AGENDA

Ordinary meeting of the

Audit, Risk and Finance Subcommittee

Thursday 18 June 2015

Commencing at 1.00pm

Ruma Mārama

Level 2A, Civic House

110 Trafalgar Street, Nelson

Membership: Mr John Peters (Chairperson), Her Worship the

Mayor Rachel Reese, Councillors Ian Barker and Brian McGurk, and Mr John Murray

Guidelines for councillors

attending the meeting, who are not members of the Committee, as set out in

Standing Orders:

·

All councillors, whether or not they are members of the

Committee, may attend Committee meetings (SO 2.12.2)

·

At the discretion of the Chair, councillors who are not Committee

members may speak, or ask questions about a matter.

·

Only Committee members may vote on any matter before the

Committee (SO 3.14.1)

It is good practice for both Committee members and

non-Committee members to declare any interests in items on the agenda.

They should withdraw from the table for discussion and voting on any of these

items.

Audit, Risk and Finance

Subcommittee

Audit, Risk and Finance

Subcommittee

18

June 2015

Page

No.

1. Apologies

Nil

2. Confirmation

of Order of Business

3. Interests

3.1 Updates

to the Interests Register

3.2 Identify

any conflicts of interest in the agenda

4. Public

Forum

5. Confirmation

of Minutes

5.1 5

May 2015 6 - 13

Document number M1202

Recommendation

THAT

the minutes of the meeting of the Audit, Risk and Finance Subcommittee, held

on 5 May 2015, be confirmed as a true and correct record.

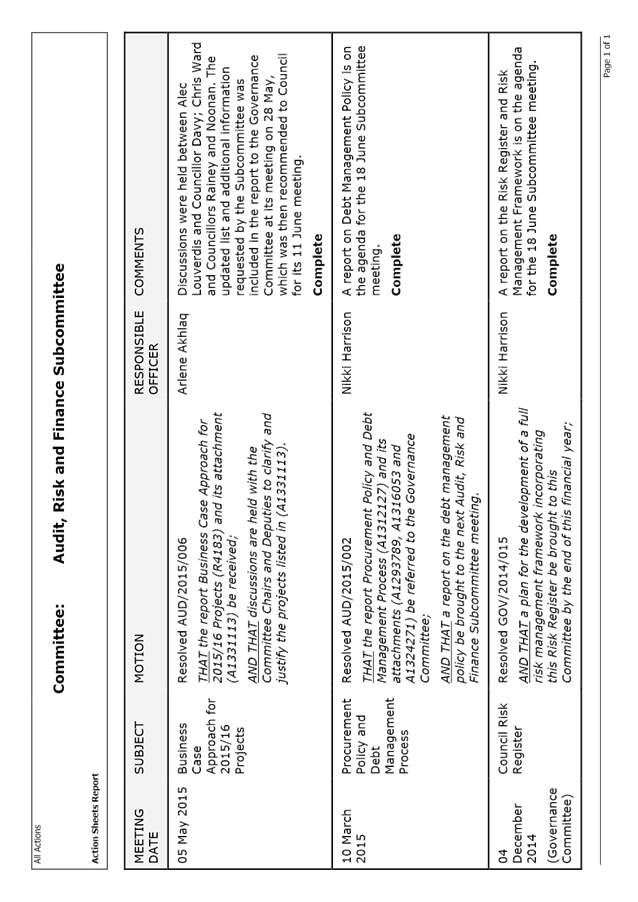

6. Status

Report - Audit, Risk and Finance Subcommittee - 18 June 2016 14 - 15

Document number R4386

Recommendation

THAT the Status Report Audit, Risk

and Finance Subcommittee 18 June 2015 (R4386)

and its attachment (A1324298) be

received.

7. Chairperson's

Report 16 - 16

Document number R4390

Recommendation

THAT

the Chairperson's Report (R4390)

be received and the updates noted.

Finance

8. Draft

Debt Management Policy 17 - 23

Document number R4178

Recommendation

THAT the report Draft Debt

Management Policy (R4178) and its

attachment (A1353429) be received.

Recommendation to Governance

Committee and Council

THAT

the Draft Debt Management Policy (A1353429) be approved.

9. Corporate

Report to 30 April 2015 24 - 43

Document number R4244

Recommendation

THAT

the report Corporate Report to 30 April 2015 (R4244) and its attachment (A1366139) be received and the variations noted.

10. Risk

Register and Framework Plan 44 - 53

Document number R4246

Recommendation

THAT the report Risk Register and

Framework Plan (R4246) and its

attachments (A1241121 and A1359808) be received.

Public Excluded Business

11. Exclusion

of the Public

Recommendation

THAT

the public be excluded from the following parts of the proceedings of this

meeting.

The

general subject of each matter to be considered while the public is excluded,

the reason for passing this resolution in relation to each matter and the

specific grounds under section 48(1) of the Local Government Official

Information and Meetings Act 1987 for the passing of this resolution are as

follows:

|

Item

|

General subject of each matter to be considered

|

Reason for passing this resolution in relation to each matter

|

Particular interests protected (where applicable)

|

|

1

|

Audit,

Risk and Finance Subcommittee Meeting - Public Excluded - 5 May 2015

|

Section

48(1)(a)

The public

conduct of this matter would be likely to result in disclosure of information

for which good reason exists under section 7.

|

The

withholding of the information is necessary:

· Section

7(2)(a)

To protect the privacy of natural

persons, including that of a deceased person.

· Section

7(2)(i)

To enable the local authority to carry

on, without prejudice or disadvantage, negotiations (including commercial and

industrial negotiations).

|

12. Re-admittance

of the public

Recommendation

THAT

the public be re-admitted to the meeting.

Minutes of a meeting of

the Audit, Risk and Finance Subcommittee

Held in Ruma Mārama,

Level 2A, Civic House, 110 Trafalgar Street, Nelson

On Tuesday, 5 May 2015,

commencing at 1.09pm

Present: Mr

J Peters (Chairperson), Her Worship the Mayor R Reese, Councillors B McGurk and

I Barker, and Mr John Murray

In Attendance: Councillor

G Noonan, Group Manager Infrastructure (A Louverdis), Group Manager Community

Services (C Ward), Group Manager Corporate Services (N Harrison), Manager

Communications (P Shattock), Manager Capital Projects (S Davies), Manager

Administration (P Langley), and Administration Adviser (G Brown)

Apology: Councillor

I Barker for early departure

1. Apology

|

Resolved AUD/2015/001

THAT an apology be

received and accepted from Councillor Barker for early departure.

Peters / McGurk Carried

|

2. Confirmation of Order of Business

There was no change to the order of business.

3. Interests

There were no updates to the

Interests Register, and no interests with items on the agenda were declared.

It was noted that there was no

information in the Members Interests Register for Glenice Paine and this needed

to be followed up.

4. Public Forum

There was no public forum.

5. Confirmation of Minutes

5.1 10

March 2015

Document number

M998, agenda pages 7 - 14 refer.

|

Resolved AUD/2015/002

THAT the minutes of

the meeting of the Audit, Risk and Finance Subcommittee, held on 10 March

2015, be confirmed as a true and correct record.

McGurk / Murray Carried

|

6. Status Report - Audit, Risk and

Finance Subcommittee - 5 May 2015

In response to a question, Group

Manager Corporate Services, Nikki Harrison advised the Risk Register would be

brought to the next Audit, Risk and Finance Subcommittee meeting and the Debt

Management Policy had not yet been adopted.

Document number R4175, agenda

pages 15 - 16 refer.

|

Resolved AUD/2015/003

THAT the Status Report Audit,

Risk and Finance Subcommittee 5 May 2015 (R4175) and its attachment (A1324298) be received.

McGurk / Murray Carried

|

Governance

7. Interests Register

Document number R4170, agenda

pages 17 - 25 refer.

It was noted that Councillor

Barker was no longer a member of the Nelson Residents Association, therefore

this needed to be removed from the Members Interests Register.

8. Events Resource Consent Charging

Regime for RM125012

Document number R4177, agenda

pages 27 - 30 refer.

Manager Community Partnerships,

Shanine Hermsen, presented.

In response to a question, Ms

Hermsen advised that Anzac Day at Anzac Park did not fall into consent

RM125012, however Opera in the Park was covered in this consent. She added that

she believed the consent did not expire but this needed to be confirmed.

In response to a question, Group

Manager Community Services, Chris Ward, advised that if there was a charge to

attend an event then it was treated as a commercial activity. He

clarified this was not the case for ‘koha’ events.

There were concerns raised in relation

to costs for the use of specific venues which could be written into a resource

consent. Mr Ward advised that fees and charges were currently being reviewed

across Council and he could provide this information to the Subcommittee when

complete.

There was general agreement that

the charge for the resource consent should be increased to $500 and that it

should be clarified this was only for commercial ticketed events.

|

Resolved AUD/2015/004

THAT the report Events Resource

Consent Charging Regime for RM125012 (R4177)

be received.

McGurk / Peters Carried

|

|

Recommendation to Governance

Committee and Council AUD/2015/005

THAT

Council consider the options for the charging regime for the use of

Council’s Resource Consent RM125012, as detailed in report R4177, and

increase the charge to $500 and apply it only to commercial ticketed events.

Peters / McGurk Carried

|

Attendance: Councillor Barker left the meeting at 1.39pm.

9. Business Case Approach for

2015/16 Projects

Document number R4183, agenda

pages 31 - 39 refer.

Senior Project Adviser, Arlene

Akhlaq, presented.

In response to a question, Ms

Akhlaq advised the definition of a business case was that it identified the

problems, illustrated how these could be resolved, and the stated expected

benefits. She added that a business case helped manage the project and would

aid decision making.

In response to a further

question, Ms Akhlaq said the bullet points under section 4.3 of the report were

from Prince 2 methodology, which was internationally accredited.

In response to a question, Ms

Akhlaq advised there was a presentation by Derek Walker from Third Bearing

during the Long Term Plan workshops and she confirmed the report had been

received by Council at the end of October 2014.

There were concerns raised that

some members had not read the Alan Bickers or Third Bearing reports.

In response to a question, Ms

Akhlaq advised the purpose of the officer report was to address the Council

resolution from June 2014, which was to ‘give consideration to the

projects that will follow a business case approach.’ She added that at

this point in time, detailed business cases could not be conducted for all

projects.

In response to a question, Group

Manager Infrastructure, Alec Louverdis, informed the Subcommittee the projects

highlighted in yellow were a first cut by the Senior Leadership Team and still

needed to be approved by Council as part of the Long Term Plan process. He

clarified that some multiyear capital projects had started this financial year

and for that reason were not shaded yellow.

There was concern around how

projects were identified and that a process should be set before moving

forward. In response to a question, Ms Akhlaq said the rationale for the chosen

projects was that management believed these needed specific attention due to

public/political interest or were of a substantial cost. She added that all

projects do receive a level of attention.

Group Manager Community Services,

Chris Ward, said the usual mechanism for projects would be through Asset

Management Plans but due to time restrictions this was the best mechanism to

draw the Subcommittee’s attention to these projects.

There was a discussion that

rationale for project selection would be beneficial especially for future

projects. It was agreed that further information would be required and that it

would be worthwhile having a discussion with committee chairs as to projects

they thought required businesses cases before the next Governance Committee

meeting.

It was suggested that a column be

added to attachment 1 showing the justification for the project selection, and

that the projects should be listed under the committee the project would be

delegated to.

|

Resolved AUD/2015/006

THAT the report Business Case

Approach for 2015/16 Projects (R4183)

and its attachment (A1331113) be

received;

AND

THAT discussions are held with the Committee Chairs and

Deputies to clarify and justify the projects listed in (A1331113).

Her Worship the Mayor / McGurk Carried

|

|

Recommendation to Governance

Committee and Council AUD/2015/007

THAT

a revised report and list of projects to follow a business

case approach be confirmed at the next Governance Committee meeting.

Her Worship the Mayor/ McGurk Carried

|

Finance

10. Letter to the Council on the

Audit for the Year Ending 30 June 2014 - Further Information

Document number R4168, agenda

pages 40 - 42 refer.

In response to a question, Group

Manager Corporate Services, Nikki Harrison, advised there had not been any

impact to levels of service from the reduction in staff.

|

Resolved AUD/2015/008

THAT the report Letter to the

Council on the Audit for the Year Ending 30 June 2014 - Further Information

(R4168) be received.

Murray / McGurk Carried

|

11. Corporate Report for the

Period Ending 31 March 2015

Document number R4194, agenda

pages 44 - 65 refer.

Group Manager Corporate Services,

Nikki Harrison, and Senior Accountant, Tracey Hughes, presented.

