AGENDA

Ordinary meeting of the

Audit, Risk and Finance Subcommittee

Thursday 12 November 2015

Commencing at 9.00am

Ruma Mārama

Level 2A, Civic House

110 Trafalgar Street, Nelson

Membership: Mr John Peters (Chairperson), Her Worship the

Mayor Rachel Reese, Councillors Ian Barker and Brian McGurk, and Mr John Murray

Guidelines for councillors

attending the meeting, who are not members of the Committee, as set out in

Standing Orders:

·

All councillors, whether or not they are members of the

Committee, may attend Committee meetings (SO 2.12.2)

·

At the discretion of the Chair, councillors who are not Committee

members may speak, or ask questions about a matter.

·

Only Committee members may vote on any matter before the

Committee (SO 3.14.1)

It is good practice for both Committee members and

non-Committee members to declare any interests in items on the agenda.

They should withdraw from the room for discussion and voting on any of these

items.

Audit, Risk and Finance

Subcommittee

Audit, Risk and Finance

Subcommittee

12

November 2015

Page

No.

1. Apologies

Nil

2. Confirmation

of Order of Business

3. Interests

3.1 Updates

to the Interests Register

3.2 Identify

any conflicts of interest in the agenda

4. Public

Forum

5. Confirmation

of Minutes

5.1 14

October 2015 6 - 10

Document number M1529

Recommendation

THAT

the minutes of the meeting of the Audit, Risk and Finance Subcommittee, held on

14 October 2015, be confirmed as a true and correct record.

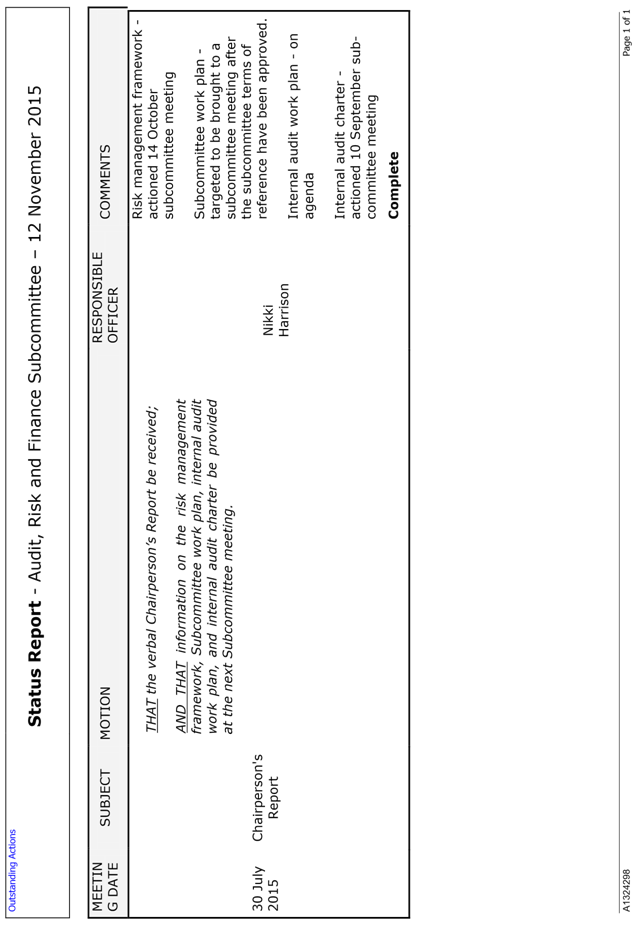

6. Status

Report - Audit, Risk and Finance Subcommittee - 12 November 2015 11 - 12

Document number R5107

Recommendation

THAT the Status Report Audit, Risk

and Finance Subcommittee 12 November 2015 (R5107) and its attachment (A1324298) be received.

7. Chairperson's

Report

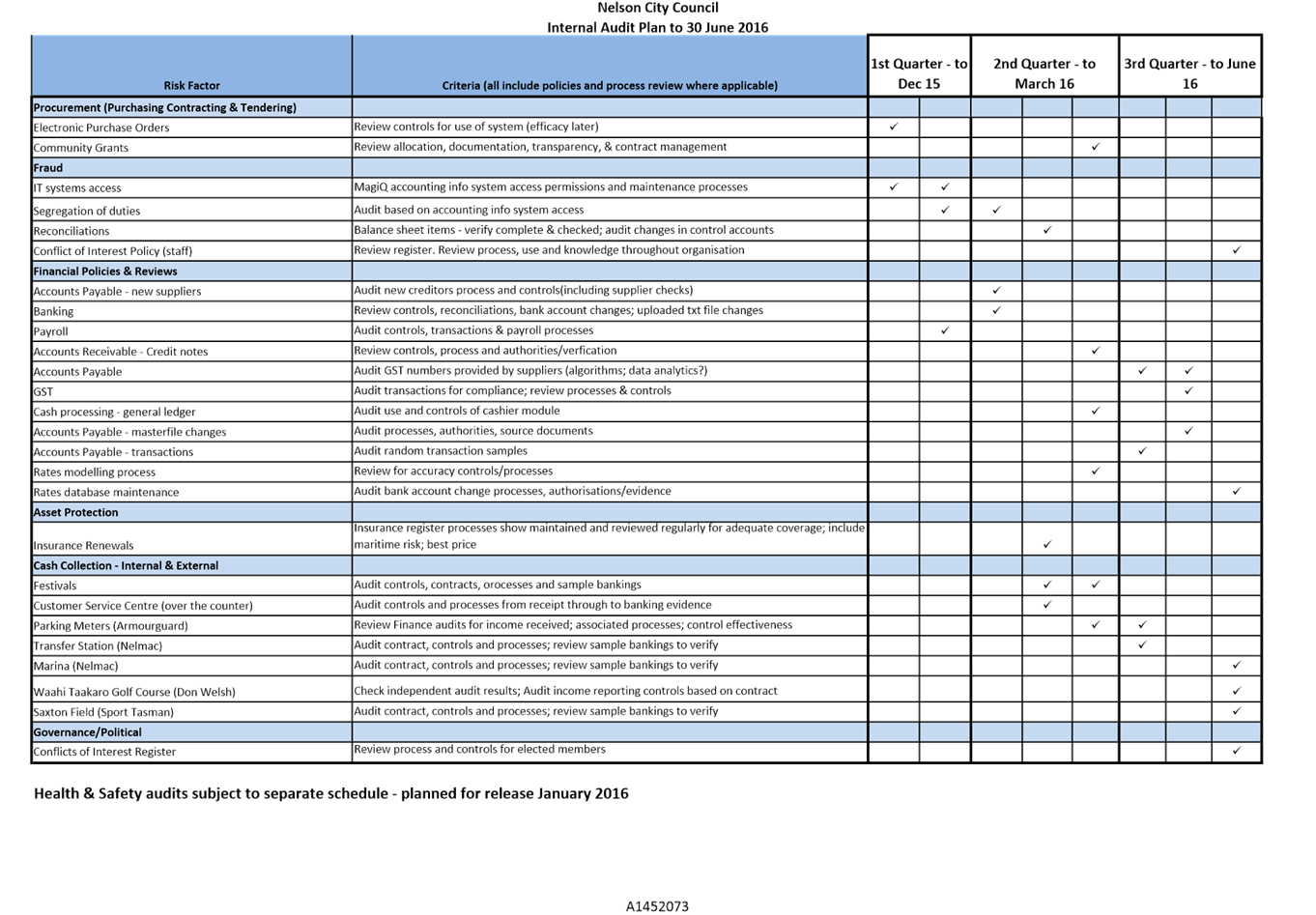

8. Internal

Audit Plan and Procedure 13 - 22

Document number R5045

Recommendation

THAT the report Internal Audit

Plan and Procedure (R5045) and

its attachments (A1452073 and A1428836) be

received.

Recommendation to Governance

Committee and Council

THAT

the Internal Audit Plan to 30 June 2016 (A1452073) be approved.

9. Corporate

Report to 30 September 2015 23 - 40

Document number R5067

Recommendation

THAT

the report Corporate Report to 30 September 2015 (R5067) and its attachments (A1448646, A1311288, A793514, and

A1437431) be received and the variations noted.

AND THAT the subcommittee

notes that funding of $8,900 has been allocated to Isel House in 2015/16 for

the operational costs of running the House.

10. Liability

Management Policy amendment 41 - 56

Document number R5077

Recommendation

THAT the report Liability

Management Policy amendment (R5077)

and its attachment (A1450461) be

received.

Recommendation to Governance

Committee and Council

THAT

the amended Liability Management Policy (A1450461) be adopted.

11. PwC Presentation

Brett Johanson, Treasury Adviser

will give a presentation on treasury risk management.

Minutes of a meeting of

the Audit, Risk and Finance Subcommittee

Held in Ruma Mārama,

Level 2A, Civic House, 110 Trafalgar Street, Nelson

On Wednesday 14 October

2015, commencing at 9.42am

Present: Mr

J Peters (Chairperson), Her Worship the Mayor R Reese, Councillors I Barker and

B McGurk, and Mr J Murray

In Attendance: Councillors

L Acland, P Matheson, and G Noonan, Chief Executive (C Hadley), Group Manager

Infrastructure (A Louverdis), Group Manager Corporate Services (N Harrison),

and Administration Adviser (G Brown)

1. Apologies

There were no apologies.

2. Confirmation of Order of Business

There was no change to the order

of business.

3. Interests

There were no updates to the

Interests Register, and no interests with items on the agenda were declared.

4. Public Forum

Mr Kerry Neal read from tabled document A1444695 regarding

Trafalgar Centre financing.

|

Attachments

1 A1444695 - Tabled

Document - Kerry Neal - Trafalgar Centre Financing

|

5. Confirmation of Minutes

5.1 10

September 2015

Document number M1459, agenda

pages 6 - 11 refer.

|

Resolved AUD/2015/041

THAT the minutes of

the meeting of the Audit, Risk and Finance Subcommittee, held on 10 September

2015, be confirmed as a true and correct record.

Murray/Barker Carried

|

6. Status Report - Status Report -

14 October 2015

Document number R4982, agenda

pages 12 - 13 refer.

|

Resolved AUD/2015/042

THAT the Status Report Audit,

Risk and Finance Subcommittee 14 October 2015 (R4982) and its attachment (A1324298) be received.

Barker/McGurk Carried

|

7. Chairperson's Report

The Chairperson said it was

pleasing to see progress made in relation to new policies and the risk

management framework which the Audit, Risk and Finance Subcommittee would be

discussing at today’s meeting.

