessment (see Wastewater comment), water loss

reduction strategy, and water safety plan (both to be reviewed in

January/February). Work has been commissioned for the project on network

capacity confirmation for growth areas and is likely to be completed by March.

Flood

Protection

5.18 The

Flood Protection activity is $176,000 favourable to budget.

5.18.1 Expenses – $85,000 less than budget – there

is a delay in programmed work waiting on global/individual consents. December

stream inspections have identified possible other areas of focus and Nelmac are

now supplying cost estimates on this work.

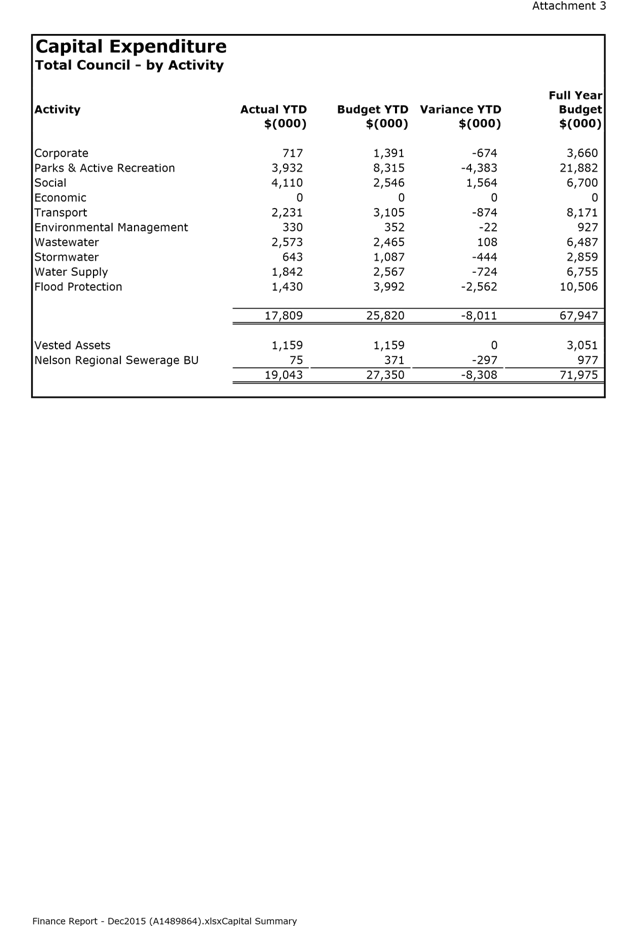

Capital

Expenditure

5.19 Capital

expenditure to 31 December 2015 was $17.8 million, $8.0 million (31%) below

budget. Details are included in Attachments 2, 3 and 5.

5.20 Improvements

in the way projects are developed and managed have led to initial delays as

greater rigour has been applied to preparing and understanding the projects.

However, expectations at this stage are that the work programme will be met.

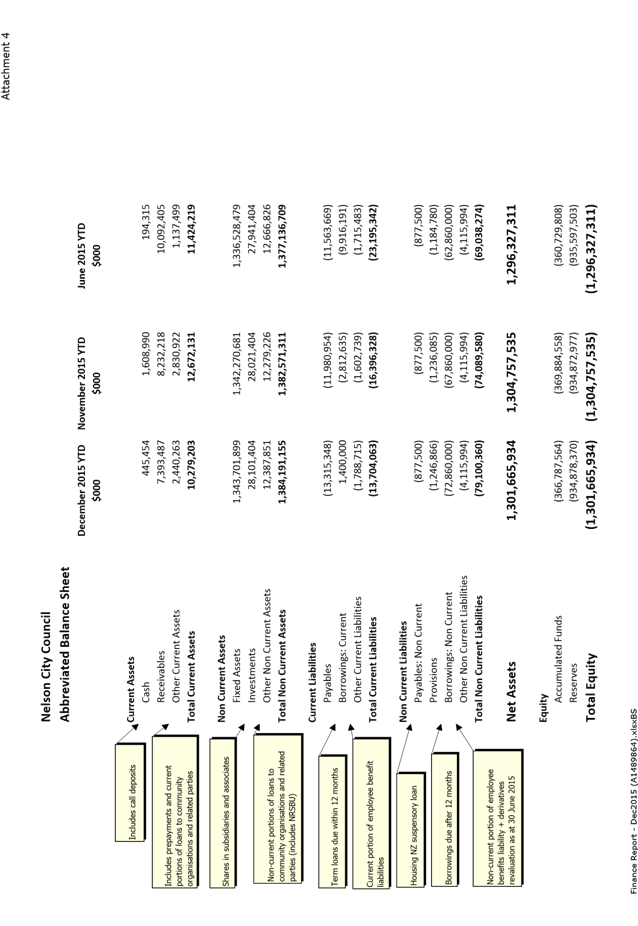

Balance

Sheet

5.21 Council

had $1.7 million in on call cash balances at the end of November from payment

of the October rates instalment. Operational expenditure utilised this balance

in December.

5.21.1 Payables include rates received in advance. As rates

are invoiced in quarterly instalments, significant movements are generated

between debtors and creditors, depending on which month of the cycle is being

reported. Balances have also built up from those ratepayers with direct debit

arrangements in advance of the next quarterly rates accounts, invoiced in

January.

5.21.2 In December, $5 million of current borrowings were

replaced with $5m term borrowings through the Local Government Funding Agency,

due in 2023.

5.21.3 Rates income for the quarter is recognised in its

entirety when it is invoiced, in this case in October. Over the following 2

months, accumulated funds decrease as expenditure is incurred. Essentially

accumulated funds reflects the timing differences between rates income and

organisational expenditure.

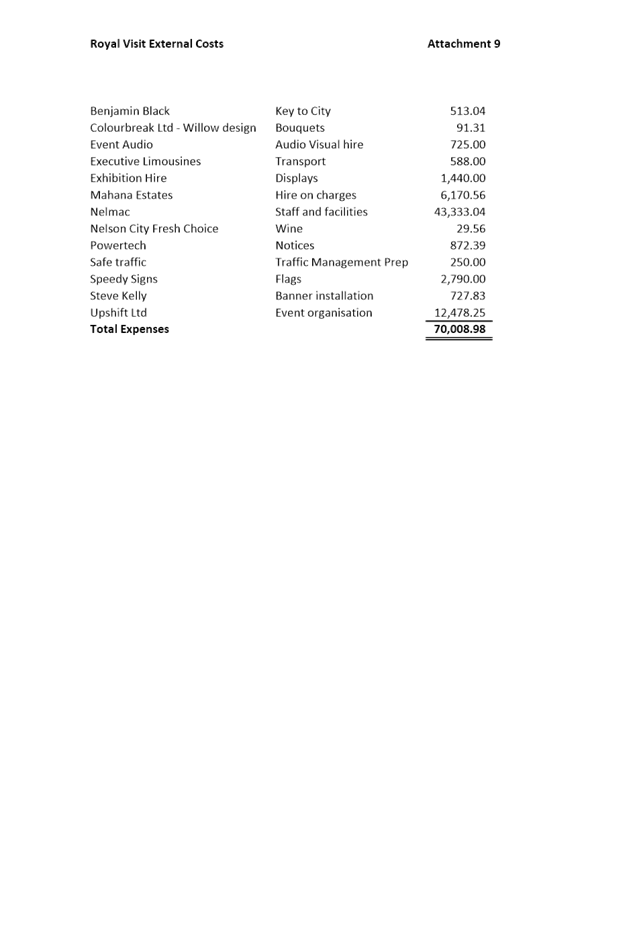

6. Royal Visit

6.1 Direct costs relating to the visit to Nelson in November 2015 by HRH the

Prince of Wales and the Duchess of Cornwall totalled $70,000. A budget of

$100,000 was approved for this event. Refer Attachment 9.

7. Consultancy costs for Chief Executive Employment

Committee

7.1 External support for the Chief Executive Employment Committee totals

$25,500 to December.

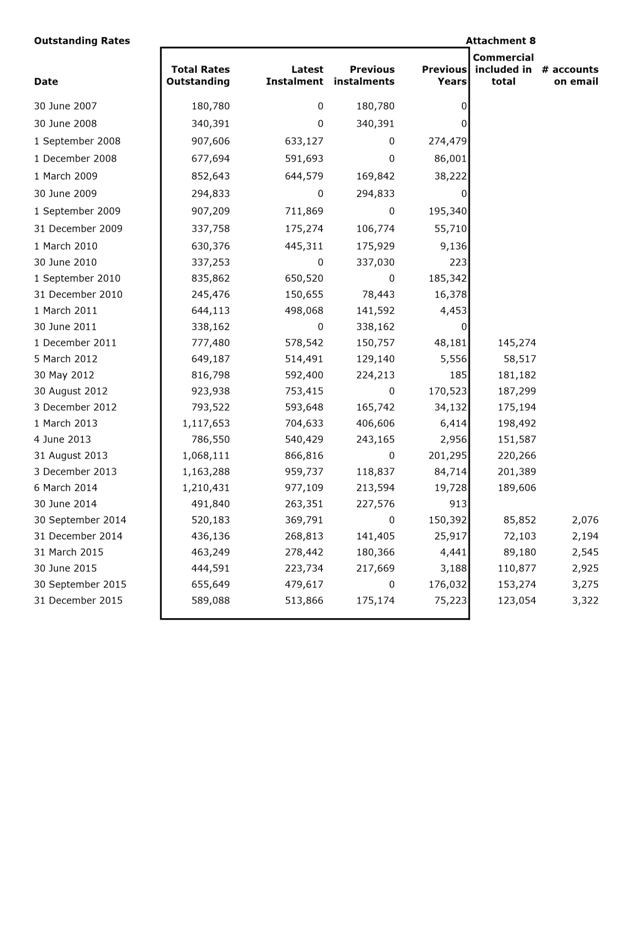

8. Outstanding rates at 31 December 2015

8.1 Please see attachment 8 for an update.

9. Tasman Street upgrade

9.1 The Tasman Street Upgrade project (between Nile Street

and Bronte Street) commenced in February 2015 and was completed in late October

2015. This project was signalled in the 2013/14 Annual Plan. The work included

the upgrade of Council underground services (water, sewer and storm water),

footpaths, kerb and channel , carriageway upgrade, re-seal, roundabout

improvements, street lighting and underground private services (power and

telecommunications).

9.2 The original project budget was $1,129,000. Following

very competitive pricing, the final budget on evaluation was reduced by

$119,000 to $1,010,000 as the tendered price was lower than the estimate. This

included a contingency (as per all contracts) of approximately 15%.

9.3 Many issues during the project led to an eventual

overspend of approximately $211,000 and a final construction cost of

approximately $1,340,000 (22% higher than the original project budget). Asset

Managers believe the shortfall should be allocated to those activities that

have benefited from the betterment the additional works have provided.

9.4 This project predated the new and now standard quality

assurance measures put in place following the review of how capital projects

should be delivered. There are now systems in place to ensure that risks (as

identified on this project) are mitigated.

9.5 The complex project included the following conditions

encountered on site that are regarded as genuine unforeseen issues:

9.6

· Incorrect

location of private underground services

· Incorrect

location of historic Council services

· Poorer

than expected ground conditions

· Poor

design assumptions

· Altering

design to mitigate unforeseen issues

9.7 These unforeseen issues also included the opportunity

for Council to upgrade existing services (termed betterment) at a reduced cost,

resulting in increased asset life, due to economies of scale and avoiding

re-excavation of the carriageway.

9.8 There have also been very positive lessons learnt from

poor design process which are now being applied to all new projects to mitigate

risk. These issues have been discussed with the external design consultant with

a view to a financial contribution to offset the additional costs.

10. Other projects update

10.1 Please

see Attachment 5 for progress reports on Council’s major projects.

11. Alignment with relevant Council policy

11.1 The finance report is prepared

comparing current year performance against the year to date approved operating

budget for 2015/16.

12. Assessment of significance against the Council’s

Significance and Engagement Policy

12.1 There are no significant decisions.

13. Consultation

13.1 No consultation is required.

14. Inclusion of Māori in the decision making process

14.1 No consultation is required.

Tracey Hughes

Senior Accountant

Attachments

Attachment 1: NCC

Detail Performance (A1489864)

Attachment 2: Capital Expenditure Graph (A1489864)

Attachment 3: Capital Expenditure by Activity

(A1489864)

Attachment 4: NCC Balance Sheet (A1489864)

Attachment 5: Major Projects Report (A1486343)

Attachment 6: Interest Rate Position (A1482829)

Attachment 7: Debtors report (A793514)

Attachment 8: Rates Outstanding (A1489864)

Attachment 9: Royal visit costs Dec 2015

(A1498466)

|

|

Audit, Risk and Finance Subcommittee

18 February 2016

|

REPORT R5350

Letter

to the Council on the audit for the year ending 30 June 2015

1. Purpose

of Report

1.1 To provide the letter to the Council on the audit for

the year ending 30 June 2015 from Audit NZ and advise on issues raised.