In response to a question, Ms

Harrison advised there were a number of adjustments to projections for year

end, however it was favourable in terms of savings. She added that the savings

were not all ratings related.

Group Manager Infrastructure,

Alec Louverdis, advised the $5,000 stated in section 5.6.4 in the report

relating to the Dun Trail slip was only for a temporary solution to open up the

track to users, and that a long term solution needed to be considered following

the submission of a geotechnical report from the Waimarama Sanctuary Trust.

In response to a question, Group

Manager Community Services, Chris Ward, said unbudgeted expenditure would be considered

by Council if there was no initial budget.

In response to a question, Mr

Louverdis advised the flood protection works had not been completed yet due to

the gravel build up from storm events in December 2011, April 2013 and June

2014, but a plan was now in place for this to progress. He added there were

issues with landowners in certain areas.

In response to questions, Mr

Louverdis said the Saxton Creek Upgrade from Champion Road to Main Road Stoke

had been defined in the 2014/15 Annual Plan but not resolved as yet.

In relation to Whakatu

Drive/Beatson Road cycleway and sewer project, Mr Louverdis confirmed there

would be minimal impact to any southern link.

In response to question, Manager

Capital Projects, Shane Davies, advised that the Stanley/Beachville stormwater

project was currently under negotiations with the landowner relating to the

easement and if this was unresolved an alternative option was available.

In response to a question, Mr

Louverdis noted the Rocks Road cycling and walking project was now being

project managed by the New Zealand Transport Agency, however this was still a

partnership with Nelson City Council and the Steering Group meetings would

continue.

Mr Davies advised the final costs

for the Maitai Walkway (Akersten Street to Trafalgar Street) were on budget. In

response to a question, Mr Davies said the Saltwater Creek/Haven Road culvert

completion date needed to be updated via the Councillors newsletter.

|

Resolved AUD/2015/009

THAT the report Corporate Report for the Period Ending 31

March 2015 (R4194) and

attachments (A1342336, A1311288, A133636, A1340305 and A793514) be received and

the variations noted.

Murray / McGurk Carried

|

|

Recommendation to Governance

Committee and Council AUD/2015/010

THAT

Council note that ongoing costs of approximately $11,250 pa will need to be

included in the Long Term Plan 2015-25 for live streaming of Council

meetings.

McGurk /Her Worship the Mayor Carried

|

12. Exclusion of the Public

|

Resolved AUD/2015/011

THAT

the public be excluded from the following parts of the proceedings of this

meeting.

The

general subject of each matter to be considered while the public is excluded,

the reason for passing this resolution in relation to each matter and the

specific grounds under section 48(1) of the Local Government Official

Information and Meetings Act 1987 for the passing of this resolution are as

follows:

McGurk / Murray Carried

|

|

Item

|

General subject of each matter to be considered

|

Reason for passing this resolution in relation to

each matter

|

Particular interests protected (where applicable)

|

|

1

|

Kahurangi Employment

Trust - Completion of Liquidation

|

Section 48(1)(a)

The public conduct of this

matter would be likely to result in disclosure of information for which good

reason exists under section 7

|

The withholding of the

information is necessary:

· Section 7(2)(a)

To protect the privacy of

natural persons, including that of a deceased person

· Section

7(2)(i)

To enable the local

authority to carry on, without prejudice or disadvantage, negotiations

(including commercial and industrial negotiations)

|

The meeting went into public

excluded session at 3.40pm and resumed in public session at 3.54pm.

13. Re-admittance of the Public

|

Resolved AUD/2015/012

THAT

the public be re-admitted to the meeting.

McGurk / Murray Carried

|

There being no further business the

meeting ended at 3.54pm.

Confirmed as a correct record of proceedings:

Chairperson

Date

Chairperson

Date

|

|

Audit, Risk and Finance Subcommittee

18 June 2015

|

REPORT R4386

Status

Report - Audit, Risk and Finance Subcommittee - 18 June 2016

1. Purpose

of Report

1.1 To

provide an update on the status of actions requested and pending.

2. Recommendation

|

THAT the Status Report Audit,

Risk and Finance Subcommittee 18 June 2015 (R4386) and its attachment (A1324298) be received.

|

Shailey

McLean

Administration

Adviser

Attachments

Attachment 1: Status

Report - Audit, Risk and Finance Subcommittee - June 2015

|

|

Audit, Risk and Finance Subcommittee

18 June 2015

|

REPORT R4390

Chairperson's

Report

1. Purpose

of Report

1.1 To update the Audit, Risk and Finance

Subcommittee on various matters.

2. Recommendation

|

THAT

the Chairperson's Report (R4390)

be received and the updates noted.

|

3. Discussion

New

Appointments Relevant to Audit, Risk and Finance

3.1 I

am very pleased to see the progress being made by the Chief Executive regarding

the new structure around internal audit, risk management and health and

safety.

Audit, Risk and Finance Workplan

3.2 I

have been working with the Group Manager Corporate Services to establish an

annual Workplan for the Subcommittee, providing a plan and timetable of regular

and scheduled activities. This will form the standard base for ARF requirements

and reporting, against which any additional specific activities and tasks may

be scheduled.

Terms

of Reference

3.3 A

second draft of a Terms of Reference for this Subcommittee is being drawn

up. It is intended that these, together with the above Workplan, will be

submitted to the next meeting.

John

Peters

Chairperson

- Audit, Risk and Finance Subcommittee

Attachments

Nil

|

|

Audit, Risk and Finance Subcommittee

18 June 2015

|

REPORT R4178

Draft

Debt Management Policy

1. Purpose of Report

1.1 To update the Committee on the Council’s Draft

Debt Management Policy as requested at the Audit, Risk and Finance Subcommittee

meeting on 10 March 2015.

2. Delegations

2.1 The Audit, Risk and Finance Subcommittee has oversight

of the management of financial risk.

3. Recommendation

|

THAT the report Draft Debt

Management Policy (R4178) and

its attachment (A1353429) be received.

|

Recommendation

to Governance Committee and Council

|

THAT the

Draft Debt Management Policy (A1353429) be approved.

|

4. Background

4.1 The Procurement Policy and Debt Management Process was

considered at the Audit, Risk and Finance Subcommittee on 10 March 2015.

The Subcommittee requested that the Draft Debt Management Policy be reported to

the Subcommittee at a future meeting.

5. Discussion

5.1 The

Debt Management Policy covers the guidelines for:

5.1.1 Extending

credit – new standard credit application forms have been put in place for

new customers applying for credit. Finance will work through a process of

getting an application in place for existing debtors as it is important that

debtors accept our terms and conditions of credit.

5.1.2 Payment

terms and invoicing – a key change from previous practice is that a list

of aged debtors will be provided to managers each month to ensure that they are

taking appropriate and consistent action in relation to the debt.

5.1.3 Debt

collection – outlines the current procedure. However, all debts

over $10,000 and/or of a sensitive nature and greater than 90 days overdue will

be reported to the Audit, Risk and Finance Committee in the future. It is not

standard practice to charge interest on outstanding debts but it is recommended

the Group Manager Corporate Services has discretion to charge interest.

5.1.4 Disputed

amounts – an Invoice Dispute Procedure is included in the credit

application form as part of the Terms and Conditions.

5.1.5 Payment

arrangement by instalments – outlines the procedure to be followed when

payment arrangements are put in place.

5.1.6 Bad

debts – this section documents the current process for writing off bad

debts.

6. Options

6.1 Accept

the recommendation – approve the Draft Debt Management Policy.

6.2 Reject

the recommendation – not approve the Draft Debt Management Policy.

7. Alignment with relevant Council policy

7.1 This

decision is not inconsistent with any other previous Council decision.

8. Assessment of Significance against the Council’s

Significance and Engagement Policy

8.1 This

is not a significant decision under the Council’s Significance and

Engagement Policy.

9. Consultation

9.1 No

consultation has been undertaken in preparing this policy.

10. Inclusion of Māori in the decision making process

10.1 No

consultation with Maori has been undertaken in preparing this policy.

Nikki

Harrison

Group

Manager Corporate Services

Attachments

Attachment 1: A1353429 -

Draft Debt Management Policy

Draft Debt Management Policy

Effective June 2015

Review date June 2018

1.

Contact:

Accounting Services Manager, Finance

1. Policy

Objectives and Scope

The Policy Objectives and Scope are as follows:

1.1. To ensure Council manages its

Accounts Receivable in such a way that reduces risk to the organisation and

protects the income earned for services provided.

1.2. Provides a consistent approach to the

management and follow-up of debt.

1.3. Provides the rules and general

guidance around extending credit to third parties.

1.4. Provides the rules around the

write-off of debt.

1.5. This policy excludes rates (including

water rates), parking, and dogs which are covered by statutory processes.

2. Principles

of Policy

The guiding principles for this policy are as follows:

2.1. Responsibilities. All business units

are responsible to provide complete and accurate information for any chargeable

work or services to external parties for billing purposes.

2.2. Risk Management. Principles of risk

management will underpin decisions made in relation to credit and debt

management. The business unit providing the goods and/or service is accountable

to ensuring that the debtor is a good credit risk, ensuring Council’s

exposure to potential debt write-off is eliminated.

2.3. Fairness and Equity. Council will

ensure that all debts are managed fairly and equitably. Parties that incur

debts do so on the understanding that Council’s standard terms of payment

are met.

3. Policy

Guidelines

The sections following are intended as a guide to ensure outstanding

debts are managed and reported to Council.

3.1. Extending Credit:

· It is the responsibility of managers

to ensure that debts raised by invoice are properly chargeable and comply with

applicable regulations, laws and Council policies.

· Standard credit application forms,

appropriate to the level of credit to be extended, or the risk, will be

completed when a customer applies for credit.

· Managers and their delegates should

request a credit check from the finance team before they agree to extending

credit. A credit check is to be based on:

o The value of the work being

undertaken is above $10K, or

o A lesser amount if the business unit

feels it is appropriate, or

o Where there is a potential risk to

the organisation, or

o Where there is the potential for an

ongoing relationship between Council and the debtor and a credit history has

not previously been established.

· In cases where the credit check

indicates a high level of risk, then the Accounting Services Manager should

determine that payment terms are to be “Cash in Advance”.

3.2. [jb1] Payment Terms and Invoicing:

· Council’s payment terms are

displayed on the invoice. Standard terms being the 20th of the month following

the date of the invoice.

· Other credit terms may apply in

relation to the approved fees and charges schedule and any ongoing changes,

e.g. cash in advance for building consents.

· Where a debtor does not pay within

the credit term, the debtor is to be considered in default of the agreement to

pay, and collection procedures are to be initiated as appropriate.

· The Managers are provided a list of

all aged debtor accounts, each month showing the status in respect of invoices

as raised by staff within their group.

· All invoices must be raised against

individuals or legal entities, i.e. limited liability companies or incorporated

societies, which provides a specific source of contact for debt recovery.

· Where possible, arrangements will be

put in place to ensure that Council’s interests are protected eg for

seasonal ground use fees, spreading payment over session rather than invoicing

all at the end.

3.3. Debt Collection:

· Where debtors are in default of the

credit terms, the Finance Team is to initiate appropriate collection procedures

after having notified the appropriate manager or their delegate of the debtor

status and confirmed that no reason exists that would inhibit collection

procedures.

· Appropriate collection procedures may

include suspending any further entitlement to credit, and/or to the extent

permitted by law, refrain from supplying further goods or services to the

customer, until such time as the outstanding debt is repaid in full.

· All debts over $10K and/or of high

profile which are likely to be reported to the Audit Risk and Finance Committee

are to be brought to the attention of the Group Manager of the group that

raised the debt.

· With the approval of the Group

Manager Corporate Services, interest may be charged on outstanding debts at

Council’s weighted average interest rate for the period it is

outstanding.

3.4. Payment Arrangement by Instalments:

· All amounts owing to Nelson City

Council should be paid in full immediately when they become due and payable.

However, there may be situations where it is not possible for an amount to be

paid in full immediately, e.g. where full immediate repayment would lead to

unreasonable financial hardship on the customer.

· Only the Accounting Services Manager

may agree to recovery of debts by instalment. The Group Manager Corporate

Services may accept a reasonable request for the payment of an outstanding

amount by instalments, provided that reasonable progress is made promptly

within a specified date.

· Any instalment repayment agreement is

to be documented in writing and agreed by both the debtor and Accounting

Services Manager.

· An explicit term of any such

arrangement is that the failure by the debtor to pay any instalment on or

before the due date will render the full amount of the debt then outstanding,

immediately due and payable.