8. Draft Asset Disposal Policy

Document number R4823, agenda

pages 14 - 19 refer.

Group Manager Corporate Services,

Nikki Harrison, presented the report.

There was agreement that the

following changes would be incorporated in the draft Asset Disposal Policy:

·

Clause 4.1 remove the term ‘real property’ and add

‘and property’ after the word Land

·

Clause 7.1, remove ‘a’ and replace with

‘the’ third tier manager

·

Add to clause 8.1 evidence and documents will be kept on file in

relation to the statement ‘examples of like items’

·

Clause 8.2 reword ‘items being disposed of on one

day’

·

Clause 8.6 broaden the definition of technology to include other

confidential information

It was suggested that the removal

of confidential information should be covered in a broad overarching policy.

There was a discussion around

what triggers the disposal of an asset. The Chief Executive, Clare Hadley advised

there were processes in place for the disposal of assets and that a disposal

was approved at a senior level. She added that officers had input to whether

the asset required disposal.

|

Resolved AUD/2015/043

THAT the report Draft Asset

Disposal Policy (R4823) and its

attachment (A1412442) be

received.

Barker/McGurk Carried

|

|

Recommendation to Governance

Committee and Council AUD/2015/044

THAT

the Draft Asset Disposal Policy (A1412442) with amendments be approved;

AND

THAT the Delegations Manual is updated to reflect the

delegations in the Asset Disposal Policy.

Barker/McGurk Carried

|

9. Draft Risk Management Framework

Document number R4887, agenda

pages 20 - 35 refer.

Group Manager Corporate Services,

Nikki Harrison, presented the report.

There was agreement that the

following changes would be incorporated into the draft Risk Management

Framework:

·

Section 6, add to 6.1 ‘The role of the Senior Leadership

Team is to report to the Audit, Risk and Finance Subcommittee as set out below

and in Table 1’

·

Clause 9.3.2 add ‘including an environmental scan’

Attendance: Her Worship the Mayor left the meeting from

10.21am to 10.23am.

|

Resolved AUD/2015/045

THAT the report Draft Risk

Management Framework (R4887)

and its attachment (A1431591) be

received.

Peters/Barker Carried

|

|

Recommendation to Governance

Committee and Council AUD/2015/046

THAT

the Draft Risk Management Framework (A1431591) with amendments be approved.

Peters/Barker Carried

|

10. Corporate Report to 31

August 2015

Document number R4939, agenda

pages 36 - 52 refer.

Group Manager Corporate Services,

Nikki Harrison, presented the report.

In response to a question, Group

Manager Infrastructure, Alec Louverdis, advised the projects included under the

Parks and Active Recreation activity in attachment 3 included retaining walls,

dredging and the Trafalgar Centre.

In response to a question, the

Chief Executive, Clare Hadley referred to the Trafalgar Centre Reopening

project in attachment 5, and explained the expenditure of $644,000 was in

relation to early project work and this was written off on advice from Audit

New Zealand. This was not included in the current budget.

Mrs Hadley said the $667,000

additional expenditure for the Trafalgar Centre was incorrectly recorded in the

Consulting Engineer, Richard Kirby’s, report to Council on 3 September

2015, but he verbally corrected this at the meeting.

It was agreed that the Audit,

Risk and Finance Subcommittee was satisfied the increase in expenditure for the

Trafalgar Centre was appropriately considered against the Significance and

Engagement Policy and followed due process.

In response to a further

question, Mrs Hadley advised the Rutherford Park development was not included

as part of the Trafalgar Centre budget.

There was a discussion regarding

further road closures in relation to the Brook Area Cycling and Walking

Improvements. Mr Louverdis advised that any further road closures would be

managed in discussion with the Communications Team, the residents and other

stakeholder groups.

|

Resolved AUD/2015/047

THAT

the report Corporate Report to 31 August 2015 (R4939) and its attachments (A1422506, A1432835, A793514, and

A1436178) be received and the variations noted.

Murray/McGurk Carried

|

|

Recommendation to Governance Committee

and Council AUD/2015/048

THAT $350,000 for the

upgrade of the Civic House verandah be deferred until 2017/18;

AND THAT $200,000 for

the upgrade of the Hunter Furniture roof be deferred until 2016/17.

Murray/Barker Carried

|

There being no further business the

meeting ended at 11.15am.

Confirmed as a correct record of proceedings:

Chairperson

Date

Chairperson

Date

|

|

Audit, Risk and Finance Subcommittee

12 November 2015

|

REPORT R5107

Status

Report - Audit, Risk and Finance Subcommittee - 12 November 2015

1. Purpose

of Report

1.1 To

provide an update on the status of actions requested and pending.

2. Recommendation

|

THAT the Status Report Audit,

Risk and Finance Subcommittee 12 November 2015 (R5107) and its attachment (A1324298) be received.

