AGENDA

Ordinary meeting of the

Audit, Risk and Finance Subcommittee

Wednesday 14 October 2015

Commencing at the conclusion of the Commercial

Subcommittee

Ruma Mārama

Level 2A, Civic House

110 Trafalgar Street, Nelson

Membership: Mr John Peters (Chairperson), Her Worship the

Mayor Rachel Reese, Councillors Ian Barker and Brian McGurk, and Mr John Murray

Guidelines for councillors

attending the meeting, who are not members of the Committee, as set out in

Standing Orders:

·

All councillors, whether or not they are members of the

Committee, may attend Committee meetings (SO 2.12.2)

·

At the discretion of the Chair, councillors who are not Committee

members may speak, or ask questions about a matter.

·

Only Committee members may vote on any matter before the

Committee (SO 3.14.1)

It is good practice for both Committee members and

non-Committee members to declare any interests in items on the agenda.

They should withdraw from the table for discussion and voting on any of these

items.

Audit, Risk and Finance

Subcommittee

Audit, Risk and Finance

Subcommittee

14

October 2015

Page

No.

1. Apologies

Nil

2. Confirmation

of Order of Business

3. Interests

3.1 Updates

to the Interests Register

3.2 Identify

any conflicts of interest in the agenda

4. Public

Forum

5. Confirmation

of Minutes

5.1 10

September 2015 5 - 10

Document number M1459

Recommendation

THAT

the minutes of the meeting of the Audit, Risk and Finance Subcommittee, held on

10 September 2015, be confirmed as a true and correct record.

6. Status

Report - Status Report - 14 October 2015 11 - 12

Document number R4982

Recommendation

THAT the Status Report Audit, Risk

and Finance Subcommittee 14 October 2015 (R4982) and its attachment (A1324298) be received.

7. Chairperson's

Report

8. Draft

Asset Disposal Policy 13 - 18

Document number R4823

Recommendation

THAT the report Draft Asset

Disposal Policy (R4823) and its

attachment (A1412442) be

received.

Recommendation to Governance

Committee and Council

THAT

the Draft Asset Disposal Policy (A1412442) be approved;

AND

THAT the Delegations Manual is updated to reflect the

delegations in the Asset Disposal Policy.

9. Draft

Risk Management Framework 19 - 34

Document number R4887

Recommendation

THAT the report Draft Risk

Management Framework (R4887) and

its attachment (A1431591) be received.

Recommendation to Governance

Committee and Council

THAT

the Draft Risk Management Framework (A1431591) be approved.

10. Corporate

Report to 31 August 2015 35 - 51

Document number R4939

Recommendation

THAT

the report Corporate Report to 31 August 2015 (R4939) and its attachments (A1422506, A1432835, A793514, and

A1436178) be received and the variations noted.

Recommendation to Governance

Committee and Council

THAT $350,000 for the

upgrade of the Civic House verandah be deferred until 2017/18;

AND THAT $200,000 for the

upgrade of the Hunter Furniture roof be deferred until 2016/17.

Minutes of a meeting of

the Audit, Risk and Finance Subcommittee

Held in Ruma Mārama,

Level 2A, Civic House, 110 Trafalgar Street, Nelson

On Thursday 10 September

2015, commencing at 1.03pm

Present: Mr

J Murray (Chairperson), Her Worship the Mayor R Reese, Councillors I Barker,

and B McGurk

In Attendance: Councillors

P Matheson, G Noonan and T Skinner, Chief Executive (C Hadley), Group Manager

Infrastructure (A Louverdis), Group Manager Corporate Services (N Harrison),

Senior Accountant (T Hughes), Senior Strategic Adviser (N McDonald),

Administration Adviser (G Brown), and Audit New Zealand (B Kearney)

Apology: Mr

J Peters

1. Apologies

|

Resolved AUD/2015/033

THAT an apology be

received and accepted from Mr Peters.

Barker/Her Worship the Mayor Carried

|

2. Confirmation of Order of Business

The Chairperson advised that

item 8, Draft Annual Report 30 June 2015, would be considered first on the

agenda.

3. Interests

There were no updates to the

Interests Register, and no interests with items on the agenda were declared.

4. Draft Annual Report 30 June 2015

Document number R4210, agenda

pages 15 - 83 refer.

Group Manager Corporate Services,

Nikki Harrison, presented the report.

In response to a question, the

Chief Executive, Clare Hadley clarified that the draft Annual Report was in two

sections, written text and financials as different officers compiled these

sections.

It was discussed that comments

needed to be requested from Councillors in relation to the draft Annual Report.

Mrs Hadley advised that she would advise all Councillors of today’s

discussion and ask for feedback while clarifying the document split.

It was highlighted that there

were some good stories to be told in relation to the draft Annual Report rates

and debt levels.

In response to a question, Ms

Harrison clarified that water was measured by consumption and not classified as

rates. Audit New Zealand, Auditor, Bede Kearney added that clearer

classification for water consumption would be published next year from a change

in local government regulations.

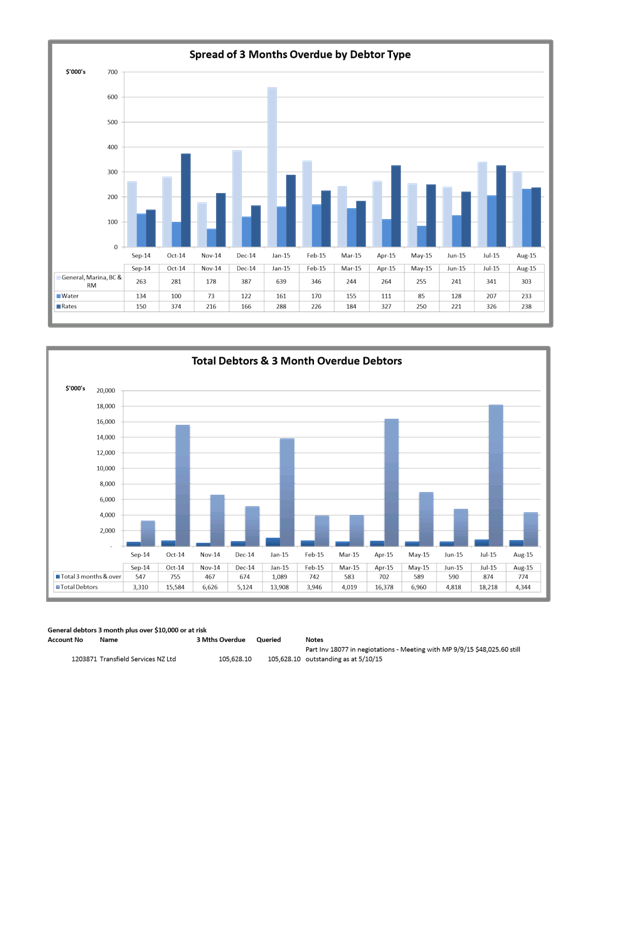

It was discussed that the status

of receivables for 2014 illustrated in attachment 1 included the Everyman and

Marina bad debts.

In response to a question, Ms

Hughes said that Port Nelson and Tasman Bays Heritage Trust Land were all

showing as zero on page 48 of the agenda as this illustrated only Council

results and not group results.

It was discussed that the wording

on page 50 in the Port Nelson section in relation to the ‘title to this

area of seabed’ should be reworded if possible.

There was a discussion regarding

Related party transactions on page 52 of the agenda in that it should include

external appointees, however it was advised that external appointees would be

included under key management personnel.