2. Delegations

2.1 The Audit, Risk and Finance Subcommittee have

responsibility for the audit of Council’s Annual Report and annual

accounts.

3. Recommendation

|

THAT the report Letter to the

Council on the audit for the year ending 30 June 2015 (R5350) and its attachment (A1499499) be received.

|

Recommendation

to Governance Committee and Council

|

THAT

Council notes Audit NZ’s comments (A1499499) and how officers intend to

address the issues raised.

|

4. Discussion

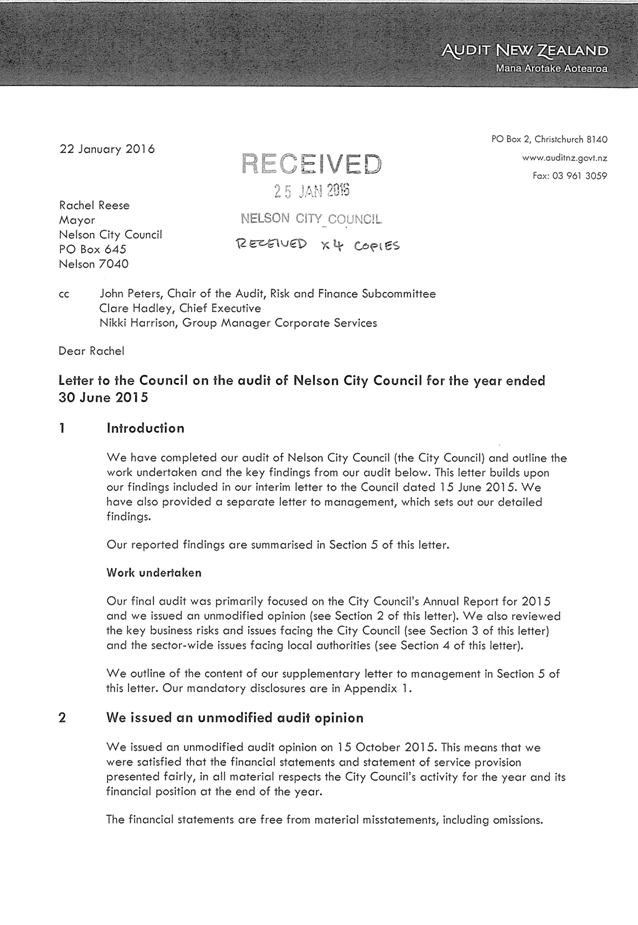

4.1 Audit New Zealand (Audit NZ) issued an unmodified

audit opinion on 15 October 2015 for the financial year ending 30 June 2015.

This means that it was satisfied that the financial statements fairly reflected

Council’s activity for the year and its financial position at the end of

the financial year.

4.2 After the audit is completed, Audit NZ issue a

management letter to Council outlining the findings of the audit.

4.3 In the letter to Council issued on 22 January 2016

(Attachment 1) a number of issues were raised. This report provides an

explanation of the issues and how they will be addressed by officers.

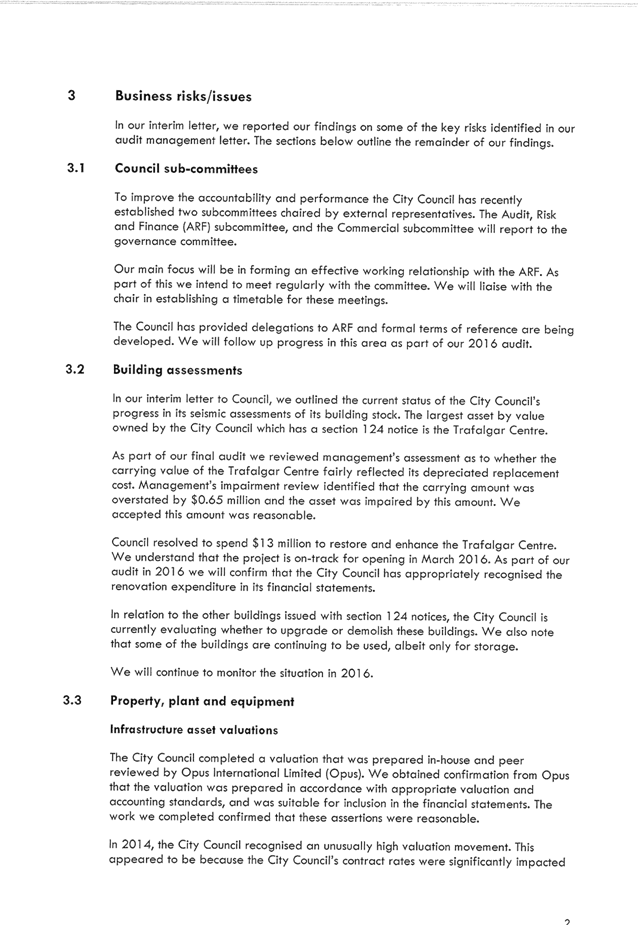

Council

sub-committees

4.4 Audit NZ note the forming of the Audit, Risk and

Finance (ARF) and Commercial subcommittee and that Terms of Reference are being

developed for the ARF subcommittee. These are due to go to the Governance

Committee 10 March 2016 for approval.

Infrastructure

asset valuations

4.5 Audit NZ noted in the letter to Council the large

revaluation in the 2014 Annual Report and the subsequent change to the

methodology used by Council in 2015 for indexing (Council carries out a full

revaluation of infrastructure assets every second year with indexing in the

intervening year). Officers intend to continue to use the new methodology

for indexing, the next instance of which will be in the 2016/17 Annual Report.

Suter

redevelopment

4.6 Audit NZ noted in the letter to Council that Council

is treating the Suter redevelopment as capital work in progress with the

intention of treating the Council $6 million contribution as a capital

injection at completion of the project. Council is funding the first

$6million of the project and is Engineer to the Contract.

4.7 Officers have subsequently met with Suter

representatives and agreed the asset transfer will occur at the completion of

the project. This will be treated as a capital injection (increase in

investment) from Council’s perspective and an increase in equity by the

Suter.

Performance

measure rules

4.8 Asset managers had developed measures that collected

the data required by the new mandatory performance measures set by the

Department of Internal Affairs (DIA) but worded to reflect the Nelson

situation. Audit has since indicated that it would like the exact wording of

the measures as set out by DIA to be used so those measures will therefore be

amended in the 2016/17 Annual Plan.

Residents

survey

4.9 Experience has shown that running a full residents

survey every year is not a good use of resources as results do not vary greatly

and so the process was not providing new insights. A new approach was

introduced which would have a full residents survey every three years with

smaller short surveys in interim years. This would allow gathering of data for

all measures once during the period of the Long Term Plan.

4.10 Audit considers the data should be gathered annually.

At this stage it is proposed to revert to that process. Officers are working on

a survey to be undertaken in May. Longer term, a review of measures and sources

of data will be undertaken.

Supplementary

letter

4.11 Audit NZ notes the matters raised in the supplementary

letter to management. The Chief Executive accepts these comments and will

address these matters prior to the 2015/16 Annual Report.

5. Options

5.1 That the Subcommittee note the matters raised in the

Letter to the Council on the audit of Nelson City Council for the year ending

30 June 2015 and the manner in which officers propose to address them.

6. Alignment

with relevant Council policy

6.1 This recommendation is not inconsistent with any

previous Council decision.

7. Assessment

of Significance against the Council’s Significance and Engagement Policy

7.1 This is not a significant decision.

8. Consultation

8.1 No consultation has occurred in preparation of this

report.

9. Inclusion

of Māori in the decision making process

9.1 No consultation with Maori has occurred in preparation

of this report.

10. Conclusion

10.1 Audit NZ issued an unmodified audit opinion on 15

October 2015 for the Annual Report for the year ending 30 June 2015. This

means that they were satisfied that the financial statements fairly reflected

Council’s activity for the year and its financial position at the end of

the year.

