AGENDA

Ordinary meeting of the

Audit, Risk and Finance Subcommittee

Thursday 30 July 2015

Commencing at 1.00pm

Ruma Mārama

Level 2A, Civic House

110 Trafalgar Street, Nelson

Membership: Mr John Peters (Chairperson), Her Worship the

Mayor Rachel Reese, Councillors Ian Barker and Brian McGurk, and Mr John Murray

Guidelines for councillors

attending the meeting, who are not members of the Committee, as set out in

Standing Orders:

·

All councillors, whether or not they are members of the

Committee, may attend Committee meetings (SO 2.12.2)

·

At the discretion of the Chair, councillors who are not Committee

members may speak, or ask questions about a matter.

·

Only Committee members may vote on any matter before the

Committee (SO 3.14.1)

It is good practice for both Committee members and

non-Committee members to declare any interests in items on the agenda.

They should withdraw from the table for discussion and voting on any of these

items.

Audit, Risk and Finance

Subcommittee

Audit, Risk and Finance

Subcommittee

30

July 2015

Page

No.

1. Apologies

1.1 Apologies

have been received from Her Worship the Mayor, Rachel Reese and Mr John Peters

2. Confirmation

of Order of Business

3. Interests

3.1 Updates

to the Interests Register

3.2 Identify

any conflicts of interest in the agenda

4. Public

Forum

5. Confirmation

of Minutes

5.1 18

June 2015 6 - 12

Document number M1286

Recommendation

THAT

the minutes of the meeting of the Audit, Risk and Finance Subcommittee, held

on 18 June 2015, be confirmed as a true and correct record.

6. Status

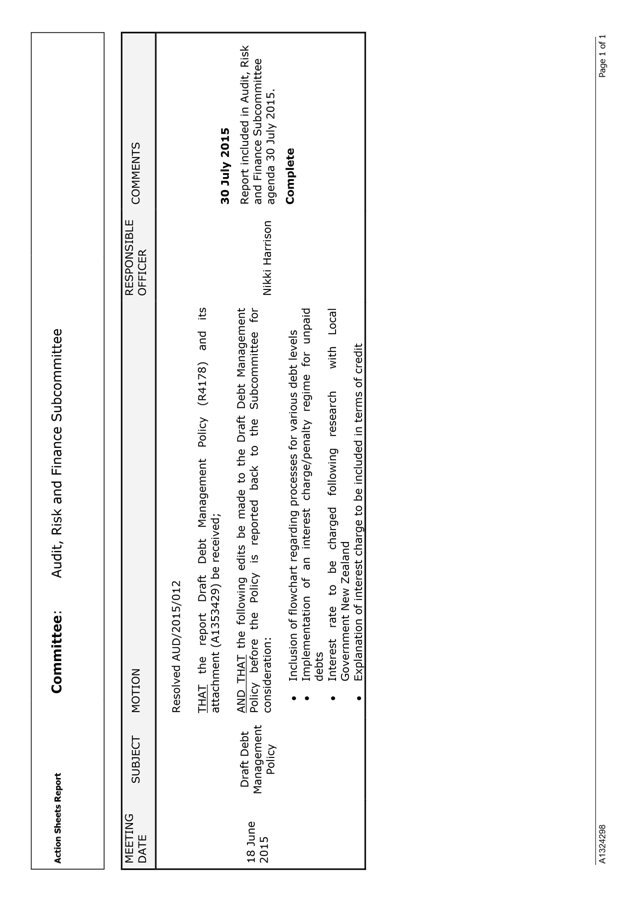

Report - Audit Risk and Finance Subcommittee - 30 July 2015 13 - 14

Document number R4596

Recommendation

THAT the Status Report Audit, Risk

and Finance Subcommittee 30 July 2015 (R4596)

and its attachment (A1324298) be

received.

7. Chairperson's

Report

8. Update

on charging interest on general debtors 15 - 22

Document number R4579

Recommendation

THAT the report Update on charging

interest on general debtors (R4579)

and its attachment (A1353429) be

received;

AND THAT

Council do not proceed with charging interest on overdue

general debtors at this time.

Recommendation to Governance

Committee

THAT

the Draft Debt Management Policy (A1353429) be approved.

9. Update

on business case approach 23 - 27

Document number R4454

Recommendation

THAT the report Update on business

case approach (R4454) and its

attachment (A1331113) be received.

10. Corporate

Report to 31 May 2015 28 - 48

Document number R4523

Recommendation

THAT

the report Corporate Report to 31 May 2015 (R4523) and its attachments (A1376070, A1384382, A1384389,

A1375171, A1366415, A793514) be

received and the variations noted.

Finance

11. Rates

Remissions for 2014/15 49 - 60

Document number R4204

Recommendation

THAT the report Rates Remissions

for 2014/15 (R4204) and its

attachments (A1383906 and A1222068) be

received.

12. Insurance

Renewal for 2015/16 61 - 64

Document number R4245

Recommendation

THAT the report Insurance Renewal

for 2015/16 (R4245) be received.

13. Bad

debt report to 30 June 2015 65 - 66

Document number R4206

Recommendation

THAT the report Bad debt report to

30 June 2015 (R4206) be received.

14. 2014/15

Audit New Zealand Letters 67 - 87

Document number R4433

Recommendation

THAT the report 2014/15 Audit New

Zealand Letters (R4433) and its

attachments (A1371563 and A1372353) be

received.

AND

THAT the Subcommittee provide any feedback on the engagement

letter to Audit NZ.

Minutes of a meeting of

the Audit, Risk and Finance Subcommittee

Held in Ruma Mārama,

Level 2A, Civic House, 110 Trafalgar Street, Nelson

On Thursday 18 June 2015,

commencing at 1.03pm

Present: Mr

J Peters (Chairperson), Her Worship the Mayor R Reese, Councillors I Barker and

B McGurk, and Mr J Murray

In Attendance: Councillors

P Matheson and G Noonan, Chief Executive (C Hadley), Group Manager Community

Services (C Ward), Manager Capital Projects (S Davies), Senior Accountant (T

Hughes), and Administration Adviser (S McLean)

1. Apologies

There were no apologies.

2. Confirmation of Order of Business

There was no change to the order

of business.

3. Interests

There were no updates to the

Interests Register, and no interests with items on the agenda were declared.

4. Public Forum

There was no public forum.

5. Confirmation of Minutes

5.1 5

May 2015

Document number M1202, agenda

pages 6 - 13 refer.

|

Resolved AUD/2015/009

THAT the minutes of

the meeting of the Audit, Risk and Finance Subcommittee, held on 5 May

2015, be confirmed as a true and correct record.

McGurk/Barker Carried

|

6. Status Report - Audit, Risk and

Finance Subcommittee - 18 June 2016

Document number R4386, agenda

pages 14 - 15 refer.

It was agreed the final list of

projects to follow a business case approach would be provided to the

Subcommittee.

|

Resolved AUD/2015/010

THAT the Status Report Audit,

Risk and Finance Subcommittee 18 June 2015 (R4386) and its attachment (A1324298) be received.

Barker/McGurk Carried

|

7. Chairperson's Report

Document number R4390, agenda

page 16 refers.

|

Resolved AUD/2015/011

THAT

the Chairperson's Report (R4390)

be received and the updates noted.

Peters/Murray Carried

|

8. Draft Debt Management Policy

Document number R4178, agenda

pages 17 - 23 refer.

It was suggested the Policy

contain a flowchart which showed the management process for various levels of

debt.

There was discussion on charging

interest for outstanding debt. It was advised that this could be done under

legislation, but may be difficult to do within Council’s systems.

The Chief Executive, Clare

Hadley, emphasised that debtors to Council could include volunteer groups,

sporting clubs and charity organisations, and discretion may be required when

applying interest.

Concern was raised that the

Policy did not contain detail on how discretion could be exercised.

Accounting Services Manager, Lynn

Anderson, advised that the outstanding debt process now commenced at 60 days

overdue.

There was discussion on whether

interest should be charged on all outstanding debt, with discretion to waive

for certain cases, or if interest would only be applied in certain cases.

Concern was raised that waiving

interest charges would create risks for Council.

It was agreed that interest would

be charged on all outstanding debt, unless an instalment arrangement as per

section 3.4 of the Policy was made prior to the due date.

It was agreed that interest would

not be charged to those on instalment arrangements, unless the arrangements

were not upheld in which case interest would be charged from the original due

date.

There was discussion on the

interest rate to charge on outstanding debt. It was noted that Council’s

weighted average cost of interest was low and may not be an appropriate level.

It was suggested that officers

contact Local Government New Zealand to investigate interest rate levels

charged in the public sector.

It was agreed that the second

sentence in the second bullet point under section 3.4 of the Policy would be

removed.

In response to a question, Ms

Anderson advised that business units received information on debtors to ensure

further engagement did not take place. She added that she reviewed outstanding

debts on a monthly basis, and Inland Revenue had certain processes to follow

before an amount could be written off.

In response to questions, Ms

Anderson advised the debt collection agency sent regular reports on progress of

collecting outstanding debts. She said that once a debt reached a certain

threshold, it would be reported to the Audit, Risk and Finance Subcommittee.

There was discussion on the

process for invoice disputes.

Attendance: Her Worship the Mayor left the meeting at

1.47pm.

|

Resolved AUD/2015/012

THAT the report Draft Debt

Management Policy (R4178) and

its attachment (A1353429) be received;

AND

THAT the following edits be made to the Draft Debt

Management Policy before the Policy is reported back to the Subcommittee for

consideration:

·

Inclusion of flowchart regarding processes for various

debt levels

·

Implementation of an interest charge/penalty regime for

unpaid debts

·

Interest rate to be charged following research with

Local Government New Zealand

·

Explanation of interest charge to be included in terms of

credit

Murray/Barker Carried

|

9. Corporate Report to 30 April 2015

Document number R4244, agenda

pages 24 - 43 refer.

Attendance: Her Worship the Mayor returned to the meeting at

1.50pm.

In response to a question,

Senior Accountant, Tracey Hughes, advised that managers were advised regularly about

high annual leave balances and there was a level at which a plan to take leave

was required. The Chief Executive, Clare Hadley, pointed out that this

information was included in Council’s Annual Report, as well as being

regularly presented to the Chief Executive Employment Committee.

In response to questions, Ms

Hughes advised that the $43,000 less than projected for landfill fees was not

at a level to be concerned about. She confirmed that headworks maintenance was

deliberately scheduled at the end of the financial year for practical reasons.

Her Worship the Mayor

congratulated Group Manager Community Services, Chris Ward, and his team on the

media coverage for the Cricket World Cup and for delivering the event under

budget.

In response to questions, Ms

Hughes advised that variances were not compared with the original budget, they

were compared to the adjusted budget as at the end of April.

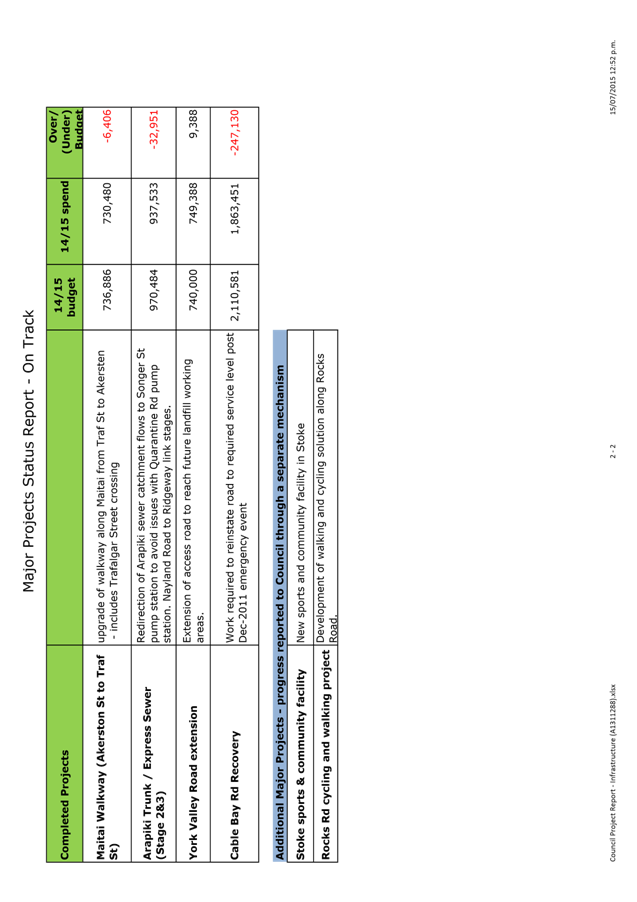

It was agreed the On Track

heading for the Completed Projects in Attachment 5 to the report (A1366144)

would be amended to avoid confusion.

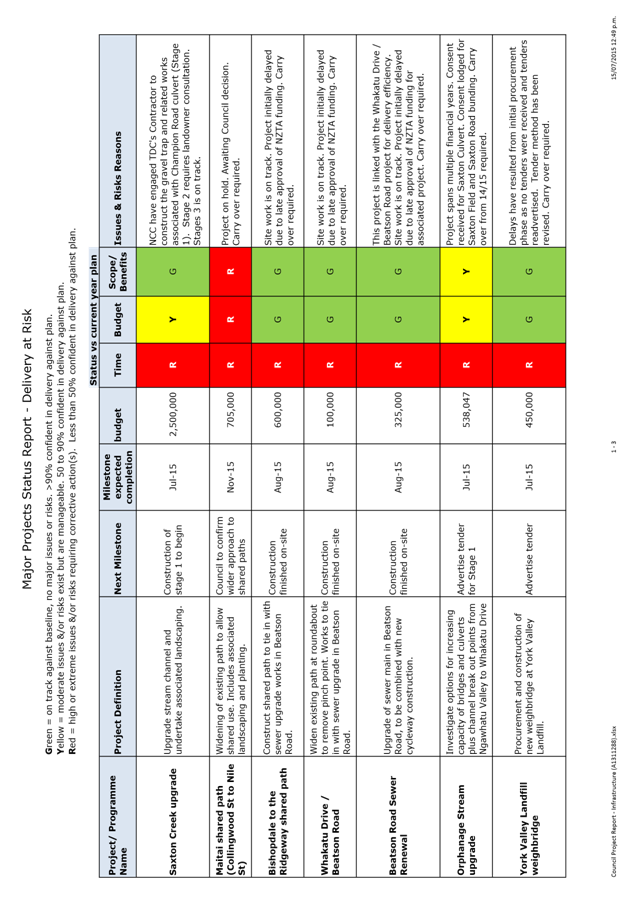

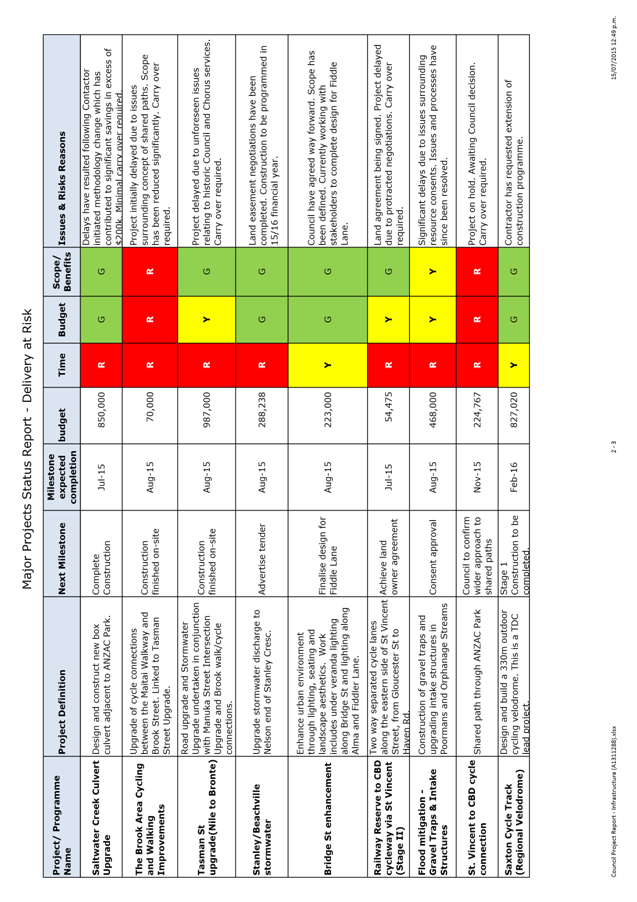

In response to questions, Mrs

Hadley advised that landowner consultation on Stage 2 of the Saxton Creek

Upgrade had not progressed during the Long Term Plan 2015-25 consultation. It

was agreed that the update should state ‘delayed due to the need to

continue landowner consultation’.