With regards to Working with

Maori in attachment 2, it was highlighted that there was no reference to

engagement with councillors.

In response to a question, Mrs

Hadley advised that documentation was still being prepared in relation to an

agreed process with iwi to tender for cultural impact assessments work for

infrastructure resource consents.

It was highlighted that there was

no commentary around inner city parking and it was questioned whether this

topic formed part of the Residents Survey.

In addition it was noted that

motor camps, the Trafalgar Centre, and Waahi Taakaro Golf Club needed

commentary under Recreation and Leisure.

It was noted that the New Zealand

Transport Agency R Funding in relation to Rocks Road would be worthwhile

mentioning also in the commentary.

It was suggested that it should

be highlighted that the shift in focus to improve footpaths was not only for

mobility scooters but for the elderly and sight impaired.

In response to a question, Ms

Hughes said that infrastructure revaluations were on a two yearly cycle. She

said last year was a full revaluation and this year was an off year. She added

the actual revaluation amounts for 2014 and 2015 in the Statement of

Comprehensive Revenue and Expense represented the increase in each respective

year.

Mr Kearney advised the Committee

that the audit was progressing well. He highlighted that there would be changes

to auditing standards next year but brought emphasis into these focus areas

this year.

In response to a question, Mr

Kearney said that it was good practice to adopt a business case approach.

|

Resolved AUD/2015/034

THAT the report Draft Annual

Report 30 June 2015 (R4210) and

its attachments (A1417003 and A1396738)

be received.

Barker/McGurk Carried

|

5. Public Forum

There was no public forum.

6. Confirmation of Minutes

6.1 30

July 2015

Document number M1385, agenda

pages 5 - 12 refer.

|

Resolved AUD/2015/035

THAT the minutes of

the meeting of the Audit, Risk and Finance Subcommittee, held on 30

July 2015, be confirmed as a true and correct record.

Barker/McGurk Carried

|

7. Status Report - Audit, Risk and

Finance Subcommittee - 10 September 2015

Document number R4799, agenda

pages 13 - 14 refer.

Group Manager Corporate Services,

Nikki Harrison, presented the report.

|

Resolved AUD/2015/036

THAT the Status Report Audit,

Risk and Finance Subcommittee 10 September 2015 (R4799) and its attachment (A1324298) be received.

Her Worship the Mayor/McGurk Carried

|

8. Chairperson's

Report

There was no Chairperson’s

Report.

9. Carry Forwards from 2014/15

Document number R4211, agenda

pages 84 - 88 refer.

Group Manager Corporate Services,

Nikki Harrison, presented the report.

In response to a question, Group

Manager Infrastructure, Alec Louverdis, advised that subject to no major

changes to the work programme he believed Nelson City Council was adequately

resourced for the capital programme of $55.3 million. It was noted that the

programme included large projects such as the Trafalgar Centre strengthening,

Rutherford Park, the Suter and Nelson School of Music developments.

Mrs Hadley highlighted that part

of the organisational restructure was to provide more support in the capital

projects area however, at times resource consents, New Zealand Transport Agency

approval, engagement with landowners and easements could hold projects up.

|

Resolved AUD/2015/037

THAT the report Carry Forwards

from 2014/15 (R4211) be

received.

Barker/McGurk Carried

|

|

Recommendation to Governance

Committee and Council AUD/2015/038

THAT

$4,233,000 of unspent capital budget from 2014/15 be carried forward for use

in 2015/16;

AND

THAT $403,000 of capital spent in 2014/15 be offset against

2015/16 budgets;

AND

THAT an amount of $107,000 operating budget be carried

forward for use in 2015/16.

McGurk/Barker Carried

|

10. Draft Internal Audit Charter

Document number R4777, agenda

pages 89 - 95 refer.

Group Manager Corporate Services,

Nikki Harrison, presented the report.

There was a discussion regarding

the work programme. Ms Harrison advised that a Standard Operating Procedures

Manual would be compiled and that the Audit, Risk and Finance Subcommittee

would review this document.

It was requested that the

following changes be made to the draft Internal Audit Charter:

·

Add the word ‘directly’ to section 5.1 in relation to

interaction with the Chair

·

Change the wording ‘if required’ to ‘as required’

in section 5.3

·

Add the words to the fifth bullet point in section 7.1 at the end

‘and integrated, and their contribution to council outcomes’

·

Add the words ‘and testing’ to the second and

subsequent bullet points in section 7.1 so it reads ‘Evaluating and

testing the reliability...’

·

Section 8.2, recommended changes to be reviewed by Group Manager

Corporate Services and Manager Organisational Assurance

·

Remove additional wording in section 10.2

There was a discussion regarding

a whistle blower mechanism. The Chief Executive, Clare Hadley advised the

Committee that Nelson City Council had a ‘Report it Now’ system to

report any unethical behaviour. She added that this function was the

responsibility of Human Resources.

It was suggested that contractors

should also be made aware of the ‘Report it Now’ system.

It was noted that the Fraud

Policy was included in the work programme for the Audit, Risk and Finance

Subcommittee.

There was a discussion regarding

expectations in relation to internal audit reporting and it was agreed that

progress against the work programme would be adequate showing high level

findings such as areas being worked on, findings and work going forward at each

meeting, as well as more structured reporting on a six monthly basis.

|

Resolved AUD/2015/039

THAT the report Draft Internal

Audit Charter (R4777) and its

attachment (A1395134) be

received.

Barker/McGurk Carried

|

|

Recommendation to Governance

Committee and Council AUD/2015/040

THAT

the Draft Internal Audit Charter (A1395134) as amended as per the Audit, Risk

and Finance Subcommittee minutes 10 September 2015 be approved.

Her Worship the Mayor/McGurk Carried

|

There being no further business the

meeting ended at 2.44pm.

Confirmed as a correct record of proceedings:

Chairperson

Date

Chairperson

Date

|

|

Audit, Risk and Finance Subcommittee

14 October 2015

|

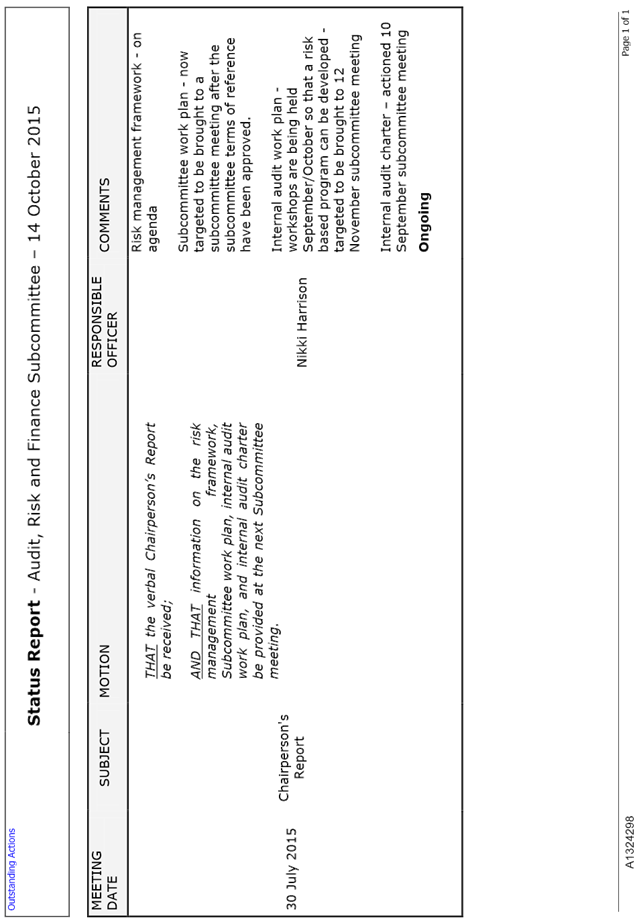

REPORT R4982

Status

Report - Status Report - 14 October 2015

1. Purpose

of Report

1.1 To

provide an update on the status of actions requested and pending.