|

Gayle

Brown

Administration

Adviser

Attachments

Attachment 1: A1324298

Status Report - Audit, Risk and Finance Subcommittee - November 2015

|

|

Audit, Risk and Finance Subcommittee

12 November 2015

|

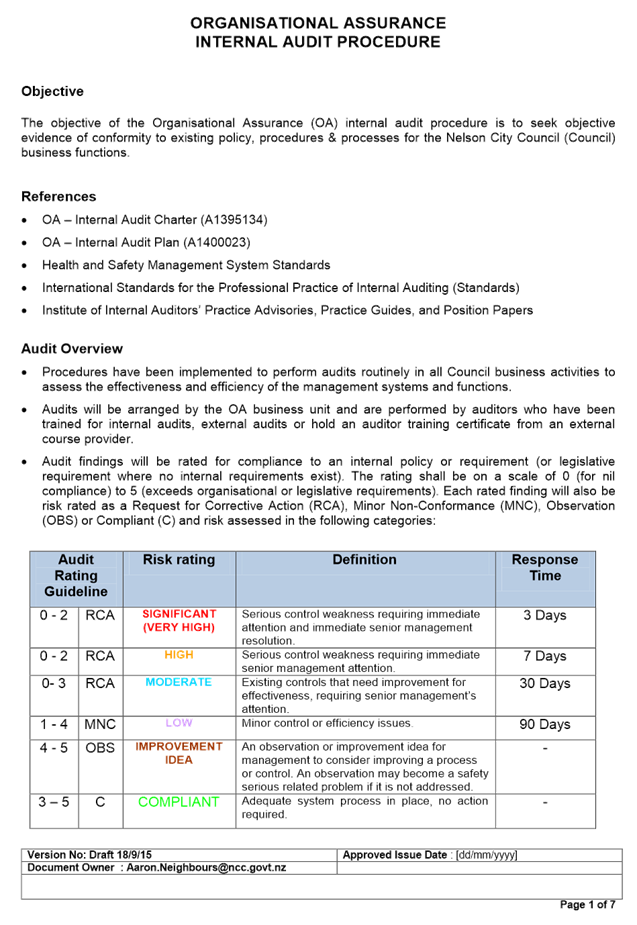

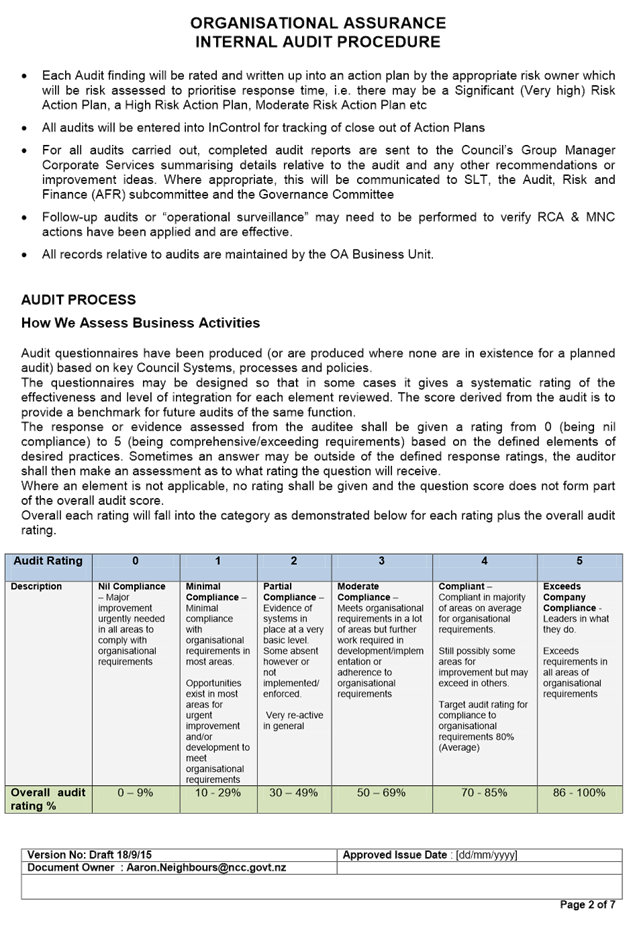

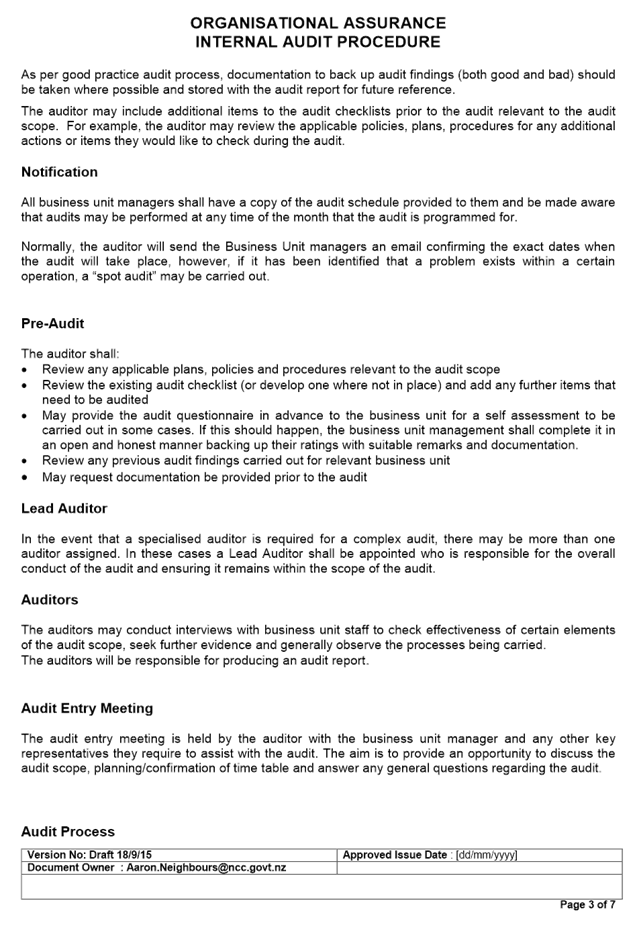

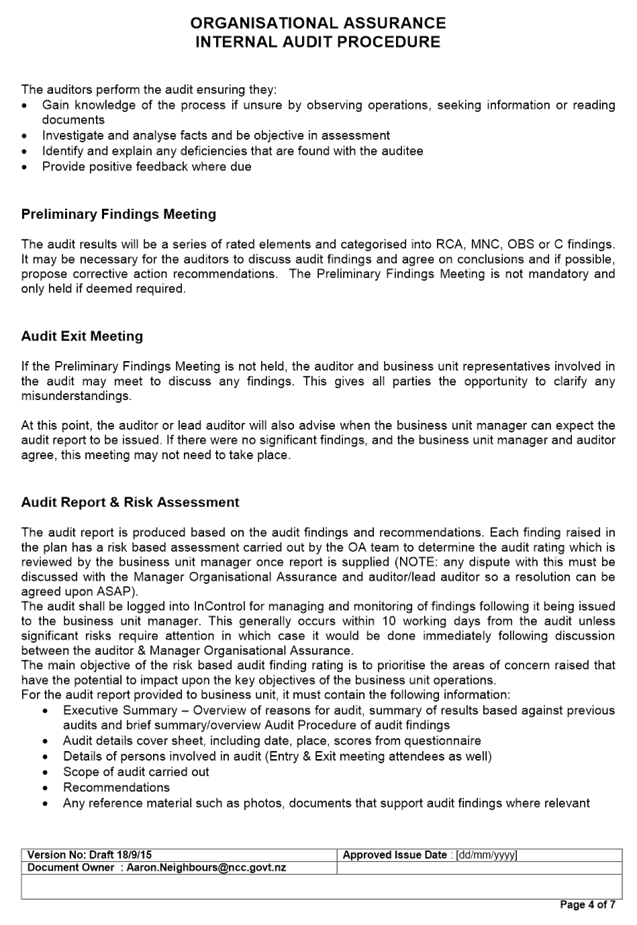

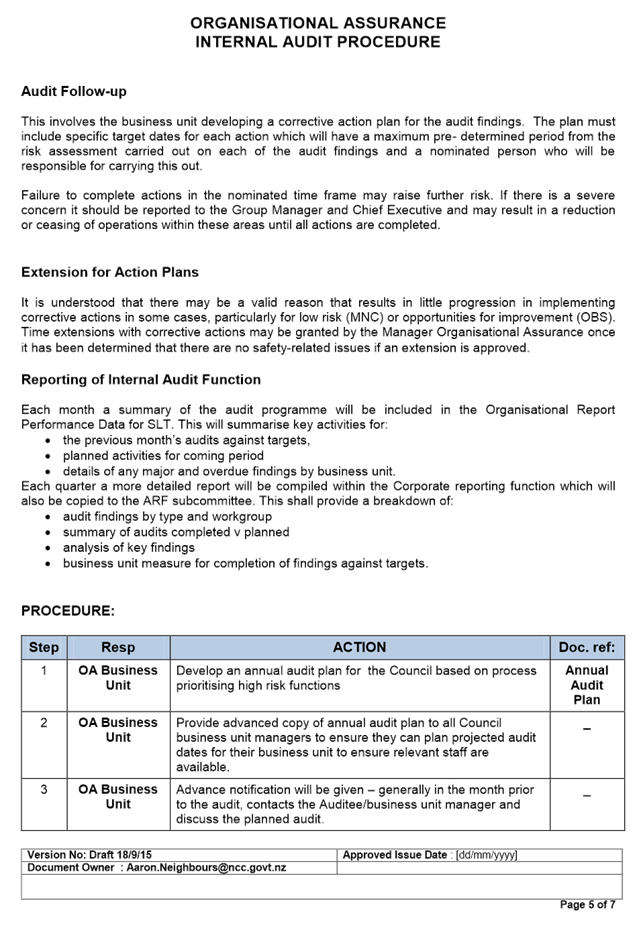

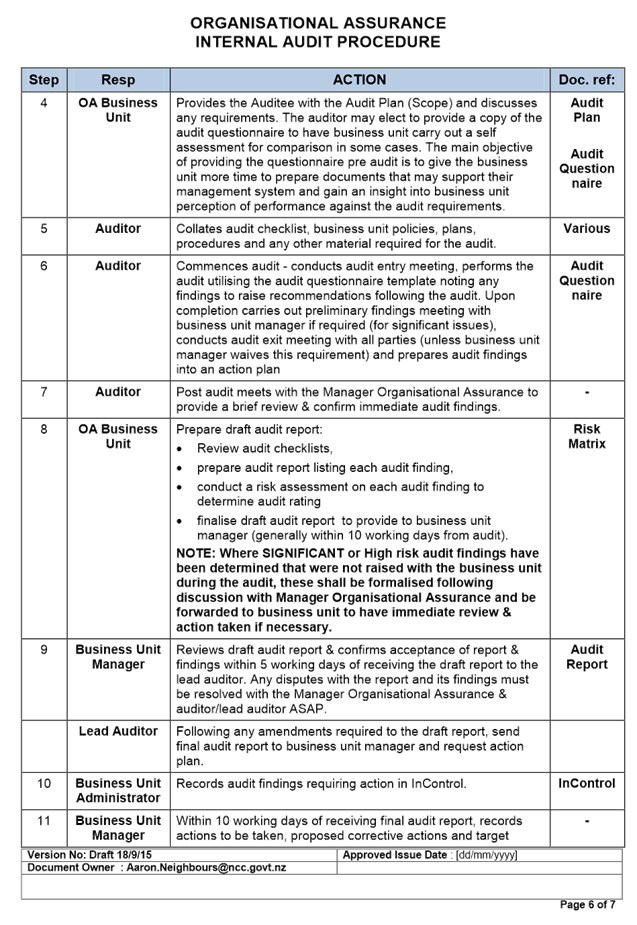

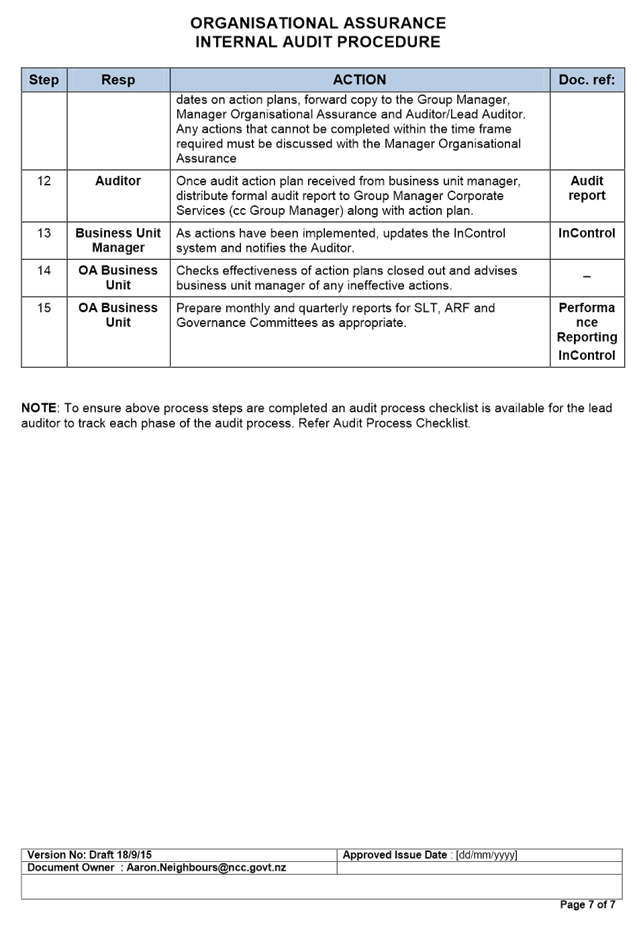

REPORT R5045

Internal

Audit Plan and Procedure

1. Purpose

of Report

1.1 To approve the internal audit plan through to

30 June 2016 and to review the internal audit procedure.

2. Delegations

2.1 The

Audit, Risk and Finance Subcommittee has responsibility for risk management and

internal control.

3. Recommendation

|

THAT the report Internal Audit

Plan and Procedure (R5045) and

its attachments (A1452073 and A1428836)

be received.

|

Recommendation

to Governance Committee and Council

|

THAT the

Internal Audit Plan to 30 June 2016 (A1452073) be approved.

|

4. Background

4.1 The

Internal Audit Charter was brought to the Audit, Risk and Finance sub-committee

on 10 September 2015 and recommended for approval to Governance and

Council.

4.2 It is intended that a risk based internal audit plan

will be brought to the sub-committee at least annually prior to the beginning

of each financial year. Risk assessments have been undertaken across the

organisation over the last couple of months and the internal audit plan to 30

June 2016 is included as Attachment 1.

5. Discussion

5.1 The

internal audit plan has been developed based on a prioritisation of a list of

all potential audit topics using a risk-based methodology. Once approved, any

significant deviation from the approved internal audit plan will need be

considered by Audit, Risk & Finance after seeking guidance (if appropriate)

from the Chief Executive and if necessary the Governance Committee.

5.2 Results of the internal audits, where appropriate,

will be reported to the Audit, Risk and Finance subcommittee.

5.3 The

Internal Audit Charter also referred to internal audit activity’s

standard operating procedures manual. The Audit, Risk and Finance sub-committee

requested that a copy of this be brought back to the sub-committee for

information and this is included as Attachment 2.

6. Options

6.1 Accept

the recommendation – approve the Internal Audit plan. The internal audit

procedure is provided for information as requested.

6.2 Reject

the recommendation – not approve the Internal Audit plan.

7. Alignment

with relevant Council policy

7.1 This

decision is not inconsistent with any other previous Council decision.

8. Assessment

of Significance against the Council’s Significance and Engagement Policy

8.1 This

is not a significant decision under the Council’s Significance and

Engagement Policy.

9. Consultation

9.1 No

consultation has been undertaken in preparing this report.

10. Inclusion

of Māori in the decision making process

10.1 No

consultation with Maori has been undertaken in preparing this report.