Nikki

Harrison

Group

Manager Corporate Services

Attachments

Attachment 1: A1499499 -

Letter to the Council on the Audit of NCC for the Year ended 30 June 2015 -

redacted

|

|

Audit, Risk and Finance Subcommittee

18 February 2016

|

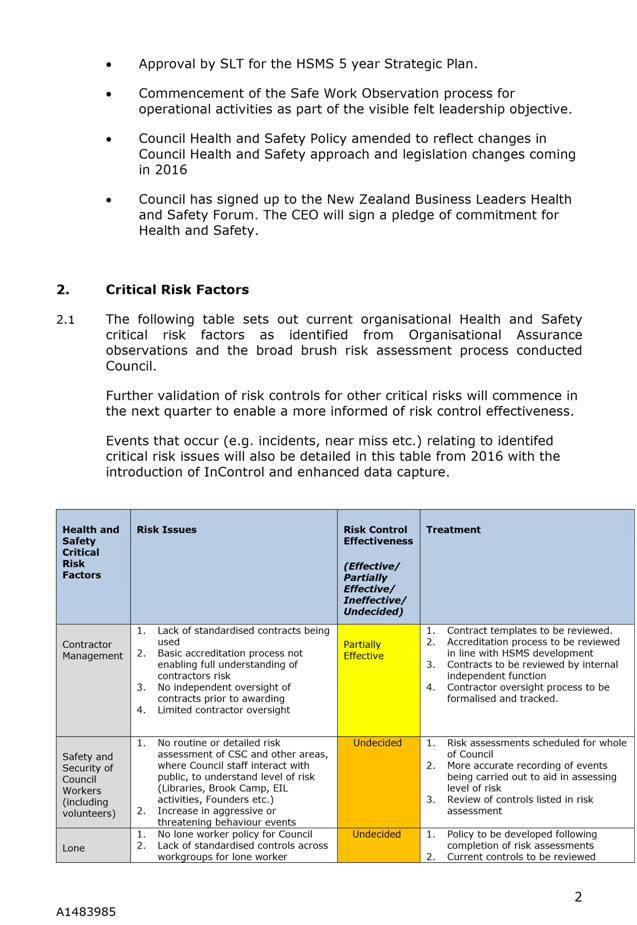

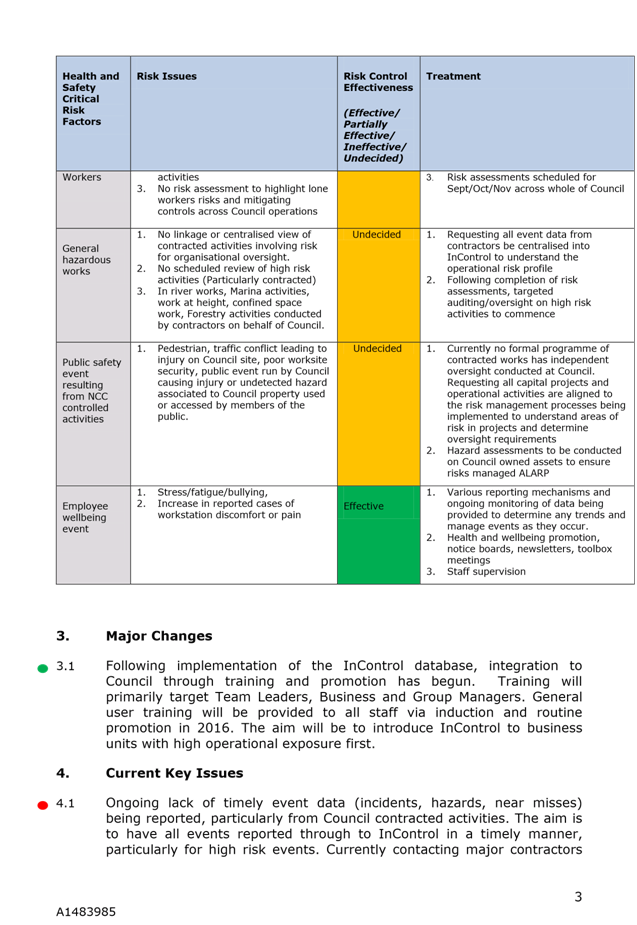

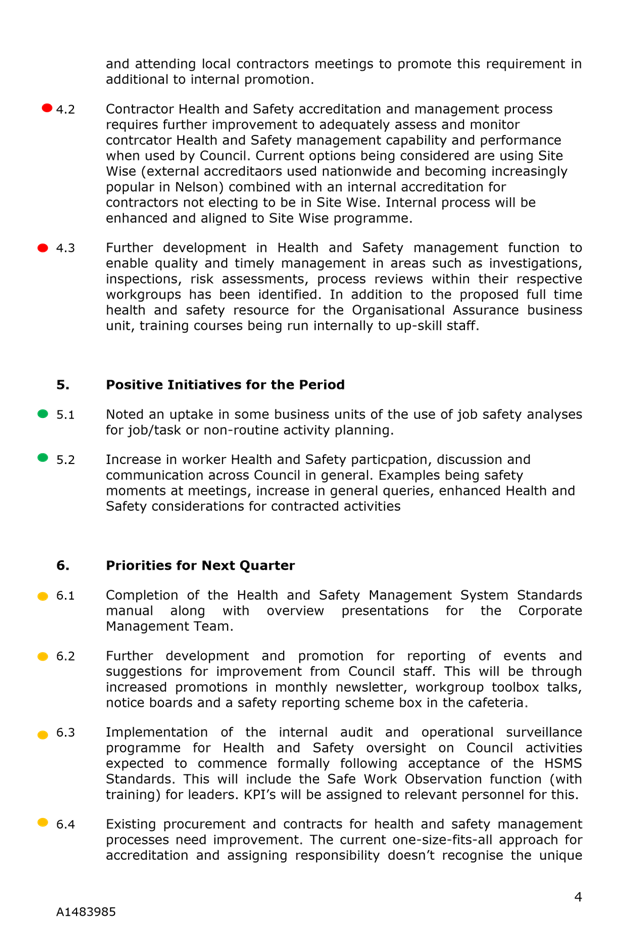

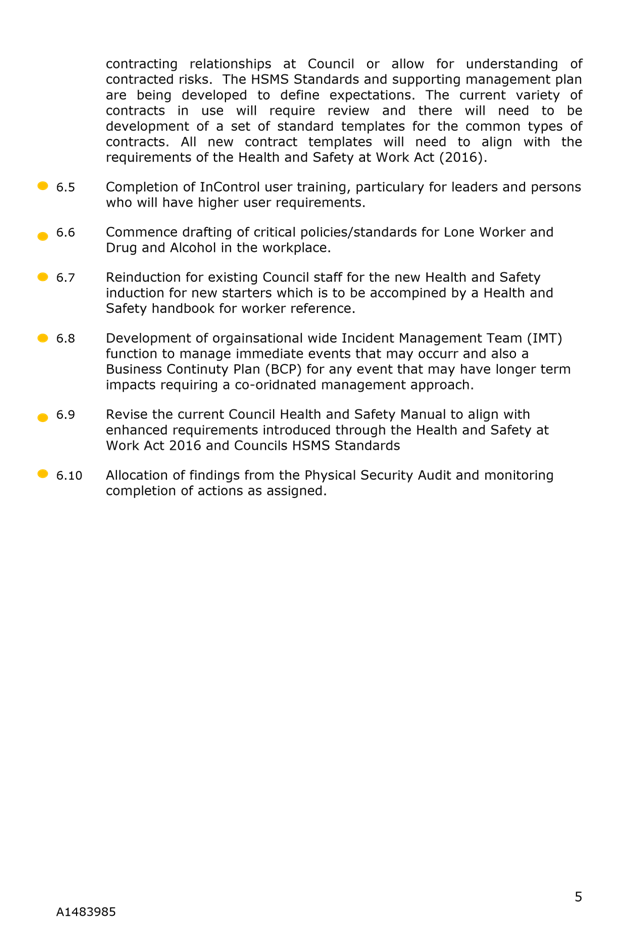

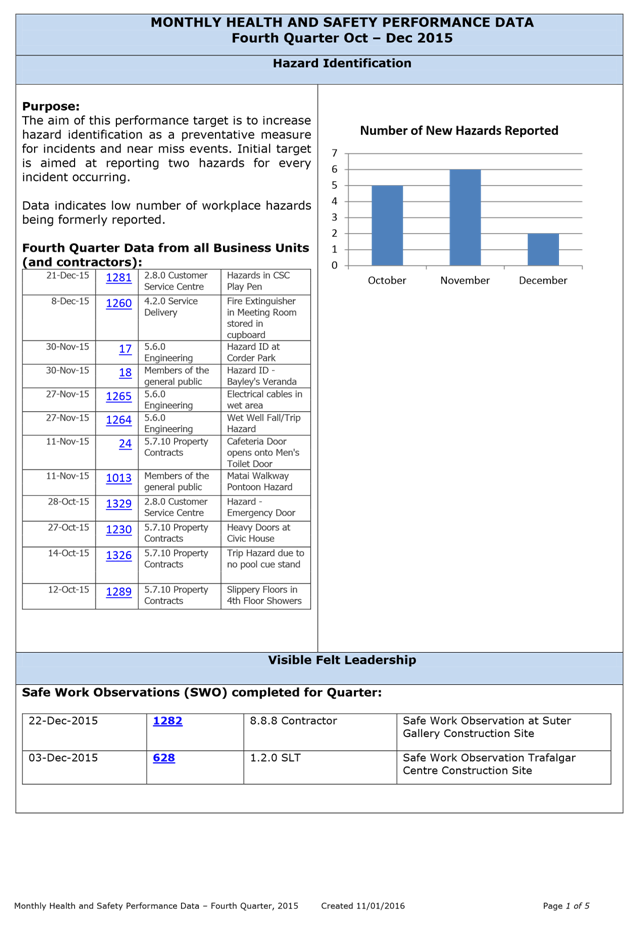

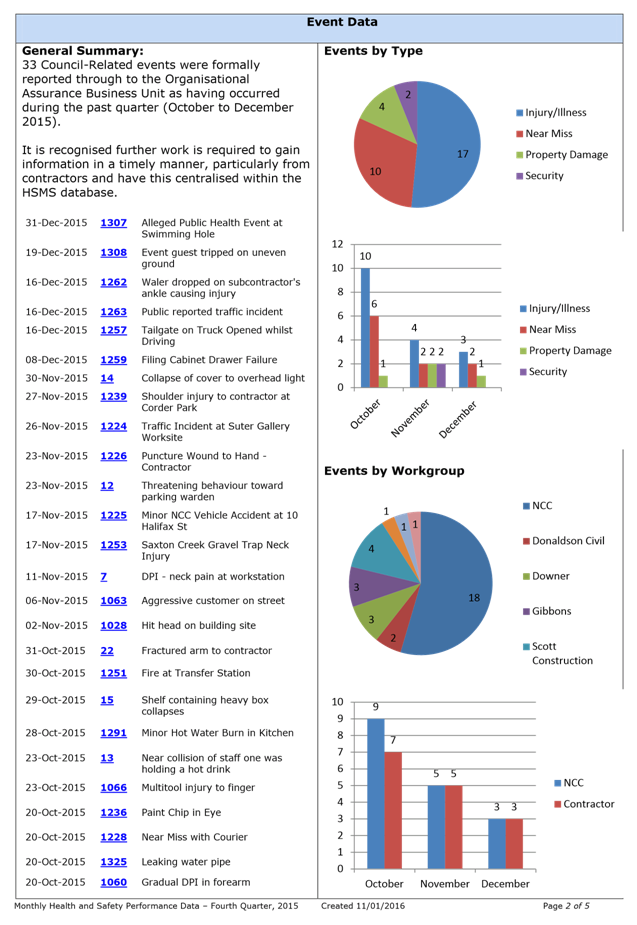

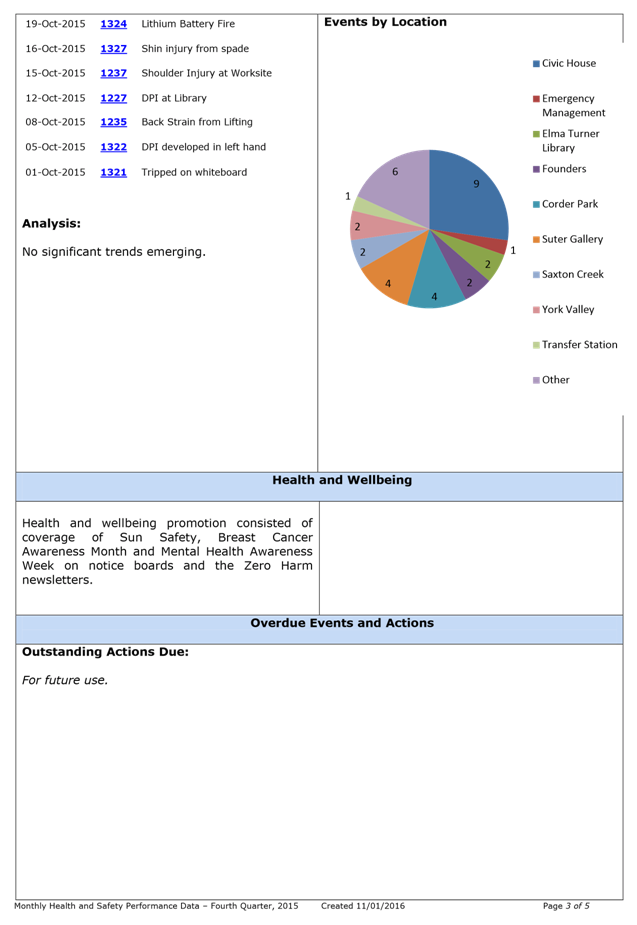

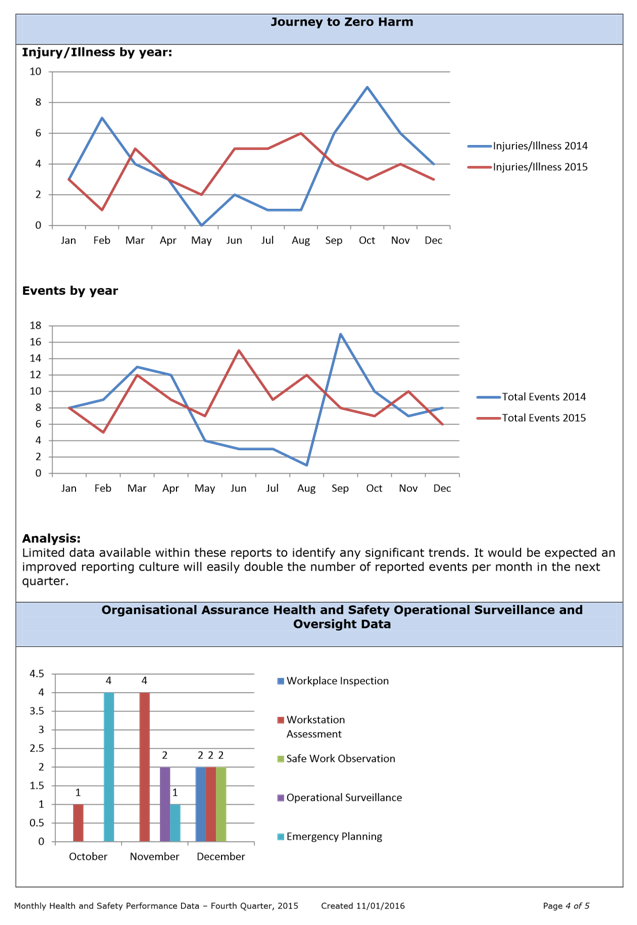

REPORT R4967

Health

and Safety quarterly update to 31 December 2015

1. Purpose

of Report

1.1 To receive the Health and Safety quarterly

update with key performance data to 31 December 2015.

2. Delegations

2.1 The

Audit, Risk and Finance Subcommittee is currently responsible for the

monitoring of health and safety in the organisation.

3. Recommendation

|

THAT the report Health and

Safety quarterly update to 31 December 2015 (R4967) and its attachments (A1483985 and A1485205) be received.

|

4. Discussion

4.1 The

Health and Safety Management System Governance Charter was approved by Council

17 December 2015 after being work-shopped with Councillors and external members

on 3 December 2015.

4.2 The

Charter outlined that monitoring of Health and Safety performance data would be

undertaken quarterly by Council to demonstrate due diligence.

4.3 It

also outlined that the Senior Leadership Team would also meet at least

quarterly to monitor the Health and Safety performance data. This Senior

Leadership Team Forum occurred on 14 January 2016 and will meet six weekly.

4.4 The

Health and Safety quarterly report is designed to inform senior leaders and the

Subcommittee of the Health and Safety management performance of Council. It

provides data analysis on both leading (preventative) and lagging Health and

Safety management system indicators. It is supported by a report providing

details of key achievements, planned activities and other issues arising.

5. Options

5.1 Accept

the recommendation – receive the Health and Safety quarterly update to 31

December 2015.

5.2 Reject

the recommendation – not receive the Health and Safety quarterly update

to 31 December 2015.

6. Alignment

with relevant Council policy

6.1 This

decision is not inconsistent with any other previous Council decision.

7. Assessment

of Significance against the Council’s Significance and Engagement Policy

7.1 This

is not a significant decision under the Council’s Significance and

Engagement Policy.

8. Consultation

8.1 No

consultation has been undertaken in preparing this report.

9. Inclusion

of Māori in the decision making process

9.1 No

consultation with Maori has been undertaken in preparing this report.