In response to a question,

Manager Capital Projects, Shane Davies, advised the delay on the Orphanage

Stream upgrade related to cultural impact assessments. Mrs Hadley highlighted

this was an issue for a number of projects.

It was suggested that issues

with cultural impact assessments needed a solution and this should be added to

the Risk Register.

In response to questions, Mr

Davies advised that considerable effort had been made to communicate with

residents affected by the Tasman Street upgrade (Nile to Bronte). He said

internal processes were being developed for project wrap up reporting.

It was asked that officers

include detail on the Maitai Walkway financials in the next Corporate Report,

and add it to the completed portion of the project status report.

It was asked that reporting on

earthquake-prone buildings be clearer in future.

|

Resolved AUD/2015/013

THAT

the report Corporate Report to 30 April 2015 (R4244) and its attachment (A1366139) be received and the variations noted.

McGurk/Barker Carried

|

10. Risk Register and Framework

Plan

Document number R4246, agenda

pages 44 - 53 refer.

The Chief Executive, Clare

Hadley, provided an update on recruitment for the new Organisational Assurance

team.

The Chairperson asked that issues

with cultural impact assessments be reflected in the Risk Register.

There was discussion on the link

between the risks of reputational damage to Council and insufficient/incomplete

advice.

It was suggested that the

Political heading on the Risk Register be changed to Political/Governance.

|

Resolved AUD/2015/014

THAT the report Risk Register

and Framework Plan (R4246) and

its attachments (A1241121 and A1359808) be received.

Barker/Murray Carried

|

11. Exclusion of the Public

|

Resolved AUD/2015/015

THAT

the public be excluded from the following parts of the proceedings of this

meeting.

The

general subject of each matter to be considered while the public is excluded,

the reason for passing this resolution in relation to each matter and the

specific grounds under section 48(1) of the Local Government Official

Information and Meetings Act 1987 for the passing of this resolution are as

follows:

McGurk / Barker Carried

|

|

Item

|

General subject of each matter to be considered

|

Reason for passing this resolution in relation to

each matter

|

Particular interests protected (where applicable)

|

|

1

|

Audit, Risk and Finance

Subcommittee Meeting - Public Excluded - 5 May 2015

|

Section 48(1)(a)

The public conduct of this

matter would be likely to result in disclosure of information for which good

reason exists under section 7.

|

The withholding of the

information is necessary:

· Section 7(2)(a)

To protect the privacy of

natural persons, including that of a deceased person.

· Section 7(2)(i)

To enable the local

authority to carry on, without prejudice or disadvantage, negotiations

(including commercial and industrial negotiations).

|

The meeting went into public

excluded session at 2.40pm and resumed in public session at 2.42pm.

Please note that as the only

business transacted in public excluded was to confirm the minutes, this

business has been recorded in the public minutes. In accordance with the Local

Government Official Information Meetings Act, no reason for withholding this

information from the public exists.

|

Resolved AUD/2015/016

THAT the minutes of

part of the meeting of the Audit, Risk and Finance Subcommittee, held with

the public excluded on 5 May 2015, be confirmed as a true and correct

record.

Murray/McGurk Carried

|

12. Re-admittance of the Public

|

Resolved AUD/2015/017

THAT

the public be re-admitted to the meeting.

Peters / Murray Carried

|

There being no further business the

meeting ended at 2.42pm.

Confirmed as a correct record of proceedings:

Chairperson

Date

Chairperson

Date

|

|

Audit, Risk and Finance Subcommittee

30 July 2015

|

REPORT R4596

Status

Report - Audit Risk and Finance Subcommittee - 30 July 2015

1. Purpose

of Report

1.1 To

provide an update on the status of actions requested and pending.

2. Recommendation

|

THAT the Status Report Audit,

Risk and Finance Subcommittee 30 July 2015 (R4596) and its attachment (A1324298) be received.

|

Shailey

McLean

Administration

Adviser

Attachments

Attachment 1: A1324298

- Status Report - Audit, Risk and Finance Subcommittee - July 2015

|

|

Audit, Risk and Finance Subcommittee

30 July 2015

|

REPORT R4579

Update

on charging interest on general debtors

1. Purpose

of Report

1.1 To update the Committee on charging interest on

general debtors.

2. Delegations

2.1 The

Audit, Risk and Finance Subcommittee has oversight of the management of

financial risk.

3. Recommendation

|

THAT the report Update on

charging interest on general debtors (R4579)

and its attachment (A1353429) be

received;

AND THAT

Council do not proceed with charging interest on overdue

general debtors at this time.

|

Recommendation

to Governance Committee

|

THAT the

Draft Debt Management Policy (A1353429) be approved.

|

4. Background

4.1 The

following resolution was passed at the Audit, Risk and Finance subcommittee on

18 June 2015:

· AND THAT the

following edits be made to the Draft Debt Management Policy before the Policy

is reported back to the Subcommittee for consideration:

o Inclusion of flowchart

regarding processes for various debt levels;

o Implementation of an interest

charge/penalty regime for unpaid debts;

o Interest rate to be charged

following research with Local Government New Zealand;

o Explanation of interest charge

to be included in terms of credit.

5. Discussion

5.1 Officers

also spoke to Napier Computer Systems (NCS), who provide our financial system

and they have confirmed that the system does not currently have the capability

of charging interest on overdue accounts. They believe the development work to

achieve this is significant and would cost the Council upwards of $20,000. This

would also require additional ongoing resourcing within Council to administer

the charging regime as Council would have to move to open item invoicing.

5.2 Officers

have also considered if this could be administered manually and believe that

this is not a robust solution and the resourcing implications are significant.

5.3 Officers

have researched the charging of interest for general debtors and have not been

able to find another council in New Zealand that does this. Local

Government NZ was also not aware of any and therefore could not provide

feedback on the appropriate interest rate to be charged.

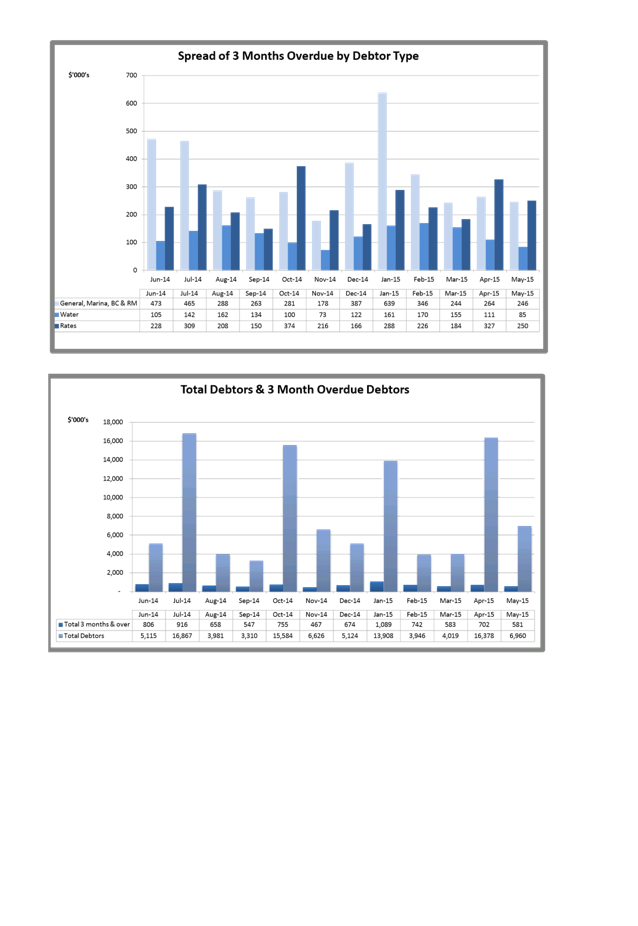

5.4 Outstanding

3 month plus general debtors is less than 1% of total debtors (including rates

and water) each month. Also, given the low level of bad debts written off

historically, officers do not recommend moving to an interest charging regime

at this time and that current resourcing would be better utilised focusing on

getting debt collection done promptly.

6. Options

6.1 Accept

the recommendation – significant cost and resourcing implications

outweigh the benefits.

6.2 Reject

the recommendation.

7. Alignment

with relevant Council policy

7.1 This

decision is not inconsistent with any other previous Council decisions as the

previous recommendation was to bring this report back for consideration of the

Committee.

7.2 The

Chief Executive has put in place an IT Steering Committee which, if a

decision was made at the Committee to proceed, means that this development

would have to be assessed and weighed up against other IT priorities. No

budget has been set aside for this development.

8. Assessment

of Significance against the Council’s Significance and Engagement Policy

8.1 This

is not a significant decision under the Council’s Significance and

Engagement Policy.

9. Consultation

9.1 No

consultation has been undertaken in preparing this report.

10. Inclusion

of Māori in the decision making process

10.1 No

consultation with Maori has been undertaken in preparing this policy.

Lynn

Anderson

Accounting

Services Manager

Attachments

Attachment 1: A1353429 -

Draft Debt Management Policy

Draft Debt Management Policy

Effective June 2015

Review date June 2018

1.

Contact:

Accounting Services Manager, Finance

1. Policy

Objectives and Scope

The Policy Objectives and Scope are as follows:

1.1. To ensure Council manages its

Accounts Receivable in such a way that reduces risk to the organisation and

protects the income earned for services provided.

1.2. Provides a consistent approach to the

management and follow-up of debt.

1.3. Provides the rules and general

guidance around extending credit to third parties.

1.4. Provides the rules around the

write-off of debt.

1.5. This policy excludes rates (including

water rates), parking, and dogs which are covered by statutory processes.

2. Principles

of Policy

The guiding principles for this policy are as follows:

2.1. Responsibilities. All business units

are responsible to provide complete and accurate information for any chargeable

work or services to external parties for billing purposes.

2.2. Risk Management. Principles of risk

management will underpin decisions made in relation to credit and debt

management. The business unit providing the goods and/or service is accountable

to ensuring that the debtor is a good credit risk, ensuring Council’s

exposure to potential debt write-off is eliminated.

2.3. Fairness and Equity. Council will

ensure that all debts are managed fairly and equitably. Parties that incur

debts do so on the understanding that Council’s standard terms of payment

are met.

3. Policy

Guidelines

The sections following are intended as a guide to ensure outstanding

debts are managed and reported to Council.

3.1. Extending Credit:

· It is the responsibility of managers

to ensure that debts raised by invoice are properly chargeable and comply with

applicable regulations, laws and Council policies.

· Standard credit application forms,

appropriate to the level of credit to be extended, or the risk, will be

completed when a customer applies for credit.

· Managers and their delegates should

request a credit check from the finance team before they agree to extending

credit. A credit check is to be based on:

o The value of the work being undertaken

is above $10K, or

o A lesser amount if the business unit

feels it is appropriate, or

o Where there is a potential risk to

the organisation, or

o Where there is the potential for an

ongoing relationship between Council and the debtor and a credit history has

not previously been established.

· In cases where the credit check

indicates a high level of risk, then the Accounting Services Manager should

determine that payment terms are to be “Cash in Advance”.

3.2. [jb1] Payment Terms and Invoicing:

· Council’s payment terms are

displayed on the invoice. Standard terms being the 20th of the month following

the date of the invoice.

· Other credit terms may apply in

relation to the approved fees and charges schedule and any ongoing changes,

e.g. cash in advance for building consents.

· Where a debtor does not pay within

the credit term, the debtor is to be considered in default of the agreement to

pay, and collection procedures are to be initiated as appropriate.

· The Managers are provided a list of

all aged debtor accounts, each month showing the status in respect of invoices

as raised by staff within their group.

· All invoices must be raised against

individuals or legal entities, i.e. limited liability companies or incorporated

societies, which provides a specific source of contact for debt recovery.

· Where possible, arrangements will be

put in place to ensure that Council’s interests are protected eg for

seasonal ground use fees, spreading payment over session rather than invoicing

all at the end.

3.3. Debt Collection:

· Where debtors are in default of the

credit terms, the Finance Team is to initiate appropriate collection procedures

after having notified the appropriate manager or their delegate of the debtor

status and confirmed that no reason exists that would inhibit collection

procedures.

· Appropriate collection procedures may

include suspending any further entitlement to credit, and/or to the extent

permitted by law, refrain from supplying further goods or services to the

customer, until such time as the outstanding debt is repaid in full.

· All debts over $10K and/or of high

profile which are likely to be reported to the Audit Risk and Finance Committee

are to be brought to the attention of the Group Manager of the group that

raised the debt.

· With the approval of the Group

Manager Corporate Services, interest may be charged on outstanding debts at

Council’s weighted average interest rate for the period it is

outstanding.

3.4. Payment Arrangement by Instalments:

· All amounts owing to Nelson City

Council should be paid in full immediately when they become due and payable.

However, there may be situations where it is not possible for an amount to be

paid in full immediately, e.g. where full immediate repayment would lead to

unreasonable financial hardship on the customer.

· Only the Accounting Services Manager

may agree to recovery of debts by instalment. The Group Manager Corporate

Services may accept a reasonable request for the payment of an outstanding

amount by instalments, provided that reasonable progress is made promptly

within a specified date.

· Any instalment repayment agreement is

to be documented in writing and agreed by both the debtor and Accounting

Services Manager.

· An explicit term of any such

arrangement is that the failure by the debtor to pay any instalment on or

before the due date will render the full amount of the debt then outstanding,

immediately due and payable.

3.5. Dispute Settlement:

· Where payment of an outstanding debt

is disputed by a debtor, the Debtors Officer will refer to the following

Invoice Dispute Procedure as detailed in the Terms and Conditions.