3.5. Dispute Settlement:

· Where payment of an outstanding debt

is disputed by a debtor, the Debtors Officer will refer to the following

Invoice Dispute Procedure as detailed in the Terms and Conditions.

· Consultation should be made with the

relevant operational staff to attempt to mediate a solution. Any amounts not in

dispute must be paid in full and on time.

3.6. Invoice Dispute Procedure:

· If the customer disagrees with a tax

invoice provided by Nelson City Council:

o The customer must notify Nelson City

Council in writing no later than 10 business days following receipt of the

invoice, setting out in reasonable detail the nature of the invoice dispute and

the reasons for non-payment

o Nelson City Council will acknowledge

receipt of such invoice dispute notice and both parties’ responsible

managers will endeavour to promptly settle the invoice dispute by agreement

o If, on resolution of the invoice

dispute, an amount is due to Nelson City Council, the customer will pay that

amount to Nelson City Council within five business days of resolution of the dispute,

or if a building or resource consent, as per the terms of the consent.

· Where only a portion of an amount

claimed in a tax invoice is the subject of an invoice dispute (disputed

portion), this clause will only apply to the disputed portion and the balance

of the amount payable in respect of that tax invoice must be paid by the

customer to Nelson City Council no later than the due date of the invoice.

3.7. Bad Debts:

· Debts unable to be collected are to

be known as bad debts and must be submitted annually to the Audit Risk and

Finance Committee for write-off if over $2,500.

· These debts are to be registered with

Council’s external debt collection agency or liquidator/receiver for

continued collection.

· The authority levels pertaining to

the write-off of bad debts have been approved by Council, as follows:

o General Manager Corporate Services

approves any debt write-off up to a maximum of $2,500 for any one item.

o Debt write-off amounts in excess of

$2,500 per item require Council approval and will be submitted to the Audit

Risk and Finance Committee.

o All debts written off are to be

recorded for future possible action and information, and systems are to be

updated to best ensure that staff are aware before raising further debts.

4. Monitoring

and Implementation

4.1. Reporting:

· All debts over $10,000 and greater

than 90 days overdue will be reported to the Audit Risk and Finance Committee.

· Other significant debts under $10,000

where there is a potential risk of non payment, or debts of a sensitive nature,

will be reported to the Audit Risk and Finance Committee.

4.2. The policy will be reviewed every

three years or at the request of Council or in response to changed legislative

and statutory requirements or in response to any issues that may arise.

5. Responsibility

5.1. The Debtors Officer is responsible

for Debtor Management, with the assistance of the Accounting Services Manager

for escalation where required. Outstanding debts will be reviewed on a regular

basis by the Debtor Officer and the Accounting Services Manager and decisions

will be made as to the most appropriate debt recovery action. This can include:

· Issue of regular reminders

· Personal contact with the debtor

· Referral of matter to the manager

responsible for initiating the debt (where appropriate)

· Escalation of matter to the Group

Manager Corporate Services and/or referral to debt recovery agents.

|

|

Audit, Risk and Finance Subcommittee

18 June 2015

|

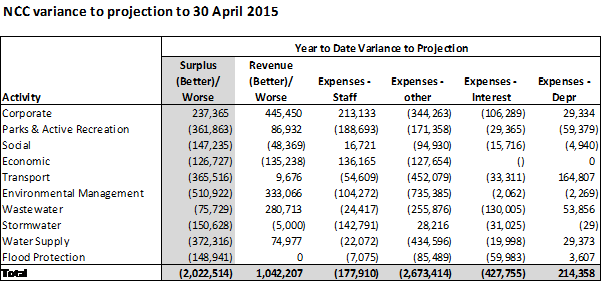

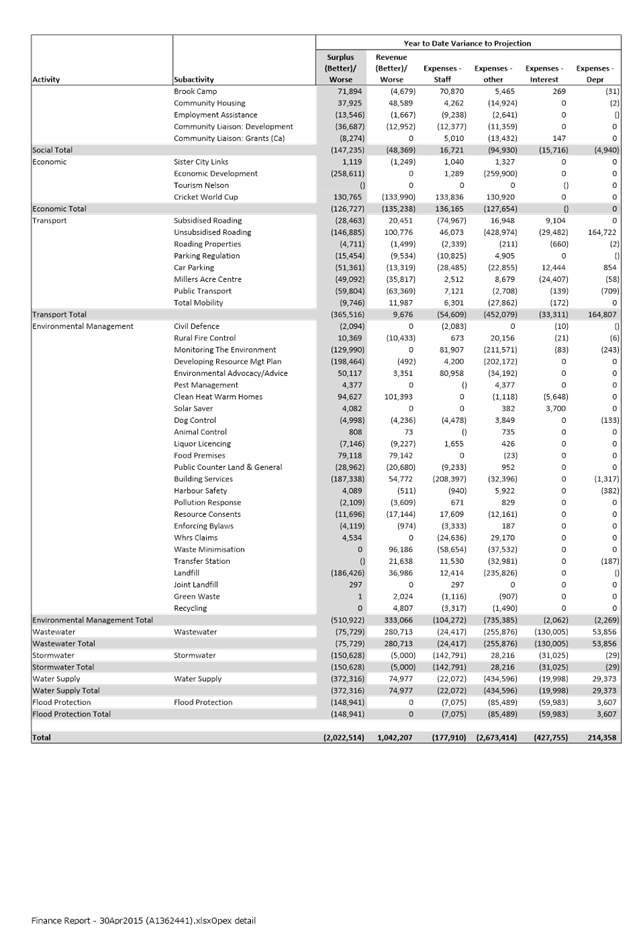

REPORT R4244

Corporate Report to 30 April 2015

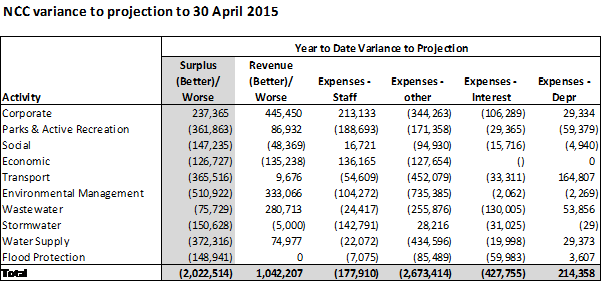

1. Purpose of Report

1.1 To inform the members of the Audit Risk and Finance Committee on the

financial results of activities for the 10 months ending 30 April 2015 compared

to the final projection, completed as part of the Long-Term Plan 2015-2025

(LTP), and to highlight and explain any material variations.

2. Delegations

2.1 The Audit Risk and Finance Committee has oversight of the management of

financial risk and makes recommendations to the Governance Committee and to

Council.

3. Recommendation

|

THAT

the report Corporate Report to 30 April 2015 (R4244) and its attachment (A1366139) be received and the variations noted.

|

4. Background

4.1 The report focuses on the 10 month performance

compared with the year to date projection. Budgets/projections for operating

income and expenditure are phased evenly through the year, whereas capital

expenditure budgets/projections are phased to occur mainly in the second half

of the year.

4.2 Projections (forecasts) were updated in April as part

of the work informing the final LTP.

4.3 Some definitions of terms used within this report:

· Operating income – all income other than rates including

metered water, grants, fees, rentals, and recoveries;

· Rates – includes the general rate, wastewater, stormwater and

flood protection rates, and targeted rates for Solar Saver;

· Staff costs – salaries plus overheads such as training, super,

professional fees and office accommodation expenses;

· Depreciation – includes all depreciation, and any losses on

asset disposal/retirement;

· Interest – includes debt interest, bank fees, interest rate

swap margins, treasury and rating agency fees.

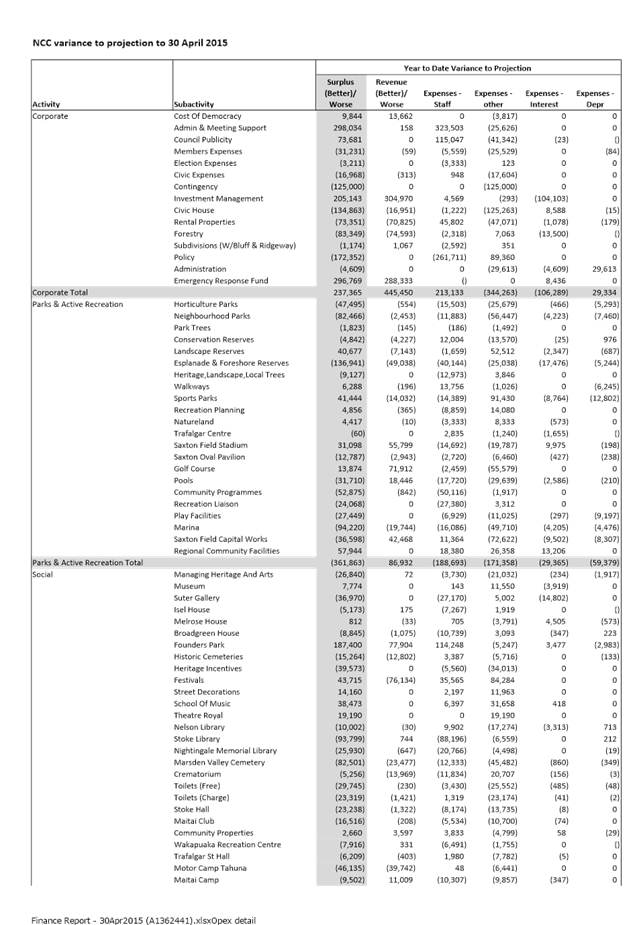

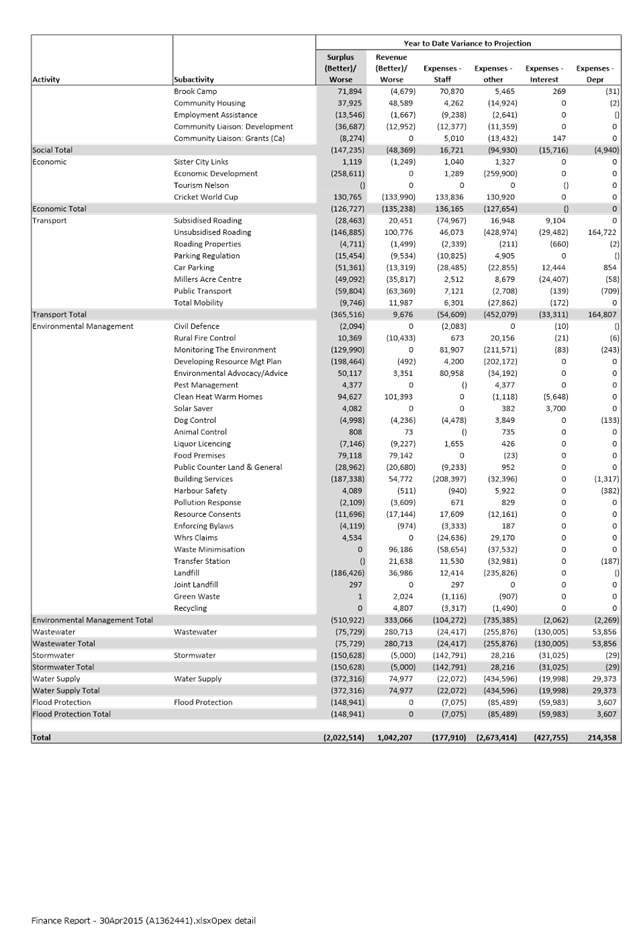

5. Discussion

5.1 The report focuses on performance to date compared with the year to date

projections. More detailed financials by sub-activity are in Attachment 1.

5.2 For the 10 months ending 30 April 2015, the activity surplus/deficits

are $2.0 million favourable to projection.

5.3 Revenue and expenditure variances are discussed by activity.

5.4 Staff expenses are $178,000 in total better than projected. Variances in

activities illustrate where staff time has actually been spent against where it

was expected to be spent at the time of setting the 2014/15 Annual Plan.

Savings identified through the projections exercise are reflected in total in

the Corporate Activity.

Corporate

5.5 The Corporate activity is $237,000 worse than projection due to a range

of factors including:

5.5.1 Revenue – $445,000 less than

projection. Income in the Disaster Recovery Fund is $288,000 under projection

due to timing of further insurance claims (in progress). Internal interest is

$299,000 under projection reflecting the timing of capital expenditure. This is

offset by the income on Rental Properties reflecting one month in advance.

5.5.2 Expenses – staff $213,000 higher than

projection . Organisation-wide savings in staff expenditure identified through

the latest projection exercise have reduced budget available in this activity.