2. Recommendation

|

THAT the Status Report Audit,

Risk and Finance Subcommittee 14 October 2015 (R4982) and its attachment (A1324298) be received.

|

Gayle

Brown

Administration

Adviser

Attachments

Attachment 1: Status

Report - Audit, Risk and Finance Subcommittee - October 2015

|

|

Audit, Risk and Finance Subcommittee

14 October 2015

|

REPORT R4823

Draft

Asset Disposal Policy

1. Purpose

of Report

1.1 To approve the Draft Asset Disposal Policy.

2. Delegations

2.1 The

Audit, Risk and Finance Subcommittee has responsibility for risk management and

internal control.

3. Recommendation

|

THAT the report Draft Asset

Disposal Policy (R4823) and its

attachment (A1412442) be

received.

|

Recommendation

to Governance Committee and Council

|

THAT the

Draft Asset Disposal Policy (A1412442) be approved;

AND THAT

the Delegations Manual is updated to reflect the delegations in the Asset

Disposal Policy.

|

4. Discussion

4.1 It

is best practice to have an Asset Disposal Policy to provide clear guidance to

staff on how and when to dispose of assets. Although Council has robust

internal processes around approving asset disposals it does not have a formal

policy.

4.2 In

documenting the policy, it is noted that there is not currently a formal

delegation in the Delegations Manual relating to asset disposals which needs to

be addressed.

5. Options

5.1 Accept

the recommendation – approve the Draft Asset Disposal Policy.

5.2 Reject

the recommendation – not approve the Draft Asset Disposal Policy.

6. Alignment

with relevant Council policy

6.1 This

decision is not inconsistent with any other previous Council decision.

7. Assessment

of Significance against the Council’s Significance and Engagement Policy

7.1 This

is not a significant decision under the Council’s Significance and

Engagement Policy.

8. Consultation

8.1 No

consultation has been undertaken in preparing this policy.

9. Inclusion

of Māori in the decision making process

9.1 No

consultation with Maori has been undertaken in preparing this policy.

Nikki

Harrison

Group

Manager Corporate Services

Attachments

Attachment 1: A1412442 -

Draft Asset Disposal Policy

Draft Asset Disposal Policy

Effective Date: September

2015

Review Date: September 2018

Contact: Senior Accountant, Finance

1. Introduction

1.1. Entities that dispose of capital

assets must ensure they have clearly set out processes to ensure that the

disposal of unwanted resources takes place in a transparent and accountable

manner.

1.2. Disposals should be carefully planned

and conducted so that they maximise value for money for the Council and

minimise opportunities for exploitation by individual employees, private

persons or organisations.

2. Purpose

3. The purpose of this policy is to set

out the principles and processes for disposal of Council assets and to provide

clear guidance to staff on how and when to dispose of Council assets.

4. Definitions

4.1. Assets – include, but may not

be limited to, financial assets (debtors, loans), real property, plant and

equipment, computer hardware, furniture and fittings, collections, vehicles,

intellectual property, data and information. Land disposals must be approved by

Council. Library books are excluded as they are covered by the Libraries

Content management guidelines which covers book disposal.

4.2. Disposal – includes the sale,

scrapping, write off, barter, trading or any other means of ceasing beneficial

ownership or custody of assets.

4.3. Write off – specially refers to

the removal of the asset from the Council asset register, or Statement of

Financial Position, at nil value.

5. Principles

5.1. Assets

will be disposed of in the manner that ensures Council achieves the best net

value for the assets.

5.2. Disposals

will be conducted in an efficient, effective and transparent manner.

5.3. All

asset disposals will be appropriately authorised and adequately documented.

5.4. Disposal

processes will ensure that assets that are sold or scrapped are removed appropriately

from the asset and financial records and insurance register.

5.5. Tight

controls will be in place to ensure that Council staff and elected members are

not advantaged over members of the public.

5.6. All

assets to be disposed of are:

5.6.1. assessed

for health and safety impacts prior to sale which are included in the sale

documentation and;

5.6.2. a

disclaimer is stated that any buyer shall be responsible for ensuring the

health and safety risks of any future use of the asset and ensuring it meets

any legal and other requirements for its intended use.

5.7. All

asset disposals must be in accordance with any relevant provisions of the Local

Government Act 2002 (Section 133, 138 and 140), Consumer Guarantees Act 1993

and Fair Trading Act 1988.

6. Policy

content

6.1. The

Council expects the disposal of assets to achieve the best net value for money

possible.

6.2. Proper

authorisation, in accordance with the Officers Delegation Manual/this policy

will be obtained before any asset is disposed of.

6.3. All

disposals of assets will be through an open, fair and transparent

process.

6.4. Every

asset disposal will be fully documented, clearly identifying the asset, who

authorised its disposal, the sale price, whom it was disposed to and recorded

in a timely and accurate manner in the fixed asset records.

6.5. Proceeds

from the sale of assets must be correctly and expediently recorded in the

financial accounting systems.

6.6. Independent

appraisals of value will be obtained for higher value assets prior to their

disposal as set out in the procedure.

7. Authorisation

7.1. The

initial decision to dispose of an asset must be made by a third tier manager

(Business Unit Manager) responsible for the asset. This should occur when

the manager becomes aware that the asset is redundant, obsolete, replaced,

damaged, stolen or surplus to requirements. Written authorisation to

dispose of the asset must be obtained from a Group Manager or the Chief

Executive (depending on the value) prior to commencing the process.

7.2. Any

sales above $50,000 must be authorised by Council. All land disposals must be

approved by Council.

8. Methods

of disposal

8.1. To

establish a perceived value, find examples of like items being sold in similar

circumstances by other sellers.

8.2. The

valuation for the authorisation and method of disposal is based on the total

perceived value of the items being disposed of on one day to a seller ie if

selling 300 $30 phones, the perceived value would be $9,000 and would required

CE signoff.

8.3. The

below table sets out the methods of disposal to be used:

8.4.

|

Estimated sale value of asset

|

Method

|

Approval

|

|

Under $500

|

Internal tender available to all staff or

Trade-in or

Gift to non-profit organisation

|

GM Corporate Services or

GM Infrastructure

|

|

$500 - $5,000

|

Public auction or

Trade-in or

Sell to dealer (3 quotes)

|

GM Corporate Services or

GM Infrastructure

|

|

$5,000-$50,000

|

Public auction or

Trade-in or

Sell to dealer (3 quotes)

|

Chief Executive

|

|

Over $50,000

|

Public auction or

Trade-in

|

Council

|

8.5. The

reserve prices for auctioned items should not be less than the book value of

the asset unless there is a tangible reason, such as market belief that the

asset is obsolete or the condition of the asset is such that it is reduced in

value. With vehicles, if selling by auction, set the reserve price by

reviewing similar vehicles on the auction site.