Nikki

Harrison

Group

Manager Corporate Services

Attachments

Attachment 1: A1483985 -

H&S Quarterly Performance Report 31 December 2015

Attachment 2: A1485205

- H&S Quarterly Performance Data 31 December 2015

|

|

Audit, Risk and Finance Subcommittee

18 February 2016

|

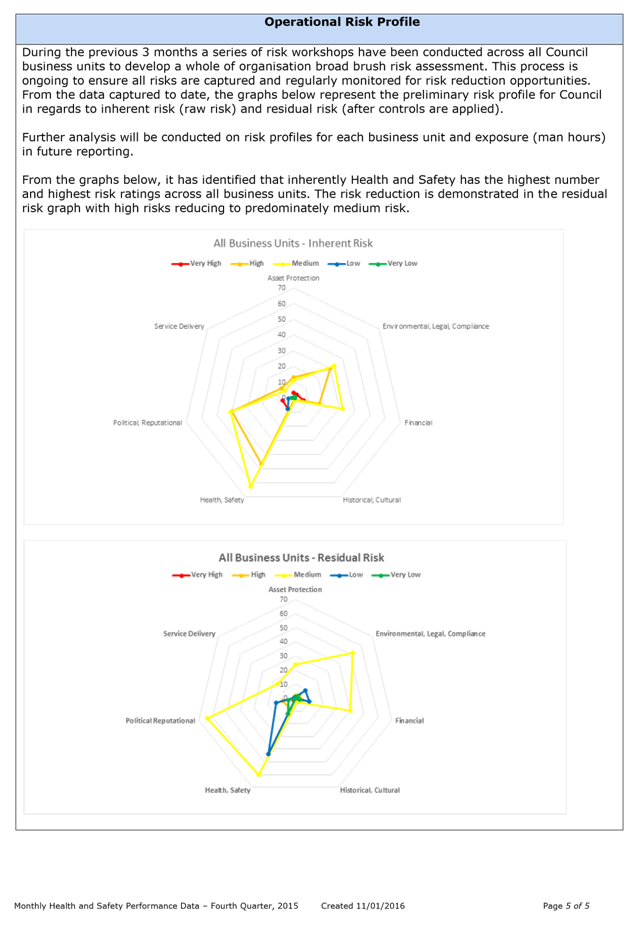

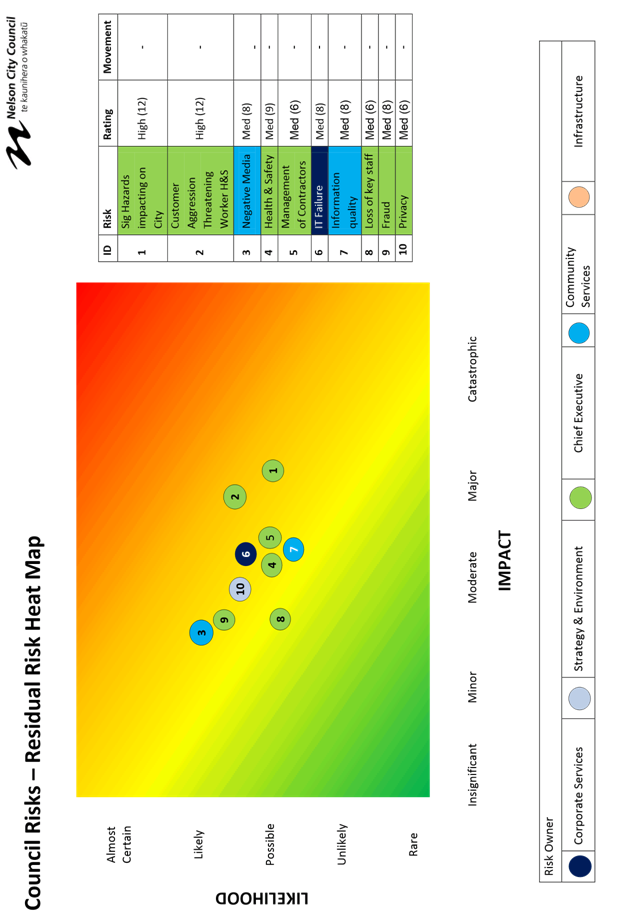

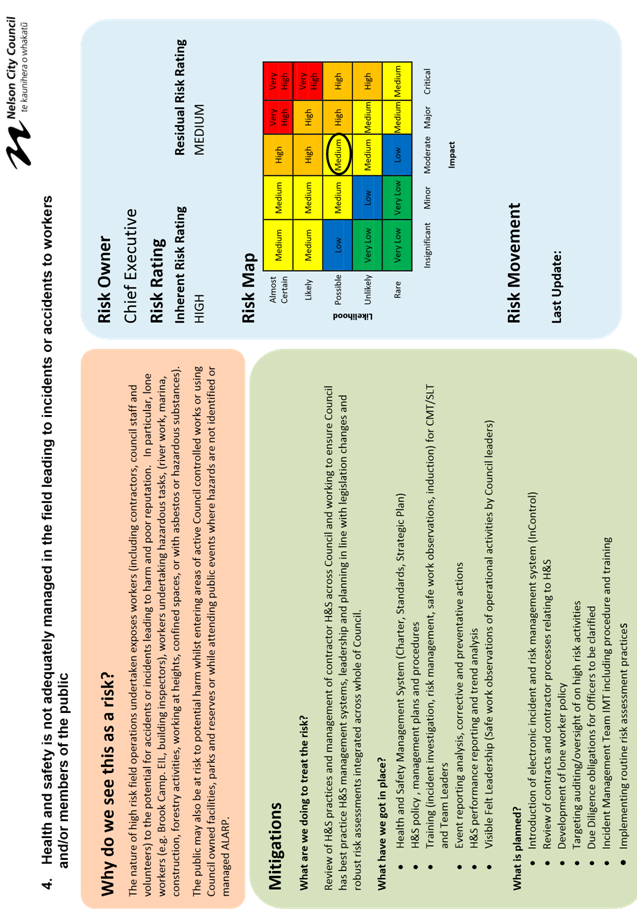

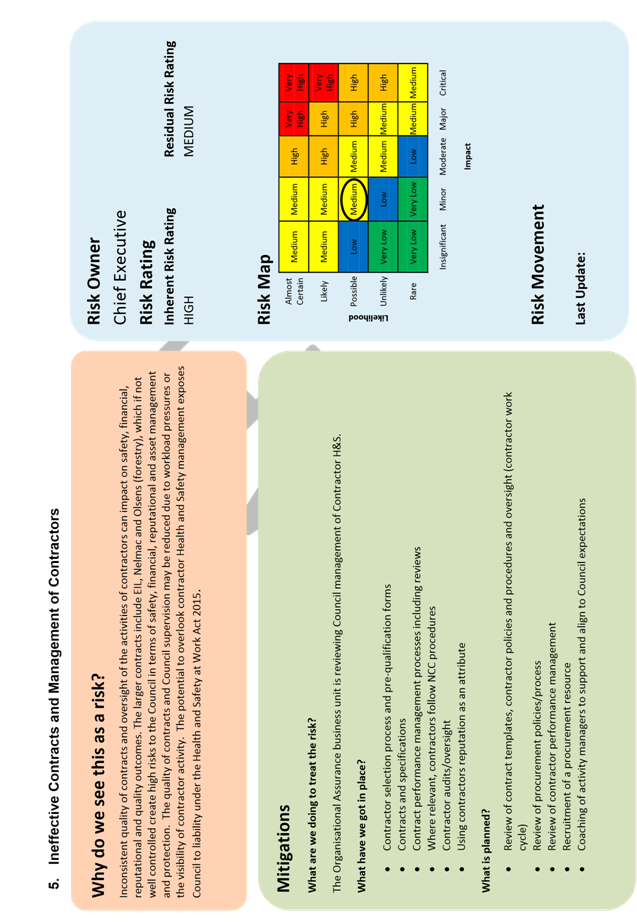

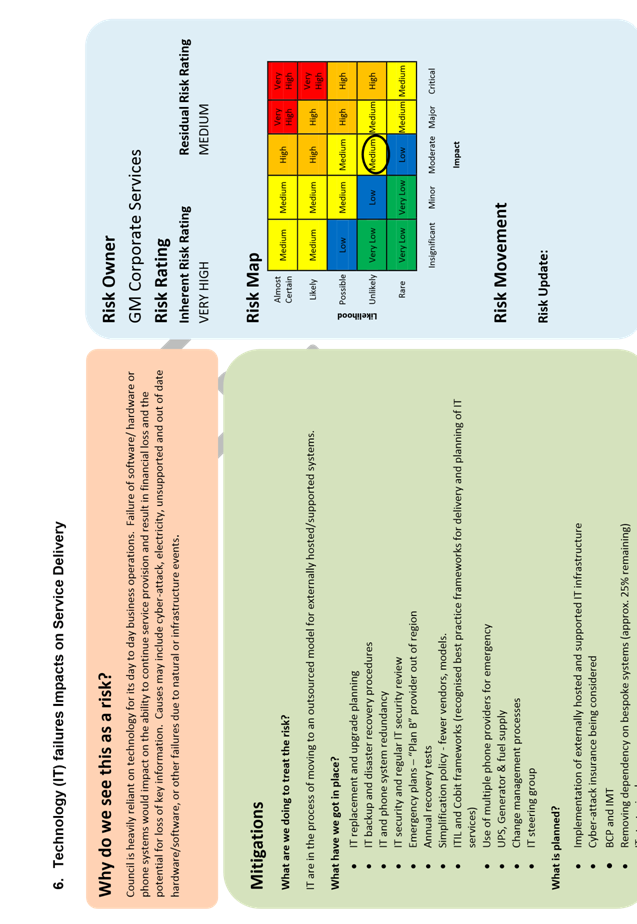

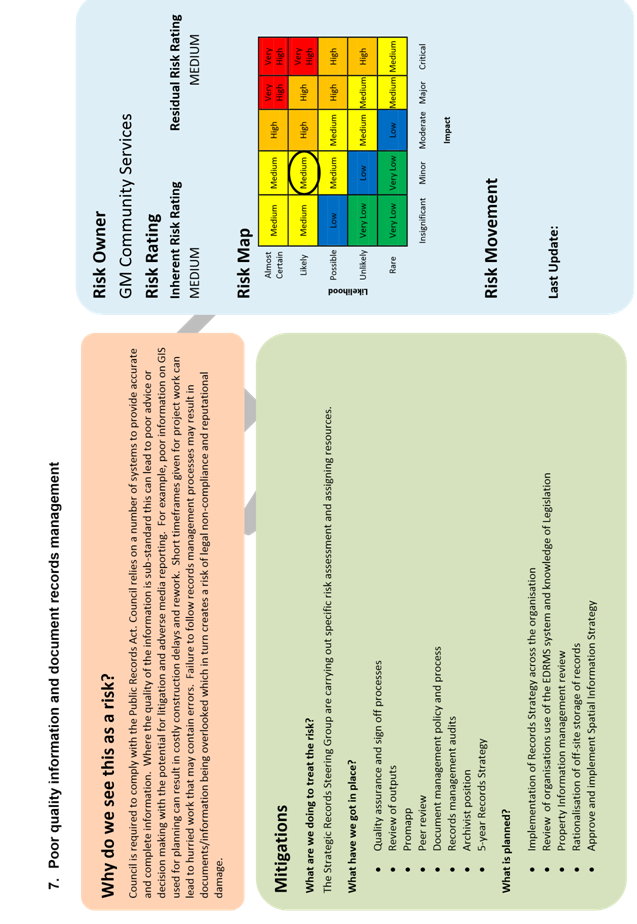

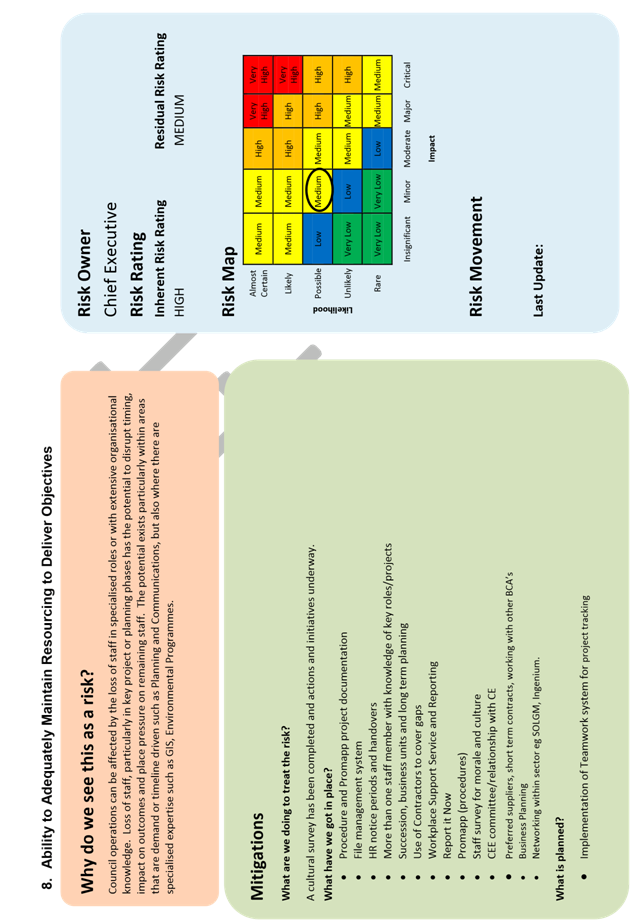

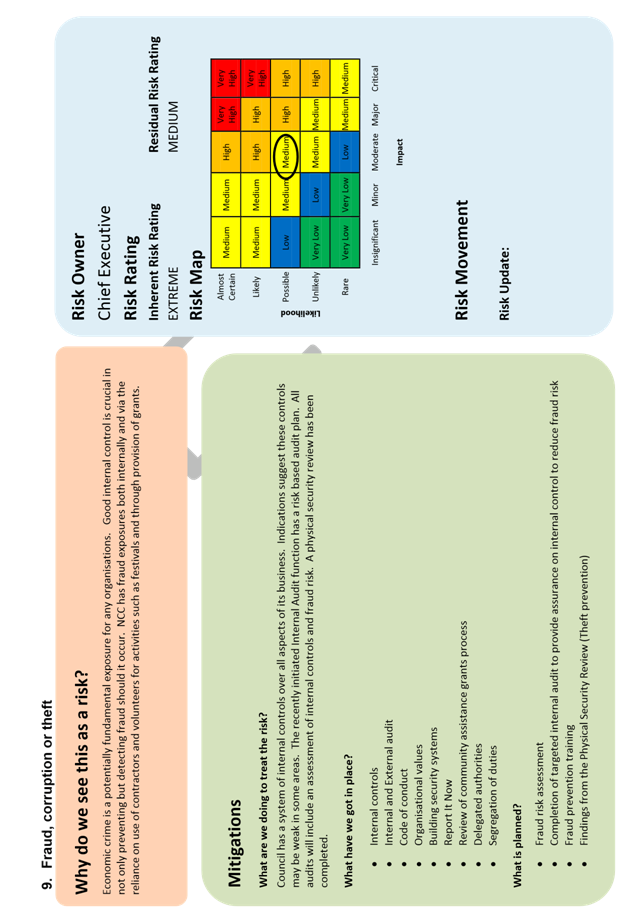

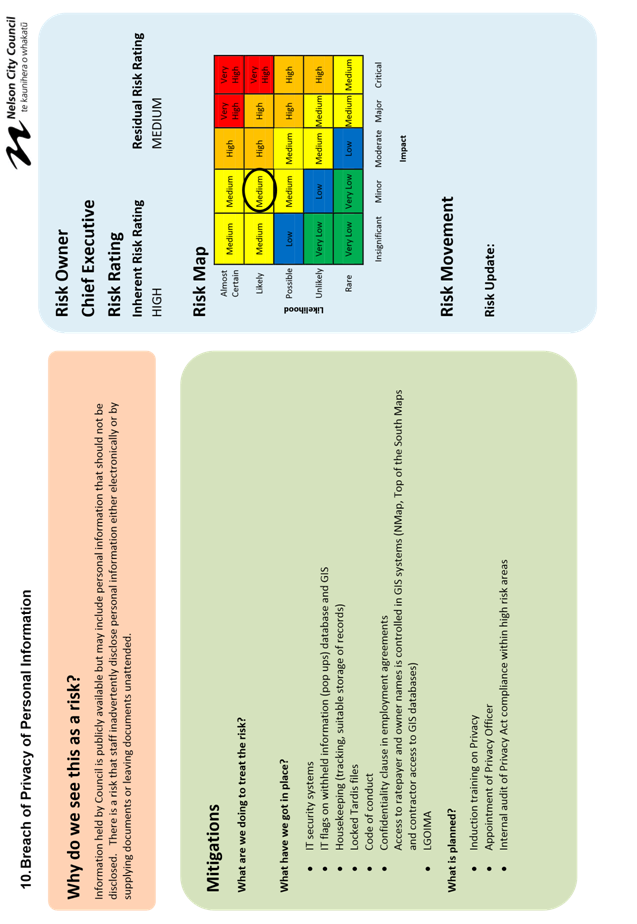

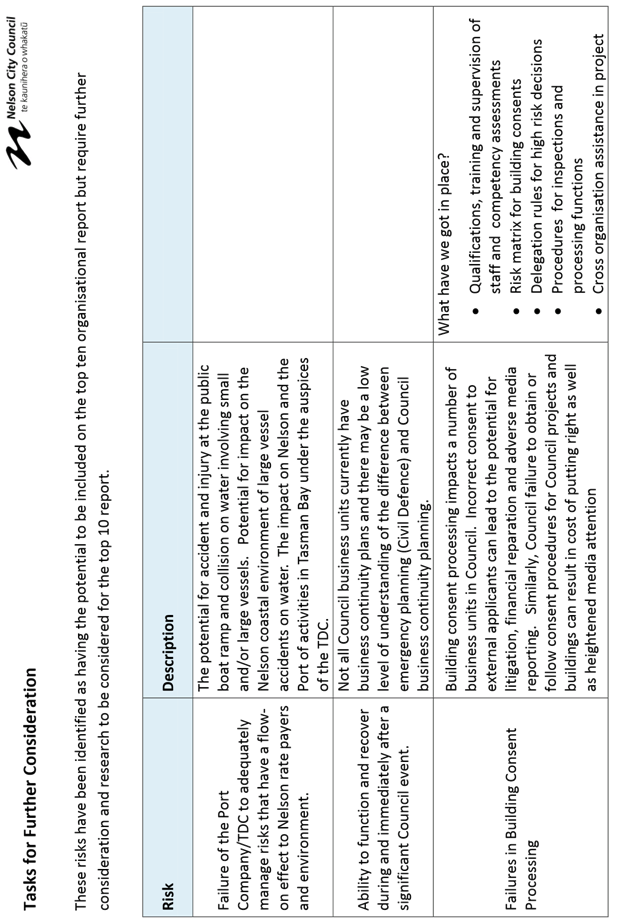

REPORT R5395

Council's

Key Organisational Risk Progress Report

1. Purpose

of Report

1.1 To update the Subcommittee on the

Council’s risk report for key organisational risk issues.

2. Delegations

2.1 The

Audit, Risk and Finance Subcommittee has oversight of the management of risk.