· Consultation should be made with the

relevant operational staff to attempt to mediate a solution. Any amounts not in

dispute must be paid in full and on time.

3.6. Invoice Dispute Procedure:

· If the customer disagrees with a tax

invoice provided by Nelson City Council:

o The customer must notify Nelson City

Council in writing no later than 10 business days following receipt of the

invoice, setting out in reasonable detail the nature of the invoice dispute and

the reasons for non-payment

o Nelson City Council will acknowledge

receipt of such invoice dispute notice and both parties’ responsible

managers will endeavour to promptly settle the invoice dispute by agreement

o If, on resolution of the invoice

dispute, an amount is due to Nelson City Council, the customer will pay that

amount to Nelson City Council within five business days of resolution of the

dispute, or if a building or resource consent, as per the terms of the consent.

· Where only a portion of an amount claimed

in a tax invoice is the subject of an invoice dispute (disputed portion), this

clause will only apply to the disputed portion and the balance of the amount

payable in respect of that tax invoice must be paid by the customer to Nelson

City Council no later than the due date of the invoice.

3.7. Bad Debts:

· Debts unable to be collected are to

be known as bad debts and must be submitted annually to the Audit Risk and

Finance Committee for write-off if over $2,500.

· These debts are to be registered with

Council’s external debt collection agency or liquidator/receiver for

continued collection.

· The authority levels pertaining to

the write-off of bad debts have been approved by Council, as follows:

o General Manager Corporate Services

approves any debt write-off up to a maximum of $2,500 for any one item.

o Debt write-off amounts in excess of

$2,500 per item require Council approval and will be submitted to the Audit

Risk and Finance Committee.

o All debts written off are to be

recorded for future possible action and information, and systems are to be

updated to best ensure that staff are aware before raising further debts.

4. Monitoring

and Implementation

4.1. Reporting:

· All debts over $10,000 and greater

than 90 days overdue will be reported to the Audit Risk and Finance Committee.

· Other significant debts under $10,000

where there is a potential risk of non payment, or debts of a sensitive nature,

will be reported to the Audit Risk and Finance Committee.

4.2. The policy will be reviewed every

three years or at the request of Council or in response to changed legislative

and statutory requirements or in response to any issues that may arise.

5. Responsibility

5.1. The Debtors Officer is responsible

for Debtor Management, with the assistance of the Accounting Services Manager

for escalation where required. Outstanding debts will be reviewed on a regular

basis by the Debtor Officer and the Accounting Services Manager and decisions

will be made as to the most appropriate debt recovery action. This can include:

· Issue of regular reminders

· Personal contact with the debtor

· Referral of matter to the manager

responsible for initiating the debt (where appropriate)

· Escalation of matter to the Group

Manager Corporate Services and/or referral to debt recovery agents.

|

|

Audit, Risk and Finance Subcommittee

30 July 2015

|

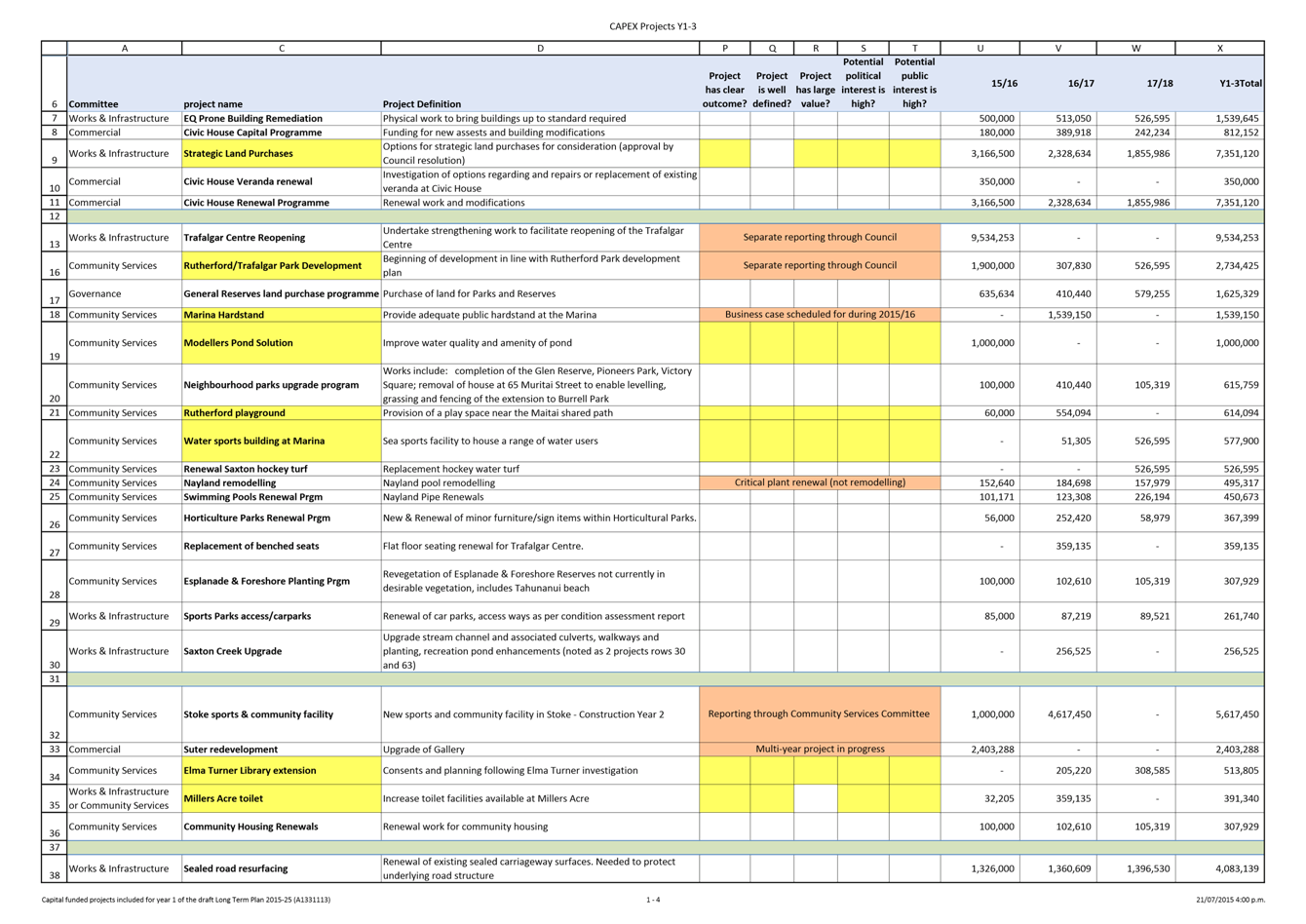

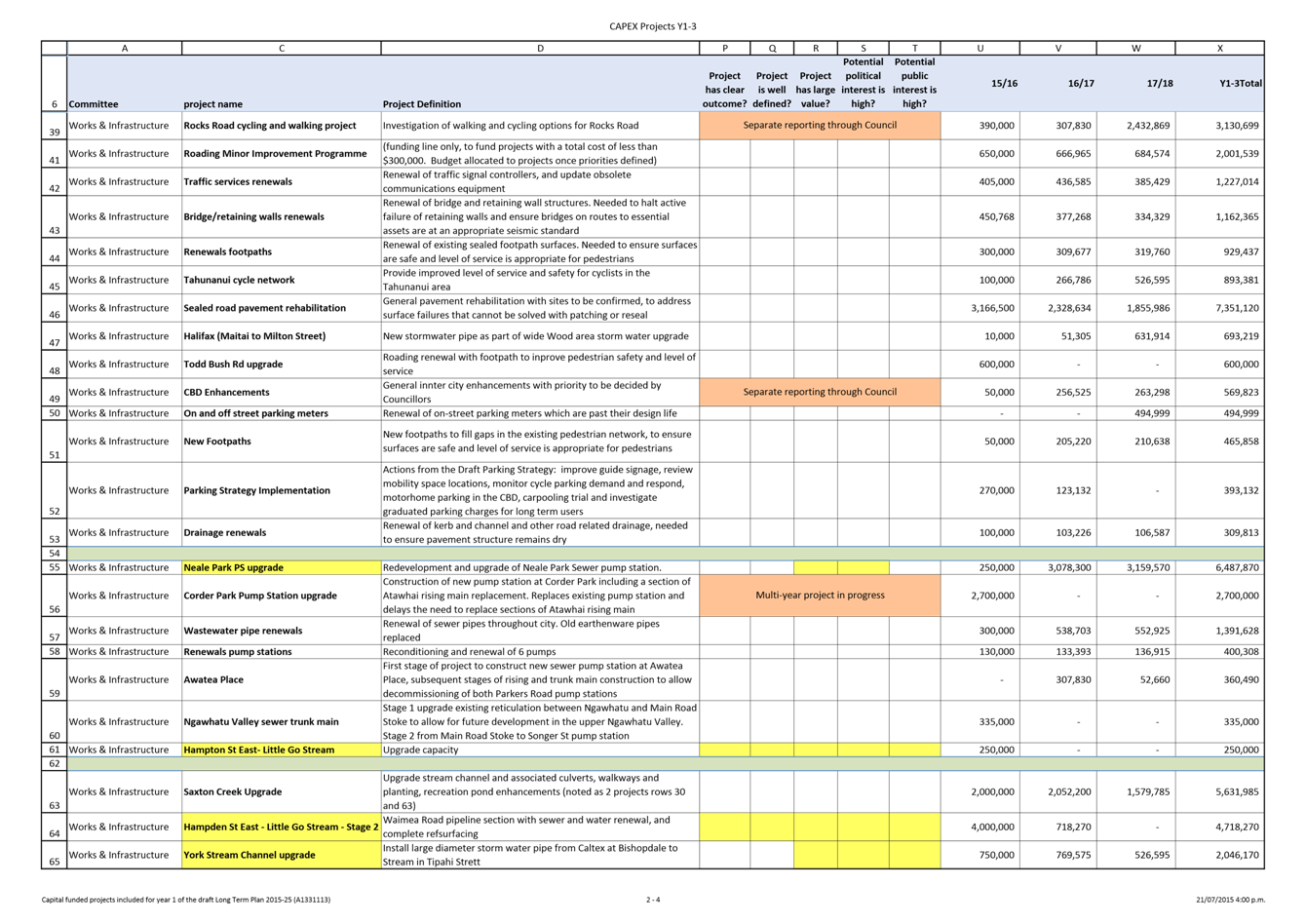

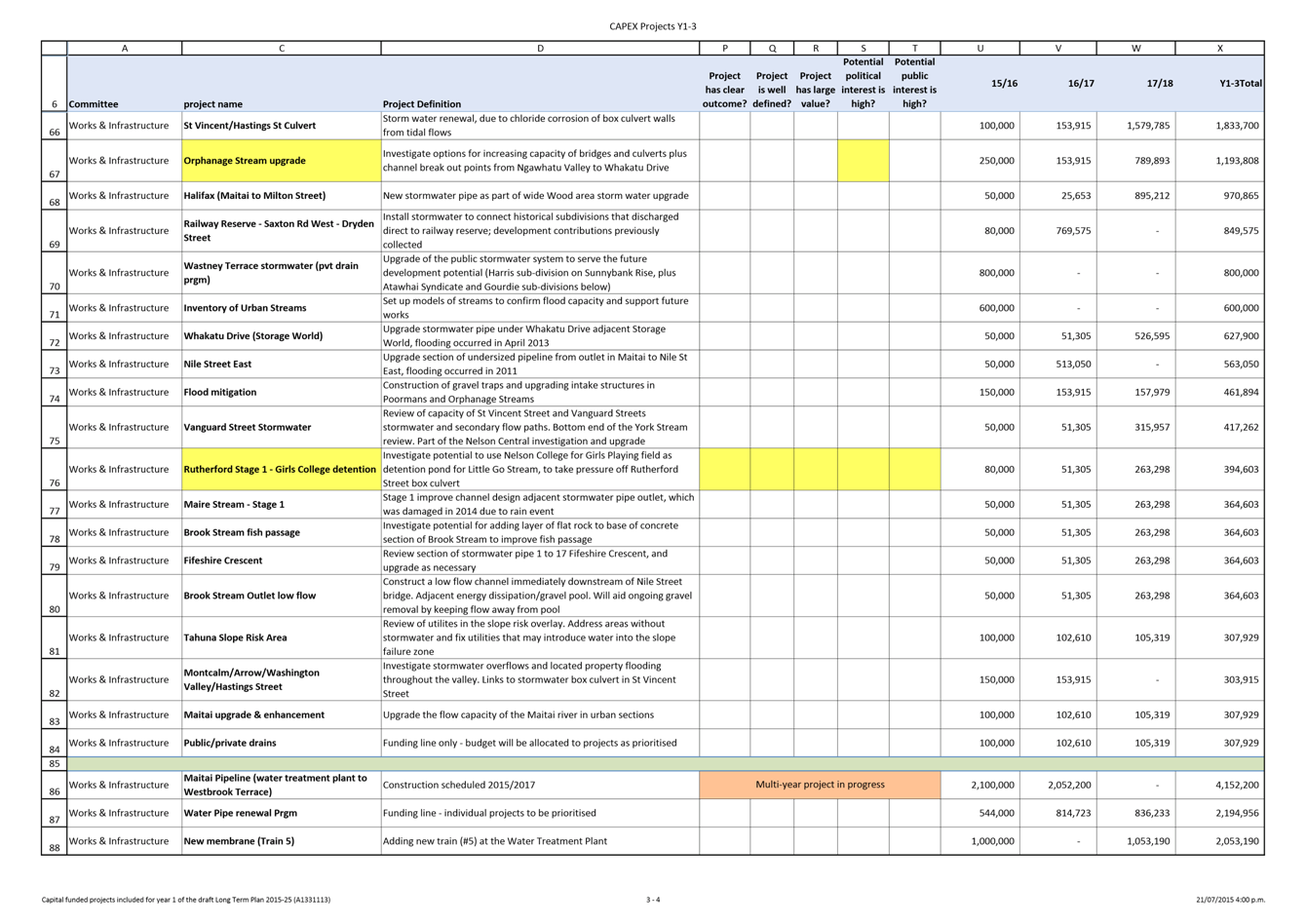

REPORT R4454

Update

on business case approach

1. Purpose

of Report

1.1 To inform the Audit, Risk and Finance

Subcommittee of the Council resolution on 11 June 2015.

2. Delegations

2.1 This

is a matter for the Audit Risk and Finance Subcommittee within its

responsibility in the areas of risk management and internal control, and

monitoring of Council’s financial and service performance.