8.6. Technology

items that hold data will not be on sold. The hard drive of the device

will be destroyed and then the item will be disposed of.

9. Related

policies and procedures

9.1. Officers

Delegations Manual

|

|

Audit, Risk and Finance Subcommittee

14 October 2015

|

REPORT R4887

Draft

Risk Management Framework

1. Purpose

of Report

1.1 To approve the Draft Risk Management

Framework.

2. Delegations

2.1 The

Audit, Risk and Finance Subcommittee has responsibility for risk management and

internal control.

3. Recommendation

|

THAT the report Draft Risk

Management Framework (R4887)

and its attachment (A1431591) be

received.

|

Recommendation

to Governance Committee and Council

|

THAT the

Draft Risk Management Framework (A1431591) be approved.

|

4. Background

4.1 The

Council risk register was last reported to the Audit, Risk and Finance

subcommittee at the 18 June 2015 meeting. At that meeting a high level

plan for the development of a risk management framework was put forward with

the intent to present the Draft Risk Management Framework to this Subcommittee

by 30 September 2015.

5. Discussion

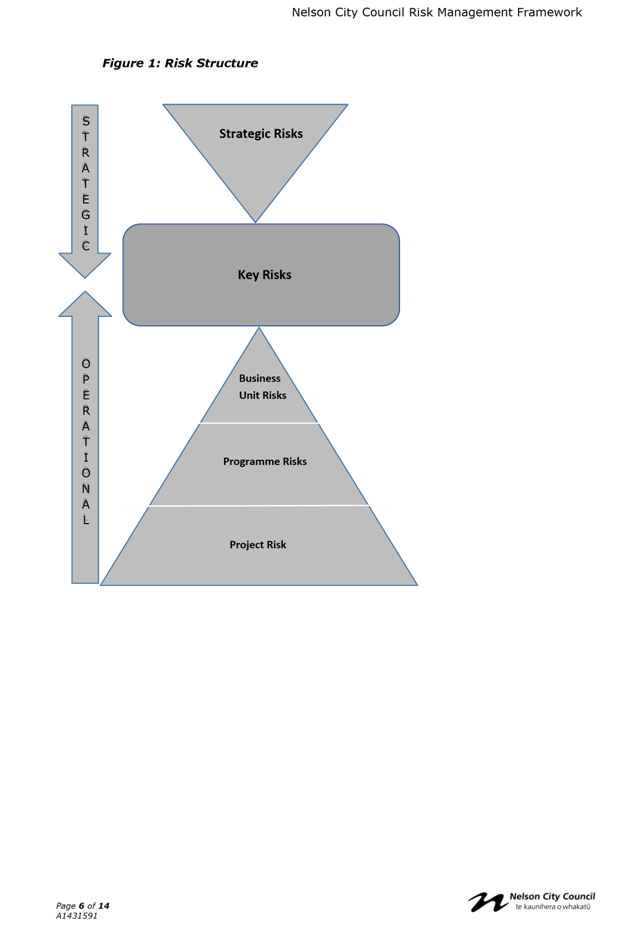

5.1 The

Draft Risk Management Framework confirms the commitment of the Council to good

corporate governance through risk management. It defines the broad

accountabilities and structures the Council will maintain in order to manage

risk. The intent of the Framework is to ensure that sound risk management

practices are an integral part of all Council processes.

6. Options

6.1 Accept

the recommendation – approve the Draft Risk Management Framework.

6.2 Reject

the recommendation – not approve the Draft Risk Management Framework.

However not having a Risk Management Framework in place would mean that

ensuring sound risk management practices were in place would be difficult.

7. Alignment

with relevant Council policy

7.1 This

decision is not inconsistent with any other previous Council decision.

8. Assessment

of Significance against the Council’s Significance and Engagement Policy

8.1 This

is not a significant decision under the Council’s Significance and

Engagement Policy.

9. Consultation

9.1 No

consultation has been undertaken in preparing this policy.

10. Inclusion

of Māori in the decision making process

10.1 No

consultation with Maori has been undertaken in preparing this policy.

Nikki

Harrison

Group

Manager Corporate Services

Attachments

Attachment 1: A1431591 -

Draft Risk Management Framework

|

|

Audit, Risk and Finance Subcommittee

14 October 2015

|

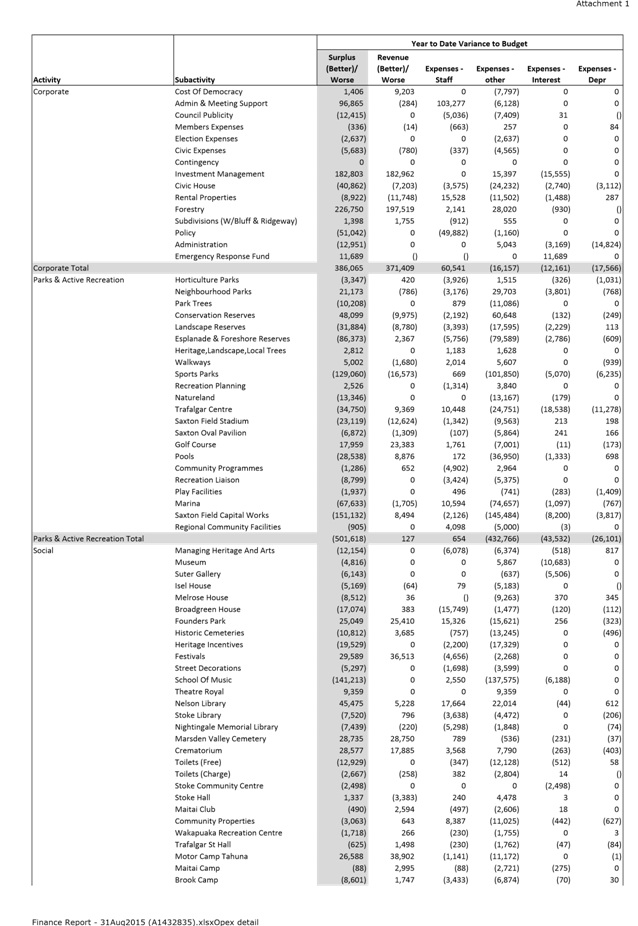

REPORT R4939

Corporate Report to 31 August 2015

1. Purpose of Report

1.1 To inform the members of the Audit, Risk and Finance Subcommittee on

the financial results of activities for the 2 months ending 31 August 2015

compared to the approved operating budget, and to highlight and explain any

material variations.

2. Delegations

2.1 The Audit, Risk and Finance Subcommittee has oversight of the

management of financial risk and makes recommendations to the Governance

Committee and to Council. Do not delete Do not

delete this line

3. Recommendation

|

THAT

the report Corporate Report to 31 August 2015 (R4939) and its attachments (A1422506, A1432835, A793514, and

A1436178) be received and the variations noted.

|

Recommendation to Governance Committee and Council

|

THAT $350,000 for the upgrade of the Civic House verandah be deferred

until 2017/18;

AND

THAT $200,000 for the upgrade of

the Hunter Furniture roof be deferred until 2016/17.

|

4. Background

4.1 The report focuses on the 2 month performance

compared with the year to date approved operating budget. Budgets for operating

income and expenditure are phased evenly through the year, whereas capital

expenditure budgets are phased to occur mainly in the second half of the year.

