AGENDA

Ordinary meeting of the

Audit, Risk and Finance Subcommittee

Tuesday 5 May 2015

Commencing at 1.00pm

Ruma Mārama (Level 2A)

Civic House

110 Trafalgar Street, Nelson

Membership: Mr John Peters (Chairperson), Her Worship the

Mayor Rachel Reese, Councillors Ian Barker and Brian McGurk, and Mr John Murray

Guidelines for councillors

attending the meeting, who are not members of the Committee, as set out in

Standing Orders:

·

All councillors, whether or not they are members of the

Committee, may attend Committee meetings (SO 2.12.2)

·

At the discretion of the Chair, councillors who are not Committee

members may speak, or ask questions about a matter.

·

Only Committee members may vote on any matter before the

Committee (SO 3.14.1)

It is good practice for both Committee members and

non-Committee members to declare any interests in items on the agenda.

They should withdraw from the table for discussion and voting on any of these

items.

Audit, Risk and Finance

Subcommittee

Audit, Risk and Finance

Subcommittee

5

May 2015

Page

No.

1. Apologies

1.1 Apologies

have been received from Councillor Ian Barker

2. Confirmation

of Order of Business

3. Interests

3.1 Updates

to the Interests Register

3.2 Identify

any conflicts of interest in the agenda

4. Public

Forum

5. Confirmation

of Minutes

5.1 10

March 2015 7 - 14

Document number M998

Recommendation

THAT

the minutes of the meeting of the Audit, Risk and Finance Subcommittee, held

on 10 March 2015, be confirmed as a true and correct record.

6. Status

Report - Audit, Risk and Finance Subcommittee - 5 May 2015 15 - 16

Document number R4175

Recommendation

THAT the Status Report Audit, Risk

and Finance Subcommittee 5 May 2015 (R4175)

and its attachment (A1324298) be

received.

Governance

7. Interests

Register 17 - 25

Document number R4170

8. Events

Resource Consent Charging Regime for RM125012 27 - 30

Document number R4177

Recommendation

THAT the report Events Resource

Consent Charging Regime for RM125012 (R4177)

be received.

Recommendation to Governance

Committee and Council

THAT

Council consider the options for the charging regime for the use of

Council’s Resource Consent RM125012, as detailed in report R4177, and

Either: remove

the charge altogether.

Or: increase

the charge and apply it only to

commercial events.

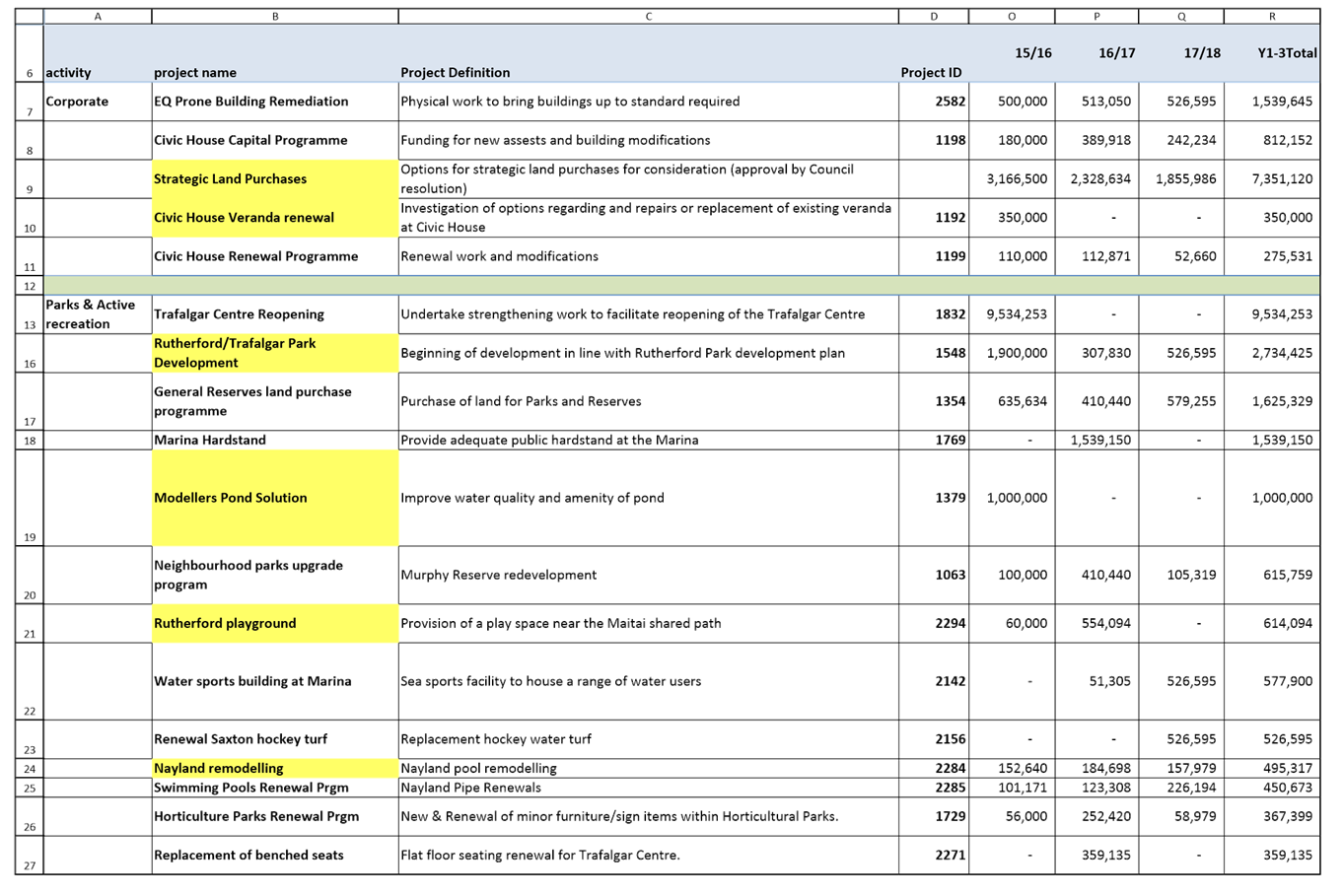

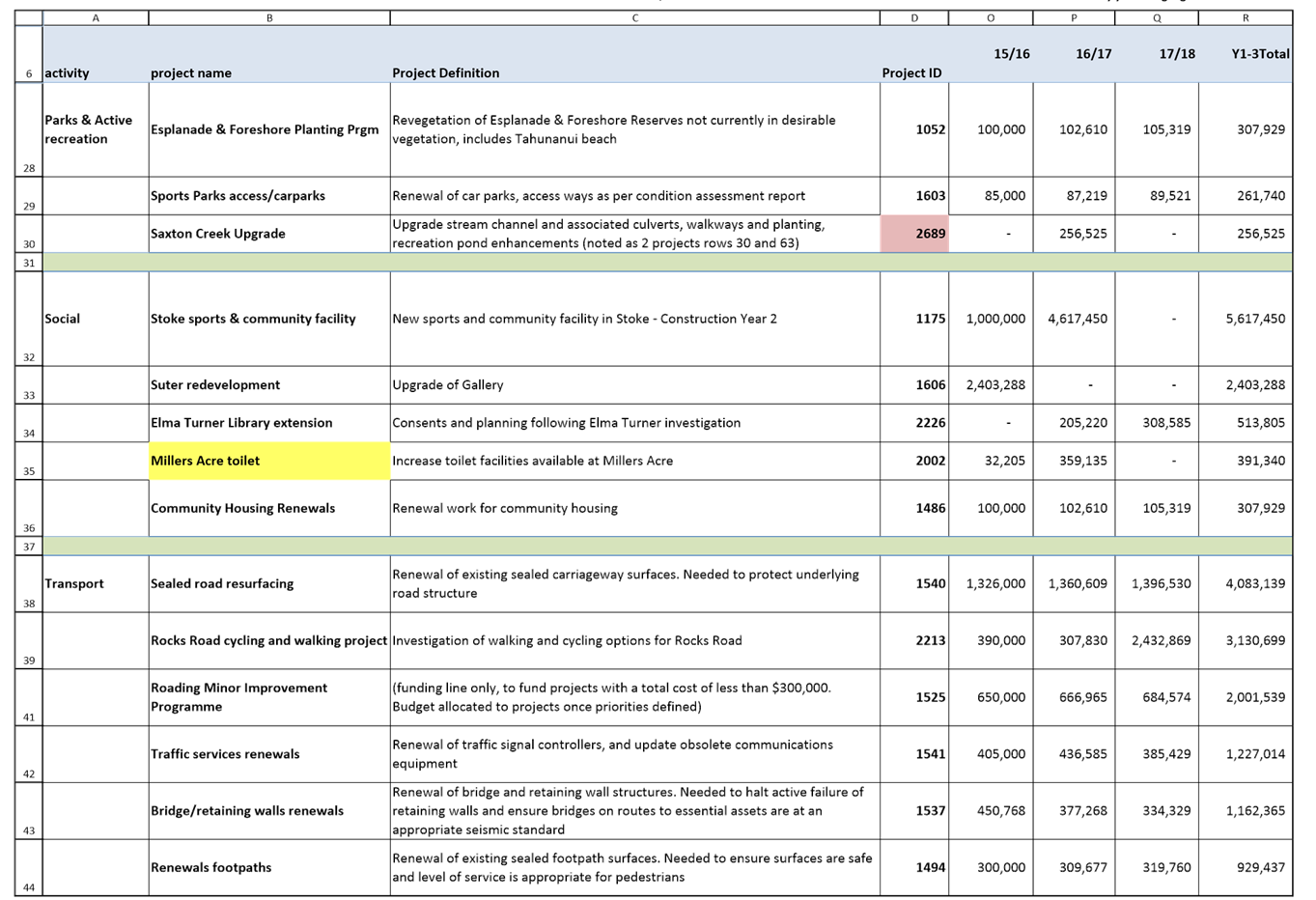

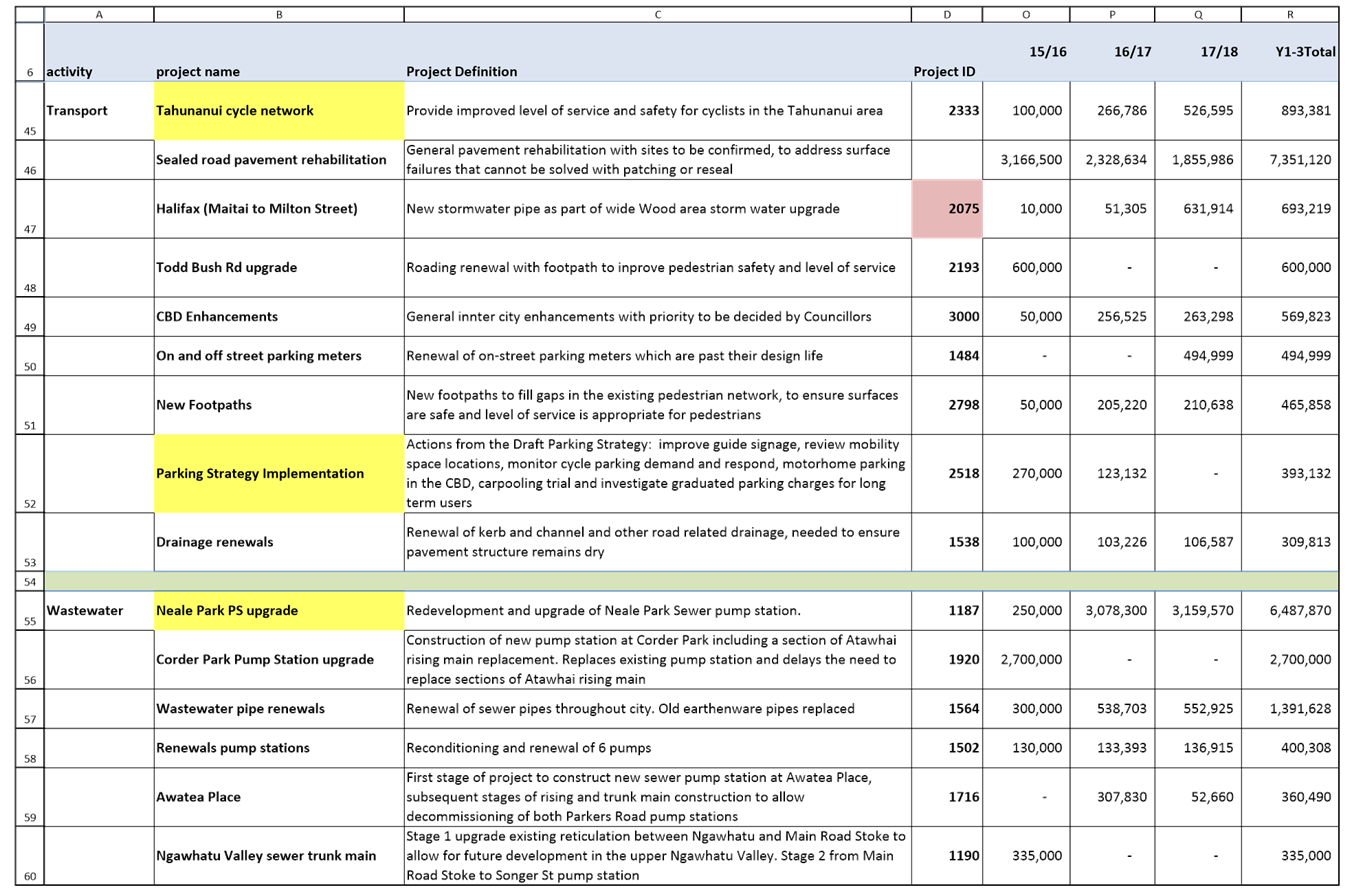

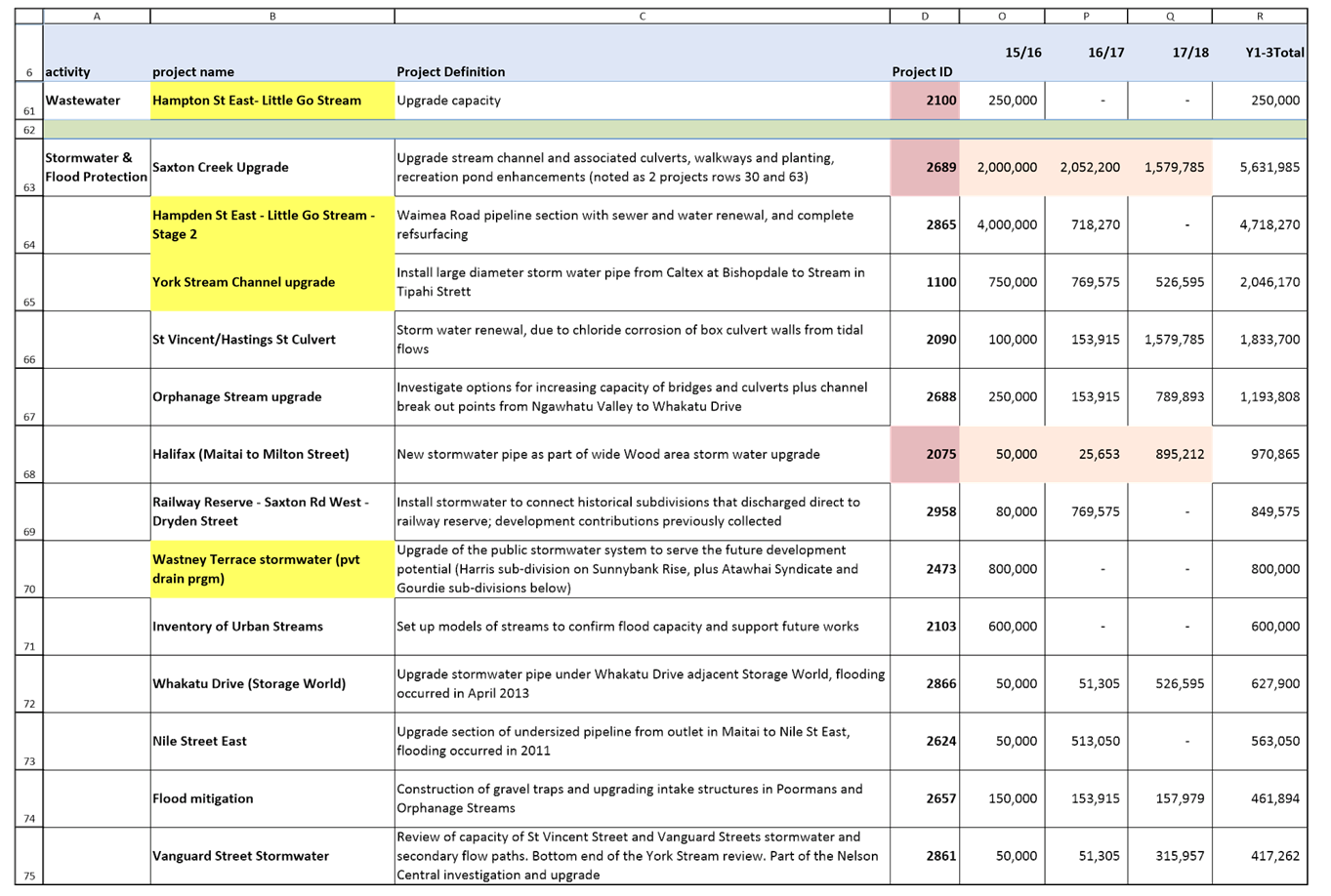

9. Business

Case Approach for 2015/16 Projects 31 - 39

Document number R4183

Recommendation

THAT the report Business Case

Approach for 2015/16 Projects (R4183)

and its attachment (A1331113) be

received.