3. Recommendation

|

THAT the Council's Key

Organisational Risk Progress Report (R5395)

and its attachment (A1461881) be

received.

|

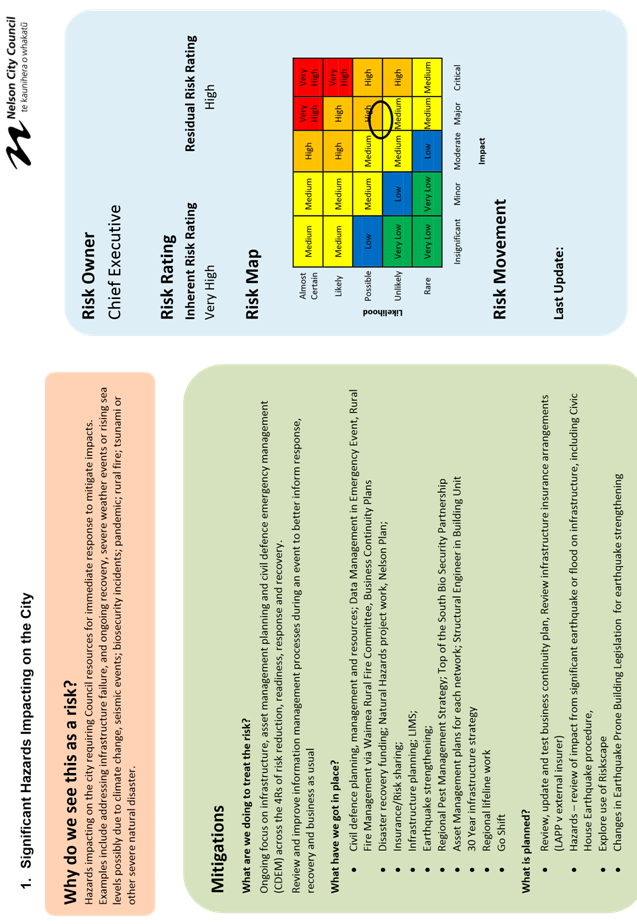

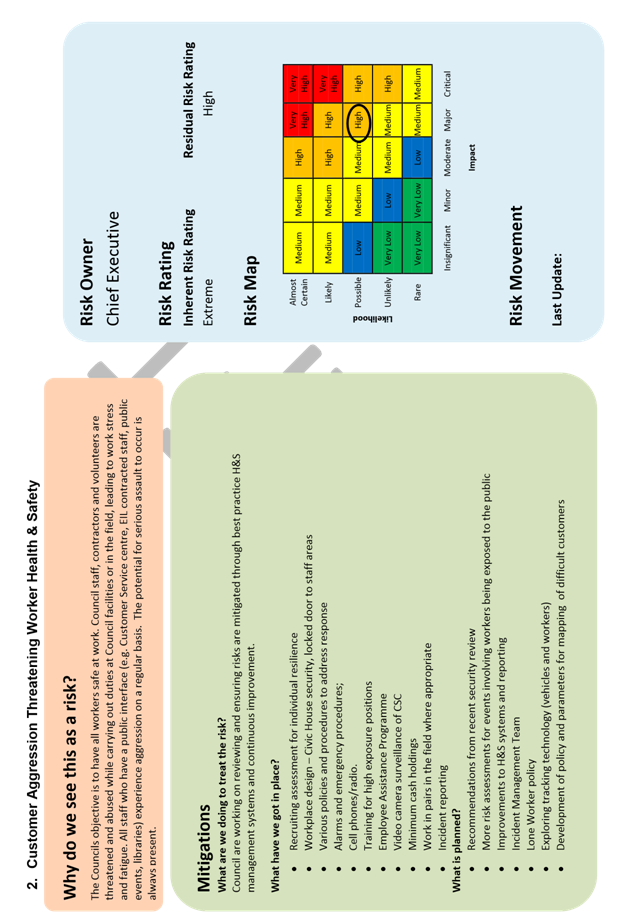

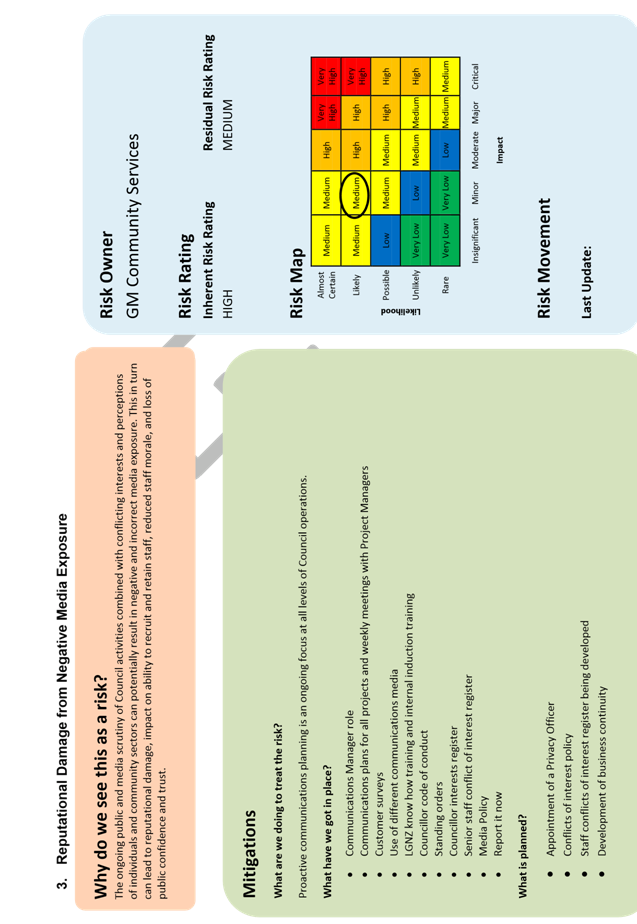

4. Background

4.1 In

2014, Council developed a high level risk register through a series of

workshops and working groups with Councillors and appointed members of the

Audit, Risk and Finance Subcommittee. This was a top down view of the

strategic and operational risks facing Council.

4.2 During

October and November 2015, a series of broad brush business unit risk

assessments were conducted with key members from each Council business unit for

the development of a whole of organisation risk register.

4.3 From

these risk assessments and that of other risk registers already in existence at

Council, the key risk issues have been identified and compiled into a specific

risk report for the Subcommittee.