Nikki

Harrison

Group

Manager Corporate Services

Attachments

Attachment 1: A1452073 -

Internal Audit Plan to 30 June 2016

Attachment 2: A1428836

- Internal Audit procedure

|

|

Audit, Risk and Finance Subcommittee

12 November 2015

|

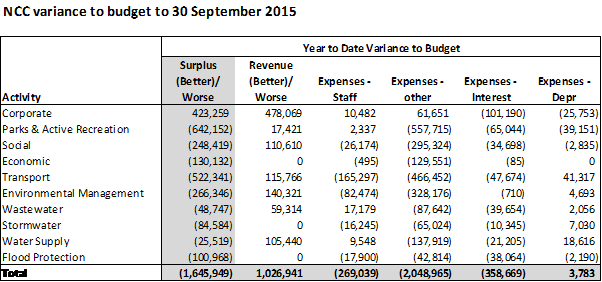

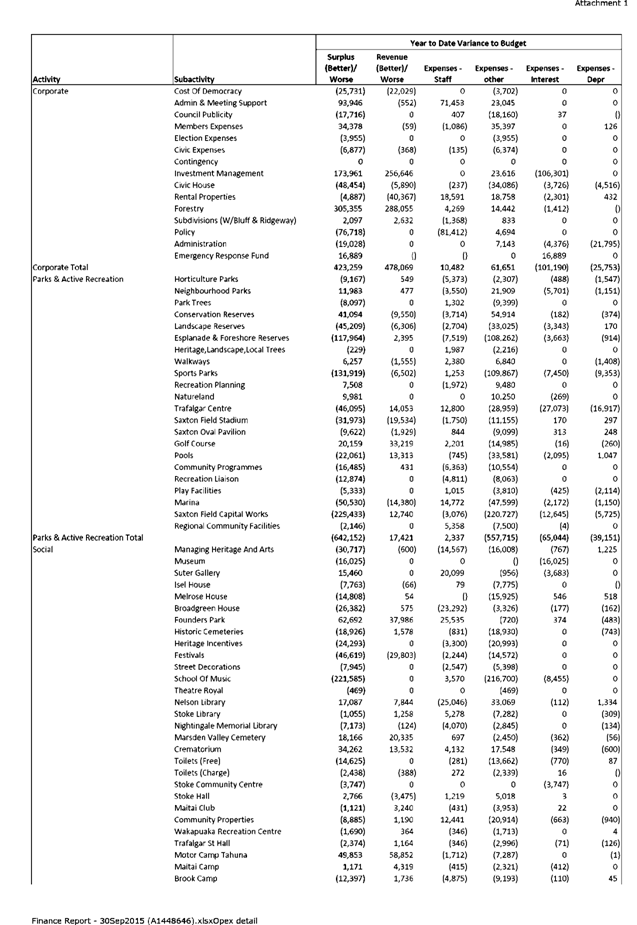

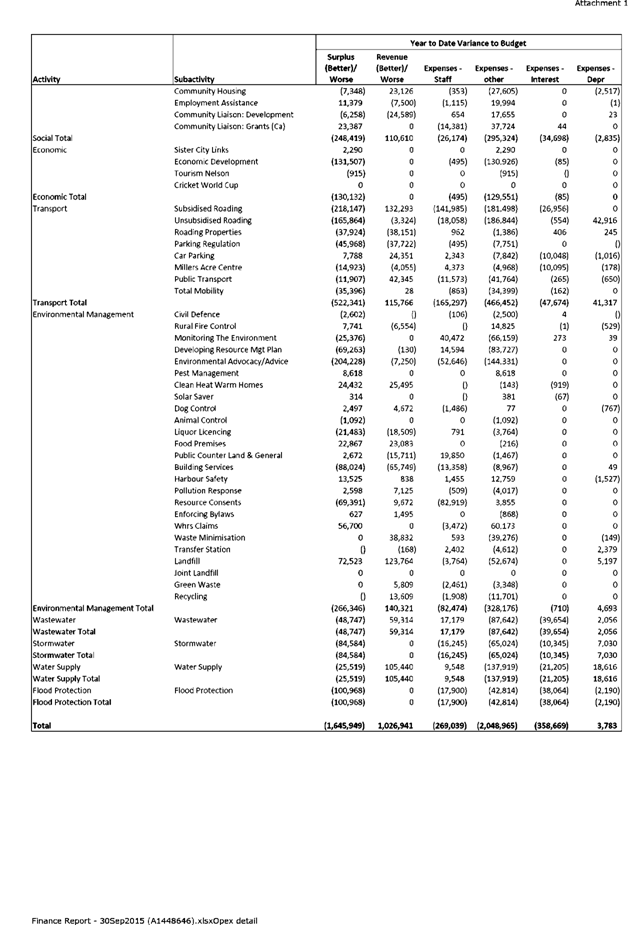

REPORT R5067

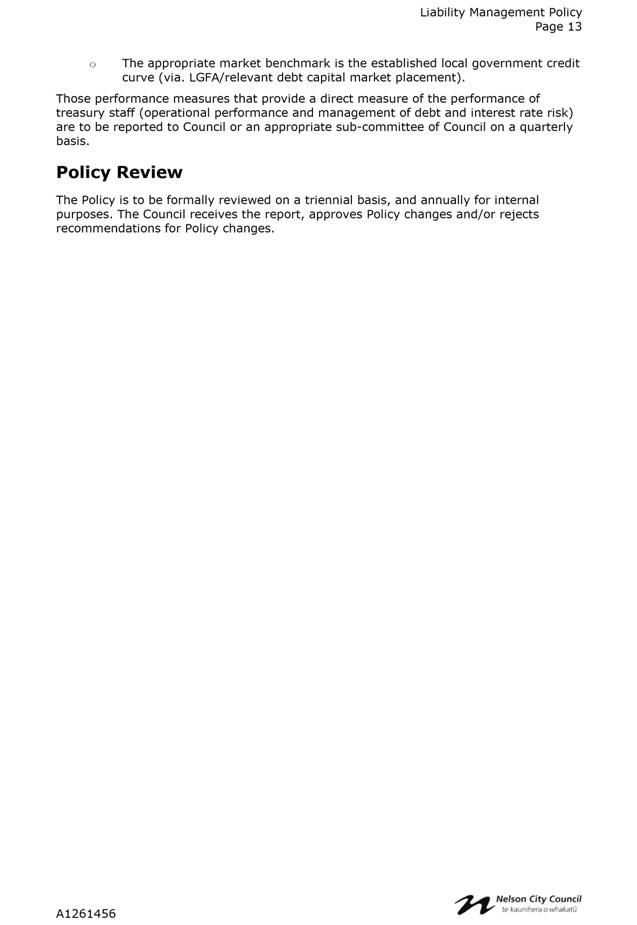

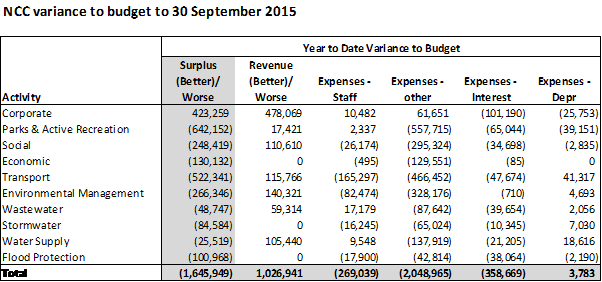

Corporate Report to 30 September 2015

1. Purpose of Report

1.1 To inform the members of the Audit, Risk and Finance subcommittee of the

financial results of activities for the 3 months ending 30 September 2015

compared to the approved operating budget, and to highlight and explain any

material variations.

2. Delegations

2.1 The Audit, Risk and Finance subcommittee has oversight of the management

of financial risk and makes recommendations to the Governance Committee and to

Council. Do not delete Do not delete this li

3. Recommendation

|

THAT

the report Corporate Report to 30 September 2015 (R5067) and its attachments (A1448646,

A1311288, A793514, and A1437431) be received and the variations noted;

AND

THAT the subcommittee notes that

funding of $8,900 has been allocated to Isel House in 2015/16 for the

operational costs of running the House.

|

4. Background

4.1 The report focuses on the 3 month performance compared

with the year to date approved operating budget. Budgets for operating income

and expenditure are phased evenly through the year, whereas capital expenditure

budgets are phased to occur mainly in the second half of the year.

4.2 Some definitions of terms used within this report:

· Approved operating budget – Annual plan plus carry forwards

plus any other additions or changes approved by Council;

· Operating income – all income other than rates including

metered water, grants, fees, rentals, and recoveries;

· Rates – includes the general rate, wastewater, stormwater and

flood protection rates, and targeted rates for Solar Saver;

· Staff costs – salaries plus overheads such as training, super,

professional fees and office accommodation expenses;

· Depreciation – includes all depreciation, and any losses on

asset disposal/retirement;

· Interest – includes debt interest, bank fees, interest rate

swap margins, treasury and rating agency fees.

5. Discussion

5.1 The report focuses on performance to date compared with the year to date

approved operating budget. More detailed financials by sub-activity are in

Attachment 2.

5.2 For the 3 months ending 30 September 2015, the activity surplus/deficits

are $1.6 million favourable to budget.

5.3 Revenue and expenditure variances are discussed by activity. At this

stage of the year individual variances tend to be immaterial and/or a mismatch

in timing between the budget phasing and actual expenditure.

5.4 Staff expenses are $269,000 in total better than budget. Variances in

activities illustrate where staff time has actually been spent against where it

was expected to be spent at the time of setting the 2015/16 Annual Plan.

Corporate

5.5 The Corporate activity is $423,000 worse than budget.

5.5.1 Revenue – $478,000 less than budgeted.

Internal interest income is $167,000 less than budgeted as 2014/15 capital

expenditure was less than projected and interest rates remain favourable to

those anticipated. Forestry income is $296,000 less than budgeted due to the

timing of the Brook Forest harvest which is due to be completed by mid

December.

Parks and Active Recreation

5.6 The Parks and Active Recreation activity is $642,000 better than budget

due to:

5.6.1 Expenses – other - $558,000 better

than budget. Water by meter is $62,000 below budget – seasonality

is a major driver of this variance with the December and March quarters

generating heavier expenditure. Grants for capital projects at Saxton’s

Field have not yet been made to Tasman District Council ($220,000 - timing),

and maintenance expenditure is behind budget by $247,000 including $62,000 for

the Marina dredging. The scope and timing (originally November) for the Marina

dredging is being revised as the submitted tender price exceeds the exisiting

budget. Some maintenance expenditure in this activity is very seasonable, and a

large number of purchase orders have been raised.

5.6.2 Interest and depreciation together are

$104,000 less than budget due to 2014/15 capital expenditure being less than

projected.