Recommendation to Governance

Committee and Council

THAT

projects highlighted yellow in document A1331113 follow a business case

approach.

Finance

10. Letter

to the Council on the Audit for the Year Ending 30 June 2014 - Further

Information 40 - 42

Document number R4168

Recommendation

THAT the report Letter to the

Council on the Audit for the Year Ending 30 June 2014 - Further Information

(R4168) be received.

11. Corporate

Report for the Period Ending 31 March 2015 44 - 65

Document number R4194

Recommendation

THAT

the report Corporate Report for the Period Ending 31 March 2015 (R4194) and attachments (A1342336, A1311288,

A1343636, A1340305 and A793514) be received and the variations noted.

Recommendation to Governance

Committee and Council

THAT

Council note that ongoing costs of approximately $11,250 pa will need to be

included in the Long Term Plan 2015-25 for live streaming of Council meetings.

Public Excluded Business

12. Exclusion

of the Public

Recommendation

THAT

the public be excluded from the following parts of the proceedings of this

meeting.

The

general subject of each matter to be considered while the public is excluded,

the reason for passing this resolution in relation to each matter and the

specific grounds under section 48(1) of the Local Government Official

Information and Meetings Act 1987 for the passing of this resolution are as

follows:

|

Item

|

General subject of each matter to be considered

|

Reason for passing this resolution in relation to each matter

|

Particular interests protected (where applicable)

|

|

1

|

Kahurangi

Employment Trust - Completion of Liquidation

|

Section 48(1)(a)

The public conduct of this

matter would be likely to result in disclosure of information for which good

reason exists under section 7

|

The

withholding of the information is necessary:

· Section 7(2)(a)

To protect the privacy of

natural persons, including that of a deceased person

· Section

7(2)(i)

To enable the local

authority to carry on, without prejudice or disadvantage, negotiations

(including commercial and industrial negotiations)

|

13. Re-admittance

of the public

Recommendation

THAT

the public be re-admitted to the meeting.

Minutes of a meeting of

the Audit, Risk and Finance Subcommittee

Held in the Council

Chamber, Civic House, 110 Trafalgar Street, Nelson

On Tuesday, 10 March 2015,

commencing at 9.01am

Present: Mr

J Peters (Chairperson), Councillors I Barker and B McGurk, and Mr J Murray

In Attendance: Her

Worship the Mayor R Reese, Councillor G Noonan, Chief Executive (C Hadley),

Group Manager Corporate Services (N Harrison), Manager Operations (S Davies),

Manager Communications (P Shattock), Manager Administration (P Langley), and

Administration Adviser (S McLean)

1.

Apologies

There were no apologies.

2.

Confirmation of Order of Business

There was no change to the order

of business.

3.

Interests

There were no updates to the

Interests Register, and no interests with items on the agenda were declared.

It was agreed that the Interests

Register would be presented to the next Audit, Risk and Finance Subcommittee

meeting.

4.

Public Forum

There was no public forum.

5.

Delegations and Terms of Reference

Document number A1297307, agenda

page 6 refers.

The Chairperson said the

Subcommittee’s terms of reference would be reviewed to ensure they were

in line with best practise, and any proposed changes would be reported to the

Governance Committee for consideration.

In response to a question, Group

Manager Corporate Services, Ms Harrison, advised that monitoring of capital

projects was included in the delegations under monitoring of financial and

service performance.

6.

Status Report – Audit, Risk and Finance Subcommittee 10 March 2015

Document

number A1324298, agenda page 7 refers.

Resolved

THAT

the Status Report – Audit, Risk and Finance Subcommittee 10 March 2015

(A1324298) be received.

Barker/Murray Carried

7.

Chairperson’s Report

The Chairperson highlighted the

important and necessary step of establishing the Audit, Risk and Finance

Subcommittee. He said the focus was on improving responsibilities and

undertakings in the areas of audit, risk and finance, and he was looking

forward to working with officers and the Subcommittee to achieve this.

8.

Corporate Report for the Period Ending 31 January 2015

Document

number A1313350, agenda pages 8-26 refer.

Group Manager Corporate

Services, Nikki Harrison, presented the report.

In response to concerns about

report information not being considered by the Governance Committee, it was confirmed

that all councillors receive a copy of Audit, Risk and Finance Subcommittee

agendas. The Chief Executive, Clare Hadley, added there was ongoing discussion

between group managers and committee chairpersons in regards to financial items

and outcomes for each committee.

In response to a question, Ms

Harrison advised there were likely to be further savings this financial year,

but that some savings highlighted in the report were as a result of timing

differences. She added that asset managers would be revising projections in

April, in order to inform the final Long Term Plan 2015-25.

In response to a question, Ms

Harrison advised that the total shareholder funds increase included a mix of

surplus and reserve movements.

Ms Harrison said the transfer of

funds to the Unsubsidised Roading account was required because the Maitai

Walkway was not considered to be close enough to the city to be covered in the

Inner City Enhancement account. She said the Maitai Walkway funding had been

split into three accounts, with a portion in parks and reserves. Ms Harrison

added that the Inner City Enhancement account was mainly funded by parking

income.

There was agreement that the

Major Projects Status Report was beneficial for the Subcommittee, and it could

be further improved by including details of project size and overall

timeframes.

In response to a question about

projects with budgets in the red category, Manager Operations, Shane Davies,

confirmed that those projects would stall if New Zealand Transport Agency (NZTA)

funding was not received. The Chief Executive, Clare Hadley, highlighted the

high degree of confidence in receiving NZTA funding due to the inclusion of

those projects in the Regional Land Transport Plan.

In response to questions, Ms

Harrison advised that any funds received from forestry insurance claims were

kept within the account that the claim related to. She said that Emissions

Trading Scheme (ETS) payments had been made and the price was lower than

budgeted and lower priced euro credits were able to be used for the current

years liability up to 31 December 2014. It was suggested that the topic of ETS

be a matter for a future memo or report to the Subcommittee.

There was a discussion on

landfill charges, with concern raised about the percentage increase in these

charges.

Senior Asset Engineer –

Solid Waste, Johan Thiart, explained that the budget had included material from

Buller and the Nelson Waste water treatment plant which did not materialise.

Senior Asset Engineer –

Solid Waste, Johan Thiart, spoke about the budgeted 20% dry solids in Nelson

North wastewater sludge, and the intention to increase this to 40% dry solids

by delaying the carting of dewatered sewage sludge. He advised the decrease in

water content would then reduce tonnage costs, resulting in overall savings for

Council.

Ms Harrison advised that even if

savings from sludge dry solids were taken into account, this would not come

close to recovering this year’s loss in the landfill account.

Mr Thiart advised that if

landfill charges were not increased, the majority of the prior year surpluses

in the landfill reserve fund would be used to offset the projected deficit for

this year. He added that increasing the fees from May 2015 would still result

in the need to use a portion of the prior year’s surplus.

It was highlighted that landfill

fees were already set to increase in July 2015 to the amount recommended in the

report. It was also noted that the higher fee appeared to be at market value.

Mr Thiart advised that the joint

landfill agreement with Tasman District Council would not be affected, as the

decision called for was only applicable to this financial year.

In response to a question, Ms

Harrison confirmed that the landfill account was a closed account.

In response to a comment on replacing

water meters, Mr Davies confirmed the process for replacement was already

underway.

After discussion on the list of

Additional Major Projects which were reported to Council separately, it was

agreed that further details would be provided in future so the Subcommittee

could understand and assess any potential risks to those projects.

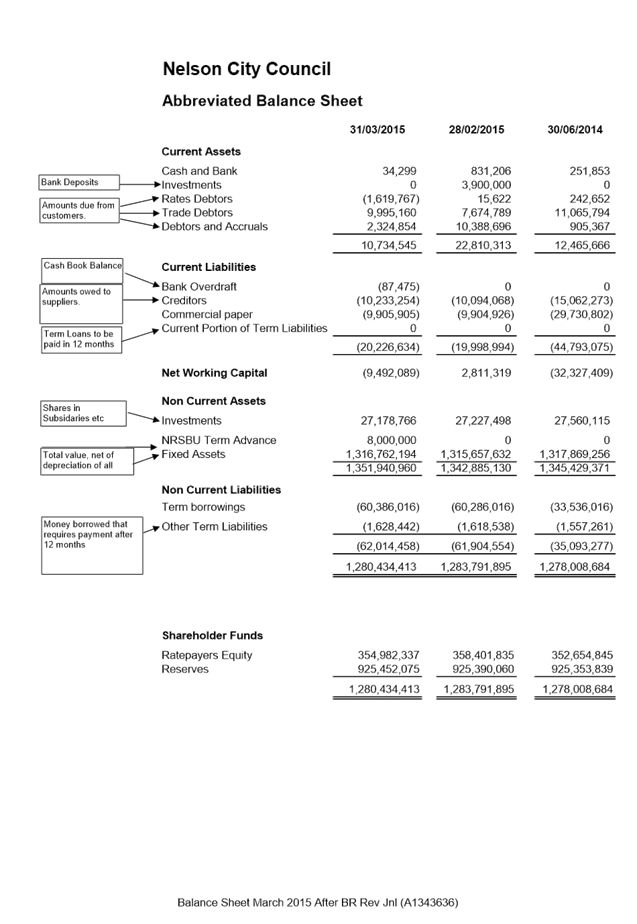

Comments were made on the fixed

rate maturity profile. Ms Harrison advised that the figures reflected

Council’s ability to issue term debt for the past two years. She added

the profile also reflected that there had been no increase in short term debt

this financial year.

The recommendations were taken

separately.

Resolved

THAT

the report Corporate Report for the Period Ending 31 January 2015 (A1313350)

and its attachments (A1313445, A1314763, A1314760, A1313550, A1313349 and

A793514) be received and the variations noted.

Barker/McGurk Carried

Recommendation to Governance

Committee and Council

THAT

the landfill charges be increased from $114 per tonnes (inclusive of GST) to

$121 (inclusive of GST) effective 15 May 2015;

AND

THAT landfill users be given two weeks notice of the increase

in landfill charges;

McGurk/Murray Carried

AND

THAT approval is given for a transfer of all capital

expenditure and debt relating to the Maitai Walkway to be made from the Inner

City Enhancement account to the Unsubsidised Roading account in order to

properly account for interest and debt in future years.

Barker/McGurk Carried

9.

Letter to the Council on the Audit for the Year Ending 30 June 2014

Document number A1304574, agenda

pages 27-37 refer.

Group Manager Corporate

Services, Nikki Harrison, presented the report.

In response to a question, Ms

Harrison advised that the indices used in the revaluation of infrastructural

assets were being reviewed in response to the comments from Audit.

There was discussion on the

reduction in staff numbers and Council’s ability to carry out control

functions. The Chief Executive, Clare Hadley, advised that staff numbers

referenced in the Audit letter included vacancies at the time of audit. She

said there had been no significant impact on operations as a result of

restructuring, and there was no ongoing concern amongst management in relation

to staff numbers.

In response to a question, Mrs

Hadley advised that a consultant was assessing the impact to Council of the new

health and safety requirements for contractors. She said there would likely be

an adjustment to the level of health and safety expertise in the organisation.

Mrs Hadley assured the

Subcommittee that Council’s health and safety requirements and procedures

were extended to contractors and consultants.

It was agreed that the

Subcommittee would benefit from a follow up report containing management

responses to the points raised in the Audit letter.

Resolved

THAT

the report Letter to the Council on the Audit for the Year Ending 30 June 2014

(A1304574) and its attachment (A1297813) be received;

AND

THAT a follow up report on points raised in the Letter to the Council on

the Audit for the Year Ending 30 June 2014 be prepared for the Audit, Risk and

Finance Subcommittee.

Murray/Barker Carried

Attendance: The meeting adjourned for morning tea from

10.17am to 10.35am.

10.

Procurement Policy and Debt Management Process

Document number A1312127, agenda

pages 38-50 refer.

Group Manager Corporate

Services, Nikki Harrison, presented the report.

It was agreed that the report on

Procurement Policy and Debt Management Process should be referred to the

Governance Committee as there was value in the Committee receiving and

discussing this item.

It was suggested that the

Subcommittee would benefit from a report on Council’s Debt Management

Policy.

Attendance: The meeting adjourned

from 11.04am to 11.12am.

Resolved

THAT

the report Procurement Policy and Debt Management Process (A1312127) and its

attachments (A1293789, A1316053 and A1324271) be referred to the Governance

Committee;

AND

THAT a report on the debt management policy be brought to the next Audit,

Risk and Finance Subcommittee meeting.

Murray/Barker Carried

11.

Liability Management and Investment Policies

Document number A1312122, agenda

pages 51-79 refer.

Group Manager, Corporate

Services, Nikki Harrison presented the report.

In response to a question, Ms

Harrison explained the purpose of forward start swaps and collars. She

highlighted that forward start swaps were a mechanism to lengthen the term of a

swap portfolio.

It was agreed that the Liability

Management Policy (LMP) should include reference to Council not undertaking

speculation.

In response to questions, Ms

Harrison advised that the measure on equity had been removed from the Specific

Borrowing Limits section of the LMP. She said the register of guarantees provided

would be presented to the Subcommittee on an annual basis. Ms Harrison advised

the Debenture Trustee was Foundation Corporate Trust and detail on this could

be included in the LMP.

It was agreed that the first

sentence in the New Zealand Local Government Funding Agency section of the LMP

needed further clarification.

Her Worship the Mayor

highlighted that the use of the dividend stream to reduce rates could be

assessed by the Subcommittee in the future.

Concerns were raised that

investments in the Marina and camping grounds were not included in the

Investment Policy. It was suggested that several Investment Policies could be

created based on different types on investment.

In response to a question, Ms

Harrison advised that the miscellaneous loans section in the Investment Policy

referred to loans to organisations such as Theatre Royal and Nelson Enterprise

Loan Trust. She added that information on these loans would be reported to the

Subcommittee on an annual basis.

It was agreed that the

Investment Principles section in the Investment Policy would be updated to

reflect that any investment would have risk and would be appropriately managed.