4.4 This

will enable the Subcommittee to be informed about the top risk issues for

Council, that each key risk issue is assigned a risk owner, provide details for

what’s in place to manage each risk issue and what is being planned to

further reduce the risk to a level as low as reasonably practicable (ALARP)

where possible.

5. Discussion

5.1 The

Risk Management Framework was approved at the Audit, Risk and Finance

Subcommittee meeting on 14 October 2015.

5.2 Since

then, the Organisational Assurance business unit has been working with business

units to develop a ‘bottom up’ view of the risks facing the

Council. This has been integrated with the work done in 2014. Attached as

attachment 1 are the top 10 risks for Council identified through this

process.

5.3 Each

Council business unit now has a specific risk register in place. Responsibility

has been assigned to Group Managers and Business Unit Managers to ensure that

these registers are kept current and that any significant change to their

controlled activities is assessed and reflected within the register. Where this

represents a significant risk to Council, this shall be reported through to the

Organisational Assurance business unit for validation and inclusion in this

reporting.

5.4 The

Risk and Procurement Analyst role has been filled and is expected to commence

mid February 2016. Following further validation on the key risk issues

identified to date, it is expected that the internal audit programme will be

aligned with a risk based approach to ensure appropriate oversight on key risk

controls as appropriate.

5.5 With

increased event reporting across Council also being targeted, oversight will be

conducted by the Organisational Assurance business unit to identify any

emerging risks and monitor for signs of weaknesses in existing controls for new

and existing risk issues.

6. Options

6.1 Accept

the recommendation – receive Council’s Key Organisational Risk

Progress Report.

6.2 Reject

the recommendation – not receive Council’s Key Organisational Risk

Progress Report.

7. Alignment

with relevant Council policy

7.1 Understanding

the risks that Council faces and the mitigations that are in place or that

should be considered, allows Council to consider the impacts on Council’s

strategic documents, particularly the Long Term Plan or Annual Plan.

7.2 This

report is in alignment with the Council’s Risk Management Framework

approved in 2015.

8. Assessment

of Significance against the Council’s Significance and Engagement Policy

8.1 This

is not a significant decision under the Council’s Significance and

Engagement Policy.

9. Consultation

9.1 No

consultation has been undertaken in preparation of this report.

10. Inclusion

of Māori in the decision making process

10.1 There

has been no consultation with Maori in the preparation of this report.

Nikki

Harrison

Group

Manager Corporate Services

Attachments

Attachment 1: A1461881 -

DRAFT Key Organisational Risks Report - Jan 2016

|

|

Audit, Risk and Finance Subcommittee

18 February 2016

|

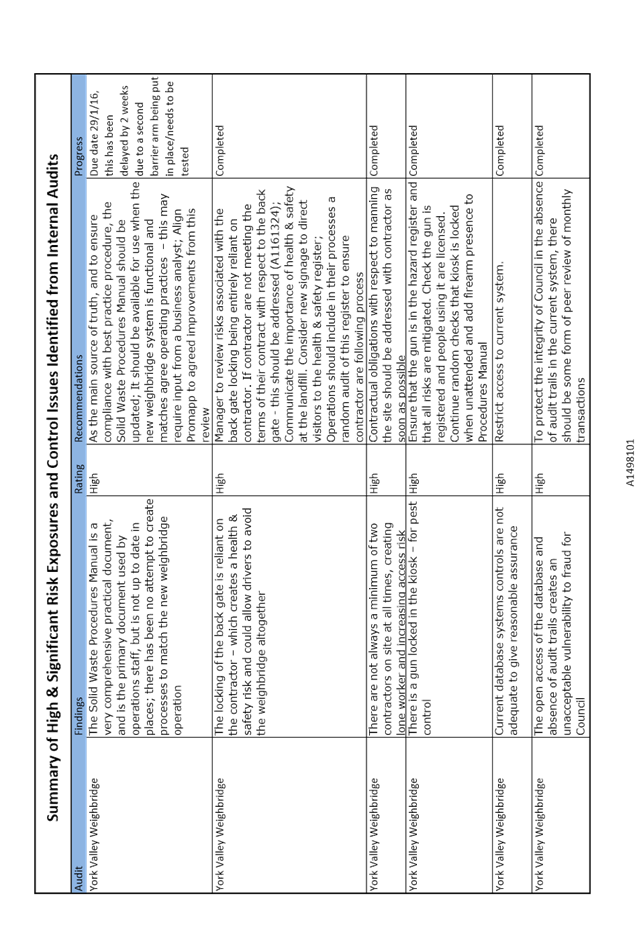

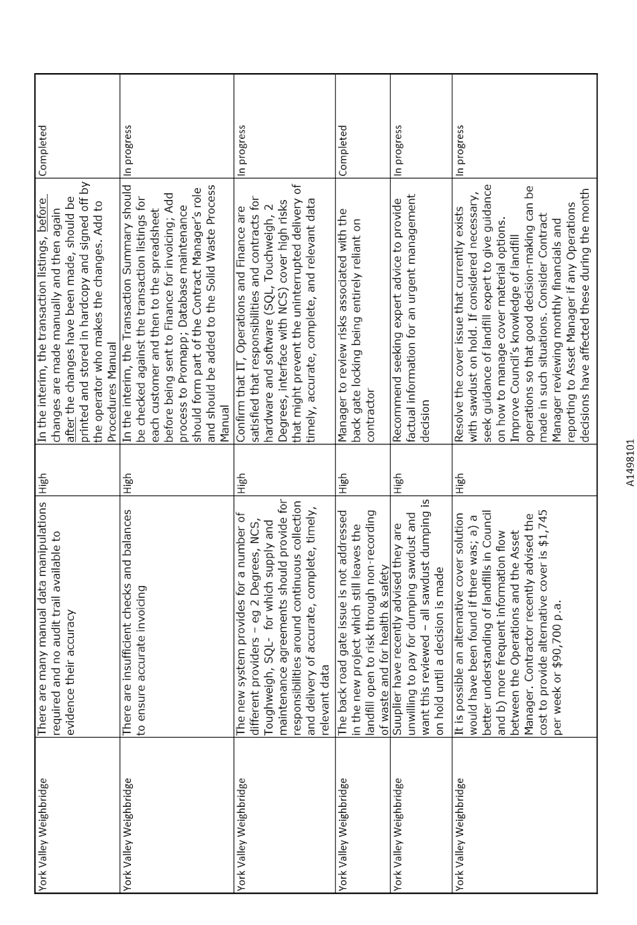

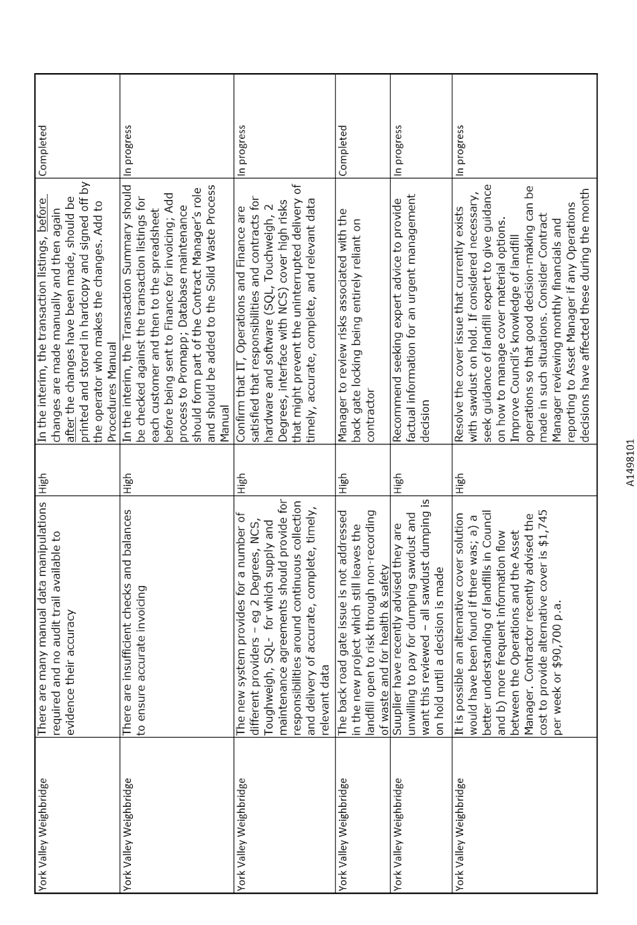

REPORT R5452

Internal

Audit Report to 31 December 2015

1. Purpose

of Report

1.1 To update the Subcommittee on the Internal

Audit activity relative to the Internal Audit Plan to 30 June 2016, and to

provide information on significant or high risks identified from audits

completed to 31 December 2015.

2. Delegations

2.1 The

Audit, Risk and Finance Subcommittee have oversight of the internal audit

activity.

3. Recommendation

|

THAT the Internal Audit Report

to 31 December 2015 (R5452) and

its attachments (A1485806 and A1498101)

be received.

|

Recommendation

to Governance Committee and Council

|

THAT

Council note the internal audit findings, recommendations and status of

action plans up to 31 December 2015 (R5452).

|

4. Background

4.1 The

Audit, Risk & Finance Subcommittee require a periodic update on the

progress of internal audit activities relative to the Internal Audit Plan to 30

June 2016 and to be informed of any significant risk exposures and control

issues identified from internal audits completed.

5. Discussion

5.1 The Internal Audit Charter was approved by the Audit,

Risk & Finance Subcommittee on 12 November 2015.

5.1.1 Under

section 9.4, the Charter requires that the Internal Audit & Procurement

Analyst report periodically to the Senior Leadership Team and Audit, Risk &

Finance Subcommittee on performance relative to the Internal Audit Plan. A

table summarising activity against the workplace is attached.

5.1.2 Under

section 9.1 of the Charter, the Audit, Risk & Finance and the Governance

Committees are to be informed of internal audit results where appropriate.

5.2 To strike the right balance between significant

findings and minor recommendations, it is proposed to report significant and

high findings to the Subcommittee.

5.3 In December, the Senior Leadership Team requested an

internal audit of the York Valley landfill weighbridge following concerns about

a potential discrepancy in revenue. No significant issues were identified

but 12 high issues were. The recommendations and status of action plans of

those are included in attachment 2.

6. Options

6.1 The

recommendation is to receive the report and note the internal audit findings,

recommendations and status of action plans.

7. Alignment

with relevant Council policy

7.1 This

report is in alignment with the Council’s Internal Audit Charter approved

in 2015.

8. Assessment

of Significance against the Council’s Significance and Engagement Policy

8.1 This

is not a significant decision under the Council’s Significance and

Engagement Policy.

9. Consultation

9.1 No

consultation has been undertaken in preparation of this report.

10. Inclusion

of Māori in the decision making process

10.1 There

has been no consultation with Maori in the preparation of this report.

Lynn

Anderson

Internal

Audit Analyst

Attachments

Attachment 1: A1485806 -

Internal Audit Report to 31 December 2015

Attachment 2: A1498101

- Summary of Significant Risk Exposures and Controls

|

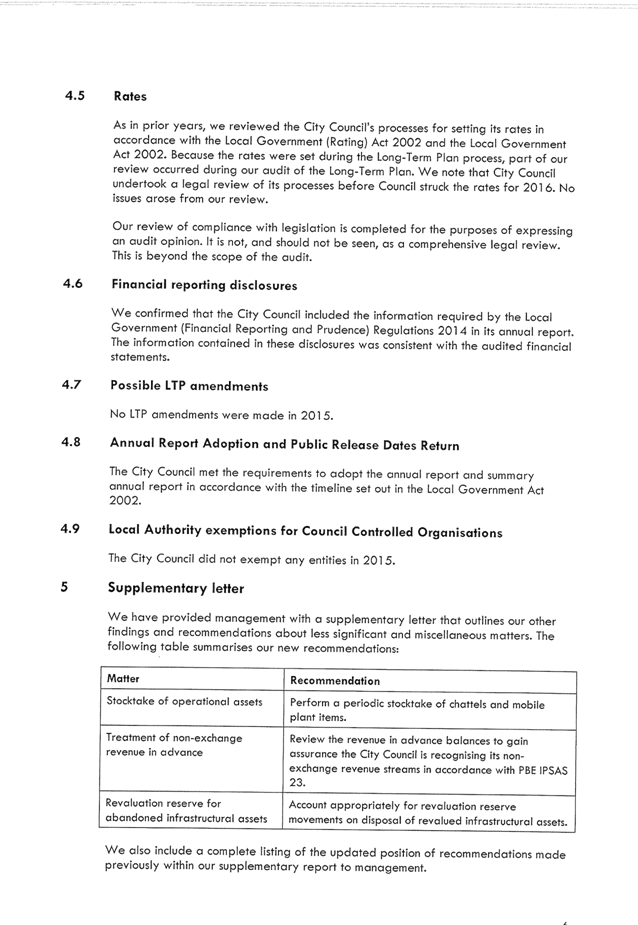

Audit Plan – All Audits planned for Second Quarter to 31

December 2015

|

Audits Not Included in Audit Plan

|

Recommendations Agreed with Manager

|

In Progress

|

Findings Risk Ratings from Finalised, Approved Audits

|

Date Reviewed by SLT

|

Audits Proposed for February 2016

|

|

Electronic Purchase Orders –

controls

|

|

|

Finalising report

|

|

|

|

|

IT Systems controls

|

|

|

In Progress

|

|

|

|

|

Segregation of Duties

|

|

|

In Progress

|

|

|

|

|

Payroll

|

|

Yes, Managers action plans to be

completed by 17/2/16

|

|

Significant

High

Moderate

Minor

|

0

0

21

18

|

Due 17/2/16

|

|

|

|

York Valley Weighbridge operations

review

|

Yes, and agreed actions entered in

InControl

|

Significant

High

Moderate

Minor

|

0

12

12

9

|

7/12/15

|

|

|

|

|

|

|

|

|

Customer Service Centre (counter

transactions)