3. Recommendation

|

THAT the report Update on

business case approach (R4454)

and its attachment (A1331113) be received.

|

4. Discussion

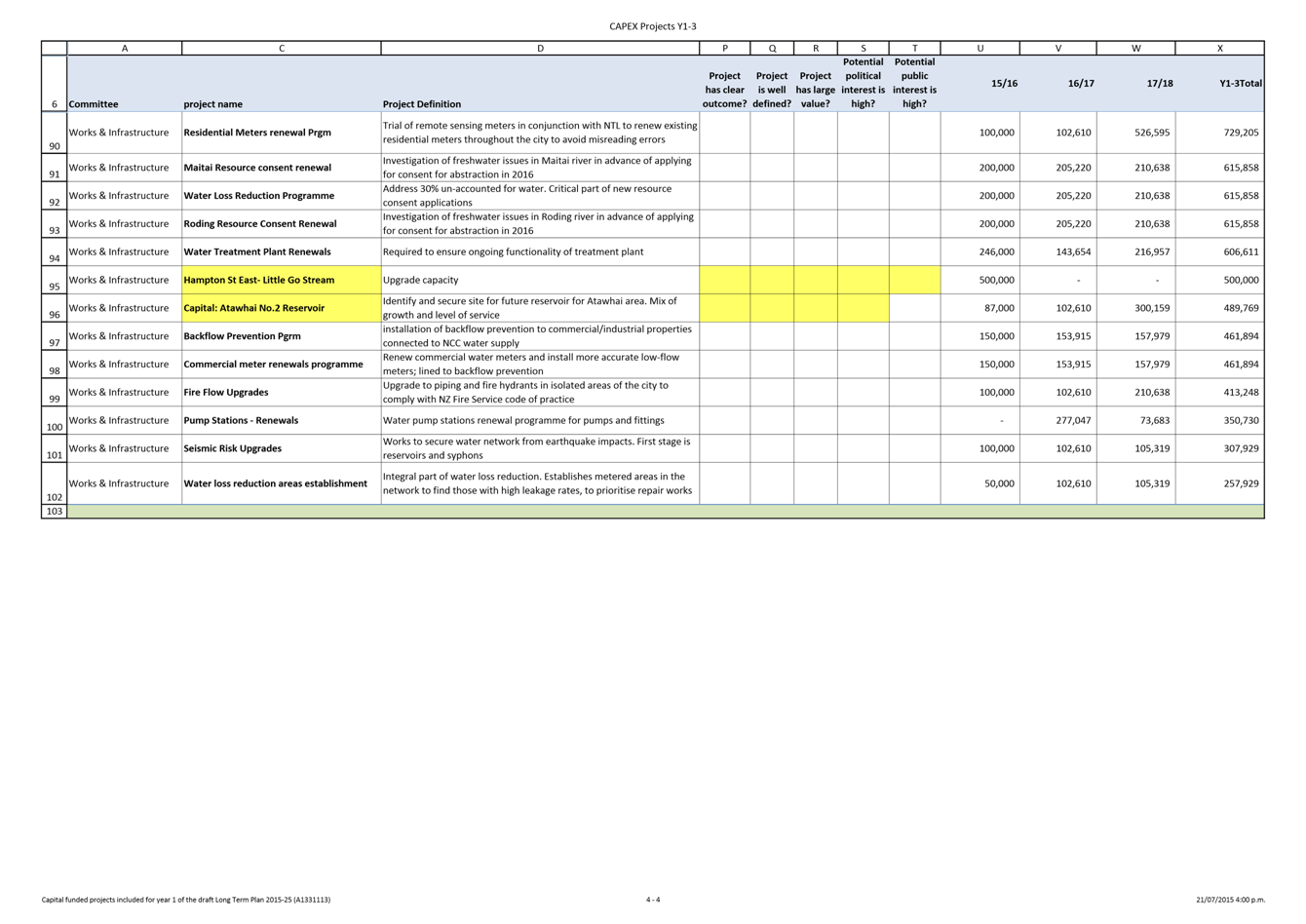

4.1 The

following resolution was made at the Council meeting held on 11 June 2015:

THAT

the report Business Case Approach for 2015/16 Projects - Revised Projects

Listing (R4354) and its

attachment (A1331113) be

received;

AND

THAT the projects highlighted yellow in document A1331113 follow a

business case approach.

4.2 At the Audit, Risk and Finance Subcommittee meeting on

18 June 2015, it was requested that the final list of projects to adopt a

business case approach be provided to the Subcommittee. This can be found in

Attachment 1.

Arlene

Akhlaq

Senior

Projects Adviser

Attachments

Attachment 1: A1331113 -

Final approved selection of capital funded projects included in the Long Term

Plan 2015-25 to follow a business case approach

|

|

Audit, Risk and Finance Subcommittee

30 July 2015

|

REPORT R4523

Corporate Report to 31 May 2015

1. Purpose of Report

1.1 To inform the members of the Audit, Risk and Finance Subcommittee on the

financial results of activities for the 11 months ending 31 May 2015 compared

to the final projection, completed as part of the Long-Term Plan 2015-2025

(LTP), and to highlight and explain any material variations.

2. Delegations

2.1 The Audit, Risk and Finance Subcommittee has oversight of the management

of financial risk and makes recommendations to the Governance Committee and to

Council. Do not delete this line

3. Recommendation

|

THAT

the report Corporate Report to 31 May 2015 (R4523) and its attachments (A1376070, A1384382, A1384389,

A1375171, A1366415, A793514) be

received and the variations noted.

|

4. Background

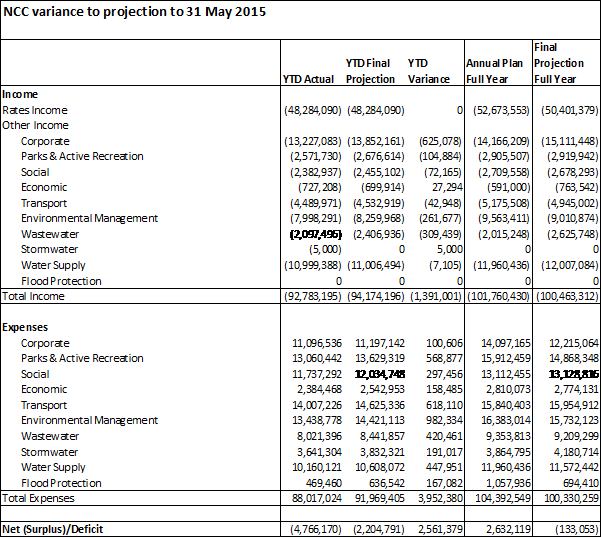

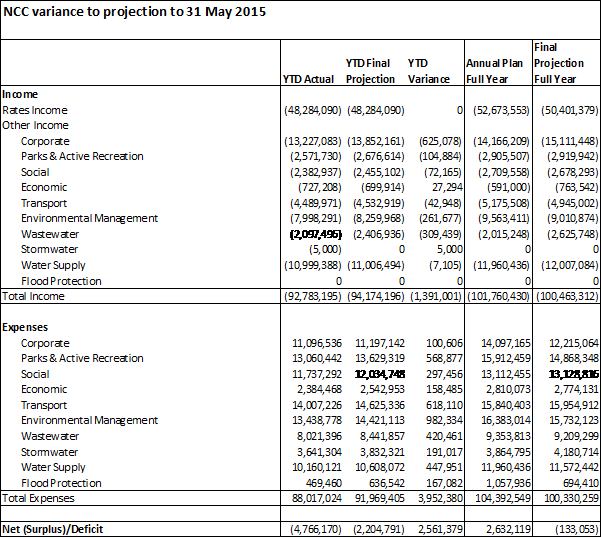

4.1 The report focuses on the 11 month performance

compared with the year to date projection. Budgets/projections for operating

income and expenditure are phased evenly through the year, whereas capital expenditure

budgets/projections are phased to occur mainly in the second half of the year.

4.2 Projections (forecasts) were updated in April as part

of the work informing the final LTP.

4.3 Some definitions of terms used within this report:

· Operating income – all income other than rates including

metered water, grants, fees, rentals, and recoveries;

· Rates – includes the general rate, wastewater, stormwater and

flood protection rates, and targeted rates for Solar Saver;

· Staff costs – salaries plus overheads such as training, super,

professional fees and office accommodation expenses;

· Depreciation – includes all depreciation, and any losses on

asset disposal/retirement;

· Interest – includes debt interest, bank fees, interest rate

swap margins, treasury and rating agency fees.

5. Discussion

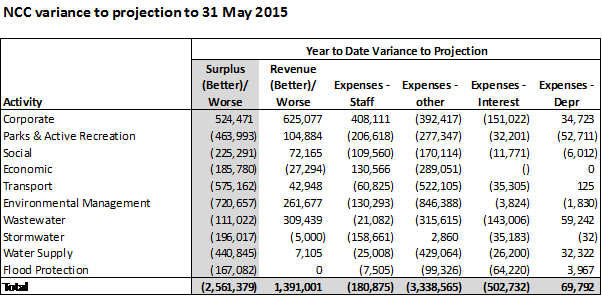

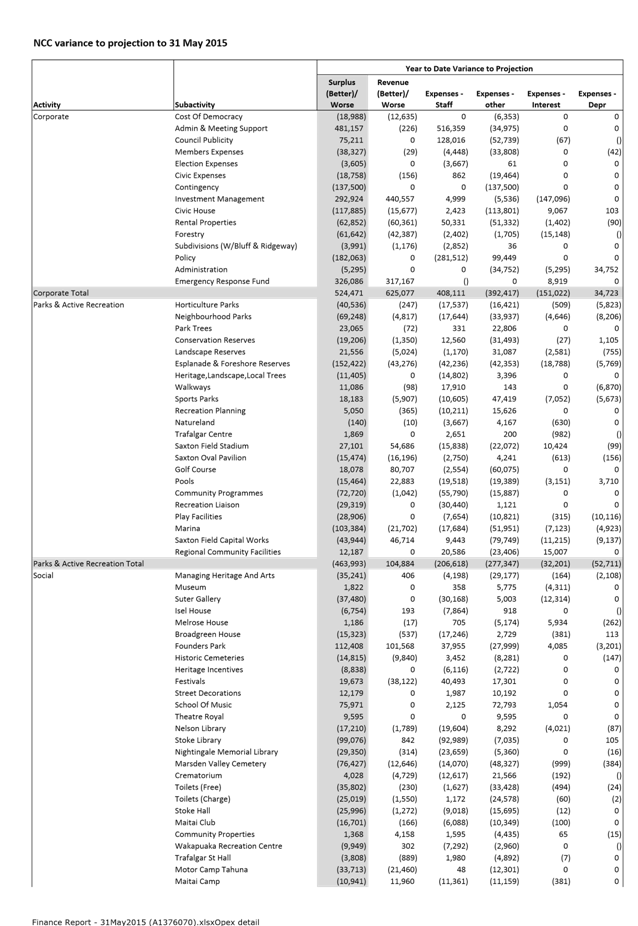

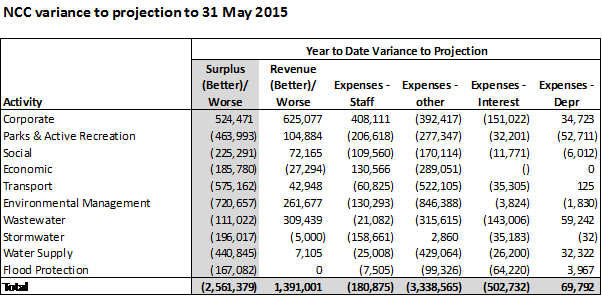

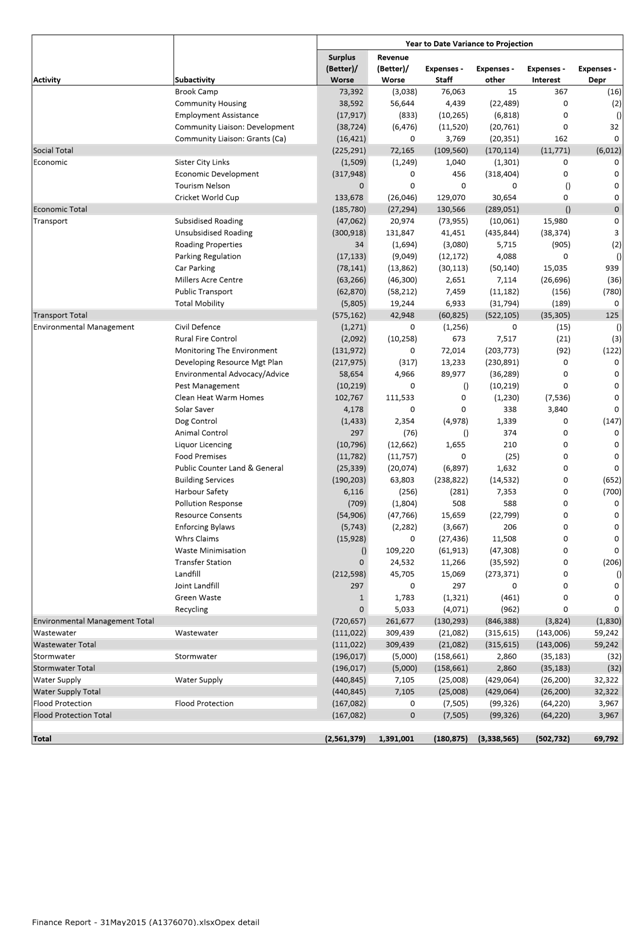

5.1 The report focuses on performance to date compared with the year to date

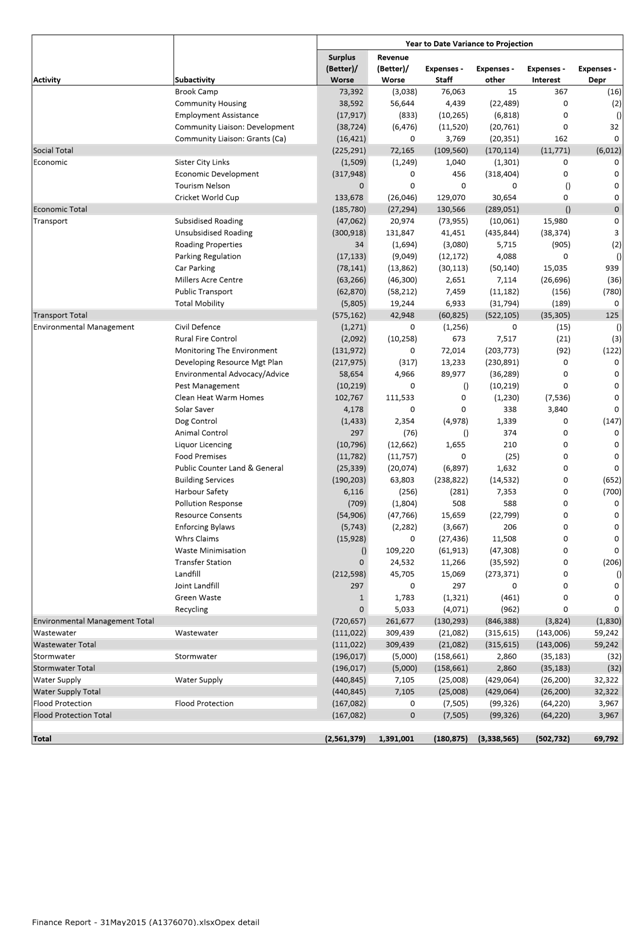

projections. More detailed financials by sub-activity are in Attachment 2.

5.2 For the 11 months ending 31 May 2015, the activity surplus/deficits are

$2.6 million favourable to projection.