4.2 Some definitions of terms used within this report:

· Approved operating budget – Annual plan plus carry forwards

plus any other additions or changes approved by Council;

· Operating income – all income other than rates including

metered water, grants, fees, rentals, and recoveries;

· Rates – includes the general rate, wastewater, stormwater and

flood protection rates, and targeted rates for Solar Saver;

· Staff costs – salaries plus overheads such as training, super,

professional fees and office accommodation expenses;

· Depreciation – includes all depreciation, and any losses on

asset disposal/retirement;

· Interest – includes debt interest, bank fees, interest rate

swap margins, treasury and rating agency fees.

5. Discussion

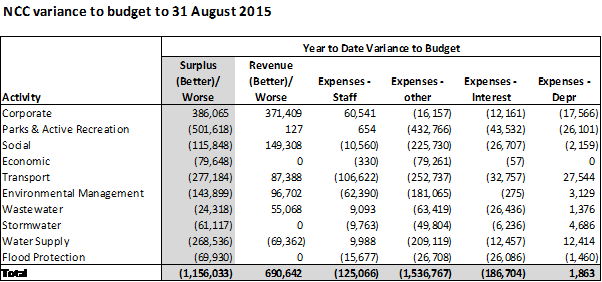

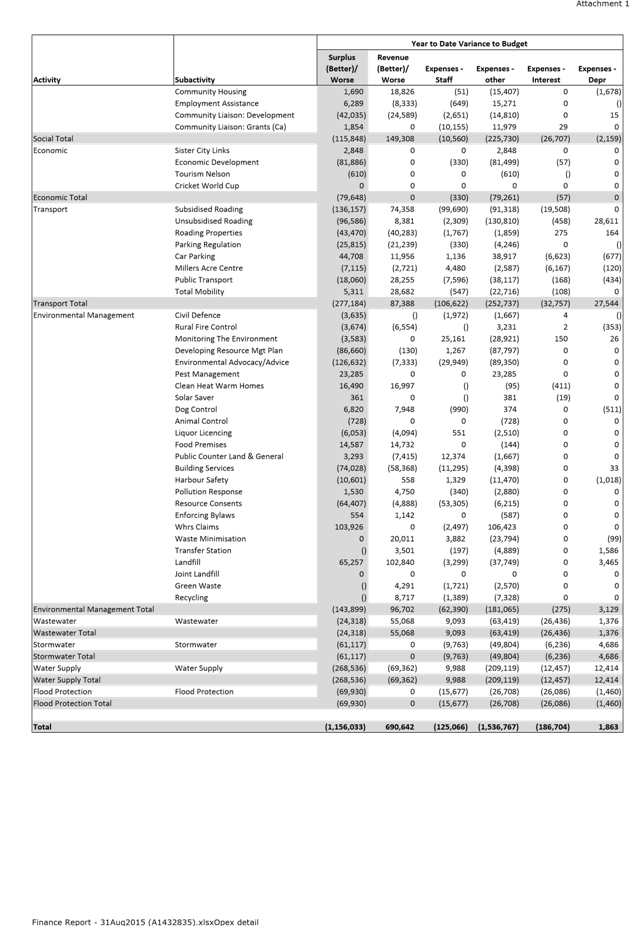

5.1 The report focuses on performance to date compared with the year to

date approved operating budget. More detailed financials by sub-activity are in

Attachment 2.

5.2 For the 2 months ending 31 August 2015, the activity surplus/deficits

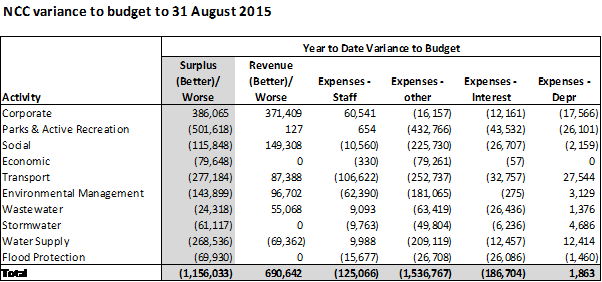

are $1.2 million favourable to budget.

5.3 Revenue and expenditure variances are discussed by activity. At this

stage of the year individual variances tend to be immaterial and/or a mismatch

in timing between the budget phasing and actual expenditure.

5.4 Staff expenses are $125,000 in total better than budget. Variances in

activities illustrate where staff time has actually been spent against where it

was expected to be spent at the time of setting the 2015/16 Annual Plan.

5.5

Corporate

5.6 The Corporate activity is $386,000 worse than budget.

5.6.1 Revenue – $371,000 less than budgeted.

Internal interest income is $183,000 less than budgeted as 2014/15 capital

expenditure was less than projected and interest rates remain favourable to

those anticipated. Forestry income is $198,000 less than budgeted due to the

timing of the Brook forest harvest (income expected to be reported in the third

or fourth quarter).

Parks and Active Recreation

5.7 The Parks and Active Recreation activity is $502,000 better than

budget due to:

5.7.1 Expenses – other - $433,000 better

than budget. Water by meter has not yet been charged to activities

($67,000 - timing), grants for capital projects at Saxton’s Field have

not yet been made to Tasman District Council ($147,000 - timing), and

maintenance expenditure is behind budget by $210,000 including $64,000 for the

Marina dredging which is due to commence in November. Some maintenance

expenditure in this activity is very seasonable, and a large number of purchase

orders have been raised.

5.7.2 Interest and depreciation together are

$70,000 less than budget due to 2014/15 capital expenditure being less than

projected.

Social

5.8 The Social activity is $116,000 better than budget due to:

5.8.1 Revenue - $149,000 less than budget due to

the timing of income for festivals, Founders, and the Tahuna Beach Motor Camp.

5.8.2 Expenses – other - $226,000 better

than budget. Expenditure for the earthquake strengthening and refurbishment of

the Nelson School of Music is behind budget by $138,000 (timing). Maintenance

expenditure is $70,000 behind budget although again there are a large number of

open purchase orders awaiting invoices.

Economic

5.9 The Economic activity is $80,000 better than budget due to:

5.9.1 Expenses – other - $80,000 better than

budget. Grants for Light Nelson and the Events Contestable Fund have not yet

been accessed (timing), and expenditure budgeted for special economic projects

and the investigation of a business incubator has not occurred to date

(timing).

Transport

5.10 The

Transport activity is $277,000 better than budget due to:

5.10.1 Revenue - $87,000 less than budget as the timing of

income from NZTA reflects the timing of expenditure.

5.10.2 Expenses – other - $253,000 better than budget,

mainly in subsidised and unsubsidised roading. The most significant underspends

in that activity are:

· Base maintenance ($188,000) including particularly pre-seal repairs,

road and footpath maintenance and subsequent road marking. This is seasonal

activity and scheduled for October/November.

· $33,000 underspent year to date in recovery works from the 2011

emergency event relating to Days Track. This work has been carried forward from

2014/15. A report on this project will be coming to a future Works and

Infrastructure committee meeting.

· Little has been spent year to date on studies and strategies

(timing) relating to the Southern Arterial Corridor Management Plan (this has

been delayed until the findings of the NZTA Southern Arterial Investigation

– Annesbrook Drive roundabout to QEII Drive roundabout are known), Stoke

Foothills Traffic Study, and Stoke CBD Study (purchase order raised).

Environmental

Management

5.11 This

activity includes Civil Defence and Rural Fire activities, Consents and

Compliance, Environmental Programmes, and Solid Waste activities. The

Environmental Management activity is $144,000 better than budget due to:

5.11.1 Revenue - $97,000 less than budget. Landfill levies are

$89,000 (20%) less than year to date budget. Volumes to landfill appear to be

declining in both NCC and TDC, contrary to both national trends and economic

growth. Underlying factors are speculative, but may include the success of

waste minimisation initiatives in the region over many years.