5.5.3 Expenses – other $344,000 better than

projection as the contingency has not yet been called on ($125,000) and Civic

House expenditure is under projection ($125,000). Property condition

assessments has little expenditure recorded against it (timing) and the budget

for post earthquake inspections (reactive budget), year to date $38,000,

currently has only $1,000 recorded against it. There is currently an underspend

of $39,000 in building and other maintenance for Civic House. Expenditure on

the Strategic Property Review is currently being incurred, but is $38,000 under

projection as at the end of April. Third party communications costs (including

production costs for Live Nelson) are under projection by $36,000.

Parks and Active Recreation

5.6 The Parks and Active Recreation activity is $362,000 better than

projection due to:

5.6.1 Revenue - $87,000 less than projection due

to timing of some revenue streams such as the golf course and Saxton Stadium.

5.6.2 Expenses – staff - $189,000 better

than projection. The distribution of staff time over the organisation differs

from anticipated and there are savings across this activity but particularly in

Community Programmes, Esplanade and Foreshore Reserves, Sports Parks and

Recreation Liaison. Savings identified through the projections exercise are

represented in total in the Corporate activity.

5.6.3 Expenses – other - $171,000 better

than projection. Regional Community Facilities is $87,000 more than projection

as the second grant to the Brook Waimarama Sanctuary Fence has been paid in

full ($524,000 - timing). Year to date expenditure is under projection in many

areas including maintenance, electricity and insurance costs and consultancy

costs.

Social

5.7 The Social activity is $147,000 better than projection due to:

5.7.1 Expenses – other - $95,000 better than

projection. Base expenditure is $122,000 underspent year to date across a large

range of activities, for items such as water, insurance, maintenance, cleaning

and electricity. Expenditure against property maintenance contracts are

currently $47,000 under projection.

Economic

5.8 The Economic activity is $127,000 better than projection due to:

5.8.1 Revenue - $135,000 better than projection.

The Cricket World Cup (CWC) cost recovery is now largely complete (producing a

timing variance) and more than anticipated. Extra expenditures not originally

in the budget have been recovered. See paragraph 6.2.

5.8.2 Expenses – staff - $136,000 more than

budgeted, almost entirely in the Cricket World Cup sub-activity. This is a

budgeting issue as the number of staff hours required was within the 4,000

allowed as part of $900,000 expenditure cap in the contract. See paragraph 6.2.

5.8.3 Expenses – other - $128,000 better

than projection. The Economic Development expenditure is under projection by

$260,000. The events contestable fund is $156,000 under projection. If unspent

at year end the balance will be held in reserve for future years. There is no

spending to date in the business incubator (timing), facilities marketing and

economic impact assessment. Expenses relating to the CWC are now complete,

producing a timing effect of expenditure being $131,000 more than projection

(see paragraph 6.2).

Transport

5.9 The Transport activity is $366,000 better than projection due to:

5.9.1 Expenses – other - $452,000 better

than projection, mainly in unsubsidised roading. The most significant

underspends in that activity are:

· Base maintenance ($89,000) including street and sump cleaning

and footpath maintenance, expected to be spent over Autumn;

· $204,000 underspent relating to UFB remediation and corridor access.

Corresponding income is also under projection.

· $57,000 underspent year to date in recovery works from the 2011

emergency event relating to Days Track. This work will be carried forward into

2015/16.

· No expenditure year to date for the southern arterial corridor

management plan ($81,000 - this has been delayed until the findings of the

Southern Arterial Investigation – Annesbrook Drive roundabout to QEII

Drive roundabout (run by NZTA) are known).

5.9.2 Depreciation - $165,000 worse than

projection. Depreciation expense in this activity needs to be adjusted for the

changes to the capital programme as generated by the projections process. Once

adjusted, expenditure is expected to be in line with the depreciation

projection.

Environmental

Management

5.10 This

activity includes Civil Defence and Rural Fire activities, Consents and

Compliance, Environmental Programmes, and Solid Waste activities. The

Environmental Management activity is $511,000 better than projection due to:

5.10.1 Revenue - $333,000 less than projection. Landfill fees

are $43,000 less than projection. Internal income in the solid waste group is

$152,000 less than projection and is offset in expenses. Building services job

sales are $55,000 less than projection. Food premises license fees are

currently $79,000 under projection with most of the income for that subactivity

being invoiced in the last quarter of the financial year (timing). $101,000

year to date income projected for the Clean Heat Warm Homes programme is part

of an end of year adjustment (timing).

5.10.2 Expenses – staff - $104,000 better than

projection. This is mainly in Building Services which has carried vacancies for

much of the year, and which has not been charged staff time from the Resource

Consents team to the extent anticipated.

5.10.3 Expenses – other - $735,000 better than

projection Monitoring the Environment is $212,000 under projection as this sub

activity contains a large number of programmes (timing – almost all of

this variance is committed with outstanding purchase orders). Expenditure

relating to the Nelson plan is currently $200,000 under projection, but there

are outstanding purchase orders for almost all of that amount. Landfill

expenditure is $236,000 under projection reflecting no expenditure yet for

Emissions Trading Scheme (ETS) levies and lower internal charges than

anticipated from other solid waste sub-activities. Other sub activities in

Solid Waste show year to date savings of $73,000.

Wastewater

5.11 The

Wastewater activity is $76,000 better than projection due to:

5.11.1 Revenue - $281,000 less than projected, related to the

NRSBU investment return. The distribution from the Regional Sewerage Business

Unit (NRSBU) is less than budgeted as input volumes from all five customers are

less than anticipated.

5.11.2 Expenses – other - $256,000 less than projection

mainly due to lower charges than expected from NRSBU, see 5.11.1.

5.11.3 Expenses – Interest - $130,000 less than

projected due to timing of capital expenditure.

Stormwater

5.12 The

Stormwater activity is $151,000 better than projection due to:

5.12.1 Expenses – staff - $143,000 better than

projection. The distribution of staff time over the organisation differs from

anticipated.

Water

5.13 The

Water activity is $372,000 better than projection due to:

5.13.1 Revenue – $75,000 worse than projection. The

residential reading round extends through May and income for the full year is

expected to be close to projection.

5.13.2 Expenses – other - $435,000 better than

projection relates to year to date underspend against maintenance budgets

($256,000), mainly in headworks maintenance where the activity is concentrated

towards the end of the year, and in reactive budgets. Base service and

operating expenditure show a current underspend of $173,000 in respect of

electricity and insurance costs (savings) and the timing of the costs of the

meter reading contract.

Flood

Protection

5.14 The

Flood Protection activity is $149,000 better than projection.

5.14.1 Expenses – other - $85,000 better than

projection. This is relating to recovery works. There has been only minor

expenditure year to date for these works (identified from the December 2011

Rainfall Event). The projects have now been re-categorised as mitigation

(capital) works and will extend into the 2015/16 year.

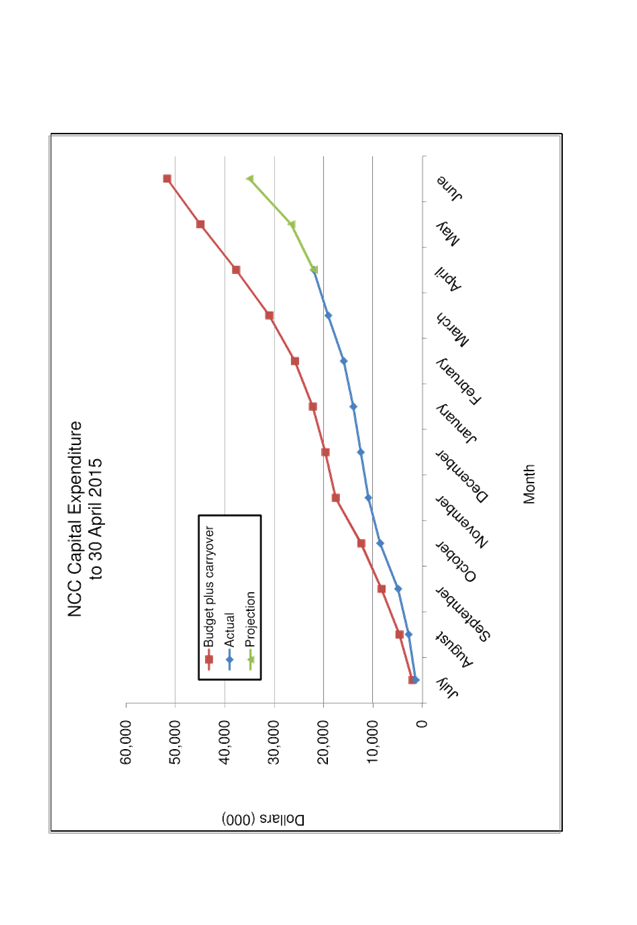

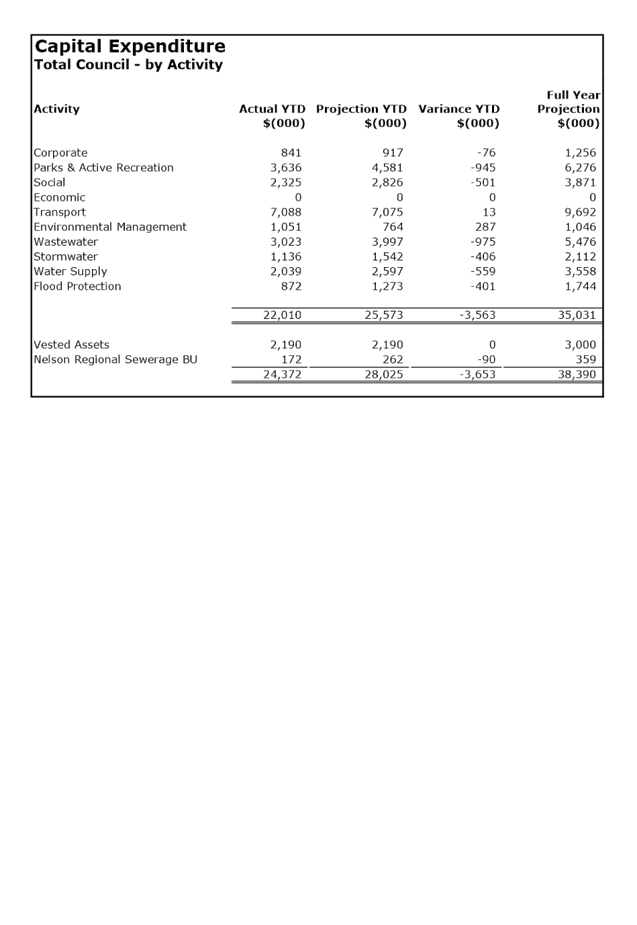

Capital

Expenditure

5.15 Capital

expenditure to 30 April 2015 was $22.0 million, $3.6 million (10%) below

projection. Details are included in Attachments 2 to 5.

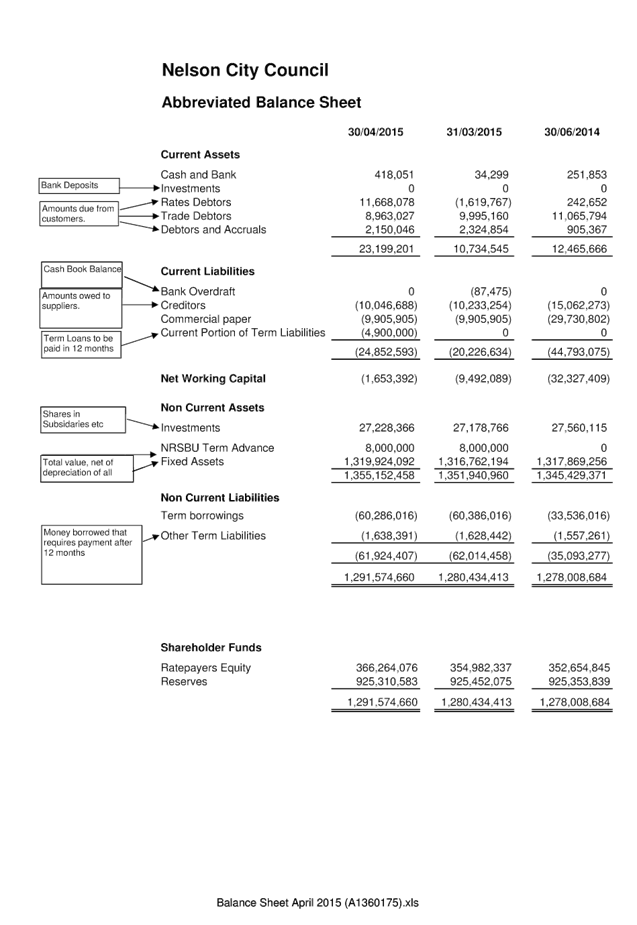

Balance

Sheet

5.16 The

Rates Debtors balance reflects the fourth quarter rates invoicing. This has

generated a similar increase in Ratepayer’s Equity.