Social

5.7 The Social activity is $248,000 better than budget due to:

5.7.1 Revenue - $111,000 less than budget due to

the timing of income for festivals, Founders, and the Tahuna Beach Motor Camp.

5.7.2 Expenses – other - $295,000 better

than budget. Expenditure for the earthquake strengthening and refurbishment of

the Nelson School of Music is behind budget by $218,000 (timing). Maintenance

expenditure is $95,000 behind budget although again there are a large number of

open purchase orders awaiting invoices.

Economic

5.8 The Economic activity is $130,000 better than budget due to:

5.8.1 Expenses – other - $130,000 better

than budget. Grants for Light Nelson and the Events Contestable Fund have not

yet been accessed (timing), and expenditure budgeted for special economic

projects and Innovate business incubator has not occurred to date

(timing).

Transport

5.9 The Transport activity is $522,000 better than budget due to:

5.9.1 Revenue - $116,000 less than budget as the

timing of income from NZTA reflects the timing of expenditure.

5.9.2 Expenses – other - $466,000 better

than budget, mainly in subsidised and unsubsidised roading. The most

significant underspends in that activity are:

· Base maintenance ($327,000) including particularly pre-seal repairs,

road and footpath maintenance and subsequent road marking. This is seasonal

activity and scheduled for October/November dependant on weather conditions.

· $50,000 underspent year to date in recovery works from the 2011

emergency event relating to Days Track. This work has been carried forward from

2014/15. A report on this project will be coming to a Works and Infrastructure

committee meeting in the New Year.

· Little

has been spent on studies and strategies relating to the Southern Arterial

corridor management Plan. This is delayed until the findings of the NZTA

Southern Arterial Investigation are released. This money will not be spent in

the current financial year. It is recommended that the Stoke Foothills traffic

study also needs to be delayed until the NZTA Southern Arterial Investigation

is released as the modelling is inter-dependant. This will then also not be

spent in 2015/16. The Stoke CBD study is underway , with the purchase order

raised and will be completed by December 2015.

Environmental

Management

5.10 This

activity includes Civil Defence and Rural Fire activities, Consents and

Compliance, Environmental Programmes, and Solid Waste activities. The

Environmental Management activity is $266,000 better than budget due to:

5.10.1 Revenue - $140,000 less than budget. Landfill levies

(including hazardous waste levies) are $123,000 (18%) less than year to date

budget. Underlying factors for volume decrease are speculative, but may include

the success of waste minimisation initiatives in the region over many years.

Building income is $72,000 above budget (21%). Volumes are roughly the same as

first quarter 2014/15, the increased revenue is a result of higher value

building applications.

5.10.2 Expenses – other - $328,000 behind budget.

Expenditure relating to the Nelson Plan and the Air Plan is currently $84,000

behind budget although significant expenditure is committed through purchase

orders. Environmental advocacy and advice (mainly Nelson Nature) is $144,000

behind budget. A monitoring programme has now been agreed and expenditure has

been committed. Solid waste expenditure is $68,000 less than budget

particularly in respect of ETS levies and toe embankment maintenance (timing),

and local disposal levies (offsetting income).

Wastewater

5.11 The

Wastewater activity is $49,000 better than budget due to:

5.11.1 Expenses – other - $88,000 less than budget.

Maintenance expenditure is $54,000 behind budget, and little expenditure has

been incurred on the studies relating to natural hazards risk assessment and

network capacity confirmation for growth areas (expected completion February

2016).

Stormwater

5.12 The

Stormwater activity is $85,000 better than budget due to:

5.12.1 Expenses – other - $65,000 better than budget.

There has been no expenditure year to date against budgets for studies and

strategies including natural hazards risk assessment, network capacity

confirmation for growth areas (work commencing November), and code of practise

for open streams (timing).

Water

5.13 The

Water activity is $26,000 better than budget due to:

5.13.1 Revenue - $105,000 less than budget (timing).

5.13.2 Expenses – other - $138,000 better than budget

relates to $64,000 maintenance expenditure unspent although purchase orders are

in place. There has been no expenditure year to date (timing) against budgets

for studies and strategies including natural hazards risk assessment, network

capacity confirmation for growth areas (results expected by end of March 2016),

water loss reduction strategy, and water safety plan.

Flood

Protection

5.14 The

Flood Protection activity is $101,000 better than budget.

5.14.1 Expenses – all expenditure classes are less than

budget by individually immaterial amounts (timing).

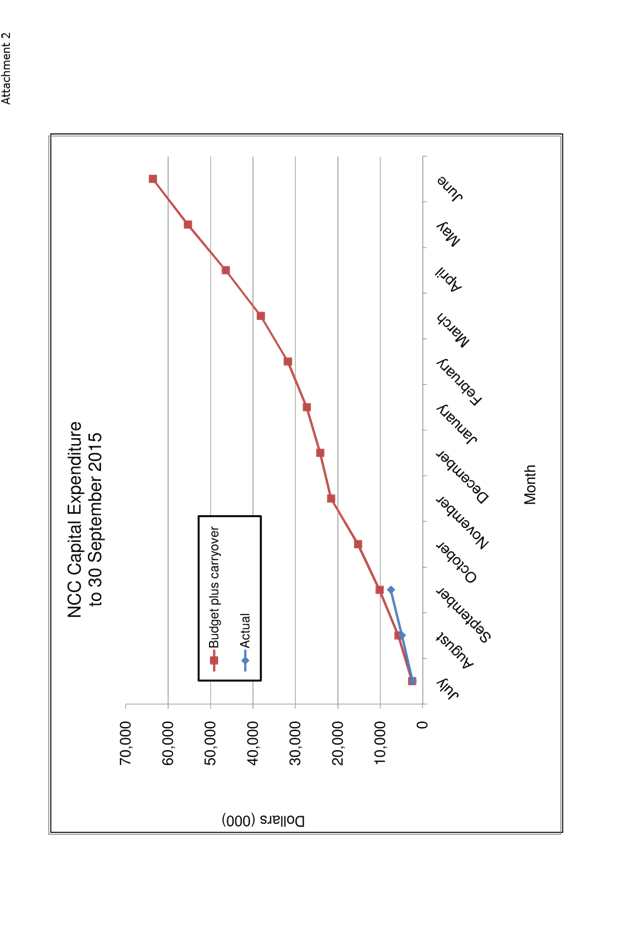

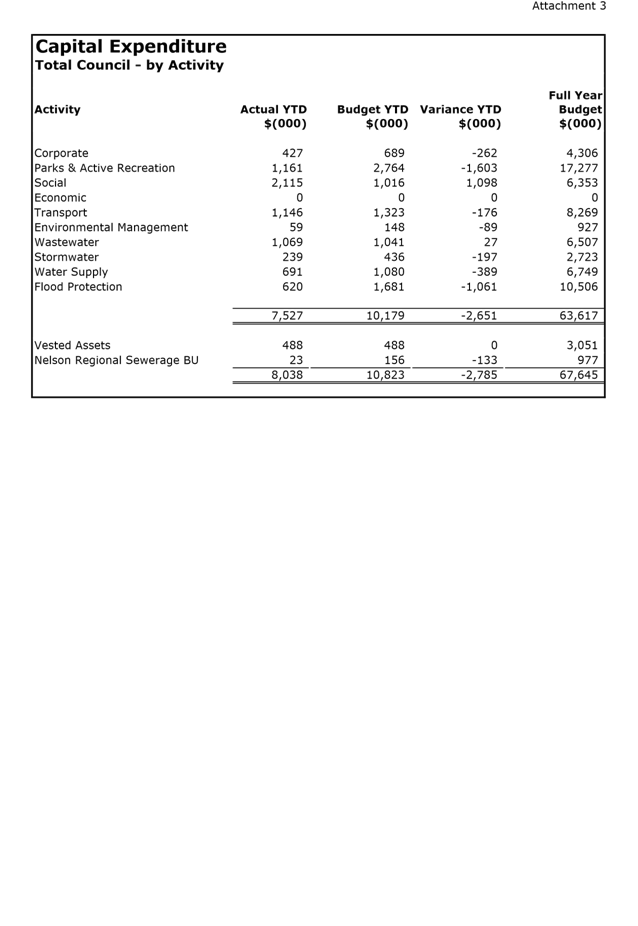

Capital

Expenditure

5.15 Capital

expenditure to 30 September 2015 was $7.5 million, $2.7 million (36%) below

budget. Details are included in Attachments 2, 3 and 5.

5.16 Changes

in project management standards and business case approach have delayed

construction phase, however expectations at this stage are that the work

programme will be met.

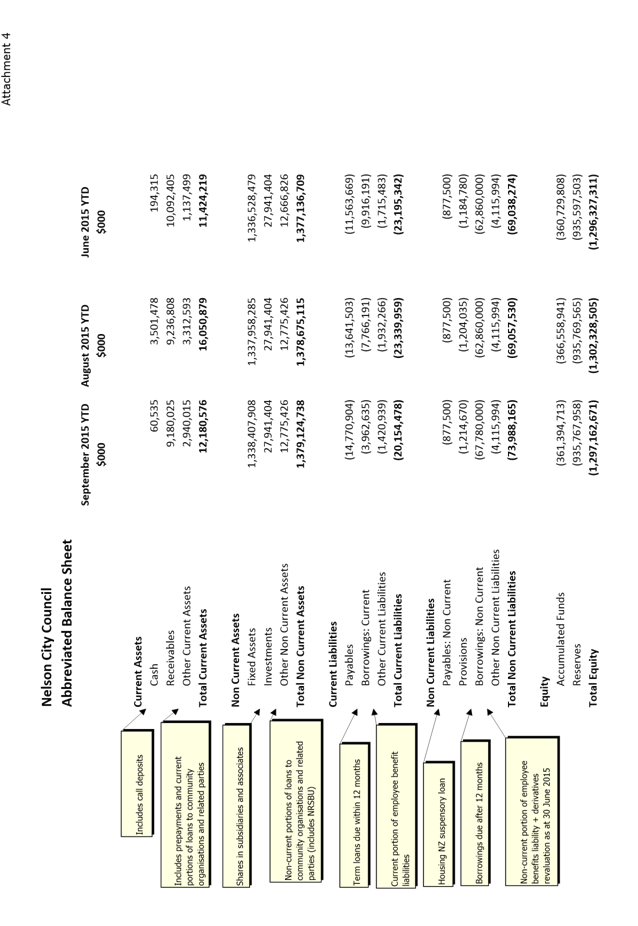

Balance

Sheet

5.17 The

creditors payment in September utilised cash balances on hand at the end of

August.