Concern was raised about

reference to Council holding no investments purely for income earning purposes.

It was queried if this reflected current holdings, and if not, if

Council’s portfolio would be impacted. It was agreed that if any

investments held for purely income earning purposes were identified, these

would be listed in the Investment Policy.

It was agreed that the first

sentence in the New Zealand Local Government Funding Agency section of the

Investment Policy needed further clarification.

Resolved

THAT

the report Liability Management and Investment Policies (A1312122) and its

attachments (A1261456 and A1261457) be received.

Barker/Murray Carried

Recommendation to Governance

Committee and Council

THAT

the Liability Management and Investment Policies, with amendments from the

Audit, Risk and Finance Subcommittee, be adopted.

Barker/Murray Carried

12.

Proposed Meeting Dates

It was clarified that the

Subcommittee could meet in-between set meeting dates should the need arise.

It was noted that a work plan

for the Subcommittee may be arranged.

It was suggested that the

proposed meeting dates be reviewed to ensure alignment with the adoption of the

Annual Report.

Her Worship the Mayor reminded

the Subcommittee that any workshops for the Subcommittee would need to be

confirmed through the Chairperson’s Report.

There being no further business the meeting ended at 11.56am.

Confirmed as a correct record of proceedings:

Chairperson

Date

Chairperson

Date

|

|

Audit, Risk and Finance Subcommittee

5 May 2015

|

REPORT R4175

Status

Report - Audit, Risk and Finance Subcommittee - 5 May 2015

1. Purpose of Report

1.1 To provide an update on the status of actions

requested and pending.

2. Recommendaton

|

THAT the Status Report Audit,

Risk and Finance Subcommittee 5 May 2015 (R4175) and its attachment (A1324298) be received.

|

Shailey

McLean

Administration

Adviser

Attachments

Attachment 1: Status

Report - Audit, Risk and Finance Subcommittee - May 2015

Status Report – Audit, Risk and Finance Subcommittee 5

May 2015

|

Date of meeting/Item

|

Action Resolution

|

Officer

|

Status

|

|

4/12/14 (Governance Committee)

Council Risk Register

|

AND THAT a plan for the development of a

full risk management framework incorporating this Risk Register be brought to

this Committee by the end of this financial year.

|

Nikki Harrison

|

5/5/15

To be reported to a future meeting.

Underway

|

|

10/3/15

Letter to the Council on the Audit for the Year Ending 30 June 2014

|

AND THAT a follow up report on points

raised in the Letter to the Council on the Audit for the Year Ending 30 June

2014 be prepared for the Audit, Risk and Finance Subcommittee.

|

Nikki Harrison

|

5/5/15

Included in the 5 May Subcommittee Agenda.

Complete

|

|

10/3/15

Procurement Policy and Debt Management Process

|

AND THAT a report on the debt management

policy be brought to the next Audit, Risk and Finance Subcommittee meeting.

|

Nikki Harrison

|

5/5/15

To be reported to a future meeting.

Underway

|

|

|

Audit, Risk and Finance Subcommittee

5 May 2015

|

REPORT R4170

Interests

Register

Attached for the Subcommittee’s information is the

Interests Register for Members and Interests Register for the Senior Leadership

Team.

This information was requested at the Audit, Risk and

Finance Subcommittee meeting on 10 March 2015

Attachments

Attachment 1: Elected Members Interest

Register A1006782

Attachment 2: Senior

Leadership Team Interests Register A1004272

Members’ Interest Register

– 2013-2016

Last updated June 2014

Elected Members:

|

Member

|

Last Update

|

Elected Member Declared Business

Interest and value

|

Spouse/Partner Declared Interest

|

|

Her

Worship the Mayor Rachel Reese

|

5

June 2014

(Interests

Register received at Council meeting)

|

Property

co-owner 4A Allan Street

Shareholder/Director

- Rachel Reese Consulting Ltd

Shareholder

- Wharehunga Forestry 2004 Ltd

Beneficiary

- TuJaes Trust

Minor

Shareholder - AMP Ltp

Minor

Shareholder - Manus Resources Ltd

Trustee

- Hilda and Auty Harley Trust

Council-related

appointments

Patron

- Civic Trust

Trustee

- Nelson Municipal Band

Trustee

- Cawthron Trust Board

|

Property

co-owner 4A Allan Street

Director/Shareholder

- RH Investments Ltd

|

|

Councillor

Luke Acland

|

5

June 2014

(Interests

Register received at Council meeting)

|

Property

owner 15 Cambria Street

|

No

declared interests

|

|

Councillor

Ian Barker

|

5

June 2014

(Interests

Register received at Council meeting)

|

Member – Nelson Residents Association

Member – Age Concern

Board member – Tahuna Beach Holiday Park

Chairman – Guardian of Nightingale Library

Trustee – Network Tasman Trust

|

No

declared interests

|

|

Councillor

Ruth Copeland

|

5

June 2014

(Interests

Register received at Council meeting)

|

No

declared interests

|

Event

Manager - Nelson Arts Festival (2013) $4,500 per annum

Nelson

Arts Festival Hireages (2013) $2,500

Event

Manager - Isel in Bloom (October 2013) and Broadgreen Rose Day (November

2013) $3,000

Event

Manager - New Years Eve Event (December 2013)

CEL

Trafalgar Centre - event preparation and packdown ($7,500)

|

|

Councillor

Eric Davy

|

5

June 2014

(Interests

Register received at Council meeting)

|

No

declared interests

|

No

declared interests

|

|

Councillor

Kate Fulton

|

5

June 2014

(Interests

Register received at Council meeting)

|

No

declared interests

|

No declared

interests

|

|

Councillor

Matt Lawrey

|

5

June 2014

(Interests

Register received at Council meeting)

|

Properties

(owner): 13/15, 31 and 33 Orsman Cres

Contributor

- 2013 Nelson Arts Festival

2013

Race Unity Day (MC)

2013

Little Day Out (MC)

Contributor

– 2014 Nelson Arts Festival

2014

Race Unity Day (MC)

Organiser

of ‘First Responders Parade 2014’ – this event received

$575 of NCC Heritage Week Funding.

|

No

declared interests

|

|

Councillor

Paul Matheson

|

5

June 2014

(Interests

Register received at Council meeting)

|

NZ

Community Trust

Nelson

Cancer Society

NZ

Fisheries Museum and Marine Education Centre Trust

|

No

declared interests

|

|

Councillor

Brian McGurk

|

18

August 2014

|

Trustee

and beneficiary of BJ and DA McGurk Family Trust

|

No declared

interests

|

|

Councillor

Gaile Noonan

|

5

June 2014

(Interests

Register received at Council meeting)

|

Deputy

Chair - Big Brothers Big Sisters

Nelson

Foodbank Volunteer

|

No

declared interests

|

|

Councillor

Pete Rainey

|

5

June 2014

(Interests

Register received at Council meeting)

|

Director

of Rockquest Promotions Ltd providing events partially funded by proceeds of

gaming trusts, as well as having technical production contracts with NCC

potentially in excess of $25,000.00. Approval for this is being sought from

the Office of the Auditor General.

Artistic

Director Opera in the park

Trustee

- Youth and Community Facilities Trust

Trustee

– Tawhiri Trust

|

Sales

manager at Media Works Nelson

|

|

Councillor

Tim Skinner

|

5

June 2014

(Interests

Register received at Council meeting)

|

No

declared interests

|

No

declared interests

|

|

Councillor

Mike Ward

|

5

June 2014

(Interests

Register received at Council meeting)

|

Business:

Studio (244 Hardy Street), and jewellery sales through Suter Gallery shop

Property

owner 10 Russell Street

|

No

declared interests

|

Externally Appointed Committee Members:

|

Governance Committee Members

|

Last Update

|

Member Declared Business Interest

and value

|

Spouse/Partner Declared Interest

|

|

John

Murray

|

Aug

2014

|

Personal

interest in two properties in Nelson City through my family trust. One at 41

Marybank Rd and the other at 72 Trafalgar Street.

Various

commercial and residential interests in property in the Nelson City

boundary. This arises because of various trusteeships held directly and

indirectly on behalf of clients of Crowe Horwath.

Principal

of Crowe Horwath in Nelson. Various relationships with business and

property owners which operate in the Nelson City.

Trustee

of the Saxton Velodrome Trust.

Secretary

and financial adviser to Te Atiawa O Te Waka a Maui Trust.

Director

of Te Atiawa Asset Holding Company Limited.

Secretary

and financial adviser to Ngati Rarua Atiawa Iwi Trust.

|

|

|

John

Peters

|

July

2014

|

Co-owner

of property at 37 Tresillian Avenue Chairman of the Nelson Tasman Region

Hospice Trust

|

|

|

Planning and Regulatory Committee

Members

|

Last Update

|

Member Declared Business Interest

and value

|

Spouse/Partner Declared Interest

|

|

Glenice

Paine

|

|

|

|

Members of Joint Committees administered

by Nelson City Council:

|

NRSBU Members

|

Last Update

|

Member Declared Business Interest

and value

|

Spouse/Partner Declared Interest

|

|

Councillor

Michael Higgins (TDC Councillor)

|

20

June 2014

|

No

declared interests

|

No

declared interests

|

|

Councillor

Barry Dowler (TDC Councillor)

|

20

June 2014

|

No

declared interests

|

No

declared interests

|

|

Councillor

Ruth Copeland (NCC Councillor)

|

5

June 2014

(Interests Register received at Council meeting)

|

No

declared

|

Event

Manager - Nelson Arts Festival (2013) $4,500 per annum

Nelson

Arts Festival Hireages (2013) $2,500

Event

Manager - Isel in Bloom (October 2013) and Broadgreen Rose Day (November

2013) $3,000

Event

Manager - New Years Eve Event (December 2013)

CEL

Trafalgar Centre - event preparation and packdown ($7,500)

|

|

Derek

Shaw (NCC appointee)

|

29

August 2014

|

Nikau

Press – sole trader

Brook

Waimarama Sanctuary Trust – Trustee

Nelson

Environment Centre – Board Chairperson

Tasman

Regional Sports Event Trust – Trustee

Saxton

Velodrome Trust – Trustee

NZ Masters

Athletics Association – Executive member

District

Licensing Committee – panel member

|

|

|

Matthew

Hippolite (Iwi representative)

|

16

June 2014

|

NCC

Kotahitanga (Ngati Koata Rep)

NCC

Compliance and Monitoring Group (Waste Water Overflow RMA Consent compliance)

Solid

Waste Joint Working Party (NCC & TDC combined Management Strategy)

Nelson Biodiversity Forum (Ngati Koata Rep)

Waimea

Plains Freshwater (Quality) and Land Management Group (Iwi Rep)

Tiakina

Te Taiao Ltd Board of Directors (Koata Alternate Director)

Marlborough

District Council Iwi Working Group (Ngati Koata Rep)

Ngati

Koata Trust – Projects Manager (Employer)

|

No

declared interests

|

|

Phillip

Wilson (Industry Representative)

|

20

June 2014

|

No

declared interests

|

No

declared interests

|

Nelson City Council Senior Leadership Team

- Interest Register

Last

updated January 2015

|

Council Officer

|

Last Updated

|

Officer’s Declared Interest

and value

|

Spouse/Partner Declared Interest

|

|

Chief Executive

Clare Hadley

|

21 July 2014

|

Trustee, Hadley Family Trust

|

Trustee, Hadley Family Trust

|

|

Group Manager Community Services

Chris Ward

|

16 July 2014

|

No declared interests

|

Regional Co-ordinator Fostering Kids NZ

|

|

Group Manager Infrastructure

Alec Louverdis

|

16 July 2014

|

No declared interests

|

No declared interests

|

|

Group Manager Strategy and Environment

Clare Barton

|

5 August 2014

|

No declared interests

|

No declared interests

|

|

Group Manager Corporate Services

Nikki Harrison

|

13 January 2015

|

Director of Local Government Superannuation Trust

(Trustee of Supereasy and Kiwisaver Supereasy)

|

No declared interests

|

|

Senior Strategic Adviser

Nicky McDonald

|

16 July 2014

|

Trustee Garin College

|

No declared interests

|

|

Kaihautu

Geoff Mullen

|

16 July 2014

|

No declared interests

|

No declared interests

|

|

Council Officer

|

Last Updated

|

Executive Member Declared Interest

and value

|

Spouse/Partner Declared Interest

|

|

Senior Legal Adviser

Viesturs Altments

|

6 August 2014

|

· Director

– Cephas Group of Companies

· Director

– Tinline Properties Limited

· Director

– Tinline Properties (Canterbury)

· Trustee

– Cephas Foundation

· Trustee

– Everawake Ministries Charitable Trust

· Trustee

– Nelson Charitable Trust

· Tinline

Properties, Palm Beach, Papamoa

· Rootstock

Charitable Trust

· Associated

Churches of Christ of New Zealand Property Trust Board

|

No declared interests

|

|

|

Audit, Risk and Finance Subcommittee

5 May 2015

|

REPORT R4177

Events

Resource Consent Charging Regime for RM125012

1. Purpose of Report

1.1 To

report back on the charging regime for RM125012 as requested by Council on 4

June 2013.

2. Delegations

2.1 The Audit, Risk and Finance Subcommittee has delegated

responsibility for management of

financial risk and monitoring Council’s financial and service

performance.

3. Recommendation

|

THAT the report Events Resource

Consent Charging Regime for RM125012 (R4177)

be received.

|

Recommendation

to Governance Committee and Council

|

THAT

Council consider the options for the charging regime for the use of

Council’s Resource Consent RM125012, as detailed in report R4177, and

Either: remove

the charge altogether.

Or: increase

the charge and apply it only to

commercial events.

|

4. Background

4.1 In

2012/13 Council obtained two resource consents for amplified sound where noise

levels breach specified rules in the Nelson Resource Management Plan. Resource

consent RM115245, also referred to as the ‘global consent’, allows

for amplified sound in parks under certain conditions and is not limited to the

number of events. Resource consent RM125012 allows for a specific number of

special events, at set noise limits, at nominated venues, on limited occasions

per year. Where events fall outside these consents, separate applications must

be made.

4.2 After

a lengthy process, the cost of obtaining these Resource Consents was

substantially higher than budgeted which resulted in an overspend of around

$150,000. On 4 June 2013, Council considered options for obtaining a return on

investment made on Resource Consent RM125012. It was resolved:

THAT

the Council confirm that the consents (RM115245 and RM125012) are a Council

investment;

AND THAT

a fee of $250 be charged for special events, where the event will be using the

Council’s Resource Consent RM125012 and Site Noise Management Plans;

AND THAT

this charging regime be reviewed and reported back to the Audit, Risk and

Finance Committee in 12 months.

5. Discussion

5.1 Applications

for the use of amplified sound and the subsequent use of RM125012 are received

through Council’s Parks and Facilities Business Unit. Records show that

since obtaining the consent, three events have been approved through this

process and fallen under the charging regime for RM125012, resulting in income

of $750. These events were community events; Bikefest Carnivelo, Carols on the

Green and Jazz in the Park. Other than these events the main use of the consent

is for Council run events.

5.2 For

the initial investment of over $150,000, the return of $750 over 18 months is

not a substantial amount. The income generated does not outweigh the cost of

administration to charge the fee, so to continue with the current charging

regime is not a justifiable return on investment.

5.3 The

investment made into these resource consents has allowed a compliance framework

to be set. Compliance with consented noise levels of events has improved

significantly and feedback from the community has been positive in this regard.

Environmental Inspections Limited report a significant decrease in the number

of complaints received and monitoring has shown compliance. The Events Noise

Management Group (set up in 2013 as an interface between Council as consent

holder and members of the community) meet quarterly in relation to resource

consents RM115245 & RM125012. At the December 2014 meeting, it was noted

that compliance around noise has significantly improved since Council invested

in these resource consents.