5.16.1 The increase in current portion of term liabilities

reflects higher levels of expenditure late in the year on capital projects

along with the funding of working capital requirements resulting from the

timing of cash in/out flows.

5.16.2 Fixed assets net of depreciation have increased by $3.2

million reflecting that expenditure on capital projects tends towards the end

of the financial year.

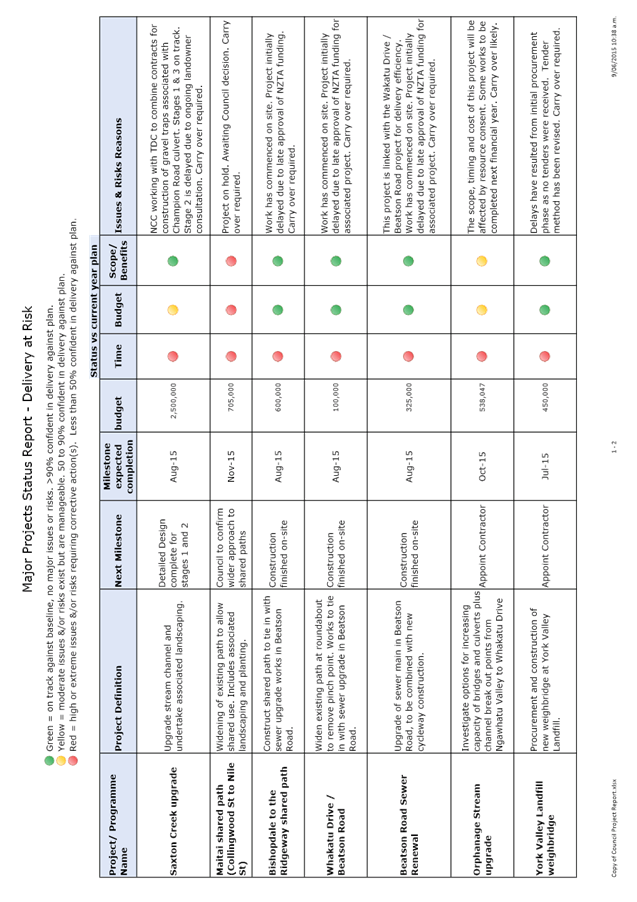

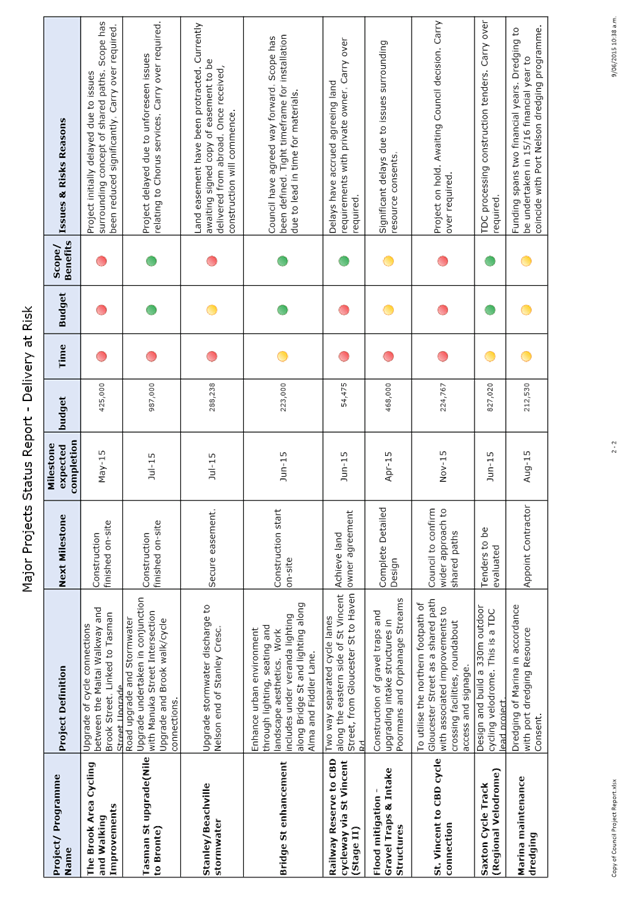

6. Projects Update

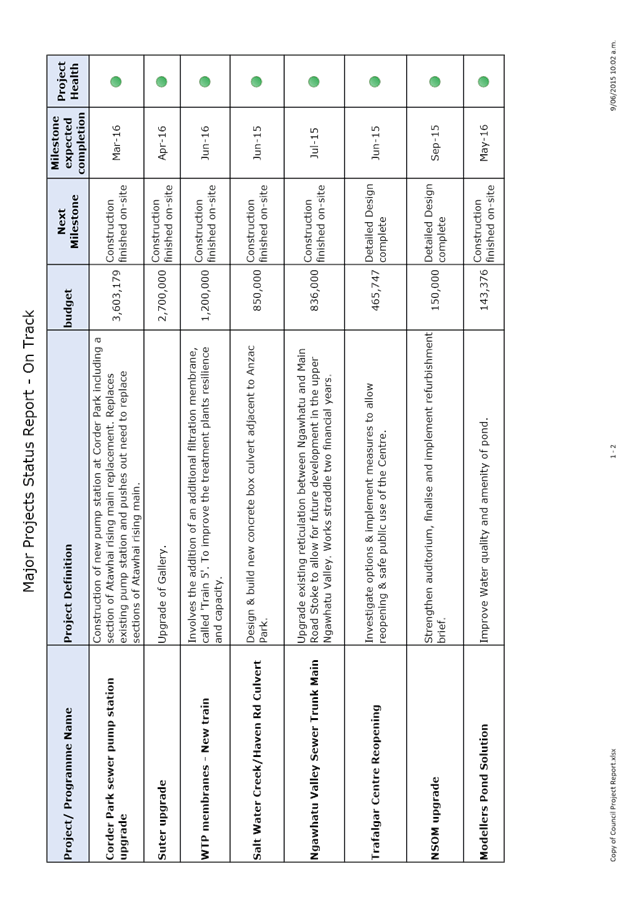

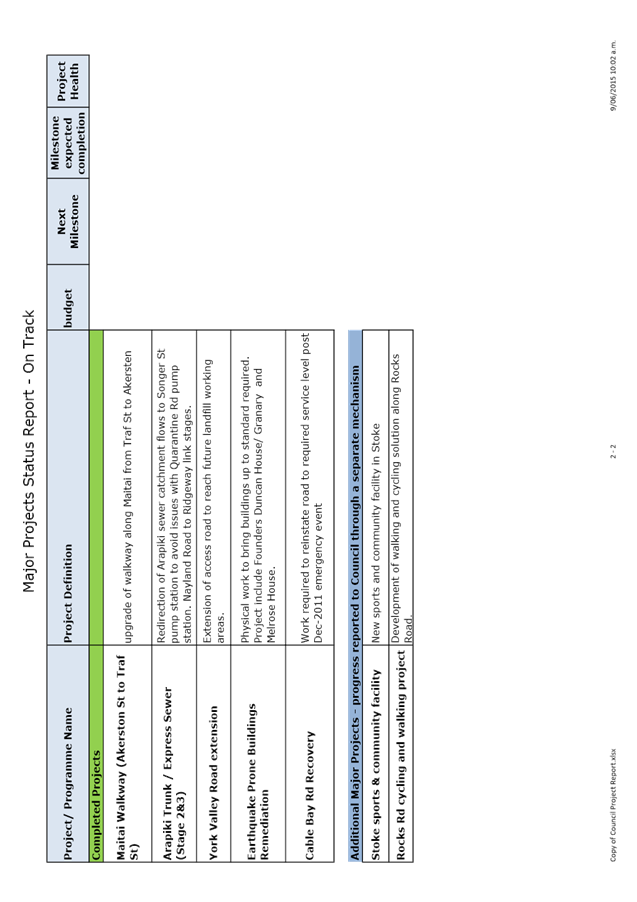

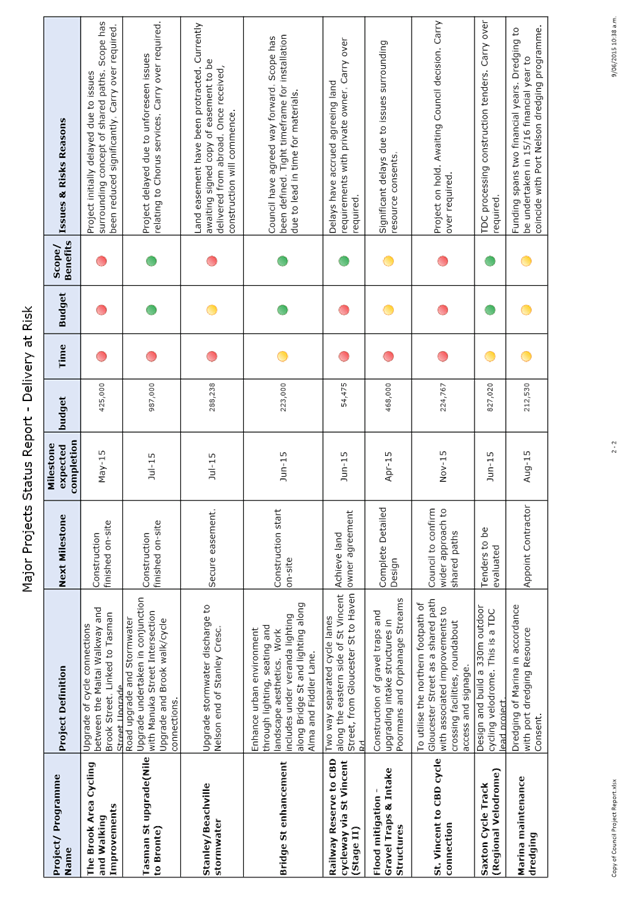

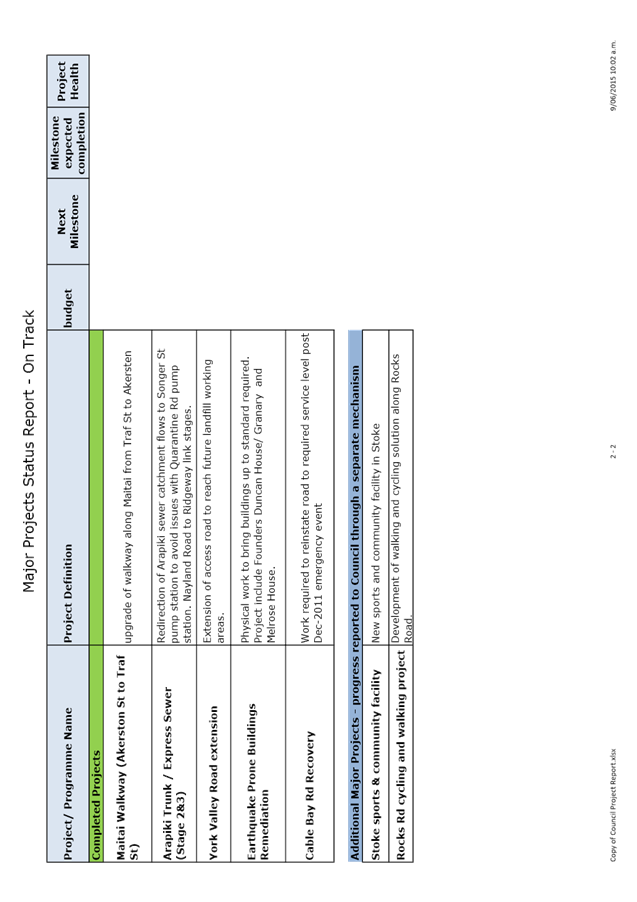

6.1 Please see Attachments 4 and 5 for progress reports on Council’s

major projects.