5.3 Revenue and expenditure variances are discussed by activity.

5.4 Staff expenses are $181,000 in total better than projected. Variances in

activities illustrate where staff time has actually been spent against where it

was expected to be spent at the time of setting the 2014/15 Annual Plan.

Savings identified through the projections exercise are reflected in total in

the Corporate Activity.

Corporate

5.5 The Corporate activity is $524,000 worse than projection due to a range

of factors including:

5.5.1 Revenue – $625,000 less than

projection. Income in the Disaster Recovery Fund is $317,000 under projection

due to timing of further insurance proceeds relating to the 2011 emergency

event. Analysis has been completed and an accrual in the region of $750,000 is

expected to be made. Internal interest is $329,000 under projection reflecting

the timing of capital expenditure.

5.5.2 Expenses – staff $408,000 higher than

projection. Organisation-wide savings in staff expenditure identified through

the latest projection exercise have reduced budget available in this activity.

5.5.3 Expenses – other $392,000 better than

projection as the contingency has not yet been called on ($138,000) and Civic

House expenditure is under projection ($114,000). Property condition

assessments expenditure is $26,000 behind and the budget for post earthquake

inspections (reactive budget), year to date $41,000, currently has only $1,000

recorded against it. There is currently an underspend of $36,000 in outgoings

and maintenance costs for Civic House. Expenditure on the Strategic Property

Review is currently being incurred, but is $37,000 under projection as at the

end of May. Third party communications costs (including production costs for

Live Nelson) are under projection by $40,000.

5.6 Parks and Active Recreation

5.7 The Parks and Active Recreation activity is $464,000 better than

projection due to:

5.7.1 Revenue - $105,000 less than projection due

to timing of some revenue streams such as the golf course and Saxton Stadium.

5.7.2 Expenses – staff - $207,000 better

than projection. The distribution of staff time over the organisation differs

from anticipated and there are savings across this activity but particularly in

Community Programmes, Esplanade and Foreshore Reserves, Sports Parks and

Recreation Liaison. Savings identified through the projections exercise are

represented in total in the Corporate activity.

5.7.3 Expenses – other - $277,000 better

than projection. Regional Community Facilities is $43,000 more than projection

as the second grant to the Brook Waimarama Sanctuary Fence has been paid in

full ($524,000 - timing). Year to date expenditure is under projection in many

areas including maintenance ($89,000), General operating expenditure ($95,000)

and consultancy costs ($127,000).

Social

5.8 The Social activity is $225,000 better than projection due to:

5.8.1 Revenue - $72,000 less than projection due

to the timing of the Founder’s Book Fair income which is received in

June.

5.8.2 Expenses – staff - $110,000 less than projected,

over a wide range of activities.

5.8.3 Expenses – other - $170,000 better

than projection. Base operating expenditure is $110,000 underspent year to date

across a large range of activities, for items such as water, insurance,

maintenance, cleaning and electricity. Expenditure against property maintenance

contracts are currently $66,000 under projection.

Economic

5.9 The Economic activity is $186,000 better than projection due to:

5.9.1 Expenses – staff - $131,000 more than

budgeted, almost entirely in the Cricket World Cup sub-activity. This is a

budgeting issue as the number of staff hours required was within the 4,000

allowed as part of $900,000 expenditure cap in the contract.

5.9.2 Expenses – other - $289,000 better

than projection. The Economic Development expenditure is under projection by

$318,000. The events contestable fund is $192,000 under projection. If unspent

at year end the balance will be held in reserve for future years. There is no

spending to date in the business incubator (timing), facilities marketing and

economic impact assessment. Expenses relating to the CWC are now complete,

producing a timing effect of expenditure being $30,000 more than projection.

The cost to rates of the Cricket World Cup overall was $113,000 less than

budgeted.

Transport

5.10 The

Transport activity is $575,000 better than projection due to:

5.10.1 Expenses – other - $522,000 better than

projection, mainly in unsubsidised roading. The most significant underspends in

that activity are:

· Base maintenance ($64,000) including street/cycleway cleaning

and footpath maintenance.

· $224,000 underspent relating to UFB remediation and corridor access.

Corresponding income is also under projection.

· $63,000 underspent year to date in recovery works from the 2011

emergency event relating to Days Track. This work will be carried forward into

2015/16.

· No expenditure year to date for the southern arterial corridor

management plan ($89,000 - this has been delayed until the findings of the

Southern Arterial Investigation – Annesbrook Drive roundabout to QEII

Drive roundabout (run by NZTA) are known).

Car parks and

meters maintenance costs and lease costs have provided $66,000 of savings year

to date.

Environmental

Management

5.11 This

activity includes Civil Defence and Rural Fire activities, Consents and

Compliance, Environmental Programmes, and Solid Waste activities. The

Environmental Management activity is $721,000 better than projection due to:

5.11.1 Revenue - $262,000 less than projection. Landfill fees

are $45,000 less than projection. Internal income in the solid waste group is

$141,000 less than projection and is offset in expenses. Building services

revenue is $79,000 less than projection. Food premises license fees are now

$12,000 better than projection with most of the annual income invoiced in May

(timing). $112,000 year to date income projected for the Clean Heat Warm Homes

programme is part of an end of year adjustment (timing).

5.11.2 Expenses – staff - $130,000 better than

projection. This is mainly in Building Services which has carried vacancies for

much of the year, and which has not been charged staff time from the Resource

Consents team to the extent anticipated.

5.11.3 Expenses – other - $846,000 better than

projection. Monitoring the Environment is $204,000 under projection - this sub

activity contains a large number of programmes and almost all of this variance

is committed with outstanding purchase orders. Expenditure relating to the

Nelson plan is currently $260,000 under projection, however invoices received

in June are expected to reduce the full year underspend to no more than

$67,000. Landfill expenditure is $273,000 under projection reflecting no

expenditure yet for Emissions Trading Scheme (ETS) levies and lower internal charges

than anticipated from other solid waste sub-activities. Other sub activities in

Solid Waste show year to date savings of $82,000.

Wastewater

5.12 The

Wastewater activity is $111,000 better than projection due to:

5.12.1 Revenue - $309,000 less than projected, related to the

NRSBU investment return. The distribution from the Regional Sewerage Business

Unit (NRSBU) is less than budgeted as input volumes from all five customers are

less than anticipated.

5.12.2 Expenses – other - $316,000 less than projection

mainly due to lower charges than expected from NRSBU, see 5.11.1.

5.12.3 Expenses – Interest - $143,000 less than

projected due to timing of capital expenditure.

Stormwater

5.13 The

Stormwater activity is $196,000 better than projection due to:

5.13.1 Expenses – staff - $159,000 better than

projection. The distribution of staff time over the organisation differs from

anticipated.

Water

5.14 The

Water activity is $441,000 better than projection due to:

5.14.1 Expenses – other - $429,000 better than

projection relates to year to date underspend against maintenance budgets

($267,000), mainly in reactive budgets. There are a number of outstanding

purchase orders however significant savings against reactive budgets are

expected. Base service and operating expenditure show a current underspend of

$173,000 in respect of electricity and insurance costs (savings) and the costs

of the meter reading contract.

Flood

Protection

5.15 The

Flood Protection activity is $167,000 better than projection.

5.15.1 Expenses – other - $99,000 better than

projection. This is relating to recovery works. There has been only minor

expenditure year to date for these works (identified from the December 2011

Rainfall Event). The projects have now been re-categorised as mitigation

(capital) works and will extend into the 2015/16 year.

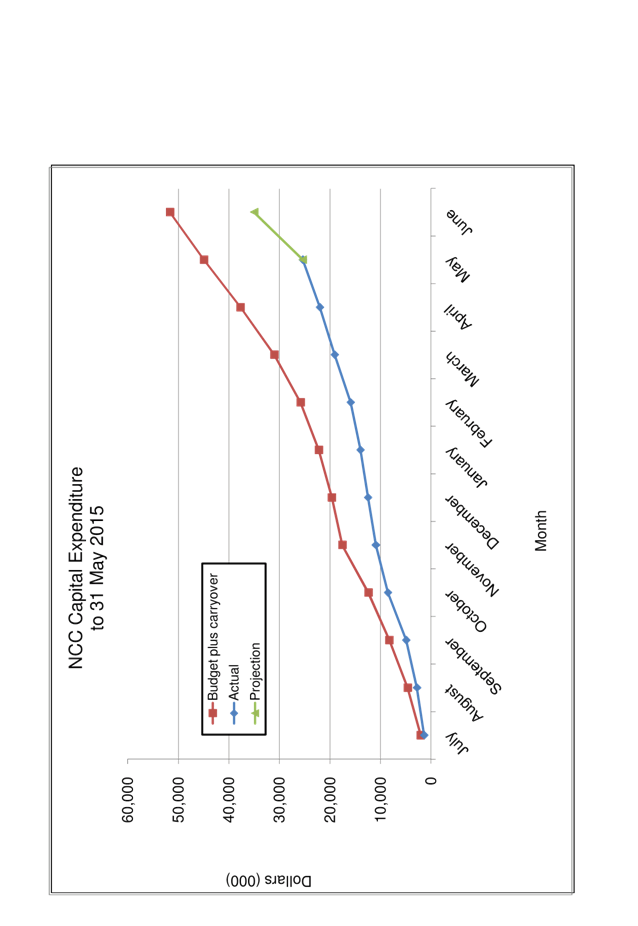

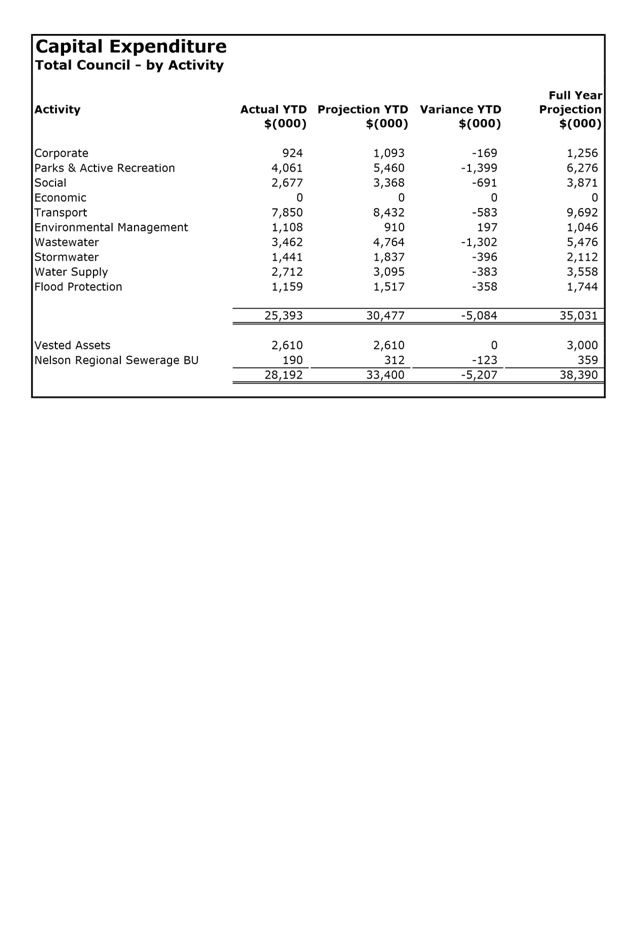

Capital

Expenditure

5.16 Capital

expenditure to 31 May 2015 was $25.4 million, $5.1 million (17%) below

projection. Details are included in Attachments 2 to 5.

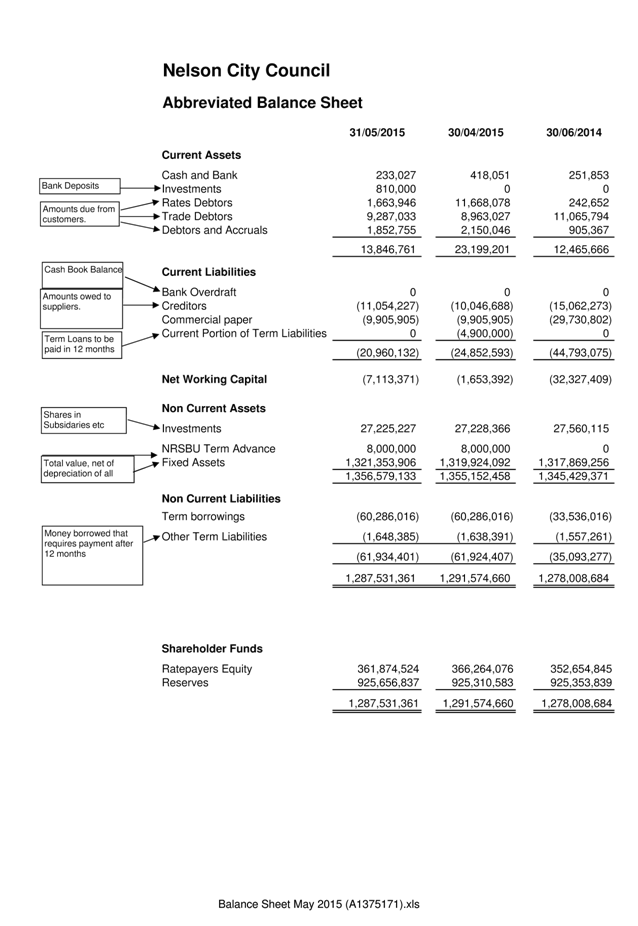

Balance

Sheet

5.17 Fourth

quarter rates invoicing fell due for payment on 28 May, generating a $10

million decrease in rates debtors. Cash in excess of that required for

operating purposes was used to clear call loan balances, leaving $810,000 on

call deposit.

5.17.1 Ratepayers equity has decreased $4.4m reflecting the

allocation to May’s income of rates invoiced in April.