5.4 It

is worth noting that the cost of applying for a separate resource consent for

an event would be well in excess of $250. Where events are able to use

Council’s resource consent RM125012 this saves a significant amount of

time and associated costs and comes with the provision of relevant Site Noise

Management Plans. Some events that did not fit the criteria of resource consent

RM125012 have had to apply for their own consent, such as the Royal NZ Pipe

Band Championships being held at Trafalgar Park in March 2015.

6. Options

6.1 There

are a number of options to consider for the future use and charging regime for

resource consent RM125012 as outlined below.

Option 1 Maintain

status quo

6.2 Maintain

status quo and continue with the current charging regime of $250 for the use of

the consent. With this option, the cost to administer the charge is greater

than the amount of income generated and the extent of the return on investment

is limited. The charge also creates a barrier to community events.

Option 2 Increase

charge

6.3 Increase

the amount charged to $500 for commercial events only (ticketed events). This

option would justify the administration cost of charging the fee. This would

still be a reasonable cost for commercial events to pay as well as saving time

and costs associated with lodging a separate application. With this option,

community events would not be charged a fee, allowing them to operate viably,

without the added barrier of a noise consent fee.

Option 3 Remove

charge

6.4 Remove

the charge altogether, accepting the initial investment as a sunk cost. Most

events under the consent to date have been community events and there is not

likely to be a substantial return on investment. Removing the charge would

allow events to operate under the consent without the added barrier of the cost

and process to obtain a consent, while ensuring compliance, which is what the

initial investment was made for. This would support events to add vibrancy to

Nelson.

7. Alignment with relevant Council policy

7.1 The

Resource Consents are required for compliance with the Nelson Resource

Management Plan.

8. Assessment of Significance against the Council’s

Significance and Engagement Policy

8.1 This is not a significant decision in terms of

Council’s Significance and Engagement Policy.

9. Consultation

9.1 No

specific consultation has taken place in regards to this report.

10. Inclusion of Māori in the decision making process

10.1 Maori

have not been specifically consulted in regards to this report.

11. Conclusion

11.1 After

Council obtained Resource Consents for amplified sound at events on Council

parks and reserves, and a limited number of special events, a charging regime

was introduced to assist in obtaining a return on investment. Due to the associated

administration costs and low return on investment to date, Council needs to

decide whether to remove the charge altogether, or increase the charge to $500

for commercial events only.