Cricket World Cup

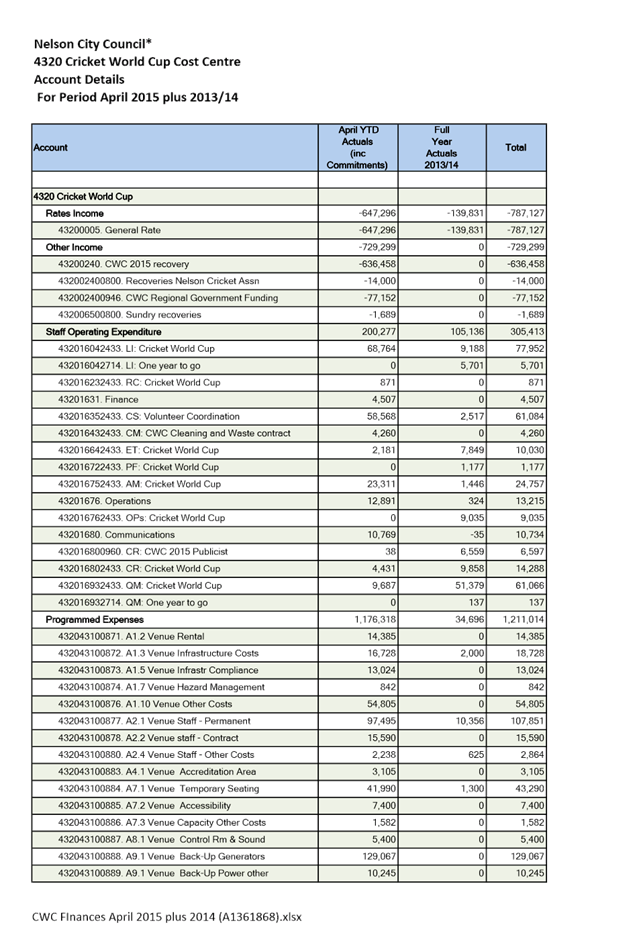

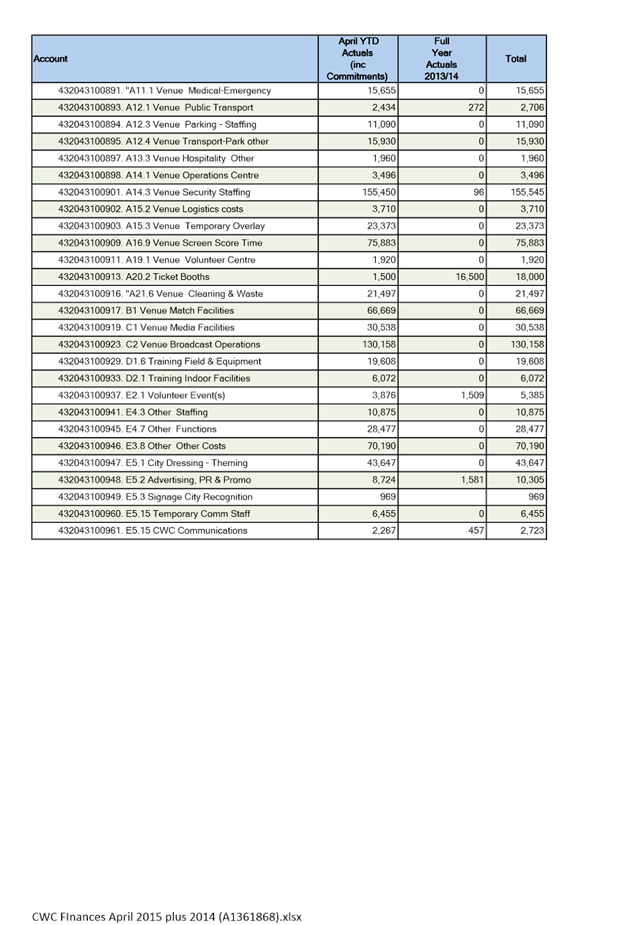

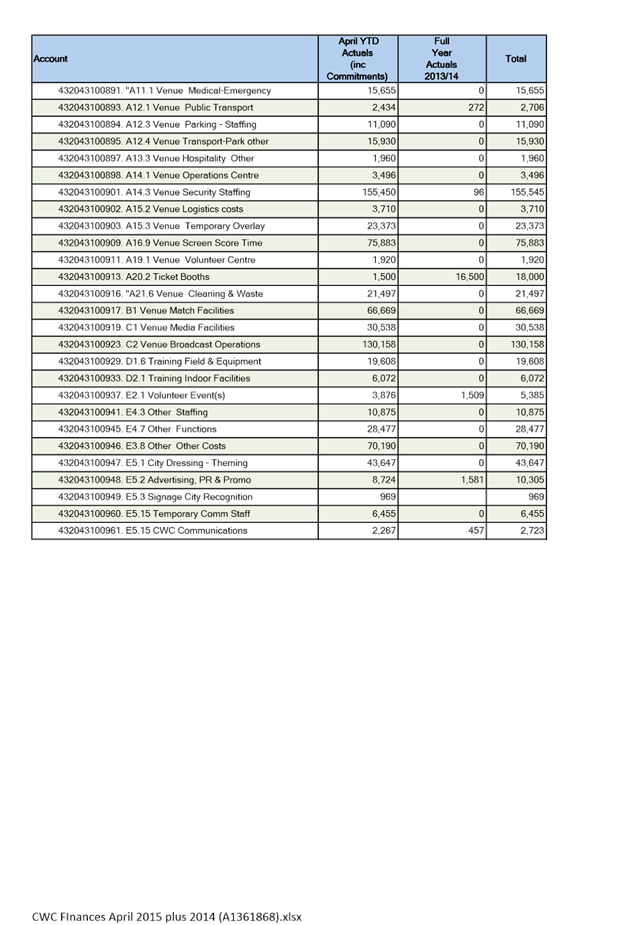

6.2 Please see Attachment 9 for

a detailed breakdown of Cricket World Cup expenditure. Council capped its total

contribution at $900,000. The rates requirement in the attachment is $787,127

– a saving against budget of $112,873.

7. Alignment with relevant Council policy

7.1 The finance report is

prepared comparing current year performance against the final projection for

the 2015 LTP.

8. Assessment of Significance against the Council’s

Significance and Engagement Policy

8.1 There are no significant

decisions.

9. Consultation

9.1 No consultation is required.

10. Inclusion of Māori in the decision making process

10.1 No consultation is required.

Tracey Hughes

Senior Accountant

Attachments

Attachment 1: NCC

Summary Performance (A1362441)

Attachment 2: Capital Expenditure Graph (A1362441)

Attachment 3: Capital Expenditure by Activity

(A1362441)

Attachment 4: Major projects status report -

delivery at risk (A1366146)

Attachment 5: Major projects status report - on

track (A1366144)

Attachment 6: Balance Sheet ( A1360175)

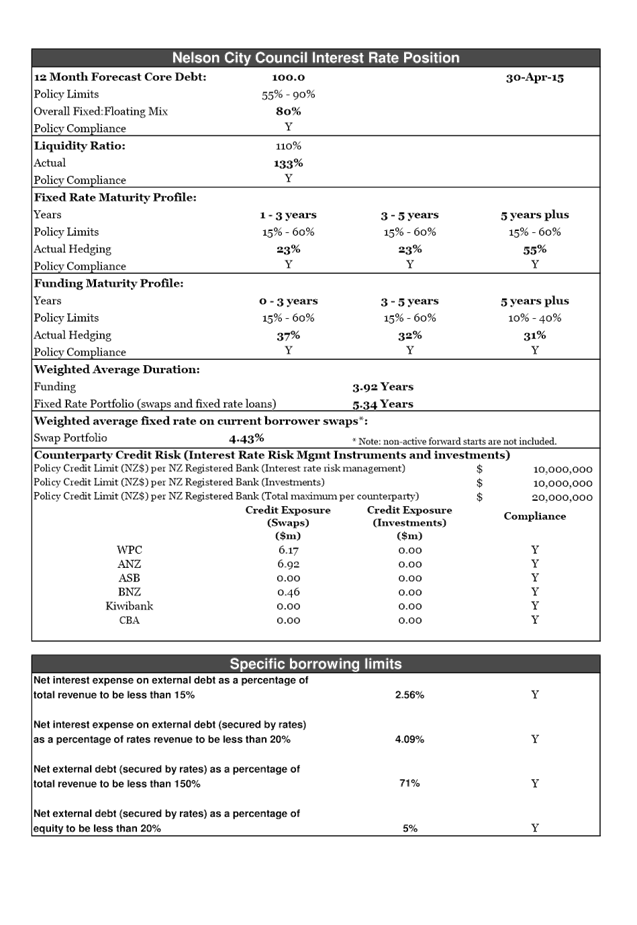

Attachment 7: Interest Rate Position Report

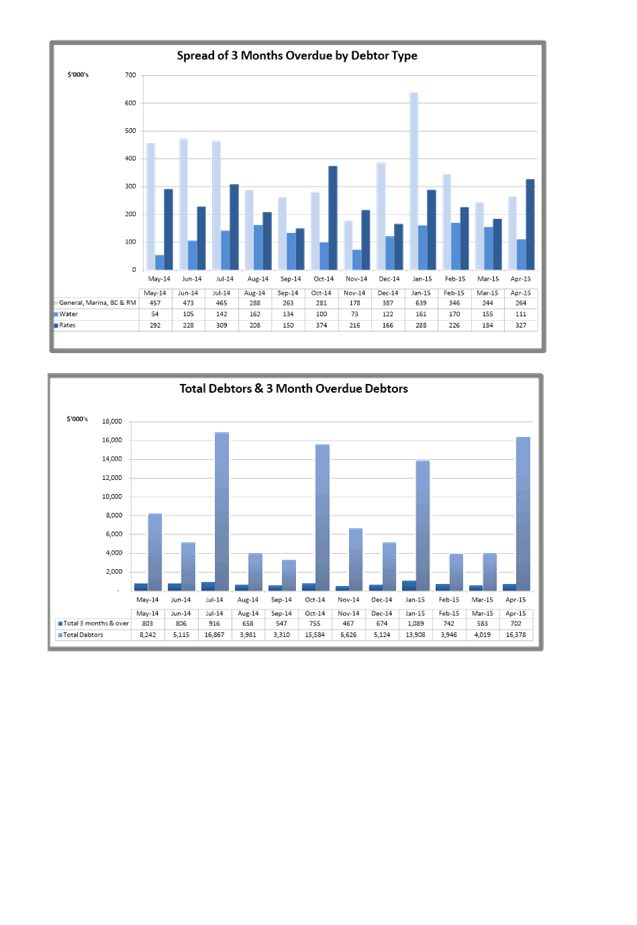

Attachment 8: Debtors Report (A793514)

Attachment 9: Cricket World Cup detailed

expenditure (A1361868)