5.11.2 Expenses – staff - $62,000 better than budget,

mainly in Resource Consents and Environmental Programmes who are carrying

vacancies.

5.11.3 Expenses – other - $181,000 better than budget.

Expenditure relating to the Nelson Plan and the Air Plan is currently $87,000

behind budget although significant expenditure is committed through purchase

orders. Environmental advocacy and advice (mainly Nelson Nature) is $89,000

behind budget. A monitoring programme has now been agreed and expenditure has

been committed.

Wastewater

5.12 The

Wastewater activity is $24,000 better than budget due to:

5.12.1 Expenses – other - $63,000 less than budget. Maintenance

expenditure is $41,000 behind budget, and expenditure has yet to be incurred on

the studies relating to natural hazards risk assessment and network capacity

confirmation for growth areas (timing).

Stormwater

5.13 The

Stormwater activity is $61,000 better than budget due to:

5.13.1 Expenses – other - $50,000 better than budget.

There has been no expenditure year to date against budgets for studies and

strategies including natural hazards risk assessment, network capacity

confirmation for growth areas, and code of practise for open streams (timing).

Water

5.14 The

Water activity is $269,000 better than budget due to:

5.14.1 Expenses – other - $209,000 better than budget

relates to $161,000 maintenance expenditure (including $60,000 reactive) unspent

although purchase orders are in place for much of that amount. There has been

no expenditure year to date (timing) against budgets for studies and strategies

including natural hazards risk assessment, network capacity confirmation for

growth areas, water loss reduction strategy, and water safety plan.

Flood

Protection

5.15 The

Flood Protection activity is $70,000 better than budget.

5.15.1 Expenses – all expenditure classes are less than

budget by individually immaterial amounts (timing).

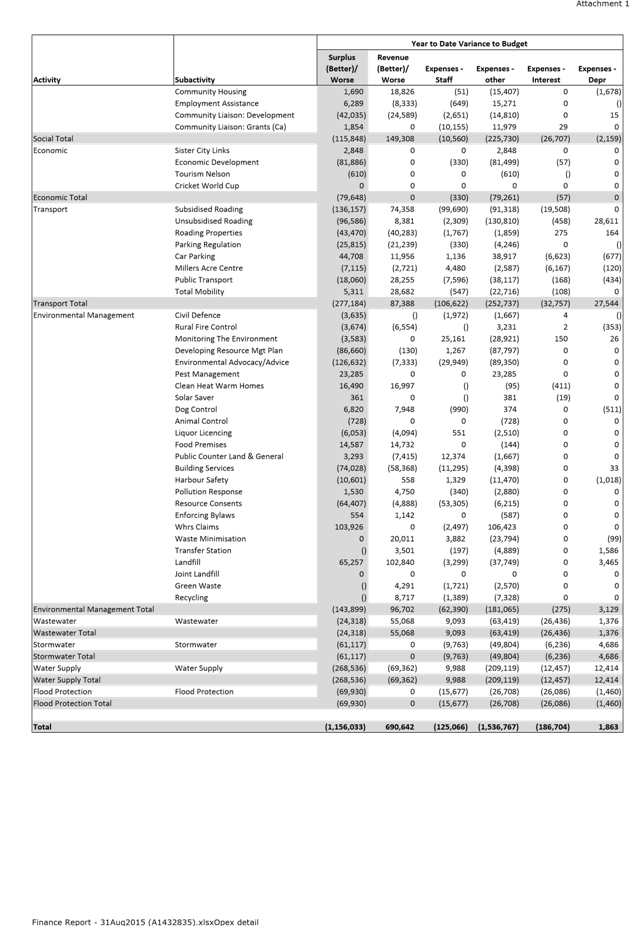

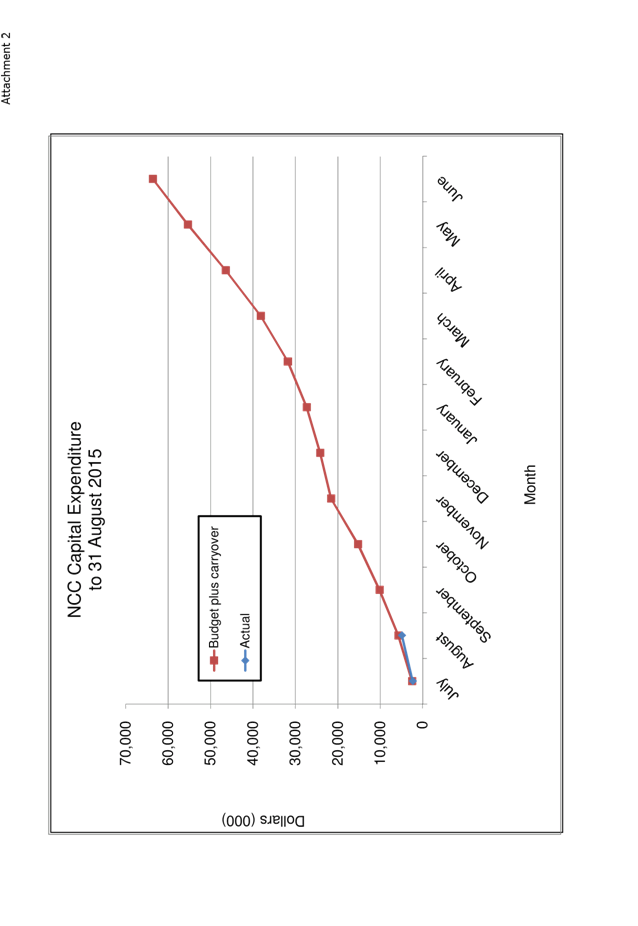

Capital

Expenditure

5.16 Capital

expenditure to 31 August 2015 was $4.9 million, $813,000 (14%) below budget.

Details are included in Attachments 2 to 5.

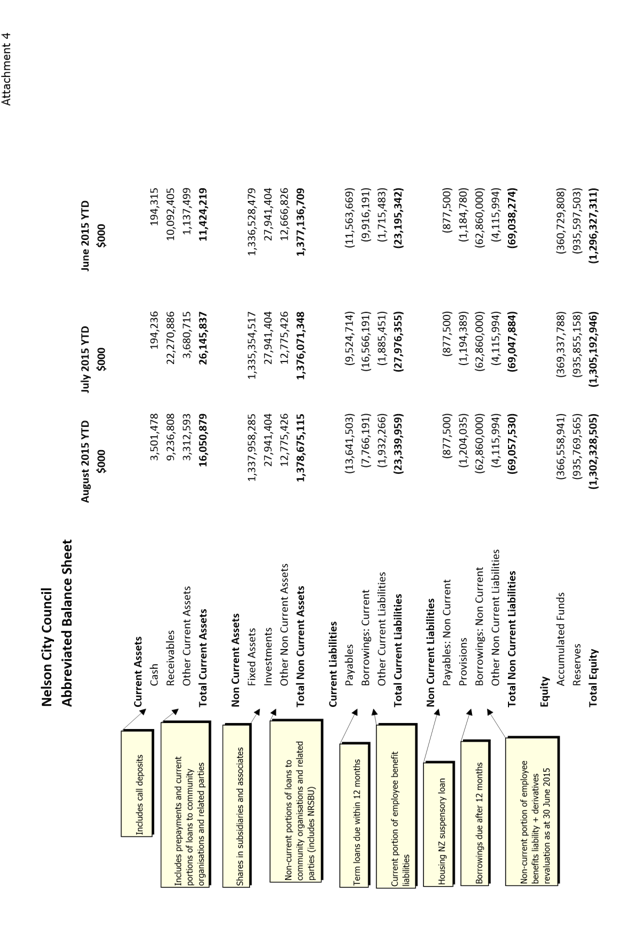

Balance

Sheet

5.17 Payment

of the first quarter rates in August generated a cash surplus which was held on

call deposit until creditors were paid in September.