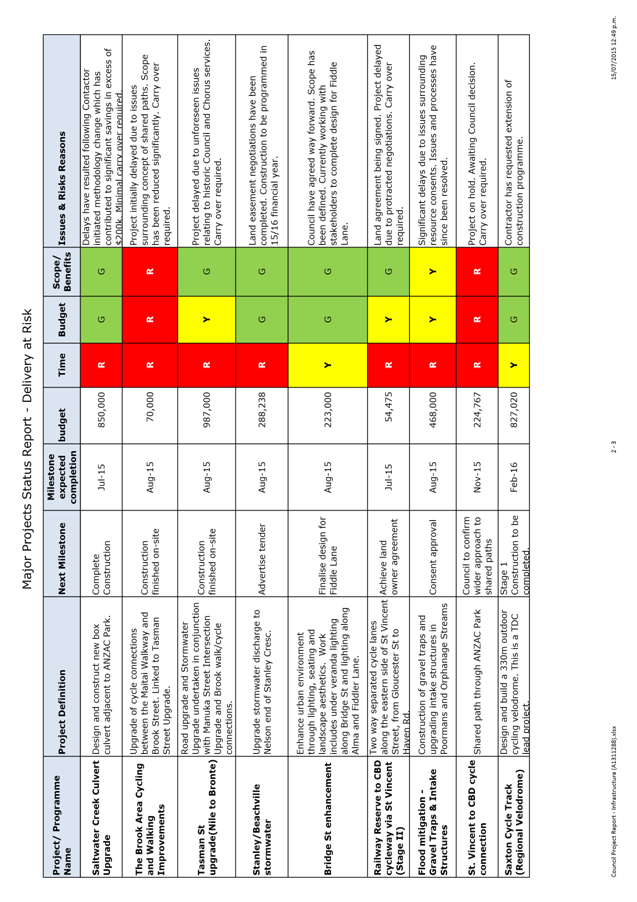

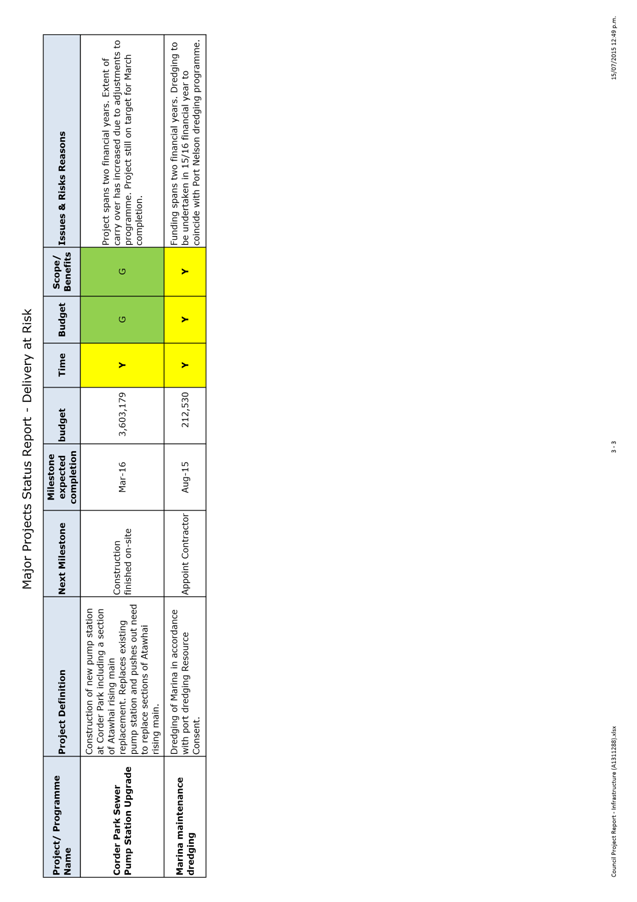

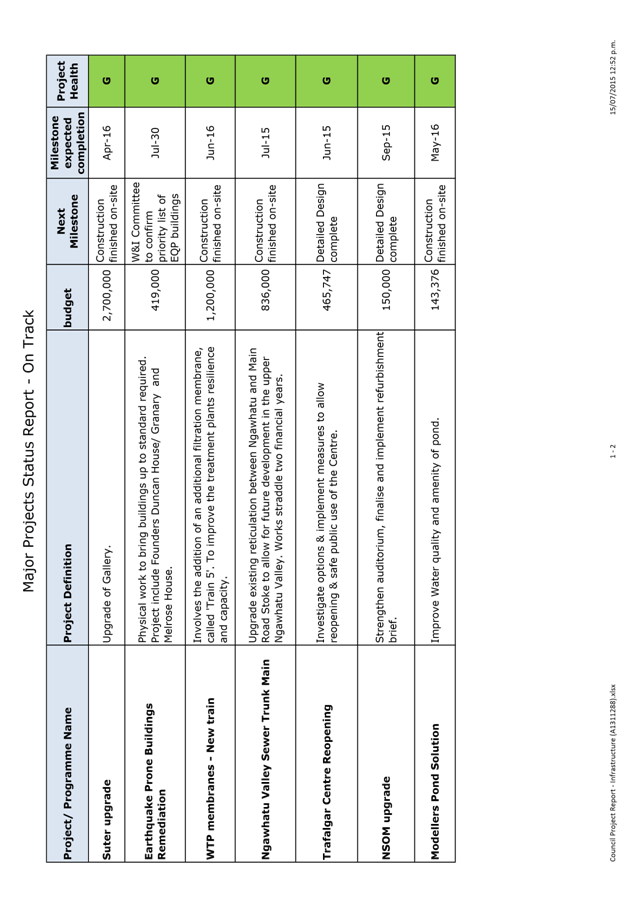

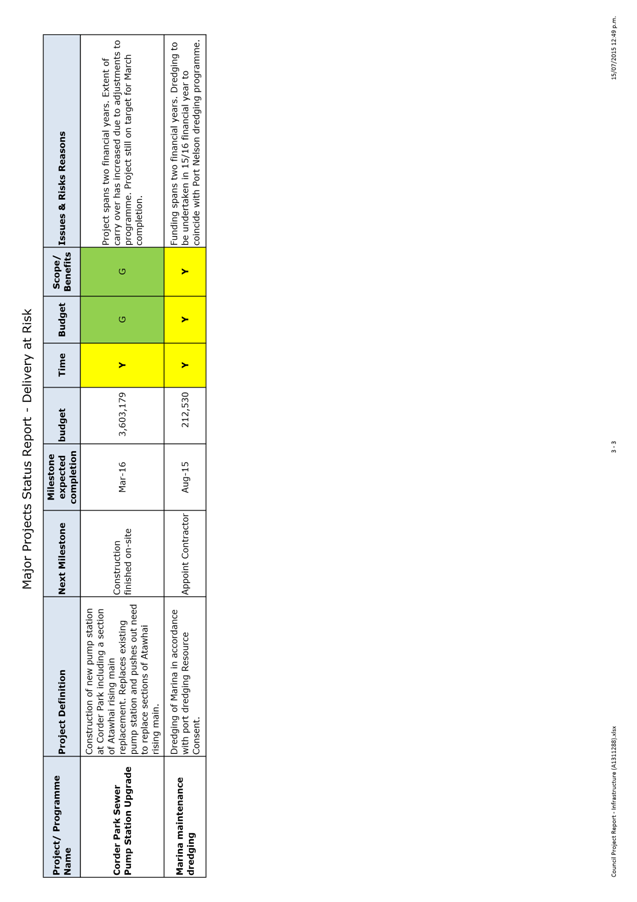

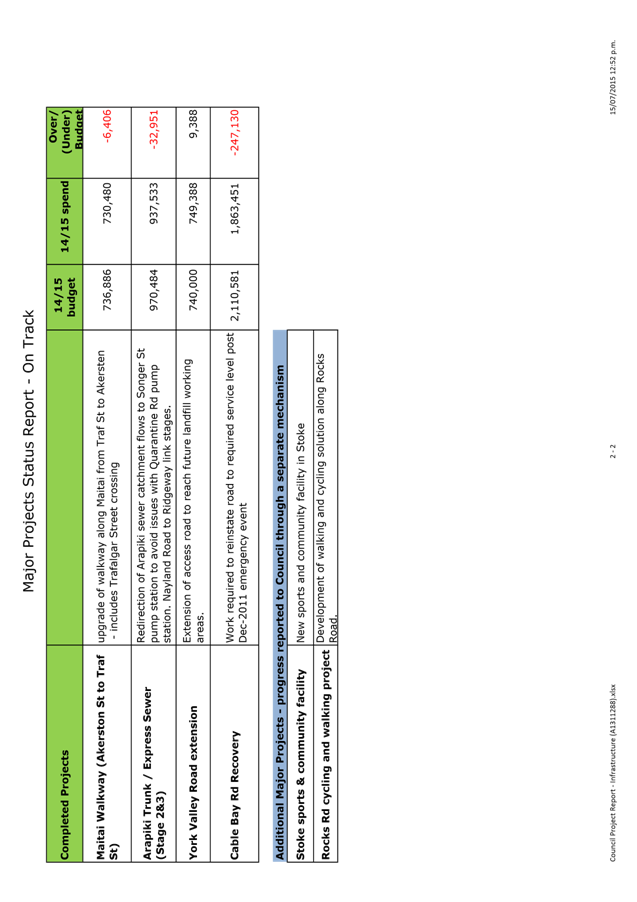

6. Projects Update

6.1 Please see Attachments 4 and 5 for progress reports on Council’s

major projects.

7. Rates Rebates

7.1 Council

administers the rates rebate scheme on behalf of the Department of Internal

Affairs. Almost 90% of the rates rebate applications are processed between

mid-July and mid-September each year. During this period three additional

staff are employed on a temporary basis to carry out the interviews and process

the applications. Staff also visit homes and some rest homes to assist

ratepayers who are unable to make it into the Council.

7.2 The maximum rebate amount and income threshold are

adjusted annually by the rate of inflation therefore reducing the likelihood of

the scheme not being utilised due to inflation and increasing incomes.

7.3 For the 2014/15 year the maximum rebate was increased

from $595 to $605 and the income abatement threshold was increased from $23,870

to $24,250. The amount of the rebate granted depends on the level of rates and

household income as well as number of dependents.

7.4 The

below table shows the uptake in rates rebates compared to previous rating

years.

|

Rating Year

|

2014/15

|

2013/14

|

2012/13

|

|

Number of approved

rebate applications

|

2,007

|

2,061

|

2,043

|

|

Dollar value of

rebates granted

|

$1,116,324

|

$1,131,120

|

$1,125,549

|

|

Maximum rates

rebate

|

$605

|

$595

|

$590

|

|

Income

abatement threshold

|

$24,250

|

$23,870

|

$23,650

|

8. Ridgeways Joint Venture

8.1 Ridgeways Joint Venture

distributed two amounts of $100,000 each to Nelson City Council in July and

November 2014 after selling a section. It has since become apparent that

further funds should have been retained within the Joint Venture for ongoing

overheads. The JV requested that the two partners inject $50,000 each and

Council transferred these funds on 30 June 2015.

9. Alignment with relevant Council policy

9.1 The finance report is

prepared comparing current year performance against the final projection for

the 2015 LTP.

10. Assessment of Significance against the Council’s

Significance and Engagement Policy

10.1 There are no significant decisions.

11. Consultation

11.1 No consultation is required.

12. Inclusion of Māori in the decision making process

12.1 No consultation is required.

Tracey Hughes

Senior Accountant

Attachments

Attachment 1: NCC

Detail Performancy (A1376070)

Attachment 2: Capital Expenditure Graph (A1376070)

Attachment 3: Capital Expenditure by Activity

(A1376070)

Attachment 4: Major Projects Status Report -

Delivery at Risk (A1384382)

Attachment 5: Major Projects Status Report - On

Track (A1384389)

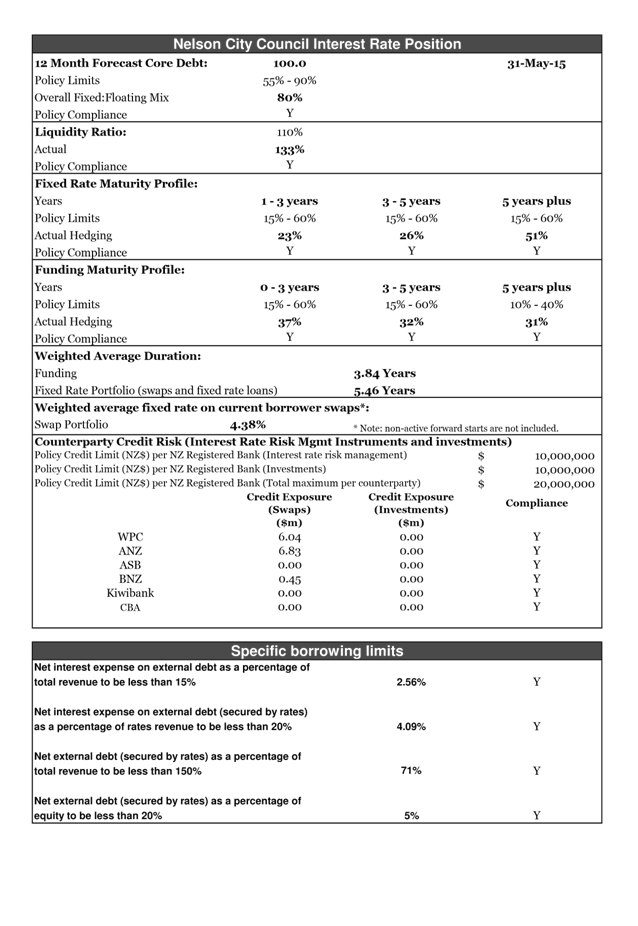

Attachment 6: Balance Sheet (A1375171)

Attachment 7: Interest Rate Position Report

(A1366415)

Attachment 8: Debtors Report (A793514)

|

|

Audit, Risk and Finance Subcommittee

30 July 2015

|

REPORT R4204

Rates

Remissions for 2014/15

1. Purpose of Report

1.1 To

update the Audit, Risk and Finance subcommittee on the Rates remissions for

2014/15.

2. Delegations

2.1 The

Audit, Risk and Finance subcommittee has responsibility for management of

financial risk.