|

|

Audit, Risk and Finance Subcommittee

18 June 2015

|

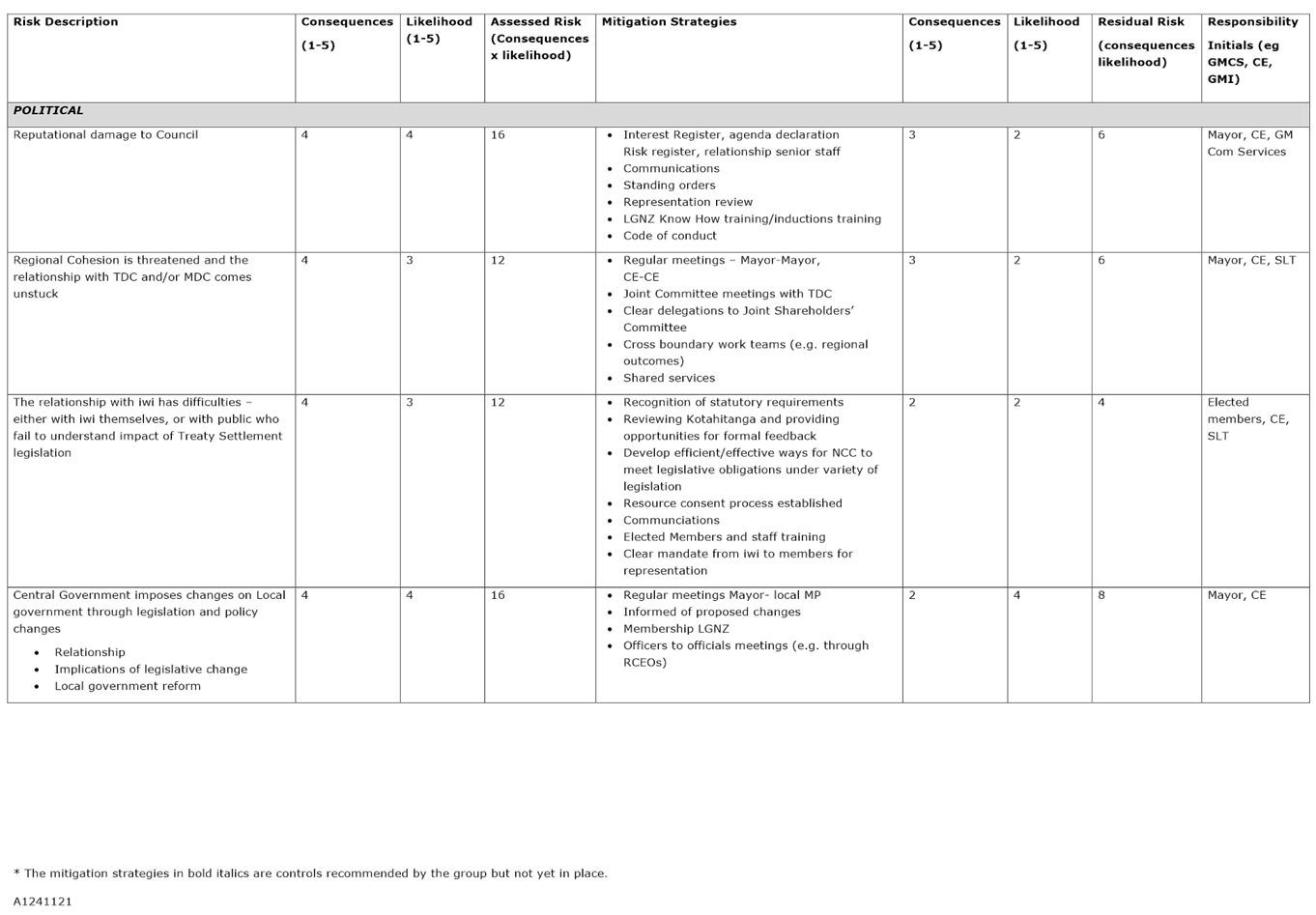

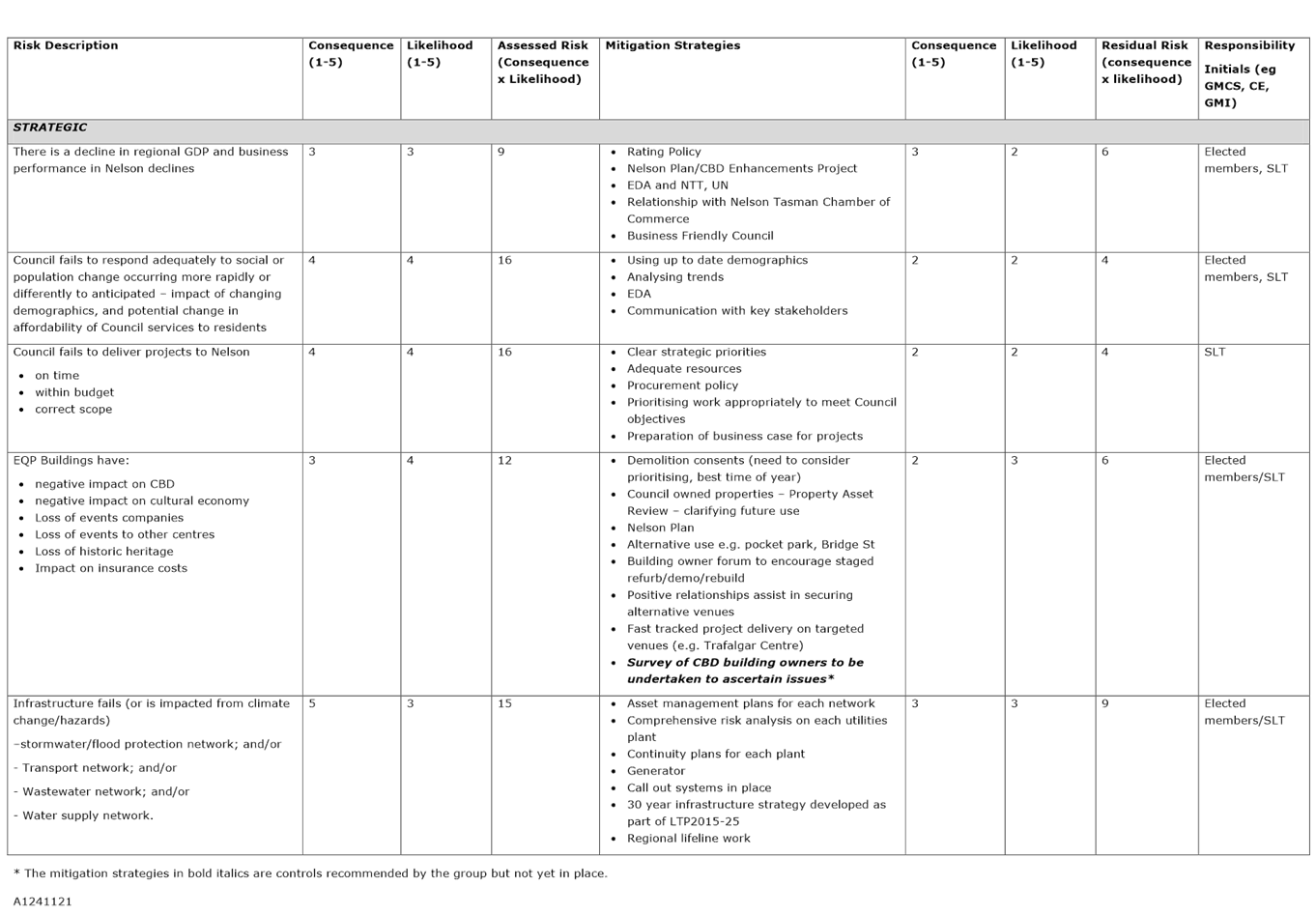

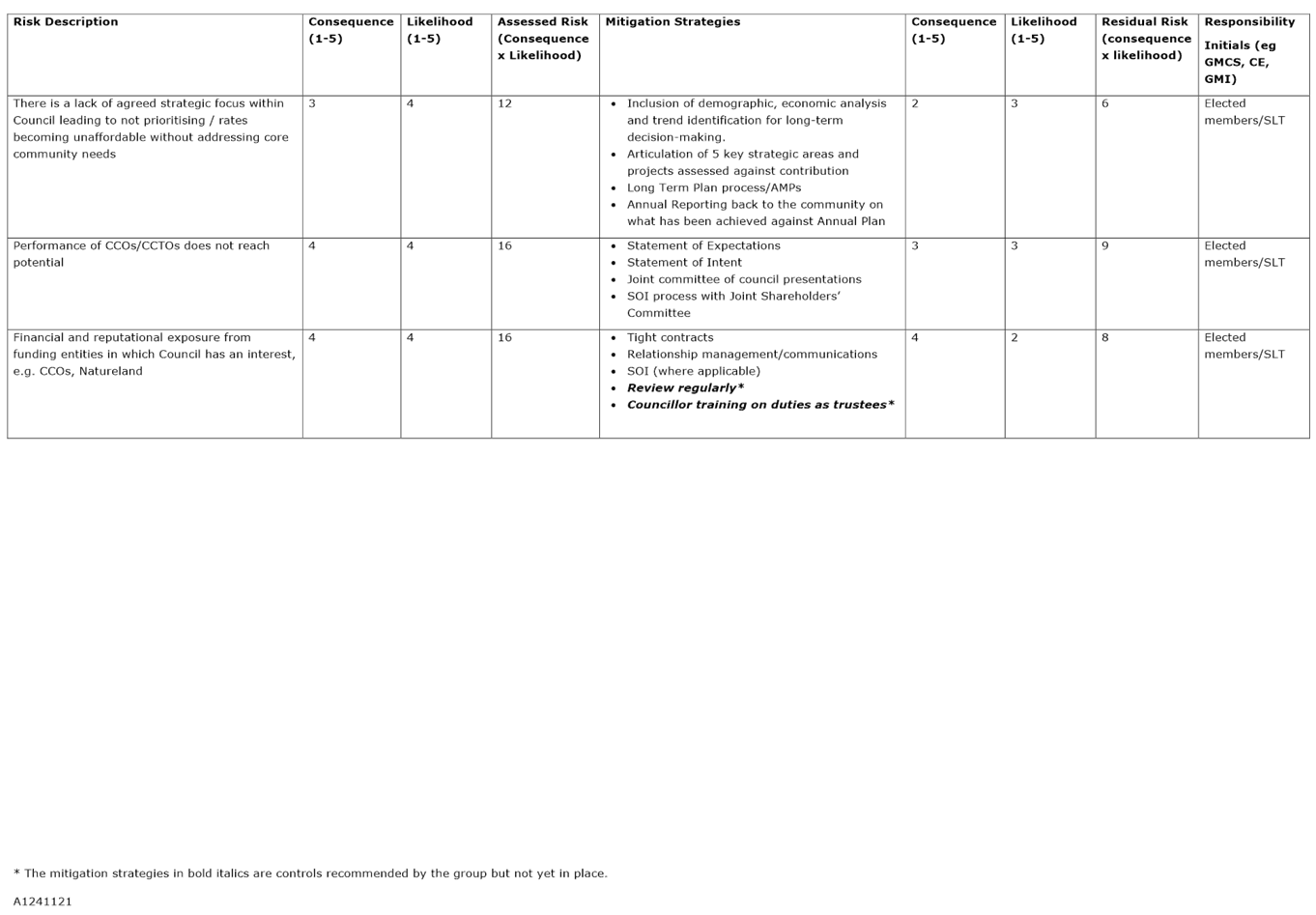

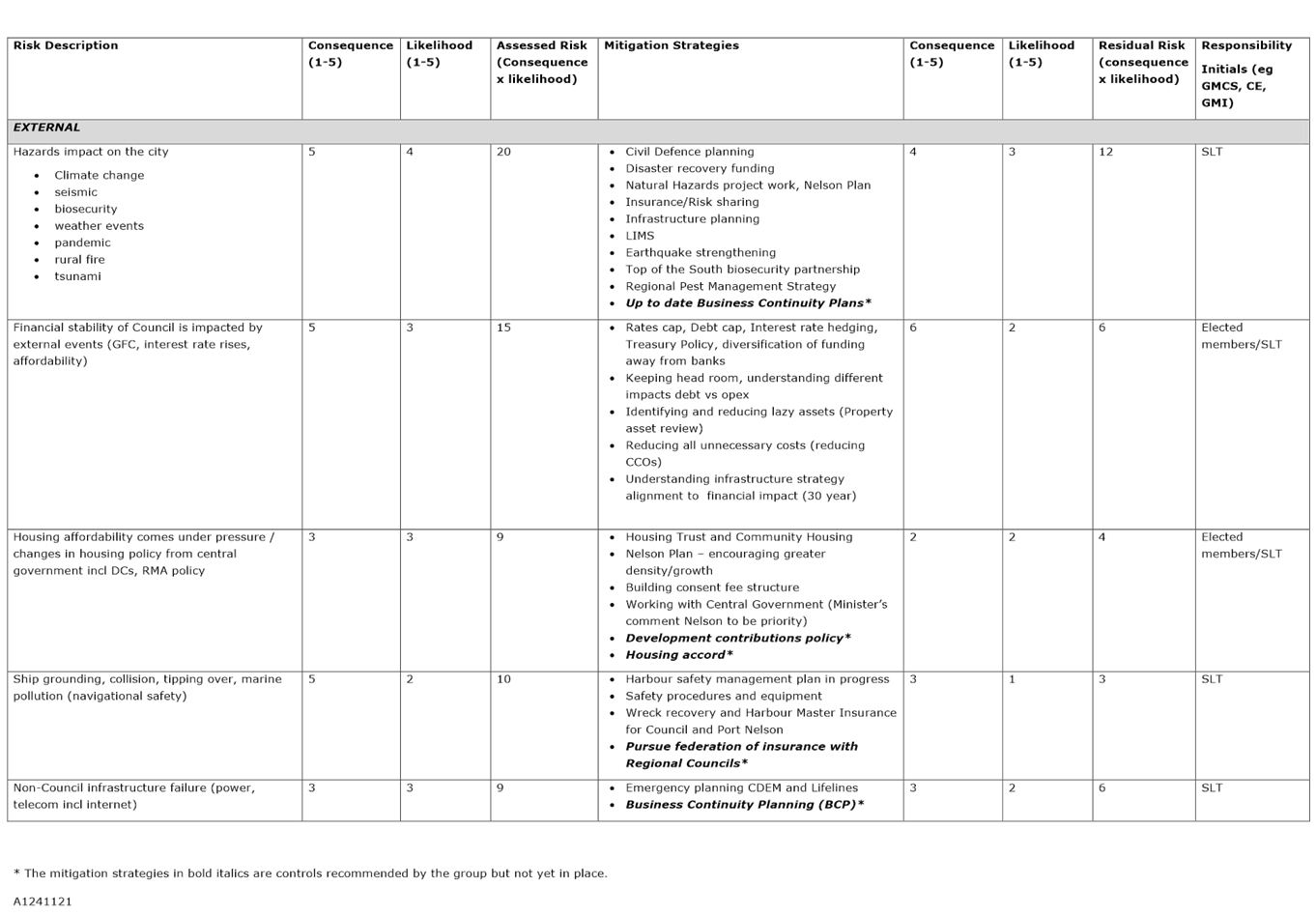

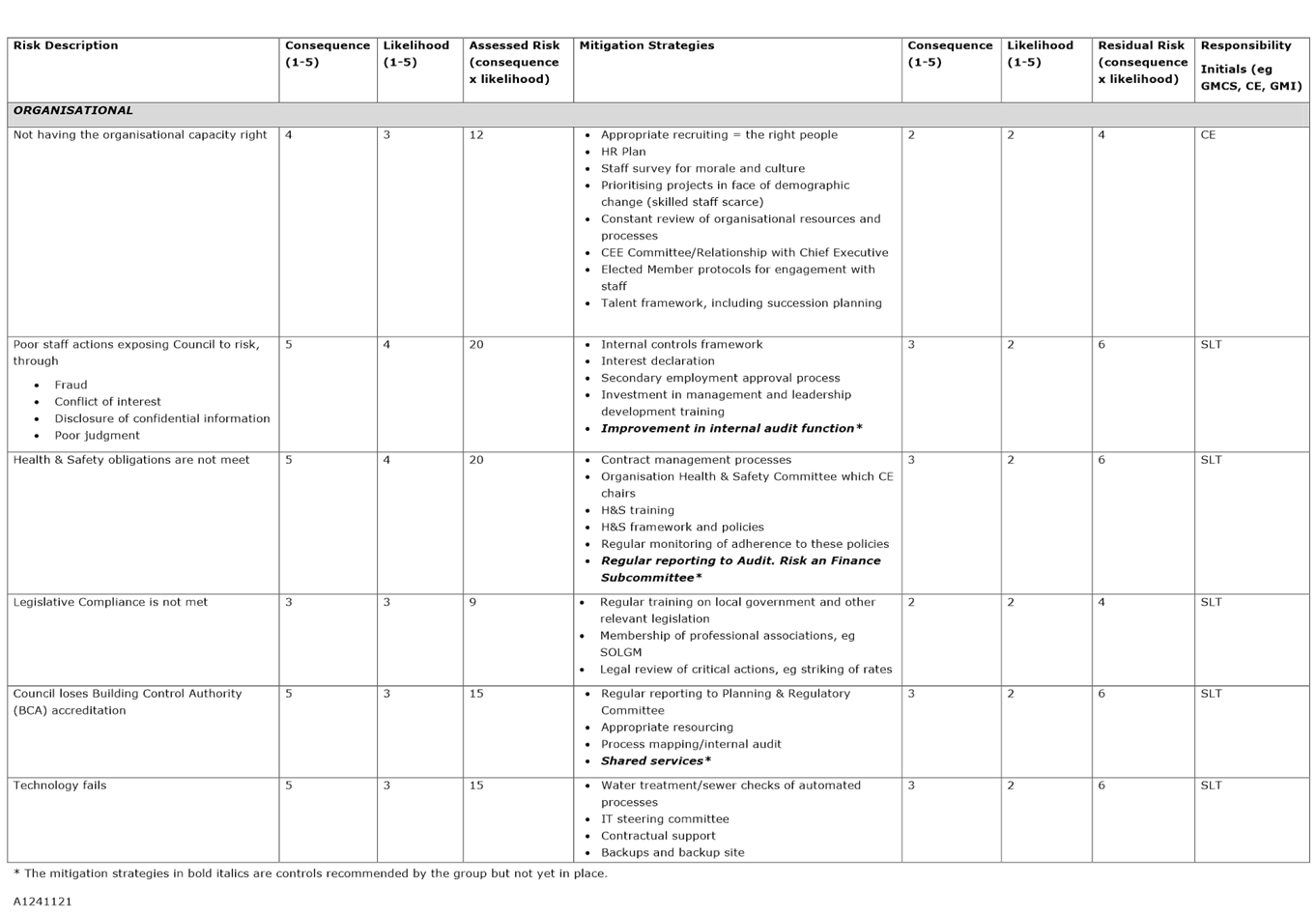

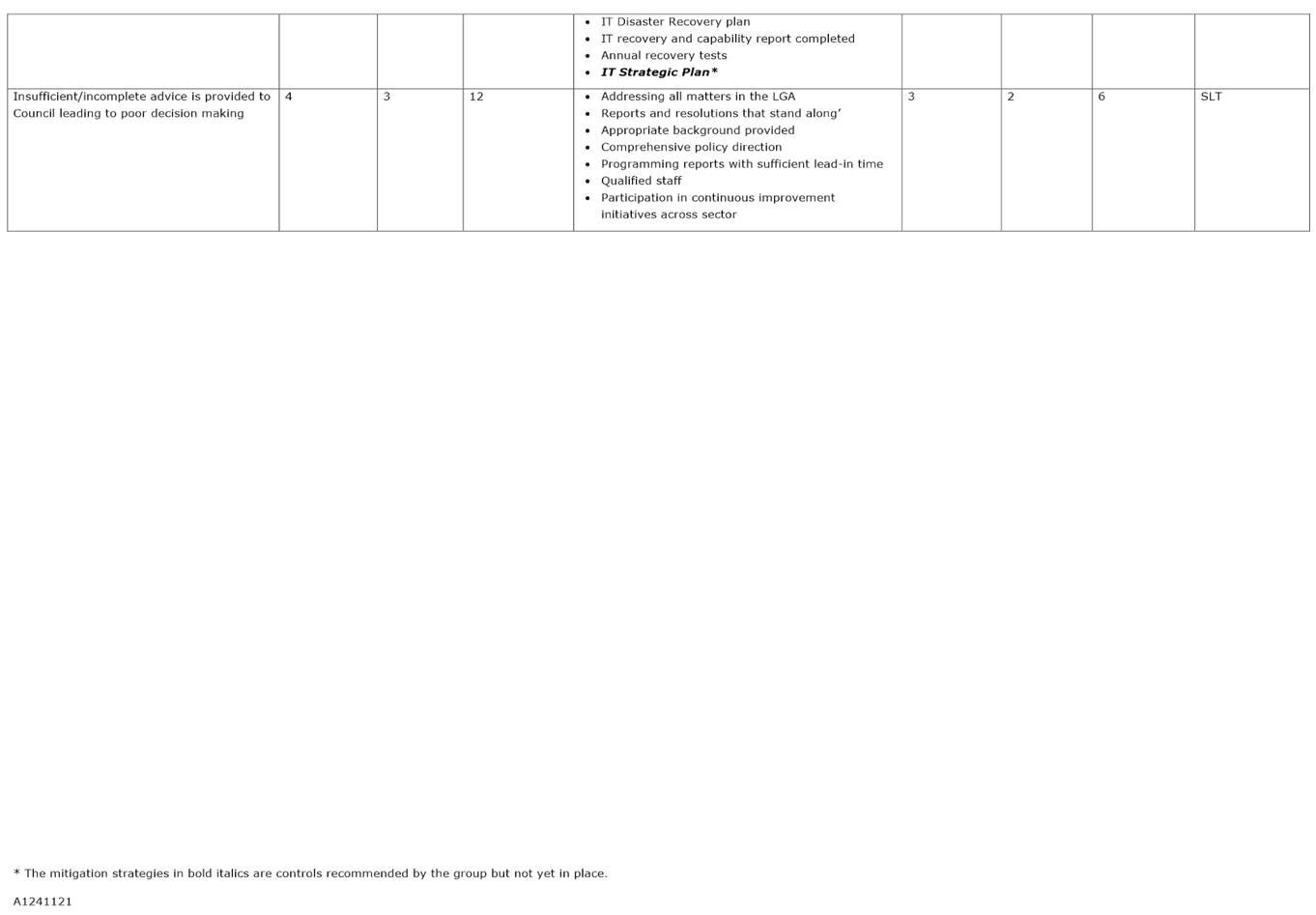

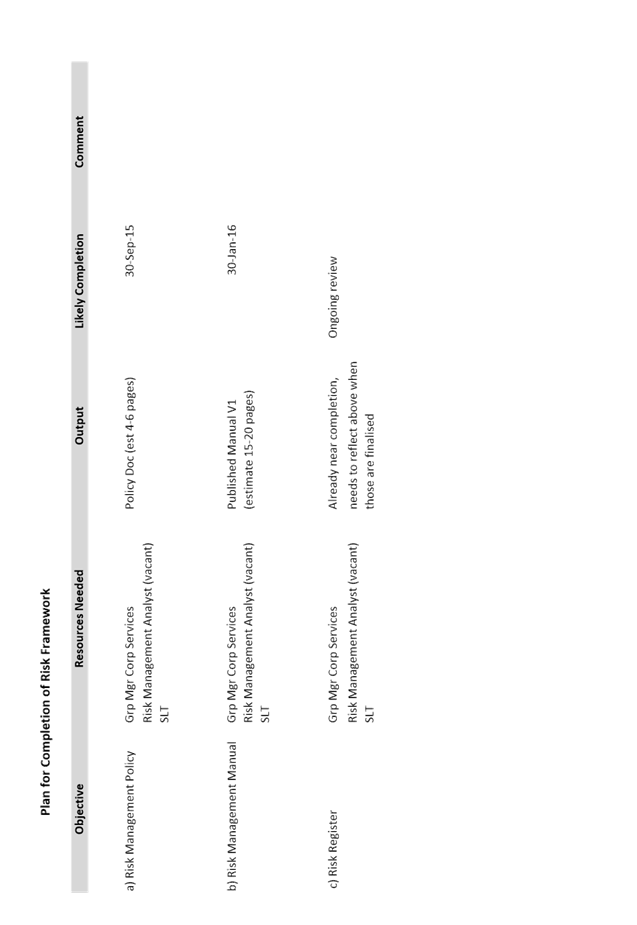

REPORT R4246

Risk

Register and Framework Plan

1. Purpose of Report

1.1 To update the Committee on the Council’s Risk

Register and Framework Plan.

2. Delegations

2.1 The Audit, Risk and Finance Subcommittee has oversight

of the management of financial risk.

3. Recommendation

|

THAT the report Risk Register

and Framework Plan (R4246) and

its attachments (A1241121 and A1359808) be received.

|

4. Background

4.1 The

Council risk register was reported to the Governance Committee at the 4

December 2014 meeting. The responsibility for the risk register now falls

under the delegation of the Audit, Risk and Finance Subcommittee.

4.2 At

the 4 December 2014 Governance Committee meeting the following resolution was

passed:

· THAT

the report Council Risk register (A1276686) and its attachments (A1241121) be

received;

· AND THAT

the attached Risk Register be endorsed in principle, including the

implementation of the highlighted controls;

· AND THAT

a plan for the development of a full risk management framework incorporating

this Risk Register be brought to this Committee by the end of this financial

year.

· AND THAT

the Committee agree the focus is to be on mitigation strategies, noting

internal audit and other internal controls will be the priority.

5. Discussion

5.1 Most

of the bold italic controls from the December 2014 risk register have been

implemented with the remaining ones to be actioned still highlighted in bold

italics.