|

|

|

|

|

|

|

|

Accounts Payable – new

suppliers

|

|

|

|

|

|

|

|

Accounts Receivable – credit

notes

|

|

|

|

|

|

|

|

Insurance Renewals

|

*Note,

Internal Audit Plan to 30 June 2016 approved by Audit, Risk & Finance 12

November 2015

|

|

Audit, Risk and Finance Subcommittee

18 February 2016

|

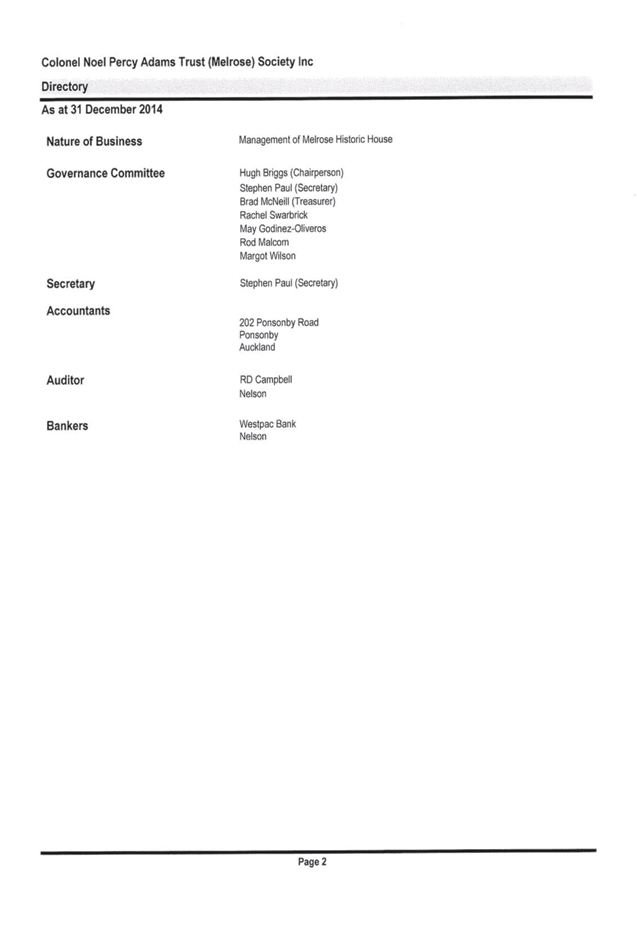

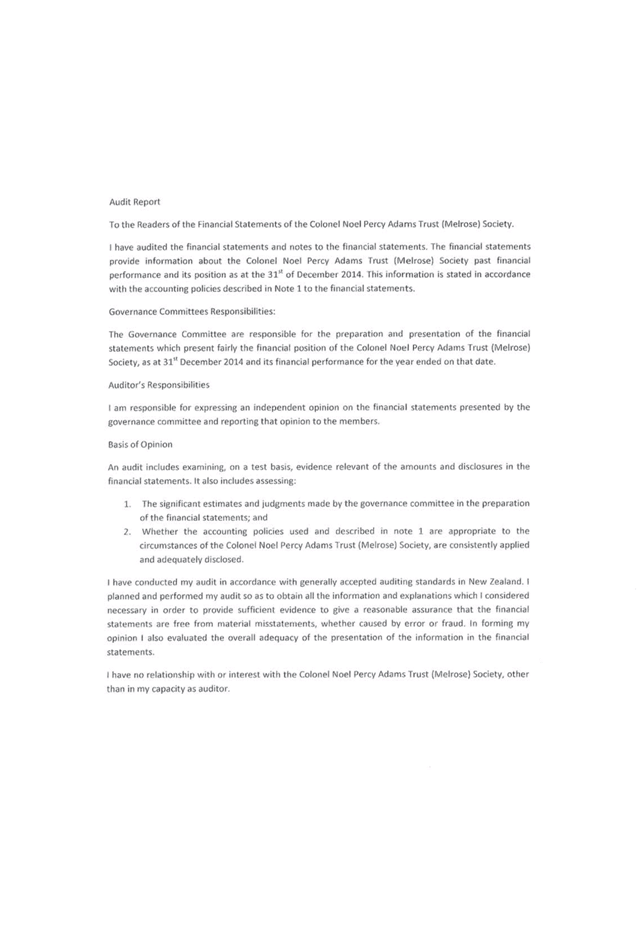

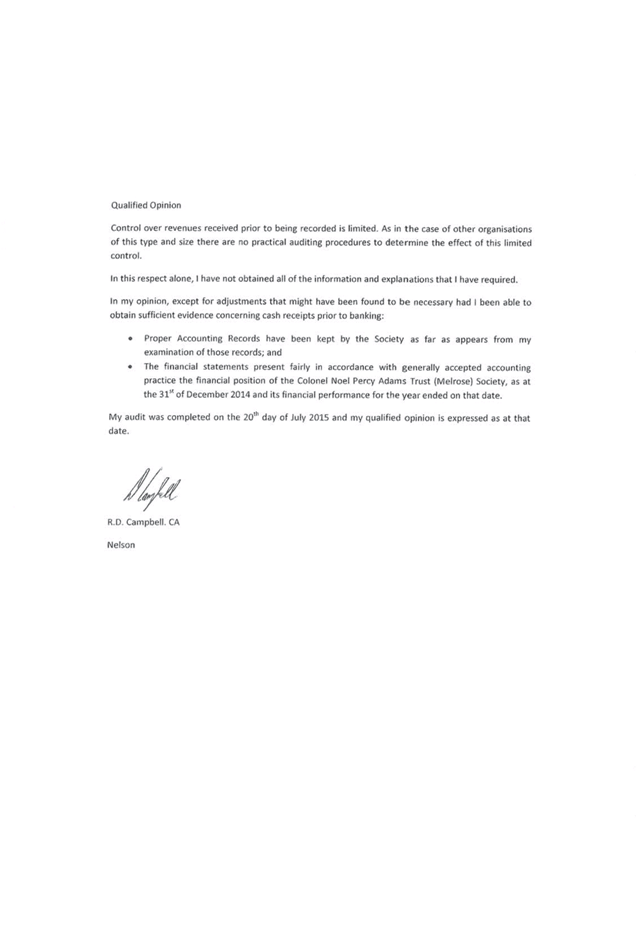

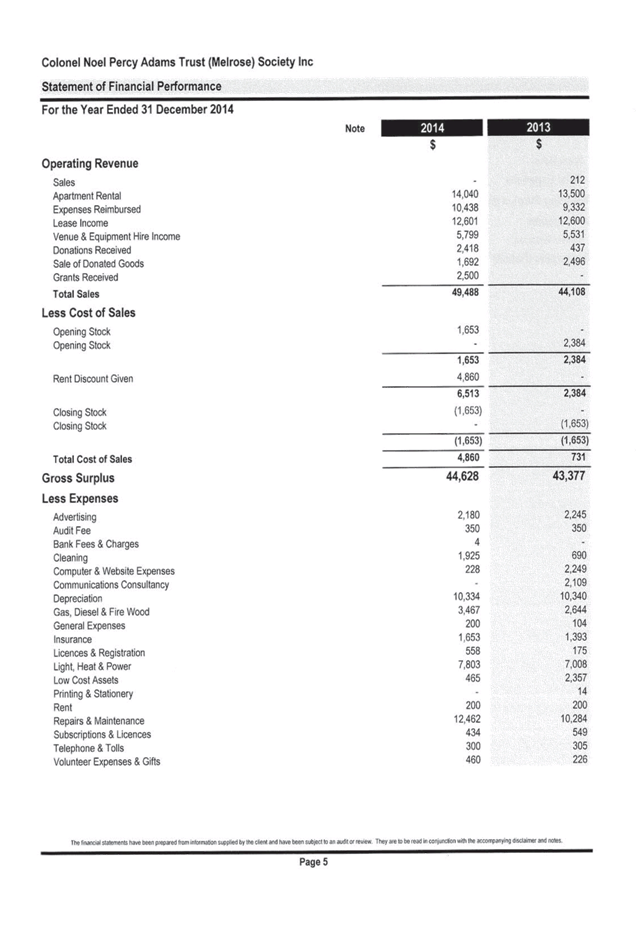

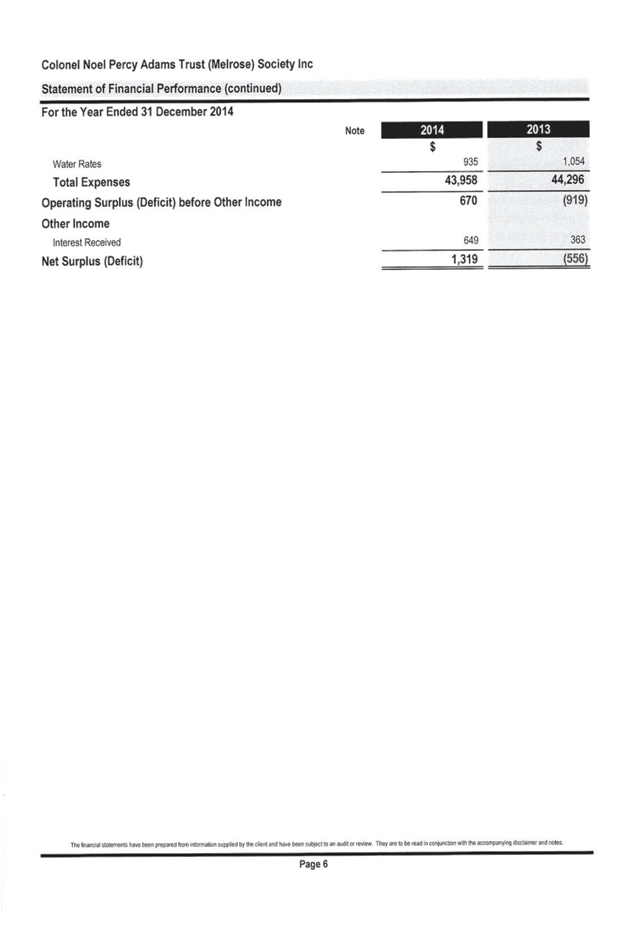

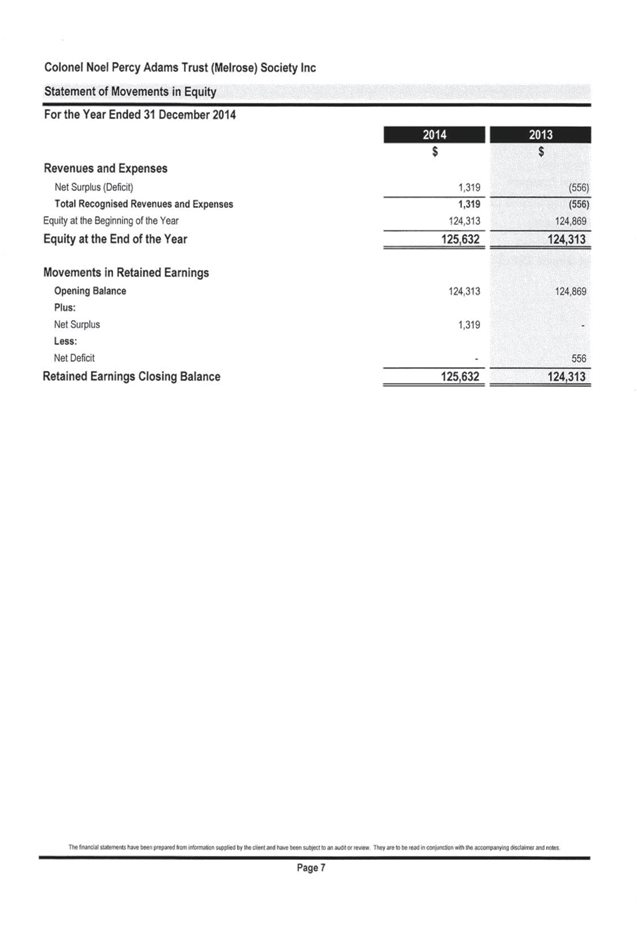

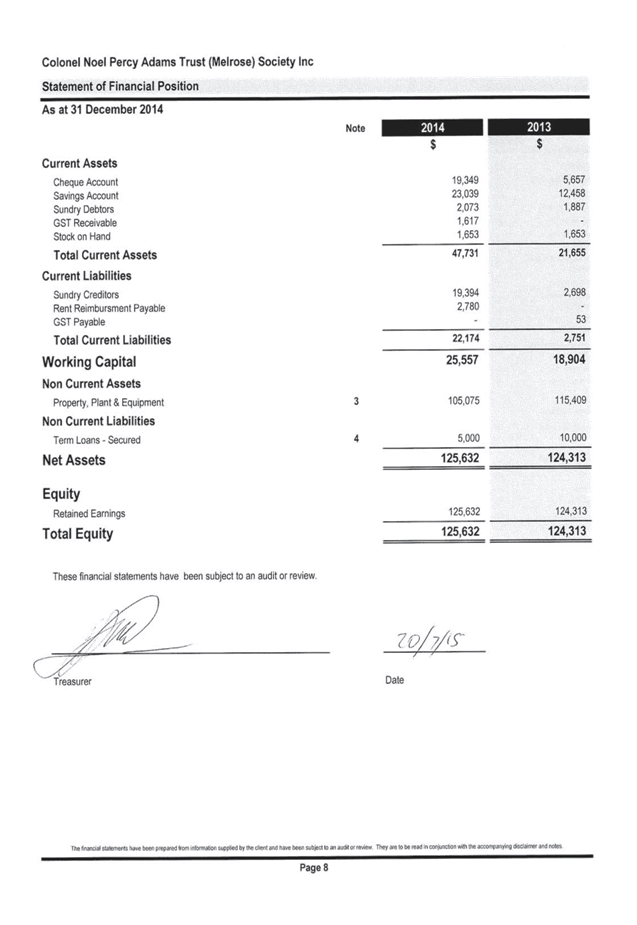

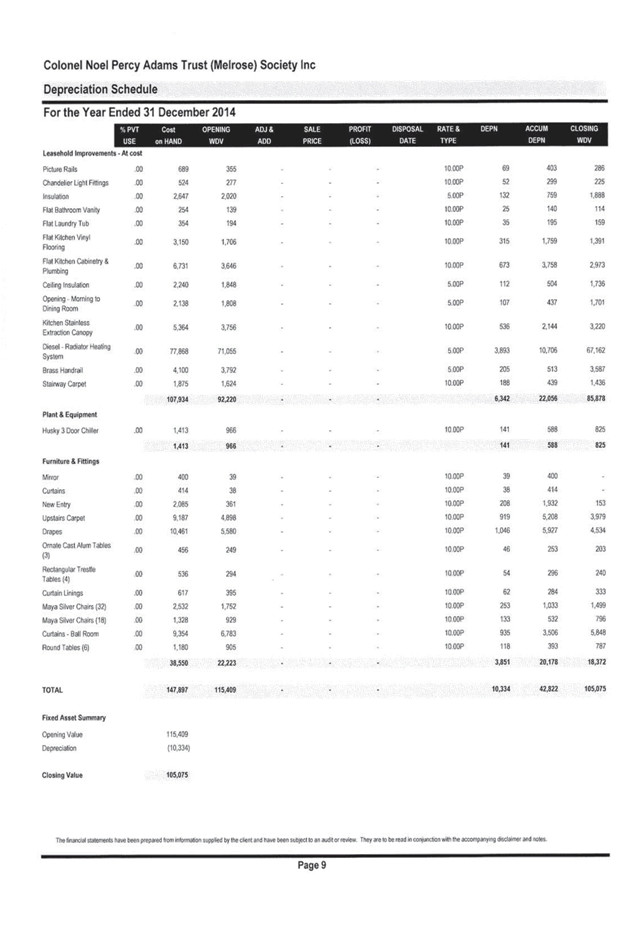

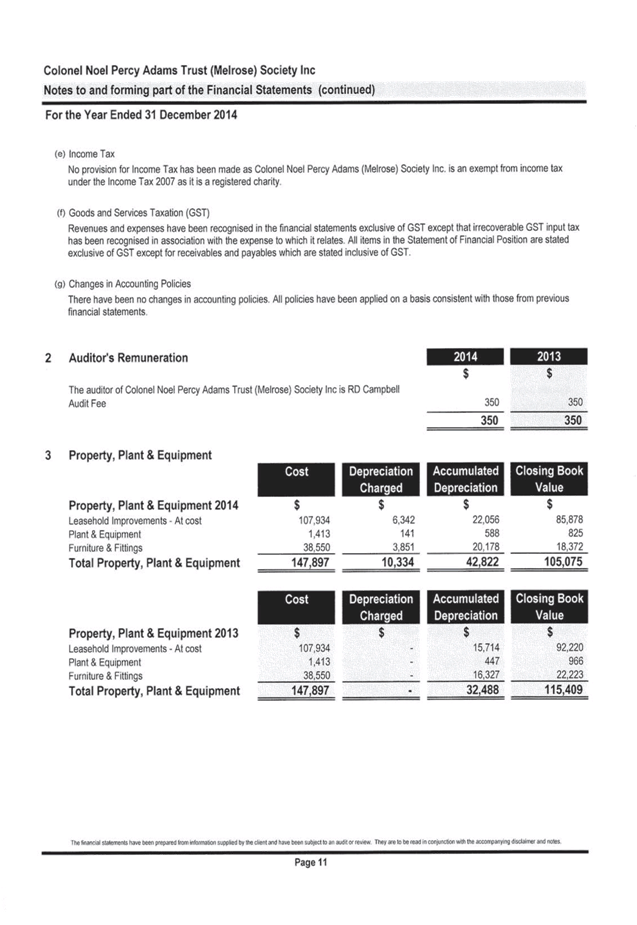

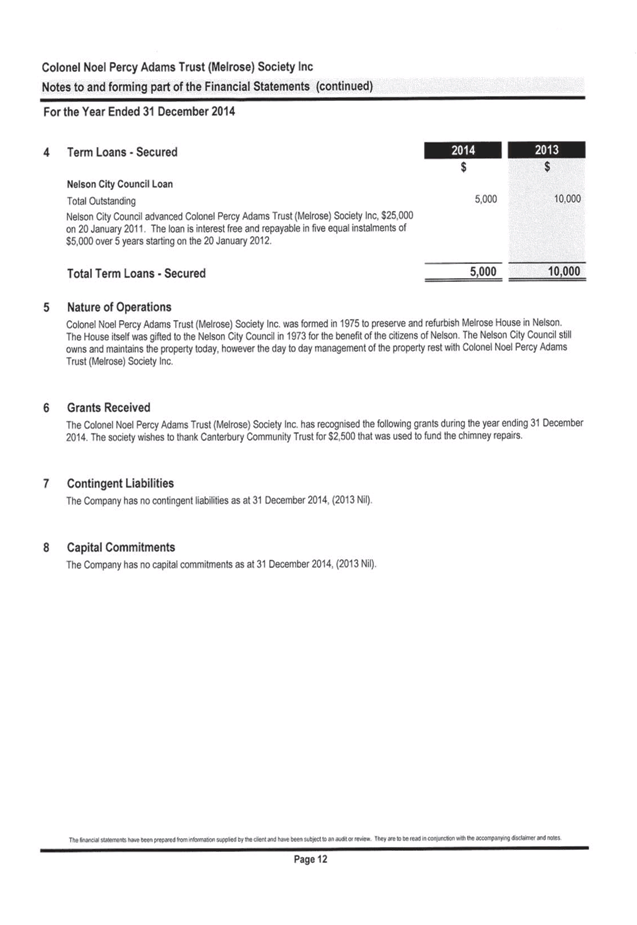

REPORT R4814

Extension

of loan facility to the Melrose Society

1. Purpose

of Report

1.1 To consider providing additional loan funding

to the Colonel Noel Percy Adams Trust (Melrose) Society for refurbishment of

toilets in Melrose House.

2. Delegations

2.1 The Audit, Risk and Finance Subcommittee has the

responsibility to monitor Council’s financial and service performance and

make recommendations to the Governance Committee and Council.

3. Recommendation

|

THAT the report Extension of

loan facility to the Melrose Society (R4814)

and its attachments (A1450076 and A1416892)

be received.

|

Recommendation

to Governance Committee and Council

|

THAT an

interest free loan of $25,000 be made to the Melrose Society for the purpose

of toilet refurbishment, subject to:

- the Society receiving a grant of $35,000

from the Rata Foundation for the same purpose;

- the designs being approved by the Property

and Facilities Asset Manager;

AND THAT

the loan is to be repaid in five annual instalments of $5000 commencing 20

January 2017.

|

4. Background

4.1 Melrose

House is currently leased to the Melrose Society until 2018. The Society

subleases part of the building as an apartment and café, and uses the

income generated to maintain the interior of the house. Council is responsible

for maintenance of the exterior.

4.2 The Society approached Council in 2011 seeking

permission to refurbish the toilets in Melrose House. The current facilities

are not in character with the house and are not adequate for the numbers of

people using the house.

4.3 Having received approval from Council for the

alterations, the Society has submitted a number of funding applications to

raise the money required for the refurbishment. The total estimated cost is

$70,000, and the Society has been allocated $35,000 by the Rata Foundation,

conditional on the other $35,000 being secured. The Society’s other

funding applications have been unsuccessful.

4.4 The Society has indicated that it would be prepared to

put up to $10,000 of its own money into the project, although it would prefer

this to be $5,000. The Society gets income of around $26,641 each year from the

subleases and is also reimbursed expenses (power etc) by the tenant. It has

therefore requested a maximum loan of $30,000 from Council (Attachment 1).

4.5 In its 2010-11 Annual Plan Council decided to extend a