3. Recommendation

|

THAT the report Rates Remissions

for 2014/15 (R4204) and its

attachments (A1383906 and A1222068) be

received.

|

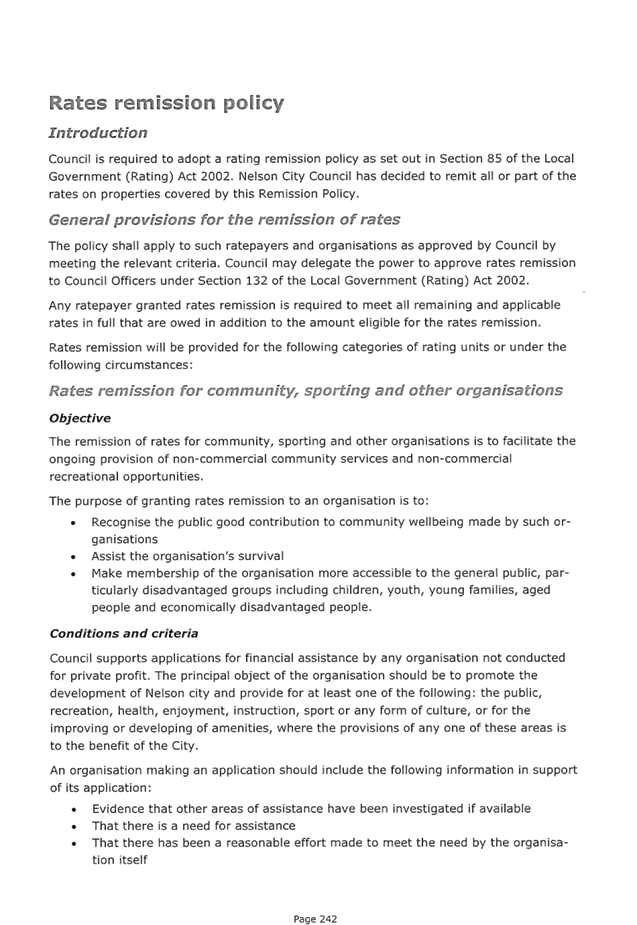

4. Background

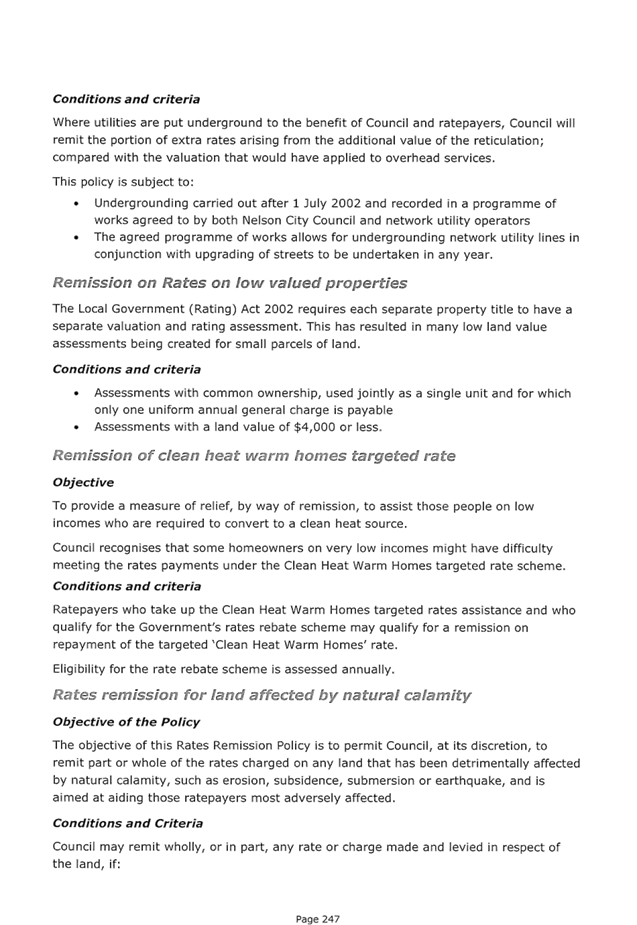

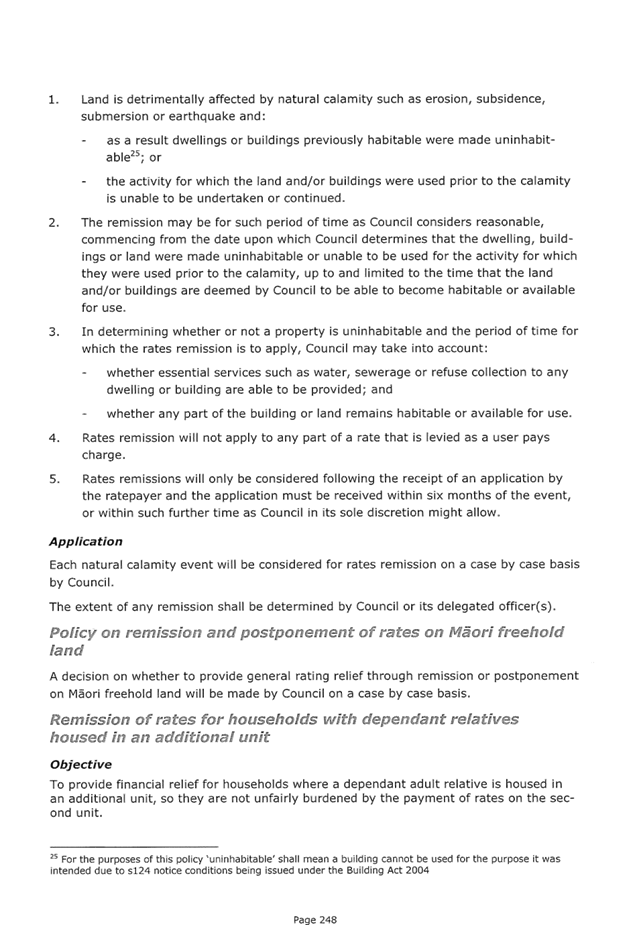

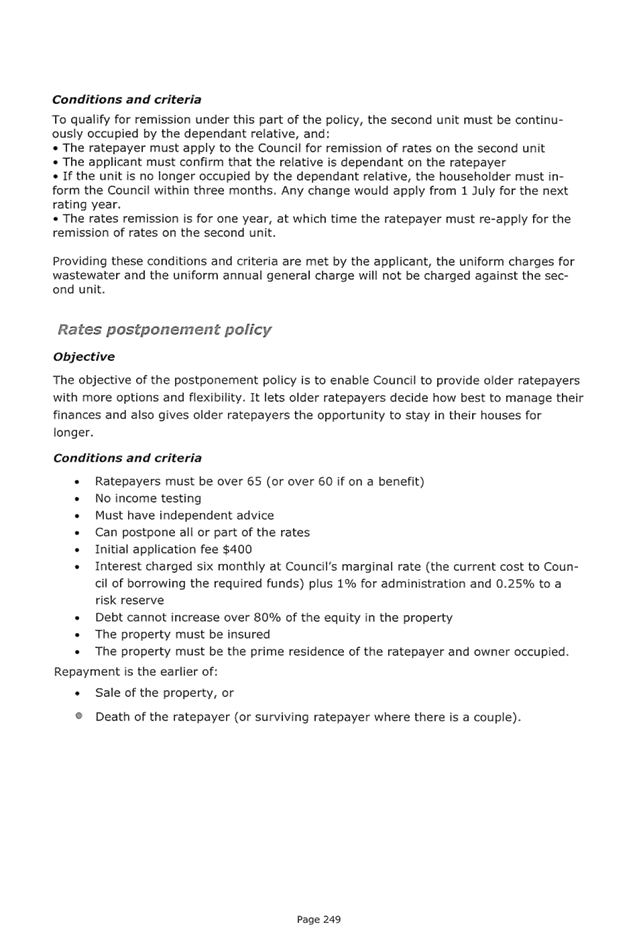

4.1 Council

has a number of rates remission policies which are consulted on through the

Long Term Plan. The policies approved through the Long Term Plan 2015-25

are included as Attachment 1.

5. Discussion

5.1 The

remission policies approved through the Long Term Plan 2015-25 have not changed

materially from the policies applicable to the 2014/15 rating year. There

were some wording changes to the remission of rates for underground utilities

and remission of charges for excess water arising from leaks.

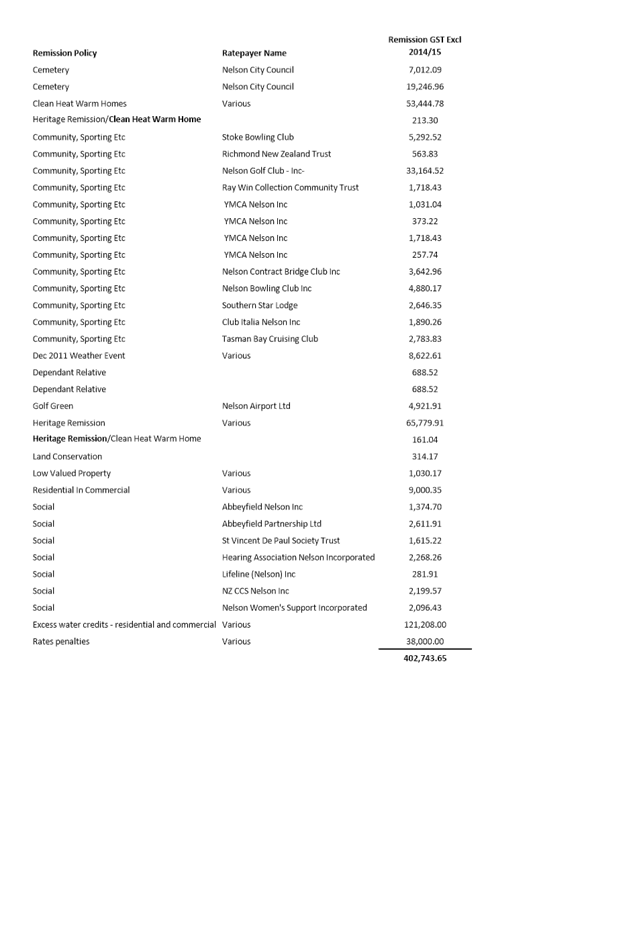

5.2 Rates

remissions for 2014/15 were $402,744 compared with $409,548 in 2013/14

(excluding GST).

5.3 Attachment

2 shows the detail of the rates remissions given for Community, sporting and other organisations and a summary of other

remissions. The remission policies are delegated to officers to administer.

5.4 Because the rates remissions are a budgeted expense,

the general rates and water rates collected are increased to cover the expected

level of remissions.

|

Rates

remissions

|

2014/15

|

2013/14

|

|

Community

sporting and other organisations

|

72,411

|

76,756

|

|

Golf greens

|

4,923

|

5,244

|

|

Rates penalties

|

38,000

|

48,000

|

|

Res properties

in commercial areas

|

9,000

|

9,000

|

|

Excess water

credits - residential

|

102,419

|

95,070

|

|

Excess water

credits - commercial

|

18,789

|

4,478

|

|

Conservation

land

|

314

|

0

|

|

Cemeteries

|

26,259

|

24,000

|

|

Low value

properties

|

1,030

|

1,000

|

|

Heritage

|

65,941

|

64,000

|

|

Clean heat warm

homes

|

53,658

|

54,000

|

|

Dependent

relative

|

1,377

|

1,000

|

|

Natural

calamity

|

8,623

|

27,000

|

|

Total

|

$402,744

|

$409,548

|

6. Options

6.1 The

recommendation is to receive the report.

7. Alignment with relevant Council policy

7.1 This

recommendation is not inconsistent with any previous Council decision.

8. Assessment of Significance against the Council’s

Significance and Engagement Policy

8.1 This

is not a significant decision.

9. Consultation

9.1 No

consultation has occurred in preparation of this report.

10. Inclusion of Māori in the decision making process

10.1 No

consultation with Maori has occurred in preparation of this report.

Theo

Aitken

Rates

Officer

Attachments

Attachment 1: A1383906 -

Rates remission policy - extract from LTP2015-25

Attachment 2: A1222068

- 2014/15 Rates remissions

|

|

Audit, Risk and Finance Subcommittee

30 July 2015

|

REPORT R4245

Insurance

Renewal for 2015/16

1. Purpose of Report

1.1 To update the Committee on the 2015/16 insurance

renewal.

2. Delegations

2.1 The

Audit, Risk and Finance committee has responsibility for risk management.

3. Recommendation

|

THAT the report Insurance

Renewal for 2015/16 (R4245) be

received.

|

4. Background

Top of the South Collective

4.1 Nelson City Council is part of the Top of the South

Collective with Tasman District Council and Marlborough District Council which

was formed 1 July 2011. The insurance broker is Jardine Lloyd Thomson

(JLT) and Nelson City Council has various insurance policies including:

· Material Damage;

· Business Interruption;

· Motor Vehicle;

· Public and Professional Indemnity;

· Crime, Statutory and Employers Liability;

· Harbour Masters and Wreck Removal Liability;

· Hall Hirers Liability;

· Personal Accident;

· Forestry.

Local Authority Protection Programme

4.2 Separately, Council is a member in the Local Authority

Protection Programme (LAPP) scheme which is a mutual scheme whose membership

consists of 33 local authorities. It is aimed at providing insurance cover

for damage to infrastructural assets from natural hazard events. It only

covers the 40% of damage costs not covered by the National Disaster Recovery

Plan which currently covers 60%. Council has $696 million of

infrastructure assets covered by the Local Authority Protection Programme

($653m 2014/15).

5. Discussion

Top of the South Collective

5.1 Material Damage premiums have decreased by $97,000 for

2014/15 however this is been partially offset by an increase in the Fire

Service Levy of $36,000.

5.2 Historically the Top of the South collective have paid

the Fire Service levies on the fire indemnity loss limit and then shared the

cost between the three parties. A recent Supreme Court decision has

overruled a High Court and Court of Appeal decision and said that fire service

levies must be calculated on the actual indemnity value of the insured property

ie view the collective as three separate contracts for the calculation even

though we are sharing a limit.

5.3 Since the Christchurch earthquakes there has been a

Natural Disaster loss limit in the Material Damage policy reflecting a lack of

capacity in the insurance market (for 2014/15 this was a shared limit of $250

million). This limit has been removed for 2015/16 at no additional

premium.

Local Authority Protection Programme

5.4 Council gave notice last year that it was considering

withdrawing from the LAPP scheme. Members must give one year’s

notice but are able to retract the notice by mid May. Council officers

believe it is financially prudent to give notice to withdraw annually so that

Council could look at other insurance options. Council gave notice 18 May

2015 that they intended to stay with LAPP for the 2015/16 renewal and again

gave notice to withdraw from 1 July 2016.

5.5 Contributions for 2015/16 for LAPP are $279,200

compared with $349,000 in 2014/15 with a $1.8m deductible. This is due to

a softening on the global insurance markets over the last couple of years. This

policy is subject to a limit for any one event of $125m total including the

central government 60% component with one reinstatement per year.

5.6 JLT (Council brokers) sourced some quotes for 2015/16

insurance cover for our infrastructure assets. For a similar deductible to LAPP

of $2m the annual premium quoted ranged between $300,000 and $375,000. This

would be subject to a limit for any one event of $125m total including the

central government 60% component.

5.7 LGNZ commissioned a report in 2013 to review the

insurance market for the local authority sector post Christchurch earthquakes

and leaky homes and the impact thereof on the 3 sector-owned entities Civic,

LAPP and Riskpool.

5.8 The report, prepared by Craig Stobo, made

recommendations which may impact on the structure and role of the LAPP scheme

in the future as well as the Central government’s role. The working

party has been set up to look at the way forward and it is advisable that

Council pay close attention to any potential future changes.

5.9 Given this, officers chose to remain with LAPP for the

2015/16 insurance renewal while retaining the right to withdraw and reconsider

other options from 1 July 2016.

6. Options

6.1 The

recommendation is to receive the report.

7. Alignment with relevant Council policy

7.1 This

recommendation is not inconsistent with any previous Council decision.

8. Assessment of Significance against the Council’s

Significance and Engagement Policy

8.1 This

is not a significant decision.

9. Consultation

9.1 No

consultation has been undertaken in preparing this report.

10. Inclusion of Māori in the decision making process

10.1 No

consultation with Maori has been undertaken in preparing this report.

Nikki

Harrison

Group

Manager Corporate Services

Attachments

Nil

|

|

Audit, Risk and Finance Subcommittee

30 July 2015

|

REPORT R4206

Bad

debt report to 30 June 2015

1. Purpose of Report

1.1 To inform the subcommittee of the bad debts

being written off for the year ending 30 June 2015.

2. Delegations

2.1 The

subcommittee has responsibility for the management of financial risk.

3. Recommendation

|

THAT the report Bad debt report

to 30 June 2015 (R4206) be

received.

|

4. Discussion

4.1 There

are no debts over $2,500 to be approved and written off for the year ending 30

June 2015.

4.2 A number of accounts under $2,500 per debtor have been

written off by the Group Manager Corporate Services under Delegation F12.

These totalled $12,185. $6,141 was for eight separate marina debts,

$4,330 for sixteen separate debts for dog impounding fees, and an $800

concession fee. The balance was minor and sundry in nature.