5.2 One

of the key mitigations was the improvement in the internal audit

function. Council is currently recruiting for a Health and Safety

Manager, a Risk Analyst and an Internal auditor and it is hoped that these

roles will be filled over the next few months.

5.3 The

risk register has been updated to ensure that all risks have responsibility

assigned. The Risk register has also been reviewed to ensure that the

risks highlighted in the Long Term Plan are adequately covered.

5.4 A

new risk relating to external infrastructure failure (power, telecom etc) has

been added during the period.

5.5 The

high level plan for the development of a full risk management framework is also

attached but timings will depend on the recruitment of staff to fill the roles

highlighted in 5.2 above.

6. Options

6.1 The

recommendation is to receive the report.

7. Alignment with relevant Council policy

7.1 Understanding

the risks that Council faces and the mitigations that are in place or that

should be considered, allows council to consider the impacts on Council’s

strategic documents, particularly the Long Term Plan or Annual Plan.

8. Assessment of Significance against the Council’s

Significance and Engagement Policy

8.1 This

is not a significant decision under the Council’s Significance and

Engagement Policy.

9. Consultation

9.1 There

has been no consultation on the risk register and framework plan.

10. Inclusion of Māori in the decision making process

10.1 There

has been no consultation with Maori in the preparation of the risk register and

framework plan.

Nikki

Harrison

Group

Manager Corporate Services

Attachments

Attachment 1: A1241121 -

Risk Register

Attachment 2: A1359808

- Risk management framework plan

Audit, Risk and Finance

Subcommittee

Audit, Risk and Finance

Subcommittee