loan to the Society of $25,000 towards the heating system in the house. The

final repayment of that loan ($5000) was made in January 2016.

4.6 A copy of the Society’s most recent accounts

(for year ending 31 December 2014) is attached for information (A1416892).

5. Discussion

5.1 The

Society is in good health, with a healthy balance sheet and a diverse

governance group. It has successfully paid off $20,000 of its initial loan from

Council and has secured $35,000 of grant funding towards the toilet

refurbishment costs.

5.2 The

Society needs to draw down the Rata Foundation grant by August 2016. If it

waited until the Annual Plan, it would not have time to make alternative

arrangements if Council chooses not to provide funding. Instead it has asked

Council to make a decision now in order to give some clarity over what the next

steps for the Society should be.

5.3 The

Society has indicated that if Council approves a loan that it would make a

submission through the Annual Plan 2016/17 for the loan to be converted into a

grant. It is recommended that Council consider that request alongside any other

funding requests received from the community when making decisions on the

Annual Plan rather than making a decision on that request now.

5.4 Council,

as building owner, needs to be satisfied that the final designs for any

upgrades to the House are approved by the Property and Facilities Asset Manage.

6. Options

6.1 Council

could choose to extend a loan to the Society, which has requested $30,000.

Officers recommend that $25,000 be allocated based on the previous precedent in

relation to providing a loan for the heating for Melrose and as the Society is

able to afford to contribute $10,000 from its own reserves to the project.

6.2 Council

could offer to provide a grant to the Society of up to $35,000. The Society has

not requested that at this time, and that any such funding would be unbudgeted.

Officers do not recommend this option as responsibility for the interior maintenance

sits with the Society. It should be noted that the Society has indicated that,

it may request grant funding through the Annual Plan 2016/17 process.

6.3 Council

could choose to decline the loan request. This may result in the loss of the

Rata Foundation grant, which requires match funding to be in place. This option

is not recommended.

7. Alignment

with relevant Council policy

7.1 There

is no funding in the Long Term Plan for this work.

8. Assessment

of Significance against the Council’s Significance and Engagement Policy

8.1 This

is not a significant decision under the Council’s Significance and

Engagement Policy.

9. Consultation

9.1 No

consultation has been undertaken in making these recommendations, other than

with the Melrose Society.

10. Inclusion

of Māori in the decision making process

10.1 Maori

have not been consulted on in making these recommendations.

Chris Ward

Group

Manager Community Services

Attachments

Attachment 1: A1450076 -

Request for loan from Melrose Society October 2015

Attachment 2: A1416892

- Melrose Society Accounts for Year ending December 2014

Audit, Risk and Finance

Subcommittee

Audit, Risk and Finance

Subcommittee