4.3 The decision is an administrative one and although the

debts are written off from an accounting point of view, a record is still kept

and if an opportunity to recover the debt arises, action will be taken. $11,805

of this balance is with Creditmens, our debt recovery agency, which we will

continue to try to recover. Every

possible effort has been made to locate and obtain payment from these debtors.

4.4 A summary of this year’s write-off compared to

last year’s provision is as follows:

|

|

Write-off 2015

$

|

Write-off 2014

$

|

|

Over $2,500

|

-

|

230,875

|

|

Under $2,500

|

12,185

|

8,176

|

|

Cost for year

|

12,185

|

239,051

|

5. Options

5.1 The

recommendation is to receive the report.

6. Alignment with relevant Council policy

6.1 This

recommendation is not inconsistent with any previous Council decision.

7. Assessment of Significance against the Council’s

Significance and Engagement Policy

7.1 This

is not a significant decision.

8. Consultation

8.1 No

consultation has occurred in preparation of this report.

9. Inclusion of Māori in the decision making process

9.1 No

consultation with Maori has occurred in preparation of this report.

Lynn

Anderson

Accounting

Services Manager

Attachments

Nil

|

|

Audit, Risk and Finance Subcommittee

30 July 2015

|

REPORT R4433

2014/15

Audit New Zealand Letters

1. Purpose

of Report

1.1 To provide the subcommittee with the letters to the

Council on the interim audit for the year ending 30 June 2015 from Audit NZ.

1.2 To provide the subcommittee with the Audit Engagement

Letter for the year ending 30 June 2015 and seek approval for the Mayor to

sign.

2. Delegations

2.1 The

subcommittee is responsible for the oversight of the audit process and the

audit of Council’s Annual Report and annual accounts.

3. Recommendation

|

THAT the report 2014/15 Audit New

Zealand Letters (R4433) and its

attachments (A1371563 and A1372353) be

received.

AND THAT

the committee provide any feedback on the engagement letter to Audit NZ

|

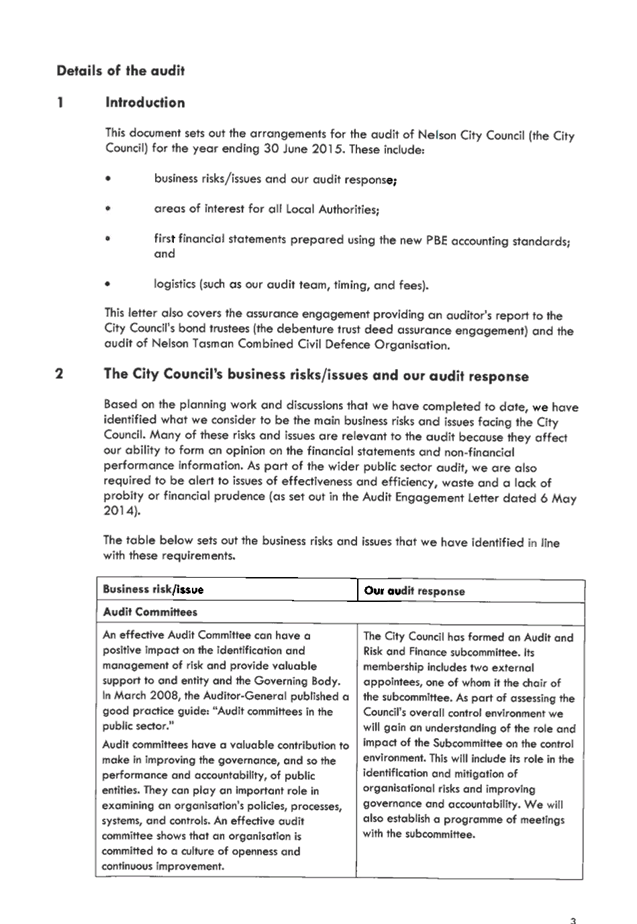

4. Discussion

Interim

audit

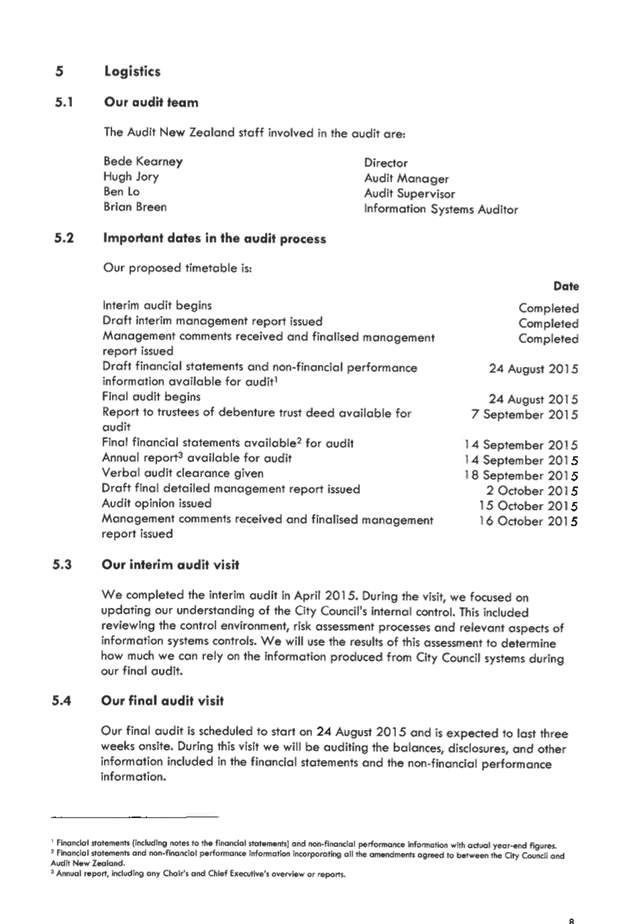

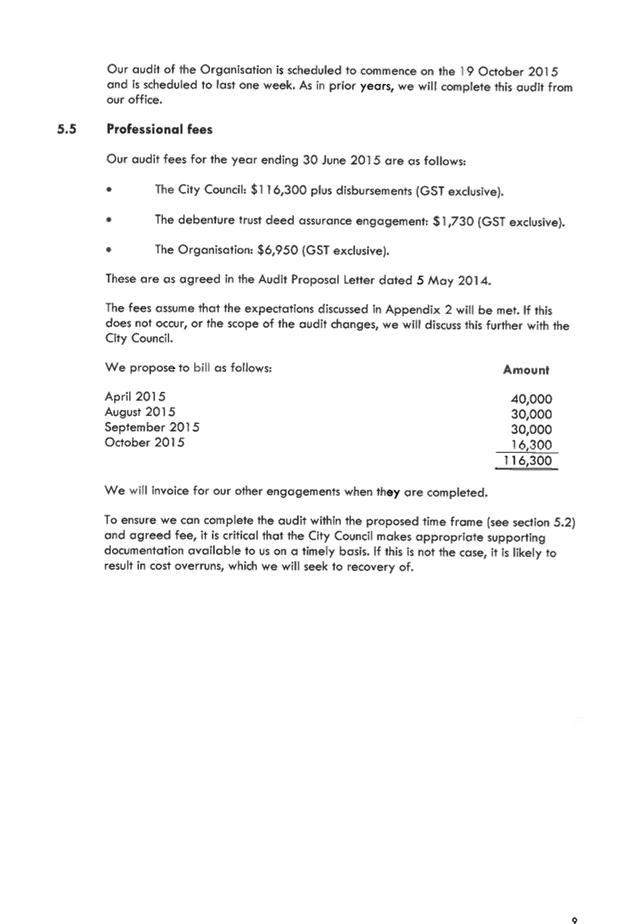

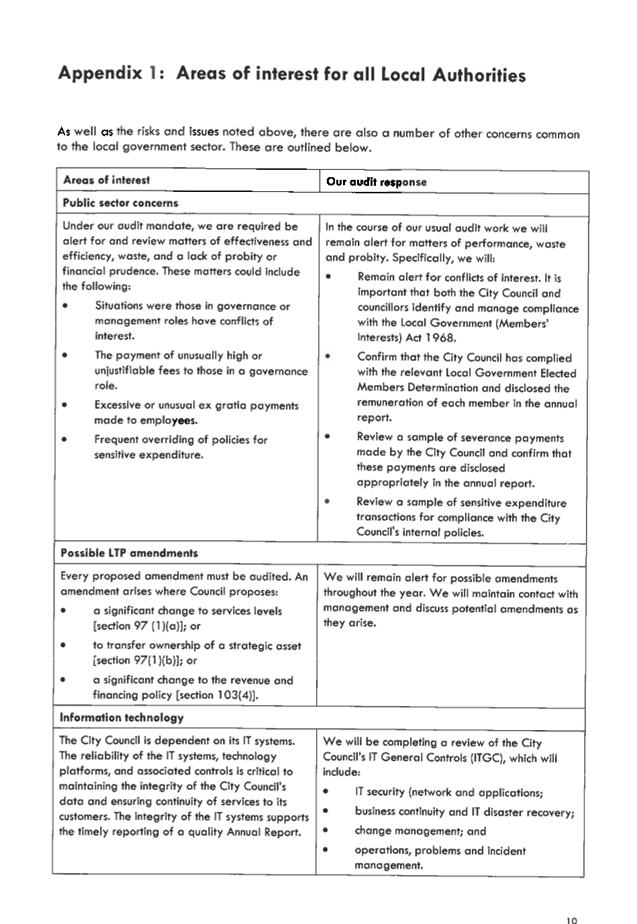

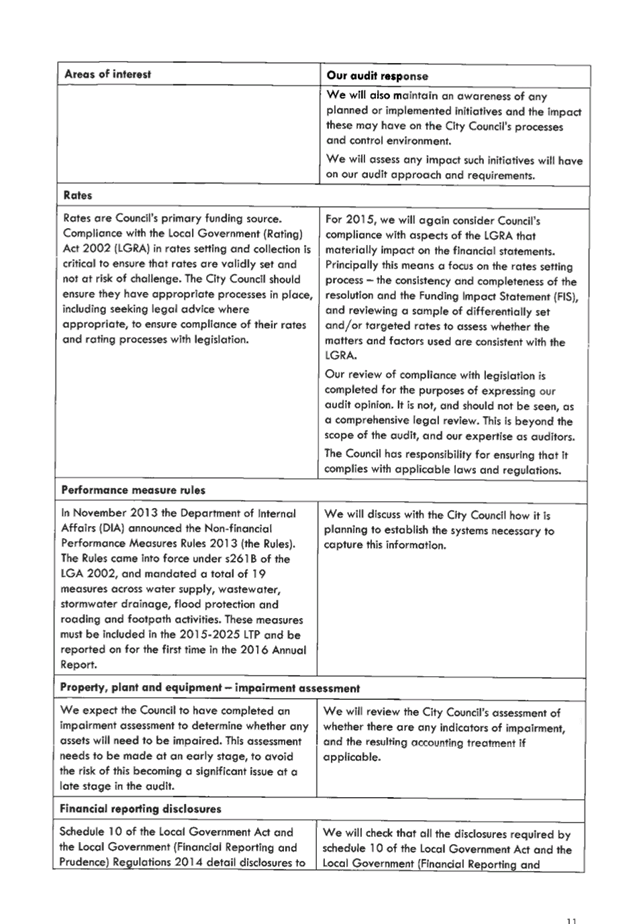

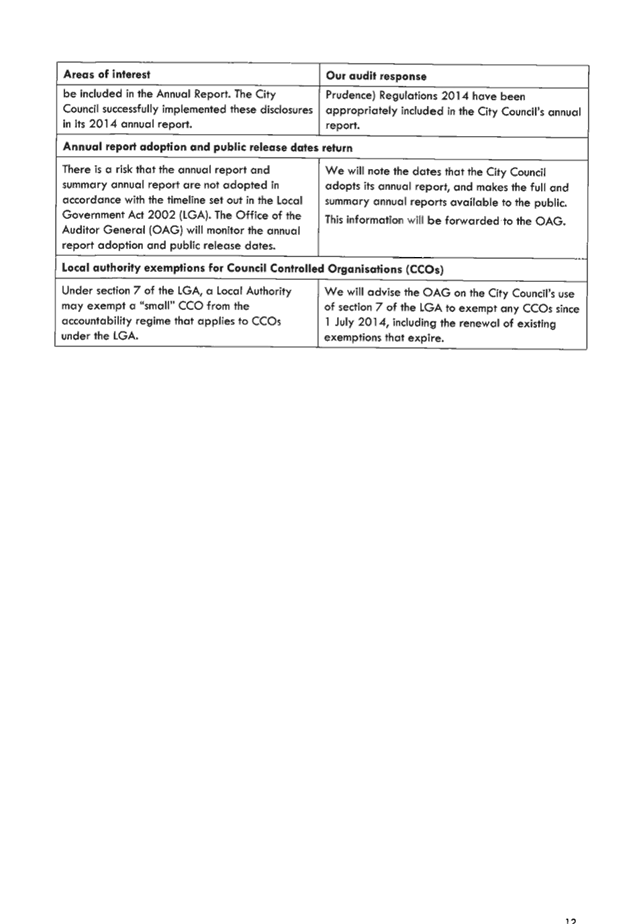

4.1 Audit

NZ carried out the interim audit for the year ending 30 June 2015 in mid April

2015 which focused on the Council’s internal controls and the overall

control environment. They issued two letters - a letter to the Council which

covers governance issues (Attachment 1) and a letter to the Chief Executive

which covers management issues.

4.2 Overall

Audit NZ found that the Council’s internal controls were operating

effectively. However they have identified areas where the Council could

consider enhancing its internal controls which are outlined in the letter to

the Chief Executive.

Audit

Engagement letter

4.3 The

Audit Engagement letter (Attachment 2) sets out the proposed arrangements for

the 2014/15 audit of the Council, including the debenture trust deed and Nelson

Tasman Combined Civil Defence Organisation.

4.4 This

letter is required to be signed by Council to confirm that the details of the

audit match its understanding of the arrangements. The Mayor has provisionally

signed the letter but this has not been forwarded to Audit NZ, pending any

feedback from this Committee.

5. Options

5.1 That

the subcommittee note the matters raised in the letters to the Council and the

Chief Executive on the interim audit of Nelson City Council for the year ending

30 June 2015.

5.2 That

the subcommittee either agree to sign the Audit Engagement letter or provide

additional feedback to Audit NZ.

6. Alignment

with relevant Council policy

6.1 This

recommendation is not inconsistent with any previous Council decision.

7. Assessment

of Significance against the Council’s Significance and Engagement Policy

7.1 This

is not a significant decision.

8. Consultation

8.1 No

consultation has occurred in preparation of this report.

9. Inclusion

of Māori in the decision making process

9.1 No

consultation with Maori has occurred in preparation of this report.

Nikki

Harrison

Group

Manager Corporate Services

Attachments

Attachment 1: A1371563 -

Audit New Zealand - Letter to the Council on the interim audit of Nelson City

Council for the year ending 30 June 2015

Attachment 2: A1372353

- Audit New Zealand - Audit Engagement Letter 2014/15

Audit, Risk and Finance

Subcommittee

Audit, Risk and Finance

Subcommittee