Shanine

Hermsen

Manager

Community Partnerships

Attachments

Nil

|

|

Audit, Risk and Finance Subcommittee

5 May 2015

|

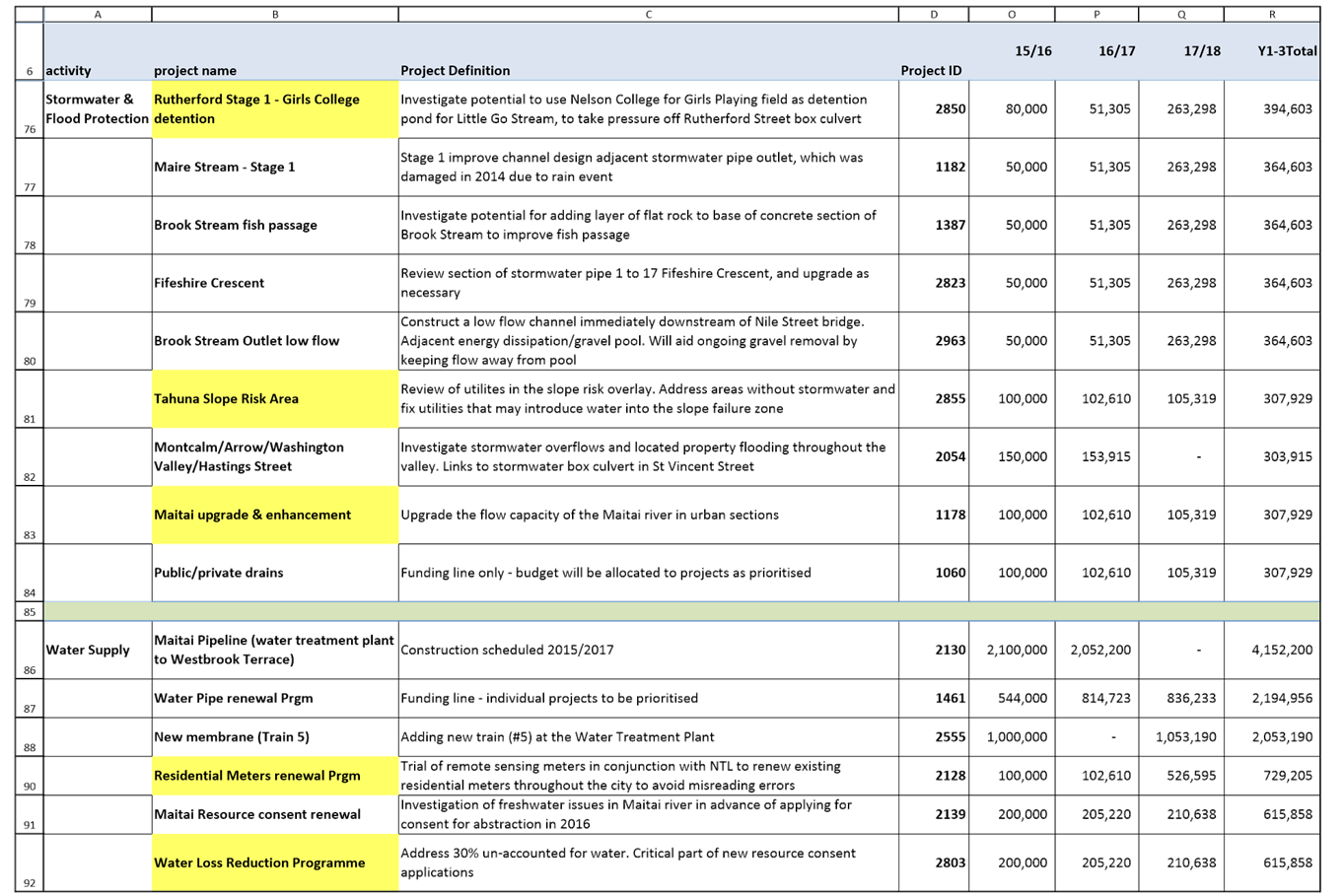

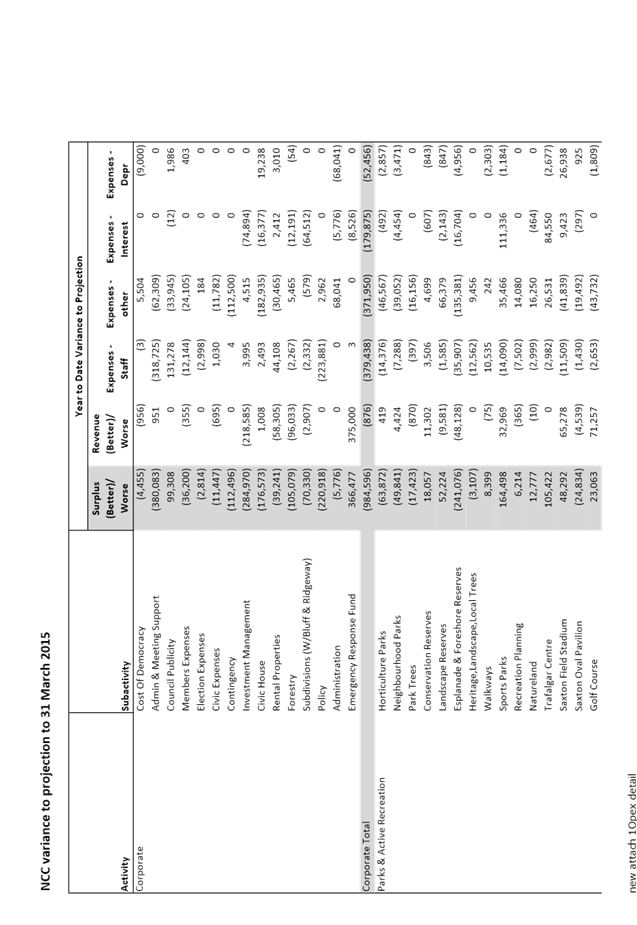

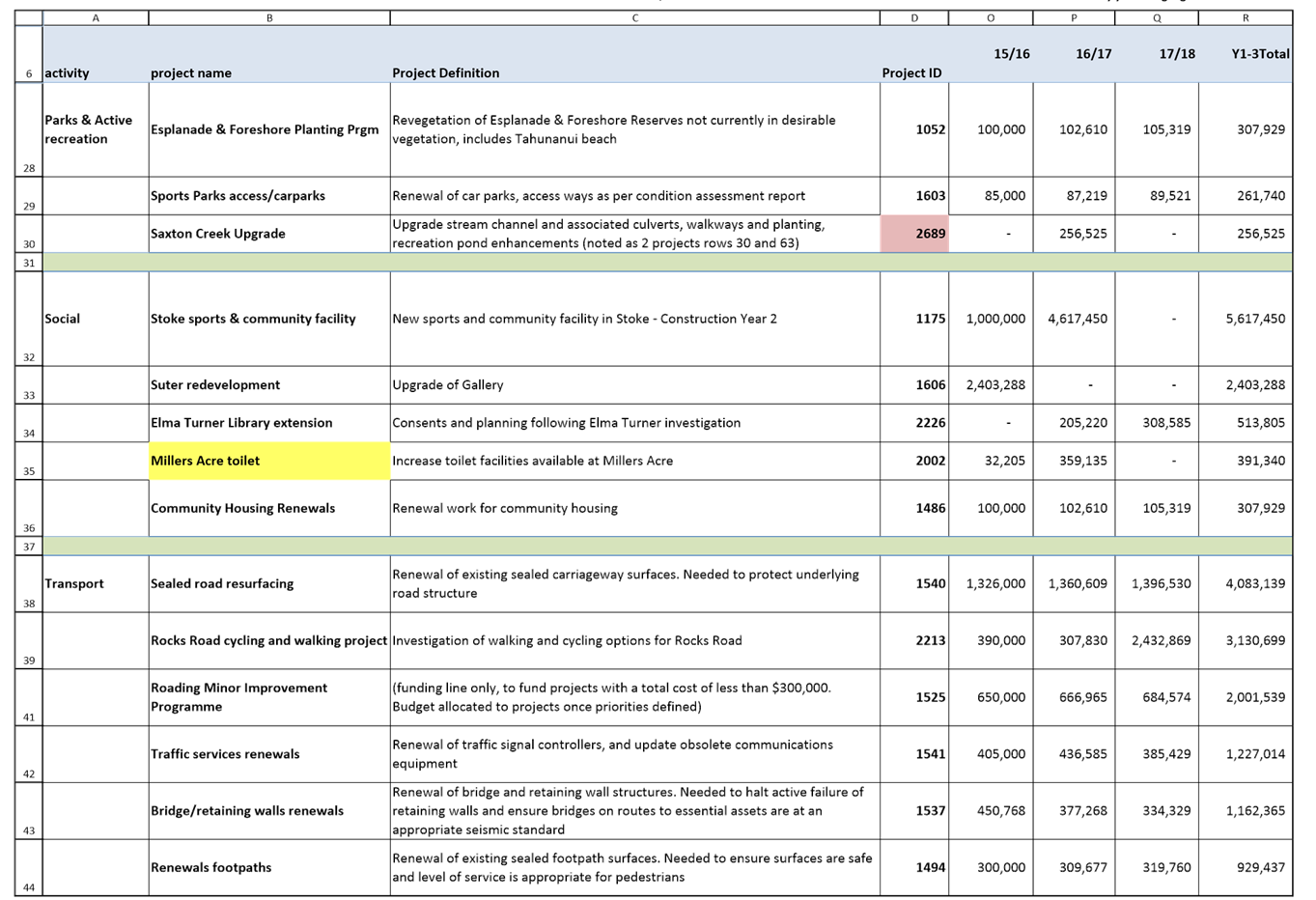

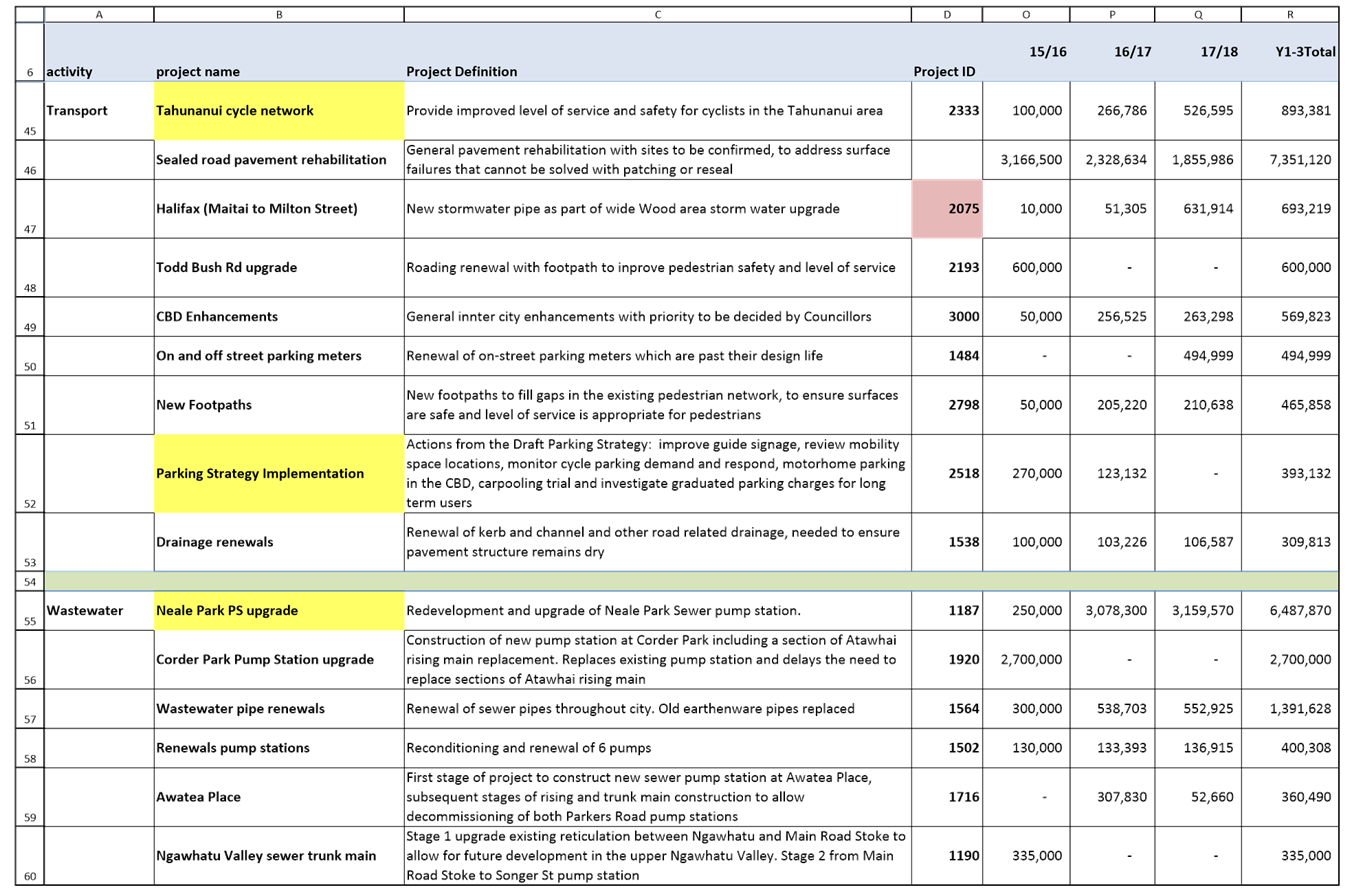

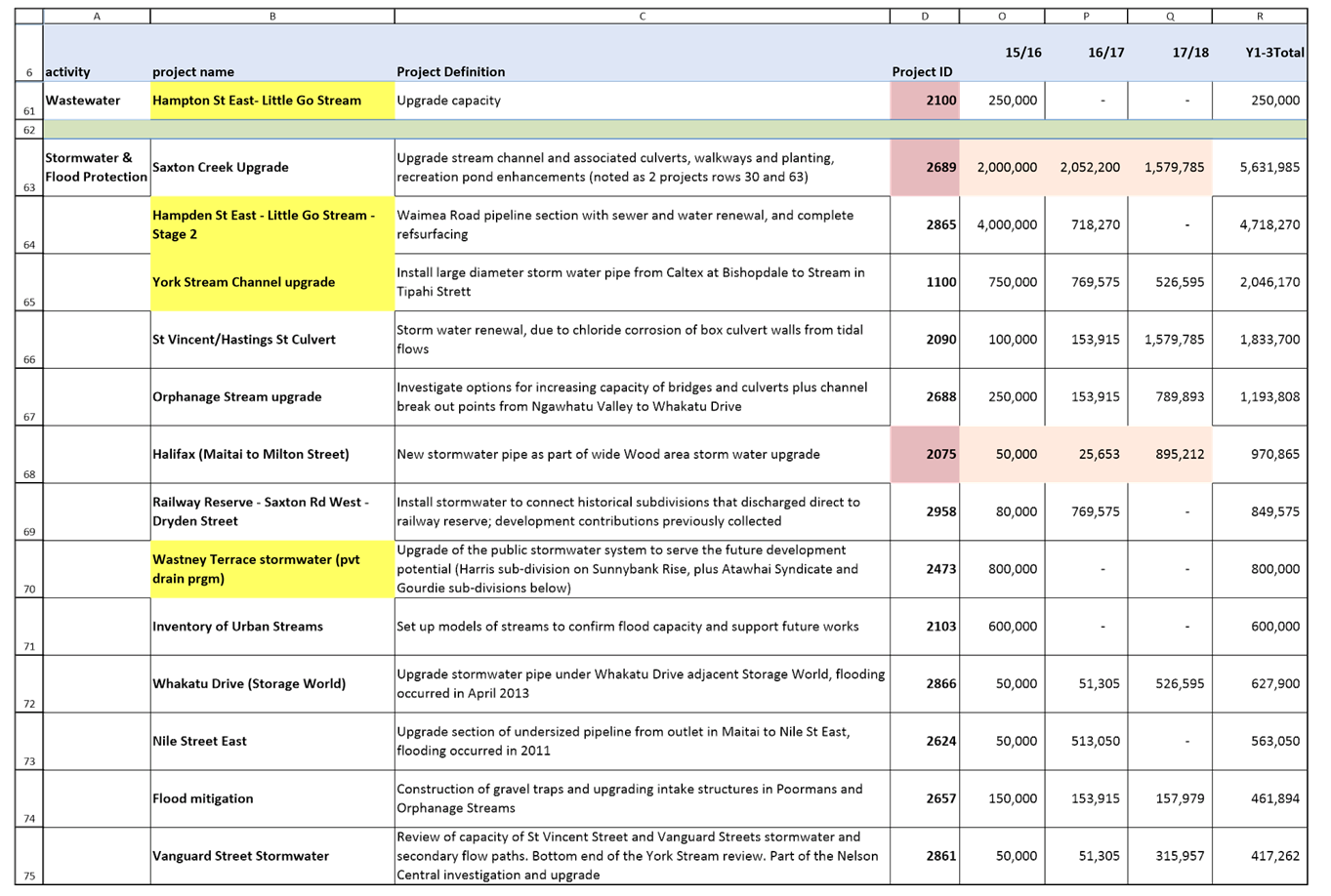

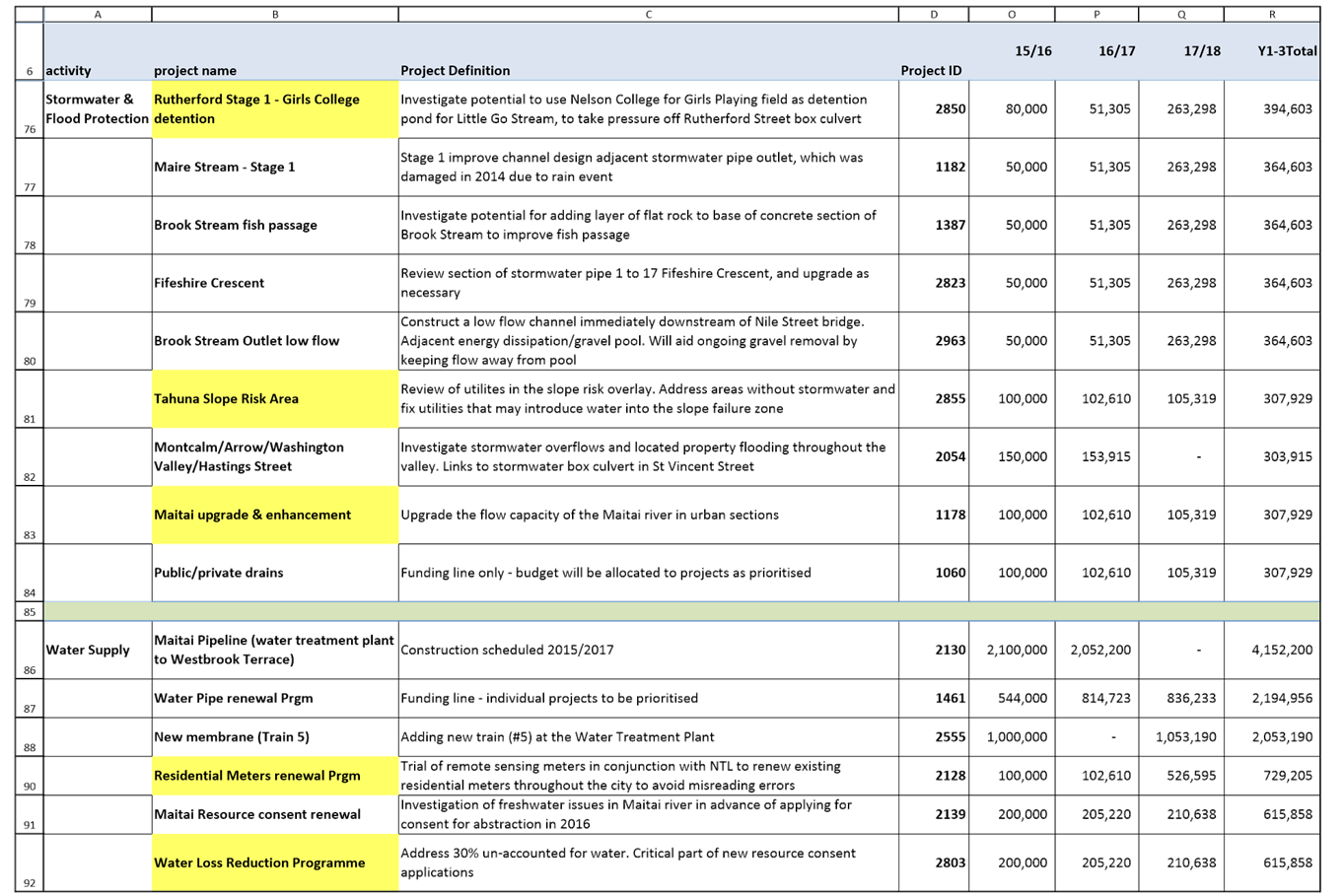

REPORT R4183

Business

Case Approach for 2015/16 Projects

1. Purpose of Report

1.1 To decide which 2015/16 capital funded infrastructure

projects will follow a business case approach.

2. Delegations

2.1 This

is a matter for the Audit Risk and Finance Subcommittee as it has

responsibility to recommend to Governance Committee in the areas of risk

management and internal control, and monitoring of Council’s financial

and service performance.

3. Recommendation

|

THAT the report Business Case

Approach for 2015/16 Projects (R4183)

and its attachments (A1331113) be

received.

|

Recommendation

to Governance Committee and Council

|

THAT projects

highlighted yellow in document A1331113 follow a business case approach.

|

4. Background

4.1 In 2014, the Chief Executive commissioned an external

review of decisions and actions relating to the southern extension of the

Trafalgar Centre. The review was conducted by Alan Bickers, of Jayal

Enterprises Ltd. The final report to Council carried a recommendation

that “for every significant capital project NCC should consider a policy

requiring the preparation and approval of a business case”. After

receiving that report, Council resolved on 5 June 2014:

AND THAT Council

note the business case approach to projects, as set out in the Independent

Review of the Southern End, Trafalgar Centre, will be reviewed and incorporated

into management practices for use in significant Council projects;

AND THAT

through the Long Term Plan/Annual Plan development, Council will give

consideration to the projects that will follow a business case approach.

4.2 Management practices that incorporate the business

case approach are being implemented. As part of this, officers have

selected a number of projects from the draft Long Term Plan 2015/25, for which

Nelson City Council management will adopt a business case approach. This

selection is based on a range of factors, such as level of capital investment

is $250,000 or more , level of risk, and level of perceived public

interest. In the first instance, initial business cases will be collated

for these projects. These projects are highlighted yellow in Attachment

1.

4.3 The initial business cases will describe:

• the

known problem, or opportunity;

• the preferred or agreed solution for

addressing the problem or opportunity, noting alternative options;

• the

estimated lifetime costs for the project and it’s deliverables;

• the

expected outcomes and benefits that will result from the project;

• the key known risks that could impact on

the project deliverables or outcomes.

5. Discussion

5.1 Projects have been included in the draft Long Term

Plan 2015/25, based on advice from officers and as discussed through the draft Asset

Management Plans 2015/25, and Council workshops for the Long Term Plan 2015/25.

5.2 A selection of projects that will follow a business

case approach is presented for consideration by the Audit Risk and Finance

Subcommittee. The list of capital funded infrastructure projects in the

draft Long Term Plan 2015/25 with a total year 1 to 3 budget of $250,000 or

more is included in Attachment 1, with the selected projects highlighted

yellow.

6. Options

6.1 The Audit Risk and Finance Committee recommend to the

Governance Committee that the projects highlighted yellow in Attachment 1 are

the selected projects that will follow a business case approach.

6.2 The Audit Risk and Finance Committee recommend to the

Governance Committee an amended selection of projects that will follow a

business case approach.

7. Alignment with relevant Council policy

7.1 This matter is not in contradiction to any Council

policy or strategic document.

7.2 The recommendation is unlikely to be inconsistent with

any other previous Council decision.

7.3 The costs associated with the recommendation are staff

time, and are accommodated within existing budget.

8. Assessment of Significance against the Council’s

Significance and Engagement Policy

8.1 This matter is not significant in terms of

Council’s Significance and Engagement Policy.

9. Consultation

9.1 The public have not been consulted on this matter.

10. Inclusion of Māori in the decision making process

10.1 Maori have not been consulted on this matter.

11. Conclusion

11.1 Following a business case approach for selected

projects fulfils the Council resolution from 5 June 2014.

Arlene

Akhlaq

Senior

Projects Adviser

Attachments

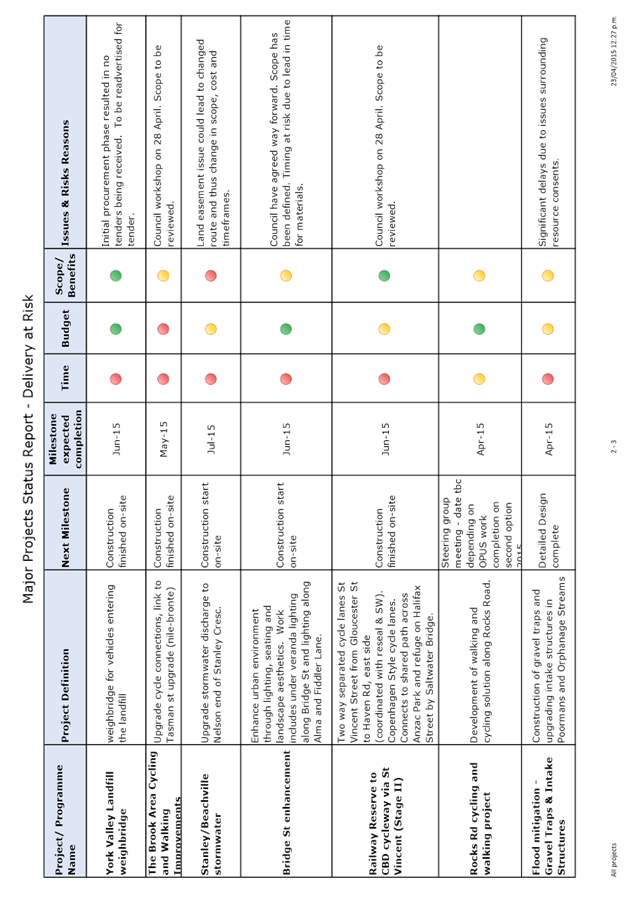

Attachment 1: A1331113 - Capital Funded

Projects included in Year 1 of the draft Long Term Plan 2015-25 - April 2015

*Only yellow highlighted cells are relevant

*Only yellow highlighted cells are relevant

*Only yellow highlighted cells are relevant

*Only yellow highlighted cells are relevant

*Only yellow highlighted cells are relevant

*Only yellow highlighted cells are relevant

|

|

Audit, Risk and Finance Subcommittee

5 May 2015

|

REPORT R4168

Letter

to the Council on the Audit for the Year Ending 30 June 2014 - Further

Information

1. Purpose of Report

1.1 To provide further detail on the Audit NZ letter to

the Council on the audit for the year ending 30 June 2014.

2. Delegations

2.1 The Audit, Risk and Finance Subcommittee have

responsibility for the audit of Council’s Annual Report and annual

accounts.

3. Recommendation

|

THAT the report Letter to the

Council on the Audit for the Year Ending 30 June 2014 - Further Information

(R4168) be received.

|

4. Background

4.1 At the Audit, Risk and Finance Subcommittee meeting on

10 March 2015, members asked for further detail on some of the comments Audit

NZ made in its letter to Council on the Audit for the year ending 30 June 2014.

5. Discussion

5.1 Further detail on each of the areas in the letter to

Council is provided below.

Rates

setting process

5.2 Audit NZ comment:

We

encourage the City Council to have a legal review of its rates setting process

each year. We believe this is particularly important when the City Council

introduces a new rate, or when changes occur to the underlying legislation

(either the Local Government Act 2002 or the Local Government (Rating) Act

2002). This would provide a useful check that the City Council continues to

comply with what are complex pieces of legislation.

5.3 Nelson City Council will continue to engage Simpson

Grierson annually to review the Funding Impact Statement prior to Annual

Plan/LTP consultation and again to review the rates resolution later in the

process prior to the resolution being passed.

Organisational

restructuring

5.4 Audit NZ comment:

The

City Council’s staff levels have dropped significantly because of this

restructuring. Staff numbers decreased in the year by 37 to 220. We will

continue to monitor the impact, if any, of this large staffing reduction on the

control environment and also whether there is any significant impact on the

City Council’s operations, as reflected in the levels of service reported

in the 2014/15 annual report.

5.5 The significant reduction in this period was as a

result of incomplete recruitment for new roles. Staffing levels have

increased slightly since 30 June 2014.

Revaluation

of infrastructure assets

5.6 Audit NZ comment:

For

2015, we recommend that the City Council review its processes as to how it

prepares the valuation. If a valuation is to be undertaken, we recommend a

full, compliant valuation be performed. If the City council believes it is not

cost effective to undertake full revaluations every year we suggest that the

City Council includes more specific cost information on unit rates and updates

asset quantity information in the infrastructural asset revaluation.

5.7 It is not cost effective to undertake a full

revaluation every year but we will review our processes around indexing.