5.17.1 Payables include income in advance. Along with receipts

for the full year rates in August (which are being released to income monthly),

balances have built up from those ratepayers with direct debit arrangements in

advance of the next quarterly rates accounts, invoiced in October.

5.17.2 In September, $5 million of current borrowings were

replaced with $5m term borrowings through the Local Government Funding Agency,

due in 2027.

5.17.3 Rates income for the quarter is recognised in its

entirety when it is invoiced, in this case in July. Over the following 2

months, accumulated funds decrease as expenditure is incurred. Essentially

accumulated funds reflects the timing differences between rates income and

organisational expenditure.

6. Isel House

6.1 On 30 August 2015 the Isel House Charitable Trust notified Council that

from 30 October 2015 it would be relinquishing its lease to manage Isel House.

Isel House now returns to the direct management of Council staff through the

Libraries and Heritage Facilities Business Unit.

6.2 As the Trust was contracted to Manage Isel House no funding is included

in the Long Term Plan to cover any of the operational costs now required to be

met by Council. Funding of $8,900 is needed for the remainder of 2015/16 to

provide services to the house whilst a decision is made as to the future

direction of the facility. This funding will cover electricity, telephone,

security and insurance costs until June 2016.

6.3 Funding beyond 2015/16 will be included as part of the upcoming annual

plan process.

6.4 Isel House will be open for the Summer provided volunteers are confirmed

by 30 November 2015. This process is in hand.

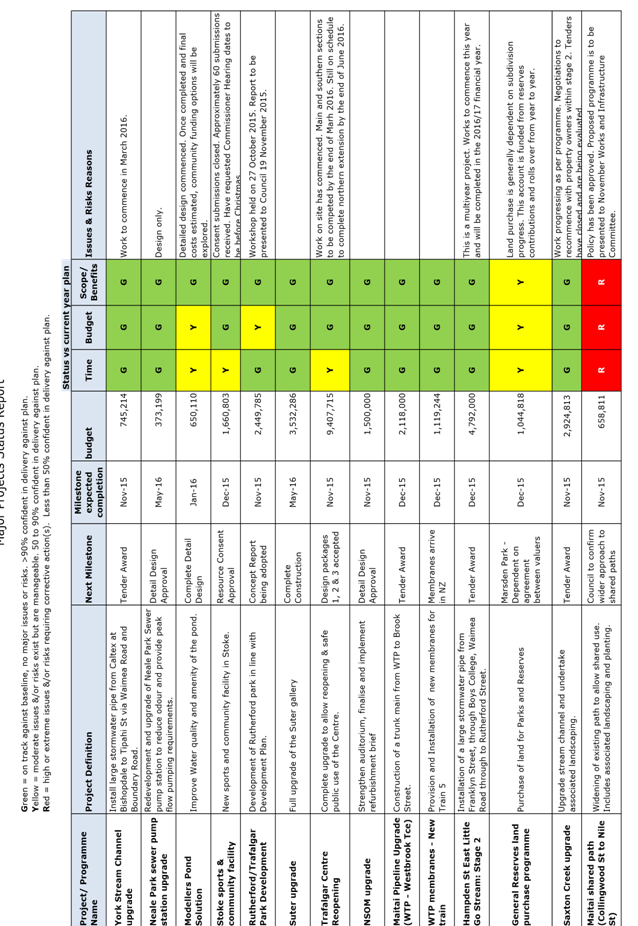

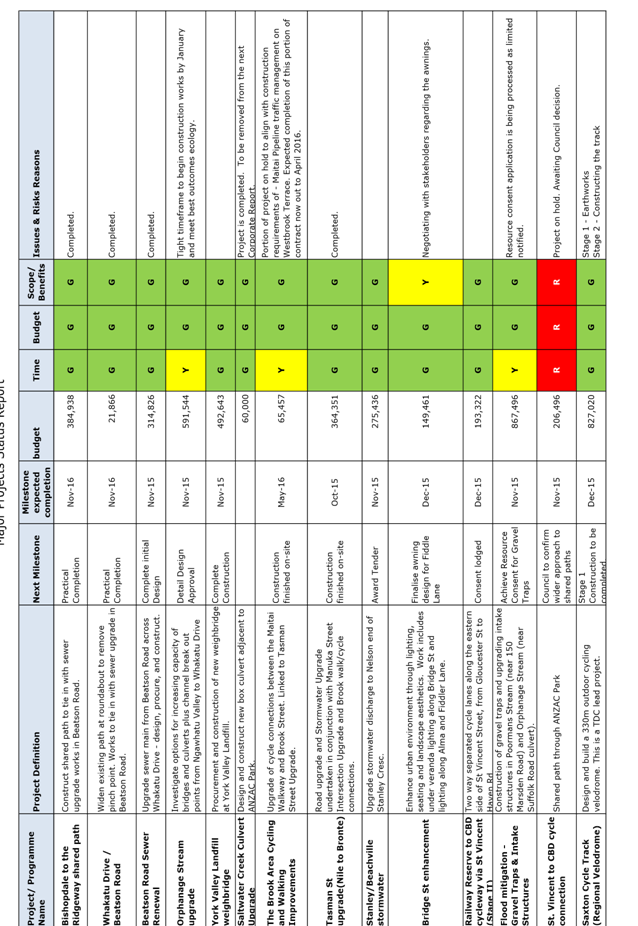

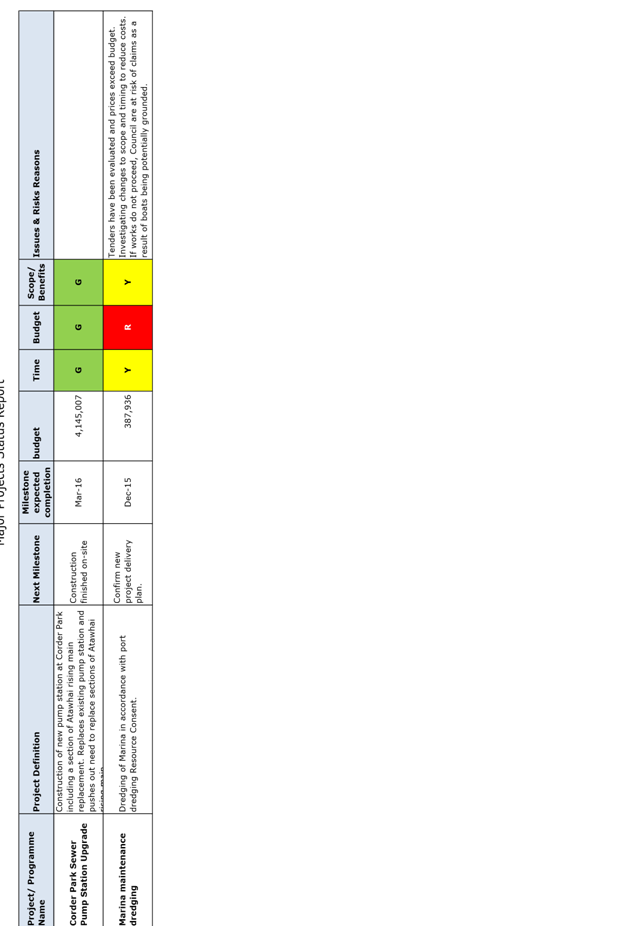

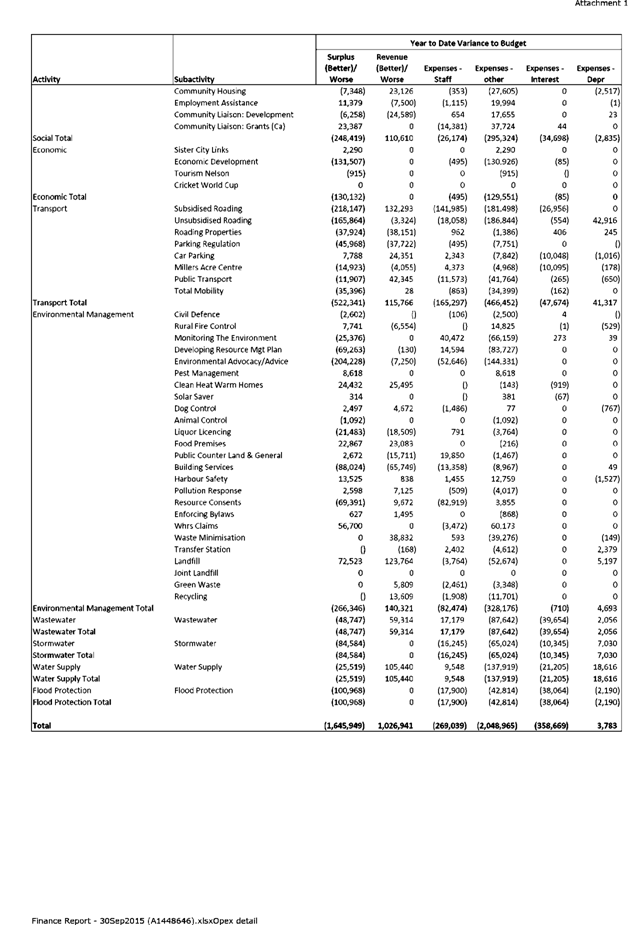

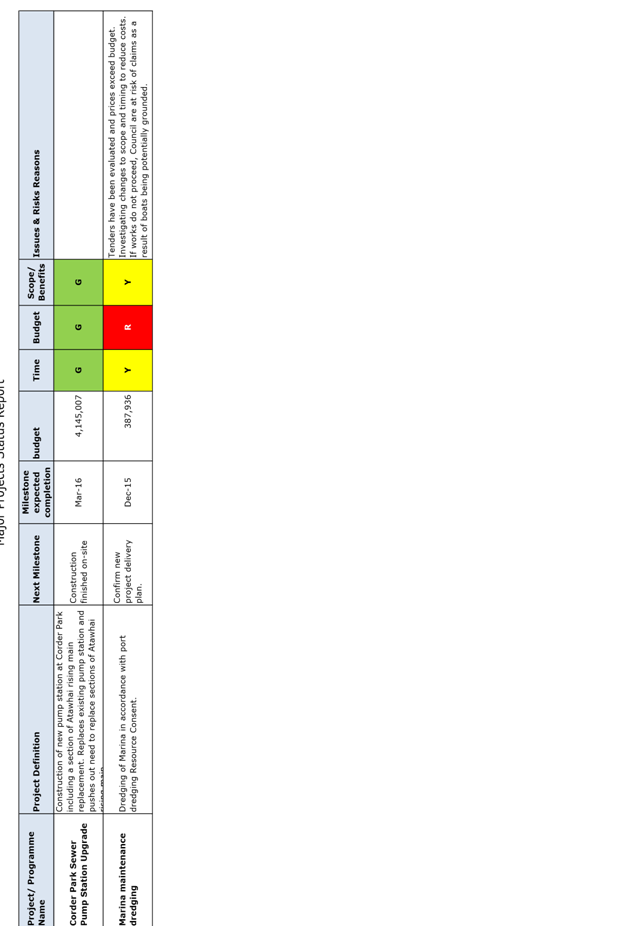

7. Projects Update

Please see Attachment 5 for progress reports on

Council’s major projects.