5.17.1 The first quarter rates were invoiced in July and paid

in August, generating the large movements in debtors in those months.

5.17.2 Payables include income in advance. $3.5 million was

received in August from ratepayers who prefer to pay their annual rates in

advance rather than quarter by quarter. This income will be released over the

course of the year.

5.17.3 Call borrowings reduced in August in line with the

payment of rates.

5.17.4 Rates income for the quarter is recognised in its

entirety when it is invoiced, in this case in July. This is reflected as a

large increase in accumulated funds in that month. Over the following 2 months,

evidenced in August, accumulated funds decrease as expenditure is incurred.

Essentially accumulated funds reflects the timing differences between rates

income and organisational expenditure.

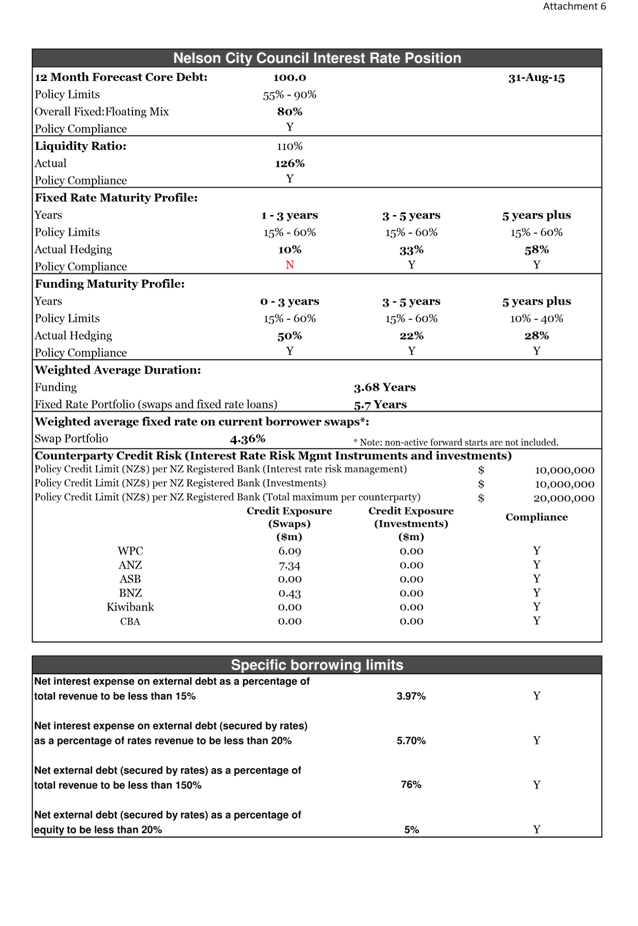

Interest Rate Position

5.17.5 The fixed maturity profile in the 1-3 years bucket is

outside of the limits set by policy. This relates to interest rate swaps and

the distribution of their start dates and termination dates. The policy makes

some allowance for temporary timing issues so long as it comes back inside the

limits within 90 days. In this case it is back inside the limits within 30

days.