Public

sector concerns

5.8 Audit NZ comment:

We followed up our previous recommendations in relation to credit

card expenditure and identified that tax receipts had not been retained in

relation to several items of credit card expenditure. We discuss this matter

further in our supplementary report to management.

5.9 Credit cards are now being administered at a more

senior level in Finance. We have reminded the administrator that if there

is no invoice, then the card holder would be liable for the expense, unless

there are exceptional circumstances. The credit card policy is circulated

regularly to credit card holders to remind them of their obligations.

Shared

services

5.10 Audit NZ comment:

This

is an area that the City Council is looking to develop and is continuing to

consider options in this area. These are mainly in relation to working with

other Councils in the north of the South Island.

5.11 Management is interested in pursuing shared services

opportunities as they arise.

Changes

to the accounting standards framework for public benefit entities (PBEs)

5.12 Audit NZ comment:

The

transition to the new standards is imminent. The City Council is responsible

for being ready to apply the new accounting standards and prepare compliant

financial statements. We expect the City Council to be prepared for us to audit

the transition as part of next year’s audit to ensure that we can

efficiently carry out our audit of financial statements prepared using the new

accounting standards.

5.13 Matters of categorisation/presentation of financial

statements have already been dealt with. Potential issues relating to

consolidation and disclosure are currently being worked through. Publication of

OAG model accounts will assist. Anticipate full compliance prior to audit

arrival.

6. Options

6.1 That the committee note the matters raised in this

report.

7. Alignment with relevant Council policy

7.1 This recommendation is not inconsistent with any

previous Council decision.

8. Assessment of Significance against the Council’s

Significance and Engagement Policy

8.1 This is not a significant decision.

9. Consultation

9.1 No consultation has occurred in preparation of this

report.

10. Inclusion of Māori in the decision making process

10.1 No consultation with Maori has occurred in preparation

of this report.

Nikki

Harrison

Group

Manager Corporate Services

Attachments

Nil

|

|

Audit, Risk and Finance Subcommittee

5 May 2015

|

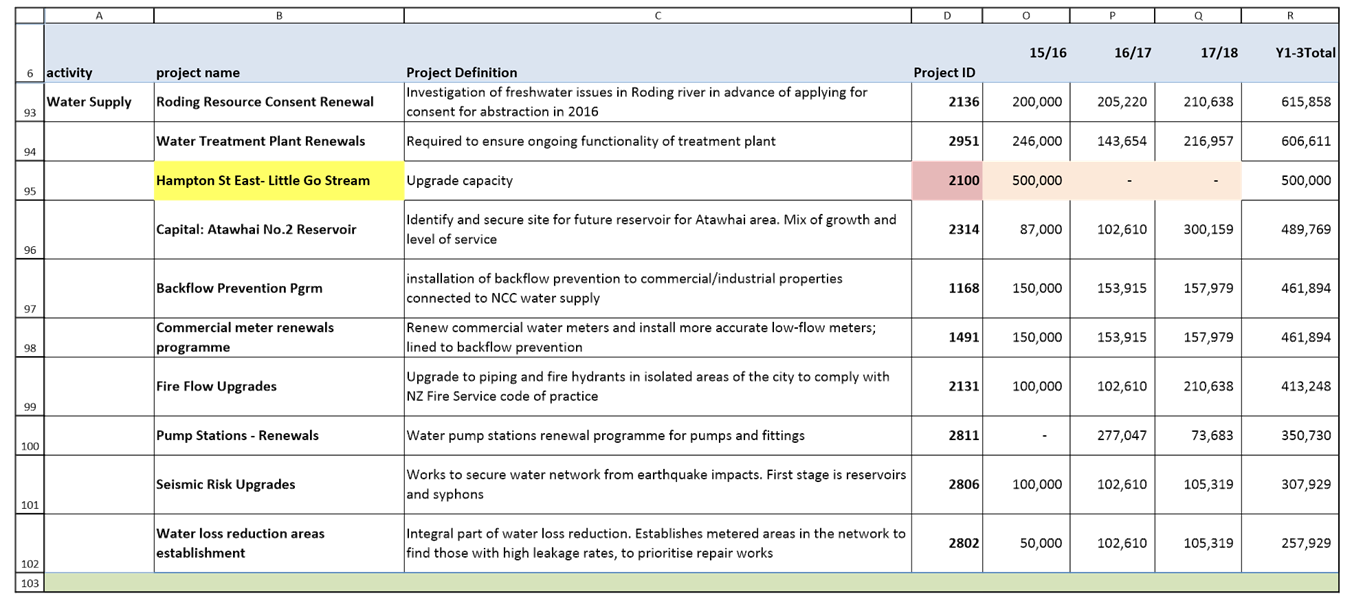

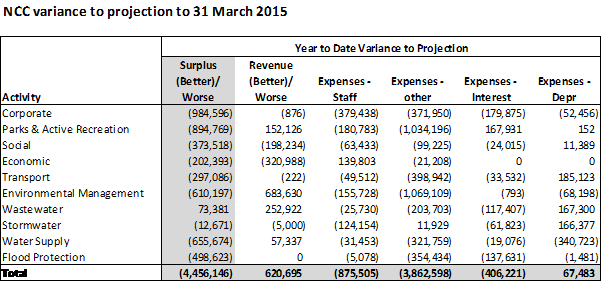

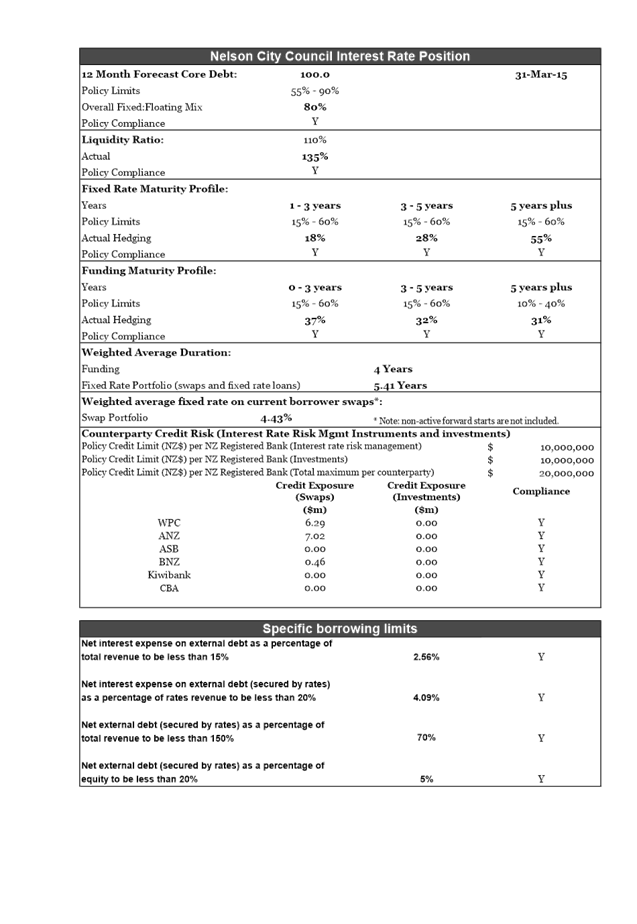

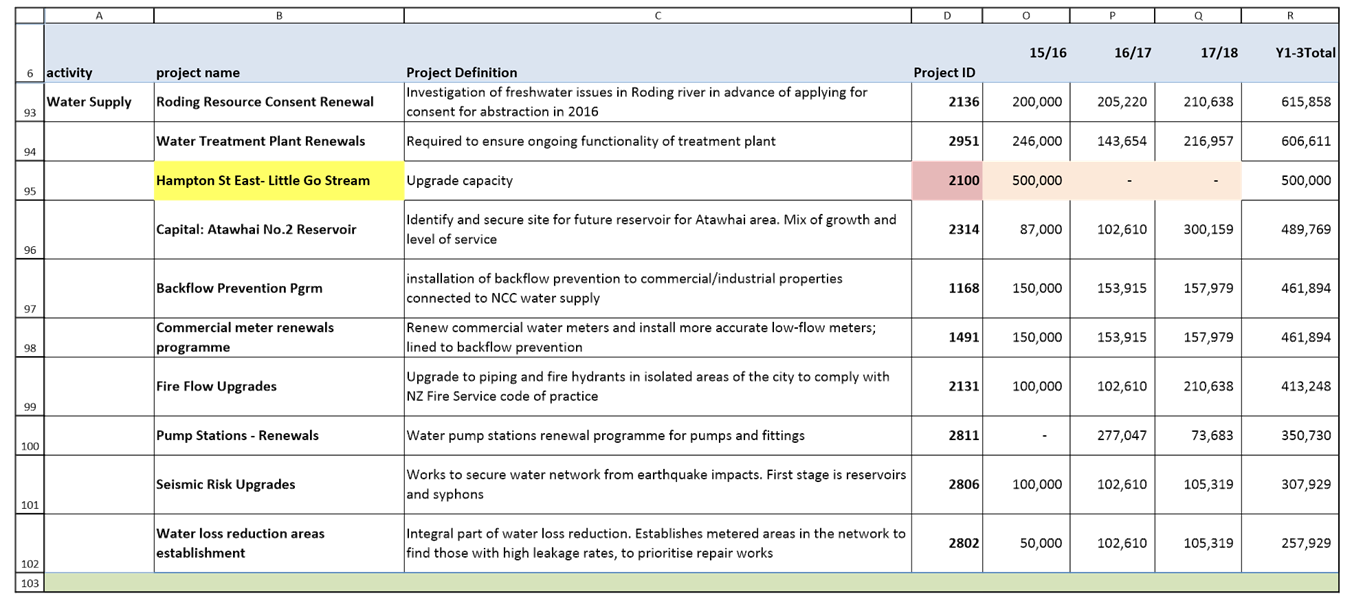

REPORT R4194

Corporate

Report for the Period Ending 31 March 2015

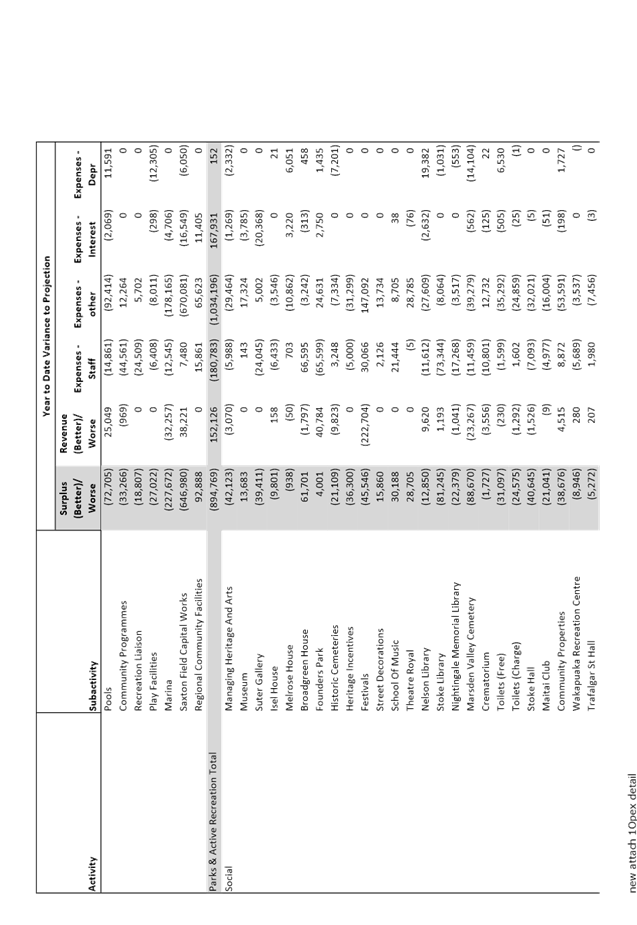

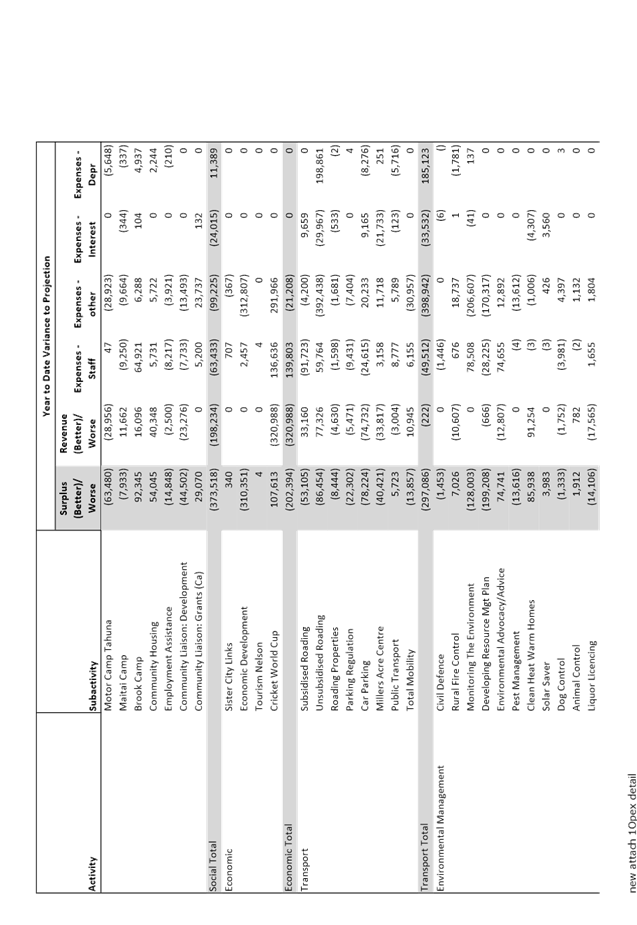

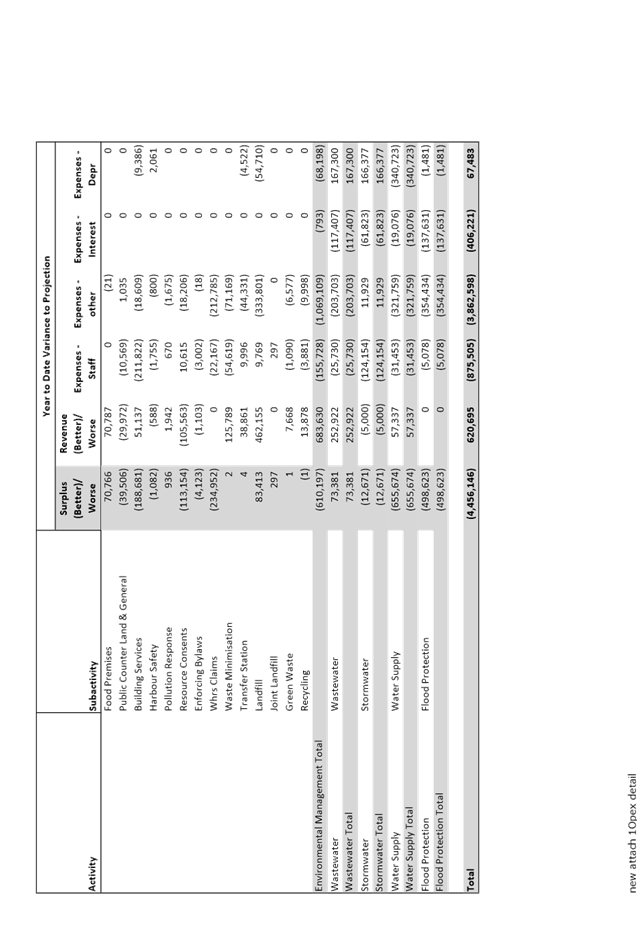

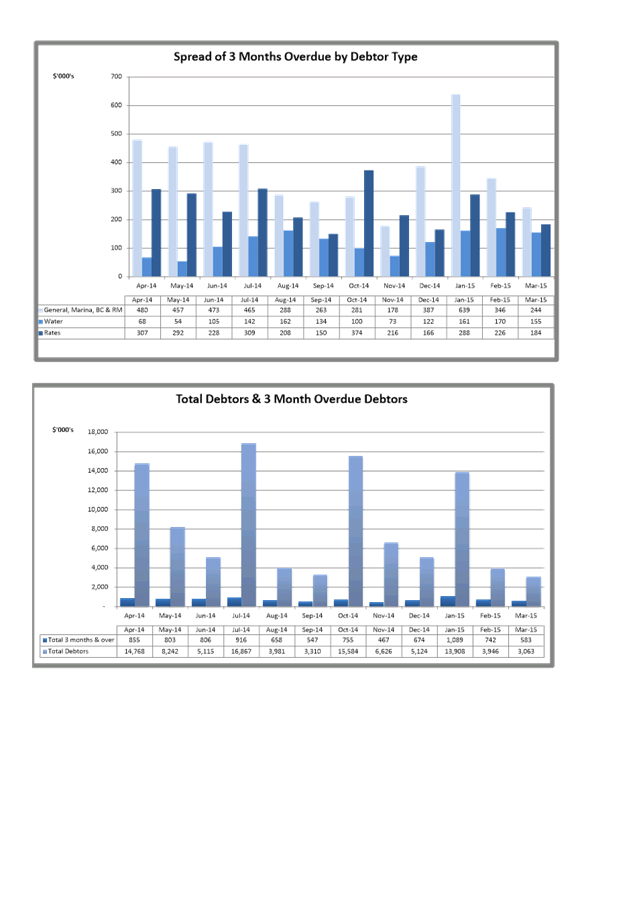

1. Purpose of Report

1.1 To inform the members of the Audit Risk and Finance

Committee on the financial results of activities for the 9 months ending 31

March 2015 compared to the first projection, completed as part of the draft

Long-Term Plan 2015-2025 (LTP), and to highlight and explain any material variations.