8. Alignment with relevant Council policy

8.1 The finance report is

prepared comparing current year performance against the year to date approved

operating budget for 2015/16.

9. Assessment of Significance against the Council’s

Significance and Engagement Policy

9.1 There are no significant

decisions.

10. Consultation

10.1 No consultation is required.

11. Inclusion of Māori in the decision making process

11.1 No consultation is required.

Tracey Hughes

Senior Accountant

Attachments

Attachment 1: NCC

Detail Performance (A1448646)

Attachment 2: Capital Expenditure Graph (A1448646)

Attachment 3: Capital Expenditure by Activity

(A1448646)

Attachment 4: NCC Balance Sheet (A1448646)

Attachment 5: Major Projects Status Report

(A1311288)

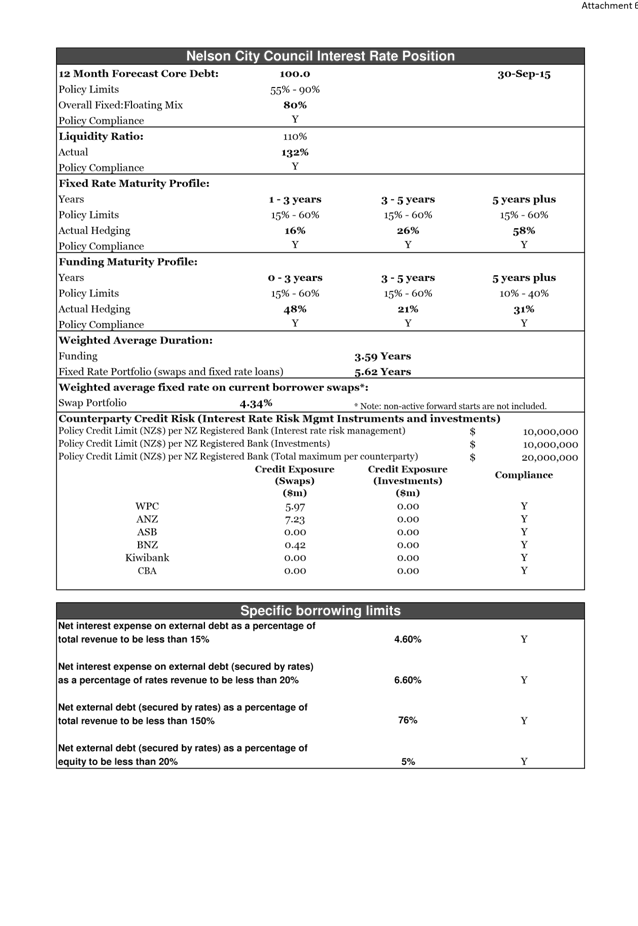

Attachment 6: Interest Rate Position (A1437431)

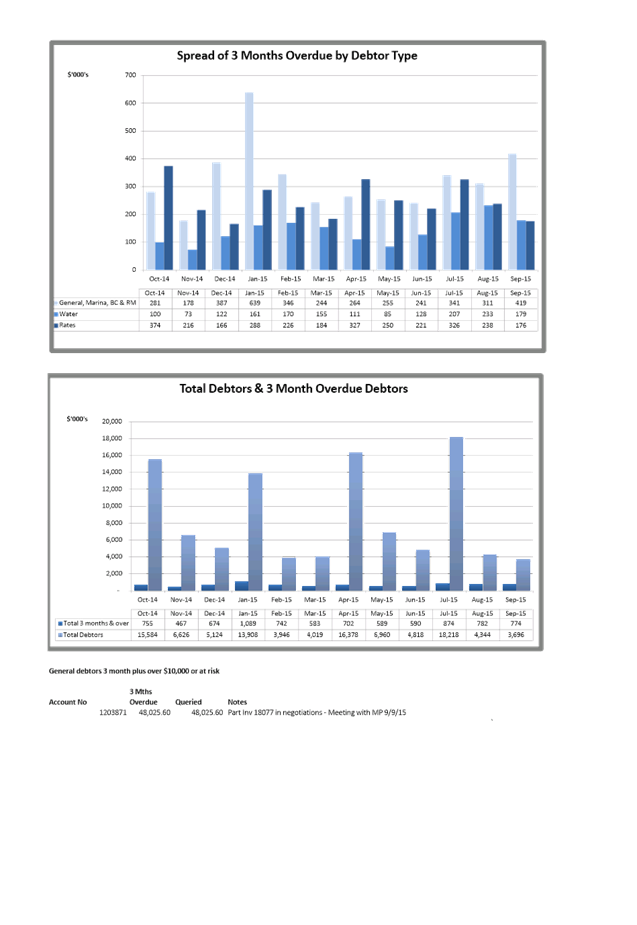

Attachment 7: Debtors Report (A793514)

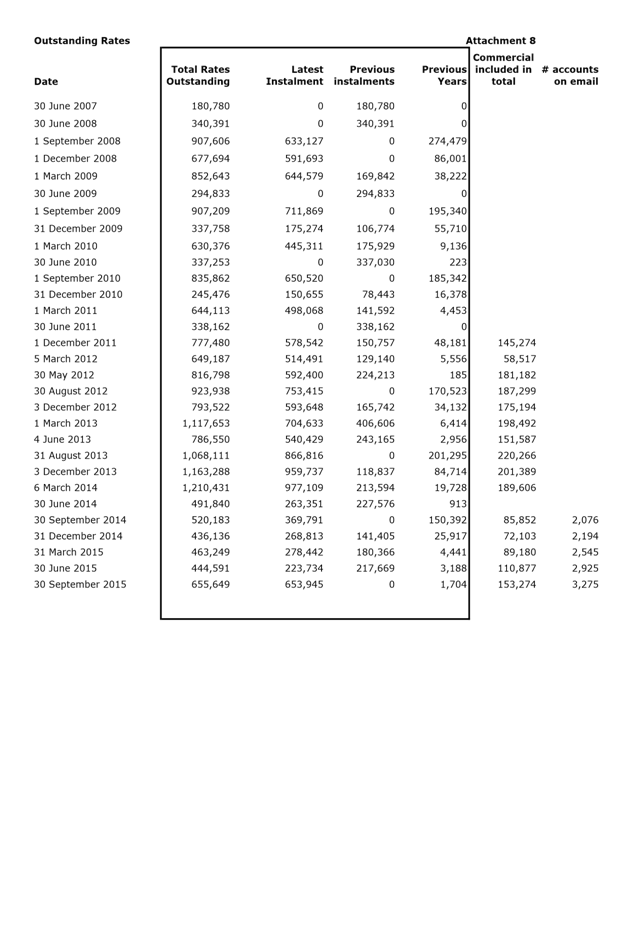

Attachment 8: Rates Outstanding (A1448646)

|

|

Audit, Risk and Finance Subcommittee

12 November 2015

|

REPORT R5077

Liability

Management Policy amendment

1. Purpose

of Report

1.1 To adopt the amended Liability Management

Policy.

2. Delegations

2.1 The

Audit Risk and Finance Subcommittee has powers to make recommendations to the

Governance Committee in relation to Council’s Treasury Policies.

3. Recommendation

|

THAT the report Liability

Management Policy amendment (R5077)

and its attachment (A1450461) be

received.

|

Recommendation

to Governance Committee and Council

|

THAT the

amended Liability Management Policy (A1450461) be adopted.

|

4. Background

4.1 The

current Liability Management Policy was approved by Council in April

2015. Previously any amendments to this Policy would have had to be

consulted on but legislative changes mean that amendments to the Liability

Management and Investment Policies can be approved by Council.