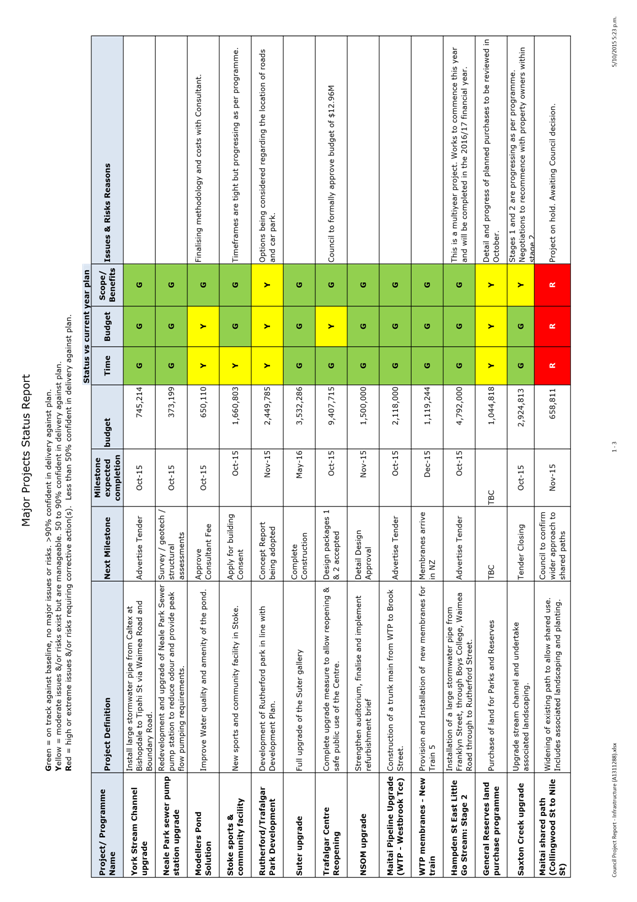

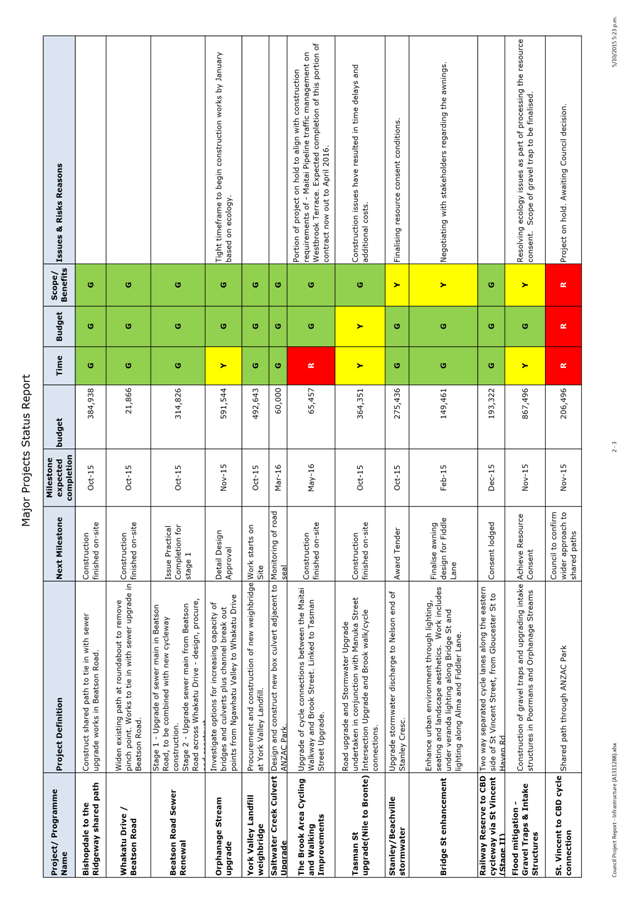

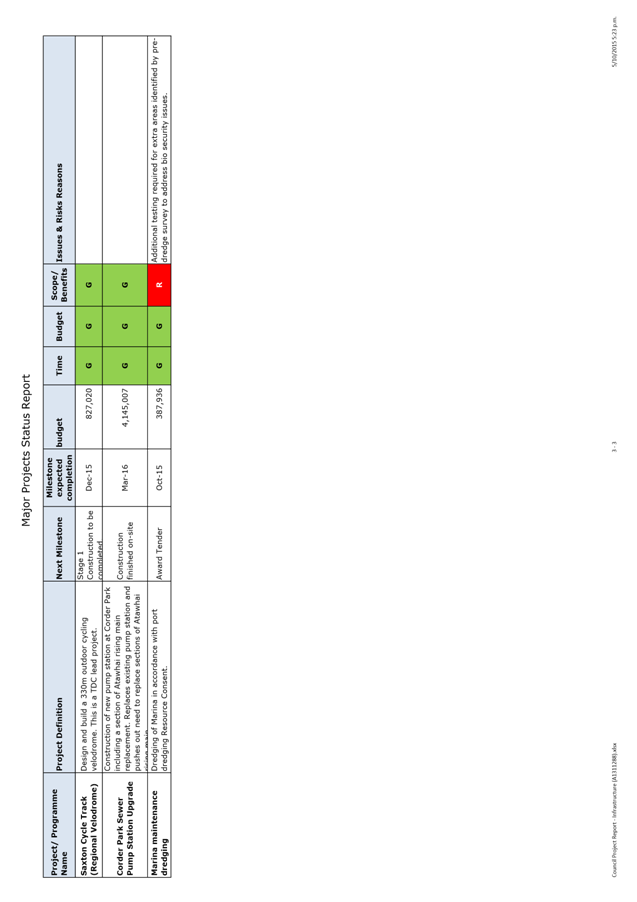

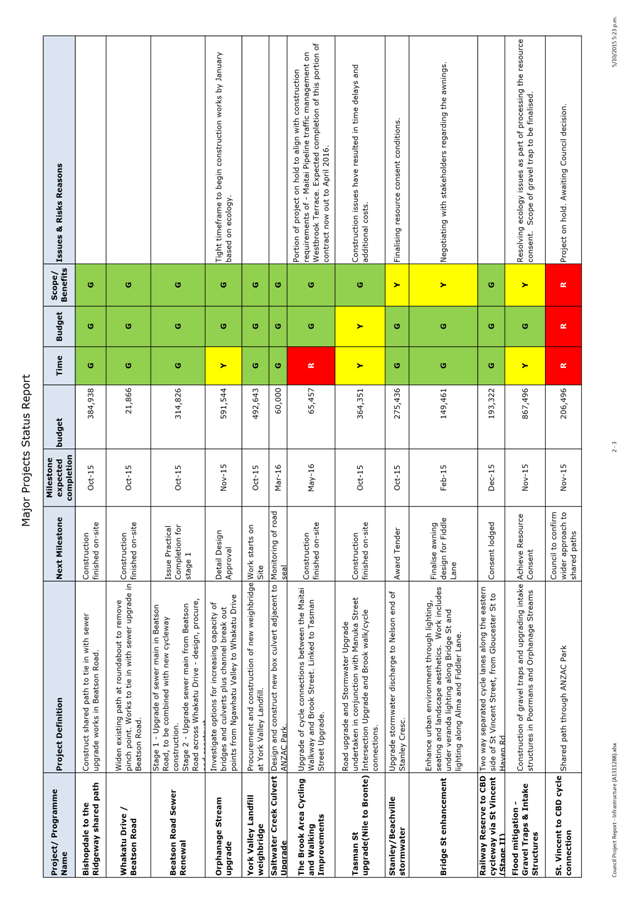

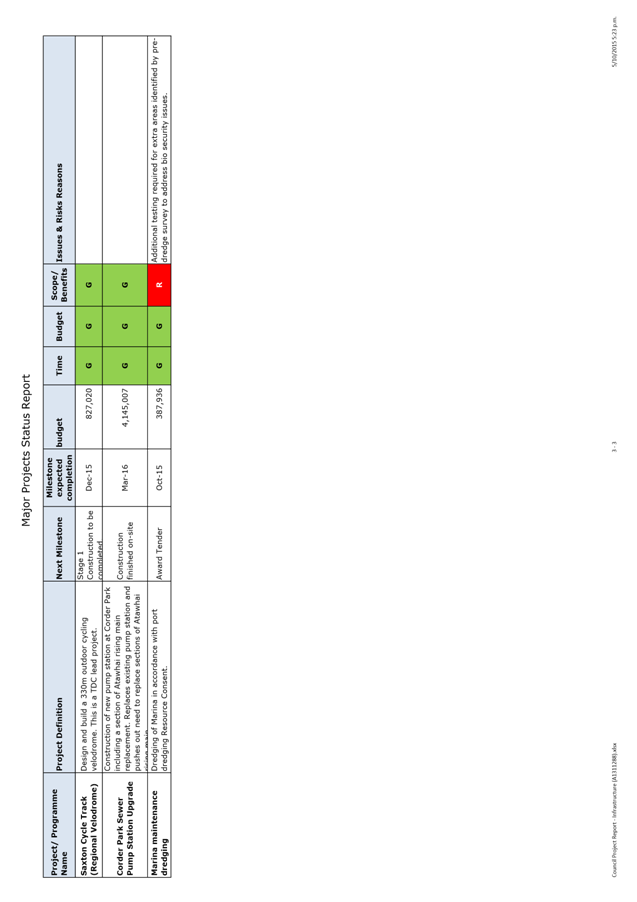

6. Projects Update

6.1 Please see Attachments 4 and 5 for progress reports on Council’s

major projects.

6.2 On 10 September the Works and Infrastructure

Committee received the outline business case for the project to increase the

number of toilets at Millers Acre, and resolved to defer the project budget of

$32,000 for design to 2016-17, and the construction budget of $359,135 to

2017-18. Work this year will be to monitor utilisation of the facility,

and assess the requirement for the project in light of the monitoring results.

6.3 Following an asset condition assessment, the planned

project to upgrade the Civic House Verandah and budget of $350,000 has been

deferred to 2017-18.

6.4 Following an asset condition assessment, the planned

project to upgrade the Hunter Furniture Roof and budget of $200,000 has been

deferred to 2016-17.

7. Alignment with relevant Council policy

7.1 The finance report is

prepared comparing current year performance against the year to date approved

operating budget for 2015/16.

8. Assessment of Significance against the

Council’s Significance and Engagement Policy

8.1 There are no significant

decisions.

9. Consultation

9.1 No consultation is required.

10. Inclusion of Māori in the decision making

process

10.1 No consultation is required.

Tracey Hughes

Senior Accountant

Attachments

Attachment 1: NCC

Detail Performance (A1432835)

Attachment 2: Capital Expenditure Graph (A1432835)

Attachment 3: Capital Expenditure by Activity

(A1432835)

Attachment 4: Balance Sheet (A1432835)

Attachment 5: Major Projects Status Report

(A1436178)

Attachment 6: Interest Rate Position Report

(A1422506)

Attachment 7: Debtors Report (A793514)

Audit, Risk and Finance

Subcommittee

Audit, Risk and Finance

Subcommittee