2. Delegations

2.1 The Audit Risk and Finance Committee has oversight of

the management of financial risk and makes recommendations to the Governance

Committee and to Council.

3. Recommendation

|

THAT the report Corporate Report for the

Period Ending 31 March 2015 (R4194) and

attachments (A1342336, A1311288, A1343636, A1340305 and A793514) be received and

the variations noted.

|

Recommendation

to Governance Committee

|

THAT

Council note that ongoing costs of approximately $11,250 pa will need to be

included in the Long Term Plan 2015-25 for live streaming of Council

meetings.

|

4. Background

4.1 The report focuses on the 9 month performance compared

with the year to date projection. Budgets/projections for operating income and

expenditure are phased evenly through the year, whereas capital expenditure

budgets/projections are phased to occur mainly in the second half of the year.

4.2 Projections (forecasts) were completed as part of the

work informing the draft LTP, and updated projections will be complete by the

end of April. We would expect variances against the updated projections to be

diminished.

4.3 Some definitions of terms used within this report:

· Operating

income – all income other than rates including metered water, grants,

fees, rentals, and recoveries;

· Rates

– includes the general rate, wastewater, stormwater and flood protection

rates, and targeted rates for Solar Saver;

· Staff

costs – salaries plus overheads such as training, super, professional

fees and office accommodation expenses;

· Depreciation

– includes all depreciation, and any losses on asset disposal/retirement;

· Interest

– includes debt interest, bank fees, interest rate swap margins, treasury

and rating agency fees.

5. Discussion

5.1 The report focuses on performance to date compared

with the year to date projections. More detailed financials by sub-activity are

in Attachment 1.

5.2 For the 9 months ending 31 March 2015, the activity surplus/deficits

are $4.5 million favourable to projection.

5.3 Revenue and expenditure variances are discussed by

activity.

5.4 Staff expenses are $877,000 better than budgeted.

$204,000 of this variance is related to savings in advertising and marketing costs

in the HR Business Unit, office administration costs such as photocopying and

postage, and various consultancy costs. The remainder is salary cost savings

resulting mainly from vacancies.

Corporate

5.5 The Corporate activity is $985,000 better than

projection due to:

5.5.1 Revenue

– One thousand dollars better than projection. Unbudgeted interest income

from Nelson Region Sewerage Business Unit (NRSBU) for the Nelson City Council

(NCC) share of debt is $342,000 year to date (transferred quarterly), offset by

unbudgeted interest expenditure for the loans now held by NCC. Council has

received a $500,000 special dividend from Port Nelson which has been used to

repay debt. This has been included in the projection, but timing differences

generate a $125,000 positive variance year to date. The Forestry insurance

claim has been settled as projected at $242,000, generating a $60,000 positive

timing difference. Income in the Disaster Recovery Fund is $375,000 under

projection due to timing of further insurance claims. Internal interest is

$214,000 under projection reflecting the timing of capital expenditure.

5.5.2 Expenses

– staff $379,000 better than projection. The distribution of staff time

over the organisation differs from anticipated and the savings in this activity

are mainly in the Policy and Administration and Meeting support sub-activities.

5.5.3 Expenses

– other $372,000 better than projection as the contingency has not yet

been called on ($112,500) and Civic House expenditure is under projection ($183,000)

largely related to the budget sitting in this activity for property condition

assessments which as yet has little expenditure recorded against it (timing).

There is a saving in cleaning and maintenance in Civic House of $44,000 as a

result of the new contract which has realised better rates. The budget for post

earthquake inspections (reactive budget), year to date $34,000, currently has

no expenditure recorded against it.

5.5.4 This

also includes unbudgeted expenditure of $16,000 for external support for the

Chief Executive’s Employment Committee. $10,000 was initially approved by

Council, $6,000 is additional.

Parks and Active Recreation

5.6 The Parks and Active Recreation activity is $895,000

better than projection due to:

5.6.1 Revenue

- $152,000 worse than projection due to timing of income expected from the Golf

Course ($71,000) and Tasman District Council’s contribution for the

running of Saxton Stadium ($65,000).

5.6.2 Expenses

– staff - $181,000 better than projection. The distribution of staff time

over the organisation differs from anticipated and there are savings across

this activity but particularly in Community Programmes, Esplanade and Foreshore

Reserves, Sports Parks and Recreation Liaison.

5.6.3 Expenses

– other - $1 million better than projection. Regional Community

Facilities is $131,000 over projection as the second grant to the Brook

Waimarama Sanctuary Fence has been paid in full ($524,000 - timing). Offsetting

this, the budgeted grant to Tasman District Council for the velodrome at Saxton

Field has not been made, resulting in an underspend of $620,000 year to date

(see major projects status report). There is an underspend of $224,000 year to

date in other maintenance categories; in particular no expenditure has yet been

made for the Marina maintenance dredging consent/plan ($156,000 – see

projects update). A year to date overspend of $112,000 in Sports Parks

programmed maintenance is offset by underspends in other programmed maintenance

budgets. Year to date there is a saving of $66,000 in consultancy costs

(timing) relating to facilities policies and $45,000 saving as the Tahuna

Erosion study has not yet been invoiced (timing).

5.6.4

An agreement has been reached to share costs 50:50 between Brook Waimarama Sanctuary

Trust & NCC to install a temporary path for cyclists and pedestrian access

on the Dun Trail, following the slip. Nelmac have been employed and the work

was completed 24 April. Officers are working on other, longer term issues with

the Trust in accordance with the Trust’s consent. The cost of this work

will be no more than $5,000.

Social

5.7 The Social activity is $374,000 better than projection

due to:

5.7.1 Revenue

- $198,000 better than projection. Income related to the Arts Festival is

$222,000 ahead of projection year to date (timing) and $144,000 ahead of full

year projection. The Founders Book Fair proceeds (year to date $94,000

projection) will not come in until the end of the financial year (timing).

Rental for the Tahuna Motor Camp is $49,000 over projection year to date after

the invoicing of the 2013/14 residual rent wash-up. Community Housing income is

$40,000 less than projected, offset by decreased expenditure.

5.7.2 Expenses

– other - $99,000 better than projection. Arts Festival $108,000 over

projection year to date (timing), offset by income. Maintenance costs are

$135,000 underspent year to date across a large range of activities, including

for the demolition of the Highland Pipe Band building which has not yet occurred

but scheduled to take place by June 2015. Base operating expenses are less than

projected by $119,000 over a range of items including electricity, water

and cleaning costs.

Economic

5.8 The Economic activity is $204,000 better than

projection due to:

5.8.1 Revenue

- $321,000 better than projection. The Cricket World Cup (CWC) cost recovery is

now largely complete (producing a timing variance) and more than anticipated.

Extra expenditures not originally in the budget have been recovered.

5.8.2 Expenses

– staff - $140,000 more than budgeted, almost entirely in the Cricket

World Cup sub-activity. This is a budgeting issue as the number of staff hours

required was within the 4,000 allowed as part of $900,000 expenditure cap in

the contract.

5.8.3 Expenses

– other - $21,000 better than projection. The Economic Development

expenditure is under projection by $313,000. There is no spending to date in

the EDA economic development fund, business incubator, facilities marketing and

economic impact assessment. Expenses relating to the CWC are now largely

complete, producing a timing effect of expenditure being $292,000 more than

projection.

Transport

5.9 The Transport activity is $297,000 better than

projection due to:

5.9.1 Revenue

– overall equates with the projection year to date, however changes in

the projection of operating income in this activity (in car parking and

unsubsidised roading recoveries) have resulted in an increased charge to rates

of $344,000.

5.9.2 Expenses

– other - $398,000 better than projection, mainly in unsubsidised

roading. The most significant underspends in that activity are:

· Base

maintenance ($136,000) including street and sump cleaning and footpath

maintenance, expected to be spent over Autumn;

· $146,000

underspent year to date in recovery works from the 2011 emergency event

relating to Days Track. A carryover may be required;

· No

expenditure year to date for the southern arterial corridor management plan

($73,000 - this was work in connection with the Nelson Plan and has been

delayed until the findings of the Southern Arterial Investigation –

Annesbrook Drive roundabout to QEII Drive roundabout (run by NZTA) are known.

5.9.3 Depreciation

- $185,000 worse than projection. The 2013/14 revaluation of infrastructure

assets at $93 million was significantly more than expected when the 2014/15

annual plan was calculated. The increase in the asset base is generating

increased depreciation charges.

Environmental

Management

5.10 This activity includes Civil Defence and Rural Fire activities,

Consents and Compliance, Environmental Programmes, and Solid Waste activities.

The Environmental Management activity is $610,000 better than projection due

to:

5.10.1 Revenue

- $684,000 worse than projection. Landfill fees are $452,000 less than projection

and $294,000 less than year to date March last year as a result of the delay in

sludge disposal from the wastewater treatment plant and waste from Buller

District . Internal income in the solid waste group is $163,000 less than

projection and is offset in expenses. Resource consents job sales are $100,000

greater than projection, and building services job sales are $52,000 less than

projection. Food premises license fees are currently $71,000 under projection

with most of the income for that subactivity being invoiced in the last quarter

of the financial year (timing). $91,000 year to date income projected for the

Clean Heat Warm Homes programme is part of an end of year adjustment (timing).

5.10.2 Expenses

– staff - $156,000 better than projection. This is mainly in Building

Services which has until now carried two vacancies, and which has not been

charged staff time from the Resource Consents team to the extent anticipated.

5.10.3 Expenses

– other - $1.1 million better than projection. Weather Tight Homes

expenditure shows $213,000 less than projection year to date. Monitoring the

Environment is $207,000 under projection as this sub activity contains a large

number of programmes (timing). Landfill expenditure is $334,000 under projection

reflecting no expenditure yet for Emissions Trading Scheme (ETS) levies and

lower internal charges than anticipated from other solid waste sub-activities.

Other sub activities in Solid Waste show year to date savings of $132,000,

mainly in Waste Minimisation. Expenditure relating to the Nelson Plan is also

under projection by $163,000 but is expected to catch up by the end of the

financial year.

Wastewater

5.11 The Wastewater activity is $73,000 worse than

projection due to:

5.11.1 Revenue

- $253,000 less than projected, related to the NRSBU investment return. The

distribution from NRSBU is less than budgeted as input volumes from all five

customers are less than anticipated. This will largely correct at year end when

additional charges will be made.

5.11.2 Expenses

– other - $204,000 less than projection mainly due to lower charges than

expected from the Regional Sewage Business Unit.

5.11.3 Depreciation

- $167,000 more than projection – resulting from the 2013/14 revaluation

of infrastructure assets, see 5.8.3.

Stormwater

5.12 The Stormwater activity is $13,000 better than

projection due to:

5.12.1 Expenses

– staff - $124,000 better than projection. The distribution of staff time

over the organisation differs from anticipated.

5.12.2 Depreciation

- $129,000 more than projection – resulting from the 2013/14 revaluation

of infrastructure assets, see 5.8.3.

Water

5.13 The Water activity is $656,000 better than projection

due to:

5.13.1 Revenue

– $57,000 worse than projection. An accrual has been processed pending

residential invoicing for the summer months.

5.13.2 Expenses

– other - $322,000 better than projection relates to year to date

underspend against maintenance budgets, mainly in headworks maintenance where

the activity is concentrated in the second half of the year, and in reactive

budgets.

5.13.3 Depreciation

- $341,000 better than projection. The replacement valuation for the water

membranes at the water treatment plant have halved and their expected useful

lives increased, generating an expected depreciation saving against projection

of $438,000 in the current financial year. This saving has been reflected in

the LTP.

Flood

Protection

5.14 The Flood Protection activity is $499,000 better than

projection.

5.14.1 Expenses

– other - $354,000 better than projection. This is year to date

underspend against maintenance budgets, including $325,000 relating to

emergency recovery works (timing). There has been only minor expenditure year

to date for these works (identified from the December 2011 Rainfall Event) as

the resource consents have yet to be granted. Works may extend into the next

financial year. Reactive maintenance is also underspent.

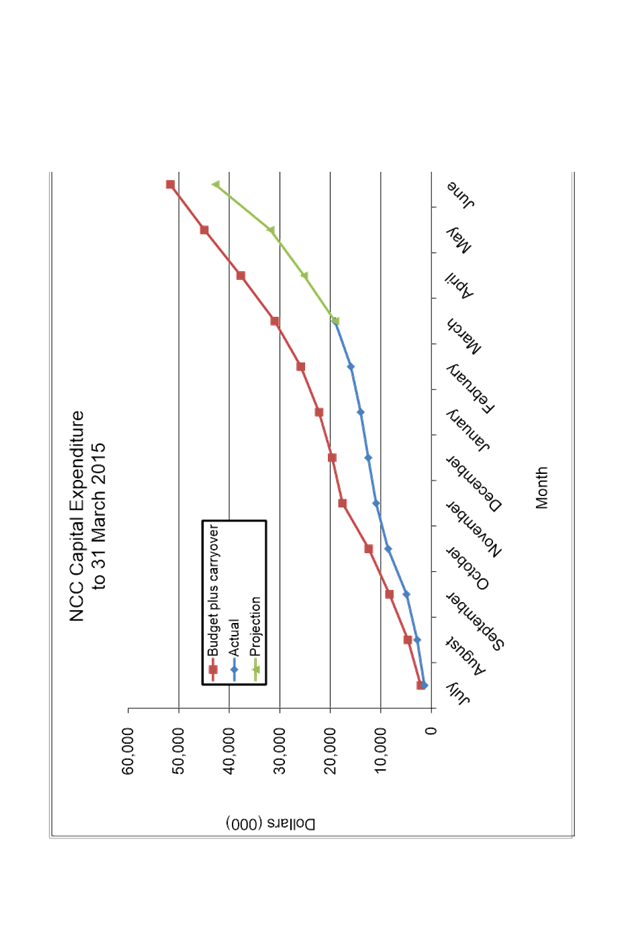

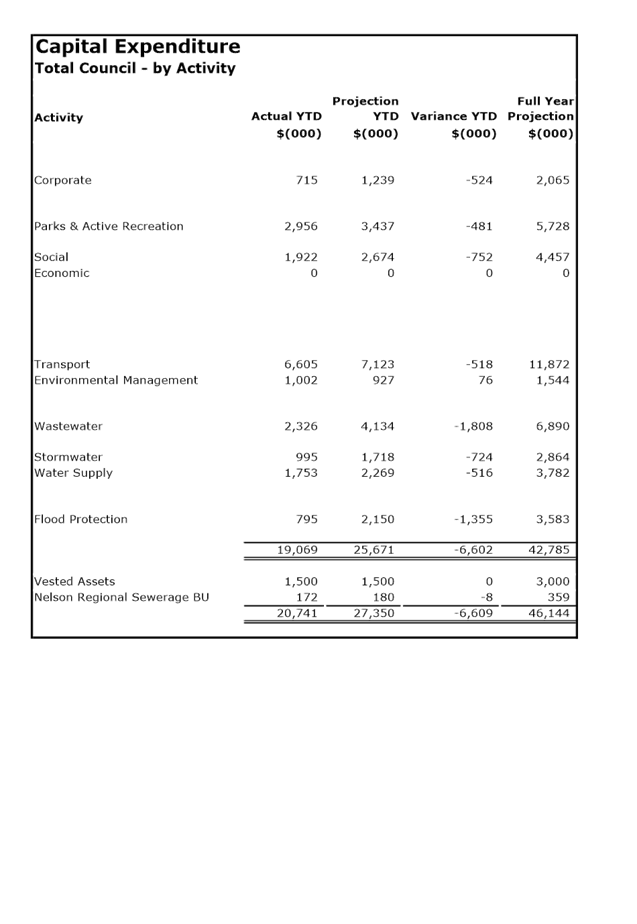

Capital

Expenditure

5.15 Capital expenditure to 31 March 2015 was $19.1

million, $6.6 million (26%) below projection. Details are included in

Attachments 2 to 5.