5. Discussion

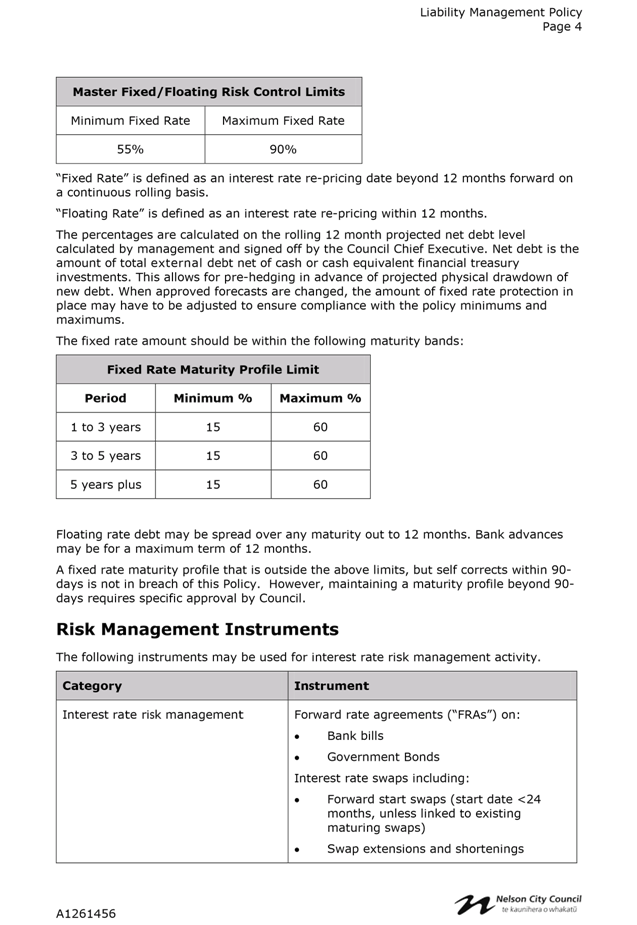

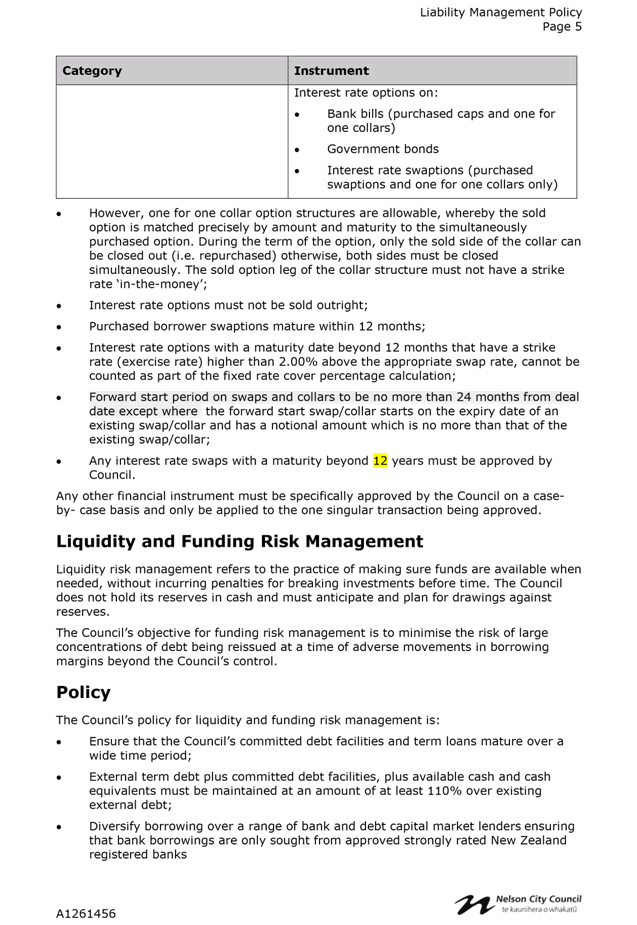

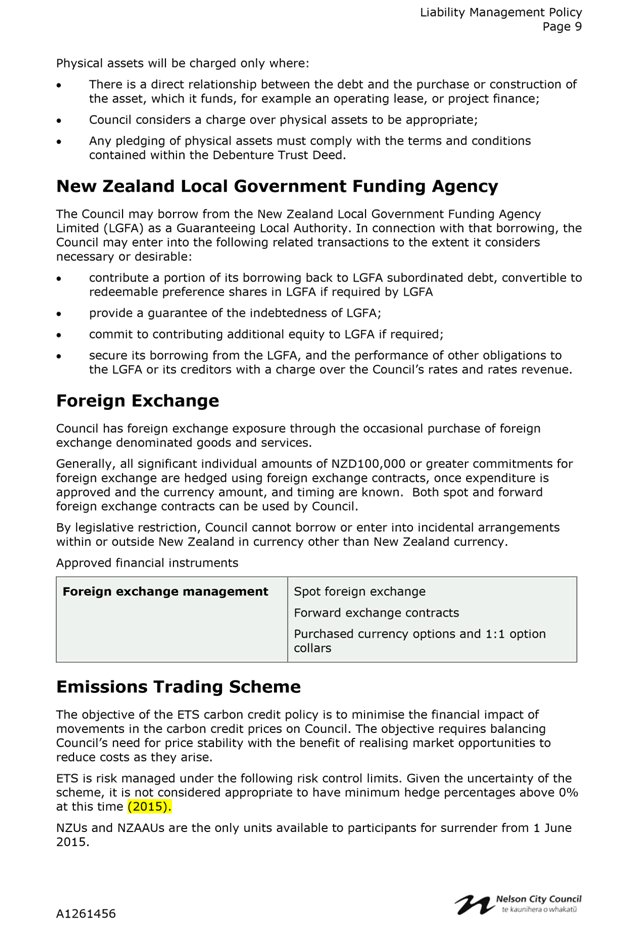

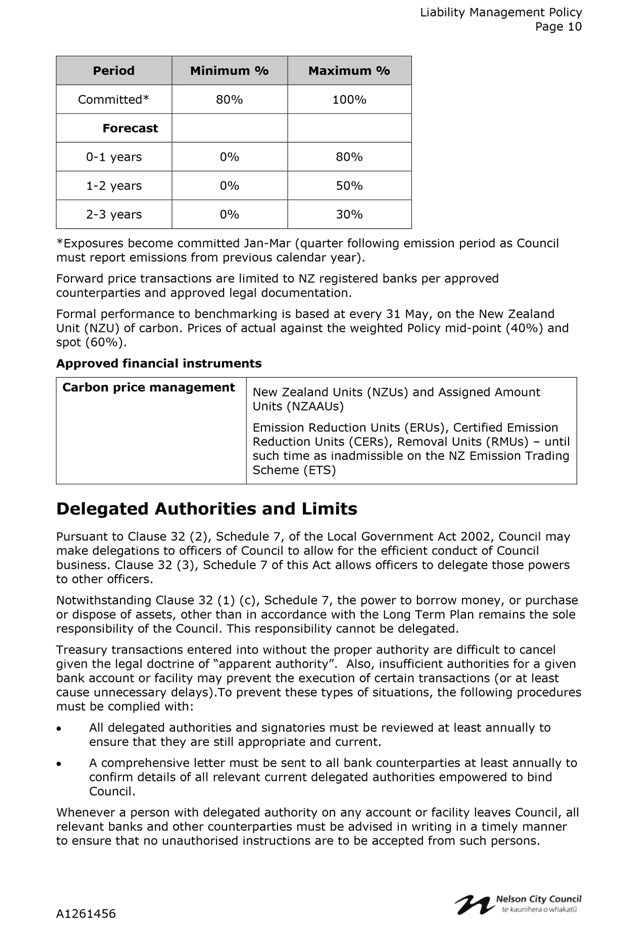

5.1 Officers

seek approval for an amendment to the Liability Management Policy to provide

for longer term interest rates swaps, to cover borrowing for terms longer than

ten years. The amended Policy is attached with changes highlighted

(Attachment 1).

5.2 The

main drivers for this change are that the Local Government Funding Agency

(LGFA), which the Council use for long term borrowing, is now issuing longer

dated debt. Also the swap market has become more liquid and actively traded

beyond ten years.

5.3 Currently

the Liability Management Policy interest rate risk control limits requires that

“any interest rate swaps with a maturity beyond 10 years must be approved

by Council”. This approach is not practical for managing interest rate

swaps as would need to refer each proposed tranche of swaps to Audit, Risk and

Finance, Governance then Council by which time the markets may have moved

significantly.

5.4 Council

has issued a $5 million 2027 maturity LGFA bond (12 years) in the September

2015 tender and are currently unable to manage the interest rate exposure

beyond 10 years by entering into swaps (without Council approval).

5.5 The

amendment proposed is that the 10 years is changed to 12 years. This has

been discussed with our Treasury advisors PriceWaterhouse Coopers (PWC) and

they concur.

5.6 It

is likely that the LGFA may make available longer dated borrowing beyond 2027

in the future. If there becomes an active swap market beyond 12 years

then it may be appropriate to revisit this delegation in the future.

5.7 Another

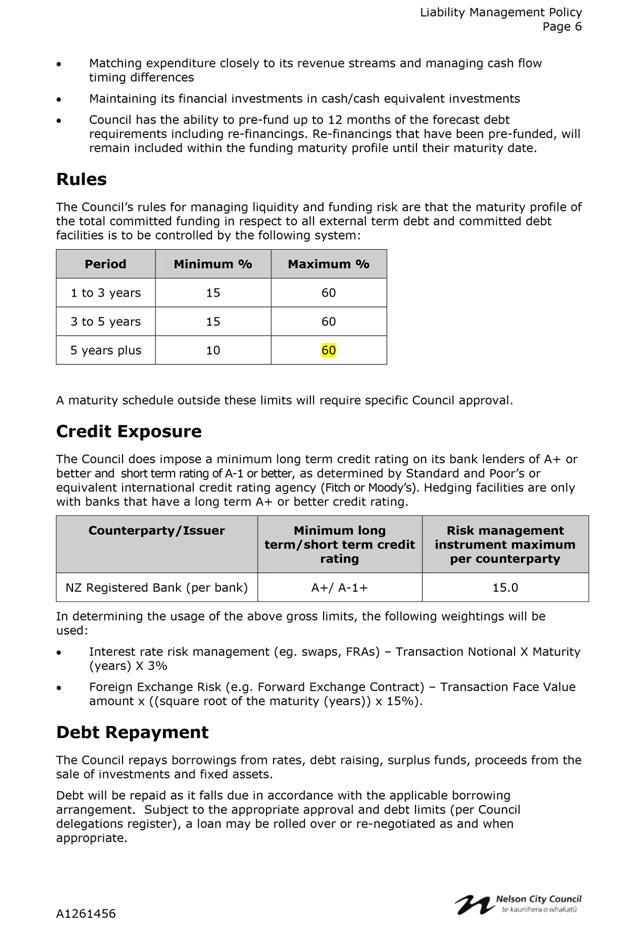

proposed amendment is that the funding risk management parameters are changed

to allow a higher percentage of external term debt and committed debt

facilities in the 5 year plus bucket. The percentage allowed is proposed

to be moved from 40% to 60%, meaning that the Council can borrow a higher

percentage of its debt for a longer term ie more than 5 years.

5.8 With increasing debt being signalled in the Long Term

Plan 2015-25, the increase in 5 year plus debt percentage allows Council to

alleviate possible congestion/constraints when raising new debt. Given the

economic life of the assets being funded, it makes sense to allow the increase

in percentage in longer term debt, in conjunction with the evolution in the

LGFA.

5.9 There

has been small tidy ups made to the Emissions Trading Scheme section which take

out any reference to Kyoto Protocol units which were no longer able to be used

post 1 June 2015.

6. Options

6.1 Adopt

the amended Liability Management Policy. The changes have been

recommended by our Treasury Advisors, PWC.

6.2 Not

adopt the amended Liability Management Policy. This is not recommended.

7. Alignment

with relevant Council policy

7.1 The

Liability Management and Investment Policies are required by section 102 of the

Local Government Act. Nothing in the proposed Liability Management Policy

is inconsistent with any other previous Council decision or Council Policy.

8. Assessment

of Significance against the Council’s Significance and Engagement Policy

8.1 This

decision is not a significant decision in terms of the Council’s

Significance and Engagement Policy.

9. Consultation

9.1 No

specific consultation has been undertaken in preparation of this report.

10. Inclusion

of Māori in the decision making process

10.1 No

specific consultation with Maori has taken place in preparation of this report.

Nikki

Harrison

Group

Manager Corporate Services

Attachments

Attachment 1: A1450461 -

Draft Liability Management Policy

Audit, Risk and Finance

Subcommittee

Audit, Risk and Finance

Subcommittee