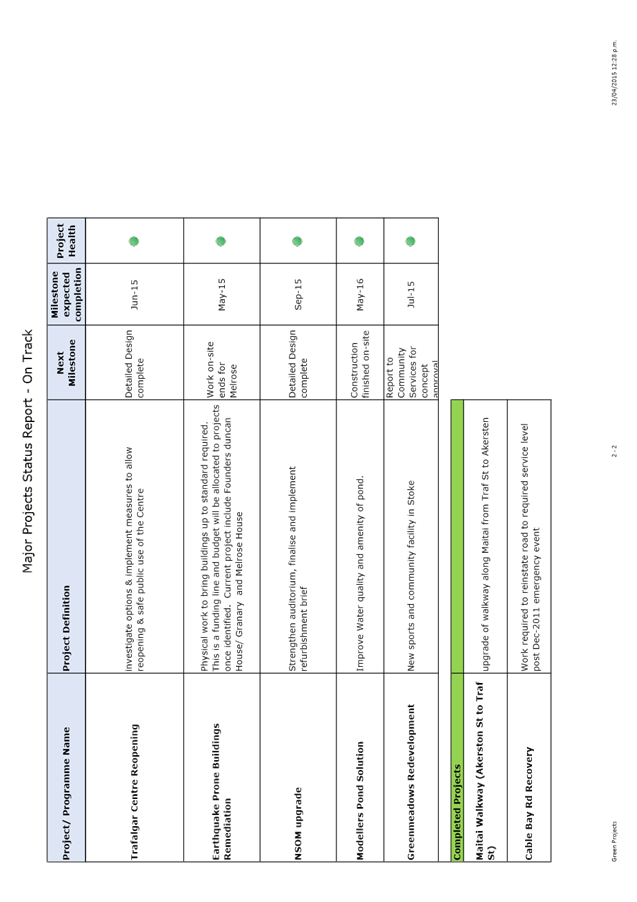

Balance

Sheet

5.16 Rates debtors are a credit balance reflecting direct

debits received from ratepayers in advance of the upcoming rates invoices.

5.16.1 The

increase in trade debtors is as a result of invoicing for the Cricket World

Cup, and the movement in the GST receivable balance (which varies significantly

due to quarterly rates invoicing).

5.16.2 The

reduction in the Debtors and accruals balance is as a result of re-categorising

the $8 million advance to NRSBU as a term asset.

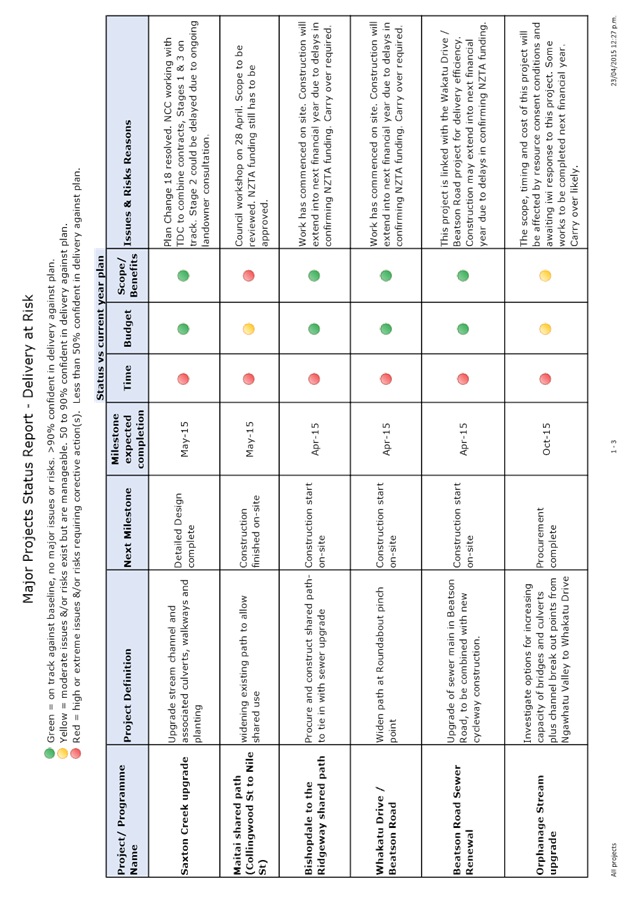

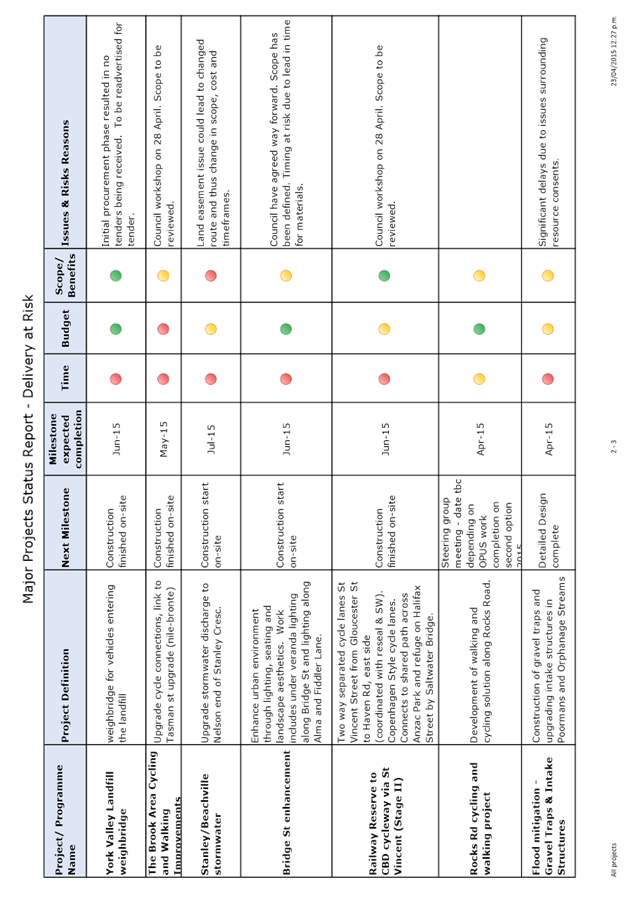

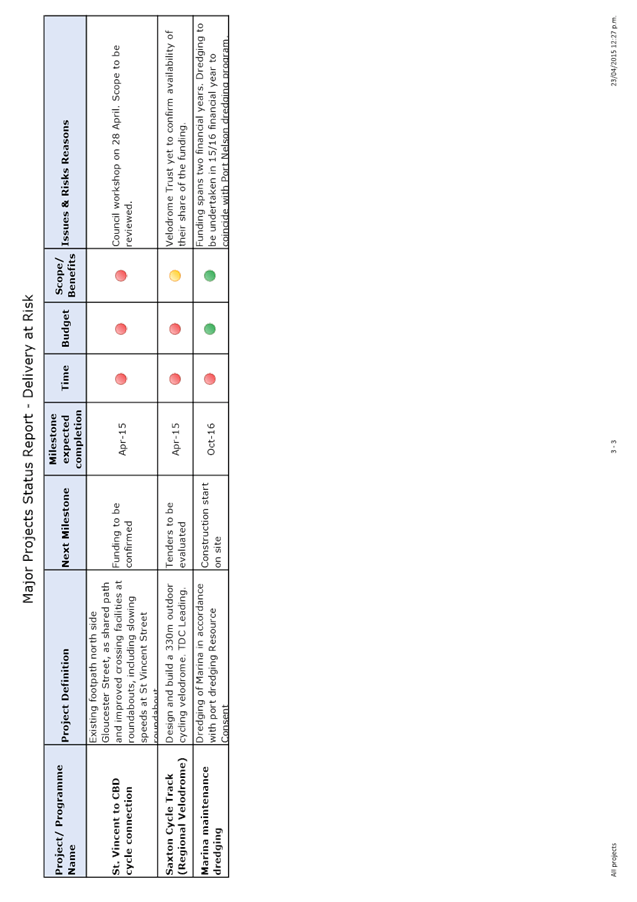

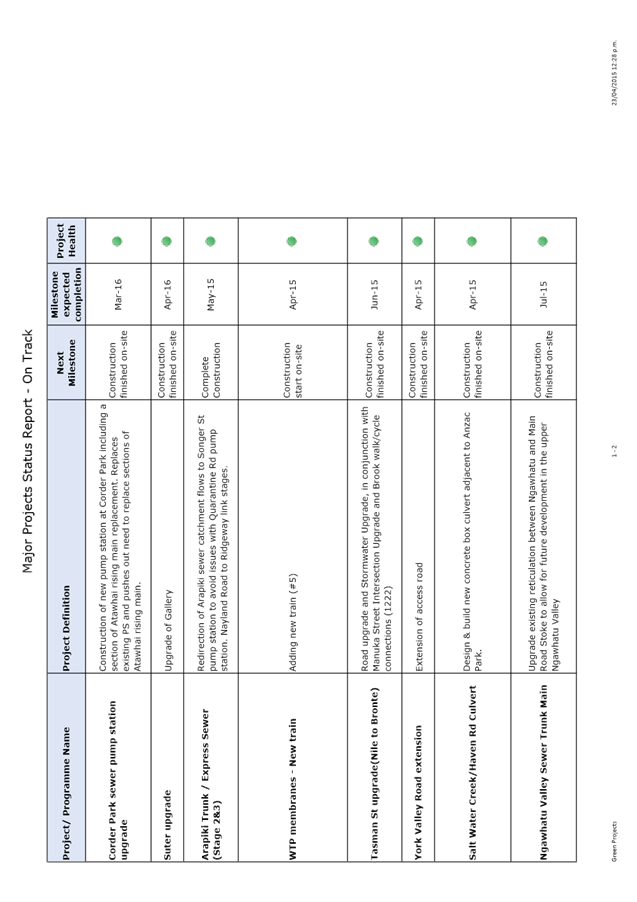

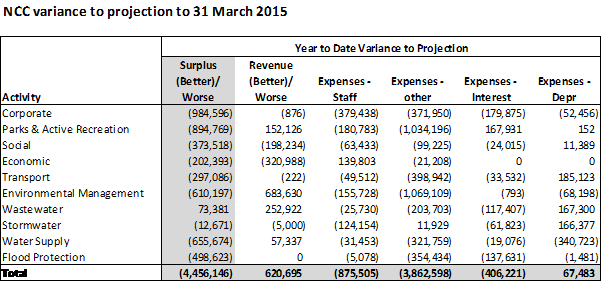

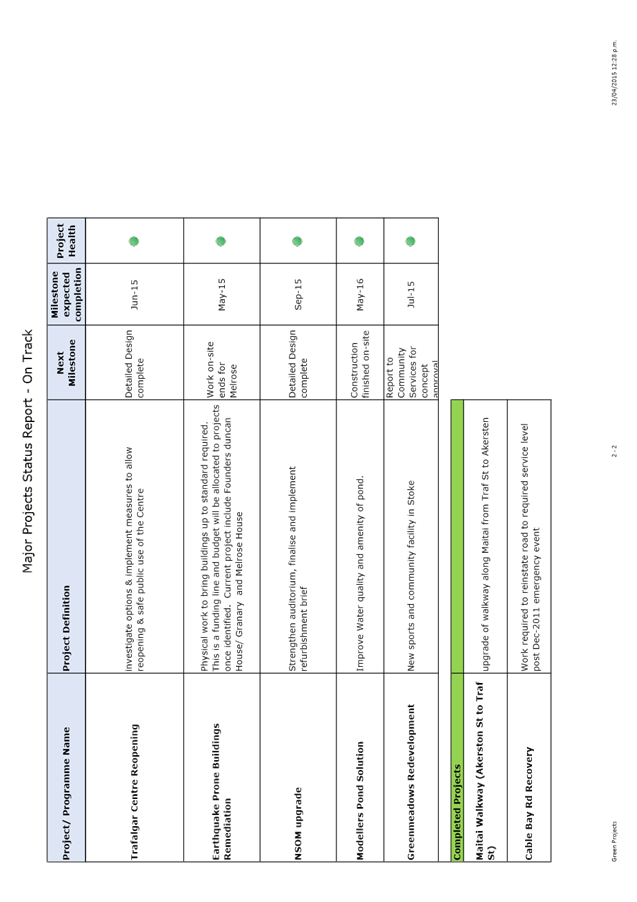

6. Projects Update

6.1 Please see Attachments 4 and 5 for progress reports on

Council’s major projects.

Live

Video Streaming for the Council Chamber

6.2 The Council approved that provision of $15,000 be made

in the Annual Plan 2014/15 to provide for video links to Council meetings if

feasible. A Business Case has been approved by the IT Steering Committee to

purchase a solution from Tandem Studios who provide live streaming solutions

for NZ Parliament, Wellington City Council, Christchurch City Council, Taupo

District Council and Hawkes Bay Regional Council. This solution has

upfront costs of $14,800 and ongoing annual costs of $11,250 which will need to

be provided for through the Long Term Plan.

7. Alignment with relevant Council policy

7.1 The

finance report is prepared comparing current year performance against the first

projection for the draft LTP.

8. Assessment of Significance against the Council’s

Significance and Engagement Policy

8.1 There

are no significant decisions.

9. Consultation

9.1 No

consultation is required.

10. Inclusion of Māori in the decision making process

10.1 No

consultation is required.

Nikki

Harrison

Group

Manager Corporate Services

Attachments

Attachment 1: A1342336 - NCC Summary

Performance

Attachment 2: A1342336

- Capital expenditure graph

Attachment 3: A1342336

- Capital expenditure by activity

Attachment 4: A1311288

- Major projects status report – delivery at risk

Attachment 5: A1311288

- Major projects status report – on track

Attachment 6: A1343636

- Balance Sheet

Attachment 7: A1340305

- Interest Rate Position Report

Attachment 8: A793514

- Debtors Report

Audit, Risk and Finance

Subcommittee

Audit, Risk and Finance

Subcommittee